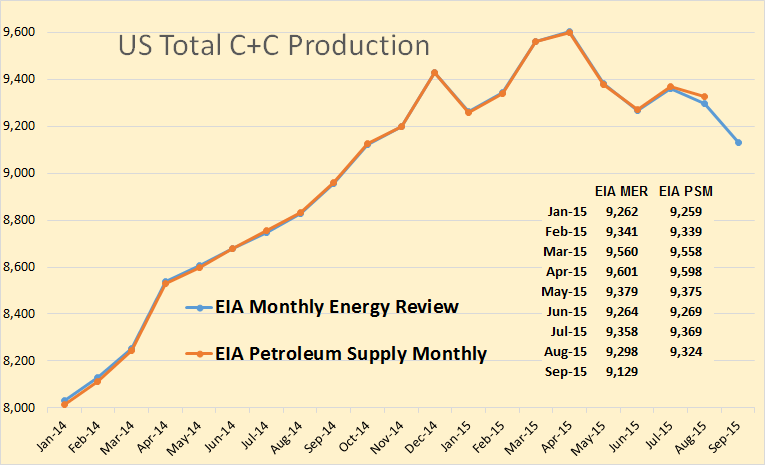

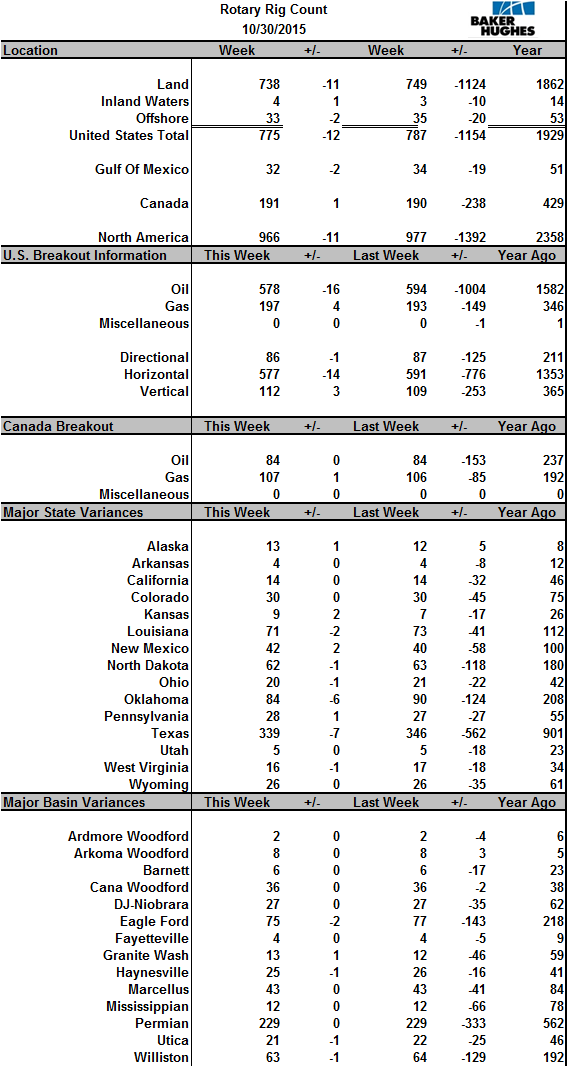

The EIA’s Petroleum Supply Monthly is just out with production numbers, through August, for each state and offshore territories. The EIA’s Monthly Energy Review is also out. This publication has US production data through September but not for individual states.

The Petroleum Supply Monthly June 15 production numbers were revised down considerably this month. And you can see they had a drop of 169,000 bpd in September. I think there will likely be an even larger drop in October. At any rate US production is finally starting to drop significantly.

The Gulf of Mexico is the one place that is bucking the trend. The GOM was up 146,000 bpd in July and up another 63,000 bpd in August for a total of 209,000 bpd for the two months.

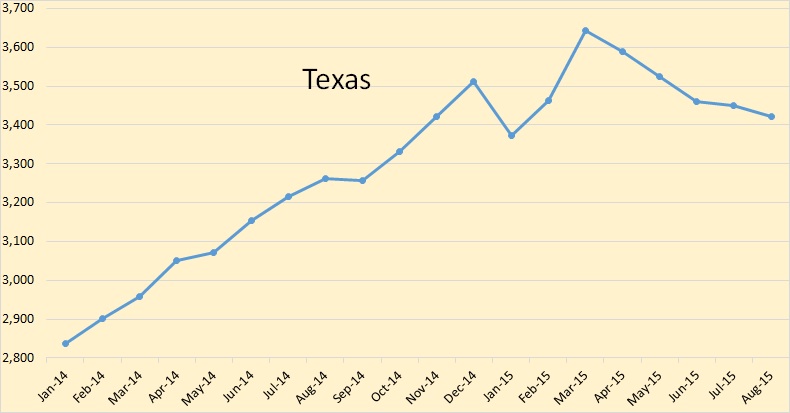

Texas was down for the fifth straight month.

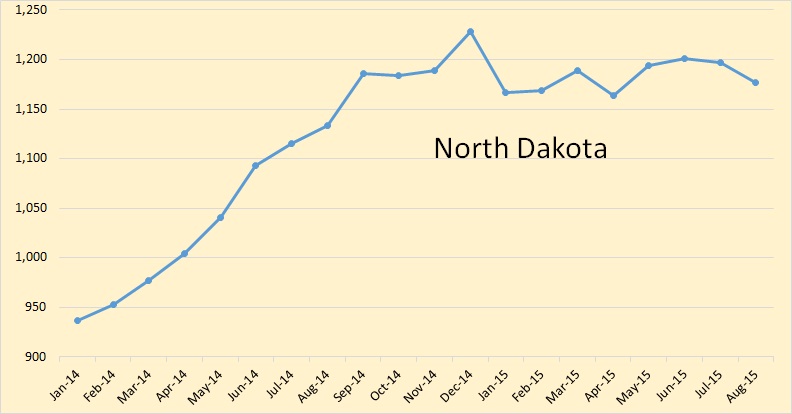

North Dakota has been moving sideways but is now below their September 2014 level.

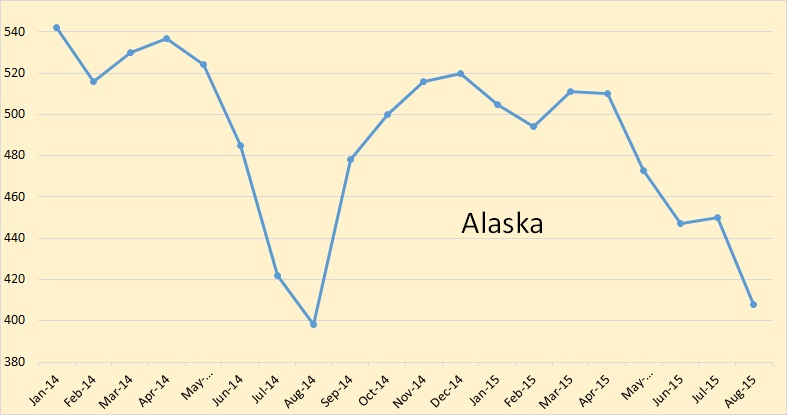

Alaska is slightly above their August 2014 level but their average annual production will drop by between 25 and 50 thousand bpd this year.

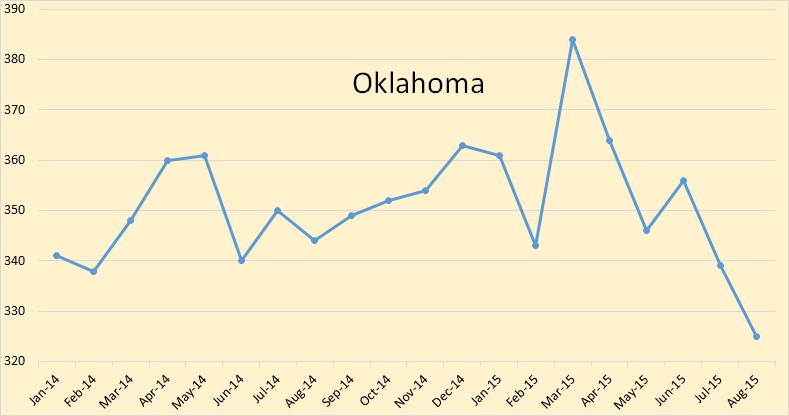

Oklahoma has dropped 59,000 bpd since March.

New Mexico which holds part of the Permian recovered slightly in August.

