A guest post by Ovi

All of the oil (C + C) production data for the US state charts comes from the EIAʼ’s Petroleum Supply monthly PSM.

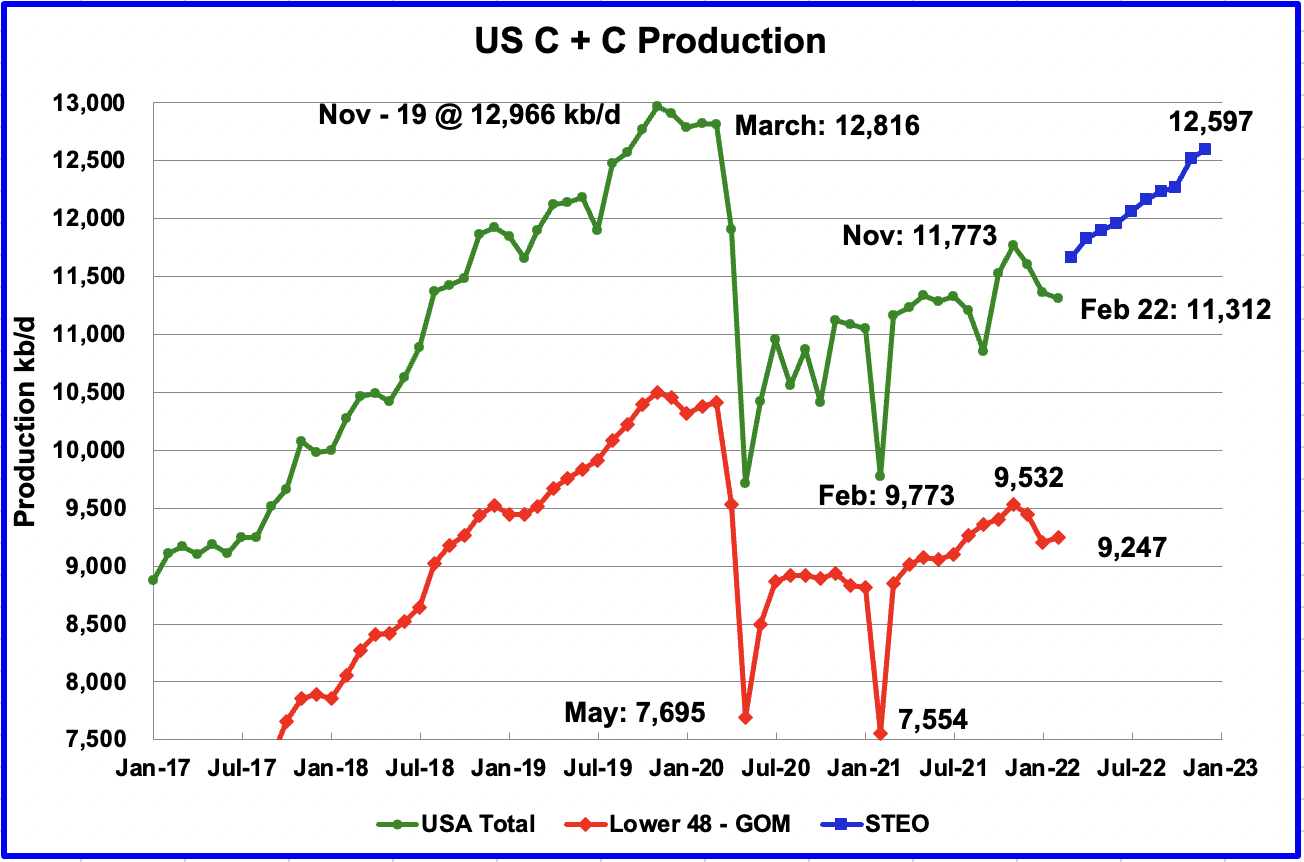

U.S. February production decreased by a surprising 50 kb/d to 11,312 kb/d. Relative to November 2021 production of 11,773 kb/d, it has dropped by 461 kb/d. The main declining states were Texas 27 kb/d and ND 23 kb/d. The major decliner was the GOM which dropped by 93 kb/d. Of the top 3 states, only New Mexico increased its production.

While overall US production was down, a clearer indication of the health of US onshore oil production can be gleaned by looking more closely at the On-shore L48 states. In the On-shore lower 48, February increased by 43 kb/d to 9,247 kb/d.

The blue graph, taken from the April 2022 STEO, is the production forecast for the US from March 2022 to December 2022. Output for December 2022 is expected to be 12,597 kb/d, a revision of 38 kb/d lower than was forecast in the March STEO report. From March 2022 to December 2022, production is expected to increase by 931 kb/d or on average 103.4 kb/d/mth.

Looking at the production trend from July 2020 to February 2020, the slope/trend of 103.4 kb/d/mth of the blue graph looks optimistic. It appears to be an economic forecast based on oil price that does not reflect current management thinking and investor demand for reduced spending and increased investor returns. Also the DPR and LTO reports below do not confirm the optimistic STEO production projection.

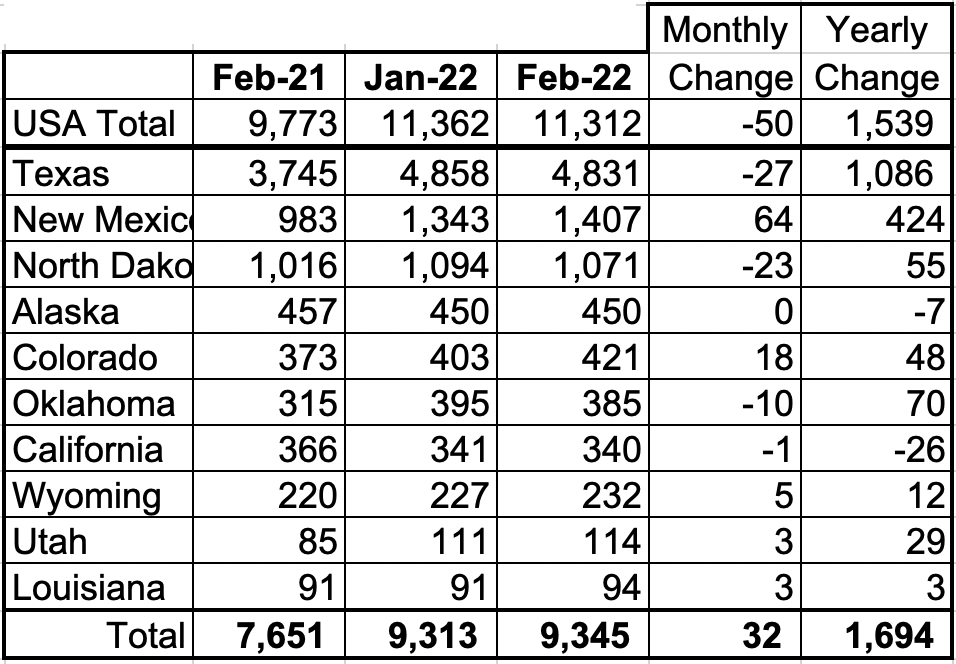

Listed above are the 10 states with the largest US production. These 10 accounted for 82.6% of all US oil production out of a total production of 11,312 kb/d in February 2022. Note that all of the above states, except Alaska and California were producing more oil in February than one year ago.

On a YoY basis, US production increased by 1,539 kb/d.

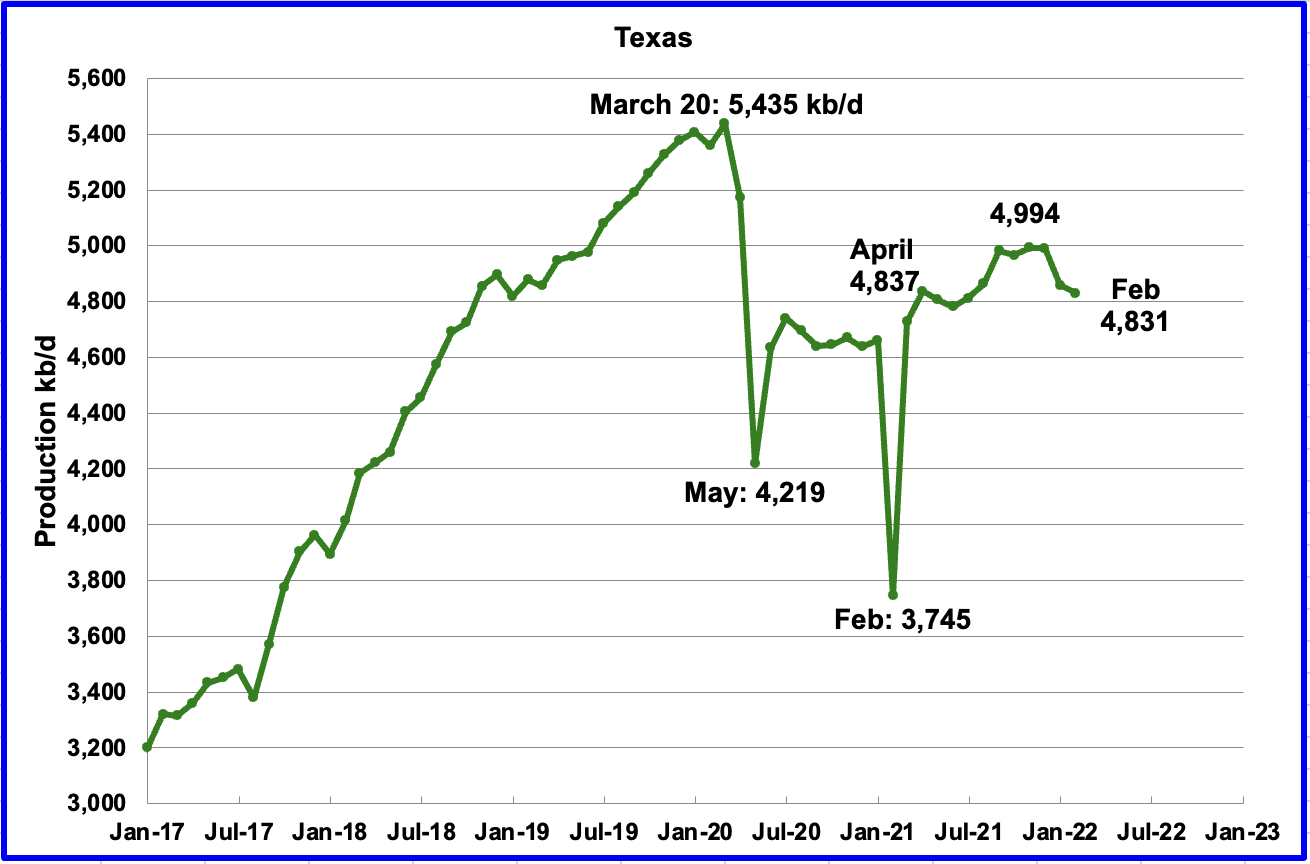

Texas production decreased by 27 kb/d in February to 4,831 kb/d from 4,858 kb/d in January. The decrease could be weather related.

In April 2021 there were close to 185 Hz oil rigs operating in Texas. By the last week of February 2022, 263 oil rigs were operating, an increase of 78 rigs and production is back to the same level as April.

February’s New Mexico production increased by 64 kb/d to 1,407 kb/d.

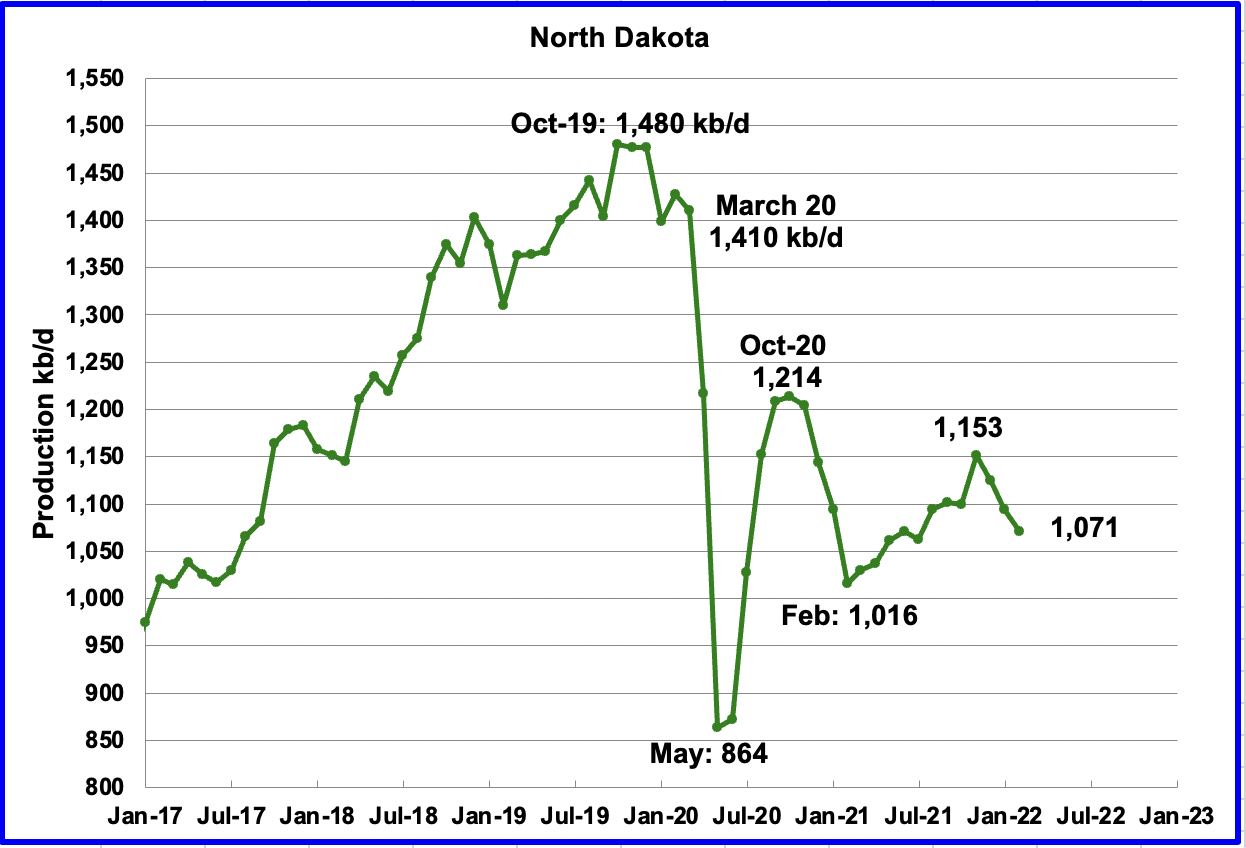

North Dakota’s February output was 1,071 kb/d, a decrease of 23 kb/d from January.

According to this source, ND’s April oil production was hit hard by two winter blizzards.

“State officials say a pair of blizzards that smacked North Dakota in April caused a dramatic reduction in oil production. The Bismarck Tribune reported that State Mineral Resources Director Lynn Helms provided state regulators updated production estimates Friday. He said the state’s oil industry had been producing about 1.1 million barrels daily until the blizzards hit. The first storm began on April 12 and lasted three days. Helms says it caused production to fall to about 750,000 barrels per day. The industry had rebounded to 950,000 barrels per day when the second storm hit on April 23. That blizzard caused production to drop to just 300,000 barrels per day. Production has since increased to about 700,000 barrels per day.”

I made a rough estimate of what North Dakota production could be in April using the above information. The projected production is expected to be close to 860 kb/d, a loss of 240 kb/d.

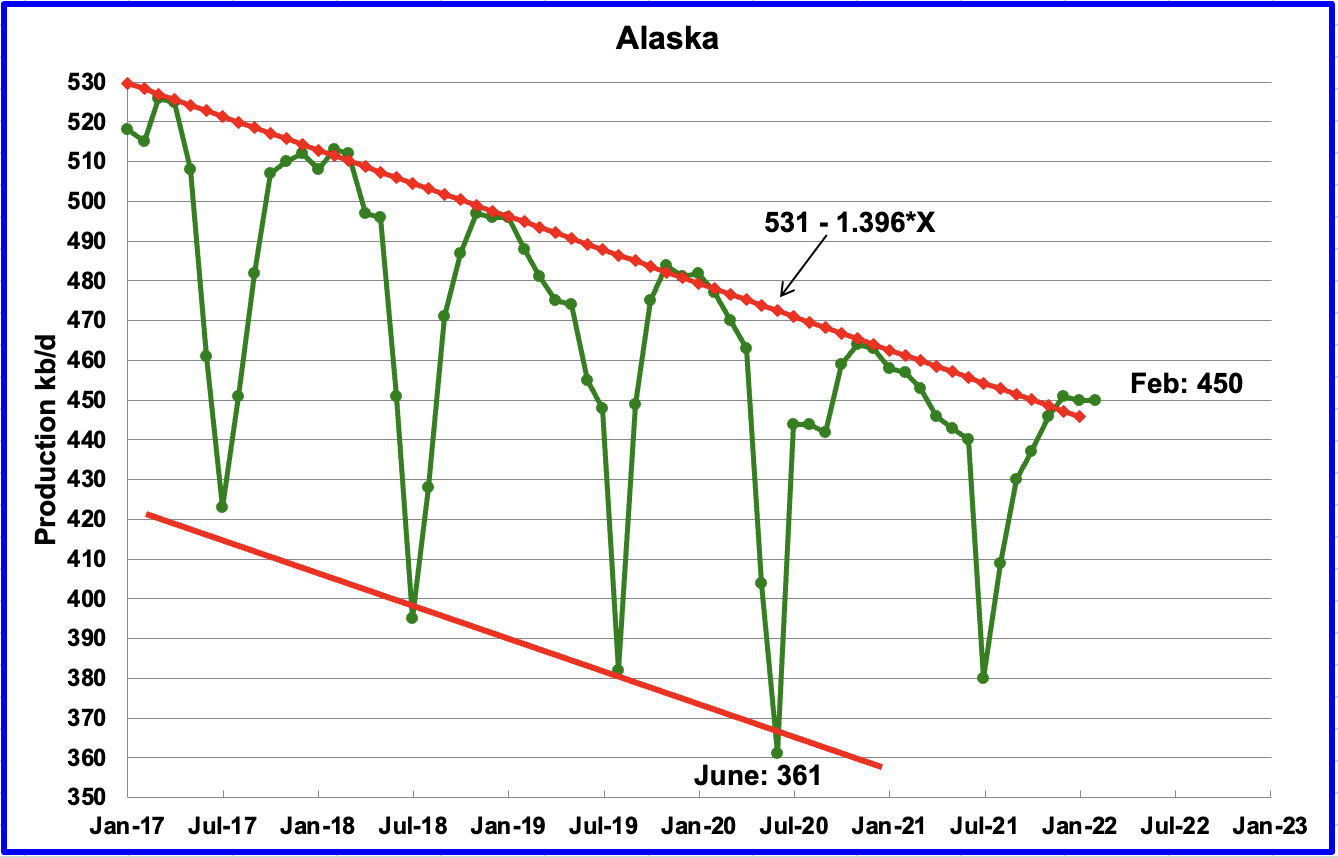

Alaskaʼ s February output was unchanged at 450 kb/d.

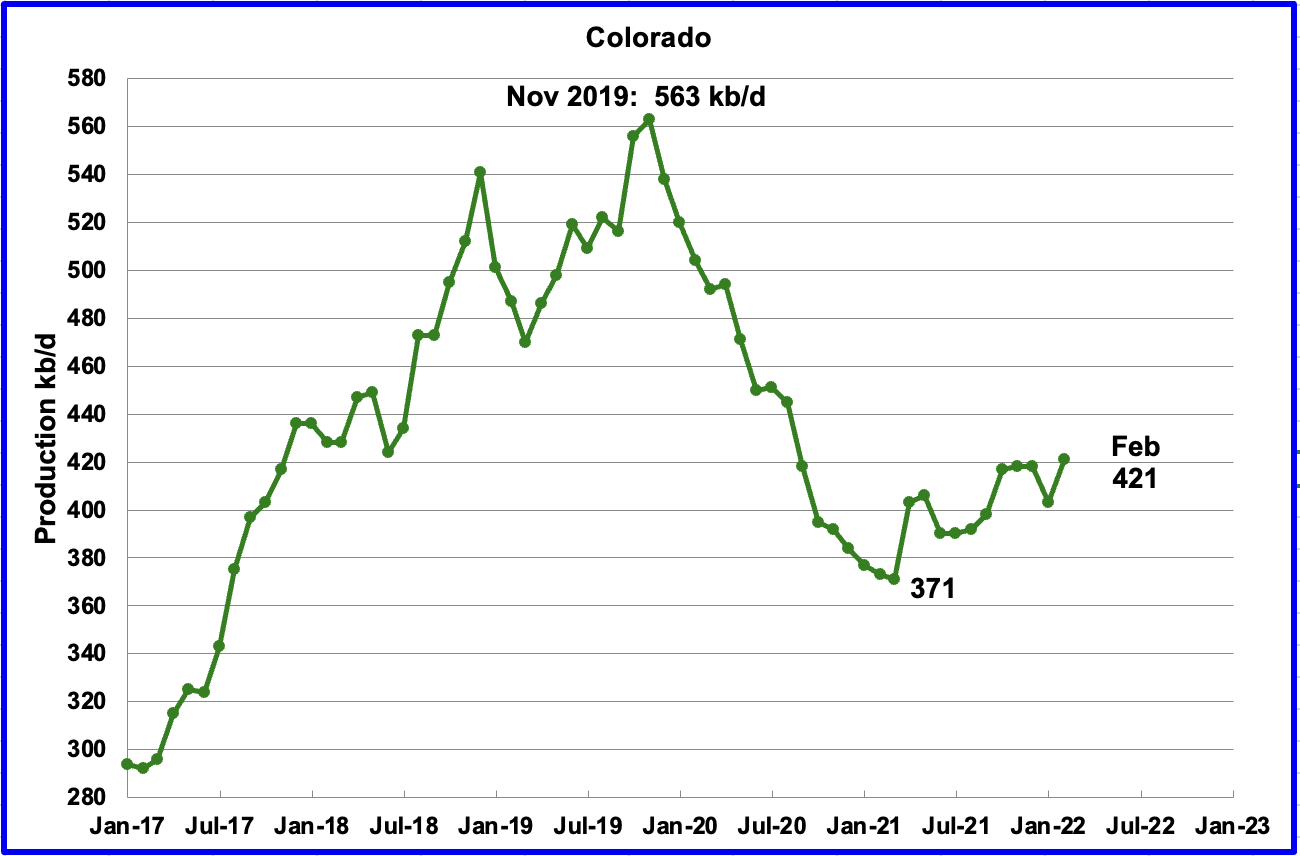

Coloradoʼ s February production increased by 18 kb/d to 421 kb/d. Colorado has had 10 hz oil rigs operating since November and added 2 in late February.

