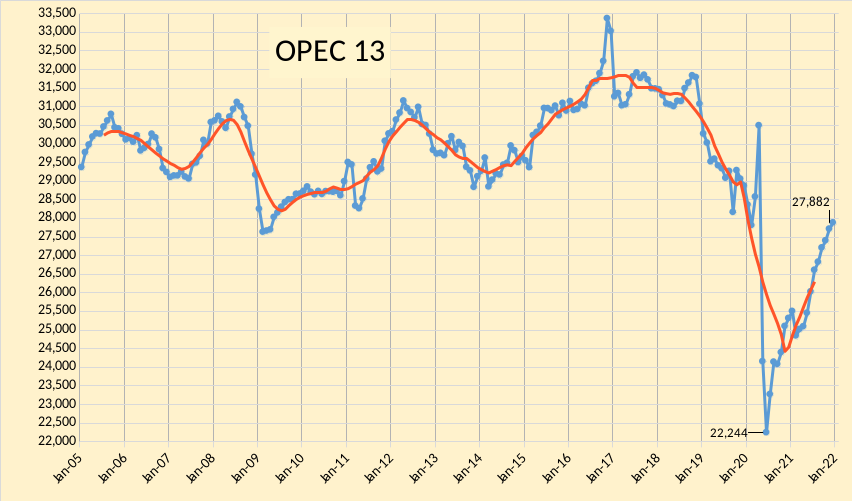

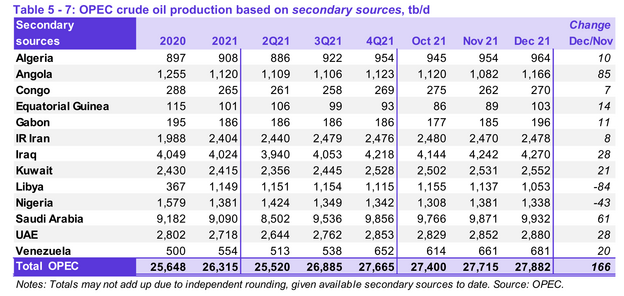

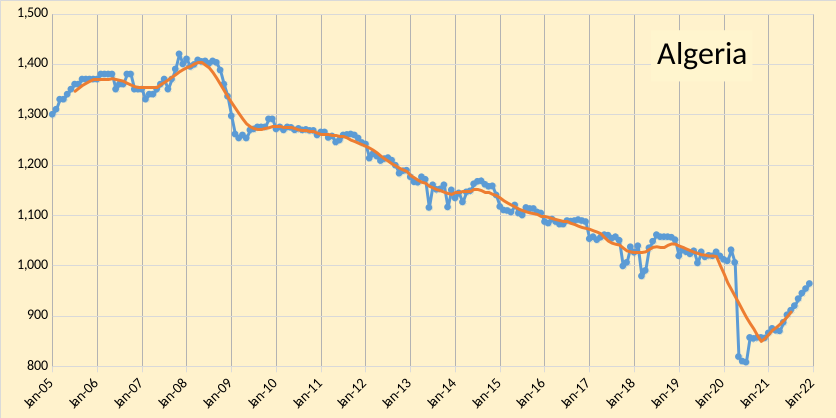

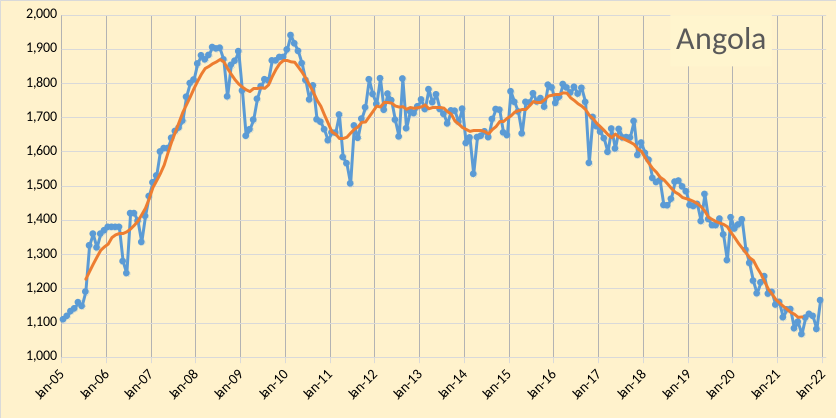

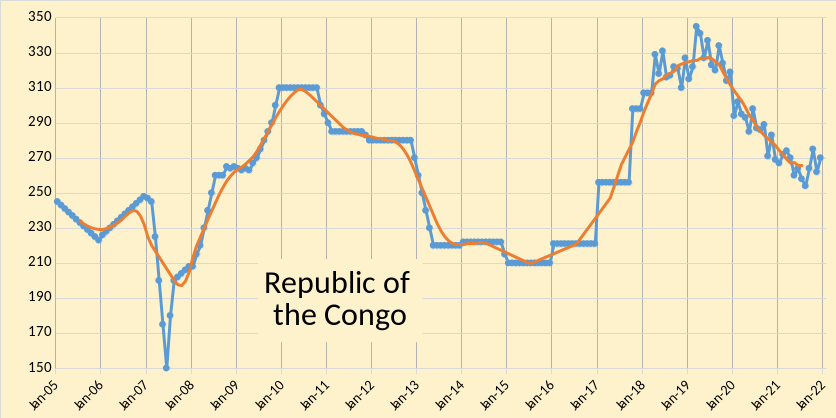

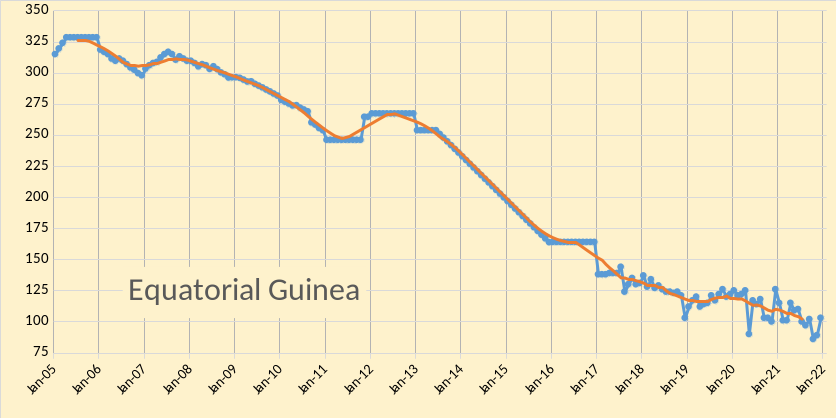

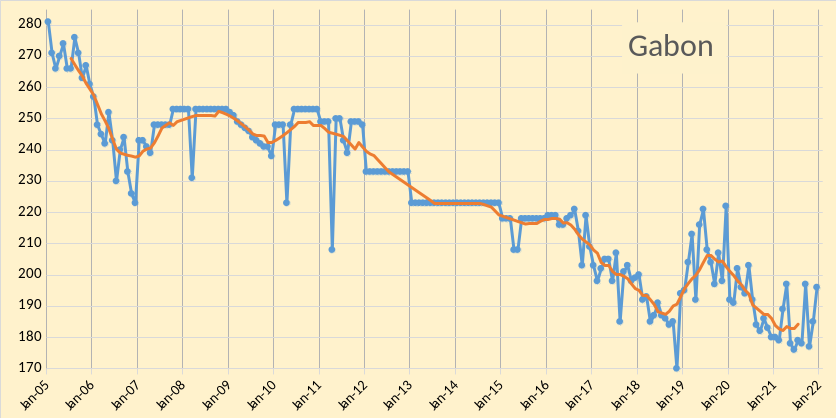

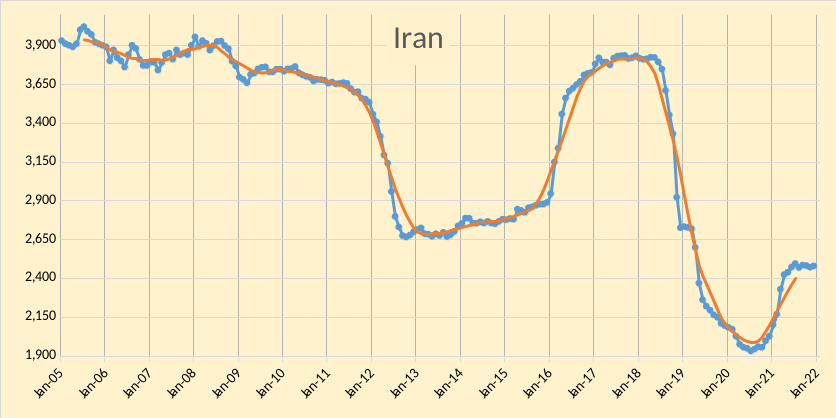

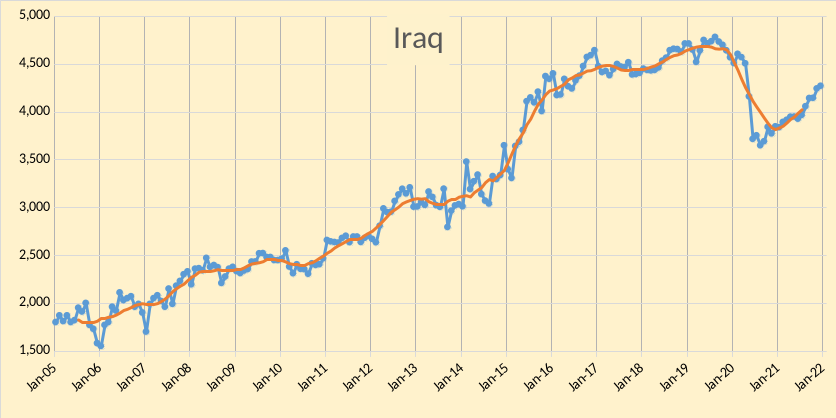

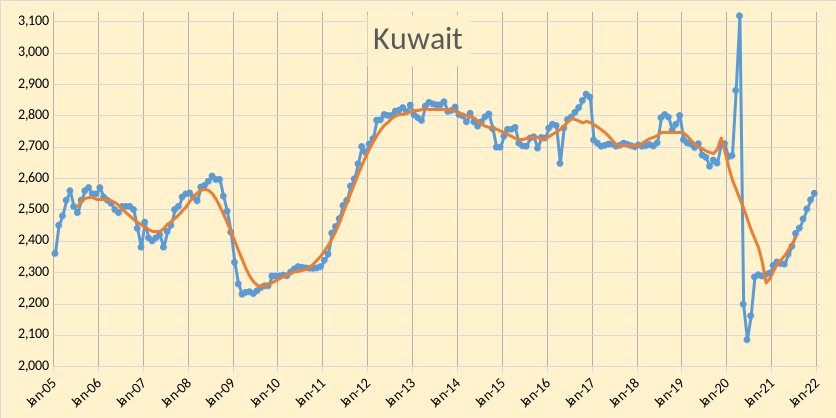

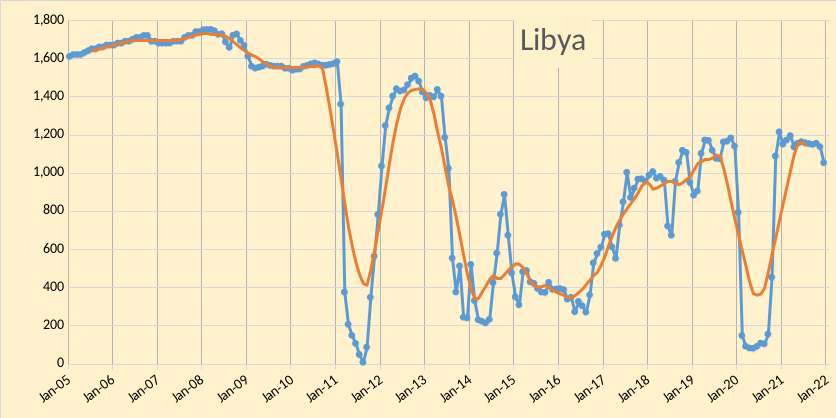

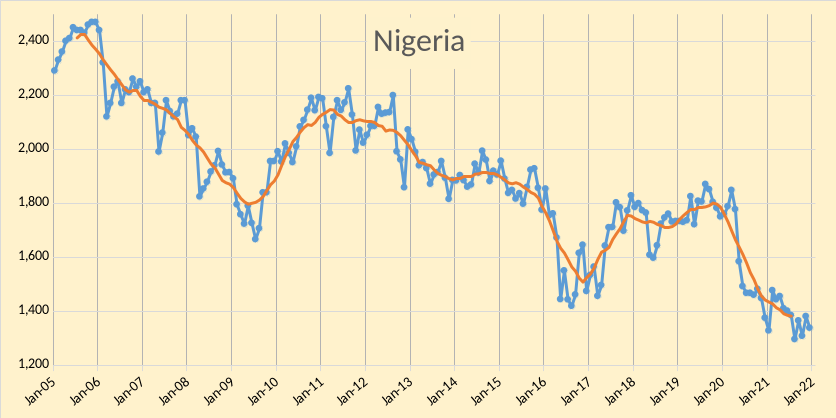

The OPEC Monthly Oil Market Report (MOMR) for January 2022 was published this past week. The last month reported in each of the charts that follow is December 2021 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

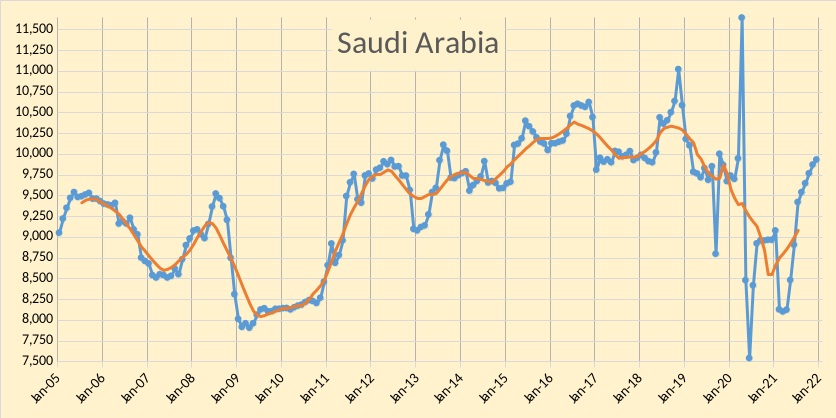

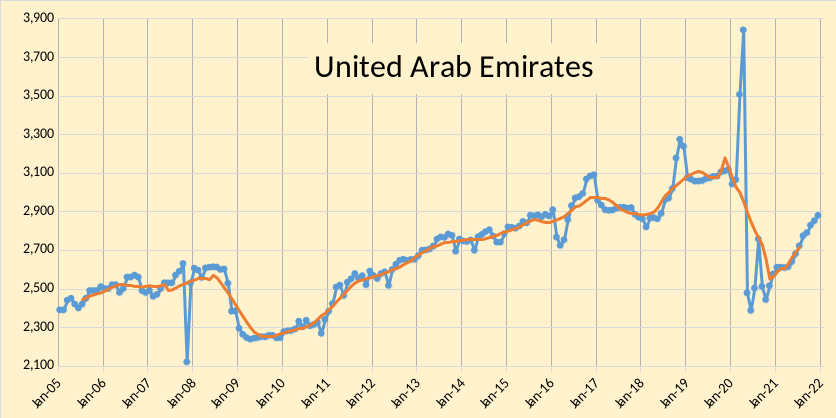

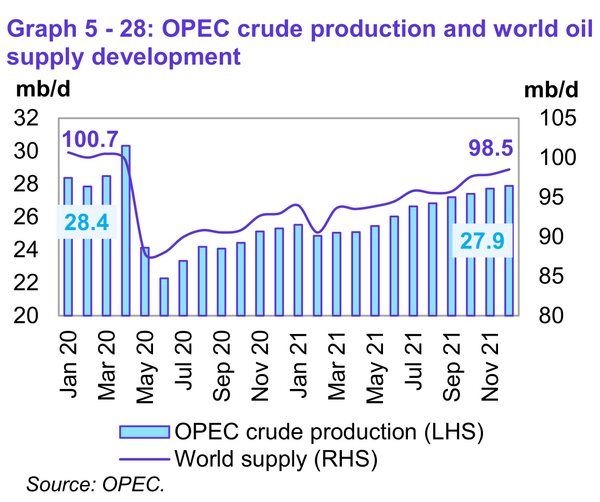

OPEC produced 27882 kb/d of crude oil in December 2021 based on secondary sources, an increase of 166 kb/d from November 2021. October 2021 output was revised lower by 32 kb/d from what was reported last month and November 2021 output was revised down by 2 kb/d compared to the December MOMR. Most of the increase in OPEC output was from Angola(85 kb/d) and Saudi Arabia(61 kb/d) followed by Iraq (28 kb/d), and UAE (28 kb/d). Seven other OPEC members saw increases of less than 22 kb/d in December 2021. Decreased output from Libya (84 kb/d), and Nigeria(43 kb/d).

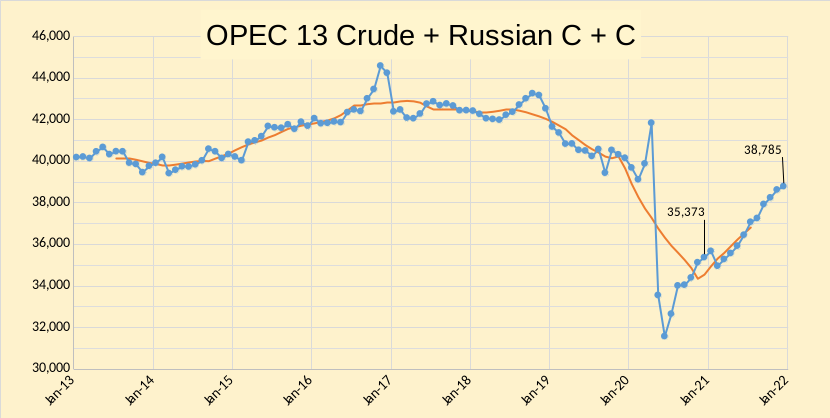

