The Texas RRC Oil and Gas Production Data is out. There appeared to be no decline in December production and may have even been a slight increase.

The Texas RRC data is incomplete and only gives an indication as to whether Texas production increased or decreased. The data appears to droop because each month the the Texas Railroad Commission receives a little more data and the totals increase, little by little, month by month, until after many months the data is complete.

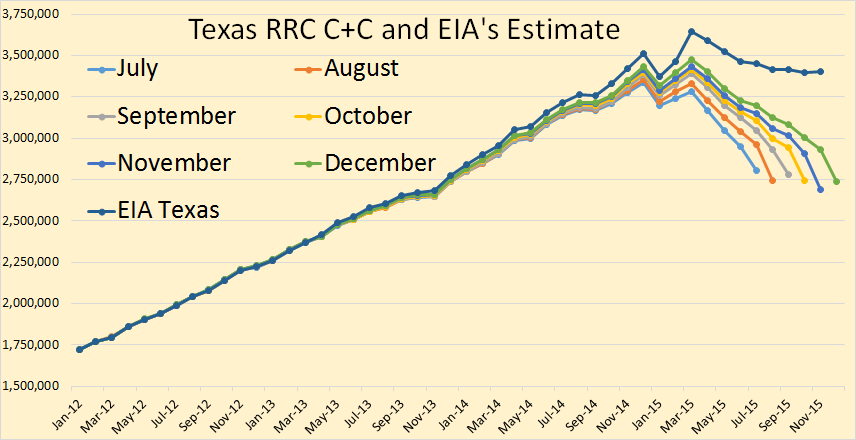

In my charts I post the past six months of data in order to give some indication as to whether production is increasing or decreasing. The final data is through December and the EIA data is through November.

Texas crude plus condensate declined a little in November but seemed to make up that decline in December. Total Texas C+C seems to be on a flat plateau, declining in Eagle Ford but making up that decline in the Permian and the rest of Texas.

The EIA estimates the final Texas data through November. They have Texas peaking in March and down about a quarter of a million barrels per day since that point.

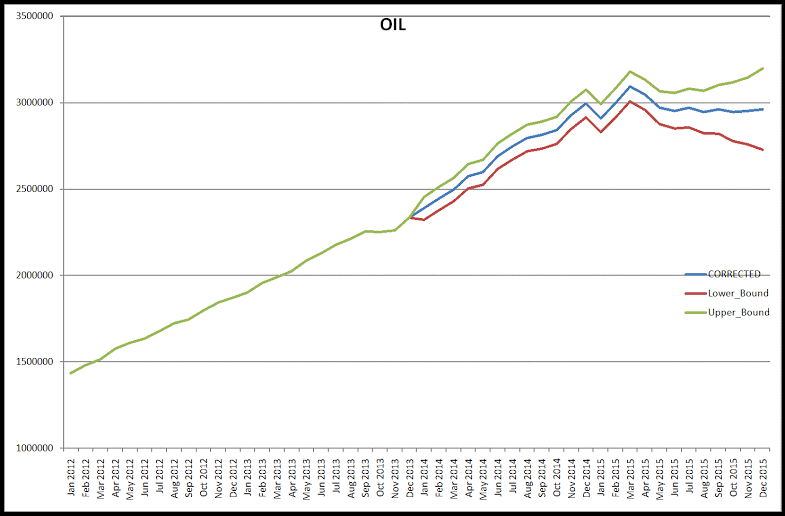

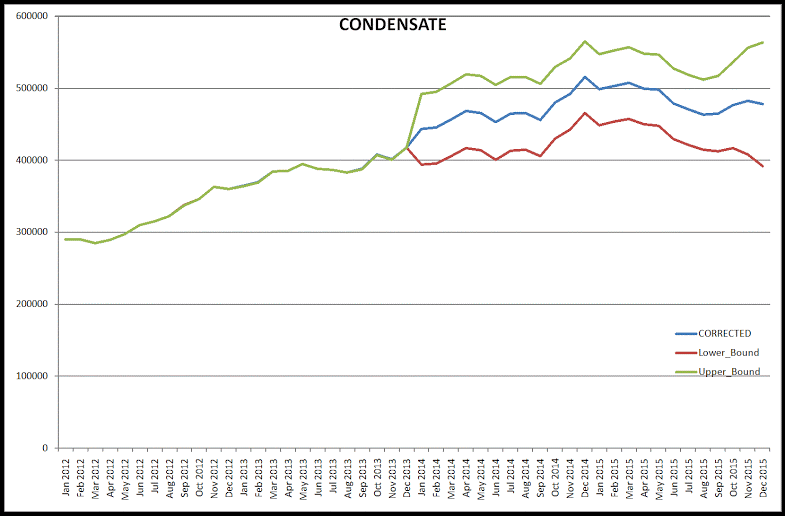

Dr. Dean Fantazzini, Deputy Head of the Chair of Econometrics and Mathematical Methods in Economics at the Moscow School of Economics, Moscow State University, has worked out an algorithm that predicts what the final production numbers will look like. He has C+C relatively flat the last few months and slightly above the EIA estimate.

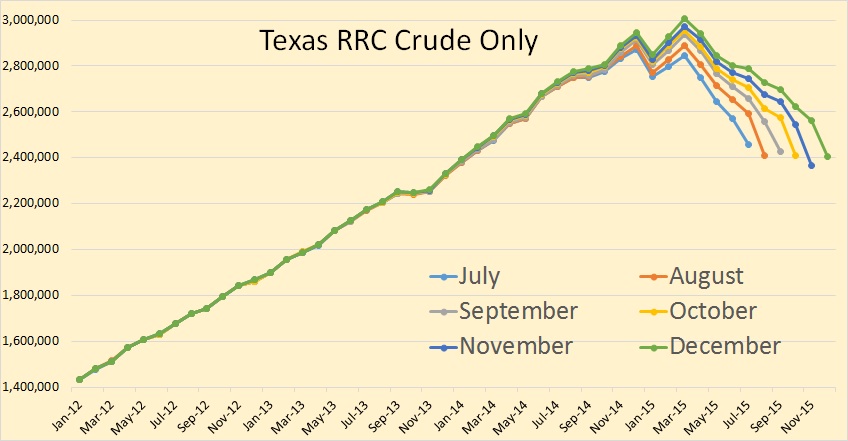

Texas crude only shows basically the same pattern as C+C.

This is Dean’s estimate of what the final Texas crude only production will look like.

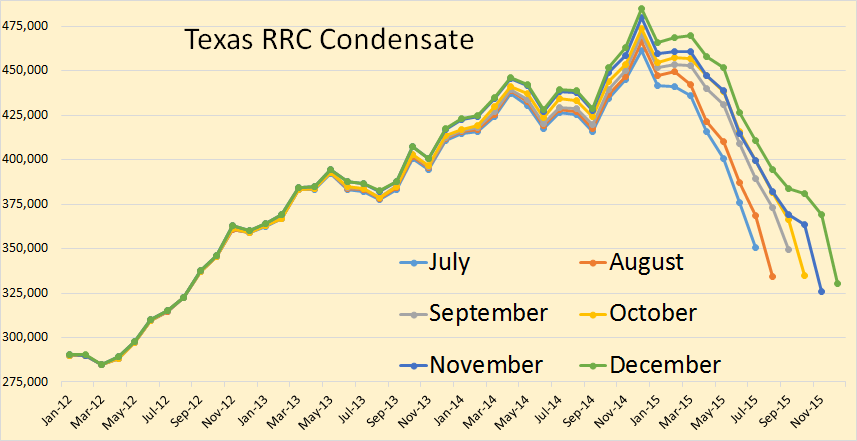

Texas condensate seems to have a slightly steeper decline than does crude only and peaked in December rather than March when crude only peaked. I use the term “peaked” to mean “peaked so far” and am not implying that it is the final peak. Only time will tell whether it is the final peak or not.

Dean’s data agrees that condensate peaked in December.

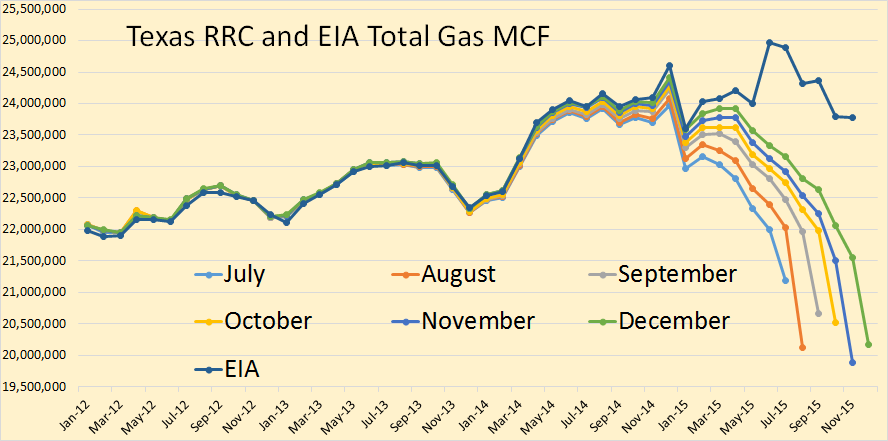

Texas total gas production, according to the EIA, peaked in June, so far, and now seems to be declining a bit faster than oil.

