A guest post by Ovi.

All of the oil (C + C) production data for the US state charts comes from the EIAʼ’s Petroleum Supply monthly PSM.

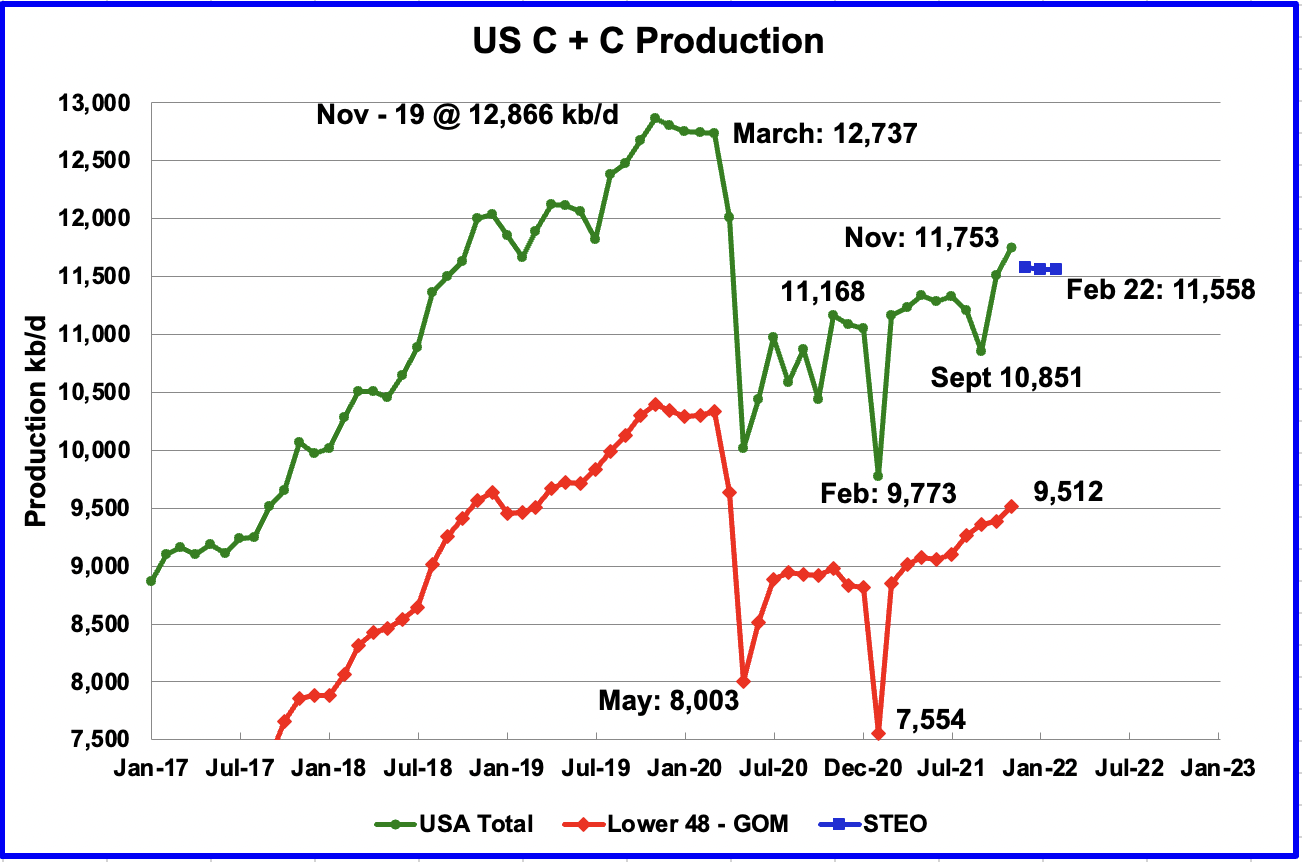

U.S. November production increased by a surprising 244 kb/d to 11,753 kb/d. The unexpected gain was due to a large production increase in the GOM, along with smaller gains in Texas, New Mexico and North Dakota. GOM output increased by an additional 108 kb/d over October after the damaged platforms were fully repaired and brought back on line.

The blue markers are from the January 2023 STEO and are forecasts for December to February production. While they seem low, they are consistent with the weekly EIA reports, which estimated November output to come in at 11,527 kb/d, low by 226 kb/d.

Overall, including revisions, November output is 280 kb/d higher than reported in the October report.

While overall US production was up, a better indication of the health of the US oil industry can be gleaned by looking more closely at the On-shore L48 states. In the On-shore lower 48, November production increased by 128 kb/d to 9,512 kb/d. The main contributors to the increase were Texas, New Mexico and North Dakota.

From July to November output in the Onshore L48 increased by 414 kb/d or at an average rate of 103.5 kb/d. Incredible

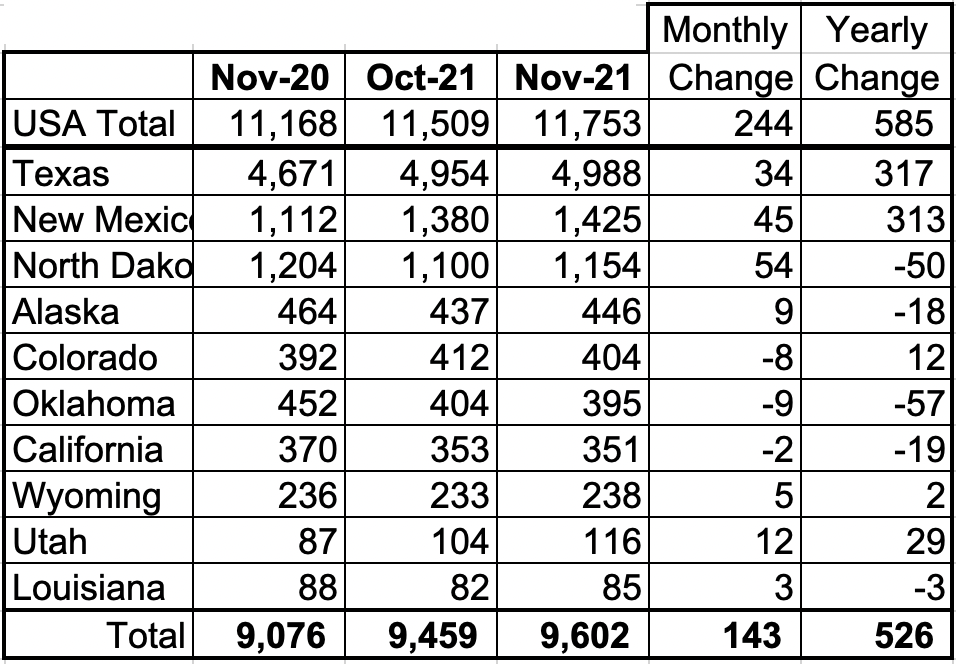

Listed above are the 10 states with the largest US production. These 10 accounted for 81.7% of US production out of a total production of 11,753 kb/d in November 2021.

On a YoY basis, US production increased by 585 kb/d.

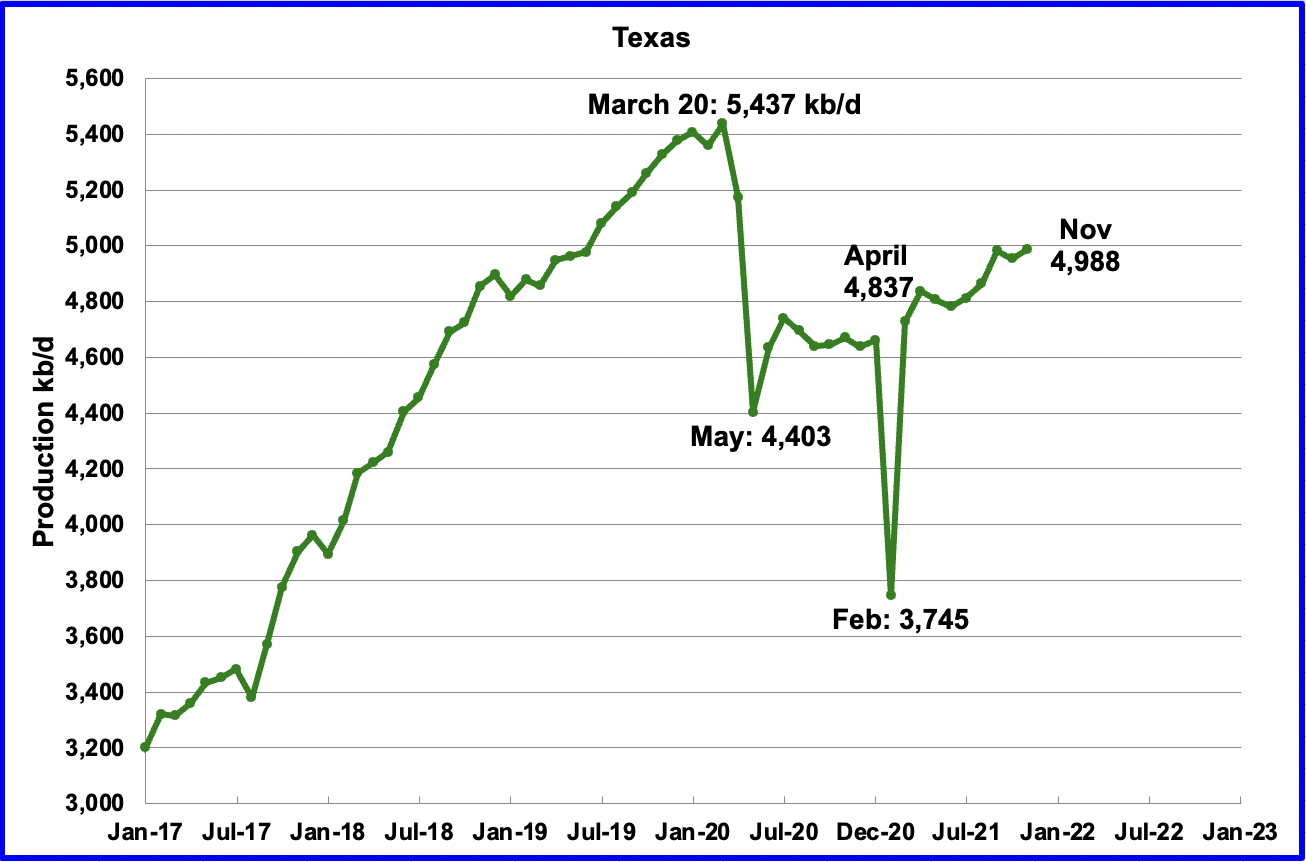

Texas production increased by 34 kb/d in November to 4,988 kb/d from 4,954 kb/d in October. Note that October’s output was revised up from 4,906 kb/d in the October report to 4,954 kb/d in this report.

In August there were close to 200 Hz oil rigs operating in Texas. By the last week of November, an average of 228 oil rigs were operating, an increase of 28 rigs. At the end of January 2022, 240 Hz oil rigs were operational.

November’s New Mexico production rose by 45 kb/d to a new high of 1,425 kb/d. It should be noted the October output from the last report was revised up from 1,333 kb/d to 1,380 kb/d, so the overall increase relative to the October report is 92 kb/d.

On average since May 2020 with output at 890 kb/d, production has been increasing at an average rate of close to 30 kb/d/mth.

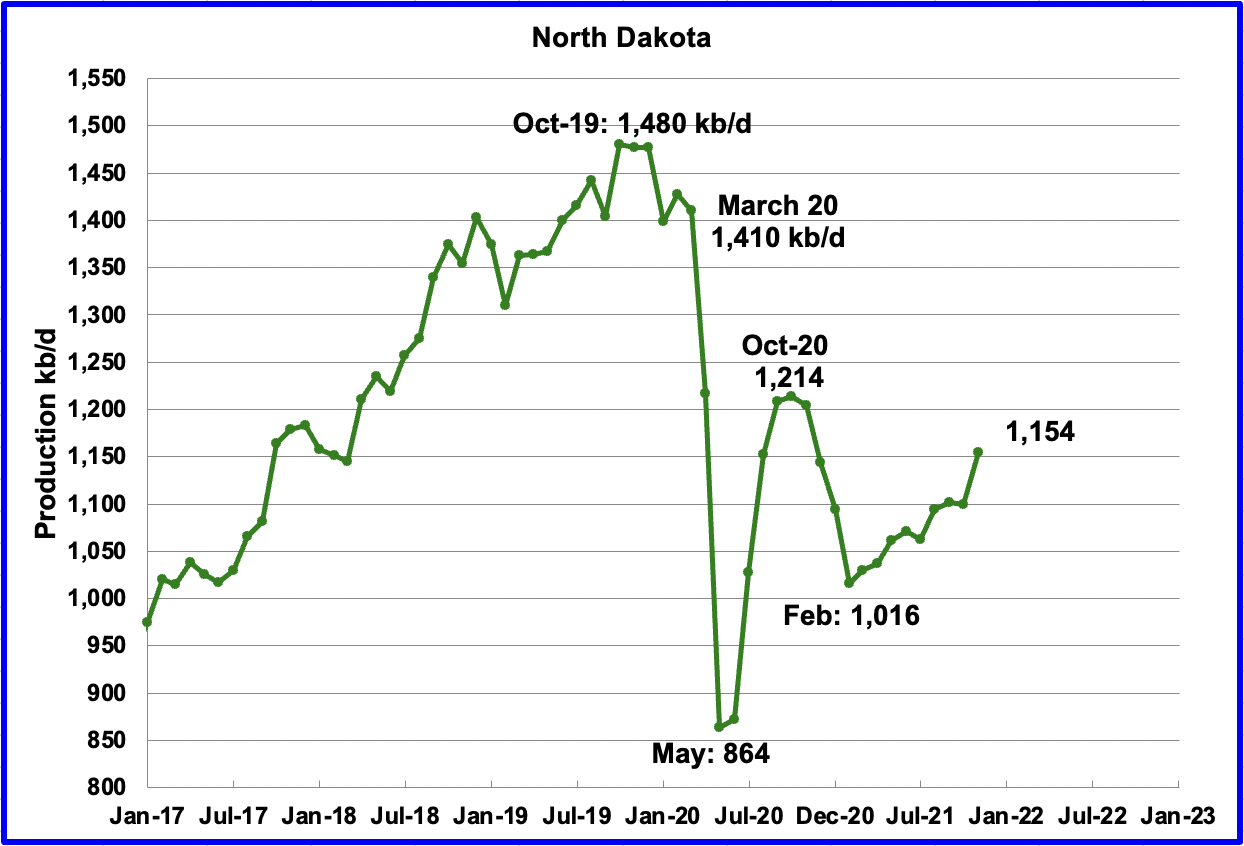

According to the EIA, North Dakota’s November output was 1,154 kb/d, an increase of 54 kb/d over October and an unexpected increase of 4.9%. North Dakota’s Oil and Gas website indicates it was 1,160 kb/d.

According to this source, “This is really the month we have been waiting for all year,” Lynn Helms, North Dakota’s mineral resources director, told reporters in a conference call. November oil production was the highest in North Dakota since December 2020.”

Another source reports that Helms said, “What we’re observing there is significant work in what we call Tier 2 and 3 areas outside the core areas as people are beginning to drill 3-mile laterals and different strategies to start developing that lesser developed area.”

A recent Rystad report also states that three mile laterals are becoming more common in the Permian. If this is also happening in the Permian, does this also imply/mean that drillers are moving out to Tier 2 and 3 areas in the Permian as a few of our contributors are saying? Also what is the trade-off of cost/revenue balance in using longer laterals in the Tier 2 and 3 areas?

Note this unexpected output increase in North Dakota was accurately reported in the EIA’s DPR and LTO reports below. At the same time, however, the DPR indicates that going forward, North Dakota’s output will increase at a more modest rate of less than 10 kb/d/mth over the near term.

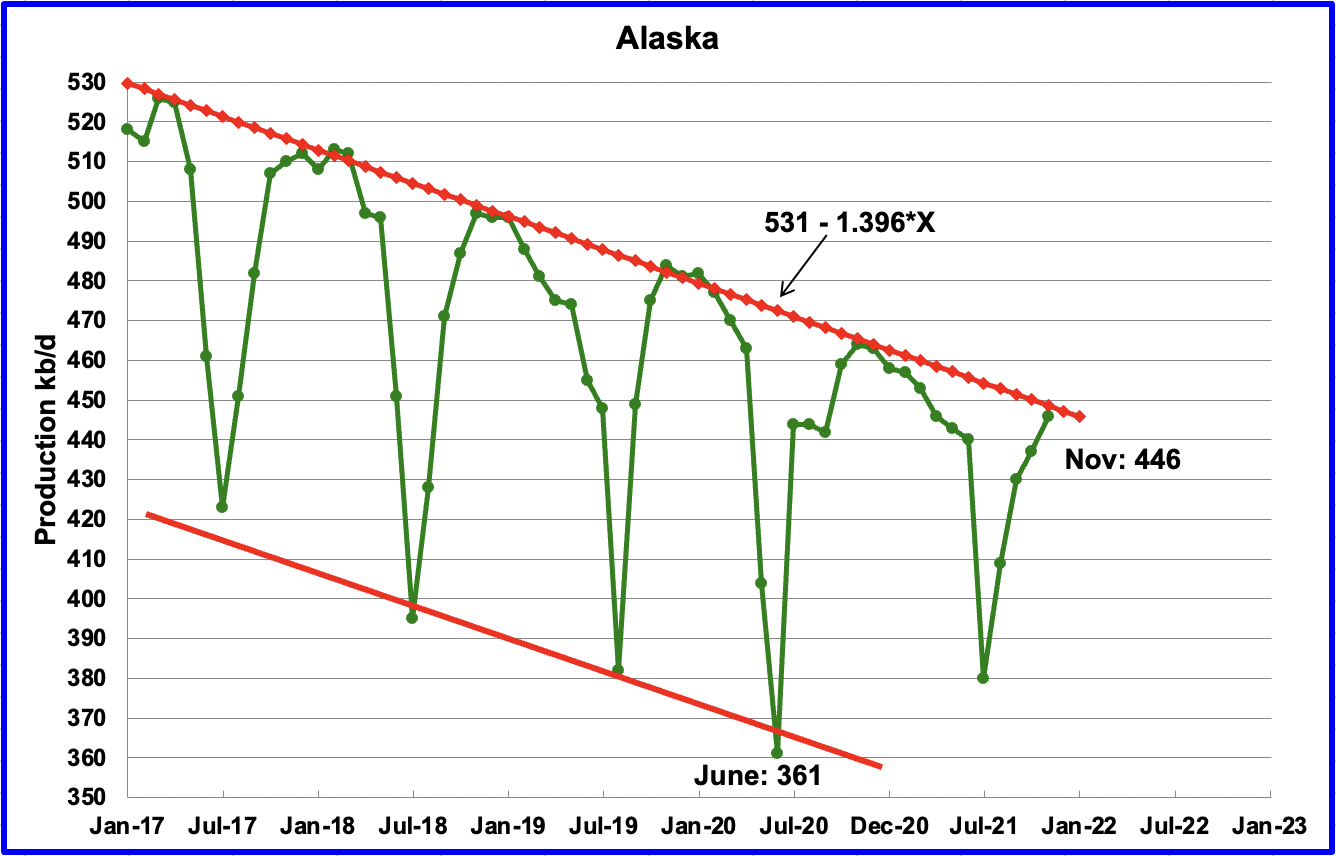

Alaskaʼ s November output increased by 9 kb/d to 446 kb/d as maintenance was completed. It will be interesting to see if December’s output exceeds the declining trend line.

