A guest post by George Kaplan

The North Dakota area of the Bakken LTO basin has accessible data from the ND Department of Natural Resources, Oil and Gas Division. Production here seems to be past peak and in general decline. The data presented here is therefore more a historical perspective than of much interest in predicting issues that may have significant impact for the future. However it may give some indication on what to expect in the Permian basins, the only ones left in the US that may have capacity to increase production. The Texas RRC does also produce good data but a global data dump produces files that are too big for my computer to handle and splitting into smaller subsets is too man-hour intensive for me to pursue.

Production Across the Area

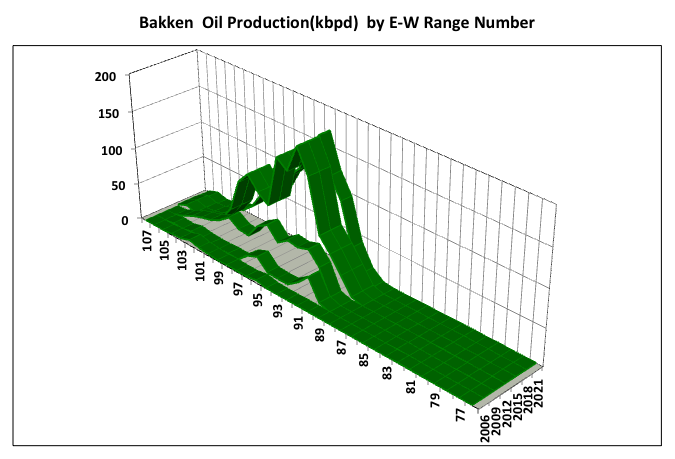

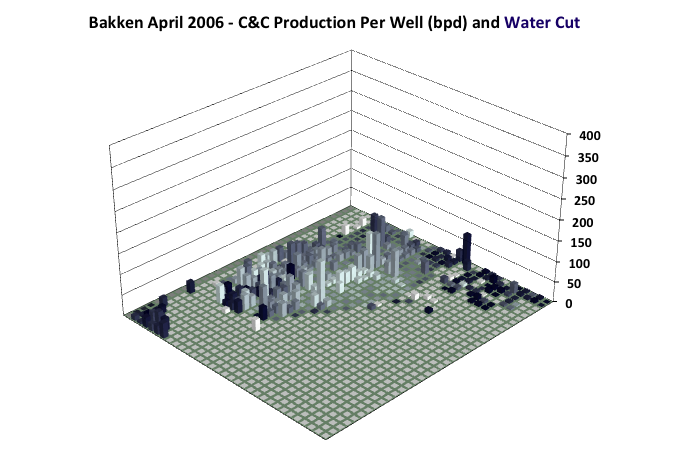

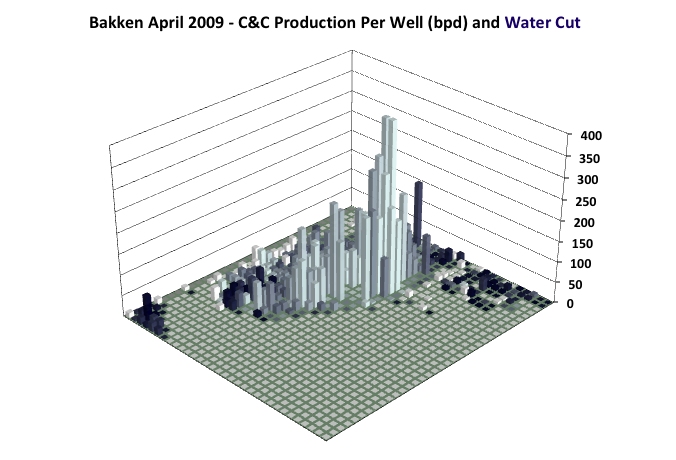

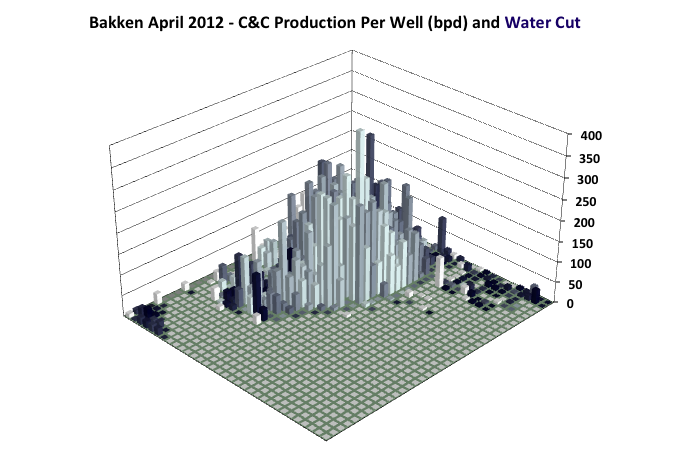

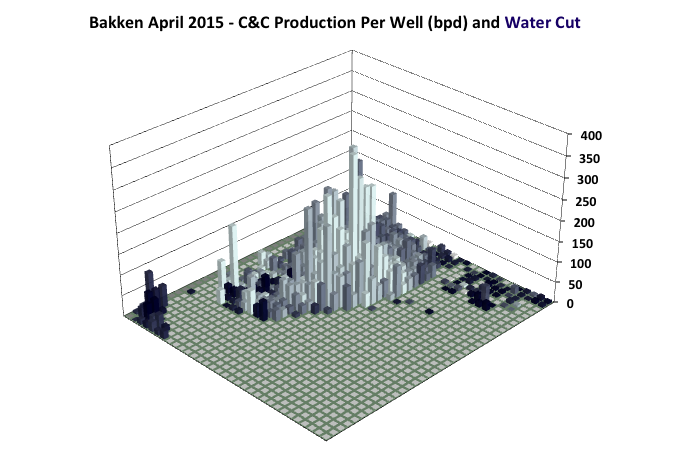

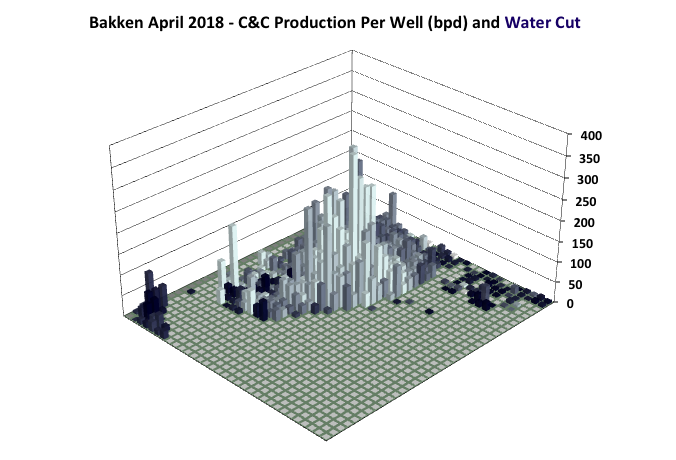

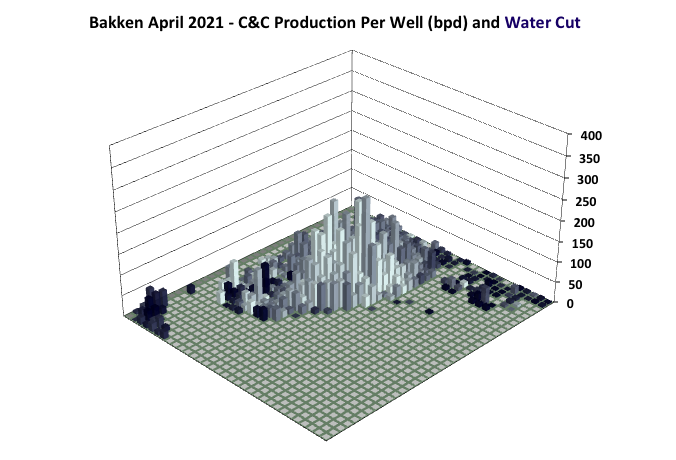

These charts show how the oil production has changed every three years by range (almost equivalent to lines of longitudes) and township lines (latitudes). These lines run every six miles and the area they contain is called a township, consisting of 36 square mile sections (that’s the simplified explanation, earth’s curvature and irregular land features make things a bit more complicated).

The production shapes indicate that there aren’t core (tier 1) areas with surrounding poorer quality areas. There is a single, small central peak area (I think geologists might call this a bright spot) and the reservoir quality declines steadily to the edges of the basin, outside of which there is no meaningful production and never will be no matter what oil prices, technology improvements or USGS fantasies come along.

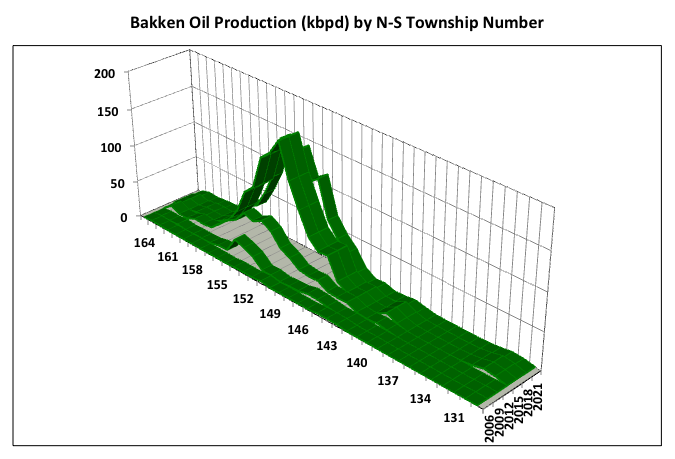

The chart below shows the production over the whole area for April 2021, looking towards the north-west. The colour shows the water cut, the darker the blue the higher the cut. All areas have about 50% water cut as soon as production starts but the peripheral areas, which are more conventional oil rather than LTO, tend to have 90 to 95% water cut, with very low oil production. Only the North Dakota production is shown and the north-south lines should really be slightly jagged as the cross each of the east-west latitude lines to account for curvature, but that’s beyond me and Excel.

