Dennis Coyne, an editor and frequent contributor to this blog, has suggested that we are not at peak oil. He argues that there is likely to be a dip in production starting next year but higher prices will cause things to turn around and we will surpass the 2015 peak by 2019. He commented a few days ago:

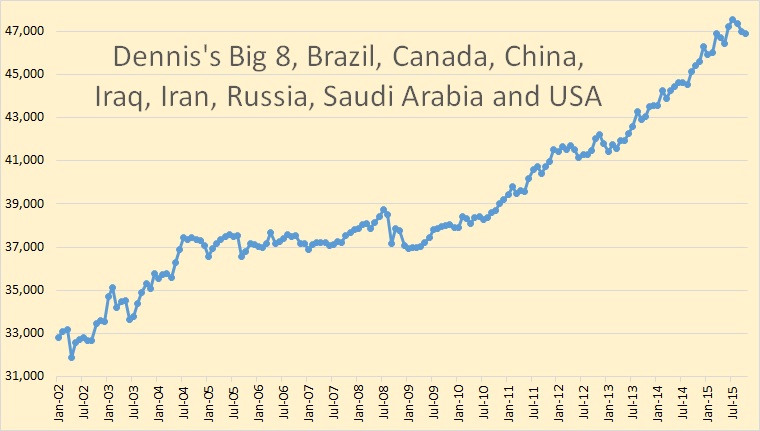

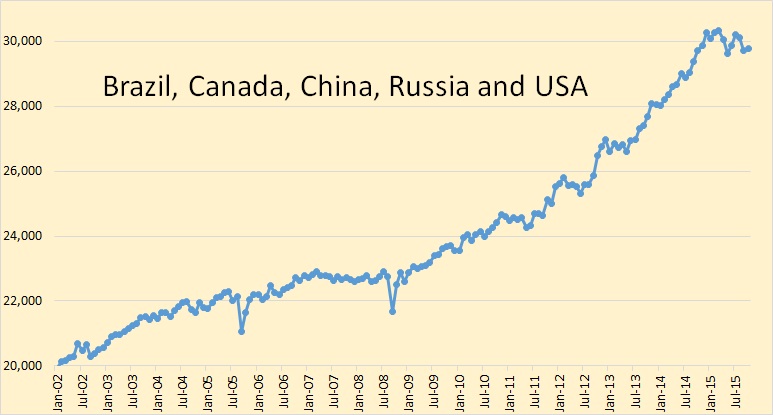

If we take some of the larger producers that have been increasing output and compare with the rest of the world(ROW) using EIA data from Jan 2004 to June 2015 (using the trailing 12 month average to focus on the trend) we see ROW decline has been relatively modest (1.4% based on the trailing 12 month output in June 2015). The eight increasing producing countries I have chosen are Brazil, Canada, China, Iran, Iraq, Russia, Saudi Arabia, and US and ROW=World minus the 8 countries just listed.

One possible scenario is that output is flat for the Big 8 in 2016 so that World C+C output falls by 485 kb/d in 2016 (average output for the year compared to the 2015 average). Over the 2009 to Jun 2015 period the Big 8 increased output at about 1300 kb/d per year, if we assume this rate slows to half the previous rate to a 650 kb/d per year increase (1.4%/year), then the peak is surpassed in 4 years in 2019. On a per country basis this would be a little more than a 80 kb/d increase in average annual output for each of these countries, though I doubt it would be divided equally.

So I have taken close look Dennis’s “Big 8” countries as well as “The Rest of the World”, and looked at their JODI data charts. The last data point is October 2015.

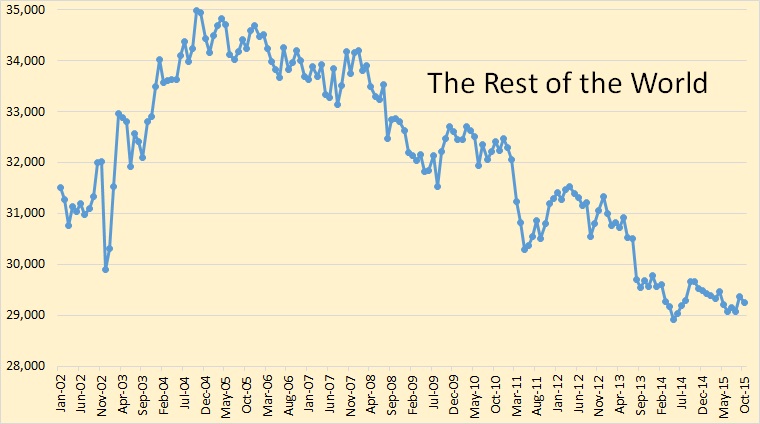

First, the rest of the world.

This is the world less Brazil, Canada, China, Iraq, Iran, Russia, Saudi Arabia and the USA. As a group they peaked in October 2004 and have been in decline ever since. They have declined in times of low oil prices and high oil prices. And barring a miracle they will continue to decline.

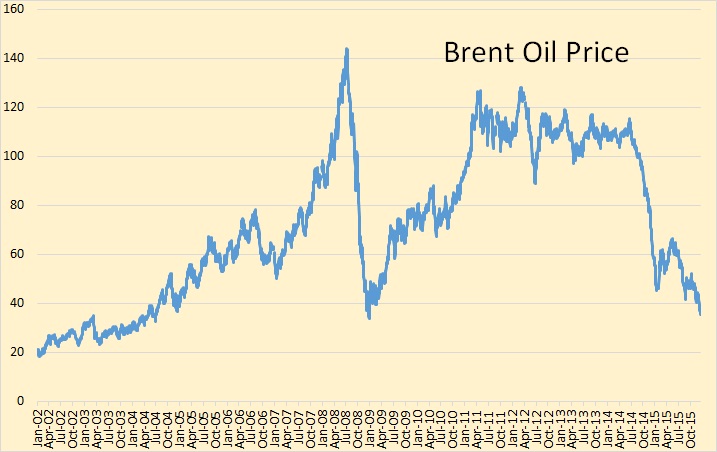

Okay, here is where the action is. You can see, from the price chart below, that they peaked in July of 2008 right when the price peaked, then fell when oil prices collapsed and did not breach their 2008 high until October of 2010 when oil pries reached $85 a barrel.

The decline in 2008 production was largely due to OPEC cuts.

Brent price went above $100 in February of 2011 and remained there, with just a couple of dips below that number, until September 2014. That price did nothing for “The Rest of the World” as charted above.

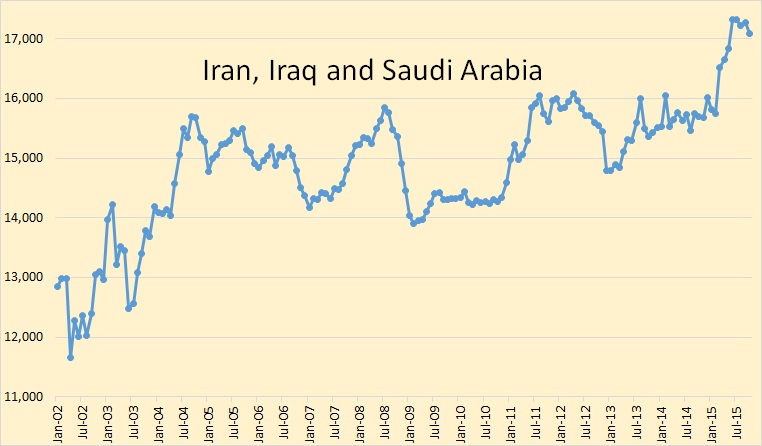

Strangely $100 oil did not do much for the three OPEC members of the Big 8 either. They stayed pretty much on the same plateau that they had been on since 2004. It was only after prices collapsed to below $50 a barrel in March of 2015 did Saudi Arabia and Iraq really begin to increase production. Since February 2015, these three, mostly Iraq and Saudi, have increased production over 1,300,000 barrels per day. Even though sanctions will soon be lifted and Iran will increase production, I don’t think there is a chance OPEC will hold their present level of production. In fact the OPEC 2015 World Oil Outlook has OPEC crude falling by 400,000 bpd from its 2015 average to 2019. Remember, just like our “Rest of the World” chart above, most OPEC nations are in decline.

The Non-OPEC 5 of the Big 8 was affected very little by the 2008 price collapse. The spike down you see in late 2008 was primarily due to Hurricanes Gustav and Ike in the Gulf of Mexico. But higher oil prices did bring a lot of high cost production on line. And if prices do return to above $80 a barrel some of that production will no doubt return. But the decline in the shale oil patch is extremely steep. Enough may come back on line to slow, or halt the shale decline but I doubt if enough will come back on line, fast enough, to make shale grow again. Or at least not nearly as fast as it has grown in the past.

