A guest post by Bob Meltz

I’ll start with a brief overview of some northern offshore GOM production statistics, and then review what I see as the current state of Wilcox exploration and development projects and finish by discussing Wilcox production data. All production statistics are from BSEE/BOEM.

Cumulative production from the federal waters of the offshore Northern Gulf of Mexico (OCS) through 2020 is 22.7 BB (billion barrels) oil and 190 tcf gas. First production was in 1947. Production from deepwater (defined by BOEM as water depths > 1000’) is 9.6 BB oil, and 22.9 tcf gas. The first deepwater production was in 1979 from Shell’s Cognac platform in 1025’ of water.

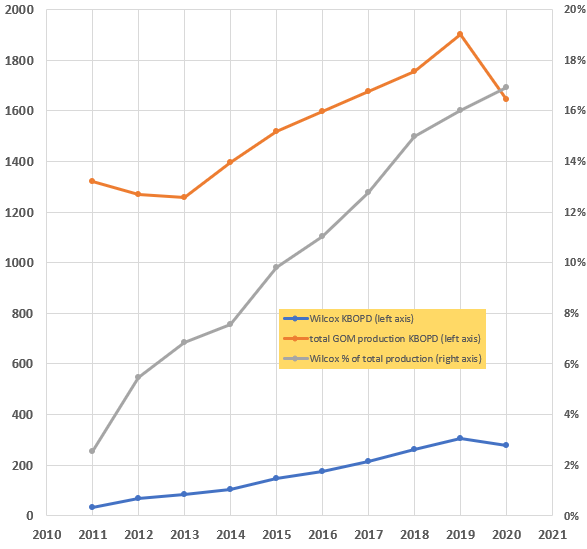

The current annual peak in offshore oil production was in 2019. Average production was 1.9 mmbopd. 2020 production averaged about 1.64 mmbopd. So far in 2021 through October average oil production has been about 1.67. With the near term queue of Miocene projects set to come online in 2022 (Mad Dog 2, King’s Quay and Vito), and the queue of Wilcox projects set to come online in 2024-2025 (Anchor, Whale and perhaps North Platte), I believe we will see another peak in production in 2 to 6 years, and this could even exceed the 2019 peak.

The Wilcox, sometimes also called the Lower Tertiary, was thought by many to be the future hope for the offshore Gulf of Mexico, providing long-term production for years. As the shelf and flex trends played out, and as the deepwater Miocene fields started playing out, the Wilcox was going to pick up the slack and keep offshore production going.

I co-authored a paper with several Chevron colleagues in 2005 that led to some of this initial enthusiasm. Here is a link to that paper.

View PDF (searchanddiscovery.com)

The article indicates potential from the play of 3 to 15 billion barrels of recoverable oil. The high-end estimate of 15 billion barrels of recoverable oil generated a lot of industry buzz at the time, but I’m glad we also included the low estimate of 3 billion barrels. As you will see later, I currently believe the ultimate recovery from the Wilcox will be closer to that low estimate.

The oil industry has faced many challenges in pursuing the Wilcox. Some include the technical challenges of drilling and completing these wells. In many cases, they are drilled through thick salt canopies onto total depths exceeding 30,000’. They are some of the deepest wells in the world, and often the top of the reservoirs are encountered below 25,000’. The deepest well in the GOM was a Wilcox test drilled by Chevron in 2013 to 35,935’ TVD_SS. Usually the Wilcox reservoirs are quite thick, often over 1000’ of gross reservoir thickness and over 500’ of net oil pay. Successfully drilling and completing these wells is not for the faint of heart.

So, after 20 or so years of exploration and 11 years of production, how has the Wilcox been performing?

First I’ll discuss the exploration story of the Wilcox.

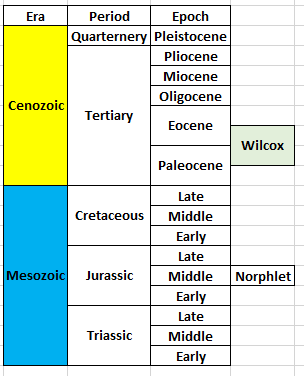

Below is a simplified stratigraphic column showing the primary producing intervals of the offshore Gulf of Mexico.

Figure 1 – Simplified stratigraphic column for the offshore Gulf of Mexico

Historically, the Wilcox has been a prolific gas producing interval onshore Texas and Louisiana. It wasn’t thought to be prospective in the deepwater Gulf of Mexico until the BAHA #2 well was drilled in 2001 in the outboard-of-salt portion of the Perdido Fold Belt. This well, classified as a dry hole, demonstrated both a working petroleum system (it did encounter 15’ of oil pay) and, surprisingly, thick Wilcox sands. This was followed in Perdido Fold Belt by the Trident discovery in 2001, and the Great White discovery in 2002.

Meanwhile, the initial test of the Wilcox section in the deepwater Central GOM was made by BHP at Cascade (2002). Interestingly, this well was not initially intended as a Wilcox test, but when the shallower Miocene section came in wet and very poorly developed, they deepened the well to test the Wilcox. The significance of this well is that it demonstrated both a working petroleum system in this portion of the GOM (the well was an oil discovery), and the existence of Wilcox sands over 200 miles east of those being found in the Perdido wells. That started to open up the potential for the Wilcox over the entire deepwater GOM. Subsequent discoveries included Chevron’s Jack and St. Malo.

A very good recent assessment of Wilcox exploration results can be found on pages 82-86 in the following BOEM document.

Deepwater-Gulf-of-Mexico-Report-2019.pdf (boem.gov)

BOEM sites 21 discoveries out of 72 exploration tests, for a commercial success rate of 29%. 24 of the wells found non-commercial oil. (If the lease in which the well is drilled is still held by the operator, it is considered a commercial success. If the lease has been dropped, it is considered a non-commercial success. Of course, in both cases, at least some oil has to be encountered.)

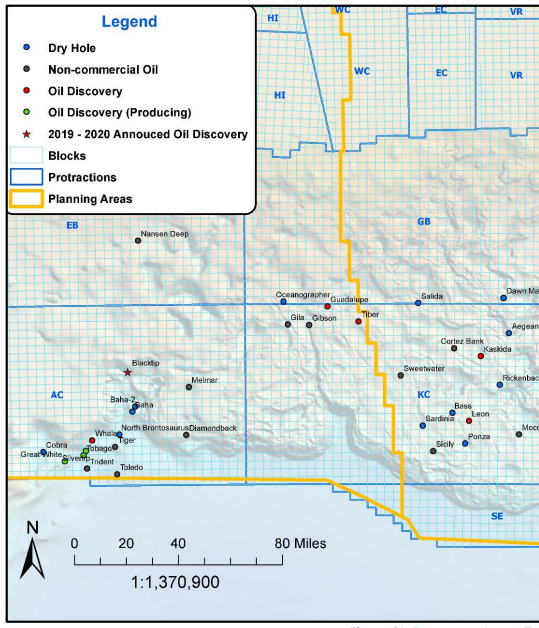

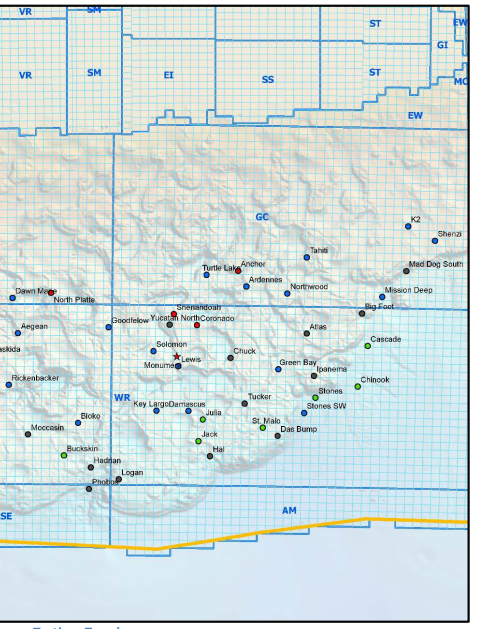

The maps below from this document show the distribution of Wilcox exploration wells in the deepwater GOM. Producing assets are highlighted in green, and discoveries in red. (At least 3 discoveries are not included on the map or their statistics: 2 in the Perdido Fold Belt area to the west of Figure 2 to be briefly discussed later – Leopard, a few blocks south of the word Brontosaurus and Blacktip North, just north of Blacktip; and Constellation, a producing asset in Fig. 3. -a bit north of Turtle Lake.)

Figure 2 – West half of Figure 61 on page 86 of BOEM document referenced above, showing the distribution of Wilcox exploration wells in the deepwater Gulf of Mexico. Lease blocks are 3×3 miles. The underlaying map is a rendering of bathymetry.

Figure 3 – East half of Figure 61 on page 86 of BOEM document referenced above, showing the distribution of Wilcox exploration wells in the deepwater Gulf of Mexico.

