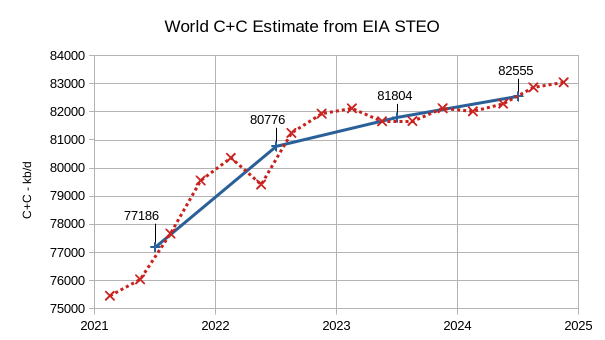

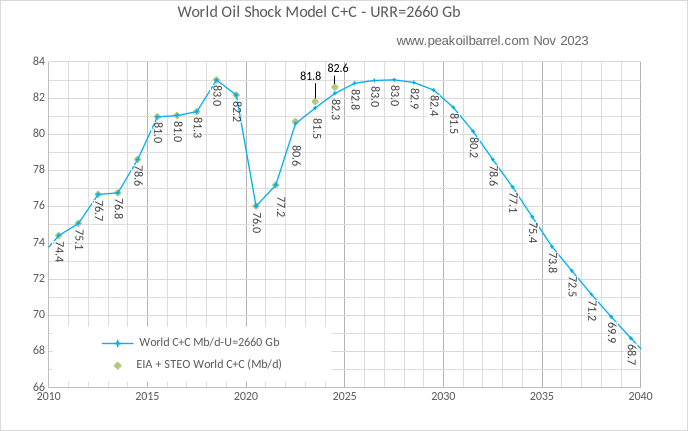

The EIA’s Short Term Energy Outlook (STEO) was published in early November. The chart below estimates World C+C by using the STEO forecast combined with past data from the EIA on World Output.

The EIA’s Short Term Energy Outlook (STEO) was revised lower in November compared to September (we skipped the October STEO). World C+C output is expected to decrease in the 2nd and 3rd quarters of 2023 and then increase over the next 5 quarters. Annual average World C+C output increases by about 1028 kb/d Mb/d in 2023 to 81804 kb/d and then to 82555 kb/d in 2024, about 445 kb/d below the centered 12 month average peak in 2018. This month’s World C+C estimates are about 400 kb/d lower than September’s estimate for 2023 and 1150 kb/d lower for 2024 due to the revisions in the STEO forecast since Sept 2023.

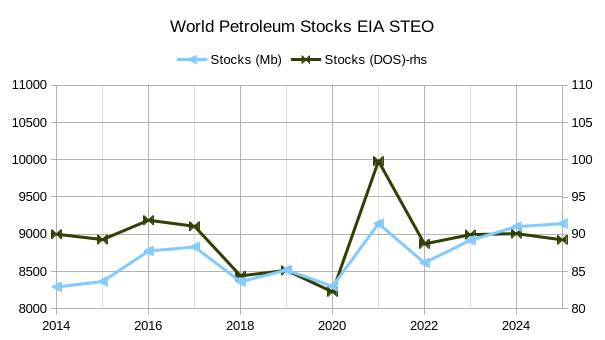

The chart above assumes World Petroleum Stocks at the end of 2014 were high enough to supply 90 days of World average petroleum consumption in 2015. Total petroleum stocks tend to rise over the long term because average petroleum consumption increases and in order to maintain a 90 day stock the absolute level of petroleum stocks must increase. The days of forward supply (DOS) on the right vertical axis is the better measure of petroleum stocks because it is very easy to see if the World stock level is above or below the target level of 90 DOS. Based on the EIA’s supply and demand estimates, at the beginning of 2018, 2019, and 2020 petroleum stocks were relatively low (less than 86 days of forward consumption) and at the beginning of 2022, 2023, and 2024 the stocks were at a balanced level (close to 90 days of supply).

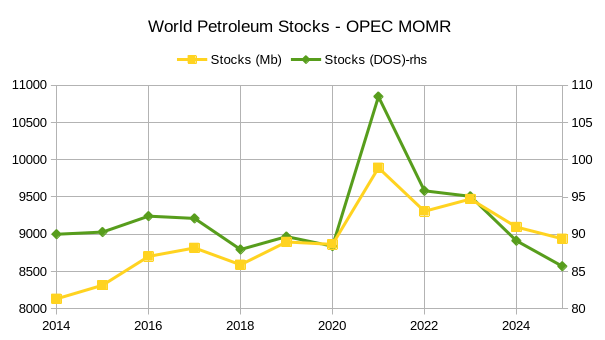

OPEC has very different supply and demand estimates for the World than the EIA. This results in the stock levels looking very different, with the OPEC estimates suggesting a balanced oil market at the beginning of 2018, 2019, and 2020 with close to 90 days of supply each year. At the start of 2022 and 2023 the OPEC estimates suggest a significant oversupply with stocks at 97 and 96 Days of forward supply in each of those years. High World demand assumptions by OPEC (about 2 Mb/d higher than the EIA estimate) result in a significant shortage by the beginning of 2025 at only 86 days of supply.

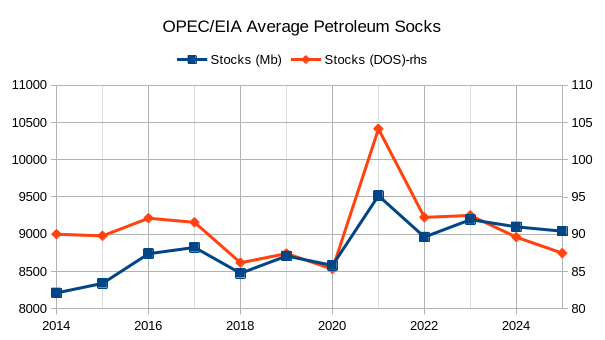

The chart above takes the average of the STEO and MOMR supply and demand estimates and uses them to evaluate stock levels based on these averages. By this estimate the World stock levels look a bit high at the start of 2016 and 2017 and flip to slight undersupply at the start of 2018, 2019 and 2020. By the start of 2021 there was significant oversupply (14 days extra), there was slight oversupply at the beginning of 2022 and 2023 with DOS at about 92 days. In 2024 the year starts at a balanced 90 days of supply and by the start of 2025 the market is a bit undersupplied at about 87 DOS. Unfortunately the World does not know if the EIA, OPEC, or IEA estimates for supply and demand are correct, this uncertainty may be one underlying cause of oil market volatility along with war, politics, weather, natural disasters and unknown unknowns.

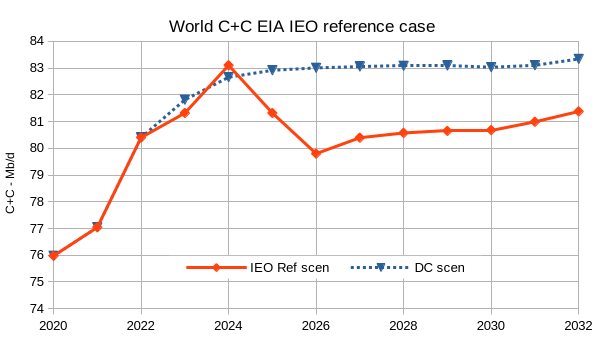

The chart above came from an earlier post on the EIA’s IEO 2023, the reasons why I think the DC scenario is a better estimate for World C+C can be found there. This chart is the motivation for a revised shock model with a plateau of around 83 Mb/d, though my expectation is that the plateau will be shorter than the DC Scenario above which assumes the EIA IEO reference scenario for transportation demand for petroleum is correct through 2032. A shortage of oil, high oil prices and the transition to electric transport are expected to lead to a fall in oil demand by 2029. See the chart near the end of this post.

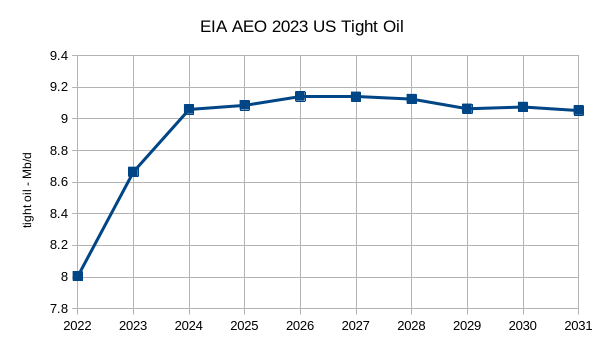

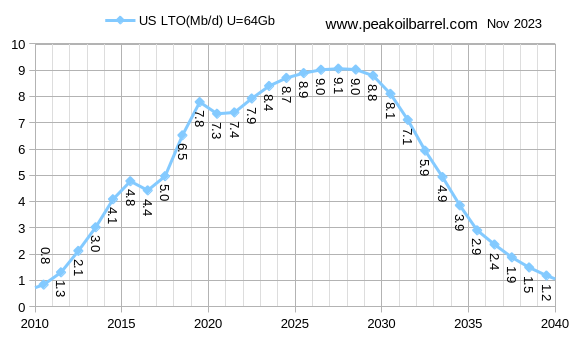

The chart above from the EIA’s AEO 2023 reference scenario for US tight Oil output suggests a plateau in tight oil output of about 9.1 Mb/d, this is part of the motivation for a revised tight oil scenario, though I expect the plateau will be shorter than the EIA scenario above. I also found an interesting paper at the Novilabs website at this link (the full paper can be downloaded at linked page) which suggests about 24000 tight oil well locations left in the Midland Basin, if we assume there are at least this many locations left in the Delaware Basin this suggests a round 90 thousand total wells for the Permian Basin (there are about 45 thousand wells currently), with only 65 thousand of these locations if limited to 20k future tier one and tier two locations.

