By Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM which provides updated information up to October 2023.

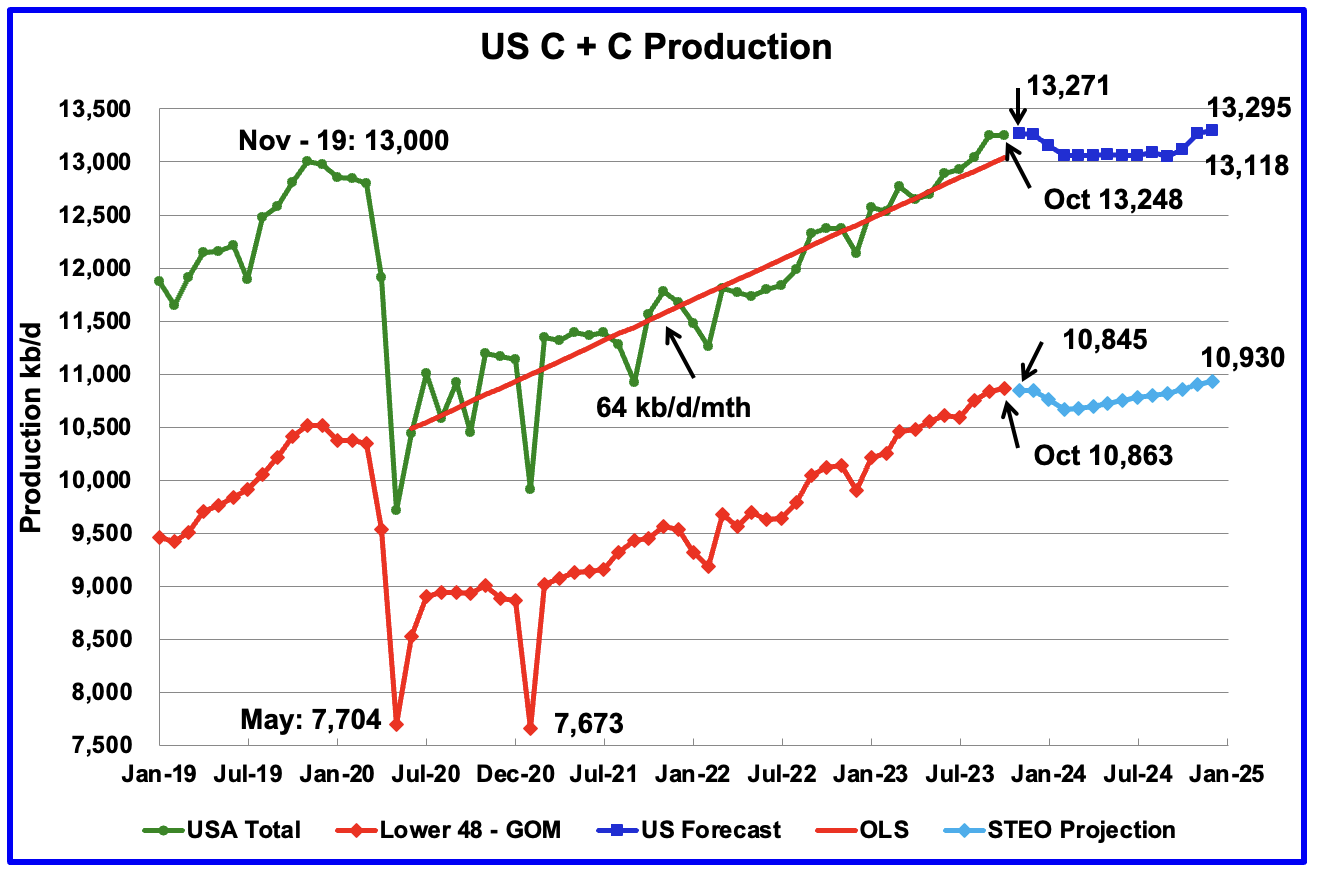

U.S. October oil production decreased by 4 kb/d to 13,248 kb/d. The decrease was primarily due to decreases in the GOM and North Dakota being partially offset by increases in Texas and New Mexico. Note that September production was revised up from 13,236 kb/d to 13,252 kb/d.

The dark blue graph, taken from the December 2023 STEO, is the forecast for U.S. oil production from November 2023 to December 2024. Output for December 2024 is expected to reach 13,295 kb/d which is 145 kb/d lower than forecast last month.

The red OLS line from June 2020 to October 2023 indicates a monthly production growth rate of 64 kb/d/mth or 768 kb/d/yr. Clearly the growth rate going forward into 2024, shown by the dark blue graph, is flat and significantly lower than seen in the previous June 2020 to October 2023 time period. From November 2023 to December 2024, production is expected to grow by 24 kb/d. Production is expected to fall from December 2023 to October 2024 before beginning to rise.

While overall US oil production decreased by 4 kb/d, the Onshore L48 had a production increase of 25 kb/d to 10,863 kb/d in October.

The light blue graph is the STEO’s projection for output to December 2024 for the Onshore L48. From November 2023 to December 2024, production is expected to increase by 85 kb/d to 10,930 kb/d. However note that the December 2024 production was revised down by 139 kb/d from 11,069 kb/d.

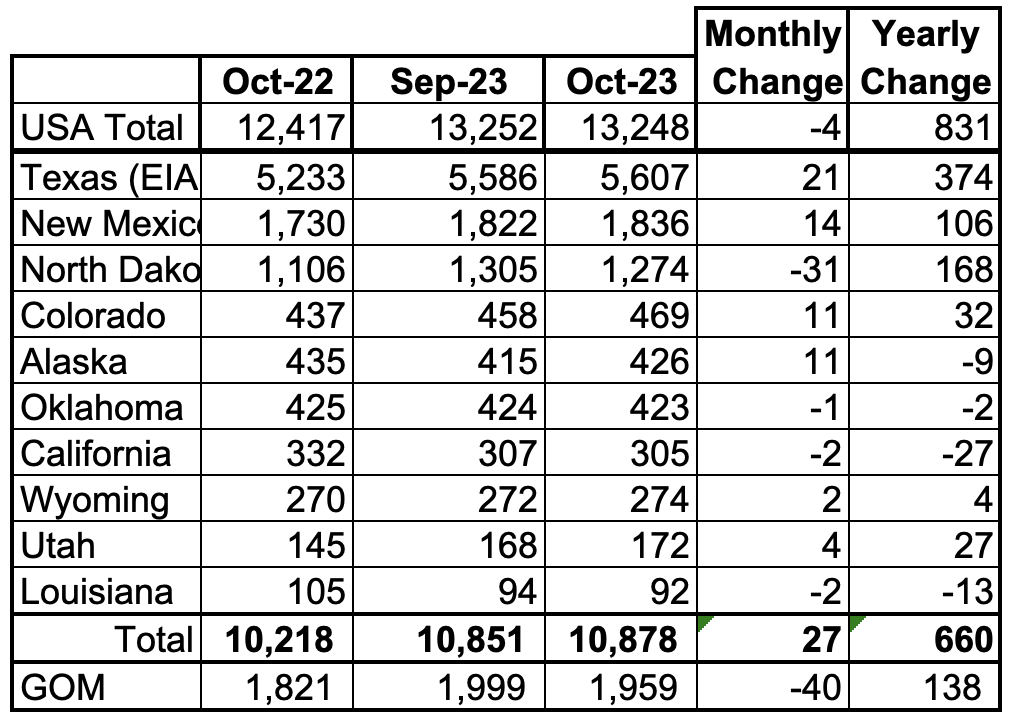

Oil Production Ranked by State

Listed above are the 10 states with the largest US oil production along with the Gulf of Mexico. These 10 states accounted for 82.1% of all U.S. oil production out of a total production of 13,248 kb/d in October 2023.

On a YoY basis, US production increased by 831 kb/d with the majority, 648 kb/d coming from Texas, New Mexico and North Dakota. GOM production dropped by 40 kb/d MoM while YOY it is up 138 kb/d.

State Oil Production Charts

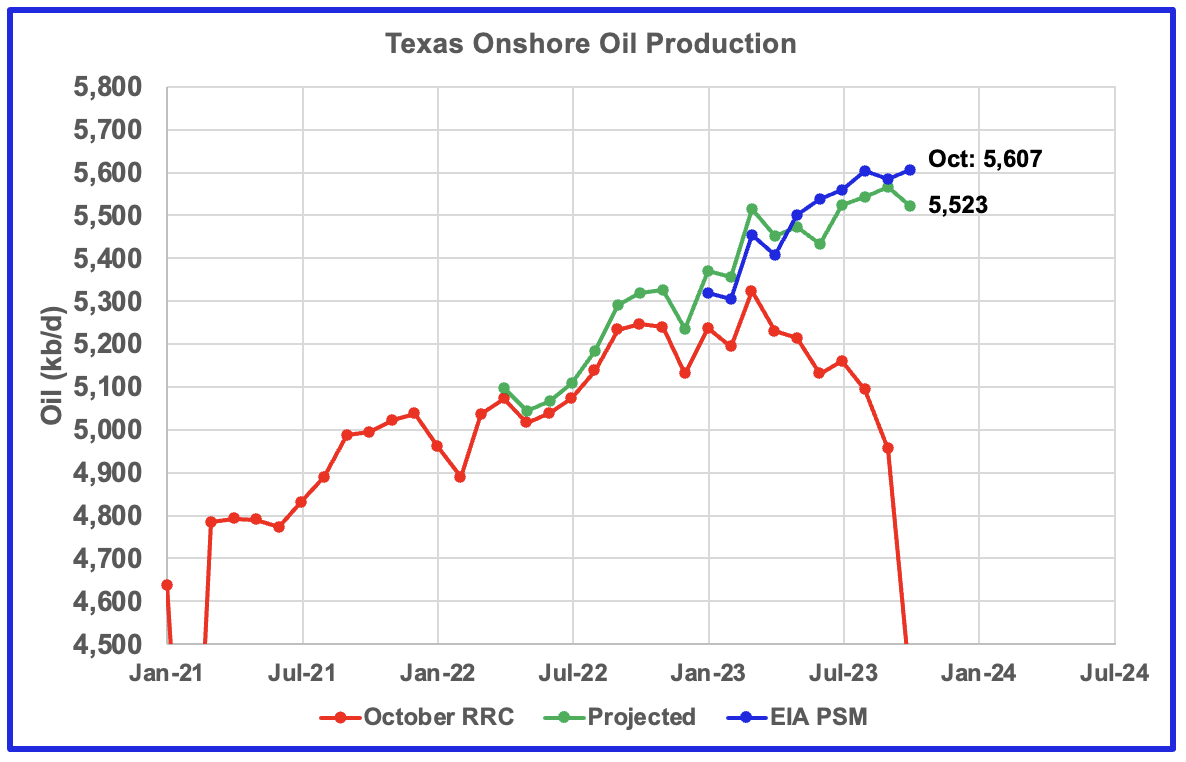

Texas production increased by 21 kb/d in October to 5,607 kb/d. However, relative to September’s production reported last month, 5,573 kb/d, October output was up by 34 kb/d.

The red graph shows Texas October oil production as reported by the Texas Rail Road Commission (RRC). The Green graph is a projection for Texas production using a methodology based on two months of production data, September and October, from the Texas RRC. The October estimate is low by 84 kb/d while the September estimate is low by 20 kb/d, 5,566 kb/d vs 5,586 kb/d. Next month the EIA’s October estimates will be revised and will be re-compared against the blue graph.

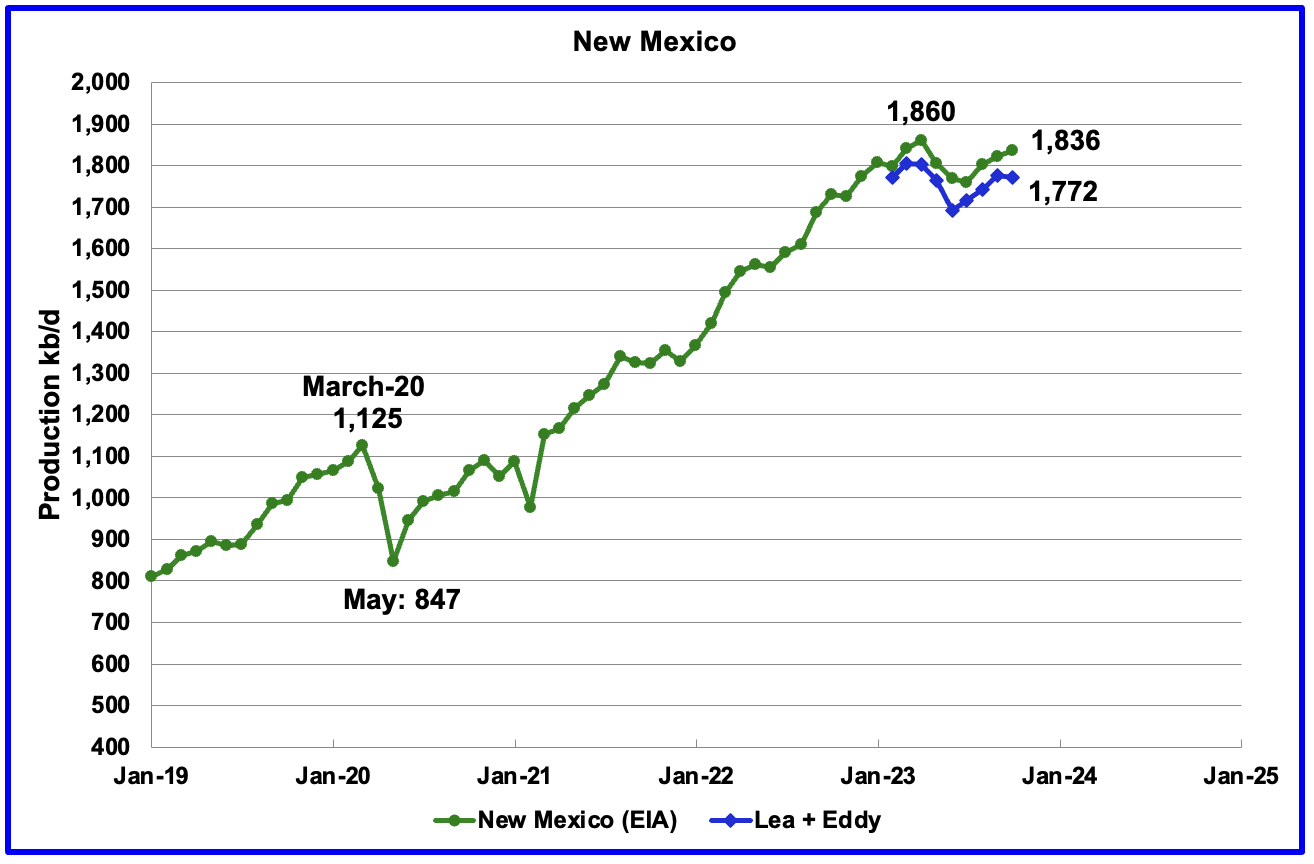

New Mexico’s October production rose by 14 kb/d to 1,836 kb/d. The combined output from Lea and Eddy counties dropped by 5 kb/d. It is interesting to see that the Lea + Eddy production trend is similar to the EIA’s except for the last month. The current gap between the New Mexico production report and the EIA’s is 64 kb/d and the majority of that gap will be closed over the next six months as the producers update their information. Part of the 64 kb/d gap comes from four additional New Mexico counties, San Juan,Sandoval, Chaves and Rio Arriba that produce close to 30 kb/d.

Of the EIA’s 1,836 kb/d output from New Mexico, 1,772 kb/d (96.5%) came from the Lea and Eddy counties. The Lea and Eddy county production data for October is not complete and will be updated over the next three months.

More production information from these two counties is reviewed in the special Permian section further down.

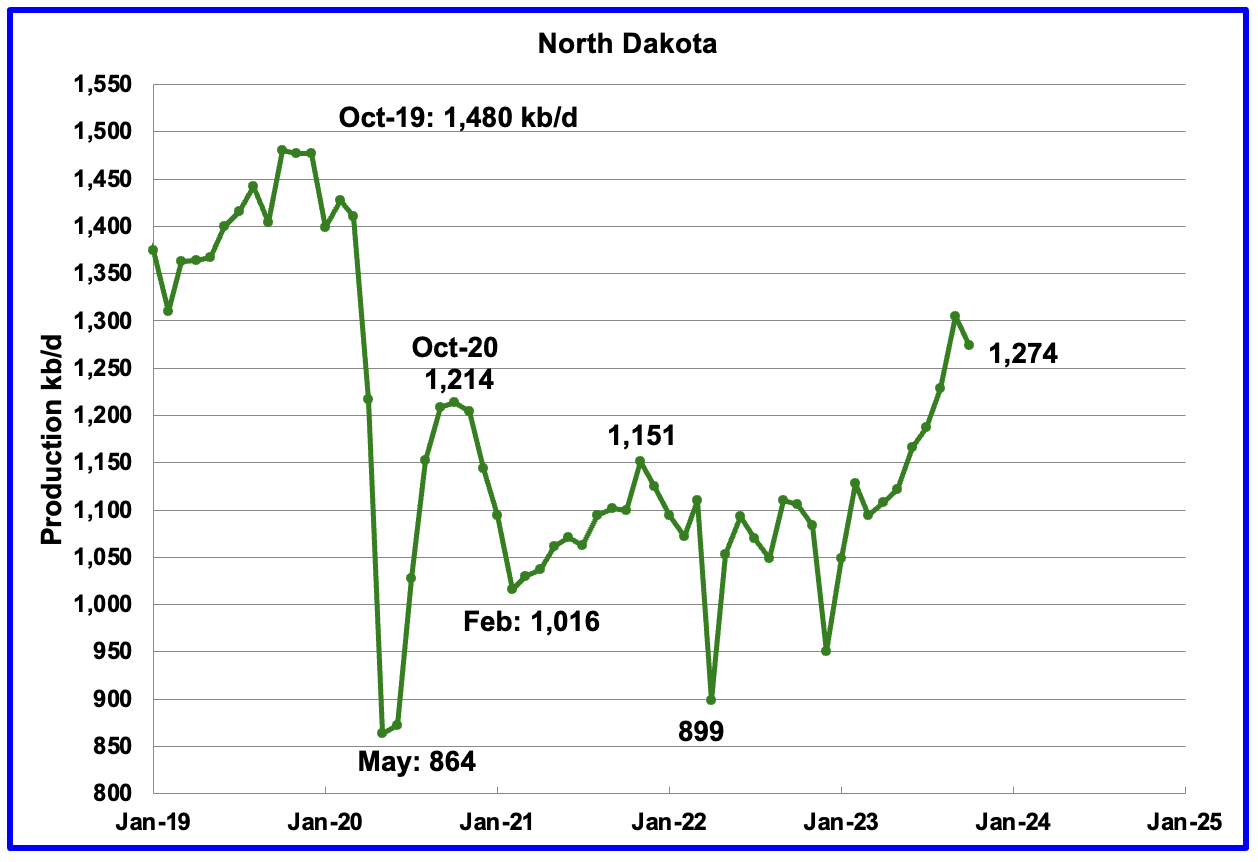

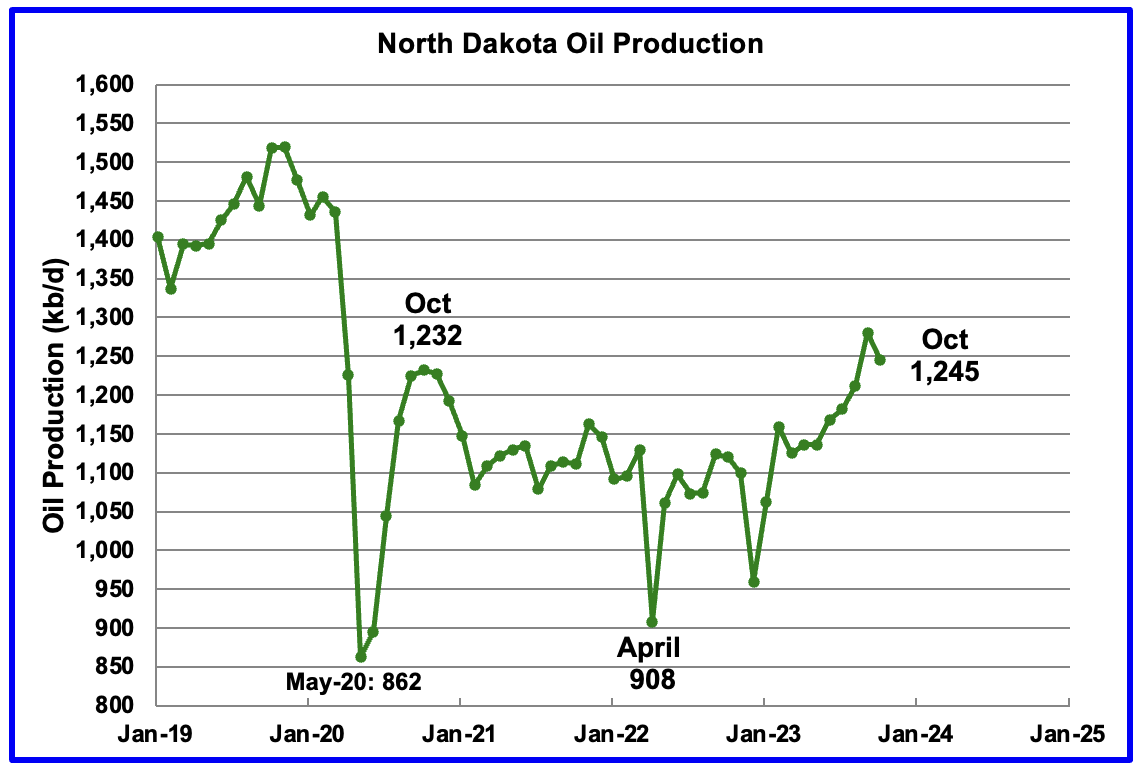

October’s output decreased by 31 kb/d to 1,274 kb/d.

