I follow the JODI World Oil Database primarily because it is now four months ahead of the EIA international data base. I make some adjustments however. I use the OPEC MOMR “secondary sources” for all OPEC data where JODI also uses the MOMR but uses their “direct communication” data instead. The OPEC portion of the JODI data is “crude only” and will therefore be somewhat less than the EIA reports.

I use the Canadian National Energy Base data for Canada instead of the strange numbers JODI has for Canada. And I use the EIA data for the few small producers that JODI does not report.

With these Changes I think I have composed an excellent World Oil Database from this composite data. And with the October data just released I have composed the below charts. The data is through October and is in thousand barrels per day.

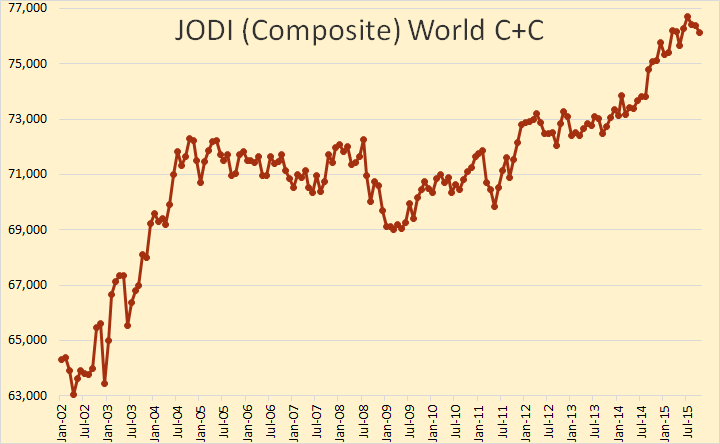

World oil production peaked, so far, in July at 76,702,000 barrels per day and in October stood at 76,128,000 bpd or 574,000 bpd below the peak.

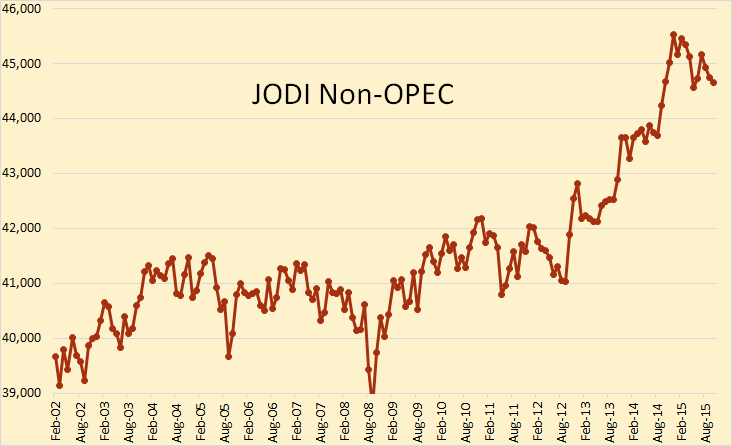

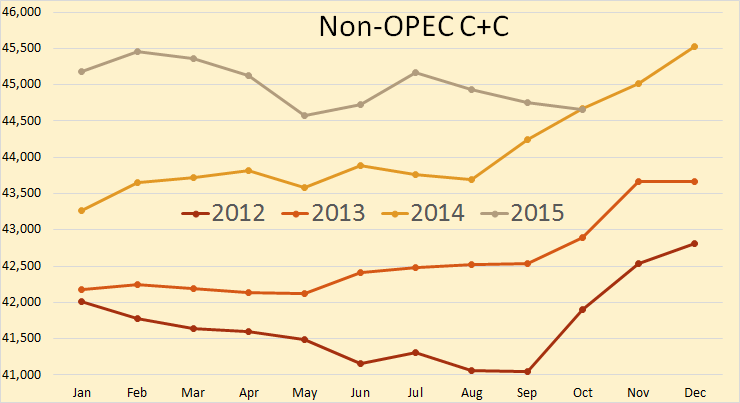

Non-OPEC peaked, so far, in December 2014 at 45,530,000 bpd and in October stood at 44,662,000, down 868,000 bpd or just under 2% in 10 months.

For the first time in 4 years Non-OPEC production has dropped below the level it was the same month the previous year. This means the 12 month trailing average has turned negative, though just barely.

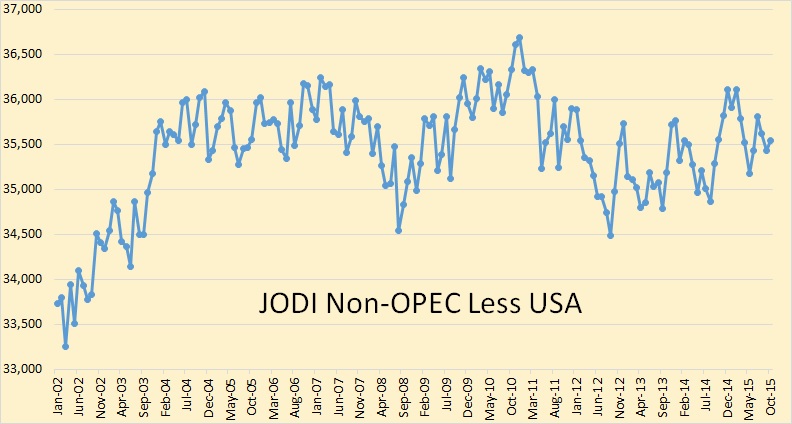

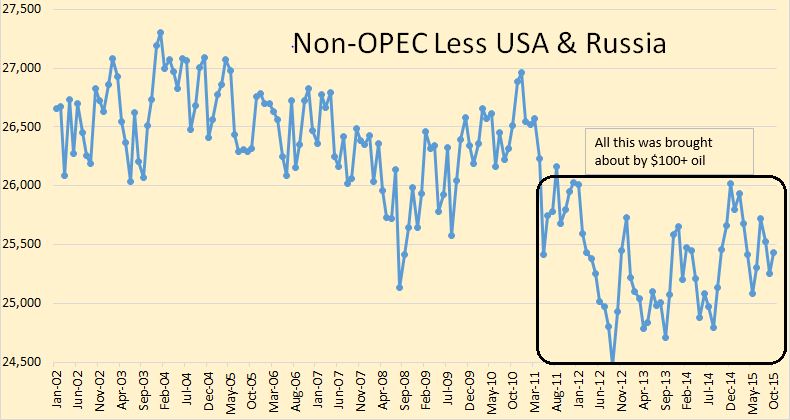

Non-OPEC less the USA has been on a 12 year bumpy plateau. In fact it stood at 35,422,000 barrels per day in October, 214,000 bpd less than the level reached in December 2003.

The data here, prior to 2012, is from the EIA. Russia and the USA are, by far, the two largest Non-OPEC producers. At best Russia has plateaued but most analysts predict she will begin to decline next year. I think that prognostication is correct. Russia, I believe, will slowly decline beginning in 2016.

The data for 2015 is the average for the first 10 months. Russia has increased production every year since 1999 except 2008 when we had the big crash. Some were expecting a similar crash in 2015. They were surprised: Siberian Surprise. I was not and I don’t expect a crash next year either. I just expect production in 2016 to be slightly less than this year.

Non-OPEC less USA and Russia is clearly in decline. Five years of oil prices above $100 could not prevent the decline. But $100 oil has brought a lot of Non-OPEC oil on line. What it did do was prevent this decline from being a lot steeper had oil been in the $60 or below range.

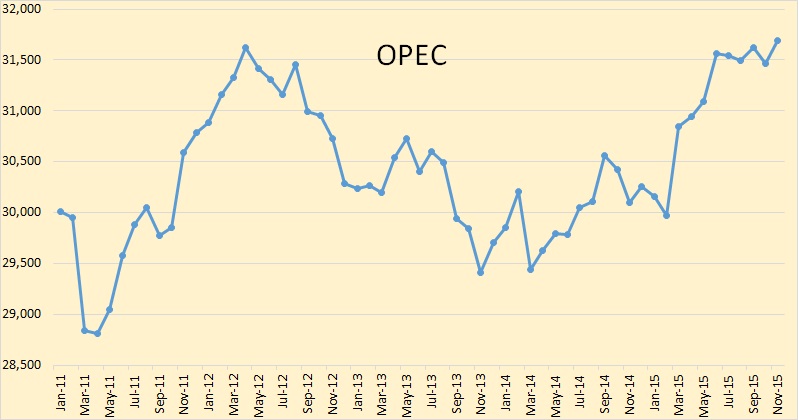

Of course if we are talking peak oil we must include OPEC. Above is OPEC crude only production through November. It is obvious, to me anyway, that OPEC is producing flat out. Only Iran has much potential to increase production. Most analysts think they can only increase production about half a million barrels per day. But that will only likely replace decline in other OPEC nations. OPEC production will likely hold steady for the next four or five years before starting a steady decline. OPEC production will not prevent peak oil.

