Much of the information for this post comes from data at shaleprofile , and assessments by the USGS. In addition a paper published in Jan 2022 by Wardana Saputra et al was an excellent resource.

The basic method used in the is analysis is covered in an earlier post, essentially the convolution of average well profiles with the monthly completion rate over time is used to model future output. I focus on the period starting in Jan 2010 and consider only horizontal tight oil wells in the analysis. Future well profiles are estimated and several future scenarios for completion rate are used, clearly the future is unknown so future completion rates and estimated ultimate recovery (EUR) for wells completed in the future can only be guessed at.

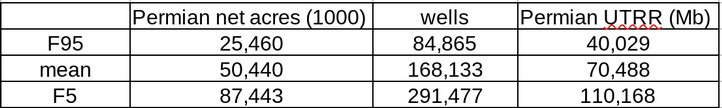

In order to make such a guess I start with the USGS assessments for the Permian basin where the mean estimate for prospective net acres as of mid 2017 was about 50 million acres. I use an estimate for average acres per well of 300 acres (about 9500 feet lateral length with spacing of 1320 feet between laterals) which gives an estimate of about 167 thousand wells. There were about 14 thousand wells already completed in the Permian basin by June 2017 so total completions would be about 181 thousand wells, if oil prices were high enough to make every potential well location profitable. Using the mean UTRR estimate (70 Gb) and number of potential drilling locations (about 160 thousand as of Dec 21, 2021 based on the data at shale profile where about 21 thousand wells were completed from July 2017 to Dec 2021), I find and estimate for the future decrease in EUR per well that will result in a UTRR of 70 Gb if all potential wells were completed.

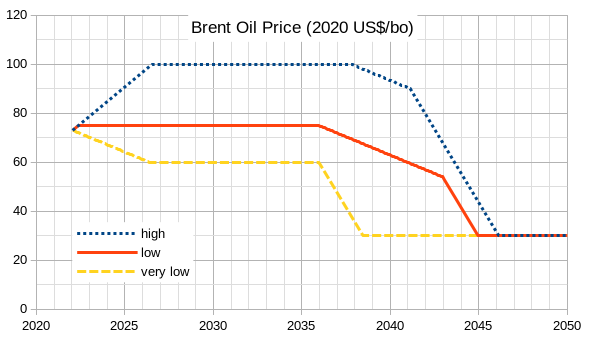

After that step a discounted cash flow analysis using guesses of future costs and prices is used to determine whether a well will be profitable to complete to arrive at an ERR for a given scenario, typically ERR is less than TRR, but in rare high oil price scenarios they could be nearly equal.

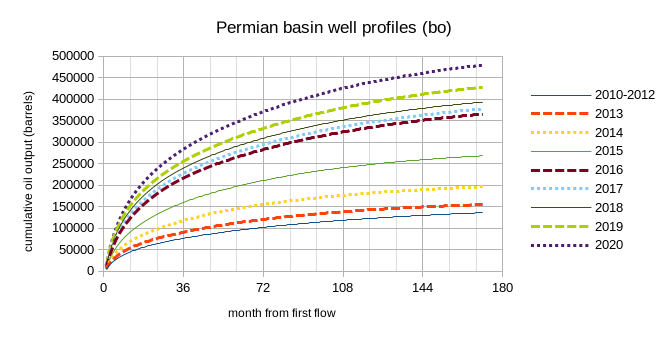

Average well profiles have been developed by fitting an Arps hyperbolic function to the data from shaleprofile.com for the average 2010 to 2012 well and then for each individual year from 2013 to 2020. In my scenarios I assume EUR starts to decrease after Dec 2020 and assume no further increase in lateral length or change in average well spacing.

Since 2010 average new well EUR has been increasing, but note that when we normalize for increasing lateral length, the productivity growth stopped in 2018 and may be decreasing slightly, unfortunately I do not have access to average lateral length data so I rely on occasional updates at shaleprofile.com. Data for these well profiles can be found here.

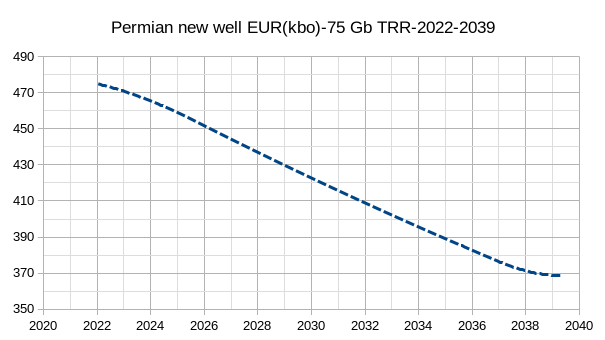

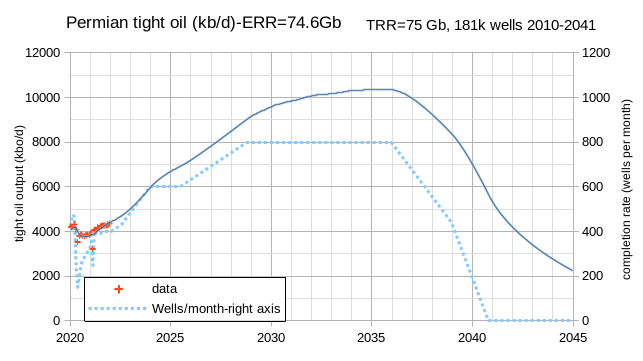

My central scenario assumes the Permian basin horizontal tight oil well completion rate increases from 400 new wells per month (the rate for past 6 months) to 800 new wells per month by July 2025 with the rate increasing by 10 wells per month from July 2022 with a slower increase of 5 wells per month from Feb 2022 to June 2022, the completion rate remains at 800 new wells per month from July 2025 to January 2037 in my high oil price scenario case and then decreases to zero by April 2039. The EUR for the average new well for the high oil price (maximum price of $100/bo in 2020$) and mean USGS TRR estimate (75 Gb) from Jan 2022 to April 2039 is shown below. No wells are completed after this date for this scenario. Note that for other TRR assumptions (F95=45 Gb and F5=116 Gb) the decrease in EUR is different (it decreases less in the F95 case and more in the F5 case). This scenario has 182 thousand competed horizontal tight oil wells from Jan 2010 to April 2039, about 34,200 wells have been completed through December 2021 based on the shaleprofile.com supply estimate for the Permian basin.

The table below summarizes USGS estimates for the F95, mean and F5 cases from the Permian basin assessments of the Midland basin Wolfcamp(2016), Spraberry (2017), and Delaware Wolfcamp and Bonespring formations (Avalon formation is also included in Delaware basin assessment). UTRR is undiscovered technically recoverable resource, net acres are total acres multiplied by the success ratio for individual benches (1 million acres with a success ratio of 0.9 would be 900 thousand net acres) and wells are estimated by dividing net acres by 300 acres per well.

Note that I use June 2017 as the mid point for these assessments as I do not have the detailed data on which formations wells were completed as of the dates of the assessments, so that is an approximation. As of June 2017 there were 13,710 completed horizontal wells in the Permian basin, based on the most recent Permian basin update at shaleprofile.com, so for the mean USGS case total wells completed would be about 182 thousand wells (F95=99k, F5=305k). The total output from wells completed through June 2017 may be about 5 Gb, this would be added to the UTRR in the table above so TRR would be 45, 75, and 115 Gb respectively for F95, mean and F5 USGS estimates.

The details of the economic assumptions are as follows (all in 2020 US$):

average well cost=$10.8 million

OPEX=$11/bo+$16000/month (monthly cost)

NGL price=35% of wellhead crude price

natural gas price=$3.50/MCF

transport cost to refinery=$5/bo

royalty and taxes=28.5% of wellhead revenue

nominal annual discount rate=10%

nominal annual interest rate on debt=7%

dividend payout=25% of net revenue

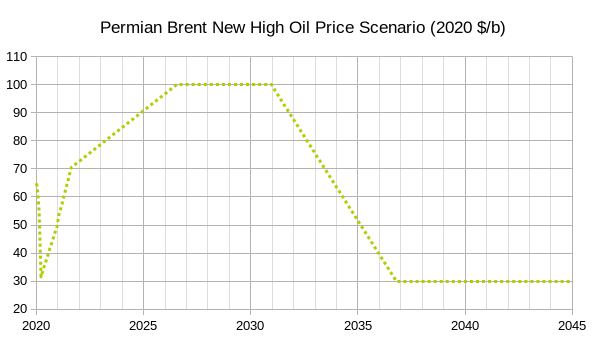

I use a discounted cash flow analysis where the scenario oil price and the assumptions above are used to estimate discounted net cash flow (DCF) over the life of the well, wells are completed when the DCF is greater than or equal to the well cost for oil price and economic assumptions above. The average well is assumed to have a 9500 foot lateral spaced at 1320 feet (roughly 300 acres per well). The three oil price scenarios (very low, low and high) are given in the chart below. Note that the very low oil price scenario is only used for one case with a 45 Gb TRR with a 400 well per month completion rate, for all other scenarios either the low or high case scenario is used.

