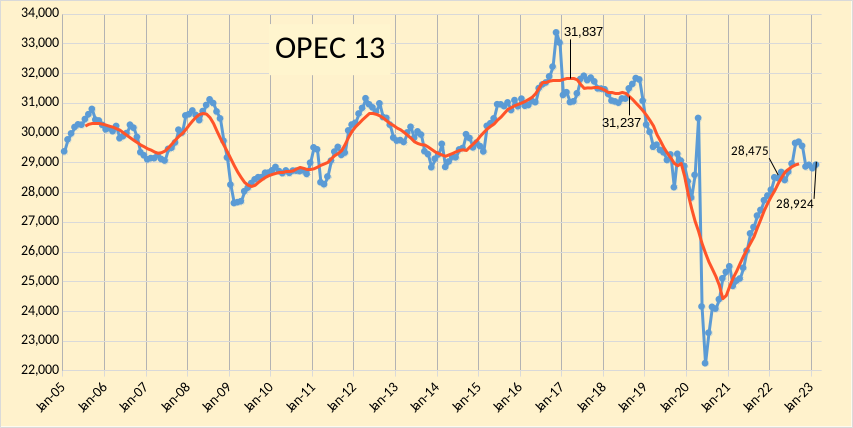

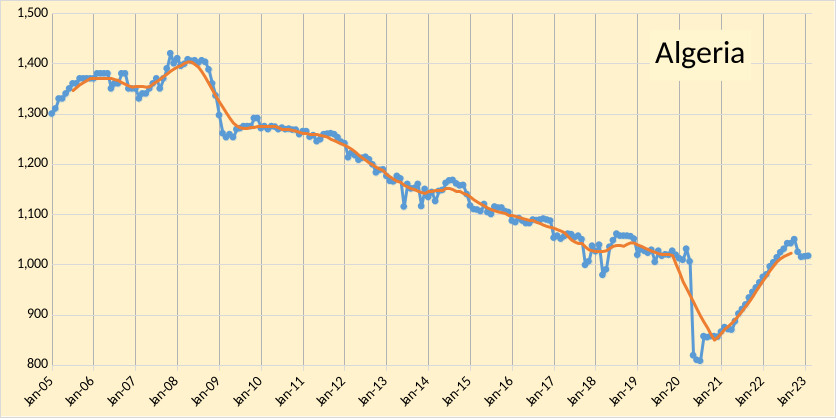

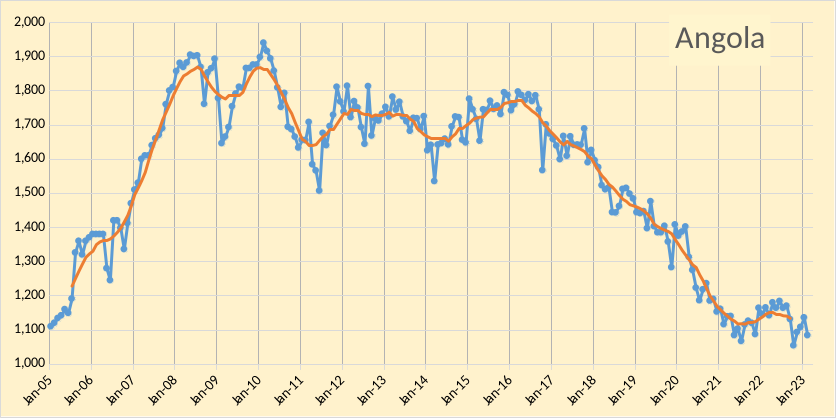

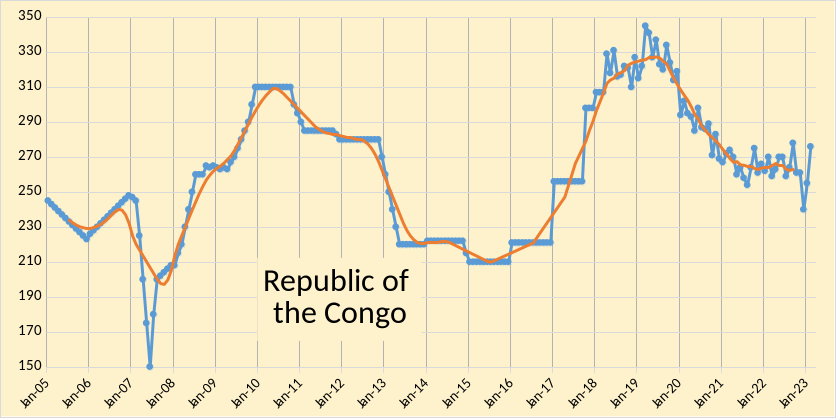

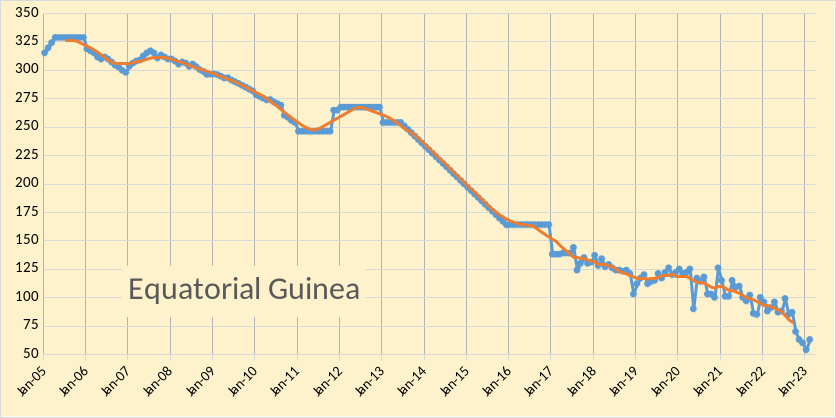

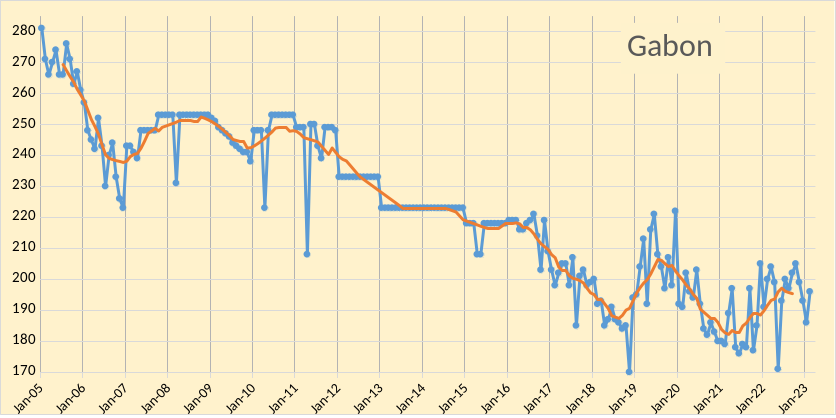

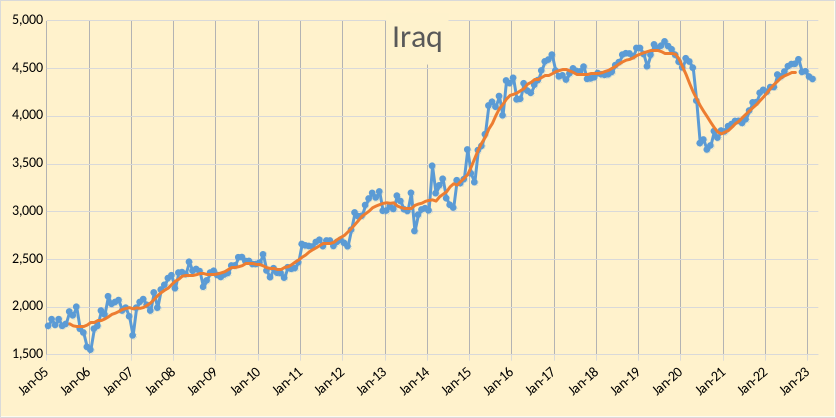

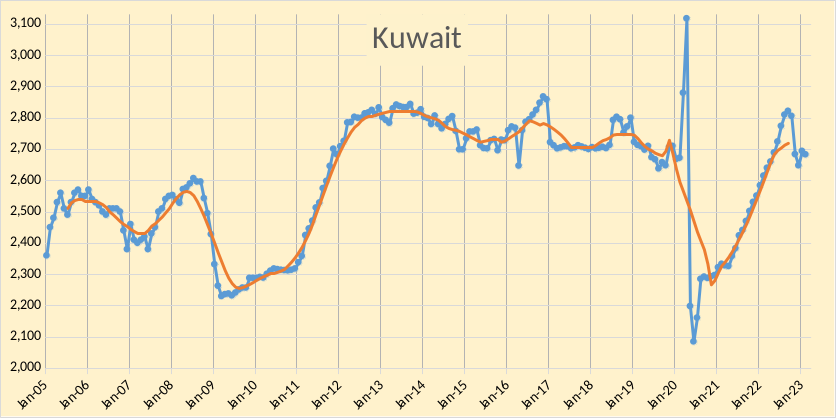

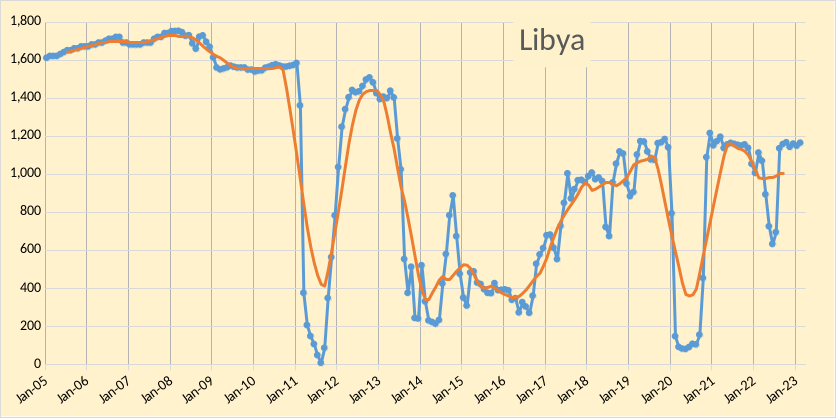

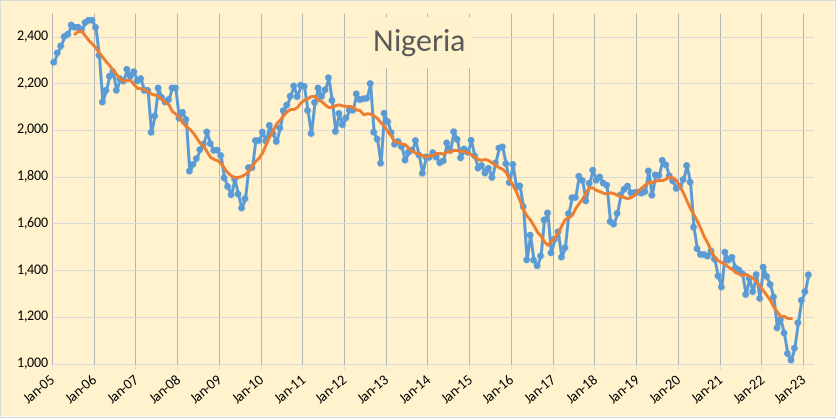

The OPEC Monthly Oil Market Report (MOMR) for March 2023 was published recently. The last month reported in most of the OPEC charts that follow is February 2023 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In many of the OPEC charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

OPEC crude output was revised lower in January 2023 by 69 kb/d compared to last month’s report and December 2022 OPEC crude output was revised lower by 7 kb/d. When the World was at its centered twelve month average peak for C+C output in August 2018, OPEC crude output was 31237 kb/d (as shown on the chart), February 2023 OPEC crude output was 2313 kb/d below that level. The centered twelve month average (CTMA) peak for OPEC crude output is also shown on figure 1 (31837 kb/d) which is 2913 kb/d higher than February 2023.