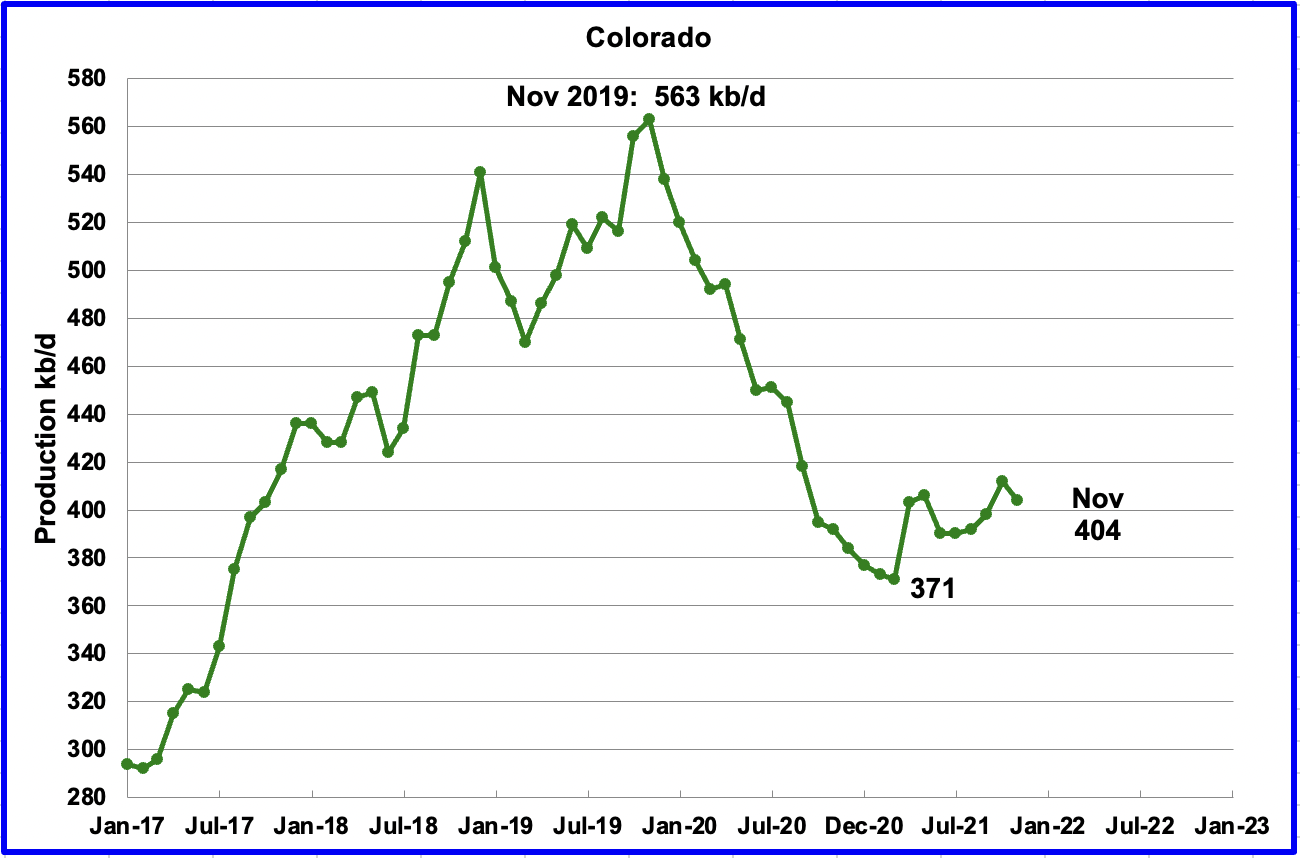

Coloradoʼ s November output decreased by 8 kb/d to 404 kb/d. Colorado had an average of 10 rigs operating in November up from 9 in September.

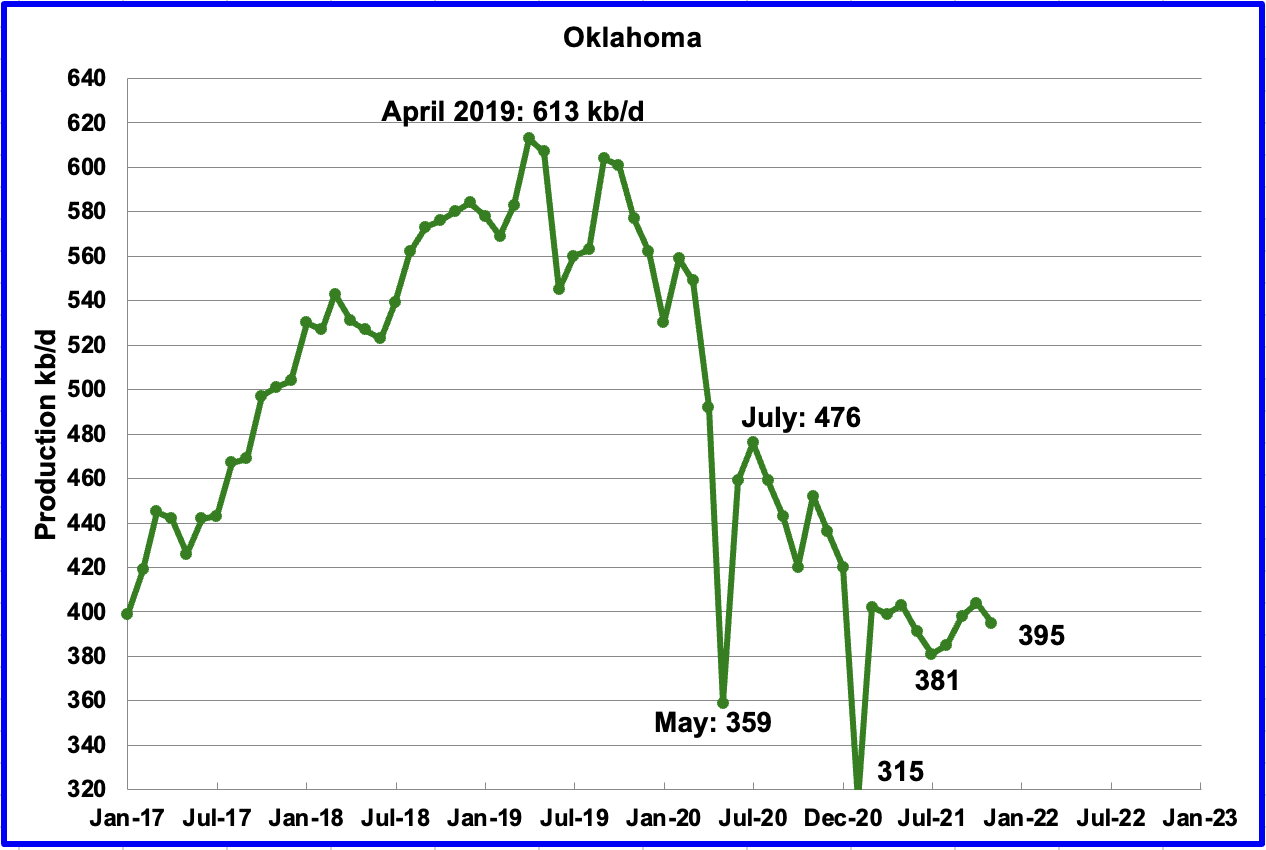

Oklahoma’s output in November decreased by 9 kb/d to 395 kb/d.

During August, Oklahoma had 29 rigs operating and by the end of January 2022 had increased to 50. The increase in the number of rigs has managed to stabilize the decreasing output trend which started in April 2019.

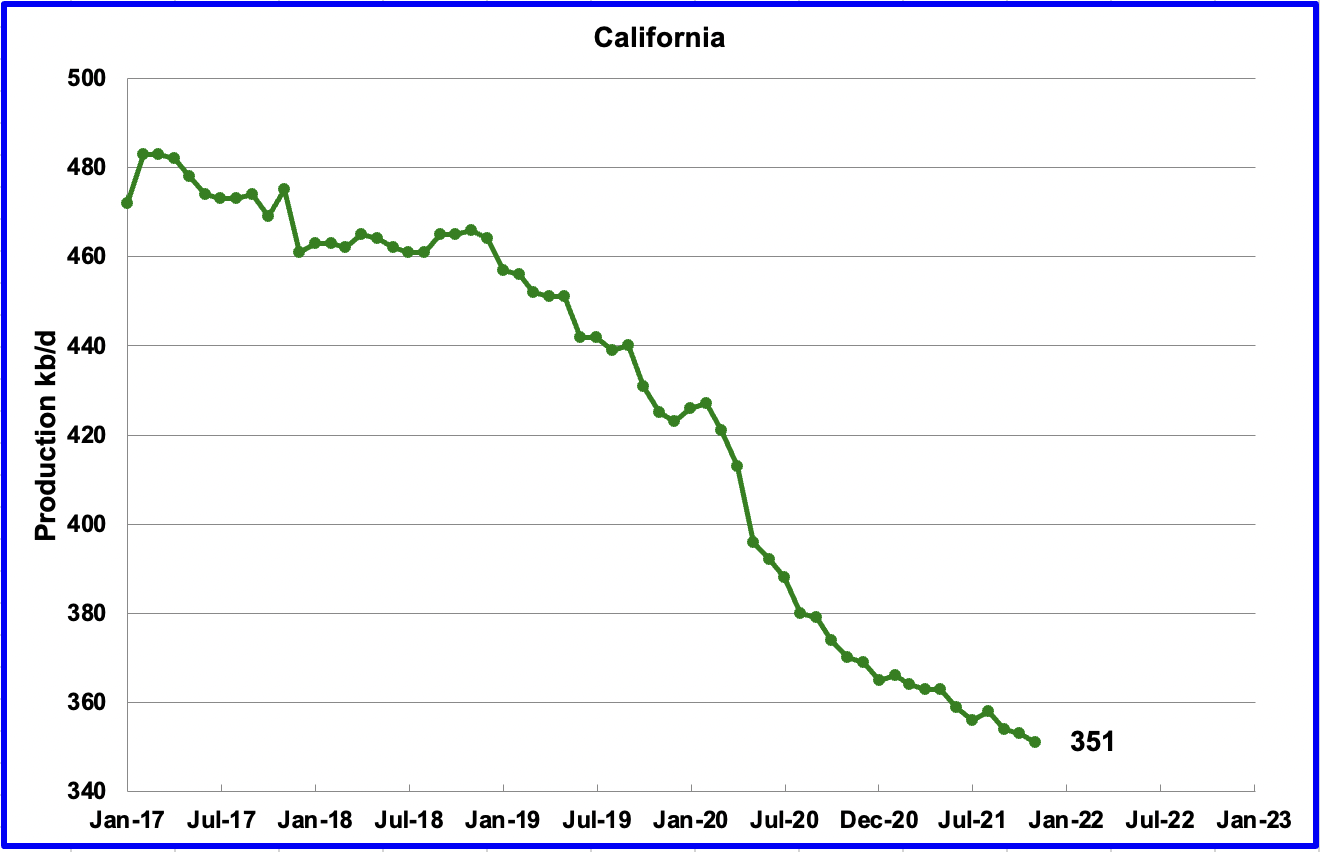

Californiaʼ s slow output decline continued in November. Output decreased by 2 kb/d to 351 kb/d.

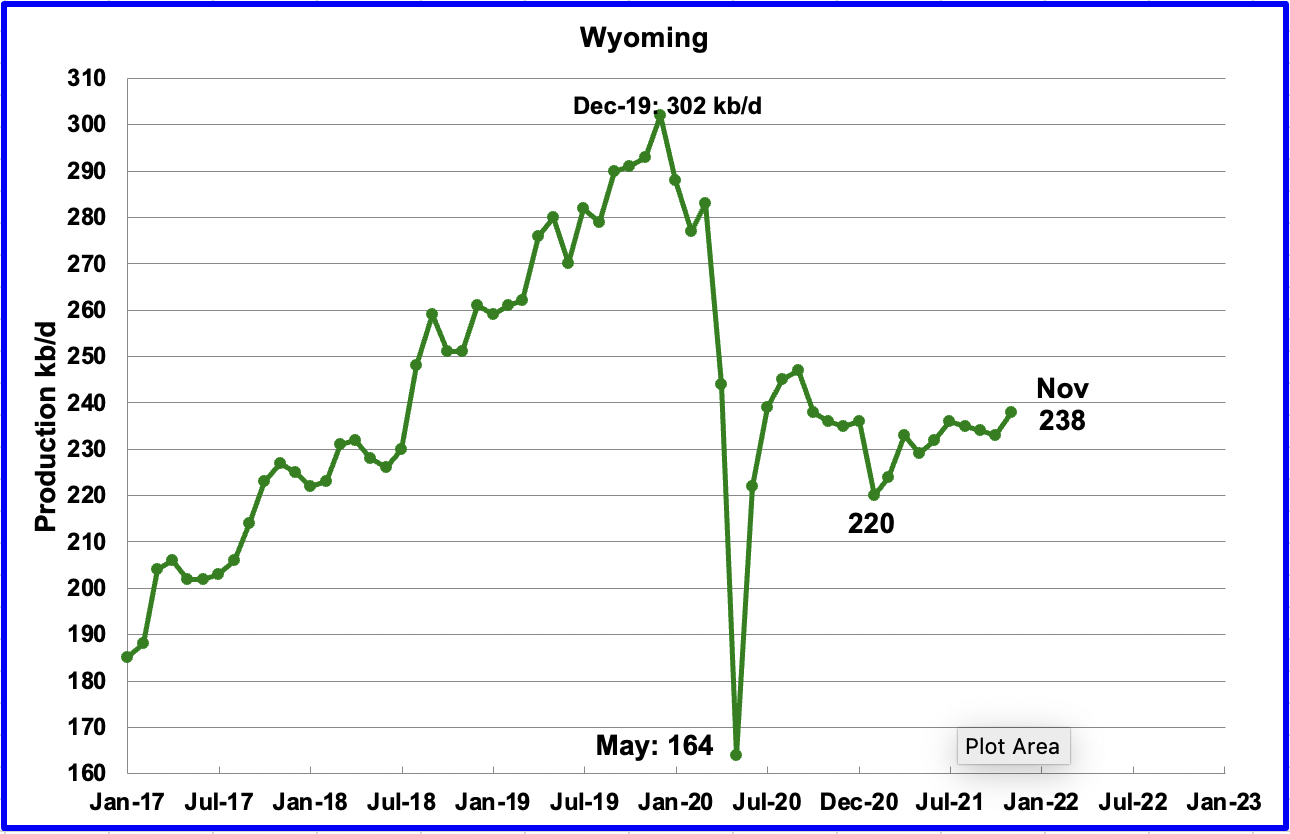

Wyoming’s production has been essentially flat since July when output was 236 kb/d. In November output increased by 5 kb/d to 238 kb/d.

Wyoming had 13 Hz oil rigs operating in September but by the end of January had decreased to 10.

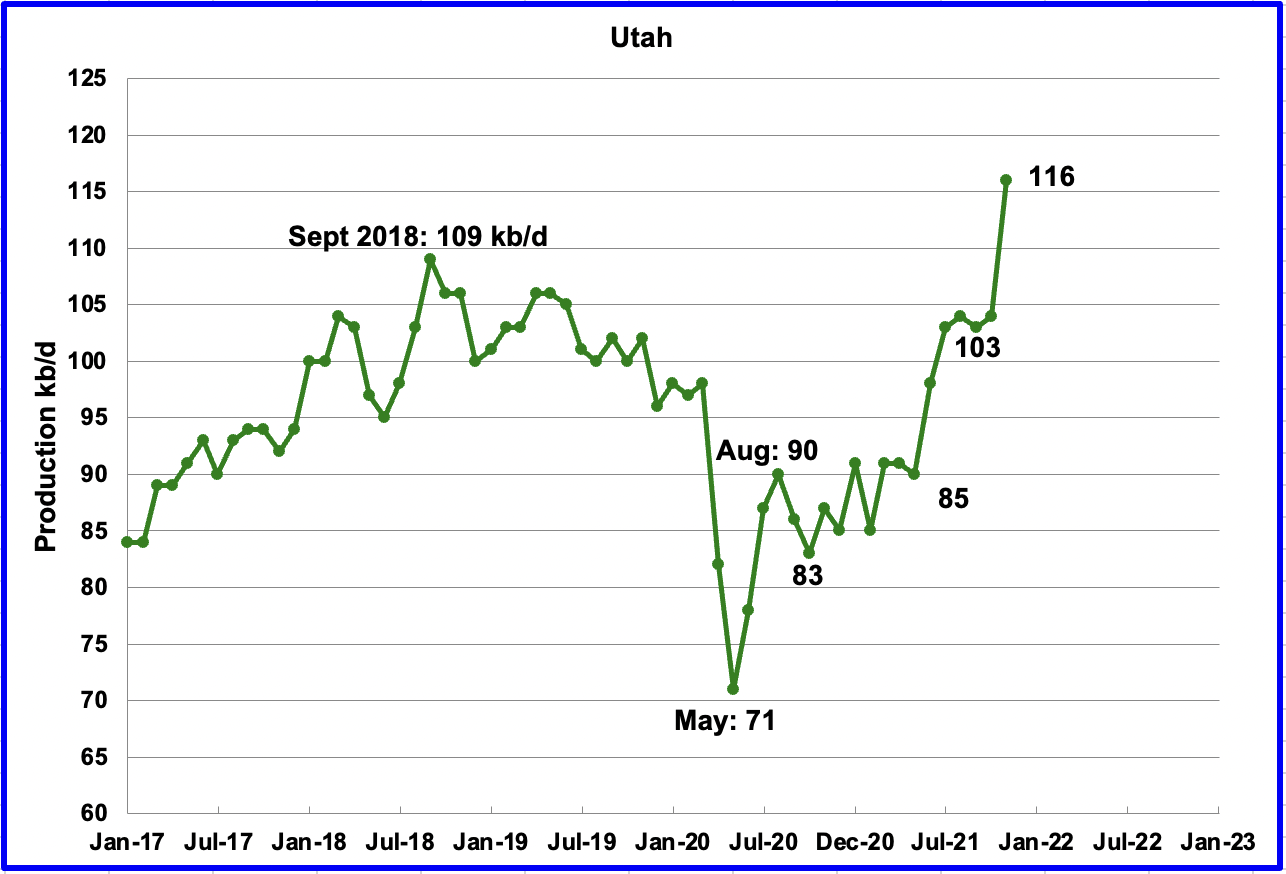

November’s production increased by 12 kb/d to a new record high 116 kb/d.

