The US EIA Short Term Energy Outlook (STEO) was published on January 10, 2023. This report generally provides forecasts for Total Liquids production for non-OPEC nations, crude only output for OPEC nations, and both C+C and Total Liquids forecasts for the US. At Peak Oil Barrel we focus on crude plus condensate (C+C) output as this is the critical input that provides most of the World’s liquid fuels used for land, air and water transportation. The STEO also provides forecasts for natural gas and electricity output as well as price forecasts for oil, natural gas, and electricity. This post will focus on oil (both total liquids and C+C).

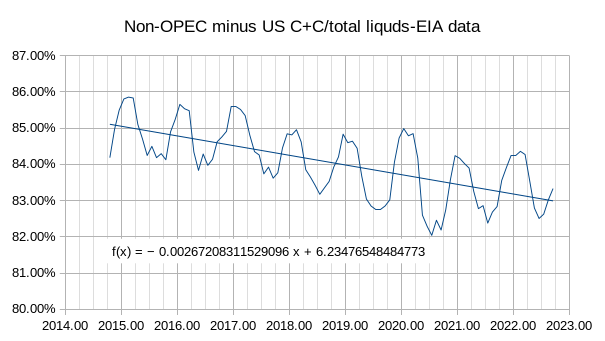

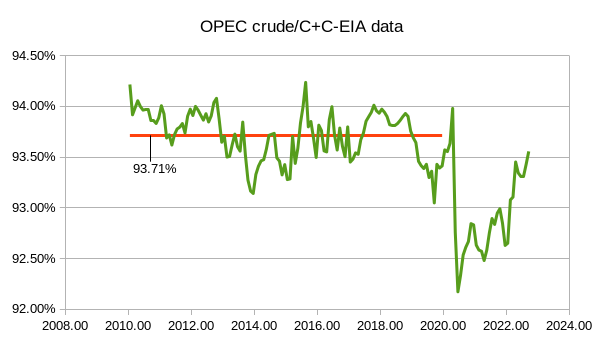

We find the OLS trend in the ratio of C+C divided by total liquids for non-OPEC minus the US over the period from October 2014 to September 2022 (it has been decreasing at an annual rate of 0.267% over that period) and we assume the trend continues from October 2022 to December 2024 (the end of the STEO forecast). This allows us to estimate non-OPEC minus US C+C. Likewise we find the ratio of OPEC crude to C+C which was relatively flat at about 93.7% from Jan 2010 to December 2019 and seems to be returning to this level since the depths of the pandemic. By assuming the ratio is 93.7% crude to C+C for OPEC we can estimate OPEC C+C from October 2022 to December 2022 using the STEO crude only estimate. The non-OPEC minus US C+C estimate is added to the STEO US C+C estimate and this is combined with the OPEC C+C estimate to find the World C+C STEO forecast.

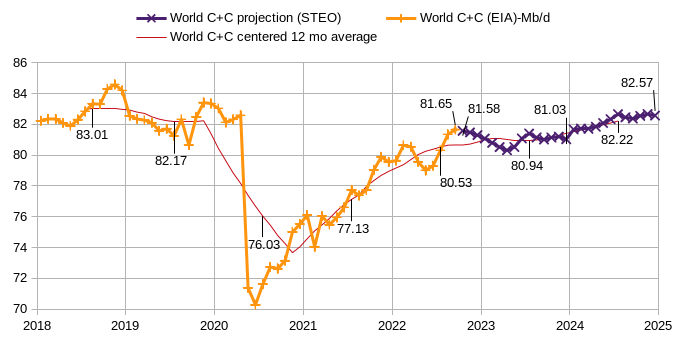

The numbers below the red line are mid-year 12 month averages for World C+C (the exception is in 2018 where the centered 12 month average peak of August 2018 is shown). The numbers above the line are for individual monthly average output in Sept 2022, October 2022, December 2023, and December 2024. Output is in millions of barrels per day (Mb/d).

Figure 2 shows the ratio of non-OPEC minus US C+C to total liquids as a percentage. The roughly sinusoidal up and down is due to changing ethanol output in Brazil from winter to summer, I have not attempted to fit the sinusoid so 12 month averages might be fairly close but summers might be overestimated and winters may be underestimated due to missing this seasonal effect. In the future I may estimate Brazil separately, to get a better estimate for non-OPEC minus US and Brazil, but have not done that this month. I use the equation on figure 2 above to project the future non-OPEC minus US C+C to total liquids ratio from October 2022 to December 2024 and then multiply this ratio by the total liquids forecast to find a C+C STEO forecast for non-OPEC minus US.

The chart above shows the trend of the OPEC crude to C+C ratio as a percentage, note that the trend of the Jan 2022 to Sept 2022 data suggests that this ratio will return to 93.7% by November 2022, to simplify I used a ratio of 93.7% for all months from October 2022 to December 2024. The crude estimate for OPEC was divided by 0.937 to find an OPEC C+C STEO forecast. The non-OPEC minus US C+C forecast was combined with the STEO US C+C forecast and the OPEC C+C STEO forecast to find the World C+C forecast shown in figure 1. The data is in a spreadsheet at this link , the filesize is 5.8 MB.

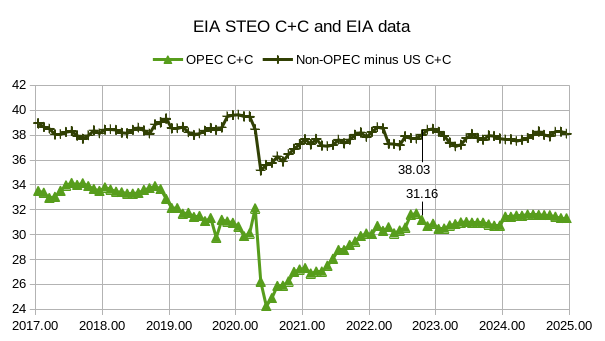

The chart above shows the Non-OPEC minus C+C STEO forecast and the OPEC C+C STEO forecast, the first data point of each forecast is shown on the chart, data to the left of that is from the EIA’s international petroleum data and data to the right is the STEO forecast.

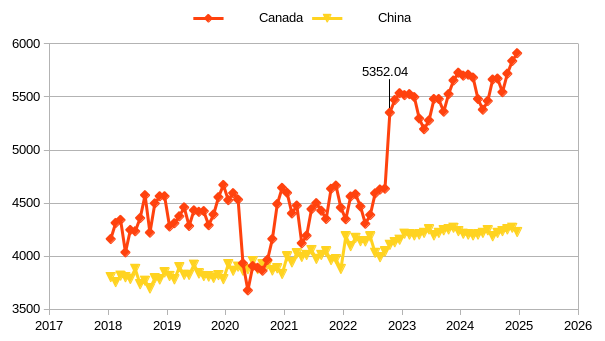

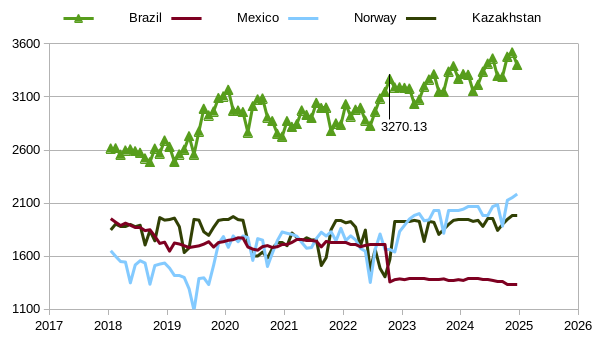

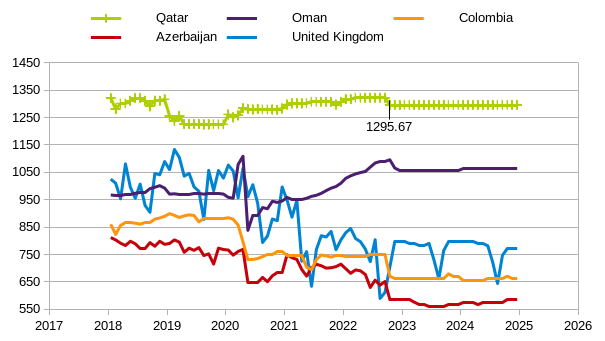

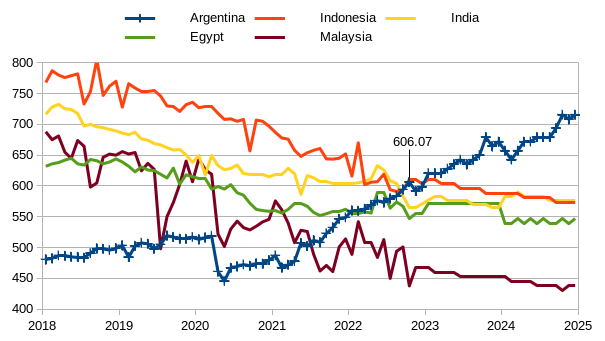

There are 23 non-OPEC nations (aside from the US) that the US EIA provides individual forecasts for total liquids output in the STEO. Two of the 23 nations have a combined forecast (Sudan and South Sudan) so there are 22 separate forecasts which covers about 94% of non-OPEC C+C output as of September 2022. A trend analysis for each of the 22 forecasts was too much work, instead I did a shortcut method by taking total C+C output from October 2018 to September 2022 and dividing by total liquids output over the same period to find a weighted C+C to total liquids ratio for the past 4 years. I assumed this would correspond to the ratio from October 2022 to December 2024 (no doubt this will not be accurate as the future is not known, likewise any past trend is not likely to continue). The methodology outlined above is used for the STEO forecasts of C+C output that follow. As was done earlier, the first point of the forecast is shown on the chart (October 2022 in every case), data prior to October 2022 is from the International data section of the EIA.