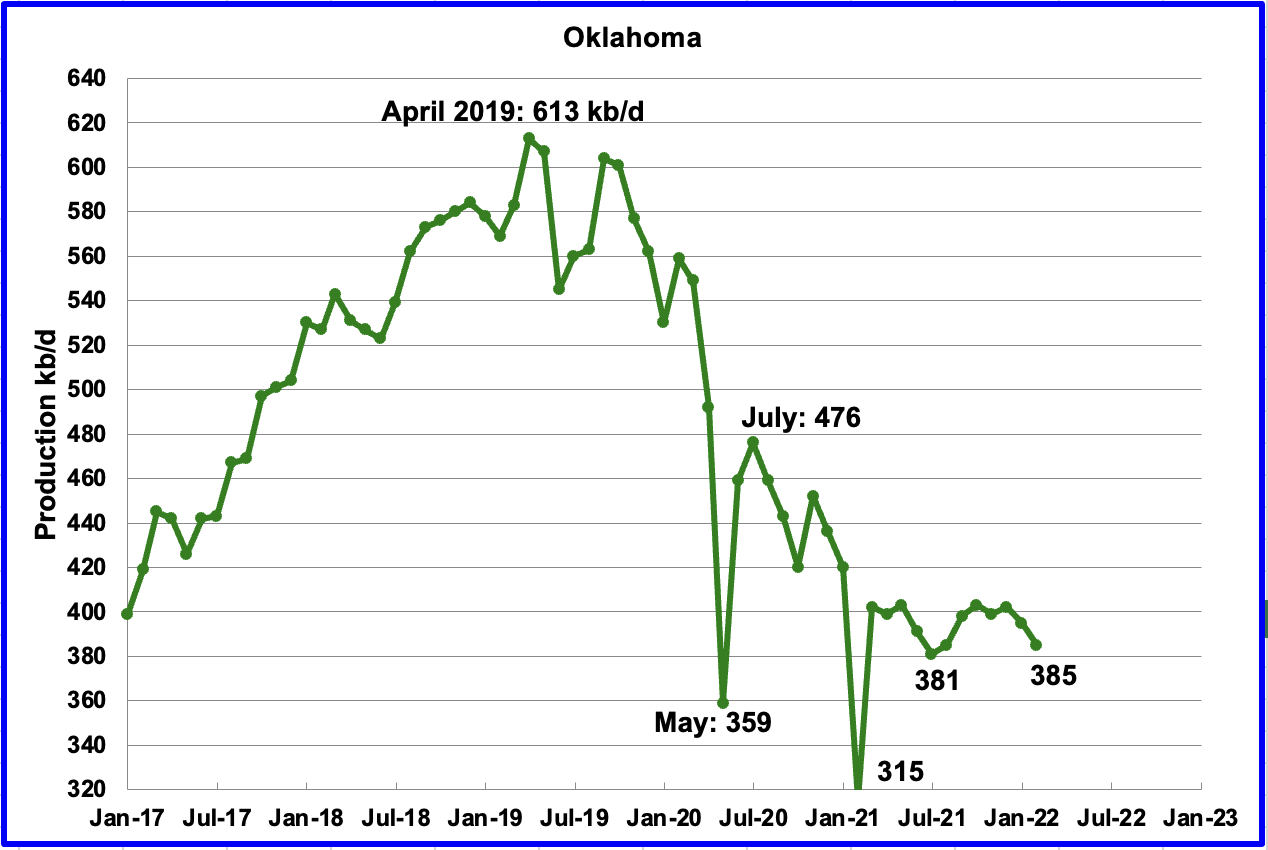

Oklahoma’s output in February decreased by 10 kb/d to 385 kb/d. Its output has remained between 380 kb/d and 400 kb/d since March 2021 even though its rig count increased from 17 in March 2021 to 53 in February.

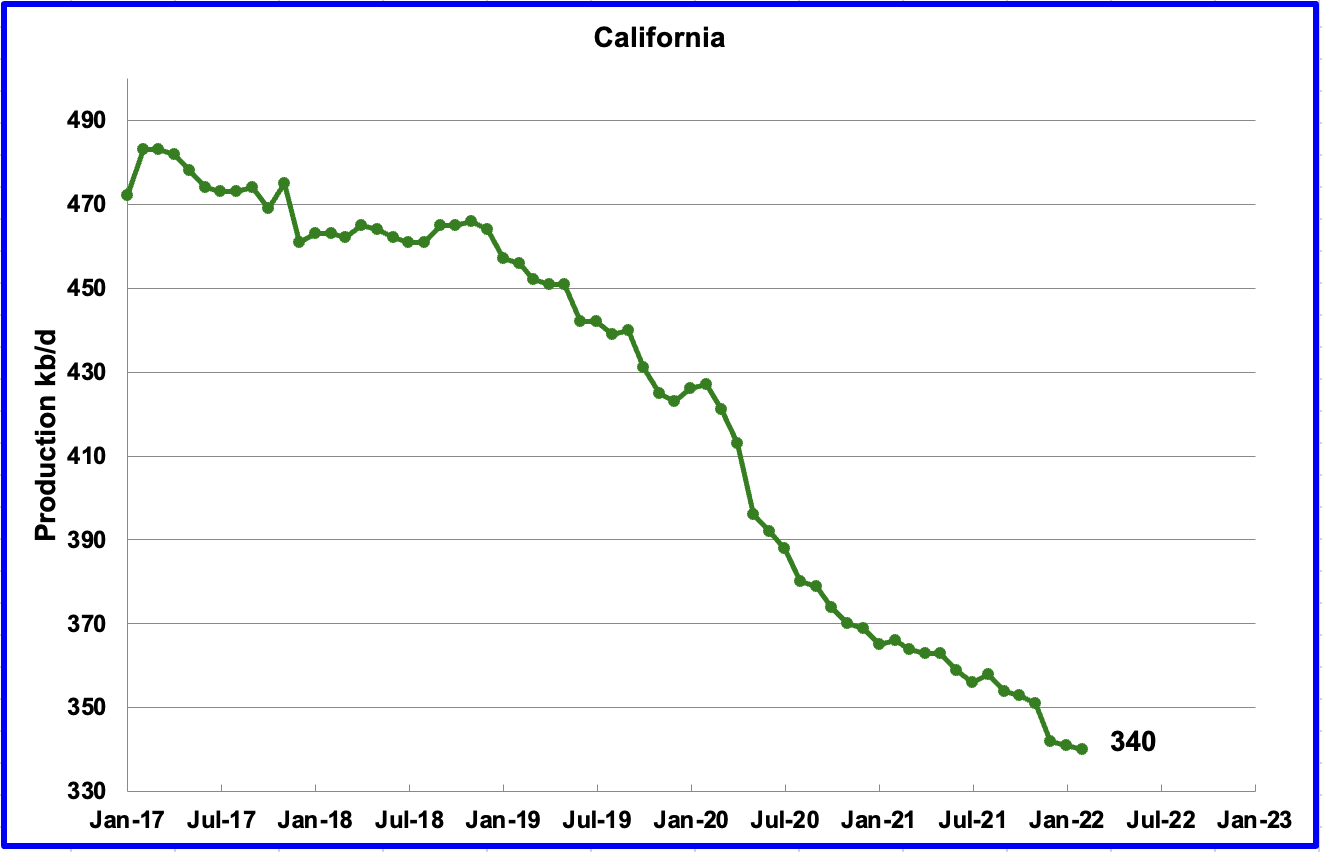

Californiaʼ s slow output decline continued in February. Output decreased by 1 kb/d to 340 kb/d.

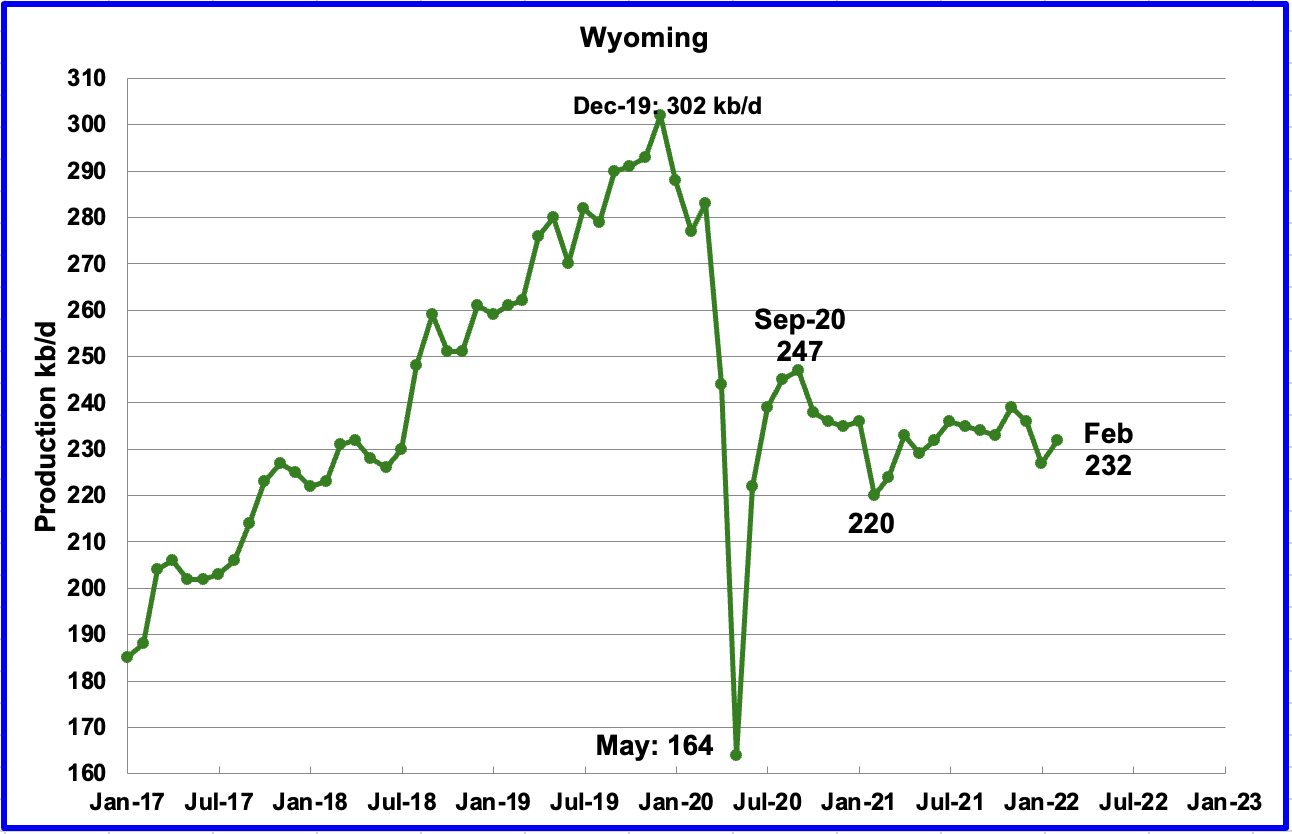

Wyoming’s production has been in a slow unsteady decline since September 2020 when output reached 247 kb/d. In February 2022 output increased by 5 kb/d to 232 kb/d, down 15 kb/d from September 2020.

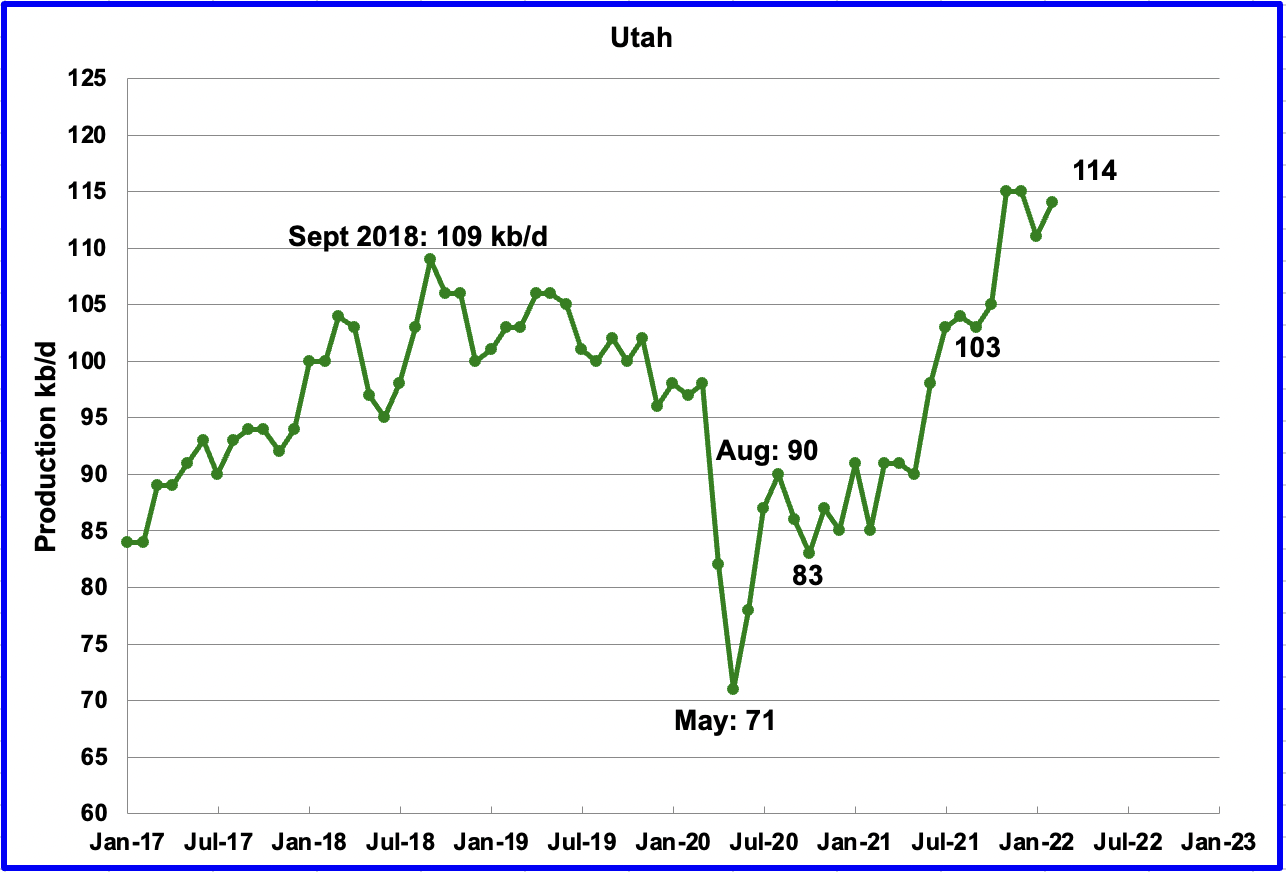

Utah’s production increase from the low of May 2020 appears to have stopped in November 2021. February’s production increased by 3 kb/d to 114 kb/d. However note that the preliminary January output record of 120 kb/d in the April report has been revised down to 111 kb/d in this report.

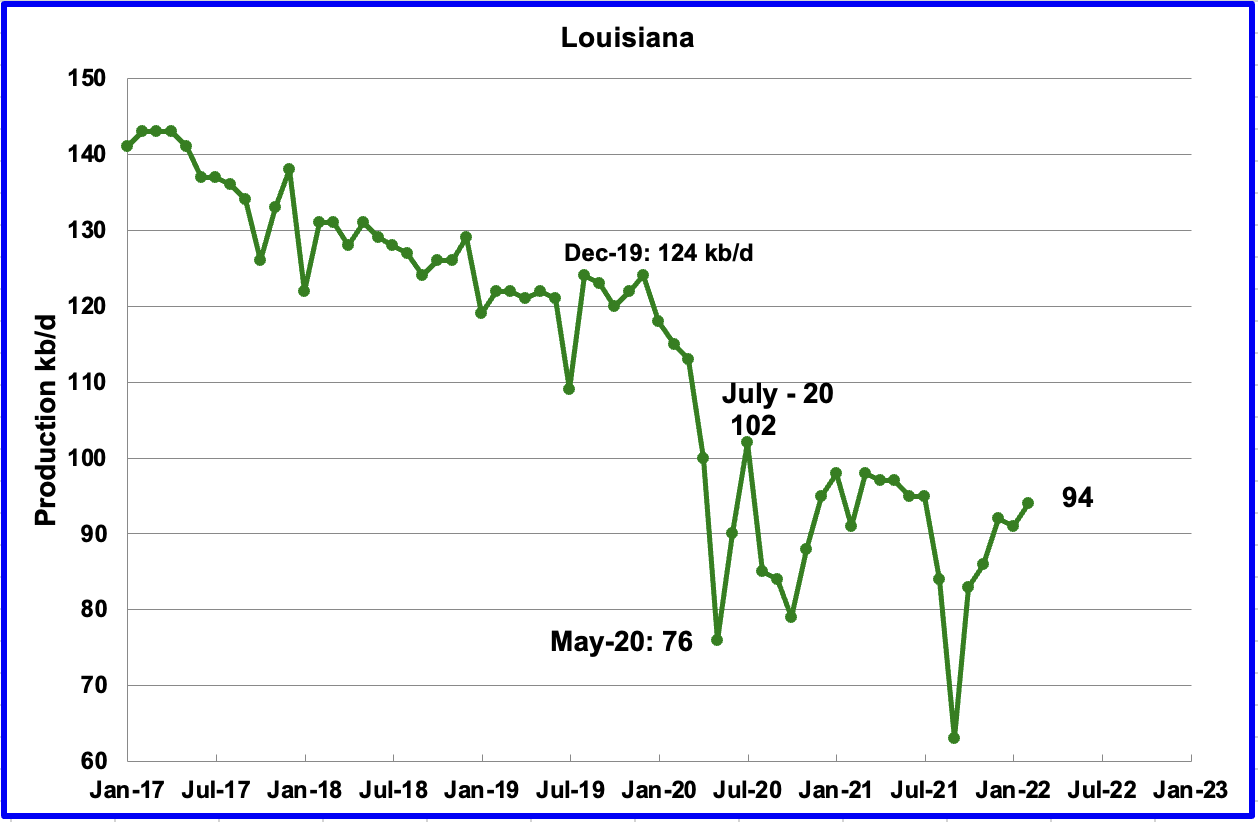

Louisiana’s output increased by 3 kb/d to 94 kb/d in February. Louisiana was one of the hardest hit states by hurricane Ida in late August. February’s output increase indicates that Louisiana’s slow recovery is continuing.

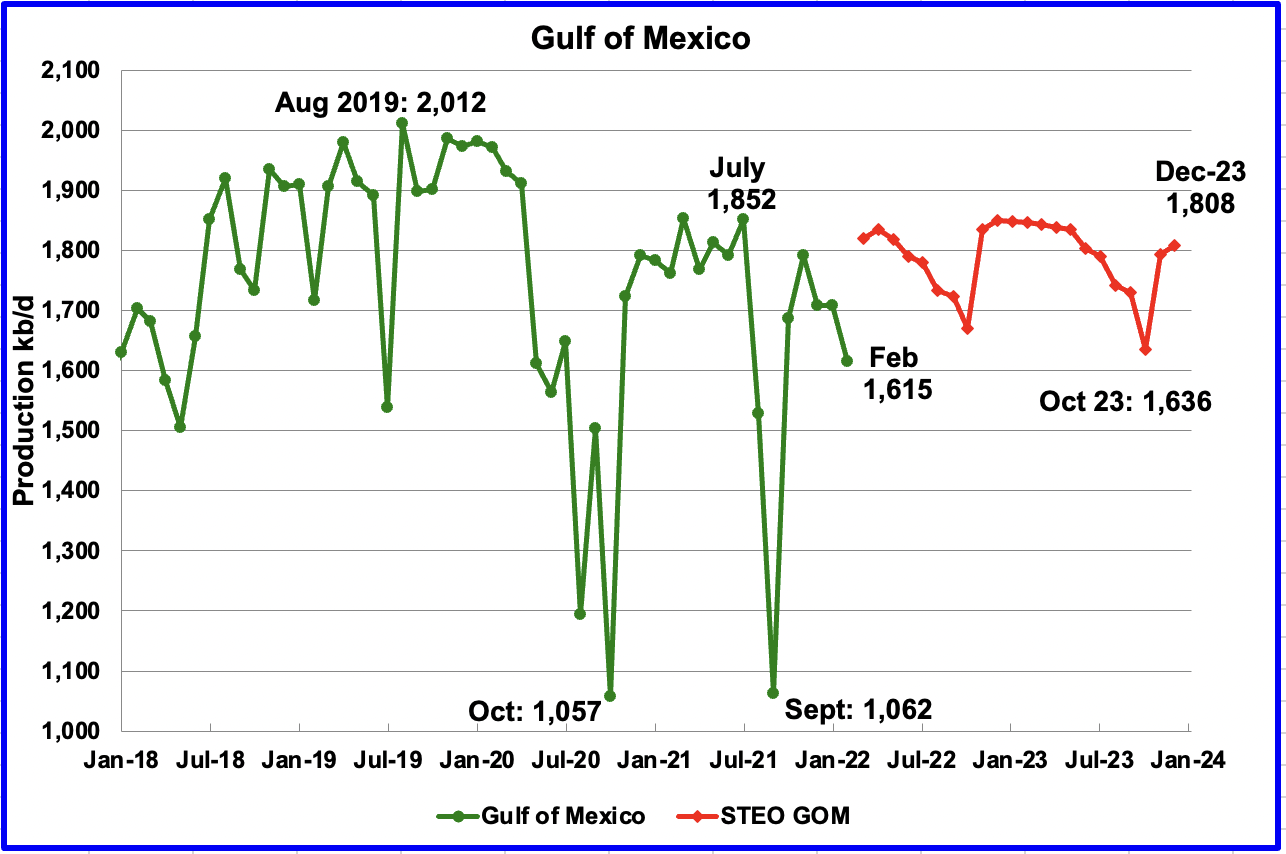

GOM production took a sharp drop in December 2021 and continued to February. Since November it has dropped by 176 kb/d from 1,791 kb/d to 1,615 kb/d in February. February’s drop was 93 kb/d. If the GOM was a state, its production would normally rank second behind Texas.

The April 2022 STEO projection for the GOM output has been added to this chart and projects output will be 1,808 kb/d in December 2023. This is 42 kb/d lower than projected in the March report and 204 kb/d lower than the high of 2,012 kb/d in August 2019. For March, the STEO is projecting a 205 kb/d increase to 1,820 kb/d.

A Different Perspective on US Oil Production

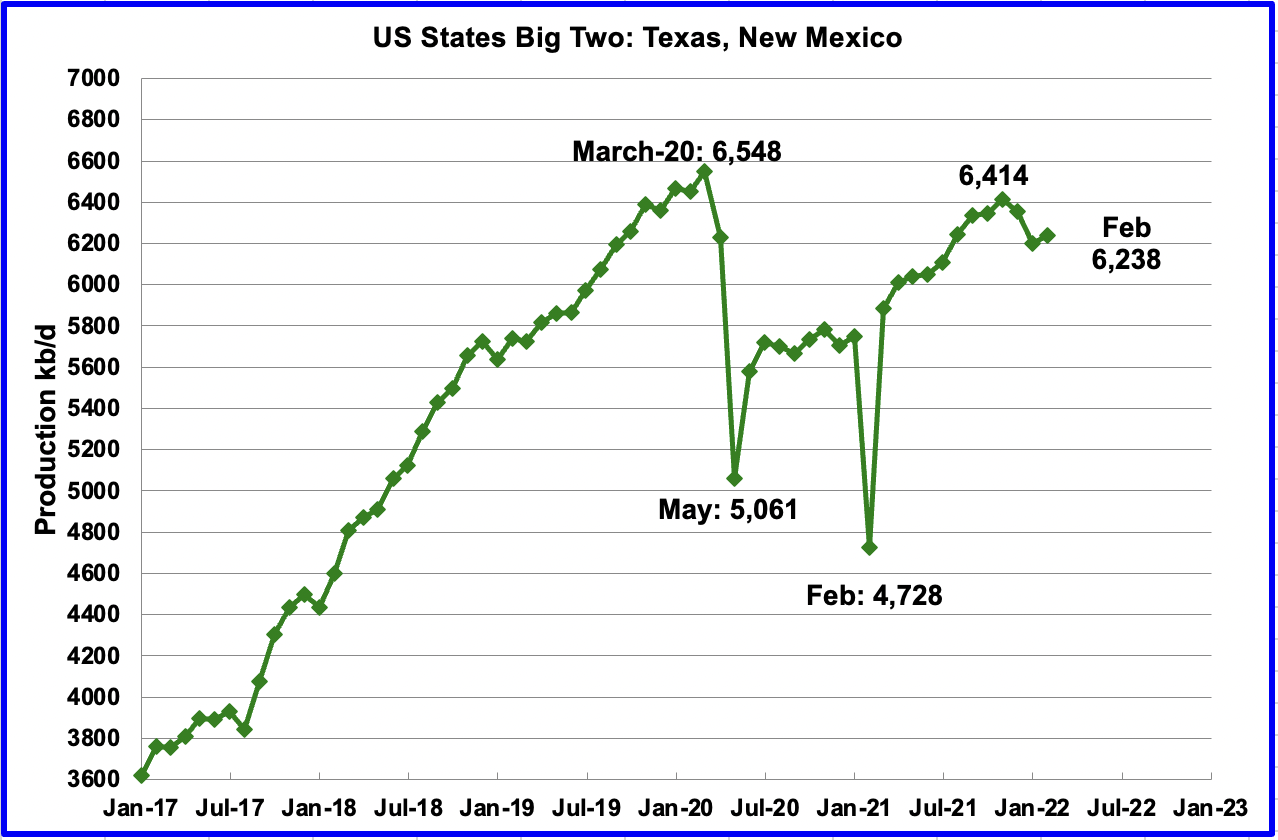

The Big Two states, combined oil output for Texas and New Mexico.

