A guest post by Ovi

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIAʼs International Energy Statistics and updated to June 2021. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

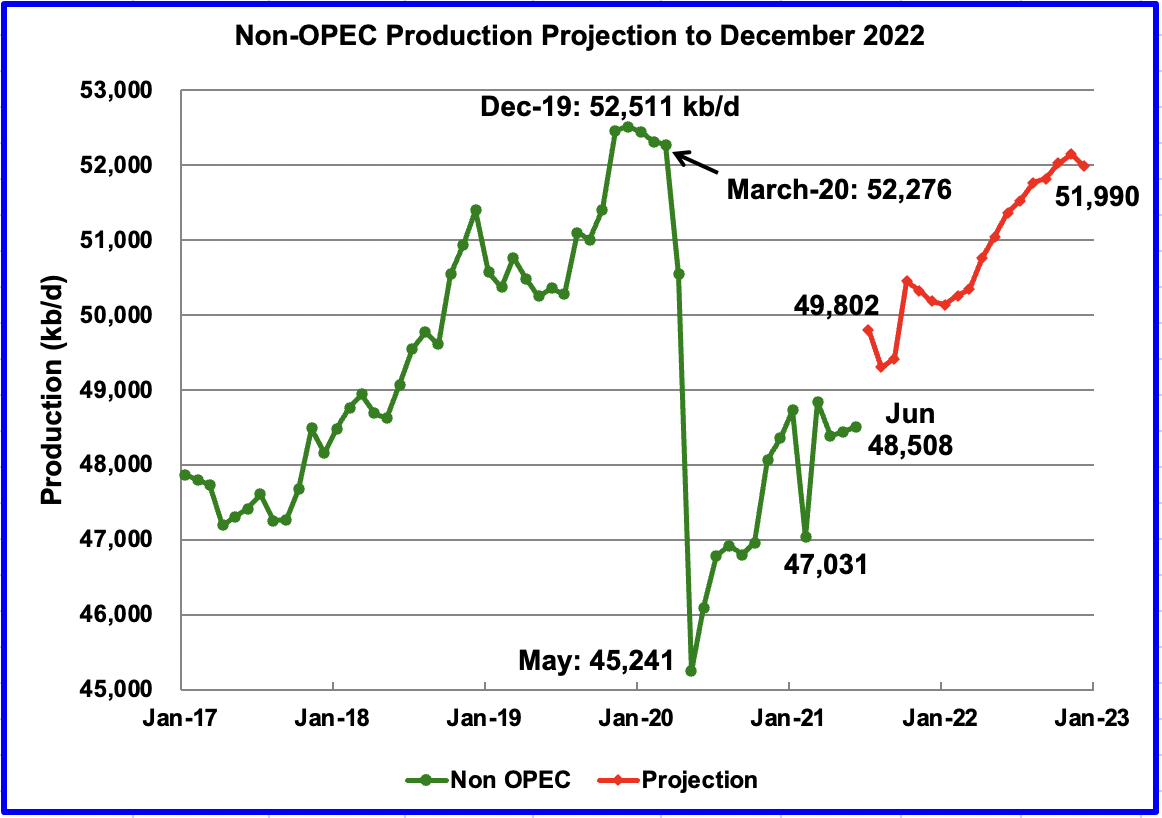

June Non-OPEC production increased by 73 kb/d to 48,508 kb/d. The biggest contributors to the increase were Canada, 249 kb/d and China, 46 kb/d. Offsetting the increases were declines from the UK, 133 kb/d, Australia, 60 kb/d and Russia, 48 kb/d.

Using data from the September 2021 STEO, a projection for Non-OPEC oil output was made for the time period July 2021 to December 2022 (red graph). Output is expected to reach 51,990 kb/d in December 2022, which is lower by 108 kb/d from the previous post.

July production for the Non-OPEC countries is projected to increase by close to 1,300 kb/d over June to 49,802 kb/d by the EIA STEO report. The big increase occurs because the STEO forecasts an increase in World All Liquids of 1,880 kb/d in July.

Ranking Production from Non-OPEC Countries

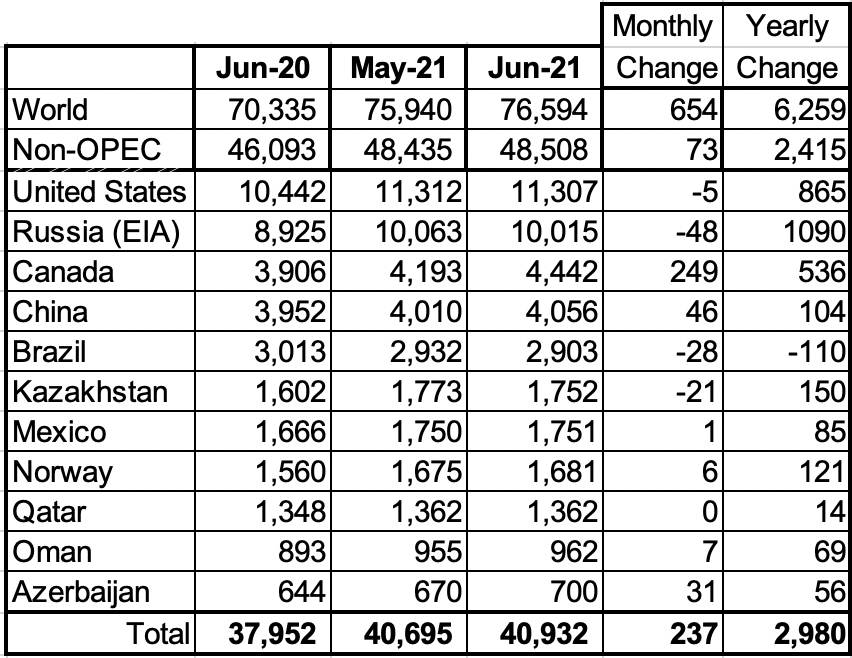

Above are listed the worldʼs 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The last two have currently fallen below 1,000 kb/d.

In June, these 11 countries produced 84.4% of the Non-OPEC output. On a YoY basis, Non-OPEC production increased by 2,415 kb/d while on a MoM basis production increased by 73 kb/d to 48,508 kb/d. World YoY output was up by 6,259 kb/d.

Production by Country

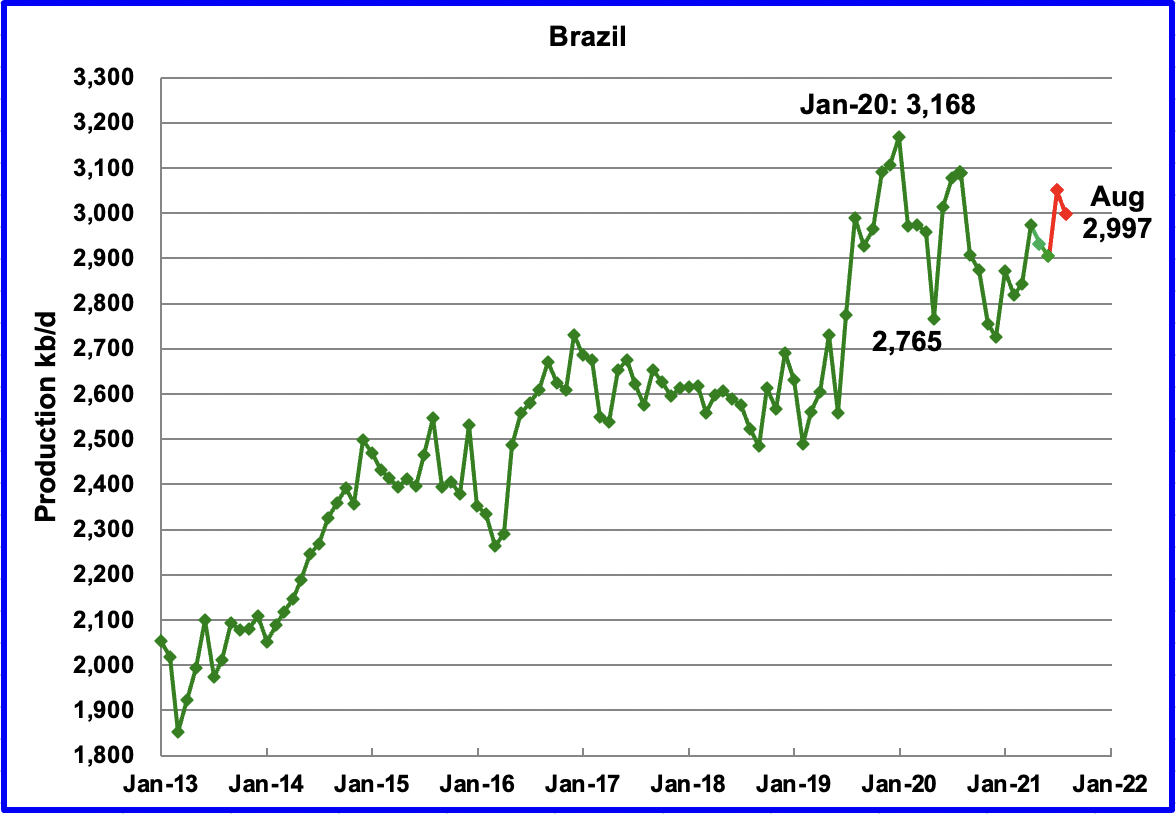

The EIA reported Brazil’s June production decreased by 29 kb/d to 2,903 kb/d. July rebounded to 3,040 kb/d, according to this source and then August dropped to 2,997 kb/d according to this source. (Red Markers)

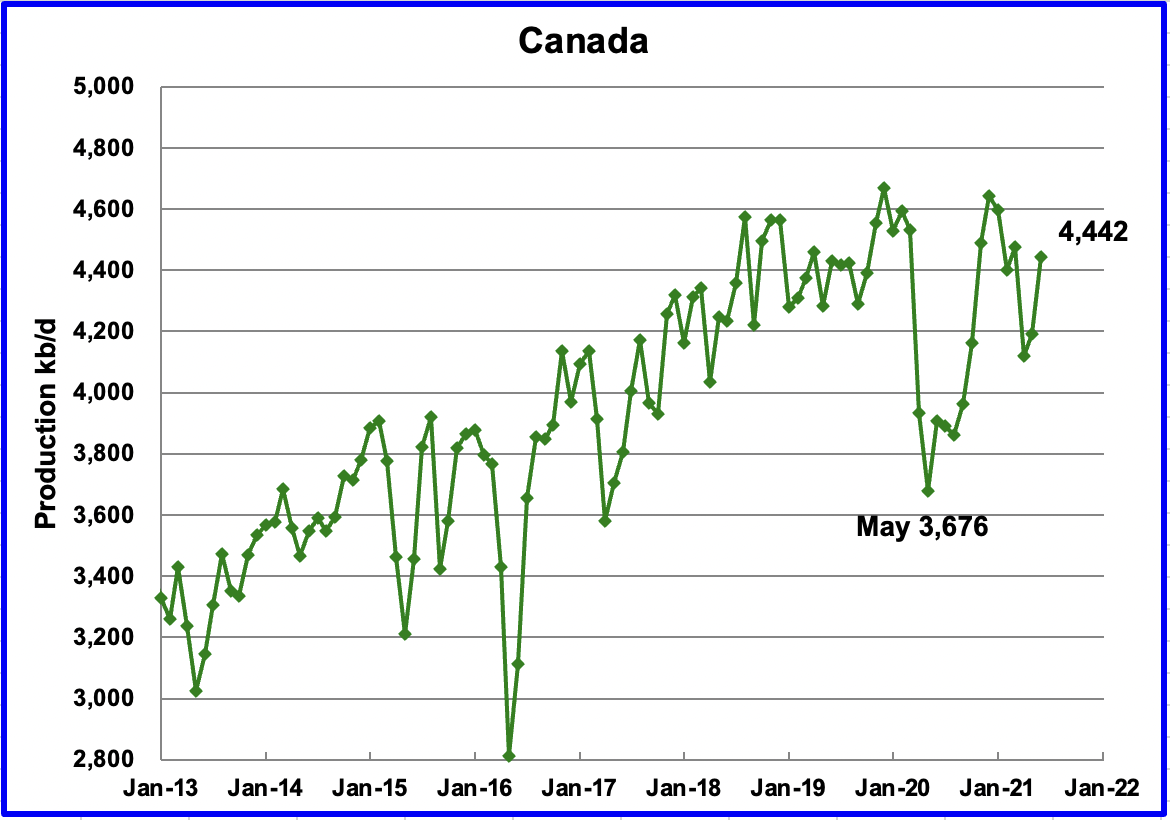

According to the EIA, June’s output increased by 249 kb/d to 4,442kb/d. The increase was due to some oil sands cokers coming back online. As more are returned online, production should return to the 4,600 kb/d range.

According to this source, Enbridge said on Wednesday its Line 3 pipeline replacement project will begin operating on Oct. 1, the first successful major expansion of Canadian crude export capacity in six years, clearing hurdles that other projects were unable to overcome.

The $8.2 billion project allows Enbridge to roughly double its capacity to 760,000 barrels per day on the 1,765 km-long (1097 mile-long) pipeline.

This is welcome news to the Western Canadian oil companies since this will lift pipeline/shipping capacity constraints.

Exports by rail in July were 142.8 kb/d up 12 kb/d from June.

Canadian oil exports to U.S. jump after Line 3 starts up following years of delays.

According to this source, weekly oil deliveries from America’s northern neighbour reached 4.04 million barrels day, the most since January, according to the Energy Information Administration. It’s only the third time the U.S. has imported more than 4 million barrels a day of Canadian crude since the agency began compiling weekly data in 2010.

The additional barrels from Canada come as a relief to U.S. refiners struggling with less supply from OPEC+, shrinking imports from Latin America, and more recently, the loss of about 30 million barrels of Gulf of Mexico production after Hurricane Ida.