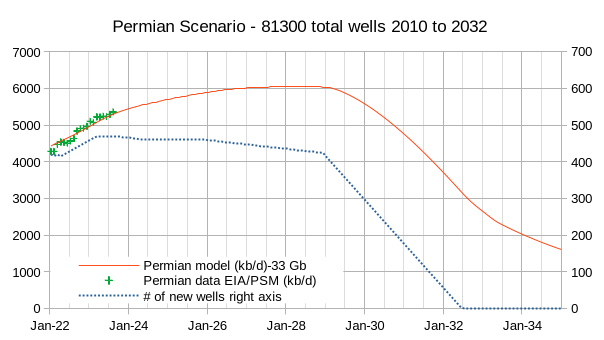

The scenario above for the Permian Basin is my main revision of my tight oil scenario with other basin scenarios unchanged from my previous tight oil scenario (link here to previous post). About 70 thousand horizontal oil wells are completed by the end of 2029 (from Jan 2010 to Dec 2029) in the Permian Basin and then the completion rate rapidly decreases as tier 1 and 2 drilling locations become scarce. The scenario URR is about 33 Gb which is much less than the USGS F95 TRR estimate of 45 Gb ( the mean estimate is about 75 Gb), note that for the North Dakota Bakken/Three Forks the eventual URR is likely to be quite close to the USGS F95 TRR estimate, so this scenario may be quite conservative. A link to spreadsheet with the above Permian scenario is here, the file is large (4.9 MB), the monthly completion rate in row 4 (delta wells) of the output sheet can be changed to create different scenarios as desired.

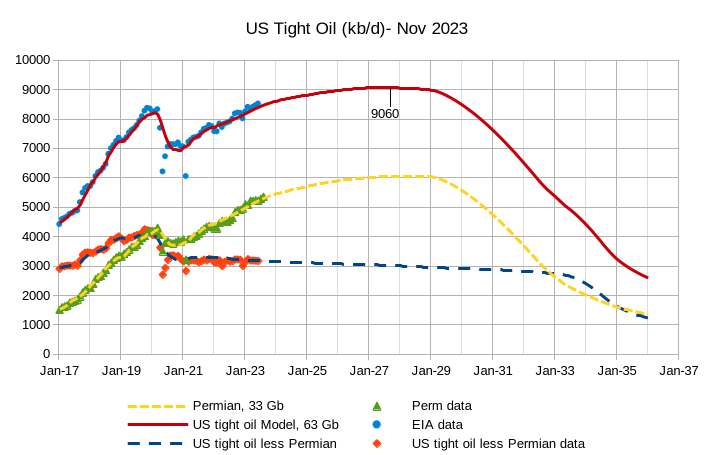

The new tight oil scenario is above with a peak about 9060 kb/d, roughly 500 kb/d less than my previous scenario, URR is 63 Gb, about 9 Gb less than previously.

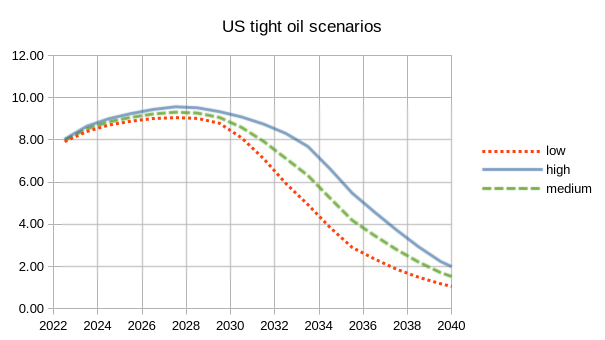

The chart above is in Mb/d (vertical axis) the low scenario has a 63 Gb URR, the high scenario a URR of 72 Gb and the medium scenario is the average of the high and low scenarios.

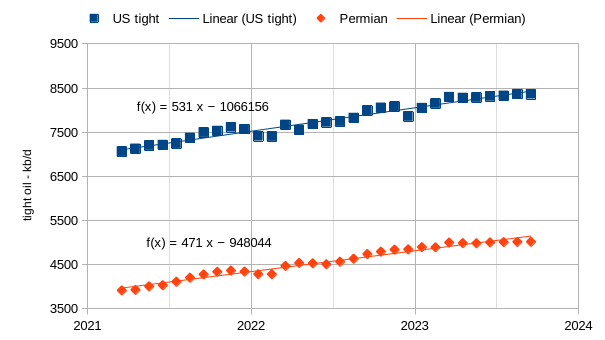

The chart above is from the EIA’s official tight oil estimate (spreadsheet at this link) and shows that Permian output has been flat since March 2023 at about 5000 kb/d. Most of the Increase in US tight oil for past 2.5 years has come from the Permian basin so we tend to focus here when considering US tight oil output.

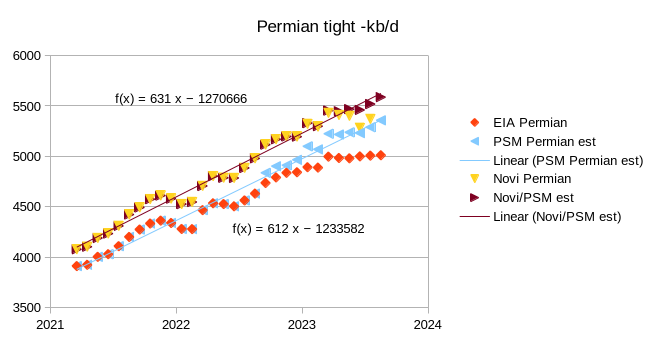

The PSM Permian estimate in the chart above looks at C+C output in Texas and New Mexico from the EIA’s Petroleum Supply Monthly(PSM) and subtracts Permian and Eagle Ford output from the total C+C in those states to estimate conventional output. For the most recent 12 months the Permian estimate may be low due to incomplete data so we look at the conventional output over the months from 13 to 24 months before the most recent data point (September 2023) and find that conventional output was relatively flat during that period. We take the average over these months (Aug 2021 to Sept 2022) and assume conventional output remains at that average level over the most recent 12 months. Permian output is then found by deducting conventional and Eagle Ford output from the TX and NM C+C output total to find the PSM Permian estimate.

I also look at Novilabs Permian output data from the most recent Permian update (post at this link), this data is also compared with PSM data for TX and NM in the way that the EIA tight oil data was. In this case the conventional output was relatively flat for the 12 months from March 2022 to Feb 2023, I assume conventional output continues at the Feb 2023 level for March 2023 to Aug 2023 to find the Novi/PSM estimate. The trend of the two estimates is similar at between 612 and 631 kb/d per year and the difference in the estimates is explained by Novilabs including all Permian formations where the EIA includes only the Wolfcamp. Spraberry, and Bonespring Formations. Note that my scenario for the Permian is more in line with the PSM Permian estimate, actual Permian output (when including all formations) may be about 200 kb/d higher than my scenario as of August 2023. Bottom line is that Permian output is likely 300 to 500 kb/d higher in August 2023 than the EIA official tight oil estimate.

Above we have my revised World C+C Shock Model with the recent estmates from the STEO for 2023 and 2024 shown on the chart, the new scenario has steep decline starting in 2029, which is earlier than my previous scenario (where it was 2033). The peak is 83 Mb/d in 2026 and 2027 and a 4 year plateau at close to this level from 2025 to 2028, URR is 2660 Gb.

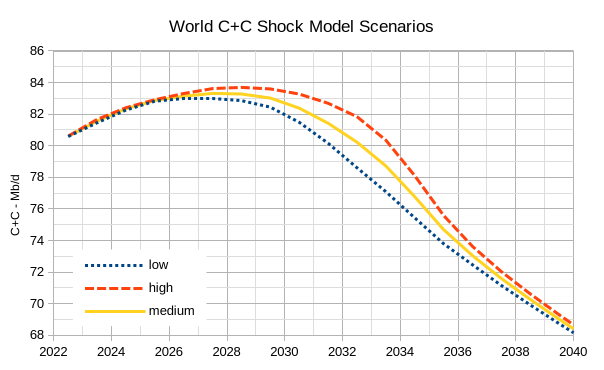

The chart above compares the previous Oil Shock Model (the “high” scenario above) with the most recent scenario (“low”), the medium scenario is simply the average of the high and low scenarios. My best guess is that World output will fall between the low and high scenarios, but it is highly unlikely any of these scenarios will be correct.

your revision in PB oil is really quite substaintial. Now, it is lower than the relatively conservative predicted in 2021/2022.

https://www.mdpi.com/1996-1073/15/1/43

The recent increase of crude, gas and coal consumption by India and China are probably underestimated, especially India, as the industrialization is picking up steam fast, i.e. the oil peaking probably will not be there till 2035 or later.