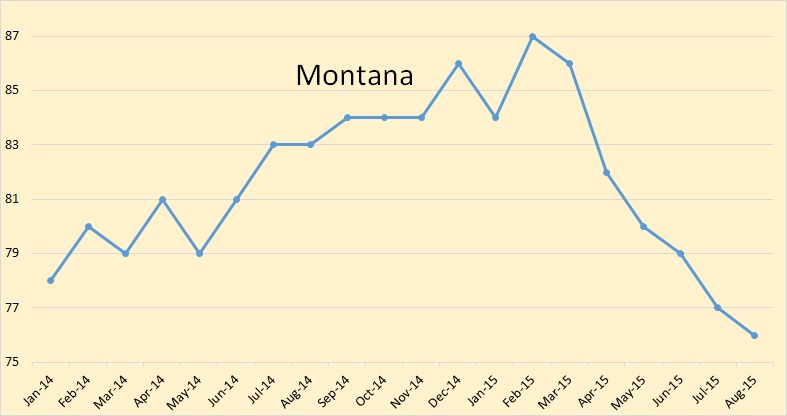

Montana which, holds part of the Bakken, has been in a downward trend since March.

Wyoming had been bucking the trend but now looks like it has succumbed to low oil prices also.

________________________________________________________

I post an email notification to about 260 people when I publish a new post. If you would like to be added to that list, or removed from it, just post me at DarwinainOne at Gmail.com

Cold winter in Alaska? Meanwhile on the other side of the pond, Mr Yergin thinks Frackers may invade the Old World.

“Europe has shale gas potential, but political obstacles prevent its development, he said. IHS research indicates that by the mid- 2030s Germany could be getting 35 of its natural gas from domestic shale gas produced from non-sensitive areas, equivalent to current import levels from Norway or Russia.”

YERGIN: ENERGY HAS ENTERED ‘NEW ERA OF SHALE’ WITH BIG BENEFITS FOR PETROCHEMICALS

http://www.ogfj.com/articles/2015/10/yergin-energy-has-entered-new-era-of-shale-with-big-benefits-for-petrochemicals.html

Major advance in battery technology:

http://www.cnbc.com/2015/10/30/hemists-make-super-battery-breakthrough.html

I found this one from the University of Cambridge: https://www.cam.ac.uk/research/news/new-design-points-a-path-to-the-ultimate-battery

Another couple of steps toward very high density batteries. Graphene seems to be the new wonder material lately. Even if the practical limits are only 5X -6X current lithium ion battery charge density, that would make EV’s lighter and have ranges of 500 to 1000 miles per charge. That should be adequate for almost everyone. Maybe we will see work vans and pickup trucks being battery powered.

There appears to be a pile of work yet to do on this one. It’s a Lithium-Oxygen battery that at present needs pure Oxygen, not air, to work. Which also means that it generates Oxygen gas during recharging.

These high energy-density batteries, even if having 90%+ charge/discharge efficiency, will generate heat through their internal resistance. Fast charging, say at 250kW, will significantly heat up a low thermal capacity (specific heat) material such as Lithium/Graphene if as little as 5% of charging energy is dissipated into the battery as heat. The less the weight of the battery vs. its electrical energy, the hotter it will tend to get.

If we have some hydrogen technology developing, there will be plenty of oxygen available, if they can’t find a way to make the battery run on air.

An internal cooling system could be integrated into the battery and could also be used to heat the battery during cold weather.

I see the battery switching industry as an alternative to owning a battery. Although with the charge densities involved it probably would not be necessary to fast charge very often.

MZ,

I have to say that my scepticism index rises a notch when I hear ‘battery switching’. One has to assume quite a degree of cross-industry standardisation as non ff cars are introduced, to avoid clogging the re-energising system up with a myriad of types of charging plugs, liquid/compressed H2 transfer valves for ‘fool’ celled cars, etc. Adding a range of exchangeable battery shapes and sizes into the mix stretches my imagination a tad. But you do have a good point.

The obvious place for battery-swapping is commercial fleets: much smaller number of vehicles, standardized/short routes, much higher vehicle utilization and fuel consumption to pay back the investment.

Not sure how it will all work yet, but I think you are making it too complicated. Think about a truck stop. Cars go one place, trucks another. It’s not a one size fits all system.

Anyway, an electric car with a 400 to 600 mile range would fill all my needs without ever switching the battery out until it fails.

I misunderstood. End of Life exchange would be no problem; but more so after each discharge, as per Aluminium/air batteries. Thanks.

I have always liked the trailer battery. Any one fits any car. Only thing standard needed is the battery hitch.

Of course, people can’t back up a trailer. But a trailer can back itself up just fine, no driver brain required.

Trailer could even rush out and snap itself on, while making endearing little puppy yelps.

The battery company owns the trailer, and so the battery can be updated any time.

Fast, easy, allows any range. Needs lotsa swap stations? Sure, just like today needs lotsa gas stations.

Wimbi, apparently Tesla can exchange batteries in 90 seconds on the S model.

Right, I saw Elon do it on that video. But then- they have all the standardization problems, and all the rest of that long weary list of swap woes already trotted out here.

Once again I see a perfectly sensible process drowned in specious quibbles from the unthinking.

Anyhow, even at this primitive first evolutionary stage, my EV is just fine for our purpose, and my wife is slowly convincing her women’s groups that it is not a mere toy, but instead is a “real car”.

And mighty cheap to operate.

Talking of trailers, Wimbi, I have a speculative, and slightly absurd, design on my virtual drawing board which I name the Heat Recovery Trailer.

The idea is to have a trailer with an insulated tank of, say, 500 litres capacity, containing Sodium Acetate Trihydrate. This is the stuff hand warmers contain, the plastic pouches containing a viscous liquid that gives off heat when crystallisation is initiated by application of a small shock. It’s cheap, and you’d only need one fill of the stuff. Resetting, and melting the NaAc, is done by heating it up again.

Anyway, put a heat exchanger in the trailer and then couple it to your ff car’s cooling system before you set off. A couple of hours or so driving later, and the NaAc solution is up to 100C+. On arrival back home you couple it into your central heating primary circuit and Bob’s your Uncle – heating until the next day at little marginal cost. The NaAc of course not only has high thermal capacity by virtue of being water-based, but also emits considerable heat of crystallisation at about 50C, the temp you want for your radiators.

A downside is having to make the central heating primary liquid the same as the car’s coolant, and avoiding leaks during coupling/uncoupling. An average car engine would probably produce some 15-20kWh of heat in two hours’ driving and there would be some loss of efficiency for the car itself.

How much would that trailer weigh?

MZ,

About 1,000kg, all in, for 500L liquid capacity. Density of NaAc.3H2O is 1.45. One could make it smaller – 200L would probably suffice for most purposes. Specific heat is 2.3; so assuming a useful temp range of 100C to 40C gives 60×2.3x200k=27MJ. I am actually not sure that the value of 2.3 for specific heat includes the latent heat of crystallisation – the total heat content may be considerably higher than 27MJ for my example. It’s quite a useful amount of stored energy.

Bygod, a man after my own heart! this could be the thing for my hot mamma- the sack of heat I toss into the Leaf for wife’s short trips to town so she does not have to use the battery.

I have a wood stove in the shop that puts out way more heat than I need as I do my pyrolyzer experiments.

But the awful truth is that she says her warm coat is more than enough and she does not desire to be in a car with any hot mommas.

Curses! Foiled again.

The one advantage the inefficiency of an ff car has over electric, Wimbi – thinner socks in winter.

At risk of sending people to sleep, I feel obliged to correct the drivel in my thermal arithmetic above. It should read something like this:

For 200L capacity. The measurement of total calorific capacity of NaAc solution is well described in:

http://vnuf.cz/papers/11_25_Vicha.pdf

and comes out as 188kJ/kg, during cooling from 52C to 25C. This includes both cooling of the liquid phase and also crystallisation of the super-saturated cooled liquid.

200L would therefore give ((1.45*200*188) + (200*48*1.45*4.2))kJ = 113MJ for total heat emitted in cooling from 100C to 25C. I suspect the second term is a little too high, so somewhere in the 100MJ region seems reasonable. It’s a surprising amount of heat.

Amazingly enough, we have managed to standardise the fuel nozzle system for filling fossil fuel vehicles at petrol/gas stations!!!

NAOM

The researches say it may take up to 10 years for their battery technology to be ramped up to mass production. A lot can happen in 10 years…

Yes, the battery could have been practical for five years by then. The money to be made from ultra-dense batteries is phenomenal. Money means research support. It will become a race.

I have been a big fan of tech news since the dark ages when you got it almost exclusively from magazines such as Popular Science or Popular Mechanics etc.

After all this time, I feel qualified to rate myself as an EXPERT OBSERVER of tech news. LOL.

For every hundred articles you read about some new tech that is going to change the world, ONE of them will make it to the market, and out of ten that make it to market, maybe one of them will turn out to be something really important.

The odds are in both a figurative and literal sense a thousand to one against any ONE of the hoped for next thousand NEW technologies working out commercially within a decade.

This does NOT mean there won’t be hot new technologies, with a few of them being game changers.

You can’t predict the winners.

Old Farmer, I worked in R&D for decades, in an area that allowed me to interact with most of the research projects, as well as the pilot plant and production end. From what I saw your estimate is way off as far as success of research projects, probably by two orders of magnitude.

Timing to product output is much faster, once a business starts research it may have products ready in just a couple of years. Slower and the competition gets there first.

