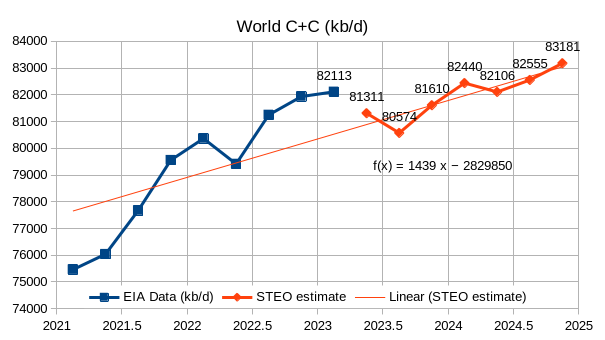

The EIA’s Short Term Energy Outlook (STEO) was published in early July. The chart below estimates World C+C by using the STEO forecast combined with past data from the EIA on World Output.

This month we have actual EIA data for 2023Q1 which increases the annual rate of increase for the forecast period compared to last month by 600 kb/d, part of the reason is an 800 kb/d forecasted drop in output from Q1 to Q2 of 2023. If we use the 2023Q1 to 2024Q4 trend the annual rate of increase is 911 kb/d, about a 100 kb/d increase from last month’s estimate. The trend from 2022Q1 to 2024Q4 is similar at about 916 kb/d. If this forecast through 2024Q4 is roughly correct, I expect increases in output after 2024 will be considerably lower, I also think this STEO forecast is optimistic. Annual average output in 2022 was 80.74 Mb/d and increases to 81.4 Mb/d in 2023 and to 82.6 Mb/d in 2024. These annual averages are 0.25 Mb/d less in 2023 and similar for 2024 as last month’s estimates.

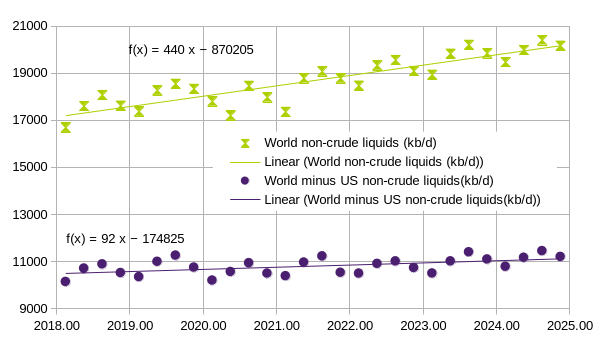

The chart above considers World liquids output that is not C + C output, mostly NGL and biofuels as well as refinery gain and compares the World total with the World minus the US. About 79% of the annual increase in liquids that are not C plus C comes from increases in the US.

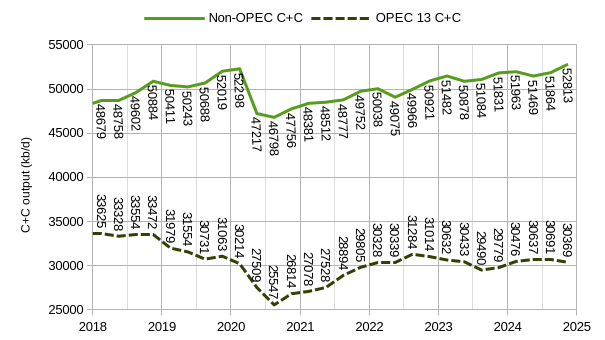

The chart above compares OPEC 13 output with non-OPEC output with the last 7 points of each series being from the STEO forecast. OPEC output increased quickly to about 30 Mb/d from about 25.5 Mb/d over the July 2020 to Jan 2022 period and has since stalled at about 30 Mb/d with a decrease from the post-pandemic peak of 31.3 Mb/d in 2022Q3 and is expected to fall to 29.5 Mb/d by 2023Q3 and then recovering to 30.7 Mb/d in 2024Q3. This is different from the announced quotas plus recent output from Iran, Libya, and Venezuela, so the EIA must believe the quotas will be changed. Most of the expected increase in World output in the STEO forecast comes from Non-OPEC producers. About 1900 kb/d from 2022Q4 to 2024Q4 or roughly 950 kb/d each year.

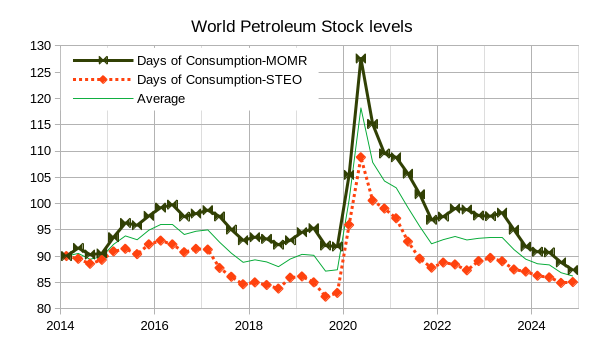

The chart above considers World petroleum stocks using data from both the EIA’s STEO and OPEC’s MOMR. I assume the stock level at the end of the first quarter of 2014 is equal to 90 days of that quarter’s consumption of total liquids for the World. This choice is arbitrary, but typically nations try to maintain about 90 days of stocks and at this time World prices were high so stocks were likely at at least this low a level. Using this assumption and the STEO supply and demand data results in very low stock levels at the end of 2019 (about 83 days of consumption), where the MOMR estimates result in a higher stock level of about 92 days of consumption at the end of 2019. The green line is the average of the two estimates. The expectation is that World stock levels below 90 days should lead to increasing oil prices and stock levels above 90 days should lead to falling oil prices. Sometimes market fear of a supply disruption (such as a War near Russia or in the middle east) can lead to price spikes unrelated to stock levels.

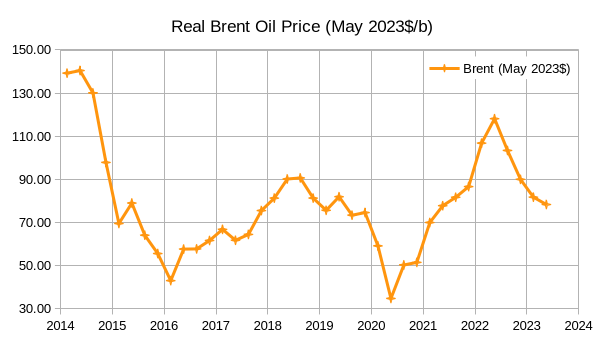

Considering the real oil price chart above for Brent Crude in May 2023 $/bo, the green average stock level line gives a fairly good indication of rising or falling oil prices with the exception of 2022 when fears over Russia’s invasion into Ukraine created a price spike. On the basis of the green stock level line falling below 90 days in late 2023, we might see rising oil prices at that point. Note that for the OPEC stock level forecast after 2023Q2 I assumed Iran, Libya, and Venezuela continue to produce at their June 2023 level over the ensuing 18 months and that the other ten OPEC members produce at the announced levels as of the most recent OPEC announcements (this includes the announced voluntary cuts) through 2024Q4. Obviously the forecasts won’t be correct, but if they were, the stock levels would be as shown and oil prices might rise in 2024.

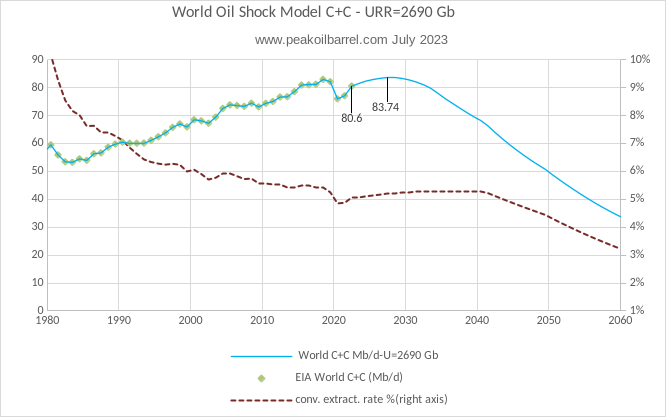

The chart above uses Paul Pukite’s Oil Shock Model to estimate future output with the assumption that a transition to electric transport reduces oil demand to less than supply by 2033 (+/- 2 years). The extraction rate shown on the right axis is for conventional oil only, a separate model is used for both tight oil and extra heavy oil. Output peaks in 2027 at 740 kb/d above the 2018 peak of about 83 Mb/d.

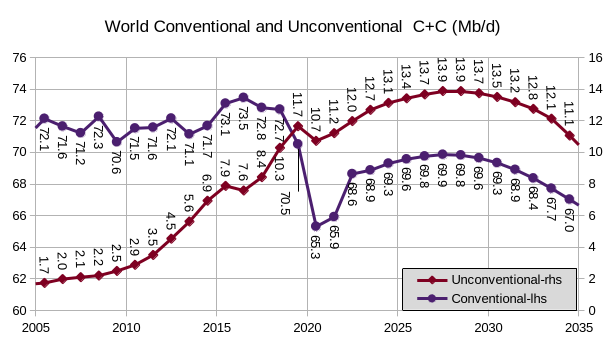

The shock model can be divided into conventional and unconventional oil scenarios where unconventional oil consists of tight oil and extra heavy oil with API Gravity less than 10 degrees. The conventional scenario peaked in 2016 at cumulative output of 1273 Gb and has a URR of 2520 Gb. The unconventional scenario peaks in 2028 at cumulative output of 77 Gb and the URR is 170 Gb. The combined model peaks in 2027 at a cumulative output of 1624 Gb.