Sheng Wu,

The Novi paper is good, but only covers Midland, it is possible that there is a greater percentage of undrilled locations in the Delaware, my assumption that the numbers are roughly equal may be too conservative.

The previous estimate might be more realistic.

Shengwu,

The paper you cite has about 55 thousand new wells drilled in core areas after 2021 for total of roughly 90 thousand wells to get a URR of about 32 Gb, peak is more conservative than my scenario at about 4600 kb/d at peak, the EUR of the average well seems to be less than my scenario (which has about 430 kbo EUR for the average well) an their scenario also uses a lower completion rate of 400 wells per month. If I had as many wells completed as their scenario 190 thousand wells, maybe 140 thousand to account for lower EUR in non core areas. The scenario below has 109 total wells completed in Permian basin with a shift to lower completion rate to account for lower EUR of noncore areas (in reality, the number of wells is about 125600 with lower EUR for noncore accounted for).

Scenario from paper cited by Sheng Wu. The base plus core scenario is about 32 Gb, when non-core is added, the URR increases to 55 Gb. My previous Permian scenario had aURR of about 42 Gb. My guess is that much (more than half) of the non-core areas will not be profitable to develop.

The problem with the scenario from the paper is that it assumed an overnight shift from all core area wells to non-core area wells, the reality is likely to be a gradual shift from more core wells to less core wells over time. At some point the proportion of non-core wells completed reaches some critical level where the entire basin becomes unprofitable and the completion rate rapidly declines at the market clearing price of oil (perhaps $100 to $110/b in 2023 US$). In addition, the transition to electric transport is likely to reduce demand for oil (along with efficiency improvements in the existing ICEV fleet). The potential for autonomous robo taxis in the future would lead to a rapid increase in vehicle miles travelled with electric transport on land.

Somewhere between 2030 and 2040 we may see oil prices plummet due to lack of demand for oil.

yes, unless oil price back to over $100 and more for long, then non-core will be developed.

Otherwise, PB core or core in Bakken and EF will be limited to 300~400K BO EUR, and the above authors and several other sources and Dennis Coyne here also have similar EUR numbers.

I am attending the Latin America URTEC conference in Argentina next month, and will present the results of Vaca Muerta.

The finding is that Vaca Muerta could also potentially produce close to 30 Billion BO after the shale oil there demonstrated almost 2~3X EUR with same normalized lateral length than Delaware/Midland.

This drastically changed the previous estimate of only 10 Billion or less by EIA.

There are also several similar VM shale fields in China, espeically the Bohai Bay, which has been a major producer of heavier black oil with little gas, and the potential is there if we realize that “shale oil === HGLTO” is not true, actually low GOR black shale oil is the top dog.

Sheng Wu,

What is your estimate for tight oil URR from China? The Argentina 30 Gb, is nice, but we need to realize that the World uses about 29 Gb of C plus C per year.

Unlike with other oil sources still to be produced (such as Permian or Bohai Bay) much of the future Argentinian oil production will be available for export. It is a huge story for S. America, and for those who are able to purchase the produced oil.

The tight oil URR from China has the potential, but so far only some small scale developments. There are several factors that hinder its developement, like Vaca Muerta, and the major one is the ownership of pipeline and market regulations.

Basically, in China, unlike the US, producers can not pay a reasonable price to sell the produced gas to pipelines, and can not sell oil and gas in the market. So, you could see solar/wind companies in China could be very very competitive because there are many players and almost free market. But in oil and gas market, it is still controlled by 3 big NO.

Even in the 3 big NO fields, there are differences in control, the largest gas field in China, the Erdos basin, has lots of low margin gases, with EUR per well only a fraction of shale gas well here. But by allowing operators from smaller drilling and servicing companies from each NO’s smaller field to pitch in, they could still produce some 6BCFPD. They could lower the cost further now with new coal bed methane production revolutions now — some numbers are matching the IP and EUR in shale gas patches in US. see my video— very interesting,

https://youtu.be/PRgw-rXZMn4?si=wPV0G__NNiYwfuyC

in theory, US coal bed methane could also revive at a bigger scale and matching today’s shale gas. So, it seems US should allow for more LNG export now.

Within each major NO fields, there is basically only one or two operator, e.g. Daqing, Changqing and Shengli, and private or other operators from other fields can not get in, therefore, they have much smaller freedom/initiative to try shale oil.

Only, small tests, like the one in Subei, if proven successful, will get accelerated by local operator, otherwise it is all largely controlled from Beijing headquarters.

In terms of technology, there is a conventional wisdom like the old coal bed methane production strategy limiting people trying new things. For example, more than half of China’s oil fields have VM like low GOR black oil shales, and people does not believe shale oil could be produced efficiently, and even now, there is one-hand-full in the world trying to market this idea.

Mr. Sheng Wu,

I have watched your video for frac’ing coalbed methane multiple times and, frankly, it blows my mind.

If I understand you correctly, by applying modern frac’ing techniques to select coal fields, it might be (already is, in China?) possible to produce significant amounts of economically viable natgas?

That concept is so simple, in many aspects, that it is simply astonishing that it has not been widely done by now.

With the very shallow depths involved in CBM, utilizing advanced recycled water processing techniques, combined with cutting edge hydraulic fracturing operations, this idea could enable unfathomable amounts of natgas to be accessible to a global market.

In fact, with coal resources present in so many energy-deprived countries, the ability to locally, economically produce large amounts of natty is simply an amazingly disruptive concept.

Certainly looking forward to more info on this topic.

Sheng Wu,

Note that in my estimate for shale gas down thread, it is really total continuous gas resources and includes both shale gas, tight gas, and coalbed methane, the USGS mean TRR undiscovered resource is about 1600 TCF, some of this has been produced since it was estimated (varying years from 2010 to 2021), but my guess for the entire URR is about 1200 TCF which will peak around 2032 at about 110 BCF/d, the US currntly consumes about 84 BCF/d and exports about 20 BCF, conventional dry NG is only around 24 BCF/d and declining at over 5% per year. US consumption of natural gas increased at 2.37% per year from 2005 to 2019, if that rate continues from 2022 to 2032 the US will be consuming 110 BCF/d by 2032, leaving only about 12.4 BCF to be exported in 2032 (less than in August 2023 (at 20 BCF).

If US consumption of natural gas stops growing altogether and remains at 84 BCF/d, then the US could potentially export as much as 40 BCF/d at its peak in 2032, but this level could not be maintained as natural output will begin to decline rapidly after 2032. By 2043 output would have fallen by 40 BCF/d, eliminating all natural gas exports unless US consumption of natural gas falls.

Sheng Wu notes- “in theory, US coal bed methane….”

Correct me if I am wrong, but it is just a hypothesis- that coal bed methane could undergo a technical revolution with enhanced extraction techniques that would yield economically viable results.

Certainly nothing to make any plans or policy on.

It will be interesting to watch.

Are there prototype projects underway?

to answer some of the questions,

I made the youtube video about coal bed methane revolution above, and here are more background.

1. the production curve after massive modern hydraulic fracing is real in the published papers and only happened 2 years ago, and in less than 2 dozen wells, but the numbers are increase very fast because in the current wellhead price, all wells with such economics (1~2BCF 1st year) could recover cost in less than 1 year, and so far the 2nd year decline is similar to shale gas in Marcellus. The CNPC CBM chief claims China deeper CBM could easily surpass shale gas and even tight sand gas in less than 5 years.

2. The wells are mostly drilled deeper than 1,500m, mostly around 2km, and according to measurement of coal samples, there is already 10~25% free gas. But the wells drilled below 2km certainly has free gas content less than 10%, but production are close to the deeper wells. There are still one-hand-full geologists who believe that hydraulic fracking converted adsorbed gas into free gas, instead they still hold the same conventional CBM fracking, i.e., fracking only increased permeability or conduction, and this only works with already free gas, i.e. the CBM has to be deep enough. My video is a small step outside convention by stating water can convert adsorbed gas into free gas, and this changed everything and yet it is enticing and easy to understand or to believe based on the basic physics and now good production numbers way exceeding only 10~20% free gas. Of course, this adsorption controversy has been there in Shale because of the old CBM legacy, and shale revolution already so successful that adsorption is left in the hindsight.

Mr. Sheng Wu,

Your recents postings have been especially informative and I thank you for your input.

Congratulations on your upcoming URTEC presentation.

If it includes a plausible 30 Billion bbl Vaca Muerta estimate, it could be the most electrifying claim in the energy world for quite some time.

(Dennis … cyber shrugging off 30 billion barrels of earl … incredible.)

1. Fracked shale

2. Argentina

3. High-desert pampas

Can shrug everything off when it comes to depleting reserves of finite & non-renewable fossil fuels. [shrug] what do you expect, a cornucopia of endless supply?

While we’re talking about Argentina, keep in mind that they have a massive untapped energy reserve in the form of both wind and solar.

Vast parts of the country have solar resource on par with places like Florida, Texas and Spain. https://globalsolaratlas.info/map

Likewise with wind…the resource and extent certainly puts them in the top 5 of capability. https://globalwindatlas.info/en

With Argentina, the wildcard elephant in the room always seems to be their internal management.