Much of new technology is not even evident to the public. How much does the public now about block copolymerization or graft copolymers and smart polymers? Yet they use them every day.

During my R&D phase of life, I thought up lots of patents, some of which went on to fame and glory in the military, leaving but a pittance to my little company which, after the prototype, was left to shiver in the dark.

But some of the most promising, while undeniably proven to perform, were never picked up by anybody, for the usual reasons.

“Not the kinda thing we do”

“We are making money now, no need to change our product.”

” Cute, but really don’t understand it. Could be some sort of trick.”

“Only a liberal would suggest that thing.”

“Military version works, sure, but costs way too much.”

I am sure there are people right now raking thru the piles of dead patents for the many that could have flown if let loose. Some of my best ones have been in that pile for many decades.

Hi Mac,

LOL I expect you’re right. Apparently there are about one million patents issued worldwide per year and it seems very unlikely that more than one percent yield useful (or profitable) products; someone probably tracks this kink of stuff. Of course even one percent of a million compounded over a few decades comes to a lot of new stuff — like anti-cancer drugs.

I looked it up and it appears as if 97 to 98% of patents never make it to market. Of course many of those may be of the better mousetrap, can opener and widget type. Sometimes several patented items or compounds are put together to make another product, so I do not know if the components are counted in that list.

I know that a serious business will not put up with that kind of wasted time and money in R&D. Most poor or unworkable ideas in the business arena are weeded out before the patent process occurs and they already know the market and have a marketing and sales team ready to promote the product.

Lots of people patent ideas that will never get past the patent stage. People file patents for new ponytail holders, for new lunch bags, and so on.

So don’t gauge technology progress by the number of patents filed.

The number of patents filed, and the number of technology advances tried, but failed aren’t really the same thing.

Bottom line my thinking is that the large majority of new technology brought to market consists of marginal improvements to existing products or services.

Game changers are rare. And a technology that in and of itself is a genuine breakthrough may not be very important.

The famous “better mouse trap ” would not really matter very much if it were LITERALLY a better mouse trap. Mice are not that important, not in the modern world, and there are other methods of controlling them.

Now if that lithium air battery works out, THAT would be a game changer sure enough. But then we would be hearing about all sorts of incremental improvements to the new battery for the next couple of decades after that- and each and every one of them would be breathlessly described as a breakthrough in short articles in the msm.

At this point Farmer, it appears as if you have wandered far beyond your information and are just talking. I mean that in as kind a way as possible, I do really think you generally have great posts and very well thought out ideas.

However, this is wandering into semantics and width of definition of terms. So cohesive discussion is very limited by language at this point.

How about a given type of solar PV gaining 10 percent efficiency. Is that a major advance? A large amount of research effort and probably some ground breaking knowledge would go into that. Plus it gives the end user a free year of power for every ten years of use. Is that major or minor? Is that a better mousetrap (catching 10 percent more mice)? Or do we have to use completely different materials or combinations of materials involving broad band capture and increases above 50% in capability?

I don’t know how to accurately define some of the terms used here.

Not long ago I read a post from a rather well known blogger on physics. I generally think he is very good at studying and disseminating information, and only occasionally wanders beyond his expertise and information.

However he did wander far on this subject and was very wrong. He took the tact that no new major discoveries in science had been made lately.

Even the best sometimes wander past their knowledge and abilities.

Mac,

I think you just need to clarify what you’re saying: there’s a big difference between something being viable, and it’s being the winner in a competitive contest.

Dozens of battery chemistries and many dozens of technical variations are being explored, but only a few will win out eventually.

VHS vs Beta…

I was mostly just trying to point out that the media constantly hypes the crap out of every little bit of technical news and that the odds of any one such piece of research leading to a breakthrough new technology are very slim.

No doubt adding ten percent to the performance of solar cells involves a great deal of cutting edge work by physicists, materials engineers, manufacturing engineers, etc, and from THEIR pov, they justifiably see that ten percent as HUGE.

But to somebody like me, a person outside the industry, that ten percent is just another incremental improvement.

How long would it have taken Shell to bring Arctic oil into production if they hadn’t come up dry this summer… they were talking late 2020 for production. A super dense battery in ten years would be a whole lot sooner than Arctic oil.

Aside from the numerous obstacles to overcome, it needs to scale.

A big order.

We really need to get beyond 1990’s Japaneses technology.

Lets hope this pans out.

1990’s Battery Tech? 1906 Edison patent. ( For Stationary app ) http://ironedison.com/iron-edison-usa-series-nickel-iron-nife-battery

10,000+ cycles. Photons abundant/PV Power affordable. efficiency not paramount. Battery for your great great grandchildren.

Come now, the lithium ion battery invented by the Japanese in the early 1990’s, is still the highpoint for anything that scales.

It has been quite a while.

Stationary is different than Traction/EV’s. But as pointed out, scaling is critical, Exide shut down the last NiFe Facility in the US in the 70’s. A clear threat to the multi-billion disposable battery business. We need MASS PRODUCED cell’s that don’t cannibalize themselves each cycle . My Grandfather’s 70’s Oil Crisis boat ” The Freedom” had redundant 32V NiFe banks. I have learned to deploy several decades old NiFe Railroad switching banks. Some customers LOVE alkaline banks. IMO, It’s stupid that such resilient solutions are replaced with Neurotoxin loaded disposable crap like Lead Acid in stationary applications. Most Lead Acid cells have less than a 6 month calendar life at temperatures > 33C. That being said, Lithium cell tech has the advantage of the most reactive metal will likely mass produced in such Giga quantities that it will win for all solid battery applications. It is happening.

Latest Generation LG ( Leaf-BMW) Pak Stack on the Bench for Bottom Balancing. Each pancake is twin cell ~.5 kWh each. ( 66Ah @ 7.4v ). 3kWh fits in a long briefcase. Application is 48V NEVs/Golf Carts. Cell cost in Low Quantity is around $300 / kWh. More economical than Lead Acid. Lots of Know How to do this right on a smaller EV scale.

Big, bulky, and not that efficient.

That is why almost everyone went with lithium ion—-

IF nickel iron battery production were to be scaled up sufficiently to justify building new state of the art manufacturing facilities and take advantage of economies of scale, HOW MUCH would nickel iron batteries cost?

Any rough estimates appreciated. There is certainly no shortage of iron or other materials needed, everything except the nickel itself would be pretty cheap. Nickel is not that expensive per kilo, but if a new battery industry started consuming it by the ton, it might GET expensive.

I totally agree about the efficiency not being that big a deal, before too long there is apt to be plenty of pv juice in need of a “home ” available during the sunny hours to charge up such batteries. I have read about some that are over fifty years old that are still in great condition.

The Edison type cell has an estimated 25 year life and can handle 80 percent discharge levels without harm. It is about four times more effective than a lead acid cell. Right now they cost about $800 per kwh. That should fall to about half if large scale production occurs.

If you use 6 kwh per day average, it would cost about $3000 per storage day. If you are looking for just overnight storage, then it would be a much lower cost. so potentially one could get away with about $1000 worth of batteries (if the price falls by 50%). I would overbuild it by 50%, but that is just me.

My corrected data for Texas (published a week ago) together with the latest EIA for Texas.

Thanks Dean

Below is the chart with the EIA newly released data for Texas vs. TRRC vs. Drillinginfo.

Drillinginfo statistics for June and July are apparently incomplete. Previous DI numbers are close to the EIA. The EIA’s numbers are little changed vs. previous month

Thx Alex,

Quit significant difference. Whats your opinion, is it the EIA number lagging and estimated and State data more accurate and up to date? There is 600.000 difference / 17%. Someone is very wrong.

As we have discussed many times, Texas Railroad Commision numbers are incomplete and are gradually revised thereafter. Even 18-month old TRRC numbers are too low.

Thanks for the info.

Dean

Ron. Thanks for the post!

Some interesting things, to me anyway.

After reading several company earnings releases and conference calls, it appears that all want to develop US shale over anything else they own. Unless foreign companies pick up the slack, it appears US majors’ lack of foreign investment might result in some steep declines.

Second interesting tidbit. Read a Seeking Alpha article about ConocoPhillips today that indicated they lost $3 for every BOE they produced company wide on a GAAP basis, with the US lower 48 incurring the highest BOE losses at $9. These figures were for the third quarter, 2015.

Finally, read that Whiting is in process of selling its water disposal infrastructure. I touched on this earlier. I was unaware this is a common industry practice. To me, selling these assets at this time is a sign of desperation. IMO this permanently devalues the producing assets with an unnecesaary expense burden. If anyone has some data on how much of this infrastructure has been sold off by the shale companies, let me know. Likewise, as I am not familiar with this practice, and especially if you think I am off base, please chime in. I can’t imagine us ever wanting to do such a thing. I note both clueless and John S posted this is quite common.

To me, selling these assets is like selling off the plumbing, wiring, furnace and air conditioner in your house and having to rent them forever.

Beyond the infrastructure sale, Whiting’s 3Q2015 results seemed like a real disaster to me, though many analysts thought it was a good quarter.

