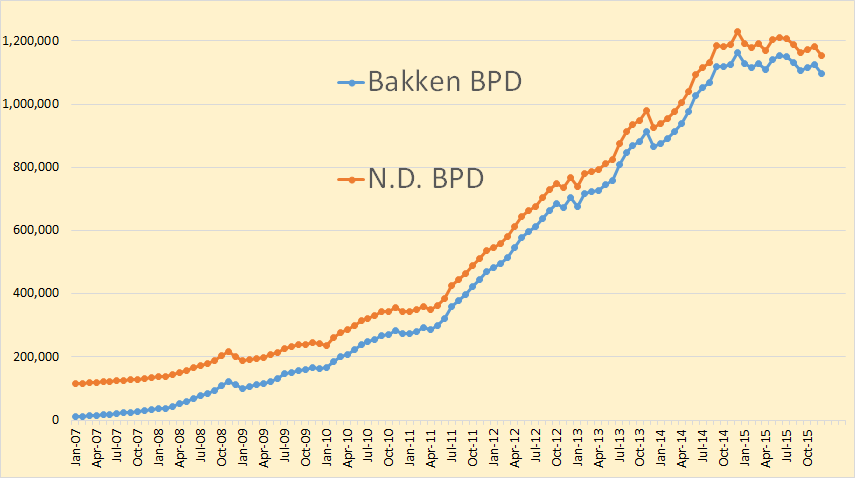

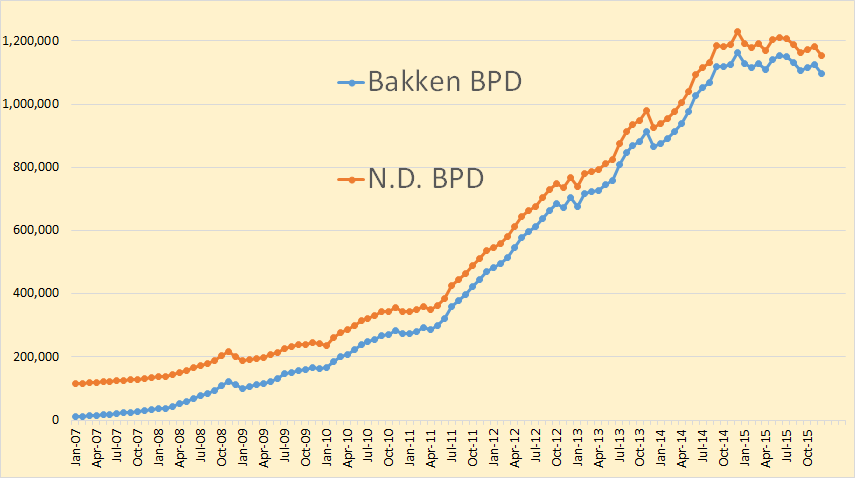

The Bakken and North Dakota tight oil production data is out.

Bakken production was down 28,604 barrels per day to 1,096,044 bpd. All North Dakota was down 29,506 bpd to 1,152,280 bpd.

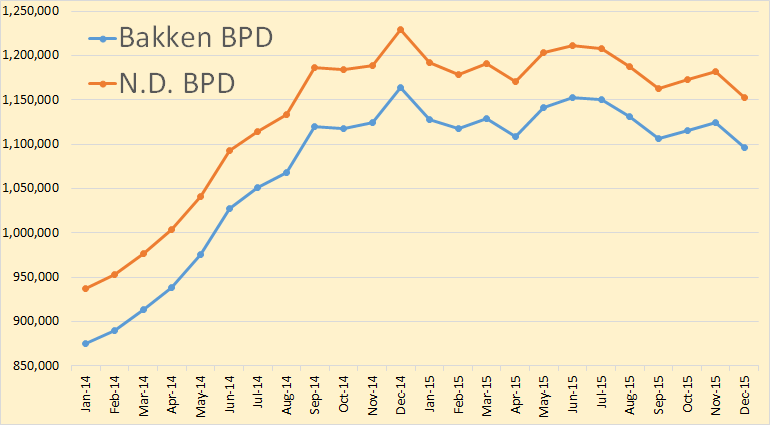

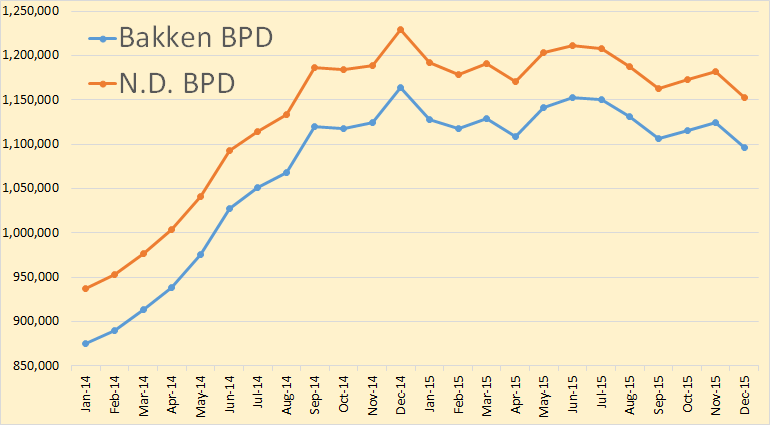

This is just the last two years of the chart above. It gives a slightly better look at what is happening.

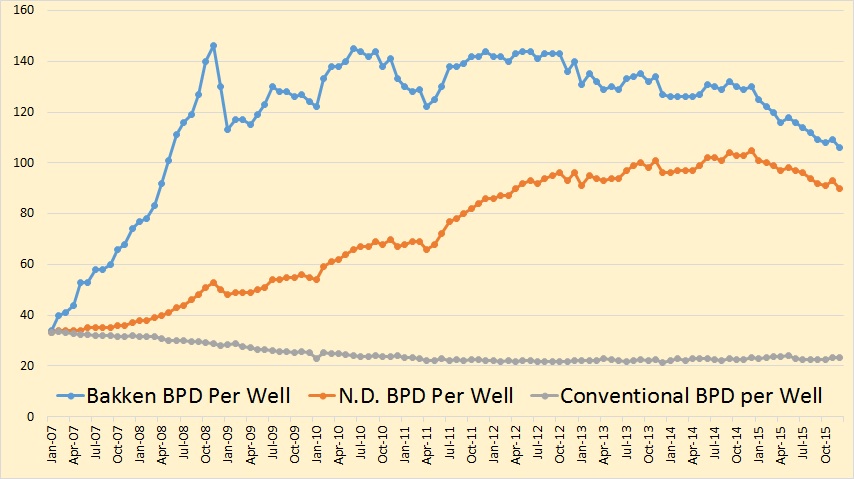

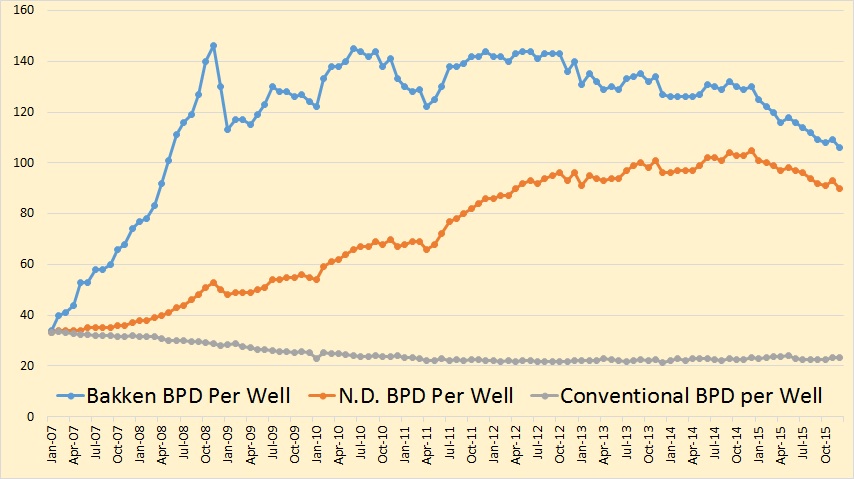

Barrels per day per well fell to 106 in the Bakken and to 90 in all North Dakota.

From the Director’s Cut

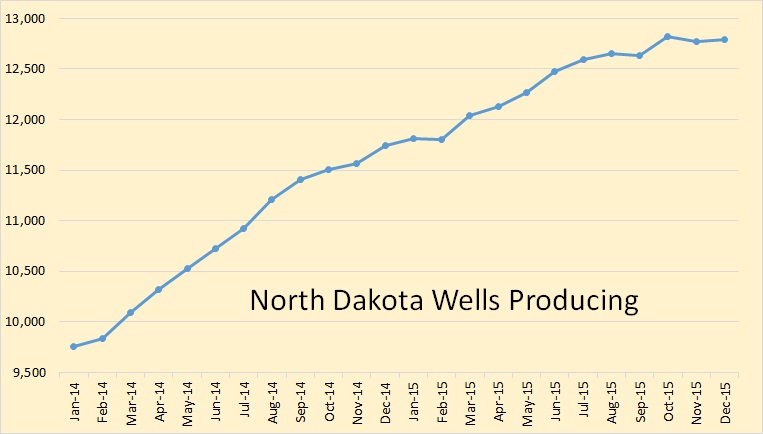

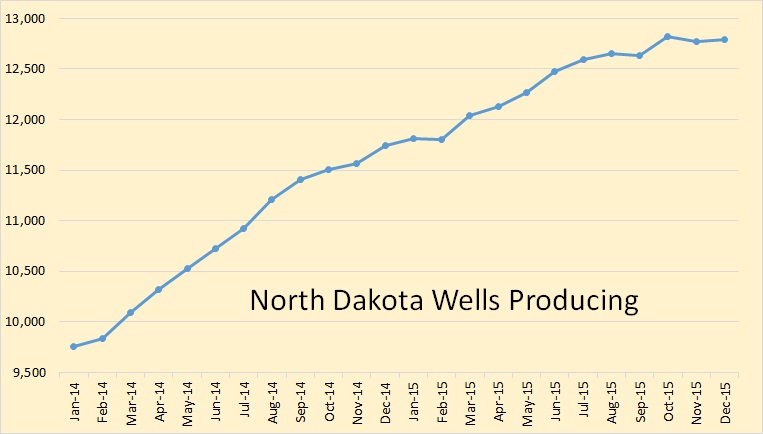

Producing Wells

November 13,100

December 13,119 (preliminary)(all time high was Oct 2015 13,190)

10,756 wells or 82% are now unconventional Bakken–Three forks wells

2,363 wells or 18% produce from legacy conventional pools.

