A guest post by Ovi

All of the oil (C + C) production data for the US state charts comes from the EIAʼ’s Petroleum Supply monthly PSM.

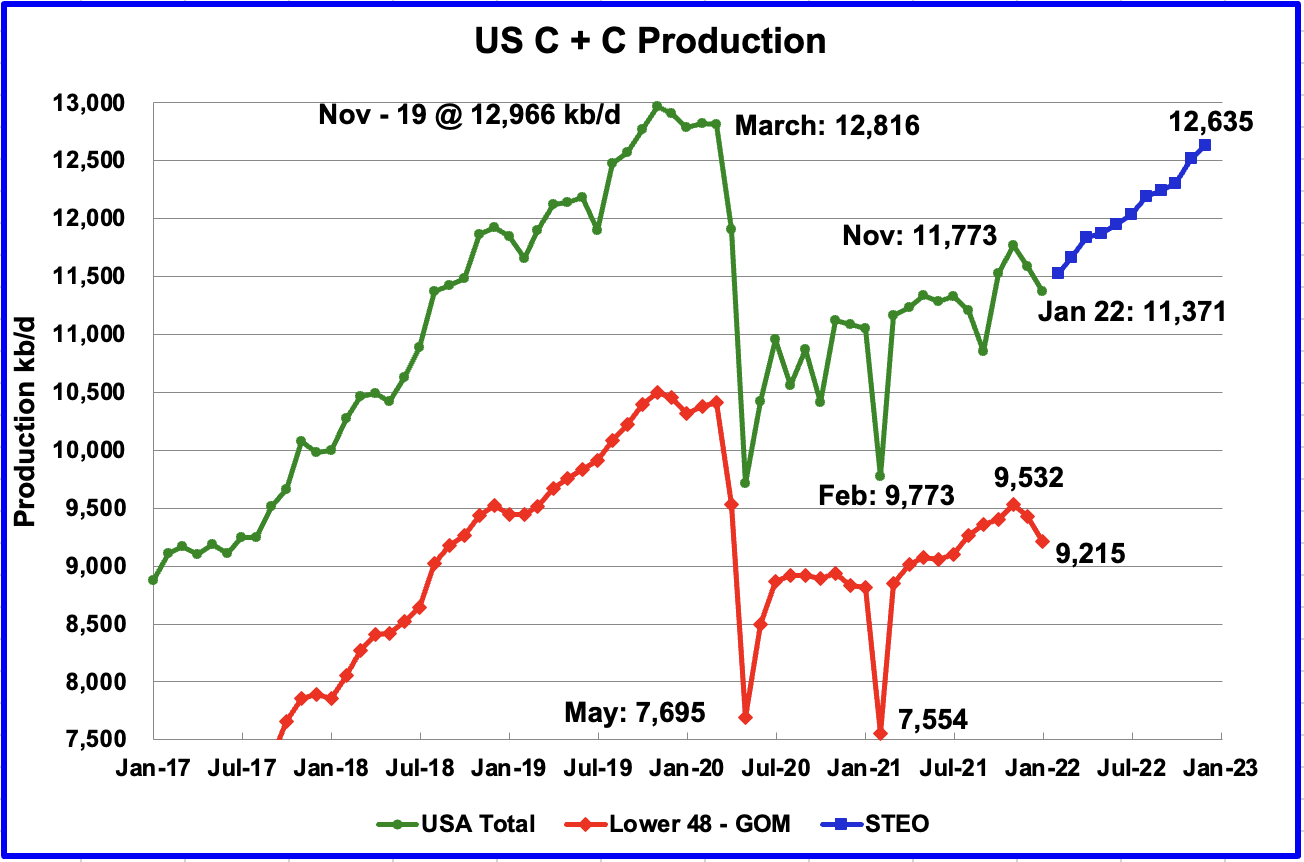

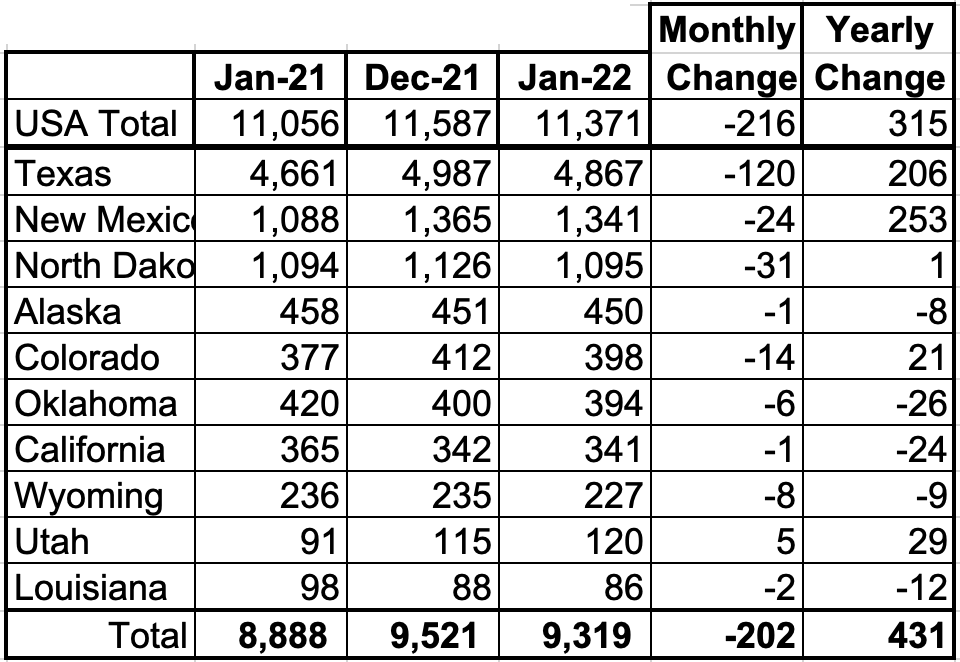

U.S. January production decreased by a surprising 216 kb/d to 11,371 kb/d. In December production dropped by 206 kb/d. The main declining states were Texas 120 kb/d, New Mexico 31 kb/d, and ND 24 kb/d. Of the top 10 states, only Colorado increased its production.

The data points in the blue graph, taken from the February 2022 STEO, are production forecasts for the US from February 2022 to December 2022. Output for December 2022 is expected to be 12,635 kb/d, a revision of 245 kb/d higher than was forecast in the February STEO report.

While overall US production was down, a clearer indication of the health of US onshore oil production can be gleaned by looking more closely at the On-shore L48 states. In the On-shore lower 48, January production decreased by 211 kb/d to 9,215 kb/d. The On-shore L48 decrease accounts for the majority of the drop in US production.

Listed above are the 10 states with the largest US production. These 10 accounted for 82.0% of all production out of a total production of 11,371 kb/d in January 2022. Note that all of the above states, except Colorado, dropped, some more than others.

On a YoY basis, US production increased by 315 kb/d or on average 26.3 kb/d/mth.

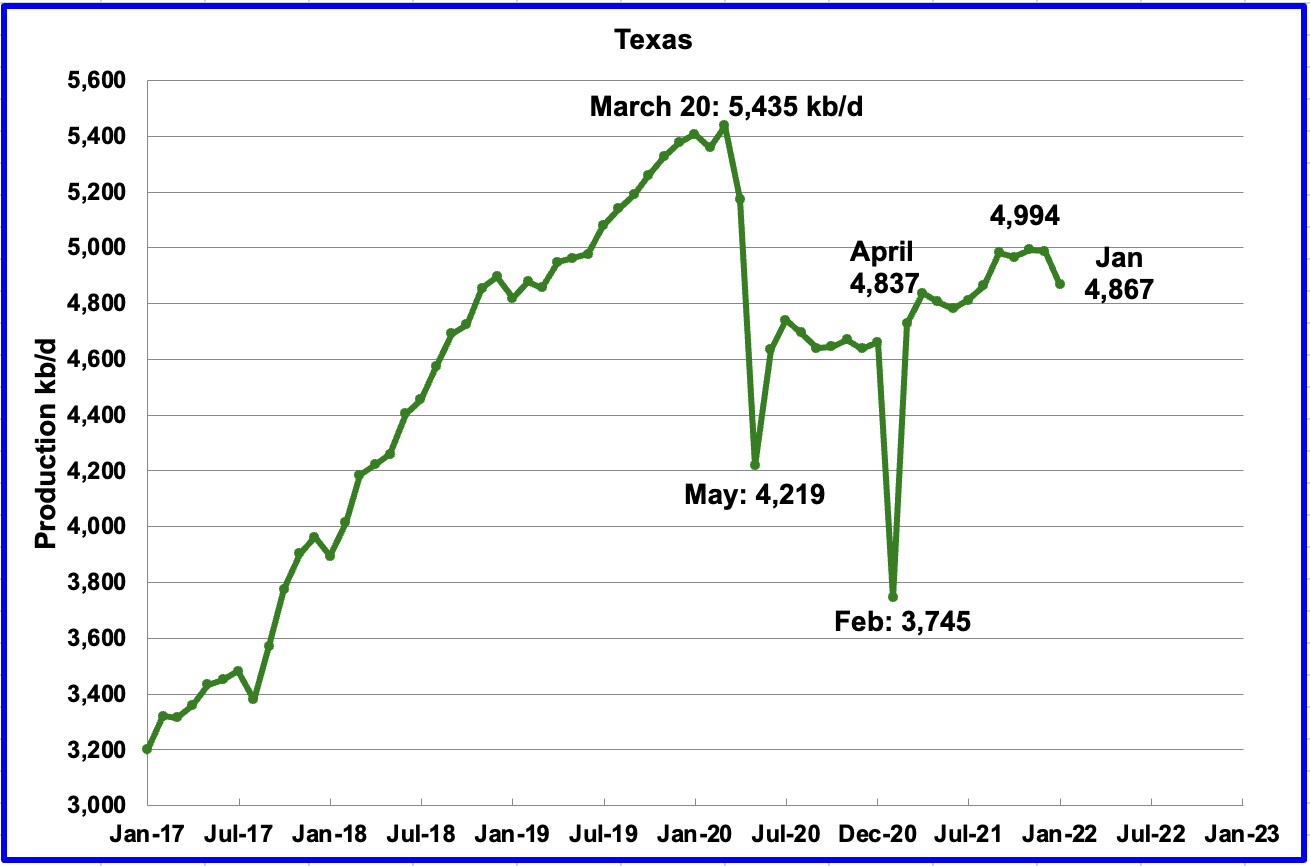

Texas production decreased by 120 kb/d in January to 4,867 kb/d from 4,987 kb/d in December.

In September there were close to 205 Hz oil rigs operating in Texas. By the last week of January, 235 oil rigs were operating, an increase of 30 rigs and production remained essentially flat from September to December and then dropped by 120 kb/d in January.

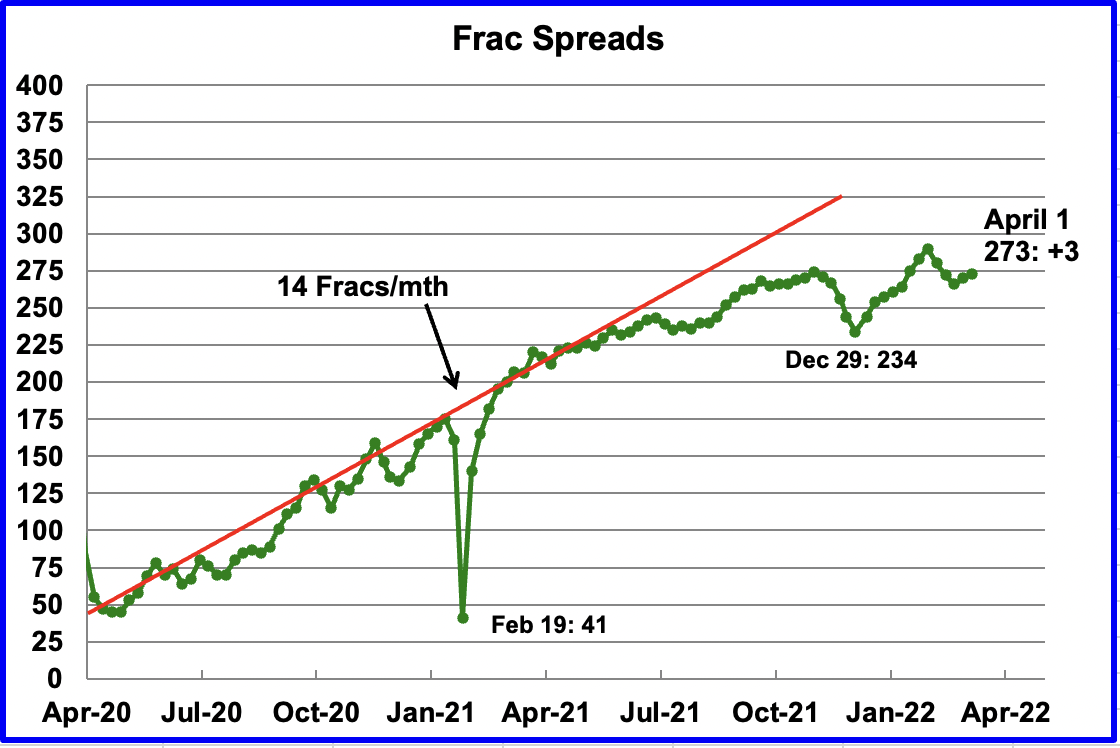

January’s New Mexico production dropped by 24 kb/d to 1,341 kb/d. From the beginning of December to the end, frac spreads dropped from 271 at the beginning to 234 at the end. By the and of January, frac spreads had rebounded to 261, still down 10 from the beginning of December.

The January drop in production in Texas and New Mexico could be related to the lower number frac spreads operating at the end of December and January than at the beginning of December. In addition, Texas experienced bad winter weather in December and January which spilled over into New Mexico. A strong winter storm brought heavy snow and bitterly cold temperatures to parts of New Mexico in the first week of February.

While summer hurricanes are a well known weather phenomenon that affects GOM production, winter storms may be a new factor to consider when forecasting December to February production in Texas and New Mexico.

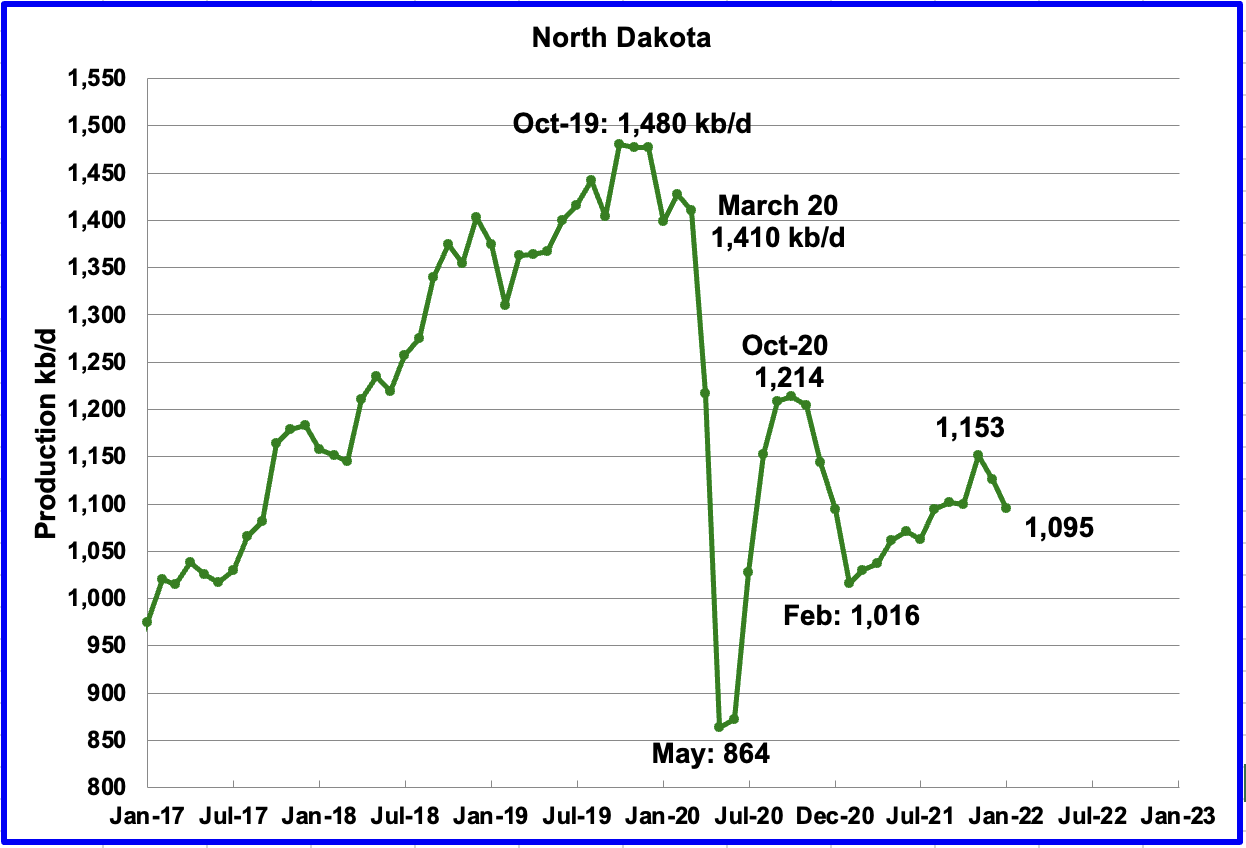

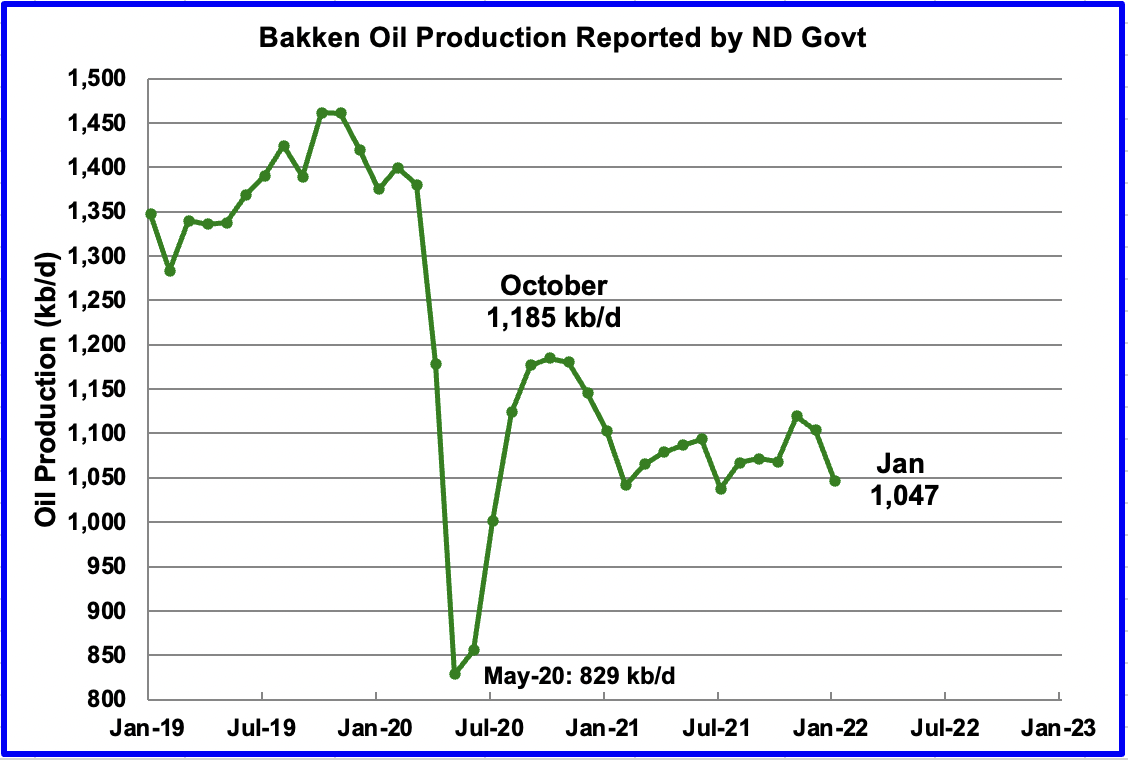

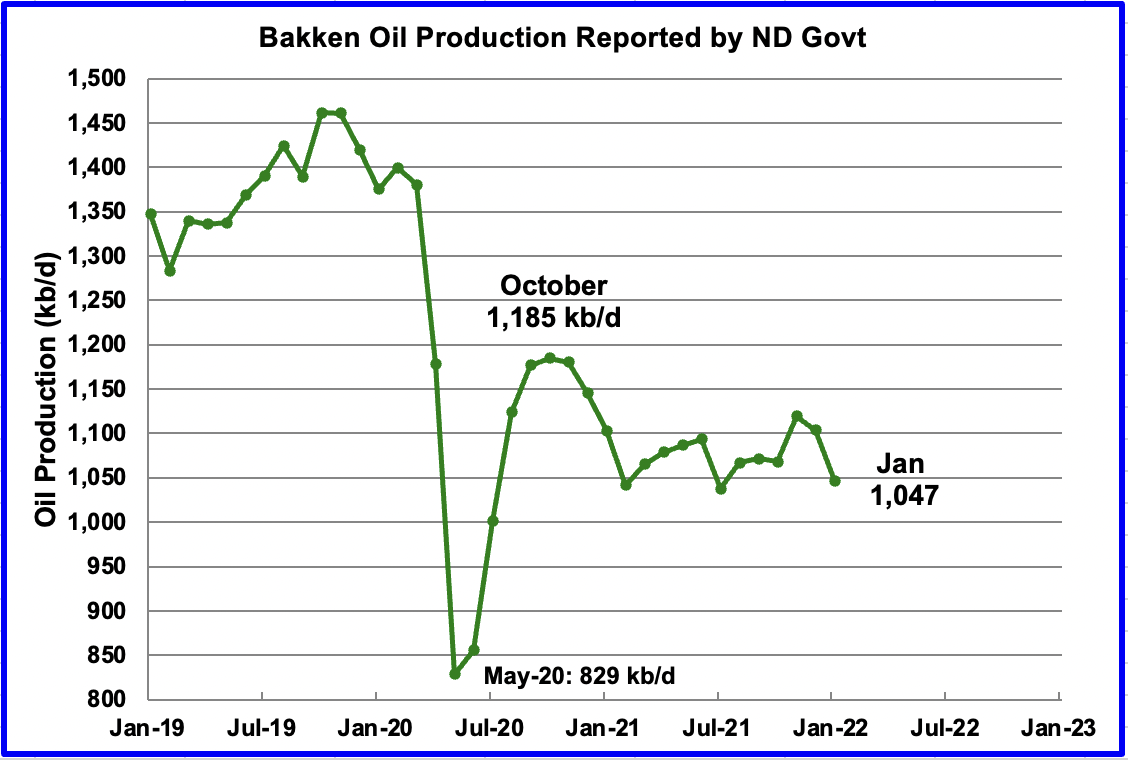

According to the EIA, North Dakota’s December output was 1,095 kb/d, a decrease of 31 kb/d from December. North Dakota’s Department of Mineral Resources reported a bigger drop in January in the Bakken.

According to the North Dakota Oil and Gas division, January production in the Bakken fell by 57 kb/d.