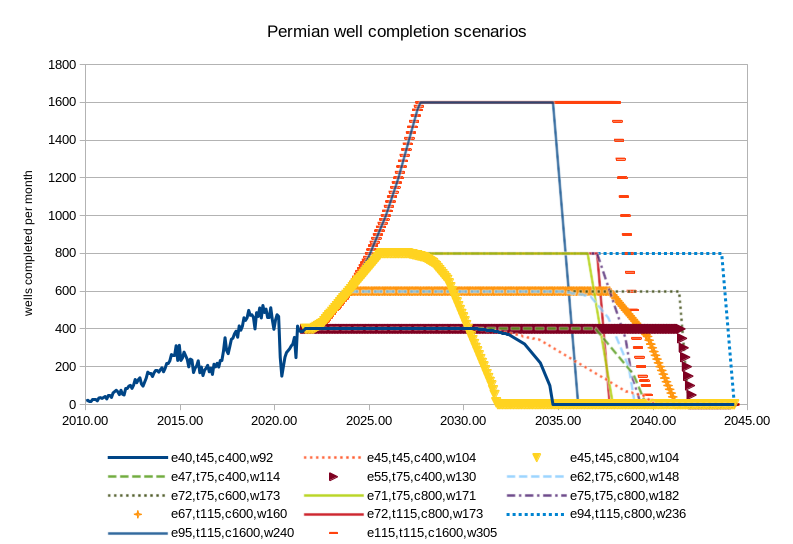

The various well completion scenarios are shown below, they are mostly similar over the 2022 to 2030 period and then the tails change depending on both the assumed TRR for the scenario (due to fewer wells in the lower TRR cases) and the oil price scenario (fewer profitable wells in the low price case). Note that only one case uses the very high completion scenario (1600 new wells per month maximum) to see if the an ERR close to the high TRR for the F5 scenario could be approached, this scenario is not likely to be realistic at any price ( and definitely not at $100/bo). Most of the scenarios have a maximum completion rate of 400, 600, or 800 per month with most scenarios either 400 or 800 completions per month. In the charts in this post I use the following notations:

e=ERR in Gb

t=TRR in Gb,

c=maximimum well completion rate in new wells per month

w=total wells completed from Jan 2010 to end of scenario in thousands

Note that where there are two scenarios with the same TRR and completion rate maximum, the different ERR and total well completions is due to different oil price assumptions (very low to high oil prices). Data can be downloaded here.

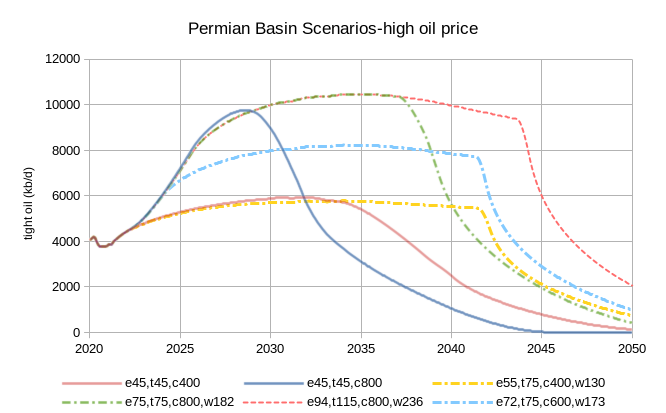

The high oil price scenarios are in the chart below. Note that the scenario with ERR=TRR=75 Gb depends on the high oil prices assumed, should there be a rapid transition to electric transport in response to high oil prices (which may rise to $150/bo in 2020$ by 2028 when oil output is likely to have peaked) in a world where the ramp up in battery production overcomes the many obstacles that exist we might see oil prices start to drop by 2035 and perhaps earlier if OPEC chooses to develop their resources more aggressively to sell their output before World demand starts to wane. We will come back to this later.

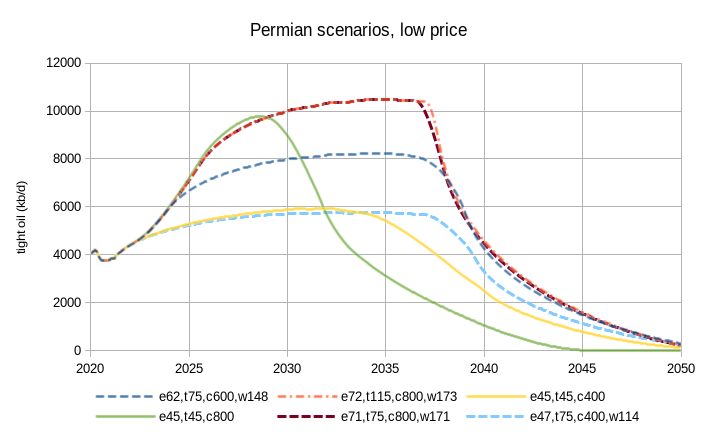

Low oil price scenarios in chart below

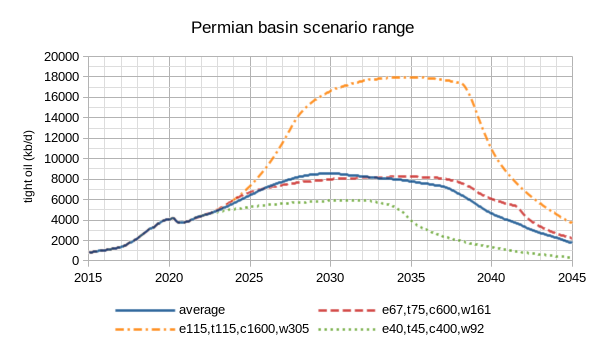

In chart below we look at the range of scenarios including the very low oil price scenario for the low completion and low TRR case and the very high completion rate scenario for the high TRR and high price case, in between we have the central 600 completion rate mean TRR scenarios averaged for low and high oil price and the all scenario average.

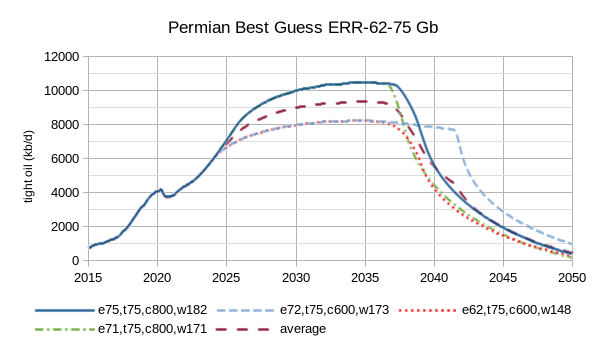

Below we consider 4 scenarios with completion rates of 600 and 800 completions per month at the high and low oil price scenarios, all are based on the mean USGS TRR estimate of 75 Gb and the ERR ranges from 62 to 75 Gb, the average of the 4 scenarios is also shown, this would be my best guess for future Permian output, the ERR of the 4 scenario average is about 70 Gb. Data for the various scenarios can be downloaded in a spreadsheet.

When we look carefully at the USGS assessments we can consider the various benches and which are the most productive volumes of rock. Of the 50.4 million net acres in the USGS mean estimate, roughly 31.4 million net acres have more prospective (higher EUR per acre) volume. These 31.4 million net acres have a UTRR of 52 Gb, when we add the 5 Gb that is likely to be produced from wells completed through June 2017, the TRR becomes 57 Gb, that leaves another 18 Gb of TRR to potentially be produced from the remaining 19 million acres, if half of this can be produced profitably that would bring the total ERR to about 66 Gb. The forecast by Saputra et al (2022) has an ERR estimate of 55 to 62 Gb somewhat lower than my estimate. Note that Saputra assumes a completion rate scenario of 400 wells per month, for my scenarios assuming the mean USGS TRR and 400 well per month completion rates at both high and low oil price scenarios, the average ERR is about 51 Gb. My guess is the completion rate will increase in the future to at least 600 wells per month where the average ERR of the low and high oil price scenarios is about 67 Gb or possibly to 800 wells per month where the ERR of the low and high oil price scenarios is 73 Gb. The low completion rate scenarios will leave a lot of oil in the ground if oil prices start to fall around 2036 to 2042 as in my oil price scenarios.

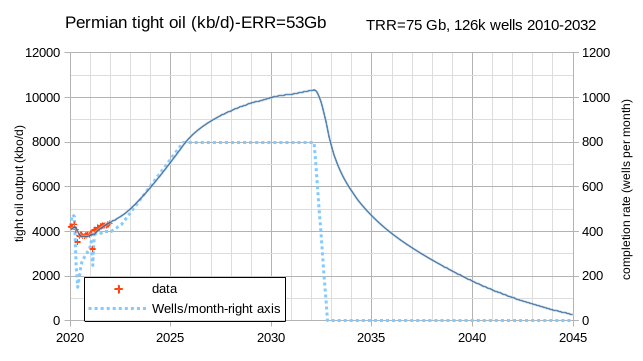

What happens if OPEC is able to increase their capacity by 2028 and/or the transition to electric transport occurs more rapidly than mainstream agencies such as the IEA currently forecast? We briefly consider this by looking at the TRR=75 Gb and 800 well per month maximum completion rate scenario under a modified “high oil price” scenario that sees prices drop rapidly ($1/month rate of decrease) starting in Jan 2031.

Below we have the resulting scenario with completion rate shown on right vertical axis. The ERR drops from 75 Gb to 53 Gb with this change in oil price scenario.

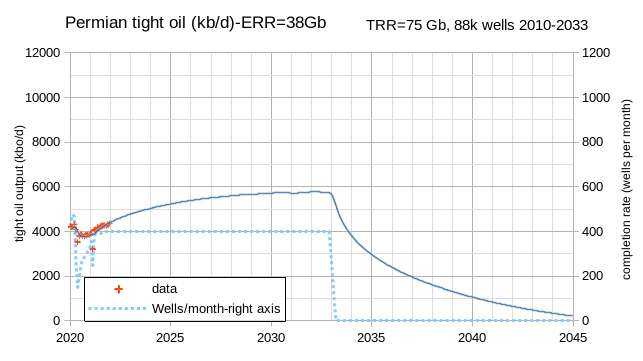

Many oil pros believe fewer completions would be a better approach to tight oil field development, let us consider the same oil price scenario and TRR assumption but reduce the completion rate to 400 new wells per month.