Rockman, who posts now over on PeakOil.com, recently posted the following which I though was so clear and to the point that it deserved a post here also.

Looker: “So in fact peak oil will really bite when it is not so economically viable to find and produce oil for the market.”

Rockman replied: Good point and there’s a great visual to emphasize that point: look at the US oil production curve. We peaked about 35 years ago. And during those decades the inflation adjusted price of oil was less the current prices…and considerably less then during the height of the shale boom.

And the shales boomed when oil price boomed. And not due to technology: horizontal drilling for unconventional reservoirs, like the Austin Chalk in Texas, was well established 15 years earlier. And fracking has changed very little for decades.

In other words US oil production peaked because oil prices essentially peaked decades ago. Yes: up and down but no great movement like we saw when the shales boomed. And US oil production almost reached a new peak because oil prices reached near peak levels once again. Which means that we may not only be at global PO but the longer it takes for oil prices to significantly increase we may never again approach current production levels as depletion continues to take its toll. The recent increase in global oil production actually is the result of low oil prices…not higher. The oil price collapse has forced some producers, like the KSA, to bring their reserve capacity into play so as to increase the revenue stream. Which also means the lower oil prices are also increasing the depletion rate of existing proven reserves as well as hampering the development of new reserves.

The recent oil price collapse may eventually be viewed as the ultimate “Oh shit” moment in the global energy dynamics.

The upsurge in OPEC production that began in March 2015 is what Rockman is talking about when he says: “The recent increase in global oil production actually is the result of low oil prices…not higher.” That point should not be taken lightly. While high oil prices drove most nations to invest heavily in infill drilling and a few new fields, now that prices have collapsed they must produce every barrel possible to maintain their budgets.

Bottom line, I am more convinced than ever that 2015 will be the year world crude oil peaked.

So as the price of oil continues lower, oil production will continue to increase.

And if the price of oil goes higher, oil production will continue to increase.

But capex is decreasing across the board.

Rig count, it must be assumed will continue to decrease.

Strange world.

Oil production will increase in those areas where it is cheap to produce oil and where maintaining public infrastructure relies on oil revenues. KSA can still profit from cheap oil. Oil production will decrease in areas where it is expensive to produce oil.

As long as drillers have access to funds, they will continue to drill – that is what they do. Price is not much of a factor as long as they have access to money. The drillers always assume the price of oil will go up. It is hardwired into their brain, despite any evidence to the contrary. At least half the time, they are right.

Not even tool pushers get to make those decisions.. I think it’s decided way upstairs by a little jerk with a Harvard degree, who likes playing with excel and decides to forecast higher prices to keep the gig alive.

So as the price of oil continues lower, oil production will continue to increase.

Oh don’t be silly. Just because Saudi Arabia has increased production in order to meet their budget does not mean the world will increase production because of cheap oil. (Iraq would have increased production regardless.)

No, upstream investment will, or has, dropped dramatically. This will cause production decline down the road.

Yes, I should have added “in the short term” to that, but then it wouldn’t have sounded as glib.

And what is “short term”?

12 months, or maybe 3-4 years.

If the world is 2 Mbbl/day oversupplied right now, and decline rates are 6%, and there is only minimal new oil wells. (so, overall decline rate is 2% ?). We should see the oversupply disappear in a year or so.

Looks closer to 10% in some cases. From previous thread.

The low prices are taking their toll.

http://www.newswire.ca/news-releases/ecopetrol-announces-us48-billion-investment-plan-for-2016-561775541.html

Ecopetrol, the largest Colombian producer announced that it will produce 755,000 barrels a day in 2016 vs 760,000/day in third quarter of 2015.

That does not sound like much a of drop, until you realize that Ecopetrol will be taking over the Rubiales field from a joint venture by not extending their partners contract.That will add 70,000 barrels a day to their production.Or about 35,000 barrels day annualized since it happens mid-year. So adjusted for this their production will decline from 795,000 barrels to 755,000 barrels per day, or a drop of 5%. And that is after spending 4.8 Billion USD. So I am guessing their base decline rate is closer to 10%

I don’t think the oversupply is 2 mm. My guess it’s less than 1.2 mm in December.

@Ron Patterson

You continue to ignore the role of geopolitics in setting the tone for the global oil market, and especially the current oil market.

KSA have not been pumping oil at a record pace in order to cover their budget (which is simply impossible at current prices without a massive devaluation of their currency which will annihilate their trade position, since KSA cannot feed or clothe itself) KSA have been doing what they are doing because they are in a shooting war with Russia. The Syrian Arab Army, the Iraqi Shia militias, the Shia-dominated Iraqi government, Iran itself, as well as Hezbollah are Russia’s allies in a grand regional struggle against NATO-GCC across the Middle East. The battlefield includes Syria, Iraq and Yemen. East Ukraine is a derivative or diversionary front in what some people describe as the First Global Hybrid War.

Russia, Iraq and Iran have massive oil (and gas) reserves that can be brought into production in the future. Something similar applies to Venezuela (but I reckon that Venezuela’s reserves will be more expensive in relative terms) This potentiality threatens the global balance of power, as western oil & gas output is destined to decline (as well as output by countries under western domination) and the potential oil production of Russia, Iran & Iraq becomes a necessity for the global economy.

This is one of the two main reasons (the other being the potential routes of gas pipelines) why we now have an extremely dangerous (media and political leaders vastly understate the true extent of brinkmanship currently ongoing) process of escalation in the Middle East.

What you fail to acknowledge in your articles, is that NATO-GCC have as a strategic imperative to strangle Russia, Iran & Iraq in any which way they can. This includes the imposition of sanctions, military pressure and all other kinds of sabotage one can think of. What we are now witnessing in the global oil (and gas) markets is that excess investment has been ongoing in places such as the US, Canada, the North Sea (as well as several offshore locations, performed by western majors) etc while there is an under-investment in places such as Russia, Iran and Iraq (also Libya & Venezuela) The latter group of countries is much less capital rich than the NATO-GCC countries (and their proxies) and less proficient technologically, hence my firm belief that their production is well below potential.

NATO-GCC’s calculation once they embarked on their oil-price war more than a year ago, was that the combination of sanctions, a crushed oil price and loss of trade with Ukraine would have pummeled Russia into submission, hence ending that country’s support for the Syrian Arab Army, Iran and Iraq. Simply put, if Russia falls, then the Middle East will be at the mercy of the NATO-GCC-Israel alliance (the world’s dominant group of countries) One can also imagine what that would entail for China’s position on the world stage.

As for Russia’s oil output in 2016, I cannot say very much. There are so many factors at play (price, sanctions, unknown Russian technological capabilities) but even if there is a considerable fall, then it will have nothing to do with Peak Oil (in the traditional sense) finally hitting Russia, but with NATO-GCC pressure bearing some fruit.

In conclusion, my point is that several countries with vast oil & gas reserves, have been intentionally starved of investment due to geopolitical factors, NOT economic ones. As for Russia in particular, I am guessing you have been in the business of monitoring the global oil industry for many years now, how many times have you heard/read western “experts” claim that any minute now, Russian oil production will be entering terminal decline? I can attest that I have been coming across such claims since the day I started following such things, more than a decade ago.

Iran & Iraq also have mythical reserves of oil still untapped. Libya, once stabilized (probably under a NATO-puppet government) can also boost its oil production significantly.

NATO didn’t do so shit-hot in Afghanistan. The days of anybody being at the mercy of NATO are long over. If NATO learnt anything in Afghanistan it’s to stay out of land wars in Asia. This has been the case since Alexander the Great but great powers seem to need a reminder every century or so. I suggest USA is no longer a dominant power. Preeminent yes but not dominant. 25 years ago anybody who defied the USA was in trouble. They’d fly half way around the world and kick your ass. On a Tuesday if they wanted. For 5 billion dollars. Today we see that Russia, Iran and China have joined together to defy USA/NATO policy in Syria and they’re doing rather well. It’ll be along time until USA fights any winning battles anywhere in Asia.

The literature on perceptions suggests that, however they come to be formed, the beliefs of national leaders (including their beliefs about the relative power of states in the international system) are slow to change.

Kenneth Boulding argues that such adjustments occur rarely, if at all, while John Stoessinger asserts that change is possible only as a consequence of some monumental disaster.

“the US, Canada, the North Sea” -those are very safe places for investing in oil production.

Stavros H,

Thank you so much.