In the chart below OPEC 13 crude and Russian C+C are shown, I expect that OPEC 13 will struggle to get to 29000 kb/d and Russia will likely top out at about 11000 kb/d, where I assume there will be no near term sanctions relief for Iran and Venezuela (together they might add 1800 kb/d in the medium term, if sanctions were removed.) Over the next 6 to 12 months we might see 1215 kb/d added from Russia and OPEC 13. I doubt they will be able to increase by 350 kb/d each month as suggested by the DOC.

World liquids output increased by 0.65 Mb/d in December 2021 to reach 98.51 Mb/d, this is about 2.2 Mb/d less than liquids output in January 2020.

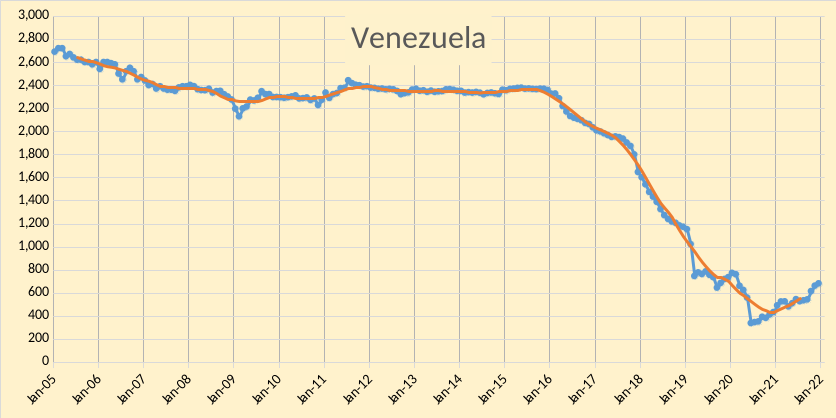

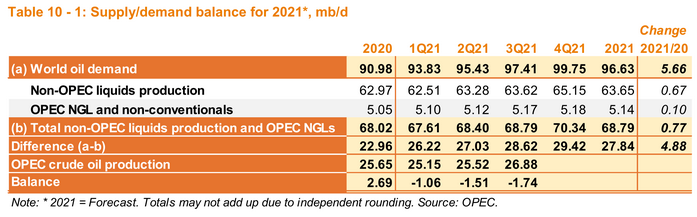

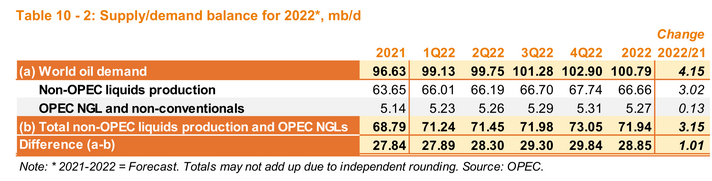

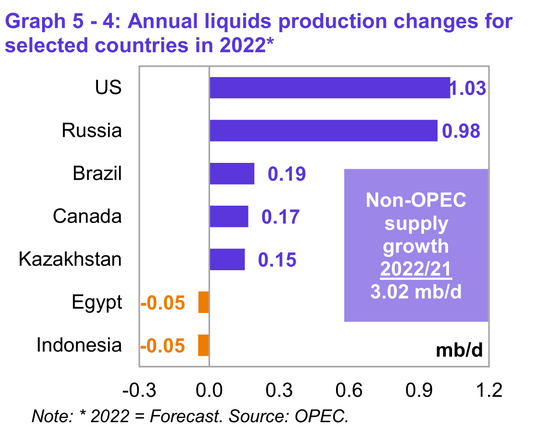

There will be a significant stock draw in 2021Q4 if OPEC’s demand estimate is correct, about 1.75 Mb/d (or 159 million barrels). If OPEC meets its 250 kb/d quota increase each month from Jan to March, there might be a surplus of 492 kb/d in 2022Q1, but note the large increase in output assumed for non-OPEC in 2022Q1 (900 kb/d). It is unlikely this estimate will be accurate in my opinion. Also consider the figure 7 below that shows non-OPEC liquids output increasing by 3 Mb/d in 2022 with two thirds of this coming from US and Russia. A better guess is about 1 Mb/d from Russia and US combined in 2022. Note that this might increase the call on OPEC to 30.84 Mb/d in 2022Q4 and OPEC is likely to fall about 1.84 Mb/d short. If sanctions on Iran and Venezuela are removed by mid 2022, perhaps leaving adequate time for them to ramp up output (roughly 1.6 Mb/d has been taken off the market by the sanctions on these two nations) the supply crunch might be less severe.

