The Texas RRC Oil and Gas production data is out. All the RRC data below is through October 2015 and all the EIA data below is through September 2015.

Important: All the Texas RRC data is incomplete, especially the latter months. They will be revised upward as the Texas RRC gathers more data. The EIA data is what the EIA expects the final data will look like.

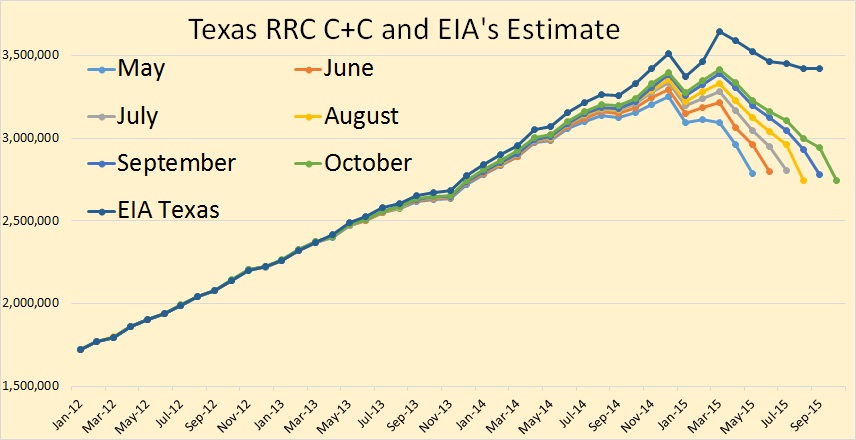

The RRC Crude + Condensate data for October shows a slight decline in October. The EIA says Texas C+C was flat, August to September.

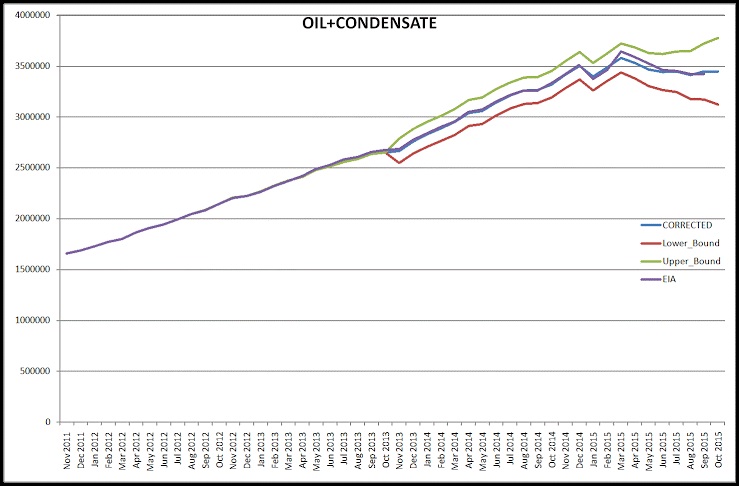

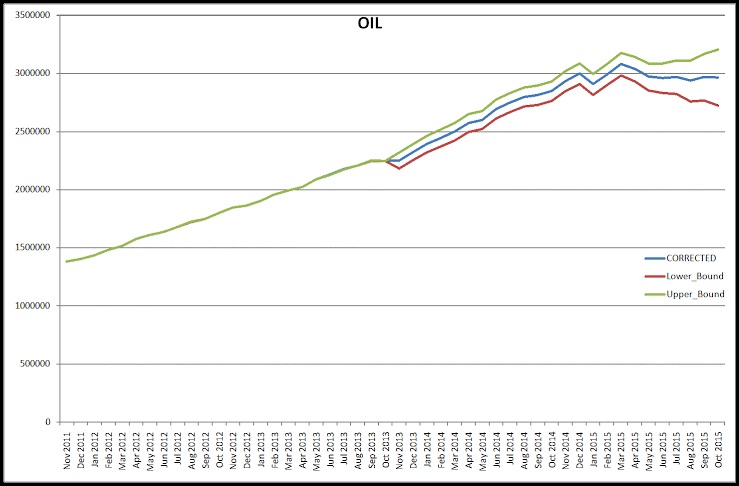

The above chart is what Dr. Dean Fantazzini estimates the final Texas C+C data will look like.

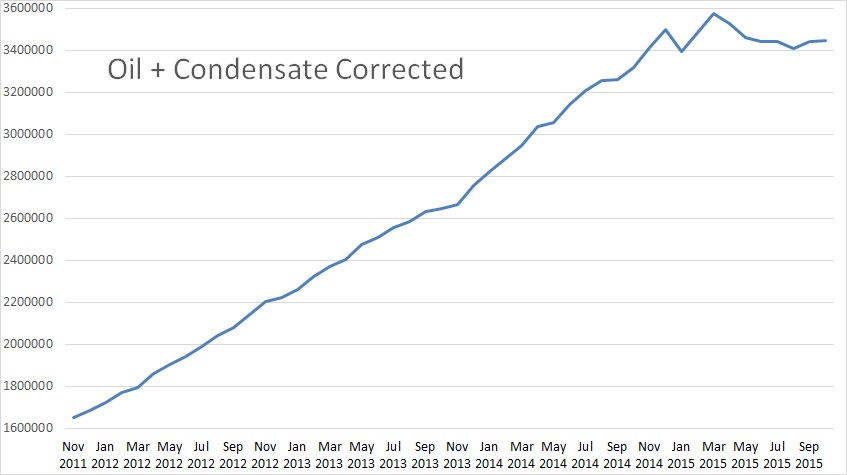

Here I have amplified Dean’s estimate in order to give us a close up of what he expects the final data C+C data will look like.

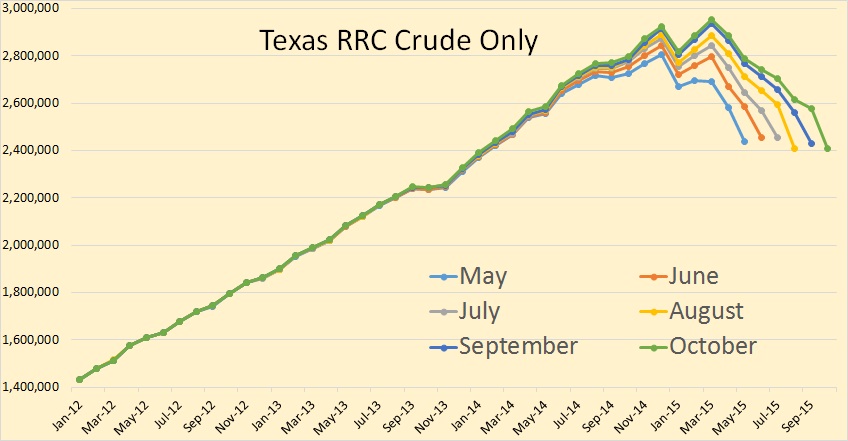

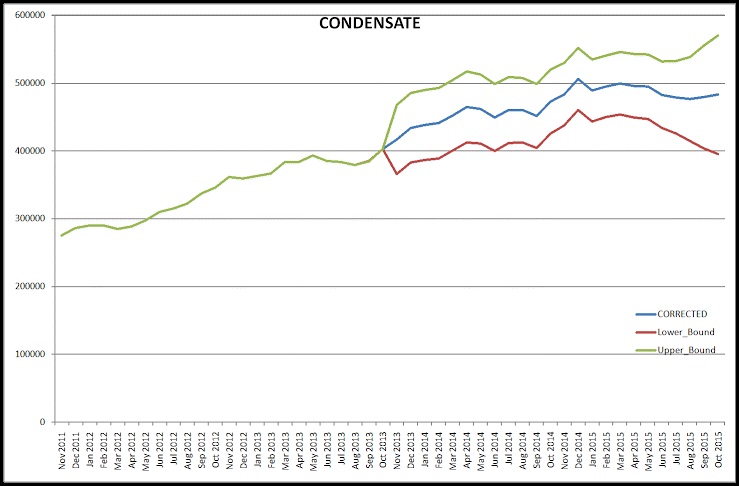

Texas RRC data shows crude only with a slight decline in October.

This is Dean’s estimate of the final Texas October crude only production.

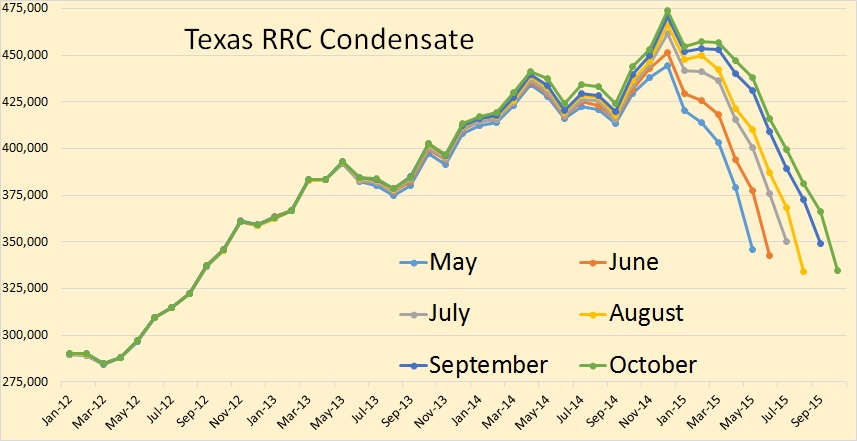

The RRC data shows October condensate a bit lower than September.

Dean however sees a slight uptick in October condensate.