Utah had 6 oil rigs operating in September and for most of January had 5 operating. In the last week of January, operating rigs increased to 6.

While this is from an old article from August, it clearly states that Utah’s oil and gas industry is as busy now as it was during Trump’s ‘energy dominance’ era.

“While state and industry leaders forecast doom for energy development and rural employment from Biden’s moratorium, which they characterized as a “ban” on development, the exact opposite appears to be happening. Utah’s oil and gas sector is waking up from its pandemic-induced slumber despite obstacles put up by the climate-friendly Biden administration.

So what’s going on? The price of oil has shot past $70 a barrel. Energy companies are acting swiftly to increase production while prices remain high, said the Utah Division of Oil, Gas and Mining.“

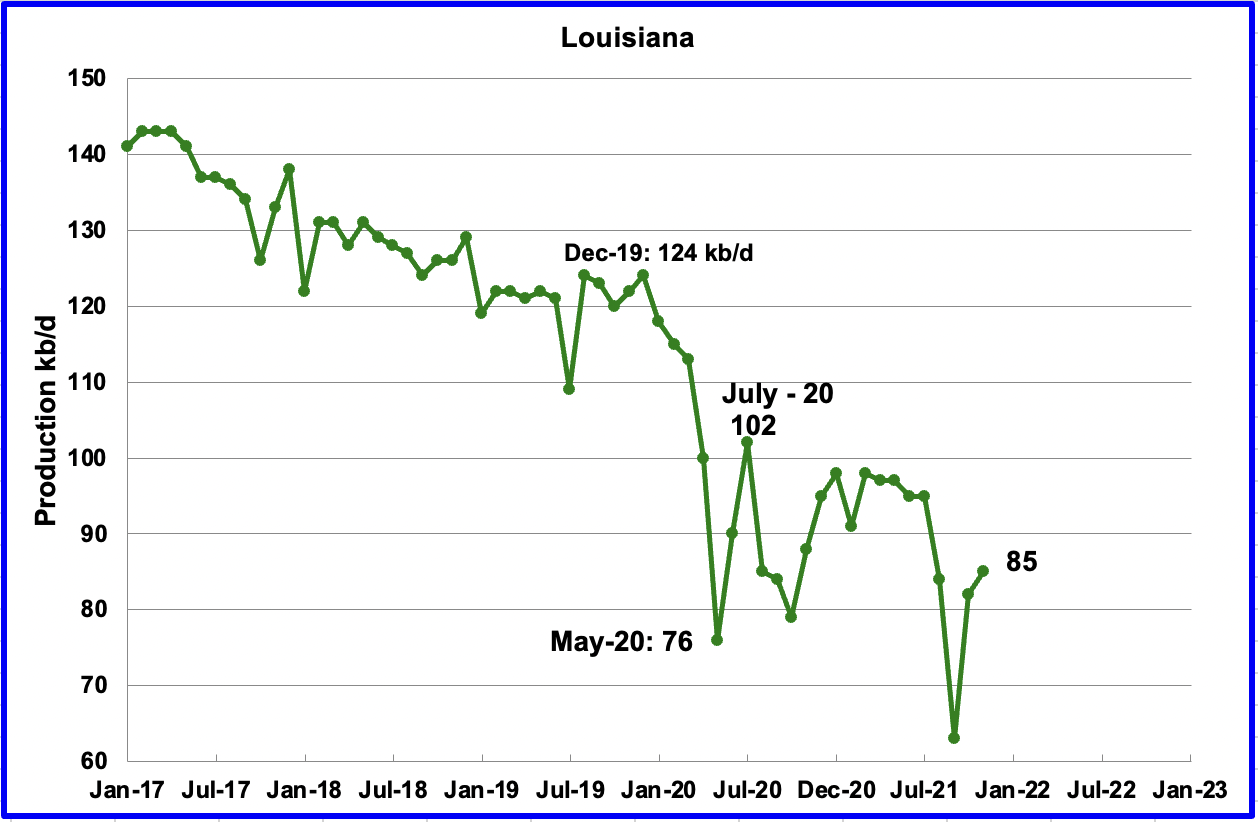

Louisiana’s output increased by 3 kb/d to 85 kb/d in November. Louisiana was one of the hardest hit states by hurricane Ida in late August. November’s output increase indicates that Louisiana continues its slow road to recovery.

Louisiana added 3 Hz rigs in January 2022 for a total of 4.

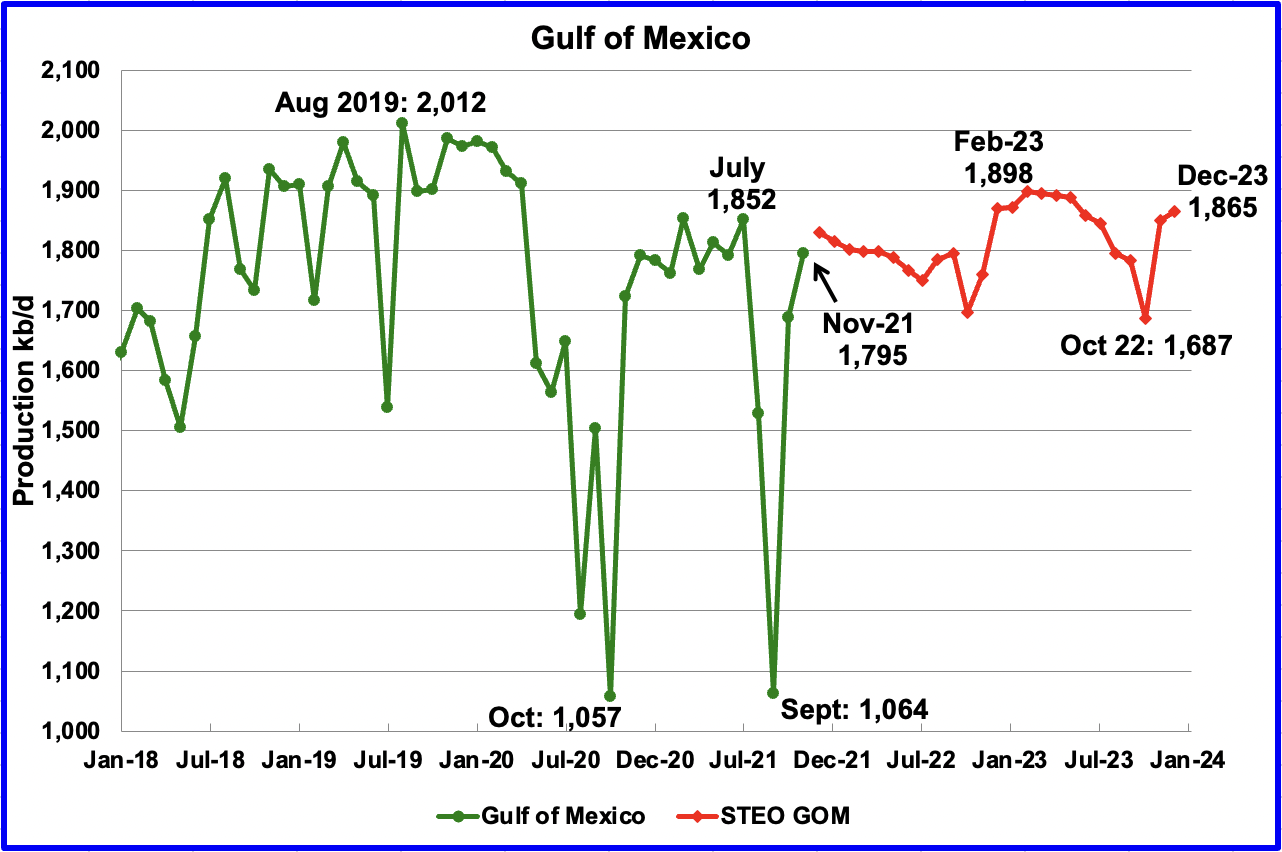

Production from the GOM increased in November by 107 kb/d from 1,688 kb/d to 1,795 kb/d. Note that October’s output was revised down from 1,744 in the previous report to 1,688 kb/d in the current one. If the GOM was a state, its production would normally rank second behind Texas.

The January 2022 STEO projection for the GOM output has been added to this chart and projects output will be 1,865 kb/d in December 2023. The January 2022 STEO forecast for the GOM output for November 2021 was 1,844 kb/d, too high by only 49 kb/d.

A Different Perspective on US Oil Production

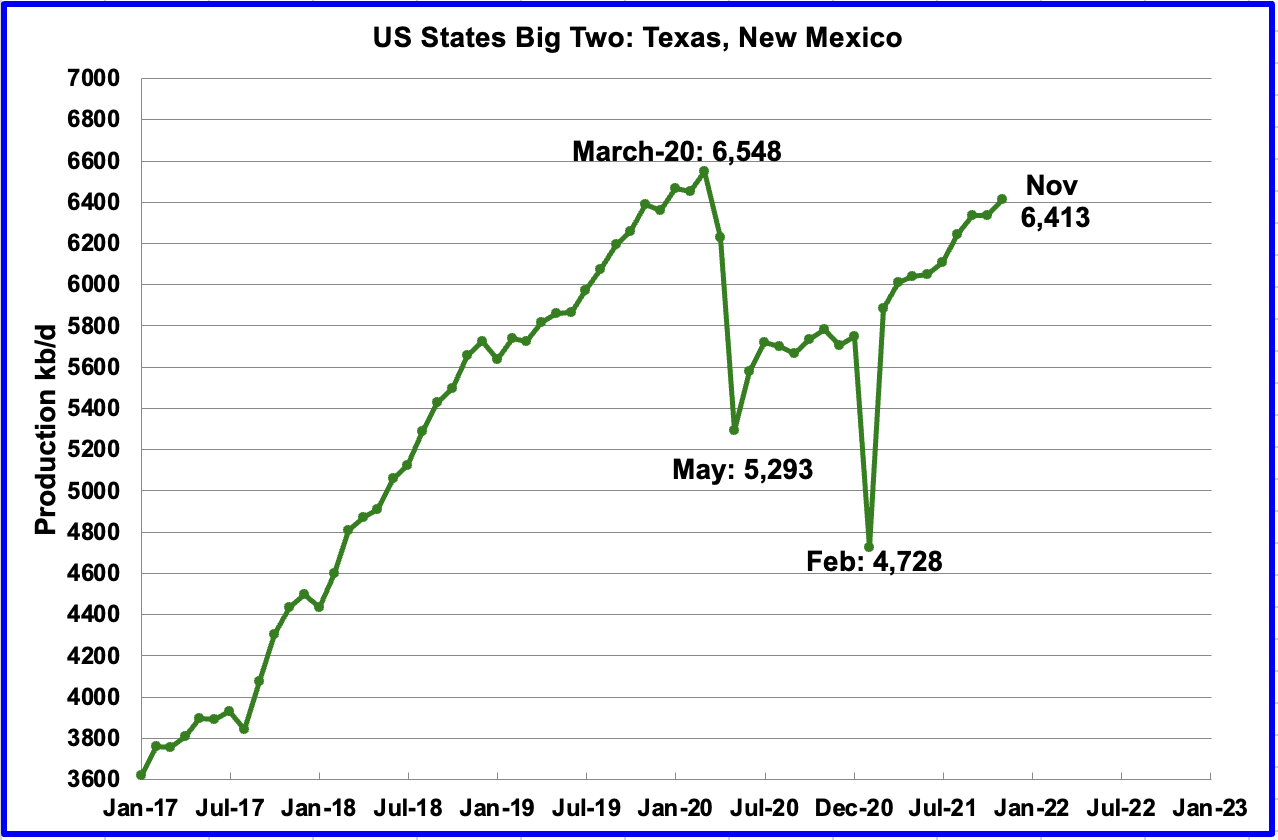

The Big Two states, Texas and New Mexico

The Rest

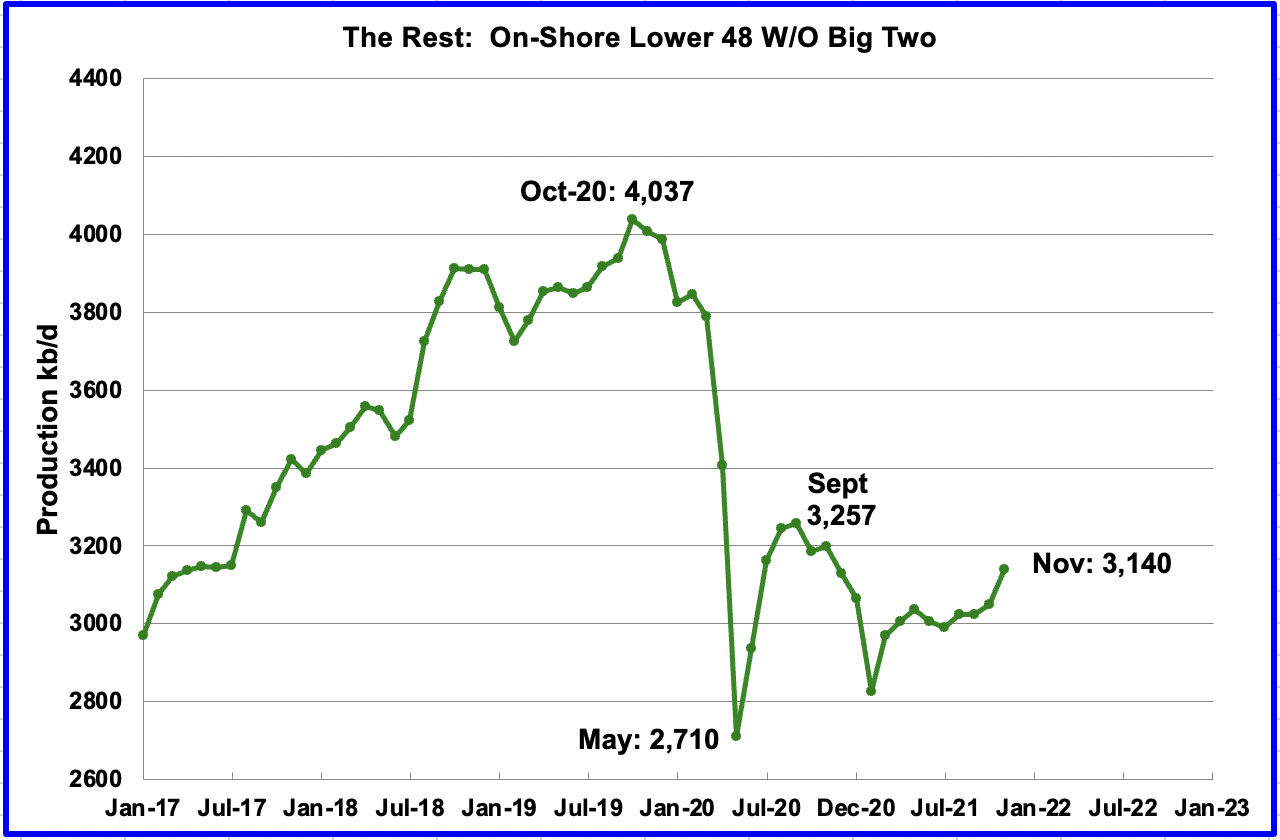

To get a different perspective on US oil production, the above two charts have broken US production into “The Big Two” and the “On-Shore L48 W/O Big Two” or The Rest.

Increasing production has returned to the Big Two states. Last month’s drop may be related to delays in information updating. While October showed a production drop last month, updated data shows that September and October output were essentially flat.

The big surprise is the large increase of 90 kb/d in the Rest of the L48 states. The main contributors to the increase were North Dakota, 54 kb/d, and Utah 12 kb/d.

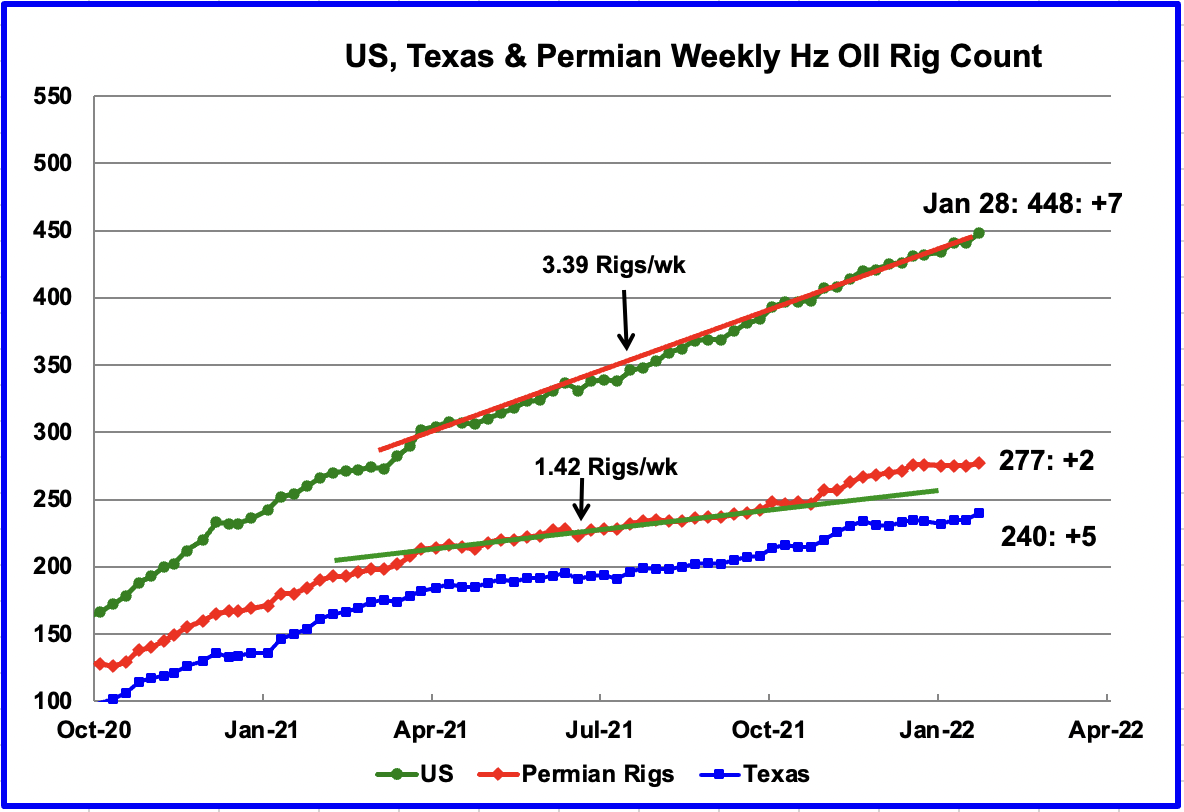

Rigs and Fracs

Since the beginning of April 2021, the US has been adding Hz oil rigs at a rate of close to 3.39 rigs/wk. Of these, the Permian has been adding 1.42 rigs/wk over the period April to October 2021. This means that more rigs were being added in other basins and states. The total Hz oil rig count for the week ending January 28 was 448, an increase of 7.