Dean shows Texas total gas production on a plateau with a slow decline. He has Texas gas production, in November, slightly above the EIA’s estimate.

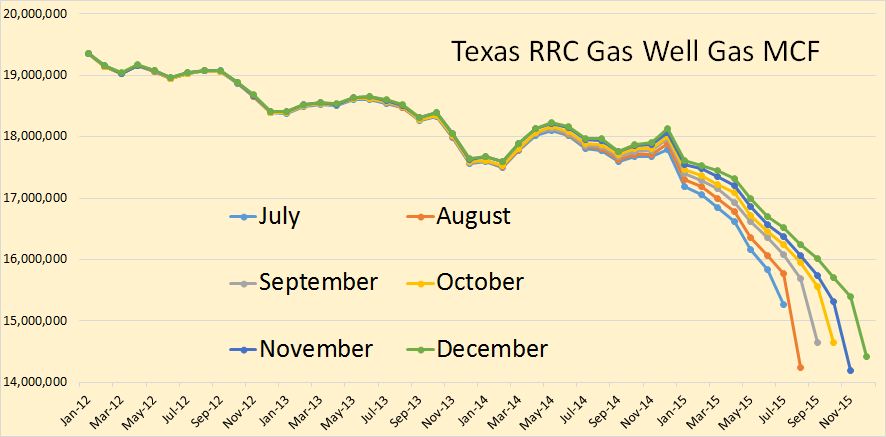

Texas gas well gas actually peaked in early 2009 and has since been in a slow but steady decline.

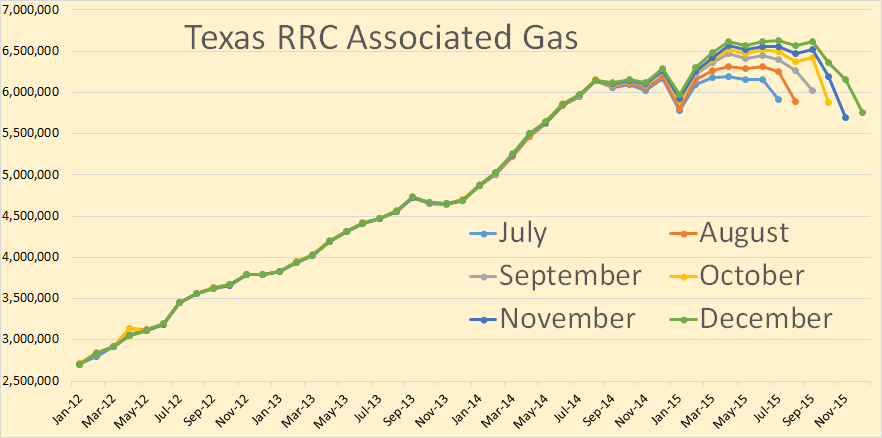

Texas gas production has been kept increasing by the increase of associated gas. The shale oil boom is largely responsible for the increase in Texas associated gas.

Available for pre-order http://www.amazon.com/The-Oracle-Oil-Geologists-Sustainable-ebook/dp/B00ZAT8WWO

While Marion King Hubbert was a revolutionary in oil industry, forecasting that American oil production would peak surprisingly soon and decline steadily thereafter, Marvin Minsky was a similar revolutionary in economics pointing out inherent instability of casino capitalism.

He advanced so called “Minsky financial instability hypothesis” which postulates that the booms and busts are inevitable under neoliberalism (aka “free market economy”) due to the nature of financial system ( https://en.wikipedia.org/wiki/Hyman_Minsky ):

What we experienced in July 2014 can probably be called “Minsky moment” for oil industry (although it is not the exact meaning of the term).

Here is a fragment of his review of Susan Strange book “Casino Capitalism” (

http://digitalcommons.bard.edu/cgi/viewcontent.cgi?article=1157&context=hm_archive ):

Just a niggle:

Thanks.

Hi all,

I noticed that Dean Fantazzini’s estimate for C+C for Texas is a little higher than the EIA estimate. The Nov 2015 estimate by Dr Fantazzini is about 115 kb/d higher than the EIA estimate. The December estimate for TX C+C output is only 70 kb/d less than the peak in March 2015 (3628 kb/d vs 3558 kb/d). I think Dean’s estimates are the best I have seen so this is worth paying attention to in my view, I expected output would have fallen by now. It has increased slightly from a low of 3487 kb/d in August to 3558 in Dec 2015. I couldn’t distinguish the blue and purple well on the Chart prepared by Dr Fantazzini, so I used a dashed line to make it clearer (for my eyes).

The post above used the wrong chart.

Chart below is correct same as in Ron’s post, but with a dashed line for EIA data to make it clearer to me, basically there is little difference between Dean’s estimate and that of the EIA (though my guess is that Dean’s estimate is better where there are any differences.)

Why wouldn’t we call the EIA liars in reporting far more Texas oil production than the RRC?

Critics say they are not lying as their difference with the RRC is initial reporting vs. final estimated reporting. If that critique were valid, then why is the oil production drop by the RRC from peak triple the fall that the EIA reports for Texas?

Coolreit, I don’t understand your complaint. The Texas RRC drop is not triple the EIA, all the data just is not in yet. More data comes in every month and after about two years or so they are equal, or almost so. Just follow the data back. The further you go back the closer they get until they eventually merge.

No, the EIA is not lying. Their guesstimate is actually pretty good.

Really? EIA keeps moving the old Texas numbers downward, and still way off. Texas is now reporting their cumulative numbers with both oil and condensate, now. I am quite sure the March 2015 numbers are no longer going to go up substantially, and that is around 106, 500, 000. EIA has it at close to 113, 000, 000. Substantial over statement by any stretch of the imagination. As I recall, they originally had it at around 115,000,000. Guess they can move it down within a year, and we can say how great the EIA’s estimation is, because it almost matches actual. Poppycock.

In reality, EIA and everyone who tries to predict Texas production based upon late reporting, may not be using the most current situations. My guess is that there is probably not more than a four month look back to get close to the right numbers. Not as much going on as there used to be. If so, that would make EIA numbers pretty far off. I remember looking at junk that were permits filed at the end or beginning of the year, and could see that there were a lot of low producing wells that just didn’t make it to the reports until then. Sometimes, almost a year back. Then too, I noticed some attempted slight of hand reporting that did not report excellent wells due to the fact the company obviously was trying to get the other areas around it. Some very late reporting on that stuff. Most of that is pretty much gone, now. I think they are caught up within about the last three months, based upon the completions I have been reviewing. Maybe not, but certainly a lot better guessing than what comes out of the EIA.

The EIA uses past data to extrapolate forward, they don’t make prognostications or employ oil prophets. No crystal balls either. I am sure very few people saw the price drop coming and the ensuing problems it would cause for oil producers.

The EIA only deals with data. So their downward adjustments would lag, as would any upward adjustments for the Texas numbers.

Hi Guy,

The current EIA estimate for March 2015 is 112,977 kb. and the RRC estimate is 107,761 kb or 4.8% lower than the EIA estimate, this is in line with the usual performance of the RRC PDQ reporting, they are very careful to get the data right, if there is any question about the data it goes into the “pending datafile” while the problem gets resolved.

It would be better if this data was just posted to the PDQ and then revised monthly, but I don’t run the RRC. It takes 24 to 36 months before the PDQ data gets to within 1% of “actual” output, it is what it is, they could learn a lot from the NDIC which does a far better job.

Ron:

I am not looking at EIA vs. RRC on a same month basis. I am looking at 8 month changes for RRC vs. EIA. RRC is down nearly triple in the last 8 months vs. what the EIA is reporting for the same 8 months.

I am with Ron on that part. Triple? For the same period as what you are to be looking at, I see maybe 10% over by the EIA. Their nimble numbers. Heck, I really can’t be sure there is actually a plateau. They completed only about 60% of the wells they did as before, so maybe they had time to post more online.

I am no fan of the accuracy of EIA, either. Any lunatic can balance weekly figures with a half million dollar plug for daily production. Was the plug for production, imports or what? Gimme a break

No, you still don’t understand what is happening. The RRC data is incomplete. The EIA data is just an estimate of what the complete data will look like when all the data is finally in.

The RRC data dribbles in. The latest months are the most incomplete and finally after a couple of years it is complete or nearly so. At that point the EIA matches the RRC data.

Look at it this way. The RRC data is just not all the data. The EIA data is all the data, or their estimate of all the data. And it will likely turn out to be a pretty good estimate.

I understand the concept. Then apply that to March 2015, which is 10 months past. Within 14 more months they are going to come up with 6.5 million more barrels of oil. Seems a stretch.

Hi Guy,

I think Ron meant that Coolreit doesn’t understand, if so I agree.

He seems to believe that the RRC data is complete, when for the most recent month reported it is about 30% too low (or only 70% of output gets reported). It takes about 25 months (or back to Jan 2014) before 99% or more of the full data is reported in the PDQ based on the past history (comparing Feb 2014 data from the RRC with Feb 2016 data from the RRC’s PDQ).

Hi Guy Minton,

It takes a long time for all of the oil to show up in the RRC’s PDQ, though there may be other reports (for taxes and such) that are more complete.

If we look at the RRC data that was in the PDQ from Feb 2014 (I saved it in a spreadsheet) and compare 11 months earlier (March 2012 data point) with the Feb 2016 reported output of C+C in March 2012 (which is probably very accurate), the old data point is 5% lower than the current data reported in the PDQ.