One of the biggest challenges presented by the Wilcox is how to handle a discovery. After drilling an exploration well where you have encountered oil, it isn’t always apparent that you’ve drilled a commercial discovery. Most of these Wilcox wells are subsalt where seismic data can be difficult to interpret, and your ability to determine how extensive an oil accumulation is can be quite challenging. As a result, no final Wilcox development decisions are made based on the results of the first exploration well (unless you decide to walk away from the project). Appraisal is a very big deal, and sometimes appraisal well results are disappointing, and the operator decides to not pursue development, and drop the leases. This results in a non-commercial oil well.

If the appraisal results are successful, and this could include multiple appraisal wells, the operator will often have enough confidence that they will be able to produce economic volumes of oil and will sanction the project, sometimes called FID or Final Investment Decision. The development may involve the fabrication of a new facility, a commitment to drill additional development wells and installation of all of the subsea facilities to bring the oil and gas to market (it’s different if you decide on an FPSO where the oil is stored on the facility, and then offloaded to a tanker). Project costs can vary from as little as a few hundreds of millions of dollars (for a small well tieback to an existing facility) to multiple billion dollar projects.

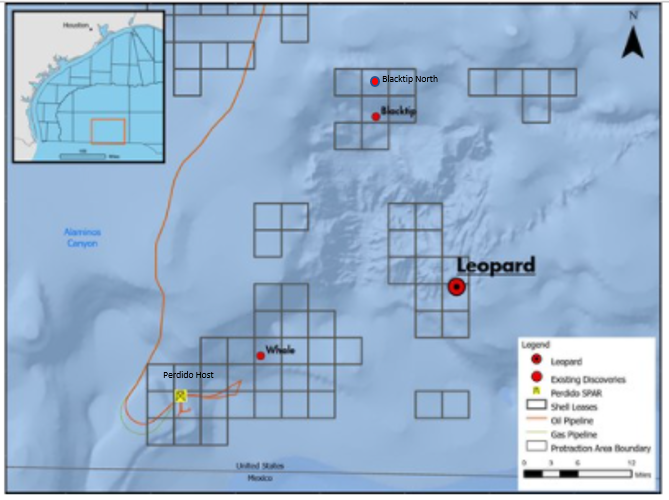

Recently, the Perdido Fold Belt area (located on the west half of Figure 2) has been a focus of exploration. A number of significant discoveries have been made by Shell and partners in the subsalt to mostly subsalt portion of the Perdido Fold belt in the Alaminos Canyon protraction area. These include Whale (2018), Black Tip (2019), Leopard (2021) and Black Tip North (2021).

The lease map below, Figure 4, courtesy of Shell with a few of my edits, shows the locations of these recent discoveries. It also shows the location of the Perdido host production facility. Note the proximity to the U.S. / Mexico international boundary. At one time there were rumblings that the Mexican government was convinced Shell would be draining oil reserves that extended into Mexican waters. This is definitely not the case. These are bright spot associated reservoirs that are very well imaged on seismic, and the bright spots clearly stay in US waters, and abundant well control confirms this.

Below is a link to a 2007 article about this.

As Deepwater Drilling Booms, Mexico’s Oil Could Leak to U.S. | Rigzone

The Perdido fold belt extends south into Mexican waters. The trend has been moderately explored in Mexican waters with BHP’s Trion discovery being the most significant and one that is very likely to be developed. The Trion discovery was made in 2012 and first oil is expected in 2026 and non-op partner Pemex’s estimate of the gross estimated recoverable resource is 485 mmboe.

Figure 4 – Lease map of the Perdido Fold Belt area showing key Shell leases and recent discoveries. Map is courtesy of Shell with a few edits. The underlaying map is a rendering of bathymetry.

Next, the production side: The first Wilcox production occurred in 2010 when Shell brought the Perdido project online, (see location of Perdido Host in Fig 4). At the time it came online, it was producing from the deepest water in the world, with the Perdido host facility in 7835’ of water. The main producing reservoirs at Great White are at about 17,000‘, about 9000‘ below the mud line. The Great White Wilcox is unusual in that it has quite favorable rock properties because it is fairly shallow – porosities in the low 20% range, and permeabilities in the 100 mD range or so. This differentiates it from the other producing fields where the Wilcox is deeper, porosities are in the 10-20% range, and permeabilities in the 10s of mDs. It is also outboard of salt and, consequently, doesn’t suffer from the seismic data quality issues seen in the subsalt areas.

Soon after, in 2012, Petrobras brought on Cascade and Chinook in Walker Ridge. They are located in the eastern portion of Figure 3 above. These fields are producing to a centrally located FPSO, the first of its kind in the GOM.

There are currently 9 fields producing from the Wilcox. The chart below shows annual production from these fields through 2020 compared to total GOM oil production. To date, peak Wilcox production was 304 kbopd in 2019. This was 16% of total GOM production in 2019. Total GOM production was down slightly in 2020 because of Covid, while the Wilcox contribution increased to 17%.

Figure 5 – Annual Gulf of Mexico oil production with Wilcox breakout

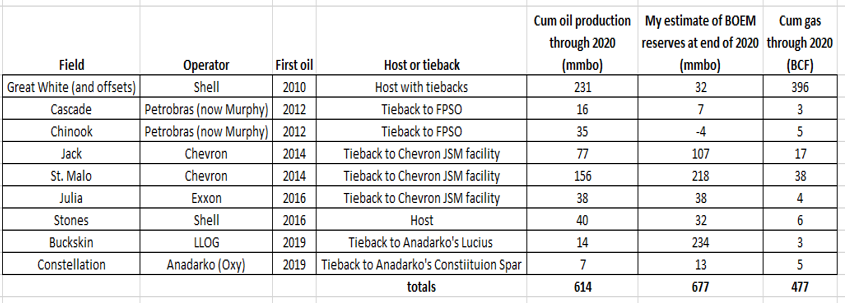

Cumulative Wilcox production through 2020 is 614 mmbo, with the per field breakout in table 1. BOEM’s latest reserve updates are through 2019, so I just subtracted each field’s 2020 production from BOEM’s 2019 reserves to get an estimate of remaining reserves at the end of 2020.

(I’ve included a column showing cumulative gas production for these fields through 2020. With the exception of Great White, these are all low GOR oils.)

Table 1 – Key information on the current Gulf of Mexico deepwater fields producing from the Wilcox.

Chinook stands out as having negative reserves at the end of 2020, meaning Murphy (the current operator) produced more oil in 2020 than BOEM’s reserves were at the end of 2019, and it has produced more than 2 mmbo through 9 months in 2021. So you can at least change that -4 to a +2.

Then it starts getting to be a question of what the most likely total recovery will be from these fields, or, how much additional recovery will these fields achieve beyond the sum of current cumulative production and my estimate of BOEM’s reserves at the end of 2020. I’m going to go with an estimate of 1.6 +/- .3 BBO as the EUR range for these fields. That captures the current cum plus reserves of 1.3 BBO (614 + 677 = 1.291 =~ 1.3 BBO) on the downside and allows for a fair bit of upside. 2 things that I can see leading to that upside are further developments at Great White and Buckskin and there certainly could be others.

Buckskin is an interesting case study. Chevron and partners drilled the discovery in 2008 and followed it up with some appraisal drilling. After not seeing a clear path to an economic development, LLOG acquired Chevron’s interest, drilled and completed 2 development wells, and brought the project online as a tieback to Anadarko’s nearby Lucius platform in 2019. Buckskin is in the southwest portion of Figure 3.

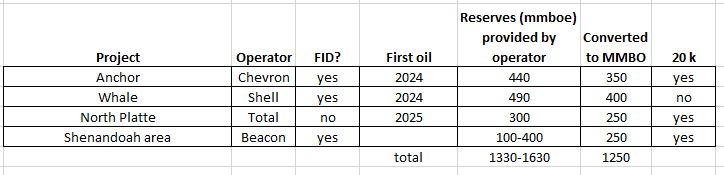

The queue of near-term future developments is quite attractive. They are shown below in Table 2. These are all projects that have either FIDed, or where the operator has shown a very strong commitment to FID. Note that 3 of them will be 20 k projects – meaning the drilling and production equipment needs to be able to handle the ultra-high pressures (up to 20,000 psi) associated with these Wilcox reservoirs.

Table 2 – Gulf of Mexico Deepwater Wilcox projects that have been FIDed, or are very likely to FID within the next year or so.

The Shenandoah development has a somewhat similar history to Buckskin. Anadarko and others drilled numerous wells at Shenandoah and nearby prospects, with the first discovery drilled in 2009, but were never able to come up with an path to an economic development. The project languished, but Beacon has come in and is planning a phased development approach. Shenandoah and offsets, Yucatan, Coronado, and Monument, are in the central part of Figure 3.

There also are a number of projects that are likely to be developed but have not been FIDed and are, therefore, a little further out in the future. They include 3 of the recent Shell discoveries in the Perdido Fold Belt area – Blacktip and Blacktip North and Leopard. Another project is a potential co-development of Leon and Moccasin (Leon is in the southeast portion of Figure 3 and Moccasin is to its east. The Moccasin label is cut off by the edge of the map.)

It’s harder to put a reserve range on these because of a lack of information from operators, but, when that’s the case, I find that the best practice is to make the range wide. So,, I’m going to put the range from .7 +/- .4 BBO.

