A guest post by Ovi

Below are a number of crude oil plus condensate (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to January 2022. This is the latest and most detailed world oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

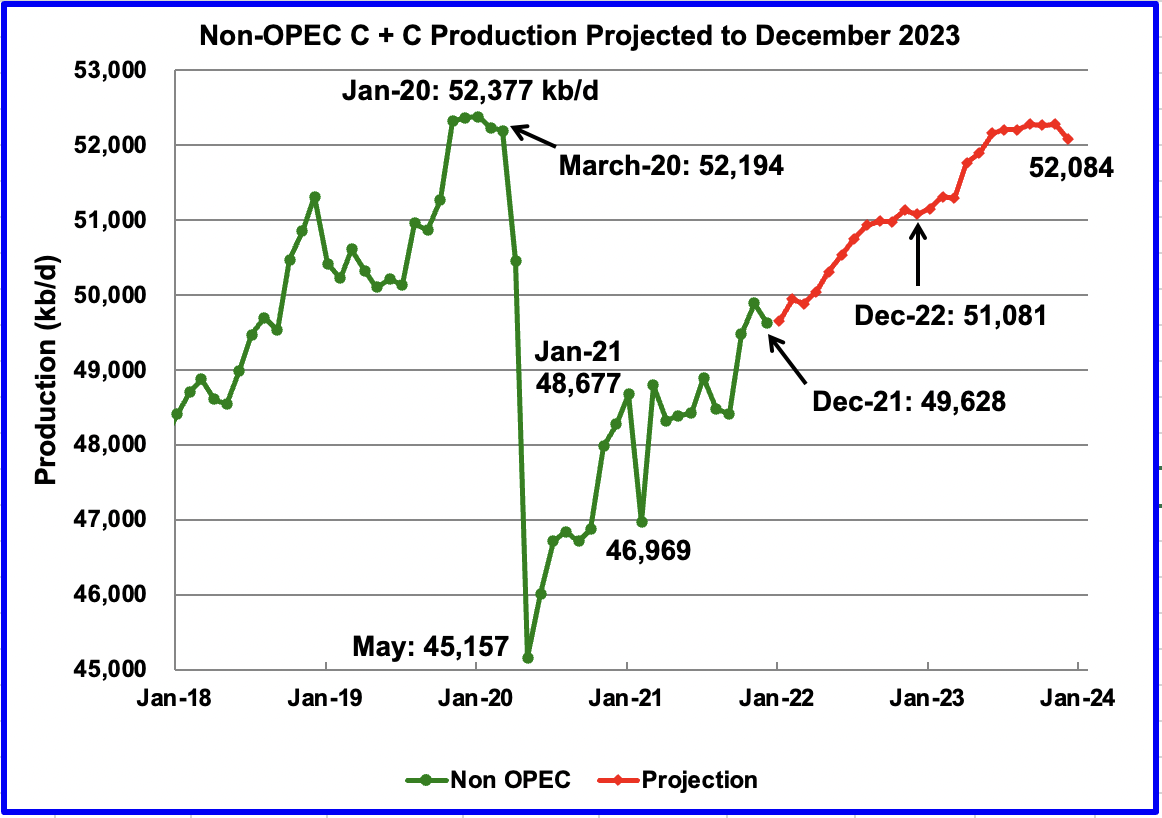

For comparison, December Non-OPEC chart posted in previous report. No Russian oil sanctions

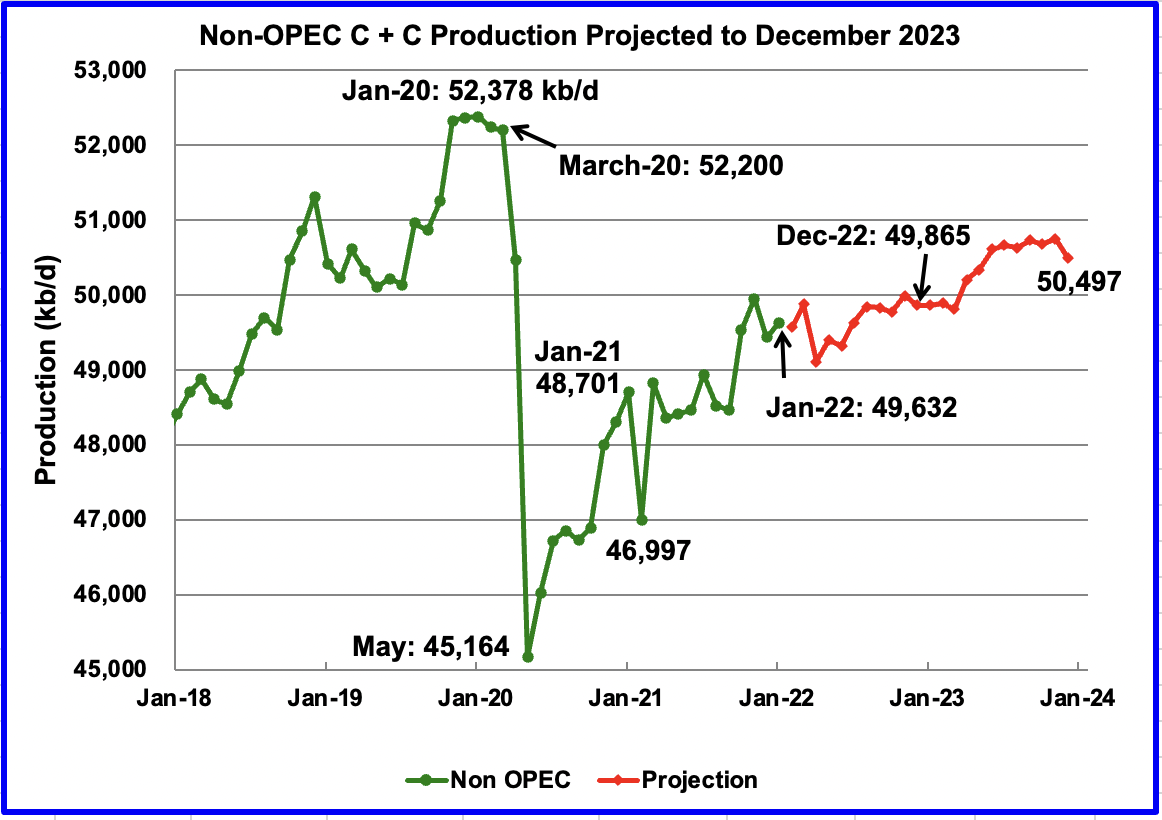

Updated January Non-OPEC chart with impact of projected Russian oil sanctions.

Since the last report, the sanctions on Russian oil production have shown up in the Russian April production chart. (See Russia chart below). The EIA has taken that information into account in their May STEO report. The previous December Non-OPEC chart (first chart) has been retained to better illustrate the change.

January Non-OPEC production increased by 198 kb/d to 49,632 kb/d. Of the 198 kb/d increase, the biggest increases came from the China 307 kb/d and Brazil 194 kb/d. Offsetting the increases were decreases from the U.S. 216 kb/d and Norway 114 kb/d. Note January’s output was 4 kb/d higher than the original December output of 49,628 kb/d, revised down to 49,434 kb/d in the current January report

The January 2022 output of 49,632 kb/d is 2,568 kb/d lower than the March pre-covid rate of 52,200 kb/d.

Using data from the May 2022 STEO, a projection for Non-OPEC oil output was made for the time period February 2022 to December 2023. (Red graph). Output is expected to reach 50,497 kb/d in December 2023, which is 587 kb/d lower than shown in the December report. Comparing December 2022 output from the December report (first chart) with the current January report, the current STEO is showing a production drop of 1,216 kb/d.

Note the production drop of 803 kb/d in April in the projected red graph associated with the drop in Russian production.

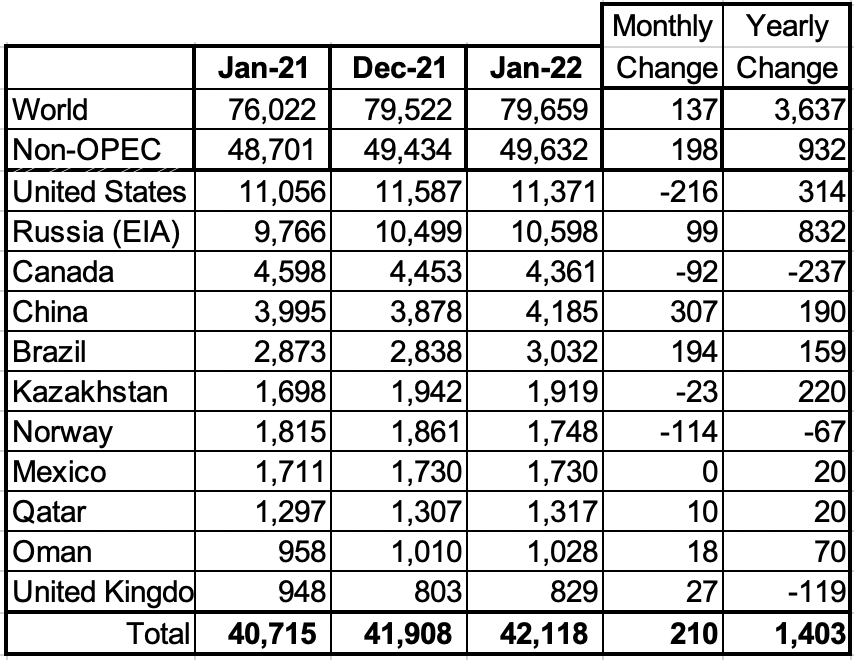

Above are listed the world’s 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The UK has been below below 1,000 kb/d since January 2021.

In January 2022, these 11 countries produced 84.9% of the Non-OPEC oil. On a YoY basis, Non-OPEC production increased by 932 kb/d while on a MoM basis production, it increased by 198 kb/d to 49,632 kb/d. World YoY January output increased by 3,637 kb/d.

Production by Country

The EIA reported Brazil’s January production increased by 194 kb/d to 3,032 kb/d. Brazil’s National Petroleum Association reported that March’s output increased to 2,981 kb/d after February’s decline. (Red Markers).

Brazil continues to experience difficulties in increasing its yearly output. However according to the IEA, production in 2022 is expected to increase in 2022. “The main growth in 2022 will be driven by the continued ramp-up of the Sepia field which came online in August 2021, along with two start-ups of Mero 1 and Peregrino Phase 2. The Mero-1 (FPSO Guanabara) was planned for processing capacity of 180,000 b/d of oil and 12 MMcm/d of gas.”

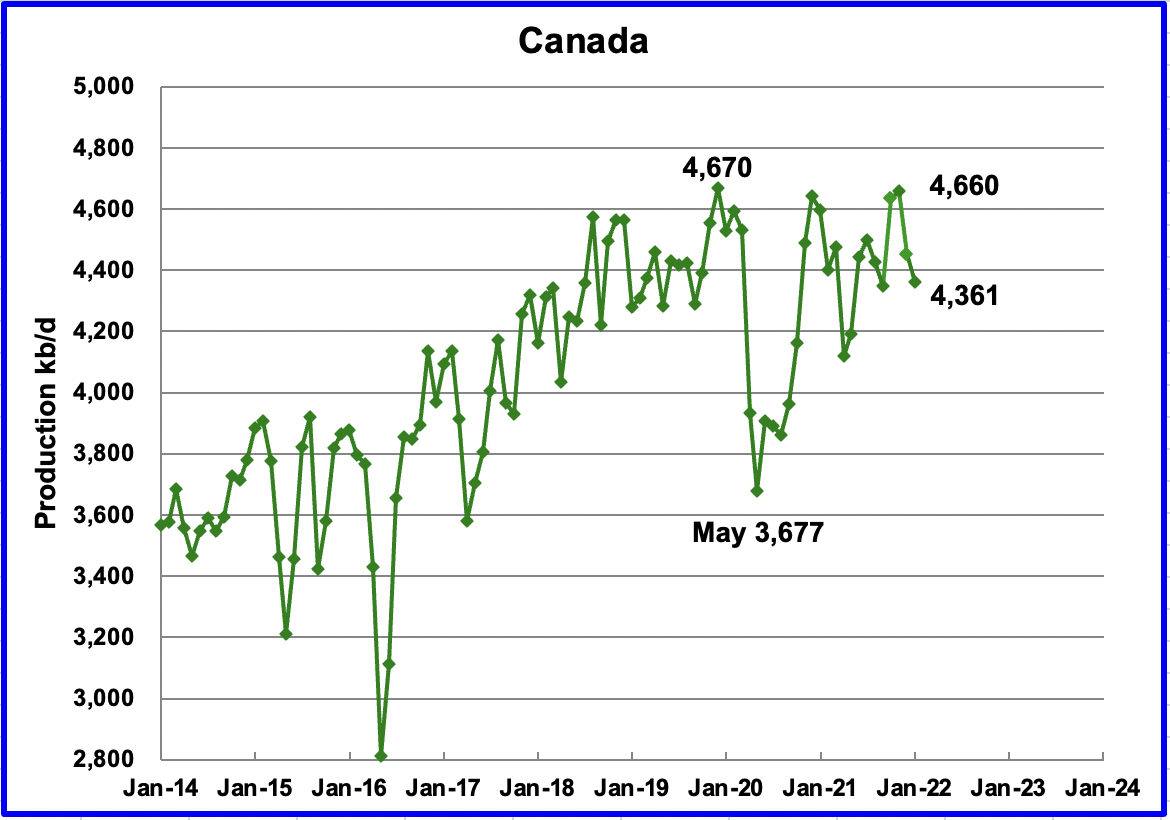

According to the EIA, Canada’s January output fell by 92 kb/d to 4,361 kb/d.

Rail shipments of crude oil to the US continue to slow. February shipments were 7.7 kb/d lower at 124.8 kb/d than January’s 132.5 kb/d.

Canadian Natural Resources CNQ (NYSE), Canada’s biggest oil producer, reported Q1 earnings. Below are some interesting operating cost numbers to compare with LTO.

- Thermal in situ operating costs averaged $14.35/bbl (US$11.34/bbl) in Q1/22, an increase of 26% over Q1/21 levels. The increase in operating costs was primarily due to higher energy costs.

- Operating costs in the Company’s primary heavy crude oil operations averaged $22.00/bbl (US$17.38/bbl) in Q1/22, an increase of 16% compared to Q1/21 levels, primarily due to higher energy related costs.

- The Company’s world class Oil Sands Mining and Upgrading assets continue to deliver safe and reliable production. Operating costs remain top tier, averaging $24.60/bbl (US$19.43/bbl) of SCO in Q1/22, an increase of 24% over Q1/21 levels, primarily as a result of lower production volumes at Scotford, together with higher energy costs, turnaround and maintenance related costs.