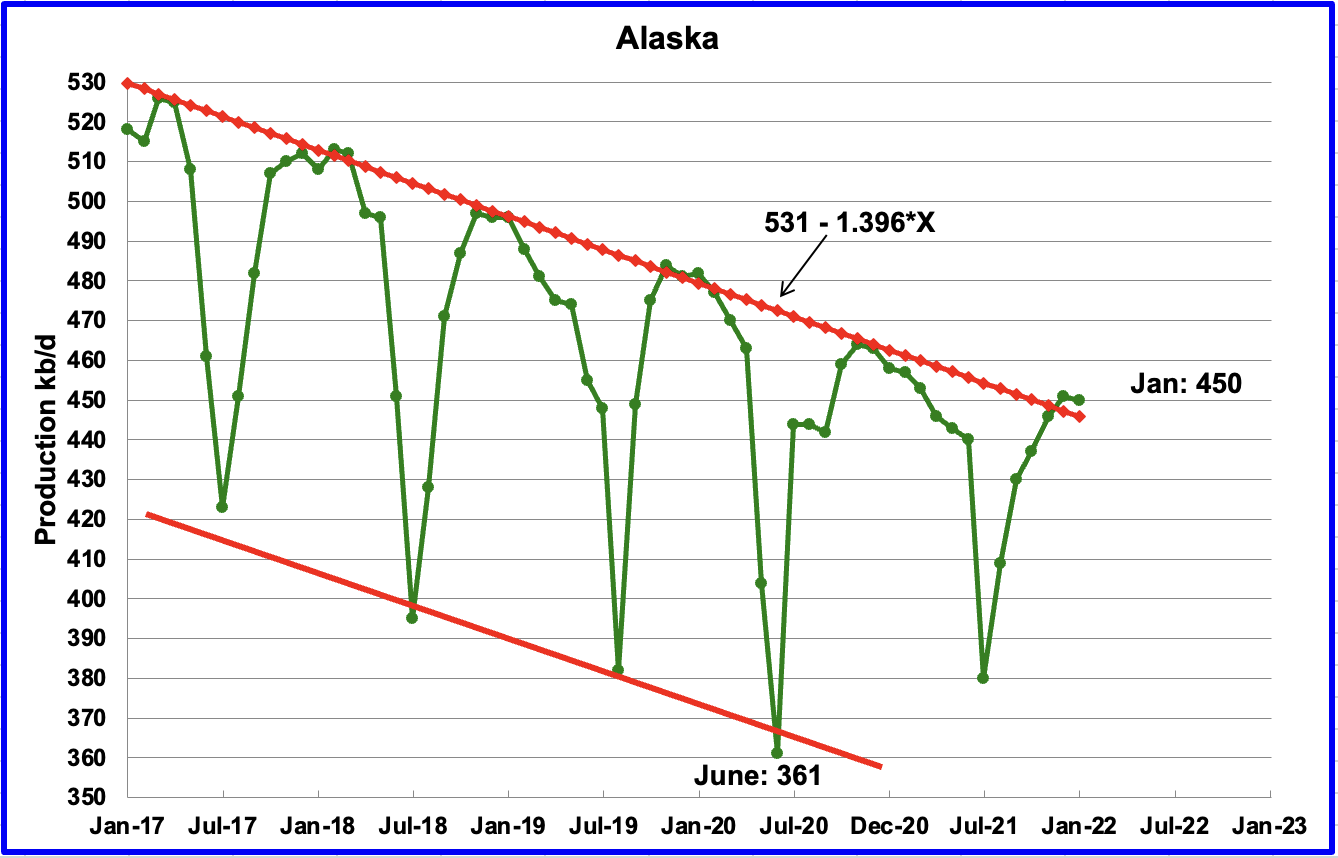

Alaskaʼ s January output decreased by 1 kb/d to 450 kb/d.

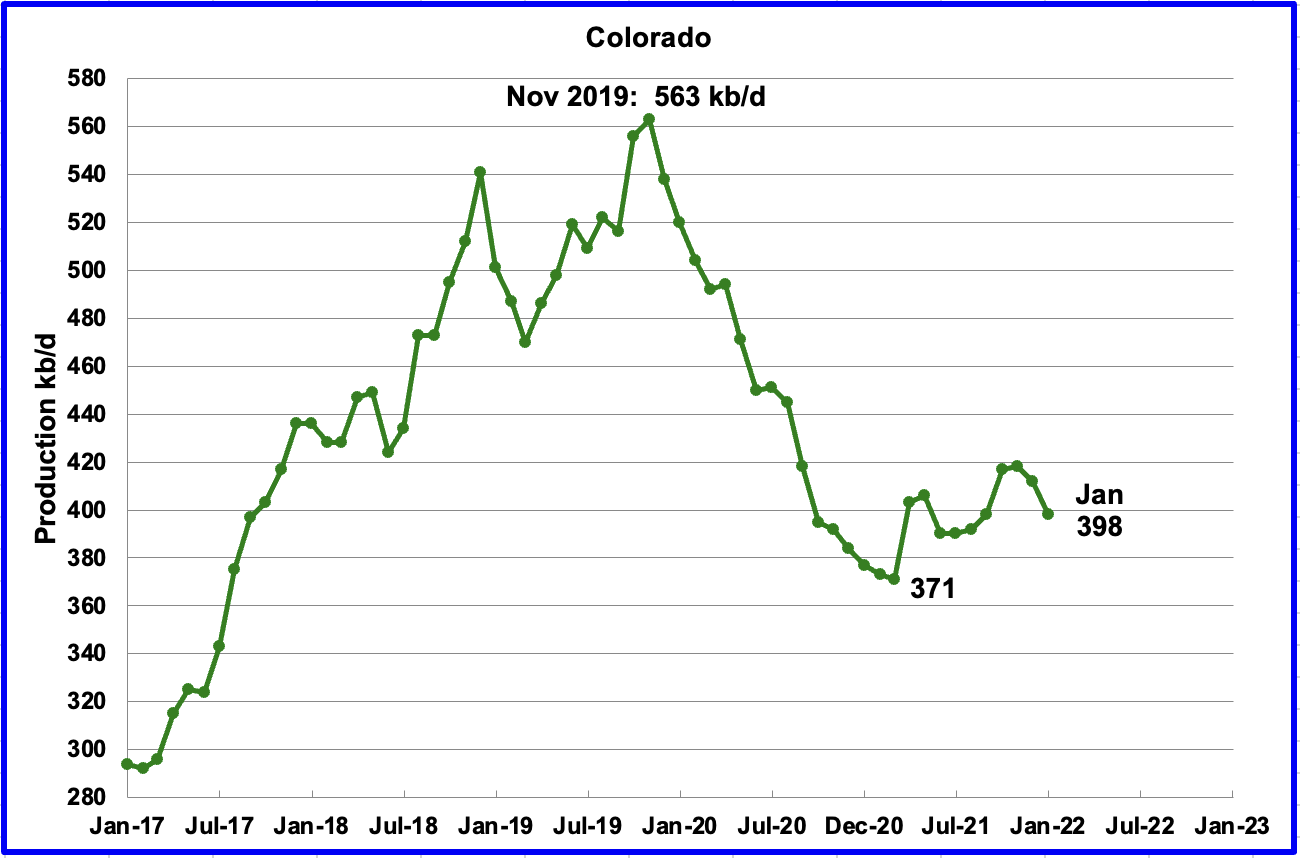

Coloradoʼ s January production decreased by 14 kb/d to 398 kb/d. However, it should be noted that December’s output was revised up from 393 kb/d to 412 kb/d.

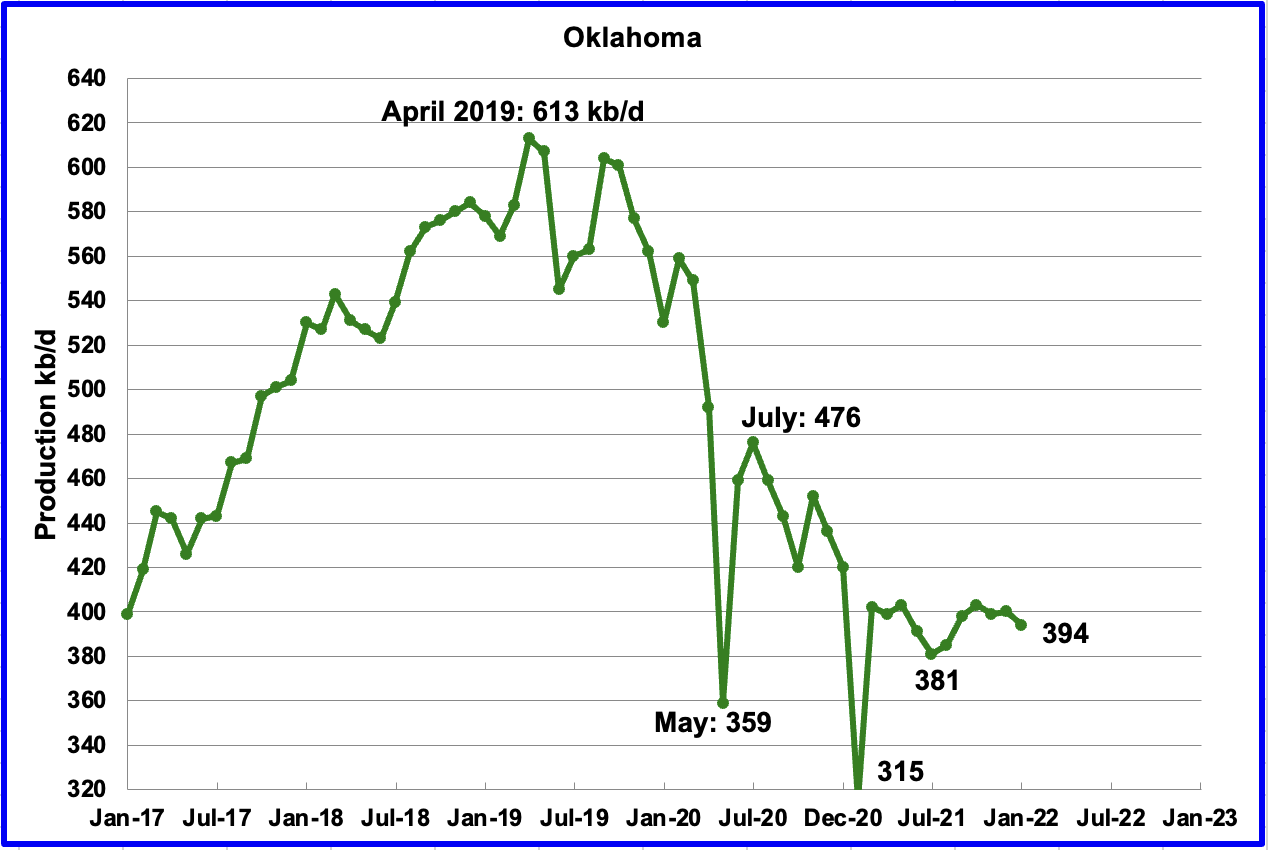

Oklahoma’s output in January decreased by 6 kb/d to 394 kb/d. Its output has remained essentially flat since March even though its rig count increased from 17 in March to 48 in January.

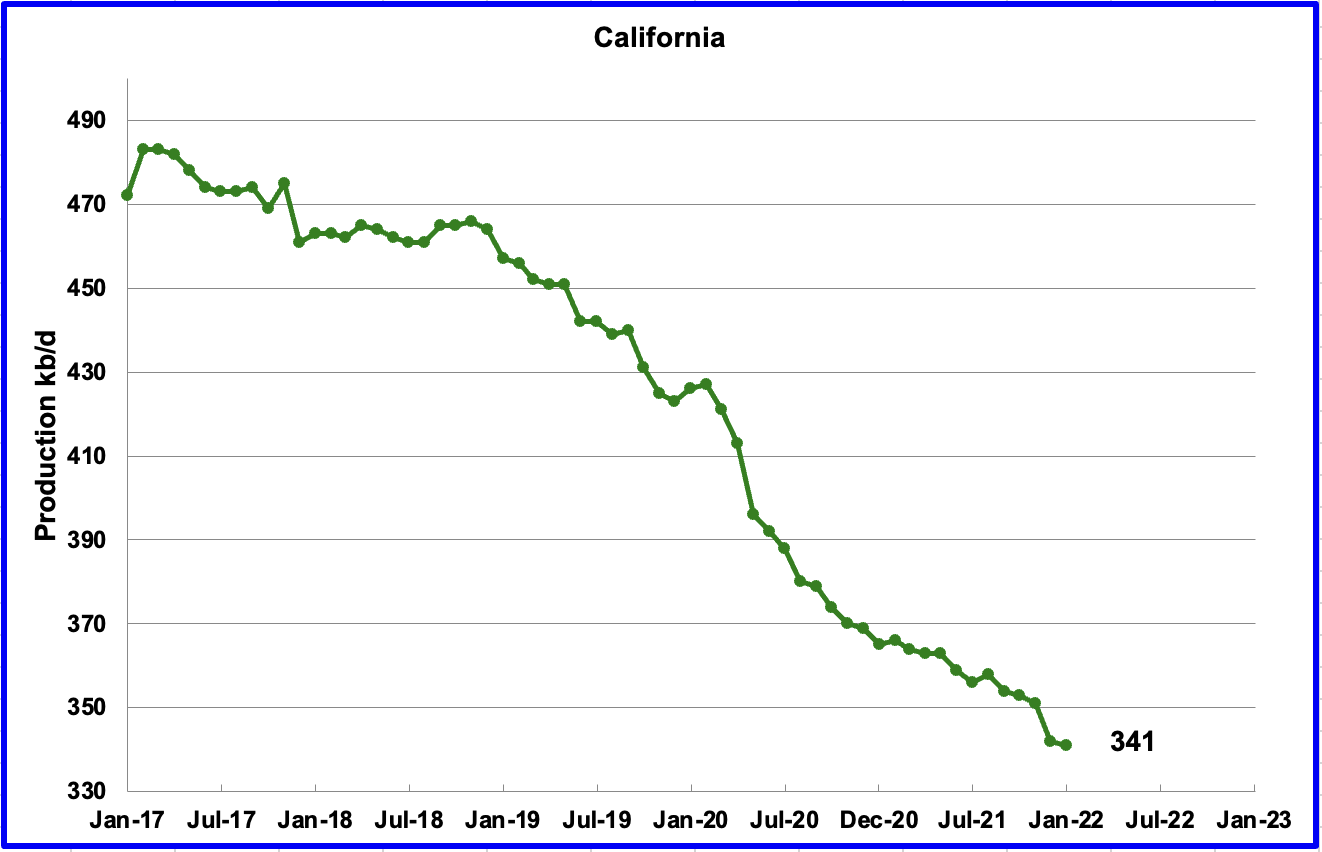

Californiaʼ s slow output decline continued in January. Output decreased by 1 kb/d to 341 kb/d.

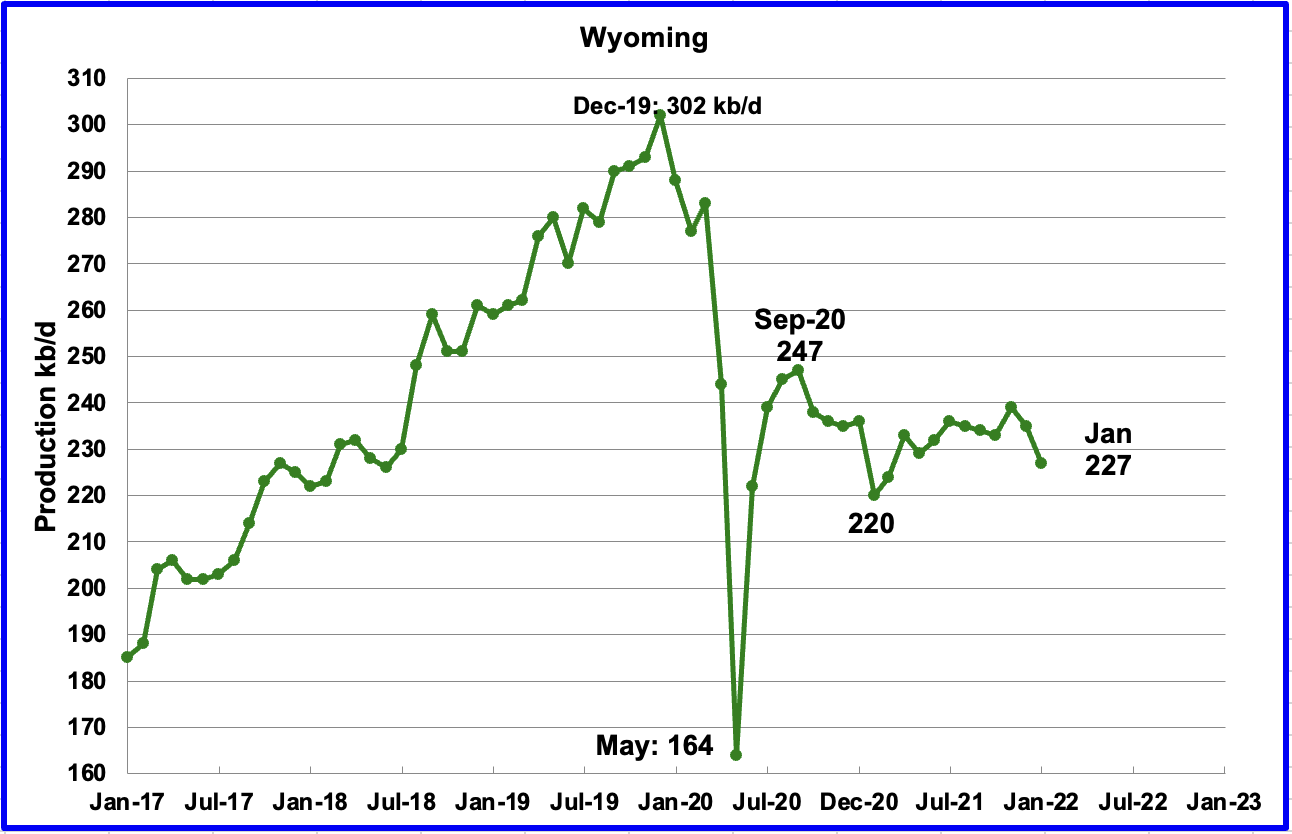

Wyoming’s production has been in a slow unsteady decline since September 2020 when output was 247 kb/d. In January 2022 output decreased by 8 kb/d to 227 kb/d, down 20 kb/d from September 2020.

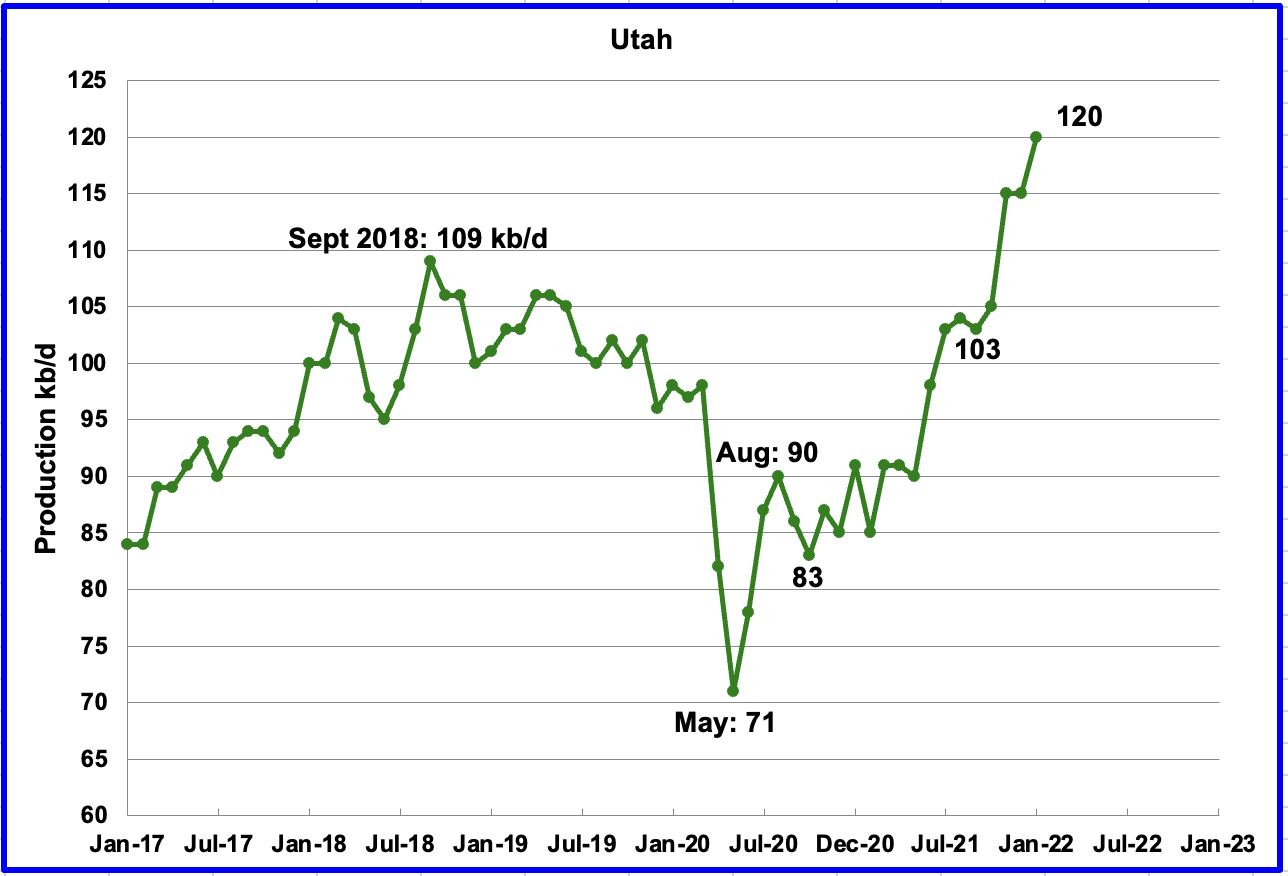

Utah’s production increase from the low of May 2020 continued. January’s production increased by 5 kb/d to a new record high 120 kb/d. Utah began to increase its Hz rig count from 6 in October 2021 to 8 in February.

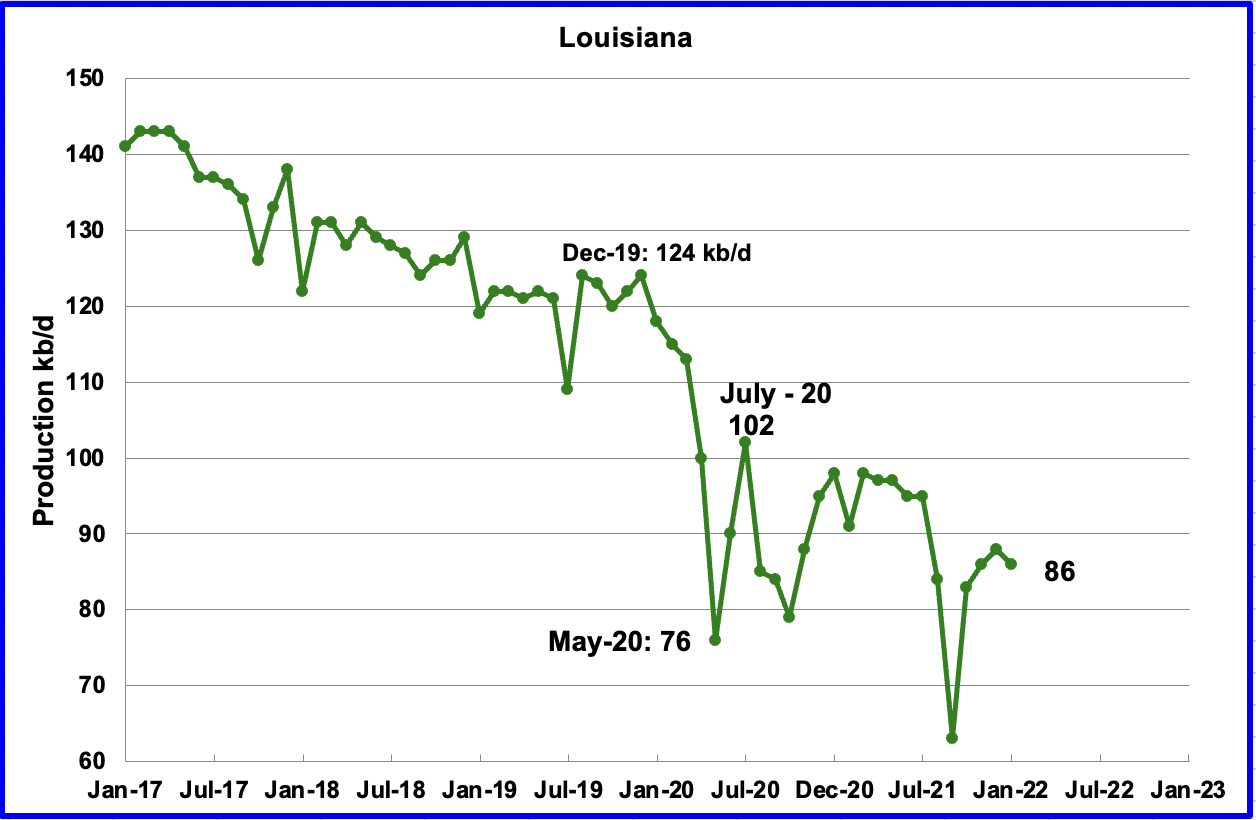

Louisiana’s output decreased by 2 kb/d to 86 kb/d in January. Louisiana was one of the hardest hit states by hurricane Ida in late August. January’s output decrease indicates that Louisiana’s slow recovery is complete.