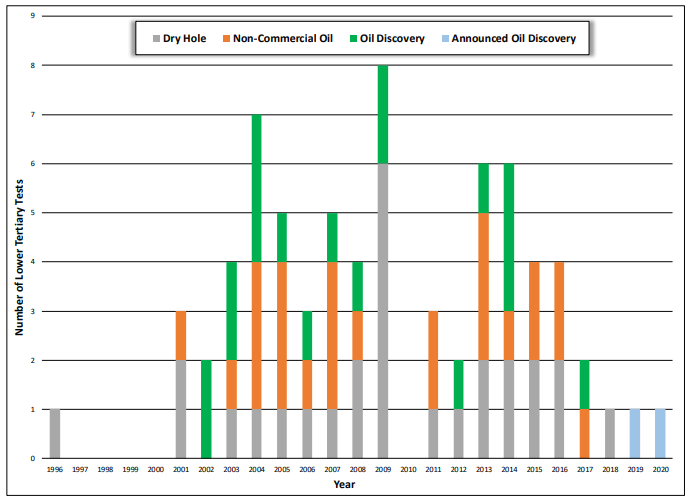

What about undiscovered prospects? It’s my view that exploration for the Wilcox is fairly mature in the GOM, so I put this range at .5 BBO +/- .5 BBO. (A high side estimate of only 1 BBO may be too conservative?) The chart below, Figure 6, from the BOEM report referenced earlier, shows how the number Wilcox exploration wells has been steadily decreasing over the last 8 years or so. This, to me, speaks to the overall maturity of the basin. Some, though, may disagree and say this is related to low oil prices.

Figure 6 – Number of deepwater Wilcox (Lower Tertiary) exploration wells since 1996. From BOEM document referenced above. No wells were drilled in 2010 because of the BP oil spill.

One source of prospects could be for operators to revisit some of the remaining discoveries that have been made but don’t appear to be on a path to development. A good example here is the Guadalupe-Tiber area in the middle of Figure 2. I could see this area getting revisited in a similar way that Beacon is moving ahead in the Shenandoah area.

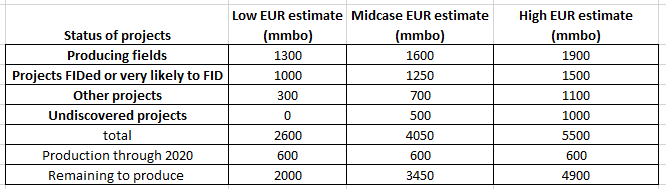

Table 3 below is my EUR ranges for all of these projects, broken out by status, in mmbo.

Table 3 – EUR ranges for Wilcox projects of varying status in the GOM.

So, after 20 years of exploration, and 11 years of production, my EUR range for the Wilcox is between 2.6 and 5.5 BBO, with a most likely EUR of about 4 BBO, pretty close to our low-end estimate of 3 BBO from 2005.

You might ask how did we ever get to that upside estimate of 15 billion barrels of recoverable oil? At that time, only 13 exploration wells had been drilled, and 9 were classified as discoveries, and about 12 BBO of original oil in place had been discovered. That results in a discovery rate of 9/13 = 69%. If you assume a similar success rate for future Wilcox wells, and assume a total of 65 prospects, that results in 45 discoveries. If you also assume a similar OOIP per future discovery as existing discoveries, the total OOIP goes to 60 BBO. (I’m just multiplying things by 5.) Then, if you assume 25% recovery, you get 15 BBO. The biggest “miss” here is the recovery factor. Because of the low perm nature of most of the Wilcox reservoirs, 25% recovery is very unlikely. 10-15% recoveries are probably closer to what operators are going to achieve. Great White is an exception to this because the main reservoir is shallower than others and has better rock properties. In fact, a fairly successful water flood is being done in this reservoir and the expected recovery factor could be 40-50% of OOIP.

Another “miss” is around the number of discoveries that have ended up being non-commercial, and unlikely to get developed.

Interestingly and in conclusion, using the BOEM data mentioned earlier plus the 3 additional discoveries that I mentioned, you get 75 total exploration wells, 24 discoveries, and 24 wells with non-commercial oil. 48 out of 75 wells found oil, resulting in a discovery rate of 64%, not too far from the early discovery rate of 69%. The commercial discovery rate, though, is 24/75 = 32%. As mentioned earlier, it is these wells that end up being non-commercial discoveries that can become real appraisal challenges. (Actually, even some of the commercial discoveries end up being appraisal challenges,, but I will leave it there.)

This is a great post. Thanks!

If you can guess, how much has the uncertainty over future oil prices and future supply/demand affected production rates in GOM?

Given the tremendous upfront costs, long lead times and public sentiment against offshore production, my naive view is that GOM will not hit its full production potential.

But I will readily admit my views are based on my sense of Federal government and public sentiment, and not what the companies may actually be looking to do regarding future development.

Again, thanks very much for this post!

Shallow Sand,

Investment decisions for GOM projects are made with long term oil and gas prices projections baked in, and once a project is FIDed and the facility starts getting fabricated, the project is going ahead. (Operators have more flexibility with tie-backs, but, even with tiebacks, I’m not aware of any cases where an operator has FIDed a tieback, and then not done it if oil prices dropped). With that in mind, in response to your question, the main way uncertainty over future oil prices impacts production rates is by operators curtailing, or slowing down, development drilling for existing projects. For example, when oil prices dropped in early 2020, alot of development drilling was deferred. Since prices have rebounded, alot of these wells are being drilled, or, have already been drilled.

I do believe all, or at least most, of the projects I mentioned in the post will ultimately get developed. I think, for example, all of the Perido area discoveries will at least get appraised to the point where Shell can make an informed “FID or not decision”

Bob Meltz–

Thanks, I learn something new everyday.

Bob Meltz,

Based on this post is it possible to update your scenarios for GOM C plus C output from 2020 to 2035?

Dennis,

That is a good idea. Give me a while to put something together for that. It may be a shorter than normal post,,

I would like to wait until final 2021 production data is in ( he says,, deftly pushing the commitment out to some nebulous future date, in the hopes that when that nebulous future date arrives, all will be forgotten.)

Bob Meltz,

Whenever you have a chance, or not. It seems you think a peak in 2025 for GOM around 1.9 Mb/d, I assume followed by decline, but how fast, your guess would be far better than anything I could produce.

Bob Meltz,

For the original estimate in the 2005 paper a range of 3 to 15 Gb for UTRR was given, I will assume the F50 was roughly 9 Gb. Now your best guess is around 4 Gb a little less than 50% of the 2005 estimate. Is this primarily because now you believe the recovery factor will be about 12.5% vs a best guess estimate in 2005 of about 25%?

I think this is what you said in the post, but I likely have it wrong. Thanks for any corrections (it is no doubt far more complex than I have said.)

There at least 2 contributing factors:

Lower recovery factor and fewer projects getting developed.

I suspect a third factor could be less oil in place per discovery, but I’m less sure of that.

Thinking about this a bit more – I suspect back in 2005 we weren’t considering the number of tiebacks that would end up being part of the overall production. I suspect we were thinking at least 100 mmbo recoverable oil per project, and tiebacks, even for the Wilcox, can be economic with smaller recoverable volumes.

Also, we weren’t considering FPSOs because they had never been used in the Gulf. I’m not sure about the economics of FPSOs vrs. conventional producing platforms, but I suspect they are more favorable, especially if you have a smaller or riskier project. As I said, Cascade and Chinook both produce to an FPSO, and Shell’s Stones also produces to an FPSO.

And, while I don’t know the specifics, I suspect some of these projects have not been that economic for the operator.

Bob Meltz,

Would those factors tend to make the estimate larger rather than smaller? In other words it would seem lower recovery factor and a lower percentage of discoveries being economically viable would have tended to reduce the URR while the factors mentioned above would tend to make the URR larger ceteris paribus. Of course my knowledge of these matters is ffar exceeded by yours, so I may have this backwards.

Thanks.

Dennis,

Your’s is a very perceptive comment, and I thought that’s how my comment could be interpreted,, basically that not only are the larger Wilcox projects able to be economically produced, but the smaller ones can also be economically produced (because of tiebacks and FPSOs), and this would result in more EUR. That is not my point.

My point is that there haven’t been the number of large Wilcox discoveries made that we thought would be made back in 2005. Overall, the discoveries that have been made have less oil in place. Now, because of tiebacks and (perhaps) FPSOs, these smaller oil in place projects can be economically developed.

By the way, ceteris paribus means “with other conditions remaining the same”, but I’m sure most of you all know that. I had to look that one up.

Bob,

Got it thx.

Maybe this has offset the lack of large discoveries to some extent.

Mr Metz , your comment of 11/1/2021 at 5.33 Pm . For me you and Mr Kaplan are the Placido Domingo and Luciano Pavarotti as far as GOM matters are concerned . However I must disagree . The current prices , markets do not support your assessment . Respects .

Bob,

This is really a great report and very informative. Having been only onshore, I have always been amazed and impressed with the GOM technology and producers. Thank you for such detailed information.