If the current reported data for March 2015 is too low by 5% that would be about 173 kb/d too low and the proper estimate would be 3650 kb/d of C+C output in Texas in March 2015. The EIA estimate is 3644 kb/d and matches very well.

I agree with Ron, the EIA estimates are pretty good, not perfect but good enough.

Hi Coolreit,

Nobody is lying. The RRC only reports some of the data in the PDQ, for the most recent 24 months the EIA data is a much better estimate of Texas C+C than RRC data from the PDQ.

Someone did something like this back in the Oil Drum days.

The world burns 1.26 trillion U.S. gallons per year.

The volume occupied by 1.26 trillion U.S. gallons is about 1.25 cubic mile.

The world burns about 1.25 cubic miles of oil each year.

So lets slice that cube up and see what we can cover with it.

There are about 80,000 Inches in 1.25 miles so we could cover 80,000 square miles with an inch thick of oil.

Now lets slice it 1/32 of an inch and we get 2.5 million square miles.

A 32nd of an inch layer of oil might not seem like much but put that much on your glasses and it would make it nearly impossible for you to see through.

US is 3.8 million sq miles

In a little over a 1.5 years we covered the entire US in a 1/32 inch thick layer of crude oil. What a mess!

World land surface area is about 57.5 million sq miles.

It takes us a little over 22 years to cover all of the land area on the planet.

Worlds oceans is about 140 million sq miles

In about 56 years we covered all the oceans in the world in a layer of oil

Earth has 197 million square miles of surface area.

So over the last 80 years we have more than covered the entire planet with a 1/32 inch layer of crude oil.

Now add in coal which is about another 1 cubic mile per year equivalent and you can almost halve those time frames, also making the 1/32 layer completely opaque, way more toxic, and very very messy.

Better yet, let’s burn the fossil fuel so we can travel around aimlessly breathing it and pretend it’s harmless to humanity

After Hadrian no competent measures were taken to protect the forests that remained. Today the few cedars that majestically stand at Bsharri are testimony to the ruthless exploitation through the ages by state and individual of the magnificent coniferous cedar forests of Lebanon.

http://forestcouncil.org/cedars-of-lebanon-the-backbone-of-ancient-traditions-and-culture/

Trees? Cut them as fast as you can for centuries and eons. Oil? Burn it all, who cares?

It doesn’t matter, humans will mow it down and pump it out, what have you, they’ll get that stuff done.

http://www.zerohedge.com/news/2016-02-21/panic-below-surface-banks-are-selling-energy-loans-cents-dollar-ensure-their-own-sur vival

As one banker put it, “we are looking to save ourselves now.”

It’s an election year. Harping on 250K firings is good strategy by the drillers because that, rather than shareholder loss, can push populist candidates to request the bailout from the Administration.

In comments, out of the clouds and convolutions, it’s little nuggets of synthesis and insight that I appreciate.

Mechanical

Watcher,

Non-conventional type of bailout already did occur and it is ongoing but only for shale portion of the oil industry. The only question is what Exxon’s and Chevron’s did to “deserve” this? I know hard to believe but we are at the point to shed tears for the conventional majors 🙂

Pssst. . .. .

http://www.zerohedge.com/news/2016-02-21/us-government-breathing-down-neck-large-banks-limit-their-energy-exposure#comments

Watcher.

I’ve been too caught up with figuring how the heck we, with zero debt (so far) are going to get through this $20 oil mess.

After running some numbers (I really need to buy software) I feel it likely that, on the whole, PV10 of lower 48 US oil and gas production is likely minimal in relation to the debt related to it at $30 WTI and $2 HH. Maybe something like 10-30% of the debt.

The problem, of course, is that well head realizations are between $8-27 for most oil and $.50-$1.50 for most gas.

For example, if I offered to give you Continental Resources or Chesapeake, provided you had to personally guarantee the debt, would you take it?

Look at Denbury Resources. They have shut in 2,300 barrels of oil production per day. Their operating costs, plus severance taxes, general and administrative expenses and interest are more than what they can sell their current production for. And they have $3.3 billion of debt. This is a 70,000 bopd company.

Same hold for California Resources. Almost zero PV10 when G & A and interest is included, and they have over $6 billion of long term debt.

Every MLP, I suspect, has zero PV10 when G & A and interest are figured in. I’d estimate they represent half a million boepd, if not more.

Sandridge, Ultra Petroleum, not small companies, likely minimal PV10, billions of debt.

After seeing where Denbury is at financially, really have to question OXY. They are the biggest CO2 producer in the US. Think about the P & A liabilities in total for their entire CO2 portfolio. At least OXY spun CRC, imagine if they still had that $6 billion of additional debt.

The supposed best company in the best basin is PXD. For crying out loud, $3.2 billion PV10 at $50 WTI. $3.2 billion of long term debt.

Heck yes, the OCC told the banks not to mark to market. If they did, every stinking reserve based loan would be called.

This $20 oil sub $2 gas is so surreal, you don’t see the forest for the trees.

If the US government is in any way behind this price collapse, they out to have their heads examined. Another dang TBTF created.

If you buy, you’re not buying on presumption of an oil price increase.

You’re buying on presumption of bailout. You’ll have to pick your instruments well because common stockholders were indeed smashed when banks were bailed out.

Buffet injected capital via preferred issues. Maybe a better plan would be conversion of debt into subordinated convertibles. You’re almost off the radar screen that way. You take a position, you won’t be part of common if the bailout kills all common holders.

There is GM, though. They wiped out everyone to save the union. Complete violation of all legal precedent, but it was “in the best interests of everyone (except the shareholders and bond holders) to forget that”. So playing the 250K firings card is a delicate thing.

The executives get to keep their jobs (or maybe more important their 401Ks and pensions get funded) and that may be all they care about in that scenario. It’s an easy rationalization to reach. “We’re already bankrupt. I’m not hurting the shareholders any by protecting my pension (and those of the workers) because they are already wiped out.”

Watcher,

“If you buy, you’re not buying on presumption of an oil price increase. You’re buying on presumption of bailout.”

That’s a very good point. Thank you !

Bailing gm out in the first place was also a complete violation etc

Always annoys me that bond holders got so self righteous on having their hands out but thought the workers should get nothing

The law making bondholders top priority is not a moral choice. It’s math. Tell them a priori that the law won’t be followed. Tell the union a priori that the law won’t be followed.

The union would elevate their pay demands because they can’t lose, even if the company is driven under.

Except that the bondholders would never have loaned money. There would have been no GM for the union to drain. Doing things as done was outright theft and total denial of recourse.

But don’t sweat it. We’ll see it again. Soon. And it will be even more apparent it is an argument over printed pieces of paper.

The law making bondholders top priority is not a moral choice. It’s math.

I never hear of that law. Bondholders are third in line after a bankruptcy, just ahead of stockholders.

Who gets paid first in a business bankruptcy?

1. First priority for debt repayment usually goes to persons who become creditors after the company files for bankruptcy.

2. Secured creditors, such as banks lending money backed by a mortgage on real estate, typically bargained for a lower level of risk.

3. General creditors, such as suppliers of goods and services, and other lenders and bondholders,…

4. Stockholders are last in line. They own the company and take greater risk. Stockholders can make money if a company does well, but they can lose money if the company does poorly. The owners are last in line to be repaid if the company fails.

Though bondholders are third, they are still grouped in there with “general creditors”, such as suppliers of goods and services and other lenders. So even though they are third, they still must battle it out or divvy up the remains with all the other “thirds”.

In other words, they are generally left with nothing, or at best, next to nothing.

Nah, you don’t understand bonds.

There are collateralized bonds (and certainly collateralized debt obligations) and there are bonds that are part of the DIP money. That puts them first.

Whoever described that called unsecured debentures “bonds”, which they are, but that’s a small subset of bonds.

Oh and btw the DIP folks have to get agreement from the first lien guys (higher priority bondholders). You can’t just declare top priority bondholders lesser priority after the filing because the company wants BK emergence to be funded by DIP. Usually they can get that agreement haha because often the DIP money is from those same bondholders.

A bond is a loan. A bank’s loan document is a bond. This isn’t complex. Only real diff is trading and that’s not relevant here.

oooh this is new:

In 2012, A trust representing “old” GM’s unsecured creditors filed suit in the Southern District of New York against GM over payments made to hedge funds in 2009 in exchange for waiving of claims against GM’s Canadian subsidiary. The deal, of which Judge Robert Gerber says he was unaware – despite its disclosure in an SEC filing on the day GM sought Chapter 11 protection – could prompt a reopening of the 2009 case.

hahah NOT A CHANCE IN HELL, regardless of validity.

Nah, you don’t understand bonds.

There are collateralized bonds (and certainly collateralized debt obligations) and there are bonds that are part of the DIP money. That puts them first.

Bullshit, I do understand bonds. I used to sell them. A collateralized bond is nothing but a bundled junk bond, bundled with other junk bonds in order to reduce the risk.

Collateralized Bond Obligation

A collateralized bond obligation (CBO) is a bond that uses a variety of high-yield junk bonds as collateral. These bonds are separated, or pooled, into tranches with higher and lower levels of risk.

Collaterizing a bond does not move it higher on the payout list. It just bundles it with other junk bonds in order to reduce the risk.