Line 5 is under another new threat. According to this source, Enbridge’s Line 5 pipeline faces a second shutdown risk in the Great Lakes area after an Indigenous band asks U.S. court for injunction

The Line 5 energy pipeline is facing another threat of shutdown: A Wisconsin Indigenous band has asked a U.S. court for a quick judgment on an application to evict the pipeline from its land.

The Bad River Band of the Lake Superior Tribe of Chippewa, which filed its application earlier this year, is asking a U.S. federal court for a permanent injunction that would require owner Enbridge Inc. ENB-T to “cease operation of the pipeline and to safely decommission and remove it.”

This latest risk to Line 5 is on top of an effort by Michigan Governor Gretchen Whitmer to cease the pipeline’s operations over fear of an oil spill in the Great Lakes. The Canadian government is trying to quash that attempt via negotiations with the United States.”

He noted that the Wisconsin band granted permission via a signed agreement 1992 for Enbridge to operate on the reservation until 2043.

Hi, my name is Canada. I’m an oil superpower

That was the headline editorial in one of Canada’s national papers on Monday May 9.

“Exports of all goods in March reached a new monthly record of $63.6-billion, Statistics Canada reported, surpassing the previous high of $58.7-billion, set in February.

The surge is powered by oil. Energy now accounts for more than a quarter of Canada’s exports, a level last hit in 2014, when crude prices were also on a tear. Back then, Stephen Harper was a vocal booster of the oil industry, and not much interested in talking about climate change. Today, Justin Trudeau is the opposite. Yet for all the Liberal government work to try to cut Canada’s carbon emissions, the economy remains as dependent as ever on pumping oil.“

The article notes the conundrum Canada faces, increasing oil production while meeting ever increasing climate change goals. “If and when the rest of the world starts aggressively pursuing policies to lower demand for oil, then prices for and production of Canadian oil will inevitably fall. Until then, Canada should have no qualms about allowing our industry to prosper and grow, with one major condition: That it heavily curtail its own emissions.“

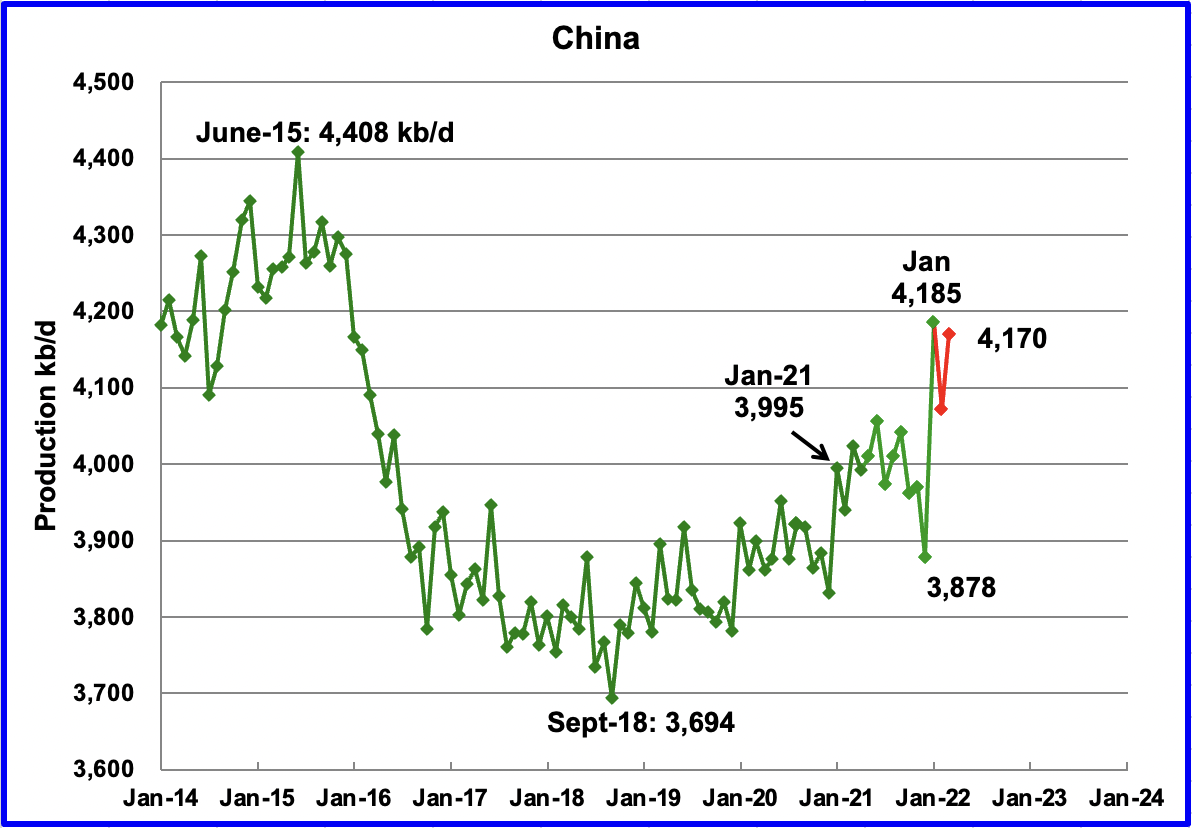

The EIA reported China’s output increased by 307 kb/d to 4,185 kb/d in January. China reported that its output dropped in February but rebounded to 4,170 kb/d in March. (Red markers).

Is this production increase since January 2021 due to the startup of new fields? China has reported the start of new oil production here and here. In related news, CNOOC revealed in early 2022 that, as part of its strategy for the year, it would increase oil and gas production in the next three years while advocating for and encouraging green energy transition initiatives.

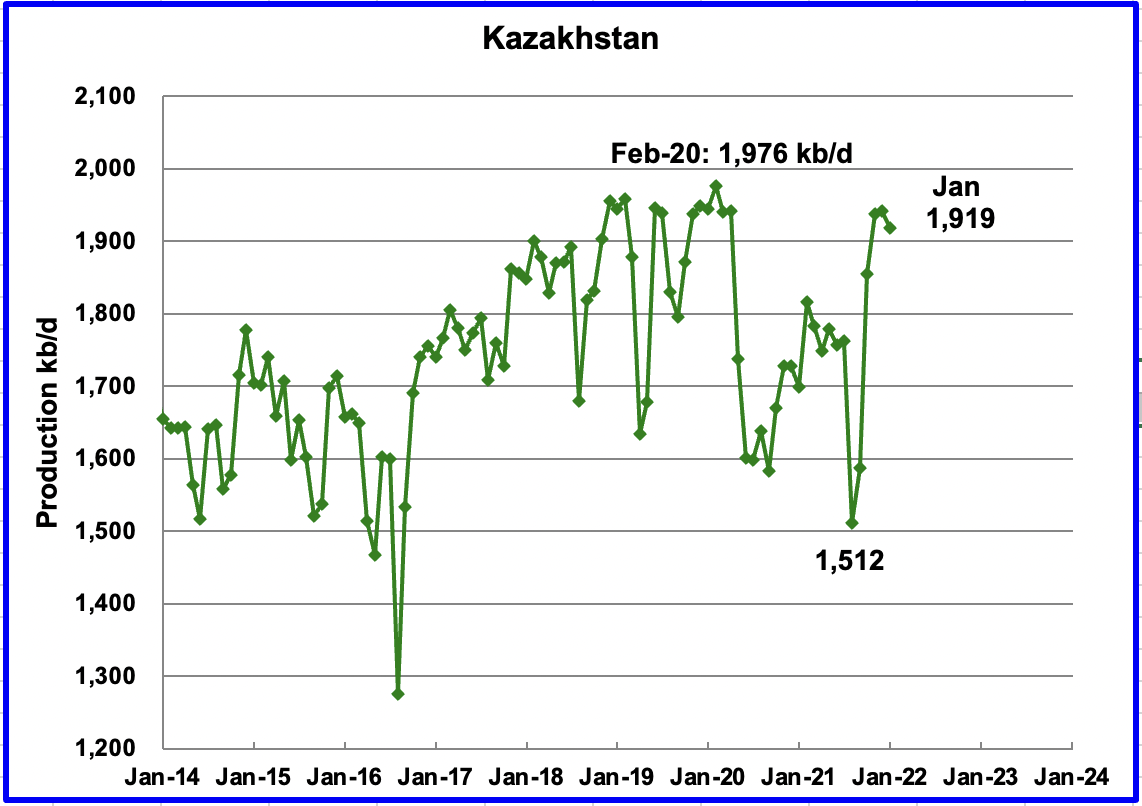

Kazakhstan’s output decreased by 23 kb/d in January to 1,919 kb/d.

Mexico’s production as reported by the EIA for January was unchanged at 1,730 kb/d.

Data from Pemex showed that February’s output climbed to 1,763 kb/d and to 1,777 in March. (Red marker). However for some unexplained reason, the EIA reduced Mexico’s official January C + C production of 1,783 kb/d by 53 kb/d to 1,730 kb/d. A possible explanation is that Mexico’s definition of condensate may be different than the EIA’s.

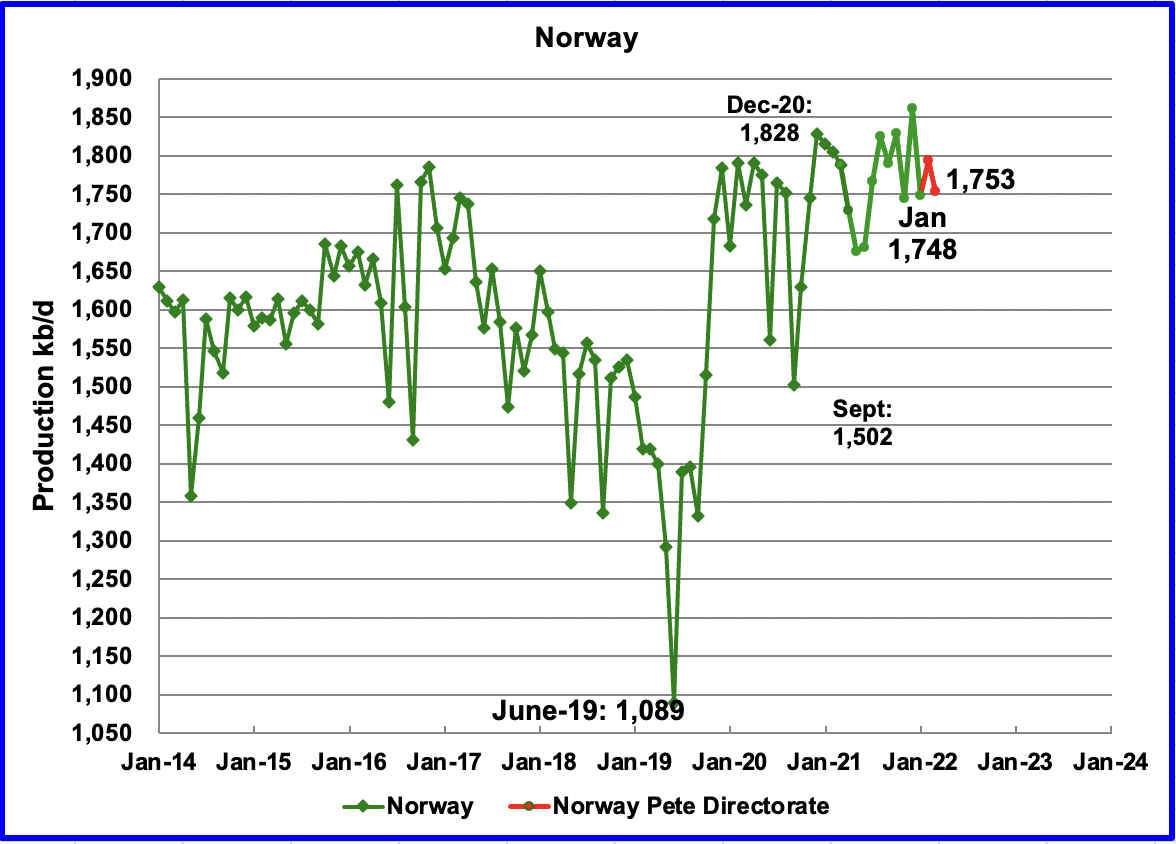

The EIA reported that Norway’s January production dropped by 114 kb/d to 1,748 kb/d. The Norway Petroleum Directorate (NPD) reported that production in February increased to 1,793 kb/d and then decreased to 1,753 kb/d in March. (Red markers.)

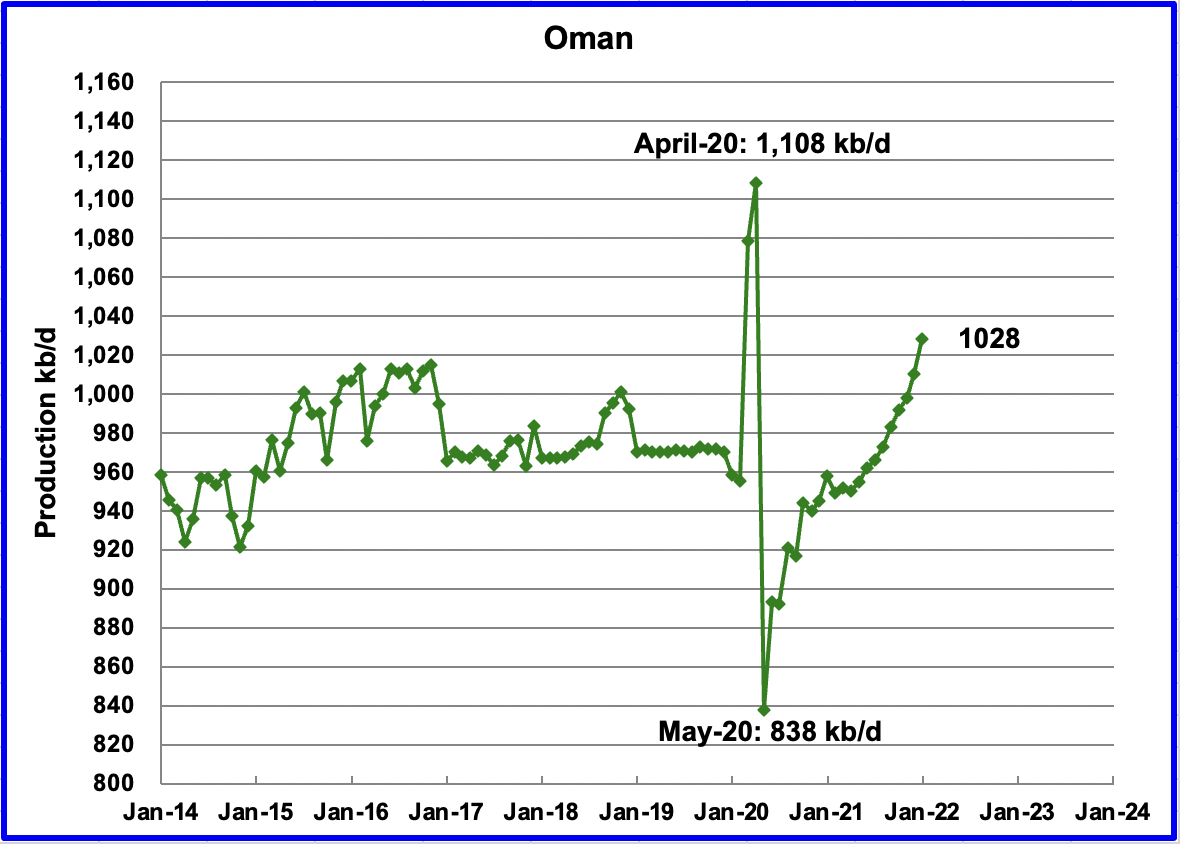

Oman’s January production increased by 18 kb/d to 1,028 kb/d.

