A guest post by Ovi

Below are a number of Crude oil plus Condensate (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to June 2022. This is the latest and most detailed world oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world. The US report has an expanded view beyond production by adding rig and frac charts.

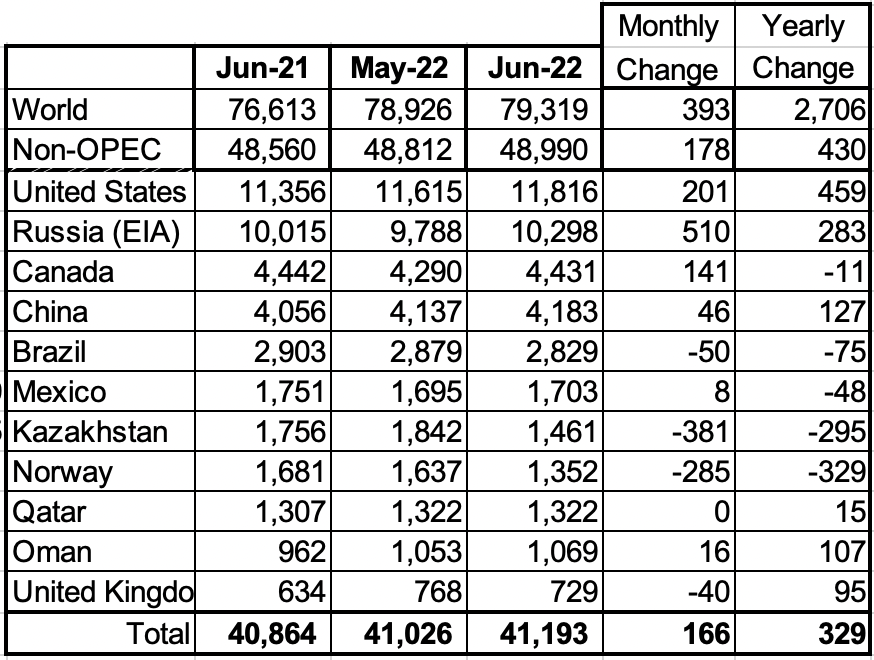

June Non-OPEC production increased by 178 kb/d to 48,990 kb/d. The largest increases came from Russia, 510 kb/d and the U.S., 201 kb/d. The largest offsetting decreases came from Kazakhstan, 381 kb/d and Norway, 285 kb/d.

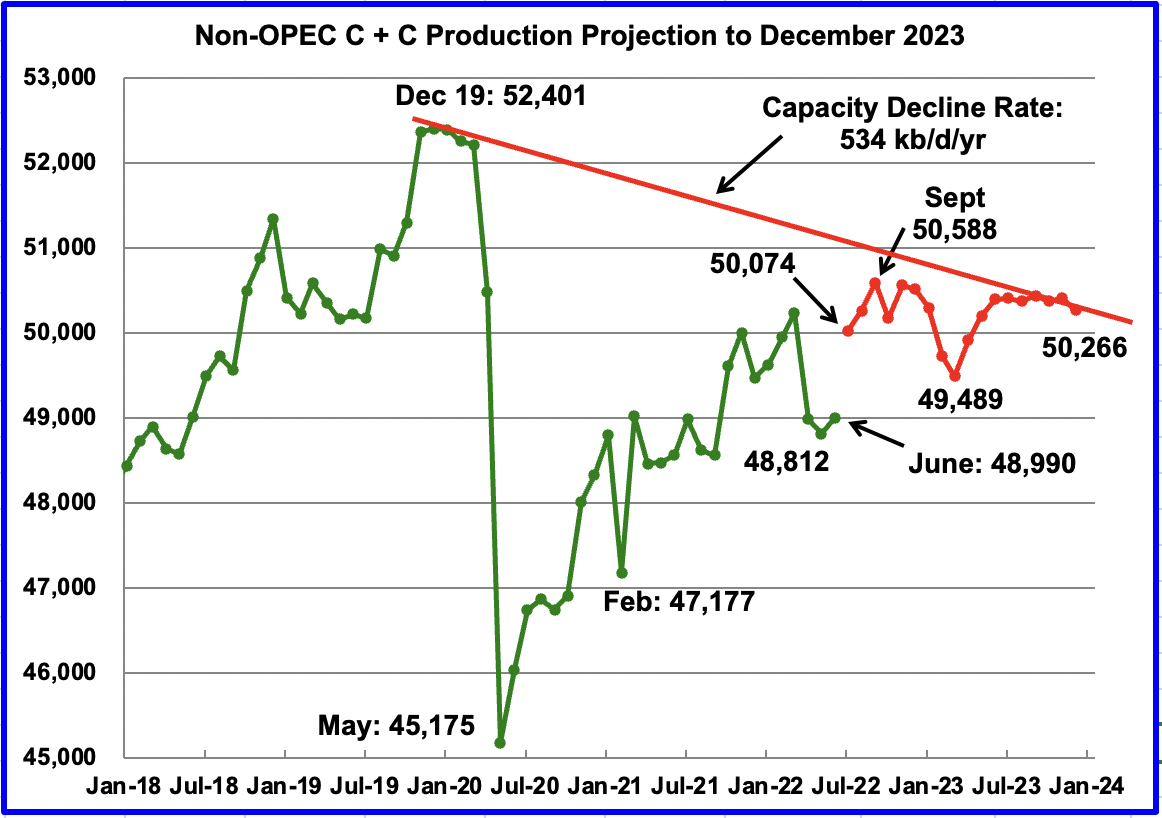

Using data from the October 2022 STEO, a projection for Non-OPEC oil output was made for the time period July 2022 to December 2023. (Red graph). Output is expected to be 50,266 kb/d in December 2023. This forecast is 608 kb/d lower than predicted in the September report due to significant downward changes in the October STEO.

The large increase in July is due to a 1,600 kb/d increase in all liquids over June forecast in the October STEO. The C + C projection reduces the 1,600 kb/d increase to 1,084 kb/d.

Note that the September 2022 high of 50,588 kb/d is the high for all of 2022 and 2023.

The red capacity decline line represents an average decline rate for Non-OPEC countries over the four years since December 2019 and is combination of the natural decline rate plus possible reduction in exploration and production capacity/investment.

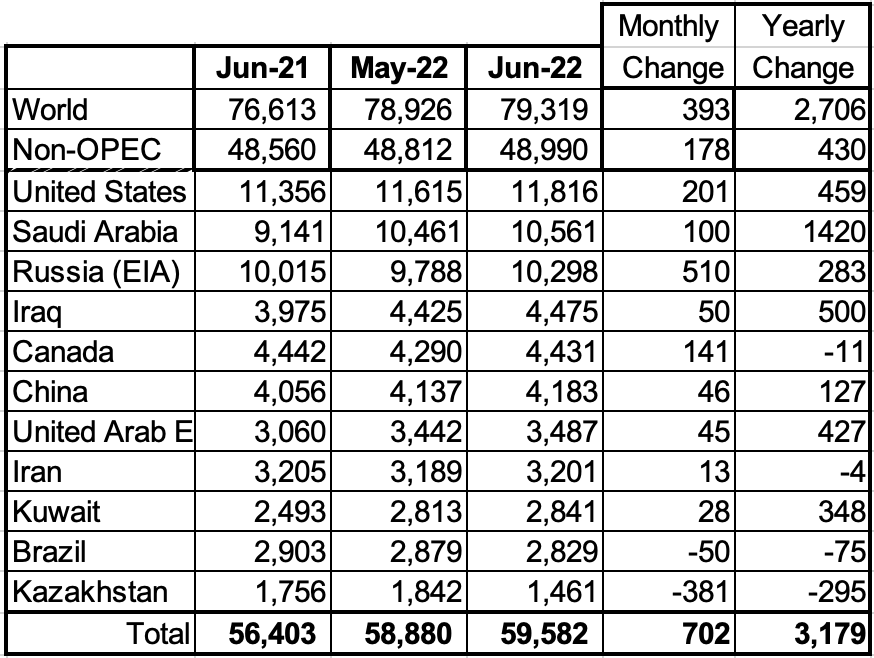

Non-OPEC Oil Production Ranked by Country

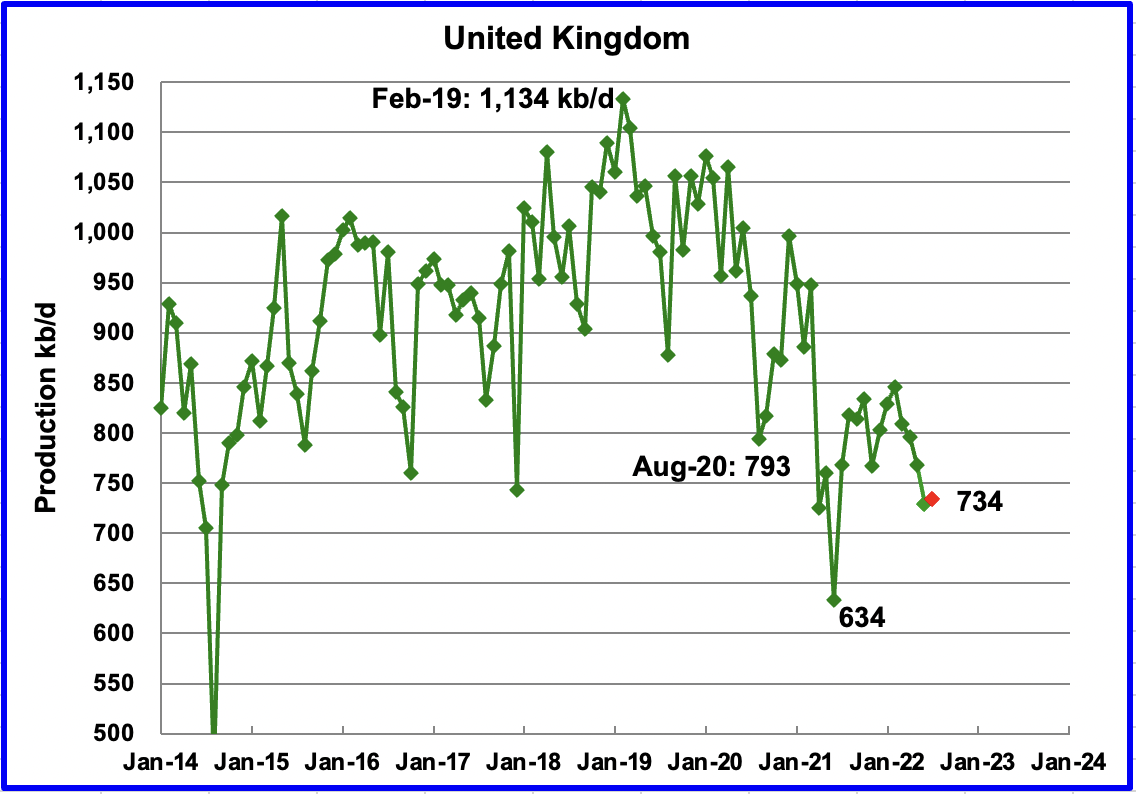

Listed above are the world’s 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The UK has been below 1,000 kb/d since January 2021. As can be seen the U.S. and Russian increases were offset by the Kazakhstan and Norway decreases.

In June 2022, these 11 countries produced 84.1% of the Non-OPEC oil. On a YoY basis, Non-OPEC production increased by 430 kb/d. World YoY June output increased by 2,706 kb/d.

Non-OPEC Production Charts

The EIA reported Brazil’s June production decreased by 50 kb/d to 2,829 kb/d.

Unfortunately, Brazil’s National Petroleum Association (BNPA) has stopped reporting Brazil’s production so that no future months are currently available.

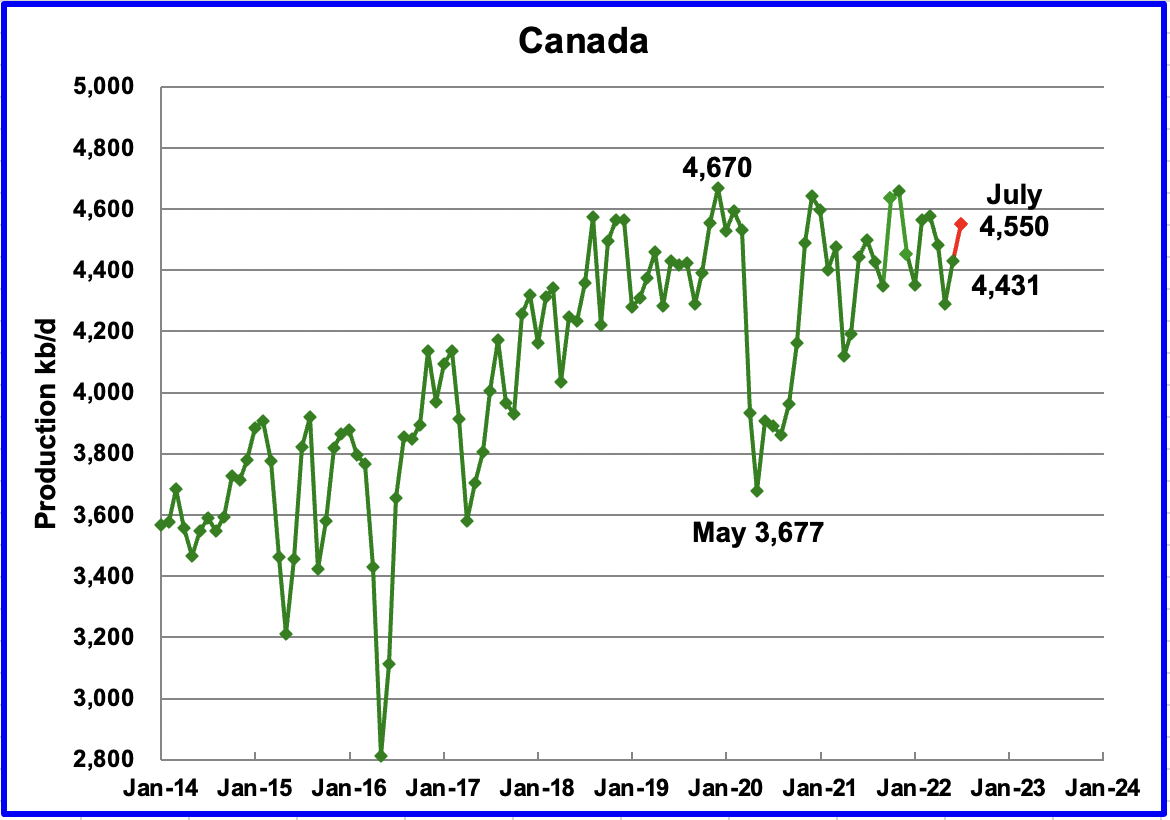

According to the EIA, Canada’s June output increased by 141 kb/d to 4,431 kb/d. Preliminary data from the Canadian Energy Regulator (CER) indicates that July production was 4,802 kb/d. However the EIA subtracts approximately 250 kb/d from the CER report. Accounting for the EIA’s reduction, Canada’s projected July output is then estimated to be close to 4,550 kb/d, an increase of 119 kb/d over June, red marker.