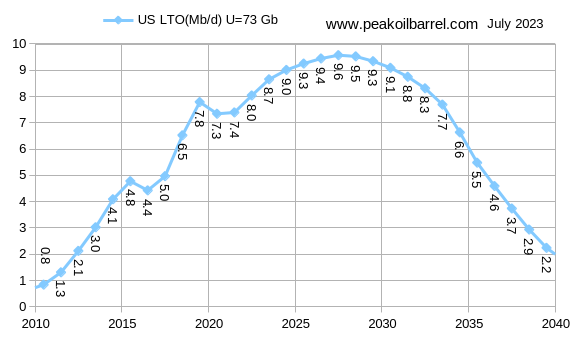

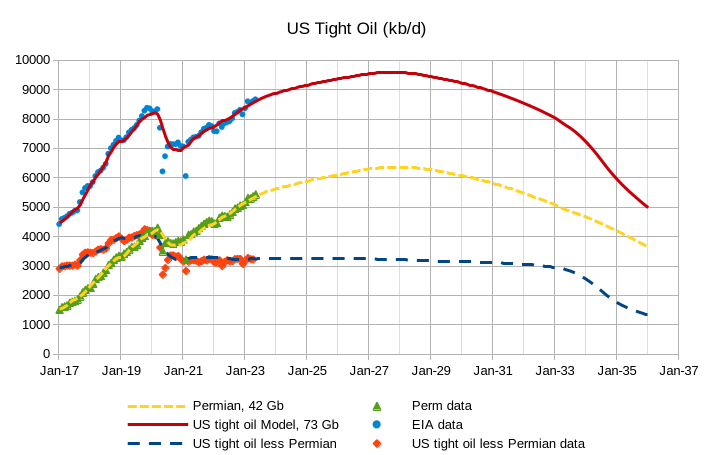

The US tight oil scenario above is a slight revision to the scenario presented last month. It peaks in 2027 at 9.6 Mb/d and has a URR of 73 Gb, slightly bigger than last month’s scenario (72 Gb last month).

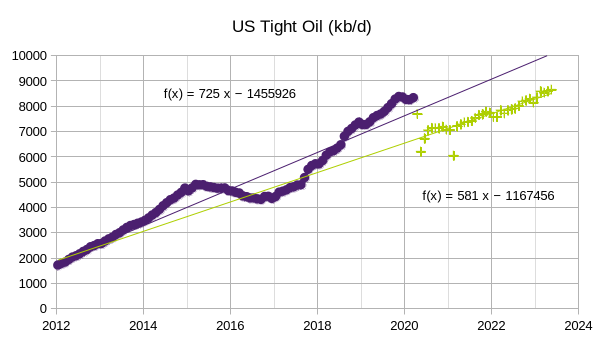

The chart above shows the most recent EIA tight oil estimate (spreadsheet at this link) with data from Jan 2012 to May 2023. Two trend lines are presented with April 2020 to May 2023 having an annual rate of increase of 581 kb/d and the earlier Jan 2012 to March 2020 period having an annual rate of increase at 725 kb/d on average.

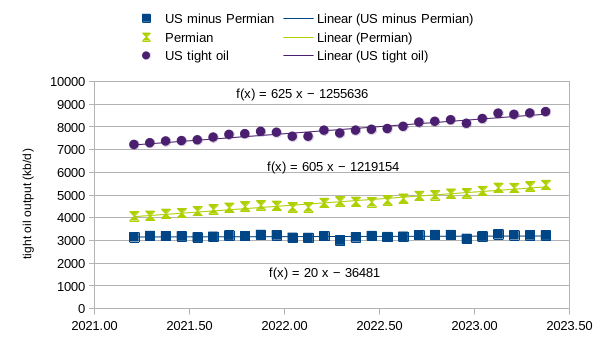

For the more recent March 2021 to May 2023 period the US tight oil trend has an annual increase of 625 kb/d, the Permian has an annual rate of increase of 605 kb/d and the rest of US tight oil (everything except the Permian basin) increased at an annual rate of 20 kb/d over the past 27 months. In the future I expect Permian output will increase more slowly and expect the rest of US tight oil to be relatively flat over the next 5 to 7 years.

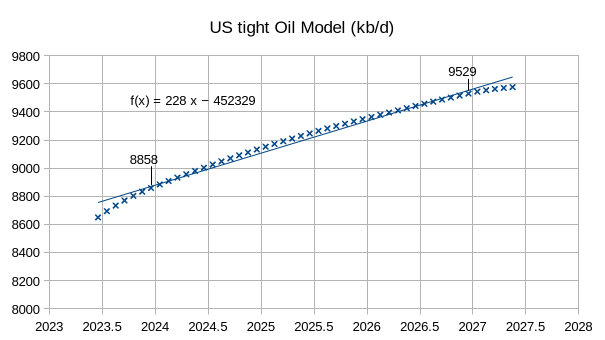

The chart above presents my tight oil scenario with monthly data from June 2023 to May 2027 with a trendline. The annual rate of increase is 228 kb/d over this period, quite a bit slower than the rate of increase over the previous 27 months (or the previous 37 months). The output levels for December 2023 and December 2026 are shown on the chart.

The chart above presents the revised US tight oil and Permian tight oil scenarios, the US tight oil less Permian scenario is unchanged from last month. The US tight oil model peaks in September 2027 at a centered 12 month average of 9578 kb/d and the Permian model peaks in December 2027 at a centered 12 month average peak of 6358 kb/d.

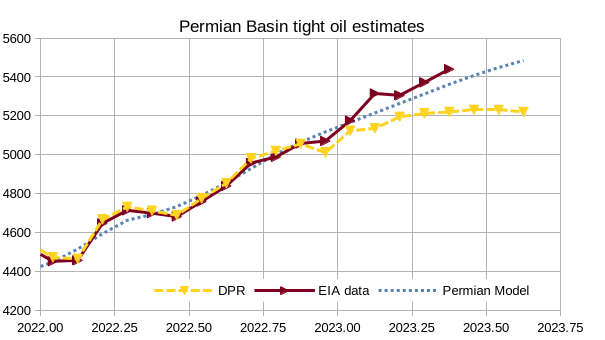

The chart above compares the EIA’s official tight oil estimate (labelled EIA data) with the recent DPR estimate for the Permian basin and my Permian Model. To compare the DPR with the tight oil estimate I found the average of the difference between the two for the June 2020 to October 2022 period which was 545 kb/d. I had checked the DPR against state data from Texas and New Mexico and the match was good over this period, after that incomplete state data led to the DPR being higher than the state estimates after October 2022. The DPR estimate shown on the chart subtracts 545 kb/d from the DPR estimate to remove the conventional oil from the Permian region that is included in the DPR estimate. The match between the DPR estimate and the EIA data is quite good through November 2022, by May 2023 the DPR estimate falls to 220 kb/d below the EIA’s tight oil estimate. My model also falls below the EIA estimate in May by 83 kb/d. For August 2022 the DPR estimate is 265 kb/d below my Permian model (which was too low in May), it seems possible that the DPR estimate for the Permian basin is too low from Feb 2023 to August 2023.

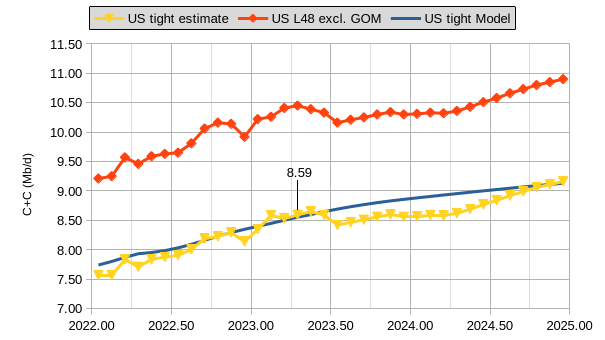

The chart above uses a similar methodology to what was used previously for the Permian Basin with the DPR and EIA estimate, but uses the US tight oil estimate and the US lower 48 output excluding the Gulf of Mexico (US L48 excl GOM) estimate from the EIA’s STEO. The difference between these is about 1.73 Mb/d on average from August 2021 to July 2022 and this was subtracted from the US L48 excl GOM estimate to arrive at a US tight oil estimate from May 2023 to December 2024. The data on the chart from Jan 2022 to April 2023 is the official EIA tight oil estimate up to the 8.59 Mb/d called out on the chart, after this the data is the estimate I have outlined with each US tight estimate data point 1.73 Mb/d less than the corresponding US L48 excl GOM data point. My model does not match this estimate very well from July 2023 to August 2024 with the model being as much as 350 kb/d too high in March 2024. In August 2023, the model is 262 kb/d higher than the tight oil estimate which might be coincidence, but the Permian model was about 265 kb/d higher than the DPR estimate for August 2022. It could be that the STEO is using the DPR for part of its modelling for US output. I will fix my models as presented this month for 6 months to see how they play out over time. We might find that the EIA estimates will be adjusted over time and it would be interesting to see how well the models do.

Thanks Dennis – I appreciate your continued analysis and unwavering model. I believe over time it will get further and further off course, as mentioned in the last thread, 1P and 2P would have to grow by very high amounts to reach the 2PC estimate that you are using (2783 Gb). 2PC includes noncommercial volumes and undiscovered oil…clearly it includes estimates for oil that will never be found!

There is a more simple way to look at this, 3 categories of oil:

300 Gb – Conservative estimate in existing fields (P10), this is likely a low estimate (90% it will be higher)

400 Gb – Average of conservative and most likely estimate in existing fields (P30), this is a slightly low estimate, (70% chance actual URR will be higher).

500 Gb – Most likely estimate in existing fields (P50), this is the best available number we have with 50% chance of being higher or lower than actual URR…

So why not model 1800 (1P), 2000 (2P), and 2500? I think 2500 is still too high, it’s likely only a 10% prob. of being higher than that. Thanks for all your work!

Kengeo,

Thanks. We will see how things play out.