The lower completion rate scenario leaves about 15 Gb of oil in the ground that is unlikely to ever be produced, if oil prices follow the “new” high oil price scenario.

Many in the oil industry doubt demand for oil will fall faster than the supply of oil earlier than 2040 to 2050, that was the basis for my initial high oil price and low oil price scenarios, combined with my skepticism that OPEC will choose to increase their capacity substantially.

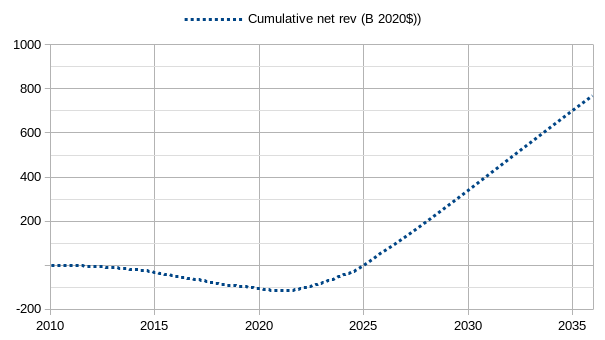

Switching back to my original high oil price scenario and considering the 75 Gb TRR and 600 well completion rate scenario and using the economic assumptions given earlier in the post, I can show cumulative net revenue basin wide from Jan 2010 to Dec 2035. Well cost is assumed to increase from $7.5 million in Jan 2010 (2020$) to $10.5 million in August 2017 and then remain at that level until September 2021, then real well cost(2020$) is assumed to increase at 1% annually, and increase of 3.5% at an annual inflation rate of 2.5%. Debt can be fully paid back by early 2025 under these assumptions and cumulative net revenue builds to about $750 billion (in 2020$) by 2036, this does not include money that could be earned on this pile cash if it were invested. Note that by some estimates drilling and completion costs per lateral foot have been falling in most tight oil basins. I assume no change in lateral length or well design after Dec 2020, so I would any cost increases long term would be marginal, close to the rate of inflation (so no change in real cost in constant dollars). The estimate below is conservative.

A final question was posed by Ovi about US tight oil and whether it might be able to meet world demand growth. If we assume the long term (40 year) trend of about 800 kb/d increase in demand for crude plus condensate continues into the future, this would be out target. I created the scenario below for the Permian basin, based on a TRR of 75 Gb, the standard high oil price scenario (first one presented in this post) and a maximum completion rate of 800 wells per month. The rate of increase was modified (reduced) from the initial scenario in the post as shown on right axis below.

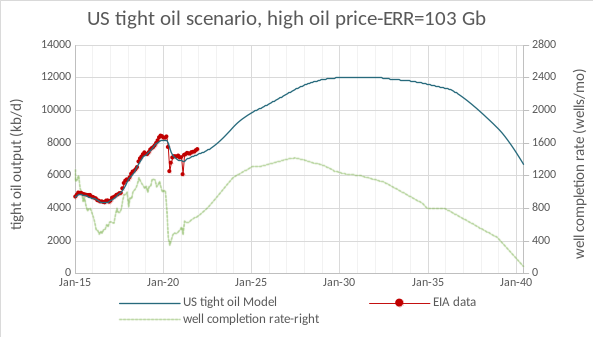

The rate of increase from june 2022 to june 2028 will be shown later, first we combine this scenario with scenarios created for all other US tight oil basins to get a US tight oil scenario.

This scenario would only occur if oil prices remain high through 2040, this is not likely in my view, if oil prices start to fall in 2032 we would see closer to 75 Gb for US tight oil URR, this scenario is optimistic/unrealistic.

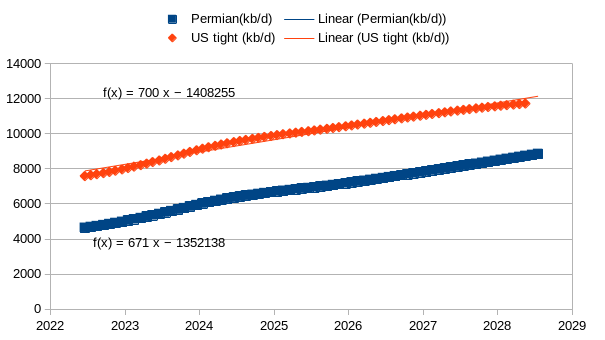

In any case form mid 2022 to mid 2028, the rate of increase in Permian and US tight oil is about 700 kb/d annually.

Dennis

A great effort and a lot to digest. I note that the last chart seems to confirm the current DPR info that the yearly increase from the Permian is in the 700 kb/d/yr to 800 kb/d/yr range. Future production will be directly related to the completion relate, well quality and a company’s willingness to ramp up production or drilling just to maintain current production.

Ovi,

Thanks.

If prices are high for a limited time (say from now until 2035 or so), producers risk leaving oil in the ground by choosing to go slowly (400 completions per month rather than 800 completions per month). Once the oil price drops to under $60/bo, the decrease in new well EUR will make the rest of the play (the part that has not been developed) unprofitable. If oil producers want to make money, they will ramp up output while oil prices are high.

There is a myth that OPEC plus has lots of spare capacity, when this myth is finally laid to rest, there may be a realization thatt we are in for high oil prices long term, at that point the ramp up in the Permian will gain some steam.

Dennis

As the OPEC commitments ramp up through May, we will have a better idea of their real capacity.

Ovi , OPEC is now what NATO is today . Mr Perry Mason ” Immaterial , irrelevant and inadmissible ” .Today’s OPEC is no more than TRCC . It is peak supply and not peak demand .

HIH,

Ha-Ha you’re really dating yourself with the Mason reference, unless you are like me…..mid sixties in age and just now catching him on reruns (Me-TV). The wife and I stay up till 11:30 pm just to watch. Good old shows are the best. Have you ever figured out what is Lt. Tragg’s “mark”.

Yeah , JAM in your age group . Agree ,they don’t make them like old anymore . Lt Tragg??Is he from “The Nero Wolfe mysteries ” series .? This is another worth watching . Enjoy and be well .

Ovi,

Yes I agree. Perhaps the larger tight oil producers are waiting to see what OPEC can produce, before making a decision on ramping output more quickly. I imagine these CEOs have teams of petroleum engineers and economists that can provide excellent analysis of the industry, so none of this would be news to them.

Dennis , all the CEO’s , petroleum engineers , financial wizards , computer champions COMBINED cannot triumph over the laws of physics, geology and the fundamentals of running a profitable business operation . They have more than enough info . The problem is that they know their operation is a loss making venture but they will never admit this .”It is difficult to get a man to understand something when his salary depends upon his not understanding it.” Courtesy Upton Sinclair .

Hole in head,

I think there are a lot of smart people in th oil industry, I give them more credit than you.

In any case they know more than me.

Dennis , of course one has to be smart to pull off a $ 700 billion Ponzi . Yes they are smart but more like Bernie Madoff and Ken Lay . 🙂 .

“I’m a former Moscow correspondent. Don’t let Vladimir Putin fool you: Russia’s invasion of Ukraine is only about one thing.

To understand the Kremlin’s motivations in regard to its smaller, and relatively impoverished, neighbor, the key fact to know is that Russia supplies 40% of Europe’s heating-fuel supplies — namely, natural gas.

Any crimp on Russia’s ability to access the European market is a threat to its economic security.

To get it there, Russia relies mostly on two aging pipeline networks, one of which runs through Belarus and the other through Ukraine. For this, Russia pays Ukraine around $2 billion a year in transit fees.

Russia is a petrostate and relies on oil and natural-gas sales for about 60% of its export revenue and 40% of its total budget expenditures. Any crimp on Russia’s ability to access the European market is a threat to its economic security.”

https://www.msn.com/en-us/news/world/i-m-a-former-moscow-correspondent-don-t-let-vladimir-putin-fool-you-russia-s-invasion-of-ukraine-is-only-about-one-thing/ar-AAUbFJ3?ocid=msedgntp

Huntingbeach

Not sure how current your Russian info is but here is a question. What is the chance that the Oligarchs supporting him might decide to topple or replace him.

Ovi , he has toppled the oligarchs a long time ago . Their best bet was when Medvedev was President but Putin undercut them by being Prime Minister and diffusing their efforts . I am not an expert on Putin but what I understand is that he reads and re reads ” The Art of War ” by Sun Tzu and a book by a German General Karl Von Clausewitz supposed to be a strategist above Montgomery , Zhukov , Patton etc . His role model is Peter the Great just like for all Brit leaders is Churchill , for India Gandhi/ Nehru , for China Mao/ Deng . However even he cannot do anything against an assassin’s single bullet , though being ex KGB he knows how the ball rolls . Best of luck to Mr Putin .

P.S : The oligarchs don’t support him it is vice versa .

hole in head

I won’t talk about the ongoing war. There are different opinions about it. It has been going on since 2014, it’s just that it has entered a more active stage. I want to write about Putin. The main thing is his merit.

From 1991 to 2000 (when Putin came), life was constantly deteriorating. There was famine. There was no work. Constant murders of oligarchs (of course they ordered each other) Organized crime appeared. Money was directly stolen from the budget: transfers transferred to “their banks” to finance the regions they disappeared no one knows where. Taxes were not paid by large companies, or rather they were paid ten times less than necessary.

With the advent of Putin, everything changed. The oligarchs who did not agree to pay taxes ran away or went bankrupt. Life improved. Organized crime disappeared. People in the country have never lived so well. President Putin, therefore, enjoys the support of the majority of citizens. And this one cannot be changed …..

“Organized crime disappeared. ”

As did opposition media and leaders.

“Organized crime disappeared. ”

As did opposition media and leaders.

