The recent price crash in crude oil, if it lasts for any length of time, will certainly affect oil production. The question is, just how great an effect will it have an how soon? But in this post I want to concentrate on what is, or was, happening to world oil production even before the price crash.

Russia, the largest producer of crude oil in the world, will peak in 2014. There are various estimates of how fast their production will decline but best case, for Russia, puts their decline at about 2% per year. They say they are depending on the Bazhenov Shale and Arctic offshore just to keep production flat in 2015. Well that is not going to happen, not in the next few years anyway. And if prices stay in the current range it is unlikely to ever happen.

OPEC is a wild card but there is little doubt that they are producing flat out right now. Only Iran has any real any real chance of increasing production very much and that only if sanctions are lifted. Libya has already increased production significantly and could increase more but very little. With the violence still going on in Libya, there is a greater chance that their production will decline.

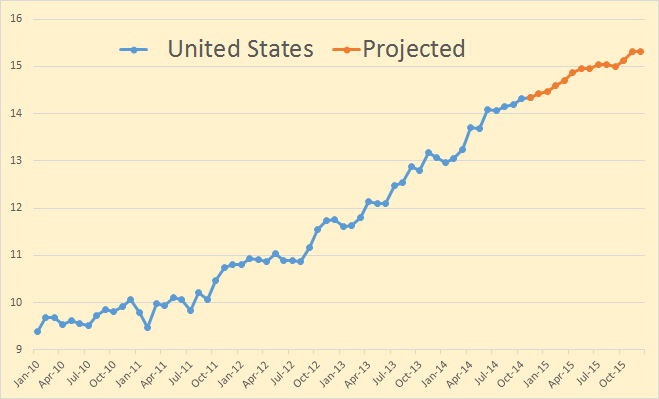

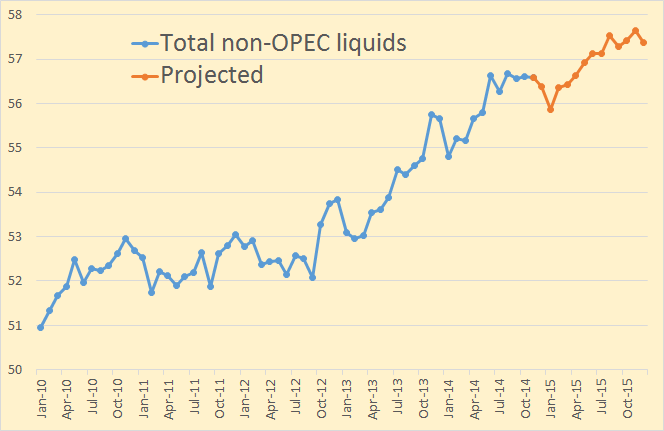

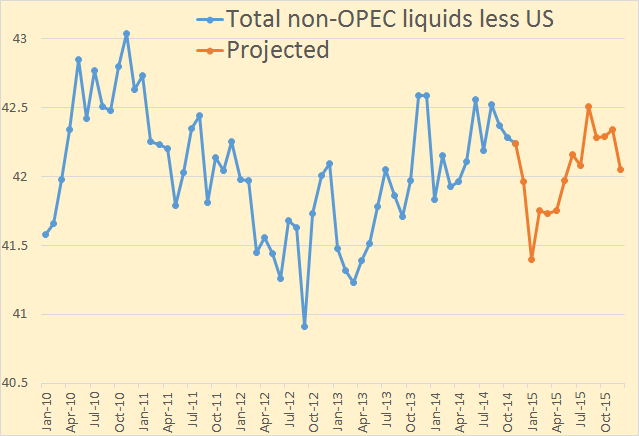

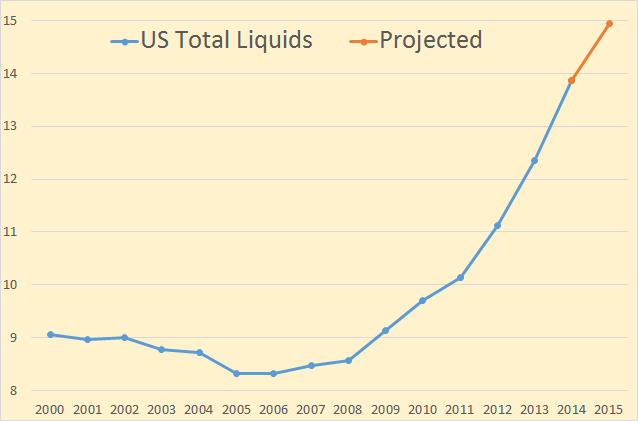

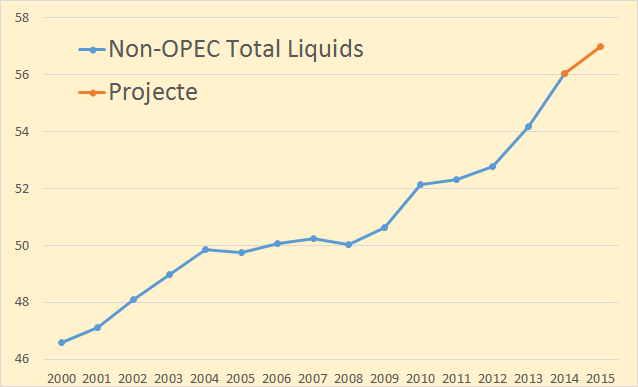

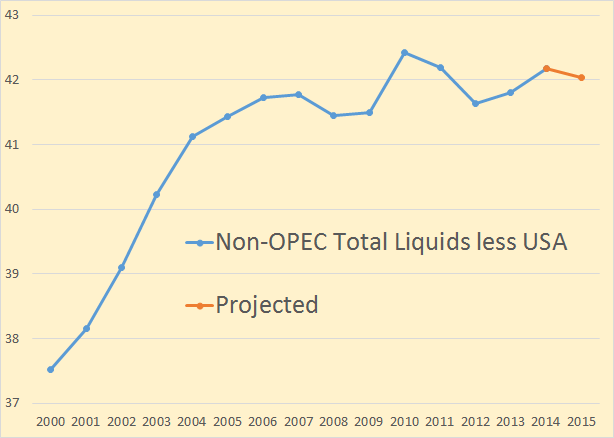

But before we go any further let’s look at what the EIA is predicting for 2015 for both the USA and the rest of non-OPEC? The below charts are from the EIA’s Short-Term Energy Outlook. Current data is through October 2014 and the projected data is through December 2015. All data is in million barrels per day. Also, very important, the data is Total Liquids which includes NGLs, bio fuels and refinery process gain. The EIA, for US production even counts refinery process gain on imported oil.

The EIA is predicting US average production total liquids will be up 1.49 million barrels per day in 2014 and up another 1.1 mbd in 2015. (I always use m for million and k for thousand.)

The EIA is predicting non-OPEC average total liquids will be up will be up 1.88 mbd in 2014 but only about half that, up .95 mbd, in 2015.

By removing the US we get an entirely different picture. The EIA has non-OPEC total liquids, less US, up .39 mbd in 2014 but down .15 mbd in 2015.

We get a slightly better picture by looking at annual production instead of monthly production.

It is a little easier to see the EIA is predicting US production growth will slow slightly in 2015.

That same slow down of growth is apparent in their non-OPEC total liquids prediction.

The EIA is saying that they expect that non-OPEC total liquids outside the USA will decline next year.

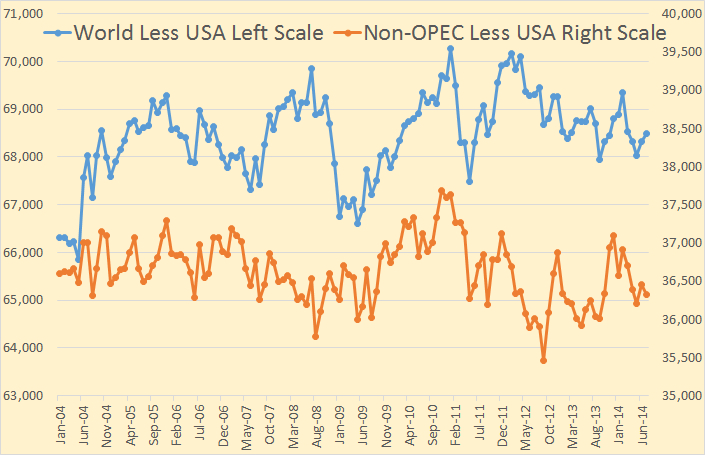

This chart is Crude + Condensate and the data is through July 2014. I show it to emphasize the point that only the US is keeping the world from peak oil. And what you see above is many nations that have improved production in the last 5 years or so but have now peaked. Only a couple of non-OPEC nations will increase production next year and those by only a tiny amount. Most nations will see a decline next year.