Geologists at the USGS say there are about 3000 Gb of conventional resources, I am using 2500 Gb which is conservative. 2PC does not include undiscovered resources (which are called prospective resources), it includes the mean estimate of contingent resources which have been discovered, but have no current plans for development. Lots of uncommercial resources become commercial at higher prices and as technology develops.

You can do your own models, even 2500 Gb is likely too low an estimate, that would be my P90 estimate. As I have mentioned, Jean Laherrere’s estimates tend to be conservative and in 2022 he estimated 3500 Gb for World C plus C URR. I would put the P50 estimate at 3000 Gb, and P10 at 3500 Gb. My 2700 Gb model is on the conservative side of reasonable estimates.

Contingent Resources are those quantities of petroleum which are estimated, on a given date, to be potentially recoverable from known accumulations, but which are not currently considered to be commercially recoverable.

It is recognized that some ambiguity may exist between the definitions of contingent resources and unproved reserves. This is a reflection of variations in current industry practice. It is recommended that if the degree of commitment is not such that the accumulation is expected to be developed and placed on production within a reasonable timeframe, the estimated recoverable volumes for the accumulation be classified as contingent resources.

Contingent Resources may include, for example, accumulations for which there is currently no viable market, or where commercial recovery is dependent on the development of new technology, or where evaluation of the accumulation is still at an early stage.

For a better understanding of contingent resources see

https://www.spe.org/en/industry/petroleum-resources-classification-system-definitions/

When I do an HL on World C plus C data from 2000-2019, I get a URR of 3030 and a peak in 2024, decline rates are under 1% per year from 2025 to 2037 and increase gradually from 1% in 2038 to 2% by 2053 and to 3% by 2077 for a Hubbert Model.

Looks like a 20 year peak plateau phase 2014-2034.

Global population increases 1.5 billion during that timeframe.

That equates to a big drop in oil/capita, accelerating post plateau.

Plan for less oil.

Hickory,

Oil use per capita was pretty steady from 1983 to 2019, it has yet to return to the 2019 level (data through 2022).

The nice straight line is about to trend on down as 7.3 B in 2014 becomes 8.8 B people in 2034,

during this high plateau phase.

Hickory,

I expect that will happen as well, note that there was little change from 2014 to 2019, though I imagine population was still growing, but oil output must have grown at a similar rate. This will change and gradually we will see oil consumption per capita decrease, the rate of decrease will be the population growth rate plus the rate of decline in oil output. Recently World population has been growing at about 0.8% per year, oil output will decline at about 1.7% per year from 2028 to 2038, so if population growth rate is unchanged (it will likely decrease) this implies a 2.5% decrease in oil consumption per capita over that decade.

The same in barrels per year

the great reset?

Dennis – Seems pretty straightforward to me:

Minimum estimate (90% actual is higher): 285 Gb

Medium estimate (50% actual is higher/lower*): 505 Gb

*this means there’s an equal chance of it being higher or lower than this value.

Maximum estimate (10% actual is higher): 1300 Gb

Another way to look at it is the most likely value is the mean of the minimum and maximum:

~800 Gb, which works out to 2,300 Gb. Therefore a conservative range for 2P is 500-800 Gb.

I believe this also matches HL methods better than any methods that estimate >2,500 Gb.

Question, what happens if you remove the ~300 Gb of overstated Middle East reserves? I imagine the maximum estimate drops to 2,500 Gb?

Kengeo,

A Hubbert linearization is pretty straightforward for the World, it does not depend on stated reserves simply on historical output, using data from 2000 to 2019 I get a URR of 3030 Gb. Note that my model is about 2700 Gb, 3030 minus 300 would be about 2730, but that is not how I arrive at my scenario. I assume demand drops after 2035 and leads to a fall in supply that matches the fall in demand as the World uses less oil for land transport. Working to reduce climate change damage will eventually see us reduce almost all fossil fuel use for combustion and transport, though some will be used for chemicals, fertilizers and other material inputs, very little will be burned as cheaper sources of energy become more widespread.

You should try doing an HL analysis. You have to do some pretty funky stuff (such as not focusing on straight line portion of chart) in order to come up with a URR that matches your expectation. Anything under 2700 Gb is not a good analysis and my judgement is that at least 3000 Gb is a best guess estimate for World C plus C URR using the HL method.

Dennis , ” as cheaper sources of energy become more widespread. ” You wrote that ??? Unbelievable . Seems like you are not sleeping proper . Get some sleep . Serious .

Hole in head,

As fossil fuels deplete they will become relatively expensive compared to other types of energy such as nuclear, solar, wind, hydro and biofuels which may become relatively less expensive than fossil fuel and more widely used over time. That’s my expectation.

Why, Dennis? Because windmills, solar panels, and nuclear power stations shoot out of the ground under tremendous pressures?

Please forgive the snark.

MikeB,

It simply is. Costs of wind and solar in particular are cheap, thought there are challenges to intermittency as they become more widely dispersed at adequate levels ( a capacity in total of roughly 3 times average electric power load) and interconnected with a high voltage grid with adequate capacity, the intermittency becomes less of a problem.

I would note that producing, refining and distributing oil, natural gas and coal is not a trivial matter, it requires lots of effort and does great environmental damage, producing wind turbines, solar panels and the grid needed to connect them also does environmental damage, but less so than fossil fuel. Alternatively we could use no energy at all, but it is a relatively unrealistic option. The best policy is to reduce energy use as much as possible while replacing fossil fuels with alternatives. It won’t be any more difficult than farming, possibly less so.

Just for information purposes . Announcement from EIA .

Joe DeCarolis

@EIA_One

·

10h

Replying to

@EIA_One

I have decided that we must forge ahead with critical NEMS enhancements to keep pace with the changing dynamics of the energy sector.

In order to accommodate this effort, EIA will not publish an Annual Energy Outlook in 2024.

Recession indicator . Diesel consumption down . Oh ,by the way a large transport company also filed for bankruptcy .

“U.S. diesel consumption fell below the 5-year average in early June 2023

That’s a bad signal for the economy ” —- Art Berman

and here is another view art did not mention

Javier Blas

@JavierBlas

·

3h

COLUMN: In this age of climate crisis, the world is consuming more oil than ever. Peak demand? Not yet.

On my calculations, global oil demand has surpassed in the past few weeks the peak set in 2019 before the covid pandemic | #OOTT via

@Opinion

bloomberg.com

The Harsh Truth: We’re Using More Oil Than Ever

The planet is getting hotter by the day, but we can’t slake our thirst for crude.

“HFI Research

@HFI_Research

·

18h

US oil demand is not great. Overall is up, but gasoline/distillate/jet fuel now matching 2022 due to weak distillate demand.

Gasoline and distillate need to pick up going forward.”

of course that is hindsight…prior to recent and ongoing price increases.

“US oil demand is not great.”

That is a Hilarious statement. Others would say US consumption is gargantuan.

Thats how I see it.

I guess it all depends on what ones goals are.

more context

Javier Blas

@JavierBlas

·

53m

Important comments on global (and US) oil demand:

“Global demand for transportation fuels as recovered substantially with gasoline and diesel demand now comparable to pre pandemic levels” — Lane Riggs, Valero CEO | #OOTT 1/2

Javier Blas

@JavierBlas

·

52m

And another key one from Valero (this time from CFO Gary Simmons): “We do believe that the DOE is understanding gasoline demand […] We’re seeing gasoline sales in our system, up 14% year-over-year, up 20% from pre pandemic levels” | #OOTT 2/2

Javier Blas

@JavierBlas

·

33m

*understating

7

5,944

Best case scenario-

The global demand for oil declines slightly faster than supply,

all the way down.

Hole in head,

I don’t put a lot of stock in EIA weekly numbers which are often off by kilometers rather than millimeters, monthly data is ok and worth paying attention to, charts based on the weekly data are garbage, its a gigo thing.

Lea and Eddy counties account for 29% of Permian production .

https://www.eia.gov/todayinenergy/detail.php?id=57020#

I think the focus is too much on the global production peak. I would like to get feed back

from this group which evidence there is that global oil markets start to disintegrate with more focus on regional oil demand like in Asia as highlighted in my post

17/7/2023

Peak Oil in South East Asia and India – Part 1 Production and

Consumption – Update 2022

http://crudeoilpeak.info/peak-oil-in-south-east-asia-and-india-part-1-production-and-consumption-update-2022

Agree wholeheartedly Matt.

I’ll add that within many countries a big dynamic going forward will be the disparity between those who can afford and procure adequate energy supplies vs those who can’t.

Matt you are noticed . Yes, you are correct in your observation above .

“2 billion people represented by these 7 countries, all on the right part of S-curve and all with significant growth in petroleum consumption.

At the same time, their combined crude oil production remains in terminal decline = growing import requirements for years to come ” — Shubham Garg

When I read the graph above from Matt and combine it with the Eurodollar issue as discussed by HHH , I see a toxic brew . Go back to the dollar crisis way back in the 90;s in SE Asia . Are they are stronger now on the dollar front than before ? Yes . How strong ? I don’t know .

When oil is put on a boat for export it’s paid for with a credit from a bank to another bank. Literally most of the “money” that exists are credit entries on bank balance sheets. Nothing physical be it cash or gold is leaving one bank and going to another.

It’s not practical to put pallets of cash or gold on a boat or plane every time there is a transaction done between two entities in two different countries.

I think most people understand this to be true but don’t understand how little physical cash there is compared to credits on the balance sheets of banks.

Credits on the balance sheets of bank determine the value and price of absolutely everything. Be it oil, be it gold, be it currencies.

Eurodollar system determines the value and price of everything.

Eurodollar system determines the value and price of everything.