Just one more note about Russia. First a few links and comments:

Siberian oil output to be supported by tax overhaul

Russian energy minister says more than 70 million (billion) barrels of oil uneconomic at this point.

Russian Energy Minister Alexander Novak said oil production in Western Siberia, once a major contributor to overall output, was declining at an average rate of around 1 percent per year. Changes in a tax system, where so-called excess profits will be taxed at 70 percent, will make Western Siberia commercially viable.

Oil production in Russia’s Khanty-Mansi Autonomous District to decline by 2.1% in 2016

Oil production in the Khanty-Mansi Autonomous District in 2016, according to the forecast by the Federal Subsoil Resources Management Agency, will fall by almost 2% to 238.1 million tons, the regional government told TASS Wednesday.

This is Western Siberia where about most of Russia’s oil is produced.

West Siberia is Russia’s main oil-producing region, accounting for about 6.4 million b/d of liquids production, more than 60% of Russia’s total production in 2013.10 One of the largest and oldest fields in West Siberia is Samotlor field, which has been producing oil since 1969. Samotlor field has been in decline since reaching a post-Soviet era peak of 635,000 b/d in 2006. However, with continued investment and application of standard enhanced oil recovery techniques, decline at the field has been kept to an average of 5% per year from 2008 to 2014, significantly lower than the natural decline rate for mature West Siberian fields of 10-14% per year.

I think it is very obvious that Russia has peaked. I think China has peaked also and Brazil is very close to peaking if it has not already.

I just don’t see the promise of a resurgence in 2019 oil production that will surpass the 2015 peak in world oil production.

But we shall see.

_______________________________________________________

Note: I am prone to typos. If you spot any in this post please advise me at DarwinianOne at gmail.com and I will make the correction

Art Berman has a graph on undulating conventional oil production in this post:

http://www.artberman.com/the-crude-oil-export-ban-what-me-worry-about-peak-oil/

The focus is too much on the global peak. We have so many oil peaks in countries and regions. Their economic, financial and geopolitical impacts pop up everywhere.

30/12/2015

Fireworks Calendar 2015

http://crudeoilpeak.info/fireworks-calendar-2015

For example Egypt, which peaked in the 90s and where production has somewhat stabilized, is always 5 minutes near an immediate foreign exchange crisis:

23/12/2015

Egypt budget and current account deficits – Can Saudi Arabia bail out Cairo?

http://crudeoilpeak.info/egypt-budget-and-current-account-deficit-can-saudi-arabia-bail-out-cairo

My post on crude oil and product stocks:

29/12/2015

Where actually is that much-hyped global oil glut?

http://crudeoilpeak.info/where-actually-is-that-much-hyped-global-oil-glut

I suspect that we actually have a condensate glut, at least in the US, and perhaps globally.

I’ll send you some beans and rice if you’d do a guest post and update us all on the GNE situation with the most recent data 😉 I’d be very interested to see how the big 8 vs ROW look from a GNE point of view.

Yeah,

Can we also have a scenario if Russia pulls their exports off the market to increase their negotiating leverage with NATO?

thanks!

I wonder if the Russians are actually capable of simply shutting off oil and gas exports for any length of time. I suspect they could manage it, by going to a war footing economic scheme, at least for a fairly substantial period of time.

Methinks I will mosey over to the CIA fact book and see just what Putin and company is importing these days.

And this is what I found there:

“complete range of mining and extractive industries producing coal, oil, gas, chemicals, and metals; all forms of machine building from rolling mills to high-performance aircraft and space vehicles; defense industries (including radar, missile production, advanced electronic components), shipbuilding; road and rail transportation equipment; communications equipment; agricultural machinery, tractors, and construction equipment; electric power generating and transmitting equipment; medical and scientific instruments; consumer durables, textiles, foodstuffs, handicrafts”

I have little doubt Russia can or at least could produce just about everything necessary, domestically, necessary to maintain a functional economy.

Imports listed:

machinery, vehicles, pharmaceutical products, plastic, semi-finished metal products, meat, fruits and nuts, optical and medical instruments, iron, steel.

Exports listed:

petroleum and petroleum products, natural gas, metals, wood and wood products, chemicals, and a wide variety of civilian and military manufactures

Sanctions can accomplish only so much.

If there happens to be any particular item they simply MUST import, they would build up a substantial strategic stockpile before playing the ultimate hard ball game.

Russian built machinery is scarce in this country, and I have no experience with it, but my old soldier friends tell me they have always had exceptionally tough, simple to maintain, and reliable equipment from small arms to trucks and tanks. They will not run out of trucks or tractors or any sort of essential machinery.

Bottom line, they could probably get along without the rest of the world easier than the rest of the world could get along without them so long as the world remains addicted to oil.

What would be the purpose of Russia starting the war? Certainly not oil resources. Food resources?

Russia can be self sufficient in food, no problem at all, excepting such things as tropical fruits.

The only reason I can see for Russia deliberately starting a widespread war would be that Putin and company might go on an empire building binge, but the odds of that happening appear to be very close to zero, in my opinion.

But wars have a way of happening, due to bad luck and stupidity or miscalculation on the part of politicians and businessmen and bankers. There are always some people around who WANT a war, for various reasons. There are plenty of that sort in the Middle East right now.

Putin is a master statesman. I think he can get his way and still sell gas/oil to those who oppose him. I wouldn’t underestimate the toughness of the Russian people or the cynical and calculating leader that they have. France, Germany, Iran, Pakistan, China and India are pivoting to Russia. I’d keep an eye on the that. USA will be out in the cold and able to play spoiler but not much more.

http://intersci.ss.uci.edu/wiki/eBooks/Articles/1904%20HEARTLAND%20THEORY%20HALFORD%20MACKINDER.pdf

I am not an expert, but my opinion is Russia wants to rebuild the Soviet Union, but a more democratic version of it.

I don’t think he is gonna go hitler on the place.

The formation of the Eurasian Economic Union on Jan 1st of this year is a move consistent with that vision.

Syria (imo) is about NATO trying to get Russia out of the Meditteranean Sea and having dominant access to Saudi Arabia and Iraq.

Then NATO would control the sea and have a good position in the middle east.

Russia is over there blowing up guys who are trying to get Assad out of power.

“my opinion is Russia wants to rebuild the Soviet Union”

What has been undone, cannot easily be re-done. The geopolitical trend still seems to be more balkanizing though, and I have seen nothing to indicate Putin wants war. Yes, Russia has a very powerful military, but Putin seems to understand that the great benefit to that power is in never having to use it. In the most recent dustup in the middle east, Putin comes across a quite credible, restrained and statesmanlike while Obama seems quite the opposite. My guess is that Putin will work within the global system to achieve his aims.

Soviet Union was just a period (1922-1991) in a much longer Russian history. Russian Empire predates Soviet Union. This is when real Russian expansion took place. In fact, Soviet Union conceded some of the Russian Empire land grabs: Finland, Poland, parts of Turkey. This is barely compensated by taking East Prussia from Germany, South Sakhalin and few tiny islands from Japan upon WW2.

In my opinion, I don’t think Putin is a terribly bad. I recall reading that Putin was never part of of the communist party. For the most part, he just wants to make Russia a great country and put its past behind it. I very much doubt there is any interest in expanding its borders when it already has more land than it can possible use.

The West should have permitted Russia to help the Ukraine, which is complete basket case. the EU/US has enough of its own problems to deal with. The West would have been better off working with Russia on many issues, and slowly let the Russia become more integral part of Europe instead of isolating it.

Yes, Russia has its problems, especially with corruption and its oligarchs, but isolating Russia isn’t going to help matters.

Maybe because they are being surrounded by a MISSILE SHIELD?

Of course, one has to wonder….given that Russian submarines aren’t blocked by the “Shield”….perhaps it is an OFFENSIVE weapon.

Some PR guy in the military said, “If we call it a shield no one will be able to figure it out”

For example,

If NATO was really vulnerable to being OIL EMBARGOED….then the only thing they could do to ESCALATE would be to threaten nuclear first strike attack.

Militaries think in terms of escalations. They are trying to achieve escalation dominance, however futile that would be in our minds.

NATO are oil IMPORTERS. They have the bad hand here.

There are no options other than military muscle.

Putin is a smart cookie. He isn’t dumb. Look at his moves.