Bonds never, ever, ever, come first. They are next to last on the payout list, right in there fighting with other creditors. Bundling the bond does not change its ranking in the payout order.

Important: A collateralized bond cannot be a bond from just one company. By definition it is a bundled bond, bundled with many other junk bonds. All of those companies will not go bankrupt at the same time so a bundled bond is safer. Only a portion of the bond can be lost if one of the bundled bonds goes belly up. But the one that does go belly up is at, or near the very bottom of the list, just ahead of stockholders.

Watcher, if you wish to make a point then you should post a link that proves your point. You know… like I do.

America is the prey, not the predator.

Shallow,

Look at Denbury Resources. They have shut in 2,300 barrels of oil production per day. Their operating costs, plus severance taxes, general and administrative expenses and interest are more than what they can sell their current production for. And they have $3.3 billion of debt. This is a 70,000 bopd company.

A pretty typical story. The true cost of the extraordinarily low rates and availability of cheap credit since 2008 is the misallocation of resources up to and including emergence of a class of Ponzi borrowers (see below). In other words stability of 2010-2014 in oil sector was highly destabilizing.

As Art Berman noted

http://oilprice.com/Energy/Oil-Prices/When-Will-Oil-Prices-Turn-Around.html

Essentially he described what Minsky called “Ponzi borrowers”.

Following Minsky the key mechanism that pushes a given sector towards a crisis is the accumulation of Ponzi debt.

From wikipedia:

https://en.wikipedia.org/wiki/Hyman_Minsky

As soon as the use of Ponzi financing of operations became widespread the bubble is ripe for popping. When for some reason the asset prices stop increasing and start doing down, Ponzi borrowers go down with some time lag.

That changes attitude of lenders dramatically and they start tightening the conditions of borrowing and make it more difficult to roll over the debt even if interests payments were paid on time.

Dominoes start falling. That means that speculative borrowers follow Ponzi borrowers as they can no longer refinance (roll over) the principal even if they are able to cover interest payments.

Collapse of the speculative borrowers can then bring down even hedge borrowers, who are unable to find loans despite the apparent soundness of the underlying investments.

I hope the government will provide some lifeline at least by allowing refinancing of the loans so that the complete collapse of shale/tight oil bubble is avoided.

I know hard to believe but we are at the point to shed tears for the conventional majors

No tears from me! If it were up to me I would prosecute the management of those companies for crimes against humanity!

It seems that scientists from the AGU are also taking a stand against these companies!

http://blogs.scientificamerican.com/guest-blog/taking-a-stand-for-scientific-integrity/

More than 100 Earth scientists, ourselves included, have signed a letter urging our preeminent professional society, the American Geophysical Union (AGU) to cut financial ties with ExxonMobil. We are joining the growing chorus of scientists who refuse to turn a blind eye to the destructive behaviors of the industry partners of our profession, ExxonMobil being the most egregious. We hope that this action will inspire our community to embark on an open assessment of the role of fossil fuel companies in the Earth sciences.

Since the drug laws apply to both sellers and consumers, shouldn’t the criminal prosecutions also apply to consumers of fossil fuels?

J. Brown,

You have hit upon one of the shameful acts of civilization. We are still treating mental patients in horrible and shameful ways. It will take a bit more growing up before society separates the criminals from the addicts and starts medically treating addicts instead of treating them to exaggerated prison sentences and filling the pockets of their private prison cronies.

The problem is not addicts, the problem is the legal and social system addicted to punishment. Doesn’t work in this case, does it?

Fred,

I know where you are coming from but all I am trying to see through the fog of lies and disinformation. This whole oil price crash is not about renewables , or how big our carbon foot print is and if people should feel “not good enough” because of that.

This is power struggle between two opposite approaches between two camps. Elite is split along the lines who has more to lose between two approaches: continuous world conflict or cohabitation and gradual shifting of power to other parts of the world. Everything points that Bankers & Big Oil are in two opposite camps. Rest of us, including small & medium oil, are just collateral damage in all of this.

Do you really believe that these critical articles about Exxon are just suddenly appearing after 100 years of pumping oil? Do really believe that Bankers via their shale pet project just pumped 4.5 mbpd within just 6-7 years for reason of profit? There is no profit. Don’t you see the blame game and the deflection from the bankers that Saudis are “flooding” the oil market? Saudis are “flooding” oil as much Norwegians are “flooding” and that is – same as before. Do you see that only shale are the “chosen one” and have a luxury of keeping the credit lines open while Big Oil is forced cutting dividends for the first time in 100 years? Too many things are pointing to this struggle that would make this just coincidence.

Ves,

This is power struggle between two opposite approaches between two camps. Elite is split along the lines who has more to lose between two approaches: continuous world conflict or cohabitation and gradual shifting of power to other parts of the world.

Very interesting hypothesis. Thank you !

Now one question.

Was not Jeb! a representative of Bush clan and by extension Big Oil in the current race ?

If so, then please note that he is a typical neocon (former member of the Project for New American Century; with Wolfowitz as a political advisor).

Also it was an oil man Bush II who got us into Iraq.

Those facts make your hypothesis about Big Oil being against imperial adventures somewhat weaker.

Just asking…

likebz.

The whole game that we get through media is deception game so if we analyze what is really going on by sticking to the “labels” we could get confused because nothing makes sense. So the first thing is to acknowledge that there is a constant change of influence and power. So the power and influence is ALWAYS RELATIVE. But constant CHANGE is absolute.

So when talk about different power structures we are talking always about interest. In the past interest of certain power structures aligned but as I said there is always that CHANGE so the interest is not aligned anymore.

liekbz: “Was not Jeb! a representative of Bush clan and by extension Big Oil in the current race ?”

Could be. But he did pull quite early from the presidential race. So? Here is that CHANGE that I was talking about that could be reflection from things on the ground, mainly from the results of geopolical developments going in favour of Big Oil but from Russia/Iran.

And look who is absolute leader in the race – “Donald “I can sit and do a deal with Russians” Trump. Well I can tell you one thing Mr. Donald did not just decided out of the blue after filming the last episode of “You got fired” that it would be fun to be president 🙂

He represents certain interests that prefer to keep their relative power through some form of cohabitation. But things can change again. There is always constant and evolving change. And as result you could have Mr. Bush as Donald’s running mate on the ticket in November. It is always more beneficial to have “your guy” sitting inside the circle then outside.

Ron. I know I am an outlier as I focus quite a bit on lower 48 conventional oil production.

EIA will have annual state production posted 2/29/16. Unless the EIA data is not complete, there will be some sizeable declines in percentage terms.

I realize these states are but a blip on the world radar, but I wonder if there is some correlation between the US conventional states and world wide non OPEC and non Russian production?

The conventional onshore states generally show growth in 2014 and decline in 2015. I wonder if that is true in places such as India, non OPEC Africa, Europe, Austrailia, etc?

Yes, there is a correlation with Non-OPEC. Non-OPEC peaked in December 2014 and is down about 650,000 bpd as of December 2015. The US portion of that decline, since December 2014, is about 230,000 bpd. The US did not peak in December however, the US peaked 4 months later, in April and is down about half a million barrels per day in December. This is all JODI data.

I will have a post on that Thursday.

Thanks Ron.

FYI, unless I made a computational error.

US less the shale states of PA, ND, OH, OK, NM, TX, CO, as well as less Alaska and GOM:

12/14: 1,597 bopd.

11/15: 1,425 bopd.

Data Per EIA.

Some thoughts:

The states with higher 11/15 than 12/14 are OH, OK, NM and CO. From my review, these are the ones with the highest overall API liquids of the shale plays, so API gravity has likely continued the upward climb for the entire US liquids production profile.

Next, some of the non shale states actually went higher into the spring, so the decline is steeper than what is shown.

I expect 12/15 for the non shale states to be lower than 11/15, thus steeping YOY decline.

I expect January through at least April, 2016 to continue to decline regardless of price as Feb oil sales are not paid until late March and any sudden price swing would not be reflected until at least May. In reality, given the carnage, it is unlikely any of these states would rebound until 2017 given most will wait several months to see if price recovery is for real.

If $20s-$30s persists all year, there will be a steeper decline from 15 to 16 than from 14 to 15.

If non shale, non OPEC and non Russia world wide oil production follows the US non shale state pattern, OPEC and Russia would really need to ramp up, absent a decrease in YOY demand from 2015. Instead, they seem ready to at least cap, if not cut for the remainder of 2016. Further, demand is expected to increase 1.2 million bopd from 2015.

I suppose it is not realistic to think that 20-30 million bopd of non-US, non-OPEC, non Russian production fell by as much as 10% from 12/14 to 12/15?

Look forward to your Thursday post!

Thanks for fleshing out some of those numbers. It seems that the next couple years are going to reveal some interesting trends.

Hi Shallow sand,

Well we know C+C output went up for the World in 2015 by about 2.2 Mb/d from the average 2014 level. So if the areas you suggest decreased by 2.5 Mb/d, that would imply the other areas OPEC, LTO, and Russia increased output by 4.7 Mb/d. OPEC might have increased by 1 Mb/d, Russia possibly 800 kb/d, which would imply LTO increased C+C output by 2.9 Mb/d in 2015 on average over 2014 average levels.

I am fairly certain that is not the case. So yes it is not realistic to assume the rest of the World matched the US non-shale oil industry in its decline.