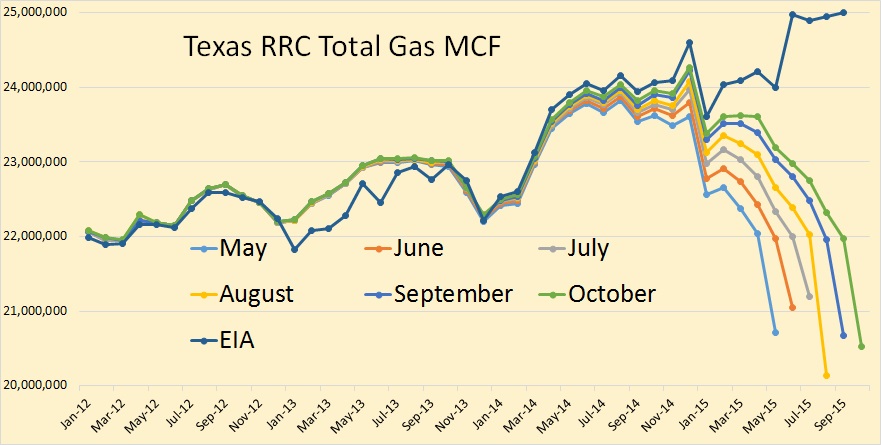

Here we have Texas RRC total gas through October along with the EIA’s estimate of Texas final gas production through September. Notice that the EIA shows a huge uptick in June with a slight down tick in July with a slight uptick in August. The RRC data simply gives no hint that this will be the case when the final data comes in. The RRC data shows a huge down tick in August.

Here is Dean’s projection for the final Texas total gas production. He does not see the huge June uptick that the EIA sees.

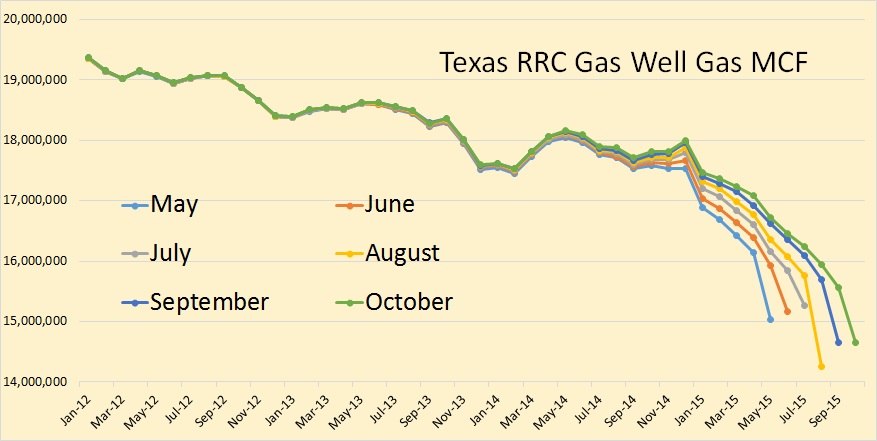

Texas RRC has Texas gas well gas in a slow decline.

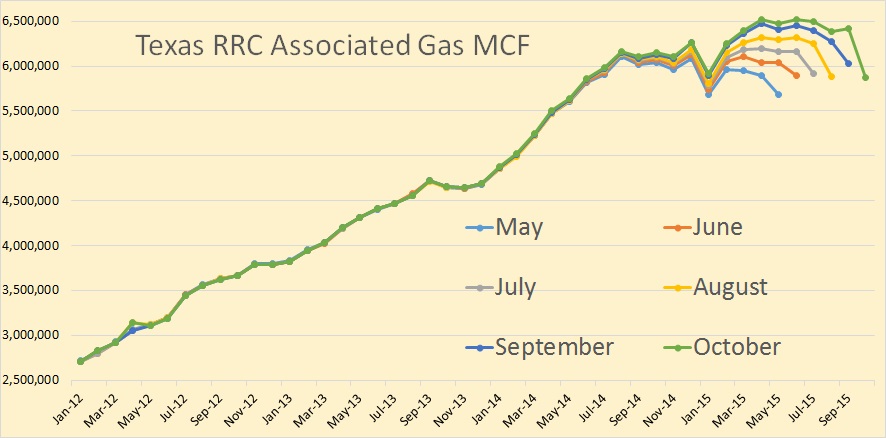

Texas associated gas is what has kept Texas gas production increasing. With the decline in oil rigs and new wells, it is likely that Texas associated gas will start to decline.

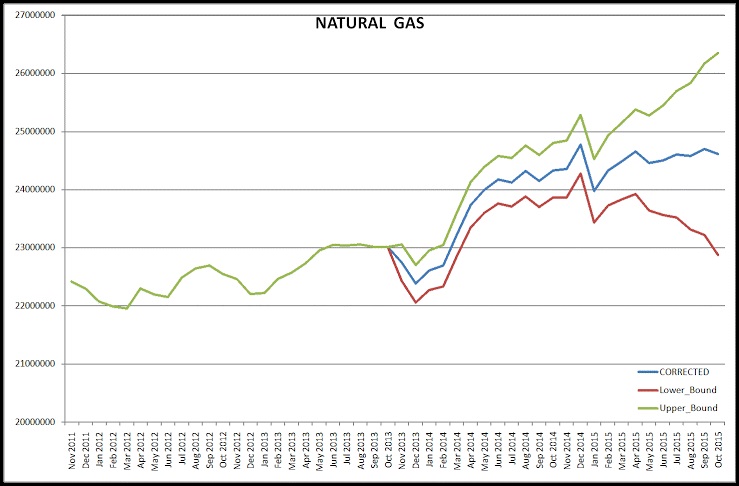

Here is the plot comparing my corrected total natural gas vs EIA: differently from the case of C+C, for natural gas we have much more variability and our estimates diverge a little bit more.

P.S. I am sorry Ron, but I forgot to send you this plot. It will be included in the next monthly update 🙂

Honestly, I do not know where this big jump in June is coming from. Unless the Texas RRC will put forward some major revision in their data in the next months, I find it difficult to justify it this jump by the EIA.

Thanks Ron and Dean,

Looks like Texas output of oil and natural gas has held up pretty well through October as was also the case in the Bakken, I imagine this will change as winter arrives (though it is late in coming in the Northeast US).

Seconded from me to Ron and Dean. The clearest and fairest presentation of oil production data anywhere available. Happy holidays to all.

Best Wishes to All for the Holiday Season. A big shout out and thank you to Ron for this excellent site. Thanks also to Dennis and the key contributors for providing such great information.

Finally, special thoughts for Doug.

Thanks ezrydermike,

I wish everyone a Happy Holiday.

Thank you Ron for a great blog.

What holiday? What’s that? A ‘charade‘ as this pope guy calls it? Hm, maybe for once I agree with someone from ‘over there’.

Holidays can be most days of the year. There is no real reason to crunch it all together like this and work like a bunch of slaves for the rest of the year. We only live once, so embrace your lives and make truth and resolve your new year’s resolution!

Oh, and a polite reminder to get your gifts early this year. Consume for Christ’s sake! That’s why you exist! Give the economy a boost this holiday season, will you? Those corporate wage-slaves in China are counting on it. And don’t wait ’till the last minute. But if you do, you can always trample over people or fight with them for some retail item on boxing day. I guess that’s a good enough name for it, ay? Season’s greetings and God bless.

Aside from that, many thanks; an out-of-pocket toddy to Ron; and also to the participants in their contributions to a great blog, even if I don’t always agree with them and think they are out to lunch.

Lastly, if cheap oil is going away, maybe it’s an opportune time to honestly re-evaluate what really matters in life.

Maybe you should disrobe, run out into the woods, eat some roots and shoots and howl at the moon.

Of course there is always Festivus. It’s for the rest of us. Let the airing of the grievences begin.

“Festivus is both a parody and a secular holiday celebrated on December 23 that serves as an alternative to participating in the pressures and commercialism of the Christmas season. It has been described as ‘the perfect secular theme for an all-inclusive December gathering’.” ~ Wikipedia

‘u’

~ Image of painting below, by Pawel Kuczynski. (Q: How many energy-slaves is the typical angel?)

Dennis and All,

I will be very non PC and wish everybody a Merry Christmas and a prosperous New Year.

4. The repeal of oil export ban and extension of renewable incentives made it into the final version. The ban on US crude oil exports would be repealed, and the administration would be prohibited from restricting exports except in national emergencies and similar circumstances. Also, as part of the agreement on oil exports, the production tax credit (PTC) for wind power installations would be extended through 2019, with a phase-down from 2017 through 2019. The investment tax credit (ITC) for solar installations would be extended for three years, through 2019, at the current rate and would then be phased down through 2021, expiring in 2023 (note that the deadline has also been changed, so that it now applies to projects where construction has started by the expiration date, rather than being put into service by expiration). This represents a significant win for the renewable sector, as discussed in our recent report. Refiners, which are negatively affected by the oil export ban, would get limited consolation from a tax benefit for independent refiners. The bill would also extend the existing biodiesel credit for two years, through 2016, but it does not appear to shift it to a “producer” credit as the Senate had proposed.

Phase outs imminent and already partially applied.

Question for Dean and Ron

When I look at the RRC September 14 production on the latest October C + C chart, it appears to be about 3.2 Mb/d. The EIA production number is slightly higher at about 3.25 Mb/d, a gap of roughly 50 kb/d. How does that gap close? Clearly the RRC production numbers are slowly increasing. At what point do the EIA numbers merge with the RRC. There is still a slight gap between the RRC and EIA data in September 13 on the latest C+C chart. Does it really take two years to know how much C + C Texas produced? Who has the best info.

Hi Ovi,

a summary of the problem with the delay of Texas RRc data can be found on my page:

https://sites.google.com/site/deanfantazzini/nowcasting-texas-rrc-oil-and-gas-data-ongoing-project

Regards, Dean

Ovi, what you see is what you get. The gap closes a little each month, and yes it takes as long as it indicates on the chart to close the gap. But it closes much faster in the in the latest months. The difference in September is almost half a million barrels per day. The difference in January is now one fifth that amount.