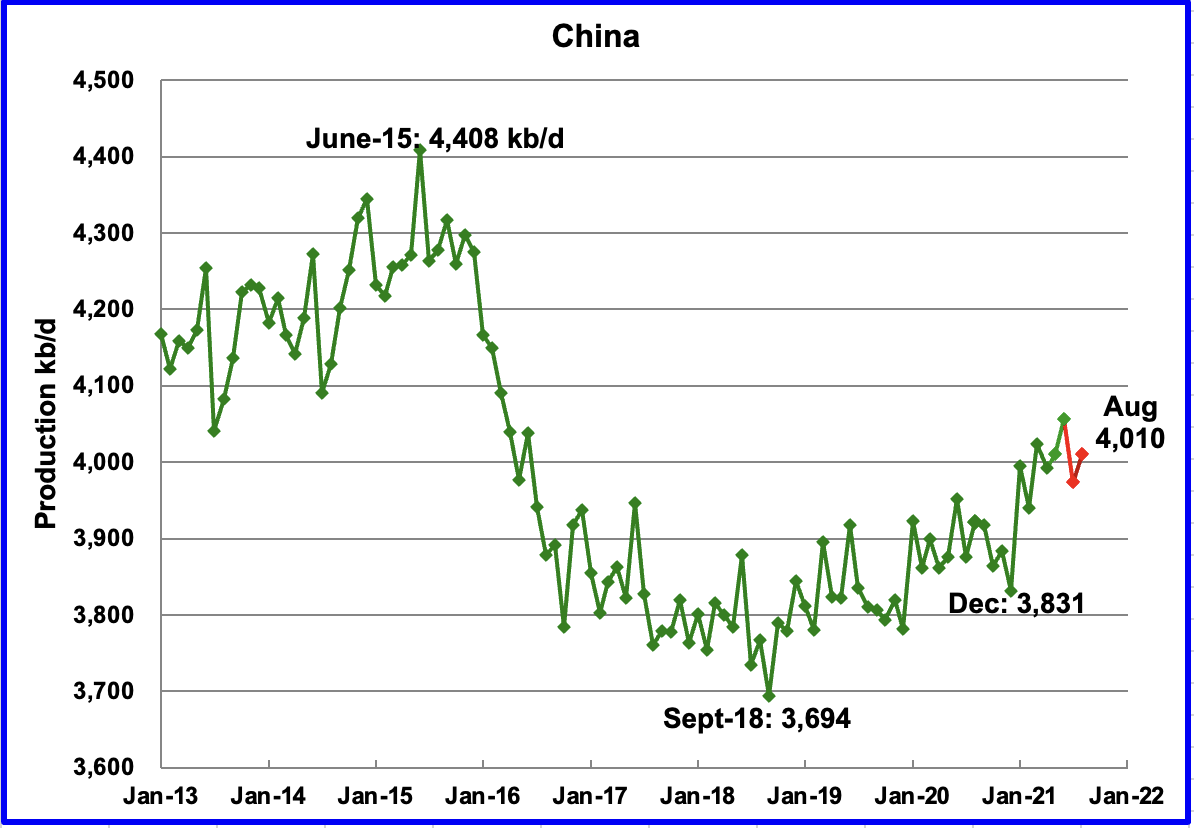

The EIA reported China’s June output increased by 46 kb/d from April to 4,056 kb/d. According to this source, China’s output decreased by 83 kb/d in July to 3,973 kb/d. In August it recovered to 4,010 kb/d according to this source

Mexicoʼ’s production, as reported by the EIA in June was 1,751 kb/d, down 1 kb/d from May. Data from Pemex shows that July and August production was up slightly to 1,772 kb/d and 1,776 kb/d, respectively. (Red markers).

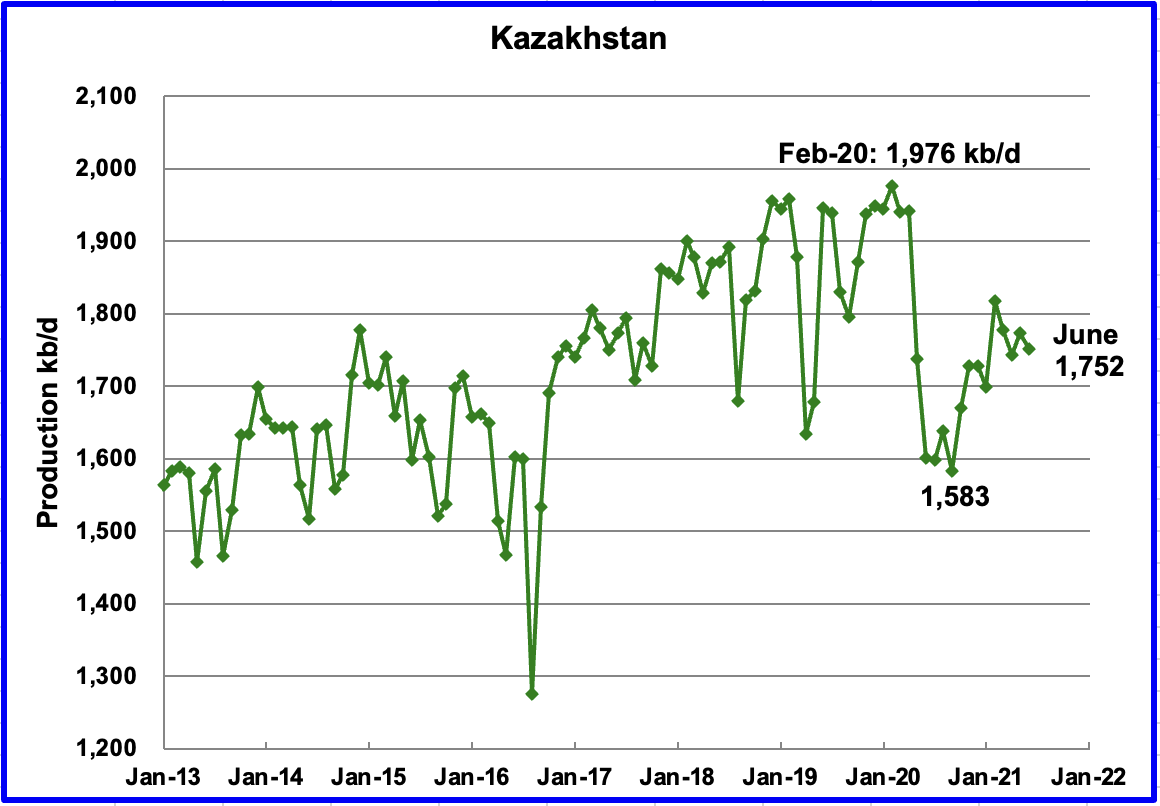

Kazakhstan’s output decreased by 21 kb/d in June to 1,752 kb/d. Will it get back to its pre-covid level which is 200 kb/d higher?

According to this source, the quota for Kazakhstan under OPEC+ will be 1,508 kb/d in September, and each month production will increase by an average of 16,000 barrels per day,” said the Energy Ministry.

Note that the 1,508 kb/d is just crude. Their crude production quota will ease to 1,475 kb/d in July, source.

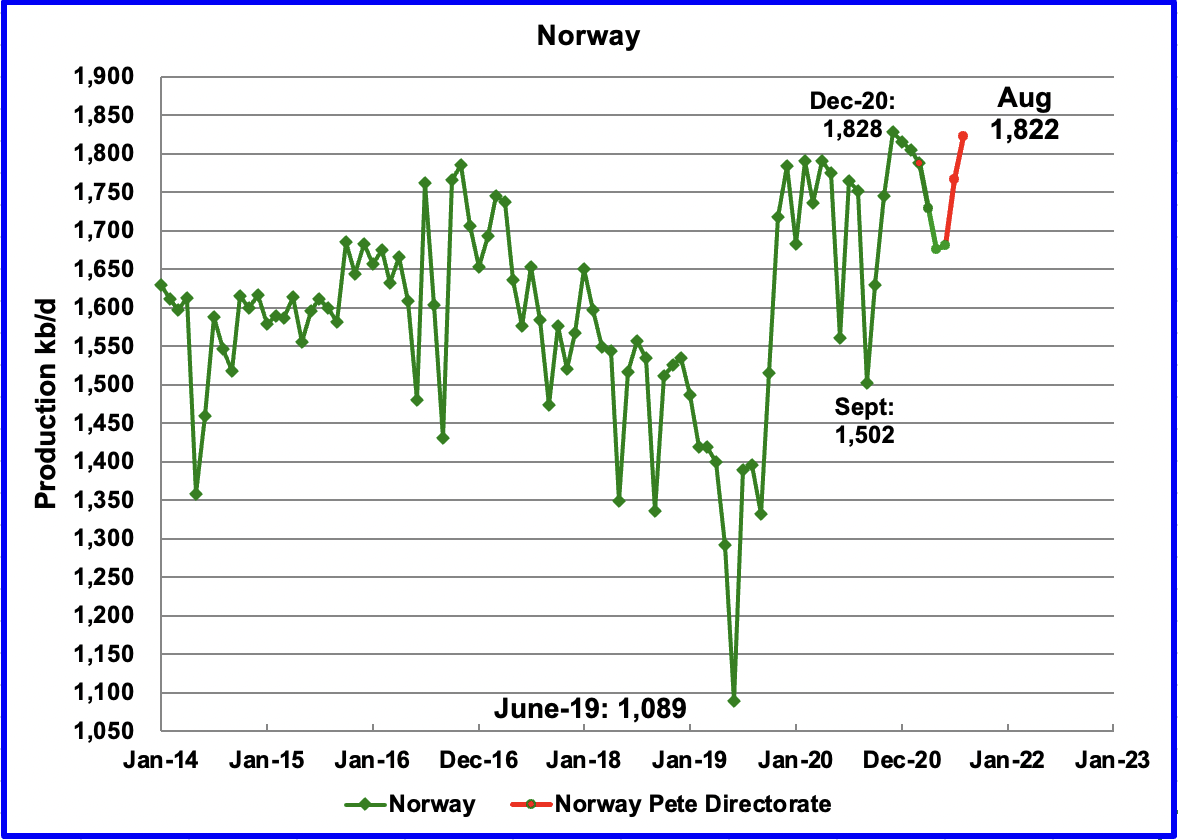

The EIA reported that Norway’s June production was 1,681 kb/d, an increase of 6 kb/d from May. The Norway Petroleum Directorate (NPD) reported that production in July had increased to 1,766 kb/d and then to 1,822 kb/d in August, red markers.

The NPD announced earlier this year that production would increase in the second half 2021. July and August were the first two months showing a significant production increase. Will September break the previous high of 1,828 kb/d, set in December 2020?

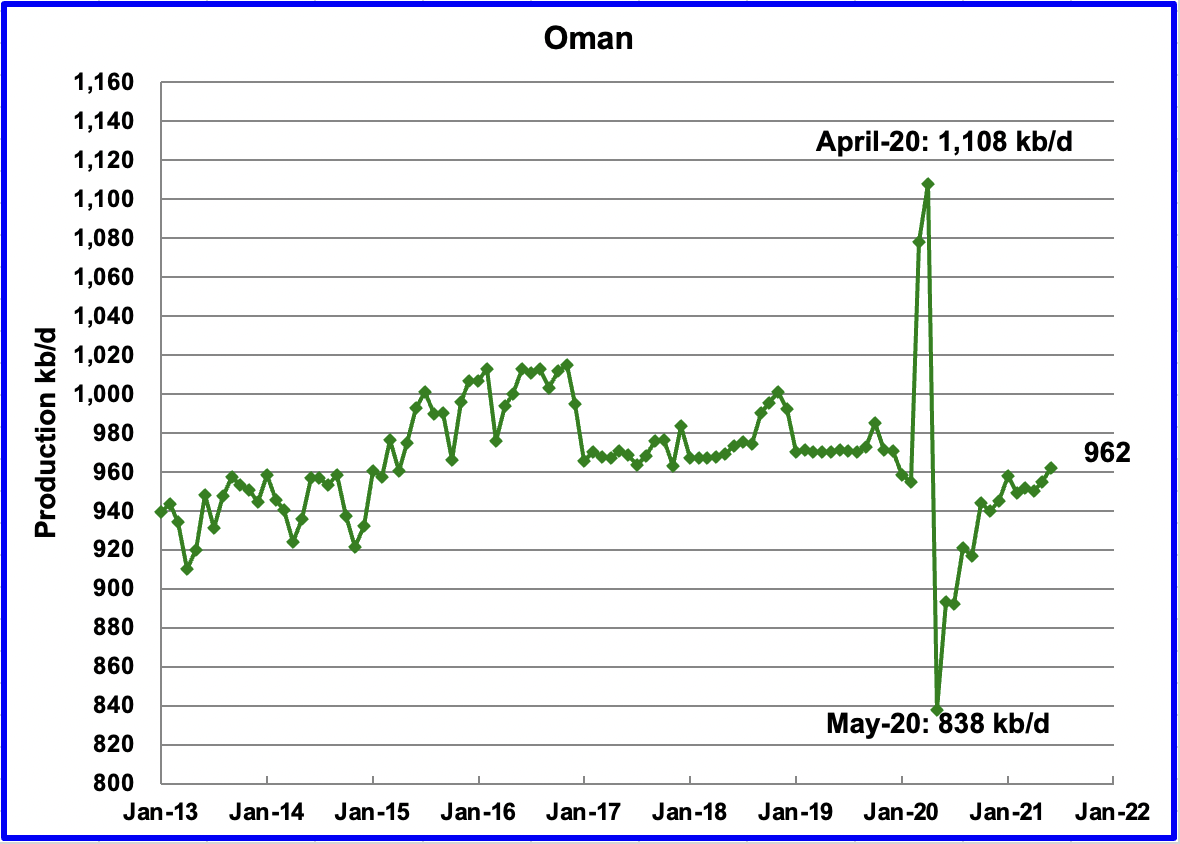

Oman’s June production increased by 7 kb/d to 962 kb/d.