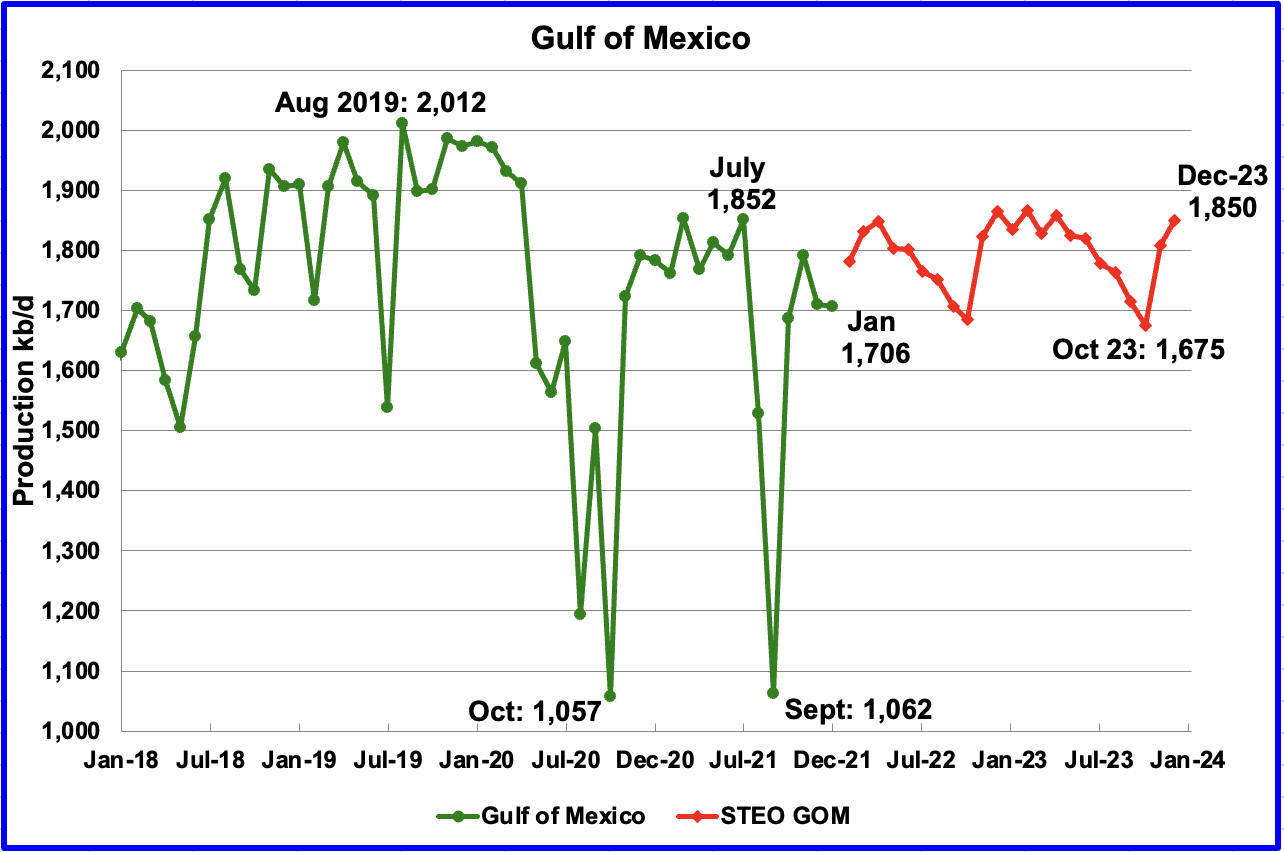

Production from the GOM was essentially unchanged in January. It decreased by 4 kb/d to 1,706 kb/d. If the GOM was a state, its production would normally rank second behind Texas.

The March 2022 STEO projection for the GOM output has been added to this chart and projects output will be 1,850 kb/d in December 2023 with a local high of 1,865 kb/d in December 2022. This is 147 kb/d lower than the previous high of 2,012 kb/d in August 2019.

A Different Perspective on US Oil Production

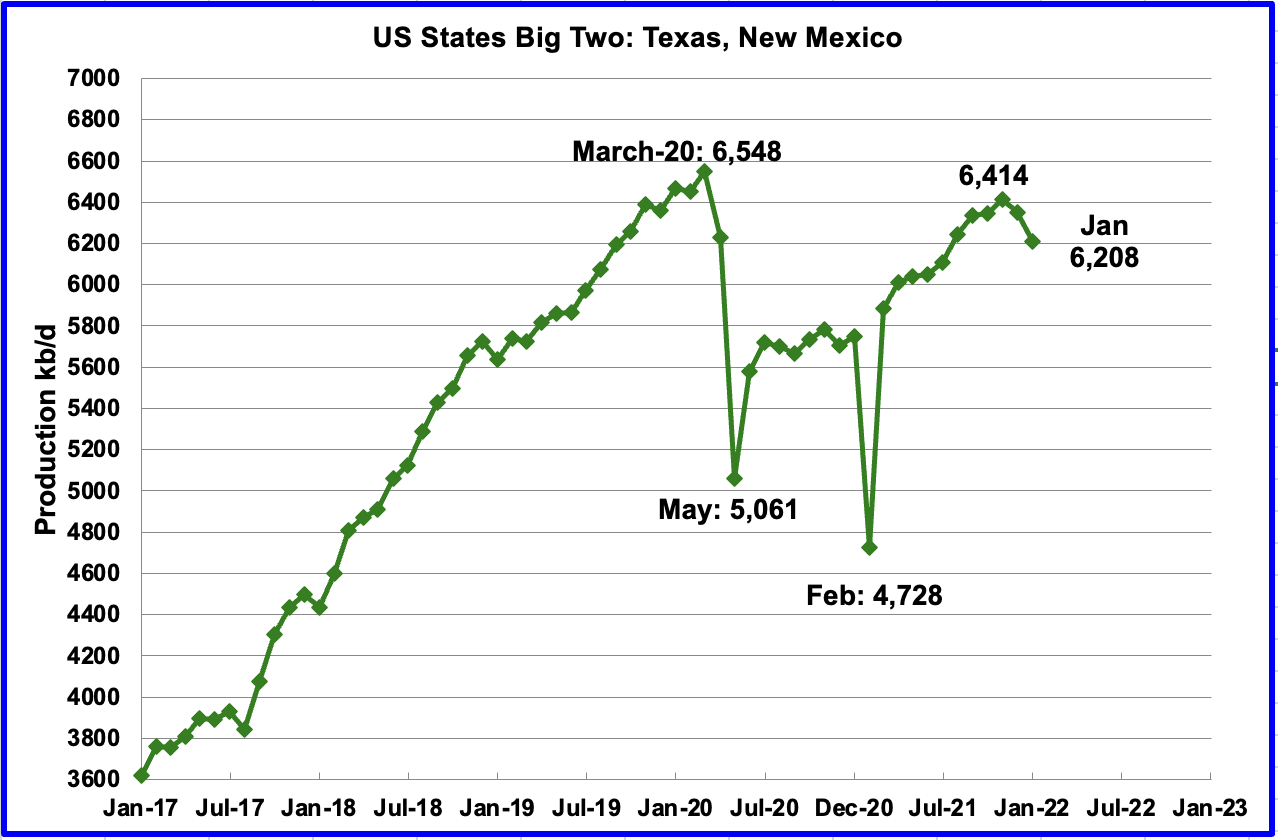

The Big Two states, combined output for Texas and New Mexico.

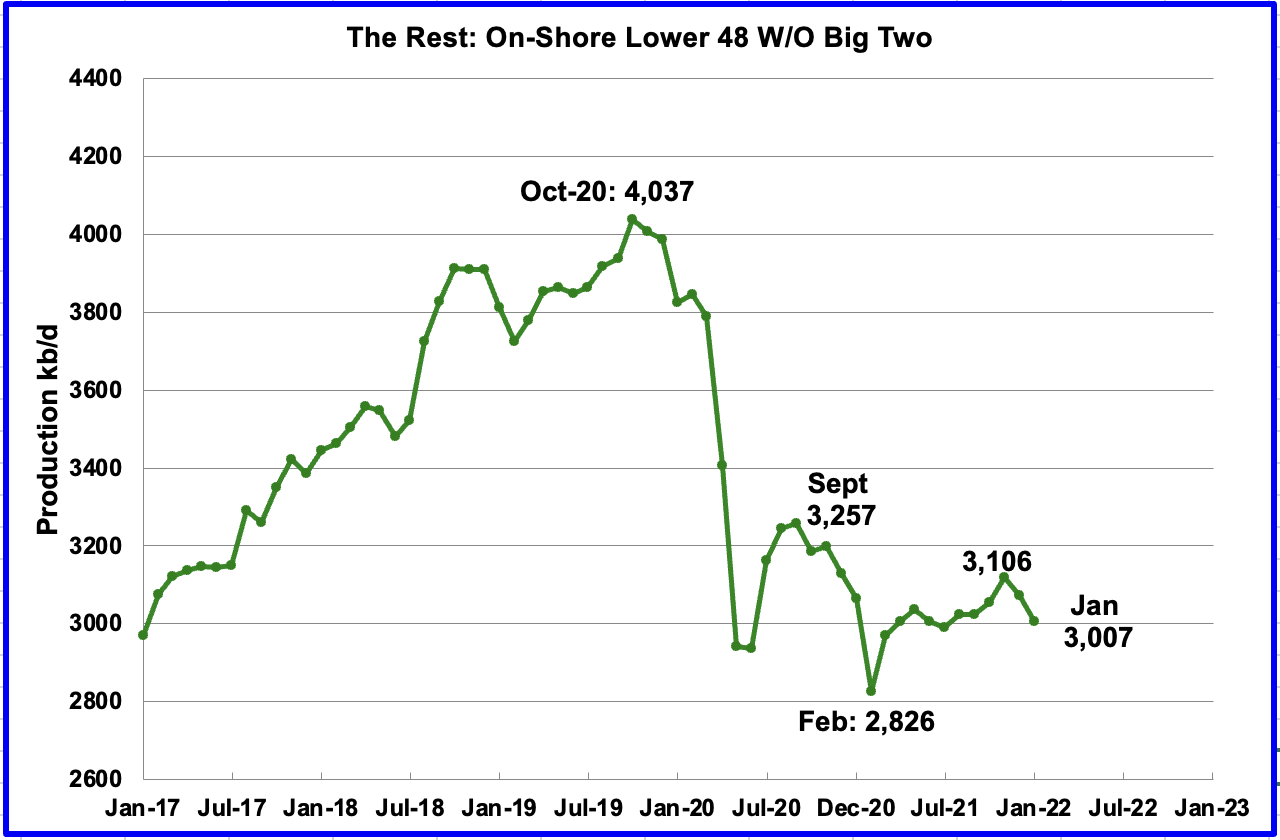

The Rest

To get a different perspective on US oil production, the above two charts have broken US state production into two groups, “The Big Two” and the “On-Shore L48 W/O Big Two” or The Rest.

January production declined again in the Big Two states. Output dropped by a combined 144 kb/d, with the majority coming from Texas, 120 kb/d. Possible contributing factors to the drop in January were bad weather, slow restarts associated with Christmas holidays and a lower number of frac spreads.

Rigs and Fracs

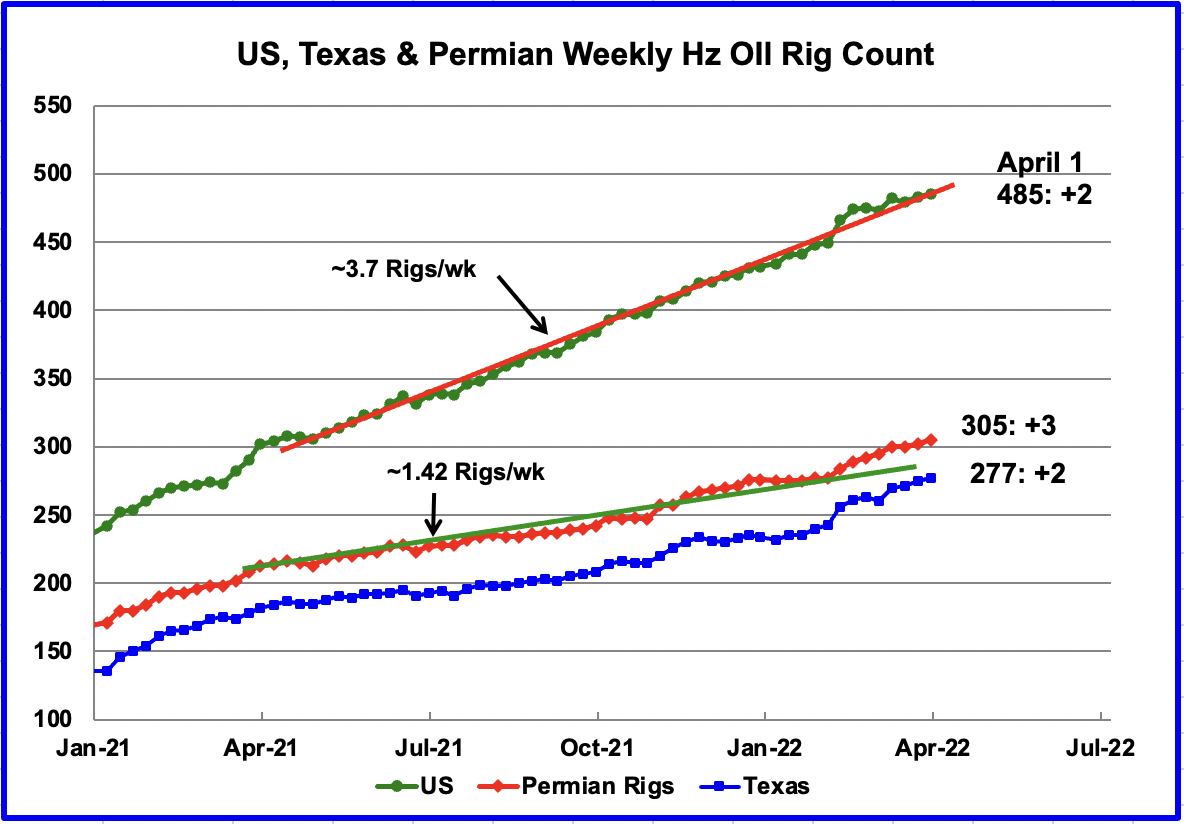

The US total Hz oil rig count for the week ending April 1 was 485, an increase of 2 over the previous week.

From the beginning of April 2021 to April 2022, the US has been adding Hz oil rigs at a rate of close to 3.7 rigs/wk. Over the period April 2021 to October 2021, the Permian added 1.42 rigs/wk, indicating that rigs were being added in other basins. However drilling activity in the Permian has been increasing since February 2022.

Since the first week February, the addition of Hz rigs in the Permian basin accelerated over the average rate as the red graph broke away to the upside from the green trend line. In the week ending April 1, the Permian Hz oil rig count increase by 3 to 305. The average rate of adding rigs from February to April 1 is close to 3.5 rigs per week.

Since the beginning of the year to the week ending April 1, the rig count in the NM Permian has bounced around 91 +/- 2. In the week ending April 1, 90 rigs were operational in the NM Permian. Over the same period, rigs in the Texas Permian increased from 183 to 305, an increase of 22. This indicates there are higher quality drilling areas in the Texas Permian.

During December 2021, 37 frac spreads were decommissioned primarily due to the holidays and the total dropped to a low of 234 at the end of December. During the month of January, 27 frac spreads were reactivated and in February an additional 29 were added for total of 283.

As of the week ending April 1, the frac spread count had declined to 273, an increase of 3 from the previous week and down 10 from the middile of February. Also note it is 2 higher than the frac spreads operating in the week ending December 3, 2021.

Note that these 273 frac spreads include both gas and oil spreads, whereas the rigs information is strictly oil rigs.

WTI

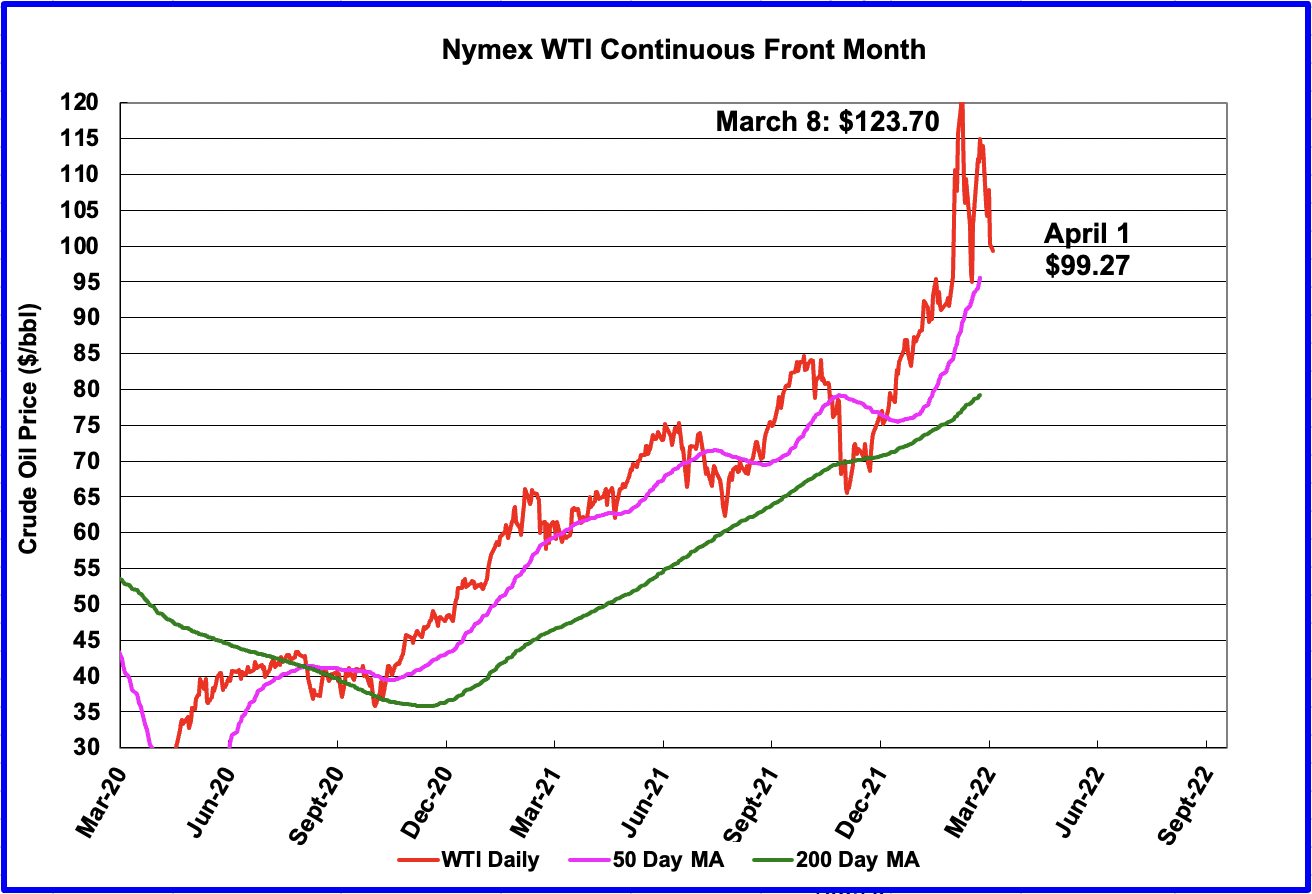

The WTI May contract settled on April 1 at $99.27/bbl. The price drop in the last few days occurred after the US announced it would release 1 Mb/d from the SPR over a period of 180 days.

1) Short Term Energy Outlook (STEO)

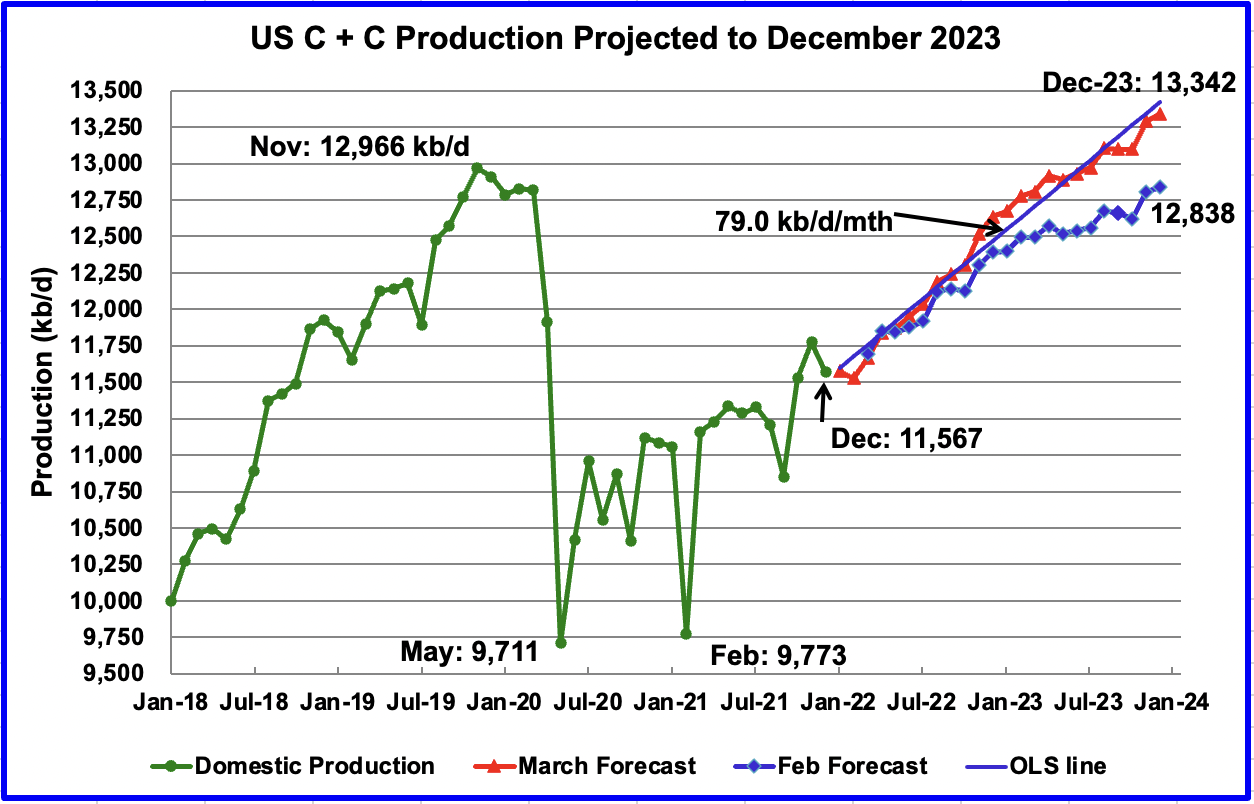

The March 2022 STEO provides projections for the next 24 months, starting with January 2022 to December 2023, for US C + C, OPEC and other oil production related parameters of interest.

The March 2022 STEO has significantly revised upward its projected US oil output from January 2022 to December 2023. December 2023 has been revised up by 504 kb/d from the previous February 2022 STEO. The increase is probably related to the oil price increase shown in the WTI price chart further down. The projected price for WTI for December 2023 has been increased from $62/bbl to $79/bbl.

The biggest change in output occurs during 2022. The increase from January 2022 to December 2022 is 1,059 kb/d over these eleven months or 96.3 kb/d/mth. Almost unbelievable. From January 2023 to December 2023, production increases by 669 kb/d.

Note that the STEO is projecting essentially flat production for January and lower for February. While January actually dropped, it is encouraging to see that the STEO was not forecasting a January increase. The reason I note this is because the DPR and LTO sections below both show increasing January and February production.

Using only the projected data and fitting an OLS line through the January 2022 to December 2023 data, the STEO is forecasting production will increase at an average rate of 79 kb/d/mth, ending at 13,342 kb/d in December 2023. The average rate in the previous February report was 50.3 kb/d/mth. If the December 2023 output is achieved, it will be 376 kb/d higher than the November 2019 record.

