A Guest Post by Ovi

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for Non-OPEC countries. The charts are created from data provided by the EIA’s International Energy Statistics and are updated to September 2022. This is the latest and most detailed world oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world. The US report has an expanded view beyond production by adding rig and frac charts.

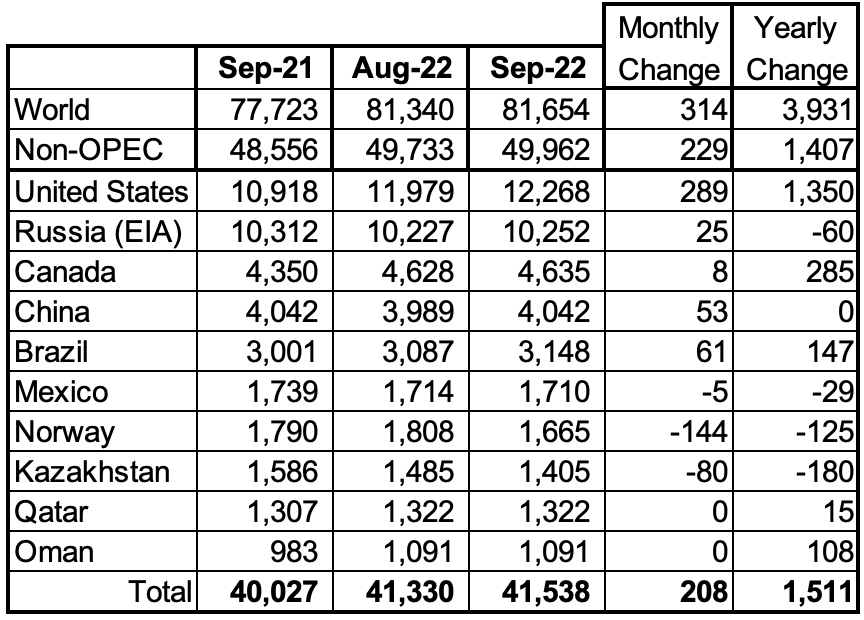

September Non-OPEC oil production increased by 229 kb/d to 49,962 kb/d. All of the increase came from the US, 289 kb/d. The largest offsetting decrease came from Norway 144 kb/d. Note that August output was revised down from 49,879 to 49,733 kb/d. This means that the September increase relative to the original August estimate is 83 kb/d.

October is expected to add 527 kb/d. This appears to be optimistic based on a few country charts below which project October production. Brazil +97 kb/d, Canada -600 kb/d, Kazakhstan +235 kb/d, Norway +100 kb/d and Russia +124 kb/d for a net of -44 kb/d. Maybe the EIA is not aware of the Canadian drop in October. The positive increments add 556 kb/d.

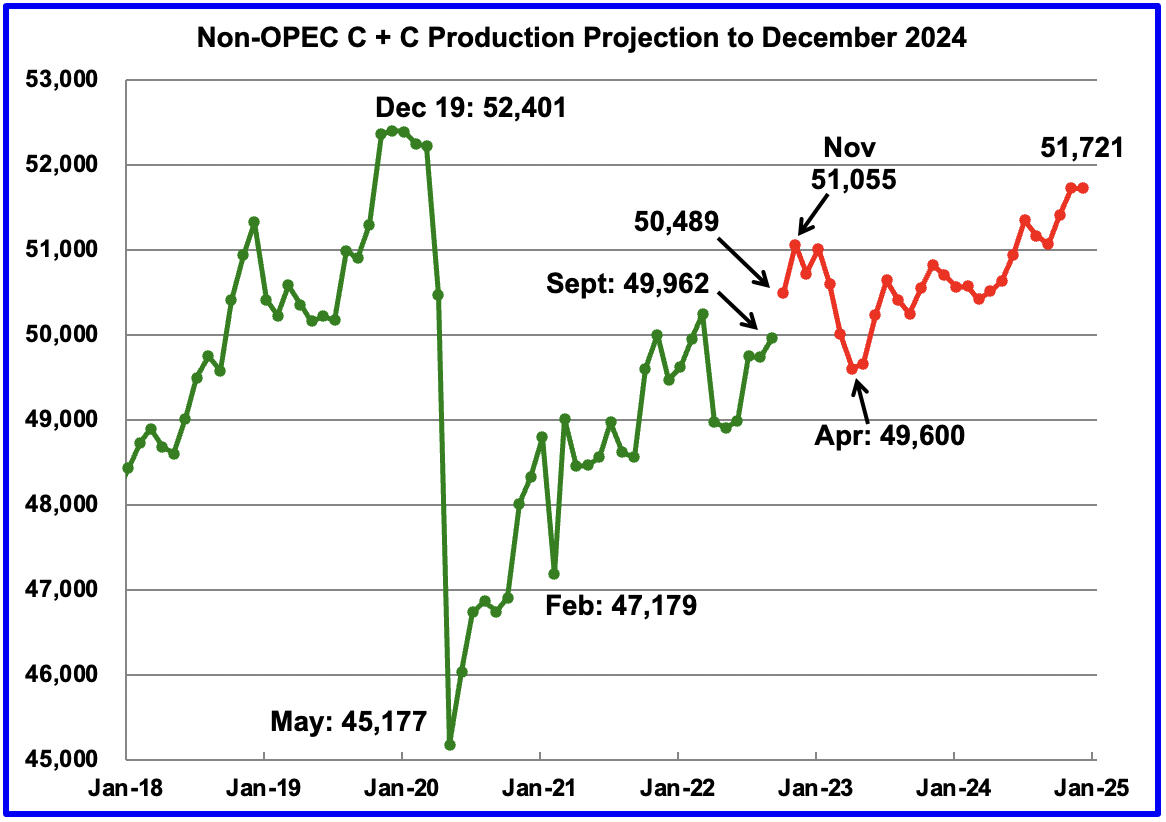

Using data from the December January 2023 STEO, a projection for Non-OPEC oil output was made for the time period October 2022 to December 2024. (Red graph). Output is expected to reach 51,721 kb/d in December 2024, which is 680 kb/d lower than the November 2019 peak of 52,401 kb/d.

Note that after the November 2022 post pandemic high of 51,055 kb/d, production drops to 49,600 kb/d in April 2023, before resuming its climb. The drop is primarily due to a projected drop in Russian oil output.

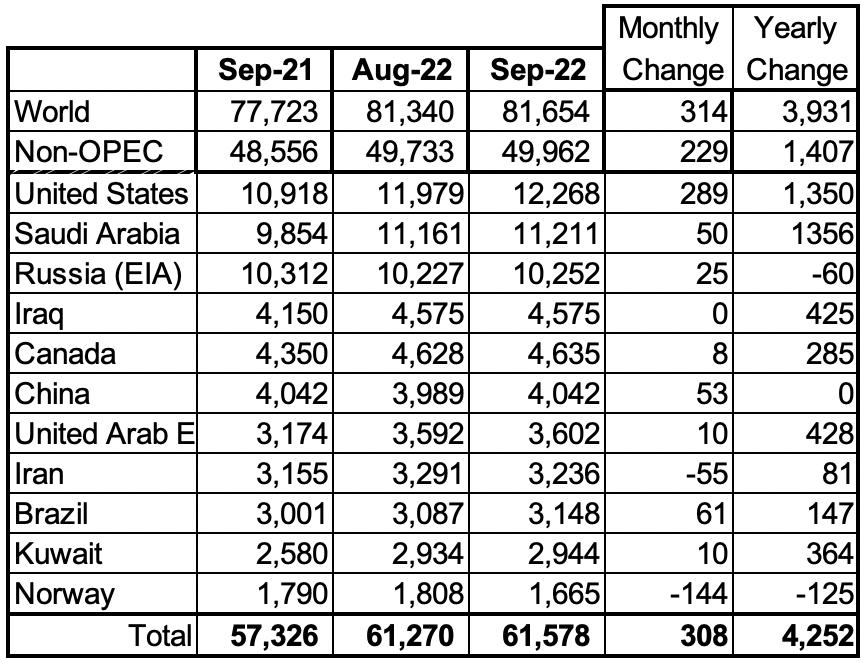

Listed above are the World’s 10th largest Non-OPEC producers. The criteria for inclusion in the table is that all of the countries produced more than 1,000 kb/d. Only Norway and Kazakhstan experienced a MoM production drop in September. The overall September production increase for these ten Non-OPEC countries was 208 kb/d while as a whole the Non-OPEC countries increased output by 229 kb/d.

In September 2022, these 10 countries produced 83.2% of the Non-OPEC oil. On a YoY basis, Non-OPEC production increased by 1,407 kb/d. World YoY September output increased by 3,931 kb/d.

Non-OPEC Production Charts

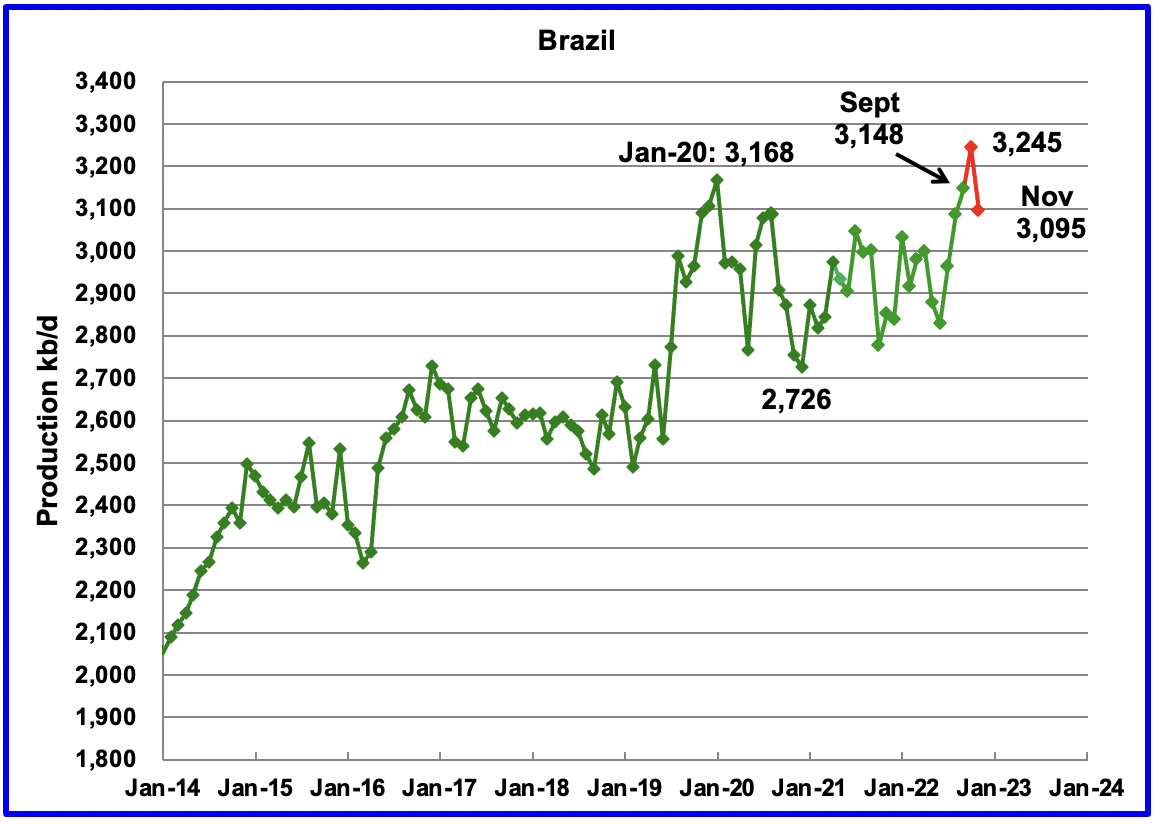

The EIA reported Brazil’s September production increased by 61 kb/d to 3,148 kb/d.

Brazil’s National Petroleum Association (BNPA) reported that October’s output increased by 97 kb/d while November dropped 150 kb/d to 3,095 kb/d. October’s production was a new record high for Brazil which was not sustained in November.

According to OPEC: Equinor’s Peregrino Phase 2 (Platform C) started production in October and is set to continue to ramp up volumes in 4Q22 and into 2023. Growth in 2022 is being driven by the continued ramp up of the Sepia field and the start-up of Mero 1 in the pre-salt Santos basin, as well as Peregrino (Phases 1 and 2) in the Campos basin.

Also, “Brazil’s 2023 liquids supply, including biofuels, is forecast to increase by 0.2 mb/d y-o-y to average 3.9 mb/d, broadly unchanged from the previous forecast. Crude oil output is set to increase through production ramp ups in the Mero (Libra NW), Buzios (Franco), Tupi (Lula), Peregrino, Sepia, Marlim and Itapu (Florim) fields. However, offshore maintenance is expected to cause interruptions in major fields. It should also be noted that Petrobras announced the platform ship Anita Garibaldi is bound for Brazil after it left its shipyard in China on October 6. The new FPSO system will be installed in the Marlim and Voador fields in the Campos basin, with production expected to begin in 3Q23. “

Much of Brazil’s production growth will be from the sub-salt frontier, where highly productive reservoirs containing light and low sulphur oil have been explored.”

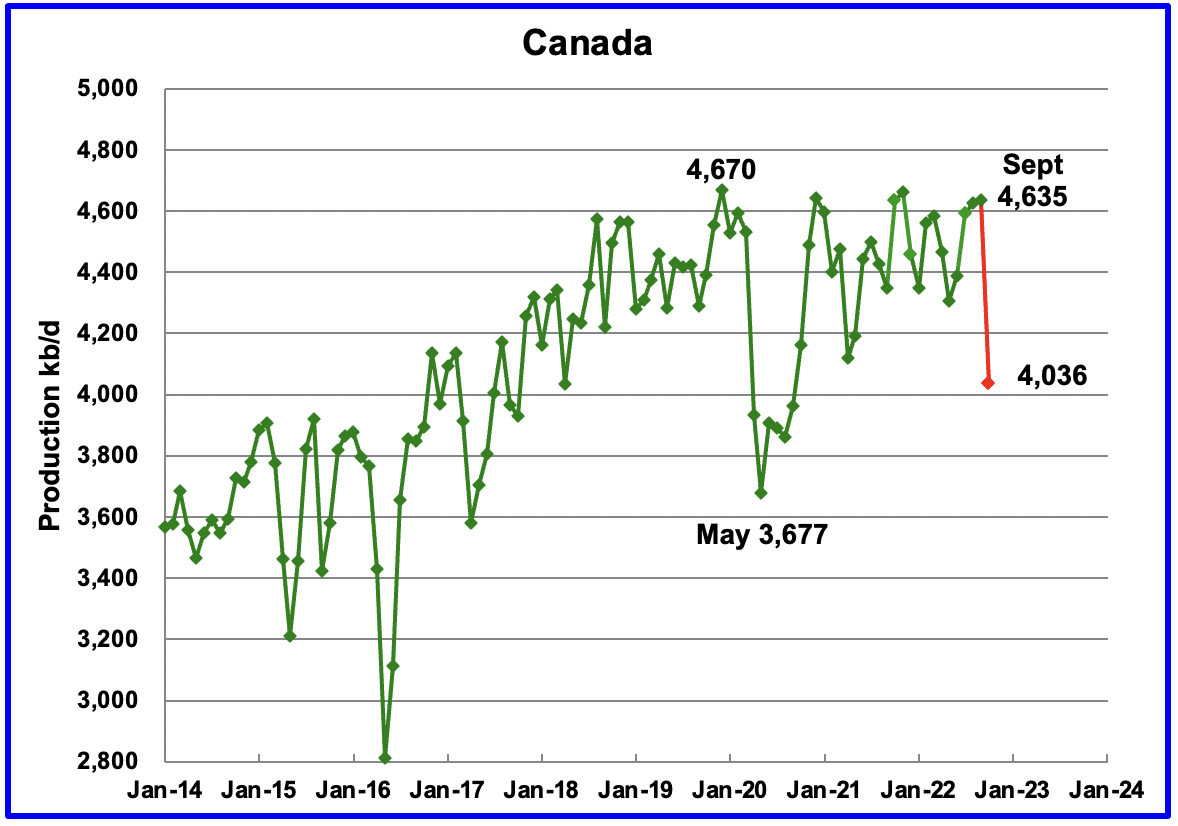

According to the EIA, Canada’s September output increased by 8 kb/d to 4,635 kb/d.