Fascinating to hear about all these particulars and challenges- thank you sir.

It sounds like new money to go after additional prospect drilling or facility development would have to be willing to accept the considerable risk of complete loss of investment.

I guess that has always been in the cards, but the risk is now much higher after all the prior exploration and appraisal work that folks like you have completed over the past decades.

Hickory,

Yes, that risk has always been part of the game. And with the cost of Wilcox wells, you can spend hundreds of millions of dollars on exploration and appraisal wells and then decide to not FID the project. Ouch!

On the other hand, it is these very projects that become Buckskin and Shenandoah, where a third party comes in on an appraised project, and moves ahead with development.

Bob.

As I know so little about offshore production, maybe you could answer a few questions for me.

1. What are the bonding requirements offshore. I have read that leaking wells are a problem. Is GOM like onshore, where operators go BK and plugging gets thrown onto the taxpayers. Any comments you have on decommissioning would be appreciated.

2. Are there any restrictions on creating overriding royalty, or other types of interests in GOM wells?

3. I assume at some point artificial lift is used. What types of artificial lift are used.

4. Where does the produced water go?

5. How are the offshore rigs powered? Is this a big challenge, and does lack of reliable power supply ever end production prematurely. I assume everything is powered by produced gas?

6. Is production all transported by pipeline? Are there storage vessels? Maybe explain the gathering a little bit?

7. I assume this varies, but what is a standard hole size and casing size for GOM wells?

8. Once a well is producing, are there still workers at the well 24/7/365, weather excepted?

9. What kinds of actions are taken to prepare for hurricanes?

Sorry for all the questions, and don’t feel obligated to answer. And if there’s a place you could refer me to where I could read articles about this, that’s fine.

Just don’t get a chance to converse with someone with your knowledge. Posters need to realize they are lucky to have resources like you and others.

Shallow sand,

Agreed, we are all lucky to have people share their knowledge of the oil industry here.

Thank you Mr Meltz, Shallow sand, Mr Shellman, LTO survivor, and Mr. Kaplan.

I can try some of these, though Bob might know better, so trust his answers more than mine:

1 – don’t know

2 – don’t know

3 gas lift, either injection at a subsea wellhead or further downhole, and electric submersible pumps.

4 overboard after treatment, I can’t remember exactly but I think it has to average 10ppm average OIW with maximum of 40ppm

5 the large platforms have gas fired turbines using fuel gas from treated produced gas (most associated) with diesel emergency gensets, I think the smaller platforms just use small diesel sets.

6 most is by pipeline for gas and oil, there are two FPSO’s which presumably use shuttle tankers, I don’t know if other platforms have storage, the are a few large gravity based platforms but I don’t know the exact designs

7 from memory they go up to 7″ for the largest deep water wells such as on thunder horse (and the deep water horizon well) but may have only been 6″.

8 subsea wells are just left to get on with things, but there may be facilities for chemical and methanol injection and they have instrumentation up to the eyeballs for monitoring and control from the central control room – a rig or intervention vessel is needed for workovers; some rigs have platform rigs but they are usually drilling new wells so while its easier to do workovers on dry trees it is not something done lightly.

9 platforms are shut down with subsurface safety valves shut on each well and pipelines isolated (i.e. a major shutdown), if they are in for a direct hit they are partially (key workers only) or fully abandoned (completely black); fpsos may be moved off station; moveable offshore drilling units are moved out of the way.

George Kaplan. Thanks for the reply!

Thanks George,

Let me add a few comments to some of Shallow’s specific questions.

1. Regarding bonding requirements – there are bonding requirements. They essentially, have to do with ensuring that operators having the financial ability to properly abandon/decommission their assets. Regarding leaking wells, etc, and who pays the final abandonment costs if an operator goes bankrupt – it does ultimately go back to the taxpayers as a last resort.

In cases I’m familiar with, though, where a big company, Exxon, Shell or Chevron, sells a field (usually a shallow water field) to a small operator, and the small operator goes bankrupt, the abandonments liability, and costs, usually go back to the original operator. These are called boomerang fields. Regarding platform abandonment itself, BSEE manages a pretty successful “Rigs-to-Reefs” program where abandoned platforms are moved to certain parts of the Gulf that have been set aside, and then dropped to the seafloor as reefs. These have become quite successful fishing locations, etc.

2. Regarding royalties – since the FEDs are the landowners of everything, royalties get paid to them. I think 1/6 royalties for shallow waters, and 1/8 royalties for deep waters,, I think.

7. a few additional comments here – the shallow casing sizes in some of these wells can be quite large – up to 30″ or even 36″

After the BP oil spill in 2010, there were 2 deepwater well containment companies formed. One is called MWCC or the Marine Well Containment Company and the other is called HWCG.

Bob

Nice report. Answers to the questions helped. What is different about the Pleistocene, Pliocene, Miocene, Oligocene layer that there was no oil.

With regard to the BP spill. Is there any assessment of the lingering damage to the fishery and tourism. Is there a consensus or is there a range of views on the state of the gulf today after the spill?

Ovi,

The Pleistocene, Pliocene and Miocene all produce both oil and gas.

All of the shelf production comes from reservoirs of these ages.

(There are a few outliers such as Norphlet gas in the Mobile Bay area offshore Alabama, and Cretaceous James Lime gas production primarily in the Viosca Knoll area)

The initial deepwater production, starting back with Shell’s Cognac in 1979, produces from reservoirs of these ages

The initial subsalt discoveries were all Miocene.

The Oligocene only produces from some of the shallow reservoirs in the Great White area, but I lump that production in with the Wilcox.

Don’t really have any insights as far as whether there are still lingering issues from the BP oil spill,, I suspect there are, but I don’t have any specifics on that.

Hi Bob,

Not to question your expertise, but wouldn’t the climate have been too cold in the Pleistocene, Pliocene and Miocene to produce oil or gas. My thought was you need a hot house earth climate to produce oil and gas as you need ocean dead zones for the accumulation of dead phytoplankton.

The oxygen minimum is off the shelf edge from 200 metres down. Between 200 metres and 1000 metres. Don’t need no hot house climate for carbon accumulation. I have found ice crystal impressions in Permian coal seams.

Iron Mike,

Just to clarify – the reservoirs are Pleistocene, Pliocene and Miocene. The source rocks in the Gulf are older, mostly Jurassic with some Cretaceous and Paleocene. The source rocks have been rarely penetrated in the offshore Gulf, but there are at least 2 notable exceptions where older rocks have been rafted over younger rocks. The source rocks have been penetrated in alot of onshore wells.

There are numerous shallow biogenic gas accumulations on the shelf. In those cases, the source rocks are the adjacent Pleistocene shales. These shallow source rocks were never buried deeply enough for thermogenic processes to occur.

Thank you for the clarification. Very much appreciated.

I misremembered a bit there – the 6/7″ was for flexible risers on individual wells, I don’t know if there is tubing made in those sizes, which would probably have been 5″. Additional info on the wells: chokes are set from petroleum engineer nominations (probably daily), wells are tested for oil/gas/water flow monthly (usually in dedicated test separator) and subsurface safety valves are regularly function tested (I think also monthly but may be longer).

I’m running through charts tonight. Chart that catches my eye the most is the US 10 year government bonds.

There is a potential breakout in yields to the up side. It’s really all about positioning. Long term I think long term yields go to zero and the catalyst is interest rate hikes.

But in short term we could see a breakout move higher to 2% and that move could happen this week. It would be a really volatile move. Likely risk off and stocks down big for at least the duration of the move.

Good chance oil has a pullback that would coincide with this move in yields.

Keep in mind that most other sovereign bonds track the US bonds and will be carried higher with it. We are talking a global tightening of monetary conditions that happens without anybody actually having raised rates.

I think yields continue to fall in China though as they have to make moves to avoid a deep contraction. But with the complete opposite monetary policy between China and US money is likely to start flowing out of China. You’ll know this is happening by watching the dollar appreciating against the yuan.

Which ultimately leads to a really big global contraction as there are just less US dollars following through global economy. Which ultimately leads to lower oil prices.

10 year BUND is already above break out level. They should get positive soon.

Yeah nominal 10 year yields in Germany haven’t been positive since about April 2019. So it’s been three years since Germany has seen positive interest rates.

There has been a whole lot of borrowing and pricing based off negative interest rates over those three years. Things are going to get interesting.

The ECB is still buying them – other only when looking into an legal .38 ( Insurances & co ). And lot’s of companies use the cheap credit for buybacks or to survive with an outdated business model.

And house prices have soared the last 3 years – a one family home goes for a million in my small suburban town now, thanks to 0.5% credits. But no way to pay back such much money with the german tax system – We have higher income tax, higher VAT and much higher energy tax than you – Electricity is now over 40 (Euro) cents.

But I think the 10 year US bonds have now crossed the chart line, too.

Stocks are down, but oil seems mostly untouched so far.

Things are going to get interresting ;).

Why do you think long term yields are heading towards zero?

( I agree with you actually although I know zip about technical analysis)

Thanks

WP

The debt load is only going higher by leaps and bounds. Interest rate hikes will be a deflationary catalyst. If they do the 4 hikes by years end that they say they are likely to do.