Rail shipments to the US in July dropped by 18 kb/d to 152 kb/d.

The current spread between Western Canada Select (WCS) and WTI has increased to $25/b from a more typical $12/b to $17/b. There is speculation the increase is related to the reduced demand from U.S. refiners due to the release of medium crudes from the SPR.

The EIA reported China’s output increased by 45 kb/d to 4,183 kb/d in June.

China reported that its output decreased in July to 4,034 kb/d and again in August to 3,989 kb/d, a drop of close to 200 kb/d from June. (Red markers)

China may be close to its current maximum production level of approximately 4,000 kb/d. To offset declines, the national oil company is investing in conventional wells and is also drilling for shale oil.

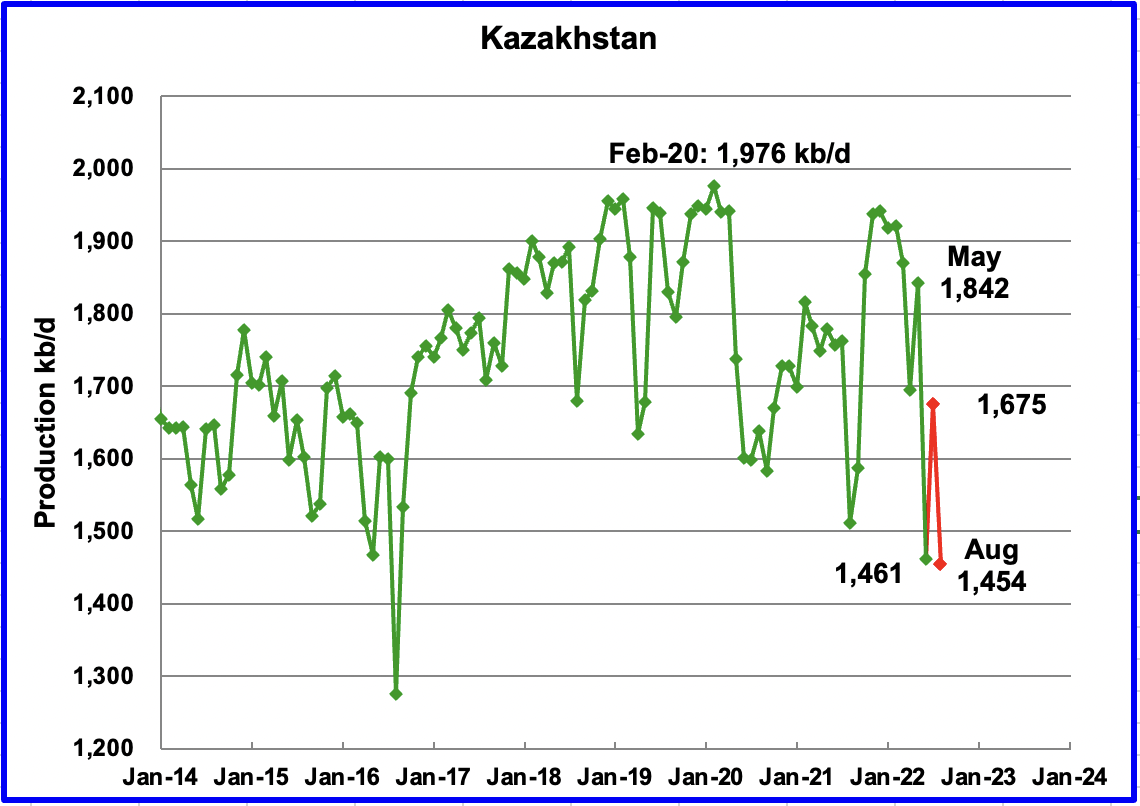

Kazakhstan’s output dropped by 381 kb/d in June to 1,461 kb/d.

According to this source, August production fell after rebounding in July to 1,675 kb/d. The article just reports crude oil production. Consequently the July and August production numbers shown in the chart are an estimate based on the percentage drop and a typical C + C to C ratio using earlier EIA data.

“The fall in output was due to a sharp decline in production in the giant Kashagan oil field after a gas leak early in August, as well as planned output curbs in the Tengiz field due to regular maintenance.”

Mexico’s production as reported by the EIA for June increased by 8 kb/d to 1,703 kb/d.

Data from Pemex showed that July’s output was 1,797 kb/d. However, the EIA is expected to reduce Pemex’s July oil production by close to 85 kb/d, to 1,713 kb/d, an increase of 10 kb/d over June, due to a different definition for crude plus condensate.

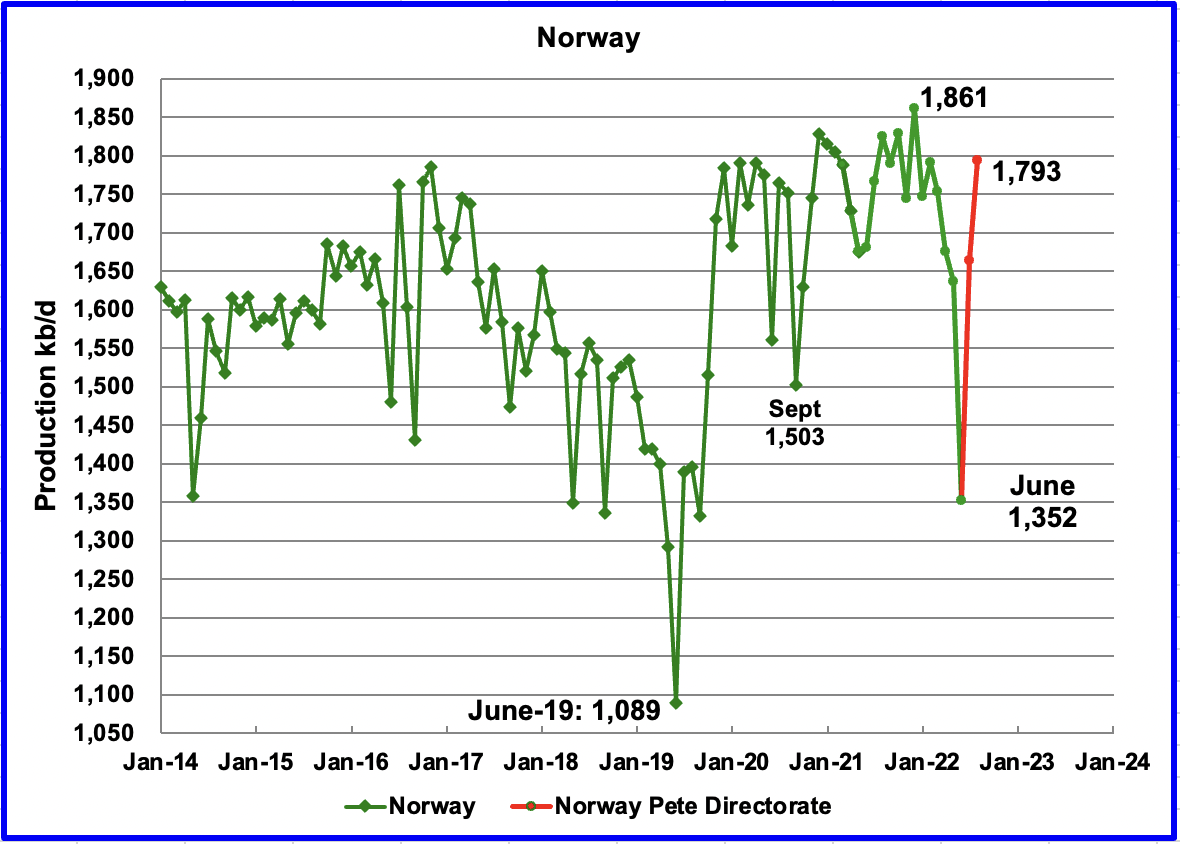

The EIA reported that Norway’s June production decreased by 285 kb/d to 1,352 kb/d.

The Norway Petroleum Directorate (NPD) reported that production increased from June to August to 1,793 kb/d (Red markers). According to the NPD: “Oil production in August was 3.1 percent lower than the NPD’s forecast and 4.7 percent lower than the forecast so far this year.”

Growth is expected in late 2022 and into 2023 when the second phase of the Johan Sverdrup field development starts production and other small fields come on line. According to OPEC “The Johan Sverdrup is projected to be the main source of increased output for the year. Neptune has also completed drilling at Fenja with the first oil on track for 1Q23. Fenja is expected to produce about 24 tb/d at peak production.”

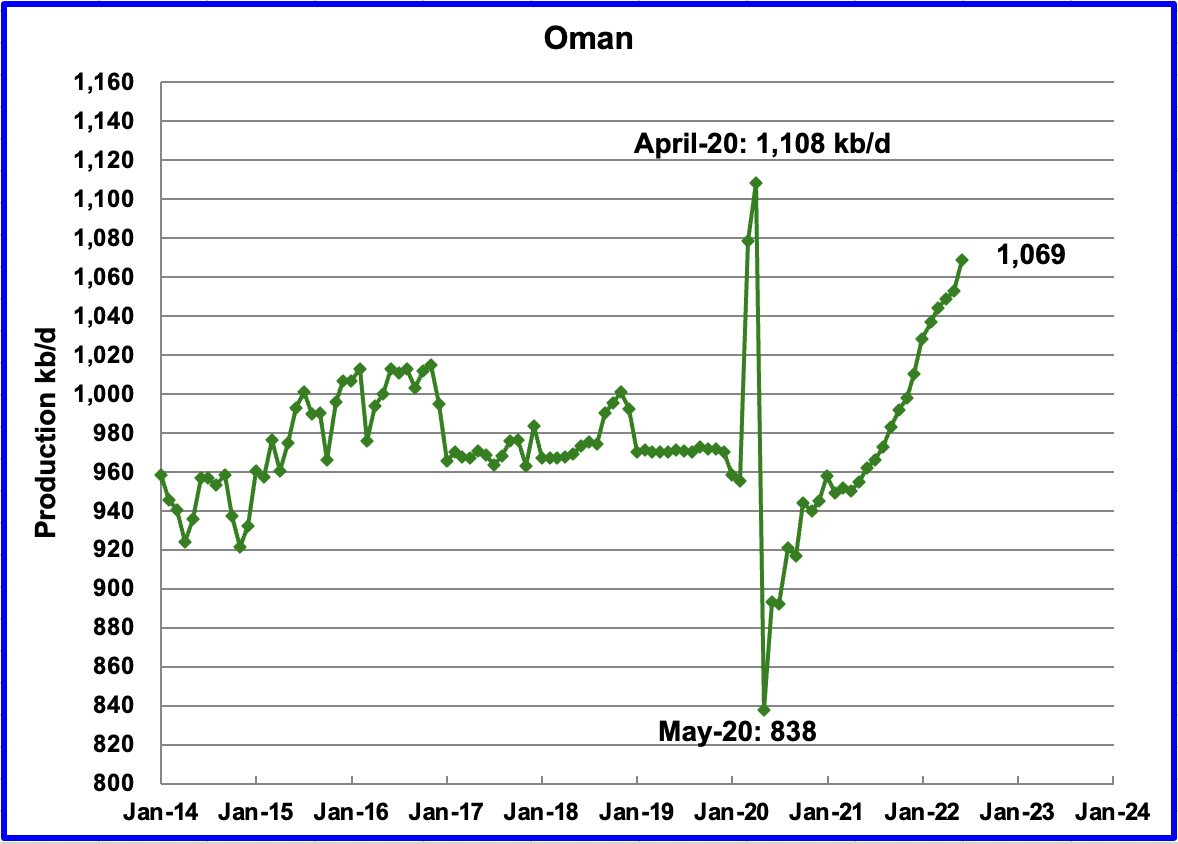

Oman’s production has risen very consistently since the low of May 2020. Oman’s June production increased by 16 kb/d to 1,069 kb/d. It is 39 kb/d short of its pre-pandemic high.

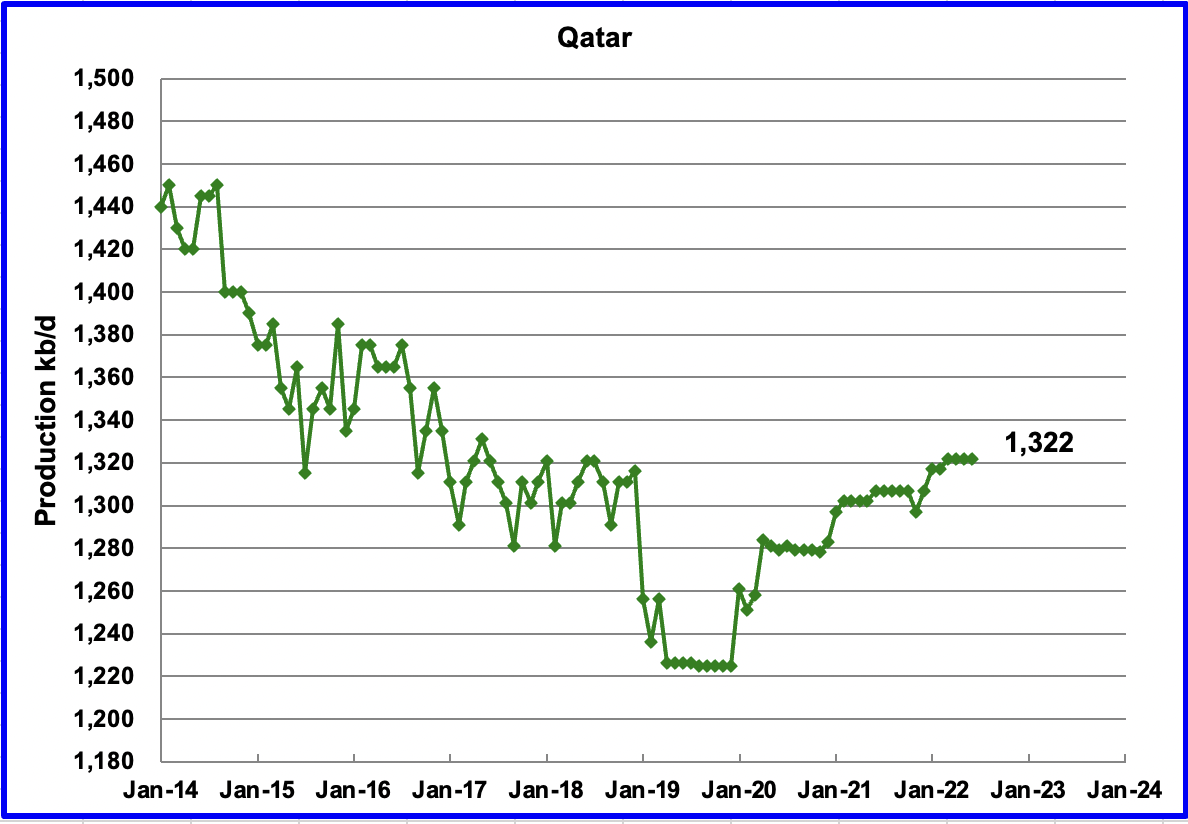

June’s output was unchanged at 1,322 kb/d.