Gas Production

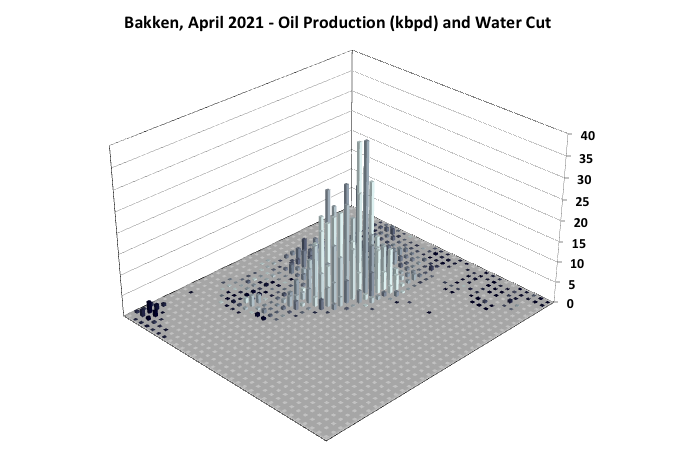

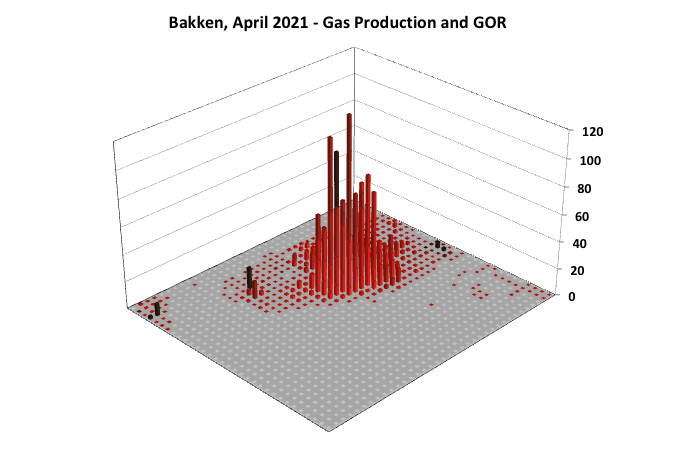

There are a few small areas that are gas prone but mostly, especially in the central region where the horizontally fracked wells are, the GOR is pretty constant with a slight correlation that higher producing wells have slightly higher GOR. The darkest red shows GOR above 10000 and the lightest at below 500, with linear gradation between.

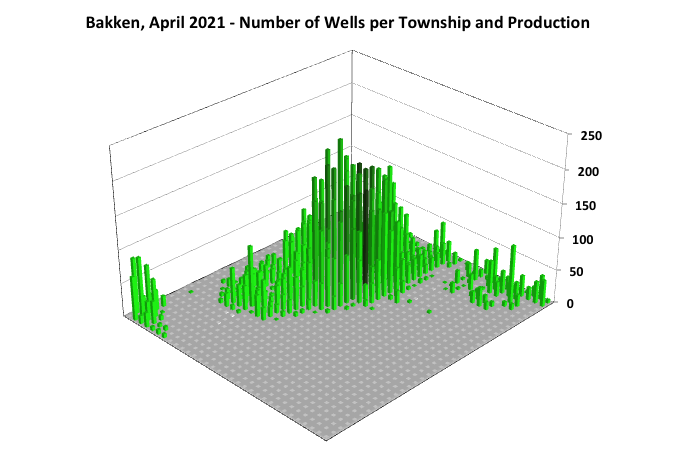

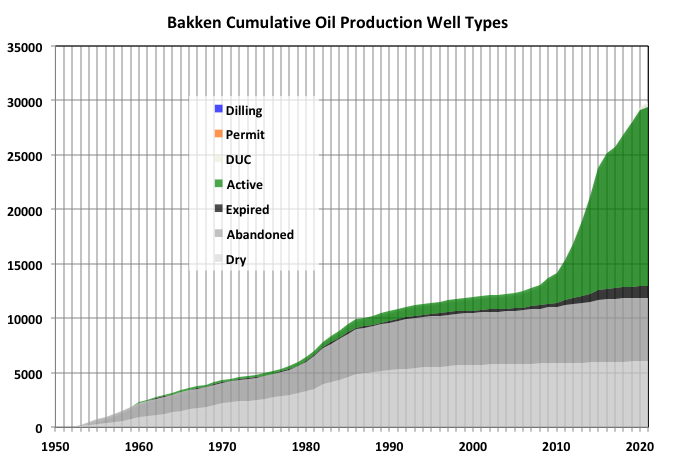

Number of Wells

More wells are drilled per section are drilled in the centre and, like production numbers, decline steadily to the edge of the productive area. The darker greens in the section show the higher production areas. In terms of well density the highest shown is 222 wells in an area of 36 sections giving an average of 104 acres per well.

Well Productivity

The highest average production per well occurred for a couple of areas in 2009 (they are actually off scale in the chart above).

There is a marked drop in the average well productivity from 2018 to 2021, and the high water cut regions closed in from the peripheries towards the centre.

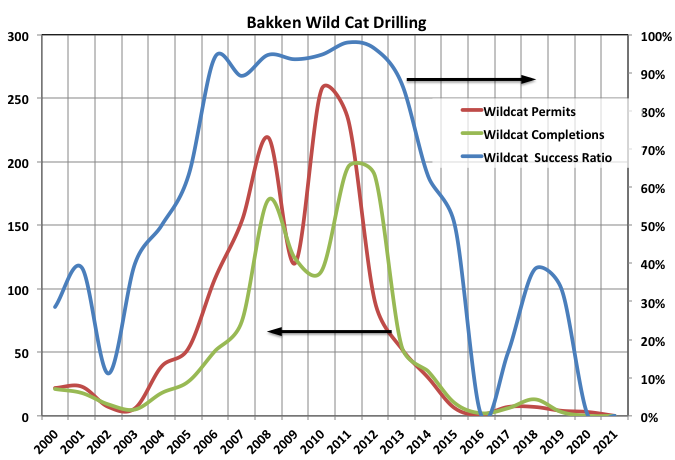

Exploration

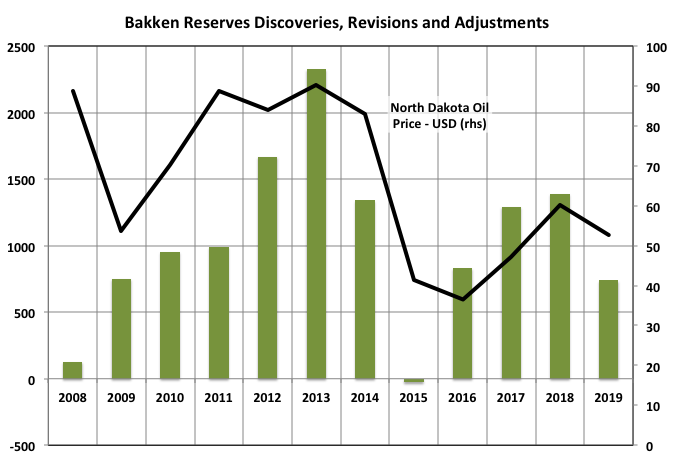

The intense exploration phase ran from about 2007 to 2014 with many wild cats drilled and a high success rate. Since then real exploration has dropped to zero and has not revived as oil price has increased. The E&Ps know where the oil is, any increases in reserves are coming because of SEC rules that limit booking until known exploitation plans are in place. Each year there are technical adjustments, generally down-wards because recovery factors have been found to be lower than originally thought and some economic adjustments because of fluctuations in oil price (but these seem to ameliorate each year).

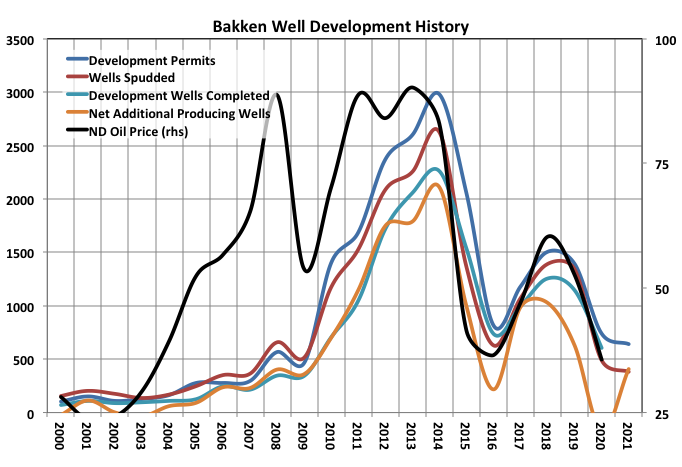

Development Drilling

The strong correlation between price and development drilling has continued through the pandemic. There seems to have been a minimum required price around $25-30 before any thing gets permitted and then a close and fairly linear relationship between new permits (with slightly later and fewer drilled wells and similarly for completions). This has to break down sometime as the resource becomes exhausted and 2021 may be the beginning of that as drilling and permitting activities remain at 2020 levels (the graphs have been prorated through May to give annual figures) even as monthly prices have been increasing (2021 price is not shown). One thing the pandemic definitely did is to cause a number of wells to be taken off-line and a significant proportion of those appear destined to be P&A’d (which will cause downward adjustments in reserve estimates).

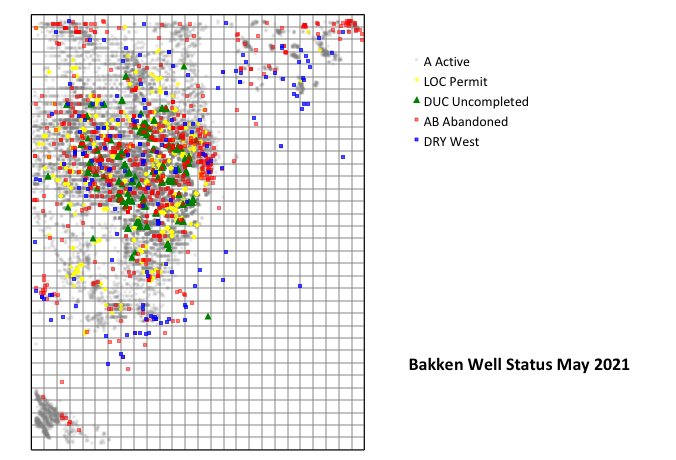

Well Activity

The visible dry well symbols neatly delineate the productive area. The DUCs and active permits are pretty evenly spread out, suggesting there are no particular surprises to be expected in production (i.e. continued decline, with most production concentrated in the centre).