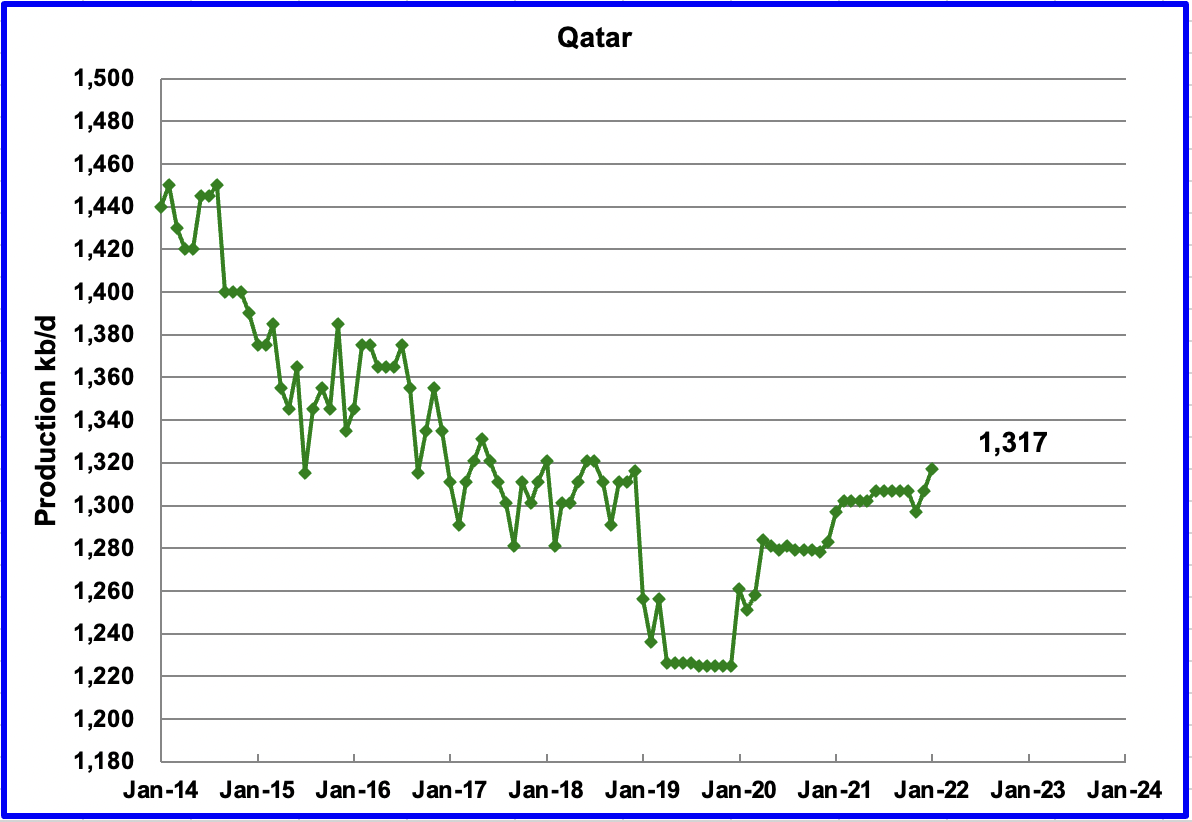

January’s output increased by 10 kb/d to 1,317 kb/d.

The EIA reported that Russian output decreased by 99 kb/d in January to 10,598 kb/d. According to this source, April’s production decreased by 1,010 kb/d to 10,050 kb/d. The blue graph represents the STEO’s forecast for Russian C + C production up to December 2022 due to the imposition of economic sanctions by the U.S. and many other countries.

The Rusian C + C forecast was made by comparing the ratio of the STEO’s all liquids output with the Russian Ministry C + C output over the period October 2021 to April 2022. Russian C + C production was close to 97.6% of the STEO all liquids data. That percentage was used to generate the Blue graph.

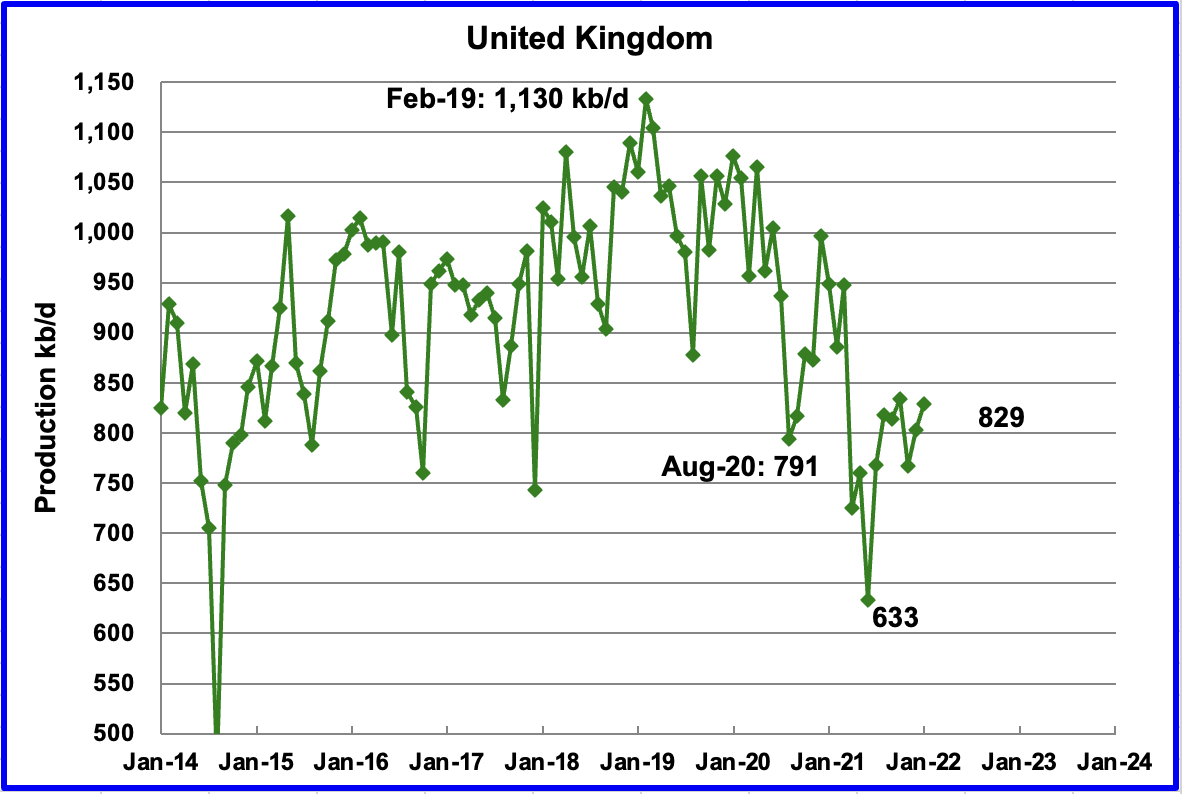

UK’s production increased by 27 kb/d in January to 829 kb/d. The chart indicates that UK oil production has entered a steep decline phase starting in February 2019.

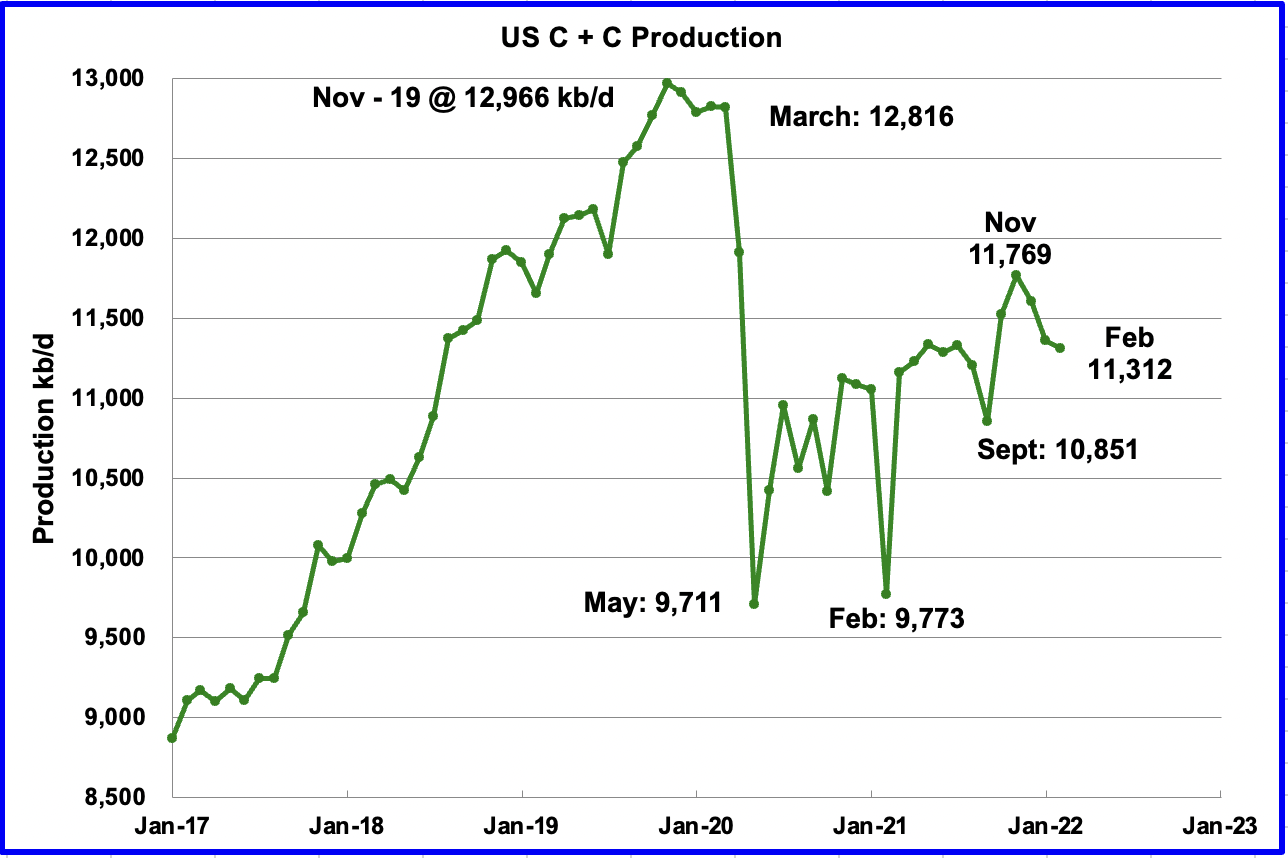

U.S. February production decreased by 50 kb/d to 11,312 kb/d. Relative to the November 2021 production of 11,769 kb/d, it has dropped by 457 kb/d. The main declining states in February were Texas 27 kb/d and ND 23 kb/d. The major decliner that made overall US output drop was the GOM which dropped by 93 kb/d.

In the On-shore lower 48, February’s output increased by 43 kb/d to 9,247 kb/d.