Yields at the long end of bond market will crash towards zero. Yield curve will likely invert with the 10 year bond at or below 1% and FED will be cutting rates or entire house of cards comes tumbling down.

Honestly we’ve had one policy error after another during the last two years fighting COVID.

And if inflation doesn’t respond to the end of QE and the 3-4 rate hikes that are coming. Then lookout.

Powell has no choice but to continue coming out like he will tomorrow and be Uber hawkish.

2022 Is When Oil Supply Panic Replaces Fears About Demand

Unless the need for oil slows dramatically, the prospect of inadequate supply and triple-digit prices is real.

https://www.bloomberg.com/opinion/articles/2022-01-09/2022-is-when-oil-supply-and-prices-panic-replaces-fears-about-demand

It’s now official. The Russian Minister of Energy just released Russian C+C production for December. They declined 3,000 barrels per day in December. Not much but according to OPEC+ they should have increased production.

Russian Energy Statistics in tons per month. In order to get barrels per day, divide by 31 then multiply by 7.33.

So if this is the new plateau they lost around 250k barrels per day.

Oh, I don’t think you can call two months a plateau, but I think it does mean they are at or very near their area of maximum production. Notice their big jump in September, less of an increase in October, still less in November, then no increase at all in December. I believe their December 2022 production will be well below their December 2021 production. I know they dream of holding a plateau of around 11 million barrels per day but very old oil fields just don’t do that. Of course, they know that, they just hope to bring new Eastern Siberian fields online to make up for the decline. That is a pipe dream also.

If you are speaking of the vostok development area, they are going to have some issues with the permafrost. If I am not wrong, near Arctic sea, the ground must be still frozen in depth but in 5 or 10 years, the permafrost will have melted. And then, everything that has been installed and fixed in the frozen permafrost will move. I think in particular of the pipes.

This problem is also happening on the North Slope of Alaska and is especially a problem for pipelines. Most of these Arctic areas are essentially frozen swamps.

lightsout,

No not 250 kb/d, December output was 3 kb/d less than November, basically output was flat.

Dennis, you misunderstood Lightsout’s post. He was not saying that Russia was down 250 kb/d in December, he was saying that if they plateau at this current level, that will be about 250 kb/d below their pre-covid level.

Ron,

Yes I believe you are correct, I misunderstood the comment.

Ron,

Russia may already have exceeded their quota in November so they kept output flat (3 kb/d is essentially a rounding error) in December.

Chart below uses average condensate output for Saudi Arabia from Oct 2020 to Sept 2021(230 kb/d) to estimate Saudi C plus C output in October and November by adding 230 kb/d to crude output as reported in the December MOMR. The chart presents C plus c output in kb/d.

Dennis, we have been over this before. Russia undershot her quota by 37,000 barrels per day.

It’s difficult to assess Russia’s compliance with the OPEC+ deal, as the CDU-TEK data don’t provide a breakdown between crude and condensate — which is excluded from the agreement. If condensate output was the same as in November — some 930,000 barrels a day — then daily crude-only production was around 9.973 million barrels, about 37,000 barrels below its December quota.

Russia’s weak December oil production signals lack of capacity

Dennis/Ron

The official crude output for Russia for December is 10,018 kb/d. With crude output of 9,973 kb/d, Russian December crude output was 45 kb/d below their commitment. The December production target is attached to the press release below.

https://www.opec.org/opec_web/en/press_room/6690.htm

Dennis/Ron

Russian November output as reported by Russia was 10,906 kb/d. Subtracting 930 kb/d of condensate, as guesstimated by Bloomberg, gives 9,976 kb/d of crude. November crude production commitment was set at 9,913 kb/d. So November crude output was 63 kb/d above their commitment.

So was Russian output in December limited by the DOC or by geology. It will take a few more months to sort this question out.

According to three Russian oil companies, it was limited by geology. https://www.bloomberg.com/news/articles/2021-11-26/russian-oil-output-growth-losing-steam-as-opec-may-review-plans

So was Russian output in December limited by the DOC or by geology. It will take a few more months to sort this question out.

Or, you could just take their word for it. As Jean wrote above: According to three Russian oil companies, it was limited by geology.And the Russian Oil Minister says he hopes to plateau, for a few years, at about where they are right now. Lots of luck with that one.

Ron

I think that Russia could get back to 11,100 kb/d this summer when it gets warmer. That is why my time frame was short.

Ron,

In November, Russia was above their quota and may have kept output below their quota in December to meet their overall commitment, it may not be capacity constraints, though After Russia gets to 11.1 Mb/d, I believe they will be close to their capacity.

For now Russian output may be limited by the DOC rather than by geology as Ovi suggests. Also note that not all Russian oil is produced by the largest 3 oil companies.

After Russia gets to 11.1 Mb/d, I believe they will be close to their capacity.

I don’t think they will hit that level but they might. After all, that is only 200,000 barrels per day above their current production and way below their previous peak. And it is quite obvious that their problems are due to geology. I don’t see how you can possibly deny that. But obviously, you do and I find that very strange.

“ANYONE who believes that exponential growth can go on forever in a finite world is either a madman or an economist”

—remarked (the economist) Kenneth Boulding.

Ron,

The question was is the flat output in December due to Russia being unable to increase output further due to geological constraints or other factors. Geological constraints are an ongoing issue for all oil fields at all times, to deny that it is a factor would be absurd, just as it is absurd to suggest that it is the only factor at play. I maintain my position that Russian output will remain on an undulating plateau at around 11 to 11.5 Mb/d from 2022 to 2028. Geology will indeed be the major factor along with access to western technology which is primarily a political calculation by Putin and NATO.

I maintain my position that Russian output will remain on an undulating plateau at around 11 to 11.5 Mb/d from 2022 to 2028.

I understand that Dennis. And I understand that is what the Minister of Energy said. However, you should realize that is nothing but hopum with no chance of being realized. I seriously doubt that the Minister really believes it. And I doubt that there is an oilman in Russia who also believes it.

Ron,

We really don’t know, but based on past experience higher oil prices sometimes result in more oil than I predict (in almost every instance to date this has been the case). The future may be different, we will see.

As to reading the mind of the Russian Minister of Energy, that is beyond my pay grade and ability.

Shale drillers delaying emissions cuts from operations, says Federal Reserve

HOUSTON (Bloomberg) –Less than half of oil and natural gas drillers in the U.S. Great Plains and Rocky Mountains plan to curb emissions of carbon dioxide and methane this year, according to the Federal Reserve Bank of Kansas City.

Those same managers said they need benchmark crude prices to average about $73 a barrel to justify new drilling and higher output. They foresee oil prices remaining above the $75 level through at least the middle of the decade, the survey found.

https://www.worldoil.com/news/2022/1/7/shale-drillers-delaying-emissions-cuts-from-operations-says-federal-reserve

Have any of the regulars here changed their minds recently about when oil will peak ?

OFM

This article appeared in my morning newspaper. According to it, peak oil may be around 2025. This is the time frame, plus or minus a few years, for some of us on this site.

https://www.reuters.com/markets/europe/shrink-fit-year-big-oil-starts-become-small-oil-2022-01-10/

OFM,

My current guess is 2027+/-1 at 86 Mb/d+/-1 for World C plus C output.

84,598 mbpd in Nov 2018 for C+C . Take it to the bank . Tooth fairies do not exist and Jeffery Epstein did not kill himself .

Note I focus on centered 12 month output for World C plus C, so the 86+/-1 Mbpd estimate reflects the centered 12 month output of World C plus C that may be achieved in the July 2026 to July 2028 time frame.

The current centered 12 month average peak is 83130 kb/d in November 2018. This peak is likely to exceeded by July 2024 (average for Jan 2014 to Dec 2024).

Oil goes over $100 by this summer. If it can stay there for three years we can probably beat the old peak by a (statistically insignificant) smidge in the 2024-25 timeframe. Then it keeps getting more expensive with no real output increases until something breaks. The biggest wildcard imo is China and their unsustainable zero Covid policy. There’s no easy way for them to rejoin the world economy with endemic Covid. They’ve really painted themselves into a corner. To me they look a lot like Japan in 1989, demographically and debt/real estate wise. Just ten times bigger. 30 years of growth has created gobs of zombie companies and corruption out the wazoo. At some point it comes down.

Stephen Hren,

That sounds like a reasonable lower bound scenario, but from my perspective there is about a 75% probability that output from 2024 to 2029 will be higher than your scenario. There are a lot of oil resources that can be developed profitably at $100/bo or more, some deepwater offshore tiebacks and tight oil as well as other brownfield projects can be brought online relatively quickly, by 2028 we may no longer need increased oil supply as demand for oil may be falling at that point.

That’s plausible. You have more faith in everything holding together longer than I do.

Stephen Hren,

Yes that is correct, if there is a civil war, nuclear holocaust, or large asteroid strike, any model of the future falls apart, future recessions cannot be predicted in advance, nor future pandemics and other unknown unknowns.

The future is impossible to predict, that is the only thing we can be sure of.