I doubt Russian C+C output will fall as much as the EIA has forecast, I expect it will settle at around 9400 kb/d, about 700 kb/d higher than the EIA STEO forecast.

The Canadian forecast looks much too high, I expect actual output will be shifted down by about 700 kb/d from October 2022 to December 2024. The mistake on the low Russian forecast and high Canadian forecast may roughly balance out from June 2023 to December 2024, but from October 2022 to March 2023 the EIA forecast may be too high due to the unreasonable jump up in Canadian output in October 2022.

The Brazilian forecast was done a bit differently than the rest of the 22 forecasts, I looked at Brazil non-C+C liquids from 2015 to 2022 and saw a pretty flat sinusoidal up and down pattern (by “flat” I mean no trend in the 12 month average, slope of trend is nearly zero), so I took the most recent Jan to December non-C+C liquids data and simply subtracted that from the total liquids forecast for Brazil to get the Brazil C+C STEO forecast.

Most of these 5 nations have relatively flat output for the forecast period, with a slight downward trend for the UK.

Egypt and India fairly flat over the forecast period with Indonesia and Malaysia trending down and possibly offset by the upward trend in Argentina’s output.

These 5 nations taken together are mostly flat over the October 2022 to June 2024 period, but output is sharply up in Guyana in the second half of 2024.

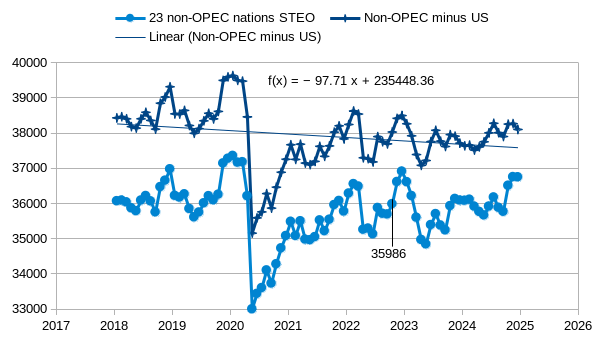

The chart above compares the Non-OPEC minus US C+C STEO forecast with the sum of the forecasts of the 23 non-OPEC nations covered in the previous 6 charts. I also show the OLS trend for the non-OPEC minus US C+C for Jan 2018 to December 2024 (a combination of data and forecast), annual decline rate is 98 kb/d.

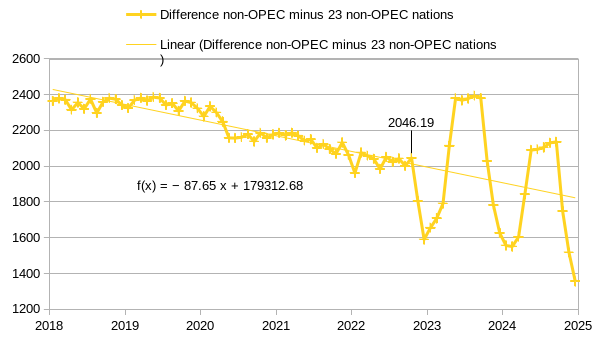

The chart above takes the difference between the two lines in figure 5. We get a strange quasi-sinusoidal pattern over the forecast period when there is no such pattern in the actual data. So for an alternative method (I call this Method 2) for the non-OPEC minus US C+C forecast, I assume all the 22 forecasts for C+C which I produced in the charts above are correct and use the OLS trendline shown in Figure 6 to estimate the rest of non-OPEC minus US C+C output and then combine this forecast with the 23 nation forecast.

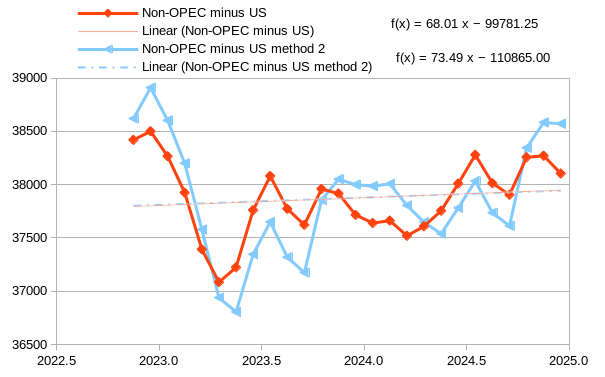

The “method 2” forecast is compared with the original non_OPEC minus US C+C STEO forecast in the chart above, the OLS trendlines are shown for each of the forecasts (one is a dash dot pattern in light blue, the other is a continuous line in light red). Look closely because there are two lines, but they are so similar that it appears to be a single line. Neither will be correct, the future cannot be predicted with this level of detail (or at all).

Thank god (and modern technology) for all the latest EV designs that have allowed such a big and obvious decline in future oil demand; otherwise, instead of heading towards zero emissions, we would still be seeing exponential growth in GHG concentrations, and will have landed our children with some real existential problems, especially considering how wildly we have underestimated how bad the extreme climate events are with only modest increases in average temperatures. /sarc

We must get away from fossil fuels fast – and that’s important because we scrap the bottom of the barrel. It’s getting more expensive the next 2 decades.

For CO2 I don’t see any hope – CO2 will be decided in Asia where the growth is. And asian people won’t let old Europa and USA dictate anything on them anymore, not an russian oil embargo and not to avoid burning coal. So the only hope here is to develop faster new tech that is nice to get and let’s look burning coal like an old steam train.

Speaking of chances, with these increase in fracking technic you can make geothermal energy available almost everywhere – fast and cheap 30.000 feet drilling is what you need to tap this. Nobody does.

Solar and wind, develop thorium and fusion to working, everything help during the last decades where is halfway cheap oil.

The other thing – keep away from the panic TV and reporters. I don’t see any weather catastrophes the last 20 years, only weather. When you look at historic events the last 1000 years we can be glad we live in very calm times.

There have been catastrophic floods and droughts, big Magdalen flood in central Europe for example where billions of tons of sediments are left (we have here a more than 10 meter deep chasm in some places that’s still visible), or a drought where the Rhine was almost empty.

The year without sun from a vulcanic eruption in the 19th century.

Or your athmospheric river from 1862 – this would make a trillion$ damage today, flooding the whole silicon valley, perhaps even destroying all Colorado river levees letting Las Vegas and half California drying out in the aftermath.

Pure statistically you have in every century a 1000 year something – so resilence is necessary anyway.

“We must get away from fossil fuels fast ”

Oh, don’t worry. That will happen without our having to lift a finger, for fossil fuels will leave us.

Whether or not it is “fast” or not remains to be seen.

Yes indeed I totally agree Mike! Peak Oil is alive and well and coming to a petroleum dealer to you soon enough.

Asia is leading the race away from carbon emissions. not having it dictated by the West.

About Asia. Asia is literally drinking oil, especially with the consumption of China. But 1) China will have to absorb the shock of the real estate crisis. Real estate represents 30% of the gdp. Therefore, this crisis will be paid during several years by a reduction of gdp growth of 30%. Which means that the growth in China will be equivalent to the growth of Western economies. 2) Chinese population began its decline. Furthermore, the working age population began also its decline. That will not help economic growth. 3) The mess of covid pandemic management in China has already slowed down the growth of Chinese economy with the result of widespread unemployement especially among young people, which will slow economic recovery in China. I don’t know (I doubt strongly) if all of this is going to keep oil consumption in China at the same level as before.

Post Covid many nations with older populations have workforce reductions of 3-5% from deaths, long Covid, and early retirements to take care of the sick. For China this could mean a drop in workforce participation of 10-20 million people. And then add the demographics on top of it. Look at S Korea. The fertility rate is 0.8. This is where China is heading.

From mid-December to mid-Januray, the Urals index averaged 47 $/b [0]. There is no future for the Russian petroleum industry at these prices. The shut in announced in December is probably a first action necessary to take unprofitable wells off line.

A production drop of 1 Mb/d is totally reasonable [1, 2]. But the big question is the effect long term on such a mature region.

P.S.: personally not expecting to see Brent above 100 $/b any time soon.

