STEO

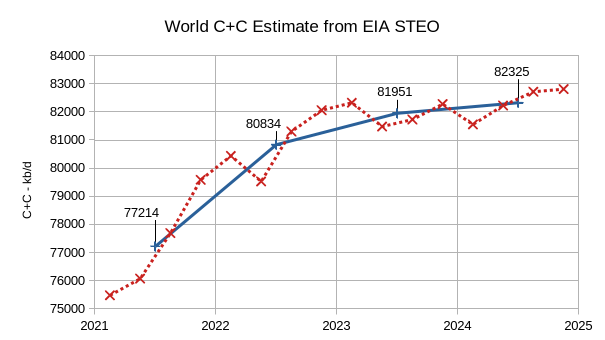

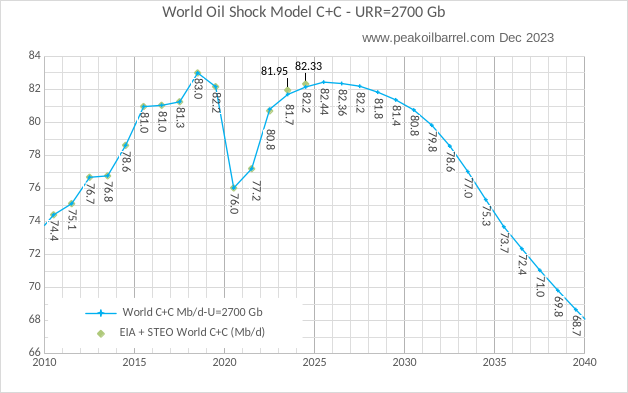

The EIA’s Short Term Energy Outlook (STEO) was published in early December. The chart below estimates World C+C by using the STEO forecast combined with past data from the EIA on World Output.

The EIA’s Short Term Energy Outlook (STEO) was revised higher for 2023 compared to last month and lower for 2024. World C+C output is expected to increase in the 4th quarter of 2023 and then decrease 2024Q1 followed by increases in quarterly output. Annual average World C+C output increases by about 1117 kb/d in 2023 to 81951 kb/d and then to 82325 kb/d in 2024, about 675 kb/d below the centered 12 month average peak in 2018. This month’s World C+C estimates are about 147 kb/d higher than November’s estimate for 2023 and 230 kb/d lower for 2024 due to the revisions in the STEO forecast since last month.

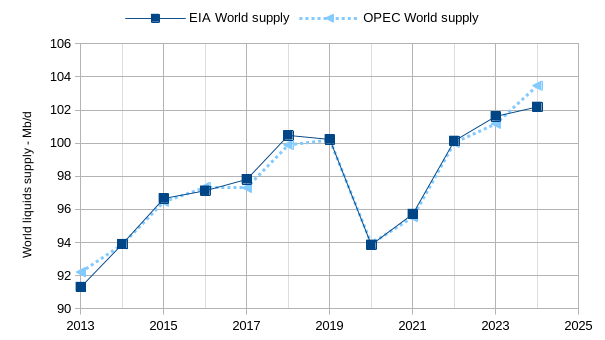

The chart above compares the EIA estimates and 2023 and 2024 forecasts of World liquids supply with the estimates and forecasts by OPEC, for most years the estimates are similar and the biggest difference is in the 2024 forecast where the OPEC forecast is 1.3 Mb/d higher than the EIA forecast.

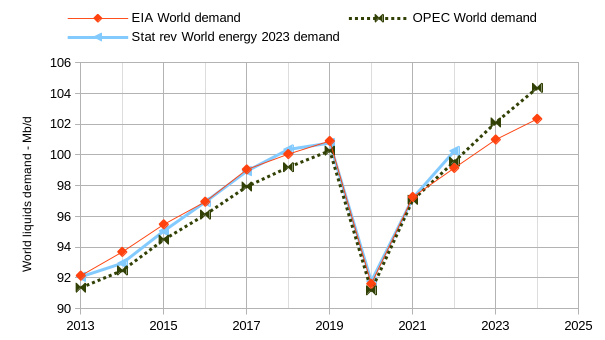

Above we compare estimates for World liquids demand from 2013 to 2022 from the Statistical Review of World Energy (SRWE) 2023, EIA and OPEC, also compared are the EIA and OPEC forecasts for 2023 and 2024 annual average World liquids demand. In this case there is a significant difference in estimates from 2013 to 2019 and in 2022. The forecasts for World liquids demand in 2023 and 2024 are also very different between OPEC’s MOMR and the EIA’s STEO, in 2023 OPEC’s forecast is 1.1 Mb/d higher than the EIA forecast and in 2024 OPEC’s forecast is 2.02 Mb/d higher.

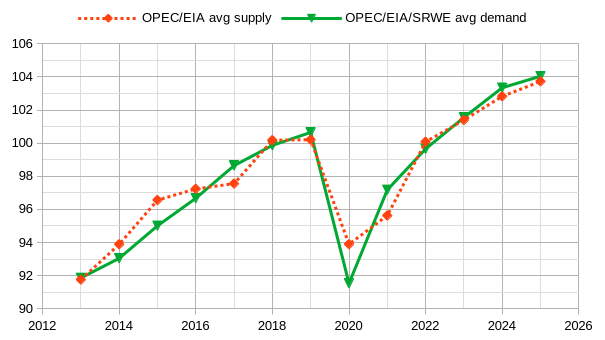

The chart above averages the estimates and forecasts presented in the supply and demand charts above, the estimate for 2025 is my guess based on recent forecasts by OPEC and the EIA in 2023 and 2024.

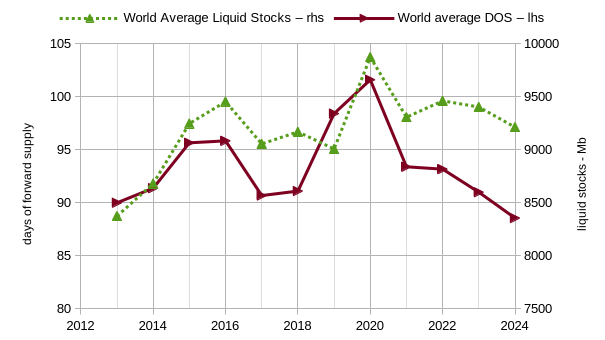

The chart above uses the average supply and demand estimates and forecasts to find World liquids stock levels. It is assumed at year end 2013 there are 90 days of forward (2014) consumption held in World liquid stocks, then supply is added and demand is subtracted from stocks each year with the absolute level shown in millions of barrels on the right vertical axis. The days of forward consumption at the end of each year are shown on the left vertical axis, with amounts that are above 92 days being oversupply and leading to falling oil prices and days of supply under 92 days suggesting undersupply and should lead to rising prices. Note that in 2023 and 2024 the chart suggests oil prices should rise, but this will only be the case if the supply and demand forecasts are accurate. The fact that oil prices have been relatively low in 2023 and are likely to continue to be low in 2024 suggests that either demand forecasts are too high, supply forecasts are too low or a bit of both.

Tight Oil

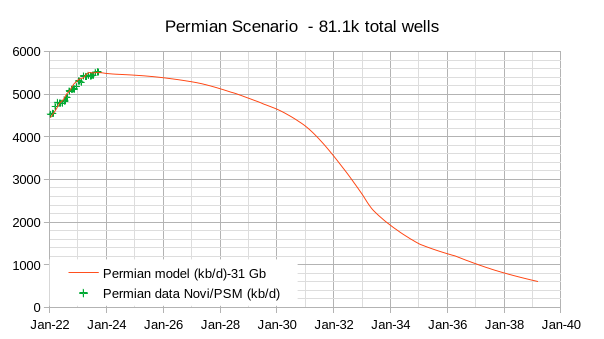

The scenario above is a departure from most of my previous scenarios where it was assumed that Permian output would continue to grow through at least 2028, before plateauing and then declining. This scenario has a 13 well drop in completions in November 2023 followed by gradual decline in completions by one well per month to Jan 2027, by 2 wells per month up to November 2029, by 5 wells per month up to Nov 2023 and by 10 wells per month up to Feb 2033 when no more wells are completed. It is also assumed the new well productivity falls by about 3.9% per year initially in 2023, with rates of decrease slowing over time as fewer wells are completed per year over the course of the scenario. My expectation of relatively low oil and natural gas prices and lower profits for Permian producers as a result lead me to this new scenario. I have left the scenario for other tight oil basins unchanged (which is likely too optimistic) so the US scenario only changes due to this new Permian scenario.