The EIA reported that Russian output increased by 510 kb/d in June to 10,298 kb/d.

According to this source, September production increased by 345 kb/d to 10,775 kb/d. While the source states the production level quoted is C + C, it appears to be all liquids since the October STEO is reporting 10,885 kb/d for all liquids. Assuming the 10,775 is all liquids, and using 0.96 for the C + C to all liquids ratio, September’s output would be closer to 10,344 kb/d, an increase of 19 kb/d over August.

However the October OPEC report states: “A preliminary estimate for Russia’s crude and condensate production in September 2022 shows a further decrease of 0.1 mb/d m-o-m to average 9.7 mb/d, while around a 10 tb/d decline is expected for NGLs.

There is a gap of 600 kb/d between OPEC’s preliminary estimate and the production shown in the chart.

The EIA reported UK’s production decreased by 40 kb/d in June to 729 kb/d. According to this source, July’s production increased by 5 kb/d to 734 kb/d (Red Marker). The chart indicates UK oil production entered a steep decline phase starting in February 2019. On a YoY basis, July production is down by 34 kb/d.

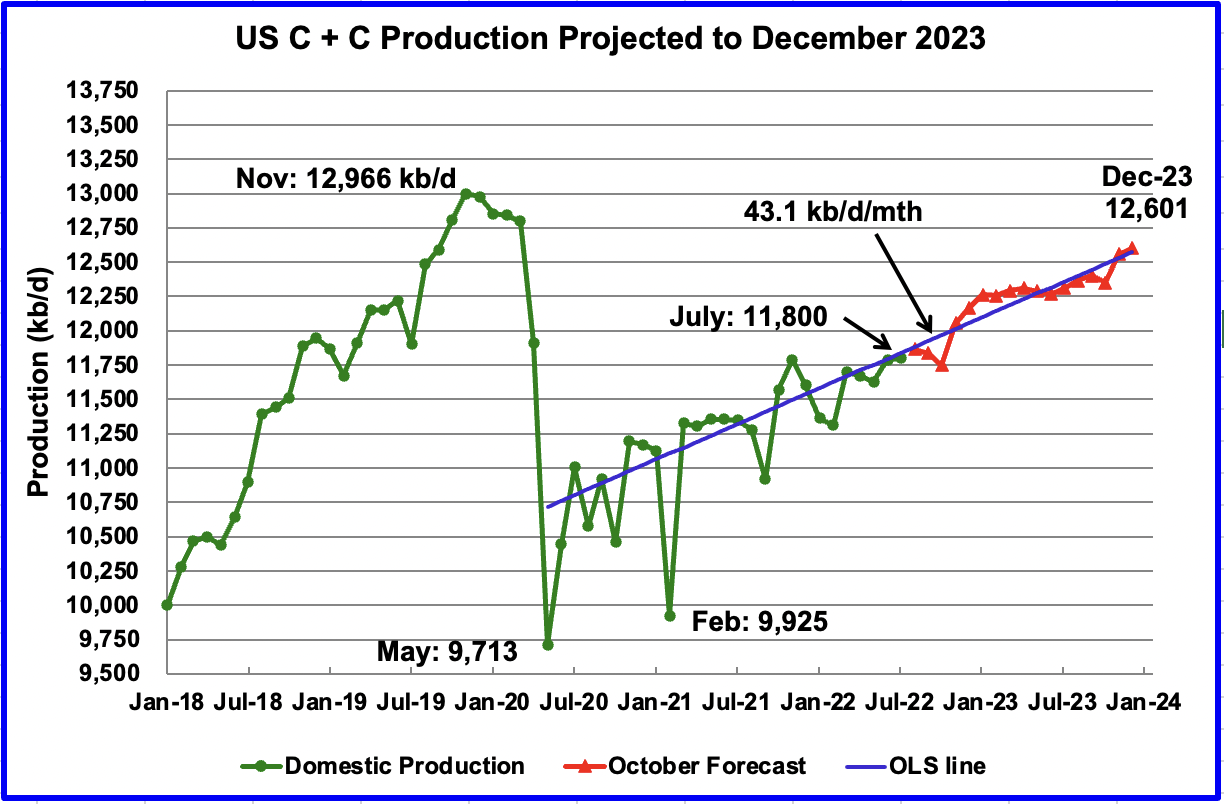

US July production increased by 12 kb/d to 11,800 kb/d from 11,788 in June. Note that the current EIA World report did not update June production to the most recently released rate of 11,788 kb/d from the original estimate of 11,816 kb/d.

The US chart also contains the October STEO projection for US output out to December 2023. In December 2023, production is expected to be 12,601 kb/d. This is a reduction of 385 kb/d from the September projection of 12,986 kb/d. Note how production from December 2022 to June 2023 is essentially flat at 12,250 kb/d.

The blue OLS line from June 2020 to December 2023 indicates a monthly production increase of close to 43.1 kb/d.

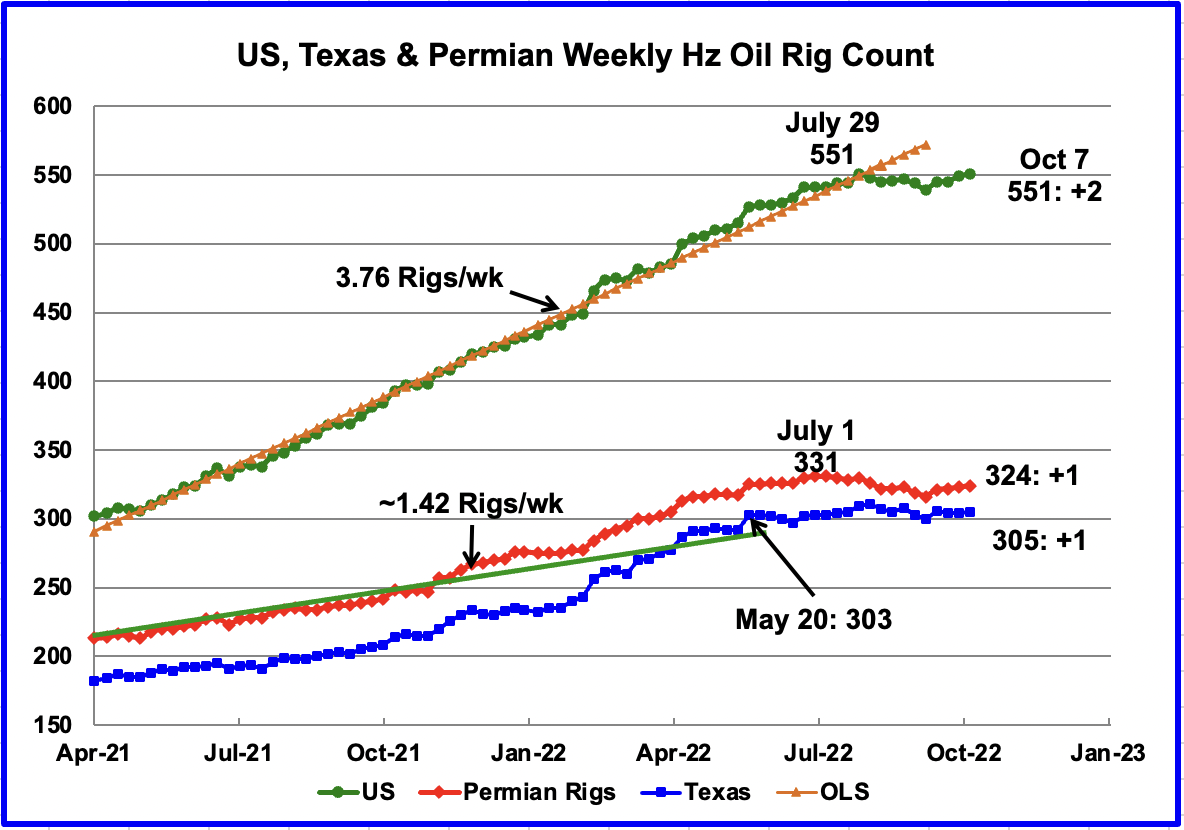

After the week ending July 29, the rate of rig additions slowed and has essentially stopped. Since then the number of operational rigs has been more or less steady at the 550 level. In the week ending October 7, the number of rigs increased by 2 to 551, the same numbers as in the week of July 29.

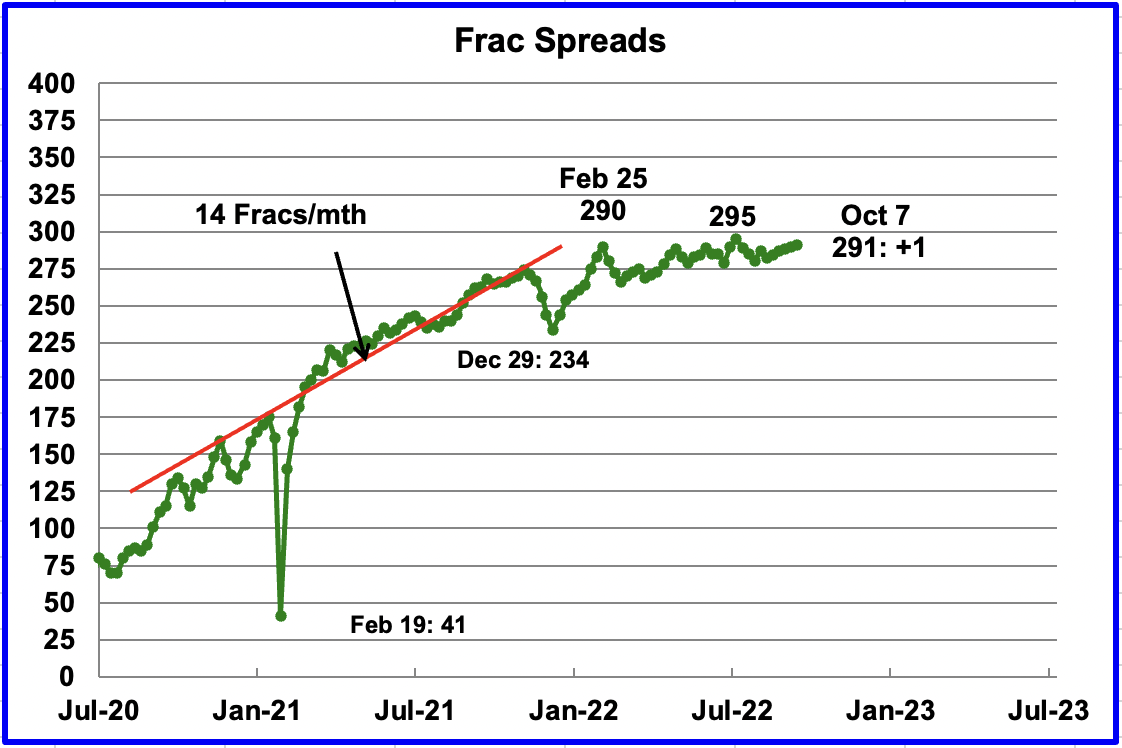

For frac spreads, the general trend since late February, when the count was 290, can best be described as essentially flat at around the 290 level. For the week ending October 7, the frac spread count increased by 1 to 291.

Note that these 291 frac spreads include both gas and oil spreads.

According to this source:

“The U.S. hydraulic fracturing market is “literally sold out,” Andy Hendricks, chief executive officer of oilfield firm Patterson-UTI said on Wednesday, as demand for equipment and services has outpaced available capacity.

Some fracking firms, including Liberty Energy, are reactivating pressure pumping equipment and deploying new fleets as prices have improved and demand has spiked. Patterson is running 12 frac spreads and on Wednesday said adding an additional fleet would be a challenge.”