[0] https://www.urdupoint.com/en/business/urals-averaged-468-per-barrel-between-decem-1626283.html

[1] https://markets.businessinsider.com/news/commodities/oil-price-outlook-2023-russia-crude-supply-eu-embargo-china-2023-1?op=1

[2] https://www.barrons.com/articles/russia-oil-price-cap-sanctions-51673624934

Luis,

Note that the EIA is predicting about a 1.8 Mb/d drop in Russian output from the November 2022 C plus C output level. My guess is about a 1 Mb/d drop from 10.9 to 9.9 Mb/d by June 2023, it might temporarily drop a bit more than this by March 2023 (perhaps by 1.3 Mb/d), but I expect markets will adjust and we will see more Russian output go to Asia, Africa, and South America and more OPEC and other non-Russian oil flow to Europe and North America. I agree we won’t see Brent hit $100/bo until 2025 or later. I expect we might see $95/bo in 2023 (maybe a 20% chance it will be more than $95/bo) and probably not much below $80/bo for Brent (less than a 20% probability it will be less than $80/bo for yearly average Brent price in 2023).

This past December in both the Carolinas the power companies flat ran out of electricity one cold morning. The result was rolling black outs. The reason was, it was still dark and the 1000,s of MW of solar power were still off line and the neighboring utilities had no spare power to help. Energy poverty is being shoved down our throats by the Chicken Littles of climate change.

Ervin,

Fossil fuel depletion is real, as is climate change. Don’t believe the nonsense spewed on Fox News.

Here is some reading for you and a 60 second video

https://royalsociety.org/topics-policy/projects/climate-change-evidence-causes/basics-of-climate-change/

Ervin comment is an excellent example of a smear campaign against domestic energy security and production typical of a certain segment [MAGA] of the republican party.

Example- During an April 2,2019 speech to the National Republican Congressional Committee Trump said the windmill noise causes cancer.

It would be nice to pretend that greenhouse warming of the earth, and fossil fuel depletion, and aging,

just were not real.

There is no question that fossil fuels are finite but when nobody knows. But human caused climate change is a religious belief. Since 1988 we been told of some catastrophic disasters just a decade away and none have even come close to happening. I’m being told to give up my freedoms and money to some politicians to save me from certain Armageddon. If only I would be willing to be cold in the winter and hot in the summer. If only I would not drive my car or eat beef. I could save the plant. I love how there was no comment about the fact the Duke Energy and the other area utilities could not supply enough electricity like that’s no big deal, like man who the hell cares. Build more turbines and solar farms, hand out Billions of free money to the corporations and let the masses pay thru the nose for power and heat. But anyway I’m a stupid closed minded fool not able to comprehend how smart the elites are. Dennis it’s my opinion that the video is pure propaganda.

there was no comment about the fact the Duke Energy and the other area utilities could not supply enough electricity like that’s no big deal, like man who the hell cares.

Huh.

You ain’t seen nothin yet.

Ervin,

Many believe what they choose to believe. Perhaps when you are gravely ill you look for those non-scientists for help.

Full information on some of the mainstream science at

https://www.ipcc.ch/assessment-report/ar6/

No doubt you will claim that is propaganda as well. You would be wrong, if you make such a claim.

The IPCC. You have got to be kidding. 100% political. Zero science.

Ervin,

Thanks for your expert opinion, all doubt has been removed.

Man with smoothest brain in the world doesn’t get climate science. Film at eleven.

I think Ervin’s comment has merit. Any student of geology can tell you that extreme temperatures were written into the rock, dating back millions of years. The equator has changed. The Siberian Traps exploded. There is a massive amount of methane gas coming up from methane mounds in the GOM and from the quagmire in Siberia.

I don’t doubt a bit that there is an anthropomorphic element to climate change, but I also believe that it has been wildly exaggerated. And I also know beyond a shadow of a doubt that the average age of death prior to electricity was between forty and fifty, and that most electricity has been generated by the burning of fossil fuels, spinning a turbine. Were it not for fossil fuels there would be no pharmaceuticals, or surgical equipment. And the average age would likely be about where it was then.

This never ending pissing and moaning about fossil fuels is driving a religious fervor, making climate change into some sort of singular manmade force, when it’s not. Sacramento was underwater when Leland Stanford was inaugurated; he had to be boated to the courthouse steps due to “atmospheric rivers.” The biggest hurricane was the Galveston in the early nineteen hundreds.

When people like Al Gore holler at the Davos Conference, it makes me want to puke. His family made their living with tobacco. Tobacco! Lots of it. And he has the moral authority to lecture me on fossil fuels?

I have no beef with EV’s or renewables, but I will state that unless we get someone a hell of a lot smarter than our current energy czar, we will be playing with fire. Because it’s going to be quite some time before the world can find something to replace fossil fuels. Nuclear would have done it, but that ship has sailed.

Carbon capture is a real entity. So is blue hydrogen giving way to green hydrogen. Renewables? Fine, feed them into the mix. Use the oil and gas purely for petrochemical manufacture if there’s plenty of energy for thermal manipulation. But the global debt is three hundred trillion. There is only so much the world can do. The major population growth is not of rich people, but poor people. And each EV takes a lot of energy to produce, to charge, to provide tires and batteries.

The world has to get realistic. All this mumbo jumbo and bellicose sounding off is dividing us into two cultures, Fox News, as Mr. Coyne put it, and CNN, as I put it. None of this stuff takes into consideration the global warming of war, yet nobody raised much of a ruckus when Geo W waged war against a country that hadn’t really done a damn thing to us. And our risk of nuclear war is probably higher than at any time since the Cuban Missile Crisis. We are only one step away from real global warming, the type that fries the meat off your bones.

Jeez, the way some people lift their skirts is truly appalling. This crap in Ukraine could be over in one day, if the world told Mr. Putin that they were going to cut his ass off from regular commerce, and if Xi didn’t go for it, inform him that we’d be moving Apple and Tesla and all the pharmaceutical companies out of China. And India that we’d cut them off if they persist in buying Russian oil. This could be over, gentlemen. As in over. But it won’t be because nobody has the balls to do that. It would interrupt global commerce, throw the world into a tailspin, wreck the community of nations.

Which would be a tremendous thing to do. Slow it down. You want pollution to decline? Slow down commerce. Is this just talk by a bunch of silly elitists who emerge from fifty million dollar Gulfstreams at Davos, or is this serious? Does anybody really think we couldn’t freeze Mr. Putin into an ice cube if we really wanted to? We could shut this down. But everyone is too interested in getting exceptionally wealthy at someone else’s expense. This can’t go on. At some point, Mother Earth will decide the outcome. And it likely will be from mass starvation of those without fertilizer and thermal modulation, and then war, likely nuclear, because we have very likely reached the Malthusian limit, especially if we’re going to go Pollyanna about global warming.

Gerry, you are, or appear to be, an “earth” scientist. I am not. I am not a SIPES member because I have no degrees in earth science; I have, however, spoken often to SIPES groups all over the country, which means nada, I know.

But I personally appreciate your observations about tight oil on AOB; though you clearly benefit from RI or ORRI in tight oil you are clearly unbiased about the issue. You have the cajones, and therefore the credibility, to comment using your real name and, most importantly, don’t let politics sway better judgement. Like the EF Hutton commercial, when you speak, people should listen.

Mother Earth is very old, human beings are little more than a fart in the wind. Of course the climate has changed; it was going to anyway. Humans have excelerated all that perhaps, but how do you alter but a pin prick in time? The bored in life always want to create drama, whenever they can. It makes them feel…important.

If someone feels he or she can mend centuries of abuse by buying a shit EV car, put your money where your mouth is and do it. Talk your neighbor into it. You won’t, however, talk the folks in Middle America with the name Gonzales, into it. Remember them? They’re the ones doing all the work so folks can yak on the internet all day long about how evil, and how quickly, we need to get past fossil fuels. The Gonzales family, or the Menéndez family can’t afford an EV. They are struggling to makes ends meet, make shit, build shit… actually PRODUCE shit.

I find, after 60 plus years in the business of finding and extracting oil and natural gas, the folks that can find it, understand where it came from, and why it is where it is, what it actually costs, are WORTH listening to. Far more so than say, economists, who don’t know jack shit about real life and can barely understand why 2 and 2 don’t always equal 5.

So…speak up, Gerry, don’t quit ! When I check in you are one of 3-4 I even click on!

The Gonzales family, or the Menéndez family can’t afford an EV.

Actually 2 and 3 wheeled vehicles are leading the charge, not 4 wheelers. And they are affordable.

https://auto.hindustantimes.com/auto/electric-vehicles/this-state-is-likely-to-achieve-100-electric-three-wheeler-sales-by-2025-study-41674281561644.html

There are about 300,000,000 electric bikes in the world, one for every 25 people roughly. There are maybe four times as many cars, but the number of electric bikes is growing muh faster.

if I may, and this is a response to Dennis who’s seems to claim the IPCC is the definitive resource on climate change. This is not an argument for or against. But as most of the freethinking individuals have learned or should have learned over the last decade, is that when most everyone is on the right side of the boat on any particular issue, a prudent approach to objective analysis of the conclusions advanced, might be to ask oneself the follow questions:

What is the context of the conclusion advanced? Do they attempt to answer the critics or the alternative possibilities? For instance. How many climate change, global warming “scientists” have ever tried to explain the various climate changes that we have adequate records for in the past let’s just say 100,000 years? Do they attempt to rule out past reasons the earths climate changed, which clearly were not the result human activity? If they have not, a reasonable question might be why have they not? That is the very definition of science. If they have not, is is reasonable to ask if the have any potential conflicts of interest, that is do they stand to advance professionally or monetarily by making such an obvious oversight? If they are advancing human activity as the sole cause or the main cause of global warming or climate change, have they themselves modified their personal carbon footprint or do they continue to enlarge it, like Al Gore or John Kerry? These seem like prudent questions and objective analyst might have. Lastly if some one is blaming human behavior for observed climate change, but have a multi decade history of demonstrably proven false claims of imminent disaster, at what point can a prudent person just say I think the guys are full of sh!t?

