A Guest Post by Dr. Minqi Li, Professor

Department of Economics, University of Utah

E-mail: minqi.li@economics.utah.edu

August 2018

This is Part 3 of the World Energy Annual Report in 2018. This part of the Annual Report provides updated analysis of world natural gas production and consumption, evaluates the future prospect of world natural gas supply and considers the implications of peak natural gas production for global economic growth.

Natural gas is in a relatively early phase of depletion. According to the German Federal Institute for Geosciences and Natural Resources, world cumulative natural gas production up to 2016 was 117 trillion cubic meters, world natural gas reserves were 197 trillion cubic meters, and world natural gas resources were 643 trillion cubic meters (BGR 2017, Table A-15). BGR defines “resources” as “proven amounts of energy resources which cannot currently be exploited for technical and/or economic reasons, as well as unproven but geologically possible energy resources which may be exploitable in future” (BGR 2017, Glossary). According to the BP Statistical Review of World Energy, world natural gas reserves at the end of 2017 were 194 trillion cubic meters (166 billion tons of oil equivalent).

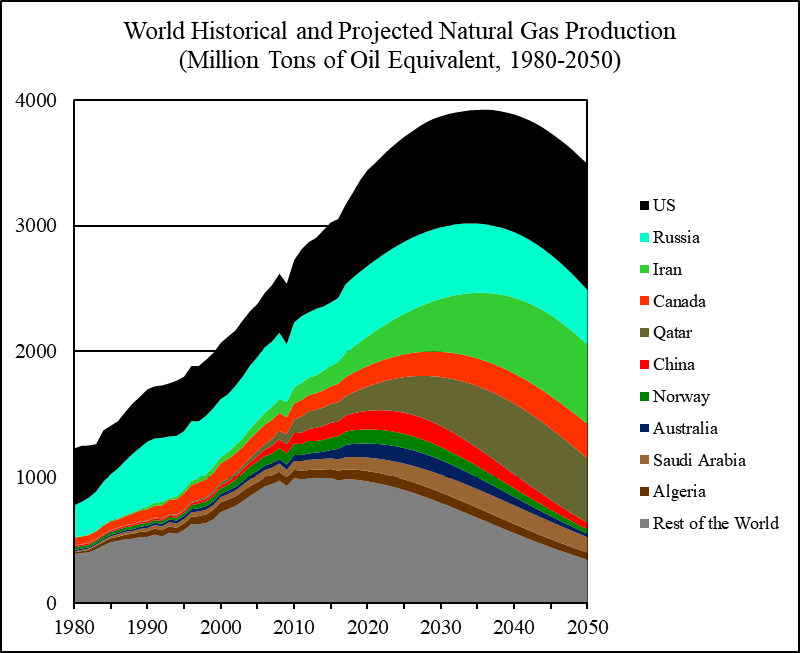

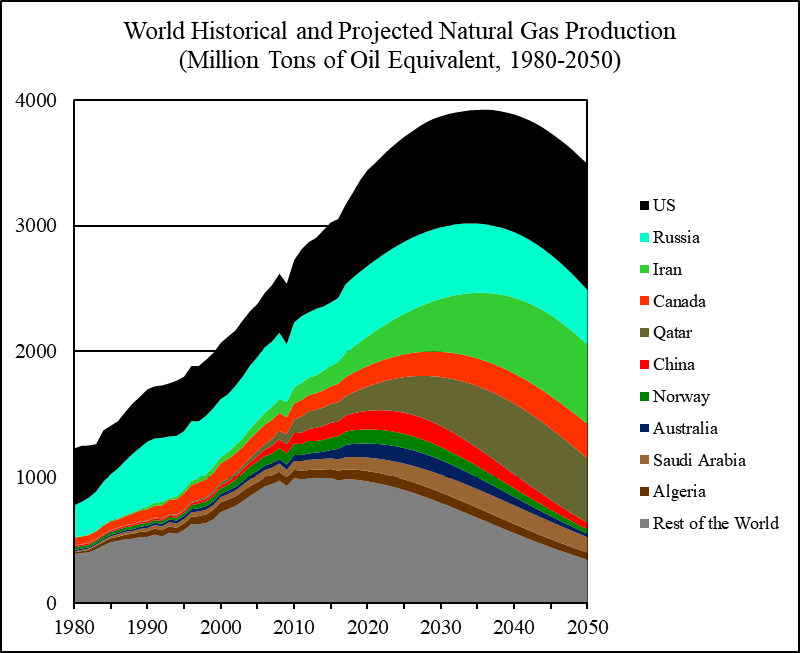

World Historical and Projected Natural Gas Production, 1980-2050

This report uses official reserves, official projections, or energy research institution estimates to establish the ultimately recoverable natural gas resources for the world’s ten largest natural gas producers. For the rest of the world (the world total less the ten largest natural gas producers), this report uses Hubbert linearization to establish the ultimately recoverable natural gas resources.

Figures are placed at the end of each section.

Natural Gas Consumption by Major Economies, 1990-2017

According to the BP Statistical Review of World Energy, world natural gas consumption was 3,156 million tons of oil equivalent (3,670 billion cubic meters) in 2017. Between 2007 and 2017, world natural gas consumption grew at an average annual rate of 2.2 percent.

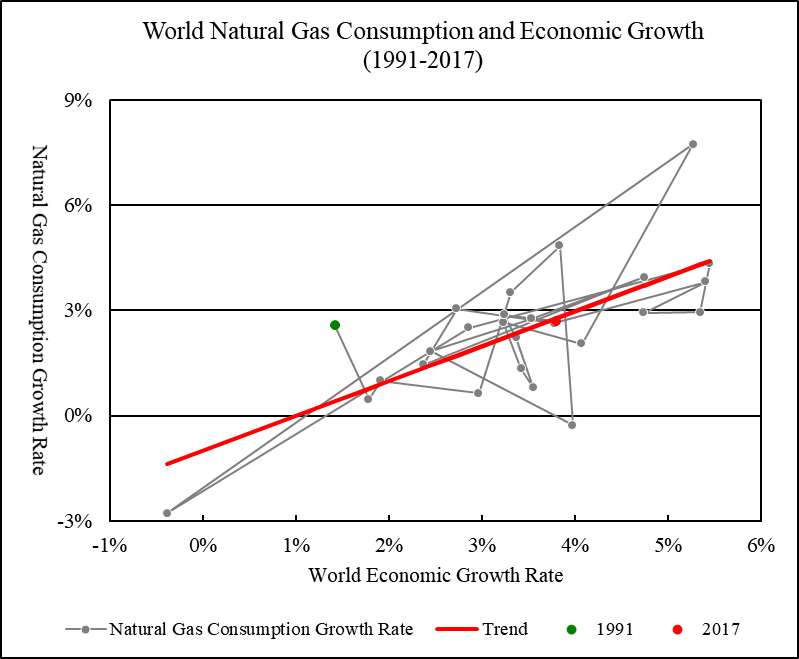

Figure 1 compares the historical world economic growth rates and the natural gas consumption growth rates from 1991 to 2017. The natural gas consumption growth rate has an intercept of -0.01 at zero economic growth rate and a slope of 0.992. That is, natural gas consumption has an “autonomous” tendency to fall by about 1 percent a year when economic growth rate is zero. When economic growth rate rises above zero, an increase in economic growth rate by one percentage point is associated with an increase in natural gas consumption by 0.99 percent. R-square for the linear trend is 0.49. In 2017, world natural gas consumption grew by 2.7 percent, a rate that is 0.1 percentage points below what is implied by the historical trend.

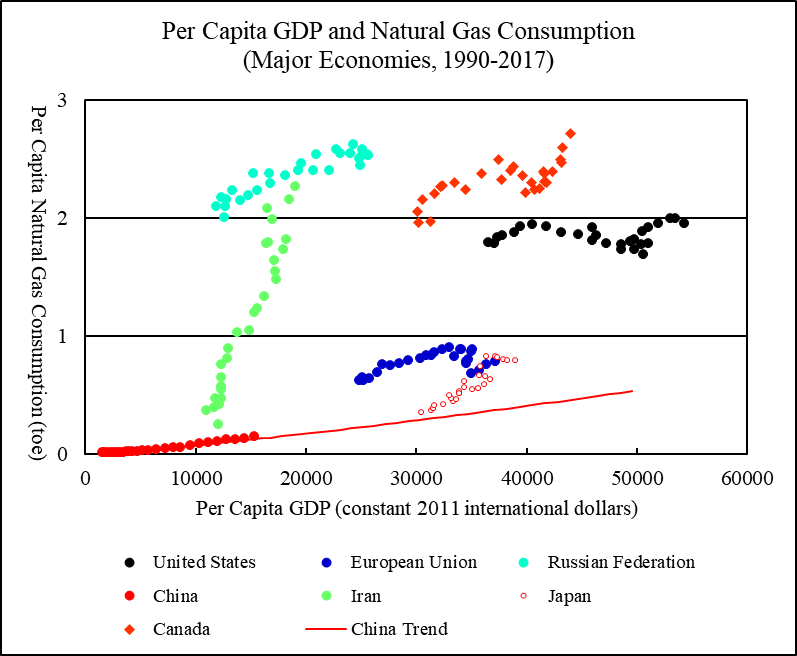

Figure 2 compares the per capita natural gas consumption in relation to per capita GDP for the world’s six largest national natural gas consumers and the European Union.

The United States is the world’s largest natural gas consumer. In 2017, the US natural gas consumption was 636 million tons of oil equivalent (740 billion cubic meters), accounting for 20 percent of the world natural gas consumption. The US per capita natural gas consumption declined from 1.94 tons of oil equivalent in 1996 to 1.69 tons of oil equivalent in 2006. The US natural gas consumption has tended to grow since then. Per capita natural gas consumption was about 2 tons of oil equivalent in 2016 and 1.95 tons of oil equivalent in 2017.

The European Union is the world’s second largest natural gas consumer. In 2017, the EU natural gas consumption was 401 million tons of oil equivalent (467 billion cubic meters), accounting for 13 percent of the world natural gas consumption. The EU per capita natural gas consumption peaked at 898 kilograms of oil equivalent in 2005 and declined to 678 kilograms of oil equivalent by 2014. In 2017, the EU per capita natural gas consumption recovered to 782 kilograms of oil equivalent.

The Russian Federation is the world’s third largest natural gas consumer. In 2017, Russia’s natural gas consumption was 365 million tons of oil equivalent (425 billion cubic meters), accounting for 12 percent of the world natural gas consumption. Russia’s per capita natural gas consumption grew from about 2 tons of oil equivalent in 1997 to 2.62 tons of oil equivalent in 2011. In 2017, Russia’s per capita natural gas consumption was 2.53 tons of oil equivalent.

China is the world’s fourth largest natural gas consumer. In 2017, China’s natural gas consumption reached 207 million tons of oil equivalent (240 billion cubic meters), accounting for 6.6 percent of the world natural gas consumption. From 1990 to 2017, China’s per capita natural gas consumption surged from 12 kilograms of oil equivalent to 149 kilograms of oil equivalent, which is still substantially below the per capita natural gas consumption levels of advanced capitalist economies.

If China’s per capita natural gas consumption continues to follow its historical trend in relation to per capita GDP, China’s per capita natural gas consumption will rise to 532 kilograms of oil equivalent by 2050 (when China’s per capita GDP is projected to rise to about 50,000 dollars). China’s population is expected to peak before 2030 and decline to 1.36 billion by 2050. Given these projections, China’s natural gas demand will rise to 722 million tons of oil equivalent by 2050.