OFM and OVI

I am still trying to understand, how is it possible (if we are very close to the peak) that non-OPEC production is roughly 2.5 times that of OPEC, whereas OPEC’s reserves are 2 times those of outside OPEC. When I asked this question before, Ron said that OPEC is lying about its reserves. But this does not seem to explain it. If we take out the Venezuela’s XH (260 Gb) and Canada’s tarsands (160 Gb) from the OPEC and Non-OPEC reserves and adjust OPEC’s reserves down owing to the quota wars in the 80’s, (say down by 200 Gb) their reserves are still about 750 Gb and the non-OPEC reserves are about 360 Gb. So we have total reserves of 1110 Gb rather than the latest OG&J number of 1742 Gb. We have now used 1400 Gb of oil and if the ultimate is about 2800 Gb, we ought to be about half way through. So how can the reserve to production ratios for OPE and non-OPEC be so far apart?

Seppo, you are asking the wrong question. The question should be: “How can OPEC possibly be telling the truth about their reserves?” Answer: They are not.

Hey, it ain’t that hard to lie and get all the ignorant folks to believe it. We used to have a president who lied every time he opened his mouth. And his ignorant worshippers believed every word of it.

“Hain’t we got all the fools in town on our side? And hain’t that a big enough majority in any town?”

Mark Twain, The Adventures of Huckleberry Finn.

Ron, if they are lying, their reserves would be much less than they claim. I adjusted it down by 200 Gb. If you adjust it down more, say by another 100 Gb, the same question remains.

OPEC hikes December oil output, but falls well short of quotas again: Platts survey

OPEC’s 13 countries pumped 28.04 million b/d of crude, up 190,000 b/d from November, while nine non-OPEC partners pumped 13.98 million b/d, an increase of 120,000 b/d, the survey found.

However, 14 out of the 18 members with quotas fell short of their targets, including even its largest producer Russia, whose compliance rose above 100% for the first time since February, when severe winter temperatures shut in wells and reduced pipeline flows.

However, 14 out of the 18 members with quotas fell short of their targets, including even its largest producer Russia, whose compliance rose above 100% for the first time since February, when severe winter temperatures shut in wells and reduced pipeline.

Angola was up as it started production from new fields!!. Surprised.

There is a complete table at the end of the article.

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/011122-opec-hikes-december-oil-output-but-falls-well-short-of-quotas-again-platts-survey

So, OPEC+ has 19 members who are not exempt. 5 are producing above quotas, 14 are not. Of the five that are producing above, two are miniscule (South Sudan and Gabon) and the other three are not especially politically stable (Iraq, Kazakhstan, and Algeria). Of course the exempt members are not very stable either (Libya, Iran, and Venezuela).

I think it’s safe to say that the ones near 200% compliance or above are not going to be producing any significant additional barrels: Congo, Angola, Equatorial Guinea, Nigeria, Azerbaijan, Malaysia, Sudan.

Saudis Are Right to Warn of a Collapse in Oil Supply

We ignore those warnings at our peril. A 30-million barrel a day drop in oil supply might seem like a victory to the most short-sighted of environmental campaigners, but without an accompanying fall in oil demand, it will come with a price tag none of us can afford — oil prices at levels never before imagined.

“Have potential investors been so bullied, or so scared, by environmental campaigners that they are unwilling to sink capital in new oil production? ”

I call bullshit on that narrative. A few points

-There is a huge amount of capital available for, in fact eager for, a target for deployment that will give a decent return on investment when taking risk into account.

-Dozens of trillions of dollars in the world have no ESG restriction or mandate. This does not even include privately held funds. Complete freedom to deploy money where they see opportunity.

-Interest rates are as low as they get. Global liquidity is as good as it gets.

If you look up the energy sector stocks traded in the USA on all of the exchanges, only a small number have a positive ROI- [return on investment].

If that improves (and I suspect it will with sustained higher prices) then investment money will be fighting to get through the door and find a place to deploy.

We have heard from industry personnel over and over just how marginal the current projects and prospects are for viability, let alone profitability. That is why investment in future projects is lukewarm.

The world is going to have to invest in both oil and all the non-oil energy sectors simultaneously, and both are going to be increasingly expensive just to keep running in place. And even running in place will be backsliding

I suspect.

For new plays investment must start NOW – to deliver oil in a few years. Drilling some infills always works – but they are speaking of new projects.

Yes, when oil is over 120$ and still accelerating money will come, for a new pork cycle.

The other thing in the western part are enviromental regulations. Canadian oil can be killed completely, so the European rest of it. Even US oil could be in danger. At least a tiny bit:

https://oilprice.com/Energy/Energy-General/Biden-Administration-To-Reduce-Oil-Drilling-Lease-Area-In-Alaska.html

WTI currently a little over $81. Still waiting on yields on 10 year bonds to brake out higher.

We’re not far from erasing the omicron/SPR release pullback that happened the day after thanksgiving.

Politically we getting back into the no fly zone on oil prices. I expect FED to come out swinging an surprise market with something unexpected. If they don’t oil will be at $100 by March or April. Heading into midterm elections this is just not good for incumbent politicians.

I think FED will speed up pace after the next red hot inflation reading that comes out Wednesday.

They must be careful – any big hammer clubing oil down to 60 for the elections will club stonks down 30%, too. And this all the Robin Hood millenialls and the 401k plan owner won’t find amusing. Lot’s of them elect democrats, even a void vote will be bad here for Biden.

So they need a scapel to lower oil prices without damaging the whole market. And pushing 10 years to either 0 or 3+% won’t help, too. This will be load, not a quiet operation. And the government can’t need loud. That’s why they tried the SPR release first – this is an operation only affecting oil.

Just my opinion – the FED has a problem.

10 year is likely just waiting on Wednesday data release.

FED has only one tool and it’s the exact opposite of a scalpel. They can crush inflation but there will be broad collateral damage.

Trying to jawbone or talk down inflation just isn’t going to work.

With inflation running just over 5% by the government numbers. It’s actually much higher in reality. And short term rates at 0.25% real rates are negative 5%. Going by their numbers.

When inflation was under 2% real rate were negative but nowhere near as negative as they are today.

In order to tame the beast they going to have to tighten way more than most people think.

“Just my opinion – the FED has a problem.”

Always, and forever. Just try to keep a leaking tanker ship moving forward, and on track.

Mission Impossible.

Yes, correct all of you HHH , Eulen and Hicks . Interest on debt is $ 500 B at current rate of 1% . At 2% ( 4 increments of 0.25 %) it is 1 trillion . FUBAR .

If I’m right in my thinking the FED has to get the FED’s fund rate or their short term benchmark rate up to 3.5-4.0% just to get us back to the pre COVID average of 2% inflation. It’s at 0.25% currently.

That is problem nobody wants to have a conversation about.

Markets will crack and go to hell before the FED ever reaches what is needed to tame inflation.

“That is problem nobody wants to have a conversation about.”

Seriously?

Just because you are not part of the conversation does not mean it is not taking place- every single day.

Hickory

When it comes to the FED if it’s not being said openly. If it’s not something talk about openly then it’s not part of the conversation. And it isn’t policy.

And until it is said openly it doesn’t even matter what’s discussed in private. Just as if it was never discussed.

The EIA’s new Short-Term Energy Outlook is just out. They now have predictions through 2023. Notice they have greatly revised down the latest three months of their Non-OPEC liquids production. December 2021 has been revised down by 860,000 barrels per day.

All data is in millions of barrels per day and is total liquids, not C+C.

As the OPEC came back more or less to their production level of March 2020 in December 2021, we can assume that, according to the estimation of production for December 2021 for non OPEC oil producers, the world oil production will be 2 millions barrels/day below the production of March 2020 in December 2021 : ?

Well, their total liquids in December were 1.86 million bp/d below their level of March 2021. But they were, in December, 2.16 million bp/d below their January 2021 level and 2.48 million bp/d below their peak of November 2019. But that is total liquids, not C+C.

The fact that the Short-Term Energy Outlook last month overestimated December liquids production by 860,000 barrels per day tells me something very profound about the EIA. To be that far off on production for a month that close is astounding. And if you notice in the chart above, they catch up pretty fast, increasing by 2.7 million bp/d by November of this year, making a new all-time high, this year! I really don’t believe that will happen.

Ron,

The EIA STEO revisions may reflect revisions in the IEA Oil Market report. In the Nov 2021 Oil Market report from the IEA they estimated World output would increase by 1500 kb/d in both November and December 2021. The December 2021 Oil Market Report (IEA) revised the November 2021 estimate for World liquids supply to an increase of 970 kb/d (about 530 kb/d less than the previous month’s estimate). The EIA likely has access to the full Oil Market report (I do not) and the revision to December 2021 may reflect the IEA revisions in the December Oil Market report.

As you well know predicting the future accurately is quite difficult (impossible really, with the odds of success very close to zero).

Resource nationalism . This is how the cookie crumbles , it begins at the edges .

https://eurasianet.org/uzbekistan-ends-gas-exports-to-china-abandons-price-increases-at-home

The question now is that tankers meant for China were diverted to Europe . Is China looking to energy starvation or energy poverty ?? Will they keep quite ??

