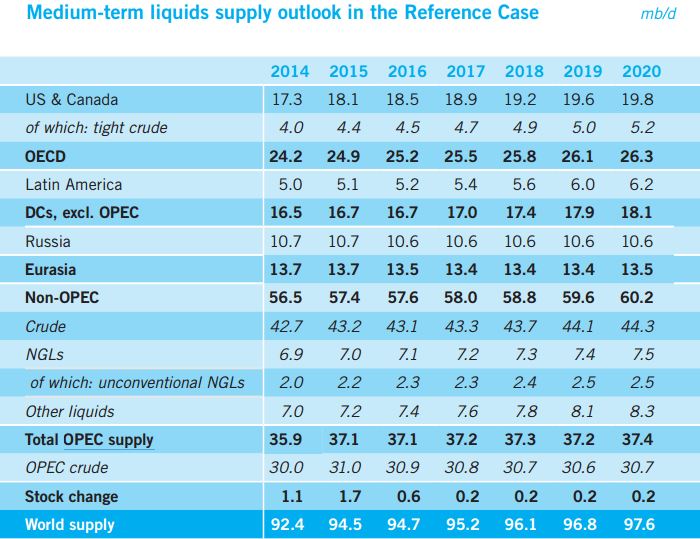

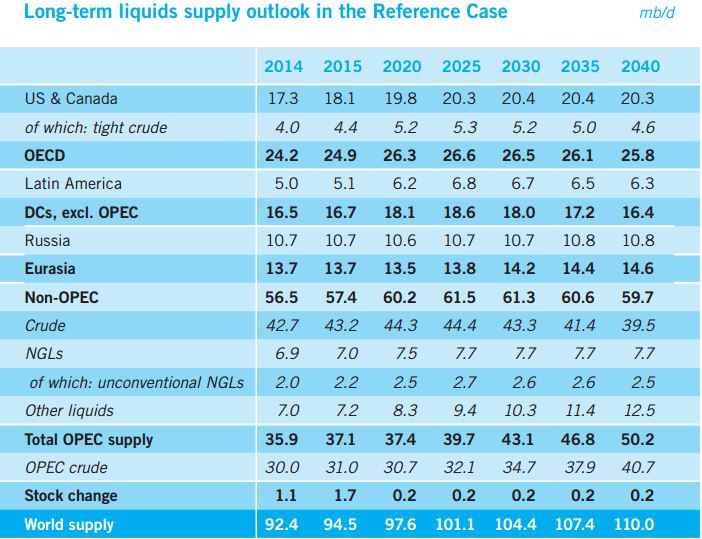

The OPEC 2015 World Oil Outlook came out a few days ago. They basically produce two outlooks, a medium term outlook to 2020 and a long term outlook to 2040. I found their medium term outlook pessimistic in some cases to optimistic in others. But I found their long term outlook to be wildly optimistic… in most cases.

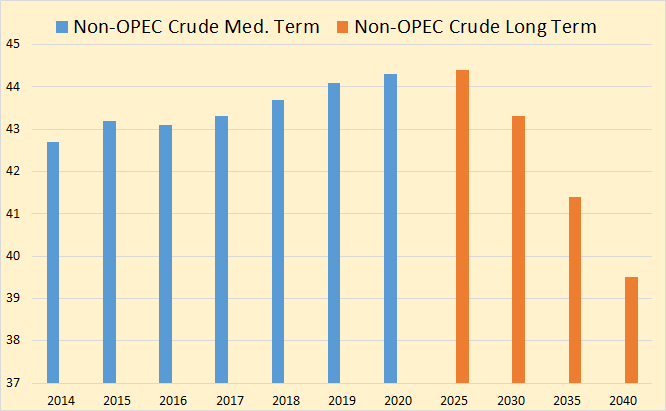

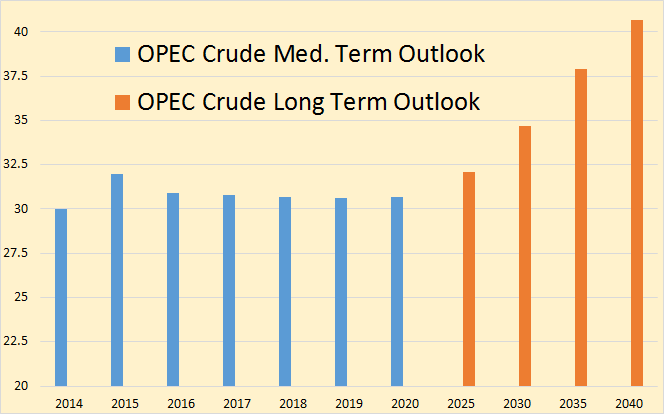

In all cases below I chart crude when it is available and “liquids” only when no other option is available. The data is in million barrels per day.

Here is their medium term outlook chart. Notice they expect both OPEC and Non-OPEC crude to decline in 2016 but Non-OPEC crude starts a slow recovery in 2017. They say OPEC crude will not start their recovery until 2019.

Here is their long term outlook. Notice the tremendous growth in “Other Liquids”, whatever that is.

OPEC expects Non-OPEC crude to be down in 2016 but to begin a slow recovery in 2017. I think that outlook is way too optimistic.

OPEC thinks their short term production has peaked and will decline by 100,000 barrels per day next year and hold on a flat plateau until sometime after 2020.

Adding OPEC and Non-OPEC crude we see that OPEC thinks World crude production will decline next year but begin a slow increase starting in 2017. Also notice that OPEC’s estimate of current crude production is well below what the EIA says is being produced and even below JODI’s production numbers. I think this is because OPEC does not count Condensate. Other than that I do not have an explanation.

OPEC expects Russian liquids production to decline by 100,000 bpd next year and hold at that level for five years, or perhaps longer. They expect Russia to increase production by 200,000 bpd over the next 20 years.

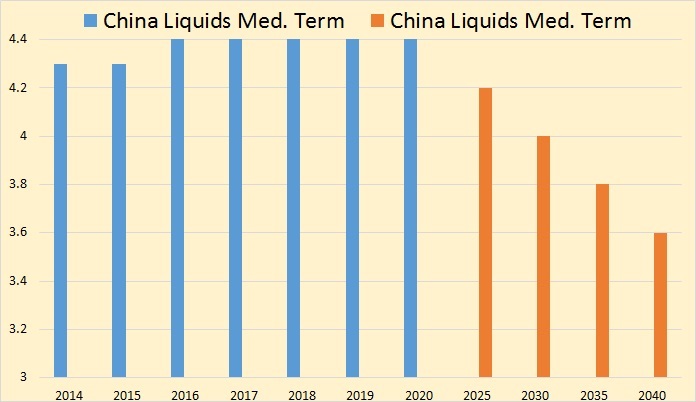

OPEC thinks China will peak next year, 100,000 bpd above the 2015 level. I think that is just a tad optimistic.

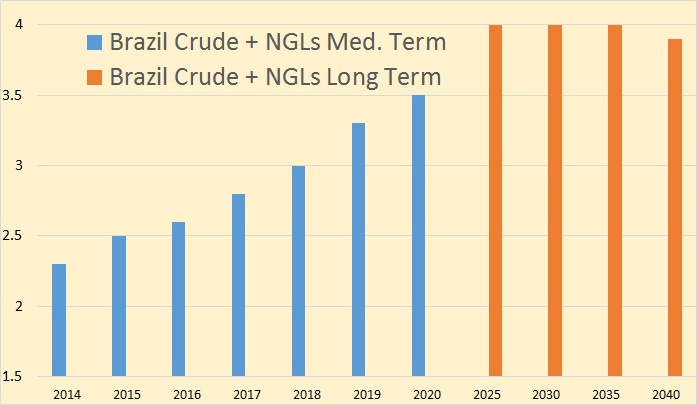

I find OPEC extremely overoptimistic concerning Brazil. So does Petrobras. Petrobras’ troubles highlight bleak prospects for Brazilian oil production to 2020

The analyst adds that Petrobras’ recent revisions to its production plans, forecasting 2.8 MMbpd by 2020, 1.4 MMbpd less than 2014, will be adjusted further. This is due to more recent Petrobras CEO statements indicating less capital expenditure and a larger divestment strategy. One key change in the investment plan for pre-salt production has been a significant reduction in the number of FPSOs brought online by 2019.