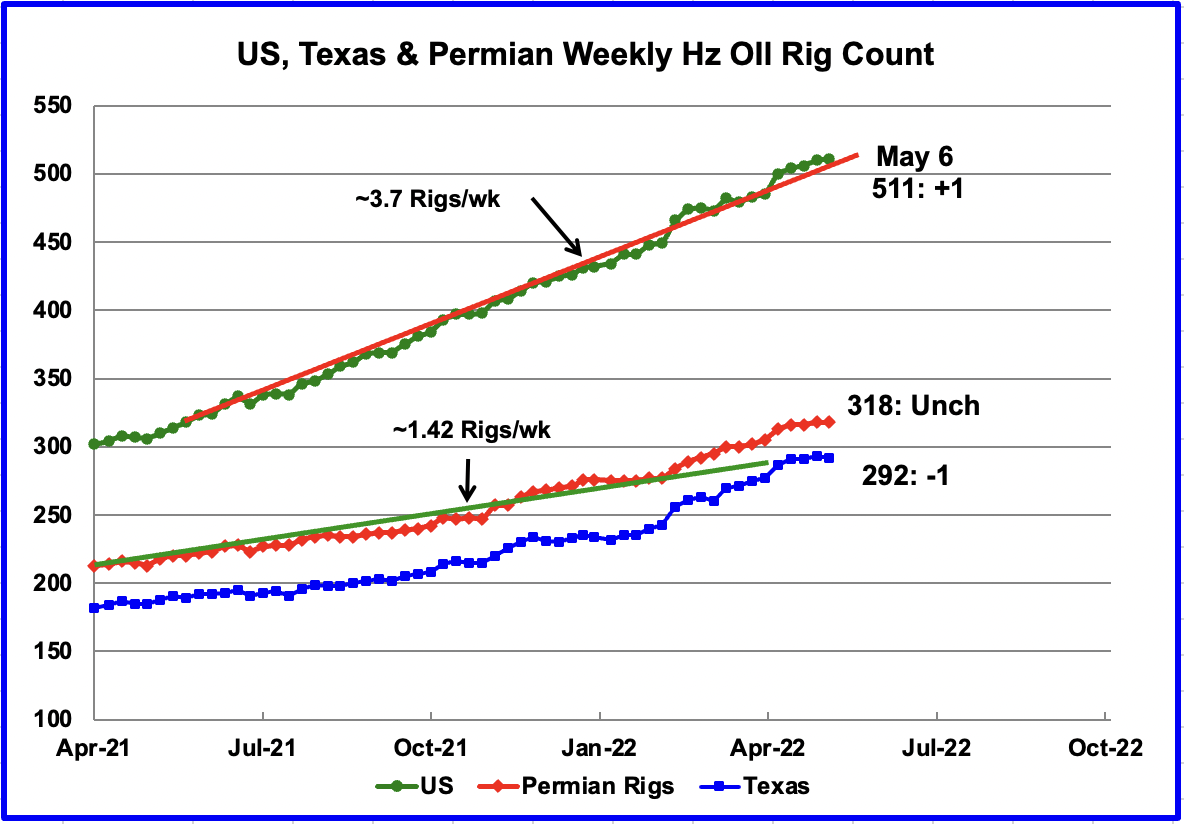

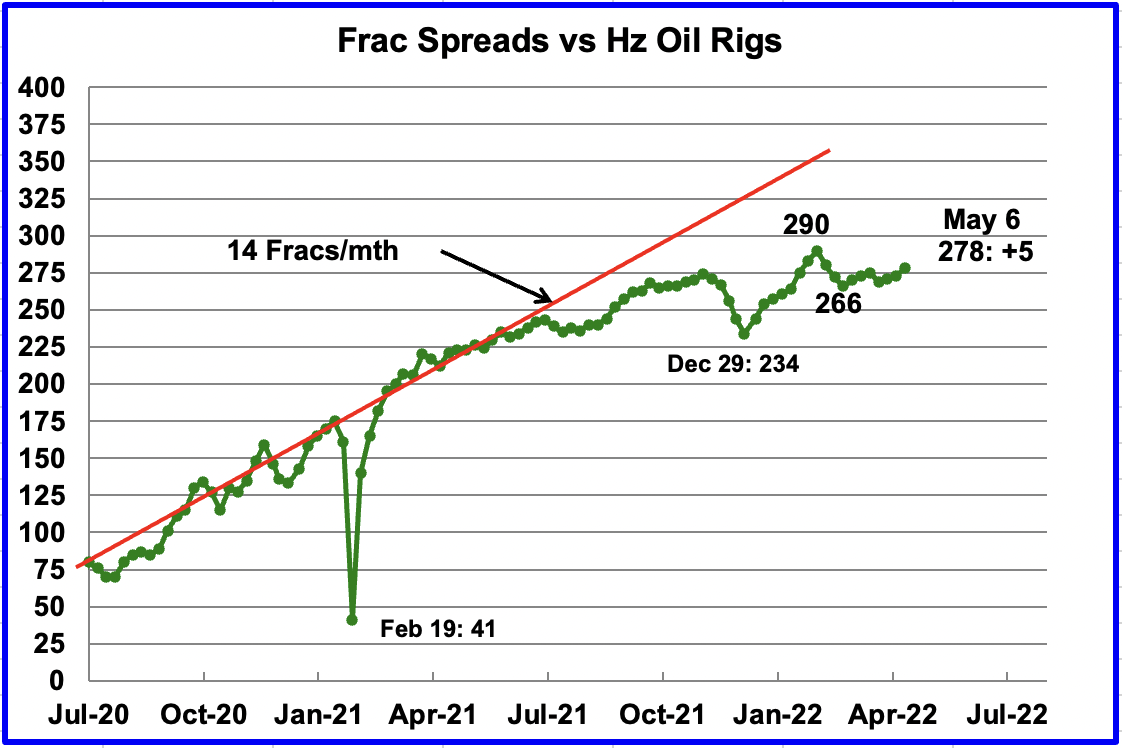

From the beginning of May 2021 to the end of April 2022, the US has been adding horizontal oil rigs at an average rate of close to 3.7 rigs/wk. However in the Permian and Texas, the addition of rigs has accelerated. This implies the rig count in the other states and basins is slowing.

For the week ending May 6, 1 horizontal oil rig was added in the U.S. for a total of 511. Permian rigs were unchanged at 318 and in Texas, the rig count dropped by 1.

For the past few months, the growth in frac spreads has not been keeping up with the growth in rigs. However for the week ending May 6, 5 frac spreads were added. Could this be the beginning of a summer push?

Note that these 278 frac spreads include both gas and oil spreads, whereas the rigs information is strictly oil rigs.

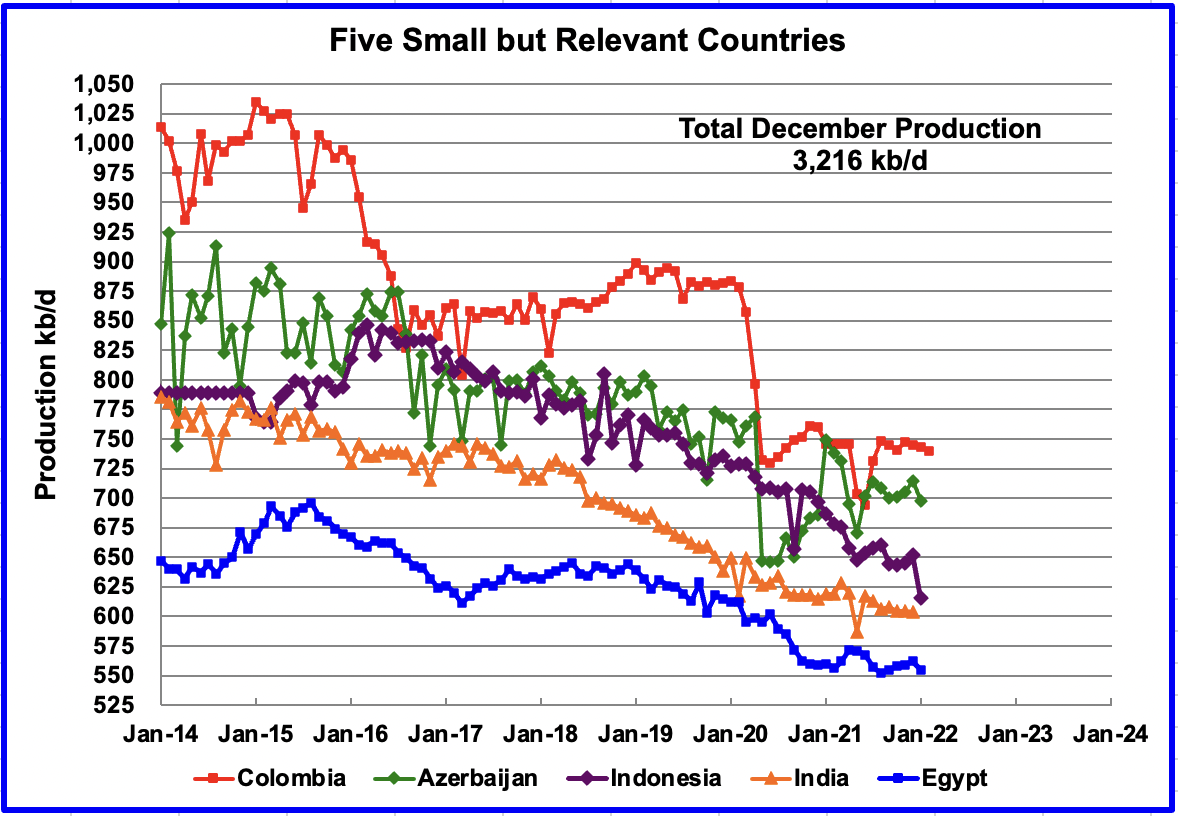

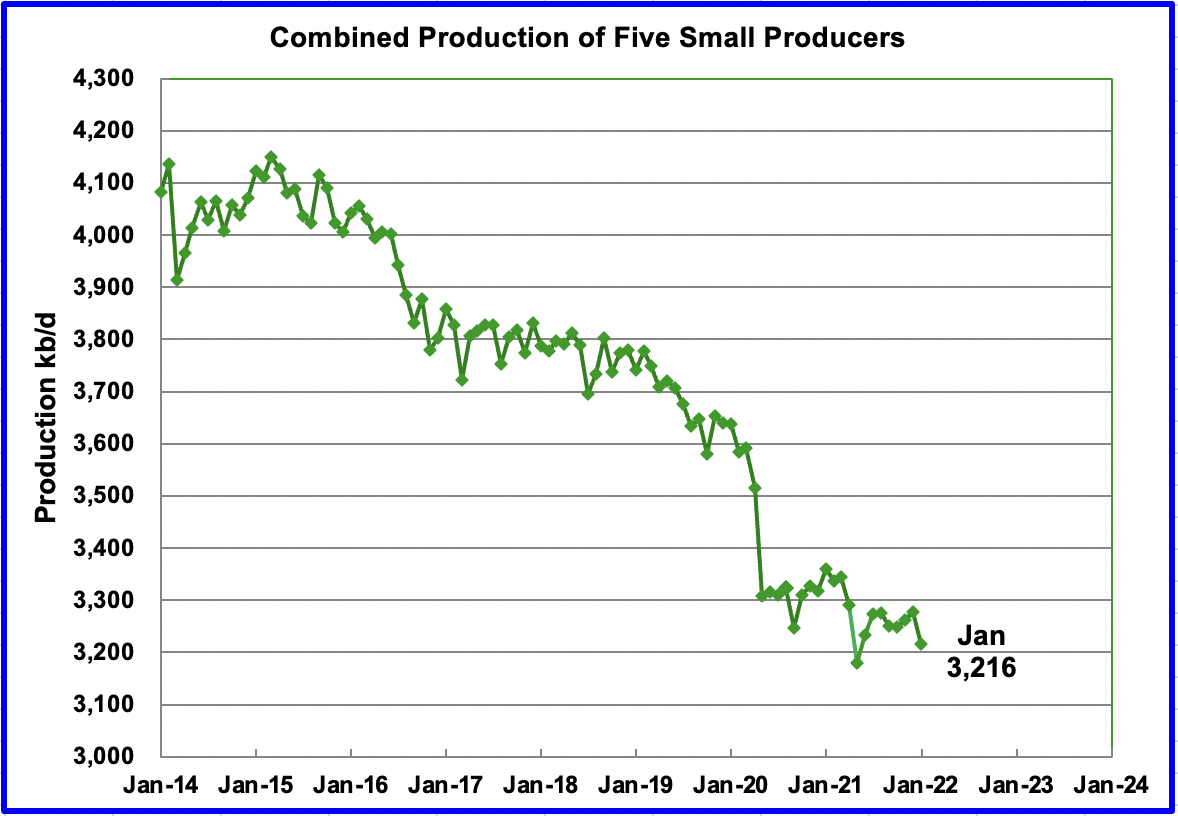

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined January production was 3,216 kb/d, down by 62 kb/d from December’s 3,278 kb/d.

The overall output from the above five countries has been in a slow decline since 2015. The drop in May 2020 from 3,500 kb/d to 3,300 kb/d was primarily from Azerbaijan, 125 kb/d, which is a member of OPEC + and Colombia.

World Oil Production

For comparison, December World oil chart posted in previous report. No Russian oil sanctions

Updated January World oil chart with impact of projected Russian oil sanctions.

Since the last report, the sanctions on Russian oil production have shown up in the Russian production chart above. That information was incorporated into the current May STEO report. The previous December World chart (first chart) has been retained to better illustrate the change between the two reports.