I would add in for context, these folks who are blaming the use of fossil fuels as the sole or primary cause of climate change, what other ideas, such as covid origin, government shut down of the economy, trump a Russian agent, etc did they advance? If a person is so wrong about so many things for such a long period of time, who in their right mind would, continue to listen to them, perhaps that is why no on watches CNN any more, but that is just a theory on my part. NO reason to answer, just food for thought to advance some objectivity when it comes to who folks listen to, where they get their information from and always ask, what are they NOT telling me?

To keep this oil related I think now it is abundantly clear, when push comes to shove politicians will dig up the last clump of the dirtiest coal on earth if it means keeping their jobs….so to me this all just BS. nat gas it the future for the next 2 decades take it to the bank.

TTT,

‘natgas [is] the future for the next 2 decades’

Couple of years back, you were amazed that an AB well had a 24 hour IP of 60 million cubic feet.

There are numerous wells that flow over 50 million first month, and dozens that flowed over over 40 million cubic feet for several months.

Top well – the Deremer 2HC – is now at 26.63 Billion cf at the 3 year mark … still flowing 12 MMcfd.

(In oil terms, this is 4.6 million barrels of earl, flowing over 2,000 bbld).

Of greater note, perhaps, is the ever increasing fairway for productive wells – both geographically and below ground.

Recent Tioga county wells – both Marcellus and Utica – are showing near-Susquehanna-like output.

Well north of Pittsburgh, XTO has a pad with 4 Marcellus wells a few years old totalling ~30 Bcf output.

They brought online a Utica well a year ago that is now at the 10 Billion cf mark.

Over a century’s worth of natty in the AB … not even considering the Upper Devonian horizons.

Gar. Own. Teed.

https://www.zerohedge.com/markets/china-becomes-worlds-biggest-lng-buyer-flurry-long-term-deals

The guy who led the investigation that cleared Trump of collusion with Russia was found to be working for Russia.

Do a search for Charles McGonigal

Texastea,

Yes questions are answered.

Try reading.

Dennis, let me first thank you, Ron and Ovi for the work you do to keep the blog up. As i wrote to you privately, from time to time i do get some actually valid, correct and actionable information here and I am grateful.

But there is really no reason for you and I to cross swords, now or the in the future. I have not seen a single actionable idea from you or any of your conclusions since I started reading this blog 10 years ago. While I applaud your growth in at least understanding in a small way, the economic impact of resource development and production and all that entails, it is clear to me you took the blue pill and liked it so much you went and got a prescription for more. From your thesis on global warming, on how advanced industrial economies will be run my windmills and solar panels, to debt does not matter and that the US government debt is not rising exponentially, left me with the conclusion you really have no clue about the real world.

And what I mean by that is, I work as a private business owner, where my credibility and reputation is my biggest asset. Decades of peer review of my work speaks for itself. If I was ever caught deliberately falsifying data like the IPCC, my career would have ended immediately.

There would be NO one out there defending me.

In your field, holding and advancing historically proven false conclusions is no shame. In fact, based on my observations, the bigger the lie or exaggeration of any idea the better ones career

becomes. That only works in academia or in the government and now sadly big corporate media. So I wish you all the best, but you are not somebody I will listen to on any subject visited on this blog. In the event this gets me banned again I hold no grudges, banning people with correct but dislike opinions and ideas seems to be the rage these days. 😉

Texastea,

Believe what you wish, it matters not to me.

I deeply believe D Coyne is a secret government agent . He is here to discredit peak oil and all the ramifications of it’s inevitable peak. Don’t you guys find it strange how he goes extremely out of his way to contradict anyone with valid points and and especially people who have worked their whole lives in drilling and production. Who in their right mind would keep this blog going for so long without getting paid. How much is the government paying you ? I hope it’s worth it and you are able to sleep at night.

Raul,

Nope. I get paid nothing. Though comments like this might end this blog.

Raul,

The absolute worst way to cover up Peak Oil would be by hosting a website call “Peakoilbarrel.com”

I am a big fan of Dennis’s work and frankly he takes too much shit.

Who cares if someone tries to model a forecast and you don’t agree with it?

Raul,

In this case I am challenging Texas tea on his incorrect beliefs on climate change. If you believe that my support for what mainstream scientists believe makes me a government agent with some top secret agenda, well that is just comedy gold.

Not sure if you have noticed but nearly all my future scenarios have crude oil peaks followed by decline. As to whether my guesses about the future are correct, we do not know, most of my past predictions have had the peak too early and/or too low. The one exception is 2020 output that I was predicting in early 2019, I did not anticipate the global pandemic in advance.

Chart below is a model from 2012, my best guess was between the low and medium scenarios on the chart below. Note that the higher of the two scenarios had a lower peak of 80 Mb/d compared to the 2018 peak of 83 Mb/d, my guess would have been perhaps a peak of 77 Mb/d in 2016. Or if we saw an undulating plateau, it might have lasted many years at 74 Mb/d.

See

http://oilpeakclimate.blogspot.com/2012/07/further-modeling-for-world-crude-plus.html

Over time as tight oil became important and as I improved my modelling for both tight oil and oil sands and did separate models for conventional oil and unconventional oil, the model has changed. There are some oil men who believe my scenarios are too optimistic and others that believe my scenarios are too pessimistic, both groups are not likely to be correct. I adjust my thinking as I learn more and get more historical data.

“I deeply believe D Coyne is a secret government agent . He is here to discredit peak oil and all the ramifications of it’s inevitable peak”

I bet also you think that trump is a trustworthy person, or that the moon landing was actually a TV production hoax.

When I see the name Raul, this is who I think of

https://youtu.be/Iw7q7j0nH_8

Schitt’s Creek is trending on twitter

” This crap in Ukraine could be over in one day, if the world told Mr. Putin that they were going to cut his ass off from regular commerce,”

We know about the Nukes.

The Russian’s could also sink every commercial naval vessel on the planet with their submarines. Imagine the Insurance implications if a few are sunk.

They also have the ability to blow up Satelittes and cut underwater sea cables ( the internet? )

It would be a suicide mission for sure.

I’ve counted 3 or 4 pipelines exploding since Nordstream. Could Mr. Putin be making life difficult on purpose?

Plausible Deniability

(I am not sure how common it is for a pipeline to explode thru technical failure vs sabatoge?)

Gerry,

Of course climate has changed significantly over billions of years, homo sapiens has only been around for the past 300,000 years (see https://en.wikipedia.org/wiki/Human ) so climate during that period is of greater interest. Over most of that period global average temperatures were -4 C to 1 C around the 1961-1990 average global temperature. Humans and much of the global flora and fauna are not likely to adapt well to global average temperatures that might rise to 2 or 3 C above the 1961-1990 global average temperature. Most biologists agree on this. See

https://www.ipcc.ch/report/ar6/wg2/

Gerry Maddoux,

Climate change is real and is occurring much more rapidly than most periods in the past, a possible exception is the major asteroid strike roughly 66 million years ago. It may become a problem that many species may not be able to adapt to, in any case fossil fuel will deplete and become expensive as this occurs so we need to find alternatives, that will be both cheaper and less damaging to the environment. For electricity production in many places with good resources wind and solar are already the cheapest option, as we build out battery, synthetic fuel, hydrogen, pumped hydro and other backup options the system will provide better service, in the mean time natural gas, coal, nuclear, and oil can provide backup.

As the EV fleet builds out and becomes more competitive, prices for EVs will fall and most consumers will choose EV over ICEV. That is how I see things unfolding, but this will occur over the next 15 to 20 years. This will reduce the problem of oil depletion and fossil fuel depletion in general while also reducing carbon dioxide emissions. The faster such a transition occurs the lower the impact climate change might have, though as George Kaplan correctly points out climate change may happen more rapidly than the mean projections of the IPCC.

Denial of reality is a form of willful ignorance, particularly for someone who is literate and has access to all sorts of information.

The thing that people fear most on energy is that there will not be enough to continue on with the big human growth story, as if it would stay noontime for ever.

Well, I am sorry to break the news…there are two interrelated problems with fossil fuels.

Both fossil fuel depletion and greenhouse gas warming are going to force the party to wind down in a big way.

We can pretend it is just not so, but that is ineffective and a delusion.

There is a small positive spin here- both of these big fossil fuel related problems can be offset a bit by a similar set of mechanisms.

A bigger message is that contraction of the human enterprise is really the only cure for overshoot.