Iran is the world’s fifth largest natural gas consumer. In 2017, Iran’s natural gas consumption reached 184 million tons of oil equivalent (214 billion cubic meters), accounting for 5.8 percent of the world natural gas consumption. From 1990 to 2017, Iran’s per capita natural gas consumption skyrocketed from 364 kilograms of oil equivalent to 2.27 tons of oil equivalent.

Japan is the world’s sixth largest natural gas consumer. In 2017, Japan’s natural gas consumption was 101 million tons of oil equivalent (117 billion cubic meters), accounting for 3.2 percent of the world natural gas consumption. Japan’s per capita natural gas consumption peaked at 825 kilograms of oil equivalent in 2013. In 2017, Japan’s per capita natural gas consumption was 794 kilograms of oil equivalent.

Canada is the world’s seventh largest natural gas consumer. In 2017, Canada’s natural gas consumption was 100 million tons of oil equivalent (116 billion cubic meters), accounting for 3.2 percent of the world natural gas consumption. Canada’s per capita natural gas consumption increased from 1.97 tons of oil equivalent in 1990 to 2.49 tons of oil equivalent in 2000. Per capita consumption decreased to 2.21 tons of oil equivalent in 2009 and rose to the all-time high of 2.71 tons of oil equivalent in 2017.

Figure 1 World Natural Gas Consumption and Economic Growth, 1991-2017

Linear Trend: Natural Gas Consumption Growth Rate = -0.010 + 0.992 * Economic Growth Rate (R-square = 0.490)

Sources: World natural gas consumption from 1990 to 2017 is from BP (2018). Gross world product in constant 2011 international dollars from 1990 to 2016 is from World Bank (2018), extended to 2017 using growth rate reported by IMF (2018, Statistical Appendix, Table A1).

Figure 2 Per Capita GDP and Natural Gas Consumption, Major Economies, 1990-2017

Sources: Per capita natural gas consumption and per capita GDP are calculated using data for natural gas consumption, GDP, and population. National and regional natural gas consumption from 1990 to 2017 is from BP (2018). National and regional GDP from 1990 to 2016 is from World Bank (2018), extended to 2017 using growth rates reported by IMF (2018, Statistical Appendix, Table A1, A2, and A4). National and regional population from 1990 to 2016 is from World Bank (2018), extended to 2017 by assuming that the 2017 population growth rates are the same as the 2016 growth rates. To project China’s per capita natural gas consumption, a log-linear relationship is estimated between the per capita natural gas consumption and per capita GDP for the period 1990-2017. China’s GDP and population projections from 2018 to 2050 are from EIA (2017, Reference Case, Table A3 and Table J4), adjusted to make the projected GDP and population levels in 2017 matching the levels reported by World Bank (2018).

The United States

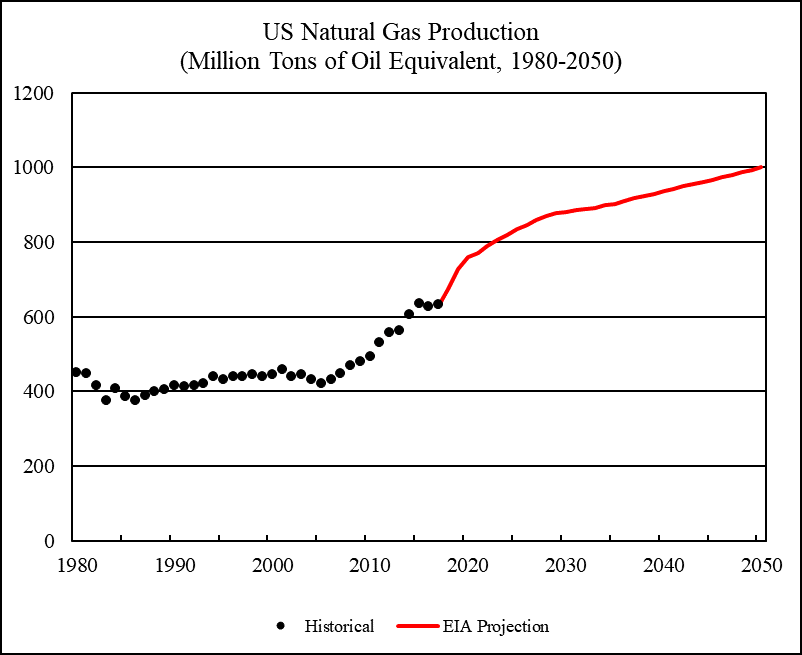

The United States is currently the world’s largest natural gas producer. In 2017, the US produced 632 million tons of oil equivalent of natural gas (735 billion cubic meters), accounting for 20 percent of the world natural gas production.

The US conventional natural gas production peaked in 1971 when total natural gas production was 505 million tons of oil equivalent. Since 2005, the US natural gas production has experienced a spectacular expansion because of the shale gas boom. The US Energy Information Administration projects that the US natural gas production will rise to about 1 billion tons of oil equivalent by 2050 (EIA 2018, Reference Case, Table A1).

The US cumulative natural gas production up to 2017 was 31.2 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Applying Hubbert linearization to the annual production to cumulative production ratios implied by the projected US natural gas production from 2041 to 2050, the US ultimately recoverable natural gas resources are estimated to be 147.2 billion tons of oil equivalent and the remaining recoverable natural gas resources are estimated to be 116 billion tons of oil equivalent. By comparison, the US “proved” natural gas reserves at the end of 2017 were reported to be 8.7 trillion cubic meters (7.5 billion tons of oil equivalent) (BP 2018).

Figure 3 shows the historical US natural gas production and the future production projected by EIA.

Figure 3 US Natural Gas Production, 1980-2050

Sources: The US historical natural gas production from 1980 to 2017 is from BP (2018). Projected US natural gas production from 2018 to 2050 is from EIA (2018, Reference Case, Table A1), adjusted to make the projected natural gas production level in 2017 matching the production level reported by BP (2018).

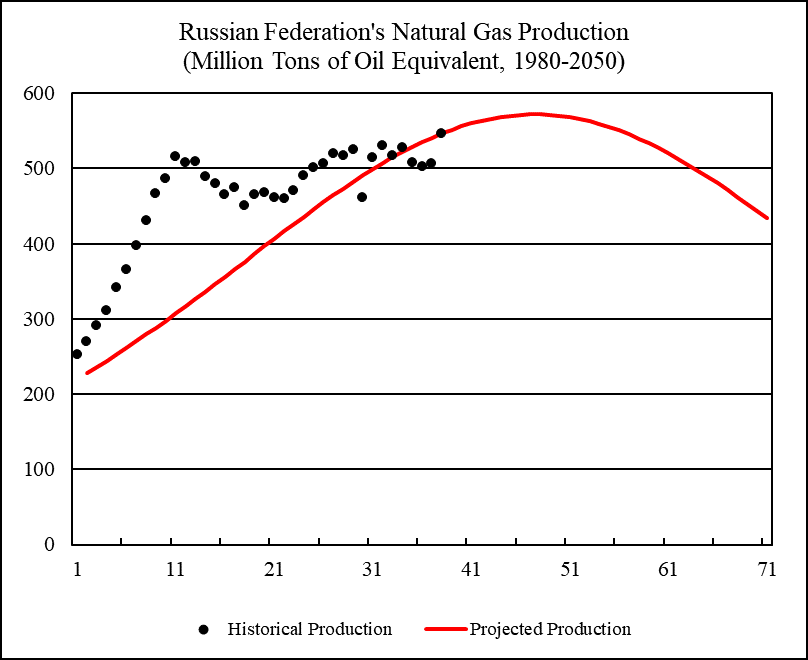

Russian Federation

The Russian Federation is the world’s second largest natural gas producer. In 2017, Russia produced 547 million tons of oil equivalent of natural gas (636 billion cubic meters), accounting for 17 percent of the world natural gas production.

This report assumes that Russia’s ultimately recoverable natural gas resources are the sum of historical cumulative production and the official reserves. Russia’s cumulative natural gas production up to 2017 was 20.1 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Russia’s official natural gas reserves at the end of 2017 were reported to be 35 trillion cubic meters (30.1 billion tons of oil equivalent) (BP 2018). The ultimately recoverable natural gas resources are estimated to be 50.2 billion tons of oil equivalent.

Based on the above assumptions, Russia’s natural gas production is projected to peak in 2026 at 572 million tons of oil equivalent. Figure 4 shows Russia’s historical and projected natural gas production.

Figure 4 Russian Federation’s Natural Gas Production, 1980-2050

Sources: Russia’s historical natural gas production from 1985 to 2017 is from BP (2018). For 1980-1984, Russia’s natural gas production is assumed to be 71.3 percent of the Soviet Union’s total natural gas production. To project Russia’s natural gas production, I used a logistic curve assuming the ultimately recoverable resources are the sum of cumulative production and official reserves. The parameters are calculated so that the projected annual production equals the actual annual production in 2017.

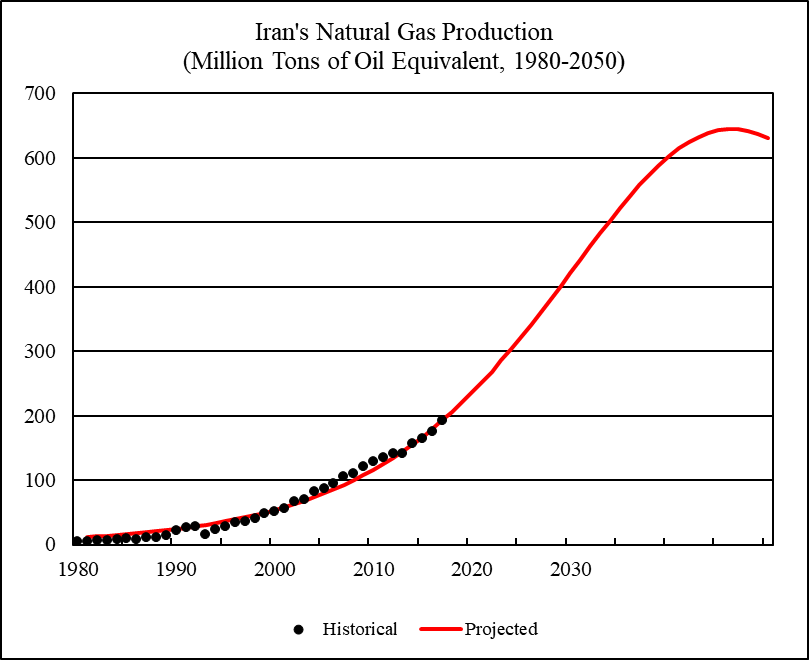

Iran

Iran is the world’s third largest natural gas producer. In 2017, Iran produced 193 million tons of oil equivalent of natural gas (224 billion cubic meters), accounting for 6.1 percent of the world natural gas production.

This report assumes that Iran’s ultimately recoverable natural gas resources are the sum of historical cumulative production and the official reserves. Iran’s cumulative natural gas production up to 2017 was 2.6 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Iran’s official natural gas reserves at the end of 2017 were reported to be 33.2 trillion cubic meters (28.6 billion tons of oil equivalent) (BP 2018). The ultimately recoverable natural gas resources are estimated to be 31.2 billion tons of oil equivalent.

Based on the above assumptions, Iran’s natural gas production is projected to peak in 2046 at 645 million tons of oil equivalent. Figure 5 shows Iran’s historical and projected natural gas production.

Figure 5 Iran’s Natural Gas Production, 1980-2050

Sources: Iran’s historical natural gas production from 1980 to 2017 is from BP (2018). To project Iran’s natural gas production, I used a logistic curve assuming the ultimately recoverable resources are the sum of cumulative production and official reserves. The parameters are calculated so that the projected annual production equals the actual annual production in 2017.