According to this source, production growth for October was lower due to October bad weather.

“North Dakota oil and gas production both fell in October, largely due to bad weather, the state’s top oil regulator says.

There were 18,619 wells producing in October, another all-time high.

The state’s figures lag two months as officials collect and analyze data from energy companies.

Most of October’s drop was due to a period of heavy snow at the end of October, state Department of Mineral Resources Director Lynn Helms said during his monthly report.

“Somewhere between 50,000 and 90,000 barrels (of oil) a day shut in, and it took a full month to completely recover from that,” he said.”

This last statement Implies that November will also be down.

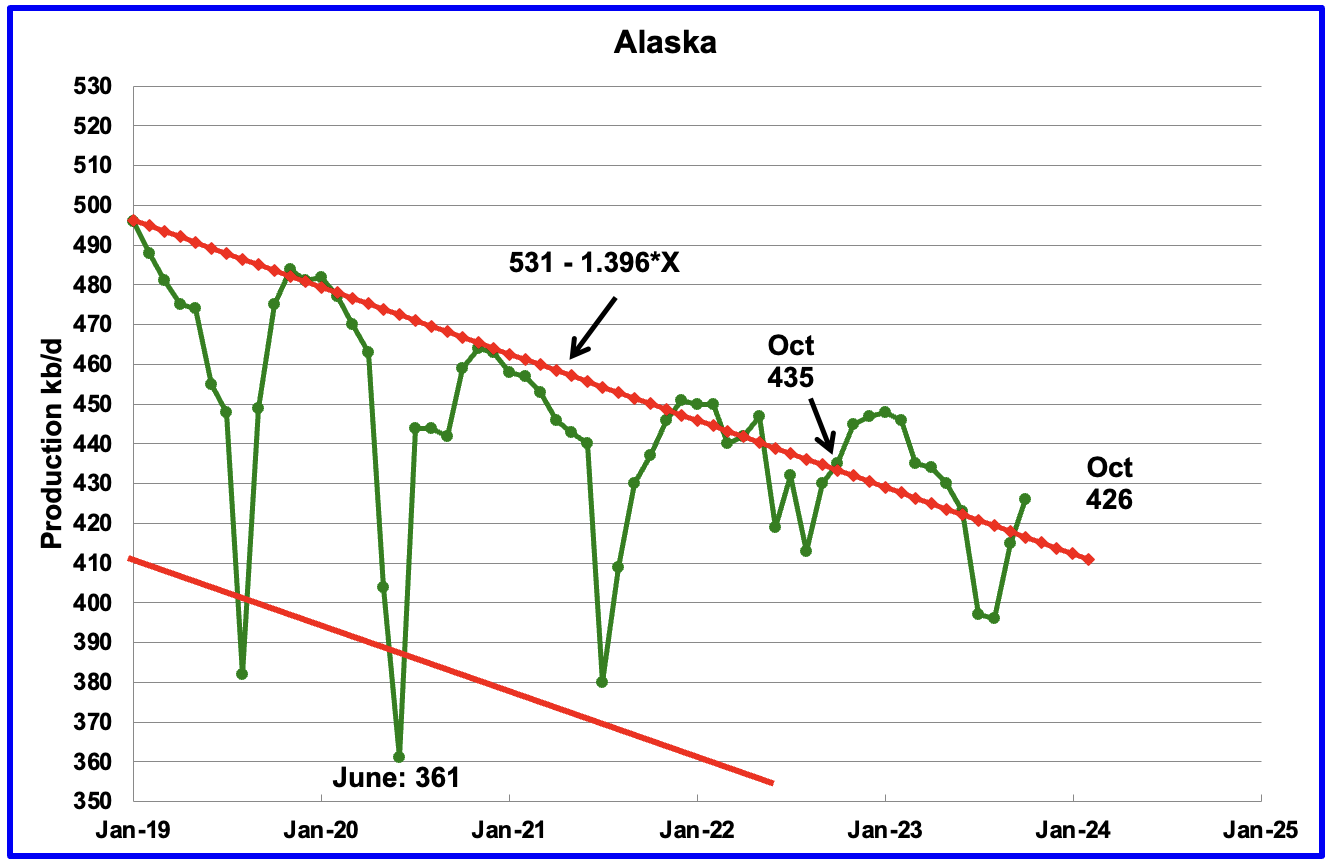

Alaskaʼs October output increased by 11 kb/d to 426 kb/d. Production YoY is down by 9 kb/d. The weekly EIA report continues to show December Alaska production is in the 430 kb/d to 440 kb/d range.

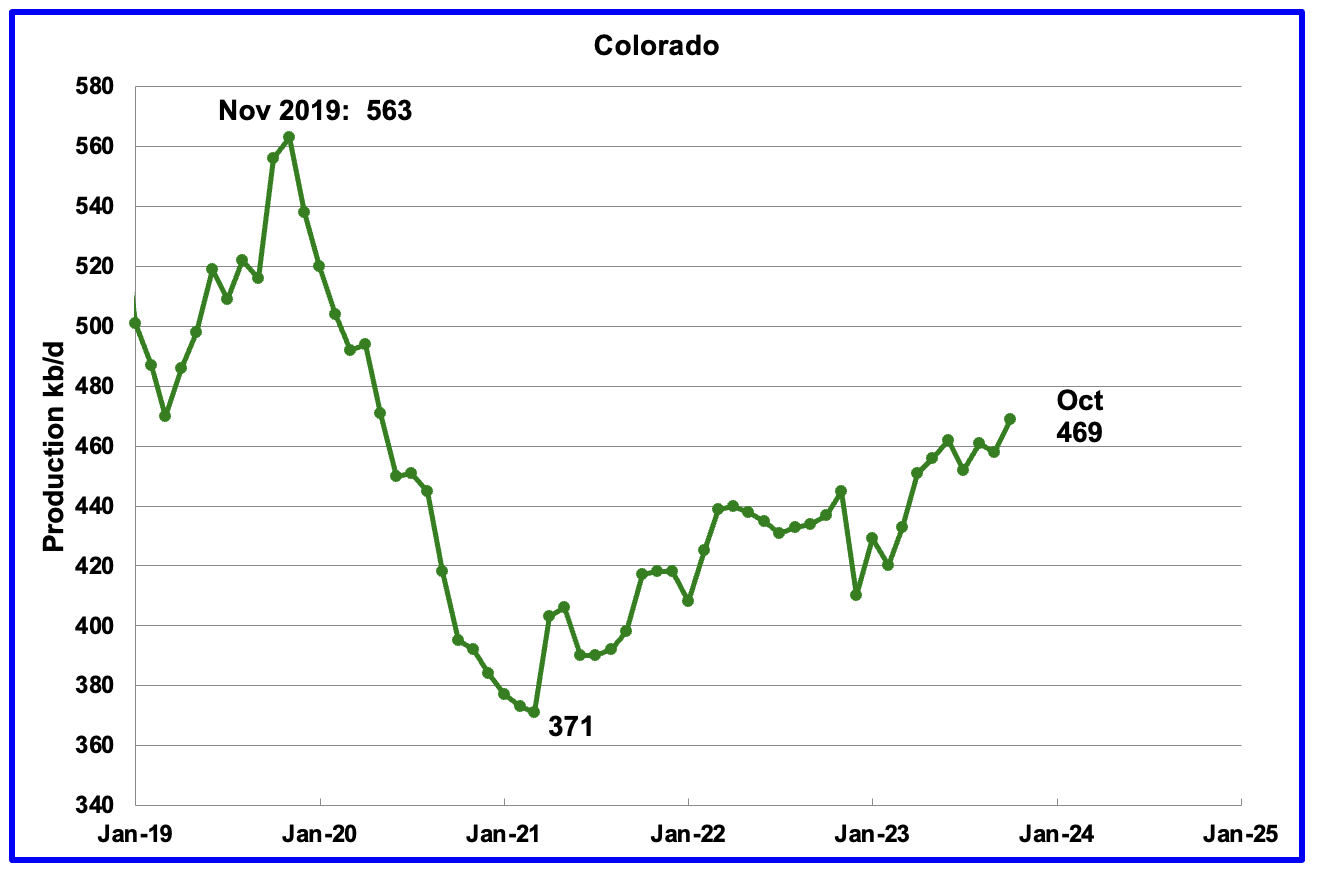

Coloradoʼs October production increased by 11 kb/d to 469 kb/d.

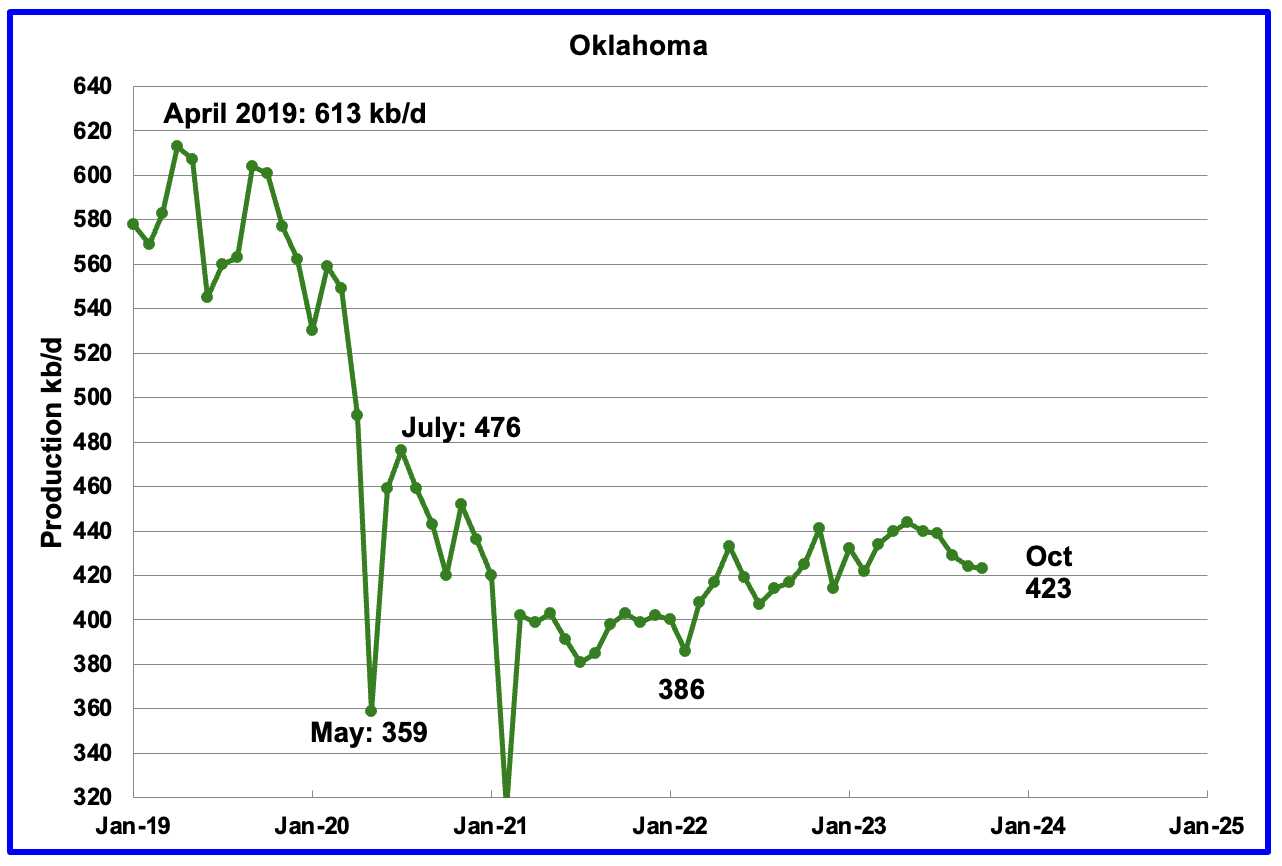

Oklahoma’s output in October decreased by 1 kb/d to 423 kb/d. Production remains 53 kb/d below the post pandemic July 2020 high of 476 kb/d. Output may be in a plateau/declining phase.

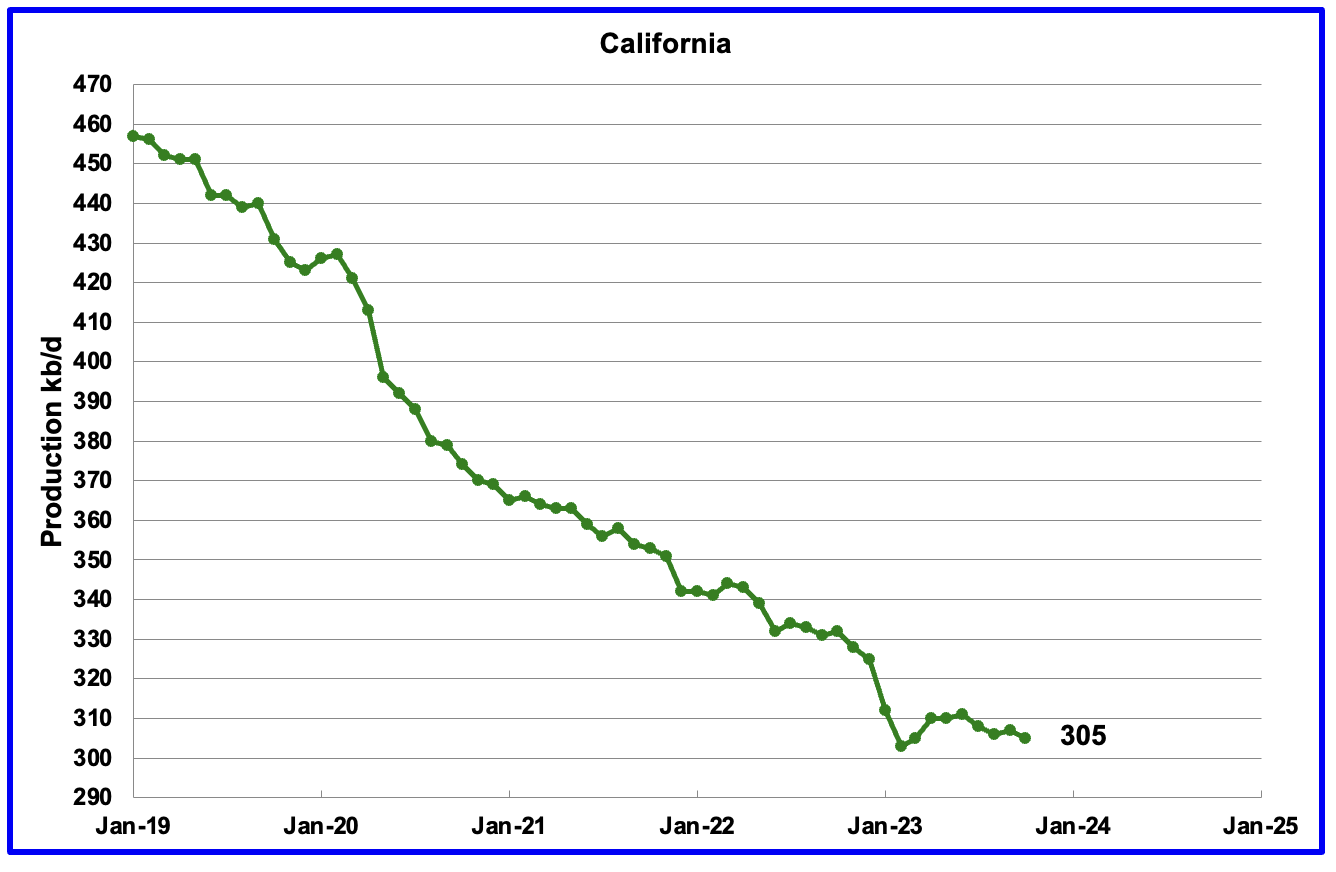

Californiaʼs October production declined 2 kb/d to 305 kb/d.

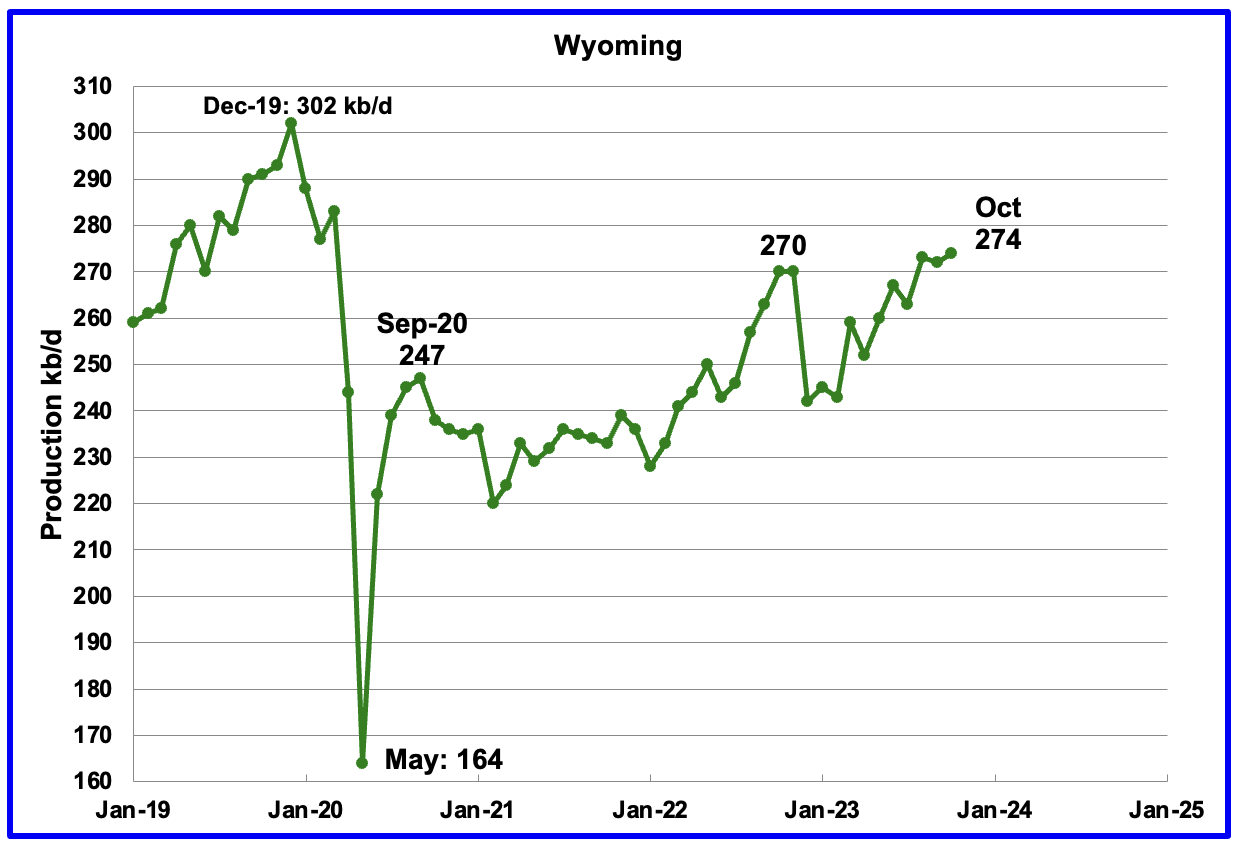

Wyoming’s oil production has been rebounding since March 2023. October’s oil production rose to 274 kb/d, a post pandemic record high, exceeding November 2022 by 4 kb/d.

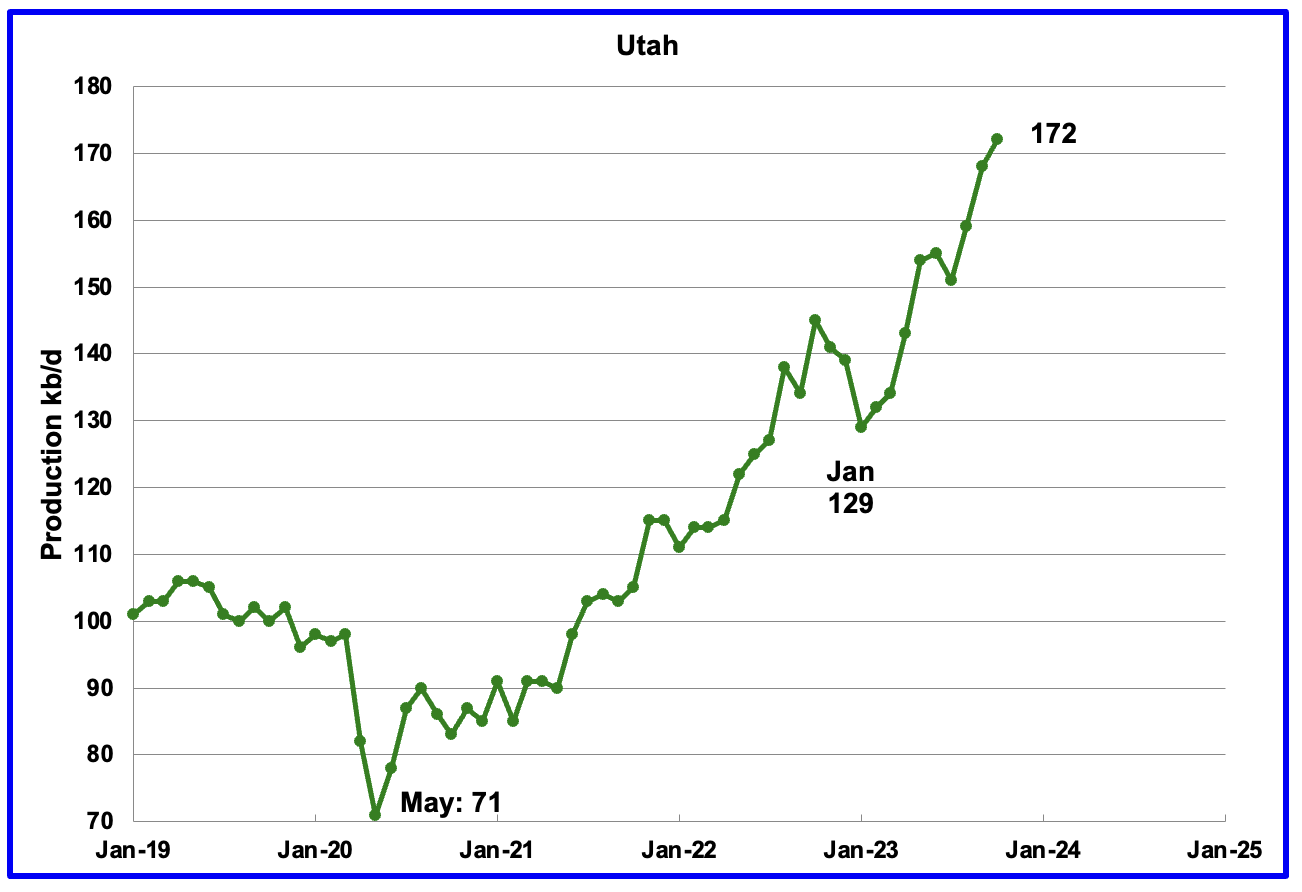

October’s production increased by 4 kb/d to 172 kb/d to another record high. For the first 4 months of 2023, Utah had 7 rigs operating. Since May the number of operational rigs has bounced between 8 and 9, which may account for the increased production.