The merging of the data happens exactly as you see it happening on the chart.

Thanks Ron and Dean

In ten years time I doubt very much most people around the world will care about small changes in shale oil production.

The United States uses 19 million barrels of oil per day. The same population in Germany, Great Britain, France, Poland, the low countries and Scandinavia use 10 million.

The United States could reduce it’s exorbitant consumption by firstly having the sort of extensive bus services that most European countries have. Ever time a train system can be built up and people would still get to work etc without any real hardship.

http://www.bueker.net/trainspotting/map.php?file=maps/germany/germany.gif

The real problems facing the world are far more difficult to adapt to.

http://www.worldwildlife.org/threats/overfishing

85% of fishing stock is being over fished and many stocks are collapsing, billions of people will be effected.

http://www.theguardian.com/environment/2015/dec/02/arable-land-soil-food-security-shortage

Due to over plowing, over use of fertilizers and not allowing land to lie fallow, vast areas of arable land is being turned into waste land or lost.

You tell’em Pete!

The usa simply needs to use a fuel tax that climas gradually to make gasoline cost $8 per gallon in today’s dollars, in say 20 years. That should give people time to adapt.

Hi Fernando,

Agree 100%. Probably something similar (half the level in tax per unit energy) on natural gas would make sense (lower because natural gas pollutes less) and on coal maybe double the tax level per unit energy compared to oil (because coal pollutes more).

Though if we could manage to get the tax on fuel it would be a start.

I also think the deal might be sweetened by gradually eliminating subsidies for renewables as the fossil fuel tax ramps up, might enable more moderate politicians to sell it to their constituents.

Compromise can be a beautiful thing as it allows us to make small positive changes.

I would take some of the fuel tax money and give a tax credit to oil produces. To make up the difference of oil sold under $45 a barrel level. It would be a mistake for these guys go bankrupted.

With all this talk of cars, highway infrastructure, taxation, wars, refugees, debt crises, climate change conferences & issues/disagreements, so-called renewables, oil industry (etc.) job cuts, and oil price rises/decreases/volatility, etc., it should be interesting to see how the bloatmeister ungovernment that was built up on cheap oil manages it all, along with its industry symbionts, in the face of peak oil and declining exergy and increasing entropy…

If I was an anthropologist of the far future with access to a time machine, I’d kill to be right here and now.

Caelan, you don’t need to kill or live your life in your 6 year old imagination. You are already here right now. Make something of yourself with the one and only opportunity you have.

Ya, no kidding. That was part of my point. Did you not get that the time machine was just a leveraging of one of this infantilistic culture’s literary/imaginary devices?

But now that you mention it, making something grown up of oneself might include transcending that very cultural infantilism that, incidentally, seems to need false or otherwise-dubious ‘leaders’ and ‘chiefs’. I certainly don’t, and might even be ok with farting in their general direction. Maybe even literally. If you catch my drift.

Emergency Opec meeting aired as Russia braces for sub-$30 oil

“Oil markets are becoming dangerous with no grown-up in charge. Spare capacity is wafer-thin, despite the glut, and any upset could trigger an oil shock…”

Disagree on subsidy for oil producers. The guys that don’t know the game should lose.

That is the way capitalism is supposed to work.

Indeed! A carbon tax should be similar to the one in British Columbia. Users are taxed and the tax is returned to the public relatively uniformly. People who use less carbon save money; people who use more lose money. Net cost to the public as a whole is zero.

Hi Joe,

It could be returned to the public or used to pay down public debt, up to elected officials and what they believe their constituents will prefer.

I agree about the fuel tax.

I think it should be phased in over no more than ten years or so. That would give people plenty of time to wear out existing cars and trucks that are less than “easy on gas” and notice enough to pay some serious attention to fuel economy when buying a new vehicle.

Unfortunately a hell of a lot of the infrastructure in the USA has been built on the ” cheap gasoline forever” sprawl model, and we are going to have a hell of a hard time getting our per capita consumption down anywhere close to European level.

But we will eventually get down to current day European consumption levels, even as Europeans do even better. We aren’t going do it just because we can.

We aren’t going to have any choice.

Fortunately people are not so slow to adapt to change as the naysayers think, when it comes to such things as driving a pure electric or a plug in hybrid car.

The range limitation and charging time arguments are imo going to go the way of the DODO bird pretty damned quick, so far as the majority of two and three car households are concerned, when gasoline prices go up past four or five bucks per gallon, and as electrics get cheaper, compared to conventional cars..

Most of the people I know with two or more cars , and I believe this applies to most multi vehicle households, own at least one car that is used almost exclusively for commuting and running local errands.

When gasoline prices spike, and the threat of RATIONING raises it’s head, people with two or three cars will be VERY happy to consider buying a car such as a LEAF or a VOLT or any one of the dozen other models that will soon be available.

Someday somebody is going to load a self propelled artillery piece or a full fledged tank on a small ship, or maybe even a very large pleasure boat or work boat, and intercept a couple of supertankers in a narrow spot, and sink both of them.

Oil tankers aren’t armored, they don’t have military grade fire fighting equipment, and they don’t have military sized crews to operate that equipment.

The bad guys already have possession of quite a few such heavy duty weapons.

Some guys I know well, retired soldiers, who put in their twenty years playing with big guns, tell me that sinking a tanker would be a piece of cake if they could just get within range of it.

Get within three or four miles, broadside, and in five minutes they could fill it full of holes, and set it on fire, from end to end.

History ain’t over.

We live in interesting times.

A few more years down the road, if I am still functional, I will own a good sized pv system, and a plug in hybrid light duty truck, or at least a plug in car similar to a VOLT.

It’s a good idea: I’d phase it in over 6-7 years.

The average car is only kept by it’s owner for about 4-5 years. For every new car sale, there are about 3 used car sales.

So, 6-7 years would give people plenty of time to adapt by changing vehicles.

Take the average and make it 12 years, 10 years sounds good.

Peter, just out of curiosity, are there any countries in Europe that are populated, per square mile, like: Montana, Wyoming, North Dakota, South Dakota, Nebraska, Kansas, Oklahoma, Texas, Utah, Nevada, New Mexico, Arizona, Maine, Oregon, Washington, Idaho, etc. If someone, say in Germany or France, wants to go home for the Holidays, how far is their average trip. How about in the US where people are scattered hundreds, if not thousands of miles apart.

Comparisons to Europe are useless.

Hi Clueless,

The majority of the US population lives in fairly densely populated areas and can be served by public transportation, there is more to the problem than public transportation.

Energy is very cheap in the US so it is used less efficiently. This will change.

I love public transportation.

I live in a country that has abundant public transportation.

Although I have a car sitting out here, I hardly ever use it. Public transportation serves my needs quite nicely.

As far as I’m concerned, the quicker the private automobile becomes obsolete, the better.

Hi Glenn,

I agree, especially electric rail and train and possibly city busses on overhead wires. Long haul busses that have most seats filled are a good bet as well. A lot of city busses do not do well in MPG per passenger. in the future, small EVs may be more effective in terms of energy use per passenger.

A combination of decent public transportation (in more densely populated areas) and high efficiency plug in hybrids may be a bridge to take us to a world with lower fossil fuel use. Eventually the World will be forced to get there because of depletion, it will be hard to accomplish in a short period of time, we should get started.

Yeah, trains are good but they aren’t the answer to everything: it takes a long time to expand their capacity, and many places aren’t dense enough to make sense.

Buses aren’t any better than cars, for average fuel efficiency. That’s because you have to serve everywhere 24×7, so you have a lot of badly under-utilized buses.

EVs, Extended Range EVs, and hybrids will be the answer for most people and most trips.

Nick G,

Are you seriously going to try to tell me that a bus that gets 6 MPG and hauls 60 passengers is less fuel efficient than a car that gets 25 MPG and hauls 5 passengers?

Obviously you’ve never lived in a place where the majority of the people don’t have private cars and must rely on public transportation. The buses don’t run 24 x 7. In the event that a person must go somewhere at night, they take a taxi. And when there are few private autos, there are taxis available at all hours.

I don’t understand this love affair you have with the private automobile. Surely you’re past the age where you believe a car is going to help you get laid.

Yesterday i was watching an old movie. Humphrey Bogart and Lauren Bacall in “The darkest passage”. Not very good, but I hadn’t seen it before. I was surprised that Boggey bought a bus ticket at SF to go to Phoenix, AZ and when he asked about departure time was told to sit down until enough tickets were sold. That was San Francisco in the US like 75 years ago. It looked to me like a third world country today. But it makes perfect sense that in a not very rich society resources are maximized at the expense of convenience.

The average existing bus gets closer to 3.5 MPG, and the average ridership in the US is much lower.

No, I wouldn’t recommend an ICE car – an EV is far better than a bus.

One of the reasons poor people don’t have much time or flexibility to read to their kids, or go to their school events, or a million other things, is that they’re dependent on mass transit.

I love trains for commuting or interurban trips. But ad hoc travel, or travel that’s outside main routes? A nightmare.

Taxis? Yikes: slow, hard to get outside urban centers and expensive. I have hopes for Uber, car sharing, and self-driving cars. But, we’re not there yet.

Nick. When I was a kid in the ’30-40’s, I and my buddy’s hitched all over with never a problem. It was SOP to just go out to the road and stand there with thumb up. People went cross-country that way.

Later, in college, after finals, all of us trooped out to the highway, stood in long but fast moving line, hitched rides home. One in front of me always got the Buick and the lady in fur coat, and I got the next one – smelly manure pickup driven by guy unacquainted with baths.

Same thing in Africa when I did business there much later. I rent a car, start driving, and pretty soon car full of locals, having partytime, and jumping off to immediately fix anything needing it, like out of gas or flat.