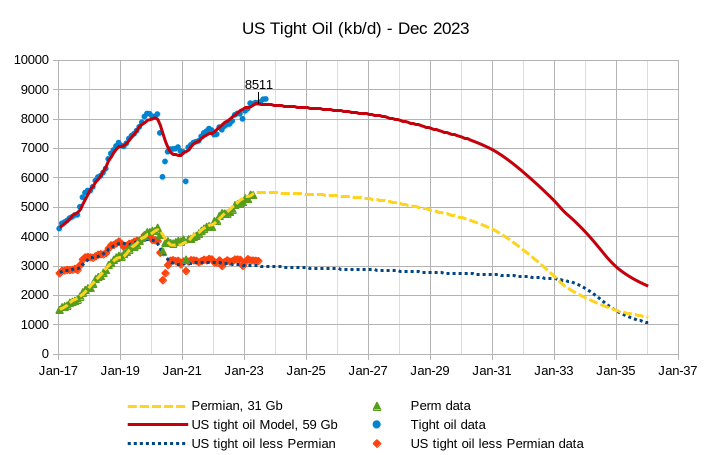

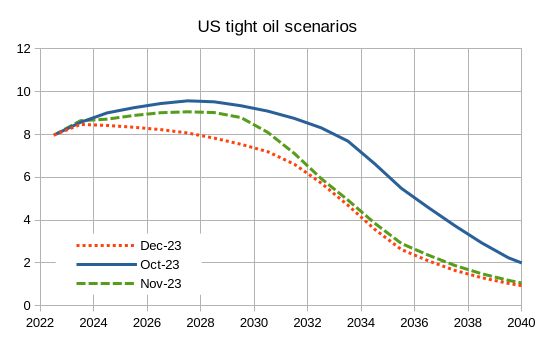

The US tight oil scenario peaks in 2023 at 8500 kb/d, about 550 kb/d lower than the scenario presented in November and about 4 years earlier. The URR is about 4 Gb less than last month’s scenario.

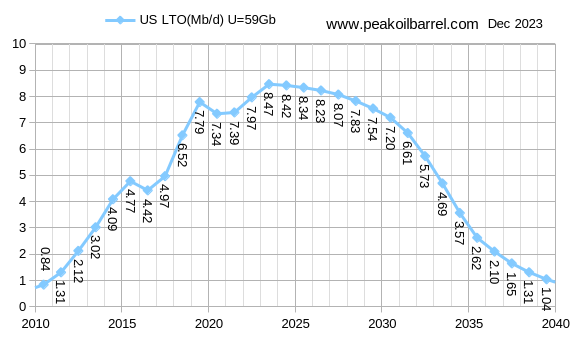

The chart above is in Mb/d (vertical axis) the Dec-23 scenario has a 59 Gb URR, the Oct-23 scenario a URR of 72 Gb and the Nov-23 scenario has a URR of 63 Gb.

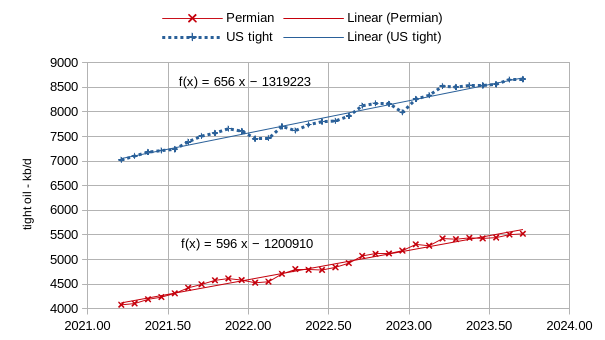

The estimates above use data from Novi labs, Texas RRC, New Mexico OCD, and EIA PSM and official tight oil estimates. Most of the increase in US tight oil output from March 2021 to September 2023 comes from the Permian basin. In the past 7 months the rate of increase has slowed to about an annual rate of increase of 320 kb/d for US tight oil and to an annual rate of increase of 205 kb/d for the Permian basin.

World Oil Shock Model

The World Oil Shock Model above reflects the new tight oil scenario with no other changes, I have changed the URR to 2700 Gb as only two digits are significant for a model with this much uncertainty. The peak is 82.4 Mb/d in 2025, the STEO estimates for 2023 and 2024 are shown from the December STEO.

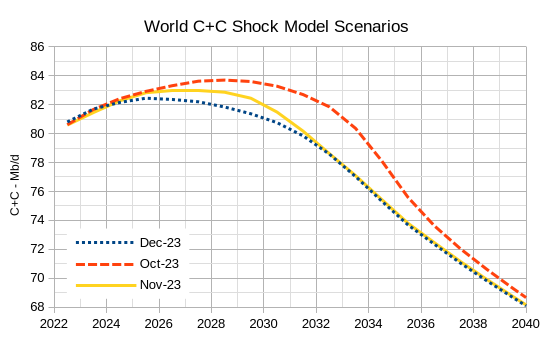

The chart above shows the evolution of the World Oil Shock model over the past 3 months, mostly due to changes in my expectation for further growth in the Permian Basin along with my expectation that oil and natural gas prices may remain lower than I had previously guessed. Roughly the Dec 2023 scenario envisions oil price at under $75/b and natural gas prices under $2.50/MCF, the October 2023 scenario expected oil prices over $85/b and natural gas prices above $3/MCF. I cannot predict future prices, but I think demand may be lower than I had expected in the past.

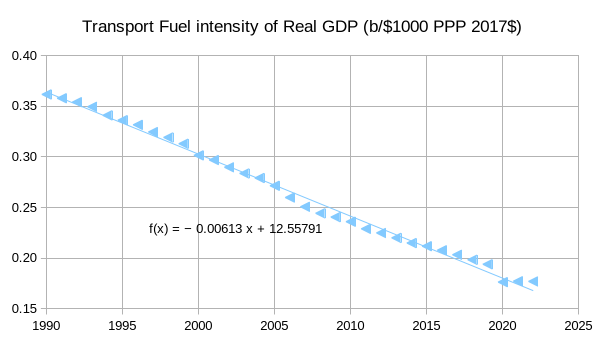

The chart above shows transport fuel intensity per one thousand dollars of real GDP for the World in 2017 international dollars which use the purchasing power parity methodology for assessing real GDP. Transport fuel is defined as gasoline, distillate/diesel, kerosene, and residual fuel found at this link. The GDP data can be found at this link. In 2022 transport fuel was about 83.5% of World C + C output by volume so I estimate World C + C demand by dividing my transport fuel estimate by 0.835. I assume World real GDP grows by about 2.5% per year due to slowing population growth in the future, where I assume the real GDP per capita growth rate of 2.2% from 1993 to 2019 continues in the future. Spreadsheet with data at this link. I use a decrease in oil intensity of 0.0055 per year after 2022 to account for the kink in the data around 2007, this may be too high a decrease in crude oil demand to be realistic, but might be considered a best case scenario for the environment and climate change.

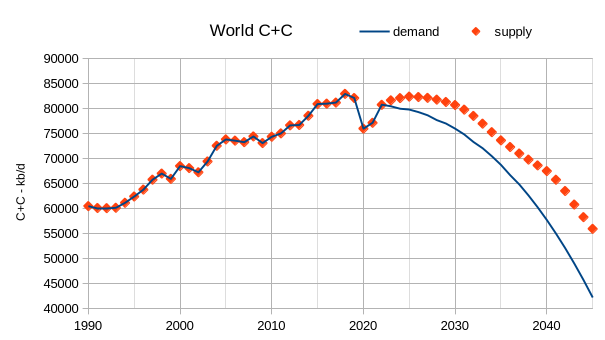

For the chart above the supply scenario is the most recent World Oil Shock Model and demand multiplies oil intensity decreasing by 0.005 barrels per thousand of real GDP each year by real GDP to get transport fuel demand. Then transport fuel demand is divided by 0.835 to get World C + C demand. A scenario with very fast uptake of plugin vehicles and commercial vehicles (assumed to lag personal vehicles by 5 years) is similar to the supply scenario through 2036, some factors not accounted for are the rapid uptake of EV 2 and 3 wheel vehicles, the improved efficiency of the ICEV fleet as more hybrids are used, and the potential of EV taxis and Uber/Lyft vehicles to replace a lot of oil use, also there is the potential for full self driving in the future, though I doubt that occurs prior to 2030 and perhaps never. In any case it is the potential for this downward pressure on oil prices due to lack of demand that has led to the revision of my scenarios. If I am wrong, then the earlier, higher scenarios are more likely to be correct.

Great work Dennis. I love it. Please keep up the great work.

Agreed.

Great work!

Andre

Thx Ron Andre and Schinzy.

Agreed!

Dennis

You have world supply of oil greater than world demand from 2024, also you assume demand which has risen over the last 3 years falling from 2024 onwards. Is that correct?

A very recent developement is the massive drive by oil companies to build oil to chemical plants. One in Saudi Arabia is due to be up and running by 2026, using 400,000 barrels per day. Another in South Korea, an Aramco subsidiary also due to start operating in 2026.

https://www.icis.com/asian-chemical-connections/2023/11/details-of-how-saudi-aramco-cotc-and-other-advantaged-feedstock-projects-could-redraw-the-petrochemicals-map/

In all 4/5 million barrels per day of oil could be diverted from producing petrol and diesel to producing chemical feedstock.

It is obvious that the oil companies and in particular Saudi Arabia are moving fast to ensure oil demand grows enough to ensure higher prices than you predict.

Nice to see a graph with C&C and NGL higher than 2018 as they are all used in the global industrial complex.

Charles,

A lot of the input of “barrels” into petrochemical facilities are barrels of oil equivalent. This includes natural gas and NGL and very little C plus C.

My expectation is that the demand forecast shown on the chart is too low and the supply forecast may be too high if oil and natural gas prices remain under 75/b, 2.50/MCF.

If prices are low reality might be between the supply and demand forecast, it is certain that neither forecast will be correct.

The demand forecast can be found at spreadsheet link.