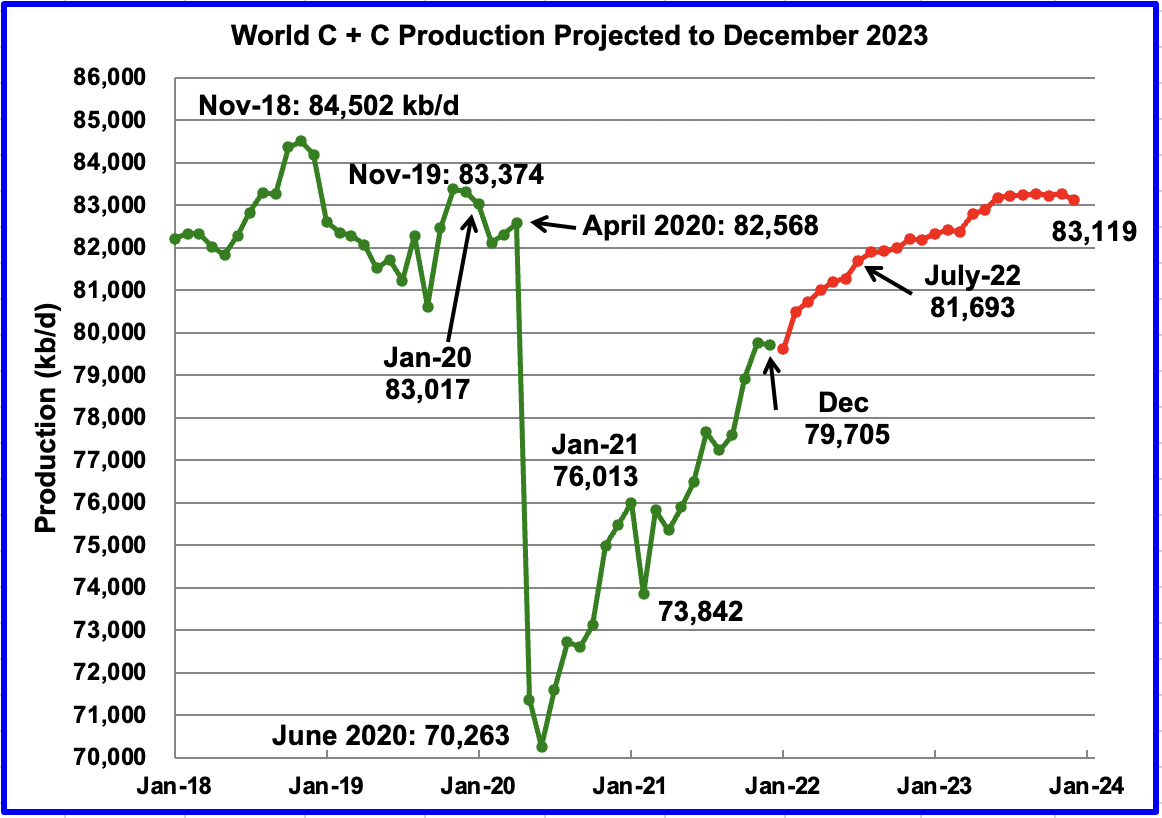

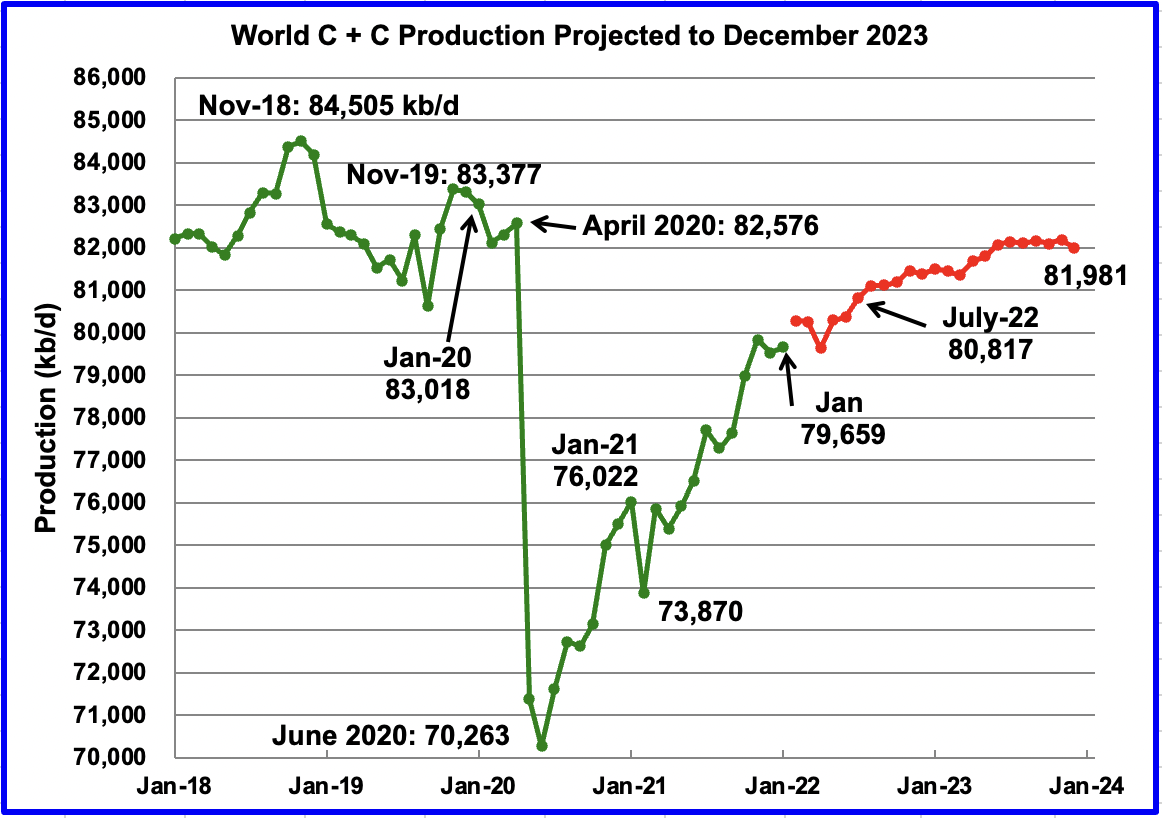

January’s world oil production increased by 137 kb/d to 79,659 kb/d according to the EIA (Green graph).

This chart also projects world C + C production out to December 2023. It uses the May 2022 STEO report along with the International Energy Statistics to make the projection. (Red markers).

It projects that world crude production in December 2023 will be 81,981 kb/d, 1,138 kb/d lower than projected in the April report. It is also 1037 kb/d lower than the January pre-covid rate of 83,018 kb/d and 2,524 kb/d lower than the November 2018 peak.

Comparing the near term July 2022 production between the two charts, the updated May chart shows a drop of 876 kb/d over the chart posted last month.

Could the plateauing shown in the later half of 2023 be an early confirmation that peak oil occurred in November 2018 at 84,505 kb/d?

Thanks, Ovi. Fantastic post! Your last sentence: Could the plateauing shown in the latter half of 2023 be an early confirmation that peak oil occurred in November 2018 at 84,505 kb/d? Obviously it does.

However, referring to your final graph, I think the EIA’s estimate of world production in the latter half of 2003 is a wee bit optimistic. I think it is about a million barrels per day too high.

Why it takes so much now for the Non-OPEC data to appear, fudging comes to mind

Ron

Thanks. My quick scan of today’s STEO shows the EIA has big expectations for increasing US output for the remainder of 2022 and for 2023. We will have to be patient with the EIA to see how production really turns out. I still think they have an economic model that does not account for geology.

Ovi,

Great post!

I imagine you noted the high oil prices assumed for the most recent STEO. That might result in increased investment in US oil fields if it is correct, in Dec 2023 they now have WTI at $93/bo.

https://www.eia.gov/outlooks/steo/data/browser/#/?v=8&f=M&s=0&start=201701&end=202312&ctype=linechart&maptype=0&linechart=WTIPUUS

STEO US output expectation is 13.28 kb/d in Dec 2023 see link below for data and chart below.

https://www.eia.gov/outlooks/steo/data/browser/#/?v=9&f=M&s=0&maptype=0&ctype=linechart

Chart for US C plus C with data from STEO, I agree with Ovi and Ron this seems very optimistic.

The STEO has annual average increase in US C plus C output from March 2022 to Dec 2023 is about 910 kb/d. US C plus C output from July 2020 to Feb 2022 increases at an average annual rate of 550 kb/d.

Haven’t they written it up somewhere so folks can check?

Reservegrowthrulz,

Not clear what you mean. Do you mean has the EIA wriiten up their economic model? Yes they have, but the model is extremely complex with a whole host of sub modules with thousands of coefficients etc, so checking on their model would require a large team of economists to make heads or tails of the model.

Perhaps you have access to such a team, most of us do not.

Are you referring to the STEO or the AEO? I believe the AEO (run in NEMS) does include a basic prototype geology section, something I found out about during one of their last annual conferences. But I thought the question was about the STEO, and I haven’t seen any documentation mentioning geology included in that one.

Are all comments being pre-moderated now, or am I just special? 😉

Reservegrowthrulz,

Sometimes comments get moderated for no apparent reason, if you make a mistake on your email address when you post the comment the system thinks you have never commented before, so that is the key thing to make sure you use consistently. If a comment gets held for moderation, check that first and if you typed in the wrong email, just copy and paste into a new comment with the correct email address (that you have used in the past).

I am not sure, I thought they used the same underlying model for both STEO and AEO.

I was wrong though, short term model discussed at page below, thanks for heads up.

https://www.eia.gov/analysis/handbook/pdf/STEO_Overview.pdf

Basically the short term model uses an economic forecast based on an IHS Markit model and weather models to estimate future demand and future oil and natural gas prices.

Oil and natural gas output are determined as in quote below:

U.S. crude oil and natural gas production:

Using the crude oil and Henry Hub natural gas spot price forecasts as inputs, EIA generates crude oil and natural gas production forecasts using a linear regression model in Eviews. This model forecasts regional-level production using historical well-level production based on decline rate data

…

USSTEM contains nearly 600 equations to forecast variables representing different energy sources and market activities.

The model is a bit complex.

Hope springs eternal. Ghana was up 1,000 barrels per day in January 2022. However, they are still below their January 2019 level.

Click on the graph to enlarge it.

Ron

Why the sudden interest on Ghana?

My mistake Ovi, it should have been Guyana. That is one of the Nations on Dennis’ “save the world from peak oil list.” Hell, they are just as bad, producing even less than Ghana.

Sorry about that.

Ron

That is what I thought you were thinking. I look at Guyana every month but it hasn’t looked too exciting recently.

Attached is the chart for Guyana.

The situation in Guyana may be a little more complex than meets the eye. On the one hand XOM and partner plan to have capacity to produce with partners 1.2 Mb/d of oil and gas (boed) offshore of Guyana by 2027.

https://www.reuters.com/business/energy/exxon-raises-guyanas-long-term-oil-production-outlook-2022-03-02/

At the same time, the govt is trying to get a better deal now that it knows there is a lot of oil in those offshore fields. “Guyana is in “no rush” to draft a new production sharing agreement (PSA) for offshore oil development, its Natural Resources minister told Reuters, reversing a year-long drive to devise new rules for future output.”

“The original PSA reached with XOM has been criticized even by the current government for being too favourable to oil producers.”

So if you were XOM, would you be rushing to make more investments in Guyana to increase production while negotiating a new and probably not as beneficial PSA?

https://financialpost.com/pmn/business-pmn/guyana-in-no-rush-to-draft-new-oil-production-sharing-pact-minister

Four projects are in production or development (120, 220, 220,250 kbpd capacity respectively). The remaining ones will be smaller FPSOs or tie-backs as capacity becomes available. The terms for XOM are so attractive that it has leeway to make a lot of concessions and still make money (of course until the next recession and oil crash when it will suddenly be back again to hand wringing mode for the oil industry). Each major IOC only has a limited capacity to take on new projects, and for each that capacity is being degraded slowly, so I doubt XOM is in a position to do much more at the moment even if it wanted to.

George

Does XOM have commitments as to when these FPSOs must come online or is it up to them to decide how much capital to assign to each one each year?

The schedule and design for the vessels would have been agreed with the Guyana government when the FID was approved, along with the royalty and tax regimes and other requirements like allowance for local engineering and procurement. It’s usually then left to the operator to deliver and operate the project. Each production agreement would be different but there would be some clauses covering penalties for the operator company’s poor performance. Usually any such problems would be from the shipyards and engineering contractors; it’s in Exxon’s interest as much as the country’s to make things as efficient as possible. Very rarely do projects get cancelled or put on hold once they’ve passed FID, there were a few in the crash in the 80s and a couple in 2015, but none with economics as good as the Guyana fields.

Note the fifth FPSO is currently in pre-FEED. I’d guess it will transfer to FEED and then through FID as the second Liza vessel is completed and brought online.

The average annual rate of increase in Guyana’s output has been 37 kb/d since they started producing oil in Dec 2019. The average annual percentage rate of increase in output has been 43%. Let’s assume 30% growth in average annual output over the next 7 years. Then we see output increase to 776 kb/d by Dec 2029, see chart below and George Kaplan’s comment above that states that there are 810 kb/d of projects being developed.

Also on Guyana see

https://oilnow.gy/featured/guyana-oil-production-to-peak-in-2035-continue-up-until-2050/

where I found chart below.

Also found this piece on Guyana.

https://oilprice.com/Energy/Energy-General/Why-Guyanas-Oil-Boom-Cant-Solve-The-Current-Energy-Crisis.html

About 120 kb/d is currently operating with a 120 kbpd FPSO, a second 220 kbpd FPSO should be operational by mid 2022, a third FPSO with capacity of 220 kbpd is expected to be producing in 2024, the final 250 kbpd FPSO is expected to start producing by 2026 or 2027, and I have seen estimates of up to 1200 kbpd total output by 2030.

Why so much interests in Guyana’s fields? They are producing less than 130 kb/d. I read under that different PSO were to begin productions in next years. But, will they have the economic and the technical environments to do so? Esoecially, when oil companies even in US are struggling to have equipments and pieces of equipments at affordable prices.

Jean-Francois,

It is expected that Guyana’s output will increase to 1200 kb/d by 2030, they have been growing at a 43% annual rate since production began in Dec 2019, about 11 billion barrels discovered so far and low production costs of $35/bo are expected. The main producer is Exxon Mobil with various partners (Hess and at leat on other as I recall). These companies have the financial weight and technical expertise to do this, and it will be very profitable at $100/bo.

The work here is exemplary. Lots of hours have been entered and may sources have been accessed and their data captured and plotted. Still, I look at the Exxon View to 2050 graphs and I see a peak around 2040 where the curve is very very flat for almost a decade. I could even say that the peak is just after 2030.

Ref: https://corporate.exxonmobil.com/Energy-and-innovation/Outlook-for-Energy/Energy-supply#Liquids

Are we missing something in our analyses? I know I harp on this but Exxon is not a fly by night company.

Peter

Looking at the total up to oil sands, the graph looks almost flat from 2023 onward. So to exceed November 2018, it will depend on Tight Oil.

LTO/US production going forward seems to be the main point of contention on this board.

Peter, no nothing is missing except read “Liquid supply highlights need for new investments ” . That is the key point “new investments ” . All analysis is based on new investment which is not coming and will not come especially now with the ESG corporate boards calling the shots . So this analysis is only ” fill in the blanks ” . Some lines on new innovation techniques that are still to be devolped , heaven knows when . File 13 .

Reversal point. Essay on the original physical dimensionality and on the inevitable energetic collapse of industrial civilization

https://www.edizionipaguro.it/?g=Libri&goo=194

Hi Giorgio , welcome to the club . I clicked on the link and it takes me to a website selling books which are written in Latin . Anyway no problem . We understand what we are talking about . Can you provide the blog some info about Italy after the sanctions and Covid ? Especially because Italy imports 45 % of its gas from Mr Putin and also had the hardest lockdown due to Covid . I have been to Torino and Milano 30/35 years back to buy second hand CNC machines . Beautiful cities , food and culture but my old associates tell me it is not ” honky dory ” anymore . An update will be appreciated .

P.S : I am a fan of Prof Ugo Bardi the thinker of the Seneca Effect .

Translated the abstract via google. The same arguments as I made in my video and Harrison Brown made in 1954 in his book Challenge to Man’s Future.

https://www.britannica.com/biography/Harrison-Brown

The ultimate cause is rooted in thermodynamics, we all should understand that by now. https://www.youtube.com/watch?v=lGrZRFDHZOk

If anyone thinks I am trying to monetize my video, with now about 2000 views, I will be long dead before it gets to million, 🙂

Well done! Your presentation will not be a surprise to those that have been following energy and growth issues for many years, but your summary is very clear and the graphics are great.

Go Bucks

Thanks for your comments Joe and Twocats. It should also be clear right now, that we should concentrate as much as possible to lower usage, for then the remaining oil will last longer.

I just got the small book by Steve Keen entitled The New Economics, in which he discusses the work of Ayres and Kummel in Chapter 4 on the need of energy to be one of the factors of production, not explicitly like Kummel, but implicitly via K=K(E), L=L(E), capital and labor. He also prefers the Leontief production function over the Douglas-Cobb, both of these are special cases of the Constant Elasticity Substitution method introduced by Arrow in 1961.

My study these economic models is not of much use, as the realization of energy as a factor of production by main stream economists will come way too late. A simple reasoning using the Douglas-Cobb model suggests that once the cost of energy becomes a substantial fraction of labor cost, we will be some way toward the pre-industrial conditions, as physical labor in some situations is more effective than work done by machines.

It appears to me that the fundamental stumbling block of economists is the Cost-Share Theorem, and thus mispricing of energy. This reminds me of the Oscar Wilde quote that “people know the price of everything, but the value of nothing”.

Some past tight oil expectations from me, March 2022 LTO output is 7701 kb/d.