–

Permitting

November 125 drilling and 0 seismic

December 95 drilling and 0 seismic

January 78 drilling and 0 seismic (all time high was 370 in 10/2012)

–

ND Sweet Crude Price

November $32.16/barrel

December $27.57/barrel

January $21.13/barrel

Today’s $16.50/barrel

(lowest since February 2002)(all-time high was $136.29 7/3/2008)

–

Rig Count

November 64

December 64

January 52

Today’s rig count is 41 (lowest since July 2009 when it was 40)(all-time high was 218 on 5/29/2012)

The statewide rig count is down 81% from the high and in the five most active counties rig count is down as follows:

Divide -85% (high was 3/2013)

Dunn -76% (high was 6/2012)

McKenzie -75% (high was 1/2014)

Mountrail -88% (high was 6/2011)

Williams -90% (high was 10/2014)

–

Comments:

The drilling rig count was steady from November to December, fell sharply from December to January, and again into this month. Operators are now even more committed to running fewer rigs as oil prices remain at very low levels. The number of well completions remained steady from 77(final) in November to 76(preliminary) in December. Oil price weakness is now anticipated to last into at least the third quarter of this year and is the main reason for the continued slow-down. There were no significant precipitation events, 5 days with wind speeds in excess of 35 mph (too high for completion work), and 2 days in Williston with temperatures below -10F.

Over 97% of drilling now targets the Bakken and Three Forks formations.

At the end of December there were an estimated 945 wells waiting on completion services2, 24 less than at the end of November.

Crude oil take away capacity remains dependent on rail deliveries to coastal refineries to remain adequate.

The drop in oil price associated with anticipation of lifting sanctions on Iran and a weaker economy in China is expected to lead to further cuts in the drilling rig count. Utilization rate for rigs capable of 20,000+ feet is about 30% and for shallow well rigs (7,000 feet or less) about 20%.

Drilling permit activity declined November to December then fell further in January as operators continue to position themselves for low 2016 price scenarios. Operators have a significant permit inventory should a return to the drilling price point occur in the next 12 months.

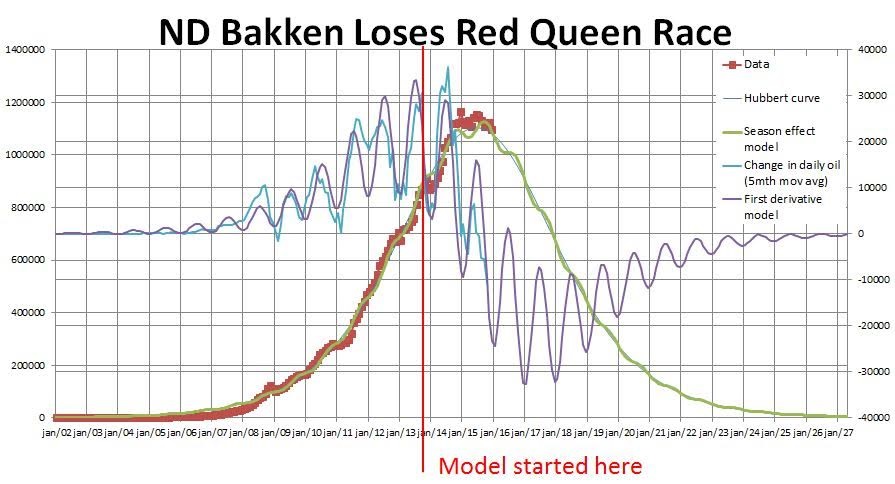

Bruno Verwimp posts me the above chart. He says so far the Bakken is following his curve exactly.

Winter just started affecting the North Dakota production numbers. There is more decline to be expected the coming months. Consider seasonal conditions combined with the maturity of the field and with low prices. The peak is behind us.

The accuracy of your curve would suggest that the drop in oil price hasn’t had as marked an impact as would be expected – i.e. the decline was going to happen anyway, no matter what. Can you comment on that?

I am, honestly, stupified myself by the accuracy of the curve, that is 25 months old now without ever tinkering the parameters of the model. It was based on Hubbert analysis, adding a seasonal effect on it. So basically it is pure geology, no impact of price whatsoever. Besides that, one needs to aware of the price collapse and the possible impact on the industry. So I might be just “lucky” to be right with my prediction, because the price collapse happened to coincide with the predicted decline in production.

For that reason I added the other set of curves: the first derivative of the model and the change in production (5 month moving average). The cool thing is: there is basically no disturbance of the expected/predicted changes in the data. The changes in the data do follow the first derivative of the model too. Would there have been a sudden policy change (due to lower prices) there would occur a mismatch between the first derivative of the model and the change in the data. That did not happen. So, basically, I believe ND Bakken is producing every barrel it can, from a geology point of view – despite the low prices.

Hi Verwimp,

Can you remind us what the URR of your Hubbert model is?

I ask because Proved plus probable reserves at the end of 2014 were about 9.3 Gb, cumulative production was about 1.2 Gb at the end of 2014,which suggests a URR of 10.5 Gb, if no new reserves are added from possible reserves or contingent resources in the future.

The decline has very little to do with geology and much to do with the oil price.

If new wells were being added at a rate of 150 new wells per month in a scenario where oil prices only fell to $80/b instead of $50/b in 2015 and then gradually rose from $80/b in June 2017 to $160/b in Oct 2020, then output would increase until mid 2020 and then gradually decrease.

If we assume profitable well locations run out at about 40,000 total wells drilled, we get the scenario below when 150 new wells per month are added from May 2015 to Sept 2031.

“If new wells were being added at a rate of 150 new wells per month in a scenario where oil prices only fell to $80/b instead of $50/b in 2015 and then gradually rose from $80/b in June 2017 to $160/b in Oct 2020, then output would increase until mid 2020 and then gradually decrease.”

Why is it that you get to make up wild, pie in the sky scenarios that logic and economics virtually guarantee has zero chance of occurring and everyone accepts it as if it were a legitimate view point?

Anyone else want to dream up a scenario with a different outcome?

Since when is a resource that is not economical to extract not a geological issue?

Why is it that you get to make up wild, pie in the sky scenarios that logic and economics virtually guarantee has zero chance of occurring and everyone accepts it as if it were a legitimate view point?

This ” wild pie in the sky” is in your head, not in Dennis’s. Suppose you outline your reasons for thinking you know so much more than Dennis?

“Since when is a resource that is not economical to extract not a geological issue?”

Your are obviously “challenged” in respect to your reading and comprehension skills, or else just have it in for Dennis for some reason of your own.

“The decline has very little to do with geology and much to do with the oil price.”

If you will go to a dictionary, and look up the word “context”, and study it until you understand it, and read the quoted line just above, carefully, slowly, you will eventually understand that the Dennis’s comment, IN CONTEXT, is about oil that was being produced when the price was HIGH , and is now being shut in when the price is DOWN.

The geology of the oil field has not changed.

Methinks you habitually take a cheap shot at Dennis once in a while.

Now I call “bullshit” once in a while myself, but when I do, I have something to say about WHY I believe what I do.

When other folks tell us that Wall Street has driven the price of oil down to peanuts, they never bother to explain just how Wall Street manages this trick.

If they want to explain it by saying Wall Street has had such a bad influence on the economy that the world cannot AFFORD oil at more than twenty to thirty bucks, and is so broke it can only afford ten dollar oil, they ought to say so in so many words, and be done with it. THEN they might have an argument with legs to stand on.

But talk about traders, who do not generally own oil fields, or oil companies, or oil field contracting service companies, or pipelines, or tanker ships or tanker rail cars, or refineries, or tank farms, or fleets of eighteen wheelers that deliver to retailers, or retail stores that sell gasoline and diesel fuel, WILL NEVER make any sense.

All the people who own all these various things respond to price, sure as hell.They respond in real life. They produce oil that goes thru the distribution and processing chain right up to the retail store where it is bought by the collective customer, who buys as much as he wants, and has near zero use for more.

If it were MILK, he could at least feed an extra gallon to the family dogs and cats. Being as gasoline and diesel fuel are nasty, and actually dangerous to have around, and expensive to store, the average user would buy very little more, over the short to medium term, than he buys today, even if the price of it went down to FIFTY CENTS a gallon.