The increased production since February has come from the Uinta basin.

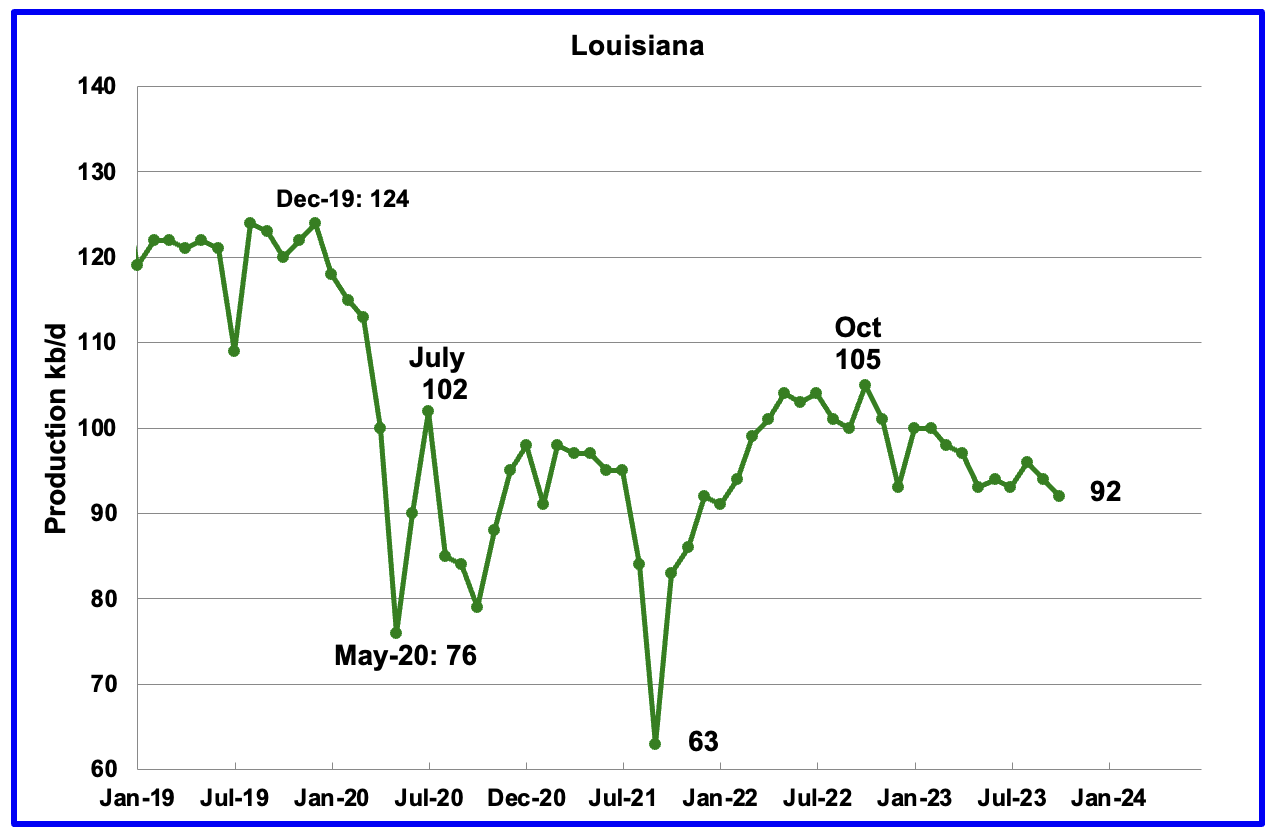

Louisiana’s output entered into a slow decline phase in October 2022. October’s production decreased by 2 kb/d to 92 kb/d and is 13 kb/d lower than October 2022.

GOM production decreased by 40 kb/d in October to 1,959 kb/d but is expected to add 36 kb/d in November to 1,995 kb/d.

The December 2023 STEO projection for the GOM output has been added to this chart. It projects that over the next eleven months production will fall to 1,822 kb/d before rebounding to 1,954 kb/d in December 2024.

It is not known if the GOM decline shown after November 2023 is related to a combination of extensive maintenance and a general decline of wells. Also disappointing production from some highly touted wells could be an issue according to this source.

“PowerNap looks like an even bigger disappointment and is declining towardsn zero having produced less than 5% of its original reserve estimate.”

A Different Perspective on US Oil Production

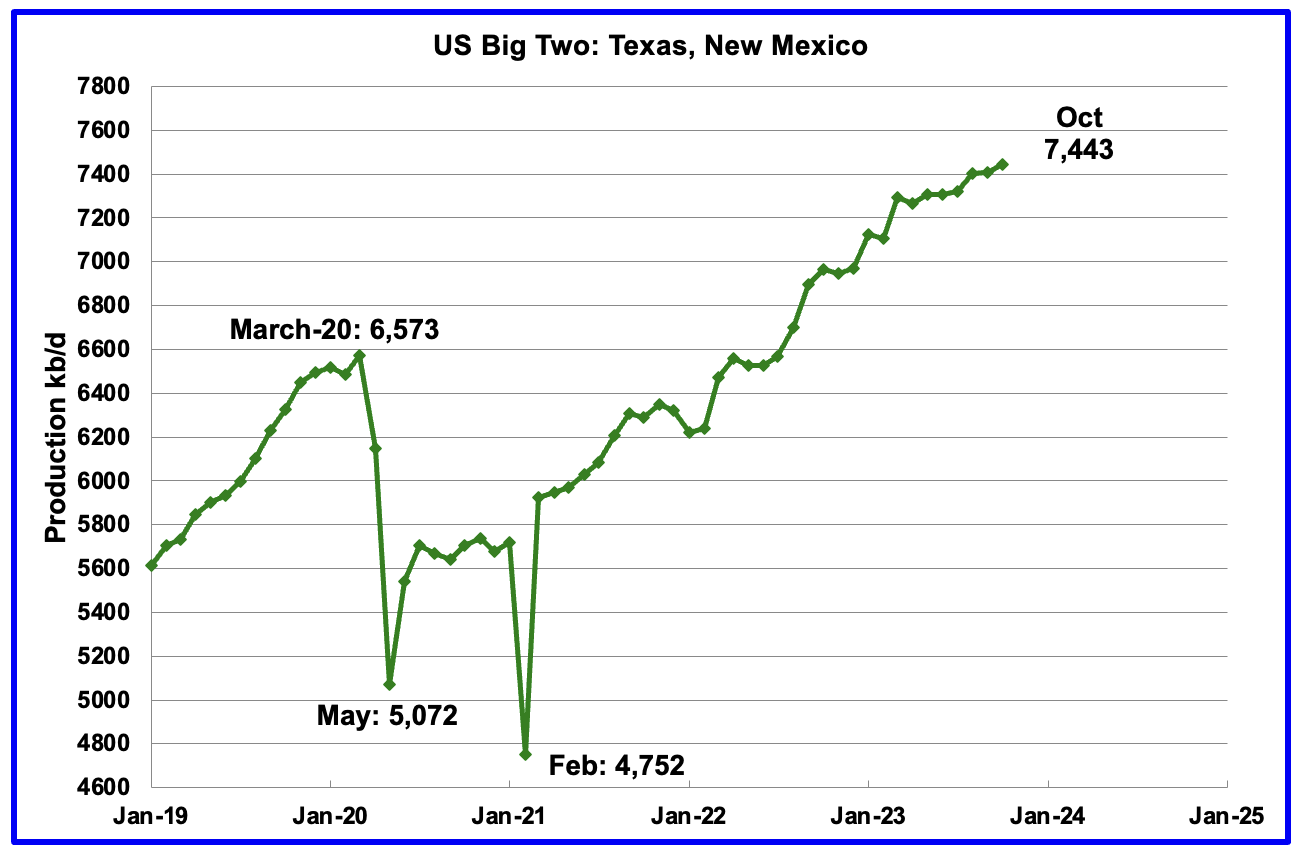

The Big Two states’ combined oil output for Texas and New Mexico.

October’s production in the Big Two states increased by a combined 35 kb/d to 7,443 kb/d with Texas adding 21 kb/d while New Mexico added 14 kb/d. October production of 7,443 kb/d is 53 kb/d higher than reported last month for September.

Oil production by The Rest

October’s production in The Rest decreased by 10 kb/d to 3,420 kb/d.

The main takeaway from The Rest chart is that current production is 673 kb/d below the high of October 2019 and this appears to be a permanent loss that will never be recovered.

The On-Shore lower 48 W/O the big three, Texas, New Mexico and North Dakota, shows a slow rising trend from the low of January 2022. October’s production increased by 21 kb/d to 2,146 kb/d. The majority came from Colorado, 11 kb/d and West Virginia 7 kb/d. It is just 12 kb/d lower than the post covid rebound to 2,158 in July 2020.

Permian Basin Report by Main Counties and Districts

This special monthly Permian section was recently added to the US report because of a range of views on whether Permian production will continue to grow or will peak over the next year or two. The issue was brought into focus recently by the Goehring and Rozencwajg Report which indicated that a few of the biggest Permian oil producing counties were close to peaking or past peak. Also comments by posters on this site have similar beliefs from hands on experience.

This section will focus on the four largest oil producing counties in the Permian, Lea, Eddy, Midland and Martin. It will track the oil and natural gas production and the associated Gas Oil Ratio (GOR) on a monthly basis. The data is taken from the state’s government agencies for Texas and New Mexico. Typically the data for the latest two or three months is not complete and is revised upward as companies submit their updated information. Note the natural gas production shown in the charts that is used to calculate the GOR is the gas coming from both the gas and oil wells.

Of particular interest will be the charts which plot oil production vs GOR for a county to see if a particular characteristic develops that indicates the field is close to entering the bubble point phase. While the GOR metric is best suited for characterizing individual wells, counties with closely spaced horizontal wells may display a behaviour similar to individual wells due to pressure cross talking . For further information on the bubble point and GOR, there are a few good thoughts on the intricacies of the GOR in an earlier POB comment. Also check this EIA topic on GOR.

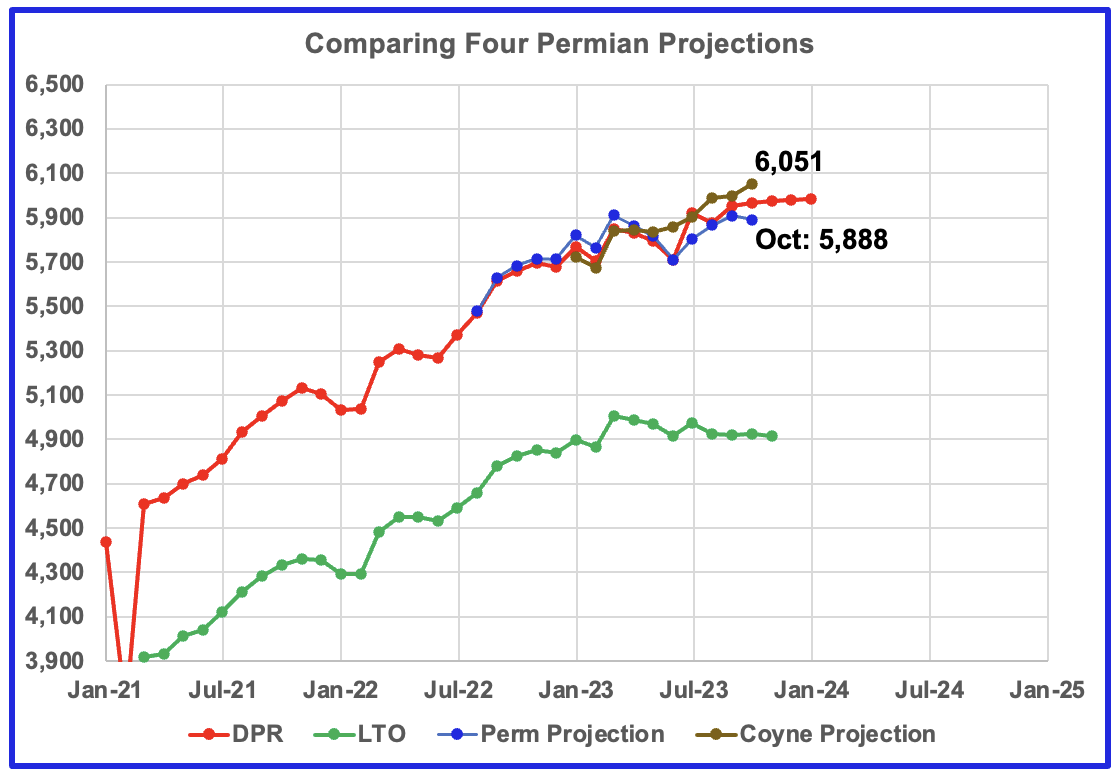

This chart shows four oil production projections for the Permian basin. The gap between the DPR and LTO projections is there because the DPR projection includes both LTO oil along with oil from conventional wells in the basins that it covers.

The red and green graphs show oil production as published by the EIA’s DPR and the LTO offices. Comparing the two, it appears that the LTO office believes Permian LTO production is currently is in a plateau phase while the DPR office is showing a small increase in growth before plateauing. The brown and blue markers are projections by D Coyne and yours truly respectively based on different methodologies.

The blue graph only uses two months of production data from New Mexico and the Texas RRC, September and October, to make its October projection. Note the projection for October is required because the October production data from the States is incomplete. A few more months of data is required to refine and modify the methodology. The blue graph is similar to the DPR and LTO graphs in the sense that it is also indicating that Permian production may be entering a plateau phase.

New Mexico Permian

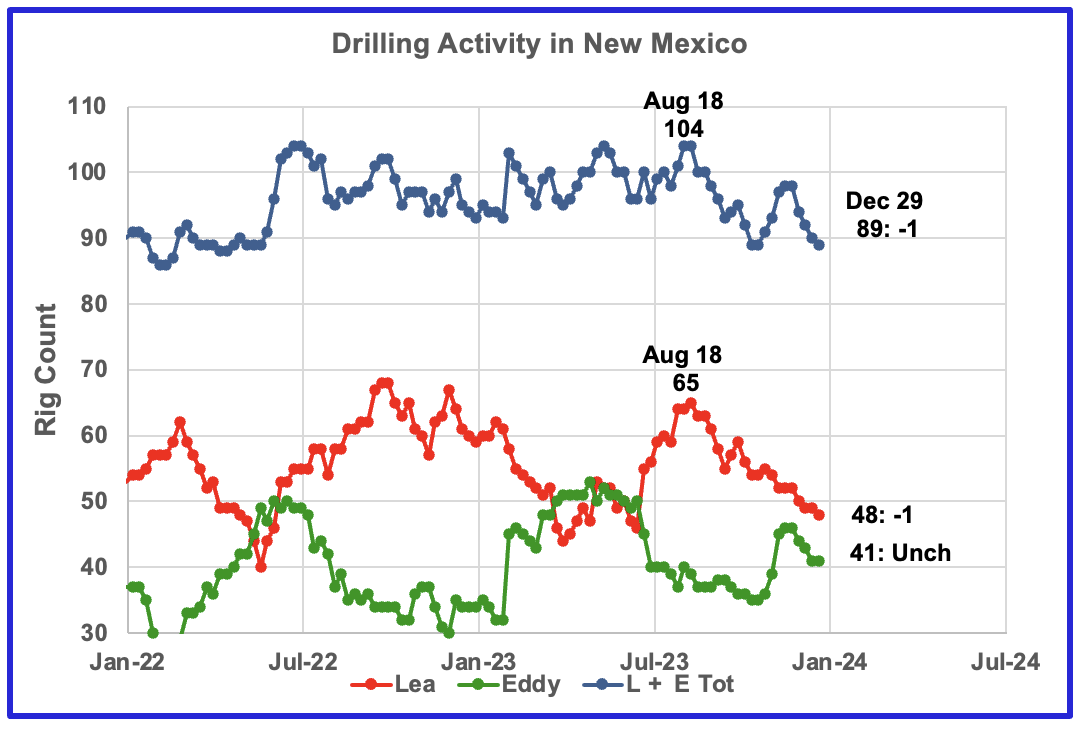

Over the past 4 months drilling activity in Lea has fallen each month. For the week ending December 29, the rig count in Lea dropped by one and was unchanged in Eddy. Since August, the New Mexico rig count has dropped from 104 in August to 89 at the end of December.

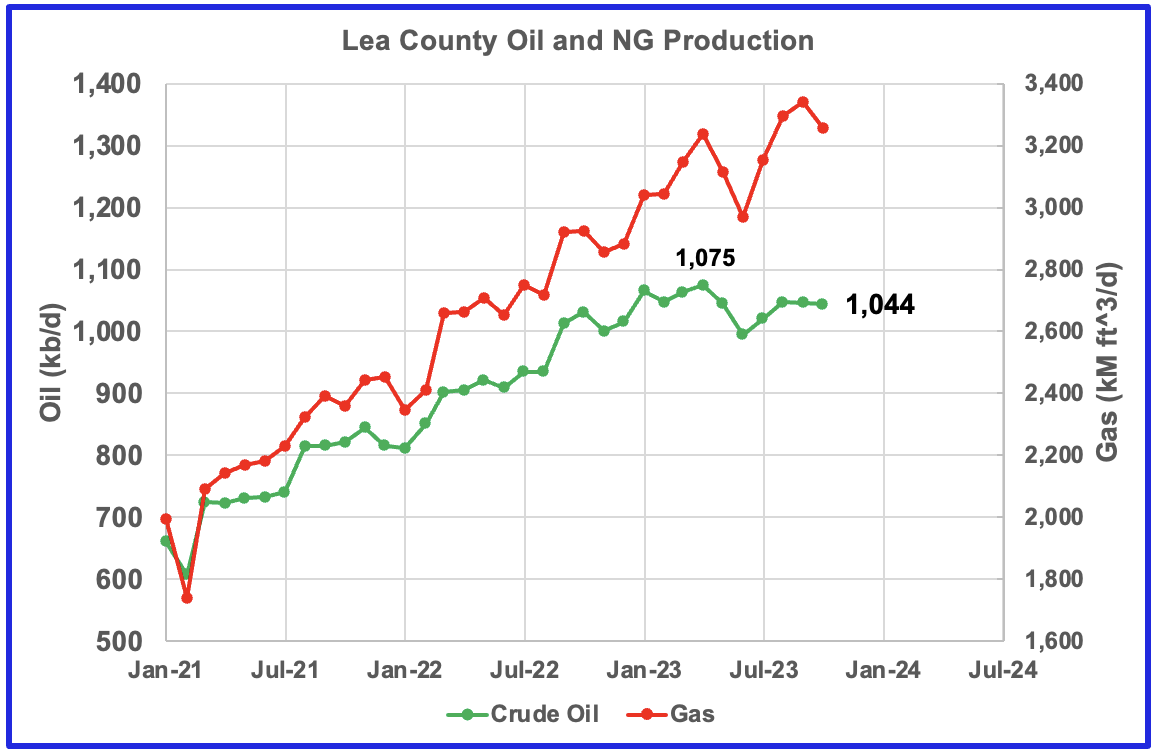

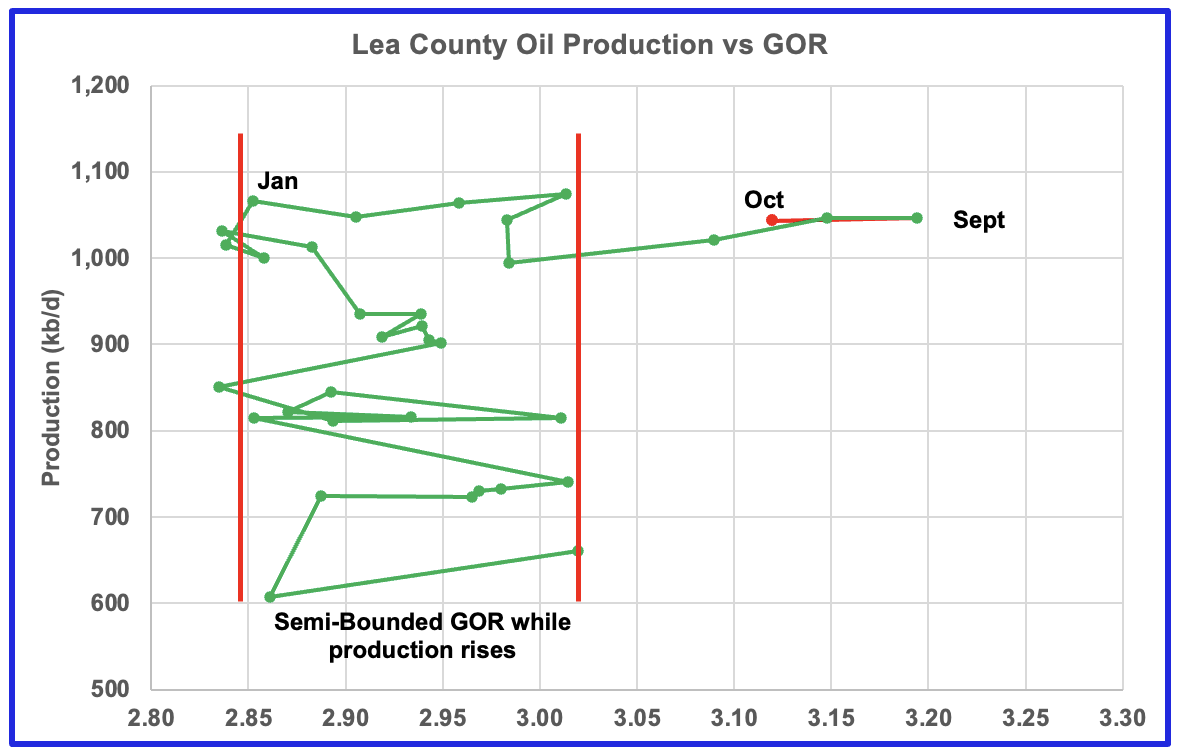

From June to September gas production rose faster than oil production in Lea county. However October saw a reversal and NG production dropped faster than oil production and the GOR dropped, next chart.