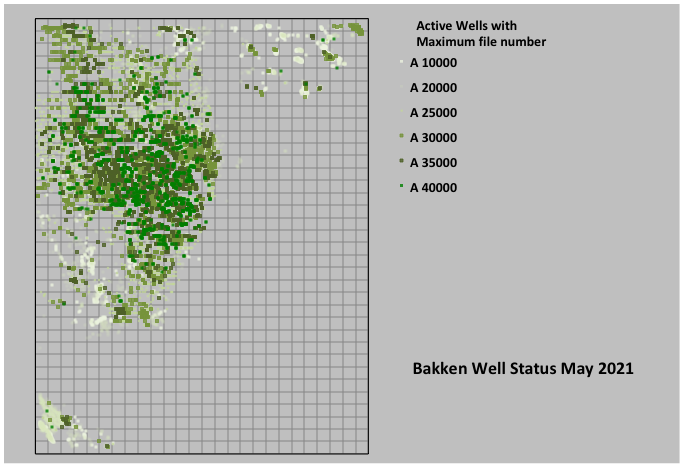

The darker spots show the higher file numbers and therefore the more recent wells. If anything the newer wells are becoming more concentrated towards the centre of the production area rather than spreading to the peripheries.

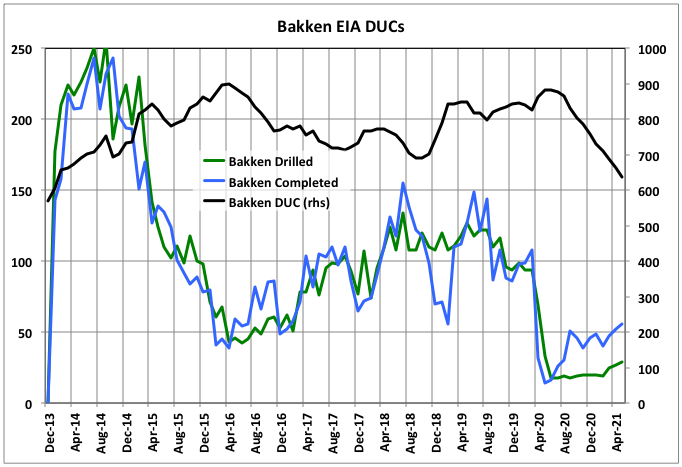

The number of DUCs (drilled uncompleted wells) has been steadily declining over the last couple of years. For logistical reasons there need to be 3-6 months inventory, at present rates that’s about 200 to 300, a level that could be hit in about 18 months if the current trend continues. Given that some of the DUCs might be quite poor quality there could be a sudden drop in new wells coming on line as soon as a year unless the economics of the remaining prospective areas improve enough to justify significantly increased drilling activity as well as the completion costs.

Production Projection

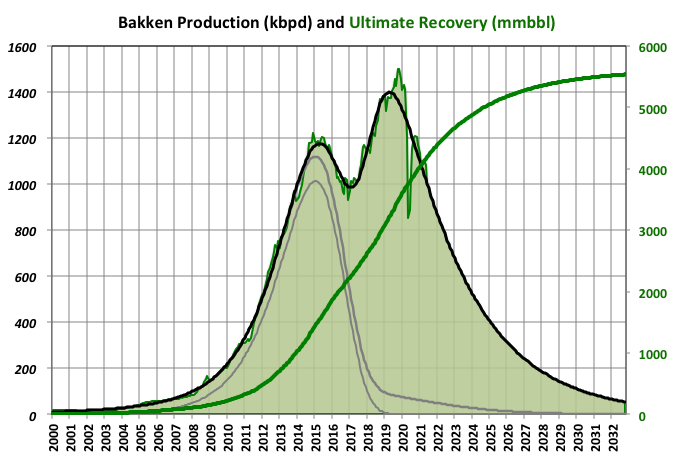

This is not so much a projection, certainly there’s no attempt at bottom up analysis) as an extrapolated curve fit using three Verhulst curves. However, given the rate that the DUCs are being used up, the lack of interest in adding new drilling rigs, the marked drop in well productivity in the most prospective areas, the rise in water cut and general downward trend in revisions and adjustments irrespective of oil price volatility the rapid decline shown may not be unjustified.

Off Topic Finish: Global Unrest and the Risk Analysis Industry

I’ve been reading a recent OECD report called “Perspectives on Global Development 2021: From Protest to Progress?” I love that question mark, and my answer is “No!”

I wonder with such reports what the ratio is of all the man-hours spent by people reading them to those spent producing them. My guess is it may be below one, especially if you discount readers who are only doing so as part of research for a similar such report – the reference lists are always huge) and in these days of internet challenged attention spans reading mostly will consist of skimming with little real attempt at understanding especially of anything that contradicts the reader’s pre-existing conclusions.

Notwithstanding that I would recommend everybody read at least the executive summary. Although from the OECD, whose members could be blamed for most of the ills that the report addresses, it is a balanced look at the rise of social discontent over the past thirty years, especially the acceleration since the 2008 financial crisis. If anything it is liberal leaning, anti growth, environmentally aware and fully recognizing that BAU cannot go on.

There are the normal omissions (not much on overpopulation) and assumptions (humans as rational actors who understand and look after their own interests above all else) and the normal happy-clappy “all is well” conclusions but even here I can see signs of nasty reality starting to impinge. Here are some of the summaries paragraphs:

To begin, the report identifies an apparent paradox of discontent that underlines the importance of looking beyond gross domestic product (GDP) as an indicator of development: why were people increasingly unhappy before the COVID-19 pandemic when the global economy had performed so well? Over three decades from 1990 to 2019, developed and developing countries alike grew almost uninterruptedly. Per capita GDP and wealth rose, extreme poverty declined sharply, middle classes emerged in a large number of developing countries and living standards improved across multiple dimensions . The report identifies four keys to unlocking this paradox: widening inequality within countries; the fact that not all well-being indicators followed the same upwards trend as income and did not reach all parts of the population; the strains imposed on the global labour force; and the worsening environmental catastrophe.

The report then dives deeper into discontent itself. While showing that protests hav e risen over the past decade in all regions, it finds that middle-income countries and middle-c lass citizens are the main drivers of this increase. It also finds evidence of contagion and commonalities between countries that lend weight to a sense of generalised discontent. Acknowledging that evidence of discontent is visible not only in protests, the report also points to declining trust in government, declining voter turn-out and declining support for democracy as proof of citizens’ dissatisfaction. Although these variables are biased towards countries with democratic systems of government, protests have also been rising in authoritarian states.

Public attitude surveys from different regions reflect this discontent and articulate citizens’ most pressing worries. They reveal that many people were struggling to get by even b efore the pandemic and that life was falling far short of their expectations. Economic issues were a source of concern for many people around the world; so too were security, governance and public services. These concerns correspond to a number of traps that confront developing countries related to low productivity, weak institutions and social vulnerability. The report also emphasises the importance of voice: if people took to the streets or refused to vote, it was often because they were not being heard.

These factors alone do not explain the rise in discontent. The report contend s that discontent emerges from interactions between the factors outlined above and fault lines within a country’s social and political context – a complexity exemplified by the relationship between inequality and discontent. These structural factors evolve over a longer timeframe and tend to be exacerbated by the megatrends of our age. The report identifies the erosion of traditional social networks and secondary institutions, the decline in interpersonal trust and the emergence and intensification of so-called culture war s as evidence of social atomisation and polarisation. Technology is exacerbating a number of these phenomena: digital divides are worsening inequalities and leaving some people feeling more alone or less satisfied with their lives, while the increasing use of online networks to share information risks exacerbating polarisation. Social media has emerged as an important tool for social movements to mobilise support. At the same time, political systems are becoming less adept at mediating social divisions.

There is a whole library of OECD publications (often in collaboration with other organisations like the FAO or World Bank). If they are all as good as this one I’ll be impressed. One new realization to me is how much damage technology has done to our social cohesion I think the pressure of increasing population density is equally damaging but not considered in the report, and the increasing heterogeneity of cultures (normally one of the better things about life today, I think) will become problematic. As a consequence people who think we are all going to pull together in the face of the coming global catastrophes, as in the spirit of the blitz, are likely to be disappointed.

The OECD output is part of an industry of academic departments, government agencies, NGOs and business consultancies coming out with reports on global risks, sometimes the discipline is called peace studies. For example:

I have found none of these others to others to be as balanced or comprehensive as the OECD paper. The organisations aimed at the business world tend to have a narrow focus on the coming year and how to profit in it, while the academic papers can feel divorced from reality, especially concerning proposed solutions.

Thanks George.

Not had time to read it all yet but thought this report also adds to the debate.

https://info.gorozen.com/2021-q2-market-commentary-iea-ushers-in-coming-oil-crisis

08/07/2021 at 1:15 pm Edit

Thanks, Lightsoout, this damn PDF is a bombshell, and from the IEA no less. In the past, the IEA, like the EIA, has always been overly optimistic. Now they are turning pessimistic. What a turnaround. From page 5, bold mine:

In previous letters, we have carefully outlined our belief that non-OPEC+ oil supply outside

of the US has already started to decline. Over the last 10 years, the only source of non-OPEC+

oil supply growth has been the shales. Except for the Permian basin, every shale in the US

is now in persistent decline. The shales remain 1.4 m b/d below their highs and our modeling

suggests they will never regain previous production peaks. Even before the massive upstream

capital cutbacks now being forced on the supermajors by ESG pressures, production from

this group was in decline. These declines will only accelerate.

And speaking of reserve growth, they post these majors reserves, and how they have shrunk, not grown.

Ron- are you quoting the IEA or the publishers of that investors newsletter?

For comparison, cumulative North Dakota Bakken/Three Forks output at the end of 2019 was about 3.3 Gb, based on NDIC data. EIA has North Dakota proved C plus C reserves at 5.9 Gb at the end of 2019, roughly 0.5 Gb of the North Dakota reserves are conventional with the rest being tight oil, so about 5.4 Gb of proved tight oil reserves.

This suggests an estimated URR of about 8.7 Gb if probable and possible reserves and contingent resources are equal to zero. My most recent Bakken scenario (assumes WTI maximum of $75/bo in the future) has North Dakota Bakken/Three Forks estimated URR at about 8 Gb. Cumulative production through May 2021 is about 3.9 Gb, so I would agree Bakken is likely past its peak.