But what will happen to US production? The price decline will most definitely affect production but how long will it take for that decline to show up? After all at the end of September there were 610 Bakken wells awaiting completion. That is a three months supply. That means any slowdown in drilling will take several months to show a decline in wells completed. However elsewhere it may not take nearly that long.

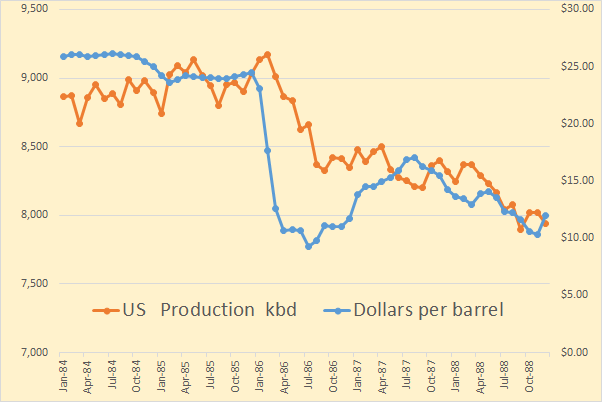

When the price collapsed in 1985 the decline was rather dramatic. However the price collapse in 2008 led to no noticeable decline in either US or other non-OPEC production. There was a huge decline in OPEC production in 08 and 09 but that was a deliberate cut.

I believe non-OPEC production less US production will be down between .5 and 1 million barrels per day next year. And I believe it unlikely that US production will be able to offset that. OPEC is still the wild card but I think it is more likely their production will decline rather than increase.

Bottom line, it obvious that we are on the cusp of peak oil and only the seemingly ever increasing barrels from US shale oil production is keeping it at bay. But it now looks like that party is about to be over. I think that it is very likely that peak oil has already arrived, if not this year then 2015 for sure.

For clarification: Peak oil for me is when C+C peaks. I do not count bottled gas and bio-fuels as oil. I would like to exclude condensate but no one except OPEC, Mexico and Norway gives up “crude only” stats so we are forced to count Crude + Condensate. I posted the EIA’s “total liquids” charts here because they make no predictions for C+C and the data they do post only goes through July 2014.

In other news: Things are getting tough all over for those financing the shale oil patch. They are starting to dump assets to pay their bills. They are caught in a squeeze between falling oil prices and rising junk bond rates.

Exclusive: KKR prepares more Samson asset sales as oil prices plunge

KKR & Co which led the acquisition of oil and gas producer Samson Resources Corp for $7.2 billion in 2011 and has already sold almost half its acreage to cope with lower energy prices, plans to sell its North Dakota Bakken oil deposit worth less than $500 million as part of an ongoing downsizing plan, according to people familiar with the matter.

KKR, one of the world’s biggest private equity firms with $96 billion in assets under management, overpaid for Samson, and persistently low natural gas prices have hampered its ability to finance the company and added to its debt burden, the people said. KKR’s plan was to shift Samson’s assets from natural gas production more into oil and liquids.

With U.S. crude oil futures down 25 percent since June, Samson has hired Bank of Nova Scotia to sell the Bakken assets, and the company is contemplating more asset sales to raise cash, the people said, without specifying which other assets…

“Everyone wants to be near the ‘sweet spot’ where the reservoir produces the most liquid and a higher concentration of hydrocarbons per square foot,” said Allen Brooks of boutique investment bank PPHB LP.

And those ‘sweet spots’ are starting to get a little less sweet with every new well.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

It always comes back to jevon’s paradox… The more we have, the cheaper it is to use, the more we will use.

A drop in high efficiency car sales and increased travelling has likely already begun in response to lower prices at the pump.

The changes in consumption will be reflected more obviously over time. It’s not as if there aren’t already billions of masses out there who aren’t interested in living “better”…

This is probabaly just another “dip” on the peak oil curve.

The immediate question is how much financial engineering took place expecting $100 oil and how will this pendulum swing affect the global currency systems. A hard crash of some kind?

It will be interesting to see how U.S. oil consumption responds to U.S. oil-derived products’ prices over time.

I wonder about the facile invocation of Jevon’s Paradox…it is easily tossed out on the stage in this and other forums to nay-say the advent of more fuel-efficient vehicles (and better energy efficiency in general) and now it is invoked as the bogeyman rearing its ugly head in response to lower oil prices.

Analysts learn to broaden their scope to try to understand all the potentially relevant factors in play in any analysis, not just the premier attribute that hangs in the air in front of them like a bright shiny bauble.

In this case, the ‘My Precious’ is the easily understood and oft-reported gasoline price at the pump.

What about other factors which may influence the vehicle miles traveled (VMT) per unit of time?

Do people have jobs? DO they have well-paying jobs, affording them significant discretionary income? Do they choose to spent some, most, or all of there discretionary income on things other than increasing their VMT (including from a zero baseline)? Even if they thought they might achieve higher marginal utility from increasing their VMT as opposed to other uses of their spare nickels and dimes, do they have that other ‘master’ precious commodity: time? Are they working overtime on their job, or maybe working multiple jobs to make ends meet and have a few ducks left over?

Can they afford car insurance? Car Maintenance? Registration and Licensing fees? Traffic violation fines?

How many places can they go that they haven’t seen before in person, or have seen non TV or the Internets, or that don’t have the same scenery and attractions that are in there back yard (McUrbanization/standardization of the U.S.) or that interest them, or are worth the hassle of time, traffic, parking fees, entry fees, lodging expenses, eating out on the road, etc? Do we propose that instead of going to WallyWorld or the nearest National Parks ($$$), ($$$), exclusive of gasoline even, that they go cruise the downtown loop, a la the 1960s and 1970s?

Let’s face it…I am talking about the elasticity of demand for oil wrt private motoring. I know folks, real well, who make in the low to mid $100Ks, who could easily afford to travel more, even before this recent price reduction in gas, who travel less than ever, due to being busy with their work, family, etc. and due to having been up the mountains and down the valleys more than a few times…for these people, their step-up traveling aspiration isn’t to drive up to Santa Fe or down to Carlsbad for the umpteenth time, it is to see New Zealand, take that dream Alaskan cruise/railway adventure, etc…but these things are too spendy, even for folks who make the low hundreds, but have big long mortgages and don’t feel they can take the time away from the almighty job, lest their slow cog gets replaced with a shiny fresh sprocket. And for the folks who are not fortunate enought to have these upper-middle-class woes…well, they are likley working multiple jobs and can’t even fantasise about driving to Santa Fe and looking at the art or Carlsbad and looking at the natural wonders, even if that interested them to begin with…thay probably want to see Hawaii and Alaska too, and are even further away from that dream than the UMC folks who are working their fragile, tenuous 70 hour week white collar jobs just to stay even.

IIRC, OFM posted some posts about elasticity of demand for oil, and, IIRC, I think the data, such that it is, shows that demand is sticky.

In sum, I perceive that Jeveon’s Paradox is not as big of a deal as some folks think.

I believe that Jevons Paradox applies to oil if the time frame is sufficiently long to allow people to change their lifestyles and habits to accommodate themselves to either substantially cheaper or substantially more expensive oil.It applies if you are talking decade scale no doubt.

But I don’t believe it matters much if at all in the short term, meaning a year or two.. We have to do most of the driving we do and we just don’t start driving a whole lot more because gas prices come down- at least not right away.

Certainly there are people who will buy a larger car or truck today than they would have six months ago – but not THAT many more – and most people are not going to be buying a new car at all.

Beyond that a brand new ’15 model f 150 which is considerably larger than some older pickups will actually get better mileage. I have an elderly Chevy 4×4 S10 that will not get the mileage the larger new 4x4f150 will get.

I’ve been looking at this drop in prices from the perspective of it simply putting a hundred dollars per month or so into people’s pockets. Somewhere else I read this as being the equivalent of QE4, but directed at the masses instead of the bankers.

So people will choose to either consider it a kind of pension and go out to buy that F150, pay off some bills or start a savings plan. Some choices will make them poorer, some richer. In either case it will be a world wide stimulus. What we can hope is that net-net the largest portion will not go to increasing the purchase of less energy efficient “toys” but to purchases that will actually enhance people’s futures.

OFM,

I think you are correct…I think that all but the stupidest people remember how gasoline prices have waxed and waned repeatedly in the past, and at least have a dim understanding that gasoline prices very well may increase again.

On top of that, even the hard-core tune-outists (people who live their lives from one TV show to the next) have a sense of profound economic uncertainty…uncertainty in continued employment, in whether their car will hold together, whether they will face a profound medical bill, the frig might crap out, their parents may need nursing home care, their kids may need some help, and on and on and on.

