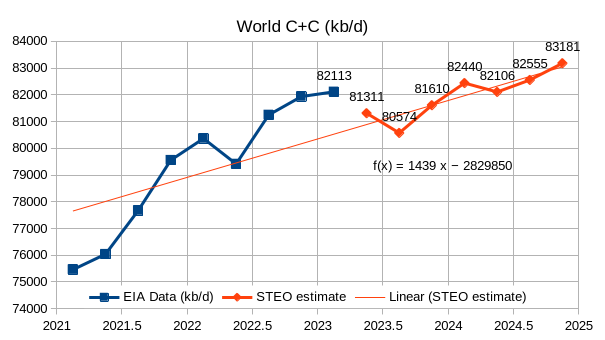

The EIA’s Short Term Energy Outlook (STEO) was published in early November. The chart below estimates World C+C by using the STEO forecast combined with past data from the EIA on World Output.

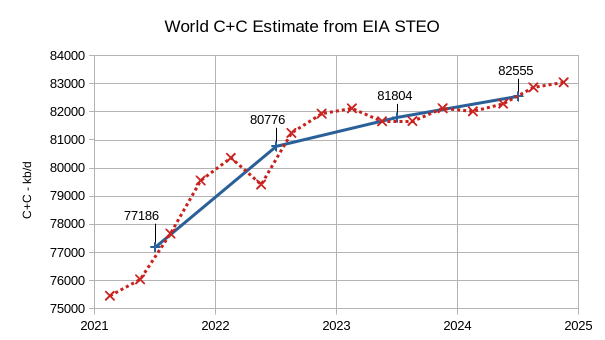

The EIA’s Short Term Energy Outlook (STEO) was revised lower in November compared to September (we skipped the October STEO). World C+C output is expected to decrease in the 2nd and 3rd quarters of 2023 and then increase over the next 5 quarters. Annual average World C+C output increases by about 1028 kb/d Mb/d in 2023 to 81804 kb/d and then to 82555 kb/d in 2024, about 445 kb/d below the centered 12 month average peak in 2018. This month’s World C+C estimates are about 400 kb/d lower than September’s estimate for 2023 and 1150 kb/d lower for 2024 due to the revisions in the STEO forecast since Sept 2023.

Read More