Coffeeguyzz,

It was 10 Gb before, now 30 Gb so delta of 20 Gb, EUR is less important than cost per barrel, I have no idea what the cost structure is like in Argentina. In some countries a lot of infrastructure needs to be put in place and royalty burdens are sometimes prohibitive.

Argentina?

Fly Fishing and wine.

Beautiful women also.

Great place.

Thanks for your encouragement, Goffeyguyzz and everyone else in this forum!

I have been perperlexed by the low GOR black shale oil produced first in China some 7 years ago, and I had no clue how it could be produced until this June, when VM also reported larger scale success.

I first thought like rest of the geologists that such low GOR high viscosity oil must be conventional oil produced from natural fractures in shale. But, VM and recent Subei China results seem to verify again and again that they are shale and need same hydraulic stimulation with predominately water, not gel fracking. Even in VM, it is not well established until 2020 when Vista drilled into the low GOR 1MCF/bbl.

In 2020-21, I did isotope logging in wells in the original low GOR shale field, Jimusaer, and it still have the highest EUR shale wells there in China and lowest GOR in the world (50scf/bbl) , and I was shocked that the maturity read by my isotope machine is already Ro~0.95, same as the Permian core where GOR is 1MCF/bbl!YEs, 20X difference in GOR, and API is only 20° versus Permian 40~43°.

The comment ‘… finite and non renewable’ fossil fuels’ indicates an unfamiliarity with this entire RNG (Renewable Natural Gas) arena.

Practically every decomposing bit of organic matter emits (creates?) methane.

This is why virtually every garbage truck trundling down the streets of the US is fueled by essentially free fuel … CNG captured from local landfills.

Sheng Wu thanks for your recent observations/input,

Regarding- “especially India, as the industrialization is picking up steam fast, i.e. the oil peaking probably will not be there till 2035 or later”

I would agree without reservation if we lived in a world with no oil depletion. I think that India, along with most countries, will have great trouble finding oil supply to meet demand appetite throughout the 2030’s and beyond, if not earlier.

Last night I talked with a friend who lives in Bangalore. He commented how Indians are now buying a lot of large SUVs and airlines are placing orders for new planes. So no demand destruction there.

I’m constantly seeing new articles about how renewables, especially offshore wind farms, are not financially profitable, even when given tax brakes. How are we going to continue to sustain the world economy and our lifestyle after 2030 if that’s when the world crude oil production starts declining rapidly? Can nuclear and renewables take over the lack of oil and eventually replace it? Battery electric vehicles and nuclear power seems to be the best solution to mitigate peak oil, but there’s no silver bullet and who knows what will happen to our financial system that is based on capitalism and needs growth in order to function. We’ll probably all meed to live in cities and tiny apartments and take public transit in the future as nobody can afford a big suburban home and a big SUV.

Europe and Asia are going to de-industrialize on a massive scale. As available oil exports trend from current levels to zero. They’ll have to make do with what is produced on their own soils.

Which is like a 3rd or 4th of what they currently use because of the ability to currently import. It’s going to be nasty.

Renewables and nuclear aren’t going to change the outcome. Current standards of living will not be maintained.

Maybe exports would be continued if someone offered over $25 a barrel?

Exports will go to zero regardless of what the price is. It could be $25 or it could be $225.

Not a matter of price. The math behind ELM is clear. One by one producers will have to either cut domestic consumption or cut exports. Cutting exports is a whole lot easier than cutting domestic consumption.

I don’t think peak oil is necessarily about peak production. Peak exports is what matters most. And we will be in a world of hurt long before exports hit zero.

Just take away a 3rd of all exports and see what the world looks like.

Saudi Arabia burns a lot of diesel — much of it imported — to run air conditioners when the sun is shining. They’ve been talking about solar for a while now, but recently they seem to have started getting more serious.

HHH,

There are a number of poor assumptions for the Export Land Model, that is why so far there has been no shortage of exports, OPEC has cut exports lately because they believe the World is oversupplied with oil and are restraining output to raise oil prices. Exports will decrease in the future mostly due to lack of demand for oil.

Or OPEC is still pumping all they can. Or market seems oversupplied as demand has fallen for economic reasons. Like wages not keeping up with price increases. Making fewer trips using gasoline is one of the easiest ways to cutback when there just isn’t enough money to pay for everything.

Global oil exports have already peaked years ago. Trend is lower exports regardless of the reasons. Which is why we never returned to pre-2008 growth trend.

Gasoline demand in the US peaked 4 years ago and is trending downwards steadily. That’s one reason we are exporting more oil. We don’t need it anymore.

If there were no alternatives available then it would be difficult for producers to maintain exports. But subsidized oil prices in producing nations has led to lots of inefficient use (for example AC use in KSA). Much of this can be replaced with solar. So ironically solar and EVs will keep the export market well supplied for the foreseeable future. If oil prices are trending downwards now it’s because the three major markets (US, China, Europe) are all rolling over demand-wise.

https://yaleclimateconnections.org/2023/05/is-this-the-beginning-of-the-end-for-gasoline/

HHH,

The World peak in oil exports was 2016 at 71151 kb/d according to Statistical Review of World Energy, in 2022 it was 68815 kb/d which was higher than 2015 at 63341 kb/d and all other years from 1980 to 2015.

Dennis, The data in the report shows Europe exporting 2.864 Mb/d and Asia Pacific exporting 6.548 Mb/d (ex Japan). Is there some double counting here. Namely, importing oil and selling refined products.

HHH, what is you opinion on the possibility that those countries with refineries, may in the future buy oil but refine it only for their own domestic use and export none. Those without refineries will be left high and dry. Of course, market economies might make such a scenario moot, for countries, such as Mexico that is now an oil importer, exported her oil until domestic consumption exceeded her production. But refining and production are different categories and I do not want to commit a category error, for the differences may be material.

Yeah before exports actually hit zero. There will be hoarding for lack of a better word. If you have refineries and can still get imports you likely not export the refined petroleum products. But at first you’ll just export less until less becomes zero.

Not there yet. But I think as exports trend towards zero which might be 15 years out from here. There will be a huge amount of refineries close there doors because they can’t get enough crude to remain profitable.

Japan and Singapore for instance have a lot of refining capacity. But they might lose their imports before say India because a lot of that oil has to pass right by India.

Isn’t the price paid for oil determined by the monetary value of its utility? I think that the utility – more accurately the monetary value of utility – is in a way the limiting factor in that when oil is used to produce some kind of output which can (and is) measured like widgets vs utility that can’t be measured like a ride in the country on a Sunday afternoon the use which the measurable utility may likely be able to pay more for any given barrel. There is also the issue that the US (and most western countries) don’t have a national energy policy so you can have a scenario where a company exports oil for X dollars because demand at home is X-1 dollar even though the humanitarian consequences are negative.

Rgds

Seppo,

Yes net exports is a better measure for that reason, or to look at crude only exports. Chart below has World crude oil exports from EIA and OPEC which is likely a better measure than crude plus products.

One of the things to take into account is the switch to solar and electric vehicles. After 11 years on my roof and with my shingles needing replacement, I will still be cash flow positive with my PV array. With my EV, fuel cost per mile is about 1/2 to 1/3 the cost of gasoline. I can go 40 miles on a $1 worth of electricity and gasoline is about $3/gallon.

Recent advances in solar cell efficiencies are edging up into the low 30% range (33.9%). That means, I will eventually be able to replace my array with something that is twice as efficient and cost a lot less per kw. Labor and material will still be going up in price.

While I could store my excess generation in a Powerwall, I think we will eventually see the electric power generating companies take over that aspect of managing electrical generation and storage. Maybe we will see them rent our roof space and save our farmlands for growing food.

In the meantime, there are a lot of voices here that have insights. We’re all trying to tease out our various and precarious situations.

“How are we going to continue to sustain the world economy and our lifestyle after 2030”

It will not be sustained.

“If Something Cannot Go on Forever, It Will Stop“ ~ Herb Stein

For example, the insanely wasteful energy consumption of the last 50 years or so. No great loss though, since little of that consumption actually improves living standards.

Take cars for example: They are almost entirely used for moving single passengers around cities and suburbs. This could easily be done with a vehicle weighing less than a on, but on average, new American cars weigh more than two tons. The huge improvements in engine efficiency since the 70s has been wasted on ridiculously oversized vehicles.

And even now, 80% of the fuel you put in your vehicle goes to heating the radiator. Switching to EVs would greatly reduce waste.

But that isn’t all. The real solution id to stop requiring people to travel long distances on a daily basis. Most car travel is the direct result of bone-headed planning by city governments.

The idea that we are better off than we were 50 years ago because our cars weigh twice as much is bonkers. But that is were all the added consumption went. The idea that we would be worse off it they weighed half as much is equally bonkers.

Coal is the answer. Liquid fuels can be made from it, and it can be burned directly. There are vast amounts of coal, way beyond present reserve levels. Lignite and peat are everywhere. When people are coldband hungry they will turn to coal to survive. CO2 and climate change are so much bullshit. The coming volcanic eruption in Iceland will expell more CO2 than man has burned in the past 100 years.

“A NASA study showed the amount of carbon dioxide that came from the Mt. Pinatubo eruption, the largest in over 100 years, is equal to half the amount of carbon dioxide that humans produce every day.”

