The IEA Oil Market Report, full issue, is now available to the public. Some interesting observations:

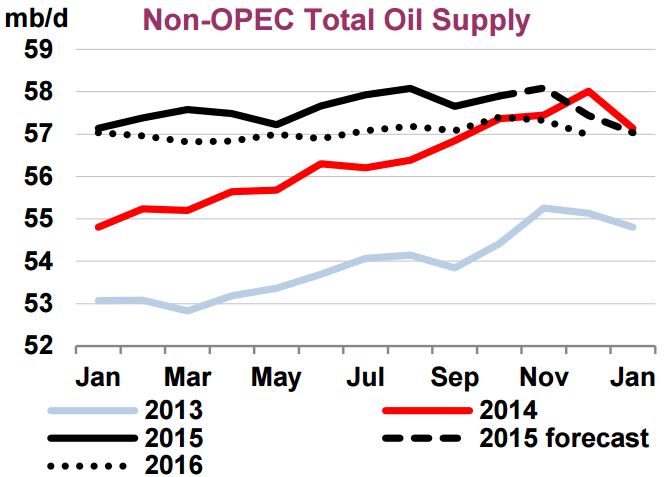

Non-OPEC oil supplies are nevertheless seen sharply lower in December. Overall supplies are estimated to have slipped by more than 0.6 mb/d from the month prior, to 57.4 mb/d. A seasonal decline in biofuel production, largely due to the Brazilian sugar cane harvest, of nearly 0.4 mb/d was the largest contributor to December’s drop. Production in Vietnam, Kazakhstan, Azerbaijan and the US was also seen easing from both November’s level and compared with a year earlier. Persistently low production in Mexico and Yemen were other contributors to the year-on-year decline.

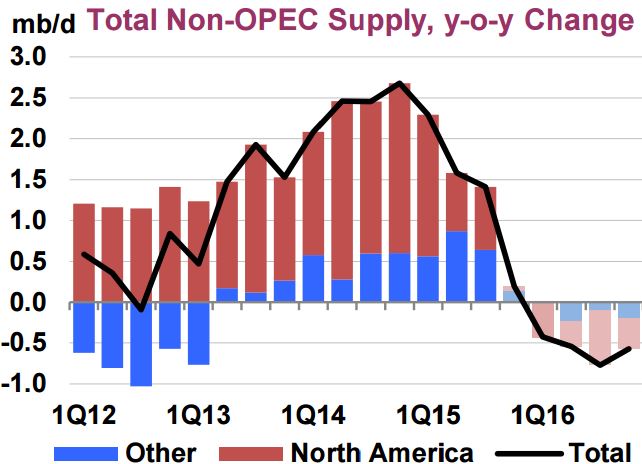

As such, total non-OPEC liquids output slipped below the year earlier level for the first time since September 2012. A production surge in December 2014 inflates the annual decline rate, but the drop is nevertheless significant should these estimates be confirmed by firm data. Already in November, growth in non-OPEC supply had slipped to 640 kb/d, from as much as 2.9 mb/d at the end of 2014, and 2.4 mb/d for 2014 as a whole. For 2015, supplies look likely to post an increase of 1.4 mb/d for the year, before contracting by nearly 0.6 mb/d in 2016. A prolonged period of oil at sub-$30/bbl puts additional volumes at risk of shut in as realised prices fall close to operating costs for some producers.

The IEA has every month of 2016 Non-OPEC production below the year over year 2015 production.

For the past four years, North America has carried the load as far as the increase in Non-OPEC production is concerned. Now the IEA believes North America will suffer the lions share of the decline in 2016.

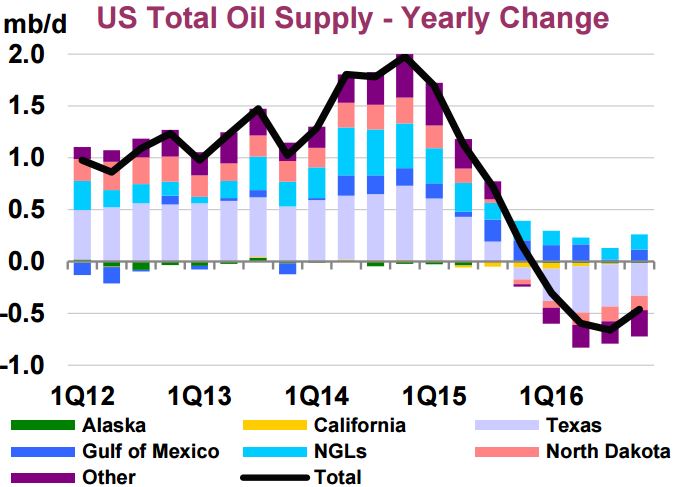

The IEA says US Gulf of Mexico and NGLs will show an increase in 2016 but every other location will show a decline with Texas showing the largest decline.

The IEA says Non-OPEC production was up 1.3 million bpd in 2015 but will be down .7 million bpd in 2016. Below are their numbers. They do not include biofuels or process gain.

2014 51.8

2015 53.1

2016 52.4

The IEA has Non-OPEC liquids in December 2015 down about 650,000 bpd compared to December 2014.

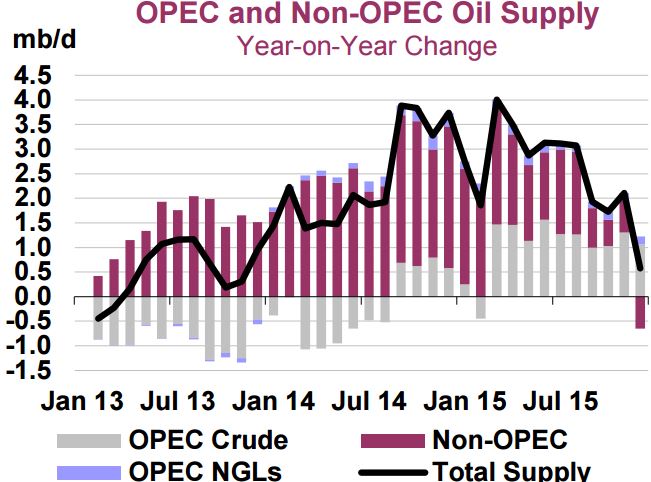

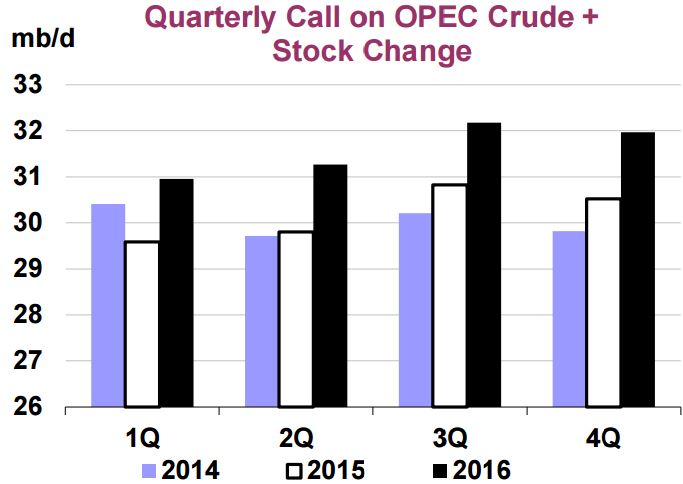

But if the IEA expects Non-OPEC production to be down in 2016, how will world oil production be able to meet the ever rising demand? Simple, just pick up the phone and call OPEC. They will supply the needed barrels.

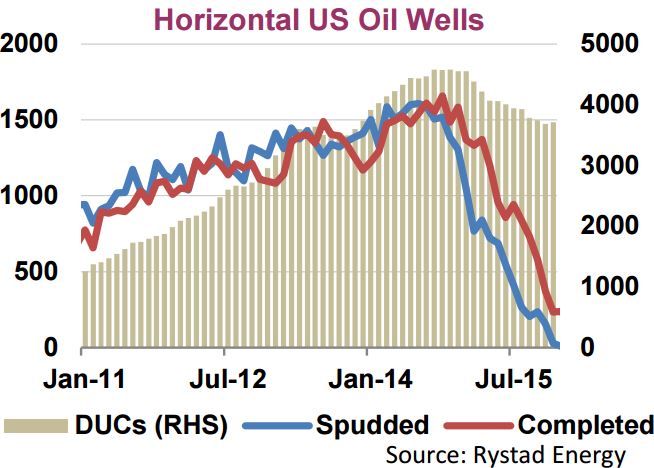

Data from Rystad Energy show the number of completed wells have by far outpaced the number of wells spudded (drilled) since 4Q14. Indeed, the number of well completions per month continued to increase several months after the rig count started to drop off, peaking at more than 1,600 wells in December 2014. The number of completions are still outpacing the number of new wells drilled, and as a result, the number of uncompleted wells, or the frack-log, has been cut down from its peak of around 4,600 wells hit at the end of 2014 to around 3,700 wells currently.

Make of the above chart what you will. I do not understand the spuds going to zero. Spuds are, quite obviously, not at zero. But then it’s not my chart.