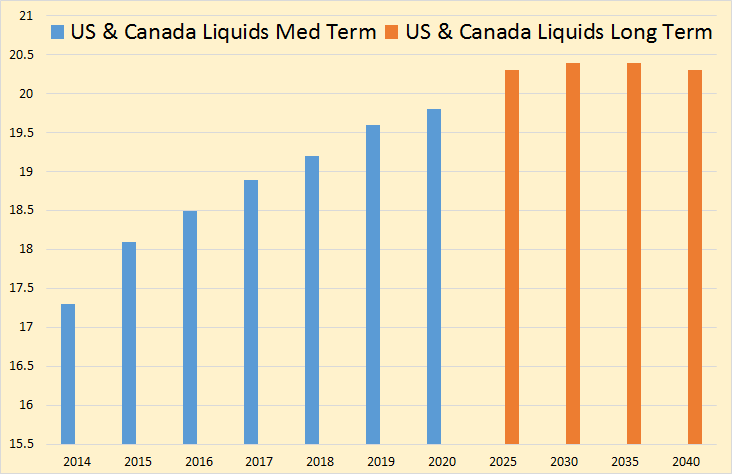

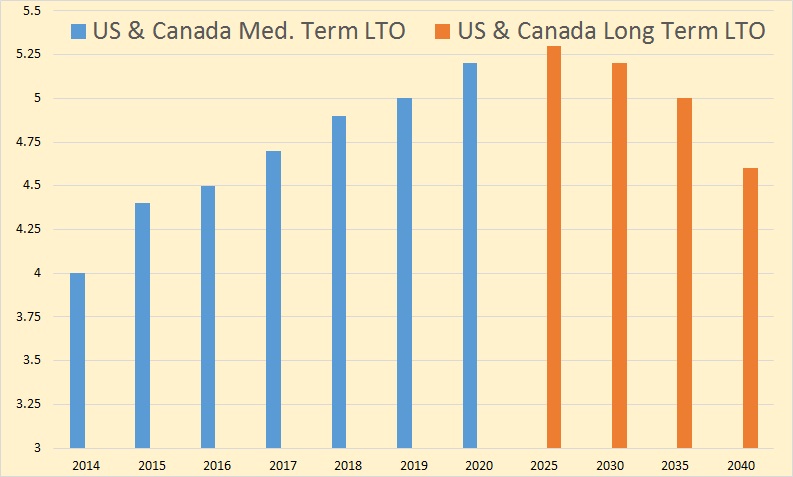

It is with the US and Canada where OPEC is most optimistic. They see US and Canada liquids production continuing onward and upward with not much of a pause.

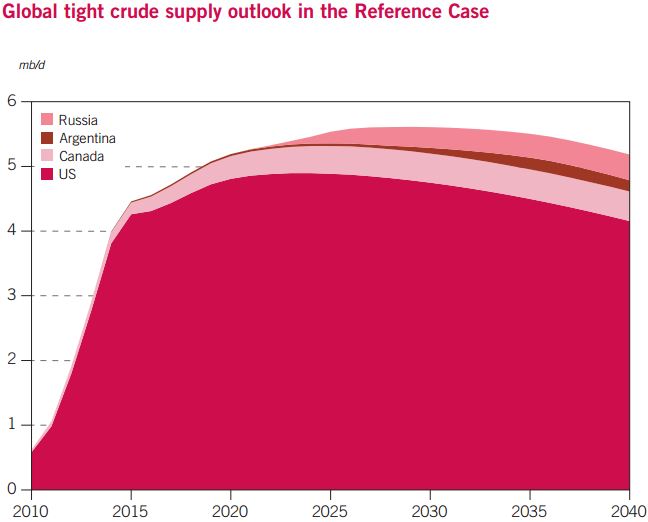

OPEC expects light tight oil to increase in 2016. They only show a slight uptick in LTO in 2016 but an uptick nevertheless. I just don’t believe that is possible. They actually pick US LTO peak, 2023.

Tight crude production from the US plays increases from 3.8 mb/d in 2014 to about 4.9 mb/d by 2023. It declines slowly thereafter to 4.2 mb/d in 2040. While the Canadian plays are not as prominent as the US plays, they increase their tight crude production throughout the forecast timeframe from under 0.2 mb/d in 2014 to less than 0.5 mb/d by 2040.

Here we see the actual LTO production figures that OPEC is expecting. They have Light Tight Oil increasing by 100,000 barrels per day in 2016. They are saying the price collapse only slowed down the growth in LTO production and it will pick back up in 2017, though it will still be increasing at a much slower rate than in years past.

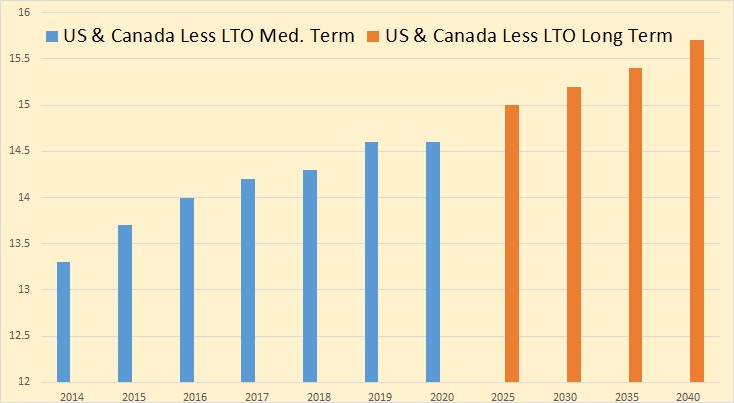

Okay, if LTO has been responsible for the huge gains in the US and some in Canada, what does OPEC’s production look like if we remove LTO from the picture. Well production just keeps on increasing… according to OPEC anyway.

Production just keeps increasing and increasing. Counting LTO the US and Canada peaks around 2025 but that is only because of the decline of LTO. The rest, which was declining before the advent of LTO, has now turned around and just keeps increasing into the far distant future.

But what about prices. Are not prices killing production in the oil patch, especially in the USA? Well the 2015 World Oil Outlook does not present any price charts or tables. But they do tell us what prices need to do in order for their reference case predictions to be fulfilled, all on page 8. Bold mine.

In this Outlook, the price of the ORB is assumed to average $55/b during 2015 and to resume an upward trend in both the medium- and long-term. The medium-term foresees a $5/b increase each year so that a level of $80/b (nominal) for the ORB is reached by 2020, reflecting a gradual improvement in market conditions as growing demand and slower than previously expected non-OPEC supply growth eliminate the existing oversupply and lead to a more balanced market. This, in turn, will provide support to prices. Translated into real prices, the oil price is assumed to be $70.7/b by 2020 (in 2014 prices).

The long-term price assumption is based on the estimated cost of supplying the marginal barrel which will gradually move to more expensive areas. This continues to be the major factor in the period through to 2040. The price of the ORB in real terms is assumed to rise from more than $70/b in 2020 (in 2014 prices) to $95/b in 2040 (in 2014 prices). Correspondingly, nominal prices reach $80/b in 2020, rising to almost $123/b by 2030 and more than $160/b by 2040. It should be noted that these are not price forecasts, but working assumptions to guide the development of the Reference Case scenario.

They are saying that if prices increase by $5 a barrel a year, from $55 a barrel that they assume will be the 2015 average, then all will be well after only a slight dip in production in 2016 and 2017. So in 2016 we should see prices averaging $60 a barrel if they get their “Reference Case” started off on the right foot.

It is also interesting to note that they see Non-OPEC production peaking around 2025 but OPEC still increasing production, not just enough to offset the Non-OPEC decline, but enough to keep world oil production increasing through 2040.

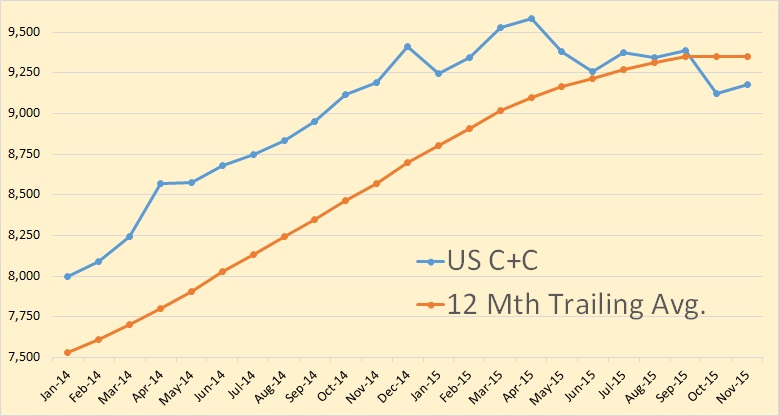

Just one more chart with data from the EIA’s latest Monthly Energy Review. The EIA Monthly Energy Review has November US C+C production at 9,181,000 barrels per day. That is 404,000 bpd below the peak in April 2015 of 9,585,000 bpd and just 7,000 bpd below the production of November 2014.

US production is clearly declining and that decline will, far more likely than not, accelerate in 2016. The point is that OPEC projection of US crude oil production is clearly in error. It is just flat out wrong, no other way to say it. I know, the production numbers for 2016 are not in yet, but the chance that US 2016 crude oil production numbers will be above the 2015 production numbers is slim to none.

OPEC has tried to hedge their bets by combining US production with Canadian production. But even that will not work. US plus Canadian 2015 production, in my estimation, will clearly be above US plus Canadian 2016 crude oil production.

I may be wrong with this prognostication, but that remains to be seen.

__________________________________________________

I send out an email notice when I put up a new post. If you would like to be on that list then please email me at DarwinianOne at Gmail.com

Also, if you see any typos or data errors in this post then please email me and I will correct them.

Does a barrel of NGL have the same BTU as a Barrel of Crude or Condensate?

If not, converting all into BTU would show whether total BTUs provided are increasing or static.

Rune Likvern says: NGLs have around 60 – 70% of the volumetric energy (heat) content of crude oil.

However peak oil will happen when oil peaks, not NGLs. Liquid transportation BTUs should not be mixed with other types of BTUs. Otherwise we would need to count BTUs from coal as well.

Some EIA million BTU (MMBTU) conversion factors:

https://www.eia.gov/forecasts/aeo/pdf/appg.pdf

Of course, what the EIA calls “Crude oil” is actually Crude + Condensate (C+C), and condensate can’t be used to meet crude oil contractual obligations at Cushing. I assume that the listed value for gasoline, 5.2 MMBTU, is a pretty good approximation for an average value for condensate.