Dec 2013 (2016 at 3250 kb/d)

https://peakoilbarrel.com/when-wil-us-light-tight-oil-lto-peak/

March 2017 (2021 at 6500 kb/d)

https://peakoilbarrel.com/future-us-light-tight-oil-lto-update/

Feb 2022 (2030 at 12000 kb/d, note the last chart in post and that I call the scenario “unrealistic”)

https://peakoilbarrel.com/permian-basin-update-february-24-2022/#more-35754

Current best guess ( May 2022, 2029 at 11500 kb/d, see chart below).

Note that the Permian scenario used for the scenario below has a URR=43.5 Gb and that scenario assumes only 26 million net acres of 50 million prospective acres in the USGS mean TRR estimate are utilized, essentially only the core areas are developed in the Permian basin.

Shaleprofile scenario for future tight oil supply at link below

https://public.tableau.com/shared/8FJPC77NT?:display_count=y&:origin=viz_share_link&:embed=y

Only basins with significant growth are shown, March 2022=6300 kb/d, Dec 2029=9700 kb/d. Permian, Eagle Ford, Niobrara, Marcellus, Powder River and Other were the chosen basins, most others were relatively flat in output over the March 2022 to Dec 2029 period.

(Comment is indirectly related to oil)

The Car Enigma

The number of personal cars in the world inventory is known, as well as the yearly PC production. The list contains both numbers.

Year; PC, million, world inventory; PC Production;

1999; 585.174; 39759847;

2000; 595.065; 41215653;

2001; 621.942; 39825888;

2002; 656.124; 41358394;

2003; 672.816; 41358394;

2004; 687.664; 44554268;

2005; 704.977; 47046368;

2006; 732.666; 49918578;

2007; 758.574; 53201346;

2008; 786.128; 52841125;

2009; 807.081; 47772598;

2010; 835.848; 58239494;

2011; 851.272; 59897273;

2012; 887.335; 63081024;

2013; 919.028; 65745403;

2014; 972.450; 67782035;

2015; 1013.241; 68539516;

2016; 1056.010; 72105435;

2017; 1094.030; 73456531;

2018; 1125.360; 70498388;

2019; 1167.572; 67149196;

2020; 1196.706; 55834456;

2021; 1245.205; 57054295;

2022; ________; 54000000 est.;

If we assume the Personal Car Producing System (PCPS) is like coal or oil mining, and the PCs are „mined“, we can use a logistic function to calculate, how large the ultimate recoverable resource of PCs (URR) is.

Whats your result ?

My result is, the URR is about 2600 million of Personal Cars. About 2200 millions are produced today. For an annual production of about 50 millions of cars, eight years of production are remaining.

The starting value for the diagram is 800 million produced cars in 1998, and the column for production numbers has been used.

Berndt,

It will be interesting to see how accurate this scenario will be in the future, we will see in 2030 how many personal vehicles are produced. My guess, 70 million to 90 million, all of which are likely to be plugin hybrids or EVs.

Dennis,

my graph uses real numbers from the real world. It is unusual, because the hubbert linearization is used for mining applications. Your guess is a hope, without reference to any facts.

What is the reason that the car productions goes down ? There is no lack of steel, aluminium, plastics. There is even no lack of oil, natural gas or coal.

But there is a lack of net energy. That is the reason for the decrease.

EV production needs about the same amount of energy as ICE production. Because EVs are not cheaper, often more expensive, they need even more energy for production.

No, Dennis, your guess is wrong. In contrast, the decay will progress even faster in the next years.

Berndt,

How are you so sure the causation is lack of energy?

Maybe there is a lack of demand, or a whole myriad of causes. For e.g. better public transportation would reduce demand for cars. High cost of fuel would also dampen demand for cars.

Berndt,

Your hypothesis is flawed. We will see in a few years this may be so.

Certainly car production will not fall to zero. If self driving cars are perfected, we might see a big drop in production of personal transportation vehicles.

That is the only way your scenario prove roughly correct. Realistically it will not happen by 2030, but perhaps by 2040.

If it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck

The diagram looks like the exhaustion of a resource, for example a coal mine. The curve has in 2009 a peak downwards. This was caused by demand. You see, demand driven effects look total different.

I know, on this forum, nobody (wants to) understand(s) the thermodynamic effects of oil production and the influence on the oil production energy. If thermodynamics is included, it swims and quacks like a duck.

Berndt,

We will see how accurate your scenario is in the future. Ducks have little to do with it.

I am very familiar with thermodynamics and statistical physics, very important stuff, but not everything is explained in those terms, there are other factors which are important.

Berndt , the problem is very few have read your paper . I acknowledged earlier that the maths was above my pay scale but the physics part was understandable . The second Law of Thermodynamics is immutable , just like 2+2 =4 . True from the time of Christ to Biden . However where I am in disagreement is the time scale . My frame is much shorter because of a financial collapse . When Letter of Credit’s are not made and trust vanishes , nothing gets shipped . It happened for a week or two in 2008 and it took $ 800 billion ( officially) and TARP to unlock the credit markets. This time it cannot be repeated , already too much debt in the system . Be well .

Berndt,

A rapid decrease in demand followed by a rapid rebound like was seen in 2008-2010 has a spike down as at 1300 on your horizontal axis. A secular decrease in demand for vehicles because of a change in the age structure of OECD nations (where the older population tends to drive less and needs fewer cars), as well as longer lasting better built cars that need to be replaced less often. In 2020 there was a big drop in demand for personal transport because many people were working from home and since the pamdemic many people have continued to work from home which again would amount to a structural shift in the demand for personal transport. In addition in urban environments fewer people are choosing to own a car and are using Uber, Lyft, and other TaaS types or choosing public transport, yet another sturctural shift in demand for personal transport vehicles.

If is far from clear that net energy is as much of a problem as you believe it to be.

Urbanization continues to increase around the world, and cars are a terrible way to get around a city. This image, for example, shows what a disaster allowing cars on bridges to Manhattan has been for transportation.

https://www.streetsblog.org/wp-content/uploads/2008/05_12/erb_capacities_small.jpg

Fewer cars are also likely in the future because they live longer. This trend will increase greatly with EVs.

Anyway they are mostly just prestige objects that spend 90+% of their lifetimes sitting around rusting in parking lots and less than 10% of their time being used.

If you ware worried about energy, you’ll be happy to hear that EVs use a lot less than combustion engine vehicles, which are mostly heaters on wheels that produce a bit of mechanical energy on the side.

I am interested Berndt.

Is there anything in English aside from your posts here where I could understand better? To me it sounds very plausible.

Thanks in advance

RL, the last article i wrote in English can be found on this blog: https://limitstogrowth.de/

There is some discussion on the thermodynamic theory, but all in german.

The article has the adresss:

https://limitstogrowth.de/wp-content/uploads/2020/01/Mar_2020_Thermo_EN_09.pdf

It is now more than two years old.

My most recent work is a book in German:

https://www.amazon.de/kurze-Endphase-Ölzeitalters-Autoproduktion-Thermodynamik/dp/3347487303

In it, formulas , derivations and graphs are newest and errors are elimated. Best is, you order the epub version and use a translation program like “deepL”. Graphs and formulas are understandable in most languages. The Hubbert Linearization is a new idea and not a part of the book.

No, Seppo Koppela does not follow me. He has written the article about the Hills Group article and found the errors of the HG. But he did not recognize the true core of the HG article. I discussed a lot with him. He still is good in finding errors, but still does not accept the core, despite he finds no errors.

Thanks Berndt,

Good to hear that Dr.Korpela has taken a look at your work. It would be interesting to hear in a nutshell by Dr Korpela why your argument in the post from March 2020 is not convincing.

I also do not find it convincing as the temperature change that would occur in the Earth is not something that would be utilized for exergy and note that the Earth system including the atmosphere is an open system with energy flows in and out and it is not clear you have taken account of that in your analysis.

As far as prices being determined by thermodynamics alone, one needs to consider all forms of energy, not just a single form such as oil. The prices of a good will be determined by the economics of the current social system that predominates on the planet (primarily market capitalism).

Physics alone does not determine the price of a good. The price of oil decreased from 2014 to 2020 because for most of the period supply of oil was higher than demand and the stocks of oil were increaseing above normal levels.

Do you have an expanation for why the price of oil has increased since 2020? Has there been some significant change in the physics?

Dennis,

all questions concerning physics and oil price have been answered – in my book.

Open systems – look at chapter 11.4.6

All forms of energy – look at chapter 11.4.9

To Seppo Korpela: Ask him. We did not discuss the post of March 2020, but we did discuss the steady state entropy rate balance, the resulting equations for oil production and we did discuss the limits of the control volume (see abbildung 12) to be used. And if you are impressed by his PH.D.: I too have a doctors title in engineering.

Berndt,

Sorry I misunderstood, you discussed the Hills Group work with Seppo which you believe has a key insight and Seppo does not.

I am impressed by his peer reviewed papers and the fact that he was a professor of engineering at Ohio State University for many years (37 I think), there are lots of PhD’s, but fewer professors.

https://scholar.google.com/citations?user=8RY9udUAAAAJ

I am not finding any peer reviewed papers under your name, but perhaps you are using an alias.

One question you did not answer is the recent increase in oil prices and its cause in terms pf physics.

Dennis,

yesterday i reread my article from 2020 to see where i was correct and where i made errors.

I did not see : a) inflation b) the war in ukraine. Both have a severe influence on the oil price.

I wrote that i expect an oil price conflict between OPECplus and the industrialized world. This is fulfilled. If i am honest, i expected that industrialized world will win and the oil price will continue to decrease. This did not happen. OPECplus is the winner, at least up to now.

They won because they are united. I expected, the west will divide them.

My expectation, that the peak of the oil production will not be surpassed, is fulfilled. Again, if i’m honest, i did expect a faster decrease of oil production. But because OPECplus is united, the are able to get higher oil prices and continue to produce.

My expectation, that the numbers of produced cars will go down, is fulfilled. And they go down faster than expected, especially in the EU.

The reason for differences between expectation and reality is the following: The people worldwide do not buy new cars, the spend their money (here = energy) to buy oil. Again, if OPECplus would be splitted, the price of oil could drop and more cars sold.

In total, i did not expect the unity of OPECplus.

Dennis,

Yes, you got it: “I also do not find it convincing as the temperature change that would occur in the Earth is not something that would be utilized for exergy”.

Any theory that relies on this cannot be rescued. That is the mild version of what is in my mind.

Seppo,

Thanks, I remembered you saying something to this effect in the past, though sometimes I don’t remember right or misunderstand. My last mechanical engineering class in thermodynamics (second semester undergrad) was in 1981, so I not an authority on the subject, pretty sure you have forgotten more about thermodynamics than I have learned.

From a review of your book

Nicht ganz verstanden habe ich, wie das mit dem 2. Hauptsatz der Thermodynamik zusammenhängt und damit, warum die höheren Temperaturen im Erdinneren als an der Erdoberfläche das bewirken.

Eigentlich ist nur zu einzusehen, dass Ölförderung ein vorhandenes Temperaturgleichgewicht ändert. An der Oberfläche wird es wärmer als vorher, im Erdinnern kälter als vorher.

Wenn ein Temperaturgleichgewicht geändert wird, kann man den zweiten Hauptsatz zur Berechnung des Energieaufwands nutzen.

Actually, the only thing that can be understood is that oil production changes an existing temperature equilibrium. It is getting warmer on the surface than before, and colder inside the earth than before. If a temperature equilibrium is changed, one can use the second law to calculate the energy expenditure.

Translation of Berndt’s response to Seppo’s comment.

The thing that Berndt seems to miss is that this energy expenditure that he calculates is of no consequence.

It is a bit like the energy expended by when solar energy melts a frozen lake.

It has very little affect on prices. Just a natural process that occurs.

It seems to me the professor’s intuition is correct.

I didn’t quite understand how this is related to the 2nd law of thermodynamics and why the higher temperatures in the interior of the earth than on the surface of the earth cause this.

Translation for English speakers of Seppo’ s comment in German

Dennis,

Change of a temperature equilibrium requires energy. Thats all.

If the sun melts ice, then the energy is delivered by the sun.

If mankind changes the temperature equilibrium of the earth crust, the energy has to be delivered by mankind.

The second law of thermodynamics is always valid. Even for oil production.

Berndt,

Nobody is claiming the second law of thermodynamics is not valid. The question is relevance. Does the solar energy utilized to melt the ice on a frozen lake in rural maine have any significant affect on the economy?

Not really.

Does the change in temperature that may occur to the earth’s crust have any engineering or economic significance in the oil extraction process?

No.

So determining this energy expenditure might be an interesting engineering exercise, just as determining how much solar energy would be needed to melt the ice on a frozen lake might be interesting, but from an oil production engineering perspective or an economics or business perspective we are none the wiser.

Seppo Korpela might agree, though he could put in more sophisticated engineering terms. There was mo important core insight of the Hills Group paper, that is the bottom line. If this energy change you are claiming is significant was never put to any useful purpose (performing actual work), then the whole exercise is a nothing burger.

Dennis,

if the required energy is small, it does not matter.

If the required specific energy (per kg) is as high as the specific energy content of the oil, it is a severe problem.

If its even higher, it can kill the world economy. And my calculations give numbers which are higher.

How to prepare for the potential downturn of the economy ? I don’t have a cooking recipe. Each one should find his own solution. But i believe, it is better to prepare if one knows whats coming than without that knowledge.

Rational Luddite,

Seppo Korpela could teach us all a lot on thermodynamics

https://www.linkedin.com/in/seppo-korpela-1bb13a11?original_referer=https%3A%2F%2Fduckduckgo.com%2F

I imagine he might have some thoughts on Berndt’s analysis.

Berndt do you have a link to your work?

Thanks Denis. I re-watched Seppo’s video just 2 days ago in fact

https://youtu.be/lGrZRFDHZOk

But I would like to examine Berndt’s “inertia”l net energy logistic hypothesis in greater detail too.

Thanks for the link Denis

Berndt-

“If we assume the Personal Car Producing System (PCPS) is like coal or oil mining, ”

Why start a mental exercise with a false assumption?

Its a good example of the fact that just because someone is good at math, doesn’t mean that they are good with reality.

Berndt,

What is the source of your data?

This source gives very different numbers (e.g., 2019 is 89M units):

https://www.statista.com/statistics/266813/growth-of-the-global-vehicle-production-since-2009/

As does this one:

https://ihsmarkit.com/research-analysis/2022-global-light-vehicle-production-outlook.html

I track the data from US, EU, China, India and UK. These countries publish monthly data. The sum of their data is about 75 % of world vehicle numbers.

For annual data, i use OICA.

https://www.oica.net/production-statistics/

If I read OICA correctly, they give 92.2M units for 2019 world production.

The number in your figure was 67.1M.

That’s a big difference.

Passenger cars 67.175M versus all motor vehicles 92.183M.