Your narrative is at least as plausible as the narrative that KSA is pumping oil at a record pace in order to cover their budget.

The narrative put forth by Ron and Rockman defies reality and common sense because, as Peter notes below, “Saudi Arabia is making half as much now producing 10 million than they were producing 8 million per day.”

http://peakoilbarrel.com/all-roads-lead-to-peak-oil/comment-page-1/#comment-551980

Saudi Arabia appears to have other motives besides maximizing its income from oil sales. Its motives are not stricly economic, and waging war is never without cost.

Again, I don’t claim to know what Saudi Arabia’s motives are, but your explanation seems as plausible as any.

One thing we can be sure of, however, is that the balance of power which attained after 1989 is now very much in flux, and is very much being challenged.

Stavro,

The big picture that you describe is somewhat on the money but the devil is in the details. And when you look at these details from different frame of mind you will get different picture.

1) If you use terms like NATO, GCC, EU, IMF you have to be aware that these are just labels that are representing cartels. In North America they like to talk about OPEC cartel but not so much about other cartels. If you don’t talk about them than we pretend they do not exist. Main purpose of NATO is not to fight the war with “enemies” but to collect a money racket from the “allies”. Country A is in the NATO, regardless if it likes it or not, has to have 3% of budget spent on military. That 3% is your racket. And that racket has to be collected every year. And you can only spend it on hardware from NATO catalogue. No free market there even if there are cheaper and better options. The more countries join the cartel the more money is in the pot. Small countries – no problem, they can join. Poor countries – no problem, they can join too. You can always extract something. In military sense these countries are useful as much as your Facebook friends (practically not friends at all) but what it does it keeps money trickling to the core.

2) Second note is about the fine print of the notion how much some country can produce oil. There is misconception in the discussion that certain country has huge X amount reserves and it will produce huge X amount of oil in the future. Country A with supposedly huge reserves, if assume it has sovereign elite, will produce just enough that suits their economic development and no more. It is as simple as that. The notion that Russia or Iran or whoever will produce so much that European elite can entertain themselves with Formula 1 races every weekend is pretty much nonsense that is result of 50 year of propagandazition. If American elite wants to piss their remaining shale oil on NASCAR races or 20 miles drive to the nearest Wal-Mart for jug of milk, or to keep military bases around the world, well, that is their choice. But eventually it will come to the point where this way of life is not possible and you have to adapt to a new circumstance. This blip period where oil prices are very low are just consequences of geopolitical war that you describe where everybody produce maximum regardless of profit in order to undercut the competition. If you don’t have domestic source of oil then you can’t play empire games anymore. You have to be “normal” country again. And that is not that tragic because if you ask 99% that question if they would like to be a “normal” country again they would take that in a heartbeat.

This potentiality threatens the global balance of power, as western oil & gas output is destined to decline (as well as output by countries under western domination) and the potential oil production of Russia, Iran & Iraq becomes a necessity for the global economy.

It’s certainly time to put the era of the “great prize” of oil behind us, and transition to new forms of transportation and energy.

If that were to reduce the chances for this kind of senseless conflict, that would be enormously valuable.

Perhaps a little ‘over read’.

The simplest explanation:

1. USA production increase from shale largely the result of a high appetite for ‘risk’ by USA financial banks and by stockholders – ‘the greater fool effect’. Partly fed by artificially low interest rates and poor returns from other instruments.

2. Saudi increase because price is low and only volume can compensate – the irony of this feedback loop is obvious.

3. Russia same. My recollection is that the Russian state takes all nett income over $30 a barrel anyway, so from the compamy viewpoint, it is BAU, but with unhappy but resigned shareholders.

4. Yes the Muslim brotherhood would like to create a Sunni (at least), maybe Wahhabi (if some Saudi get their way) series of religious based states from Turkey through Syria, Iraq, then down the Gulf countries (at least). To this end, it is likely many or most sponsor terrorist factions, all with ‘plausible deniability’.

5. Russia has had a base in Syria for many years. They are no more going to give it up then they are going to give up the Crimean sea base of long standing (contrast the number of bases in foreign countries Russia has vs USA -startling!). In addition, competence – or standard mark one viciousness of the of Middle East Govts everywhere – Govt. or not, Syria is (was) a secular, i.e. no state religion, country. Many sides got along, all sects are in the army, but the nation is being cracked open along sectarian (religous) lines by outsiders. Same happened in Iraq, where prior to USA invasion Sunni and Shite lived well mixed in Baghdad. Now Baghdad is divided into Sunni and Shite areas. Think North and Southern Ireland. Same consequences.

Russia’s interest was (is) in pipeline access through Iraq, through Turkey. Iran same. Israel would also benefit.

More than that, existentially, Russia is worried about terrorist coming up into Russia from the countries bordering itself and Turkey, and coming in via Afghanistan, once it too falls under Muslim Brotherhood/Gulf wahhabi influence. America, you must recall, has no such problem geographically (Mexico is Catholic).

6. Yes, USA would like to wrest the oil and uranium resources from Russia via breakup of Russia in to client states. Tried once in the 90’s, failed. Probably, but not certainly, will fail again. Even with ‘success’, USA ‘success’ would come at the price of the Iraqisation of large parts of southeastern Russia – under terrorist influence.

7. Expect a long grind to draw the line against religious extremists. Ironically, Europes greatest hope for secure oil supply in future is a strong Russia. With or without Putin, Russia, with their strong focus on trade and their apparent adherence to International norms and laws is Europes security. Not so much USA.

8. Everything is domestic politics and short termism in USA and Western Europe. Certain other parties step back and take a longer view.

2005: Peak Conventional Oil

2015: Peak Oil

We should look not at the consequences of Peak Oil, but to Peak Oil as a consequence of the underlying economical and financial global situation. Peak Oil is going to make sure we never recover during the cyclical upswings. We have found the limits to growth, and those limits are going to be getting smaller with time.

So are you denying this:

http://euanmearns.com/a-new-peak-in-conventional-crude-oil-production/

I know a lot of people in the peak oil scene keep clinging to that 2005 date, might be time to let it go.

Matt,

As per your link Euan Mearns sites 73.2 Mbpd in 2005 vs 74.28 Mbpd in December 2014 according to the EIA. The problem is that the figures from JODI, IEA, EIA & BP etc are not all in perfect agreement and I don’t think we can definitively say that world production is “x’ amount with that degree of accuracy especially since the numbers are often revised up or down a year or two down the line. What we can do is look at the general trend over several years & its clear that 2005 marked a point where conventional oil production either peaked or at best grew very slowly within the context of a rather bumpy plateau. So the highest oil prices in history failed to significantly increase conventional production and low oil price environment is unlikely to be conducive to new sources of unconventional production. I would suggest on that basis that the future does not look too rosy.

Hi Matt,

In 2015 C+C output will be about 79.4 Mb/d, the data is not perfect but output will not be revised down by 6 Mb/d.

As far as 2005 being peak “cheap” oil, the lowest monthly oil price was about $46/b in Jan 2005 and for the year oil was $59/b (all prices in Dec 2015$).

For 2015 the average oil price will be about $49/b and the lowest monthly price was about $42/b in Nov 2015. I would say 2015 has been peak “cheap” oil, though some may claim the condensate should not be counted, we do not have good international data on the condensate output so we can only speculate on that.

So what are we calling “oil” nowadays? http://resourceinsights.blogspot.com/2012/07/how-changing-definition-of-oil-has.html Can anyone provide a graph of the ratio change between crude and condensate over the years? http://www.aogr.com/magazine/editors-choice/growing-condensates-require-optimized-designs-for-gathering-processing

There is not good data on international condensate output, the only decent data we have is on crude plus condensate ( and that data is not great, but the best we have). Crude output has always included some condensate output in the data reported and few nations separate the crude and condensate data. OPEC, Canada, Russia, and the US do, and that is a lot of World output, we can assume the ratio of condensate to crude is the same for the rest of the World and make an estimate of the crude divided by C+C. I have not done so, but I believe others have.

No. That in 10 years production has managed to temporarily increase by 1.5%, when in the previous 10 years it grew by 18% fits my concept of Peak Conventional Oil. Conventional oil got to a bumpy plateau in 2005. A bumpy plateau is by definition bumpy. We are in a bump. If production keeps increasing, it will negate the Conventional Peak Oil. If it falls back it will not.

I refer to the 2005 plateau as “peak cheap oil”. Today’s current price certaintly does not reflect today’s marginal cost of supply already built into the production stream.

Peak Oil is going to make sure we never recover during the cyclical upswings. </i

That will be true for the really stupid consumers and importers, who refuse to deal with reality and switch away from oil and fossil fuels. Like tobacco company ceo's smoking 3 packs a day…

Are any of you posters actually in the oil industry?