He is pushing forward IMO because NO ONE CAN stop him once peak oil bites.

NATO are oil IMPORTERS. They have the bad hand here. There are no options other than military muscle

Well, there is the option of eliminating oil imports by switching to electrically powered transport.

That would be extremely effective, and far, far cheaper than the military option.

This kind of military calculation makes it clear that oil is very, very expensive. People talk about oil being cheap, but a very large military is very, very costly, and war is far more expensive.

Build up cash reserves ( they had about 300 billion before NATO sanctions were employed).

Wait for a cold winter or peak driving season and then have a “pipeline” malfunction for about a week.

Or………..

Build pipelines to China and India and sell it there instead.

Ask the Ukrainians how Russians use energy for power….

Of course the Yankees and the Pommies would do the same thing if in same boat…

“If there happens to be any particular item they simply MUST import, they would build up a substantial strategic stockpile before playing the ultimate hard ball game.”

Spare-parts for agricultural machines are that “particular” item.

Those are currently not affected. If those come onto the list of sanctioned items it would mean a bit time escalation of the whole game. But at such a point Russia might cancel gas exports to the EU / NATO member states.

I don’t know much about Russian agricultural equipment, but I doubt they are importing much in the way of really important farm machinery.

Russia unquestionably has the engineering capacity and industrial capacity to build anything necessary in the way of agricultural machinery.

And for that matter, spare parts can be stockpiled too.

Russian history provides the Russian people with plenty of reasons to do what is necessary to maintain a strong defense, which includes the domestic manufacture of any and all critical machinery that might not be available in the event of a war.

Again, I think the odds of Russia deliberately starting a wide spread war are just about ZERO.

But shit does happen.

“I don’t know much about Russian agricultural equipment”

Some of Russia’s leading manufacturers of agricultural equipment:

http://en.rostselmash.com/

http://www.agramacholding.ru/

@AlexS

Very interesting: “RSM 161 features a high-power and fuel-efficient 6-cylinder Cummins QSL8.9, L6, 380 h.p., St-IVf engine.” – http://en.rostselmash.com/products/grain_harvesters/RSM_161

I may wonder how depended the Russian brands are on imported key parts for their products – like for the Cummins (Columbus, Indiana) engine..

@Florian (further below)

Yes, I got my hints based on information concerning similar brands/products.

Ert,

in the past, all their products were manufactured with 100% locally-produced parts.

When the Russian market was open for foreign competition, they thought it is more efficient to import some parts.

With the sharp devaluation of the rouble, it might be again more economically justified to use locally-made parts.

Ert,

http://www.ymzmotor.ru/en/

YMZ produces engines of old designs and new localized versions of Western designs.

Right now, the price of imported engines is much more prohibitive than any sanctions. “Replacement of import with local analogs” is the most popular buzzwords in press-releases of corporations.

Syndroma, nice link to the YMZ website! I’m sure the Russians are quite capable of producing high quality ICE engines locally and much cheaper than importing them or even their parts. At least for now.

BUT, Whenever I see that kind of manufacturing plant I can’t help but think how energy intensive they are and how wasteful any manufacturing process is, that depends cutting and removing metal.

That is still the old linear consumptive economic model. It is a model that is unsustainable for the long term.

Here is some food for thought. Typical ICEv has about 2000 precision made moving parts and only about 17% thermodynamic efficiency of converting fossil fuel into work.

EV, computer on wheels, about 20 moving parts and and about a 95% conversion rate of converting energy contained in a battery into work.

Are the Russians planning for disruptions of the old linear economic model to a circular economic model?

http://www.ellenmacarthurfoundation.org/

Or is the plan to just try and maintain the old ways for as long as possible?

Fred,

Yes, they call it “closing the nuclear fuel cycle”. And it involves building a fleet of fast breeder reactors. The first one was connected to the grid a few weeks ago.

Syndroma,

Yes, they call it “closing the nuclear fuel cycle”. And it involves building a fleet of fast breeder reactors.

That’s interesting!

Are these U-238 based or Thorium-232 based?

Though my original question was more about the redesigning of the entire extractive economic model and a moving away from the linear consumptive model.

Basically redesigning the entire current economic model from the ground up.

As in: Re-thinking Progress: The Circular Economy

http://goo.gl/i2uzsD

Fred,

http://www.world-nuclear-news.org/NN-Russia-connects-BN800-fast-reactor-to-grid-11121501.html

U-238 -> Pu cycle

I understand that your original question was more general. But energy is the foundation of any activity. If your energy production involves once-through mining, there’s not much sense in optimizing your economic model. The technologies of closed nuclear fuel cycle make use of all the depleted uranium already mined. It may last for millenia. Also they solve the problem of spent once-through nuclear fuel by reincorporating it in the cycle.

Current Russian plans is to develop fuel for BNs with uranium-plutonium-neptunium-americium mix from reprocessed fuel. I think it suits your “regenerative by design”.

Fred M,

Is there any place using Th-232 reactors?

China, India, Russia I think and maybe Oak Ridge are working on developing such, but I don’t know that any are at the stage of deployment.

I think thorium reactors would be an improvement over uranium ones but I’m not up to speed on the current state of development.

I’ve got a small Belarus tractor. It is built like a tank. A Kubota looks like a Miata alongside it…tinny and fragile. It was 1/3 the price new compared to a small Kubota, and that was importing it through Arkansas into Canada and paying the freight. Of course, our dollar was at par when I bought it 8 years ago.

I have heard about a few Belarus tractors in this country, and the owners are apparently satisfied, except when they need parts.

You can reasonably expect to keep a new car ten to fifteen years before it depreciates no just about ZERO. Industrial machinery and farm equipment is different. Once you have problems getting a critical part quickly, even for a twenty year old machine, then you will never buy that make again.

Word gets around fast.

No farmer will buy a five or ten year old used tractor unless they expect to be able to keep it running another twenty years.

Tractors SIT AROUND a lot, which is one reason they are kept in service fifty years or more. Mine are all domestic makes fifty years old or more, and will continue to give excellent small farm service for another twenty five years at least. Our OLIVER is no longer suitable for ” front line ” duty however, because OLIVER went out of business decades ago.

But if it were a car, I would not hesitate to take a cross country trip in it.

If Belarus had succeeded in establishing a customer base, the company would likely have done well in the USA.

I have a friend who is representing Claas in Russia and Belarus. They are specializing in harvesters. He has been telling me for about a year that the only business in Russia has been some spare parts but very limited. So without proper replacement, harvesters are coming to a standstill after a while. He thinks that the ones that have survived so far can last another harvest (2016) but after that its over. Reason beeing the low Ruble/USD rate which makes parts very expensive.

I am not in that business and do not know if this applies to other suppliers (John Deere et al) as well.

There’s a sea change in the world of spare parts. With the exception of certain parts which require very high mechanical strength, nearly anything can be 3-D printed these day. Most of the very-high-strength parts are very simple things like axles. So it’s getting easier and easier to maintain old stuff…

Are the neocons peddling more “let’s have war with Russia” bullshit? Or are we letting our imagination roam after playing computer games?

SatansBestFriend says:

The Brazilian journalist Pepe Escobar discounts the possiblity of that happening, since it would be playing into the hands of the War Party:

Jimmy, where does the line form for the beans and rice? I’m there. I’ll bring the tortillas, jalapenos, and hot sauce to share.

Still waiting on updated liquids consumption data from the EIA.

However, condensate has one of the steepest decline rates – at least in Texas. As November and December 2014 production has been very high, the rates are very likely much steeper in November and December 2015, reaching record decline rates of 50% (see chart below).

Fracked wells have an extremely sharp production curve which maxes out in the first year and has a decline rate approaching 50% per year. Of course we have a condensate glut. But production will drop very quickly as the frackers go bankrupt and stop drilling.

“29/12/2015

Where actually is that much-hyped global oil glut?

http://crudeoilpeak.info/where-actually-is-that-much-hyped-global-oil-glut ”

Ha. If one has an extra 2 or 3 days of wages in cash, does it constitute a glut of money?

The EIA has raised a lot of the 2015 production numbers today. April is back up to 9,694 mbpd from 9,585 mbpd published last month.

I don’t understand how the numbers can vary so much on monthly updates.

Hi Ron and all,

Just to be clear, the title of the post says “Doubting the Peak”.

Not a great title imo, because it implies that I doubt there will be a peak, which is not the case.

I think the peak will be between 2021 and 2025, with 2023 being my best WAG.

“Doubting the Peak in 2015” would reflect my previous comments more accurately.

I only say this because many people read no further than the title, the content of the post itself makes my position quite clear.