There are many variables floating around in peoples’ noggins besides the day-to-day price of gasoline…most of these variables have big potential downsides and thus constrain peoples’ behaviors, and thus you are correct in surmising (IMO) that gasoline elasticity of demand is pretty sticky over the course of at least a year or two.

In the bigger picture, this widespread profound uncertainty, backed by real economic constraints for most people, puts a lid on ‘economic growth. Besides that, even people of limited means probably have all the big screen TVs and smart phones that they can use. There is only so much food you can eat…witness the obesity situation…there are only so many hours in a day…there is only so much information/services/products a person can consume, even if they had more money.

Two large factors: 1) People are financially constrained and 2) even if they weren’t, they are constrained otherwise…people are ‘full’…like after finishing their Thanksgiving plate…their houses and apartments don’t have any room for more stuff, and more stuff has stopped making most folks feel any better.

It would be swell if society redefined ‘the good life’….Peak Consumerism arrived a while ago. Peak video games, peak TV shows, peak sports viewing, peak UTube vids, peak restaurants, peak motels, etc. More =/ better and/or happier.

Shuffling along, your thoughts mirror mine.

Everything in our world reeks of excess, of oversupply, of hubris, of a system gone out of control.

Where you see excess I see poverty. The picture popped up in my facebook feed today. People standing in line waiting to buy cheap electronics.

What strikes me is how unpleasant public spaces are. They are so fixated on getting a TV screen with an additional inch diagonal that they don’t notice they are living in the third world.

Where you see excess I see poverty.

I certainly do see the excess but I also see the poverty, a profound poverty of spirit and imagination. That line in a way, is reminiscent of a line leading to a soup kitchen during the depression. It also makes me think of junkies lining up to get their fixes from their corporate pushers. These poor

peopleconsumers have been profoundly brainwashed but somehow I just can’t really bring myself to feel sorry for them anymore…I deal with these people every day and I find them to be just as Arrogant, greedy and petty as our so called leaders. Ours has to be the most dystopian civilization that has ever existed!Cheers!

More to the point of this blog, low density car based societies are going to be at a distinct disadvantage if oil runs out. Cities that have invested in the infrastructure needed for high density living arrangements have much lower fuel costs.

A drop in high efficiency car sales and increased travelling has likely already begun in response to lower prices at the pump.

If the US really aims to be energy independent, the pitch should be that we scale back oil consumption so that we only use what we produce from local wells.

I expect the market is somewhat asymmetrical. The drop in price is going to cause a lot more damage in the short term to the supply side than it is going to cause any structural change on the demand side.

It’s easier for a few drillers to go bankrupt than it is for consumers to buy a whole new fleet of cars.

I nominate this comment as the best individual comment I have seen here is some time.

”It’s easier for a few drillers to go bankrupt than it is for consumers to buy a whole new fleet of cars.”

There is a LOT of food for thought in this one sentence when it comes to figuring out what may happen to the economy over the short to medium term.

Thanks 🙂

” But it now looks like that party is about to be over. I think that it is very likely that peak oil has already arrived, if not this year then 2015 for sure.”

Ron,

Bold words. From a lesser thinker I’d probably just gloss over them.

This recent price collapse is interesting. It has the potential to burst the shale bubble and or destabilize other oil exporters relying on oil prices to placate the masses.

The last 5 years of so have been rather dull on the peak oil front. Things might just be getting interesting again.

The last 5 years of so have been rather dull on the peak oil front. Things might just be getting interesting again.

Things have been dull for some but not so dull for others. I have watched major national oil companies skim the cream from the top of their old fields in an effort to increase production, or at least keep it flat. And I have wondered why all those prognosticators who have declared the death of peak oil cannot see what was happening. The high price of oil enabled some US drillers to squeeze a little oil from source rock that was too tight to fool with at lower prices. Then with US production increasing by over a million barrels per day per year, everyone celebrated the death of peak oil.

No, I found the last few years extremely interesting, and now things are about to get even more interesting.

Ron, et al.,

If one looks at the proportional aggregate rate of real GDP per capita for 65-70% of the world economy (US, EZ, Japan, and China), “stall speed” occurred in Q4 2013-Q1 2014 and has decelerated to a rate historically occurring at the onset of recession. The same pattern occurred in winter-summer 2001 and 2008.

The US has appeared to “decouple” because of the debt-induced shale oil boom/bubble and associated growth of energy-related transportation that has skewed US industrial production higher than otherwise would be the case. Also, subprime loans have been driving (bad pun) growth in auto sales, without which sales would be 11-12 million instead of 16 million. Subprime auto loan delinquencies and defaults have already begun to rise, and one can imagine a similar event occurring in the shale oil sector, which will eventually hit banks that have grown rapidly commercial and industrial loans in the energy sector.

Moreover, note that the US stock market was a lagging indicator of the economy in 2001 and 2008, crashing 2-3 quarters after the economy had already entered recession in late 2000 and late 2007.

Finally, the crash in the price of oil in 2008 occurred in part because of the unwinding of long leverage in oil futures in response to the recession-related slack demand conditions occurring throughout 2008, as is occurring today around the world.

I’ll reiterate from a week or so ago, Peak Oil occurred in 2005-08, at least in per capita terms. Peak Oil likely occurred in absolute terms in 2011-12 with the increasing energy cost of extracting energy becoming prohibitive; or the fossil fuel energy cost of extracting the marginal costlier barrel reaching a threshold at or above which it is no longer economically feasible to continue growing investment to extract, transport, refine, store, distribute, etc.

Put another way, we can’t afford to profitably extract oil above $40-$50 AND grow real GDP/final sales per capita so that demand is sufficient to continue extracting the costlier, lower-quality oil. This implies that neither can we afford to build out renewables at necessary scale AND grow real GDP/final sales per capita AND simultaneously maintain the fossil fuel infrastructure indefinitely.

We are likely to see global demand for energy and goods and services constrained sufficiently hereafter, even at the oil price in the $40s-$50s, while production declines with the lower price of oil and decelerating or contracting real GDP/final sales per capita as the long-term secular trend hereafter.

This is the definition of Peak Oil and “Limits to Growth” (LTG), and we’ve been at or near the log-linear limit bound of LTG since 2005-08.

What is required now is for corporate, financial, and political leaders, and mass-media influentials to “get it” and publicly begin without delay the process of mass-social conditioning of the population to the imperative to transition from the oil-, auto-, debt-, and suburban housing-based economic paradigm to one of efficiency, conservation, and a steady-state economy and policies that ensure a socially acceptable material standard of reduced consumption per capita and maintenance of well-being for as many people as possible.

“The market” (including gov’t enabling) will not accomplish this by itself, if ever; rather, it will do what it does best: respond to price, profit, and tax incentives to efficiently concentrate resources, income, wealth, and political power to the top 0.01-0.1% to 1% owners of the means of production while marginalizing the bottom 90% working-class masses and rewarding for their acquiescence and compliance the next 9% professional middle class below the top 1%.

The policies that enabled the Oil Age, and from which most of us benefited, must now be transformed to adapt successfully to the post-Oil Age epoch hereafter. The task will be extremely challenging, to be sure, especially when a large majority of leaders and the public do not understand Peak Oil and LTG, and the implications. There is every incentive for those benefiting the most from “the market” to ensure that we do not understand.

Very good summary. Ta.

Hi Patrick,

I agree that the thesis is interesting and I believe it describes what must happen in the future. However IMF GDP data in purchasing power parity (PPP) terms and constant 2005 international $ along with UN population data, suggests that GDP per capita has not stopped growing over the 1980 to 2012 period. The average growth rate of GDP per capita (in 2005 $ using PPP measure) has been 1.8% on average over the period. Wealth has been concentrated at the upper income levels in the US over the period, but it is not clear if this has happened worldwide. Chart below.

I agree. The best summary of what has been happening that I have read anywhere.

The policies that enabled the Oil Age, and from which most of us benefited, must now be transformed to adapt successfully to the post-Oil Age epoch hereafter.

I’ll add this link. http://www.nytimes.com/2014/12/01/world/climate-talks.html?partner=rss&emc=rss

Some people close their ears when confronted with global warming, but if they are presented with the above thinking instead, maybe their behavior will head the right direction for economic reasons. They may think they can ignore global warming, but if it finally dawns on people the realities of peak oil, they might start to phase it out.

Excellent! I would add the requirement that it is IMPERATIVE that we get off ff’s to preserve the biosphere for the next generations. Which means of course, we have a severely limited budget remaining. And so, to use Ugo Bardi’s analogy, we have to quit eating that seed corn and instead plant it to grow renewable sources, mainly solar.

We all know about the auto industry after Pearl Harbor- they quit private cars NOW, and went on to war production. I kept our 37 chevy running by ripping off the copious supply of car corpses littering the landscape- as did everybody.