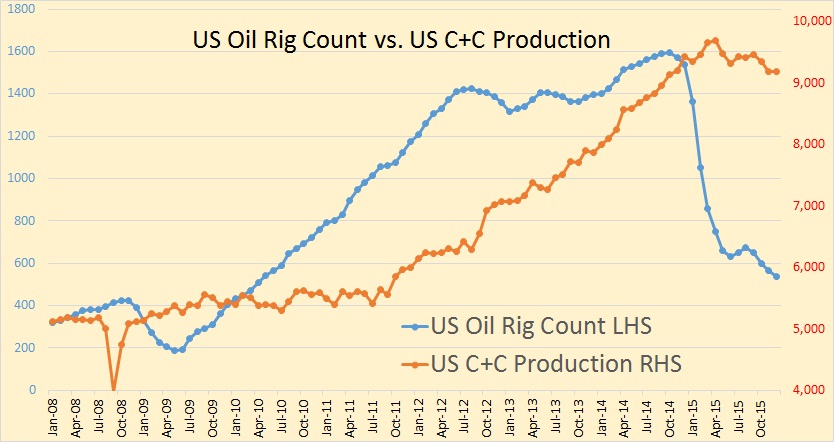

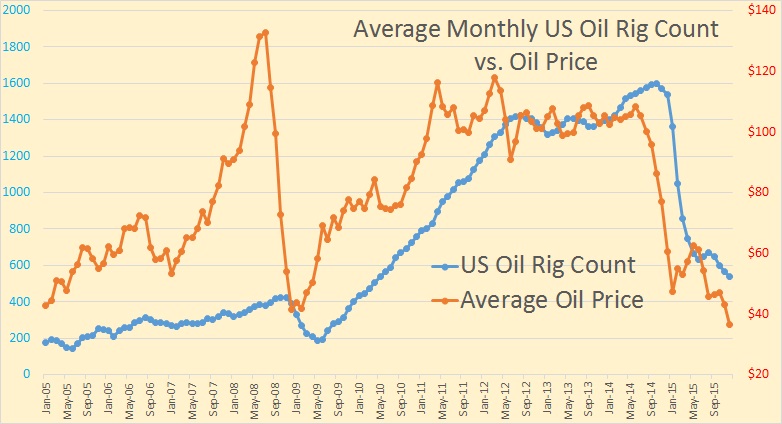

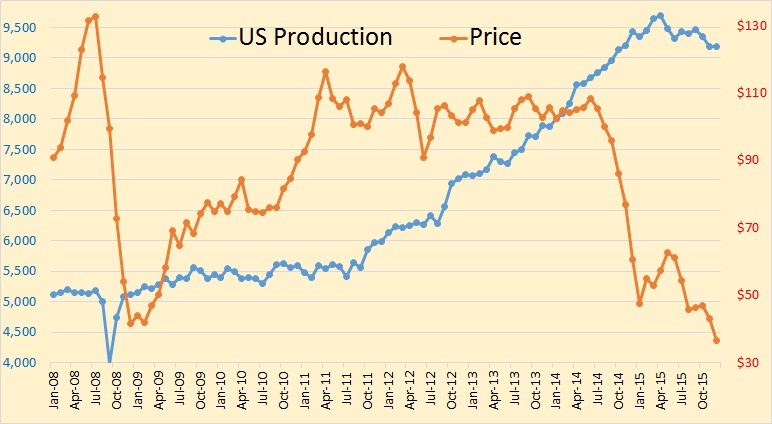

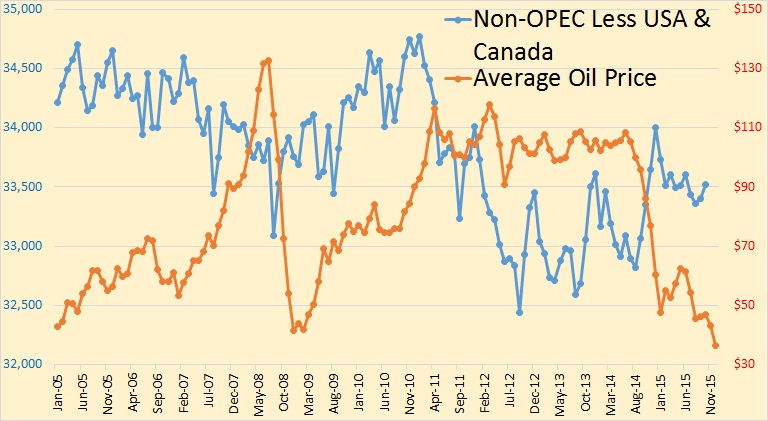

And here are a few charts of my own. I thought it would be interesting to make some comparisons between price, rig count and production. In all charts below the right axis is always color coded with the chart data. All data is through December 2015 unless otherwise noted.

The above rig count is just the oil rig count, not the total rig count. There is obviously a delay between rig count and production. Just how many months that delay is, is not completely clear.

All price data is from Index Mundi and is the average of three spot prices; Dated Brent, West Texas Intermediate, and the Dubai Fateh, in US Dollars per Barrel. Quite obviously the rig count follows the price with a delay of from one year to as little as three or four months.

And production follows price, somewhat, with a delay that is hard to calculate.

Well, production has followed price in the USA and Canada. But elsewhere everyone just seems to be producing flat out regardless of the price. Just as the price was peaking in early 2011, Non-OPEC production, less USA and Canada, began to decline. Production in this chart is only through October.

The recent surge in world production that was brought about by high prices was a USA and Canadian phenomenon only.

Edit: The above statement has created some confusion. There have definitely been some serious production gains by Iraq and Saudi Arabia. But those gains came largely after the price of oil had already started to collapse. Those gains were despite collapsing oil prices, not because of high prices.

“The recent surge in world production that was brought about by high prices was a USA and Canadian phenomenon only.” ~ R. Patterson

That says it all….

Thanks for the update Ron.

Be well,

Petro

Could this have been due to the special place US has in the hierarchy.

When camels are thirsty they are chewing thistle to relieve their thirst, but the thistle is dry, so in fact their own blood relieve their thirst.

Dogs chew old bones but there is nothing in them, but pieces of splited bone pierce their mouth ceiling and fresh blood makes them think there is food in there.

This is what US has done f.ed the little economic moment it still had because is the forefront of the empire, he is going for the fresh blood of shale.

As I have repeatedly stated on this blog, the global oil market is not a market like those for smartphones, automobiles or ladies purses. The global oil (& gas) market is a STRATEGIC one. Which goes on to say that the core states, such as first of all, North America, then NW Europe get to have the first and final say.

The problem for the US, Canada, Norway and the UK (the only wealthy countries producing large quantities of oil) is that their oil reserves are extremely marginal and can only be accessed with high oil prices (in the long-run) This problem is compounded by the fact that high oil prices enable geo-strategic rivals such as Russia/Iran/Iraq/Venezuela to be more defiant than they would otherwise be.

The oil rich countries that are directly controlled by the US & co (the US Empire) also known as GCC, follow an oil production policy that largely suits the core states themselves, depending on the situation and their ability to affect the global market.

In my view, this is what preceded the recent oil market collapse:

NATO-GCC to Russia in 2011/12: “Give up Assad, or we’ll fill our media with BS stories about you. We will also ‘encourage’ our corporations to not invest in your country”

Russia to NATO-GCC: “You have been doing that for ages, who cares for even more propaganda. Assad stays”

NATO-GCC to Russia in 2013/14: “Give up Assad, or we will turn Ukraine against you, there will be serious trouble for you, as now we will make our economic warfare against you, official. Moreover, our ‘regime-change’ efforts will intensify”

Russia replies to NATO-GCC: “Bring it on, Assad stays”

NATO-GCC to Russia in 2014: “We will pummel the oil price into oblivion*, we promise that you will feel the strain, just give up on Assad or we will destroy you”

Russia replies to NATO-GCC: “I have seen worse. Assad stays”

*Notice that NATO-GCC did not use the oil-price weapon until one of two things happened:

a) Time-pressure on regime-changing-Syria became serious.

b) The shale and tar sands infrastructure had been already put in place under high oil prices.

But back to Ron’s core (and largely correct) claim that the global oil production gains of recent years have been a North American phenomenon (I would also add Iraq)

North America has been able to ramp-up production spectacularly in recent years because of the following reasons:

a) It’s capital rich. Instead of diverting all of that QE-enabled loans to the parasitic “housing market” and lots of inane Silicon Valley start-ups (that fail 99 times of 100) it was wiser to have some dough flow into the “shale oil & gas miracle” as well as Alberta’s vast tar sands deposits. Which made both economic as well as strategic sense.

b) As North America was a massive oil importer circa 2009 (Canada cannot be seen in isolation, but as appendix to the US) this increased oil production went a lot way in: a)boosting economic growth (North America has easily outpaced other advanced economies since the Lehman crisis) b) Minimize the US trade deficit and therefore: c) Boosting the value of the US dollar.

As I have noted many times before on this blog, some (maybe several) countries around the world have massive oil reserves that are far more prolific than those currently being exploited in North America. But these countries, do not enjoy neither the political/military clout over the GCC, nor remotely the financial capital to engage in such massive (and risky) investments. Countries outside of the US, Canada (to a lesser extent UK, Norway ) that are major oil producers, need to accrue massive profits from their oil sales, since they universally divert most of those funds into financing the government, the military and social spending, while they must also keep some for re-investments into their oil sectors. US & Canada are uber-happy if they can more or less break-even.

But the peak-oil-environmental bias of many, does not allow them to see this.

Your strategic analyses are very interesting Stavros, and fit many of the things we all know are true. However I have a problem with the “We will pummel the oil price into oblivion” part.