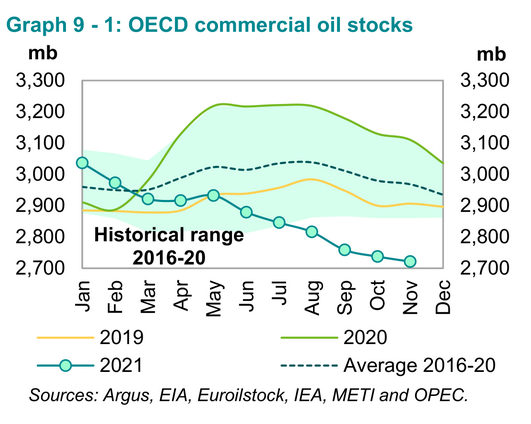

From MOMR (page 65):

Preliminary November data sees total OECD commercial oil stocks down by 16.0 mb m-o-m. At 2,721 mb, they were 389 mb lower than the same

time one year ago, 247 mb lower than the latest five-year average and 221 mb below the 2015-2019 average.

My expectation is that OECD commercial stocks will continue to fall through the end of 2022.

The OPEC big 5, Saudi Arabis, Kuwait, Iran, Iraq, and the UAE are almost back to their pre covid level. The other eight, however, are still about one million barrels per day below that level. They have been on a plateau for fourteen months now. They are in obvious decline as the chart below clearly shows. And, they are at about the level they should be according to their decline rate. The other five will have to make up for their one million barrel per day decline.

Anybody know which oil producing countries are managed by a central authority (vs a ‘free for all’ market approach without significant regulatory restriction such as we have in the US)?

I ask with the following in mind- a nation with oil reserves and central planning authority might intentionally produce at a less than maximum ‘all out’ rate in order to sustain their output over more decades, attempting to avoid a boom and bust scenario and having the goal of extending production to a time when others countries are more depleted and the prices for product will be higher. Its what i would do.

Intentionally slower pace, steady progress, longer run time.

I´m afraid such a country would soon be “liberated” by the US, so we will never know how it would work out…

Edit: or by some affiliated group of nations, in some treaty.

This article is a month old yet it is important as it tells us what Russia plans to do in the first quarter 2022.

Russia plans lower oil exports for Q1 2022 despite OPEC+ plan to raise output

MOSCOW, Dec 17 (Reuters) – Exports and transit of oil from Russia are planned at 56.05 million tonnes in the first quarter of 2022 versus 58.3 million tonnes in the fourth quarter of 2021, a quarterly export schedule seen by Reuters showed on Friday.

Russia’s plan for lower export loadings comes at a time of its planned gradual increase in the state’s oil output next year under a recent OPEC+ agreement.

On a daily basis Russia’s own oil exports and the transit of crude from Kazakhstan, Azerbaijan and Turkmenistan via Russia’s Transneft pipeline system will decline by 1.7% in the first quarter of 2022 compared to the fourth quarter of 2021, Reuters calculations showed.

Export Land Model math applying to Russia here? Demographics in Russia are pretty bad. They have to export their way to prosperity. As they just don’t have to demographic profile to consume their own production.

The fact they are cutting exports is very telling of the dire situation their oil industry is in. It’s not like their domestic demand is increasing by any huge amount.

As exports from Russia and Saudi Arabia decrease their revenue decrease. Which will decrease their ability to bring more oil and gas to market. Doom loop.

“Russia’s trade surplus widened to USD 21.06 billion in November of 2021 from USD 7.39 billion in the corresponding month of the previous year. Exports surged 62.4 percent to USD 48.96 billion, the highest since December 2013, boosted by sales to non-CIS (64.8 percent) and CIS countries (49.2 percent). Meanwhile, imports rose at a softer 22.6 percent to USD 27.90 billion, driven by purchases from non-CIS (21.3 percent) and CIS countries (34.4 percent). “

Russia is building floating nuclear power plants to not only produce arctic oil but also mine lithium and copper and other recourses.

But are they even going to make money if prices don’t go much higher and stay higher. Don’t let a trade surplus fool you. Higher nominal oil prices can make the value of their exports seem great even if volumes of exports aren’t making higher highs.

Russia oil exports peaked in 1988. When the price of oil was $15. Russia had a second more recent peak after they recovered from collapse. Which was in 2006. And oil was $58. 2006 was 16 years ago and between 2006 and today and oil prices were much higher for a period of time between 2011-2014 than they are currently and Russia still hasn’t seen a peak in exports higher than in 2006.

Oil exports from Russia have been on a 20 year plateau and they are starting to come off that plateau. They also need much higher prices in order to try to extend that plateau.

And everything they have left is the hard to get to and costly variety.

$58 in 2006 is today about $79 inflation adjusted. If the oil was there to increase exports we at the price they should be increasing at. But they are cutting exports instead.

My friendly neighbor Norway has previously been less smart, exporting oil at fairly low prices during maximum production. However, they have now smartened up a bit, so they now export electricity at high prices, and importing it at low prices, contrary to us, the Swedes, who do the opposite…

https://www.nordpoolgroup.com/Market-data1/Power-system-data/Exchange1/ALL/Hourly111/?view=table

You have probably seen the other picture before but must post it as a new post, as required by the hosting agency…

Hint:

Russia imports less than any other major country.

With a large energy and agricultural production, a highly educated and small population, largest country on Earth, etc.

It would do just fine with minimal exports.

It just happens to have one of the largest oil reserves.

How Russia became the world’s LEADING wheat exporter:

“Mainly through increased yields, Russia saw its wheat production double to 60 million tonnes in 2010 and to a record 85 million tonnes in 2020.”

I think that’s the point. When Russia and Saudi exports fall a lot of dominos fall. It doesn’t really matter if production goes a little higher from here in producing countries if that doesn’t equate into more exports.

Wheat takes a lot of fossil fuel inputs btw. Their exports of wheat will also be cut in not too distant future.

And it’s not like exports have to go to zero for there to be a problem. Just a little less here and there and people go hungry.

In just a handful of years at most the US will be importing on a net basis a lot more oil than we do today as shale oil production collapses. Which everyone here agrees will happen it’s just a matter of when. That means somebody somewhere gets left out in the cold.

I think that’s the point. When Russia and Saudi exports fall

You are missing the point— Russia can live at its current level with little oil exports.

Saudi’s need oil to survive.

In Russia, the entire economy depends on taxes on the export of hydrocarbons. The thought is that projects where the cost is high will not be implemented until the price increase makes it possible to pay taxes on projects. So about 10 years ago, when they did not yet know the exact reserves in Yamal (80% of gas production) , they wanted to develop the Shtokman gas field (the Barents Sea 650 km to Murmansk). But they refused – the estimated cost was $ 150 per thousand cubic meters …

In Russia, the entire economy depends on taxes on the export of hydrocarbons.

Really?

—–the oil-and-gas sector accounted for 36% of federal budget revenues.

“Really?

—–the oil-and-gas sector accounted for 36% of federal budget revenues.”

—–

Hightrekker. Of course, 36%. But the surplus value of the hydrocarbon industry is simply huge. The industry is highly profitable. There are several dollars of income per dollar invested. Revenues from the industry are a multiplier for the rest of the economy.

The profits from exports are used to purchase components for industry and the production of goods.

In conditions of discrimination, there are few goods to sell abroad from Russia. Markets have long been divided. There was a time when the share of civil aviation in the world was approximately 25-30% for the USSR. For objective reasons, it is difficult to integrate into the world trade in high-tech goods.

What’s the oil production and reserves of Yemen to warrant that brutal genocide by the coalition of ” freedom and democracy ” ?

Remember that Wahhabirabia and the others gulf feudal monarchies are kingdoms not regimes in western vocabulary so they can get away with it.

You don’t get the ressources by air raids, as done for many years now.

You get them only after an old style invasion – or a complete capitulation. No sign of this in this war.

The economics of invasion aren’t good: https://www.americanthinker.com/blog/2022/01/one_reason_russia_wont_invade_ukraine.html

That has never stopped the United States [Viet Nam, Aphg, Iraq],

but perhaps Russia is more rational?

Interdependencies do not stop wars. France and Germany were interdependent prior to WWI. At the time, a war was seen as inconceivable for this reason, e.g. Norman Angell, 1910. The Great Illusion: A Study of the Relation of the Military Power in Nations to their Economic and Social Advantage. London: William Heinemann.

“Interdependencies do not stop wars”…

entirely, but perhaps makes war much less likely?

Ask yourself this, which can you survive longer: less income, or not heating your home in winter? I think Europe may be in for a surprise if they think Russia losing a bit of cash will stop them going into Ukraine if they want to.

To quote President Palmer from 24, “It may hurt us, but it will destroy you.”

Dennis

Attached is a table which compares the December crude output of OPEC countries with their required December output. The overall deficit is 629 kb/d. As you can see, the biggest deficiencies are in Angola and Nigeria. While SA is also showing a much smaller deficit, I have noted at the bottom that “official communications” show that they are above target.

I also note that SA is now producing 9,932 kb/d, which is 855 kb/d above their January 2020 output of 9,077 kb/d. It will be interesting to see how much they will increase production to erase the OPEC plus deficit.

I also note that SA is now producing 9,932 kb/d, which is 855 kb/d above their January 2020 output of 9,077 kb/d.

I think you meant their January 2021 output.

Ron

Thanks for the wakeup notice. I did mean January 2020 but looked up the January 2021 data. January 2020 production was 9,739 kb/d and very close to the same production level for most of 2019. (See Dennis’ SA Chart).