Over the longer term, the average user will perhaps buy a nicer, larger, more powerful car, if he can afford a new car.

The airline industry will cut ticket prices,eventually, being forced to do so by competition, because fuel is a HUGE part of air line expense items,but they will hold off as long as they possibly can. Even so, it will take a while for air travel to pick up just because ticket prices are down.

There is a logical, air tight, exceedingly simple explanation for the low price of oil.

More oil is coming to market than the end user wants, and the price will stay low until production falls back enough that the end user HAS to pay more for oil.

I am waiting for the smoke and mirror guys to explain how it is that Wall Street forces producers to pump and sell oil.

Wall Street may have loaned the money to the folks in the tight oil business—- But who thinks Wall Street lent that money with the INTENT of putting the borrowers into bankruptcy, with the CONSEQUENCE the loans would not be repaid?

ANYWAY, Saudia Arabia and Russia aren’t financed by Wall Street. Chinese oil companies are not financed by Wall Street.

MOST of the oil produced in the world is not financed by Wall Street.

As the price goes up,the end users who are least prepared to pay higher prices will necessarily cut back , and the oil they DON’T burn will be burnt by the people who can afford to pay more.

You can learn all this stuff at any REAL university, where the econ professors are not PC idiots, in the first basic course.

Hell’s bells,I learned it in COW COLLEGE over half a century ago. They still teach it pretty much the same way in most real universities, so far as I have checked.

Hi Jef,

Both geology and price influence output. If oil prices had remained $80/b or higher, output would not have declined. Both geology and economics are included in the model, following the work that Rune Likvern has done in the past and using the data that Enno Peters has so graciously provided to develop better well profiles for the average Bakken well.

Hi Jef,

The point of the scenario was to show what might have happened if the price had not decreased. It was to serve as a counterpoint to a Hubbert analysis that suggests prices don’t matter, only geology.

I think geology is important (that is why I use the well profiles developed from actual output data from the NDIC).

I don’t know what future number of wells will be added, but I am sure the oil price will imfluence the decision of how many wells to complete.

One way to think of the scenario above is if I had done it back in July 2014 when oil prices were still about $100/b.

I certainly didn’t see the future drop in oil prices coming and would have thought the price scenario was very conservative.

Clearly such a scenario would have been wrong, as most of my scenarios are. The future is difficult to predict.

“The future is difficult to predict.”

Oh I think it is very easy to predict that the global economy can not endure $100 + oil humming along supporting current demand yet alone the growth required for your predictions.

Hell it’s not even a prediction it is simple observation but don’t let that get in anyones way.

Hi Jef,

The World endured oil prices over $100/b from 2011 to mid 2014. World Economic growth was between 2.3% and 2.8% per year from 2011 to 2014 according to the World Bank.

http://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG/countries?display=graph

As oil becomes more expensive (as it is in Europe due to proper tax policy) people will use it more efficiently.

I support policies that would make oil more expensive (through higher taxes) so we would use less of it. People would demand more public transportation (light rail and rail which can be electrified) and better urban design so biking and walking would be preferred modes of transport.

No doubt you would claim that is BAU lite, but BAU is changed gradually over time unless there is a crisis and then change becomes more rapid (US during Great Depression). Unfortunately a crisis can lead to other outcomes that are less desirable.

Those growth % are only due to the fact that the central banks of the world pumped trillions of dollars into the FIRE economy. The other 90% of the global economy, some call the real economy suffered greatly.

The only reason oil production didn’t collapse is because of that same trillions of $ pumped into the economy.

If you think that any of this is natural, sustainable, or repeatable you have another think coming.

Hi Jef,

The real economy is not affected all that much by the central banks. The expanded money supply just circulated more slowly.

If you are concerned about the distribution of wealth, I agree that is a big problem.

Less developed countries have been growing more rapidly than OECD nations so they are catching up, much more of this needs to happen as it leads to more educated women and lower births per women which will eventually solve the population problem.

The growth in GDP happened, it may not be sustainable over the long term, it will slow as population peaks and declines (peak around 2050 for population.)

Dennis – Is there a reference for the URR numbers – I’d guess USGS. I think their numbers cannot be used the way official oil company numbers can (i.e. their reserves are really more like resources (i.e. technically recoverable, but with no price associated). In California shale their numbers dropped by 97% overnight. The Verwimb curve looks to give about 2.0 to 2.5 URR, is that not in line with Campbell and Laherre, who might underestimate a bit as that is what reservoir engineers do, but not too much.

I’m not sure how to interpret probable, possible and contingent reserves in LTO terms. In conventional reservoirs they often relate to neighbouring areas that look similar in geology (i.e. may contain traps with oil) or fault blocks in the same formation which haven’t been drilled, or uncertainties about recovery factors or oil/water contact. To turn them to proven reserves requires drilling exploration wells. The uncertainties when drilling source rocks seem different – the area is known but productivity can be orders of magnitude different.

Your numbers would be right if the assumptions are right but there seem many more ways for them to be wrong – i.e. have even thousand wells actually been profitable to date, let alone 40000 in the future.

Hi George,

The wells would be profitable if prices had remained above $80/b (or this would be true for the “average” well, some would be more profitable and some would be less, but we know that every oil company drills “above average” wells. 🙂

The bad California LTO estimate was the EIA and not the USGS.

The EIA gathers proven reserve data and for the Bakken at the end of 2014 this was 5.5 Gb, there was 1.2 Gb of cumulative production, so at minimum the URR would be 6.7 Gb, if we assume the average well has an EUR of 250 kb and the probable reserves are zero (highly unlikely), then 6700 Mb/0.25 Mb per well would be 26,800 wells. Typically probable reserves are about 70% of proven reserves, let’s be conservative and use 50%.

That results in 8.3 Gb of proved plus probable reserves, then add 1.2 Gb of cumulative output from 1950 to 2014 and we have a URR of 9.5 Gb. Note that I have assumed no new discoveries or any additions to 2P reserves in the future to get this 9.5 Gb URR estimate. I think that is too conservative and usually use 10 Gb as a round number for the URR.

The EIA reserve data is at the link below:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RCRR01SND_1&f=A

At the end of 2014 proven reserves were about 6 Gb and at the end of 2006 they were 0.4 Gb, I have assumed that most of the increase in reserves was due to Bakken/Three Forks reserves because most of the oil produced from 2007 to 2014 in North Dakota was from the Bakken/Three Forks.

The USGS Bakken/Three Forks Assessment presentation can be found at the link below:

https://drive.google.com/file/d/0B4nArV09d398cDZMNW5yRWxVM1k/view?usp=sharing

See slide 16, mean undiscovered technically recoverable resources (UTRR) in Bakken/Three Forks is 7.4 Gb.

See slide 18, North Dakota has 78.6% of the Bakken/Three Forks UTRR or 5.8 Gb. Add proved reserves (note that we are assuming probable reserves are zero which is very conservative) of 3.3 Gb at the end of 2012 (the assessment was published in 2013) and also add 0.7 Gb of cumulative output to the end of 2012 and we have a TRR of 9.8 Gb.

If we had added probable reserves of 1.6 Gb (50% of proven reserves), the TRR would be 11.4 Gb.

Also note that Jean Laherrere has always argued that proved plus probable (2P) reserves is the best estimate and is what should be used rather than proved reserves. So the best estimate for URR is 11 Gb rather than 10 Gb as long as oil prices in the future are high enough to make production profitable.

Dennis – so EIA had a large estimate for Monterey shale, reduced it a bit and then USGS knocked it down to almost nothing. Why can’t something similar happen on the undiscovered ‘reserves’ that EIA are quoting for Bakken?

2P estimates from conventional fields, where the producing companies hold all the rights but maybe haven’t drilled in all areas, have usually come out pretty close to final recovered oil. There are legal obligations on the operating company to be as accurate as possible, they will have good seismic and have spent a lot of money checking upside and downside before FID on the project. With numbers from EIA on land which no company has yet shown interest in and requiring unconventional wells, I can see some significant differences (not that I’m saying one way or the other – I don’t know enough in general in LTO or the specifics in Bakken – just an interested observer).

Hi Eustace,

The undiscovered resources are USGS estimates

see

http://pubs.usgs.gov/fs/2013/3013/

The EIA estimates are proved reserves gathered from company data see

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RCRR01SND_1&f=A

Take 2014 reserves and subtract 2006 reserves and that gives an estimate of Bakken/Three Forks reserves in North Dakota. Cumulative output at the end of 2014 was 1.2 Gb, so proved reserves plus cumulative production was about 6.7 Gb at the end of 2014. Typically probable reserves are between 50% and 80% of proved reserves, a best guess would be 65%, but a conservative estimate would be 50%, this would suggest a URR of at least 9.4 Gb, if no possible reserves were added to 2P reserves in the future (which is unlikely at best).

Dennis,

As far as I can see in your above chart you are assuming that new wells will grow by close to 160 new wells per month.

However, December growth from November were just 19 new wells from 13,100 to 13,119 and down from October 15. In addition, the tight credit conditions will very likely force companies to abandon wells.

As your price forecast has been catastrophic on the wrong side and you have also missed the huge opportunity to short oil (buying DWTI instead of UWTI), there is already mounting evidence that your production forcast is going horrible wrong.

Isn’t it time to rethink your models?

Hi Heinrich,

The point of the second scenario was to show that if we ignore the oil price (as Verwimp does) we can get a very optimistic scenario.

Why has the number of new wells added each month decreased?