You’re making up the numbers so outrageously.

https://skepticalscience.com/volcanoes-and-global-warming-intermediate.htm

“Volcanoes emit around 0.3 billion tonnes of CO2 per year. This is about 1% of human CO2 emissions which is around 29 billion tonnes per year.”

thanks for a great visual comparison, but I don’t understand the optical thickness scale, is that for the volcanos?

It just indicates the increase in aerosols that have come from the volcano – i.e. a proxy for volcanic activity (see link).

Well, depends how you read the sentence. Could also be understood as “CO2 coming Pinatubo eruption corresponded to only half of CO2 produced by human activity in a single day” 🙂

==> Vulcano eruptions contribute marginally to CO2 emissions. However they contribute a lot to stratospheric dust.

A big eruption in Iceland could even cool the atmosphere for a year or two.

Try to land. The carbon dioxide emissions of the volcanic activity are approximately 0,6 billion metric tons/year according to a study published in 2013. https://www.climate.gov/news-features/climate-qa/which-emits-more-carbon-dioxide-volcanoes-or-human-activities

$.02 the best path for mitigating peak oil is antiticipating it and reducing oil consumption by choice before being forced to do so by price or availability. Expending wealth and income for an expensive energy consuming vehicle in order to maintain petrol fueled behaviors is missing the mark.

As I look at your charted projections Dennis (thank you!),

I just don’t see how the time from roughly 2029 and throughout the 2030’s is going to avoid being a time

of severe oil product shortage for most of the world. Shortage as in appetite much higher than supply, with severe consequence.

Yes, there will be an accelerated and urgent shift toward electrification of all oil product combustion applications,

but this global project is too big to get done quickly enough at this late stage and meanwhile the population is growing towards 9 billion (estimated 2037).

Lets keep in mind that replacing light transport combustion mechanism is only one facet of the oil supply issue.

And I believe that there is zero chance that extremely turbulent geopolitical storm will be avoided in this period, and that this factor adds up to the very high risk of oil supply disruption below the potentials charted. Sorry to say that this disruption risk cannot be overestimated, and yet is not predictable in scope, timing, locale and specific repercussions.

Those who have had things the easiest (US as the best example) have a huge risk of shocking shortfall. The current glut of oil has made us extremely complacent.

Hickory,

The rapid decline in oil output assumes demand for oil decreases due to the transition to electric transport, yes there are other uses for oil, but land transport of goods and people is at least 60% of demand for C plus C. The problem for oil companies in the 2030s may be low oil prices due to insufficient demand, high cost unconventional, deepwater offshore, and artic oil projects may cease.

In 1901 Spindletop came in. In many ways it marked the beginning, as well as Iran oil discovery in 1908. Oil was now proven to be abundant enough to be reliably used as a primary energy source. In 1917 NYC retired its last horse drawn tram and gasoline powered trams and cars became the primary transportation. WWI used horses as the primary infantry transportation however by the time WWII took place it was the keep trucks and tanks. In only 45 years the complete energy transition had occurred. Including rockets planes and nuclear which was supposed to be the next transition but it never happened.

We might say that by 1945 we saw the end of the beginning. From 1950 to 1973 the total industrial output of the world was greater than the period of 1800 to 1950. The US GDP was growing at 6% through that period. All the moon landings took place during that period and most nuclear power was planned during that period. The fastest military and private planes were designed and built during that period. Then suddenly it ended why did technology dry up?

In 1970 US oil production peaked causing the entire global economy to shudder. It always been about energy not technology. Technology is a corpse without energy. So in 1970 we were at the end of the beginning and the beginning of the end. Try as we might after 50years there is no transition from oil rather a desperate increase in its production and consumption.

The middle of the end was 1970 to 2005 and was met with multiple boom bust cycles as the financial and real economy out paced each other all the while debt was added to masks the underlying contraction in real GDP inflating assets and keeping energy prices low. By 2005 conventional oil peaked and the debt was untethered from any reality . Energy is Money. That marked the middle of the end.

Where we are now is the end of the end. There is no real growth in any economy. It’s all just supply side shortages inflating prices. Shale was the last gasp of a dying industry that was built on cheap credit and inflated production figures. And no matter how you want to count it the growth in C+C NGL and all the other light components are dragging down the energy content of oil in aggregate.

Prices are making wind and solar unaffordable now but no surprise because it was also unaffordable in the 70s .

If an energy transition could have worked it would have already just as it did in 1901-1945 it never came and never will.

JT,

Alternatively, from 1945 to 1970 oil output grew at about 7% per year and prices were cheap as oil supply kept pace with the increase in demand for oil. After 1973 oil prices became more expensive and after 1979 output crashed and prices increased even more. It took 13 years for oil output to return to the 1980 level as higher oil prices reduced growth in oil demand to under 2% per year from 1982 to 2004, from 2005 to 2019 output grew at only 1% per year and we may never produce more than in 2018. It will take time to transition to electric transport, just as it took many years to replace horses. For the past 5 years most energy growth at the World level has come from non-fossil fuels. If non-fossil fuel energy growth continues its recent pace of increase, it won’t be long (maybe a decade or so) before fossil fuel energy use starts to decrease. due to lack of demand for fossil fuel energy.

For the World real GDP grewe at an average rate of about 2.8% per year from 1980 to 2022. High World growth rates from 1945 to 1980 were due to recovery and rebuilding after World War 2 and the Great Depression.

If we consider GDP per capita for the World, the growth rate from 1960 to 1979 was 2.6% per year on average and from 1980 to 2019 it was 1.65% per year on average. As the World becomes wealthier on average growth rates will tend to slow. Population growth will also continue to slow as it has been doing since 1971.

Dennis, oil grew at a rate of 7% per year to 1970, because it was relatively easy to find and despite the TRRC trying to keep a lid on too much supply, there was plenty from around the world.

Oil became cheaper than gas, coal or wood as an energy source. While the world GDP on average did rise, there were still 80% in abject poverty, relative to western lifestyles. The growth rate did not fall because the world was wealthier, it fell because oil was still cheap and the easy to find and develop stuff had been found and developed. EROEI started to rise..

Western lifestyles were at there peak at the end of the cheap oil phase in the early 70’s. In this country a man on an average/median wage (they were around the same back then), could buy an average house, have an at home wife, 4-5 kids and still afford annual holidays, boat and/or caravan etc. The house only took a decade to pay off as well. Now 50 odd years later, it takes a 2 income couple with no kids to pay off a mortgage on a below average house on average earnings (which are way above median earnings), over a much longer time period…

Average GDP per capita is higher because it’s concentrated in the top 1% in 2023. The wealth exists on paper, meanwhile the world is in deep debt paying for everything pulling future resource use into the present.

Solar, wind and nuclear are struggling because of high interest rates, making the economics much worse. Offshore wind cancellations, SMR cancellations, large solar projects just not being planned anymore (in this country), because of negative pricing when the sun shines and wind blows. Theoretical capacity factors of 37% becoming actual 24% further destroying economics.

Oil, coal and gas discoveries have made individuals, companies and countries wildly wealthy relative to others. Can you name any that have become wildly wealthy from the energy provided by solar, wind or nuclear??? I don’t know of any. It tells you everything you need to know about the economics and energy return. It’s just not there…

“Population growth will continue to slow”… So what? It needed to be negative decades ago to provide a world in the future, worth living in. We have been destroying the environment at an increasing rate by destroying forests and habitat to graze domesticated animals and grow crops on for centuries, and now the burning of fossil fuels are catching up with massive changes to climate which will accelerate the decline of the overall environment.

Everything about the ‘transition’ is an illusion. It’s all based on fossil fuels being increasingly used to mine ever lower grades of ore to build out everything, which requires more energy than in the past for the same production. It requires more building of processing plants, smelters and factories, for the ‘growth’ of all the transition goods..

The mining, processing, smelting and factories all have to be built creating the raw materials needed to put together a solar panel or wind turbine, so a lot of the energy cost is upfront, all done with FFs.

The ‘reserves’ of the minerals are nowhere near enough for the transition and the claimed reserves by USGS often don’t exist. The one country I bothered to look into detail of USGS reserves being Australia, only has 25% of the claimed reserves. I wonder if every other country is similar.

It is debt, that is now getting hard to service that has kept our civilization going as long as it has, with promises of a bright future from a simple transition spread to keep the masses relatively happy. Meanwhile people are slowly waking up to how much worse off they are already compared to their parents and grand parents for the young…

Some people are better off, the average GDP or whatever not telling the real story as the EROEI continues to fall.

Any energy generating plant that has a LCOE more than a tenth of what current common energy production units are, (EG oil currently $47/Mwh) are not compatible with a modern civilization for anything other than the very few wealthy.

At some point though the population will rebel against the increasingly fewer wealthy, and/or leaders get elected promising to take action against the wealth of someone else to make people his/her supporters) better off. It could be the wealthy, a minority, or the neighbouring country/countries, history is replete with examples.

Once the production rates of oil fall, with an accelerating rate, the investments for renewables and nuclear, batteries will dry up, they will become unaffordable to most. I’ts obviously because they totally rely on oil for mining and transport, then use coal and gas in manufacture which also rely upon oil for their production..

We live in an extremely complex system with many feedback loops affecting all types of investments, building and supplies of everything. Problems are relatively easy to overcome when there is more of everything from increasing fossil fuel availability, but once in severe decline cascade failures from negative feedback loops will effect everything imaginable and some you wont see coming..