So December 2021 production of 9,932 kb/d is only 193 kb/d higher than January 2020. Over the next six months we will see if SA can increase and maintain a production rate of over 10,000 kb/d.

Ovi,

Thanks. I doubt the deficit from Nigeria and Angola can be made up. The best hope for higher OPEC output is an end to sanctions on Iran and Venezuela. Eventually UAE, Iraq and Saudi Arabia might be able to raise output in a high oil price environment.

A repost of Norways production/oil income, as mentioned above.

Courtesy Rune

Edit: a similar graph might be made of Permian frackers…

I’d love to see that chart updated to show 2021. That chart ends in 2011 right at beginning of high oil price period of 2011-2014.

I think if you extrapolate it out beyond 2021 you’d see that unless prices go way higher there will be lack of revenues to support funding and or ability to borrow cash to support and maintain future production.

HHH,

The world is now upside down.

Norway recently achieved more than 300 USD/BOE (1 BOE = 159 Scm or 1 BOE is about 6 Mcf) for natural gas as opposed to about USD 87/Bo for crude oil.

(On a BOE basis natural gas now achieves about 4 times more than crude oil.)

I got Norway natural gas reserves at 72,358,000 mcf and production at 5,763,408 mcf which at current rate of production they run out of natural gas in 12-13 years. If those numbers are correct they better get as high of a price as they can get.

They have their sovereign wealth fund. Most of which is invested in global stock markets. Smaller slices are in bonds and real estate. That wealth could literally vanish in short amount of time if they are unable to exit their positions during a global liquidity crisis or dollar shortage crisis. A repeat of 2008. $1.4 trillion wealth fund up in smoke.

These high energy prices increase odds significantly that something systemic breaks.

Eurodollar market is where the breakdown will occur.

The most recent NPD (Norwegian Petroleum Directorate) data confirms your R/P number of 12-13.

More than 90 % of Norwegian gas extraction (ex installations) is exported to Continental Europe and the UK, or close to 25% of the EU + UK consumption.

Something is going on in the Eurodollar (inverted yield curve) system, and according to some sources, the Eurodollar system is 3-4 times bigger than the US Dollar system.

The Fed has no jurisdiction over the Eurodollar system.

What is unknown is how much firepower the Fed has left for an upcoming USD liquidity squeeze.

I am also in the camp that the present high energy prices are not sustainable…..after that, we will have close to free energy……. for some time 😉.

Eurodollar system creates actual dollars that are injected into global economy. FED creates bank reserves that are denominated in US dollars that never leave the FED.

It will be up to US government to spend dollars into economy. Not the FED. Good luck 😁

Actual money in the US onshore dollar market is created by commercial banks via loans. Which FED manipulates banks to do with lower interest rates for borrowers.

FED QE is nothing but a collateral swap. They swap bank reserves for US treasuries and MBS with primary dealers. Which allows collateral not to be marked to market. No money is injected into economy during the process.

Banks however do use the bank reserves created by the FED at REPO to borrow collateral from the FED in the form of treasury mainly T bills. Collateral for which they use to borrow money at REPO to fund daily transactions between banks. So shrinking the amount of bank reserves or FED’s balance sheet is a no go. Margin debt used to pump asset prices takes a hit if FED’s balance sheet were to ever shrink.

Eurodollar market dwarfs the FED and the onshore dollar market though. And when there is a contraction of lending in Eurodollar market all hell brakes loose and you get a wrecking ball dollar.

Oil at $147 and 2008 have one thing in common. First people believe what they are told. It was high oil prices or subprime mortgage in USA that caused the crash.

No it was smooth sailing Eurodollar market that created the dollars that drove oil to $147 and it was a contraction in the Eurodollar market that lead to the crash of oil prices and subprime and all of 2008

People are focused on just the inflation created by supply side issues. But it’s these very supply side issues that will limit the ability of the banks the create the dollars or the loans in Eurodollar system from doing what they are supposed to do.

China lockdowns lead to less lending. Is by far the biggest.

European natural gas shortage if it continues will lead to less lending.

@HHH excellent summary. One minor addition worth thinking about: The connection of subprime to the Eurodollar market was largely a self-fulfilling prophecy. Pristine collateral is UST’s. In good and stable times various lower tier collateral was often used. This included increasingly sketchy MBS based products. The growing fear that the underlying collateral would be devalued became a self-fulfilling prophecy. There was at least some whiff of reality to this, probably caused in part by a slowing housing market – which may have a causal root in oil prices – or at least shared late-cycle phenomena.

At the end of the day the Eurodollar market exists because Americans save less than they invest. This is the same as importing more than you export. Low savings are a perennial problem.

America has been a net importer of goods and services for generations, and a net exporter of dollar bills in exchange. This works because international supply chains need to be kept liquid, and local currencies can’t provide that service.

The Fed can’t control the Eurodollar market, but the American government could easily tighten Eurodollar supply by taxing domestic consumption, especially of oil, which would stem its import and encourage its export.

Also I think the Eurodollar should be called the Asiadollar, because the euro pretty much killed the Eurodollar market in Europe.

Hello Laplander,

I received your email back in Sep-21, but I have had a ton of other issues to tend to.

I will of course reply to your email.

I am looking into updating said chart with data as per 2021.

Found a slighty more recent graph, but still a bit old,,,

Don´t think things have improved that much though, but I know Johan S has exceeded expectations. Still they are only at the 1,8 mmbd range…

Laplander,

I have a post showing the same figure with data as per 2016.

https://wordpress.com/post/runelikvern.com/1210

(Chart was updated as per 2017, but not posted)

Note the charts are forecasts for sanctioned fields at the end of the year.

Johan Sverdrup produced more than the operator’s expectations when the chart was developed.

(I was aware that some projected a higher output from Johan Sverdrup, but at the time settled to use the operator’s (Equinor) data.)

Attached is the latest Norway production data from the Norway Petroleum Directorate. The green line is EIA data up to September. The red markers are for Oct, Nov and Dec from the NPD.

The October increase was due to a number of factors according to OPEC, which also explains the increase in December.

“The higher oil output in October was due to first oil from Aurfugl Phase 2 by operator Aker BP as well as rising production in Martin Linge, which started-up in July. Part of this monthly increase is also due to the return of some fields from seasonal maintenance. Moreover, after years of delays, the Yme field in the southeastern part of the Norwegian sector of the North Sea started production on 25 October. At its peak, the field should deliver around 56 tboe/d.“ In addition, the the second phase of the Johan Sverdrup facility is planned to start up in 4Q22.

The November drop was due to technical difficulties which were resolved in December and brought Norway’s production to a new local high since Jan 2014.

From link below

https://www.norskpetroleum.no/en/production-and-exports/production-forecasts/

The Norwegian Petroleum Directorate forecast below, expected peak is 2.03 Mbpd of crude plus condensate in 2024 from a 2021 level of 1.77 Mbpd (increase of 260 kb/d over next 3 years.

USA peak 12,868 Kbpd Nov 2019

World peak 84,598 Kbpd Nov 2018

I sound like a needle stuck on a broken record but am helpless . The facts are the facts . These will not be surpassed .

Hole in head,

The last statement is an opinion. I agree on your facts. Also a fact that there have been many past peaks that were then surpassed in the future. Eventually this will no longer be the case, when that occurs is highly speculative. World 12 month average peak is about 83.5 Mbpd (can’t remember exact number) in Nov 2018 for centered 12 month average. Single monthly records are of little interest, sustainable output is what matters in my opinion.

World oil 12 month average peaked at 83,130,000 barrels per day in April 2019. That 12 month average will never be surpassed.

End of story.

Will one of the great ironies of modern history be that for a brief time POST PEAK — April 2020 — oil prices actually “went negative” when inventories were full, but world supply had begun its permanent decline?

Stay tuned.

Ron,

That is speculation on your part, there are no future facts. We will see in 2025 to 2028 if 2018/2019 remains the peak in 12 month average output. I doubt it. The trailing 12 month average is April 2019, the centered 12 month average is Oct/Nov 2018.

Dennis, you speak as if those extremely optimistic charts on your part are not speculation. No, they are no more than wild ass guesses on your part. At least I study the charts of all the major oil producers and the combined charts of all the minor oil producers. I am firmly convinced of the results of my research. My research tells me that peak oil is in the rearview mirror.

I will make another prediction. We will not have to wait until 2025 to 2028 to know when peak oil happened. I predict we will know before the end of 2023. In fact, world production in 2022 is going to tell us a lot more than you think it will. With Brent at around $88, every nation will be producing flat out. Let’s just see how much they can produce.

Oh, I watched the Art Berman video. Art has the exact opinion as I do. And not just peak oil either, though we do agree there, but also about the state of the world and the coming anarchy. Have you ever noticed how often very smart men think alike? 🤣

Ron,

I agree all predictions about the future are speculation and I consistently say so.

You make statements about the future as if they are fact, in fact they are not.

I also look at historical production of all nations, past discoveries, the rate that resources have been developed, and utilize research by many others in reaching my conclusions.

They remain guesses about the future.

On what happens in 2022 and 2023, it takes time to develop resources, it does not happen overnight. It is unlikely the 2018 peak will be surpassed in 2022 or 2023, but between 2024 and 2028 there is a high likelihood (80% or higher) that the previous 12 month peak in World C plus C output will be surpassed. After 2028 I expect 12 month average output of World C plus C will likely be decreasing. All of it is speculation.

Dennis, sure I speak of the past peak as if it were a fact. I have every confidence that it is. But if I am wrong then I will freely admit it. I will not make excuses as is the habit of a lot of people.

However, making a statement like: there is a high likelihood (80% or higher) Is far worse than just saying I am convinced that peak oil is in the rear-view mirror. It sounds like you have actually done some serious calculations, when in fact you just pulled that 80% number right out of your posterior. I consider your crime far greater than mine. 😇

Ron,

Here is a quote,

World oil 12 month average peaked at 83,130,000 barrels per day in April 2019. That 12 month average will never be surpassed.

The first statement above is a fact on that we agree. The second appears as if it is fact, notice the certainty implied by the use of will.

It is a possibility that your second statement is correct, in my opinion the odds are about 1 in 5.

Yes both are guesses, and both are likely to be incorrect, you are certain you are correct (or seem so) I am fairly certain you are wrong. We will see.

Berman says @ 40:00:

“you can’t compare a barrel of oil to PV because oil burns and does work and there is your measurement, you can’t do that with sun or wind because they come in a barrel and don’t burn, what do you with a barrel of sun? ”

Man, sounds all scientificy and objective doesn’t he?

He then goes on to talk about energy density and comes up with the astounding fact that more energy comes out of a 6″ natural gas pipe than a 6″ PV panel… or some nonsense. Yeah, sunlight on your shoulder is more diffuse than fossilized sun out of a well, but the choice isn’t between RE and fossils, the choice is between RE and nothing.