It is because the price of oil fell from $110/b to $30/b. It is not only a matter of geology it is both geology and economics.

I note that when I ask what you think the future price will be, you don’t give an answer, then in the future you can say, see I was right about the price, I said it would be “higher” than most people think. Can you tell us what most people think, do you mean the futures price of $40/b for Brent in Dec 2016?

If that is what you mean, that is far from a bold prediction. If the Dec 2016 average spot price for Brent is $41/b, you can say, see I make very accurate predictions as you have all Brent oil prices from $41 to infinity covered by your “prediction”, very clever indeed.

So how about a little narrower range for your Dec 2016 average spot price for Brent crude?

Note that the first scenario I posted is what I think is likely, the second is what might have happened if the price of oil had remained at $80/b or higher as most people (including the futures market) believed in Sept 2014.

Looking at EIA futures prices for crude, contract 1 (next month’s futures contract) in Sept 2014 averaged $93/b in Sept and contract 4 (4months ahead, so Jan 2015) was $91/b. How accurate were these futures prices? Let’s look at the spot price for WTI in Oct 2014 ($84/b monthly average, or $9/b lower than the average futures price in Sept) and Jan 2015 ($47/b monthly average or $44/b lower than the futures price from 4 months earlier).

It is pretty easy for oil price predictions to be wrong, the only way to be correct is to make no firm prediction, maybe zero to infinity will be the future oil price, then all bets are covered.

However, December growth from November were just 19 new wells from 13,100 to 13,119 and down from October 15.

Heinrich, that is not exactly correct. In December there were 19 additional wells producing. Wells producing are the total of new wells minus wells shut in. A lot of wells are being shut in these days. Helms says there were 77 well completions, meaning new wells. Enno may have a different, and more accurate number however.

Hi Ron.

Enno’s estimate is 79 new wells added, probably at least 78 of them were Bakken/Three Forks wells.

Dennis, The URR of my Hubbert Curve is only 2.77Gb. That just gave me the best fit to the data prior to december 2013.

I have a problem with any assumption of a constant number of wells being drilled every month for decades to come. If there really are another 30k something wells to dril, Americans will go for it as soon as possible. When there is a dollar to be earned today citizens of the USA will not wait until tomorrow. They go for it. So an assumption of 150 new wells per month during decades will never materialise. It will grow until, lets say 600 new wells per month within a 5 year timeframe (the production of rigs needs to follow, as does the road infrastructure.) and then fall back to zero, resulting in a Hubbert curve once again… (I am generalizing all citizens of the USA now, I know, and that’s never right, but you know what I mean.)

Hi Dennis,

“The decline has very little to do with geology and much to do with the oil price.” It might. Absolutely. But… Please follow the thought experiment below:

(1) I made my model, not taking price into account.

(2) As far as until now: the model fits.

(3) I did not, and still do not, need price to explain what happens.

(4) We indeed had a fall in price, and a fall in drilling activity.

(5) Notice: correlation does not mean causation, and cause and consequences might be the other way around than intuitively understood.

The popular statement is: “The price fell because OPEC refused to close the tap.” Is that correct? When I check Ron’s graphs OPEC didn’t add much production lately, the USA did! It’s the USA that flooded the markets with oil. The USA caused the price collapse. Shale oil caused the price collapse. Shale oil caused it’s own demise. Falling price was just a consequence of producing more than a certain critical level whatsoever. You see? 🙂

If you check long term oil price evolution and production evolution, there is basically no link at all. I think more than by price oil production is driven by hope to make a profit.

Verwimp,

Being analytical, the time coincidence of the peak in your graph and the oil production peak, could be due to:

a) Chance

b) The model correctly capturing oil production dynamics.

Since your model does not include oil price, and oil price has changed drastically, for b to be correct, it follows that oil price has to be irrelevant for oil production dynamics, because if it is not, then a is correct.

I don’t think anybody here thinks that oil price is irrelevant for oil production.

You just got as “lucky” as anybody predicting Peak Oil for 2015 before the summer of 2014. Without the price crisis Peak Oil could have been delayed.

I have always had a problem with pure geological “Hubbert” models. Oil production depends also on the economy and if you don’t include the economy you can only get it right by chance and since the economy is a lot harder to predict than geology if you do include it, then you get a cloud of scenarios, and therefore you are not predicting much.

Javier, Bakken is a Hubbert poster child. Look at the linearisation, please. There is no change in the field dynamics post june 2014. There is no change in the field dynamics post price collapse. As for now: I rest my case: (b) The model correctly capturing oil production dynamics.

Hi Verwimp,

A Hubbert linearization is not reliable when such a short period is used, it is typically done using annual data of at least 10 years. Even then it often underestimates the eventual URR.

The Hubbert linearization technique has many flaws see

http://www.theoildrum.com/node/2357

Annual data of at least 10 years results in 10 datapoints. I use monthly data of >6 years, resulting in >70 datapoints, of which most of them are nicely collinear, besides the annual winter dip. Why would this not be reliable, when apparently every new datapoint fits with the model so far, in such a way that the 25 datapoints result in an R²=0.92 compared to the model?

One typically uses annual data because of a lack of monthly data. One typically uses at least 10 years because one needs to consider a significant timeframe in the history of the field. I consider the entire history of the field.

Hi Verwimp,

The history of the Bakken/Three Forks goes back to 1953, so you do not really capture the entire history of the field.

Below I will demonstrate what happens when a Hubbert Linearization is done too early.

As Dennis pointed out, Hubbert Linearization is indeed deeply flawed. Any curve that shows an inflection point like we are experiencing now will show linearization over such a short time period.

Convolution-based approaches such as Dennis applies are more mathematically sound as they use actual physics and observational data. He is also doing a good job of applying demand effects into the formulation.

Sorry Verwimp,

I am not buying your argument, because it is logically faulty. Your graph is just a model that depends critically on production following a particular logistic curve and not other. The price crisis has reduced the number of rigs and production bringing the peak forward maybe a few years. The new logistic curve is more similar to what you modeled, that is all.

You cannot extract any conclusion from the fact that your model and oil production correlate. It was not inevitable as production has been affected by the price crisis. You will fool yourself if you think otherwise.

Hi Verwimp,

You are correct that for the economy as a whole, oil output does not correlate well with the price of oil, it tend to be tied to economic output. I will not try to convince anyone, but in my view the causation arrow between oil output and GDP points from GDP to oil output. Higher GDP results in higher income which increases demand for oil, raises oil prices, makes oil production more profitable, and leads oil producers to increase output.

Consider the following thought experiment. Oil demand increased at a level that was equal to the increase in oil output and the oil price remained at $110/b. Would the well completion rate in the Bakken Three/Forks have fallen from 2200 new wells per year to about 1000 new wells per year in that scenario?

If so what would be the reason for the decrease in well completion rate.

It is absolutely true that oil producers are in business to make a profit. That is the reason the price of oil matters.

Note that my claim is not that geology does not matter, it is that both geology (supply) and the economy (GDP which determines demand) are important.

The URR of your model (2.8 Gb) is less than proven reserves plus cumulative output(6.7 Gb). It is not surprising that it would have reached a peak in April 2015 at about 50% of the URR.

You are correct about a steady 150 new wells added per month being too low, it may be higher than that, there is always a limit to how high these rates can go determined by infrastructure. Exponential growth does not continue, the growth becomes linear and gradually slows to a stop due to geological constraints.

Note that the USGS Assessment suggests a TRR at the F95 level of 10 Gb, that is there is a 95% chance that the TRR for the North Dakota Bakken/Three Forks is more than 10 Gb based on the USGS analysis.

I agree with your criticism of my model, the linear addition of new wells is a simplifying assumption to try to model decreasing new well EUR. Something that needs work.

I would note however that the rate that wells were added to the Bakken /Three Forks increased gradually from May 2012 to Oct 2014 (12 month centered average rate of well completion) from 150 new wells per month to 185 new wells per month over about 30 months, just a little over one well per month.

Eventually the increase would flatten to a maximum rate due to infrastructure, social, economic, and geological constraints.

Scenario below tries to adjust in consideration of your criticism (which I appreciate).

“If so what would be the reason for the decrease in well completion rate.”

I don’t know, Dennis. I really don’t know. Some fysical limit. Too many oil trucks blocking one another on every road crossing, damage to roads, too many dry wells outside of the sweet spots, … I have no idea. I live 4000 miles away from Bakken. Someone here living in the Bakken might tell me what these limits were.

In the 1970’s oil production in the lower 48 declined while prices increased dramatically. It was just post peak decline. Nothing to do about it. Now we see stagnation (and soon decline) of production in times of declining prices and there is a causal relation seen in these events. I don’t need that causal relation to recognize a peak and post peak decline. That’s it actually. If price did influence Bakken production, something would be visible in the first derivative, or at least in the Hubbert Linearisation. Both did not happen. (see above) Please realise it still might happen! That would be it! That would result in a downward bent of the linearisation and that would result in even more extreme production decline! Woow!

Hi Verwimp,

See the following,

http://peakoilbarrel.com/bakken-december-data-big-decline/#comment-560185

There are many problems with HL especially its tendency to underestimate URR.

Oh, the Hubbert linearization tends to be concave up rather than linear, so the results tend to be an underestimate of the URR.

Hi Verwimp,

Your suggestions for physical limitations might explain why output could not increase faster than it has, but North Dakota had no problem completing 185 new wells per month over a 12 month period (the maximum 12 month rate) and was able to truck oil and water just fine at 1163 kb/d in Dec 2014 so there is no reason they could not continue at that level, in fact there is a great deal of excess rail capacity to move oil out of North Dakota.