For the first nine months of 2015, the EIA estimates that the ratio of US Lower 48 condensate* to US Lower 48 “Crude oil” Production, i.e., C+C, was 22%, or 2 million bpd of Lower 48 condensate production:

EIA expands monthly reporting of crude oil production (i.e., C+C) with new data on API gravity:

https://www.eia.gov/todayinenergy/detail.cfm?id=23952

These numbers are consistent with some estimates that I used in the following comment, where I tried to come up with an estimate of actual global crude oil production (45 API and lower crude oil, i.e., the stuff that corresponds to the global price indexes), versus global condensate production, using the only available data, some EIA API gravity estimates for the US and EIA/OPEC data for the OPEC countries.

My premie was and is that we have been on an “Undulating plateau” in actual global crude oil production, while global natural gas production and associated liquids, condensate and NGL, have so far continued to increase:

http://peakoilbarrel.com/jean-laherreres-bakken-update/comment-page-1/#comment-534101

After showing similar rates of increase from 2002 to 2005, global NGL production was up by 26% from 2005 to 2014, while global C+C production was up by only 6% over the same time period (EIA).

*Condensate with API gravity of 45 degrees or more

What is condensate used for?

most of condensate is mixed with crude oils as a refinery input;

some is used as petrochemical feedstock

Condensate is basically natural gasoline.

My principal point is not that condensate doesn’t produce the full spectrum of refined products that we get from 38 API gravity crude oil; my principal point is that the available data strongly suggest that actual global crude oil production (45 API and lower gravity crude oil) has been on an undulating plateau since 2005, as annual Brent crude oil prices doubled from $55 in 2005 to the $110 range for 2011 to 2013 (remaining at $99 in 2014).

In other words, I think that actual global crude oil production effectively peaked in 2005, while global gas production and associated liquids, condensate and NGL, have so far continued to increase.

Note that based on the following chart, it’s very likely that about 40% of 2015 US Crude + Condensate (C+C) production exceeds the upper limit for WTI crude oil (which has an API ceiling of 42):

https://www.eia.gov/todayinenergy/detail.cfm?id=23952

I take your points.

If Condensate is basically natural gasoline, can one infer that the amount/effort of refining required to produce retail gasoline is fairly ‘easy’?

If this is so, and if gasoline is the primary refined product from crude oil (measured in volume, sales price, and/or ‘importance’ to the economy) then is this not a ‘good’ thing? And does this help explain why gasoline prices are rather low in the U.S. presently? Is it not preferable to refine ‘natural gasoline’; in to ‘retail gasoline’ rather than process heavy oils, some perhaps contaminated with sulfur and vanadium or whatnot?

Of course I don’t posit that this situation will go on for the long term, not that it is a ‘good’ thing wrt long-term energy planning (or lack thereof due to short-term thinking referencing current low price signals).

As noted above, my principal point is not that condensate doesn’t produce the full spectrum of refined products that we get from 38 API gravity crude oil; my principal point is that the available data strongly suggest that actual global crude oil production (45 API and lower gravity crude oil) has been on an undulating plateau since 2005, as annual Brent crude oil prices doubled from $55 in 2005 to the $110 range for 2011 to 2013 (remaining at $99 in 2014).

I take your point.

Perhaps either or both of these things have happened since mid-2014:

1) The ‘system’ has adjusted somehow to effective use the current crude + condensate + NGL ratios being produced at the wellhead.

2) The World economy has become unsound/fragile enough that it cannot support a crude oil price, not for long without lurching into recession or worse, than the current Brent market price of $37.89/bbl.

Perhaps since gasoline comprises some 53% of U.S. finished products from crude oil, then having a goodly amount of condensate which is ‘natural gasoline’ has contributed to the rather low prices for retail gasoline seen in the U.S. over the past year.

I wonder what the price trends have been over the past years for distillate fuel oil and kerosene and other non-gasoline products? Have they gone up in price (as opposed to gasoline)?

U.S. Petroleum & Other Liquids Product Supplied:

http://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbblpd_a.htm

The bumpy price plateau for Brent (which I take it as a marker for Brent production in your example?) has been a bumpy plateau from Q1 2011 through nmid-2014, after which it nosed-dived to the current $37.89 price.

http://www.nasdaq.com/markets/crude-oil-brent.aspx?timeframe=10y

Surely the actual global crude oil production (45 API and lower gravity crude oil) has not spiked since early 2014, has it? If not, then the Brent price is not a reliable proxy for such production. See my conjectures (#1 & #2) above. There may be other conjectures which may be valid. Of course none of these ideas may be mutually exclusive.

Please note that I am scoping much of my commentary to the U.S. situation…although Brent and WTI and other price constructs are supposedly indicative of the World’s supply and demand situation, yes?

Perhaps since gasoline comprises some 53% of U.S. finished products from crude oil, then having a goodly amount of condensate which is ‘natural gasoline’ has contributed to the rather low prices for retail gasoline seen in the U.S. over the past year.

53% is little high.

How many gallons of diesel fuel and gasoline are made from one barrel of oil?

Refineries in the United States produced an average of about 12 gallons of diesel fuel and 19 gallons of gasoline from one barrel (42 gallons) of crude oil in 2014. Many other petroleum products are also refined from crude oil. Refinery yields of individual products vary from month to month as refiners focus operations to meet demand for different products and to maximize profits.

However condensate, or naphtha, or natural gasoline, three names for the same thing, is not really gasoline. Gasoline is primarily octane or C8H18. Naphtha is primarily pentane, or C5H12. (Though naphtha does contain a lot of other hydrocarbons.)

Condensate is the lightest liquid petroleum product. That is it is a liquid at sea level pressures and room temperature. You can burn it in your car like gasoline. But your car will knock terribly, and your motor will not likely last very long.

Some farmers who were located in oil producing areas in the twenties and thirties made a regular practice of burning condensate in their tractors, because they could get it for next to nothing, and actually FOR NOTHING in some cases.

All they had to do was just put a bucket under a drip on an oil rig sometimes!

Tractor engines back in those days would run on almost anything, once you got them warmed up. They ran slow, at low temperatures and had very low compression ratios. So they usually stood it ok.

There are numerous stories about folks trying to run Model T’s and Model A’s on condensate and getting their arms broken for their troubles trying to start them with the hand crank. Condensate would probably destroy a modern engine in very short order.

Ron,

Thank you very much for your accurate clarification.

I was working off of this EIA Table:

http://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbblpd_a.htm

I divided 8921 (finished gasoline) into 16969 (finished petroleum products) to get the ~53% figure (I rounded down to the nearest whole number). The numbers express thousands of barrels per day.

However, to your point, when one divides 8921 (finished gasoline) into 19106 (Total Crude Oil and Petroleum Products) I get ~ 46% (again rounded down to the nearest whole number).

This is in agreement, to the tolerances of casual conversation, with the reference you provided of 19 gal of gasoline from each 42 gallons of crude, which is ~ 45%.

You run an excellent site and I wish you and the participants and readers a fine New Year. It is a shame that the MSM does not provide thought-provoking information and analysis as is found here and on several other sites…I suppose that ignorance is bliss and bread and circuses are the order of the day, have been so for quite some time, and will continue to be so.

No way that oil price will be average $60 per barrel in 2016. Russian budget assume base scenario $50 but they will lower on $40-45 average in 2016. Russians said they not expected that average oil price be over $60 till 2018, they are very pessimistic on oil price.

I have one question: what is really number for LTO reserves in USA(USGS and EIA) on price around $60-70(in 2015 $)? Because, if it is around 30-35 billion barrels this all charts(not only OPEC but EIA) for US LTO production are mathematically impossible. They have average US LTO production on 4-4.5 mb/b but when you calculate that on 25 years period reserves need are around 40 billion barrels.

4.25mb/d x 365 days=1.55 billion barrels per year

1.55 barrels/year x 25 years=38.7 billion barrels.

I’m something miss or badly calculate?

“Russians said they not expected that average oil price be over $60 till 2018, they are very pessimistic on oil price.”

They don’t. My impression is that most Russian analysts expect mass bankruptcy of shale companies in the USA and $50-$60 on average in 2016

http://www.finanz.ru/novosti/valyuty/chto-budet-s-cenami-na-neft-i-kursom-rublya-v-2016-godu-1000971038

http://www.vestifinance.ru/articles/65848

Google translate is your friend 🙂

It is not government prediction but private funds and Lukoil, biggest private oil company in Russia. This is official government prediction, unfortunately it is on russian.

http://i73.fastpic.ru/big/2015/1201/b8/df6cd754ec0dc3da1e6480127c206fb8.png

First row is projections of price, two scenarios:

Base price for Ural(around $2 discount on Brent)

2016: $50

2017: $52

2018: $55

Pesimistic

2016-2018 average price $40.

All budget plans, GDP, CPI are project on this oil price projections in Russia.

So russian goverment don’t see oil price on brent over $60 in 2018.

And if i’m correct, Russian Central Bank and finance/economic minister now make plans for $30-35 average price for 2016.

I just see official numbers of EIA for LTO reserves in USA and that is around 14 billion, if that is true all predictions about US LTO production on 4mb/d in next 25 are imposible, they even imposible if there is increased of 200% in LTO reserves from today level.

Russian oil company, Gazpromneft, recently said that their current operations will remain profitable at $15 per barrel, and at $20 they will drill new wells

oil companies may remain profitable, yes, but $15-20 oil for several years means severe budget crisis, economy going strongly south and rising risks for social stability

it is unclear if oil companies could function well under such circumstances

What they said – is that they can withstand a short period of very low oil prices by limiting investments to maintenance capex. Nobody thinks that oil prices can remain at $15-20 levels for a long time.