So many things you are missing. All your predictions and wishcasting is based on a static world with no technological improvements.

Much investment is and has gone into new recovery tech. Some coming online now. I’ve seen them.

You are missing the boat. Peak oil available is still decades away.

Peak oil available is still decades away.

What is “peak oil available”? I have never heard of that one. Sounds like bullshit to me. Peak oil production is the only thing that matters.

And yes, several of our posters are actually in the oil industry. Are you?

Actually, I agree with that. My own feeling is that oil will peak sometime between 2020 and 2030, and that peak production will stay within a fairly tight range for five plus years during that decade.

I agree with that prediction too, Arceus.

Hey Stilgar, BrainChump, Arceus,

Tell your “feelings” to NATO (missile shield, regime change in Syria), Russia (Syria, Ukraine, Turkey) and China (South China Sea resource grab, asserting itself in the oil exporting countries).

I bet they will “feel” impressed with your “feelings” about oil production.

The US Military predicted Peak Oil in 2015 using data, math and petroleum geology…..not “feelings”.

ELM + Putin = Horrible News for NATO aligned countries (oil importers).

Based on that equation “my feelings” are you are going to see very crazy geopoilitical movements…like we already are.

Time to BRUSH MY TEETH. I want them nice and shiny for PEAK OIL.

Do you have a link to the US military’s report?

http://www.theguardian.com/business/2010/apr/11/peak-oil-production-supply

It was in their JOE 2010 ( I think report).

I’ve noticed it hasn’t appeared in any others reports. Did they publish this document and change their opinion drastically a year later? I doubt it!

It was signed off by General Mattias (commander of Joint Forces) which means he reviewed it, and put his name on the line.

GOOGLE: JOE 2010 Report Peak Oil.

It will pop up as the second link. It is a .pdf file.

“By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 million barrels per day,” says the report, which has a foreword by a senior commander, General James N Mattis.

They missed the shale boom. Like everyone else.

But look at how the militaries around the world are acting provocatively. Must have similar forescasts IMO.

Arceus Wrote:

“My own feeling is that oil will peak sometime between 2020 and 2030, and that peak production will stay within a fairly tight range for five plus years during that decade.”

CapEx has collapsed and a lot of new projects have been canceled. Most of the projects that were canceled take 3 to 7 years to bring new oil to the market. In the meantime, existing production continues to deplete. For the cancel projects to be restarted Oil prices will need to more than double and stay there for a considerable period before Oil drillers will restart CapEx increases. They aren’t going to restart them until Oil prices have stabilized for a considerable period.

By the time Oil prices recover and stabilize, world production likely be losing production faster than newer projects can come on line because of the long development time. It the Red Queen is coming and staying for good.

World economics is also likely to put a drag on Oil demand now that the Emerging Market has breached Peak credit/debt. Asia and Brazil are now in freefall and in recession. Thus consumption of Oil will be much lower as the credit/default cycle will take a decade or more (if ever) to recover. In the US/EU there still hasn’t been a real recovery, despite 7+ years of zero interest rates. The EU is still in recession and the US will be recession by the spring.

FWIW: We would have already been in permanent decline if it wasn’t for the shale drillers drilling wall street for money (ie related to ZIRP – Zero Interest Rate Policy). Shale needs oil prices above $105 to be profiable (ie pay down debt and still make a profit). Shale drillers borrowed about $500 Billion (If I recall correctly) to pay for all the CapEx needed. If the shale drillers were unable to borrow hundreds of billion, there would never had been a shale drilling boom. Like the EM debt bubble there is also a Shale Drilling debt bubble that has popped. No one today is willing to throw money at the drillers and nor will the do so in th next 20 years. We are on the verge of a wave of shale driller defaults and lots of investors are going to lose their shirts.

Perhaps if economics did not play into future production, Peak Oil could be deferred to the 2020-2030. Unfortunately economics do matter and its going to force peak sooner (very likely 2015).

They aren’t going to restart them until Oil prices have stabilized for a considerable period.

Wouldn’t they restart them when the futures strip allows them to fully hedge their production?

Nick Wrote:

“Wouldn’t they restart them when the futures strip allows them to fully hedge their production?”

In my opinion Oil companies and Investors will be skittish to jump back in when oil prices recover, on the chances that prices will drop again resulting in more losses. An investor that lost a lot of money investing in shale is not going to be too keen on investing in energy.

Most of the money investing in shale was not based upon long term hedging contracts. I also doubt their will be very many business looking for long term price contracts (also gotten burned with them). At least not enough contracts to make much of a difference to affect the global production.

Most of the money investing in shale was not based upon long term hedging contracts.

Well, sure – they got over confident. And, they got burned. Badly.

I also doubt their will be very many business looking for long term price contracts (also gotten burned with them).

Well, if that’s the case we’ll see that in the futures’ strip. But, a lot of businesses are deciding they need to hedge their consumption, in order to have price certainty.

Have you seen any sign of the futures market contracting overall??

“Some coming online now. I’ve seen them”.

What have you seen? Any links to supporting data and documentation would be appreciated.

It seems to me that it is you that is wishcasting. Share your inside info please.

I guess this is the secret technology that makes (will make) Pioneer and EOG profitable at 30USD in the Permian?, if Art Berman knew of this technology he would not be so cynical. 🙂

http://www.artberman.com/less-than-2-percent-of-permian-basin-is-commercial-at-30-oil/

‘Peak brainpimp’ ^u^

Can’t be that secret. The guy who drives the water truck seems to have been briefed.

I have been in the oil industry for 40 years. Please let us know about the technical improvements you have in mind, which will allow us to produce at 80 mmbopd c+c for decades. Once I see your response I can comment on whether you know as much as you think you know. ?

So Rockman’s post points to a ‘peak oil dynamic’ (his phrase) leading to a shark’s fin production profile. Rapid depletion of already drilled wells, and a collapse in the rate of drilling world wide, and abandonment of thousands of economically marginal stripper wells and a collapse of investment in longer lead time investments like deep water, arctic, and heavy oil/tar sands should all lead to a super spike in oil prices in a year or two as all those new Chinese and US SUV drivers discover that the global glut of stored oil is declining fast just as production falls off a cliff. That, if nothing else beforehand, will pop the next financial bubble, and trigger the next financial crisis.

Ralph,

Rockman says nothing about a coming shark’s fin of decline. He has pointed out several times that that is just what will not happen.

He posts at peakoil.com, if you want to follow his arguments.

Ralph wrote:

“should all lead to a super spike in oil prices in a year or two as all those new Chinese and US SUV drivers discover that the global glut”

China is in a recession and on the verge of a debt crisis. Demand for vehicles has already collapsed. the US is close to another recession. I expect worldwide demand to shrink considerably in 2016. Thus putting a cap on Oil prices. That said if the Middle East breaks out into full blown war, than its likely to spike back up.

FWIW: Its not just Oil is falling, so is everything else. Just about all commodities are in a state of freefall. Excess capacity everywhere and buyers are disappearing.

Rockman seems to be reiterating what others have been saying wrt the question of why do producers still produce at these low prices? Why don’t they just shut it down and wait for the price to go up?

It is because while you make less money when prices are down you make even less when you don’t produce.

So with low prices production will continue as long as possible until it can’t.

With high prices demand is hampered and everyone is afraid of the economic impact.

Peak Oil!

Jef,

Exactly. Low prices? You don’t earn much. Shut down? You earn nothing.

You still have to keep the lights on.

Rockman is a producer. What he’s talking about is what he does.

Iraqi production could face decline in 2016….they simply cannot pay their bills even with emergency loans from world bank….only OPEC increase 2015 was Iraq and SA….SA going full out and Iraq declining, Russia full out….Iran…who would invest there st $35 oil? US shale capex cuts will bite and declines will increase in 2016.

Thanks for the post. I find it very informative. One question I have is why the JODI totals are around 75 million bopd, when world production is often discussed as being around 90 million bopd. I suspect the difference is in how condensate and bitumen are counted, but I would like to know what the differences are.

Ron’s actually on top of these little variances in oil stats from various sources. He juggles the secondary sources choice with gov’t reported and the issue of C+C vs just C. The choices always look rational to me.

As to what leads to decline in output when, it’s pretty amazing to me that people still try to predict this stuff. I can find you distinguished analysts saying opposite things, and you can find them too, and without much effort. The odd part of this is the reluctance of people to recognize none of them know anything.

One other thing worth thinking about. There is no long run. The long run is now, because now was the long run a year or five ago. No one is allowed to say such and such is true today “but in the long run” something else will be true. What’s true now is true in the long run.