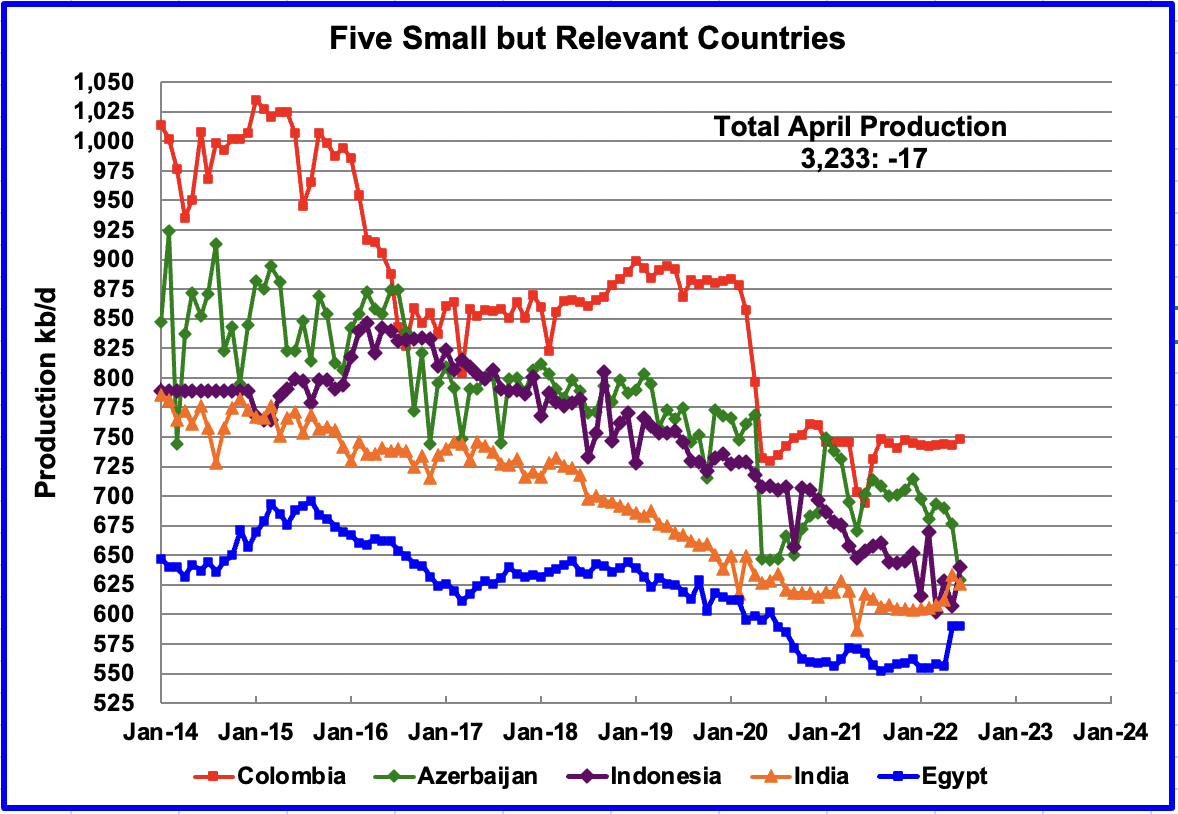

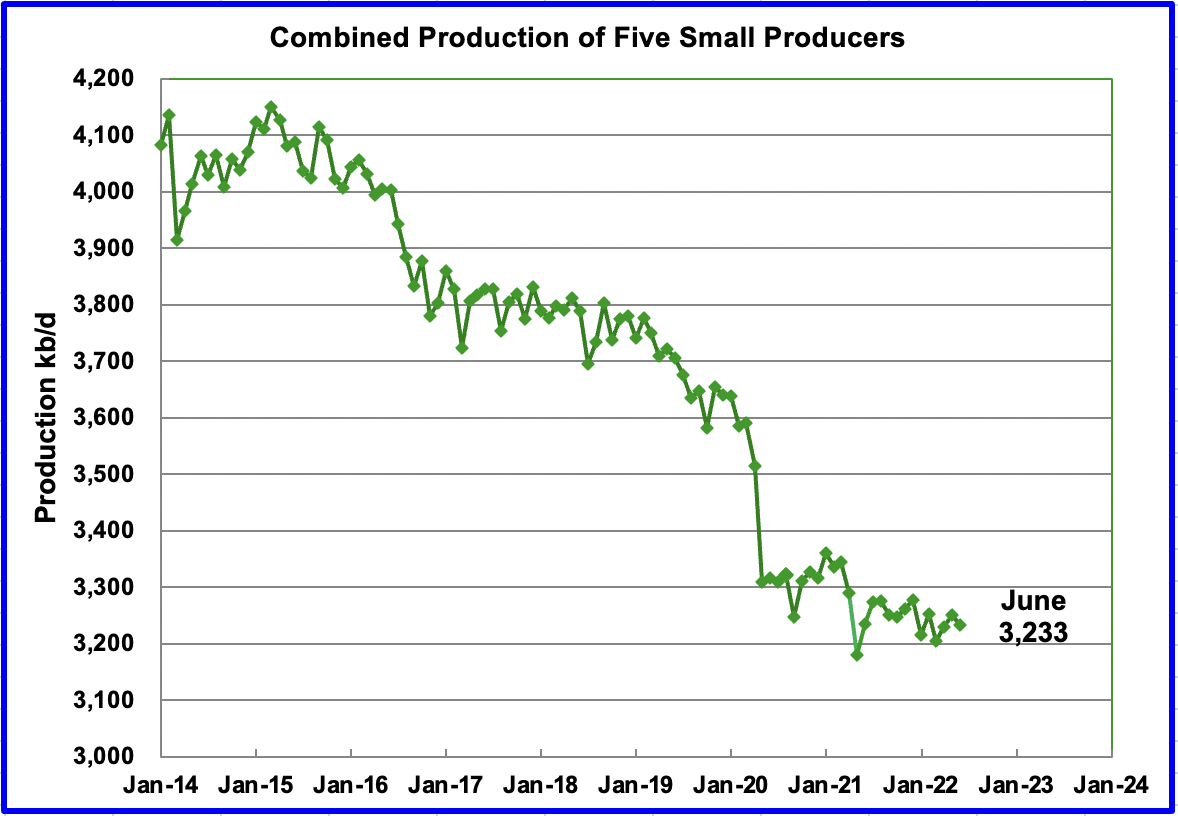

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined June production was 3,233 kb/d, down 17 kb/d from May’s 3,250 kb/d.

The overall output from the above five countries has been in a slow steady decline since 2015 and the decline continues.

World Oil Production Ranked by Country

Above are listed the World’s 11th largest oil producers.

In June 2022, these 11 countries produced 75.1% of the world’s oil. On a YoY basis, production from these 11 countries increased by 2,706 kb/d.

The largest increases came from Russia, 510 kb/d and the U.S., 201 kb/d. The biggest offsetting decreases came from from Kazakhstan, 381 kb/d and Norway, 285 kb/d. Note that Norway fell out of the Top 11 table due to its big production decline in June.

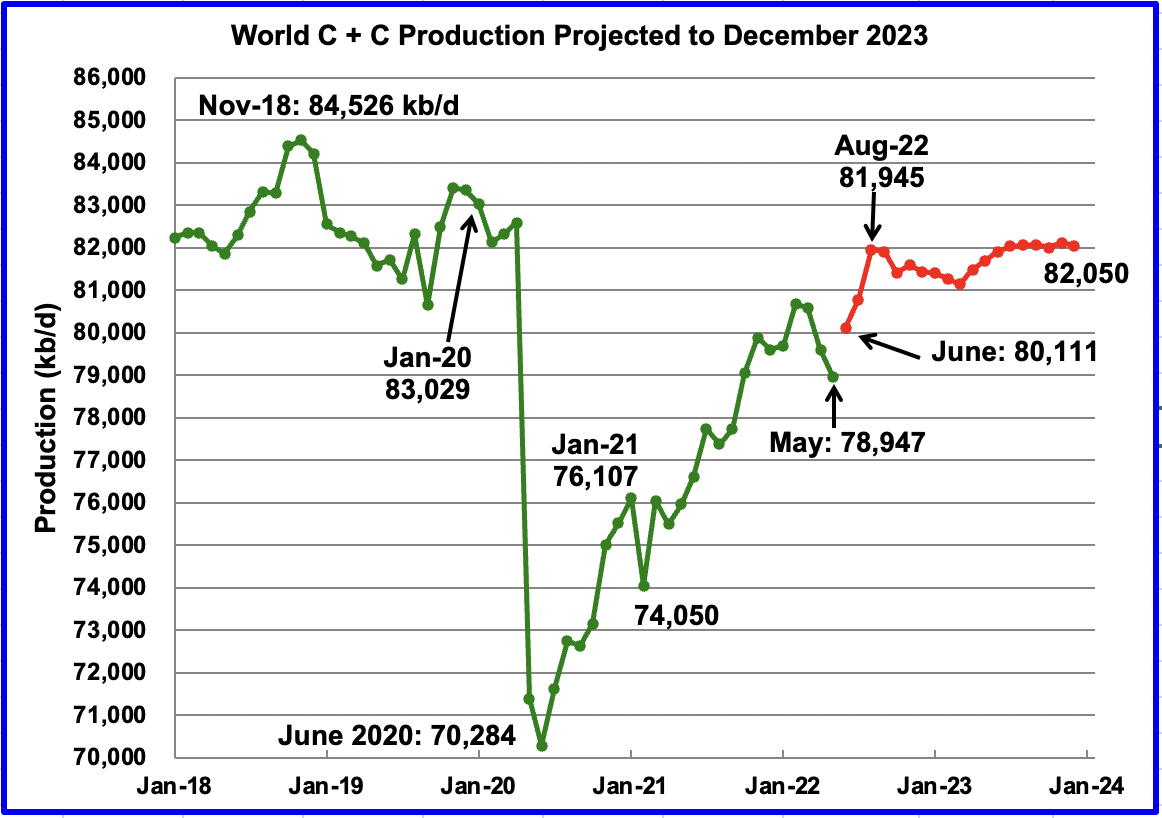

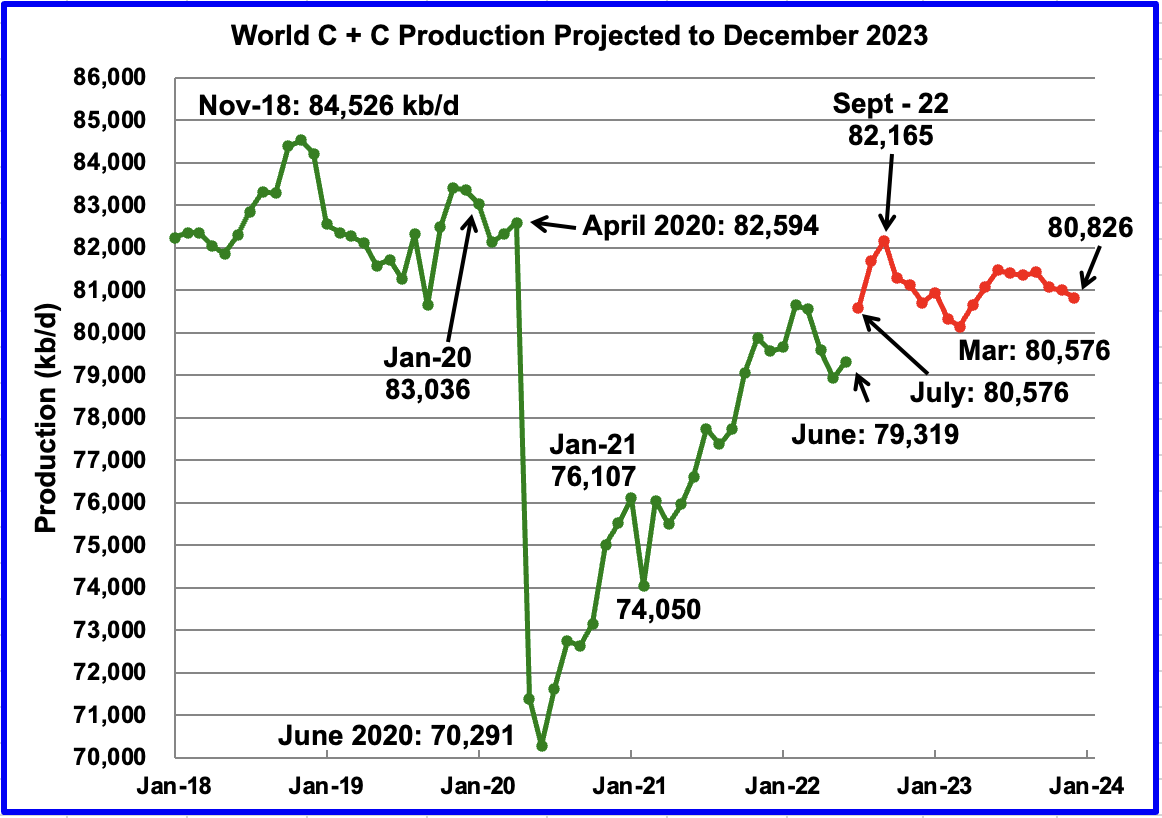

World Oil Production Projection

September Chart

October chart

World oil production in June increased by 393 kb/d to 79,319 kb/d according to the EIA (Green graph).

This chart also projects World C + C production out to December 2023. It uses the October 2022 STEO report along with the International Energy Statistics to make the projection. (Red markers).

It projects that World crude production in December 2023 will be 80,826 kb/d, a decrease of 1,224 kb/d from the projection in the September report. For a comparison of the post August projection with the previous September projection, the September chart has been added before the October chart.

The large July increase of 1,257 kb/d is due to a 1,600 kb/d increase in all liquids over June. The December 2023 output is 3,700 kb/d lower than the November 2018 peak.

The rise of close to 2,846 kb/d from June to September seems aggressive. However, it is associated with projected US and OPEC + production increases. After September 2022, World production decreases and September 2022 could be the new post-pandemic high.

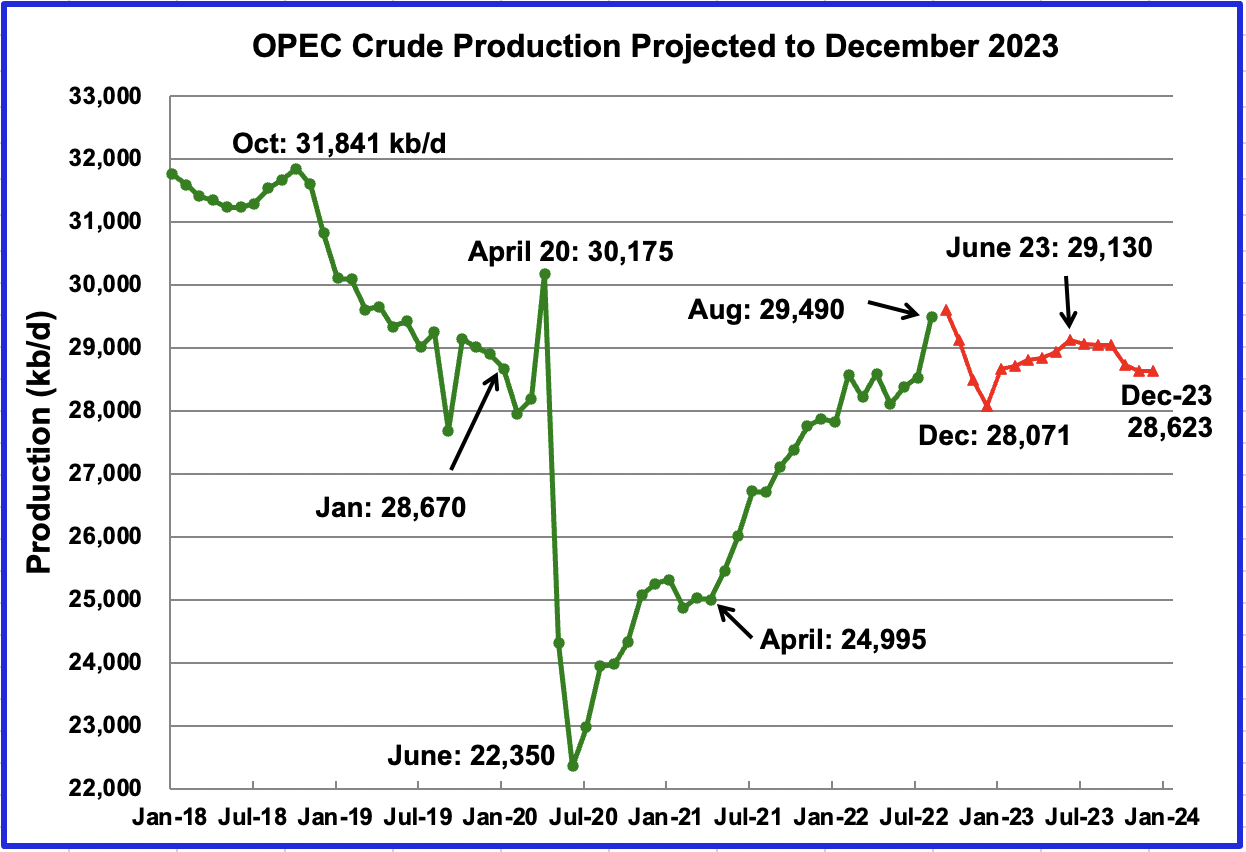

STEO OPEC Production Projection

As noted above, part of the decrease in World oil production after September 2022 is due to the projected drop in OPEC production by the STEO, along with known cutbacks and sanctions. The August and September production levels are close to the current OPEC published figures.