—-

Hickory. You are using unreliable information. Of the four all-Russian news radio channels, one is sharply anti-government (anti-Puitn), one is neutral and two are pro-government. As for TV, I can say there are anti-government ones, you can watch any of more than 400 channels, including CNN.

And yes, Hickory

, in today’s world, censorship has lost its meaning with the Internet, you can choose information at your discretion. Which is what most citizens do, depending on their beliefs. In Russia, I think the Internet is the cheapest in the world, like cellular communications. Let’s say I pay for unlimited Internet + cellular communications + internet in the house $7 per month.

Mearsheimer on Ukraine

https://www.mearsheimer.com/wp-content/uploads/2019/06/Why-the-Ukraine-Crisis-Is.pdf

Alexander,

Yes my understanding is that Hitler was also supported by many Germans for many of the same reasons. He appears a psychopath from afar.

D Coyne. Yes, of course, Denis may seem like you are writing the truth. But I don’t agree with you. Hitler wanted to destroy other peoples. Putin wants to stop the war in eastern Ukraine, secure the borders of Russia. And yes, I know for sure that the Western media publish false information.

Putin wants to stop the war in eastern Ukraine, secure the borders of Russia.

Bullshit! Putin started the war in eastern Ukraine. If he wanted to stop it he could just pull his storm troopers out.

And yes, I know for sure that the Western media publish false information.

You know nothing but what your Minister of Propaganda tells you. If any Russian media published the truth about Putin, they would be thrown in prison. Damn! How can anyone support what Putin is doing? And yes, Putin is even worse than Hitler. Putin wants his empire back. Nothing could be more obvious than that.

And when you tell us Putin just wants to secure his borders because he fears a Ukraine invasion you then you are here to spread Russian propaganda that you know are damn lies.

Ron Patterson. Everything that I want and can say, you will consider propaganda. Therefore, I will not write. I believe that Putin is right, but nevertheless he made a mistake, did what your leadership wanted. Now we will live in a new world. The only thing I want: so that a world war does not start with clear consequences. And a video: people are trying to leave the Ukrainian military: https://www.youtube.com/watch?v=Lx9KPVHQs5E

Yep–

Russia lost 85% of its GDP, and it was desperation

(the USA lost 20% during the depression of the 30’s)

Putin turned that around

This was unexpected by my analysis (current)

I do have a degree in Russian History from University of California, but it has been a while.

Alexander , on the same page as you regarding Mr Putin . He bought Russia back from the abyss into which Yeltsin and the oligarchs had pushed it .

Alexander

Andrey Bezrukov suggested that Russia will need to became an autarky.

Have you heard any discussion about this in Russia?

Seppo Korpela. I have never heard or read about discussing or changing the political system in Russia. In general, there are many political movements in Russia. For example, in St. Petersburg and Moscow, there is the most opposition to the Putin government. My youngest son works in St. Petersburg in To an Israeli company as a programmer, so everyone there is against the war in Ukraine and dislikes Putin. In the provinces, support for Putin is more than 90%. There are marginal groups that are pro-communist and even monarchist, but they don’t talk about them seriously.

Alexander, I am not saying that the political system will be changed as such, but slowly the country might drift to autarky as resources are depleted in the rest of the world. Shifting toward autarky can take place slowly one decision at a time.

I have hard time seeing such for example in Saudi Arabia because they are based on oil and gas, and without grains. But Russia could get by on its own resources, unlike Europe and the USA. When I gave my talk in India, I had some discussions with some of my friends there and we agreed that India’s fall will be much less than that in USA. The future will be painful to everyone and how to soften the blow should be in our minds right now.

Seppo , not only Andrey but many others . The baseline argument is that when resources are limited there has to be a rationing otherwise the rich ( oligarchs ) will corner all the resources and the rest will be left to fend for themselves . This argument is a result of the increasing inequality that is now prevailing . I see an increasing trend towards to autarky as LTG is coming into play .

Seppo , when you talked with the guys at IIT they were the creme de la creme and brightest of the bright . They all are going to be in Seattle , New York , etc after they finish their courses . Now let me give the other side . 800 million which is 66% of the population live( survive ) on 5 Kg of wheat/ rice + 1kg of chickpeas provided free PER FAMILY PER MONTH by the govt . That works out to 1200 calories per person per day . I never make statements I can’t support . India will not fall far. Yes , because their is nothing below to fall down to . The next step down is starvation .

https://www.globalhungerindex.org/india.html

VERY long time reader here and greatly appreciate all of your posts and comment discussions…

China demand for hydrocarbons of any and all types is voracious. How rapidly can Russia move ‘unsold’ production from Europe markets to East Asia (China)? Can an Arctic tanker route temporise until Pipelines for NG and oil are laid?

ThisNannupLife. There is one railway route to the east of Russia (Trans-Siberian Railway), it is loaded at 100% (mainly coal to China). There is a project for the Railway in Chukotka (300 km for 40 million tons of high-quality coal).

The proposal of the Vostok pipeline project (from Yamal, through Mongolia to China) was rejected by the People’s Republic of China for unclear reasons for an indefinite time, despite the announcements of the Russian Federation.

Thus, I think it is impossible to reorient energy flows in the foreseeable future from west to east.

Thank you for this. Which will raise the question of whether Russia will even threaten to turn off the West flowing taps. Having just emerged from a damaging COVID caused one shut in do they really want to shut in again?

ThisNannupLife

The game is played. There will be no return. Russia, at best, will repeat the fate of North Korea. I hope we will not bring things to war. A little propaganda: Putin hoped that his military would be greeted with flowers, which happened in the east, but not in the north. And yes, the military have an order not to use artillery and heavy weapons in cities, this order is strictly enforced, like the other one: Do not destroy water pipes, infrastructure and power plants. There is light and water in all cities. If you are shown the opposite, this is Western propaganda.

Sincerely

Alexander

West Korea!

Alexander,

I don’t know how this will all go, except for poorly.

And that includes for Russia.

Anything that Putin had hoped to gain by invasion will be dwarfed by the loss of

economic activity experienced by the country as a result of isolation,

and also dwarfed by the severe loss of respect and trust for the country.

It is sad for the Russian people, to have a leader who has made such decisions.

Nato will be much more unified as a result of this action, and the neighboring country citizens are going to be much more unified in their distrust and disdain for the Russian state.

Someday Russians will realize that the sooner Putin is gone, the better will be the future prospects of their country, and for all of the neighboring citizens. (not so good for Lukashenko)

Many leaders in the west are thinking that Putin has become mentally unfit recently.

Are people starting to worry about this in Russia too?

My contrary view “Anything that Putin had hoped to gain by invasion will be dwarfed by the loss of

economic activity experienced by the country as a result of isolation,

and also dwarfed by the severe loss of respect and trust for the country.”

2/3 of the world’s population (India + China) abstained in the UN . The five eyes + Europe is not the world . He cannot be isolated because he has critical minerals plus he controls critical minerals thru his supporting countries Uranium in Kazakhstan (43 % of the world’s supply), Potash via Belorussia (15% of the world’s supply , gas via Turkmenistan . It is not NK which is a one trick pony .

When did he or any top Russian General say that the war was going to be blitzkreig ? Unlike Cheney, Rumsfeld , Wolfowitz etc who said that their shock and awe tactic will subjugate Iraq in a week . Bush put up “the mission accomplished ” sign two weeks later and the US is still bogged there 20 years later .

Now to financial matters . We underestimate that this was not war gamed and that there is no plan B .

1. Moscow stock exchange fell by 45 % . Nothing happened . No Panic . Why ? First MOEX is where the big boys play hedge funds , investment banks etc . There are no day players or Robinhood and Schwab type platforms . These players are suave and if they exit they will suffer a loss just like BP . To cut a long story short it is the Foreign Institutional Investor who is losing money and not the ordinary Russian on the street . The FII’s will come back when the crisis is over .

2. Rouble devaluation ; Rouble devaluation is a problem but can and will be calmed down as long as their are no physical shortages of basic goods . Transfer of Roubles from the saving account to under the mattress of the Russian civilian is not going to kill the financial system . The FX can be handled via capital controls . The banks can make a rule that anyone can buy/sell upto $5000or $ 10000 on his personal account . This will pacify all those small holders of Fx and bring confidence .With $ 600 billion reserve this is achievable and will calm the market . All commercial transactions say transfer of funds for imports / finance etc will be screened . As I write they have already taken the first steps.

To expect that events were not going to be disruptive would be clumsy and stupid . I do not expect the war to be long . All parties want an end except those who will profit from the chaos . The problem for Putin right now is who to negotiate with on the other side ? . He will not negotiate with the US on this . Today is Day 5 of the war . On Day3 the Russkies paused their operation as there was talk that negotiation are underway and then Zelensky relented .

https://www.zerohedge.com/markets/russia-central-bank-bans-selling-russian-securities-foreigners

A joke going on the net :

Putin : I have

Aluminium

Fertiliser

Oil

Gas

Nickel

Wheat

Palladium

Titanium

The West :We have

Windmills

SolarPanels

CRT

WOKEISM .

😉 , 😉

Western banks with exposure to Russia :

Raiffeisen 35 %

OTP 7%

UniCredit 6%

Soc Gen 4%

Citi 2 %

What would I do ,if I was Putin (Which I am not ) ? Sell oil and gas against gold and roubles . Set an artificial price for both just like was in USSR times . Set the price where it is beneficial to the Russian Federation . Then see the rats and cockroaches run .

All currencies are FIAT and the gold price manipulated at LBMA . He won’t be doing anything new .