An update . Now even Russia .

https://kun.uz/en/news/2022/01/07/uzbekistan-completely-stops-natural-gas-export-to-russia

WTI’s over $80 today. It looks like Biden’s SPR release has failed to bring down gasoline prices.

The laughing guy on the Biden SPR release . ROFL.

https://twitter.com/StreetBomber/status/1479137921001213956

Frugal,

Did anybody think the SPR release would do anything to oil prices? I never did. The move was symbolic to show Biden was “doing something” about high gasoline prices.

Oil exports from Russia peaked in 1988. We all understand they collapsed as a country and their oil industry also collapsed. Still 33 years later they have yet to eclipse the high made in 1988.

Oil exports from Saudi Arabia peaked in 1980. Had another much lower peak in 2013. Still 9 years later they haven’t surpassed the high mark made in 2013.

Oil exports from Venezuela peaked in 1998.

Oil exports from Mexico peaked in 2005.

Oil exports from Nigeria peaked in 2010.

Oil exports from Iran peaked in 2004.

Oil exports from Indonesia peaked in 1980.

Oil exports from UAE peaked in 2013

Only 6 countries that export oil with any significants that haven’t seen a peak in exported oil are Canada, Iraq and USA, Kuwait, Brazil and Kazakhstan.

Does it really matter if we see a new peak in production if that doesn’t translate into more oil being exported?

No, I don’t think it really matters. I wish we could have a chart of “World Net Oil Exports”. That would be very interesting. But we had net oil production peak in 2018-2019, depending on whether you are talking monthly or annually. But net oil exports likely peaked two or three years before that.

Thanks, HHH for posting this. It is very interesting.

HHH

In reply to Ron Patterson.

I couldn’t find a chart showing all global exports combined. But I was able to look up each oil exporter individually between 1980-2020.

There was some difficulty finding just the volumetric data in chart form. A lot of charts had natural gas an other liquids added in under oil exports and then others were in dollars which can be misleading in times when oil was high priced.

Agree HHH and Ron-

volume of ‘oil available for export’ is the big factor that stabilizes global economic and geopolitical relationships.

Here is a story from today, right up this alley-

“China doubled down on imports of Iranian and Venezuelan crude in 2021, taking the most from the U.S.-sanctioned regimes in three years as the nation’s refiners brushed off the risk of penalties to scoop up cheap oil. Chinese buyers, particularly private refiners, have benefited from Washington’s tough line on Iran and Venezuela, continuing to buy their oil long after their counterparts elsewhere in Asia ceased purchases. The risk that non-U.S. entities may lose access to the U.S. financial system or have their American assets frozen if found guilty of breaching the sanctions hasn’t dissuaded them.”

HHH,

As long as there is no interplanetary export of oil only production and consumption matter. A big change in World exports which are equal to World imports is that the US is importing far less crude oil today than at the peak in 2008. Currently the centered 12 month average of US crude net imports is about 3000 kb/d, at the peak in 2005 the centered 12 month average of US net imports of crude oil was 10200 kb/d.

Dennis- that is nice for the USA,

But this issue of eventual tightening of oil exports will be extremely tough for countries that don’t have enough domestic supplies, and yet do have big industry/internal demand. This includes many countries in Europe and Asia such as China, Germany, Korea, Japan, India

If they don’t electrify quick the shortage of oil for import will be a very big issue, as you know.

Hickory,

I mostly agree that the need to electrify transport is important. Note that fewer net imports for the US means more is available for those other nations on World markets. As oil available for export diminishes and the supply on World oil markets becomes short as a result, we are likely to see oil prices rise. This will likely lead to increased demand for electric transport and lower demand for new ICE vehicles, my models of the EV transition suggests that World demand for oil may fall below World supply of oil by 2029-2032 (depending on assumptions about the rate that demand for new plugin vehicles increases with the assumption that the supply can meet that demand.)

Beyond that point of peak World demand for oil we will see oil prices start to fall and there will be an excess of oil on World markets at higher price levels.

There will likely be a period where the World oil market is very tight from 2024 to 2028 and oil prices might be very high during this period ($120 to $150 per barrel in 2020 $), this may increase demand for plug in vehicles leading to a faster transition to EVs, if supply of EVs can keep pace with the increase in demand.

“likely be a period where the World oil market is very tight from 2024 to 2028 and oil prices might be very high during this period ($120 to $150 per barrel in 2020 $)”

yes, I think that is a likely scenario too

I couldn’t find a chart showing all global exports combined. But I was able to look up each oil exporter individually between 1980-2020.

CPI inflation reading came in at 7.0%. Core inflation was 5.5% so far yields on 10 year bond have move slightly lower.

Bond market already starting to price in an economic contraction or at least deceleration? Due to high prices. That is the way I’m reading this. If this is where long term bonds peak then they can only do a handful of rate hikes before they collapse the yield curve.

I’d say FED has a problem here. And by extension so does all markets and prices. We could get runaway price inflation and runaway oil prices. Or we can get crashing markets. 50/50 on which way this thing goes.

There won’t be a happy medium here unfortunately.

Yes, looks like the long road the FED was kicking the can down comes to an end.

They can’t tollrate 7% inflation doing nothing. And they can’t tollerate a total market crash. The moment wages start to move big deal up, inflation will be hard to stop. Especially when supply problems won’t go away fast.

The question is how fast does this escalate? When turning down QE to 0 until march this will be the first test. No more big buyer of bonds – movements here will be much more extreme without the one maximum “stupid” buyer.

The ugly thing is additional, even when they stop QE and do some tiny increases, there is enough central bank money out to create a big inflation. As you wrote some time ago central bank money is now lended by only factor 2 – it can go up to 10. So any monetary space for a runaway inflation even without new QE.

Or a credit crunsh deflation with inversed curve – not better.

My scenario: They will hike until the market crashes. Then they panic (because politic panics and there is fire in the streets) and they will reverse 180 degrees panic buying everything to stop the crash. And they’ll get a big inflation.

Only way price inflation come down is if dollar continues to appreciate. If they raise rates and dollar sinks inflation continues on its merry way higher.

They don’t control long end of bonds curve right now. Both the FED and treasury want higher slightly higher yields on 10 year to give them room between the spread of FED’s funds rate to be able to cut rates later during next crisis.

2-3 more dollars on oil price and Biden will be calling Powell on the hotline.

Hedge funds are long oil giving price a big push.

Maybe Biden does “temporary “ price controls on oil. Puts a ceiling at $70 or something. Only thing is it would crush the oil industry and the moment any price controls are lifted we get an absolute moon shot in price and inflation.But they can’t afford to sit back and do nothing.

Hmm, a price control on oil.

The US still imports a lot of oil – mainly for rotating around gravities. So the government would have to pay the difference while importing. Possible, a few billion here and there doesn’t matter.

Surely it will hurt domestic production, so more expensive imports.

But that’s cheaper than hammering down stocks and real estate with the big interest rate increase hammer. That surely will kill oil, but everything else, too. Say goodbye to stock buyback on credit, say welcome margin call.

Controlling the long bonds they can do to some extend only during QE, running out soon:

– Reducing yield by buying like mad (like the ECB buying everything italian ): easy

– For increasing yield they have to throw their bought bonds on the market – as long as they have some. To keep QE at level they would have to buy even more short bonds then, decreasing yield here.

So a kind of artificial yield curve – this could only be an emergency stopgap to do something.

They did a thing like this during “Operation twist”, buying long term and selling short term to decrease long term interrest rates in 2011 – I think it was to strengthen real estate market by creating cheaper house credits on this way.

More likely if the price goes high this summer, exports will be banned by Dems. This should dramatically lower the domestic oil price while ratcheting up Brent.

… and you will have to pay big for your imports, too.

The refineries you have are still not tooled to intake that much light oil from the shale. So you will have to close down half of the permian, and continue to import as much as before (the USA imports and exports 8 mbd at the moment). Only for higher prices ( the ca 3 mbp will be missing in the world market ).

And retooling the refineries is a longer and expensive process – that’s why it isn’t done so far. They are still configured from the classical Texas oil boom time.

Stephen Hren,

The Democrats will never be able to pass an export ban in the Senate, I don’t think they have 60 votes to end a likely filibuster.

You guys are talking nonsense. The US was a net oil exporter in 2021.

Petroleum Overview

Ron,

US was not a net exporter of crude oil. Net imports of crude were around 3000 kb/d, with about 6000 kb/d of imports and 3000 kb/d of exports. The ban on exports always applied to crude only as I am sure you know.

Sorry Dennis, I just screwed up. I meant to say net oil importer. The monthly petroleum review clearly shows the US was a net oil importer for the first 11 months, (average). Sometimes I just think my head ain’t screw on right. 🤯

Ron,

No problem, if I had a dime for every time I made a mistake, I would be a wealthy man. 🙂

Remember the creative accounting that the Trumpsters did to classify the USA as a net oil exporter? They counted UNREFINED IMPORTED crude oil as being produced by the USA since it was being REFINED here.

Price controls just result in lines at the gas pump, this would really piss people off.