The Canada Energy Regulator reported September output of 4,942 kb/d, 307 kb/d higher than the EIA due to a difference in the definition of condensate. Preliminary estimates indicate that Canadian production could drop by 600 kb/d in October to 4,036 kb/d after accounting for the typical 300 kb/d higher production reporting by the CER. Light oil production was down by 200 kb/d and heavy was down by 400 kb/d.

Rail shipments to the US in September dropped by 28 kb/d to 127 kb/d and rebounded to 156 kb/d in October.

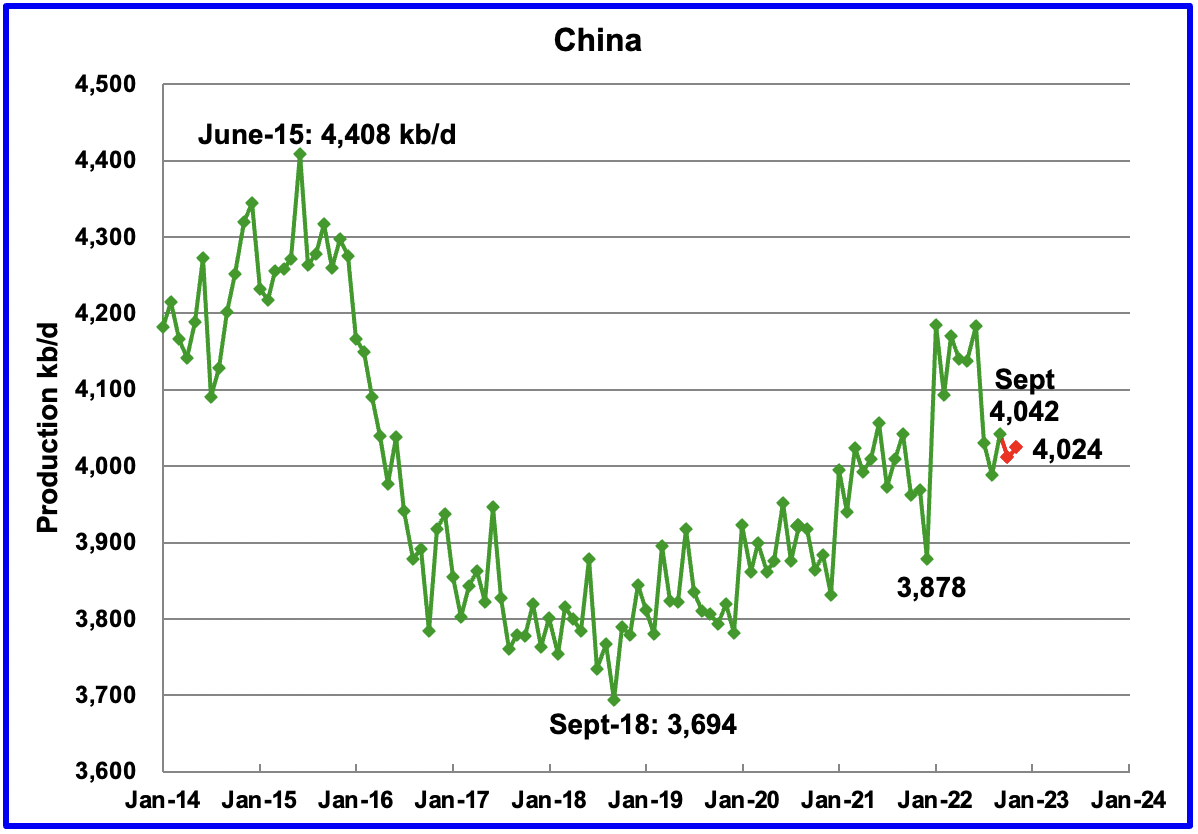

The EIA reported China’s output increased by 53 kb/d to 4,042 kb/d in September.

The September EIA production report is the second time there has been a disagreement between the official Chinese report and the EIA regarding China’s oil production. Up to July 2022, the EIA report and the China report were spot on. The National Bureau of Statistics of China published the following statement for September production, “In September, it produced 16.81 million tons of crude oil.”

Using 7.3 barrels per ton, the September output of 16.81 million tons coverts to 4,090 kb/d. The EIA report is 48 kb/d lower than China’s report, approximately a 1% reduction. Note that the above China statement refers to crude production. The EIA may now be removing some liquids from the China Bureau “crude” production number. We will continue to track this sudden change between the EIA and the China Bureau of Statistics.

The official China bureau reported that China’s output decreased to 4,011 kb/ in October and increased to 4024 kb/d in November. A small correction/reduction was made to oil production reported in October and November, reflecting the EIA’s lower production reporting.

China may be close to its current maximum production level of approximately 4,000 kb/d to 4,200 kb/d. To offset declines, the national oil company is investing in conventional wells, deep water wells and is also drilling for shale oil.

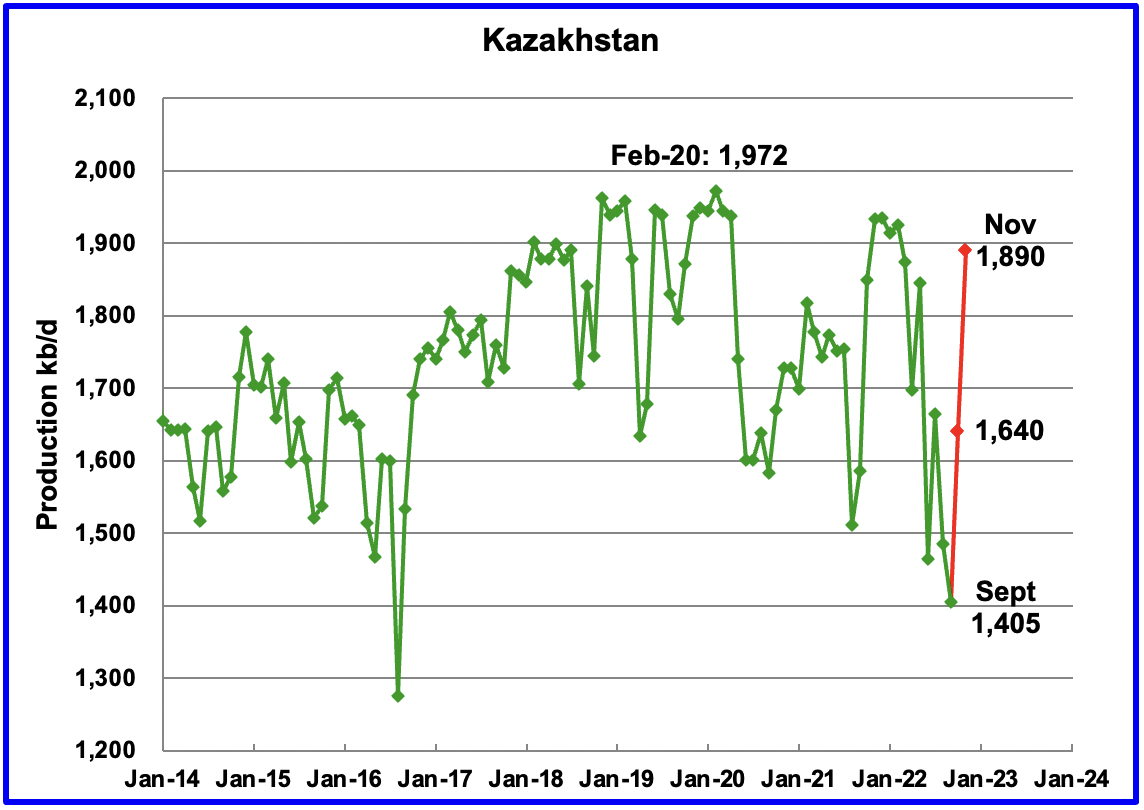

Kazakhstan’s output decreased by 80 kb/d in September to 1,405 kb/d.

According to OPEC, “The fall in output was due to a sharp decline in production in the giant Kashagan oil field after a gas leak early in August, as well as planned output curbs in the Tengiz field due to regular maintenance.”

According the this source, “production at Kashagan, one of the world’s largest oil fields, sharply declined on Aug. 3 due to a gas release. Kashagan had planned to boost output to 500,000 bpd after upgrades.”

Production is expected to recover in October according to this source. Production was restored in late October after the gas leak was repaired and reached 1,890 kb/d in early November, an increase of 405 kb/d over August.

Mexico’s production as reported by the EIA for September was 1,710 kb/d.

The October and November estimates, red markers, were obtained by using the Pemex increments over September production and adding those to the EIA’s September output because Pemex reports higher production than the EIA.

OPEC continues to forecast flat production for Mexico in 2023 due to decline rates in mature fields.

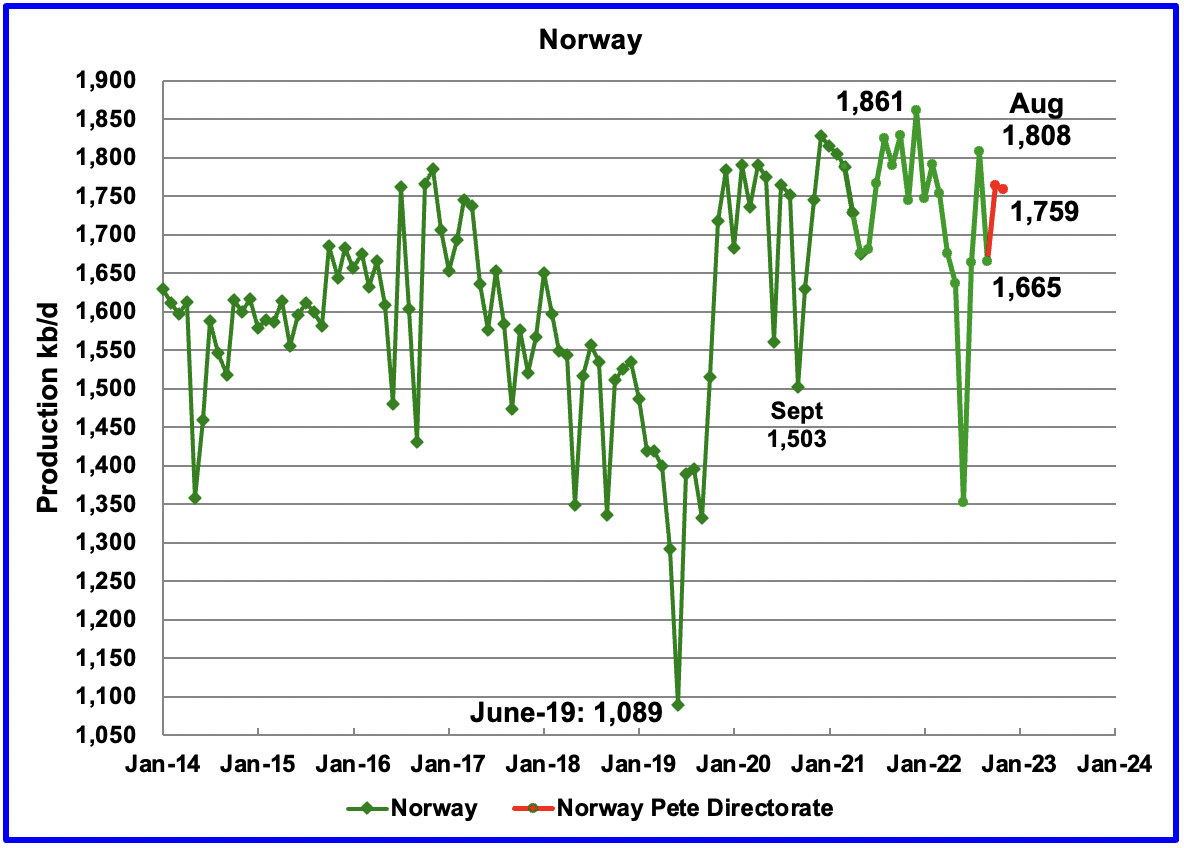

The EIA reported that Norway’s September production decreased by 144 kb/d to 1,665 kb/d. OPEC reported the drop was due to maintenance in the Oseberg and Troll fields. October’s production increased to 1,764 kb/d.

The Norway Petroleum Directorate (NPD) reported that production decreased by 5 kb/d from October to November to 1,759 kb/d (Red markers). According to the NPD: “Oil production in November was 8.7 percent lower than the NPD’s forecast and 5.7 percent lower than the forecast so far this year.”

Growth is expected in late 2022 and into 2023 when the second phase of the Johan Sverdrup field development starts production and other small fields come on line. According to OPEC “The Johan Sverdrup Phase 2 is projected to be the main source of increased output for later this year and next year. Equinor has confirmed that Johan Sverdrup field startup occurred on Dec 15, 2022.

“At plateau, the Johan Sverdrup field will produce 720,000 barrels of oil daily, aiming to rise to 755,000 barrels per day. Johan Sverdrup alone can thus meet 6-7 percent of the daily oil demand in Europe. Recoverable volumes in the Johan Sverdrup field total 2.7 billion barrels of oil equivalent.”