So many peaks claimed, so many peaks refuted in the future. It strikes me that this website, comprised of quite a few holdovers from TOD, once thought this was the peak. Check out conclusion #3. http://theoildrum.com/node/3868

It should also be noted that years after this petroleum engineer ventured an opinion as discredited as that of Colin Campbell’s 1990 global peak oil, another TOD editor had this to say in 2011. “Truth in Energy” being the title by this gang of Happy McPeaksters. The quote from Art is at about the 13:45 mark, “when I look at the volumes of oil, I don’t see enough to make a difference” when referring to the US. Watch the entire thing, because moments like this were the beginning of the end for both ASPO and TOD. https://www.youtube.com/watch?v=dcFYB3gelyA

Rinse, recycle and repeat didn’t work when Colin Campbell began doing it by the turn of the century. Endlessly claiming peaks just because there was one (or 2, 3 or 4 prior) is faith based belief in action. Why is the most recent peak THE peak? Because I want it to be. Because I can’t study the past and understand WHY multiple peaks have happened, or the distances between them, or the independent variables involved that aren’t related to some amateurs bad guess on how resource economics basics work. Come on folks, surely the remnants of TOD can do better than rinse, recycle and repeat?

Mr. Reserve Growth Rulz, I agree. Any damn fool should know that reserves will just keep on growing and growing forever. And because they will keep growing, oil production will never peak.

And it should be obvious to everyone that because peak oil predictions were wrong in the past, they will continue to always be wrong in the future. Hell, that’s just common sense. Isn’t it?

Not to mention the fact that oil is clearly abiotic in origin and not “finite” as these “happy mcpeaksters” seem to think … The nerve of these killjoys.

Mr Patterson, my nom de plume isn’t ReserveGrowthRulzForever, but ReserveGrowthRulz. This was based on the obvious fact that starting sometime after 1980, something else was causing production volumes to be replaced. The WHY volumes were being replaced is called “reserve growth”.

As far as those who cannot learn from past mistakes constantly rinse-recycle-repeating peak oils, that is nothing more than historical fact. I would challenge that the object of this exercise is no longer the silliness of declaring every peak that comes along as THE peak oil, but the true genius will be in forecasting how many more will occur before FINALLY the Broken Clock McPeaksters can collapse, exhausted, after their 3rd-8th-13th peak claim, and declare victory. Of course peak will happen, Hubbert’s expression of 3 distinct points related to the extraction of a finite resource has never been in question. A beginning at 0, a maxima along the way and a return to the the final point of 0, once again.

I understand that your demonstration of the techniques used to dismiss my LUDICROUS claims (otherwise known as perfect foresight 🙂 )of peak oil being ridiculous 15 years ago is nothing more than proof of what HASN’T been learned among the faithful remnants of that wildly entertaining time. Let the Broken Clock routine continue!

A beginning at 0, a maxima along the way and a return to the the final point of 0, once again.

I’m glad that you admit the reality of the mathematical neccessity of a maximum. Considering the importance of that peak for modern civilization and the earth’s climate, why disparage people who are urgently attempting to discover when it has or will be reached?

And considering that the peak will almost certainly be closer to the year 2000 than 2100, fixing such an important event within a decade or two is accurate enough. There is no need to ridicule people for being a few years off.

I’m sure that there are a few people, perhaps like yourself, who take a very long view and want to wait a hundred years or more after the peak before declaring it, but some people are understandably anxious about peak oil and its consequences; peak economic output, peak civilization, peak population, peak peace.

Anyone who isn’t on pins and needles about the timing of peak oil is not paying attention.

Why would you be glad that anyone recognizes mathematical necessities? Like faith based belief is somehow the assumption of what works? While folks might want to assign to me all the typical strawmen, saying it don’t make it so.

I consider all peak oils. So your question about peak being closer to 2000 than 2100 is EXACTLY the question that needed answered. And of COURSE I get to ridicule people for being deterministic in their thinking, regardless of the date they choose. There are no facts in the future, so the instant someone simply picks a year, odds are it will be wrong. That is just a given of a simplistic deterministic method. Pile on top of that the idea of resource size being the main independent variable, and you’re already halfway to why the broken clock routine might be the only option available to those who operate this way.

As far as declaring peak oil, anyone who continues to randomly pick dates in the future without considering why it has been wrong in the past (and here is the key…LEARNING FROM IT) are simply playing the broken clock game.

As far as declaring peak oil, anyone who continues to randomly pick dates in the future without considering why it has been wrong in the past (and here is the key…LEARNING FROM IT) are simply playing the broken clock game.

Reserve Growth Guy, now I see why you are so full of shit. You just assume dates are picked randomly, with no other criteria than pulling the dates right out of our ass. And you assume the data from each nation cannot be analyzed, that any nation now in steep decline might easily turn things around and suddenly reach new heights of production.

Russia, one of the world’s three largest producers, has already stated that its oil production has peaked. Many other nations have been in decline for years. I have analyzed every major oil producer on earth and have concluded that world oil production very likely peaked in 2018-2019. The below article was published this past December.

The Very Real Possibility Of Peak Oil Supply

Peak Oil Supply

Though rarely discussed seriously, Peak Oil Supply remains a distinct possibility over the next couple of years.

In the past, supply-side “peak oil” theory mostly turned out to be wrong mainly because its proponents invariably underestimated the enormity of yet-to-be-discovered resources. In more recent years, demand-side “peak oil” theory has always managed to overestimate the ability of renewable energy sources and electric vehicles to displace fossil fuels.

Then, of course, few could have foretold the explosive growth of U.S. shale that added 13 million barrels per day to global supply from 1-2 million b/d in the space of just a decade.

It’s ironic that the shale crisis is likely to be responsible for triggering Peak Oil Supply.

In an excellent op/ed, vice chairman of IHS Markit Dan Yergin observes that it’s almost inevitable that shale output will go in reverse and decline thanks to drastic cutbacks in investment and only later recover at a slow pace. Shale oil wells decline at an exceptionally fast clip and therefore require constant drilling to replenish the lost supply. Although the U.S. rig count appears to be stabilizing thanks to oil prices rebounding from low-30s to mid-40s, the latest tally of 320 remains far below the year-ago figure of 802.

Although OPEC+ nations currently have about 8 million barrels of oil per day of spare capacity, the current price levels do not support much drilling at all, and the extra oil might only be enough to cover the shortfall by U.S. shale.

One comment on the above article. Anyone who believes OPEC has 8 million barrels per day of spare capacity “at any price” just fell off a turnip truck.

Sir , we all knew about fracking in 2010 but did you know about QE? It was only free funding that made shale oil possible and extended the date . Now as the funding dries up so will shale oil . You and others here know that all increase in supplies since 2010 has come from shale . If you knew about QE in 2008 ( when Bernanke and Paulson triggered it ) then I will recommend your name as the next chief of the FED .

P.S : I support QE because it gave us an extra 10/15 years of the good life , but I don’t take my eyes of the ball . Unfortunately for us QE has run out of road . What next ? I think the tool box is empty . Second question for you ? Was Malthus wrong or just early ? Was Hubbert wrong or too early ?

QE funded Shale oil in around about way. US pension funds needed 7% return and could no longer make that happen. Still do and still can’t. Even with leverage they couldn’t make it happen investing in fixed income or government bonds. QE pushed $19 trillion in pension fund money to invest in all kinds of stuff. Including shale oil. It’s the corporate debt these pension funds are buying.

QE is not money printing contrary to popular belief. Corporate debt is in a bubble, Bid there by yield starved pension funds. Stocks are in a bubble bid there by CEO’s who sold debt to pension funds and used the money to do stock buybacks. Housing is in a bubble. In order to keep bubbles inflated we have to have lower interest rates. Not higher.

Money isn’t coming from the FED because they can’t print money. All QE does is transfer assets to it’s balance sheet via a collateral swap. So the collateral that underpins the entire economy both real and financial doesn’t get repriced or market to market at a much lower value.

I expect FED’s balance sheet to double to 16 trillion then again to 32 trillion. They have no choice. It does create a problem though. If they are unwilling to let collateral reprice lower in any meaningful way to make things more affordable it creates a huge gap between the haves and have nots.

I’ll just assume that pension fund money will be funneled into going Green. And I’ll assume that these pension funds will be on board with the whole ESG movement. So yeah money will be cut off to fossil fuels.

I’ll also assume that when quality of life falls off a cliff things like ESG and carbon neutral will be abandoned.

HHH,

Very well said and I wholeheartedly agree. Thanks

I know I hardly post as I feel intimidated with all the smart commenters here. But please know that as a long time lurker, that I am quite sure there are many other people like me on this great blog site.

Doc Rich , you are welcome here . Don’t feel intimidated or embarrassed even if you make an incorrect observation . We are bozos on the same bus looking to avoid the ill effects of ” peak oil ” and the end of the oil age . Hope we will see more of your comments .

What the Fed did during the bailout of 2008 was pretty much a pure assetswap though. They bought questionable mortgages at 100c on the dollar and gave treasuries in return.

QE is funded by freshly created (“printed”) money. A bank gives the Fed a bond and the Fed gives the bank reserves. Those reserves can be lend out (currently they are overall not lend out which is why reverse repos are at an all-time high).

The net result is that yields are pushed down below their free market level which is causing distortions as we see (saw?) in the funding of – for example – shale companies.

QE can be a collateral swap but it that does not seem to be case – the consideration that banks are receiving aren’t treasuries but newly created reserves. Keep in mind that both the private sector as well as the public sector can create money.

Rgds

WP

Bank reserves aren’t money.you can’t buy anything with bank reserves. Banks can’t take these bank reserves and go buy stocks or anything else with bank reserves. You also can’t extinguish debt with bank reserves. Bank reserves aren’t money. They sound like money and the Fed wants you to believe they are printing money but they are not. And reverse repo pays 5 whole basis points. Think about that 0.05 is what that looks like. Bank reserves are useless. Banks use these bank reserves at reverse repo to access the treasuries the Fed has on its balance sheet as collateral to fund their market positions. And there is a huge collateral shortage due to Fed buying all the T bills. That’s why reverse repo is at 1 trillion $

@HHH

I thought the FED buys the bonds in an open market operation. They have to pay somehow – and if they pay with useless reserves nobody would sell to them, or at least with a big premium.

I think the bonds can be used as collateral directly, or sold, so why sell them for useless reserves? Who sells the bonds to the FED – they can’t buy directly from the state.

Guys, the Fed does not buy bonds on the open market and they do not buy them from banks. They buy only Tresurary Bonds from the US Treasury.

How does the Federal Reserve buy bonds?

The Federal Reserve monetizes the U.S. debt when it buys U.S. Treasury bills, bonds, and notes. When the Federal Reserve purchases these Treasurys, it doesn’t have to print money to do so. It issues credit to the Federal Reserve member banks that hold the Treasurys. It then puts the Treasurys on its own balance sheet.