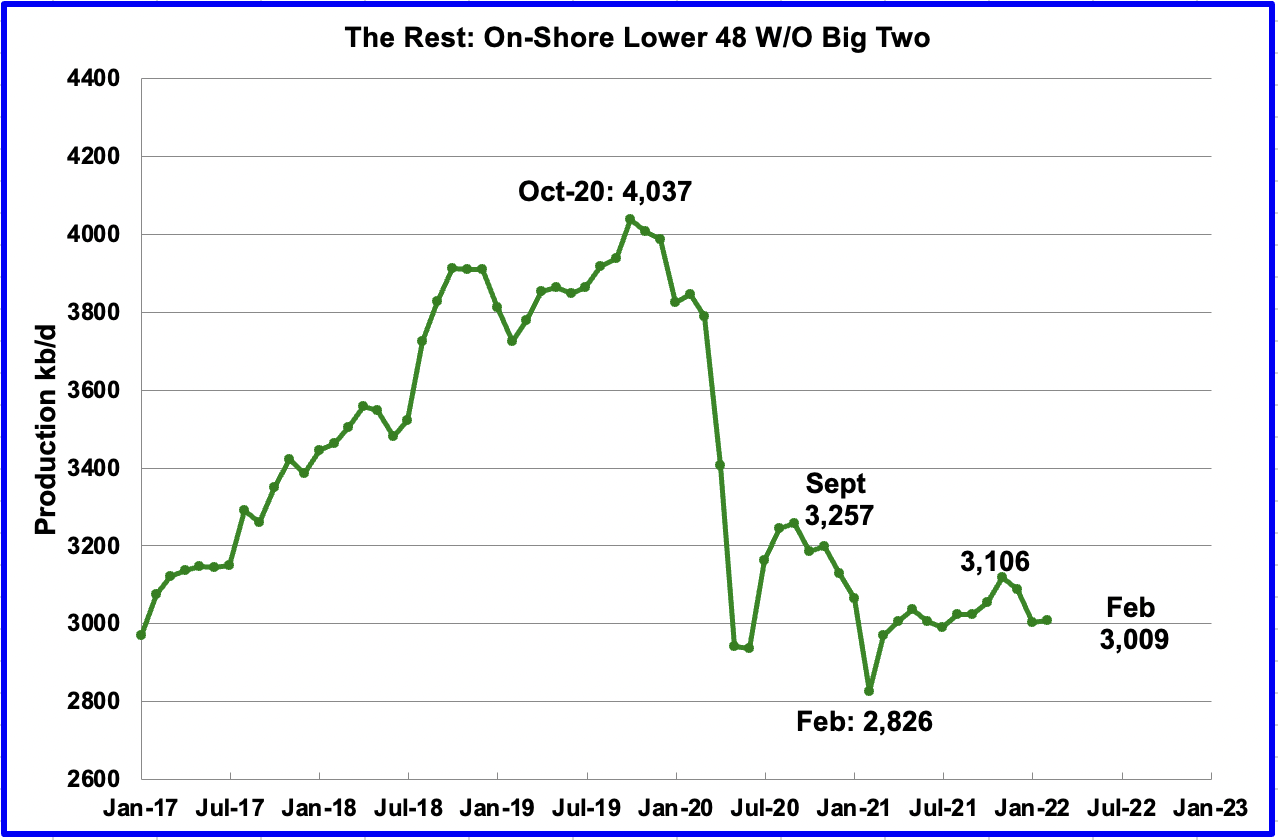

Oil production for The Rest

To get a different perspective on US oil production, the above two charts have broken US state production into two groups, “The Big Two” and the “On-Shore L48 W/O Big Two” or The Rest.

February production increased in the Big Two states. Output increased by a combined 37 kb/d, with New Mexico adding 64 kb/d and Texas dropping by 27 kb/d. From June 2021 to February 2022, production has increased by 658 kb/d or on average 32.9 kb/d/mth.

Over the last year, the Rest appear to be holding steady at close to 3,000 kb/d.

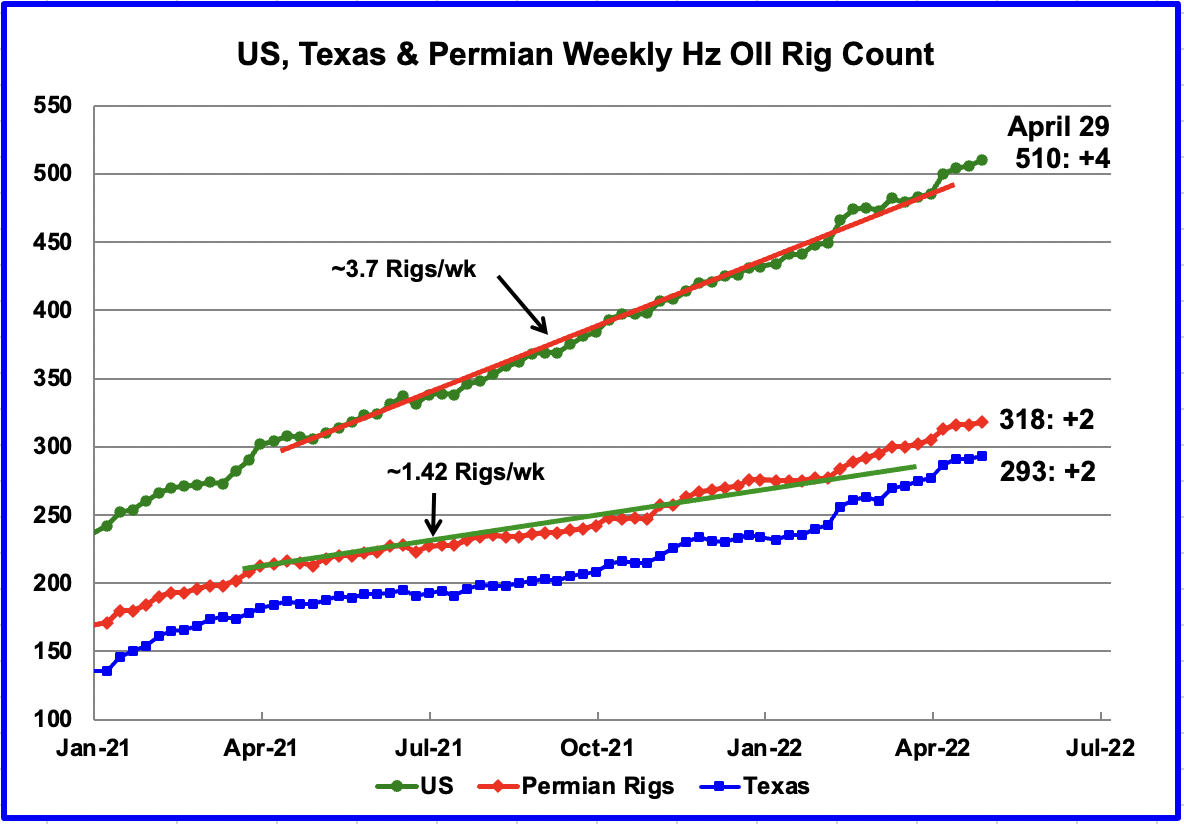

Rigs and Fracs

The US total Hz oil rig count for the week ending April 29 was 510, an increase of 4 over the previous week. The latest rig data appears to continue the earlier trend of the addition of 3.7 rigs/wk, on average.

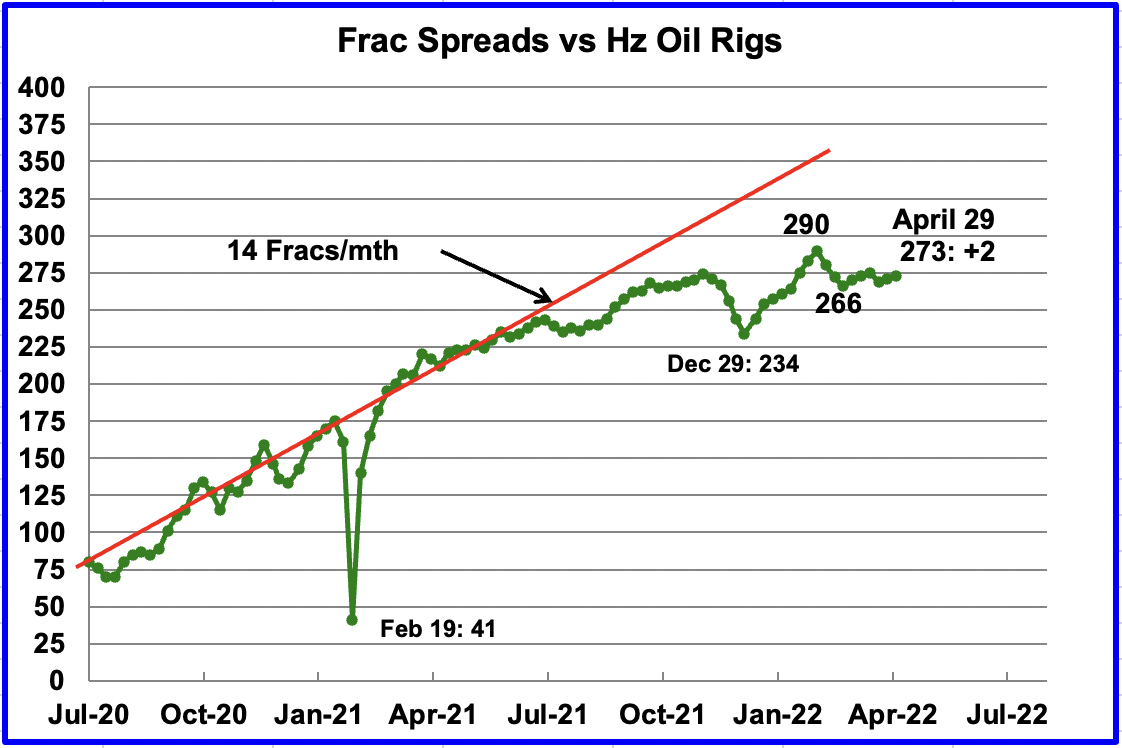

During December 2021, 37 frac spreads were decommissioned primarily due to the holidays and the total dropped to a low of 234 at the end of December. During the month of January, 27 frac spreads were reactivated and in February an additional 29 were added for total of 290.

In the week ending April 29, the frac spread count increased by 2 to 273 and was down 17 from the high of 290 at the end of February. During April, 25 Hz oil rigs were added while the Frac spread count remained unchanged at 273.

Note that these 273 frac spreads include both gas and oil spreads, whereas the rigs information is strictly Hz oil rigs.

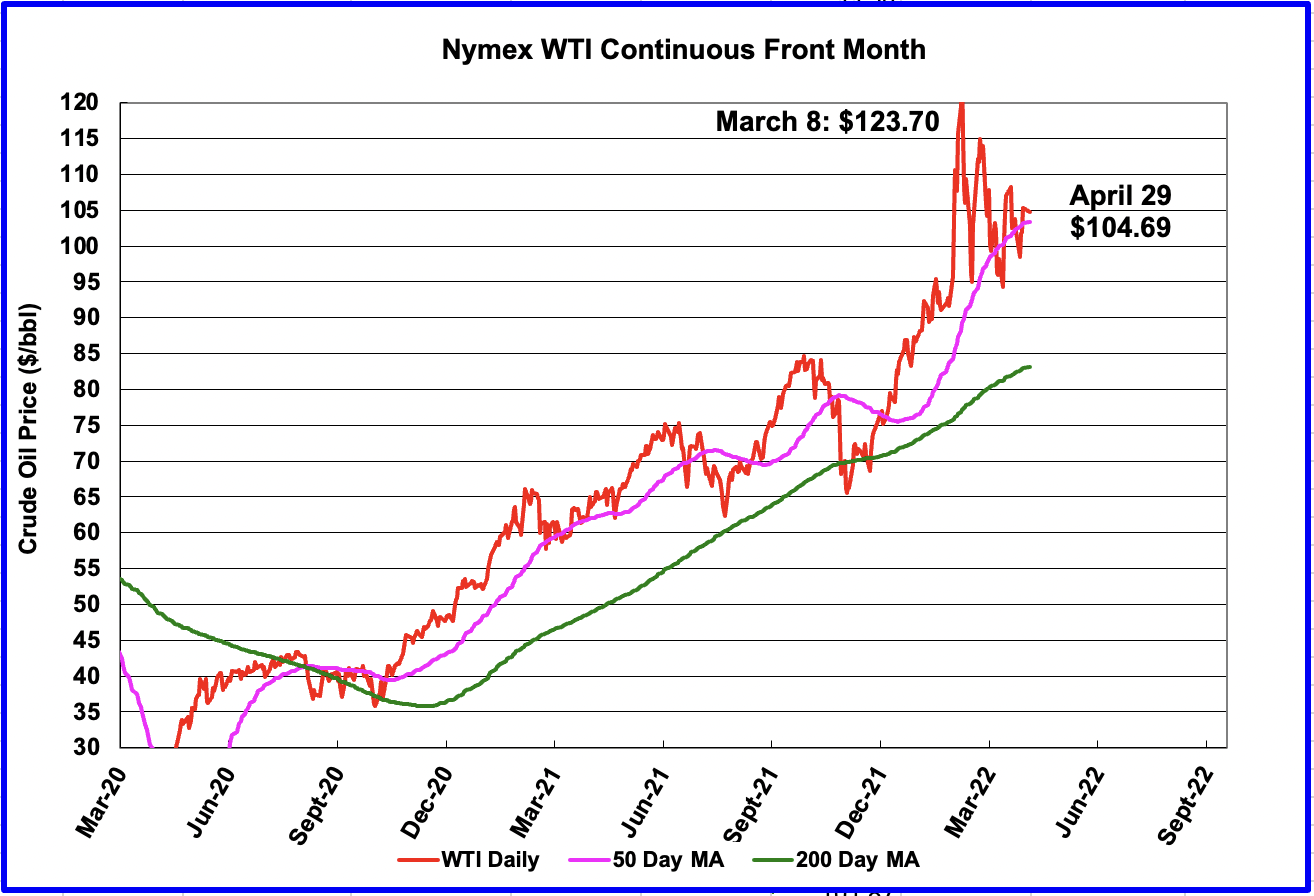

WTI

The WTI June contract settled on April 29 at $104.69/bbl. The price has been bouncing around $100/b for the past few weeks due to the release of SPR crude and Beijing lockdowns, offset by supply concerns.

1) Short Term Energy Outlook (STEO)

The April 2022 STEO provides projections for the next 23 months, starting with February 2022 to December 2023, for US C + C, OPEC and other oil production related parameters of interest.

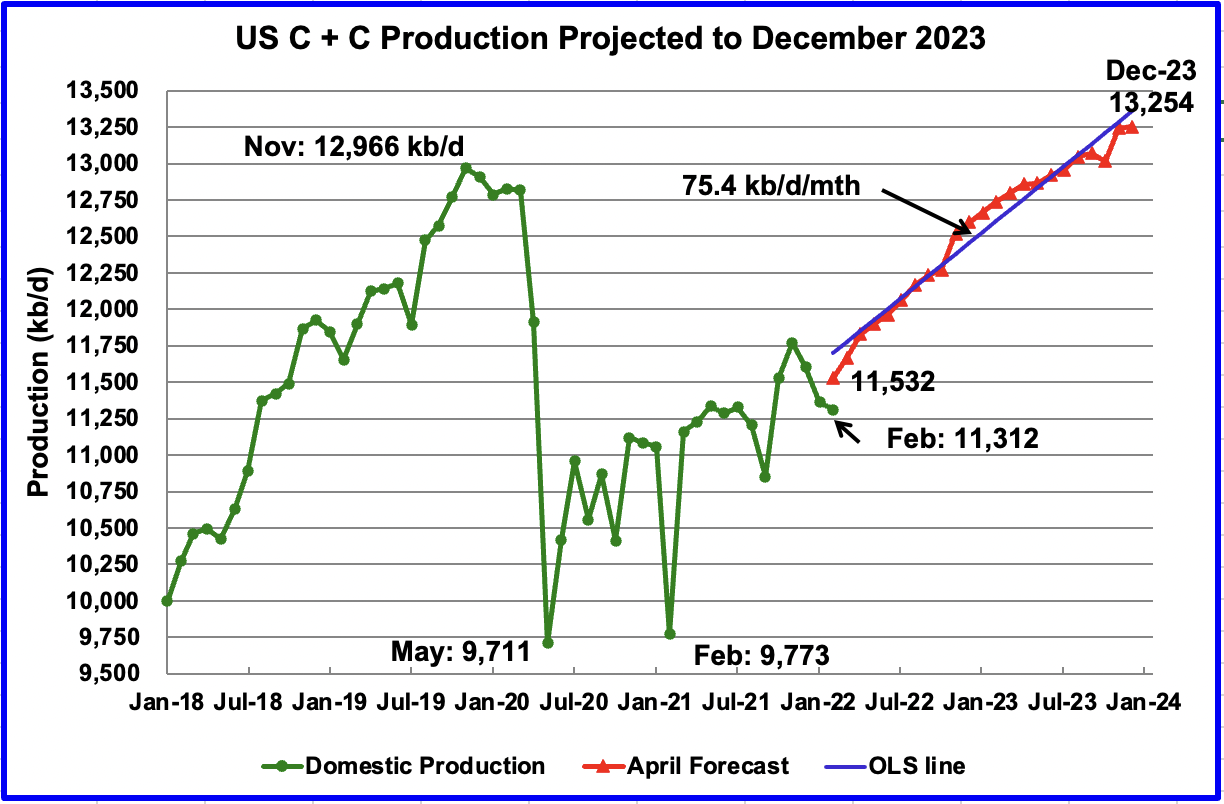

The April 2022 STEO has revised downward its projected US oil output from February 2022 to December 2023. December 2023 has been revised down by 88 kb/d from the previous March 2022 STEO. In December 2023 output is expected to reach 13, 254 kb/d. Output does not exceed the previous peak of 12,966 kb/d till late 2023.

Using only the projected data and fitting an OLS line through the February 2022 to December 2023 data, the STEO is forecasting production will increase at an average rate of 75.4 kb/d/mth, down from the average rate of 79.0 kb/d/mth in the March report. If the December 2023 output is achieved, it will be 288 kb/d higher than the November 2019 record.

Note the discrepancy of 220 kb/d between the actual February US oil production of 11,312 kb/d vs the STEO forecast of 11,532 kb/d.

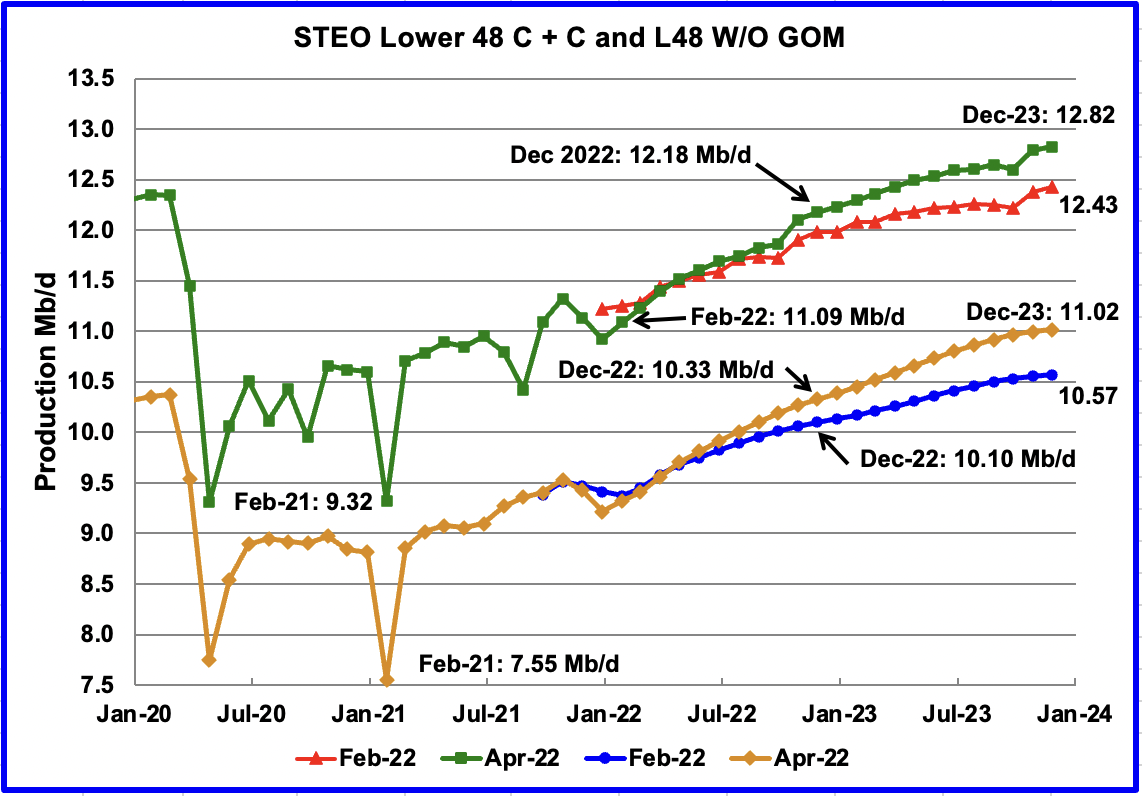

This chart compares the STEO’s forecast for the L48 states from the February report with the current April 2022 report to better illustrate changes in the EIA’s forecast. For the Lower 48, the December 2023 output has been revised downward by a modest 100 kb/d compared to the March increase of 490 kb/d.

The April STEO output projection for the Onshore L48 states has also been revised down to show decreased production in 2022 and in 2023. The output projection for December 2023 has been decreased by 50 kb/d to 11.02 Mb/d from the previous forecast of 11.07 Mb/d.

From the orange graph, one can notice a definite slowing in the production rate in the later half of 2023. Is this a hint of possible further slowing in monthly production increases in the Onshore L48 beyond 2023?