The drop in oil price is the explanation and it does not matter who “caused” the oil glut, producers will cut back their investment when profits fall and that is exactly what we see happening in North Dakota. As I said before there are many reasons the “geological” hypothesis for reduced output is not convincing, it is much more a matter of oil prices and profitability.

Dennis,

“for the economy as a whole, oil output does not correlate well with the price of oil, it tend to be tied to economic output.”

Is a lot easier. Oil output correlates with upstream capital spending, and capital spending depends on how well oil companies are performing economically, what are the economic perspectives, and price of oil.

Now this graph tells you two things not reflected in a Hubbart linearization:

– That upstream capital spending since 2005 has been growing a lot faster while oil production has been growing a lot slower.

– That upstream capital spending is undergoing its biggest reduction in history.

Both together define the 2015 Peak Oil.

Hi Javier,

No it doesn’t describe peak oil, it simply shows the market is oversupplied and this is how it balances.

Basic economics my friend.

I agree with you on Hubbert Linearization, not a great method for determining URR.

Is Javier Spanish for denial?

If something is backed by evidence and hurts your feelings then you can “Javier” it into my imaginary land!

Dennis,

The market you talk about is to the left of the red arrow in the graph. To the right of the red arrow you have a situation that requires ever increasing amount of investment just to keep production flat.

“The greatest shortcoming of the human race is our inability to understand the exponential function.”

Albert Bartlett

Now, if we just need increasing investment just to keep production flat, and investment doesn’t grow, we get a reduction in production, but if investment declines, we get an exponential decline of production, and if investment declines hugely as it is happening, we are going to watch a huge decline for a long time. Then to make up for the losses we would have to triple or quadruple the investment, and we will simply be unable to do so. Our weakened economies running on less oil will not be able to do so. Our consumers, burdened by debt and stagnant wages and multiple part time jobs will not be able to pay the oil prices necessary to do so.

Dennis, define the conditions necessary for you to accept that Peak Oil has taken place. Time with production not raising above 2015 levels, or decline in production or combination. Seems to me that some people will never accept Peak Oil no matter the time or the decline since last peak. They will always think that higher production is possible and will find justification outside Peak Oil for the production decrease.

Hi Javier,

The test is simple. High oil prices (over $100/b in 2015$) for 3 years or more with no new peak in C+C output.

See following article:

http://www.woodmac.com/analysis/PreFID-oil-projects-global-breakeven-analysis

The decline in investment will mostly affect output in 2018 and later chart below from article linked above.

Dennis,

Then what happens if oil prices never go over $100/b in constant money as Gail Tverberg defends? Or if it goes over but comes down again before 3 years?

Do you have a definition of Peak Oil that does not depend on oil price?

Hi Javier,

I don’t agree that prices will remain low, when an important commodity becomes scarce its price will rise. You and Gail assume there will be an economic collapse and I assume you both must think that it will be permanent.

If that was the case peak oil would be the least of our problems, but I do not find such an analysis convincing.

Essentially the argument is that there will be no supply constraint, there will be a demand constraint that will keep oil prices permanently at a level where the oil output level remains below 2015, and I think that is unlikely over the long term.

Output will dip a little in 2016, oil prices will recover to $75/b or higher and oil investment will resume.

If we ignore price and simply look at output levels it took 17 years to get back over the 1979 peak after the oil shock of 1980-82, so that could be our time, after 18 years we might conclude the peak was behind us. Or we could look at the drop in overall output from 1979 to 1983 where production dropped by 15%. So if we assume 2015 annual C+C output is 79.9 Mb/d we might conclude the peak had been reached if output drops by more than 15%, so under 67.9 Mb/d.

For me without high oil prices as I first suggested, this would be needed, especially prior to 2030. I believe by 2030 we will be at or beyond the peak (this would be an undulating plateau scenario at around 80 Mb/d from 2015 to 2030.)

Oh and I do think oil output will peak, I am not convinced that 2015 will be the peak, I think it will be between 2020 and 2030, depending on what happens to the economy and oil prices in the future.

Dennis,

>15% decline in oil production then. That can be achieved easily in less than 10 years. Before 2025. Just watch.

“If that was the case peak oil would be the least of our problems”

Obviously, but Peak Oil is the main cause of our problems. The Peak conventional oil of 2005 caused the price increase that made the subprime bubble and the financial leverage unsustainable. The Peak exports of 2007 contributed to the downfall of the highly indebted oil importing countries in the debt crises of 2010 and 2012. The oil reduction that is coming is going to wreck the global economy. Lack of oil will not cause high prices, will cause poor economic performance and thus low or moderate oil prices. But you are right, oil will be the least of our problems as unemployment will be very high and unemployed people consume less oil.

Hi Javier,

Without high oil prices, about 2042 to get to 67.5 Mb/d, I doubt the economy will perform as you foresee.

Mr Verwimp – thanks. It would seem amazing that price changes like we have seen didn’t play a part but: a) the actual flattening of the curve started in late 2014 before the OPEC meeting that killed the price, which means drilling/completion strategies would have been changing in the six months before that, when prices were still high; b) through 2015 till now the price crashed by a factor of four to six – but could anyone look at that undulating plateau and explain it in price terms.

I worked on North Sea projects (and a very short time on an Alaskan one) in the late 1980’s and there was an apparent price disconnect then in a different way, prices were very low but projects just kept getting approved, while Houston was going bust.

I’ve never seen first derivative and seasonal cycle trends used like that before. They are pretty smart and add useful insight.

There was a sharp deceleration in the Bakken ND production growth rate from 2Q12 to 1Q13 (the effects of low base).

But from April 2013 to December 2014 growth rates remained relatively stable at around 30% y-o-y.

It was falling oil price (after Nov 2014 OPEC meeting) that caused a sharp decline in drilling/completion activity and, a result, in the Bakken production growth in 2015.

Bakken ND y-o-y oil production growth, 2010-2015

Hi AlexS,

Exactly right. In addition prices started to fall after July 2014 which gradually reduced the completion rate, in addition the wells were being added at a pace that was outstripping the ability of completion crews to keep up so that was the main reason for the fall in the growth rate to 30%, they were at their maximum completion rate and eventually this slowed due to lower prices.

Bakken ND y-o-y oil production growth, 2013-2015

Bakken ND y-o-y oil production growth vs. WTI oil price, 2013-2015

AlexS,

Not much to be said except very nice work! Thanks.

This seems like it might be a spurious correlation though, unless that is the average WTI over the prior 12 months.

Otherwise, how is the price in a specific month meant to predict the production change over the previous 12 months?

gwalke, I think you are reading this wrong. Price in a specific month is not an issue, it’s the general decline in price over several months. And price is not predicting production. Year over year production decline is just following price decline.

Hi Gwalke,

I agree with Ron.

Notice that the price decline occurs about 6 months prior to the decline in output growth. The number of wells completed has decreased, that is a fact.

Do you propose the decrease in oil prices has nothing to do with the decrease in the number of wells completed in the Bakken/Three Forks?

If you are arguing that there is a lag, I agree, the chart shows pretty clearly that this lag is about 6 to 8 months.

If you are going to argue that oil price doesn’t matter, what is your explanation for the decreasing rate of well completions?

My complaint is that correlation is not causation. These are presented together to suggest a causal link. Your causal mechanism for y-o-y production growth change is price month by month in that graph.

All I’m saying is that you can’t attribute the difference in production Jan14-Jan15 to the price change Jul14-Aug14, which is what is happening in that graph and what you have both said in these comments. You need to compare them over the same time scale, otherwise its apples to oranges.

All I’m saying is that you can’t attribute the difference in production Jan14-Jan15 to the price change Jul14-Aug14,…

Ahhh but I think you can. Shale oil is very expensive to produce. And it is only natural that when the price collapses, then production of this very expensive oil slows dramatically… with about a six month delay of course.

If you think that, you need to explain why the price and production figures in the other 11 months had no effect on Jan 15 production.

Bakken oil rig count followed with a 5-month time lag the decline in oil prices.

The rig count started to decline only in November 2014, when oil price dropped below $70/bbl after OPEC decided not to cut output.

Bakken oil rig count vs. WTI oil price

In turn, y-o-y change in the Bakken oil production is closely correlated with the rig count.

Y-o-Y change in the Bakken oil production vs. monthly-average oil rig count

verwimp has a compelling chart that shows price independent change.

You have a compelling chart that shows price dependent change.

So what do we conclude?

Hi Commenter,

Verwimp’s charts are nice, but as Javier suggests correctly the decline on his chart and the current decline in actual Bakken output are a coincidence. The URR happened to have been chosen so that the peak almost coincided with the drop in oil prices. Note that the URR of 2.8Gb is too low by a factor of more than 3 based on USGS estimates and that proven reserves plus cumulative production are 6.7 Gb so at minimum we would expect the URR to be at least 6.7 Gb, when we add probable reserves to get 2P reserves (this would be the petroleum engineer’s best guess with a 50/50 chance of reserves being higher or lower), the URR estimate rises to at least 9.5 Gb.

The USGS TRR estimate of 11 Gb would result from 1.5 Gb eventually being added to 2P reserves from the “possible” reserve category as more drilling defines the basin more fully.

My pleasure. And thanks for your comment, Mr. Kaplan.