Since the end of October, the addition of Hz rigs in the Permian basin accelerated over the average rate as the red graph broke away to the upside from the green trend line. However the rate of adding rigs has slowed in January 2022. Could be related to a longer Xmas break. In the week ending January 28, the Permian Hz oil rig count increase by 2 to 277.

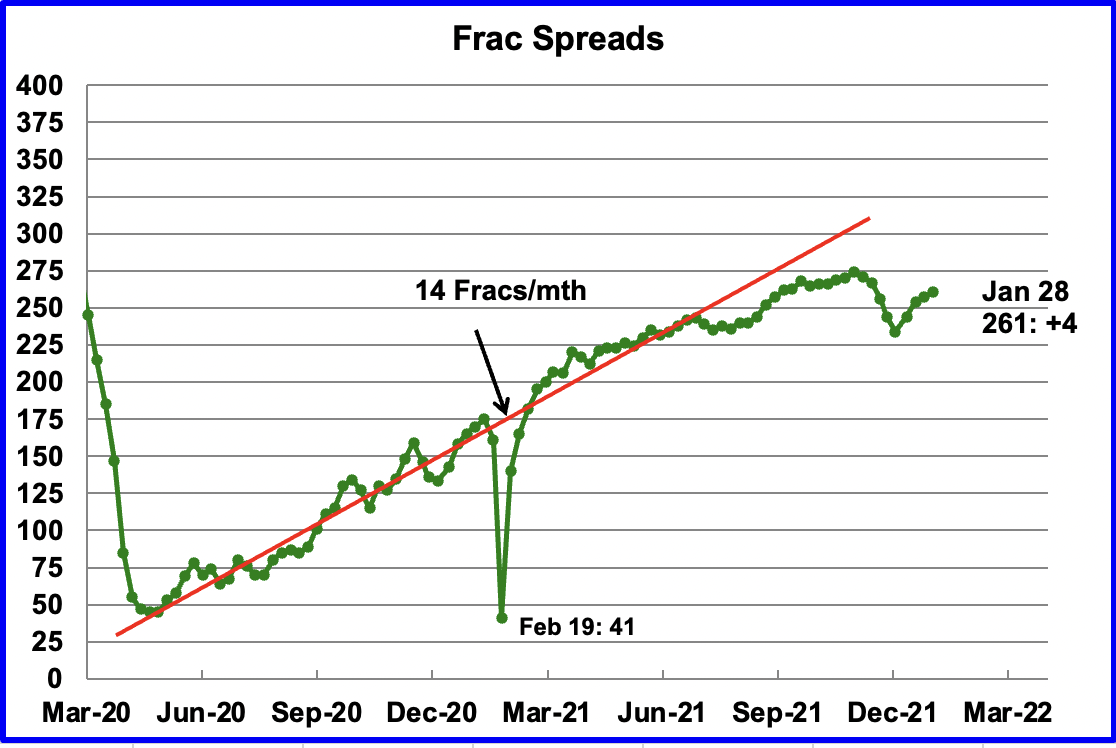

Starting from the week of July 23, 2021, frac spreads were not added at the previous rate of approximately 14 spreads per month. During December 2021, 37 Frac spreads were decommissioned primarily due to the holidays and dropped to a low of 234. During the month of January, 27 frac spreads were reactivated. In the week ending January 28, 4 were added for a total of 261.

Note that these 244 frac spreads include both gas and oil spreads, whereas the rigs information is strictly oil rigs.

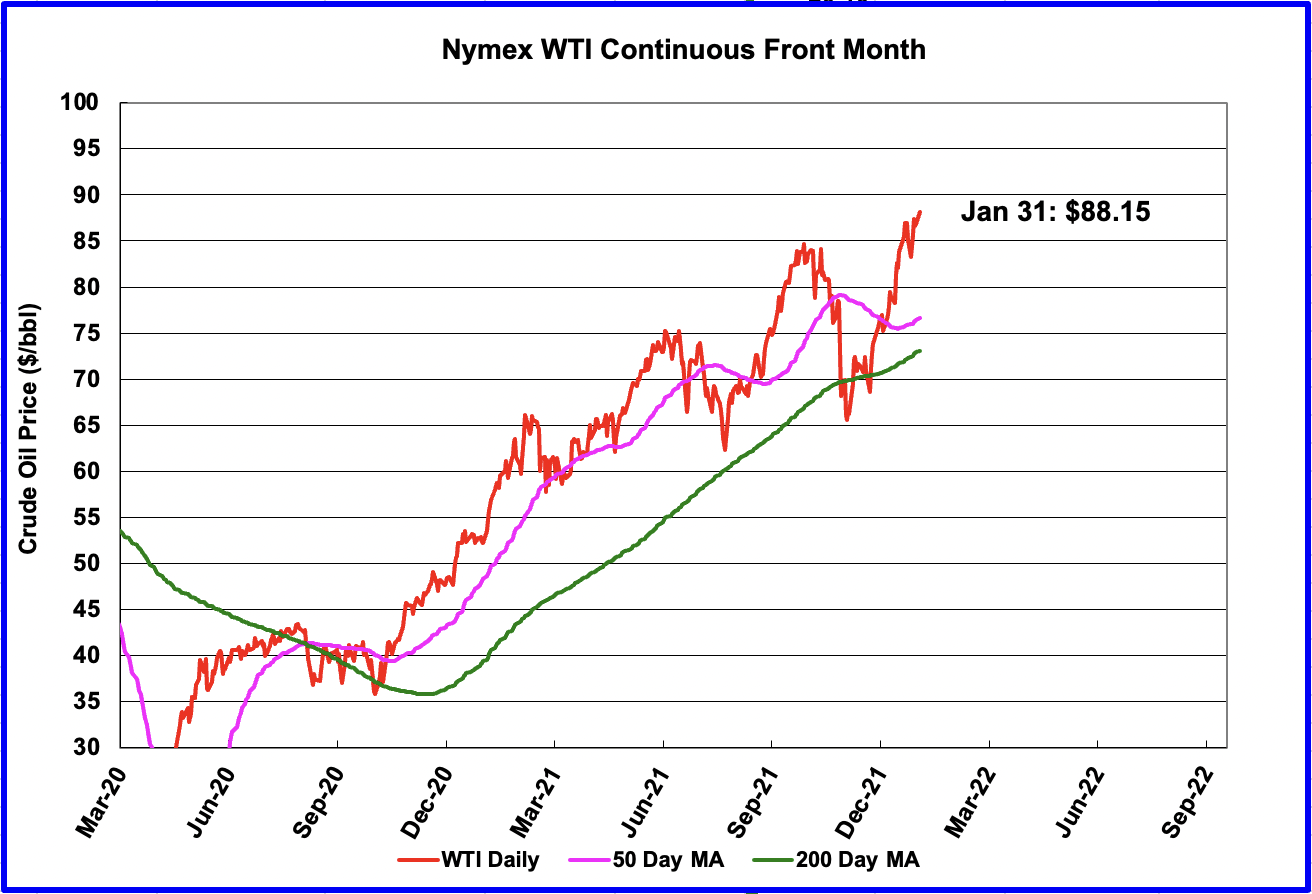

WTI

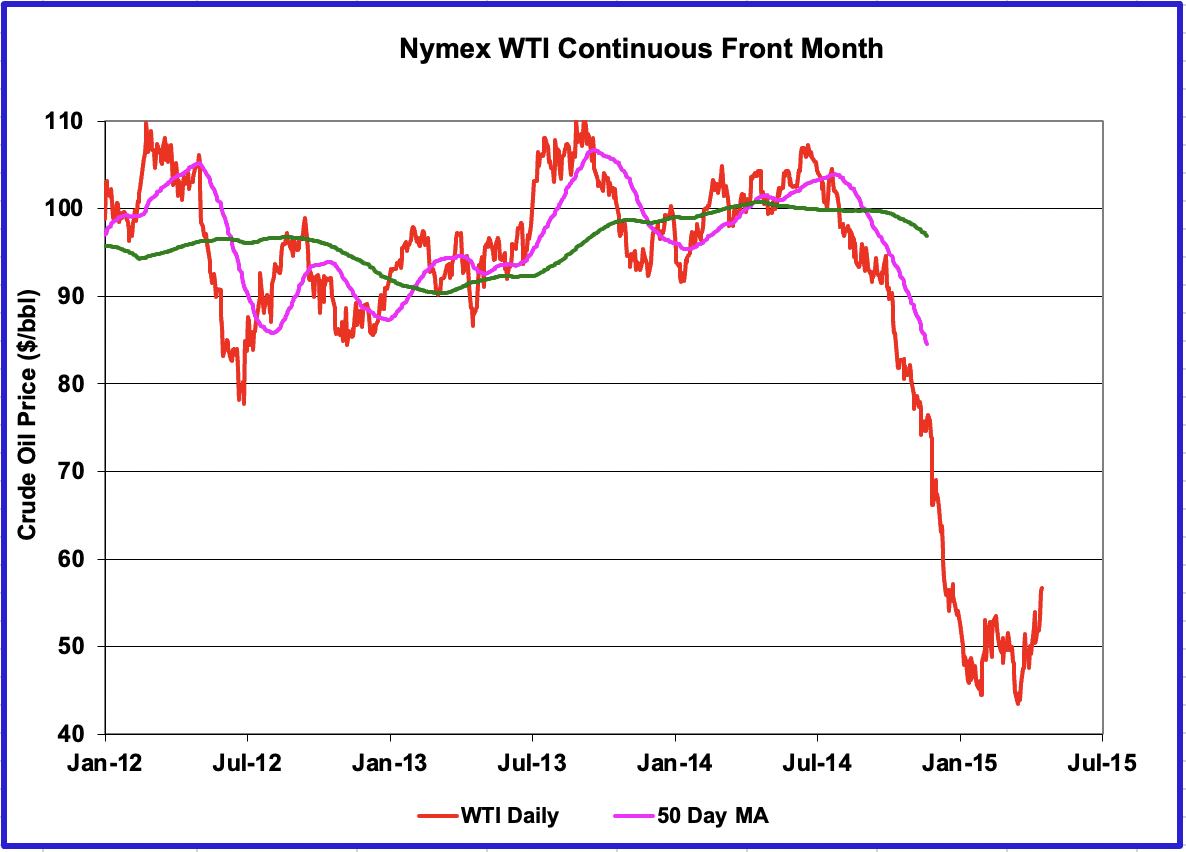

The WTI March contract settled on January 31 at $88.15/b, a new local high, last seen in 2014. See next chart.

WTI rebounded to $110 in early 2012 and again in 2013. The $110/b level will provide major resistance to WTI’s upward trend.

1) Short Term Energy Outlook (STEO)

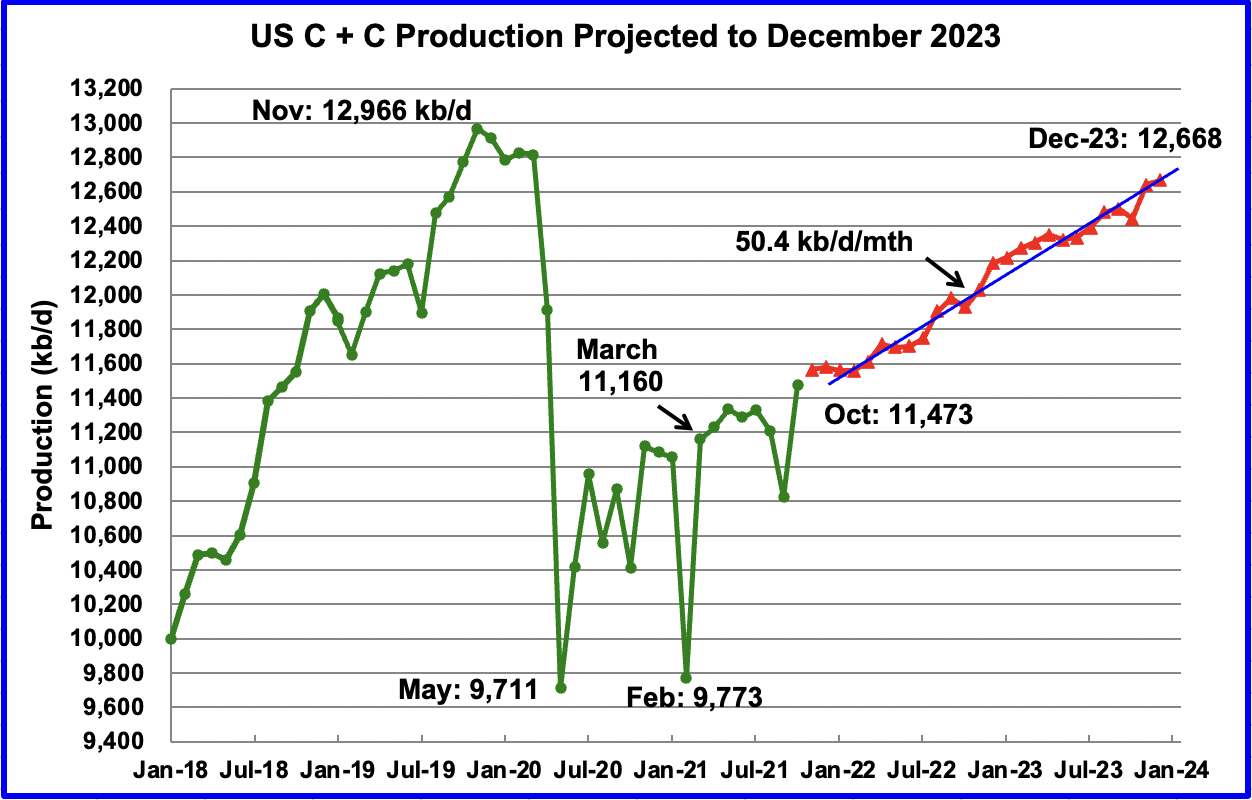

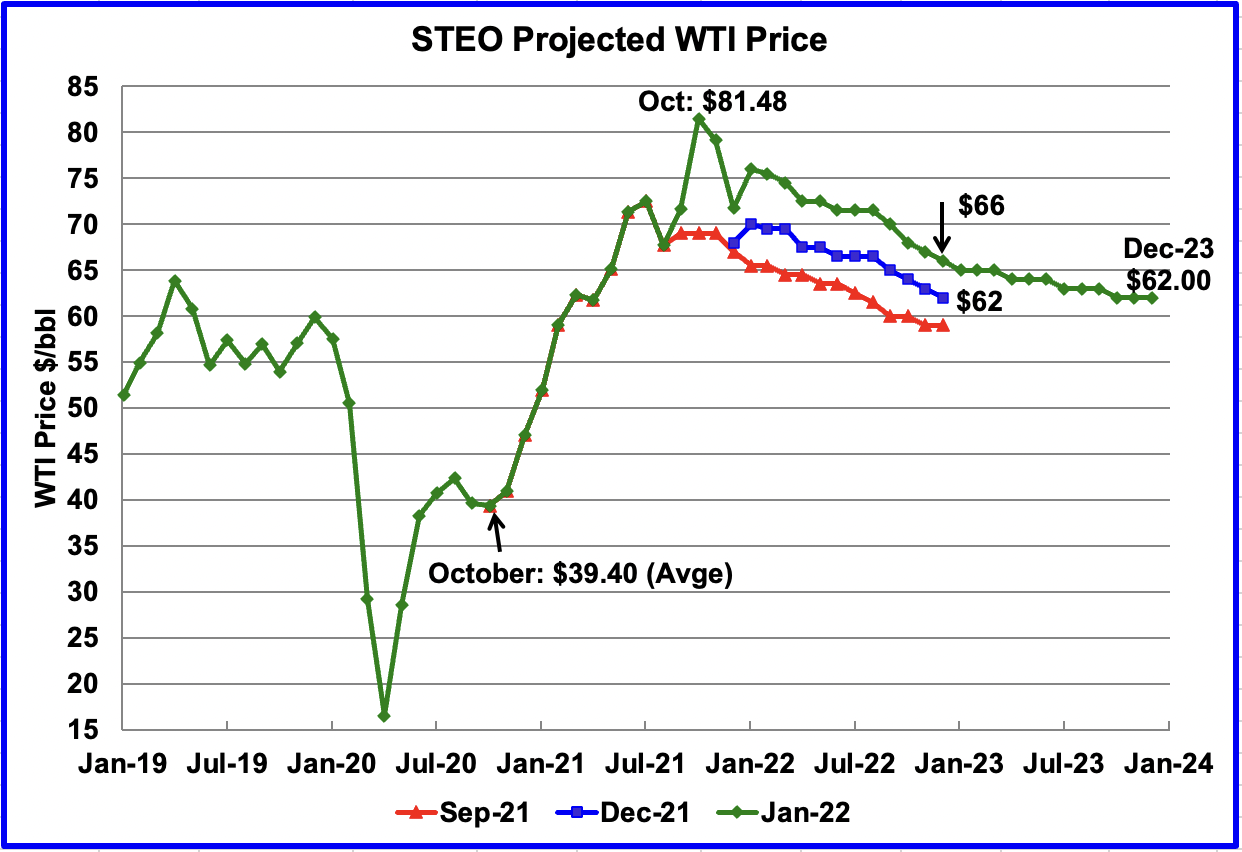

The January 2022 STEO extends the EIA’s projections out to December 2023.

It provides projections for the next 26 months, starting with November 2021 to December 2023, for US C + C, OPEC and other oil production related parameters.

The January STEO has revised downward its projected US oil output from March 2022 to December 2022. Output from November 2021 to March 2022 will remain relatively flat at close to 11,550 kb/d.

From March 2022 to December 2023 production will increase at an average rate of 50.4 kb/d/mth, ending at 12,668 kb/d in December 2023. This monthly increase is down from the previous monthly increase of 83 kb/d/mth from July 2021 to December 2022 shown in an earlier STEO post.

If the lower rate of monthly production increase is correct, the projection is music to the ears of OPEC because if yearly demand growth rate returns to the expected pre-covid rate of 1.0 Mb/d by mid 2022, this means that OPEC can continue to increase their production without fear of lowering the oil price, provided they can increase their output.