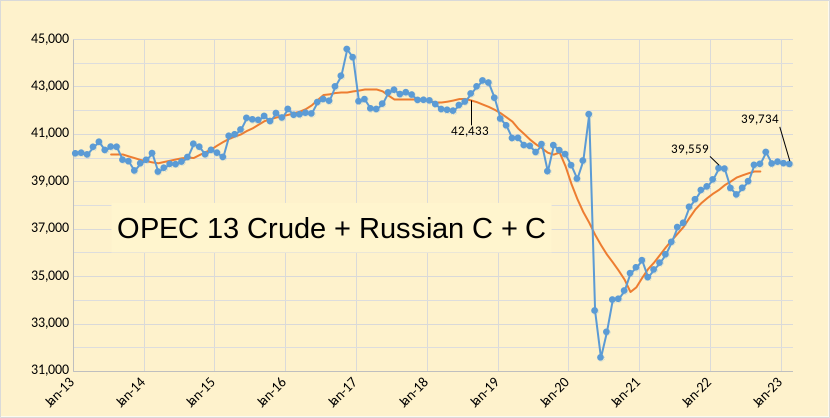

In the chart below we have Russian C + C and OPEC crude oil output. The centered 12 month average (CTMA) of output for OPEC13 crude and Russian C+C was 42443 kb/d in August 2018 when World C+C output was at its centered 12 month average peak, output for Russia and OPEC was 2699 kb/d below the August 2018 CTMA at 39734 kb/d in February 2023. In the past 12 months OPEC and Russian output has increased by 175 kb/d from 39559 kb/d in February 2022.

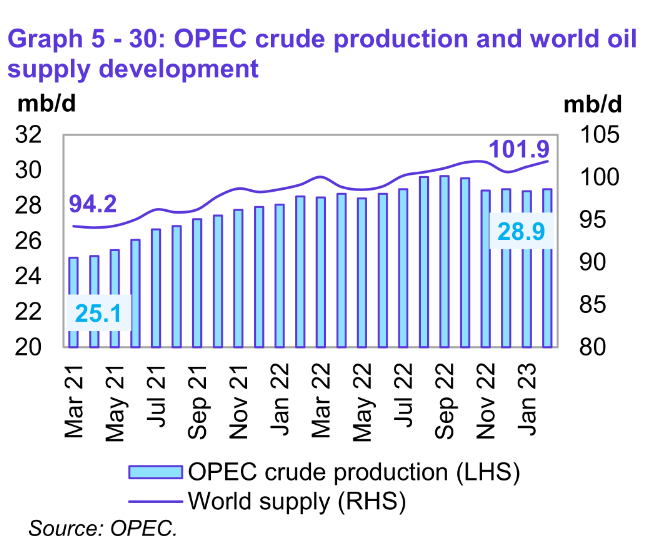

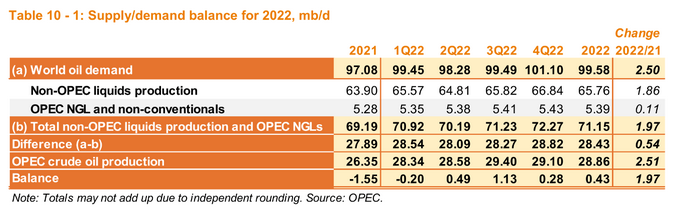

Based on OPEC estimates, World Oil Suppy (all liquids) was 101.9 Mb/d in February 2023 7.7 Mb/d higher than output in March 2021, OPEC crude oil output increased by 3.8 Mb/d over the same 23 month period. World C+C output was 76 Mb/d (EIA estimate) in February 2021 and over the Jan 2021 to November 2022 period World C+C was about 80.6% of World total liquids output (based on EIA estimates). Assuming the ratio of World C+C to total liquids has remained close to the level of the Jan 2021 to Nov 2022 period we can estimate that World C+C might be around 82.1 Mb/d in Feb 2023. This suggests that World C+C may have increased by roughly 6 Mb/d over the past 23 months. This is about 200 kb/d higher than the EIA estimate for November 2022 (81.9 Mb/d).

The OPEC estimate for demand for OPEC crude in 2023 is forecast to be 29.26 Mb/d, about 160 kb/d lower than last month’s MOMR estimate. If OPEC can return to the 2022Q3 level of output (29.4 Mb/d) and its demand and supply estimates are accurate, then oil prices may remain subdued in 2023. I think their supply estimates for non-OPEC output may be too optimistic and expect oil prices will rise. If there is a severe recession in 2023 worldwide, oil prices may remain under $80/bo.

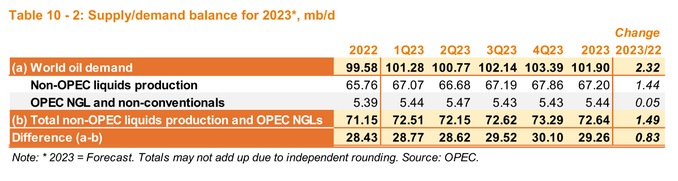

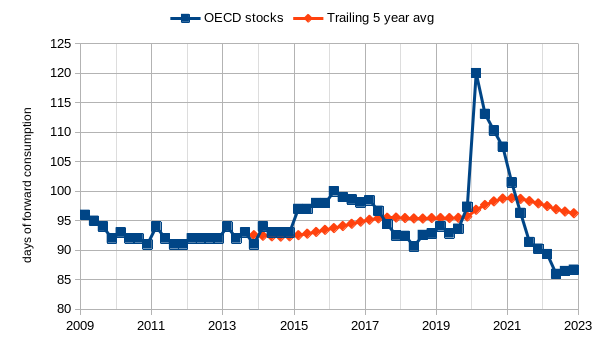

OECD oil stocks are at about 87 days of forward consumption, close to the low point since 2009. Visibility for World oil stock levels is not good which might be part of the reason for recent oil price volatility.

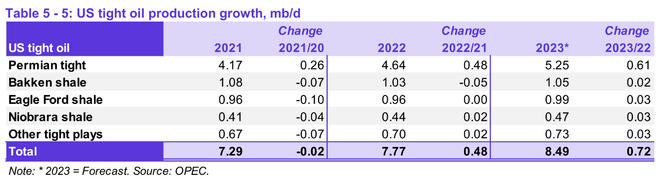

OPEC expects US tight oil will increase by 720 kb/d in 2023 compared to 2022 (annual average output for both years), with most of this coming from the Permian basin (610 kb/d). This is a downward revision from last month’s MOMR estimate for US tight oil by 30 kb/d for all of US tight oil and 10 kb/d for the Permian basin. My most recent model for US tight oil has the increase from 2022 to 2023 (annual average output for each year) at about 394 kb/d for all US tight oil, with about a 399 kb/d increase in the Permian basin.

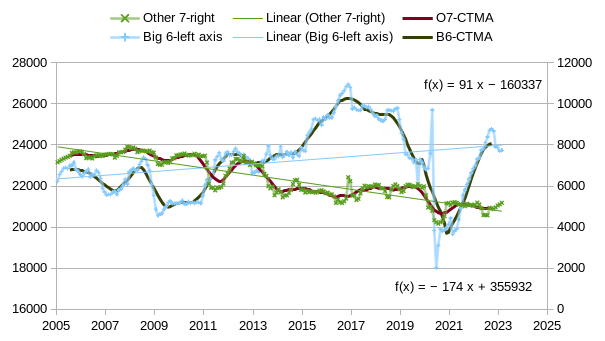

A final note on comparing the top 6 OPEC producers in 2015 (Big 6 are Saudi Arabia, Iraq, UAE, Kuwait, Iran, and Venezuela) with the “Other 7” OPEC producers. The chart below has the Big 6 plotted on the right axis with the Other 7 plotted on the right axis. Notice that the scale from minimum to maximum is the same on both axes (that is the difference from the largest to lowest number on each axis is 12000 kb/d), this allows the slopes to be visually compared more easily. The vertical scale on each of the following 4 figures is the same (maximum minus minimum is 12000 kb/d).

At first glance it appears that OPEC output might continue to decline in the future as the net of both slopes is -83 kb/d per year over the Jan 2005 to Feb 2023 period. Note the sharp decrease in the Big 6 line especially after 2018, before the pandemic began. A possible explanation is revealed by plotting the Big 4 which includes Saudi Arabia, Iraq, UAE, and Kuwait.

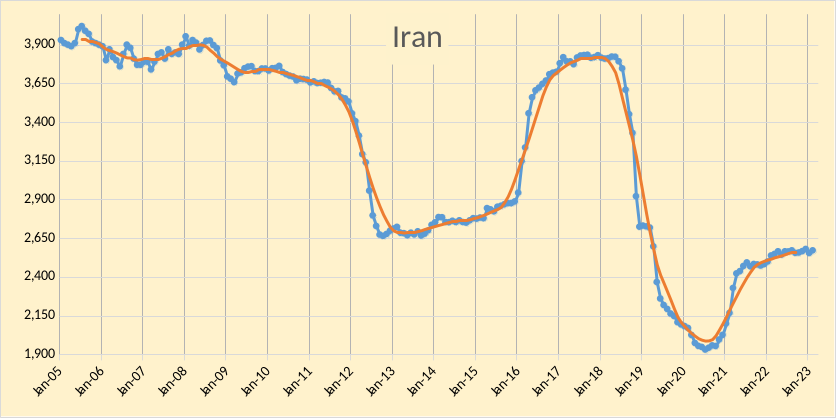

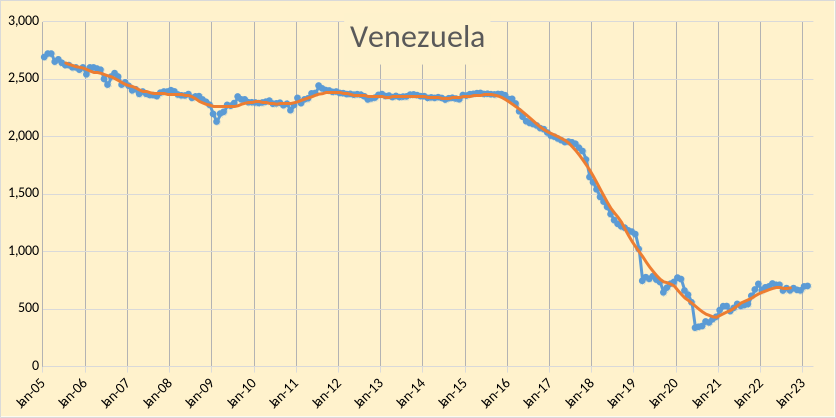

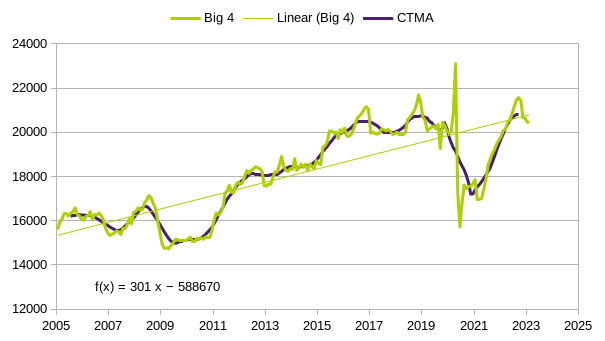

For the Big 4 the CTMA peak is the final point to the right and the trend from Jan 2005 to Feb 2023 is an annual increase of 301 kb/d. In 2018 the US imposed severe sanctions on both Iran and Venezuela and caused a severe downturn in crude oil output in both nations. This was in part a result of the Trump administration believing the Saudi America story which led to poor policy decisions. The chart that follows shows combined Iranian and Venezuelan output.