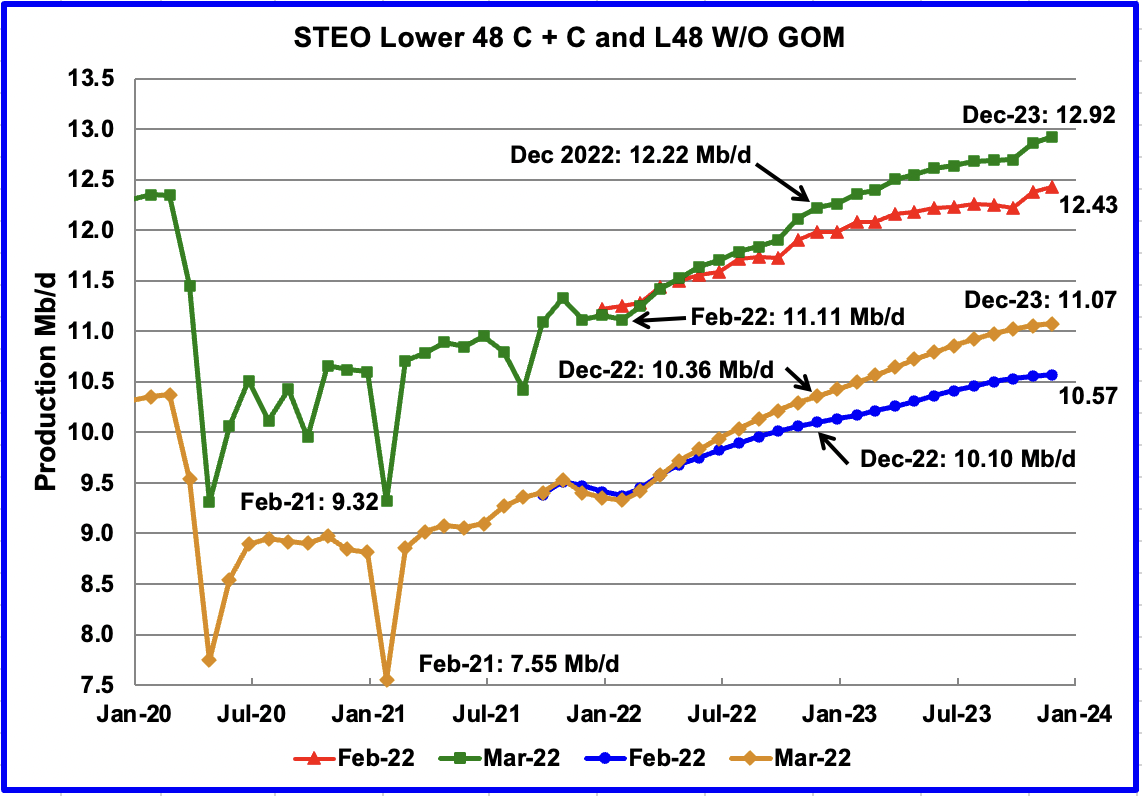

This chart compares the STEO’s forecast from the February report with the current March 2022 report to better illustrate the big change in the EIA’s forecast. For the Lower 48, the December 2023 output has been revised up by 490 kb/d from 12.43 Mb/d to 12.92 Mb/d.

The February STEO output projection for the Onshore L48 states has also been revised up to show increased production in 2022 and in 2023. The output projection for December 2023 has been increased by 500 kb/d to 11.07 Mb/d from the previous forecast of 10.57 Mb/d. From the orange graph, one can notice a definite slowing in the production rate in the later half of 2023. Is this a hint of possible further slowing in monthly production increases beyond 2023?

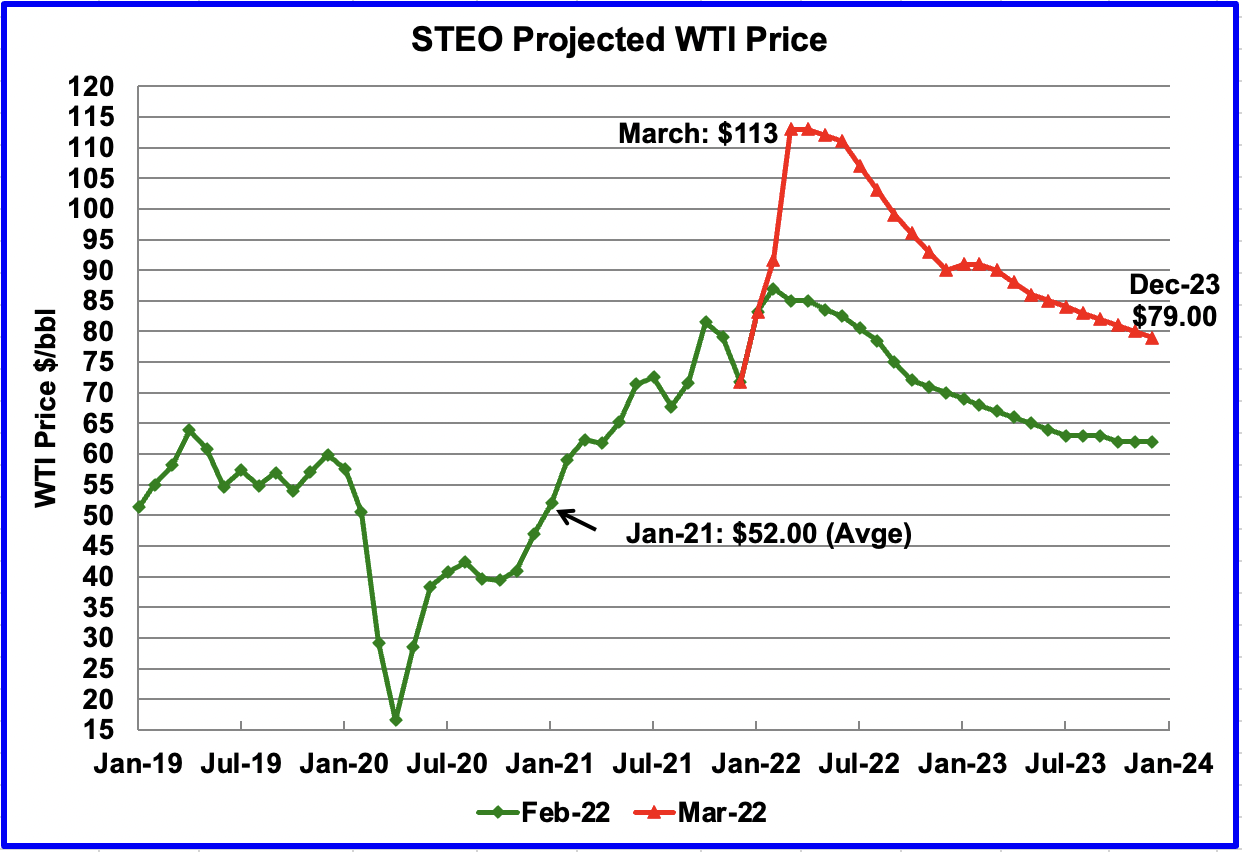

The March 2022 STEO oil price forecast continues to show a steady decline from the EIAs new March peak of $113/bbl to $79/bbl in December 2023. Essentially the EIA is continuing to forecast that the only direction for the price of WTI going forward is down to $79/bbl.

The May contract settled at $99.27 on April 1, $12.73/bbl lower than the EIA’s forecast of $112.00/bbl average for the May contract.

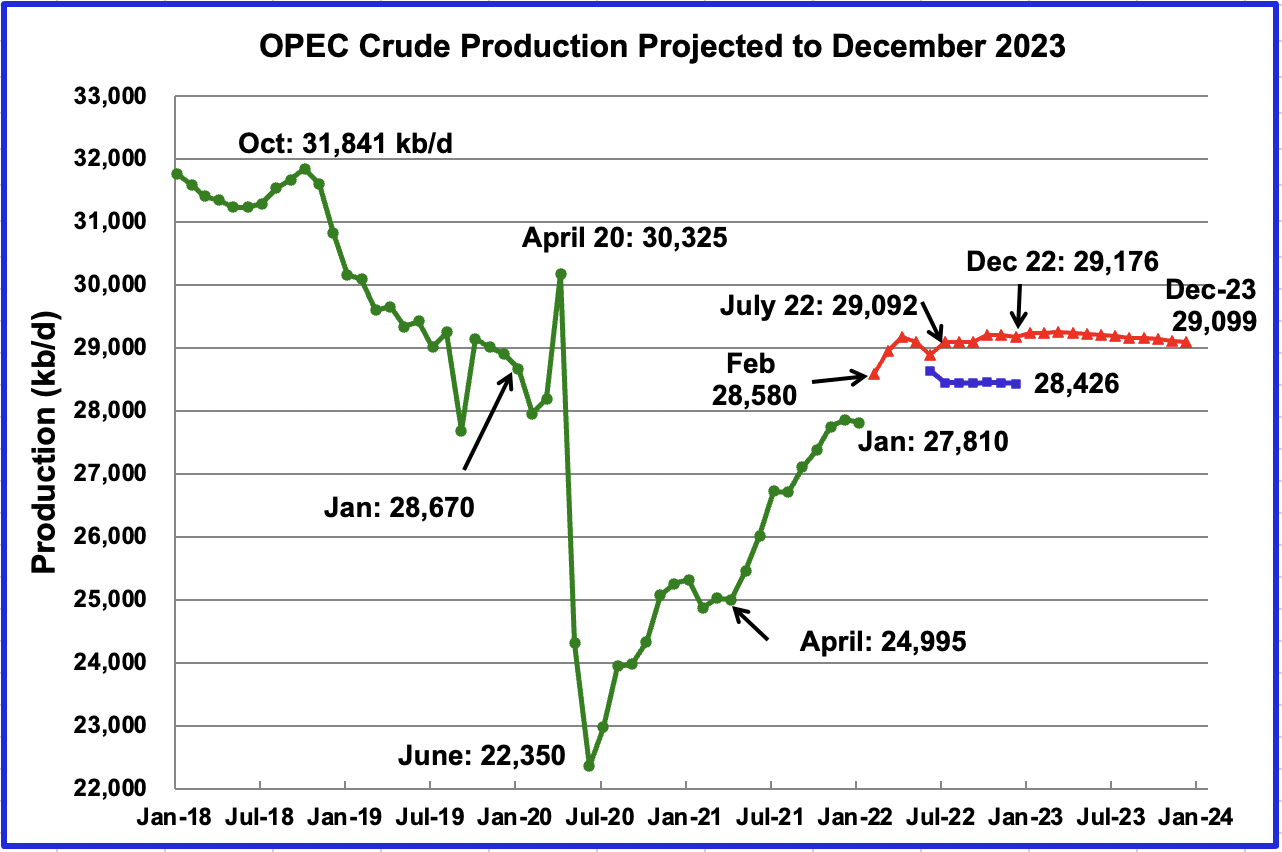

This chart shows the STEO’s March forecast for OPEC crude output from February 2022 to December 2023 compared to their December 2022 forecast. (Blue markers). Output for December 2022 has been increased by 750 kb/d in going from the December report to March. This is an additional increment of 200 kb/d over the February report. It is not clear if this increase is expected due to expected decreased Russian production associated with sanctions on Russian oil.

OPEC’s output is projected to increase from January 2022 to July 2022 by 1,366 kb/d to 29,176 kb/d. After July 2022, output remains essentially flat at slightly above 29,000 kb/d out to December 2023.

For February 2022, the EIA STEO forecasts OPEC production to be 28,580 kb/d. Actual February production as reported by OPEC was 28,473 kb/d, lower by 107 kb/d.

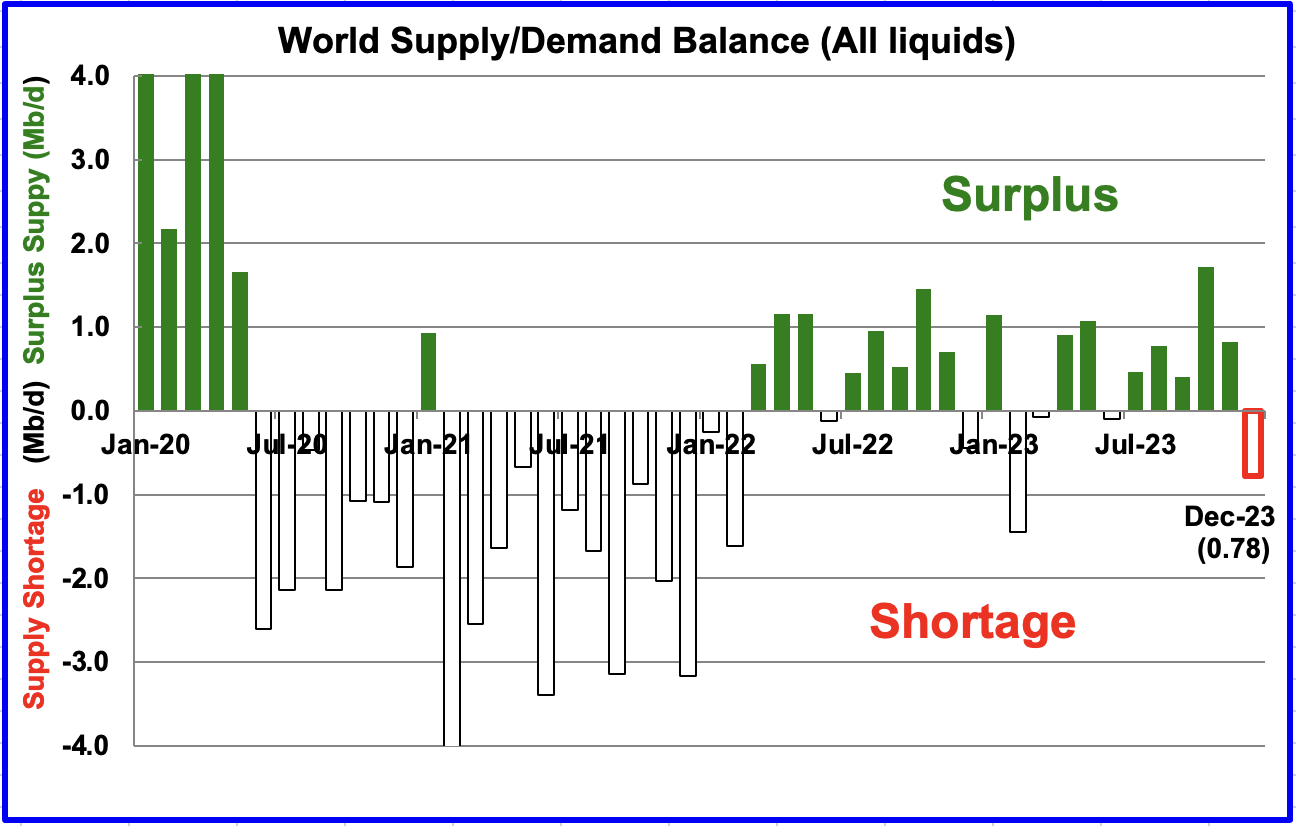

This chart shows the historical world supply/demand balance up to January 2022 and after that, the EIA’s forecast out to December 2023.

From February 2022 to December 2023, the STEO is forecasting an average monthly surplus of close to 421 kb/d, 457 kb/d lower than last month’s average. The sanctions on Russian oil and increased prices could see a big revision to this forecast next month.

2) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The March DPR forecasts production to April 2022 and the following charts are updated to April 2022.

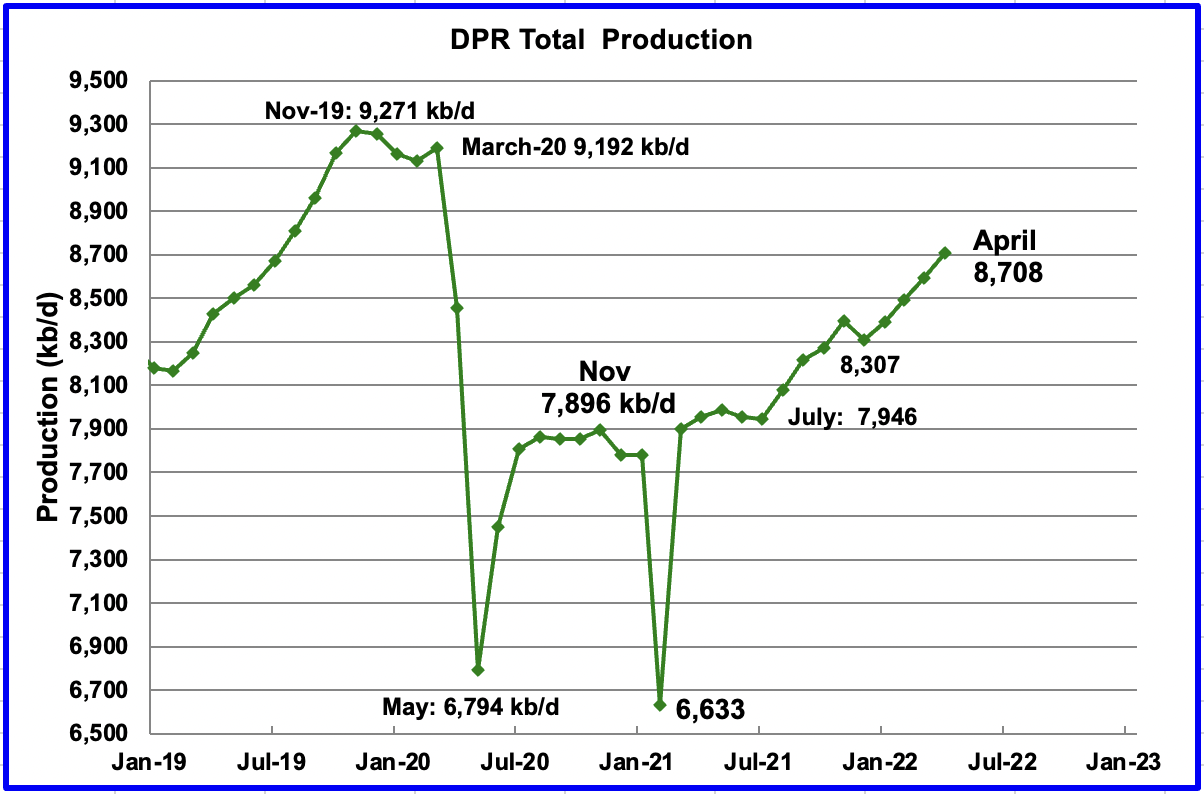

Above is the total oil production projected to April 2022 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional fields.

The DPR is projecting that output for April 2022 will increase by 117 kb/d to 8,708 kb/d. From December 2021 to March 2022, output in the DPR basins is forecast to increase by 401 kb/d or by an average of 100 kb/d/mth. Note that this monthly production rate is close to the STEO rate of 96.3 kb/d projected for all of 2022 in the STEO section above.

Did April production really increase? In the February DPR report, March output was projected to be 8,707 kb/d. The March report revised March output down to 8,592 kb/d and April is now only 1 kb/d higher at 8,708 kb/d than the original February forecast.

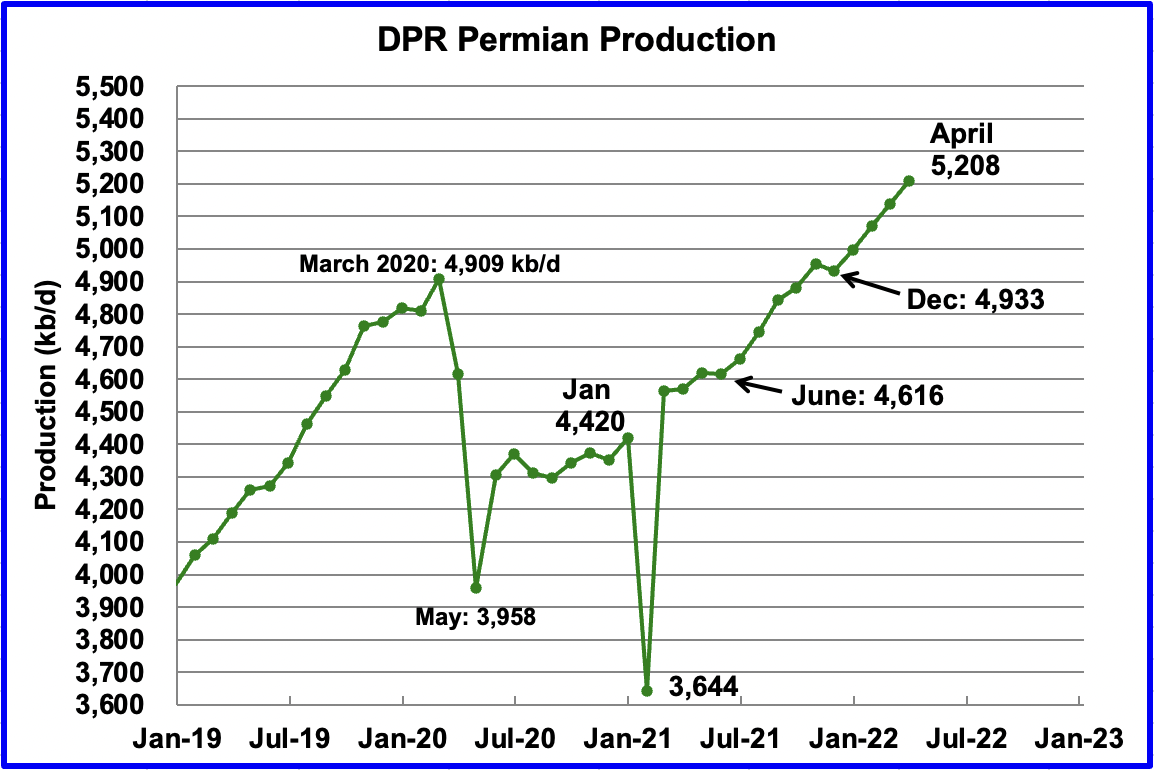

Permian output exceeded 5,000 kb/d in February 2022 and continues to increase. In April, production increased by 70 kb/d to a new high of 5,208 kb/d. From December to April, production is forecast to increase by 275 kb/d or at an average rate of 68.8 kb/d/mth. If the Permian were part of OPEC, at 5,208 kb/d it would be the second largest producer after Saudi Arabia.

Due to revisions, April’s Permian output is just 3 kb/d higher than the DPR’s March forecast of 5,205 kb/d reported in the previous February report.

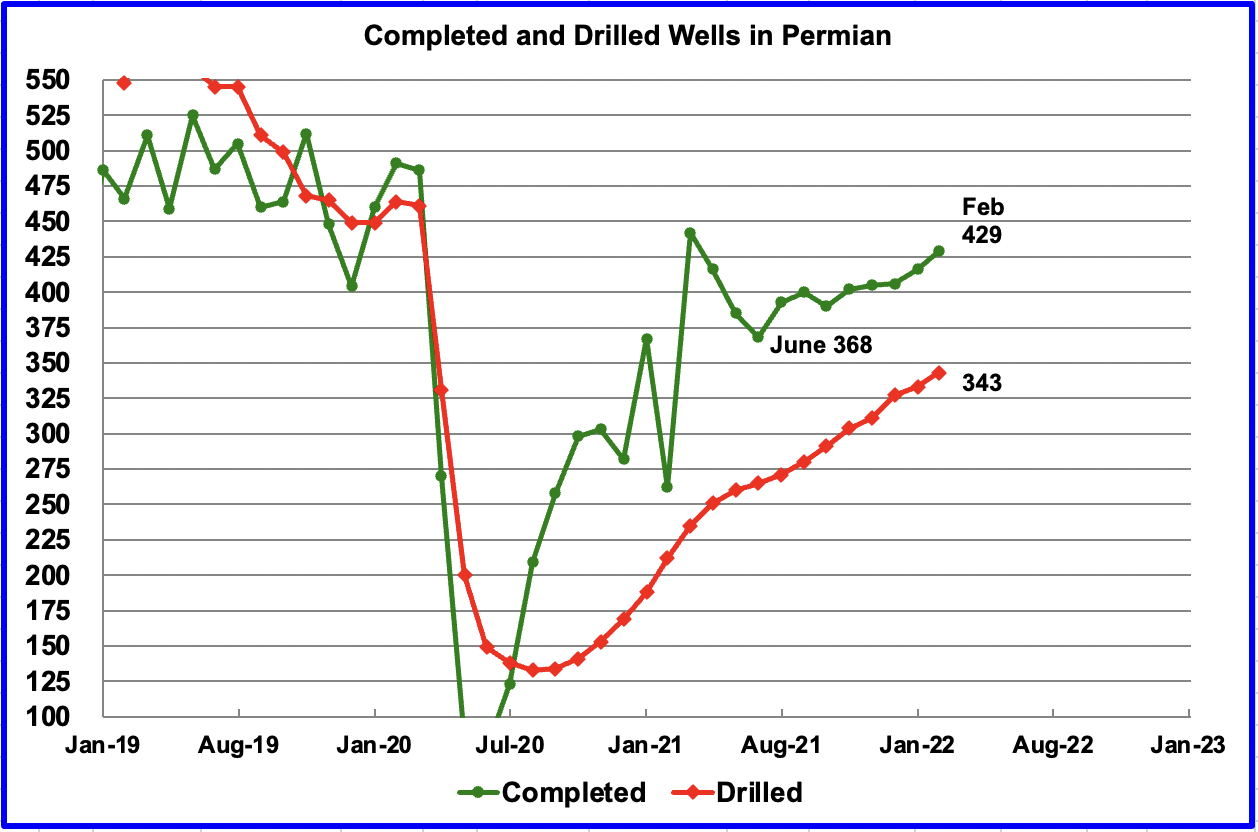

During February, 343 wells were drilled and 429 were completed in the Permian. The completed wells added 340 kb/d to February’s output for an average of 793 kb/d/well. The overall decline was 268 kb/d which resulted in a net increase of 72 kb/d. Of the 409 completed wells, 338 were required to offset the decline. It is the completion of the additional 91 DUCs, over and above those drilled, that accounts for the increase in the production in the Permian.