October oil production was 1044 kb/d and relatively unchanged since August, even though the rig count has dropped by 17.

After much zigging and zagging, oil production in Lea county stabilized above 1,000 kb/d while the GOR started to increase in January 2023 and exceeded the semi-bounded GOR in July 2023 while production remained relatively flat. The data for the last four months, July to October, is incomplete.

This zigging and zagging GOR pattern within a semi-bounded GOR while oil production increases to some stable level and then moves out to a higher GOR to the right has shown up in a number of counties. See an additional two cases below. While this is the fourth month in which Lea county has registered a GOR outside the semi-bounded GOR range, the trend has changed since the GOR has started to drop.

This dropping GOR trend has also shown up in Martin County. This implies that the concentration of dissolved NG in the oil phase is lower than previous months at the current temperature and pressure conditions and that going forward the GOR should continue to drop. A deeper explanation for this reversing GOR phenomena, if it continues, would be much appreciated.

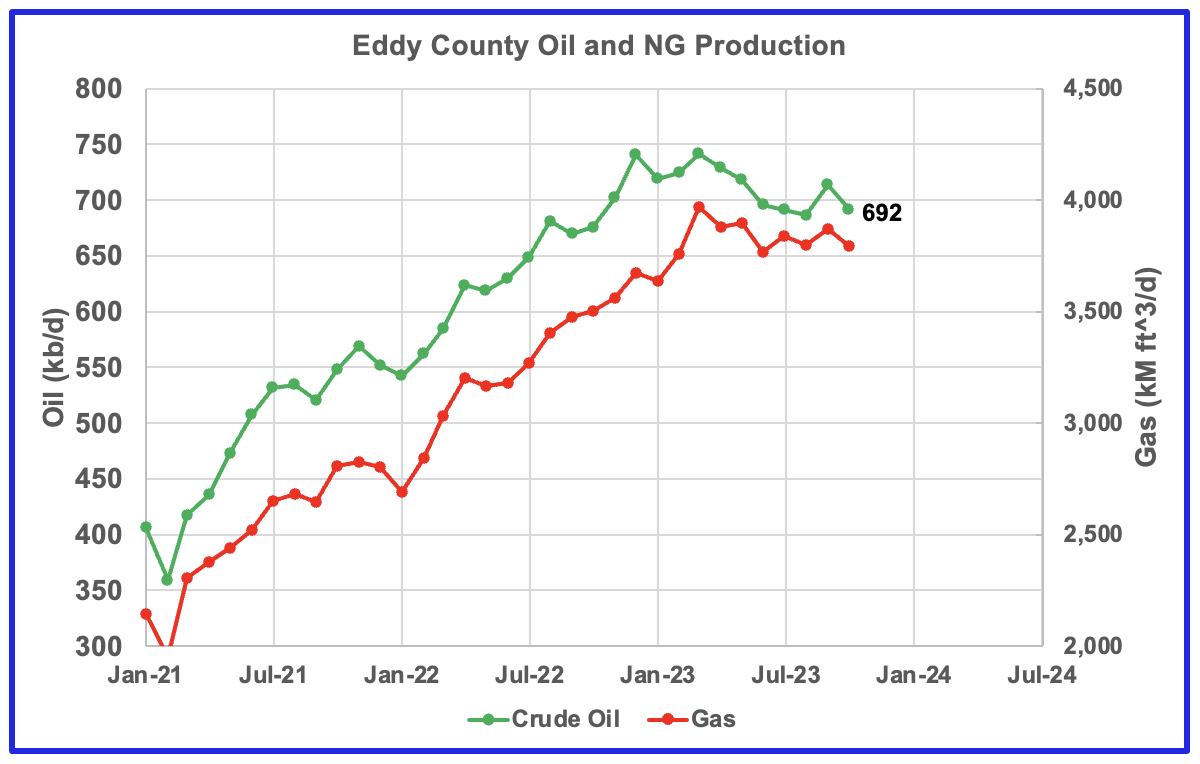

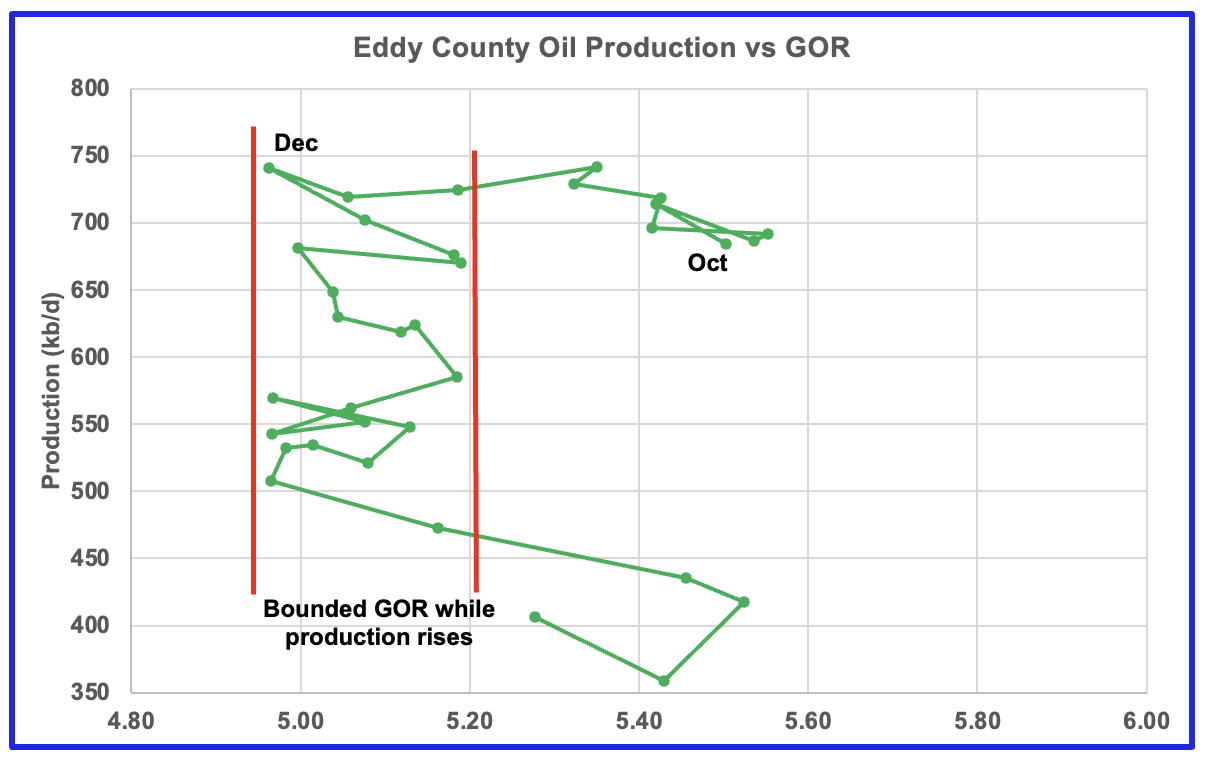

Eddy county oil production is showing early signs that it has peaked. October production was 692 kb/d.

The Eddy county GOR pattern is similar to Lea county except that Eddy broke out from the semi bounded range earlier and for a longer period while oil production has been dropping.

Texas Permian

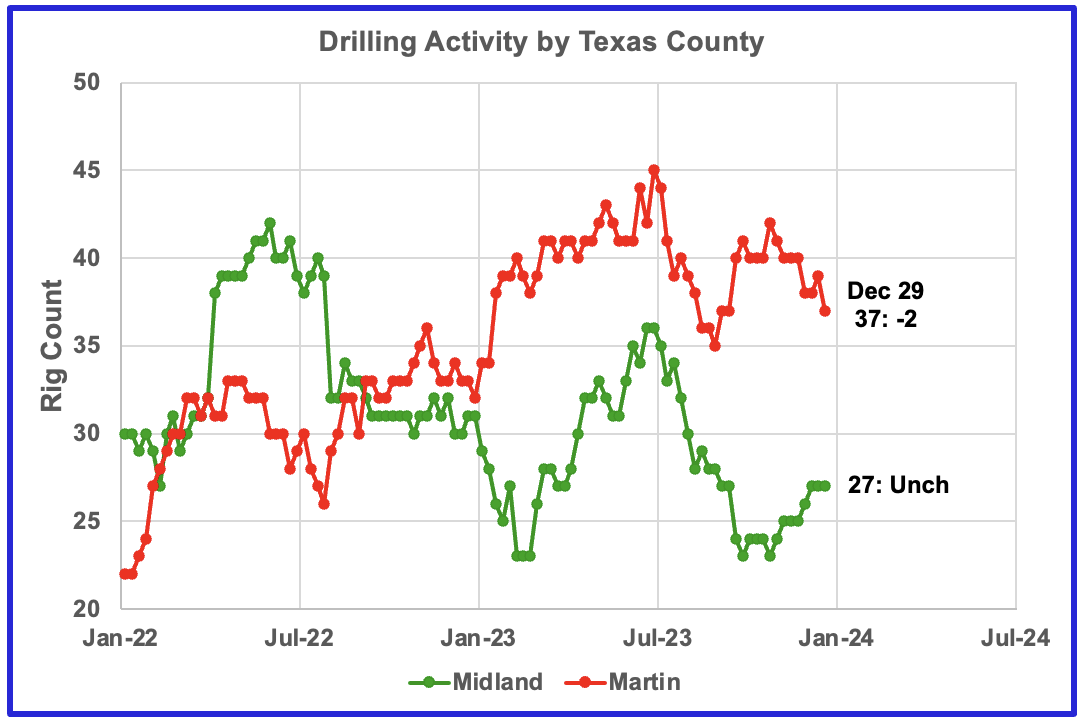

During December drilling activity increased in Midland county while it dropped in Martin county.

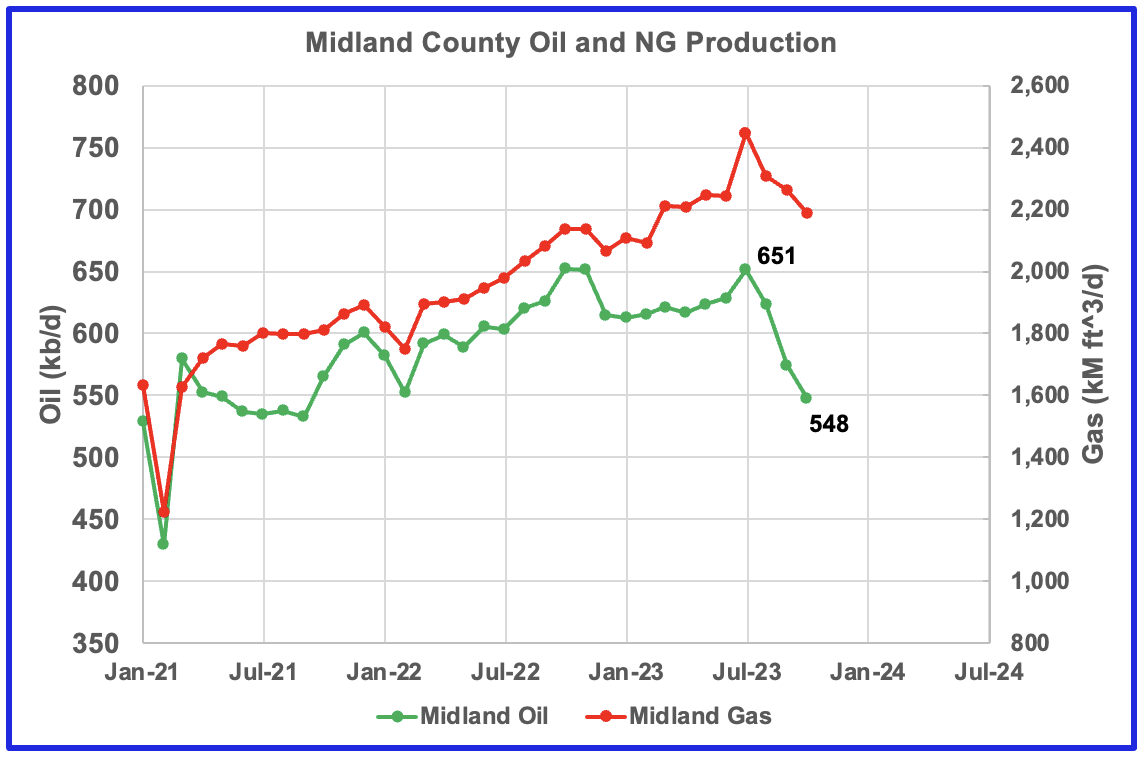

Both natural gas and oil production are dropping in Midland county. Cannot find any explanation for the July spike in oil and gas production. Oil production has dropped by 103 kb/d to 548 kb/d since July.

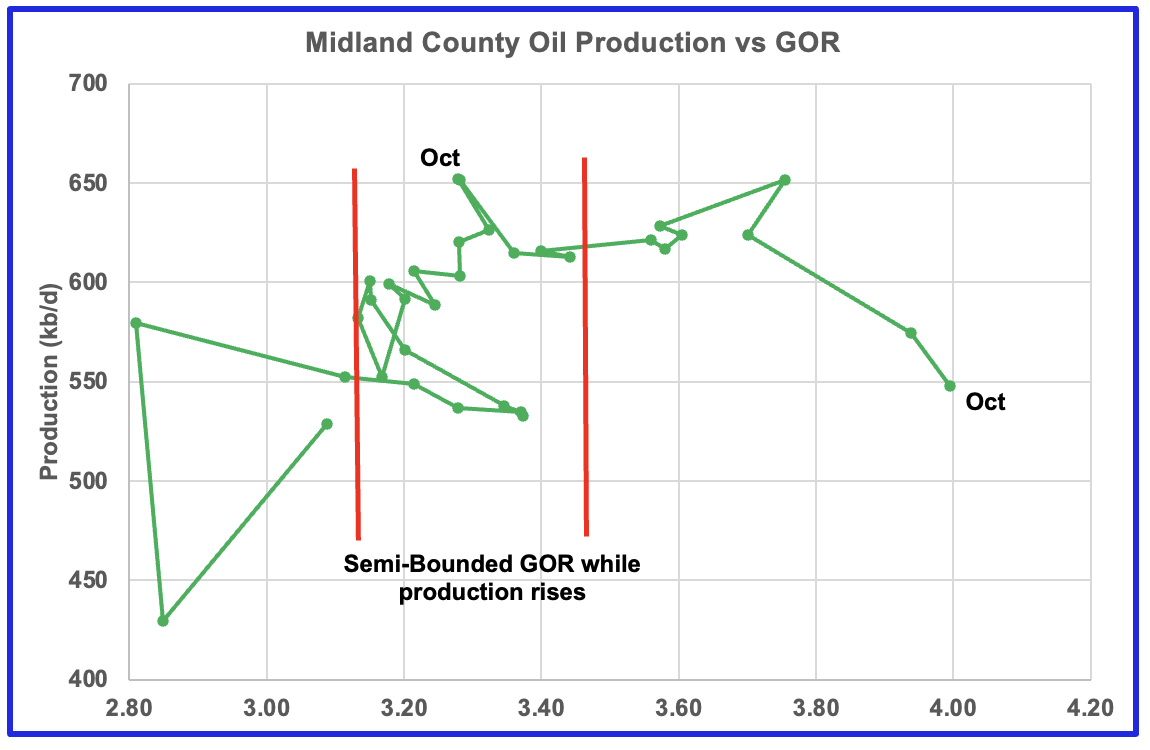

Oil production is dropping and the GOR is increasing. It appears that Midland has entered the bubble phase?

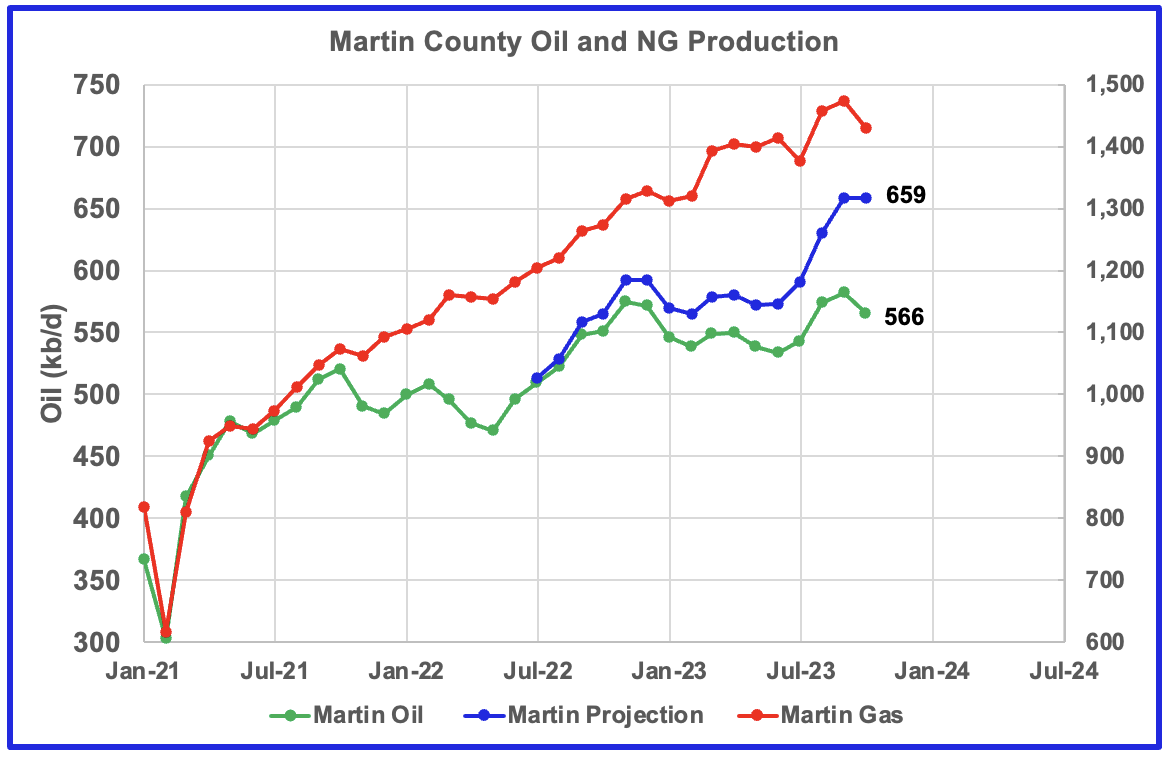

Both natural gas and oil production are increasing in Martin county.

The blue line is a production estimate which the Texas RRC will be reporting for Martin county one year from now as drillers report additional updated information. This projection is based on a methodology that used September and October production data and will be re-estimated next month.