SWIFT sanctions are bogus checkout the list of banks . Second tier banks like the S&L banks in USA , cooperative banks in UK , Spaarbanken in Benelux and Landens bank in Germany .All international banks will not be affected .

“The central bank said the debit and credit cards of sanctioned banks, which it listed as VTB (VTBR.MM), private lender Sovcombank, Novikombank, Promsvyazbank and Otkritie Bank, would keep working in Russia without restrictions.

“Cards from these banks will not be able to be used with the ApplePay and GooglePay services, but standard contact or contactless payment with these cards is available in full throughout Russia,” the central bank said.

For a better prespective watch this video

https://www.youtube.com/watch?v=YMrVu4IafOg&t=248s&ab_channel=DifferenceFramestheWorld

Another interesting fact . Zelensky has dual citizenship Israeli and Ukranian . How many countries in the world allow the top office to be held by such persons ? Answers ?.

P.S ; I am not anti Semitism or anything . It could well be India – Ukrainian or German- Ukrainian or Japanese – Ukrainian citizenship ,

Thank you so much for your support in a difficult moment! Hole in Head. But I see the situation worse than you. I have in touch some of the military who are taking part in the hostilities. They are very dissatisfied. They are not allowed to use artillery and tanks because of civilians , the loss of only the killed Russian military is more than 500 people. Despite the fact that three groups of 15-20 thousand people invaded Ukraine + the East Ukrainian Corps with Russian officers of 30-35 thousand people. Of these, well-trained infantry is not more than half. Recruit conscripts in Russia – there is no sense they are not prepared, cannon fodder + this will lead to protests of mothers. This is not enough for a vast territory. Ukrainian troops make up 250 thousand people, half of them are prepared for hostilities. With superiority in aviation and technology, it is possible to win, but to establish control over the territory I think it’s impossible. My assumptions, at best:

Achieve autonomy or independence of the rebellious east. Stop shelling of Donbas. Peace treaty with Ukraine in March. + Limited contacts on imports and exports. And yes, restrictions on the arms race.

Thanks again for your support. Regards

Alexander

Discussion of Russian military logistics:

https://warontherocks.com/2021/11/feeding-the-bear-a-closer-look-at-russian-army-logistics/

Explains why they run out of fuel and food.

And yes. Be sure that Russia will hold out no matter what sanctions. Unlike you, we are ready to eat only grass and walk on foot, if only the Motherland lives …

Thank you, Hickory. I agree with you almost everything, except that “Putin has become mentally ill.” Yes, of course, I think that he did not count on the result that he received.

The conflict in Ukraine began before the annexation of Crimea. In 2013, anti-Russian sentiment began to be promoted in Ukraine. This is absurd. To ban the language. I can only imagine why this is necessary. Now Putin has decided that the moment has come to solve this problem. I guess he miscalculated. Now Russia will repeat the fate of North Korea. I guess you should not hope for Putin’s departure, an even worse replacement will come.

We all have to live with this.

I am sorry. I do not want war. But I will not betray the Motherland, like my sons and most fellow citizens. I hope for peaceful coexistence with Europe and the World, and not for a new arms race. Yours faithfully

Alexander

Alexander , ” I think that he did not count on the result that he received. ”

According to who ? The Western Media ? I don’t remember Putin , Shoigu or Gresamov saying they will mop up Ukraine in a week . Now another question ? Now days with the smartphone everyone is a cameraman . I don’t see much clips of fighting between Ukies and Russkies . OR even of Russkies firing at random on the public . MSM needs a crisis to sell . Yes , they termed the 6th January incident as ‘” revolution ” and ” invasion ” . They need “event , incident and accident ” .

Your , “I am sorry. I do not want war. But I will not betray the Motherland, like my sons and most fellow citizens. I hope for peaceful coexistence with Europe and the World, and not for a new arms race.” With you 100% on this .

An old quote ” In times of war , truth is the first causality ” . Sifting through the fog of war is a challenge specially in this era of 24/7 news circus . Be well and with sympathies .

But I will not betray the Motherland,..

Your Motherland is being run by a Madman!

Alexander.

An additional note- we all know that the Russian forces are generally displaying a large measure of restraint in using only a small portion of the weapon systems at their disposal, and avoiding the wholesale destruction of cities and peoples.

Thus far. The world is watching.

Still, over 500,000 people have fled to neighboring counties for safety.

Ron Patterson,Hickory

I regret that everything is developing this way, I have no influence on events. Nevertheless, I cannot act differently. I am against any military conflicts, against the buildup of nuclear weapons – this is the main evil that should not be allowed.

Hole in Head

https://www.youtube.com/watch?v=0QpcA0Tx3X0&t=0s

Side note, I think I remember a country electing a leader that some deemed unfit for office and possibly insane… I just can´t remember which…

Laplander,

“I remember a country electing a leader that some deemed unfit for office and possibly insane”

And I certainly remember it very well, having voted against him a few times in the recent past.

And yet most who elected him would do it again.

Its the biggest danger to the democracies of the world, as I see it.

He would flush civil society down the toilet for his own gain.

That made me laugh Laplander

https://www.rand.org/pubs/research_reports/RR3063.html

Russia is sinned against as well as sinning. That link is to a Rand report from 2019 entitled “Extending Russia”. What it proposed was that the US do a rerun of Star Wars and cause Russia to spend too much on defense thus harming its economy. On page 16, the authors complain that:

Significantly, Russian leaders seem committed to keeping defense spending under about 5 percent of national GDP. If this is the case, then the United States will find it hard to persuade Russia to substantially increase defense spending unless it convinces the Kremlin that new threats to Russian security demand a change to this policy.

On page 4 they note:

In fact, a risk discussed throughout this report is that Russia could respond to certain U.S. measures in ways that harm the interests of the United States or its allies or in ways that reduce stability.

Which is what happened. One thing this war has shown is that the Russian army is amateur hour. Running out of fuel. Running out of food!

In my post of 1:10 yesterday I outlined that Putin has already “war gamed ” the financial sanctions of SWIFT and assets . He has acted accordingly and instituted capital controls , etc . However he got hit below the belt with the clamp on USD based Russian assets of the govt (not of the oligarchs) overseas . This is illegal and I think the Chinese must be thinking about their horde of USD assets .This has whittled his cash ammo , but he will manage . What is interesting is that these were nuclear options and you can use this card only once . Well , it’s gone . The next option for NATO is to send its troops on the ground . Mr Putin has not yet even opened his briefcase and he is keeping his powder dry .

Alexander , fighting a war with one hand tied behind your back is difficult . Russia is not only fighting a hot war but also an information war in which the opponents are better armed . However I think since the MSM is now so discredited nobody believes them . Social Media is where the battle is . I am encouraged by what I have seen . In my country (India) an election has been won by a regional party which beat the hell out of the biggest political party in the world(300 million members) ,richest political party in the world and 100% control of MSM . The resources of the regional party were 5% than those of the national party . Social media is a game changer . Despair not .

David , a question for you . “Which is what happened. One thing this war has shown is that the Russian army is amateur hour. Running out of fuel. Running out of food! ”

Did you see the extraordinary footage of a line of Russian tanks and armored vehicles all blown up and twisted on a quiet road in broad daylight?

Who destroyed them, and how? And in or around those vehicles, did you see any DEAD RUSSIAN BODIES? I didn’t. I would think there were quite a few. Where did they go? Who took them away, and why? Were these Russian vehicles operated by remote control from Moscow?

Of course, as in every recent war, US TV reporters, “on the ground” in the Ukraine, are doing stand ups in stone quiet areas where nothing at all is happening, and these “reporters” are relaying press updates originating from New York and Washington. That’s standard. “We’re sending you to Kiev/Kyiv on the midnight flight, Fred. Don’t forget your helmet. We’ll feed you AP dispatches through your earpiece and you just repeat them…”

Epstein didn’t kill himself and there was no Russiagate .

Putin is isolated . Says who ?. The MSM . Question why not even a choo from any friends in the ME . Where are the Saudis ,Kuwaitis, Jordanians ,Egyptians etc all US protectorates. They know which side the bread is buttered . Now the cherry on the cake .

https://www.timesofisrael.com/bennett-declined-ukrainian-request-for-military-aid-report-says/

https://uk.news.yahoo.com/hungary-not-allow-lethal-weapons-142334201.html

Another joke . Putin is shivering .

https://indianexpress.com/article/sports/vladimir-putin-stripped-of-black-belt-over-ukraine-invasion-7795484/

ROFL

“Which is what happened. One thing this war has shown is that the Russian army is amateur hour. Running out of fuel. Running out of food!”

—

I think you are wrong. Time will tell. Most likely everything will end before the end of March. The “desert storm” in Iraq lasted longer. Russia is of course a poorer country than the United States and it has less armed forces, they save on them, but do not save on “nuclear forces” containment.”

The question arises: why did this happen?. I want to remind you before the War in Ukraine, about ten days ago, Putin and his Foreign Minister Lavrov expressed their “concerns” about Ukraine’s entry into NATO. They simply were not heard, or rather sent far away.

Now it’s worth considering what will happen next, but of course Russia will turn into a semblance of North Korea and only after 20 years will be able to return to its current level, it will work on “import substitution.” But what will happen in the world during this time? How will it replace oil and gas and wheat from Russia. Of course, he can do it ….

+https://www.youtube.com/watch?v=1vdiEABLFoo

Hole in Head. Thank you, I have long understood where your homeland is. I’m worried if they will be able to sow wheat in Ukraine this year?

Will the war interfere? Ukraine is on the 4th place in the export of wheat.

Fertilizers have become very expensive and the harvest around the world in 2022 may be less.

https://www.indianpunchline.com/india-shouldnt-miss-world-war-pointer/

An answer to your question : Why did this happen ?