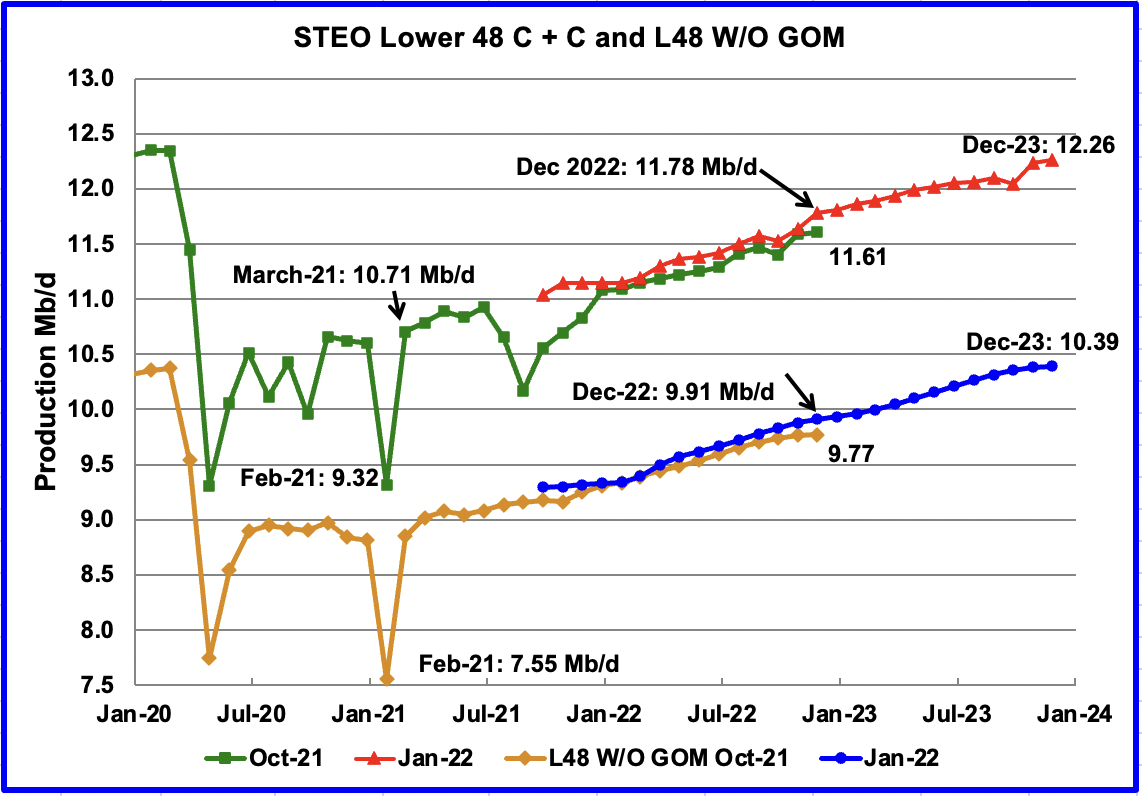

This chart compares the STEO’s forecast from the October report with the current January 2022 report to better illustrate how the January 2022 output forecast changed the October 2021 predictions. For the Lower 48, the December 2022 output has been revised up by 170 kb/d from 11.61 Mb/d to 11.78 Mb/d.

The January STEO output projection for the Onshore L48 states has also been revised to show increased production in H2-22. The output projection for December 2022 has been increased by 140 kb/d to 9.91 Mb/d from the previous forecast of 9.77 Mb/d. From February 2022 to December 2023 output is forecast to increase at an average rate of 47.7 kb/d/mth.

The January 2022 STEO oil price forecast continues to show a steady decline from the October 2021 peak of $81.48/bbl to $62/bbl in December 2023. Note that the STEO has just moved their $62 price target from December 2022 to December 2023. Essentially they are continuing to say that the only direction for the price of WTI going forward is down to $62.

The big forecast change for WTI occurred in updating from the September 2021 report to the December 2021 report to January 2022. The major change in the current January forecast is an increase in the average WTI price by approximately $4/bbl over the December report and moving their $62/bbl out to December 2023.

The March WTI contract settled at $88.15 on January 31, $13.65 higher than the EIA’s forecast of $74.50 for the March contract and higher than the EIA’s October peak of $81.48/b

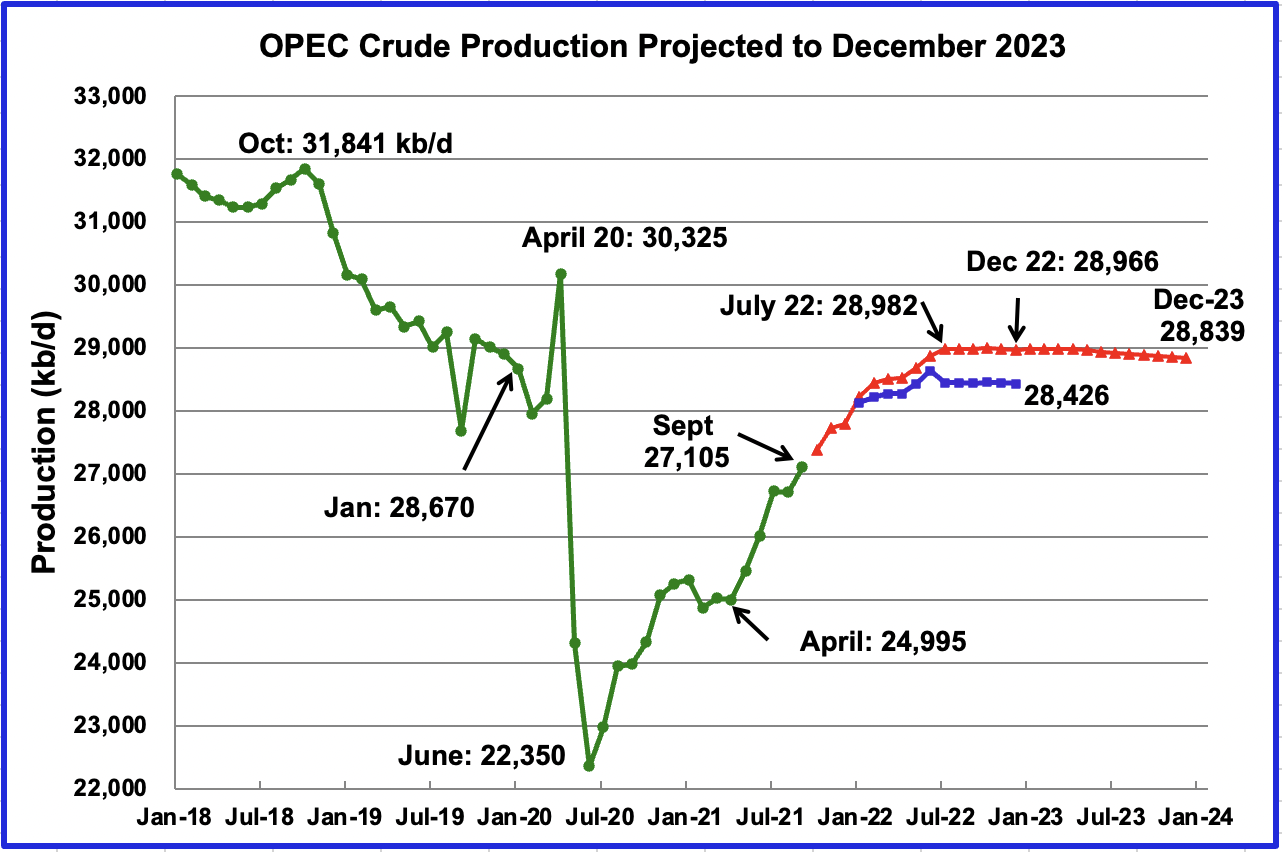

This chart shows the STEO’s January forecast for OPEC crude output to December 2023 compared to their December 2022 forecast. (Blue markers) The output from July 2022 to December 2022 has been increased by approximately 450 kb/d in going from the December report to January. No reason was provided.

OPEC’s output is projected to increase from September 2021 to July 2022 by 1,877 kb/d to 28,982 kb/d. After July 2022, output is essentially flat at close to 28,900 kb/d out to December 2023.

For December 2021, the EIA STEO forecast OPEC production to be 27,790 kb/d. Actual December production as reported by OPEC was 27,882 kb/d, higher by 92 kb/d. A reasonably accurate projection by the EIA.

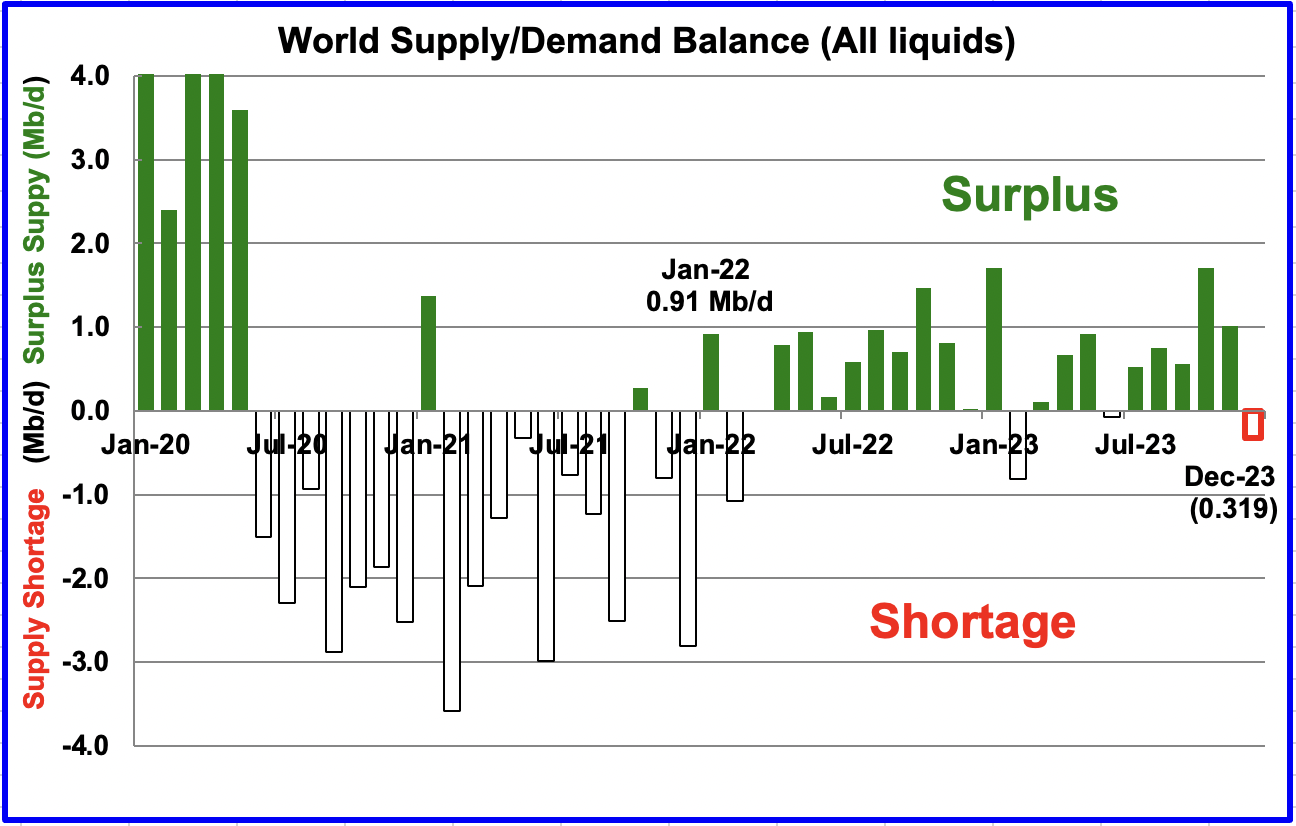

This chart shows the historical world supply/demand balance up to November 2021 and after that, the EIA’s forecast out to December 2023. From January 2022 to December 2023, the STEO is forecasting an average monthly surplus of close to 726 kb/d. However this surplus will be used primarily to refill the worlds inventory. For instance, US total inventory in late January 2022 is down by 107 M barrels from January 22, 2021

This expected surplus between January 2022 and December 2023, along with the variant, Omicron, and the US SPR release may make OPEC + reconsider their planned monthly 400 kb/d production increases somewhere in second quarter of 2022. However, as the price of Brent and WTI continue to increase beyond $85/5, there is no indication at this time that they are thinking of cutting back.

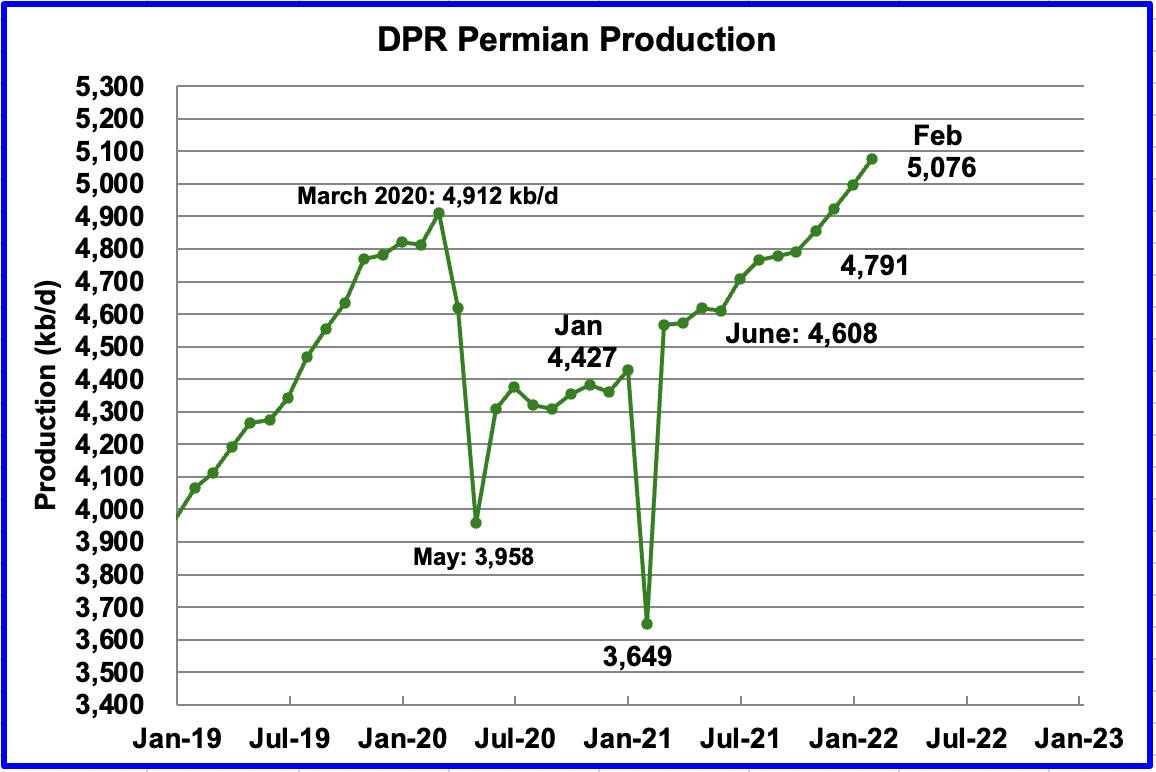

2) Drilling Productivity Report

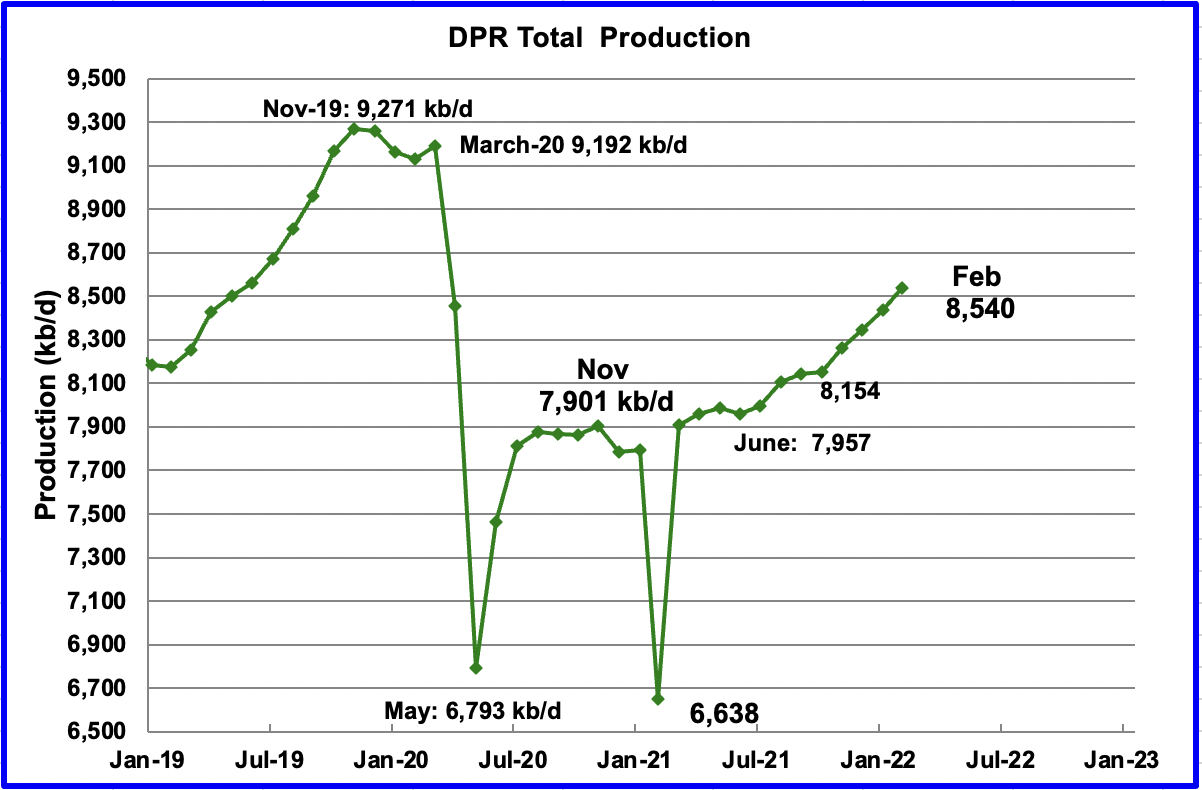

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The January DPR forecasts production to February 2022 and the following charts are updated to February 2022.

Above is the total oil production from the 7 DPR basins that the EIA tracks, projected to February 2022. Note that the DPR production includes both LTO oil and oil from conventional fields.

The DPR is projecting that output for February 2022 will increase by 105 kb/d over January to 8,540 kb/d. From October 2021 to February 2022, output in the DPR basins is forecast to increase by 386 kb/d or 96.5 kb/d/mth and appears to be accelerating since February added 105 kb/d. The Permian basin is the primary contributor to the US production increase.

If the average output rate of 96.5 kb/d/mth were to continue for another year, this would add 1,158 kb/d/yr to US production, which could potentially begin to disrupt world oil supply and cap the increase in the price of oil to below $100/bbl.

This output rate projection of 96.5 kb/d/mth is in sharp contrast with the STEO forecast above. It indicates that from November 2021 to March 2022, output will remain essentially flat at close to 11,550 kb/d and then start to increase at a rate of 50.4 kb/d/mth out to December 2023, essentially 1/2 the rate indicated in the STEO.

Permian output is projected to exceed 5,000 kb/d in February to a new production high of 5,076 kb/d. From October to February, production is forecast to increase by 285 kb/d or at an average rate of 71.3 kb/d/mth.