There were a number of long term projects in deep water and elsewhere that offset the declines.

World petroleum liquids production (ex biofuels and processing gains), y-o-y change in 2015 (mb/d)

Source: IEA oil market report, January 2016

Dennis. What did Canada, Norway and Brazil increase output by?

My focus in making

the comment is on conventional onshore. That is something the three countries I mentioned have little to none of.

I suspect we are seeing a rapid decline of onshore conventional production world wide.

The point I am trying to make is we are likely becoming much more dependent on LTO, offshore and tar sands than we realize.

Hi Shallow Sands,

AlexS answered above (thanks, you are wonderful). About 400 kb/d increase in total liquids from North Sea and Barents (Norway and UK), Brazil and Canada.

See table above from IEA for breakdown.

We will become more dependent on those resources over time and LTO will not be able to increase beyond 2025 if not developed outside the US, oil sands will develop slowly, I am not too sure on how much we can depend on deep water, but it requires oil over $80/b for most future development.

Well, it’s always a good time to get in the business if you are spending other people’s money and you don’t have to pay it back

http://www.bloomberg.com/news/articles/2016-02-02/chesapeake-founder-tom-ward-says-30-oil-a-good-time-to-get-in

But having done business w/ Tom and his minions, I will say that he is a very smart guy but I am not sure I want to repeat the experience.

John,

I wonder if Tom Ward mentioned the Sierra Club just sued Chesapeake, Devon and Dominion LLC last week for earthquake damages in Oklahoma and Kansas due to deep waste water injection?

Steve

My impression of TW is that he doesn’t lose sleep over the debris he leaves behind.

Is there any way of splitting out Eagle Ford and Permian data? I’m going to guess Eagle Ford looks a lot like the Bakken curve and peaked in early 2015 and is now in slight decline, while the Permian has been inching up but might be about to turn over.

There is, but definitely not easily. You could go by district and separate out the formations, but keep in mind the formation name may change. Especially when you get into districts 7-8 (and more) with the Permian. Because, there is no formation named Permian, it is a multitude of formations. I just take for granted what others report is close enough.

The Permian will no doubt see some decline, based upon the the overall drop in rigs. However, the decline rates are, overall, not nearly as deep as the Eagle Ford or Bakken. It won’t be as spectacular.

Oil firm bankruptcy in North Sea: http://www.oilandgaspeople.com/news/7398/suttie-pulls-plug-on-first-oil/

This is quite interesting from the article: “French bank BNP Paribas last week confirmed it would halt funding oil and gas companies with large capital requirements, particularly in the US.”

Anybody in this forum invested in UBER should try like hell to get rid of it double asap but small investors are probably STUCK.

It seems a UBER driver has gone around picking up fares and shooting people, this afternoon.The people he shot and killed apparently were NOT UBER customers, but still…………

I’m not a lawyer, and don’t have any idea what the LEGAL situation might be, but the stock is likely to nose dive as soon as the exchanges open.

This sort of thing can be final straw that makes or breaks changes in the law affecting new transportation industries and so is relevant to the discussion here.

Come on OFM, you should know better!

If you Google Taxi Driver kills passenger you get this result:

About 289,000 results (0.52 seconds)

Here’s the first one:

Man pummeled by taxi driver dies: police – NY Daily News

http://www.nydailynews.com/…/man-pummeled-taxi-driver-dies-polic…Daily News

Sep 24, 2015 – A man who was pummeled by his taxi driver after trying to evade paying the fare has … A cab driver told cops he beat a 42-year-old passenger to death in the Bronx because he … Cab driver shot, killed by passenger in Bronx.

OFM,

Just an fyi, Uber isn’t a publicly traded company and doesn’t yet have official plans for an IPO.

Uber has not yet gone public

That goes to show just how LITTLE time I spend following the stock market, in terms of specific companies.

It seems to me I remember reading about UBER having a market cap of so and so much, an ungodly amount.

So how do you come up with a market cap if there is no share price, because the shares are not for sale ?

Most likely I was reading about some other similar company and half asleep.

In any case , this rogue driver apparently did not harm any customers, but some of them are probably going to sue UBER just the same, for emotional distress, or something, because they rode with this guy last week or last month, and the negative publicity is going to tarnish the company’s rep with the public.

OFM,

The last time Uber raised money the amount of dollars each venture capital firm was willing to pay for a 1% stake of the company was equal to a total value of $50 billion. That is where the market cap analysis comes from.

For comparison, FedEx, a global company with massive hard assets of land and infrastructure, had a market cap of $47 billion at that time (probly less now due to stocks being down since then).

That fact alone would make me run from any IPO offering Uber does. Uber has valuable data to sell in regards to, say, Tesla, Apple, or Google wanting to appropriately supply markets with autonomous vehicles, but Uber has zero ability, in my opinion, to dominate the autonomous taxi market.

It would take a massive capital investment to purchase the necessary autonomous vehicles, which would devalue the company off the bat due to debt. On top of that, the leaders in getting autonomous taxis to market plan on doing it themselves. Why would google invest billions of dollars and a decade of time in developing the tech only to give their edge away to a young company like Uber?

Google and Apple keep trading places for the largest companies on Earth. If ANYONE has the capital necessary to invest in the hard assets of deploying autonomous vehicles it is them, with collaboration with parts manufacturers and/or in partnership with established car companies that have the capacity and infrastructure already in place to mass produce rapidly, efficiently, and cheaply.

If anything, Google, Tesla, and Apple already have enough data and the right talent to determine how to supply each market. Everywhere I go my Android phone is collecting data on where I go, at what speed, and how many OTHER Andoird phones are out and about. I personally feel Uber will be the MySpace or AOL of the disruption of the taxi business.

Uber will not vanish overnight, but, starting around 2020, will face a 10 year period where they are outcompeted by the far cheaper alternative of autonomous taxis. They’ll be phased out one metropolitan area at a time (it takes time to produce millions of autonomous taxis), and will eventually settle for being bought out for far less than the $50 billion they are valued at.

Thanks Brian,

Your analysis rings true to me. IF I were looking at investing in UBER, the first question I would ask would be WHY this company should be expected to dominate it’s industry, and the second one would be, whether the industry itself has legs.

I can’t see any entry barriers that are even remotely adequate to keep other companies from being as successful, or more so, in this car for hire industry, such as protect other industries. New companies just starting out are not going to be successful at manufacturing computer chips or cars, as a rule, the capital costs of getting into such industries are ENORMOUS.

For a service company, capital costs are trivial by comparision. You are dead on imo.

And for what it is worth, I expect to live long enough, if I am lucky, to see autonomous cars on the lot at local dealerships.

So UBER would fail on both accounts by my own methods.

I believe in real estate myself, so long as you also have sense enough to understand that fundamentals ARE fundamental, and that bubbles can and do happen even in real estate.

So far, nobody has been able to figure out how to manufacture desirable, DESIRABLY LOCATED land in a factory and deliver it to places where it would be worth megabucks. LOL

Out of all the companies including the small startups in Silicon Valley, most of them have either already gone broke, or will go broke or will be bought up by a larger company for peanuts. The winners pay a thousand to one, in terms of buying stock for a buck and selling years later for a thousand, but picking the big winners when they are still small is impossible.

OTOH-EVERYBODY who bought real estate in Silicon Valley in the early days made out like a bandit. EVERYBODY.

Well, UBER is going to need a new driver in Kalamazoo as of yesterday.

It is a privately held stock and that might be even worse, much worse. Google Ventures bought some.

http://fortune.com/2014/06/20/uber-plays-hardball-with-early-shareholders/

The shareholders who sold were lucky.

I’m sure this incident will just reinforce Uber’s already clearly expressed intentions to go completely driverless. Har har!

On a more serious note: I think this wacko’s random shooting of innocent bystanders has a lot more to do with a deeply diseased American society and culture than it has to do with Uber.

Uber should sue the media for promoting the connection. Many murderers work somewhere, but the places of business are usually not put on stage and paraded around if they had nothing to do with the crimes. All drivers are vetted at the local, state and federal level before being hired. Just think about the number of school shootings and post office shootings over the years. Yet media doesn’t blame the schools, at least not much.

Uber has it’s work cut out for it if it wants to continue growth. In order to go driverless they would have to become a taxi company (with all those added regulations and costs) or align themselves with taxi companies. Right now the drivers are subcontracted and Uber is the administrator and software providers for the rides. Also, I would not put my company at risk on a technology like autonomous driving until it was well proven in all conditions. Errors can be very expensive when dealing with passengers.

One thing I have never been able to believe is that using Uber reduces fossil fuel consumption.

It really has nothing at all to do with UBER.

UBER just happened to be unlucky that this nut case was a UBER driver.

The company name has been prominently mentioned in the vast majority of news stories about this tragedy, which is unfortunate for the company. It will deter some potential customers , and it will provide folks who have it in for the company an opportunity to bad mouth UBER for not screening drivers more carefully.

What seems to happen in comparable situations, is that the stock price of a company what has this kind of bad luck declines sharply, and quickly. If you own some, and you are quick enough, you can maybe sell ahead of the decline , and buy it back cheaper in a few days or weeks. This sort of thing does not usually have much if any long term effect on a solid company.

Now if this guy had shot a UBER customer……… THAT would have been a real disaster for the company. That sort of bad news has nine lives.