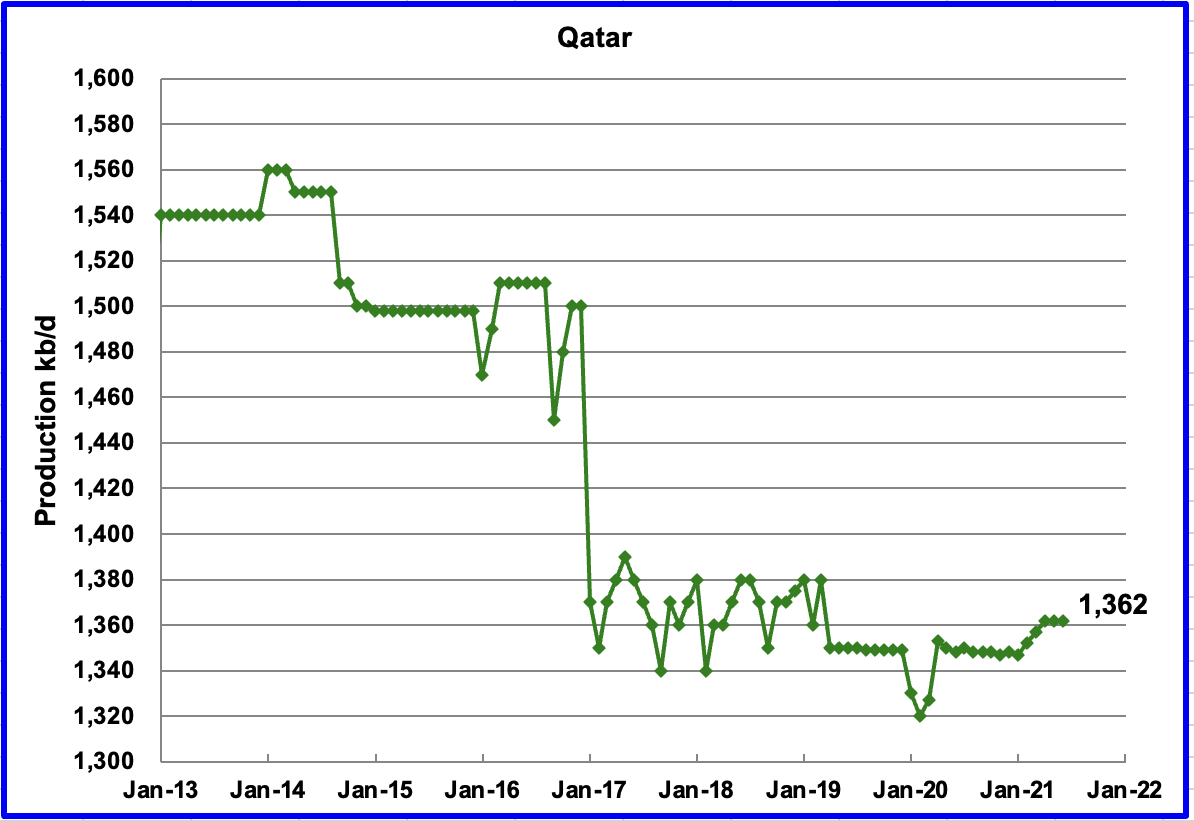

June’s output was unchanged at 1,362 kb/d.

The EIA reported that Russian output decreased by 48 kb/d in June to 10,015 kb/d. According to the Russian Ministry of Energy, Russian production in August was 10,426 kb/d.

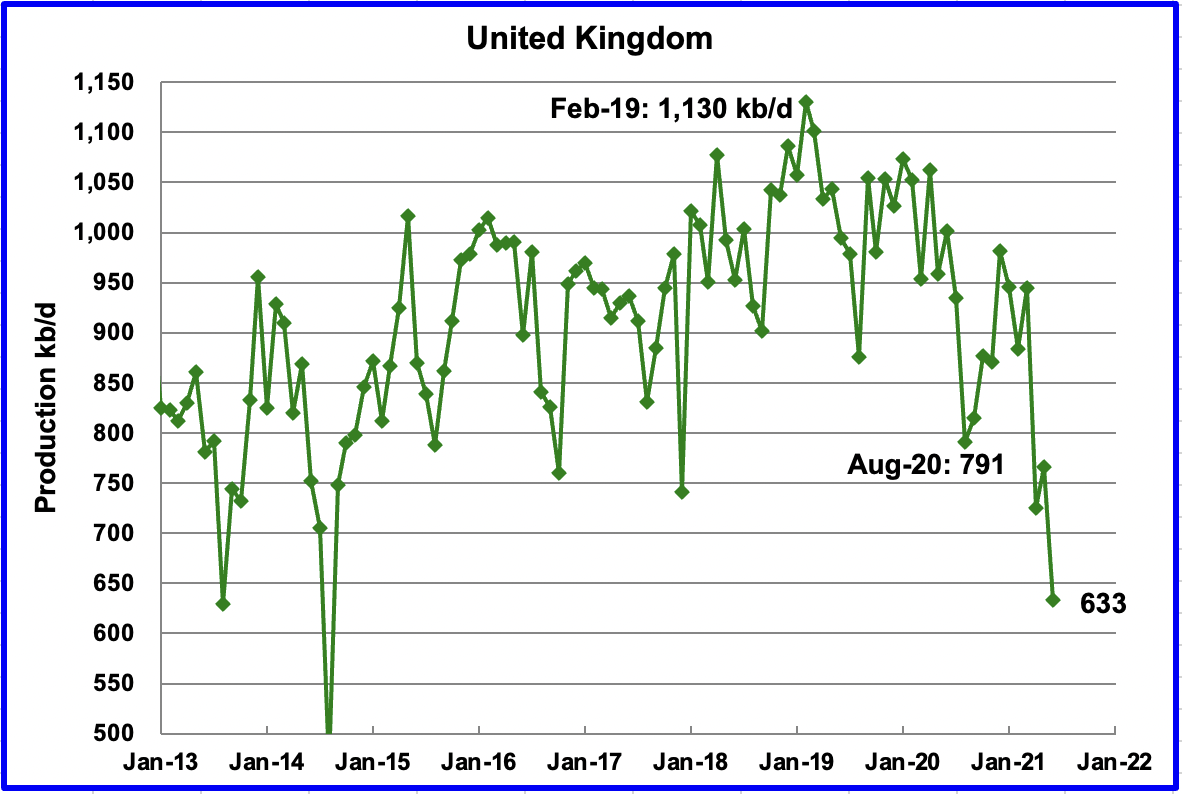

UK’s production decreased by 133 kb/d in June to 633 kb/d.

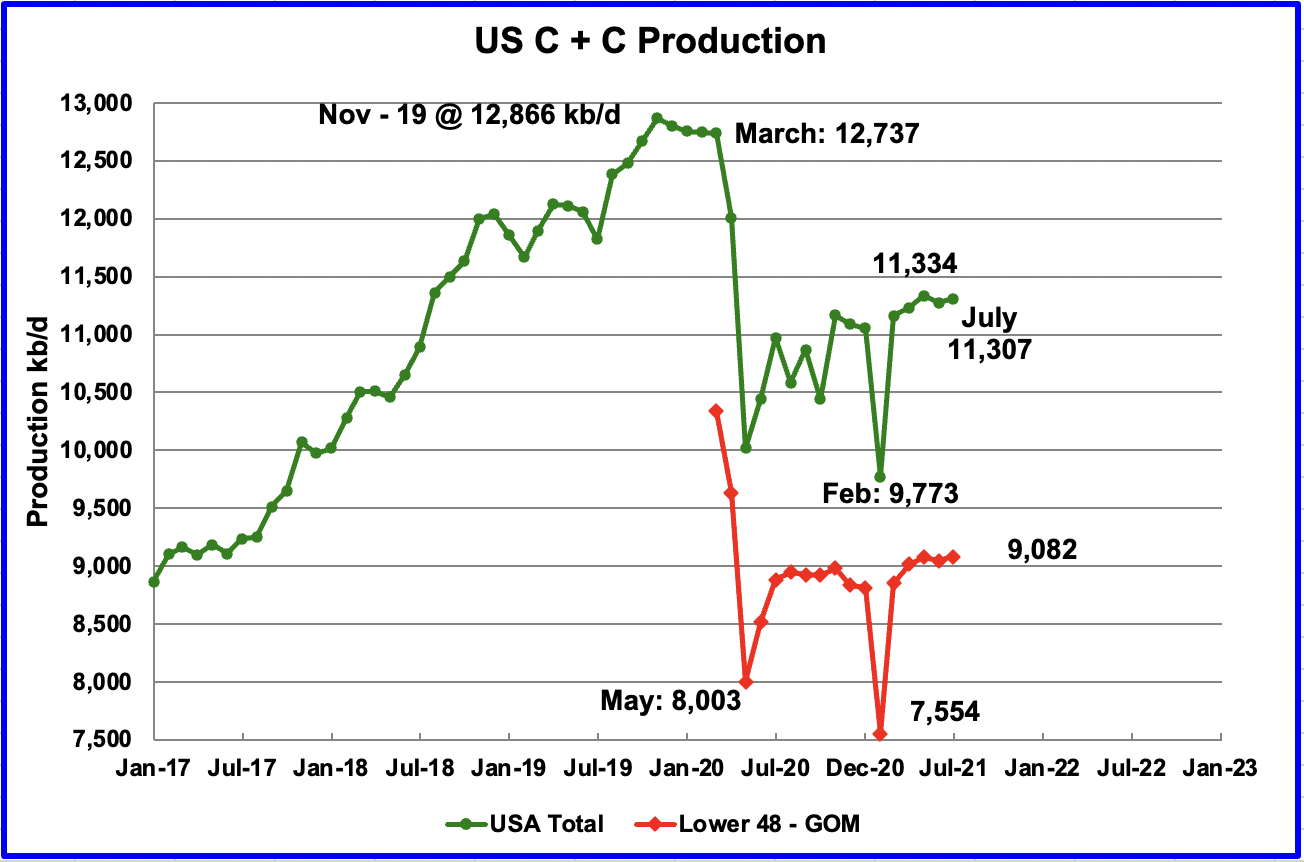

U.S. July production increased by 31 kb/d to 11,307 kb/d from June only because June was revised down from 11,307 kb/d in the August report to 11,276 kb/d in the current September report. From March to July, production increased by 147 kb/d or 36.8 kb/d/mth on average, down from 49 kb/d/mth in the previous report. July production is still lower than May’s output of 11,334 kb/d.

The EIA October 1 weekly inventory report showed that output continued at the 11,300 kb/d level.

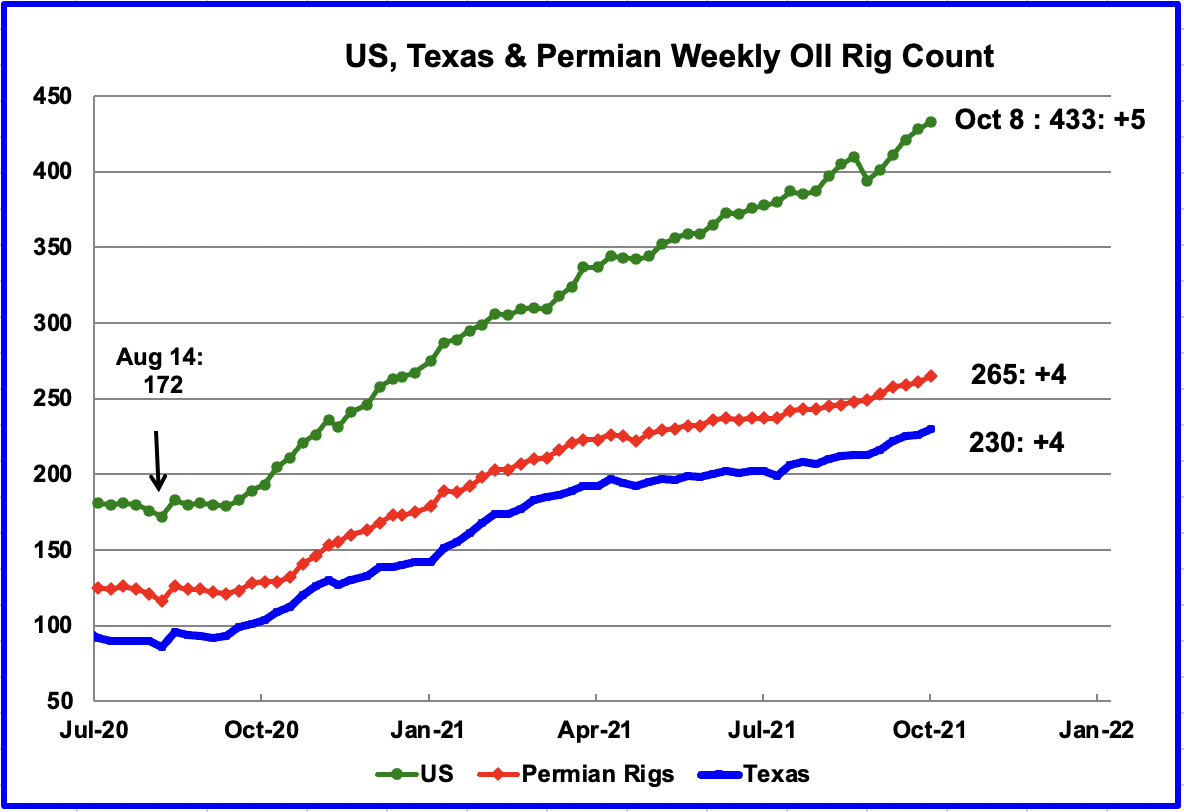

In the week of October 8, the US oil rig count increased by 5. Interestingly Louisiana is still down 7 rigs from its pre-Ida hurricane number of 18. The + after the rig number is the increase from the previous week.

