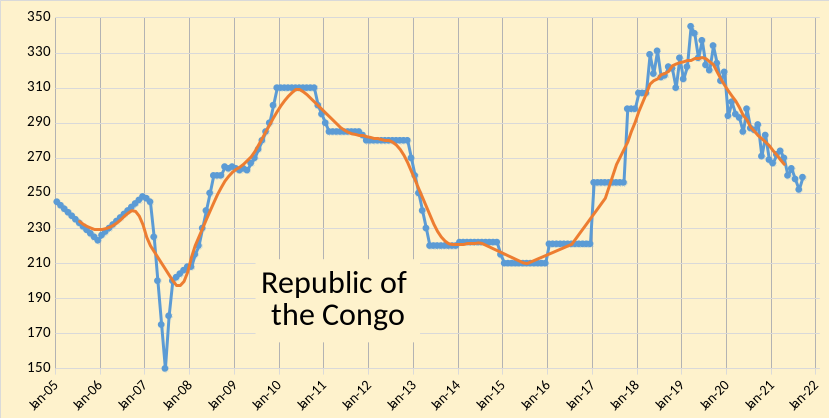

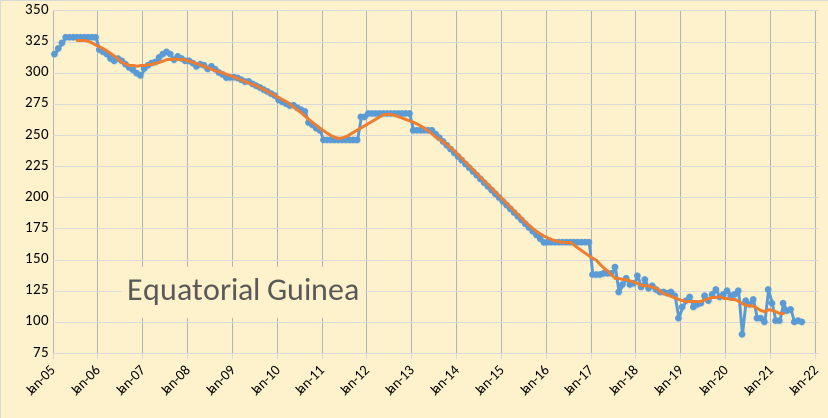

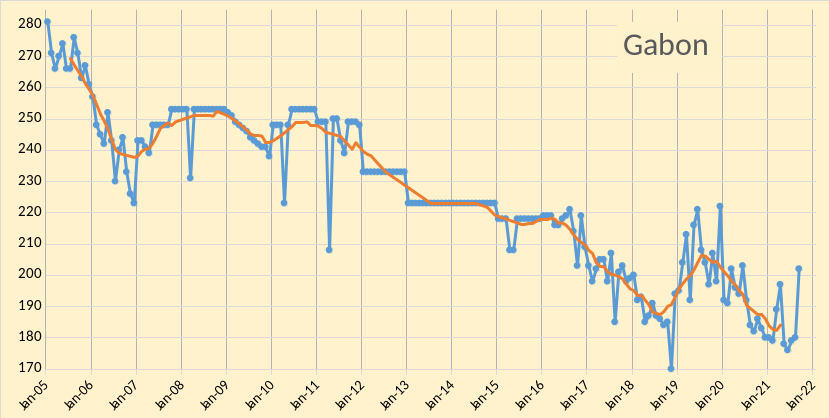

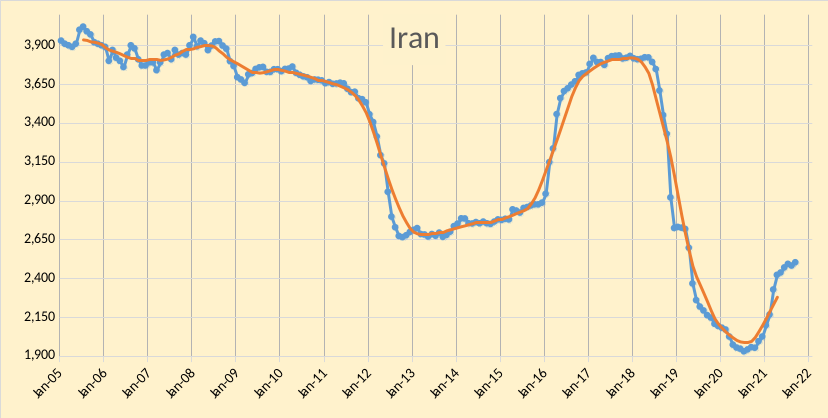

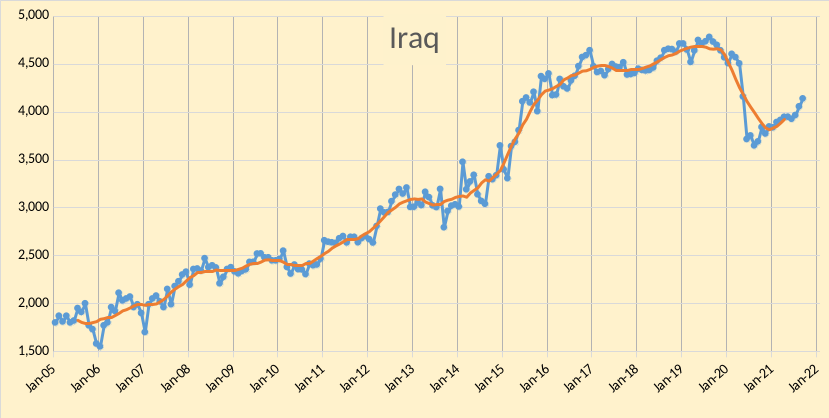

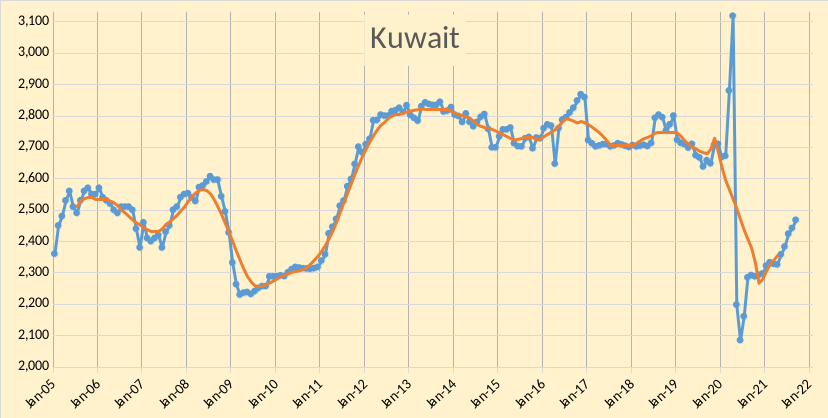

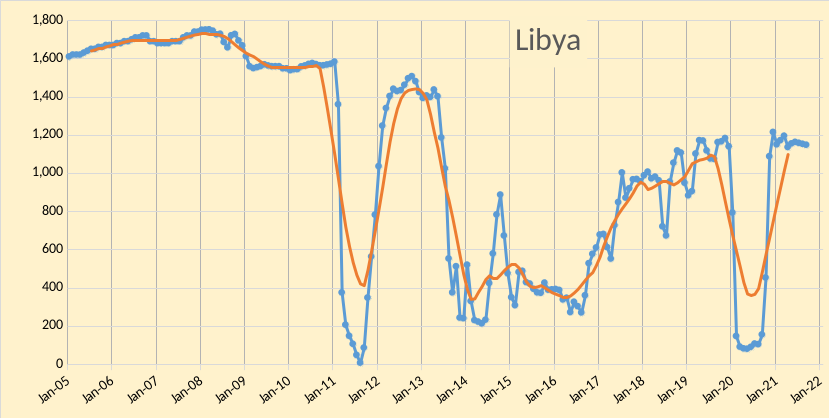

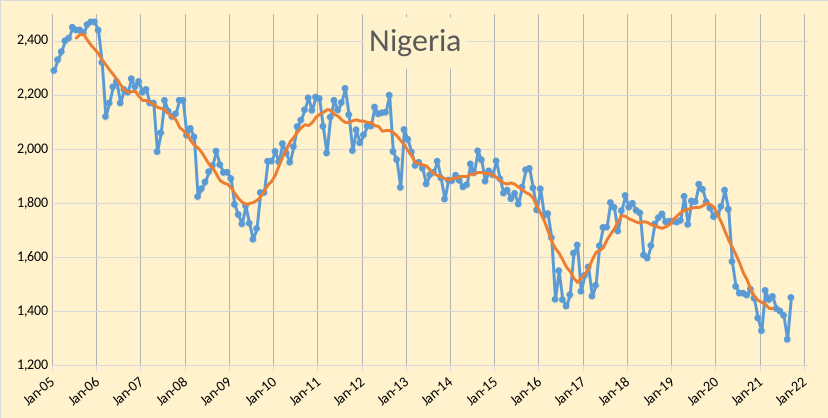

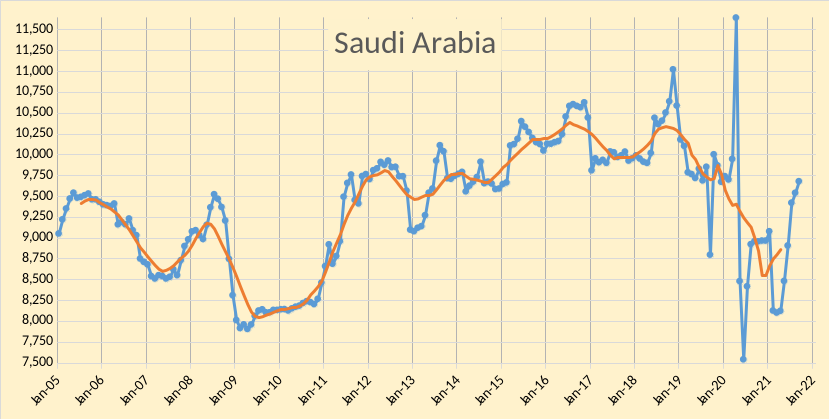

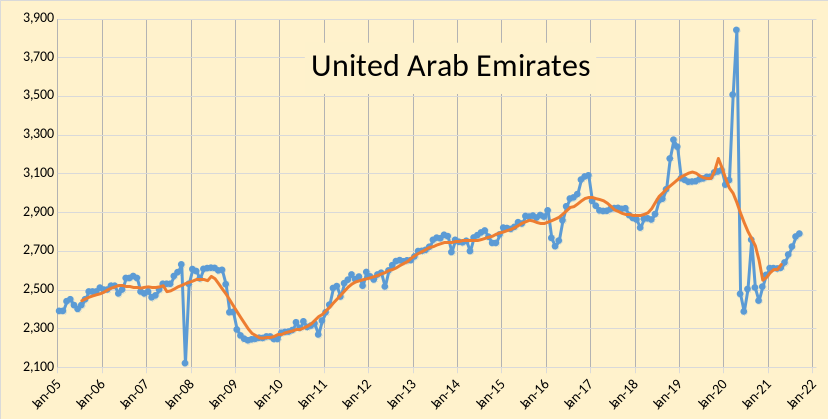

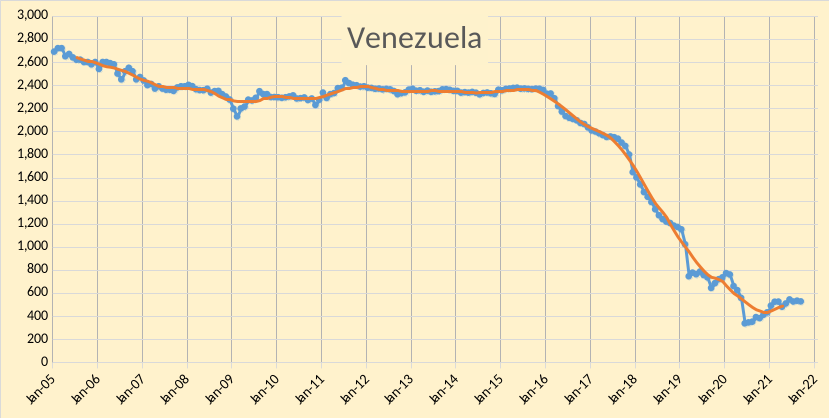

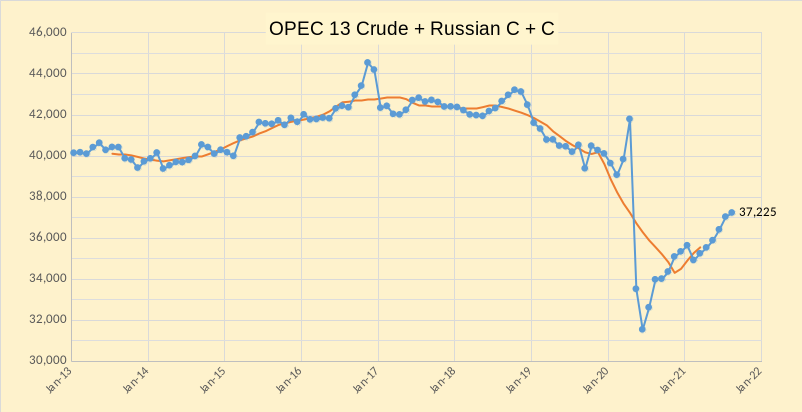

The OPEC Monthly Oil Market Report for October 2021 was published this past week. The last month reported in each of the charts that follow is September 2021 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

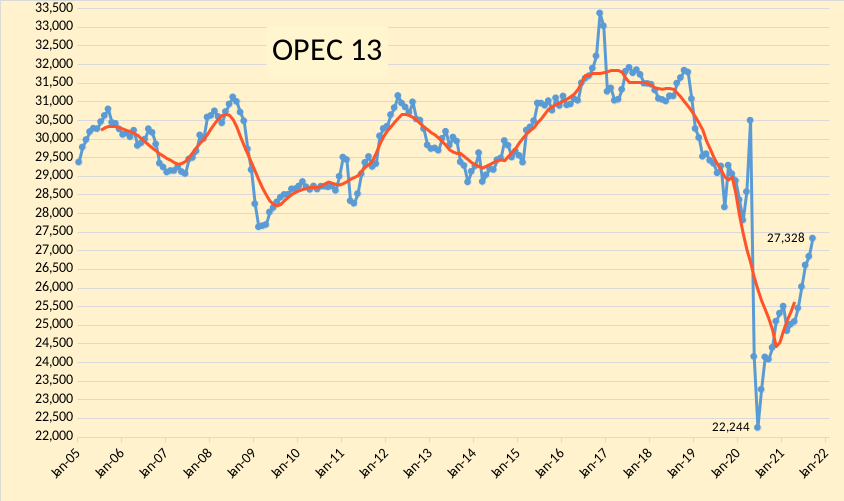

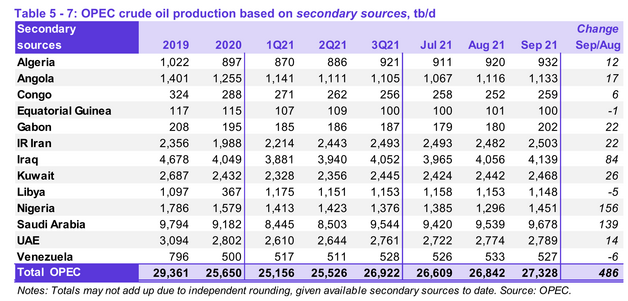

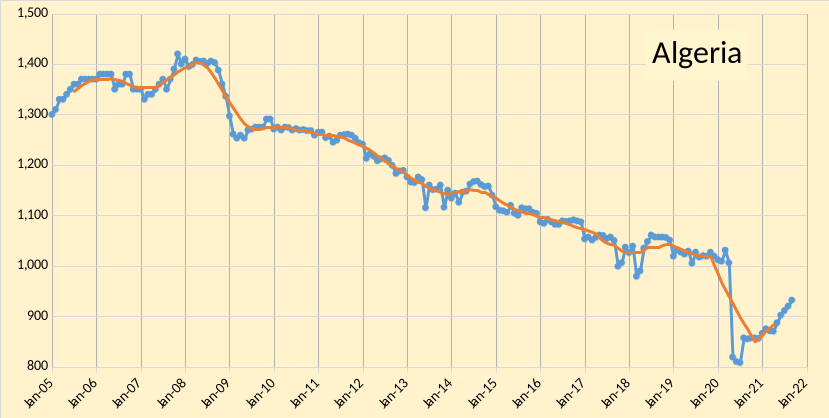

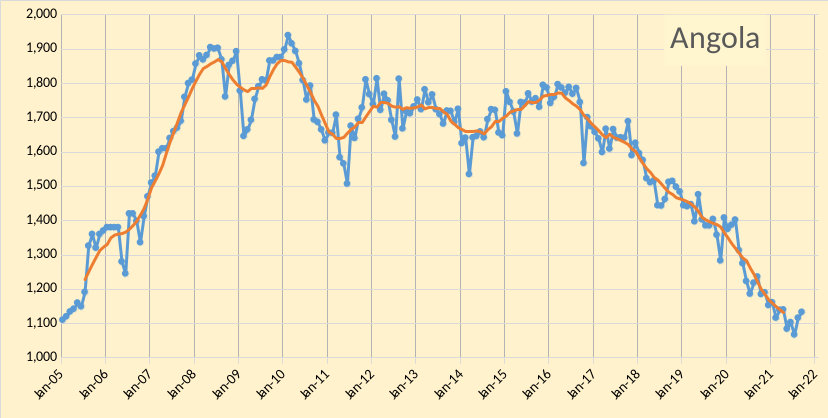

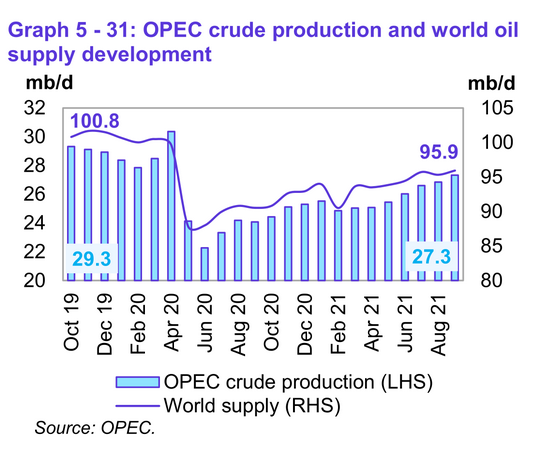

OPEC produced 27328 kb/d of crude oil in September 2021 based on secondary sources, an increase of 486 kb/d from August 2021. August output was revised up by 80 kb/d from what was reported last month and July output was revised down by 2 kb/d. Most of the increase in OPEC output was from Nigeria(156 kb/d) followed by KSA (139 kb/d), and Iraq (84 kb/d). ). All other OPEC members saw increases of less than 26 kb/d in August 2021, and decreased output from 3 nations was only 12 kb/d in total with half of that from Venezuela.