DC, the difference is this is Crude + Condensate and does not include Natural Gas Liquids. The 90 million bpd you quoted does include natural gas liquids. That said however the JODI numbers are somewhat less than the EIA numbers because the EIA counts OPEC condensate while JODI does not. Also there may be a few very small producers that does not report to JODI.

The EIA has world crude plus condensate at about 80 million barrels per day. The EIA has production of Crude Oil, NGPL, and Other Liquids at 93,770,000 barrels per day in June 2015. That was a jump of about one and one quarter million barrels per day from May. Somehow I just don’t really think that was the case.

Ron

According to you Saudi Arabia were doing everything possible in Jan 2013 just to stop decline.

http://www.theoildrum.com/node/9798

Yet here we are 3 years on and they are producing 1mmbld more and flooding the market.

Please explain. Why would a country drive down the price to maintain market share when they know they will lose market share due to declining production.

According to you Saudi Arabia were doing everything possible in Jan 2013 just to stop decline.

And they did. In addition to dramatically increasing infill drilling in their old fields, they brought Khurais on line, then increased water injection in Khurais and in 2013 they brought Manifa on line ahead of schedule.

Saudi Aramco Starts Pumping From Manifa Oil Field Ahead of Plan

April 15, 2013

Saudi Arabian Oil Co. started producing crude from Manifa, the world’s fifth-largest oil field, on April 10, three months ahead schedule.

Saudi Aramco, as the state-owned producer is known, said today the field will produce 500,000 barrels a day of Arabian heavy crude by July and it will reach 900,000 barrels a day by end of next year.

And they are still working desperately to stem the decline in their old giant fields.

Saudi Aramco to expand Shaybah, Khurais oil output in 2016-17

“This will bring it up to a million barrels (per day). We’re in the process of awarding the contract in the next few days,” he said, adding that an ongoing project at Shaybah will also add 250,000 bpd of natural gas liquids output in end-2014.

The Khurais expansion project was at the front-end engineering stage and the expansion to increase the field’s output by 300,000 bpd to 1.5 million bpd should be completed by 2017, he said.

Khurais, Shaybah and Manifa are all very old fields that, for various reasons, were mothballed years ago. But now they are called into service to to stem the decline in their other old giants.

Saudi intends to hold production at current levels for several more years. How successful they will be remains to be seen. But they have not and will not dramatically increase production.

Peter said:

Peter, did the Saudis buy into the hype being peddled by Team Carbon (see graph below from https://www.eia.gov/conference/2015/pdf/presentations/hamm.pdf ), and want to stop “the Great American Shale Revolution” in its tracks.

Could the Saudis be that stupid, to believe the hype emanating from Team Carbon?

I doubt it.

I suspect that the Saudis and Russians have other reasons for wanting the price of oil low, reasons which folks like Rockman cannot even conceive of.

We are wandering about in a wilderness of unknowns, but that doesn’t stop the speculation.

Glenn

I think you are right, their reasons are unknowable at the moment.

Saudi Arabia are making half as much now producing 10 million than they were producing 8 million per day.

The next few years will be interesting, that is for sure.

I suspect that the Saudis and Russians have other reasons for wanting the price of oil low, reasons which folks like Rockman cannot even conceive of.

But apparently you can. Else you would not know this was the case. Please give us those reasons.

I’ll take a quick stab here. The U.S. has overplayed its hand for too long. For most of the world, the decline of the U.S. is an eagerly anticipated step in the evolution of a new world economic order. So it comes as no surprise that more than a few countries are actively working toward that outcome. First and foremost in achieving this is the removal of the dollar as the world reserve currency. Second, perhaps is to destroy the U.S. economy. And third, perhaps is to make the U.S. economy almost entirely dependent on foreign-supplied oil and funds.

What joins men together is not the sharing of bread but the sharing of enemies.

I thought you just said it was unknowable. Now you’re explaining it. Give it a rest dude.

Jimmy,

That was me that said we do not know the reasons why Saudi Arabia has decided to decimate the price of oil, not Arceus.

…

+10!

Typical Glen remark, implying that he knows what nobody else does but he never backs up his statements with anything substantive.

I still think he has a really bad case of Dunning-Kruger. Rockman may not have a crystal ball but one always knows where he stands and where he is coming from.

Furthermore there are plenty of people on this site and other sites that are more than capable of critical thought and putting 2 and 2 together and read the writing on the wall… Most peole here are pretty smart!

Fred Magyar,

When it comes to the “one always knows where he stands and where he is coming from” and “putting 2 and 2 together and read[ing] the writing on the wall” department, you’re no slouch yourself.

Words like doubt, uncertainty, and skepticism don’t seem to be part of your vocabulary.

I am willing to bet the farm that Rockman has forgotten more about oil, including the politics of oil, than GS will ever know.

I think the Russians are siding with the shiah side in what seems to be a religious war. KSA is run by Sunni extremists, their blood brothers are ISIL, Al Qaida, the Taliban, and Boko Haram. Russia is siding with Iran, Iraq, and the Assad clan in Syria.

Interesting fact: Christians usually sided with those in power. In Syria, the Christians were Assad backers.

The ongoing war has the USA grinding itself down, bogged down because the American political system is an Israel lobby franchise. The Russians are much more independent, they will work with the Iranians to eventually overcome the wahabi menace. And I think the Israeli right wing, which orchestrated the current mess when they set up bush to invade Iraq, will have to backtrack.

In my opinion KSA actions relate to geopolitics, mostly with Iran. KSA does not want Iran to gain an upperhand and helping to suppress Oil prices will have an impact on Iran’s economy.

The Syria & Yemen civil are proxy wars between Iran and KSA. the US shale industry is just collateral damage.

Peter Wrote:

“Saudi Arabia are making half as much now producing 10 million than they were producing 8 million per day.”

KSA wants to build a gas pipeline to supply the EU with NatGas and thats a driving force for the Syrian proxy war. Underneath KSA’s oil fields is a lot of NatGas. But to avoid damage to the Oil fields they won’t start tapping the gas until their fields are fully depleted. My guess is that they want to get the gas pipeline built soon. Iran and Russia don’t want KSA to build a pipeline into the EU which would undermine Russians market share, and Iran wants to collapse the house of saudi.

If you go to Saudi Americo’s website, you and download their tech white papers, about all of the advance oil recovery techniques they are using to extract the oil now floating on a sea of water. They show graphs of data plots showing that their best fields are nearly depleted and that they now have to accurately target oil trapped in pockets to sweep up the remaining oil. I posted few links of selected articles a year ago. In some locations they are on the second and third horizontal drilling projects as the water level rose above the lateral drill run.

I recall that at least one of the SA articles discussed plans about tapping the NatGas reserves below one of the large oil fields that is nearly completely depleted.

Thanks for the explanation.

Hi Ron,

Why is the JODI C+C estimate 3 Mb/d less than the EIA’s estimate for peak monthly output (about 80 Mb/d), do you fill in the countries that do not report to JODI (using EIA data) or is that output left out of the JODI estimate?

Chart with EIA estimate from Jan 2005 to June 2015 in chart below (scale is chosen to be somewhat similar to Ron’s chart (14,000 kb/d range on vertical axis and similar range on horizontal axis), there is a difference between the JODI and EIA estimates of about 3 Mb/d from about 2009 to 2015 for World C+C, possibly because the JODI data is incomplete.

Dennis, the JODI data does not include OPEC condensate. Also it is likely that there are a few very small producers that are not counted.

The JODI data may be a little incomplete but not by enough that matters. The EIA data is also incomplete in that they must estimate a lot of production numbers. For instance, their estimate for Venezuela is totally incomplete as it seldom changes at all. I think that in many cases the JODI data is superior to the EIA data.

For a few countries such as Venezuela that may be the case, for the overall World estimate of C+C output, I think the EIA estimate is better, too much trouble for me to put several different estimates together, my past experience was that JODI had a lot of missing data. In June, the EIA OPEC estimate minus the OPEC data in your charts gives about 2 Mb/d for OPEC condensate, so it looks like only about 1 Mb/d of missing output from your JODI composite data. Possibly the EIA has overestimated C+C output. Hard to know.

Stuff I missed the last few days.

1) The US per capita consumption is blah blah blah and that’s more than any country in the world.

Wrong. Saudi Arabia’s per capita oil consumption is quite a bit higher than the US number. They ain’t the only one. Kuwait is even higher. And with that error all the rest of the argument is rendered non credible.

2) US oil consumption is GDP driven. Not passenger car driven. Those cars don’t get driven as much in recessions. Sunday afternoon drives aren’t family priorities anymore. mazama shows this little down tweak in 2008. So countries with less GDP should not be expected to consume as much oil per capita. Even Kuwait’s consumption graph had a slope tweak in 2008.