Question about impairments.

CLR has taken few in 2015. They report earnings 2/24. They disclosed PV10 fell about $15 billion from 12/31/14 to 12/31/15.

$15 billion divided by the outstanding shares is right at $40.

So, will they report a loss that includes a $40 per share impairment?

The stock is at $17.46.

Further, PV10 at $50 WTI, less long term debt/outstanding shares = roughly $3 per share.

Interesting this one hasn’t tanked further.

Of course, with PXD, long term debt of $3.2 billion = PV10 of $3.2 billion. At $50 WTI.

They have a high percentage of 2016 oil hedged, but considerable amount with three way collars.

Who wants to bet that the aggregate PV10 of all US based non integrated E & P public companies is less than their aggregate long term debt at $50 WTI? And we are at $30 WTI.

Maybe I will try to add it up in about a month or so, once the 10K are out.

If that is true, how many billions of market cap is purely a bet that oil prices are headed well north of $50 before debt cannot be extended?

Wonder how the gas weighted stack up?

Shallow,

Can you explain to me if PXD, PV10 is =or< long term debt, why is not PXD declared insolvent, and suspended from trading, as they would be technically bankrupt.

Toolpush. Per their Q4 press release, it appears all categories PV 10 is $3.2 billion. From another press release the same day (2/10/16), it appears long term debt is $3.2 billion.

They are not insolvent if they can make debt and expense payments. They have hedges, which definitely helps them. Keep in mind, however, PV10 was calculated at $50 WTI and $2.65 HH.

Looked at Denbury, who has about 70K bopd, about half CO2 flood. Long term debt $3.3 billion, PV10 at $50 WTI $2.3 billion.

PXD stock at $122. Denbury stock at $1.

I guess that is why they call it a casino, the stock market thing we put our 401k’s in and W wanted to invest SS money in. LOL.

Thanks shallow,

It looks like I got my definitions of insolvency mixed up. Amazing that PXD can own more than they are worth and still be at $100 per share!

Toolpush.

I have been running some numbers at $30 WTI and $2 natural gas. Just plugging in numbers, not specific to any company. Assuming $25 well head oil and $1.50 wellhead gas. But I am including interest and G & A in addition to OPEX, transport, P & A.

There really isn’t any significant value, even with $8 OPEX, which is really pretty low for oil weighted companies.

For a company with OPEX like Denbury, the assets are not, they are liabilities, because they are cash flow negative now at those prices.

Note: I escalate OPEX at 3% per annum, which I have found is fairly common, at least for five years or so. Shale has almost no PV10 when you do that as it becomes CF negative in year 2-3 due to steep decline. I’m using 25% decline in the shale reference, per PXD saying ceasing activity in EFS will result in 25% decline in 2016, then tapering off 5% per year till getting to 5% annual, then holding at 5%.

SS,

PXD’s net debt is lower because they expect $1.6 billion in cash from the stock offering and $500 million in cash from the sale of the pipeline.

Still, at current prices PXD is trading at 20 times EV/EBITDA inclusive of hedges. I have been saying this for a long time – the market is pricing ALL shale companies as if the price of oil is $70 per barrel.

Texas Crude and condensate are basically holding flat, yet associate or casing head gas is on the increase. An indication of a rising GOR, similar to the Bakken.

Depending on which side of the fence you are sitting, It could be drilling more gassy parts of the reservoir, or those damn chokes, that keep vibrating open!

Shallow,

I’m curious what are low decline vertical waterflood properties selling for in this environment? Aren’t these in general better in a lower priced environment (say $50ish) than the shale plays? I can’t really figure out why horizontal permian gets so much hype in this environment. I’ve found 2 permian players that seem to make money at 50 and below, RSP permian and Callon Petroleum, but they are valued as if oil is +80 trading at over $100k per flowing barrel. The lowest cost producers I’ve found are all vertical producers and MLPs. MCEP is probably the lowest cost producer in the U.S. and they do pure low decline waterfloods. They have quite a bit of debt but even with that they’re trading at $40k per flowing barrel including all debt.

Kelly b. Right now, unhedged, 2/16 price looks to be $16-$26 depending on location.

I sincerely doubt there are many secondary projects will all in costs (excluding interest) under $20. Just look at MCEP.

How do you price assets that are barely making money, breaking even, or losing money?

Likewise, re shale. PXD values PUD PV10 at about $350 million. It isn’t too economic. They are saying that, not me. Some 600,000 acres in the Permian with PUD PV 10 of $350 million at $50 WTI.

The only value in lower 48 onshore is that prices rise substantially in 2016. It is practically all an option at current levels. The PV10 values tell us that.

What happens to GM, for example, if they can suddenly only sell new vehicles for $5-15K?

One company you mention is Mid-Con. In 2014 PV10 was $664 million. But look at costs. LOE $22.93, production taxes $5.56, G & A $12.58. LT debt $205 million.

Granted, in Q3 2015 they had hammered costs down to $19.60 LOE, $.46 production taxes and $5.04 G & A. At $25 wellhead there is $0 PV.

Yes, Mid-Con is hedged. Only way they may survive. I’d say almost secondary and tertiary projects are underwater at $30 WTI in lower 48, when G & A is included.

Shale oil LOE is only low due to a high number of new wells. I think 5+ year old wells have LOE $15-$30 for the most part, with outliers of course.

Shallow-

Have you looked at production declines for shale wells older than 5 years old? Shalies have touted the long flat tales with 5-6% declines into the future. I’ve been wondering how accurate those decline rates are, now that we have some older wells to look at.

John Keller. Take a look at Enno Peters shale profile.com. Very good info regarding Bakken and Niobrara. He is working on EFS and Permian for Texas also, but tougher job due to production reported on leases basis instead of well basis.

Note, CRZO reported today. They are one of the stronger companies in EFS and Permian. Yet PV10 is barely above long term debt at $50 WTI. They are fairly well hedged compared to some others. In fact, over a third of Q4 revenue was from hedges.

Lots of reports this week.

Thanks Shallow!

John,

Some time ago I had a look at the effect of refracking on well declines of old shale wells. The reason is that those refracks have an out-sized effect, if you just average the total production of old shale wells.

See below the year-on-year decline of shale wells in ND, if just 214 wells are removed (from which I strongly suspect they have been refracked – for some I have positive evidence). So far I don’t see evidence that the year-on-year decline drops clearly below 10% a year.

Enno,

Awesome chart. Thanks!

Is there a provision for “Survivor bias?”

In other words, how many wells that were put on line in 2007, 2008, etc. are plugged & abandoned or temporarily abandoned?

Jeffrey,

Yes, in my ND data I always add 0 production months after the last reported month by the NDIC. So no survivor bias in the info I present.

Do you have the percentages of non-producing wells by year? For example, currently non-producing wells as a percentage of 2007 completions.

Hi Jeffrey,

I have given you that data in the past. The well profiles do not have survivorship bias as long as a zero is entered for output for abandoned wells. That is what Enno does.

I can send you Enno’s spreadsheet or Ron can, just email and ask.

Let’s assume a fully developed lease with 10 wells, all completed in 2010, and 2010 production averaged 1,000 bpd. Let’s assume that we lose 200 bpd per year and let’s assume that we lose one well per year.

2010: 1,000 bpd, 10 wells

2011: 800 bpd, 9 wells

2012: 600 bpd, 8 wells

2013: 400 bpd, 7 wells

As I understand it, the approach you guys are using is that you divide the annual average production by the original 10 wells, to get the average production per well per year, in order to eliminate survivor bias.

However, note that when it comes to rate of change, there is no difference between calculating the year over year rates of change for total production, or total production divided by 10. For example, the exponential rate of decline from 2012 to 2013 for total production was 41%/year (natural log of 400/600), and the exponential rate of decline from 2012 to 2013 for total production divided by 10 was also 41%/year (natural log of 40/60).

In other words, it seems to me that the year over year rates of decline shown above refer to the rates of change in total production, and dividing by the original number of wells has no effect on the year over year rate of change calculations* (unless I am missing something).

In any case, since dividing by the original number of wells does not seem to have any effect on year over year rate of change calculations (versus using total production by year), I think that a useful chart would be to show the percentage, by year, in the number of plugged & inactive wells, divided by total original completions in a given year. For my example, the percentages would be:

2010: 0%

2011: 10%

2012: 20%

2013: 30%

Of course, when the percentage hits 100%, lease production hits zero.

Incidentally, it seems to me that there is an unavoidable survivor bias, since it stands to reason that the wells that are still producing after five years for example are the better wells, with a lower rate of decline than the wells that were plugged or became inactive in the first five years, and year over year rate of change in production numbers give no information about the number of wells that “die” along the way, which is why I think that a companion chart showing the percentage of plugged/inactive wells makes sense.

*If we calculate the surviving well rate of decline from 2012 to 2013, the year over year exponential rate of decline would be lower of course (27%/year, the natural log of 57/75).

Hi Jeffrey,

To me (and possibly Enno), using the original 10 wells in the denominator is adequate to calculate the average well profile.

Note that in the first five years the wells abandoned are very low (probably less than 1% per year).

As I said before, request Enno Peter’s data from Ron and make any chart you would like.

Oh and it would be nice if you stop claiming survivorship bias when both Enno and I have repeated this several times, but you continue to bring it up.