The available evidence is that the price of oil followed very closely the supply/demand ratio. The chart below is from Dr. Ed’s blog.

I am always skeptical of interpretations that are not supported by evidence. There are multiple theories about who caused the oil price to go down and why. I rather stick with the data, it is not a PO bias but quite the opposite. A supply/demand mismatch caused it and nobody wanted to cut production unilaterally.

The oil rich countries that are directly controlled by the US & co (the US Empire) also known as GCC, The oil rich countries that are directly controlled by the US & co (the US Empire) also known as GCC, follow an oil production policy that largely suits the core states themselves, depending on the situation and their ability to affect the global market.

That statement makes no sense whatsoever. Just who is/are “US & Co”? Would that be Obama? Or perhaps the US Congress? Or perhaps the US Oil Companies? Then in the second half of that long sentence, you completely contradict the first half of the sentence. You say: follow an oil production policy that largely suits the core states themselves,” Now which is it? Are they controlled by US & co, or are do they pay no attention to whomever in the US that is doing the controlling and follow a policy that simply suits themselves?

I would definitely agree with the second half of your sentence, the GCC states do exactly what they damn well please. And I would definitely disagree with the first half of your sentence. They would pay no attention to any US politician or businessman that might call them up and try to tell them what to do.

But back to Ron’s core (and largely correct) claim that the global oil production gains of recent years have been a North American phenomenon (I would also add Iraq).

Well no, that’s not what I said. Yes, recent oil production gains have been from US, Canada, Iraq and Saudi Arabia. But what I said was:

The recent surge in world production that was brought about by high prices…

The recent gains in Iraq and Saudi Arabia were after the price already started to fall. Those gains were not brought about by high prices. They were despite a steep decline in prices.

Ron,

“US and Co” is essentially a codename for NATO. It is ruled by international financial elite (Davos crowd) which BTW consider the USA (and, by extension, NATO) as an enforcer, a tool for getting what they want, much like Bolsheviks considered Soviet Russia to be such a tool.

The last thing they are concerned is the well-being of American people.

It is ruled by international financial elite (Davos crowd)…

Oh! Well excuse me. I thought it was ruled by the Bilderberg Group. When did the Davos crowd take over from the Bilderberg Group? Or, are they just co-conspirators in this giant conspiracy that rules so much of the world, including the GCC and the USA? 😉

Forgive us conspiratorial barbarians Ron, you are right there is no US Empire, we just don’t know to truly appreciate US as the beacon of democracy in the World as she is.

Oh don’t be a fucking wise ass Yiedyie. The US is far from perfect. The opposite of a silly conspiracy theory is not something perfect. The opposite of a silly conspiracy theory is the use of common sense.

Suncor Energy Inc to cut spending by 10% after surprise $2-billion loss

The Canadian oil giant has lowered costs and delayed projects to weather collapsing prices that are making many oil-sands operations unprofitable. The 2016 spending cuts come after the company eliminated more than 1,000 jobs and slashed its budget last year.

They insist on lumping biofuels with crude oil etc. I would call them the Energy Disinformation Agency.

Fernando,

They include separate numbers for biofuels production and refinery processing gains

Alex, they lump everything in the discussions and most tables intended for public distribution. I spend a lot of time explaining to people their graphs and most data tables are covering up what happens to crude oil and condensate. I consider their practices to be deceitful.

Does this say anything to anybody here?

http://www.resilience.org/stories/2016-02-03/renewables-could-outcompete-costly-risky-lng-investors-warned

They are costlier and riskier because renewables are supported by FITs. That is called market distortion.

The construction of nuclear Hinckley C in England is also being supported by guarantees on electricity prices for decades.

By placing the risks on the consumer one can do wonders with the market.

Sorry Javier,

you confuse costs with prices: The FITs are prices, the fact that REs are build is that the costs are lower in comparison to fossil alternatives. Even with a changed market design you can not reduce the cost advantage of some REs.

With the exception of lignite onshore wind is by far the cheapest generator in Europe for new capacity even when we allow a very generous price increase for net integration in Europe.

NG is too expensive to compete for large volumes and is under pressure in the peaker application by PV and batteries. Hard coal also has no real chance.

Costs of new capacity in central Europe [EUR/ kwh]:

lignite: 0.04

onshore wind 0.05 – 0.08

hard coal 0.07

NG 0.09

PV 0.10

nuclear: > 0.11

offshore wind: 0.07 – 0.13

rooftop PV: 0.15

As the prices for far offshore wind drops at a high rate, my guess is that nuclaer is economically dead as dead can be. Rooftop PV is more expensive but the customer pays high prices for electricity, it still makes money.

There’s more info to be extracted from last chart.

Non-OPEC less USA & Canada is in decline even if Russia is not (FSU including Russia is in decline).

The decline proceeded through 2005-2008, but their income was maintained through increasing prices.

They reacted to the loss of income in 2008 by pumping enough to reverse the decline. Once they recovered their income the decline was allowed to proceed, but showed an increased rate of decline than before due to the previous increased pumping.

Starting in 2012 a new effort is being done to reverse the decline that produced strong increases in late 2012, and late 2013. The effort is increased in 2014 with the falling prices producing a larger increase in late 2014.

However the increase in late 2015 is missing. The last reversion of the decline might have come to an end. If that is the case, we could see a new loss of 2 Mb/d in less than two years from non-OPEC less USA & Canada.

USA & Canada might lose another 2 Mb/d in the next two years, leaving a loss of 4 Mb/d for OPEC to compensate.

No wonder they have been so fast to lift sanctions on Iran. We are going to be very short on oil.

“We are going to be very short on oil.”

Barring the world wide economy going downhill hard and fast, I belive Javier is dead on.

We will have likely have an opportunity to see how fast the driving public here in the USA will change it’s ways and start buying more fuel efficient vehicles, and driving them less.

The big bets auto manufacturers have made on pure electrics and plug in hybrids are going to start paying off sooner, rather than later than most people expect, imo.

Most people who have expressed an opinion on the question seem to think that even with production overall declining, and the economy doing ok, it will still take close to a year to clear out all the oil that has gone into storage. If they are right, prices will go up more gradually than they crashed.

Otoh, a huge amount of oil may have been put in newly established or newly expanded strategic reserves, and stay there. Folks who would know don’t seem to be saying much, publicly.

My guess is that Venezuelan production is more apt to decline than hold steady or grow for the next year or so, but after that, the political situation might improve enough there for oil production to improve as well.

How long that might take is anybody’s guess, but it will certainly take a while for people with money to get comfortable with spending it in that unfortunate country again.The investment will have to come first, so it seems unlikely to me at than Venezuela can increase production noticeably in less than a couple of years,even if things go well there.

I am not as cynical as some regulars here, but if oil spikes up hard and sharp, with ISIS and or other like finded outfits holding back production in Iran and Iraq, I expect Uncle Sam and a few of his good buddies will find it expedient to put the boot to them, so as to keep the oil flowing.

Military intervention will not get RID of such outfits, but it can put more friendly people back in control, temporarily, from anywhere from a few months to a few years.

From the pov of Uncle Sam, and his pals, this sort of thing is a pain in the butt, but necessary, and sort of analogous to my problems with bugs , from the farmer’s pov. . When bugs get to be too big a problem, I fire up the old pesticide application machinery, and SPRAY’EM, which gets rid of MOST of them, for a while.

Spraying them is my best and really only practical short term option. Keeping the oil flowing is apt to be our only practical short term option as well, and if it takes troops on the ground to keep it flowing, the odds are close to one hundred percent we will send the troops.

Oldfarmermac,

The price doesn’t need the glut, if there really is a glut which I doubt, to be cleared to start raising. It is all a question of perception. If demand keeps growing at about 1.2% year on year and production continues declining at about 1 Mbpd/year or more the prices will start moving up in about six months regardless of reserves. The market is a future discount mechanism, it reacts to what it perceives is going to happen in the near future, not to what is happening now.

The drop in production in my opinion is pretty sure. It is baked in the cake after almost a year an a half of price crisis. In fact the price crisis is probably going to affect future production for years.

The only question is the demand. For the demand to be sustained we need the economy to hold and it is looking more and more like we might get a recession in 2016. The stock markets are the last indicator that is giving bad signals. That is in my opinion the biggest danger to oil recovery. Should we get an economic crisis in 2016, the oil prices are not going to recover and oil production will continue falling at accelerated decline.

>>Barring the world wide economy going downhill hard and fast,

I do believe that is what is happening, although it is not obvious yet. Check out the daily e-mail newsletters from David Stockman or the Automatic Earth. They are bleak.

Javier

The bigger the straw, the more straws and the harder one sucks…the more violent and more sudden the gargle noise at the end of the Slurpee…and ultimately the worse the “brain freeze”.

Be well,

Petro

Yes Petro, it looks like we are making everything in our hand to ensure a very steep decline at the other side of Peak Oil. We are not saving anything for later. We are in a hurry to crash.

…and that is the reason you should NOT be optimistic on climate Javier, for as we go through this energy/economic/ecology/environmental predicament, we will f*** that up (or what’s left of it), as well.

We are done…is just a matter of time.

The question is: are we going to go full retard in fighting/”saving” ourselves and turn our Beloved Earth into a Venus (which will mean no rebound after the 6th extinction for ANY organized form of DNA), or are we going to go

“slowly” and “quietly” into the dark and after a long period of time(possibly several millions of years) give the planet a chance to heal and start over…?!?!