It’s a good run, and a very interesting and smartly made model, well done. But I would caution that price did indeed play no real role in the 25 months in question. Operators basically had no financial constraints due to 0% interest rate policies and yield chasing banks, and Wall Street rewarded ever-increasing production. I have said this time and again in response to the guys who see shale as “responsive” or “the new swing producer” – it simply hasn’t responded to price previously.

However, if we see a series of large bankruptcies (Whiting is a prime candidate here), with assets changing hands to more circumspect operators and creditors getting burned with losses, price is likely to play more of a role. That may well result in a tick upwards and possibly a second mini-peak (i.e. at a lower level than 2015 averages) on that downward slide the other side of peak.

That said, we also argue that companies are overstating their reserves, which suggests a quicker decline.

“price did indeed play no real role in the 25 months in question. Operators basically had no financial constraints due to 0% interest rate policies and yield chasing banks, and Wall Street rewarded ever-increasing production.”

Then why did they reduce their capex by 40% in 2015?

Because their costs fell as service companies lowered their prices and they switched to infill drilling, plus they spudded fewer wells.

Now we need to answer: Given this, why did yearly average Bakken production grow in 2015 over 2014 if it responds most to price? Why did it remain pretty much flat month to month over 2015?

Answer: many companies are debt ponzis and thus don’t respond well to price. Instead, they are focussed on gaining more debt funding. As such, they respond to Wall Street metrics (total production being one), and they need revenue to service debt, even if that revenue is gained at a loss. Thus they grew production by increasing initial production in the first 18 months of a well’s life at the risk of less overall recovery. Meanwhile price focussed companies’ production declined (most notably EOG). The two broadly balanced out, so production was flat. If all companies responded to price, production would have collapsed in 2015.

Thus price played little role in the first ramp-up of production, but will play more of a role in preventing a resurgence of shale output if assets change hands from debt ponzis to price responders.

Perhaps no role in 25 months is hyperbolic – how about “no role in the first 13 months, and then a small role in 2015”?

Hi Verwimp,

The monthly HL can be done, but does not always give good results.

For Saudi Arabia the HL for 1973 to 1990 using monthly data gives a URR of 67 Gb, chart below.

Hi Verwimp,

Continuing with Saudi Arabia HLs, the HL above seems that it might be a little low, would you agree? Perhaps it was a little too soon for an accurate result after 216 data points? So let try another period from 1991 to 2007 which results in a URR that is about 3 times higher (2.8 times higher in fact) at 190 Gb,

chart below.

Hi Verwimp,

So a final Saudi Arabia HL using the most recent data from 1993 to 2015 (again this is monthly data, about 260 data points), the URR in this case is about 250 Gb, about 4 times the original URR estimate of 67 Gb (3.7 times in fact). Perhaps your estimate of 2,8 Gb should be multiplied by 3.7 which would give us 10.4 Gb and be in the right ball park? 🙂

Chart below.

I agree completely: KSA oil production did not follow the bell shaped Hubbert curve, so the results of the linearisation of their data are not collinear. Why? Because they purposely slowed back their production during the 1980’s! Because they purposely did not let their production grow during the 1990’s and the 2000’s. Because they decided to leave something for their next generation. Because they are such a big player, they would derail the entire oil economy if they would have let the beast go. You see the same pattern with gas in the Netherlands: they keep production flat and they are making profits for 40 years now. But it’s my impression that this all feels very un-american, isn’t it? To slow down and to keep something for later, when it comes to make money? That’s why the USA has boom and bust cycles so often and so severely. Like Bakken conventional oil (I presume) between 1988 and 1995: very boom and bust. This was an era with stable oil prices (WTI = ~20 USD).

Verwimp – I agree. Any OPEC country, but especially Saudi, is a bad example for H/L predictions. Hubbert predicted as much himself. Any imposed outside constraint such as a price cartel or onerous environmental limits will lead to a flattened peak and a thick tail. The pure logistics curve comes from population growth and decline where the only constraint is access to a finite resource (food) combined with a fixed gestation period. Recent shale developments with free money supply might turn out to be as close to this as the oil industry has ever got – time will tell.

I think the converse of this might also apply. If production is artificially boosted other than by natural resource price signals, e.g. in a command economy requiring high income for cradle to grave welfare programs or military adventures, then production would be accelerated (such as by in-fill drilling programs), the peak would be skewed later and a Seneca collapse might ensue. Again we’ll wait and see, but hopefully not.

Hi Verwimp,

The same analysis applies to the US lower 48 output.

I just don’t have monthly data for the US going back beyond 1994, which is why I chose Saudi Arabia.

The HL does not give a reliable estimate when annual output is 20% or more of cumulative output as was the case every year from 2008 to 2015 for the Bakken/Three Forks. For the US from 1864 to 1870 the annual output divided by cumulative output(aP/Q%) was about 15 to 20% and the HL pointed to 90 million barrels at the time. Since that time the US 48 aP/Q% has been under 20% every year and somewhat reliable HL analyses only occurred when aP/Q% was under 5% for the most recent year of the HL. Example of a US48 HL done too early resulting in a URR estimate too low by a factor of 4.

Hi Verwimp,

North Dakota Bakken/Three Forks HL estimate using annual data, notice aP/Q% is about 25% in 2015. The URR estimate of about 4.5 Gb is too low by a factor of about 2.4.

Hi Verwimp,

The US did have production controls through the RRC up to 1972 where Texas acted as the swing producer for the World to maintain price stability, the output for the US lower 48 output still followed a Hubbert curve to some degree from 1930 to 1972 (the period the RRC controlled Texas output).

Bottom line a Hubbert Linearization is unlikely to give reliable results at this stage and as I have not convinced you by now, only future results might change your mind.

Verwimp: “That’s why the USA has boom and bust cycles so often and so severely.”

It is not just US phenomenon to have boom & bust cycles but in all capitalist monetary systems where there is built in price inflation and there is need for constant “reset” (deflation) of the system you have boom& bust cycles.

Hi all,

An alternative to Bruno Verwimp’s model where the wells added decreases due to low oil prices and then increase when oil prices increase in the future. The URR is consistent with USGS estimates of about 10 Gb for the Bakken Three Forks.

Dennis,

I think that flat output in 2015 and the likely decline in 2016 is mainly due to low prices, not depletion.

Therefore I agree with you that Bakken oil production will rebound and there will be another peak, higher than December 2014

I think it is largely a question of where the assets are held when the dust settles. If it is with the majors or other conservative institutions, the rebound will definitely be slower and probably peak at a lower level than the boom years. If held by venture capital hoping to make a quick buck, we may see a rebound at boom-type speeds, followed by another crash when they (or the greater fools they sell to) run out of credit.

Hi Gwalke,

At the peak 12 month period there were 183 new wells per month completed in the Bakken. I have assumed the completion rate gradually ramps up to 165 new wells per month over a 30 month period and then remains at that level. The infrastructure is already in place, this should not be hard to accomplish.

Note that under the oil price scenario I have assumed the NPV of future cash flow at a 10% real discount rate (13% nominal at 3% inflation) for the average well is $7 million for wells completed July 2017 and peaks at $9.4 million (2015$) in Jan 2020. At that point the number of wells completed levels off at 165 new wells completed per month.

A more realistic model would have the number of new wells gradually decline as the NPV declines to $0.5 million by Oct 2030. The model is by no means perfect.

A modified model is below with new wells completed decreasing after NPV falls under $5.8 million in Dec 2023, NPV falls to $0.5million in Aug 2037 and new wells are no longer completed.

URR is 9 Gb in this scenario, peak is 1180 kb/d in early 2023.

Nice to meet you again, Dennis! I was waiting for you. 🙂 The future will tell who had the best idea. Reality may turn out to be something in between our ideas. At least I understand for the coming year we agree. Down down down. Prices may (and will) rise again. But I do not see another 27k wells being drilled in that North Dakota landscape. Just look at it on Google Maps. There are wells everywhere! Where are the North Dakotans going to drill 27k new wells? The USGS is an important institution, but I believe they overestimate Bakken URR greatly.

Bruno,

According to Lynn Helms, potential number of North Dakota Bakken-Three Forks wells is 60,000.

http://oilpatchdispatch.areavoices.com/2015/08/14/10000-bakken-wells-drilled-50000-to-go-helms-says/

There are currently 10,756 producing unconventional Bakken–Three forks wells. Even including the shut-in wells, the total number of drilled Bakken-TF wells unlikely exceeds 12-13 k.

So the number of potential well locations is still high.

Many of them are outside the sweet spots, but if and when oil prices rebound, a large part of potential B-TF wells may be economically viable.

Potential would surely mean take the area of the source rock and divide by the minimum average well spacing. They can’t know all the petrogeology until they start drilling in new areas.

Hi George,

I agree the 60,000 well number is too high, but I think the range of 40 to 45 thousand North Dakota Bakken/Three Forks wells is reasonable.

Note that I double checked my average well profile for the Bakken/Three Forks and it is 320 kb. So taking round numbers of 80% of 10 Gb (a conservative USGS mean TRR estimate) or 8 Gb and dividing by 0.32 Mb/well we get 25,000 wells.

If we take our 11 Gb TRR estimate, but we assume the EUR gradually decreases when the sweet spots become saturated with wells, then we might use a lower EUR for the average of all wells drilled. Let’s assume EUR is 250 kb on average for all wells drilled and the URR is 11 Gb,

then 11,000 Mb divided by 0.25 Mb/well would be 44,000 wells drilled.