I’m sorry that the facts seem to offend you, but were there any errors in what I posted?

And why not show the number of plugged/inactive wells by year, since all you guys are calculating is the year over year rate of decline in total production?

In any case, let’s go back to my example and use some different assumptions. Let’s assume a fully developed lease with 10 wells, all completed in 2010, and 2010 production averaged 1,000 bpd. Let’s assume we have one good well and nine poor wells. Let’s assume that we lose 200 bpd per year and let’s assume that we initially lose three wells per year, until we are down to the one good producing well.

2010: 1,000 bpd, 10 wells

2011: 800 bpd, 7 wells

2012: 600 bpd, 4 wells

2013: 400 bpd, 1 well

My point is that the year over year rate of change calculations, regardless of whether one calculates it based on total production or total production divided by 10, do not reflect the fact that 90% of the wells are no longer producing three years after initial production. So, does the year over year rate of change calculation for 2014 and later years (reflecting production from the one good well) accurately reflect the overall rate of change for wells on the lease?

As I said before get the spreadsheet and do what you like.

There is no survivorship bias in the average well profiles published by Enno Peters.

End of story

People will believe what they want to believe, and I’m sorry that the facts seem to offend you.

US oil and gas rig count forecast by Raymond James.

It seems completely unrealistic, but they expect a sharp rebound in drilling activity from the second half of this year.

Source: http://www.ogj.com/articles/2016/02/bhi-us-rig-count-loses-30-in-latest-drilling-dive.html

In light of the recent declines, financial services firm Raymond James & Associates Inc. further reduced its forecast US rig counts for 2016-18 in its most recent industry brief.

RJA now projects an average 2016 count of 500, down from the 620 the firm projected just last month and down nearly half compared with the 2015 average. The new bottom is expected occur in April at 400 units, compared with RJA’s previous projection of 550 in June. [The most recent rig count is 514 – AlexS].

A drilling rebound isn’t seen until late 2016, the firm says, as many E&P firms are likely to first focus on drawing down their uncompleted well inventories and improving their balance sheets, while waiting for consistently higher crude oil prices and a labor force recovery.

The count is forecast to end 2016 at 700 units, adding just 300 during the second half.

… the lower activity this year should still lead to even more robust growth in 2017-18,” the firm said.

RJA expects the average count to jump 106% year-over-year in 2017 to 1,030, and rise 32% year-over-year to 1,358 in 2018.

“Despite the strong growth expected in 2017-18, we don’t see the rig count reaching the heights of 2014 levels again, as rig efficiencies continue to advance at a solid clip,” the firm added.

Alex,

I think their forecast is based on the belief that the US government will somehow (may be indirectly via OPEC June meeting) help to rotate the existing debt in 2008 banks bail-out fashion.

likbez,

They may also assume a sharp rebound in oil prices (I do not know what their forecast is).

Or they completely ignore the issue of shale companies’ negative cashflows, debt, etc.

Alex,

“Or they completely ignore the issue of shale companies’ negative cashflows, debt, etc.”

Possible. But IMHO Raymond James is often good with guessing trends (up/down).

I think their forecast is based on the belief that the US government will somehow (may be indirectly via OPEC June meeting) help to rotate the existing debt in 2008 banks bail-out fashion.

No, I don’t think that is the case at all. Oil companies are not banks and don’t have the same priority as banks. There will be no bailout of oil companies by the government. That is just not going to happen.

Who will have the money to buy the assets/acreage? Will it be domestic money, or will it be the big pools of money from China (currently has just over $ 3 Trillion in foreign reserves), or the Arab oil producing nations?

The following should interest a few people here. It is from the LinkedIn account of Amy Fox. as with POB, the comments are enlightening.

Amy FoxPresident & Founder, Chief Peddler of Geomechanics at Enlighten

Geoscience

How Junk Science Set the Oil and Gas Industry Back 50 Years

February 13, 2016 • 2,745 Views • 130 Likes • 46 Comments

Admittedly, I am stealing a headline by one of my favorite bloggers,

Liz Ryan at Forbes, who writes unabashedly about ludicrous HR policies

and how to avoid them (specifically, this post). But still, I mean it.

I went to a luncheon talk the other day about incorporating

geostatistics into reservoir modeling. I could sense the speaker’s

frustration at the lack of adoption of rigorous science in widely used

industry workflows. Despite being one of the preeminent names in his

field, he’d clearly been singing his song to deaf ears for some time.

At the end I asked him if approaches like the one he had just talked

about had already been adopted in other industries. His reply elicited

a collective gasp from the audience. He said that if he had given the

same talk to an audience in some other industries, they would think it

was the 1950’s. The 1950’s. That’s some food for thought.

Here are a few rhetorical questions that I puzzle on frequently:

Why is the lag between academia and industry longer in oil and gas

than other industries?

Why are the geosciences in general, and oil and gas in particular, so

reluctant to apply techniques that have been considered common

practice in other industries for decades?

Why is the oil and gas industry so quick to jump on “easy answer”

bandwagons and waste billions of dollars on them?

Why are so many people who are considered “experts” in their field in

the oil and gas industry often actually woefully behind the latest

developments in their fields? Worse, how can they be considered

experts when they lack a real understanding of the fundamental

concepts underlying what they do?

In west-central Alberta, the ballpark cost of a vertical well is

probably $1-2 million. The cost of a horizontal multi-stage

hydraulically fractured well is more like $5-10 million (I didn’t

research these numbers. I’m just basing them on what I’ve seen in the

past). Did multi-stage horizontals make producing from unconventional

reservoirs possible? Of course. Did they make it economic? For a

while, when oil was $100 per barrel. Did they make production

predictable? Not even close.

Predictability is the holy grail in this industry. Investors (external

or internal) don’t want to feel like they’re playing a game of chance.

They want to know that it’s more likely than not that their investment

will pay off. This, I think, is why oil and gas companies constantly

fall for red herrings (see, e.g., my many tirades against the

ridiculous oversimplification that is the “brittleness” craze). They

want an Easy button, which service companies are more than happy to

sell (often at steep cost). The service companies then sit back and

count their money during the years or decades it takes industry to

realize that the latest Easy button didn’t actually work. Those of us

trying to shout “It’s not that simple!” can’t be heard over the din,

or worse are muzzled because that’s not what anyone wants to hear.

To be fair, and I’ve said this before, there are pockets of innovation

in the oil and gas industry. But what worries me is that what looks

like innovation to us probably looks like late adoption from the

outside.

A couple of years ago I had an idea for better understanding caprock

integrity in operations like SAGD. It was geostatistical in nature. I

was having lots of trouble getting people to understand it, so I went

to literature to find an example. Guess where I found it…… in HIV

transmission research from the 1980’s.

Let’s look at hydraulic fracture modeling. In the latter part of the

20th century many good hydraulic fracture models were developed for

vertical wells in conventional reservoirs. They were calibrated with

real data. Today those same models are still being used routinely to

model multi-stage hydraulic fractures in horizontal wells with minimal

to no calibration. And we’re surprised when reality doesn’t look like

what the models predict?? That’s insane. Are there better models out

there? Sure there are, more all the time, but they are complex and

often expensive (as is collecting data for calibrating them). Are they

more expensive than a dry hole?

As I end this latest rant (I swear, I’ve got a sense of humor, but I

take this stuff pretty seriously), I’m going to quote Liz again. In

her post on the truth about online job hunting she said, “…when a

piece of technology or even worse, a mindset about technology is

installed and people get trained on it, they don’t want to change it.

They don’t want to learn anything new.”

Written by

Amy FoxPresident & Founder, Chief Peddler of Geomechanics

For a successful technology, reality must take precedence over public relations, for Nature cannot be fooled.

Richard P. Feynman

The month over month changes in the Texas RRC report have been basically flat during the end of 2015, yet the year over year changes are flabbergasting (see below chart for Texas condensate).

As this is due to the high growth rate in 2014, it shows nevertheless the increasing dynamics of the slowdown process. For condensate the year over year decline rate has been a staggering 29% (in November the year over year decline has been just 17%). The yearly decline for oil and gas well gas has been 17% and 20% respectively.

I know the numbers will be revised, yet the monthly change of the year over year decline is now way over 5%. So, this means annualized a 50% year over year decline for the next 10 months for all categories. The 50% year over year decline for condensate will come already during this spring.

All indicators, the bond market, rig count, low oil prices and the yet strong dollar point to an even accelerated trend over the current year. Only a major political event can now stop this train.

From IEA medium-term oil market report 2016:

Further, it is becoming even more obvious that the prevailing wisdom of just a few years ago that “peak oil supply” would cause oil prices to rise relentlessly as output struggled to keep pace with ever-rising demand was wrong. Today we are seeing not just an abundance of resources in the ground but also tremendous technical innovation that enables companies to bring oil to the market. Added to this is a remorseless downward pressure on costs and, although we are currently seeing major cutbacks in oil investments, there is no doubt that many projects currently on hold will be re-evaluated and will see the light of day at lower costs than were thought possible just a few years ago. The world of peak oil supply has been turned on its head, due to structural changes in the economies of key developing countries and major efforts to improve energy efficiency everywhere.

I fear that there will be a rude awakening for some in the next few years.