The three things that stood out to me were:

They announced 38% production increase – so they told investors that in response to prices falling 60%, they produced more oil (?!);

They announced that they have increased the sand per frack job, and intend to increase it further – telling investors that they are risking the long-term recovery factors of their wells for short-term production rate gains;

They announced they will update their EUR curves on the basis of the IP of these new “enhanced completions”, and even used 24hr IP to discuss how amazing their 7 million lb of sand fracks are – essentially telling investors that they are juicing their IP in order to hoodwink them about well profitability.

gwalke, I would also like to see an explanation for your three things.

For a historical perspective, as of 9/30/15, Whiting Petroleum produced 165K BOEPD average (80% oil), and had $5.25 billion of long term debt. D,D & A runs over $20 per BOE.

As of 12/31/2005, Whiting Petroleum produced 41K BOEPD (76% oil), and had long term debt of $875 million. D,D &A ran $8 per BOE.

So, during at time when WTI was north of $80 per barrel, Whiting increased production fourfold and long term debt six fold. They have not added debt in 2015, CAPEX is being funded by asset sales and an equity raise in early 2015.

Whiting has the best acreage in the Bakken, except for maybe EOG and QEP. Production at year end will fall to 147K BOEPD due to decreased CAPEX. They hope to hold there by spending over $1 billion less in CAPEX.

Not a bad company other than an ill timed purchase, IMO. Just need higher oil prices like all US producers.

Nothing really wrong with the geology they own, but oversanding wells to make IP look good to Wall Street is very likely going to damage long-term recovery.

Peak Words will never happen. har

We are in a new age of wind, so!ar, batteries, nuclear, hydro, what have you. The best news available, at the moment.

The oil age is history, coal is ancient history. Just the way things are, might as well give up and give in.

Oil? What oil? We don’t need no steeeenking oil. Coal? What coal? We don’t need no stinkin’ coal!

Until you need some, then everything changes. ☺

Another short history lesson:

https://www.lloyds.com/lloyds/about-us/history/corporate-history/the-lutine-bell

The Lutine Bell, weighing 106 pounds and measuring 18 inches in diameter, is synonymous with the name of Lloyd’s. Traditionally it has been rung to herald important announcements – one stroke for bad news and two for good.

The bell was carried on board the French frigate La Lutine (the sprite) which surrendered to the British at Toulon in 1793. Six years later as HMS Lutine and carrying a cargo of gold and silver bullion, she sank off the Dutch coast. The cargo, valued then at around £1 million, was insured by Lloyd’s underwriters who paid the claim in full.

There were numerous salvage attempts and in 1859 the wreck yielded its most important treasure – the ship’s bell. It was hung in Lloyd’s Underwriting Room at the Royal Exchange and was rung when news of overdue ships arrived.

Whenever a vessel became overdue, underwriters would ask a specialist broker to reinsure some of their liability based on the possibility of the ship becoming a total loss. When reliable information became available the ringing of the bell ensured that everyone with an interest in the risk became aware of the news simultaneously. The bell has hung in four successive Underwriting Rooms. In the Royal Exchange 1890s-1928, Leadenhall Street 1928-1958, Lime Street 1958-1986; and in the present Lloyd’s building since 1986.

The bell is no longer rung as the result of a vessel becoming “overdue”. Today, the ringing of the Lutine bell is generally limited to ceremonial occasions, although in rare instances exceptions are made.

https://www.lloyds.com/lloyds/about-us/history/corporate-history/the-lutine-bell

Dr. Pavlov would be stumped.

Let us make one special exception!

Ring it once for oil, once for coal, makes it two times and that’s good news! Bad news is good news!

You better believe it. It’s true!

Coal and oil are the bread and butter. Solar jelly and wind peanut butter are OK, but they’re not as good without the bread. Might replace the butter, but not quite, nice try, not even close.

The charts and graphs tell the real story.

Once the oil age is over, it’s over. When the HMS Oil sinks, the life boats won’t be there.

Coal will hang in there, rise to the occasion, the knight in shining armor arriving just in time to save the day. Back to the good old days when life was a dream, a rowboat moving gently down the stream.

Back to sails, just to make it all happen all over again.

Sorry for the maritime digression. Water might replace oil for the long haul. Oceans of water, not a problem.

Oil is. Coal, not so much. Solar does all of the work, the sun better be there tomorrow or there will be trouble in River City.

Gettin’ a little windy, I’ll stop. One last thing: Posole. It is killer.

Hah! had to look up “posole” to see I already knew it as “pozole”.

And until I read the wiki article, I didn’t get the “killer” reference either.

https://en.wikipedia.org/wiki/Pozole#Ritual_significance

hmmm, “tastes like pork…”

Well, that’s one way to deal with overpopulation.

“Bad news is good news!”

And good news is bad news.

Prometheus stold fire from Zeus while the god was resting with Ganymedes, and wisdom in arts from Hephaestus and Athena.

http://www.maicar.com/GML/Prometheus1.html

Prometheus then gave fire, along with wisdom in arts, to humanity so that men could exercise those crafts.

Zeus, however, having been robbed, was not happy.

“Prometheus, you are glad that you have outwitted me and stolen fire … but I will give men as the price for fire an evil thing in which they may all be glad of heart while they embrace their own destruction,” Zeus told Prometheus.

Fearing the consequences of his own cleverness, Prometheus told his brother Epimetheus never to take a gift from Zeus, but Epimetheus, a man with no foresight, accepted Zeus’ gift (Pandora), and he only later understood what had happened. For until that time men lived free from ills, toil and sicknesses, but Pandora opened a jar containing all kinds of evils, and these flew out, afflicting mankind ever since. Only Hope remained there.

Prometheus among men came to be called “benefactor,” a curious title considering that humans rapidly made a habit of employing Prometheus’s gifts to cook and burn one another in many ways.

“only hope remained there”.

As J.M. Greer recently pointed out, hope was not left as a blessing, but as the final curse.

http://thearchdruidreport.blogspot.com/2013/05/the-shape-of-time.html

QUOTE: Hope is not a virtue in such a world. Whether or not Hesiod invented the story of Pandora’s box, he’s the source from which every later version derives, but there’s a detail you’ll find in modern versions of the tale that is not in his account. The usual version these days is that when all the plagues and curses in the box flew out to afflict humanity, Hope remained behind as a kind of consolation prize. In Hesiod, it’s not a consolation prize, it’s the nastiest of the curses that Zeus put in the box, the enticing delusion that things will get better when they won’t. Early Greek poets liked to use fixed adjective-noun pairs—the rosy-fingered dawn, the wine-dark sea, and so on; when the word “hope” appears in ancient Greek poetry, the adjective normally assigned to it was “blind.”

That’s the world in which Hesiod lived. The point that too many of his modern interpreters don’t grasp is that his attitude, and the practical implications of that attitude which filled the verses of Works and Days—distrust the new, rely on traditional wisdom, aim for modest goals, keep a year’s supply of grain on hand so you don’t starve—were better suited to his world than, for example, our faith in the limitless potential of the future would have been. In an impoverished tribal society scrabbling for survival amid the ruins of a far more complex culture and the long-term impacts of ecological collapse, accepting the reality of decline and the likelihood of further trouble to come was a better strategy than any of the alternatives; in the language of evolutionary ecology, it was adaptive. It’s unlikely to be an accident that visions of time like Hesiod’s are very common in the hard times that follow the collapse of major civilizations.

Goddam it Greer, you commit the sin warned against by Maimonides , equating impossible with unlikely.

Hope is quite logically based on the intrinsic unpredictability of the future.

You can perfectly well be cautious and plan carefully for worst case, but not forget possibility of less worst case.

The real sin is to quit when you still could – tho highly unlikely- win.

tons of examples in history.

distrust the new, rely on traditional wisdom, aim for modest goals

That’s agricultural-poverty thinking. That’s the kind of thinking that we see in the Middle East, that imprisons women in the home and forces them to avoid education and have children.

Any empire in an agricultural era was bound to collapse in poverty, because their actual underlying annual growth rate was about .001%: empires had to be organized theft to grow.

It’s basically the same thing now, only orders of magnitude worse.

“A low-energy policy allows for a wide choice of lifestyles and cultures. If, on the other hand, a society opts for high energy consumption, its social relations must be dictated by technocracy and will be equally degrading whether labeled capitalist or socialist.” ~ Ivan Illich

Just because it is obvious that there is no hope for the continuation of BAU, it does not follow, that there is no hope for anything else either.

“Bad news is good news!” And good news is bad news.

I see where China is facing a “collapse of the workforce and a demographic crisis.” So maybe mankind’s continued prosperity depends not only on producing vast quantities of coal, natural gas and oil, but of babies too?

But not to worry. China, just like River City, has a man with a plan. And he, just like Harold Hill, promises to keep the music playing:

“The best laid schemes o’ Mice an’ Men. Gang aft agley,. An’ lea’e us nought but grief an’ pain,”

Damned engineers and economists ought to be REQUIRED to read some poetry and history every morning before being allowed to have breakfast. LOL

Mice are smart. They don’t fall for traps anymore, but they love peanut butter. They do manage to eat the peanut butter without springing the trap.