Is not political (at least with me…is evolution and our nature!)

Unfortunately…I am beting (hoping and praying to be dead wrong!) on the former…

Be well,

Petro

P.S.: I adore Spain! I almost ended up doing the Pilgrimage by car once from Barcelona through Aragon to Santiago, but I opted for Zaragosa and Madrid instead…

One other time “copied” the Mediterranean from Figueres to Barça to Malaga to Seville and then north to Lisbon and Porto…but enjoyed port so much that stayd there and did not proceed to Santiago and La Coruna as previously planned.

…until next time.

Petro

Our climate worries are the product of a big misunderstanding. We produce a lot of CO2, we observe warming, we know CO2 is a GHG so has to increase warming in the atmosphere, we deduce that the warming has to be due to the CO2. Looks like a perfect trap and we fell for it. Only part of the warming is due to CO2. Our capacity to influence the Earth’s climate is a lot more limited than we credit ourselves with. The climate looks stable enough for the next 2-3 centuries, and afterwards the danger will be cooling, not warming.

Our capacity to damage the environment is a lot bigger. If we crash a lot of sensitive species, like gorillas, are likely to go extinct. We are likely to burn a lot of forests too and for a little while contaminate a lot more since in most places no environmental law will be respected. But if our numbers go down fast and hard the environment in many places will start recovering quite soon, and in a few thousand years the world could be better than it is today for most surviving species, and new species will start to fill empty niches.

In the end the world usually finds a way to self regulate. We have to give it a little credit, it is incredibly old. We can do a lot more damage to ourselves than to the world. Ours is a very fragile civilization.

“Our climate worries are the product of a big misunderstanding” ~ Javier

Oh, I understand well Javier!

I am not like others here who argue with you about Al Gore (if you catch my drift). I know you are a scientist who believes in proof and numbers.

I understand your prospective very well. I am not arguing with you on CO2 and NH4 numbers (although we can discuss that till next week…) and what CNN/NBC/FOX etc said…or what Bernie/Hilarious/Trumpet tweetted….

My point is that you underestimate our ability/capability and plain old stupidity to do harm.

When things will unravel (I do not mean recession….I mean really unravel: collapse, war, famine, etc, etc…!) we shall go full retard and devastate everything and anything…moving or glued….standing or crawling….breathing or vegetating… trembling or hibernating…

I mean anything and everything!!!!

When things unravel, the > 120ostorage pools, > 47oreactors, >10onukePowered ships/subs and >2000oNukeWarHeads which we will put to “good” use, as well as God only knows how many tons, or gallons of chemicalBiological poison that we use today world wide – will “take care” of environment and climate for us.

-Let us not forget that we are after all ONLY animals…the cleverest ones for sure, but in the end slaves of biology, environment and evolution!

I disagree with us calling ourselves Homo Sapiens-The Wise Ape.

We are NOT wise, we are clever. The more appropriate term would have been : Homo Callidus-The Clever Ape.

-In the end though, cleverness will take us so far…and will be our ultimate cause of demise…

“Whoever wishes to foresee the future must consult the past; for human events ever resemble those of preceding times. This arises from the fact that they are produced by men who ever have been, and ever shall be, animated by the same passions, and thus they necessarily have the same results.” ~ Machiavelli

Be well,

Petro

Oh, I agree with you on everything. However in my experience the most likely outcome is usually not the worst possible as is usually not the best possible either. Some places might become inhabitable and others sustain heavy environmental damage, but I just don’t see very likely a global catastrophe of the scale you describe. Most damage will be inflicted upon ourselves limiting our capacity to damage the environment.

Javier Wrote:

” However in my experience the most likely outcome is usually not the worst possible as is usually not the best possible either. Some places might become inhabitable and others sustain heavy environmental damage”

As the global economy continues to deteriorate, the odds increase of another global war. The great depression sparked lots of economic turmoil, resulting in the rise of fascism, communism, and other ‘isms that resulted in WW2. I doubt “this time” will be different.

I think we will also see lots of nuclear plant failures as countries in economic crisis fail to perform proper maintenance, and keep damaged/faulty reactors running. In the past, gov’t had sufficient resources to clean up and contain meltdowns, in a long term global economic depression they probably won’t. Ukraine is currently in that position. If a Ukraine reactor meltdown, who is going to contain/clean it up? Perhaps the US or the EU will cough up the resources, but at some point there will be a meltdown which no one has the resources to stop it.

I think reactor meltdowns and loss of containment in Spent fuel pools will leave very large parts of the world uninhabitable for a very long time.

“As the global economy continues to deteriorate, the odds increase of another global war.”

Actually quite the opposite. Countries in serious economical problems do not usually start wars. They have to sort those problems out first.

Regarding the dangers of runaway meltdowns in nuclear reactors all over the world, apparently they are not that high. I looked onto the issue some time ago and found that most of my fears were unfounded.

Countries in serious economical problems do not usually start wars. They have to sort those problems out first.

This is true, they are less likely to start a war with their neighbors. But countries, like Venezuela, that have very serious economic problems are far more likely to experience civil strife… and civil war.

“Only part of the warming is due to CO2”

Yeah, like about 110%. Natural drivers are cooling us.

A Comprehensive Review of the Causes of Global Warming

http://www.skepticalscience.com/a-comprehensive-review-of-the-causes-of-global-warming.html

Yes, and it might become 200% in the future if nature continues not collaborating with the hypothesis. But you see it is all attribution as it has never been measured, it is an assumption from the hypothesis that more than 100% of the warming must be due to GHGs and 0% to natural warming. I keep telling Dennis that this is a central tenet of the hypothesis, because Dennis as well as most climatologists do not think that to be possible (see graph below).

I find it curious that people would say with a straight face that from 1950 more than 100% of the warming is due to GHGs, when essentially all the warming from 1650 to 1950 was natural.

Yet people, like Dennis, that believe that natural warming surely has contributed to observed warming do not understand that the warming observed is so little that unless it is all or even more attributed to humans, there won’t be any danger coming from warming and no point in implementing CO2 cuts. They have painted themselves into a corner.

The hypothesis is becoming so absurd in its details that most people that defend it have no idea what they defend.

…my favorite piece of literature from your country is written by one my favorite writers of all time:

M. Cervantes.

You are a scientist. Not everybody can think alike.

Trying to explain is like fighting windmills…

My advice is: don’t become a D. Quixote…

I am fairly confident you understand what I mean and, I am sure you have better things to do than trying hard to explain to the uninitiated that water vapor is a bigger “warmer” than CO2…

Be well,

Petro

“Yet people, like Dennis, that believe that natural warming surely has contributed to observed warming do not understand that the warming observed is so little that unless it is all or even more attributed to humans, there won’t be any danger coming from warming and no point in implementing CO2 cuts.”

I read this a few times and still don’t really get it – it assumes knowledge from previous comments that I haven’t read, but if you have a chance can you clarify – is the argument that warming is happening naturally and we can do nothing either way?

Is there a link for the source of the chart? For the averaging the numbers in categories for ‘unknown’, ‘other’ and ‘don’t know’ seem to be taken as equivalent to 100%, or just ignore them, in each case giving a higher average (maybe the IPCC one)? Also it has the average been based on the lower number in the range rather than the mid-point (difficult to tell without the actual values, and not sure what to take for >100% value – maybe 110 as was quoted previously).

Mr. Kaplan,

That paragraph means the following:

– Warming is likely to be a combination of natural and man-made causes.

– Since warming has been less than expected and part of it is due to natural causes, man-made warming is much less than expected, and therefore not dangerous for a very long time.

– Since man-made warming is much less than expected, any effort to curb it is likely to have a negligible effect on warming.

To avoid that logical conclusion IPCC defends that more than 100% of warming is due to GHGs. Most scientists however think that some of the warming is natural. No consensus on that.

That graph comes from Verheggen et al. 2014. Scientists’ Views about Attribution of Global Warming. Environ. Sci. Technol., 2014, 48 (16), pp 8963–8971

They polled 1868 scientists working on climate science. The question for that graph was Question 1. What fraction of global warming since the mid-20th century can be attributed to human-induced increases in atmospheric GHG concentrations? Quantitative answer options in percentage ranges of GHG contribution. Answer options included >100% (i.e., GHG warming has been partly offset by aerosol cooling).

The answer >100% is the correct one according to IPCC, but only 17% of scientists chose that one. I guess IPCC opinion does not represent most climate scientists in some crucial questions.

Javier

Thanks for the reply. In editing my question I managed to delete a large section and it become partly incomprehensible – sorry for the confusion.

After a bit of googling: I take it you reject the possible mechanisms described in Skeptical Science for the natural warming to 1940 that are no longer active?

From a scan of the survey article it would appear that the authors explain their lower scores in scientists agreeing with human GHG induced warming because theirs was a survey and the IPCC and others assessed peer reviewed articles. The articles would be more represented by the most active and better known climatologists than their survey, which would be more one-man-one-vote. Do you think that reasonable?

From your comment below -for me not knowing the exact amount of warming expected would seem to be a reason to study further – not to reject the possible warming as too small to worry about at this stage.