3) And finally, again, what’s the point of this consumption hand wringing. Why would an American strive to cut consumption in order to save some for a Chinese housewife with a new SUV? Their consumption is growing and so is India’s and it ain’t gonna stop. You want to spout conservation, do it in Mandarin. Why inconvenience yourself when you can suppress other people’s consumption by force.

Watcher

1)US consumption is besides a couple of small countries the highest in the world.

http://www.indexmundi.com/map/?v=91000

compared to other western industrial countries it’s consumption is totally unjustifiable.

2) Driving a Ford F150 or an ampera to work has nothing to do with GDP and everything to do with needless oil consumption. So stop saying things which even an 8 year old would find obvious

US consumers will not cut consumption out of the goodness of their hearts, they will be forced to do so when prices make cuts necessary.

..

Chinks?

Arceus,

It refers to Watcher’s point #3 in his above comment. To wit:

And yet many prognosticators claim that oil glut will last a decade. http://www.forbes.com/sites/markpmills/2015/12/21/shale-wars-round-two-congress-acts-on-exports-russia-capitulates-on-price-and-opec-blinks/

That is perfectly compatible with Peak Oil. Indeed it would contribute to it, as an oil glut destroys oil production.

Hi Javier,

Even if we assume there is a recession that continues forever, unless oil demand falls faster than oil supply forever, eventually oil prices stabilize at some number above zero.

If the oil price is very low (say $10/b) wouldn’t you expect that demand might fall more slowly than supply would fall and lead to oil scarcity?

If that sounds reasonable, then as a consequence oil prices will rise to some level where there is enough supply to satisfy demand at the prevailing oil price. That oil price is likely to be more than $60/b (no idea how far in the future this will occur).

One has to make pretty unrealistic assumptions for the performance of the World economy and the ability to produce 79 Mb/d at under $35/b over the long term in order for the current glut to be maintained at current oil prices for more than 2 or three months imo.

Hi Dennis,

I am not saying that an oil price recovery or even that temporary high prices are not possible. I am just saying that the probabilities of them to contribute to a higher than present oil production are quite low. After all US oil demand never recovered pre-2008 levels at any oil price. If global demand behaves in the future as US demand, then regardless of oil prices, demand will not induce higher than present production ever.

Javier

Are you really trying to make any comparison with the US and China and India?

The one overwhelming difference, the United States car ownership is at saturation point. At over 800 vehicles per 1,000 population, so if more fuel efficient cars are bought then consumption goes down, simple.

China has only around 100 vehicles per 1,000 and a population nearly 5 times that of the United States.

China’s vehicles fleet in increasing at a phenomenal rate, they will Sell 23,000,000 vehicles this year. China’s consumption will continue to grow to fuel an ever increasing number of cars.

India is far behind but vehicle sales are increasing also.

http://www.siamindia.com/statistics.aspx?mpgid=8&pgidtrail=14

The United States and OECD countries are the exception when it comes to vehicle numbers per capita, most of the world is catching up.

They are latecomers when the party is about to end. You are just thinking within the box.

The growth engine is broken. Too much debt, too much population, too few resources, excess of labor, low consumption, decreasing returns. It cannot be fixed. It will be a question of when it stops, but in the meantime it will require less energy.

Most people, like you, only see an increasing number of problems. things no longer go as well as they used to go. Each one has a particular solution that will turn around the situation. EVs, increased fracking efficiency, thorium molten salt reactors, debt forgiveness, population control. It is the illusion of control.

Javier

What do you mean people like me. You do not have a fucking clue what I know.

You are really clever in pointing out the obvious problems. A really clever person comes up with solutions. Losers like you always say it can’t be done. No one ever remembers problem finding losers. They do remember problem solvers.

I.E. Isambard Kingdom Brunel. Edison, Marconi, The Wright Brothers.

Peter,

That’s because, as I said, you think we are facing a problem, when in reality we are in a predicament. Unlike problems, predicaments don’t have solutions.

Problem solvers, heroes, great politicians, big inventors, they all appear when things are on the upside. ¿How many great names can you cite from the decline of the Roman Empire between 200 and 475 AD? The best of the Romans of that time could only temporarily halt the decline.

Javier said:

¿How many great names can you cite from the decline of the Roman Empire between 200 and 475 AD? The best of the Romans of that time could only temporarily halt the decline.

Javier, I don’t think history is quite as mechanically deterministic as what you believe it is. Take this example from Bryan Ward-Perkins’ The Fall of Rome, for instance:

By constrast with the West, the eastern empire was relatively untroubled by civil wars and internal unrest during the period of the invasions, and this greater stability was undoubtedly a very important factor in its survival…

There is no very obvious reason for this greater stability in the East, beyond good luck and good management. In particular, through the dangerous and difficult years after Hadrianopolis, the eastern empire had the good fortune to be ruled by a competent and well-tried military figure, Theodosius (emperor 379-95), who was specifically chosen and appointed from outside the ranks of the imperial family to deal with the crisis. By contrast, the ruler of the West during the years of crisis that followed the Gothic entry into Italy in 401 and the great crossing of the Rhine in 406 was the young Honorius, who came to the throne only through the chance of blood and succession, and who never earned any esteem as a military or a political leader. Whereas the figure of Theodosius encouraged a healthy respect for the imperial person, that of Honorius, dominated as he was by his military comarades, probably encouraged civil war….

Honorius himself never took the field; and his armies triumphed over very few enemies other than usurpers.

Glenn,

I don’t believe for a moment that if Eastern and Western empires would have swapped emperors at 379 they would have swapped destinies. They were very different entities. Both have their share of good and bad emperors. The Western system ensured good emperors lasted as little as bad ones. By splitting the empire they got the less dysfunctional part to survive longer. The Eastern part still got a functioning commerce, the Western part relied only on rural income as its commerce collapsed. They had very little income to face the situation.

The right people can only appear if the right conditions are present.

Javier said:

The right people can only appear if the right conditions are present.

Well I suppose it depends on whether one believes in the “great man” theory of history or not.

Do the times make the man, or the man the times?

I don’t think the jury’s in on that one yet.

Hi Javier,

I think the chances that demand will not increase in China, India, Brazil, and other rapidly developing economies is exceedingly low, so we will have to disagree. Demand has continued to grow for the World, it just has not grown as fast as the oil supply.

So if your expectation is that World demand for oil priced at under $50/b will not increase over the next 5 years, then you are expecting a Worldwide recession. That is possible, but not that likely in my view.

You should read the following report (and not just the headline and blurb), based on that report there are reasonable solutions to the debt problem and that problem is focused mostly on a few advanced economies. Read at least the executive summary to get a flavor of the research.

http://www.mckinsey.com/insights/economic_studies/debt_and_not_much_deleveraging

Dennis,

The debt problem is one of the big wild cards. It adds yet one more layer of complexity over phenomena which are already highly complex, making forecasting even more difficult.

As I’m sure you know, the experts are all over the map when it comes to debt.

And as I’m sure you also know, any discussion of debt is quintessentially poltical. Debt instruments are all but worthless without some authority to enforce their collection.

I will print the paper out and look forward to reading it leisurely.

Hi Dennis,

I am quite sure that you would have thought in 2006 that the chances that oil demand would not increase in OECD, and other rapidly developing economies were exceedingly low.

Debt is a human problem and thus amenable to human solutions, albeit without growth those solutions are bound to be painful to some parties involved. A lot of the other problems are physical in nature and thus not amenable to human solutions. Getting rid of debt would not buy us a lot of time.

A lot of the other problems are physical in nature and thus not amenable to human solutions.

Repeating this does not make it true. Oil and fossil fuels are expensive, polluting and risky. EVs, wind, solar, nuclear, hydro, etc., are cheaper, more reliable, more abundant, healthier, etc., etc.

Yes, they are so full of advantages that we are investing less and less on them.

Looks to me that the transition is working backwards. And to me the most convincing argument is the evidence.

we are investing less and less on them.

What makes you say that? Solar and wind are still going strong. US sales of EVs and hybrids have plateaued due to dirt cheap oil, but…oil isn’t cheap due to supply limits, is it? And, when oil becomes expensive again, we can expect EV/hybrid sales to pick up again.

The obvious meaning of EV/hybrid sales is that prices still matter. That’s what the evidence shows.

Nick G,

Are you so blinded by your bias towards renewable energy as to ignore the global trend in investments in clean energy for the last 5 years?

We have tried them and found them so fantastic that we don’t want to expend our money on them.

Javier,

Wow!

Knock-out punch.

A few thoughts:

There was a peak in German spending, because they were bringing the industry up to scale.