Cooperation is much underutilized but highly effective survival skill, forgotten only recently in our addiction to ff’s and GM propaganda.

I agree. It was still that way in the 70’s, but things have changed since. Now in the US, people are scared of you – it just doesn’t work.

So I am told. Wonder if true, seems to me unlikely that average person has changed much.

Anyhow, easy to see lots of ways to assure rider/driver that the other is a genuine human, and not any kind of nut.

After all, even my lowly Leaf will start only when the genuine me asks it to.

Uber is a start. They’ve started a carpooling function.

Other apps like that, which prequalify users, would work. I believe there are some out there, though I have the impression that they’re having a bit of a hard time getting traction.

Clueless

That is a fair point, but my guess is no studies have been done in Montana etc about where and how often people drive.

With that knowledge rail lines can be built and interconnecting bus routes laid on.

In less densely populated areas of Europe people often drive to the closest town which has a train and continue their journey from there.

http://www.railway-technology.com/projects/toursbordeaux-high-speed-rail/

People in Europe do travel long distances to work and do use public transport if it is there.

Peter,

There is a reason why the United States has only about 5% of the world’s population but uses something like 25% of its oil. It came about as a result of many decades of brainwashing.

The brainwashing began in the 1930s.

Here is a link to a video that gives an idea of the kind of propaganda Americans have been subjected to by the automobile industry, working hand-in-glove with the petroleum industry, for the past 75 years:

After 75 years of this kind of PR it is nye on impossible for someone like Nick G or oldfarmermac to think outside the box, or to imagine any future not dominated by the car culture. The programming is complete. We may not have very happy people, but we do indeed have very happy cars. See, for instance, oldfarmermac’s comment below:

http://peakoilbarrel.com/texas-rrc-oil-and-gas-production/comment-page-1/#comment-551663

Much of the future imagined in the 1939 GM positivist puff piece “Futurama” came true, especially the part about suburbs, roads and freeways. But there’s now trouble in paradise.

Futurama — “the great American way” the film also calls it — has collided head on with reality, and the empire of consumption has a cold, which could easily become pneumonia. The dream of Futurama now runs the risk of morfing into a nightmare. Nevertheless, the futurists cling to the dream like a drowning man in stormy seas clings to a life raft.

Those who have lived outside the US, in places where most people use public transportation, can immediately recognize that most of the arguments put forth by Nick G and oldfarmermac are specious. Their arguments fall into the Margaret Thatcher type of argumentation: TINA (There Is No Alternative!) But as you and I know, there are alternatives, and quite good ones.

Mexico uses less than a third of the oil per capita than what the United States does, and people manage to get around just fine.

http://www.indexmundi.com/map/?v=91000

Imagine that!

…

Here’s what GM, in 1939, imagined the future to look like.

And this.

And this.

And GM’s imagined future, as it turns out, largely came true.

Mexico uses less than a third of the oil per capita than what the United States does, and people manage to get around just fine.

Are you kidding me? That’s your argument? All we have to do is reduce our economy to the same level as Mexico’s and we will manage to get around just fine on a lot less oil?

Well you do have a point. Those Mexicans flooding across the border are not driving Cadillacs, or even Chevrolets. They are walking on worn out shoes or are barefooted. The question is, are they getting around just fine?

Ron,

So what’s your argument? That the United States can continue BAU?

I just don’t see how a country like the United States that has run a cronic trade deficit for over four decades, much of it due to imported oil, can go on forever.

Will there never be a day of reckoning?

Will the magic of renewables technology save the day, so that Americans will not have to alter their hallowed “American way of life,” or take a hit to their standard of living?

Glenn, don’t try to change the subject. It’s not my argument, it’s your goddamn argument. The statement that the Mexicans are getting around just fine is just stupid. They are not.

No, we cannot continue with BAU. My argument has never been that we will continue with BAU. But my argument has never been we that will do just fine with a lot less oil. We will do terrible on less oil! And coming down from BAU will be just god awful. We will not do just fine.

Ron Patterson said:

Have you ever been to Mexico?

Do you have any knowledge of how the transportation system in Mexico operates?

I very seldom use my private automobile, and yet I manage to get around just fine, all with public transportation.

And if we look at empirical surveys of why Mexicans go to live in the United States, better transportation isn’t among them. Surveys consistently show that over 90% of the Mexicans who go to live in the United States go in search of employment.

http://www.eumed.net/tesis-doctorales/2009/adg/Causas%20de%20la%20emigracion%20de%20Mexico%20a%20Estados%20Unidos.htm

Public transportation in Mexico is far superior to that in the United States, at least if moving people with less energy is the criterium.

Yes I have been to Mexico.

Glenn, you still do not seem to understand why your argument is so stupid. Your argument is:

Mexico uses less than a third of the oil per capita than what the United States does, and people manage to get around just fine.

The implication is that Mexico uses less than one third the per capita oil as does the US because they use public transportation. That is implicit in this question:

Do you have any knowledge of how the transportation system in Mexico operates?

Mexico uses less than one third the per capita oil as the US, not because of their transportation system but because of the abject poverty of its citizens.

It is called the “Fallacy of Irrelevant Thesis.”

Just for reference.

Per capita GDP:

Mexico $10,326

U.S.A. $54,629

Median Income:

Mexico $4,910

U.S.A. $30.616

Glenn, where are you in Mexico?

Ron,

So you don’t like the Mexico example?

Then how about the UK/Eurpean one that Peter pointed out in his comment above?

The United States uses 19 million barrels of oil per day. The same population in Germany, Great Britain, France, Poland, the low countries and Scandinavia use 10 million.

http://peakoilbarrel.com/texas-rrc-oil-and-gas-production/comment-page-1/#comment-551611

The bottom line is that other countries, including Mexico, do a much more efficient job, energywise, of moving people around than what the United States does.

And one of the reasons they can do this is because of more fully developed public transportation systems.

Caelan,

I live in Queretaro, which is about 120 miles north of Mexico City.

Glenn, I do not dispute that the USA has an exceptionally poor public transportation system. That was never in question as far as I was concerned. The point is you gave a very absurd example of the efficiency of Mexico’s public transportation system. That is that they use one third the per capita oil use as does the United States.

No, no, no… that proves absolutely nothing about the efficiency of Mexico’s public transportation system.

And if you cannot see that this was a fallacious argument then there is there is no point in ever debating anything with you again.

If you are going to make a valid argument Glenn, then use valid examples, not bullshit like that.

Ron,

Let’s back up to my statement that you took umbrage to:

Mexico uses less than a third of the oil per capita than what the United States does, and people manage to get around just fine.

Here’s what I meant by that statement.

Mexico is covered with an elaborate web of bus routes. One can get from just about any Podunk to any other Podunk using this web of buses, and the cost is very low.

For instance, let’s say I want to go from my house in Queretaro to downtown San Miguel de Allende, a small town located about 45 miles from where I live.

First I walk to the bus stop which is a couple of blocks from my house. From there I take a local bus to the long-distance bus terminal.

The cost is 4 pesos, or about $0.24 USD.

The local buses look like this, and are fueled by natural gas.

These buses run about every 5 minutes, so there is never much of a wait.

From the Queretaro bus terminal I take a long-distance bus to the bus terminal in San Miguel de Allende.

The cost of this leg of the trip is 40 pesos, or about $2.35 USD.

The long-distance buses look like this, and they run every 30 minutes or so. The wait time is therefore never too long.

These buses are operated by private companies, which are for-profit enterprises that receive no subsidies from the government.

Then when I get to San Miguel de Allende I take another local bus from the long-distance bus terminal to downtown. Again, the cost of this is about $0.25 USD, and these buses run every few minutes.

The total cost of the trip: $2.85 USD.

So like I say, people in Mexico manage to get around just fine, without private automobiles, and for a pittance of what it costs to operate a private automobile.

This is what happens in poor countries like Mexico where most people can’t afford the luxury and exorbitant cost of a private automobile.

Now compare that to the United States. Let’s say I wanted to go from San Antonio, Texas to Lockhart, Texas, using public transportation. Well of course I couldn’t, because there is no public transportation connecting these two points. The only way is by private automobile, which is very costly and very inefficient, energywise.

“I live in Queretaro, which is about 120 miles north of Mexico City.” ~ Glenn Stehle

Cool, how do you like it?

Caelan,

I love it. I can’t imagine moving back to the United States.

But I must admit that I don’t like it as much as I did when I moved here 15 years ago.

Since then, the population of Queretaro has about doubled, from a little less than 1 million to a little less than 2 million. So it has much more of a city feel to it than it did before.

Mexico is very rapidly becoming globalized. There has been a proliferation of consumer credit, which didn’t exist before. People who are not indebted have a completely different outlook on life than those who are indebted.

And the city planners have copied the American model. There’s a great deal of urban sprawl as living in the perifery (sort of what in the US we would call the suburbs) and big box stores and shopping malls have become stylish. And of course the dream of every poor Mexican is to have his own private automobile, so the traffic is much worse.

The security situation has also deteriorated greatly. I used to be able to travel anywhere in Mexico I wanted, as it was very safe. I could go to the most remote of little villages in my explorations. I would no longer risk that. There are a lot of don’t-go places where one can get in trouble right quick, and without even looking for it.

You, as an anarchist, I think would really enjoy exploring some of the indigenous communities. Many of them have managed to preserve some of their traditional values and communal way of life, which is about as far from capitalism and as close to anarchism as one can find these days.

I’m unsure we realize exactly what’s in store for us after the peak… which could be right now…

The casual talk on here about fuel, etc. taxation for example… This of course makes all kinds of implicit assumptions that I’m unsure those who make them are entirely aware of. They throw it out anyway, like at a party over drinks, but to the exclusion of adequate analyses of the intricacies of the system.