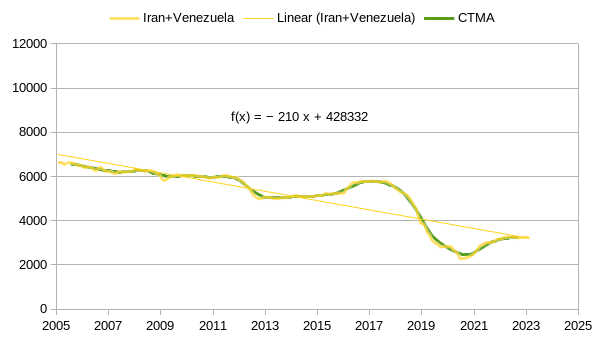

Venezuela plus Iran had been declining slowly for many years from 2005 to 2017 (most of this was Iran up to 2017), then a steep decline from 2018 to 2020 due to sanctions plus the pandemic and now output has stabilized at about 3200 kb/d. Output is unlikely to deteriorate much further and is more likely to increase slightly over the next 5 to 10 years as sanctions may be gradually lifted (or nations may find ways around the sanctions). The main point is that the annual decline rate of 210 kb/d for Iran and Venezuela is likely to change to zero or become a slight increase in annual output. In addition higher oil prices may lead to more development of OPEC resources in the Big 4 (or Big 6 with sanctions relief) which could lead to higher OPEC output. Even without higher rates of resource development I would expect OPEC could raise output by at least 125 kb/d annually over the next 5 to 10 years.

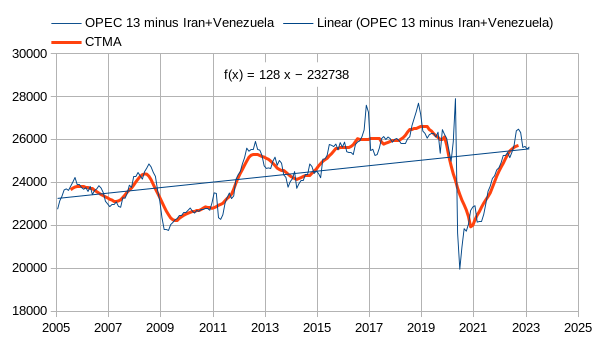

If we consider OPEC 13 minus Iran and Venezuela as in figure 12, we see output increased at an average annual rate of 128 kb/d per year over the Jan 2005 to Feb 2023 period, if that rate continues in the future and Iran and Venezuela simply maintain their Feb 2023 output, then OPEC minus Iran and Venezuela would return to the level of Jan 2019 (the CTMA peak of 26620 kb/d), OPEC 13 would be at 29891 kb/d. This would be 1946 kb/d below the all time OPEC 13 CTMA peak. At the rate of increase shown on the chart it would take 7.5 years for OPEC to reach that level. Note that the pandemic had a significant impact in the rate of increase, prior to the pandemic from Jan 2005 to Dec 2019, the rate of increase for OPEC minus Iran and Venezuela was about 248 kb/d per year. It seems unlikely that OPEC returns to its previous peak unless Iran and Venezuela increase output which also seems unlikely at present. OPEC crude output may not breach 30,000 kb/d in the future, unless OPEC accelerates the development of its oil resources.

I think it is likely OPEC peaked in 2016 while OPEC less Iran and Venezuela peaked in 2019. But the plateau began in 2016 as the red line shows.

But we could really draw the line anywhere. Lines mean nothing. It is just silly to believe future production will follow the lines we draw. All we have is our best guess. My best guess is OPEC 13 peaked in 2016 and it’s all downhill from here.

Ron,

I agree there are many different lines that might be drawn, I also think it likely that the OPEC peak may be in the past, but a high oil price environment long term (over $100/bo) and/or a recovery in Iranian oil output (as was seen recently in 2016 to 2018) might get us pretty close to that previous centered twelve month average (CTMA) peak in early 2017. We might also see a long undulating plateau (at 29 to 31 Mb/d) in OPEC output for 20 years, followed by decline.

Ron – Agree, here’s my take on it using Dennis’ chart…even assuming the largest possible values for URR (>3000 Gb) we are still past the 50% point…the only thing a plateau would accomplish is a much steeper drop somewhere down the road…so the longer we maintain course the worse the cliff becomes…it’s truly impressive that tight oil bought us 15 years…but depletion never sleeps…

Hey Dennis, maybe the market is well supplied and the world is more efficient today than most of us believe. More efficient vehicles and manufacturing, less commuting, front door delivery’s, Europe changes, Russian economy, war and China Covid slow down. Maybe we’re past peak demand.

I don’t think Venezuela, Iraq and Iran are geologically constrained. Iran could increase production by 4mbd and Venezuela, Iraq could add 2mbd each for 10 years pretty easy.

Huntingtonbeach,

Eventually demand bay become the constraint on further output growth, but I don’t expect that until 2035 or so, I am also less optimistic that OPEC can raise output significantly in the short term, I think 30 Mb/d is the current limit without sanctions relief for Venezuela and Iran, perhaps high oil prices will change US policy as the SPR has limited capacity so further draining of the SPR will no longer be an option.

Dennis

Nice job.

The question of what to do with Venezuela and Iran in charts is always a problem because their past does not reflect their essentially unchanging flat current output since January 2022. We might see a small increase in Venezuela now that Chevron is allowed to produce oil there.

Attached is the latest table from the IEA that shows February production and effective spare capacity in the last column. Assuming those numbers are correct, and if the 3,320 kb/d of spare capacity is added the the current OPEC 13 production of 28,924 kb/d, total OPEC 13 production is 32,244 kb/d. This puts OPEC production barely above the 32,000 kb/d reached in mid 2017 and late 2018.

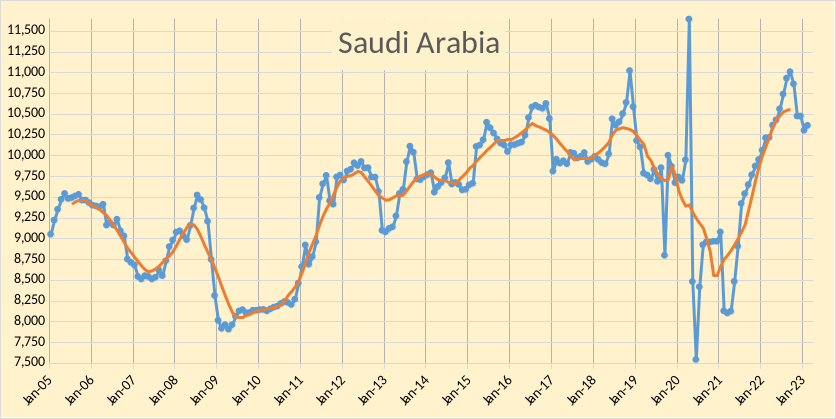

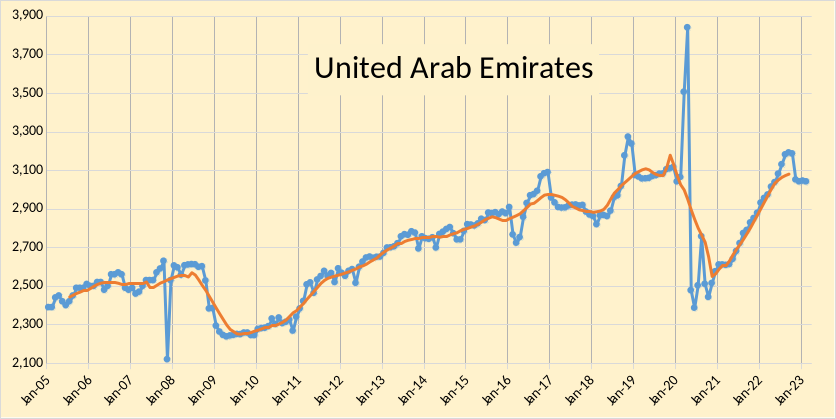

The biggest spare capacity increases come from SA and the UAE. Neither one has demonstrated the ability to produce at those IEA levels for more than one month. Both have reached slightly lower production in early 2020 as shown in your SA and UAE charts. In a stretch I could see SA spare capacity in the 1,000 kb/d to 1,250 kb/d range and the UAE in the 500 kb/d range. So I think a more realistic OPEC spare capacity estimate is in the 2,000 kb/d range, which would put max OPEC production at 31,000 kb/d about two years from now if demand starts to pick up.

Ovi,

Thanks.

I agree with your assessment, but only if we assume on major new developments in OPEC big 6, especially the Big 4 from my post and low long term oil prices (defined below). UAE and Iraq have claimed in the past they could raise output with new investment, it seems likely that Saudi Arabia and Kuwait might be able to do so as well. We may find out if the predictions of $100/bo oil prices prove correct, note that the recent EIA AEO reference case has nominal oil prices over $100/bo for WTI for most of the 2023 to 2050 period. A lower long term oil price environment (nominal oil prices under $70/bo) would be more consistent with a max OPEC capacity of 31 Mb/d.

Dennis

Yes there could be some increases from Iraq, SA, Kuwait and UAE but it will take time to bring on the new capacity, in the order of five years. In the meantime world and OPEC decline continues 24/7.

Note that SA states that Ghawar declines at 2% per year, even with infill drilling. I wonder if that is a reasonable assumption to assume for the other big OPEC countries.

Provided demand picks up over the next six months, which I believe it will, we will begin to see how the supply side reacts to this stress.

Since I believe we are close to peak production, I think the only meaningful lines to draw are from 2018 and going forward. World production, excluding the U.S., entered a new slower growth production phase in 2018.

We are staring down a very serious financial crisis with a financial system which can’t even handle 5% interest rates in the western economies. Chinas economy doesn’t look bright either so where is the demand coming from?

Ovi,

Some nations decrease and others increase, not clear why we would ignore data prior to 2018, data after 2018 is affected by sanctions, pandemic and War in Ukraine, so not clear it provides much information. In chart below blue line is CTMA.

Dennis

Attached is a world C + C chart starting in 2010. I am not going to put any lines on it but to my eye, it appears to be in a topping pattern after 2016. Your chart shows the same plateauing trend after 2015. Current world November 2022 production is close to 1,000 kb/d below the November 2016 level.

If you check Ron’s World W/O US chart below, you see a very flat plateau at 72,000 kb/d starting in 2016.