It may be that demand is flat for C plus C for 5 years if transprt fuel intensity of real GDP decreases at 0.005 rather than 0.0055 as shown on the chart, such a simple model is unlikely to reflect reality.

Dennis

The articles explain these are new refineries that are designed to process crude oil into chemicals.

Current facilities usually produce 80% diesel, petrol and aviation fuel. These new facilities will use crude oil to produce mainly chemicals.

https://www.aramco.com/en/what-we-do/energy-innovation/advancing-energy-solutions/crude-oil-to-chemicals

facilities are being built and trials on better plants are well under way by several major oil companies.

We will just have to see what effect they have

Charles,

There is only so much demand for petrochemicals. At some point no more of these refineries will be needed.

That Saudi project is a research and development project that may or may not become a reality.

The Saudis may be worried there will be no use for their crude oil in the future.

Dennis

No they are actually building one plant in Saudi Arabia and building one in South Korea. Another plant is up and running in China.

Why don’t you do some proper research on these matters.

The additional 500 million people on the planet by 2030 and the increased wealth will ensure demand for Chemicals from oil increases considerably.

You have said several times population growth is slowing down, do you actually know the facts?

In 2030 the global population will still increase by an additional 70 million people and in 2040 by an additional 55 million

https://en.wikipedia.org/wiki/Projections_of_population_growth#/media/File:World_Population_Prospects.svg

Just like yourself they will all be using chemicals in soap, washing up liquids, rubber tyres etc etc etc

Charles by 2030 the global population would have increased by about 350-400 million not 70, thats the annual change.

Charles,

Yes you have just shown that indeed population will grow more slowly in 2040 than in 2030, so population growth is “slowing down”, just as I said.

Petrochemical use may increase, much of it may come from natural gas rather than C plus C. My guess is that the increase in petrochemical use will be less than the decrease due to less C plus C being used for land transport over time, but my guess could indeed be incorrect, the future is difficult to predict imo.

From the Link you posted above:

Of the research tracks, the most advanced is the Thermal Crude to Chemicals (TC2CTM) program.

Saudi Aramco has already entered into a Joint Development Agreement with U.S.-based leading technology provider CB&I (now McDermott) and Chevron Lummus Global to further accelerate the development and demonstration of the technology.

This collaboration will substantially accelerate this technology toward commercialization and our team is working to demonstrate the technology on a larger scale at CLG’s Richmond Technology Center.

Sure sounds like R & D to me. In fact the entire page is talking about research and development, sometimes the research does not pan out. That’s how the world works.

Charles,

OPEC is actively trying to raise oil prices which tends to reduce World demand. Though so far they have not been successful, when we see all of OPEC producing at capacity, that would suggest they are trying to increase demand.

At that point investment in expensive unconventional oil may cease, if increased OPEC output ever occurs.

Great work Dennis. Thanks.

A scenario that has slower decrease in demand with transport fuel intensity decreasing by 0.005 barrels per thousand international 2017$ (PPP) from 2023 to 2035 rather than 0.0055 as in post and then increasing to 0.006 from 2036 to 2045, and EV transition scenario with no autonomous vehicles assumed, but high growth in sales of plugin vehicles 41% per year intitially in 2023 falling to 35% annual growth by 2029 when sales are at 100% of light duty vehicles. The commercial fleet share of plugin vehicles is assumed to follow the personal vehicle share lagged by 9 years. I do not consider improved efficiency of ice vehicle fleet due to more hybrid sales or the 2 and 3 wheel vehicle market which may be significant in emerging economies and assume autonomous vehicles never become a viable technology in these scenarios.

Dennis

I think your EV transition is optimistic even for Europe and the US. Sales at 100% in 2029?

Not many will buy an electric car when petrol is $3 a gallon, if your prediction that oil prices will not go over $100 then many poorer countries will not see much growth in electric cars

https://www.globalpetrolprices.com/gasoline_prices/

Charles,

I agree my scenario is optimistic, prices of EVs will reach parity or be even cheaper than ICEVs within 5 years, currently total cost of ownership is about the same or cheaper for EVs.

Charles,

As of Dec 25, 2023 only 24 nations (mostly oil exporters) had prices under $3 per gallon. China at $4.30 per gallon and India at $4.74/ gallon. So if oil prices remain roughly where they are we won’t be seeing $3/gallon for most of the World unless oil prices fall further.

Dennis, thanks for the great work.

Curious, what made you finally abandon the AV/Robo Taxi theory in your models? I know we debated this a while back, but we haven’t discussed in a while. Was it due to the recent failures and setbacks at the trial tests? Or, did you adopt the other theory that Robo’s may only displace human operated taxi/Ubers?

Thanks

Gungagalonga,

Progress has been slow, so I am being conservative. If the problem is ever solved, it will reduce vehicles needed as most driving will be done by the vehicle which can operate 24/7 as needed. This will cut the vehicle fleet by a factor of 4 or more and accelerate any transition to EVs, a game changer that I have left out of the discussion until it becomes a reality.

If autonomous vehicles become a reality, most people will choose not to own a car as travel by robo taxi will be far cheaper per mile travelled. Only the very wealthy or “driving enthusiasts” will own a car. The driving enthusiasts may be relagated to tracks or off road courses because robotaxis will be far safer than human drivers, it will be considered too risky to allow human drivers on roads.

Charles —

You assume that cheap electricity is the only incentive to buy an EV, but that may change. Car manufacturers are aggressively downsizing their engine manufacturing already. Instead they are pouring money into battery production and software.

The industry is in the middle of a massive upheaval and companies are trying to change themselves into something more like consumer electronics companies.

The question is what vehicles will be available for end user to buy in 2030, and at what price. Consumers may turn to EVs because they are available and cost less by then.

Alimbiquated

Car manufacturers are moving away from ICE to electric in many countries. However in poorer countries there is a large market in used cars and they are the only cars most people can afford.

These countries tend to have cheap petrol also, so petrol and diesel cars are the only option for poorer people.

It will take many years for a second hand electric car market to become as big as the current ICE vehicle market.

The idea that cars are a solution to he problems of the poor is the result of decades of car company propaganda and terrible urban planning that bans a useful transportation system.

In fact cars are not a viable means of transportation in an increasingly urbanized world. And as this chart shows, most of the current displacement of oil consumption by EVs is poor Asians using electric 2 or 3 wheelers.

https://cleantechnica.com/2023/05/17/wef-sees-huge-drop-in-oil-demand-as-electric-vehicle-sales-rise/

Meanwhile the Chinese are producing very small 4 wheeled vehicles for urban use that are in a totally different price range than combustion engine vehicles.

https://electrek.co/2023/08/26/cheap-chinese-two-seater-electric-car-alibaba/

Charles,

I would think the only poor nations that have cheap fuel prices are those that are oil producers this is a pretty small proportion of the population of less developed nations.

I agree it will take time, scenario below is very optimistic/unrealistic.

Used vehicle sales are greater than new vehicle sales in the US because here too most people can’t afford a new vehicle. Cheap petrol is still expensive when incomes are low but still beats muscle power. My fella Muricans would freak out and revolt if gasoline was some ridiculously unrealistic high number like $20/gal but if the choice was pushing that 3400 lb compact 20 miles or paying $15 to do so most would pay if the need warranted it.

My $.02 is the used EV market will never get as big as the used ICE market because there won’t be the energy to build that many EVs, run the economy and the existing ICE fleet.

most people can’t afford a new vehicle

Yes, as the Canaanite woman said, the dogs eat the crumbs that fall from their master’s table. The American transportation system is built for the rich. There is little threat of it failing for the poor, because it already has.

That’s why there are payday loan companies for car insurance located in strip malls with no pedestrian access where their neighbors offer minimum wage jobs. Forcing minimum wage workers to buy cars creates all kinds of opportunities for predatory lenders. That’s also why you see huge ads for ambulance chasing lawyers when you’re stuck in traffic on poorly designed roads. If the transportation system were functional, the ambulance chasers would go out of business.

If poor countries adopt the system they will experience the same problems.

Thanks Dennis, great work and interesting scenario updates.

I got some questions, why has your URR changed ? Do you think demand will die down quicker due to higher electrification of transport hence lower oil prices/demand ? Or just reduced demand due to the global economy being weak ? Even then in both scenarios the distribution curve could have the same URR just flattened out to a larger time scale.

Do you see geological constraints coming into the picture at some point to affect supply ? Or will we never see physical supply side issues, and only the demand side dictating the market ?

Iron Mike,

The fall in oil intensity of real GDP is a big part of the story, it may not continue at the rate of the past 32 years, but if it did and real GDP per capita grows at historical rates with population following scenarios from Wolfgang Lutz et al then oil demand will tend to fall. URR falls due to lack of demand for oil as it gets replaced by other energy resources. The main geological constraint will be lower oil and natural gas prices making difficult to access resources (oil sands, tight oil, Arctic Oil and some deepwater resources) unprofitable to produce so the oi remains in the ground. So it is a story of peak demand rather than peak supply. So it is mostly a transition away for oil and other fossil fuel that leads to the lower demand as I see it rather than a weak global economy.

I no longer see $100/bo (in 2023$) in our future, I think peak oil prices (on an annual basis) are in the past.

Dennis,

So just to be clear, peak oil is a none issue for you then ?