The author retired as Foreign Secretary of India (he reports only to the Foreign Minister/Prime Minister) . Very interesting view . Would Russia be the next Yugoslavia had Putin not moved . Another one . Several theories .

https://nakedemperor.substack.com/p/why-did-putin-invade-ukraine-now?utm_source=url

“Putin is isolated . Says who ?” – Hole in the Head.

Answer – says Putin. Just look at the size of the tables he uses for meetings, How far apart were Vlad and Macron when they sat facing each other at that vast white round table? And the long narrow rectangular table that Lavrov and Vlad sat at so far apart they had to use microphones to speak to each other. What’s the point – does Putin fear visitors will infect him with covid? Or assassinate him? or is he sending the message that he is faraway anbd innaccessible. Self fulfilling prophecy – he wants to make others feel subordinate and faraway and innaccessible and separate from himself the Great Man, and in consequence he cuts himself from contact with other men and really does become isolated, remote, separate from all the worshipping minions .

Mike G , isolated . Here is a picture 5days ago . Yes , he isolates himself from idiots like Macron the midget who struts around the stage signifying nothing . The guy goes around Europe with a puffed chest when his popularity rating in France is 16 % . Putin is 68% even today . For your information

1. Khersan fallen

2. Mariopal under absolute control

3. Next in line Odessa

4 . Eastern front ” cauldron” almost complete . This is where most of the Ukie army is .

5 . Kiev closed from all sides . The Russians have however opened up one corridor to allow citizens to leave .

6. Russian Navy in 100 % control of the Sea of Azov and the air space . The Western media asks ” Where is the Russian Air force ? ” Answer they are at base eating popcorn . Why should they waste fuel when there is no enemy aircraft ? they don’t get paid to shoot vultures and eagles .

Yeah , Biden said Ukraine is winning .

The West has gone crazy . Sanctioning cats . Read this . I don’t make the news , only report it . Pussies .

https://indianexpress.com/article/world/russia-ukraine-invasion-sanctions-cats-7798494/

Putin is the cowedly crazy pussy. Killing innocent citizens. You, his useful idiot.

In political jargon, a useful idiot is a derogatory term for a person perceived as propagandizing for a cause without fully comprehending the cause’s goals, and who is cynically used by the cause’s leaders.[1][2] The term was originally used during the Cold War to describe non-communists regarded as susceptible to communist propaganda and manipulation.[1] The term has often been attributed to Vladimir Lenin, but this attribution has not been substantiated.[3][4]

https://en.wikipedia.org/wiki/Useful_idiot

HinH Wrote: The guy goes around Europe with a puffed chest when his popularity rating in France is 16 % . Putin is 68% even today .

Bullshit! I don’t believe that for a goddamn minute. HinH Where do you come up with such bullshit? You know there was no recent survey in France about Putin’s popularity. And if there was he would not come close to 68%. You just made that shit up. Do you take us for damn fools? Are you a fucking shill for Putin? It sure sounds like it.

Putin is definitely isolated. Russia is becoming isolated. Russia definitely cannot survive for very long with the sanctions the rest of the world has placed on them.

Ron , regarding Russia surviving . The difference is in the keywords ” Strength ” and “Resilience ” . Who is more resilient ? You know the answer or better we will just let it play out . ” This too shall pass “

Dear. You have isolated yourself from Russian news agencies. You listen only to what matches your political preferences, thus cutting yourself off from the opportunity to conduct an objective analysis. Your news agencies are biased. Listening to Ukrainian Joseph Goebels, you receive unreliable information.

Given the day rates of deepwater oil rigs it might be expected that oil price would have a big effect on the number of rigs operating but, at least in GoM that doesn’t seem to be the case (there is a relatively small positive trend in the years shown but most comes from pre-2015). Even allowing for a delayed effect there is only minor impact (delaying the WTI price by 1-2 months gives the best correlation but it is only slightly better than no delay). So far in February (not shown) as prices have gone to average around $100 rig numbers have dropped to twelve total. A part of the impact is that as prices rise demand for rigs may increase but so too do the day rates. However I think the bigger impacts are that geology trumps economy and that short term prices are less important than the overall expected price profile over the 20 to 30 years of a projects life (and especially for high-risk, high-cost exploration wells).

From that Saputra/Kilari/Patzek paper there are almost half a million vertical wells in the Permian – I had no idea the numbers were that big. No wonder methane leakage is higher than expected. I don’t see how it would be possible to monitor all these even as they are producing and still less as they are plugged and abandoned – assuming they all will be, which I find increasingly doubtful as material and labour resources get scarcer and social conditions continue to deteriorate over the next decade or two. I’m not clear on the economics but those wells are only expected to produce another 2 billion barrels total by 2050 so I’d have thought P&A costs might be a large portion of the (undiscounted) remaining revenue.

George,

There is a mistake in the Saputra et al paper on the number of horizontal wells in the Permian basin. In the body of the text they give one number(around 55k), but if you add up the data in their charts it is closer to the shaleprofile estimate of about 32k (June 2021) horizontal wells completed in the Permian basin. I emailed the author, but got no response.

The Saputra paper you linked to is for vertical wells in the Permian. It’s not clear to me how this is relevant to your analysis of horizontal wells. Before I have to read the entire paper, I want to make sure you linked to the correct one. Or are you only looking at part of the paper, and if so, which pages.

Thanks!

I found this forecast from another Seputra et al paper on horizontal Permian wells that differs substantially from your “Permian Best Guess” forecast:

https://www.mdpi.com/1996-1073/15/1/43

I was unable to load the graph, but they gave production maxing out at under 5M/day until trending downwards at around 2035. A much more reasonable assessment, although still overly optimistic, and the paper is well worth the read.

Stephen Hren,

I agree the paper is excellent, it is the same one that I intended to reference, but I chose the wrong one, thanks for the correction. This has now been corrected in the post.

From the paper:

Based on the historical drilling rate, we choose 400 wells per month as a base for future drilling schedule.

They get 54.4 to 62.4 Gb for Permian ERR and as I noted in my post, if I assume a 400 well per month drilling rate (as they did) I get about 51 Gb for the Permian ERR (slightly lower than Saputra et al, 2022. Note also their assumption for wells drilled is about 189.6 thousand total wells drilled (where I have corrected the mistaken estimate of 53700 horizontal wells completed as of June 2021). If we add up the number of wells in figure 6 of the paper we get 34902 wells, fairly close to the shaleprofile.com estimate (33923 wells as of November 2021).

My mean TRR scenario (75 Gb) has at most 182 thousand wells. Much will depend on the future price of oil. If the mean TRR scenario is roughly correct, the ERR is likely to be at least 50 Gb, at minimum in a very low oil price scenario the ERR might be as low as 40 Gb, but this is not very likely unless WW3 is around the corner. Hopefully communication between the US and Russia will remain open.

Stephen Hren – is this the chart you meant?

Yes that’s it thanks!

Dennis, thanks for the corrections. My understanding of the USGS reserves is that they treat much of the acreage as more homogeneous than it is in fact proving to be. As drillers gets pushed out of core areas they will be engaging in ever increasingly risky returns, as production is likely to vary greatly and be lesser generally due to the fact of being “child” wells (as LTO survivor has described). Add on to this the volatility in oil prices and I would be very shocked to see things develop in the manner you have laid out, even if the resource base is as large as you think, which I also doubt highly. I am seeing your predictions for the Permian run often twice what other knowledgeable folks are saying, which is an extreme outlier on the optimistic end. I worry you are instilling a false sense of complacency in your readers. You are way out on the tail end of the bell curve of possible outcomes. In sum, I remain utterly unconvinced.

Stephen , correct . Utterly unconvinced . Couldn’t have put it better .

Stephen Hren,

Not true, they divide the plays into different assessment units and some are more productive than others, also if one looks at the F95 estimates this is likely the core areas and it is highly unlikely thatthe ERR will be less than the 45 Gb of the USGS estimates. Read the USGS reports, they are brief and I linked to the correct documents in this case.

If we simply isolate the best assesment units the mean TRR estimate is about 57 Gb. Fairly close to the Saputra et al, 2022 estimate. Note that the chart above assumes a 400 well completion rate. Their model also makes the assumption that only core areas are developed first and then producers move on to non-core areas. I think the fact that some non-core wells have been completed suggests that ther will be a gradual transition where there is mix of core and non-core development that gradually shifts from core to non-core as core areas run out of space. For a different perspective we can look at the shaleprofile .com supply projection.

https://public.tableau.com/shared/MSG9RRGHP?:display_count=y&:origin=viz_share_link&:embed=y

See link above, output projected at 6694 kb/d in Dec 2029 assuming a 388 well per month completion rate.

My model has a TRR=75 Gb, high oil price scenario at 5710 kb/d in Dec 2029 with an assumed 400 well per month completion rate. In any case the 400 well per month rate of well completion will be exceeded by mid 2022, so it will be impossible to see if the projections would be correct.

Stephen Hren,

We will see. Most I my scenarios in the past have proven to be underestimates.

Consider these older posts

https://peakoilbarrel.com/future-us-light-tight-oil-lto-update/

and

https://peakoilbarrel.com/us-light-tight-oil-lto-update/

This second scenario missed the future pandemic, but proved too low at the end of 2019 and in early 2020.

EIA estmates are for ERR of 122 Gb for reference case and 159 Gb for high oil supply case. My high estimate is somewhat lower than the reference case and my best guess is 57% of the reference scenario.

My best guess is about 11% higher than the Saputra estimate, which seems to me to be close to the lower bound of what is likely for the Permian, the EIA estimate for the Permian is about 73 Gb which seems about right. I think the EIA estimates for the rst of US tight oil are too high.