Also attached is the Rystad discovery chart from 2015 and on. No big oil discoveries and always less that what was consumed.

So IMHO there are a numbers of indicators showing world oil production entering a plateauing phase after 2016. So without significant discoveries, use of past production, i.e. back to 2010, to predict future growth is not realistic.

‘Bumpy plateau (over 80 mbpd) through the end of the decade, roughly.’

I can autograph copies of this, out at a table around the side entrance.

Ovi,

I expect slower growth than 2010 to 2019 in the future, but the “top” you see is a result of several events, oversupplied World oil market in 2018 and then the Pandemic in late 2019. I think there will be further growth. Note that there are a lot of discovered resources yet to be develoed and there is likely to be reserve growth if oil prices rise and potentially more discovery. There is quite a bit of unconventional resources yet to be developed, take Canada for example where only 19 Gb of 161 Gb of Canadian oil sands proved reserves are under active development as of the end of 2020 (according to BP Statistical Review of World Energy.) Similarly only a small proportion of Venezuela’s unconventional resources have been developed. Much of this resource might never be developed, if oil demand peaks by 2035 as I expect, but the resource is there.

Ovi,

We could use a short time frame. Such as the following chart, but I think the answer is not very realistic.

Ovi,

I agree using 2015 to 2019 may make sense, but note that using that period when oil prices were low, might not predict future growth very well. The 2011 to 2014 period was a period with higher oil prices, if we see higher oil prices for a sustained period, we may see higher growth rates than 2015 to 2019. Remember also that OPEC plus was reducing output in 2019. So 2015 to 2018 may be more accurate for future growth in a low oil price environment.

Rystad Discovery Chart

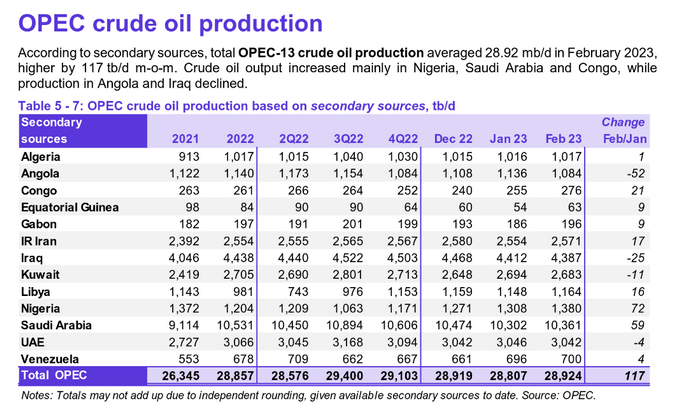

From the OPEC Monthly Oil Market Report

For 2023, Russian liquids production is forecast to drop by 0.7 mb/d to average 10.3 mb/d. Annual growth is revised up by around 152 tb/d from theprevious monthly assessment, due to higher-than-expected production in 1Q23 (although production projection for remaining months of the year is maintained as projected last month). In addition to a number of planned start-ups this year, by Lukoil, Gazprom, Novatek, Sigma Energy and others, it should be noted that Russia’s oil forecast remains subject to high uncertainty due to geopolitical developments in Eastern Europe.

U.S. shale drillers “well prepared” to manage potential credit crisis Bold mine

(Bloomberg) – U.S. shale explorers are well prepared to manage a potential credit crisis after piling up cash and paying down most of their debt, according to private equity firm Kimmeridge Energy Management Co.

“I don’t think the upstream business has ever been in better position for a downturn than it is today,” Kimmeridge managing partner Ben Dell said in an interview. “We’re heading to being essentially debt-free as an industry.”

The shale industry has historically been heavily reliant on loans secured by their oil and gas assets, stoking concern that the turmoil engulfing the banking sector will cut off drillers’ access to credit. Fears of a recession, meanwhile, are weighing on fuel prices and threatened to erode profits after a two-year bonanza.

But shale drillers have made a strategic shift in recent years from reckless spending and unchecked output growth to strict capital discipline. The new business model could help shield the industry from the fallout of a credit crunch.

SNIP

Record costs from a shortage of labor and supply-chain snarls are contributing to a slowdown in production growth from the U.S. shale patch. Explorers are also running out of top—tier acreage. In recent weeks, some of the biggest U.S. oil companies have reaffirmed plans to keep growth low this year.

“If you grow, you accelerate your inventory problem,” Dell said. “Until capital comes into the space, until multiples expand, there’s actually no real incentive to grow.”

GET READY FOR EVEN LOWER OIL & NATGAS PRICES….. FOR DUMMIES

Here is a chart that energy investors need to look at. While Europe faced certain Energy Death Last Year, it survived due to three factors:

1) Very Warm Winter

2) Green Energy Outperformed

3) Cut Back On Natgas Demand & higher LNG Imports

Due to these reasons, Europe’s Natgas inventories are now 110% higher than they were last year. Furthermore, if the current trend continues… then Europe WILL NOT NEED any more NATGAS by the end of August… inventories will be completely full.

If this is true… what will that do to Natgas prices?

steve

Steve

Maybe this just means they have more than enough for heating. Maybe the big chemical plants like BASF and Bayer can restart their chemical factories.

I think Germany’s chemical demand is much bigger than heating demand.

Ovi,

Maybe… however, with the United States Natgas Inventories at 5-year highs at this point, and we are now we are heading into the Spring Surplus-Storage mode, I don’t see this as BULLISH for NATGAS either.

The next 1-2 quarters going to be quite interesting.

steve

Steve

I wonder what will happen to US NG storage as the Freeport LNG plant comes back online and the second and third liquefaction trains start up.

By the way, I am not a NG bull.

OVI,

Here are some points to consider. While it is true that Freeport LNG will come back online at Full Capacity shortly, it will be shipping 2-3 more LNG tankers per week. It is currently doing one tanker.

However, total U.S. Dry Natgas production increased by 5-6 bcf/d (101 bcf/d vs 94 bcf/d), compared to the same period last year. Thus, Freeport coming online at Full capacity won’t use up all of this extra natgas supply. And then we have U.S. natgas consumption soon falling to lows during the Spring.

If we continue to see U.S. natgas inventories increasing more than the 5-year average highs, even with Freeport online, then it will be bearish for the Natgas price in the short-term (1-2 quarters).

steve

Steve , here is a website that you can consult for daily gas storage etc in the EU . I look for stock/consumption ratio .

https://agsi.gie.eu/

also

https://gas.kyos.com/gas/de

Hole,

Thanks… I use the first link, but not the second one. I’ll check it out.

steve

World Less USA seems to be stalling. This data is through November 2022. Look for December and January to drop.

Ron,

World output is the important number, why leave out the US, last I checked it was on planet Earth?

Dennis

US production from November 2016 to November 2019 increased at a rate of 1,270 kb/d/yr. Going forward US production will increase at something less than 500 kb/d/yr. That is why it is important to ignore US production over the period 2014 to 2020.

No other country has ever increased production at the US rate over those three years and I don’t think that the US will do that again.

Ovi,

Over that same period Nov 2016 to Nov 2019, Iranian and Venezuelan C plus C output decreased at an annual rate of 1212 kb/d. This also is not likely to be repeated. A better chart looks at World C plus C minus US, Iran, and Venezuela.

Dennis

Attached is the same chart as yours but I have added your favourite CTMA. It tells the same story. Plateau after 2016.

Just noticed that Ron put up the same chart. Great minds …..

Ovi,

What has happened after every plateau in World C plus C output from 1973 to 2017? Perhaps history may repeat, until 2030 or so.

Ovi,

The CTMA should only be included for the points on your green line, that would exclude the last 5 points on your red line, also the first 6 points on the red line at the left of your chart should also be left off. Notice that this is the case with all of my charts that include a CTMA.

Dennis

New plateaus came because new fields were discovered and came on line. LTO also came on line. Discoveries have been meagre since 2015.

The CTMA graph is correct. They used data before and after what is shown on the chart.

Ovi,

I understand it is correct, but the proper way to chart a CTMA and monthly data is to show all the monthly data that is used to calculate the CTMA on the chart, in my opinion.

Note that in every chart that shows a CTMA, that is how I do it.

On plateaus, some of it is discoveries, some of it is the rate of development, some of it is war and politics, some of it is the price of oil, in many cases “peak oil” has been claimed and then something not foreseen occurs and oil production continues to rise. I do not think we know what will happen, we might see a long plateau, we might see a slight increase or we might see a small decrease. Historically my best guesses have been wrong on the low side, except for major unforeseen events such as the Covid-19 Pandemic. Perhaps this time will be different.

Dennis

I think the important thing is that a CMTA is calculated correctly. Not quite sure why one has to show empty starting and end points.

Also I am not a fan of adding CTMA to every chart, I find it adds nothing except confusion to the eye. Also in some cases it looks totally ridiculous, especially at the current time when dealing with the covid crash.

CTMA must be used in the context of trying to make a point or clarify a discussion. If one is discussing peak oil, should it be by month or a 12 month average, CTMA adds value to that discussion.

In the case of my chart above, it is difficult for the eye to sort out the volatility of the monthly data from January 2015 to 2020. The CTMA in that case helps to clarify what happened on average over that period. It nicely show that production was essentially flat.

Not being critical, just expressing my view that graphs should be kept as simple and clear as possible and relevant to the discussion.

Ovi,

You are welcome to do your charts how you like and I will do the same. I prefer the centered twelve month average because it lines up better with the monthly data and avoids the 6 month shift to the right that we get with a trailing 12 month average, but if we are going to use the 12 month average and also show the monthly data, it seems clearer to me to show all of the monthly data that is used to calculate the 12 month average shown on the chart. To me, Ron’s chart is more enlightening than yours in my view because all monthly data used to calculate his 12 month average is shown on his chart.

Ovi,

Remember that real oil prices were relatively low from 2015 to 2022, compared to 2011 to 2014. Higher oil prices might change the future rate og growth.

Dennis, I have said it before and I will say it again: Your charts are designed to obscure rather than to enlighten. You deliberately stopped your data at November 2019. Why?

My chart below clearly shows that the World oil production without the USA, Iran, and Venezuela seems to have stalled at over 2.5 million barrels per day below the monthly peak and one million barrels per day below its 12-month average. The data is through November 2022.

Of course, the decline from Iran and Venezuela will not be repeated. The decline will be in the rest of the world. And US shale will not be there to make up the difference.

Click on the chart to enlarge it.

Ron,

It stopped at 2019 because it was intended to show the prepandemic trend.

Obviously output went down sharply during the pandemic and then has recovered sharply. I expect it will reurn to the prepandemic trend within 18 months and then might follow that trend for 5 years or so.

Note that output has plateaued many times from 1973 to 2022, followed by an increase in output. Yes output is currently below the 12 month peak, output is likely to increase in future.

Dennis, I was just showing that world production without the USA has declined by about three million barrels per day since the 2016-2018 plateau. Now that the general consensus is that the USA has peaked, or is about to, that without the USA’s input world oil production is in deep shit.

Yeah, and what Ovi said in the above post.

Quick to judge, quick to anger, slow to understand…ignorance and prejudice and fear walk hand in hand

Ron

I wonder if the EIA report of propane/propylene inventories 40% above the five year average is inhibiting the enthusiasm of the shale drillers?