There’s enough stuff in everybody’s garage to keep us going fine for the time needed to get up to speed with solar. And everybody would be happier without all that crap. Hurt the economy? The existing economy should be not just hurt, but executed for crimes committed. BAU is insane.

Also, I believe it is possible to sidestep the barrier of the existing blind power structure by starting with the small but growing community of those who will in fact do what is needed right now without coercion. I know lots of such people, and am striving to knit them together in this small community- with some success so far.

Hurt the economy?

The changeover to renewables should create quite a few jobs, which would then put more money into consumers’ pockets. There would probably need to be some debt and government financing to get things going, but the result shouldn’t be more expensive than fighting wars, and should produce far greater benefits for the economy as a whole.

The changeover to renewables should create quite a few jobs, which would then put more money into consumers’ pockets.

I find such wild optimism truly comical.

OK, Ron, I hear you. So what’s your solution? Keep up the insanity?

Just who the hell told you I had a solution?

OOPS! Sorry, Ron. Shouldn’t have put it that way. I knew full well that you didn’t pretend to have a solution.

Thanks for all the good work you do with this site.

Long time readers of your writing already knew you do not have a solution or pretend to have a solution. Some might see increased U.S. production as a reprieve, as some additional years to confront the reality of peak and declining oil production. Well, we will be too buy luxuriating orgasmically in the arrival of cheap gas to think about such unpleasant things as the temporary nature of this phenomenon.

For the first time ever, Honda CRVs are outselling civics. Yes, that is better than large SUVs outselling civics but it perfectly illustrates the fact that no learning has occurred nor will it occur.

I find such wild optimism truly comical.

We’re paying people to fight wars. Supposedly the pipeline will supply jobs. So put those same people into post-oil jobs.

The neglect of American cities would be equally comical if it weren’t such a tragedy. America has missed vast opportunities in the last couple of generations.

Transitioning fully to the ‘renewable utopia’ that most reports seem to posit is possible rests largely on the assumption that we have a functioning economy and access to large amounts of cheap energy and cheap building materials for the next 2-3 decades. The energy of all these things is front-loaded, so you need to have lots spare to invest. Plus they never seem to consider the various tipping points in grid saturation that they’re likely to reach. The implitic assumptions in most of these scenarios are entirely unrealistic when viewed through a peak oil/peak net energy lens.

I cringe when someone starts their comment with a loaded term such as ‘renewable utopia’ then goes on to talk about strawman arguements against implicit assumptions and doesn’t for a moment consider their own implicit assumptions that the current, wants are more important than needs, paradigm will also continue for ever… Trust me on this one, there will be a drastic change in that particular paradigm much sooner than later. People will quickly come to terms with simple realities such as no one NEEDS 24/7 neon lights!

Cheers!

I don’t see how the requirement of access to a functional economy to do a renewable buildout is a “strawman”, but whatever. I think you’re expecting more from human psychology than is likely to happen. People tend not to settle for less happily.

I don’t see how the requirement of access to a functional economy to do a renewable buildout is a “strawman”

That isn’t the strawman part. The strawman is the assumption that everyone who talks about renewables is still stuck in BAU paradigm. BAU by definition is dead and only a delusional imbecil would expect a future civilization based on renewables to be a utopia if our current profligate use of energy is to continue unabated. There exists a growing number of people who are thinking completely outside the BAU box. These people are schooled in systems thinking and have a pretty good grasp on both the physical and the social sciences. I posted this link the other day and I’ll post it again here to underscore at least one concrete example of the kind of synergy I’m talking about.

http://bfi.org/ideaindex/projects/2014/living-breakwaters

The strawman is the assumption that everyone who talks about renewables is still stuck in BAU paradigm.

Yes, that is the point. Renewables won’t have to power the same lifestyles that we have now. A lot will be eliminated. But that isn’t bad.

People don’t need to live in big houses. They don’t need to drive big cars and have one car per adult. They don’t need the current commercial airline system. They don’t need agriculture to produce corn for corn syrup, ethanol, and animal feed, and so on.

Business as usual isn’t sustainable. That doesn’t mean nothing is sustainable.

I cringe when someone starts their comment with a loaded term such as ‘renewable utopia’ then goes on to talk about strawman arguements against implicit assumptions and doesn’t for a moment consider their own implicit assumptions that the current, wants are more important than needs, paradigm will also continue for ever

That’s the point. We’re using the energy now. We’re using oil, gas, and coal to keep business as usual. We are employing people for business as usual. We are paying people to build gasoline cars, fight wars, grow corn for corn syrup, etc.

So I can’t see how making the switch over to renewables would be any less doable than what we are doing now. If we are keeping the world afloat now via energy use, why is it not possible to swift how that energy is being used, what is being built, and what jobs people are being paid for?

China, for example, has used lots of cement to build projects no one wants. Why continue with that?

Republican propaganda has done well in America. It started in the Nixon White House with the CREEPs (the committee to re-elect the president). They introduced the psyops methods developed to overturn Castro into American political discourse.

The Republicans hate the idea of reducing pollution or energy consumption, so half witted strawman arguments about “greens” have been programmed into people’s brains. Nobody even notices any more. They think it is polite, well-reasoned commentary, like funny nicknames for Obama. You should see my facebook feed.

Plan Outlines Low-Carbon Future for Germany

By DIANA S. POWERSNOV. 30, 2014

AMSTERDAM — Scientists have developed a comprehensive computer model that simulates German energy supply and demand, in a bid to establish whether it is feasible for Germany to rely on renewable energy sources to power its economy and meet its carbon dioxide emission reduction targets.

Developed by Hans-Martin Henning and Andreas Palzer, two physicists at the Fraunhofer Institute for Solar Energy Systems, in Freiburg, the Renewable Energy Model-Deutschland, or REMod-D, is a computer simulation that models an all-sector future energy system for Germany, matching supply and demand on an hourly basis over a full year.

Using real data from 2011 and 2012, the researchers have run millions of simulations to optimize the model. They say they have demonstrated that there are several economically viable ways to achieve a low-carbon future, using existing technologies.

“We wanted to answer the question: Is it possible for Germany to meet its ambitious CO2 reduction target using predominantly renewable energies?” Mr. Henning said in an interview. “And, if yes, what is the composition of this system, and what is its cost?”

The answer to the first question is an unequivocal “yes,” according to Eicke Weber, the institute’s director and a professor of physics at Freiburg University.

http://www.nytimes.com/2014/12/01/business/energy-environment/plan-outlines-low-carbon-future-for-germany-energy.html?mabReward=RI%3A6&module=WelcomeBackModal&contentCollection=Opinion®ion=FixedCenter&action=click&src=recg&pgtype=article

A certainly long posting. The short view from Kiel:

http://www.geomar.de/index.php?eID=tx_geoweather_webcam&webcam=foerde-large

Once again. For the money the Germans have already thrown at solar, while still toasting scads of coal, as seen in Kiel, they could have built out the entire French nuclear fleet.

Oh, my! Why haven’t we done this years ago? Such easy!

The Germans bought the world cheap solar. Thanks to their investment, the prices have crashed. News items like this are getting more and more common

http://cleantechnica.com/2014/11/29/dubai-shatters-solar-tariff-records-worldwide-lowest-ever/

It’s a done deal. The prices will continue to fall. There’s no point whining about the cost, because making renewables cheap was the main goal of the program in the first place.

The question now is not whether solar is a “good thing”. The question is how will the rest of the market react to it being the cheapest source of energy , which it is likely to be in the 2020s (if wind doesn’t beat it).

Currently the electricity market is dominated by “baseload” generation. These are inflexible cheap plants that produce 24/7 and make money by overcharging during the day.

Solar and wind have already killed these plants in Germany by forcing them to pay the grid to take their energy (because the plants can’t be shut down). The utilities are abandoning them. So the supposed weakness of renewables is a bigger problem for the non-renewables.

Negative electricity prices are already commonplace in Germany. An interesting business opportunity.

Ho, victory laps for solar? When humanity has not even hardly begun to think how to kick the Carbon habit, and does grow that faster than these renewables? Interesting. Some might even say, premature. But do carry on. You were saying something about the Chinese coal burn, I believe?

Wow, Nick, that is a super good quote, and I am gonna send it around to my local renewable energy group right now. This is really heavy ammo.

Now, how come the Germans keep acting as if they are using their brains, and we keep acting like we don’t have any??

Did we ship them off to Sweden with our garbage that they get from us to turn into their electricity?

The Germans also import millions of tons of garbage a year for incineration.

It’s amazing to me they talk about possible gas shortages in the Northeast while exporting vast quantities of perfectly good fuel to be dumped.