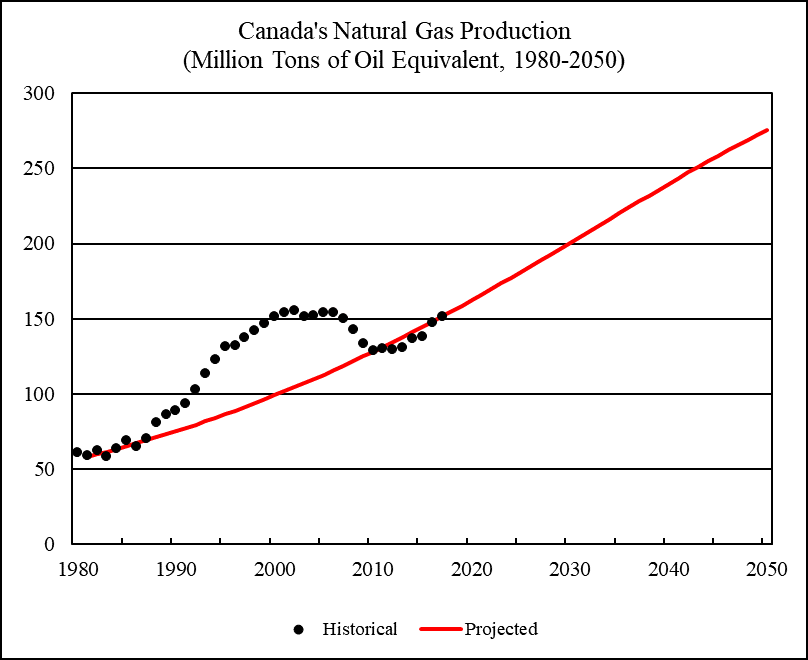

Canada

Canada is the world’s fourth largest natural gas producer. In 2017, Canada produced 152 million tons of oil equivalent of natural gas (176 billion cubic meters), accounting for 4.8 percent of the world natural gas production.

Canada’s conventional natural gas production peaked in 2002 when total natural gas production was 155 million tons of oil equivalent. Since 2010, Canada’s natural gas production has resumed growth driven by the shale gas boom. Canada’s cumulative natural gas production up to 2017 was 5.6 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Canada’s “proved” natural gas reserves at the end of 2017 were reported to be 1.9 trillion cubic meters (1.6 billion tons of oil equivalent) (BP 2018). The “proved” natural gas reserves are evidently too conservative as an estimate of Canada’s remaining recoverable natural gas resources.

The German Federal Institute for Geosciences and Natural Resources estimates Canada’s ultimately recoverable natural gas resources to be 46.4 trillion cubic meters (39.9 billion tons of oil equivalent) (BGR 2017, Table A-15). Using the BGR estimate as Canada’s ultimately recoverable natural gas resources, Canada’s natural gas production is projected to rise to 276 million tons of oil equivalent by 2050. Figure 6 shows Canada’s historical and projected natural gas production.

Figure 6 Canada’s Natural Gas Production, 1980-2050

Sources: Canada’s historical natural gas production from 1980 to 2017 is from BP (2018). To project Canada’s natural gas production, I used a logistic curve using the ultimately recoverable resources estimated by BGR (2017). The parameters are calculated so that the projected annual production equals the actual annual production in 2017.

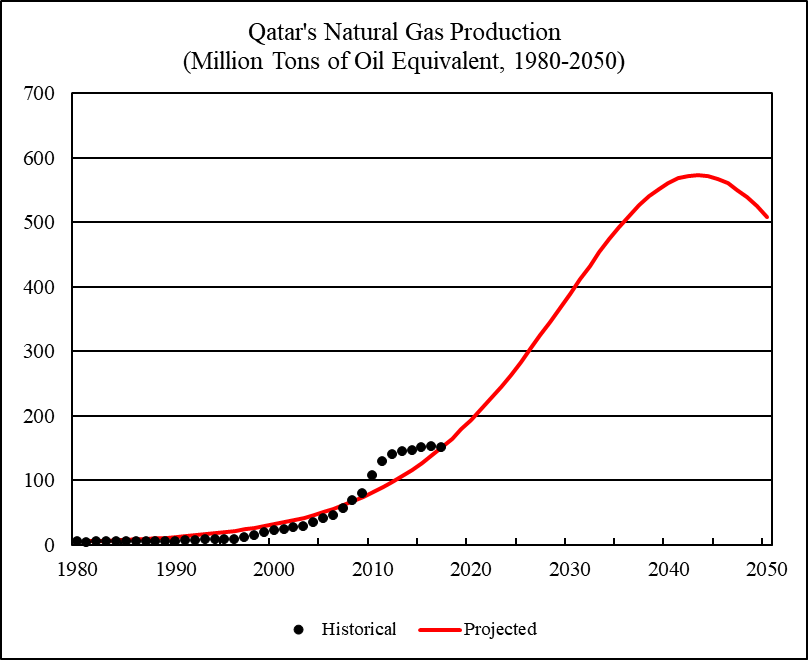

Qatar

Qatar is the world’s fifth largest natural gas producer. In 2017, Qatar produced 151 million tons of oil equivalent of natural gas (176 billion cubic meters), accounting for 4.8 percent of the world natural gas production.

This report assumes that Qatar’s ultimately recoverable natural gas resources are the sum of historical cumulative production and the official reserves. Qatar’s cumulative natural gas production up to 2017 was 1.7 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Qatar’s official natural gas reserves at the end of 2017 were reported to be 24.9 trillion cubic meters (21.4 billion tons of oil equivalent) (BP 2018). The ultimately recoverable natural gas resources are estimated to be 23.1 billion tons of oil equivalent.

Based on the above assumptions, Qatar’s natural gas production is projected to peak in 2043 at 573 million tons of oil equivalent. Figure 7 shows Qatar’s historical and projected natural gas production.

Figure 7 Qatar’s Natural Gas Production, 1980-2050

Sources: Qatar’s historical natural gas production from 1980 to 2017 is from BP (2018). To project Qatar’s natural gas production, I used a logistic curve assuming the ultimately recoverable resources are the sum of cumulative production and official reserves. The parameters are calculated so that the projected annual production equals the actual annual production in 2017.

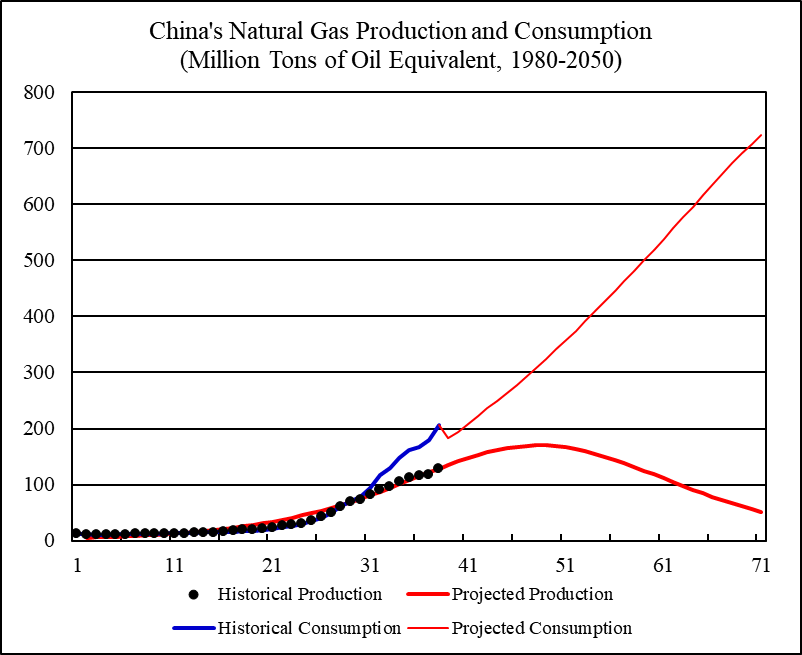

China

China is the world’s sixth largest natural gas producer. In 2017, China produced 128 million tons of oil equivalent of natural gas (149 billion cubic meters), accounting for 4.1 percent of the world natural gas production.

This report assumes that China’s ultimately recoverable natural gas resources are the sum of historical cumulative production and the official reserves. China’s cumulative natural gas production up to 2017 was 1.7 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). China’s official natural gas reserves at the end of 2017 were reported to be 5.5 trillion cubic meters (4.7 billion tons of

oil equivalent) (BP 2018). The ultimately recoverable natural gas resources are estimated to be 6.4 billion tons of oil equivalent.

Figure 8 compares China’s historical and projected natural gas production and consumption. China’s natural gas production is projected to peak in 2027 at 170 million tons of oil equivalent. China’s natural gas consumption is projected to rise from 207 million tons of oil equivalent in 2017, to 358 million tons in 2030, 538 million tons in 2040, and 722 million tons in 2050. Under the projections, China’s net natural gas imports (consumption less production) will rise from 78 million tons of oil equivalent in 2017, to 191 million tons in 2030, 427 million tons in 2040, and 671 million tons in 2050. This will be equivalent to 21 percent of the world natural gas production in 2017.

Figure 8 China’s Natural Gas Production and Consumption, 1980-2050

Sources: China’s historical natural gas production and consumption from 1980 to 2017 is from BP (2018). China’s future per capita natural gas consumption is projected by assuming that per capita natural gas consumption will grow in accordance with the historical relationship between per capita natural gas consumption and per capita GDP (see Figure 2). Future natural gas consumption is then calculated using per capita natural gas consumption multiplied by the projected population. China’s population projection from 2018 to 2050 is from EIA (2017, Reference Case, Table J4), adjusted to make the projected population level in 2017 matching the population level used by this report.

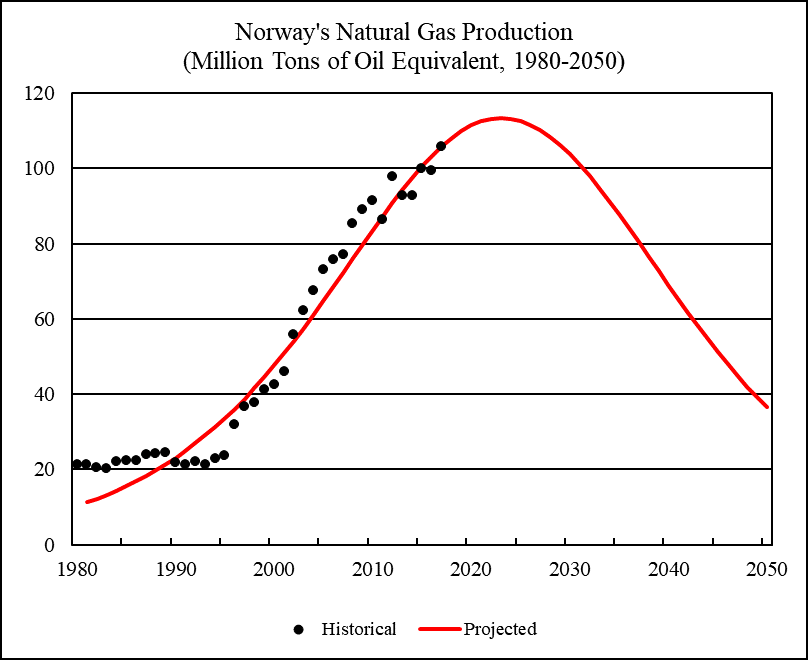

Norway

Norway is the world’s seventh largest natural gas producer. In 2017, Norway produced 106 million tons of oil equivalent of natural gas (123 billion cubic meters), accounting for 3.3 percent of the world natural gas production.