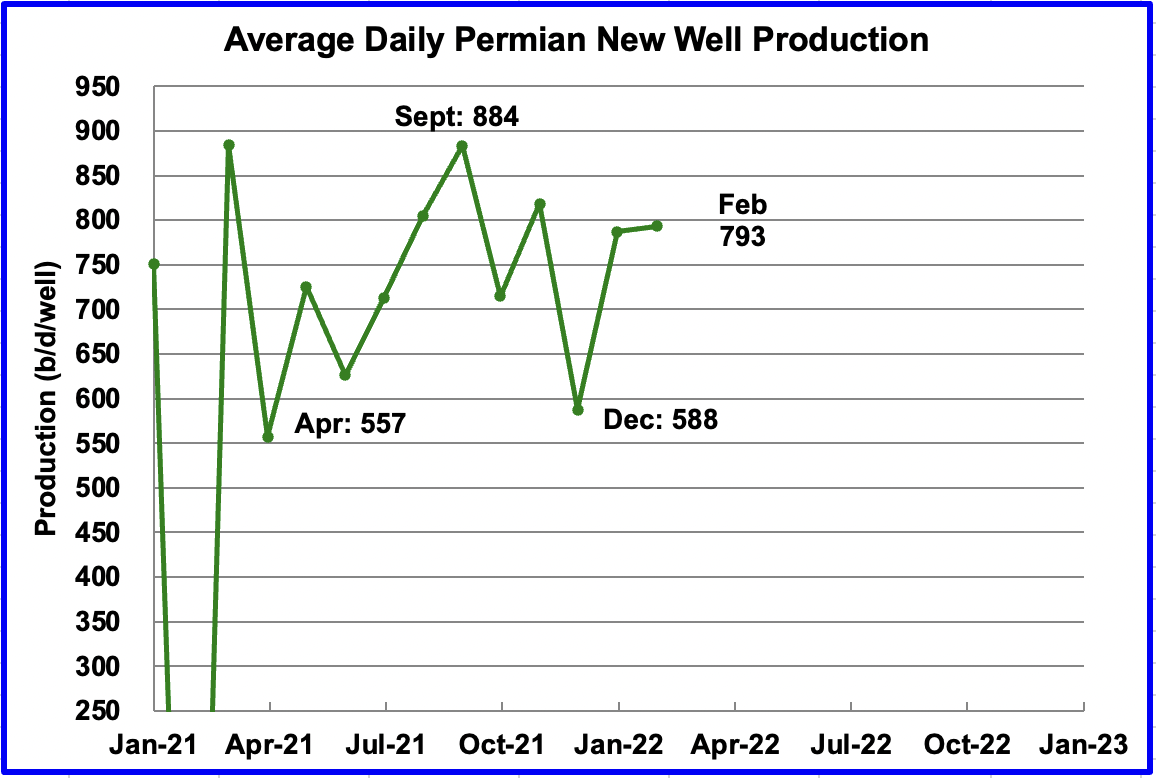

This chart shows the daily production from the average new Permian well tracked on a monthly basis. The daily output for new Permian wells was divided by the number of completed wells, as reported in the DPR and DUC reports.

For instance, during February, new wells produced 340 kb/d from 429 wells for an average of 793 b/d/well. The DPR back checks their earlier estimates and it appears that the average first month output is close to 800 kb/d. December dropped due to bad weather in Texas. Well production data is only available up to February to make this estimate.

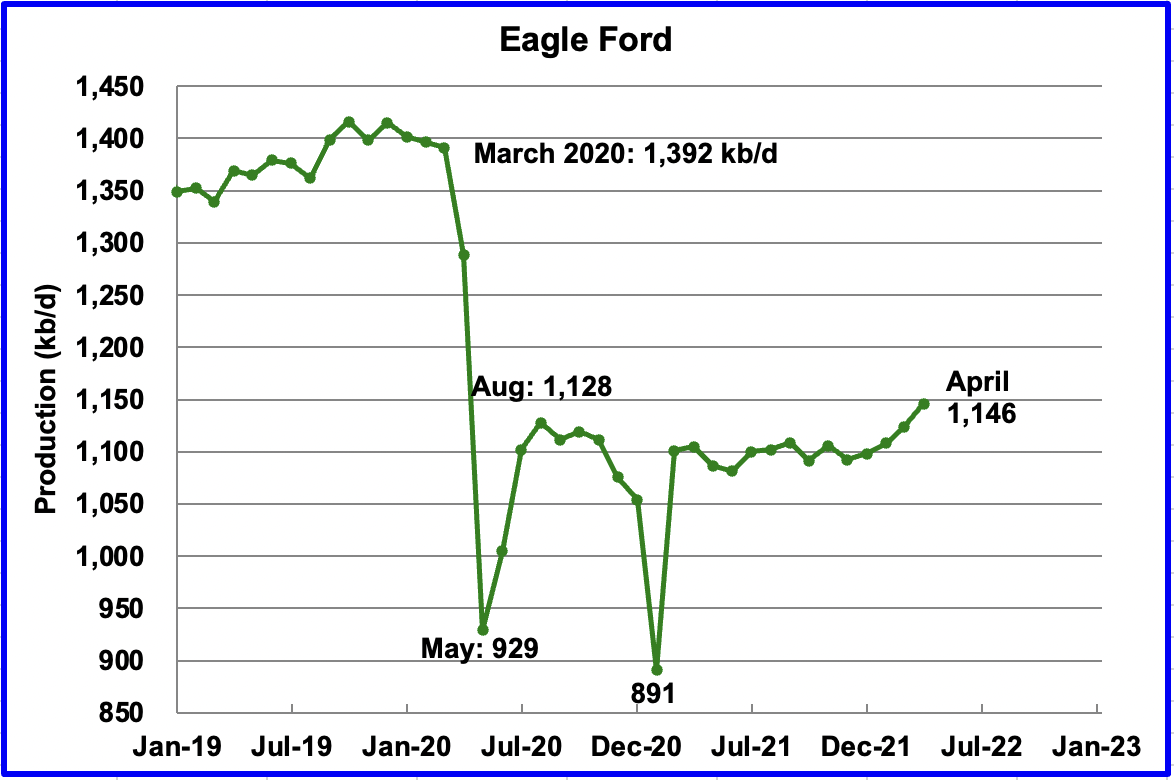

Output in the Eagle Ford basin has been showing an increasing trend since January 2022. For April, output is expected to increase by 23 kb/d to 1,146 kb/d. Since the beginning of the year, 9 rigs have been added for a total of 47, which explains the increasing output.

Again April’s output is the same as was reported for March in last month’s report.

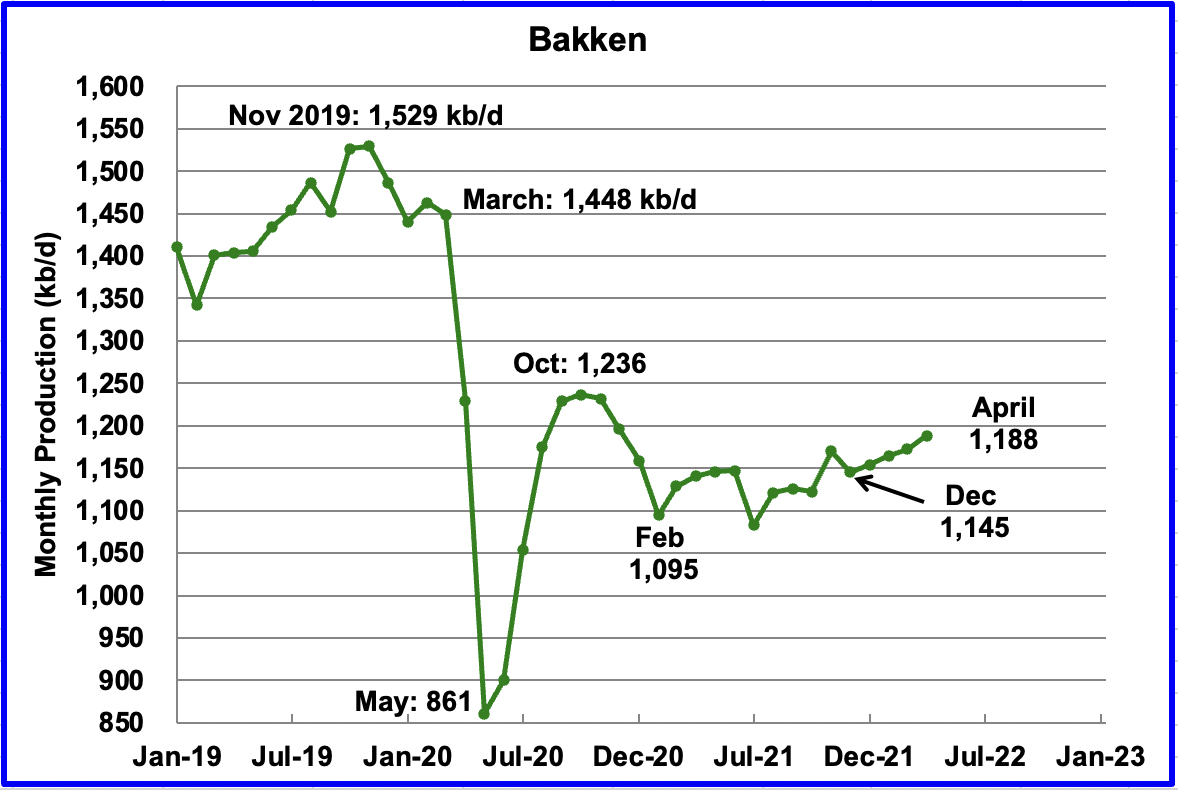

The DPR forecasts Bakken output in April to be 1,188 kb/d an increase of 16 kb/d over March. In this case, April production is 10 kb/d lower than was forecast for March in the previous report.

According to the North Dakota Oil and Gas division, January production fell by 57 kb/d. Note this drop is not shown in the DPR chart above.

According to this Source, Helms said the prospects of North Dakota returning to being No. 2 in oil production “are slim to pretty far away.”

Helms reported last month that New Mexico has replaced North Dakota as No. 2 in oil production.

As of January, North Dakota has 16,856 (preliminary number) producing wells. The month before the state had 17,200 producing wells.

Helms said the number of well completions has been volatile since the pandemic as the number of active completion crews dropped from 25 to one, then increased to 11 this week

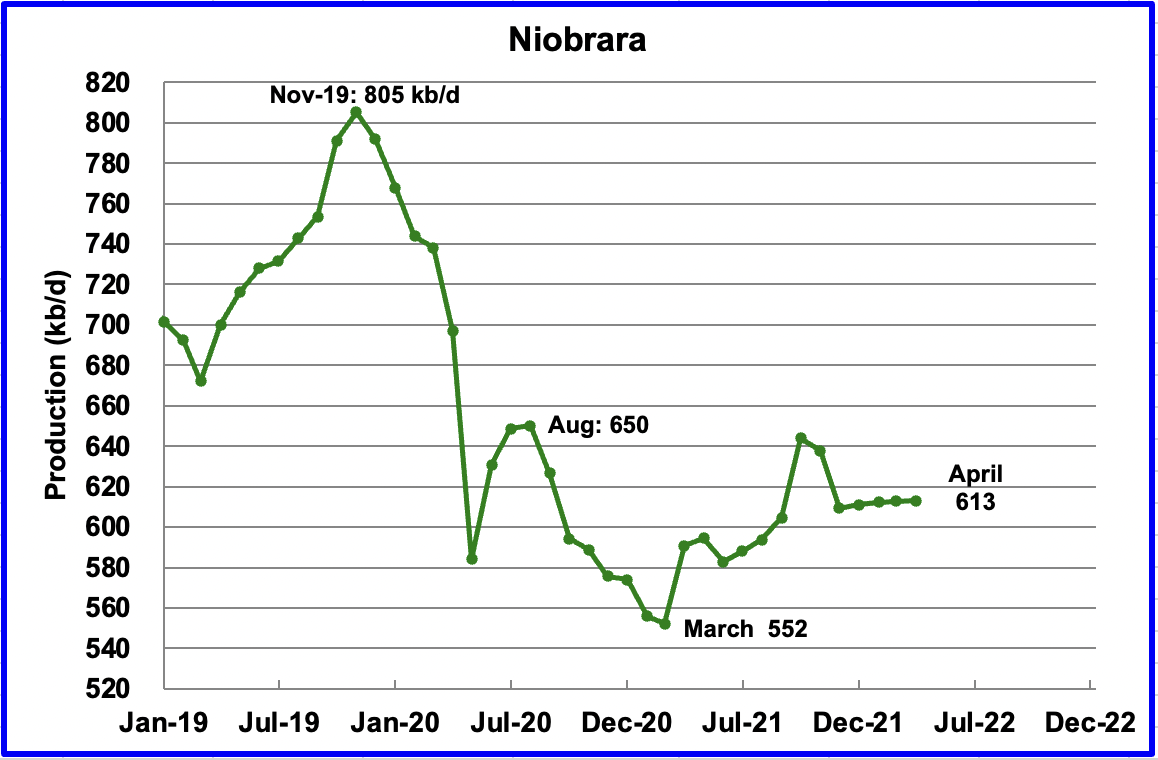

Output in the Niobrara is now showing signs of starting to plateau at 613 kb/d.

DUCs and Drilled Wells

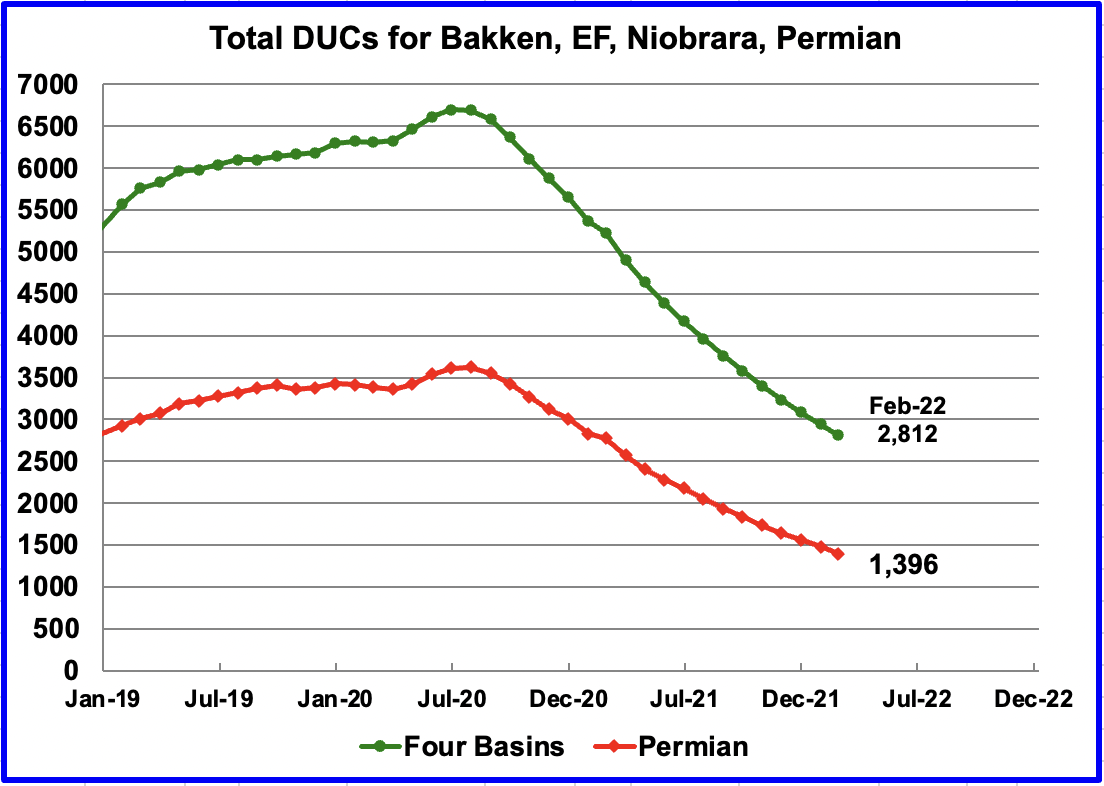

The number of DUCs available for completion has continued to fall every month since July 2020. Prior to July more wells were drilled than were being completed.

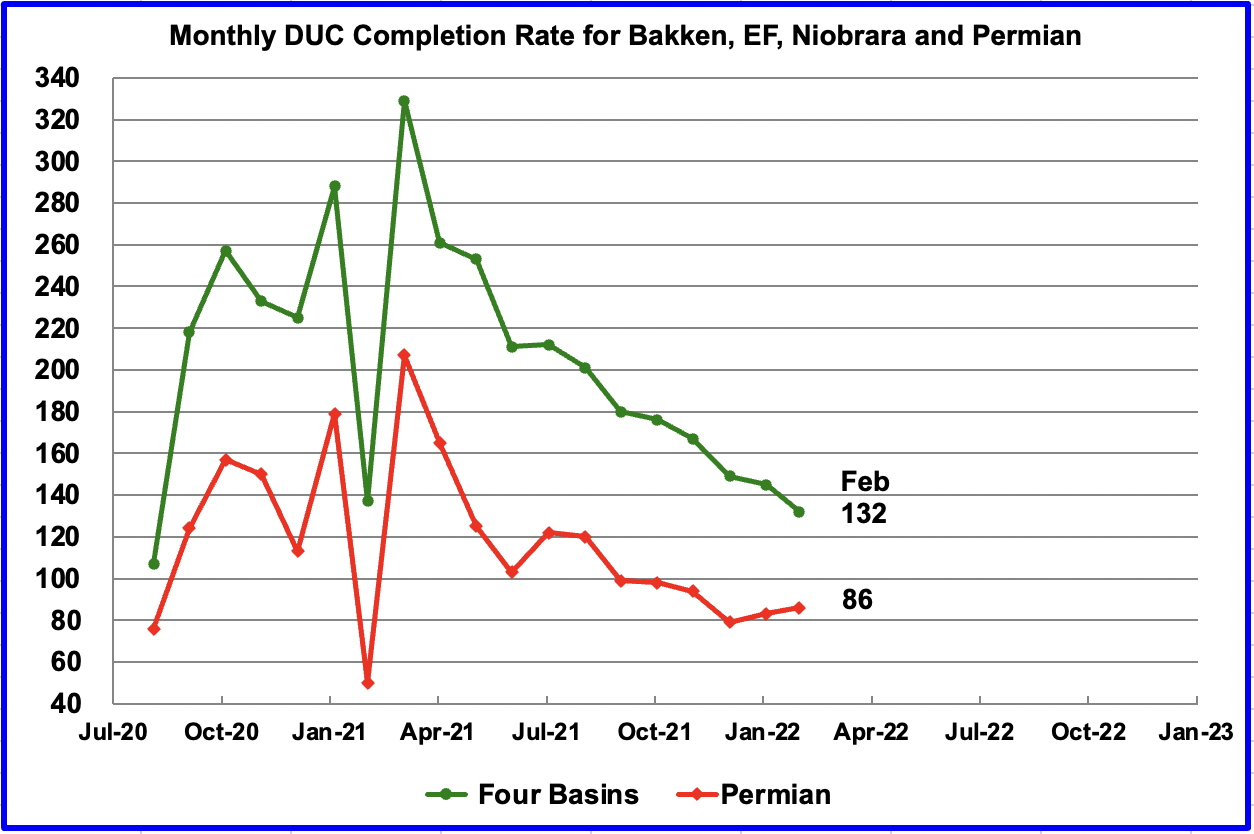

In these four primarily oil basins, the monthly completion rate of DUCs started to slow after peaking in March 2021. For example, in March 2021, 329 DUCs were completed. In February 2022, 132 DUCs were completed.

However in the Permian the trend has changed. The completion of DUCs has increased for the last two months. In February 86 DUCs were completed, up 3 from 83 in January.

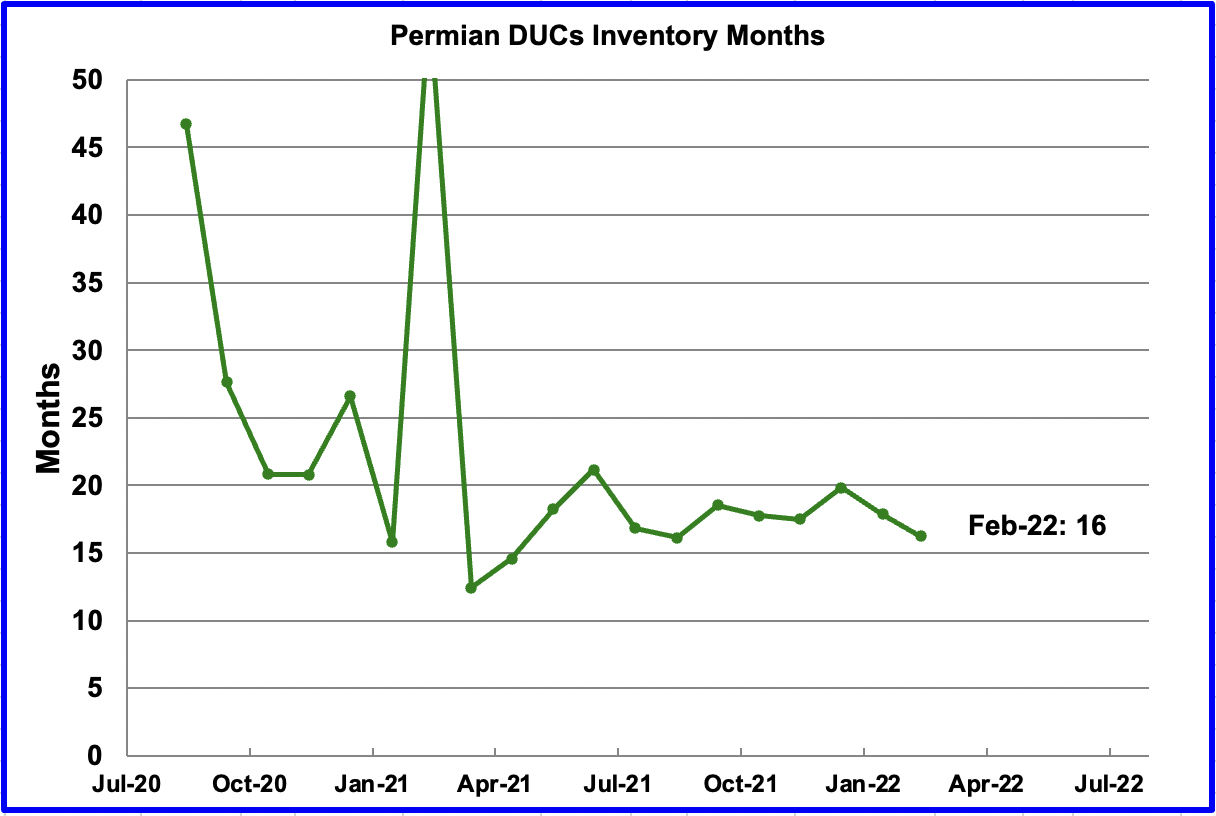

If Permian DUCs were to be completed at the latest rate of 86 DUCs/mth, that translates into 16 months of inventory, assuming the remaining 1,396 are all commercially viable. Interestingly, this 15 to 17 months supply of DUCs has remained fairly constant since July even though the number of DUCs continues to drop every month.

In the Permian, the monthly completion of wells has been increasing since the low of 368 in June. In February 429 wells were completed, 13 more than in January. Over the same time, 343 new wells were drilled an increase of 10 over January.

3) LIGHT TIGHT OIL (LTO) REPORT

The EIA’s LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The March 2022 report updates tight oil production to February 2022.