Iron Mike,

I think the transition to alternatives to fossil fuel and the associated problems that entails is a more interesting problem. I am not fully convinced that this theory (of peak demand) is correct, I may well be wrong, it will be interesting to see how it plays out. I have expected for a long time that we would see very high oil prices. I am still waiting for confirmation, the lack of a supply shortage has lead me to alternative hypotheses that may reflect reality more accurately. We will see.

Guess I am on the fence.

Dennis,

Thanks for the clarification. It is very hard to tell whats going to happen with all these moving parts. You could very well be right. I am on the fence as well. It seems oil traders might be anticipating a recession hence the weak prices.

I personally think there is a debt saturation scenario, hence the weak global economy which is affecting oil prices. We will see what happens.

Iron Mike,

I agree very complex, I don’t see the debt problem that many see, much of the increase in World debt levels is due to more people having access to credit, in developed areas in particular, but even in developed areas the use of credit is more widespread. If credit contracts suddenly because private borrowers and lenders stop borrowing and/or lending, then there would be a severe recession in the absence of government fiscal spending to offset such a contraction.

If governments in general respond in the fashion of Herbert Hoover and decide belt tightening is the proper response to a lack of aggregate demand, then a recession becomes a Depression. Hopefully the voices of laissez faire are not listened to, but the response of Europeans to the GFC makes one wonder if economists are still being taught economic history.

Dennis,

Most people who have access to credit are already relatively asset wealthy or are borrowing large amounts to pay for property (an owner occupier whose lion share of salary goes to debt repayment reducing consumption). This further increases wealth inequality. Central banks play a major role here as the markets require access to cheap cocaine or credit via loose monetary policy. Loose monetary policy has increased asset prices to ridiculous levels, most of which are owned again by the already wealthy.

Belt tightening or rehab is a good thing for these type of markets. Zombie companies are side effect of loose monetary policy.

While the ranks of zombie companies are small, years of loose monetary policy highlighted by quantitative easing, high leverage and historically low interest rates, have contributed to their growth. Economists argue that such policies preserve inefficiencies while stifling productivity, growth, and innovation.

https://www.investopedia.com/terms/z/zombies.asp

You and I will never see eye to eye on this issue. We come from different generations. But central banks monetary policy and government fiscal policies directly contribute to wealth inequality. Now if you want wealth inequality fixed, asset prices have to come bank to some semblance of normality were fundamentals dictate prices, not speculation and gambling via cheap credit (a good recession will fix this).

The issue i have with your line of thinking is you want an end to wealth inequality but you advocate for loose monetary policy and fiscal policy to deter recessions. Which in my view is a contradiction.

Anyway i think the bottom line, all these factors are having an impact on the global economy due to the debt burden (public and private) which is causing reduced consumption and in effect lower oil prices.

Iron Mike,

We fundamentally disagree, on that we agree. Wealth inequality has much to do with government policy on income taxes and inheritance taxes. Who do you think suffers most when there is a severe recession? My understanding of history is that there were not a lot of wealthy or formerly wealthy people in bread lines during the Great Depression. Personally I don’t think monetary policy should be the main lever used by governments and have no problem with tighter monetary policy, but I doubt that will solve anything. The less wealthy will be unable to afford a mortgage to buy a home which for many less wealthy people is their only significant asset.

Let’s say we were rulers of the World and created a severe recession by very tight monetary policy say 15% interest rates for short term government securities (or whatever number you deem tight enough). Asset prices for homes and other built infrastructure fall to reasonable levels as a result.

Who do you think would benefit? Unemployment rates would likely double, middle class homeowners might see the value of their real estate cut in half and those who became unemployed might lose their homes all together because they would no longer be able to pay their mortgage and their home might now be valued for less than the balance of their mortgage. The wealthy would have plenty of money to buy up assets at half their former value, wealth inequality would likely become worse.

Alternatively a policy could be adopted where tax advantages for capital gains and dividends are eliminated (these exist in the US, I don’t know the tax codes in all nations). A highly progressive income tax structure could be established like that in the US enacted in 1969, but indexed to inflation (this was a mistake in the original 1969 tax code where the tax brackets were not adjusted annually for inflation).

The highest marginal tax rate was 70% for income over 200k (equivalent to about $1.6 million today). There is much less wealth inequality in some nations than in others due to different government policies. Other measures that could be taken are free post secondary education or more support for such education by government as this is another advantage that the children of the wealthy have.

Monetary policy is a small piece of the puzzle, fiscal policy and tax policy and education and health care policy are far more important in my view.

Perhaps it is different where you are from, in the US many people, even those who are less wealthy can get credit in the form of a credit card, or a car loan, those who save for a down payment can get a home with 10% down for a first time home buyer, in some areas homes are cheap enough for middle class people to afford, other areas homes are too expensive for most (San Francisco/ Silicon Valley area for example).

This may vary from nation to nation and area to area within nations.

Iron Mike. Question about this- “Now if you want wealth inequality fixed, asset prices have to come bank to some semblance of normality were fundamentals dictate prices”

That line of thinking depends on correction of wealth inequality by destruction of the asset worth owned by the super wealthy. Why do you not not consider the alternate path where assets are redistributed , rather than destroyed?

For example, stock option monetary gains for those with net worth over $5M could be taxed at 90%, while the owner would still have been rewarded extraordinarily for their efforts or good fortunes. Same applies to other capital gains, whether in real estate or financial assets. These things should always be taxed at much higher rates than is work income, rather than the opposite as is the current long term condition (at least in the US).

Dennis,

I actually agree with a lot of the points you made. The only thing is if we set the feds fund rate at the hypothetical 15%, people wanting to buy a house can borrow a lot less from the banks, assuming they are prudent individuals who save more than they spend. But you are right about the pain for the lower class and people who live their lives on credit. Which seems to be a lot of people.

You are also right about the importance of tax policies and monetary policy being the main lever governments rely on. The right tax and fiscal policy can reduce inequality. I am with you on that.

Our primary disagreement is I think recessions/depressions are necessary to filter out unproductivity, market inefficiencies and imprudent/risky corporate behaviours. After it is over the corporation/business’s that survive will be more prudent, productive and efficient. I’ll meet you halfway: If a recession/depression scenario was allowed to play out with fiscal policy targetting the lower/middle class that might work well. No bailouts, bailins and nothing too big to fail.

Regarding lower oil prices, I think a vast majority of incomes are going to debt servicing which naturally reduces consumption of goods and services. This phenomena might be responsible for lower oil prices I suppose, its just conjecture.

Hickory,

Rather than penalize those in the middle class that might have saved money to buy stocks, it seems better to tax capital gains and dividends the same as ordinary income.

If we want to tax the very wealthy at 90% marginal tax rates, then do so for all income, but leave middle class people to have their capital gains and dividends taxed at their normal marginal rate.

Dennis,

The middle class inherits a ton of cash annually, they aren’t all saints working and bleeding for every dollar. I know, I grew up middle class, but I have never inherited a dime. Further, many of the billionaires today started with nothing… that’s the beauty of a free market where success isn’t penalized by aggressive and unnecessary tax on success. It allows a person to achieve their goals and create amazing discoveries… also remember that many people do not desire wealth…. they are uncomfortable with it. My dad is one of those people. He is 82 and retired and still lives off only 20-30% of his retirement income. Saves money every month…. he hit Peak Lifestyle… we are not all the same and some of us don’t desire wealth. That is a very important point that many people forget.

Taxing the wealthy would erode the charitable engine that builds much of the US education, hospital, foundation infrastructure that supports countless charities and individuals. The Wealthy produce this and giveth away. I know several big donors that would stop if the US went to an aggressive wealth tax system like your90% scenarios. Without the wealthy, many of our schools, universities and hospitals would not exist as they are today. They would need to be funded by tax dollars controlled by an inefficient government… and we all witness how savvy financiers the US gov is…. right?

So, don’t mess with the wealthy…. you may not like the results and unintended consequences. Success should be celebrated, not attacked. Idiot Trump aside, of course.

Gungagalonga,

I think more equality is a good thing and don’t think society should have to beg billionaires for hospitals and universities. There are no saints, not in the middle class nor in the billionaire class. The difference is that the money of the billionaire allows them to wield undue power and influence, there amy be some billionaire saints, but there are many sinners as well. I prefer to put the money in the hands of the people and their representatives to decide how it is best spent. Some of us think democracy is a good thing.

Dennis

Great modelling. I think for now, the biggest question/mystery going forward is US growth.

Attached is the US October update. US down. L48-GOM up

Ovi,

Thanks.

Good guess on October output, note that US C plus C in September was revised higher by 16 kb/d compared to the November PSM so compared to that estimate October output was about 12 kb/d higher than the November estimate for September 2023. Also the STEO has October output at 13260 kb/d which was too high by 12 kb/d, but that is pretty much spot on (within .09% of reported value).

Dennis

I think we are heading into the slow growth/plateau phase. It really comes down to the drillers and what they think of WTI at $72/b and Permian oil drilling cost of $42/b: “The lowest break-evens across major Permian Basin counties at $42 per barrel each, compared to the Permian average of $45 a barrel” quoted from the linked reference below.

Right now Permian production is increasing slightly due to the use of DUCs. I guess the drillers and big oil companies will have to decide whether they want to support OPEC or do they just want a lower price for WTI.

