A guest post by Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs September Petroleum Supply monthly PSM which provides data up to July 2022.

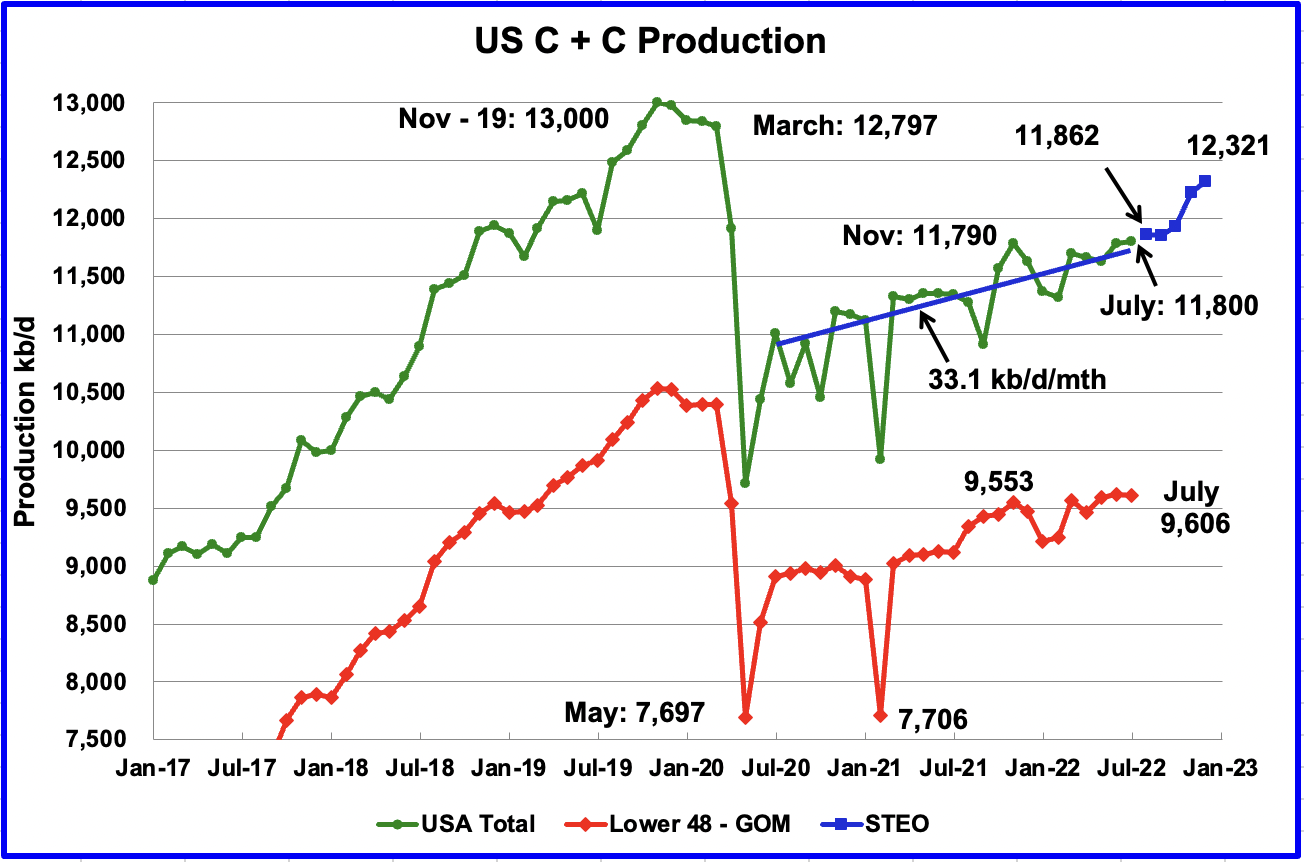

U.S. July production increased by a minimal 12 kb/d to 11,800 kb/d. For July, the states with increasing production were offset by states with decreasing production. July’s production was a new recent high. Production was 10 kb/d higher than November 2021 which was producing at a rate of 11,790 kb/d. However it should be noted that June’s oil production was revised down from 11,816 kb/d to 11,788 kb/d in the September report.

While overall US production increased, a clearer indication of the health of US onshore L48 oil production can be gleaned by looking more closely at those states. In the On-shore L48, July production decreased by 11 kb/d to 9,606 kb/d from June’s 9,617 kb/d.

The blue graph, taken from the September 2022 STEO, is the production forecast for the US from August 2022 to December 2022. Output for December 2022 is expected to be 12,321 kb/d, 127 kb/d lower than projected in the August report.

From August 2022 to December 2022, production is expected to increase by 459 kb/d or at an average rate of 115 kb/d/mth. This rate is more than triple the rate of the Blue line covering US C + C production from July 2020 to July 2022. The blue line, which just used July 2020 data and July 2022 data to estimate an average rate, has a production growth rate of 33.1 kb/d/mth. The much higher forecast production rate for the last half of 2022 could be related to an upcoming increase in GOM production. See GOM chart below.

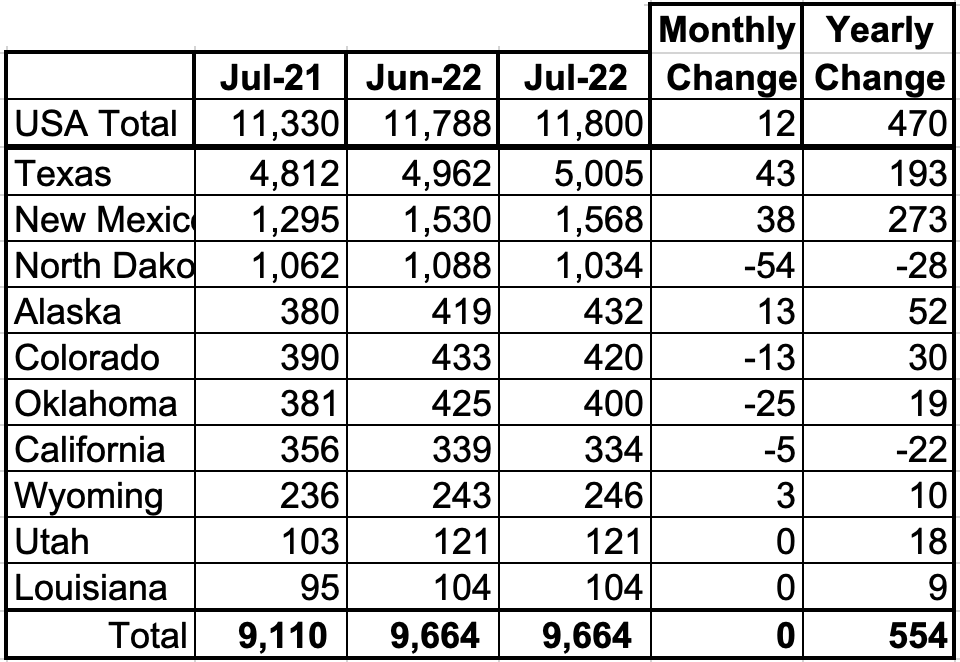

Oil Production Ranked by State

Listed above are the 10 states with the largest US production. These 10 accounted for 81.9% of all U.S. oil production out of a total production of 11,816 kb/d in July 2022. As can be seen, the states with increasing production were offset by decreasing production in the remaining states for no net monthly gain.

On a YoY basis, US production increased by 470 kb/d with the majority having come from New Mexico and Texas.

State Oil Production Charts

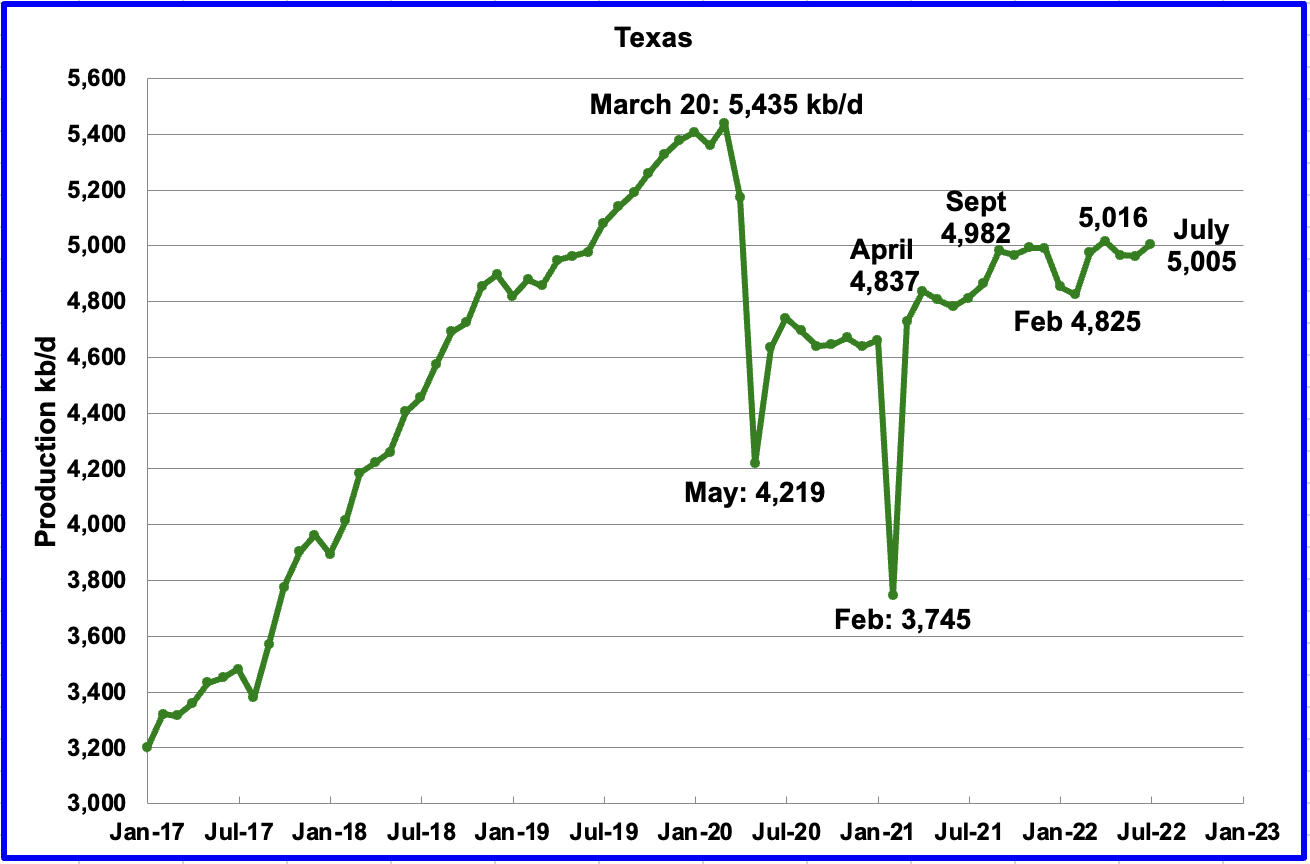

Texas production increased by 43 kb/d in July to 5,005 kb/d from 4,962 kb/d in June.

In September 2021 there were 205 Hz oil rigs operating in Texas. By the last week of July 2022, 309 Hz oil rigs were operational, an increase of 104 rigs and production increased from 4,982 kb/d in September 2021 to 5,005 kb/d in July, an increase of just 23 kb/d over a period of ten months.

Texas production has been essentially flat over the last 10 months. This could be due to the slower growth in the Texas Permian being offset by the decline in the Eagle Ford basin.

July’s New Mexico production increased by 38 kb/d to 1,568 kb/d to a new record high. From January 2022 to the end of May, close to 92 rigs were in operation in the New Mexico Permian. However in July operational rigs peaked at 104. The recent production increase is due to more wells being drilled and more wells being completed than drilled.

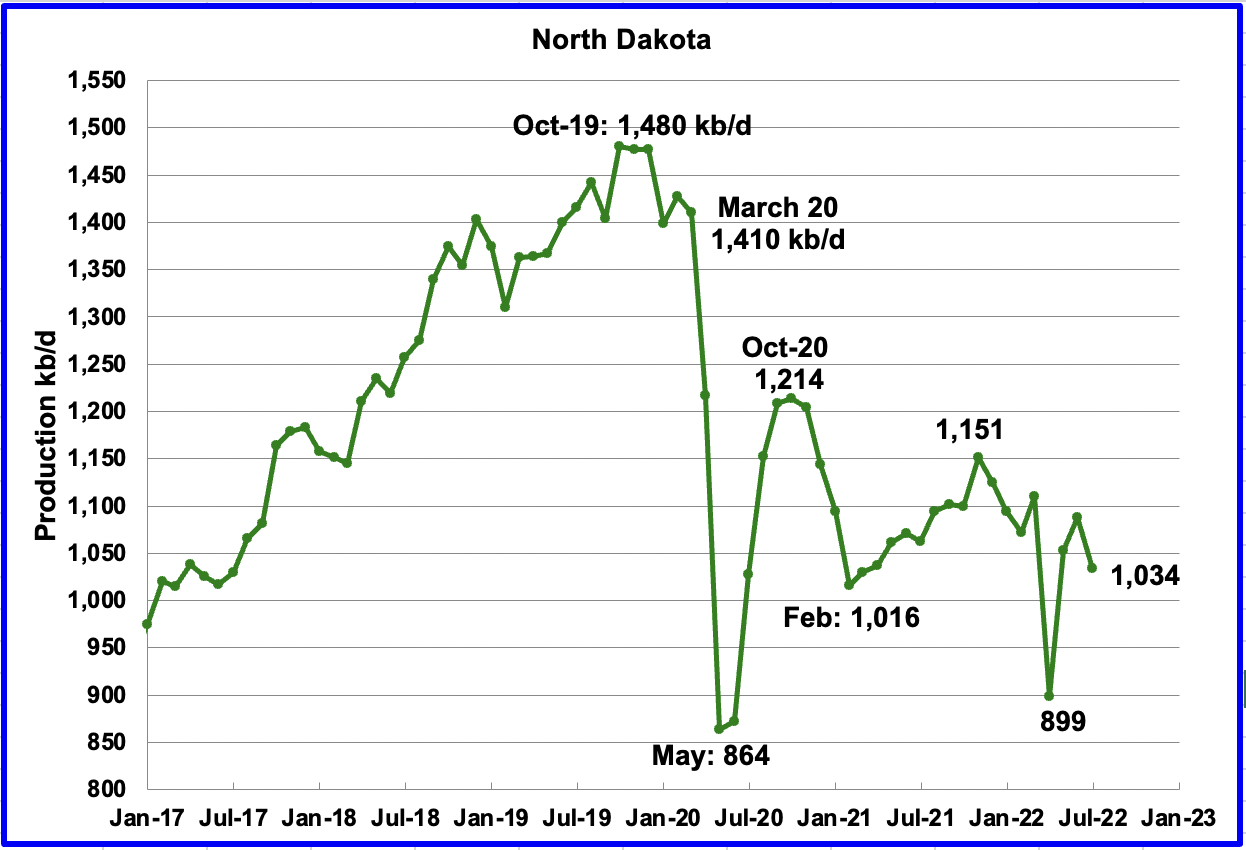

North Dakota’s July output dropped to 1,034 kb/d, a decrease of 54 kb/d from June.

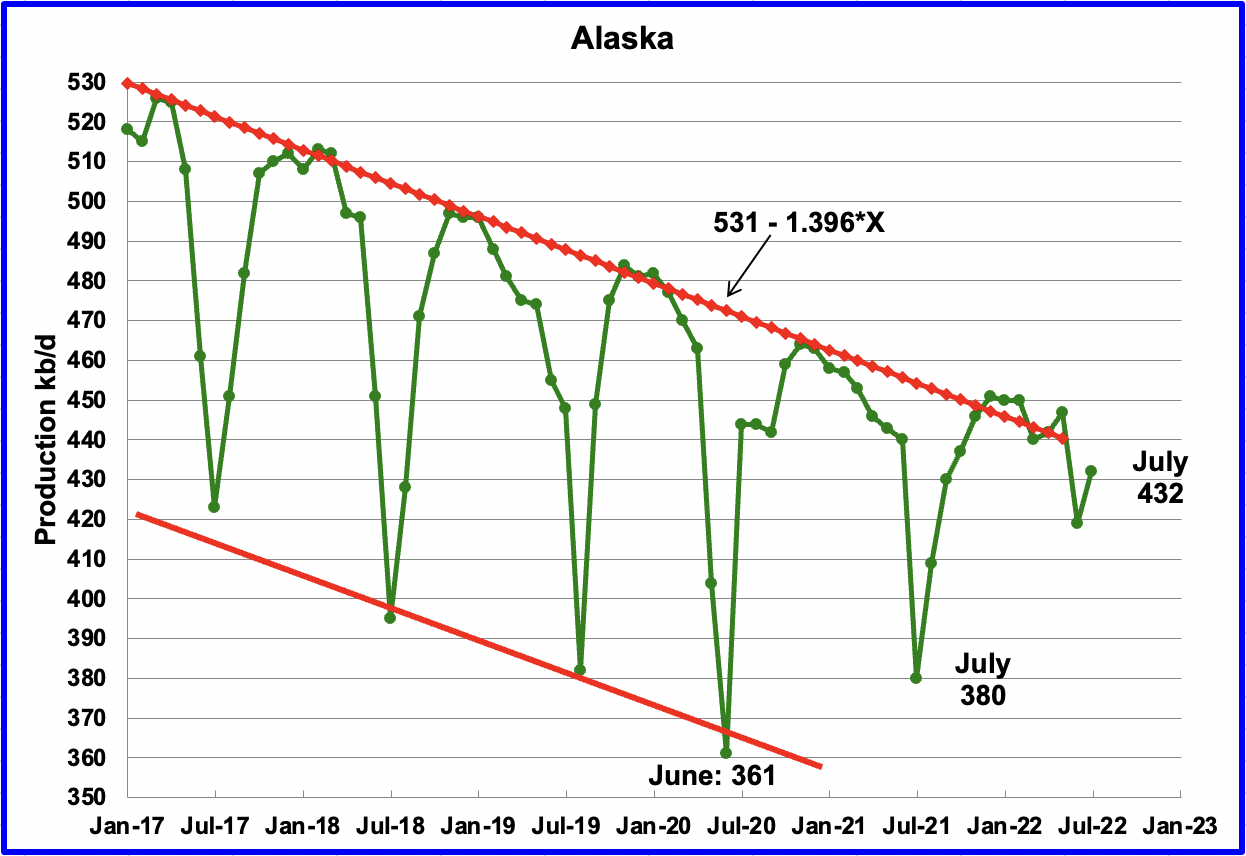

Alaskaʼs July output increased by 13 kb/d to 432 kb/d. July production typically rebounds due to the end of summer maintenance.