Norway’s cumulative natural gas production up to 2017 was 2 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Norway’s official natural gas reserves at the end of 2017 were reported to be 1.7 trillion cubic meters (1.5 billion tons of oil equivalent) (BP 2018). The official reserves are probably too conservative as an estimate of Norway’s remaining recoverable natural gas resources.

The German Federal Institute for Geosciences and Natural Resources estimates Norway’s ultimately recoverable natural gas resources to be 6.1 trillion cubic meters (5.2 billion tons of oil equivalent) (BGR 2017, Table A-15). Using the BGR estimate as Norway’s ultimately recoverable natural gas resources, Norway’s natural gas production is projected to peak in 2023 at 113 million tons of oil equivalent. Figure 9 shows Norway’s historical and projected natural gas production.

Figure 9 Norway’s Natural Gas Production, 1980-2050

Sources: Norway’s historical natural gas production from 1980 to 2017 is from BP (2018). To project Norway’s natural gas production, I used a logistic curve using the ultimately recoverable resources estimated by BGR (2017). The parameters are calculated so that the projected annual production equals the actual annual production in 2017.

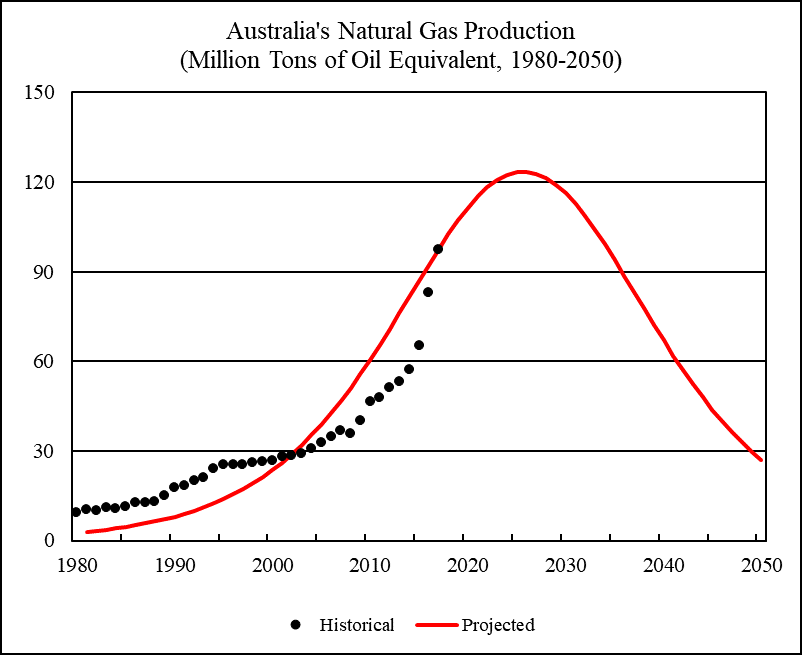

Australia

Australia is the world’s eighth largest natural gas producer. In 2017, Australia produced 98 million tons of oil equivalent of natural gas (114 billion cubic meters), accounting for 3.1 percent of the world natural gas production.

This report assumes that Australia’s ultimately recoverable natural gas resources are the sum of historical cumulative production and the official reserves. Australia’s cumulative natural gas production up to 2017 was 1.2 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Australia’s official natural gas reserves at the end of 2017 were reported to be 3.6 trillion cubic meters (3.1 billion tons of oil equivalent) (BP 2018). The ultimately recoverable natural gas resources are estimated to be 4.3 billion tons of oil equivalent.

Based on the above assumptions, Australia’s natural gas production is projected to peak in 2026 at 124 million tons of oil equivalent. Figure 10 shows Australia’s historical and projected natural gas production.

Figure 10 Australia’s Natural Gas Production, 1980-2050

Sources: Australia’s historical natural gas production from 1980 to 2017 is from BP (2018). To project Australia’s natural gas production, I used a logistic curve assuming the ultimately recoverable resources are the sum of cumulative production and official reserves. The parameters are calculated so that the projected annual production equals the actual annual production in 2017.

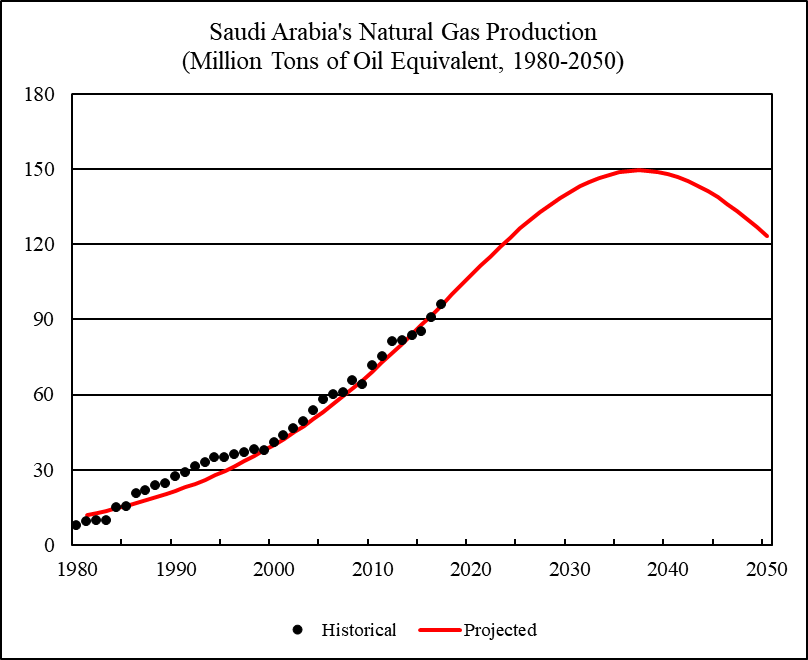

Saudi Arabia

Saudi Arabia is the world’s ninth largest natural gas producer. In 2017, Saudi Arabia produced 96 million tons of oil equivalent of natural gas (111 billion cubic meters), accounting for 3 percent of the world natural gas production.

This report assumes that Saudi Arabia’s ultimately recoverable natural gas resources are the sum of historical cumulative production and the official reserves. Saudi Arabia’s cumulative natural gas production up to 2017 was 1.8 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Saudi Arabia’s official natural gas reserves at the end of 2017 were reported to be 8 trillion cubic meters (6.9 billion tons of oil equivalent) (BP 2018). The ultimately recoverable natural gas resources are estimated to be 8.7 billion tons of oil equivalent.

Based on the above assumptions, Saudi Arabia’s natural gas production is projected to peak in 2037 at 149 million tons of oil equivalent. Figure 11 shows Saudi Arabia’s historical and projected natural gas production.

Figure 11 Saudi Arabia’s Natural Gas Production, 1980-2050

Sources: Saudi Arabia’s historical natural gas production from 1980 to 2017 is from BP (2018). To project Saudi Arabia’s natural gas production, I used a logistic curve assuming the ultimately recoverable resources are the sum of cumulative production and official reserves. The parameters are calculated so that the projected annual production equals the actual annual production in 2017.

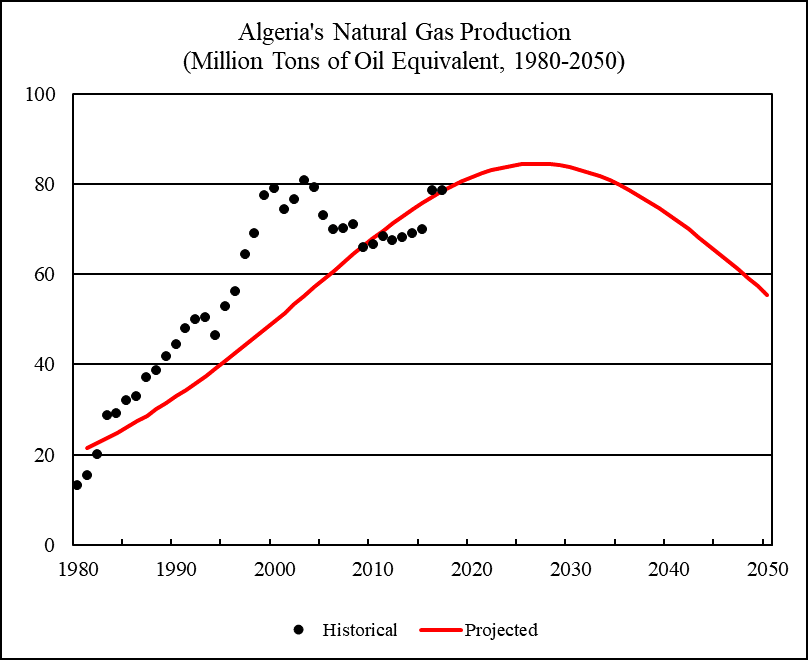

Algeria

Algeria is the world’s tenth largest natural gas producer. In 2017, Algeria produced 79 million tons of oil equivalent of natural gas (91 billion cubic meters), accounting for 2.5 percent of the world natural gas production.

This report assumes that Algeria’s ultimately recoverable natural gas resources are the sum of historical cumulative production and the official reserves. Algeria’s cumulative natural gas production up to 2017 was 2.2 billion tons of oil equivalent (cumulative production up to 2007 is from BGR 2009, Table A 4-2, extended to 2017 using annual production data from BP 2018; 1 trillion cubic meters of natural gas = 0.86 billion tons of oil equivalent). Algeria’s official natural gas reserves at the end of 2017 were reported to be 4.3 trillion cubic meters (3.7 billion tons of oil equivalent) (BP 2018). The ultimately recoverable natural gas resources are estimated to be 5.9 billion tons of oil equivalent.

Based on the above assumptions, Algeria’s natural gas production is projected to peak in 2027 at 85 million tons of oil equivalent. Figure 12 shows Algeria’s historical and projected natural gas production.

Figure 12 Algeria’s Natural Gas Production, 1980-2050

Sources: Algeria’s historical natural gas production from 1980 to 2017 is from BP (2018). To project Algeria’s natural gas production, I used a logistic curve assuming the ultimately recoverable resources are the sum of cumulative production and official reserves. The parameters are calculated so that the projected annual production equals the actual annual production in 2017.