“Doubting the Peak in 2015” would reflect my previous comments more accurately.

Done.

Thanks Ron.

The possibility of a global recession in 2016 must be taken into account in any scenario, given how weak is the economic situation of the world.

A global recession in 2016 probably means the peak oil in 2015 will last for at least 10 years, and probably forever.

The peak will last forever? Yeah ok PhD guy lol

It was a confusing sentence, but I think he meant the peak record year of 2015 would probably last forever.

Yes, that is what I meant. Thanks.

Recessions are seldom predicted in advance. All possible scenarios cannot be covered.

The severe recession in 2009 slowed growth a little from 2011 to 2014 relative to 2002 to 2007.

The recession you anticipate may start between 2025 to 2030, 2016 not very likely.

Recessions are hard to predict, however it is clear that they are a periodic feature of our economic system.

Probably low oil prices have saved us from a recession in 2015 because the deterioration of the world economy since 2013 was very fast. However the “solution” has placed all the commodity exporting countries in recession or close to it, while the advanced economies are not taking off despite low oil prices. So we essentially are at the edge of recession hoping that a general recovery that so far has eluded the world economy will sustain a commodity and oil price recovery that would let us go through a few more years before the next recession. However any shock during this period would plunge us directly into recession. All bets are off.

Hi Javier,

You are correct that minor recessions are a periodic occurrence in the World economy, with unknown frequency in the future, the nature of the cycles are far from a simple sinusoid. Severe recessions are quite infrequent, in the past 100 years there have been 2 periods when World economic GDP growth was negative (1930-1935) and 2009.

The World economy has been growing at an average rate of 2.6 % from 2011 to 2014, based on IMF data (using market exchange rates rather than PPP). From 1980 to 2014 the average World GDP growth rate was 2.8%, so the idea that the World economy is doing very badly is not very accurate (in 2014 World GDP grew at 2.7%).

IMF forecasts for 2015, 2016, and 2017 are 2.5%, 3%, and 3.2% respectively for World GDP growth at market exchange rates.

http://www.imf.org/external/pubs/ft/weo/2015/02/pdf/tblparta.pdf

See World Growth Rate based on Market exchange near bottom of table.

The World economy is not as weak as you seem to believe.

Dennis,

GDP is a terrible measure to follow economic performance in real time.

The global situation is not bad, it is worse. It is as bad as it was in 2012, except that 3 years later in the business cycle.

It’s Official: Global Economy Back In Contraction For First Time Since 2012 According To Goldman

The Global Leading Indicator has turned again negative in 2015. OECD industrial production is very weak. The emerging markets haven’t been this bad since the great recession. China hasn’t been this weak in decades.

If the situation gets worse we will fall into global recession again. Our saving grace is low oil prices. The economic situation is not worsening fast, so we might still avoid recession, for a time.

HI Javier

GDP is far from perfect but the best measure we have.

It is how recessions are determined.

A recession is possible, but not more likely than 50/50 imo.

GDP looks at recessions through the rear mirror with over six months delay from when they really start. We could be falling into recession right now and you would not know it through GDP until mid-July.

A 50% chance for 2016 is not consistent with your prediction of recession by 2025. By then the probability would be 1-(0.5)^9 = 99.8% that it had taken place before.

Hi Javier,

I did not say the chance of recession is 50% every year from 2016 to 2025, only for 2016, and I said the chance in 2015 is not higher than 50/50, in other words, the probability is greater than zero and less than 50%. Read carefully.

Fair enough Dennis.

In this matter, everybody’s opinion is probably worth the same. Even the experts have an appalling record at predicting recessions. The boss of ECRI embarrassed himself enormously in 2012.

The state of the global economy however is not debatable. You can see the glass half empty or half full, but the amount of water that it contains is not what we would like.

Hi Javier,

I use the World Bank and IMF to assess the World economy.

http://www.imf.org/external/pubs/ft/weo/2015/02/pdf/c1.pdf

Above we have the IMF forecast,

World Bank data below

http://data.worldbank.org/indicator/NY.GDP.MKTP.CD/countries/1W?display=graph

Dennis: look back before the aberration of the 20th century, and really severe recessions are really common. The “long recession” of 1878 – 1900 is one example. Prior to the industrial revolution, they were arguably the *norm*.

It’s actually only good government policy — money-printing, mostly — which has prevented the severe recessions from being more common in the 20th century.

An alternative explanation is that recessions were made less common and less strong by a stronger economic growth fueled by fossil fuels.

Matt, excellent. Thanks.

There is no global “glut” of oil in terms of (1) Jeffrey Brown’s Export Land Model and available net oil exports and (2) yours truly’s metric for US, Japan, EZ, and China’s post-2007 differential trend rates of oil consumption to final sales and the deceleration of growth of final sales, i.e., implying that at least 70-75% of world real GDP per capita is at stall speed and thus constrained by the supply and price of oil consumption to GDP and the level of gov’t spending and net debt services to wages and GDP.

Not only is there no effective global “glut” of oil (the perceived glut is the result of unprofitable, unsustainable shale and tar oil production in the US and Canada), especially per capita in the West and worldwide, the price of oil in the $30s against decelerating real final sales/GDP per capita is not “cheap”, requiring a price of oil at, or below, $20 for 5 or more years hereafter to permit 70-75% of world real GDP per capita to avoid further deceleration hereafter.

These factors (and many others) are the definition of Peak Oil and associated “Limits to Growth” (LTG), and by extension, the “End of Growth” (EOG).

Looking at absolute levels of oil production without accounting for population growth, available net exports of oil for world consumption per capita, and the price and level and rate of change of oil consumption to final sales/GDP misses the principal factors that indicate and entrain the effects associated with Peak Oil.

That is, without understanding the foregoing metrics, one does not ACTUALLY understand Peak Oil, and not understanding Peak Oil implies that one does not fully perceive the implications of Peak Oil, which further suggests that one is not prepared for the consequences of Peak Oil (and the end of the Oil Age epoch) hereafter.

“Not only is there no effective global “glut” of oil (the perceived glut is the result of unprofitable, unsustainable shale and tar oil production in the US and Canada), especially per capita in the West and worldwide, the price of oil in the $30s against decelerating real final sales/GDP per capita is not “cheap”, requiring a price of oil at, or below, $20 for 5 or more years hereafter to permit 70-75% of world real GDP per capita to avoid further deceleration hereafter.”

If that’s true, BC, then we are up sh!tcreek, but is it true? I guess we’ll find out soon enough.

Is this the 545289658th time that someone has claimed that Russian oil production has peaked?

In any case, oil production is a function of primarily price. If the price is right, then there will be oil for many decades ahead. Oil production is also a function of geopolitics. Also a function of technology and also a function of alternatives. Ron seems to be missing the point that for decades, oil rich countries have no choice but to defer to a great extent to Western oil production. Those that are included in the Western security and financial system (GCC) have an extra incentive to do so, saving their oil for the future.

Is this the 545289658th time that someone has claimed that Russian oil production has peaked?

Don’t be a fucking smart ass. Make your point without stupid exaggerations.

In any case, oil production is a function of primarily price.

Really? Look at the chart above marked “The Rest of the World”. Now tell me, at what point did very expensive oil increase production.

Oil production is also a function of geopolitics.

Bullshit! Oil production is affected by geopolitics. But it is not a function of geopolitics. Oil production is a function of the cost of production versus the price of oil… but the most important function is the availability of oil in the ground to produce. If the oil is not there then geopolitics or the price of oil counts for nothing. And that is what Stavros fails to understand.

Ron seems to be missing the point that for decades, oil rich countries have no choice but to defer to a great extent to Western oil production.

What in the hell are you talking about? Since when has Saudi Arabia deferred to Western oil production?

Those that are included in the Western security and financial system (GCC) have an extra incentive to do so, saving their oil for the future.

Give me a break. Every country is producing every barrel they possibly can. Which country was holding back when oil was over $100 a barrel? Saving oil for the future? They are in recession right now. Most of them anyway. No one is hording oil. A lot of oil is not being produced because of the very low price of oil but everyone is still trying desperately to meet their budgets by producing every barrel they possibly can at the cost they can afford.

Ron,

OK. Let’s assume there is no geopolitics here. But then why Saudis are damping oil at such a low price.