ConocoPhilips continues to pursue the Willow oil project in Alaska while NGO’s oppose it. Alaskan officials hope the project will help offset declining oil production in the state.

“The largest proposed oil and gas project on U.S. federal lands moved one step closer to approval in early July. At 180,000 barrels per day, or 629 million barrels of oil over the course of its 30-year lifetime, the Willow Project would produce more oil than any other public-lands fossil fuel development. The Trump administration’s Interior Department approved the project in October 2020. But in August 2021, a federal judge rejected it following a lawsuit over the project’s impacts on the climate, nearby communities and area wildlife. The Biden administration agreed to conduct another environmental review, which the Bureau of Land Management (BLM) released on July 8.”

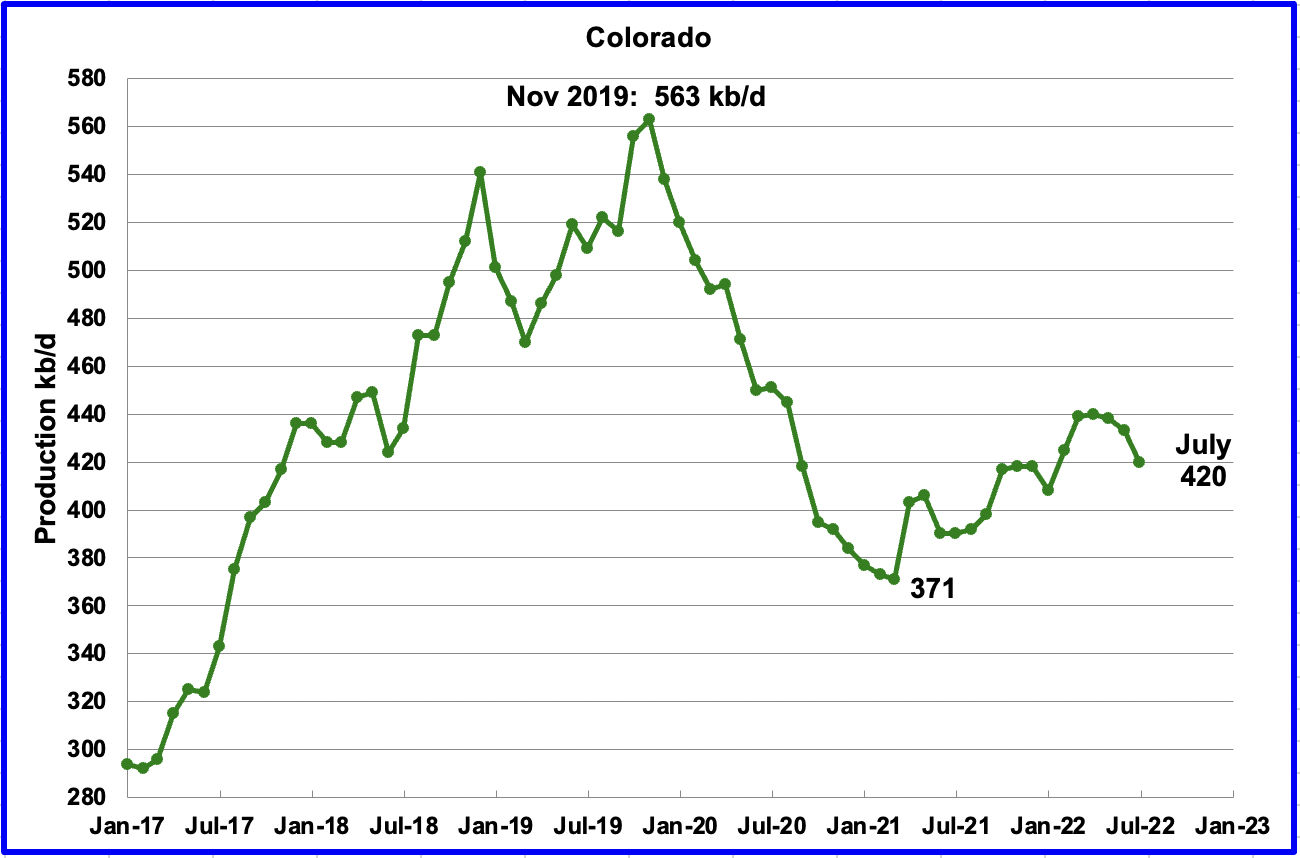

Coloradoʼs July production decreased by 13 kb/d to 420 kb/d. After having flat production in March and April, production began to decrease. A recent Colorado report forecasts little oil growth is likely in Colorado for 2022.

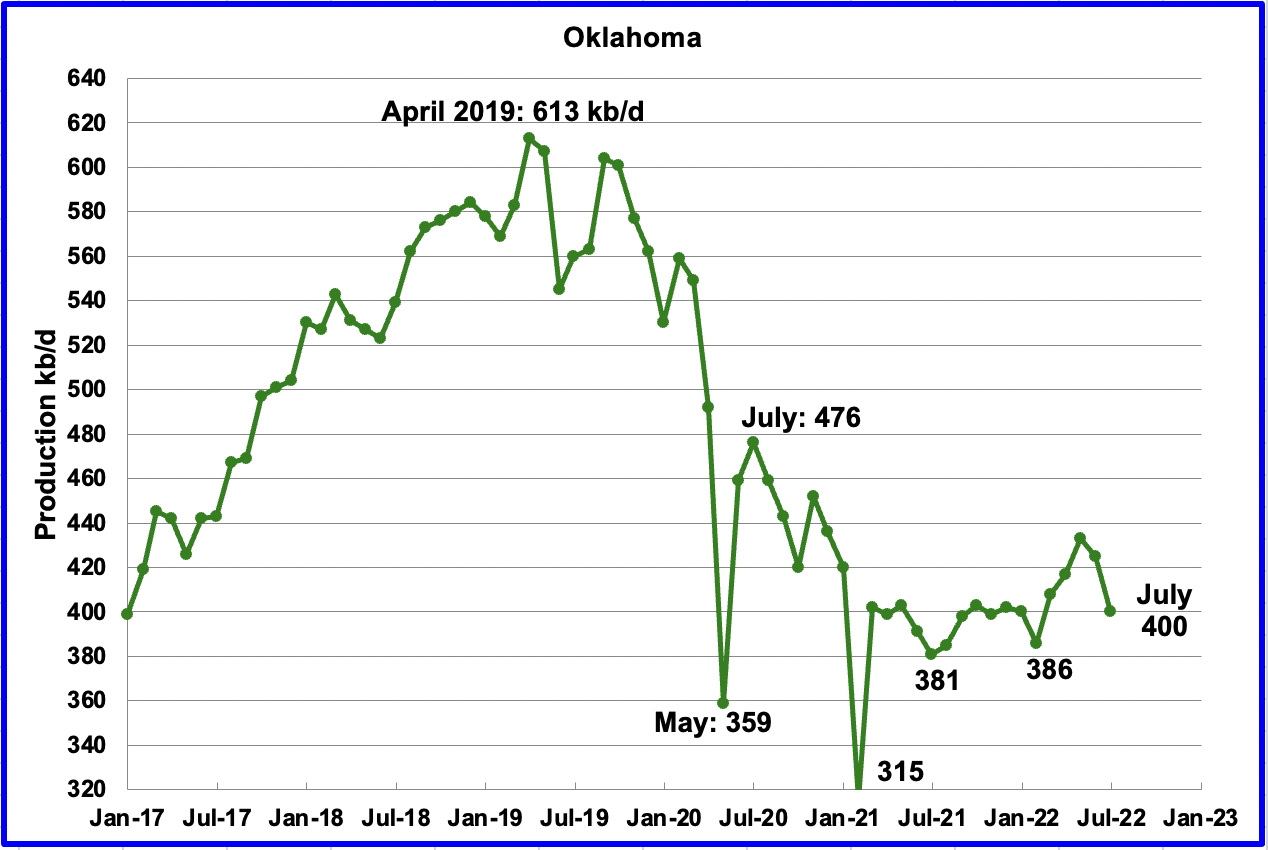

Oklahoma’s output in July decreased by 25 kb/d to 400 kb/d. From January to April, close to fifty rigs were operating in Oklahoma. In July the rig count increased to 57. Since March 2021, production has been hovering around 400 kb/d.

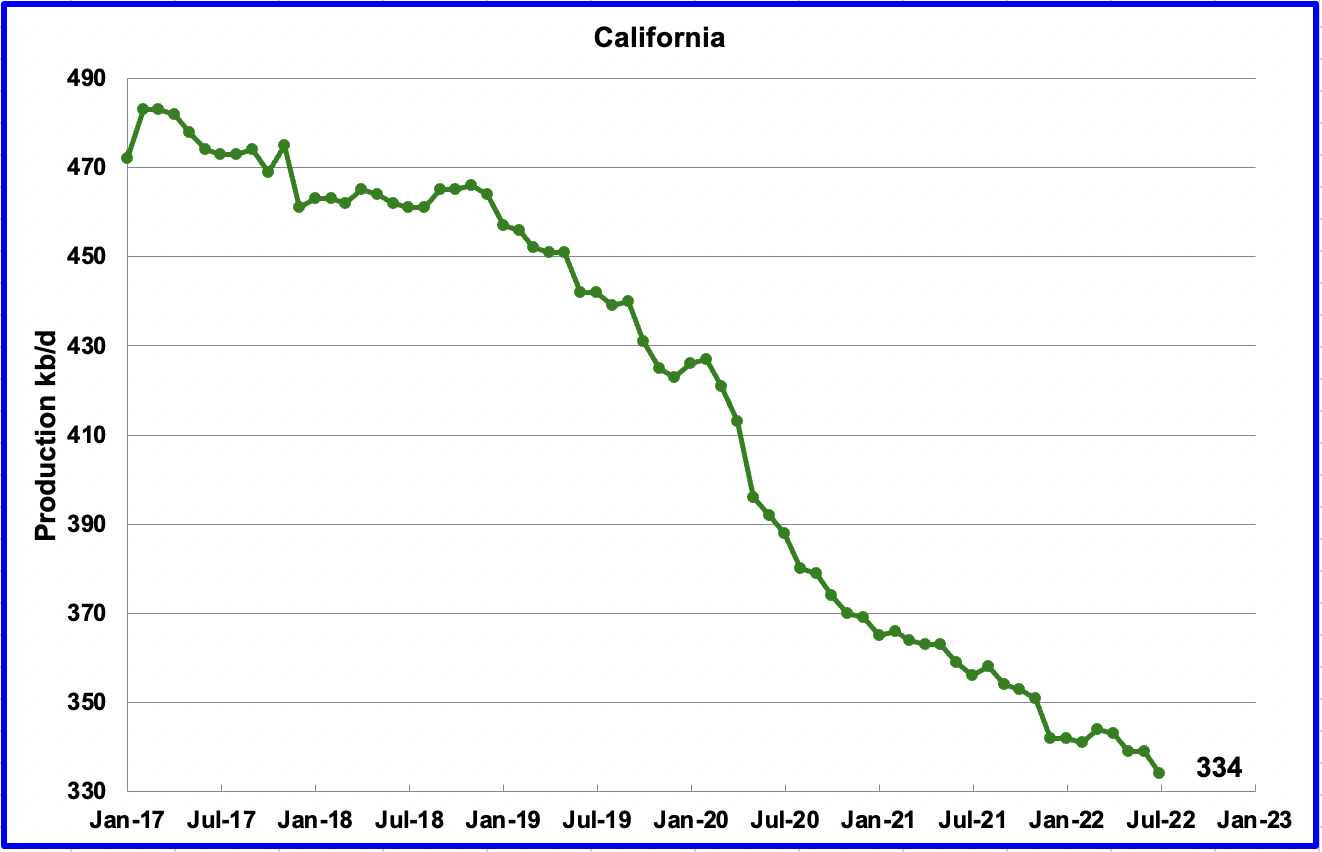

Californiaʼs slow output decline continued in July. Output decreased by 5 kb/d to 334 kb/d.

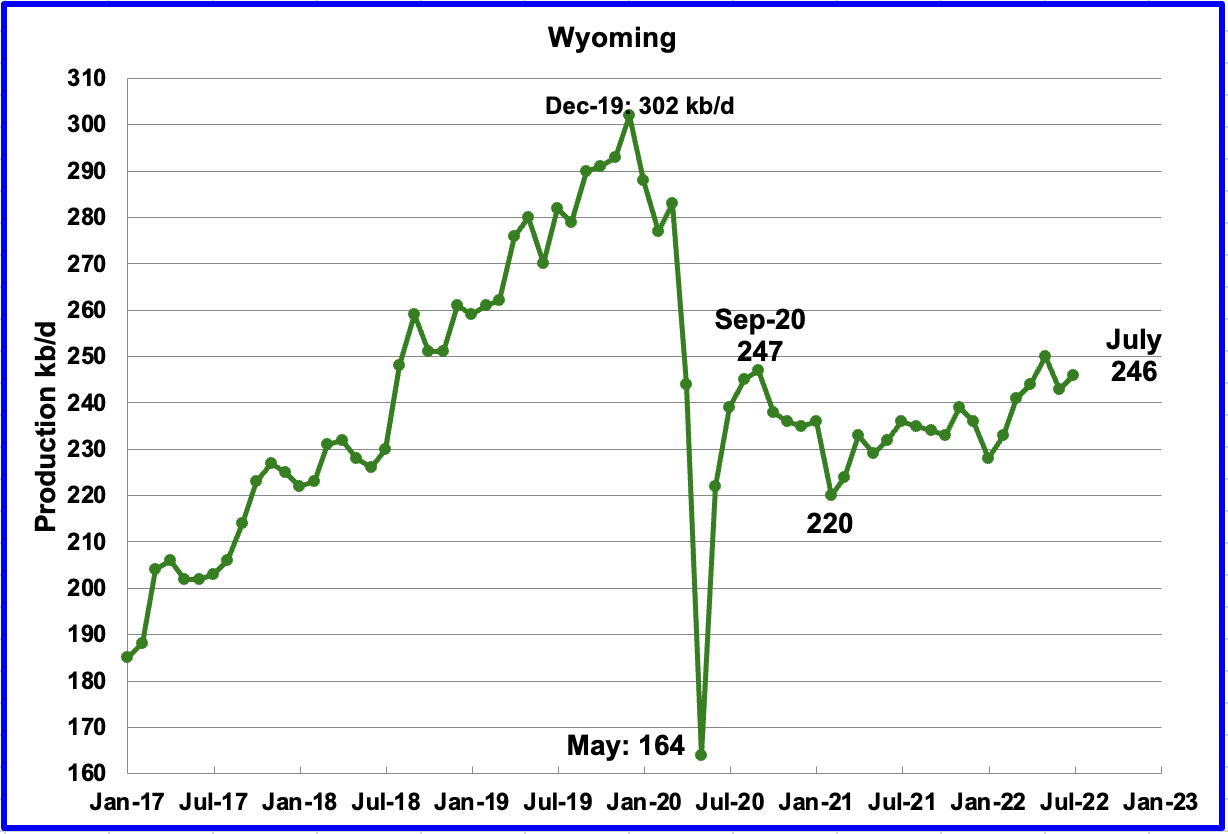

Wyoming’s oil production has been on a slow unsteady uptrend from the low of 220 kb/d in February 2021 due to increased drilling. July’s output increased to 246 kb/d.

In August, a new oil field was discovered. A geological company confirmed the Wyoming deep discovery has total Original Oil in Place of 993.5 million barrels.