For example, you can’t pay for fuel or taxes without a job (another kind of money sink/knock-on effect for ungovernment)– at least one that feeds into the large-scale ungovernment– that was built on cheap oil, along with many jobs (for the mere maintenance of complexity), not on increasingly-expensive oil or on ‘renewables’.

For another, you can’t run this kind of society on an entirely-new renewable infrastructure that doesn’t actually exist, even if the current grid could handle it.

Threads

(“But the connections that make society strong, can also make it vulnerable…”)

Caelan,

You make an excellent point.

In the United States, or anywhere as far as that is concerned, what are the possiblities of decoupling the aggregate economy from the oil economy?

It seems like we should be able to make some progress in this direction, but how much, and at what cost?

what are the possiblities of decoupling the aggregate economy from the oil economy?

The ground transportation part is pretty straightforward. Electrify trains, short range trucks and passenger cars. Move freight to rail.

That takes care of about 80% of fuel consumption.

Hi Glenn

In England homes within walking distance to a rail station go for a premium. When a rail line was electrified and train speeds increased, house prices in those towns went up. Driving for an hour or 2, working all day and driving home in the dark and rain is exhausting and dangerous.

Also average fuel consumption in the US is 28 per imperial gallon in the UK it is 50. Just there the US could save 5 million barrels per day without any additional public transport.

At $7 per gallon.

http://www.bloomberg.com/visual-data/gas-prices/20152:United%20Kingdom:USD:g

No one in the UK buys things like this.

http://www.ford.com/trucks/f150/

Peter,

Yep.

From the Bloomberg article you link:

No one can compete with the U.S. when it comes to burning gasoline. Americans guzzle 1.2 gallons per person per day, more than any other country by a long shot.

But as President Bush famously said back in 1992, “The American way of life is not up for negotiations. Period.”

http://www.ipsnews.net/2012/05/us-lifestyle-is-not-up-for-negotiation/

One of my favorite cities is Paris France. Inside the peripherique it has a close to perfect level of density. Having shops at street level with offices and residences above make for a very livable city, and I absolutely love the Metro. It is much more convenient than a car.

I would very much love to live in a city such as Paris where I wouldn’t need to own a car. As it is, my house is within a half mile of the city center of my town, so I can easily walk or bike to most places I need to go. I love that, but there is no way that I can get by without a car. It is a necessity.

We do have a decent transit system of buses, light rail, and commuter rail. I use it as much as possible when I need to go further than is practical under my own power. I do this by choice. It would be more convenient to drive.

But I’ve lost my idealism about transit. One Saturday I had to wait two hours at the rail station for the next homeward bound train simply because the bus I took to the station ran 15 minutes late. I missed the train by five minutes.

That’s one anecdote of many. There is always something or other going on with it. It’s kind of a crap shoot really. You might get to where you need to go near the time you need to get there. Maybe.

So, it takes twice as long, and if there are two people travelling together, it costs more than taking a car, and that is just the fare, which is about 20-25% of the actual cost. The bus and the heavy rail are diesel, so they aren’t clean either.

In my opinion, electric cars change the whole equation. In dense cities private automobiles make little sense, but transit, taxis, bikes, and feet work great, but what do you do with vast medium areas like Atlanta, Houston, Phoenix, or low density suburban sprawl? These areas were built for cars. It’s a dumb thing, but it’s the dumb thing we’ve got.

Which will be cheaper? Abandoning all of this built environment, or switching to electric vehicles? Sure, roads are expensive and need oil to maintain, but asphalt these days is pretty much 100% recycled, at least in my region.

Electric cars have a lower total cost of ownership right now, and I suspect that within ten years EV’s will just be flat out as cheap or cheaper than combustion cars to buy. That will change everything.

The U.S. guzzles 1.2 gallons of fuel per car per day, as Glenn noted. That’s a daily range for one car. 107 square feet of solar PV provides sufficient power for that much range – six panels – about the same area footprint as the car.

For every 19 electric cars on the road, that is one less daily barrel of required oil. That is a barrel of oil that can be used for some other purpose, like manufacturing PV or wind turbines, or to offset production declines.

I think Ron is very likely right. Human nature has doomed us. We are in overshoot and we will collapse the ecology of the planet upon which we depend, As an isolated question on its own however, I fail to see why a transition to renewably powered electric transport isn’t feasible with the technology we have now at the prices we will have soon. The fleet turns over every fifteen years.

Economy, politics, social inertia and social upheaval may very well prevent it though.

We shall see.

Hm. What I see right here and right now is far more hopeful.

Local bank will give interest-free loan for purchase of EV.

EV club has formed to buy in bulk, share rides, provide ICE when longer range needed.

Local group writes op-eds giving facts and figures justifying EV. I and other EV owners contribute to this with actual daily experience.

We drive about 20 mi./day, and average about 4.2 miles/kw-hr. Oddly enough, provided by 6 PV panels.

As I keep saying, I am guessing that the average citizen of USA could get along nicely on maybe 10% of what we use today, given a little sense in using what we have right now in our energy tool kit.

Reason – we are world champion wasters, so easy to get to be less so.

Local group is getting together to put up big PV array a short distance out of town on a “reclaimed” coal field, and is dickering with grid owners to allow special rates to EV owners who are planning to demand only solar/wind from the grid.

Wimbi, you are a green socialist! You are living in a fantasy world. Alternative energy doesn’t work. Give it up already. The only solution to all all our problems is more oil! I guess it’s just too bad that we are near or at ‘Peak Oil’… 🙂

Ahh—

“When ignorance is bliss, ’tis folly to be wise”

Us hillbillies are having lotsa fun in our fragrant little cloud of fantasy, and hey, way cheaper than dope anyhow.

And all grown locally, too.

Um, just like the dope.

Rather unexpected U.S. rig count.

Oil rigs: +17

Gas rigs: -17

Here is the total Baker Hughes Rig Count

I read a comment on SA, and this was also my impression after looking at the Niobrara, that it is up to the operators to classify what their rigs are drilling(gas vs oil). Especially in gassy plays like the Niobrara and Cana rigs may be reclassified between the 2 categories while drilling similar wells.

Enno,

I was also thinking that some rigs may have been reclassified from gas to oil.

Besides, some operators may have to start drilling before year-end to retain their leases.

In any case, I don’t think that the unexpected increase in oil rigs signals a change in the declining trend.

We built our cities wrong. And with every new Target or Wal Mart we make it worse. We will never be able to build an efficient public transportation system that can serve most people without first taking apart the massive sprawling infrastructure and 3 acre lots that ring most of our cities and even our medium sized towns. But that’s no reason not to start building public transit infrastructure where we can. Some places aren’t without hope.

Warning, this comment is not for those into sound bites. 😉

There is little doubt that mass transit is cheap and energy efficient, if the population density is high enough to make it work.

I have lived in a couple of cities, and used both buses and subways, but avoided them when possible. The buses ran on a hub and spoke arrangement, and it took forever to get where I wanted to go most times.

Furthermore except at peak hours, they ran only every half hour, or every hour, and not at all in the wee hours. Taking a cab ONCE cost as much as gassing up my car for a week, not to mention standing on the street a block from my place waiting for the bus.

And while the per passenger per mile fuel economy of a full bus is superb, the fact is that a hell of a lot of buses run almost empty, a lot of the time, with half a dozen or fewer passengers during the off hours being quite a common occurrence.

Nick might be right about the fuel economy of a city bus fleet compared to the fuel economy of autos, taken all around. The bus company is generally compelled to provide service when customers are few and sometimes non existent.

When I was into real estate, being CLOSE to a bus line was actually a detriment in terms of renting or selling a house. The sort of tenants you wanted could afford cars, and had drivers permits. The poor folks tended to cluster along the bus routes, and hold the crappy downtown jobs. The trend as a result was that the closer you were to the bus route, the more apt the neighborhood was to go slowly downhill.

But at least the buses DID them TO WORK and BACK HOME without transferring , and in a reasonable length of time. They ran quite often at rush hours, not much more than five minutes apart in some parts of town.

And for somebody who COULD get by without a car, they were a REAL bargain.

The people able to do so simply moved away.

I know this situation is reversed in some cities where congestion is really bad, and a lot of well paid people use the buses. Gentrification happens too. Just not every time.

I am in favor of buses and subways etc but agree with Nick that they are not going to be the answer most places in the USA in the medium term.

First off, it is entirely possible to buy a car, if you need one anyway, that takes you where you want to go, in the city, for an incremental cost that is only a minor fraction of the cost of a bus ticket. A Prius would have gotten me from my apartment to campus a whole week, just for the gasoline, for the price of one days bus tickets. Consider the time and convenience factors, and it is easy to see why I drove my old junker car to classes, because I had to have a car to get to many various places the bus simply did not go. Places I WANTED or needed to go.

Now consider the infrastructure and sprawl problem, and let’s think a little about how it can at least be minimized, if not actually solved.

Zoning can be revised to allow businesses to go where the people are.

There is no real reason why hair dressers, lawyers, dentists, self employed service men such as plumbers, etc etc should have to locate in commercial districts, and kept out of residential neighborhoods.

We could see the return of the delivery boy, with the internet and smart phone and shopping apps making it really easy for the supermarket to box up your groceries, and deliver them within a fifteen or twenty minute window, for a very modest fee, or no fee at all.

There really isn’t any reason we should not get snail mail on alternate days, and get by fine with half as many postmen and mail carrying vehicles. Just don’t rehire any that retire, until the goal is met.

People that have houses close to the jobs that cannot be moved into neighborhoods are going to retire and die, and the people who buy have need of houses close to such jobs will buy them. I have half a dozen new neighbors within a few miles who sold out in northern Virginia for megabucks and moved here to the sticks. All of them sold to somebody who really needed to get close to the federal action in and around DC.