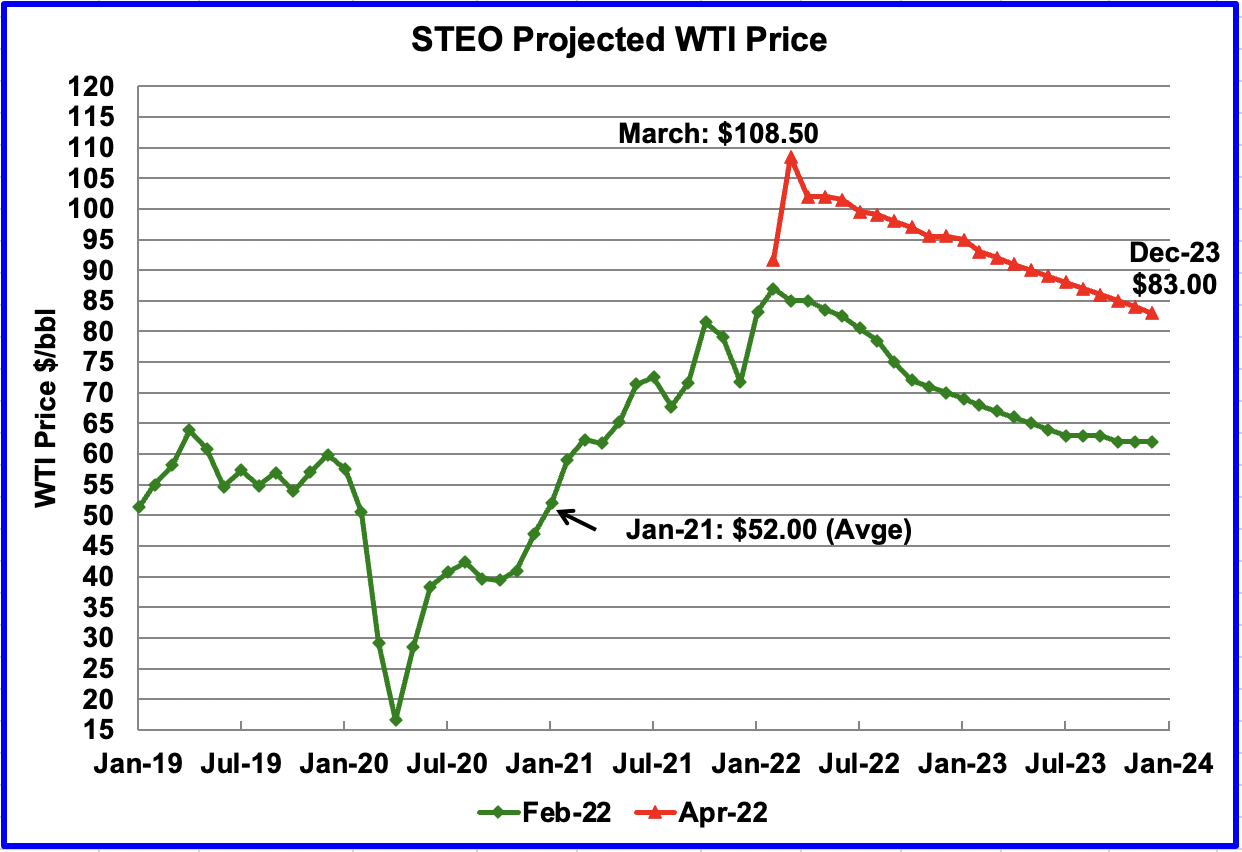

The April 2022 STEO oil price forecast continues to show a steady decline from the EIA’s new March peak of $108.50/bbl to $83/bbl in December 2023. Essentially the EIA is continuing to forecast that the only direction for the price of WTI going forward is down to $83/bbl. However it should be noted that the December 2023 price has been increased over the last 3 months. In the January 2022 report, the December 2023 price was projected to be $62/bbl.

The June contract settled at $104.69 on April 29, $3.19/bbl higher than the EIA’s forecast of $101.50/bbl average for the June contract.

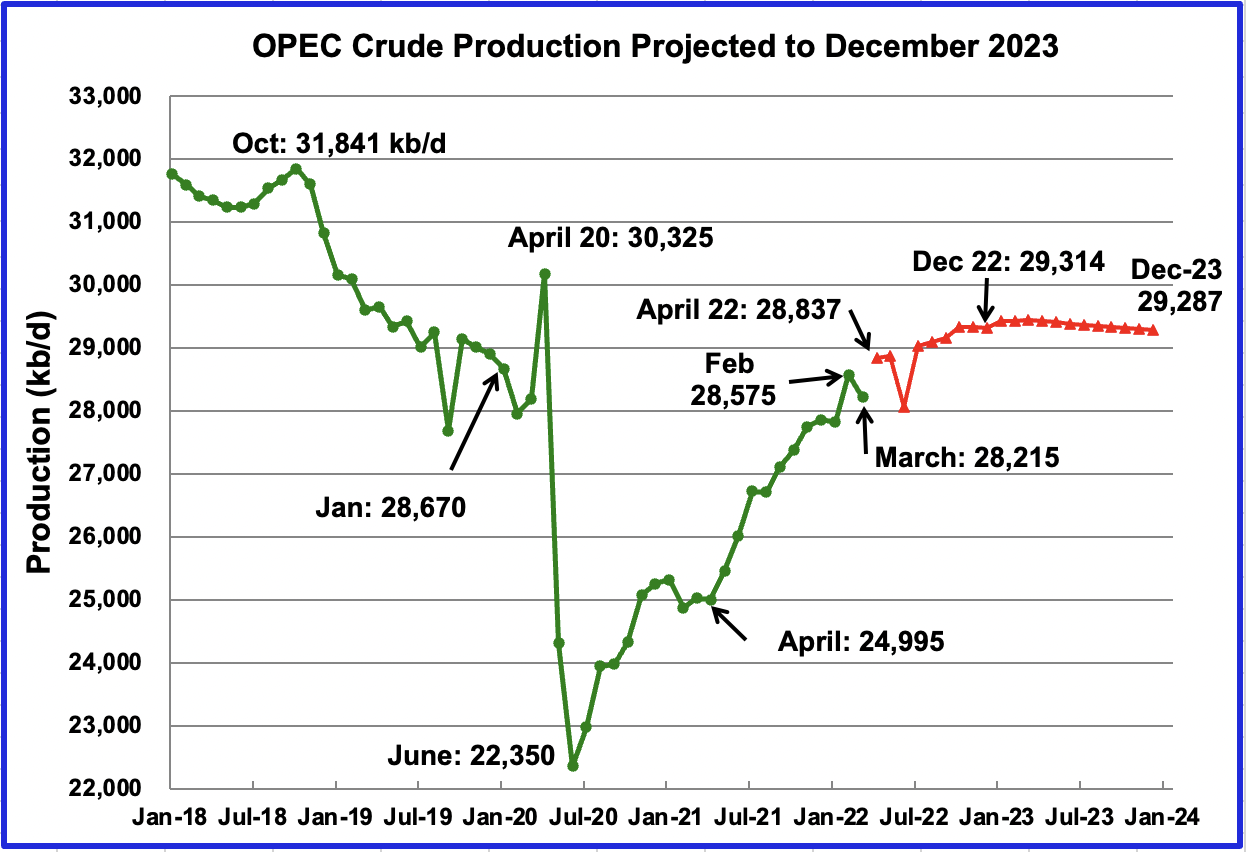

This chart shows the STEO’s April forecast for OPEC crude output from April 2022 to December 2023. OPEC’s output is projected to increase from April 2022 to December 2022 by 477 kb/d to 29,314 kb/d. After December 2022, production remains essentially flat at 29,300 kb/d out to December 2023.

For March 2022, the EIA STEO forecasted OPEC production to be 28,215 kb/d. Actual March production as reported by OPEC was 28,557 kb/d, higher by 342 kb/d. It is not clear why the EIA estimate was so low.

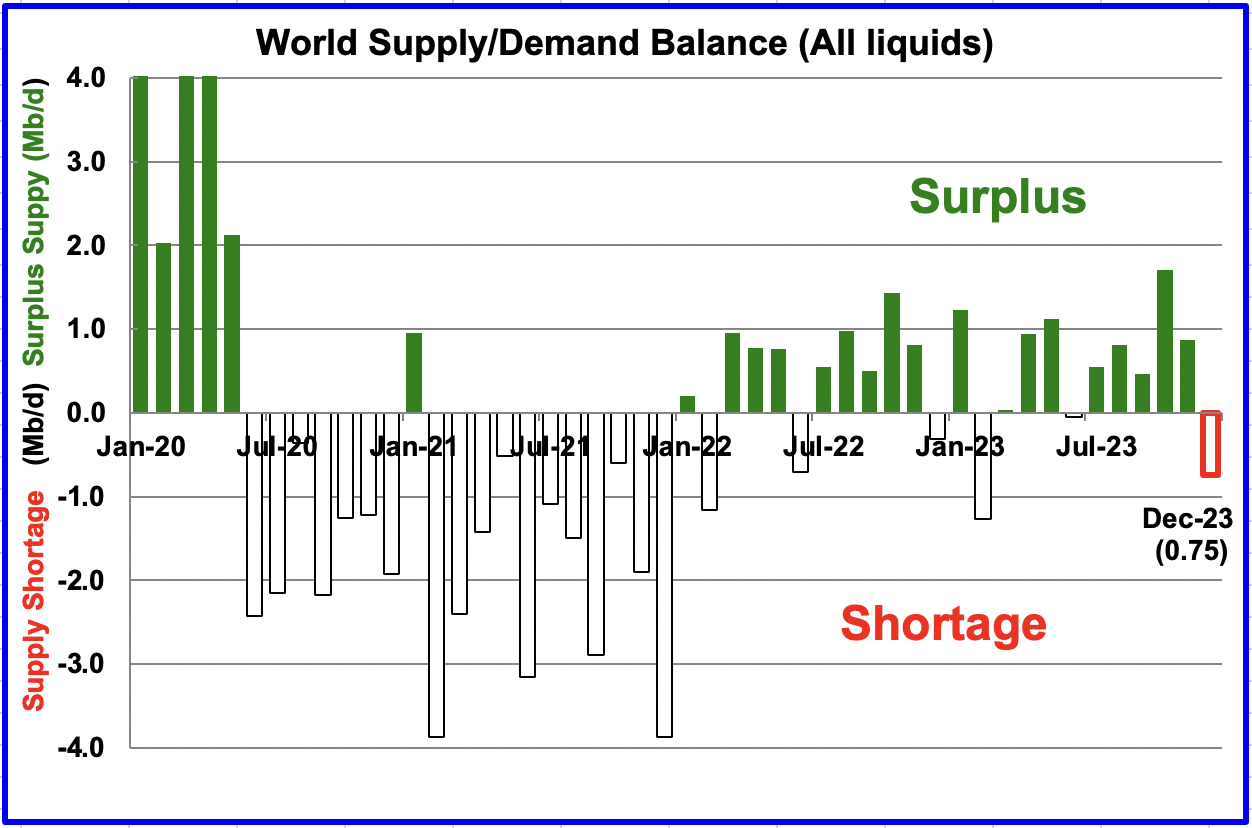

This chart shows the historical world supply/demand balance up to February 2022 and after that, the EIA’s forecast out to December 2023.

From March 2022 to December 2023, the STEO is forecasting an average monthly surplus of close to 518 kb/d. The sanctions on Russian oil and increased prices could see a big revision to this forecast next month.

2) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The April DPR forecasts production to May 2022 and the following charts are updated to May 2022.

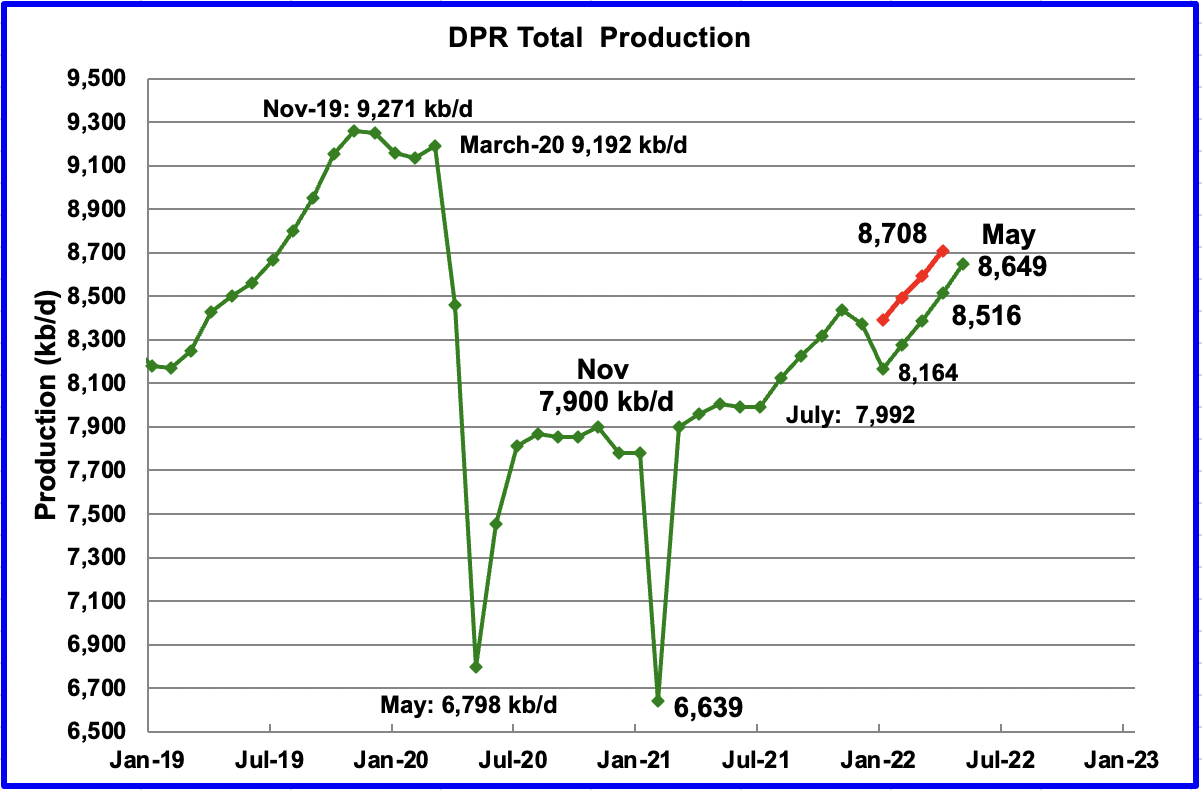

Above is the total oil production projected to May 2022 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional fields.

After the EIA reported lower than expected US production for December and January, the DPR revised its output forecast down.

The DPR is projecting that output for May 2022 will increase by 133 kb/d to 8,649 kb/d. From January 2022 to May 2022, output in the DPR basins is forecast to increase by 485 kb/d or by an average of 121 kb/d/mth. Note that this monthly production rate is much higher than the STEO rate of 75.4 kb/d projected for all of 2022 in the STEO section above.

Did May production really increase? In the March DPR report, April output was projected to be 8,708 kb/d (Red markers). The current April report revised April output down to 8,516 kb/d and May is now 59 kb/d lower at 8,649 kb/d than last month’s April forecast.

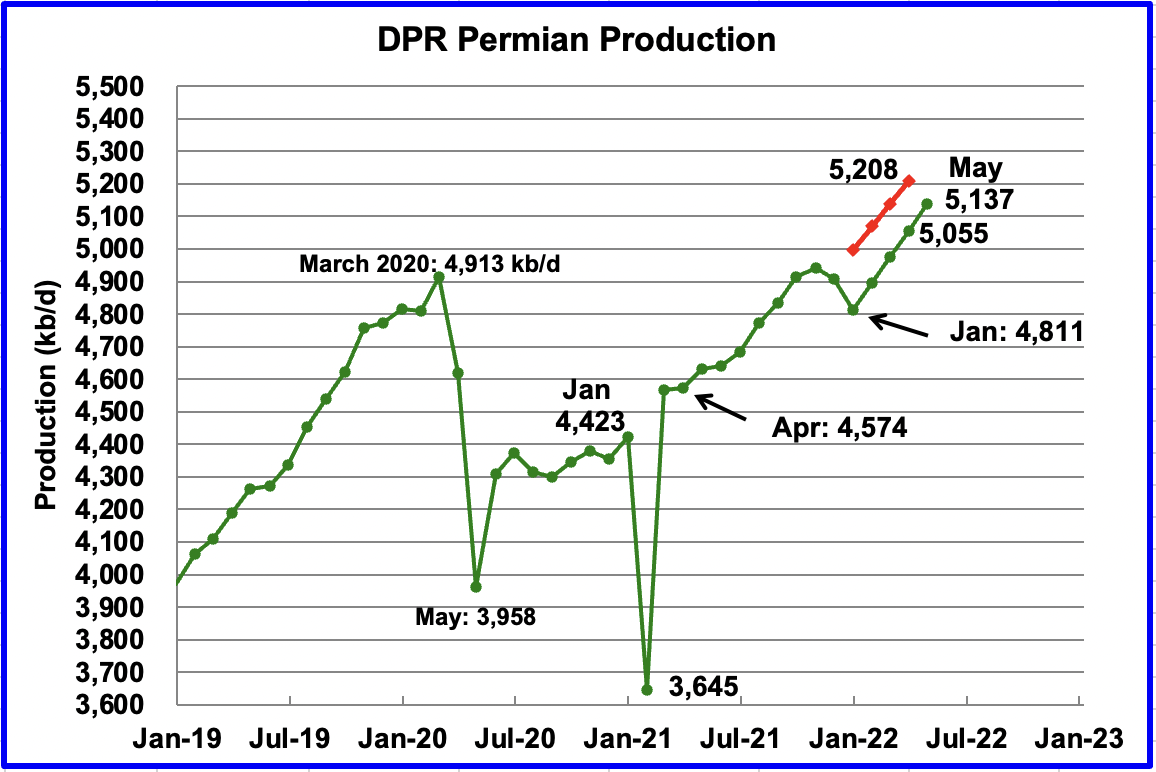

Permian output exceeded 5,000 kb/d in March 2022 and continues to increase. In May, production is expected to increase by 82 kb/d to a new high of 5,137 kb/d. From January to May, production is forecast to increase by 326 kb/d or at an average rate of 81.5 kb/d/mth. If the Permian were part of OPEC, at 5,137 kb/d it would be the second largest producer after Saudi Arabia.

Due to revisions, May’s Permian output is 71 kb/d lower than the DPR’s April’s production forecast of 5,208 kb/d reported in the previous March report. (Red markers). April was revised down by 153 kb/d to 5,208 kb/d from the April report forecast.

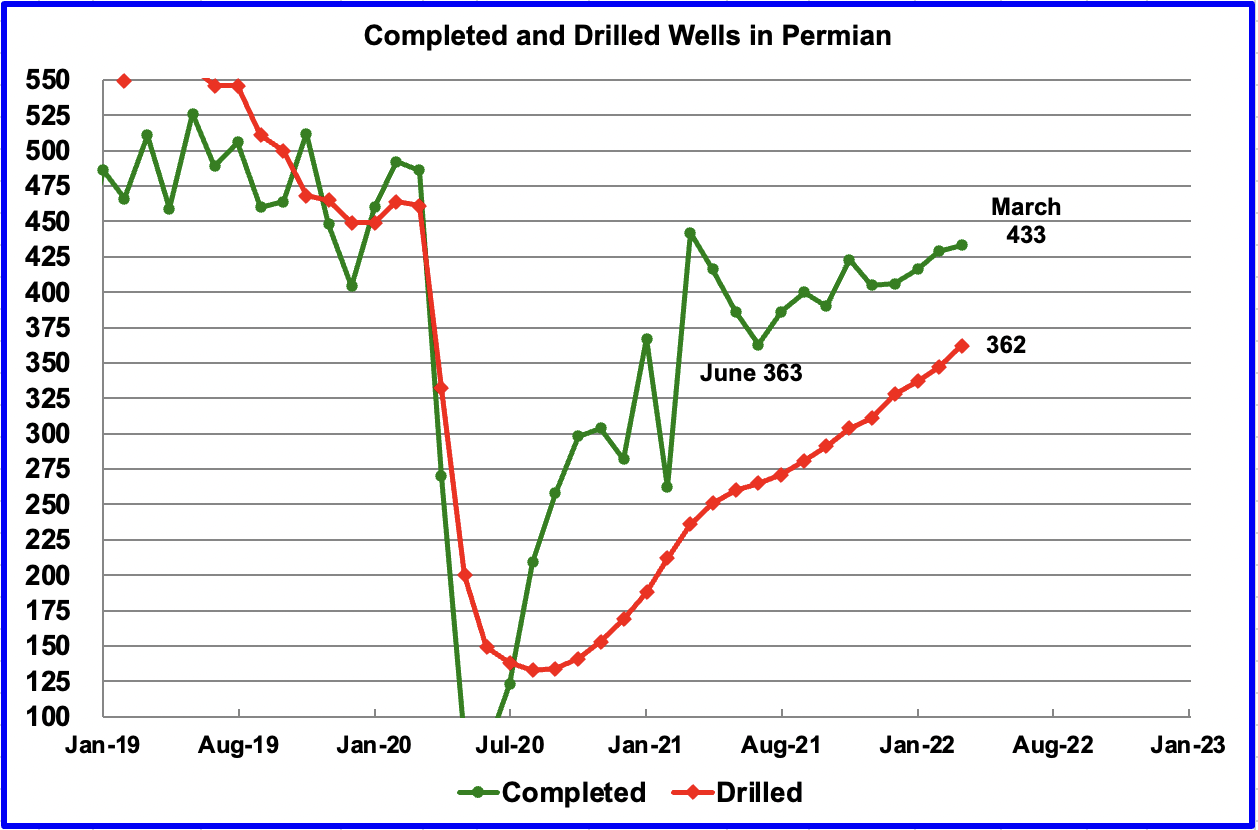

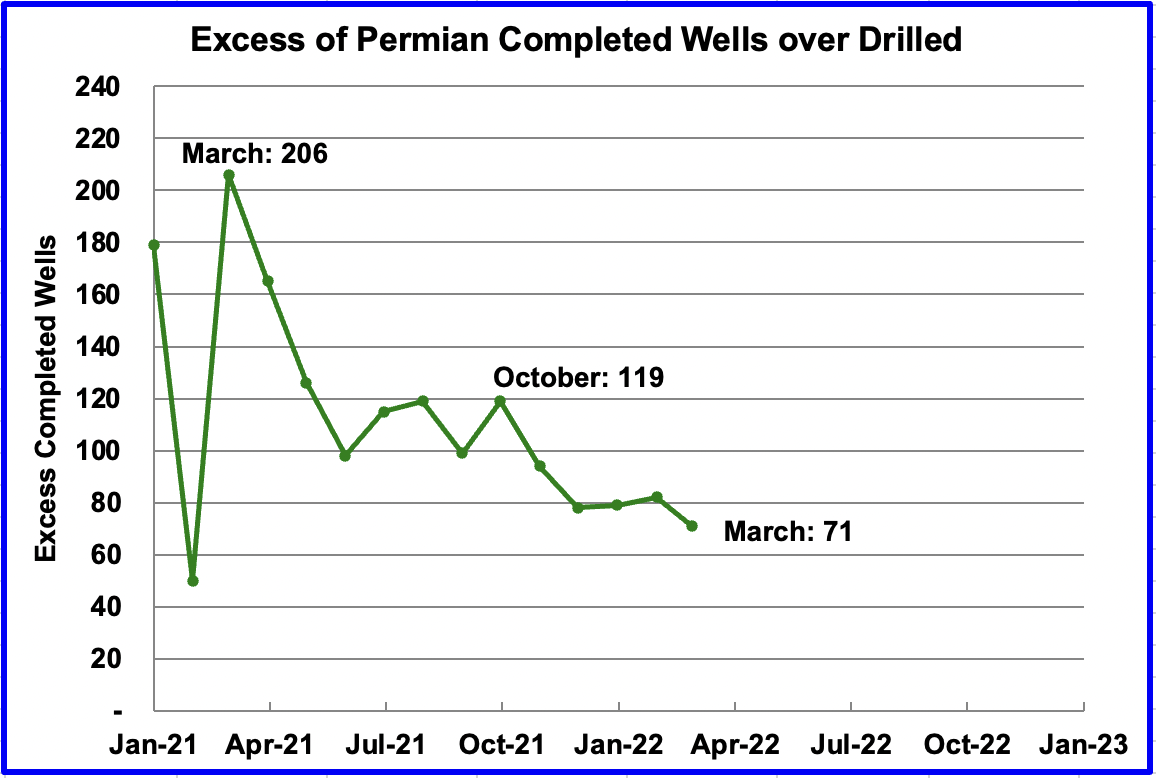

During March, 362 wells were drilled and 433 were completed in the Permian. The completed wells added 343 kb/d to March’s output for an average of 792 kb/d/well. The overall decline was 264 kb/d which resulted in a net increase of Permian output of 79 kb/d. Of the 433 completed wells, 333 were required to offset the decline. It is the completion of the additional 100 DUCs, over and above the drilled wells that accounts for the increase in the production in the Permian.