“they can withstand a short period of very low oil prices”

depending on how long that ‘short period’ is everyone can lol

“Nobody thinks that oil prices can remain at $15-20 levels for a long time”

I think they actually can. Thats not likely but if global economy is weak enough then higher prices (in constant dollars) might not be affordable long enough.

$15-20 for a long period of time?

Guess we should give up here in the US. Almost no one survives that. One year of prices averaging $49 WTI, which followed 5 years of very strong prices, has caused several BK and put many more companies in distress.

Unless, of course, you believe Mark Mills, who thinks US LTO will soon be profitable at $15-20 WTI through technological advances.

. I suppose there is quite a lot of legacy oil, meaning oil in fields that are already developed, that can be gotten out of the ground for less than twenty dollars a barrel. Twenty ought to be enough to cover day to day operating costs in a lot of oil fields.

But my wild ass guess is that such oil probably represents only a rather minor fraction of daily world wide production.

It seems obvious that many American stripper wells for instance are running deep in the red at less than twenty to OVER FORTY bucks, on a day to day basis. If prices will stay in this range, the owners of such wells are going to be FORCED to give it up.

Hopefully somebody who crunches numbers can throw a little light on this question.

Now insofar as subsidies being used to maintain production, yes, paying producers extra money will get some extra production.

But this is merely a BULLSHIT argument, because the producer is STILL getting the price HE must have to continue to produce. WHERE the money comes from is irrelevant, in terms of his staying open for business.

test comment.

US lto URR will be about 30 to 40 Gb if Oil prices follow the eia reference case

https://www.eia.gov/forecasts/aeo/images/fig_21.png

This?

If that is true, 30-40 billion barrels LTO reserves, they chart and predictions are useless because all LTO will be extracted by 2040.

Sarko

EIA forecast is too optimistic

My guess for LTO is based on USGS and David Hughes work. Decline will be steep after 2023 for US LTO.

It’s not matter is i’m optimistic or pessimistic, it is not mathematically possible. I don’t speak about geology, steep decline of wells etc. I talk about reading chart which EIA presented. If there is 40 billion LTO recoverable reserves on $60-70 barrel(EIA in 2013 put 14 billion, on $100, so i put numbers nearly 3 times greater because of technology, costs squeeze etc.) it is not possible be on 4-4.5 mb/d on average 2015-2040.

4.5mb/d x 365 d x 25 years= 41 billion barrels.

Sarko,

According to the EIA Annual Energy Outlook 2015 (base case), technically recoverable resources (TRR) of LTO in the U.S. are 78.2 billion barrels (+35.8 bbls of NGPLs).

In AEO 2014, these estimates were 59.2 billion barrels and 27.6 billion, respectively;

In AEO 2013: 47.1 billion barrels of LTO.

I do not know where your number of 14 billion comes from?

To note, estimates of technically recoverable resources do not depend on the price of oil, and the EIA does not provide estimates of economically recoverable resources.

I am not saying that the EIA projections are correct, but at least their LTO production forecasts correspond to their TRR estimates.

http://oi66.tinypic.com/2mzmctv.jpg

U.S. Crude Oil and Natural Gas Proved Reserves

With Data for 2014 | Release Date: November 23, 2015 |

https://www.eia.gov/naturalgas/crudeoilreserves/

US tight oil reserves 2014: 13. 365 Gb

And yes they claim resources on 78.2Gb(until this year was 58 Gb, how is possible so much growth on resources in this price environment is mystery for me), but that is potential resources no proven reserves which for now stood on 13. 365 GB.

But in end it is not matter what they claim for potential resources, they can claim 1 trillion barrels but what is matter reserves and for now they are 13.3 GB, i put 3 times greater number and 4-4.5 mb/d average 2015-2040 is mathematically not possible in that case.

Proved reserves is a completely different category.

EIA production projections are based on TRR

OK

Thank you for that clarification.

Also, i use data which Dennis Coyne put on 30-40 Gb, which is pretty optimistic for proven reserves, you must admitted that.

That is Hamm 24 Gb projections in Bakken, plus 100% growth proven reserves in Eagle Ford plus 4 times greater reserves in Niobara and other plays(outside of Bakken and EF) than now. Pretty good.

Dennis’ numbers are for TRR as well.

He says that his “guess for LTO is based on USGS and David Hughes work”

But, unlike the EIA, USGS updates estimates for shale plays resources relatively seldom. And David Hughes’ past forecasts of LTO production have proved too conservative.

Hi AlexS,

I use USGS for the Bakken/Three Forks, Hughes for the Eagle Ford (which might be too conservative, I would use USGS estimates if they were up to date), the Permian and other US LTO plays I have assumed will be 20 Gb for LTO, which is just a guess, but 40 to 50 Gb is probably in the ballpark for URR, based on wells drilled to date. The EIA tends to over estimate resources using private forecasts which are not very good.

Remember their Monterrey shale estimate?

“how is possible so much growth on resources in this price environment is mystery for me”

TRR estimate is not dependent on price.

It is calculated based on the “Area with Potential” (in sq. miles), average well spacing (wells/per sq mile) and average estimated ultimate recovery (EUR) per well

Hi AlexS,

The EIA seems to base their TRR estimates on investor presentations, their LTO TRR estimates are very optimistic. Probably 20 Gb total from Bakken and Eagle Ford and about 20 Gb from the Permian LTO and other US LTO plays for a total of 40 Gb is reasonable. The 80 Gb TRR estimates are likely to be high by roughly a factor of 2 in my opinion.

We will see a steep decline in US LTO output between 2020 and 2025.

Dennis,

the EIA’s EUR estimates for all tight oil plays are much more conservative than in companies’ presentations. It seems that the increase in TRR estimate was due to tighter assumed well spacing. But the actual well spacing in currently producing subplays is in many cases even tighter than the EIA assumptions.

I don’t want to guess what is the right number of TRR because of too many uncertainties (including potential impact of technologies on LTO recovery rates).

What may have a negative impact on LTO production is not TRR, but low oil prices + poor economics of shale companies.

Hi AlexS,

The tighter spacing is likely to result in lower EUR for the tightly spaced wells. The USGS is smart enough to realize this is likely to be the case, the EIA knows less.

Another flawed assumption is that the tight well spacing will be profitable throughout the play and that the quality of the wells will be uniform throughout the play.

A cursory look at the Bakken data shows that these assumptions are not very good. The tight spacing will only be profitable in the sweet spots with high oil prices.

Most oil exporting nations prepare a budget based on what they think is a very conservative oil price forecast. The surplus is placed in a savings fund, or is used to supplement the budget. The one thing you can deduce is that Russian government experts think the price will be higher than $50 per barrel.

Russia’s budget is based on $50/bbl in 2016, but there are stress scenarios assuming $40/bbl and even lower

Ron I note that in the post, some places use the word Supply and in others, Production. In OPEC terminology, Supply adds processing gains to Production. Could this be part of the difference you mention between EIA and OPEC?

No, I don’t think so. In the charts that I copied and pasted, they say supply and, in this case anyway, they mean total production. And I was comparing only the supply marked as “crude”. This does not include anything except crude. OPEC’s total “crude” is way less than the EIA’s or even JODI’s “crude + condensate”.

The number from OPEC WOO excludes condensate

I have posted a comment on this in the previous thread

http://peakoilbarrel.com/all-roads-lead-to-peak-oil/comment-page-1/#comment-552304

Global crude + condensate supply by category, 2014

Source: OPEC WOO-2015, excel download for the figure 3.15

Thanks AlexS,

So for 2014 only a 400 kb/d difference in the OPEC and EIA estimate for World C+C, which was 77.8 Mb/d.

The actual net energy available on a per barrel basis, the way the accounting is done, including ever higher percentages of very light oil, condensate, natural gas liquids, etc, MUST be falling off significantly.

How we should account for this loss in energy density is debatable, in terms of the peak oil debate. But in the real 3D world, it is no doubt already a big enough loss that it should be accounted for in forecasting future consumption measured in barrels.

If oil production is going to actually increase , for another couple of decades, in the face of the depletion of today’s legacy oil fields, then the exploration guys are going to have to work some miracles, finding oil in substantial amounts, in places that have been combed over multiple times already. And the production guys are going to have to come up with some miracles too, in order to keep the per barrel cost in constant money below a hundred bucks.

Now being a practical old farmer, I do believe in ” miracles”, having witnessed half a dozen or so over my life time,for example cell phones, no till planting, genetic engineering, etc. But I don’t believe in PREDICTING they will come to pass within any given field, within any given time frame.

I am with Ron, I believe all these rosy forecasts are nothing less than ridiculous, in terms of increasing total production annually going forward, especially at the prices mentioned.

Here is a bit of timeless wisdom, the work in plain language of a genius who FORGOT more about the socalled mind of the naked ape than the combined social science faculty of most universities these days knows COLLECTIVELY.

This just might be a perfectly good explanation for these rosy forecasts- assuming they turn out wrong. If they do hold true, nobody will be able to laugh at me, or Ron, because we are going to be beyond such troubles. 😉

Read it for insight and for pleasure.

http://www.paulgraham.com/cornpone.html

Incidentally,

Merry Christmas to one and all, it is the thought that counts, not the mythology.

It would put a real smile on my face if somebody will explain to me PRECISELY and EXACTLY how to link to an old comment,using plain English, no jargon, without copying and pasting the comment itself. .

I am always glad to get another little present, lol.