Ron : the Fed does not buy treasuries from the Treasury:

https://www.federalreserve.gov/faqs/how-does-the-federal-reserve-buying-and-selling-of-securities-relate-to-the-borrowing-decisions-of-the-federal-government.htm

Rgds

Vince

Yeah, I misspoke there. The bonds are actually bought by the public as Treasury Bonds. The money actually goes to the Treasury to finance the debt. That is over and above the money collected via taxes. But it is the same thing. The money from the sale of the bonds goes to the Treasury. The Fed is just the middle man.

QE is this exact opposite of what they say it is. They say it’s loose monetary policy. Fact is low interest rate are a sign of tight monetary conditions. They are a sign that money isn’t really following through the economy like it should. If the FED was actually printing money. Flooding the economy with money. You’d see liftoff. Only inflation we have is supply side disruption. Which will remain or get worse due to lockdown in China and elsewhere and drought in western USA.

FED tightens monetary conditions to lower interest rates. Hoping lower interest rate will spur leading. And it doesn’t work. And higher interest rates will surely not work either. Japan has been doing QE for 30 years and it hasn’t worked.

Only reason why markets are still bid is $19 trillion of pension fund money that has to have 7% return. The need for 7% return on capital trumps all logic. They have to invest otherwise they have no chance of meeting obligations. That is why every dip has been bought. Why we don’t see any meaningful correction or revert to the mean in equity markets.

Yes it will end one day. And oil or lack there of will play big part in why it all comes to an end one day. Timing is the only real question.

With 7.5 million people in the next 5 weeks losing not just their federal unemployment benefits but state as well. A lot of the open job will be filled. Which there are 1.4 million more open jobs currently than people on unemployment benefit. If you believe what the data says about that which I don’t. A lot of those 10 million available job were double counted. But in any case the unemployment number is set to drop very low if you go by government numbers. Which is a problem for the FED. They have to talk about tapper at that point.

FED is going to need bad data. And a lot of it. Because it would be major policy error to allow interest rates to rise.

Reservegrowthrulz.

We will see if the North Dakota Bakken/Three Forks has peaked. There have been many peaks for World output, that is correct, eventually World output will also peak, perhaps due to a peak in demand and demand falling faster than supply at market clearing oil prices.

There are many examples of individual nations that have peaked, I doubt that the current peak in UK C plus C plus NGL output will be surpassed for example.

A scenario with prices over $130/bo (in 2021 $) could potentially lead to a new Bakken Peak, if the completion rate was high enough (about 160 wells completed per month).

Even such a scenario does not reach the monthly peak, but I focus on centered 12 month average and a scenario can be created that has a new peak, but very optimistic assumptions must be made (a very high oil price scenario with a very high completion rate). In my view such a scenario is low probability, perhaps about 5%.

Dennis, we are ALWAYS seeing things peak. We saw it at TOD in the Bakken, just as we did the world, just as we saw it for the world in 1990 when Colin began trying his hand at randomly trend fitting production. You are correct that there are plenty of examples of regions peaking. Including ones used by Hubbert as examples of how the concept works. Go check out his 1956 work and examine his Ohio example, and compare it to what happened AFTER 1956. Do I need more than Hubbert’s own examples to demonstrate that claiming a peak most certainly doesn’t make it so? Sometimes years, decades or even of a majority of a century are required to reveal what was missed in the now, when claiming a thing in the future. I know we have discussed probability before, and how you throw out a number for a particular scenario. I believe I have previously mentioned that the probability flowing from the system is my preferred method, rather than guessing.

Rulz says:

Do as I say not as I do is his byline. What else is the shock model but a careful analysis of probability flows given that the laws of finite supply exists? This is actually more tractable than trying to predict the flow of a virus through a population, as that can always reappear after it has seemingly disappeared. Not the case with a non-renewable resource of course.

Rulz needs to go through these contortions to try to save face.

“What else is the shock model but a careful analysis of probability flows given that the laws of finite supply exists?”

If memory serves, you once claimed that the less you knew about the thing you are predicting, the better the answer was. My response to that, even back then, was that building from the ground up, rather than the top down, was a better approach. I demonstrated this by asking you what the resource estimate was, in your system, for the Falkland Islands. You answer was “subtract everything else from the world, and the remainder is the Falklands answer” which, while entertaining, demonstrated that you couldn’t use a single geologic piece of information to answer that question, and couldn’t answer the question because you didn’t even know WHAT to subtract. Compare this to a bottom up approach, where the information a geologist knows and can quantify, the sedimentary history, the generation window and timing, the organic material available to make oil or gas, can be turned into a small scale estimate. I read parts of your book Paul, and it demonstrates exactly what you told me before it was written. Pick some data, and apply complex and purposefully uninformed trend fitting. Call me old fashioned, thinking it comes in handy to know some of the particulars involved. Remember the good old days? Which one of these was yours? Let me guess…one of the ones that said a peak would happen, rather than what reality revealed? http://theoildrum.com/files/PU200804_Fig3b_small_0.png

“Rulz needs to go through these contortions to try to save face.”

I was the one who knew where random trend fitting would get you back then. And interestingly, you should now as well. Have you ever heard the phrase “married to your model”?

Reservegrowthrulz,

There is no doubt that an analysis that mapped every cubic meter of the Earth’s crust would be more accurate. Go do it, looking forward to seeing it. I do not have the time or resources to produce such an analysis.

Has there been a lot of output from the Falkland Islands?

Note there is a lot of information in the World that is proprietary, so you could claim that we are not using all the information that exists. This is true, we use the information we have access to. Note also that curve fitting is done all the time in the oil industry and in science when confirmation of a proposed theory by utilizing empirical evidence is performed.

I agree using probabilities is a good idea, though probabilities of future economic conditions will necessarily be quite subjective, so determining the “probability flowing from the system” will yield a different answer for any given analyst. For example I would probably put the probability that the North Dakota Bakken/Three Forks has peaked at 65% and you might think the probability is 5% (or less). On UK C+C+NGL output I would say the probability that the peak has passed is about 95% probability, perhaps you might think 50%.

For World output the peak is likely to be determined more by demand than supply as the transition to electric land transport reduces demand growth and keeps oil prices in check (likely to less than $130/bo in 2021$). This is likely to keep conventional World C plus C URR under 2800 Gb and unconventional C plus C (defined as tight oil plus extra heavy oil with API gravity less than 10 degrees) URR at less than 300 Gb (World C plus C URR of 3100 Gb with a 90% confidence interval of 2800 to 3400 Gb).

Dennis,

I would go further in that every mathematical model representing some physical data is an example of curve fitting. It’s just a matter of what dimension the curve is. If it’s one dimensional curve it’s essentially fitting to a point. If it’s more it will be a multi-dimensional curve or manifold. So slamming something by calling it “curve fitting” is not much of an insult 😉

Rulz is also very confused about assigning this assertion to me ” the less you knew about the thing you are predicting, the better the answer was”. Perhaps what he is trying to recall is the Maximum Entropy formalism of making predictions about a data distribution via a minimal number of assumptions. Thus if all one knows is the mean one can apply a damped exponential and if all one knows is the mean and variance, one can apply a normal Gaussian distribution. This is nothing new, but it works very well and actually forms a basis of the field of statistical mechanics in physics.

Overall Rulz is upset that we are digging through the available data and taking responsibility by putting our names to our analyses, while he is not.

RESERVEGROWTHRULZ Is your argument that oil production hasn’t peaked, therefore it will never peak ?

Hint:

As we know, global peak was in Nov of 2018.

That is getting a ways in the rear view mirror.

But we shall see

That is the latest peak oil in a long line of peaks, both real and claimed (before and after sometimes). It would seem more useful at this point to estimate how many more peak oils there might be rather than pretending that only the most recent is likely to be THE peak.

I’m waiting—-

We will see who is right

Of course not. But that seems to be one of the first claims assigned to me regardless. I absolutely state for a fact that oil will peak, and anyone who says otherwise is an idiot. The clue is that Hubbert was exactly right about a finite resource having 3 defined points through the time of extraction, a beginning at 0, and end at 0, and a maxima somewhere in between. Between those two 0’s are where all the fun is.

Reserve Growth/Adam,

The biggest innovation, at the moment, that will upend current projections will be EOR … Enhanced Oil Recovery.

Several factors are in the process of bringing this about.

One big one is the near universal adoption in the Bakken of the relatively new gas lift iteration termed Single Point High Pressure. This is prompting the implementation across the Basin of umpteen number of compressors.

Second factor is the use of solvents (unidentified, but sounds like d-Limonene) that Liberty is testing in another EOR pilot in the Bakken.

The results of Liberty’s Stomping Horse EOR project pointed out the obstacles needed to be overcome so that much of the remaining OOIP can be economically produced. Several of these challenges are being addressed by current EOR pilots by Hesse and others. Public results should be more readily accessible in 12 to 18 months.

COFFEEGUYZZ

Thanks for that post.

Single point high pressure gas lift is not new but may be a new application up there or perjuring the name. One benefit of increasing GOR over time is the availability of the gas for gas lift or gas lift assisted plunger lift. Pads with multiple wells make gas lift between wells feasible. Gas lift is the only process, by my way of thinking, that could be applied to purge the lateral from stem to stern however it would be very inefficient but way better than the alternatives that come in second such as N2 jobs.

I am curious as to the use of solvents in the EOR process by Liberty as the oil is light and thin unless there are paraffins or other residuals that drop out under pressure depletion and gas breakout. If you have more specifics let me know.

That is great info because this is the type of exploitation evolution that changes the decline curve and EURs. Looking forward to your follow up.

Rasputin,

Regarding ‘purging the lateral from stem to stern’ …

There are numerous approaches from different outfits tackling just that topic, clearing slugs/solids/crappola from the lateral with some touting a ‘tube within a tube’ approach.

Little outfit out of Michigan (Horizontal Lift?) has an interesting video describing their hardware.

Using the numbers posted on Bruce Oksol’s Milliondollarway site (all publicly accessible on the ND DMR site), some new wells are ‘using’ between 50 thousand and 150 thousand cubic feet of gas per day. This is produced gas that is neither flared nor sold. If it is being re-injected for AL, it is, essentially, being recycled.

As for the ‘other residuals’ dropping out under pressure depletion, you may very well appreciate looking at the ~18 page pdf put out by the UND EERC describing the results of the Stomping Horse EOR project.