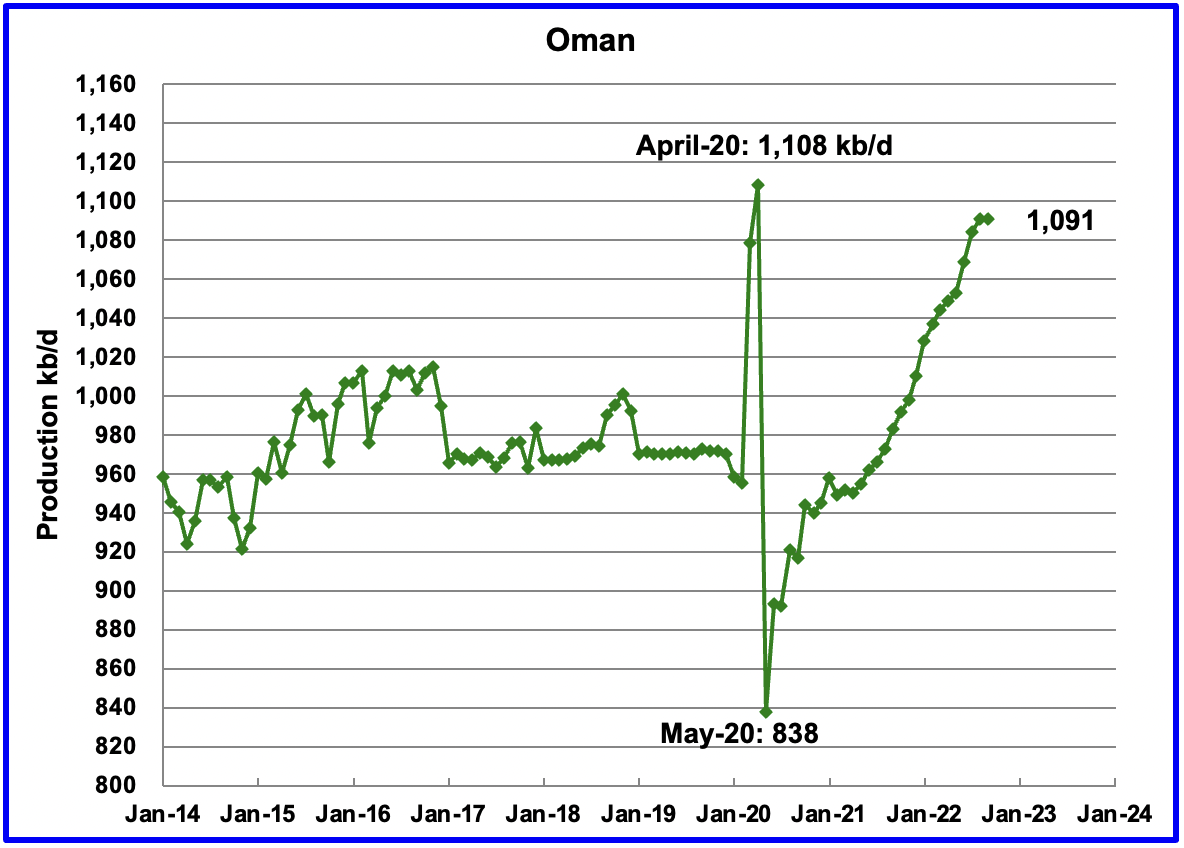

Oman’s production has risen very consistently since the low of May 2020. Oman’s September production was unchanged at 1,091 kb/d. It is 17 kb/d short of its pre-pandemic high.

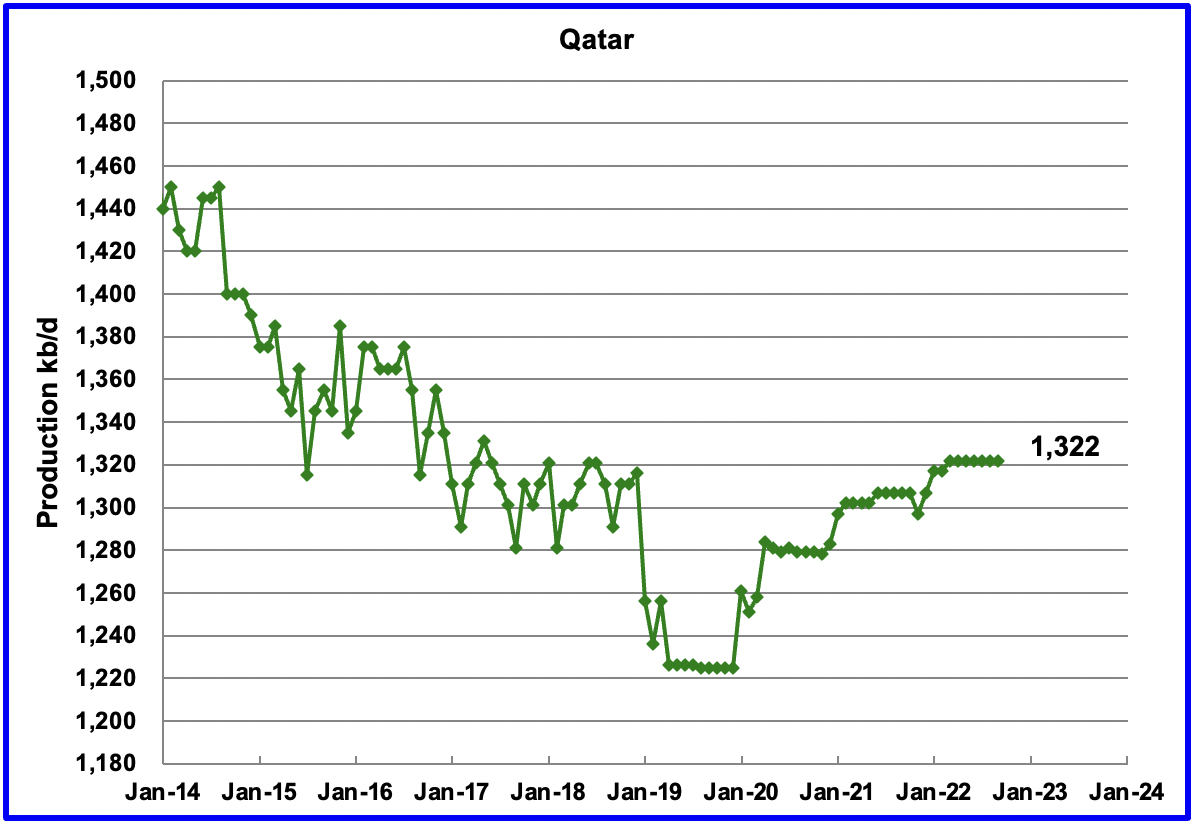

September’s output was unchanged at 1,322 kb/d.

The EIA reported that Russian output increased by 25 kb/d in September to 10,252 kb/d.

Russia’s Ministry data for October production of 10,780 kb/d was taken from this source and November’s 10,900 kb/d was taken from this source. In light of all of the sanctions, it is surprising to see such robust production.

December production is shown unchanged based on this statement: Russia will keep oil production in December at the November level amid the EU’s embargo and the price cap, Deputy Prime Minister Alexander Novak told reporters.

The EIA production numbers for October to December are derived from the Russia Ministry data by subtracting 404 kb/d. In the past, when production data was obtained directly from the Russian Energy Ministry, it was found that the EIA arbitrarily subtracted 404 kb/d from the Ministry data.

Production at Russia’s Sakhalin-1 near full oil output after Exxon exit. According to this source: Oil output from Russia’s Sakhalin-1 project has recovered to 140,000-150,000 barrels per day (bpd), about 65% of the capacity and will soon hit full level of about 220,000 bpd.

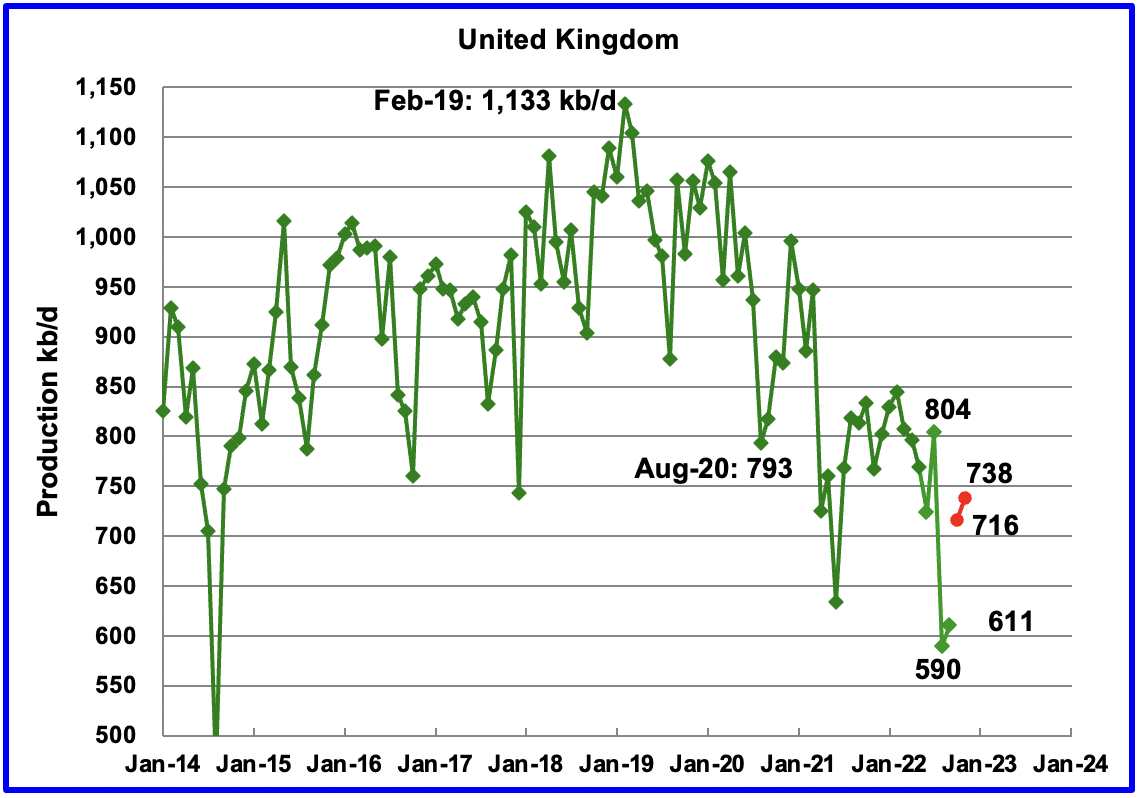

The EIA reported UK’s production increased by 21 kb/d in September to 611 kb/d.

According to this source, North Sea Transition Authority (NSTA), October’s production increased by 115 kb/d to 716 kb/d (Red Markers) and an additional 22 kb/d in November to 738 kb/d.

The UK petroleum regulator said that three key elements could help boost production in North Sea.

According to this report, “More recent signs suggest that drilling will pick up in the medium term. Commodity prices have stayed consistently high this year, accelerating development plans of 30 projects which target 1.5 billion barrels and are currently progressing towards consent decisions.