Hideaway,

The growth rate was high from 1945 to 1970 because the World was rebuilding after the destruction of World War 2, poverty is a problem which is likely to continue, more equitable distribution of wealth could in theory be addresses with tax policy, but the wealthy have great influence in government and in some nations (such as the US) are permitted to buy elections with unlimited spending so I am not hopeful that things will improve (in the US things have become much worse since major tax reform reducing taxes on the wealthy under Ronald Reagan.

Note that in the past energy use was much less efficient, fossil fuel typically only converts about 30% of the energy to work, a system using electric power produced by wind and solar does much better (likely 2.5 times better).

In my nation, most people paid of a home mortgage over 30 years in the 70s and earlier and the average home was much smaller back then than it is today. For the US real GDP per capita grew at 1.8% per year from 1970 to 2022. For China real GDP per capita grew by 7.4% per year over the same period. Wealthy nations grow more slowly than less wealthy nations.

https://fred.stlouisfed.org/series/A939RX0Q048SBEA#0

https://fred.stlouisfed.org/series/NYGDPPCAPKDCHN

As fossil fuel becomes short in supply prices rise and humans adjust. Goods and people can be moved using electricity (both EVs and electric rail) as oil becomes expensive. As prices rise more supply will be available (compared to a lower oil price scenario) and demand for oil will fall.

Fossil fuel consumption (sum of oil, gas, and coal) grew at about 4% per year from 1965 to 1979, at about 1.9% per year from 1982 to 2010 and at about 1% per year from 2011 to 2019. From 2018 to 2022 the growth rate in fossil fuel consumption has been about 0.3% per year on average.

Data from https://www.energyinst.org/statistical-review

Dennis ….. “The growth rate was high from 1945 to 1970 because the World was rebuilding after the destruction of World War 2”

So totally ignoring the other 80% of the world is OK by you. The reality is that whether it’s re-building or just building it takes a lot of energy, energy we didn’t have after the growth of oil stopped being exponential in nature around 1970-3.

If there was plenty of energy then the growth could have continued unabated until the rest of the world had caught up.

Dennis…. “Note that in the past energy use was much less efficient, fossil fuel typically only converts about 30% of the energy to work, a system using electric power produced by wind and solar does much better (likely 2.5 times better).”

This is the biggest lie stated by the entire renewables and nuclear industry, not because it’s untrue, but they miss out the biggest part of the picture… It ignores all the products which directly come from fossil fuels which would have to be made by electricity. It ignores all the storage needed with renewables, much larger and longer transmission systems, it ignores long distance travel by planes and ships.

So what is the efficiency of making synthetic fuels using electricity and carbon capture from atmosphere for plastics, fertilizer, bitumen, coking coal and cement?? Make sure to include all the energy that goes into the equipment like electrolyzers and the mining for the raw minerals, plus the processing plants for those minerals, plus, plus, plus…

EVs wont move without plastic contents, which are not recyclable for original use….

What happened when fossil fuel use declined below 4% again?? Debt blew out across the world. Our economic games created money out of thin air in the form of debt to drag future use of resources, the easier stuff into the present, because the energy component of the cost was too high to do it out of present cash flow. The growing level of debt, even if it is to ourselves overall, still has a cost in interest that isn’t borrowed into existence, so becomes a larger percent of the overall cost of the system…

Do you think it’s only a coincidence that right around when growth in fossil fuels slowed, the EROEI of those fossil fuels also started to go down, that debt went up and economic growth went down, while those in poverty were kept in poverty by the lack of growth??

Hideaway,

The fact is that wealthy nations grow more slowly than less developed nations, as the World becomes wealthier on average growth will slow.

In most developed nations, HV transmission network is already in place. Note that fossil fuel could continue to be utilized for petrochemical inputs, ships can be powered with natural gas, wind, or nuclear and air travel could be reduced or eliminated, it is not a requirement for human existence.

Average annual growth rates for real GDP per capita from World Bank has high income nations at 2.7% per year from 2000 to 2022 and for low and middle income nations the average annual growth rate for real GDP per capita was 7.65% per year.

https://data.worldbank.org/indicator/NY.GDP.PCAP.KD?locations=XO&view=chart

Also EROEI of wind and solar at point of use are better than for oil and natural gas.

See

https://www.mdpi.com/2071-1050/14/12/7098

Hideaway

You are wasting your time trying to open the eyes of Dennis.

He is blinded by his learning of old economic thinking that is already showing itself to be based on classroom theory and not real world experience.

You will notice he uses things like GDP per capita, which is the biggest distortion of what is really happening in the world.

For the poorest 20% in the US their household purchasing power has declined over the last 30 years. Working in the same jobs they must work overtime just to buy what they did 30 years ago working 37 hours per week. Most middle income families are no better off.

https://www.pewresearch.org/social-trends/2020/01/09/trends-in-income-and-wealth-inequality/

The richest 0.1% people have a total wealth of over 18 trillion dollars, while 50% have only 3.6 trillion.

https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/table/

You will notice Dennis never talking about the Gini coefficient because he simply doesn’t understand how it actually relates to real people.

You are correct the best time for poorer people was when oil and food was cheap. That time has gone.

Also Dennis has not got a clue of the cost of electricity storage he says mindless things like storage is getting cheaper. Cheaper than what?

There is no one so blind than a rich man who can afford food and electricity no matter the cost. Today people in so called rich countries are dying because they can’t.

Charles,

Yes there is wealth inequality in the US which I am well aware of, and I am aware of the shortcomings of mainstream economics, in some places in Europe wealth inequality is far less than in the US. I advocate for a highly progressive tax code with no special treatment for the income of the wealthy class (dividends and capital gains are taxed at lower rates in the US than wage and salary income). I also favor high tax rates on the wealthy as was the case from 1932 to 1981 in the US which tends to reduce wealth inequality.

I agree median income is a better measure than the average. For the US real median personal income (income per person) rose at about 1.03% per year on average from 1982 to 2022 while real GDP per capita (which is average income per person) rose at 1.64% over the same period due to increasing wealth inequality, much of this was due to changes in the US tax code after 1981, with top rates on income reduced from 70% in 1981 (from 1944 to 1963 the top rate was over 90% for wage and salary income) down to 28% by 1990, it has since increased to about 39.6% for the top income bracket.

Wealth inequality is improved with tax code and social safety net and the US does a very poor job of this, My one vote cannot change the political landscape in the US.

The GINI index is a national index, I usually look at the World as a whole and the GINI Index is not available at the World level.

Comparing UK with US, the GINI index is much better in the UK (32.8 in 2019 and 27.4 in 1979) than the US (41.5 in 2019 and 34.8 in 1979) a lower number means less income inequality. Part of this is a far better social safety net in the UK, I am not familiar with tax policy in the UK.

Dennis, respectfully, outside of people with real physical or mental issues…. wealth inequality is truly helped by education, desire, tenacity, hard work and maybe a little luck. Many billionaires started with very little and yet achieved great financial success. Social programs tend to get people hooked on free money, risking the lazy syndrome to kick in.

But really a discussion for off topic…

Gungagalonga,

Wealth inequality, has more to do with the advantages wealth gives people to accumulate more wealth. Tax policy and social safety nets have a powerful influence on a more equal distribution of income. It has very little to do with innate talent and hard work. The wealth distribution in much more equal in most European nations than the United States and this is mostly a reflection of differences in government policy between nations.

The US is very backward in this regard, that’s why we have amongst the lowest average life expectancy of high income nations and one of the most unequal distributions of income.

We could do much better, but alas many people in the US believe in the myth that the laissez faire economy results in the optimum outcome.

Dennis

For every dollar of GDP growth since 2008 has been accompanied by 3 dollars of debt. And the rate of GDP growth is less than the rate of inflation. We can easily argue that present GDP growth is an artifact of inflation. And not a very good one since they should at least be equal. Solar and wind projects are being cancelled because even with subsidies they’re not economically viable and particularly wind is learning that it has engineering and maintenance limits. All the while interestingly lithium prices have collapsed. Which sounds like a good thing unless you’re a lithium mining company who built out the operation on higher prices and lower interest rates. And what happened to demand?

When we publish chart after chart based on future assumptions the moon is the limit. URR will be what it will be but projections based on future guesses are well guesses. Might as well pull numbers out of a hat. 2000, 3000, why not 10,000.

What are we seeing actually happening? SPR is drawn down Cushing is drawn down Russia and Saudis are “limiting “ exports. Prices aren’t rising. Diesel demand is falling and dollars are in short supply globally. Bankruptcies are rising wars are increasing migrants are flooding over national boundaries around the world. Retailer are closing stores because of theft including fast food chains. The city’s of the future are refugee camps that are now multigenerational.

These things don’t happen unless the system is under extreme pressure in the real economy not the financial fantasy economy that the government projects. When a ship is sinking who are the first to know? The rats. When you see rats abandon ship it’s time to abandon ship. Those living at the lower levels of this enormous dissipative structure called the global economy are the first to recognize the problem and do something about it. The Marie Antoinnette set are still holding on the their techno green utopian dreams.