No Mr. Kaplan, I do not reject anything that science has established. And science has established that the 20th century has seen a level of solar activity higher than the 19th century, and higher than the 18th century. No doubt CO2 (and CH4) has increased the warming of the second half of 20th century, but to claim that natural climate variability has played no role when we have a pathetic understanding of climate is just going too far.

Since 2000 solar activity is going down towards long term trends, and warming is petering out despite 35% of all CO2 added since. Think about it. More than one third of all the CO2 and almost no warming to show. El Niño performance is going to keep the function for a few more years. Afterwards it will be curtains for the catastrophic AGW troupe.

The article shows the difficulty in supporting the extreme interpretation of no role for natural variability in a scientific consensus. I do not attach any importance to a scientific consensus. You just need one scientist with the correct answer, one Galileo, one Newton. However when they poll scientists in general they do not get the desired answer. Meteorologists in general resist the idea of something particularly odd happening to climate. So they then poll only climatologists, but they still don’t get the desired answer, so they start fiddling with the data until they get the desired answer by limiting the poll to those climate scientists publishing more in the current scientific climate, and therefore more likely of making a living out of promoting catastrophic AGW. They don’t have a scientific consensus to show, they have a consensus of those supporting the CO2 hypothesis. Big deal. And this has nothing to do with science, only with trying to convince people to accept the political decisions that they want to take.

I guess the “warming is petering out” statement is a bit beyond me. The analyses by a few different parties which try to eliminate ENSO (and for some also aerosol cooling) effects indicate continuous, fairly steady warming. Or do you consider these numbers to have been politically adjusted?

The effect of GHGs on temperature is logarithmic so there should be a bit of smoothing over (which I don’t see in the official curves anyway). But the worrying thing is surely that the effects of long term temperature rises of any size on local weather might be highly non-linear – e.g. hyperexponential and/or chaotic with various tripping points (and largely unknown to climatologists or meteorologists).

For example at one time Lovelock had a model in which there wasn’t much warming expected to be seen until a sudden step change to a new, much warmer steady state happened (some time around 2050 I think). He has changed his mind occasionally so this may be out of date but I can’t find on the internet and don’t have access to his latest books.

If, in 3 or 4 years, there is no significant cooling following the the decay of this El Nino (and assuming no monster La Nina to replace it) that would presumably strongly support the anthropogenic warming hypothesis contrary to your argument.

Javier:

“You just need one scientist with the correct answer, one Galileo, one Newton.”

His name was Arrhenius.

http://earthobservatory.nasa.gov/Features/Arrhenius/arrhenius_2.php

Fairly steady warming, Mr. Kaplan? The scientific literature on the pause is overwhelming. Are all those scientists wrong? Is it a decision by somebody to increase the temperature detected by buoys on the sea surface the solution to a planet that is no longer warming at the same rate?

You can worry about anything you want, tipping points, non-linear effects or runaway increases, but at the end of the day what you have is a hypothesis that predicts a lot more warming that we have got. We are in the worse emission scenario from 20 years back, yet we have got less temperature increase than the best scenario. Fear is a choice.

You got it wrong, Mr. Kaplan. The anthropogenic warming hypothesis is the one that needs proving, and that is done by disproving the null hypothesis, that an important part of the warming is natural. If we continue putting CO2 in the atmosphere the warming of the world has to continue increasing, otherwise the anthropogenic warming hypothesis is incorrect. No significant cooling means nothing, no significant warming means an incorrect hypothesis.

Hi Javier,

There are natural causes which are very variable over time, and there are anthropogenic causes to warming.

I understand that quite well. When many factors are taken into account the change in temperature is explained fairly well.

The models are by no means perfect.

CO2 in the atmosphere explains quite a bit of the warming since 1850, but not all the fluctuations which are mostly due to ENSO and other oceanic effects, along with volcanic eruptions.

Sure Dennis, but you have to realize that there is no way to measure the contribution towards warming of every cause and thus the attribution of warming is a guess based on our very imperfect knowledge of the climate.

If we knew how much warming was man-made we would know the climate sensitivity, but after more than 30 years it has not even been constrained a little. It was and still is estimated at 1.5-4.5.

Read this on ZH a day or so ago.

http://www.zerohedge.com/news/2016-02-03/shale-shock-big-leg-lower-oil-coming-after-many-shale-plays-found-have-far-lower-bre

Would love to hear what others and Art Berman have to say. Seems to good to be true unless they are trying to goose the shale market investors one last time.

Thanks Ron for providing such a valuable forum on this crucial topic

Look at how much $$ the large players such as ExxonMobil, Chevron and ConocoPhillips lost in US lower 48 in 2015 with average WTI of about $50 and natural gas of $2.60.

Current WTI hovering around $30 and gas hovering around $2.

We have discussed LTO break even ad nauseum here since 2014. I am sure if oil goes below $10 WTI there will be claims of $1 break even by LTO pundits.

Yep. I believe I have discovered the LTO pundit formula for determining the break even price.

Take the current price of WTI then subtract 20% =Break Even Price

And if not by the pundits, then certainly by the pack of trolls and sockpuppets that spend their days posting on Peakoil.com site.

I use to post on that website NR, but got really tired of certain posters so I go there sometimes to see what articles are being posted and maybe read some of them, but I do not post there or read the posts. It’s too bad it got taken over by a few bad seeds.

“I am sure if oil goes below $10 WTI there will be claims of $1 break even by LTO pundits.”

Shallow sand,

Not sure about $1 breakeven, but there are claims of $22 breakeven at some

subplays in the Eagle Ford.

Texas Isn’t Scared of $30 Oil

February 4, 2016

http://www.bloomberg.com/news/articles/2016-02-03/texas-toughness-in-oil-patch-shows-why-u-s-still-strong-at-30

Texas has a message for $30 crude doomsayers: Bring it on.

A handful of shale patches in the state, which would be the world’s sixth-largest oil producer if it were a country, are profitable with crude below $30 a barrel, according to an analysis by Bloomberg Intelligence. In the Eagle Ford’s DeWitt County, which produced more than 100,000 barrels a day in November, the average well can be profitable with U.S. benchmark crude at $22.52 a barrel, $4 below the lowest level this year.

Drive 200 miles southwest to Dimmit County, and drillers need $58 oil. The wide range of break-evens, a term for the price at which a well goes from profitable to unprofitable, illustrates one reason why shale production from exploration and production companies has been more resilient than expected.

“It may be harder to kill many U.S. E&Ps than analysts originally thought,” Bloomberg Intelligence analyst William Foiles said in the presentation. “The wide range of break-evens undermines efforts to come up with a single threshold for U.S. shale producers.”

It’s easier to survive low oil in some places than in others. Bloomberg Intelligence analyzed everything from the average well output to the amount of local school taxes to learn the average break-even cost for drilling in different rock formations in counties across Texas’s two big shale regions, the Eagle Ford in south Texas and the Permian Basin.

Nine areas had break-even costs at $30 or below, including some of the biggest oil-producing counties in Texas, such as DeWitt, Midland, Martin and Reeves, with had combined output of 430,000 barrels a day in November, according to the Texas Railroad Commission.

Oil prices can be even lower to justify completing wells that have already been drilled but haven’t yet been hydraulically fractured, or fracked. Companies have built up a fracklog of more than 4,000 of those wells in the U.S. It’s economic to complete wells in 18 different areas in the Permian and Eagle Ford at sub-$30 oil. In Reeves County in the Permian, oil prices above $14 justify fracking an already-drilled well.

Even within one county, break-even costs can vary widely depending on which company is drilling and the richness of the rocks they’re tapping, said Kathryn Downey Miller, a principal at Lakewood, Colorado-based energy research firm BTU Analytics LLC. In DeWitt, for example, about 45 percent of wells drilled in 2014 would have been profitable with oil below $20, but another 5 percent needed $70 oil.

“You see a great amount of variability between operators, even in a small geographic area like a county,” she said by phone.

That variability makes it difficult to tell when companies will give up drilling. For instance, while companies reduced the number of new wells coming online in Dimmitt County to 65 in the third quarter last year from 226 in the first quarter, they increased activity in DeWitt County by 77 percent.

“The good news is we’re primed and ready for when we need to see a return to activity in North America,” Miller said. “This lower price environment is making companies defer big oil projects, so there will be an opportunity for U.S. shale producers to contribute to production growth, and they’ll be better able to compete than they’ve ever been.”

Alex

The break even price point can seem sometimes like an endless discussion, but the operational aspects that are enabling far higher resource recovery at far shorter time frames is not open to debate.

It is happening and will continue to happen.

Bringing 11 wells from one pad online at an average cost way less than $3 million, like PDC just did in the Niobrara, will become the norm in certain areas, not the exception.

Drilling two laterals 500′ apart, and having each well produce almost 500 MMcf of natgas per month, like Rice’s Blue Thunder wells, is becoming the standard in eastern Ohio.

Employing far more effective fracs via proppant type, amount, and precise placement not only is boosting initial output, it is enabling more long lasting conductivity to the wellbore.

EOG and Whiting are leading the way, along with a handful of smaller, entrepreneurial Canadian operators.

While the attention may be drawn to the financials, the underlying ‘how it’s getting done’ continues, IMHO, to be the big story.

Is this the beginning, middle or end?

I attended a dinner tonight at the Midland Petroleum Club. My wife and I sat next to a former local banker. He told us that one of the banks in town has 26 bank examiners in its office this week.

JohnS. As you know, no amount of talk can change the fact that the US E & P industry is completely toast if $30 WTI and $2 natural gas persist.