Especially when you read stories like this:

http://www.heraldonline.com/2014/11/06/6501925/chester-landfill-fire-has-turned.html

Hi Nick,

Please don’t quote an entire article, post the link and take out the most important excerpts, just a few lines. Thanks.

Note that when a comment is too long many people don’t bother to read it. I am guilty of this error, quite often.

Thanks Dennis, I have shortened the article considerably. Left the link so if anyone wishes to read the entire article they can simply go there.

I don’t really worry about copyright infringement but quoting the whole article, when the article is very long, is just foolish. It just takes up way too much space.

One thing I always think is missing in these analyses is an investigation into how we get from where we are (large stable grids supplied by centrally generated electricity from spinning sources based on burning stocks when we need them) to where we want to be (distributed grids powered largely by sources which we cannot turn off and on at will).

Transitioning from one to another there are going to be various feedbacks and tipping points as we try to affect system change. Has anyone analysed those, tried to model how a transition would work? The current UK grid operator has said that they’ll struggle to balance the grid with 30% wind penetration. Since economic grid scale storage is presently a nonexistant technology, how are we going to get to these various targets without impacting stability?

The issue of lock in in complex systems is quite a real one and probably constrains the paths which are realistically available to us.

Hi Sam,

One possibility is to build excess capacity in wind and solar with some spinning backup powered by natural gas, a study at the University of Delaware in 2011 showed that such a system can provide up to 90% of load hours at low cost, backup can eventually be provided by batteries, fuel cells, and vehicle to grid (or the lowest cost combination of these three). Any excess energy which cannot be used for heating, recharging batteries, creating hydrogen for fuel cells or pumping water uphill for use in hydro dams can simply be dumped to ground. There is plenty of capacity in the grid to move the distributed power around and if not grid capacity can be expanded where needed.

The study was in 2012 not 2011, blurb at link below:

http://www.udel.edu/udaily/2013/dec/renewable-energy-121012.html

Study at page below (pdf link in upper left corner of page):

http://www.sciencedirect.com/science/article/pii/S0378775312014759

From the abstract:

We find that the least cost solutions yield seemingly-excessive generation capacity—at times, almost three times the electricity needed to meet electrical load. This is because diverse renewable generation and the excess capacity together meet electric load with less storage, lowering total system cost. At 2030 technology costs and with excess electricity displacing natural gas, we find that the electric system can be powered 90%–99.9% of hours entirely on renewable electricity, at costs comparable to today’s—but only if we optimize the mix of generation and storage technologies.

Dennis,

I’ve read that study, and it was interesting (I disagree with some of their assumptions though), however it basically represents an “end state”, that we desire to move our system to. I’m more talking about how we get from here to there without hitting any tipping points (if there are any) in the operation of the grid in the interim. An example being how does the UK get past the 30% wind integration in the grid without significant stability issues.

Similarly, in that study, the end state looks stable, but how do things function when only half of the renewable capaicty is built and there’s no storage available, what do you do if different technologies become available later than you planned for. If you have long periods of instability, presumably that impacts whether or not the final grid ever gets built, etc. The current approach in Germany seems just to involve throwing shit at a wall and seeing what sticks. I’m not sure that it’s the best way to get a stable transition because of the potential for nonlinear response.

Here are some thoughts:

Variance isn’t the same thing as unpredictability/unreliability. Wind output can be predicted to a large degree, which allows planning, and reduces or eliminates a need for spinning reserves.

As we add multiple windfarms, presumably with output either non-correlated or only partly correlated, the ratio of variance to mean output falls sharply. Also, many windfarms are negatively correlated, so that careful site selection reduces system variance.

Geographic balancing between parts of the grid only requires transmitting balancing amounts, not the whole load. A cost optimized grid will not have world-girdling, massive transmission lines.

Only a small % of a region’s wind power would need to be transferred between regions in order to provide balancing, and possibly not as far as one might think. Sometimes it’s just a matter of a number of sub-regions getting their power, on average, 100 miles from their west, rather than 100 miles from their east, and in effect you’ve transferred power from the western edge of the overall region to the eastern.

We really don’t need much more peak capacity – perhaps none at all for many years, with good time-of-day pricing and DSM. That renders most of this argument moot, at least as a boundary: we can use existing generation if we have to as a backup.

Wind farm peak capacity credits are a little like getting a dog to talk: the interesting thing isn’t how well the dog talks, but that it talks at all. The fact that even a small cluster of wind farms can have a 1/3 of average capacity credit, or wind at a regional level have an average 55% credit, is important.

I see local wind capacity credit as solving roughly 40% of the diurnal intermittency problem; long-distance transmission solving about 30%, and DSM solving the rest. DSM alone could make an enormous contribution: think 220M EV’s (with 2.2TW peak demand or output) doing a dance of load balancing with the grid. This doesn’t even touch the legacy peak capacity which could provide backup – this we’d want to minimize to minimize CO2 emissions, but that wouldn’t be hard with DSM as a short-term factor: we’d only need it for very unusual, long-term lulls.

Biomass would be enormously useful for grid stability. Biomass is an obvious, and workable, candidate for the job of providing backup for seasonal lulls in wind & solar production. OTOH, it’s not necessary.

Solutions for seasonal lulls in renewable production include overbuilding; production of hydrogen, ammonia, methane or other synthetic hydrocarbons with surplus electricity; compressed air storage; pumped storage; nuclear; overbuilt geothermal; etc, etc, etc.

There are a number of workable solutions to intermittency. Some are cheaper than others, some combinations are more optimal than others, but there are wide variety of ways to skin this cat.

Electric vehicles can be built in the same factories that made ICEs, and with the same people. Wind turbines can be built instead of coal plants, and coal miners could install turbines and solar panels.

The transition to renewables would provide all the employment needed to replace Fossil Fuel industry employment.

The problem: there would be winners, and losers. There would be more winners than losers, but the potential losers are fighting far more desperately than the prospective winners.

And this orgy of consumption as usual would accomplish…what? I walked past nearly a mile of double-lane fulls of traffic going, well, nowhere last night. This is not uncommon. The sidewalk was wide open, aside from a few bicyclists, a USPS truck (engine idling), three dogs, and four other pedestrians, two of whom illegally jaywalked across the road (the beg buttons are a rather long ways away). Shiny car man was beeping at the car ahead of him for presumably not zooming around me as I crossed by the corner sushi place. Good fun. I hear there was possibly some collision or whathaveyou on that giant expensive single point of failure that is I-5. So. Assume the relaunch of the electric car is somehow viable for The Billions as claimed. Then what? Folks sitting around, still going nowhere? Oh, Progress! What, widen the roads? Hey, hey, they dropped a cool billion into the I-405 expansion—ease that beltway out a few notches, yep—and travel times are…slower!

The losers of this mindless car consumption would include, I don’t know, Allison Liao.

Add a “Collision Avoidance” system.

https://www.youtube.com/watch?v=0tiHwzGsotA

Actually the solution to a lot of problems in American infrastructure would be to narrow the lanes in the existing roads and increase the number of lanes, or simply ban large vehicles and vehicles without riders from using all but a single lane.

One problem with SUVs is they waste oil, The obvious solution is to tax oil. The other problem is they are road hogs. The solution here is either road pricing or simple bans.

Another problem related to the fetish for oversized vehicles is parking lots. A third of urban America is parking lots. Add this to another third taken by roads and you realize a lot of the driving you do is driving past car infrastructure. Since local government has failed, it will take a federal tax on surface parking to eliminate the plague of free parking.

I think it would be better to keep the lane width, and introduce more narrow vehicles that can split a lane.

http://www.commutercars.com/

Yeah John B, But nobody really has an incentive to drive them unless there are special lanes for them. It’s a good idea though.

Also, I believe it is possible to sidestep the barrier of the existing blind power structure by starting with the small but growing community of those who will in fact do what is needed right now without coercion.

Wimbi, I think you are right that there are people in many communities who are doing some really fantastic grassroots work and are getting local politicians and businesses to join them. I think we are seeing the beginnings of a shift in the tides, no pun intended, given the topic addressed in the following link >;-)

http://bfi.org/ideaindex/projects/2014/living-breakwaters

Living Breakwaters is a comprehensive design for coastal resiliency along the Northeastern Seaboard of the United States and beyond. This approach to climate change adaptation and flood mitigation includes the deployment of innovative, layered ecologically-engineered breakwaters, the strengthening of biodiversity and coastal habitats through “reef streets”, the nurturing and resuscitation of fisheries and historic livelihoods, and deep community engagement through diverse partnerships and innovative educational programs. The transformative educational dimension amplifies impact to the next generation of shoreline stewards while leveraging the expertise of the members of the SCAPE Architecture team, who are making groundbreaking inroads into state and federal agencies, setting new precedents for multi-layered and systemic approaches to infrastructure planning.