No September data has been published by the Russian Energy Ministry for Russian C + C output so the chart below updates data through August 2021 with the latest Russian and OPEC crude data.

World liquids output increased by 610 kb/d in September based on OPEC estimates to 95930 kb/d.

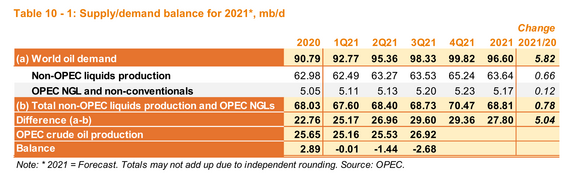

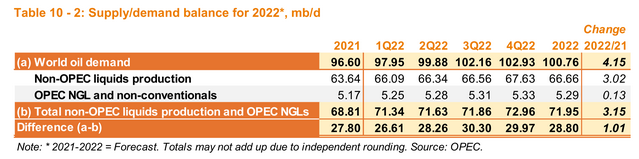

Based on the OPEC supply and demand balance for 2021 and 2022 in figures 18 and 19 above and a likely OPEC capacity of 28.4 Mb/d, it seems likely the World will be short on oil in 2022, especially the second half of the year, unless Iranian sanctions are removed. Also note the 3000 kb/d increase in non-OPEC output in 2022 compared to 2021, this seems optimistic.

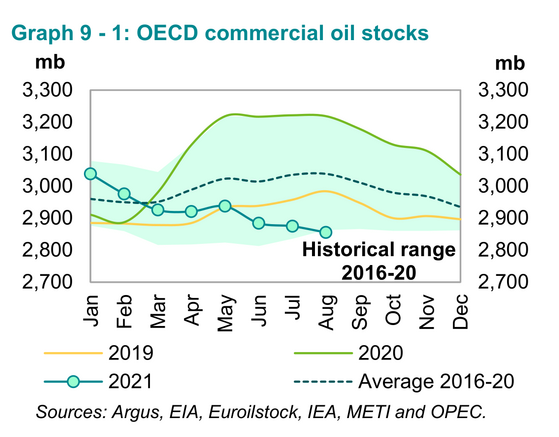

In August OECD Oil stocks fell 183 million barrels below the 5 year range, this indicates a likely increase in oil prices. Based on OPEC estimates for 4th Quarter call on OPEC in 2021 and a 4th quarter increase in OPEC output of 500 kb/d (probably optimistic, but this is the OPEC plan at present) we would see OECD stocks fall by another 137 million barrels in the 4th quarter of 2021. Unless we see a severe economic crisis near term the direction of oil prices will be up, perhaps to $95/bo in 2020 US$ for Brent by years end.