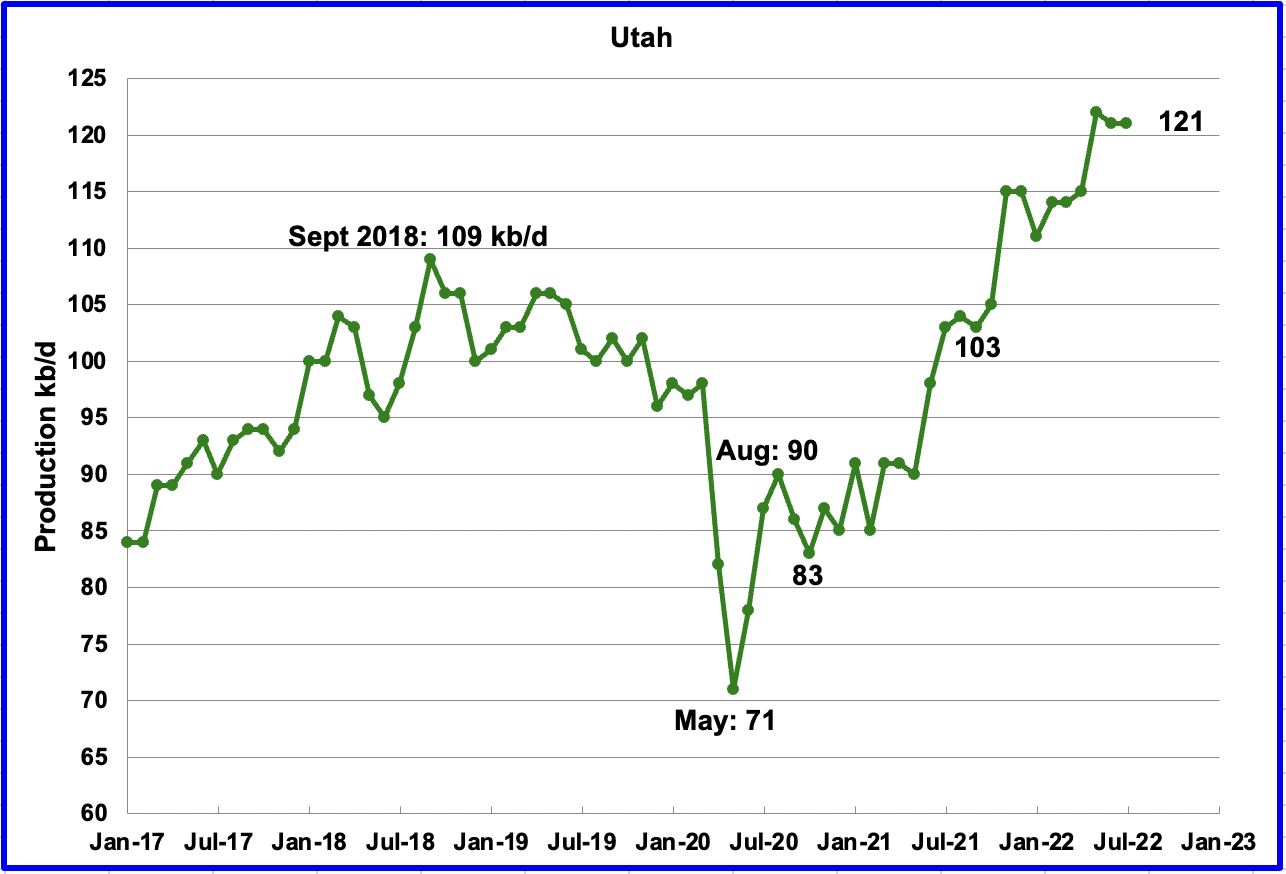

Utah’s production hit a new high in May of 122 kb/d but dropped in June and July. July’s production decreased by 1 kb/d to 121 kb/d. Utah had 9 rigs operating in early July and then dropped to 7 in the last two weeks.

Louisiana’s output was unchanged in June and July at 104 kb/d. July’s output of 104 kb/d exceeded its previous high of 102 kb/d in July 2020.

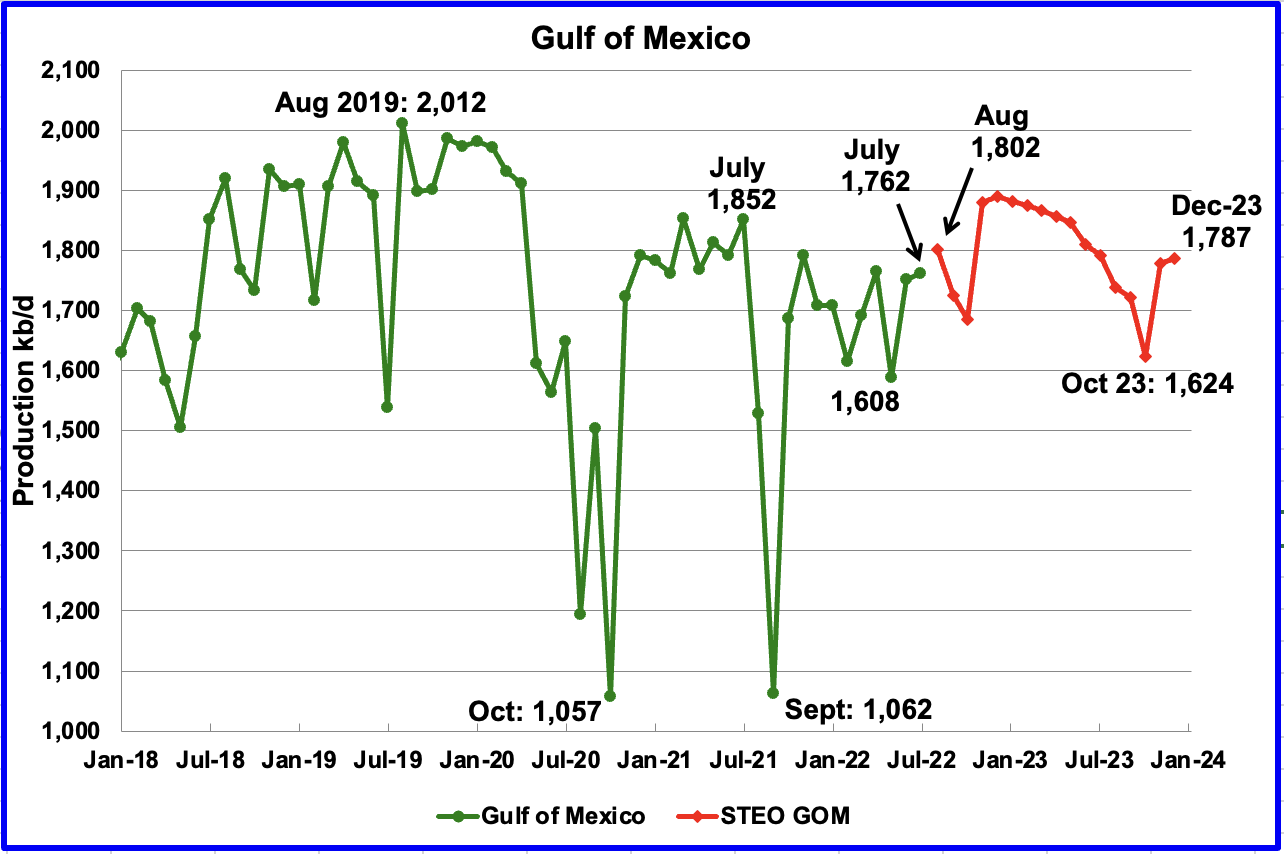

GOM production increased by 10 kb/d in July to 1,762 kb/d. If the GOM was a state, its production would normally rank second behind Texas.

The September 2022 STEO projection for the GOM output has been added to this chart and projects output will be 1,787 kb/d in December 2023, slightly lower than August 2022 at 1,802 kb/d. For August 2022, the STEO is projecting an increase of 40 kb/d to 1,802 kb/d. However over the next 18 months, the sharp increase shown in November will be slowly eroded by the 24/7 decline rates in other GOM fields.

A Different Perspective on US Oil Production

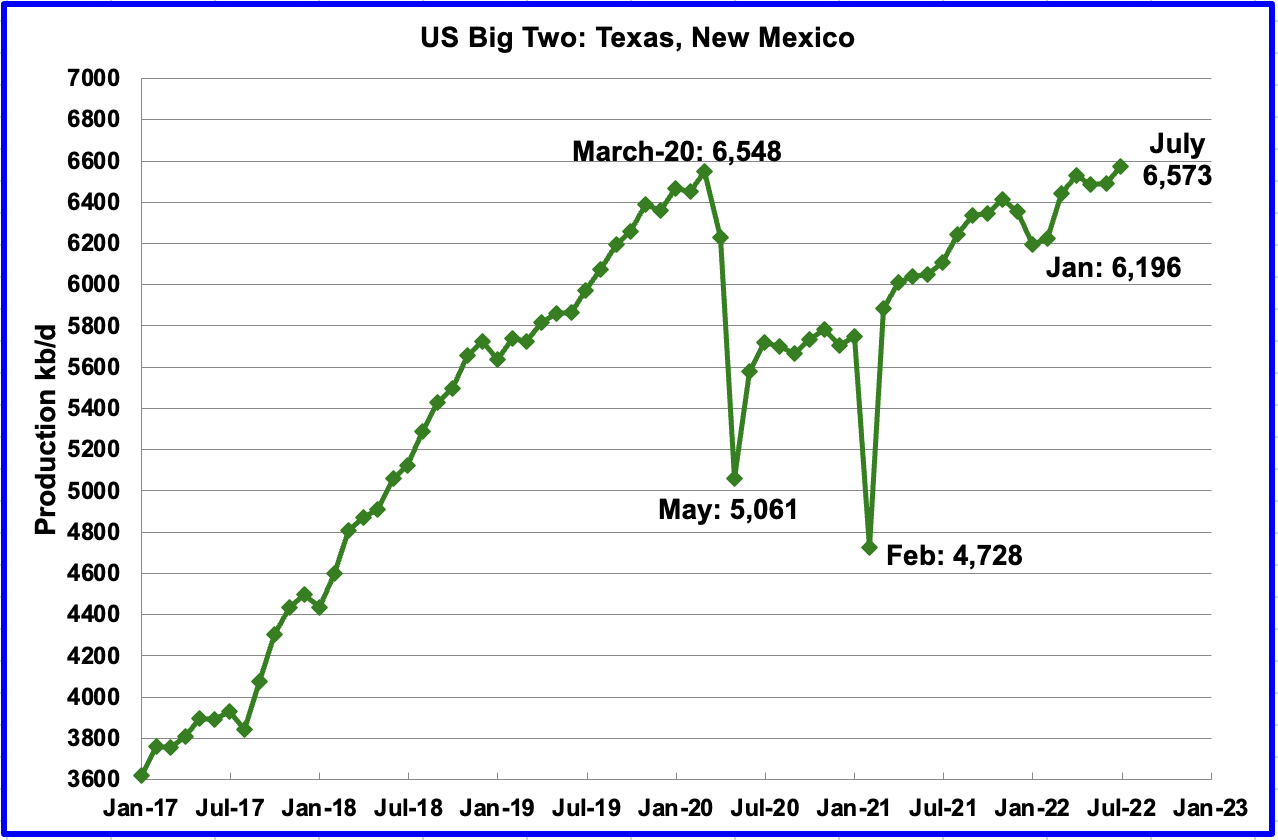

The Big Two states, combined oil output for Texas and New Mexico.

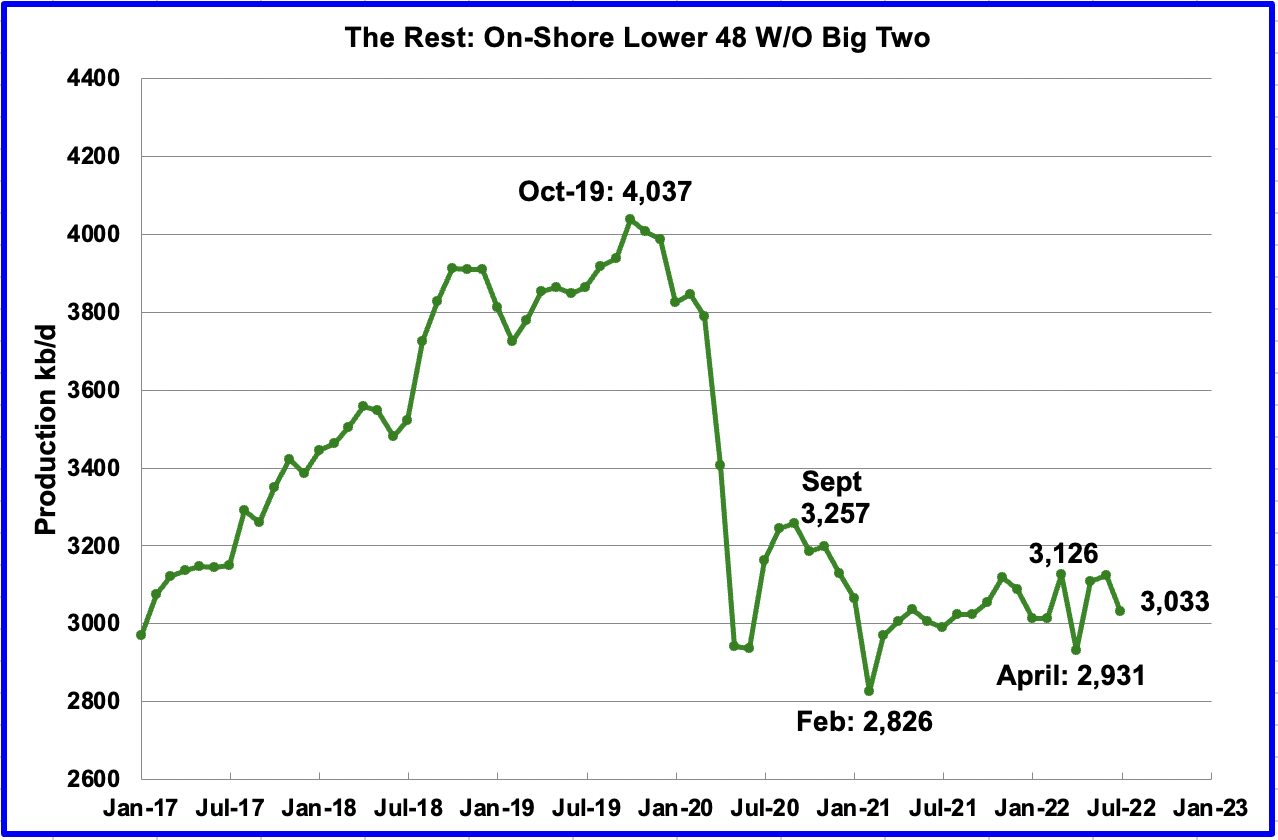

Oil production for The Rest

To get a different perspective on US oil production, the above two charts have segregated US state production into two groups, “The Big Two” and the “On-Shore L48 W/O Big Two” or The Rest.

July’s production in the Big Two states increased by a combined 81 kb/d to a new high of 6,573 kb/d with Texas increasing by 43 kb/d and New Mexico adding 38 kb/d.

Over the past year, production in The Rest appears to be holding steady at close to 3,100 kb/d. In June The Rest dropped by 92 kb/d to 3,033 kb/d.

The main thing to notice in the Rest Chart is that current production is 1,000 kb/d below the high of October 2019. The question we need answered Is “Is this a permeant loss that will never be recovered?

Rigs and Fracs

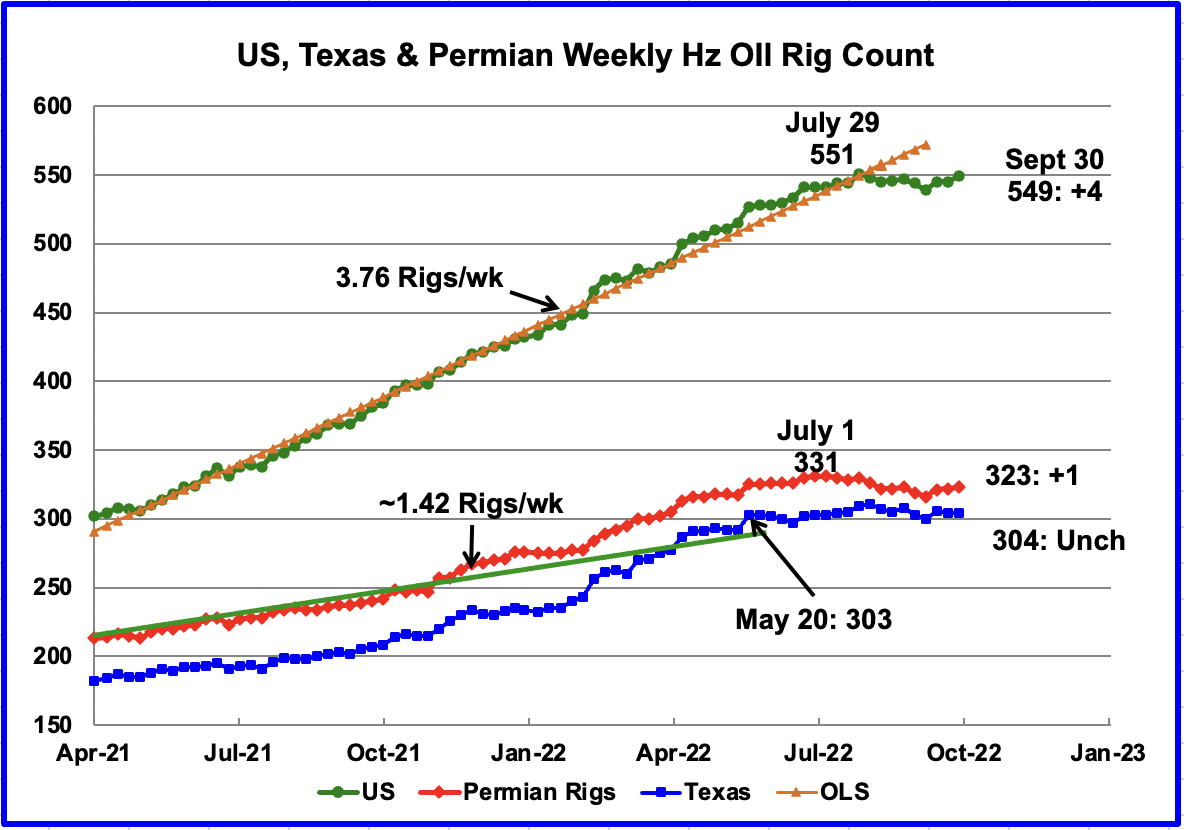

Since the beginning of April 2021 through to the week ending July 29, 2022, the US has been adding horizontal oil rigs at a rate of close to 3.82 rigs/wk, orange OLS line, and peaked at 551 rigs in the week ending July 29. However since then the number of operational rigs has been more or less steady at the 550 level. In the week ending September 30, the number of rigs increased by 4 to 549, bringing them back close to the 550 level.

In the Permian and Texas, the general trend for the number of operational rigs since July has been flat to slightly down. Is this related to the drop in the price of WTI?