I don’t know. Sentences like that last one “The transformative educational dimension amplifies impact to the next generation … setting new precedents for multi-layered and systemic approaches to infrastructure planning.” make my eyes glaze over.

>

preserve the biosphere for the next generations

<

Wimbi, few appreciate that these next generations are being born now, not in some far off future time.

NAOM

True, but I was referring to the maybe one percent who right now do know that now is here.

I am suggesting that those people can come together and grow in numbers and influence, and right here, anyhow, that is what they are actually doing. A measurable fact, here, anyhow.

Here is a pretty ordinary place.

“peak oil” per capita (world) occured around 1980.

Below per capita consumption :

http://www.manicore.com/documentation/petrole/usage_petrole_graph9.jpg

My personal opinion is that most of the pundits who natter on in the cyber world know either nothing or next to nothing about oil and merely want to make themselves feel good by pointing out that peakers are supposedly dumb or deluded. They find this to be a very easy game to play since it takes them only a minute or two to find plenty of authorities who maintain that peak oil near term is myth.So they get to play righteous and smart and make condescending remarks about peak oil believers.

A very substantial number of so called journalists also fall into this trap.They are just playing it safe by going along with the conventional wisdom of the conventional crowd of people in charge of this old business as usual world.

Here and there you will find a reporter or journalist who will investigate the subject and report his or her findings but the MSM media seldom find space for such stories and articles anywhere near the front page and only occasionally do they find space in the back pages. My estimate of this state of affairs is that the owners don’t like to rock the boat anymore than necessary and tell the editors what’s what when it comes to not disturbing the stock market or the housing market etc.

Beyond that the editors of just about any publication I have ever seen have an obvious bias in one direction or another in terms of their politics- and this bias bleeds over to the tone and content of their publications.

Then in addition to all this there are without a doubt PLENTY of both pundits and business managers and economists and politicians and joe blows and susie six-packs on the street who firmly believe that even if peak oil is a real phenomenon it hardly matters because THE MARKET THE WONDERFUL WONDERFUL MARKET AND THE INVINCIBLE IN VISIBLE HAND were created by our LOVIN AND MERCIFUL SKY DADDY who WORKS HIS WORKS OF MERCY THRU THESE TOOLS.

Convincing such people to change abandon such deeply held beliefs is about as futile an undertaking as sweeping back the incoming tide with a broom.

When the day comes there is simply no longer enough oil to run the economy such people will ALWAYS rationalize their beliefs as sound by explaining the shortage as the result of evil greedy businessmen holding it back for higher prices or slimy environmentalist vegetarian lesbians wanting to force us all to go naked and eat sprouts and dimmercrat politicians wanting to put every body on welfare so as to control the country via welfare checks.

People believe what they want to believe and media mostly print or broadcast what ever promises to bring in the maximum number of readers sympathetic to the owners personal agendas- and the maximum number of advertising dollars of course.

This is not to say that if you take the time to really poke around a little you can’t mostly and easily discover the truth about most issues. It just takes a while- and most people are not interested enough to be bothered when it comes to peak oil , or global warming, or depleting fossil water , or crashing fish stocks, or superbugs, or even atom bombs.

I found during the dotcom heyday that business reporting was pretty bad. The average business reporter hadn’t been trained in business and generally reprinted whatever press releases he received. There was virtually no digging.

Now, with the online news cycle, I can’t say to what extent business reporters lack business training (they probably still do), but they are so eager to fill up online space that they write many, but poorly researched, stories. If the trend is to say “peak oil is over,” that’s what they all say. It’s a headline, whether or not it is true.

What continues to mystify me is how so many reporters can miss the reality that if cheaper, easier oil was available, no one would be bothering with fracking and tar sands. Getting oil from these sources is expensive and messy. No one would be bothering if the old oil sources were still adequate.

I think the sudden drop in prices is just a symptom of the fact that there is still a large gap between the cost of oil to producers and the price consumers are able to pay without really feeling much pain. There is so much play in the market that the prices is more or less random.

Hi Ilambiquated,

An alternative hypothesis is that the oil supply curve is steep in the range of 60 to 120 dollars per barrel (2014 US$) and that small changes(shifts) in the oil demand curve can cause large swings in the oil price.

I guess that would make sense if the peak oil story is true. If the industry can’t produce any more, then small changes in demand would have a big influence.

The peak oil story does not have to be true (though I believe that Ron’s guess about peak may be correct), you only need a steep oil supply curve.

Since 2005 the long term oil supply has been fairly steep, but over shorter periods such as 2007 to 2009 the short term supply curve has been steeper, with a price change of 75 to 100 $/b only changing supply by 850kb/d. The oil shock from the Arab spring caused a very steep short term supply curve from 2010 to 2011 with a price increase from 81 to 106 $/b only increasing World supply by about 100 kb/d (annual output change). The long lag between changes in oil demand and the change in oil output in response results in volatile prices.

The periods of oil price stability were in part a result of either the Texas Railroad commission (in the 50s and 60s) or OPEC (after 1983) adjusting World oil supply to match demand. In some cases OPEC was unable to keep prices stable in response to oil shocks, currently OPEC wants to regain market share by keeping prices under $70/b. If prices remain under $85/b, it is likely that 2014 will be the peak year for World oil output, and even if prices rise back to $100/b output may not rise much above 2014 levels, but a plateau might be maintained for a couple of years with the real oil price at $100/b, though the oil demand response is hard to predict.

Forgot to mention. The long tern oil supply curve (dotted trendline in chart above suggests a 75% rise in oil price results in roughly a 4.7% increase in oil output (where oil is crude plus condensate) since 2004. If this long term trend holds I would expect a real oil price of $130/b (2013$) might get us to 77 Mb/d, I think it unlikely that this long term supply curve will remain stable, so such predictions are not very useful. Oil prices at that level are likely to cause recession in short order and below ground factors may not allow such an increase in output of crude plus condensate.

On the other hand, fuel efficiency has barely moved at all in America, and the movement is mostly driven by government fiat. With a few exceptions, I don’t see Americans abandoning the suburbs or clamoring for more public transportation.

This suggests to me that people aren’t feeling much pain. Of course as I mention elsewhere, it is tough to change these big infrastructure trends. But even new car fuel efficiency improvements are meager.

I’m not questioning that oil prices are volatile, I’m wondering why. I think it is possible it is driven (within the corridor defined by the pain on the supply and demand sides) by speculation — that is, the aggregate opinion of the traders.

If short term oil supply and short term oil demand curves are steep,

(and over a 6 month period or less they are quite steep), then no speculation is needed to explain oil price volatility.

The drop in prices is a sign of too much supply. I’m amazed to see this is being ignored. As to why there is too much supply, it’s a combination of slower demand growth and supply increases in a very few countries.

http://www.telegraph.co.uk/finance/oilprices/11262690/Why-black-golds-low-prices-wont-last-long.html

This was posted yesterday but it is worth posting again since a lot of readers probably missed it.

So far as todays key point is concerned I would bet that Ron is right. Peak oil if we mean the real stuff- traditionally defined crude- is almost for sure here now or within the next few months.

The only point that I might differ on is how long it will be before oil prices go up again. I think it won’t be long at all- not more than six months at the most. This is assuming the economy doesn’t succumb to an acute attack of one of the it’s many other chronic illnesses between now and then of course.

But even if prices go up sharply and soon there probably will not be enough new production brought on line to offset the decline of legacy production.

OFM, thanks I did miss that in the last thread (some of them seem to stretch even longer than the old Drumbeat)I’ve read a lot of Liam Halligan from 2008 onwards and I would say he is one of the very few from a conservative business background who is fully peakoil aware.

I thought it was silly in that he attributes the dollar spike to Yellen announcing the end of QE in June, but the rate of QE taper was already thoroughly in place (since about January?), and had been for six months by June, so there was nothing special at all in any Yellen June statement.

It’s way too much coincidence that the huge dollar spike aligned on the calendar with oil (and copper and gold and silver)’s fall, and I believe some other commodities also lined up like that. Too much coincidence. The yardstick was doing it and it doesn’t have to be linear.

We have other events pending, in the context of what’s ahead. We have Greece’s upcoming elections. Those have lots of Euro smash potential (which drives the dollar up more). Japan’s election in a few weeks could be Yen huge, but I don’t know of anything talked of there that would stop Kuroda from his Oct 31 gigantic QE, even if Abe loses.

OTOH early next year we’ll get US Q4 GDP first look. A strongly negative number on that would depress the number, but that’s months away, and such moves tend not to be anywhere near what we’ve seen this year for FX.

depress oil’s price — which is a number I guess

I would expect a rebound in one-two years’ time. However, as prices increase we will see more activity, and reduced demand. Peak oil depends on how you define oil. We are likely at peak conventional oil. Condensate and NGL should continue to increase. Biofuels, syncrudes from gas to oil, refinery gains also have to be taken into account. It’s a very complicated dance.