China and Russia are having to help Mongolia with oil shortage. All them trucks loaded with coal headed to China use a lot of diesel. Without Russian help that coal never makes it to China. How long this can continue depends on what happens to Russian supplied energy.

I don’t read Global times. But the 75 mile long traffic jam of mainly trucks loaded with coal sparked my interest in exactly how Mongolia is able to transport all this coal.

https://www.globaltimes.cn/page/202109/1235183.shtml

Strange that they would transport coal by trucks. Coal is a low energy density fuel. Why not transport it by train?

There’s only one main railway in Mongolia. It’s called the Trans Mongolian Railway and runs north-south from Ulan Ude in Russia to Jining in China. It features a single, broad (Russian) gauge track and an antiquated signalling system. At the China-Mongolia border, the trains must switch their bogies so that they can run on standard gauge tracks that are used in China, and this process takes several hours. In other words, this railway was never developed to handle high capacity.

Thanks Frugal. The amount of energy in a truck load of coal is probably less than the energy expended by burning diesel to transport that coal.

What a waste.

EIA says there are 20 m BTU in a ton of coal.

https://www.eia.gov/tools/faqs/faq.php?id=72

A truck can haul 40 tons on the road. That is the maximum allowed in the US anyway. That’s 800 m BTUs in a maxed out coal truck.

https://ops.fhwa.dot.gov/freight/policy/rpt_congress/truck_sw_laws/index.htm#:~:text=Federal law controls maximum gross,the National Network (NN).

Diesel is about 140K BTU per gallon, and a truck might get 6 mpg.

140K*7 =1 m. 6*7 = 42, so roughly 40 miles = 1 m BTUs.

https://www.eia.gov/energyexplained/units-and-calculators/british-thermal-units.php

800 m BTU * 40 miles /1m BTUs = 32,000 miles.

By this back of the envelope calculation it would seem that a truck could go 32,000 miles on the energy of the coal it carries. But my numbers are pretty vague. For example, I doubt a 40 ton truck would get 6 mpg. Divide by 2 and you get 16,000 miles.

Factor in 35% efficiency of a coal-fired plant and you’re down to 5,000-6,000 miles.

Feel free to challenge my numbers, I m just spitballing it.

EDIT: Apparently the US average is 72 ton miles per gallon

https://www.fleetequipmentmag.com/truck-freight-ton-efficiency/

My initial calculation was 6*40 =240 ton miles to the gallon, off by a factor of more than three, not the two I guessed at.

So my new estimate is about 3000 miles as the maximum distance you can haul coal to burn for electricity.

Alim , your methodology is correct but the basic data incorrect . 40 tons is for independent trailer loads . The trucks in the photo are 3 axle rigid tippers . In Europe the maximum GVW ( gross vehicle weight ) for these is 25 tons . GVW is vehicle weight + load . I would allow for overweight ( no rules in China ) . I would base my calculation on a 20 ton load . Actually prefer 15 ton because the trucks are not carrying powdered coal but “stone or rock coal ” lumps . Volume will be larger than weight . Just my two bit , on the whole you are on the correct path .

Yes, our european Trucks are 36 ton total weight, including freight.

Diesel usage is round about 30 litres / 100 km.

Coal transport here is by (river) ship whenever possible, or by train. Transporting coal by truck is a desparate stopgap method.

You can’t calculate in the efficiency of the coal powered plant. Buring the Diesel has a similar bad efficiency.

Some power plants are already burning oil. The 1 million $ question is, how many and how much. When oil burning gets wide spread, all calculations about oil demand this winter are waste and prices positioned to shoot up.

Eulenspiegel —

It’s true that diesel burns inefficiently in a power plants, but it is even worse in a truck. So I was just ignoring that.

However I think you are right. I need to compare the electricity output with the miles driven, not the BTUs with miles driven. That raises the estimate to 9,000 miles.

About 36 vs 40 tons those are metric tons, which are about 2,200 English pounds.

I live near Garzweiler, a huge lignite mine, and they burn the stuff on site.

FRUGAL —

You said: “At the China-Mongolia border, the trains must switch their bogies so that they can run on standard gauge tracks that are used in China.”

The Trans-Siberian railway by-passes Mongolia and crosses directly from Russia into China at the border crossing at Zabaykalsk/Manzhouli. This is a direct connection between Russian and China. Manzhouli itself is in the Inner Mongolia Autonomous Region and nothing whatsoever to do with Mongolia. Perhaps you are confusing Inner Mongolia with Mongolia but, believe me, they are TOTALLY different places. BTW Having traveled along this route, and worked in the region, I know it well.

I admit there are plans to establish rail lines through Mongolia to transport products between China and Europe some day but for Russian coal they are still using the “old route”, the good old Trans Siberian Railway.

Sort of related article.

CHINA CALLS FOR HUGE BOOST IN COAL OUTPUT AT INNER MONGOLIA MINES TO FIGHT POWER CRUNCH

“Chinese officials have ordered more than 70 mines in Inner Mongolia to ramp up coal production by nearly 100 million tonnes as the country battles its worst power crunch and coal shortage in years.”

https://www.abc.net.au/news/2021-10-08/china-calls-for-boost-in-coal-output-to-fight-power-crunch/100526158

Railway West Inner Mongolia to Central China

It was built to facilitate coal transport from Inner Mongolia and Shanxi to China’s southern provinces at up to 200 million tons a year. The railway is also the first north-south railway in China that is dedicated to coal

https://en.wikipedia.org/wiki/Haoji_Railway

CHINA’s 1813.5km Haoji Railway – a north-south heavy-haul coal line – was officially opened on September 28, 2019

The electrified line runs from Ordos City in Inner Mongolia south through the provinces of Shaanxi, Shanxi, Henan, Hubei, Hunan and Jiangxi to Ji’an. The section between Taoli Temple and Pingtian is double-track, while the rest of the line is single track with provision to lay a second track if necessary. The line has a maximum speed of 120km/h.

Construction started in 2015. The project, which was formerly known as the Menghua Railway, faced some major challenges as the line crosses the both the Yangtze and Yellow rivers twice. It also passes through the Mu Us desert, the Loess Plateau, and three mountain ranges. There are 770 bridges with a total length of 381km and 229 tunnels totalling 468.5km.

The Haoji Railway has 21 terminals and has a design capacity of more than 200 million tonnes a year.

https://www.railjournal.com/freight/china-opens-1813km-heavy-haul-railway/

Here is a map

One of the main reasons for building the nearly 2,000-kilometer (1,243-mile) long railway is to ease transportation bottlenecks in the domestic supply chain. China is rich in coal — with its resource concentrated in the northern provinces of Inner Mongolia, Shanxi and Shaanxi — but the distribution is uneven.

The country is mainly served by trains hauling supply from the west to the east, including on the Daqin Railway. Coal is delivered to ports such as Qinhuangdao and Caofeidian before getting dispatched on ships to users in the south.

https://www.hellenicshippingnews.com/chinas-energy-game-plan-features-a-giant-coal-hauling-rail-line/

DOUG, I’m talking about the Trans-Mongolian railway, not the Trans-Siberian railway. The Chinese use standard rail gauge while the Russians and Mongolians use broad rail gauge. So anytime a train crosses the Russia-China border or the Mongolia-China border, you need to change bogies. I’ve traveled on both on the Trans-Mongolian and Trans-Siberian railways so I can confirm that this is true.

Eulen ,”When oil burning gets wide spread, all calculations about oil demand this winter are waste and prices positioned to shoot up. ”

Good point , needs thought . Already ad blue production is maxxed out and if diesel also then things could be very difficult .

I was thinking same thing and maybe they do use trains but currently it’s just not enough to fulfill demand so it’s also being put on trucks now.

Which all points to the the gravity of the situation and what lengths they feel they need to go to in order to get it.

Also means China is unable to get more coal supply from Russia. Which to me would make more sense than Mongolia.

I guess most Russian coal headed for China would pass through Mongolia anyway.

Peak oil , peak gas and peak electricity . The Perfect Storm . Just dusted Richard Duncan’s ” The Olduvai Theory ” or peak electricity . Duncan’s calculated peak electricity to be +6 years after peak oil . He had peak oil pinned in 2006 so for him electricity decline was to start in 2012 . Since we have peak oil in 2018 will 2024 be when the bulbs flicker . Well, electricity outrages are happening worldwide even as this posted . I think we are going to need a bigger boat .

http://www.energycrisis.com/duncan/olduvai.htm

http://www.thesocialcontract.com/pdf/sixteen-two/xvi-2-93.pdf

https://www.youtube.com/watch?v=2I91DJZKRxs&ab_channel=Movieclips

Richard Duncan always was a riot. He had North America listed for like rolling blackouts by 2012, and then sometime around 2005-6 or so he declared that because of lack of natural gas, the rolling blackouts had been moved up to 2008, with the permanents now in the 2012 timeframe. His work is a great reference for the pseudo science of faith based doom.

This is true. So many propheteers were dead wrong, or just crazy. It has pretty much ruined the credibility of peak oil analysis in the public’s eyes (even though Duncan was addressing electricity generation). End-of-the-world rhetoric has permanently alienated much of the public. “Once burned, twice shy.”

The fundamental principles have not changed: fossil energy is finite; wells deplete and roll over; reserves have little to do with flow rates; the sum of all well rollovers will mark the end of the growth in supply. Not the end of oil, the end of the growth of supply.

But no one is listening anymore, except those of us who tune in here.

Mike B , a very good assessment of what I had posted ” The Olduvai Theory ” and the response there of by Reservegrowth . My question to Reservegrowth is

1. Was Malthus wrong or early ?

2. Was Hubbert wrong or early?.

3. Was Duncan wrong or early ?.

4 . Is Meadows (LTG) wrong or early ?

5. Was Hanson wrong or early ?

6 . Is infinite growth on a finite planet possible ?

As Mike B said in his last line “But no one is listening anymore, except those of us who tune in here. ” .