Ron,

The consensus might be that the US has peaked on POB, but in the real world it is a minority view. I respectfully disagree.

Note also that the US CTMA peak was 14 months after the World CTMA peak.

The consensus might be that the US has peaked on POB, but in the real world it is a minority view.

Dennis, please read, or listen to, the link: “Peak Oil Gets Admitted” posted by George Kaplan and myself below. The whole thing please, and give us your opinion. The conses of opinion in the real world will change a lot sooner than you think.

Ron,

I think the IEA has it right, demand will peak for oil and other fossil fuels. Many claim renewables won’t cut it, I think they are wrong, I was unimpressed with his writing off of EVs and renewable energy. I agree fossil fuel resources are limited, solar power is relatively unlimited and the main ingredient of solar panels (sand) is very plentiful. Stationary batteries can be made form many different kinds of materials (not simply lithium used for cell phones, laptops and BEVs).

This is a major hole in the analysis in my view.

Dennis, I am not going to argue as to whether renewables will cut it or not. My claim is that peak oil happened just over four years ago and I think that will become obvious this year. I think that was the point of the article.

As to renewables, things are going to happen a lot faster than you, or almost everyone else imagines. If renewables can ramp up that fast, then great. I have my doubts but I am not a renewable expert so I will not argue that point.

Ron,

Output is likely to increase over the next 5 years in Saudi Arabia, UAE, Iraq, Kuwait, US, Canada, Brazil, Norway, and Guyana, there will be some decline elsewhere, but by less than the increases in those 9 nations.

Dennis, I am not at all sure the combined production of those nine nations will increase very much. But I am confident that the world, less those nine nations, will decline quite a bit. The chart below shows the world less your Big Nine, Saudi Arabia, UAE, Iraq, Kuwait, US, Canada, Brazil, Norway, and Guyana, increasing in the last month but that was primarily Kazakhstan recovering from severe pipeline problems. Look for the chart below to see huge declines throughout 2023.

Sorry Dennis, but I think you severely miscalculate this one.

Click on the chart below to enlarge it.

Ron – That is an extremely useful plot. My analysis below, key take away is in past 8 years that group is down ~6 MBpD.

-Immediately following the late 2014 peak, it shows annual decline rate of 0.5% (July 2015 thru April 2017)

-Decline rate increases to 1.9% between April 2018 thru Jan. 2019

-Another big increase to 4.4% between Jan. 2019 thru Jan. 2020 (before Covid)

-Next step down is Covid, where decline rate went to 17% (Apr. 2020 thru Dec. 2020)

-Post Covid recovery decline rate appears to be 0.5% right now.

Looking at the 8 year period of Oct. 2014 thru Oct. 2022, the average decline rate is 1.7%, which is a loss of nearly 1 MBpD annually. If we see decline rate of 5% return for this group then that will be a loss of 2 MBpD annually.

For the big 9, I would disagree with Dennis that he can expect any growth from them. As I’ve said since last year, best hope is producing group could remain flat (and right now that looks to be asking too much)…

Dennis will eventually see the light, I’m sure of it.

Ron,

The chart would be better to show World minus 11 nations, the nine I mentioned plus Iran and Venezuela. In your chart the “rest of World” sees a decrease of about 4500 kb/d from June 2018 to Oct 2022. Roughly 3000 kb/d of that decrease came from Iran and Venezuela due to US sanctions. The World minus 11 nations would have a decrease of bout 1500 kb/d over a 4 year period, about 375 kb/d annually. I expect Iran and Venezuela will be flat to up going forward and the “Big 9” are likely to see increased output. Note also that the steep decline from 2018 to 2020 is explained by OPEC plus cuts (only 4 nations from the 18 nation group subject to cuts is part of the big 9) in 2019 and by further cuts during the pandemic, also snactions n Russia due to the war in Ukraine have had an impact.

Kengeo,

We will see, I adjust my expectations based on the data I see, for now my expectations are unchanged best guess is a new World peak in 2028 /-2 years for C plus C CTMA.

Dow futures are up 224

Nasdaq futures are up 63

WTI is up 31¢ to $67.05

UBS buys Credit Suisse for $3.2B

Does this mean that the Banking crisis is over?

No, Banking crisis has just begun. Bond holders are taking the loss. A lot money was just lost. And absolutely nothing is fixed.

Going to be a lot of deposits leave UBS because of the way this was handled. The shareholders of UBS were suppose to vote on it. That was taken away by government.

Not saying there won’t be any reprieve here. But nothing is fixed. It will take markets a bit to sort it out.

If dollar deposits start leaving. Their currency will get crushed and the swap lines with the FED isn’t going to matter much because they are just swapping bank reserves.

And raising interest rates to fight currency flight will crush the value of the collateral on bank balance sheets. Their banks are loaded with negative yielding government bonds.

Decade long experiment with negative interest will comeback to haunt them.

Michael Howell thinks that soon banks will be nationalized in many countries.

WTI less than $50 within a week or two looks distinctly possible. I don’t see TPTB having many short term tools that they can employ to reverse current sentiments and there are any number of outside shocks that can hit the markets to make things worse (e.g. fall out from whatever happens with Trump tomorrow, refinery strikes in France). More negative news about oil production might boost prices a bit but that seems to be too long term for the markets to take in – they seem mostly to respond to short term (and volatile and unreliable) storage numbers (and mostly crude alone without including products, which I’ve never understood).

George – The only way that happens is if OPEC doesn’t cut supply…Are you thinking OPEC is going to go head to head with US shale again like they did in 2014/2015? My guess is they don’t need to this time around and won’t let oil price drop below ~$65.

Most are calling forecasts of ~$100+ over medium timeframe…

Adjusted for inflation, today’s WTI price is 2005 equivalent of <$50…that's very low. $150 oil price seems likely by June…

Well, they have some tools. The discount window for instance. I’m assuming it would be a shock for most people to learn that a week ago actually surpassed the 2008 GFC in terms of borrowing. “so you’re saying there’s a chance?”

https://www.reuters.com/markets/us/fed-emergency-lending-banks-boosted-overall-fed-holdings-latest-week-2023-03-23/

I think prices are ultimately headed lower, there will be a few bounces along the way though. But the fundamentals are weak. Look for a close underneath the $65 support and the 200 weekly moving average. Should be the tell tale sign of further declines.

and by “fundamentals” I’m assuming you mean – the entire global economy

Outsized market moves are actually more common features of bear markets. (slow never-ending melts are more common in bull markets). Just as an example – during the dot-com crash, the NASDAQ had 11 rallies of +10% or greater from 2000 – 2002. And S&P had similar repeated outsized moves during 2008-2009.

Here’s a good article about peak oil.

https://thehonestsorcerer.medium.com/peak-oil-gets-admitted-eb0ea928e10

Thanks, George, I missed this one. Hey people read this Peak Oil article! Or, you can listen to it.

Peak Oil Gets Admitted? Bold theirs

Inmy start of the year essay I predicted how peak oil will be announced in 2023 — only to be buried under a pile of BS. Well, here you go, and it’s only March. Paraphrasing Captain Benjamin L. Willard from the movie Apocalypse Now we could say:

“Oh man… the bullshit piled up so fast [in the energy business], you needed wings to stay above it.”

Before we start flapping our wings, first let’s hear the admission that peak oil is not a crackpot theory. As Mr Kern, the Educated Realist from Oilprice.com — “the no.1 source for oil and energy news” — explained with his own words (my emphasis added in bold):

Peak oil is the point in time when worldwide petroleum production reaches its maximum point and begins to decline. It occurs when reserves of easily accessible oil are depleted, and it becomes increasingly difficult and expensive to extract remaining reserves.

There is a lot more to this article. It is a nine-minute read. If you are serious about peak oil, you will read it. Even if you are a peak oil denier, you will either read it or or admit you don’t believe in evidence, you only stubbornly think you know the future. However, I am aware of only one outright peak oil denier who posts on this blog and he goes by the handle “Resservegrowthrules”. Simply being off by 10 years does not make one a denier. 🤣

You can even listen to it. Just click on the little “listen” thingy above the headline: Peak Oil Gets Admitted?

Ron – Even Rystad has been predicting this (~2019 peak) for a long time, I guess the only thing is they expect a very long plateau…but their model (Ucube) assumes significant annual discoveries which could be brought online relatively quickly (which is completely ridiculous for lots of reasons – A-simply not finding discoveries, B – future discoveries (if any) will be complex and expensive to develop, meaning they will take a long time to happen. Here’s an output from Ucube dated ~2016 (Erik Wold)…

http://web.idg.no/app/web/online/Event/energyworld/2016/pdf/wold.pdf

Thanks Kengeo. Of course this article is totally out of date. But it is interesting to see what they expected to happen back in 2016. I do wish these kind of projections would deal with crude oil or C+C instead of total liquids. What might happen to natural gas liquids has very little to do with crude oil. Making predictions by mixing NGLs into the barrel with crude oil is only a confusion factor.

“If you are serious about peak oil, you will read it. Even if you are a peak oil denier, you will either read it or or admit y”ou don’t believe in evidence…”

Those who can calculate when peak oil happens can’t also be deniers. And those who have claimed it previously, and keep doing it because, you know, they FORGOT they predicted it, are suffering from both selective memory and a broken clock problem on this topic.

RGR, you are absolutely full of shit and an egomaniac of epic proportions. It really doesn’t matter in the big scheme of life what predictions failed, when or why, it only matters that one is capable of not focusing on the past (and all that anger, wow! I’ve read your shit on POMB)…but the future.

In that regard, you have absolutely NOTHING to offer, as a retired engineer or just a plumber from Boca Raton, bored out of his mind, who enjoys being a disruptor (who knows, really…you are scaret to say). If you have something to say, say it. Try not to say it at the “expense” of someone else. Be productive, not counter productive.

Lets try this, I’ll make it easy for you: how many more years of HZ tight oil production from the Permian Basin can be “had,” at current oil and natural gas prices (3.20.23)…without borrowing more money? And don’t forget all that debt. Do the best you can with the well economics thing ( I know its hard for engineers); us dumb McPeaksters need hep.

Forget the political bullshit, the if, ands and buts; you are “supposedly” an engineer (you have Dennis Coyne fully onboard, that’s for sure), enlighten us. Ten, twenty, forty more years? We all need guidance from the SPE and those that really know.

You owe us. I’m an SPE member, I’ve read the the moral obligations you have to your profession, your code of ethics. Let’s hear something, anything, other than ridicule.

The dude has had the luxury of criticizing a discipline which has only one correct answer but virtually an infinite number of incorrect answers.

+1

Mike says “you are absolutely full of shit and an egomaniac of epic proportions.” This coming from a “man” who has a chip on His/her shoulder the size of Texas. Every time I read anything you write, a feel a bit more sorry for you than the time before.

What a waste of life, if you truly have been financially successful in your oil “bidness” why don’t you go take a walk, get a girlfriend, watch a sunset, go fishing, do a crossword puzzle something that actually might give you some pleasure in your final years. Nothing you say or add here (not unlike any one else including me) is going to make one bit of difference to any outcome. You come across as a humorless, bitter, egoistical numb nut with nothing to add to almost any discussion.