In 2015 they exported over 7.3 Mb/d and got 118 Billions. In 2012 they exported something between 7.658 Mb/d (CIA, probably crude only) and 8.42 mb/d (Bloomberg, probably crude and refined products) and got 336.1 billion.

http://www.bloomberg.com/news/articles/2013-07-29/saudi-arabian-2012-oil-export-revenue-gained-5-as-iran-fell-12-

If they just cut 1 Mb/d and that allows to preserve 2014 average price of oil (not even 2013 average price) they would get 125 billions (and preserve 12 Mb from their depleting wells for moment of higher prices which will eventually come.)

In any case they managed to achieve almost 3 times drop of revenue from 2012. Three times !

Now they have almost $100 billion budget deficit in 2015 (and almost the same, 86 billions estimate of deficit for 2016) and only around 600 billions in reserves.

Questions:

1. Why they rocked the boat?

2. Where is the logic in their actions, unless we assume that they want to destroy Iran (and hurt Russia) ?

3. Why MSM spread all this BS about Saudis defending their market share ? Does it look like they are defending something else ?

To tell you the truth, I haven’s a clue.

If the leadership in Saudi Arabia is aware of its own paper barrels

http://crudeoilpeak.info/opec-paper-barrels

they are running out of time

Matt, your link says:

Opec believed to overstate oil reserves by 70%

Of course they are. I have been thrashing this straw for 10 years. Why are folks just catching on now?

Hi Matt,

You do understand that there are different categories of reserves, proved, probable, and possible, I hope.

There are also speculative resources that move into the reserves category over time as the discovered fields are understood better over time as more wells are drilled and data is gathered. Prices and new technology also effect the assessment of reserves.

So it is entirely possible that with no new discoveries that increased oil prices and improved technology can result in discovered reserves and resources gradully moving from speculative resource to possible reserve, then to probable reserve, and then to proved reserve over the course of 35 years.

This is commonly called reserve growth and in the United States, where data is more transparent, proved reserves grew by 7.27% each year on average from 1980 to 2005 (before the LTO boom).

If we assume no discoveries in OPEC over that period and use EIA data for output and reserves from 1980 to 2005, then reserve growth for OPEC would have been 4.38%. Actual reserve growth would have been lower as there were some OPEC discoveries over this period (I just don’t have the data).

If we assume 5 Gb of discoveries in OPEC nations on average each year from 1980 to 2005, then the annual reserve growth falls to 3.53%, less than half the US rate of reserve growth for proved reserves. If OPEC reserves grew at one fourth the US rate, then proved reserves for OPEC (assuming 5 Gb/year of discoveries) would only be 562 Gb in 2005, about 327 Gb less than reported by the EIA.

The actual level of OPEC proved reserves is unknown and is likely to be less than the reported level. My guess is the proved plus probable OPEC reserves may be roughly the level of reported “proved” reserves. It is unfortunate that there is a need to guess.

Door number two looks damned good from my pov.

Some reasons why, from my pov.

http://peakoilbarrel.com/opec-2015-world-oil-outlook/comment-page-1/#comment-553273

It’s one click there, one click back.

One theory afloat is that the US and Saudi Arabia are allies in an economic and political war against their enemies. According to this narrative, the intent of Saudi Arabia dramatically increasing oil production during a world oil glut, and sending oil prices into a tailspin, is to shipwreck the economies (and the polities) of US and/or Saudi enemies — e.g., Venezuela, Iran, and Russia.

The war, however, is not being conducted without inflicting significant damages on US allies — e.g., Mexico, Canada, Saudi Arabia, Colombia — and domestic US production as well.

Ambrose Evans-Pritchard, for instance, published an article a couple of days ago about the immense economic damage being inflicted on Saudi Arabia’s economy and polity:

We’ll see who blinks first, or who is left standing after all the bloodletting takes place.

“According to this theory, the intent of Saudi Arabia dramatically increasing oil production during a world oil glut…”

Saudi Arabia hasn’t dramatically increased oil production. Their most recent peak in June of 2015 was only a couple hundred thousand barrels per day more than the previous peak back in mid-2013. That’s about 2-3% increase over two years. I wouldn’t call that, dramatic.

http://peakoilbarrel.com/opec-crude-oil-production-charts/

I think you’re arguing semantics.

Would you also argue that the Saudi response to the glut in 2009 was the same to its response to the glut in 2015?

Ron is basically correct. The people who think that oil production is a function of the price are assuming that the oil is there to produce. Now, unless there are a few supergiant fields out there, already discovered and waiting for some State Oil Company or some multi-national oil company to make a Final Investment Decision, that assumption is incorrect. There is a handful of locations which could potentially have supergiant oil fields that are so far undiscovered, I’m not that confident that they are there to find, since discovery in the last couple of decades has been a long way short of consumption, even after the price went sky high and everybody and their dog was spending big on exploration.

What interests me is the bit from the previous post, where OPEC projected prices based on their estimate of what it cost to produce the marginal barrel. I think that is a good line to take, until it reaches the point where governments of OPEC countries decide that, with Peak Oil passed and production in irreversable decline, they are going to start hoarding production and make the rest of the world go short.

The thing to realise with projecting prices based on the cost of production of the marginal barrel is that it should be taken as a tendency working on a 5 year or even decadal scale. In time periods short of that, you can get price wars sending prices down below the marginal cost and price spikes producing windfall profits even for the highest cost producers. The price wars lead to national and multi-national oil companies cutting back on capital expenditure, which eventually leads to stagnating or declining production and a recovery in prices. Price spikes lead to huge resources being spent on exploration and development as everybody wants to cash in.

OPEC’s production assumptions are a lot less sensible than their price projections. They assume two things:

(a) That the oil is there to increase global production; and

(b) Most of that oil, from 2020 to 2040, will come from OPEC countries.

Conventional crude oil production is flat out right now and, as I said above, unless someone is hiding a few undeveloped supergiant fields somewhere, it’s got nowhere to go but down. Let’s look at unconventional sources, then.

1. Polar and deepwater oil. A huge amount has been spent exploring for this and the results have been underwhelming. Sure, they’ve found oil, but not in anywhere near the quantities needed. Shell recently pulled out of the Arctic because of the combination of environmental protests and poor exploration results. If they were discovering heaps, they’d just tough out the protests – as anybody who knows the first thing about corporate capitalism could tell you.

2. Canadian tar sands. Production of these has been expanding, but it hasn’t been to the rate that one might imagine from the published resource data. This is because the rate of production is subject to certain limits, due to inputs. The relevant inputs in this situation are water and natural gas – and it is water which is the harder limit. Basically, they can’t produce more oil from the tar sands than the rivers of the region can support. These limits will sooner or later, and I believe sooner, put a ceiling on Canadian production. Absent a huge shift in consumption caused by climate change mitigation action, it will keep at that limit for many decades to come, but it won’t exceed it.

3. Venezuelan extra heavy. This is the factor about which I know least, but there doesn’t appear to be a lot of it on the market yet. There seem to be a lot of obstacles in the road of high production.

4. Tight oil. One thing that everybody who is knowledgable admits is that there is a lot of “oil in place” in this category. The question is how much of this is recoverable in a practical sense. This industry has developed in the US, primarily because it brings a number of environmental hazards with it and, outside the US, landholders are blocking exploitation because of environmental concerns. In the US, landholders have a financial interest in ignoring these concerns, because mineral royalties are vested in the landowner.

Tight oil has been developed in the US on the basis of unrealistic projections of ongoing production, due to depletion rates being vastly higher than admitted when spruiking to investors. Sooner or later, it was bound to run into problems. These problems have arrived sooner, as opposed to later, due to OPEC’s price war, which is aimed at sending the tight oil industry broke. Producers have cut back on drilling and concentrated with increased intensity on “sweet spots”, where production is likely to be highest. They have also introduced technological progress that has cut the price of drilling substantially and thus cut the break-even price for a well of a given production level, but the industry is still losing money. A loss-making industry is unsustainable and, therefore, will not be sustained. Something has to give.

Eventually, the price of oil will recover to be equal to or greater than the marginal cost of production. At this point, what will be relevant is just how extensive the sweet spots in the tight oil formations are. Having been burnt once, investors will be working on much more careful examination of likely decline rates and won’t support drilling wells just to keep production up, if those wells won’t recover their costs within the time frame of the investment horizon. The $64 thousand dollar question, therefore, is how long the US tight oil industry is going to be able to keep finding sweet spots where they can extract sufficient tight oil to pay back the cost of drilling.

What’s going to happen in other countries? Not a great deal, I predict. Opposition from the local population, led by local landholders, will delay and minimise production from tight oil reservoirs. It won’t completely prevent a tight oil industry developing in many other countries, but it will ensure that it never develops the dimensions of the current oil industry. Tight oil production will be a buffer for production on the way down, but it won’t counteract the declines caused by the depletion of conventional oil fields.