Thanks Ovi. Once again POB is top of the favs.

Thought I’d post this here on the politics of peak oil

Failure to respond to the SaudiArabia’s slights would reinforce the perception that Washington is a mere oil dependent, susceptible to demands.

https://responsiblestatecraft.org/2022/10/11/five-ways-biden-can-re-evaluate-the-saudi-relationship-now/

It will be interesting to see international relationships change as peak oil develops.

Survivalist

All of those ideas are bad. It would just open a venue for the Russians and Chinese to move in.

Biden should have put forth a two prong approach as part of the transition to a greener world. Green initiatives and more US production.

– Promote green initiatives and increase U.S. production to maintain independence.

– Covid killed U.S. and World oil production. The government will help and encourage U.S. producers to increase output.

– The government will strive to get an oil price that is fair for U.S. producers and consumers by releasing some oil from the SPR.

The EIA has an administrator that doesn’t even know how much oil the US produces and uses. They only see green there and have not thought about an orderly transition.

She should have been out front with presentations showing how the price of oil crashed during the pandemic and why gasoline was so cheap and what the US was going to do about it. Being out there showing you are doing something is essential in politics.

Not a peep and I am afraid it is going to hurt them in November. It is unfortunate that some of those top people did not see the great charts we put up here at POB.

Ovi.

It seems we never hear government officials in the United States discuss achieving a stable oil price. Apparently they see no issue with the roller coaster.

I will note also I don’t think they have any idea what the goal should be for oil prices. I think Obama was happy in early 2016 when they were $25-30 and I recall Trump indicating he thought US producers could make strong returns at $40.

I have always thought a US policy on oil should recognize just how much oil is needed to transition away from it. Think of all the mining, manufacturing and transportation demand there will be to convert the fleet and to build out wind and solar.

For as much oil as the US produces, the government leaders are totally clueless about it.

Not sure who is worse, government officials or the majority of the US media, when it comes to oil.

Shallow sand,

There are some in the industry and some oil analysts that have claimed nonsense such as tight oil is profitable at $40/bo, people hear what they want to hear and pick those analyses that they agree with or hope to be true.

As to oil price stability, it is wishful thinking to believe that can be achieved. Price controls simply lead to shortages and the government would likely do a far worse job than the market at achieving efficient allocation of resources in my opinion.

Not that this does not suggest that markets are perfect, far from it, government intervention is needed to reduce monopolistic and oligarchistic power as well as to address both positive (infrastructure) and negative (pollution) externalities, and also to address wealth disparities through appropriate tax policies.

Nonsense of tight oil at $40/bbl? You are talking of current expensive horizontals? Not those of us doing this work in vertical shale wells with hydraulic fracturing during the last century? Never produced a single one of them with oil prices greater than $20/bbl or $2/mcf.

What were prices in 2022$?

That is the number that matters. Back in 96 when oil price was around 20 real price was around 40. This price was being claimed as breakeven back in 2018, but it never was credible.

What years were you drilling wells?

“Not sure who is worse, government officials or the majority of the US media, when it comes to oil [policy?]

To be complete lets add the ‘oil industry’ to the list. The big decision makers in the industry have been basically in a ‘free for all’ mode for the past 100 years.

Those few calling for some form of self control or regulation in order to smooth out production, prices, and longevity of national production have completely swamped by the majority of the players in the industry. Its certainly not the only industry to behave in a often counterproductive manner enabling a boom and bust undercurrent, but it is perhaps the greatest example.

SS

I did not intent to convey the idea that the government should be trying to control the price of oil in general. I was just thinking in response to how the war just added more pressure on oil prices.

A huge difference between the decision making in – for example SA and the US is that in the US there are many individual producers, all with different expertise and capital structures but all with the goal to optimize individual profits. In a way decisions are tactical, specific to individual companies. In countries like SA decisions are made on a national level, and the individual projects are all funded with the same capital stack. Profit is one of the motives but not the only one. Longer term political and strategic goals enter the picture, leading to a decision-making process which at times may lead to outcomes which are quite different from the straight profit maximization goal in places where resource extraction is not nationalized.

Rgds

WP

Cheers Ovi,

“It is unfortunate that some of those top people did not see the great charts we put up here at POB.” ~ Ovi

This website needs a Twitter feed 😉 I nominate OFM as its custodian; who’s usually good for a few yards of interesting text.

I found this recent podcast that you might find interesting. It seems to be more of an economic analysis and dismisses allegations of KSA politicizing oil prices.

The most recent episode is called “why is OPEC cutting oil production?”

https://www.aljazeera.com/podcasts/essential-middle-east/

It’s perhaps worth noting that KSA took the side of USA/Ukraine et al during the recent UN General Assembly vote. Allegations that KSA is taking the Russian side seem thin on the ground.

Survivalist

Also these politicians have short memories. They seem to forget that OPEC increased their 400 kb/d monthly increases to 650 kb/d for July and August.

My guess is the OPEC cut was supposed to occur AFTER the mid terms, not before it.

While KSA is the one being accused of playing politics with the price of oil, it would seem that perhaps it’s instead the Democrat leadership thats doing it.

OPEC couldn’t care less about the US mid-term elections. Everything they do is based on the interest of OPEC nations only.

While KSA is the one being accused of playing politics with the price of oil, it would seem that perhaps it’s instead the Democrat leadership thats doing it.

Instead? It’s not one or the other. It could be both or neither. However, it is only natural that Biden wants oil prices to fall. Why on earth would anyone see any kind of malicious intention in that?

A shift from the have not’s to the haves. Energy exporters know fiat currencies are walking dead, so what we see is a reversal of power from surplus energy, fiat currency based economies to the real world. There’s ‘some’ independency between those tectonic plates, as they both know. We’ll see how it turns out. Getting out of paper is one thing to consider….

Tectonic plates do what they do, crushing everything in its way.

In sure Ron is right, OPEC cares little about the mid terms, and it seems KSA may now suffer some consequences for having that kind of attitude.

The Democrats are not happy about higher gas prices, or something; not good for winning the mid terms. KSA has been accused, with little evidence, of being pro Russian. Pro Russian is an interesting pejorative these days. Very Steele Dossier.

It would appear that perhaps the only malicious intent is what certain Democrat politicians have hopes for in terms of consequences for KSA, secondary to OPEC perusing their own interests and cutting production.

Biden threatens ‘consequences’ for Saudi Arabia after OPEC cut, but his options are limited

https://www.cnbc.com/amp/2022/10/12/biden-threatens-consequences-for-saudi-arabia-after-opec-cut.html

The Democrats want to punish KSA for failing in what they perceive to be a key performance indicator; to wit, helping more Democrats get elected in the midterms. I know OPEC doesn’t care about the mid terms, Ron. If anyone ask

Biden he’ll tell you that’s the problem, hence the “consequences” for KSA. It’s interesting when US domestic politics influences foreign policy to such a degree; alienating KSA in order to win domestic power; compromising national power abroad in order to win political power at home. There seems an inherent tension in it.

Im not justifying it.

Im explaining it.

Let’s see what develops.

So true. All of the current administration’s moves are only due to their desire to impact the results of the mid term elections. Draining the SPR , bullying of KSA and on and on really show that the current administration is the one using oil as a political weapon desperately trying to win votes. Two more years of their anti business policies (ESG) and unbridled spending could surely bring us back to 1929. It’s really worse than the Jimmy Carter years. At least he tried to implement policies that promoted and encourage conservation which neither political party wants to embrace.

The thoughts in this sub-thread are similar to my own.

The Saudis, the Democrats, and the Republicans all see no political or economic advantage (at least in the short term) in a fact-based discussion of oil.

It’s all name-calling and posturing: by claiming politicization, all sides can avoid the question of depletion, and transfer the blame for high prices to someone else.

OVI, when will you put Great Britain in the Small but Important group? There getting there, rather quickly I might add. I don’t know when Norway, Kazakhistan and Mexico will drop out of the top 11, but I imagine it will be in the next five years.

Seattlepeak

I presume you have heard the phrase, “Great minds think alike, fools seldom differ”. I debated that question while reviewing the post and decided I was running out of time and do it the next post.

I actually generated the second graph to see the change. You can now see how the UK decline dominates.

Your awesome OVI. Thanks.

Thought I would post this concerning what OPEC says their oil reserves are and see if anyone agrees with them.

OPEC states their reserves at 1,241.82 billion barrels or 80.4% of the world total. They give non-OPEC reserves at 303.25 billion barrels or 19.6% of the world total. Over the past decade, OPEC has produced just under 40% of the world’s C+C production.

Now does it make logical sense that those possessing 80% of the world’s underground oil produces, over the last several decades, only 40% of the world’s oil while those possessing only 20% of the world’s underground reserves, produce 60% of world C+C production?

They say they have over four times the reserves of all non-OPEC nations combined yet produce only two-fifths of the world’s oil production. I say that is bullshit. What do you think?

OPEC Share of World Crude Reserves, 2021

Ron

They know they are lying and they know that we know they are lying and so they will keep on lying.

We will never find out until demand rebounds to a point that will stress OPEC’s capabilities.

Ovi,

It is possible that much of the OPEC oil reserves are not developed because they believe their capacity is adequate to supply the World oil market. There is not much point producing 100 Mb/d for World C plus C if demand is only 80 Mb/d.

But of course that has to be the case. And of course all non-OPEC nations would have the exact same motive. Why would they need all that money anyway. They all know the exact amount of oil the world needs and they all, that is every damn one of them, collude to not produce the oil and make all that money. Of course, the OPEC nations sometimes announce that they are deliberately cutting. But now we find out they are deliberately cutting when they say they are not. That is damn sneaky of them. 🤣

Dennis, you have come up with a lot of reasons to explain why the Middle East oil producers are such truth tellers, but this is by far the best one yet. 🤣🤣🤣🤣🤣

Ron,

Aside from a few nations that have joined with OPEC in the Declaration of Cooperation, I am not aware of an organized effort to limit oil production by the rest of the World. OPEC on the other hand makes monthly predictions of World demand and World supply and in many cases sets quotas based on the call on OPEC for oil supply.

What do you believe would happen to the price of oil when OPEC over produces? We get a rough idea by looking at the spot price for WTI on April 20, 2020 when it fell to less than zero (not sure how that even works, we will call it zero.) For the week ending April 24, 2020 the average spot price was $3.32/bo.

I do agree that OPEC lies about their reserves being “proved” reserves. For many OPEC producers the reserves may be over stated by about 70% and are closer to proved plus probable reserves than proved.

Robert Rapier believes the evidence for Saudi Reserves point to 270 Gb of proved reserves in 2019. He makes a convincing case :

https://talkmarkets.com/content/global-markets/how-much-oil-does-saudi-arabia-really-have?post=210858

https://talkmarkets.com/content/global-markets/discussion-of-saudi-arabias-oil-reserves-provokes-some-emotional-responses?post=211436

https://talkmarkets.com/content/global-markets/saudi-oil-reserves-growth-has-lagged-the-rest-of-the-world?post=211686

Dennis, I agree that OPEC nations often decide to cut production in times of oversupply. Historically I would guess that has been about half the time. You, however, suggest that they all must be cutting even when there are no quotas on their production.

Really Dennis, do you think that is a reasonable scenario?

I would suggest that it is blatantly obvious that in times of no quotas, all OPEC nations are producing flat out. And they have never stopped trying to squeeze every possible barrel oil out of their reserves.

Ron,

No not cutting production, just not expanding capacity beyond what they think is needed. If OPEC as a group believes 30 Mb/d is adequate capacity to meet the call on OPEC, they will not expand that capacity. If they expect future demand will be 35 Mb/d for OPEC oil, they may choose to expand their capacity in order to meet that demand.

I agree when there are no quotas they will produce at whatever rate they believe matches their current sustainable capacity. If output at that rate results in a high oil price level (as in 2011 to 2015) they might choose to expand their capacity. Often the bottleneck is gas, oil, and water separation facilities, pipelines, or port facilities rather than maximum output from the oil field. Sometimes more development is required in existing fields or new fields need to be developed.

Oh no. Robert Rapier lost two of his children in 16 months

FYI

https://twitter.com/RRapier/status/1579874021918638081

Paul,

Thanks for the information, so sorry for his losses.

based on production OPEC should have only about 200 billion reserves

Some years ago it was widely accepted that OPEC quoted original recoverable oil in place as reserves (so the fact that they hardly changed reflected them hardly ever finding anything new or adding upward revisions). That may have changed but there was a recent paper from the Shift project using Rysted data that seemed to agree. The African members (Angola, Nigeria, EG, Congo, and one I can’t remember) have western IOCs in charge of most production and these have to report remaining reserves honestly for SEC – their numbers would definitely agree.

GK,

Probably Gabon is the one you didn’t remember, those 5 nations had a total of 50.7 Gb of reserves at the end of 2020. If those are indeed proved reserves rather than 2P reserves, that would suggest 2P reserves of about 86 Gb for those 5 nations.