If you do a search, google, for instance, peakoilbarrel, poster’s name, the following results will be from an old peakoilbarrel post. When you find the old comment in the comments, there is a date, click on the date and the comment will appear, the url will have the comment number, copy that, you will then link to the comment. I hope it helps or at least ‘splains how to it is done.

http://peakoilbarrel.com/us-production-by-states/comment-page-1/#comment-544642

Thanks Ronald,

So utterly SIMPLE, but just not at all obvious or intuitive. Find the comment, click on the date, and the URL displays. Copy it.

You can look for this answer a week in computer help forums,and guaranteed, it will take everybody who posts in them at least three pages of jargon to say the same thing.

Yesterday we had a good discussion ongoing about the case for disruption and RR’s current positions involving the future of renewables and of the oil industry.

I have a LOT of respect for RR, but he has to make a living, like most of us. Keep in mind WHERE he posts these days, and that he consults for businessmen who are necessarily concerned with short term and medium term results.

http://peakoilbarrel.com/all-roads-lead-to-peak-oil/comment-page-1/#comment-552507

RR on 60 Minutes. I am waiting to see OFM on 60 Minutes. http://www.energytrendsinsider.com/2014/01/08/60-minutes-the-rest-of-the-story/

Hi Robert,

I WISH, but unless a meteor hits my house or something equally unlikely, I will never make national tv. I AM however putting together many thoughts here in this forum, and LOOKING FORWARD to their rebuttal. Better to be wrong now than later when I find a publisher, IF I ever find one for my book in progress.

As I said before, I have great respect for RR, but what he does NOT say is as important as what he DOES- at least on some occasions in some forums. And of course he has no control over tv show editors after being interviewed etc, as he points out in the link you posted.

Read this for nuance and clarity.

http://peakoilbarrel.com/all-roads-lead-to-peak-oil/comment-page-1/#comment-552496

Best Sentiments of the season to Ron and everyone here. I wish there were a few more hours in the day to keep up with all the Ronposts and comments.

Could this be a head fake on the part of OPEC, an attempt to appeal to the wishful thinking of Western policy makers (e.g., the sublime promises coming out of Cowboyistan and Planet Green) and to lure them into believing they have OPEC by the short hairs?

If so, OPEC has plenty of takers, such as Anatole Kaletsky:

Quoting Anatole Kaletsky:

In a normal competitive market, prices will be set by the cost of producing an extra barrel from the cheapest oilfields with spare capacity.

No, that is simply not so. I have heard this claim made many times in the last 15 or so years. That is the claim is that: “Oil is priced on the margin.” That is, as Kaletsky believes, the price of oil is set by the cost of producing the highest price barrel. And every time that is proposed, it gets shot down by people a lot smarter than me.

If the cost of producing that extra barrel is, say $80 a barrel, but only 80 million barrels can possibly be produced and the world could use 90 million barrels, then the price will rise to a lot higher than $80 a barrel.

Oil, just like everything else in the world, is priced by supply and demand and not what it costs to produce the highest priced barrel to produce.

Note: There are a few exceptions to the supply an demand rule. Rationing for example. Or price controls… or if you can corner the market on any one product like a life saving drug. Or another example: Congress says Medicare is not allowed open bidding for drugs but must pay the price that big Pharma asks. Big Pharma bought your congressman and demanded that the “no bid” clause be wrote into the bill. They did as they were told by the money that bought them their election.

The Veterans Administration is allowed to bid for the lowest price on drugs and as a result they get their drugs at a far cheaper price than does Medicare.

Hi Ron, and from one old sinner and heretic to another, lol, Merry Christmas, it’s the thought that counts.

“If the cost of producing that extra barrel is, say $80 a barrel, but only 80 million barrels can possibly be produced and the world could use 90 million barrels, then the price will rise to a lot higher than $80 a barrel. ”

This would be true in the SHORT TERM, and maybe out into the medium term.

But I maintain that if eighty million barrels can be produced for eighty bucks, a few more million barrels can be produced at a HIGHER PRICE, although there would be a significant time lag involved.

One thing is FOR SURE. MORE money can bring on more production, if if enough time is allowed and enough money is spent, at least in the oil industry, in the medium time frame.

Maybe at a hundred twenty five bucks, ninety million barrels would be easily possible.

But if the economy cannot support the one twenty five price, then less will be sold, and in the LAST analysis, it can be maintained that the cost of the marginal barrel DOES determine the price- allowing for time lags of course.

Such arguments are very much like the contest between checker players when both players are down to two kings each. Winning is damned near impossible, if the opponent knows the game.

You win in the short to near term, because it takes a good while to ramp up production. I think I win in the longer term, allowing the industry time to spend my hypothetical additional capex.

Money isn’t purchasing power, Mac.

The drillers can charge what they like but that does not give their customers the means to meet the price.

Okay … you can change the numbers. $25 becomes $80 … overnight. The number changes and nothing else. The purchasing power of $80 is the same as what $25 used to be.

The driller uses the same inflated dollars as the customer. He must pay no more $79 to extract the same barrel of oil and still make a profit.

… Oops, he’s not making a profit. He hasn’t for years. Only if the customer pays $80 for $25 oil does this plan work. It isn’t just the US: all the other businesses in the country and around the world would use the same inflated dollar. Hard to see how that would work: the economy would crash due to the effect of 320% hyperinflation.

It could be worse. The price change would be proportionate, the drillers costs would increase the same proportion as the final sales price. If the driller pays $79 to wring each barrel out of hard rock NOW he would need over $250 to extract each barrel in the higher cost future … the same barrels he might hope to sell for $80 … a $170/barrel loss on each and every barrel.

If the price rose slowly over a period of year, it would not have the desired marginal effect on extraction. Just like lower prices are not immediately reducing extractive output, today.

Let us now consider, the numbers aren’t changed for their own sake but instead reflect real purchasing power … every customer will earn 320% more in order to pay the much higher real price for petroleum! That’s great: Joe Stiglitz and Matt Bruening would approve. How will it happen? Driller purchasing power and the finance industry that props it up would lose purchasing power equal to that gained by workers!

In the end, the workers would be fooled as their purchasing power would be reduced or eliminated. This is because driller failures would mean less ‘goods’ to purchase. Even if their purchasing power increases … it declines. Do you see the feedback loop?

Most people can’t, that’s why they believe in electric cars and other bits of ‘technology’, unicorns and fairies.

Keep in mind, wage trends (all wages being borrowed from the employers’ customers and their bosses’ customers, etc.) are pointing to outright deflation. Eventually, employees will be outright slaves like those shrimp peelers in Thailand. They aren’t going to afford anything, much less $80- or $50- or even $20 fuel.

Hi Steve,

I do not dispute most of what you have said, but you have NOT addressed the original question. You are engaging in pounding the table, rather than pounding the facts or pounding the law, as my good fishing buddy and attorney puts it.

It is patently ridiculous to claim or assume that the cost of production of all the oil produced is the SAME. A NEW barrel in a great spot in Iraq, if the country settles down, might cost twenty dollars, all told , to produce. A NEW barrel from someplace up in Canada, tar sands oil, might cost seventy or eighty, a new field in the North Sea might need a price well over a hundred to justify production.

Various producers all over the world will have various costs, most likely none being less than twenty to thirty bucks for new production. No new oil will be produced at over a hundred ( for now) except if management is willing to GAMBLE the price will be over a hundred by the time production starts, or there are major cost overruns.

Some oil will always be produced at a loss, because once you have sunk enough money into the new field, finishing it, rather than abandoning it, will be a better decision.MISTAKES WILL BE MADE.

I have said NOTHING whatsoever about purchasing power, except to say only so much oil will sell at any given price, according to what the economy can afford.

HOW MUCH or HOW LITTLE oil SELLS , at WHAT PRICE, is utterly irrelevant to the question as to whether the price of the marginal barrel determines production.

Such arguments are always somewhat circular in nature, but if oil stays at a given price for any substantial period of time, then producers who can produce for less, will produce, and make a profit.

Those who cannot produce at that given price will eventually give it up, but only after holding on for a while hoping prices will go up.

Somewhere along there, in the production cost continuum, that PRODUCTION COST is the SAME as the prevailing price, allowing for time lags etc.

THAT cost, unless I am now totally senile, which is a possibility, is by DEFINITION the cost of the MARGINAL BARREL.

EVERYTHING ELSE is noise. Rationing is noise, subsidies are noise. Politics in general is noise,because what is put in, or taken out, of production via politics is PAID FOR, by some means or another.

If for instance a national oil company produces at a loss, then the loss should properly be attributed to the government, which instructs it to do so. There can be good reasons, such as keeping men employed, or harming enemies, but these are still real costs, paid for by SOMEBODY. In the last analysis , the citizens of the country pay for such policies.

A new TESLA does NOT cost ten grand less because you can get tax credits. It still costs the goddamned same, you are just getting a gift from the government when you get the tax credit. You can’t keep it, you MUST surrender it to TESLA , or you DON’T get the car. OR the credit. TESLA gets PAID THE SAME , tax credit or none. It makes no difference to TESLA.

I have never even HEARD of an economist who is taken seriously who does not believe in marginal costs determining production level in a competitive industry-Allowing for subsidies, price wars, business cycles, etc, all of which introduce enormous amounts of NOISE.

In industries where producers have PRICING POWER, production costs may have very little to do with selling prices and volume.

Diamonds are the classic example. But even so any producer more or less has to accept the price the diamond cartel offers for his production, since the cartel pretty much controls the marketing of diamonds.

This means diamonds too have a marginal production cost, which determines the upper limit the miner can spend to work a given deposit, per diamond or per carat or whatever. If his costs are less, he produces, if higher, he holds off.