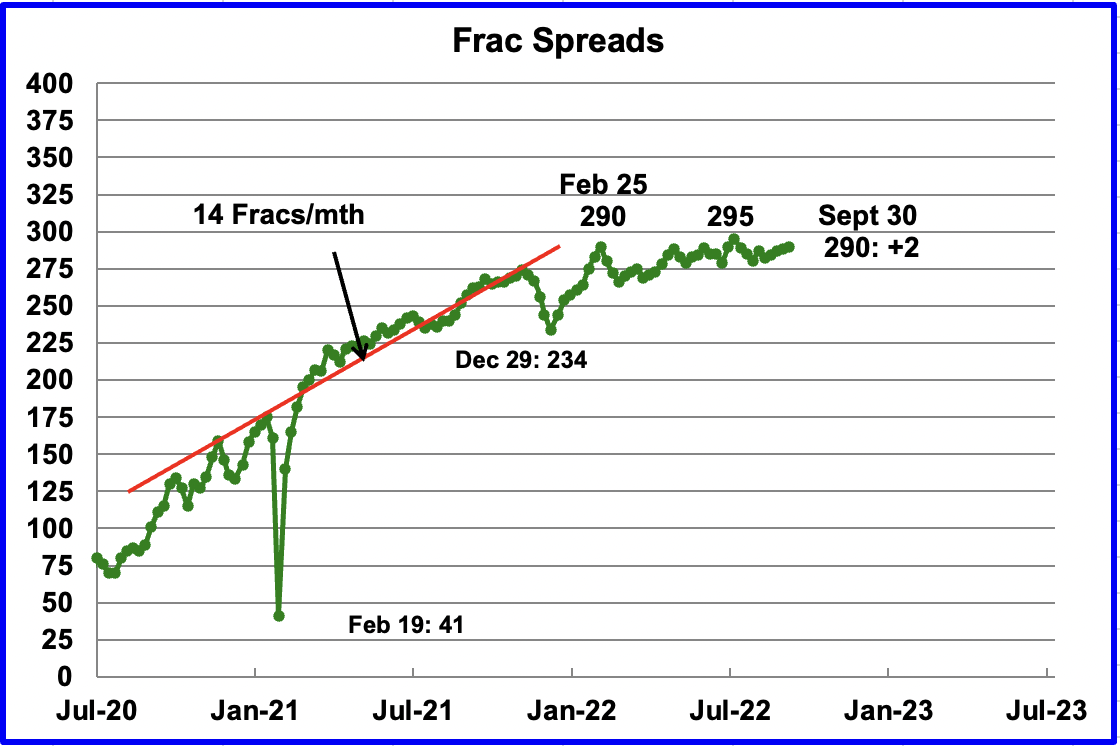

For frac spreads, the general trend since late February can best be described as essentially flat around the 290 level.

Note that these 290 frac spreads include both gas and oil spreads.

September Light Tight Oil Update

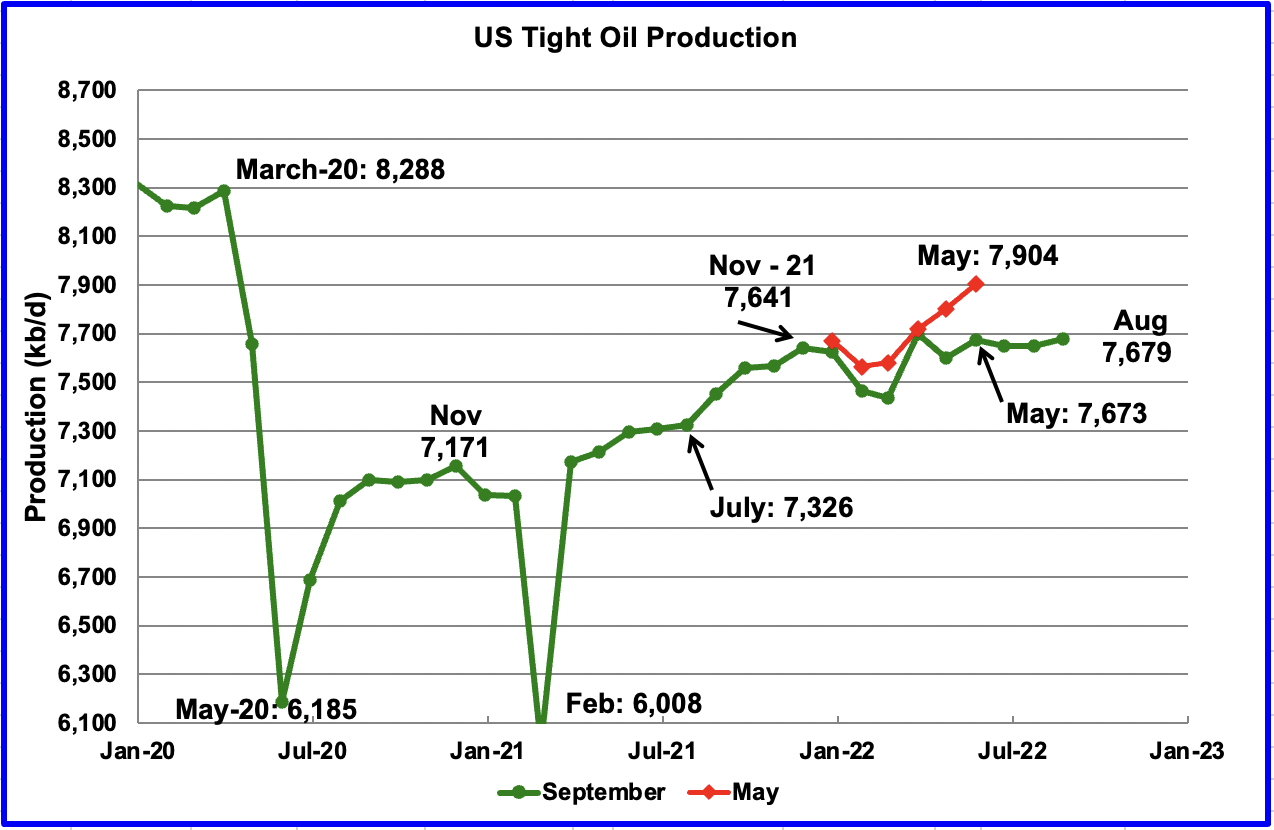

The EIA’s LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The September 2022 report updates tight oil production to August 2022.

The last LTO report was published in May because of operational issues and the EIA took the opportunity to update the information used to produce the LTO. First look at the new September report indicates the updated report is much better and may be more reflective of what is happening in the field.

August’s LTO output increased by 28 kb/d to 7,679 kb/d.

The EIA’s September LTO report made significant downward revisions to the production forecast in the May report. The biggest revisions in output occurred for April and May. May output has been reduced by 231 kb/d from 7,804 kb/d to 7,673 kb/d.

More significantly though is that the overall output has shown very little growth from November 2021, 38 kb/d, and no growth since March. This is consistent with the trend shown in the first chart where little growth has occurred since November 2021. The lack of growth is a combination of increasing production in the Permian and decreasing production in the Bakken and Eagle Ford. See below.

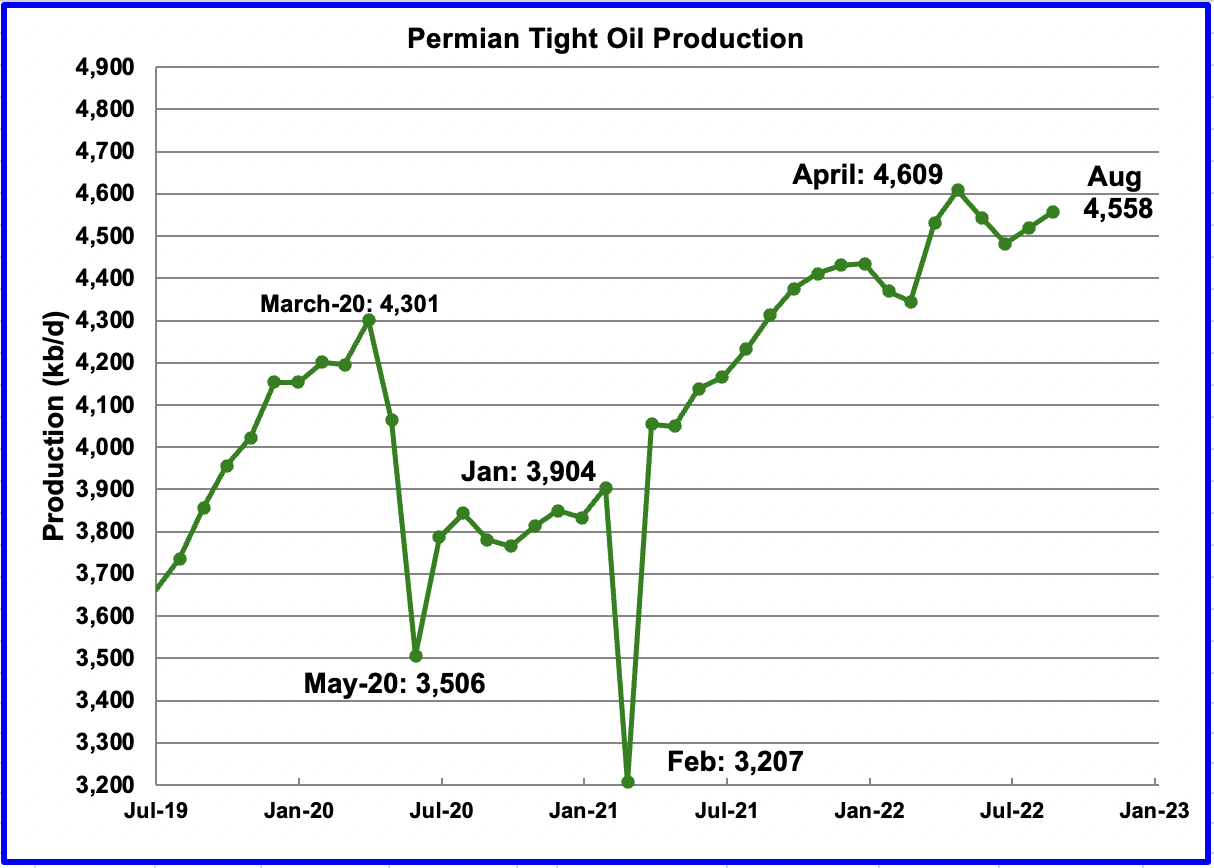

August’s output increased by 38 kb/d to 4,558 kb/d and is 257 kb/d higher than the high of 4,301 kb/d recorded in March 2020. It is not clear why production dropped in May and June.

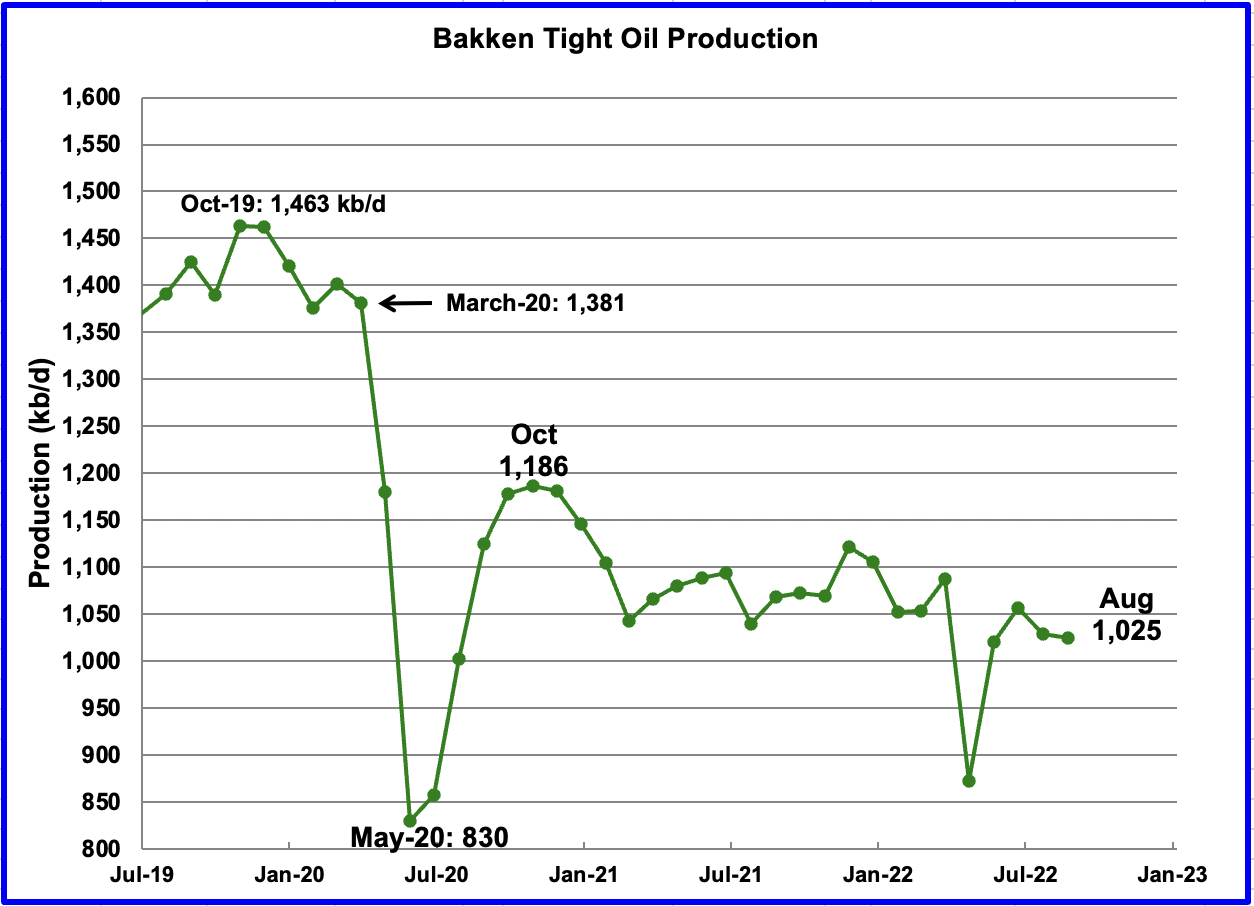

The Bakken’s August LTO output decreased by 4 kb/d to 1,028 kb/d. The output since October 2020 shows the same overall declining trend as in the North Dakota chart above.

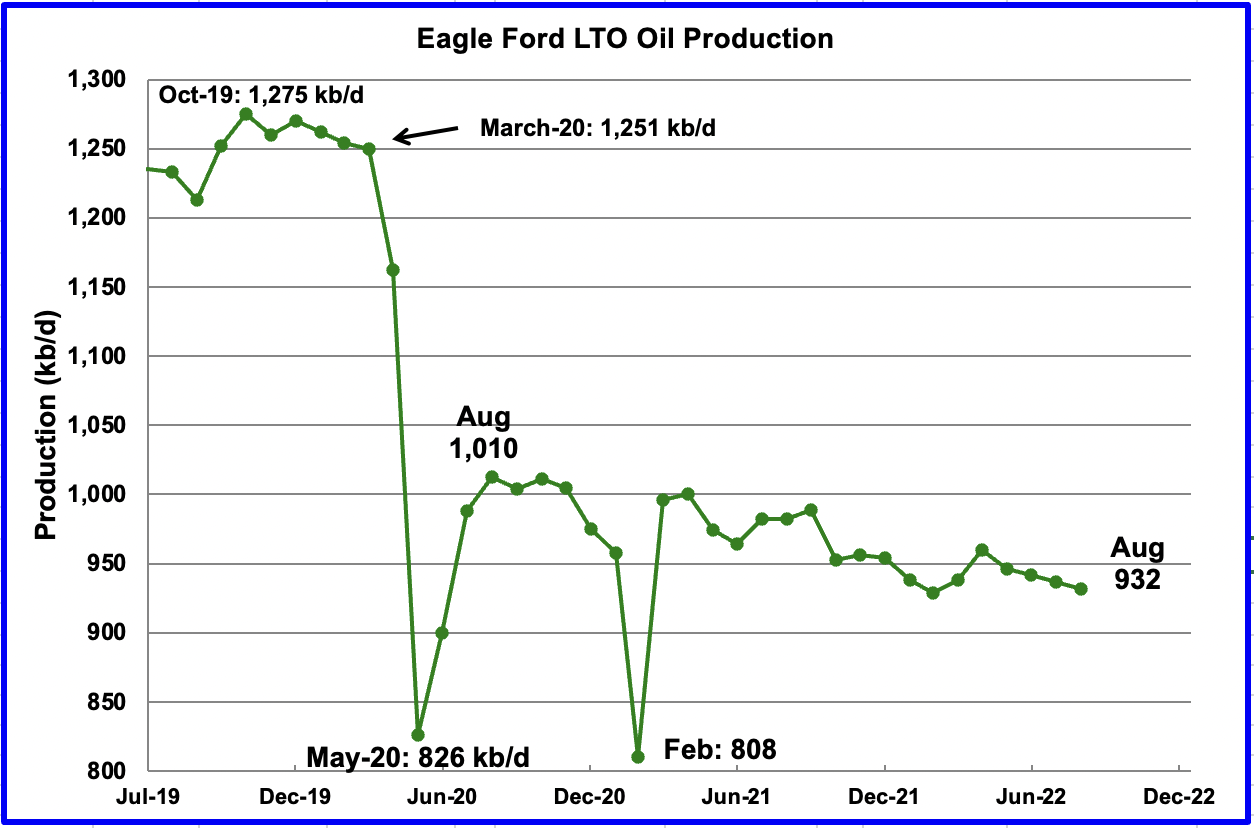

Production in the Eagle Ford basin decreased by 5 kb/d to 932 kb/d in August. Eagle Ford appears to have entered a slow decline phase.