The WSJ has an article on the IEA outlook, with an interesting chart (do Google Search for access):

WSJ: IEA Sees Global Oil Markets Rebalancing Next Year

IEA says ‘supply and demand will gradually rebalance by 2017, with a corresponding recovery in oil prices from around $30 a barrel’

Copy of an email I sent to some Oil Patch folks:

Attached is an article in today’s WSJ about the IEA’s most recent outlook, for the balance between global total liquids supply & demand. There is a very interesting chart in the article. Apparently, oil prices were trading up today, because of the report.

However, the IEA outlook does not take into account two critical factors: (1) The composition of the global Crude + Condensate (C+C) inventory oversupply (mostly condensate, in my opinion) and (2) Even as production increases, net exports can fall, because of domestic consumption in net oil exporting countries.

Some of my comments on net oil exports:

Following is a link to a discussion, in three sequential comments, of the Export Land Model (ELM, a simple mathematical model which assumes a 5%/year rate of decline in production and a 2.5%/year rate of increase in consumption, in a net oil exporting country), the Six Country Case History (major net exporters that hit or approached zero net exports from 1980 to 2010, excluding China) and the (2005) Top 33 Net Exporters, with graphics for each item:

http://peakoilbarrel.com/opec-except-iran-has-peaked/#comment-556985

Note that what I define as the ECI Ratio (Export Capacity Index) is the ratio of production to consumption, and CNE = Cumulative Net Exports (for a defined time period).

Based on the mathematical model, which is confirmed by the empirical data (Six Country Case History), a declining ECI Ratio tends to correlate with an accelerating rate of depletion in remaining CNE.

For example, about the only metric that most analysts focus on is the top line production number in a net oil exporting country, and from 1995 to 1999, Six Country production rose by 2%, but in only four years they had already shipped 54% of their post-1995 CNE.

I estimate that Saudi Arabia may have already shipped in the vicinity of half of their post-2005 CNE. Note that annual Saudi net oil exports fell from 9.5 million bpd in 2005 to 8.4 million bpd in 2014 (probably remaining at about 8.7 mililon bpd in 2015, EIA + BP data). In other words, Saudi net exports, after increasing very rapidly from 2002 to 2005, have almost certainly been below their 2005 rate for 10 straight years. But the hidden danger, which almost no one is focused on, is the ongoing–and accelerating–rate of depletion in remaining volume of post-2005 Saudi and Global Cumulative Net Exports of oil.

Regards,

Jeffrey Brown

FYI oil was up in asia last night $1.50 rather a lot of hours before the report. Gradually, too. Not a sudden event like a leak.

It’s all noise.

The world of peak oil supply has been turned on its head, due to structural changes in the economies of key developing countries and major efforts to improve energy efficiency everywhere.

Increasing the extraction rate simply increases the depletion rate. I can’t see how anything humans do can change that fact. In other words, nothing can turn peak oil on its head.

“… structural changes in the economies…”

Yea, its called tanking.

Hi Jef,

I took a look at old IMF World Outlooks from 2008 to 2015 and they do tend to overestimate future real GDP growth (market exchange rates) for the World.

On average for the future two years (2016 and 2017 for current report) they tend to estimate about 0.6% too high (average of 2008-2014 reports) and for the following 3 years about 1.23% too high. When I adjust the current forecast to account for this tendency the average World real growth rate from 2015 to 2020 is about 2.2%.

Chart below shows individual years.

There is no growth, just the illusion of growth. All of it was borrowed. Every dollar unit of incremental GDP requires multiple dollars of incremental debt.

Hi Ves,

GDP is a measure of what is produced. If the cars produced run you over, that illusion hurts. Then you have to go to the imaginary hospital, in the imaginary ambulance.

The Matrix was interesting, but it was only a movie. 🙂

Denn – I know you are not ignorant of the fact that GDP measurement includes the “production” of debt which has been the largest element of GDP for some time now.

Hi Jef,

See https://en.wikipedia.org/wiki/Gross_domestic_product

GDP can be determined in three ways, all of which should, in principle, give the same result. They are the production (or output or value added) approach, the income approach, or the expenditure approach.

I prefer the production approach.

The OECD defines GDP as “an aggregate measure of production equal to the sum of the gross values added of all resident, institutional units engaged in production (plus any taxes, and minus any subsidies, on products not included in the value of their outputs).”

Note that for every borrower there is a creditor, for the planet as a whole there is no problem with debt as long as we aren’t borrowing from aliens. 🙂

Currently there is an excess supply of liquidity provided by central banks driving the price of borrowing (interest rates) to very low levels. The aim is increased debt to boost economic output, but clearly it is not working which implies that debt may not be as high as many believe.

The solution to high unemployment in this situation (near zero interest rates) is higher public debt through deficit spending by governments. This increases income and tax revenue as employment increases and eventually reduces the need for fiscal stimulus.

Basic Keynesian Theory, known since 1936 see

https://en.wikipedia.org/wiki/The_General_Theory_of_Employment,_Interest_and_Money

“Hi Ves”

Hi Dennis,

it was not me 🙂

Yep should have been VK, sorry.

Hi Frugal,

Correct. I think what has surprised many, including the IEA is that a few years ago they worried that high oil prices would be a problem as oil supply growth would struggle to keep up oil demand growth.

That has not proven to be the case from late 2014 until today as oil supply growth has outpaced oil demand growth. This is mostly due to a change in strategy by OPEC to focus on market share rather than oil revenue.

I believe that high oil prices will be back, but have been convinced by AlexS that it will not be as soon as I have been predicting. Long term projects that will come on line and be ramping up in 2016 and 2017 may keep oil prices under $80/b through mid 2018, we may not see prices rise to $100/b or more (2015$) until 2019, when the current delays in long term oil investment will start to affect oil output in a big way (2 to 3 Mb/d less output than if the projects deferred had been completed).

To me the undulating plateau scenario looks somewhat plausible, unless there is a financial crisis, in which case demand and price will fall along with output. I have no prediction for when such a crisis might occur, but the scenario below ignores that possibility.

The financial crisis is now. Stock crash due within a few months and maybe weeks.

http://www.hussmanfunds.com/wmc/wmc160222.htm

Hi VK,

Better bury your savings in the back yard.

The IEA has actually increased its medium-term global demand projections compared with the previous year’s report. This reflects a much higher 2015 base, but also slightly higher growth rates in 2016-2020.

As a result, projected demand in 2020 is now almost 1.5 mb/d higher than in MTOMR-2015 (100.5mb/d vs. 99.05mb/d).

From the new report:

“…our forecast for oil demand to 2021 is for annual average growth of 1.2 mb/d (1.2%) which represents a very solid outlook in historical terms. Oil demand breaks through the 100 mb/d barrier at some point in 2019 or 2020. A major change from the 2015 MTOMR is the higher base from which our forecast begins. In 2015 world oil demand increased by 1.6 mb/d (1.7%), one of the biggest increases in recent years stimulated to a large extent by the rapid fall in oil prices that began in the second half of 2014 and gained momentum in 2015. However, any expectations that the most recent fall in oil prices to USD 30/bbl oil will provide further stimulus to oil demand in the early years of our forecast and send annual rates of growth above 1.2 mb/d are likely to be dashed. In the first part of 2016 we have seen major turmoil in financial markets and clear signs that almost any economy you care to look at could see its GDP growth prospects downgraded.

Since 2014 the non-OECD countries have used more oil than OECD countries and the gap will widen in years to come. However, the rate of demand growth in the non-OECD countries is vulnerable to being pared back as the cost of energy subsidies becomes a major burden and governments take action. This will probably not have an immediate impact on demand in the early part of this forecast, but later on we might see that the reduction in expensive fuel subsidies in many countries, including the fast-growing Middle East, does have a significant effect on growth. Also, rising energy use has brought with it terrible environmental degradation, particularly in the fast-growing Asian economies, and oil’s part in this is recognised by measures to limit vehicle registrations and use. Although reducing subsidies and tackling pollution will affect the rate of demand growth, it should be stressed that non-OECD Asia will still remain the major source of oil demand growth with volumes increasing from 23.7 mb/d in 2015 to 28.9 mb/d in 2021.”

Global liquids demand (mb/d): IEA Medium-Term Market Reports 2016 vs. 2015

The IEA’s non-OPEC C+C+NGLs production estimate for 2015 in last year’s MTOMR proved too pessimistic.They have underestimated the resilience of high cost oil production, particularly that of the US LTO. As a result, actual non-OPEC production was 1.1 mb/d higher than in last year’s report.

Still, the agency expects non-OPEC production to decline by 0.6mb/d in 2016 and 0.1mb/d in 2017 before a gradual recovery from 2018. Projected decline in 2016-17 should be mainly driven by LTO. Expected non-OPEC production in 2020 is 0.4mb/d lower than in the MTOMR-2015.

From the new report:

In the year since the 2015 MTOMR was published, the supply side has provided many surprises. By far the most significant has been the resilience of high cost oil production and in particular that of light, tight, oil (LTO) output in the US. As oil prices cascaded down from more than USD 100/bbl it was widely predicted at various milestones that the extraordinary growth in total US crude oil production from 5 mb/d in 2008 to 9.4 mb/d in 2015 would grind to a halt and move rapidly into reverse. Growth certainly ceased in mid-2015 but the intervening period has seen a relatively modest pull-back and total US crude oil production in early February 2016 was still close to 9.0 mb/d, aided by expanding production in the Gulf of Mexico.