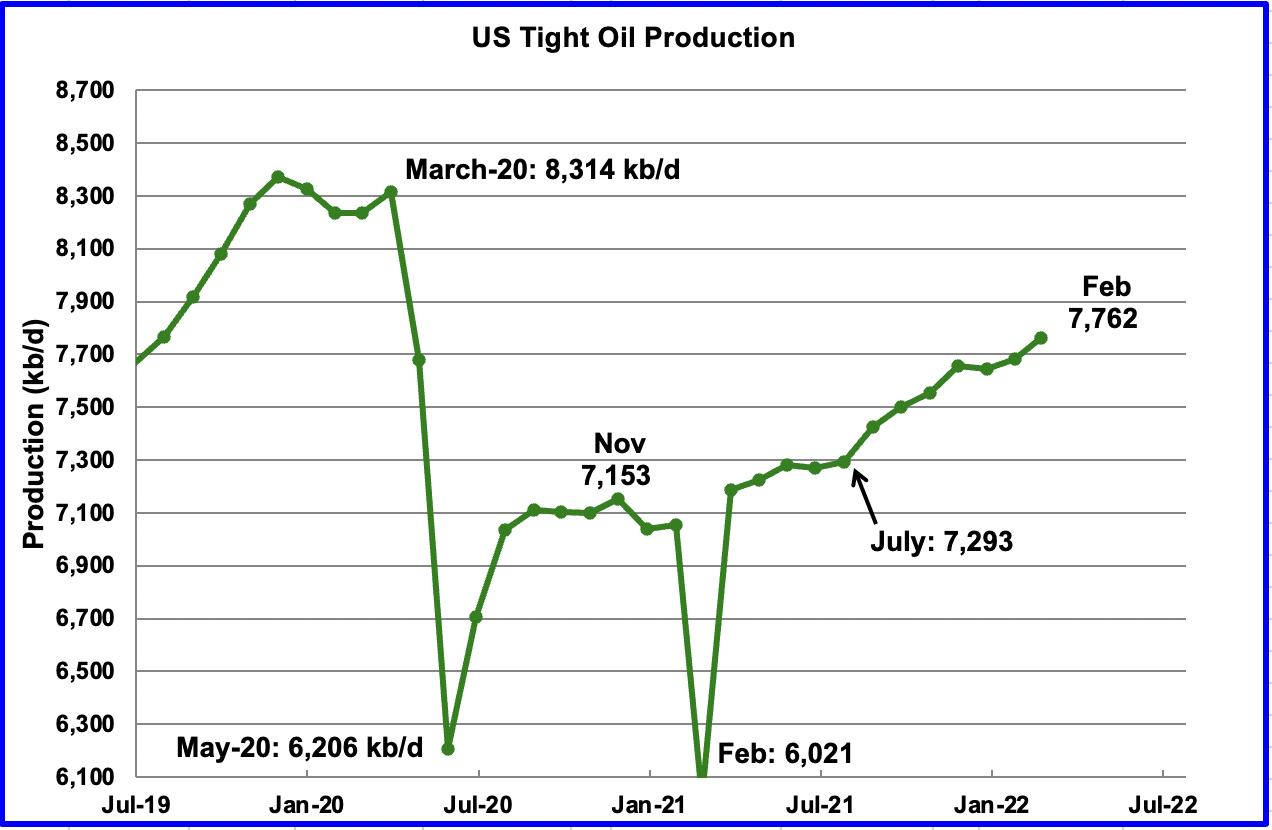

In contrast to last month’s report, the March LTO report has made minimal revisions to the previous production numbers. February’s LTO output increased by 78 kb/d to 7,762 kb/d. From July to February, output increased by 469 kb/d or at an average rate of 67 kb/d/mth.

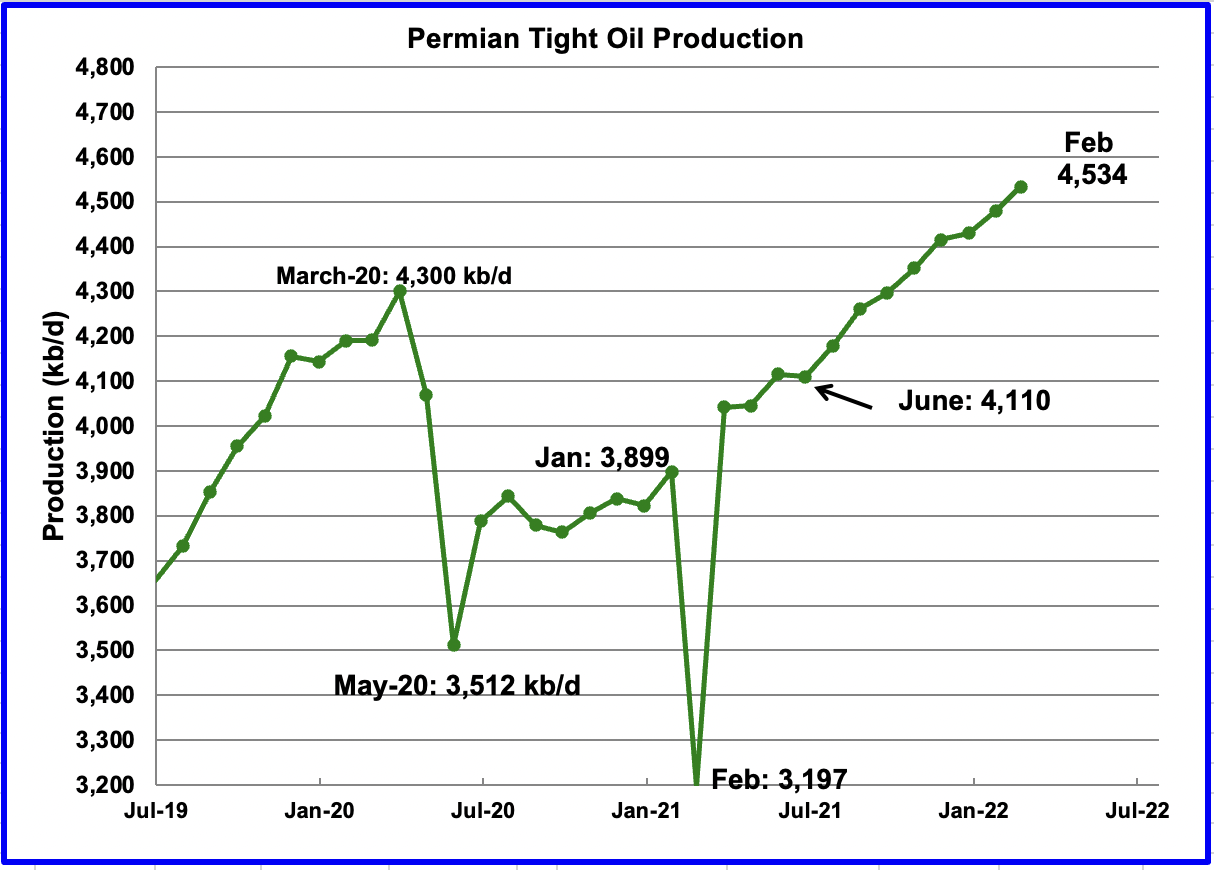

Permian LTO output first reached a new high of 4,352 kb/d in October 2021. February’s output increased by 64 kb/d to 4,534 kb/d and is 234 kb/d higher than the previous high of 4,300 kb/d in March 2020.

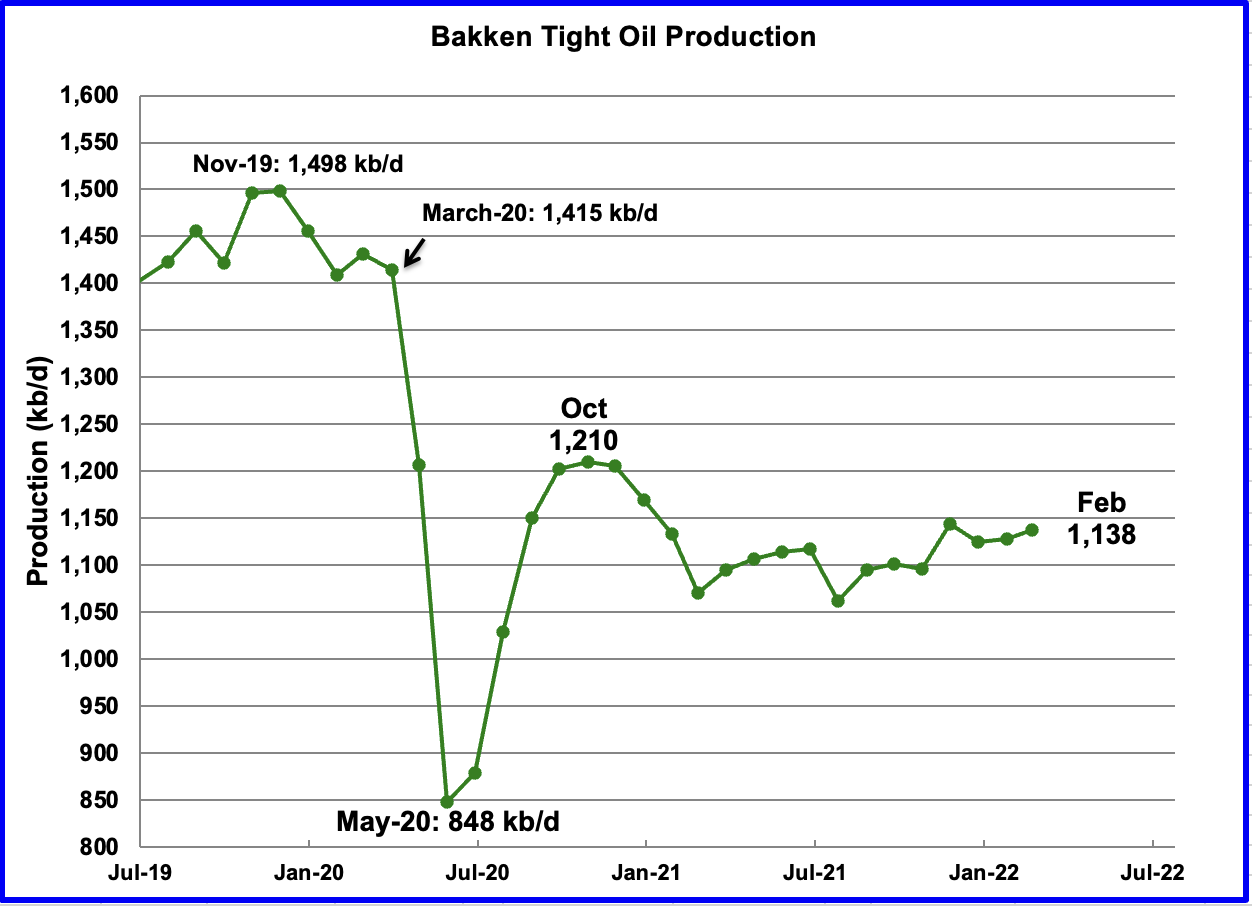

The Bakken’s February output increased by 10 kb/d to 1,138 kb/d. Note it is still below the October 2020 level of 1,210 kb/d.

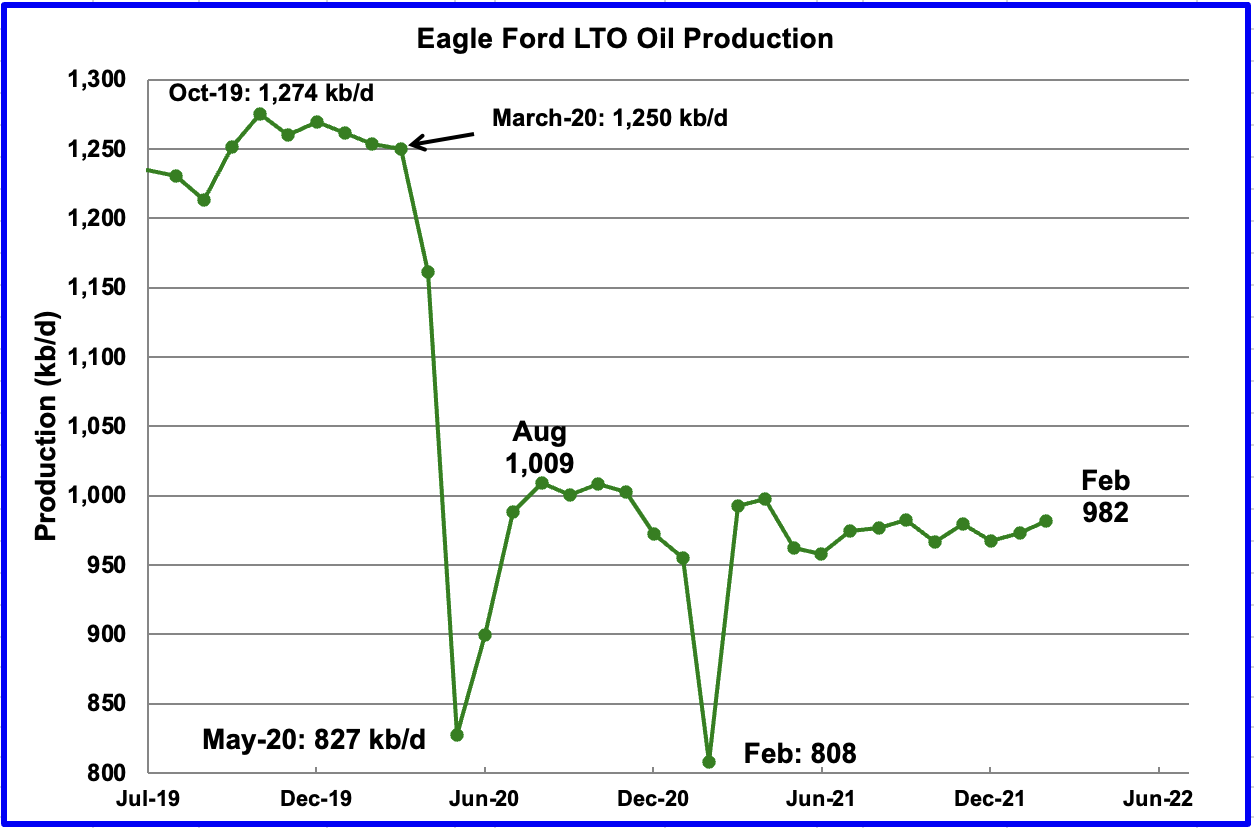

Production in the Eagle Ford basin since February/March 2021 has been essentially flat. Are the drillers doing this intentionally or is it just accidental?

The Eagle Ford basin produced 982 kb/d in February, which is lower than the August 2020 output of 1,009 kb/d.

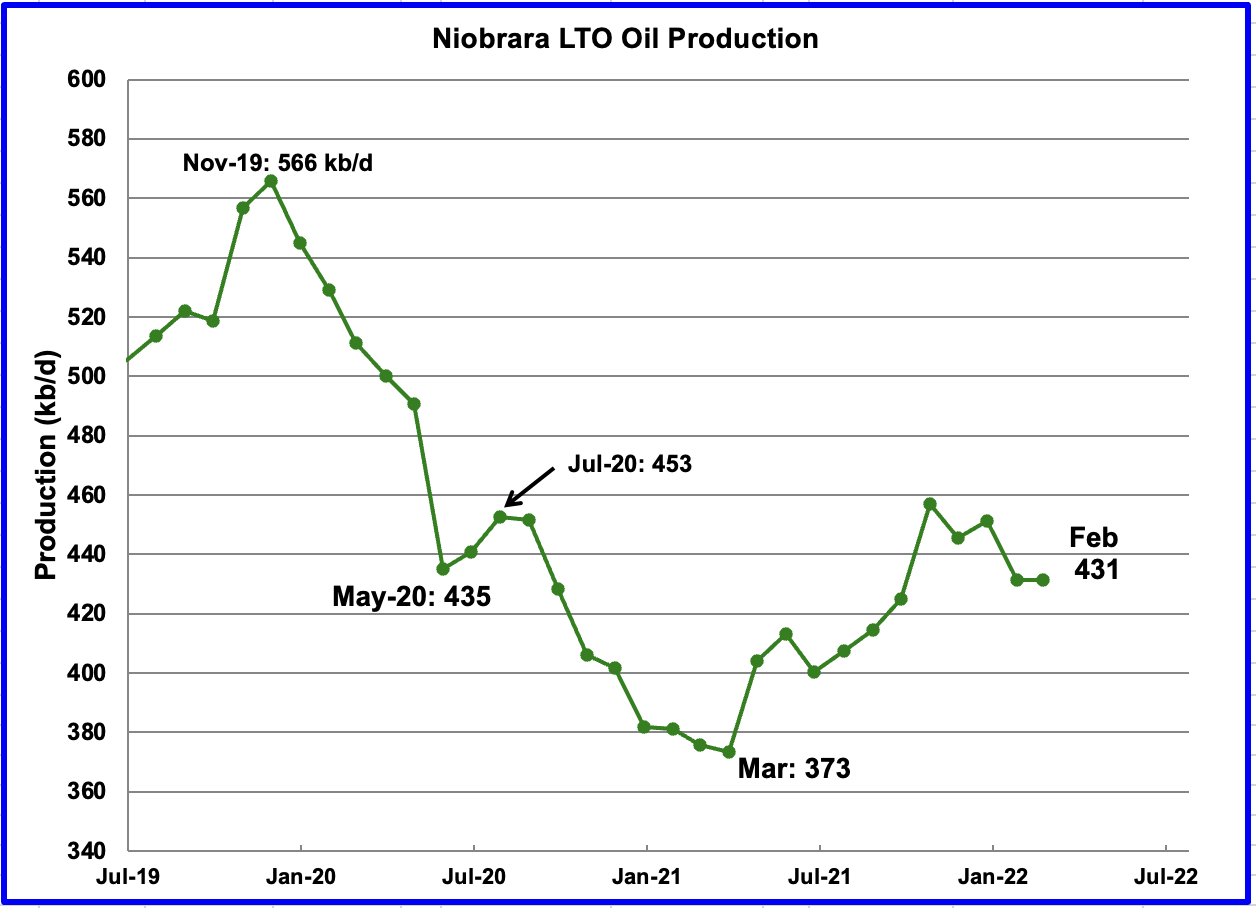

After increasing production from March 2021 to October 2021, output in the Niobrara began to drop in November 2021. February’s output was flat at 431 kb/d.

From July to March, the rig count in the Niobrara increased from 10 to 14.

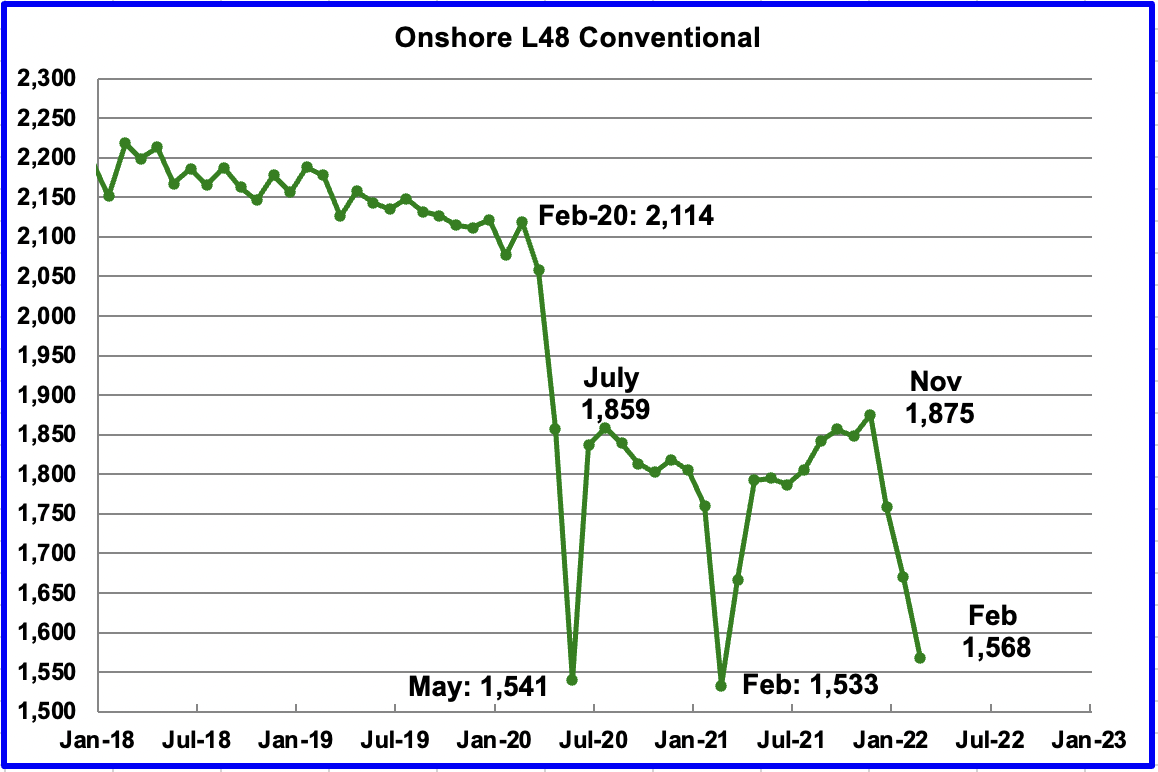

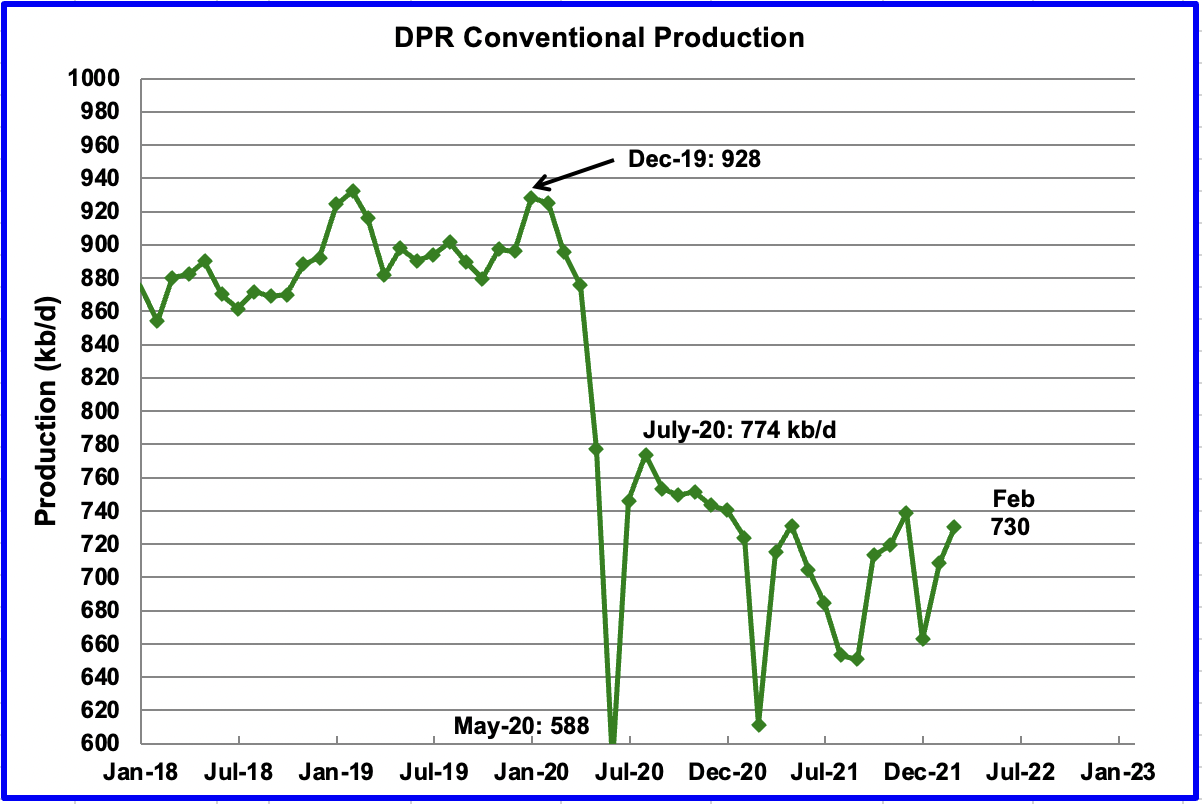

On-Shore L48 Conventional Production

Conventional oil output in the Onshore L48 declined by 102 kb/d in February to 1,568 kb/d. This estimate is based on a combination of the expected February LTO output and the March 2022 STEO report that has a forecast for the US On-shore L48 output for February 2021. Data up to November 2021 is actual EIA production data.

If the real production number for January were to be used, conventional oil output would be lower than the February output shown. However a note of caution is in order. This chart is derived by subtracting two large numbers which are subject to revision, particularly the latest months, which greatly affects the output after November.

This chart shows conventional oil output in the DPR fields. It was obtained by subtracting the LTO basin data from the DPR data. The chart shows that the large decline of conventional oil in the US, shown in the previous chart, is not associated with the DPR basins.

As noted above, this chart is derived by subtracting two large numbers which are subject to revision.

https://mishtalk.com/economics/mishtalk-tv-with-the-head-energy-trader-at-price-futures-group

Can Biden lower the price of gas?