I think that modifying the Permian model was the right move.

https://www.mrt.com/business/oil/article/eia-two-new-mexico-counties-dominate-permian-18199019.php

Ovi, in addition to the completions drawn from the DUC pond, the waters are muddied further by minimum annual or continuous drilling/completion obligation clauses found in many of the more contemporary oil & gas leases. These are most often included in lease documents for larger ranches in the resource plays in West Texas and South Texas. Sometimes in extreme low-price environments, the mineral owners can agree to grant the operator a temporary pause on the continuous drilling obligations, but not likely at current prices.

So, operators on larger ranches are sometimes forced to drill and complete new wells at a loss to continue to retain 100% the leased acreage.

Hard to quantify the impact of this, but it is out there and certainly adds new production in not so ideal price environments.

Gungagalonga

Another unknown to add to the mix of unknowns.

Thanks Gungagalonga. So the obligation is to drill, but not to complete the wells? That might explain DUC inventory increasing and decreasing over time, but it would be more important to have a well completion obligation and that’s probably what you mean. Also I suppose they could drill and complete the wells very slowly to meet the obligation unless there are specific time constraints. Maybe there are ways to work around this and minimize the damage.

There are often very specific time constraints in Oil, Gas and Mineral Leases that require the drilling AND completion of wells to earn or retain acreage that one has leased, or “rented” for a limited time frame. Newer leases made in the Permian Basin, or Farm-Outs, or Conditional Assignments covering old HBP acreage that is 80 years old, often require 120 days between $12 MM dollar wells to earn or retain acreage. Its rediculous.

All mineral owners do that, big or small, its not limited to big ranches. Drilling commitments are the height of American greed and pretty much the sole reason 90% of all Permian tight oil production is exported to foreign countries. We overdrilled and cannot absorb the oil in US refineries, so we export it all away, never to be seen again.

If a Lessee pays $20 MM dollars for the “right to drill” on a lease, that Lessee is going to comply with all the leasehold obligations it must to retain acreage on that lease. Many really sophisticated mineral owners, and the really greedy ones, will require a Lessee to drill a well every 120 days to specific benches…or it looses that acreage, or that bench.

It has all become so convulated that the shale sector now knowingly drills pooled units, or “allocation” wells in Texas when Texas law prohibits forced pooling. The Supreme Court is yet to rule on allocation wells but the tight oil sector thinks its shit doesn’t stink so it keeps doing it, with the TRRC’s blessing. Again, all for exports.

The TRRC could stop all this stoopid shit in its tracks with proper regulations but mineral ownership in Texas, as one might expect, is a powerful lobby group and contributes tens of millions of dollars to campaigns in Texas, primarity the three TRRC Commissioners, one of which is due for replacement in 2024.

Its all about money and <1.8% of the American population that have minerals under America's largest shale oil basins would fight to the death to prevent regulation slowing down the development of personal minerals. They bellyache the loudest about curtailing oil and LNG exports.

The SEC contributes to all this stuff with its 5 year PUD, proximity to PDP well rule also. Hundreds of billions of dollars have been borrowed on the SEC proximity rule, then bankrupted out on over the years. It was a joke.

Almost everyone involved in this enourmous shale endeavor makes enormous money from it all and believe it is there "right" to free money. They'll have enough money when there is no more Permian oil and gas to survive, the rest of America won't. They basically don't give a rat's ass.

I am a mineral owner, and a royalty owner, by inheritance from generations before me, and by purchase, using my own money. I was well aware of the risks of the purchase of those minerals and I accept them. Its just business. Life changes, my country is changing, hydrocarbons are becoming scarce and something has gotta give, somewhere, to make this stuff cheaper to get out of the ground.

Or, we're toast.

Thank you Mike,

Just the tip of the iceberg of the stuff I do not know, I appreciate the education.

Dennis, I have seen a variety of continuous drilling clauses (CDC). Some are more aggressive and mandate a larger number of annual wells to be drilled and completed and some are less aggressive and have only a few wells drilled annually and not also completed. The point of a CDC is to protect the mineral owner’s interests on larger tracts of acreage from an oil company just drilling and producing one well and still being able to hold all the acreage for the life of that single well production.

Another asset the oil company potentially loses if violating the CDC obligation is they may lose all depths deeper than the currently producing formation or depth…. meaning, for example, if they drill and produce the Spraberry on a 10,000 acre tract and then violate the CDC obligation, they may lose all depths below the Spraberry, like the Wolfcamp. Extreme example and unlikely to happen obviously… but the incentive to drill in poor commodity environments can persist due to this. This depth severance can also be designed in many different ways in the lease, so lots of variability here too.

That’s why you sometimes see continued drilling and completion activity that seems irrational relative to the commodity price environment. They are forced to do so by contract.

Thanks Gungagalonga.

Thanks Ovi,

I agree with plateau or slow growth for US, the breakeven of $42/b, is nonsense, it might apply to less than 5% of wells drilled (and maybe less), for the average Permain basin well the breakeven is at least $65/bo using a 10% discount rate and Natural gas at $2.50/MCF. A 12 million dollar well would payout at about 48 months at $70/b and $2.50 for natural gas, this would be barely profitable, Mike would prefer to see payout at 36 months to make a decent profit for the high risk of producing oil which would require $80/bo and $2.50/ MCF NG.

This is part of the reason Mr. Shellman expects Permian output to decline, he knows way more than me, he is most likely correct. There are other factors like water scarcity, declining average well productivity, higher GOR, and lots of stuff I have missed because I don’t know the oil business.

The more you know, the less you know—-

Hightrekker,

Thanks. I am often told I know less than I think, so I guess I should think I know more?

I am pretty sure the folks that teach me more are correct, there is so much that I don’t know that I cannot fully appreciate how little I know, so your adage is apt.

Thanks Dennis.

Just to clarify, this is a falling demand, low oil price scenario from here on out—aside from the occasional blip that is.

Correct?

Pops,

That is the latest guess based on what I foresee for future demand. My crystal ball has been acting up and the magician may have messed it up 🙂 Time will tell, but please don’t use this to guide future investments as I am wrong much more often than I am right (ask my wife, she will confirm that I am only right when I agree with her.)

Excellent job Dennis.

This paints the next decade or two in such a dramatically different light than most people have envisioned over the years… with demand dropping slightly faster than supply and as a result the price of oil not skyrocketing (short of geopolitical isolation events).

A repercussion of this outcome will be a larger amount of stranded oil. The ‘high cost to produce’ oil reserves will be left in the ground to a degree greater than most people had projected previously.

The 2030’s will be the decade when the world at large gets electric transportation as the new standard mechanism- Simply glance at the updated chart posted by Dennis-

World Oil Shock Model C=C URR 2700

to let this message sink in. All of the enabling mechanisms will be in place, with the biggest remaining wildcard on timing being global purchasing power.

Thx Hickory, note of caution that I may well be wrong and this may be a Pollyannaish scenario.

Hickory

History shows us that low prices for a commodity drives up demand.

Coal was expensive due to mine flooding and the first pumps were very poor at keeping the mines dry. The Newcommen engine was an improvement but still only rich and middle class people could afford coal.

When Watt invented his pump, mines could keep water free very cheaply, coal became cheap and consumption skyrocketed.

In the 1950s only rich people had televisions as the cost 6 months salary for the average family. Today people throw away working televisions to get a better model.

Oil at $80 is dirt cheap and will drive up consumption until the world cannot produce any addditional oil.

India for example has 1.4 billion people, it could increase oil consumption 400% and still only use a third of what each American uses.

I see gradually increasing prices and a global production peak around 2028, oil prices will be over $120 a couple of years before that.

I have seen high price as the most likely scenario too. Its hard to imagine continual prices below $100, although less demand is in the realm of possibilities. For example long standing tight global credit and lower collective purchasing power than previously projected could make that happen.

I also have long suspected that geopolitical discord will interrupt supply to some places even much more than it has in the past 70 years. A market that is not completely border blind makes it all much harder to predict.

I no longer make a guess as how it will play out.

Charles,

Oil will not be able to compete with electric transport, about 74 Mb/d of crude oil was produced in 2022.

Perhaps output will increase a bit with higher oil prices, but prices of EVs will continue to decrease and ICEVs will no longer be able to compete in terms of TCO, demand for crude will likely fall, there may be a bit of increase in the demand for petrochemicals that may offset some of this decline in land transport demand. So far we have not seen oil prices rise as much as I had expected, it may be that demand growth has been slower than I had expected, we will have better estimates of 2023 oil demand in July 2024.

Note that OPEC has 2019 refinery throughput (MOMR Dec 2022 page 54) at 81.4 Mb/d. The Dec 2023 MOMR (page 53) has 2022 refinery throughput at 79.1 Mb/d, and their 2023 forecast is 80.8 Mb/d for refinery throughput.

D. Coyne,

Your chart on fuel intensity of Global GDP shows a nice linear fit, which is nothing more than a spurious correlation. Both variables are highly complex, with dynamic compositional sub-variables, and there is no empirical reason to expect a neat linear trend.

This becomes clear when you dig deeper into the compositional effects.