There is no answer to your question that you will except, so why ask it? You are one of the folks here that has a decade long record of being wrong, tell us what you learn from that experience, it should be plenty. If you haven’t learned anything you might do some deeper reflection on your capacity to learn. IN the mean time here is one from louie to pick up your day.

https://www.youtube.com/watch?v=VqhCQZaH4Vs

Sorry Tex, but I will have to agree with Mike S. on this one. People like you and RGR, who have nothing to do but criticize other people’s posts are a sorry lot. How about posting your own predictions? And how accurate were your past predictions? I believe, just like RGR, you had none. So you have nothing to do but sling mud at everyone else.

Let me borrow a phrase from Mike S. You are absolutely full of shit.

Get a life.

Peak Oil: The Perennial Prophecy That Went Wrong

Ariel Cohen – Contributor – I cover energy, security, Europe, Russia/Eurasia & the Middle East

Nobody can quite agree on when we will reach the point of Peak Oil or even what will cause it. Norwegian state-owned oil company Equinor and energy researcher Rystad Energy predict a peak around 2028 owing to low investments in oil supply and increasingly efficient competition from renewable energy projects. McKinsey Consulting and French oil and gas company TotalEnergies, estimate peak oil in the early and mid-2030s respectively due to slow growth in the chemical industries as well as peak transport demand.

A recent OPEC outlook report estimated steadily increasing demand, which would result in peak oil in approximately 2040. The International Energy Agency and U.S. Energy Information Agency foresee oil demand “plateauing” and recommend immediately exploring alternatives to sustain energy needs. According to BP’s outlook, international oil demand may double as the developing world buys more ICE cars and builds Western-style consumer societies, and peak oil not hit until 2050 based on known oil resources with the application of today’s technology.

American geoscientist Marion King Hubbert predicted that global crude-oil production would peak in 2000. Sadad Ibrahim Al Husseini of Saudi Aramco predicted that Peak Oil occurred in 2006.

Debates about Peak Oil do not serve the environmentally or economically conscious. Peak Oil will happen when technology makes ICE too expensive relative to the electric engine for transportation, and environmental regulation would make the polluting gasoline obsolete.

https://www.forbes.com/sites/arielcohen/2022/11/30/peak-oil-the-perennial-prophecy-that-went-wrong/?sh=28b62a572bbe

Virtual Walk: Beautiful Beach Sunset in 4K over Monterey Bay, California

https://www.youtube.com/watch?v=BCJdm2RLjHE

I am doing well, TT; thanks for asking. The girls all send their best. Fishing, yeah: I did an overnight trip to the back of Alasan Bay the other day and nailed a 28 inch trout on an 8 weight and pink crab pattern I’ve caught permit on. In a foot of water! She was full of eggs and I put her back on her bed, both of us better for the experience. She won’t do that again for awhile. I hope.

I should apologize to the community for that rant but you see I get tired of people using fake names to ridicule people. It’s weanie-neck; the worst kind. You know, sorta like you just did to me. Again. How many times is that now?

And I’ve got this thing with pompous engineers, or people who claim to be engineers (or other oil “professionals”) looking down on folks. That arrogance is exactly why 98% of America hates the oil and gas industry. Everybody’s got a right to be worried about oil in America and if you are truly “professional, you wouldn’t arrogantly shove your bias opinions down their throats. Antagonism is a stupid way to make a point.

Me and Coots both hated engineers and other phony people. Its as old as the oilfield. Maybe this will explain it better: https://www.oilystuffblog.com/single-post/coots-1968. If its too long I understand. You could do it in multiple sittings.

All’s good here, Bluebonnets and Paint Brushes everywhere! Natty prices suck, uh? You royalty owners need tougher drilling commitment provisions in your leases; we need moar Freedom gas! Moar LNG terminals, moar pipe, more exports ! Moar money for you !!

Ron, I have learned a thing or two in life and one is there is little value in arguing with an old man. SO I will not take the bait below as I know where it comes from. On the other hand, since I first starting posting here, I attempted to bring my experience as an active oil and gas professional, with 4 decades of experience in mapping, packaging, raising money and investing in oil and gas deals. Those in my position KNEW the crap that being spewed here on BOP regarding the impact of horizontal drilling technology would have and said so, too much distain here. That’s fine I could care less, if people want to stay stupid and ignorant its no skin off my back. But as long as I am permitted to do so, i will confront outright falsehoods or out right propaganda regarding the industry. Those who were wrong and missed the biggest impact to our domestic energy industry since the East Texas Field or Spindeltop discoveries, are in no freakin position to throw stones. And, by the way I may have a bit of fun doing it. I think based on the investments being made we may be in the 3 or 4 inning in the buildout, many years of oil and gas professional providing the necessary oil, gas and nat gas products to a demanding world, with that I say Cheers, isn’t it your vodka time 🥃

Tex, RGR is a blowhard that can do nothing but criticize others. He brings up my 2015 wrong pridiction over and over again. Sure I was wrong but so was everyone else who did not see the shale revolution coming. And that was everyone! So RGR’s shit was getting old. Mike S. came to my defense. Then you trashed him for doing so. That pissed me off. Why didn’t you just stay the fuck out of it? RGR deserves all the criticism anyone can pile on him. He is nothing but a blowhard.

Yes, I am an old man but I do not drink Vodka or anything else for that matter. I used to drink bourbon but I quit six months ago. I got to enjoying it too much and I could see where that was headed. So I quit.

American geoscientist Marion King Hubbert predicted that global crude-oil production would peak in 2000.

King is ON FILM saying his prediction “assumes an orderly evolution,” which obviously is NOT going to happen, which is his tacit acknowledgement that his own prediction is bound to be wrong. That’s why Hubbert said–back in the goddamned 80s–that we have to start converting to solar and nuclear, NOW, which means in the 1980s.

This is identical to Carl Sagan saying in 1985 about global warming mitigation, “If we don’t do something now, it will be too late later.”

We didn’t do anything in either case.

And so we’re fucked.

“And so we’re fucked”

Mike B, when in your lifetime haven’t we been fucked ?

May I suggest you take a view of young professional ball players. Currently in the Western Conference Division of the NBA, its a battle for half the teams to make the playoffs with less than 10 games left to go in the season. Not all the teams are going to get in. After every game the players get interviewed by the press about how their going to get into the playoffs. Their answer almost every time is to not look forward past the next game and to focus on the things they can control to win it.

Go back 15 years vs. today. Today we have a viable alternative to ICE and a proven reserve of shale to make a reasonable manageable bridge to electric transportation. Regarding those who believe there is some “energy cliff” looking at us in the near future are just fear mongering. I’m in the Dennis, RGR and TT camp. There is oil out there that is not counted in the proven reserves. It’s going to be more expensive and the market economy will adjust. Labor and capital will be the primary factors to the energy supply curve in your lifetime.

HB: The oil patch needs a Steph Curry to pull this one out. And there’s only one Steph Curry.

Here you go, from SPE’s Journal of Petroleum Technology:

https://jpt.spe.org/plummeting-energy-return-on-investment-of-oil-and-the-impact-on-global-energy-landscape

The SPE writer introduces a term as concerning as The Red Queen, this one is Energy Cannibalism. What happens when EROEI keeps declining.

Well, I might grant you the egomaniac angle, but in a relatively limited area. Dennis might be on board, you can ask him why. I certainly have paid close attention to his methods and logic if only because he has them, he lacks to my satisfaction the near religious fervor on the topic that advocates have…I won’t mention names but then I probably don’t have to. Ron.

I am known for telling folks how silly their ideas were as far back as 2005, and will happily allow that (and all the usual derogatory claims) to be the sum total of my reputation in McPeakster amateur hour environments until I choose otherwise.

From what I can tell you have the reputation of, and are only “known” for… having the manners of a goat.

Fortunately, for both of us, you don’t owe me a thing, no sir.

He’s also known as a chickenshit

Standard Chartered Blames Gamma Hedging For Overdue Oil Selloff

Oil prices have crashed spectacularly, with WTI crude falling from $80.46 per barrel just 10 days ago to the $67 range, while Brent has declined from $86.18 per barrel to the $73 range, levels they last touched in December 2021. On Friday, things improved slightly, with Brent moving into the $75 range and WTI testing $69.

Commodity analysts at Standard Chartered warn that the oil price crash has been exacerbated by hedging activity–specifically, due to gamma hedging effects, with banks selling oil to manage their side of options as prices fall through the strike prices of oil producer put options and volatility increases. The negative price effect has been exacerbated because the main cliff-face of producer puts currently occupies a narrow price range.

While gamma hedging effects did not cause the initial price fall, they have caused a short-term undershoot, further magnified by the closing out of associated less committed speculative longs. StanChart has worked out the distribution of producer puts based on a survey of 46 U.S. independent producers.

Banks are deleveraging to free up collateral. Not saying that there isn’t any truth in that article because there is. What he is saying is absolutely true.

But the CTA’s are also shorting oil and stocks. I disagree with the view that the selling is overdone.

In a banking crisis, banks tighten lending standards and don’t make loans that they would normally.

We are in the 1st inning. 200 small and mid size banks in US are in trouble. This will take months to play out.

If anyone bothers to look at financial records of any Chinese banks then we are really screwed.

FUBAR . SNB now has to offer a line of $250 billion . Black hole .

https://www.reuters.com/business/finance/switzerland-puts-up-260-billion-francs-credit-suisse-rescue-documents-2023-03-20/?taid=6418762664bd6100013e43d0&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

If the SNB could print money there would be no need for taxpayer money from government. Bank reserves are no substitute for bank deposits.

And bank reserves also aren’t high quality collateral that can be used in REPO to secure funding.

SNB is useless. But in order to keep appearances up they must do something even if that something amounts to nothing.

In a way though that is exactly what the FED is doing – buying long dated bonds at par when they are trading at 70-ish creates reserves for the banks which have super short duration. So that fixes the fundamental issue of the maturity mismatch that the banking system is facing. The cleaner way of course is to raise equity to plug the Hold To Maturity ( HTM) gap that they are facing but my guess is that current shareholders aren’t fans because of the dilutive effect and new shareholders want to get a good deal i.e. a low price.

Rgds

WP

Reminds me of nuclear power, benefit now, let some other poor schmuck pay later.

Peak Oil? It is more and more in the news these days. Soon everyone will be talking about it. This YouTupe podcast is the perfect example. However, it is one hour long so I doubt many of the members of this blog will take the time to watch it.

Have We Reached Peak Shale?

It is as much about peak oil as it is about peak shale.

Yes, very good vid. You will learn a lot about world shales. Six of the best ten shales in the world are in the US. The Permian is the ONLY source of oil growth in the world, acc. to vid.

I’ll watch it thanks.

RON,

The real question is… have we reached PEAK STOOPIDITY?

steve

BERNDT – Not sure if you are looking at this post/comments.

Curious on your estimate of annual decline rate for next ~5-10 years.

My estimates have world production dropping 3-5% for next 1-2 years…

But increasing considerably after that (6% drop in 2026, 7% drop in 2027, 9% drop in 2028, 12% in 2029, 15% in 2030, and 20% in 2031). 70 MBpD in 2026, 60 MBpD in 2028, and 50 MBpD by 2030…

The primary cause for this drop in production is depletion from Russia, China, Iraq, UAE, Kuwait, and Norway. These six countries make up almost 30 MBpD (11 Gb annually) of supply and don’t have many remaining reserves (1P = <40 Gb).