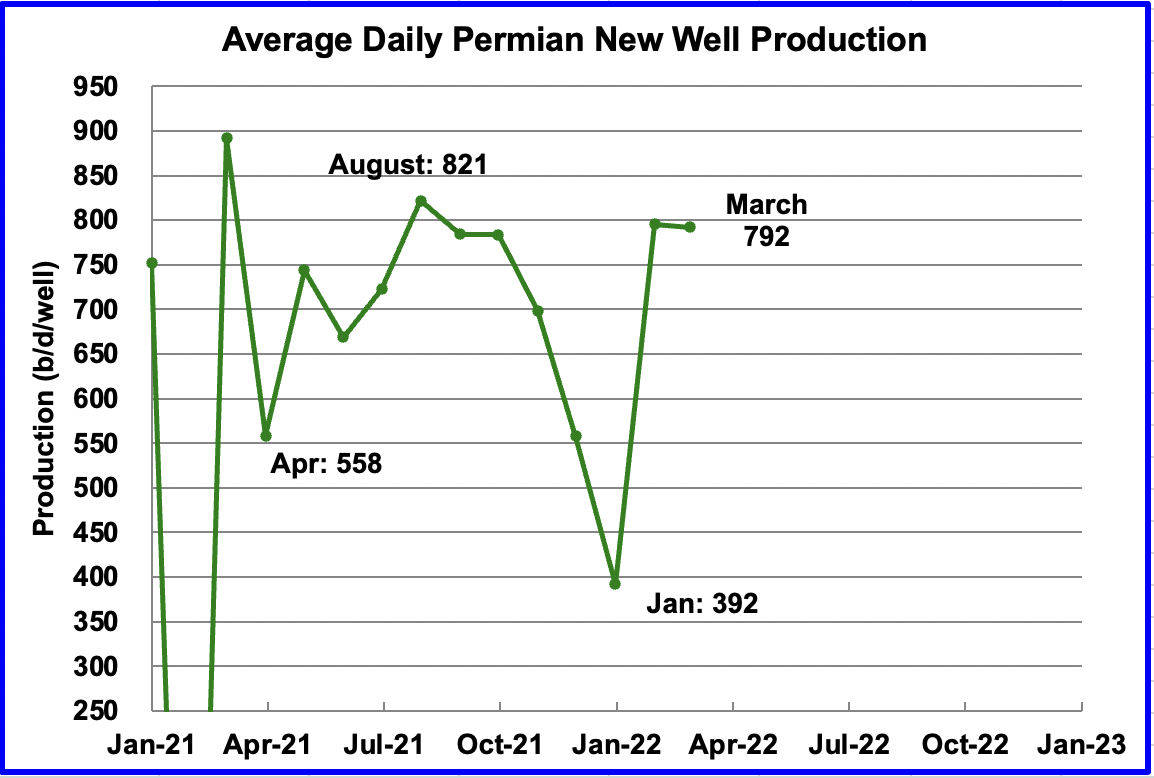

This chart shows the daily production from the average new Permian well tracked on a monthly basis. The daily output for new Permian wells was divided by the number of completed wells, as reported in the DPR and DUC reports.

It appears that the average first month output is close to 800 kb/d. January dropped due to bad weather in Texas. March was essentially unchanged from February at 792 kb/d.

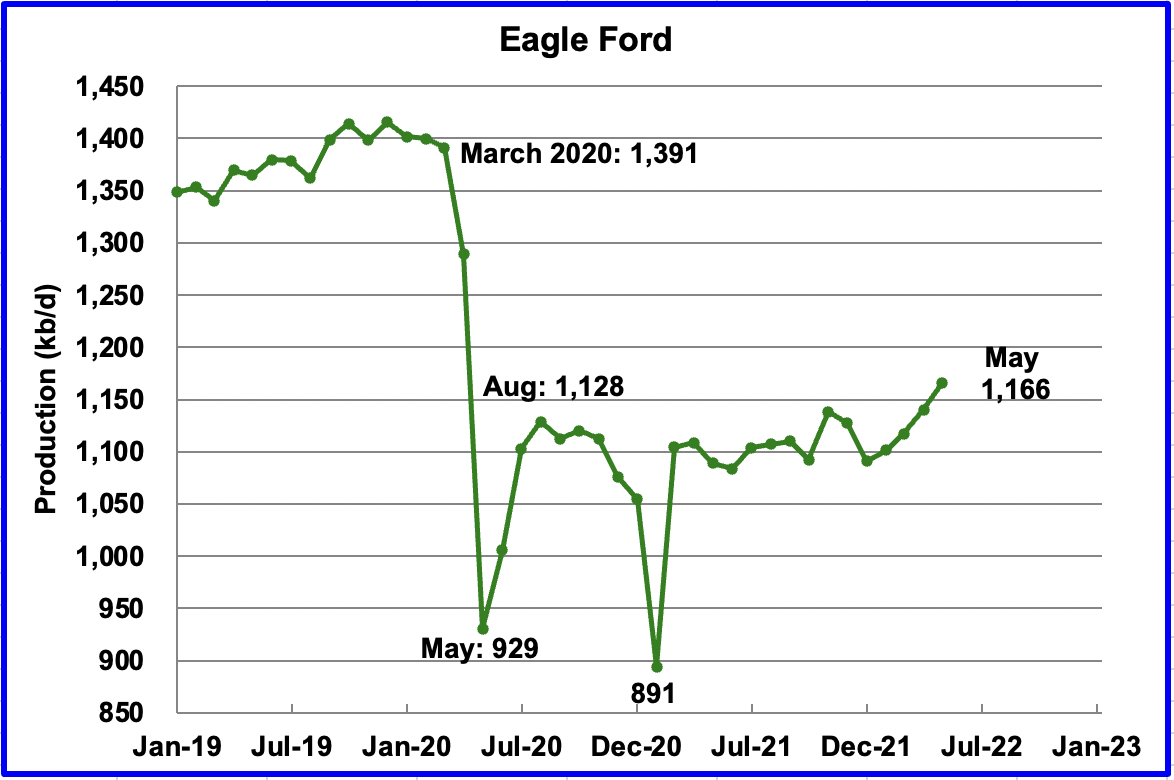

Output in the Eagle Ford basin has been showing an increasing trend since January 2022. For May, output is expected to increase by 26 kb/d to 1,166 kb/d. Since the beginning of the year, 13 rigs have been added up to the end of April for a total of 51, which explains the increasing output.

The DPR forecasts Bakken output in May to be 1,186 kb/d an increase of 17 kb/d over April. However after revisions, May production is 2 kb/d lower than was forecast for April in the previous report.

As noted above, April production was hard hit by severe winter weather and this could be reported in the next DPR update.

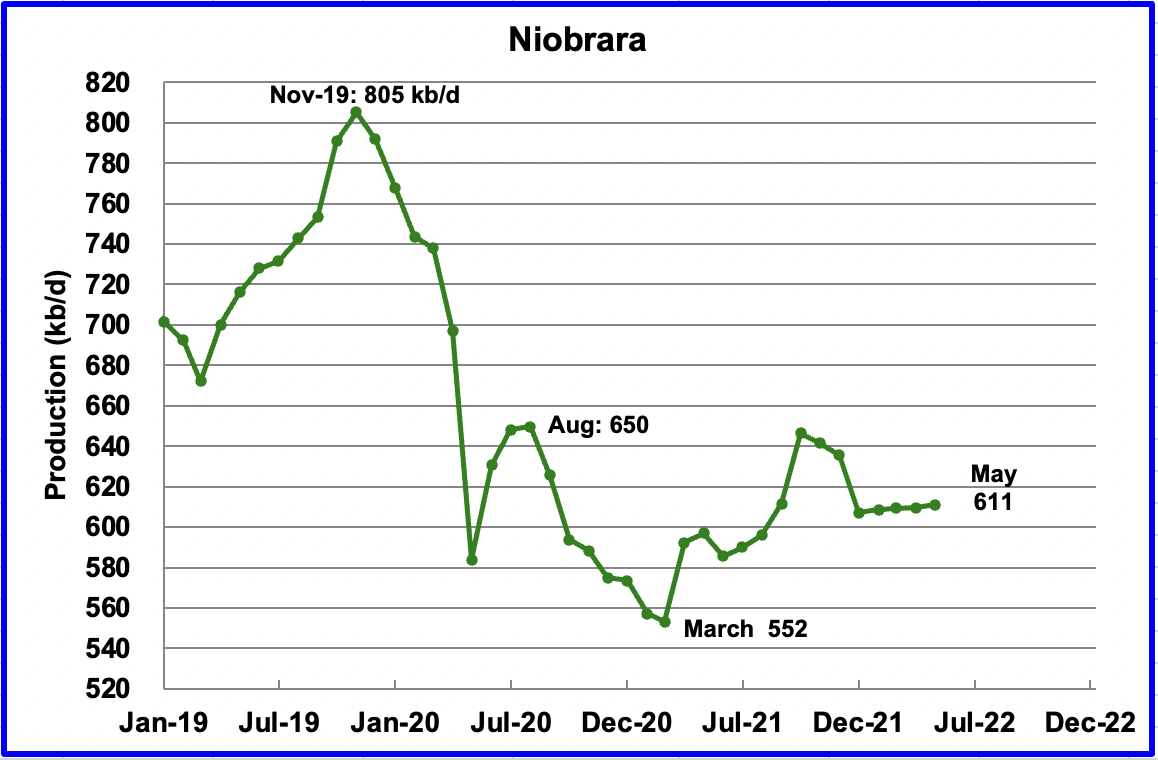

Output in the Niobrara is now showing signs of starting to plateau at 611 kb/d.

DUCs and Drilled Wells

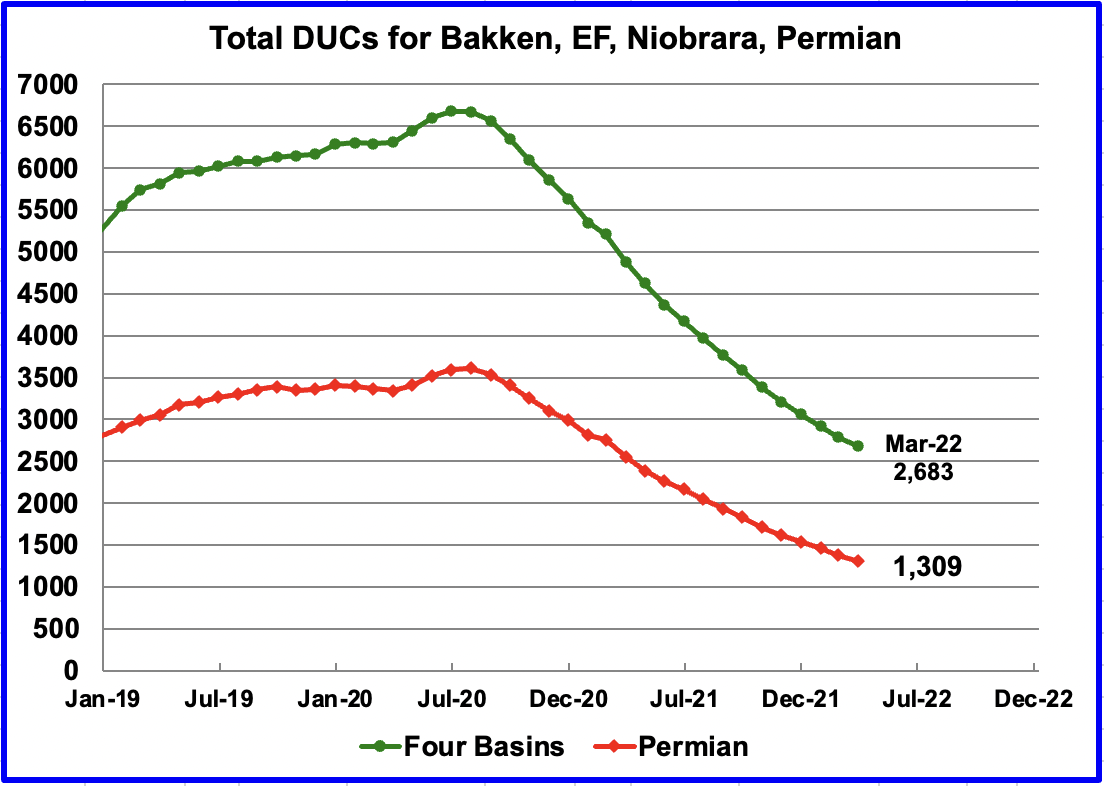

The number of DUCs available for completion has continued to fall every month since July 2020. Prior to July more wells were drilled than were being completed. Note that the current March gap between the two graphs is much smaller than in July 2020.

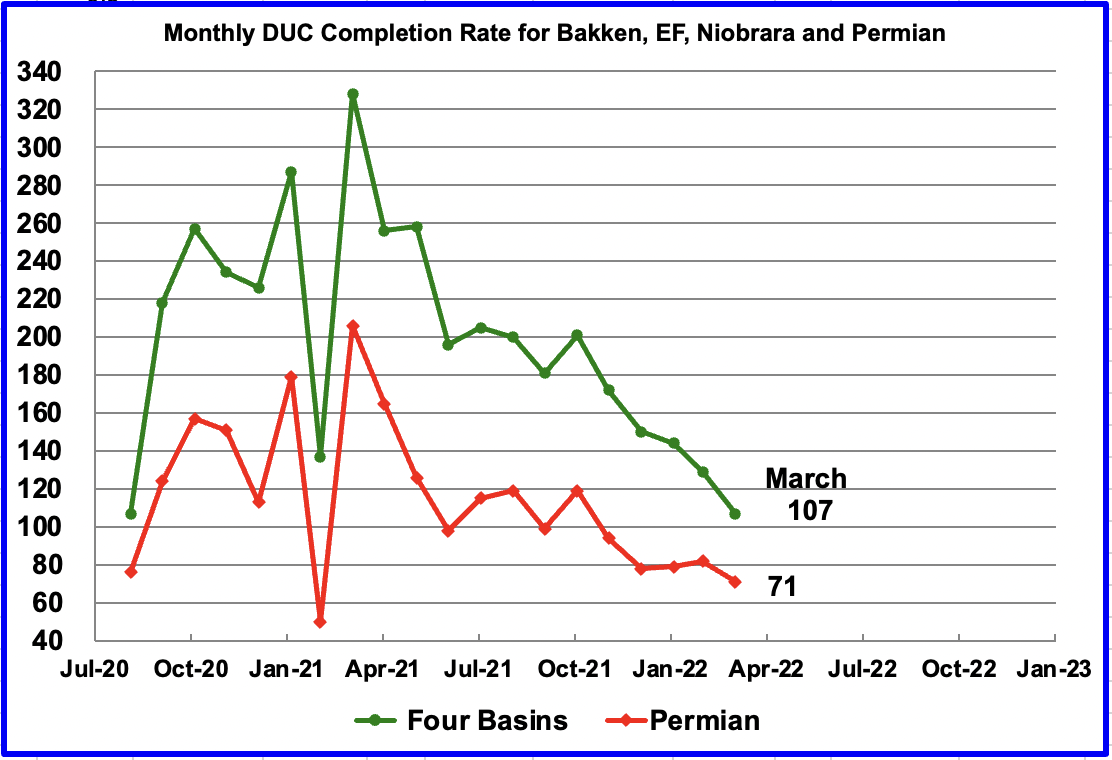

In these four primarily oil basins, the monthly completion rate of DUCs started to slow after peaking in March 2021. For example, in March 2021, 329 DUCs were completed. In March 2022, 107 DUCs were completed. Similarly the monthly completion rate for DUCs the Permian continues to fall.

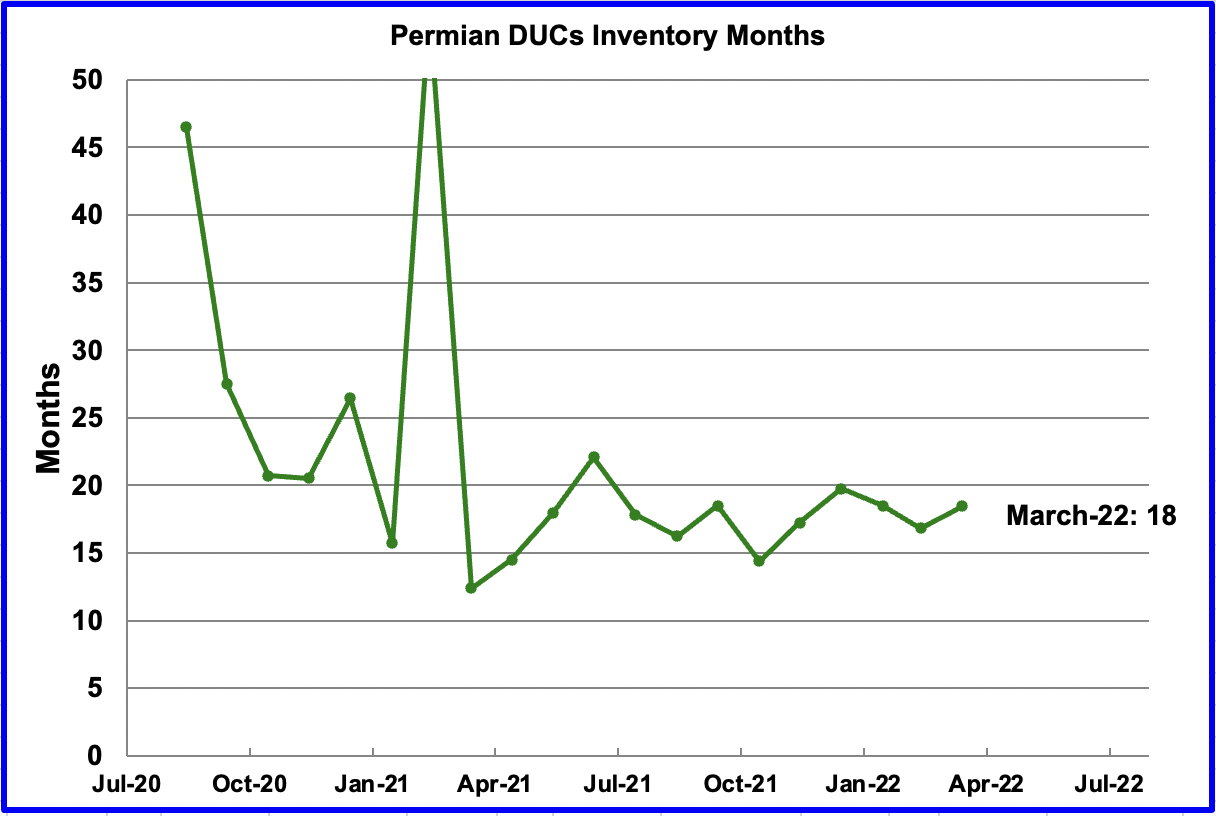

If Permian DUC’s were to be completed at the latest rate of 71 DUCs/mth, that converts into 18 months of DUC inventory, assuming the remaining 1,309 are all commercially viable. Interestingly, this 15 to 20 months supply of DUCs has remained fairly constant since July 2021 as the number of DUC completions continues to drop every month.

In the Permian, the monthly completion of wells has reversed direction since the low of 363 in June 2021. In March 433 wells were completed, 4 more than in February. During March, 362 new wells were drilled, an increase of 15 over February. To counteract the slowing completion rate, drilling has been increased. See next chart.

In October 2021, 119 more wells were completed in the Permian than were drilled. In March the number of excess wells completed was down to 71 since the drilling rate was higher than the completion rate.

DPR Production Decline Rates

The DPR reports monthly on the past and future production of tight and conventional oil in the seven basins it covers. Typically the DPR is four months ahead of the EIA’s monthly production report.

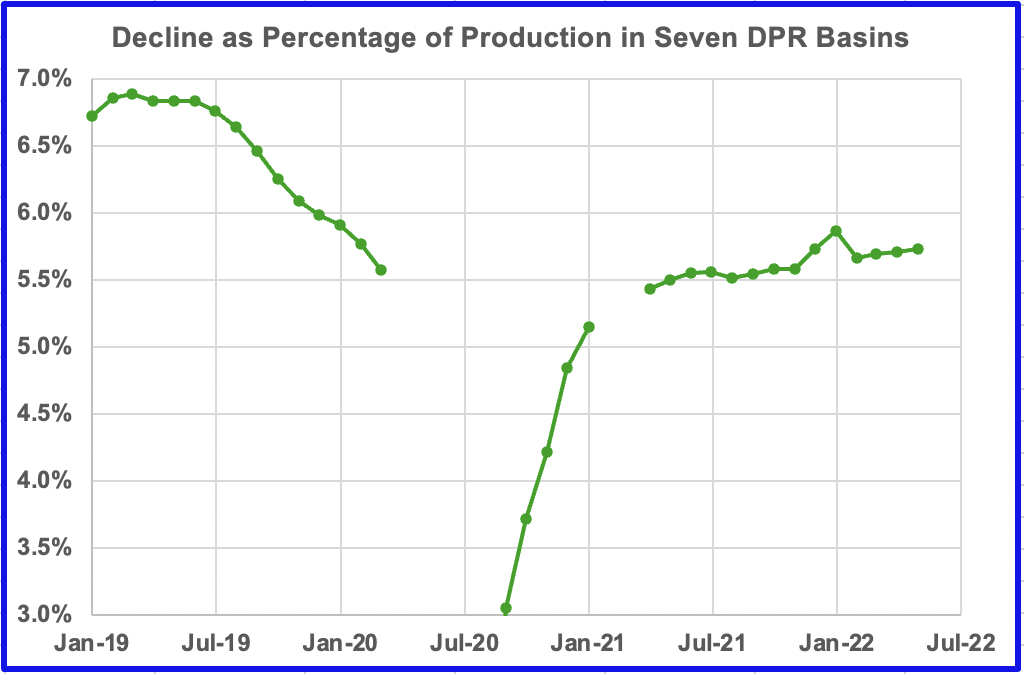

This chart shows the overall decline rate as a percentage of production. It peaked in early 2019 at 6.9%. In early 2020 as production plunged, decline followed suit. No data is shown between March 2020 and August 2020 because of the variability in the data associated with the varying production levels. The decline data stabilized in April 2021 and it is that data that will be used going forward to correlate decline rate with production.

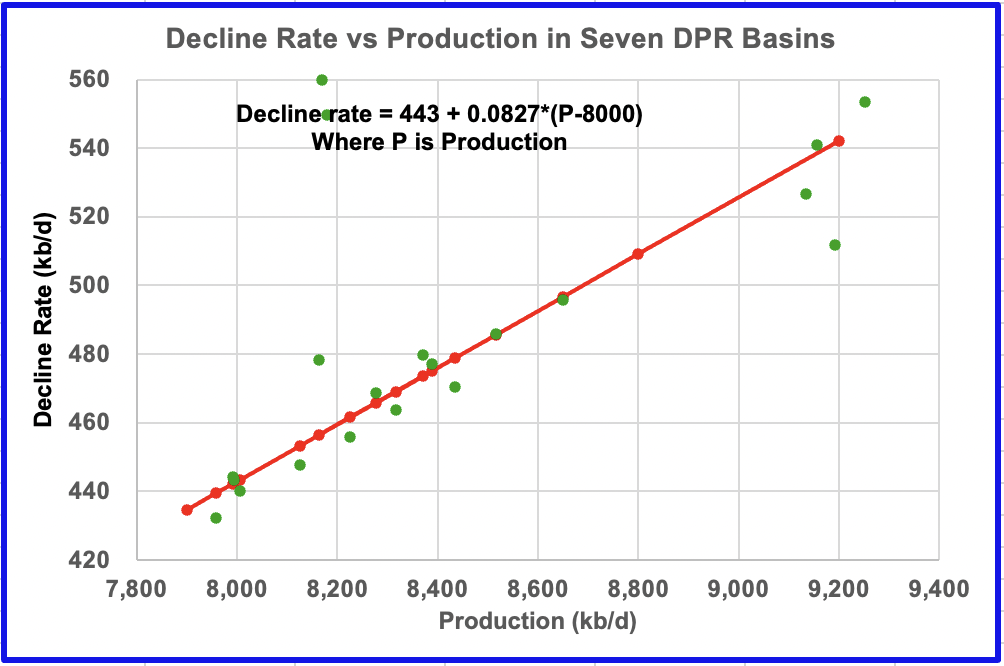

This chart shows the relationship between the decline rate and production rate using only the latest combined data for the seven DPR basins. The OLS line only used the most recent data between April 2021 and May 2022. However the chart includes some data from the time when production was higher, i.e. the four markers around production at 9,200 kb/d. Their position close to the OLS line may be purely accidental since they are from a different dynamic production period.