Ah. Well, two notes.

First, I think OICA is using a different definition of passenger car than that used widely in the US. The US term is “light vehicle” instead of “passenger car” (see the Federal Highway Administration), and includes SUVs and pickup trucks, as they are (at least in the US) primarily used for passengers.

So, I think that means that the OICA numbers for passenger cars are going to be lower than they should be, especially during periods where customer demand is shifting from sedans to SUVs and pickups.

Where demand is shifting away from sedans, OICA passenger car numbers will be misleading.

2nd, these numbers are for production, which will be different than sales. There will be significant timing differences which could be misleading.

3rd, except for the last two years, there is no evidence that I have seen that production is constrained (at least for ICES), and in the last two years it has been constrained by the availability of chips (which have been limited by planning errors, not by resources like energy).

Gasoline and diesel retail prices are hitting fresh record highs in the US (and several EU countries) this morning. In the US, gasoline climbs to $4.404 per gallon (up 48% y-on-y), and diesel rises to $5.553 per gallon (up 78% y-on-y)

Are you the real Javiar Blas from Bloomberg? I doubt it as he is too busy to visit this discussion group. But I am reading his/your book World for Sale. Fascinating account of the commodity traders in the world.

This article explains why Russian oil production will never recover. Bold mine.

The Inevitable Decline Of Russia’s Oil Industry

Russia’s oil production is already falling and will continue dropping in the coming months and years as Moscow will not be able to redirect to China and India all the volumes it is losing in the West. As the European Union tries to work out the details of a proposed full embargo on Russian oil imports by the end of the year – by potentially exempting Hungary and Slovakia for two years from complying with a ban – buyers in Europe and major international traders are increasingly shunning Russian oil.

Western sanctions on banking transfers and the expected EU embargo have forced Russia to reduce oil production. Russia simply doesn’t have enough storage, and its willing customers in emerging Asia are not expected to offset the drop in deliveries to Europe fully.

Sanctions and embargoes over Putin’s war in Ukraine will cripple Russian oil production for years to come. Restrictions, combined with the lack of access to Western technology to pump harder-to-recover oil and enhance production from maturing wells will hit Russia’s oil industry not only in the near term but also in the long term, analysts say. Many wells may never be revived to pump crude again, they add.

Podcasts from Oxford Institute for Energy Studies on Russia and Ukraine at link below (many of these focus on natural gas and LNG rather than oil.)

https://www.oxfordenergy.org/?s=russia ukraine

publication at link below is interesting

https://a9w7k6q9.stackpathcdn.com/wpcms/wp-content/uploads/2022/05/Russias-Invasion-of-Ukraine-New-Oil-Order.pdf

also

https://a9w7k6q9.stackpathcdn.com/wpcms/wp-content/uploads/2022/04/Russias-invasion-of-Ukraine-and-global-oil-market-scenarios.pdf

Thanks Dennis, interesting scenarios they are running. They make the case for an Iran return scenario which is also possible. Their projections regarding supply see a surpassing of the peak in 2019, which implies they believe ultimately that price of brent will increase short term but settle there after 2023, not sure where excess supply will come from though, i might have missed it in the document as a i was glancing through it.

Iron Mike , Iran is selling all the oil it produces since ages . Ages since I hear of tankers offshore storing Iranian oil . This is 40 years + of sanctions . How do you think they survived ? They have the trump card which is a nightmare for Washington ?? Shutdown the Strait of Hormuz . They know Washington is NATO ( No Action Talk Only ) 🙂 . So deal , then all they sell by ” off books ” becomes ” on books ” . No deal , no problem . Doesn’t seem they are in a hurry . Grab what so ever you are drinking and relax . 🙂

Hole in head,

The secondary sources estimate production and they do it fairly well. Iran might be exporting some oil on ships flagged under other nations. The output is as reported, that’s why they agreed to the JCPOA, if the sanctions had no bite, they would never have reached agreement. Currently they likely feel they are in the drivers seat as the World oil supply is very tight, so they are pushing for a better deal and Russia is trying to create roadblocks as well. In addition there is a lot of opposition to the deal in the US and from enemies of Iran in the Middle east. It seems unlikely a new deal will be reached.

The below chart is OPEC+ C+C through January 2022. They peaked in 2017 and at that time they were 63% of world C+C production. Today they are 58% of world production. Notice how round the hump is. Almost a bell curve. That is how production peaks for such a huge percent of the world’s production.

Click on graph to enlarge.

Ron , for some ” De Nile ” is a river in Egypt . 🙂

Ron,

Sanctions imposed on Iran in mid 2017 explains the very slight decline in OPEC output in 2018, also sanctions on Venezuela were imposed in 2019 and OPEC cut output in 2019, then there was the pandemic in 2020 to the present as well as sanctions on Russia, so this has more to do with politics than geology. Nice chart though.

Of course, that is correct Dennis. It is never just geology. It is always politics, money, and geology. It always has been and it always will be. Peak oil is still peak oil whether it is caused by politics, money, geology, or some combination of all three.

Ron,

I typically think of peak oil in terms of geology and economics, shocks like a war or a pandemic or a severe recession, or a cartel limiting output due to low oil prices (as occurred in 2019), I tend to put in a separate category, likewise a fall in output due to low oil prices and a lack of demand because the World has found an alternative source of energy for land transport (as might occur by 2030 to 2035), I would put in the category of peak demand (low oil prices being the reason for declining output) rather than peak supply (where oil prices would remain high and output would continue to decrease.)

It is difficult to know how it will all play out, a big drop in Russian output may not be able to be replaced short term, but eventually Russian output may stabilize at 9 Mbpd as they ship their oil to Asia and elsewhere rather than Europe and North America, this could take a few years for the market to adjust. High oil prices for a prolonged period may result in more oil supply than you imagine. It might also speed the transition to electric power for personal land transport, which will reduce demand. The future is particularly difficult to predict at this time, I realize that it is very clear to you, but not at all clear to me.

Dennis, there is no separate category for peak oil. Peak oil will be, or rather was, peak oil regardless of the category you place it in. You are not allowed to say: “This does not count because it was caused by politics.” Of course, you can say that but all it will show is that you do not understand what peak oil really is or what it means.

About alternative energy. I am all for it. But fossil energy, particularly crude oil, will decline way faster than alternative energy can replace it.

Dennis, this is far more important than you seem to realize. Fossil energy is collapsing while the world population, and the demand for cheap energy, are increasing. Almost every day I drive out on the highway and I see the massive amount of automobiles and trucks. And I think to myself: “They think all this is going away and be replaced by batteries or some other thing.” I know that is total absolute bullshit.” It is just not going to happen Dennis. I would be delighted if it did, but I do not live in that dream world.

Dennis, peak oil is in the rearview mirror. But there is a far more important factor in play here. Our survival depends on the energy we have to support our population which has far outgrown the ability to live off the land without the aid of massive inputs of fossil energy. Sunshine and wind, which I dearly love, will not come even close to replacing fossil energy.

However, Dennis, I will be 84 years old next month. I will, very likely, be safely dead when the shit hits the fan. And it tears my heart out that my children and grandchildren will still be around.

And no one seems to be preparing for the inevitable. They seem to believe that those windmills and solar panels will fix it all. Damn, they might as well believe that God will just not let it happen. Reality is just something that…. damn it, I quit for the night. Time for another toddy. 😂

Ron,

It will take time to replace the light vehicle fleet, but by 2035 close to 100% of light vehicle sales will be EVs, then it it just a matter of 14 years for most of the remaining ICEVs to be scrapped, as far as wind and solar, a highly interconnected widely dispersed set of wind and solar sites will require very little backup and some can be done by natural gas or synthetic fuels produced with excess supply during windy or sunny periods, the synthetic fuel plants would be located in areas with high wind or solar resources wher there would be frquent periods of excess power output which would be utilized for synthetic fuel production.

I agree the peak will be the peak, but it is easier to take when the peak occurs because there is a lack of demand, which you seem to believe is impossible, and I believe is likely by 2035.

Oil and coal will go first, and as natural gas depletes and becomes expensive, that too will see peak demand (probably around 2040 for natural gas).

By 2050 we will likely see peak population and the demographic transition will result in falling population as more and more families will choose a one child family. Population can fall pretty rapidly.

Your comment makes a clear distinction that is usually never brought up in discussion: There are proximate causes and ultimate causes. The proximate causes are many, but the unitary reality of peak looms behind it all.

Mike B,

We all agree oil output will peak at some point in time. Ron believes the ultimate peak will be 2018 or 2019 (depending on whether trailing or centered 12 month average output of C plus C is used). I think we will see a new peak in the 2027-2029 range at about 85 Mb/d. It is possible demand will fall due to high oil prices and people moving to electric transport, we can only guess how it might play out.

Some people, like me, are preparing for the inevitable and have been for decades. Admittedly, our numbers are very few, but the invitable end of growth and the end of industrial civilization has been obvious for a long time. Anyone who has children and grandchildren should have been preparing for their future in subsistence horticulture for just as long.

Anyone who has children and grandchildren should have been preparing for their future in subsistence horticulture for just as long

Yeah, I agree. The problem is my kids and grandkids don’t believe a damn word of it.

Here is my usual incremental C&C graph

3 May 2022

Will the world ever reach peak crude production of November 2018 again?

https://crudeoilpeak.info/will-the-world-ever-reach-peak-crude-production-of-november-2018-again-part-1

EVs require a new mining industry (dependent on diesel). Interesting demo from the Australian public broadcaster:

4 corners program 9/5/2022

Digging in: why powering a green future means more mines

https://www.abc.net.au/4corners/digging-in:-why-powering-a-green-future-means-more/13873540

Sorry for this late contribution. I am still not back on the mailing list

Matt,

I haven’t been doing the mailing list usually there is a new post weekly.

Ron, perhaps you have already mentioned this, but would you repeat it if you can. Why is there a discrepancy between what OPEC Monthly gives and what EIA gives for crude + cc for OPEC countries. Is it a matter of NGL’s for some countries? If so, which?

No, it has nothing to do with NGLs. It is simply condensate, nothing else. The OPEC MOMR reports crude only, no condensate. The EIA reports crude plus condensate. That is supposed to be the only difference.

Condensate usually runs anywhere between 6% and 10% of total production. However Qatar produces more condensate than crude oil, or used to anyway.

Thanks

Self explanatory .

https://www.rigzone.com/news/lng_supply_crisis_to_hit_hard_this_winter-11-may-2022-168954-article/

I notice that no mention is made of the continuing drop in drilling rigs in Canada. This will surely show as a drop in production into the future.

Jay Woods,

Canadian rig counts always drop in the spring (at least since Feb 2011), probably due to mud season. See chart below, every year rig count drops in the spring, in most years the peak is during winter, perhaps the frozen ground makes it easier to move rigs in winter.

https://bakerhughesrigcount.gcs-web.com/na-rig-count

Jay Woods,

A great chart by George Kaplan (far better than mine) at link below with an explanation.

https://peakoilbarrel.com/december-us-oil-production-unexpectedly-drops/#comment-736168

My wife and I recently purchased a Tesla Model Y. This replaced a Jeep Cherokee, which averaged around 25 mpg. The Cherokee was a lease and we put about 43K on it in 3 years. This got me thinking about the impact electric vehicles are currently having on oil demand.

If it is assumed that a BEV replaces an ICE which, on average, got 30 mpg and traveled 10K/year, (conservative compared to our mileage and usage) then it takes about 4 million BEVs to reduce about 100K barrels/day of oil demand. A quick Google search suggests about 4 million BEVs were produced in 2021 (another 2.5 million plug in hybrids). So last year at least 100,000 barrels/day of oil demand destruction–this estimate ignores plug in hybrids.

According to Statistica, there are 12 million electric vehicles on the road today. It is not clear how many of these are plug in hybrids. However, I think it can be safely assumed that, to date, BEVs have taken at least 200,000 barrels/day off the road.

A quick Google search shows that current estimates are for 6 million BEVs (excluding plug in hybrids) will be produced in 2022. So an additional 150,000 barrels/day will be taken off the market this year by BEVs. Thus, by the end of this year, 350,000 barrels of demand destruction/day.

These numbers are still very small but growing, and will only accelerate. This will be particularly noteworthy as pickups and other large vehicles start to hit the road. Rivian and Ford are now producing very low numbers of pickups, but the demand for these vehicles is extremely high–all that is missing is production. Telsa has a target of 2023 for their Cybertruck.

BEVs don’t need to replace all oil production–at least not in the near term. But keeping up with declining production is vital. Based on these numbers, I think a plausible argument can be made that this could happen.

Let the arrows fly.

Keep in mind gasoline is an inevitable part of a “barrel of oil.” While there is some flexibility in how a barrel can be cut – you can’t have a world where we still use diesel, jet fuel, etc. and no gasoline. It would have to be flared or disposed of somehow. BEV’s and hybrids replace gasoline demand with (all source) electricity demand. The most likely outcome I see is that gasoline will be relatively cheaper for other consumers, and other oil fractions more expensive, if BEV’s roll out in force.

Gasoline can, in some sense, be looked at like a “loss leader” or a subsidy for the remaining fractions.

Nice observation, BB. Your comment, “BEV’s and hybrids replace gasoline demand with (all source) electricity demand” is profound. There are no free lunches.

Maybe they could dump the gasoline into the rivers as they used to in Ohio back when kerosene was the main product of refining. (Two of my great grandfathers were “oil pumpers” in late 19th-early 20th century Lima oilfield of Ohio.)

This obsession with keeping cars on the road as resources deplete and the atmosphere warms is a uniquely western delusion, I think. It’s business as usual, with a green fig leaf covering its naughty bits (stress on grids, metals and rare earths depletion, slave mining, etc.).

By god, those cars better keep running. Who gives a shit that environmental destruction is already baked into the cake? I fully expect EVs to take off so the elite may smugly drive while the rest starve.

Yes, gasoline is a little less than half the cut of a barrel of oil, but it is significant. Gas and diesel together account for around 70% of a barrel. Both gasoline and diesel can theoretically be replaced with all electric. For instance, there are a lot of players looking to electrify class 8 trucking, from Tesla to Cummings. They will sell as many as they can make. Tesla has announced 2023 as their (latest prediction) for the start of their semi program. I am skeptical, given all the delays since they announced the program in 2017. But if they can deliver on the specs they announced, it is a game changer.

City busses is an area where the transition to electric is happening fairly quickly. Even heavy equipment for mining industries and ferry boats are slowly being electrified. All of this is happening now–it is not theoretical. The question is can the transition keep up with depletion. I think it is at least plausible.

Mining is the oldest part.

Deep mining is mostly electric since long – because of oxygen and poisoning. And some pit mining is electric, too, where big machinery can be supplied by flexible cables – because of low movement range.