These days I don’t set the trap the first time around, I push some peanut butter onto the trap and they come along to enjoy the feast. Once they have eaten the peanut butter from the trap that is not set, they’re extremely vulnerable. The next time I set the trap to spring, then they’re completely fooled. They fall for it every time.

My plans are superior to those of mice.

Or, you take a tin box, make a teeter totter top lid, smear some pbutter on the lid, put it in the mouse runway. Mouse has to check out the smell, teeters the lid, in for it.

Next morning, take your box of mice out to the barn, call the cat(s), dump the mice, and watch an exciting miniature roman circus for a few seconds, mice playing the christians.

Strap your pants legs.

OFM – I’m an engineer and I read your posts every morning. Sometimes you to wax poetic and you’ve been around long enough that many of your experiences are now considered ancient history. Does that count? Can I eat breakfast now?

Hi HVAC Guy,

I DID put an LOL at the end of that comment. 😉

A yellow smiley shows up better, I will use them exclusively from here on out.

Seriously engineers and economists really should read some history and poetry, on a regular basis.

Otherwise they might forget that (eventually) idiots are going inevitably wind up in control of whatever they create, and that there really is such a law as the law of unintended consequences, which is in my humble layman’s opinion potentially even MORE important than the basic laws of chemistry and physics etc.

The laws of physics enable you to make EXCELLENT predictions about what you build.

Unfortunately predicting the behavior of naked apes is not quite so straight forward.

Hi HVAC man,

I did put an “LOL” at the end of that remark. Probably should have used a smiley, it would have shown up better. 😉

Nobody should take ME very seriously, unless the topic has to do with agriculture.

Otherwise, just assume I am only trying to draw out other forum members to see what they think about the various topics I bring up.

I do deliberately try to provoke serious thought and get good conversations going.

Perhaps I am taking credit where none is due, but I think by way of example the current discussion of grid vulnerability due to terrorism can be traced back to my remarks and questions concerning super solar flares a week or so ago and the possibility of the grid going down. I pointed out then that there is NO backup supply of large transformers etc.

They are at least beginning to think about this issue, and have done an exercise on replacing a large transformer quickly.

http://www.dhs.gov/science-and-technology/power-hungry-prototyping-replacement-ehv-transformers

We have not yet reached Peak Stupidity.

The author of this article extolling the virtues of China’s recent abolition of the one-child policy is Peak Stupidity’s current spokesperson:

http://news.nationalgeographic.com/2015/10/151030-china-one-child-policy-mei-fong/

Ratio of working people to retired old people my ass.

So the answer to this impending ‘labor shortage’ and ‘old folks support

workers shortage’ is to produce even m ore people at a faster rate and thus drive the population ever higher?

A sustainability Ponzi Scheme.

China, put on your collective (~1.3 Billion) thinking caps and do better than this…learn to adapt to a falling population which will level off over a century or so, plus maybe a couple or three decades, at a more sustainable level. Gods, I thought these Commies were into long-term planning…looks like they caught a bad case of western short-term thinking flu.

The End of Mor is coming… Nature bats last.

Peace be with you,

The Emissary.

Yes, I had the same thought. Why do you need more young people to support old people? Why can’t you structure the economy so the burden and the resources don’t need to come from family members? Get more productive jobs to do more with less, and don’t require that the elderly only be supported by their own kids.

The simplest answer to better health and longer lives, which cause an excess of retirees:

Postpone retirement age!!

Let’s see: would I rather work 5 years longer, or die 5 years sooner…such a hard decision…

If you delay retirement for 20 years and retire at age 85, you will be working a job that a twenty year-old person in the workforce should be working, but will have to wait until they are forty to begin to make a living. You will be forcing a young person to live with no job most of their productive years. It is pure greed to continue to work until you are 85 and not retire at 65. ?

Would you want an 85 year-old fireman riding the fire truck to a five alarm fire or a forty year-old fireman drinking coffee while fighting the fire?

It is greed that dominates delaying retirement, not living longer. har

I dunno. I look around, and somehow it looks like there’s plenty of things that need doing. More than enough to keep everyone busy, no matter what their age…

Right, there’s an overwhelming load of things needing doing to get us off ff’s and drag the carbon back out of the air. Trouble is, of course, that the wherewithall to do it is instead blown on mindlessly searching for more carbon to put into the air.

Or, wasted on utter frivolity that just gives us a belly ache.

Wrong attitude, wimbi, dammit. Emphasize the fun and the benefits of the new life, everybody already knows about the current collective suicide pact and is rightly weary of hearing more about it.

R. Walter said:

But it’s mighty tasty.

There’s a pozoleria a couple of blocks from my house.

But one more time, it looks like maybe good is bad.

Thank you for the post/update, Ron!

Be well,

Petro

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mA8

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mRq

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mRs

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mRu

TX, ND, WY, and LA are in recession.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mRC

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mRB

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mRE

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2mRF

CO, OK, AK, and WV might have been/be in recession, or close enough.

A few days old…

Chinese Company Pays More Than $1B For Texas Oil Fields

http://www.manufacturing.net/news/2015/10/chinese-company-pays-more-than-1b-for-texas-oil-fields

or behind WSJ paywall

http://www.wsj.com/articles/chinese-property-developer-snaps-up-texas-oil-fields-1445773022

“A Chinese investment company is buying $1.3 billion in West Texas oil assets.

Yantai Xinchao Industry Co. of Shanghai, The Wall Street Journal reports, will purchase fellow investment company Ningbo Dingliang Huitong Equity Investment Center. According to a regulatory filing, the deal includes the acquisition of oil properties in Howard and Borden counties from Tall City Exploration and Plymouth Petroleum.

Those companies are owned by Boston-based private equity firms ArcLight Capital Partners and Denham Capital Management, respectively. …”

Looks like Howard and Borden counties are up in the Permian area,

so maybe a combination of conventional and light tight oil ?

Tall City Exploration just sold some other land to Aubrey McClendon’s new company.

http://www.mrt.com/top_stories/article_b246df70-7501-11e4-aa2a-0ff3b94e955c.html

Though I wouldn’t believe every word in the Midland Reporter-Telegram,

the following article quotes a guy saying “Historically, a frac job required a million tons of sand; now it’s 8 (million) or 12 million tons of sand,”

Clearly confusing tons and pounds.

http://www.mrt.com/business/oil/top_stories/article_00ce17fe-7e88-11e5-8ec1-0ffe920904bc.html

McClendon paid over $30,000 per acre for his acquisition in Reagan County, over $300,000 per producing bopd.

How could one possibly justify that sort of land cost, other than on speculation that the price of oil will rebound soon?

It seems the low oil prices have not cooled the speculative fever.

After Spindletop gushed its oil at 75,000 bpd, land around Beaumont sold for one millon dollars per acre. In Pennsylvania at Titusville, land sold for one million dollars per acre. After the boom became bust, it was at 25 cents per acre.

30 grand today is small potatoes.

“Though not a California well, the Spindletop gusher, which blew out on January 10, 1901 near Beaumont in East Texas, had a great impact on the California oil industry. Spindletop was not the first nor the biggest gusher – the Adams Canyon, Shamrock and Blue Goose gushers of California were earlier and the Lakeview gusher was bigger. However, Spindletop was certainly one of the great gushers of all time, and, most important, it heralded the birth of the Texas oil industry.”

http://www.sjvgeology.org/history/gushers_world.html#spindletop

Down the slippery slope of descent and ruin. For 80% of Americans life has been getting harder and harder.

http://www.paulcraigroberts.org/2015/10/29/us-on-road-to-third-world-paul-craig-roberts/

The evidence is everywhere. In September the US Bureau of the Census released its report on US household income by quintile. Every quintile, as well as the top 5%, has experienced a decline in real household income since their peaks. The bottom quintile (lower 20 percent) has had a 17.1% decline in real income from the 1999 peak (from $14,092 to $11,676). The 4th quintile has had a 10.8% fall in real income since 2000 (from $34,863 to $31,087). The middle quintile has had a 6.9% decline in real income since 2000 (from $58,058 to $54,041). The 2nd quintile has had a 2.8% fall in real income since 2007 (from $90,331 to $87,834). The top quintile has had a decline in real income since 2006 of 1.7% (from $197,466 to $194,053). The top 5% has experienced a 4.8% reduction in real income since 2006 (from $349,215 to $332,347). Only the top One Percent or less (mainly the 0.1%) has experienced growth in income and wealth.

The Census Bureau uses official measures of inflation to arrive at real income. These measures are understated. If more accurate measures of inflation are used (such as those available from shadowstats.com), the declines in real household income are larger and have been declining for a longer period. Some measures show real median annual household income below levels of the late 1960s and early 1970s.

And if one considers the declining quality of many of the products purchased, inflation would look sky high.