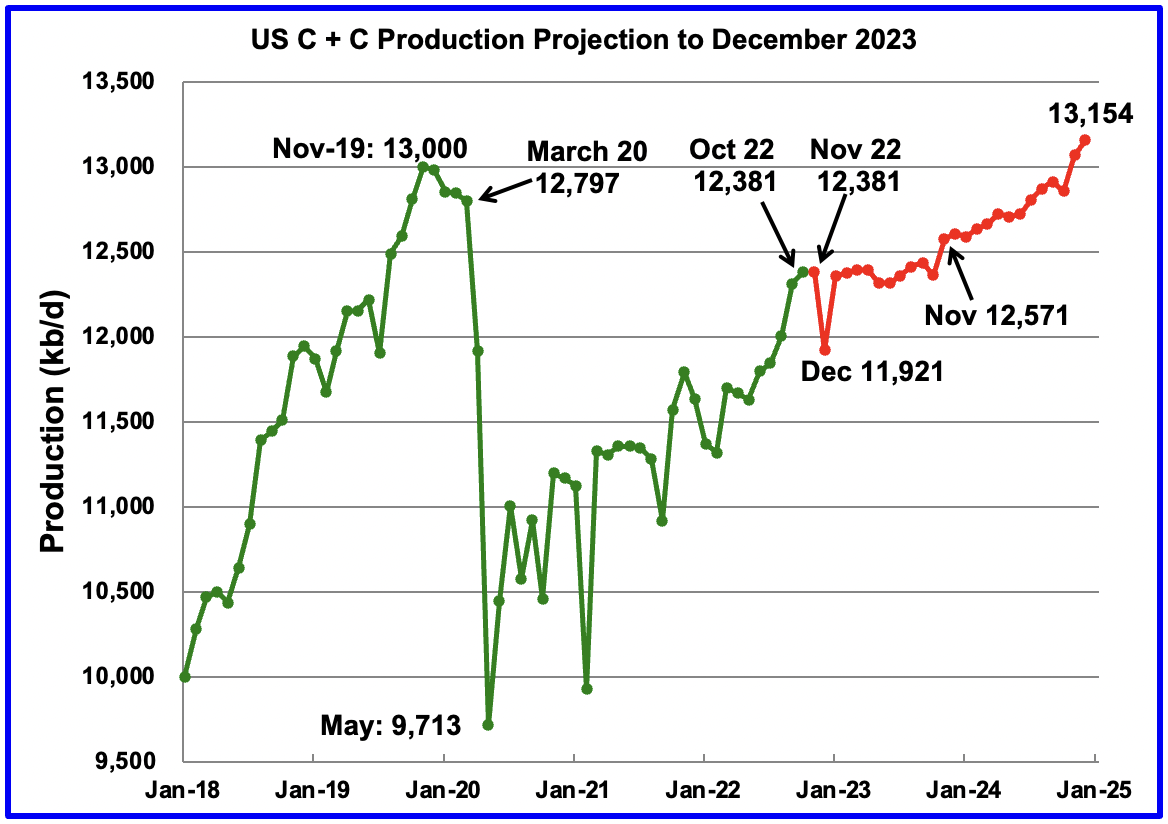

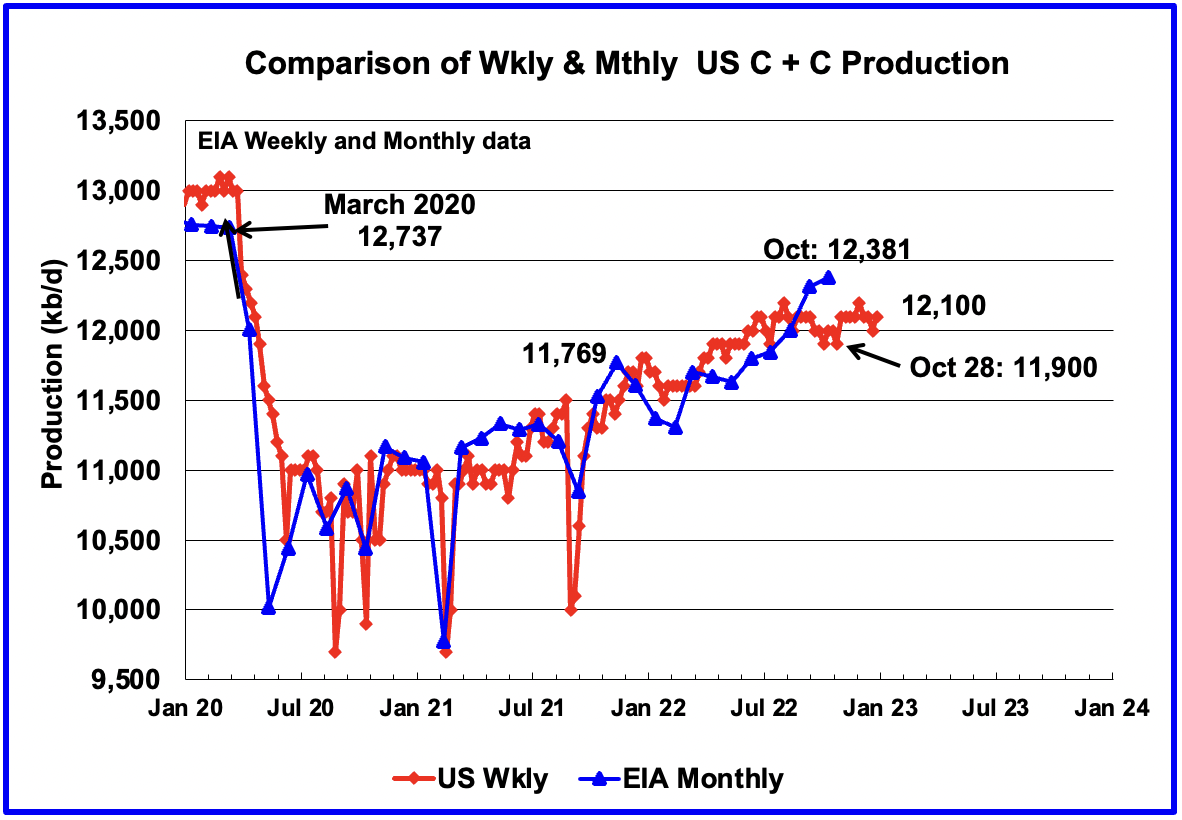

U.S. October production increased by 69 kb/d to 12,381 kb/d to a New post pandemic high. For October, the state with the largest increase was New Mexico, 41 kb/d, along with a number of smaller increases from the other producing states.

The red graph is the EIA’s forecast for US oil production out to December 2024. Output reaches 13,154 kb/d and exceeds the pre-pandemic high of 13,000 kb/d. Note that there is essentially no production increase in the US from October 2022 to October 2023. Production begins to rise again in November 2023. The December drop is associated with extreme weather in North Dakota and possibly Texas and New Mexico.

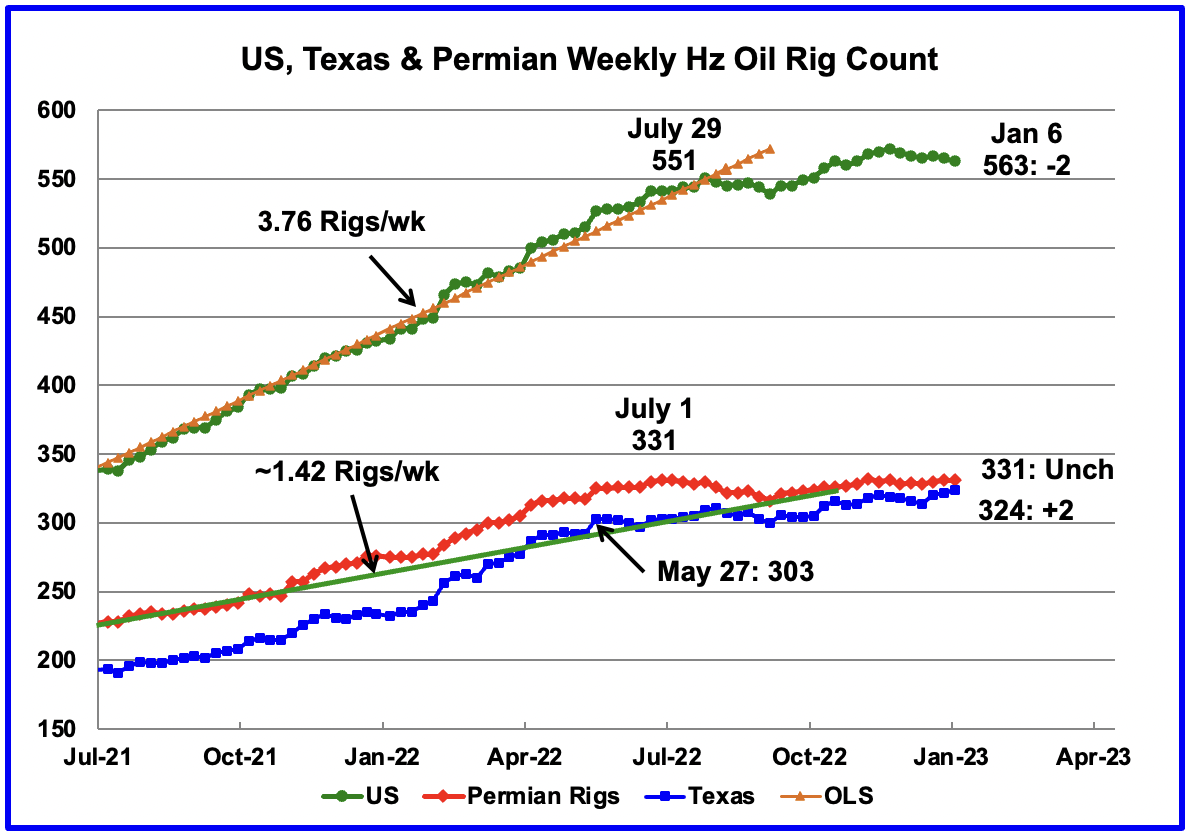

After the week ending July 29, the rate of Hz rig additions slowed. However since the low of 539 in the week ending September 9, Hz rig growth returned until the Thanksgiving/Xmas break period. From a high of 572 rigs in the week ending November 25, the rig count has dropped to 563 in the week ending January 6.

Permian rigs were unchanged at 331 in the week ending January 6 and are still at the same level as the week ending July 1, 331. With Permian rigs essentially flat since July 1, this implies that rig activity has increased in the other basins. Texas rigs increased by 2 to 324, in the week ending January 6.

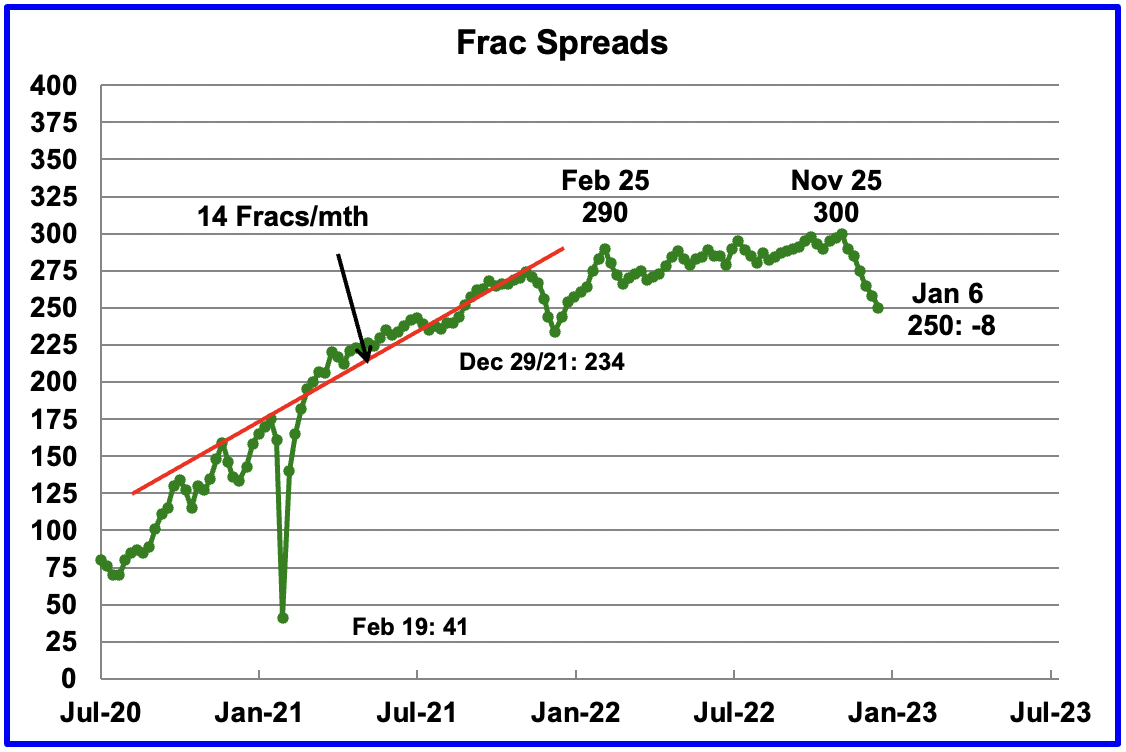

For frac spreads, the general trend since late February 2022, when the count was 290, can best be described as essentially flat at around the 290 level up to the end of November. For the week ending January 6, the frac spread count decreased by 8 to 250 and is down 50 spreads from the high of 300 on November 25. The count should return close to 300 by late February 2023.

Last year the frac count peaked in mid November and then headed into the Thanksgiving and Christmas break low of 234 in December 2021, down 40 from the November high.

Note in the US production chart above, output fell in December 2021 and January 2022. Will the same trend be repeated this year as the spread count drops? See next chart.

Note that these 250 frac spreads include both gas and oil spreads.

Note that most of the weekly production numbers since October 28 to the last week in December have been close to 12,100 kb/d, 280 kb/d lower than October’s output of 12,381 kb/d.

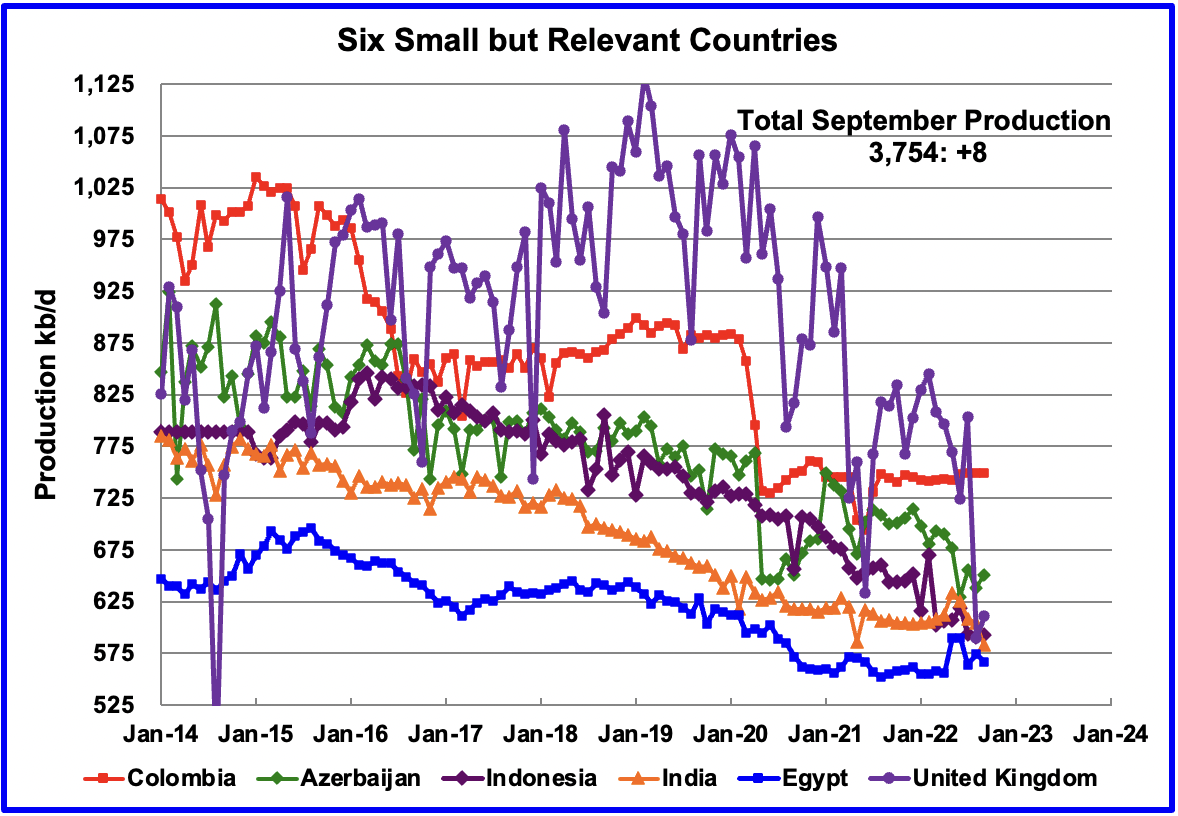

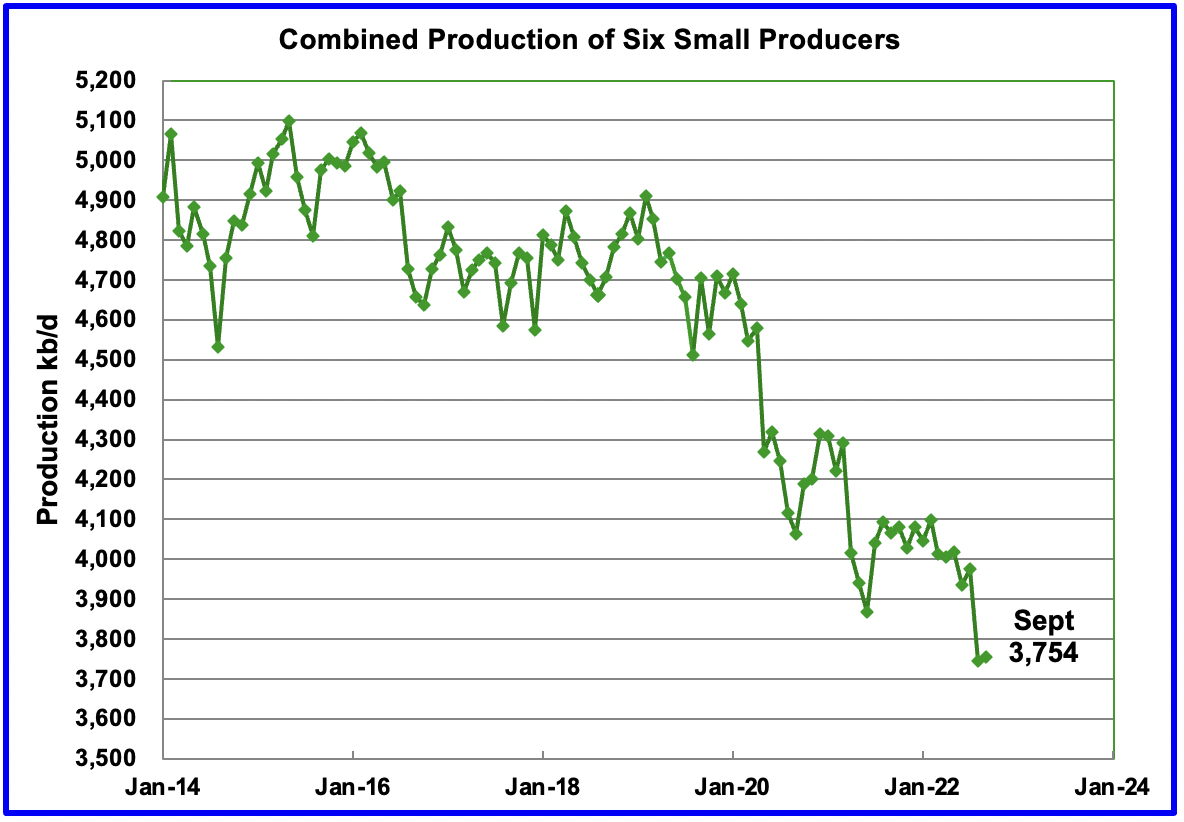

These six countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Note that the UK has been added to this list since its production has been below 1,000 kb/d since 2020.