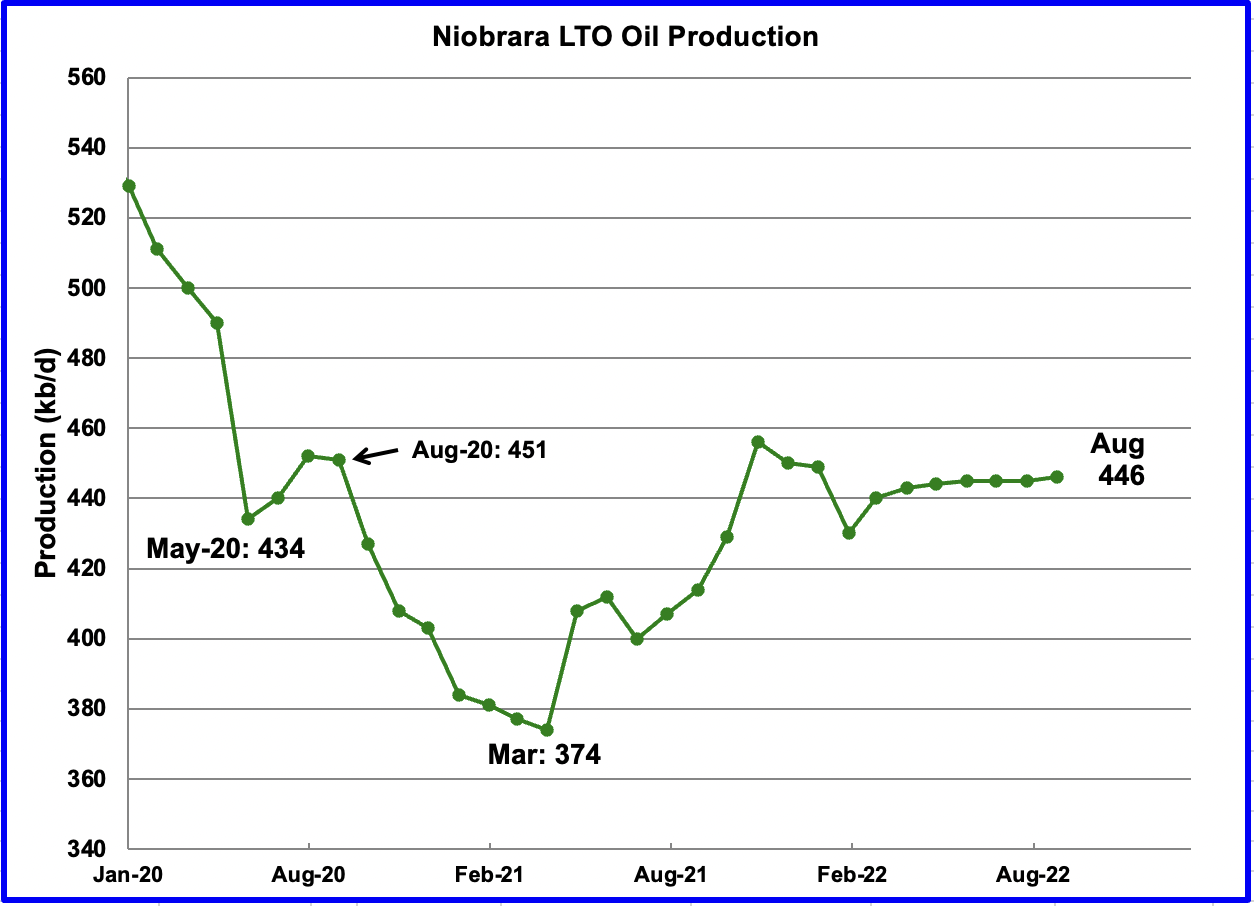

After increasing production from March 2021 to October 2021, output in the Niobrara began to drop in November 2021. Production since April has shown little growth. August’s output increased by 1 kb/d to 446 kb/d.

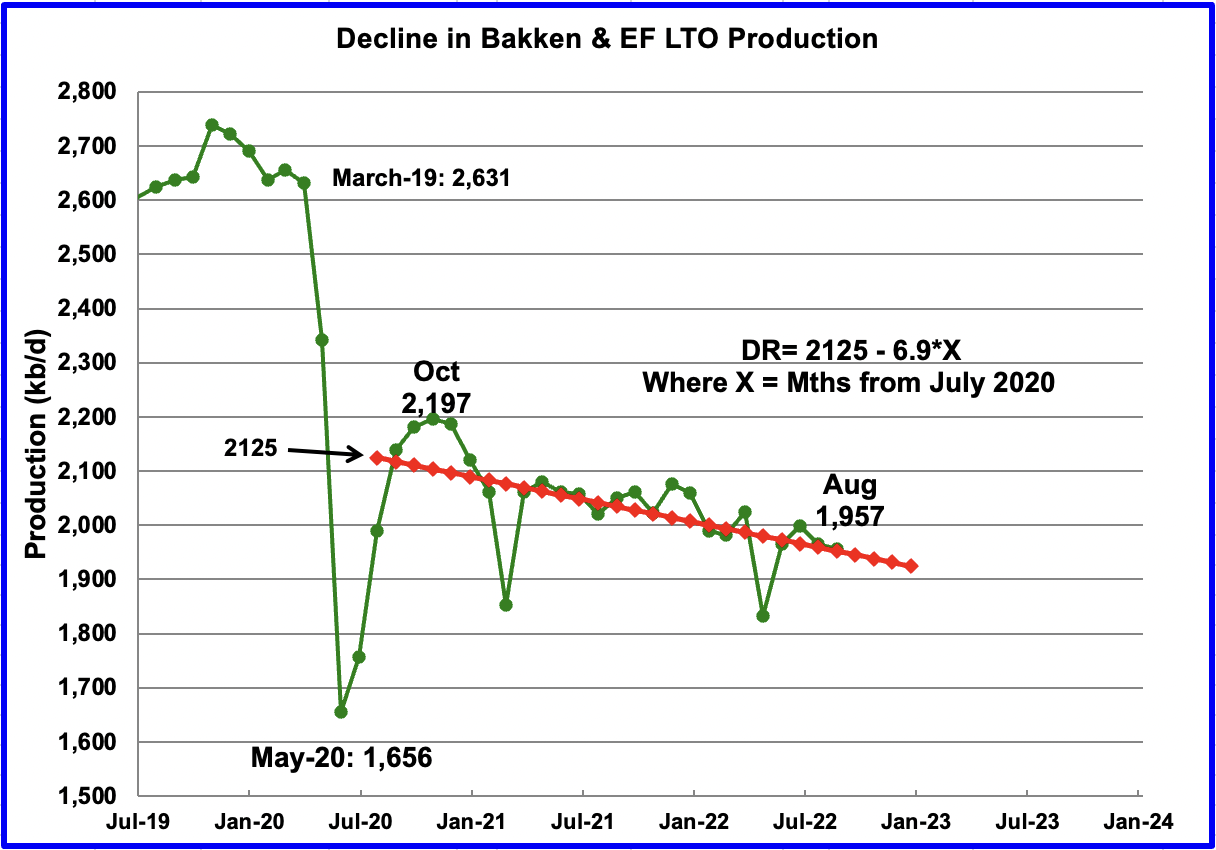

Production Decline in the Bakken and Eagle Ford

As noted above, monthly production in the Bakken and Eagle Ford basins since October 2020 has been in a slow decline. The decline being addressed here is not the rapid decline associated with LTO wells. Rather it is the decline associated with the lower productivity of new wells, see next chart, along with reduced investment in rigs and frac spreads.

The above chart is the combined output from the Bakken and Eagle Ford basins since they are so similar. Using data from July 2020 to August 2022, the OLS line gives a combined decline rate of 6.9 kb/d/mth.

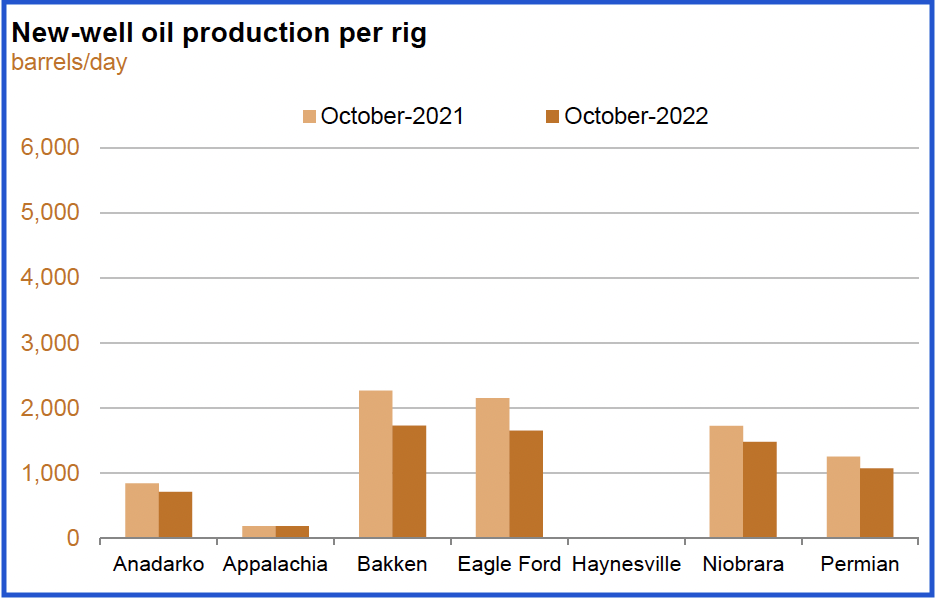

The September DPR report shows YoY decline in new-well oil production per well in the Bakken and Eagle Ford basins.

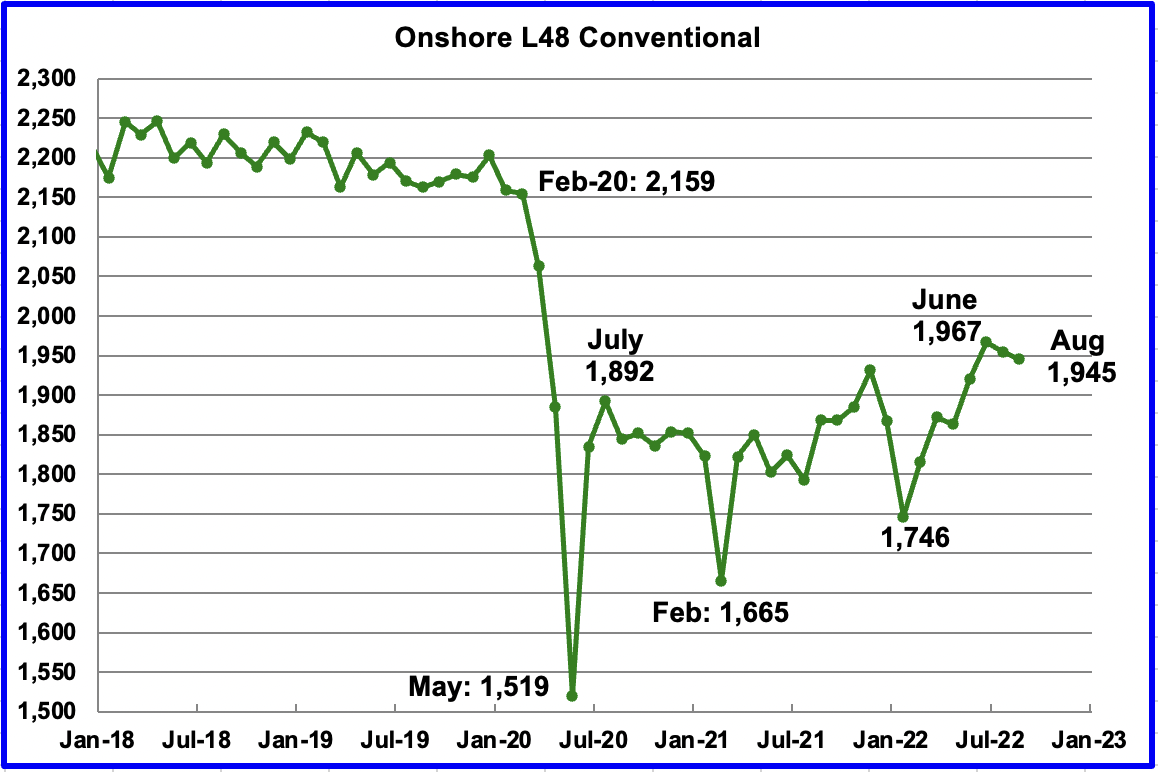

On-Shore L48 Conventional Production

Conventional oil output in the Onshore L48 dropped by 10 kb/d in August to 1,945 kb/d after reaching a new recent high of 1,967 kb/d in June. This estimate is based on a combination of the expected August LTO output and the September 2022 STEO report that has an August 2022 forecast for the US Onshore L48 output. Data from May to July in the STEO has been replaced by the actual EIA production data from the current September report.

A note of caution is in order. This chart is derived by subtracting two large numbers which are subject to revision, particularly the last two months, June and July.

Looking at the Flip Side

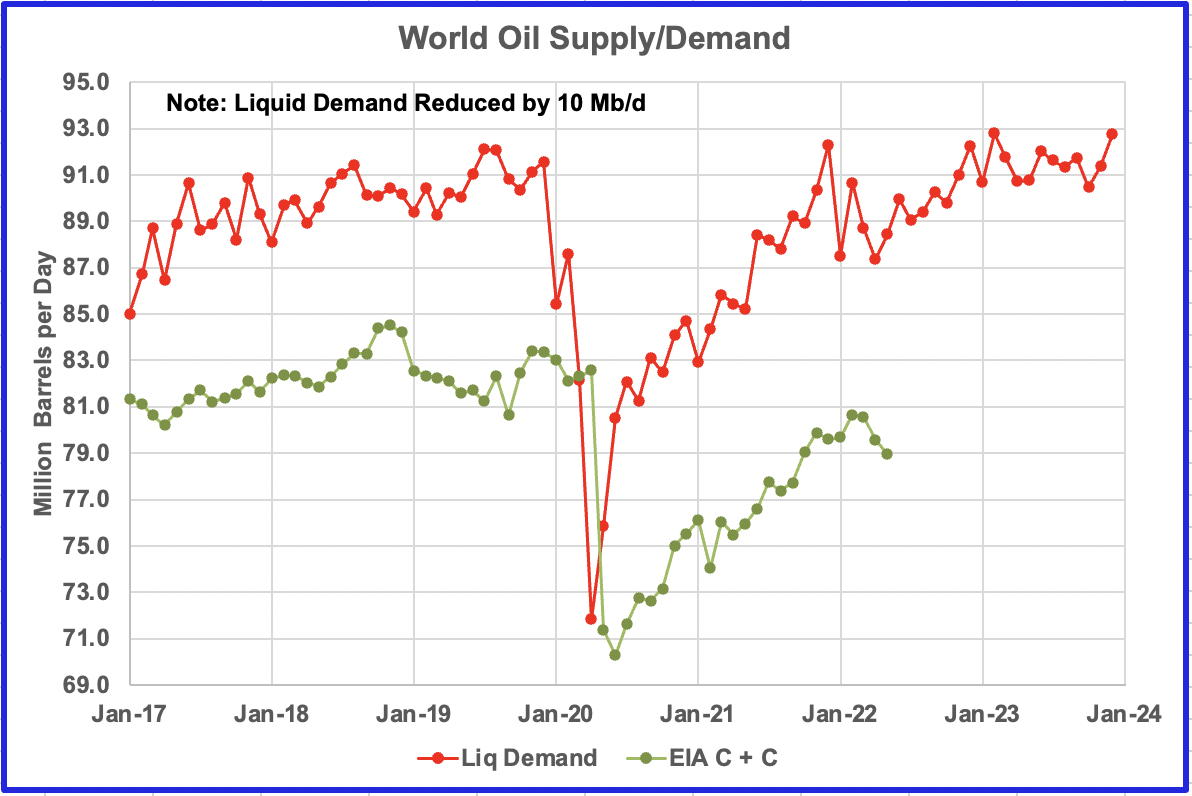

In recent times, many pundits have been addressing the issue of Peak Demand vs Peak Supply with the Peak Demand voices being heard more often. However little evidence is presented to justify the claim that peak demand is in the rear view mirror. While this site focuses on the supply side, we need not restrict ourselves.

The above chart presents the EIA’s STEO data for All Liquids demand. Initially the All Liquids supply data was added to the chart but it was difficult to discern much from it as the lines kept crossing. As a second thought, the EIA C + C data was added. This provided a clearer chart that better showed the trend between supply and demand. To bring the two graphs closer together, 10 Mb/d was arbitrarily removed from the EIA All Liquids demand data.

The average demand for All Liquids (reduced version) from January 2017 to December 2019 was 89.75 Mb/d. The average demand for C + C was 82.13 Mb/d. The difference being 7.62 Mb/d.

On the other side of the pandemic, the oil market has not yet achieved a stable equilibrium due to the impacts of the Ukrainian war. However just looking at the first five months of 2022, average demand for All Liquids is 88.88 Mb/d. Note that demand continues to build from the low of March to year end. From the low of March to year end, demand increases by 5 Mb/d. Average supply of C + C over the first 5 months is 79.89 Mb/d, for a difference of 8.99 Mb/d. The increase in the difference between demand and supply is partially being offset by the SPR release of 1.0 Mb/d.

There are a few things to notice in the above chart. Peak demand occurred in July 2019 while peak production occurred in November 2018. Peak demand will exceed the November 2019 peak again in December 2022 and February 2023, based on the STEO demand forecast. To assess whether the world is approaching a second lower production peak, demand needs to exceed the November 2019 peak for a sustained period in the first half of 2023 so that the supply side can be stressed. If the supply side is not stressed in 2023 to the point that prices rise, that could be an indication the peak demand pundits may be correct and that Ron will be vindicated in saying Peak Oil is in the rear view mirror.

Hi gang. I just wanted to tell you about my new book that has just been published. It’s called “A Worldview Based on Evidence”. Everyone has a worldview but very few are based on evidence. Most are based on dogma of religion or the dogma of science. Have a look and let me know what you think.

I included my free will essay in chapter 1 but added to it.

A Worldview Based On Evidence

Also, my website is live again. Check it out.

http://thefinetuneduniverse.com/

Thanks,

Ron Patterson

Congratulations Ron. Don’t know when I’ll find the time to read your book but I will put it on my long list of books to read.