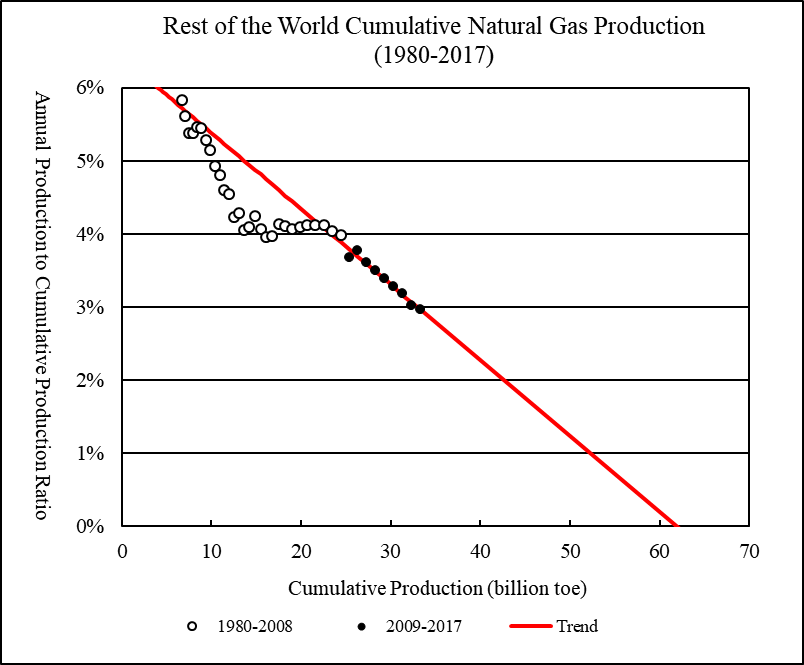

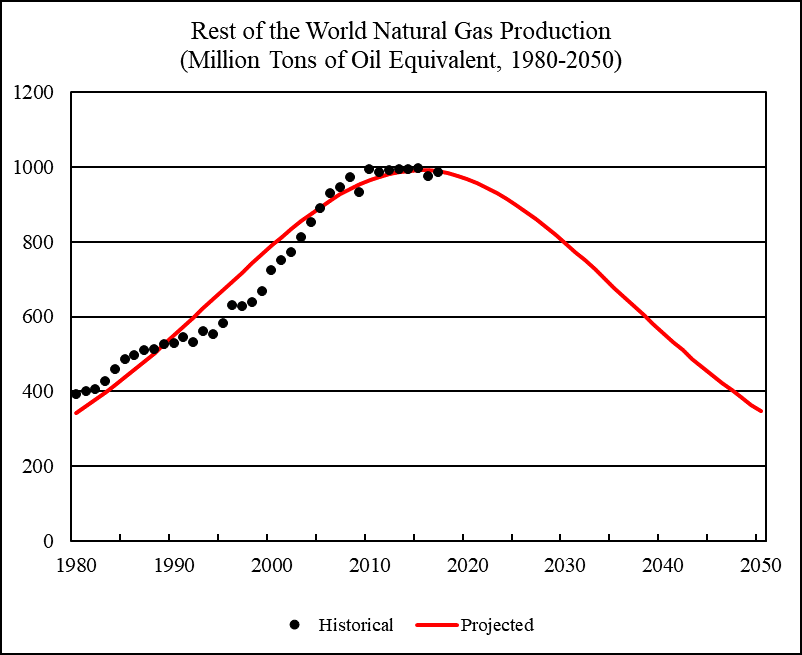

Rest of the World

Rest of the world is defined as the world total excluding the ten largest natural gas producers. In 2017, rest of the world produced 985 million tons of oil equivalent of natural gas, accounting for 31 percent of the world natural gas production. Rest of the world’s natural gas production has been on a plateau since 2010. In 2015, rest of the world’s natural gas production reached 996 million tons of oil equivalent, the highest level in history.

Figure 13 projects rest of the world’s annual production to cumulative production ratios against the historical cumulative natural gas production from 1980 to 2017. Hubbert linearization is applied to the annual production to cumulative production ratios from 2009 to 2017. Regression R-square is 0.963. Where the downward linear trend meets the horizontal axis indicates that rest of the world’s ultimately recoverable natural gas resources will be 61.9 billion tons of oil equivalent. Rest of the world’s cumulative natural gas production up to 2017 was 33.3 billion tons of oil equivalent. Thus, the rest of the world’s remaining recoverable natural gas resources are estimated to be 28.6 billion tons of oil equivalent. The parameters from the Hubbert linear trend are used to project rest of the world’s future natural gas production. Figure 14 shows the rest of the world’s historical and projected natural gas production.

Figure 15 shows the historical and projected world natural gas production. World cumulative natural gas production up to 2017 was 103 billion tons of oil equivalent. World ultimately recoverable natural gas resources are estimated to be 384 billion tons of oil equivalent. World remaining recoverable natural gas resources are estimated to be 281 billion tons of oil equivalent.

World natural gas production is projected to peak in 2036 at 3,921 million tons of oil equivalent and decline to 3,489 million tons of oil equivalent by 2050.

Figure 13 Rest of the World’s Cumulative Natural Gas Production, 1980-2017

Sources: Rest of the world’s cumulative natural gas production up to 2007 is from BGR (2009, Table A 4-2). This is used as the reference point. Cumulative production ending in other years is calculated using annual production data reported by BP (2018).

Figure 14 Rest of the World’s Natural Gas Production, 1980-2050

Sources: Rest of the world’s historical natural gas production from 1980 to 2017 is from BP (2018).

Figure 15 World Historical and Projected Natural Gas Production, 1980-2050

Sources: Historical natural gas production from 1980 to 2017 is from BP (2018).

References

Interesting, I have little to no knowledge on gas production. How does the Vaca Muerte (dead cow) fit in?

Vaca Muerta would be part of “Rest of World”.

I have a difficult time conceptualizing the gas, but this looks significant.

https://www.epmag.com/producers-set-sights-vaca-muerta-1690866

Ok, not so significant, after conversion.

Updated Shock model for World Natural Gas URR=19,000 trillion cubic feet or 450 billion tonnes of oil equivalent. Peak is about 4090 Mtoe per year in 2038 with a plateau between 4050 and 4090 Mtoe/year from 2033 to 2043.

My old post from 3 years ago (July 2015) is at link below

http://peakoilbarrel.com/world-natural-gas-shock-model/

I have updated case B to account for output data from 2015 to 2017 (in 2015 I only had data through 2014).

I have assumed a maximum extraction rate of 4.6% of producing reserves and that the extraction rate continues to increase at the average rate of increase from 2002 to 2017 until the maximum extraction rate is approached.

Chart below has model output only from chart above converted to Mtoe/year instead of TCF/year, to make comparison with Dr Li’s estimate easier.

Mtoe=million tonnes of oil equivalent and TCF=trillion cubic feet.

Actually, fairly comparable.

Guym,

Yes,

I think the BP numbers may be dry gas and I am using gross minus reinjected gas, dry gas is roughly 90% of the gross minus reinjected on average from 1980 to 2017. So for my peak of roughly 4100 Mtoe/year, the dry gas output would be about 3700 Mtoe/year, which is slightly less than Dr Li’s estimate.

Clearly there are a wide variety of possible projections, depending on multiple factors such as natural gas prices, geology, and technology and the assumptions one makes about all of these factors in the future.

The rate of development of natural resources might increase or decrease, extraction rates might accelerate or decelerate and URR might range between 300 Gtoe and 600 Gtoe, the future output path is of course unknown, but we can create possible scenarios with concrete assumptions about future rates of resource development and future extraction rates.

Dennis, that’s very interesting.

Yes, BP gas number is for dry gas

The BGR total original resources (cumulative production + reserves + resources) are 957 trillion cubic meters or 823 billion tons of oil equivalent.

So a URR of 384 billion toe implies a recovery factor of 47%, roughly comparable to the recovery factor of my oil URR estimate. My oil URR compared to BGR total original resources implies a recovery factor of 48%

Minqi,

Does the BGR estimate include speculative resources like Gas hydrates and EOR applied to shale gas?

Steve Mohr did a pretty comprehensive analysis of all fossil fuel in his PhD thesis in 2010 (link below) and his high estimate for natural gas was a URR of 600 Gboe, the BGR estimate seems unreasonable to me.

https://www.dropbox.com/s/pqzqkbueso6papm/Steve%20Mohr%20Thesis.pdf?dl=0

An Update by Steve Mohr et al in 2015 at link below

https://www.sciencedirect.com/science/article/pii/S0016236114010254?via%3Dihub

I also did a brief post on Steve Mohr’s 2015 paper at link below

http://peakoilbarrel.com/projection-of-world-fossil-fuel-urr/

A comparison of various tables in BGR report suggests that the natural gas resources cited above includes shale gas, tight gas, and coalbed methane but excludes aquifer gas and gas hydrates.

What “EOR applied to shale gas” are you considering? I have never seen anything viable applied large scale to conventional gas. Doing it to shales sure looks difficult.

Fernando,

My mistake thanks. The name is enhanced oil recovery, so not applicable to natural gas.

Would you agree that the BGR natural gas resource estimates (assuming these are TRR estimates) seem a bit on the high side?

Dennis, im not sure. I need to read the german report and get back to you.

Thanks Fernando

Just took a look at US producing reserves for natural gas from EIA data from 1996 to 2016 (only data I have available), the average extraction rate for US natural gas is about 13% over this period with a range of 11% to 15%. An alternative World Shock Model with 540 trillion cubic meters (19,000 TCF) or 450 million tonnes of oil equivalent and higher future extraction rates is presented below, this is likely to be too optimistic, where my previous scenario may be a bit on the pessimistic side in my opinion. Reality may fall between these two scenarios if the URR estimate is roughly correct and there is no major depression through 2100 (too optimistic an assumption in my view).

Hi Dennis, I guess you meant 450 “billion” tonnes of oil equivalent

Minqi,

Thanks for the correction.

Yes it should have been 450 Gboe, rather than 450Mboe. Only off by three orders of magnitude. 🙂

Various forecasts for US production from the EIA’s Short-Term Energy Outlook – Table 4a.

Chart: https://pbs.twimg.com/media/DkA_DB6XsAAIBG5.jpg

EIA STEO: https://www.eia.gov/outlooks/steo/

The International rig count is without the USA or Canada and so I had a look at world oil production without the USA or Canada

https://pbs.twimg.com/media/DkAjnFJXcAAEwdL.jpg

Definitely a two to three year lag between high rig count, and increased production. Need a lot more rigs counted.

https://oilprice.com/Energy/Energy-General/90-Oil-Is-A-Very-Real-Possibility.html

Nick has it nailed. Iran losses as the same time they realize US production is not as expected. Just going to take some time to absorb. Meanwhile, inventories go down.

I was curious how much it costs to liquefy and ship nat gas.

Found this example from 2017 but not sure how accurate it is-

Henry Hub $3.45/MMBtu

Liquefaction charge $2.25/MMBtu

Total = $5.70

Shipping to Japan via Panama canal = $1.10/MMBtu thus destination cost of $6.80

I assume there may be a cost at the destination for re-gasification for the network distribution?

On the Projected Graph, The US (black graph) is the only country with the majority of UNCONVENTIONAL NG with a rapid decline. Conventional and Unconventional are different beasts. So the US slice is valid only if sweet spots are maintained as well as drilling and fracking rates. seems like they are not comparable.

I know there is a lot of untapped unconventional gas. I have no idea if the price is ever going to cause more drilling to capture it. Most shales have some similarity to the Eagle Ford. Easily, two thirds of the Eagle Ford is hardly being drilled, because they stay mostly in the oil window. The two windows with limited drilling, are the gas/condensate window, and the pure gas window. Gas window stretches all the way to Mexico, and beyond. Little activity in the Barnett shale, either. The only one I know of that is actively seeking gas is Apache in their Alpine High, which also has some oil, and is a low lying fruit.

How much of Canadian natural gas is used in the oil sands?

George Kaplan,

Good Point.

https://www.neb-one.gc.ca/nrg/ntgrtd/mrkt/snpsht/2017/04-03ntrlgslbrtlsnd-eng.html?=undefined&wbdisable=true

According to page above about 25% of Canadian natural gas demand is the Alberta oil sands. In 2016 about 2.4 BCF/d went to oil sands. Output for Canada was 16.6 BCF/d, so about 14.4% of Canadian Natural gas output was used to produce oil sands in 2016. Canada produced 6 BCF/d more than it consumed in 2016, based on BP data.

Yeah, that’s important. I recall some yrs ago examination of how much nat gas refineries were using — and certainly Suncor and the oil sands.

That could be a heads up of sorts for Minqi Li. Nat gas doesn’t have the variance (as best I know) that oil does in terms of assay.

It might seem complex enough to just try to keep track of production and consumption and where either is happening, but oil is not all created equal and that would be a sort of qualitative granularity all the other analysis doesn’t have.

EIA weekly out. Crude down marginally, and finished stocks up marginally. Big news is they re-benchmarked the production down 100k. It is now at 10.8 million. Only about 100k to 150k over actual, now. So, they have split the difference. STEO for August will look a little different. Each month until the end of the year, it will decrease.