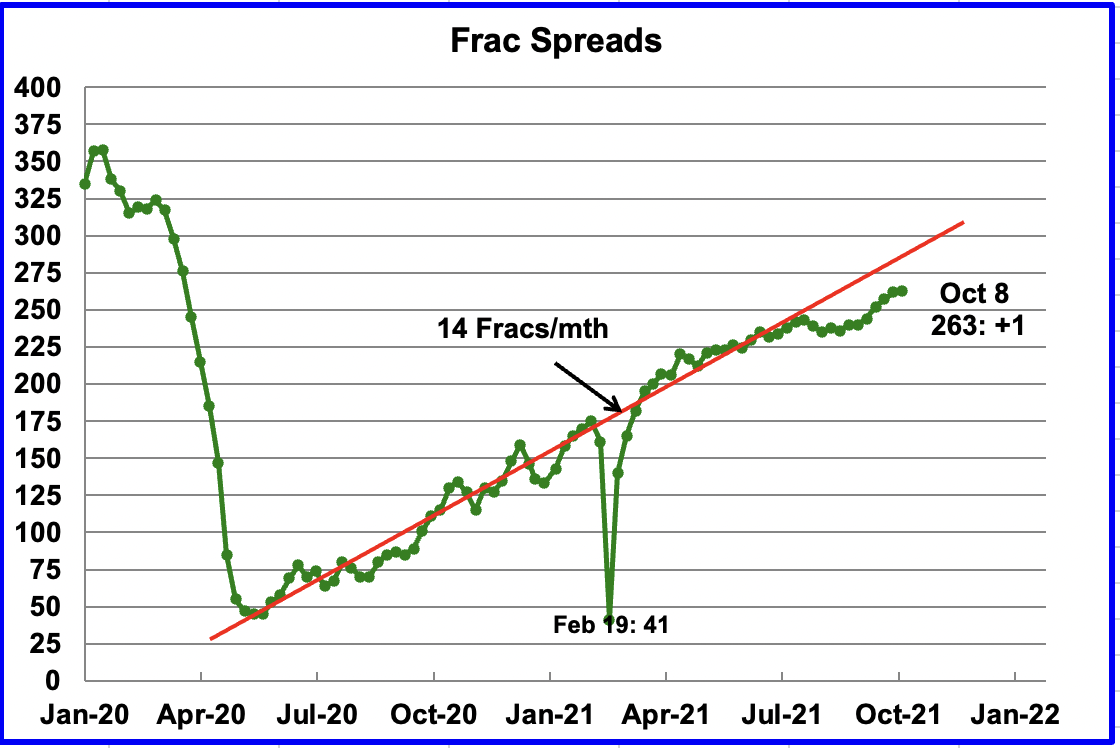

After a period when frac spreads were holding in the 240 range in August and early September, frac spreads began to increase in late September to above the 250 level. In the week of October 8, 1 frac spread was added for a total of 263. There is a hint of slowing in the rate at which weekly frac spreads are being added.

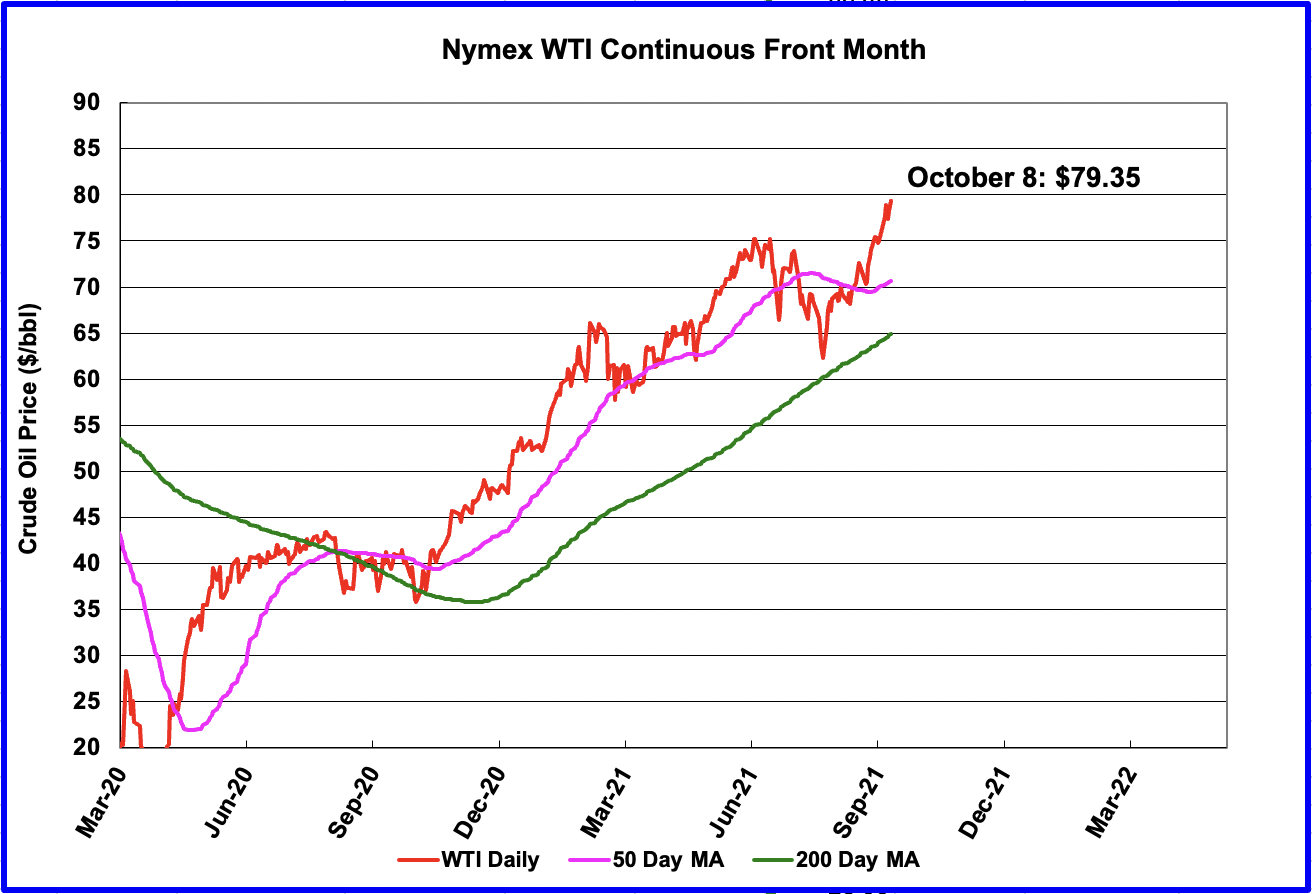

WTI settled at $79.35 on October 8, 2021. The high for the day reached $80.11. The low for the day touched $78.63.

It is the highest settled price for WTI since October 31, 2014, when WTI was dropping from its previous high of $106.91 on June 13, 2014.

Those were the days. 👍 Are they coming back? Place your bets.

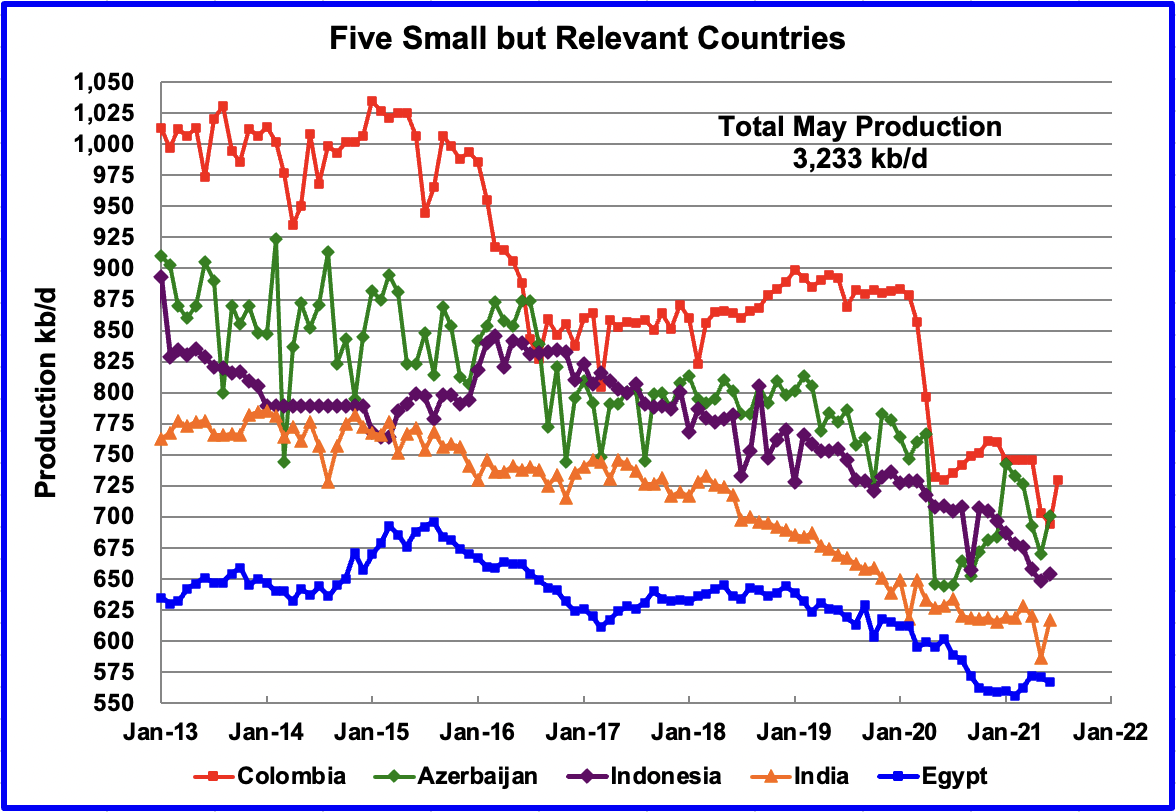

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined June production was 3,233 kb/d, up 54 kb/d from May.

World Oil Production

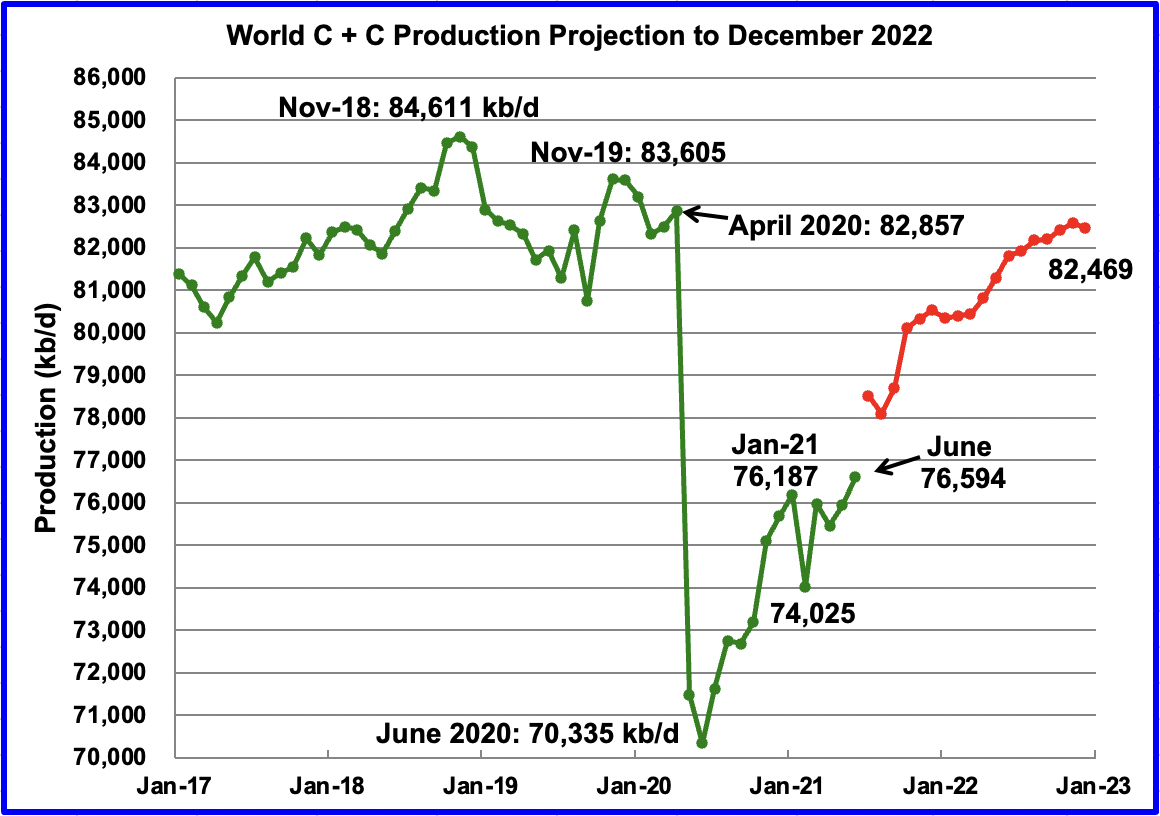

World oil production in June increased by 654 kb/d to 76,594 kb/d according to the EIA. Of the 654 kb/d increase, the biggest contributor was Saudi Arabia again, 465 kb/d, followed by Canada, 249 kb/d. The biggest decline was recorded by the UK, 133 kb/d. This big drop caused it to drop from the Table above and let Azerbaijan take over the last spot.

This chart also projects world production out to December 2022. It uses the September STEO report along with the International Energy Statistics to make the projection, red markers. It projects that world crude production in December 2022 will be close to 82,469 kb/d, 99 kb/d lower than forecast in the previous report.

The current December 2022 forecast is 2,142 kb/d lower than the November 2018 peak of 84,611 kb/d. As best that I can remember, this may be the biggest gap that I have reported.

Thanks, Ovi.

Thanks Ovi , for all the info . Very well laid out and defined . My reaction . Nothing of interest . Canada is the only one that has still potential , all others are in decline . The forecast that production will increase by 1,888 kbpd is “sleight of hand ” as it will be mostly NGL . US still struggling to cross the previous peak . Tks once again .

I think Norway is an interesting case to follow, as most here probably know they peaked at 3,1 MB/day in 2001, so that one will definately be hard to beat. But beeing curious I re-read George Kaplans post from two weeks ago (looking forward to part 2) and I also went back and checked some old stuff at crudeoilpeak for more info. There I among other things found what I remembered seeing a couple of years ago, namely a graph of Norways oil extraction rate and earnings at the time of “production”, made by Rune Likvern, and they seem to have sold the bulk at fairly low prices…(and invested it in USTs and stocks…)

Anyway, there is also a graph in that linked post from Aleklett, from an ASPO 2010 presentation which supports Dennis claim that extraction can, and sometimes will, exceed forecasts, alas, that was the same year as Johan Sverdrup was discovered so the size of the discovery was probably unknown at that moment.