Their combined September production was 3,754 kb/d, up 8 kb/d from August’s 3,746 kb/d.

The overall output from the above six countries has been in a slow steady decline since 2014 and the decline continues.

World Oil Production Ranked by Country

Above are listed the World’s 11th largest oil producers.

In September 2022, these 11 countries produced 75.4% of the world’s oil. On a YoY basis, production from these 11 countries increased by 3,931 kb/d. Note that every country except Iran and Norway increased production in September.

The largest increase came from the US, 289 kb/d. Norway had the largest production drop, 144 kb/d.

World Oil Production Projection

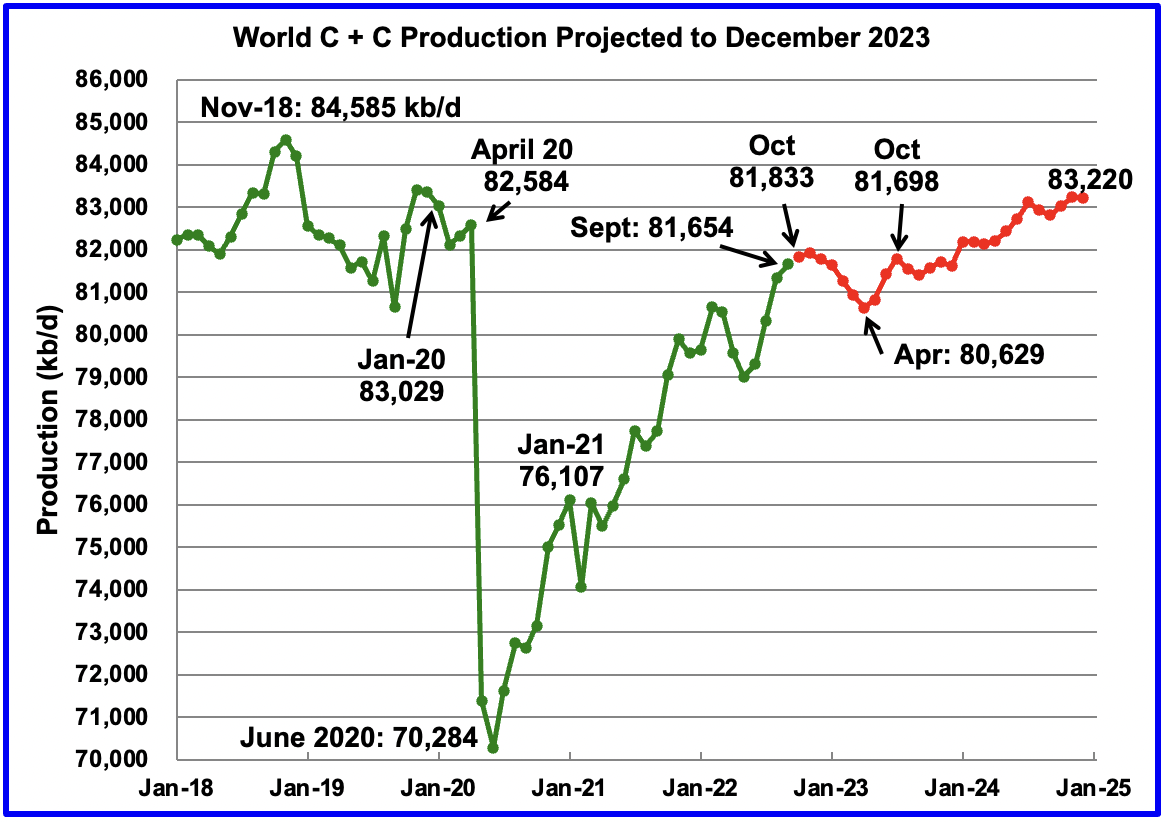

World oil production in September increased by 314 kb/d to 81,654 kb/d according to the EIA (Green graph). Note that August production was revised down from 81,446 kb/d to 81,340 kb/d. This means that the September increase from the original August estimate was 208 kb/d. October is expected to add 179 kb/d to 81,833 kb/d.

This chart also projects World C + C production out to December 2024. It uses the January 2023 STEO report along with the International Energy Statistics to make the projection. (Red markers).

It projects that World crude production in December 2024 will be 83,220 kb/d. Note that this post pandemic high of 83,220 kb/d is 1,365 kb/d lower than November 2018 peak.

The drop from November 2022 to April 2023 is primarily due to a projected drop in Russian oil output.

Great post Ovi, thanks.

I cannot agree with that last chart, the world C+C projection to December 2033. I am projecting World C+C production to be below 80,000 kbpd by December. My guess would be 79,000 Kbpd in December.

The September non-OPEC production should give us a clue. Almost everyone has peaked. OPEC has peaked also. Only the US has anything left in the tank and that ain’t very much.

Hey, we had everyone’s guess at oil prices for next year. How about some guesses at oil production. You have mine. I did not and will not guess at prices however.

Essentially the lower the production, the higher the prices and vice versa. I guessed roughly the same average price for 2023 as for 2022, so my guess is 80,000 bpd for 2023. Ron, are you tracking these guesses?

The correlation between production and demand is extremely delicate. Each in itself is almost unpredictable, even less so the combination. Too many unpredictable factors such as politics, debt, or a possible recession are at play. I think Ron is right in not guessing. However, I did so assuming that there will be an economic downturn (at least) in the second half of 2023 that will lead to lower prices. But, of course, that’s as wild a guess as anyone’s.

And of course, thank you Ovi for that work! Beside Ron’s scepticism concerning the recent months, 2024 looks quite optimistic. Where does all that new oil come from?

Westtexasfanclub,

Much of the explanation for the small increase in World output in 2023 is due to falling Russian output in 2023.

The chart below shows average annual output for Russia (all petroleum liquids) from the EIA STEO forecast from January 2023. Annual average output falls from 10.94 Mb/d in 2022 to 9.49 Mb/d in 2023, a drop of 1.45 Mb/d. Output stabilizes in 2024 at 9.43 Mb/d according to the EIA short term energy outlook. Note that the STEO forecasts the average annual WTI price to be $77.18 in 2023 and $71.57 in 2024, these seem too low to me. My expectation is about $90/b in 2023 and $95/bo in 2024.

Click on chart to make it bigger.

Ron/Westexasfanclub

I have a process that uses the ratio of past EIA C plus C to All Liquids and uses that info to convert the projected all liquids data to C plus C. I have two methodologies that yield two slightly different future scenarios. The second scenario is attached so you can compare it with the one posted.

Attached is a table that shows a number of large increases for All Liquids for 2023 and 2024. The US C plus C production is shown in the US chart in the post. As can be seen the big production increase comes in 2024.

My guess for end 2023 is 81,700 kb/d

My guess for December 2023 is 81250 kb/d for World C plus C output. I expect average annual output for World C plus C in 2023 to be about 81 Mb/d. Chart below gives my guesses through 2030, average annual World C plus C output is shown on chart.

World Forecast #2.

Ovi,

Is there a typo on chart above for Dec 2024 output? It looks like 83.6 Mb/d or so reading from vertical scale.

A slightly different estimate using the fact that non-OPEC minus US non crude liquids increased from 10% of total liquids to 17% over the Jan 2000 to Sept 2022 period (using OLS trend). The annual rate of decrease for the crude plus condensate to total liquids ratio (which decreased from 90% to 83% over 12.6 years) was about 0.32% per year. I assume this rate of decrease continues from October 2022 to December 2024. Also crude to crude plus condensate ratio for OPEC producers was flat at about 93.7% from Jan 2010 to Dec 2019 (93.7% is the average over this period). I assume the OPEC crude to crude plus condensate ratio is 93.7% from Oct 2022 to Dec 2024. These assumptions combined with total liquids fro non-OPEC minus US output forecast in the STEO and crude output for OPEC from the STEO and US C plus C output in the STEO are combined for a World C plus C projection. Also shown is the 12 month centered average of the data plus projection with data below the data line showing centered average output in Nov 2018 (output for 12 month centered average was at 83 Mb/d from August to Nov 2018) and July of 2022, 2023 and 2024. The data above the line is for Sept and Oct 2022 and Dec 2023 and Dec 2024. Interesting that for this projection the annual average output for World C plus C increases by only 290 kb/d from 2022 to 2023 (from 80.5 Mb/d to 80.79 Mb/d).

I took another look at 12 month average of non-OPEC minus US C plus C to total liquids ratio and it seems this flattened from about 2020 to 2022, the most recent 12 month average is about 83.5% and if we assume this is the ratio from October 2022 to December 2024 we get a different projection shown in chart below. This is more in line with Ovi’s projections.

Yes, I will track them. But someone else needs to do as well as I could kick out at any time. I will be 85 in June, in fairly good health, but at my age, you never know. 😫

I will give you 30 days to change your prediction. Otherwise, your guess is locked in.

The guesses so far are below. I will post updates daily if they change.

Hey Ron I’ll guess 79,500 Kbp/d & this reminds me of the show – The Price is Right with Bob Barker. Unfortunately we don’t have the hot babes turning over the prices like the show.

And remember that our quantum information is copied throughout the universe – multiverse (Quantum Darwinism) so we all live on forever. So there are copies of you, Ovi and everyone else in infinite space time.

Stay healthy and keep going! Izzy Stardust (my college radio DJ name WSUC from the 70’s Cortland State SUNY, NY.

I don’t think it’s a good idea to mention the multiverse to Ron lol

Got it Izzy, thanks. I will post it later today. I will wait and see if we get any more.

Yeah, all those other Izzy’s out there in the multiverse probably guessed something else. 🤣

Just so we are all on the same page, these predictions are for monthly output in December 2023, or that is what Ovi and I have said. Ron wrote 2033, but I assume he also meant Dec 2023 and the 2033 was a typo. Frugal just said 2023 after all of us said December 2023, so I assume his guess is also Dec 2023 and perhaps Izzy as well.

The average of the 5 guesses so far for World C plus C average output in December 2023 is 80290 kb/d. This is about 1364 kb/d less than September 2022 output of 81654 kb/d. It looks like Ovi’s guess is likely to be best from my perspective.

Latest predictions for C+C production in the month of December 2023.

EIA reports crude and associated gas reserves separately from C&C and total wet gas so gives a true GOR measure for oil producers. The GOR in all tight production areas show increases, some quite dramatic, which would be highly concerning for conventional fields, but I’m not sure how bad for tight oil (it seems inevitable that this happens for pressure deletion drive on fracked wells so it must be factored in from the start when considering the economics, but I could have it completely wrong).

Permian (“East” is East New Mexico production area).

Bakken (2018 had no gas data for North Dakota because of operator confidentality).

Eagle Ford

You are 100% right and to make matters worse no one is really sure if the so called tight “reservoirs” are retrograde condensate in nature meaning when the overall field pressure reaches a certain level, the gas comes out of solution and prevents the flow of oil to the well bore almost acting as a bottom hole separator.

Are you talking about retrograde shale gas wells? I don’t understand how tight oil could behave like that. In a retrograde gas liquid forms as the pressure is let down at constant temperature. That can be a big problem in conventional gas wells too, but it’s predictable because the composition is known from sample analysis.

I think you are describing solution gas drive reservoir behavior, not retrograde condensate. Retrograde condensate is where liquid drops out of natural gas and gums up the works, solution gas drive is where gas is entrained in the oil, pressure drops below bubble point, gas comes out of solution, GOR begins going up, and remaining oil loses its drive mechanism slowly. Normally you would reinject to avoid this, but reinjecting into shales doesn’t appear to be something in use at this time.

Ovi – I think the majority of the possible new projects in the UK are for gas, but I don’t know how the reserves and production would split.

George

You could be right. Saw this today

Shell finds gas in North Sea prospect and embarks on commerciality evaluation

“Located to the northwest of the Breagh gas field in the Southern North Sea, Pensacola is a Zechstein Reef prospect and was previously ranked as “one of the highest impact exploration targets to be drilled in the gas basin in recent years.”

Would this be in UK waters?

https://www.offshore-energy.biz/shell-finds-gas-in-north-sea-prospect-and-embarks-on-commerciality-evaluation/

Yes – southern North Sea is mostly dry gas fields and in UK sector, I think a bit extends into Dutch waters (not Breagh, just the formation in general).

Ovi,

Note that the October estimate from the CER has no oil output data for several provinces which together produce about 600 kb/d, so the apparent drop in Canadian output in October is simply a matter of incomplete data for the preliminary estimate. The September estimate is relatively complete, but October has data missing from MB, SK, and BC which accounts for the missing barrels, a better estimate would be to assume the October data is similar to the September data which would lead to flat output in October for Canada relative to September 2022.

Dennis

I usually go down to rows 45 and 46 and add them up to get the totals. Since all of the cells are filled, I thought that they were a forecast that filled in the missing data. On closer checking, it is not a forecast.

I still think that Canada will be down for October, but not 600 kb/d.

Ovi,

I look at the historical data tab and it is clearer on that sheet that there is missing data and which provinces have reported output. They do not try to fill in the blanks the way the EIA does by using surveys or historical lags in the data. We will see in a week or so when the Jan report comes out.

Huntington beach,

You asked in last thread about jet fuel.

Using BP data from

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/energy-charting-tool-desktop.html#/results/et/jk-cons/unit/kb/d/regions/tWORLD/view/area

in 2019 7971 kb/d of jet fuel consumed (peak level through 2021).