The cost of production of diamonds will vary from place to place, just like anything else produced by making holes in the ground. .

There might be plenty found in one spot, hardly any a mile away, then plenty again another mile away.

It is INSANE to assume there is a lack of competition in the world wide oil industry, especially at this time, when it is in the throes of a cutthroat price war, with blood everywhere, and a lot of producers already in bankruptcy and plenty more headed there soon.

OF COURSE some deep pocketed producers will deliberately run at a loss, hoping to force out some competition, and maybe buy up some assets at fire sale prices, and make up their losses with plenty to spare, when prices go up again. THAT is noise too.

The cost of extraction is irrelevant to the end-users whose only concern is the availability of funds.

The ‘utility’ of fuel or other resource being offered is irrelevant to the miner/driller whose concern is likewise the availability of funds.

Both driller and customer are competing for the same funds. If driller needs more funds due to geology or some other reason the customer will be deprived of them. If the proportion of funds allocated to drillers and customers remains unchanged, the driller is effectively denied funds and there will be a shortage due to depletion. When the greater proportion of funds is allocated toward drillers the customers must do without … as they must right now. The ongoing decline in fuel price speaks for itself.

Nobody in the fuel industry has purposefully set a low price. If drillers could gain more $$$ they would. Instead they are hunting for a market which is increasingly deprived of credit … deprived by the drillers themselves answering their own credit needs. When the regime breaks down and credit is (ultimately) gone what will be left to bid is use that offers an actual economic return.

That means agriculture and some emergency use. Everything else is discretionary/recreational.

That means the bid is likely to be a negative number … it’s also where the fuel price will ultimately sink to, a negative number. Oops! Bye, there goes the entire oil industry! That is what is underway right under everyone’s nose!

We desperately need to invent a better use for fuel besides to waste it for fun. Looks like we will run out of fuel before we can come up with something.

🙂

Oops! Bye, there goes the entire oil industry! That is what is underway right under everyone’s nose!

True dat!

But when anyone, tilts their head forward, to see what is under their nose, it is no longer under their nose so they can’t see it 🙂

— Can’t see it” modify to “can’t see what’s NOW under their nose.

Fred, I always admire your logic, so similar to mine. Does that earn me promotion to honorary Hungarian?

So, having maybe got your attention, I get to the point. Can any of you Hungarians explain what I, a mere saxon deep in the dark, wet hills, cannot fathom.

1) no choice, we gotta get off ff’s real quick

2) that given, we gotta leave those megabarrels we already know about right where they are.

3) so, whatthehell are we doing looking frantically and expensively for yet more of them that we gotta leave in the ground?

4) seems to simple me cheaper by far to not bother with finding them, and leave them in the ground, than find them at great cost and THEN leave them in the ground.

Yes? No? I seek enlightenment; for some reason, it’s abnormally dark around here, even for this time of year.

“The Martians” was the name of a group of prominent scientists (mostly, but not exclusively physicists and mathematicians) who emigrated from Hungary to the United States in the early half of the 20th century.[1] They included, among others, Theodore von Kármán, John von Neumann, Paul Halmos, Eugene Wigner, Edward Teller, George Pólya, and Paul Erdős. They received the name from a fellow Martian Leó Szilárd, who jokingly suggested that Hungary was a front for aliens from Mars. (This is analogous to Enrico Fermi’s answer to the question whether extraterrestrial beings exist: “Of course, they are already here among us: they just call themselves Hungarians.”) Source Wikipedia

We welcome you to join us on our home world, wimbi! 🙂

Alas, as for logic and critical thinking skills, very few humans possess those skills… perhaps a few Richard Feynman’s here and there or a Daniel Kahneman or two, an E O Wilson and a few others…

Yet another one was my favorite prof, Egon Orowan, who gave us wonderful insights on how science really works, from anecdotes from the early part of last century before Hitler bestowed all of those guys on USA & GB.

When asked by a bolder than usual student why his lectures contained near none of the putative subject matter, he replied:

“I have written what I know about that in the book, you have read it, so now we are free to talk about important things.”

Hi Steve from VA,

The amount of funds available are not fixed, they grow as the economy grows. So your competition for funds explanation does not really hold in practice. In the long run the price of a product will tend to be near the marginal cost of the most expensive producer. If there is not enough demand for the product at that price, the price falls and the most expensive producer goes out of business.

Available funds have nothing to do with this story. That is all about money and banking and the central bank setting interest rates that allow the economy to operate close to full capacity (low unemployment rates).

One could argue that the economy will tend to underutilize productive capacity especially when governments cannot implement expansionary fiscal or monetary policy when needed (as in European nations that are part of the Eurozone.)

That is indeed a problem which might eventually be recognized by Europeans. A choice needs to be made between a strong central European government under the present system or returning to individual nations with separate monetary and fiscal policies. The present arrangement will not be stable in the long run.

Hi Steve,

I will not dispute most of what you have said, but none of it is relevant to the question of the relationship between production, price, and marginal costs, in a competitive marketplace.

You are pounding the table, as my good fishing buddy and attorney would put it, rather than pounding the law or the facts. That’s what you do when you don’t have a case, you try to distract the audience.

When all is said and done, allowing for time lags, political manipulation, etc, some producers have costs low enough to sell at some given price, say seventy bucks. If their costs are higher, they eventually give up. If lower, they continue to produce.

Some are going to have costs just a hair under the example, seventy dollars. They will produce the last marginal units,- in a truly competitive market.

FOR SURE some producers will run at a loss for a long time, hoping to drive competitors out, maybe buy up assets at fire sale prices, etc, and make big profits later. Some may produce at a loss because their sovereign governments give them no choice in the matter, for various reasons.

But in the end, in the last analysis, in a competitive marketplace, some producers have cost equal to the going market price. This cost by DEFINITION is the marginal unit cost. They make money if price goes up, lose money if price goes down. After a while they usually quit unless prices go up at least a little, leaving them with a slim profit margin.

This eight seventeen comment is posted because the one above it seemed to have gone astray. Comments usually appear right away, but the earlier one did not show for me.

Mac, sometimes the spam filter catches your comments because of the extreme length of the comment. If you would shorten them a bit they would not get caught.

Also a lot more of your comments would get read if they were shorter. Very few people bother to read those very long rambling comments.

Brevity is the soul of wit.

Mac is the Saudi of comments. Flooding the market place and fighting for his share of comments with supertankers of them sitting on the edge of his finger tips. Ready to pollute the internets until the lights go out. Just waiting for the other posters to go out of business. After he has destroyed us all, he’s going to rise the price of his comments and we will all bow to him as the God of comments. This is all part of Donald Trumps capitalist-fascist plot to make America Great Again.

Only Nick G can save us and our freedoms with his solar powered EV propaganda machine.

Now pay no attention and go shop until you drop !

Paid for by Amazon

LOL! Thank you 🙂

The very buttons are popping off my shirt at the thought of such (satirical ) praise coming my way.

😉

But I am going to change my ways, and post long comments at the end of the PREVIOUS main post, and put a link in the current main post from here on out. Anybody interested can just click, everybody else can easily skip.

http://peakoilbarrel.com/all-roads-lead-to-peak-oil/comment-page-1/#comment-552692

Hi Old Farmer Mac,

I agree.

When people talk about marginal cost pricing, it is the cost that a high cost producer will be willing to produce a product for in the long run.

If the price needed to balance supply and demand rises above the marginal cost of the most expensive barrel then over time more expensive resources are produced until the cost of the marginal barrel rises to the higher price.

Ron is correct that supply and demand always determines the price. Marginal cost pricing is all about the decisions of the suppliers in maximizing profits at any given price level. many people don’t see this until intermediate level microeconomics so it is not commonly understood.

Hi Dennis,

And like bugs circling a light, the whole affair is circular in nature, to a large extent. What customers can and will pay determine price at the upper limit, but what determines prices the REST of the time, is the cost of production of the commodity.

If I could truly control the supply of apples, I could get two dollars a piece for them at the farm. But we shut down the family orchard mostly because other growers , with larger operations and lower costs, ran us OUT, given that we are too old to be expanding.

At least one orchard within a few miles will be “shut in” PERMANENTLY this year, because the trees are old and cost of producing it is now above the going wholesale price. The land is also a bit too steep for the latest generation of machinery, so it won’t be reset with new trees.

As Shallow Sand often reminds us, you can’t just turn off the lights and lock the door and go back in a year or two, you have to spend a lot of money, meantime, and MORE THEN, in order to reopen an oil well.

I am not surprised after learning about the costs of temporary abandonment of wells that producers are so reluctant to shut them in, preferring to gamble on prices going up.

Hi Old Farmer Mac,

I agree on already producing wells.

What I can’t figure out is why they continue to drill and complete new wells in the LTO plays at these oil prices.

There is much I do not understand, but it seems they are hoping that prices will go up and that the other oil companies will stop completing new wells.

Kind of a game of the last man standing, perhaps.

If the cost of producing that extra barrel is, say $80 a barrel, but only 80 million barrels can possibly be produced and the world could use 90 million barrels, then the price will rise to a lot higher than $80 a barrel.

Ron,

Read what he said carefully. He said “prices will be set by the cost of producing an extra barrel from the cheapest oilfields with spare capacity.”

So, he’s talking about a situation where current production is below it’s short-term capacity. You’re talking about a situation where current production is above it’s short-term capacity.

Hi Ron.

There is a great deal of debate on the blog about price at the moment but all things financial post 2008 are subject to manipulation.

Surely the only important factor from a peak point of view is the cost of extraction in energy terms when it costs one barrel to produce one barrel the cost is too high.