The attched picture is from a 2015 update where Sverdrup was accounted for, but with all that in mind, are they creaming Sverdrup out as fast as they possibly can, considering current production level?

http://crudeoilpeak.info/global-peak/norway-peak-oil

But George´s post 2 will maybe answer that…

Laplander , tks for bringing up the names of Rune and Aleklett . It has been a real long time since I heard about them . I admire their work and clarity . I also await Mr Kaplan post 2 .

I´m also thinking about Jeffrey Brown, aka Westtexas, for an update on ELM, the Export Land Model, that would be really interesting now, a couple of years later. Mazamascience doesn´t seem to update their data for oil exports anymore, but it was a really good site for different countries and regions. Perhaps they (and Ron) were all just a bit ahead of their time…

(where´s Leanan btw?)

Addendum, but they all helped me to get to the acceptance phase, and start preparing…

I remember asking about LTO around 10 years ago on The Oil Drum, and Jeffrey was adamant that the US would never exceed it’s 9,600 bpd level of about 1971.

I kept an xls on the old computer, tracking Bakken output but when it crossed 1000 kBpd in 2015 or so I stopped updating it…So I bought one more second hand (pre-owned in the US) snowmobile to enjoy the fun while it lasted, but I knew it was short term…

He should not be ashamed that he was wrong. The same assumptions about oil’s finiteness, and the peak and decline of individual fields, still hold true. C. Campbell continually warned us not to be over concerned about the timing (or the exact quantity) of peak but about “the long decline that follows.”

@ Mike B, I sure hope it will be a “long decline”, otherwise things will get really interesting…

I remember asking about LTO around 10 years ago on The Oil Drum, and Jeffrey was adamant that the US would never exceed it’s 9,600 bpd level of about 1971.

Nick, this is just bullshit. In 2011 the shale revolution was in its infancy. Hardly anyone foresaw its true potential. You are trying to do nothing but imply that Jeffrey Brown was nothing but a hack because he did not foresee the shale oil phenomenon. If not, then what is the purpose of your post.

Does the fact that Jeffrey did not foresee the quantity of shale oil to be produced mean that the Export Land Model is invalid? No? Then what the fuck is the point of your post if not just to belittle him?

The fact that Jeffrey did not foresee the shale revolution, does not follow that the Export Land Model is invalid. That is what is called a non-sequitur. One has nothing to do with the other. Only someone who wishes to belittle him would dare try to make such a nonsensual connection.

I apologize for the outburst but in my dotting old age, I have become far less tolerant of such non-sequitur nonsense.

He should not be ashamed that he was wrong.

Well, being wrong should carry no shame – I haven’t seen anyone who really anticipated the potential of LTO. His real mistake was in being so adamant about it. That’s the continuing problem of Peak Oil – a lack of recognition of the difficulties of this kind of forecasting. PO enthusiasts have continually overstated the certainty of their data.

C. Campbell continually warned us not to be over concerned about the timing (or the exact quantity) of peak…”

The timing is the crucial question. That’s what makes Peak Oil important. If PO happens in 100 years, or even 50, it’s a non-issue.

…but about “the long decline that follows.”

That’s the other key mistake of PO. PO is NOT the End Of The World As We Know It. In fact, PO can’t come soon enough – the risks of FF-induced Climate Change are far higher than the risks of PO.

It is obvious that oil, natural gas and coal will peak some day. Its impact on the society is a function of when it happens. If oil had peaked in 2005-2008 timeframe, the impact on the society would have been disastrous, comparable to WW2 (without the bombs). Now, not so much. We are in the early stages of transitioning to electric transportation, at least for the non-aviation sector. We are also in the early stages of transitioning to SWB (Solar Wind Battery) grid. By 2030, if 90%-95% of the VMT (Vehicle Miles Traveled) are in EVs and if 90%-95% of our grid is powered by SWB, peak oil is inconsequential.

The Peak Oilers and ELM proponents will eventually be right , but it will not matter by then.

Gotta love a cornucopian who’s a self appointed expert in everyone’s mistakes.

You realize sverdrup is medium or heavy oil and therefore useless.

John , a simple question . Last total C+C is 77 mbpd (rounded off ) . How much of this output per you is ” real ” oil and how much ” just called out oil ” . If you can qualify with origin source e.g 7mbpd of shale according to you is ” just called out oil ” . Let us see your analysis . Perhaps you can also dissect the 77 mbpd figure into heavy , medium and light category .

They are not “creaming” Sverdrup, its just a field in its own league. Extraction will be north of 80% of total resources in place when all is said and done.

The marketed api for sverdrup is 28 and the analysis shows a lot of heavy products https://www.bp.com/content/dam/bp/business-sites/en/global/bp-global-energy-trading/documents/what-we-do/crudes/johan-sverdrup.xls

John, i assume you are not talking to me right?

Assistance needed . Can someone tell me what is API of the oil that KSA , Kuwait , etc burn for electricity ?

Generators are joint generation/desalination machines. Runs on diesel. Two big refineries in Kuwait. Refines 31 API oil and also newly 48 — no diesel in that.

Thanks Watcher . Running on diesel . Let us see when they become Lebanon . 🙂

P.S ; And to add fuel to the fire ” Water desalination ” . What could go wrong .

And not by a small amount, 70% of KSA tap water is dessalinized water, but I think they are trying to move to more gas for power/water (not that it make a huge difference)

Yvest , last I recall was that KSA was importing NG from Qatar or UAE to pressurize it’s own oilfields . However that is a minor issue , you put it correctly ” not that it makes a huge difference ” .

HiH, that is not correct. Saudi is importing natural gas from Qatar but not for pressurization of their oil fields. All their pressurization is done with water injection. They are importing natural gas for electrical generation and water desalination. They burn all the gas they produce domestically to generate power and water but they simply do not have enough gas for that. So they burn a lot of crude oil in their boilers. They can buy gas for a lot less than they get for their oil. So they had much rather buy gas and sell oil.

Qatar and Saudi Arabia eye peace, a mega gas deal could follow

Qatar and Saudi Arabia have several good reasons to finally settle their political differences. Agreeing what could be the gas deal of the century is perhaps the best.

The kingdom burned almost 900,000 b/d of valuable liquid fuels for industrial use and power generation in 2017, according to the Riyadh-based energy think tank, King Abdullah Petroleum Studies and Research Center.

Replacing this oil with natural gas could generate more than $10 billion of additional export revenue at current market prices, or add to its existing cushion of spare crude capacity that was recently tested by the attacks on Abqaiq.

Buying gas from Qatar is one of the cheapest ways for the kingdom to remove oil entirely from power generation, but first must come peace after a near three-year total breakdown in diplomatic and economic relations.

A partial thaw came this week when King Salman bin Abdulaziz invited Qatar’s emir, Sheikh Tamim bin Hamad Al-Thani, to attend a gathering of the Gulf Cooperation Council leaders in Riyadh later this month. Although the emir declined the invitation – sending his prime minister instead – the direction of travel is undeniable.

“Gas supply has always been the Achilles heel to Saudi’s ambitious economic growth plans,” said Samer Mosis, senior analyst at S&P Global Platts Analytics.

“While the kingdom has equally ambitious plans to expand non-associated gas production, Saudi Aramco’s track record in this arena is spotty at best. A gas deal with Qatar would be the rational solution to this conundrum, but Saudi would be loath to build a dependence on Qatari gas.”

On paper, Saudi holds the world’s fourth-largest gas reserves and is the Middle East’s third-biggest producer after Iran and Qatar. But output of natural gas – most of its current output is associated with its oil – could have been much higher had Saudi fully developed its resources.

There is a lot more to this article but you will need to click on the link to read it.

Tks , Ron for the differentiation and clarification .

This a good point and nobody is able to answer it. Notice how sloppy the oil industry is with statistics about basic facts like oil grades.

https://i.ibb.co/SwtY9rd/6-C7-EFE2-F-857-D-4784-9794-A05867-D23698.jpg

These graphs show what happens assuming all the domestic consumption is useful light oil. We know that Saudi was around half Arab light grade in 1999 and it’s worse now. American imports are 15% light.

The wedge between light oil production and domestic consumption has to be closing fast. Kuwait is entirely producing in the rumaliah area and Burgan is dead, Kuwait has hardly any real oil production. All the good stuff is Saudi and uae and uae is already diluting.

Since oil peaked in 2018, and assuming half Saudi output is light, and all the domestic consumption is light oil, exports will die by 2025. UAE is a similar situation and peaked 2016.

Kuwait is essentially irrelevant and doesn’t produce much light oil since it’s all the northern fields now.

The car industry has already collapsed. Everyone’s gonna die really soon and nobody really cares. NGL will run out in a few months and utility prices will spike, there will be blackouts like already in China.

Baker Hughes US oil rig count +5 to 428

One question, is the current rig count enough to keep the current production stable?

I would doubt it but I really have no idea. One of the oilmen on the site could give a far better answer than I.

If you look at the actual data in RRC all the real wells like Texas ten Y were drilled before 2015. Production is dominated by a handful of big leases drilled years ago anything new is a joke.

In GOM it’s definitely dead there’s hardly any activity.

Drilling is just morons screwing around at this point it’s obvious production is near peak. It’s only growing at all from minor expansions of a few existing leases.

Ron

IMO this guy is on fire.

https://youtu.be/MSK04HPznmM

Thanks for the link, he’s sharp.

RU & KSA obviously have nothing to spare because any time they pretend to produce more, their storage falls.

It’s actually that UAE is spiking with heavy oil, I posted this before. The inventory falling alone is not even the worst.

Also pops,

https://web.archive.org/web/20210714083822/https://peakoil.com/forums/the-world-outside-america-has-been-in-peak-oil-since-2005-t78054.html

Yeah, I agree. Great video. This guy has obviously been following Saudi and Russia and obviously sees their problem. As to Saudi’s APO, why would they give money away? Why would they sell something that was more valuable to the purchaser than to themselves? Obviously, they would not. And he nailed Russia pretty well also. Thanks for the link.

Matt Mushalik from down under has a very good site and info ,unfortunately is missed out . Read here about Saudi reserves etc after the Abqaiq attack

https://crudeoilpeak.info/?s=Abqaiq

Ron

Attached is an addition to your chart. It’s petty obvious which comes first, WTI or Rigs.

Thanks for the post Ovi. Very interesting information!

GreenBub, HIH, Survivalist

Thanks for the compliments.

Once we get US crude output data near the end of the year, like March next year, we will get an idea of how world demand will begin to stress OPEC and its partners.

At the current time, US production appears to be stuck in the 11,300 kb/d range and unable to help in addressing increasing world demand, as it did in 2017 and 2018. In fact for the past year, the US has been a net importer of oil and it has increased over last year. The four week moving average for net imports last year for the week ending October 2 was 2,311 kb/d. For the week ending October 1 this year, net imports averaged 3,812 kb/d, an increase of 1,500 kb/d.

If the US cannot reduce its net oil imports by increasing internal production, this will begin to stress OPEC plus and in particular SA with their ability to meet increasing world demand.

While we may not currently be at peak oil, we may currently be in the situation where world monthly oil demand is increasing at a faster rate than world increasing monthly supply.

Ovi,

If oil prices keep increasing, which is likely if demand is growing faster than supply as you suggest (I agree with your assessment), then eventually the high oil prices might lead to increasing CAPEX levels for the oil industry. If that is correct, we will eventually see US output increase. I do not know what oil price level will cause this, my guess is $85 per barrel or higher.

Dennis

I agree that rising oil price will increase capex. However will it be sufficient to relieve the pressure on OPEC plus.

On the short and medium term there will be no big increase in US oil.

The capacity limitation, discussed here often, prevent this. Pre ordering steel pipe for 6 months, labor shortage, clogged logistic pipelines to china (that spare part for our rig is somewhere in the limbo …) will only allow very small increases at very high prices. Price increases of 50% + as reported by shallow will eat away CAPEX without gitting more holes – and needing even more CAPEX.

In long term this will solve – most of these problems are the after – COVID – problems restarting the world economy again. I know the companies are working on it. Perhaps many more things will be produced domestic.

Eulen. I’m just reporting price increases in our small field.

I don’t know the numbers in the Permian Basin, which is where the oil production growth will come from.

Have to think prices are up there also, and that labor is scarce?

Ovi,

Yes, the combination of demand destruction and increased supply will eventually balance the market at some higher oil price. Only oil produced can be consumed.

Opec will produce as much as they can by May 2022, and oil prices will simply adjust to balance demand and supply.

Dennis

Agreed. By next May OPEC, Russia and US capabilities will be much clearer.

Natgas item. China recently outlawed bitcoin mining. Those miners have headed to NoDak. Offering to capture flared natgas on site at fracked wells. Oil production companies interested. Bitcoin miners run generators on the natgas — also on site. NoDak winter cold reduces main CPU and graphics card CPU cooling reqmts. Free-ish power to create Bitcoins.

Amusing, the world of Twitch streamers — gaming types. Raging about Bitcoin. Graphics cards have price driven up by Bitcoin miners.

Fuel shortage forces shutdown of main Lebanese power plants

Beirut, Lebanon – The two main power plants in crisis-hit Lebanon have gone out of commission, effectively stopping all state electricity in the country.

The shutdown on Saturday of the Deir Ammar and Zahrani plants, which have generated very limited electricity in recent months, took place due to a diesel fuel shortage, sources said.

The World Has Hit the ENERGY CLIFF…

This has been my message for the past several years. I knew the world would hit the ENERGY CLIFF soon, but it seems as if we have done so already. Thus, the world now at the Top will experience more extreme volatility and chaos as high prices-shortages turn into low prices-surpluses. Thus, in time… recessions will turn into a depression that never seems to end.

Rinse & Repeat.