HHH I think we all realize that physical cash is just not used for anything anymore. Hell, I don’t even use it anymore, even to buy a hamburger. But I was totally unaware that the Eurodollar had taken over as the world’s primary reserve currency. I totally missed that news flash. When did that happen?

” I totally missed that news flash. When did that happen?”

I think it just happened without anyone noticing.

It wasn’t designed.

It emerged out of buying behaviour,

A reserve currency is a function of math. nothing else.

People like to hold things denominated in dollars cause they are stable and reliable.

People like to hold things denominated in dollars cause they are stable and reliable.

I agree. Oil is still traded, in the vast majority of cases, in dollars. And that is what the emergent buying… and selling behavior… is doing… in spades.

No, the eurodollar has not, very silently, become the world’s primary reserve currency. But if you have data to dispute that claim, I would gladly look at it and admit my error if I find your data convincing.

I am a newbie to the whole Eurodollar thing.

Yeah, some data supporting the claim is in order.

HHH, got any?

Yeah, some data supporting the claim is in order.

HHH, got any?

Thanks, Andre; I couldn’t have said it better. 🤣🤣🤣🤣🤣🤣

Eurodollars ( the word Euro is misleading….it has nothing to do with the EURO or Europe)

Are US dollar ledger entries that are overseas and they are still valid and used in transactions.

But, Ron is correct….HHH please support your claims with evidence?

Eurodollar became global reserve currency in the 1950’s. The majority of Eurodollars are dollars that are created. Loaned into existence, in offshore markets around the world.

Yes it perfectly legal for banks outside the US to create money or bank ledger entries denominated in US dollars. Which are used as money by global monetary system.

Global banking cartel is a very good way of looking at it. These bank ledger entries require zero bank reserves denominated in US dollars that the FED creates out of thin air.

One is the global reserve currency the other is not. One is used in 70% of global transactions the other is used in 0% of global transactions.

There wouldn’t be nearly enough dollars outside US for global economy to transact in without these banks creating the credit needed to conduct business transactions. Global trade would be a small fraction of what it is today without these Eurodollars.

Why can’t we all just transact in each other’s currencies. There are only so many Chinese yuan or Indian rupees that Russia can use. Americans don’t use British pounds to pay for anything. We trade with them but can’t use or have no need for their currency. Eurodollars are excepted pretty much everywhere.

Eurodollars are ledger credits. Nothing physical ever leaves one bank and goes to another. Banks are basically book keepers that just keep track of the credits.

When there is a let’s call it a hiccup in the Eurodollar market where these Eurodollar banks decide not to extend credit or make it expensive to extend credit because of counterparty risk or lack of collateral or even lack of energy in real economy. Whatever the case. These credits determine how many dollars are in the monetary system. And ultimately the value or price of all currencies and commodities. 2008 was a global dollar shortage. That actually started in France of all places. Most people have no clue to that fact.

Yes it was a bank in France that kicked off 2008 monetary crises.

But no data?

@andre – you notice that too? you beat me to it, but my comments get put into a special holding pen for Ron to hold a little sword of damocles over. 😉

TwoCats, I am sorry about that. I would fix it if I could. Also, Dennis and Ovi could approve your post if they ever checked the pending file, but obviously, they don’t.

I check it frequently because that is where I check for new posts. I only go to the main post if I need to reply.

But I am getting old and won’t be around much longer. 😫 No one will approve your post then when I am gone. 😫😫😫

I have a probable solution. If you create a new email address, then that might fix the problem. I would have to approve your first post, but your approval should be automatic after that.

SOFR which replaced LiBOR this year is deeply inverted. The banks that create all the money in the Eurodollar market are telling you through all the yield curves that the worst of what is coming down the pipe hasn’t hit yet.

You can’t view exactly what Eurodollar banks have on their loan books. Central banks don’t even have that information. You have to look at other stuff like Japanese bond yields. They are already low. But when you see them going lower when they are the only major central bank not raising interest rates it tells you there is huge demand for safe an liquid assets above and beyond the central bank buying.

Why is that? Because opportunities in real economy to make money aren’t good so people buy government’s bonds instead. Buying government bonds instead of lending money into China. When you see USD/CNY go up meaning dollar is gaining value against the Chinese yuan it means less Eurodollars are flowing into China.

You have to look at what currency swaps are costing people. Again, you have to post some form of collateral to get a currency swap at a bank. If collateral becomes impaired for any reason. Which can happen for a variety of reasons. You have post more collateral to borrow or swap for the same amount of dollars.

Eurodollar market can become collateral constrained. Where entities within the economy don’t have the collateral needed to create Eurodollars.

2008 was or started as a collateral shortage or banks unable to properly value the collateral they had on the books in France.

Over the next 12 months or so. We will see a whole lot of collateral on the banks of the small and mid sized banks get repriced as CRE loans are walked away from in mass.

That doesn’t mean oil can’t get a short term bid. It just means in the longer term oil is going lower much lower in price. We have to get to the other side of the incoming recession before oil becomes an attractive buy again.

“… It’s not practical to put pallets of cash or gold on a boat or plane…”

A better way of putting this, for me anyway, would be this- that a real world transfer of anything results in a discount or tax on the energy available in the purchased oil. The margin is too low already.

Jeff Snyder has a series of videos on the Eurodollar and currency wars . Here is one .

https://www.youtube.com/watch?v=wRsopaUFjgI

fantastic post HiH, thank you. I just finished the intro/overview (about 25mins) and it seemed like a great summary. At least I can say that it was presented in a way that is pretty easy to understand.

luckily we’ve had HHH on the thread to signal to this issue. I would like to see HHH start posting actual data to show how the Eurodollar system is under strain. if such data exists publicly. hopefully the video addresses this as well.

I just finished Edward Chancellor’s book The Price of Time, and curiously he did not mention the Eurodollar system separately. I have watched many of Jeff Snider’s videos and my understanding of the creation of this system stems from the fact that the world industrial center moved from Great Britain in the 1880’s to USA with its high point in 1945. This made the USD the most stable currency and businesses outside the US saw it prudent to borrow in dollars in order to limit the currency risk.

What Would Happen to Russia’s Oil and Gas Industry if the Government Fell?

If Russia’s government were to collapse, we would likely see substantial upstream declines.

That’s what Joseph Gatdula, the Head of Oil and Gas at BMI, a Fitch Solutions company, told Rigzone, adding that the reformation of a new government, whether peaceful or violent, would influence the extent of those declines.

“When the Soviet Union dissolved relatively peacefully in 1991, crude production fell by 10 percent that year and 13 percent in the year after, with declines peaking five years later at 40 percent below 1990 levels,” Gatdula said.

“State control of the oil and gas industry was much higher during Soviet times, so these declines are not likely to be repeated if the transition is orderly,” he added.

There is much more to this article. Click on headline link to read it.

They can see this in Russia, but somehow they cannot see this ever possible in US? Why?

Though CIA models predict “civil war” or similar unrest for a while now:

https://www.washingtonpost.com/outlook/2022/01/06/civil-war-books/

https://www.washingtonpost.com/magazine/2022/03/08/they-are-preparing-war-an-expert-civil-wars-discusses-where-political-extremists-are-taking-this-country/

It’s Trumpism all the way down

WTI just punched a $80/b ticket

Caught my eye also—

Dennis

Nice Job. A lot of good projections. I note that your tight oil model is slowly rolling over. The Permian will be the interesting basin to watch for the next while.

Attached is supply/demand chart created using the STEO supply/consumption data (all liquids) in the July STEO.

It is showing that over the next 17 months, only four months show a significant surplus. I think what this is saying that demand will begin to stress the supply side and force some of those OPEC plus cuts to be reinstated. It will be the beginning of the trek to the next post covid high. The effect of the July SA 1 Mb/d cut is starting to be felt as WTI settled over $80/b today.

The PDF in the STEO report shows a daily decline in inventory of 60 kb/d for 2023 and 230 kb/d for 2024. The STEO shows the July 1 Mb/d drop in OPEC crude and then a slow rise.

It will be interesting to hear what comes out of the OPEC meeting in early August. Will SA extend their 1 Mb/d cut into September?

Thanks Ovi,

There was a very big surplus of oil stocks built up during the Pandemic (about 464 Mb excess supply during first 6 months of 2020, on your chart this would be 6 months with an average surplus of 5.83 Mb/d), your chart does not show that. I think days of consumption is the more important metric as consumption increases it takes a larger total stock level to meet the 90 days of supply that is aimed for. The idea is straightforward in my mind, if average consumption is 100 Mb/d for the World, then 90 days of supply would be 9 billion barrels of oil in World stocks. If only 50 Mb/d of oil was consumed the stock level would only need to be 4.5 Biliion barrels. OPEC has different supply and demand estimates than the EIA. OPEC believes World Stock levels are much higher than the EIA does so they may not act to increase output unless they revise their estimates.

Yes my tight oil estimate has always rolled over, but the peak has been moved forward a bit to 2027. I will try to leave it alone for a while so we can see how badly I do.

Dennis

My earlier charts used to start in 2020 but for this one I removed it to more clearly show that 2022 was in surplus and that 2023 and 2024 were going to be draw years.

Attached is the same chart starting in 2020 and the surplus production was huge in 2020

WTI Chart. Looks bullish. How long before it challenges the previous high at $83/b.

with a weekly close above $80 that resistance becomes a floor that I think OPEC intends to defend. I think the ceiling will be the mid $90’s. I don’t know if they will announce It but that is were I would expect to see some of the Saudi BBls to begin to come back into the market. To late for any SPR refill. now that we have shot up all our ammo, for the first time is 10-15 years we are not in control of our own destiny (USA). Great for oil and gas producers but the consumers will be strained and continued inflationary pressures will persist in both food and fuel. 1970’s redo in my opinion.