OPEC Reserves are likely 2P reserves, if we deduct Orinoco reserves (262 Gb in 2020) OPEC conventional 2P reserves are about 953 Gb. If we deduct Canadian oil sands reserves (161 Gb) and tight oil reserves (20 Gb) from non-OPEC reserves to get a rough estimate of conventional proved reserves of 336 Gb. To get a comparable estimate we can either divide OPEC reserves by 1.7 to convert to proved conventional reserves of 561 Gb, alternatively we could estimate non-OPEC 2P reserves by multiplying proved reserves by 1.7 and get a non-OPEC conventional 2P reserve estimate of 572 Gb. So for World conventional proved reserves we have at the end of 2020 about 897 Gb, plus about 40 Gb of unconventional tight oil plus Canadian oil sands in active development, so about 937 Gb in total at the end of 2020. For 2P reserves the total would be about 1593 Gb which would be the F50 estimate, also called the technical or engineering best guess estimate which would have about a 50/50 probability of reserves being either higher or lower than this estimate. At the end of 2020 cumulative World C plus C output was about 1409 Gb which would suggest with no future reserve growth and no future new oil discovery, that World C plus C URR would be about 3002 Gb. A possible scenario for future output with a URR of 2980 Gb, below

They also reoprt non-OPEC reserves. Their reserves are, according to OPEC, 303.25 billion barrels, less than one fourth those of OPEC nations. But wait, those are only 2P reservs as well. That would mean non-OPEC reserves, again, according to OPEC, are about 100 billion barrels. But then we would have to treat Canada the same as Venezuela, and not count all that hard to get shit, that would bring non-OPEC 1P reserves down to about 75 billion barrels.

But if they are truth tellers, they would give OPEC reserves in the same catagory as non-OPEC reserves. But if they are damn liars they would give OPEC reserves as 2P reserves while giving non-OPEC reserves as 1P reserves.

Which are they Dennis, liars are truth tellers?

Ron,

I am not making the same argument as Robert Rapier. I think many have OPEC producers overstated their proved crude oil reserves. I take my data from BP Statistical Review of World Energy

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Try re-reading my previous comment more carefully:

Oil reserves

OPEC conventional 2P=953 Gb (exludes Venezueal Orinoco reserves=262 Gb)

OPEC conventional 1P=2P/1.7=561 Gb

non-OPEC conventional 1P=336 Gb (excludes Canadian Oil sands=161 Gb and US tight oil=20 Gb)

non-OPEC conventional 2P=1P*1.7=572 Gb

World conventional 1P=897 Gb

World conventional 2P=1525 Gb

World total 2P=2137 Gb (of which 612 Gb is unconventional oil (extra heavy oil plus tight oil)

World URR=3546 Gb, if reserve estimates above are accurate.

Note that my expectation is that only 190 Gb of unconventional oil will actually be extracted and approximately 2800 Gb of conventional oil. My best estimate of World URR for crude plus condensate is about 3000 Gb, but that estimate may be too conservative.

Noted Dennis. I am glad that you now agree with almost everyone else in the world. You, apparently, now agree that those OPEC folks are damn liars. Congratulations. I knew you would come around sooner or later. 😁

I have suggested that the supposed “proved” reserves of OPEC were in fact proved plus probable reserves for at least the past 2 years, perhaps longer. This has long been explained by how OPEC allocates quotas and when Iraq raised its “proved reserves” most other OPEC producers followed. In 1988 Saudi reserves increased from 170 Gb to 255 Gb, 255/170=1.5, this is roughly the ratio of 2P/1P reserves, perhaps this is coincidence, but I think not.

Paul told me that the oil shock model didn’t predict oil production correctly when he and it were pretending that peak oil was like 2008 or whatever, all because he couldn’t see into the future. Do you know if he has corrected this admitted flaw in the model that it might now be taken seriously? 🙂

No model can predict the future.

So Paul was just pretending when he was claiming peak oil a dozen or so years back? Wish he would have told us that then.

Couldn’t respond to your price comment above because of the awful format here, but no, I was doing multi-stage slick water fracturing in shales back in the 80’s and 90’s, and with real prices at that time, not an adjustment compared to today. Recently I showed you work done by the EIA in the Eagleford, and while the volumes available for $40/bbl in todays dollars didn’t equate to much oil, it did equate to some. Do you happen to have some corresponding or similar high areal resolution resource and economically recoverable analysis to substantiate the $40/bbl idea? I tend to give analysis a higher relative value than just someone saying it is, same as you probably.

Reservegrowthrulz,

I have pointed out on many occasions that I do not have the same access to proprietary databases that you may have. Of course there might be a few wells (perhaps 1% to 5% of completed wells) that might be profitable at $40/bo. The analyses I point to are from Rystad, where in Nov 2021 they were estimating an average breakeven price for tight oil at $37/bo (see link below)

https://www.rogtecmagazine.com/rystad-energy-as-falling-costs-make-new-oil-cheaper-to-produce-climate-policies-may-fail-unless-they-target-demand/

That estimate is absurd based on average well profile data for the Permian basin, the average 2020 well breaks even at about $60/b for Brent (refinery gate price, wellhead price at $55/bo), if we assume a real annual discount rate of 7.5% and average well cost of 13.3 million (full well cost) assuming NGL sells for 35% of the price of crude and Natural gas at $4/Mcf. Note that the 7.5% real annual discount rate is too low to be realistic because this well would pay out at 77 months and oil men suggest a 36 month payout is best with 60 months at most being reasonable. If we use 48 month payout as a guide for breakeven, the oil price would be $70/b at the refinery gate to achieve this. That would correspond to a real annual discount rate of 17% for the well to be barely profitable.

There are lots of stange “breakeven” concepts out there, a proper breakeven price means the IRR of the investment will be equal to an alternative equally risky investment.

RGR said about someone else:

Reminded of the fact that earth scientists are a weak link in the chain. They were never educated in how to do controlled experiments and so have little insight into how science works. Unsurprisingly, they are then at a complete loss for producing useful research into how nature actually works.

Yes, Dennis and I realize that oil production prediction is challenging, but that has more to do with economic game theory being involved, and that is known to be intractable. The essence of game theory is more widely known as “gaming the system” and of course business people will do whatever it takes to get a financial advantage. This includes redefining what crude oil means and then including all that other stuff in the oil category. Surprise, surprise that the peak will shift out.

Deffeyes predicted correctly that (conventional) crude production would peak in 2005. This peak is the logo on my website

https://crudeoilpeak.info/

https://pbs.twimg.com/media/FfG8d_KaUAAMJEC?format=jpg&name=small

This peak caused the US recession in 2007

https://www.brookings.edu/wp-content/uploads/2009/03/2009a_bpea_hamilton.pdf

and the oil price shock in 2008 which in turn triggered the financial crisis 2009. Has it already been forgotten that this crisis started in car and therefore oil dependent US suburbia?

What was not predicted was the US shale oil boom starting in 2010/11 which was financed by the Federal Reserve printing money (QE1 – QE3). Even Bush and Cheney could not imagine $100 oil (2011-2014) and invaded Iraq in 2003.

The above graphs show there are many peaks in various countries, each impacting on the local economies. Rystad estimated the Russian peak even before the invasion in Ukraine. It’s in my post

28 Feb 2022

Russian oil production update Nov 2021

https://crudeoilpeak.info/russian-oil-production-update-nov-2021

At present I am busy with coal supplies to aging Australian power plants because everyone assumes that EVs will solve much of the oil problem.

7/10/2022

Sale of Vales Point: How will Czech brown coal baron Pavel Tykac with

business registered in Liechtenstein impact on NSW coal and energy markets?

http://crudeoilpeak.info/sale-of-vales-point-how-will-czech-brown-coal-baron-pavel-tykac-with-business-registered-in-liechtenstein-impact-on-nsw-coal-and-energy-markets

In the last 20 years Australia failed to build sufficient pumped hydro to store renewable energy

Do you have a reference for Deffeyes defining conventional for his claim in 2005? I didn’t see it on any of the two links you provided. I presume that conventional oil is that requiring oil and gas wells to be drilled from the surface in some way, completed open hole or cased and completed, all the usual type of development that had been going on since at least the late 40’s? Other oil types being more mining operations, such as those done in the Athabasca, or anything the US might choose one day within the oil shales of the Green River Formation in the Piceance Basin.

Reservegrowthrulz,

One way of distinguishing conventional and unconvention oil is to use the USGS concept of continuous resources (tight oil and oil sands in Canada and Venezuela) and non-continuous, where resources are trapped in “pools”. By that definition the peak for “conventional oil” was in 2016, at least so far. Perhaps this will be exceeded in the future, though my gues is that it will not as the world transitions to electric land transport over the next 20 to 30 years, with demand falling to less than supply at $100/bo in 2022$ around 2035 or so with falling oil prices thereafter as the EV transition gains momentum.

That’s also a good way to look at it, as discrete resources scatterred over a region rather than as a continuum of lower density and grade, which is why one can use statistical sampling techniques to estimate where we are at in terms of a cumulative. Exploiting the continuous crud would be the nail in the coffin for preventing climate change.

The difference between 2005 and 2016 is meaningless given the uncertainty.

Should really make a Sankey flow diagram that would help explain how the USA consumes 20 million barrels of oil per day while it only extracts less than 12 million barrels of crude oil from it’s territory, all the while complaining to be “oil independent”.

If stated OPEC reserves were true, then the depletion rate of non-OPEC vs OPEC = 80.4%/19.6% x 60/40 = 6.15. In other words, non-OPEC produces 6.15 times more barrels per barrel of reserves than OPEC.

I agree that stated OPEC reserves are BS — there’s no way the above number is realistic, not even close.

Having oil and producing oil are two separate questions. You can have it but not be able tech wise to produce it.

CC, OPEC has been at this game for over 70 years. There is absolutely no reason that they would be less able to produce their reserves than non-OPEC nations. To suggest that OPEC nations are not as technically wise as non-OPEC nations is…. is…. no, I will not use the word. I will just say it is absurd.

Edit: I forgot to add. All OPEC nations have always used Western firms such as Baker Hughes, Halliburton, and Schlumberger. They all have the exact same technical support as Western firms.

That includes Russia as well. Without the Western Service companies and technology due to economic sanctions, their production will also fall dramatically.

In seeing the dialogue between you and Dennis, I would also suggest that if OPEC has all of these undeveloped huge oil fields, we would see storage in these countries rising steadily instead of falling steadily.

I believe KSA cannot sustain 11 million barrels per day without buying Russian oil either directly or through China and with the Russian Sanctions beginning in November, their proposed production cut may coincide with the the Saudis revealing their true sustainable production capacity (which I believe is a little under 10 million barrels a day) . The Saudis certainly are not willing to test having their assets in the US frozen.

LTO survivor,

Sustainable capacity depends on proved developed producing reserves.

As I am sure you are aware, this number is always less than proved reserves. I am simply saying the ratio of pdp to 1P is far lower for middle east OPEC producers.

Earlier Dennis, and I guess the rest of us, agreed that if the world were to surpass the peak hit in 2018, then it was up to these 11 oil producers. They were Saudi, USA, Russia, Iran, Iraq, Kuwait, UAE, Norway, Canada, Brazil and Canada. We called them the Big 11.

Well, Russia has now become part of the problem, no longer part of the solution. It is now the Big 10. The Big 10, as of June 2022, are about half a million barrels per day below their pre-covid level and about 900 Kbp/d below the world November 2018 peak.

But what about the rest of the world? After all, if they are declining, and indeed they are, then it is up to the Big 10 to make up for that decline. Well, it turns out they are not doing so well. They are 4,304 Kbp/d below the world peak in November 2018, they are 3,216 Kbp/d below their pre-covid level, but worst of all they are now 2 million barrels per day below their pre-covid decline rate. Their decline rate is increasing. Apparently, they shut down a large number of marginal wells and now they cannot be restarted.

Ron, these are great graphs. We have had high oil prices almost all year, with nothing to show for it. I try to be open-minded but this recent OPEC+ cut smacks of desperation. I can’t see a path forward from here that gets us back to the November 2018 peak. Not with Russia in the state it’s in and the collapse of the Iran talks. It’s just not possible any more.

Stephen Hren,

When oil prices return to over $100/bo and stabilize at that new level (my guess would be around $115/bo for Brent crude), we may see more investment by the oil industry, if not oil prices will continue to rise until either more investment occurs or enough demand is destroyed to balance the market, it will be a bit of both, but I doubt oil prices reach more than $140/bo in 2022 US$ for an annual average price.

Hey shallow sand, would you consider drilling new wells at $115/bo in 2022 $, assuming drilling costs rise at the annual rate of inflation (based on core CPI)? Assume you have seen prices at an average annual level of $115/bo for past year with volatility of plus or minus 5% (say in March 2024).

Possibly Dennis, looking like less than 5% odds at this point. To get to the old peak everything needed to go right: Permian ramping back up, Russia and Saudis full throttle, Iranian sanctions removed, Brazil and Canada ratcheting up. Instead everyone already looks maxed out or declining.

Stephen Hren,

Yes OPEC and many others are close to capacity at present, capacity is likely to increase imo, if oil prices rise in the future as I expect (to at least $110/bo for Brent in 2022 $). My estimate of the odds output will we lower or higher than my best guess scenario are 50/50. This assume discovered oil resources continue to be developed at the historic rate and the extraction rates for conventional oil resources increase to about the 2018 extraction rate.

It is expected there will be increased output from Norway, Canada, Brazil, Guyana, UAE, Iraq, Saudi Arabia, and the US over the 2023 to 2030 period, there will be decline elsewhere, but this will be far outweighed by increases, with a net increase of about 5 Mb/d from 2023 to 2030.

https://oilprice.com/Energy/Energy-General/US-Shale-Could-Peak-In-2024-Energy-Aspects.html

“Amrita Sen: U.S. crude oil output from shale basins could peak in 2024.

So far this year, the United States has managed to increase its total crude oil production by 200,000 bpd.”

Huge increases in oil price and shale barely treaded water this year.

Stephen,

It takes time for higher oil prices to affect output, we will see what happens when SPR releases stop, Russian oil sanctions become tighter and oil supply becomes very tight. It is possible there will be a severe recession in response so demand will fall, this is difficult to predict. If the recession is not severe as I suspect (World real GDP growth at 2.7% in 2023) oil prices will be at $110 per barrel or more for most of 2023 and we might see more growth in tight oil output than we have seen so far in 2022.

Much of the increase in World output from 2022 to 2030 will be from US tight oil, but there will be increased output from other nations as well (UAE, Iraq, Iran, Saudi Arabia, Canada, Brazil, Norway, Guyana, and Argentina).