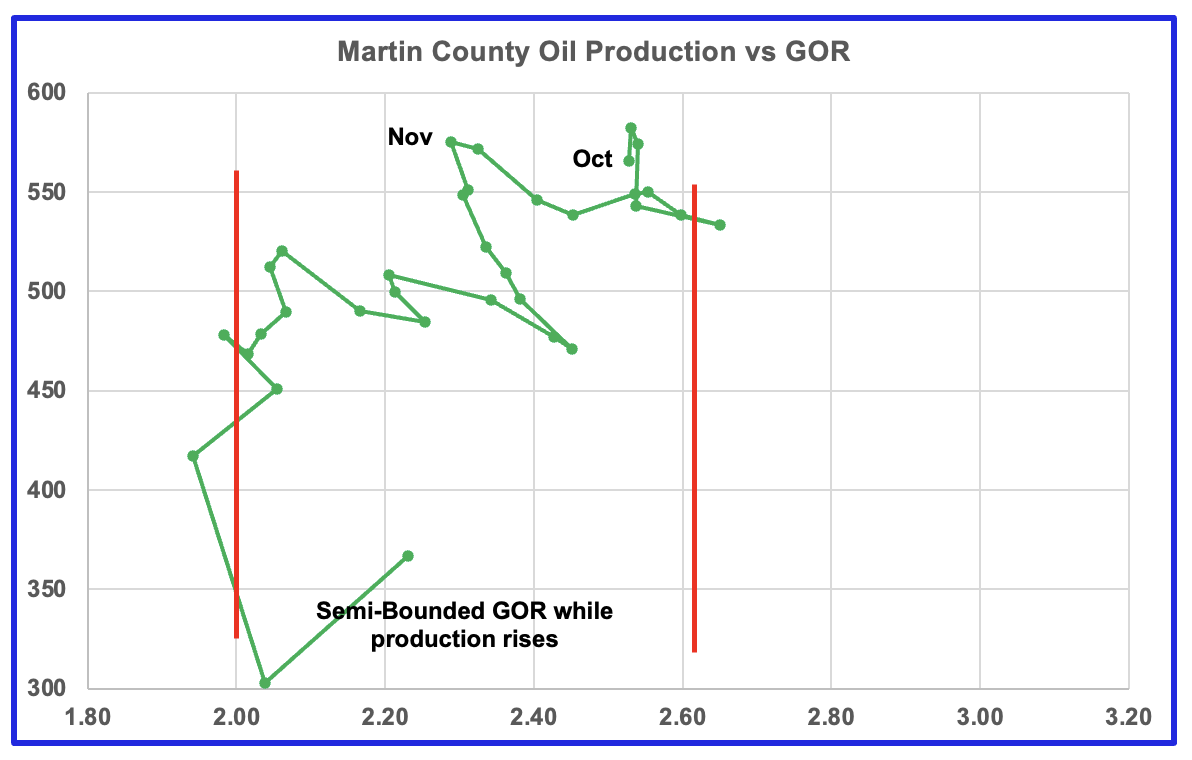

Martin county is displaying a new trend of increasing oil production while at the same time showing a retrograde GOR. Martin county has the lowest GOR of these four counties and at a GOR of 2.53, Martin may not be at the bubble point that results in a dropping oil production trend.

Three of the four oil production vs GOR charts above are exhibiting characteristics indicating that three of the largest oil producing counties in the Permian are in the bubble point phase and are close to or past their peak? Not clear as to what is happening in Martin County.

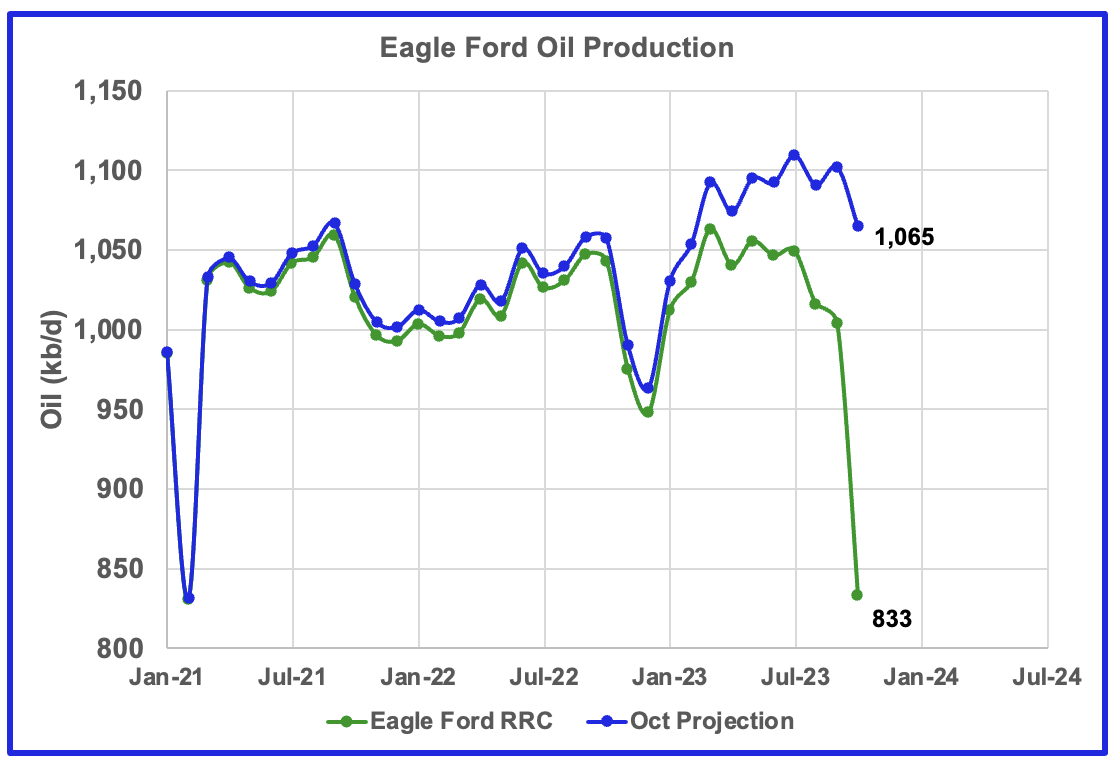

Eagle Ford Basin

This chart is an estimate for oil production in the Eagle Ford basin using the RRC output from Districts 1 and 2, which are the two main districts comprising the Eagle Ford basin. The green graph shows the most recent production data from the Texas RRC. The blue graph is the expected oil production that the RRC will post about about a year from now.

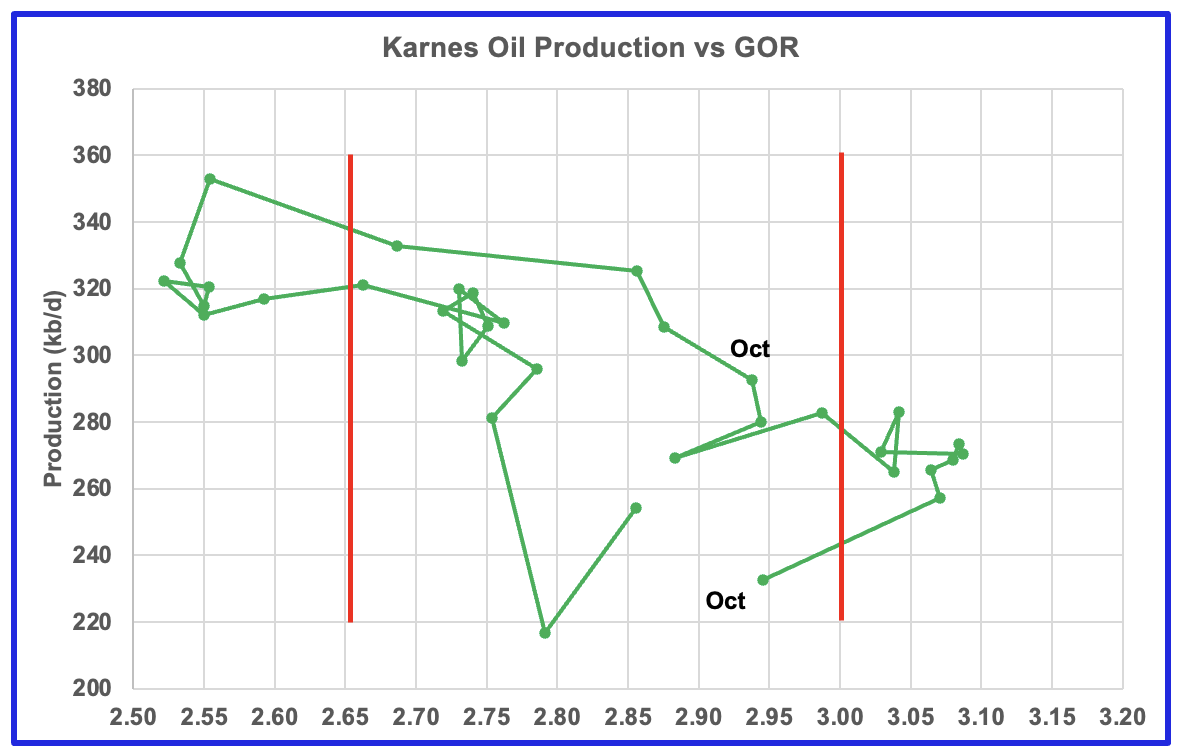

Karnes county is the biggest oil producing county in the Eagle Ford basin and is ranked as the seventh largest oil producing county in Texas. Both oil and gas production are falling in Karnes county and both are down close to 30% from the peak.

This is the GOR vs oil production for Karnes county but the GOR is still within its typical range while both production and GOR are dropping. This may indicate that Karnes county wells never entered the bubble point phase and weren’t very gassy to start with. Karnes county ranks fifteen in Texas natural gas production.

Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The December DPR report forecasts production to January 2024 and the following charts are updated to January 2024. The DUC charts and Drilled Wells charts are updated to November 2023.

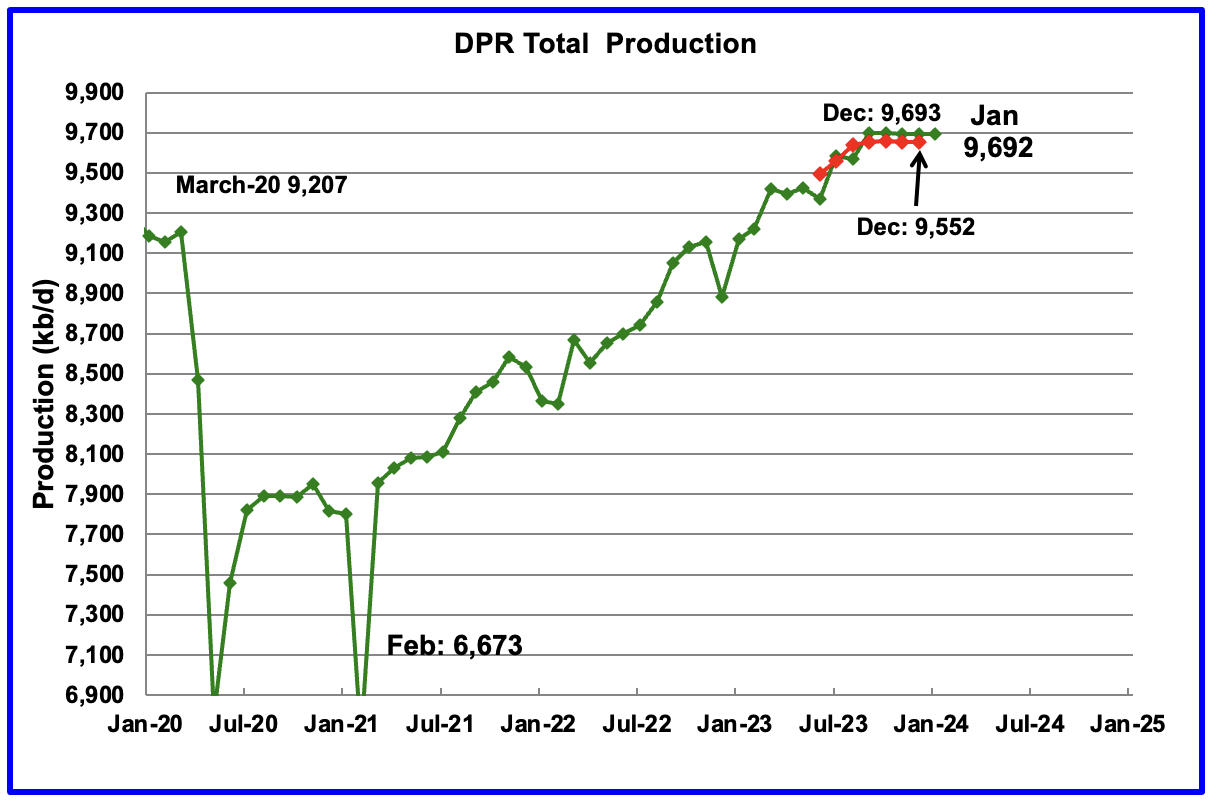

Above is the total oil production projected to January 2024 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional wells.

The DPR is projecting that oil output for January 2024 will decrease by 1 kb/d to 9,692 kb/d.

While the green graph shows DPR production being essentially flat since September, it also had an upward revision to its production since the last report, red graph. For December, DPR production has been revised up by 41 kb/d, from 9,552 kb/d to 9,693 kb/d with the biggest increase occurring in the Bakken basin.

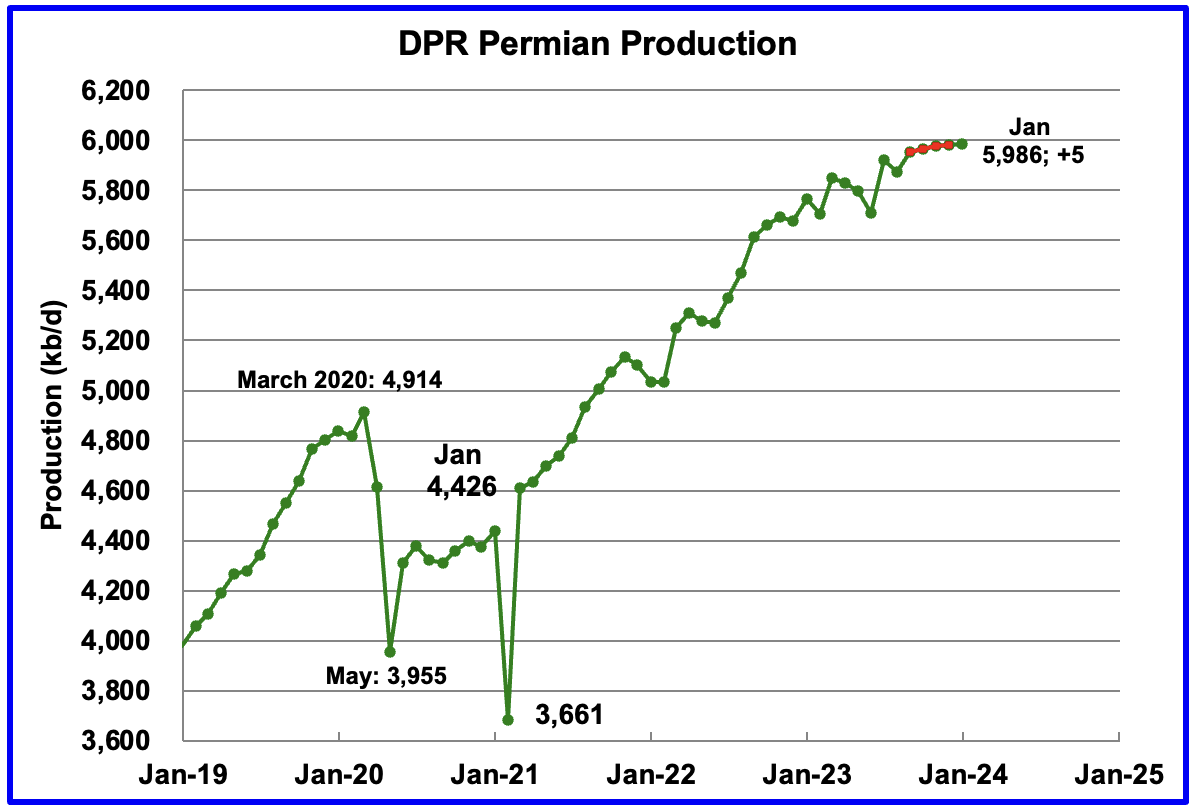

According to the EIA’s December DPR report, Permian output continued its slow rise in January. It is expected to increase by 5 kb/d to 5,986 kb/d. The last five months of production data clearly show a dropping trend in monthly production growth.

What is remarkable about the December projection is that the production from September to December is the same in both the November and December DPR reports, note the overlapped red and green markers.

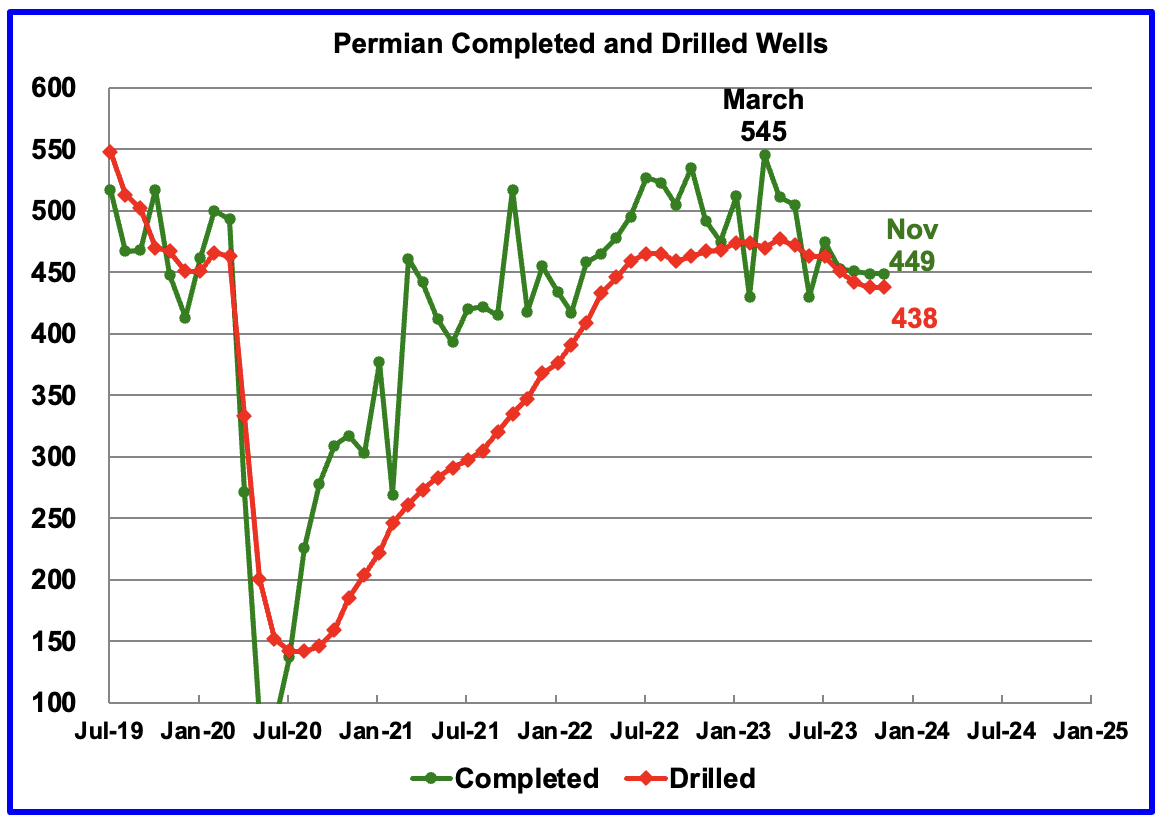

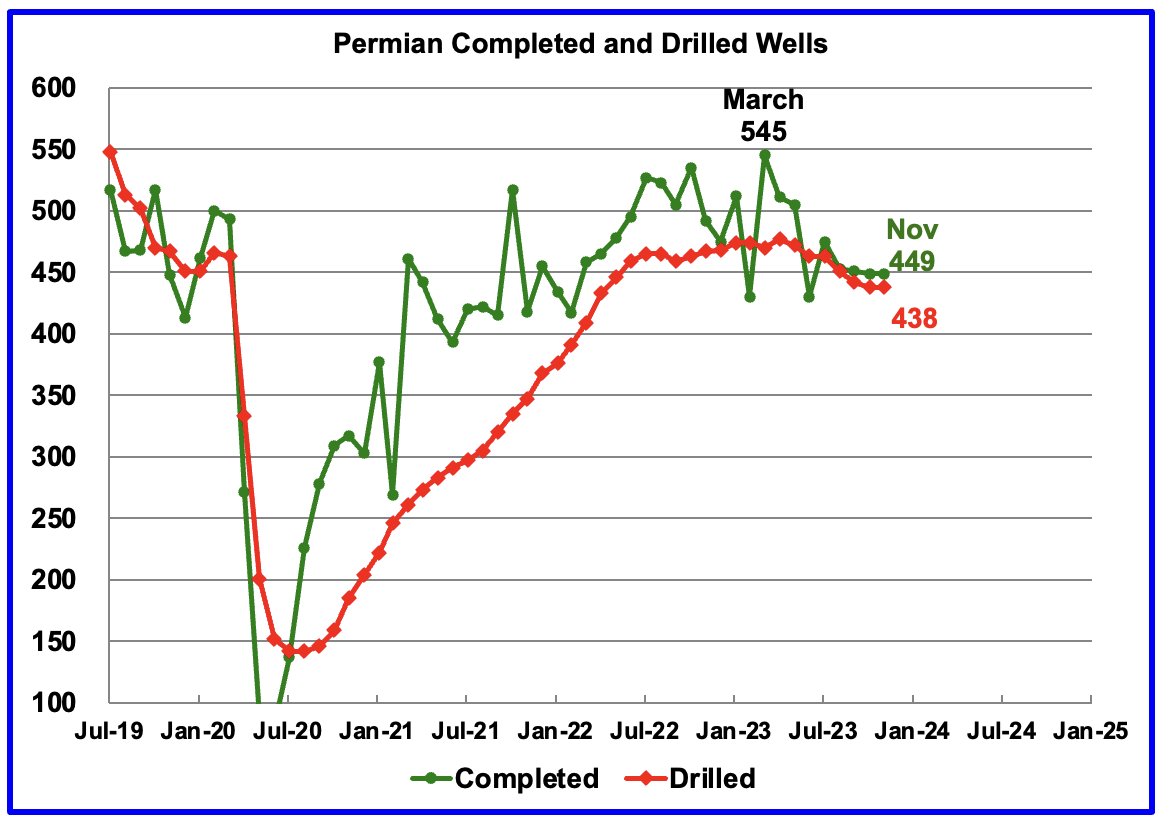

During November, 438 wells were drilled and 449 were completed in the Permian. (Note that November is the latest month for DUC information). The completed wells added 410 kb/d to November’s output for an average of 913 b/d/well. The overall decline was 400 kb/d which resulted in a net increase to Permian output in November of 10 kb/d. Of the 449 completed wells in October 438 were required to offset the decline. Those extra 11 completed wells producing at 913 b/d resulted in the 10 kb/d increase in November.