This is not just a European or China Energy Crunch. We are seeing record low Heating Oil Inventories in the United States: https://www.zerohedge.com/commodities/us-heating-oil-supplies-lowest-decades-ahead-winter

And, as I posted at the end of the last Oil Post, which I would like to post here again, is that the U.S. Energy Industry produced 2.35 mbd of propane last week, but exported 1.25 mbd. Thus, the domestic market and inventories received 1.1 mbd. So, with FREE MARKET CAPITALISM AT WORK, Americans may face possible propane shortages and high prices this winter.

The ENERGY CLIFF has arrived.

steve

Steve , I hope they are still manufacturing blankets in USA or even that is off shored to China ? . 🙂

HOLE,

That would be funny if it wasn’t the case… but it is. Also, the notion that there are all these BACKED-UP Container Ships off the coast of California, seems to ignore that a significant portion are empty with no place to go waiting for U.S. Exports that aren’t in demand overseas.

With the energy crisis also now hitting Lebanon: https://www.bbc.com/news/world-middle-east-58856914, India: https://twitter.com/JavierBlas/status/1446768445593460740, the Balkans: https://twitter.com/JavierBlas/status/1446752064252661773

The notion that ALL WILL BE FINE, regurgitated by the clueless, because we have PLENTY OF ENERGY RESERVES or MAGICAL GREEN ENERGY… no longer passes the smell test.

This is the FALLING EROI causing havoc and problems throughout the world.

steve

“Fertilizer prices are climbing very, very, very fast as ammonia plants in Western and Easter Europe shut down or curtail production in response to record high natural gas prices.”

https://mobile.twitter.com/JavierBlas/status/1446508052761432065

North America also:https://pbs.twimg.com/media/FBNG7dBWYAw51XJ?format=jpg&name=large

Food price increases coming next year.

I think Australia and New Zealand are the biggest blanket exporters. They have lots of wool.

Most heating in the US is with natural gas or electricity, in rural areas if heating oil or propane prices rise too much people use wood for heat.

In my experience electricity is the primary backup to propane & fuel oil. Space heaters are very easy.

Did you hope to gain credibility here by citing a far-right, conspiratorial libertarian blog Zero Hedge? Guess I can put you on ignore now.

Mike B,

Are you going to put me on IGNORE because I also quoted the BBC & a BLOOMBERG ENERGY ANALYST?

And by the way, the Zerohedge article on Heating Oil Inventories came from information from Blloomberg.

When people react this way…What the hell has the world come to…. LOL??

steve

You aren’t quoting the BBC and Bloomberg Energy, you are quoting a repackaging of their statement by a propaganda outlet of the Russian government.

Effective propaganda is always a mixture of truth and lies. Otherwise it’s jut nutty like the constant stream of lies Trump emits. It’s preaching to the choir, and even the choir is starting to roll its eyes. So the fact that your propaganda contains scraps of truth is no defense.

By republishing Zerohedge you are showing yourself to be an asset in Putin’s effort to destroy Western democracy and re-establish the Soviet Union. And you are instrumentalizing this forum.

The question is whether you are a conscious asset or just a dupe.

I read Zerohedge on regular base. Many informations about Money and FED are very good – and I get information about my own country not published or published very late and small here.

One example. This information I haven’t read in our newspapers:

https://www.zerohedge.com/energy/german-power-plant-halted-after-it-runs-out-coal

I verified it over the next week – but it was always in side notices. There is no interest from our press to point everyones nose at the fact we are on the brink of a Texas style blackout this winter. And we’ll shut down 2 of our last nuclear sites this winter. Hopefully it’s a stormy and rainy winter – then wind power will work.

To compensate it, I read some leftist news, too.

PS: The broken windmill they’ve shown was bigger in the press here.

EULENSPIEGEL,

I too read zero hedge on a regular basis along with a bunch of other websites including this one. I guess I am a dupe.

News sources mostly show their biases by omission. It’s good to read a variety.

Greenbub

That may be the comment of the month on this site.

As the Russians say: trust, but verify. There is nothing wrong with Zero Hedge as a springboard on to other stories that may not have been picked up by the MSM.

And, frankly, does anyone get a gold star for regurgitating everything the BBC, CNN, FOX, DM, Grauniad, or WaPo put out? They all have their biases and blindspots.

BBC, CNN, FOX, DM, Grauniad, or WaPo…have their biases and blindspots.

Good, god, no. The BBC (or CNN or WaPo) is not anything like Fox. Fox is a toxic mess of deliberate misinformation, and not comparable in any way to normal media. Please tell me you know that!!

Thanks Nick, we can agree on that.

Question: Where does Kiebler live, Greenland perhaps. How can anyone living in the civilized world not be aware of what an outlier Fox news is? How can anyone not living in a cave for the last decade not be aware that Fox News has no news at all, nothing but fanciest propaganda? Fox is destroying American Democracy. There could be no Trump without Fox.

Ron,

Sadly, this may be an example of “false equivalency”, which is a deliberate propaganda tactic of the far right: “We’re bad, but so are you!”…

Description:

The argument simultaneously condemns and excuses both sides in a dispute by claiming that both sides are (equally) guilty of inappropriate behavior or bad reasoning. While the argument appears to be treating both sides equally, it is generally used to condemn an opponent or to excuse ones own position.

Example:

“Nearly all members of the scientific community agree that climate change is real; but there are also those who believe that climate change is a hoax. So there are supporters and critics on both sides of the debate.”

“We condemn in the strongest possible terms this egregious display of hatred, bigotry, and violence – on many sides; on many sides.” – Donald Trump (Aug. 12, 2017, in response to violence at a white nationalist rally in Charlottesville held earlier that day.)

https://www2.palomar.edu/users/bthompson/FalseEquivalency.html

I live in the UK, as I’ve mentioned numerous times.

And as someone who has grown up with the Beeb and The Guardian as a constant in the household, let me laugh at anyone thinking they are somehow beyond the same propaganda or convenient missing of certain stories shenanigans of the obviously ridiculous Murdoch shit.

The BBC News dept. is a shadow of its former self. Anyone who actually dealt with Brexit, day in and day out, will tell you that. And The Guardian has now gone the way of the Indy in being all about getting that rage bait from the clique they appeal to. It’s truly depressing.

And I’m sure the WaPo, run by one Mr. Bezos, is completely impartial on things relating to, say, shitty business practise.

Notice my point was that you SHOULD question all outlets, not that they are all equivalent. But if you say stuff like the BBC is somehow above all this, I’m just going to have to ignore anything else you say on that matter because you’re clearly out of the loop.

I would argue that if it wasn’t Fox, it would be some other outlet that rallied the tea party folks to vote in Trumpy or some other hothead. The 24/7 news business is, well, a business. And that means they need to make money, same as any other. That’s why journalism is basically dead and state owned bodies like the BBC are open to manipulation by gov’t interference. This is why there are no truly impartial and all encompassing news outlets, but then that doesn’t mean one can look at the Daily Mail or CNN and split the difference.

Without free market you just get no propane. Or you get a coupon for 10 bottles of propane and can try to get it.

Than you need enough black market currency to redeem your coupons. And in a cold winter this will be expensive, too.

The state will not solve things – think at the most idiotic corona policies – that’s how the state solves things.

You’ll still have to regulate some things – there is no working completely free market. You’ll have to take the best of both. One possible thing for example is to work with the strategic petroleum reserve – releasing barrels in a crisis like this approaching winter crisis, and rebuying them when things settle.

I ordered a pizza this morning from my favorite place where I live. It was about 11:30am on Saturday morning. And the guy answering the phone said they were out of regular pepperoni but still had old world pepperoni.

The horror of it right 😂

It’s little trivial things now. But if your paying attention even in the most affluent parts of the country things are changing.

Majority of people haven’t even connected the first two dots together. Much less have a clue that ordinary life is going to change pretty drastically in the next few years.

Right now here in the USA it’s football season be It college or professional. I’m soaking it in and enjoying it. Thinking by the end of this decade we might not even have football seasons anymore.

One by one things that are normally done will disappear as we go over the energy cliff. Heck a lot of higher education or college’s won’t even be here a decade from now.

Energy poor means you only do the things that are absolutely necessary. The poorer you become the smaller the list becomes of what is necessary.

Don’t go apocalyptic – I thing it’s enough to scale down just a few things in the USA.

Your per head energy usage is more than the double than here in Germany. And I think we can live good enough (going on vacation 2 times a year), and the Bundesliga still plays soccer (that’s our thing, all other sports are a side show).

When I was in the USA 8 years ago I just wondered about all the waste. Cars used almost double the gas as here while driving very calm (didn’t wanted to get in contact with the police), comletely unisolated windows in a modern hotel – temperatures in this region are between -20 and +40 celsius, they must get poor paying the utility bill.

You have lots of low hanging efficiency fruits – just earn them. We are here at the harder part now.

As with all things, energy efficiency savings are subject to the law of diminishing returns.

Eulen , ours’s is a ” The Landfill Economy ” . In this my waste is your income . Stop waste and crash the economy . Don’t believe ,look what the decimation of travel , tourism and hospitality industry (about 18% of the World’s GDP) has done to the economies of countries like Thailand , Turkey , Egypt, France, Italy etc . I know they are yet not breaking each other’s heads but the social fabric is unravelling . Easier said than done . No pain, no gain .

Tourism isn’t waste. It provides valuable entertainment (and education) which people are willing to pay for.

In the US, “tourism” consists of people towing gargantuan “mobile homes” behind monster trucks, behind which is usually a third vehicle, a car of sorts, which apparatuses they park in “natural” areas where they can plug in, turn on (the tv) and drop out waste products into septic fields, all the while roasting the planet with CO2 and befouling our views.

IT IS DESPICABLE.

Mike–

I couldn’t of said it better.

I thought Alim was into saving the planet from oil. Now he’s a global tourist industry advocate.

https://www.nature.com/articles/s41558-018-0141-x

Do the cornucopians have any coherent thoughts?

Alim , your POV is no go .

Entertainment : Entertainment is important but not essential . Without entertainment societies have other problems like alcoholism etc . Example the FSU where their was no entertainment except WWII movies and Khrushchev on TV . However entertainment does not mean take a flight from NYC to Cancun , Delhi to Bangkok and Brussels to Malaga to get plastered and shoot your load . There are similar options closer than to spend all the FF .

Educative : This is a narrative spread by the tourism industry . How much are you going to learn or get educated by visiting Paris for a week ? The travel time from the time I leave my house , drive to the airport ,checkin ,checkout and drive to the hotel in Paris is 4 hrs .This does not include flight time . I could get more info on France, Paris and French culture by surfing the internet for 4 hours . Yeah , I won’t be able to take photos of myself touching Eiffel tower or of La Louvre so that it I can say “I was in Paris last week ” at the next cocktail party .

As Survivalist said “Do the cornucopians have any coherent thoughts?”

Lightsout,

That is true, but the fact remains that US per capita energy consumption is 2 times the average European level. In addition Worldwide there is a huge amount of energy wasted by internal combustion engines and producing steam used in turbines for electric power. Also a lot of heat is wasted in buildings that are poorly sealed, not well insulated and that don’t take advantage of available passive solar.

World energy use would be far lower if energy was expensive because buildings would be improved and more efficient power production and transport would be utilized.

As an engineer who designs sustainable buildings for a living I have to add there is a “yes, but” to this. Having just attended one of the annual award banquets for architects (my clients) in this industry last week, the topic is on my mind. Unfortunately, much of the energy used by a building through its total life is used during construction (embodied energy). This ratio tends to be worse for sustainable buildings.

http://faculty.arch.tamu.edu/Jos%C3%A9%20L.%20Fern%C3%A1ndez-Sol%C3%ADs/Research/Peer%20Reviewed%20Papers%20-%20Presentations/Files/Manish_Solis%20Measurement%20Protocol%20Need%202.pdf

I was impressed two years ago (the last time the event was held before COVID) when the key note speaker mentioned to the room something along the lines of “…if you use air conditioning in your house, you’re not really serious about sustainability…” There is indeed much which could be done to reduce energy use. Could we mandate max/min temperatures? 2% savings for every degree, more or less. We can also ban leisure air travel, theoretically. What will be politically possible?

I’m all for aggressive building codes – but high up on the list should be (1) smaller buildings, (2) long lasting buildings. Also, adapting to being much less comfortable in existing buildings

When I was in the USA I noticed they didn’t harvest even the low hanging fruit – things like double glass windows I have rarely seen. I don’t speak from sophisticates isolation and passive house standard.

Eulenspiegel,

In cold areas of the US double paned windows are standard in construction since 1985 or so. Insulation standards have also improved over time, again moreso in northern parts of the US.

Older homes are not as well built for energy efficiency.

BlondBeast,

The report you linked to simply says that better standards are needed, and that current data is very low quality:

Sartori and Hestnes [38] conclude, after reviewing 60 case studies from past literature, that for a conventional building, the embodied energy could account for 2-38 percent of the total life cycle energy, whereas, for a low energy building, this range could be 9-46 percent.

A range of 2 to 38%? Nine to 46%?? These are enormously wide ranges.

Thormark [57] asserts that embodied energy of a low energy house could be equal to 40-60 percent of total life cycle energy

Well, sure. If you dramatically reduce operational energy, than the percent of lifecycle energy accounted for by embedded energy will rise dramatically. That’s simple math.

Efficiency is very, very useful. It can help us get through the temporary bottleneck we’re facing, as we transition away from fossil fuels. But in the end, it’s not the most important thing. The most important thing is to stop burning fossil fuels as an energy source.

@ D Coyne

I was near St. Luis. Hot summers with clima on, cold winter storms direct from the North. And single glas windows – I don’t get it.

And in the northern part I would recommend triple glas windows. They are common standard for new buildings here.

@Nick

With the transition efficiency is even more important – you can build from both sides then to make transition a lot faster. Using less energy leads directly less new power sources, less deep storages and less new infrastructure needed.

Four years ago I visited an office of our company in Ann Arbor MI. We stayed there for a week.

It was a bizarre place in many ways. For example, employees were packed into cubicles to “save space”, but two thirds of the cubicles were empty. Their product was dying so there were no plans to add employees.

The office was so cold that the ladies had formed a knitting group and taught each other how to make fingerless gloves to keep their hands warm enough to use a mouse.