There are no doomsters here . Everyone here is coming of his free will and with no agenda but to understand better the predicament that is at hand . If I am a doomster then so is Dennis because he also believes in peak oil( he says 2030, I say 2018) but he has never denied peak oil . By your definition all here are doomsters . Frankly this blog is one of the last lines of defense who make an effort to educate the asleep world as to what “Peak oil ” is and what the dynamics are . For other points on forecasting I will make a separate post .

P. S : Acknowledgement to all Dennis, Ovi , George , Ron , etc etc for all the work you guys do and that too without a fee . I know all of you are going to kill me for talking about money . Thanks to all the commentators for keeping the conversation civic .

Wrong or early? Reminds me of my short stint as a stockbroker. What most stockbrokers know is that insider traders are almost always right, and almost always early. That is they see the fate of their company, either something good or something bad, and buy or sell their own stock accordingly. But they see it happening long before it actually does happen.

I think we can see the same phenomena in our predictions about the fate of civilization. Most of us can clearly see what is bound to happen. But we underestimate the resilience of civilization to forestall the inevitable.

We are right but early.

Peak Oil would be prone to happen much earlier if it wasn‘t for the cheap interests after the crash of 2008. Fracking gave the world one decade more of oil and a heap of debt for the post oil generations (who are getting insanely indebted anyway with wind, solar and eventually fusion). Cheap energy has peaked many years ago and slowly but surely debt is working its way to the surface like the lava on a canarian island.

Predicitons are always difficult. Take as an example peak ice on the poles. It happens every year, the solar impact is easy to calculate, even climate change can be factored in, nor do there exist peak ice deniers. But it is impossible to predict the exact day or week of the peak, it simply falls into a timeframe of about two months. Same with peak oil: It will happen somewhen between 2005 and 2035 (now there are 14 years left, historically a ridiculous small amount of time). But it is more probable, that the peak will happen in the central area of the predicted time: around 2020. So here we go, 2018 is our best bet until now …

“who are getting insanely indebted anyway with wind, solar”

Funny.

According to a coal promoting organization- the Fed Government provided from 1979 to 2018 over $100 B dollars in subsidy to wind and solar industries.

https://www.americaspower.org/its-time-to-end-subsidies-for-renewable-energy/

The US spent $649 Billion on fossil fuel subsidies in 2017 alone, according to Forbes.

https://www.forbes.com/sites/jamesellsmoor/2019/06/15/united-states-spend-ten-times-more-on-fossil-fuel-subsidies-than-education/?sh=427c377e4473

Challenge your assumptions, lest they become beliefs.

WESTEXASFANCLUB —

I think the real reason for low interest rates is the flood of cheap Asian (and Eastern European) labor into world labor markets. Globalization is a giant deflation machine. The central banks are just riding the wave. They can’t raise rates.

I also think the main reason for investment in renewables is that the cost of renewables is predictable. Build a gas-fired power plant and you have to ask yourself what gas will cost in ten years. If the price crashes you’re golden. If it goes up you have a stranded asset on your hands. Any guesses on gas prices in 2031?

But you know exactly what your costs will be if you build solar. Banks like their investments to be predictable. Risk and high interest rates are two sides of the same coin.

EDIT:

Fossil fuel insiders tend to eye investment in renewables suspiciously. But those investments can be seen as bets that fossil fuel prices will be high. Investing in fossil fuel fired power plants is betting that fuel prices will be low.

I think there is a lot of confusion in public discourse about whether fuel prices should be high or low.

Interesting to note that one of the recipients of this year’s Nobel Prize in Physics was awarded for being able to demonstrate that the global warming signal was man-made and not natural — even though there is a significant fluctuating signal on top of the trend .

The argument of Nobel winner Klaus Hasselmann is thus similar to the argument used by peak oil prognosticators — that in spite of sporadic oil finds leading to brief respites, that the downward trend in oil reserves will continue. The difference is that no one will be awarded a Nobel Prize for an oil depletion analysis.

Sorry Paul , he won the Noble prize for Physics and not for Climate Science . If Sachin Tendulkar is the best cricket batsman does not mean he is also competent as Messi on the football field . It is his opinion and not his thesis on climate change . Everyone is entitled to an opinion .

Reservegrowth , China , India , Kyrgyzstan , Lebanon and now let us add Austria , Swiss and Italy . Was Duncan wrong or early .??

https://lenews.ch/2021/10/18/swiss-president-warns-nation-to-prepare-for-electricity-shortages/

https://www.ots.at/presseaussendung/OTS_20211013_OTS0162/was-tun-wenn-alles-steht-verteidigungsministerium-informiert-gemeinden-ueber-blackout-bild

Italy imports its electricity from Austria , Swiss and France . Best of luck to Mario .

Hole in Head said:

Look it up. That’s what I said. “Interesting to note that one of the recipients of this year’s Nobel Prize in Physics was awarded …. “

One can argue whether that Hasselmann is less deserving than others but don’t start by trying to condescendingly correct me for something that needs no correcting.

Why peak electricity is an issue ? 58.7% of the world’s manufacturing output is from 5 countries , USA , China, Germany , Japan and South Korea . China’s and Germany’s electric woes have often been posted here . USA’s electric grid has been rated “D” by civil engineers . My info says that only North Dakota and Wyoming are electricity surplus states , of course electricity is imported from Canada . Japan and South Korea have no coal, NG or hydropower . Nuclear in Japan is a problem after Fukushima . Both countries rely on LNG from Qatar . Highly fragile arrangement . Without electricity is no metals . Follow the turmoil in steel , magnesium, aluminum , fertiliser production as factories have shutdown . Grounds for thought .

this is worrying as th UK plans another 33GW capacity of offshore wind. Power outages will cause issues in them being built. Sure we import the tech but the countries we buy from are also having engery issues.

If the UK has a cold winter then our supply laws state domestic use gets the natgas first so industries will shut down. Back to the 3 day week perhaps.

interesting times

Forbin , adding more offshore wind capacity ??? Some will never learn even from their own mistakes.

Stupid is what stupid does — Forrest Gump

Well, Hinkley point C juice will cost UK consumers £106/MWh as of 2021, with start 2026, according to a recent update while wind presently cost less than half… The intermittancy is of course a factor to be dealt with, but there are several options there.

https://www.bbc.com/news/uk-england-somerset-58724732

Laplander , options like this .:-)

the option the UK has chosen is nat gat with 3 days reserve apparently .

nothing on the shelf at the mo although iron air batteries are looking good but you still need to charge them . And then there’s amount needed TWh of electricity . So there will be many sites as I doubt any one place would want 10’s of TWh near them in our crowded island.

“Some will never learn even from their own mistakes.”

Apparently the posting of poorly thought out notions and preconceived opinion based proclamations are exactly the kind of mistakes that people fail to learn from.

I’ll wager that the worlds utilities know just a little more than the commentators here about electricity generation and feasibility of adding specific additional capacity-

Globally- “More than 80 per cent of all new electricity capacity added last year was renewable, with solar and wind accounting for 91 per cent of new renewables…..Wind expansion almost doubled in 2020 compared to 2019 (111 GW compared to 58 GW last year).”

https://www.irena.org/newsroom/pressreleases/2021/Apr/World-Adds-Record-New-Renewable-Energy-Capacity-in-2020

This trend is just beginning and failure to acknowledge the growing strength of the industry is like pretending that automobiles weren’t feasible in 1915.

Like every other single other sources of energy, there are big shortcomings to these newer mechanisms of energy capture. But the resource is perpetual and abundant, and in large parts of the world are among the least expensive option per kWh.

The alternative to failure of deployment is not pretty, but will be great for those who hope to profit on energy shortage (they will be able to anyway) and for those whose great desire is to witness rapid onset of instability and poverty stacked upon poverty.

Hickory ,” Like every other single other sources of energy, there are big shortcomings to these newer mechanisms of energy capture. But the resource is perpetual and abundant, and in large parts of the world are among the least expensive option per kWh. ”

Hicks , why are you shooting yourself in the foot ? Big shortcomings ( your words ) and the rest is beyond me . Abundant resources and perpetual ?? I had posted this earlier but once again ” My tennis coach believes I have abundant and perpetual resources to defeat Djokovic in the Australian open and Nadal at Roland Garros . ” I must tap into them . Ridiculous .

More wind farms but from where will they get the wind ?? I have a solution , watch the video . This godman from India will help . 🙂 . He takes care of both wind and gas which Boris needs desperately .

https://www.youtube.com/watch?v=ZaZ4Dbr4RLc&ab_channel=KaliManu

P. S : I know the consequences of failure to transition , unfortunately the train has left the station .

Hicks , the truth , nothing but the truth .

https://oilprice.com/Latest-Energy-News/World-News/Coal-Generation-In-UK-Jumps-As-Wind-Speed-Drops.html

It would be funny, it you weren’t serious.

HinH- “the rest is beyond me .”

Clearly.

Or is it that you’d prefer Europe to rely more even more heavily upon Russia ?

Hicks , first the cartoon was a specific swipe at Boris Johnson whom i find a loathsome figure . Nothing against the Brits or any others . I will end with the wind turbine debate, since let us say, my views on this have already been postulated . Regarding Russia , my like or dislike ( for that matter even Mevrouw Merkel ‘s) is least important . The TINA ( There Is No Alternative ) factor is in play . Beggars can’t be choosers . Europe better get used it . See the change in tune . Some people just learn the hard way .

https://www.zerohedge.com/energy/after-rapid-fire-blame-putin-headlines-european-commission-quietly-affirms-russia-not

For the nth time ” Don’t mess Putin “

Hole in Head

Quoting Zerohedge, a Russian state propaganda outlet, to prove Putin is invincible is a bit naive. At best.

Alim . the zero hedge and media was discussed extensively on both the threads earlier so no need to reinvent the wheel . ” Don’t mess with Putin ” . Sure if you want take a chance , here is a list of some munching carpet

1. Saakashvili from Georgia .

2. Obama from USA ( over Syria)

3, All the kids from Ukraine

5. Netanyahu from Israel .

6 . Lukashenko from Belarus

7. Merkel caved on every occasion .

8. Erdogan ever in debt to Putin after saving him from the coup .

A lot of minor godfathers here and there .

Don’t say you were not warned .

Hole in Head,

Well I guess we know now wich side your bread is buttered on.

it is also fickle and built on capacity comparisons and not delivered power.

the only alternative to alternatives is nuclear and there is not much political will in the UK , then add on the white elephant of Hinckley then frankly I do not know what the UK population will do when we go through another 3 day week and the lights going out .