Wait, does the American government still dictate wages and prices? I remember Tricky Dick Nixon’s Cost of Living Council, run by Donald Rumsfeld and his lapdog Dick Cheney, but I’m pretty sure Jimmy Carter swept away all that central planning crap.

It looks like Biden’s idea is along the lines of “buy low sell high”, which makes sense to me. The price will sort itself out, or not.

Shocker!! . Pressure depletion exists. Running harder to stay in place. As usual great post Ovi. Thank you for your contributions.

LTO Survivor

Thanks for the encouragement.

I am conflicted with with the pressure drop explanation, poorer drilling areas and other reasons provided by many to fully explain the production drop that keeps appearing for the Permian/Texas. The conflict comes every time I look at the info posted for Permian output at Shale Profile and the EIA DPR/LTO reports.

Below are the latest two charts for the Permian from Shale Profile. The first one shows the peak production for the second month. The 2020 wells averaged 835 barrels per day. For 2021, the average was 905 barrels per day. I have no idea if the increase is from longer laterals or from better quality drilling counties.

The second chart shows Total barrels at various months. Comparing 2020 with 2021, It appears that the 2021 wells are as productive the 2020s and do not show the improvement shown in the peak production chart.

Appreciate that I know nothing about oil production in the Permian. I am just trying to sort out the number of opinions I see here and the ones on Mike’s website regarding the Permian’s future.

My basic problem is I see essentially constant year over year production from Permian wells at Shale Profile and many opinions indicating the Permian is finished.

Throw in the big drop in December and January production numbers for Texas/NM and it becomes a bit difficult to sort out which factors provide the best explanation

Chart 2

Ovi,

As you know lateral length has increased so output per lateral foot has not increased since 2018, it has decreased slightly. Unfortunately I don’t have recent data.

Here is the most recent post that I found with lateral length info for entire Permian. A rough approximation is 5000 foot laterals in 2015 with roughly a linear increase to 10000 feet in 2021 or an increase of 833.3 feet per year.

https://shaleprofile.com/blog/permian/permian-update-through-august-2021/

This data could be used to normalize for lateral length (but we need to estimate from the chart).

Ovi,

I no longer have the higher-level membership for Shaleprofile, but when I looked at the Permian wells in 2021, we can clearly see in the chart that Fluid and Proppant levels increased significantly. Furthermore, the laterals have doubled from one to two miles, while the proppants and fluids have more than doubled since 2016.

With the spike up in Fluid and Proppant levels in 2021, this is the RED QUEEN SYNDROME in pure technicolor style.

steve

Found a chart on Permian lateral length from Rystad

https://www.rystadenergy.com/newsevents/news/press-releases/Permian-new-well-productivity-set-to-breach-1000-boepd-in-2022-on-record-lateral-footage/

Using estimates from that chart and data from shaleprofile for wolfcamp, bonespring and spraberry formations in Permian at 12 months I can normalize for lateral length for 12 month cumulative output per 1000 feet of lateral from 2015 to 2020. Chart is below.

Note that in 2015 the average 12 month cumulative per 1000 foot of lateral was about 15960 barrels per 1000 feet of lateral and in 2020 the average 12 month cumulative per 1000 feet of lateral was 18975 barrels. The average annual rate of decrease from 2016 to 2020 was about 191 barrels per 1000 feet of lateral and if that rate continues in the future it would take 16 years for the rate to reach the 2015 level. Some of the decrease may be related to longer laterals being less efficient at recovering oil compared to shorter laterals, though the cost savings in capital cost per barrel of oil recovered makes the longer laterals attractive from a profit maximizing perspective.

Activity in the Permian HZ play has been led lately by small private companies who can actually make money at these price levels; they have raised industry money on fair to good economics and are mostly out of debt. But their acreage positions are small and increasing D&C costs are changing those economics now; none of that activity will last. DUC’s are still being completed, but that won’t last either. Normalizing well parameters matters, as has been stated. Again, initial potentials and how a well is produced is an operational elective, often designed for maximum front end cash flow.

EVERY top ten producer in the Permian is suffering from poorer well quality and declining EUR’s in their core areas, many significantly. As the gentlemen suggests, that is a direct function of over drilling and pressure depletion. My instincts tell the THAT is a far better explanation for the reduced activity of large public companies than the lame excuses they make up. Those core counties and core areas are the window into the future, not technically recoverable, imaginary oil in USGS goat pasture. If that was doable out there in the frontier, at $110/$5 they’d be all over it like white on rice. They’re not, they’re still high grading core areas for poorer wells. There’s only one explanation for that.

In the mean time, America exports 2 times more tight oil to foreign countries every year, most of it FROM the Permian… than the TOTAL volume of oil stored in the entire SPR system.

America is speeding to a red light.

Thanks Mike,

Was it and unusually cold January this past winter (2022)? You are there in Texas (though the state is huge so you may only know your area as far as weather), I am not, but no weather events that I remember came close to the Feb 2021 event in January 2022.

No, not at all.

Thx Mike

Mike,

Does it seem like conventional oil output in the onshore Texas/New Mexico/ Louisiana area decreased by about 14% in Jan 2022? This seems unlikely from my perspective, but as you know I know far less than you and may be missing something obvious.

Let’s see if these numbers are getting corrected in the next report – I think the latest month always is a bit prelimitary.

I don’t belive in such big swings without an explanation – cold weather, big maintaince, main pipe blowing up, the usual stuff. At least they still where drilling and fracking.

I was just a couple of hundred miles due west of the Permian, in New Mexico. There we had an exceptionally mild January. In fact, it was an exceptionally mild winter.

Thx Ron,

Thought you were in Southeast.

I was in the Southeast until July of last year. Then I went back to New Mexico. But two weeks ago I moved back to the Southeast. I now live in Huntsville Alabama with my son who recently lost his wife to heart failure. Sometimes I think I have come home to die. But I do hope to live a few more years. Anyway, I do not expect to ever move again, but you never know.

Ron,

Sorry to hear about your daughter-in-law. Enjoy your family.

Mike,

There has been some discussion that longer laterals will tend to reduce EUR per 1000 feet of lateral, but that the reduced total D and C costs per 1000 feet of lateral makes the longer lateral wells attractive from a profitability stand point. At some point an optimum average lateral length may be determined in the Permian Basin, and the EUR might stabilize in the core areas. It would be interesting to see the normalized well profiles in the North Dakota Bakken/Three Forks, because I think the average lateral length has been around 10000 feet for many years in that basin and looking at well profiles we still have not seen much deterioration in cumulative output. That basin is getting pretty long in the tooth and I have been expecting to see average new well EUR decrease since 2012, 10 years later and I am still waiting. See link below for “not normalized” Bakken Well profiles

https://public.tableau.com/shared/XQCCN9HZG?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

Great work ovi . Lot of different calculations . Can’t be more transparent . Muchos Gracias .

HIH

Thanks. Much appreciated.

My thought . The SPR release is now going to be a permanent feature until and unless Pentagon steps in and puts a stop . For politicians ” Short term pain for long term gain ” does not work .

The SPR release is now going to be a permanent feature until and unless Pentagon steps in and puts a stop .

HH are you under the impression that the Pentagon has its Commander in Chief… in the Pentagon? No, the Pentagon’s Commander in Chief resides in the White House and only he dictates SPR releases.

Or perhaps you had a military coup in mind. Not likely. Every military officer in the Pentagon is at least twice as smart as Donald Trump and none would dare try such a stupid stunt as the Donald tried to pull off.

Ron , I understand the technicality you are getting at . What if Miley and Austin were to tell Biden that the SPR was needed by the armed forces ( say for a war in South China Sea) and should not be released for public usage . ? You think Biden would overrule them ? Technically he can , but practically I think the chances are extremely low . Reading the media, there are two forces at work on the Ukraine question . The neocons who would like NATO to get directly involved vs Miley and Austin who want to keep out . Luckily Biden is listening to the latter .

“Or perhaps you had a military coup in mind. Not likely. Every military officer in the Pentagon is at least twice as smart as Donald Trump and none would dare try such a stupid stunt as the Donald did.”

No , Ron nothing like this . The people would rise against such an attempt . Yes the opioid crisis , paid for MSM along with fakebook and stuff has numbed the people but still enough sane people who would revolt in case of a coup . I have still faith .

What if Miley and Austin were to tell Biden that the SPR was needed by the armed forces ( say for a war in South China Sea).

Really now? War in the South China Sea? Do you actually think the generals or the Secretary of Defense would propose such a war to Biden? Anyway, if such a war were probable, Biden would be way ahead of them with knowledge of the world situation.

No, there is not a snowball’s chance in hell that the Pentagon will tell Biden to stop pumping oil from the SPR.

Ron , you misunderstand me again “Really now? War in the South China Sea? Do you actually think the generals or the Secretary of Defense would propose such a war to Biden? ”

Did I say USA will start a war ? What if China goes across the Taiwan straits ? This is Xi Ping’s call not Biden’s . Beijing holds the aces . Long supply chains are over and the story of the blue fleet with the aircraft carriers is over . Hypersonic missiles are the new boys in town . USA can be reactive but not proactive. It is not in a position to initiate any action in the South China Sea . It will loose a war in that region . Several simulations and even the Rand Corporation have said the same . Who provides intelligence info to Biden ? Surely not Hunter . It is the MIC . Hypothetically Biden overrules Miley and Austin , all it will take is a leak and it is the end of his presidency . Next in line ” Cackling Harris ” , replace her and then we have 80 yrs old Nancy Pelosi . I have posted often that my inspiration were Edison, Ford , Carnegie , Sloan , Paine , Vidal , Mencken etc but the current leadership is a disaster , however ” the people get the leadership they deserve ” . Who am I to argue ? So to to put in the word to your “No, there is not a snowball’s chance in hell that the Pentagon will tell Biden to stop pumping oil from the SPR. ” Well they told Biden keep NATO out of Ukraine and Biden listened . Men in uniform matter .

” Well they told Biden keep NATO out of Ukraine and Biden listened . Men in uniform matter .

So that is why NATO did not storm Ukraine. The US Generals advised against it, or else we would be in the middle of Ukraine right now. I sure hope Biden and the rest of NATO keep an open line to the Pentagon, they will definitely need to know what to do next. 🤣

Ron . During the last days of Trump when he was showing extreme signs of eccentricity and looked he would start a war with China Pentagon stepped in . Miley called up his counterpart in Beijing and assured him that nothing will happen under his watch . This is public knowledge . Men in uniform matter .

https://apnews.com/article/donald-trump-china-united-states-michael-pence-joint-chiefs-of-staff-caba520490ba574393f1cb6d1e961dba

No sir . Canada tar sands are not the savior . Excellent analysis .

https://www.resilience.org/stories/2022-02-16/a-case-study-of-fossil-fuel-depletion/

Nice read, a great intro and fleshing out of the concept of resource depletion. The takeaway that he shows ineluctably:

As time passes:

Wells produce less oil;

Wells are depleted more rapidly;

A greater share of production is met by recently drilled wells.

Also a thought/question on the tar sands specifically:

Since they are so dependent on cheap natural gas and nat gas is becoming more of a global market, especially with the war in Ukraine, could there a tipping point where gas prices in Alberta get too high and all tar sands are suddenly uneconomical?

The article appears to exclude Canadian tar sand production, instead focusing on the type of production no longer relevant in terms of overall Canadian oil production. An amusing idea, focus of what doesn’t matter rather than one of the largest resource plays on the planet. As far as saving the planet, no, the Canadians probably couldn’t do that by themselves, but between them and a coherent Venezuela could probably handle any overall underlying decline globally through at least mid-century, if not longer.

Reservegrowthrulz,

Not clear that oil sands can be developed as quickly as depletion may occur, but after 2035 it probably will not be needed in any case as oil demand will likely be falling faster than supply, oil prices will drop and new oil sands development will no longer be profitable. Most forecasts I have seen for Canada (from the Canadian government or CAPP) do not anticipate rapid development of oil sands resources.

An old adage of drag racing. Speed costs money. How fast do you want to go? Resource development is about the same. Canadian tar sands sitting more at the marginal end of the spectrum than not, this adage would be quite applicable.

Of course, if the supposition is that demand will fall then the entire equation changes to one of knocking off the marginal barrels through lack of investment and the usual depletion until natural decline matches the rate of demand decline. The point being, scarcity in terms of oil production between now and mid century isn’t the main issue, unless someone wants to pile other assumptions on top of the equation, wars, environmental legislation with teeth, geopolitical decisions, artificial mechanisms (sanctions with teeth on the usual suspects) etc etc. The CER most certainly doesn’t project the rapid development of their tar sands. And the country also has the potential of activating legislation to artificially limit it as well, making it quite interesting a scenario, price and environment and laws of the do-gooders against the desire of First Worlders to just keep sucking down the crude.

Out of curioisty, you don’t model these types of effects do you, your systems are more technically oriented and you have to install assumptions of production change on a sort of ad hoc basis?

Reservegrowthrulz,

I mostly focus on land transport demand for crude and associated products. I model how fast the world transitions to electricity in land transport (with a fast and slow transition) for simplicity I assume the rest of World demand remains constant at the 2019 level (likely a poor assumption, but looking at major crude oil product categories at BP and subtracting gasoline and diesel, the consumption of the rest (excluding LPG and ethane) had been relatively constant from 2008 to 2014, I assume this situation might return. Over 1999 to 2019 the average annual rate of increase was 127 kb/d (using OLS on data), so I could use that for the increase in non-land transport oil demand.

I assume supply tends to match demand when I do my model subject to resource constraints and the historical time from discovery to producing reserves.

The bottom line is that it is likely supply exceeds demand after 2035 in a low supply scenario and by 2030 in a high supply scenario (fast transition/low demand scenario in both cases).

RG ” An amusing idea, ” . Yes , till it isn’t .

Some maths . The real oil in the USA is

Conventional 1.5 + GOM 1.7 + Alaska 0.5 + LTO (Total minus exports ) 2.3 = 6,0 mbpd

Total consumption is 20 mbpd

Where will this 14 mbpd going to come from ? Further note that 6.0 mbpd will continue to decline . Draining the SPR will not work .

+ 24 hrs and still no responses ‘. Can I conclude that the USA is in a pickle but refuses to acknowledge this ? Denial the first stage of grief .

Hole in head,

Tight oil output in Jan 2022 was 7684 kb/d, US exports of crude were 3347 kb/d, the net for tight oil would be 4.34 Mb/d, add conventional, GOM , and Alaska (3.7 Mb/d) and the total is 8.1 Mb/d.

US inputs of crude oil to refineries was 15.45 Mb/d in Jan 2022, net imports of crude were 3.04 Mb/d and net exports of petroleum products was 3.6 Mb/d, about 15.4 Mb/d of finished petroleum products were supplied in Jan 2022, and about 1.4 Mb/d of gasoline and diesel were net exports, of the 15.5 Mb/d, 8 Mb/d was gasoline, 4.1 Mb/d was diesel, and 1.4 Mb/d was jet fuel, the rest was less important miscellaneous products so 13.5 Mb/d minus the net exports of 1.4 Mb/d for about 12.1 Mb/d of the important stuff consumed. A large piece of the petroleum products is LPG (3.9 Mb/d) and not really related to crude oil (essentially these are NGL which is a byproduct of natural gas production).

The US has been an oil importer for a long time. This is not a new problem.

Also note that until recemtly the oil market had excess stocks of oil that it was draining back to normal levels (from March 2020 to Jan 2022). Now the market is undersupplied and stocks are below normal levels. At some point oil prices rise to a level such that stocks will build back to the 5 year average level, or this seems likely based on past history.

OK , Dennis 8 mbpd as you say . Still required 8 mbpd of crude at refinery level . Consumption is 20mbpd of finished products . Did the 16mbpd refining capacity produce 20 mbpd of finished products ? How can output be more than input ? The laws of Physics prevail . This means that US imported 4 mbpd of finished products . Correct me if I am on the wrong track ?

Hole in head,

Keep in mind these numbers are volume not mass and barrels of different products have different densities (crude>diesel>jet fuel>gasoline>NGL in density terms).

Of the 20 Mb/d of total petroleum products about 4 Mb/d is hydrocarbon gas liquids, so the amount of finished products that are based on crude is about 16 Mb/d and of that about 1 Mb/d is biodiesel and ethanol, so the real number is about 15 Mbpd and of this about 1.5 Mb/d of gasoline and diesel are net exports so the amount consumed in the US is really about 13.5 Mbpd.

product supplied (NGL 2840 kb/d in 2019, gasoline=9300 kb/d in 2019, diesel=4100 kb/d in 2019, jet fuel=1740 kb/d in 2019 for 15140 kb/d total supply in 2019

https://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbblpd_a.htm

gasoline net exports (700 kb/d in 2019)

https://www.eia.gov/dnav/pet/pet_move_neti_a_epm0f_IMN_mbblpd_a.htm

diesel net exports (1100 kb/d in 2019)

Subtract net exports (1800 kb/d) from product supplied in 2019 and we get 13340 kb/d of product consumed in the US in 2019.

Also about 980 kb/d of biofuels were fed into the refining process in 2019 along with 16560 kb/d of crude oil,

https://www.eia.gov/dnav/pet/pet_pnp_inpt_dc_nus_mbblpd_a.htm

of that crude net imports were 3819 kb/d.

https://www.eia.gov/dnav/pet/pet_move_neti_a_epc0_IMN_mbblpd_a.htm

Tks , Dennis for the breakdown . A lot of fog to be cleared in many areas .

Hole in head,

Your basic idea that the US will need oil for some time is correct, eventually a lot of the oil demand will be replaced with EVs and the US likely has enough natural gas to make the transition to wind, solar, hydro, geothermal, and nuclear power for most electricity production. The faster this can be accomplished the lower we can keep atmospheric CO2 concentration, better government policy will help, fewer old white guys in the US Senate would help.

Ovi. Great work!

I note you and Dennis discussing US lower 48 onshore conventional. It might be too much work, but most of the larger states have free oil production data.

You might discuss this analysis with Enno Peters. He might have some thoughts on how to use this data to analyze US lower 48 conventional.

Unfortunately we are living in a short term thinking world. It seems analyzing US conventional over its long history might be of some relevance?

Few (outside this blog anyway) appear to realize how much more quickly the US is plowing through shale compared to US lower 48 conventional. It took over 100 years for US lower 48 conventional to peak? I assume that peak occurred in 1970/1971?

Also, not a lot of consideration as to how much smaller of a geographic area shale is compared to lower 48 conventional. Especially when it comes to production growth.

It’s also bizarre to see politicians who were “leave it in the ground” flip to “drill baby drill.” I really didn’t expect that to happen.

Ron, what are your thoughts on how the Democratic leadership has completely flip flopped? I’m pretty disappointed with them. We need somebody to level with the American people that we do not have unlimited oil reserves. Even the Democrats now seem to think we should just hammer the hell out of what remaining shale we have, and that it will last for decades. It seems to me they have fallen into the Republican’s false narrative of unlimited shale?

Of course, when the EIA puts out ridiculous long term forecasts, maybe we should accept that?

I usually don’t want to get into the politics, but this SPR reserve is a big, big deal. Who would have thought in April, 2020 we’d be set to take the SPR to a level not seen since 1983? In April, 2020, the Democrats in the House blocked filling the SPR to the top with $20 oil because that would have been a “Big Oil Bailout!” Geez. That sure doesn’t look good now.

Mike and I discuss the politics a little, he being an R and me being a D (although I’m not sure that I’m anything anymore). I think we agree that somebody in Washington needs to get more serious and long term focused on oil.

The Democratic Party must stop demonizing everyone who works in the fossil fuel industry. A much better approach would be to level with the American people. The message should be, we are going to need every drop of oil and every btu of gas. We need to make it last as long as possible. We need to produce, transport and burn it in the most environmentally responsible way as possible. We need to transition to other energy, not just for environmental reasons, but because we really have to due to lack of future supply.

Isn’t telling the truth the best approach in the long run?

Shallow sand,

Does the winter weather explanation for falling conventional oil output sound reasonable? In the Northeast the winter was fairly mild, not sure about your neck of the woods and maybe Mike S can comment on Texas. The report that Ovi found about cold weather in Jan in Texas did not sound severe, it sounded like a normal winter cold spell that would not affect production in any way.

By my calculation Jan 2022 showed a 14% drop in L48 onshore conventional crude output from the December level, does that sound like what was happening in the conventional L48 onshore oil business in January?

My guess is that either the tight oil estimate or the US C plus C estimate in the PSM will be revised significantly in the future. A small drop in January due to low temperatures may be common, but 14% seems unusual.

Chart below uses PSM data (first link below) and official US tight oil estimates(second link below).

https://www.eia.gov/dnav/pet/xls/PET_CRD_CRPDN_ADC_MBBLPD_M.xls

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

L48 minus GOM is US total C C minus Alaska minus Federal GOM. Then I subtract tight oil from this to get conventional output. The last data point is Jan 2022.

Often the oil production data lags by a year or so (Texas and Oklahoma and many others) before is is mostly complete. So getting a real time answer is difficult.

Usually the PSM is pretty good as the 914 survey of about 375 of the largest oil producers in the nation covers at least 85% of output in most states and in the larger states like Texas and New Mexico the coverage is probably close to 90% of output being reported in the 914 survey (in Texas it is about 88.5% of output and in New Mexico about 94%.)

The problem is the rest of the output is assumed to follow the large producers in a relatively stable relationship. If we get a situation where small producers are increasing output while larger producers are holding steady or cutting back on output then we can get a mismatch in the estimate by the EIA. This is likely what has occurred in December and January. In the future as better data comes in the estimates will be revised.

Longer term chart starting in Jan 2000 to show how unusual such a drop on L48 onshore conventional is.

We have good explanations for April/May 2020 (negative WTI oil price), and Feb 2021 (severe winter storm in Southwest). There is not a good explanation for the drop in Jan 2022 in my opinion.

Shallow Sand

I agree.

Short term political thinking and lack of understanding about the range of energy issues is the overwhelming theme of our countries approach since atleast the last 50 years.

Boom and Bust cycle of resource development and lack of a longterm energy policy are good examples of the failure to understand and failure to institute good industrial policy.

The use of the SPR currently is a mistake in my eyes, should be reserved for emergency use- critical shortage.

Not for shortterm market smoothing.

The shortterm thinking makes both parties look foolish, but our system rewards that. Politics is the ultimate Boom and Bust industry. It makes for poor policy.

If our system rewarded longterm thinking we would be in better shape.

Not sure how to get there.

I’m not interested in a 20yr dictatorship. I would fight it hard.

Hickory. Agree.

Shallow Sand

Thanks for the encouragement. I have gone to many State sites but have not had much luck in finding oil production data.

I think that laying out a truthful practical two prong approach on how to best use the remaining US oil and gas and the need to plan a practical transition over a reasonable time frame is what required. Unfortunately, laying out such a plan would supply more fodder and crazy counter claims for the GOP that it would result in more confusion and division. I fear the US is so divided these these days that I cannot see how things can improve going forward. Hope I am wrong.

I think that Putin’s goal of splitting/dividing the US has been very successful, unfortunately. When you see Americans cheering for Putin, I often wonder if I am in a nightmare. How can such intelligent people in the House and Senate put their own personal gains ahead of the great American dream. Totally confusing to me.

Ovi , “When you see Americans cheering for Putin, I often wonder if I am in a nightmare. How can such intelligent people in the House and Senate put their own personal gains ahead of the great American dream. Totally confusing to me. ”

No sir , you are not in a nightmare . The public maybe numbed but they are not stupid . They know which side the bread is buttered . As to the Congress and Senate got me thinking about a movie ” The Aviator ” starring Leonardo Di Caprio (Howard Hughes) . Here in the incident Caprio meets a senator who is a lobbyist for Boeing . The senator has his hands in his coat pockets . Caprio says ” Hi senator , nice to know for a change you don’t have your hands in other people’s pocket ” . Relax . If you are confused it is a good sign . This means that your heart and your head are in alignment . Be well . Always your well wisher .

Ovi.

Go to Texas RRC PDQ.

You can obtain Texas oil and gas production data for free. I think you’d be able to separate horizontal from conventional.

Other states also have free data last I looked, including ND, Utah, Colorado, Wyoming, Montana and Kansas. New Mexico and Oklahoma didn’t have as accessible data, as I recall. I also think California has free public data.

Enno Peters sets forth his sources on shaleprofile.com. Take a look at those. States publish both conventional and horizontal.

Conventional is a lot more work to compile, but maybe looking at a few states could help?

Shallow sand,

The RRC PDQ does not have an easy way to distinguish horizontal from vertical well output without going through the individual records of 300,000 wells. A skilled programmer like Enno Peters can accomplish this, for mere mortals with his incredible skills, it is a very time consuming process.