Texasteatwo

I agree with you that the 90s are SA’s new 80s after accounting for inflation over the last two years.

How is this for a crazy idea. I think Biden should send someone over to SA to talk to the Prince and make a fixed price deal for 100 M barrels of oil at $85/b delivered over a year. That would give the Prince more sales without affecting the market surplus condition. Could also help repair the current rift between B and MBS.

At some point reality has to set in for these two.

I was re-reading the most recent Permian post at Novi labs and found this chart, which I hadn’t noticed earlier because it was small. I blew it up and thought I should share it.

This chart suggests for the Permian as a whole the newer wells have a lower GOR for any given cumulative output. This is the opposite that I would have expected.

See https://novilabs.com/blog/permian-update-through-april-2023/

The chart below takes the lower right panel of the last chart in the post and enlarges the chart so it is readable.

The chart is for the entire Permian basin and the wells are not normalized for lateral length.

Notice how the 2016, 2017, 2018, and 2019 GOR vs Cumulative output lines are right on top of each other with 2020 and 2021 having lower GOR at any given cumulative output level. Too early to make a judgement on 2022 wells, but they seem to be following the 2021 wells so far.

Dennis

Attached are two charts using daily production vs GOR for two counties. I think that cumulative output is the wrong parameter.

The Lea chart is hinting at the beginning of a straight line decline .

Howard, next chart is interesting. Is the straight line the clue that it is gassing out. I am wondering if the monthly update will change much in the chart since these are based on ratios

Ovi,

That was the chart given, too much work to reproduce GOR vs time. I like the idea of looking at how wells have changed over time, but separating out over years we can see of older wells have lower GOR than newer wells, that gives more information than looking at all well vintages mingled together as is the case with the state data by month.

Oh, Lord, Ovi, please don’t listen to this dribble above. THAT dribble is the EXACT opposite of what you should be looking for in issues of GOR to liquids production profiles, all leading to indications of eventual depletion. You are on the right track. Of course sweet spots, large operators in those sweet spots, and core counties matter in the big picture. Howard is one of the six core counties in the Midland Basin! How can anybody ignore THAT. Good grief.

And you would do well to listen to Gerry. He understands. A fella named John has posted some time-framed Novi charts at OSBFS that are very relevant to this subject. GOR goes up, bubble point occurs, liquids go down, then eventually GOR goes down. The Permian HZ play is now 9 years old; this tight oil stuff is in Hospice Care by year 12.

You seem genuinely interested in learning about real oil and gas to be a better analyst; I applaud that.

Mike,

Dribble is what basketball players do. Drivel is nonsense that is spoken.

Mike,

So we are looking for GOR to be decreasing with time when we have reached bubble point, are we seeing that on a countywide basis? Or perhaps for specific operators in specific counties?

For the average 2007 Permian well at 180 months of output tha GOR is about 25 MCF/bo. For the average 2008 Permian well at 168 months the GOR is about 8.3 MCF/bo and for the average 2009 Permian well at 156 months the GOR is about 6.1 MCF/bo.

If we look at Howard county for 2013 (4 wells) it looks like bubble point might have been reached around month 108 from what has been described. GOR goes from about 2 up to 12 in a short period and then drops back to about 3 roughly 4 months later.

See link below from Novilabs

https://public.tableau.com/shared/6Y5C8CPHW?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

Gerry Maddoux,

Could you take a look at chart linked below, please?

https://public.tableau.com/app/profile/peters6703/viz/shared/6Y5C8CPHW

You can toggle between oil and gas on upper right of chart under product, At month 106 there is a spike in oil output and for month 108 there is a large spike in gas output. There are only 4 wells on this chart of 2013 horizontal wells competed in Howard county, does this look like the wells are reaching bubble point around months 105 to 109? It seems to match with what has been described.

Thanks.

Dennis, first…I am not an engineer. I find them confusing, mostly driven by egos and degrees and hard to listen to. They typically think they know more and always have to have the last word. Admittedly, I am biased because I was in well control for a long time. They didn’t know shit about that stuff. So, often NOT being an engineer helps explains things so that people can actually understand issues better. That is my goal. And to increase awareness of depletion, that nothing lasts forever, not even the Permian, to stop exports and keep American resources IN America.

Gas to oil ratios are typically an individual well metric, like cholesterol levels in blood work for your annual checkup. GOR statewide is totally meaningless and most of the time, meaningless for an entire county, and certainly for a basin like the Midland or Delaware. EXCEPT in the unconventional HZ play where entire counties are packed full of wells on close spacing. Then county wide GOR’s can become very relevant. In core areas, in sweet spots that are stuffed with wells, GOR is very important.

If you wish to use GOR as a means of predicting the future you can’t make generalized statements about it, you must work from the bottom up, too much time or not.

When I see well productivity, or liquids well productivity decline by big operators in a county, I see rising GOR in the same sweet spots… 100% of the time. Its depletion. EOG, for instance in Lea County. Or Pioneer in Midland County. Ultimately what I see with densely populated sweet spots will happen county wide, like Howard County in the Midland Basin. How quickly depletion occurs in sweet spots is an indication of how MUCH quicker the same thing will happen on the flanks.

GOR is generally only relevant to certain (tight) oil reservoirs with solution gas/oil expansion as its primary drive mechanism, ‘drive’ meaning the energy that moves hydrocarbons to the wellbore. Induced energy from a frac first creates conductivity to the well bore, then that poops out and Mother Nature takes over.

“Gassing out,” by the way, is an old oilfield term used to describe bubble point in tight, depletion gas reservoirs. Most tight oil kids these days would not even know what gassing out means. Old farts do. I heard somebody I respect a great deal say today he thought the entire Permian Basin was gassing out. He was old too.

In densely populated sweet spots, or counties, initial reported GOR’s are important. To me they are an indication of trouble.

GOR goes up as tight liquids are produced from dense shale, or shaley carbonates. Bubble point occurs and oil rates roll over and start downhill. But GOR does not immediately follow that liquids decline and GOR can keep going up as liquids decline. Then, after some period of time, gas begins depleting, GOR goes down and the well has entered Stage 4 depletion, the last of its days. I’ve seen data sets of early Permian wells drilled that have already reached Stage 4 depletion, LOTS of them. I am amazed at how dumb people are about infrastructure build-outs and LNG terminals to handle Permian associated gas. That associated gas in boundary defined shale containers (SRV’s) won’t last long either. I don’t get it, then again, I always used my own money.

So GOR is all over the map for a county, at first; newer wells have rising GOR, older legacy wells have declining GOR. Individual well GOR is often misreported. Averages, extrapolating past trends into the future is fruitless. Nothing is certain, things change down there in the dark all the time. The GOR metric matters only in areas stuffed with laterals, in primary benches getting drained, and then to sort it out you must work from the bottom up, from the inside out.

That’s my story and I’m stickin’ to it.

Thanks Mike.

Did that chart look like wells reaching stage 4?

Howard County 2013 Oil, note month 105 to 108 change in output

More detail can be found at link for GOR by toggling between gas and oil, this chart represents only 4 horizontal wells that were completed in Howard county in 2013.

Howard counts 2013 Permian wells gas output, notice month 108. Oil output was 27 b/d for Month 108, GOR=12. For month 106 oil output was 93 b/d and gas was 148, GOR=1.6.

Ovi,

Here is GOR for average 2015 and average 2018 Permian basin wells, using GOR on x axis and Output in barrels per day on y axis. The output has been normalized for lateral length(output per 10 thousand feet of lateral which is close to the average lateral length in the Permian in 2022), with 2015 wells averaging 6322 foot lateral lengths and 2018 wells having average lateral lengths of 8006 feet. I used number of wells in midland basin and delaware basin in 2015 and in 2018 from Novi labs and used Novi labs data from April 2023 report and page linked below for lateral length estimate (I do not have access to Novi lab data for lateral length).

https://www.eia.gov/todayinenergy/detail.php?id=50016

I wonder if frictional losses in the longer laterals result in an increase in GOR as I expect the losses for natural gas might be lower than for crude, there are many who know more about this than me, but I have read online that frictional losses along the length of the lateral can lead to lower productivity per foot of lateral.

Note that the data is for the average well from 2015 and from 2018 and the data is from month 2 (lowest GOR) to month 48 (highest GOR).

Ovi,

We might have newer wells will lower GOR values not being reported yet, perhaps it takes some time for them to be set up in the RRC database, in any case this is speculation, I think the last 3 to 6 months of data May not be very good. New Mexico has a regulation that data must be reported within 45 days to the stae agency, but I have no idea if there is any enforcement, it might be any fines are very low so the data may not be timely in New Mexico. They probably have a much smaller database of wells than Texas so the job may be easier in New Mexico of getting all the data in the database and accessible online. What does the Lea county chart look like for GOR vs time?

Also, the biggest county as far as Permian output in the Delaware basin is Lea county, it might make sense to look at the corresponding largest producing county in the Midland Basin which is Midland county, this is the core of the core for Midland basin.

Texas RRC data for Pioneer Natural Resources wells in Midland County Texas GOR in MCF/bo.

Pioneer Midland county GOR vs oil output (kb per month) Jan 2018 to May 2023, same data set as previous chart but different format preferred by Ovi.

Note that I mislabelled the vertical axis it should be kilobarrels per month, my apologies.

Dennis

I think we are onto something new, definitely for me, and we need to be following this new may to chart production from counties/companies. This is the first month of data and it will be kept separately each month so that the change over the next three to six months can be compared.

Attached are two charts. Midland GOR which is vaguely similar to the PNR chart posted. They both bottom close to January 2022 before the GOR starts to rise.

Ovi notice how much Midland increased in 2020, it could be that completion rate is slowing. which would increase GOR.