The US should fair better but I’m too old to emigrate now 😉

Forbin , I know how you feel . I use to visit the UK ( from India ) to buy used machines when Thatcher began the great dismemberment of British industry . Graveyards of skeletons made of iron and steel ( blood , sweat and tears of the ordinary blokes ) . What was a bounty of North Sea oil was diagnosed as a success of Thatcher’s policies . Well , the North Sea is over and so is UK . UK will be the first nation in the devolped world to go down the tube . I did a comparative study of Japan and UK in the post peak oil age and have guided a few Brits to seek better future in Canada . If you are interested ask Dennis for my e mail address and contact me . Maybe you can assist some young ones while there is still a window available , though it is very narrow .

P.S : I did the analysis for a Brit expat based in Dubai about 10 years ago .

Forbin, I would suggest some better insulation to the brick-insulated houses, and three glazed windows to start. And when there is overcapacity from wind you could make ammonia, to be used as fertilizer feedstock.

A 1m3 insulated accumulator tank with water would also deliver 70 kWhs, with a deltaT of 60C, to be used for 2-3 days or so, this was more or less standard from the 90´s in Sweden if you had a wood fired boiler, but it´s also useful for ground source heat pumps and direct resistance heating at low electricity prices.

But I think NS2 might be operational in Q1 2022, that should take the pressure of in Europe and thusly UK too for a while, so the English could book that trip to Magaluf now.

Edit, not to be rude, but the writings been on the wall for a long, long time so I have a hard time to feel sorry for the unprepared…

HiH below, but that would at least lead to a slightly lower transit loss, not sure how big though… (And a bit of a problem for Ukraine)

Edit 2, But wait, isn´t there a nuclear plant a bit north of Kiev, just some assembly required…

Laplander , NS2 is not going to bring additional gas in my opinion . It will only re route gas from the conventional pipelines via Ukraine . The UKIES were stealing and charging Russia for the privilege’s .

Laplander ” Edit 2, But wait, isn´t there a nuclear plant a bit north of Kiev, just some assembly required… ”

You mean the one they bought in Legoland , Denmark . ? Just joking Laplander . One Chernobyl is enough .

“Some will never learn even from their own mistakes.”

“Apparently the posting of poorly thought out notions and preconceived opinion based proclamations are exactly the kind of mistakes that people fail to learn from.”

This sounds a bit disparaging to the faith based belief system of peak oil doom, seems to me.

Endless growth is faith-based. Peak oil describes the way things work.

The Lima oilfield in Ohio is gone (my backyard growing up. We had no idea we were sitting on a depleted oilfield). Do you think it’s ever going to come back?

Why should other oilfields be any different?

Isn’t the sum of all oilfield peaks world peak?

And if there is no plan, couldn’t “doom” be an understatement?

I don’t know, but it doesn’t require faith.

My info says that only North Dakota and Wyoming are electricity surplus states , of course electricity is imported from Canada .

I’d be curious to see your source on that. The US does import a relatively small amount from Canada, and also exports power to Mexico, for net exports of about 39 terawatt-hours or about .5% of total consumption: https://www.statista.com/statistics/183944/energy-in-the-us-and-electricity-imports-from-1999/

https://www.statista.com/statistics/183945/energy-in-the-us-and-electricity-exports-from-1999/

Here’s more info, below. It covers the country, then each of the states – here’s quotes for the first 4 states, Alabama, Alaska, Arizona, Arkansas:

” Alabama generates more electricity than it consumes, and typically sends about one-third of its output to nearby states.”

“Alaska has its own electric grid, which means that “whatever electricity is created there is what they’re consuming,” said Glenn McGrath, a power systems analyst at the Energy Information Administration. “It’s about as isolated as you can get.”

“Arizona supplies electricity throughout the Southwest.”

“Arkansas generates more electricity than it consumes and exports power to nearby states.”

https://www.nytimes.com/interactive/2018/12/24/climate/how-electricity-generation-changed-in-your-state.html

@ Hickory: of course there are subventions for the oil industry. Low interest rates alone are an enormous incentive. And see the cost of wind and solar in proportion to their energy production: about 5% of fossile (over all, not only electricity). And please don’t get me wrong: i’m not against renewables. But they requiere a big upfront investment, nobody will deny that. And this, in a finacially unstable world, can become a serious problem.

@ WestTexasFanClub-

I agree.

The costs of replacing some of the energy now provided by fossil fuels as they deplete will be huge, from buildings that use less energy, to energy storage and better grid, to vehicles that are electric, and more.

The upfront investment has been a huge obstacle for nuclear power for example [especially after some big projects went bankrupt at rate payer expense].

I am not optimistic about that financing happening quickly or at sufficient scale, for many reasons.

Seems we are destined to learn things the very hard hard.

btw- I am texas fan club member as well, if being a Bob Wills fan counts.

Bob Wills counts. He and Jeffrey Brown (so do Buddy Holly and Roy Orbinson).

The costs of replacing some of the energy now provided by fossil fuels as they deplete will be huge, from buildings that use less energy, to energy storage and better grid, to vehicles that are electric, and more..

This is misleading. The costs are large, it’s true, but almost entirely because the energy industry is large. Maintaining the FF industry is equally expensive. And the energy industry is large because the overall economy is large. It’s all a matter of context.

The upfront investment has been a huge obstacle for nuclear power for example [especially after some big projects went bankrupt at rate payer expense].

-Conventional nuclear is requires large scale because the physics of heat engines tends to require it. That’s not true of wind and solar: wind and solar projects can be built at almost any scale. There are economies of scale, but it’s nothing like you see with nuclear.

-Nuclear is very risky because it takes a long time to build, much longer than wind & solar. A nuclear plant can take 10 years, while a PV plant can start providing power in less than 6 months and be finished in 12 months (with luck). PV and wind can be built in many phases, if desired to reduce risk.

Heck, PV can be put on a residential roof and be economic. Not even the most imaginative of dreamers thinks that will happen any time soon with nuclear.

Nick,

You might not prefer to digest the reality, but the transition costs away from depleting fossil fuel is going to be very very very high.

Like a mortgage on a house- its a 30 year plan just to get underway.

Got credit? [I ask not you, but the world in general]

We’ll see how much of it can be accomplished.

But the attempt will be made, since the failure to get the job done will result in a rapid and involuntary decline in population- to put it nicely.

the transition costs away from depleting fossil fuel is going to be very very very high.

Well, how do you know? What makes you think it will be significantly higher than the investments required to simply maintain BAU?

I agree that a crash program to eliminate fossil fuels in 10 or 20 years would entail some real costs in accelerated depreciation and stranded assets. But most capital assets are depreciated in periods of 30 years or less. Most working assets need to be replaced in that time frame.

On the other hand, the wind will probably pick up on the Atlantic coast of Europe by the end of the week.

As predicted, the wind picked up. Wind generated about 31% of German electricity today, up from 17% yesterday.

https://energy-charts.info/charts/energy_pie/chart.htm?l=de&c=DE&interval=day&datetimepicker=19.10.2021

That should put a damper on gas prices.

Full disclosure: I looked at the weather prediction before I made my original prediction.

Anyone who is interested in good weather tracking/forecast mapping site- this one is worth looking into.

https://www.windy.com/?2021102200,46.271,1.714,5

It’s a thing of the wetter pattern of the whole winter – not just a few days. Conditions will stay on – the green will oppose north stream. Let this continue over the winter, switch off the nukes on 31.12. and see how the show continues.

Yes, we’ll get a storm, and calm high pressure weather after it. And it’s still autumn. The winter is over in march.

If we get the same weather pattern in January – March(2 weeks+ high pressure weather) , we have the problem. Little wind, not much solar anyway and very cold. If they haven’t organized enough hard coal until then, we’ll see blackouts. Gas will be used for heating.

By the way, oktober had not much wind until now. The gas supply is already under pressure with this – and you can already see they use hard coal over gas. This isn’t acceptable for a green agenda – gas should be used before coal.

So far today for electricity generation in Germany wind is 55%, hard coal is 2% and gas is 3.5%.

Even solar is 7.5%, more than hard coal and gas put together, although this has been a dark cloudy day.

That doesn’t including heating gas, just electricity.

Would you care to bet whether there will be widespread blackouts in January in Germany due to lack of fuel? Never mind we can revisit it when the time comes.

Alim ,” so far ” . Care to define ? 1 hour, 1 day, 1 week , 1 month or Jan- Oct 2021 . ??? Yes , I have saved your post and we will revisit it when the time comes . Two simple quotes to explain my viewpoint .

1. The chain is as strong as it’s weakest link .

2 . A small hole can sink a big ship .

Just look at the whole Oktober so far – lots of gas and coal have been used .

Next year most of nuclear Power is gone so more coal needed.

Wow the latest plan from KSA beyond oil.

https://youtu.be/wXgzb6qedx4

Lightsout , after Space X flight I am adding this to my ” Bucket List ” . 😉

Is that the stupid things to do before we all die bucket?

Lightsout , yes . See smiley .

Peak oil is coming. That won’t save the world

More than 50 countries and the European Union have pledged to meet net zero emissions targets. If they live up to those commitments, demand for fossil fuels will peak by 2025, but global CO2 emissions would only fall 40% by 2050, far short of net zero.

If demand peaks by 2025, production will not have passed the 2019 peak by that time. However, I do not believe demand will peak in 2025. Not even close.

Ron,

Note this is fossil fuel use(oil, natural gas and coal), that is likely to exceed the 2019 peak by 2023, I agree it is not likely that we will see a peak in fossil fuel consumption by 2025, probably more like 2030 to 2035 for all fossil fuel as a transition to non-fossil fuel sources of energy will take some time. From 2011 to 2019 the average annual rate of fossil fuel consumption growth was about 1.078% per year based on BP data for fossil fuel consumption in exajoules. Consumption dropped by 5.6% in 2020 and I expect 2% and 3% growth in 2021 and 2022, by 2023 we will likely return to trend growth rate with a new peak, the growth rate is likely to slow as the world transitions to other forms of energy over the next 10 to 15 years, we could see a rapid reduction in fossil fuel use as wind, solar, and other forms of non fossil fuel energy gain momentum.

Hmm, I may think that a little bit of chaos coming along the fights for the last oil reserves available could help to achieve this goal.

Good read over at oilprice if it hasn’t been linked already:

https://oilprice.com/Energy/Crude-Oil/How-Much-Oil-Can-OPEC-Realistically-Add.html

Interesting reading. The article talks a lot about OPEC not being able to increase production due to under investment in new capacity, as if the cash pot for such things were infinitely deep. It says nothing about geological limits that in many cases preclude increasing capacity. If the UK invested more in oil ‘exploration’ do these writers seriously think that it would ever discover enough new oil in the North Sea to be a 4mbpd producer again? The same is doubtlessly true of many OPEC producers.