The chart showing the asphaltene recovery (C10 – C20) with propane is astonishing

This seems to validate the idea that the larger molecules are unable to ‘squeeze’ through the micro pathways and, thus, promote both blockage and an increasingly lighter hydrocarbon product at the wellhead.

Regarding Liberty’s solvent in EOR .. it was only described as some type of eco friendly type of bio agent, or some such.

I immediately thought of that colorful, tiny outfit (out of Colorado? Utah?) that was – literally – washing kerogen-saturated earth in heated tanks loaded with tons of Fast Orange type cleaner.

Preposterous sounding, sure, but an intriguing concept nonetheless.

(The SAGD boys up in Canada have been successfully using solvents for years).

The scope and pace of innovation never ceases.

Coffee.

As I recall, you have been discussing EOR in the Bakken for several years and have touted Liberty’s efforts in that regard.

Isn’t it correct that thus far EOR has resulted in few extra barrels in the Bakken and other shale plays.

If I am wrong, can you point to some data backing the barrels shale EOR has produced?

Shallow, there has been virtually no successful recovery in the Bakken to date via EOR.

The pilot project by Liberty – Stomping Horse – failed due to insufficient gas supply. (Sounds like an odd reason to me). However, the ability to both track and control the injected gas was – according to them – both achieved and repeatable.

This is no small accomplishment.

As far as successful EOR, you are certainly aware of EOG’s success in the Eagle Ford for several years, now.

Likewise, that tiny outfit up in Canada, Granite Oil, has also been successful using reinjected field gas for repressurization and – to an extent – a miscible sweep. They were bought out by a bigger outfit last year, I believe.

The geology up there (Viewfeild Bakken?) is conducive to that approach.

I no longer track these matters closely, but a determined, diligent observer might be surprised at what is out there.

Coffee “As far as successful EOR, you are certainly aware of EOG’s success in the Eagle Ford for several years, now. ”

Maybe they succeeded on the technical side but did they make additional money ? Did they pump additional oil or did they just pump the existing oil faster ? Sometime it is all about showmanship . You know better .

Coffee.

I am aware of the huff and puff by EOG and others in the EFS. My reading indicates that multiple compressors, which can push gas at up to 9,000 psi, are required and these compressors cost about $4.5 million each. So maybe if oil gets back up over $100 sustained. Based on a review of shaleprofile, it looks like these wells aren’t making much of a dent.

As for Granite Oil, it sold for $79.7 million. A very small producer in the grand scheme of things.

My point is that, thus far, EOR is no game changer in shale, unlike how EOR has been one in many conventional fields throughout history.

An example would be our little field, where by the late 1930s, production had fallen to just over 1 million per year. Then came WW2 and waterflood. By 1960, production had increased to a secondary peak of over 4 million barrels per year.

Only since 2014 has our little field fallen back below the lows of the Great Depression. Waterflood resulted in extending our field’s life for decades.

It remains to be seen if shale EOR can do that. The oil is there, I suspect what is really needed is a very high oil price.

Shallow

If that 9,000 psi compressor qualifier came from Exterran, you may want to look at the copy just below the graphic, to wit, ‘access to lean fractionated gas’ … aka methane.

This implies that field repressurization is the primary mechanism for that application of EOR.

The Bakken is different.

Theŕe is a 2018 presentation online (46 pages) from James Sorensen of the UND EERC that describes the Stomping Horse project in an excellent fashion.

Where methane has been found to have a Mean Miscibility Pressure of over 4,500 psi, ethane is only ~1,360.

Propane plummets to ~650 psi MMP.

Operators in North Dakota have very strong incentives to use their abundant rich gas for its miscibility characteristics as much as for field repressurization.

As of the other day, per Justin Kringstad, North Dakota produces about 600,000 barrels of NGLs per DAY …over one half its oil output.

With high pressure compressors springing up all over the Bakken, with thousands of 2 mile laterals sitting underground … surrounded by rock still holding 90% of its original oil, with a quarter of a million barrels of ethane being rejected every day into the gas stream (bumping the parameters of the Northern Border takeaway pipe), there are many, many factors falling into place that would lead one to surmise that Bakken EOR will become a hot topic within the next 2 years.

The additional 25%+ recovery rate garownteez it.

25% more recovery is good.

But expensive compressors, extra installations and huge utility bills for pumping lot’s of gas into the hole at high pressure make this a financial zero sum game easiely, or even a loss.

It’s the same problem as in the hydrogen car discussion in the other tread – compressing and decompressing lot’s of gas to high pressures eats up a lot of energy.

Water flood recovery looks like to use up much less electricity for the pumps, making these extra barrels cheaper.

You can always have better recovery technics, but they have to pay out financial and energetic.

As an exteme example, you could dig out all the all the source rock with mining equipment like coal and queeze out 100% of the oil in a processing plant. You’ll yust have to power it with an atomic plant (or a giant solar farm) and sell it for 500$ a barrel – but you would have lot’s of oil. So recovery technology has not only to work.

Eulespeigel

Those are valid points, but – again – they are being addressed in rapid fashion.

When a retired EOG engineer proposed, in 2016, his new concept of Artificial Lift using a single injection in place of the historical ~15/20 points which necessitates using relatively expensive valves, an immediate problem arose as no large volume high pressure compressors were widely available on the market. Hence, custom made units were expensive.

EOG collaborated with a compressor company, had a few units built which showed success, and now other companies are using this process.

Eliminating the problems and expenses with Electric Submersible Pumps has been a big upside to this high pressure gas lift approach.

However, this new reality of having a large, expensive (but getting cheaper) compressor on a pad with 6 to 12 wells greatly facilitates – both operationally and economically – the concept of rich gas re-injection for EOR if the technique can be proven to work.

The Stomping Horse project showed that it can work.

As for power expenses, these units use onsite gas to fuel electric generators which provide the electricity.

This is a reason why so many cryptocurrency miners are now in the Permian and Bakken capturing the unwanted flared gas to power generators for their mining needs.

This gas flared or wasted for useless things like bitcoin mining sells in the Asia market for lots of $, and even here in Europe it costs 6 cents per Kwh (burn value) at the moment. So it is 14 us cent / Kwh electricity when you take a modern 50% turbine.

So think again what you are burning there. You are just waisting a ressource because someone forgot to build a pipeline (or everyone is still pumping too fast and forgot earning money by bumping more then pipeline capacity).

Imagine they forgot the oil pipeline and build the gas pipeline. Then there would be big lakes of burning oil to be able to sell the gas fast.

PS: Bitcoin mining is a complete waste. There are modern proof by stake concepts for digital currency – then you could run the complete bitcoin network on round about 10,000 Rasberry Pis for 100Kw electrical power when they convert.

You are certainly discussing why reserve growth rulz Coffeeguy. But in order to create a system to handle everything currently known in order to predict a peak, you’ve got to be far more inclusive as to the mechanisms that haven’t been properly included in the past.

I had posted this at the fag end of the last post . Dennis and Ron had made comments but I am bringing it on to this thread to know as to what members or lurkers think about this .

“I am going to toss a ball , let us see where it goes . Some bullet points .

1 . There is now a consensus (yes a few holdouts ) that the world peaked in 2018 .

2 . There is now a consensus (yes a few holdouts ) all the major producers Russia , USA and Opec 5 are past peak .

3. Shale oil is now a ” sunset ” play .

4. USA peaked in 2019 .

5. The price of oil will not touch $ 100 on a sustained basis (+6 months in continuation )

6. ELM will trigger unintended consequences that we do not know of just like the ” war on terror ” .

7. Anything or any addition or subtraction to my bullet points is most welcome . Agree or disagree let us churn the mixture . Let the games begin .

P.S : To lurkers , this is a civilized blog (tks Ron , Dennis and bloggers ) come out of the woodwork and post your opinion .

HinH-

I would be very surprised if oil did not sustain above $100 in this decade.

Probably we come at this differently because I don’t see demand being as price sensitive (fragile) as you do.

We also see a countervailing force very differently- I suspect that in late decade electric vehicles will start making a significant dent in petrol demand.

Hickory —

In my view there s a huge gap between what consumers are willing to pay for liquid and what it costs to provide it. As evidence of this consider the high taxes in Europe, which make $5 a gallon prices normal.

As a result, in the short term it’s mostly just market psychology that drives oil prices, not supply and demand. For example when Bush started his little adventure in Iraq, prices shot up, on fears that turmoil in the region would reduce supply, and stayed high even when there was very little actual interruption. When people noticed that the Arab Spring didn’t do much to interrupt supply, prices fell.

So I don’t expect prices to go above $100 again unless some new panic like the 9/11 hysteria occurs.

Alim-

I’m thinking that in this decade that supply will indeed fall below demand (not just expectations or psychology), and the shortfall will be sustained long enough for higher oil prices.

Severe global recession for some reason would make this notion false.

Hicks , we are now not in a recession we are in a depression . Selling inflated priced houses and shuffling overvalued paper is a ” zero growth ” . It only leads to increasing inequality . No economy in the world has reached “pre covid ” status and it is already 18 months . The way things stand today it seems 2021 will also be a washout like 2020 . Why do i say we can never go back ? The reason is that Covid killed the travel , tourism industry which was 17% of the total world’s GDP . This is not coming back . One cannot kill such a dominant contributor and expect to regain lost ground . What we are now experiencing is a REBOUND it is not a RECOVERY . If you are in a hole 50ft deep and regain 30 ft you are still in the hole .

Regarding prices , what quotes we get are futures prices which at this stage are difficult to gauge with the rolling lockdowns in the short term (12 months) . In the medium term my guess is that demand will not rise at a fast rate because the world is going to get poorer . Demand will be stagnant or show a small increment due to population rise ( even the poor, very poor use kerosene ) but the demand per capita will decline . The growth engines which were South East Asia have been the worst hit by the Covid crisis and it will take anything from 3 years (extremely lucky ) to 5 /7 years for them to reach pre covid levels . This will keep a lid on price of oil .

Just something of interest , India imported the same level of oil in 2021 what it imported in 2018 but the import bill is up by 190 % . Luckily they have a good buffer of US dollars but not all economies are so well geared to face such a rise .

P.S : The USD surplus in India is not due to trade but by remittances of workers in USA , Europe( software etc), KSA , Dubai , Qatar(construction ) etc . India has a negative trade balance .

https://www.livemint.com/market/commodities/indias-crude-import-bill-rose-over-190-at-24-7-bn-in-q1-11628190965940.html

Its been about 7 months since vaccinations started.

Within another year everyone who wants one will have had a chance.