What you call “transportation fuels” is incorrect, as you lump residual fuel oil into the group. Residual FO has been historically mostly used for heating and electricity, with a small fraction as maritime bunker fuel. All of these uses have been DECLINING with growing GDP, so if you plot Residual FO intensity of GDP it will not be linear but sharply downward parabolic. This is masking the much more robust intensity for mogas, diesel, and jet.

The simple math with this declining component would tell you that what looks like linear relationship would ultimately break down, as the declining component becomes less and less weighted in the composition. If you squint you can actually see the flattening at the bottom of your chart.

Then when you look at Global GDP, that’s an extremely complex variable, with some components that are oil-intensive and others that are not. What has been happening is that the OECD countries have been producing more and more of a low-oil-intensity GDP (Instagram videos, financial derivative trading, etc.), while transferring the oil-intensive GDP share to the non-OECD. That latter GDP is lower-valued due to currency exchange rates and wage costs in non-OECD countries.

Bottomline is that if you value GDP in a currency, such as US$, you are not accounting for physical global product, but for its valuation. With your neat downward linear trend one pitfall is that it creates an impression of a world economy that is becoming more and more fuel-efficient. In reality the two biggest factors contributing to the downtrend is the phasing out of Fuel Oil and the OECD/non-OECD dynamics in global GDP.

I have been thinking a lot about this issue and tinkering with available data, and my rough estimate is that true transport fuel (mogas+jet+diesel) intensity of true physical global product has probably held flat over the past 30 years.

Interesting, thanks.

Here is transport fuel intensity using OPEC ASB data for World and World Bank real GDP data (2017 international $). Transport fuel here is defined as gasoline, kerosene and distillate fuel.

Note that PPP methodology tries to account for cost of living differences, though no doubt is imperfect.

Note that from 1990 to 2019 the PPP method give average real GDP growth of 3.4%, the real GDP based on market exchange rates has an average increase of 3.06% per year.

There has also been a significant increase in the proportion of transport fuel as defined above as a proportion of World C plus C output from 1990 to 2022. The equation is

0.00348*year-6.282 (I drop outlier year of 2020 for this OLS). Using that to transform transport fuel (with real GDP assumed to grow at 2.5%/year in the future) by dividing by transport fuel to C plus C ratio (from equation), I get the following. Supply is the Oil Shock model from the post and demand is the analysis described in this comment.

Note that your scenario as shown in chart below might be valid through 2030, after that I expect the transition to electric land transport will keep demand significantly below supply.

The transport fuel as a fraction of C+C normally has been growing as FO is being cracked deeper, but there is no way this is a linear process. In fact it is probably close to complete, the only significant remaining pocket of FO use is electricity generation in the Middle East…

Also, can you explain the sharp kink in 2023? All indications are that mogas+jet+diesel is up sharply this year, but you have it down?

I do not have data for 2023. Prices are pretty low, so perhaps consumption is down. we won’t have real data (as opposed to forecasts) for another 6 or 7 months.

Here is ratio transport fuel to C plus C 1990 to 2022 (2020 dropped from dataset.)

Perhaps the relationship will change in the future.

D.Coyne,

The trend will inevitably change or otherwise at some point you would be getting an yield of more than 100% from a barrel of oil. Trendlines cannot overcome basic chemistry.

We can crack hydrocarbons, but it is much harder to condense them. As a result there will always be light ends that never turn into transport fuels (refinery gas and light naphthas) and on the other end, the delayed cokers will always produce petcoke, that’s just simple chemistry. All the gains have to date been from cracking residuals, and we are at the end of this process.

KDmitrov,

Perhaps correct, I don’t know where the limit is for further cracking of residual fuel.

Do you have a reference? I can’t seem to find much on this on the web.

Mistake on previous World C plus C estimate in response to KDimitrov (residual fuels excluded), revised chart below (error in previous spreadsheet.)

My expectation is that transition to EVs, plugin hybrids, and hybrids will reduce demand for oil significantly.

D. Coyne,

I still do not get how you model a sharp decline staring with 2023, without ever even reaching 2019 consumption level. That’s not very credible. 2022 was still a very pandemics-affected year, in Asia in particular. All the data we have so far for 2023 shows a healthy increase in demand.

The effect of EV at this point is just a speculation, it sounds rational, but there is no trend showing the massive dent in fossil fuels that you predict. It’s rather “handwavy”.

Kdimitrov,

If we look at crude oil output as a proxy for crude oil demand (over the long run these will tend to be equal), do you expect crude output will be up significantly in 2023? It certainly doesn’t look like it will reach 2019 levels.

The model below looks at crude plus condensate intensity directly and uses the 2007 to 2019 trend in C plus C intensity of real GDP and projects forward from 2023. Supply is from the oil shock model.

I have a model for EV/plugin vehicles based on sales growth for plugin vehicles for 2013 to 2022, the average rate of sales growth has been 42% per year, I assume this decreases by 1% each year until 100% sales are reached, I assume commercial vehicles follow a similar trajectory starting 9 years later.

A specific set of assumptions, it is assumed ice vehicles are scrapped at an average life of 15 years.

The recent models are not showing sharp decline, they are showing flat demand for the next few years maybe a slight decrease.

Below is demand 2023 to 2030

80863

81073

81193

81219

81151

80985

80717

80345

EV Model presented at link below

https://peakoilbarrel.com/eia-short-term-energy-outlook-and-tight-oil-update-december-2023/#comment-767884

I appreciate your comments, you may well be correct, this started trying to understand the apparent lack of demand growth we have seen in 2023, next year may be different.

KDimitrov,

Any research that confirms your view? I am using standard World data from World Bank and OPEC, can you point me to the data behind your analysis? Otherwise we are just telling stories. How is “true physical global product” measured in your view? That is a problem if you don’t have numbers to back up the analysis.

D. Coyne,

The way I think about is that I look at mobility indices, instead of GDP measures. The assumption is that real/physical GDP is tied to mobility, but in any case, I consider mobility as a more relevant metrics for economic development than GDP, no offense to video-gamers and Instagram influencers.

There are many mobility indices that I look at: car registrations and sales, commercial flights, ton-miles, etc.

What you see is that most of these indices run faster than global GDP in non-OECD and slower in OECD. Then, I look at fuel intensity as a measure of fuel consumption relative to the mobility index, to get a feel for improving fuel efficiencies.

Light vehicle transport measures outrun handily mogas consumption, which is not surprising given that it is extremely USA dominated, and there has been several major developments here: 1) Increasing fuel-efficiency standards, especially after Obama, 2) ethanol mandate, and 3) recently EV/hybrid adoption. In the rest of the world it is less pronounced, but there are developments with LPG powertrains, EV, etc. For diesel and jet, fuel consumption is tracking closer to flights and ton-miles…

In any case, mobility indices for non-OECD run faster than population growth, and fuel intensity is not lagging by much. So, by simple extrapolation, as the non-OECD component becomes heavier and heavier weighted, the global fuel intensity will be flattening out and not going down as the gross trends in yours (and others) charts tend to predict.

(The EV story is still just a narrative, it can cause inflection but so far I haven’t seen any inflection in mogas fuel intensity, the trend that is there from ethanol mandates and increasing fuel-efficiencies is intact. I view it as just a continuing trend for mogas, which has been growing at 1.5% trend worldwide, a bit slower than light vehicle miles and registrations, but still faster than total oil, which I think was at around 1% trend.

Oil consumption is lagging transport fuel consumption, due to the abatement of Residual FO and increasing refinery complexity which cracks the Residuals into lighter fuels…As this trend is nearing its end, oil consumption should start trending up faster, closer to the transport fuel trends)

KDimitrov,

Without specifics sounds hand wavy. We would need to know specifically which mobility indices you look at, do you have something published that we can look at?

Many have argued that oil is the master resource, but sometimes it seems people need to make up their own measures (which are available only to them) to prove their point. GDP measures are not perfect, but if you are going to create some other arbitrary measure, to convince anyone that it has relevance the numbers must be shared.

Mobility is not an end unto itself, so not the best measure of general well being in my view.

You assume mobility is tied to real GDP, but if you want to look at real GDP, then look at real GDP, rather than some made up number in your head.

D.Coyne,

Fair, this was just a comment. I have been meaning to organize all my data and research on this topic and write it up, but haven’t had the time. This is just a hobby for me.

For now all I can say is that you misinterpreted my point. You can use GDP data, it is useful for many purposes. However, you cannot equate GDP growth rates to mobility in non-OECD countries. It’s not just the raw number, but the rate of change. You may be correct that global GDP would slow from 3% to 2.5%, but it is incorrect that non-OECD mobility will have the same rate of change. That’s the compositional effect that I was talking about. OECD has a very different demographics profile, GDP composition and correspondingly oil-intensities than non-OECD. As the weight of the latter grows in the world economy its trends will become more significant in the global aggregates.

Cheers

Kdmitrov,

As non-OECD becomes developed demand for mobility will decrease, for now the growth rates are what we have seen, as the world moves to electric tranport oil demand from mobility demand is likely to decrease. I don’t have access to mobility data for non-OECD.

Just World C plus C and real GDP, I agree the relationship is lkely very complex, it is surprising there is any correlation at all, perhaps it is spurious, though I would expect real GDP and oil use to be correlated. A better correlation is C plus C vs natural log of real GDP rather than linear relationship.