Stephen Hren,

Also check out my post on Permian from Jan 2021 particularly figure 9 in that post, note that I also underestimate Permian output for 2021 in those scenarios. Despite what many here seem to believe, my past estimates have generally been conservative, except for estimates in 2019 and earlier missing the future pandemic, I did not anticipate the pandemic before 2020, nor will I be able to forecast future crises in advance (my crystal ball is out for repair).

https://peakoilbarrel.com/permian-basin-the-death-of-tight-oil-has-been-greatly-exaggerated/#more-29970

Note that if I assume no wells are completed after June 2021 (similar to the Saputra base case), the ERR estimate for my model is 13.1 Gb, quite similar (and slightly lower) than that paper’s estimate. For Data from Jan 2010 to June 2021 compare to my model the correlation coefficient is 0.9983, I am always amazed that such a simple model produces such good results. Future results will not be as accurate because it is impossible to accurately forecast future completion rates or the rate of increase or decrease of new well EUR (I assume it decreases, but have been making the assumption that EUR will decrease next year for the past 10 years, I have been consistently wrong about that, but at least it has levelled off in Pemian and Bakken and we are seeing some decrease in the Eagle Ford.)

The EIA has remaining Permian oil reserves at end of 2020 of 16Gb. Production to date is about 9Gb, giving 25Gb ultimate recovery. With 6Gb reserves are non-productive, all of which would be approved new developments that are not yet online That leaves 19Gb as the base case recoverable reserves, which is more than estimated in that paper that indicates a total of just under 13Gb. The 25Gb is less than the 32, 54 or 63 that the Sapruta paper indicates for core, non-core and other respectively. The Permian tight oil development is earlier than the other three main basins but it is already showing signs that cumulative revisions are trending negative. This is a pattern that seems to continue in the other basins so that ultimate reserves gradually decline towards the end of life. To get to the Sapruta estimates the Permian will need significant discoveries to be added for several years. I don’t believe the companies don’t know almost exactly what their holdings in core are (although probably an overestimate because ultimate recoveries per well seem to be lower than originally thought) and new discoveries are really just FID decisions allowing resources to become reserves. I can see 32Gb being achieved (i.e. base and core) but I’m not sure that the non-core totals will be easily achieved.

George Kaplan,

Looking at UK North Sea proved and 2P reserves, the ratio was about 1.7 for 2P/1P historically. Proved reserves are not a good estimate for ultimate recovery.

If we take the 16 Gb of proved they might be 27 Gb of 2P reserves, plus 9 Gb would be 36 Gb and this is 2020 reserves which were based on a very low oil price. Higher prices will tend to increase reserves. There are also possible reserves and contingent resources which over time may be moved into probable or proved reserve categories.

My guess is that the Saputra estimate may prove conservative.

Stephen,

I mistakenly chose the wrong link, sorry. I meant to reference the paper you cite below.

It is above rather than below.

George.

I will give you a real world example on P & A from late summer 2021 to now with regard to the time it has taken.

We plugged 6 vertical wells. 5 were 900-1,000’ and the other was 1,500’. We approved the project in September. Three wells were plugged in late October and three were plugged in late December, early January. The surface casing was cut off at 4’ below the surface and metal swedges were welded on late January, and the wells were buried and surface restored.

We still are waiting on an electrician to remove the electric boxes from the well sites (service has been disconnected). We are still waiting on the service company who will dismantle and restore the surface of the small tank battery, consisting of one oil separator, two stock tanks and one water tank (and electric box there also).

The small injection pump, rods, tubing and down hole pumps, pumping units, electric motors and other salvageable equipment has all been removed and taken to our shop for future use.

Winter weather can be a problem. We hope the remaining work will be finished by April.

The landowner has been very good. Did not own minerals so happy to see the wells plugged. Likely won’t hear complaints from mineral owners, given there were over thirty splitting 1/8 royalty interest in very little oil production. Two of the wells were injection. One a water supply well. Three producers each averaging just 1/4 BOPD each.

I estimate there are 1-2 million of these types of wells in the USA, no telling how many additional ones that were improperly P & A.

Ours are among the simplest in the USA to P & A. I can’t estimate how long it would take to plug everything in the USA.

If there wasn’t a labor shortage, our project would have taken a week. But everyone working on it also works on keeping existing wells going. The rig used is also used to repair tubing leaks and down hole pump repairs. The company handling equipment removal and land restoration does all kinds of heavy equipment work, and not just for oil and gas.

We have zero complaints about the service companies. We know our job is back burner since it isn’t producing oil. Companies are scrambling to keep production going and re-activate wells still shut in due to April 20, 2020.

There used to be crews that did nothing but plug wells. Those don’t exist here at this time.

I will also say to date state regulators have been great. Easy to work with when you are doing something voluntarily. They now seem to understand there is a labor shortage. They are now short handed too, with regard to inspectors.

Production in our little field actually went up in 2021 compared to 2020 despite just two new wells being completed in a field of over 2,000 active wells. But 2021 was the third lowest production in the field ever, with discovery year 1905 being the lowest, followed by 2020.

SS – Thanks for the details. Is there a scenario where things improve? The most important variable should be price, but it’s gone up faster and higher than most expected and seems to have had quite minor impact in many key areas. Out of interest: 1) Does well P&A require a drilling rig or just work over equipment (or neither) and does it vary from well to well? 2) Are there any issues with NORMs (naturally occurring radioactive material – usually scale that absorbs radon) in the equipment? 3)Does the operator/owner have to provide some sort of bond, lien or other guarantee to ensure the P&A costs are coveed?

George.

1. Work over rig and pump.

2. We have very little NORM issues. Thankfully. All iron coming out of holes is tested, rare to find in our shallow sandstones. Deeper wells is a different story.

3. Operators post a bond. Amount is not adequate to P & A. I think this is pretty much the case in most states onshore lower 48.

Also, I made an error. Not a swedge welded on top of the hole but a steel plate. Swedge is on T/A wells above surface.

Also, our wells are so shallow and mostly have 4 1/2” producing string, so we just cement from top to bottom if there is adequate cement behind the casing. We plugged 1980’s era wells with good cement records, so that’s how that went.

My understanding is deeper wells and especially horizontal wells are much more involved.

Thanks – a couple of other things: who picks up the liability for P&A f the operator goes bust? I’d assume it’s a state responsibility but is there also federal support available? Where is the data on the wells’ design and condition at abandonment kept? Is that part of responsibilities of RRC or ND resource and minerals division (for example) or does EPA (or other) have a role? Who monitors the plugged wells and is this specifically funded (like the bonds for P&A) or is it just funded as part of general state or federal tax income?

George.

The P & A of bankrupt companies falls on the state.

Operators pay an annual well fee, per well, which funds plugging of wells by the state. So even though bonding is way too low, there is another mechanism by which the state raises funds to plug abandoned wells. This fee raises millions annually.

The state hires contractors to plug the wells. They are the same contractors private companies hire to plug wells.

Well inspectors monitor plugged wells. If a well starts leaking, there will form a wet spot on the surface. The state will hire a pit to be dug, and a tank truck to periodically drain the pit until the well is plugged.

Leaking wells are almost always 100 year old wells that were improperly plugged. A lot of those merely had fence posts shoved down them. Plugging rules weren’t established until the Great Depression. The leaks are caused by a combination of improper plugging or not being plugged, along with being in a water flood.

Another thing to explain. Much of our field has been drilled twice, or even three times. Many wells were plugged in the 1960’s and early 1970’s properly, but when this was done companies didn’t go back and drill out and re-plug wells that were P & A prior to the Great Depression. This is because wells were also not required to be permitted until the Great Depression. There is a record of almost all of the pre-permit wells, but there were some never recorded.

Then the Arab Embargo came. Most of these old leases were leased again, drilled again and put under water flood again. Over time, the re-injected water would find the old improperly plugged holes.

If a well beings to leak within an operators lease, even if the well is not on the operators bond, the operator is liable for plugging the well. We have plugged many of these types of old wells over the years. Our pumpers locate these or sometimes farmers will locate them. Usually a wet spot covering a small surface area measuring a few feet across is what is observed. When this happens, we are required to shut in all injection within 1/4 mile until we plug the well.

Because most of our field has been re-leased, most leaking wells are not plugged by the state, but by the operators. The state only plugs wells where there isn’t an active oil and gas lease and the operator is no longer in business.

We also own farmland where there were leases 100 years ago that were long ago abandoned. We have had old wells begin to leak. Even though we didn’t have to, we have plugged these ourselves at times. The state only plugs so many wells a year, and we didn’t want to wait. It’s not cheap, but we wanted to control the process. The state has let wells leak a long time (years) before getting around to plugging them.

The US Coast Guard can get involved in these matters if a leaking well threatens to go into a navigable water way. This jurisdiction is actually very broad, as a leak into any stream of any size leads to a navigable water way. The Coast Guard has gotten involved a couple times in our field in egregious situations. That was many years ago when there were some non-local operators. Almost all operators here are now local, and won’t just let things get that bad. The state EPA also is much more strict and doesn’t let things get that bad either. Last time I recall the Coast Guard getting involved was over 20 years ago.

Biden Administration has legislation to provide federal funds to states to plug abandoned wells. Will be interesting to see how these funds are administered.

Updated scenario for trying to match the World’s 800 kb/d annual increase in oil demand (40 year trend) with a smoother ramp up in completion rate, ERR=74 Gb, 180 thousand total horizontal wells completed after December 2009 in Permian basin. Rate of average annual increase in output from June 2022 to June 2029 is 692 kb/d for Permian basin in this scenario.