Ultimately, oil prices will come down as high prices lead to economic deterioration in the economy. Oil provides energy that runs the economic machine and delivers real goods and services. The economy is a thermodynamic machine that generates wealth through the action of energy on matter. This implies a ceiling on the affordable oil price per unit wealth. This ultimately limits how much cash companies and nations can pour into oil exploration, or any other energy development project.

Many market analysts talk about Peak Demand, as if it somehow separate from supply issues. But demand will always be a function of affordability. Peak demand has already occurred in most Western countries, because consumers cannot afford to pay the price for many marginal uses of energy, because those uses generate insufficient wealth to be sustainable in the face of higher energy prices. It has nothing to do with us being oh so clever and more efficient and switching to electric vehicles, which are so far only a minor part of the private transport market. Industrial economies need cheap energy to prosper. Peak demand will occur because of demand destruction. And in many places it already has.

OPEC will max out again at 42, Russia at 11, USA at 11 for a few years, maybe 2023-25, the end of the peak plateau. There is not enough oil left or investment to get it out coming down the pipe. Then the fall happens. One by one each country will become Lebanon or Haiti. Somewhere it will stop but I can’t say where. Because enough oil will finally be left to make the transition for the remaining countries. Basically Russian Roulette but with collapse.

I read this article yesterday and they are finally reporting what the Industry has been experiencing for a year. I have enjoyed this new post and I appreciate what the participants have been writing. I just got back from Italy two days ago and am back in the loop.

I think the ESG investing mantra has really limited if not crippled the recovery in the domestic fossil fuel producing industry. We are drilling up a gas field in East Texas and the lack of qualified labor and materials is severely impacting our plans for pace of development. I expect this is happening all over the US in every other oil and gas producing region.

What’s interesting to me is that in years past, if oil and gas prices were spiking like they are currently, the ramp up in drilling would have responded instantaneously. This recovery seems different. Perhaps 🤔 my analysis will be proven wrong but without a vibrant investing and banking community supporting the industry, we will continue to see moderate to negligible growth in Shale production over the coming years just as the article implies.

One other interesting observation is that the deals being presented to our group and to me as a private investor are really low quality. The generation of idea generating geologists looking for conventional reserves has all but disappeared. The LTO industry created a lot of geo-professionals that serve as development geologists with a mining type mentality.

With this recent price surge, we are dusting off some of our old conventional prospects to see if they lend themselves to exploitation through the new technologies advanced by the Shale revolution.

For a final thought, don’t think we are a bunch of doomsayers here but I would suspect most contributors to this site are generally optimists in their daily lives. I am or I would have never spent the last 40 years in the oil and gas exploration industry. I think we are a group of knowledgeable people trying to gather information and tell an honest story as we see it regarding a finite supply of one the most important resources in our world. I am hopeful that the new green wave will bring about better forms of energy that are sustainable and environmentally friendly but in the mean time this transition could be a bumpy one but it all begins with transparency and honest facts about finite supply.

Question LTO S-

“One other interesting observation is that the deals being presented to our group and to me as a private investor are really low quality.”

With that in mind, would you or are you inclined put your own savings or credit up for deployment on these projects?

I am very interested in oil & gas production but mostly development drilling opportunities. If I want to bet on the price of oil, I will buy Conoco and Chevron ( they haven’t cratered to the anti fossil fuel crowd).

If I want to make money in oil and gas, I would be very interested for example in drilling a horizontal well in a “Red Fork” field in Oklahoma to recover bypassed reserves. This isn’t sexy but it can be very profitable. I prefer conventional reservoirs because the decline curves are shallower and more predictable and I believe on a per foot total well cost way more profitable. I wonder what the shale companies will do when they can’t consolidate and production starts screaming down. These wells are not cheap to operate with sub pumps and inherent water production especially when they decline to stripper type production.

I dont know that I have answered your question but the fool I am keeps me investing in new projects because I do think now is a great time to make money. Private Equity other than a few Pros like Encap, NGP, Vitol are gone and I think this opens the market back up to people who understand the industry. However, I am very selective about these projects because a lot of what I have seen is very speculative and not very well defined (not a lot of deal generating geologists left).

I think projects like shallow sand operates can be very profitable now and in the future because his costs are contained and he runs an efficient operation. It isn’t sexy but its profitable a predictable. I advised him not to sell his production a while ago and I bet he is glad he still has it. He will do very well and is a good guy.

LTO Survivor,

Really appreciate your analysis, especially your last paragraph. Your insider knowledge is just so important to this site IMO.

I think the world of all of you guys on this site. I learn so much and never cease to be impressed by the posts and the incredible knowledge regarding other parts of the world and alternative energy which I am keenly interested in. We have been so profligate as a nation in our use of energy and the day of cheap energy is coming to an end. I do have a lot of hope that there will be solutions to keep the human race alive and this website gives me a lot of hope as we all struggle to tell our story but willing to embrace new solutions. I am feel lucky to have a forum to discuss these topics. I can assure you they are seldom discussed in Bank Boardrooms or Private Equity Investment committees. I was always shocked at how little knowledge bankers and Investors had about the true inner workings of the worldwide and domestic exploration and production industry. I made many decisions based on the information I gleaned from this site. It was very helpful in my career.

Dennis’s OPEC 13 Crude + Russian C+C shows a gradually decreasing production from around 43 mmbpd at the end of 2018 to 40 mmbpd at the beginning of 2020 when the pandemic hit. Does anyone know what caused this 3 mmbpd decrease?

Frugal , Occam’s Razor ” The simplest explanation is the best explanation ” . They are maxxed out .

Frugal,

OPEC reduced output in 2019, also sanctions on Venezuela and Iran had an effect, those two nations alone dropped about 900 kb/d in 2019, the rest was OPEC cuts in output.

Is gas really heading to $2 a litre in Canada?

How the hell did we get to US$200 oil? In April 2020, West Texas Intermediate (WTI) was selling as low as US$20.10 a barrel!

It’s an enormous understatement to say the formula for oil pricing is complicated. First, though, as Rozencwajg pointed out a year ago, exploration for new reserves was already dwindling pre-2020. COVID-19 then put what we all thought was going to be a long-term damper on demand. Exploration, especially in the U.S., was even more severely curtailed.

Instead, we got a much-more-rapid-than-expected return to boom times, followed by an increase in American oil imports. As recently as April 2020, the US was exporting as much as 2.3 million barrels per day (B/D); 18 short months later it’s a net importer to the tune of 1.7 million B/D. Meanwhile, demand in China may have been as much as 1.4 million B/D higher than it was in pre-pandemic 2019. Globally, Rozencwajg says that the oil market is actually 1.2 million B/D in deficit, “the highest reading on record.”

In the article, it states the Canada is going to adopt the Clean Fuel Standard. The purpose of that standard, when proposed by California, was to reduce the use of Canadian oil sands in their gasoline and diesel. The Canadian government is now taking another shot at Alberta without most Canadians realizing this is the objective. It should be noted that the US has not adopted a clean fuel standard.

In my opinion Canada is the most likely country to experience a banking crisis over next two year’s. They are way over leveraged debt to income and as China chokes on it’s lack of energy. CCP is likely to around up the wealthy in China MBS style.

All that hot money that flowed from China into Canada over last two decades will flow back home.

Canadian real estate is guaranteed by government so there will be a shit load of real estate being transferred to their central banks balance sheet.

China’s energy problem is everyone’s problem. It’s just most people don’t see what is coming.

Yes I agree that Canada is in a massive real estate bubble, similar in scale to the 2006 US housing peak. Debt to income ratio’s are at record highs, and the federal government has and continues to run underrepresented deficits. The only things currently holding back an economic collapse are record low interest rates and continued borrowing by both government and consumers. The government is paralyzed and has no idea how to stop this cycle, possibly realizing that the only effective cure is a deep recession but this isn’t palpable to the population. I’m really surprised on how long you can kick the can down the road …

HHH and Frugal , thanks for your inputs on Canada . i knew their were problems but not the depth as you have outlined .

BIS publishes 5 metrics of economic health which if one is checked predict a 50% chance of banking crisis to follow. Canada currently checks 4 out of 5 boxes. The fifth, housing affordability, is unchecked only because Canada has had high prices for so long. The metric compares to Canada’s recent history – and so would otherwise check 5 out of 5.

https://www.youtube.com/watch?v=hZhV5dXgSTM

Dennis

Looked into where that OPEC 3.0 Mb/d increase was coming from for 2022. Below are the main contributors. The year end output’s for 2021 and 2022 are in the first two columns. Looks like OPEC is expecting big increases from the US and Russia. I guess OPEC still accepts the US estimates.

21 22 Change

US 17.6 18.4 0.8

Canada. 5.5 5.6 0.2

Norway 2.1 2.3 0.2

Brazil 3.7 4.0 0.2

Kazakhstan 1.8 2.0 0.2

Russia 10.8 11.8 1.0

Total 2.6

Ovi,

Thanks.

Russia looks unrealistic to me, US might be reasonable when we figure in growth of NGL from increased natural gas output, I perfer to look at C plus C rather than all liquids, that is a problem with both OPEC and IEA analyses.

About Kazakhstan, the increase is perhaps impossible as the oil productions of their different fields decreased due to the decline of the ressource and the investments necessary to increase the production will be carried out in the next two to five years. https://www.upstreamonline.com/production/kazmunaygaz-suffers-oil-production-slump/2-1-1047192

The higher oil price goes the more problematic it becomes for China to do massive stimulus that keeps global growth in positive territory.

WTI is on its way to $84 this morning. Government spending is only thing that keeps global growth from contraction. Now think about all the trillions in government spending since March 2020.

If your government you have to figure out some way to get inflation and oil prices under control in a hurry before this becomes a crisis.

A crisis will solve high inflation and oil prices but crisis tend to make changes to those who are in power.

I think oil price is their least problem at the moment – the coal and gas scarity has already lead to factory shutdowns. No stimulus can fight this. And coal and gas has rocketed even hight (in % ) than oil the last year. Oil isn’t on ATH in the asian region, gas and coal is.

At least they still get all the oil they want.

India is shutting down factories, too, because of coal problems.

So where does the price of coal,NG and oil go if they put the pedal to the floor on stimulus? If prices are high now and they do more stimulus therefore create more demand then they really are going to have problems.

You can’t do stimulus in this environment. Or it’s suicidal to do so.

Yes, that’s totally right.

Here they discuss now to cushion the population from the rising energy prises – welfare benefit receivers should be paid by the state, for the rest they want to lower fuel taxes so nobody should notice the rise.

When every country does this, and does much stimulus I can see a big comic style “BANG” this winter.

Propably they’ll shut down some industry – as already done in China. Everyone needing Aluminium gets a big problem for example.