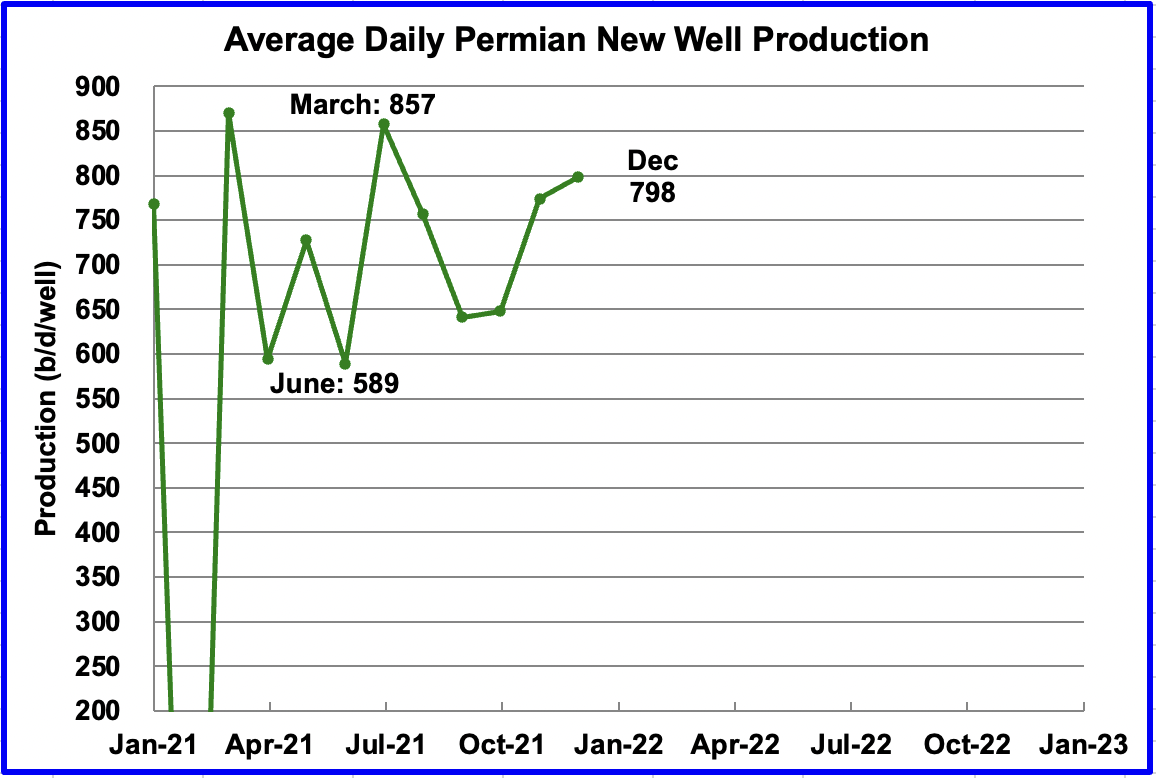

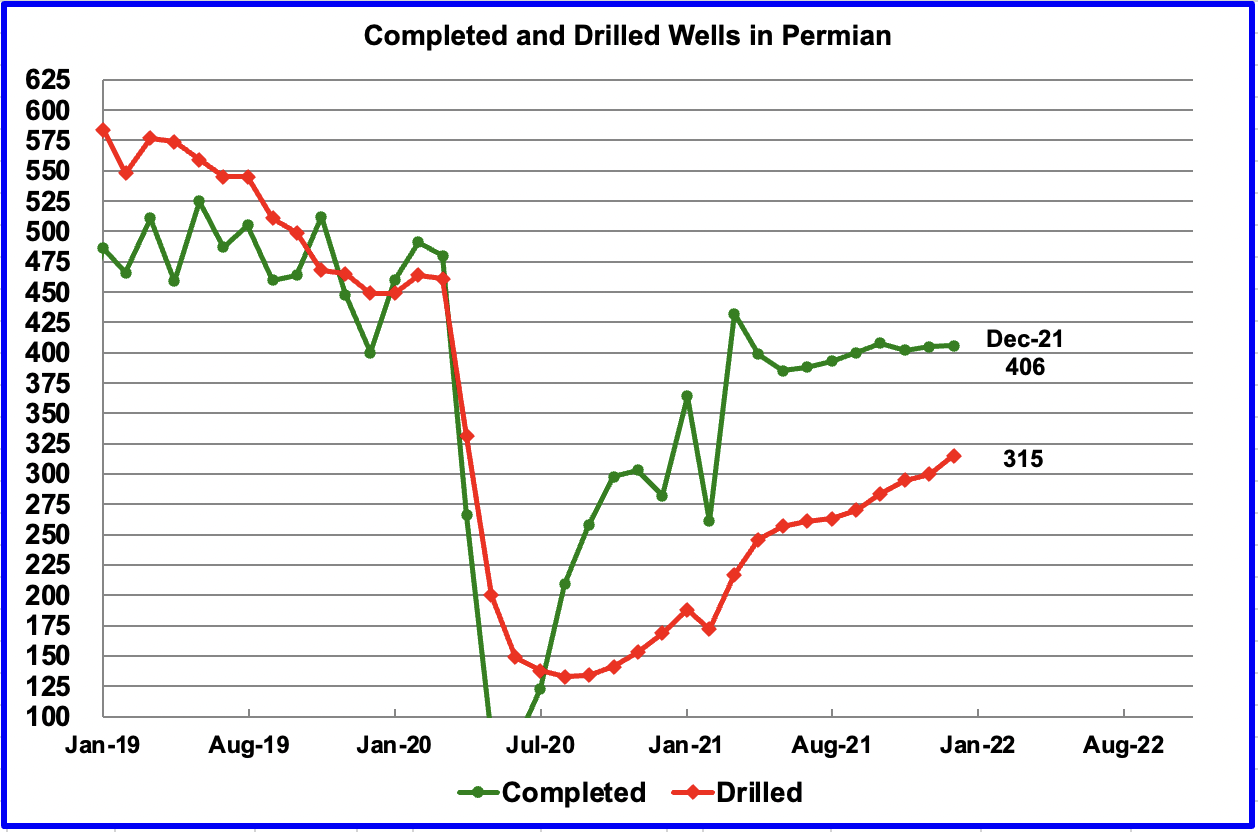

During December, 315 wells were drilled and 406 were completed in the Permian. The completed wells added 324 kb/d to the forecast December output for an average of 798 kb/d/well. The overall decline was 254 kb/d which resulted in a net increase of 70 kb/d. Of the 405 completed wells, 319 were required to offset the decline. It is the completion of the additional 87 DUCs, over and above those drilled, that accounts for the increase in the production in the Permian.

This chart shows the daily production from the average new Permian well tracked on a monthly basis. The daily output from new Permian wells was divided by the number of completed wells, as reported in the DPR and DUC reports.

For instance, during December, the new wells produced 324 kb/d from 406 wells for an average of 798 b/d/well. The DPR back checks their earlier estimates and it appears that the average first month output is increasing and moving closer to 800 kb/d. Well production data was only available up to December to make this estimate.

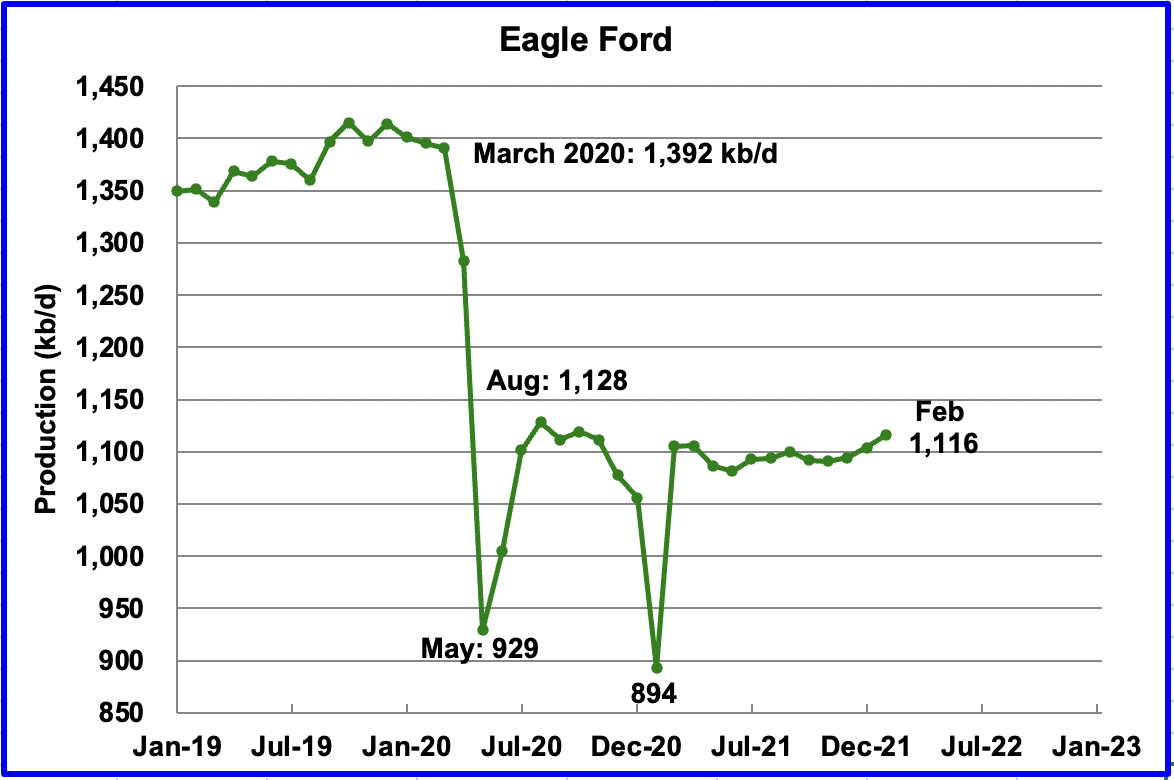

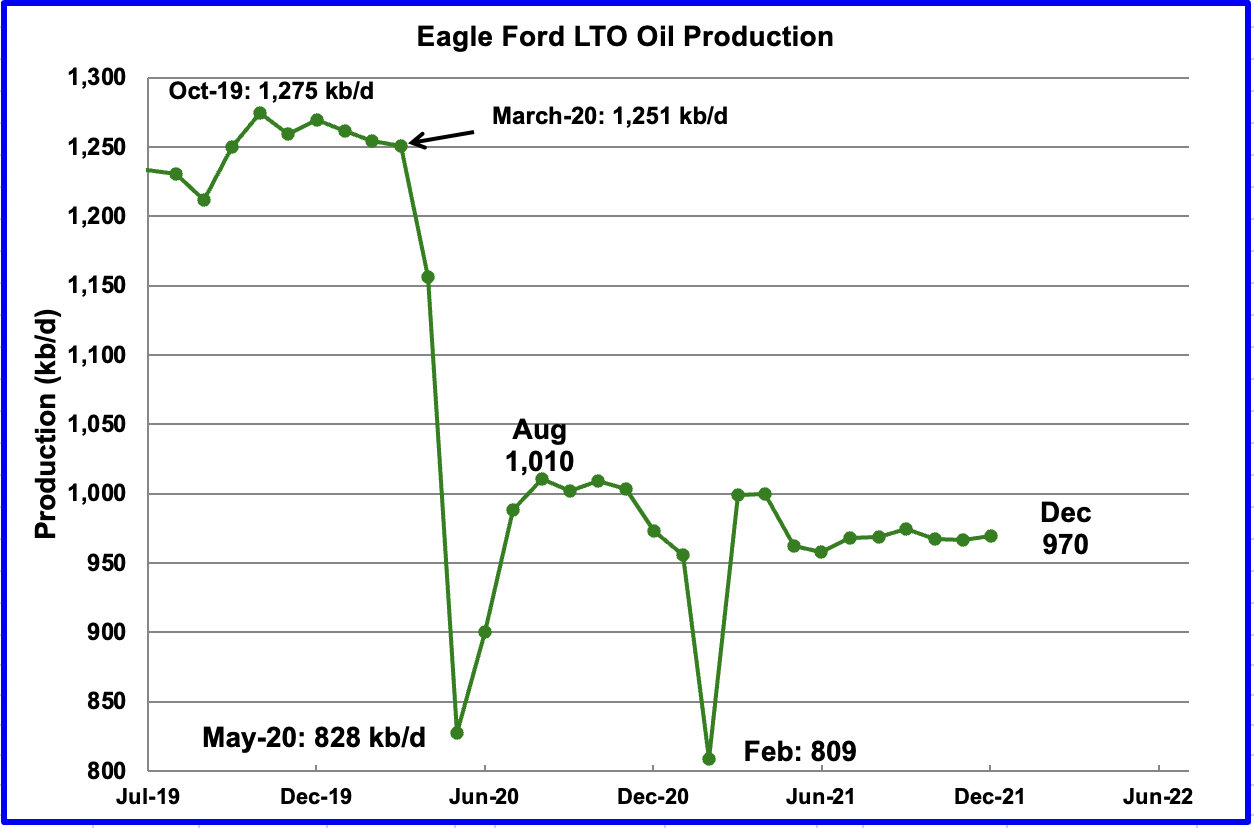

Output in the Eagle Ford basin has been showing an increasing trend since September 2021. For February, output is expected to increase by 12 kb/d to 1,116 kb/d.

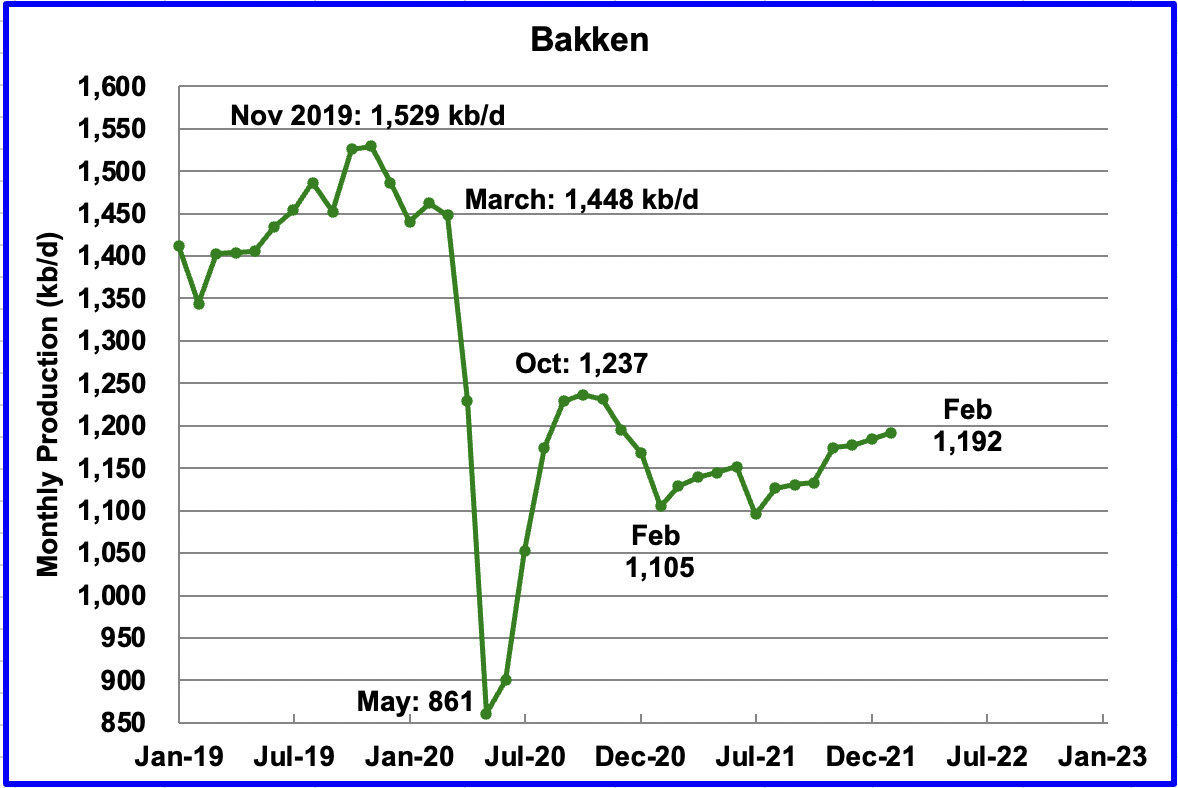

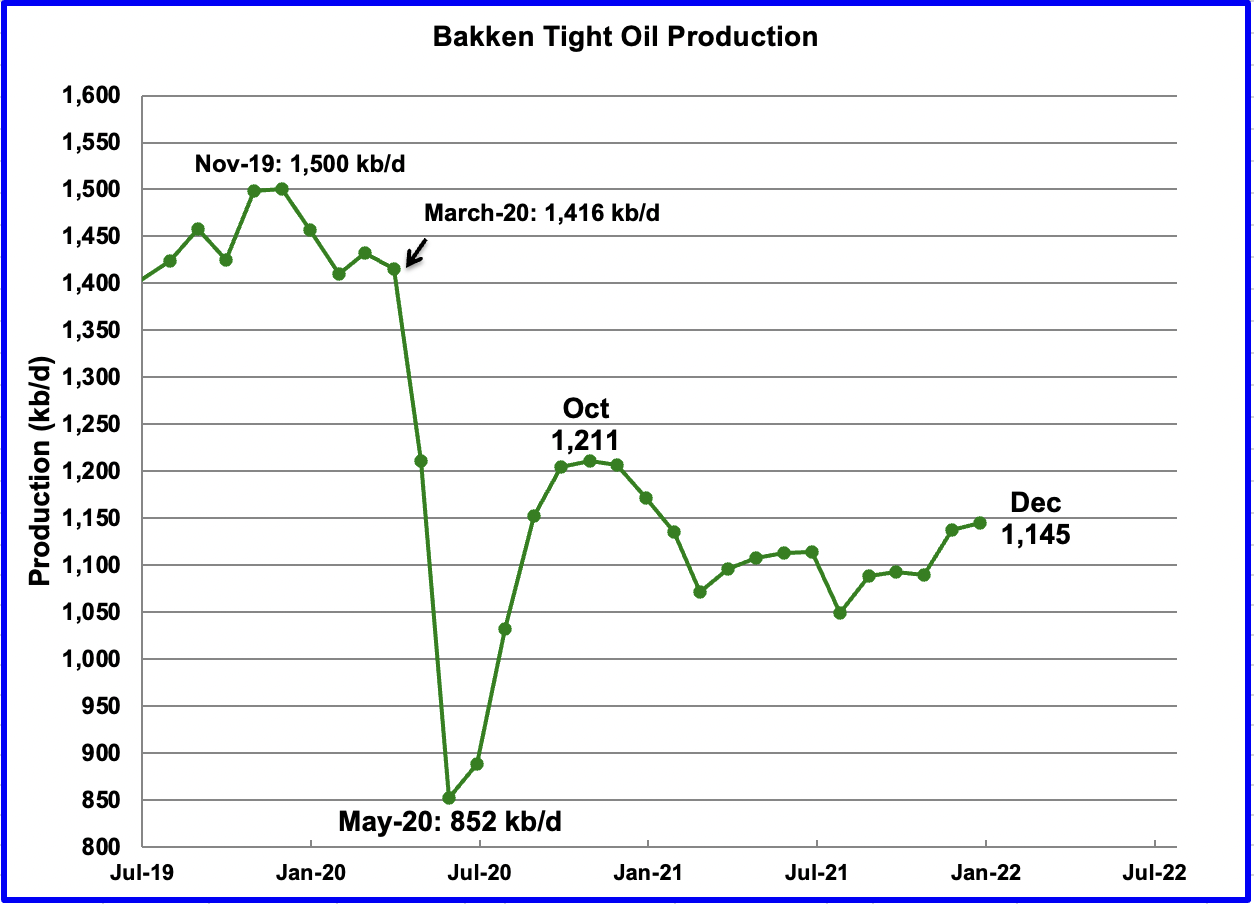

The DPR forecasts Bakken output in February to be 1,192 kb/d an increase of 8 kb/d over January. The step-up in output shown for November appears in the North Dakota state report above.