In summary, the price of production of the marginal barrel of oil is going to go higher – a lot higher, but the marginal barrels won’t be additional ones. Rather, rising prices will cause demand destruction. It is already doing so in OECD countries, and it will start doing it in Third World countries too, as existing fields deplete and have to be replaced by new and extraordinarily expensive oil.

Perhaps I’m misguided and naive. BUT! No matter how hard I try I just can’t see a continuation of the age of oil. Not from a social political and economic perspective. Not from a geopolitical perspective. And certainly not from a purely geological perspective.

Now granted that where I am in Florida for the Holidays gasoline at the pump is supposed to drop below $2.00 after New Years. Everyone is out and about shopping and celebrating. Last Night I made the huge mistake of driving down A1A a 12 mile ride to my girlfriend’s home on South Beach that took me almost three hours in bumper to bumper Traffic. I was surrounded by gigantic SUVs pickup trucks, muscle cars, luxury cars etc… Every one was leaning on their horns cutting each other off and coming close to dangerous road rage. Probably most of these people were slightly inebriated and who knows how many were packing… I’d guess a lot more than I wanted to know.

The American populace is either completely clueless or everything I have read on this site, on TheOilDrum and a few others over the last decade or so was/is completely wrong. So how long can this party continue before reality hits. Again I could be completely off the mark but I have a hunch that even when the price of oil goes back up high enough for shale fracking in places like the Bakken a lot of the oil companies involved will have gone belly up and it will take a long time for others to come in and fill vacuum created.

Then in the rest of the world we still have Jeffrey Brown’s ELM to deal with.

Yet everywhere I look I just see people merrily planning for a BAU future based on fossil fuel. I keep trying to understand what I’m missing.

I put this little parody of the consequences of ELM theory together a few years ago so it is a little dated but things haven’t gotten much better anywhere that I have seen.

https://drive.google.com/open?id=0BxK2xt5iKFTAcUh0d1gtOXRDWlU

So in closing, yes, I know that alternatives such as wind and solar will not and cannot maintain BAU but neither can oil. 7+ billion humans wanting ICE powered lifestyles and US style consumption can’t be maintained and a good example of this is the reduction in the Chinese economy’s growth rate, I’d go as far as to call it a crash. So anyone have any thoughts on when this party will finally end and reality set in?

Happy New Year!

“I was surrounded by gigantic SUVs pickup trucks, muscle cars, luxury cars etc… Every one was leaning on their horns cutting each other off and coming close to dangerous road rage.”

Therein lies the rub Fred; the reality of human nature, the real reason for our pessimism. Here its F-350s, all in some kind of a race: sorry, no EVs as far as the eye can see. Status trumps sense; guys with F-450s who wouldn’t carry a box of cornflakes on the back for fear of marring the paint and women taking toddlers to playschool in the meanest SUV available because “its safer for the little guy”.

Friend of mine working on a customer’s pickup, its got something in there that’s turbo charged and produces 750 hp. But if you have a small penis/brain, I guess that’s what it takes to compensate for it…

My assumptions about Texans driving large pickup trucks: They just got laid off from their job, their wife left them, their dog died, they just left a bar, and they have a loaded handgun.

Safety first, eh?

Do the risk assessment and stay away!

Here in sodden north of England the weather is discouraging at least some of us – combined with our nasty cold viruses. And some of it, it seems, has come all the way from Texas and is heading for the North Pole. But I am sure the dopamine reward system lives on. Like Fred for the life of me I wonder if I am missing something! I guess the water will close over us (metaphorical and real) when OFM is looking the wrong way! ;-). Florida looks as though it could show the way with sea-level backed-up all the way from the North Atlantic.

Roll on the Year – Have Fun

Phil

Hi Phil,

If you are located more than a hundred feet above sea level, you are personally safe for at least a century or two. Longer than you are apt to live, for SURE. 😉

Talking TOO MUCH TOO LONG about sea level and climate troubles may actually be counter productive in terms of convincing the average man on the street that sea levels ARE going to rise sharply within the next hundred years or so.

Cry wolf often enough and lay people actually cease to believe in real wolves.

It might be better to try to convince the man on the street to cut back on carbon by indirect means, by appealing to his own shorter term and more personal interests.

It IS to his advantage to cut back on burning coal on health and security grounds, and force the growth of renewables based on such economic arguments as local employment, local taxes, national security, better balance of trade in importing countries, etc, etc.

Nobody wants to be preached at, endlessly.

Appealing to a man’s own interests is a better strategy.

Talking TOO MUCH TOO LONG about sea level and climate troubles may actually be counter productive in terms of convincing the average man on the street that sea levels ARE going to rise sharply within the next hundred years or so.

LOL, you should talk to the average person in the street in South Beach Miami during one of our ever more frequent floodings of Collins Ave. I think most of them are already convinced…

http://www.miamiherald.com/news/local/community/miami-dade/miami-beach/article41534928.html

We all know that the average person has the answer, Fred.

But the question is how much of that is due to rising sea levels and how much to land subsidence, because after all land subsidence due to heavy coastal development is 100% anthropogenic, but 0% climate.

American Scientist: That Sinking Feeling. Dense development can complicate projections of land subsidence in coastal regions.

60 years of global warming separates those two pictures of Miami, yet if anything, it looks like Miami has expanded its area and has a lot more beach. Damn evidence, we should see Miami getting smaller.

We all know that the average person has the answer, Fred.

For crimminies sake! Please, Javier, my comment was intended as a bit of good natured ribbing towards OFM. I could have posted a bunch of pictures of the average person in the street standing ankle deep in salt water on Collins Ave on a sunny day during high tide.

Quite frankly I couldn’t give a flying fig what the average person in the street thinks about anything, so just drop it already, Ok?!

I know all about land subsidence and I have lived in the greater Miami area for almost 20 years. I’ll bet I know more about what is happening in Miami than you do. Especially when it comes to water tables, aquifers, flooding, local coral reefs, spiny lobster, sea grass in the bay, fish like Tarpon, the manatees, alligators, and American Crocodiles etc, etc…

Whatever the proximate cause I can assure you that the flooding of streets in South Beach is very real and that it also affects the entire coast and has become more and more common in the time I have lived here.

I also know what you think about climate change and sea level rise, I’m done debating this topic with you or anyone else for that matter. And I don’t care what you or anyone else thinks of my views on this subject. It just isn’t important to me anymore what people think.

At the end of the day what I really care about is all the ecological damage I see everywhere I look! And the one thing I can tell you 100% for sure, is that almost all of that damage is a consequence of all the people living the good old American consumptive lifestyle! So as far as I’m concerned at this point whether or not climate change is anthropogenic and if it is or isn’t causing sea level rise in Miami for all practical purposes is moot. It is definitely people who have been and are continuing to cause damage to the local ecosystems…

We all know that the average person has the answer, Fred.

For crimminies sake! Please, Javier, my comment was intended as a bit of good natured ribbing towards OFM. I could have posted a bunch of pictures of the average person in the street standing ankle deep in salt water on Collins Ave on a sunny day during high tide.

Quite frankly I couldn’t give a flying fig what the average person in the street thinks about anything, so just drop it already, Ok?!

I know all about land subsidence and I have lived in the greater Miami area for almost 20 years. I’ll bet I know more about what is happening in Miami than you do. Especially when it comes to water tables, aquifers, flooding, local coral reefs, spiny lobster, sea grass in the bay, fish like Tarpon, the manatees, alligators, and American Crocodiles etc, etc…

Whatever the proximate cause I can assure you that the flooding of streets in South Beach is very real and that it also affects the entire coast and has become more and more common in the time I have lived here.

I also know what you think about climate change and sea level rise, I’m done debating this topic with you or anyone else for that matter. And I don’t care what you or anyone else thinks of my views on this subject. It just isn’t important to me anymore what people think.

At the end of the day what I really care about is all the ecological damage I see everywhere I look! And the one thing I can tell you 100% for sure, is that almost all of that damage is a consequence of all the people living the good old American consumptive lifestyle! So as far as I’m concerned at this point whether or not climate change is anthropogenic and if it is or isn’t causing sea level rise in Miami for all practical purposes is moot. It is definitely people who have been and are continuing to cause damage to the local ecosystems…

So just leave me out of this discussion from now now on, TKS!

It’s called beach nourishment.

https://en.wikipedia.org/wiki/Beach_nourishment

The photo is before and after the restoration project of the Florida coastline.