At this time information on the number of drilled and completed wells is not available to account for the 5 kb/d Permian production increase in January.

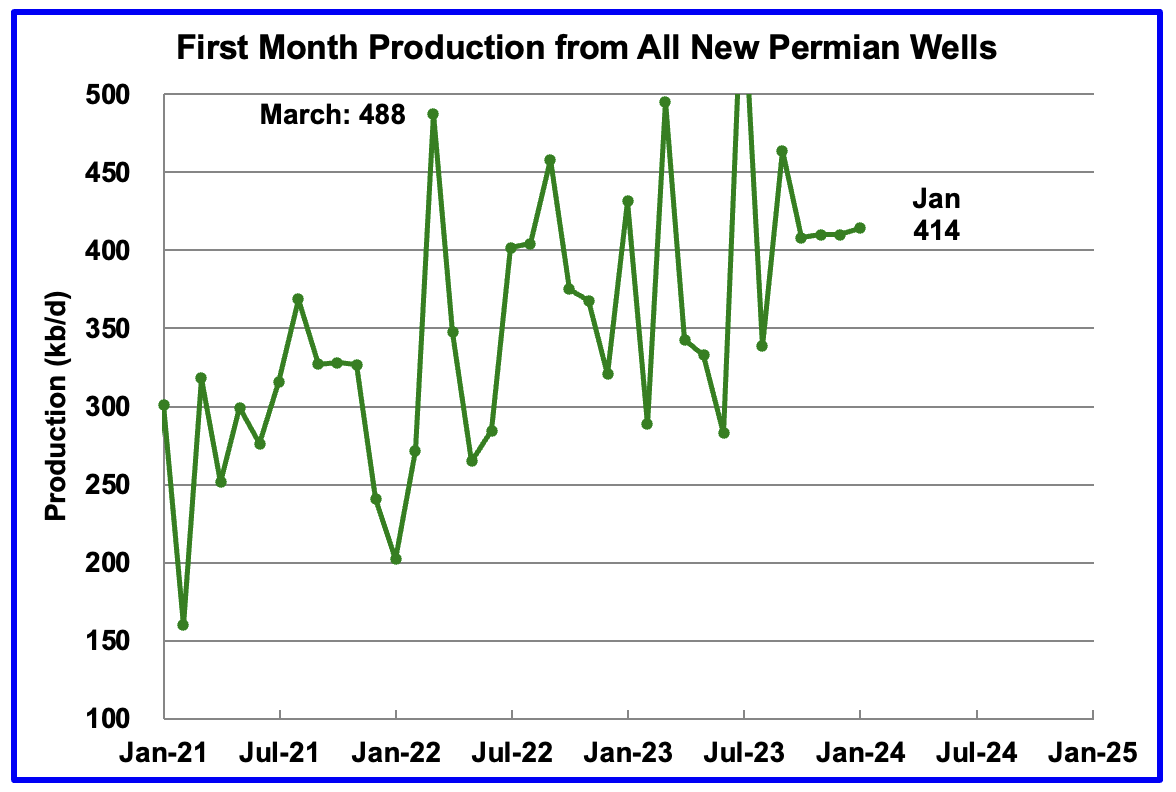

This chart shows the average first month total production from Permian wells tracked on a monthly basis. The total monthly production from the newest Permian wells in January is expected to be 414 kb/d and 4 kb/d higher than December.

Recall that this production of 414 kb/d is offset by a decline of 409 kb/d for a net overall output increase in the Permian basin of 5 kb/d, actually 4.65 kb/d, the smallest recent monthly increase. The monthly increase in November was 9.8 kb/d. This all hints at slowing production growth in the Permian.

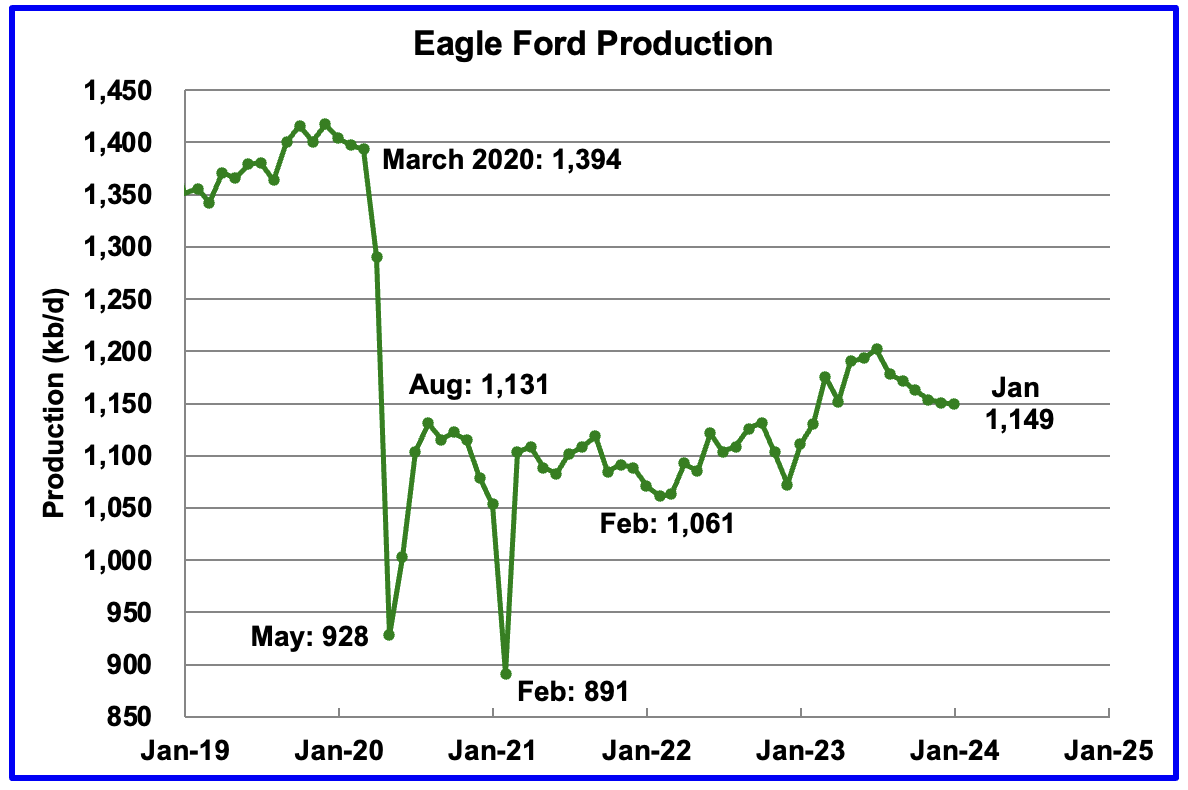

Output in the Eagle Ford basin has been in a downtrend since August. December’s forecast projects January output to decrease by 2 kb/d to 1,149 kb/d. The Eagle Ford’s output for November was not revised in the December report.

At the beginning of the year 2023, 68 rigs were operating in the Eagle Ford basin. The rig count began to drop in mid March to 60 and slowly dropped further to 47 in November. December has seen an increase of 3 to 50 rigs.

The DPR forecasts Bakken output in January will be 1,308 kb/d, 2 kb/d higher than December. September 2023 to January 2024 production is now projected to be 63 kb/d higher than the post pandemic peak of 1,245 kb/d in October 2020.

Note that the production from September to December has been revised up by 34 kb/d in the December report and accounts for most of the upward revision to DPR production.

The North Dakota government reported that October production dropped by 35 kb/d to 1,245 kb/d. The October drop was associated with a severe weather storm in North Dakota.

Note that in the Bakken chart above, September production shows a similar spike in production. The DPR is missing the October decline associated with inclement weather.

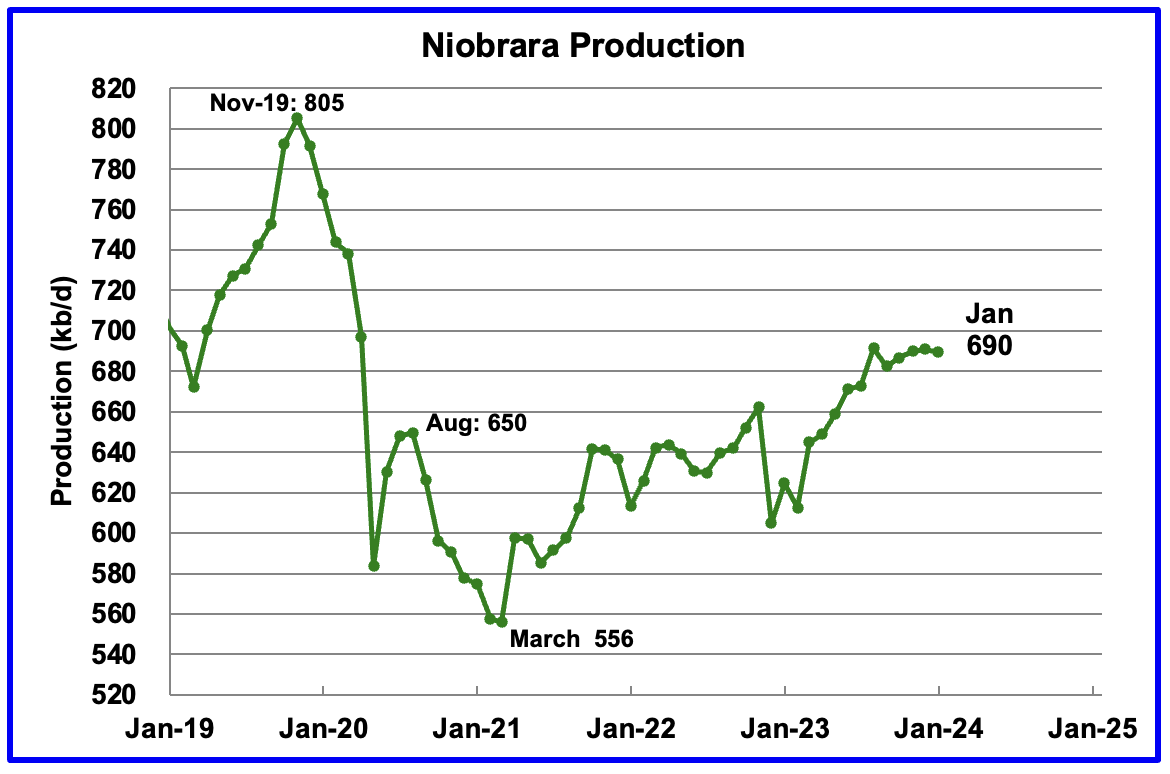

Output growth in the Niobrara continues to slow. January’s output decreased by 1 kb/d to 690 kb/d.

Production increased starting in January 2023 due to the addition of rigs into the basin but stabilized at 16 ± 1 rigs in March and April. However from August to December, the rig count has held steady at 14.

DUCs and Drilled Wells

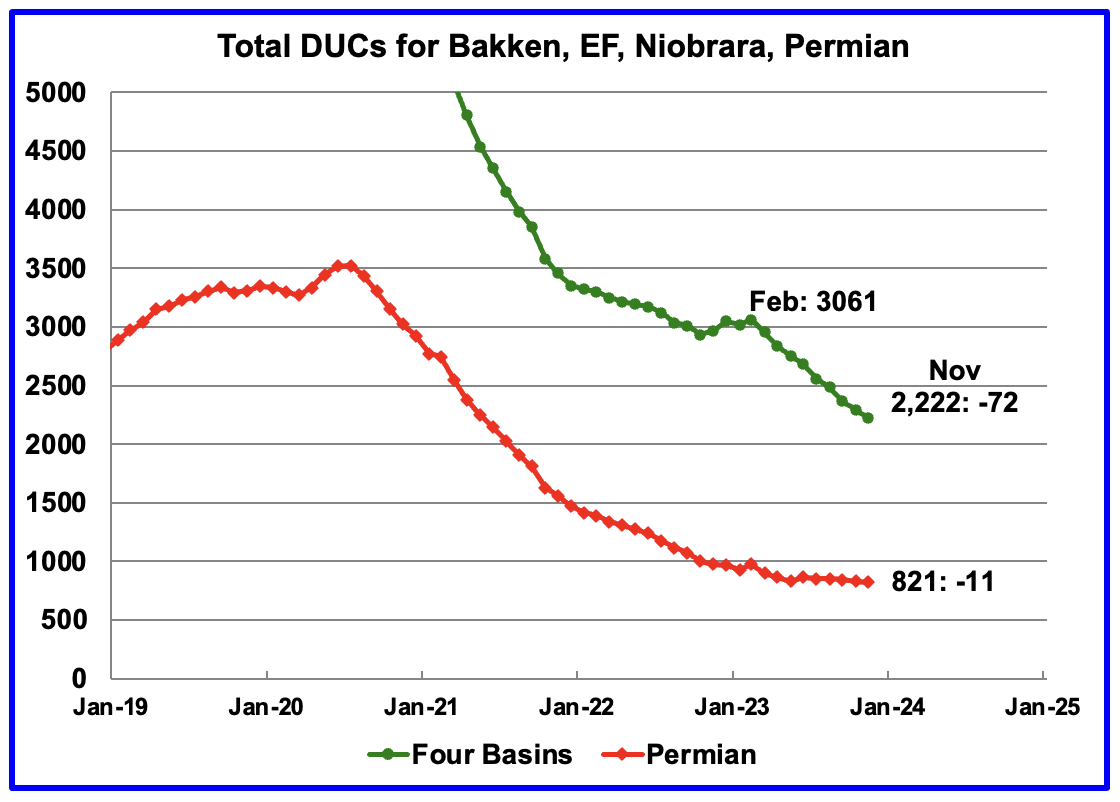

The number of DUCs available for completion in the Permian and the four major DPR oil basins has fallen every month since July 2020. November DUCs decreased by 72 to 2,222. The average DUC decline rate since March has been 93 DUCs/mth. Of the 72 DUCs decrease in November, 29 came from the Niobrara followed by 15 and 17 from the Bakken and Eagle Ford respectively.

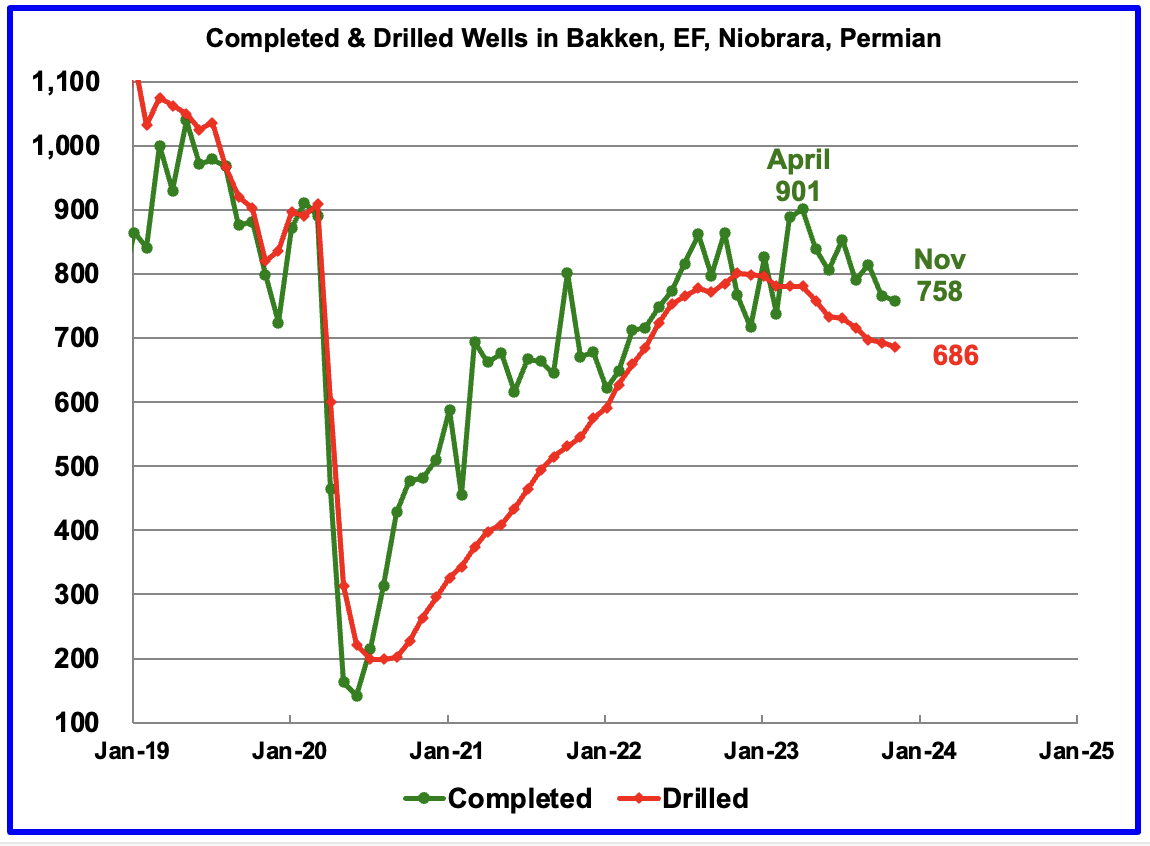

In these 4 basins, 758 wells were completed while 686 were drilled. Both drilled wells and completions are down from higher levels in early 2023.

In the Permian, the monthly completion and drilling rates have been slowing since the March 2023 high of 545.

In November 2023, 449 wells were completed while 438 new wells were drilled. The gap between completed and drilled wells in the Permian is now very small compared to late 2022 and early 2023. Regardless, it is those extra completions that increase Permian production.

The Permian, as of November, had 821 DUCs remaining and the completion rate was 449 wells/mth. This means the current cycle time between drilling and completions is 1.83 months or 56 days.

Great article! Thank you, Ovi.

It is interesting that production for August and Sep was revised upward, yet none of the other Supply & Disposition factors (Imports, Exports, Refinery Input, Stock Change, C5 transfer to crude) changed. This resulted in more negative Adjustment Factors, which were negative to start with. As of now August Adjustment is at a whooping -620kbpd! That’s a bit strange.

Some people tend to think that production numbers are overstated, resulting in a need for a negative adjustment. However, it is not very credible that EIA revisions will lean further into that “error”, raising past production and subtracting from the Adjustment.

I’d have to go with Exports as the weak link, as it is the only parameter not collected by EIA directly (they take the numbers from Customs). Most likely the Exports are either understated for the past three months or they are not as diluted with C5 as the EIA thinks.

Kdimitrov

I think another big error, possibly biggest, is in the counting of the EIA’s crude oil stocks. Somebody has to report the volume of crude in all of those tanks. While many of those tanks may have automatic readers, some are still measured using a dip stick. Think of the errors possible in reading and transcribing those numbers and sending them off to the EIA.

Attached is a stock balance table that shows how the numbers are juggled. Bottom line is that the adjustment is required to cover all of the errors in the first three rows. The table is a comparison for the weeks ending December 22 and December 29. The adjustment factor has shifted by 1,228 kb/d over one week or 8,596 barrels for one week.

The numbers on the left are from the EIA’s weekly balance sheet.

Ovi,

These types of fluctuations in the high-frequency weekly data are understandable.

First, I know for a fact that timing of exports/imports entries does not match the stock survey date, so you can have tankers that are not yet reflected in Import/Export numbers but the oil is already in or out of storage, that’s a big source of variability from week to week. Second, weekly production numbers are just estimates. Third, as you say, there may be errors in stocks reporting, especially around end of the year.

What you don’t expect is is to have directionally biased adjustment, all these errors should eventually get reversed and canceled out. Especially, you don’t expect a directional Adjustment bias in the low-frequency monthly data. That PSM data is supposed to be more accurate and proofed, that’s why it is so delayed.

EIA had for a few years a directional bias with a positive Adjustment factor, and they addressed it over the past year or so. However, the last 4 months we seem to have a very substantial negative Adjustment bias for some reason.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRUA_NUS_2&f=M

Kdimitrov,

It does seem to be a statistical mess.

It’s just raw data not suitable for publishing. The time scale is too short to give good results, with tankers transporting several million barrels and lot’s of estimates.

Monthly data is much better in this case.

Eulenspiegel,

The monthly data also has adjustments which seem to be biased over the long term.

If you click on the link that KDimitrov posted, it is monthly data from PSM, not weekly data that never gets revised.

This is an old post from June 2023, but it was one of their most popular posts in 2023, excellent analysis imho.

https://blog.gorozen.com/blog/the-permian-basin

Worth a re-read if you have seen it already.

Thanks for all the information sharing Ovi.

I still don’t understand why you make this statement in bold however-

“The main takeaway from The Rest chart is that current production is 673 kb/d below the high of October 2019 and this appears to be a permanent loss that will never be recovered.”

I concur that the rate of production will likely never be matched, however the overall eventual production (URR) is unrelated to the rate of extraction since other factors like demand and pricing and international trade policies figure into the long term equation of production. A lower rate of extraction may simply extend production longer into the future.

A minor point, I submit.

Great job Ovi,

What would your Martin county GOR chart look like if you used your projected crude output with projected natural gas output (using similar methodology as your crude projection), if you have the natural gas data to do this?

Might be interesting to see if there is any difference from your current chart, as your projection is likely to be more accurate than the reported RRC data for the past 12 months or so.

Dennis

Attached is the chart you requested using projected NG and C + C production to see whether there was a change in the GOR. For October, the GOR dropped by 3%.

Thanks Ovi,

Did you do a natural gas projection? If so it would be interesting to see how that changed vs the state data as reported. I assume the red line is the projected GOR.