Nixon tried price controls. When the price controls were lifted we got a huge surge in inflation.

But when they get desperate you can’t rule out anything.

I think the FED is hoping if they drag it out long enough prices will come down some on their own and they won’t have to do as much.

So far they have done nothing to bring inflation down other than talk about it. QE should be ended immediately. Why wait 3 months? They should be hiking rates now. They aren’t really serious about inflation.

HHH,

They are winding down QE, it cannot be done overnight with disrupting financial markets, this action will affect interest rates in time. Doing too much too soon will lead to a recession, they will see how unwinding asset purchases affects inflation and if still a problem they will raise the Fed funds rate incrementally over several quarters. They are hoping to find the right balance between employment and inflation. A difficult wire to walk.

Dennis,

In order to fight inflation they have to disrupt markets. They can end QE slowly and raise rates slowly. But inflation won’t respond to that.

All avoiding disrupting markets means is higher inflation. Because as long as things are good and markets aren’t crashing. Why not bid up oil? Why not bid up stocks? Why not bid up housing.

HHH,

Yes they need to disrupt things a bit, but it can be overdone as in the 1980s when a severe recession resulted, tightening of money supply can be overdone in my opinion. The Fed is trying to avoid that. There was a lot of fiscal stimulus during the pandemic and a lot of pent up demand in the system.

Since 1970 inflation has went to 5% or higher and peaked seven times. And every single time we’ve had a recession immediately after inflation peaked.

I’m not going to try to call exactly when inflation peaks this cycle. Heck China is locking down ports which should put upward pressure on prices. But there is absolutely zero reason to believe that this time will be any different.

Yields on 10 year bonds likely just signaled inflation just peaked and recession is imminent. Keep an eye on bonds. If yields sink here. We are likely at the start of a recession and FED ending QE and hiking interest rates will be forgotten about shortly.

If we get a short squeeze in long term bonds which is likely underway at the moment. Yields could half from

where they are now in short time. Putting 10 year under 1%.

I’m thinking we are entering some type of inflationary recession or stagflation. Where perhaps prices continue to go up but economic growth first decelerates then goes into contraction.

And honestly I don’t know how they remedy that. If you try to inject more money to kickstart growth you just get more inflation. If you hike rates to fight inflation growth will just contract even more.

HHH,

I think the Fed has gotten better with dealing with oil shocks, worldwide pandemic shocks they are probably less adept at as the last one was a century ago.

Keep in mind that from April 1973 to August 1982 the CPI was over 5% for annual inflation every single month. Inflation was over a 7% annual rate every month from August 1973 to December 1975 and then from May 1978 to Feb 1982, June 1982 was the last time annual inflation rate was over 7% (prior to December 2021).

Hint:

Paul Volcker

Dennis , yes there was a lot of fiscal stimulus but ” pent up demand ” is a false narrative . Nobody went and got himself two haircuts , an extra shirt or shoes . Nobody took a vacation of 4 weeks because he missed out on his earlier vacation of 2 weeks . The fiscal stimulus shifted demand from different sectors ( restaurants , travel ,leisure etc to certain forced changes to lifestyle due to lockdowns example if you are now WFH then maybe you buy some new furniture , computer etc . Time pass activities like gardening or home improvement etc . Those stimulus cheques had to find a place . Some of it went to buying stocks and crypto’s . Anyway that party is now over . The current inflation is a problem from the supply side . The FED has no control . It can print dollars but not semiconductors .

From another blog but interesting .

Some maths here but the crux is this:

“In a nutshell, the 10-year rate cannot break 2.5%.

At 2.5% our adjusted debt service to GDP moves to 2.74%, matching the all time high in 1985.”

Powell said four hikes. Yeah, four 0.10% hikes. And the market knows it. With continuing $400B/mo back-door. however, without BBB and $3Trillion hitting the streets in payoffs, there won’t be enough cash on the ground to keep the system from locking up. Which it is, look at the empty shelves nationwide.

Part of that is real but part is a show, look at the backlogged containers worldwide, never seen before. In 300 years. So…everyone dismantled their cranes? Uh, no. It’s a scam, or a sabotage, but they’re up to something.

https://macroheathen.com/macroheathen-blog/f/interest-rates-still-cannot-rise-heres-why

Hole in head,

Many people spent less money during the pandemic and as the situation has improved with more people being vaccinated demand has increased. I agree supply has also been a major factor in inflation, the system does not respond well to fast changes in demand, supply chains cannot keep up and the pandemic has disrupted supply chains.

Fed policy is less about money supply and more about interest rates and those can affect demand if they rise. Higher interest rates may lead to less home buying (and home building) and lower levels of business investment.

Paul Volcker remedy isn’t on the table. IF FED does 4 rate hikes like they say they will do this year. They invert the yield curve and inflation really spirals out of control as nominal negative interest have to be considered.

Negative nominal interest rates kill the dollar and CPI goes to 20% instead of 7%.

Their road to kick the can down ends in 2022.

HHH,

The relationship between US real GDP growth and the rate of inflation is far from as simple as you assert. The data is below, essentially there is no correlation from 1960 to 2020. Data from Fred

https://fred.stlouisfed.org/

Dennis,

Currently the 10 year bond can go either way. We are either going to get a technical breakout that likely goes to 2% or it’s a false break an yields are headed lower.

Both have implications on which way growth goes over next 6 months. You can have inflation and growth at same time. Most people call it reflation. Which we’ve had over last 18 months or so.

We can get stagflation where growth is slowing but inflation isn’t. Likely what we are transitioning into.

History shows long end of bond yield curve falls after they start hiking short term rates.

They running out of room to play this game unless negative nominal interest rates are on the table.

Which would cause and inflationary boom. As dollars would be borrowed like never before and invested into everything that’s not dollars.

Might even get a growth boom but it won’t last. They just be expanding dollar debt like never before. And it would end in a deflationary collapse when all those borrowed dollars fail to get paid back.

Dennis , your post a12:22 PM . If shale is a Ponzi then the FED was/is running along with CCP the two biggest Ponzi schemes ever in modern history . If ZIRP and QE are not Ponzi’s then please justify . The problem with Ponzi’s is that they all run out of road and end in a disaster if not a catastrophe . Don’t believe ? I wish I could get Bernie Madoff or Ken lay to explain this . HHH is bullseye ” 2022 is when we run out of road ” . The problem with Ponzi’s is that they can run for a long time and desensitize the majority that the Ponzi is the ” new normal ” .

The Russians are not letting a good opportunity go to waste. High inflation and high energy prices gives them good leverage for a trade war. Electricity prices are already brutally high here in Europe and a long trade war with a large energy supplier is the last thing we need. Russia is also a large mining and forestry country so in a hard trade war it wouldn’t be just oil and electricity that would jump in price.

There have been numerous comments here over the past months regarding Russia’s failure to ramp up oil production lately. I suspect they don’t want to ramp up production as they want to use fuel shortages as a bargaining trick.

Chart for World oil imports using BP Statistical Review of World energy (oil trade tab and oil consumption tab in barrels). Also shown is percentage of World consumption that is imported.

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Note that for the World oil imports are equal to oil exports.

It will be interesting to track this- thank you.

The near term peak of world oil import 2018-19 may end up being the long term peak.

We will see in a few more years.

Got electricity?

Hickory,

World consumption decreased in 2020 as expected due to the pandemic, but on a percentage basis the peak in the percentage of World oil imported was in 2020, rather than 2019 (peak in World imports was 2019 at 70404 kb/d, the peak percentage of oil imports divided by oil consumed was 73.5% in 2020, in 2019 it was 72.1%.)

Supply projection for permian from http://www.shaleprofile.com at link below

https://public.tableau.com/shared/DXQTY9KSD?:display_count=y&:origin=viz_share_link&:embed=y

Permian tight oil at 6496 kb/d in Dec 2029 with 68465 total horizontal tight oil wells completed from Jan 2009 to Dec 2029 assuming oil rig count, rig efficiency, and average new well productivity is unchanged from Dec 2021 to Dec 2029 (obviously just a simplifying assumption, well productivity will decrease and rig count is likely to increase over this period).

What’s the usefulness of so long a projection? Esecially when 2020 and 2021 on the graph are not that smooth

Svaya,

There will always be statistical noise leading to small variations around trend (look at the Jan 2017 to Dec 2019 part of the chart, it is relatively smooth with small wiggles). The pandemic obviously affected output, as well as the severe winter storm in Feb 2021 in Texas. The scenario from 2022 to 2029 is a what if exercise for Permian basin output if the rig count were to remain constant, average new well productivity (or the average EUR of new wells) remains constant and rig efficiency (average number of wells drilled per month for each rig operating) also remains constant. As I suggested none of these assumptions is likely to be correct and as I often say there are an infinite number of possible future scenarios, the likelihood that any single scenario chosen from that infinite set will be correct is approximately 0 %.

So one could easily claim that all projections of the future are useless.

I am good with projection but I am skeptic of any model that is not known and I cannot verify the data that goes in it

Svaya,

The model has been presented in the past see

https://peakoilbarrel.com/oil-field-models-decline-rates-convolution/