Dennis, your optimism knows no bounds. 😇

Ron,

Here is the chart using a log scale on the vertical axis so that the slope of the curve indicates rates of increase and decline. The rate of increase from 2022 to 2030 is quite gradual about 3% per year.

Its a good chart.

People will be happy because they get to see their cliff.

LOL, Hickory. I hate log charts. And I hate Zen koans, as Hightrekker pointed out. Although the two aren’t necessarily related…

John Norris,

Below I plot the natural log of tight oil output, the idea is to see the rate of growth over time, which in this case corresponds with the slope of the curve.

For the semilog chart at link below

https://peakoilbarrel.com/june-non-opec-oil-production-rises-from-u-s-and-russia-boost/#comment-747456

The average annual rate of increase in tight oil output from jan 2022 to Dec 2025 is 4.94%/year and from Jan 2026 to Dec 2029 the average annual rate of increase is about 1.77%/year.

In a conversation with LTO Survivor I had a year or two ago he suggested tight oil might grow at around 5% per year, though his opinion may have changed.

The talk of tight oil peaking in 2024 is likely incorrect in my opinion. If oil prices rise to $100/bo by 2023 and remain at that level until 2030, this is roughly what the EIA expects for tight oil for that level of prices (from AEO 2022 this is the average of reference scenario and high oil price scenario).

Peak is around 11 Mb/d if we assume oil prices remain under $104/bo in 2021 $ through 2030.

Yes, whenever oil goes beyond $100, the world economy starts to slow so we should not assume that investments will be done on the basis of these high oil prices. See also my earlier comment in particular on Russia.

I appreciate your website is doing the hard work to monitor oil production. Unfortunately, I am no longer receiving email alerts to your posts so I am always late with comments

Matt,

I have stopped the emails, there is a new post every 7 to 10 days.

Matt,

The World economy grew at about 3% per year from 2011 to June 2014 when Brent oil prices averaged about $103/bo in 2015$. Also note that in 2022 $ this would be about $127/bo for Brent crude. Perhaps $140/bo in 2022$ might lead to a severe economic crisis, difficult to say, it might just lead to greater sales of EVs and might reduce demand enough to reduce market tightness.

” In the land of the blind, the one-eyed Jack is King.”

For the above scenario to occur, primarily from the Permian, over 4.7MM BOPD of NEW Wolfcamp, Bone Spring and Spraberry production will have to be REPLACED, and grown, for the next 10 years. Every year. Year after year. This replacement/growth will have to come from five to six, maybe seven, already over-drilled counties in two sub-basins, where gassy oil wells are quickly turning into oily gas wells. It will NEVER happen and suggesting that it might, even to a very few, is a great disservice to our country. As someone actually IN the oil and gas business for the past half century I would be ashamed to make these kind of predictions.

I am reminded of the meathead three months ago who said, on social media, the Permian Basin had 200 years of oil left in it. People all over America, even politicians, STILL quote this fella.

He was a realtor from Midland.

The US is on track to grow tight oil production only 225K BOPD in 2022, not 1MM BOPD as has been projected by Kings. And, as some of us have known for years, the end of Permian growth is perhaps much closer than estimated.

https://oilprice.com/Energy/Energy-General/US-Shale-Could-Peak-In-2024-Energy-Aspects.html

Prices have not continued to rise, as projected by Kings, they have declined. D&C costs have exploded. Economics are worse in the Permian, even with higher product prices. This is reality, not “hope.” Why this would change, drastically, over the next decade and things would get better, not worse, is sorta…not reality based.

Lastly, Kings have suggested here, constantly, that all future drilling can be paid for out of net revenue and all Permian debt, whatever selective number that is, “can be paid back by the end of 2024.”

So far, not so good. A number of large tight oil producers in the Permian are actually adding debt.

https://oilprice.com/Energy/Energy-General/US-Shales-Debt-Detox-Is-A-Huge-Win-For-Shareholders.html

Only 11% of accumulated long term debt has been paid back since 2020; this from a selective group of 30 of the top tight oil producers in the country, most of who were originally in Permian, or retreated to the Permian. With private debt, it’s much. much less. I have stated many times the US tight oil sector will NEVER pay its debt back; I stand by that.

Be weary of one-eyed Jacks with absolutely nothing invested in the outcome of their projections.

Some great recent posts by Mike

https://www.oilystuffblog.com/forumstuff

Mike,

Great post!! As an active investor.( God only knows why), I am personally experiencing all of the above. No amount of theoretical data will ever replace the economic realities of producing oil & gas. With current product prices and exploding D & C expenses, we are making lower IRRs than we were at $55 per barrel and $3.00 gas despite whatever the publics spew out on their IR decks quarterly. Just saying!!!

Mr. Survivor I would say you are very courageous man, sir. I got to see several AFE’s lately from proposed long lateral town wells within the city limits of Midland and I was stunned. I am spudding a little well next week where costs are up 30% YOY; these HZ wells were closer to 45%. 2:1 ROI’s over 10-12 years is a very tough way to make a living. I wish you the best of luck, sir.

Oil will likely go back up in November, I suspect, after the self serving political manipulation ceases, as you suggest. Our country’s much needed relationships with OPEC and the ME are being systematically flushed down the toilet…exactly like the SPR. All Americans should be livid about draining our nation’s oil savings account over politics and a stupid election.

Thank you, Stephen. And Avocado…still $3 bucks for ones the size of baseballs in S. Texas. Affordable avocado’s are past peak.

What draining America of oil is the stupidly oversized vehicles and the terrible urban planning that forces people to drive everywhere.

Waste not want not, my grandmother used to say. But she’s long gone, Americans prefer to roll coal and whine about shortages instead.

LTO Survivor,

How much is full well cost in Permian for horozontal well with 9500 foot lateral, I am currently using 13.3 million, also what is OPEX per boe on average for a an average 2018/2019 well? I am using about $12.5/boe over the life of the average 2020 well. I get an IRR of about 36% over the life of the well, which is about a 2 to 1 ROI over life of the well in real dollars assuming average rate of inflation at 2.5% per year. I assume the well is shut in at 20 bo/d.

LTO Survivor,

How much is full well cost in Permian for horozontal well with 9500 foot lateral, I am currently using 13.3 million, also what is OPEX per boe on average for a an average 2018/2019 well? I am using about $12.5/boe over the life of the average 2020 well. I get an IRR of about 36% over the life of the well, which is about a 2 to 1 ROI over life of the well in real dollars assuming average rate of inflation at 2.5% per year. I assume the well is shut in at 20 bo/d at about 14 years after first flow. EUR=479 kbo, 2000 MCF nat gas, and 168 kb NGL.

Well said, Mr. Shellman, thanks for your comments.

Interesting comments. Thanks.

So LTO Survivor, do you expect oil and natural gas prices are likely to decrease in the future?

Below is the oil price scenario I use for my Permian scenarios, it seems pretty conservative to me. I assume NGL sells at 35% of the wellhead price of crude which is $5/b below the Brent price and Natural gas I assume sells for $4/MCF.

Rather than picking ceertain counties or companies to make my case, I use the average well profile for Permian basin by year based on Novilabs data. I assume the Permian basin completion rate increases by 3 wells per month from 400 wells per month in Dec 2022 to 550 new wells per month by February 2027 and ten remains at that level until 2031 and then decreases at 5 wells per month reaching zero in Feb 2040. Obviously a guess, but that is the scenario.

Permian scenario with maximum completion rate of 550 wells per month. The scenario has a URR of 51.5 Gb and total wells completed from Jan 2010 to Jan 2040 are 117,668.

For the ND Bakken/Three Forks I expect a URR of about 8.9 Gb with the USGS mean TRR estimate about 11 Gb, so the expected URR is about 81% of the mean TRR estimate by the USGS. In the case of the Permian basin the mean USGS TRR estimate is about 75 Gb and my scenario URR is about 51.5 Gb or 68.7% of the USGS mean TRR estimate. In short, the Permian scenario is far more conservative than my North Dakota Bakken scenario.

Many would suggest the scenario is far too conservative, see for example

https://oilprice.com/Energy/Energy-General/Rystad-US-Shale-Production-To-Peak-At-145-Million-Bpd.html

On a linear scale the growth rates look unrealistic, but if we look at a semi-log plut to get an idea of annual growth rates (proportional to the slope of the curve on a semi-log plot), we see the scenario has far lower growth rates after 2022 than historical rates of growth in the Permian based. See chart below.

It would be interesting to get comments from Reservegrowthrulz, as he would probably think my scenario is absurdly low, in contrast to other expert opinions here.

Mr Shellman,

I would note that when output is not rounded to the nearest 1 Mb/d, my projection is 7.7 Mb/d for annual average tight oil output in 2022, average annual tight oil output was 7.2 Mb/d in 2021, so this is a 500 kb/d increase in output. The average output for US tight oil for the first 8 months of 2022 has been about 7.6 Mb/d. Also note that high oil prices in 2023 to 2028 of around $100/b in 2021 $ could make my projection too conservative, the EIA expects this price level would lead to tight oil output of 11 Mb/d by 2028, rather than 9.6 Mb/d for my scenario.

My projections have mostly been too low, maybe due to blindness. Of course your projections are always excellent, can you tell us what Permian output will be at the peak and when that peak will occur?

“… meathead three months ago who said, on social media, the Permian Basin had 200 years of oil left ….”

Daniel Yergin?

Mike,

From the article on debt you posted:

With capital discipline and the desire to strengthen balance sheets, the U.S. shale industry could potentially become debt-free by early 2024 if prices stay strong and discipline prevails, Deloitte said in a report in August.

My projection on debt was specific to the Permian basin and assumed both strong oil prices (over $80/bo) and capital discipline (wells paid for with cash flow), I also assumed 25% of cash flow was paid out as dividends, though I did not anticipate costs rising by as much as they have, so that forecast from 2020 will likely be wrong as the assumptions proved incorrect.

Dammit, these guys are admitting they have very little spare capacity. They know they are producing flat out and cannot produce enough to meet demand if it increases by only a couple of million barrels per day. Why don’t more people pay attention?

‘The world should be worried’: Saudi Aramco — the world’s largest oil producer — just issued a dire warning over ‘extremely low’ capacity Bold mine.

‘The world should be worried’: Saudi Aramco — the world’s largest oil producer — just issued a dire warning over ‘extremely low’ capacity. Here are 3 stocks for protection

The global oil market remains tight according to Saudi Aramco, the largest oil producer in the world. And that does not bode well for a world that still relies heavily on fossil fuels.

“Today there is spare capacity that is extremely low,” Saudi Aramco CEO Amin Nasser says at a conference in London. “If China opens up, [the] economy starts improving or the aviation industry starts asking for more jet fuel, you will erode this spare capacity.”

Nasser warns that oil prices could quickly spike — again.

“When you erode that spare capacity the world should be worried. There will be no space for any hiccup — any interruption, any unforeseen events anywhere around the world.”

Ron,

It is evident that spare capacity is low, I have been predicting high oil prices for quite a while, releases from the SPR cannot continue after the level reaches zero, maybe then the market will pay attention.

Well, perhaps. They will start screaming “Why did someone not warn us of this coming catastrophe?” Someone did, even the Aramco CEO tried to warn them. But another someone kept telling them, no, oil production will keep increasing until C+C reaches 100 million barrels per day around 2032.

They listened to him instead.

Pity. 😄

Ron,

Who is predicting C plus C at 100 Mb/d by 2032? EIA has it at about 87 Mb/d in 2032 in their most recent international energy outlook, my best guess is 84 Mb/d in 2032 (peak in 2030 at 85 Mb/d) the EIA has about 86 Mb/d in 2030.

Nasser is basically saying oil prices will be high when demand recovers, I agree. I do not think he is saying that output will decrease, just that increases will not be possible without more investment, I agree with that as well, my expectation is that high oil prices are likely to increase the level of investment in the oil industry.

Sorry, Dennis, I mistook your above LTO chart for a world C+C chart. Okay, I stand corrected. Your prediction is 84 million barrels per day in 2030.

No, you misunderstood Nasser. What he said was: “When you erode that spare capacity the world should be worried.” It could not be clearer. He knows full well that OPEC is out of spare capacity and knowing that the rest of the world is producing flat out, that they are out of spare capacity as well.

Read it again Dennis. It could not be clearer. Of course, it is your opinion that if we just had more investment, then more oil would magically appear. Investors’ actions are never based on today’s oil prices. They are based on what they expect oil prices to be in the future, sometimes years in the future. Investors look at what is happening with exploratory wells today and decide, “Too many dry holes and too many low-production wells, it just ain’t worth it.”

That Dennis is why there is so little investment. Nothing is based on today,s oil price or what they expect oil prices to be one or two years from now.

Ron,

The current oil price affects expectations of future oil prices. High oil prices today will affect investment decisions in the future. In any case, tight oil rates of growth have been affected in the past by the price of oil, currently supply bottlenecks for both labor and captal inputs to oil production along with a change in investor sentiment have reduced investment levels for tight oil. A prolonged period of higher profits in the tight oil industry is likely to change this investor sentiment.

Note that my shock model scenario has conventional output growing by only 0.6% from 2022 to 2030 (about 364 kb/d per year). This is less than half the historic rate in kb/d (historic rate is about 785 kb/d per year from 1985 to 2005). More recently conventional oil output has grown more slowly, in part due to oversupply from tight oil.

Note that my shock model scenario has conventional output growing by only 0.6% from 2022 to 2030 (about 364 kb/d per year). This is less than half the historic rate in kb/d (historic rate is about 785 kb/d per year from 1985 to 2005)

Slowly, slowly, Dennis, reality is creeping into your worldview. If this keeps up, you will be agreeing with me in a couple of years. 🤣

Okay, I was just joking there. Please excuse my dry humor. But instead of “growing by only 0.6%”, declining by 0.6% would put you a lot closer to reality. But hang in there Dennis, sooner or later you will get it right. I was not joking when I said sooner or later, you will agree with me that peak oil was in 2018. After all, no one can deny reality forever.

Ron,

We will see. I base a lot of my analysis on widely accepted estimates of oil resources by the USGS, Jean Laherrere, Steve Mohr, and many others.

My estimates of crude plus condensate URR are:

Conventional C plus C=2800 Gb

Unconventional C plus C = 200 Gb

USGS TRR estimates

Conventional C plus C=3200 Gb

Unconventional C plus C=750 Gb

Jean Laherrere URR estimates

C plus C less extra heavy oil=2600 to 3000 Gb

Extra heavy oil (API Gravity 10 or less)=200 Gb

Below is my estimate compared with the EIA’s International Energy Outlook 2021 (next update in 2023). Up to 2030 my estimate is roughly the same as theirs, by 2050 the difference is about 42 Mb/d (EIA=99 Mb/d and Oil shock model=57 Mb/d in 2050).