A good many small businesses can actually be operated from a residence these days with nobody even knowing or giving a damn, and such businesses are going to get to be a lot more common.

The engineer I use has a desk and a phone in town, but you have to make an appointment to see him in his office. Otherwise he stays home, and you get him on his cell phone or by email. My physician’s commute time is ZERO, he lives above his office, in a rural area with no zoning restrictions, except for heavy industry.

There is no real reason we could not allow people to use their personal cars to provide public transportation, other than the vested interests of cab operators and bus companies, etc.

I could see somebody running a bus from my neighborhood to the small town near where I live every morning, to the industrial district, getting there at six thirty so everybody can be punched in at seven, and another to the business district getting there at seven thirty so everybody can be at their desk by eight.

The owner operator of such a bus could make out like a bandit and still charge less than half as much as a city operated bus. He would park it and go to work just like his passengers ya see. And any way there are no city buses in my local small city . And if there were, the city would not run them out to my neighborhood ten miles from the nearest traffic light anyway.

And speaking as a sometime gearhead, I can say without a shadow of a doubt that two hundred mpg equivalent cars that will last just about forever are easily within the reach of most suburbanites with their own McCastle today, and that any major car company could have them on dealers lots in three or four years, easy as pie.

There are ONLY TWO real reasons you cannot buy such a car today. No car company is willing to build them, because the public is not yet ready to buy them. ( They would be very small, and very unfashionable, nerdy nerdy cars, two seats only fore and aft, and not very peppy. )

The other reason is that our safety mommies will not ALLOW them to be built. THEY would rather see us on bicycles or motorcycles than allow us to own a really small cheap car.

I hope anybody interested will post additional suggestions, I am writing a book. Seriously. 😉

And thanks to Ron, and this fine blog, I am getting the benefit of lots of expert technical and social commentary free of charge. 😉

“allow us to own a really small cheap car.”

What ? ? 2016- $12,660- 26city/39hwy

http://www.chevrolet.com/spark-fuel-efficient-car.html

Beats the hell out of 1971 Ford Pinto, $1919, 70hp, 21city/32hwy – 45 years ago –

Hi Chief,

The Spark is a wonderful car compared to Pinto , for sure, in every respect.

But it ain’t ever gonna get up around a hundred mpg.

That is going to require shrinking it by half again, meaning fore and aft seating for two etc.

Go that route with a VERY small engine, etc, and you can actually get a hundred mpg, using light weight materials and keeping the speed down.

Put a smallish state of the art battery in there, along with the diesel lawn mower motor, and she will get the two hundred mpg equivalent I mentioned.

Most people seem to believe such a car will never sell in the USA, but consider the sunk investment in suburbia.

Would you rather ride a damned inconvenient, possibly non existent bus, sharing your commute with the “great unwashed”, waiting at bus stops, transferring, etc, ?

Moving to downtown is not going to be an option, good cheap downtown housing is non existent.

Joe and Suzy Suburbanite will have two basic choices. Give up the McMansion, or give up the automobile as we know it today, for something built along the lines of the experimental car VW built a while back. I forget the name of it, but it got well over two hundred mpg.

My thinking is that we will be downsizing to Spark sized cars , and then downsizing again, because I personally believe oil will eventually go up to two hundred bucks or maybe even more, in current day money.

I sure as hell will never farm with a mule if I can get diesel for twenty bucks a gallon. Feeding my machinery on days I need it with twenty dollar diesel would still be a hell of a lot cheaper than feeding a mule every day of the year, and paying out five or ten or more times the labor expense to get the same amount of work done.

(Aside for NICK, if diesel gets THAT expensive, tractors might run on batteries, sure enough. Assuming enough lithium to build them can be found, etc. )

Gasoline will still be affordable even at ten or fifteen bucks a gallon if you get good enough mileage.

I expect coal to liquids and or biofuels or made from scratch ( co2 and water ) fuel to keep the price of oil from ever going much above two hundred bucks.

Prices that high would probably make it profitable to use wind and solar power to manufacture liquid fuel.

I could use a two seater with a third seat facing backwards in a hatchback. A 20 KW gasoline engine coupled to a 30 km range battery bank. Maximum speed 90 kmph. But it does have to have heater and AC.

Hi Fernando,

I am willing to bet ten dollars to a stale donut you are personally well enough off to own two cars, and could conveniently drive the smaller one almost all the time.

How many trips out of ten, on average, do you have TWO passengers instead of only one, or none?

If gasoline gets to be tightly rationed, you will want to save every drop possible, even though you are well to do, so as to have it available for the occasional longer trip etc.

Those of us who MUST drive but are “hard up” for money will drive whatever has the lowest total cost of operation that we can buy.

A brand new car is generally out of the question for the working, driving poor. They necessarily buy older cars.

These days in my part of the world, this usually means a mid nineties to early two thousands compact or midsized car.

Anything much older means too many repairs, and anything newer means too high a purchase price.

One thing that is usually forgotten, or deliberately overlooked, by the mass transit partisans is that many or most working poor people who drive in the USA save a LOT more on housing costs than they spend on their cars.

The last place I owned and lived near the big city ( twenty miles one way ) cost me four hundred a month, and it rents now for eight hundred.

A reasonably comparable place IN that city today costs three thousand a month, at least, and you would still lack peace and quiet and privacy.

You would still need a car too, because you would want to go enough places that owning a car would be cheaper than calling a cab day after day.

Purists and green religion nut cases will scoff at the idea, but there is no reason at all a battery electric vehicle cannot be heated with a small bottle of propane, either throw away or refillable. This would go a LONG way toward solving the cold weather range issue, at very minimal cost.

AC is always going to suck up a good bit of power. But cars can be built to minimize the power draw, and a lot of the time they can be precooled while still plugged in, etc.

It might be possible to isolate the drivers seating area from the rest of the car interior for instance, using some new tech similar in principle to self latching seat belts. This would probably cut the AC power draw by eighty percent when riding solo.

This would be easy to do in a two or three seater fore and aft arranged car. It would be a lot harder with conventional side by side seating and rear seats as well.

We forget that once upon a time there was no such thing as parking meters, or service stations.

Charging stations, coin or card operated, will eventually be quite common. Cities will install quite a few of them right along side parking meters because they will be money makers, just like the parking meter.

Put in four quarters to park an hour , or eight quarters to buy PARKING PLUS EIGHT quarters worth of gasoline equivalent battery charge while you take care of your errand. Plus you could jump in a nice cool car when you finish your business.

Some or most of the ideas I post will not come to pass. I am hoping forum members will post their own ideas, or unusual ideas they have run across in other forums.

I understand that selectively reflective glass is now available, but still to expensive to use it in automobiles. Such glass combined with the right paint would mean a car sitting or driven in the sun would not heat up like an oven, but still allow the sun to warm up the car on a cold day.

Hell, yes, we could strap a bottle of propane on every EV, add a propane stove and a small chimney. But I’m not sure there’s enough propane to heat a zillion Chinese cars in winter.

How do people come up with these things?

I’m too lazy to try and dig up some real data, but I think heat pumps work just peachy for heating an electric car.

Even at worst case, electric resistance heat, I don’t think it would be that bad, especially if the 2017/18 crop like the G2 Leaf, the Chevy Bolt, and the Tesla M3 have 200+ mile ranges as anticipated.

At highway speeds 200 mile range is two hours of driving (Leaving a buffer), so if the heater was a 1kW electric resistance heater running at full blast for two hours it would require 2kWh’s which would reduce your range by 6 miles – not that significant in the context of a 200 mile range.

A heat pump would be up to 300% more efficient than a resistance heater, so now we are down to a mere 2 mile range reduction.

I haven’t tried the experiment yet on how long it takes to warm up the interior of a frozen car with a 1kw electric heater. I intend to, but Winter is not cooperating by showing up this year.

AC with a little more plumbing and controls is a heat pump.

Dunna know why my Leaf, with AC, is not rigged up that way. Maybe they figure the straight resistance heat is ok re battery range, and maybe it is.

Our car winter heating system is a real good coat. My very good one makes me feel like a knight of the round table- spear proof.

Anyhow, the coat is a necessity regardless of mode of transport – unless you are young and foolish, and run around near naked, ending up in the ER, as is so common in college towns.

I did that – once.

“But it ain’t ever gonna get up around a hundred mpg.”

THE 2016 SPARK EV

Electrify your ride

$18,496- 82 mile range, 128 city/ 109 hwy

http://www.chevrolet.com/spark-ev-electric-vehicle.html

solar panels optional

Yes, the electric model.

I failed to make it clear I meant a hundred mpg using an infernal combustion engine only. A hundred mpg on diesel fuel is doable, but it will require a very small , very light, super streamlined, super easy rolling car, and keeping the speed down.

Here is the Honda of your dreams. 110 mpg combined city/hwy, $219 It’s been in the market place for 50 years.

http://www.lanemotormuseum.org/collection/motorcycles/item/honda-sport-65-1965

I’ll take the EV and the panels

OFM,

The US has a few physiological problems to get around before small cars ever make the big time. First, seat belts make accidents more survivable and large vehicles are not the only way to safe driving.

CE,

The Spark, maybe a bad choice. My daughter who is living in the states, is driving a Mirage, 1200cc 3 cylinder stick.She gets just around 50mpg on the freeway, and as most driving over there seems to be freeway driving, it seems to be the relevant number. It is better at 45-50mph.

Hi Push,

The Spark wasn’t meant to be a choice, but an example. Your Mirage just backs up my example that there are low cost options available.

“It is better at 45-50mph.”

This is another topic that deserves addressing. What is the optimal speed society should embrace? I think 60mph could be expectable with governed new ICE vehicles moving forward. EV’s actually have slower optimal energy speeds than ICE.