Here something from Zerohedge:

https://www.zerohedge.com/commodities/la-nina-sparks-early-freeze-china-coal-supplies-languish

Looks like China take big money in it’s hand to buy any energy now – this gets interesting. Every LNG vessel, including from the USA, now goes to Asia – Europe will have to fall back to Putin.

Unless the wind picks up. Even your god Putin can’t stop the North Sea wind.

Yeah, when we get a long russian high (meterologic, not wodka) we get problems.

Nice thing to hope to have storms the whole winter long, and parts of autumn. “Hope” is not that reliable. Since we have zero green energy storage, the coal and gas has to be powered on the moment the wind fades.

And why god – I don’t like Putin. But the EU needs the russian gas. Germany could have started fracking, the netherlands has closed their fields because of earthquake fears – so russia is the only dealer left in town. And asia is buying all the LNG this winter, so good luck to catch the few tankers left on the market for big money.

PS: Looks like we get La Nina conditions this winter. This trends to cold northern winters, with low wind. Better have these gas caverns filled.

How about power when I need it, not when nature decides to throw a storm system my way and cause damage?

If nuclear power was discovered now, we’d be hailing it as a miracle solution to climate change. Instead, we’re telling people to bend over and take the costs of a system that falls over in fair weather.

This is fucking insanity, and I say that as a massive proponent of averting climate change. The radio today was full of people here going on at length about how they can in no way afford the heat pumps we’ll be forced to buy, along with EVs, to deal with decarbonisation. Gov’t is putting up £5k towards a thing that costs at least ten grand. It’s absolutely farcical.

I guess people must have a load of savings I’m missing out on, because I sure as shit cannot afford to get any of these alternatives people keep harping on about. Must be great having spare cash to revamp the entire heating and transport setup one has.

Kleiber —

>How about power when I need it, not when nature decides to throw a storm system my way and cause damage?

The energy is there when it is there. And when it is there, it is the cheapest around. The current electricity system is based on the idea that the cheapest energy is the energy with the steadiest output, basically because it depends on keeping water hot.

That is changing. The cheapest energy is now intermittent. You can build a plant (like nuclear) that needs to have a steady output to be cheap, but it will lose money when renewables kick in.

Those are the cards that the current state of technology have dealt us.

With less OPEC oil production spare capacity than claimed by OPEC and estimated by the IEA and others, the world oil supply is less certain and potentially closer to insufficient versus rising demand. With observed low elasticity of demand of oil consumption, a tighter oil market than consensus could result in much higher prices if supplies were to be disrupted or demand were to grow more than expected. Having seen this already with European and Asian natural gas and coal, and with a potential surge of oil demand for power generation this winter, the risk of an oil price shock is real and worth serious consideration.

https://bisoninterests.com/content/f/opec-spare-capacity-is-insufficient-amid-global-energy-crisis

Oil prices climb as Covid recovery, power generators stoke demand

Oil prices hit their highest level in years on Monday as demand recovers from the Covid-19 pandemic, boosted by more custom from power generators turning away from expensive gas and coal to fuel oil and diesel.

Hi all,

Ovi asked me about oil price and its effect on the economy.

I took annual real GDP in 2010 $ from world bank and realoil prices from BP stats and found annual growth rate for World real GDP and did a linear regression against oil price for 1974 to 2019 data. See chart below.

The regression shows no significant statistical correlation between oil price and World real GDP annual growth rates over the period covered (1974 to 2019). The p value for the F statistic is 0.61, any value above 0.05 indicates no significant statistical relationship for the regression.

Thanks Dennis.

Good to have facts to base understanding on.

Do you think that this lack of correlation will continue over the next decade, in the face of depletion that will begin to affect the oil supply available to many countries?

For all those who have previously stated that oil price will not climb, or that global economy (and oil demand) will never recover from Covid- perhaps time to re-evaluate your beliefs, or assumptions if you prefer.

It is noteable to see how so many tend to intermingle their assumptions with their beliefs, as if they are one and the same. I guess that just how ‘believers’ operate.

Hickory,

The only thing we can say for certain is this is what the relationship has been over the 1974 to 2019 period, the future relationship is unknown, things might change or they might not, at the World level I suspect oil prices will have only a small influence on economic growth, note though that I am often wrong, these relationships are far from simplistic and a simple single independent variable linear regression misses many factors.

Ovi also suggested I try this analysis for the US only because lower fuel taxes lead to a bigger change in consumer fuel prices as crude oil prices change than would be the case in European and other OECD nations where fuel taxes are higher (so the percentage change in petrol price in response to rising crude prices is smaller than in the US.)

The analysis shows statistical significance at the 95% confidence level, but not at the 99% confidence level, the significance for the F statistic is 0.028, a value less than 0.05 indicates significance at the 95% confidence level and a value less than 0.01 indicates significance at the 99% level. There is a correlation but not a strong one (99% confidence).

Chart below I did not label axes etc, but the vertical and horizontal axes are similar to previous chart, data is for 1974 to 2019 and for US real economic annual growth rate (vertical axis) rather than the World.

I won’t disagree with your findings on GDP at all. But really it’s a meaningless metric because of how it’s counted. One would believe everything is ok if the only thing we looked it is GDP.

Heck China just printed a 4.9% GDP. Must mean things are great there. 😁

Sorry, Dennis, but your image for world GDP says nothing. What about this one ?

The diagram for the sum of five areas shows two times, that a high oil price results in a drop of car sales: first time in 2018 to 2020, a second time in 2021. And it shows twice, that low oil prices are required for growth: in 2015 to 2017, and at the end of 2020 to 2021.

Berndt,

Not sure that motor vehicle sales is a great proxy for economic health. Real GDP annual growth rate is not a perfect measure, but it is a better measure of of economic growth than vehicle sales in my opinion.

Does the price of oil affect real economic growth at the World level? Statistically from 1974 to 2019 the answer is no.

HHH,

Monetary policy affects inflation, but when we use constant dollars as is done here, the “printing” of money is not part of the analysis. Also note that debt at the World level is money that is borrowed from other humans as long as there is no interplanetary lending and so far the numbers there are pretty much zero.

Commercial banks print money when they make loans. Central banks don’t currently have power to print money. They create bank reserves out of nothing. But until they are made legal tender they aren’t money and they aren’t inflationary in any way. They are deflationary as they are used to hold long term interest rates near zero.

Bank reserves never leave the central bank. Or get into real economy. The bonds the FED buys are second hand bond that were already bought by a primary dealer. Doesn’t increase money supply only redistributes dollars that already exists.

Banks can buy anything with bank reserves.

They need them to transfer money to other banks – otherwise they are broke. So in normal times they are inflationary – in the old time (before 2007 and the QE) the amount of bank reserved defined the amount of possible credit money in the system – round about 1:10 of bank reserves vs. credit money (with other regulatories). Tightenening them was the tool to combat inflation. They have been limited additional in this time – it wasn’t possible for a bank to just take a bond and lend a reserve againt it when there wasn’t a free reserve available.

But now they created too much, nobody can take that much credit. There are enough free bank reserves to create a hyper inflation out of the clear sky when the belief at the money fails.

Now it’s a case of: you can lead a horse to water, but you can’t make it drink.

First they wanted to create inflation with the bond buying, later they had to control long term bonds to avoid everything crashing down because of too much dept.

Also the current car market is pretty wild. For example German car sales are back down to the numbers of the mid nineties. Even stranger, 30% are plugins. The number of good old fashioned combustion engine vehicles sold hasn’t been this low since the late sixties.

Meanwhile the head of the world’s biggest car company is publicly demanding from his engineers that final assembly costs of EVs be cut by two thirds. Strange days indeed.

Plugins are easy to explain.

The buyers take the free government money – tax credits, price subventions and additional company car tax credits.

The reduced sale is easy to explain, too. Try to buy a car – there is a thing called “chip shortage” reported since at least the last 6 months everywhere. It’s real. Car companies drop shifts or close factories temporary.

Easy to explain, perhaps. But apparently not easy to predict. I can’t thank of anyone who saw this coming a few years ago.

Dennis . automotive industry is 30% of the world’s GDP ,if no autos then what ? Yes agreed GDP is not the perfect parameter but we work with data we have, EIA and IEA are all we have for the oil industry

and we use them as a base inspite of defects .

Hole in head,

Lots of stuff can be produced besides cars, such as heat pumps, solar panels, wind turbines, and plenty of stuff we have not yet imagined. There was a time when there were no cars, there were more buggys pulled by horses, and saddles etc, things change. The drop in 2020/2021 is due to supply disruptions worldwide due to the pandemic, eventually these will ease.

This is true so long as the overall trend is in the direction of more – more use of resources and energy.

I don’t know of any example of declining aggregate consumption of energy and resources in a functional society. This of course doesn’t mean it’s impossible. I remain skeptical, based largely on the .99 correlation between energy consumption and GDP.

I think we have to go this way regardless, but assume some degree of depression, social and economic collapse (or more charitably “transformation”) is baked in the cake.

Blondbeast,

Note that energy can be produced with other means besides fossil fuel. As fossil fuel prices rise there will be more incentive to invest in cheaper energy sources. Less fossil fuel has been used per unit of real GDP over the lost 10 years compared with the 1984-2010 period (about half as much). As we transition to electric transport, wind, solar, hydro, nuclear, and geothermal power, as well as better buit buidings and more heat pumps for heat, less and less fossil fuel will be needed. In fact prices of fossil fuel will start to fall due to lack of demand by 2035 and much of the resource will become a stranded asset.

@Dennis

It may be true that high FF prices incentivize investment in other forms of energy production it remains to be seen whether these sources are cheaper in an environment where high FF prices also mean that less money in total is available to be spent on anything at all.

My statement regarding energy use was about total energy, not fossil fuels. Even though I don’t accept your assertion about decoupling (Váden et al., 2020a) if I assume your statement is correct the correlation is only weakening, during a time period where clean debt adjusted GDP is also decreasing.

In 2020 127 GW of solar 111 GW of wind power generation were added, along with 60 GW of fossil generation. https://irena.org/publications/2021/March/Renewable-Capacity-Statistics-2021 Of note, this was accomplished by a fossil fuel economy. There is an important difference between a change in the % mix of newly added capacity vs either an actual decline of FF usage, or a decline in total energy production.

I’ll have to credit that since we’re speculating about the future we’ll have to wait and see. If we have a year in which no new fossil capacity is added and the economy continues to function, I’ll owe you a coke. If we have a year in which the above obtains and also the total amount of all-sources energy used globally decreases, I’ll eat my hat and go long ESG.