I am starting to think many desire that very result, including the current White House occupant.

The current White House occupant is an alien from the Andromeda Galaxy.

U3: 4.9%

Mean U.S. gasoline prices < $2/gallon for two weeks running.

Interest rates low.

Inflation Rate low.

Housing prices have rebounded from their recent crash but are not skyrocketing.

De-scaled U.S. human and financial bleeding in Afghanistan and Iraq.

Resisted the siren songs for U.S. boots on the ground new quagmires in Libya and Syria.

Resisted the drum beat to fight Russia in Ukraine.

Rejected the war hawks' call to arms to bomb and/or invade Iran in favor of diplomatic engagement.

Not over-reacted to North Korean to Chinese chest-thumping.

Did not succumb to the call to panic about the Ebola outbreak in Africa and the resulting handful of cases in the U.S.

Enacted the ACA which has slowed the growth of health care costs and allowed increased numbers of people to have health insurance…single-payer Universal health care would have been much better but the folks in the pockets of the insurance, pharma, and chain hospital industries prevented the ultimate rational course of action.

You, Fernando, have the oddball perceptions.

Shallow,

is 1:30PM EST and asked about $10 tax per barrel by a journalist during the just wrapped-up press conference, the PREZz said the following among other:

“…is better to do it now that the gas prices are low and EXPECTED TO STAY LOW FOR SOMETIME TO COME…”.

Don’t shoot the messenger…

Be well,

Petro

Have heard from someone who I believe knows better than the Bloomberg writer that “there are likely little to no Wolfbone wells in Reeves country that are even close to being economic at $45 dollar oil.”

Take it for what it’s worth

I especially like the following:

“Oil prices can be even lower to justify completing wells that have already been drilled but haven’t yet been hydraulically fractured, or fracked.

Companies have built up a fracklog of more than 4,000 of those wells in the U.S. It’s economic to complete wells in 18 different areas in the Permian and Eagle Ford at sub-$30 oil. In Reeves County in the Permian, oil prices above $14 justify fracking an already-drilled well.”

Probably this amazing insight was discovered after a field trip to a local bar and in-depth communication with locals. As if money spend on initial drilling can just be written off and does not hang on the company balance sheet.

Looks like “Fuser rule” (http://peakoilbarrel.com/the-ieas-oil-production-predictions-for-2016/#comment-558538 )

“Take the current price of WTI then subtract 20% = Break Even Price” can be amended to “Breakeven_price=0.7*WTI” for Bloomberg honchos 🙂

I grow weary of this BS.

OXY has a 19 well Wolfbone package for sale in Pecos Co., which shares a border with Reeves Co. 100% GWI, 75% NRI. 16 producing, 1 SWD, 2 already plugged. 8/8 production is 300 bopd, 496 mcfpd. Wells completed 2014-2015.

So I suppose for OXY and the rest we ignore wells like the above, and continue with the $22 break even BS because someone hit a few good wells the next county over?

I’m ready to give up. If the massive losses experienced in 2015 do not make believers out of anyone, neither will the upcoming even greater 2016 losses.

The capacity of humans to believe what they want to believe despite all opposing fact and logic is a fundamental flaw in our species that has no doubt played a significant role in bringing us to this sorry point in history. Being an optimist, I hope that future surviving generations of humans will have almost entirely rid themselves of the genetics and/or psychological weaknesses that enable so many of us to thoroughly deceive ourselves. THAT might help make the world a better place.

Ironically, just after posting this I see a flyer in my email. Apache has 6 Wolf bone wells plus large acreage tract for sale in Reeves and Pecos counties.

The 6 wells are producing 220 bopd gross, 165 net. Those likely don’t break even at $92, let alone $22.

Funny how we get this Bloomberg report at the same time both oxy and apache are trying to bail on wells and large undeveloped acreage positions in the same freaking location. I also recently pointed out another oxy package in Loving Co., with one strong well and two weak ones. Bloomberg touts it as low cost too.

$22 break even. Ha!!

FWIW: I suspect they are cherry picking the very best wells. For instance there are probably a handful of wells in Eagle ford that have a breakeven below $30, but the rest of the other hundreds of wells don’t even come close.

People have a habit of telling half truths, either because they have an agenda or some fanatically belief. LTO/Shale is done, just like the housing bubble popped in 2007, but it wasn’t until 2008/2009 that the bottom of the barrel fell out.

carried over

And it won’t evolve with Trump and current ‘surrounds’. It will evolve with the likes of Trump et al. sitting down around an enlightened table of real equality and democracy.

Otherwise, Trump et al. et Empire et uneconomy/ungovernment/The Age of Unenlightenment will help drag us into a ‘Nouveau Dark/Middle Age’… Comprenez-vous?

In a high tech free society, the uneducated and unskilled will struggle with poverty and unemployment. At the same time blaming their economic problems on their environment they don’t understand.

Loser 2.0,

You have succumbed to the same fallacy of many of my engineer friends…that if just everyone would be as smart of they and secure STEM degrees, then everyone would have a decent payday as they.

I try to point out, that all things being equal, vastly increasing the number of engineers would mean they all would get paid much less!

They try to counter with the old chestnut of supply-side economics…’if they build it they will come’ argument…more engineers would create the demand for more engineering works, a rising tide will lift all boats and so forth.

I ask them what great and massive new level of effort engineering needs to be done, and whether throwing more engineers at these challenges would be the answer, and who exactly is going to fund these efforts, and they falter. For example, would a much greater number of engineers result in a breakthrough in commercial nuclear fusion power? And who would fund that research? When my engineer friends bring up all the panapoly of supposedly great and wonderful massive engineering projects…roads, rails, dams, canals, or whatnot, I remind them of how much of this kind of stuff was built through the infusion of public funding…sure these things were done by ‘private’ enterprise’, but that would not have happened without tax dollars hard at work.

The real irony is that these clueless engineers are currently working for private companies who are in existence because of their government contracts…when I tell these people that they are a form of federal employee, just a highly disposable form, their eyes glaze over. After that, I let them get back to their (PowerPoint) ‘engineering’.

Thanks for playing…you’re fired!

I thought that The Dark Ages was characterized by a very much colder climate, which caused widespread famine. Like the settlements on Greenland that had to leave. If so, then we might be in great shape with global warming.

I’ve heard that AGW is countering a glacial age or global cooling, but that the effect of the former is more pronounced.

ConocoPhillips cuts dividend from 74 cents to 25 cents.

Lowered 2016 Cap Expenditures Guidance From $7.7B To $6.4B.

ConocoPhillips 4Q Loss $3.45B

Statoil losses increasing, 11% capital budget reduction for 2016, but no announcement of additional layoffs that I have seen:

“Norwegian oil giant Statoil has posted a net loss for the fourth quarter of 2015. Net loss for the quarter was NOK 9.2 billion, down from a net loss of NOK 8.9 billion a year ago. For the full year 2015, the company’s net loss was NOK 37.3 billion.”

(NOK 37.3 billion = $4.4 billion)

Also 3% production decline y-o-y

http://www.offshoreenergytoday.com/statoils-4q-loss-deepens/

Boom.

“Boom.”

Exactly.

A lot of companies overspend in 2015. Several did other stupid things. Some currently are raided by their own management. In any case when you look back at 2015 US production resilience its is clear the US shale players overspend funds by a very significant amount (continuing “carpet bombing” of “sweet spots” with new wells ) and thus many might pay the price for that at the end of 2016 if they were wrong about their expectations of oil price recovery.

The form of the futures curve that exist now guides many if not most investment decisions. Due to it a lot of people will lose their jobs in 2016 and a lot of new capex will be cut to the bones.

Futures curve essentially predicts two things: (1) demand will not go up significantly or enters “death spiral” as Citi predicted; (2) oil can be forever produced at prices below, say, $65 in the same or rising volumes.

If both those postulates are wrong there will be “Boom !” at some point.

The first postulate is really weak: unless China has a hard landing demand most probably will continue to go up this year, probably by more then 1Mb/d. The second is a fallacy despite all talk about Iran reentering the market and flooding the world with cheap oil.

So I suspect that there will be “Boom !” in the form of short squeeze …

Malthus was correct – “The power of population is indefinitely greater than the power in the earth to produce subsistence for man”

M. King Hubbert was correct – He predicted that, for any given geographical area, from an individual oil field to the planet as a whole, the rate of petroleum production of the reserve over time would resemble a bell curve.

Richard Duncan was correct- The Olduvai theory divides human history into three phases. The first “pre-industrial” phase stretches over most of human history when simple tools and weak machines limited economic growth. The second “industrial” phase encompasses modern industrial civilization where machines temporarily lift all limits to growth. The final “de-industrial” phase follows where industrial economies decline to a period of equilibrium with renewable resources and the natural environment.

The Limits to Growth was correct – (Although IMO they didn’t give enough value to the waste stream factor in their model) The original version presented a model based on five variables: world population, industrialisation, pollution, food production and resources depletion. These variables are considered to grow exponentially, while the ability of technology to increase resources availability is only linear.

Marx was correct – In this first volume of Capital, Marx outlined his conception of surplus value and exploitation, which he argued would ultimately lead to a falling rate of profit and the collapse of industrial capitalism.

All of the issues and concerns regarding the convergence of constraints discussed around the internets over the last 10 years or so on legitimate sites like TOD and others were for the most part correct.