TWO PEAS IN A POD… Global Oil & Major Gold Discoveries Have Collapsed

I’ve shared information to subscribers on my website and in video interviews that Energy Has Been The Main Driver of the Economy, While Gold & Silver have been the Store of Energy Value for the past 2,500 years.

What took a massive amount of trees to make charcoal to smelt gold, and silver during the Roman Empire was the leading factor that gave the precious metals their function as MONEY & A STORE OF ENERGY VALUE.

Why is Fiat Money not a Store of Value… because the ENERGY COST to make Paper Bills is pennies on the Dollar vs. the $1,550 it now takes to produce one ounce of gold.

Regardless if anyone believes the information above, but it sets the stage for the following two charts.

The First Chart is the collapse of Global Oil Discoveries and the Second chart is the collapse of Major Gold Discoveries.

,b>Peak Oil and Peak Gold mean, Fiat Money will, in time, not be worth the paper it’s printed on…

GOD HATH A SENSE OF HUMOR.

steve

And now the Major Gold Discoveries…

Average Exploration Cost Per Oz (Inflation Adjusted)

1990-1995 = $75 per oz

2016-2021 = $1,420 per oz

The World isn’t prepared for what is coming. 🙂

steve

This one’s for my buddy Steve,

“ExxonMobil made its first world-class oil discovery in Guyana’s territorial waters in 2015. Since then, the energy supermajor has made over 30 high-quality oil discoveries in the 6.6-million-acre Stabroek Block which Exxon estimates holds at least 11 billion barrels of recoverable oil resources.”

https://oilprice.com/Energy/Crude-Oil/Guyanas-Oil-Industry-Is-In-For-A-Stellar-Year.html

Remember Exxon Steve ? You had them filing BK less than 2 years ago.

Hey Steve,

Question for you: what are your thoughts on holding $PHYS in a reg brokerage acct? Wise if SHTF? While I know holding physical is always the way to go, there comes a point where one starts getting wary about having too much in the house.

Thanks,

Tom

Tom,

While many in the precious metals community believe that the Sprott PSLV and PHYS ETFs are the “SAFER” investments, the only real place for Large Institutions to get exposure in gold and silver are on the large ETFs like GLD, IAU, and SLV.

If someone is going to invest in a Gold or Silver ETF, and is looking just for metal gains, I don’t see much difference between them.

However, it’s probably the wisest to own some physical metal stored either at one’s home in a safe or in a private vault facility. Those who have larger investment funds, should like to diversify their metals portfolio in ETFs and Physical owned.

steve

Looks like a bumpy plateau. But if US peaked the world peaked.

Svaya,

Not likely that the US has peaked. Tight oil scenario below assumes oil prices rise to 90/b in 2023 and then gradually to 110/b from 2026 to 2030 and then decline as transition to electric transport reduces demand for oil. tight oil output grows at about 5% per year from 2023 to 2026 and then slows to zero in 2028, followed by decline.

World peak expected in 2028 if World URR is roughly 2800 Gb (Lahererre et al estimated about 3500 Gb World C plus C URR in 2022). In the past Jean Laherrere has been conservative in his estimated for World URR (in 2018 he estimated about 2700 Gb).

Thanks Dennis. I have a suggestion to consider for the decline phase of your projections-

Electric transport, even if wildly successful in deployment over the next 20 years (your chart timeframe) will only offset at most 1/2 of current global crude oil demand, and perhaps closer to 1/3rd offset.

The rationale here is that

-not all transport will be electrified

-the non-transport uses of crude derivatives are growing in proportion of total production over time as more and more countries industrialize and the absolute purchasing power of humanity grows (for the time being).

-Over the next 20 years it is debatable just what fraction of the farm, mining, forestry, fishery, air transport, cargo transport on the ocean, and military fuel use will be offset by electrical mechanisms

-the population is growing, with more than 1 billion more people over this short timeframe

[“Road transport consumed more than 40% of all oil demand in 2019”, “Road transport is responsible for 50 percent of oil consumption worldwide”,]

The big wild card on oil demand will be the trend of global purchasing power. I’m sure there are over 7 billion opinions on that.

The world’s population is more than three times larger than it was in the mid-twentieth century. The global human population reached 8.0 billion in mid-November 2022 from an estimated 2.5 billion people in 1950

~ UN

Electric vehicles and heat pumps are low hanging fruits in the energy transition. It is impossible that industry output will not shrink substantially due to fossil fuel shortage if the time horizon is long term enough.

The good news is that we could get by with less concrete, steel, advanced materials and products to still cover the most pressing needs with something resembeling the current economic system being largely intact for probably a few a decades. With emphasis on could. There is also the perspective that a lot of heavy infrastructure costs can be taken upfront and last for a long time. The commercial shipping fleet of a bit more than a 100 000 ships will be able to serve global trade for a long time, even if levels of conflicts are on a higher level as fewer ships would be needed anyway.

There are probably more natural gas resources left around than oil; and we are going to need it to balance electricity generation and the more secondary objectives, but still important, being heating and industrial usage.

As for these words having anything to do with oil. It is of critical importance that we actually get a long tail of oil production fat enough for many decades (next 50-100 years), being the most flexible and a very dense energy resource. An objective is to get oil usage down to 20-30% of what it is now pretty fast and try to hold on to that tail. It could be obliterated to a too low level for future generations, which would plesant at all. Not very likely that the current BAU system would cut oil production fast enough due to human nature some would argue. If the total energy system is robust enough and we don’t get a geopolitical collapse (which very much can happen, at least in the more distance future), it should be possible to keep the system going for the next few generations. A smaller version of it. Which is the time horizon that matters most I would think (at least for me).

Hickory,

Note that for World output things are a little different. The scenario below uses the tight oil scenario above. Output falls to about 57 Mb/d by 2050 and to 46 Mb/d by 2060, most of C plus C is used for land transportation, if oil becomes very expensive less will be used for air transport and water transport and there will be plenty if needed for farming and mining, potentially this can be replaced with synthetic fuels produced with excess wind and solar output in the future.

Thanks Dennis. Really appreciate your efforts to shine a light on all this.

If production holds at/above current levels out to 2033 as the chart shows

then the global economy will be very fortunate in that regard.

10 years gives plenty more time to prepare for the inexorable decline to follow.

In fact a pretty big proportion of the current global ICE fleet could scheduled for an appointment at the recycling yard over that time frame if people decide to see whats coming.

I know that many people in oil rich countries don’t see much of an issue with oil depletion- its someone else’s problem…in the future.

Have no doubt that for the majority of the worlds people who live in oil importing countries the scenario looks different.

Just about everyone in a country like the US has come to view the past 70 years as normal- where most workers could afford to own a large personal vehicle that has a very inefficient engine and a tank big enough to get 3-600 miles of range.

Well, that isn’t normal folks…its an aberration in the history of humanity. On this earth that ‘luxuriant’ culture of transport will be a passing moment during peak Holocene, for most people.

We will still all get around, but miles traveled by motor are going to much more valued/valuable/appreciated (and paid for) in the next phase of history. There will be a growing financial incentive to live most of your life a lot closer to home- work and leisure.

Regardless of belief.

That bulge doesn’t look like anything from the past

Svaya,

US C plus C output centered 12 month average

July 1966 to December 1975

I’ll take the under on this one. 8500 max.

Tom,

We are pretty close to that now, we will see. US tight oil output was 8143 kb/d in November 2022. The rig count has come down a bit since November, but not enough to flatten output in my view. The US horizontal oil rig count 4 week average fell from 570 at the end of November to 563 for week ending Jan 20 (about 1.2% over 1.75 months.) The horizontal oil rig count remains above the monthly level of all months of 2022 prior to November. For 4 major tight oil basins (Bakken, Eagle Ford, Permian, and Niobrara) the horizontal oil rig count has been pretty flat since November.

I thought better to post it here . Time Bomb . Rolling over debt from 0.5% to 4% or plus . HHH , what is news on the junk bond market . Update please .

Leverage works great on the way up. But turns into a real bitch on the way down.

Those who are lending money. Or buying junk bonds are doing it with borrowed money. Pension funds are leveraging up to the hilt trying to close the gap between what they have promised and what they can actually deliver. Hedge funds and large institutional investors ditto. They are all leveraging up some sort of collateral and buying junk bonds.

Then the companies that issued the junk bonds buyback their own stock shares with the money received from junk bond sales.

Some CEO’s like Elon leverage up their stock shares to buy other companies like Twitter. Not saying Tesla is a junk bond. But the same stuff goes on in highly rated corporate debt as does in junk bond world.

What could possibly go wrong here?

Why not buy US treasuries where yields are currently instead of chasing yields in corporate debt? It would be a whole lot safer.

Why even fund shale oil in this environment? When you can buy treasury debt yielding between 3.5%-4.8%

There are a lot of junk bonds that won’t be rolled over.

I think the treasury yield curve and Eurodollar curve are kinda saying loudly that what is ahead is bad.

Medicare and Medicaid cost the USA 2 Trillion dollars last year. That number is growing at 9% per year and is being driven by the underlying medical industry and it is embedded into the system.