Fred Magyar said:

My thoughts exactly.

Here’s a somewhat harsh critique of Nicholas Stern’s book Why Are We Waiting?. Its written by an environmentalist who understands how sticky the problem is, and how the current crop of environmentalists is not tackling the problem:

I think that is a good line to take, until it reaches the point where governments of OPEC countries decide that, with Peak Oil passed and production in irreversable decline, they are going to start hoarding production and make the rest of the world go short.

That is a point I have tried to make for years. Back in the days of The Oil Drum, I made that point over and over but no one seemed to understand.

When it becomes obvious to the world that the peak of world oil production is in the past many countries, not just OPEC countries, will decided that they need to hold onto as much of their oil as possible, for their own benefit.

Now I know some people will say that countries. like Saudi Arabia, must sell their oil in order to by food for their people. That is correct however if the price doubled they could still sell only half as much and still have the money to feed their people. And countries like Russia could sell a lot less oil if it looked like hoarding oil would be to their advantage.

Were we a rational society, a virtue of which we have rarely

been accused, we would husband our oil and gas resources.

– M. King Hubbert

In the face of ever declining oil resources, almost every oil producing nation on earth will suddenly become far more rational than in the past concerning their oil and gas resources. And this will drastically exacerbate the problem for oil importing nations.

At that time it can be predicted that any importing nation or group of nations having sufficient oil and military power to wage war will go to war. This is the same situation that Japan faced in 1940.

Of course instead of alleviating the problem a war will make it worse for everybody affected.

Javier said:

Jonathan Schell, however, in The Unconquerable World claims that two developments put an end to the “logic of war”:

1) Nuclear War:

2) People’s War:

That wars cannot be won has never been an excuse for not fighting them.

Javier,

You may be right.

Maybe I’m giving the human animal too much credit, and its capacity for rational behavior is even less than what I believe it to be, which isn’t much.

Maybe active nihilism will rule the day, and man will go out in a nuclear holocaust.

And while it is not considered polite to mention it, because it offends the hell out of just about everybody, the fact is than non western people CANNOT defend themselves via people’s wars against either major western powers, or rising industrial non western powers.

“Kill’em all and let God sort’em out used to be a figure of speech.

Killing them all now, or close enough to all, is perfectly feasible, if a country with a large modern military establishment chooses to wipe out a smaller less powerful neighbor. The only hope of a real underdog would be for allies to come to the underdog’s defense.

Even machetes and spears are adequate to the task, if the manpower and the will are adequate.

I think Al Qaida is winning. The war is going to take several hundred years. Thus far they have the USA and a few allies bogged down in Afghanistan and Iraq, have tendrils in Northern Africa, and are introducing moles into Europe and the USA.

According to a CIA analyst whose writings I read, the main danger the USA faces is porous borders, but the American elite is perceived as suicidal, they allow a free flow across borders, and it’s only a matter of time before a nuclear device is exploded inside a us city.

This CIA analyst believes the USA has simply boxed itself in by offering unconditional support to a lawless Israeli government which controls USA politicians via the Israel lobby. Thus the USA pits itself against the Muslim world’s restless masses, loaded with huge numbers of young people willing to die to defend their religion and territory.

The problem I see is that, while to the CIA, and to me, this coming debacle is quite evident, we know the subject can’t be discussed too much without ruining careers or even being arrested. I mention it because I’m old, and this has been hammered in me after reading what I did from the above mentioned CIA analyst (who by the way is retired).

Oldfarmermac: “the fact is than non western people CANNOT defend themselves via people’s wars against either major western powers, or rising industrial non western powers. ”

So that explains, I assume, why Iraq’s government is aligned with Iran rather than being its enemy like Dubya would have preferred. And it also explains why most US troops have been withdrawn from Afghanistan at a point where the Taliban are the strongest they’ve been since 2001.

It’s one thing for the US, or some other imperialist power, to invade a country and knock over its government. It’s another thing altogether to pull off a successful occupation in the teeth of popular opposition. I’m no fan of either the current Iraqi government, or of the Taliban. But Uncle Sam’s preferred solutions haven’t been popular on the ground – and have lost out.

Let’s see… China could conquer and confiscate Iran while Russia could do likewise to Iraq. The EU would be given Libya, and the U.S. would take Venezuela. Of course, it would be done with the express intent of providing “the world” with needed oil.

Did I miss any key areas? Nigeria perhaps. Kazakstahn?

SatansBestFriend says:

“Can we also have a scenario if Russia pulls their exports off the market to increase their negotiating leverage with NATO?”

oldfarmermac says:

“I wonder if the Russians are actually capable of simply shutting off oil and gas exports for any length of time”

Arceus says:

“What would be the purpose of Russia starting the war?”

oldfarmermac says:

“The only reason I can see for Russia deliberately starting a widespread war would be that Putin and company might go on an empire building binge”

“Again, I think the odds of Russia deliberately starting a wide spread war are just about ZERO.

But shit does happen.”

Glenn Stehle says:

“A fitting Russian response would be Moscow defaulting on all debt to Western banks in retaliation for the sanctions. An extreme step would be blocking natural gas shipments to the EU….”

Arceus says:

“Let’s see… China could conquer and confiscate Iran while Russia could do likewise to Iraq. The EU would be given Libya, and the U.S. would take Venezuela. Of course, it would be done with the express intent of providing “the world” with needed oil.

Did I miss any key areas? Nigeria perhaps. Kazakhstan?”

Gentlemen, what are you smoking today??? :)

LOL – personally, I do not believe there will be a war over oil. The primary actors that might consider a war to gain access to oil will have enough energy resources to avoid that – at least for a while.

Like Dennis, however, I also do not believe we have hit peak oil yet and that will occur in the next decade. There is still some economic sleight of hand that can postpone the reckoning for a bit longer.

Alex S,

What are you trying to say, that countries haven’t used state violence in the past to control natural resources, or won’t be tempted to do the same in the future?

And what Pepe Escobar said is that Putin will not be lured into making some brash move, even though that might be “a fitting Russina response,” because he rejects the war logic of the War Party.

I can’t speak for anyone else, but I wasn’t smoking anything.

I was drinking new years beverages though…LOL.

I agree that Russia is unlikely to pull all their exports off the market

But if world oil production starts declining, I have no doubt oil exporters will try to use that to their advantage.

How that manifests itself, I guess will have to wait and see.

thanks for the dialogue.

You missed the part where an Iranian resistance force defeats a 2 million man Chinese army using suicide warriors, fighting like Hezbollah did to defeat the Israelis in 2006.

Two things Ron.

First I believe it is reasonable for oil producers to take a different perspective than yours wrt peak. Approaching peak or even at peak can be seen as a time to sell while there is still any semblance of a market left.

Second you assume that at a doubling of price the economy would not flinch and continue to burn at current rates. Neither producers nor banking/finance are confidant that that will be the case.

Approaching peak or even at peak can be seen as a time to sell while there is still any semblance of a market left.

No, we are talking about well after the peak. We are talking about the time when everyone realizes that the world’s oil supply will now decline forever. You are talking about “approaching the peak”. That was last year. And “or even at the peak”. That is right now. Very few seem to know that so everyone is trying to pump and sell every barrel they possibly can.

And even if I am wrong, even if we are not yet at peak, the point is that when we do reach the peak no one will know that so they will not behave like they would if they knew the world’s oil supply will, from this point on, decline forever.

Second you assume that at a doubling of price the economy would not flinch and continue to burn at current rates. Neither producers nor banking/finance are confidant that that will be the case.

Again, I was speaking of the time after the peak when world oil production has dropped perhaps 10 to 20 percent below peak levels. Producers, banking/finance have no idea what they would do because they have never faced that position before.

Also, burning at the current rates, or a much lower rate, have nothing to do with anything. We are talking about a point in time when we are obviously well past peak oil.

And please don’t insist that the early 80s we faced such a situation. We did not because everyone in the world, except a few imbeciles, knew the reason for the drop in production was the Iran – Iraqi war, and the associated “Tanker Wars” in the Persian Gulf, not peak oil.

The point is Jef, how will producing nations behave when they realize that the world’s oil supply will now decline forever… but… but… they still have oil and every other nation in the world wants it.

Ron,

You are assuming that demand for oil will be at that point above supply. I am not saying that won’t be the case, but there is the chance that global economy will be so messed up at that point that there won’t be that much demand for oil. Hoarding in that scenario makes no sense. Future humanity might not have much use for oil because most people would be jobless and penniless and concerned mainly with finding food. An 80% reduced demand for oil could be easily satisfied despite peak oil.