I could go on and on but I think I made my point. No one has been correct all the time or on every subject which should not even need to be said.

Not one of the problems outlined above, along with many others, has been resolved, none of them have gone away. They are all still with us and the fact that outright collapse has not yet happened does NOT mean they never will and in fact that most likely means that we have gone even further into over shoot than even William Robert Catton, Jr. the author of Overshoot could have imagined, insuring an even grander collapse.

So quit all your whining about how wrong everyone was because they gave you the wrong day, time, and address for the party.

“The moving finger writes, and having writ, moves on;

Nor all your piety nor wit shall lure it back to cancel half a line;

Nor all your tears wash out a word of it.”

BUT – you can ADD to it. The learn-to-live-where-you-are-with-what-you-have movement is alive and growing, and stronger parts of it WILL survive any general collapse. We can then move on from there to what we all could have had if we had applied a little piety and wit in the first place.

Things down Venezuela way are getting to be more interesting by the day, to the misfortune of people who live there.

I copied this from a blog. The WSJ article mentioned is real, but so is the paywall. You can read the first couple of lines of it.

”

Cash-strapped Venezuelan Government Imports Massive Loads of Newly Printed Paper Money

http://www.latinpost.com/articles/11…-planeload.htm

Venezuela’s economy is a mess, caught in a spiral of low oil prices after decades of extravagant spending by a government which was buoyed up by oil and nothing else. The government has clamped down again and again with price controls, scapegoating, and harsh emergency economic measures. Nobody ever seems to have enough money.

Now the Venezuelan central bank has somehow found the money to pay for more money. It has imported five billion paper bills in 50- and 100-bolivar denominations and is looking to import ten billion more.

Venezuelan printers did not have the money or resources to print the billions of bills the government demanded, so the bills have been printed elsewhere. The demand was so vast that no single foreign printer had the capacity to provide them, so multiple printers worldwide have been employed.

According to sources, who have opted to remain anonymous, the Venezuelan government, under the leadership of President Nicolás Maduro, has ordered billions of banknotes to be printed abroad and shipped to the Latin American country, in order to get more money circulating. In fact, sources stated that the bank notes were so numerous that they filled about three dozen 747 cargo planes, reported The Wall Street Journal.

Billions of banknotes to take a lot of space, after all.

There is a Wall Street Journal story on this, but it is behind a paywall. ”

In the meantime, the Madure regime continues to basically give away gasoline, which those fortunate enough to put their hands on it , smuggle out of the country, as best they can, trading it for food or real money which can be used to buy food.

Venezuelan oil production will probably collapse along with the rest of the local economy.

Just splashed, Obama wants a $10/barrel tax on oil to fund clean transport.

This should do good things for oil demand and save shale, or not.

Except . . . shale oil is almost all in red states so that’s not really an imperative, one supposes.

I saw that article this AM too, and am wondering what some of the well informed posters here think that would do to the oil industry. $10 a barrel is no small amount of money. Maybe he’s starting off at 10 knowing it will get whittled down to 1 or less a barrel, which would mean he’s learned something about negotiating.

And maybe he is paying attention to our promise at Paris to CUT use of FF’s?

Things like that can actually happen, sometimes.

Obama has been playing a clever long game with respect to climate change, and quite well too.

Is this proposed $10 tax suppose to be,

1/ A tax on US production?

2/ A tariff on imported oil?

3/Both of the above?

A tariff would be real hard to bring in, in these days of supposed free trade. Especially from the NAFTA countries. But the US some how seems to think international agreement only apply to other counties when push comes to shove.

If the $10 is only applied to US production, then it just shuts down large parts of the US oil production and increases imports. Is that the plan?

As much of this money, is suppose to be going to improved transport optiona and infrastructure, surely the easiest an most logical increase in oil tax would be to increase tax on Gasoline and diesel! But there seems to be a unwritten constitutional amendment stating no increases in road fuel taxes in the US.

You fellas do make life difficult for yourselves,when the logic is so simple!

Good luck.

How would it go over if he proposed a 30 cent for each dollar of grain sold tax on all grain that is raised in a non-organic manner, and/or with equipment that burns fossil fuels?

How about a 30 cent tax on each dollar of wages earned if the laborer gets to and from work by a fossil fueled vehicle or works in an industry which accomplishes anything by way of fossil fuels.

What is wrong with shared sacrifice for the common good?

Hi Toolpush,

The tax may be at the petrol pump. So $10/b would be about 24 cents per US gallon (or 6 cents per liter). By European standards this would be quite low. Currently the volume weighted US average Federal, state and local tax is about 48 Cents per gallon, so the increase would be about 50%. Currently in the US the average gallon of petrol is $1.76/ US gallon ($0.46/liter), so the tax would raise the price to $2/gallon.

Note that the Federal tax on gasoline is 18.4 cents per US gallon and it was last raised in 1993 (23 years ago). The tax is not indexed to inflation.

It is certainly a good time to raise the tax.

Real gasoline prices (in constant dollars) have not been this low in the US since 2002 (annual average was $1.79/gallon that year in 2015$). The annual average gasoline price in 1993(2015$) was $1.82/gallon.

Dennis,

A fuel tax would be a lot more sensible than a tax on oil production, but I have changed my mind. I feel it would be a great idea to place a $10/barrel tax on US oil production, (sorry Shallow, I am being selfish for a minute). This should put a few million barrels a day on ice,from the US, allowing international prices to rise, increasing Capex world wide except the US. Rigs will go back to work and I can live my days out in the oilfield a happy man.

Now back to reality!

At one time, Boone Pickens advocated putting a tax on US gasoline/diesel that would bring US fuel prices more in line with European fuel prices, offset by cutting the US Payroll Tax. This would of course have been a per gallon tax far in excess of what Obama apparently suggested.

From a few years ago:

http://www.getamericaworking.org/making-lean-green-tax-shift

BTW it looks like Boone Pickens recently sold his oil holdings and is 100% in cash.

http://oilpro.com/post/22097/t-boone-pickens-has-sold-all-his-oil-holdings-video

Oil is by and large a red state industry.Convenient for the D’s of course.

But I would still support the tax, as a matter of good national policy.

Hi Old Farmer…A two sentence post? Is that a record?

It used to be, lol.

Excellent plan, the black stuff is far too valuable to piss up the wall as we currently are, it is so underpriced in the world’s biggest economy, giving an appalling market signal to waste it as fast as possible. Tax is a more important too to get right than almost anything else, and no, dear Americans, that doesn’t mean eliminating it. Tax the right things, and incentivise the right things. And for the oil patch, done right, this should also mean the restoration of decent margins.

http://gizmodo.com/obama-wants-to-tax-oil-companies-and-give-the-money-to-1757162698

Shame the medievalists that run the US will keep this threat to feudalism and a fried biosphere from becoming real….

Patrick, in the last few elections we have placed Republican majorities into the US legislature specifically to block blatantly unconstitutional overreaches by a deeply unpopular leftist president. Consequently, this latest plan from the executive-in-chief has no hope of going anywhere, as implementation would not only hurt the hardworking men and women of America by forcing them to needlessly pay more for energy, since the energy companies would certainly pass the additional costs brought about by the tax onto the consumer, but would also be one more example of the executive branch violating the 10th Amendment.

Patrick, in the last few elections we have placed Republican majorities into the US legislature specifically to block blatantly unconstitutional overreaches by a deeply unpopular leftist president.

Wow, how did that deeply unpopular leftist president ever get reelected with, not just a majority of electoral votes, but a majority of the popular vote as well. It is likely because he is only deeply unpopular among the right wing nut case set.

“It is likely because he is only deeply unpopular among the right wing nut case set.”

The “right wing nut case set” must be HUGE.

Republican majorities in the United States Congress are an outcome of gerrymandering created by Republican controlled state legislatures.

What is gerrymandering?

Exactly, Gerrymandering seems to be the only science Republicans take seriously. Or perhaps it’s an art?

Additionally; to the rest of the world Obama is a centre right politician, it’s just that the crazies have so taken hold of affairs in the US that all perspective is lost.

It is frankly impossible to even parody the crazy right that stands for mainstream politics in the US; whatever joke you run there’s some politician, actually in office, that surpasses it.

I am absolutely dead sure no Democrat ever ever ever in history engaged in gerrymandering.

And them there republicans that control all them there state legislatures got in control of all them there legislatures by gerrymandering them formerly blue states even before they GOT control, yessiree, them there dimocrats in control of them there states were sound asleep …………. oh never mind.

A partisan is a partisan, and thinking is by definition never included in a partisan foot soldiers intellectual tool box.

Now it IS true that ONCE in control of state legislatures, R’s happily engaged in gerrymandering, which HAS had the effect of throwing some congressional seats to the R side.

But the average hard core D foot soldier will never in a thousand years allow the thought to enter into his mind that JUST MAYBE a hell of a lot of stupid ignorant plumbers, carpenters, cops, soldiers, teachers, truck drivers,lawyers, farmers, small business men, union members, preachers, housewives, retail clerks, bankers, doctors, lawyers, Indian chiefs, ad infinitium, LIKE the older more traditional (republican oriented these days ) vision of what life OUGHT TO BE be like in the USA BETTER than they like the recent D version.

Not every body wants pot legal. I do.

Not everybody wants Uncle Sam to go around disarming the citizens of this country. I don’t.