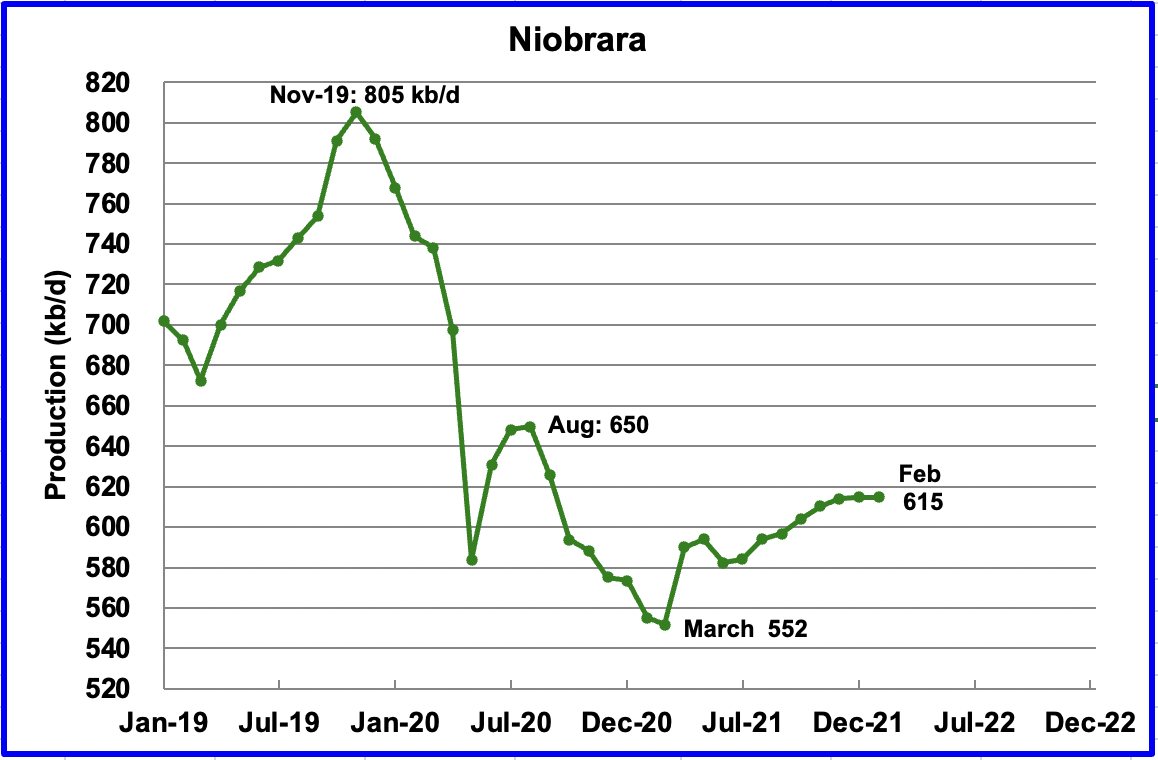

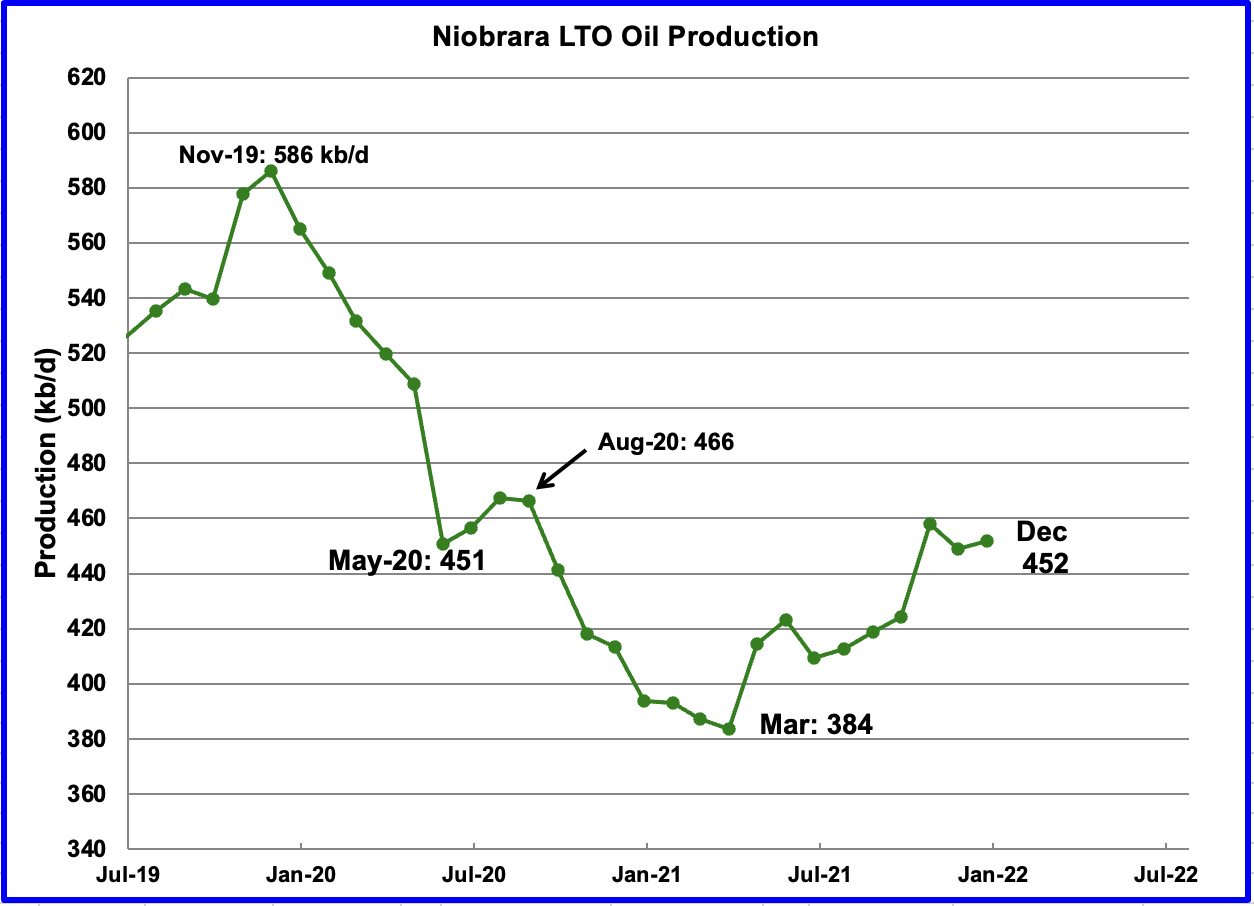

Output in the Niobrara has been rising since July but is now showing signs of starting to plateau at 615 kb/d.

DUCs and Drilled Wells

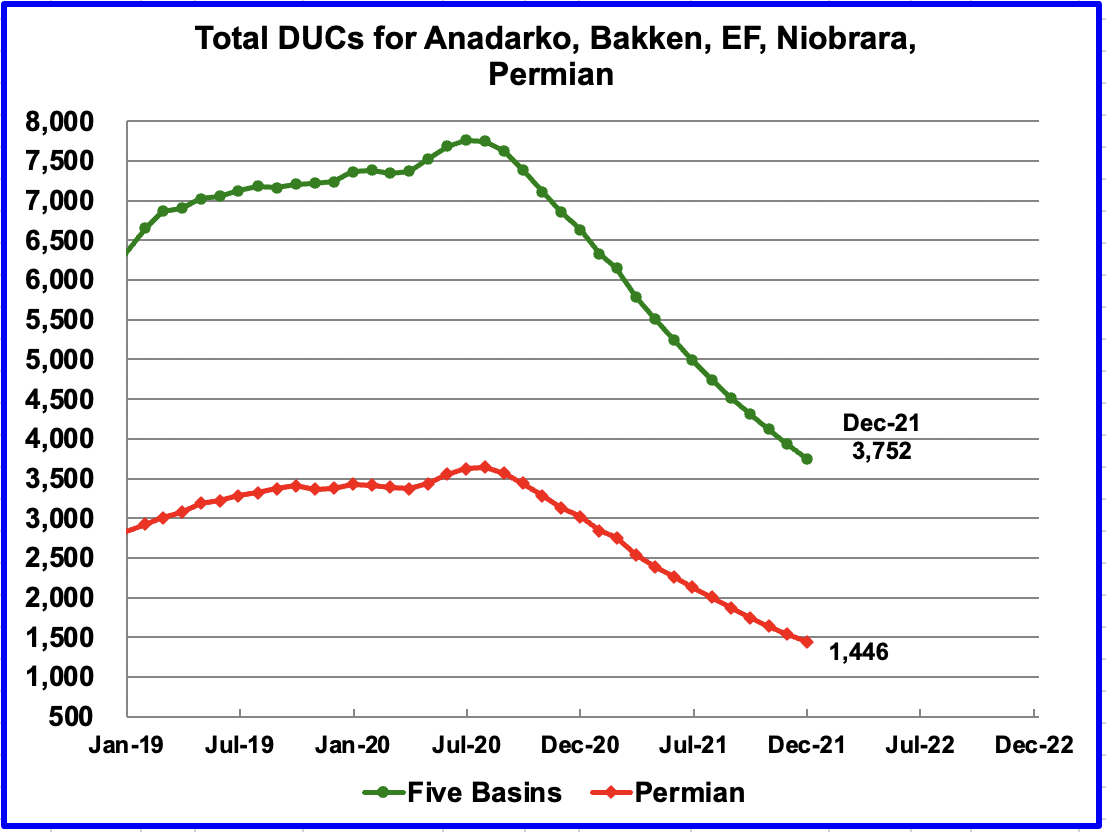

In these five primarily oil basins, the utilization/completion rate of DUCs started to slow after peaking in March. For example, in March 2021, 361 wells were completed. In December the utilization rate, i.e. completion rate was down to 179 from 191 in November.

In the Permian, 91 DUCs were completed in December, down from 105 in November. If Permian DUCs were to be completed at the latest rate of 91/mth, that translates into a 16 month inventory, assuming the remaining 1,446 are all commercially viable. Interestingly, this constant supply of 15 to 16 months of DUCs is not shrinking since fewer DUCs are being completed each month.

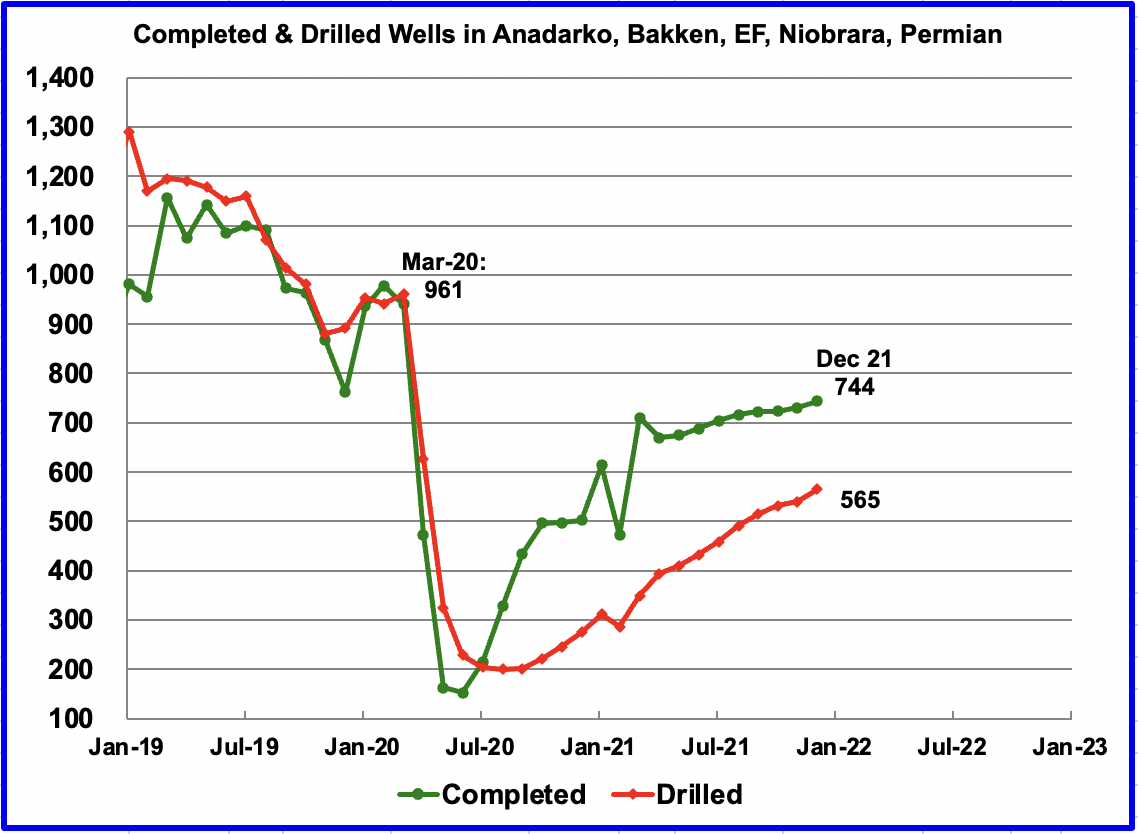

While the completion of DUCs has slowed, the overall completion rate of Wells has also slowed in these five oil basins. To compensate, the monthly drilling rate has been increased. From May to December, an additional 22 wells per month over the previous month were drilled. At the same time the monthly completion rate was also increasing, but at a lower rate of 11.4 wells per month.

For December, completions increased by 13 to 744 while drilled wells increased by 25 to 565.

In the Permian, a similar trend in slowing completions is developing. In December 406 wells were completed, 1 more than in November. However, 315 new wells were drilled an increase of 15 over November.

What is noteworthy and perplexing at the same time in this chart is the number of monthly completions in the Permian from August to December were roughly constant at 403 +/- 2. What is the the lack of increase in completions signalling?

3) LIGHT TIGHT OIL (LTO) REPORT

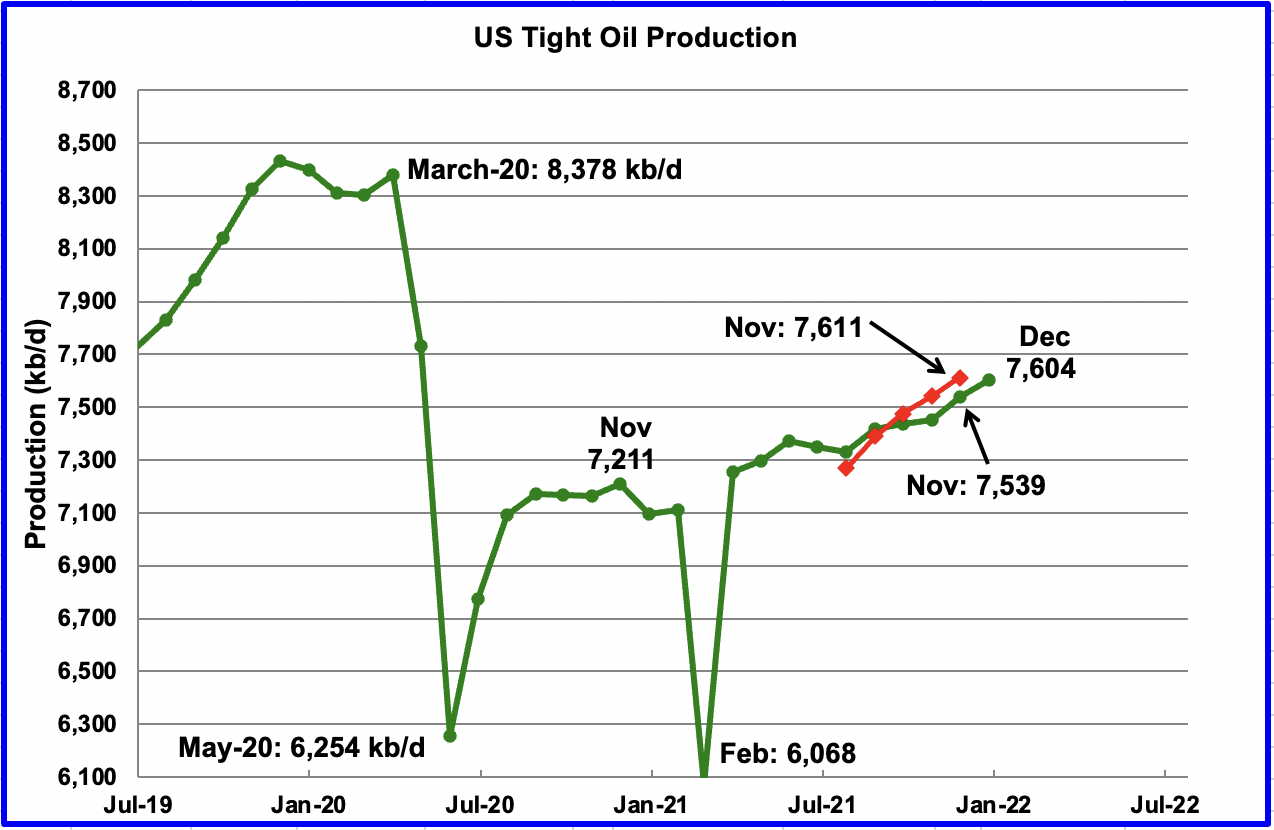

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The January 2022 report projects the tight oil production to December 2021.

The January LTO report revised down the December LTO projections by close to 70 kb/d for October and November 2021. The five point red graph shows the previous December LTO forecast. As can be seen, November was revised down by 72 kb/d.

December’s LTO output is expected to increase by 65 kb/d to 7,604 kb/d. Again there is a difference in the outlook between the LTO and the STEO for December. The STEO is forecasting flat out for December while both the DPR and LTO are showing increasing production?