Clearly oil can be drilled and extracted at huge financial loss as we now see but if credit remains available then this does not curtail production and the fed has unlited ability to create credit.

Ron,,

What they call “OPEC crude supply” is not projected actual production, but “the requirement for OPEC crude”, i.e. global demand less non-OPEC supply. OPEC NGLs and OPEC other liquids (mainly GTL).

Actual OPEC crude production will most likely be higher (Iran, Iraq, Lybia)

Alex, I just quoted the barrels they said OPEC would produce. I cannot get into their heads and ascertain their reasoning for making those projections. But I sure do not agree with your scenario.

OPEC’s long term projection most certainly does include higher production from Iran, Iraq and Libya. And I think that long term production will be far lower than they project. Just where in the hell do you think they are going to get an extra ten million barrels per day? Or even more if you are correct in that that they will produce even more than they are predicting.

Ron,

This is how all OPEC forecasts, including MOMR and WOO, are structured. They never make projections for OPEC members’ production.

Rather, they are projecting “requirement for OPEC crude” (see page 1[28] of the report).

Similarly, the IEA is projecting the “call on OPEC crude” in its OMR and Medium-Term oil market reports.

My personal view is that, based on spare capacity and new project schedule, OPEC could add up to 3 mb/d by 2020. However, the actual increase will be much lower, due to production decisions, low oil prices and political instability. I agree that further increase to 40 mb/d by 2040 looks very speculative.

OPEC liquids production forecast: OPEC WOO 2015 vs. EIA AEO 2015

Very interesting AlexS.

The EIA and OPEC seem to be on the same page.

Yes, Dennis

All what was said about allegedly over-optimistic OPEC’s production estimates can be attributed to the EIA, IEA and most other LT energy forecasts.

They must be assuming a large increase in Venezuela. Rather than write a bunch about Venezuela, here’s an old post I wrote about the current problems they face

http://21stcenturysocialcritic.blogspot.com.es/2014/10/is-venezuela-running-out-of-oil.html

Here’s a bs set of forecasts I prepared:

http://21stcenturysocialcritic.blogspot.com.es/p/venezuelas-oil-reserves.html

This purely imaginary set of scenarios includes one case with regime change and a steady $160 per barrel, which allows total country production to increase from 2.1 to 8.3 mmbopd (roughly) by 2050. The increment in 2040 would be about 4 mmbopd above this year’s rate.

Note that I’ve actually planned developments for up to 1.2 mmbopd. We had a smaller project and investment in mind, but pdvsa had shown plans for 1.2 incremental, and I needed a solid study to show them the huge amount of infrastructure they needed to consider. To scale up to the 8.3 mmbopd I simply stacked more “pseudo projects” delayed in time in lesser quality areas.

There are significant technical issues involved in a mega project like that. I can’t really spill what I know, but it should be clear that the pace of development has a limit. To be honest, if I were consulting for the government I wouldn’t recommend a peak higher than 6 mmbopd for the whole country. And even that may be contrary to the country’s interest.

The EIA expects most of incremental OPEC liquids production to come from the Middle East: + almost 10mb/d between 2014 and 2040;

North African OPEC members are expected to add 1.56 mb/d;

West Africa: 1.16 mb/d

and South America only 0.72 mb/d

OPEC total liquids production forecast (mb/d)

Source: EIA Annual Energy Outlook 2015

Alex, the EIA may have a better idea, but I wonder what OPEC projects for Venezuela?

This morning I saw a message from a friend in KSA, who saw my comment about my Venezuela estimate, and passed it on to his circles. I’ll wait a few days to see if I get feedback from either Saudi or Venezuelan veterans.

Ron Patterson said:

So why would OPEC publish something which flies in the face of factual reality, and so blatantly?

Surely they have people on the payroll way smarter than any of us who know that what they are publishing is not true.

Why would they make such a glaringly false claim?

OPEC always miss on demand/supply by 2-3 mb/d in 10 year period. For example, demand before crisis 2008/09 are overestimated by 2-3 mb/d for 2015 but after crash 2008/09 underestimated for 2 mb/d. That is pretty much because that might mean $40-50 or $80-90 price. If you don’t believe just look on OPEC site WOO from 2007 onward.

I don’t call that they make huge failure in projection, i think that supply in future will be lower 1-2 mb/d per decade and demand higher but only marginally, max 500kb/d, per decade. But like a stated today oil is trading on 1-2 mb/d margin on supply/demand difference and that mean big difference in price.

Why would they make such a glaringly false claim?

Oh good god, they do not do it intentionally. They make mistakes, not false claims. And their projections, like the projections from the EIA or the IEA, have always been off by a considerable amount. And like the EIA and the IEA, their projections have almost always been off on the high side. They always project that far more oil will be produced than actually will be produced.

I have no explanation for this except that the people who’s job it is to do this seem to always have an optimistic bias. These people flat out do not believe in peak oil so nothing in their projections can indicate that oil will peak. How could they possibly project something they firmly believe will never happen? Well, not in their lifetimes anyway.

The simplest explanation is that projections about anything are usually quite conservative. There are two very good reasons for that. Conservative projections are on average more probable to be right than radical projections. And if you end up being wrong, a conservative projection will never get you in trouble. Also, the people doing projections tend to use group thinking, because they don’t want to be outside of the pack and be proven wrong.

That’s why you can never trust projections about anything from professional casters. On a changing world they are almost always missing by a wide margin.

“Why would they make such a glaringly false claim?”

ONE-Institutional inertia. Ya don’t contradict your boss the supervisor who wrote the LAST forecast and the one before that to any extent greater than necessary .

TWO-The people producing the forecasts work for bosses much higher up the ladder, bosses with agendas having to do with politics and the long term fortunes of their countries and their industry. Truth is dispensed or ignored in such circumstances as suits the agenda.

Forecasting cheap and plentiful oil for decades to come is an excellent way to delay the adoption of renewable energy, and electrified transportation, to substantial extent, at trivial expense.

This is DAMNED GOOD for the material fortunes and physical security of the House of Saud, which dominates OPEC, and which depends on the military might and good will of the USA to ensure it’s continued existence, other than as refugees and prisoners.

There are plenty of people in the USA who believe we are necessarily addicted to imported oil. I am one of them myself, if we assume a time frame of less than fifteen to twenty years. I don’t think we have ANY real hope of weaning ourselves off of imported oil any quicker, and maybe not much hope even after that. Circumstances will FORCE us to adapt to importing less and less ever more expensive oil as time passes imo.

So- Even though I hardly care at all, except in the abstract, about what happens to the denizens of ” Sand Country” , I think it is in our Yankee interests to try to keep things on as even a keel as possible “over there” which means supporting our oil exporting business associates in that part of the world. I hesitate to refer to any of them as our FRIENDS. They aren’t, not really, not in my opinion, at least.

Bottom line, forecasting cheap oil out the ying yang is imo damned good politics on the part of OPEC.

YMMV.

I find this discussion interesting and naive.

OF COURSE they make false claims. False claims are the basis of finance, accounting, marketing, business, and politics in the whole world.

Our world is filled with false claims. Everybody is making false claims, all of the time.

As people who are supposedly objective thinkers and skeptics, you should recognize this. But your belief in the “goodness” and honesty of the system prevents you from understanding this.

But your belief in the “goodness” and honesty of the system prevents you from understanding this.

That is absolute bullshit. As May West said, “Goodness had nothing to do with it.” You mind is just filled with the stupid idea that everybody is lying every time they open their mouth. It is the duty of all oil monitoring agencies, the EIA, IEA, OPEC, etc, to make predictions. And predictions are extremely difficult. But some people with tiny minds seem to believe that every prediction they make is part of some kind of conspiracy theory… so therefore of course they are lying, or so you think.

No, these are just fallible people trying to do their job the best they can. But the world is full of conspiracy theory nutcases that believe everything is some kind of conspiracy and therefore everything any agency like OPEC says has to be a lie. But your belief that everyone is lying about everything prevents you from understanding this.

Hi Ron,

In addition to pointing out institutional inertia and political considerations, I should have added your response, which is also a good solid answer.

Because they believe in oil. Religiously, almost.

All the evidence in the world has no more effect than rain on a duck’s back if the person in question refuses to look at it. A duck never gets wet, no matter how hard it rains.

😉

oldfarmermac said:

But the guys from the Domestic Energy Producers Alliance certainly are not guilty of making the same mistake OPEC did.

https://www.eia.gov/conference/2015/pdf/presentations/hamm.pdf

And you would not argue that the guys from Cowboyistan don’t have the oil religion, would you?

There seem to be some schisms appearing within the church.

My comment was in response to Ron Patterson’s comment, indicating I agree with his personal explanation for such bullish oil production forecasts out until 2040.

Ron said, “I have no explanation for this except that the people who’s job it is to do this seem to always have an optimistic bias. These people flat out do not believe in peak oil so nothing in their projections can indicate that oil will peak. How could they possibly project something they firmly believe will never happen? Well, not in their lifetimes anyway.”

I agreed, saying ” Because they believe in oil. Religiously, almost.”

We weren’t discussing DEPA forecasts.

I am glad to see you post stuff from DEPA, some of it is new to me, and throws some light in previously dark corners.

The Domestic Energy Producers Alliance says OPEC has declared war on US domestic oil producers.

I suspect it’s a lot more complicated than that. But that’s what the word is coming out of Cowboyistan.

How did I know this response was coming?

Utterly predictable.