Don’t expect a reply from Art if you send him an email. He doesn’t know how to return it without a stamp and envelope. I couldn’t believe he said what he did.

Ron,

I agree with you. I was having a conversation with one of my oldest friends who also “was” an Independent oil producer. He was a great geologist/oil finder and now is retired. We both agree that the oil industry at least in the United States ceased to be an economic business when the projects we invested in yielded a potential (if successful) of less than 4 times your money based on undiscounted cash flow. I asked him to dust off some of his work and come up with some conventional prospects. He claims that the conventional prospects are way too small to justify the risk.

We then discussed why the Shale industry is an illusion. The company that bought my company has debt to EBITDA ratio of 2.5:1. ( I sold my shares as fast as I could) Their production (without any drilling) would decline by 50% in a year. This means that prices would essentially have to increase by 50% in order to maintain the same EBITDA year over year. The math simply doesn’t work and we came to the same conclusion that any company in the Shale Industry with a debt to EBITDA ratio of over 2.3:1 is a total zombie company with a significant chance of going bankrupt. Most of these companies are worth the debt value only leaving zero equity value for the investors. If this is a good business model that portends growth, please explain to me what sophisticated investor would play this game? The decline of these shale wells and now mostly child wells is so wicked that if you do not get pay back within 12 months, you will never make any money. The cost to operate a typical 3 year old Shale well making 20 barrels a day is probably only economic at above $120 per barrel once you include water disposal, pulling costs once or twice a year, equipment failure plus average operating costs and finally the typical 25% Royalty. If you don’t make your profit from the end of year one to the end of year 3, you will never make any money on these ventures.

So when I look at Dennis’s charts which show a peak in the Shale oil production being around 2025, I wonder if we are looking at different industries. I don’t know whether we will see $100 oil or $150 oil but at current prices (even at $85) most companies are really bankrupt theoretically with no real path to pay off the debt. One thing to also consider is that the majority of the banks have forced the companies to hedge a minimum of 2-3 years with swaps. Therefore most of the companies other than the larger unhedged companies are not enjoying the benefits of higher cash flow from WTI at above $85 dollars and are in fact losing big money on the hedges while their production is at near peak.

I can’t speak for the rest of the world’s potential for increasing production but I know that the US shale industry is an illusion and will fall off a cliff sooner rather than later.

Art is very smart and I happen to agree with his views but as an optimist I also have hope for the discovery of breakthrough technologies to avert anarchy and wars over scarce resources.

LTO Survivor,

I use royalty and severance payments at an average of 28.5% of wellhead revenue. At $77/bo and $3.50/MCF for gas at wellhead, and NGL at $28/b, the average 2019 Permian well pays out at month 20. (undiscounted net revenue is equal to $10.5 million at month 20). My understanding from Mike Shellman is 36 months is usually adequate for a profitable well to payout. If we use a dicounted cash flow analysis where the net present value is equal to well cost, we would need a real annual discount rate of 55% or a nominal annual discount rate of 57% (assuming a 2% annual rate of inflation). The average 2019 Permian well based on shaleprofile data and a hyperbolic fit to data with terminal decline at 13% per year after month 85 (hyperbolic used for months 24 to 84 from first flow) has cumulative output of 407 kbo, 1900 MMCF of natural gas, and 158 kb of NGL at month 144 from first flow at output of 20 bopd.

Note also my economic analysis assumes about $192 thousand (2020$) per year is spent on average on downhole maintenance for the average well over its life.

We have been living in a very strange place these past 13 years. A place in which interest rates and bond yields are actually negative when corrected for inflation. A lot of previous predictions of peak oil date made before 2009, failed to anticipate the effect that zero or negative effective interest rates would have on what had previously been uneconomic oil and gas deposits. There was very little unconventional production before 2008. If rates rise substantially due to inflation, global production is going to plummet. Zero interest rates and artificially low bond returns (resulting from QE) have masked weakness within the hydrocarbon sector. Would anyone be drilling shale if interest rates were at 5%?

This discussion is about when world oil 12 month average has peaked or will peak. Regarding barrels of oil

At least as important is ERO(E)I of those barrels. Already in 2012 (and earlier) ASPO conference speakers talked about this.

“The important thing (so far) – economically – is NOT Peak Oil but a cessation of growth in oil and energy,” Hall continues.

Next he describes the energy return on invested (EROI) concept: the energy delivered to society divided by the energy put into that activity. In countries around the world, Hall and his students have found a declining EROI for oil production.

Hall presents the “cheese-slicer” diagram that shows that the economy must extract energy, use it to produce GDP, which is then divided into two categories: investment and consumption. We invest in energy acquisition, infrastructure maintenance, and discretionary investments. Consumption is split into staples and discretionary. The charts begin in 1949, and if the EROI continues to decline as Hall suggests, by 2030 a much larger percentage of investments must be devoted to energy acquisition, greatly challenging both infrastructure investment and discretionary investment.

By D. Ray Long, originally published by ASPO-USA

August 6, 2012

Maybe this is less important than in the past ?

If important (almost) same way, we shouldn’t look at the number of extracted barrels only.

And what about the quality of crude oil and contaminations with different kind of elements ?

Han, yes I know EROI is very important. But where do we find those figures for OPEC, or Russia, of for the USA. Barrels is all the data we have so that is all we can track. I know it is not a perfect measure of what is happening in the oil patch, but it is all we have. Therefore I will keep tracking barrels per day.

…..EROI is very important. But where do we find those figures for OPEC, or Russia, of for the USA.

Ron,

Those figures cannot be found, because it will be impossible to measure them. That goes almost without saying.

I brought this subject up to ‘declare’ that Peakoil is most probably in the rear view mirror, when declining ERO(E)I is taken into account. Even without looking at this parameter, counting only barrels, it could be in the past. According your opinion.

Important then is: how long could a world production plateau last, during which world oil exports won’t decline drastically (at least in theory)

how long could a world production plateau last, during which world oil exports won’t decline drastically (at least in theory).

I don’t think a plateau in exports would last very long. When it becomes obvious that peak oil has passed, some exporting nations will start hoarding their oil. And due to the fact that oil prices will spine sky high, they can export less and still make more money. It will be crazy times.

“It will be crazy times”

And those people/companies/regions with electric capable transport will look brilliant.

Did you write the title, or did the editors do it for you? Love the hedge though, you know, just in case the 6th peak oil of the century showed up (it did), and do I hear a bid for the 7th?

https://oilprice.com/Energy/Crude-Oil/Why-Peak-Oil-Is-Finally-Here.html

Nope, I wrote everything there. And I was three years off. It is better than Dennis’ guess of 2026 to 2028. He will be eight to ten years off. 🤣

You are 3 or 4 years off… currently. Hell, it took Hubbert what, 45 years to be wrong about the US peak? The SECOND time he claimed it in 1956, not the first time he did it back in like 1936-38, I forget which. It took TOD 5 years to implode after getting gonged off the stage with their 2008 call, but they were far more visible than this place, and the professional stigma must have been making some folks awful warm to continue to be associated with it.

Ron,

We will see, I guessed 2020 in 2012 and was also wrong. Your 2015 call seemed wrong to me and I said so at the time. A claim that 2018/2019 will be THE peak also seem incorrect we can see in 2025 to 2028 what happens.

HIH

The EIA is predicting that in December 2023, US production will be 12,668 kb/d, just 298 kb/d short of the November 2019 peak. Also note that the November 2019 peak has been revised up by close to 100 kb/d.

I am not saying that I agree with their forecast. They are also saying that WTI will be $62 in December 2023.

Dennis, where will we manufacture the surplus DUCs from to show month over month growth which is the only reason we have seen any growth in 2021. Tell me how the Drilling Rig count will increase with the diminished labor pool? I had to shut in two new wells that I just completed because while there are plenty of disposal trucks and SWD capacity around me, there are zero drivers available to haul off the frack water.

The “woke” Labor pool has moved on to alternative energy platforms (another Wall Street scam) or they are starting an ESG side hustle (which is also a huge money waster). I do believe in limiting emissions and recycling frack water but other than that ESG is another “woke” fabrication that has zero intrinsic value and cannot actually produce the goods and services necessary to run an economy.

The only reason PE touts ESG is so they can raise more money from the Pension funds requiring ESG to earn their 2% management fee for just opening their office doors in the morning. Having worked closely with PE, I can honestly say that I have never been less impressed with allegedly very well educated people in my entire business career. They have zero talent in the category of “value add” and usually minimal industry specific wisdom or experience.

LTO Survivor,

when you use PE do you mean private equity? There are many meanings of PE. Horizontal oil rig count has been increasing in the Permian basin, higher pay for drivers will eventually attract more truck drivers.

Dennis,

PE= Private Equity

Tight oil official estimate is out for Dec 2021 see “tight oil production estimates by play” at page linked below

https://www.eia.gov/petroleum/data.php#crude

December 2021 at 7.6 Mb/d about 832 kb/d below Nov 2019 peak. Centered 12 month average (CTMA) for July 2021 (most recent data point) is 7.27 Mb/d about 830 kb/d below the Nov 2019 CTMA of 8.1 Mb/d, the Nov 2018 CTMA for tight oil (at World C plus C peak) was 7.04 Mb/d. Units for vertical axis on chart below are millions of barrels of crude plus condensate per day.

Latest Art Berman video . Talks sense . Also says OPM in shale has dried up and the growth party is over .

https://www.youtube.com/watch?v=vyxddYfXaQk&t=2275s&ab_channel=Wealthion

Art says, bluntly, growth in oil supply has stopped. Not “we’re running out.” But–supply has stopped growing.

Truly amazing talk after about minute 25. He even uses the “O” word after minute 40 or so.

What he says after minute 45 about mass migration and refugees in the future just blows my effing mind, because IT IS THE LATE BRONZE AGE ALL OVER AGAIN. (See “Sea Peoples”.)

There’s a more radical written presentation here

https://www.artberman.com/2022/01/05/the-climate-change-trip-to-abilene/

or here

https://www.artberman.com/2022/01/19/oil-it-was-the-best-of-fuels-it-was-the-worst-of-fuels-art-berman-and-nate-hagens/

I thinkthese might have been written partly by Nae Hagens and it is mostly a retread of Prof. Rees’s ideas bu interesting to see them embraced by someone so prominent in the oil industry,

Art Berman claimed that there was no significant oil in shale formations in the US in 2011. On video. Does his saying anything on video matter when now whatever he says contradicts his professional “knowledge” in 2011? Maybe he learned stuff since then? Maybe we should, about the value of his opinion on a topic that he now contradicts himself on?

People say a lot of stuff.

In 2016 Dennis Gartman said oil would never be above $44 WTI again in his lifetime.

I try to avoid predictions.

I do like trying to figure out how many wells can be drilled per unit in places like the Permian basin.