The equation says that for every 100 kb/d of production increase, the decline rate increases by 8.27 kb/d, on average. That makes sense since the newest wells have the highest decline rates.

3) LIGHT TIGHT OIL (LTO) REPORT

The EIA’s LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The April 2022 report updates tight oil production to March 2022.

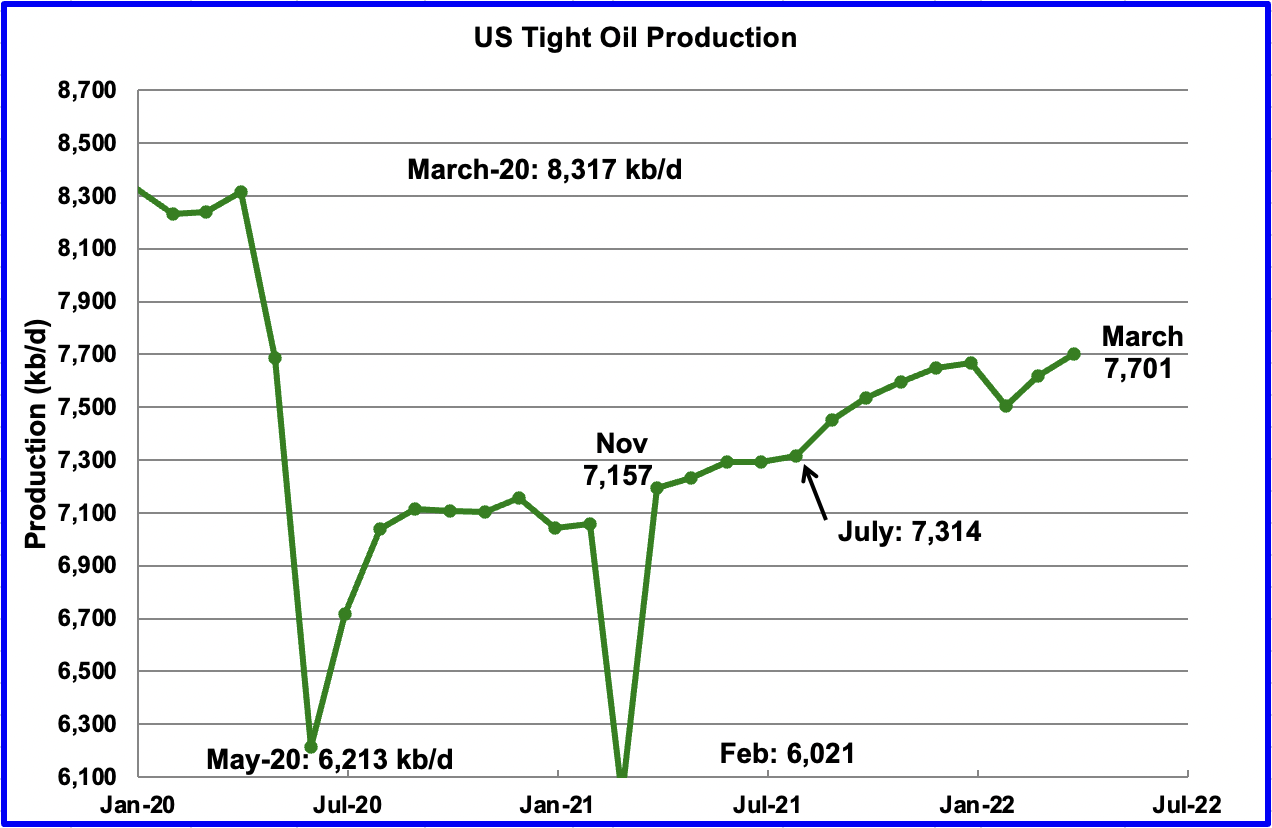

The April LTO report has made downward revisions to their production forecasts in the previous March report. In most cases March output is lower than the previous February ones. This follows the same trend reported in the DPR report.

March’s LTO output increased by 84 kb/d to 7,701 kb/d. However, it is 61 kb/d lower than the February output of 7,762 kb/d reported in the March report.

To get a better indication of the overall trend in LTO growth, it is better to look at the growth from July 2021 to March 2022. Over that period, output increased by 387 kb/d or at an average rate of 48.4 kb/d/mth. This is 64% of the expected US oil production growth rate reported in the STEO section above.

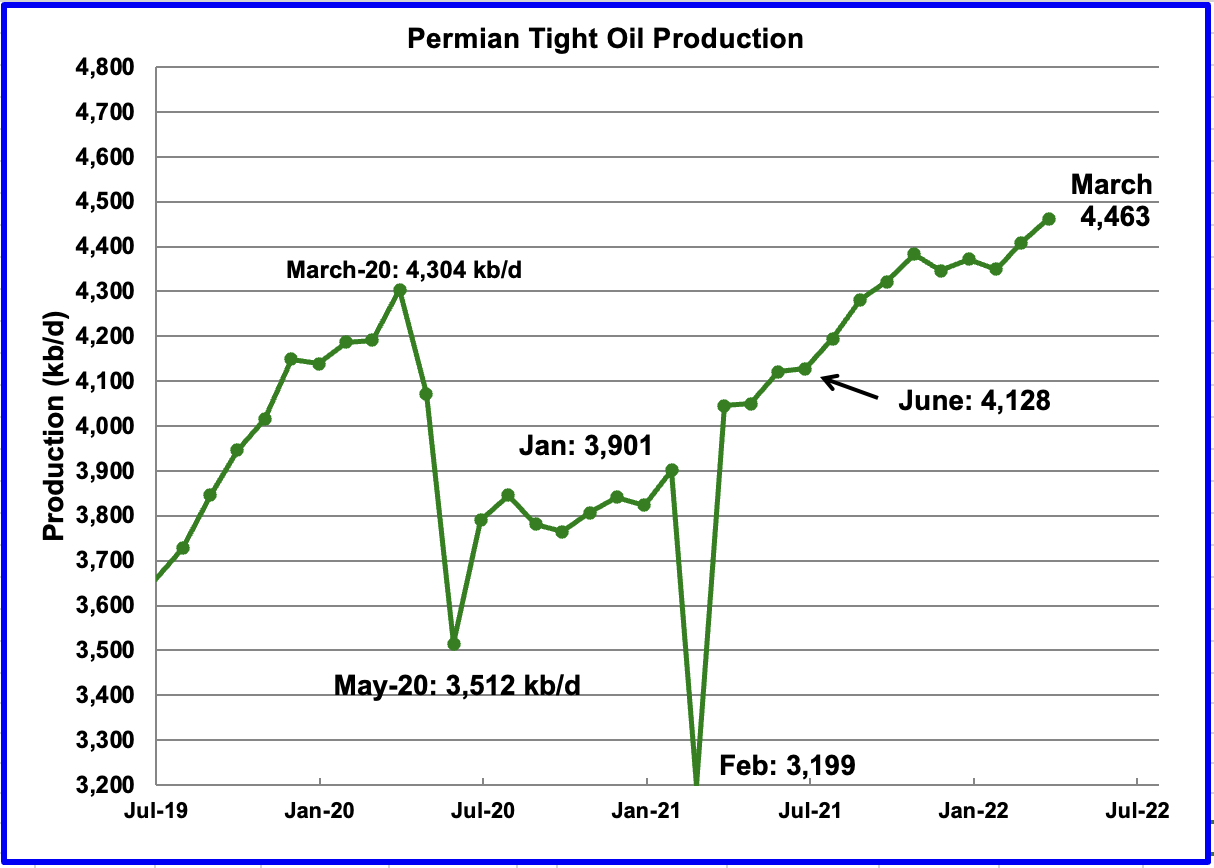

Permian LTO output first reached a new high of 4,322 kb/d in September 2021. March’s output increased by 55 kb/d to 4,463 kb/d and is 159 kb/d higher than the high of 4,304 kb/d recorded in March 2020.

Note that the March output is 71 kb/d lower than the February output of 4,534 kb/d reported in the March report.

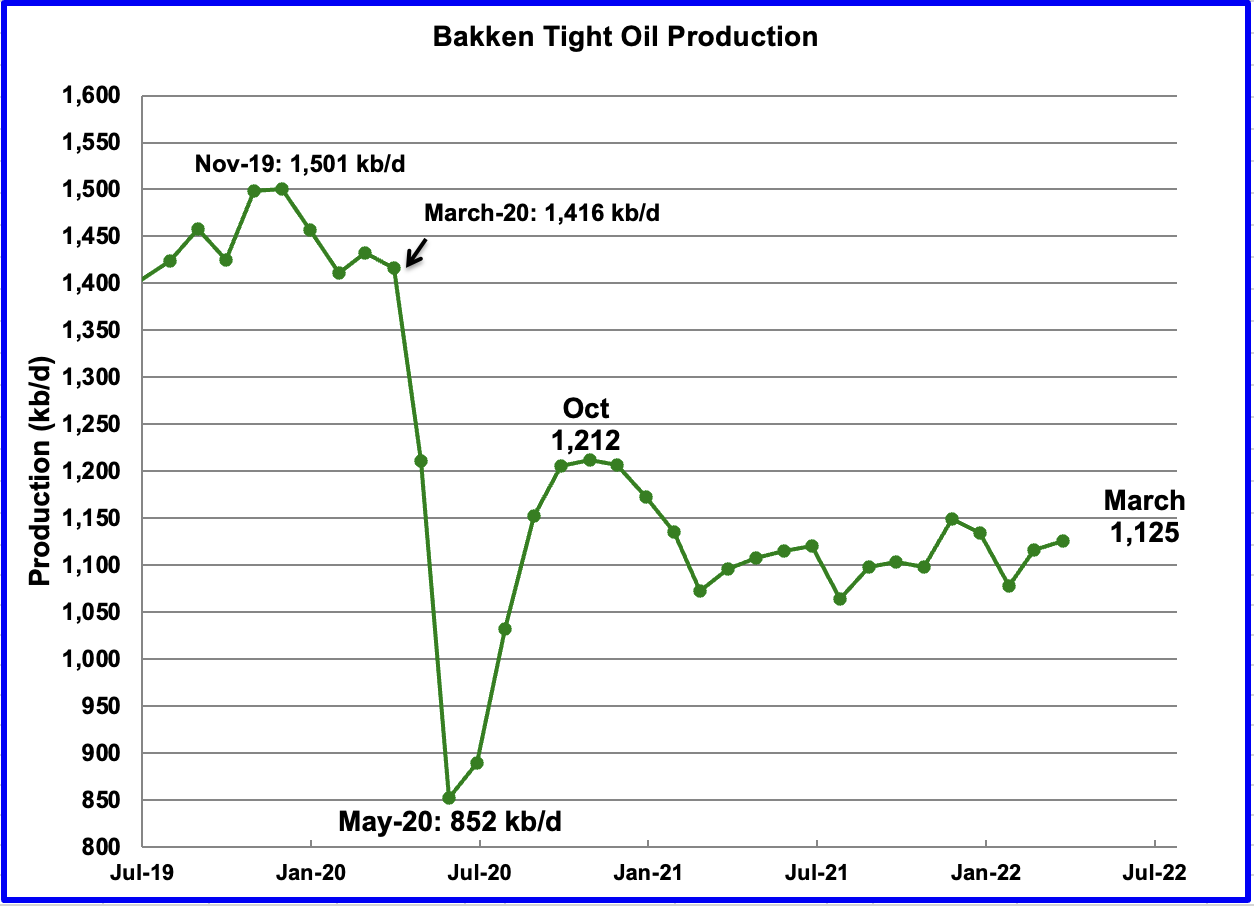

The Bakken’s March output increased by 8 kb/d to 1,125 kb/d. Note it is still below the October 2020 level of 1,212 kb/d.

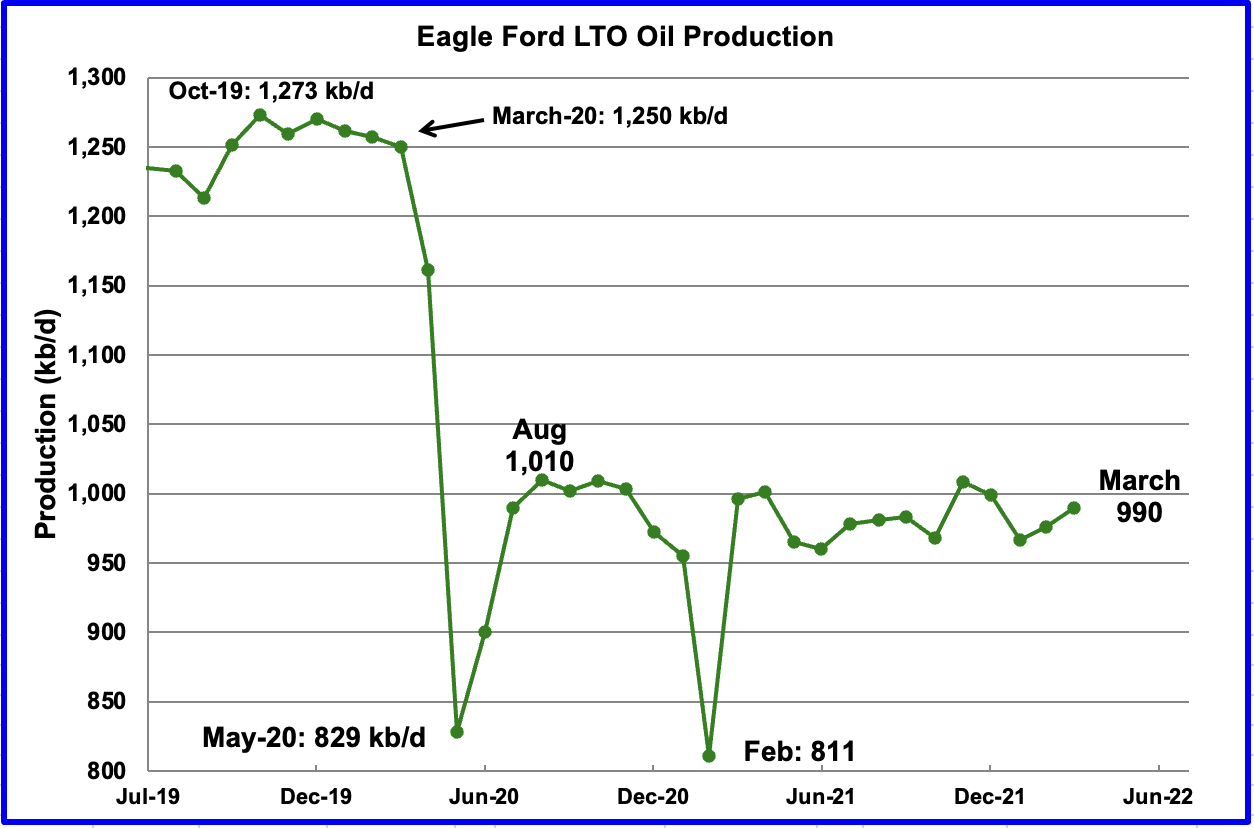

Production in the Eagle Ford basin since August 2020 has been essentially flat. Are the drillers doing this intentionally or is it just accidental?

The Eagle Ford basin produced 990 kb/d in March, which is lower than the August 2020 output of 1,010 kb/d.

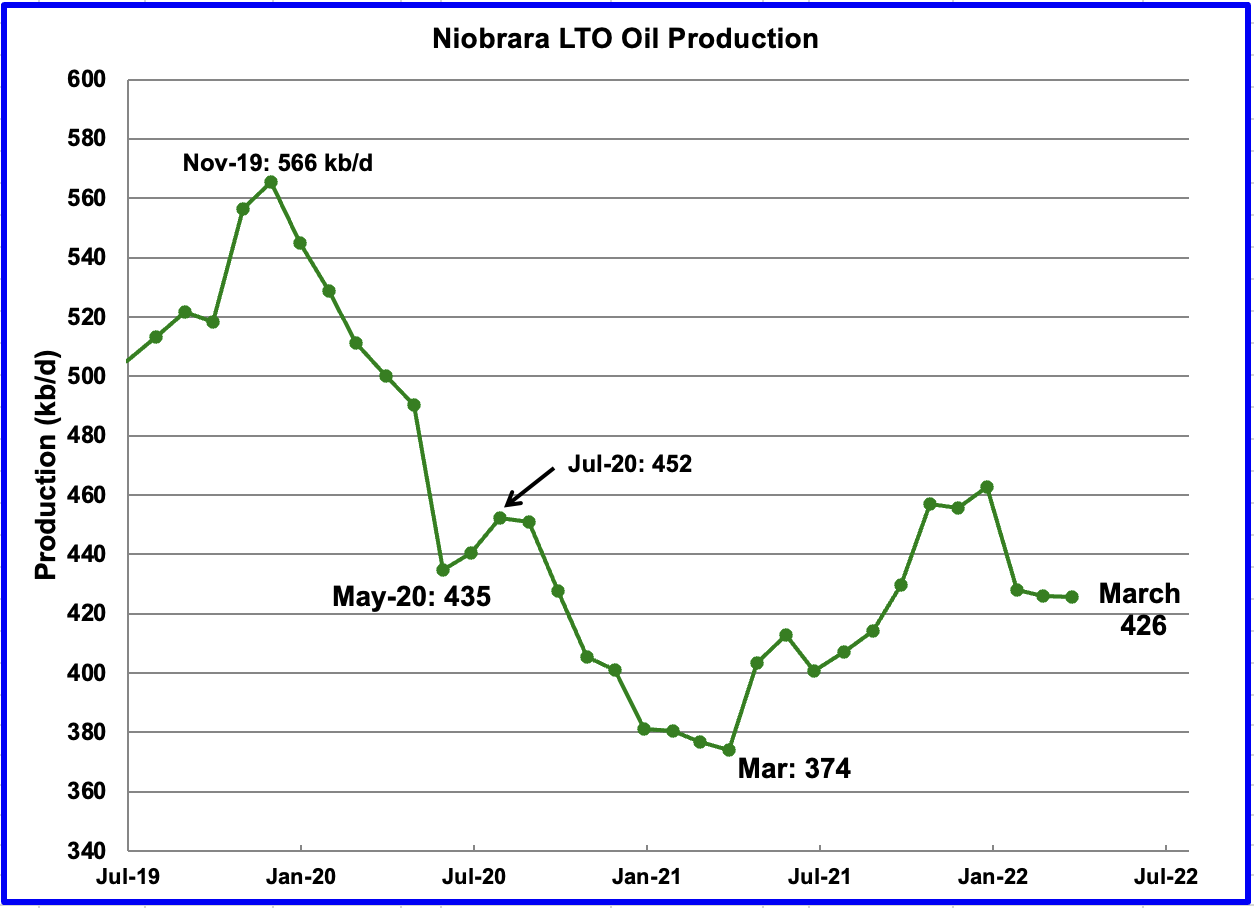

After increasing production from March 2021 to October 2021, output in the Niobrara began to drop in January 2022. March’s output was essentially flat at 426 kb/d.

On-Shore L48 Conventional Production

Conventional oil output in the Onshore L48 rose by 76 kb/d in March to 1,706 kb/d. This estimate is based on a combination of the expected March LTO output and the April 2022 STEO report that has a March 2022 forecast for the US On-shore L48 output. Data from January to March in the STEO has been replaced by the actual EIA production data from the current April report.

A note of caution is in order. This chart is derived by subtracting two large numbers which are subject to revision, particularly the last two months, February and March.

World Oil Production Without the US

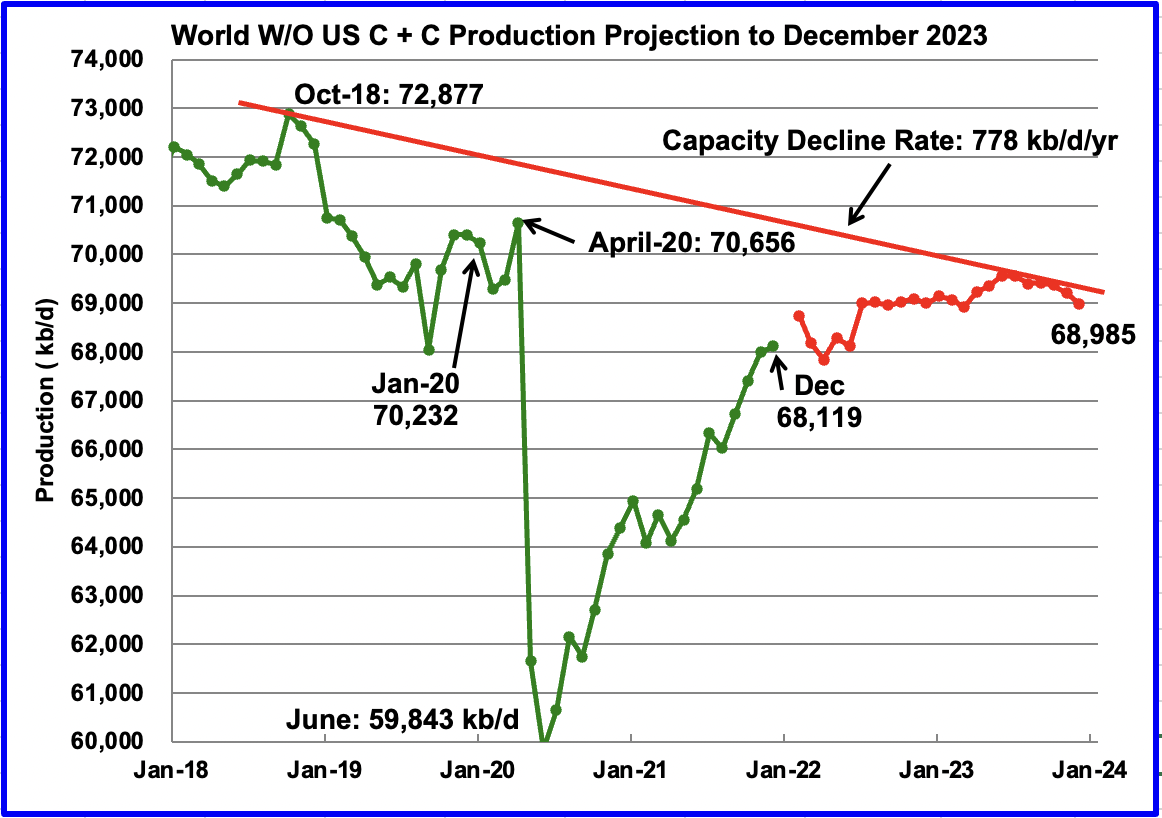

World W/O US oil production increased by 122 kb/d to 68,119 kb/d in December 2021 according to the EIA.

This chart also projects world production without the US to December 2023. It uses the April 2022 STEO report along with the December International Energy Statistics to make the projection. (Red markers). It projects that World crude production W/O US in December 2023 will be close to 68,985 kb/d. Note this projection estimates that output will be essential flat from June 2022 to December 2023. In other words, starting in June 2022, World oil production without the US will be close to 3,900 kb/d lower than in October 2018.

Note that the chart also shows a Capacity Decline Rate line of close to 778 kb/d/yr over the years 2018 to 2023. Capacity decline encompasses natural decline and decline associated with reduced investment for drilling and exploration.

The Inevitable Decline Of Russia’s Oil Industry

While Russia’s oil and gas industry may have both been hurt by sanctions and boycotts, it is still set to see its tax revenue increase this year.

In the long term, however, Russia’s oil industry appears to be entering a terminal decline, with Europe set on moving away from Russian energy.

Russia will attempt to find customers for its oil and gas in the East, but it won’t be able to replace the losses it sustains from the West.

Rystad had Russian oil production entering terminal decline next year even if the invasion had not happened.