It was interesting to note that at the beginning of the year the majors were already cutting investment in unconventional oil including deep-water. If they were struggling to make money at $100 + oil what will their investment plans look like now? The thing is as far as domestic shale goes those who keeping on the treadmill on the back of investor money will keep going as long as that money keeps coming in, if we look at what happened with shale gas even rock bottom prices have not stopped production. If geology dovetails with economics then there will be a blood bath in the high yield bond market and I’m not sure that unconventional production will ever significantly recover in the US.

Noted that a few Ronposts ago. What a coincidence the majors reined in big projects early 2014, and reined them in sharply, and not just one major, they all did.

Late last night I looked up EOG’s levered free cash flow and found a startling -$500 million number. The severity of the event is about 100X larger than MSM knows and several times larger than the Gentle Decliners see. The whole concept of the big boys buying up the bankrupt small guys so that the event is softened and made gentle gets gutted when you see that the big boys Have No Money. But then I noted Bank of America was FORCED to buy Countrywide during 2008’s Apocalypse. They refused at first, but Bernanke and Paulsen FORCED them to acquire even though they could not afford it.

The point being there . . . cataclysm in these things can always be addressed by the Fed’s printing press.

We need more information about what happens to flowing wells if they are shut down for a year or two? What happens to the geology? I speculated that no one has done any long term studies of what happens to thin oil if you expose it to fracking fluids for a year or so at high pressure and temperature. Maybe it breaks down into something non oil. That would be eyebrow raising.

Watcher,

“What a coincidence the majors reined in big projects early 2014, and reined them in sharply, and not just one major, they all did” Would you care to expand on this? Come now elucidate your thoughts.

No. But it is a juicy coincidence, yes?

Watcher,

Mike has pointed out that the wells that are producing will not get shut in. The cost of continuing to produce oil from these wells is probably about $12/b, transport is $12/b, and royalties and taxes are about 30% of well head prices. If wellhead prices were $28/b ($40 at refinery gate), royalties and taxes would be $8.40/b plus OPEX of $12/b for a net revenue of $7.60/b. Companies that go bankrupt will sell these wells to small companies that have not taken on a lot of debt and can continue to operate. Mike has said he will not touch these shale wells with a 10 foot pole, but at the right price he might buy some wells and take a chance on some one year old wells that would net $1.6 million at $28/b at the wellhead, if he could buy them for $500k (and the assumptions for cost etc that I have made were verified by an expert.)

Can you pick well by well when you are buying? My understanding is that when you are buying you are buying by the certain area and you have to buy the ones that have reclamation and remediation liability attached to them. Where these costs end up?

Ves,

If you are correct about the way it works, then someone would analyze the group of wells under consideration. I imagine you might have to buy all the wells on an individual lease, but if a company is bankrupt the assets will be sold to the highest bidder and I do not think the purchaser is required to purchase all assets. Even if they were so required, I imagine there are M+A specialists that would buy the whole company at a discount and then sell it off in pieces.

Okay. If one were concerned about all this, one would form a LOT of LLCs and have each one own just 1 oil well. A bit like in rental property. Don’t put multiple items in one LLC or they are all vulnerable to legal grab should an occasion arise.

And thus the loan that funded the drilling of a well that is now 2 yrs old and flowing too little to service the loan . . . what happens there? The well can fund oil hauling trucks and flush water but it can’t service the loan. This is a single well, isolated within the LLC. What do you do if you’re the LLC principal? You can’t “just operate the well and not pay the loan”. That doesn’t fly. The creditor will seize assets and this also abrogates all the trucking contracts. It doesn’t just smoothly keep flowing. It has to litigate. Which means get in the docket queue.

A bigger company with loans for all of its wells of varying age, they (EOG I just checked) has sharply negative levered free cash flow. Look it up on finance.yahoo.com. -700 million. That’s operating revenue minus all costs including debt service. It’s negative. The value of their leases has appreciated and they can probably borrow on those to keep the wheels turning (and probably have) but -700 million was at $100/barrel. Who is going to lend now? How do they keep the oil flowing from already existing wells if they default? Default, btw, is called bankruptcy because bond law is (or was pre GM) absolute. If you default on one bond, you default on all of them.

But this, as have all things post 2008, walks the broad line on the ground of pretending capitalism is dictating things and knowing that if you can make a case for national (or global) systemic risk, the Fed will print money and save you.

Now the Fed would like to cultivate the delusion too, so maybe they’ll find a way to trash the dollar down and elevate oil. That would be more concealed a maneuver than printing money and handing it to EOG and CLR.

here is some info that I got how is done. if somebody is buying wells it’s all process of negotiation. Seller will say I am selling these 100 good wells but you have to buy these 10 crap ones with environmental liabilities on them. And they negotiate.

In bankruptcy I am not sure what the process is and who has seniority getting the assets. But I found out that there is another type of wells called “orphan wells”. These are the wells that nobody wants them. And they end up in government hands and it is their liability for decommissioning them. This info for Canada and I really don’t know if it is any different in US.

Did a lot of reading about that some weeks ago. It’s the same. If a huge swath of bankruptcies are declared, there is no one to plug and abandon and the surety bond won’t cover it.

So the state has to do it, and they do it slowly in keeping with available budget. They won’t be pleased about this and you can bet legislation will be enacted to prevent it happening again — all of which makes it hard to restart shale, where “hard” is defined as another $40/barrel reqd price above what is present breakeven — and that obstacle is just from the new regs. Not lender reluctance.

In fact, it just occurs to me, when anyone leaves a failed business, he’s not happy about it.

Toss in some alcohol and you might have rather a lot of orphaned wells with the spigots open flowing out onto the land.

Nothing happens to the “geology.” Geology is the science of things that happened to the earth tens of millions of years ago. We do not alter what occurred in a certain geological time period by sticking a straw into it. Mechanically, wellbores that are frac’ed and full of proppant can suffer fracture closure if shut in for long periods of time. Over burden can cause induced fractures to close.

Texas is a funny place! It’s economy is incredibly dependent on the knowledge that Geology provides, yet the scientific basis of that knowledge runs counter to the belief structures of so many of it’s citizens… and political leadership.

Some months ago I was musing about genetically modifying the oil eating bacteria used in Gulf spill cleanups so that the critters can live at high temp and pressure underground.

Then terrorists can inject them in all major fields and watch Cataclysm.

So in general I am wondering if there are other mechanisms for permanently, irreparably damaging oil fields — like long term (year or two) exposure of the oil to the frack fluid. Pure speculation.

There’s always money to buy broke oil companies. When the price goes down enough, the vultures move in. That’s not something I would worry about.

Even if oil production has already peaked, it does not mean that prices will be high. In my view there have been significant changes in demand over the last five years as oil at > 70 USD per boe has been priced out of the heating (residual) oil market. Natural gas, LPG, coal, biomass,propane…… ( at 20 USD per boe) and even electricity from natural gas (40 USD per boe) are much cheaper. The market size of heating oil stands up to 15 mill bbl per day and this excess supply is searching for a new home. In my view it will take at least one year until prices can recover again. When the market has worked off this excess supply, the oil markt will be much smaller and concentrating on transportation fuels, which has a higher barrier of entry, and organic chemicals.

What reference are you using for a home heating oil market that large?

In the US, it looks to about 230,000 barrels/day.

http://nationalaglawcenter.org/wp-content/uploads/assets/crs/R43511.pdf

One reference is the BP statistical review. It is not only home heating oil, but mostly residual fuel oil used by utilities. The residual fuel market in the US shrank from 1.0 mill bbl per day 10 years ago to around 0,2 mill bbl per day (EIA reference: ia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WREUPUS2&f=W). The same trend occurs in Japan, Europe and recently also in China at massive decline rates. Mideast residual fuel oil is still growing slightly, yet will be declining as well in my view in the future.

The overall liquids market will continue to grow in this low price environment. When supply and demand are closer to balance and we see stocks drawn down the oil price will rise.

The IEA now suggests worldwide consumption will increase by 1.13 million barrels per day in 2015, this after several recent adjustments downward. I agree with Mr. Patterson that neither OPEC, nor non OPEC production can cover that. The $64 dollar question is can the US shale industry continue its relentless manufacture of well after well after well? I think not, even if, rather when prices begin to rise again in late 2015.

For all the banter and swagger in the shale oil industry’s propaganda about 50,000 wells and energy independence it somehow forgot about oil prices and oil price volatility. It assumed prices would hang around a hundred dollars and life would forever be peachy. That was stupid. Something tells me that the boys that are funding this shale thing have had enough, or will shortly have enough and want to see some money, some serious debt reduction.