I am not saying that reduced demand way below supply capability is what is going to happen, just that we cannot discount that scenario.

Javier, are you and Jef the same person? Anyway…

Yes, you are correct. If the world goes completely to shit before the world becomes aware that the peak of world oil production is in the past, then all bets are off. There is no way to predict chaos or the outcome f chaos.

My scenario does not take into account the total collapse of the world as we know it before serious oil decline. I must assume that does not happen. But if it does, then nothing else matters anyway.

I am not saying that reduced demand way below supply capability is what is going to happen, just that we cannot discount that scenario.

On this I’m with Javier and Tony Seba.

The reason we can not discount this scenario is because of a perfect storm combination of disruptive technologies coming together and completely changing the current paradigm.

If you take deep learning algorithms, to create viable driverless technology, couple that with computers on wheels which are what EVs are and you introduce businesses such as Lfyt, Uber and Zip Car you could conceivably disrupt the entire current paradigm of private car ownership which most still seem to take for granted will continue.

Personally I don’t think it will. So if that scenario comes to pass oil and private cars become obsolete in the not too distant future. So it might not be guaranteed to be oil, oil oil forever.

Clean Disruption Interview – US Embassy Wellington, New Zealand

Tony Seba

https://goo.gl/AXie72

All of the necessary technologies for this scenario to come to pass are already in place. many of my urban friends have already begun to give up private car ownership because it is cheaper and more efficient to get around by Uber.

While I don’t have any hard data I’m sure that all the people who get picked up by even one Uber car during any day must be using less fuel because that alone eliminates their private cars from the roads and they no longer need to buy gas.

This is Uber’s stated current vision.

https://newsroom.uber.com/nyc/taking-1-million-cars-off-the-road-in-new-york-city/

At Uber, our vision for the future is one of many fewer cars on the road. We believe traditional car ownership can be a thing of the past. Why own an extremely expensive asset, worth tens of thousands of dollars, that sits unused most of the time?

So I have to ask. Why couldn’t this scenario come to pass and be expanded upon to every urban center on the planet.?

IMHO I would not be putting money into oil or automobile manufacturing companies at this juncture in global events.

Fred,

“So I have to ask. Why couldn’t this scenario come to pass and be expanded upon to every urban center on the planet.?”

Because 98% of us who have a personal vehicle and the 90% who don’t, don’t want to wait for and than sit in a community transport. It’s a lot like the same reason your home beats the hell out of living in a motel or taking the bus.

Because 98% of us who have a personal vehicle and the 90% who don’t, don’t want to wait for and than sit in a community transport.

Sorry, not buying it! I’ve lived in places like Manhattan and currently have been spending time in Sao Paulo. I never had a problem taking public transport, walking or more recently Ubering. I can get an Uber car to pick me up in less than 5 minutes whenever I really want to sit in a car.

I’ve been spending the holidays in Miami which doesn’t have the best public transport system in the world yet taking the TriRail down to Miami is still almost always faster than driving on I95 and they have WiFi on board and I can work while riding.

BTW as far as sitting goes I just can’t understand why people seem to prefer sitting for hours in bumper to bumper traffic in the so called comfort of a private car. I think they have been watching too many car commercials portraying the imaginary pleasures of the freedom of the open road.

Perhaps that has been one of the most positive results of my having given up watching television over a decade ago. I’m not as brainwashed by consumer advertising and artificially created desires and I can see actual reality for myself without the rose colored glasses.

BTW I now cringe, every time someone tries to refer to me as a ‘consumer’. I prefer to be addressed as a person…

The pleasures of private car ownership are IMHO grossly overrated while the costs of such ownership are glossed over.

Your mileage may vary 🙂

Ok Ron, I see what you meant now but I believe (and I believe that producers and banking/finance believes) that when production is down 10 to 20% and “…when they realize that the world’s oil supply will now decline forever…” its game over for humanity so it doesn’t matter what they sell it for or if they can sell it at all as all markets will be in collapse.

Jef: “I believe … that when production is down 10 to 20% and ‘…when they realize that the world’s oil supply will now decline forever…’ its game over for humanity”

Way too doomerish! The world (and this is particularly the case in the US) is extravagant in its waste of oil. In the short term, oil demand is price inelastic, because it is a side effect of decisions people have spent big money on and need big money to change. If you drive a thirsty SUV, or have a crazy 500 km/week commute, you scream blue murder about rising petrol prices because you have no alternative but to pay them.

In the longer term, however, people adapt. What do they replace the SUV with when it reaches the age of the previous car they sold? Will people decide in favour of a 500 km/week commute when they’re choosing a job or buying/renting a home? Even in the US, you’re getting city and State authorities building public transport systems, something unthinkable 20 years ago.

Oil production will have to fall a lot more than 20% before there is any threat of social breakdown.

Ablokeimet,

Our economy is sustained over that extravagant oil waste. The interconnections between recreational oil industries (leisure, tourism, restaurant, etc) and the rest of the economy are inescapable.

Spain is a poster child of what happens after peak oil. Our oil consumption has reduced by 25% respect to peak value in 2007. The entire country has gone up against the punch bowl being taken away to reduce deficit and limit debt growth, to the point that now it is ungovernable and we are going to have to repeat elections.

And this happens even though our economy has been sustained by a guarantee from ECB that has prevented the worst from taking place. Despite that unemployment remains >20%.

Spain has been very lucky to experiment peak oil while most of the world has not yet. Thanks to ECB the worst has been avoided, yet the people are furious and voting radical options and Catalonia wants to break free.

Adaptation is not possible. Once the world goes down 15% in the use of oil it is going to be changed in a multitude of ways that most people are not going to like at all. The Soviet Union broke down after its peak oil. We can only imaging that on a global scale.

I don’t think we are going to see many wars or a world war. When nations are on dire straits they seldom wage wars.

Javier and I have our differences but I will have to say he hit the nail on the head here.

Just pointing out waste in the system is completely misleading. Millions of people depend on that waste for their livelihood. The entire tourist industry depends on it. Bar and restaurant workers depend on it.

All that wasteful spending and wasteful use of oil generates a living for many millions of people. People who just write them off are just not very deep thinkers. And that is being kind.

Ron,

I think you and I should concentrate on our coincidences that are many and not in our differences that are basically one. It looks strange that little disclaimer you put every time you agree with me, unless it is some type of honor 😉

Sorry Javier, but if a man says evolution was the already the accepted theory by all academics at the time Darwin published his Opus, then I must qualify my every reply to this man. Otherwise they just might think I agree with him on that position also.

God, that would be embarrassing.

Ron,

It is a pity that you are so close minded to anything that contradicts your beliefs even if it comes from somebody who knows more than you do about biology, being a biologist, and is willing to provide evidence of everything that he says. I always take the opportunity to learn from anybody.

After living in the states for 5 years I think I understand a little how the political debate between creationists and science defenders has shaped the evolutionary thought there, to the point that Darwin has become a sacred cow and science history before Darwin has been forgotten or erased. In Europe evolution is not challenged, so we have a more enriched view of the evolutionary debate before Darwin as it was carried out almost exclusively in Europe.

The first evolutionary writings were already in the 18th century by Comte de Buffon and Charles Darwin’s own grandpa, Erasmus Darwin. They lacked a mechanism, but the idea was already expressed very clearly. Erasmus Darwin “Zoonomia; or the Laws of Organic Life” (1794) already develops many evolutionary ideas like:

“would it be too bold to imagine, that in the great length of time since the earth began to exist, perhaps millions of ages before the history of the commencement of mankind, would it be too bold to imagine, that all warm-blooded animals have arisen from one living filament, which THE GREAT FIRST CAUSE endued with animality, with the power of acquiring new parts, attended with new propensities, directed by irritations, sensations, volitions and associations; and thus possessing the faculty of continuing to improve by its own inherent activity, and of delivering down those improvements by generation to its posterity, world without end?”

This is a very accurate description of evolution without a mechanism. In 1794. By Charles Darwin’s grandfather.

To anybody in biology it became very clear during the first half of the 19th century that evolution was a fact. Geologists had developed the Unitarianism theory that explained a slow transformation of the Earth. Different fossils filled every epoch. The succession of species was accepted by almost all. They didn’t call it evolution because that word meant a different thing by then.

“Biologists in the mid-1800s largely accepted that evolutionary science could provide accurate explanations for the history of life and for biological diversity” (pg. 614, first paragraph)

Evolution, Medicine, and the Darwin Family

Michael F. Antolin. Evo Edu Outreach (2011) 4:613–623