Kdimitrov,

I found this from EIA (from 2017), probably the Low liquids demand case is more relevant given what has occurred fomr 2017 to 2023.

https://www.eia.gov/analysis/studies/transportation/scenarios/pdf/globaltransportation.pdf

They see a big increase in natural gas use for transport which has yet to materialize.

The two largest lithium deposits ever were discovered this year and they are both in the US. Extraction technologies have advanced rapidly from 50 to 90%. Other enormous deposits are almost certainly out there these are just the easy to find ones in our own backyard. Solid state batteries are coming on the market for real in the next two years. The price of lithium batteries looks set to fall by half over the next 4-5 years easily blowing past EV price parity with ICE cars and of course substantially lower operating costs even at $3 gas. Electricification looks unstoppable for transport across the board at this point. Exxon is getting into lithium extraction.

https://oilprice.com/Metals/Commodities/Worlds-Largest-Lithium-Reserve-Discovered-Beneath-Californias-Salton-Sea.html

https://www.chemistryworld.com/news/lithium-discovery-in-us-volcano-could-be-biggest-deposit-ever-found/4018032.article

https://corporate.exxonmobil.com/news/news-releases/2023/1113_exxonmobil-drilling-first-lithium-well-in-arkansas

EV price parity by mid-decade as battery prices fall – Goldman Sachs

https://www.goldmansachs.com/intelligence/pages/electric-vehicle-battery-prices-falling.html

It’s interesting how quickly Americans are to claim the biggest in the world of, whatever, without doing any research. For example the Exxon lithium, ….”Exxon’s landholding is estimated to have 4Mt of LCE”

In the middle of the Congo at a place called Manono there is a spodumene deposit with a resource of over 500Mt and an estimate of 1.5B tonnes overall. Brought back to LCE equivalent about 50M tonnes of LCE.

There are probably hundreds of millions of tonnes of spodumene around the Black Hills of S Dakota, if anyone bothered to look there. Plenty of photos on the web about the Etta mine that had the largest spodumene crystal ever discovered..

Lithium from brine is extracted via huge evaporation ponds in desert like conditions in Chile and Argentina. How will the evaporation ponds go in Arkansas with the rainfall there? People are working on other extraction technologies, but it will take energy, which is provided by the sun in South America.

All lithium extraction from whatever source involves mountains of fossil fuel use/extraction. Spodumene heated to 1100*C with gas, sulphuric acid coming mostly from sour crude oil and gas, etc.

There a lots of lithium deposits all over the world, lithium shouldn’t be a problem, getting pure lithium carbonate or hydroxide is the energy intensive bit. No-one bothered to search for lithium until about 8 years ago when EVs started to gain momentum..

It’s far more likely that copper becomes more of an issue in the future, we have already mined all the large easy to get deposits..

Do EV’s even actually matter?

What I mean is even if you were to switch all light vehicles over to EV’s you would still need the same amount of oil if you wanted the same amount of diesel and all the other things that get made from a barrel of oil. Jet fuel, bunker fuel etc. A lot more than just gasoline is made from a barrel of oil. You still have to have the same amount of oil. Otherwise you get less of all the things that are produced from a barrel of oil.

The argument that EV’s are going to lead to less fossil fuel consumption just doesn’t hold water.

The up a coming global depression we are going into however will do a lot to curtail fossil fuel consumption.

We could do away with globalization, global shipping and global air transport.

But then again the supply chains needed to buildout EV’s and everything solar and wind are way more complicated than the supply chains needed to build ICE vehicles.

you would still need the same amount of oil if you wanted the same amount of diesel and all the other things that get made from a barrel of oil.

Say this a thousand times, please. Art Berman has been beating this drum for a while now. What this means is that a reduction in gasoline demand alone DOES NOT reduce actual petroleum consumption.

IF gasoline consumption is reduced, and IF we still need the same amount of diesel, what is the fate of all that excess gasoline?

In Ohio in the late 19th century, when kerosene was the product everyone wanted, they just dumped the gasoline into nearby rivers. I wonder how that would go over today?

Art Bermann does not know everything.

Today oil refineries can be designed to produce alot less petrol.

https://www.mckinsey.com/industries/chemicals/our-insights/from-crude-oil-to-chemicals-how-refineries-can-adapt-to-shifting-demand

https://www.futurebridge.com/blog/crude-oil-to-chemicals-future-of-refinery/

Instead of producing 10% chemical feedstock they can produce 50% and there are plants being built that will produce 80% chemical feedstock

That changes the gasoline to something else—chemical feedstocks. That does not reduce the number of barrels of oil needed overall.

Might just result in a huge glut of gasoline. As demand for other products besides gasoline remains.

Which would make gasoline cheap.

Or chemical feed stocks become so abundant that they are too cheap to make a profit on. Yet demand for diesel, jet fuels and bunkers fuels remains. So refiners that gear up to make more feedstocks lose money.

Mike B

Tell Dennis that.

The world population grew by 1 billion people in the last 13 years and as a consequence we are using an additional 15 mb/d.

Dennis thinks that because the global population will take longer, 16 years to increase by another Billion that we will be using 15mb/d less than today. A real 30mb/d reduction in proportion to the population in 2010.

Dennis no longer believes in Peak Oil as in supply constrained but Peak Oil as in demand driven

Charles,

It’s not that difficult. We believe in bean-counting. Try counting the number of beans in a volume, using whatever method you desire, and you have an estimate of the true amount of beans in the container. It’s just that some people don’t care on the number of beans, and will only complain when they are all gone and then move on to ignoring another pending crisis.

Charles,

I use the data to guide my analysis, provide different data from a reliable source and I will adjust my thinking. Note that forecasts are not data. The fact is that per capita oil consumption has been decreasing for many years at the World level along with oil consumed per dollar of real GDP. My expectation has been for many years that oil prices would rise as oil supply stopped growing as quickly, 2023 has suggested this may not be the case as oil prices have been relatively low due to lack of demand growth. The theory in the paper you posted in the last thread suggested the linear decrease in oil intensity of real GDP as a possible explanation. Seems like a possibility, we will have to see what happens in the future, also the transition to EVs may make this possible.

My model is for C plus C, in the past 13 years demand has increased by 6.7 Mb/d (see refinery throughput data at SRWE).

HHH,

The commercial vehicle fleet may also transition to EVs and some long haul heavy duty transport may move to electrified rail, this reduce the need for diesel fuel, perhaps air travel will be reduced or move to synthetic or biofuel. There is some measure of flexibility in the refining process depending on how it is set up and it may also depend on how heavy the crude input is, I don’t have the chemical engineering knowledge to know all the ins and outs of what is possible. My understanding is that the ratios are not fixed, there is a range of possible outputs that are feasible.

Exxon will be using Direct Lithium Extraction as stated in the article I posted. The open evaporation ponds are rapidly becoming an obsolete technology. Much of EVs are currently displacing diesel consumption in Europe as many of their passenger cars are diesel. Busses and local box trucks will be next, just look at Amazon and UPS, they are already switching over. Y’all will continue to go through the 2020s confused as to why oil prices are dropping and consumption dropping at the same time the economy grows. I guess that’s what happens when you get set in your ways.

https://spectrum.ieee.org/amp/direct-lithium-2665947975

Two Chinese manufacturers just announced they will produce small urban EV’s that don’t use lithium, rather they will have Na Ion batteries. These are viable for most people who are just trying to get 50 miles a day travel accomplished.

And the world has plenty of Na, in addition to lithium.

Na as a salt, and Li as a feldspar. Both minerals which require lots of energy to crack to elemental form and thus reconstitute.

Stephen Hren ….. From the article you linked to…

“Which technology for DLE will win is still unclear. There is as yet “no clear winner in terms of what customers want and what the technology can provide,” she says. But all the DLE separation technologies being piloted now are already used for other purposes, says Goldman Sachs analyst Hugo Nicolaci, and that should speed up commercialization. “Expect the first real wave of DLE projects from later in the decade.”

Just because they are working on a technology does not mean it will be a success, or provide the purity needed by lithium batteries. Then there is the energy issue and materials needed for all the processes involved.

DLE is another of those ‘fantastic ideas’ if it ever works, with cheap materials and minimum energy. Unfortunately there are always tradeoffs, which is why the process was never used for lithium batteries at the earliest stages of lithium battery development.

The holey grail of lithium extraction would be doing it without needing soda ash to separate lithium from the brine in Lake Uyuni in Bolivia, which has high magnesium levels, requiring something like 17 tonnes of soda ash per tonne of lithium carbonate produced (IIRC).

Hideaway, read the Exxon press release I posted above. Exxon is using DLE in Arkansas, of course they won’t tell which one it’s likely proprietary. So it’s not some pie in the sky technology but one that Exxon-Mobil who obviously has tons of drilling experience will be using starting in 2026. Likely multiple techniques will be used based on local conditions and technology availability.

This type of advance is part of the all the research going on globally in battery development. It has reached enough inertia that it is consistently producing annual reductions in battery cost of 10-15%. The only exception was 2022 when lithium prices increased tenfold for a while due to a commodities bubble and supply chain bottlenecks. The main point I was making is that such a supply shortfall is unlikely for the foreseeable future. It’s also significant that Exxon is hyping their lithium extraction. Hard to imagine a decade ago.