Hickory

I agree. “A lower rate of extraction may simply extend production longer into the future.”

However, the question this blog is addressing is “Peak Oll” in the World and US. This question is related production rate. Essentially what I am saying is that there is little hope that the Rest will contribute to a significant increase in US production rate in the future. For the US, Peak US is all about the Permian.

I see, yes that make sense. Thank you.

Another example of illegal oil production that is not happening

https://gulfsands.com/media-hub/illegal-oil-production-in-north-east-syria/

Too often corrupt politicians are years ahead of honest but incompetent ones

Just like illegal fishing which accounts for up too 15% of fish caught, it takes real determination to find the facts and plan to stop it.

Charles,

Yes they estimate 20 kb/d and perhaps as much as 80 kb/d for all of Syria. I would note that OPEC reports about 32 kb/d of output from Syria in 2022 with between 21 and 32 kb/d of output for all years from 2014 to 2022. The Statistical Review of World Energy reports 93 kb/d in 2022. So this stolen oil may already be accounted for in the data.

Dennis

The tanker Hawk has recently unloaded oil in China, where did that oil come from?

Charles,

I do not track individual tankers? I understand there is oil on the water that tries to avoid detection to avoid sanctions or because the oil or products were stolen. The point is the oil can be accounted for at the well head and at the refinery gate, how it gets from point A to point B is not of great interest to me. Feel free to try to track every tanker and pipeline and truck and rail car that carries oil. Report back with what you find.

“often corrupt politicians are years ahead of honest but incompetent ones”

Here’s where all the cases against Trump stand as he campaigns for a return to the White House.

What you need to know, CHARLES –

Former President Trump faces 91 felony counts in four criminal cases in Washington, New York, Florida, and Georgia.

Trump was charged with violating Georgia’s anti-racketeering law by scheming to illegally overturn his 2020 election loss. He’s also accused of election interference in a federal indictment.

In June, Trump was charged with hoarding classified documents and refusing government demands to give them back.

In March, Trump was indicted in New York on state charges stemming from hush money payments made during the 2016 presidential campaign.

The four-count indictment includes charges of conspiracy to defraud the United States government and conspiracy to obstruct an official proceeding: the congressional certification of Joe Biden’s victory. It describes how Trump repeatedly told supporters and others that he had won the election, despite knowing that was false, and how he tried to persuade state officials, then-Vice President Mike Pence and finally Congress to overturn the legitimate results.

After a weekslong campaign of lies about the election results, prosecutors allege that Trump sought to exploit the violence at the Capitol by pointing to it as a reason to further delay the counting of votes that sealed his defeat.

https://whyy.org/articles/trump-indicted-third-time-where-cases-stand/

Chart of Big 3 C plus C output from March 2021 to October 2023. Big 3=Texas, New Mexico, and North Dakota, the 3 highest producing States in the US. The average annual rate of increase has been about 663 kb/d over the period covered on the chart, about 2.6 years.

These 3 states cover 3 large tight oil producing areas, the Permian Basin, Bakken/Three Forks, and Eagle Ford, so it is fairly representative of tight oil output in the US in terms of rate of change in output.

Looking a this chart, tight oil shows no sign of plateau through October 2023.

If we add in Colorado to get the Big 4 Tight Oil Plays (Permian, Bakken/TF, Eagle Ford, and Niobrara) we get the following from March 2021 to October 2023. Not much sign of plateau here either.

Dennis

The only points that matter on the chart are the last two. It is the same situation with the first chart in the post. The big difference is the first chart has projections out to December 2024 which show a continuation of the slow down in monthly production growth.

I think we will know better in two or three months whether the trend shown in the DPR chart has got it right. What we won’t know is whether the slowing production is due to geology or managed growth by the oil majors.

Ovi,

The DPR and STEO are often revised higher to reflect higher output as it occurs. This has been occurring for the DPR for the past 6 to 8 months and the STEO for years. So I will go eith the longer term trend for now until the actual data starts to change. Two months of data is not a trend in my book, just a blip. The data never follows a straight line on a month to month basis. There are many cases where the two month trend would give us decreasing tight oil output over the March 2021 to October 2023 period, but I think we would agree the general trend has been increasing tight oil output over the past 2.6 years.

I think you have been expecting Permian output and tight oil in general to plateau soon for about the past 6 to 8 months. Eventually I think this will be right, so far the data isn’t showing it, at least to my eye. Maybe in a few months this will change.

Using the Drilling Productivity Report Dec 2023 it looks as if production from Permian, Eagle Ford and Bakken is flattening out

It seems that folks need to periodically be reminded that US tight oil is NOT extracted and reported in real time. October production, just now be reported by the TRRC in Texas (the ONLY data that matters!), actually “occured” six months ago, about the time the Permian rig count began to decline (6.23). “Lag time” between spudding and first reported production includes delays in frac’ing, delays in flow back, delays in stabilizing the well for reporting to the TRRC and then 60 days between being issued allowables and published production by the TRRC.

Rig counts are now down, fewer completions are occuring from new wells, DUC’s (the REAL cause for 2023 production surpises) are now pretty much “deducted,” https://www.oilystuff.com/forumstuff, and well productivity in key, core counties of the Permian is now tanking. The gas monster has got ’em.

Relying on big government entities like the Energy Inaccuracy Agency for data is, forgive me, lazy. Those entities all have political agendas and are run by grossly inefficient…government employees that work 9-3, four days a week.

Its not hard to sort all this out working from the top down, it just takes work. Statistical trendology is worthless in analyzing oil and gas; past performance NEVER, ultimately, is an indication of future results. Depletion never rests. Ovi’s gettin’ it; listen up.

Lea County, New Mexico is done; stick a fork in it. As Lea County went, so goes the Permian Basin HZ tight oil play.

Art Berman is right…its the beginning of the end for the Permian, and for US tight oil production.

Mike,

You’re a humble guy. I think Art’s been reading your work and thus changed his mind on the Permian.

Anon, you are kind to say that. Thank you. It only matters to me the truth gets told and that Americans, and people importing Permian tight oil, start to wise up. With regard to predicting tight oil performance in the future, the now is far more important than the past.

Mike,

The EIA estimates from the 914 report have been pretty good. Trends can indeed change.

The DPR is showing slowing tight oil output as is the STEO.

For scenario above I assume the following completion rates and also assume well productivity falls at about 4% per year.

US tight oil scenario using Permian scenario (URR=31 Gb) presented earlier. US tight oil URR=59 Gb, with 25 Gb already produced as of Sept 2023. The centered 12 month peak for the scenario below is 8621 kb/d in February 2024, the monthly peak occurs in Sept 2023 at 8627 kb/d. The scenario assumes WTI oil prices remain between $70 and $75 per barrel (annual average prices in 2023 US$) from Jan 2024 to December 2030 and start to fall to lower levels after 2030. A correction is needed for the US less Permian basin scenarios as they should have reduced completions after 2030 to reflect lower oil prices. This correction would reduce the URR by perhaps 5 Gb or so.

Perhaps this is what abundance looks like to some.

Modification to US tight less Permian results in Scenario below, URR reduced to 58 Gb (less of a difference than I expected). Modifications to scenarios for other basins (which I have not done for about a year) pushes the peak forward to June 2024 from the previous scenario (where peak was Sept 2023) and the peak is about 100 kb/d higher than the previous scenario due to adjustments to the non-Permian scenarios to better match output data.

The 914 survey is data reported by the largest producers in Texas and New Mexico representing about 90% of total C plus C output. This is what we have from the survey data for March 2021 to October 2023 for Texas and New Mexico.

Data at link below (spreadsheet from EIA)

https://www.eia.gov/petroleum/production/xls/comp-stat-oil.xlsx

Permian DUCs for wells spud starting in 2019, after Dec 2022 the data may not be accurate because it takes some time for the state agencies in Texas and New Mexico to process all the forms and data.

The EIA and Novi labs have very different numbers for wells drilled (aka spud) from July 2020 to December 2022. The difference for total wells drilled over the July 2020 to December 2022 is 2071 wells (Novi records 2071 more wells spud than the EIA).

If we added the 2071 wells to the DUCs, assuming the spuds by Novi and completions by EIA are bothe correct we get about 2892 DUCs for the Permian basin instead of the 821 DUCs estimated by the EIA in the DPR.

Mike,

Where did that Novi DUC chart come from? I cant find it except at your blog.

Well, that is precisely why you need to ignore the stupid EIA, IEA, DPR, LTO, IPAA, NCAA and PETA when trying to understand US tight oil and be a releavant energy analyst. You have to do your own work and use deductive reasoning. Honest to God, you cannot predict oil and gas production without knowing something about it, first hand.

Sometimes collecting data costs money. If you don’t have that money to spend on what your analyzing, then you often don’t have all the data and your analysis is incomplete.

I assume you are thinking you might find where the chart is from, in a different context than what I presented it, and alter its meaning to fit your agenda. Sorry, that’s all there is, the chart. It doesn’t need any further explanation, since you are a NOVI believer.

Recently Helms said the same thing in an interview, also on OSB, about Bakken DUC’s; they are gone.

Struggle with it all you wish; its reality.

Mike,

Yes, this is a hobby and I will not spend my money on subscriptions for Oil and gas data, they are expensive. I do use RRC and OCD data as well as the free Novi data along with EIA data.

Mike,

Can you define a DUC for me? I may not be understanding the definition correctly. Seems a little hard to believe that the DUC count could be zero either in the Bakken or Permian Basin, which seems to be what you are saying.

As I understand it every well that is completed must first be drilled, so essentially every completed well must have been a DUC before it was completed. How could DUCs be “all gone”?

It would seem to imply that drilling and completion work had ceased altogether.

There would have to be some inventory of DUCs in order for there to be completed wells.

Mike,

On Bakken DUCs see the following Director’s Cut

https://www.dmr.nd.gov/dmr/sites/www/files/documents/Director's%20Cut/12.21.23%20Directors%20Cut.pdf

October has 353 wells waiting on completion (I assume these would be DUCs), in October 96 wells were completed (preliminary estimate), so about a 3.5 month supply of DUCs.

If the Permian had a similar inventory of DUCs, completions were about 450, so a 3.5 month supply would be about 1575 DUCs almost twice as much as the EIA DUC estimate, but less than half the Novilabs estimate of about 3500 DUCS. You mentioned DUCs at half the EIA estimate, around 425 DUCs, this would be about a one month supply, seems there would be problems if the DUC inventory were in fact that low, not clear the logistics would work.

Mike,

The chart on your blog shows wells spud in 2020, I imagine there were wells spud in 2021, 2022, and 2023, so we would want to include those, when we do we find (at Novilabs) that in Jan 2023 there were about 2177 DUCs in the Permian Basin that were spud in 2020 or later, after Jan 2023 the numbers are likely not very accurate due to late reporting to state agencies. If the completion rate was 475 wells per month (roughly the 2023 average monthly Permian Basin completion rate through October 2023), this would be about a 4.6 month inventory of DUCs.

Mr. Coyne, I am aware of what the Novi chart is designed for. 2020 was the probable peak of viable DUC’s in all US tight oil basins; the chart shows, clearly, that within 30 months all those DUC’s were gone. That is the point of the chart. Not my chart, Novi’s chart. It was used in the context in which I presented it.

What on earth this subsequent littany of comments from you are on DUC’s, I have no idea what they even mean. Its very confusing. I asume you want there to be more DUC’s than there actually are because your models will then be more accurate? Are you arguing with Novi, the EIA, me, or just for the sake of arguing?

I suggest you spend more time trying to sort out what the difference is between wells in progress, actual DUC’s… and dead DUC’s. Your definition of DUC’s is way wrong.

_______

I ask myself all the time why people wish to portray there to be more affordable oil in the US than there actually is. The answer is always the same: money and/or ego and the need for relevance on social media.

Its a dumb thing to be arguing about.

If I’m wrong about the future of the Permian and the ignorance of oil exports, and we slow exports and leave some of it in the ground, for our kids, then what the hell? Sue me. We’ve got more oil to ease people’s financial pain and get us through an economic transistion to renewables.

If you, Dennis, are wrong about abundance, then you have effectively dismissed the need for conservation, created more confusion among people who know no better and, because of oil exports, we will run out sooner and all of us be harmed.

Like Berman says, if you have more money than you need at a given money in time, do you just give the rest of it away?

I can sleep way better warning people of the former, anyway I can, particularly using 60 years of experience IN the business; NOT the latter.

I don’t know how people can sleep blathering, constantly, about oil abundance, actually.

Hi Mike,

Thanks. Just trying to learn. Thanks for the tip. Perhaps when you refer to a DUC you mean deferred completions.

Here is one explanation of what a DUC is, yours may be different. It also explains WIP, deferred completions (DUCs not part of WIP) and dead DUCs.

https://www.forbes.com/sites/drillinginfo/2016/06/27/american-ducs-drilled-uncompleted-wells/?sh=4c924304729c

I don’t think my scenarios suggest abundance, but everyone is different. I agree producing less would be a good idea, my scenarios present what is likely rather than what I would like to see. I presented a Permian scenario upthread, is that what abundance looks like to you?

If we use 475 completions per month for Permian basin and assume WIP wells are those DUCs from past 6 months, we might have around 2700 to 2850 DUCs that are a part of WIP. The deferred completions (DUCs older than 6 months) would be roughly 707 to 857 for the Permian basin (depends on whether 2700 or 2850 is the correct number for WIP), if we use only DUCs from 2022 and 2023 and assume all other ducs are “dead DUCs”, based on Novi data.

Mike,

On further thought, I think I see what you mean about abundance, recently I have guessed that demand for oil might fall faster than supply leading to falling oil prices. This certainly does imply abundance. That low demand hypothesis may indeed be incorrect, it was presented as a possible explanation for low oil prices, the fact is that average real oil prices in 2023 were about half (56%) of the level of 2011 to 2013, the EIA expects oil prices to remain at roughly the 2023 level in 2024 and 2025 (and they are usually not right).

I have been expecting an increase in oil prices since 2016 and have been consistently wrong, but hey if I say prices will remain low, they are bound to rise.

If I am wrong about slowing growth in demand for oil, we will know it because oil prices will rise. Low oil prices either imply supply is too high or demand is too low. You seem to think supply growth is near its end, I agree. Now we need to reconcile that assumption with low oil prices, by deduction it seems slower demand growth for oil would be the likely explanation.

I also agree banning crude oil exports is a good idea and reducing the number of LNG export facilities that are built in the future would be a good idea for similar reasons imo.

914 Survey of large oil producers in Texas, New Mexico, North Dakota, and Colorado (top 4 oil producing states in the US responsible for most tight oil production.)

Mike,

Don’t RRC employees also work for the government of Texas? Government employees just the same as those that work for the EIA.

Mike,

We are all aware it takes time from the start of drilling a well until production starts, what we do not know is the average “lag time” for a horizontal tight oil well from start of drilling to start of production, can you give us an estimate? I have seen different estimates from 4 to 6 months, is that roughly right?

Matt,

As I imagine you are aware, the DPR is a model and the last 5 to 6 months are not based on real data, but a model tied to rig counts, sometimes it is pretty close, often it is not very good. That is why the numbers are revised each month.

This is the stacked graph.

When trying to attach a JPG file I got following message:

Oops! That page can’t be found.

It looks like nothing was found at this location. Maybe try one of the links below or a search?

Matt

You have to reduce the file to less than 60k before it will upload

Now that the serious decline rates are in the pipeline, what should we do?

Rig Report for week ending January 5. The Frac report has not been updated.

– US Hz oil rigs increased by 1 to 457. There has been little change to the rig count over the past five weeks.

– Permian rigs were up 3 to 298. Texas Permian added 2 to 208 while NM was up 1 to 90. In New Mexico there was a big change. Lea county dropped 4 to 44 while Eddy added 5 to 46.

– Eagle Ford dropped 1 to 44.

– NG Hz rigs were down 1 to 107 (not shown)

Ovi,

The primary Vision Frac Spread Count is down 4 WoW and 14 YoY to 236

Lea and Eddy county Rig count

Lea county dropped 4 to 44 while Eddy added 5 to 46. Note how the rig counts have crossed.

Has some new bench been discovered in Eddy county?

Do Ovi and Dennis really know anything about the oil industry?

A friend knew someone who worked in security in Iraq. He said theft of oil, forged figures, forged export documents were the norm if you could pay the right official.

The EIA only know what they are told and the people who tell them are corrupt.

This is just a snippet of what is happening in countries like Iraq, Iran, Venezuela, Russia.

https://apnews.com/article/iraq-oil-basra-us-invasion-corruption-disparities-b155140f9e9f9a2c962c4513cb7b1730

I know it happens in Iran, the regime is corrupt to the core.

Charles,

The EIA gets its data from many different secondary sources, as does OPEC and the IEA.

Dennis

What are these data sources?

Charles,

They are listed under notes and sources at link below

https://www.eia.gov/international/data/world/petroleum-and-other-liquids/monthly-petroleum-and-other-liquids-production

Charles. You don’t need to spend any time here. Its voluntary.

It would be good if you keep contributing your constructive observations, but this isn’t some kind of pissing tournament.

In my view Charles has asked some of the most germane questions on this board. Like where in the world is the IEA getting its data? Well, for years they obtained almost all of it from Platts. But the chief oil analyst at Platts once admitted that he clipped out the oil shipping news from the back of Lloyd’s List and put it into the equation. Then–I don’t know when exactly but about the time the IEA tilted toward abrupt green energy transition–OPEC became irked with the IEA and quit them, along with Platts. They shifted to Argus, which ironically relies somewhat on Lloyd’s List as well. Charles, whoever and wherever he is, may be a bit churlish, but with all the data that is promulgated in the faith of science, it certainly pays to know exactly the purveyors of the information you’re relying on, and what their ulterior motive might be. Stick with it, Charles, you’re doing fine. Like most things, the devil is in the details, and those are damn hard to come by.

Agree. It seems to me that Ovi and Dennis are trying hard to work with facts as best they can find them. Its hard to find facts about black market factors.

Gerry Maddoux,

Perhaps the data reported is wrong, someone would need to point me to the correct data, I would be happy to use it, but don’t have 50k to drop to get it, so will work with the free data that is available.

You guys can find another website that has that data available, I doubt it will be free.

How much is the subscription to Lloyd’s list? There is Argus, Rystad, IHS, and probably others. Information is never perfect, I imagine taking the average of IEA, EIA, and OPEC estimates gets us close enough to the truth. But I don’t look for conspiracies behind every piece of information I find, I will leave that to Charles.

Whoa! I have zero malice in making my comments. I merely stated that Charles is right to question the origin of the data that is purchased by the IEA. We are living in fairly unusual times, whereby sanctions are upon fossil fuels from several countries: Iran, Russia, Venezuela. Yet, within the last year, the U.S. administration sent an emissary to Venezuela with the express purpose of possibly buying their oil; an “Iran Deal” has been back on the table, then off; and everyone in the oil world knows about transshipment of Russian oil. The IEA has turned decidedly anti-fossil fuel and pro-green, and its offices are in London (the Green Energy Capitol), as are many of the offices of those from whom it buys its data. I have absolutely no quarrel with anyone on this site, but it does seem a bit unusual that a fellow can’t question if there might be a little bias being introduced, or if there might be a couple of million unaccountable barrels of oil between the supply and demand numbers. But you know what, Dennis, I’ll take your kind invitation and exit. You’re dead right: this is your site and you can handle it however you wish. I think you’ve done a nice job, along with Mr. Patterson and Ovi. I’m obviously trying to drive a square peg into a round hole, and since I use my true name and sometimes use it for honorable purposes, I don’t wish to sully it. Thanks for the opportunity to put down my thoughts, which have sometimes been right, sometimes wrong, but always parsed with consideration and a quest for truth.

Gerry,

There may be some bias in reported numbers, but note that I look at data from OPEC, EIA, and IEA, there might indeed be some bias, but not all of it in the same direction,

the numbers match up fairly well in terms of data, sometimes the forecasts are different, for example OPEC forecasts oil demand that is much higher than either the EIA or IEA, but output numbers are fairly close for OPEC, IEA and EIA.

Now we might assume as three major agencies are both estimating (for 2022 and earlier) and forecasting for 2023 similar output levels, that these might be fairly close to the truth (though of course one can claim otherwise). Demand forecasts for 2023 are significantly higher for OPEC vs EIA and IEA. Let’s assume that OPEC is correct and demand for oil is about 2 Mb/d higher than oil output. Does this track well with the oil price environment in 2023? Would we expect relatively low oil prices if the OPEC demand forecast was correct?

Maybe you see something that I do not.

The other website with data that is correct would be interesting to all of us, the invitation was for someone to find it, though my guess is that it would require a subscription and the cost might be high.

I love your comments, but I cannot create data, I do not have the resources to track every barrel of oil produced or refined, I leave that to others with more resources.

Without data we are left with anecdotes, which is of little interest to me.

Charles,

Corrupt officials exist everywhere, do you believe this is revelatory?

Dennis

What i find incredulous is that you think all the corruption, falsified production data, illegal shipments, simple theft is all accounted for by the EIA.

Research has estimated 5% of oil production vanishes by all sorts of clever illegal activity.

EIA make no mention of data from Windward, so how do they know how much oil is illegally exported from Iran, Venezuels, Russia?

Who is monitoring Russia production? what companies actually go to Russian fields and check?

Charles,

OPEC follows Russian output very closely as the are part of the DOC, this also applies to Nigeria, Iran, Iraq, Libya, and Venezuela. The refinery throughput and C plus C output numbers are very close from 1980 to 2022, compare EIA output data and Statistical Review of World Energy refinery throughput data.

If there is actual good research that identifies 5% more oil is being produced than was previously thought, the data would be out there for all to see and the statistics would be adjusted.