Full data in spreadsheet at

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

World C plus C output in 2019 from BP was 83122 kb/d, so jet fuel consumption was 9.6% of crude plus condensate output. In 2021 World jet fuel consumption was 8.6% of World C plus C output (last data point available).

I presented a revised Permian scenario with a URR of 38 Gb in previous thread shortly before this thread was posted (at link below).

https://peakoilbarrel.com/us-october-oil-production-pushed-higher-by-new-mexico/#comment-751423

Below I show what US tight oil output would look like with this scenario, this scenario was used for my World output projection presented earlier (2800 Gb with peak in 2028 at 83.9 Mb/d). Tight oil peak occurs in June/July 2028 at 9.89 Mb/d, URR of 70 Gb.

Often it is presumed that if the road transport sector was electrified

then crude oil would be in lower demand, since that sector accounts for about 49% of crude oil product consumption.

But we need to remind ourselves that we can’t simply pick and choose the refined products that are in demand.

All of the other types of end product consumption will still be growing as the world population and economy grows, even if gasoline consumption gradually stabilizes and subsides.

Flexibility of refining output has limits.

https://www.statista.com/statistics/307194/top-oil-consuming-sectors-worldwide/

Hickory,

I get about 52% of 2021 crude plus condensate output consumed by road transport, of a total of 64% of crude plus condensate that is diesel and gasoline. So roughly 12 % is used by home heating, mining, industry, farming, and marine transport. About 9% of crude output is used a jet fuel.

Chart below has consumption of petroleum products excluding diesel, gasoline, ethane, and LPG. Growth from 2000 to 2021 has been at about an average annual rate of 49 kb/d.

Vertical scale is kb/d.

Dennis,

You are getting closer to my view but I am more conservative on the growth based on current costs and product prices. That can change of course at any time.

LTO Survivor,

Thanks. I agree.

The scenario assumes that oil prices rise from current levels. If I assume current price levels continue indefinitely, then the scenario would be more conservative. The scenario for tight oil has output increasing at an annual rate of 5% per year from Jan 2023 to Dec 2025 (a wise man once suggested to me that this might be the future growth rate for tight oil output), after that the rate of increase slows to zero by mid 2028. The oil price scenario I use is below, I assume NGL sells for 35% of the price of crude and Nat gas at $4/MCF. Obviously this price scenario will be incorrect, nobody can accurately predict future oil prices.

World bank projections for US GDP to be at 0.5% for the year of 2023. Their projections for Eurozone GDP are 0.0%. Globally GDP in at 1.7% for the year of 2023.

Their projections are optimistic because they believe central banks are somehow in charge of the economy. My guess is the yield curves have it called right and we see negative global GDP for the year of 2023.

I think what will make this a financial crisis instead of a mild recession is the amount of debt that’s been loaded up onto the economy. Debt be it private, corporate or public is at record highs. Only way that debt can be serviced is through growth in the economy.

There are a lot of good supply side arguments to why oil has to only go higher in price. But you have to ignore what global financial crisis would mean to oil prices in order to remain long oil through 2023

HHH,

From

https://www.bis.org/statistics/totcredit.htm?m=2669

The debt is not at all time highs.

Oh, Jesus Dennis it’s barely moved off its all time highs and it’s a problem that it has in fact moved slightly off the all time.

If debt fails to continue going higher it means debts start getting defaulted on. It means credit is contracting. If that line in your graph continues lower it means I’m right in calling global financial crisis.

HHH,

Debt is close to the level of 2016 to 2020, not at record highs. Now you have moved the goal posts. Is higher debt better? The average Credit to GDP for the World was about 242.5% from2016Q1 to 2019Q4, for latest quarter reported (2022Q2) it was 247.7% down from 290.8% for 2020Q4.

It is not a convincing argument that both high debt and low debt are bad.

I (guess) the isssue is not so much the total debt level as the direction (expand, stagnant, decline). Decline could signal deflation ahead as more money is allocated to repaying debth, debth is defaulted on and/or less new debt is issued. In the present situation rates are also going up so more money have to be allocated to servicing existing debt than before. However, HHH seems to think the market crash is imminent. This could offcourse be true but why now and not 6M ago or 6/12/18M into the future? And why does it have to be a crash and not just a “soft-landing”?

This all comes back to the yield curves. Why are the deepest most sophisticated markets in the world hedging against a really bad outcome? Because that’s is exactly what an inverted yield curve is.

What are they seeing in the global economy that hasn’t yet shown up in the data?

If China opening back up was going to be great for everything why are these markets hedging against catastrophe?

China coming back was only supposed to be great for everyone. They never counted on the covid epidemic infecting millions and likely causing a severe recession in China. Well, that and all the other problems China is having. China is in very serious problems, and this covid thing only makes it much worse.

HHH,

There is uncertainty about future actions by central banks, the inverted yield curve may simply be a reflection of what the market thinks about future inflation rates, in the short term they expect inflation will be high and longer term the expectation may be that inflation will be lower. We will see. What is you current prediction for average WTI oil price in March 2022? At one point you were expecting $25/b by March 2022 (this might have been a daily closing price prediction of $25/b from March 1 to March 31, you didn’t really say).

and that’s why you’re not an economist. It’s the particular. not the average. the debt cycle is rolling over. Sure the central banks of the world could turn the spigot back on, but inflation is still > 6% YoY. I don’t know a single person that is getting 6% yearly wage increases. So nearly everyone is getting poorer by the day.

We haven’t even discussed Shadow Banking.

You constantly state things in terms of GDP. But again, I don’t know a single person who makes money based on GDP. Total cumulative debt is, I believe, at all time highs, esp. when taking into account “off the books” hedges. So on at least one technical level HHH was correct, and you were wrong to say he was incorrect.

That said, it’s been a very good run though for the CBs and money borrowers, basically running the table since 2008. So it seems to me they’ve done very well and should be commended for keeping this nightmare going.

We are clearly heading towards a recession and the job market will get hit pretty hard. What HHH is pointing out is the potential for a global credit crises. And there have been plenty of signs, including inverted yield curve (which has presaged a recession at close to 100% for the past 100 years). Take for example Japan’s move a couple months back.

https://www.nytimes.com/2023/01/03/business/japan-bonds-interest-rates.html

Eurodollar curve inverted back in Dec. 2021. Yes there is something like $80 trillion of dollar denominated debt that’s off the books. Meaning it doesn’t show up on balance sheets of the banks that make these dollar swaps.

Of which $65 trillion has a duration of less than a year. There is a long list of countries in need of a IMF bailout. Only the IMF doesn’t actually have US dollars to lend.

What the IMF does have is SDR’s or special drawing rights. Think of them as a form of collateral. They create these SDR’s out of nothing. Countries still have to go into the market and use these SDR to borrow dollars. Means they have to find a willing counterparty to accept the SDR’s as collateral for loans.

China’s large commercial banks went heavily into the dollar swaps market to try to make up for the lack of dollar liquidity. What could possibly go wrong?

Everything will seem ok until something breaks. And when it does oil will be back at $25 in a hurry and all the oil going to $140 people will be scratching their heads.

No one completely understands the Eurodollar System.

And it does not mean “Euro” vs “Dollar”

in this context “Euro” means “created outside of America”…poorly named..yes

It means….you can’t have a global economic system sending paper dollars and gold around the world for every transaction.

Eurodollar means “Ledger Entries” in US dollar units.

And the USA Central Bank has no control over it.

see jeff biden at Eurodollar university: https://www.youtube.com/@eurodollaruniversity

It is mind boggling.

At some point, maybe about now or maybe later on, we will reach the point where the long era of global economic growth ends…and the new era of contraction will be upon us.

You can think of it in terms of GDP/capita, or population, or collective purchasing power, or energy availability. They all pertain to the core notion.

Peak of credit/debt could be one way this manifests.

At some point, people and companies and countries will simply be credit unworthy, and will be unable to service the debt they already have accumulated.

Not just some people, but enough insolvency to topple what is a like a huge building with a tiny foundation.

Some people may disagree with the idea that eventually, and perhaps very suddenly, the pattern will shift from a long and tremendous 10,000 year accelerating growth phase to a inexorable contraction phase. I don’t understand how one can vision a system immune to gravity, like a person who thinks they can live forever. But its not the only thing I don’t understand.

There is an enormous amount of dollars that are lent into the US from outside the US via the Eurodollar market.

When energy markets get tight or when energy is high priced. Lenders become less likely to make these loans. So what I’m saying is you can very well see a dollar liquidity problem right here in the US. US isn’t immune.

Twocats,

Find me a better measure of World debt with some real data to back you up and we will discuss. I don’t go for hand waving and anecdotal evidence. GDP is income.

See income approach at

https://en.wikipedia.org/wiki/Gross_domestic_product

“Over the last two years, the richest 1% of people have accumulated close to two-thirds of all new wealth created around the world, a new report from Oxfam says.”

The growth in GDP is not a good indicator of the ability of a country to service its debt load, since much of the global wealth accumulation is sequestered from the public budgets. Sequestered as in avoiding taxation, avoiding over-site, and largely avoiding investment in the real economy.

Hickory,

Wealth is a stock, income is a flow. A standard way of looking at the ability to service debt is to look at income measures, do we have good data on World wealth? Can you point me to a reliable data set?

I found this

https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html

Note that a lot of credit issued is backed up by assets.

Hickory,

I envision slowing population growth with a peak in 2070 or so for World population. If we look at the trend in real GDP per capita it has been fairly steady at about 1.4% per for about 50 years. As long as the total debt can be serviced with income there is not a problem. Fewer people (as population decines) means less output and less credit needed. The system would see steady state (no growth) once population is declining at 1.4% per year (assuming growth in per capita income continues at 1.4% per year. If population decreases more quickly than the rate of growth of real GDP per capita then the economy contracts. It is also possible that real GDP per capita starts to slow as it has already in more wealthy economies as the World economy becomes more developed.

That scenario is what we would expect if everything goes very smoothly.

I don’t expect things to go smoothly enough for the continued growth trajectory to pan out.

Maybe that makes me pessimistic, or perhaps just cognizant of the overextended position of humanity in relation to the physical and biological world upon which we live.

A simple analogy- too many goat in a pasture will graze it down to the roots, and then they will starve.

Population overshoot it is called.

I think we are deep into it, enabled by several factors- including the one time burst of fossil energy over the past 150 years.

Our clever minds will not make us immune to population overshoot correction, perhaps the cleverness will just speed up the process in a destructive way as we rush at full speed toward obstructions.

Hickory,

Perhaps we see growth slow very quickly, it is also possible that population declines more quickly than I have assumed, fewer people helps the problem of overshoot.

“fewer people helps the problem of overshoot”

Yes, but getting there in a timely manner is the hard part.

Dennis,

Am I correct to assume that doesn’t include interest on the credit, which have been increasing alot in the second half of 2022.

As Warren Buffet says in reference to debt:

“When the tide goes out you can see who is skinny dipping”

Alot of perceived wealth is debt.

Iron Mike,

I believe that is correct, but have not delved into the details.

Description is at link below

https://www.bis.org/statistics/about_credit_stats.htm?m=2673

The chart is of “All reporting countries (aggregate) – Credit to Non financial sector from All sectors at Market value – Percentage of GDP – Adjusted for breaks” Based on the page linked above interest is not included.

“World bank projections for US GDP to be at 0.5% for the year of 2023”

Make sure you subtract Government Debt spending which is additive to GDP, which is a huge crock of poo!!

My household GDP went up 50% last year after I took out a huge loan at 6% interest.

The biggest additional event this year is the China reopening.

Jet fuel usage already goes up big there, oil import allowances increased big, too. There is a lot of pent up travel demand waiting for the plug pulled – and a much more smooth way to operate industry without lockdowns in your factory or your key part supplier cut off.

The corona wave in the big cities is already past it’s top, it was short and hard. I expect to see chinese tourists and businesmen here again this year.

“That would mark a sharp increase from the world’s $300 trillion pile of debt — or 349% of global GDP — as of June 2022, as leverage rises slightly faster for mature economies than emerging peers…”

https://www.bloomberg.com/news/articles/2023-01-13/s-p-warns-global-debt-racing-to-366-of-gdp-risks-next-crisis?leadSource=uverify wall

It is not only the debt it is the 3D trifecta that is the perfect storm . Debt , Deficits , Demographics .

George Kaplan: “The GOR in all tight production areas show increases, some quite dramatic, which would be highly concerning for conventional fields, but I’m not sure how bad for tight oil.”

George, the physics is a bit different for shale. Reservoir pressure consistently drops when hydrocarbons are removed from a tight space. At some point, the pressure falls below the bubble point, and that is when gas emerges from the rock, and also out of solution. It does so at the exact time that the oil is diminishing, so the GOR rises dramatically at that point. That’s what made these big fracked wells so parabolic. They were running them unchoked to get massive flushes, only to see a sudden uptick of the GOR. When that happened, you shouldn’t spend next month’s royalty check, because it’s going to be considerably smaller.

I doubt if the physics are different, the way they manifest might be (but not in first principles). The rock and oil/water are effectively inelastic, so gas would evolve pretty much with the first oil removed, it shouldn’t be a surprise to anyone. I don’t understand what the choke has to do with anything, the issue is the present state of the fracked part of the well, not how fast you got there.

How much fuel does an airplane consume ? Interesting information . Also tricks used to lower consumption .

https://www.urbe.aero/quanto-carburante-consuma-un-aereo-di-linea/

If you are flying a 150, not much.

But almost no one is.

A 172 (most popular private) doesn’t use much more.

But still, 5-7 per hour

“I doubt if the physics are different, the way they manifest might be (but not in first principles). The rock and oil/water are effectively inelastic, so gas would evolve pretty much with the first oil removed, it shouldn’t be a surprise to anyone. I don’t understand what the choke has to do with anything, the issue is the present state of the fracked part of the well, not how fast you got there.”

Choking and artificial lift are the two measures that have resulted in most increases in longevity of the shale wells. Prior to this, wells declined by about 75% after the first nine months to a year. Letting a high-pressure fracked well run full-out, with no injection of reservoir gas, spells an early death.

Artificial lift produces more oil, choking simply slows down the production, but generally operators don,t want that – they want their money back asap. Are you suggesting gas injection is widely used? If so where do you get your information? Like ethane, CO2 and water injection it’s experimental, at best there may be a couple of trial wells in operation. Injection needs all sorts of topsides equipment – separators, compressors, flowlines, wellheads – they just don’t exist at any scale in the tight oil basins. A tight oil well’s production does start to drop precipitously immediately it comes on line – every well without exceptions – as flow drops artificial lift is introduced..

OPEC+ crude oil output rises in December, as Russia manages to keep pumping: Platts survey

OPEC and its allies increased crude oil production by 140,000 b/d in December, the latest Platts survey by S&P Global Commodity Insights found, as Russia largely maintained output in the face of an EU ban and the G7’s price cap.