Why no one is talking about this is baffling? But peak oilers can relate. No news is good news!!

The Healthcare industry is 20% of GDP ( 1 out of every 5 dollars is spend on medical in USA) .

If you try to change Medicare and Medicaid you just shift the problem to citizens that can’t afford to pay.

http://www.market-ticker.org.com ( Karl Denninger is the expert on this).

Karl said he presented this infomation to a bunch of politicians / congress critters. He said they understood but don’t want to touch it with a mile long pole.

Lot’s and lots of things are not going to get paid back once the medical system collapses and hopefully recovers to a sustainable 4% of GDP.

Not if…WHEN. Either the government collapses, the citizens go bankrupt or we destroy the medical system and start over.

Rapid deflation is a bitch. Might be best to sit in cash as that grows in value during deflation.

My POV on Karl Denninger . A real maverick , not an a**hole as the fraud John McCain . Karl’s advice on avoiding sugar and carbs has done wonders for me . His analysis on finance are terrific , unorthodox . Unfortunately he is a PO denier , but I can live with that .

P.S : The last I drank a cola was in 2011 . Pizza 2009 .

Karl will push your buttons. He will draw some strange conclusions sometimes (Climate Change denier and he is a birther – the absurd Idea that Obama is not an American citizen ).

But he is great on other topics.

He denies Peak Oil because he thinks the USA can convert coal and kerogen to oil. His definition of Peak Oil is very USA centric.

He thinks we should have Nuclear Based CTL facilities in USA.

Karl has created an echo chamber. Any post that is not in total agreement with the site’s consensus will lead to a ban. Occasionally he has good observations ( although by no means unique – like the one you mention that one should not eat processed, sugary foods) but there is no original thinking. He loves being sucked up to by his regulars.

I think that after his tea-party push ended he’s been kind of directionless.

Rgds

WP

Weekend Peak,

Karl founded one of the first internet companies in Chicago (MSCNet) on the planet and the political Tea Party. Some argue he was part of creating the internet ( Pretty good accomplishment in my mind)

To his credit, he abandoned the Tea Party after he said it was hijacked by NUTTERS.

He sits around blogging and researching all day cause he doesn’t need to work for money.

The first few days of giving up carbs and sugar is a bitch. You are going thru an addiction withdrawal.

But after that it is great. You lose weight without excercising. You feel better.

I stopped drinking sodas and eating candy and haven’t had a cavity in decades. It was the sugar that was causing them.

We are hunter gatherers who ate meat (including the fat) and green vegetables. Our bodies are efficient at processing those.

We did not evolve drinking Coca Cola and eating ice cream.

You look at anyone who is seriously overweight and I guarantee you they are consuming lots of sugary drinks.

It is that simple.

Copy/paste from OFW . The math is never wrong .

Duke of oil

My wife and I homeschool our 13 yr. old granddaughter. I recently saw a graph showing the U.S. federal debt. When my granddaughter was born in 2009 the debt was $9 trillion (round numbers). Today it stands at around $31 trillion.

Because my granddaughter knows how to calculate exponential growth, I gave her the numbers and asked her to calculate the annual % growth in the U.S. debt since her birth.

After a minute or so of calculations she told me that it was a 9.5 % annual increase.

Wow!

If you apply the “Rule of 70” (70 divided by the annual % increase gives the doubling time). Dividing 70 by the 9.5% gives just over 7 years until we would reach $62 trillion of debt!

This makes the 2.3% annual increase of “Gigajoules of Energy Per Capita” (see Figure 1 in Gail’s current post) look rather benign. Not really. If something continues to grow at 2.3% a year for a century then the final quantity will be 10X what it was initially.

Draw your own conclusions.

Loading…

Reply

Dennis

A lot of good work trying to predict the future oil production.

The STEO has a demand side also and I think you should be posting a chart similar to what is attached. I am not sure if it is possible to sort out demand for C + C. The attached chart is just the result of subtracting all liquids supply and demand.

Based on this EIA data, I find it difficult to believe that eight months of the year will be showing surplus oil supply. Maybe the surplus could be more associated the NGPLs rather than C + C

The problem with projecting surplus/shortage in the future is that it makes no allowance for the actions of OPEC , all of the surplus quantities shown above can easily be erased by OPEC adjustments to their production rates. For the time being, they have the world right where they want it, and that will not change until they no longer have capacity to match demand.

Old Chemist

That is what alarmed me about this chart. OPEC has already announced their cutback and the chart is showing all of that surplus. Where is it coming from? Also more Russian sanctions are supposed to start in February.

Ovi,

I think the EIA is assuming that U.S production will over counteract all the declines from Russia and OPEC. EIA projections are beyond a joke in my opinion. They make 1 assumption and base an entire forecast on that.

I think EIA projections are based on GDP growth, not on geology. GDP will increase by some amount, and that means demand will increase by some amount, and supply will increase to meet demand.

Alim,

Maybe, but that assumption is likely incorrect. If the world gets positive GDP growth there is no guarantee supply will meet demand. OPEC might choose to give demand the shaft and cut or keep production steady. Hence their forecast in my opinion is useless.

Alimbiquated

I agree with you that the EIA model is based on GDP growth.

“Maybe, but that [EIA] assumption is likely incorrect. If the world gets positive GDP growth there is no guarantee supply will meet demand.”

Yep, but consumption will match production.

Will a shortfall in production relative to demand restrict GDP?,

or perhaps I should ask when?

To be clear, i don’t think the model is very good. I was just explaining how I think it works.

Ovi,

A good idea thanks. We don’t have great demand numbers from the EIA so it is more difficult to estimate World C plus C demand, we could possibly deduct NGL from total demand for rough estimate.

Ovi,

Actually the EIA does not even have a specific demand estimate (refined products output after 2014) so we would need to us data from BP to estimate demand (that data exists up to 2021). EIA model uses a combination of price and GDP in its short term forecast, though price might be an output rather than an input to the model (with price being determined by the balance of supply and demand).

Ovi,

I double checked that and I was wrong, there is annual consumption data for the World.

Dennis

First off I think the prime focus should be 2021 to 2024, just like the EIA.

I am not sure that BP data can be used against EIA because of data consistency. Another choice would be to do EIA all liquids and compare it with OPEC supply/demand. Since the EIA data comes before OPEC, that comparison could be done in the OPEC report.

Ovi the STEO has data from Jan 1997 to Dec 2024, so it is not clear that the EIA focus starts in 2021.

From STEO

https://www.eia.gov/outlooks/steo/data/browser/#/?v=30&f=A&s=0&start=1997&end=2024&map=&maptype=0&ctype=linechart&linechart=~PATC_WORLD

Harbor Energy cutting jobs because of U.K. windfall tax:

https://energy.economictimes.indiatimes.com/news/oil-and-gas/harbour-energy-to-cut-jobs-due-to-uk-windfall-tax/97118033?redirect=1

Hickory: “Denial of reality is a form of willful ignorance, particularly for someone who is literate and has access to all sorts of information.”

If this statement was meant as a rejoinder to me, then it is misplaced. I am sometimes ignorant, but never willfully.

And on the subject of energy, I don’t believe I am ignorant, just pragmatic. The same goes for global climate change.

I have looked pretty carefully at electricity, because really that and the production of petrochemicals and food is what this all comes down to. People don’t do well without electricity. And since the advent of manmade electricity–only about 150 years–well over 75% of electricity has come from the spinning of a fossil fuel powered turbine. As an end-product of natural gas, CO2 fixing with atmospheric nitrogen (the Haber process), there is no replacement for ammonium nitrate fertilizer, without which there will be insufficient food.

Pascal said, “all men seek happiness.” You can’t be happy if you’re freezing, or burning up. And you can’t be happy when you’re starving, or doing without medications. In a nutshell, you can’t take 8 billion people and tell them they’re late to the party and they’ll have to make do.

You talk about willful ignorance, I find it ridiculous that we’re using corn as a biofuel when 13-million kids live in food-insecure homes in America–and God only knows the count in the world. I find it equally ridiculous that there is such a tremendous shortage of nitrogen-based fertilizers that the hunger problem is going to get worse, not better. And no, the fertilizer problem isn’t entirely on Putin–plants have closed across the U.S.

I am not a very religious man, but I am spiritual, and I believe wholeheartedly in the basic goodness in mankind, and also the basic badness. The human spirit strives for happiness, just as Pascal said. When a group of very elite people–call them the upper .0001%–are jetting around in $50M Gulfstreams preaching the gospel of sudden climate change to a group of people just trying to survive, it’s not going to end well. A few years ago, I bought Richard Branson’s book on climate change and the new world. He stated in it that he’d flown over a million miles in his jet the previous year. I find that sort of arrogance absolutely astounding!

In fact, this growing dichotomy will probably result in war. Because that’s what people do when they’re panicked and angry and hungry and impoverished. Note: I’m told that war is really is bad for the climate.

” I am spiritual, and I believe wholeheartedly in the basic goodness in mankind, and also the basic badness.”

That qualifies as “willful ignorance” for me

Gerry- “this growing dichotomy will probably result in war. Because that’s what people do when they’re panicked and angry and hungry and impoverished. Note: I’m told that war is really is bad for the climate.”