You have a valuable blog, Ron, but you have a giant blind spot. You actually believe in the honesty of the system. There are many other doomers and peak oilers who understand how manipulated everything is.

I’ll leave it at that.

No, I just don’t believe everyone is lying all the time.

Really, it must be a terrible world you live in. Everyone in the oil business is lying about everything. Everyone working for OPEC, the EIA, IEA, JODY, Platts, etc. etc. are lying. The media is lying with every word they print.

As I said, you live in an awful world.

Some people do lie and some people do tell the truth. We know executives must put up the best front they possibly can without it being obvious they are lying. Sometimes it is obvious as in: “Tobacco does not cause cancer.” But those lies are soon found out. They don’t say that anymore.

You must be realistic. Only if you are realistic can you even have a clue as to when people are lying and when people are telling the truth. But if you believe everyone is lying all the time then there is nothing real in this world. Don’t ever read anything or listen to the news because it is all lies. People like that should just curl up in the fetal position and wait for death because there is nothing but lies in the world.

Dead on Ron,

The world would screech to a halt pdq if everybody was lying most of the time, never mind ALL the time.

Most industries can get away with bending the truth to some extent to suit their own agendas, some of the time, but the truth generally rules, and almost always comes out, eventually.

Commodities in general are highly manipulated imho. Naturally, Chinese buyers of copper, iron ore and other commodities have an interest in talking down the Chinese growth story. Why pay more?

OPEC was founded largely to gain pricing control over multinational oil companies, effectively drawing a line in the sand pitting the middle east and venezuela against the West.

OPEC wants us to feel fine, avoid energy saving measures or consider reducing dependency. Maybe the global warming issue comes into play in USA and Europe behavior, they want to reduce dependence but can’t say it openly?

These estimates are totally meaningless and I believe that all insiders are fully aware of this fact. In all probability, these estimates are either designed to obscure what is really going on in the global energy industry from the general public, or are just some token effort to provide some kind of forward “guidance”. I would not take them seriously at all.

Stavros,

Well that’s certainly my take too.

I’ve been hanging around old oil men and card sharks for way too long to take anything they say at face value. In my younger days, I was quite an accomplished card player myself.

When I first graduated from college I was working for Cities Service Oil Company as a junior engineer. I was making $800 a month from Cities Service, and two to three times that in my spare time playing cards.

Poker is a game based on information availability. We don’t ever know for sure how good or bad another player’s hand is, often until it’s too late.

A poker player gains an advantage if he observes and understands the meaning of another player’s tell, particularly if the poker tell is unconscious and reliable. Sometimes a player may even fake a tell, hoping to induce his opponents to make poor judgments in response to the false poker tell. After all, poker is a game of deception.

After working for Cities Service and a couple of other independent oil companies for a few years I went to work for a couple of third-generation Hunt boys. H.L. Hunt, they said, had also prided himself as being an accomplished poker player.

One of the landmen I worked with was one of the old timers that had worked for H.L. Hunt in the early days. He told me that Dad Joiner, the promoter who drilled the discovery well for the East Texas Field, teamed up with a self-trained geologist by the name of Doc Lloyd.

Lloyd had drawn a map which supplied the “scientific” information necessary to justify the drilling of the discovery well for the East Texas Field. The map had all the major producing oil fields at the time located on it, and Lloyd drew lines through these. The point where these lines intersected Lloyd called “the apex of the apexes.” And that’s where Joiner drilled the Daisy Bradford No. 3.

H.L. Hunt had lease holdings to the east and south of the Daisy Bradford No. 3, but he had drilled a dry hole on his leases. However, to the west Deep Rock Oil Company was drilling a well, and Dad Joiner owned almost all the leases in between the Daisy Bradford No. 3 and the Deep Rock well. If the Deep Rock well struck oil, then there was a good chance all the leases between it and the Bradford farm contained oil beneath them.

At that point, Hunt still didn’t know how good Joiner’s holdings were, but he set up an arrangement that would tell him before anybody else knew. He assigned one of his scouts to hang around the Deep Rock rig and get information about what was underground. As soon as he knew something he was to call Hunt.

Hunt, his business associate Pete Lake and his attorney J.B. McEntire began a high-pressure campaign to isolate and entertain Dad Joiner. The old hustler was kept from contact with anybody outside the hotel and there was constant partying with women and booze for the old man, who, even at an advanced age, led an active life. Hunt finally received the call from his scout: The crew at the Deep Rock well had reached sand, and the scout had seen the drilling samples from the well which indicated a rich oil find. That meant that the field, however big it might be, extended westward into the major part of Joiner’s lease.

With this information in hand, Hunt was now ready to relieve Joiner of his lease block. Hunt of course did not mention his scout’s call about the Deep Rock well, but he did remind Joiner of all the oilfields that had been flooded by water and otherwise played out soon after their discoveries. Joiner had been around long enough to know that was true, and in a few hours, he accepted Hunt’s offer.

The old Hunt Oil landman told me Joiner had oversold his leases by several hundred percent, so it took years to clean up all the legal mess.

In retrospect, nevertheless, the worst that can be said about the coup that Hunt pulled off against the old oil promoter was that he had conned a con man.

Hunt called that deal “the greatest business coup” of his career. And indeed it was. It laid the foundation for an oil and gas empire which was to eventually make Hunt the richest man in the world.

A really loathsome piece of work who as you seem to be pointing out has been the template for several generations of ‘self made men’.

So I think this is a brilliant report.

Anyone in OECD holding out for higher prices makes decisions based on this then even the 3 million barrels of additional supply, which is 600,000 barrels per day per year, will not happen.

Even if that does, at $55 demand should grow in excess of 1 million barrels per day per year.

The best part about this is if SA has the biggest hand in getting this report done, and I have no reason to believe otherwise, all OPEC members should be ready to cooperate with cuts.

At $55 half the OPEC members get bankrupt in 5 years, including Saudi Arabia.

I think once December 31st passes OPEC might cut. Why December 31st? That is the price the auditors will use to assess the value of the oil in the ground for US shale companies. A low price then assures they will not get any credit increases till December 2016 even if the price rebounds.

If they are going to cut, it will be after December 31st.

“The best part about this is if SA has the biggest hand in getting this report done, and I have no reason to believe otherwise, all OPEC members should be ready to cooperate with cuts.”

Saudi Arabia is a vassal state and such decisions should be approved in Washington. This is approximately $500 billion stimulus for the US economy in two years (may be slightly less) and low oil prices are probably the best chance to avoid sliding into recession in 2017 and for FED to prepare for it by raising interest rates in 2016.

That suggests that they will be kept low as long as possible. If statistics needs to be manipulated to achieve that so be it.

Also low oil prices keep Russia and Iran on the ropes using lifting sanction as a Trojan horse, which is an explicit goal of Obama and neocons, who surround him:

https://www.washingtonpost.com/business/economy/as-crude-oil-prices-plunge-so-do-oil-exporters-revenue-hopes/2015/12/23/ed552372-a900-11e5-8058-480b572b4aae_story.html?hpid=hp_hp-top-table-main_oil-910pm:homepage/story

=== quote ===

At a time of tension for U.S. international relations, cheap oil has dovetailed with some of the Obama administration’s foreign policy goals: pressuring Russian President Vladimir Putin, undermining the popularity of Venezuelan President Nicolás Maduro and tempering the prospects for Iranian oil revenue. At the same time, it is pouring cash into the hands of consumers, boosting tepid economic recoveries in Europe, Japan and the United States.

“Cheap oil hurts revenues for some of our foes and helps some of our friends. The Europeans, South Koreans and Japanese – they’re all winners,” said Robert McNally, director for energy in President George W. Bush’s National Security Council and now head of the Rapidan Group, a consulting firm. “It’s not good for Russia, that’s for sure, and it’s not good for Iran.”

… … …

In Iran, cheap oil is forcing the government to ratchet down expectations.

The much-anticipated lifting of sanctions as a result of the deal to limit Iran’s nuclear program is expected to result in an additional half-million barrels a day of oil exports by the middle of 2016.

But at current prices, Iran’s income from those sales will still fall short of revenue earned from constrained oil exports a year ago.

Moreover, low prices are making it difficult for Iran to persuade international oil companies to develop Iran’s long-neglected oil and gas fields, which have been off limits since sanctions were broadened in 2012.

“Should Iran come out of sanctions, they will face a very different market than the one they had left in 2012,” Amos Hochstein, the State Department’s special envoy and coordinator for international energy affairs, said in an interview. “They were forced to recede in a world of over $100 oil, and sanctions will be lifted at $36 oil. They will have to work harder to convince companies to come in and take the risk for supporting their energy infrastructure and their energy production.”

Meanwhile, in Russia, low oil prices have compounded damage done by U.S. and European sanctions that were designed to target Russia’s energy and financial sectors. And when Iran increases output, its grade of crude oil will most likely go to Europe, where it will compete directly with Russia’s Urals oil, McNally said.

Ha….the conspiracy theory ideas.

That 500 Billion of stimulus is really $250 billion as the shale “miracle” dies in house.

And what does the $250 Billion cost?

Well SA is bleeding $10 Billion a month at current prices. So over 2 years that is $250 Billion. So that is net zero impact.

But wait….SA economy is 1/20th that of the US.

So this $250 Billion is 20 times worse for them as it is good for the US. Seems a very painful way to give everyone 50 cents more off a gallon.

Yeah…don’t buy those theories for a second.

True, thanks. I was wrong as for “stimulus”. It is a mixed blessing. Also this theory presupposes really poker players level of intelligence in Obama administration. So it must be wrong.