OPEC’s 13 countries pumped 28.98 million b/d in December, an increase of 110,000 b/d from November, led by Nigeria, while 10 non-OPEC partners including Russia added 13.73 million b/d, a rise of 30,000 b/d.

Combined, the alliance produced 42.71 million b/d in the month. Russian volumes wobbled slightly to 9.86 million b/d in the month, down just 10,000 b/d, the survey found.

Higher Oil Prices Have Not Led to More Exploration

https://www.rigzone.com/news/higher_oil_prices_have_not_led_to_more_exploration-12-jan-2023-171706-article/

This is another piece of evidence that oil companies are not particularly interested in increased investment for the future, even as energy prices rise. Is it because of geology, ESG, ERoI limits, risk aversion, labour shortages, supply chain issues, economic contraction or all those and more? The general downward trend in discoveries over the last ten years seems likely to continue. It will be interesting to see the spending plans and 2022 history (for spending and reserve changes) in the coming round of annual reports.

The reason for stagnant exploration boils down to the perceived poor overall prospects of good

Return on Investment.

All of the reasons you listed get boiled down to the bottom line analysis.

Same reason Chevron CEO said in June- ““My personal view is there will never be another new refinery built” on U.S. soil, said Wirth. “You’re looking at committing capital 10 years out, that will need decades to offer a return for shareholders”

He went on to put blame on government policies, but really it just comes down to the base economic prospects.

15 “high impact” wells…. now everything is okiedokie….

“When asked what the 2023 high impact drilling company table would look like, Jamie Collard, Westwood’s Exploration Research Manager, told Rigzone that the company landscape for high impact exploration will continue to be dominated by supermajors and NOCs this year.

“ExxonMobil and Shell are expected to be the most active, both drilling more than 15 high impact wells,” Collard said.”

Rgds

WP

There are probably several angles to why oil exploration is lackluster. Wars and resource nationalism makes exploitation of minerals in general more difficult than before, even if prospects are there. And then there is the obvious conclusion that prospects are getting poorer, which is probably true as well. There are some minor bright spots like Guyana for oil, and several bright spots for tight gas and condensate outside the US. It is what we have to work with, and I understand that there are arguments for both to speed up production of oil&gas to make up for a shortfall, but also the more long term perspective to be conservative and let production fall regardless.

It is not any easy answers as to what speed is possible or optimal when it comes to the energy transition. A major fallout is whether lower levels of living standards should be accepted; it is against human nature to plan for that.

Ron

I am reposting your production guesses because it is too far up for my comment.

I just realized that we will not know the answer to this prediction till April 2024. That is going to be a long wait. 😡😡😡😡😡

My final forecast based on STEO projection and EIA international data, in this case I use the 24 month OLS trend in non-OPEC minus US C plus C to total liquids ratio from October 2019 to September 2022 and assume this trend continues through Dec 2024.

The estimate for the end of 2023 using the average of 2023 and 2024 annual output average is 81700 kb/d, similar to Ovi’s guess. From my Oil shock model using a similar method (average of 2022 and 2023 annual output), I get about 81300 kb/d for the end of 2023. If it is ok I would like to revise my estimate to the average of these estimates from oil shock and STEO projection, that would be 81500 kb/d for World C plus C output in December 2023 for monthly average output. I think it likely that either Ovi’s guess or my new guess will be fairly close.

Ova, true, we will not know the exact answer before April 2024, but we will know something by late summer of this year, 2023. Dennis’s charts show World production bottoming out this spring and hitting a high this summer.

I have no idea how he arrived at this conclusion, but I think he believes Russian production will bottom out by then and then turn up and return to its old highs. That is not going to happen. They may bottom out, but there will be no upturn. And the rest of the world will continue to decline. The US is the only wild card. I have no idea what is going to happen there, but whatever it is, it will not be anything spectacular.

Back to a years long, ondulating plateau is somehow the best that could happen to the world in terms of adaption. Ron, don‘t you consider it possible that at least the 12 months average could top the 2018 peak?

Anything is possible WTFC, just not very probable. The 12 month average will almost definitely not surpass the November 2018 peak. That would be by far the most unlikely thing to happen. I do not think the monthly peak will ever surpass the November 2018 peak. The 12 monthly average peak was January 2019. The 12 monthly average will never surpass that either.

But I never say anything is impossible.

Westtexasfanclub,

I would put the odds at 4 in 5 that the World C plus C 12 month average output will surpass the 2018/2019 12 month average peak (centered 12 month average peak is August 2018, trailing 12 month average is Feb 2019) before December 2028. Best guess is late 2026. Single month peaks are of little importance in my view.

Ron,

My forecast is just the STEO withe the assumption that OPEC crude is 93.5% of OPEC C plus C, based on recent history and that non-OPEC minus US non-C plus C liquids follows the increasing trend of the 2018 to 2022 period. These assumptions are necessary to estimate C plus C to Dec 2024.

Of course Dennis. You are just agreeing with the EIA STEO. Your previous prediction was 81,000 Kbpd, so you are being pretty consistent.

Ron,

Not really, this is how I interpret the STEO and what they are predicting for crude oil output. My guess is 81300 kb/d, but and average of my guess and the EIA guess (aka the STEO) is about 81500 Kb/d which would be my current best guess for December 2023. I think right answer will be between 81300 and 81700 kb/d.

Well, you may be right but I think the odds are against it. It depends whether the demand rises enough to increase prices enough. Prices would have to be dramatically high for your scenario to happen.

If we don’t have a recession, if China avoids economic collapse, or at least avoids a recession. And a recession in China, at this point in time, seems like a lead pipe cinch. Things aren’t looking so hot for India either. And it looks like Sri Lanka and Pakistan are both headed for bankruptcy and total collapse.

Dennis, the world economy does not look all that promising. I think a surge in oil prices is extremely unlikely. I think it is far more likely that oil prices will remain below $100 a barrel and oil production will decline in 2023 rather than increase.

If there is a mild recession and World real GDP growth of 1.7% in 2023 as forecast recently by World bank I think we might see a small increase in 2023 output compared to 2022 (yearly average output up by perhaps 200 to 500 kb/d). I expect average oil price in 2023 will be about $90/bo, this will be enough to see output rise. EIA expects average annual prices in 2023 of under $80/bo for WTI. If the EIA oil price forecast is correct, then we might see a small decrease in World C plus C output in 2023, but I think the odds are about 1 in 4 that oil prices will be as low or lower than the EIA oil price forecast for 2023.

Ron,

I expect roughly flat output from Dec 2022 to Dec 2023 at about 81500 kb/d. Note that from September 2022 this would be a slight decrease in World C plus C output. For annual average output 2022 will be about 80500 kb/d and 2023 I expect to be about 81500 kb/d, an increase of about 1000 kb/d.

Dennis, your 2022 average of 80,500 kbd is pretty close. My data shows the average will be 80,400 kbd. However, your estimate of 2023 average of 81,500 kbd is wildly overly optimistic. My estimate of 79,000 kbd is probably a little low, but I am predicting that the 2023 average will be lower than the 2022 average.

Ron,

There have been lots of cases of you claiming my expectations of the future were wildly optimistic, in many cases they have in fact been pessimistic. We will see if my 81500 guess proves correct, it is possible it is too high, but note that this assumes output does decrease from the September 2022 level for 2023, it is basically a slight decline in output in 2023 from current output. I do not expect the recession in 2023 will be very severe.

Dennis, September production was 81,654 kbd, the high for the year and the highest since before the covid collapse. The last two months of 2023 will be over half a million bp/d below that level. And all of 2023 will be below that level.

Yes Ron,

Notice that 81500 is less than 81654, so on average I expect 2023 output will be less than September output. I don’t try to predict individual months, I will let the EIA do that. So I agree 2023 output will be less than 81654 kb/d, but I doubt the average output in 2023 will be 1100 kb/d less than Sept 2022 output as you predict. Russian output will fall, but it will be more than offset by increases elsewhere.

Dennis, I am not at all confident that 2023 production will be as low as 79,000 kbpd. It was just a number I wrote down so I will stick with it. But if production is 79,800 kbpd, I will not be surprised. No big deal. But I am confident that 2023 production will be lower than 2022.

In this wild guessing I‘m with Frugal‘s round number. But to mark a difference, put me down for 79,750 Kbp/d please.

Good Guess FTFC

81,700 … Kbp/d … Ovi

81,250 … Kbp/d … Dennis

80,000 … Kbp/d … Frugal

79,750 … Kbp/d … WestTexasFanClub

79,500 … Kbp/d … Izzy

79,000 … Kbp/d … Ron

73,000 … Kbp/d … Lightsout

78,500 for me.

But I’m reality challenged

Got it Hightrekker, thanks.

Predictions for C+C production in the month of December 2023.

81,700 … Kbp/d … Ovi

81,250 … Kbp/d … Dennis

80,050 … Kbp/d … LTO Survivor

80,012 … Kbp/d … Seppo Korpela

80,000 … Kbp/d … Frugal

79,750 … Kbp/d … WestTexasFanClub

79,500 … Kbp/d … Izzy

79,000 … Kbp/d … Ron

78,500 … Kbp/d … Hightrekker

73,000 … Kbp/d … Lightsout

My guess is 80,012 kb/d from logistic model without any fudging. best, Seppo

Got it, thanks Seppo. By the way, all your posts are still going to the pending file. I would fix it if I could but I have no idea why that is happening.

81,700 … Kbp/d … Ovi

81,250 … Kbp/d … Dennis

80,012 … Kbp/d … Seppo Korpela

80,000 … Kbp/d … Frugal

79,750 … Kbp/d … WestTexasFanClub

79,500 … Kbp/d … Izzy

79,000 … Kbp/d … Ron

73,000 … Kbp/d … Lightsout

My guess is 80,050,000

Got it. Thanks, LTO Survivor.

81,700 … Kbp/d … Ovi

81,250 … Kbp/d … Dennis

80,050 … Kbp/d … LTO Survivor

80,012 … Kbp/d … Seppo Korpela

80,000 … Kbp/d … Frugal

79,750 … Kbp/d … WestTexasFanClub

79,500 … Kbp/d … Izzy

79,000 … Kbp/d … Ron

73,000 … Kbp/d … Lightsout

Just so there is no misunderstanding, these predictions above are for the Month of December 2023, not the average for 2023.

https://www.dailymail.co.uk/news/article-11633123/Huge-flames-seen-miles-explosion-hits-gas-pipeline-connecting-Latvia-Lithuania.html

“Lithuania is situated on the Baltic Sea where the Russia-to-Germany Nord Stream gas pipelines were destroyed by explosions last year”.

Yet another pipeline explosion near Russia

Put me down for 73,000 please.

Frac spreads have started to return from the holidays.

This week’s count increased by 4 and is unchanged from a year ago, 254. Last year from the holiday’s low of 234 to the February high, 56 frac spreads were re-commissioned. If the same happens this year, we could see a high of 310 in late February after which the count bounces around 310.

With the Rig count still flat in the Permian, the frac count in the Permian should also remain roughly constant and the extra Fracs above 300 may be distributed amongst other basins.

Ovi, the holiday drop this year was a bit deeper than that of last year. And, it is likely that the recovery will be much slower and not as great as last year. I predict that frac spreads will not reach 310 by the end of February.

You can notice that the upward slope of frac spreads slowed down quite a bit in 2022. I believe the slope will turn down in 2023. I would not be surprised if it never reaches 300 again. But what could change all this is if oil prices shot above $100 a barrel. Then all bets are off.

Ron

It will be interesting to watch what happens. According to the STEO, US production will be flat from October 2022 to October 2023.

Ovi,

I agree, I have the STEO estimate for World C plus C as lower in October 2023 (81128 kb/d) than in October 2022(81654 kb/d) by 526 kb/d.

2022 exploration drilling review and 2023 High Impact well (HIW) drilling outlook

2022 exploration drilling delivers 18.7 Bboe

By the end of November 2022, a total of 178 discoveries had been made globally from new-field wildcat (NFW) drilling equating to just over 18.7 billion barrels of oil equivalent (Bboe) recoverable (conventional). To put this in perspective and once a full year of results is realised, it could surpass 2019 and be the most discovered recoverable resources from exploration drilling across the last five years outside of North America (L48). To date 2022 has delivered some big discoveries, within some new plays and countries, likely as a result of work undertaken by operators on portfolio high-grading which took place during the pandemic, or potentially before that, when companies began to adapt their portfolios for the energy transition. In addition, the industry continues its resurgence following the coronavirus disease 2019 (COVID19), which combined with the tailwinds of the high oil price all add to an impressive year in exploration.

Could someone explain what a high impact oil well is? I keep seeing this HIW mentioned more often these days

https://www.spglobal.com/commodityinsights/en/ci/research-analysis/2022-exploration-drilling-review-and-2023-high-impact-well-hiw.html

Targeting more than 100mmboe recoverable in greenfield sites.

Thanks George

What was confusing was the short form, HIW, referred to wells. Your explanation refers to a new greenfield and clarifies statements such as this one.

“From HIWs spudded in 2022, a total of nine wells were reported as P&A, dry.

Financial Times: What the end of the US shale revolution would mean for the world

Echoes much of what gets posted on this site.

Behind a pay wall unfortunately, but interesting. Perhaps there is a free copy out there somewhere.

https://www.ft.com/content/60747b3b-e6ea-47c0-938d-af515816d0f1

https://coinunited.io/news/en/2023-01-16/commodities/what-the-globe-would-look-like-if-the-us-shale-revolution-ended/

… if we turn out to be more dependent on oil than the current projections suggest, we’ll have serious issues, says Bob McNally, a former assistant to President George W. Bush who now heads the Rapidan Energy Group.

According to McNally, it would be a time of “economy-wrecking, geopolitically destabilizing, boom and bust fluctuations.”

I don’t think there’s too much “if” about it.

UAE says OPEC faces volatility in both supply and demand

OPEC is facing “volatile prospects” in oil markets both in supply and demand, UAE energy minister Suhail al-Mazrouei told Asharq TV on Saturday.

He said this was due to European sanctions on Russian crude taking effect in addition to China lifting its “zero-COVID” policy.

OPEC production capacity was down 3.7 mln bpd due to fewer investments in the oil sector, Al-Mazrouei said.

He also said UAE is taking preemptive steps to compensate for the reduced oil production capacity in some countries by bringing forward its five million barrel per day oil production capacity expansion to 2027 from a previous target of 2030.

https://thearabweekly.com/uae-says-opec-faces-volatility-both-supply-and-demand

Thanks Ovi,

It will be interesting to see if other middle east OPEC producers choose to increase their capacity. Iraq has long claimed it could increase capacity, but it is not clear they have the political stability to enable such an expansion, Iran also might be able to increase capacity, but likewise would find this difficult. I imagine Saudi Arabia has the potential to increase capacity in the future, I am unsure about Kuwait, they might not have much potential for increased capacity.

Art Berman ,

Art Berman

Rising costs .