Not everybody wants people to suffer because they can’t afford medical care. I don’t and therefore support single payer.

Not everybody wants the kids to go to all too often super crappy schools, run by government and teacher union monopolies, so some people support school vouchers and educational choice. I support choice in education.

But then I try hard to THINK at least a little, once in a while.

The typical hard core R foot soldier is no better informed, no more intelligent, and no more morally upstanding than the typical D foot soldier.

NOT AT ALL. Only a fool, or a R would make THAT argument.

It is impossible to see the forest if you are standing in the middle of it, no matter your political orientation. Understanding requires a certain amount of objectivity.

Republican majorities in the United States Congress are an outcome of gerrymandering created by Republican controlled state legislatures.

So you’re saying that the Republicans gerrymandered their way into holding a majority in the US Senate? How does that work? And what about there being 32 Republican governors versus 18 Democratic governors, is that also something to blame on gerrymandering?

Not to mention, as oldfarmermac said in his excellent post, gerrymandering cuts both ways. Take Illinois, Maryland, and Massachusetts, for example. Three states where the Democrats have super-majorities in their respective state legislatures, yet each state elected a Republican governor in 2014, the first election for governor in which the district maps created after the 2010 Census were in effect. Isn’t that the least bit suspicious?

Is Armageddon located in Syria?

Saudi Official Says Kingdom Ready to Send Troops to Syria

http://abcnews.go.com/International/wireStory/saudi-official-kingdom-ready-send-troops-syria-36717765

“Asiri’s announcement came shortly after Russia said it suspects Turkey of planning a military invasion of Syria. Ministry spokesman Maj. Gen. Igor Konashenkov said Thursday in a statement that the Russian military has registered “a growing number of signs of hidden preparation of the Turkish armed forces for active actions on the territory of Syria.””

Who has ongoing military operations in Syria?

1. Syria

2. ISIS

3. IRAN

4. NATO (US, EU)

5. TURKEY (NATO, but for a non-NATO agenda)

5. KSA?

All we need is China to join in, to make it an official global war ( contained inside of one small third world nation for the moment)

In general, Russia, Iran and Assad are winning. They are about to wipe out the rebels holding Aleppo.

That would effectively eliminate anyone for the US to support.

It also would pretty solidly assure that no GAZPROM challenging pipeline of Qatar gas to Europe is going to happen.

The reaction across the board is a tad desperate.

How the heck is Saudi going to get troops into Syria? No shared border there. Through Iraq? Can’t see that happening because Iraq is aligned with Iran. Through Israel? Bwahahahaahahahahaha! Through Jordan? Eh, well I guess that might work. Reasonably short supply lines too.

Well, let’s get this party really rockin’ and rollin’! C’mon everybody! Let’s do the twist!

Saudis Say Cash Crunch Won’t Derail an Ambitious Foreign Agenda

http://www.bloomberg.com/news/articles/2016-02-04/saudis-say-cash-crunch-won-t-derail-an-ambitious-foreign-agenda

Saudi Arabia won’t let the plunge in oil prices derail a regional agenda that includes waging war in Yemen and funding allies in Syria and Egypt, Foreign Minister Adel al-Jubeir said in an interview.

“Our foreign policy is based on national security interests,” al-Jubeir said on Thursday at the Ministry of Foreign Affairs headquarters in the kingdom’s capital, Riyadh. “We will not let our foreign policy be determined by the price of oil.”

The bankruptcy of the corrupt, medieval, bigot, terrorist exporting regime of Saudi Arabia would be one of the few positive things of continuing low oil prices.

WetOne Wrote:

“How the heck is Saudi going to get troops into Syria? No shared border there. Through Iraq?”

Through Turkey. If you read the article, Russia officials stated that Turkey appears to be staging for a military invasion of Syria. which is just absolutely ludicrous.

Watcher concluded:

“The reaction across the board is a tad desperate.”

Yes, hence the reference to Armageddon. In desperate times, people lose all common sense and start doing the unthinkable things.

That said, I have a suspicion that KSA may soon become unstable and and start to come apart in the next year or two. The Russians have effectively routed ISIS in Syria. All these ISIS fighter will probably be returning home soon. Idle, unemployed radical fighters usually don’t settle down.

Saudi troops are going to get their ass kicked so hard. It’s going to be pathetic. Saudis are soft. Their leadership is incompetent. Their army has never seen battle on any reasonable scale. I don’t know whether to laugh at the very idea of Saudi troops fighting in Syria or cry for the poor buggers that are gonna be turned into buzzard feed.

Mercenaries. Pakistanis and others. American mercenary business as well. They will have the best equipment money can buy, and Iraqi trained men. Same as Yemen.

We need Caelan to teach these militaries the virtues of anarchism….before it is too late!

/sarc

Oh no, don’t mind me. Keep fighting and maintaining ‘the narrative’ and we’ll likely get it.

We’ll get it systemically fighting/cheating/threatening/etc. ourselves into a kind of stone age where things more or less even out again, [sarc style=”smooth BBC narrator-type voice”] or the easier way, with psychosociopolitical advancement & enlightenment [/sarc].

Karen Elliott House, author of “On Saudi Arabia,” has an Op-Ed in the WSJ in regard to the question of succession in Saudi Arabia.

The question is whether 56 year old Crown Prince Mohammed bin Nayef (King Salman’s nephew) or 30 year old Deputy Crown Prince Mohammed bin Salman (King Salman’s son), or someone else, will succeed King Salman. An excerpt from the Op-Ed, “Some of Mohammed bin Salman’s uncles and cousins insist that the senior members of the family are organizing to meet with the king in the “near future” to ask him to restrain or remove his son.”

Inside the Turmoil of Change in the House of Saud

As oil prices drop and external threats mount, a 30-year-old crown prince is suddenly ascendant.

http://www.wsj.com/articles/inside-the-turmoil-of-change-in-the-house-of-saud-1454632133

New report: solar rooftops can strengthen an aging power grid and save Californians $1.4 billion every year

By SolarCity

February 04, 2016

http://blog.solarcity.com/distributed-grid-white-paper

http://www.solarcity.com/sites/default/files/SolarCity_Distributed_Grid.pdf

From above,

Data from Rystad Energy show the number of completed wells have by far outpaced the number of wells spudded (drilled) since 4Q14. Indeed, the number of well completions per month continued to increase several months after the rig count started to drop off, peaking at more than 1,600 wells in December 2014. The number of completions are still outpacing the number of new wells drilled, and as a result, the number of uncompleted wells, or the frack-log, has been cut down from its peak of around 4,600 wells hit at the end of 2014 to around 3,700 wells currently.

This seems to make a total mockery of all the claims in the media, that they were drilling cheaper wells, and saving them for future production, with an ever increasing number of DUCs.

Rystad Energy’s analysis makes a lot more sense, that the shale drillers were completing more than they drilled, to conserve current cash, then the often stated line saving DUCs for the future . Especially when the shale players are fighting for a future that may not exist for them.

From Andrew Slater’s Real Time Arctic Air Temperature Images

Hat tip: Arctic Sea Ice Forum

The warmer it gets the more it radiates into space, humidity is really low, so a warmer North Pole is an improved radiator.

This week’s ice mass is approaching averages, and the warmer Barents is causing a larger amount of snow precipitation. It seems to be a very well tuned feed back mechanism.

Meanwhile El Niño is causing a lot of precipitation over California. This means they can stay there for a bit longer. ?

Australian response:

http://www.climatecouncil.org.au/climate-science-to-be-gutted

They have been telling for years now that the science is settled, and they have been hoisted by their own petard. If the science is settled then there is no longer such need for climatologists in modeling, measuring and basic research and they are going to hire experts in adaptation and coping. It is sort of fun hearing those scientists now say that the science is settled but in a way that is not completely settled.

I guess that was another forecast they couldn’t get right.

I’ve always wondered, do the people at the climate change forums talk about oil as much as some people on this oil forum seem to love to talk about climate change?

Dave – Great Question! !

Dave – Great Question! !

This is why:

Home

Energy and Human Evolution

Non-OPEC Charts

Of Fossil Fuels and Human Destiny

OPEC Charts

The Competitive Exclusion Principle

The Grand Illusion

What is Peak Oil?

World Crude Oil Exports

World Oil Yearly Production Charts

These are the topics our gracious host has listed up top as being of interest to him, as the creator of this blog, and the person who does nearly all the work associated with keeping it up and running. He gets a little help from guest columnists, but otherwise, he does it himself.

Hardly anybody would be paying any attention at all to the concept of anthropogenic climate change except for the fossil fuels connection.

Fossil fuels, climate, and human destiny are conjoined triplets.

In regard to Dave’s (Texan) question:

Well done, OFM.

I just get tired of coming here to learn about current oil production and seeing the comment threads be completely derailed by postings about climate change which have little direct relevance to the information contained in the parent post made by Ron. Many online communities would tend to consider such activity spamish or trollish behavior intended to hijack the community, but I guess if Ron is OK with it, that’s what counts. I still do wonder though if the people like aws. who seem to come here specifically to post about climate change news in turn go to the climate change forums and post about oil-related news.

This is a peak oil site as opposed to just an oil site.

So perhaps you can find regular oil sites to ‘learn about current oil production’, and maybe talk up your particular brand of anthropogenic climate change.

See also Oldfarmermac’s comment in the vicinity as well as this site’s links/topics above.