Trucking – all big european constructors have already electric short range delivery trucks in their catalog. I’m seeing several of them already in town.

At Mercedes Benz trucks you can order everything electric from a delivery 7.5 ton to a 26 ton with up to 400 km range.

Order – not just a project as with the Tesla truck.

And 400 km is enough for many trucking tasks here. Just for the long distance hauling we will see Diesel engines for a longer time. But it’s ok to harvest the lower fruits first.

To Whom it may concern:

There is no question about intelligence of the people that regularly visit this site, really smart. When on the topic of EVs I think a large blind spot appears. With a little effort the change in the cost of the metals required for batteries can be found. In the past18 months they have exploded. Lithium carbonate alone has increased by 10X. Sure the battery manufacturers have supply contracts but in time, batteries that have $100s of lithium carbonate will now have $1000s of the metal. What doesn’t seem to be thought about is doing the math. To double the EVs on the road the metal supply chain has to lead the way. Where and how is this going to happen? China already processes 80% of the worlds lithium carbonate. By the way it’s an energy intensive dirty process. With the western world keying every major energy decision off of the carbon atom, an energy poverty existence will surely follow.

It’s just: Supply chains need time to be build. There is a lot of Lithium out there, it needs time to build up and develop all the infrastructure. It won’t go in a few years.

And the high prices help: Here around the corner they start building a geothermal heating plant for a big city. And they will extract the Lithium from the brine before pumping it back underground. With dirt cheap Lithium, this part wouldn’t be build I think.

Electric trucks and busses for application where they work today(hint: not long range hauling) it makes much more sense for them as for electric cars. They are much more on the road than private cars, lessening the pressure on Diesel consumption much more per KG lithium used.

Moving away from carbon is a good deceision for Europe at least – being completely dependend on the world market with little backup in the own country isn’t the best thing as you can see today.

With some aching the US could get oil indipendend ( small cars and pickup trucks only when you need to transport something for example). Europe can’t.

Eulen , “There is a lot of Lithium out there, it needs time to build up and develop all the infrastructure. ”

There is a lot of gold in the seabed . Go and mine it . All what is technically possible may not be economically feasible . Remember the Concorde airplanes ? Maybe the De Lorean car ? etc etc Obviously not .

P.S : Are the trucks bringing components to the Tesla factories also electric ? Are the customers who come to pick up their Tesla walking / cycling or coming in an ICE ? Oil is the master resource . As goes oil so goes industrial civilization . You can run but you can’t hide .

I was recently out in Napa valley and Big Sur on vacation and I was astounded at how many Teslas we’re on the road. I swear it was one in every ten cars. Coming from the Mid-Atlantic/Southeast US this was clearly a shock to me. I think it is genuinely possible that EVs will “save the day” for personal transport. Of course as an LNG guy I’m cognisant of where the electrons will need to come from to charge this EVs but either way it was an eye opening experience.

It probably helped that regular unleaded was $9.99/gal in Napa.

LNGuy,

Hope you had some nice wine while in Napa, beautiful vineyards.

I imagine in time that much of the charging will come from wind, solar, hydro, geothermal, and nuclear power. Eventually natural gas will deplete and become expensive (it is pretty darned expensive now, especially in Europe and some Asian nations), as this occurs wind and solar will look very cheap in comparison. It will not happen overnight, but maybe by 2040 we might be at 65 to 70% wind, solar, hydro, nuclear in OECD.

Gasoline can also be used in combined cycle power plants. I used to work at one that was permitted to burn diesel, naphtha and gasoline. It mostly burned naphtha because that was cheaper from the refinery than gasoline.

Any combined cycle plant that burns natural gas could quickly be converted to liquid fuels, including gasoline, with a simple turbine fuel nozzle change and addition of a high pressure fuel supply pump.

Mr Clarkson , easier said than done . This is not a light switch . Complexity killed the cat . 🙂

Cavebio,

I have created EV transtion scenarios that confirm what you suggest, light personal vehicle plugin sales growth was 108% in 2021 and the average annual rate of sales growth from 2014 to 2021 has been 40% per year. Assuming 39% sales growth from 2022 to 2027 and then a decrease in the rate of growth to zero by 2031 (when all new car sales are plugins), I get the scenario below. Note that I have assumed 70% of plugin sales are BEV and that 50% of plugin hybrid miles are on electricity with the other 50% using fuel at 30 MPG. By 2040 I assume the portion of plugin hybrids starts to decrease by 1% per year falling to a minimum of 1% of the personal vehicle fleet by 2068. Heavy trucks are assumed to start moving to EVs by 2026 and follow a similar trajectory as personal vehicles but delayed by 9 years.

This scenario is no doubt optimistic, demad falls below supply by 2028 for this scenario where demand for oil from uses other than land transport is assumed fixed at the 2019 level (this is a simplifying assumption which is likely incorrect).

Chart above is C plus C supply and demand in millions of barrels per day.

Thank you for sharing Dennis. It will be interesting to see if production of BEVs can catch up with global demand. We ordered our Model Y in August 2021–It was delivered in February 2022. Once in our driveway, two of our neighbors ordered one–they ordered within days of us receiving it and taking a test drive with us. Their deliveries are currently scheduled for February 2023. If our experience is typical, then there is an exponential increase in demand occurring. Lots of compelling new models from a variety of companies will come online in the next couple of years.

This is going to be a very interesting time to observe.

Cavebio,

Congrats on the MY, I have had the M3 since 2018, very nice, a MY is supposed to get here in July or August LR AWD Aero wheels, did you get your car when they promised or did you have to wait?

Agree it will be interesting to watch, most car companies are having trouble keeping up with demand, supply chain may be the limiting factor.

Cave bio,

My data shows about 17 million, plugin vehicles, perhaps 70% of these are BEV or roughly 12 million are on the road at the end of 2021. Let’s say each is driven 12k per year and each replaces a vehicle that had fuel economy of 30 mpg. That is a savings of 9.52 barrels per year for each BEV, times 12 million would be 114 million barrels per year or 313 kb/d of fuel saved. The plugin hybrids might save another 67 kb/d assuming 50% of miles driven are utilizing electricity, so a total savings of 380 kb/d. If we add the 6 million EVs expected to be produced in 2022, that adds another 156 kb/d saved or 536 kb/d. My expectation is that we will have 350 million EVs on the road by 2031 and this alone will reduce demand by about 4.5 Mb/d, the 150 million plugin hybrids might reduce fuel used by another 1.96 Mb/d for a total savings of almost 6.5 Mb/d, by this time there will be short haul trucks, and buses that will be battery powered, long haul trucking would be better replaced by electrified rail.

The key thing to remember here is that those who drive the most are the most incentivized to switch to an EV, as the price per mile is so much lower. So generally speaking you will replace the ICE cars that are sucking up the most gas off the roads. I don’t know what the numbers are, but my guess is that the top 10% of cars based on miles driven drive probably 25% of the miles. It’s exactly these folks who are now switching to EVs en masse. They save so much on fuel the vehicles literally pay for themselves.

Hate to butt in , but you guys think USA/ Europe is the world . There are 1,45 BILLION automobiles in the world and out of this 1.1 BILLION are passenger cars . What are you going to do ? Drive them into the sea ? You talk about EV’s having huge demand and they can’t supply . Yes , that is because they can’t produce . LTG is here , ignore it at your risk . I have said earlier that before we have lines at the pump we are going to have a financial crisis that will make 1929 like a walk in the park . Talking about EV’s is dumb when you can’t even provide baby milk powder (USA ) , cooking oil ( Europe ) , flour ( India) etc to your citizens . The future is here . Watch it on the link below . Don’t say later that this is a ” black swan ” because it isn’t . Nothing bad happens until it happens to you .

https://www.youtube.com/watch?v=p1uYeLg1UUQ&t=4s&ab_channel=PakistaniTrucks

Hole in head,

Cars get scrapped all the time, typical life is about 14 years. The scenario I use has the following for ICEV passenger vehicle fleet and plugin fleet in millions of vehicles. The transition happens gradually over a period of 25 years.

Dennis , 25 years . = 2047 . ROFL . 🙂 . Stretch it to 2077 = 50 years . Take your time , mankind is no hurry . What , me worry ? ( MAD magazine )

Hole in head,

1.4 billion vehicles will take some time to replace, they were not built in a day and they won’t be replaced in a day.

Feel free to create your own scenario, by 2044 there will be very few personal vehicles on the road that use fossil fuel in an ICE, if self driving cars are approved by 2030, this ice fleet curve will drop very quickly because most transport will occur in a robo taxi and very few people, except the very wealthy will choose to own a personal vehicle, they will simply use a robotaxi. Miles travelled per vehicle will increase to 30 to 40k per year and the number of vehicles produced will drop drastically, this will speed up the transition to electric transport by a factor of 3 to 4 because each EV built will take 3 to 4 ICEVs off the road a single EV travelling 40k will take 4 cars that travel 10K off the road).

For electric trucks see

https://chargedevs.com/newswire/heavy-duty-electric-trucks-start-to-appear-in-fleets/

Excerpt:

Research firm Wood Mackenzie estimates that just over 2,000 electric trucks were in service in the US at the end of 2019, and predicts that that number will grow to 54,000 by 2025. Most analysts say the transition is beginning, but that it will be a gradual process. “I think 2020 was the year of commitments,” Mike Roeth, Executive Director of the North American Council for Freight Efficiency, told Transport Dive. “If everybody [does] what they say will do, this will happen pretty fast.”

Note that in 2018 there were about 13 million heavy duty trucks on the road, so 54000 trucks is about 0.4% of the 2018 total. It will take time to ramp up production, just as it taking time in the passenger car space.

If we have 60% annual sales growth we get close to the 54,000 truck total in 2025 and if we assume this sales growth continues to 2034, we arrive at 5 million trucks by 2035 and by 2041 we get to 14 million trucks (no more sales growth after 2034, just linear increase.

Only 1% of the fossil energy that is spent in cars goes to moving a person around. Average person is 150 lbs in a 3000 lb car at 20% combustion efficiency = 1%.

Most electric vehicles will not be cars, they are too inefficient because of their crappy weight to payload ratio.

https://www.ebicycles.com/ebike-facts-statistics/

Raising the efficiency rate to 5 or even 20% will not be very difficult over twenty years timeframe if we include smaller EVs such as bikes, scooters etc

Stephen,

A Model Y costs 63k, a RAV4 is about 30k and gets about 28 mpg. Over 200k miles at $4/gal that is 28571 dollars, the cost for electricity would be about 3.75 cents per mile (assumes no supercharging which costs 2.33 times as much) which is about $7500 over 200k miles. So the savings is $21251 over 200k miles and note there is higher insurance cost for MY and the opportunity cost of the extra 32K spent on the Model Y up front.

This is not a particularly fair comparison because although a Toyota is nice, the Tesla is a much nicer car. If we compare the Tesla MY with the BMW X5x40i AWD, the price is the same and these cars are of similar quality. The BMW gets 25 MPG, so $24500 in fuel saving with no supercharging. If 25% of the 200k miles are powered with superchargers (35 cents per kWh), the savings in fuel cost would be about $22k over 200 thousand miles assuming gasoline at $4/gal and electricity cost at home at 15 cents per kWh and supercharging cost at 35 cents per kWh with 150k miles powered by home charging and 50k miles powered by superchargers. The electric range for the Model Y is 330 miles and it is AWD.

Just curious, how are the roads going to be paid for without taxes on gasoline? The EV vehicle owners aren’t paying for this, so the economics you are shamelessly touting for EV which is – just oh so wonderful – as EV drivers pay absolutely nothing to use the same road the ICE drivers have to pay for. Life is really great, and you can shill your battery ride to all the neighbors because hey! You aren’t paying for the road your driving on! Wonderful! And the much heavier weight of an EV compared to an ICE tears up the road that much more! But what do you care? You’re driving your EV for free on the same road paid by ICE gas taxes, and then bragging about how low your operating costs are compared to ICE vehicles!

Here in Europe we pay a yearly “car tax” so that could probably work for EV’s too.

It would have to be a bit higher than what we pay today, since as you say most is covered by taxes on fuel.

It’s a decent argument but it doesn’t hold up. Gasoline taxes only make a small dent in the funds needed to maintain roads. Taxes from federal funds, state fuel taxes, state weight-mile taxes from trucks, and state vehicle and registration fees are used to maintain roads. Some states (like Washington) have a extra registration fees for battery vehicles to make up for the loss in gasoline taxes. It’s been a political non-starter to raise gasoline taxes for a while now, although that is one of the better ways to encourage EV ownership.

Philip , your view is USA centric . Here in Europe and India ( I know) and I can presume also in ROW, Mike Sutherland is right on the dot . Take away the FF taxes , the EU and India will collapse even before you bat your eyelid . I can assure you of this .

A Tesla Model Y weighs 300 kilos less than a Ford Explorer.

As for gas taxes, many places have programs to subsidize electric car ownership: they encourage people to buy, and industry to manufacture. Lack of a gas tax is essentially part of this subsidy. Once they are firmly established, they roll back the subsidy. My guess is that they will also start some kind of usage tax once EV’s are more common.

Mike Sutherland,

This can be addressed, by having all vehicles pay road taxes when the car is registered based on gross vehicle weight and mileage, it doesn’t happen yet, but it will in the future. The current tax can be left on fuel as a carbon tax, note that not enough road taxes are collected from fuel taxes to maintain roads in any case, much of that is paid from local, state, and federal taxes.

See

https://www.instituteforenergyresearch.org/regulation/gas-tax-little-road-costs/

Here in North Carolina I pay $160 extra a year for road maintenance since I don’t pay a gas tax when I pay my property taxes on my car. I’m. It sure if that’s enough or not but it seems like a reasonable charge.

Stephen,

That seems like a good system, is it a flat fee or based on last year’s miles travelled?

It seems to me that all cars should pay in this way and the gas taxes should remain as a carbon tax that gradually rises to encourage people to switch to EVs, it could even be a fee and dividend approach where the money is placed in a pool and is shared equally among all tax payers as a rebate when filing taxes, or if could just go to general Federal and/or State tax revenue. Up to the voters in each state how to utilize the state portion of the fuel tax.

Just a couple of things. 20 US states currently charge EV owners an additional fee for road taxes. The Feds could do this also. Any fair fee charged doesn’t really change the economics of EVs versus ICE vehicles. Two states, Arizona and Missouri actually charge EV owners as if they had an ICE vehicle that gets only 9 or so miles per gallon.

The weight of a Chevrolet Suburban is around 6K lbs while a Tesla Model Y is around 4.6K lbs.

Hello Mike,