Oil price from 2019 to now up from 55/b to $80/b an increase of about 45%. Rig rates have gone from 22k to 29.5k, an increase of 35%. I have also read recently that the top 10 independent shale oil and gas companies have paid down debt.

https://oilprice.com/Energy/Crude-Oil/US-Oil-Production-Growths-Path-Is-Clear.html

Excerpt:

The Wall Street Journal reported this week that between mid-2019 and mid-2022, the ten largest U.S. shale independents paid down 17 percent of their collective debt, reducing it to $84 billion. The best performers were Occidental Petroleum, which cut its debt load by half, and Marathon Oil Corp, which reduced it by about a quarter over the period.

So about 17 billion in debt was paid off, likely most of this in 2021 and 2022 as prices were quite low in 2020.

https://insideevs.com/news/630769/tesla-snatches-2022-us-luxury-sales-crown-from-bmw/

For the first time in nearly 25 years, an American automaker is again number one in luxury sales in the US. Tesla grabbed the luxury sales crown from BMW for the 2022 calendar year, selling 158,612 more vehicles than the German automaker in its home market. In 2021, BMW had beaten Tesla by about 23,000 vehicles based on estimates.

The EV maker delivered an estimated 491,000 vehicles in the US last year, up 44 percent, and exceeded 1 million deliveries globally, according to Automotive News Research & Data Center estimates.

Tesla Model Y was in the top 6 vehicles sold in the US in 2022, just behind the Toyota Camry.

https://www.caranddriver.com/news/g39628015/best-selling-cars-2022/

Top 3 spots are pickup trucks (Ford, Chevy, and Dodge), then the Toyota RAV4, Camry and Model Y (Model 3 was number 15).

It will be interesting to see what happens with the recent price drop in the price of the Model Y by about 13k, plus the 7500 fed rebate, a total of 21k for those who qualify (joint income less than 300k for married filing jointly). They will sell like hotcakes.

Interesting discussion on this topic

https://cleantechnica.com/2022/11/28/evs-could-account-for-90-share-of-the-market-by-2027/amp/

Stephen , If you can’t afford it then you can’t have it . I have posted earlier on the affordability issue several times . Cleantechnica is a ” prime the pump ” site . Now read what happens when the rubber hits the road .

https://www.dailymail.co.uk/news/article-11621267/Electric-car-makers-brakes-UK-production-drivers-think-vehicles-expensive.html?mc_cid=7cc89f3000&mc_eid=4961da7cb1

HiH, UK EV market is already past 40%, yet the article says the UK will only be producing a quarter EVs by 2025. I think that’s a problem for Uk car manufacturers, not customers.

https://cleantechnica.com/2023/01/09/uks-ev-share-hits-40-in-december-tesla-model-y-overall-bestseller/

Stephen , Dump CleanTechnica it is “Prime the pump . Here are the facts . It is only 16.6% which includes PHEV .

https://heycar.co.uk/blog/electric-cars-statistics-and-projections

Hole in head,

You are comparing apples and oranges. One looks at December 2022 sales and the other at total 2022 sales. Market share of EVs in UK in December 2022 was 33% from the piece you linked. They do not give a December 2022 figure for plugin hybrids, but if we assume it was the same as the total year figure at 6.3%, then plugin car sales in December 2022 were 39.2%, not very far from the Clean Technica estimate of 39.4%.

And the 16.6% estimate for all of 2022 did not include plugin hybrid sales of 6.3%.

Here is the math BEV=267203, pluginhybrids=101414,

plugin cars=BEV and pluginhybrids=267203 plus 101414=368617.

Total UK new car registrations in 2022 were 1.61 million so new plugin car registrations were 368.6k/1610k=22.9% for the year.

What the difference between an annual average of 23% and a December average of 39% suggests is rapidly increasing registrations of plugin vehicles, particularly BEVs.

Dennis , “It will be interesting to see what happens with the recent price drop in the price of the Model Y by about 13k, plus the 7500 fed rebate, a total of 21k for those who qualify (joint income less than 300k for married filing jointly). They will sell like hotcakes. ”

Hey , why lower prices if it was a top seller (top six) ? Reason .They are sitting on a lot of inventory which they must move. They cannot move their inventory in China also . Worse , the second hand market for Tesla’s and it’s trade in’s has crashed . Best of luck Mr Musk .

Hole in head,

Obviously used car values will drop due to fall in new car price. No there is not a lot of inventory, the difference between production and sales is simply vehicles in transit from factory to consumer. Prices are being dropped because two new factories in Berlin and Austin Texas are ramping up output and there is competition from other manufacturers that didn’t exist before. Also the drop in US prices for the Model Y was because the IRS did not consider the Model Y as an SUV because of the vehicle weight (it s mass was too low) the threshhold to get the rebate was 55k so Tesla reduced the price so buyers would qualify for the rebate. The Model Y price in the US with the federal rebate is about 47k, the average selling price for new vehicles in the US in 2022 was about 45k, the Model 3 is 37k after rebate for base model (range of 272 miles).

For many this is not affordable on that I agree.

They were top 6 in 2022, they want to be top 4 next year, there is a big gap between RAV4 sales (400k) and Model Y (250k), so this would be a 60% increase in sales, perhaps not achievable. The RAV 4, similarly equipped to the Model Y is about 35k, so 12k cheaper than the Model Y, many will not be able to afford the higher price. The VW ID4 AWD pro (Model Y is AWD) starts at 50k, but only has 255 miles of range vs 330 for model Y.

Reason .They are sitting on a lot of inventory which they must move.

Not the case. They are increasing production, and are booking orders.

They are using the tax incentive to buy market share. And not just electric car market share: general car market share. They noticed that ice cars are dead in 12 years: no reason not to accelerate their doom (and that of their manufacturers) by turning the screws as tight as they can. With the government paying for it!

They cannot move their inventory in China also .

Also not the case: they dropped the price there as well, and cleared their inventory, according to the Electric Viking. They are at war with BYD there.

Between changes in battery chemistry (to lower battery prices), speeding up production at their existing factories (to lower unit cost), building new facilities, and the various tax incentives, they will be able to keep their prices down and still make a profit.

So: Tesla is aiming to become the dominant car company in North America, and the rest of the world while they’re at it. Note I said “car company“, not “electric car company”.

They’ve already won North America: the other majors can’t build out their supply chains for electrics fast enough. They will need to be bailed out before 2030.

As for China, more of a guessing game, but it’s not unreasonable to think that Tesla will be #1 or #2 there in the mid term (2030-ish).

And if the Model 2 (or whatever they will call it) and the Cybertruck show up this year (as is rumoured), their dominance will be assured.

Me : They cannot move their inventory in China .

Lloyd : they dropped the price there as well, and cleared their inventory,

Which means they were stuck with inventory they could not sell and resorted to discounts . They will be stuck with inventory again . Their course of action should be lower production .

Dennis , new production in new locations does not lead to ” economy of scale ” . Anyway the issue is affordability and not availability . You are missing the woods for the trees .

P.S : You –For many this is not affordable on that I agree

Just an observation . In my opinion the sales in Europe of EV’s has peaked . Most of the sales were in Norway an outlier flush with money from the wealth fund and cheap hydropower . Second is Netherlands . Still flush with cash from the gas from Groningen . Rest are laggards and I don’t see how EV’s are going to overcome the affordability issue as we enter into a recession and stagflation . Talking about affordability , the EV ‘s are nonstarters in poorer parts of Europe whole Central, East and South Europe . Things that make me go–hmmm,

A question ? What happens to the Tesla’s owned/leased by car fleets eg car rentals , corporate fleets etc . All are now underwater with the lowered price and will have a lower residual value at the end of the contract . Can Musk afford to piss off these bulk buyers or will he make good the loss ? Any thoughts ?

Their course of action should be lower production .

Not if you have spent months or years building out your production capacity. They didn’t decide to do this last Tuesday: they have had since August (when the $7500 US tax credit was announced) to tailor their global pricing strategy to this new reality. They obviously disagree with you, and they have the advantage of knowing what their costs and profit margins are.

Lloyd , of course the factories were not built overnight . Tesla Shanghai began construction in 2018 . Musk and team sure did not know what would happen in 2022 . Anyway nothing shameful or embarrassing if you cut production when the market is down . OPEC cuts production and so does Apple . Companies have to adapt to a change of facts or they will be in trouble ,

Your comments seem to be trying to justify your thesis that the European EV market has peaked. You offer no evidence for this, and your main complaint- that the price is too high- is followed by a complaint that dropping the price must mean too much unsold inventory. Tesla increased sales by almost 50% last year, with 95% of total sales Model 3’s. My understanding is that they have dropped the price of Model 3’s in Europe: it will be obvious fairly quickly whether demand has peaked (and spoiler alert: it hasn’t).

Re: Used Car market: The price of the Ford Model T dropped from $850 to $260 between 1908 and 1927. People still buy Fords.

Re China inventory: According to Inside EVs, the excess inventory was the result of a very bad December (https://insideevs.com/news/630433/china-tesla-retail-ev-sales-december2022/), and not a long-term downward trend. If you know you are cutting prices in January, that excess inventory is not an issue. And considering they sold 30,000 cars in three days after the price cut- essentially eliminating the unsold inventory- I hold that Tesla does, in fact, know their business better than you do.

Lloyd,

Tesla has pretty fierce competition from BYD and others in China, the price was likely dropped to remain competitive in that market. Tesla as you know has a tiny inventory relative to most other manufacturers, most of it is simply vehicles in transit to customers as their “transporter” (as in Star Trek) technology has not yet been perfected. 🙂

I should know better than to continue playing whack-a-mole here…

We will not know when electric car demand has peaked until robust analysis has been done after the fact. Your opinion is just that: your opinion, not backed up by robust statistical analysis, and is, in fact, a prediction of a peak. So it has no factual value in this discussion.

Tesla has lowered it’s prices, and is known to be working on a lower-priced model. Smaller and cheaper Chinese vehicles are coming to Europe and are already being sold there. These factors will affect the rate of EV adoption, and unless they are roundly rejected by European consumers, will increase adoption rates. Until we know the effect of these new factors, your “peak European EV Adoption Thesis” remains a prediction based on anecdotal observation, and I give it as much credit as it is worth.

The Model T analogy is a sound one. Your argument against it is nonsensical and non factual.

As for your complaint about the stock price fluctuation, this is a feeble attempt at deflection, because you can’t actually refute the core of my arguments.

Re: HOLE IN HEAD

01/19/2023 at 2:03

From Inside EV (pmhttps://insideevs.com/news/624922/europe-plugin-electric-car-sales-october2022/)

Europe: Plug-In Electric Car Sales Increased 14% In October 2022

“Passenger car registrations in Europe increased in October by 14% year-over-year. The third positive month indicates an end to the challenging period of decline (from June 2021 through July 2022).”

So: Not everyone agrees with you. To reiterate: You are taking incomplete data, making predictions about the future and claiming it as fact.

If time proves the Chinese can’t sell in Europe, or Tesla’s price cuts don’t convince buyers to switch from ICE cars, or Tesla doesn’t make the Model 2, or the European manufacturers don’t move to BEV’s, then you can say “I win!”

But we won’t be at that point for some years.

You are entitled to your opinions, and your predictions and theses about the future. But they are guesses until they actually happen.

Hole in head,

Economies of scale can result from having more factories producing more cars, in all factories there is knowledge gained through the production process, the improved methods are shared throughout the company leading to lowered costs. In addition higher output leads to greater production of the inputs by other companies where the same process occurs. You are incorrect that economies of scale only occur at a single large factory or in a single location.

See

https://en.wikipedia.org/wiki/Economies_of_scale

EVs are non-starters in some areas at present I agree. Costs will continue to fall and affordability will become less and less of an issue.

Dennis , “Costs will continue to fall ” . You think so ? Ever hear a Simon Michaux analysis on minerals needed to produce EV'”s .? If not then I will post one but I think it has already been posted on the other thread . OK , costs will fall (hypothetically )but so will purchasing power (realistically ) . Inflation is a bitch . I have oft said ” Tesla makes toys for the big boys ” . Well the big boys have bought all the Tesla’s they could or you think Gates , Bezos & company will buy Tesla’s to infinity . I can promise you that Gautam Adani (4Th richest in the world ) isn’t buying one . No charging stations in India . 🙂

Lloyd , a peak in Europe is not a thesis , it is an observation and I have posted supporting argument to back this . Do you have a counter ? Your example of Ford 1908 -27 is irrelevant today . How irrelevant ? I gave my grandson a rotary dial telephone as a birthday gift and he did not know even how to dial a number .

-” I hold that Tesla does, in fact, know their business better than you do. ” Agree . Now my question , what do the financial markets know better than we don’t know ? Price at peak $ 661 to $ 91 low , a crash of 74% . Reminds of a movie scene of Richard Pryor . Caught in bed by wife with another woman .

Wife : I can’t believe my eyes .

Pryor : What are you going to believe , me or your f***ing eyes ?

So whom are we to believe ? Financial markets or ??? . 🙂

Lloyd , I am correct . Here is data

2021 total sales 2.27 million including BEV’s .

2022 total sales 2.20 million . Breakup. BEVs: about *1.3 million

PHEVs: about *0.9 million

Total: 2,189,991 . So not even 2.2 million ,but I am generous .

Do you even know the Chinese brands that meet EU standards and can be imported ? You don’t , so here for your info . Only MG . Further MG is the brand what use to be MGB in Britain . MGB went bankrupt about 10 /15 years ago . The Chinese purchased the plant dismantled it and reassembled in China . Their ICE adventure was a failure ,so they switched to EV ‘s . Just last week talked with the MG distributer in my region ( West Flanders, Belgium ) . Total sales in 2022 were 23 cars . By the way total sales of MG cars only EV’s in India 2022 is 3899 units ( 310 cars per month or 10 cars per day ) . ROFL . Data prevails .

China’s EVs & Green Energy Manufacturing For Dummies…

It’s no coincidence that China is the leading EV manufacturer in the world and the largest producer of Wind & Solar power units.

Why? It’s easy… near Slave Labor wages, and its massive Coal-Fired Power generation at 4 cents per kilowatt-hour allows China to OUT-COMPETE the rest of the world.

Matter-a-fact, China holds 7 out of the 10 Top Slots among Global Wind Turbine manufacturers. While Europe continues to shut down Wind Turbine plants due to high energy costs, China continues to pump out Wind Turbines as it LAUGHS all the way to the Bank.

Furthermore, China is producing roughly 50% of the EVs in the world because of the same super-low Energy-Labor economics stated above.

Unfortunately, as the world heads over the ENERGY CLIFF circa 2025, we will see more and more countries’ ABANDON Green Energy & EVs as they are more focused on massive Social Unrest, Protests, and Inflation.

GOD HATH A SENSE OF HUMOR…

steve

Huh that would be a curious move if there’s an energy crisis then why would people abandon a technology that is 4-6 times as efficient? But you know best Goldie Pants.