Baring new variant or other economic body blow, the world economy is on track to resume energy demand at prior levels, and above.

Is what it looks like to me.

Hicks , the vaccine is a single point solution to a health issue , it is not a solution to a multi-dimensional issue like the economic system . Vaccine will not wipe out the debt , it will not bring back jobs . You put too much hope on the vaccination . When do we get herd immunity ? 80%-90% ?

Just for laughs ” We will get herd immunity when Pfizer has a turnover of $ 1 trillion ” 😉

Hickory,

It’s worth noting that $100+ oil barely dented consumption. If it really comes to shortages I think prices might go significantly higher, unless there is a concerted government push to cut consumption.

Alim, last $ 100 oil was July 28 2014 . The whole environment has changed . 7 years is a long time ago . It is a much poorer world . With the pandemic it is now an absolute new paradigm .

Comments from previous thread at link below after 1st comment

https://peakoilbarrel.com/us-may-oil-production-growth-surprises/#comment-722680

You might be right, but I am just an ignorant passerby here.

Ron , did you get around to reading the book recommended by Steve ? If yes , your viewpoint .

HH, probably not because I have no idea what book you are talking about. Refresh my memory.

Ron,

“TOO MUCH BY HALF” Coming Cut In Proved Oil Reserves, by James Dietrich.

steve

No, I did not read a lot of it. But I did skim it and read a lot of it. I was disappointed. It is just this guy’s life story, his life in the oil patch. Only in the last few pages does he get into what we thought the book was all about. From page 232:

There’s a wide variation of the proportion of total hydrocarbon volume that will not flow, varying from nearly “0” for most parts of really great reservoirs–like those of Johan Sverdrup (Chapter 22) — to nearly “1” for many parts of really poor reservoirs — like those of Novy Urengoy (Chapter 16). A number of “1/3” is a reasonable single low estimate for applications worldwide, implying that “2/3”, or less, of so-called proved reserves are movable. In other words, proven reserves on average are Too Much by Half.

The book was not what I expected.

That’s what put me off too. I read the sample on Kindle on a train ride and was disappointed that it didn’t seem to have the meat. I guess it is purely memoir rather than some dry textbook sprinkled with anecdotes.

Saudi rig count at ten year low:

https://ycharts.com/indicators/saudi_arabia_oil_rotary_rigs

July 31, 2021: 27

July 31, 2020: 48

July 31, 2019: 66

Evidently nothing worth drilling . That is a big down leg , from 66 to 27 in just two years . Tks for the update .

Hole in head,

I would think they have cut back on CAPEX spending just like non-OPEC nations have done. US oil rig count for example went from 776 to 385 over the same period (July 2019 to July 2021). As prices rise and market stabilizes we are likely to see the rig count rise both in the US and elsewhere in the World. Rig counts will follow oil prices as the fluctuate higher and lower, usually with a 6 to 9 month lag.

Dennis,

True that – capex for all oil companies has declined. However, with oil rigs at 27 vs around 60 before the pandemic, the Saudis can hardly claim to have higher capacity than before. Their historical peak annual production is around 10.5mmbpd (the max they produced in a year) and now they have got a baseline of 11.5 and claim 12mmbpd of capacity.

Is that believable in light of the rig count cut by half? Especially because we have to consider that some of the rigs will be required to offset base declines. They used to require 60-70 oil rigs in the 2014-20 timeframe with minimal increase in production. So, I would guess 2/3rd of the oil rigs were purely to offset declines i.e. to maintain production. Now suddenly, without a year of investment, they can claim higher capacity with less than half the oil rigs. They must have sprinkled some magic dust on those rigs, I think

Ancient Archer,

Saudis have claimed 12.5 Mb/d of “capacity” since 2010. They have been producing less oil lately due to OPEC cuts so less need for rigs. When they ramp up output we will likely see rig counts rise.

Not also that if rig count were high, people here would say, “see their rig count is high and they are not increasing output”, if it is low they say “see there are no prospects to drill”. This seems to lead one to think that no matter the rig count people have preconceived notions that no amount of evidence will change.

I look at output first and the reasons it might have changed. Saudi Arabia remains the World’s swing producer, it is pretty well advertised that OPEC is limiting production to support prices. I do not think this is a grand conspiricy to hide declining output, World demand is lower than 2019, OPEC has adjusted output, nothing more.

Dennis, I’m more inline with your thought here. Saudi capacity has been in the same ballpark for the last half century. I think this is their hard infrastructure capacity of ports and pipelines moving product out of the country. If you think about it, they have had no reason to increase it for the last 50 years. Clearly 40 years ago they could have exceeded 12.5 mbd on a medium term basis and I suspect on a short term basis they still can. Surely Iran and Iraq being politically constrained for the last 40 years have geo ability for more capacity.

I think all three of these countries can increase production with additional capex. I keep hearing here “they” are producing “all out”. I don’t even know what that means.

I keep hearing here “they” are producing “all out”. I don’t even know what that means.

“Flat out” is the more common term. And I really think you know what that means.

Your right, “flatout” was the term. Which could mean a foot on the floor of the accelerator of a straight six powerglide 57 Chevy. Or, the pedal to the metal of a 70 Hemi 426 Barracuda 4 speed. They both have a top and quarter mile trap speed but their different. My point, it’s all about the difference in Capex.

Production is a function of Capex. No investment, no oil. More investment, more oil. Are the Saudi’s at flatout investment? I don’t think so.

No, of course not. We now have the Covid oil consumption depression. No one should be producing flat-out right now. Nevertheless, a lot of countries are doing just that. But not Saudi, not right now anyway. But that is exactly what they have been doing for most of their history of oil production. Saudi could produce perhaps 10,000 Kbp/d right now, but not much more.

Their highest yearly average was 10,388,000 bpd reached in December of 2016. They will never ever reach that level again.

Ron,

Have you been able to correspond with the oil geologist, Jeffery Brown? I really enjoyed his discussions on his Export Land Model (ELM). He is on record that Saudi Arabia will not be able to export oil by 2030. Have a hunch he is right. Thanks

No, I haven’t heard from Jeffrey in about a year. I don’t know what has happened to him. But he still might show up, I am hoping.

sure. when you want to produce flat out, you also invest flat out. In fact, I think that investment will continue going up when the peak is reached and production plateaus or declines. but that’s another discussion topic.

My point here was that the Saudis are going to produce more in the near future. At least that’s what they have promised. They have already announced a monthly increase in production to the end of next year and global demand is also going to increase, so I don’t think there is any doubt that they are going to want to increase their production.

My question is this: If they want to be positioned to increase production in the next few months, shouldn’t they be investing more capex? shouldn’t they be drilling more and using more oil rigs? Right now, and not in the far future. What am I missing here? This is the point where I would expect them to increase their capex and oil rigs. However, oil rigs have just touched the lowest point since 2005. Rigs were at 33 at Jan 21 and now they are at 27. Again, what I am missing here?

Dennis, as to the veracity of Saudi capacity notwithstanding their claims regarding the same, who knows! They have never produced even close to their capacity – actually that’s not true – they produced 12mmbpd for only about a month during the OPEC Russia oil price war in April last year. But that number was surely bolstered by drawing down from their reserves. Their reserves number at 268bn bbls has not changed over the last 30 years, so excuse me if I doubt their word as to their production capacity.

If you have ever dealt with Arabs you would know that positioning, bluffing and extraordinary claims are part and parcel of their business dealings. It’s not that they are lying intentionally, but that’s how they do business. Don’t make the mistake that everyone in the world follows your Anglo-Saxon method of doing business.

Ancient Archer,

Saudi reeported reserves are likely to be proved plus probable rather than proved, reserve estimates change over time, in the US proved plus probable reserve estimates grew by about 63% from 1980 to 2005. Let’s take Saudi reserves as reported in 1980 ( at that point they may have been “proved reserves”) and then multiply by 1.5 to estimate proved plus probable reserves and then assume there was reserve growth of 63% as was the case in the US.

In 1980 proved reserves were 168 Gb times 1.5=252 Gb times 1.63 (63% growth)=411 Gb, then subtract 66 Gb produced from 1981 to 2005 and we get 345 Gb in 2005, they actually reported 264 Gb of reserves in 2005 so their reserves grew much less than US reserves over the same period. If we take the 264 reported and add 66 Gb produced we get 330 Gb, then divide by 252 Gb in 1980 and we get only 31% reserve growth for Saudi Arabia, half the level seen in the US over the same 25 year period (1980 to 2005).

As to increased oil rigs, they probably don’t need many at present as they are producing a considerably less than capacity, as they ramp up output and need more wells they will employ more rigs.

At some point Saudi Arabia will reach a maximum annual output level, I doubt Ron will be correct that 2016 will be the peak. In fact when we use EIA data for centered 12 month average C plus C output, the peak was June/July 2018 at 10597 kb/d. I expect this peak will be surpassed as oil prices rise and Saudi Arabia continues to increase their capacity.

We will see, I expect this to occur between 2024 and 2032.

Dennis, according to OPEC’s secondary sources, Saudi 12 month average peaked in December 2016. I am sure you are aware that Ghawar is in decline. Abqaiq is over 90% depleted. I am sure that Safaniya and Berri are in decline also. After all, Saudi admitted in 2006 that their fields had an average of 8% decline. How in heaven’s name can you doubt that they are not in decline today?

The decline of oil has already begun Bold mine

Most of Russia’s oil comes from aging fields in Western Siberia that are in decline, and Minister of Energy, Alexander Novak, has warned that Russia’s oil production could drop by 40% by 2035. Saudi Arabia – in spite of threatening to increase production – also appears to be in decline. According to Bloomberg, the giant Ghawar oil field in Saudi Arabia is “fading faster than anyone guessed.” Last year, Saudi Aramco oil company published financial figures, revealing that Ghawar’s historic production has declined by 24% in six years.

Aramco reports a natural decline rate of 8%, which means their production would fall by half in less than nine years, without investing billions annually into new wells and new technology on marginal sites. In 2005, Saudi Arabia increased its operating rig count by 144%, to increase oil production by 6.5%.

Ron,

For the World we use C plus C data and generally the EIA data for International C plus C data is pretty good, for crude only the peak may have been 2016, but that is not an apples to apples comparison with World data which is C plus C.