This is the GOR vs Production chart for Midland county. The first part is similar to the one for PNR in that it wanders all over the place. However both show a similar trend for the last six to 7 months in that they are moving horizontally and slightly down.

As for how much those last six months will change going forward, I think very little because it is a ratio.

Let’s follow and see what happens.

Ovi,

I’m assuming the interval between the data points is monthly?

Yes

Howard

Note the straight line. Is that the clue to gassing out?

Ovi,

When the data is not complete we could see GOR decrease if the newer wells (with lower GOR) have not been reported, but the older wells that have already been set up for reporting and have on average higher GOR are being reported. The Texas RRC data takes some time to become complete, they have about 400,000 wells (maybe more) to keep track of so it is no easy task to get this data together in a timely way. The last 5 data points on your chart will likely change over time.

Also if you look back at 2020 you will see that as completion rate falls the GOR will increase.

Ovi,

I have some old RRC data saved on my computer, here is the most recent RRC statewide estimate compared with two earlier dates for GOR.

Howard GOR vs time

You have it right, Ovi.

From a simplistic standpoint, if you take a shale oil well past the IP90 (comfortably settled into gradual decline) and just plot oil production and GOR, the two curves will run parallel for X number of months. Then, in a month, the GOR moves up briskly while the oil production curve falls just as dramatically. Applying armchair gas physics, you are looking at the bubble point, and oil production driven by solution gas is almost at an end. This is called by a variety of equally ominous terms: accelerated decline, terminal decline, end of life. Said well can limp along producing 25-50 barrels a day for quite a few months, but the big money is done.

If a person were so inclined, he or she could generate a whole family of curves for a county. That’s where we are in Howard County illustrated above. Enough wells have reached the bubble point to paint a composite picture of decline.

Parenthetically, I believe such a graph is true for every single shale oil well ever produced. It’s the gas physics speaking from a well-contained single-hole reservoir. And if you produce frack crosstalk or fugitive bench-to-bench fractures, you usually shorten the time to bubble point (except for the rare “halo” effect).

One other point, with time past the bubble point, the monthly gas production will eventually fall, but by that time the oil production has fallen by a corresponding amount, so the GOR will continue to splay out from the oil curve. These curves are being drawn by hundreds of thousands of shale oil wells.

Permian Basin Average 2015 and Average 2018 wells normalized for lateral length GOR vs cumulative output per 10 thousand feet of lateral.

Russian Crude Oil Exports Continue To Plunge Bold theirs.

Russia’s crude oil exports by sea continued to slump last week.

Russia’s crude shipments plunged by 311,000 bpd to 2.73 million bpd in the week to July 23.

Russia’s crude oil exports by sea continued to slump last week and are now well below the February levels and nearly 1.5 million barrels per day (bpd) lower than the recent peak at the end of April, tanker-tracking data monitored by Bloomberg showed on Tuesday.

Russia’s crude shipments plunged by 311,000 bpd to 2.73 million bpd in the week to July 23, as exports out of the Western ports on the Baltic Sea and the Black Sea crashed to 1.17 million bpd, down by 625,000 bpd from the previous week, according to the data reported by Bloomberg’s Julian Lee.

Crude shipments from the Kozmino port in Russia’s Far East, from where the voyage to top customers China and India is much shorter, rose in the week to July 23, but couldn’t offset the plummeting crude export volumes from Novorossiysk on the Black Sea and Primorsk and Ust-Luga on the Baltic Sea.

So in the week to July 23, nationwide Russian crude exports by sea, at 2.73 million bpd, were 1.48 million bpd lower than the peak seen in the final week of April, according to Bloomberg’s data.

Tanker-tracking data have already started to show in recent weeks that Russia’s seaborne crude oil exports were declining from the highs seen in April and May.

Last week, Russian crude oil shipments plunged to a six-month low in the four weeks to July 16.

This week’s data compiled by Bloomberg suggests shipments plummeted further in the following week to July 23.

In early July, Russia said that it would cut its crude oil exports by 500,000 bpd in August in a bid to ensure a balanced market, and the reduction in exports would come from a further 500,000-bpd cut in oil production.

Vessel-monitoring data suggest that Russia has started to reduce supply to the market, which, combined with the Saudi production cut of 1 million bpd in July and August, would tighten market balances.

By Tom Kool for Oilprice.com

Dennis – Re: URR above. Best I can manage is ~2,400 Gb or 2,340 Gb excluding tight oil. I believe the most likely URR to fall at 2,000 Gb plus or minus 10%. Can you point to the exact values that allow you to plot HL of 3,000 Gb? Below are the values I used for 2016 thru 2024:

0.058783587 1288.625

0.057148282 1316.75

0.056508517 1344.93

0.053896184 1373.01

0.052477884 1400.59

0.051168105 1426.67

0.049905352 1452.75

0.048687138 1478.83

0.046508229 1505.11

You may also notice that URR from 2012 USGS data is equal to 2,400 Gb if you include cumulative production of 1,200 Gb plus their F5 estimate (95% actual reserves being lower) of 1,200 Gb. They also provide a mean of 565 Gb, implying 1,765 Gb.

With that, it appears there’s a very low (5%) probability that URR would be greater than 2,400 Gb.

What’s interesting is that if you back out the mistated middle east reserves (almost 400 Gb), your URR of 2,700 Gb drops to ~2,300 Gb…

Kengeo,

742.16 0.030726175349455

765.47 0.0304512068787004

789.50 0.0304434209379239

813.99 0.0300791375783232

838.08 0.0287501102493823

863.11 0.0289989717905777

888.00 0.028023940941725

912.57 0.0269322938088177

937.95 0.0270488642811685

964.46 0.0274931690712702

991.44 0.0272142158292159

1018.34 0.0264081799810003

1045.12 0.0256253480366469

1072.32 0.0253656808403798

1099.03 0.0243090729587277

1126.21 0.0241317614101455

1153.64 0.0237722740635703

1181.64 0.023703116832658

1209.68 0.0231791604640464

1238.40 0.023185631988023

1267.97 0.0233228314623485

1297.57 0.0228117214001823

1327.25 0.0223598643150042

1357.56 0.0223310359604216

1387.57 0.0216286516140875

Data above is cumulative production and annual production divided by cumulative production from 1995 to 2019.

The USGS estimate for conventional oil is 3000 Gb, you are leaving out reserve growth which is a real thing, my model looks at World discovery data from Laherrere and models future discoveries and reserve growth with a model that uses 2800 Gb of discoveries plus reserve growth from 1870 to 2294. The OPEC reserve estimates are not part of my model.

See

https://pubs.usgs.gov/sir/2015/5091/sir20155091.pdf

Along with the 565 Gb of undiscovered resources in the 2012 report you need to add the 665 Gb of reserve growth in the paper linked above (note that this does not include reserve growth in the US.

See also

https://pubs.usgs.gov/fs/2012/3052/fs2012-3052.pdf

For US see

https://www.doi.gov/news/pressreleases/USGS-Releases-US-Oil-and-Gas-Reserve-Growth-Estimates

Reserve growth for US was estimated at 32 Gb in 2012 for conventional resources only.

Output in 2019 was about 30 Gb, cumulative production was about 1388 Gb, 30/1388=0.0216. You might have used Mb/d, you want to convert to Gb/year, so 80 Mb/d is 80*365.25/1000=29.22 Gb per year, then divide the output in Gb for the year by cumulative production for that date.

For the data presented above(1995-2019) the URR is 2857 Gb, if we use 2001 to 2019 data the URR is 3098 Gb. I omit the 2020 to 2022 data because the pandemic and recovery from the pandemic in 2021 and 2022 was an anomoly. If we use all data from 1993 to 2022 the URR is 2786 Gb. I don’t use future data (from 2023 and 2024) to do these estimates.

Kengeo,

The 565 Gb mean estimate is for undiscovered conventional oil resources outside the US. You have to add 2P reserves to cumulative production along with reserve growth. So 1200 Gb cumulative output plus 565 undiscovered conventional resources is 1765 Gb, then add reserve growth of 665 Gb and we get to 2430 Gb of cumulative production, undiscovered conventional oil resources, and reserve growth. At the end of 2012 World conventional reserves were about 1296 Gb, if we subtract 400 Gb to occunt for middle east reserves possibly being inflated we get 896 Gb of 2P reserves, when we add this to the 2430 Gb estimate to include all oil resources we get 3326 Gb for World conventional resources. If we add my guess of 170 Gb for unconventional resources we get 3496 Gb for Total World C plus C URR, very similar to the Laherrere et al 2022 estimate of 3500 Gb.

Dennis –

Best I can tell the data support an estimated URR of ~2 Tb, we’ve produced 1.5 Tb and we have just under 2P of 0.5 Tb. While there may be future discoveries and reserve growth, so far it doesn’t appear they are significant. An additional 1 Tb of growth/discoveries would be welcome as it would buy ~35 years. With that in mind, we need to be finding/growing reserves at ~30 Gb per year, that’s not happening. It’s not clear if you are counting US tight oil in your URR data, but if using >2010 values then you should remove tight oil to see what conventional is doing, taking ~2005-2010 data sets result in URR of ~2.2 Tb…maybe instead of ~800 Gb of discoveries/growth there are only 200 Gb? Once again, I get URR of 2 TB plus/minus 10 percent…either way we have produced ~80% of all oil that’s there for the (easy) taking and a bit of the oil that was not that easy (tight/deepwater)…I’m sure we will squeeze every last drop even if doing so causes the worst climate the earth has seen in millions of years…

This is moment we realize the damn fuel gage is broken and we thought we had half a tank but we’re running on fumes (it’s ironic since half the comments are discussing the “big gas-out”).