The narrative of flying cars and energy too cheap to meter and the like were fantasies to keep the serfs inline. All the while their pensions were pillaged by an economic system built on infinite growth on a finite planet. Things that are impossible are, well, impossible. And there are no particularly bad characters behind the scenes or in front of the screens they’re all bad actors because that’s all they are. They’re acting as if they’re able to make a deference and they never could.

Resources and the access to them drive economic development and nothing else. When resources decline you have to shift to where they still exist by negotiation or war from an individual level in the case migration or national level in the case of the US proxy war with Russia.

JT,

The metric I used is real GDP per capita which adjusts for inflation. So no we cannot argue that real GDP groeth is due to inflation. At the World level there is no net debt as long as we don’t have any interplanetary debt. For every finanial liability in the World there is an offsetting financial asset, in short debt is money owed to ourselves. There have always been problems in the World, I expect this will continue for a long time.

My resource estimates are based on the research of others, the USGS estimated conventional oil resources (crude plus condensate from non-continuous oil reservoirs) for the World at about 3000 Gb in 2000, Laherrere et al estimated about 3500 Gb for total World C plus C resources (includes continuous resources) in 2022, my estimate is about 2660 Gb.

Prices of resources will rise and fall based on market conditions (rising when the market believes the resource is in short supply and rising when the matket thinks there is an over supply.

From an EROEI perspective wind and solar at point of use are as cheap as coal.

See https://www.mdpi.com/2071-1050/14/12/7098

Except coal is dispatchable Dennis. You burn it when you want. The wind blows when it wants.

That simple fact is lost to those living with mortal fear of carbon dioxide.

Feel free to ignore depletion, and global warming, and election results.

Its what you do.

C185 pilot,

Coal is expensive, and climate change is a problem, also coal will become more and more expensive as it depletes.

See https://history.aip.org/climate/index.htm

Except coal is dispatchable

Depends on the fleet. Traditionally, coal plants are not built to react quickly to changing demand. Instead they are designed to generate a steady “base load”, regardless of real demand.

The term “dispatchable” can be pretty misleading. especially considering how old the fleet has become in rich countries.

Your’s is an exceptionally evocative paper, sir.

One nice thing about inflation is that it reduces the value of outstanding debt. If I have $100 in debt and inflation is 5%, then a year later that debt is worth 5% less. And societies that have experienced hyperinflation are essentially debt free. It’s not a great trade-off, since savings vanish as well, but it’s true.

The Maoists also demonstrated this in the 1930s and 1940s. Rural China had gone though a horrible period starting roughly with the silting up of the Grand Canal in 1848. The population crashed, and the surviving farmers had been reduced to debt slaves. It was common for farmers to being paying debts so slowly that it would take a century to pay them off, and debt was inherited. They often lost their land when they couldn’t make payments but weren’t allowed to leave the village.

The Maoists, on the run from the Nationalists and the Japanese, would curry local support by marching into the village, seizing the municipal building where records were kept, and burning all the records of debt and land ownership. Problem solved. Rural debt simply vanished in their trail and the peasants cheered. Again, not a great trade-off, considering the insane excesses of Mao’s reign, but an excellent demonstration that debt is a social construct only vaguely connected to physical reality.

I don’t see how it makes sense to claim debt is directly connected to energy and that inflation is real, unless you assume the real value of energy is falling. If energy is the basis of debt and money, then energy shortages should lead to massive deflation and increasing debt. If currency is simply government fiat(or more realistically, manipulation), then it would lead to inflation and decreasing real value of debt. But I don’t see a scenario with increasing inflation and increasing outstanding debt being triggered by energy shortages.

I have a feeling that some very powerful people may take umbrage at debt vanishing and may even have something to say about it.

Above the numbers are real GDP per capita from

https://fred.stlouisfed.org/series/A939RX0Q048SBEA#0

From 1947 to 1979 average annual growth in world real GDP per capita was 2.36% per year, from 1980 to 2008 average annual growth in real GDP per capita was 2.10% per year. From 2009 to 2019 the average annual growth in real GDP per capita was 1.60% per year, as less developed nations grow their rate of growth slows so we expect World annual growth rates in real GDP per capita to fall over time.

Another way to look at real GDP per capita growth rates is to look at the natural log of world real GDP per capita, there is a clear break in the data around 2008/2009. The average annual rate of growth in world real GDP per capita from 1947 to 2007 was 2.19% per year, and from 2009 to 2022 (dropping the 2020 pandemic data point which is an outlier) world real GDP per capita annual growth rate was 1.62% per year.

Note for those not paying attention. In 2008/2009 there was the Worst Global recession since the 1930s, followed in 2020 by a worse recession than the 2008/2009 episode, the claim is that the GFC had something to do with high oil prices, but oil prices were high from 2011 to 2014 with little ill effect on the World economy so the claim that the GFC was caused by high oil prices seems dubious. The more likely cause was poor regulation of the Global financial system from 1980 to 2008 which eventually led to the GFC. The slowdown in global real GDP per capita after 2009 is likely a good thing for the planet from an environmental perspective.

JT,can’t argue with that.

I’m going to state the obvious. Why would anyone invest in shale oil or renewables or nuclear when the risk free return of government debt is 5%? And you can actually use leverage to make outsized returns on risk free returns?

Until conditions force interest rates back to near zero where is the money going to come from? Shale oil now has to compete with government debt for dollars.

While I totally expect interest rates to go back to near zero over time. The conditions required to get them back to zero are not oil price positive. They are actually very negative for oil prices.

So less capital available to oil ultimately means less oil supply. One would assume higher prices right? But I think oil prices have to go much lower to open up capital via low interest rates.

How do you lever those returns when the yieldcurve is inverted? What capital is cheap enough to make that work?

Rgds

Banks can’t make money by borrowing on short end and lending on the long end but that doesn’t mean other entities can’t take a treasury bond or MBS and go into REPO market and borrow funds to purchase government debt yielding a risk free 5%

US government debt is extremely attractive right now. And since borrowing dollars in Eurodollar market requires collateral why not hold US debt? You have to have dollars to operate on global scale.

That’s just how it is. Here lately Euro’s and Yen have become less transacted in globally. Which are the two runners up to the dollar on a global scale. So dollar has become more reinforced as global reserve currency as of late.

But if we see interest rates spike in REPO due to say insufficient collateral. Price of oil is going to implode. Because that’s where the leverage is created and used to borrow the dollars needed to drive oil prices higher.

Remember back in 2018 when interest rates in the REPO market spiked to 10% basically overnight? In response FED immediately dropped rates to zero and did QE but said it wasn’t QE. I don’t think their response matter one iota as they don’t set rates in REPO but they have to react. Anyway I think something similar maybe worse is likely to happen in REPO market within the year or so.

Banks have tightened lending standards. As property values fall both commercial and residential real estate backed securities will fall in value. Which are used on a large scale to borrow funds via REPO.

My question still remains – Where can I borrow at a rate less than what treasuries are yielding?

Rgds

Vince

Sunday morning musings on oil and world energy by a lifelong energy watcher:

If the world doesn’t have adequate energy it will most likely devolve into chaos, fear and anger. In a word, war. And any nation that develops inadequate energy will fall behind; that age-old experiment has recently been substantiated in Germany. The planet suffers from a crisis of expertise; it needs an energy guru.

We are in the middle of one of the silliest transitions imaginable. Wind projects are untenable outside high-velocity wind tunnels (like the one through Texas, Oklahoma and Kansas, on up into Wyoming). Solar has a different problem–the panels are made in China using low-quality coal. Even the EV’s pose a problem: due to the battery they weigh between 2 & 3 tons, eating up the roads. Ask the UK: they now have established a 9B pound pothole fund–and seem to have been unaware that macadam is manufactured from bitumen; at an API of 8-10 the heaviest (and frequently the dirtiest) of the oil hydrocarbons. In the U.S. road taxes are hooked to gasoline, so the ICE drivers are subsidizing the EV drivers–which won’t stand forever.

Nuclear has been the answer for a very long time. It is clean and about the only carbon footprint comes from the vast amount of concrete in building a plant, harvesting ore and developing yellow cake. There is plenty of uranium; we certainly know how to enrich it. The safest way to power the utility plants that are already in place would be with SMR’s, which if fast-tracked could be developed, along with the fuel source, in very short order.

People may have to come right up against the inconvenient truth of the energy formula. Right now there are too many idealistic untruths being promulgated, too much silly money going into untenable projects. As that transpires, LTO exportation is moving steadily along, connate water is distorting Ghawar, and the only exciting new discoveries are Guyana and the coast of Africa. There are the fabulous Brazil pre-salts, of course. That oil is pristine but getting to it is a very expensive, hazardous endeavor. We’ll treasure the pre-salt oil so much some day that it’ll be worth going after in great quantity. All in all there should be plenty of hydrocarbons to use for necessary petrochemical production if power plant electricity were generated by nuclear.

BUT, in order to get from A (a terrible, untenable situation) to Z (what I’ve outlined), we need to switch from inelastic to elastic hydrocarbon pricing–perhaps tying the price of oil to a linchpin, like say core inflation (similar to lending rates tied to the Libor). We can’t continue to see individuals and companies pour billions into a project only to experience a dump in pricing down to $20/barrel, then, when the project is bankrupt and supply is pinched, experience a moonshot to $150/bll. Regulation? Probably if it can be done without corruption, but if the TRRC fails to regulate unheralded venting and flaring of methane gas into the troposphere, it is hard to imagine the regulation of production and exportation of hydrocarbons on a broad scale.