Another good source for data is BP statistical review of World energy, which has the Saudi peak in 2016 for C plus C. In any case the difference from 2016 to 2018 12 month averages is quite small, about 1.4%. As to the decline, it is decline after investment that is of interest. Since 2004 it has been claimed that Saudi Arabia is going to decline soon. From Jan 2005 to December 2019 the average trend in KSA output was (using EIA estimates) about a 115 kb/d average annual increase in output over that 15 year period.

As I suggested we will have to see if a new peak is established, perhaps not, but certainly a plateau is likely to be maintained for 5 to 10 years maybe longer if World demand for oil continues to increase.

Profits thru the roof though. So, there’s that.

Yes , thru the roof , but their is a difference between “gross ” and ” nett ” . If so honky dory then why borrow to pay the dividend ? The argument that Saudi Aramco is separate from the House of Saud does not hold . Aramco’s balance sheet is the balance sheet of KSA . 95% of the revenue of KSA is oil . Very similar to PEMEX being the proxy for Mexico . If and when PEMEX defaults so will the Mexican government .

P.S : High oil prices helped of course .

George

Thank you for your work and your addendum. Truly, both are very much appreciated and food for much thought.

On the technical side, have you included the Three Forks/Sanish in with the Bakken? Forgive possible errors in my memory but I recall a well we had in the Antelope Field that produced from both and the Sanish was a conventional reservoir. Since getting out of ND over 15 years ago I have never looked back as dealing with the other HZ strippers was a monumental money and mental sink. At any rate, isn’t the Antelope Field a sweet spot; to which I will imply the result of the TF/S reservoir and production? It would be of great import to sort this out and see how much the TF/S cumulative production has skewed the Bakken ultimate recovery to the positive which would be implied upon the basin in general by Dennis and others. No slight intended but this may be an issue of no minor significance; I just can’t say so myself.

In my opinion, the Williston Basin is hell on earth for production in the US although I only have experience in a few basins but have followed the industry long enough to make that reasonable generalization. Most of the production is sub salt and if you do not know what that implies ask and I’ll explain it later. Several of the reservoirs have highly divergent water chemistries which make commingling problematic. The Silurian produces super salt saturated waters which, if not diluted downhole with fresh water, will yield free salt in the produced oil. The service sector in my time was still priced for the very large or major companies operating there and the mindset was cutting a fat hog and not efficiency. Back then, there were only two big gas gatherers so your wellhead net backs were horrible. I could go on, but when you add in well known weather, logistical and labor issues, this basin is not for the faint of heart. There are some benefits as well such as very sufficient water disposal zones and multiple pays so it’s not all negative.

Perhaps my inference here is that the Bakken has a much higher breakeven price and barrels to payout than other unconventional plays.

As always, please educate me and correct errors and bad assumptions.

Rasputin

I have been keeping an eye on these DUC’s but not seen any data so far.

From company announcement.

“Williston Basin update – Whiting operated wells

In March 2021, Zephyr completed the acquisition of non-operated working interests in five wells located on three separate pads operated by Whiting Petroleum Corporation (“Whiting”):

· The producing Iverson 11-14HU well;

· The S-Bar 11-7HU and 11-7TFHU wells (which were drilled but not completed (“DUC” wells) at the time of acquisition); and

· The Feehan 11-9HU and 11-9TFHU wells (which were also DUC wells at the time of acquisition).

In the period since the completion of the acquisition, Zephyr has received its scheduled monthly revenue payments related to its interests in the producing Iverson well. In addition, the S-Bar and Feehan wells were all completed by Whiting during the second quarter of 2021 – completion operations progressed as envisioned, at expected lateral lengths and ahead of schedule.”

More from Lightsout’s link up top: The IEA Ushers in the Coming Oil Crisis

The foundation for the upcoming oil crisis is now firmly set in place. The world is re-opening

and global oil demand is recovering strongly. By the beginning of 2022, global oil demand

should be making new highs. Non-OPEC oil supply has fallen by over 2 mm barrels per day

from its 2019 peak and non-OPEC oil supply growth will turn negative as we progress

through this decade. A structural gap will soon emerge between supply and demand. As

early as Q4 of 2022, demand will approach world oil-pumping capability — a first in 160

years of oil history. The ramifications will be huge and the investment implications monumental.

They are saying that as early as Q4 of 2022, demand will outstrip supply. That is the opposite of peak demand. And, at that time, supply will likely still be far below the 2018-2019 peak.

From Ron’s link above:

Over the last 10 years, the only source of non-OPEC+ oil supply growth has been the shales. Except for the Permian basin, every shale in the US is now in persistent decline. The shales remain 1.4 m b/d below their highs and our modeling suggests they will never regain previous production peaks.

Ron

I also found the section of the report on Gas production very interesting, here in Europe gas markets are in turmoil and there was an expectation that LNG from the US would save the day, however…..

Too bad the Bakken is a bust. Don’t worry though, I’m sure the Permian will come through to make Dennis’ dreams of a new US peak come to fruition. Meanwhile, over in Africa…

https://oilprice.com/Latest-Energy-News/World-News/African-Oil-Producers-Struggle-To-Raise-Oil-Production-As-Investment-Lags.html

Stephen,

It is not clear to me that Verhurlst curves will give an accurate forecast, If oil prices rise as I expect, the completion rate in North Dakota Bakken Three forks is likely to rise in the future.

We might see a new US peak if oil prices rise to over $85/bo for WTI, I would put the odds that this will be true by 2023 at about 3 in 4.

George Kaplan,

Excellent detailed write-up on the Bakken. What a difference in ten years since Continental Resources, Harold Hamm stated in 2011 that there were 24 billion barrels of oil in the Bakken. This is precisely what the book, TOO MUCH BY HALF was getting at. Basically, the oil industry transitioned from using Oil Reserve Engineers’ estimates of oil in a reservoir and how to produce it (using fluid dynamics), compared to the glorified Geologists today who focus more on OOIP- Oil Originally In Place. The industry wanted the more OPTOMISTIC & INFLATED oil reserves from the Geologists who were glad to do it for a nice salary. It was a WIN-WIN for everyone except the investor and public.

This was the main beef by the author and Oil Reserve Engineer, James Dietrich.

Unfortunately, very soon, the market is going to realize the SOBER TRUTH that there are a lot of overstated RESERVES & inflated ASSETS.

That being said, while some companies plugging away in the Great U.S. Shale Oil Black Hole are making some Free Cash Flow finally, ExxonMobil isn’t one of them. If it weren’t for ExxonMobil’s International Sector, they might as well SHUT DOWN THE DOORS here in the United States.

ExxonMobil’s acquisition of XTO did more to GUT Exxon of its profits and Free Cash Flow than anything else in the past 20 years.

Hopefully, this chart will show how ExxonMobil invested $32.8 billion from 2016 to Q2 2021 in its U.S. Upstream Sector to lose $3.8 billion in Earnings compared to the much more profitable International Sector.

However, it’s even worse because I have omitted two quarters:

Q4 2017 = $7.0 billion Earnings U.S. Upstream Sector due to one-time Tax benefit

Q4 2020 = $16.8 billion Impairment write-down U.S. Upstream Sector, mostly due to the Shale Oil Black Hole

So, the net of those two quarters is an additional $9.8 billion in losses. If we tack that on to the $3.8 billion, it would be a total of $13.6 billion in losses in its U.S. Upstream Sector. I’d imagine Exxon Management was glad they were able to generate most of their Free Cash Flow from their International Sector to pay U.S. Shareholders dividends.

With U.S. Oil Production likely to decline 75% by 2030, the country will become a much different place.

steve

A medium Bakken oil price scenario where WTI prices rise to $75/bo in 2021 $ by April 2022 and remain at that level until Dec 2035 and then decline to $27.50/bo in 2021 $ by 2075. The high price scenario presented earlier has a maximum completion rate of 160 new wells per month after 2020 (read from right axis), prices of Brent crude in 2021$ also on right axis, subtract $5/bo for WTI price. The medium price scenario presented below assumes a maximum completion rate of 110 new wells per month (this is about the maximum 12 month average completion rate from 2017 to 2020). My expectation is that there is about an 80% probability that actual output will be higher than this scenario, as my expectation is that the price scenario used for this scenario will be lower than actual oil prices.

See chart below, clicking on it will make it bigger.

The analysts who worked on the Rystad energy data concerning USA found a decrease of oil production of 20% or so for 2030 by supposing that oil shale will maintain more or less its production untill 2030. It’s in the report of the shift project of 2021 about future oil supply of Europe.

A high price Bakken scenario where oil prices rise to $125/bo in 2021 $ by July 2030 and remain at that level until July 2033, oil prices rise by $6/year from July 2022 to July 2030, then decline by $3/year until reaching $30/b in 2067, all prices in 2021 US$. Note that my expectation is that there is a low probability this scenario will be correct, perhaps an 80% probability that output will be lower than shown here.

See chart below.

Comparison of high price and medium price scenarios presented above on a single chart,

my expectation is that there is about a 65% probability tht actual Bakken output will fall between these two scenarios as the “medium” oil price scenario is likely lower than future oil prices and the “high oil price scenario” is likely higher than actual oil prices will be. It is also highly likely my scenarios will be incorrect as there are many assumptions built into these scenarios and any (probably all) are likely to be incorrect.

Chart below, click on chart for larger view (medium price model URR=8.5 Gb, high price model URR=10.3 Gb).

A final very low Bakken scenario using the medium oil price scenario, but assuming a completion rate of 35 new wells per month for most of the future (from October 2021 to Jan 2041, last well competed in May 2041), this is similar to the current assumption made by shaleprofile for the North Dakota Williston basin supply projection as of August 6, 2021. My expectation is that there is about a 95% probability that future North Dakota tight oil output will be higher than the scenario presented below. ERR is about 7.8 Gb with about 24000 total wells completed. Note that about 16471 horizontal wells had been completed in North Dakota as of May 2021 (data from Shaleprofile).

The scenario below uses shaleprofile data as the basis for North Dakota Bakken well profiles developed by me using decline curve analysis, mistakes in the analysis are by me.

The shale profile supply projection has North Dakota Williston basin output at 791 kb/d in December 2029, my model has output at 516 kb/d for North Dakota Bakken/Three Forks in December 2029. A difference between these models is that I assume productivity decline in Bakken starting in July 2019, the shale profile supply projection assumes no productivity decline after May 2021 (this is just a model simplification that is different from my model).

Quick comment on scenario above. My expectation is that there is about a 98% probability that North Dakota Bakken/Three Forks output will be higher than presented in the scenario above after Sept 2021. North Dakota tight oil output is likely to remain above 900 kb/d for the next 9 years at least.