Your 5% number is vapor, not a believable number.

Can you point me to the peer reviewed research that gives the 5% estimate? Is it 5% every year, has it changed over time. I am interested in actual data rather than mentions in the press which are sometimes not well researched.

Output at wellhead and input to refineries are the numbers that matter.

How much extra Russian output do you think there is? You don’t think Western sanctions have had any effect on Russian output due to many Western firms pulling out of Russia? I think OPEC has a handle on this. Check their crude oil output estimates for Russia and note that the EIA numbers will be a bit higher because condensate is included.

Charles,

What research points to 5% missing oil? Can you point me to it. I have not seen it. I might believe it if I saw it. Most of the evidence you have presented is anecdotal, I am looking for numbers of barrels of crude for specific years. If we assume World output is about 81000 kb/d, 5% would be roughly 4000 kb/d of extra output that is not accounted for. I have asked this question before, who is producing this 4000 kb/d of unaccounted for oil output. Probably not a member of OPEC, because OPEC would be well aware of what its members are producing, I have suggested Russia in the past and you said obviously you didn’t mean Russia.

So where is this 4000 kb/d of extra oil being produced? If you are going to make the claim, tells us where we should look.

OPEC is part of it – just a few comments above there are reports of deep corruption in Iraq and Iran.

If you want to sell black oil from an oilfield, you won’t count it in your official report so the government has it easy to crackdown on you.

These countries are very corrupt – I only have reports from first had (a collogue on a company I worked) who told me about coal corruption in Uzbekistan. A relative from him made “deals” with coal there, he was very proud on him.

All I can tell you this coal was never counted anywhere – as was the money that flowed – and this one “deal” wasn’t that big but it was usual practice.

Eulenspiegel,

OPEC uses secondary sources to estimate output, the OPEC nations watch each other very carefully, particularly when there are quotas in place. Do you believe there has been a sudden change in the level of corruption? I imagine there has always been corruption and that everyone knows about it, including the companies that make the data estimates for the secondary sources.

Data is never perfect.

Denniss

This chart is in response to your question at:

https://peakoilbarrel.com/us-october-oil-production-held-steady/#comment-768227

The projections for both oil and NG show potential increases of 16% and 13% respectively as the data is updated over the following months.

Thanks Ovi.

Launching the New 2024 WTI Oil Price Challenge

Time to have some fun with real data we can see and will be accountable for next year. Let the Guesses begin.

You will need to make 2 Guesses

1) Closing price for WTI on December 31, 2024

2) Average price for WTI for 2024 as calculated from the EIA’s link:

https://www.eia.gov/dnav/pet/pet_pri_fut_s1_d.htm. This is item 13 on the weekly PSM.

To keep this fair here are my non-exclusive guesses.

1) $100/b

2) $85/b

1) $45

2) $65

I just want be clear and attach why. The banks are in trouble. Not just in the US. I think we will see all time lows in interest rates in China. Perhaps interest rates go to zero in China. As you can see I think oil prices will be higher the first half of the year.

Interest rates have to go lower or insolvency issues creep up due to underwater collateral.

There is a lot of oil consumption that revolves around Chinese real estate. If real estate prices continue lower in China it’s a problem for the banks and oil prices.

There will be no preemptive rate cuts to fix the collateral issues at the banks. Only when things are burning down will we see the rate cuts come.

OK I’ll go for it:

Closing = $100

Average = $100

Hopefully I’ll do better than last year!

My WAG is oil on 31/12/24 at around $120 and yearly average to be $95, based on tight oil production falling and Saudi unable to increase by the full 1Mbbls/d they cut.

Ovi,

I think closing price for WTI will be: $73

average price of WTI 2024: $95

My guess is a closing 12/31/2024 price for WTI of $115.00. An average for the year of $96.00.

Average 2024 closing price and Dec 31, 2024 closing price both at $75/b for WTI.

If you don’t mind me joining in this year:

-Average WTI 2024: $84.75

-EOY WTI 2024: $86.00

Gungagalonga

Everyone is welcome. Good luck in winning the grand prize.

We haven’t heard from:

Weekendpeak

KenGeo

Stephen Hren

Westexasfanclub

Hickory

Paul Pukite

Mike Shellman

LTO Survivor

Charles

Steve

Gerry

Plus +++++

$68 average

$65 closing

If I guess enough times eventually I’ll be right!

Or just dead lol

$79 Average

$89 Closing

bonus- Peak Global Combustion Day July 31, 2033

92$ closing

85$ average

Polished my crystal ball recently ;).

$73 average.

$76 closing.

Any attempt to forecast oil price is meaningless because in a situation of stagnation of production and of stagnation of economy, the oil price would vary for nothing.

Probably true but predicting has some entertainment value ( at least for me)….

rgds

WP

Jean

This is just an annual fun game.

Jean Francois,

I disagree, a stagnating economy might result in lower oil prices, if demand falls below supply at the prevailing price due to less economic activity. The average real Brent Oil Price in 2023 US$/b from Jan 2011 to Dec 2013 was $147/bo. I doubt we will ever see real Brent Oil Price that high in the future for a monthly average price. Chart below presents monthly average real Brent Oil Prices Jan 2010 to December 2023. From Jan 2015 to Dec 2023 the average real Brent monthly oil price in 2023$ was about $74.32/bo, roughly half the average level from Jan 2011 to Dec 2013.

78 Average

92 closing

rgds

WP

if i can join too 🙂

closing price : 113 $

average price : 97 $

https://aspofrance.files.wordpress.com/2023/12/ngforecastsevolution.pdf

J. LaHerrere forecasts pg 15,16

“Shale gas (or tight gas) production is important in the US since 2005 but will peak in 2024…

US shale gas HL ultimate is about 630 Tcf with a peak in 2024 or 2025 as Marcellus is

peaking and Permian and Haynesville in 2025.”

This will be at odds with many other peoples sense of the trajectory of US shale gas production.

My projection for continuous gas in US. URR=1480 TCF. This uses USGS mean TRR estimates and may be too optimistic.

A slightly more conservative scenario with URR=1200 TCF.

Why do these projections show such a rapid falloff of nat gas production from US shale?

I had assumed a long fat tail, understanding that this is a different beast than shale oil.

Hickory,

This is the nature of Hubbert models, I have not tried to use a similar methodology as I use for tight oil for shale gas. I have simply taken the TRR estimates by the USGS, then downsized the mean estimates by about 80% and then applied a Hubbert Curve, for the assumed URR, the peak would need to be lower in order to have a fatter tail as the URR is just the area under the curve. Laherrere’s analysis also may use a Hubbert curve, but the URR is only 630 TCF, about half of my “conservative” estimate, Laherrere’s peak is about 85 BCF/d (current US output is about 80 BCF/d).

Argus expects slower tight oil growth in 2024.

https://www.argusmedia.com/en//news/2525371-us-shale-oil-growth-faces-slowdown?backToResults=true

Frac Report

I checked the Farc site and there is no update for January 5. The last update was December 29. I wonder if they have decided to stop publishing their frac data.

Ovi,

Try this

https://www.aogr.com/web-exclusives/us-frac-spread-count/2020

or you might be referring to fracfocus

https://fracfocus.org/data-download

Dennis

Your first reference is for 2020 data.

I have used the second one in the past but it is usually 6 weeks delayed. The latest start frac day in the current report is Jan 2.

Ovi,

The different years are listed near the top of the page, just click on year.

https://www.aogr.com/web-exclusives/us-frac-spread-count/2024

It is for week ending Jan 5, down 4 to 246 and down 14 from one year ago.

The frac focus data seems months delayed for full counts.

Ovi,

Here:

https://www.aogr.com/web-exclusives/us-frac-spread-count/2024

Dennis/Kdimitrov

Thanks. The data wasn’t there when I last checked around 2:00 PM.

Tried at 4:00 and there it was,

Chart is posted below.

Frac Spread for Week ending January 5

The Frac site finally updated the count sometime this afternoon.

The count was down by 4 to 236, 2 more than the previous low of 234 on December 29, 2021.

Can someone involved with Fracs provide information on the typical time lag between the completion of the Frac and first day of oil flow/production.

My experience is that it’s usually a pretty quick transition from the final frac stage to breaking the seals/disc and flowing back. Maybe 1-3 days on average?

If I remember correctly, early on in the Eagle Ford… I think there was a very brief industry discussion to pause after completing a frac job. This was referred to as a Shake and Bake job. Meaning complete fracing the well, then pause for some determined time frame…. then flow back. I don’t think this went well or long in the science department…. and the norm seems now to be going immediately to flowback after fracing.

Gungagalanga,

How big a DUC inventory do you think exists in the Permian? I would think they would need at least a 3 month supply for the logistics, at roughly 475 completions per month (last 12 months average), this would equate to about 1425 DUCs, a 4 month inventory would be about 1800 DUCs. Does that sound in the ballpark from what you know?

Also how long does flowback last? I think by first flow, Ovi means the start of producing oil at normal WOR, so after flowback (which I would think is mostly water and proppant).

Ovi,

I found this on flowback.

https://kimray.com/training/flowback-quick-guide

Flowback typically lasts between 30 and 120 days. The fluid produced during this phase is a mixture of crude oil, natural gas, water, and sand.

Dennis

Great find. Clears up a lot. In the post above at the end it states: “The Permian, as of November, had 821 DUCs remaining and the completion rate was 449 wells/mth. This means the current cycle time between drilling and completions is 1.83 months or 56 days.”

Assuming that a completed well is added to the DUCs as soon as the well is completed, the cycle time I mention, 56 days, must be close to the average Flow Back time plus some time the well is sitting idle, waiting to start the Flow back.

A few days back I thought I saw a post by Mike Shellman that said that Novilabs was showing there were about 300 DUCs in the Permian and that he didn’t believe there were closer to 800 DUCs as reported by the DPR. That didn’t make sense to me since that meant a cycle time of closer to 20 days, which seemed short. I can’t seem to find the original post but there appears to be a number of answers at the link below. Maybe I got it wrong and he was discussing the Bakken. Not sure how to get to the original article on Mikes Forum Stuff. The original article included a chart.

https://www.oilystuff.com/forumstuff/forum-stuff/pretty-close-to-50-of-the-bakken-oil-production-increase-is-driven-by-completion-of-duc-wells

Ovi,

I think the EIA DUC count may not be correct, typically they would have about 6 months of DUCs that are work in process (WIP) inventory and then some amount of DUCs where completion has been deferred either due to low oil prices or some other reason (possibly running out of budget at year end) or stuff I don’t know about. As of July 2023 the deferred completion DUCs were on the order of 700 to 850 in the Permian based on an average completion rate of 450 to 475 and Novi data. This implies that the completion/flowback process takes roughly 6 months.

When Mike refers to DUCs he may be ignoring the WIP DUCs and only considering the deferred completions that were spud less than 2 years ago as being viable DUCs, it is a little unclear. He does not trust any of the EIA data it seems. I try not to ask too many questions because he gets upset and believes I am challenging his expertise rather than trying to learn.

He might answer questions from you though.

Dennis

What makes you think that the Permian or any other basin would have an inventory of 6 months. When completing 450 wells per month, that translates into a back log of 2700 DUCs.

I think the DPR count of 821 is reasonably correct. They have to go out to some of the bigger companies to request info on DUCs. Looking at the numbers supplied by the DPR, it looks like the DUC backlog is closer to 2 months

Ovi,

Look at every other basin and inventory, a drilling info article I linked in a comment respobding to Mr Shellman suggest wells in process consist of the wells drilled for the past 6 months, perhaps that information is wrong, but my guess is that the Permian DUC count by the EIA is wrong. Novi labs has a duc count of about 3500 wells, wells completed for the past year have averaged roughly 475 wells per month, 6 times 475 is about 2850 wells which seems much more in line with the Novi estimate for DUCs. The average for all tight oil and gas regions is about 4.7 months, and for all regions except the Permian the average is 7.4 months.

I think the DPR may be wrong, I trust the data from Novilabs more than the EIA estimates.

Question for the Nate H, Art Berman & Simon M enthusiasts:

IF the world replaced 100% cars with EVs tomorrow, but still needed diesel and jet fuel etc in current volumes to supply shipping, aviation, trains, trucking goods, heavy equipment, mining, plastics etc; how much gasoline would be created as a byproduct of the needed refining processes and in need of disposal?

Asking for a friend

Survivalist

I can’t give you an answer but can provide the following info as a clue.

For calculating refinery margins there was a calculation known as the 3-2-1 crack spread. This is based on old refinery technology that said a good rule of thumb to estimate the refinery margin was to assume that 3 barrels of crude produced 2 barrels of gasoline and 1 barrel of diesel.

So depending on the state of technology of the refinery, modern or old, and the quality of the oil, light/heavy, that ratio will vary across refineries. Could a modern refinery get to 2-1-1 crack spread?

I know that the syncrude sweet blend coming from Canada’s oil sands and shipped to the gulf coast is biased toward making diesel.

A refinery was specially built in Alberta to maximize the production of diesel from the oil sands. It produces 70 kb/d of product, of which 40 kb/d is diesel.

https://nwrsturgeonrefinery.com/project/maximizing-the-value/

Cheers Ovi. Thanks very much.

Peak Oil or Peak demand

Back when The Oil Drum was running, the issue of peak oil was very serious. A decline in global oil production of 0.5% per year or more would have very serious implications for the entire world. There would not be enough oil to provide for all our cars, trucks taking food and goods around the world and not enough fuel for all the ships and aircraft. Peak Oil would see large price rises and inflation and loss of jobs in sectors which are not vital, such as the holiday industry.

Dennis and many others now believe that we no longer face the problem of oil scarcity because demand will fall earlier and faster than supply. If this is the case, then peak oil is really of little interest. Why bother talking about a problem which is actually not a problem any more?

A decline in global oil production of 0.5% per year or more would have very serious implications for the entire world.

Naw, I think the estimate back then was much higher. I believe it was around 2% per year. If you do the math, I think you will find that the decline since November 2018 has been higher than 0.5% per year. And the demand decline has been greater than 0.5% per year. Covid could be responsible for that.

You are correct, peak oil will not be a problem if demand continues to fall as fast as supply. I have serious doubts that that will happen. The old giant and supergiant fields are all nearing the end of their lifetimes and new newer smaller fields have a much higher decline rate. Discoveries are not even keeping close to annual consumption. Consumption is 80 million barrels per day and consumption is around 5 million barrels per day. Not no, but hell no, demand will not fall that fast. Production will hit a Seneca Cliff soon, but demand will not.

Ron

Decline from 2018 has been reversing over the last 3 years, crude including NGPL which all go into the petrochemical industry has broken all records.

https://www.iea.org/reports/oil-market-report-december-2023

Massive increase in c and c in non opec has caused OPEC plus to cut production 2 or 3 times.

At the moment there is so much oil that prices are far lower than 2011to 2015.

Now OPEC has spare capacity which can feed back in at any time.

I remember on the Oildrum every time OPEC would cut production some know nothing would say OPEC had peaked.

C and c will exceed 2018 this year or 2025.

C and c will exceed 2018 this year or 2025.

Not a snowball’s Chance in hell that will happen.

Nov… 2018 84,589,000 barrels per day

Aug… 2023 80,700,000 barrels per day

Difference. -3,880,000 barrels per day

Ron

You can’t take one month. Accepted peak is as Matt Simmonds said it is sustainable production for at least a year, followed by irreversible decline.

Provide a 12 month moving average. Not only is the gap very close, the gap is closing down.

So we are not seeing an irreversible decline at the moment.

If demand increases as you think and supply cannot grow then we will start to see strong price increase at least to levels sen in 2014

This year will reveal much

it’s really a good resume of the problem of peak oil. It would have been really interesting to have data about oil production per size of fields. I remember the paper made by the UKERC 10 or 20 years ago in which you have a chart who show an exemple of what happen when old and giant oil fields decline and are no longer compensate by newer and smaller fields. Which is exactly what have happened in the UK and Norway (and in many mores countries). If you look at the world crude oil production (strictly crude so without NGL, condensates, refinery gains, biofuels…), you will clearly see that if you exclude Brazil, Iraq and North America unconventional oil the peak has happened almost 20 years ago, with a decline rate of 670 kb/d since.

French fries

The end of cheap oil happened as Colin Campbell said it would. The glut ended with Norway, Uk, Mexico going into decline followed by many other.

So far however there has always been a new source that has just managed to add additional production to world production. Brazil, Canada oil sands, tight oil.

I think we are coming to the end of discoveries that can add a little more oil, Namibia and Guyana being the latest.

The weight of old declining fields will tip the balance towards permanent decline probably once OPEC spare is used up.

I still think peak will be 2028 plus or minus a year either way. Decline rates will exceed demand decline forcing prices to balance the difference.

Charles, no one knows if a successful transition will occur and even if it does it will likely only be a partial one. Other limits to growth will likely kick in at some point. Civilization hangs in the balance, so there will be plenty of drama there regardless.

Charles,

My peak demand hypothesis is only a hypothesis, it will be interesting to see how it plays out. My guess is that there will be serious challenges as fossil fuel energy output reaches a peak. Maybe we can transition to other forms of energy along with using energy more efficiently and perhaps not, it remains an interesting problem to me and there are no simple solutions in my view and many believe there are none at all.

Dennis

Your comments and graph just a couple of weeks ago suggested you were reasonably sure demand will fall from this year, even predicting oil prices being under $100 from here on.

https://peakoilbarrel.com/eia-short-term-energy-outlook-and-tight-oil-update-december-2023/

You can’t keep changin your mind every few weeks, are you thinking of going into politics?

https://www.energypolicy.columbia.edu/publications/oil-intensity-curiously-steady-decline-oil-gdp/

The link above is quite clear every increase in GDP requires an increase in oil consumption.

The world becoming more efficient by 0.01barrel per $1,000 GDP. Currently it takes 0.39 barrels per $1,000 increase in GDP

The data which you have misunderstood states that this year it will require 1.068mb/d to generate a trillion dollars of GDP and next year it will require 1.041mb/d.

When global GDP hits $1 trillion more than it is now, I expect global oil consumption to be around 1 million barrels per day higher.

Global electric cars sales would need to hit 40 million per year to see demand flat and 60 million for demand to fall. As I said there will be millions more trucks globally and each truck uses the same amount of fuel as 30 cars.

Charles,

I presented a scenario based on a set of assumptions. If the assumptions are correct, then demand will fall and prices are likely to fall.

I am far from sure that the assumptions are correct. The future will always be unknown and every scenario created projecting what will happen in the future is certain (probabiity=100%) to be wrong.

I have probably stated as much thousands of times, but perhaps you missed it.

From your second link:

The time trend also reflects a gradual regime change from a supply- to a demand-constrained global oil market. In percentage terms, oil intensity first declines at rates lower than global GDP growth, allowing global oil demand to rise. Over time, given its linear functional form, the rate of intensity decline will accelerate to outpace the rate of global GDP growth, in which case global oil demand would peak and start to decline.

This is where I got my hypothesis.

Also note that there are two different metrics for World real GDP, one based on market exchange rates which does not take account of cost of living differences between nations (this metric was used in the paper you cited) and the other which uses purchasing power parity (PPP) exchange rates which does take account of cost of living differences between nations. The second measure is preferred by many international economists. I use the real World GDP based on the PPP measure to assess oil intensity and also use refinery throughput as a measure of crude plus condensate demand.

In 2022 about 0.2147 barrels of crude plus condensate were consumed for every $1000 of real GDP in 2017 international $ produced ($139.3 trillion in 2022 for 29.9 Gb of C plus C input to refineries). I assume the linear decrease in oil intensity from 2005 to 2022 continues in the future and that real GDP grows at about 2.5% per year, both of these assumptions are likely to be incorrect, this is a hypothesis. The demand scenario is based on this hypothesis and the supply scenario is my recent oil shock model. The demand is less than supply from 2024 to 2033 for this scenario and is the reason that I expect oil prices may be low, if the scenario is correct (probability=zero).

Dennis

I really don’t know how you think India will remain at 1.5 barrels per person when US consumption is at 20 barrels per person.

https://www.reuters.com/business/autos-transportation/sales-indian-suvs-soar-smaller-cars-skid-december-2024-01-01/

They are just getting started. If you knew the figures you would think twice about demand peaking this year. If Indian per capita consumption increases to a lowly 3 barrels per person, India’s consumption will hit 11mb/d.

We will know soon enough

Charles,

Yes we will see, I don’t expect that Indian consumption won’t increase, I expect relatively flat World demand for C plus C for a few years followed by decline, but only if oil intensity follows the linear trend of the past 15 years or so. Quite possible that it will not, as I often say there are an infinite number of possible future scenarios, choosing the correct scenario has odds of approximately zero. This is true for me and everyone else except the omniscient.

Charles,

In some nations such as China they are expanding the number of heavy duty trucks and buses that use natural gas. Also the efficiency of the World light duty fleet is increasing and there are a lot of two and three wheel ICEVs that have been replaced with EVs, these trends will continue reducing the demand for oil.

Charles, because supply could certainly fall faster than demand either before or after peak. And since oil is a key input the the economic engine it bears great concern.

Throw in the patchy distribution of production and you have the perpetual specter of geopolitical instability exacerbating regional supply shortage. The success and failure of nations can hinge on these issues.

Hickory

I agree. The poorest and most corrupt will fall first as some already have

Finding yourself in the ‘wrong’ trading bloc may prove disastrous. Echos of WWII, potentially.

Hickory

We now know what Russia is prepared to do to gain resources.

https://www.rferl.org/a/ukraine-destroyed-cities-russia-war/32454453.html

The Chinese goverment is even more brutal in scale

https://www.hudson.org/human-rights/the-ccp-wages-a-second-genocide-against-falun-gong

China, Iran and Russia are now very closely knit in terms of trade and ambition

Survivalist,