Might as well put that projection in a chart for everyone to see and marvel at.

People get excited by steep descents.

Unless we are entering a catastrophic era that has nothing to do with global geologic oil reserves,

I’m guessing that you are a tad pessimistic on this early decline phase.

Your decline to 60 Mbpd in 2028 will come a minimum of 5 years later, as I guess it.

I’ve rarely been the greater of two when it comes to optimism on energy supply…this is a near first (some would call that a second).

In short, I think there will great economic incentive to produce tough oil for a long time.

An extremely disruptive problem will be failure of distribution…much worse than the patchy distribution this world has now. Importing countries that have been accustomed to purchasing oil products may find that their traditional suppliers have switched to a different preferred block of customer countries, and not necessarily based on the dollar as the trading medium.

The ‘coalition of the aggrieved’ is gathering strength, while the pax Americana conditions are on a slow fade, and the industrialized, aging and overextended oil importing nations are gradually losing the relative monopoly on economic and geopolitical clout. Its a case of resting on your laurels and taking the advantageous scenario since the 1950’s for granted. A whole different set of peoples of the world are the motivated ones now.

As I see it.

Kengeo, i look often at peakoilbarrel.

My last calculation has resulted in the following:

-The world needs each year about 2.2 percent of a BOE more energy to produce crude oil.

-Crude oil today requires about 150 percent of its energy content to get produced.

-All kinds of energy are used by the oil production process and converted to oil energy.

I believe, the world can sustain this high energy requirements until 2027. Up to 2027, the oil supply will remain relatively high (only 2% loss each year), after that it will go down fast (10 % loss each year).

Yesterday, i have finished my english version of the book containing all calculations. Now, i look for english native speakers to help me to eliminate errors.

Happy to proofread.

rgds

WP

You can find the preprint book in pdf form on researchgate, DOI 10.13140/RG.2.2.31431.78243.

3 minutes ago, i have uploaded it.

Thanks – I will download later today.

rgds

WP

Do you have a reference other than the DOI? I can’t seem to search by DOI…..

Thanks

WP

This Link works for me:

https://www.researchgate.net/publication/369388244_THE_LAST_YEARS_OF_THE_LAST_YEARS_OF_THE_OIL_AGE_THE_OIL_AGE_Physics_kills_Oil_and_Cars_Physics_kills_Oil_and_Cars_THE_LAST_YEARS_OF_THE_OIL_AGE_Physics_kills_Oil_and_Cars?channel=doi&linkId=6419e9d9a1b72772e4177d1b&showFulltext=true

Nevermind – I am an idiot.

I got the paper and will read it.

rgds

WP

I pinged you on LinkedIn – can you accept?

Thanks

WP

BERNDT

Could please provide some examples to back up the following quote from your comment above. What is your data source. Can’t believe this is happening in SA.

-Crude oil today requires about 150 percent of its energy content to get produced.

OVI, thats the wrong question. I have calculated the energy to be supplied by the world economy, not the part of SA. My diagram is valid for the average energy, not for single countries or oil fields.

This is not for EROI, it is for “Societal EROI”, as defined by Charles Hall.

BERNDT

I am not into that FUZZY societal stuff created by economists.

I will stick with real world EROI. That is what shows up in the bottom line of the oil companies

No offense Berndt, but this frankly seems impossible to calculate. Can you share your formulas, input data, and the source of that data?

I’d actually be happy with the formulas only.

see above

Kengeo,

proved reserves are less important anthan proved plus probable reserves which are the petroleum engineer’s best guess estimate. Over time the 2P reserves tend to increase as fields become better understood as they are produced. Read Laherrere on this subject, and note that Laherrere has tended to asuume reserve growth would be zero on average and has had to continually increase his estimates of URR in part because he does not account for the fact that reserves tend to be revised higher over time.

Ok, sure Dennis…I’ll quote him one last time:

“Dennis Coyne forgets geology and bases his forecast on unrealistic ultimate with drilling unrealistic number of wells

He follows EIA unrealistic AEO2022 reference

Dennis forgets often also the historical past, making graph on recent past”

We might not have Laherrere figured out but he certainly has you figured out…

Kengeo,

Laherrere often gets things wrong, the only place I use specific numbers of wells is for tight oil and my tight oil scenarios are pretty conservative with a URR of about 70 Gb (EIA has a URR of about 127 Gb for tight oil). How about sources for your quotes for Laherrere? I look at World oil production from 1870 and use Laherrere and the research of many others in my analysis.

See

https://aspofrance.org/2018/08/31/extrapolation-of-oil-past-production-to-forecast-future-production-in-barrels/

From paper above see page 15 to 16 where Laherrere writes regarding World less extra heavy oil

Graph 2018 production forecast for U = 2600 (creaming curve) & 3000 Gb (HL)

So averageing these two we get about 2800 Gb for URR, then add Laherrere’s estimate for 200 Gb of extra heavy oil (100 Gb each from Venezuela and Canada) and we get a URR of 3000 Gb for World C plus C, see page 115 for extra heavy oil URR ( Canada oil sands 115 Gb URR and Orinoco URR=100 Gb).

A more recent Laherrere estimate from 2022 has World C plus C URR at 3500 Gb.

Also see Laherrere’s Bakken estimate from https://peakoilbarrel.com/bakken-oil-peak-jean-laherrere/

In that post from 2014 he estimated about 2.5 to 4 Gb for URR for North Dakota Bakken output. Art the end of 2021 North Dakota Bakken cumulative output wass 4.1 Gb and proved tight oil reserves were about 3.9 Gb at the end of 2021, for a total URR of at least 8 Gb, roughly 2 times Laherrere’s estimate. My current best guess URR estimate for ND Bakken is about 9 Gb with 27000 total wells completed (abut 17000 wells had been completed by the end of 2022).

My early scenarios probably did overestimate the number of future wells, based on reports by the NDIC which projected 60000 wells and others that used about 40000 wells. I also underestimated in 2014 the increase in new well productivity that would occur from 2013 to 2018. My best guess in 2013 was about 8 Gb plus or minus 2 Gb see

http://oilpeakclimate.blogspot.com/2013/10/exploring-future-bakken-decrease-in.html#more

From that post:

The most realistic cases would have economically recoverable resources between 6 and 10 Gb, with the best estimate around 8 Gb. Cases 1 and 3 are the most realistic presented in this post, …

Fig 1 from that post in Oct 2013 below

Thanks Hickory – Appreciate your perspective and input.

I recognize it’s a very aggressive estimate…look at the shark fin plateau model. It’s pretty easy to lose 10% in a year, Russia will be a good example.

I agree with Ron that the decent should be steeper than the run up, either way we will know very soon.

It’s not going to take 15-20 years to figure this out.

There are only 3 options:

A- Growth continues (a new world max would be reached soon, within 12-24 months or so)

B- Plateau for some period then modest decline

C- Decline happens (or continues from 2018), likely decline between 2%-10% annually.

A major contributing factor could be related to failure of world economics/currency.

From what I can tell, no one hear (except maybe 1-2) believe option A is remotely possible. Several or maybe half here think option B is possible. But majority here consider option C is most likely.

Momentum is the key, and everything is pointing deceleration of production and prices, a vicious feedback loop for producers of the more expensive fields.

Depletion rates of 5-10% seem reasonable:

“Decline and depletion rates of oil production: a comprehensive investigation

Mikael Höök , Simon Davidsson , Sheshti Johansson and Xu Tang

Published:13 January 2014https://doi.org/10.1098/rsta.2012.0448”

Peak cars 2017 -2018 . If you can’t afford it then you can’t have it .

https://www.zerohedge.com/markets/stock-clearance-most-major-automakers-slash-prices-china-demand-stalls

In the US light vehicle sales/capita peaked in 1978, and is now down almost 40% from that peak.

But cars last a lot longer, and the roads are as packed as ever.

Its only one country, but most countries have more than enough vehicles.

https://www.advisorperspectives.com/dshort/updates/2023/03/03/vehicle-sales-per-capita-as-of-january-2023

The countries where people are riding hanging out of the bus windows, and up on the roof, are not in that category. Lack of affordability is nothing new for billions.

Notable countries with the fewest vehicles/capita-

VietNam, Pakistan, India, Nigeria, Kenya, Philippines, Congo, Egypt, Iraq

All of these have a lot more vehicles on the road than ever before.

Have there purchases peaked? I doubt it.

https://hedgescompany.com/blog/2021/06/how-many-cars-are-there-in-the-world/

As an EV owner and l long-time oil observer, I have come to terms with the limitations of EVs as a replacement for ICE vehicles and the need for oil. There seem to be many who believe EVs can replace ICE vehicles. That is somewhat true for people like me who live in a suburban community with a garage where a Level 2 charger is installed. Of course, that assumes that the electrical infrastructure in my community could handle large scale EV adoption — it cannot at present. It assumes that the electrical generation capacity will grow at a sufficient rate to provide the electricity, I don’t see how that happens, certainly not from renewables. And what about apartment dwellers, particularly those in dense cities like NYC? And does anyone believe EV semis will replace diesel semis?

I own two EVs and still need an ICE vehicle for long trips or even shorter trips when I didn’t have time to recharge my car. Eventually the recharging network will relieve some of that, but we are a LONG way from being there. There is nothing today that matches the convenience of an ICE vehicle when it comes to adding range quickly.

But what if it did happen? What if ICE vehicles were replaced by EVs as the EV proponents envision? What would the economic impact be? No more auto mechanics except those at dealers who are trained to work on EVs — and many fewer of them will be needed due to the reliability of EVs. Drastic reduction in employment in the oil industry. Reduced employment in the auto industry as EVs require far fewer parts. Drive down any main street and count the number of businesses that exist only to repair or service ICE vehicles (engine, transmission, parts stores, muffler shops). Tremendous economic disruption.

Of course I understand this could not and will not happen overnight. But I wish that those who see an EV future as an unvarnished positive would understand what an EV future, if it were possible, would look like. We have built a society based on the convenience of transportation powered by the most convenient and energy dense fuel.

“unvarnished positive ”

Nope…but it will sure beat the alternative

which is having no back up plan for depleting transport fuel,

and thus resorting back to nonmotorized modes- walk bike mule

Yes, tremendous work to be done.

Electricians rising.

No one should be pretending that the big fade in abundant oil will leave civilization unchanged,

and that certainly includes our collective expectations for transport.

STEPHEN,

You bring up legitimate concerns about Ramping Up EVs. However, the 50-ton Brontosaurus in the room is that diesel is by far the most important liquid fuel, not gasoline. Even ramping up EVs, reduces more gasoline demand, but I am not really seeing that.

Regardless… the Trains, Ships, Barges, Trucks, and Airplanes, run on Diesel and Jet Fuel. Anyone crazy enough to get into an EV Airplane… please include me in your will.

steve

Steve

The first step has been taken. Pictured is a modified Dehavilland Q100 Hybrid. Note the battery packs on the side of the fuselage.

While not explained in the article, this is an aircraft powered by a propellor driven electric motor and a turbine engine driving a generator. At takeoff, power is provided to the motor by the battery and the turbine. During cruise for a limited range, power comes from the battery, possibly 100 miles, just a guess. When the battery gets low, the jet fuel powered turbine kicks in for the additional range. Similar in concept to a plug-in hybrid car.