In the post I discussed two different high oil price scenarios, the first high price scenario in the post I will call high price scenario 1 and the sceond which was discussed I will call high price scenario 2. The comment above linked below

https://peakoilbarrel.com/permian-basin-update-february-24-2022/#comment-735644

uses high price scenario #1.

In the chart below both scenarios are shown for easy comparison.

I modified the 75 Gb TRR scenario presented in an earlier comment (2/26/22/ 8:04 AM EST) where the ERR was 74 Gb using high oil price scenario 1 by usig high oil price scenario 2 and adjusting the completion rate accordingly (so that all wells completed would have DCF > well cost for prices and costs assumed). The ERR is reduced to 50 Gb and total wells completed decreases to 118 thousand wells (2010 to 2032), the earlier scenario had 180 thousand wells completed from 2010 to 2040, bottom line is that future oil prices will have a significant impact (in this case a change of 24 Gb of tight oil output).

For the high oil price scenario 2 Permian scenario presented above (2/26/22, 8:56 AM EST) with an ERR of 50 Gb, we combine this with our standard US minus Permian scenario and find the US tight oil ERR is 79 Gb with an average annual rate of increase from June 2022 to June 2028 of 722 kb/d. Decline for this scenario after 2032 is steep as determined by the assumed steep decrease in oil prices. Note that this scenario may also be unrealistic and might be thought of as a lower bound to US tight oil output with the upper bound at the ERR=103 Gb based on high oil price scenario 1.

Comparison of 79 Gb and 103 Gb US tight oil scenarios, the average of the two is shown, but the future price after Jan 2032 will determine where the output path will be, if anyone would like to suggest alternative future oil prices, I could run the model with those.

These scenarios are based on the Permian scenarios with a maximum completion rate of 800 wells per month. The completion rate starts at 400 per month in Jan 2022 and increases by 5 wells per month each month until 800 wells per month is reached 80 months later (September 2028), this corresponds with an average annual increase in completion rate of 11% over that 80 month period.

Thank you for putting so much mental effort into this project Dennis. Truly impressive.

Of course no one knows what specific assumptions to make on all this, and the fact that you are the first to acknowledge these uncertainties is appreciated and is due respect.

Everything i see points to a high price scenario, driven by global demand on one hand and depletion on the other, being the big theme of the whole situation for this decade.

The countervailing forces against a high price scenario of Iranian exports, unpredictable recession/depression (lower demand), and the rate of implementation of electric transport being big wildcards .

And of course there is the unpredictability of international affairs.

https://www.reuters.com/business/energy/ukraine-crisis-will-disrupt-crude-coal-lng-flows-even-without-sanctions-russell-2022-02-25/

Thanks Hickory.

Yes a great deal of uncertainty, I agree with your assessment, nice concise summary. No doubt there are many unknown unknowns yet to be added to the list. The interesting thing to me is that there might under the right oil price scenario and adequate supply of tubing , rigs, labor, etc and lack of output increase from the rest of the World (say flattish output for World minus US crude plus condensate) be enough tight oil supply to keep oil prices from crazy levels ($150/bo or more in 2020$), at least through 2028, also demand may increase a slower rate than 800 kb/d per year as EVs gain market share and reduce demand, especially after 2025 or so. In any case these scenarios will no doubt be far from the mark, especially the best guesses, though I think Permian output will be in the wide range between my lowest and highest scenario, as a WAG maybe 4 in 5 odds Permian output will be in that wide range (40 to 115 Gb ERR and peak output between 6000 and 18000 kb/d, some time from 2027 to 2037).

Of course I could just say there will be a peak in the future at some ERR and output level, but this narrows it a touch.

“but this narrows it a touch”

good one.

One more scenario using a high oil price 3 scenario where high price 3 is the average of the high oil price 1 and high oil price 2 scenarios. This new price scenario is plugged into the Permian model and then combined with the rest of US tight oil, the resulting model has ERR=94 Gb, the new average in the chart is the average of all three scenarios.

Although sanctions are not directly targeting Russia’s oil, there will be major headwinds for their oil and gas industry as the political and financial situation deteriorates for them. They are already struggling to meet their quotas. Peak Russian production looks to be in the rear view mirror.

https://oilprice.com/Latest-Energy-News/World-News/Sanctions-Or-Not-Russian-Crude-Is-Getting-Hit.html

Dennis, while increasing lateral length is one component of increasing individual well productivity, have you also incorporated what appears to be a far meatier component? Found this top level bit of work buried in other EIA publications, check out the second chart which breaks out a lateral length increase component from better completion designs/efficiency. I bumped into this phenomena back in 2011 or so with the early Bakken development, so I’ve got no doubt it exists, but it looks to have continued after I stopped paying attention to it a decade ago. This EIA blurb seems to confirm the idea.

https://www.eia.gov/naturalgas/weekly/archivenew_ngwu/2022/01_27/

I would also venture that this particular work would indicate that using an average well profile would underestimate resources going forward, if newer development sits on the high side of the average consistently. Which appears to certainly be the case in the Marcellus.

Reservegrowthrulz,

Yes the estimate will be too low if well productivity per lateral foot continues to increase, but data suggests this is not the case in the Permian basin, since 2018 when normalized for lateral length, average well productivity has been either flat or decreasing.

So this might be happening in the Marcellus, but not in any of the tight oil plays since 2018.

Well now you’ve got me curious, and I’ll have to run off and check. I seem to recall calculating out improvements in the Bakken formation post 2017, but I can’t recall if I normalized for LL or completion type, or some of the obvious knock on effects of aging acreage involving solution gas drive reservoirs.

Also, do you do gross level estimates without formation and formation bench level differentiation? The EIA DPR drives me bananas because they just add everything up and make blanket statements, and then the press picks it up and broadcasts it and every oil ignorant “analyst” and bloggers trumpet it through their platforms and suddenly most of the world is dumber because of it.

Reservegrowthrulz,

Yes the analysis is by basin (Permian, Eagle Ford, Bakken, Niobrara, and the rest of US tight oil), the focus here being on the Permian. Teasing out the formation and bench data takes a lot of work with the data I have to work with, which is basically what I find at the blog at http://www.shaleprofile.com and USGS and EIA data.

Basically I take the basinwide wellprofile as from the page linked below, I have to pick each data point off the chart manually, a data download is thousands of dollars per year, too rich for me.

https://public.tableau.com/shared/K3GKQ4CRY?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

Dennis, Have you looked at this chart digitizer app? I have used this on occasion over the years and it works very well. It is being maintained so it’s llikely getting even better.

https://automeris.io/WebPlotDigitizer/

Thanks Paul,

It does not work well at shaleprofile.com, it may have been designed to make collecting the data difficult as the website makes money by subscriptions to download the data.

A cool tool though.

My operative example of the value of tearing down to the appropriate component part comes from a decade ago when doing lifecycle analysis of layer caked discrete accumulations, specifically in the Permian. The research was designed to establish the cause of anomalous field level declines, to underpin some reserve growth models,

Basin-wide means you can’t even figure out the magnitude or frequency of the signal noise, and in the Permian, that is a biggy.

Reservegrowthrules,

I do not doubt the analysis would be better, without access to data, I cannot proceed.

This top-down analysis of future tight oil estimates using USGS technically recoverable resource, NOT RESERVE, estimates as a crutch, is actually quite lazy, and purposefully misleading to the American public. I would personally be very concerned about how misleading, save the fact that I don’t believe a lot of people read this shit anymore, thankfully.

Well productivity in the Permian Basin is now declining at an alarming rate (if you don’t have ALL the data, what sort of analysis is that?); WOR, GOR and costs are all going up in 2022. The economics used to determine profitability are mostly wrong, the intent is to make the reader believe higher prices fixes everything. “Type” curves after 14 years of data should be ignored by even the most casual observer; the use of DCA and “ARP” DCA methods are irrelevant without knowing how “best fit” use was determined. To the casual reader that all sounds very impressive; don’t be fooled. Many large independents in the Permian Basin in 2021 drilled the worse wells they have EVER drilled.

Most of the Permian Basin has already been developed on 330 foot spacing, even less; an indication of how sweet the cores are and how bad wells are outside these core areas; anybody can research that simply by looking at New Mexico and Texas Field Rules, what is allowed and what’s not, including what has already occurred.

No Permian operator wants to move out into the vast unknown, if they did they already would have started at $65/$4. Instead they keep drilling infill shit on 330’s with 40 acre tolerances. Google that. Google field rules for Phantom (Wolfcamp) or SandBone (Bone Springs) or Sprayberry Trend Fields, for instance. Do the damn work, if you must, don’t put any credence in this analysis. Pressure depletion is real; children make 30 % less than mother and father. We have already seen the best the Permian Basin has to give up.

The USGS TRR stuff is totally irrelevant. Our nation is at a precarious time at the moment, near war perhaps; conservation and awareness of limited tight oil resources in our country is the order of the day. Flaring, crude oil and LNG exports need to stop, NOW! As does the sort of analysis that suggests tight oil abundance for the next decade. It is a grave disservice to Americans and should be ignored.

https://www.oilystuffblog.com/forumstuff/forum-stuff/midland-basin-usgs-assessment as a

Hi Mike S . Thanks for making the omelette . Nobody made one without cracking some eggs . 🙂

Note that I use 1320 foot spacing based on input from LTO survivor and assume wells are shut in at 20 bopd based on input from someone who knows far more than me.

My understanding is that the spacing rules of say 330 feet are a minimum, is that correct? I do not believe an operator has to space their wells that tight if they do not believe it is profitable to do so. I think LTO survovor told me that 330 foot spacing is a disaster and that if he were to have continued in the tight oil business he would have chosen to use 1320 foot spacing, that is the basis for my spacing choice.