This brings up what to me is the biggest point in the fossil fuel peak story- the high risk for loss of stability in parts of the world that have it now.

The dichotomy you speak of is not about the “very elite people–call them the upper .0001%”, however.

The dichotomy will primarily be about those who are going to be energy ‘haves’ vs those who are ‘have nots’.

And secondarily those who are displaced by flooding, drought, fire, and poverty vs those who are not.

It is a fallacy to think that if you are fortunate to live in a place with relative safety and abundance, that what happens to 5 or 6 billion others won’t be a problem coming to you. And that pertains to global warming affects as well as to energy shortage with its economic and geopolitical instability fallout.

There are all kinds of people in various states of denial about these things. Right, left, and drifters.

I couldn’t agree more.

So far, the net effect of hysteria and the total lack of a coherent energy policy has resulted in a shocking increase in the consumption of coal. When Boris Johnson prepared his talk for the global warming conference in Scotland, he used lamplight powered by coal. Or at least the coal utility plants were started up at the time. Cheap coal, too, not the good stuff. Does that not strike you as paradoxical?

And there is a massive waste of “stealth” energy. For example, the electricity used to power the cloud has been estimated to be equivalent to the amount that would supply 6.4 million homes in America. Multiply that for the globe. I’m not entirely a Luddite, but I would suggest that the price for that is much too low. And that as the population grows, it can’t be sustained. Bloomberg–not exactly a conservative place–estimated that the cloud takes up 1% of electricity in America. Wow! Just frigging wow!

I don’t have a problem with very rich people doing whatever the hell they want to do. I have a problem with them subverting the system, making massive profits on things like the computing cloud, and global travel via private jet, whilst lecturing the rest of the population about global climate change.

True, but we shouldn’t be surprised to see coal relied on heavily wherever people don’t have other forms of energy available. And a lot of the coal still readily available in many locales is lower grade as you indicated.

And if not coal, then wood. 8 Billion people can take down the residual forests very quick , if it comes to that.

Wasted or optional energy- absolutely. Add to the list cryptocurrency and much of the ‘traditional’ financial industry, data centers, much of the global leisure industry, and the big one- internal combustion engines which waste roughly 60-80 % of the energy content of fuel fed to them.

On ‘coherent energy policy’, and the excesses of the ultra wealthy, there is a hell of lot to say on these things. I’m going to hold my tongue for now, other than to say that both sides of the political spectrum can have some very legitimate points to make on these subjects, at least worth listening to.

When discussing the cloud, remember the electricity used to power that would be switched over to on premise servers instead. I suspect that would consume about the same electricity.

The problem with cloud is that you don’t know where your data is stored ( Is it in India? China? Mexico? )

Can I get it back?

What if the cloud host (Amazon Web Services) goes bankrupt?

How do I know the governments of those companies haven’t stolen the data? it would be easy to do!!

Having worked on some cloud projects, if you want to cancel you might have to pay extra to get your data back!!! And they probably keep the backups…but you would never know.

Wrong website for this discussion

KIA boss says EV’s are unaffordable . Coming from a guy who has a ” skin in the game ” .

https://notalotofpeopleknowthat.wordpress.com/2023/01/23/affordable-electric-cars-not-viable-kia-boss/

As of Oct Kia is having trouble meeting demand- “The Kia Niro EV now has an average wait of nine months for delivery”

And they are not unusual in this.

Peak gasoline?

~ https://adamtooze.substack.com/p/lebanese-inflation-iwo-jima-how-the

George

You have railed many times about the export of US Crude. From my perspective, I think the bigger issue is the over production and export of NG and how the market has reacted by collapsing the price by 65% from 9.71/MBTU to 3.38/MBTU.

I would agree that some of the drop is due to reduced European demand. However I think the more recent drop from November is due to US over production. Are the producers still making a bundle of cash at $3.40/MBTU

Ovi,

Re ‘are producers still making bundles of cash …?’

The fourth quarter of 2022 presentations/conference calls will be forthcoming in a few weeks and an answer to your question may become more clear.

Prior to the inflation push starting in early 2022, the cost to drill, complete, transport and process gaseous hydrocarbons in the Appalachian Basin was in the $2.50/mmbtu – range (essentially per 1,000 cubic feet).

Widespread claims of ~15/20% inflation will increase that threshold, with longer term contracts possibly offsetting the expenses somewhat.

The upcoming projected development plans will reflect just how economical (or not) these low prices affect the bottom line.

The oil drillers face a different set of parameters and may be able to receive lower gas prices – generally speaking – than the natgas-focused operators.

Ovi, the temporary closure of the Freeport LNG plant which accounts for 2bcf a day when operating, as well as the near record (I think 2nd) warmest US January on record accounts for much of the decline in nat gas prices.

https://www.naturalgasintel.com/freeport-lng-seeks-approval-to-begin-restart-of-2-38-bcf-d-facility/

If ‘George’ is me then I have absolutely never railed against US oil export (if not me then ignore the following). Groups like XR and Leave Oil would like it to become a stranded asset, but oil is far too much a magic molecule for any to be left in the ground if it can be produced economically, which is why EVs are worse than useless as a means to tackle climate change.

I don’t know all the economic arguments but the US refineries are not designed to handle the light tight oils so the buyers effectively have to swap light cargoes for heavy imports, otherwise production would have to be constrained. I think there have been some Fox News types arguing for leaving the oil in the ground for later generations, the king in Saudi said something similar for the reserves there, but I don’t know how the global economic and political set up would allow that to happen. It would really require some kind of autarky in the USA, which normally can only happen under extreme socialist or fascist regimes.

The whole of the history of oil and gas is characterised by boom and bust cycles with over production alternating with under investment, so I don’t think the recent LNG issue is anything new.

Sorry for the long reply, I doubt many got through it all.

George

The question was meant for you but clearly I have the wrong guy. My apologies.

It could be that my question should have been directed at Mike?

Ovi,

I think Mike the oil man from Texas is concerned about US exports of crude oil, I think he has said it is ok to export to Canada and Mexico, but thinks it should stop there, though I may not have correctly understood him.

Mr Coyne , Mr Shellman never ever said anything about exports to Canada and Mexico . Period . His lament is that USA is exporting oil that should be conserved for the coming US generations . Yes , you are correct — I may not have correctly understood him.

P.S : No apologies needed . This is , what in accounting is called ” an error apparent on record ” ,

Hole in head,

As I recall Mike said in a comment to Ovi that exports to Mexico and Canada were ok as far as he was concerned.

Ovi might also remember this exchange with Mike.

Possible that I misunderstood.

Dennis

I think you are correct.

Now that George has replied, I think Mike is who I was thinking.

Indeed, I am an outspoken critic of tight oil exports from Texas, where ALL of US oil exports originate. My opposition to tight oil exports is based entirely on a probable future of scarcity and not being able to predict, precisely, when wind and solar will replace fossil fuels. I believe in conservation of natural resources and saving for the future. As an actual Texas oil man for 60 years I know, first hand, what NOT saving for the future results in.

Mr. Coyne is correct, I have, in fact, suggested that towards the end of the fossil fuel era it will be a gang fight. Us against them. The West, against all others. OPEC has now aligned itself with China and the East. Google it. Work at it, you will agree with me. Its serious shit. When we run out of Wolfcamp tight oil, not if, we will be at the total disposal of OPEC to hep us. They are no longer our reliable source for future oil.

WTF are we doing then…exporting OUR oil away?

Canada has something to give back for US LTO exports. So does Mexico, and the rest of South America, particularly Venezuela. The oil they have in the ground is the kind of oil the US needs, desperately. They are our neighbors. The quality of oil being produced, matters. It matters way more that volume.

I am not a Fox News whatever. George Kaplan is full of shit. I am, after 60 years IN the business, with my own money, worried about depletion. And, forgive me, I put America first, over fucking England. Or Singapore, Or Rotterdam.

Sue me. Your legal basis will be that I am a socialist, or a fascist (?), because like Mexico, Venezuela, or the KSA I have suddenly decided giving my country’s remaining resources away is not a good idea? That I would rather care for my own family, than yours?

Good luck with that.

All importers of US tight oil feel the same way Kaplan does…gimme, gimme. It is, afterall, America, and we have it to spare. We can print money with the best of ’em, and produce that tight LTO shit until the cows come home, regardless of economics. It’s only money. And debt means shit to America. I have hunyeds of visitors to my blog from all over the world and they EXPECT America to deliver, until it can’t anymore. The idea that these countries are our allies, and will put troops on the ground to support the US, is beyond stoopid.

Oil and LNG exports sounds EXACTLY like the trillions of dollars of aid we give to every dickhead in the world, right? Because we ARE America.

Phfttttt.

By the way, Ovi is spot on… the tight OIL industry can’t keep its credit cards in its purse so it continues to drill oily gas wells wells. It can’t hep itself. Overproduction of…gas, in America (it’s not a world traded commodity, gas) IS driving the price down. Dumb bastards, tight oil.