Dennis does the above chart trigger any revisions in your peak oil predictions. Or, perhaps it doesn’t because you just don’t believe a damn word of it. 😂

Ron,

Yes I don’t have much faith in any predictions about future output, even my own. Potentially high prices due to low Russian output triggers faster than expected development of resources in Saudi Arabia, Iraq, and UAE and those nations make up the difference between the yellow and black lines above. In the past high oil prices resulted in higher output than I had expected, that could occur again. Also, the Russian oil can be put on ships and sent to Asia instead of going to Europe or this certainly seems possible.

Dennis, I agree, partially, with what you are saying. However high oil prices cannot extract blood from a turnip, or oil from a dry hole. The problem is geology, not the price of oil.

As I recall, you insisted that Russia be included in the nations that would increase world oil production. Rysted says they would be part of the problem, not the solution, even before the Ukraine invasion. Of course, Russia will find many ways to sell its oil in spite of sanctions. And you seem to think that finding buyers for their oil fixes their problem. Finding buyers is not their problem. All the oil service companies and other major oil companies pulling out of Russia will cause their falling production to become even more severe. They had serious problems before the sanctions. Now those problems are seriously aggravated.

However, The world is slowly waking up to the seriousness of the problem, even if you have not. 🤣

Oil: ‘Something far more serious is going on,’ says analyst

Ron,

Part of the Rystad article tou posted said Russia won’ tbe able to find buyers for their oil, perhaps the Big service compaies pulling out of Russia will be a problem, but a smart Russian entrepreneur could hire the talent needed and form their own oil service company, these might already exist in Russia, but if not there is no reason such companies could not be developed with State support. We will see how it plays out, tight oil would not have been developed in the US if oil prices had remained under $40/bo long term, even at the high oil prices of 2011, most of us were saying that tight oil would not amount to much. Oil prices change the equation, despite what you assert.

See what I thought in Dec 2013 at link below, at the time I thought this scenario was too optimistic, in fact it was far too pessimistic.

https://oilpeakclimate.blogspot.com/2013/12/when-will-us-ltolight-tight-oil-peak.html

but a smart Russian entrepreneur could hire the talent needed and form their own oil service company, these might already exist in Russia, but if not there is no reason such companies could not be developed with State support.

Oh, that is a real stretch Dennis, I mean a real stretch. And if such talent exists for the hiring, what might be their reward? You must know they would be far more rewarded if they emigrate than if they stayed in Russia. And you must know that such talent if it exists, would not dare to immigrate to Russia.

Dennis, I think you are totally forgetting the political implications here.

Thanks for he exchange.

Ron,

People are willing to work in a foreign country if the pay is high, if they pay enough they will find people.

Really Dennis? Russia is not just another foreign country. Who would go to Russia today, risk their lives to work in Siberia or some other cold dark place in Russia? And for what price?

Oil service companies in the USA today are having trouble finding and keeping talented workers, and they are offering very high wages. To turn that down to go to darkest Russia, which is ruled by a madman. What kind of wages would that take?

Anyway, I am not prepared to argue with Rystad. They know far more about Russia’s future oil production prospects than I do. I know no one can see what the future holds, especially in a country ruled by a madman, but nevertheless, I trust their predictions far more than I trust my own…. or yours. 🤣

For those not interested in my link, I expected a peak in US tight oil at about 3250 kb/d for all US tight oil in 2020 in my December 2013 blog post linked above. Average US tight oil output in 2020 was about 7300 kb/d, more than double my estimate from 7 years earlier. At the time my focus was on Bakken and Eagle Ford output as these were the biggest tight oil plays, the rest of US tight oil (Permian, Niobrara, and Anadarko basins mostly) I expected to peak in 2020 at about 2000 kb/d. The reality was that the “rest of US tight oil” (everything except Bakken and Eagle Ford) produced about 5100 kb/d in 2020 for the annual average with a peak monthly output of 5380 kb/d.

Here is what I said about my scenario in December 2013:

This scenario is indeed optimistic, but not nearly as optimistic as the EIA’s scenario for LTO in the 2013 Annual Energy Outlook. For comparison I computed the ERR for 2013 to 2040 for my US LTO scenario, it was 17.6 Gb over that period, the EIA scenario has a total output of 24.5 Gb over the same period, 40% higher output than an already optimistic scenario. My guess is that reality will lie between the blue curve and the green curve with the most likely peak around 2018+/- 2 years at about 3.1+/- 0.2 MMb/d.

I was in fact far too pessimistic in my prediction. For other US LTO besides Bakken and Eagle Ford I was too low by a factor of 2.7, in my “optimistic” estimate.

Ron,

I expected Russia would return to roughly their precovid level of output once they were no longer bound by quotas, clearly the situation has changed with the Ukraine invasion and sanctions, I imagine Russian output will be lower than I had anticipated, how much lower is difficult to say. I think you are wrong about serious problems before the invasion based on the research I have read by experts in the Russian oil industry. I have yet to see any peer reviewed research on the effects of the current situation. Rystad might be right, but I would rather take a set of analyses from OPEC, EIA, IEA, etc and see the range of expected outcomes, I think it is a bit early to draw any conclusions.

I expected Russia would return to roughly their precovid level of output once they were no longer bound by quotas,…

Exactly what previous output are you talking about. The Russian oil Minister himself said he hoped to get within 200,000 bp/d of their pre covid level. They were within 50,000 bp/d of that level when the invasion hit. Are you talking about what the Russian oil Minister said or what their pre covid level was?

It is Rystad’s job to estimate the future production of different countries. Their clients depend upon it. On the other hand, OPEC, EIA, and IEA have no such clients. I trust Rystad far more than I trust any of them. I mean just look at what OPEC is projecting today. They said they would increase production by 274,00 bp/d in April and they managed a measly 10,000 barrels per day. Rystad could probably have given a far more realistic prediction. Hell, I could have given a far more realistic prediction. 🤣

Ron,

Output level of 2019 about 11252 kb/d is what I would call the Russian pre-covid output level, I expected they might come close to that, maybe 11000 kb/d, which they had accomplished by March 2022 (output was 11022 kb/d). Paper below has Russian output at about 11 Mb/d in 2023, that was my guess before the Russian invasion of Ukraine, I will revise my position when I hear an expert analysis on the matter.

https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/09/The-Future-of-Russian-Oil-Production-in-the-Short-Medium-and-Long-Term-Insight-57.pdf

Paper below has Russian output at about 11 Mb/d in 2023, that was my guess before the Russian invasion of Ukraine,…

Dennis, I really don’t think so. if I recall correctly you insisted that I include Russia in one of the nations that would increase oil production above their previous peak. I called them “Dennis’s big 10.” You then insisted that I include Russia. So I changed it and called them “Dennis’s big 11”. However that is not that important.

I will revise my position when I hear an expert analysis on the matter.

I doubt there is any kind of expert that can predict what is going on in Putin’s brain. But regardless Russian production will never reach 11 million bp/d again. It will drop below 10 million bp/d either in May or June. After that, It will never reach 10 million bp/d again. Putin has already done that much damage.

Dennis, peak oil was in 2018-2019. End of story. Russia is now forever part of the problem, not part of the solution.

Ron,

You have often called peak oil, Russia may not return to 11 Mbpd due to sanctions etc, clearly things have changed since Russian invasion of Ukraine. Difficult to know how it plays out, high oil prices may increase output elsewhere more than you estimate.

Certainly that has been the case in the past.

I have posted what I have been seeing for many months. There is a shortage of trained oilfield personnel from Roughnecks to Geologists. There is a shortage of capital to support the oilfield service industry and not just in the United States. The ESG mandate has destroyed the concept of investing in dirty industrieswith the fossil fuel industry being at the top of the list. Finally we are running out of quality locations in the Permian. The publics wont say it and instead tout production maintenance accompanied by dividends. While it appears sexy it has never been the mantra of growth companies and it is more like a long dated death sentence for these companies. If you don’t replace reserves and grow then one is better off to pay down debt, slash staff and produce out the reserves.

We have the example of the 1970s where high oil prices drove gas guzzlers off the roads and our consumption of oil declined. Maybe this will drive the Hummers and SUVs off the roads

Ron and Dennis,

if you have a chance, take a listen to the public discussions on energy during the SOTU. Especially, the “discussion” with Borrel and Stub. The goal is not only for the EU to stop importing crude oil from Russia, but to prevent Russia from exporting altogether. What is taking shape is an embargo similar to those imposed to Iran or Venezuela.

At this moment Orban is managing to block this course of action, but he is very isolated. He will eventually fold, or will just be left behind.

A few more details:

https://markets.businessinsider.com/news/commodities/eu-oil-ban-russia-global-shipping-insurance-exports-tankers-2022-5?op=1

Luis,

Interesting thx.

If 7 Mbpd were removed from the market it will be a big problem. I doubt they will be successful blocking all Russian exports.

My question is: Where does “peak oil” stand now? From a geophysics standpoint, peak oil is simply an inevitability. Oil ‘production’ is a misnomer, as all ‘production’ is essentially an extraction (barring the necessary refinement processes that may justify some aspect of using the word, ‘production’). And this extraction is reliant upon a resource that takes millions of years to emerge, while all available extraction can deplete it faster than this rate of renewal. I understand that nat gas and fracking have innovated beyond these projected limitations, and perhaps even more aspects of exploration have also led to new discoveries for extraction that also left the ‘peak oil’ theory in the dust. But that is only for now, am I correct? Are we facing a situation where the inevitabilities of climate change actually become paramount for their consequences sooner than the peak oil limitations of extracted energy?

Evan, this thread is stale. It was posted on May 2. If you expect anyone to see it or read it, then you should post it on the latest thread.

Go here: http://peakoilbarrel.com/ then click on “Read More”.

Evan

As Ron mentions, you should post on the latest blog.

With regard to your comment “even more aspects of exploration have also led to new discoveries for extraction that also left the ‘peak oil’ theory in the dust.” NO.

Recent discoveries have been very low. In 2021 only 4.7 B barrels of oil and gas were discovered and of that only 3.1 B barrels were oil. Appreciate that the world currently consumes close to 30 B barrels of oil a yearl. See attached chart

As for where we stand, many of us think that peak oil in in the rear view mirror and that as demand increases the second lower peak could occur in the 2023 to 2024 time frame. It depends on demand increasing to the pre-pandemic level and oil prices staying in the range $100/b to $125/b that doesn’t cause a world wide economic collapse. Oil above $125/b begins to have an increasingly negative affect on the economy.

Ovi , haven’t gone thru the post ( late here in Europe ) but why ” surprisingly ” . It should be ” unsurprisingly ” . Many have been following the trend and said it will fall . As they say in Wall Street ” The trend is your friend ” . 🙂 . Tks for the effort and work .

Hole in Head

I thought that the December and January drops were related to weather and expected output to increase in a warmer February. Also the STEO had February heading back up.

Also it was down due to big drop in GOM.

OPEC oil output in April barely rises as African outages weigh-survey

LONDON, May 2 (Reuters) – The increase in OPEC’s oil output in April undershot the rise planned under a deal with allies, a Reuters survey found, as declines in Libya and Nigeria offset supply increases by Saudi Arabia and other top producers.

The Organization of the Petroleum Exporting Countries (OPEC) pumped 28.58 million barrels per day (bpd) in April, the survey found, up 40,000 bpd from the previous month and short of the 254,000 bpd increase called for under the supply deal.

OPEC and its allies, known as OPEC+, are slowly relaxing 2020 output cuts as demand recovers from the pandemic. OPEC+ meets on Thursday and is expected to confirm a previously agreed output hike despite the surge in oil prices after Russia’s invasion of Ukraine.

“Probably the view is to maintain the plan,” an OPEC delegate said of Thursday’s meeting.

The deal called for a 400,000 bpd increase in April from all OPEC+ members, of which about 254,000 bpd is shared by the 10 OPEC producers the agreement covers.

OPEC keeps over promising and under preforming. OPEC + Russia will be down for a second month in a row.

Thank goodness for China’s Zero Covid policy or we would all be screwed right now lol

Lol 100% only thing keeping a lid on oil prices.

HHH , for a change ” the Japanese did it ” . 🙂 . Not Putin .

https://www.zerohedge.com/markets/japan-emerges-biggest-driver-behind-recent-surge-treasury-yields

I call BS on that. The Japanese are selling 60bn of treasuries, which is a drop in the bucket vv the total treasury market, or the amount of debt the US issues every year

https://fiscaldata.treasury.gov/datasets/historical-debt-outstanding/historical-debt-outstanding

Rgds

WP

WP , . Japan has been the largest buyer of treasuries as far as my my memory goes . Flipping from a buyer to a seller is significant , the amount is not important . Markets look for indicators and move on sentiment .

ELM in the treasury market ? 😉

That zero hedge article doesn’t really tell the whole story. Keep in mind if Japanese pension funds are selling then there is a buyer on the other end of that. Somebody bought those treasuries from them.

There is high demand for treasuries because they are the collateral used in the REPO market. Which is where all the financial engineering in the world takes place.

I expect as this global dollar shortage becomes more severe that there will be a lot more selling of US treasuries. People will sell them to get the dollars they need to service their dollar denominated debts.

When there is plenty of dollar liquidity outside US foreigners tend to buy US treasuries because they have the dollar surplus to do it. And they tend to sell when dollar liquidity is in short supply.

This is exactly why Hong Kong and eventually China’s currency pegs are going to break. I expect the selling in China to far exceed that of Japan over next 24 months. Their stockpile of FX reserves which are mainly US treasuries is going to shrink drastically.

China’s currency is going to implode.

Zero hedge article paints this as a problem for the US when in actuality it’s a problem for everyone outside the US.

Dollar liquidity is created in the REPO market and if you don’t have the collateral you can’t play. Dollar shortage is very much a systematic collateral shortage.

The dollar liquidity that bid oil to $100 was created in the REPO market.

The importance, and what repo markets actually do in the financial system is quite grossly underrated. In many instances it is the dog, not the tail, but for some reason it doesn’t often make it to the front page of the WSJ.

In 2007 it was the repo markets that signaled quite clearly that Lehman ( and later on Bear and Citi) also, were in trouble even when the headlines were still positive. For the same GC (General Collateral i.e. on the run treasuries) on a triparty repo (the safest type there is) LEH and BS (such an aptly chosen ticker) had to pay more than Goldman/JP morgan etc for the exact same underlying collateral risk. That spread kept creeping up and up and up until the whole thing blew apart.

Rgds

WP

Also – it is quite possible that Japan needs to / chooses to intervene in the USD/JPY market by buying yen and selling dollars. In order to have dollars to sell you first have to liquidate your treasuries. It may be as simple as that… but who really knows.

rgds

WP

HHH , isn’t the inflow of dollars into USA inflationary for the US public ? I never knew what a Eurodollar was until I learnt it from you . Underrated issue until you go into detail just like the REPO market . Kuroda asked Yellen to intervene in the currency market but she refused . I found this article interesting regarding the Yen . I have long maintained that before we have an oil crisis we will have a financial crisis . The same asset rehypothecated gives an illusion of wealth but it is what Bernanke called ” wealth effect ” . This is coming unglued .

https://brucewilds.blogspot.com/2022/04/higher-interest-rates-and-inflation-are.html

The U.S. Shale Patch Is Facing A Plethora Of Problems

https://oilprice.com/Energy/Energy-General/The-US-Shale-Patch-Is-Facing-A-Plethora-Of-Problems.html

From your link:

The U.S. government appears to believe that the country’s shale production can be raised simply by throwing enough money at the problem.

This assumption fails to understand that not all the problems currently faced by drillers are financial, with some drillers simply unable to get their hands on the material they need to boost production.

These companies are also suffering from a lack of high-quality acreage and, in some cases, are struggling to secure financing.

It appears that oil from the shale patch might not be rising as fast and as far as some folks assume. 😫

Given the high rate of decline of other fields, a lot of fields need to come online to offset the difference

Svaya , not only new fields we need the grade of oil that will give us diesel . Diesel is king .

US LTO,

Using DPR minus conventional in DPR regions for April and May 2022 estimate (687 kb/d).

https://www.ogj.com/general-interest/companies/article/14275872/diamondback-staying-disciplined-on-production-growth?o_eid=1079H7861712I7P&rdx.ident%5Bpull%5D=omeda%7C1079H7861712I7P&oly_enc_id=1079H7861712I7P

Citing market volatility and an ongoing shortage of parts and people, the leaders of Diamondback Energy Inc., Midland, Texas, are sticking to the in-line-with-2021 production targets they laid out early this year.

“Increasing activity today would result in capital efficiency degradation and would not meaningfully contribute to the global supply and demand imbalance in the oil market today,” Chairman and Chief Executive Officer Travis Stice said in a statement accompanying Diamondback’s first-quarter earnings report. “Therefore, we are focused on maintaining our operational excellence and producing one of the lowest-cost and environmentally friendly barrels in the world.”

In the first 3 months of 2022, Diamondback averaged production of 222,800 b/d and a little more than 381,000 boe/d. For the second quarter and the rest of the year, Stice and his team expect those numbers to be 218,000-222,000 and about 370,000 boe/d, respectively. Their plan calls for Diamondback to add a net 248-267 wells this year and for capital spending to still come around $1.75-1.9 billion. In first-quarter 2022, the latter number was $437 million, just above the low end of the company’s quarterly guidance.

Thanks Seppo,

At 1.9 billion in capital spending on 267 wells, that would be about 7.12 million per well. Note that in my analyses I use 10.3 million per well in 2021$ to evaluate the economics of the wells in the Permian basin, I assume an average lateral length of 9500 feet and a well spacing of 1320 feet for about 290 acres per well. At the end of 2018 there were about 50 million prospective net acres in the Permian basin for the USGS mean estimate. I assume the most prospective half of these 50 million acres are developed (about 25 million acres) enough for about 86000 wells. About 21000 horizontal tight oil wells had been completed in the Permian by the end of 2018 (according to shaleprofile.com), so my scenario has roughly 107,000 wells completed in the Permian basin from 2008 to 2033. As of Dec 2021 (again from shaleprofile.com) about 34,000 horizontal tight oil wells had been completed in the Permian basin. If my scenario is correct (it is not) that would leave roughly 73,000 horizontal wells to be completed from Jan 2022 to Dec 2033.

Your scenario is not correct. I suspect with pressure depletion very real and increasing daily, I predict no more than 5 more years of development in the Permian at this rig rate.

Mr. Survivor, on the five years, I’ll take the under, thanks.

Two halves of just two Counties in the New Mexico part of the Delaware Basin account for all tight oil growth in the Permian. Two benches in the Bone Springs and one in the Wolfcamp produce that growth. Texas provides most of the frac source water for those two counties in New Mexico and then receives the bulk of the produced water back from New Mexico for re-injection. That can’t go on much longer, nor can New Mexico operators, like EOG, continue to high grade those 3-4 benches in those two Counties on 330 foot spacing. Well quality is headed for the toilet.

When New Mexico rolls over, so will the Permian.

https://www.oilystuffblog.com/forumstuff/forum-stuff/the-big-dog-in-the-delaware-basin

Here is the history

Mike,

Estimating cumulative output at 12 months in Permian New Mexico and Permian Texas using charts from Enno Peter’s latest Permian update on the shaleprofile blog I get an increase in output per 1000 feet of lateral from 2019 to 2020 for both New Mexico and Texas, I am reading from charts so the numbers may be a bit off, but I get:

state–Year–output (kb/1000 feet)

TX—-2019—-17.65

TX—-2020—-17.98

NM–2019—-25.33

NM–2020—-28.13

Blog post at link below, see well productivity section

https://shaleprofile.com/blog/permian/permian-update-through-december-2021/

Mike,

I was being over optimistic to hedge my bets. It has been brutal in every way in the Permian. I signed AFE’s to drill 13 wells as a non-op in Eddy county and the AFE’s are rising daily. I don’t anticipate we will be able to get these wells drilled within 2 years. Without the completion of DUcs in the Permian, production will be falling.

LTO Survivor,

In the past you suggested a 5% rate of annual growth in Permian output might be feasible. Has your thinking changed?

Also if we assume 430 new wells per month (current completion rate) for 60 months, that would be about 25,800 future wells completed. At roughly 300 acres per well that would be roughly 7.7 million acres left to be developed, does that sound about right to you?

Dennis,

I just dont see 430 wells completed every month once we roll through the DUCs. The Permian will be fortunate to stay flat over the next 5 years.

LTO Survivor,

I am fairly sure rig counts will rise to a level that allows DUC count to stabilize and allow 430 completions per month, what completion rate do you expect?

The number of wells spud has been increasing at about 10 per month on average in the Permian basin for the past 12 months, if that continues, by October 2022, there will be 430 wells drilled per month and DUC count stops decreasing if completion rate remains constant. A scenario with constant completion rate at 430 wells per month (it was 433 wells completed in March 2022) until Dec 2026 would look like the chart below, we would need to see a lower completion rate for the flat output scenario you envision.

This extremely conservative scenario has a URR of 23 Gb (about 5.2 Gb of cumulative production to the end of 2020) with about 59,000 total wells completed from Jan 2010 to Dec 2026, about 34,000 wells had been completed from Jan 2010 to Dec 2021, roughly 25000 wells are completed from Jan 2022 to Dec 2026 in this scenario. Proved reserves in the Permian were about 11.9 Gb at the end of 2020, and 2P reserves were likely about 20 Gb, so it is likely that at least 25 Gb of Permian tight oil will be produced, it seems likely the possible reserves and contingent resources will be added to 2P reserves over time at high oil price levels.

LTO Survivor,

Scenario below assumes flat output in the future for Permian, we would need to see completion rate decrease as shown on dashed line on right axis in chart below. URR about 24 Gb, roughly 50% of USGS F95 TRR estimate. Completion rate needs to fall to about 310 wells per month over time for output in the Permian to remain flat as you suggest.

I doubt this will be correct.

Recent shaleprofile supply projection for Permian, 6420 kb/d in Dec 2026 with constant completion rate from July 2022 to Dec 2026 at 436 completions per month. Click on chart for larger view.

Dennis, according to one of your charts below, and the one from ShaleProfile, you have the Permian increasing by about 1.8 million bp/d between now and 2027, and dropping after that. Assuming the rest of the USA declines by .3 million bp/d by then, that leaves the USA increasing by about 1.5 million bp/d by 2027.

I would not argue with those figures but we would still need almost another 2 million barrels per day to reach the high 12-month average of 2019. It would be entirely left up to the OPEC big 5, Saudi, Kuwait, UAE, Iran, and Iraq to make up the difference. The rest of the world, that is World less OPEC big 5 and the USA is clearly in decline and will decline. They are declining by about 400,000 barrels per day per year. If that trend continues then by 2027 they would be down by another 2 million barrels per day.

And since Russia recently joined the big decliners, there is absolutely no doubt that this trend will continue.

That means the OPEC big 5 alone would have to increase production by at least 4 million barrels per day per year by 2027. I just checked my chart of the OPEC big 5. They reached their 12-month average high in May 2017 and that average was down over 2 million bp/d by February 2020, just before the covid collapse.

Given that OPEC is already showing serious signs of being unable to increase production, do you really believe that they can actually increase production by 4 million bp/d by 2027?

Click on chart below to enlarge.

Ron,

My best guess scenario for Permian has output peaking at about 4 Mbpd higher than the most recent shaleprofile estimate in 2028. So US output increases but about 2200 kbpd more than you have estimated. Iran has another 1300 kbpd they could add to output if sanction were removed. That gets us to 3500 kbpd more than your estimate, also the proper level to look at is not the previous OPEC CTMA peak, it is OPEC CTMA output at the previous World peak for CTMA in Nov 2018.

Do I think the big 5 OPEC producers can raise output by 800 kbpd by 2028?

Yes.

OPEC decline in 2019 was due to quotas.

Three problems with your scenario Dennis.

1. You overestimate Permian future production.

2 You underestimate the decline in the rest of the USA if you even consider that at all.

3 You vastly underestimate the decline in the rest of the world’s oil production.

It is my opinion that not that world production will just not breach the 2018 high, but world production will never even reach the pre-covid level. OPEC is within half a million barrels per day of that level right now, but the world is still 2 million bp/d from that point.