Of course, price is down, because we have analysts like this:

https://oilprice.com/Energy/Crude-Oil/Oil-Falls-Despite-Crude-Inventory-Draw.html

Production was reported as 10.8, not slightly less than 11 million. Can’t even read what she is reporting on.

And the STEO was changed, as it reports average US estimated for the year to be down .1 million for 2018, and down .1 million for 2019 to be 10.7 and 11.7 respectively. Small changes over time will not catch the analysts’ eyes. It will probably end up being 10.5 by year end, and closer to 11 next year, as actual. 2020 will be a different story, and I couldn’t come close to guessing on that.

And, we have adjusted to a .3 million barrel a day build in 2019, from a .7 million barrel a day build. Poppycock! The STEO is overstated by far more than .3 million barrels a day, by itself, and doesn’t consider any Iran drops, or anything else, for that matter.

http://ir.eia.gov/wpsr/overview.pdf

https://www.eia.gov/outlooks/steo/pdf/steo_full.pdf

Despite the decrease in oil inventories, the price of oil falls mainly due to the decrease in the demand of refineries in China. Serious symptoms of recession. Personally I think that prices will fall instead of rising, despite lower oil production.

https://www.nasdaq.com/article/oil-falls-as-concern-grows-over-chinese-refinery-demand-20180808-00747

That’s pretty confused to me. Supply from Iran is likely to drop by a million barrels a day. US is nowhere near expectations of what they are supposed to supply, and can’t get there until close to 2020. But the major concern is that China is only consuming 300k more than last year, and 120k more than last month.

Oil Prices Slide As China Imposes 25% Tariff On U.S. Oil

https://oilprice.com/Energy/Energy-General/Oil-Prices-Slide-As-China-Imposes-25-Tariff-On-US-Oil.html

The idiot continues to do Putin’s dirty work

HuntingtonBeach,

China has removed crude oil from the list of announced sanctions.

Is this all a ruse until midterms? Are we going to get coal in our stocking come Christmas when oil goes from 70 to 85 dollars in a short time frame? If there are any shut downs due to hurricanes we could get some huge inventory drops.

US weekly ending stocks August 3rd

Crude oil down -1.35 million barrels

Oil products up +1.01

Overall total, down -0.34 (shown on chart)

Natural Gas: Propane & NGPLs up +2.9 (not included in chart)

https://pbs.twimg.com/media/DkGchLxXsAEeJg3.jpg

A weekly measure of inventories

https://pbs.twimg.com/media/DkGdEs4WsAEe_vc.jpg

Chart of China’s crude oil imports (7.33 barrels per ton)

General Administration of Customs

https://pbs.twimg.com/media/DkEDGB4X0AAVKN2.jpg

Why does Xi Jinping have to tell the oil companies to increase production and reserves – did they not know that already? Targeting more shale gas is understandable though given that it can be extracted in an economic sound way. The shale gas reserves in China are huge but somewhat difficult to produce I have heard.

BEIJING (Reuters) – China’s state energy giants pledged this week to expand domestic oil and gas exploration and production and increase in particular natural gas supplies following an instruction from President Xi Jinping to boost national energy security.

https://www.reuters.com/article/us-china-oil-xi/china-state-firms-to-expand-domestic-oil-gas-exploration-after-xis-call-idUSKBN1KT1B1

The new chinese communist party economic model is a hybrid. They adopted capitalism with central direction and controls, a system which is still in flux. I think they look closer to Mussolini than Lenin.

someone was saying that China has now excluded US crude oil imports from tariffs, is that right?

Crude oil is exempted according to Argus. Not sure if that includes condensate, but all other products are due for 25% import tax.

China will impose a 25% tax on most energy commodity exports from the U.S. starting Aug. 23, including oil products, liquefied petroleum gas and coal, but is exempting crude oil, Argus reports.

https://www.argusmedia.com/en/news/1731873-china-drops-us-crude-from-tariff-retaliation-list

The weekly oil production estimate of the EIA with respect to the US falls by 100,000 barrels. It stands at 10.8 million barrels. Despite this, despite the fall, the price of the barrel fell by 3.5%. The crash is on the way

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

Crash in supply means higher prices. If higher prices cause an economic collapse, the timing of this will be later imho.

If oil gets to $130/b or higher, perhaps there will be a recession, though $110 to $120/b was not a problem for most of the World from 2011-2014 and World GDP is considerably higher today so it might take $150/b to cause problems. I don’t foresee a 12 month average price of $150/b occurring before 2023, though I do expect we will see a gradual increase in 12 month average Brent oil price in 2017$ by about $12/b each year on average over the next 6 years. On a monthly basis there will no doubt be quite a lot of price volatility as the market adjusts to the reality of the coming peak in oil output in 2023 to 2027.

Historically, major global recession tended to happen when oil spending as % of world GDP (current US dollars) rose by about three percentage points within a relatively short period of time. This was the case for 1972-1974 (from 1.2% to 4.4%), for 1978-1979 (from 3.8% to 7.4%), and for 2003-2008 (from 2.2% to 4.8%).

During 2011-2013, world oil spending was close to 5% of world GDP but did not represent a significant increase relative to the 2008 price peak, though world economic growth for these years were relatively sluggish.

In the current business cycle, oil spending as % of world GDP reached the lowest point in in 2016 (2%).

World GDP is currently about 80 trillion dollars (current US dollars). Nominal GDP will grow in the next few years because of underlying economic growth as well as inflation and world nominal GDP is also sensitive to exchange rate. Ignore exchange rate changes, world GDP in current US dollars may be about 93 trillion dollars by 2020 (assuming 5% annual growth rate from 2017 to 2020).

5% of 93 trillion dollars is 4.65 trillion dollars.

World oil consumption in 2017 was 98 million barrels per day (BP definition). If world oil consumption rises by 1.5 million barrels per day per year, it will be 102.5 million barrels per day by 2020. Annual consumption will be 37.4 billion barrels.

4650/37.4 = 124 dollars

This back of envelope calculation confirms Dennis’s estimate that a 130 dollar per barrel oil price in the next few years is likely to lead to a global recession.

Interesting elaboration. Tariffs, and their resulting inflationary results maybe something else that could pressure a recession? Not buying some things from China is not an option. In the for instance of steel pipes for the oil industry, there is not only the tariff, but US manufacturers immediately raised their prices for pipe. $130 oil price would cause great pain in any country, other than those net export countries. Tariffs get passed through to the consumer, too.

Few yrs ago there was speculation that the nature of shale had changed the impact of oil on GDP.

The extrapolation would be if a lot of money is spent on oil, it’s going to the shale drillers/suppliers and truckers and the enormous spike in employment that comes from such frantic drilling trying to counter legacy decline rates.

And so, history need not be informative.

Again.

The statistics are getting smeared because nowadays “oil” includes an ever increasing amount of NGL. I usually look at worldwid refinery inputs to figure out whats real oil and whats the “other stuff”.

Fernando,

I agree and use EIA data for World C+C. See

https://www.eia.gov/totalenergy/data/browser/index.php?tbl=T11.01B#/?f=M&start=200001&end=201804&charted=12

April 2018 World C+C output=81821 kb/d

2017 average World C+C output was 80937 kb/d

based on EIA estimates

Dec 2017 World C+C was 81470 and Dec 2016 World C+C was 81728 kb/d, so output decreased from the end of 2016 to the end of 2017 by 250 kb/d and has increased in the first 4 months of 2018 by 250 kb/d, if that rate continues for all of 2018 we would see World C+C output rise by about 750 kb/d in 2018. Also note that the trend in World C+C output from 1983 to 2018 is an increase of 800 kb/d on average each year, so if the output trend from Dec 2017 to April 2018 continues we may match the long term average increase in output (where supply will match demand over long periods) in 2018. If the consumption increase of C+C (input to refineries) is much higher than 800 kb/d in 2018, we may see oil prices continue to rise, likewise if supply growth is below 800 kb/d we would also be likely to see oil prices increase in the absence of a World recession.

Difficult(nay, impossible) to predict future recessions or oil prices, that much most people agree on.

Dennis, if we use Minqi Li’s reasoning, correct his oil rates to account for NGL and other sources, the result is about $136 per barrel.

I have a hunch that oil prices will be pushing beyond that $130 to $140 per barrel barrier by 2040. This starts favoring electric vehicles, hybrids, renewables, nuclear. Their growing market share cuts fossil fuel use, and the net temperature difference between an extended Paris agreement and a path controlled by market forces is slim. Something like 0.3 deg C.

This is why it makes more sense to develop lower cost nuclear and geoengineering to accelerate the carbon sinks. Im even thinking we need to research genetically modified birch and other trees which can extend taiga into tundra. Having treess with thicker and taller trunks should help a lot.

I mention it because the tree outside my dining room has started growing again after many years, it has more branches, more leaves, and i can no longer see the swimming pool.

Fernando,

It is not clear that if externalities (such as the risk of an accident) are included for nuclear that it is actually lower cost.

If we had a better understanding of the Earth System, then geoengineering might make sense.

The rather high likelihood of unintended consequences that may follow any attempts at geoengineering makes this worse than nuclear power from a cost perspective when potential externalities are included.

Solar, wind, geothermal, hydro, waves, batteries, and greater efficiency are probably the safest and lowest cost (including externalities) approach.

Better access to education foe women and access to birth control and equal rights for women would go a long way to reducing the total fertility ratio (TFR) which would eventually reduce pressure on the environment as population peaks in 2070 and then declines as the TFR for the world falls to 1.5 or less, population could fall to under 2 billion by 2300 and in 2500 we can stabilize the planets population at around 1 billion (or whatever number makes sense as we will know much more in 400 years).

If something like the Mohr et al (2015) medium (case 2) scenario (leaving out kerogen and gas hydrates) proves correct and we also see lower cost wind, solar, hydro and nuclear replace much of fossil fuel use after 2040, then emissions between RCP2.6 and RCP4.5 (call it RCP3.55) might keep the planet at a relatively reasonable temperature, if ECS is close to 3C per doubling of atmospheric carbon.

Safer in my view to try to keep anthropogenic carbon emissions at 850 Gt or less from 1750 to 2500. This goal will be difficult to achieve, perhaps impossible.

Cant understand geoengineering unless its researched and piloted. However, the warmist community has control of research institutions, and they have clear political aims: “social justice”, dedevelopment, socialism (aka horrible dictatorships and poverty), enforcing a vegetarian diet, and of course killing bad oil companies.

However, i think a bit of reason is starting to prevail over dogma. For example, the recent hothouse earth paper has a very subtle suggestion to “study carbon sink efficiency enhancement” or words to that effect.

So i imagine, if the world hasnt fallen in the hand of a bunch of vegetarian commies, we will see dogma defeated and geoengineering research will be funded, as it should, because reason will have won and the power elites will all agree they ain’t about to stop oil from being produced.

Fernando,

Research into better understanding of the earth system makes sense. When that is accomplished then geoengineering might be worthwhile research.

I am not advocating stopping oil production, the market will do that as cheaper forms of transport drive down demand for oil to the point that oil prices fall and much of the expensive resources are no longer economically viable.

This is basic capitalism, vegetarianism not really part of the picture.

I really like my pet ideas: 1. Genetically modified birch and other trees which can be seeded or planted in the taiga-tundra boundary. The taiga is moving north, might as well have taller trees which thrive in 500 ppm CO2.

2. Seeding the ocean to increase the number of critters able to take carbon and make carbonate. This may require dumping iron, calcium, and magnesium minerals.

3. Building a pilot nuclear powered ice resistant floating platform to pump sea water up in the air inside but close to the sea ice boundary. That should promote heat release to the air, and form ice crystals. It should be a very effective ice making machine in winter.