Just for fun I weighed a couple of my old cotton tee shirts and two new ones. The change from old to new was minus 38%. Since the surface area is the approximately the same, the major change is in thickness.

However, the feel of the tee-shirts is much different also, so I am not sure what other physical changes are occurring between old and new.

What I am sure about is that the old T-shirts last at least 15 years (some are beyond 20) and the new ones are shot after one or two years. That is an amazing decline in product longevity. Cost is less, but the longevity is far less.

The new underwear briefs (Fruit of the Loom) is showing even worse longevity problems.

Has anyone come across a study of product quality change over time?

The quality of popular brands of work clothing has declined by half in my opinion over the last few years.

So one is left wondering what is causing the downward mobility of most Americans. Is it caused by increasingly less abundant natural resources, making it more costly to exploit those that remain? Or is it caused by one group of humans which is more aggressively exploiting another group?

Most Americans seem to believe it’s the latter. The Economist reports that:

So Americans are mad as hell. And as they descend into an orgy of victimization, even rich white straight protestant men can be heard bellowing for victim status.

Where will it all lead, and especially if the politicians are no longer able to bring the bacon home?

I’m reading Christopher Simpson’s the Science of Coercion where he notes that Harold Lawswell, one of the seminal “scientific engineers of consent” in the United States, claimed that “successful social and political management often depends on proper coordination of propaganda with coercion, violent or non-violent; economic inducement (including bribery); diplomatic negotiation; and other techniques.”

So beginning around the turn of the century, the scientific engineers of consent unleashed a Weltanschauungskrieg (“worldview war”) on an unsuspecting public, Simpson argues, in which they sought “a shift in which modern consumer culture displaced existing social forms.”

“We have thought in terms of fighting dictatorships-by-force,” Donald Slesinger noted of the new strategy and tactics, “through the establishment of dictatorship-by-manipulation.”

As Simpson goes on to explain, for the scientific engineers of consent

Ordinary people are to be kept voiceless, Simpson concludes, “voiceless in all fields other than selection of commodities.”

So now, after a century of hammering the values and worldview of a mass consumer culture into the peoples’ heads, how quickly can the public’s worldview be turned around?

And if we remove “economic inducement” and “vocie in the selection of commodities” from the toolbox of the scientific engineers of consent, what’s left? Propaganda; coercion (violent or non-violent); diplomatic negotiation; and “other techniques”?

“The conscious and intelligent manipulation of the I’m reading Christopher Simpson’s the Science of Coercion where he notes that Harold Lawswell, one of the seminal “scientific engineers of consent” in the United States, claimed that “successful social and political management often depends on proper coordination of propaganda with coercion, violent or non-violent; economic inducement (including bribery); diplomatic negotiation; and other techniques.”

That sounds an awful lot like this crap!

organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. …We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. …In almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons…who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind.”

― Edward L. Bernays, Propaganda circa 1928

There is no doubt that this way of thinking is the basis of the so called capitalist infinite growth paradigm. Which only has a chance of working up until the point that physical limits of our finite planet are reached. Then the shit tends to hit the fan for all concerned.

The interesting thing is that is also part and parcel of the cultural memes presently prevalent in the industrialized societies of wealthy western industrialized nations. These memes have been spreading throughout the world at a very rapid rate and it is MHO that this meme is spreading what amounts to a terminal cultural pathology. In other words it is a dead end with an expiration date.

The good news is, that it isn’t written stone that the current culture itself can not be deeply disrupted and profoundly changed.

Technological shifts occurring now because of perfect storm of maturing technologies and the end of age of oil, are bringing us the Uberization of many facets of our civilization that we had taken for granted as almost eternal and immutable. “Like we all need a car to be free!”

Well, a lot of young people are no longer buying into that world view. So the old guard and power brokers of the linear consumer society such as the Oil Majors, Automobile manufactures,and producers of unnecessary useless consumer goods are losing their grip on economic power to the new crop of digital entrepreneurs who are ushering in a totally new economic, political and social paradigm.

Technology is changing the way we interact and form connections within society.

This video a the end of my post might seem a bit off topic but to me it underscores how different this new world has the potential to be. I especially love the example of an expensive commercial failure of a consumer product that suddenly became cheap enough for use as a musical instrument in a computer orchestra and the fact that a thousand people can suddenly come together in a show of support by singing together… And If I could travel back in time, I’d murder Eduard Bernays.

Ge Wang:

The DIY orchestra of the future

https://www.ted.com/talks/ge_wang_the_diy_orchestra_of_the_future

We need to stop thinking linearly!

Fred Magyar said:

Well somebody’s still “buying into that world view.”

http://www.statista.com/statistics/200002/international-car-sales-since-1990/

North American car sales appear to be flat and Europe’s sales look like they have declined.

Only Asia seems to show significant increases.

Considering that populations have grown in most places in the world, I would say this chart does indicate a lessening of interest in cars.

Boomer said “Considering that populations have grown in most places in the world, I would say this chart does indicate a lessening of interest in cars.”

Maybe it is not so much interest as need or economics. Much of the new population is in the cities where cars are not generally essential. Also many people are way too poor to afford a car even if they needed one, a bicycle or scooter is about their peak ability to afford.

Here in the US there are at least twice as many registered cars as there are licensed drivers. So there is little necessity to buy new.

Fred Magyar said:

The idea of cultural transformation has been with us for a long time. It’s very much part of the Christian evangelical tradition, and we can see how the idea played out in practice after Spain’s and Portugal’s conquest of the Americas.

Combining cultural revolution with technological transformation, however, seems to be a purely 20th-century innovation. And the idea has been no less appealing to left Hegelians than it has been to right Hegelians.

On the left, we see the notion of a combined cultural-technological revolution emerge first with the Russian nihilists. “Drawing heavily on the German materialists Jacob Moleschott, Karl Vogt, and Ludwig Buchner,” Michael Allen Gillespie explains in Nihilism Before Nietzsche, “the nihilists argued that the natural sciences were preparing the way for the millennium.”

“This turn to materialism was also bound up with the growth of atheism,” Gillespie adds, which was “given a concrete reality by materialism, especially in combination with the Darwinism that became increasingly popular with the nihilists.”

“We are witnesses of the greatest moment of summing-up in history, in the name of a new and unknown culture, which will be created by us, and which will also sweep us away,” Sergey Diaghilev gushed in 1905.

This nihilist brand of Futurism, combining cultural revolution with technological revolution, was to prove highly attractive to the later Bolsheviks, even though the Russian avant-garde which occurred under Lennin would be quite different from the Socialist Realism which took place later under Stalin.

Anatoli Lunacharsky, Lennin’s Commissar for Education and Enlightenment, wrote in 1917, “If the revolution can give art its soul, then art can endow the revolution with speech.”

“There was a need to explain, encourage, teach and enthuse the masses,” Victor Awars explains in The Great Russian Utopia. “Agit-Prop was to be the means.”

In the catalogue for the Tenth State Exhibition organized by Lunacharsky in 1919, El Lissitzky wrote:

In May 1924 Vladimir Tatlin in his lecture “Material Culture and Its Role in the Production of Life in the USSR” offered a synoptic statement of what was still the task at hand:

The same sentiment is heard again a year later when Vladimir Maiakovskii declared that: “To build a new culture a clean sweep is needed. The sweep of the October revolution is needed.”

What is happening is “the conversion of revolutionary effort into technological effort,” is how Asja Lacis summed it up in 1927.

In this poster, one can see how the worker’s revolution was melded with the technological revolution, all under the banner of the Russian Revolution.

Nikolai Dolgorukov

Transport Worker! Armed with a Knowledge of Technology.

This is a cultural-technological revolution that is taking place:

Teens spend a ‘mind-boggling’ 9 hours a day using media, report says

http://edition.cnn.com/2015/11/03/health/teens-tweens-media-screen-use-report/index.html

The much ballyhooed cultural-technological revolution that people do not want private automobiles? Or want to switch to EVs? Where’s the empirical evidence of that?

Hope, I suppose, springs eternal.

Shadowstats estimates of inflation are not more accurate.

In 1960, the average US household size was 3.33 people. In 2014, the average household size was 2.54 people. So, the average household size has decreased by 24%. What does that mean economically? Well, the average household income in 2014 is divided amongst 24% fewer people. So, the average person in a household in 2014 has more real income to spend than the average household person did in 1960.

Clueless wrote:

“What does that mean economically? Well, the average household income in 2014 is divided amongst 24% fewer people. So, the average person in a household in 2014 has more real income to spend than the average household person did in 1960.”

More likely households have less money to send since more income is used to service the debt on the home. In 1960 a family of four could get by on a single income. Today, households are struggling with two income earners. The difference between households of the 1960’s and of the post mid 1990s is the explosion in household debt.

Interests are low because the industrialize world is insolvent, including gov’t, corp, and personal. Everyone is buried in debt. Interest rates probably will never rise, until there is a currency crisis that forces them up. The US would default if it interest rates normalized since the interest payments would balloon and most of its tax revenue.