Four of the six core counties in the Midland Basin are 30 miles by 30 miles. Those are Midland, Martin, Howard and Glasscock. Not that big really. Midland County already has over 3,600 shale wells, or about 8 per 1,280 acres. If those are all in a single zone, that would be on 660’ spacing. That’s already getting pretty tight. That is the same spacing as we are required to space our 900’ vertical sandstone wells in our tired old stripper field that will turn 117 years old this summer.

I figure all of the core areas in all basins will eventually go the way of Parshall in ND.

That is unless someone figures out how to get a secondary of tertiary recovery project going that is akin to the water floods and CO2 flood we have seen with conventional production.

People do say a lot of stuff. Have you ever seen Art explain how his expert geologic knowledge didn’t know there was significant oil in the shales in the US? Like….ANY? Why would he just say ignorant stuff?

I don’t know what he’s said or why.

People say stuff that is controversial to get attention.

I kind of like to just look at the production info on shaleprofile and see how companies are doing.

I used to do that on IHS, but shaleprofile is a lot easier (and cheaper) to use.

For example, EOG is completing some huge wells in NM Delaware Basin and they are really growing production.

In November, 2021, EOG had 1,826 wells in the Permian basin produce 323,503 BOPD. That’s a lot of oil.

The 279 wells completed in 2021 produced 175,573 BOPD.

The 242 wells completed in 2020 produced 53,041 BOPD.

The 293 wells completed in 2019 produced 43,181 BOPD.

The remaining 1,012 wells completed 2008-2018 produced 51,708 BOPD.

EOG has top notch acreage in the Eagle Ford. Looks like EOG hit a monthly peak in the EFS in September, 2018 with 286,399 BOPD from 2,736 wells. In August, 2021, the last EFS blog post on shaleprofile, EOG produced 203,471 BOPD from 3,574 wells.

EOG also has top notch acreage in the ND Bakken. Looks like EOG hit a monthly peak of 96,473 BOPD from 576 wells in the Bakken in September, 2014. In November, 2021, EOG had 804 Bakken wells which produced 22,150 BOPD.

Shale has saved the world’s bacon. As an owner of conventional production, it has probably cost me a decent amount of money. But it has probably been good for the other investments I have.

I figure shale will eventually go the way of US conventional, but I tend to think it won’t be a gentle decline down the production hill.

But maybe I’m wrong. I hope I am, because a fall off a cliff won’t be pretty for a lot of things.

Or maybe most of us are wrong and abiotic oil will save us?

Abiotic isn’t where the oil is to be had for a reasonable price, as we continue to consume and demand more. Canada and Venezuela are. One being a geopolitical problem, the other being a potential environmental restriction, should the government decide the environment means more than its ability to make plenty of money without additional taxation of its citizens (and what government has ever thought that?).

My production experience is almost exclusively with shale gas and shale oil and light tight oil. The common knowledge back in the 80’s and 90’s when I was working in the industry was that the Appalachian Basin would never become anything of note because you couldn’t put the lease rights back together again. Boy was that wrong. If anyone was actually interested in the downfall of shale, they only need to do the work to see the precursor events. You can bet that Art can’t do that, he is a straight up broken clock routine, can’t happen…oops….can’t be big enough to matter…oops….can’t last when price drops (2016)…oops…..can’t turn the US into worlds largest producer…oops….can’t grow any more……tick tock tick tock.

I believe that the Shale companies with great balance sheets will gobble up the “Shitcos” with debt laden balance sheets and look for greener pastures off shore and over seas with their free cash flows. Believe me, the C-Suite team at EOG know full well that they need to reinvent themselves over the next few years to stay relevant as an oil producer. They have had a track record of being innovative and hard working so I believe they will survive but in a different form.

Art is a scientist turned capitalist, like many of us (including me). Difference is he is prioritized with selling an extremist fantasy to attract eyeballs…. much like the Weather Channel promoting climate change fear so they can charge more for ad time. Art is selling his wares for profit, and to advertise, he fans the flames of panic. Really a simple concept… we all hear the radio ads about Medicare saviors and time share property white knights. Art says… come buy my stuff for the answers to the end of civilization! Get a membership and you will be enlightened to prepare for death! By the way, I am not condemning him for this, he has made tons of cash… and that! …Is capitalism and more power to him. My problem is that I do not think Art’s opinions are worthy of the folks in this medium for a scientific discussion.

Regardless of Art Berman, where do the shale bulls think a company like EOG will be long term?

In the grand scheme of things shale has hit so fast. But look at what has happened to EOG in EFS and Bakken. Drilled a lot of wells after peak and production still has fallen a lot.

Will the Permian be different?

How attractive is EOG when it’s average well produces less than 50 BOPD? Less than 25?

So much depends on the price of oil and gas, of course.

Very hard stuff to predict. But looks to me like EOG will need to find another “big” shale basin once the limit gets hit in Eddy and Lea.

The last US shale profile post shows that EOG hit a peak in 2/2020, right before COVID hit.

About 800 wells added through September, 2021, and EOG was still 90k BOPD below that 2/2020 peak.

EOG is a good proxy, “Double Premium” acreage and wells in the three big oil basins, plus some decent stuff in Wyoming.

Which is smarter, ramp up drilling and grow production, or try to keep it flat and make it last a few more years?

Hard to predict oil prices when the range since shale started big in 2008 has been a monthly average of $15-135. So how fast to crank it up?

I’d like to talk to the Econ guys in these big shale companies. I assume they have some?

I don’t think Art is a scientist.

“Arthur E. Berman [M.S. Geology, Colorado School of Mines] is a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. During the past year, he made more than 25 keynote addresses for energy conferences, boards of directors and professional societies. Berman has published more than 100 articles on oil and gas plays and trends.” (from oilprice.com)

Thanks, RGR. Now we know not to care a goddamned bit about what you “think.”

Mike B , thanks for saving me the trouble . Kudos .

I don’t really want to get into a debate over Art Berman.

I’d rather focus on whether the Permian Basin is going to get back to the tremendous growth it was in pre COVID, how long it will last, etc.

The idea seems to be PB will grow for at least a decade, if not more, because of multiple benches. Not sure how accurate that is.

Also, what is the optimal spacing? Both Mike and LTO Survivor make the case it is 4-5 wells per 1280 acre unit. In fact, it seems LTO sold a large part of his Delaware Basin holdings for this very reason.

Mike is not an internet oil producer. LTO is not an internet oil producer. Both are on the ground in two of the largest shale basins in the USA. One of those, the EFS, seems to have hit a wall. The other has turned out to be massive, but how much higher can it go?

Art Berman is an engineer, not a scientist.

“Art Berman is an engineer, not a scientist.”

What, he can’t be BOTH?

And you, Al, you are a punk.

Thanks for the link, interesting discussion. I think the only way oil prices will fall to sub $50 is a major economic depression. Which doesn’t seem likely at the moment, but who knows.

Regarding oil consumption. I think we are at the flip side of what occurred during march-april 2020.

Incredible what has happened in such a short period of time. Oil prices will continue to edge higher for now i think.

Saudi Arabia to stick with OPEC+ quota despite shortfall from other producers Bold mine.

Saudi Arabia does not plan to pump more crude beyond its quota to make up for other OPEC+ members’ production shortfalls, the kingdom’s energy minister, Prince Abdulaziz bin Salman, said Jan. 17, despite increasingly tight spare output capacity among the group.

OPEC and 10 allies are hoping to restore their production to pre-pandemic levels by late 2022 through a series of monthly 400,000 b/d production hikes, but not all members are likely to get there, having already hit their maximum output levels or come close to it.

That has raised doubts about the OPEC+ alliance’s ability to keep markets amply supplied and led to speculation other members with sufficient spare capacity — namely Saudi Arabia and the UAE — would have to step in to keep the market well-supplied.

“They have hit their maximum output level.” That’s the same story many other nations, not just OPEC+. It is not only that they have hit their maximum output level, their maximum output level will decline a little every month. Even one of the world’s three largest producers, Russia, has hit its maximum output level and will decline from now on. Of course, there will be months where they have a slight increase, but the general trend will be down.

We are in the post-peak period of world oil production.

In other words, most or all of the post-Covid oil production recovery has already taken place.

For the vast majority of nations, I think that is a foregone conclusion. There may be a few of the OPEC nations that have some recovery left, but not very much. Every non-OPEC nation is producing flat out, and many of them are in decline.

Ron

There are four Non-OPEC countries that will continue to increase production for a few more years, Brazil, Canada, Norway and Guyana. Kazakhstan is a potential fifth.

What is critical here is the decline rate in those countries that we know are in decline. It is close to 500 kb/d/yr. The countries mentioned above will not increase their production by 500 kb/d/yr.

If the IEA, EIA and OPEC are correct in their prediction that demand in H2 22 will exceed pre pandemic levels, that will put a lot of stress on the few OPEC countries with spare capacity. The first clue will come the March OPEC report when SA is committed to provide 10,227 kb/d in February and an additional 107 kb/d every monthly after that to September.

Ovi,

You forgot the US, it will at minimum return to previous peak in 2019, likely 1000 to 2000 kb/d higher than the peak 12 month average.

Ovi, World oil production, less the 11 largest producers, (Dennis’ big 11), since 2016 has been declining at an average rate of 860,000 barrels per day per year. They are now about 2.5 million barrels per day below their pre-covid level….and declining! And they will continue to decline. Your growth nations will not even come close to making up that deficit.

Ron

When I look at that chart, decline is from Jan 2013 to Jan 2020, 571 kb/d/yr. (27,000-23,000)/7 = 571 kb/d/yr. Not 860 kb/d/yr.

After Jan 2021, when production starts to decline again, a new decline slope will develop. There is insufficient data yet to see what that decline rate will be.

I was very clear about the countries I mentioned.

“The countries mentioned above will not increase their production by 500 kb/d/yr.”

Ovi, when I did the calculation again, the data was pretty much what I said it was.

I started at September 15 and averaged every 12 months from that point. The results are below with the first data being the September 2016 previous month. The top row is the actual data for that month and the bottom row is the 12 month average for the 12 previous months.

Ron

I have plotted the data in your first line in the attached chart. What is clear is that 2020 is a discontinuity in your data, similar to what is shown in your original chart.

The slope of the first four years is 567 kb/d/yr, similar to the number I noted above. Looking at the second segment 2020 to 2021, the slope is 494 kb/d/yr. It will take a few more years to better define that slope.

Another way to look at your data is to look at the blue line in the chart. it shows a steady slope of 567 kb/d from Sept 16 at 24,800 kb/d to Sept 2020 to roughly 22,300 kb/d and then imagine a discontinuity or vertical drop of 1,300 kb/d to 21,000 kb/d and then a new slope, similar to the previous one.

So what does this chart say to those countries that can increase their production.