The battery improvements are not just an EV thing. This is too narrow a focus. Most of the reductions in oil consumption from electrified transport have come from converting inefficient smaller engines in mopeds, rickshaws etc.

Batteries make everything more efficient, even burning coal. Just like renewables make power when it’s not wanted, baseload power from coal and nuclear generate electricity in the middle of the night when it’s not needed. Having batteries to capture this power for 6-12 hours and use it later in the day will eliminate the need for peaker plants and reduce waste. Lost energy everywhere can be captured and used. And for transport if that use is in an electric motor rather than an internal combustion engine, the efficiency of use increased at least fourfold. Our entire energy system has massive inefficiencies built into that batteries can help solve without more inputs.

Stephen Hren … Exxon is not using DLE in Arkansas, they ‘plan’ to. The type of DLE is ‘still to be decided’, all from the document you linked to.

They are currently drilling their first hole into the formation.

The expected resource is 4Mt LCE, a drop in the ocean compared to world supplies of lithium and demand.

It sounds to me like a great marketing exercise for Exxon showing the world how green they intend to be. DLE is still not proven on industrial scale for lithium extraction to battery grade requirements.

Uh, no, that’s not what it says. Nice try though.

“ After using conventional oil and gas drilling methods to access lithium-rich saltwater from reservoirs about 10,000 feet underground, ExxonMobil will utilize direct lithium extraction (DLE) technology to separate lithium from the saltwater.”

This is what happens when you try to have a discussion with someone who is too chickenshit to use their real name. They just lie to try and support their point and don’t care.

Stephen Hren,

The document does seem to be announcing plans with a target for 2027, in many cases these projects are never realized.

Hi Stephen,

The article includes these bits which are quoted

“will utilize”

” The company is targeting its first lithium production for 2027″

First lithium in 2027 means they are not producing any at present.

The article is just the usual corporate marketing spin?? It’s full of hopes, wishes and plans. They might end up doing it, or they might work out it is too expensive and drop it from plans, we simply don’t know.

What we do know is they will use it for marketing as much as possible..

Hi Hideaway, I understand what you’re saying now, I apologize for my insulting comment.

Lithium can be extracted from brine with filters. They have test facilities at geothermal sites already.

This evaporation method is just simple old tech you can use without thinking.

https://www.oilystuff.com/forumstuff/forum-stuff/pretty-close-to-50-of-the-bakken-oil-production-increase-is-driven-by-completion-of-duc-wells

Surge in Permian is from DUC’s that are being completed and their numbers are dwindling, straight from the horses mouth.

If I am reading correctly this is why production is up but rig counts are falling. Not greater efficiency.

Be sure to check out the comments.

https://www.msn.com/en-us/news/world/brazil-shows-concern-as-venezuela-slams-uk-warship-sent-to-guyana/ar-AA1mcS29

Things getting frisky as the UK sends warship to Guyana and Venezuela launches military excercise in response.

Guyana is the hottest oil prospect in South America at the moment.

Don’t forget the Falkland Islands history lesson.

There are things lurking beneath the water that neutralise South American Navies.

Maduro has staked all of his political capital on the ‘take over Guyana’ project. No way for him to back down from the claim without a fight.

The Argentinian’s (Falkland Island War) attempted to surround the British Royal Navy.

Then the British started sinking their ships.

Those buffoons (the Argentinian military leaders) didn’t realise there were submarines in the water…Complete incompetence.

No offense to Argentinians who are undoubtedly great people.

The buffoons were the unqualified leaders.

And the Falklands does have oil!

<iThe buffoons were the unqualified leaders.

Agree-

A group of right wing fascists .

Not the brightest porch lights on the block.

Having oil in the ground isn’t much good if its EROI is too low to find a way to extract it. The Sea Lion project has been around since 2010 and has had at least three FEED attempts with no FID yet, though one is promised for late in 2024 – we’ll see. At 250 mmbbl it’s not quite big enough for a decent anchor project and without an anchor the smaller resources in the area can’t be developed or even investigated. I’m pretty sure UK would like to see the back of the Falklands if there was a politically acceptable way out; it’s an expensive liability like most of the British Empire became after the first world war.

Venezeula and Guyana are a whole different ball game than the Falklands.

USA : “UK u guys can have Guyana; we will take Venezuela”

UK : “Agreed”

From reading George’s posts, he is smarter than me on oil no doubt and probably life in general…LOL.

Venezeula has more oil reserves than Canada and Guyana is looking juicy.

I remember Russia was over there about 10 years ago “exploring” to the ire of John Kerry and Barrack Obama.

news reads US October crude production sagged

https://oilprice.com/Latest-Energy-News/World-News/EIA-US-Crude-Oil-Production-Rates-Sag-In-October.html

Sheng WU

The US production chart was posted further up.

https://peakoilbarrel.com/eia-short-term-energy-outlook-and-tight-oil-update-december-2023/#comment-767888

The leak in the Main Pass pipeline started mid November (still not found let alone fixed I think) and takes away about 75 kbpd additional, mainly Horn Mountain, in GoM. October is about six months since the Permian rig count started to fall. The drop in Eagle Ford started a couple of months early and has steepened a bit. Rig counts have been steady for a couple of months but the most recent oil price fall should start impacting around now as existing contracts end and new ones may not be put in place with lower prices.

Sheng Wu,

September output was revised higher, October is down form the revised number, but it is higher than the number estimated for September in the last PSM, output down only 4 kb/d, about 0.03%.

D Coyne,

There is some deviation between C+C production and consumption from year to year. I use Refinery Input from the BP Statistical “bible” as a proxy for consumption. Since refined products have a shorter shelf life it is a better proxy for oil consumption than oil output.

In 2018 and 2019 we had higher production than input (520kbod and 351 kbod respectively) in 2022 we had the reverse (crude destocking) of 781 kbopd. In 2022 Refinery Input was close to 82MMbopd, and that was with much of Asia still experiencing the pandemics effects. Your model has 1MMbopd lower inputs in 2023. That would be a major surprise, IMO.

Regarding GDP, nonOECD will eventually become more “virtual” yes, however the gap in annual fuel demand per capita is so huge that it will take decades. Simply put, developed countries add miniscule amount amount of oil per each $1T of GDP produced, bringing World GDP intensity down. That’s not the case for nonOECD at all.

GDP is the valuation of goods and services produced. In some parts of the world these are more virtual and in others they are more physical. That’s the point.

Kdmitrov,

That is why we take the total real GDP of the World and don’t do it for every individual nation. Likewise we look at total World fuel demand. Crude produced will be roughly equal to crude inputs to refineries especially over a 30 year period. Yes there will be small year to tear variations between output and input to refineries.

Thanks for the suggestion on refinery throughput, using that metric we get the chart below,

Dennis, …. “That is why we take the total real GDP of the World and don’t do it for every individual nation.”

Which currency do you use, as this will make a difference? I would assume in $US being the reserve currency, but other countries where the currency has varied vs the $US, would make a difference if measured in that currency.

How does the real GDP in gold terms look compared to oil intensity??

Hideaway,

Gold is a commodity and is no longer used as a medium of exchange, it would make no more sense to use apples to value real GDP as gold, but you can do what you like, you can find real GDP in terms of any good you wish.

See

https://en.wikipedia.org/wiki/Purchasing_power_parity

This is the measure preferred by many international economists and may reflect different living standards better than market exchange rates.

For Global oil demand to fall there needs to be a total reversal in what has been happening in places like India over the last 15 or so.

https://www.statista.com/statistics/664729/total-number-of-vehicles-india/

Everyone whats to be like Europeans or Americans where there are over 800 cars per thousand people.

https://ourworldindata.org/grapher/registered-vehicles-per-1000-people

Certainly demand for oil will fall in countries that already at car saturation levels. Every electric car will replace a petrol or diesel car. In places like India, Russia, Africa this is not the case and most cars bought in the next 10 years will be ICE vehicles. India, Africa, South and Central America and Russia have over half the world population and they will end up using as much oil as Europeans do now

Charles,

I imagine Chinese EV manufacturers will have a lot of success in India and Africa, so it is not clear that you are correct except in African nations that produce oil, they might be an exception.

Rig and Frac Report for week ending December 29

Rigs Up. Fracs Down

– US Hz oil rigs increased by 1 to 456. There has been little change to the rig count over the past four weeks. Is this the new steady state rate for Rigs, 450ish?

– Permian rigs were up 2 to 295. Texas Permian added 3 to 206 while NM was down 1 to 89. In New Mexico, Lea county dropped 1 to 48 while Eddy was unchanged at 41.

– Eagle Ford dropped 1 to 49.

– NG Hz rigs were up 1 to 108 (not shown)

Frac Count for December 29 continues its typical Holiday Slump

The frac count decreased by 12 to 240 this week. The Frac count has entered the trend of the past few years when Fracs start to drop after Thanksgiving.

Friday’s count was just 6 higher than the Dec 29, 2021 count of 234.

JP Morgan Says Peak Oil Demand Is Nowhere In Sight

This a very contrarian article with a different perspective. Best to read the whole article.

Keene opened the discussion by recalling Malek’s 2021 assessment that emerging markets would push crude demand—and prices—higher, and asked Malek if that remained the case.

“If anything, I think it’s strengthened,” he replied. “There is demand in the world that we just simply cannot see.”