That is why it costs 3500 dollars per year to access his database.

I have not looked at other states, but my guess is that it is just as difficult to access the data, it is all there, but pulling the data together in a way that is useful to look at the big picture requires a subscription to Enverus or shaleprofile. I know I don’t have the money for this, I will not speak for Ovi.

Dennis.

I know to get something you could publish like Enno does would be much work.

I just thought by maybe looking at counties that don’t have shale, or subtracting shale from the total, you might see something.

Shallow sand,

Yes I get your idea now. shaleprofile suffers from the same problem of lagging data due to its source for Texas data (RRC). Using the supply estimate at shaleprofile for Texas tight oil and subtracting from EIA data is the best I can do with my limited skill (I am far less talented than Enno Peters). Chart below shows that result.

Shallow sand,

One way to do this would be to combine Texas data for total output and subtract shaleprofile data for texas, that is probably the best we could do, but only the data up to about Jan 2020 would be complete, the Texas data is still very much not up to date.

Chart below has RRC data and EIA data for Texas C plus C in kb/d.

Ovi,

the resident Putin sympathizer on PeakOilBarrel has on this thread called for the US military to assert a form of military rule/martial law on US energy resource (SPR).

He is not a citizen of the US and i consider this meddling in the internal affairs of this country,

and given the war of words, minds, and cybernetworks that Russia has engaged against this country, I take offense to this kind of activity. And it certainly not the first from him.

Its not my site, but if it was- I’d give him notice of 2 strikes on this political activity against a nation to which he is not local. Three strikes and you’re gone.

He is free to be against the US ,NATO, Ukraine, and sovereignty of countries and democracy. But keep your political work out our of house.

Shallow Sand —

The truth is that people working in the oil industry are a tiny and shrinking minority of America, and most of them are getting screwed by the industry. There’s a saying in Appalachia, “The company gets the coal, and the miners get the shaft”. It’s not much different in the oil industry.

As to the message to the American people, it should be “Stop wasting energy.”

Yes. I am not inherently a pessimist but I believe the war in Ukraine is just the beginning of a prolonged world war fighting over control of scarce resources.

Yes – and the only way out is to get rid of the stuff.

On the short way it is everything that helps and is fast. Developing own ressources blocked by processing Nimbys (Germany now will drill for gas), Solar and WInd development is fast, too and can reduce peaker gas demand – and on the long run something like thorium or fusion plants can provide energy independence (or at least you can stockpile for 10 years or more, making wars about the stuff obsolete, too). Or additional a new international clean hydrogen infrastructure – where every sun rich country can take part, not only these few with good hycdrocarbon ressources. Or everything at once.

This is a way out of the end of fossil age.

On the other hand – Russia is the least country on the world who needs to expand military to get hydrocarbon ressources. Prospectors in this huge country will be much more effective. This war is more about dictators hobbies.

Have to concur with the resource driver but doubt this is a hobby war… I suspect it is driven by Russia’s existential concerns about its own fossil fuel export future.

Quote from part of a recent post:

Control of Ukrainian pipelines and resources are a natural complement to Russia’s known, strategic, aim of buying into and controlling Eastern Mediterranean fossil fuel exporters. Think: gangster drug kingpin (but the drug is fossil fuels). Take out the competition and take over his patch (literally = Ukraine). Offer ‘protection’ to Eastern Med development and exports (explaining Putin’s military support propping up the Assad regime in Syria).

See:

https://www.thisnannuplife.net/why-war-why-now/

Spriv, re Syria, check out Tartus, Russia’s only Mediterranean port eg:

https://en.wikipedia.org/wiki/Russian_naval_facility_in_Tartus

Dennis.

Cold weather is the only thing I can think of.

I know Texas has a reporting lag, but haven’t followed that for awhile. Has that gotten any better? Might be good to look at TX counties that have a fair amount of conventional, but no shale?

Shallow sand,

Did it seem to you that the past winter was colder than normal? In my area it was warmer than normal, but perhaps not true in Texas. If there was a severe event like Feb 2021, I think it would have been in the news. Maybe I missed it? The weather explanation doesn’t really explain it in my opinion. Was there a big drop in conventional output in your region in January?

Dennis

Here is another link. The headline sounds good but I could not get the article.

https://www.washingtonpost.com/nation/2022/01/19/texas-winter-storm-power/

Ovi,

That was a forecast, seems it was not really a big deal in the actual event.

Dennis.

We had an average winter.

TX and NM had a cold snap.

Ovi and shallow sand,

Report from NOAA for Jan 2022 at link below

https://www.ncei.noaa.gov/access/monitoring/monthly-report/national/202201

A pretty normal Jan for temperatures in Texas at about the long term average.

There was a lot of worry about cold weather after the disaster in Feb 2021, but there were no severe cold weather events in Texas in Jan 2022 that I can find on the internet.

Maybe Mike Shellman or someone else who lives in Texas can confirm this. Was Jan 2022 and unusually cold month in Texas relative to normal January weather in Texas?

From what I can tell the answer is no.

Dennis.

I looked and the cold snap in the Permian was the first week in February. So cold weather isn’t the explanation for January, at least for that basin.

Shallow sand,

They know how to handle cold in ND, so probably not there. I think for the most part it was an average to warm winter in oil producing areas.

I think the explanation is a bad estimate by the EIA for Jan 2022, we will know more in the future as the data gets revised, probably around May 1.

Let the games began . ” Dancing with wolves ” is different from ” Dancing with the bear ” . 🙂

https://www.zerohedge.com/energy/gazprom-halts-gas-shipments-europe-critical-pipeline

This happened already before the war. North Stream I is still running full bore, fullfilling the contracts.

Otherwise we would see the mother of all stock crashes here in Europe, and emergency laws at every corner. I wouldn’t rule out this still can happen.

The problem is even deeper: Even when deliveries continue, this is only the base contract with no addons. Winter started with only 65% storage capacities, and even when the russian contracts are fullfilled completely Europe needs extra gas from LTO.

One question: Is it possible to cross the Atlantic with a gas pipeline? North Stream II is completely submerged in the baltic sea – but this is shallow. It would be much more efficient than these cooling / expanding at huge energy losses.

THE ENERGY CLIFF: Real Or Fantasy

Many of you may have already seen this chart of the Global Oil Production Profile WITH and WITHOUT Debt. This chart came from one of Nate Hagen’s YouTube videos.

I bring this to the attention of the group for discussion because I believe the dynamics of Debt are overlooked in regard to the oil industry and overall economy. Nate suggests that debt has brought on unconventional, unprofitable oil (in BLACK) and also brought forward oil from the future to increase production on an annual basis (say to 100 mbd) than would have been otherwise if debt was not used.

Global debt has doubled since the 2008 Financial Crisis from $150 trillion to $300 trillion. With the world now reaching RESOURCE LIMITS, it seems to me that growth is over and with rising “REAL INTEREST RATES” a lot of this debt is not serviceable or sustainable. Thus, we soon see the Debt Bubble Burst.

This would be bad for the Oil Industry because one person’s debt is another person’s asset. When Debt and Assets POP, then investment in the oil industry grinds to a halt or declines considerably.

This makes sense to me, but I would enjoy other comments.

steve

This is an excellent point.

In our monetary system, debt is how money is created.

Conjectures:

1. Creating money to buy a good increases the price of that good.

2. Creating money to produce a good decreases the price of that good.

In the 10 years ending in December 2019, a great deal of money was created to extract oil. According to the preceding conjectures, this increased the quantity of oil produced while decreasing its price.

According to Christopher Leonard who wrote “The Lords of Easy Money” the Federal Reserve created $900 billion between 1914 and 2008. Between 2008 and 2021, the Federal Reserve created $3.5 trillion. Clearly this money creation had an effect on oil extraction. I think central banks have backed themselves into a very tricky position. Will they continue to create money at the same rate, or will they reign in money creation?

Schinzy,

I agree with your view. The central banks are stuck between a rock and a hard place.

The whole system is based on ever expanding credit and consumers of that credit in the form of debt.

I cant see a soft landing from this debt binge the world has been hooked on. Humans seem to be laugh now cry later type species.

Schinzy,

Money velocity has dropped as much of the money created is in th accounts of the wealthy unspent.

Money velocity in US at link below

https://fred.stlouisfed.org/series/M2V

Money turns over at about half the rate in 2021Q4 as it did in 1997Q4. The problem of too much debt is generally much ado about nothing. Developing economies have more access to cerdit facilities than in the past and have taken on more debt. If people are worried about government debt, they can vote for representatives that will raise taxes or cut government spending (or both).

In the US, typically Republicans want to cut both taxes and spending and generally they have caused increases in Government debt when they hold the executive branch.

Link below is US Federal Debt to GDP ratio

https://fred.stlouisfed.org/series/GFDEGDQ188S

Notice the rise from 1980 to 1992 during 12 years with a Republican in the White house, Clinton actually brought debt to GDP down while in office. Bush 2 saw a rise in government debt to GDP and Obama a big rise due to GFC. Note how Trump did nothing to Debt to GDP (it did not decrease but remained flat until the pandemic) and the big spike during the pandemic was mostly during Trump’s last year in office (2020). Debt to GDP has mostly been decreasing while Biden has been in office (2021 Q1 and first full quarter in office was 2021 Q2)

Steve,

Do you have any thoughts on the (apparent) demise of the petrodollar system and how this is likely to play out? I’m a total ignoramus of financial matters but as a long retired geophysicist still try to follow significant trends in the petroleum industry, likely a machoistic hobby.

No doubt that without ready access to easy credit that boom cycle of oil development would have been much slower, and thus have longer legs. Easy credit and very little regulation is how we do these things in the US. Gives very high growth for a short time. Its like the recurrent real estate boom and busts we have seen.

I tend to be much more conservative on these kind of things, preferring a slow and steady course. But that attitude doesn’t get you a seat at the table of decision makers in this country. And it doesn’t give you as fast growth in the economy. Like driving 45 instead of 70mph. Slower, but getting better overall range.

Most everyone jumps on board when the opportunities look exciting, and so the price we will always pay is bust.

This current disruption to global oil trade as a result of the Russian invasion serves as a fast forward glimpse to scenario that we should expect with increasing severity during this decade. If anyone needs any more warning, sorry this is it.

I agree with Mike- exporting oil and gas, other than to balance grades for refining purpose, is extremely shortsighted. You wouldn’t run a company like that (for long). But owners of the resource are eager to reach as many customers and as fast as possible, and we have very little in the way of energy or industrial policy/regulation in this land of revolving door leadership and partisanship above all else. Could you have imagined a politician in Texas in 2013 telling the oil industry that development of the Permian was going to be curtailed to a gradual pace by heavy regulation mechanism? They would have been shown the door quick, to put it politely.

And so like the Europeans and many poor importing countries are currently experiencing, we will learn to wean ourselves from high oil consumption the painful way, gradually moving toward energy poverty. Energy poverty can move you back a couple hundred years on the standard of living scale, and drain your wallet quick.

I think energy poverty if it does come to fruition, especially in countries who had enjoyed the higher standard of living that that energy has provided would led to war, whether ‘civil’ or otherwise.

We are all drug addicts as far as abundant cheap energy is concerned. Withdrawal symptoms from that addiction is unimaginable.

Hence rehab (renewables) might be a softer landing. But even then the overshoot dilemma has to be addressed.

Very unpredictable how this will all play out.

oil is to american democracy as silver was to Athens and the Roman republic. Once that source of wealth delcined both Rome and Athens declined, so will American and Western democracies .

my 2 pennies worth , and enjoy the sun set whilst you can , here have some popcorn

interesting times ahead

Forbin

Forbin and Iron Mike , your head is correctly placed above your shoulder . Both of you say the things that “are ” and not the way ” they should be ” . Collective madness is called sanity in todays world . Both of you dodged that . Kudos .

Steve at current oil prices, no new debt is needed in tight oil plays, well can be financed from operating cash flow with plenty left over to pay down debt and pay out dividends. Under $75/bo in 2021 US$ this might no longer be the case, but with short oil supply I doubt we see an annual oil price of $75/b or less in 2021 US$ in the near future (next 8 years).

No; not even close.

https://www.oilystuffblog.com/forumstuff/forum-stuff/cash-flow-capex

Mike,

Wow a 35% increase in D+C cost, I think in the past you have suggested average D+C cost in the Permian at around $9 million. So today your estimate would be about $12 million? Do I have that right? Possibly $13.5 million for full cycle capital cost (from spud to P&A).

At $75/bo at wellhead in 2021 $ and $3.50/MCF for natural gas and $26/b for NGL, the average 2019 Permian basin well has cumulative net revenue of about $13.6 million (2021 $) over the first 31 months of production. The discounted net revenue over the life of the well using a 27.5% annual discount rate is $14.2 million (2021$) over the life of the well (assuming P&A at 20 bopd). Cumulative barrels of crude is 420 kbo, cumulative natural gas is 1.9 BCF and cumulative NGL is 158 kb over the 157 months the well produces. The cumulative net revenue over 157 months is $24.4 million in 2021$.

Link to spreadsheet with hyperbolic well profile at link below (average 2019 Permian Basin well)

https://peakoilbarrel.com/wp-content/uploads/2022/04/hyperbolic-well-permian2019new.xlsx

Cumulative barrels of oil at 24 months for model is 216 kbo. Terminal decline at 13% per year begins at month 72, month 22 to 71 use Arps hyperbolic fit to data as in spreadsheet.

No oil here in Germany, but one of our customers got the building of a new warehouse delayed because of steel shortage + extreme price increase.

Yes, costs have gone up considerably. They do that sometimes in real life.

https://www.forbes.com/sites/daneberhart/2022/04/02/supply-chain-woes-inflation-crimp-us-producers-growth-potential/?sh=16d24e7d505d

The Haynes and Boones poll/chart, however, was relative to where CAPEX to drill tight oil wells is coming from, in real life, and clearly shows that credit/debt is still an important part of the tight oil business model.

Thanks Mike,

At Pioneer news release linked below

https://investors.pxd.com/news-releases/news-release-details/pioneer-natural-resources-reports-fourth-quarter-and-full-year-0

it is indicated that capital spending might be as high as 3600 million with 505 wells completed, if we assume all of the capital spending is for these new wells and supporting infrastructure, that would be $7.13 million per well, if we assume costs have increased by 35% that would increase well cost to $9.62 million. Note that I use an average well cost in my models of $10.5 million in 2021$, slightly higher than the 9.62 million. Pioneer also claims that 2022 wells will be paid for with forecasted operating cash flow.

Mike:

We just called our local supply store for a quote on 2 3/8” steel tubing.

$4.78 per foot for used tested, drifted. They don’t have any in stock right now.

No quote for used, tested “Louisiana gas pipe” which we understand is tubing that was new API when first used, has only been in a gas storage well, and was tested. They haven’t had any of this in stock for so long they had no current quote.

$7.50 per foot for new limited service. Just 1,200’ in stock.

$9.39 per foot for new API. Just 1,800’ in stock.

Pre-Covid we were paying roughly 1/3 of these prices, maybe a little more than 1/3. We used to buy a lot of the gas pipe for around $2.60 per foot as I recall, without pulling bills out.

Also, we used to pay $375 for rod jobs and $550 for tubing jobs on wells under 1,000’. Now the minimum is $575 for rod jobs and $850 for tubing jobs. They also seem to be adding other charges to those bills.

To get under 1,000’ of 2 3/8” tubing tested at the well was $175. It’s now $300.

To heat a 100 or 115 tank of oil used to be $300 and is now $450.

A 140 barrel fiberglass water tank delivered to the tank battery in county was around $4,000 and is now around $6,000.

We bought some used but reconditioned Jensen pumping units just last year for $2,500. Now they are $5,000.

One that hasn’t went up too bad yet is downhole chemical. Was $993.44 per drum including tax, now $1,080.40 including tax.

All of the above are pre-tax. The prices quoted unless otherwise stated are pre-COVID.

SS, all very familiar here in S. Texas and the same for everyone in W. Texas drilling HZ wells. OPEX is up +40%, D&C costs a solid 35%.

But that, and this… https://ycharts.com/companies/PXD/total_long_term_debt

is real, and relevant; best discuss it where it matters.

Hi Shallow sand,

What has happened on the revenue side? Have costs increased so much that it is no longer profitable to produce?

Other well cost estimates from EOG and Devon below, seems the range is $6 million to $8 million per well for CAPEX.

EOG forecasts 570 wells in 2022 at 4500 million, about $7.9 million per well

https://investors.eogresources.com/news/news-details/2022/EOG-Resources-Reports-Fourth-Quarter-and-Full-Year-2021-Results-Announces-2022-Capital-Program-Declares-1.00-per-Share-Special-Dividend/default.aspx

Devon expects to complete about 330 wells using about 2050 million, about $6.2 million per well (about 75% of spending expected to be in Delaware basin).

https://s2.q4cdn.com/462548525/files/doc_financials/quarterly/2021/q4/Q4-2021-DVN-Earnings-Presentation.pdf

Shallow sand,

When I adjust my spreadsheet to evaluate breakeven wellhead price for average 2019 Permian well with CAPEX increased by 35% (to $11 million per well from large producer average of around $7 million per well) and increase OPEX by 40% (based on Mr Shellman’s estimates for cost increases), I get the following.

Payout at 60 months, breakeven at $57/bo at wellhead with natural gas assumed to sell at $3.50/ MCF at wellhead and NGL sells for 35% of wellhead oil price.

Payout at 36 months at $62/bo at wellhead with same NG and NGL assumptions as above.

Assuming we use a 10% nominal annual discount rate, cumulative discounted net revenue is equal to capital cost plus 300k for P&A cost (in 2021$) at a breakeven price of $49/bo (with same NG and NGL assumptions for price as given in example one above), where I assume the well is shut in at 20 bopd.

If we assume the well continues to produce while net revenue is positive, the breakeven oil price falls as low as $48.30/bo and the well produces for 228 months and is shut in at 8.89 bopd with cumulative output of crude at 450 kbo, natural gas cumulative is 2259 million cubic feet and cumulative NGL is 187 kb.

Mike,

Yes Pioneer issued a lot of debt in early 2021 at very low interest rates and had taken on on significant debt with the merger with Parsley Energy in 2021, they are also paying out a very high dividend which is what their shareholders want. As interest rates rise they may decide to pay down their debt we will know more in February 2023.

The $2.5 billion of debt issued at 0.75% due in Jan 2025 (0.75 B), 1.125% due in Jan 2026 (0.75 B), and 2.15% due Jan 2031 (1 B) was used to retire Parsley and Jagged Peak debt at 4% to 6%.

Details at news release linked below

https://investors.pxd.com/news-releases/news-release-details/pioneer-natural-resources-announces-pricing-public-offering-7500

Seems a smart move to reduce interest payments.

Dennis.

I am just reporting actual costs in our field.

We are still doing a lot better financially despite the expense increases.

There isn’t any drilling going on in our field as of now. Maybe that changes this summer. We have no plans to drill in 2022. We have discussed drilling in 2023. Will see how oil prices and costs go this spring and summer.

Shallow sand,

Nice to hear that you are doing well, it would be nice if costs did not rise, but as Mike said, we live in the real world. Hope Mike is doing well also.

No big projects are possible without debt. Only small stuff – and LTO is ironically such small stuff possible.

Normal oil projects are investing billions or double digit billions of $, before one drop oil is produced. And all European societies since the median age had their economies grown on debt.

No single merchant was rich enough to supply a south sea expedition, or a new ore mine. Or not crazy enough to put all of his wealth in this one risky thing. Sharing risk and taking up money was the key for economic development. The stock market and more modern credit system was developed hand in hand for this reason.

I would claim withoud credit there still would be no oil market – all the oil industry wouldn’t have developed.

When an oil company is big enough, it can finance smaller projects by taking credit by itself. This looks like financing from cash flow, but in most big companies this is internally regulated as a credit with a cost / repay calculation. This is done to avoid too much unprofitable projects.

Eulenspiegel,

I was referring specifically to Permian basin tight oil production. Large projects (Arctic or deepwater offshore) are carried out by oil majors who have very good access to credit markets at relatively low interest rates. Smaller producers in tight oil basins can ramp up output at 10% per year by self financing from operating cash flow.

Shift from corn to soya . What does that do to the biofuel production needed as an additive or blending ?

https://finance.yahoo.com/finance/news/u-farmers-pivot-corn-soy-163048486.html

Will Liebig’s law of the minimum decide our fate ? An interesting article .

https://www.resilience.org/stories/2012-01-04/there-more-it-oil/

Kurt Cobb also focuses on the Liebig’s law and self sufficiency of nations .

https://resourceinsights.blogspot.com/2022/04/easier-said-than-done-national-self.html

Unfortunately the true horrors of war and atrocities committed by the retreating Russians is becoming apparent. I expect a policy shift by the West in all things, not just energy.

Lightsout , I will refrain from the first part to avoid fallout . But the second part ” I expect a policy shift by the West in all things, not just energy ” . Question ? What policy shift is possible ? From now over a year I am looking at problems from a three lens perspective which are Overshoot , LTG and Liebig’s law working in tandem . Always I have hit a dead end . The only solution is de growth . De growth is the only way out with minimum damage . Damage there will be no matter what path we choose . How do we convince the 7 billion that the party is over ? Read the link I just posted for a better understanding . Tks .

Dennis . In the ‘ Annual Energy Outlook ” post we had an exchange about the NG situation for industry in Germany and its effect . Here is a link you will find informative . The chief of BASF has come out and said that at 50% capacity utilisation he will have no alternative but to shutdown the world’s biggest chemical complex . That would be disastrous for the downstream industries . No paints , dyes inks, water purifying chemicals etc . I hope sanity will prevail . This announcement was made after the” Roublegas ” decree from Moscow . So very latest .

https://thehitc.com/german-industry-raises-alarm-about-energy-rationing-plan/

Hole in head,

As I said before, the nations of Europe will decide what policy is best both short term and long term. As I have suggested, Russia may be losing its best natural gas customer over the long term, that is their choice.

Dennis , ” Russia may be losing its best natural gas customer over the long term, that is their choice. ” Let me turn it at 180 degrees ” EU may be losing its best natural gas supplier over the long term ” . Ever hear about the Power of Siberia the new pipeline to be ready by 2025 to bring gas from Russia to China ? The choice is not for Moscow to make but Brussels . The world is ” peak gas ” . Who will get what is for Moscow to decide and not Brussels . Beggars can’t be choosers .

Hole in head,

An exchange is an agreement between buyer and seller, Russia is not the only gas producer, it may be that China and India will get the Russian gas, this is up to the nations involved. There may be plenty of natural gas on the market by 2025 relative to demand for natural gas. As wind, solar, hydro, geothermal and nuclear power expand the market for natural gas may shrink, we will see.

Gas and oil for gold.

The Bank of Russia, their Federal Reserve central bank, has officially offered to pay 5000 (created from thin air) rubles for 1 gram of gold. That establishes a floor for the price of gold. As long as an infinite source of money (any central bank) is willing to pay that, it can’t go lower. This extrapolated. Comex says gold is worth some number of dollars and that defined the ruble to USD (also created from thin air) exchange, which is stronger now than pre-invasion.

There is not much that can be done about that. No one will argue with an infinite source of money. Comex might try to manipulate the USD price of gold lower, but they would have to also try to manipulate the value of the ruble lower, and they would face an infinite source of money in that. No private exchange will try this, and the Fed does not have such a mandate. It would be very hard to keep such a thing covert.

GAZPROM wants rubles. Europe wants to pay in Euros. The loophole that will allow all this to happen is European buyers can indeed pay in Euros provided they open an account with GAZPROMbank. This bank is currently not sanctioned, since the energy complex was generally not sanctioned. So Euros can be deposited at that bank by the gas buyers, and the Euro/Ruble conversion will align with the price of gold, and will be determined at the Moscow FX. Note this maneuver also ensures that bank can’t be sanctioned.

Europe has generally already agreed. This allows their leaders to say they defeated Putin’s decree that they must pay in rubles, but that’s not what is happening. The gold maneuver has essentially defined the currency exchange ratio and trading won’t affect it, unless the trading is in gold — and that is a global matter with huge buyers in China and India.

It would seem inevitable this will take place with oil, too.

Watcher , thanks for going behind the curtain .

I think the folk at the RCB worked out the gold for rubles loophole precisely to avoid a trade stand off. Settle NG and Oil (or anything Russia exports and prices in rubles) in gold and no one has to deal with fiat they don’t want/don’t need/can’t use and above all DON’T TRUST.

Perhaps step one towards a new world reserve currency based in part on gold and other reserve currencies.

Check out Zoltan Pozar’s perspectives on Bretton Woods III here:

https://www.youtube.com/watch?v=q0EahFBruFA