At the moment, the emerging markets (ie Brazil, China, India, etc) are the leading economies heading into a crisis. They used cheap & easy credit for economic development. However their economic boom is now quickly fading into a bust and there is no buyer of last resort left to export excess capacity to.

What people choose to spend their income on has no effect on the amount of income that they have. In 1960, more people [% wise] rented, which in many cases cost them more than home ownership.

Cluesless wrote:

“What people choose to spend their income on has no effect on the amount of income that they have.”

I should have used “discretionary income”. They spend a lot more than they earn. They spend all of their income as well as their future income, by going deep into debt. Subtract interest payments to service the debt from their income.

“In 1960, more people [% wise] rented, which in many cases cost them more than home ownership.”

Not really. In most instances renting is cheaper when including the cost of location, property taxes and maintenance which are never included in rent vs. ownership. Most people who buy homes, do so at greater distance to their work location than those that rent, because they can’t afford it. Generally the cost of buying a home close to work is much higher. Commuting costs are also never factored in. People that rent generally live closer to work. People also buy bigger homes than they would normally rent.

For the last half century or so in my part of the world, renting has been cheaper short term but MUCH more expensive over any term longer than four or five years. I have plenty of acquaintances who have had fixed interest rate PITI loan payments on their houses that were only a third of the going rent for an identical house right across the street after fifteen or twenty years.

Land lords pay building insurance , property taxes etc just like homeowners.

House prices can crash by HALF and you can just LAUGH about it if you are in a house you have owned for a decade or more because chances are you will still be above water.

I would agree that falling incomes and the concentration of wealth are inter-related problems. In my view Paul Craig Roberts is no voice of authority, but rather a crank. And “If more accurate measures of inflation are used (such as those available from shadowstats.com)” this statement is utter nonsense. This low inflation environment is one of the major problems facing the world economy and benefits only the top 0.01% of the wealth distribution. They don’t refer to methods of hedging against inflation as wealth preservations strategies for nothing and pretty much the only people with any wealth to speak of are the 0.01%. Everyone else benefits by spending the crap. With great wealth comes great political power. When wealth is concentrated so is political power and when political power is concentrated economic policy follows. The current economic policy not just in this country but globally reflects the interests of the 0.01% of the world economy and has led to historically low inflation. Low inflation is in the economic interest of great wealth. As are reduced public spending and shrinking public sector.

If you are an average 40-50 year old working person, check the interest rate on your auto loan. Then check the interest rate on your home mortgage. Look back, say 30 years to 1985, and recompute your payments using 10% for an Auto loan and 9% for a mortgage. Now, tell me that low interest rates only benefit the rich.

Maybe you are a wealthy, retired person with $1 million in CD’s with average maturities of 5-10 years, and no home mortgage and no car payment. Check your annual retirement income – probably lucky if it is $20,000. Look back to, say 30 years ago to 1985, and compute your retirement income with $1 million invested in a similar mix of CD’s. Probably at least $60,000. Now tell me how happy you are that you are rich and that you are a huge beneficiary of low interest rates.

Interesting to see the large publicly traded companies are selling legacy assets.

In particular, Chevron is selling its interest in the Seminole San Andreas Unit in Gaines Co., TX. The unit is generating them over $400K per month. It is a CO2 flood still producing over 20K BOE per day gross, and is operated by Hess.

Shell is selling a large block of lower 48 royalty interests located in 10 states, generating over $250K per month.

Chevron is also selling another legacy block of conventional wells operated by them in the Permian Basin, which currently generates over $300K per month.

What is also interesting is of all is these are all listed for sale on the Internet auction. IMO they are selling these assets at a really poor time. Are even the super majors in need of cash to the extent they would sell premium onshore lower 48 assets at the low end of the market? Maybe they do not see a rebound anytime soon? Yikes. However, the same things happened in 1998 and many buyers hit it big with prices from late 1999-2014.

Also looked at conventional wells for sale in Dunn Co. ND. They are under water with oil at the well around $30. I note that the wells produce super saturated salt water and require fresh water flushes to operate. Watcher has mentioned this before. These wells are in the Duperow formation. Do middle Bakken and TFS require large amounts of fresh water also?

Edit: I found the answer. Per a 2013 National Geographic article, all Bakken and TFS wells require water flushing such that when the field is fully developed with 40-45K wells, the field will require in excess of 10 billion barrels of fresh water annually.

Looking at the production and lease operating statements for the older conventional wells I examined, I estimate 10+ year old middle bakken and TFS wells will need over $50 WTI just to break even on an operating basis, not including any work over expense.

North Dakota wells are at a distinct disadvantage due to the salt issue.

Throw on top that the companies have added to product gathering and salt water disposal costs by selling of this infrastructure to raise cash, I believe long term ND oil production will be among the hugest cost in the lower 48 on strictly an operating basis.

Perhaps selling off assets looks better than borrowing money from a bank to pay dividends to your shareholders? Watcher would probably know the answer to this.

shallow sand,

For big oil companies, selling and buying assets is a constant process. They are “optimizing asset portfolio”

shallow sand said:

It’s hard to tell, since everything hinges on what happens in the future.

One thing is for sure, and that is that Permian Basin O&G assets are, despite the low oil and gas prices, still selling for several times what they sold for in the pre-shale days.

Take Concho Resources purchase of Marbob in 2010, for instance:

Concho picked up 150,000 net acres in the deal. That’s a little bit north of $8,000 an acre.

At the time of the sale, the old timers thought Marbob’s founder and president, Johnny Gray, had cut a fat hog.

But if you compare $8,000 an acre to the more than $30,000 per acre Aubrey McClendon just paid, it looks like Gray sold too soon.

One could find other comps, but I think the price of Permian Basin O&G assets over the past 15 years has been consistently upwards.

Shallow,

Analyzing why the companies are selling legacy properties that make some money at this moment can lead you to the trap called “sunk cost fallacy”. “Sunk cost fallacy” is exactly the same for big oil companies as for individuals.

Sunk-cost fallacy occurs when people make decisions about a current situation based on what they have previously invested in the situation. For example, spending $100 on a concert and on the day you find that it’s cold and rainy. You feel that if you don’t go you would’ve wasted the money and the time you spent in line to get that ticket and feel obligated to follow through even if you don’t want to.

It’s is cold and rainy in the oil industry right now.

Glenn. I got an email from Raymond James which detailed Q3 sales. Permian basin were substantially higher per flowing barrel than the rest of the US lower 48.

AlexS. I do agree companies are always selling assets, but interesting to see larger higher quality assets on the public block. Either no solid offers privately, or maybe companies are finding online sales are the best way to go.

Yes, but if the $30,000/acre price Aubrey McClendon paid is typical, it looks like oil & gas asset prices in the Permian Basin are hotter than ever. And this despite the drop in oil prices.

Diamondback Energy, for instance, in September 2013 paid $440 million for 12,500 acres of net mineral rights in the shale play in Midland County. That’s $35,000/acre, but for mineral interest, and back when oil was selling for well over $100/barrel.

http://ir.diamondbackenergy.com/releasedetail.cfm?releaseid=788419

Just imagine, McClendon paid over $30,000 per net acre for leasehold working interest, with oil at $45.

The EIA’s Electric Power Monthly was updated last Tuesday (October 27) and I stumbled upon a utility focused blog that reported with the following headline:

EIA: Gas generation edges out coal for 2nd consecutive month, 3rd time this year

For the second consecutive month, but only the third time ever, gas generation exceeded coal according to data from the U.S. Energy Information Administration. The shift has been recognized for years, but cheap gas and tighter environmental regulations have accelerated the trend. Coal power production is down significantly in the last decade — falling from more than 2 million GWh in 2015 to about 1.6 million GWh last year. In that same period, gas-fired power went from 761,000 GWh to 1.1 million GWh.

To put the figures another way, Argus points out that in 2008 coal generated twice as much power as gas, but last year only produced about 40% more.

Earlier this year, April marked the first time gas generation exceeded coal. Electric Power Monthly data showed gas-fired plants around the country produced 92,516 GWh, compared with 88,835 GWh of coal. Coal regained its top status in May and June, but in July was once again edged out.

For anybody interested in electricity generation from the utility standpoint Utility Dive appears to be quite an interesting site.

About Utility Dive

Welcome to Utility Dive. Our mission is to provide busy professionals like you with a bird’s-eye-view of the Utilities industry in 60 seconds.

We cover industry news and provide original analysis. Throughout the day, our editorial team analyzes the top news stories and publishes in-depth feature articles. You can also use our site to check out industry stock prices, browse jobs, and more.

Alan,

Good to point out Utility Dive. It’s a great resource.

Graph of electricity generation by source as a percentage of total, from the EIA Electric Power Monthly.

Graph of solar thermal and solar pv electricity production from the EIA Electric Power Monthly.

The Spanish Ship ” El Galeon ” is open for tours in the port of Pensacola till Nov 8th.