I love how TT and CG (?) like to think its because of market hiccups. Yeezaww! Its entirely because the sector they so desperately cling to… is stoopid.

If you are going to rail on me for this comment, grow a pair, and use your own name. Did you copy that, HB? TT? I can use crayons if you need. In other words, I want to check you out, see what kind of oil man, or oil woman you are, where you get your money, and how. If YOU have any “cattle.” It’s only fair, right? Everyone can know exactly who I am, where I’ve been, and where I am going. I am just a junky ass stripper well operator, a small farmer from the American Midwest. What I MIGHT have done 40 years ago does NOT make me who I am today; it does not mean I know Jack about oil and gas. What I am doing now, in real life today, not on the internet, does.

Mike

Sorry to get you confused with George. Pls accept my apologies.

While I appreciate and agree with your perspective on keeping these precious resources, I have to wonder where the price of oil would be today if the US limited the amount of oil it exported. The US typically has net imports of close to 2,000 kb/d.

The US is in this difficult position of deciding whether to keep some oil in the ground and make up the demand deficit by importing more or producing it internally. Reducing internal demand by letting the price of gasoline rise is clearly a NO-NO.

Here In Canada we have a government which is putting obstacles in the way of new oil and gas developments due to CC. I suspect 10 years from now when these resources are in short supply in the world the government will be saying “Weren’t we Smart?” On looking back, how many will realize that a good decision was made for the wrong reason. Ottawa and Alberta are at war over the Feds oil and gas policy.

When I posted the NG chart two days ago, NG was $3.40/MBTU. Today it is $2.81/MBTU. When do the driller wake up?

Thanks Mike,

Just to make sure I understand you correctly, you are saying exports to North and South America are ok, but not to Europe or Asia, do I have that right?

“Did you copy that, HB?”

Shellman, there are somethings in you comment I can agree with you, Oil depletion has been on my radar since 1973 sitting in a vehicle in line for hours waiting to fill the gas tank. I understand the importance of oil to the economy. I believe almost all Americans are wasteful with such an important limited resource. Don’t that go to your head, there are other more important resources like air and water. Maybe your even a little at fault and the industry you love, because you have made it to easy for Americans to be so wasteful over the past years, all in pursuit of the all mighty dollar. Your love for your industry is because of what you don’t know. Just like how every parent has the best child.

I have a deep affection for America also. I just don’t wear it on my chest like you do. It has brought me a comfortable life I don’t think I could have experienced born anywhere else. What I don’t do is begrudge others that who have not been as fortunate as myself. Entitlement because one is born on one side of a political line rubs me the wrong way. I view it as “willful ignorance”.

Comments like the one below are why your not going to find any personal identification information of myself online. I don’t even use a real email address at POB, or use LinkedIn or Facebook.

“And, forgive me, I put America first, over fucking England. Or Singapore, Or Rotterdam.”

You are entitled to your opinion. but your over the top abusive of Dennis is just wrong and uncalled for. The root of it is because of your lack of education of economics and comes across as someone who is insecure. Because you know how to dig a hole, doesn’t make you an expert on world politics and economics. Dennis doesn’t pretend to be an expert on how to dig a hole.

“you catch more flies with sugar than vinegar”.

You seem to like to use the dog shit approach. But I have to admit, I read a lot of your comments. At minimum, there entertainment with your ego chest pounding. If you are truly interested in myself. Don’t assume, ask(nicely). It doesn’t matter if my name is John Doe, HB or HuntingtonBeach. Your just trying deflect from your entitled beliefs. To Mike or Mike Shellman, or whoever you are today. I will always only be HB.

Mike,

Venezuela and KSA both are oil exporters, they do not give their oil away they sell it to the highest bidder, just as US tight oil producers do. If all nations decided to follow your advice tomorrow and chose to not export any crude oil, the US would be short by about 6000 kb/d, this is about 35% of US crude input to refineries so it would be a big adjustment. As far as the 4000 kb/d of tight oil exported in October 2022, it is not likely there is enough demand from North and South America for those exports so output would need to decrease, demand from Canada and Latin America for tight oil was about 568 kb/d in Oct 2022, so if demand did not increase (perhaps there are refinery constraints as is the case in the US) we would need to see US tight oil output decrease by about 3400 kb/d. Also this would take 3400 kb/d off the World oil market and would likely lead to higher oil prices in order to balance demand with supply.

This would be good for oil producers (except perhaps tight oil producers in the short run) and not so good for oil consumers. It would be good for the environment as this policy might lead to oil being left in the ground permanently.

I doubt it will become US policy in the future. Texas could act on its own through the RRC by requiring wider well spacing.

One aspect on this is clear- the USA must either do a huge retooling of the domestic refinery equipment to handle lighter oil,

or do a combination of import/export to arrive at a grade oil that our refineries can handle- as we do now.

The retooling of refineries in a major way is not going to happen in these twilight days of oil production.

So, the discussion of export/import needs to be on a ‘net’ basis

if its to relevant to to the overall situation.

About 15 years ago, the refiners spend billions of dollars retooling for heavy crude expected to come from Canada and Venezuela. Only to get millions of BPD of light delivered to them in their pipelines. With depletion and EV’s in the pipeline now. Their not going to make that mistake again.

Hickory,

Doing the analysis by looking at net imports of crude oil misses the fact that the US has 3400 kb/d of tight crude output that cannot be utilized by US refineries due to inadequate capacity. You are likely correct that this refinery capacity will not be expanded, that is the reason the US changed the law on crude oil exports. Basically a reduction of 3400 kb/d in tight oil output would eliminate US exports of crude and it is unclear how the World would replace this oil supply, it would be a struggle as OPEC is near capacity and would take time to ramp output elsewhere.

Yes indeed Dennis, and that is exactly why when we hear calls to ban oil exports it is a simplistic viewpoint that ignores the refinery reality.

If someone called for ‘no net export’ of petroleum product,

then they would at least be acknowledging some of the more complex reality of the domestic oil situation.

This is a one decade issue in any case.

And yes, a net export ban would be a significant negative ripple on the world economic scene. It would help accelerate the move toward electric vehicles via the basic mechanism of relative price incentive advantage.

“oil is far too much a magic molecule for any to be left in the ground if it can be produced economically, which is why EVs are worse than useless as a means to tackle climate change”

Perhaps, if you mean that someone is going to burn the oil even if an EV driver doesn’t.

Nonetheless, EV’s are an outstanding mechanism to respond to another problem-

Oil Depletion…if people still intend on having the option of affordable travel in the next decade.

And, I’ll point out that the ‘magic molecule’ oil is far too valuable to be wasted on light vehicle transport.

Important discussion to have as we watch global oil and gas volumes plateau. Perhaps our elites and big government should reconsider demonizing the precious resources of Oil and Gas that we have left. Society’s rhetoric is reckless and harmful to many poor humans. This speaker is the CEO of Liberty Oilfield Services and shoots very straight here.

https://youtu.be/iI6EksICMB0

“Liberty” lol. Gotta love the Orwellian names these straight shooters come up with. Discouraging people from wasting precious resources seems like a smart plan to me.

you comment gets extra credits for Random Capitalization though.

It’s the little things that matter Alimbiquated.

Glad You enjoyed my emphasis being placed on very important things! 🙂

You are correct about waste. That is rarely good. The sad part is that poor and starving people are just trying to live. We in the west are causing them great harm by shaming the use of this wonderful solar energy to help them survive. (Oil and gas are in fact Mother Nature’s organic batteries.)

Encouraging oil and gas development would allow for an incremental barrel to exist, even if temporarily in the market. This would lower energy input costs which would in turn lower capex to build out a renewable grid for the future. It all makes sense if you think about it, yet we chose to shoot ourselves in the foot and harm the poorest among us in the process. Unnatural acts rarely end with a good outcome.

Really appreciate yours all other contributors’ comments on this forum!

” Unnatural acts rarely end with a good outcome.”

Well, that pretty much sums up the situation with the human presence on earth, starting with

smelting of copper and tin, or was it domestication of the wolf, or perhaps the gathering of fire, or the use of stones as weapons…take your pick.

btw- I was recently struck by the idea that a female was probably first to use a stone as a tool, about 2 million years ago to fight off an unwelcome attempt at sex.

The right to choose. I support it.

I read Mike Shellman’s note, and the reactions to it. For my own reasons I had decided not to write anything down here again, but then decided to end with this.

You have a pretty good international site here, but man, do you need some real-world experience, titrated by some humility. A fellow who has “dug a hole” barely has a voice. A guy who can “build a chart” is king. And a fellow who–I suppose–lives in Huntington Beach and goes by a nom de plume gets to critique it all, using ninth-grade syntax in a pseudo-sophisticated manner. Are you sure this is the way you want to build your forum?

Mike Shellman is right: when the U.S. runs out of LTO, it’s pretty much over. There is a reason why these guys have overproduced. The CEO’s traditionally were reimbursed according to a production ratio. Even that could have been reined in if we had ever bothered to develop a comprehensive energy policy in the U.S.–and the world. We have allowed a Secretary of Energy to make partisan decisions about which she knows quite a bit less than your average pipe-fitter in Midland.