Congrats on your new book! I will definitely check it out and let you know what I think. As an author of 2 science fiction novels I know how much work it takes to write and publish a novel. I have a hunch that you are writing about the universe explained by science through your objective reality viewpoint. It should be interesting. Izzy Doroski

Actually, Izzy, it’s more about the evidence denied by science. But if you are religious, you will not like it.

But if you are religious, you will not like it.

Abandoning the Cabbages For Christ population?

One cannot abandon something they were never associated with.

I know Ron—

Will check out the book also–

Congratulations!

I am definitely spiritual but not religious. I went to Catholic grade school which was like a military training camp but public high school & college. I think that our viewpoint of reality is conceptual through consciousness and governed by the laws of quantum mechanics & classical physics. Although lately strong new evidence shows that classical physics emerges from quantum physics and that quantum physics is the basis of everything we know of in the universe.

The dogma of science. I like that one….the idea being that science itself isn’t evidence based?

Reservegrowthrulz,

See Kuhn’s, Structure of Scientific Revolutions. There is more to it than evidence alone.

See

https://en.wikipedia.org/wiki/The_Structure_of_Scientific_Revolutions

No, that is not what I meant at all. Of course, science is evidence-based, at least most of it. The problem is that a lot of science is not evidence-based. The multiverse has not one iota of evidence to support it. And every scientist will admit as much. There is not one whit of evidence to support string theory. And they will also admit as much. The many worlds theory is about as cookie as they come. About 20% of cosmologists buy into it while the rest think it is the most absurd thing ever to come down the pike. But there is strong evidence to support almost all of science, only the fringe stuff is not evidence-based.

On the other hand, there is a lot of evidence that most science denies. There is overwhelming evidence that materialism is not all of existence. But such existence is vehemently denied by about 90% of all scientists. They call it naturalism. They know, with absolute certainty that nothing outside the material world exists therefore they will not even bother to look at the evidence. After all, it would be a total waste of time so why even bother to examine what others call evidence?

The reason for their refusal to even examine the evidence is that they associate anything non-material with religious superstition. As Christopher Hitchens correctly put it, religion poisons everything. But it has not one damn thing to do with religion. And that is what most scientists don’t realize. And that is what the book is about.

Thanks for the synopsis. As someone with a career in science, I’m trying to true up the idea against my experience and it isn’t quite working. The religious part anyway. I presumed that religion had nothing to do with it going in, and I don’t recall working with folks who appeared to ever think otherwise. Evidence, hypothesis, a theory, empirical testing, analyze, rinse-recycle-repeat.

Reservegrowh, this is just so damn frustrating. Of course, religion has nothing to do with what science believes. It has everything to do with what they disbelieve. They know, correctly, that all religion is bullshit. They know that there was never a god named Yahweh, Allah, Zeus, Posiden, or any other name. They know all the miracles in the Bible are total bullshit. Therefore they conclude that materialism is all there is.

Okay, I am not going to write another book here. But it is not what scientists believe, it is what they disbelieve is where they go wrong. They disbelieve that anything non-material exists at all. They are so certain in their opinion that they refuse to examine any evidence to the contrary. And religion has everything to do with it. Religion has poisoned their mind. Religion poisons everything.

Mr. Patterson,

(Reluctant to jump in here …),

You may find Carolyn Myss’s view somewhat relevant.

To wit,

“Spirituality is an Individual’s recognition of the existence of a non physical Reality.

Religion is a social and cultural expression of that”.

This dovetails neatly with Pirsig’s Zen and the Art of Motorcycle Maintenance wherein Pirsig’s towering intellect irrefutably shows the limitations of Reason. (The Church of Reason example presents a disquieting context of much of modern day ‘rational’ discourse).

If you are familiar with much of Kaku’s work, he brilliantly – in exceptionally clear terms – shows how it is generally an expansion of current scientific dogma that continuously enlightens human knowledge, that is, enlarging understanding of that which exists but is presently beyond our ken.

This comes full circle in aligning the quip from ‘The Dancing Wu Li Masters’ in that cutting edge, super smart scientists from various fields are metaphorically climbing the Mount of Knowledge, only to find that the pinnacle is already occupied by the Mystics.

Interesting view.

Coffeeguyzz, thanks for the post. I read Zen and the Art of Motorcycle Maintenance in the early 80s but don’t remember much about it now. I am familiar with Kaku’s work. He is a string theorist and a strong advocate of the multiverse. I think both are nonsense. But if anyone could produce any evidence for either, I would change my mind. He is a kind of mystic, however, a pantheist. I am close but not a pantheist. Pantheists believe god is the universe and the universe is god. That says way too much in one breath and not nearly enough in another.

I am familiar with the metaphor of the mystics already at the pinnacle of the mountain when the scientists finally get there. I don’t like it. It implies that the mystics already have the answers. I am a mystic and I sure as hell don’t have all the answers. Actually, I have damn few of the answers, but that’s what makes the search so much fun.

What does “they disbelieve that anything non-material exists at all” mean? As a scientist, can you name something or general category of non-material that I ignored during my career? Science never struck me as about my own opinion, and studying peak oil for me was completely about examining evidence to the contrary. Matter of fact, I made my bones in proving things to the contrary as opposed to discovering things new and exciting.

can you name something or general category of non-material that I ignored during my career?

Of course not. I know absolutely nothing about your career.

Kaku has totally bought String Theory.

As after the Standard Model, physics has hit a brick wall.

It is creative fiction, so far.

The whole damn multiverse bullshit is creative fiction.

Reservegrowth, just one more thing. You wrote:

I presumed that religion had nothing to do with it going in, and I don’t recall working with folks who appeared to ever think otherwise.

I am not a scientist but I read a lot of science books, I mean a lot. Over the years I have read hundreds. You are mistaken if you think they never discuss religion. They talk about it quite often. They even write books denouncing religion. “A Universe from Nothing” by Lawrence Krauss is an example. I could give the titles of many others. They talk about it on YouTube videos. I give examples in my book. So when you say “I presumed that religion had nothing to do with it going in,” you are simply wrong.

When you say “they” you are including me, and I never discussed religion or got into an argument with any other scientist about it. I have no doubt someone must be doing this if you’ve seen them doing it in print, but certainly it never came up during work hours that I am familiar with. I don’t mind being wrong when it comes to religion being mixed in there somehow, but your experience in science must be in a more interesting field that the geosciences perhaps. I tried to keep my observations on this topic to the evidence in a career of doing it.

“They” means scientist in general. Of course, some never discuss religion. I read mostly those that do. Like Lawrence Krauss or the late Victor Stenger, or Martin Rees, and I could name more.

I tried to keep my observations on this topic to the evidence in a career of doing it.

Well good for you. However, the discussion of the fine-tuned universe is about religion. Or at least the Bible bangers try to make it about religion. Cosmologists are fully aware that the universe is indeed fine-tuned. And they argue about it, they make YouTube videos about it, and they write books about it. If you have not checked these arguments out, then you are missing a lot of fun.

And I argue they are making The Wrong Argument

Hey Ron I will debate you on your comments (the multiverse, materialism, many worlds ) in the near future but not on this thread since it is pertaining to US oil production.

It’s really not a big thing with me Izzy. I have been debating for years. I debated Kent Hovind twice. (If you don’t know who he is, google him.) But I have never debated a scientist, only religious fundamentalists. We can go to the other thread or on my website. Thefinetuneduniverse.com.

But if you need a month or two to bone up, that’s fine with me. 🤣

Any video / recordings of Ron vs Hovind.

I would enjoy watching those.

Sorry, both debates were in the early 90s, well before the days of YouTube or even the internet. Also, videos in those days were on VHS tape. Everyone had a VHS player, but there were damn few VHS cameras.

That was before Hovind went to prison for tax fraud.

Ron: With all of the “overwhelming evidence that materialism is not all of existence”, it’s weird that the Randi Challenge never paid out.

Richard, I will not discuss this subject anymore on this thread. Post it on the non-petroleum thread, and I will be glad to discuss the James Randi Scam.

Just got a call from my editor. They uploaded the wrong manuscript to the printer and to Amazon. The “Note to from the Editor” should not have been in there. Several corrected strike-throughs were left in the manuscript, there were no page numbers, and chapter 11 was left out of the contents page, though it was still in the book. They are going to correct the kindle immediately and swap out all the books already shipped.

Sorry for the screwup.

Oh, I thought it was a book about oil,

Just bought your book for my Dad. I think he will enjoy your perspective, though I haven’t read the book myself, yet.

It doesn’t look like Amazon ships your book outside the USA.

You might want to look into that ( if you can ) as I suspect you have developed some fans that don’t live in America.

thanks!

I hope you get the corrected copy. But I doubt it, i t just went to the printer yesterday. But everything is in the original flawed copy, just no page numberss and a few errors.

Doesn’t matter. The content is what matters not the formatting.

I didn’t mean to imply that I am not buying it for myself. I can’t wait to read it.

I live outside the USA so I can’t get it (says out of stock)

A collector’s edition with the editor scribbles!!

thanks!

It says “Out of stock” because they pulled all the flawed copies. The new stock should be there in a few days. Sorry about that.

The talk is OPEC cutting 1.5 million b/d at their meeting this Wednesday. Honestly with everybody teetering on recession. If you run prices back up to $100+ it’s a nail in the coffin that brings prices down much lower. Not really in OPEC’s best interest but that doesn’t mean they won’t do it.

So basically at this point we’ve got New Mexico to grow production…

Stephen Hren,

For past two years Texas and New Mexico have grown C plus C output at an annual rate of 579 kb/d. Texas at an annual rate of 272 kb/d and New Mexico at 307 kb/d. Period is August 2020 to July 2022 and trend is based on ordinary least squares (OLS) regression on the data from those 24 months.

If we look at annual growth rates as a percent of output, New Mexico is growing much faster than Texas, 24% per year for New Mexico vs. 6% per year for Texas over the past 24 months.

If we look at all of US C plus C over the past 24 months we see all of the increase came from Texas and New Mexico.

But now the Eagle Ford may be declining as much as the Permian is able to increase. So maybe just New Mexico

Stephen Hren,

The Texas data includes both Permian increases and Eagle Ford decline, the net gain for the past 24 months in Texas has been about 270 kb/d per year, using OLS regression on EIA C plus C data.

Of course the trend could change and I agree that in percentage terms New Mexico is growing much faster, but in absolute terms there is only a slight difference over the past 24 months.

Stephen,

You are correct… over the past few years, Permian production from New Mexico continues to rise significantly, while the Texas Permian has been, virtually… FLAT.

steve

If we look at what has happened since mid 2020, both Texas and New Mexico have seen increased output. New Mexico has increased much faster as I said earlier in percentage increase, about 24% vs 6% per year for Texas.

Keep in mind that the Texas data is not very good for the most recent 6 months or so, they have significant delays in reporting all oil output. That is why on Enno Peter’s posts he gives an estimate of what production will be after all the data comes in, it is higher than what his chart shows.

In the most recent Novilabs post on the Permian (Sept 1, 2022) the chart has 4486 kb/d for May 2022 output, but in the post Enno says:

Permian tight oil production rose to a new output record in May, at around 4.6 million b/d (after upcoming revisions, horizontal wells only). Not all this production is reported yet by the state agencies, thus the apparent drop in production in the above chart.

Since the bottom of Covid, aggregate TX Permian is up about 11 MMbbl/month. Aggregate NM Permian up about 16 MMbbl/month. So a 60/40 split in favor of NM.

Dennis,

New Mexico is a much smaller area than the Permian with two countries (Eddy and Lea) producing the bulk. They also lie on the western flank of the Delaware basin.

I believe two things have fueled the growth:

1. Harder to drill in New Mexico due to theabundance of State and Federal leases with more well site regulations as well. Many operators feared the Biden administration would eliminate leasing on Federal lands and became more active to protect their leasehold positions.

2. Many operators were running out of leasehold to drill not only in the Permian and the “Texas” Delaware. Much of the undrilled core locations are owned by larger companies like Chevron,, ConocoPhillips, Exxon and OXY. I am seeing a smaller number of independents drilling in Texas and opting to drill acreage in New Mexico for the same reason as I stated above. Also the wells in New Mexico are generally shallower and less expensive.

These are not necessarily substantiated by any facts that I have but general consensus from folks I have visited with in the industry.

LTO Survivor,

Thanks for this information.

I had a response to your comment near the end of the previous oil thread and Schinzy asked for more information. I included a spreadsheet that might be of interest. Link to start of comments below. The average OPEX over the life of the well is about $10.50 per BOE in 2022$, at a well cost of $12 million, IRR is about 47.5% assuming annual infaltion rate of 2.5% (real IRR is 45%) at $75/bo at wellhead and NGL sold at 35% of wellhead crude price and natural gas sold at $4.60 Mcf.

https://peakoilbarrel.com/norway-august-oil-production-rebounds/#comment-746837

Thanks Dennis

Schinzy,

You’re welcome. Let me know if you see any obvious errors.

Thanks.

Dennis,

Costs have risen out of sight. Most service companies are not expanding, labor is in short supply and steel for casing is in even shorter supply as mills in Europe are shutting down, banks have redlined the fossil fuel industry. Drilling costs have soared monthly as drilling companies are charging $32k per day as opposed to $25 per day. Mobilization and demobilization of Drilling Rig costs are through the roof and almost $1 million per well up form $500k. Total D & C costs for a 10,000 Hayneville Shale well have gone from $1,400 per foot to almost $1,800 per foot depending on the size frac. At the current price of gas, theses wells net a little better than 2:1 if everything goes right. I believe this is why we are not seeing production growth as oil and gas companies are paying down debt, making distributions and living within cash flow.

This is a good thing in that impedes unbridled growth and violent product price swings but I wouldn’t anticipate shale production rising as fast as you may think. Political headwinds, ESG policies ( a la SEC proposed rules by Gary Genslar) , Private Equity prohibited from investing in Fossil Fuels, and Banks redlining the industry all play a part in limiting growth in production. This Thursday CEOs of major banks will go before Congress to discuss new restrictions on loaning to oil & gas companies.

It hasn’t worked out very well for Europe this year.

LTO Survivor,

Wow, if we assume a 10,000 foot lateral that is 18 million per well, I assume costs are similar in the Permian basin, is that correct?

At that cost and assuming $10.50/boe for OPEX we would need $95/bo and $4.60/Mcf just to get an IRR of 32.5% (assuming 2.5% annual rate of inflation) for the average 2020 Permian basin tight oil well.

What number do you target for IRR?

Dennis.

The only wells drilled this year in our field are a few that have been drilled by a company that owns its own drilling rig. So I don’t know the D & C costs.

I do know that plugging a well in our field is approximately 1.5 times more expensive than it was at the same time last year.

I also know that reactivating a temporarily abandoned well is much more expensive than one year ago, primarily due to much higher rod and tubing expense, as well as much higher rig expense. It also takes a long time. We set up one this summer and the rig finally got there now. The service company has several rigs stacked that could all be running if there was labor available. Experienced rig operators just aren’t out there.

Thanks shallow sand,

This may explain the low completion rate.

For those that think it is better to drop the Feb 2021 “outlier”, consider the following definition of outlier in the post linked below

https://www.freecodecamp.org/news/what-is-an-outlier-definition-and-how-to-find-outliers-in-statistics/

For the Texas plus New Mexico C C Data from August 2020 to July 2022 (24 months), the low point in February 2021 has a value of 4752 kb/d. IQ1=5732, IQ3=6370.5, the IQR=IQ3-IQ1=638.5.

A low outlier is less than IQ1-1.5*IQR=5732-1.5*638.5=4455 kb/d, so what seems to be an outlier visually on the chart is not by the interquartile definition as 4455<4752.

Paul Pukite know statistics in far more depth than me, he has suggested to me that unless there is a compelling reason to drop a data point, it should not be done. I tend to agree.

The original chart this comment refers to is at link below

https://peakoilbarrel.com/us-june-oil-production-shows-little-growth/#comment-746917

Oil Jumps at the Open as OPEC+ Considers Big Production Cut

Oil surged in early Asian trading after delegates said OPEC+ was considering cutting output by more than 1 million barrels a day when the group meets this week to stem a slide in prices.

A few other articles have indicated that they are looking to keep prices in the $90/b range.

The bigger question is are they really doing this to keep oil at $90/b or are SA and UAE struggling to keep production at their current high levels. That may be the bigger issue.

https://www.bnnbloomberg.ca/oil-jumps-at-the-open-as-opec-considers-big-production-cut-1.1827085

Demand is a term that in this context really means the measured Consumption,

which takes into account how much was needed or wanted, and how much could be afforded.

And of course the consumption can be hard limited by lack of physical supply in the marketplace- for whatever reason.

I say this simply because many people get thrown off by the term ‘demand’.

The only company that I have found with increasing numbers of exploration wells is CNOOC. The other two national oil companies that report on SEC, Pemex and Petrobras, have shown declines in line with IOCs and independents. CNOOC delisted from stock exchanges in 2020, along with many other Chinese companies, so there won’t be any more data. Pemex and PBR low numbers are probably due mostly to loss of onshore and shallow offshore drilling while deep water drilling has been retained, and probably increased for Pemex.

Success rates for CNOOC and Pemex have been declining while for PBR they have improved. The deep water pre-salt wells in Brazil are very expensive so I’d imagine PBR would want to be very confident before committing to exploratory drilling.

Although exploration has increased the CNOOC discoveries have been steady or slightly declining so discoveries per well have shown a distinct falling trend, and are also much smaller than for Pemex or PBR. The high discovery years for PBR discoveries were when large numbers of new FPSOs were approved for new fields, mostly in large pre-salt basins that were actually newly drilled some years previously. There haven’t been many new projects approved in the last few years and reported drilling results have often been poor.

Development drilling for all three companies has been falling. For Pemex and PBR this reflects moving to fewer but more productive deep water wells, for CNOOC I don’t know what it means; production for C&C has been on a near plateau since the 2014 price crash but natural gas has increased.

Thank you Ovi for the great post and especially the look at demand. The relatively small drop in world demand during Covid leaves me skeptical of peak demand claims.