There are a few energy experts out there with Big World ideas and a pragmatic thought process. It would probably take a board. And there’s where it all goes to S#*t! Show me the money!

‘LNG export capacity from North America is likely to more than double through 2027’ !!!- EIA

We expect North America’s liquefied natural gas (LNG) export capacity to expand to 24.3 billion cubic feet per day (Bcf/d) from 11.4 Bcf/d today as Mexico and Canada place their first LNG export terminals into service and the United States adds to its existing LNG capacity. By the end of 2027, we estimate LNG export capacity will grow by 1.1 Bcf/d in Mexico, 2.1 Bcf/d in Canada, and 9.7 Bcf/d in the United States from a total of 10 new projects across the three countries.

https://www.eia.gov/todayinenergy/detail.php?id=60944

Hickory,

Yes we are under the illusion that natural gas is plentiful, many of these projects will never pay out unless the US reduces natural gas consumption to zero in order to have enough natural gas for export. We should really slow down on the rush to export all of out energy resources, it is not smart policy.

For this coming 10-15 years it will be a mad rush to use up Nat Gas as quickly as we can.

‘Slow and steady’ is not a method of conduct we are familiar with.

Mr. Coyne: “We should really slow down on the rush to export all of out energy resources, it is not smart policy.”

If you own natural gas, what are you to do with it, Mr. Coyne? On a daily basis the administration, including the Energy Secretary, takes potshots at fossil fuels, highlighting, by the way, NG. They threaten to shut it down, and along those lines have blocked pipelines that would take NG from the wellhead to where it is needed in the United States of America. So, given that political backdrop, is the owner of natural gas property supposed to just sit there and go bankrupt? I actually do own quite a bit of natural gas, and I want it out of the ground and sold before the very leader of the free world blocks it, and I want as much as possible run through an LNG train and put on a tanker, before he also shuts that down. I’m just curious here, what would be the game plan for making a living and also saving some for the future? With the administration blocking NG cooking stoves, when do you suppose they’ll block NG altogether?

Mr Maddoux,

I agree with Mr Shellman that exporting our energy resources as quickly as possible is a poor policy decision. There is lots of drilling for natural gas which could be slowed down to conserve for future use.

My suggestion is to not increase the LNG export capacity any further.

That’s not an answer.

Does the owner of NG get reimbursed when the federal government prevails and shuts it down?

Who is the arbiter of production and shipping?

And while millions of tons of coal with a GHG # twice that of NG is burned by china of course but also (last winter) by Europe.

Lots of criticism, shy on solutions.

Gerry, you have called for an ‘energy guru’ to make policy. If this country had such a thing- [wise longterm energy policy]- then nat gas and oil would be regulated to keep steady production out into the future rather than to use it all up quick.

But I seriously doubt that any such regulation is in the cards.

I won’t pretend to have any good idea for how an individual such as you should handle their holdings.

Gerry Maddoux,

Nobody except you has suggested shutting down natural gas production, don’t ascribe something to me which I do not agree with. I think exporting our energy resources may be a bad idea, for all of the reasons that Mr Shellman has given more eloquently, than I have done.

One example at this link and read Mike’s comments where he expounds further.

https://www.oilystuff.com/single-post/the-case-against-us-oil-exports

I did not always agree with this and used to advocate for free markets, but in some cases that may not be the best policy.

The US banned crude oil exports for 40 years, I am not suggesting a ban on natural gas exports, just slowing down the approval of new LNG export facilities (those that have not begun construction). Production is decided by the producer, just as when there was a crude export ban, individual producers made production decisions based on the market conditions.

I guess you are not a fan of Mr Shellman’s suggestion that reducing energy exports is a good idea. What he suggests makes sense to me. The US government (FERC) can decide which export facilities get approved which has been the case for years.

Also consider the following chart for a future shale natural gas output curve for the US (most recent growth in US natural gas has been from shale gas). The peak is around 2033 at 110 BCF/d with an assumed URR of about 1200 TCF for shale gas. The LNG export facilities have about a 30 year life, for those built by 2025 they would plan to operate until 2055 (at which point output will be about 20 BCF/d. If the 10 BCF/d of expanded export capacity get built adding to the current 20 BCF/d that gets exported we would be at 30 BCF/d by 2027 and by 2052 there would not be enough production to fulfill export needs, unless US consumption of natural gas falls to zero by then. In August 2023 the US consumed about 86 BCF/d.

Not clear we can get to zero consumption by 2052.

Also I would not suggest investing in these LNG export facilities, the excess capacity by 2042 at LNG export facilities will result in many bankruptcies, probably once the peak in 2033 becomes clear.

Gerry were you involved in this before 2015? If you produced any oil was there reimbursement because you could not export your crude oil?

I am not in the business, but am not aware of any such reimbursement to crude oil producers from 1975 to 2015 when crude oil exports were not allowed. Perhaps I missed it.

Revised Shale gas scenario URR=1480 TCF (previous scenario was 1200 TCF), reality may be somewhere between these two scenarios, maybe 1340 TCF URR for continuous gas resources in US (includes shale gas, tight gas, and coalbed methane resources).

For this scenario the peak is about 125 BCF/d in 2035.

Dennis, slowing down natural gas production (or oil) can’t happen in the USA… private mineral ownership rules. Holding back production and development merely for a possible unknown future need that isn’t guaranteed is not going to happen. We are free to develop (or have developed) our privately owned mineral interests as we see fit and when we see fit.

As I have told Mr. Shellman, this discussion of slowing down O&G mineral development in the USA is only good for a conceptual discussion. We are a capitalist society with free markets. The Federal government could slow things down on their mineral acreage, but the majority of the US mineral ownership is private US citizens that will benefit from developing at a pace responsive to market conditions… and those minerals will be developed as market conditions allow, not brutalized by government shutdowns. So, slowing down production for a prognosticated future is not going to happen in the USA. Nor should it.

Gungagalonga,

The US did not allow exports of crude oil from 1975 to 2015 and it was a mistake to repeal that ban in 2015. It would be perfectly legal for the US to reinstate that ban and add natural gas and even coal to the export ban for national security reasons.

Then the resources could be privately developed as owners wish.

The natural gas export ban would not be fair to those who have already invested in LNG facilities so the best option would be to not allow any future LNG facilities to begin construction after Jan 1, 2024 and also not allow any expansion to existing facilities that have not already been approved by FERC, at least there would be less future growth in natural gas exports than with current policy.

I disagree that draining the US of its energy resources as quickly as possible is wise policy. US legislators were wise enough to see this in 1975, maybe Mr Shellman can convince others. I would love for him to lay out his case here at peakoilbarrel, but he has declined.

A smart investor would not touch these future LNG projects with a ten foot pole, they will fail badly as natural gas peaks in the US as the decline may well be faster than any reduction in natural gas demand and US shale gas will be too expensive to be profitable on the World LNG market.

Untrue, actually. Google “proration,” “allocation,” old rules on GOR tests of individual wells and the history of the TRRC.

The Texas Natural Resource Code is part of our State’s Constitution and the law. It mandates the prevention of resource waste, conservation of natural resources, preservation of bottom hole pressure to maximize recovery rates and the protection of the correlative rights of other parties affected by mineral extraction issues. Those laws are written for ALL Texans, not just mineral owners.

Three individuals elected to the TRRC every six years have taken it upon themselves to ignore those laws entirely. All of that happened with the beginning of the tight oil phenomena in 2008-2010. One the many results of that has been flaring and 10% recovery rates of tight oil in place.

American companies have spent trillions of dollars to develop other countries hydrocarbons over the past century only to get run out of that country when nationalization occured, everything lost. Nothing in life is a done deal.

Mineral ownership in America is a privilege, not a right. The privilege belongs to very few, actually. That ownership IS subject to risks; if the TRRC, for instance, was to get its head out of its ass and be forced to adhere to existing laws, to save what’s left of our country’s valuable resources, production could slow down any number of ways. And should.

But it won’t. Money and personal greed in America now takes precedence over our country. We’re on a mission from God to drain ourselves dry, ASAP.

Thanks Mike.

Hello Dennis, I never said we should drain “as quickly as possible”, I just support free markets responding to demand by delivering supply as it is needed in the framework of reasonable regulation on production to minimize waste, etc. It’s never perfect as we overshoot and undershoot, but free markets are better than government control mechanisms.

I wonder if Morocco should stop exports of phosphate as they will need it all eventually, likewise for various other commodities that some countries control the lion’s share of, like say Brazil banning niobium exports.

The world has been a relatively peaceful place since the mostly free trading of commodities has happened. Restricting something that another country needs is one of the easiest ways to start hot wars, anyone remember Japan around 1941 and their lack of access to oil..

Dennis if you believe that Natural gas/oil is so important for the future of The USA, then you really don’t believe that renewables are able to substitute for all FFs at all…

Gungalonga,

I also think well regulated free markets work fairly well for allocating scarce resources. Note that behind this “optimal allocation of scarce resources” meme is a theory that assumes a perfectly competitive market where goods are traded at market clearing prices which are known to all. Such a world only exists in Microeconomics textbooks, it is very far from reality.