2. Seeding the ocean to increase the number of critters able to take carbon and make carbonate. This may require dumping iron, calcium, and magnesium minerals.

Really bad idea! I’d recommend learning a little more about marine biology, marine ecosystems, ocean acidification and how marine organisms make carbonate…

http://www.noaa.gov/resource-collections/ocean-acidification

Carbonate ions are an important building block of structures such as sea shells and coral skeletons. Decreases in carbonate ions can make building and maintaining shells and other calcium carbonate structures difficult for calcifying organisms such as oysters, clams, sea urchins, shallow water corals, deep sea corals, and calcareous plankton. The pteropod, or “sea butterfly,” is a tiny sea creature about the size of a small pea. Pteropods are eaten by organisms ranging in size from tiny krill to whales and are a major food source for North Pacific juvenile salmon. When pteropod shells were placed in sea water with pH and carbonate levels projected for the year 2100, the shells slowly dissolved after 45 days. Researchers have already discovered severe levels of pteropod shell dissolutionoffsite link in the Southern Ocean, which encircles Antarctica. Pteropods are small organisms, but imagine the impact if they were to disappear from the marine ecosystem!

A better bet for geoengineering is storing carbon in topsoil. It’s cheap and easy. Topsoil could easily store enough carbon to trigger an ice age. Arid regions all over the world a plagued by flash floods, which release huge amounts of carbon by stripping off topsoil.

All you need to do is build check dams in the gullies and dig ditches on the contour lines. A little tree planting helps too, but nature will do most of the work. No science fiction technology required.

Most important rain harvesting and flood prevention bring local benefits as well as global ones, which means they have a realistic chance of being implemented.

Soil Microbes convert Soil carbon into CO2:

http://environment-ecology.com/ecological-design/255-biosphere-2.html

“Daily fluctuation of carbon dioxide dynamics was typically 600 ppm because of the strong drawdown during sunlight hours by plant photosynthesis, followed by a similar rise during the nighttime when system respiration dominated. As expected, there was also a strong seasonal signature to CO2 levels, with wintertime levels as high as 4,000-4,500 and summertime levels near 1,000 ppm. Many suspected the drop in oxygen was due to microbes in the soil. The soils were selected to have enough carbon to provide for the plants of the ecosystems to grow from infancy to maturity, a plant mass increase of perhaps 20 tons (18,000 kg).[19] The release rate of that soil carbon as carbon dioxide by respiration of soil microbes was an unknown that the Biosphere 2 experiment was designed to reveal.”

Best option is start planting lots of evergreen trees in cold areas to let the trees sequester carbon. Preferable a non-monocrop so planted areas don’t get devastated by insects & disease. Different plants will have different defense systems thus making it hard for one disease or insect to spread like wildfire. Also planted trees should include fire breaks.

Trees could be planted by aircraft, or semi-automated drones. Planted trees also serve as a future timber resource (capital recovery).

That said, this is largely pointless as developing nations are cutting\burning forests, Mangroves and Peak Boggs, to make way for aquaculture. The more land that is cleared for ag. the bigger the populations are supported. The Indonesian bog fires alone,have released more CO2 that all of Japan annually.

That said the real elephant in the room is increasing risk of another global war. The 2020’s will seem a difficult decade as debt, demographics and resource depletion are all likely to create a really bad crisis. Lots of unhappy people select charismatic leaders that make grand promises, that depend on empire conquests.

Minqi,

Perhaps correct, but a flaw in your analysis is using the BP consumption numbers which includes about 17 Mb/d of output that is not C+C (NGL, biofuels, CTL, GTL), where it is only C+C that sells for something close to the Brent price.

Better to use EIA C+C data for the World, a spike in prices might cause a recession, but it is likely to be temporary in my opinion as oil output is increasing through 2025 and while a plateau is maintained, possibly until 2030. When oil output starts to decline the World economy may have difficulty adjusting and when the markets finally come to the realization that peak oil is real the World economy may fall into a depression, (2030 to 2035 time frame). In the mean time economists need to re-read Keynes so the mistakes made by Europe in response to the GFC will not be repeated. Fiscal austerity by governments in the face of inadequate private investment is the basis for a repeat of the mistakes made by the US in 1929 to 1932.

Dennis

The recession has already started, not due to peak oil, but due to massive debt on a national and personal level.

https://www.theguardian.com/business/2017/sep/18/uk-debt-crisis-credit-cards-car-loans

wages have fallen in real terms for most people and many people paid for things with debt. Most cars are now sold on a loan and return basis.

http://www.autoexpress.co.uk/car-news/consumer-news/99331/concerns-grow-over-uk-subprime-car-finance-deals

People are spending less and as a result many, many stores are closing down.

https://www.express.co.uk/pictures/pics/10035/High-streets-retailers-shops-close-closures-pictures

Many banks are vulnerable, they closing branches everywhere in order to protect themselves.

We had 2 branches in our small high street, they are both gone.

https://www.independent.co.uk/news/business/news/uk-bank-branch-closures-which-research-natwest-hsbc-a8399041.html

A country with a strong economy and very low debt levels could cope with $150 oil. Unfortunately there are not many countries like that.

Councils cannot afford to fund care homes.

https://www.express.co.uk/news/uk/959234/care-home-crisis-uk-government-elderly-care-bankruptcy

Only people with money can afford private homes, at a cost of £50,000 to £80,000 per year and this in no way guarantees good treatment.

https://www.telegraph.co.uk/science/2018/03/21/abuse-neglect-present-nine-10-care-homes-survey-shows/

Peak oil will be the final nail.

Peter,

Problems in the UK are self-inflicted due to poor policy leading to economic uncertainty. The UK is not the World.

Using IMF data for 2010 to 2017, World real GDP (PPP) grew at about 3.5% per year on average and World nominal GDP (PPP) grew at about 4.9% per year on average over the 2010 to 2017 period.

If we consider the longer term trend in World real GDP growth rates (PPP) from 1985 to 2017, the average annual growth rate was 3.6% per year.

Dennis

One could say every country’s difficulties are self inflicted.

You have mentioned GDP as if it is the most important matrix of measuring the global ecnomy. It is not.

The United States debt is out of control and is consuming more and more tax just to pay the interest.

https://www.thebalance.com/the-u-s-debt-and-how-it-got-so-big-3305778

https://www.thebalance.com/interest-on-the-national-debt-4119024

The United States deficit is extraordinary.

https://www.marketwatch.com/story/us-deficit-now-projected-to-top-1-trillion-starting-next-year-2018-07-19

The government effectively steals $1 trillion from future earnings to pay 25 million government workers an average salary of $40,000 per year.

Great trick borrow loads of money reduce unemployment and increase GDP. and fool some of the people all the time!

The interest of the debt is an astounding $310 billion. And this is at a time of the lowest interests in the history of the world.

When the price of oil goes up, inflation will start to move northwards and the Fed will respond with interest rises.

You will see then that the United States is as much of a basket case as Spain and Italy.

Trump is also driving China and Russia closer together along with Iran and others. They will circumvent the Dollar dominance and the dollar will fall in value.

US debt is fine, though higher taxes would make sense while the economy is doing well to pay off some government debt. Trump’s trade policies are definitely a problem and eventually the resulting trade wars might lead to a recession.

GDP is not a perfect measure, but in other comments I have shown total debt levels (both public and private non-financial company debt) and BIS (Bank for International Settlements) data does not show that there is a problem.

Much of the increase in World debt has been in emerging economies, China, and India which historically have not had very good access to credit. As these countries develop and have better access to credit markets their debt to GDP levels will approach that of the OECD and World debt to GDP will increase. That’s a major part of the story for increased debt levels from 2002 to 2017.

How would you propose we measure World economic output without using GDP?

Dennis says US debt is fine.

There is one born every minute

Dennis thinks that a government that has to pay 25,000,000 people $40,000 a year with money that does not exist is fine.

You did say it is fine did you not Dennis?

If you honestly calculate inflation at what it really is 4-6%, GDP growth is flat as a pancake the last decade. Look at health care, rent and other basic necessities that the US government doesn’t correctly account for. Why is that? Oh yeah to keep the COLA for Social Security to a bare minimum.

Peter,

Yes I did. Read some main stream economics.

Try

https://www.bis.org/publ/arpdf/ar2018e.htm

Hah, hah. The OASDI has no debt, has huge investments and a surplus at the end of each year. All deficits are funded by multi-trillion dollar investments, so no debt occurs.

Asset reserves are close to $3 trillion and yearly income is about $800 billion.

Asset reserves are generally higher at the end of the year than the beginning.

The US is being gaslighted by it’s own citizens and by foreigners. Most citizens have no clue what the truth or reality is and they just hear the bullshit

Total income 2017 was 825.6 billion dollars mostly from income taxes.

Total expenditure was 806.7 billion dollars.

Asset reserves at the end of 2017 was 2891.8 billion dollars.

So no more bullshit about money that does not exist. It is sheer lies that stupid and agenda driven people spread around to satisfy their delusions and agendas.

AdamB,

The core inflation data is pretty good.

See

http://www.thebillionpricesproject.com/usa/

Gonefishing,

Thanks. I agree.

For those like me that don’t know the acronym OASDI see

https://en.wikipedia.org/wiki/Social_Security_(United_States)

In short,

OASDI = Social Security

If funds run short, more money will be collected or benefits will be cut back or both.

Peter,

The U.S. exports worthless paper and bombs that’s about it. Oh yeah and high as hell API oil.

GF I had to look up the term gaslighted. But it’s you who are being gaslighted. It sounds like you have look at the numbers (825B, 806B) reported as “off balance sheet” in the US budget and taken these as the beginning middle and end of Social Security spending (SSA). Since you use the term OASDI, you pretty much have to include DI spending, which brings the 2017 outlay to $945B. SSA spending can also be taken to include SSI which in 2017 brought outlays over the $1T mark for the first time.

As 2017 spending is now widely reported, it is easy to look up.

As far as the “multi-trillion dollar investments” of the Social Security trust fund, it sounds like you imagine this being managed like an endowment, or a sovereign wealth fund, which actually holds real assets. Is that what you think? In reality the money was spent and replaced by a marker. It’s a very important marker, and I do not expect the US govt to ever default on it, but that’s all it is. The marker earns a guaranteed rate of return (you can look it up at treasurydirect.gov, currently abt 2.7%) similar to a T bill or note. Unfortunately for budgetary purposes, those earnings must by paid by the treasury. The money will either come out of the general fund, which is already in deficit so there’s really no extra money there, or the treasury will sell notes to raise the money. As stated this is not a problem. The Fed will buy the notes if no one else will.

But it’s not as if there is an independent source of revenue here, like IBM corporate bonds, or German treasuries, held by the social security trust fund. It’s a zero sum game, where the US will borrow from itself as much money as is necessary to make ends meet. And interest in one pocket, is being withdrawn from the other pocket. If you don’t understand these basics of US financial policy, and you think “foreigners” are spreading disinformation, you’re just being a dumbass.

A lot of good posts here. I am leaning towards a somewhat low oil price “ceiling” for a recession to trigger, maybe 110-120 dollars/b. Countries accustomed to low interest rates (most really) are subsceptical for inflationary pressure that would make it difficult keep interest rates from rising damaging the economy. Also, some of the asian high growth countries would have a hard time with 100+ oil prices if the dollar stays this strong ahead. A recession in some small countries that start to infect the larger ones after a while could be a scenario.

All kinds of sudden supply shocks with a prolonged spike in oil price would most likely trigger a recession once we are around 100 dollars/b territory.