Hey Chief, re optimal speed embraced by society, except for highways most city byways in Sao Paulo have limits of 70km for cars and 60km for trucks and buses. Highways have max posted speeds of 120km for cars and 90km fot trucks and buses.

Hi Fred,

“Highways have max posted speeds of 120km for cars and 90km fot trucks and buses.”

The above is very similar to what we have here in California at 70mph/55mph. Most vehicles have about a 15 to 20% energy savings reducing from 70 to 60.

I quickly added up 12/14 oil production and 10/15 oil production for the following counties/units, of which each produce at least 5000K bopd. I believe all is conventional production (vertical wells, not high volume fracks).

Kinder Morgan – SACROC Unit – Scurry Co., TX

Kinder Morgan – Yates Unit – Pecos Co., TX

Hess – Seminole San Andreas – Gaines Co., TX

XTO – Means San Andreas – Andrews Co., TX

XTO – Fullerton Clearfork – Andrews Co., TX

Sheridan – company wide production – Andrews Co., TX

XTO – Hawkins Unit – Wood Co., TX

Apache – company wide production – Hockley Co., TX

Chevron – company wide production – Hockley Co., TX

OXY – company wide production – Hockley Co., TX

Burlington Resources -Waddell Ranch- Crane Co., TX

12/14 – 143,772 bopd

10/15 – 130,405 bopd

The only two without significant declines were Fullerton Clearfork and Hawkins, both operated by XTO (ExxonMobil).

I also pulled up some companies/counties that I believe are almost strictly conventional. The first number is 12/14 barrels of oil, the second is 10/15 barrels of oil.

Identity 12/14 10/15

Breitburn 365,164 320,828

Legacy Reserves 285,373 243,270

Linn 576,470 225,725

Citation 229,690 204,773

Mid-Con 55,756 68,055

Gregg Co. 202,731 165,408

Rusk Co. 157,106 141,312

Wichita Co. 179,345 125,666

Shackleford Co. 50,666 33,004

Archer Co. 107,957 80,919

I understand October numbers are not final. However, all that are down were trending down from December, 2014.

Clearly supports my earlier posts about the decline of US onshore conventional. It is rolling over in TX as the conventional producers are trying their best to survive what shale has wrought. Up 17 oil rigs today. Crazy!

Is 87 vertical rigs an all time low??

Thanks Shallowsand,

I added up your data

and 12/14 output was 2,354,030 and 10/15 output was 1,739,365 for all your reporting.

This is about a 3% per month decline rate and a 30% annual decline rate, yikes!

No doubt a lot of lower producing wells are being temporarily or permanently abandoned at these oil prices. If oil prices continue lower or even remain at the current level (around $35/b), the LTO plays cannot be far behind.

Edit: As much of this data is from Texas, I question if we are comparing apples with apples, I just don’t trust the Texas data.

Dennis.

I agree possibly on the county data, which comes from a large number of operators, some of whom maybe are late in reporting.

However, all but Citation are public companies. Citation is a large private company in business since the early 1980s. I feel their numbers are accurate, and as I noted, there were down trends pretty much across the board from December, 2014. Also, many were heading up in 2014. I think the extreme drop in numbers of vertical rigs beginning 12/14 has taken its toll. Just 87 vertical rigs drilling in latest report, I suspect lower than the depths of 1998-1999. The low point on oil rigs per EIA was 108 in July, 1999. Not sure how many of those were non vertical.

Did you read my Kansas post? Also declining significantly.

I’ll look at some others and post as I have time.

shallow sand,

If your numbers for conventional onshore production are correct, that implies that, at least until recently, conventional accounted for a large part of the decline in total US output. Hence, LTO production was more resilient than we thought.

AlexS. I agree. Many LTO producers reported higher Q3 than Q2 production and most were higher in Q2 than Q1. Many, however, are guiding lower for Q4 and 2016.

As far as my numbers being correct, I am just pulling them off state websites. I am very capable of typographical errors, so if you see something amiss, please point it out.

I think LTO has held up somewhat because the reduced capex was primarily the result of cost deflation. In 2016, the reduced capex will translate directly into much fewer wells being drilled as there is not much room for lowering costs. So far, the reductions look to be at least 25-30% from 2015 levels.

Hi Shallow sand,

Kansas looks like about a 13% drop, but the numbers are a little different (annual average vs monthly output) so not really an apples to apples comparison.

Dennis. Have you reviewed the Kansas Geological Survey website? It has monthly production by county and state wide in Excel.

Hi Shallow sand,

No I just used the numbers you presented. Can one safely assume that most of the oil output in Kansas is conventional?

Dennis.

Most is, except for a few counties along the South Central border with Kansas. Harper Co. is the primary horizontal county, I think. It had a big increase in 2014 but stagnated in 2015. Ellis, Russell and Rooks are among the largest conventional producing counties. Maybe take a look at the 2014 and 2014 excel spreadsheets, which list by county and statewide.

Hi Shallow sand,

So if we look back 12 months from the most recent month reported (Sept 2015), the annual decline rate has been 14% in Kansas.

As you have suggested before, these high decline rates are due to a lack of new wells drilled and possibly to a deferral of workovers due to low oil prices. Chart with Kansas oil output Jan 2013 to Sept 2015 in kilobarrels per day.

Ignored by most, Utah experienced high percentage production growth 2011-2014. It is trending down in 2015.

All numbers off state website, cumulative barrels of oil:

2011. 26,277,505.

2012. 30,204,365

2013. 35,005,414.

2014. 40,910,690.

2015. 25,807,544. Thru 8/15.

My comment. I think the leg down in July, followed by the further leg down recently will hammer onshore US conventional.

Big difference between $50-55 well head and $25-30 well head. Make or break for many, us included.

I have a hunch those numbers are BOE. I can’t see Utah producing 900,000 BOPD.

Fernando

The Utah numbers are correct. 2014’s 41MM is bout 900k bo/week.

Gas for the year was 453Bcf.

Why would you quote week when he quoted day.

Watcher

Fernando mistook ( apparently) Utah’s annual 40,000,000 bbl output as equating to 900,000 per day as opposed to it being the weekly output.

That’s why.

Utah annual average C+C production (kb/d)

source: EIA

2010 68

2011 72

2012 83

2013 96

2014 112

Jan-Sep 2015 105

Ok, so I blew a zero. If it makes you feel better I only do it once a day, and I no longer have to sign off on anything other than small money transfers to anticommunist organizations.

Hi SS,

Can you say a little something about what is involved in shutting in a stripper well that is running in the red, in terms of how much it would cost to put it back into production a year or two down the road ?

I have read that some such wells, maybe a lot of them, will never be put back into production, if once idled for any period of time.

The ONE oil man I know, personally, owns a dozen or so stripper wells outright,land and all, and if he shuts them in, he won’t have to worry about leases at least. But he is only around once in a while, and I haven’t had a chance to talk to him recently.

I do know from previous conversations that if he has to make any significant repairs, or do any serious maintenance work, he has to hire it done.

OFM.

The costs vary quite a bit, depending on well depth, how corrosive water is, etc. Also, much would depend on the injection system. How long shut down matters a great deal.

Imagine the difference between idling your tractor, in the elements, for a month or two versus a year or more.

My observation is that each well likely will have to be worked over, rods, tubing and down hole pump replaced on many. Maybe will need to be sand pumped and acidized. Electric motors would be removed from the wells and injection pumps so as not to be stolen when shut down. They would have to be reinstalled. Same with injection pumps. Electrical can be a concern. Mice like to chew on.

If roads and locations are not maintained, that would require expense. Many times pumping units are removed from idle wells and used as replacements on producing wells when $ is tight, so that is also a possible issue.

A large (for our field) operator shut in a large percentage of production (30-40%)I believe in 1998-1999 crash. My understanding they lost money trying to get everything back going again for the next 18 months or so once prices rebounded in 1999.

Shutting down wells is a last resort, especially with a water flood. The few we have shut in thus far are not floods, or maybe a low volume well in a multi well flood.

I’d say on a shallow well like ours, $2-15 thousand to reactivate after a year or more idle, depending on what happened down hole and what equipment is still left. Given at $80 oil well head, your are talking probably a $10-15 thousand annual pre tax profit, it is a big decision to make to shut in.

I would also note some wells can be run intermittently. I hear a lot of that is going on now. Kind of like driving the old work truck every so often to warm the engine, etc.

I will say I hate to see these wells plugged, given the number we reactivated that were just as economic many times as ones continuously produced. As long as they can be safely T’A, I say short term that makes sense. Two of the most efficient leases we operate are ones we reactivated after them being shut in many years. Others had them, went BK, and they went idle. Many times leases are shut in more based on the overall solvency of the operator, than on how economic they are on their own. I just looked and one is running $9 per Bbl OPEX, the other $16 OPEX for 2015. Wish it was all in that ballpark!

I’ve been involved in operations with lots of marginal wells. We wanted to implement a flood, but economics were marginal, so we pulled the jewelry, put in an old kill string, filled with a light hydrocarbon and a nitrogen cap. These wells were monitored once a month for pressures. And some remained shut in for years. Eventually we had used equipment coming off another field and we restarted with a poboy operation. This needs cooperation from the regulators. But it can be done.

Thanks SS and Fernando.

I don’t have much at all to say about the hands on end of the industry, because I know so little about it, but guys like you two have enabled me to at least get out of kinder garden and into the first grade.

U.S. Oil Output has First Year-on-Year Drop Since 2011, API Says

http://www.bloomberg.com/news/articles/2015-12-17/u-s-oil-output-has-first-year-on-year-drop-since-2011-api-says

U.S. crude production in November posted the first annual decline in almost five years as falling prices curbed investment.

The U.S. pumped an average 9.11 million barrels of crude a day in November, down 0.8 percent from a year earlier, the American Petroleum Institute said in a monthly report Thursday.