This means that those countries that can increase their output have to produce an extra 550 kb/d/yr to offset the decline and in addition have to make up the one year loss of 1,300 kb/d.

Ovi, I have emailed you the Excel worksheet with my data. I have checked and double-checked it. I stand by it. It is correct. The 2020 discontinuity does not matter because by September 2021 they had fully recovered from that. I made a slight mistake in the data I posted above because I began with the difference in 2017 instead of 2016. But it did not matter because it came out almost the same.

I measured using the monthly data and then using the difference between 2015 and 2021, and dividing by the six years elapsed. They both came out the same. That data is in bold below.

I stand by that data. It is correct. The annual decline for the combined world oil production, less the Big 11, is declining at around 850,000 barrels per year or more.

World oil production was, in September, still over 5.5 million barrels per day below its 2018-2019 twelve-month average peak. World less Big 11 is 2.5 million barrels below that level while the big 11 is still 3 million barrels per day below that level.

Since the world less the Big 11 will decline, even more, that means the Big 11 must increase its September production by 5.5 million barrels per day to make up that gap. Well, 5.5 million barrels per day plus the amount that the World less the Big 11 declines. And as I said, they are currently declining at the rate of 860,000 barrels per day per year.

That will be a Herculean task for Dennis’ Big 11. I just don’t think they can do it.

Of course Ron , your arithmetic is correct . 600 million barrels used from inventory .IEA had calculated 400 million . Ovi had posted a link on this . We are in a supply crunch .

No , I will redefine this as ” peak demand” . This is the narrative that the deniers love .

Ron, “That will be a Herculean task ” . What is that ? 5.5 mbpd + 865Kbpd ( make it 1mbpd ) = 6.5 mbpd . That is what KSA EXPORTS PER DAY to the world . You just let the bull loose in the China shop . As Colin Powell said ” If you break it then you own it ” 🙂 . Hope you carry a lot of product liability insurance . 🙂

Those 11 nations increased output from 49000 to 61000 kb/d from Jan 2013 to Dec 2019 (7 years), this is an average annual rate of increase of roughly 1714 kb/d. Currently the big 11 are at around 57000 kb/d, about 4000 kb/d below pre-covid level, if previous rate of increase continues we would see output for big 11 increase by about 6800 kb/d in 4 years, the rest of the World declining at about 567 kb/d per year over the 2020 to 2025 period would see output fall by 3402 from the Dec 2019 level and by 3969 kb/d from World centered 12 month peak. The difference is 6800-3969=2831 kb/d above the centered 12 month peak from Oct/Nov 2018.

Dennis wrote: if previous rate of increase continues we would see output for big 11 increase by about 6800 kb/d

If the previous rate of increase continues? Dennis, you know that is not going to happen. 823 kb/d of that average annual increase, almost half, was from the USA alone. Do you seriously believe that is going to happen again? Yes, shale oil may continue to creep up, but very slowly. Those boom days of an increase of almost 1 million barrels per day per year are gone forever.

And of the other 10 nations on your list, some will actually decline and the others will contribute but a pittance to the overall production.

Dennis, it just ain’t gonna happen.

I saved a New York Times column from 2005 to which this article refers:

https://www.greencarcongress.com/2005/03/algeria_opec_ha.html

“Algeria’s minister for energy and mines has said that OPEC has essentially reached its production limit.”

We are now 16 years later and it sure looks like OPEC+ can’t deliver on it plan of 400,000 b increase per month through this spring.

Ron,

US tight oil keeps increasing, Norwegian output is expected to increase up to 2025, Brazil and Canada are both expected to increase and many forecasts have Russia maintaining flat output at least until 2025 and possibly until 2030. OPEC may also see increased output from Iraq, Iran, UAE, Saudi Arabia, and Kuwait, difficult to know how it plays out, but if oil prices remain at current levels or rise higher World output is likely to continue to increase up to 2027, we are likely to see flat to declining output after that unless oil prices fall, in which case decline may occur sooner than 2028.

Dennis, who are you trying to convince, me or yourself? It sounds to me like the latter. Yes, the US, Canada, and Brazil just may increase a bit. But that will not be nearly enough to make up for the decline in the rest of the world. You keep ignoring the decline in all those declining nations. And there are a lot of them, including Russia.

At any rate, lest just wait three or four months, that will tell us a lot about what is about to happen. You and I battling about what is about to happen means nothing. I am anxiously awaiting the next four to six months. I know they will tell us a lot.

Take care, Ron

Ron,

I am explaining to the other readers my reasoning, I know you will not be convinced.

Well, you started your comment with:

Ron,

US tight oil keeps increasing,…. etc, etc.

Since you addressed the comment to me, I just naturally assumed you were talking to me. 😂

Dennis.

Have you every looked at the shaleprofile blog on a county by county basis for the Permian, Bakken and Eagle Ford? Interesting stuff to say the least, in my opinion, anyway.

I wish I had more time, this stuff is fascinating.

Four of the six Midland basin counties that produce the majority of the oil are just 30 miles by 30 miles square. If the entire county were broken down into 1,280 acre drilling units for two mile laterals, each would have 450 drilling units approximately.

Midland County already would have over 8 wells per 1,280 drilling unit. Maybe that’s why it is on a plateau?

The two larger counties are Upton and Reagan. SW Upton has very few shale wells. Reagan wells appear to be inferior.

Likewise, in the Delaware Basin, it appears Reeves and Loving might be slowing down. Eddy and Lea are really now the core of the Delaware (or the Double Premium, as EOG management would say).

Double Premium makes me want to drink some of my Jack Daniels single barrel. lol.

If you normalise each county’s production (so the area under the curves are the same and the peaks match) it looks like they all have very similar shapes so it might be expected than the few counties still growing will turn down soon. It would be interesting to GR and water cut on county basis but I can’t figure out how you do that in Shaleprofile anymore. I guess the original data is available through RRC but downloading from there is an absolute pain.

Shallow sand,

I tend to focus on the entire basin, note that in the Permian there are as many as 6 viable benches (or horizons) where wells can be completed, especially in the core counties, So for each county figure 450 times 6 times 4 wells per drilling unit or 10800 wells on 4 wells per section width spacing. Note also that some of the Delaware counties are far larger than those in the Midland basin.

Baissically there are likely about 30 million acres at minimum that could be developed at the end of 2017in the Pemian basin, at 275 acres per well that would be about 109 thousand wells, maybe 15 to 20 thousand wells have been completed since the end of 2017 leaving 90 thousand to be completed, this assumes high oil prices, there is a narrow window from now to 2030 where oil prices will be high.

Dennis.

Of course, this is the whole debate.

What data are you relying on regarding all of these benches being everywhere in the PB, besides company investor presentations?

Our field has multiple productive formations from 800’ to 4,100’. I can think of 11 different zones, and we presently operate wells producing from 7 of them.

Of course, of the 11 zones, only 1 is found on almost all of the acreage in our field, and it has produced well over 90% of cumulative oil, which is approaching 300 million barrels.

These pays each have their own distinct characteristics and issues. Some are susceptible to secondary recovery. Some aren’t. Some rapidly decline. Some have very difficult water issues. Some are more gassy.

I think you will find most fields of any size have multiple pays and there is little uniformity across all acres of the field.

Aren’t some of the benches in PB only found on some of the acreage? Aren’t some not as productive as others? Are you using geological data when you arrive at total locations?

You can get a good sense for just how very variable the distribution of various layers are by looking at the diagrams/maps in the EIA presentation on the Wolfcamp zone-

https://www.eia.gov/maps/pdf/Permian_Wolfcamp_Midland_EIA_reportII.pdf

Thanks Hickory.

I am sure there are maps like these for other formations and areas also.

Produced water is also getting to be a bigger deal. Looks like about 270k BWPD of the produced water disposal capacity could be shut in by TRRC.

Shallow sand,

I am mostly relying on the USGS assessments, but the paper I recently referenced at link below

https://www.mdpi.com/1996-1073/15/1/43/htm

That paper looks carefully at the geology and expects 55 thousand wells in the core areas and 100 thousand wells in non-core areas to be added to the wells completed by mid 2021 (roughly 30 thousand wells) for a total of 185 thousand wells.

My methodology prior to reaing that paper was to take the USGS mean estimate from the best benches with net acres (this adjusts for probability of a successful well) of about 30 million acres after 2017 left to be developed. I take the spacing suggested by LTO survivor (1320 feet between laterals) and average lateral length of 9000 feet (273 acres per well) divide 30 million by 273 and get about 110 thousand wells, the mean TRR estimate for those 30 million acres is about 45 Gb, add that to cumulative production and proved reserves at the end of 2017 (about 5 Gb) and I get a TRR of 50 Gb, similar to the paper’s estimate for core plus non-core of 52 Gb.

Since reading the paper I have adjusted my TRR lower based on this new research. The 110 well scenario yields about 40 Gb for TRR, but I have increased the number of wells to match the paper and assume faster decrease in new well EUR than my earlier estimates.

Shallow sand,

If you look at that paper by Patzek’s student from 2022, make sure to re-read carefully page 14 of the PDF. The $35/b breakeven for core areas assumes $4/MCF for natural gas, and the core areas breaking even at any natural gas price is based on an assumed oil price of $60/b.

Somehow you got the impression (based on previous comments) that they claimed $35/b and andy natural gas price for break even. If you read carefully you may agree that you misunderstood on a first skim through.

USGS Permian assessments are at link below

https://www.usgs.gov/centers/central-energy-resources-science-center/science/permian-basin-oil-and-gas-assessments

It was some decent work by Patzek though. He started off back when he was lead ASPO joke maker doing the usual silly bell shaped curve routine, but moved it into a far better technical realm than the likes of Art ever did, or Engelder. Geologists both though, so the more technical aspects can’t be considered their forte. Anyone who doesn’t take into account a range of price futures nowadays is just behind the 8-ball of this thing bigtime.

Reservegrowthrulz,

Patzek has a PhD in Chemical Engineering, a lot of his research focuses on geophysics and petroleum engineering.

There is a significant difference in training between geology and geophysics.

Shallow sand,

The various benches are not assumed to be everywhere. The best benches are Wolfcamp A and B in both Delaware and Midland basins, the lower spraberry bench in midland basin and the the second and third bone spring benches in the delaware basin. All together those benches have net acres of over 33 million acres. Net net acres take mean estimate of potential productive acres and multiply by the mean estimate of probability of a successful well. For most of these benches the mean estimate of probability of success is about 95%. If we assume the average well is about 273 acres, then about 121 thousand wells could be completed. For midland wolfcamp this would be 27 thousand wells after Dec 2016. For midland spraberry this would be 13.7 thousand wells completed fter Dec 2017. For the Delaware wolfcamp and bonespring this would be 81.5 thousand wells completed after Dec 2018, so roughly two thirds of total wells completed after Dec 2016 would be Delaware basin wells according to this analysis. To arrive at TRR I take an estimate of 400 kbo per well and multiply by 122 thousand wells and get about 48.8 Gb.