You should reevaluate the myriad assumptions you have to support an analysis that there will be a plateau or even future growth.

Kengeo,

The URR for all C plus C using Hubbert Linearization is about 3000 Gb.

Using 2P reserves is silly, the 2PC number is the best estimate for reserves plus contingent resources.

The contingent resources have been discovered and simply have no current plans for development within the next 5 years, as 2P reserves deplete, mor of the contingent resources are developed and become a part of 2P reserves. Also reserves grow over time, so assuming the 2P estimate at the end of 2022 will not increase over time is simply wrong. Also more oil will be discovered.

Laherrere’s estimate for World C plus C URR is 3500 Gb and for conventional oil (excludes extra heavy oil and tight oil) the URR is about 2500 Gb.

See link below for US crude reserves

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RCRR01NUS_1&f=A

and link below for US annual C plus C output

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPUS1&f=A

In 1970 US crude proved reserves were about 39 Gb, 2P reserves were about 66 Gb.

From 1971 to 2021 the US produced 143 Gb of C plus C and at the end of 2021 2P reserves were about 70 Gb. If there had been no increase in 2P reserves after 1970, the US would have been able to produce no more than 66 Gb and current 2P reserves would be zero. What actually happened is that cumulative 2P reserves increased by 143 Gb plus 4 Gb or 147 Gb in total.

It is utter nonsense to think that World cumulative C plus C production plus current World 2P C plus C reserves will be equal to World C plus C URR.

Conventional C plus C alone will have a URR of about 2520 Gb and unconventional oil URR will be at least 170 Gb, for a total World C plus C URR of about 2700 Gb, at minimum. If the transition to electric transport is slow, the URR may be higher in line with Hubbert models (3000 to 3500 Gb).

Can you point to the 5 year average reserve growth and discoveries then? Is it in line with a URR of 2.5-3.0 Tb? I get the impression that at best it is only about 5-10 Gb each year. That means that next 20 years would only provide an additional 0.2 Tb meaning a URR of 2.2 Tb, maybe you see the data differently? I see no reason to look at 1970s and think that 2020s would see similar level of reserve growth and discovery…that seems silly.

Dennis – My review shows world reserves have been shrinking 5% annually for at least past 5-10 years. 1P in 2016 was 381 Gb, 2023 it’s 285 Gb. For 2P, 2016 was 655 Gb, now it’s 505 Gb. For 2P, about 140 Gb were produced during that timeframe meaning that there should be 515 Gb 2P leftover. This implies 2P shrank by 2%, maybe oil price or tech plays into the equation…regardless something doesn’t seem right…

Kengeo,

Let’s assume as you do that 2016 2P reserves were 655 Gb and further that there is never any addition to these reserves from contingent resources. From the end of 2016 to the end of 2022 there were 175 Gb of C plus C produced in the World, so we would expect, if your analysis is correct, that at the end of 2022 2P reserves would be 480 Gb.

For the World we don’t have very good reserve data, difficult to find your 2016 estimate.

Laherrere has World 2P at about 1100 Gb in 1985 and cumulative production was about 524 Gb. By your account URR= cumulative production plus 2P reserves so in 1985 this would suggest a URR of 1624 Gb. At the end of 2022 cumulative production was 1473 Gb, which suggests 2P reserves of 150 Gb, if the URR estimate from 1985 were correct, the 1985 estimate was too low by at least 350 Gb (if your method is correct, which it is not). Using 2020 data for 2P reserves from Laherrere (700 Gb) and cumulative production (1415 Gb) in 2020, cumulative production plus 2 P reserves were 2115 Gb in 2020. Where did the increase in reserves come from? A combination of discoveries, development of contingent resources and reserve growth equal to about 490 Gb from 1985 to 2020. I do not assume the increases in reserves will continue at the same rate as before, likewise in the absence of any evidence I do not expect there will be no increases in the future. In fact there are at least 700 Gb of contingent resources that have already been discovered, possibly as much as 1500 Gb of contingent resources, future reserve growth and new field discoveries.

See https://www.sciencedirect.com/science/article/pii/S2666049022000524?via=ihub

Figure 5 in Section 4.4 of paper linked above has the chart with 2 P reserves.

The numbers are directly from Rystad…not sure why you increased the interval to almost 40 years…these are just estimates, everyone understands they can change yearly for at least 3 reasons, technical, economic, discoveries. The data is trending opposite as you suggest, so usually that’s a red flag for assuming growth of 700 plus Gb. It’s clear you turn a blind eye when data don’t support your argument, that’s too bad as you are doing yourself a disservice.

Kengeo,

I think Jean Laherrere likely knows much more than you or me. His estimate is 2500 Gb for conventional URR and 3500 Gb for World C plus C.

Can you explain what a contingent resource is? Try

https://en.wikipedia.org/wiki/Oil_and_gas_reserves_and_resource_quantification#Resources

The Rystad 2PC estimate is 1283 Gb, this includes the 780 Gb of contingent resources which have already been discovered. 2C=2PC-2P=1783-505=778 Gb at the end of 2022 according to Rystad. There a multiple lines of evidence which suggest a 2000 Gb estimate is too low, the contingent resources along with continued reserve growth and discoveries over time will likely lead to a minimum World URR of about 2700 Gb, or perhaps Jean Laherrere’s more optimistic 3500 Gb estimate will be correct. This is the realistic range in my view, 2700 to 3500 Gb for World URR, though my guess is that it will be towards the low end of this range.

Dennis –

Lots of governing bodies on oil classification (USGS, SEC being the oldest – developed in 70s/80s).

Contingent Resources per USGS are essentially “Marginal Reserves” aka Discovered Sub-commercial. These are only 1 step up from “Demonstrated Subeconomic Resources”. Below that there is only Undiscovered Resources.

It’s common sense/knowledge that the “Commercial Best Estimate” is made up of both Proved and Probable reserves (2P). 2P is ~500 Gb, with cumulative production nearing 1,500 Gb. The best estimate available for URR is therefore 2,000 Gb.

World conventional production peaked somewhere around ~1,000 Gb cumulative production give or take 10 percent. URR is then ~2,000 Gb plus or minus 10%.

1P reserves are nearly 300 Gb, so we can say with a high level of technical certainty that URR is at least 1800 Gb (there is still a 10% chance this number is too high). But it’s difficult to estimate a URR beyond 2,000 Gb as those estimates likely contain a large amount of marginal reserves and subeconomic/unrecoverable resources.

Ultimately, we are looking at ~10 year supply of oil, not 50 years…that’s for sure…and I think you realize that is inherently true.

Kengeo,

No conventional oil as defined by Laherrere (exludes tight oil and extra heavy oil), peaked in 2016 at 1273 Gb. aaaaai gave you the most widely used definition of contingent resources, the 2C estimate is the P50 estimate for these resources which have been discovered and are not considered to be commercial in the next 5 years at current prices. A change in the price of oil, natural gas and NGL can change this estimate, as can new technology and technological, commercial and political developments. Over time contingent resources get developed and become a part of 2P reserves, this is the way the oil industry works. It is the reason the US has produced 150 Gb of oil since 1970 while 2P reserves have increased.

I won’t try to explain this any further, I would consider estimates of World URR by Laherrere over time, in 1998 URR=1800 Gb, in 2022 URR=3500 Gb.

Common sense says the looking at only 2P reserves and cumulative production will lead to a severe underestimate of URR.

In fact, in the past even HL has led to underestimates of URR, but now this seems to no longer be the case.

Dennis –

Would you agree with these values for URR estimate of ~2,500 Gb? It sounds like it all comes down to future growth and discovery…

Cumulative 1,500

Proven 270

Probable 215

Growth 150

Discovery 360

Ken geo,

You do understand that the roughly 800 Gb of contingent resources have already been discovered right?

So even if discoveries in the future are zero, all that is needed is for contingent resources to be developed and they will become reserves. It is likely that 2P reserves will grow by about 778 Gb. We are getting closer, but I am including unconventional oil, maybe you aren’t.

Oil companies discovered 12 billion barrels last year

That was boe, i.e. oil and gas, representing only about a fifth of that used. Also last year was the lowest leasing sales on record and this year through June only 2.6 billion boe had been discovered, 42% down from 2022. Guyana and Namibia may not have much left, Suriname, Sierra Leone and Senegal have so far been disappointing. Current trends indicate discoveries are going to tail off to zero in the early 30s, which means there might only be a year’s worth of production yet to be discovered.

George

No it was not.

BOE was 20 billion

Ofshore west Africa has vast number of blocks still to go to auction

https://africa-oilweek.com/articles/qa-the-gambia-looks-to-oil-for-economic-growt

Just one of the countries with oil

https://oilprice.com/Energy/Oil-Prices/Clean-Energy-Investor-OPEC-Breakup-Could-Send-Oil-Down-To-35.html

I post this for two reasons. For most of you it will be a good laugh, for some of you it will lead to continue confirmation bias. Choose your path carefully grasshoppers!

Javier Blas

@JavierBlas

·

12h

And another hash truth:

Total CEO Patrick Pouyanné, asked today about high electricity prices in Europe:

“The world has changed. […] The energy transition has an impact on the energy prices, and there is no way to make the transition in Europe without an even higher price.”

surprise surprise surprise

Want to see extraordinary high prices…attempt no transition to other sources of energy.