Paoil,

A drop in demand for liquids of 20% is a pretty big drop (from 91 Mb/d in Dec 2019 to about 72 Mb/d in March 2020). The forecast demand in 2023 is relatively flat, but forecasts are often incorrect.

The lockdown-dip in oil demand saw many writers predicting the permanent onset of green energy dominance–some the same writers who predict peak oil demand. But covid didn’t fundamentally change energy delivery and oil demand has snapped back with remarkable speed. Tinkering like the Inflation Reduction Act will artificially influence the market and perhaps reduce oil demand a little bit in the USA. But the 1.4 billion people in India represent a great deal of future oil demand as do the 3+ billion people with little to no current access to oil. If there was a source of reliable energy BETTER than oil then the foundation for peak oil demand would exist. Covid lockdowns were a great little tinkering experiment–but they didn’t change the desire of the people of India and Africa to consume like the Americans.

PAOIL,

Based on World liquids consumption data from BP Satistical Review of World Energy, the annual rate of increase in consumption from 1982 to 2019 was about 1169 kb/d. What many have argued is that the rate of increase may gradually slow over time. If we return to the 1982 to 2019 trend line we would expect World liquids consumption to reach 112.4 Mb/d by 2030, I doubt we ever reach that level of World liquid energy consumption as define by BP. Energy will become more expensive and the World will use energy more efficiently while gradually transitioning to other types of energy for land transport.

PAOil-

” If there was a source of reliable energy BETTER than oil then the foundation for peak oil demand would exist.”

The foundation for global peak ‘demand’ is oil depletion.

You can’t can’t consume what isn’t available for sale.

Your statements are a good example of how people get mixed up about the terminology ‘demand’.

Other factors, such as lack of affordability, might also decrease Consumption.

But in the end the base issue comes down to Depletion.

And we are now on the big global oil plateau, with the only off-ramp being a down trend in production and thus a down trend in consumption (regardless of what people may or may not want).

disclaimer- I am not denying the possibility that this plateau phase may have a minor rising component as Dennis portrays. Nonetheless I consider global production to be at rough peak plateau beginning in 2018

Hickory,

I tend to agree we may be on a bumpy plateau from 2016 to 2035, if there is a new peak it might not be a lot higher than the 2018 peak and at most would be 2 to 4 Mb/d higher, in the grand scheme, it is a drop in the bucket.

a 19 years bumpy plateu isn’t that too many years, do we have a precedent for this ?

Ed,

No, there is no precedent, but many in the past have predicted this. Note that part of this prediction assumes a fairly wide up and down limit for the “plateau”. So the model below has an average output from 2015 to 2038 of 81 Mb/d, if we assume the plateau is 81 /-3 Mb/d, the scenario has this from 2014 to 2039, with the exception of pandemic years of 2020 and 2021, 23 years in all.

If we prefer a tighter output range of say 82 to 84 Mb/d, then we could call the plateau from 2028 to 2036.

On that bumpy plateau comment (with chart) the long plateau is 2015-2039 with a range of 78 to 84 Mb/d (81 plus/minus 3 Mb/d), or a shorter plateau with a tighter range of 82 to 84 Mb/d (83 plus/minus 1 Mbpd) from 2028 to 2037. The long plateau (25 years) has output range of plus or minus 3.7% of the mean and the shorter plateau (10 years) the output range is plus or minus 1.2%.

Dennis, a month or so ago you posted your predictions for world C+C until 2028. You showed world production increasing by 1.9 million barrels per day from 2022 to 2023. I estimated production decreasing by 1 million barrels per day during the same period. I stand by my prediction. Have you changed yours? If so, what are you predicting now?

Best Guess Yearly C+C Production

…………. Dennis .. Ron

2020 ….. 76.0 ….. 76.0

2021 ….. 77.0 ….. 77.0

2022 ….. 78.7 ….. 80.0

2023 ….. 80.6 ….. 79.0

2024 ….. 82.3 ….. 78.0

2025 ….. 83.5 ….. 77.0

2026 ….. 84.3 ….. 76.0

2027 ….. 84.8 ….. 75.0

2028 ….. 85.0 ….. 74.0

Ron,

That previous estimate I only had tight oil data through May 2022, recently I got new data through August 2022 that I did not have previously.

Also note the “bumpy plateau” is not my best guess, this would be the minimum output I would expect. My current best guess estimates for World C plus C starting in 2022 (in Mb/d):

78.16, 78.84, 80.34, 81.67

Ron,

For current best guess World model, peak is 2030 at 85 Mb/d.

a revision to the scenario is below based on feedback by Ron.

see link below

https://peakoilbarrel.com/us-june-oil-production-shows-little-growth/#comment-747343

I share your opinion that we are on a bumpy plateau. How would you define the end of the plateau?

Old Chemist,

I would say if three year centered average output falls to less than 90% of the average of the previous 5 years, we would know. As a concrete example let’s say the average output for 2031 to 2033 is 76 Mb/d and the average output from 2026 to 2030 was 85 Mb/d, I would then call the end of the plateau, though perhaps even 95% might be enough. Obviously a subjective determination. Also if this happens during a period of falling oil prices due to lack of demand (say in 2032 and 2033) we would be unlikely to see output recover.

My current best guess estimates for World C plus C starting in 2022 (in Mb/d):

2022 . 2023 . 2024 . 2025

78.16, 78.84, 80.34, 81.67

Dennis, that makes no sense whatsoever. Here is 2022 production for the first six months.

79,651 . 80,640 . 80,545 . 79,583 . 78,926 . 79,319

Six Months average … 79,777 Kbpd

Your average estimate for 2022 of 78,160 is 1.62 million barrels per day below the current 6-month average. To average 78.16 million bpd for the entire year, the average production for July through December would have to average 76,320 Kbpd for each of month.

Dennis, world C+C production hit 80.64 million barrels per day in February 2022. Your prediction for 2022 average output is almost 2.5 barrels per day below February production. You know that is not realistic. I think you are deliberately lowballing it just so that next year you can say: “See, my estimates are almost always very conservative.”

Ron,

I have not focused on 2022, that is based on what I expected from last year. You have been banging the drum that output will be decreasing a lot in the second half of 2022. Keep in mind these estimates are for annual average output rather than for individual monthly output.

What is your prediction for average annual output in 2022?

Note that the slow growth of the past 12 months has also led me to reduce the future growth rate estimate.

If you look back at my past estimates you will find that mostly they have been too low (in the absence of Worldwide pandemics and such).

If I revise my 2022 estimate to 79.5 Mb/d, my best guess estimate is revised to (starting in 2022):

79.50

80.25

81.00

81.89

82.84

83.65

84.29

84.66

84.89

84.86

84.52

83.81

82.66

81.14

79.50

This scenario is a rough plateau of 7 years from 2027 to 2033 at between 83.5 and 85 Mb/d, with average output of 84.4 Mb/d over that 7 year period (Jan 2027 to December 2033).

Dennis, my prediction has not changed all year. I posted it some time ago along with your prediction.

Best Guess Yearly C+C Production

…………. Dennis .. Ron

2020 ….. 76.0 ….. 76.0

2021 ….. 77.0 ….. 77.0

2022 ….. 78.7 ….. 80.0

2023 ….. 80.6 ….. 79.0

2024 ….. 82.3 ….. 78.0

2025 ….. 83.5 ….. 77.0

2026 ….. 84.3 ….. 76.0

2027 ….. 84.8 ….. 75.0

2028 ….. 85.0 ….. 74.0

My prediction is still 80 million barrels per day average for 2022. Your prediction has only recently changed. It went from 78.7 million bpd to 78.16 million bpd. That change was, apparently made, last month. Your estimate dropped by just over half a million bpd, just this past month, not last year after you had a full five months of 2022 production. That, Dennis, is what I cannot understand. You had the data right in front of you yet you still made a ridiculously low estimate for 2022.

Yes, I expected Russia to drop more than they have. And I still expect Russia to decline by at least 2 million barrels per day below their February high by December. But if they do not decline that amount by December, I will just say, “I was mistaken.” It’s not really that hard to say, Dennis, you should try it sometimes. 🤣

I am suspicious of their reported September production as reported by only one source, the Moscow Times. I have seen several articles stating their steep drop in September exports. However, if there are other sources confirming that Moscow Times estimate, then I will just accept that.

One more thing. Now that you have the first six months world production data right in front of you, yearly average so far 79,777,000 barrels per day, do you wish to update your 2022 prediction? Or do you still wish to still maintain that 2022 world production will still be about 78.16 million barrels per day?

Ron,

I agree my 2022 estimate was not very good, though I don’t remember you mentioning it earlier. This was based on my expectation that OPEC and Russia would not be able to increase output as much as they have done so far in 2022, the fact that I have revised my scenario is an admission that I was wrong.

As I have often pointed out, and will repeat, the future is unknown, the number of posible futures is infinite and the odds of a correct prediction of future World C plus C output is exactly zero. Every prediction I have ever made in the past has been wrong and I expect my future scenarios will also be wrong, any correct prediction is a pure luck and if we just extend to more digits will also be incorrect in the fine details.

My expectation is that my scenarios will be wrong in every case, so I don’t even bother to point out this very obvious fact.

That revision to 2022 was based on lower tight oil output than I expected, I was less focused on conventional oil production.

I am surprised you expect 80 Mb/d for 2022, based on your comments that seems high.

Chart with best guess shock model scenario for World C plus C in Mb/d.

Dennis wrote: I am surprised you expect 80 Mb/d for 2022, based on your comments that seems high.

My goodness Dennis, I know how to read the data and estimate accordingly. 80 million is only 223 Kbpd below the current average of 79,777 Kbpd. And we know August and September production will very likely be well above 80 million bpd, I think my estimate makes sense. I expected OPEC to begin producing flat out to take advantage of those very high prices that began in March and lasted through July.

I read the data and make predictions based on that data. So far I have been pretty close. And the data tells me that peak oil was in 2018. I think I will be damn close on that one.

Ron,

I agree that the 80 Mb/d guess may be about right for 2022. Using that (instead of 79.5 Mb/d for 2022) I the following for a revised scenario (first year is 2022):

80.0

80.6

81.3

82.2

83.1

83.9

84.5

84.9

85.0

84.8

84.3

83.5

82.3

80.8

79.1

The problem with predicting the future based on past trends is that the underlying tech keeps changing, Countries that develop later don’t necessarily follow in the footsteps of developed countries.

For example, I remember hearing in the 1980s that telephones would never be widespread in Africa because there wasn’t enough copper in the world for all the land lines. Today there are a billion phone lines in Africa. How was this possible? Africans skipped the land line stage of telephony history.

Internal combustion engines are a dying technology. Every dog has its day, like land lines, cathode ray tubes for TV screens and electronics, typewriters, tape recorders, wind-up mechanical clocks and many other ingenious technologies.

This is a bitter pill to swallow for the oil industry, but the car industry has already decided to ditch internal combustion engine. Investment in next generation combustion engines has collapsed in recent years. It’s a done deal, not some wild eyed prediction. You can gin up some foolproof arguments about why it is physically impossible or why it doesn’t fit your personal preferences etc, but automotive engineers won’t be listening.

The tech is dying, and it’s not coming back. And with it dies most demand for oil.

The primary point you make is certainly true and obvious to anyone keeping track of automotive news,

but keep in mind that it is going be a very slow fade for oil transport fuel demand.

Question is- will the slow fade in petrol demand be a close match for the fade in petrol availability that is now on the verge of happening due to both depletion and due to geopolitical disruption?

I think that in many parts of the world the match between supply and demand will be poor on the way down. We’ll see.

Hickory —

>very slow fade for oil transport fuel demand

I doubt this, since heavily used vehicles like delivery vans and taxis will switch fastest. EV sales are rising at about 50% a year even while car sales in general are collapsing. It will take time to replace the fleet in raw numbers, but gross fleet percentage is a bad proxy for fuel use, because most cars are parked >90% of the time anyway.

Be that as it may, the point I was making was not about how fast demand would fall in rich countries, but about how fast it would rise in developing countries. I was responding to PAOIL’s remark about “the desire of the people of India and Africa “. Since there are relatively few cars in poorer countries, they will switch to electric more quickly than countries with large “incumbent” combustion engine fleets as they develop and their fleets grow.

Tobacco companies took the move away from smoking in rich countries in stride because the could rapidly expand their business in developing countries. Oil companies will not have that luxury.

I don’t see fast switching in Africa and other developing countries.

The electric grid is nowhere to charge electric cars there – it’s already permanent at the brink of collapse. Connecting a 11 KW wallbox will cause a blackout in many situations.

And improving it is a state thing – and the governments are often notorious corrupt.

And no, private installation of solar cells is not an option for most people – there isn’t much money there to do big frontload investments. It’s more a “living on a prayer” infrastructure – getting a can of gas at a time if you operate a car. Operating a car is 95% commercial in Africa, that’s why I don’t say driving a car.

Oil isn’t going anywhere, and neither are ICE vehicles any time soon.

And before you refer back to it, there is nothing remotely comparable to the phone analogy unless you happen to know of a teleporter being invented about now.

This is the same wishful thinking that got Germany to become the most retarded nation in Europe in terms of energy policy. Fossil fuel usage is only going up, not down.

>Oil isn’t going anywhere

A bold claim to make on a peak oil website, but Im sure you have a detailed argument to back it up.

Peak oil doesn’t mean oil vanishes. Kinda the first misconception people outside the peak oil community need correcting on.

PAOIL

Thanks. I think we will need to keep looking at the other side. Being in non-normal times makes it difficult to know what the new normal will be like. I do think that these higher prices will continue for a while and we will have to wait to see what the new consumption levels will be. They will hit bottom at some point and then start to climb again.

OPEC output up 230 kb/d.

https://www.bloomberg.com/news/articles/2022-10-03/opec-output-rose-last-month-after-libya-recovery-symbolic-hike

Excerpt (North African nation referred to is Libya):

The Organization of Petroleum Exporting Countries boosted oil supplies by 230,000 barrels a day to 29.89 million, with about half the gain coming from the North African country, according to a Bloomberg survey.

How does that square with OPEC exports down by 166,000 barrels per day in September?

OPEC Crude Oil Exports Trend Lower In September

Crude oil exports from all OPEC oil producers were down in the first 25 days of September compared to the full month of August, according to data from Petro-Logistics cited by commodity analyst Giovanni Staunovo on Wednesday.

Between September 1 and 25, OPEC’s crude oil exports averaged 21.648 million barrels per day (bpd), which was 166,000 bpd lower than the average OPEC crude oil exports for the full month of August.

Crude oil exports out of Iran plunged by more than 700,000 bpd, per Petro-Logistics’ data. Oil exports from the Islamic Republic – exempted from the OPEC+ deal – averaged just 450,000 bpd between September 1 and 25, down by 710,000 bpd compared to the full month of August, according to the data Staunovo cited.

Ron,

I have read that some OPEC producers were buying Russian oil so they could export more. Perhaps that changed in September, production and exports are two different things, also one or perhaps both estimates may not be accurate.

Dennis

Below Is an open link to the Bloomberg article. BNNBLOMBERG is associated with Bloomberg. I just did a search using some words in the title and the BNN link also came up

OPEC Output Rose Last Month After Libya Recovery, Symbolic Hike

https://www.bnnbloomberg.ca/opec-output-rose-last-month-after-libya-recovery-symbolic-hike-1.1827264

US Oil-Output Growth to Top Government Forecast, BNEF Says

Bloomberg is looking at 2023 and 2024 and 2024 growth drops like a stone from 900 kb/d to 200 kb/d.

The latest BNEF report estimates daily US oil output to increase by more than 900,000 barrels next year. The expected production of 12.85 million barrels of crude per day exceeds the Energy Information Administration’s forecast by 250,000 barrels.

BNEF forecasts production to increase by less than 200,000 barrels in 2024, to 13.04 million barrels per day. Oil production in the Permian Basin is estimated to reach 5.8 million barrels per day by the end of 2024.

The US may see slowed production growth in 2024 if producers do not complete more wells. This could further tighten markets, especially if oil demand recovers in the next two years. The Organization of Petroleum Exporting Countries and its partners already have limited capacity to raise output, Liu noted.

https://www.bnnbloomberg.ca/us-oil-output-growth-to-top-government-forecast-bnef-says-1.1824506

Ovi,

Thanks… looks like the circa 2025 Energy Cliff scenario may be more FACT than FICTION… LOL.

By the way, I posted this chart up the thread, but wanted to post it again lower as there’s a BIG DIFFERENCE between the New Mexico and Texas Permian production profiles.

New Mexico is certainly where all the growth has taken place in the Permian. Texas is been FLAT DEAD… LOL.

steve

Steve

Thanks for the charts. While not as specific as the NM Permian and the Texas Permian, the charts for Texas and NM show the same trends. While Texas contains both the Permian and EF, the post pandemic production trend is slightly down for the EF and the EF output is about 1/4 of the Permian. This means that the Texas chart post pandemic reflects what is happening in the Texas Permian. NM is all Permian.

Texas cumulative chart

NM cumulative chart

Thanks Ovi,

Based on the cumulative for the 2021 Permian basin wells at 12 months it is clear why there is a higher rate of increase in completions for New Mexico than Texas (roughly 220 kb in NM vs 160 kb in TX).

Ovi,

Also notice that in 2015 at 24 months the New Mexico and Texas wells had similar productivity (though perhaps not when lateral length is accounted for (Delaware basin wells tend to have shorter lateral, especially back in 2015). Since 2015 there have been Marginal productivity increases in Texas Permian, but they have been far more robust in the New Mexico Permian.

Based on that, it is surprising there wasn’t a greater move to New Mexico sooner.

Ovi,

Indeed… troubling signs in the Texas Permian, especially when we look at what’s happening with Water Production. Water production in the Texas Permian peaked and now continues to decline, which suggests ALL IS NOT WELL in the Permian. No pun intended. 🙂

However, if we look at the New Mexico Permian, water production continues to increase, hence the HUGE RISE in oil production in this state.