After a day in the freezing meeting room (we couldn’t open the windows to warm up) we got them to complain to the janitor. The next day someone showed up with a stepladder, removed a ceiling panel in the foyer and fiddled around with a wrench for about 20 minutes.

As a result, the office next to the meeting room got several degrees warmer. However, it was a corner office reserved for senior management. There was no management on site senior enough to enjoy this privilege, so it remained empty. The janitor never came back.

The hotel was similar. The room temperature was set to 65 F when I checked in, and the air conditioner was extremely loud. I switched it off and opened the window when I was in the room.

I am pretty sure there is some potential for optimization of energy use in America. I grew up in East Tennessee in a house without air conditioning. It was sometimes unpleasantly hot upstairs, but I survived into adulthood.

My grandfather made some enormous contributions to S. California architecture (see https://www.rmsdocumentary.com/). Coming back to France after spending the summer in Los Angeles, I was horrified at current trends in building in Los Angeles. My grandfather was famous for bringing the outdoors in, that is to say that he made use of the temperate S. California climate to integrate exterior living spaces and views into his house designs. The current trend is to bring the indoors out. Because real estate prices are based on indoor area, buildings fill up the entire lot they are located in leaving no room for plants. Don’t these people know that one of the 9 clinically proved reasons for depression is lack of contact with nature? The market is a complete failure when it comes to satisfying the needs of the city. The new houses I see going up are all built for people with lots of money while there is a tremendous homeless population with very little money.

Michael Reynolds has shown that it is possible to build passively heated houses in many climates out of dirt, tires, glass, bottles, and other stuff that frequently ends up in landfills (key search word: earthship). Other people have shown that you can build fire resistant passively heated multistory dwellings from hay. Living green roofs do a good job of insulating from heat and increase biodiversity.

Though not an expert, I have heard that current building codes stifle innovation and creativity. My grandfather used to build things to code before the building was inspected. As soon as the inspector was gone he would tear things down and rebuild them solving architectural problems, but not to code.

@Nick G – no major objection. I pulled the article quickly – we’d generally use a “around 25%” if quoted on it. My firm does a lot with net zero, and now carbon neutral, in construction.

Efficiency runs us into Jevon’s paradox, too. Don’t get me wrong, I’m all for energy efficiency for those of us who can afford it. I’m renovating a small cabin to be net zero myself, for some resiliency for my family. And I push it whenever I can.

But no matter how sustainable you make concrete, there is nothing as sustainable as less concrete.

Efficiency runs us into Jevon’s paradox, too.

Maybe a little. I confess that I worry a little less about lighting levels with LEDs. But after you reduce energy input to 10%, a 20% increase in output from that base will only take you to 12% – I can’t imagine people increase their square footage much because of reduced energy operating costs.

That does point out the importance of careful regulation combined with carbon taxes, to deal with the overall universe of energy consumption and not just a few outliers.

But no matter how sustainable you make concrete, there is nothing as sustainable as less concrete.

Yeah, conventional cement is bad. Have you seen anyone using any of the alternatives that have been developed recently? My sense is that builders are very resistant to changing their time-tested methods…

@NickG – I have seen some of this “carbon sequestering concrete” technology which is quite cool. So far it is limited to a few metro regions, and typically for mega projects ($100M construction cost and up).

But as with many sustainable building methods the argument has been that luxury builders and high-end projects subsidize the roll-out and economies of scale. To some extent this has been true. There are encouraging developments in many areas moving toward the Passive House system (U.S. east coast affordable housing moving in this way). Many other municipalities have decarbonization plans and electrification plans in place. I’m in the “skeptical, yet supporter” category.

For instance, once mega project we are working on (600ksf+) is trying to go all electric with emergency backup. We recently informed them they need 40ksf of space dedicated to battery storage to meet their goal. There are some encouraging funding sources out there now in the ESG space as REIT’s are pressured to improve the energy profile of their building stock. Had a chiller replacement this week accept an option to switch to a heat pump style system at significant improvement. The reason given was they are pursuing investment from European sources which require these commitments. Let’s hope it all can hang together long enough for us to give it our best shot.

(All this being said, I acknowledge individuals should pursue the lower tech and reuse type approaches. Big fan of earth ships and permaculture as noted by other comments. But I think this kind of stuff being available broadly will not be in time due to building codes, big ag, etc.)

trying to go all electric with emergency backup. We recently informed them they need 40ksf of space dedicated to battery storage to meet their goal.

Hmm. Why do they need storage? If they weren’t focusing on sustainability, would they have onsite generation? Are they simply trying to downsize their diesel backups and reduce diesel consumption?

@Nick G – Having emergency backup is part of the certification they are pursuing, and needed for tenants (lab spaces). Ordinarily they would have a natural gas generator – which is quite sensible. In this case “no gas connection” is part of the rating system, and quite silly imho. Natural gas (or deisel) has many important uses. There is some chance we may get an exception on this one. Good questions!

Natural gas (or deisel) has many important uses.

What are you thinking of?

What are you thinking of?

Nick, there are many, many important uses for natural gas and diesel. That should be obvious to anyone. Are you truly unaware of this fact?

Ron,

I believe we’re talking about an office building complex, not an industrial complex. Clearly they’ve decided not to use natural gas for HVAC. So, what’s left?

Actually, I can see a case for liquid/gas fuels for long-term power backup (not necessarily from fossil fuels, of course, as I’ve discussed often). Batteries are more suited for very short term backup. But BlondBeast seems to be talking about other things.

@Nick G – The value of natural gas or diesel for emergency power for labs (or more commonly hospitals) has to do with disaster planning and redundancy. For instance – hospitals commonly require an electrical hookup to two separate electrical feeds, and also water feeds – just in case, since people may die if one goes down. These locations are also often designated as emergency shelters for local disasters. A fair amount of planning based on local infrastructure goes into deciding on the reliability of the gas system in a crisis, vs the capacity to store diesel – and for how long. These issues for hospitals at least in the U.S. are codified by building standards (N+1 redundancy for mission critical facilities)

The value of NG or diesel in other areas (be it power generation or HGV) I’ll leave to others, as I have generalist knowledge and opinions but not expert knowledge. C.V. note my company of which I’m a parnter has designed 300+ net zero, LEED certified or passive commercial buildings in the 20M-100M range in the last 15 years. I will credit I am staggered at how little the people in my industry understand primary energy issues. I feel like I’m on an island, despite consulting to large municipalities about a decarb future.

BlondBeast,

Yes, I’m very familiar with healthcare backup power – I thought you were talking about something else. I agree: I suspect that the NG hookup requirement was aimed at routine operations like HVAC.

As I said above, liquid or gas fuel seems to fit the operating profile of a backup system. I’d say your project deserves a waiver.

Eventually we’ll use synthetic fuel of some sort.

BlondBeast,

Here’s a thought for your gas connection waiver: a very large battery is almost certainly higher carbon than a gas generator because of the very large embedded energy of the battery!

Batteries are very low carbon in applications where they get daily use. In applications where they get one or two brief uses per year they are neither cost-effective nor low carbon.

Lightsout —

We are nowhere close to where we could be in energy efficiency.

“You have lots of low hanging efficiency fruits – just earn them. We are here at the harder part now”.

To which I directed my comment.

It’s virtually impossible for everyone to not die in 3 years.

The op isn’t even that focused, NGL inventory is a third below last year.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=W_EPL0XP_SAE_NUS_MBBL&f=W

America has 2m bpd light oil consumption. If ngl inventory is falling 50m per year that’s 100k per day. The deficit started around March so it’s 200-300k now. That’s a 15% deficit. Ngl isn’t oil obviously but because natural gas is eroi useless it is coming out of oil.

Everyone will die in 2024 so the collapse of the car industry- half the economy- means 30% annual decline from here. We already see 15% this year.

Hello, just greeting everyone! Ultimately, I did post close to nothing but keep on reading the barrel regularly. I’m sure there are many others who do so. The work and comments here are very appreciated, a big thank you to all the contributors.

Interesting article. You should probably break it down by API gravity to see spiking, but otherwise it is a interesting trend.

I think the biggest thing that will be in the way of higher priced oil is still going to be the dollar. And it’s not what goes on at FED that determines the strength or weakness of the dollar. It’s global dollar funding that determines the strength or weakness of the dollar.

Currently China is managing their currency peg to the strong side. But dollar denominated debt is blowing up and getting defaulted on. China imports a little over $2 trillion of stuff from rest of world if you use 2019 numbers. That means about $2 trillion US dollar get exported from China to rest of the world.

If China imports less it means less dollars exported to rest of the world. Which means US dollar funding comes under pressure. If you look at currency markets it already happening. A strong dollar wrecks everything.

I know I’ve been talking about a much stronger dollar taking oil price down for awhile. There will some lag in time frame. But it’s coming.

HHH

On November 2, 2020. the DXY was 94.13. On Oct 11, 2021, the DXY is 94.31. Essentially no change. On November 2, 2020,WTI settled at 36.81. On October 11, 2021 WTI settled at 80.52, more than doubling. This seems to imply that the price of oil has little effect on the DXY. See DXY and WTI charts below.

Also it says that the world needs double the amount of $US to trade oil. Daily trade at $80/b and trading 80,000 kb/d needs $US 6.4 B/d.

At this point it seems to me that supply/demand for oil plays a bigger role than the DXY in deterring the price of oil.

Your thoughts would be appreciated.

It’s really about dollars available to bid price. DXY matters and so do a lot of other dollar indexes. But they aren’t what really matters

It’s dollar funding, the Eurodollar market the shadow money that you can’t see. The dollar loans that you can’t see in a index that actually matter.

Eurodollar system was working smoothly before 2008-2009 crisis. Eurodollars are the dollar denominated credit or debt that allows world trade to happen. The Eurodollar market froze in 2008 crisis. And what I’m says is that going to happen again.

The stuff Evergrande is defaulting on are Eurodollars. It’s a symptom of a dollar credit shortage or a Eurodollar shortage.

This just the beginning. Strong dollar will take down a few other things first before oil has it’s oh shit moment.

I’m not saying oil can’t go higher. Right now I’m long inflation. Higher oil prices are included in that. What I am saying is this inflation will lead to a blowup in dollar funding. Which will crush the inflation. And prices.

This price inflation is temporary regardless of the lack of supply.

The Fed doesn’t back dollar denominated loans made outside of the US. China can vouch for that.

There just aren’t enough dollars circulating to service all theses loans made outside US. Inflation is like pouring gas on this fire. Because it takes more dollars something that there is a shortage of to buy the same amount of stuff.

Settled WTI price today, $80.52

Above should have read

On November 2, 2020,WTI settled at 36.81. On October 11, 2021 WTI settled at 80.52, more than doubling.

Everyone’s dying really fast, phantom peaked, New Mexico is about to.

And the funny thing is: The higher the energy market prices are (the current coal, gas and oil price spikes), the more $ they need to export. So the oil price depends on the $ price, and the $ price on the oil price since China is the biggest importer.

That’s irrelevant they can borrow.

The real problem is the API of oil is declining and everyone is getting fake stuff.

https://i.ibb.co/v3gNRhR/9-C302-FE5-544-E-47-BF-8125-E92-DCA8743-B7.jpg

First, the “trend line” do not fit the data. Second, LTO has increased US supply of light crudes and thus demand for heavy needs to be met by imports. If there has been any “API-scarce grades” then these would probably be found in the medium or upper medium range.

Umm. Everything besides light oil is utterly useless.

John Thompson, you are a complete idiot. Every weight of oil is useful, including very heavy oil to make asphalt. Or just heavy crude for bunker fuel. There are no useless weights of oil.

But every post of yours is just so fucking stupid.

We had such a blooming idiot here before. His name was Mark. We banned him because of his continuous very stupid posts. Then he came back as Bob. Banned again because of his continuous posting of very ignorant posts.

Now he is back calling himself John Thompson. Mark, Bob, John, your ignorance gives you away. Damn, you just cannot hide stupid.

Mr. Patterson

This individual posted for years on the Peakoildotcom site initially as Shortonoil, then Mustang19.

To say it was nonstop, nonsensical gibberish would be an understatement.

Most peculiarly, he actually seemed to have a small, fanatically devoted band of followers.

China may import for $2 tr a year but it exports for $26 tr a year (2019). That would make it a net importer of $600 bn (in paper dollars) a year.

China runs a fiscal 10% deficit and now since import prices are so much higher. They will be running huge twin deficits. Think Argentina but a much larger and much more important country

Their 2 trillion in Reserves mostly US treasuries won’t last long trying to defend currency peg.

China will be epicenter of next crisis.

That’s pretty much nonsense.

For one thing, the “twin deficits” idea is comparing apples to oranges. The may seem related, but they really aren’t.

Also you are claiming they will run a current account deficit, when I read your comment correctly, but you have no data. You are just randomly claiming some future event. If it happens, it would be wildly out of sync with the trend of the last thirty years or so.

Alimbiquated , when nations, countries or empires tip over ,they tip over . 30 years , 70 years , 300 years of history take a back seat . Ask the Brits or the Soviets . As was remarked on the fall of the Soviet Union ” Nothing happened for 70 years and then 70 years happened in 7 days . “

Hole in Head —

Kind of like the Patagonian flu that’s going around. No symptoms at all, then suddenly Bam! you fall over dead.

So If you aren’t showing any symptoms, you probably have it.

Back in 2018 when oil price was $75 ish China’s current account turned negative for a quarter. They got a reprieve from it as oil price fell. They import a massive amount of oil. Still do. But now it is not just oil it’s coal and NG that are also issues.

As long as China’s dollar reserves are growing they can continue expanding credit within their own borders in their own currency.

China’s banking system is about $48 trillion. And it’s reserves are only about $2 trillion. They don’t have enough US dollars not even remotely close. It would be different story if China’s currency was accepted as payment outside their own borders.

And as the pile of dollars they do have disappears. The current account turns negative they lose ability to defend peg. Which will compound the inflation problems they are having. They must defend peg at all cost to hold back inflation.