Clearly, some people love that idea.

https://oilprice.com/Energy/Crude-Oil/Tightening-Fundamentals-Have-Given-Oil-Prices-Significant-Upside.html

“The analysts have also projected that global inventories will fall by 310mb by end-2023 and another 94mb in the first quarter of 2024 thus keeping oil markets backwardated and pushing oil prices higher. According to the experts, Brent price will remain unchanged at USD 88/bbl for Q3 2024 but will climb to $93/bbl for Q4. Demand will hit an all-time high in August and then set fresh highs in December 2023 and again in February, March, June and August 2024. However, they have forecast that global oil demand will fall to a seasonal low of 99.33mb/d in January 2024, the only month in the current decade when demand is expected to plunge below 100mb/d.”

yippie -ki -ye back in business boys😎

Ron is right to repeat warnings about Russian oil production. There is usually a feed-back loop between government instability and oil production. The Soviet Union collapsed because the peaking of West-Siberian oil production at the time did not allow Russia to export more oil to Eastern Europe which did not have foreign exchange to buy oil on the world market. And then Chernobyl.

4/10/2010

Russia’s oil peak and the German reunification

http://crudeoilpeak.info/russia%E2%80%99s-oil-peak-and-the-german-reunification

I know someone who met Gorbachev personally at a climate change conference. He confirmed he knew about the oil shortages BEFORE the collapse of the SU, as was mentioned in the book quoted in the above post.

Updated graph

http://crudeoilpeak.info/wp-content/uploads/Russia_oil_production_vs_consumption_1965-2022.jpg

Thanks for posting this, Matt. As your charts show, 50% of Russian production comes from Western Siberia and another 10% from the Urals. These fields are in steep decline. What is happening right now in Russia is a combination of sanctions and natural decline. Some people see Russian production recovering to 10 to 11 million barrels per day after sanctions are lifted. Or perhaps producing that much today by ignoring sanctions and shipping to China and India. That is total nonsense. The decline that you will see by the end of 2023 will be permanent. There will be no recovery of the decline in Western Siberia and the Urals.

Write it off. It’s gone.

I read a few months ago one of Russia’s oil officials said they expected 2023 to be the peak year of production for Russia.

And one of the reason for the Russian invasion of the Ukraine to get at its undeveloped oil and gas reserves?

SHALE GAS…. FEAST or FAMINE FOR DUMMES…

EQT just released its Q2 2023 Results, and we shouldn’t be surprised that it lost money. I don’t see this changing in Q3 2023 unless there is some major Geopolitical event as U.S. & European Natgas Inventories continue to be well above 5-year averages.

Indeed… the Natgas Glut continues. This is due to STAGE 2 of the ENERGY CLIFF… Surpluses & Low Prices.

Interestingly, Europe’s natgas Inventories are now even higher at this point, compared to the 2020 pandemic shutdown.

However, as low Natgas prices begins to GUT the Shale Gas Industry, we will likely see a decline in more Gas Rigs. Thus, in time, falling Gas supply and rising demand during the winter will push the world back into STAGE 1: of the ENERGY CLIFF: Shortages & High Prices.

Rinse and Repeat.

steve

Exxon and Chevron Stalk More Shale Deals as Profits Dip — WSJ

11:11 am ET July 28, 2023 (Dow Jones) Print

By Collin Eaton

Exxon Mobil and Chevron collectively banked nearly $14 billion in second-quarter profits Friday, down from last year’s record-breaking levels but adding to their war chests as they eye acquisitions in the oil patch.

Exxon scooped up pipeline operator and oil producer Denbury for $4.9 billion in July and Chevron agreed in May to buy shale driller PDC Energy for $6.3 billion. Both transactions were all-stock, low-premium deals that showed the companies could still make big bets despite a push by Wall Street for austerity.

Exxon CEO Darren Woods said the company is actively on the hunt for acquisition targets that are a good match.

Conditions are ripe for a deal frenzy in the oil patch this year. The shale industry has shifted from the rapid growth it pursued for more than a decade to a mature business underpinned by fiscal restraint and hefty shareholder payouts. The continued run of profitable quarters has helped Exxon and Chevron improve their balance sheets while increasing dividends and buybacks, potentially giving them more leeway with shareholders to pursue deals.

Exxon said it had $29.6 billion in cash at the end of the three-month period, compared with its record high of $32.7 billion at the end of March. The company expects a recent series of cost cuts will add up to $9 billion in savings by the end of this year, compared with spending in 2019. Both companies also showered investors in cash. Exxon spent $8 billion on shareholder distributions via dividends and share buybacks in the quarter; Chevron spent a company record of $7.2 billion.

Woods, Exxon’s CEO, has told investors the company is working on technology that will boost the amount of oil it can wring from a well in the Permian, as it seeks to grow production there to 1 million barrels a day by 2027.

Exxon also recently purchased drilling rights in a lithium-rich part of South Arkansas, seeking to extract the mineral, and has plans to build one of the world’s largest lithium processing facilities nearby, the Journal reported.

On Friday, Woods said Exxon could use skills the company has developed over decades of drilling and refining to produce lithium from brine water, at a lower cost and with a smaller environmental impact than lithium mining.

Valero Energy Tops Q2 Estimates

10:15 am ET July 27, 2023 (Benzinga) Print

Operating income at the Renewable Diesel segment came in at $440 million, higher than $152 million in the prior year, with sales volumes averaging 4.4 million gallons per day (up +2.2 million Y/Y) on volume addition from the startup of the DGD Port Arthur plant in Q4 2022.

The Ethanol segment’s operating income was $127 million (vs. $101 million a year ago), with production volumes averaging 4.4 million gallons per day in Q2.

Adjusted EPS of $5.40 came above the consensus of $5.08.

In Q2, Valero repurchased shares worth $951 million and paid dividends worth $367 million.

Operating cash flow stood at $1.5 billion in Q2 2023. Capital investment was $458 million in Q2 compared to $653 million a year ago.

Valero’s cash and equivalents stood at $5.1 billion at the end-Q2. It held a debt of $9.1 billion as of quarter-end.

Dividend: Last week, the company declared a quarterly cash dividend of $1.02 per share, payable on September 5, 2023, to stockholders of record as on August 3, 2023.

Is OPEC about to collapse?

OPEC: is the end (finally) nigh?

Historically, forecasts of OPEC’s imminent demise have proved well off the mark. However, what the cartel faces now is not just a dispute between members but a permanently inhospitable environment. Keeping the group together as demand declines for good may prove an impossible task.

OPEC energy and oil ministers attending the 8th OPEC International Seminar in Vienna earlier this month were, on the face of things, surprisingly upbeat. The organization’s Secretary-General, Haitham al-Ghais, expressed confidence that new members would be joining in the foreseeable future; he declined to name any of the candidates, although it is known that Ecuador, which quit in 2020, is considering rejoining. He also claimed that OPEC members would account for 40% of the world’s total oil production by 2040–45.

Meanwhile, the cartel collectively stuck to its guns on its above-consensus forecast that demand would increase this year with what is an abnormally high—by historical standards—2.35 million barrels per day (bpd), and it hinted that its forecast for demand growth in 2024 would be around double the International Energy Agency’s (IEA) forecast of 860,000 bpd. Indeed, the only negative note among OPEC member country delegates was concern over what some see as underinvestment in new output.

Yet all is not well, as the following two, in my view related, points should make clear.

Oil demand will not support prices

First, between October and June, the thirteen-member cartel, in conjunction with the 11 non-members that are also in the OPEC+ group, agreed to cut output in three instances, for a total of over 4 million bpd. At the start of last week, Saudi Arabia announced that it would extend through August the voluntary cut of one million bpd it announced in early June; this was quickly followed by Russia’s announcement that it would trim its output too, by 500,000 bpd next month. In principle, at least, this means that total OPEC+ output next month will stand over five million bpd below its output this time last year, i.e. around five percent of total world consumption.

However, the headline consequence of these cuts is that Brent crude sat at $78.47 per barrel when markets closed for the weekend on 7 July, as against $91.80 per barrel immediately before OPEC+ announced its first cut on 5 October (and $107 per barrel a year ago!). As things stand, both Russia and Saudi Arabia could decide not to persist with these latest cuts beyond August. But further extensions currently look, to me, to be much more likely. Besides, the remaining four million bpd reduction is due to remain in place until 2024 in any case.

The above is only about one-third of this article. A lot or really interesting stuff is in the rest. I had no idea that OPEC was having that much trouble. But I should have, noticing that the UAE, and others have declared that they will cut no more.

More about a potential OPEC Collapse. Again, the below is only about half the article, which also contains a link to a 5 minute video explaining why this may happen.

Portfolio manager says OPEC+ alliance could break — sending oil prices down to $35 a barrel

An influential oil producers’ alliance could collapse if unity dissolves around output policy, according to the managing partner of investing group Clean Energy Transition.

Speaking to CNBC’s “Street Signs Europe” on Thursday, Per Lekander said waning oil demand growth and a lack of cooperation may facilitate the demise of OPEC+ — a group of 23 nations that produces roughly 40% of the world’s crude oil.

The breakup of OPEC+, Lekander said, could send oil prices careening to as low as $35 per barrel.

“In a growing market, time is your friend. You just need to wait a bit and things tighten up and improve,” Lekander said. “In a declining market, time is your enemy. You have to keep cutting, keep cutting, keep cutting.”

He added, “The more negative growth [there] is, and the less cooperation you have — and remember the last OPEC decision, it was really the Saudis doing it on their own … so I would say, if my forecast is correct, and I’m very sure it is … it is going to break.”

A spokesperson for OPEC was not immediately available to comment.

OPEC+ has been trimming oil production since November. Oil prices, which are down sharply year-to-date, were trading slightly higher on Thursday afternoon.

Brent crude futures with September expiry were up around 0.8% at $83.53 a barrel at around midday London time, while U.S. West Texas Intermediate crude futures

with September delivery rose 1% to trade at $79.56 a barrel. Both contracts are up over 12% so far this month.

“There was a period in the 1990s and the 2000s where supply was so much, they couldn’t jack up the price, but for most of the time, the oil price since 1974 has been artificially too high,” Lekander said.