Hi AlexS,

My guess is that 400 to 500 wells have been shut in since drilling started in the Bakken, prior to 2004 the drilling rate was very low, most of the drilling has happened since 2005 and not very many of those newer wells have been abandoned. There were 10,373 wells producing in the Bakken Three/Forks, and my estimate is that about 10,734 wells have been drilled and completed through Dec 2015. So if 38,000 wells are drilled, that leaves 27,000 locations. Note that I have tried to estimate profitability, but well costs could increase less or prices might rise higher than I have assumed, the 60,000 well estimate by Helms may assume a much higher TRR than the USGS mean estimate.

I have assumed a well cost of 8 million which rises gradually to 9.2 million from Dec 2015 to Aug 2020 and then remains at that level in 2015$. This is because more frack stages and proppant will increase well cost over time.

Oil prices rise from $75/b in Jan 2017 to $160/b in Oct 2020 and then remain at that price level until 2050.

Wells become unprofitable to complete in Oct 2030 and the wells completed quickly drop to zero by Feb 2032 (15 month period where 10 fewer wells are completed each month).

Hi Verwimp,

Note that the idea is that of Rune Likvern, though any errors are mine not his. I have taken his Red Queen Model and used the great data which Enno Peters has gathered from the NDIC and very graciously shared with me and many others to develop average well profiles in combination with the number of new wells added each month (it was 79 new wells in December according to Enno Peters data). That is the model, it is an accounting exercise. Assume all wells are “average wells” with an average production profile, determine the number of new wells added each month and add it all up in a spreadsheet. That is the model and it was first presented by Rune Likvern at the Oil Drum in Sept 2012.

See http://www.theoildrum.com/node/9506

I first tried to reproduce Mr. Likvern’s work at my blog at link below.

http://oilpeakclimate.blogspot.com/2012/10/using-dispersive-diffusion-model-for.html

Looking at it now (eighth chart in the post is closest in assumptions to what actually happened to the well profiles from 2012 to 2015) it is amazing how close I came to production in Jan 2016, I was too optimistic about how many new wells would be added, but mostly it was pretty close. About 1225 kb/d predicted in Jan 2016 with about 12,500 wells drilled, there were only 10730 wells drilled through Dec 2015, maybe 10,800 by Jan 2016. Also my well profile had very limited data at that time based on data very graciously shared by Rune Likvern.

Rune Likvern’s original model needs no work, combined with the wonderful data shared by Enno Peters it is the best model we have.

Predicting the future well profiles and the future number of new wells added future will always be difficult.

As the sweet spots run out of room the average well profile for new wells will have a lower EUR.

One wrinkle in my model is I try to guess at when this decrease will start and how rapidly the EUR will decrease. This in turn depends on the rate that new wells are added, more new wells per month implies a faster decrease in new well EUR. There is only so much oil that can be recovered, I have assumed that the USGS TRR is roughly correct.

I meant to show the chart from my Oct 2012 blog post,

this was just reproducing the work of Rune Likvern, though I guessed farther into the future than he did at that time, my guess for the total number of wells added was too high, especially in 2015, my estimate for Jan 2015 was pretty close, but I did not anticipate a crash in oil prices and my guess for the number of new wells added was too aggressive in 2015 (about 2300 new wells, the actual number was about 1450 new wells). In any case it is surprising that this first guess was as close as it was.

Mr. Verwimp, that is one frightening graph you have there. If the production follows the graph for the next six months, people are going to start to really notice.

I do have a question though. If there continues to be completions of wells in the 70’s per month, will that be enough to level the descent, considering the increased initial output due to better or more intensive fracking techniques?

Hi GoneFishing, the graph is just as frightening as it has been ever since I built it 25 months ago, (and published in the comment section on this blog once every three months approximately.) Now it is getting attention, suddenly.

People are already starting to notice in the shale gas fields, they are clearly past peak.

As for your question on how many wells per month are needed to level the descent, I would like to point to the models Dennis Coyne presents here. That is, basically, exactly the exercise he undertakes. As far as I understand, he needs something like 150 wells per month to keep production at the actual level.

You should understand there are some 10.000 wells now, all of them are declining according to the average well profile (this is: huge decline during the first year, more moderate decline later on.) Anyway: I don’t believe 70 fresh gushers a month will compensate for the decline of 10.000 wells. Neither do I believe 70 wells will be added on average during the next months.

Hi Bruno,

My model for each month takes the average well profile, which has not changed for 12 months or so and simply substitutes past guesses at future number of wells with the actual number of new wells completed. That is it. I do tend to change my guess of the future number of wells completed based on new information, such as the current price of oil and future forecasts of oil prices along with well cost and information about capital spending by LTO focused companies.

In scenarios I presented in 2012 I did not foresee the present oil glut and I assumed new wells would continue to be added at 2400 to 2800 new wells per year. For the past 12 months the well completion rate has been about 1450 per year and for the past 3 months the rate has dropped to 908 new wells per year (annualized past 3 months).

Note that for your model to be correct, at least 60 new wells per month will be needed, notice that my model has only 50 new wells per month from Jan 2016 to June 2017, but that output is lower than your model.

For example my model has output at 800 kb/d in Jan 2017, but your model has output at about 840 kb/d, that would require about 60 new wells per month from Jan 2016 to Jan 2017, if my model is correct.

We do agree that 70 new wells per month will not be completed, we could both be wrong, the LTO players stubbornly complete new wells seemingly impervious to low prices.

I keep thinking they will slow down, but they are doing so more slowly than I had anticipated.

Additional buried costs of Unconventional extraction are surfacing. Fracking and production liquids are live costs – how often is liquids disposal cost breaken out for the life of the well?

“Though fracking industry proponents scoff at any intimation their so-called vital industry poses even scant risks to the public, a new study published in Toxicology and Applied Pharmacology just proved those critics right — fracking wastewater causes cancer.

Using human bronchial epithelial cells, which are commonly used to measure the carcinogenesis of toxicants, researchers confirmed fracking flowback water from the Marcellus Shale caused the formation of malignancies.”

http://www.zerohedge.com/news/2016-02-17/heres-new-study-fracking-industry-doesnt-want-you-see

Fracking wastewater causes cancer. CRUDE OIL CAUSES CANCER!!

Really?

http://www.zerohedge.com/news/2016-02-17/if-oil-stays-35-what-energy-company-leverage-will-look

“Citing up-to-date analysis of production data and cash costs from over 10,000 oil fields, Wood Mac said it believes 3.4 million b/d, or less than 4% of global oil supply, is unprofitable at oil prices below $35/b.

Even the majority of US shale and tight oil, which has been under the spotlight due to higher-than-average production costs, only becomes cash negative at Brent prices “well-below” $30/b, according to the study.”

So why are so many producers struggling and/or going broke?

That $30 to $35 mark must be well-head costs of production without overheads?

The present ND price is $16.50 for one thing. The analysis is for operating fields and does not include exploration or new developments, without which oil companies would have a short lifetime.

One also has to consider both Lease Operating Expenses (LOE) and G&A costs (plus debt service).

I think they are only including OPEX or what I call LOE.

As I have mentioned previously, these expenses typically include only the electricity or other power costs to operate the wells, the chemicals used on a regular basis down hole, minor repairs, and direct lease labor. At least that is the way the shale guys report it. Otherwise, why do they always report $4-$8 per BOE in company reports, yet I see much higher than that on the lease operating statements sent to non-operated working interest owners for interests for sale on the auction?

I have my doubts as to whether they are including in OPEX finding and development costs, including the costs to lease the land, permit the well, drill the well, complete the well, equip the well, any subsequent equipment that is capitalized and not expensed, including replacement of tubulars, rods, down hole pumps, etc. over the life of the well, both ordinary work overs such as repair of tubing leaks and replacement of down hole pumps, as well as work overs such as sand pumping, acid, re-perforation, re-fracking, all transportation costs, all general and administrative expenses, all severance, extraction, production, income, ad valorem, etc. taxes, and interest payments on debt.

In the real oilfield, not the one displayed by the shale cos. in their Urban skyscrapers, what is most important is what goes in the checkbook, what goes out of the checkbook and the current balance in the checkbook. Classifying a rod job as CAPEX does not change the fact that a check has to be written within 30 days (apparently 180+ days for shale) to the contract company who pulled the pump.

Due to the skyrocketing of costs in the industry from 2005-2014, I believe this crash is more severe than 1998-1999, despite Brent and WTI oil prices not quite falling to the inflation adjusted lows of that period, as well as the fact the basis spreads are much wider for certain crudes (think Bakken, Western Canadian Select, etc.) than they were in that era.

We are suffering much more than in 1998-1999 for sure, on the very same leases. The combination of cost inflation, reserves that are tougher to produce, and in the case of marginal producers like us, natural decline, makes dropping into the $20s (or below) brutal.

The vast majority of US publicly traded E & P have PDP PV10 reserve values LESS than long term debt at $50 WTI. At least I suspect the 10K will show that in the next 15-45 days as they are released.

Keep in mind we have been hovering around $30 WTI in 2016, after hovering around $40 WTI since last fall. I imagine PDP PV10 is less than half at $30 WTI as opposed to $50 WTI. I further suspect that PUD PV10 in almost non-existent in the US onshore lower 48 fields at $30 WTI.

Remember that reserve based lending standards typically do not allow for a borrowing base in excess of 65% of PDP PV10 (recently PV9 due to historically low interest rates). This includes not only first lien bank debt, but any other types of second lien or junior debt.