Also China regulates the price on electricity. So while imports can cost 5 times what they did two years ago for coal the full cost isn’t past on to the consumers. Cost are only allowed to rise something like 10-20% So when it comes to coal imports 5 times the amount of dollars are leaving for the same amount

of coal as it was 2 years ago. And cost aren’t being recouped by the end users.

It wouldn’t surprise me one bit if China and India have a war over coal imports if supply can’t be ramped up to meet demand btw. Try factoring that into price of oil.

There is a thing known as China’s credit impulse. If your not familiar with it google it. This credit impulse is there as long as China has growing reserves of US dollars.

HHH,

They will simply not defend the peg to the US dollar.

They are heavily defending it right now Dennis. They have too because of inflation.

They don’t defend it their problems get worse by multiples. They will abandon the peg if inflation continues as it has been. When they just don’t have dollars to defend it. And some very bad things happen to markets and prices when that happens. Higher oil goes the higher the odds of what I’m saying happens.

Everyone would cheer for lower prices if they grasp the gravity of what higher priced oil means.

Dennis, the alternative for China on breaking the peg are devaluation , inflation , bank defaults etc etc . Chaos and mayhem that is unimaginable . If they break the peg the Yuan will go the way of Zimbabwean dollar . Pray they hold the dam .

Hole in head,

The currency should float, just like Euro, dollar, pound, swiss franc, yen, won, etc.

An artificial peg tends to cause more problems than it solves. It simply distorts markets.

China’s economy is the second largest in the World and on its way to becoming the largest economy in the World, the fact that they try to manage exchange rates is just silly.

If they want to claim to be a major economic power they should stop acting like a third world nation.

I think that based on PPP, China already has the largest economy.

Dennis , the currencies that are free floating still manage their exchange rate vis a vis the USD . Remember the Plaza Accord with Japan in the 70’s-80’s because the Japanese were managing the Yen to their benefit . In a fiat currency based system USD is the top honcho . China just followed the Japanese mercantilist policy to get rich but more aggressively . It is now impossible to unwind without causing massive upheaval worldwide . China is 17.8% of the world’s manufacturing output . Asking China to float the Yuan will be like asking the USA to abandon the ” petro dollar ” status . Easier said than done .

I agree with HHH s that they are going to impose capital controls to prevent capital flight . The real estate bubble in China is $ 5 trillion . It has burst and is unravelling . In the 2008-09 crisis the real estate bubble in the USA the value crashed by 50% .

Nick G , yes on PPP basis , but all is debt . The problem of the debt being tied to the USD currency peg has been well explained by HHH .

The Export Land Model

The Export land model is not a theory, it is nothing but pure common sense. Jeffrey Brown coined the phrase about fifteen years or so ago. It is explained here: What the Export Land Model Means for Energy Prices

But basically, it means that any exporting country will, quite naturally, increase its domestic consumption. And, all exporting countries will eventually start to decline in oil production. When that happens, the combined increase in domestic consumption and decline in domestic production, will both add to the decline in oil exports.

That means that peak oil will have a double-barrel effect on the world’s economies. Importing countries will be in dire straights. Keeping world order under such circumstances will be difficult to say the least.

The ELM model is moderately useful. It’s interesting to look at countries like KSA, for instance, and how they’re managing their net exports. It’s also interesting to look at the remarkably stupid behavior of major oil exporters, who repeatedly subsidize domestic consumption: that includes the US, KSA, Venezuela, etc. Unfortunately, it’s not just exporters who do this stupid thing, as we see in countries from India to Lebanon.

But it makes a basic assumption that the only thing that matters are exports. That’s clearly not true, as we’ve seen from the impact of the US reducing it’s imports. A reduction in imports is just as important as an increase in exports. Similarly, an increase in imports is just as important as a decrease in exports. In other words, oil is fungible, and where it’s produced and where it’s consumed is not so important. Texas oil exports are as important as those of Kuwait.

The result: the most important thing is the net world balance of production and consumption, not net exports.

But it makes a basic assumption that the only thing that matters are exports.

No, ELM makes no such assumption. By what strange logic did you arrive at that conclusion?

A reduction in imports is just as important as an increase in exports.

Errrr, Nick, I think there is something you really fail to understand about Middle East oil exporters. They do not import oil or oil products. They export oil and oil products and almost nothing else. You seem to think that the USA is an example of the world’s major oil exporters. Nothing could be further from the truth. For the past several decades the USA has been a net oil importer. Currently, as our consumption has increased, it’s pretty much of a wash.

Texas oil exports are as important as those of Kuwait.

Oh my God, are you serious? First of all, First of all, US oil companies export oil, Texas does not. The US is not important at all when it comes to net exports. As the chart below shows, the USA, on average 2021, is a net oil importer by a piddling 63,000 barrels per day. It’s basically a wash.

The result: the most important thing is the net world balance of production and consumption, not net exports.

Good gravy, what the hell does that mean? The world must consume no more than it produces? Wow! How did you arrive at that conclusion? Nick, some countries produce almost nothing but oil and some countries produce no oil whatsoever. That, Nick, is the problem. In a world of declining oil production, the producers only will have it all and the consumers only will have almost nothing.

Bottom line, as the production from the world’s major oil exporters begins to decline, their consumption will not decline. They will consume a greater and greater proportion of their own production. That will make their exports decline at a greater rate than their production declines. And that is all that it says. Countries like Japan, South Korea, Germany, France, etc., etc. will suffer far greater than the world’s major oil producers. And if a person cannot understand such basic logic then they have a very serious problem.

Ron,

If most nations continue to freely trade goods and services, then oil will become expensive as nations that nedd oil imports try to outbid each other, also it makes subsidies in oil producing nations more expensive in the sense that if you give away oil to domestic consumers at $10/bo when you can sell the oil for $120/bo on World markets, then the NOC is losing $110/bo for every barrel used domestically rather than exported. It is possible in this situation that nations will reduce the level of subsidy at home, prices for fuel will increase and consumption will decrease within producing nations.

In addition high oil prices will speed the transition to non-oil alternatives such as CNG and batteries.

Of course Dennis. That is already happening. From January 2018:

Saudi Arabia Subsidies

Saudi Arabia recently scaled back some fossil fuel consumption subsidies that artificially lowered the price of fuel for its citizens, increasing its country’s gasoline prices by 50 percent. Saudi Arabia’s government also started a policy to reduce fossil fuel subsidies in 2015 when the kingdom raised the price of 95 Octane gasoline from 0.60 to 0.90 riyal. Currently, the government is considering the details of a plan to phase out subsidies for gasoline and jet fuel. This could result in a hike of about 80% for octane-91 grade gasoline to about 1.35 riyals per liter (0.36 cents)

And of course, this reduction of subsidies, in every exporting country, will continue until there are no subsidies at all. That will just be the natural progression of events as the world’s oil supply continues to decline. Production countries already see the handwriting on the wall. And in just a few years there will be no subsidies at all and consumption will continue at a steady rate. And as production continues to decline, exports will decline even faster.

Ron,

You assume consumption continues at a steady state, that is a poor assumption. As oil supply become short and oil prices increase, consumption of oil will decrease as people and businesses switch to either BEV or CNG for transport (and in some cases to electrified rail). We are likely to reach a point where consumption decreases more quickly than supply and oil prices start to fall. My guess is that this (decreasing oil prices) occurs between 2030 and 2040, best guess is 2035. Obviously as oil prices start to fall, no further development of expensive resources (tight oil, oil sands, artic oil, and deepwater offshore) will occur and World supply of oil will fall to balance the market.

Dennis, I make no assumptions whatsoever. All I am doing is giving the basics of the Export Land Model. It is nothing more than just plain common sense that as an exporting nation’s oil production starts to decline, their exports will decline faster than domestic consumption.

Of course, as world production starts to decline prices will go up and consumption will go down. I never doubted that for a minute because that is something else that is no more than just common sense.

But world exports and imports will decline faster than production declines. The exporters will be the “haves” and the importers will be the “have nots”. Surely, Dennis, that is just not too hard to understand.

Dennis, you are the one making irrational assumptions. You assume that renewables will replace oil fast enough to cause a drop in demand, thereby causing the price to drop even in a world of declining production. But to your credit you do not see that happening for another decade or so. But the Export Land Model will kick in long before then.

Our difference Dennis is on the timing of Peak Oil. I see happened 2018-2019. You see it a decade later. A decade will give renewables time to kick in… well almost. But if we are already post-peak, shortages will be felt long before renewables can take over.

Ron,

Yes we disagree on timing and on whether the export land model makes good assumptions. If the export land model proves correct, oil prices will be very high and those high prices just lead to a quicker transition to EVs and CNG (compressed natural gas) for transport as well as a general move to more fuel efficient vehicles.

If you think high oil prices cannot affect World consumption of oil in a hurry see 1979 to 1983 when World oil consumption fell by 10.6%, in the 4 years leading up to 1979 oil consumption had grown by 17% so this was a swing of almost 28% from the previous trend. In today’s case we have a new and better technology to replace ICE vehicles which did not exist in 1979, so we might see a greater swing in oil consumption than was witnessed in 1979 to 1983.

It will be interesting to see how it plays out, a lot of auto manufacturers are jumping on the EV bandwagon.

Let’s say ELM is correct as you assume and that 2018 is the final peak in oil output as you also assume, what oil price do you expect in the medium term, say 2025, if the pandemic has wound down? You seem very pessimistic about future supply and any possible substitution for oil use from EVs or natural gas, so I would think this implies very high oil prices, perhaps $120/bo or more (in 2020 US$) for Brent crude in 2025?

Ron,

It is nothing more than just plain common sense that as an exporting nation’s oil production starts to decline, their exports will decline faster than domestic consumption.

That’s not realistic. It may be common sense, but so is a flat earth.

It really makes a hidden assumption that production from other countries is still rising, so that oil prices stay low. If all major exporters are reducing their exports, and importers like the US don’t compensate with more production then oil prices will rise dramatically and all consumers (including those in exporting countries) will have to reduce their consumption in order to match production with consumption.

Really, the ELM model assumes that consumers in exporting countries will be shielded by price controls and subsidies, but as we have discussed relative to KSA, this cannot last forever. Price pressures will break those price controls and domestic consumers will have to take their share of the cuts in consumption.

And, as Dennis notes, those cuts in consumption don’t have to be painful. Smart consumers will shift to alternatives. Some alternatives, like EVs or solar power (think KSA!), will be cheaper and better…

If the export land model proves correct,….

Dennis, you don’t seem to understand. The Export Land Model is a statement of fact, not something that just might happen. It is a hard-cold fact that oil production in exporting countries will peak and start to decline. Now those countries could sacrifice their own population and cut domestic consumption instead of exports. Fat chance of that happening. But if it does, then I am just wrong.

If you think high oil prices cannot affect World consumption of oil

Dennis, when did I ever make such an assumption??? I challenge you to dig up a post of mine making such a claim. I am not a blooming idiot Dennis. I have always asserted high prices, of any product, affect consumption. This does not negate the Export Land Model. In fact, I stated just a couple of days ago that a nation could make just as much money by exporting half as much oil because the decline of world oil production would at least double the price of oil. That country could keep domestic consumption steady, decrease exports by 50%, and still get as much revenue from their oil as before.

It will be interesting to see how it plays out, a lot of auto manufacturers are jumping on the EV bandwagon.

Consumers must jump on the EV bandwagon for the EV revolution to work.

I would think this implies very high oil prices, perhaps $120/bo or more (in 2020 US$) for Brent crude in 2025?

I think you are a little low. I would guess closer to $150/bo by 2025 in 2020 dollars.

Nick wrote: It really makes a hidden assumption that production from other countries is still rising, so that oil prices stay low.

No, nick, makes absolutely no such assumption. In fact is oil prices go high, it makes the Export Land Model far more likely. If prices double then a country can export half as much and still have the same export revenue.

Really, the ELM model assumes that consumers in exporting countries will be shielded by price controls and subsidies,…

Again, it makes no such assumption. Of course, domestic prices will increase. Prices will increase all over the world. But every national leader, even in a dictatorship, ignores the welfare of its citizens at its own peril. The Arap Spring revolution proved that point in spades. Every nation will appease its own citizens while still trying to get the best price for its exports. But the national leaders must try desperately to appease their own citizens, else there will be a revolution and they will be out at best and hung at worst.

Smart consumers will shift to alternatives. Some alternatives, like EVs or solar power (think KSA!), will be cheaper and better…

Someday, yes someday. But not nearly fast enough to counter the decline in world oil production.

Ron,

Every nation will appease its own citizens

In other words, ELM assumes that exporters will have price controls and subsidies that shield their consumers from oil market price pressures.

Right?

Right?

Wrong. You are obviously forgetting that in most exporting nations, especially those in the Middle East and Africa, the oil is owned by the country.

They will not shield their citizens from high prices. They will have higher prices, just not as high as those in Japan or Germany. Everything will be a calculated trade-off, Nick. Nothing will be cut and dried.

That’s the way it already is Nick. Saudi Arabia is cutting the subsidies to its citizens. Every year they get cut just a little more. And that is the same for almost every other exporting nation.

You seem to think everything will be either black or white. Either huge subsidies or no subsidies at all. No, it is always somewhere in between.

These were the net exporters at the end of 2019, based on BP data.

Ron,

The export land model, which you defend as being correct from a common sense point of view, assumes consumption in exporting nations will not be affected when World output peaks and starts to decline.

The assumption is very likely to be wrong.

The assumption implies that consumption will not be affected by prices or that exporting nations will continue to subsidize domestic oil consumption. Both of these are also bad assumptions.

A lot of bad assumptions are wrapped up in that common sense model.

It was also a common sense theory that believed light objects would fall more slowly than heavier objects.

It is fairly common for common sense notions to be proved incorrect by careful analysis.

Dennis- I believe that the domestic consumption in exporting nations will be generally restricted by higher global prices and lower internal subsidies, but nonetheless the shortfall in exports will still grow as depletion unfolds.

Some countries like Saudi Arabia or Nigeria or Iran or Russia may have trouble with civil unrest if the domestic supply of affordable energy is restricted too much.

To be an energy importer is a very vulnerable state of being going forward.