Production of natural gas liquids rose 6.4 percent from November 2014 to 3.32 million barrels a day, a record for the month and 28,000 barrels short of the all-time high reached in August.

Total deliveries of fuel, a measure of demand, rose 1.2 percent from a year earlier to the highest November total since 2007.

Gasoline consumption rose 3.2 percent from a year earlier and jet fuel demand climbed 6.2 percent, while distillate fuel slumped 1 percent and residual fuel use tumbled 46 percent as prices for natural gas declined.

My comment: The EIA’s preliminary estimate for November is 9.17 mb/d.

We will know later the exact number, but it seems that the decline in output is accelerating by the end of the year

Magnum Hunter files Chapter 11:

http://www.cnbc.com/2015/12/15/magnum-hunter-latest-oil-producer-to-seek-bankruptcy.html

China’s electricity generating capacity, January-November 2015

Is that you, Li?

Hey Fernando, you never know, maybe it is Jack Ma, masquerading as Li… The real question is why does it matter to you? Does that graph somehow offend your sensibilities because of who the author of the post is?

I wanted to pass him the secret code to the university of Utah’s Mormon student center’s back door.

Capacity Utilization rates by source of electric power

China’s electricity generation, January through November 2015

Electricity generation has been converted to rate of generation. For example, China’s total electricity generation in November was 466 terawatt-hours. This is converted to a rate of generation of 647.2 Gigawatt. That is, if 647.2 GW of generating capacity runs 24 hours a day and 30 days a month, it would have generated 466 TWH.

New installation of generating capacity by source of electric power

Shale Oil Production in Bakken, Eagle Ford Held Steady in November: Platts Bentek

http://www.platts.com/pressreleases/2015/121815b/no?hootpostid=7da8c0be16213d5c336d783ed00ab303

It appears I am onto something. Most of the US drop in oil production will be due to drops in US conventional oil.

It is all about financing, IMO.

How about this scenario, if GS is correct and we go to $20 WTI, re a bakken well in 2016

Oil sales $12 x 88,000 net barrels. $1,056,000

Gas sales. 100,000 mcf at $1.00. $100,000

Gross sales. $1,156,000

Less:

OPEX @ $4.00 $386,000

Sev tax @ 10%. $115,600

G & A @ $2.50. $241,665

Interest at 5%. $375,000

2016 net. $38,335.00

I doubt even those prices will be enough to remove all rigs from the Bakken.

KL,

However, the fierce battle for market share comes at a price for the US economy. Over 1 trillion USD in oil related equity losses, 500bn in bond devaluation in oil related bonds including private equity bond losses as well as a 10% loss of the general high yield bond market. So, in my estimate the US economy has lost already over 2 trn USD so far. Most of it are paper losses, yet the impact is huge. In effect, the US, Saudi Arabia and Russia are subsidizing the economies in Europe and China. Thank you America and keep going, we can need this stimulus package.

A pretty good article on Seeking Alpha this morning:

If It Keeps On Raining, The Levee’s Gonna Break

Venezuela is basically insolvent and after recent elections could see increasing violence and perhaps even a civil war. This should have a relatively small impact on our economy and multinationals. Companies like Ford (NYSE:F) and ConocoPhillips (NYSE:COP) have already taken their lumps and written off their investments in the country for the most part. The tens of billions the Chinese has investment in the country in recent years looks more and more like a very bad bet however.

The Chinese didn’t invest ten of billions. They loaned money. Some of the money was stolen or simply disappeared, but they are SUPPOSED to get that money back in oil payments.

Some of us are pointing out the loan covenants aren’t kosher because the National Assembly didn’t approve them. Therefore what the Chinese risk is having the new National Assembly investigate and reveal the terms, declare them illegal, and tell the Chinese to go fish.

The Chinese have their own central bank. They can create whatever disappears.

It gets better. The loans are supposed to be tied to the purchase of Chinese junk. The Chinese got pissed off when they realized billions were being stolen rather than returning to China to pay for Chinese goods.

Art Berman has a new post up regarding the Permian Basin: http://www.artberman.com/less-than-2-percent-of-permian-basin-is-commercial-at-30-oil/.

In the “for what it is worth” category tomorrow, the Midland Reporter Telegram will have an opinion piece from Scott Sheffield, Chairman and CEO , of Pioneer Resources about the impact of the end of the export ban. It can be accessed from http://www.mrt.com.

John S. I think Pioneer is being kept afloat by a good hedge book, which will not last forever.

For example, in Q3, oil price before hedges was 42.46, after hedges 62.93. NGLs before hedges 12.39, after 13.67, gas before hedges, 2.53, after 3.40.

I sometimes wonder if the Permian and OK tight oil plays get more of a pass because they are newer and not as homogeneous as the Bakken and Eagle Ford shale.

°°°°Art Berman said:

There is an economic war going on of global proportions, and the geopolitical stakes are enormous. Most of the chest beating falls into the category of war propaganda, and that’s why these guys get away with their outrageous claims.

°°°°Art Berman said:

Right. But up until now there was never a disparaging word from Thomas about the Eagle Ford shale.

Now that it’s impossible to deny that the Eagle Ford is in decline, time to move on to greener pastures.

John, Shallow, Mr. Stehle

You folks may want to recognize the analytical process that Art Berman uses in this piece closely resembles numerous others who were consistently shown wrong when early on looking at the Bakken. Please Google back a few years’ predictions to verify this.

If 98% of Permian is uneconomic at $30, I would be surprised as I would think 100% should be.

However, all you folks who chart the numbers should see that the big push towards horizontal drilling just started to get underway relatively recently in the Permian, yet Mr. Berman uses the earlier, learning phase wells to make his overall projections.

These wells will continue to increase in productivity as the costs to drill/complete come down. (Monobore wells alone should show significant improvements).

30 bucks per is squat.

Tens of billions of barrels of recoverable resource is not.

coffeeguyzz,

Well I certainly hope you’re right.

But these fast talking, wheeler-dealer promoter types in the oil and gas business and their cohorts on Wall Street have been throwing out highly inflated reserve figures for quite some time now.

For instance, in 2013 the Fort Worth Star Telegram wrote an article titled “Report questions long-term productivity of gas wells in Barnett Shale.”

Back in the heyday of the Barnett Shale (2005 – 2008) the financial reports of companies active in the Barnett Shale routinely threw out average EURs of 5 BCF per well.

By the time of the writing of the Star Telegram story in 2013 they had lowered their sites a little bit: to an average of 3 BCF per well.

However, a study conducted by the U.S. Geological Survey the year before had pegged average EURs in the Barnett Shale at only 1 BCF per well.

And an “as-yet-unreleased study” of the Barnett Shale by the Bureau of Economic Geology at the University of Texas at Austin, which looked at the performance of 16,000 wells through June 2011, projected an average lifetime production of 1.44 BCF per well.

Undaunted by all this, the article quotes Gregg Jacob, Devon Energy’s unit manager for the Barnett Shale, as saying “Devon expects its 4,800-plus wells in the Barnett Shale to produce the equivalent of 3 billion cubic feet of gas, natural gas liquids and oil over their lives.”

Chesapeake claimed that the Barnett Shale wells on their DFW Airport Lease would produce for “At least 50 years.”

“At least 50 months” would have been more accurate. Five years after the initial wells were drilled and completed, about half of that initial group of wells were already plugged and abandoned.

Coffee. It is tough to analyze the Permian, at least compared to Bakken and EFS. Many different zones. I have seen tremendous wells and wells that wont have cumulative production of 100K BO. Look at the energy net auction site.

Look at my post above about Pioneer’s 2015 hedging gains.

Remove those and plug in $18 per BOE, which is where they are today. Pioneer hemorrhages cash at $18 BOE.

Pricewise we are past the point of arguing about economics. Plug in todays oil, NGL and gas prices into any company’s PDP PV10. See if you can find one US public E&P, outside maybe XOM, that has greater PDP PV10 value than long term debt. If $50 WTI and $2.75/nat gas dropped CLR from $22 billion to $9 billion, where does $34 WTI and $1.75 gas put it?

This is extreme, and is only getting worse. People who are about to BK are usually in denial.

Answering OFM’s question about the VW concept car, XL1 or whatever it was/is called…some 200+ mpg supposedly:

http://www.autoguide.com/auto-news/2013/03/volkswagen-xl1-gets-261-mpg-is-not-a-concept-car-2013-geneva-motor-show.html

http://www.greencarreports.com/news/1087980_orders-for-261-mpg-volkswagen-xl1-exceed-production-of-200

http://www.caranddriver.com/reviews/2014-volkswagen-xl1-first-drive-review

http://www.usatoday.com/story/money/columnist/healey/2013/12/07/vw-xl1-shows-how-to-get-200-mpg/3883503/

http://www.wired.com/2008/07/laugh-at-high-g/

http://themindunleashed.org/2014/04/volkswagens-new-300-mpg-car-allowed-america-efficient.html

http://www.snopes.com/politics/conspiracy/xl1.asp

$100,000…$120,000…OK, at these prices these are ultra-rich folks’ toys…

With $1.75/gallon gas in my major U.S metropolitan area(and the price has been sub$2.50 for QUITE a while now) , what incentive is there for our drivers to buy these?

Is there some sort of ‘conspiracy’ to keep these off U.S. roads…or is it just a case of the existing safety regs getting in the way?

OK, this ia a VW car…I will ask the obvious:

1) Will it be a mechanical nightmare to upkeep with super-expensive repair bills?

2) Can we tryst anything VW says, esp. re furl efficiency? First stories said 300mpg, then 235 mpg, then 200 mpg (highway), then one article claims 180 mpg city…where is the ‘floor’ on the mpg claims…where does the truth lie?