Therefore, at $50 WTI, almost all US onshore based E & P DO NOT qualify for reserve based credit with US banks. And we are at $30 and change today.

In reality, any equity value these companies have is purely a bet that the current WTI and HH futures will not hold, but will go substantially higher in the near future (yet this year).

I know I and others have been beating this drum for a long time, but dang it the truth has to be said. Just because 1% of wells in the Sprayberry Wolfcamp play in Midland Co., TX are worth drilling and completing at $30 WTI does negate the fact that the entire industry is in jeopardy without a significant price spike.

I would really like to know how much industry debt to banks is delinquent. I bet there is still a lot of pretending going on by the banks with regard to provisioning energy loan losses.

Make no mistake about it, this has been a price crash of epic proportions.

“I think they are only including OPEX or what I call LOE. ”

Woodmac mentions cash operating costs, not full-cycle costs

Cash operating costs include not only LOE, but also taxes, G&A.

Not sure if they include interest expense.

As regards LTO full cycle costs:

“full life cycle economics require an oil price in the range of $40-$60,” Wood Mackenzie said.

http://www.marketwatch.com/story/oil-output-barely-dented-despite-crudes-plunge-2016-02-05?mod=MW_story_top_stories

AlexS. They may include taxes and interest, but I bet a lot of costs that are necessary to keep the lease producing are put in CAPEX and not included.

For example, I look at a lot of LOS for shale wells.

LOE runs $10-20K routinely per well in the Williston Basin, with newer wells tending to be more costly due to higher produced water disposal costs.

Invariably, however, there will be a monthly LOS with an extraordinary charge, some times in excess of 5 times the routine monthly LOE. Sometimes it is not readily apparent what these charges are for. Sometimes they are routine work overs, pump changes, tubing leaks. In any event, I believe at least some of these costs are being capitalized. Anything permissible to reduce the per BOE cost of LOE in company reports will be taken advantage of, and likely even required by GAAP, and reported differently for income tax purposes.

It appears ND is granting operators the ability to idle wells producing 40 bopd or less for up to 24 months.

Based on Enno Peters shale profile website, it is apparent many wells fall below 40 bopd within 60 months of first production. I suspect most wells under 40 gross bopd in the Williston Basin cost $25 per BOE+ to keep online. Given the differential to WTI in that basin, I suspect they generally are in the negative at current prices.

Regardless, if a 3-4 million bopd cut were announced by Russia and OPEC, I suspect prices would rally significantly. So even if Wood Mac is including all the necessary expenses to keep production online, 3-4 million bopd underwater is a big deal.

shallow sand,

Based on 3Q reports by some large shale players, their cash opex is well within $30/boe. Some of the costs you have mentioned may be capitalized.

But in any case, if the current wellhead price in the Bakken is $16.5, they are all in the red (ex hedges)

“if a 3-4 million bopd cut were announced by Russia and OPEC”

Don’t count on this. There will be not cuts

AlexS. I agree there will not be 3-4 million bopd of cuts. There may not be any cuts. However, Russia, GCC, Iran and Iraq are talking and trying to come up with something. They are not able to withstand $30 oil for years on end, $30 is painful now. As I stated, they saw traders pushing to the teens, and this step is an attempt to at least stop that.

In any event, 3-4 million bopd underwater cannot go on indefinitely. My point is at least some of that 3-4 million bopd will come offline and/or shrink via natural decline. Because adding new wells requires more than $35 bopd in many places, likely most places, what is coming offline wont be replaced until prices rise.

I think you have indicated you see prices slowly rising, so I think even you agree that $30-35 wont be a multi year price.

My comments are directed to the way the US industry reports expenses. Go to websites where working interests are for sale. Invariably there will be an economic summary that will have an “*excludes non-recurring costs” statement. Then look at the non-recurring costs, hidden in the data package. To me, non-recurring costs are the costs for a new well, or the costs to increase production from an existing well, such as opening a new zone, re-stimulating and existing zone, etc. Non-recurring costs should not include routine down hole and surface repairs. However, US companies routinely categorize them as such.

My comments on costs are very US centric. US onshore is really the only thing I have knowledge of. I apologize if it looks like I think the US is the whole world, which I know it is not.

US companies have to impress Wall Street. I have reviewed Russian company reports at your suggestion. It is noteworthy they are more fact, and less fluff. Not many “pretty” optics or financial measures like IRR, EBITAX, CAGR, etc. You should read some US company conference call transcripts. The US companies have to impress people who, IMO, do not seem to understand the important things, but have learned to speak the jargon. Fortunately the SEC requires 10-K and 10-Q reports. Lots of good information there.

Look at the company statements about CAPEX spend. It is not all to increase production. Facility improvements are usually listed. I wonder what all is included in that category.

Another of my broken record points is new, flowing wells under one year old have very low OPEX and therefore I predict OPEX will rise quickly as there are less new wells added proportionately to the total.

I am just reporting anecdotal reviews of lease operating statements in US shale plays. I agree, likely the lesser wells are usually the ones that are for sale.

On a worldwide basis, it would be neat to have access to a database which categorizes production by age. For example, of the world’s 78 million bopd, 7% comes from wells completed prior to 1980, 18% 1980-1990, etc. (Number I made up).

Although we are hyper focused on the short term, due to being in survival mode, the recent chart you referenced on CAPEX spend US and world wide is crucial. We really haven’t seen a huge increase in production worldwide despite the large CAPEX spending increase.

Assuming we survive this, we are in it for the long haul (decades health willing). If worldwide demand continues at 1 million bopd increases year over year, the price must necessarily rise, cut or no cut.

I still think US LTO needs $80 or higher to be a viable business and $100+ will be needed to add 1 million bopd per year, akin to 2011-2014.

I think that Qatar is the poster child for post-2005 crude oil versus Crude + Condensate (C+C) production.

OPEC 12 data show that Qatar’s reported crude oil production, despite billions of dollars spent on enhanced oil recovery, fell from 0.8 million bpd in 2005 to 0.7 million bpd in 2014 (OPEC crude only data), while EIA data show that Qatar’s C+C production increased from 1.0 million bpd in 2005 to 1.5 million bpd in 2014.

Production of condensates rising in Qatar http://www.oxfordbusinessgroup.com/analysis/production-condensates-rising-qatar

Thus my characterization of the global oversupply as a house of cards built on an unstable supply of actual global crude oil production that requires vast capital expenditures in order to keep crude oil production from crashing.

Mr. Brown – this is a minor point in the great scheme of things but I find it annoying I can’t get the answer. Do you know how Qatar (or ‘other sources’) report liquids from their GTL plants (Oryx and Pearl). There are condensate and NGLs that come with the gas feed but then there are diesel and lighter liquids that are made from the gas in the GTL process. Do these get counted as gas, liquids, both or neither? The total adds up to at least 200,000 bpd which is a significant portion of Qatar’s output.

I would assume, but I don’t know for sure, that GTL products would be counted in the EIA’s total petroleum liquids + other liquids category.

The EIA and IEA report GTL as “other liquids”.

It is counted as other liquids.

Qatar

Qatar was the world’s fourth-largest dry natural gas producer in 2013 (behind the United States, Russia, and Iran), and it has been the world’s leading liquefied natural gas (LNG) exporter since 2006, with 31% of market share in 2014.2 Qatar is also at the forefront of gas-to-liquids (GTL) production, and the country is home to the world’s largest GTL facility. The growth in Qatar’s natural gas production, particularly since 2000, has also increased Qatar’s total liquids production, as lease condensates, natural gas plant liquids, and other petroleum liquids are a significant (and valuable) byproduct of natural gas production.

Shallow sand,

“My comments on costs are very US centric. US onshore is really the only thing I have knowledge of. I apologize if it looks like I think the US is the whole world, which I know it is not. ”

I appreciate very much your comments, as they help to understand the real picture in the US onshore oil industry. The US is not the whole world, but the US LTO is a very important part of the global oil.

In the past 3-4 years I was also paying primary attention to shale players, and I came to conclusion that their financials, not just their resource base, are very “unconventional”.

“Russia, GCC, Iran and Iraq are talking and trying to come up with something. They are not able to withstand $30 oil for years on end, $30 is painful now. As I stated, they saw traders pushing to the teens, and this step is an attempt to at least stop that.”

I agree. Oil exporters are trying to change the sentiment in the market and to neutralize the attempts of speculators to push oil prices below $20.

“I think you have indicated you see prices slowly rising, so I think even you agree that $30-35 wont be a multi year price.”

$30-35 is obviously unsustainable. The market will gradually re-balance itself. I expect a $40-50 range by the end of the year. It seems that investment banks’ analysts are also projecting a gradual oil price rebound.

WTI oil price consensus as compiled by Bloomberg vs. forward curve

Hi Shallow Sand,

I always appreciate your analysis. Thanks.

If the price forecast in AlexS’s chart is correct how would that affect onshore conventional production in the US?

I would think there might be some temporary abandonment and deferred maintenance and I imagine there would be some decline in LTO output as well. What would your guess be as to how much US L48 output would decline if the oil price forecast above for 2016 is correct (looks like about $41/b for the 2016 average price.)

Dennis. Thanks. So many moving parts. However, I did post awhile ago about the decline in lower 48 US conventional production from 12/14 to 6/15.

As I recall, that decline annualized was about 14%. A drop of around 200K bopd, from 2.6 million to