Thanks for the comments Mike. But I would like to think we are all on a first name basis here on POB, so just call me Ron.

Hi Mike,

As you have 50 years in the business and know how these things go in the real world, do you think it is likely that the LTO drilling will shut down completely at $68/b for WTI? I would think things will slow down considerably (from 5000 wells per year to 2000 wells per year for Bakken and Eagle Ford combined, possibly less). If this guess is correct, output will decline and eventually prices will increase.

The big question is: “Will the drilling rates increase as prices rise or will LTO players become much more conservative and resist the urge to expand too quickly?” By your comment above I think you would expect that a few lessons would have been learned and the LTO investment will become much more conservative. I also assume that this reduced rate of drilling would not allow the the LTO plays to recover to present output levels.

If oil prices remain at $70/b, I agree with Ron that the peak may be here, if oil prices rise back to $100/b and remain there, the decline might be delayed by 1 or 2 years (plateau from 2014 to 2018.)

I have no idea what will happen to oil prices except that they will rise, fall, or remain where they are probably in the range of $60/b to $100/b (in 2014$) over the next 5 years or so.

G’day, Dennis:

Producing shale wells will not get shut in, whatever the price, IMO. Sunk costs, debt requirements, leasehold issues, etc. requires that wells keep pumping; some cash flow is better than no cash flow. I have seen your incremental lift costs per barrel of oil estimates evolve over the past 6 months, goodonya. I might now say that 12 dollars a barrel might be too much and maybe 8-9 dollars is more like it. I am no expert on that and for the record, I would not take a shale well if you gave it to me, lol. I have no faith in those long EUR tails and plugging and decommissioning costs are sky high on those puppies. It there is a fire sale on shale wells it won’t be big integrated companies doing the buying, it will be independents and they are going to have to borrow money, more money, to buy those wells.

I believe there will be shale wells drilled at less than 65 dollar oil, yes. A very smart friend of mine said recently that regardless of net cash flow, shale oil companies MUST keep booking reserves to keep the money guys off their backs. But, as you correctly state, the rate of well manufacturing is going to slow way down. I think rig counts are going to plummet soon. I have been astounded, and pleased (for myself), that oil prices have been so high, and so stable the past 3 years. I have not seen much of that in my day, save the 60’s and early 70’s. The shale oil industry has rolled for two reasons…high, stable prices. Them days may be over now.

If we have reached the maximum production rates of oil and condensate in the world, we have also then seen the best the shale oil industry had to offer. Oil prices got ’em; I knew it would. Shale oil was not a “revolution,” as it touted, it was just an uprising.

Forget growth, can the LTO industry in American hold its ground at 70 dollar oil, Dennis?

Mike

Hello Mike and Dennis,

Is it possible that the U.S. government could step in as a buyer for the SPR to help these shale producers? QE 3?

Best,

Tom

The government, if they did decide to buy oil, would buy it at the market price. I don’t see how that would help shale producers.

Ya I agree with Ron. An SPR buy would not drive up demand enough to stop the price decline.

Hi Tom,

What Ron and Watcher seem to be missing is that by purchasing oil for the SPR, there would be an increase in demand, so there might be a small increase in price which would help the oil companies. If Euan Mearns analysis that a decrease in demand of only 1 mb/d caused prices to fall, then an increase in demand by the same amount might cause oil prices to rise.

Any effect would end when the SPR is full, and there is probably not a lot of excess space to store the oil, in fact the SPR may be full already, in which case it would not be an option.

Based on Wikipedia information there is space for about 36 million barrels before the SPR reaches capacity (based on Oct 2014 data).

So if the US government bought 500 kb/d to put in the SPR, it would reach capacity limits in 3 months.

Given the low prices, this does not seem to be a bad idea, except that anything the government does that raises oil prices would not be looked on favorably by the public, so the government would buy oil slowly in an attempt not to affect oil prices. (Maybe at 250 kb/d.)

If the purchase rate is very slow, and prices don’t change then it does not help the oil companies very much.

Correction, capacity limits would be reached in about 2 months if purchases were at 500 kb/d and 4 months at 250 kb/d.

Correction 2.

Watcher gets the demand thing, but thinks it will not be significant, this is likely to be correct because the government does not want to be seen as interfering with the oil market.

Hi Dennis and Ron,

I appreciate the feedback.

I will push back just a bit on the U.S. not wanting to be seen as interfering with the market. As you note Dennis, filling the SPR while prices are low would be a logical thing to do, and thus, it seems to me, would be easy to spin to avoid any perception of market manipulation. Now, if there is not enough space in the SPR to have a meaningful affect on demand, then it is a moot point.

Best,

Tom

Hi Tom,

I would agree the government might fill the SPR if it acted logically, generally speaking politics and logic seem to be mutually exclusive 🙂

Illogical indeed, thanks again Dennis.

Hi Mike,

Thank you. I always appreciate your perspective and am confident that your guesses about LTO (even though you don’t run any LTO wells) are far better than my estimates.

At $71/barrel (in 2014$), there will be no growth in LTO output. Even if oil prices return to $100/b in 2014$ by 2030 (2.4% annual increase in realoil prices), output will decline, but not as quickly as with oil prices fixed at $71/b.

I compare how things might look at fixed oil prices ($71/b) and with oil prices slowly rising. Reality may be somewhere between these scenarios. Or if oil prices rise more rapidly than my “high price” scenario, output might be higher.

Note that this “high price” scenario is between the AEO low price scenario(oil prices at $75/b in 2030) and the reference scenario (where prices are $123/b in 2030 in 2014$.) Chart with two scenarios below.

Hi all,

A chart with 3 different price scenarios, low, medium and high. The low and medium are the same price scenarios as my previous chart and the high price scenario has real oil prices rising at 4.9% per year from $70/b in Jan 2015 to about $140/b in Jan 2030 about twice as fast a rate of increase as the medium price scenario. Reality will be somewhere between the low and high scenarios, but my guess is that between the medium and high scenarios is more likely than below the medium scenario.

Another 99.993 scenario’s to go before Watcher will admit that you were right somewhere. 🙂

Thanks for these elaborate projections, Dennis. They are allways very insightfull because you allways mention your assumptions.

Hi Verwimp,

I am actually not hoping to be right, just taking the improved data from Enno Peters, FreddyW, some of the ideas that you present, the cogent criticism from Doug Leighton, Ron. Mike, and others to update what might happen in the Bakken.

The assumptions in the above scenario is that the underlying TRR approximately matches the USGS mean North Dakota Bakken/Three Forks estimate (April 2013). Then I input economic assumptions into the model which are:

All figures in real 2014 US$:

Well cost $9 million

real annual discount rate 7% (equivalent to a 10% nominal rate)

royalty and tax rate 26.5% of wellhead revenue

OPEX $4/b

Other costs $4/b

Transport cost $12/b

The future new wells added are assumed to fall quickly to 150 new wells per month from 200 new wells/month in Sept 2014 to 150 new wells/month in Nov 2014 and then remain at that level.

It is also assumed that new well EUR started to decrease in July 2014 and reaches a maximum rate of decrease of 8% by Dec 2014. When the net present value(NPV) of future output from a well is equal to the well cost the well is no longer profitable and as the NPV falls towards 9 million the number of new wells added is assumed to decrease. Under the assumption that 150 new wells per month causes the EUR to decrease at an 8% annual rate, if the new wells added is cut in half to 75 new wells per month the EUR rate of decrease falls to a 4% annual rate.

Balancing all of these factors so that the new wells remain profitable under the economic assumptions I am using, results in the scenarios presented.

I realized after I did the scenario above that I had assumed 40,000 wells for the high price case as a maximum. I adjusted this downward to 35,000 wells maximum (between David Hughes optimistic and realistic cases in Drilling Deeper) and adjusted the “high price” scenario to a 4.3% annual rate of increase from 2015 to 2040, the real oil price is $131/b in 2030 in this scenario. All other economic assumptions are unchanged from the previous scenarios(in fact the low and medium price scenarios are unchanged only the high price scenario is different). The high price URR falls to 8 Gb from 9 Gb in the previous scenario, note that this is similar to David Hughes “optimistic” estimate of 8 Gb by 2040 ( his realistic estimate is 7 Gb, which is similar in magnitude to my medium price estimate). Chart for modified scenario below, again I think somewhere between the medium price and high price scenarios is realistic.

I doubt there will be any real decrease in wells completions until the middle of 2015, if then. In September there were 610 wells waiting to be finished. After wells have been drilled, the majority of the money has already been spent so there is no need to slow down the fracking crews.

Also there has been no appreciable decline in drilling rigs working in North Dakota.

I do expect that there will be a decline of drilling in the fringe areas. But even wells already started in these areas will still be completed.

Hi Ron,