I base a lot of my analysis on widely accepted estimates of oil resources by the USGS, Jean Laherrere, Steve Mohr, and many others.

Yes, I know that Dennis. You have stated many times that your estimate of future oil production is based on what is reported to be left in the ground. There are a lot of problems with that method. First, they may be wrong. It is impossible to really know how much oil is left in the ground. And all oil reserves are not equal. Most of what is left are “hard to retrieve reserves” Then there are always political problems. They have always been with us and will always be with us. Most of the Venezuelan oil will never be recovered. Well, not in our lifetimes anyway. And a lot of reserves are controlled by the madman Putin.

My analysis is based on what comes out of the ground and the increasing production versus the decreasing production of all the world producers. Up until 2018, the increases were winning that battle. But then the tide changed, and the decreases are now winning… big time.

But on one point I agree with you. That point is “we shall see”.

Ron,

Not just what is left in the ground, it is based on technical 2P reserves, past production, as well as estimates of discovered resources. When one uses all available information, rather than a subset of that information, one gets a more accurate estimate of the future. It will still be wrong though because future rates of development of resources and extraction rates for conventional resources, as well as output of tight oil and extra heavy oil have an infinite number of possible paths, choosing the correct future path from an infinite set has odds of zero.

The decreases were caused by OPEC cuts in 2019 and then the pandemic, output has recovered quite a bit since then and though you believe that will not continue, I think you are wrong. I agree time will tell, it always does.

Dennis, the world had recovered from the covid collapse by January 2021. I have posted below a graph with a comment stating that. I posted it down there to get a wider area for my graph.

Ron,

Demand had not recovered by 2021, it was almost 3700 kb/d less than 2019.

Dennis and Ron –

Glad to see the discussion continues, as always I’m perplexed by Dennis’ rationalization of higher expected overall global oil production. A very simple exercise is to look at the top 3 producers (US, Saudi Arabia, and Russia). From about ~2010-2020 saw exceptional growth (mainly US) at an average annual rate of increase for the top 3 of about 4% each year.

As far as I can tell the main debate is whether that exceptional growth rate will continue.

In 2011 top 3 were 24.5 MBpD. Slightly before COVID hit top 3 were almost 34 MBpD (note that this level is slightly lower than the level of ~36 MBpD that would be expected if the 4% growth rate continued). With exception of US, top 3 rebounded from COVID lows by late 2021 (about a year ago) – US took another 6 months longer or so.

Ignoring COVID, top 3 producers should see production approaching and exceeding 40 MBpD in 2023.

Does it seem reasonable to expect this to happen? More over, if the 4% growth rate continued we would expect >42 MBpD by 2025.

Comparing 1 year growth intervals for US, we see August 2021-2022 added only 0.5 MBpD (under a high price environment no less).

In stark contrast, US between August 2017-2018, 1.5 MBpD was added (9.5 to 11). This was with oil prices ranging from $50-$75.

So I ask you Dennis, what are the fundamental differences between 2010-2019 and 2021-2022?

Even if US could continue at a growth rate of 4%, is this enough to offset all of the losers (average decline of 0.8 MBpD each year)???

All of this while not even talking about Russia…

I understand the US has considerable oil reserves, but I just don’t think it has the amount that is needed in order to get significant production growth over next year or so. We also have transport and refining limitations to deal with.

It seems the cards are stacked extremely high against additional growth…

Kengeo wrote: Ignoring COVID, top 3 producers should see production approaching and exceeding 40 MBpD in 2023.

Does it seem reasonable to expect this to happen? More over, if the 4% growth rate continued we would expect >42 MBpD by 2025.

Not even close. The world’s top 3 producers were at 32,675,000 barrels per day in June 2022. In 2023 I expect them to be at least 1.5 Mbpd below that level and down at least another million barrels per day by 2025.

With Saudi cutting and Russian production down due to sanctions, the only growth will come from the USA. And any increase in US production will be dwarfed by the decline in Saudi and Russian production.

Click on graph below to enlarge.

And just for grins and giggles. 😆

Click on graph below to enlarge.

Kengeo,

On only needs to look at my estimates for future growth to see that I don’t expect 4% growth in the future. As I often point out, it is World output that matters so we add up production from all producing nations.

So nobody is claiming exceptional growth for all three of these nations. I expect tight oil will grow at an average annual rate of about 3% per year fro 2022 to 2029. Overall World output grows at an average annual rate of 0.9% from 2022 to 2029 in my best guess scenario (from 80 Mb/d to 84.9 Mb/d over 7 years). The scenario is consistent with projections from the EIA up to 2030 and is more conservative than several scenarios I have seen.

Consider the Rystad estimate in the article below (from Feb 2022)

https://www.rogtecmagazine.com/rystad-energy-oil-at-100-could-trigger-an-additional-2-2-million-bpd-of-us-tight-oil-output-by-2023/

My scenario has tight oil output growing by at an average annual rate of 370 kb/d each year from July 2022 to December 2029.

Thanks for the link.

This article gives more details:

Saudi Aramco: The Oil Market Is Ignoring Supply Fundamentals

Oct 4 2022

The ongoing energy crisis, while intensified by the Russian invasion of Ukraine, didn’t start with the war, according to Aramco’s top executive. Years of underinvestment, a lack of a backup plan, and alternatives not ready to step up and replace conventional energy are the real causes of this state of energy insecurity today, Nasser said at the Schlumberger Digital Forum last month.

At the London forum today, he reiterated his view that underinvestment would come back to haunt the markets.

According to Nasser, upstream underinvestment continues due to pressure from investors and policymakers. Short-cycle projects are coming on – not long-term projects that will anchor and sustain production.

“We need to build up some spare capacity in oil, gas and LNG otherwise any outages or increased demand will seriously stretch producers and could cause more turmoil in markets,” Aramco’s CEO noted.

“Oil demand will continue to grow until 2030,” Nasser added, reaffirming the Saudi view that the world needs adequate oil and gas supply before moving away from fossil fuels.

“Alternatives are not ready yet. We need to decarbonize oil and gas and develop CCS but we must do this with adequate oil and gas supply,” the Saudi executive said.

https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-The-Oil-Market-Is-Ignoring-Supply-Fundamentals.html

Underinvestment after 2014 (when oil prices dropped and after QE3 ended) has been reported for many years and is well documented

https://www.verdict.co.uk/global-fight-oil-gas-investment/

In my opinion, the underinvestment reflects the problems you have when the easy oil has peaked including in Saudi Arabia itself

1/10/2019

The Attacks on Abqaiq and Peak Oil in Ghawar

http://crudeoilpeak.info/the-attacks-on-abqaiq-and-peak-oil-in-ghawar

The link to the London Forum, where Amin Nasser spoke:

https://www.energyintelligenceforum.com/

Note it is from the same organization

https://www.energyintel.com/

which in 2007 published Sadad-al-Husseini’s oil reserve table in which he had crossed out 300 Gb of resources

It’s here in my post:

http://crudeoilpeak.info/opec-paper-barrels

The link to http://www.energyintel.com/om/program.asp?year=2007

returns page not found

That’s how history is buried

It seems to me that whoever (probably the USA) destroyed the Nord Stream

pipelines put a large damper on oil prices. Without Russian nat gas,

European industry will not be competitive. Europe will deindustrialize. The

euro will fall with respect to the dollar and Europe will consume a lot less

oil.

It seems to me that whoever (probably the USA) destroyed the Nord Stream

pipelines…

What a very stupid ignorant statement. Biden would have had to approve such action. Anyone who thinks Biden would have done that is dumber than dirt.

Nuff said.

Maybe Schinzy bases this on a reliable source (Alex Jones?).

Schinzy- “European industry will not be competitive. Europe will deindustrialize.”

Putin would like to Europe struggle so that they are less likely to provide support and weapons for Ukraine. He is a spiteful person, and since he has control over Russian military actions without much push back, it is likely that Russia was behind the attack.

Most other countries have plenty of internal push back that would have prevented this action.

I am not sure if non-state actors could have accomplished this.

If there are any non state actors who could pull it off then I can’t imagine who they would be; It’d be a balls up.

The destruction of Nordstream accomplishes 2 things for Putin:

1) He’s got an expensive excuse to not supply gas to Europe.

2) It is a pretext for why he can start blowing up your oil and gas infrastructure.

I am convinced the timing of Putin’s actions and Peak Oil are not a coincidence.

Part of his plan is the dependency of his opponents on his resources.

Ugo Bardi wrote a post recently in which he remarked that we are always fighting monsters when our real problem is resource depletion. There were monsters in Iraq and Afghanistan. A monster in Syria. Monsters in Iran. A monster in Libya. What is extremely rare is a positive outcome to military intervention. In Secular Cycles, Turchin and Nefedov state that at the end of stagflation populations are rarely happy with their leaders while during the growth phase, they are. I think people are people and often the situation makes the leader more than his DNA.

Character assassination is the easiest propaganda play in the book. You think the US government doesn’t lie and manipulate the news media? Check out Matt Orfalea’s videos in which he documents systematic lying with astonishing conviction on main stream media: https://rumble.com/c/Orf

Check out the one on Hunter Biden’s laptop which was Russian disinformation before the 2020 election. Verifying emails on a forgotten laptop is about the easiest thing a journalist can do.

” our real problem is resource depletion..”

No. The real problem is that we are all the monster.

We are all the monster

Amen to that, well said.

No, that is a lazy thing to say which unfairly maligns an arguably small but significant segment of humanity. There are angels on this earth, I have met them and can confirm that they exist. And there are others, while not quite angelic, manage to govern themselves adequately such that they are a net positive to the human condition. There are monsters to be sure, but this description is most definitely not universally applicable and wrongfully waters down the significance of what a monster is and what they are capable of. It is like the left calling those who disagree with them a racist whenever it suits them; soon enough, the word lost any sort of definitive meaning and is now just a lazy slur to be used as a shield by the feebleminded.

Perhaps you have not heard of rape, or murder, or war, ethnic cleansing and genocide, starvation as a weapon of conquest, and the grotesque destruction of the natural world.

Oh sure, sometimes there are small flickers of kindness, but that pales in comparison to the evil deeds.

If you don’t see that humanity is a monster it is a great example of how one can live life with their eyes closed shut tight. Looking in the mirror is more palatable that way.

Let’s not put monsters down by comparing them to us humans.

My guess is on Poland. Russias primary method of influencing Germany this winter is to play the taps on/taps off for leverage. Now that leverage is gone. Russia wouldn’t likely compromise their own leverage over Germany. Germany has now been influenced towards making more assertive policies with regards to supporting Ukraine, secondary to decreased Russian leverage. Poland was probably the one most sick of their shit, and the next in line to play Home Team if shit goes sideways, so they ain’t fucking around.

The pipeline created a wedge issue. Now it don’t.

https://en.m.wikipedia.org/wiki/Wedge_issue

“The pipeline has been opposed by Ukraine and Poland and has left Washington in a difficult position with some of its European allies. It has also caused political infighting within Germany’s new coalition government and left the West divided in its response to the situation.”

https://www.aljazeera.com/amp/news/2022/1/25/ukraine-russia-what-is-nord-steam-2-and-why-is-it-contentious

I’m somewhat leaning towards a Ukraine-Poland collab.

That truck bomb on the bridge was a tricky job. I wouldn’t be surprised if Poland had their fingers in that also.

This line of reasoning also raises the possibility of a Russian operation with the goal of a ‘false flag’ narrative arising, such as implicating Poland or the USA.

I am not optimistic that clarity on this operation will come to the surface.

I don’t feel Russia would need to undermine its pipeline leverage in order to do some false flags. False flags are for internal consumption. Russia could have done any number of false flags other than blowing up their pipeline leverage to create wedge issues in Germany. The pipeline job is more like a No Flag job than a False Flag job, primarily because responsibility is unattributed.

The truck thing could have easily been a sloppily packed arms shipments; a lone wolf disappointed in his draft #, a false flag, maybe Poland did it to muddy the waters; the list of reasonable possibilities is quite long.

Russia says they have figured out the long circuitous route the shipment took to the bridge. If correct it’s a hell of a job; giving the package a check up; trying to keep eyes on it; timing it right for command detonation by an observer. That’s a lot of ingredients; a lot of pots simmering on the stove.

https://youtu.be/NmmWkJtuxz4

The truck bomb on the bridge, I am told, was an SAS operation. The person stating this appears to have had some inside information on the actors.

Thanks Mike, now we know.

/s

There is no way NATO SOF were involved in that. They may have had assistance in planning from a NATO power, but no Brit or Yank or Pole was on the ground doing it. I’d believe internal Russian agitators assisting Ukraine over that.

Ron,

Excellent point in regard to OPEC reserves vs. their production, especially to Non-OPEC. The world is getting ready to hit the ENERGY CLIFF, not because there are 1-4 trillion barrels of all kinds of worthless technically recoverable resources on the planet, but because the world economy can’t afford to pull that SHITE out of the ground economically.

So, we continue to debate this issue from those in the world who wake up in the morning and base their life on HOPIUM and those who are more PRAGMATIC.

Unfortunately, most humans today that are making leadership decisions are both very SMART & STUPID. But, there isn’t much in the way of WISDOM guiding the human race. That is why we head over the ENERGY CLIFF… DEAF, DUMB, BLIND… and STUPID.

Lastly, I tried to contact James Dietrich, the retired petroleum reservoir engineer who wrote the book, TOO MUCH BY HALF, to chat and do a possible interview for my website. He replied by saying, his Book and work took a very large toll on his life, and all he wants to do now is to put it behind him. Thus, he no longer wants to discuss it anymore, but says the implications from his book are still true today.

So, again… WISDOM has totally EVAPORATED from the HUMAN MIND as its leaders try to do whatever possible to keep the LIGHTS on for another few years before the PHAT ENERGY CLIFF LADY SIGNS…

GOD HATH A SENSE OF HUMOR…

steve

” leaders try to do whatever possible to keep the LIGHTS on for another few years”

Its not just leaders, after all leaders are really just followers of their constituents except in absolute autocracies/theocracies.

No its not just the leaders- its all of the worlds citizens [energy consumers].

Who purchased a new vehicle in the past 10 years, for example. I’m sure it was with full hope and expectation that they would be able fuel up at will.