I would say that even with less than 100 dollars a barrel. We may even be witnessing the trigger of everything with top prices of $ 70 a barrel. It is not the same 130 dollars, with a world economy without debt, without derivatives, and with interest rates at 5%, than a world economy in which central banks can not lower interest rates (They are now at 0%) , and an over-indebtedness that prevents procrastination. By logic, today, maximum oil prices have to be less to enter recession. Read Steve Ludlum.

PD: Countries like Turkey, Venezuela, Iran, Argentina or Nicaragua are in recession. I would point out that on the way to China they are, and I am looking forward to the fracking industry in the USA …

Monsieur George,

From BIS data, World Debt to GDP has not changed a lot from 2002 to 2017. Lots of economies with debt to GDP above the average are doing ok, for mortgage lending 3 to 1 debt to income is considered viable, probably would work for the World economy as well. So current levels of World debt to GDP with a ratio of 2.44 to 1 is not likely to be a problem, the debt can be serviced.

Note chart below is in % so 100% would be debt to GDP is a 1 to 1 ratio, 200% is 2 to 1 ratio and 300% would be a 3 to 1 ratio (a common rule of thumb for mortgage lending).

Where is natural gas used? According to the IEA Key World Energy Statistics (2017)

Distribution of Natural Gas Primary Consumption, 2015

Electricity Generation 28%

Industry 18%

Transportation 3%

Residential, Commercial, and Agriculture 21%

Non-Energy Use 5%

Intermediate Uses and Losses 24%

In the oilfield it is used for lighting up the area by flaring the useless stuff? Or, you may have that included in other losses.

I haven’t seen a field flaring gas regularly since 1988. And I dont see a reason to allow such flaring nowadays, except in very remote low rate fields.

Fernando,

Have you been to the Permian basin lately? From what Mike Shellman says, natural gas pipeline constraints have led to operators flaring all the natural gas that they are allowed, after that they have to shut in production or I assume there are fines.

They should not be allowed to flare. Its the 21st century, and they can and should plan ahead for gas handling. Flaring is like a restaurant owner saying he has to throw garbage out the front door because he doesnt have a garbage container in back.

Fernando,

I agree as does Mike Shellman the flaring is wasteful and should be reduced as much as is feasible.

You and Mike would know better than me what is possible.

The best approach is to drill wells from pads. A pad can take say 24 wells (the trick is to make sure the wells dont have kinks and super tight turns). Its possible to drill and produce if the wells are spaced right, the lines are buried, and the pad surface is covered with a competent material.

The pad design includes a test separator, and depending on the area, other equipment. I prefer to have several pads hooked up to a satellite where gas is separated, dried, and compresssed a bit to send it to a plant. The design rate is x, and say up to 100 wells can be drilled over the years to keep facilities full. I like to keep the same people, rigs, crews etc working for years, because they can be trained like football teams, which allows them to improve, cut costs, raise production, etc. its also useful to keep drillers around so you can hit their bonus when they drill a crap well full of doglegs.

The #2 use is surprising.

2018-08-08 HOUSTON (Reuters) – U.S. shale producers that spent the last year promising to control capital spending and adhere to strict financial controls are finding the lure of higher oil prices irresistible.

Pioneer this week said it would expand its 2018 budget by around $450 million, with roughly 60 percent of that due to rising costs and around 35 percent stemming from increased production activity.

https://www.reuters.com/article/us-oil-shale-usa/lured-by-higher-oil-prices-u-s-shale-producers-boost-capex-idUSKBN1KT2OG

WTI Midland (Argus) vs. WTI Cushing

August 7th – is the highest the futures curve has been in 2019 since I started watching it – I’ve not heard any news to explain it.

CME -> https://www.cmegroup.com/trading/energy/crude-oil/wts-argus-vs-wti-calendar-spread-swap-futures_quotes_settlements_futures.html

Chart https://pbs.twimg.com/media/DkJbTpSWsAAD-Df.jpg

Probably less oil produced. My guess. You have some Pioneers, but half of the production comes from small producers. I have read in some articles, that there is still, maybe, 200k per day improvements in pipelines due toward the later half of 2018, and the first half of 2019. I don’t expect that will create a mad dash for new oil, rather helping decrease the spread is more likely. The bigger pipelines seem to be moving the expectations of completions to a little later in 2019 and 2020. That 11.7 barrels per day expectation by the EIA for 2019 is looking less likely every day.

This sounds like the extra 220 kb/day that you mentioned. PAA’s Sunrise Expansion project to Cushing, it could start in the fourth quarter 2018.

https://seekingalpha.com/article/4196140-plains-american-pipeline-lp-paa-q2-2018-results-earnings-call-transcript?part=single

Good read, yes that is what I was talking about. Also, note the big pipeline, that was originally expected to come online in the early first quarter of 2019, has been moved back two months, already.Probably, no new big pipelines until the last quarter of 2019, or later.

2018-08-09 (Bloomberg) The number of “completion crews” has declined in the Permian (since early June, but only down to the early May level)

Chart https://pbs.twimg.com/media/DkKg9YzW0AADrgw.jpg

They will continue to drill for DUCs and completions. They have to in order to keep production amounts level. The magnitude of activity for level, or slightly increased production, is not that far away from increasing production. These wells have high first year declines. Most of which comes in the first six months.

Nice data, the only rational response from independent producers without access to pipeline capacity is to stop completions until the spread from Midland vs. WTI is bearable. I am not following this closely, but it seems like a pretty hard stop for some companies addicted to “the hamster wheel” of activity.

https://oilprice.com/Energy/Crude-Oil/EIA-US-Oil-Production-Growth-Is-Slowing.html

He is getting better each day on his reporting. Now, he states that pipelines are not the only reason for slower growth than expected out of the Permian. What I said over a year ago. All these new pipelines are an overkill. I just don’t think that all of the growth expected out of the Permian is possible. Over time, probably. Not 2 million more in a short time. Too much activity required. The oil is there, the peak won’t be as high as expected.

Guym,

I agree many of these oil pipelines may not be needed, makes more sense to develop the resource slowly so that the pipelines can remain at full capacity for a longer period, it would be better to ramp to 4 Mb/d and remain at that level for 5 years than to ramp to 6 Mb/d and only remain near that level for 2 or 3 years, a lot of capital will be wasted on excess pipeline capacity if the ramp to 6 Mb/d is attempted in the Permian basin.

The smart pipeline companies will not be fooled by investor presentation hype, they should consult with Enno Peters or Mike Shellman.

My models suggest perhaps another 2 Mb/d by 2022 is possible (so that’s about 4.5 years as I only have data through June 2018). In June 2018 Permian LTO output was 2647 kb/d according to EIA estimates, I think 4500 kb/d by June 2022 is possible so 1850 kb/d over 4 years or about an average annual increase of 462 kb/d in Permian output from 2018 to 2022.

A better plan would be an increase to 4000 kb/d (337 kb/d increase each year) as the pipelines would remain full for a longer period as the plateau at 4000 kb/d could maintained for a longer period. It would also help with various constraints on labor, sand, trucks, water, etc. and perhaps help to keep costs down.

A master plan for E&Ps. Coordination of who gets what may be a problem? 2 million may be possible, the oil is there, but each increment will take massively more activity levels. Water, sand, rails, crews, roads, trucks, truck drivers, and more. Just don’t see it, myself

Guym,

What do you think is doable? Note I suggest 4500 kb/d which is a bit less than a 2 Mb/d increase and about 500 kb/d annual increases which is less than the 2017 increase. The 4000 kb/d “plan”, which could be done by the RRC as they make the rules, only requires under a 400 kb/d increase each year over 4 years, seems like that could be easily handled by Permian infrastructure, but perhaps not.

Do you consider 4 years a short amount of time? Note that over the past 4 years Permian output has grown by about 400 kb/d each year on average. In the past 12 months the growth rate was 775 kb/d, I agree that rate of growth is not likely to be maintained. I do think half that growth rate (400 kb/d) may be reasonable.

It has grown that much each year, I know. I have read other articles that state Permian growth was slowing due to constraints prior to pipelines clogging. Each 400k increase level requires more activity level than just the same as last year, or production would decrease due to the high levels of first year declines. At some point, it requires an activity level that the boondocks of the Permian can not support. Activity levels are also somewhat price dependent. At the right price, you can overcome many problems.

I would make a wag, and say that, at the current oil price, the production increase in the Permian would stall at around 500k more. At a higher price, which both of us project, it could increase to 2 million given enough time. 4 years is enough time, given enough highly paid truck drivers, who will travel over completely torn up roads. Or, there will be long lines of slow moving traffic waiting for construction crews to repair the torn up roads. Big Sirkorsky helicopters might be economically viable, at some time. Zoo time.

I don’t see the RRC getting involved in setting up any restrictions.

Guym,

I agree, not likely RRC will intervene. However, the pipeline companies may decide there is not enough long term output to make their projects viable, so they may be the limiting factor.

If they build too much pipeline capacity they will lose their shirts.

I imagine there is quite a bit of tax revenue from the increased oil production and some of that revenue can be used to rebuild and upgrade the roads.

Permian Basin scenarios below have low price case with oil price rising to $80/b by 2019 and a medium price case with oil prices going to $115/b by 2025 (2017$ in both cases). The dotted line is the average of the low and medium price cases and the dashed line (read on right axis) is completions per month.

Based on my modelling (well profiles based on data from Enno Peters at shaleprofile.com) in June 2018 roughly 390 wells were completed in the Permian basin, the completion rate only needs to increase to 446 completions per month by late 2019 for the average scenario to happen (4030 kb/d in 2022).

These scenarios assume the TRR for the Permian matches the USGS mean estimate and I have assumed the parts of the play not yet assessed will have a mean TRR of 8 Gb. Permian TRR=36 Gb.

Lol. We do not see it much differently. The pipeline companies see 2.5 million more coming out. Your model sees a little over one million if prices rise. I agree, not much more, if any. Which estimate is right? Well, I don’t stand to lose billions if I am wrong.

As to the roads, the State will repair them. Oil companies better get used to the snails pace the State has in repairing them.

Guym,

The high price case has a peak in 2024 at 4800 kb/d, about 2200 kb/d higher than June 2018 (this does not include Permian conventional output, only tight oil). This may be a bit less than expected from the pipeline companies, but often they speak in terms of total Permian basin output which is 300 to 500 kb/d higher than the tight oil portion.

Dennis, if the Permian is peaking in 2022 (and I assume all USA tight oil also), who do you think will be pumping so much more oil to delay a world peak until 2025-2030? I’m just not seeing who will be able to step up to fill the gap by then, with so many other producers likely falling into the post-peak column in the interim. I just want a list, no charts please and thank you.

When the USA peaks, the world peaks. End of Story.

Hi Ron,

In 2017 OPEC and Russia were restricting output and we had declining output from Venezuela and Libya due to political problems, at some point the political crises in Venezuela and Libya may be resolved and output could increase from those nations.

In the mean time oil prices will rise and there will be more output from OPEC, Russia, Brazil, and Canada that may fill the gap after the US peaks, China might also figure out how to produce tight oil at some point.

Dennis, When and if Venezuela overthrows Maduro, little will change for at least a decade. Venezuela’s theft of contractors assets will keep them out for a decade or so. In the meantime, Venezuela does not have the talent or equipment to increase production. And Maduro will likely be in power for another decade at least.

The situation in Libya is unlikely to get much better any time soon. And the problems in Nigeria are only going to get worse.

Russia is at or very near her peak. Even with the last two months increase, Russia is still producing less than she did at the end of 2016.

China? You have to be joking.

Brazil may produce a few more barrels but not very many more. Not enough to make any difference whatsoever.