In part as a result, the cost of solar is plummeting: dollars today buy far more capacity than they did 5 or 10 years ago. That chart would show pretty decent growth if it was in actual capacity added.

Even that $ chart doesn’t show a decline in money invested, just a plateau.

Don’t forget: wind and solar investments are cumulative, unlike oil and FF: we don’t consume them, and they don’t deplete.

FInally, the fact that we’re not investing quite as much as we should is certainly not evidence of their usefulness or lack thereof: it’s evidence of fierce resistance to change from legacy FF industries. We see quite a bit of evidence for this resistance right here on this blog…

Sure Nick,

Besides not being able to trace a trend it is clear that you know how to spread the blame around and make excuses. Renewable energy is so perfect that if we are spending less money it must be the evil Koch brothers fault.

I really wish renewable energies where the solution to the energy problem, alas they are not, and the evidence is pretty clear. The transition is only taking place in some people’s imagination. We are just adding a nice touch of renewable energy to our mix. And it makes the mix more expensive and less reliable. A pity.

it must be the evil Koch brothers fault.

Sadly, they do indeed get a lot of the blame.

“Poor Exxon. They used to be the oil company that everybody loved to hate. This spawn of the Standard Oil breakup had it all: Obscene profits, the Exxon Valdez, a mean CEO who sneered at clean energy, blatant funding for climate deniers.

But now, the new ExxonMobil is just not that special anymore.

It turns out that all the big oil companies are buying elections, paying front-groups to spread lies about climate change and dumping their tiny investments in clean energy while continuing to put out soft-focus ads touting how green and socially responsible they are. And they just don’t seem to care that much about preventing oil spills either.

In these days of peak greed, you have to drill pretty deep in the oil patch to find the worst of the worst.

A real gusher

Well, after coming up with a bunch of dry holes, the environmental and government-reform movements seem to have found the activist equivalent of Old Spindletop: Charles and David Koch.”

See http://transitionvoice.com/2011/02/more-reasons-to-hate-the-koch-brothers/

Hi Javier,

The level of investment will be related to economic growth. You are leaving that out of your analysis. Investment in everything decreases when economic growth slows. A proper analysis would look at investment in renewables as a percentage of total investment.

You clearly are cherry picking to make your argument.

Try again.

Growth Rate of GDP in the OECD from 2005 to 2014 where most of the alternative energy investment has taken place.

Yes, they are so full of advantages that we are investing less and less on them.

Sure. but why do you look at the splinter in your brother’s eye, but not notice the beam in your own eye?

How come everywhere you look you see cuts in the oil patch?

(Bloomberg) — Crime is rising, home prices are falling and food banks are overwhelmed in Calgary as job losses spread. And the worst isn’t yet over in the heart of Canada’s oil patch. Some of the city’s largest employers are poised to cut more jobs in 2016 as they reduce spending for a second straight year, adding to an estimated 40,000 oil and natural gas positions lost across the nation since the crude price rout began 18 months ago.

And the story is pretty much the same in the oil industry everywhere around the globe. The global economy has systemic problems and to highlight a temporary plateau in renewables investment is to miss the big picture by mile!

http://www.rigzone.com/news/oil_gas/a/142243/Calgary_Woes_Spread_as_Oil_Patch_Budget_Cuts_Deepen_in_2016

Dennis,

The graph that I put was global investments in renewable energy. The one that you put is OECD GDP. Is that your example of a proper analysis?

Fred,

Oil is dying and renewable energies are not rising to constitute a credible alternative. That is the big picture.

That is the big picture.

Ok, Javier, I guess were’re all fucked then, may as well have one last big party for New Year’s!

Not all, Fred.

I don’t think the Amish are going to notice.

I don’t think the Amish are going to notice.

That’s ok, I’m not going to party with the Amish. I’m spending New Year’s in South Beach Miami with friends and family.

However it is worthwhile mentioning that the Amish have been using Solar PV for some time now.

Why the Amish are embracing solar

One reason why solar is becoming increasingly popular among Amish communities is the fire risk of their traditional lighting methods such as kerosene lamps and candles – especially for the elderly and younger members of their communities. It also gives their communities the ability to have cheaper, cleaner electricity with the perk of remaining off the grid. In a nutshell, solar is a win-win for the Amish – they remain off the grid, preserving their culture while reaping the benefits of clean renewable energy when needed.

I guess fossil fuel turned out to be too hazardous for them in light of better technology such as solar…

Fred, with regard to the Amish, I imagine that you’re also aware that many cultures have gone down certain techno-systemic paths and ‘sold themselves out’ to ‘dependencies’ that are then hard to back out of.

I also imagine that you’ve heard of David Korowicz who speaks about stuff like that.

I have concerns that this FFueled status-quo-fed fetish for renewables that many on here seem to have a real kinky fetish for may prove to be too S&M/B&D for what can be handled.

As for the Amish, well the concept has taken on a metaphor that seems a bit removed from the reality, and I’ll wrap this post with an interesting quote from CNN:

“The Amish are not at all a monolithic block. There is a patchwork of communities — and there so many of them which are so radically different from each other.

The community that I lived with… does not use cell phones, and would not allow people in their community who are actually members to use cell phones.

CNN: How do Amish communities decide which technologies to allow?

Brende: There are several overlapping factors but I think the most important one is the effect whatever given technology might have on the community and the relationships among the members — whether (the technology) strengthens the cohesion of the community or weakens those ties.

It’s quite clear that Amish groups that monitor technology in a discerning way — with an eye to its effects on the community in the long run — do last longer and have more cohesion in their community. The group I was with had almost zero attrition in their members. They were very watchful of technology. There are Amish groups that adopted the automobile early on and those groups either disappeared all together or became small and attenuated, because the automobile is very destructive to community relations that are based on face-to-face contact.”

Javier,

You never responded to my comments on that renewables investment chart.

The majority of Amish churches decided a long time ago that they will not allow certain technologies since they would disrupt their way of life. When the Automobiles started to become available to the common folks such as the Model T etc. a number of Amish bought themselves cars, until the churches decided that they do not want the changes that this would bring to their society. So the Auto had to be demonized, and made anathema so that no one dared to cross that line. In order that nobody gets around this rule and to apply the same concept to other areas they banned the use of all air tires. So now the devil is to be found in the air inside a tire. Similar rulings were put in place to ban electricity from the grid, but with time many churches allowed generators for shops and farms and some of the more progressive churches, allowing household appliances etc to be run off these generators.

These more progressive churches are the ones that are allowing wind and solar electricity, and so we have a solar boom in some Amish communities, only because their religion does not allow the use of electricity off the grid.

Don’t think for a moment that the Amish are not affected by oil peaking. They rely on driver’s with autos for most of their transportation. Cheap grain and hay, from conventional farmers, to feed their livestock. Factories, and the construction industry for jobs. Walmart and Home Depot and China for cheap goods.

They are in the same predicament as all of us, with a few advantages and a couple disadvantages when it comes to the dynamics of Peak Oil.

“Predicament” isn’t the right word.

“Habit” is the right word. We have a bad oil habit, which we need to break.

Hi Javier,

You are correct my “analysis” was intended to show that investment spending had slowed as I did not take the time to dig up the data, you provided no link and it was hard to determine where you got your chart (too small to read the fine print).

I used IMF data for global investment spending (nominal)

http://www.imf.org/external/pubs/ft/weo/2015/02/weodata/index.aspx

and used the following report to find global investment spending for renewables

http://fs-unep-centre.org/sites/default/files/attachments/unep_gtr_data_file_11_may_2015_amc_lm.pdf

I found the percentage of total global investment spending on renewables since 2004. Your chart seems correct but cuts off the growth phase from 2004 to 2009. The slow down in investment is due to lower spending on renewables in Europe where spending ramped up very rapidly and poor economic performance has led to less European renewable investment since 2011 (in 2014 it was half the 2011 level). Eventual increases in the price of natural gas and coal will reverse this recent (2011-2013) downward trend. In 2014 the percentage investment in renewables was 1.4% and the peak in 2011 was 1.55%.

That’s a very weak article. One thing is this persistent talking about oil glut. EIA figures for world production probably have margin of error well above 1%. That means plus/minus 1 Mb/d. So when they are talking about 1 Mb/d extra production this is within the margin of error of their measurements. So the glut might exist but it well might be not.

I think redistribution of oil production facilities is what in play now. Which started with Iraq and Libya wars and continued with Syria war. Kind of “Disaster capitalism” translated into oil dimension (http://www.amazon.com/The-Shock-Doctrine-Disaster-Capitalism/dp/0312427999). Who do you think will own Venezuela fields in two or three years?