The breakdown in TRR is 10.8 Gb for Midland wolfcamp after Dec 2016, 5.5 Gb TRR for Spraberry after Dec 2017, and 32.6 Gb TRR for Delaware Wolfcamp and Bonespring formations. About 67% of total Permian TRR after Dec 2016 will be from Delaware basin, based on conservative estimates of TRR. Note that my 49 Gb Permian UTRR estimate is only about 67% of the USGS mean TRR estimate.

Shallow sand,

The following PDF has details for various benches of Delaware sub-basin of Permian.

file:///tmp/mozilla_d0/5044DelawareBasinInputForms.pdf

I read all of the back and forth about peak oil and all I know is that the world/wall street/ Greta Thunberg all out attack on the fossil fuel industry for the past 7 years has finally won by eliminating capital from replacing reserves and the chickens will come home to roost. Playing catch up in a mature industry is not possible without outrageous amounts of capital being spent.

On a different note. I have just finished completing two horizontal sand (not shale )wells and while there are plenty of water trucks lined up available to haul the recovered frack water to a disposal nearby, there are ZERO ( that’s 0) available drivers to pick up our water so that we now have to shut the wells in temporarily. Where did all of the work force go? It’s unbelievable. These are high paying truck driver jobs and no one available to fill them.

“all I know is that the world/wall street/ Greta Thunberg all out attack on the fossil fuel industry for the past 7 years has finally won by eliminating capital from replacing reserves ”

To the contrary- If there is a good energy investment there is trillions of dollars looking to book it, whether its nucs, or oil, or wind, etc.

Blaming “Greta’ for poor economic performance (return on investment), and well depletion, and high cost of developing residual resource is weak.

Poor performance will sour the taste for people seeking a solid investment.

“Since 2015, industry analysts Haynes and Boone have listed nearly 800 exploration and production, oilfield services and midstream oil and gas companies that have filed for bankruptcy, with a debt load of more than $300 billion. ”

“Since 2010, the stock values of the four largest oil and gas firms have plummeted by more than half.”

“The companies at the center of the U.S. fracking boom have fared worse than most other segments of the industry, consistently spending more on drilling and production than they generated by selling oil and gas. ”

“According to The Wall Street Journal, large publicly traded oil and gas producers spent $1.18 trillion on drilling and pumping oil over the past decade, largely on fracking, while bringing in only $819 billion. To stay afloat, many oil and gas companies took on substantial debt, setting the stage for subsequent bankruptcy filings and debt write-downs.”

““Living Beyond Their Means: Cash Flows of Five Oil Majors Can’t Cover Dividends, Buybacks.”

https://www.ewg.org/news-insights/news/oil-and-gas-industry-decline

But clearly the economics are improving, even if the geology and labor conditions are not.

I think you can’t borrow money for tight oil wells because they don’t make financial sense. I can only imagine if I were selling solar panels that depleted 40% every year and were useless after five years what all you oil folks would say. But yet, there’s your typical shale well. Instead the PV panels being installed today will still be close to 90% efficient after 25 years, long after most of us old farts commenting here and dead and buried. How much tight oil will be coming out of those tens of thousands of shale wells in 25 years? My guess: zero. The fact is that investing in shale oil is a colossal waste of resources and we should instead be installing PV everywhere. But I’ll let Greta know you’re pissed at her I’m sure she’ll be really upset lol.

I guess maybe thinking about this too much today between doing laundry, paying bills, watching some NFL and trying to stay warm.

But pulled up shaleprofile and limited US to EFS, Bakken, Permian, OK, WY and CO.

Prior to COVID, completing about 10.5K wells per year. I’d assume one well per 100 acres (that would be 12 in a two mile lateral unit, which to me is probably too many).

Anyway, at that rate chewing up 1.05 million acres per year, before we get into how many benches. 2020 and 2021 that has backed off to 6,000+ completions per year in those plays.

Midland County has less than 600k acres. So, pre Covid, US shale was chewing through about two Midland counties per year. Now they are down to chewing up just a little over one Midland County per year.

Just fascinating stuff. If it wasn’t for shaleprofile we couldn’t visualize all of this.

so how many Midland County ‘s are left ?

Forbin

There are ten counties in TX and NM producing 94% of Permian Basin oil. Four are the size of Midland County (including Midland County). The other six are larger, but not all acreage in these four appear to be productive.

As Enno Peters pointed out in his most recent blog post, only three are significantly growing at present. Lea and Eddy in NM, and Martin in TX.

The other counties are Reeves, Loving, Midland, Howard, Glasscock, Reagan and Upton, all in TX.

Over 1/3 of the rigs are currently running in Lea and Eddy.

I would note Andrew’s, Scurry and Fisher have recently grown a lot, but from a very small base. Two of these counties also already have tens of thousands of conventional well bores.

Mike S on the ten counties .

https://www.oilystuffblog.com/single-post/ten-counties?postId=94afb6d2-d814-435e-b02b-ef106f0ae3d2

An amazing comment by “Anne” left at the article:

Wonder how many know that at best this light crude is trade bait to bring in the heavy oil we actually run?

Part 2 of the counties and benches from Mike S . Knowledge is power .

https://www.oilystuffblog.com/single-post/top-ten-counties-top-four-benches-part-two?postId=2c522646-a1b2-435d-b199-b84561547329

Shallow sand,

I think one well per 300 acres might be a better figure, so 3 million acres per year. Note though that on average there might be 3 benches per acre so as far as land area your 1 million acres per year at a 10 thousand well per year completion rate and 3 benches per acre would be about right.

Oh dear!

Great graphic!

Tells us a lot about DUC’s

The world’s oil stockpile is nowhere to be found

https://indexedworldnews.com/2022/01/24/the-worlds-oil-stockpile-is-nowhere-to-be-found/

Where did all the oil go? According to the latest estimates, the world should still be awash in oil stockpiles built up during the pandemic. But that’s not what the actual data on oil supplies show.

OPEC’s Shrinking Capacity Could Send Oil Above $100

The oil market is quickly realizing that many OPEC producers may not have the capacity to boost output much further.

OPEC+ has been undershooting its collective production targets for months and will likely continue to do so in the months ahead.

Low spare production capacity could leave the world without a buffer to offset sudden supply disruptions, which are always lurking in the global oil market.

As the OPEC+ group unwinds its production cuts, the oil market has realized that not only do many producers in the pact lack the capacity to boost output further, but those who can pump more are reducing the global spare production capacity, thus exposing market balances to unexpected supply disruptions, and oil prices to further spikes. Most of the world’s global spare capacity is currently held by OPEC’s Middle Eastern members Saudi Arabia and the United Arab Emirates (UAE). Those two producers have the potential to raise their output as OPEC+ continues to unwind the cuts, but they are doing so at the expense of declining spare capacity.

Low spare production capacity could set the stage for a prolonged oil price rally because the world would have a lower buffer to offset sudden supply disruptions, which are always lurking in the global oil market.

The unrest in Kazakhstan and the blockade in Libya in the past month highlighted the challenge that the oil market will be facing if spare capacity continues to shrink. And shrink it will—that is, if OPEC+ continues to add 400,000 barrels per day (bpd) to its production quota every month until it unwinds all the cuts.

SNIP

Sure, the United States, Canada, and Brazil—all of which are outside OPEC+ pacts—are expected to raise their oil production this year as high prices and growing demand incentivize more activity and drilling. In the U.S. shale patch, however, capital discipline continues to be a key theme, so annual production increases are not expected to be anywhere near the 2018-2019 surge in output.

“In the U.S. shale patch, however, capital discipline continues to be a key theme, so annual production increases are not expected to be anywhere near the 2018-2019 surge in output.”

‘Capital discipline’ as a key theme in the shale patch…wow what a concept.

So, production of the permian basin oil shouldn’t happen all at once in a boom and bust fashion?

That concept would have been useful to apply back starting about 8 years ago.

What gives? Good question.

Oil prices are up but the taps aren’t flowing like they should be

The price of oil is at a seven-year high, above $88 dollars per barrel. Demand is rising and may surpass pre-pandemic levels by the end of 2022, the International Energy Agency forecast last week, as the global economy seems not to have been stalled by omicron. And yet, many top oil-producing countries are falling short of their quotas. What gives?

Several posts ago I had called out the myth ” oil on the sidelines ” waiting for higher prices . My analogy was cash waiting ” on the sidelines” which will enter the stock market if the market does ” this ” or if it does “that ” . There is no oil waiting for higher prices . You cannot extract what does not exist . If not now , then when ? Or maybe ” If not now, then never ” . Choose one .

Hole in head,

There are no sidelines in the oil industry. I imagine the oil proscould comment on how things change when the oil price is $50/bo vs when it is $100/bo. My impression based on past comments is that all else being equal (ceteris paribus) higher oil prices tends to lead to higher profits than lower oil prices. This intern affects investment decisions and how much capital is employed.

I will leave it to others to correct this.

Projects take time to get ramped up, the activity doesn’t just change on a dime.

These aren’t easy things to get done.

Sustained prices over consecutive years is what we should expected to move the needle on production

(assuming supply chains and labor conditions and interest rates are favorable).

This isn’t a pop-up store or day trading or choosing a prom date.

Sustained prices over consecutive years is what we should expected to move the needle on production.

World oil production dropped by over 11 million barrels per day in May 2020. It was up by almost 2 million bp/d in November 2020, down by over 2 million bp/d in February 2021 and up by almost 2 million bp/d in March.

And if you look back over the past decade you will see several months with movements of over 1 million bp/d. No, It does not take years to ramp up production due to prices. In years, the price could easily double or halve. Prices have been up long enough now for production to be ramping up significantly.

Of course, finding and developing new resources does take years. So don’t look for much help there for a long, long, time. The article below came out on December 28th, 2021.

Oil and gas discoveries are at the lowest level since 1946

Oil and gas firms are having their worst year for new fossil fuel discoveries in decades and reserves are dwindling. The oil and gas industry is on track to discover just 4.7 billion barrels of oil equivalent (boe) by the end of 2021, its worst performance in 75 years, according to the research firm Rystad Energy.

Ron,

I was commenting on the statement made above-

“There is no oil waiting for higher prices . You cannot extract what does not exist .”

And the point I was making is restated well by you-

finding and developing new resources take years

Hickory,

Lots of resources have already been found that are not developed, so any discoveries just add to the pipeline of undeveloped resources. Much of this is simply a matter of developing discovered resources when oil prices reach a level where it is profitable to do so. Some projects are all set to go and waiting on final investment decision (FID), when oil prices reach $100/b the rate that oil resources are developed may increase.