*Industry note: On a commercial scale I do indeed see increased application of heat pumps at a staggering pace. I also see decreased application of end-user solar (admittedly grid scale has increased as noted above), including less solar thermal and less geothermal than my firm designed in the 2000-2010 period. This has corresponded to less available grants. I’ve also noticed many building rating systems focusing less on brute energy efficiency and more on nebulous qualities such as wellness and indoor air quality. Of note, our current energy codes still base energy savings on a cost basis – dollars vs btu’s…when comparing energy saving designs vs baseline buildings – a tragedy my firm campaigns against as at least locally gas is cheaper. (e.g. an energy savings target of 10% above code minimum is based on saving 10% of the cost of energy, not the annual btu’s or kw. This math still favors natgas in most of our markets nationally)

Blondbeast,

I look at actual solar and wind output rather than capacity. I agree energy and GDP are highly correlated, but where the focus here is peak fossil fuel, often readers equate energy with fossil fuel only so I am pointing to actual data on fossil fuel. Future data we have to wait for.

blondbeast,

Wind and solar consumption in EJ (adjusted by BP to make equivalent to fossil fuel primary energy) from 2011 to 2019, average growth rate was 16.9% per year. (see chart below)

If we assume this rate continues until 2035 and then falls to 10% from 2036 to 2047, we get 48% of the 2019 level of fossil fuel primary energy use (490 EJ) from wind and solar in 2040 and 94% of the 2019 fossil fuel primary energy consumption in 2047. These estimates are likely too optimistic.

“Also note that debt at the World level is money that is borrowed from other humans as long as there is no interplanetary lending”

Dennis, this has been repeatedly shown to be false. A large amount (most?) debt comes from money that was created out of thin air at the time a commercial bank gave someone a loan. Debt as money lended from one person to another is an outdated idea that is mostly no longer true in the modern economy.

This from the Bank of England explains more: https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy

“Commercial [i.e. high-street] banks create money, in the form of bank deposits, by making new loans. When a bank makes a loan, for example to someone taking out a mortgage to buy a house, it does not typically do so by giving them thousands of pounds worth of banknotes. Instead, it credits their bank account with a bank deposit of the size of the mortgage. At that moment, new money is created.”

This new money is only “borrowed” in the sense that the borrower has to pay it back… But at no point did some other account balance go down in the process of creating that debt.

They need the banknotes in form of central bank liquidity when the credit taker buys the house.

That’s why banks can go broke – when they could create real money out of thin air they couldn’t go broke. They would just create new money to pay all their bills.

Yes they can put a million $ in your bank acount with a key stroke – but this money exists only in the bank.

To get central bank reserves they either already own them, or swap in cash (cash is direct central bank money) or take a AAA+ bond as a security to lend them. That’s why government bonds are so important, and the shortage of them can lead to problems.

Nikko,

In the case of a mortgage the real asset in a piece of property is the collateral for the loan, if the mortgage is not paid the bank gets the house and in many cases people (wealthy individuals pay cash for property and their bank balance does indeed change. There is also a lot of corporate debt in the form of bonds and a lot of government debt also in the form of bonds, this debt is indeed paid for with bank balances.

Debt can indeed be a problem for financial institutions when assets are inflated and when borrowers can no longer pay their debt due to an economic down turn they will not own a foreclosed property with equal value to the debt owed. This can cause banks to fail.

Blondbeast , I don’t know anything about insulation ( never needed it in India) . Just scanning the net and came across this regarding Boris Johnson’s directive to replace all gas boilers with heat pumps . Quite a critic .

https://notalotofpeopleknowthat.wordpress.com/2021/10/20/this-heat-pump-scheme-is-a-bung-to-the-rich/

The replacement/renovation issue is indeed a big equity problem, as are EV subsidies. These favor higher income brackets who can either afford the purchase (and enjoy the subsidies) or have access to credit.

I was referring mainly to multi-family new construction housing in the U.S. I see most urban developments using VRF heat pumps.

We have designed a few large conversions from chillers to heat-pump style chillers.

HiH, no AC then either I suppose?

Since it quite stupid not to insulate an airconditioned building.

Laplander , no AC . My dad constructed the house with high roofs , several windows and good cross air ventilation . However the temperatures in 1990 in Delhi was upper limit 38 degrees centigrade . Now at peak it is 48 degrees . Because of all the cement and asphalt ground temperature is 52-53 degrees centigrade . F***ing hell on earth .

@laplander: One of my partners is from the Delhi area. According to him most AC being added in India is being added by individuals to existing condos. Whether it’s foolish or not to insulate can be looked at from many factors – (comfort, climate concerns, etc.) but what tends to be used by individuals is the cost of energy vs first cost. In the absence of building code requirements the only folks deciding otherwise tend to be wealthy, concerned with ecology or both.

Don’t get me wrong I advocate for superinsulation every day. I’m in the process of superinsulation and existing cabin for my own permanent residence. The main logic for me is reducing heating needs for an all electric building to make solar affordable and reduce wood heating needs to a minimum. I do not plan on AC. Windows and ceiling fans.

Peak cars in 2017 . Am I correct ?

The OICA gives numbers for world car sales.

Interesting chart to put it mildly.

Plenty to ponder and speculate on

-will the global sales going forward ever be higher than it was in 2020?

-is the decline in sales an indication of peak prosperity (for the 99.7% of ‘commoners’)

-will the global passenger miles traveled by road have peaked as well? [I doubt it]

-is this decline in new vehicle purchase a deliberate choice to delay until more/better/cheaper electric vehicle choices are available in a few more years?

-does this reflect the reality that modern vehicles endure so much longer than those produced in the last century, and thus the interval needed to replace a prior purchase is greatly prolonged?

Hickory, my first diagram shows that the oil price is a significant input for the number of car sales. I assume, in the second diagram the same input is valid. Cars get too expensive for people.

So, my opinion is:

-the decline in sales is an indication of peak prosperity (for the 99.7% of ‘commoners’ )

Berndt,

Oil prices were lower in 2019 and 2020 than in 2018. Car sales decreased. Is your thesis that lower oil prices result in lower car sales? Seems counterintuitive.

If I do a regression on OICA data from 2005 to 2020 and real oil price data there is no statistically significant correlation, p-value of the F statistic is 0.308, any value of 0.05 or more indicates no correlation at the 95% confidence level.

Dennis,

First: Car prices change with inflation. It makes little sense, to use inflation correction for one axis and no correction for the other one.

Second: Averaging of data makes effects unrecognizable. Monthly data contain much more information than annual data.

Third: Time exists. Time dependent effects exist. It makes no sense to mix old data with new data.

Monthly data for car sales before 2015 are different to data after 2015. After 2015 a significant correlation between oil price and sales exist. The more expensive oil is, the less cars are sold.

Interestingly, a lot of information can derived out of the diagram. If we use three time spans, we get three linear fits.

The cross of each fit line with the y=0 axis allows to calculate the oil price which limits car sales growth. Above the price, sales decrease, below it, they increase.

Span……Total cost Oil..Daily C&C Prod…Price Brent

…………………G$/d……….kbbl/d……………..$/bbl

2016-2018…4,78………..81592………………59

2019-2021…3,96………..78517………………50

Now the limit is 50 $/bbl. Oil prices higher than 50 $/bbl result in a decrease of sales.

Error in graph: First time span is 2013-2015

Berndt,

Car sales is in units of cars sold not dollars, already corrected for inflation. So not correcting for inflation would be the mistake.

We do not have car sales for all of 2021, so no good data point for 2021. Also the car sales are lower in 2021 due to a chip shortage unrelated to cost of oil.

Monthly data tells us little because car sales are seasonal. If we are going to claim that the relationship is “total cost of oil” (defining what this is would be helpful) to car sales then time is not part of the equation, the relationship should be invariant with time.

You used annual data in your second chart, as did I. I don’t have acccess to monthly data.

So what is the p value for the F statistic for each of your linear regressions? Is the null hypothesis rejected at the 95% and 99% levels?

Berndt,

I define total cost of oil in constant 2010 $ as World C+C output times average annual oil price. I have looked at annual passsenger car (PC) unit sales data from 2005 to 2020 and found the annual change in PC sales for 2006 to 2020. Then a linear regression on delta PC sales vs total cost of oil per day (for the World) . I find that the p value for the F statistic of the regression is 0.16, it needs to be less than 0.05 to reject the null hypothesis (no correlation) at the 95% confidence level (for the 99% confidence level it would need to be less than 0.01).

Passenger car sales are seasonal, so unless we try to adjust for this seasonality, monthly data tells us little.

The last diagram now with R2-values.

The monthly car data is from CEICDATA, with the most recent data from local associations like VDA, CAAM, ACEA, FADA and FRED. Because the data car data vary very much from month to month (seasonal effect), i use for each monthly value in the diagrams the average of the last 12 month. (Centering of the monthly data might increase the R2-values)

The total cost of oil (G$ per day) is the product of daily oil production in barrels times average price for the month in $. Both values are from EIA. I use the product of oil production times oil price because i want to have all three things: number of cars, price and production in one diagram.

The oil price varies with inflation, and car prices vary with inflation. Because both are affected, i have not included any inflation correction in the car sales diagram.

berndt,

It makes sense to use real GDP in economic analyses because inflation varies randomly over time, if we are using unit car sales, real GDP is the only numbe that is sensible.

Also the fact that you need to use 3 different lines for your data over an 8 year period suggests there is no statistically significant relationship. What is the r squared for all of your monthly data from 2013 to 2021? Note r squared is not enough to determine statistical significance, you need to look at the p value of the F statistic (sometimes labelled in spreadsheet regressions as “significance F”. If this value is more than 0.05 it indicates no statistically significant correlation at the 95% confidence level. Also any value greater than 0.01 indicates no correlation at the 99% confidence level.

Run a simple regression it takes two minutes in a spreadsheet and let us know what you find.

Dennis,

the determination of R2 for the whole nine years 2013-2021 gives 0.008. I am quite sure, this value will hold if i include all car sales data beginning in 1900, even if i include data from the roman empire.

For me much more interesting are the values of 50$ in 2020 and 59$ in 2017. The last one is 64$ if inflation corrected. Both values give the limit for car sales growth. The diagram shows Brent prices together with the Limits for cars. The limit values are nearly on the quadratic fit line for Brent prices. So, not the oil maxima prices are most important for the car industry, the average is.

Comment: At the moment it is not possible to attach the graph, i will try again later.

I have no luck in attaching my image. The procedure, which always has worked, doesn’t function today.

https://assets.wallstreet-online.de/_media/1591/board/20211022084833-brent-price-cars-en-211022.png

Berndt,