How about predatory pricing with the effect deliberately multiplied via HFT and hedge funds mechanism? Right now Saudis are engaged in predatory pricing. That’s an established fact. Actually the hypothesis that Saudis want to hurt US shale industry is extremely weak: Saudis are the USA vassal state and are in principle incapable of such action without prior approval of the US government. So it looks like the USA shale industry is just a collateral damage of this bombing. Real target of this bombing lies elsewhere.

It will be interesting to see how long prices below $40 persist. At this price level most producers have losses and somehow the situation continues. My impression is that the mechanism to force producers to endure such losses is Saudis + stock exchange HFT and futures.

In any case current low prices is a sign how dysfunctional the international finance system has become.

I don’t think we should be discussing peak oil anymore, it may get around as I try to buy stuff. Can’t we discuss something like miss world?

Miss Oil Country (2015) and Miss Lube Rack (1955).

(That’s Mister Wheel Alignment [1951], upper-left I think.)

Caelan,

Where do you come up with this stuff?

Anyway, not to be outdone by your little Zapatista you posted on the last thread…..

Ah the shameless innocence of children. ^u^

(That one may shape up the immune system.)

Ron, I suspect that the global oil production glut does not exist.

Some of the reasons given to support the glut are interesting:

The Saudis cut prices to protect market share.

The price went down.

US storage increased after imports surged.

The Saudis, OPEC, Russia, refused to cut production.

Industrialized countries storage increased.

Tankers are lined up to unload.

Are massive futures trades and a bit of theater causing the glut? What is your opinion?

Regards.

What is your opinion?

No, I do not think futures traders can cause a glut and certainly not the appearance of a glut if none exist. Glut may be too strong a word but there definitely was an oversupply as evidenced by the storage levels, not just in the US but all over the world.

US storage increased after imports surged.

The Saudis, OPEC, Russia, refused to cut production.

Industrialized countries storage increased.

Tankers are lined up to unload.

That is the very definition of an oversupply, and perhaps even a glut.

There is something of a case to be made for that (no glut)…

It goes something like this – oil production has been declining since the Sauds and Opec decided not to cut production. But in reality, only a few countries have actually increased production since then and it was not by a huge amount. At the same time as production has levelled off, demand for “cheap” oil has been increasing steadily. Moreover, most oil production is measured in boe or barrel of oil equivalents (not all of it is crude oil), and so crude oil production may have actually decreased more than many believe. At the same time, rig counts have fallen dramatically as have investments in new oil projects. It would seem, viewed in a certain light, that oil would be ready to rebound and fairly quickly.

But not so fast. There are many more things to consider, and here are just a few. Look at natural gas and how it has declined for a very long time, and it is not hard to imagine oil doing the same thing. Also, the dollar has been strengthening (which is a negative for all commodities) and Yellen and company appear to want to keep it that way. The world is swimming in debt and this limits economic growth which in turn limits demand for oil. Also there are Iran, Iraq, Libya, Russia and Venezuela – all of which likely have the potential to increase oil production. Unemployment seems to be growing – this subdues demand for oil.

Anyway, just a few things off the top of the head…

Also there are Iran, Iraq, Libya, Russia and Venezuela – all of which likely have the potential to increase oil production.

None of these countries, quoting you: likely have the potential to increase oil production. Every one of these countries are currently producing every barrel of oil they possibly can. Libya and Iran will likely have that potential sometime in the future, but not today. By how much is just not known at this point.

Venezuela has very serious political problems and their production is far more likely to go down than up. But if you think Russia has the ability to increase production you need to explain why your prognostications are better than just about everyone else in the world who are predicting Russia will decline.

Iraq is a big question mark. I don’t think they have much ability to increase production. And their political problems are likely to get a lot worse instead of better.

As for there being no glut, there is a very definite oversupply at the moment. Otherwise supply and demand is a myth. And it most definitely is not.

I was not saying that those countries had the immediate ability to increase oil production – I was looking out a little further than that. In fact, I agree near term that worldwide oil production will decrease for possibly several years, leading many to believe that peak oil arrived in 2015. But the world runs on oil as you are well aware and there is no replacement. Yet peak oil continues to insist upon itself.

I suspect Schumpeter’s gale of creative destruction will play out over the next few years and the implosion of previous ineffective regimes will result in a new upsurge of production. I also suspect there are many changes in the coming years that will catch most of us by surprise, and the new economic order see some standing on a higher and others on a lower rung. Business as usual will not be available to everyone.

I also suspect there are many changes in the coming years that will catch most of us by surprise,

I have no doubt that you are correct. However to assume that these changes will all allow higher oil production is more than a little absurd. It is far more likely that they will be economically very bad news.

Oil production in most of the world is from very old fields that are in serious decline. To assume that all this will be turned around if only we can get oil to $80 a barrel again is truly absurd.

As you have mentioned, much of the remaining oil in the world is located in failed states. When the world needs oil that oil will be produced – by force if necessary. The new world order will not be as “kind” as in previous years.

It takes a lot less effort, to blow up Oil infrastructure, then to build, maintain, and defend it.

Hi Ron,

If $80/b doesn’t do it, then the oil price will rise to $100/b, if that’s not enough, then $120/b, $150/b is about as high as is feasible and I think that would result in more oil output than some believe is possible. It will also not last long before causing either a recession or another oil glut (recession far more likely imo).

the world runs on oil as you are well aware and there is no replacement.

That’s completely unrealistic. Oil doesn’t power the world, it powers transportation, and transportation can run on other things: gas, synthetic fuel, and most of all electricity (which in turn can come from many things).

One of the things I find interesting about Venezuela is that they import natural gas. Canada, for example, uses plenty of natural gas to power its bitumen mining operations. Without natural gas Canada would either have to import NatGas to mine bitumen or alternately burn bitumen, or semisynthetic crude and its end products, to mine bitumen. I feel that Venezuela’s lack of sufficient natural gas will hamper its bitumen mining operations. Just a thought. I’m just spit-balling.

Yes, EROI values for tar sands are bad. It takes a lot of energy to mine bitumen as well as to upgrade it to synthetic oil that can be put into a refinery. And, it also requires liquefied natural gas to turn it into dilbit (diluted bitumen) so it can flow through pipelines. Cost-wise, this may be the most expensive oil being produced today.

What isn’t often mentioned is the rate at which this “oil” can feasibly be recovered. And, almost never mentioned is that Canada’s tar sands oil reserves remain at about 170 billion barrels which is enough to keep the world fueled for less than six years.

Hi Doug,

The Canadian Association of Petroleum Producers forecasts future reserve development. The oil is expensive and it takes time to develop, at the right price these reserves will continue to be developed ($35/b is not the right price, but $80/b might be enough). It will help reduce decline rates, that is all.

Clearly all World output will not be supplied by oil sands output alone. Also more reserves will be developed as the oil sands deplete so the eventual recovered oil sands will be more than current proved reserves as probable and possible reserves move into the proved category over time.

“Also more reserves will be developed as the oil sands deplete so the eventual recovered oil sands will be more than current proved reserves as probable and possible reserves move into the proved category over time.”

Totally wrong. Even the new Alberta government realizes increasing oil sands production is at odds with Canada’s greenhouse gas emission targets. And, if the Feds get their way (which they always do) most tar sand oil will NEVER see production. Some companies involved have already admitted this and stated “reserves” previously slated for development are now permanently stranded. The equation for this decision usually involves economics (especially access to NG) but more-and-more the greenhouse gas card comes into play. Our new (federal) government is decidedly on the green side.

Hi Doug,

That would be good for the environment, but whether these resources remain in the ground, remains to be seen.

Often environmental promises are not followed through, at least in the US, perhaps Canada will do better.

It seems the better policy would be to put a hefty tax on carbon emissions at the well head or mine mouth and let the market decide what will be produced. The Carbon tax could be set at $30/tonne and rise at 5% per year plus the rate of inflation, perhaps the greens ruling Canada will put such a policy in place and let consumers and businesses decide how much to produce and consume at the new higher price.

Unfortunately the US government is not as enlightened so a carbon tax in the US is unlikely to become law as long as there is an ice sheet on Greenland.

Jacobs did a study that found Canadian Bitumen 12% more carbon intensive than European oil production. Or something to that or so. Wells to wheels I believe they call it.

http://www.energy.alberta.ca/Oil/pdfs/OSPolicyReviewPathwayStudy2012.pdf

I read somewhere that a guy from Sanford did a similar study and got 17%. So we can perhaps agree the carbon intensity is 12 to 17% higher for bitumen mining in Alberta.

Given that most of the pollution from a barrel of oil is generated when you burn it and not when you mine it I would think 12 to 17% isn’t gonna keep it in the ground.