El Galeon Andalucia (refered to as in Spain) is a 170 foot, 495 ton, authentic wooden replica of a galleon that was part of Spain’s West Indies fleet. With information about 16th century European sailing techniques and technology, as well as important Florida history exhibits, El Galeón will tell the 500 year story since the arrival of Juan Ponce de León on the eastern shore of Florida.

http://www.elgaleon.org/galleons.html

She was protected from last weeks storm by the Deepwater Pipe Layer “Global 1200. ”

http://www.marinetraffic.com/ais/details/ships/shipid:738385/mmsi:576725000/imo:9463815/vessel:GLOBAL_1200

U.S production without Alaska and Federal Offshore. An almost linear decline rate of 67 kb/d/mth.

Does that graph represent crude only or C+C?

That is C+C. The EIA does not publish crude only data.

Lower 48 onshore C+C production is down 334 kb/d between March and August, of which Texas is down 221 kb/d, of which Eagle Ford is down 170 kb/d (EFS estimate from DPR).

Thus the Eagle Ford, which was always viewed as the lowest cost LTO play, accounts for more than half of the decline in total US onshore production ex Alaska. Furthermore, the EIA’s DPR predicts an even bigger drop in EFS production of 190 kb/d between August and November.

How can this be explained?

I tend to agree with Rystad Energy and some others claiming that the EIA overestimates the decline in U.S. C+C production

Hi AlexS,

I updated my estimate of Eagle Ford output using RRC data on the percentage of total Texas C+C output each month from the Eagle Ford (EF) play and multiplying this by Dean’s most recent Texas C+C estimate. EF C+C output was 1577 kb/d in March and 1422 kb/d in August, so fairly close to the DPR estimate for the change in output.

The difference may be accounted for by the DPR including all output from the Eagle Ford region, where I only count the specific output from the fields considered a part of the Eagle Ford play by the RRC.

Chart below gives the EF C+C estimate on the left axis (green line) and the percentage of Texas C+C output from the Eagle Ford play (%EF/TX) on the right axis (blue line).

Dennis.

I know that EIA DPR numbers are for the “Eagle Ford region”, which is bigger than EFS. But was is important here, are not the absolute numbers, but the estimated decline in production.

According to the EIA, EFS production dropped by 170 kb/d between March and August, and is expected to decline by 190 kb/d between August and November.

This compares with relatively modest declines in the Bakken and continued growth in the Permian.

I am wondering, what are the causes of divergent performance in EFS compared with other shale plays.

Maybe the EIA is just underestimating Eagle Ford production?

As I see from your chart, your estimate is close to the EIA’s

Hi AlexS,

I agree that the change in output is the important thing. The estimate from the EIA’s DPR for March to August decline is fairly close to my estimate, I was simply sharing with everyone that the DPR estimate is not LTO only, it includes all output from the region (which you have pointed out to me in the past). The difference between my estimate and the EIA’s DPR might be explained by this difference.

I do not have a good explanation for why there has been such a drop in the Eagle Ford, possibly the sweet spots are all drilled up, perhaps the number of wells producing has dropped relative to the Bakken, or perhaps they are choking their wells to a greater extent in August relative to March. There are petroleum engineers, geologists, and oil men who would know better than me what might be going on.

According to Baker Hughes there were 186 oil drilling rigs in the EF at the beginning of the year. That is now down to 64. What is amazing is how much the production has been maintained with nearly 2/3 fewer rigs.

The Permian went from 522 to 222 oil rigs over the same period. That’s a 57% decline in oil rig count. Combine this modestly lower degree with which rigs were removed from oil drilling with the lower decline rates for Permian wells and we should be able to explain most of the difference between the EF and the Permian.

It’s C + C data from PSM. Note it stops at Aug.

Interesting:

http://seekingalpha.com/article/3625706-2-private-equity-giants-are-selling-their-shale-to-china

I had a look at the wells that got plugged and abandoned in ND over the last year. I found that since July 2014, the 47 wells that got plugged for good (status = PA, plugged and abandoned) were really horror wells: the average PA well produced for 8 years, and produced 22 kb of oil, while producing 5 times as much water (110 kb), and 3 times that much gas in MCF. Only 7 of these 47 were Bakken wells (5 MB, and 2 TF).

Several of these wells were producing before 2007, of which I don’t have the production history though, so they are less bad than indicated above.

Many more wells got at least temporarily plugged (200-300, but didn’t get the status PA yet). Based on Shallow’s info on well economics, I had expected to see more uneconomical wells plugged and abandoned with less terrible production profiles.

It appears so far that wells are only plugged and abandoned when there is literally no chance that they will ever become economical. Does PA’ing a well affect HBP? Temporarily abandonment may be a cheap option compared with plugging, and it keeps open the option to start the well again?

Enno,

Thanks for the info.

As I understand, most of the PA wells in ND are conventional stripper wells. If more such wells are plugged, that would have only a marginal effect on ND’s overall production.

Enno,

In Texas, the general rule is that wells must be plugged and abandoned when the lease is no longer producing oil and/or gas in paying quantities. There is much debate over exactly what “producing in paying quantities” means but again speaking in general terms a wells is considered to be “producing in paying quantities” so long as the operator earns at least $1 over and above its operating and producing costs.

This is not a very high hurdle and so many, many wells are left temporarily abandoned until the last wells on the lease stops producing. There are other abandonment costs too. Many current oil and gas lease require the surface to be restored to its original condition. So caliche must be removed, grass reseeded, tank batteries removed, environmental damages remediated.

As an aside comment, oil and gas law in Texas, and current case law, DOES NOT require an Operator to pay the surface owner for damage to its surface. As a practical matter today most if not all oil and gas leases provide for the payment of damages. But again, generally speaking, the amounts are negotiated between lessor and lessee. This is problematic when the mineral ownership has been seperated from the surface owner.

As another aside, I try to preface my comments by saying “In Texas or the general rule” because other states may have different laws or case laws BUT OFTEN, Texas law is adopted by other jurisdictions because Texas is seen as the precedent setting state.

Enno. Companies will hold off as long as possible on plugging a well.

It seems to me there are many wells in ND on the monthly report showing zero production. Most are not Middle Bakken TFS.

There are two early 1980s Duperow wells for sale in Dunn Co., that have been operated at a loss all year. I’m sure they were very profitable 2010-2014. The owner will not plug them out until there is absolutely no other option. Like almost all ND wells, they have to be flushed with fresh water to produce them.

By the way, each of those old wells are at about 400K BOE from IP to date. Sound familiar? They are making about 15 BOE per day average each and OPEX is running in the $40s. This will be how almost all Middle Bakken and TFS wells will be 10 years plus out, IMO. Not going to be huge cash flow from them. And all that debt will still be there.

Alex, John, Shallow,

Thanks for your comments on this.

John S said:

Not only then, but sometimes when it hasn’t been separated.

There was a rancher in Borden County who owned both the mineral and surface rights to his ranch, and he was hell on wheels to negotiate surface damages with. And any little old leak or spill would cost you a bundle.

I was friends with his son, and he told me some great stories about Claytie Williams, who you mentioned in the last thread.

Modesta, Claytie’s second wife, my friend told me, was from a ranching family in Borden County. Her grandfather’s surname was Good.

Anyway, the first oil field they discovered on the Good Ranch they named the Good Field. And then later on, when they discovered a second field, they dubbed it the Very Good Field.

Modesta’s first husband was impotent, the story goes. So her family prevailed upon her to divorce her first husband and find her a real stud. That was Claytie Williams.

Claytie was a poor boy, but man did he take the ball and run with it. He began by building out gas gathering systems to capitalize on the large amounts of associated natural gas in West Texas that had previously been flared.

Later he got into the upstream business and was very active in drilling wells in the Giddings Austin Chalk Field. By the 1980s, he was on the Forbe’s 400 list of the richest Americans. He sold his Austin chalk interests just in the nick of time to PetroLewis, which is rumored to have saved him from financial ruin.

Anyway, Claytie was always flamboyant. My friend told me some promient rancher’s daugher in Borden County was getting married, and all the wedding guests were gathered on the ranch for a big party. Everyone was decked out in their sunday best, and low and behold Claytie and Modesta show up in a helicopter, blowing dust and dirt on everyone. Claytie’s grand entry didn’t go over too well with the other guests, I am told.

Claytie became even more legendary when he ran for governor. At one point he refused to shake hands with his Democratic opponent, Ann Richards, who he boasted he would “head and hoof her and drag her through the dirt.” That went over almost as well as when he said “Rape is like the weather. If it’s inevitable, relax and enjoy it.”

Claytie managed to lose the election to his Democratic opponent, and this in an overwhelmingly Republican state. So his knack for making money didn’t extend to the realm of politics and getting votes.

Claytie is one of the most colorful oilmen to have ever hailed from West Texas, which is no small feat considering West Texas was home to any number of highly colorful oil barons and baronesses, including Dora Roberts, J.E. Mabee, and Roy Parks, amongst others.

GlennS,

What was his swimming pool shaped like?

I don’t know. I never met Claytie or Modesta, and never stepped foot in any of their houses.