Unfortunately, All SHALE OIL BOOMS suffer the BUST. I would say in a year, or so, the New Mexico BUST will begin.

BLUE LINE = Water Production

GREEN LINE = Oil Production

YELLOW LINE = Water Oil Ratio

steve

Steve/Dennis

So we just need to watch NM to find out when the US enters the plateau phase.

Ovi,

If we assume things don’t change in Texas Permian, that might be true. My guess is that there will be more development in Texas in the future.

Steve,

Completion rate has been falling in the Texas Permian since 2019 and it has been rising in the New Mexico Permian. The WOR decreases as the completion rate falls. Generally a lower WOR reduces costs for disposing of produced water and is considered a favorable development. The rising WOR in New Mexico may be of greater concern.

Dennis

Attached is a table that shows the Hz oil rigs operating in the various states and basins. The information appears to be enlightening and confusing at the same time for NM and Texas. NM has 102 rigs operating. I assume they are all in the Permian. The Permian total is 323, implying there are 221 in the Texas Permian. Roughly a 2 to 1 ratio.

The latest DUC report shows 435 completions in the Permian. Using the 2 to 1 ratio to apportion the completions would allocate 290 to Texas and 145 to NM. (Actually closer to 300 to 135) Allowing for the fact that the NM wells are about 30% more productive, it is difficult to explain the growth of oil production in NM and the flat profile out of Texas based on this rig and completion info. Am I missing something or is there something wrong in the data?

Ovi,

Number of wells drilled will reflect the rig count, but completion rates can be different as DUC stock can be utilized without drilling. Also keep in mind that there are a lot more horizontal oil wells in Texas than New Mexico, so it takes more new wells drilled in Texas to make up for legacy decline from older wells. Also there is a couple of month lag (2 to 6 months) at minimun between changes in rig counts and changes in completion rates.

It seems the 240 rigs or so in the Texas Permian is what is needed just to maintain output (although output has risen over past two years in the Texas Permian) whereas the 85 rigs or so in the New Mexico Permian is enough to increase output at a faster rate (in percentage terms) because there are fewer old wells that are contributing to legacy decline.

Dennis

The higher legacy decline in Texas could account for part of the difference.

Dennis

I forgot add, maybe your model could explain this.

Ovi,

My model does not distinguish between Texas and New Mexico, it takes total Permian output, completions, and average well profiles basin wide. Would take some work to try to tease some information out.

Using Novilabs data for Permian wells completed through Dec 2020, for Texas wells from Dec 2020 to Dec 2021 output fell by 1200 kb/d, for NM wells the decrease was about 410 kb/d, roughly 3 times higher. There were 7025 NM Permian wells completed as of Dec 2020 and 23,174 TX Permian wells as of Dec 2020.

So we need more new wells in Texas to make up for the legacy decline. Probably about 250 new wells per month (maybe 300 I haven’t run the model to check) would be needed just to account for legacy decline in Texas, fewer wells would be needed in New Mexico, perhaps 83 to 100 wells.

Ovi,

Based on my model roughly 225 wells per month need to be completed in the Texas Permian basin to keep output flat, while in the New Mexico Permian about 75 wells would be needed at the end of 2020. If the ratio of Texas to New Mexico Permian wells has remained similar today, the number of wells needed would be higher, about 263 for texas and about 88 for New Mexico.

Ovi,

Looking a little more closely at Novilabs data, I find that at the end of 2021 about 23% of all Permian wells were in New Mexico and the rest in Texas. The legacy decline of the 34741 horizontal wells completed from January 2008 December 2021 (8203 of these completed in New Mexico) was 245 kb/d for Dec 2021 to March 2022 in NM and 534 kb/d in Texas. So the combination of greater average new well productivity in New Mexico and the higher legacy decline in Texas may account for most of the slower rate of growth in Texas compared to New Mexico. Note that over time if more wells are completed in New Mexico compered to Texas, the rate of growth will slow down in New Mexico as legacy decline rate will increase, also fewer wells being completed in Texas will tend to reduce the legacy decline rate compared to an alternative scenario where the completion rate remains high.

Ovi,

The BNEF forecast is pretty aggressive, a recent Permian scenario is shown below, maximum completion rate is 472 wells completed per month in December 2024, Permian tight oil output is 5521 kb/d for December 2024 and it is 5046 kb/d in December 2023, output in August 2022 was 4551 kb/d. The BNEF forecast has Permian oil output at 5800 kb/d at the end of 2024, though perhaps some of this is conventional oil. If we assumed about 600 kb/d of conventional Permian output, the tight oil output from the Permian would be only 5200 kb/d which is a conservative estimate. Note that the scenario I present is the high end of my range of scenarios, I have other scenarios with output as low as 5275 kb/d at the end of 2024 with completion rate rising to only 424 completions per month by December 2024 from 400 per month in August 2022.

The annual rate of increase from July 2020 to August 2022 was about 11% for Permian tight oil and for August 2022 to December 2024 the annual rate of increase is 8.6% for my scenario. From 2012 to 2019 the average annual rate of increase in Permian output was 29% per year.

Everyone is predicting peak oil demand, and no one is talking about peak production. But is there a difference? How will we know when oil production starts to decline in earnest? I guess it will be the price. If prices are high at decline then it’s peak supply, if prices are low, then it’s peak demand.

At any rate, at the end of this article, there are 28 companies and organizations that predict the date for peak demand. As best as I can tell, they are talking total liquids here. The article is quite long and I have only posted a short part of it here.

The Biggest Argument For Peak Oil

BP’s peak oil demand prediction in 2020 turned out to be wrong.

A relatively large number of forecasts don’t see peak oil happening within the next few decades.

Advancements in ICE engines and increased fuel efficiency have had a serious impact on fuel consumption.

It’s been two years since British oil and gas supermajor BP Plc. (NYSE: BP) dramatically declared that the world was already past Peak Oil demand. In the company’s 2020 Energy Outlook, chief executive Bernard Looney pledged that BP would increase its renewables spending twentyfold to $5 billion a year by 2030 and “… not enter any new countries for oil and gas exploration”. That announcement came as a bit of a shocker given how aggressive BP has been in exploring new oil and gas frontiers.

When many analysts talk about Peak Oil, they are usually referring to that point in time when global oil demand enters a phase of terminal and irreversible decline. According to BP, this point has already come and gone, with oil demand slated to fall by at least 10% in the current decade and by as much as 50% over the next two. BP noted that historically, energy demand has risen steadily in tandem with global economic growth with few interruptions; however, the COVID-19 crisis and increased climate action might have permanently altered that playbook.

However, BP has been forced to do a mea culpa after it became clear that the COVID-19 pandemic that began more than two years ago has not resulted in a significant reduction in oil demand.

Ron,

I just ordered your book on Amazon. Can’t wait to read it. Good luck with it

Thanks, much appreciated.

Hi Ron

I ordered your book as well on Amazon. I am looking forward to reading it ASAP.

Thanks, Mike, but they screwed it up. The publisher sent the wrong manuscript to the printer. It had a publisher. It had a personal note to me, with no page numbers and other errors. They are going to try to pull it back and get the right copy printed. They will have to throw all the current printed books away and replace them. If you get a bad copy, let me know, and I will send you a good one, at no charge. That goes for anyone else on this list that gets one of the bad copies.

Ron, this is a great question, what is the difference between peak supply and peak demand. The definitions are squirrelly. And for sure the notion of peak demand is a bit ridiculous on lots of levels. Let’s take for granted that most of the 8 billion folks living on earth would enjoy having a standard of living similar to US standards. If that were the case then oil demand would be probably a billion barrels a day.

But peak demand is not measuring desire. You only count if you have money and can make a demand on the economic system for fossil fuels. Take Sri Lanka for example. Lots of people there can no longer afford cooking gas because of the economic crisis. Does that mean they no longer want to cook their food? Of course not. But they have become severed from the economic system and their desires no longer are tallied. What peak oil is doing and will continue to do is cut off less financially stable countries and send them back to the Middle Ages.

Meanwhile many advanced countries are reaching peak population and do not have huge growth in demand. Energy efficiencies are continuing in the building sector and even more so with the conversion of ICE cars to EVs, a roughly 75% reduction in energy use for each switch. So demand in these established markets is likely peaking. As oil supply begins to contract this decade, peak supply will be masked by indicators of peak demand in established economies. Meanwhile every year a Sri Lanka, Haiti, or Pakistan will fall off the energy cliff and then you won’t hear much more about them. So I strongly doubt there ever be a moment when the media shouts Peak Oil! Honestly it is too difficult a concept for most people to ever understand, sadly.

Peak supply is when the giant fields reach the last 10% of oil in place for recovery. Peak demand is when the central banks funds printing stops prior to hyperinflation.

Good definition CC. Of course there will be some kind of „peak demand“ when the economy is tanking due to energy scarcity. They might even paint it green, telling the people they are „reducing global warming“. But the primary peak who causes all this, is the geologic one. The one that IMO happened in late 2018.

U.S. shale producers to stay on sidelines if OPEC+ slashes output

“I don’t foresee any changes up or down for our position, and that includes what we have working for 2023,” said Joseph DeDominic, CEO of Anschutz Exploration Corp. There is a paucity of good rigs and workers, and the company’s 2023 capital budget is nearly finalized and will not be influenced by OPEC cuts, he said.

“Until more capital is made available for U.S. producers, they’ll be hard-pressed to increase production and OPEC will continue to have control over pricing,” added Brad James, CEO of Enterprise Offshore Drilling.

https://www.reuters.com/markets/commodities/us-shale-producers-stay-sidelines-if-opec-slashes-output-2022-10-04/?rpc=401&

While I’m sure the geology/decline rates must play a role in the slow down, there must also be a component of the higher interest rate environment at work…

The slowdown in June/July does correspond with higher rates…

Price-wise, current oil market looks eerily identical to the 2007-2008 oil shock and the market turmoil that followed. If the same situation, then the markets need to drop another ~30%, bottom out in next 4-6 months…

Curveball now is that world is fundamentally different than 15 years ago.

Population is 20% higher (8 billion vs 6.6).

The Russian war in Ukraine is the likely trigger for it all.

The role of US in the world has changed considerably, particularly our relationship with China and other countries has deteriorated.

I would almost say we are seeing the slow death of BAU and globalization.

For the models above, average peak year is between 2025-2030, average peak rate is 89 +/- 10. Will be curious to see the future estimates in 6 month to a year…buckle up – next 6 months is going to be a wild ride…

PS – got a paper copy of Rons book, looking forward to reading it!

Ken Geo,

There are 28 scenarios with 8 of them having the peak before 2021, there are 4 scenarios with peaks between 2024 and 2026, 4 scenarios with a peak in 2030 and there are 10 scenarios with the peak in 2040 or later, note that they do not give the peak amount for scenarios peaking between 2024 and 2026, only the 2030 output (not the peak) and it is not clear if this is all liquids or something else, but the all liquids peak so far (in 2018) was 100.5 Mb/d.

The scenarios that we can determine the peak are those with peak years of 2030 or later. For that group of 14 scenarios the range of the peaks is 96 to 126 Mbpd with an average of 106.7 Mb/d for all of those scenarios.

Scenarios with a peak less than 100.5 Mb/d must be using something other than all liquids, perhaps C plus C plus NGL (2018 peak was 94.2 Mb/d).

Excellent remarks.

Based on recent slow growth of US tight oil, I created a new tight oil scenario with average annual growth rate of tight oil output of 3.2%/year from June 2022 to June 2027. For the past 24 months US tight oil grew at an average annual rate of about 5.5% per year, but growth was slower for the past 12 months.

In chart below I consider US lower 48 onshore (OS) C plus C output for the August 2020 to Sept 2022 period where I use the most recent STEO estimate for August and September along with EIA data for the rest, I define L48 OS as US output minus GOM and Alaskan output. There is one data point that is an outlier in February 2021 and I adjust that data point from 7.67 Mb/d to 8.16 Mb/d which is the edge of outlier status (using interquartile range method).

The annual rate of increase is about 443 kb/d, I use this rate of increase for future output from October 2022 to Dec 2023 in my “alternative scenario” in chart below, output in Dec 2023 is 10.25 Mb/d for the alternative scenario vs 10.75 Mb/d for the STEO. Note that the STEO has US L48 excluding GOM output increasing at an annual rate of 850 kb/d from July 2022 to Dec 2023, this may not be realistic considering the rate of increase over the Aug 2020 to Sept 2022 period. Also presented is what the rate of increase would be if my recent tight oil scenario is correct and non-tight L48 OS output remains flat. The tight oil scenario has an annual rate of increase of 383 kb/d from July 2022 to Dec 2023, that scenario has December 2023 US L48 OS output at 10.17 Mb/d, note that July 2022 US L48 output was 9.56 Mb/d.

Prediction is very hard

I noticed that the actual data is geting less an less, and forecast more and more years, so you have on your graph 2 and a half years of actual production against 22 years of production prediction

it would be nice a chart with 90% data and at only 10 percent prediction/extrapolation call it what is worth

Ed,

I agree predictions are difficult and wrong about 100% of the time. Chart below has all data from Jan 2000 to Aug 2022 (that is all the data available), I show an estimate back to 1950 and the model from Jan 2010 to Dec 2039. I assume average well productivity is unchanged from the average 2020 well from 2021 to December 2039 when the last US tight oil well is completed in the scenario. The maximum completion rate after 2022 is 1160 new wells per month from Jan 2026 to Jan 2028, in August 2022 the completion rate was 885 new wells per month and in 2019 the average completion rate for the year was 1073 per month and the peak centered 12 month average completion rate was 1293 new wells per month in March 2015.

My assumptions about future completion rates and future average new well productivity are both likely to be wrong. The scenario simply shows what would occur if the assumptions of the model are correct.

Ed,

Also note that if the chart ended in 2030, it would look like I expect tight oil output to continue increasing forever, the details are likely wrong, but I expect a peak after 2030 followed by steep decline in output. Note that the EIA’s reference scenario from the most recent annual energy outlook from 2022 has US tight oil on a plateau from 2025 to 2050 at about 9 Mb/d. as in chart below.

In a joint letter, the two top US oil industry groups say “recent discussions with officials raise significant concerns that the [Biden] Administration might pursue a ban or limits on refined petroleum products” exports

https://www.api.org/~/media/Files/misc/AFPM-Granholm-Letter-on-Refined-Product-Exports

That’s pretty big news, isn’t it?

I see another 6.2 million BO was drawn from the SPR last week per API. Down to 416 million, or 240 million below the level in July, 2020.

When does this program end?

Shallow sand, my understanding is the end of October.

Wouldn’t be hard to replenish it at $120 dollars a barrel?

A 1 million barrels/day release from the SPR about to stop combined with a potential 2 million barrels/day reduction from OPEC+. I wonder what this will do to oil prices?

Higher oil prices will deeply damage the global economy I think a recession is unavoidable at this point, its just a matter of how severe it will be.

I believe we are going to find out that central banks can’t save the day. In the most brutal way.

Uk is going into a depression not recession. So is Germany.

Central banks pinning interest rates low so collateral won’t be repriced isn’t going to save the day. Uk is getting ready to find that out soon.

In the meantime if OPEC fails to go large today with it’s production cut, oil prices are going to tank.

The government here in Germany already started the 200 billion € “double whammy”.

So that’s the way – more and more expensive government programs, financed soon by the ECB. Monetary devaluation, either by deflationary or inflationary breakdown and restart.

At years end they introduce a more generous “people money” social security program. Everyone who don’t want to work in low paying jobs can stop working, get’s his rent paid + 500€ pocket money and may add a small mini job to earn some more (or go black working).

Very attractive in the time of extreme expensive gas and heating oil times…. the state pays this. When my partner still would be single, it would pay more than working at the current cost level here.

I think some central banks are going to start doing QE while raising rates like the U.K did. No one knows what the outcome of this will be.

Oil definitely has some headwinds, with the anticipation of recession and decreasing demand, but proper production cuts (assuming implemented) will put a floor on the prices i think. We probably never see oil in the $20s again, i don’t think OPEC+ will allow another repeat of 2020. All speculation on my part though.

https://www.dailymail.co.uk/news/article-11281509/Britain-sends-warships-North-Sea-protect-underwater-gas-oil-pipelines-internet-cables.html

Britain sends warships to defend North sea oil rigs

Monkey werx: https://www.monkeywerxus.com/blog/the-nord-stream-2-pipeline-sabotage

Here is an update for US car sales. The x-axis is the brent oil price converted to energy, measured in BOE. 11.05 USD are today 1 %BOE. The y-axis are car sales in thousands per month. Each point of the curve is the car sales average of the last 12 months, together with the average oil price of the month.

The blue arrow shows the current energy threshold for a significant car sales rise. The threshold is derived from an evalution of the yellow lines, which show the last significant rises of car sales in 2013 and 2021.

BERNDT

Please explain “11.05 USD are today 1 %BOE.” I am assuming BOE is barrels of oil equivalent. Please explain the hoops of getting 11.05 USD equals 1% BOE.

Hi Ovi,

for the conversion of USD to energy i use the energy intensity diagram. It is world GDP divided by world primary consumption for each year. The value for 2022 is estimated by interpolation of the 2021 and 2020 values, The current energy intensity value is about 0.65 USD/kWh. An BOE is equal to 1700 kWh, so 100 % BOE correspond to 1700*0.65 = 1105 USD.

BERNDT,

What is the data used for World GDP? Is it the World Bank in the current USD? According to the World Bank, Global GDP increased to $96.1 trillion in 2021. However, the increase was mostly due to the $44 trillion of debt added in 2020 & 2021.

Wouldn’t the Energy Productivity be even less if we were to adjust for Inflated GDP due to the large debt increase?

steve

Hi Steve,

i use the world bank data, 96.1 trillion USD in 2021.

https://data.worldbank.org/indicator/nY.gDP.MKTP.CD