The idea here is to replace the standard turbo-prop engine which has to be sized for takeoff power and may only need 60% power for cruise. So the turbine engine used to power the generator would just be sized for cruise power.

I think the market for this type of aircraft would be Europe, India and China which may have a large number of routes under 200 miles.

https://dehavilland.com/en/news/posts/de-havilland-canada-working-with-pratt-whitney-canada-to-support-the-development-of-sustainable-hybrid-electric-aircraft-propulsion-technology

Hybrids are a great technology for extending available oil resources. Toyota and Honda both took the position that hybrids are better and that’s why they are behind the curve on EVs. If I had to live with one car, it would NOT be an EV, it would be a hybrid or a plug-in hybrid. Unfortunately, all the emphasis today is on pure EVs (BEV). But, as I said, EVs make sense primarily for suburban homeowners with garages. For anyone else, hybrids make sense.

Stephen

The problem is California which is pushing for 80% BEVs by 2035. The problem is exacerbated by the 10 NE states that have adopted California emission standards over Federal emission standards. Toyota has been fighting the California Standard and have a partial victory.

Things could change around 2030 if Lithium prices continue to rise.

Yes, the diesel issue is an interesting one. As far as I know, you can’t make just diesel from crude — you have to make gasoline and other liquids in various fractions. Correct me if I am wrong about that.

In an all EV world where diesel is still in use, gasoline would be a waste product without a market. Of course, this will not happen. Gasoline would continue to have value and gasoline powered cars would continue to be produced to use it, even if just as hybrids and PHEVs. This, I think, would give longer life to the viability of ICE vehicles.

Stephen

I would expect the price gap to grow between gasoline and diesel as excess gasoline is produced.

The world will learn to make due with cargo being transported by residual bunker oil, electricity, and perhaps hydrogen, as oil products available for transport becomes too expensive or unavailable.

No choice but to make do.

I suspect that much of the optional uses of transportation will be weeded out over the next couple decades [super wealthy exempt from limitations , as usual].

We can make a priority list of oil product use.

Either the market or politicians will eventually make and enforce such a list.

Here are few list items to consider

-using diesel to grow corn for ethanol is ridiculous [the net energy output per acre is pitiful]. Almost any other use of the prime farmland would be an improvement

-on the other hand, most diesel for agricultural food and fiber purposes is a high priority

-close to 100% of aircraft travel is optional, and can be simply phased out quickly. I would continue on with search and rescue, law enforcement, and coastal defense flight operation capabilities, for example

-RV travel, hobby fishing, and cruise ships are the type fuel use that could be phased out quickly without the collapse of civilization

-in the US the Nixon mandate for nationwide 55mph speed limit to conserve fuel could be re-initiated and enforced by automated camera detection linked directly to your newly required Federal Credit/Debt Ledger for instantaneous balance adjustment…

The move toward a system of supply restriction/rationing/penalties will be pretty quick if ‘the market’ doesn’t get the job done in what is perceived as an effective and equitable manner.

Electric transport looks pretty damn compelling when faced with a soon to come future of depleting oil,

despite the biggest drawback- range not what you have been used to.

I am so surprised by the attitude of many…desperately holding on to the notion that one option is to just stay the course with petrol just as it has been for 70 years. Sorry to pop the bubble folks, but time to change our act. Its twenty or thirty years late to just be getting started, but the change needs to embraced with intense enthusiasm if you want things to rolling.

I agree — we are headed to a future of “make do”. It will not be an electric utopia nor a medieval dystopia. But our current mode of living will come face to face with the reality that it can’t continue. I expect I will live to see just the beginning of the change, but my son will certainly see it in full form in his life time. You are also right that EV transport looks compelling — that’s why I have two of them! But it will be available primarily to those in the correct situation — relatively affluent suburban home owners. I see my EVs as long term insurance policies against whatever may come.

Some interesting statistics can be found here: https://www.researchgate.net/figure/Summary-of-the-EV-Owners-Demographic-Characteristics_tbl1_335455046

EV owners are primarily older males (>50), highly educated, high income, and have 2 or more vehicles.

Another report summarizes: “The current top demographic of EV owners are middle-age white men who earn more than $100,000 and own a home with a garage to support home charging.”

Your ideas about the demographics of EV ownership is

-certainly not what is seen in the biggest EV country…China

-is going to be an antiquated demographic characterization even in the US as this decade rolls on

“And does anyone believe EV semis will replace diesel semis?”

Two and Three axle class 8 day cab tractors that return home to be charged overnight are doable with todays batteries. You can include class 7 and below bobtails doing local delivery also doable.

Over the road highway tractors demands are far from being served by todays batteries. It’s my belief we would need to see at least a doubting of todays battery storage ability or self driving highway units which could slow down, platoon their speed and reduce energy demands. Self driving changes the cost function per mile and driver rest downtime factor.

Example, Today a owner operator picks up a 45′ trailer of limes in Ventura at 6pm on Friday and has 58 hours to deliver it to the market place in Chicago 2000 miles away at 6am Monday morning for $3500. The driver runs most of his route at 75mph , works two log books to fake being legal and spends $2000 in fuel getting 5mpg. The self driving rig runs at 50mph and consumes 2KW per miles at a cost of $1000 with 18 hours to recharge and no labor.

Agree that EV Semi’s aren’t remotely scalable yet.

Problem is most states besides CA have truck speed limits of 70-80 MPH. Tesla Semi at those speeds would likely burn 3 kw/mile, dropping it’s range to 300 miles. This would mean driver (or driverless rig) would be stopping every 4 hours to charge for an hour and your 2,000 mile trip take a lot longer (I don’t think there are any drivers that want to give up 3-4 hours per day to charge). No sure there would be real fuel savings, lots of range anxiety to boot… annually each EV Semi could consume 250 MWs. Assuming 10% market at some point – that would be around 250 TWs (daily load of ~1 TWs, which is more than 25% current demand). To get 50% EV Semi’s on the road we would need to at least double electricity generation…

Unfortunately, it seems like Semi’s should be the last to get electrified…also, what do you do with 10-15 million semi’s that are no longer needed? What does the EV Semi do when the power is out???

Conversion to hydrogen seems like a better option than using 1000kwh battery in a semi (which is enough to power 10-15 passenger EVs). Those 10-15 EVs would also use a fraction of electricity compared to the Semi (50-100 TWs total vs. 250 TWs for the Semi).

The EV Semi (Tesla) will be a niche vehicle for the giant companies to buy and highlight in their sustainability reports, a good reason why we haven’t seen them delivered (more than a few) yet…

The future of EVs is small and efficient formats (2 wheels, 3 wheels, and other ultralight setups). Large EVs are too power hungry, reality is long haul freight should be done via train anyway/not trucks…trucks should be used to move short 100-200 mile distances…

The EV Semi (Tesla) will be a niche vehicle for the giant companies to buy and highlight in their sustainability reports, a good reason why we haven’t seen them delivered (more than a few) yet…

Tesla says their semi is good for 80% of runs (500 miles without recharging, so a 250 mile round trip), and cost much less to fuel and maintain. You haven’t seen more because they are still ramping up production. It takes time to sort out production lines and supply chains.

Regarding long-haul there is already a quite efficient mode of transport, perhaps you´ve heard of it, it´s called electric rail…

But for final delivery, BEHVs will work great. H for heavy, if needed.

The problem is not the trucks, it’s the recharging. I read recently that a truck stop builder wanted to include eight recharging stations for future EV truck use. The plan was shot down by the town because those eight slots would use more electricity than the entire town. Really good article on this issue:

https://www.bloomberg.com/news/articles/2022-11-14/tesla-s-electric-semis-are-coming-and-trucks-stops-aren-t-ready?leadSource=uverify%20wall

Just think through the implications. Chargers that sit idle most of the time then create the demand of a small town? How do you ever balance the grid? Sounds like they’ll need backup diesel generators to me.🤦♂️

Hello Stephen,

I’ve been an EV owner (’18 Bolt, ’22 Model Y) for 4 years now and have taken cross country trips in both cars. I would agree with your assessment if you are driving a Bolt or similar smaller packed, slower charging EV. I have no qualms about driving cross country in a Model Y or similar EV with about 300+ miles of range. The Supercharger network is first rate and many motels are offering Level 2 overnight charging.

My cross country experience says that with a 300+ mile range, I need to stop and refresh (rest room and meal). At 60 MPH, this is approximately once every 4 to 5 hours. While doing a refresh stop, I plug in and recharge. Time-wise, it is about the same as doing the same type of stop with an ICE except the refueling comes either before or after the refresh period. I’ve timed it and it works out to be about the same +/- ~5 minutes???

At home, my PV array generates 300 to 400 kwh in January. At 4 miles per kwh, this is 1200 to 1600 miles. The problem is the initial expense and I have no way of capturing the electricity I don’t use. It goes out on the mains.

I can see adding a Powerwall and another array of similar square footage but I am waiting for more denser batteries and more efficient solar. The other technology is V2G where my EV acts like a Powerwall. How this all transpires is a crap shoot.

With regard to your statement about auto mechanics, my ICE mechanic wants to buy my EV when I go to sell it. I go to him for my state safety inspection. But I see him in the same position as saddle makers, blacksmiths, and other horse related businesses back in the early 1900’s. He thinks he can still make a go of it with EV’s that need A/C services, etc. I hope he is right but I am not so sanguine. But we will see.

We are definitely living in interesting times.

Fast chargers work if you are on main highways. It’s a different story when your trip takes you off the beaten path. But even with fast chargers, you can’t beat the range and quick recharge provided by a gas pump, not to mention the iniquitousness. We are a long way from EVs providing an equal level of convenience compared to ICE vehicles.

Stephen.

In some ways ICEVs are more convenient, but “refueling at home is pretty convenient, with a little planning EVs work fine with Tesla’s supercharging network, which is widely available in the Northeast, even in fairly rural areas off the interstates. I no longer own an ICEV, just 2 Teslas, they work fine for me. Far nicer than any vehicle I have owned in the past.

It’s crossing over and favoring EVs for most applications. A little planning and you can get by just fine. The only place where I might run into a problem are remote off the road situations and for those, I can rent a car or jeep or pickup. Last time I ran into such a situation was in SW Texas in the Big Bend area. Very few Level 3’s in the area but a number of Level 2’s.

If I were to do it today, I would take my time. Overnight charge while viewing the stars at a motel but then I’m retired. A Level 2 and 14 hours of charging can add 350 miles. Arrive at 5 PM and leave at 7 AM the next day.

A Tesla Model 3 has batteries with an energy density of around 250 wh/kg. Next year one of the Korean(?) companies is said to have batteries with 360 wh/kg and there is a battery announced from a lab with an energy density of 685 wh/kg. Add 10% to that density and it would have an energy density of 753 wh/kg or 3 times the density of a Model 3 pack. The range of a Model 3 is 359 miles but with a 753 wh/kg pack, that range could extend to over 1,000 miles.

The cases where ICE vehicles have a use-case over an EV are diminishing.

Goldman’s Currie reiterates bullish oil thesis: The greatest impact from regional bank crisis will be to limit the capital available to shale drillers, which would ultimately curb oil supply.

“What kind of lending gets hit? It’s what’s going to go to the shale patch.”

https://twitter.com/zerohedge/status/1638154269701308416

Thoughts? Figure some here would know the ins and outs of funding in shale.