I just don’t understand why you never mention the declining production in the rest of the world.

Click on the below graph to enlarge.

Ron,

Chart below has World minus (OPEC big 5 plus US plus Russia plus Venezuela), the trend line is an ordinary least squares linear regression on data from Jan 2015 to Dec 2018 (blue squares), average annual decline is 232 kb/d or about 0.67% per year.

Despite your claim that my Permian scenario is too optimistic, this is a claim you have often made in the past about my scenarios and for the most part the scenarios I have produced have been very conservative. This is also very likely to be the case for my 43.5 Gb Permian basin scenario despite claims to the contrary by many here, especially if oil prices remain high from now until 2030 as I suspect will be the case.

We will see if conventional oil resources get developed more quickly than the 2016 to 2022 period when oil prices were low over the 2023 to 2030 period when oil prices may be very high ($100/bo plus).

Click on chart for larger view.

Dennis, your charts are really hard to read so I just made my own to try to figure out what you were talking bout. I think I see your point which was that Venezuela was a major contributor to the decline. That is true but they, that is the rest of the world, is still declining. And notice that in the last year they have done nothing.

However, that does not change the fact that World oil production is still 3 million barrels per day below the 2019 12-month average. That is about to change however as Russian oil production has tanked. OPEC production has stalled, or nearly so. That leaves the USA to make up that difference. Will they do it? Of course not.

Click on the below chart to enlarge.

LTO.

Guess it’s looking good we hung onto our production at this time?

Maybe someday if this labor and material shortage ever gets fixed, we might even drill a couple wells.

Dennis, Mike Shellman has shown repeatedly that drilling outside the core six counties in the Permian/Wolfcamp is unproductive. I’ve not seen you refute his analysis in any meaningful matter, but perhaps I missed it. If all that other acreage is so awesome, why the hell isn’t anyone drilling there?

https://www.oilystuffblog.com/single-post/oil-literacy

Indeed, Stephen, thanks. Its a good question. At $100/$6 why is there STILL so much high grading going on in core areas of both sub-basins in the Permian, on 330 foot spacing, when wells are getting worse?

Because all that goat pasture out there the USGS believed six years was productive is really not so productive after all. Those were USGS ESTIMATES of resource potential over hundreds of square miles based on multiple different benches that have since proven not to be so good. Since those assessments both sub basins are now almost fully delineated and whatever there is left to do will be within the confines of those productive boundaries.

Nothing in life much turns out like you think, or hope; multiply that reality x 30 in the oil and natural gas business.

330 foot spacing is suicide. I believe 4 wells per section is the absolute limit.

LTO Survivor,

I use 4 wells per section in my model for Wolfcamp and Bonespring and 3 wells per section for the Spraberry.

Mike.

As you and LTO also point out, who is physically going to do the work to drill all of these extra wells?

The shale boom happened partly because after GFC, we had nearly 10% unemployment and many who moved to work in the shale fields and other fields.

Not the case now. Heard this morning on Bloomberg radio there are more than two job openings for every unemployed person in the USA.

Our field still has a serious labor shortage, with less than 10 service rigs running and with no rigs presently drilling new wells, despite $100 oil prices.

Heck, there are still hundreds of wells here SI since the Covid collapse, although that is slowly being worked off.

In 2014, our field had over 100 new wells drilled and around 30 service rigs in the field.

I know our field is anecdotal. But figure it’s the same most everywhere else?

LTO Survivor,

Many Permian core areas have 3 or 4 benched to target. A section with 330 foot spacing in 4 benches would have 64 wells in a section, 16 wells per bench. Have you seen a lot of sections with 64 wells? Or even 48 wells ? If only 3 benches are targeted.

Stephen,

My scenario, focuses on the best benches of the Permian and the core areas, that amounts to approximately 25 million net acres out of 50 million prospective acres identified by the USGS.

Also my scenario assumes the average well is spaced at 1320 feet as has been suggested by LTO survivor. also note that if oil prices remain at $90/bo or higher until 2035 and then falls to $30/bo by 2040 (all prices in 2021 US$), if average new well EUR has decreased by 30% from the average 2020 well EUR by 2035 and natural gas is still selling for $6/MCF, then this lower productivity well will pay out in 28 months at today’s real operating costs if the capital cost of the well is $10.3 million in 2021 $. Net cash flow over the life of the well is $14 million, and at an annual discount rate of 10%, the discounted net cash flow over the life of the well is $12.3 million. If we raise the annual discount rate to 24%, then discounted net cash flow over the life of the well is equal to the well cost for the oil and gas prices I have assumed (NGL sells for 35% of the crude cost). The EUR of the 2035 well is assumed to be 333 kbo.

Note that I have been expecting decreases in average new well EUR since 2013, so far the decreases have been fairly minor in the Bakken, which is the most mature tight oil play.

Unfortunately I do not have access to recent data on well profiles normalized by lateral length for the entire Permian basin, only snapshots of individual counties or companies which does not tell the whole story in my opinion. I use that data that is available to me. The price for the full data availability is $3348 per year, more than I can afford.

Scenario with 104 thousand total wells completed in the Permian basin has a URR of about 43.5 Gb, similar to the USGS F95 TRR estimate of 44 Gb for the Wolfcamp, Spraberry, and Bonespring formations of the Permian basin (an estimate which has about a 95% probability of being at least as large as 44 Gb.

Reservegrowthrulz has hinted that my estimates are too conservative, so not all oil industry pros are in agreement on the future of the Permian basin.

Scenarios below have a 40 Gb scenario where 400 wells per month are completed from 2022 to Sept 2030 and then ramp down to zero by the end of 2034. After Dec 2021 56,670 wells are completed in the Permian basin in that scenario, I believe that scenario is too low, LTO survivor believes this is two times more than the wells he thinks will be completed (about 27000 wells for his scenario, I think). Mr Shellman thinks it will be lower than that.

It would be interesting to see what Reservegrowthrulz thinks, but my guess is that he thinks the 75 Gb estimate by the USGS would be about right for the prices I have assumed and that even higher prices (say $150/bo or higher) would make even a 75 Gb URR estimate for the Permian too low. I think the 45 Gb estimate is the minimum that is reasonable unless peak demand hits earlier than 2035 as I have assumed, lower oil prices due to peak demand in 2030 or so could lead to 40 Gb or less.

The shaleprofile.com supply projection which assumes a constant completion rate of 432 wells per month from June 2022 to December 2029 has Permian output at 6950 kb/d in December 2029, my “average” scenario (which averages the 40 Gb and 43.5 Gb scenarios) has Permian output at 7225 kb/d in December 2029, the average scenario has a maximum completion rate of 525 wells per month from March 2026 to Sept 2028 and completion rate falls to 495 wells per month in Dec 2029.

Yes but still the question: why is this area not being drilled at $106 oil and $8 gas? Is it because people in the oil biz don’t like money, or that there’s no money to be made outside of the area already being developed in the Permian?

I think it’s safe to assume that wells in this large area that is part of the USGS survey are not profitable at the current high prices or we would see a rush to develop them. What then does this say about their potential future development? IMHO it does not bode well. Yet for your models to be anywhere near accurate, these areas need to be developed…

Stephen,

Not sure what part you are missing here. The 43.5 Gb model above assumes only 25 million of 50 million prospective net acres are developed in the Permian basin (about 50% of the total). Every oil play has sweet spots, those get developed intensively, before less productive areas are developed. Currently there are shortages in man power, sand, steel tubing, and probably lots of other stuff that I am not aware of (pumps and frack spreads come to mind, maybe storage tanks, LTO Survivor and Mike could give us an extensive list no doubt). So we will not see everything developed all at once, the oil operators will develop the areas where they can make the most money.

There have been about 21,500 wells completed in the Permian basin since mid 2017 (when USGS assessments were completed) on perhaps an average of 250 acres per well, that is about 5.4 million acres. Lateral length has increased over time and now the average well is about 290 acres per well, on the 19.6 million acres in the core areas that remains we could fit perhaps 68,000 more wells.

I keep hearing output cannot increase any further, but output has increased at an average monthly rate of 35 kb/d over the past 13 months in the Permian basin ( an annual rate of about 418 kb/d). This is a slower rate of increase than 2018 and 2019, but it is not flat output, if oil prices remain high and supply chain issues and labor shortages get sorted over time we may see this rate increase.

Stephen,

My scenarios assume only half of all the net acres from the USGS mean assessments for the Permian basin get developed (about 25 million of 50 million net acres), I chose these numbers based on what I read at Mike’s blog, basically choosing the areas that had already been developed. So the “goat pasture” that Mr. Shellman often refers to is left for the goats and never gets developed in my 43.5 Gb scenario.

Note also this does not happen overnight, the wells are completed from 2022 to 2034, over a 12 year period in the scenario, which in my view is very conservative.

Also note that if producers wait and develop resources slowly, by 2035 oil prices are likey to be falling and any remaining tight oil resource will become a stranded asset and will never be developed.

That remaining tight oil that has not been developed by 2035 will be there not only for our grandchildren, it will remain in the ground our grandchidren’s grandchildren as well.

Stephen,

When I look at the map on the oilystuff post you linked I mostly see 14 to 16 wells per section width. Basically 330 foot spacing would be 16 wells per section, but note that these 2 dimensonal maps don’t show you that there are 3 or 4 benches in each section of the Wolfcamp and Spraberry, so the 16 wells shown are not really spaced at 330 feet, we likely have 4 wells per section width at 4 different vertical depths and have the 4 wells per section wdth (1320 foot spacing) that LTO survivor has said is optimal. Or that is my guess. I am sure that Mr. Shellman knows this, so it is not clear why he is claiming 330 foot spacing, in the map he shows most sections are not in fact spaced at 330 feet, that would require 64 wells per section width for sections with 4 viable benches. A minimum of 4 benches is true for most of the area of the 6 core counties of the Midland basin.

Mr. Coyne, the focal point of that post I wrote was to try and help people NOT in the oil business understand field rule spacing, how drilling units are formed and developed, regulatory restraints that affect development and how difficult it is to steer radiuses from single well pads, particularly in the Phantom Field of the Delaware Basin. Clearly in your regard, I failed: I should have used crayons.

The Field Rules for Phantom Wolfcamp and Bones Springs Fields ARE 330 feet between wells and there are numerous instances where that has been done in that fields development, here’s just one: https://www.oilandgas360.com/wpx-finds-success-330-spacing-wolfcamp/, there are others. If you had read the post you would understand the TRRC does not distinguish between benches in Phantom Field, that the Wolfcamp, for instance, is defined as a vertical correlative interval that is nearly 4000 feet thick. Same with the Bone Springs. Nothing is filed by operators with the TRRC in 3-dimensional form. The public has no way of knowing what “bench” has a lateral in it and which one doesn’t, nor do we know which benches within a correlative interval or interfering with each other or draining each other, all quite prevalent in real life.

I made no “claims,” about anything; I was trying to help. I am unclear what the point is you are trying to make in this comment other than to give credibility to your ridiculous models at my expense and the 50 plus years I have filing drilling permits in Texas. You are insulting to me, to everyone else on this forum actually IN the oil business trying to help, and to my entire industry.

Personally, I don’t even know why anyone gives you any benefit of the doubt with regard to analytical credibility. The data you live and breathe by you don’t even know it means or how to apply it in real life. You know, nor understand, absolutely nothing about oil and gas. You ask constantly for others to do your research for you, for their opinions, then pick and choose what information suits your beliefs. You really should find a different hobby.

I don’t post on anti-oil barrel anymore because I am tired of your shit. When other people do post my stuff, kindly just ignore it.

Mike,

You give the impression in your comments that 330 foot spacing is commonly used, just because that is the “rule” for allowed spacing doesn’t mean it is common practice. Yes I have read about companies trying very tight spacing for their wells, my understanding is that is was not a profitable practice and not many companies are using that approach.

Here is a quote:

Indeed, Stephen, thanks. Its a good question. At $100/$6 why is there STILL so much high grading going on in core areas of both sub-basins in the Permian, on 330 foot spacing, when wells are getting worse?

How were we supposed to interpret this comment by an oil field expert?

Are there a lot of wells spaced at 330 feet? I am sorry to insult you, I am simply trying to understand what you are talking about. I was under the impression you knew that a lot of wells were spaced at 330 feet, LTO survivor says this is bad practice (suicide was the term he used as I recall), I am assuming both of you know what you are talking about and am trying to reconcile the difference.

Perhaps you mean that most of these operators are following bad practice and are choosing 330 foot spacing? I tend to think oil operators are very smart and would choose the optimum set up, which according to LTO survivor is 4 wells per section (in a given bench such as Wolfcamp A). Do I have that wrong?

That post of yours was great, thanks. I used approximately the areas shown in your post to reduce the net acres in my model from about 37 million net acres for the most productive benches in the USGS assessments of the Wolfcamp, Spraberry, and Bonespring formations of the Midland and Delaware basins to about 26 million net acres and developed spearate well profiles for the Wolfcamp Midland wells, Wolfcamp Delaware wells, Spraberry wells and Bonespring wells using data from shaleprofile.com, that is the basis for the 43.5 Gb Permian scenario where I assume a maximum completion rate of 650 wells per month for the Permian basin as a whole is reached in September 2026 (ramping from 400 per month in early 2022) and taht level is sustained for 24 months and then the completion rate gradually falls to zero by April 2034. This cumulative output is similar to the USGS F95 TRR estimate for the Permian basin (44 Gb).

Dennis

Why is this chart different than the EIA’s LTO chart in Section 3 above?

Ovi,

In March 2022 the difference between DPR and LTO reports was DPR was higher by 687 kb/d. I assume in April and May 2022 this conventional output in the DPR regions remains 687 kb/d and deduct that amount from the DPR estimate in April and May to extend the estimate for LTO output to May (from your chart which ends in March), the monthly increase for the OLS trend is 48.5 kb/d, very similar to the estimate in your post, but with the estimate extended by 2 months to May (7962 kb/d), April 2022 would be 7829 kb/d, based on this estimate. The estimates will likely be wrong because conventional output may not remain at 687 kb/d for 3 months, and because the DPR estimates and LTO estimates will likely be revised in the future.

Dennis

Recall that the Bakken had a big production drop in April due to weather.

Two blizzards, not just one. Posted April 29.

BISMARCK, N.D. The first storm began on April 12 and lasted three days, causing production to fall to about 750,000 barrels per day. The industry had rebounded to 950,000 barrels per day when the second storm hit on April 23. That blizzard caused production to drop to just 300,000 barrels per day. Production has since increased to about 700,000 barrels per day.

Ovi,

Yes, just using the most recent DPR, as you know these projections are updated monthly. The April and May estimates in my chart are likely to be incorrect, also the data for Jan, Feb, and March from the LTO estimate are also likely to be revised in the future.

When will Mexico get in on the tight oil/gas ballgame.

Eagle Ford, for example, doesn’t stop at the Rio Grande.

I guess the longer they delay, the more they will earn from it.

Hickory,

I believe that I have read that the Eagle Ford formation in Mexico is mostly gas and not a lot of liquids. Though the price of natural gas is pretty high these days, not sure they have a lot of infrastructure in place for onshore oil output in Mexico.

I may have that wrong on Mexican areas being more gas prone, perhaps it will be developed.

OPEC fails to boost output as members face capacity woes Bold mine.

The OPEC cartel — which has struggled for many months to revive oil supplies halted during the pandemic — effectively failed to increase output at all last month, as members remained plagued by capacity constraints.

While Iraq made a substantial boost, countries such as Libya and Nigeria saw their production fall amid operational disruptions and diminished investment, according to a Bloomberg survey. Even group leader Saudi Arabia didn’t hike by as much as permitted by their agreed quota.

International crude prices are holding near $105 a barrel as OPEC’s struggle is exacerbated by a de facto embargo on Russian supplies by many refiners following the invasion of Ukraine. The lofty price levels are feeding into an inflationary spike that’s battering consumers and threatening growth, alarming policy makers around the world.

Key consumers such as the U.S. have grown exhausted with pressing the Saudis to fill in the supply gap, and taken to deploying emergency oil reserves. The kingdom’s refusal to open the taps more quickly reflects its belief that markets remain adequately supplied despite the war launched by Russia, with which it jointly leads the OPEC+ alliance of producers.

The coalition is likely to stick with its established plan, ratifying another modest addition of 430,000 barrels a day when it gathers on Thursday, according to delegates. But as the survey indicates, the group may struggle to implement much of the stipulated amount.

The Organization of Petroleum Exporting Countries added just 10,000 barrels a day in April, compared with a scheduled 274,000 a day, the survey showed. It pumped an average of 28.7 million barrels a day.

While Iraq bolstered output by 170,000 barrels a day to 4.46 million, Libya countered this with yet another stumble, slipping by 150,000 a day amid port and field closures.

Saudi Arabia added just 70,000 barrels a day, about two thirds of the permitted increment, leaving their production at 10.34 million a day — or roughly 100,000 a day below the kingdom’s target.

They wanted to increase production by 274,000 barrels per day, but they managed to get an increase of only 10,000 bp/d.

US Car Sales

To stabilize the sales numbers, either the FED must print fresh money or the oil price must fall below 50 USD.

Berndt , no need to stabilize . The industry is in a slow crash due to supply of semi conductors and other supply side issues . This is going the way of commercial aircraft manufacturing .

Many car companies are earning themselves golden water taps at the moment due to the chip shortage – here they don’t need to give any discounts most times anymore. Or they can hike prices by big amounts as for electric cars.

That’s keeping up profit. Normally you don’t buy a new car without at least 20% discount to list price here. That’s gone, and the companies pocket these 20%.

And for electric cars: VW ID.3, Tesla and Ford F150 Lightning: All sold out for this year. So big profits.

Eulen , yes the companies are creaming profits FOR THE MOMENT . It is not important how far they are sold out , could be 5 years but if they can’t produce cars then all those orders are nothing but fluff (BS) . The semiconductor problem is permanent . I will make it simple ” We cannot have resource depletion and increasing complexity at the same time ” . Here is a link and I can provide many more as to why semiconductor shortage is permanent and there is ”no way out ” . Peak car sales were in 2017 .

https://energyskeptic.com/2021/fragility-of-microchips/

Hug your car and make friends with a autoafbraak ( salvage yard ) to keep it running .

The FAO Food Price Index makes a giant leap to another all-time high in March

https://www.fao.org/worldfoodsituation/foodpricesindex/en/

Thanks for this Jeff, interesting to look at the break out numbers at the bottom of your link. Vegetable oils at 248 this month from just around 100 in 2020.

Diesel prices hit a nominal record of $5.51 this week. Interesting this is occurring without a big run up in crude:

https://wolfstreet.com/2022/05/02/price-of-diesel-spikes-to-wtf-record-5-51-gasoline-jumps-to-4-18/

Thanks Jeff,

I think the prolonged conflict will continue to inflate FAO.

In not already posted:

https://www.zerohedge.com/commodities/shale-producers-face-42-billion-hedging-losses

Looks like a lot of the money by the high oil price windfall goes to the banks.

Looks like a lot of the money by the high oil price windfall goes to the banks.

I don’t think so. Banks don’t usually deal in hedging options or oil futures. The other side of those hedges will likely be held by refineries and other purchasers of oil. However, a huge percentage of those betting on high oil prices will be just traders and speculators.

D. Coyne doesn’t believe hedging is a significant part of energy companies activities since its so speculative. So… I guess you can shove that fake news up your you know where /sarc I’m only miffed because I literally said this was going to happen like 6 months ago and Dennis absolutely shut that down, so I’m only paying it downward.

Twocats,

Actually I don’t operate in the finance world, I imagine like most of these transactions there are winners and losers. If one pays a lot of money to ensure protection from oil prices decreasing, and then oil prices increase, that is money wasted or lost when a bad bet is made. In other words if I set up a bunch of contrcts to sell my oil at $70/bo and the price goes to $100/bo, I lose $30/bo, if the price goes to $40/bo I am ahead $30/bo.

Some companies choose to not hedge and they just get the market price. Probably not many of these for large oil producers.

U.S. Domestic Oil Production: Verities And Balderdash

Summary

Shale production has plateaued and could actually be on the decline.

This contradicts expectations for substantial growth currently in place.

We discuss recent data from an industry expert that highlights reasons why these expectations simply cannot be met.

There is no such thing as a free lunch.

Looking for more investing ideas like this one? Get them exclusively at The Daily Drilling Report.

There are increasing signs that shale oil and gas production has plateaued, and may be on the decline. These facts are at odds with the EIA’s own expectations of an 820K BOPD increase in production over the next year. An estimate that’s already been shaved by 30K BOPD, and will be again. Soon, if this trend is sustained over the next few months.

This is a very long article but well worth your time. There is a lot of shale hype out there. This contradicts a lot of it.

HOLE IN HEAD

IGNORED

04/30/2022 at 6:20 am

Diesel will be the straw that broke the camel’s back .

https://oilprice.com/Latest-Energy-News/World-News/Diesel-In-Crisis-Mode-As-Prices-Break-Records.html

https://www.reuters.com/business/energy/rosneft-cuts-diesel-exports-key-russian-port-zero-2022-04-29/

I posted this . There is already rationing in Africa and Latin America . Don’t argue about crude production worry about diesel . Once the diesel goes it is full stop . Read Alice Friedman’s ” When the trucks stop running ” .

https://www.zerohedge.com/commodities/us-east-coast-diesel-stockpiles-hit-record-low-fuel-crisis-nears

Is there a highway or truck traffic trend indicator for Europe or particular countries that you know of, for following?

It will be interesting to see if the roads get quieter, like during peak Covid months.

Diesel is the one to watch .

https://www.freightwaves.com/news/the-world-is-running-short-of-diesel-product-tankers-could-win-big

I struggle to put gasoline in my car.

Yet I can figure out that Russia and the USA are in trouble regarding oil production.

The question, I have is What does Putin know about Saudi Arabia?. You know he knows more than we do.

Actions speak louder than words.

Russian oil exports outside ex-Soviet Union up 2% April 1-28

The source also said that, Russian oil and gas condensate production for the period declined by almost 9% to 10.05 million bpd, in line with an Interfax news agency’s last-week report.

Click on chart below to enlarge.

The only thing holding oil prices somewhat down now are the chinese COVID lockdowns – otherewise I think we would be already in the 150$ region.

10 year bonds topped the 3% now, junk bond index flirts with the 7.

Financing gets expensive – all the LTO companies still sitting on their hedges will have a hard time financing the new wells.

Sell low , buy high . Biden seeks to replenish the 60million barrels of the SPR . Good for higher oil price .

https://edition.cnn.com/2022/05/05/energy/spr-biden/index.html

Does he want 200$ oil? Or ration cards for everyone?

In fall he wants to refill – so instead of the +1 mbpd -1mbpd, together with the start of the european Russia boycot and higher US interrest rate (good luck financing a new shale boom).

Eulen , a great opportunity for the traders like Glencore and Trafigura . Buy discounted Russian oil at a $ 30 discount , relabel it and send it to Cushing . Washington will turn a blind eye but 10% for the ” big guy ” . 🙂

P. S : I am not joking . Remember Marc Rich of Glencore , fugitive from US living in Switzerland but was pardoned by Hilly Billy on his retirement from office . ” It is a big club and you ain’t in it ” -George Carlin .

Ron , what happened for this reversal ? We had a discussion on this and I said that when the ” men in uniform ” say to the POTUS ” enough is enough ” we can’t maintain our operational efficiency at this level of SPR , he will cave . Could be a reason ? Men in uniform matter .

HinH, once again, men in uniform do not tell POTUS what to do. He tells them what to do. The idea that the Generals could tell Biden what to do is just silly. You should know better than that.

The president does have many advisors that advise him on what might be the best course to take. But in the end he is the one that makes the decision.

Biden had raided the “rainy day” fund when it wasn’t raining.

to all experts

as we can see in the last two years, the production remains on a high plateau, respectively decreases. This is despite record high prices. One would think that maximum production would be necessary.