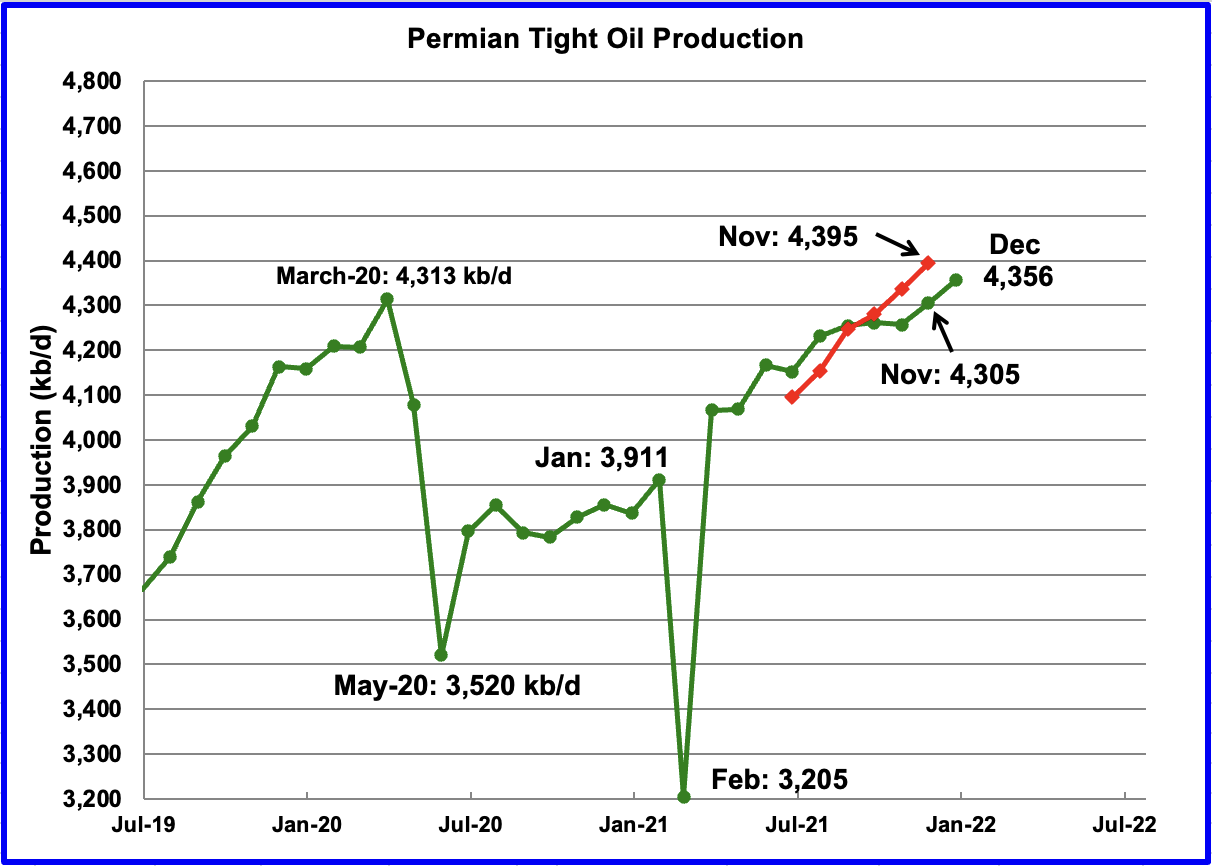

Permian LTO output reached a new high in December of 4,356 kb/d, an increase of 51 kb/d over November. The latest report adjusted November’s output down by 90 kb/d as was reported in the December 2021 report.. Note that the December output is lower than the November output of 4,395 kb/d estimated in the previous December report. Red Graph.

The Bakken’s December output increased by 7 kb/d to 1,145kb/d.

The Eagle Ford basin is expected to produce 970 kb/d in December, essentially flat since July, which came in at 968 kb/d.

Output in the Niobrara in the latest LTO report in showing steadily increasing production from July to October to 459 kb/d. However, November and December output declined.

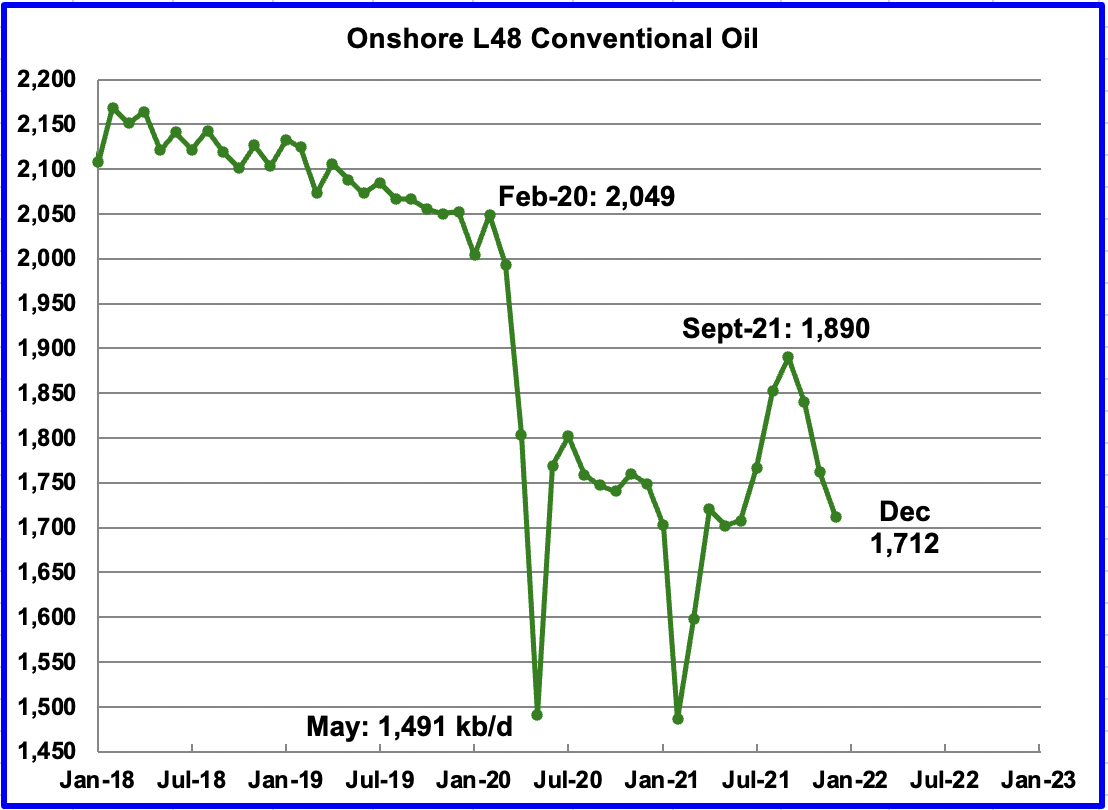

Conventional oil output in the Onshore L48 declined by 50 kb/d in December to 1,712 kb/d. This estimate is based on a combination of the expected December LTO output and the January 2022 STEO report that has a forecast for the US On-shore L48 output for December 2021. The average decline rate from September to December is 59.3 kb/d/mth.

A note of caution. This chart is derived by subtracting two large numbers which are subject to revision, particularly in the latest months, which greatly affects the output after September.

Ovi, you are a champion. I could have never come up with a post this detailed when I was running things. I mean this post is the best I have ever seen. Thank you, thank you, thank you. I hope you around here for a very long time.

Ron

Ron

Thanks. Most of it was done shortly after each EIA report came out. Today I just had to add the state production data plus clean up a few loose ends.

Thanks to you for starting the site and for Dennis for carrying the big load on many replies. Many thanks also to the participants who provide a lot of insight and different perspectives.

Ovi,

I agree with Ron. This is a fabulous post and really great info. I still believe that the DUC completions in Excess of drilled wells are keeping the production number up in the Permian. Perhaps we will see an increase in drilling rigs but man is labor in short supply and the costs are through the roof. I think there is a limit to the drilling rig growth due to labor and lack of capital.

LTO Survivor

Much appreciated. Your contributions to this site are also much appreciated.

Wondering if you have any insight on those three mile laterals and whether they are being used in the Permian in Tier 2 and 3 areas?

Ovi, your post is big work, thank you. Here are a number of arguments to counter Rystad’s, ‘bigger is always better’ article on Permian lateral lengths: https://www.oilystuffblog.com/forumstuff/forum-stuff/rystad-s-record-breaking-permian-wells. Rystad’s piece I believe is designed to be deceiving from the standpoint of what defines “better well production,” (IP180?) and of course uses BOE as the metric… in areas where gassy oil wells are turning into oily gas wells.

85 % of drilling permits filed thru December 2021 in the Permian are all still in core areas of the top 10 counties.

Great piece Mike, thank you.

Everyone should take a loo at your chart at link below, very informative and read your post.

The chart comes from http://www.shaleprofile.com by way of http://www.oilystuffblog.com (link to post in Mr. Shellman’s comment above repeated below.) It includes the 6 largest producing counties in the Midland basin, new well productivity (cumulative barrels of oil produced at 6 months per 1000 feet of lateral)is not increasing when we normalize for lateral length in the Midland basin.

Link to chart (from full oilystuff post)

https://static.wixstatic.com/media/a27d24_5781158b1acd46ec8a8512ae136c1c6a~mv2.png/v1/fill/w_1408,h_647,al_c,q_95/a27d24_5781158b1acd46ec8a8512ae136c1c6a~mv2.webp

Full oilystuff post at link below

https://www.oilystuffblog.com/forumstuff/forum-stuff/rystad-s-record-breaking-permian-wells

Make sure to read the comments at Oilystuff, lots of great stuff.

Thank you Mr. Shellman for sharing your knowledge.

Thank you, Dennis.

Mike

Much appreciated. Your input and more importantly your insight and analysis are greatly appreciated. My task is fairly straight forward, try to repackage the EIA data as best I can.

In looking at your latest post and in particular the Texas RRC GIS map, I see that the drills/wells fan out in a linear pattern. Where are the laterals? Secondly could a rig be placed where the arrow is pointing and drill toward the top of the picture to get oil out of the empty area,

I hope these are not dumb questions. Appreciate that I know nothing about drilling and the oil industry.

Ovi, those are the laterals. The drill platform is in those pentagon shaped graphics. In the top center drill platform, they have drilled five wells, or laterals, from one droll platform. I have no idea what the green and red dots are.

Perhaps locations of previous wells drilled to assess the quantity of oil contained in the concerned bedrock.

The triangles are what happens when you graph a horizontal well using only the surface lat/long and toe location. It shows up as this chicken foot pattern. If you have the wellbore survey, then you can GIS three points, surface, heel, and toe. On a 2 dimensional plot, the laterals then show up as straight, usually parallel lines, with a second short, highly angled line from the heel back to the surface point. The line is short because it represents the distance of only the build section of the well, determined mostly by the DLS the engineer who designed it is willing to accept.

Ovi,

I also know far less than the oil pros. The laterals are the long lines on the chart, the pentagon shapes are the drilling pads. The two sections (2 square miles) near the top middle of the chart you show, have 9 wells per 2 square miles. LTO survivor has suggested that anything more than 4 wells is too tightly spaced, but there is the possibility that these 9 wells are spread between two different benches, the best benches in the midland basin are usually Wolfcamp A and Wolfcamp B (upper and lower) as well as Spraberry lower (based on USGS Midland basin assessments of Wolfcamp in 2016 and Spraberry in 2017).

Those with access to shaleprofile data or familiar with the details of the RRC data can determin exactly which benches are targeted by specific wells, I don’t know how to do that, but the experts like Mike Shellman, LTO Survivor, Tad Patzek, and geophysicists at the USGS have access to this data.

In the highest EUR areas of the Permian basin as of the end of 2017 there were about 31 million net acres that might be potentially developed in these higher productivity benches (lower Spraberry, Wolfcamp A and B in Midland and Third Bonespring and Wolfcamp A, B and C in delaware). The TRR for these benches might be as high as 49 Gb, but when we account for economics and potentially falling oil prices after 2029 (with oil prices assumed to rise to $100/b from 2024 to 2029) the ERR is more likely to be in the 28 Gb to 36 Gb range, depending upon maximum completion rates chosen by producers.

A lower completion rate (400 new wells per month maximum) results in lower ERR as the falling oil price assumed after 2029 leaves a lot of oil in the ground (ERR=28 Gb). A higher maximum completion rate (800 new wells per month with linear ramp from 400 to 800 from April 2022 to August 2025 and then constant competions at 800 per month up to Dec 2026 followed by a ramp down at an increasing rate. Scenario for Permian basin high completion rate scenario described above is below. All wells financed from operating cash flow after September 2020, all cumulative debt from Permian basin (starting from Jan 2010) is paid off by March 2025 for the assumptions of this scenario.

The economic assumptions: natural gas assumed to sell at $3.50/MCF at wellhead after August 2021, crude oil price ramps from $73/bo in Jan 2022 to $100/bo in August 2026 and remains at that level until July 2030, NGL sells for 35% of crude price per barrel (all prices in 2020 US$) and average well cost is $10.8 million (includes all costs including P and A), oil transport cost to refinery assumed to be $5/bo (refinery gate price assumed to be $5/bo above wellhead price), nominal annual discount rate 10%, nominal annual interest rate on debt 7%, royalty and taxes 28.5% of wellhead revenue.

It has also gone beyond just benches that the public is familiar with now. Designations of formation benches (A-B-C-D) has progressed to sub-bench designations (A-1, A-2, etc.). I know I had mentioned to you previously Dennis that I didn’t have access to about the only system in the country that does this kind of detail work, which was true at the time, but things have since changed.

Reservegrowthrulz,

No doubt there is more detailed information, I use the assessment units in the USGS assessments as that is all I have access to. I don’t have the funds to access expensive databases, so I so the best I can with limited data.

I have seen some information on the internet that 1760 foot spacing is ideal in the southern Delaware basin (3 wells per section width) to avoid well interference (I assume this is within a single targeted horizon). Does there tend to be more well to well communication in the x/y (horizontal plane) than in the vertical direction? It is not clear what the spacing needs to be between benches and whether for example we could target Wolfcamp B1 and Wolfcamp B2 in the same section or even Wolfcamp A and Wolfcamp B, are there impermeable layers in between Wolfcamp A, B, C, and D and between Spraberry and Wolfcamp and Bonespring and Wolfcamp that prevents interference in the vertical direction?

Ovi, thank you. There are no “dumb questions” by anyone genuinely wanting to understand the oil business better, and for the right reasons. I’ve been in it for a half century and I still ask dumb questions every day.

The section of TRRC GIS map you’ve shown reads like this: the octagon symbol at the very top, along the section line, is surface location (pad) for four laterals on the left, drilled north to south. The lines are the actual laterals and the little dots at the end of each line are the toes of the lateral, the terminus or TMD (total measured depth of the lateral). The laterals must comply with spacing distances at the point in which they enter the productive bench, in this case the Wolfcamp (what bench in the W/C we don’t know by this map). This is called Phantom (Wolfcamp) Field, by the way. Terminus points must comply with distances between wells AND lease lines.

All of these laterals (6K to 8K ft.) would have been drilled to the same bench, most likely to facilitate simultaneous stimulation (zipper frac’ing). So the exactly spacing of the laterals is a little confusing, except at the terminus. Its beyond the scope of the map mechanics to plot precise lateral tracks by lat/long coordinates that would find these laterals wander around quite a bit both up and down and sideways. The toes of the laterals, the little round circles, will be colored in some day, red for gas, green for oil. These wells on the left are Anadarko wells.

There is another surface location (pad) on the right that has five laterals in it, also drilled north and south into the Phantom Wolfcamp Field; one of those wells has already been classified as a gas completion by the TRRC. These are Cimerex wells.

So your arrow actually points to no place an additional lateral could be drilled unless field rules for spacing were changed and it would then have to be joint well between Oxy and whoever owns Cimerex now. Not likely, that, as most likely this has been drained.

At any given time there must be hundreds of lawsuits between operators in the Permian regarding incorrect spacing distances, mineral trespass, all kinds of shit goes on out there, ALL the time. Tens of thousands of different players, operators and mineral owners alike; it is all VERY complex. No two operators, nor the obligation they have to their Lessors/Assignors, have the same common goal; they don’t care about optimum spacing for benefit of America’s long term energy security; if somebody else’s ‘A” wells are going good next door, they’re going to drill ‘A’ wells on their minerals across the fence.

In this map section there are producing vertical oil wells, abandoned vertical oil wells, dry holes, and several SWD wells. It gives on an indication of how complex this tight oil stuff is and how much its development is designed/controlled by private mineral ownership. “Ideal” spacing between wells is one thing… who owns or leases the minerals is the controlling factor.

For that reason, and several others, working top down to determine how many locations are left in the Permian Basin, and future supply, from, for instance, USGS TRR estimates, is meaningless. I have a comment on that very thing in the Delaware Basin at my place. Nobody understands yet the economic meaning of Tier 1 v. Tier 3 (whatever that actually means); if you look at flank counties, the quality of flank wells, in flank benches already drilled, a lot of that stuff won’t work at $140, sustained.

I hope this helps. The TRRC GIS maps is available on the web. Please feel free to come by my place to ask questions anytime.

Thank you, Mike.

Mike, Dennis, Ron

Thanks for explaining the symbols and clearing up my confusion on the meaning of lateral wells.

When I read Simmons book Twilight in the Desert, he spoke of the development of Maximum Reservoir Contact wells. These were wells with a main central well and then wells that were drilled laterally from the main well.

So that is the picture I had in my mind when I kept reading of lateral wells in the Permian which I couldn’t relate to the picture provided by Mike.

Currently, some wells are targeting multiple formations/benches/sub-intervals and there needs to be a determination made as to which bench the well will be assigned to, with various folks working with the wellbore surveys having different ideas on how they do this.

I heard they are in Tier 2/Tier 3 and also in New Mexico where you have potash issues and need to avoid the potash mines while drilling the vertical section. It is highly unlikely that due to friction pressure any part of the last 5,000 feet of the wells get efficient fracks. I always though 7,500 feet of lateral created the best economics on a per foot basis while most drilled 10,000 foot laterals to hold more acreage by production.

High prices and demand .

https://www.reuters.com/business/energy/india-shows-early-signs-high-coal-lng-crude-prices-hurting-demand-russell-2022-02-01/

The article says that they have slightly lower imports for one month, but does not provide any info to support the headline of lower demand.

Longer term consumption (rather than import) data will tell the true story on demand.

Ovi,

This was an outstanding post that concisely, clearly presented much historical data with additional forward looking projections.

Great work.

Regarding Tier 2/3 economics involving 15,000 foot laterals, recent Appalachian Basin history may offer some guidance.

From 2017/18, it was common for the cost to D&C a well to run $1,200/$1,100 per lateral foot.

Today, most major operators claim costs are down in the $600/lateral foot range with some being even lower.

The lengthening of the lateral is the main reason. (Thus, a 3 mile lateral would run a bit over $9 million per).

As frac pressure management challenges increase the farther out towards the toe, hydrocarbon recovery tends to be somewhat proportionately less than with shorter wells.

Liquid recovery is far more difficult than gaseous product in longer laterals, but the ever evolving Artificial Lift processes continue to adapt.

As has been mentioned months ago, there may be a convergence with the growing implementation of high pressure gas injection (for AL), and underground pressure management as the significant capital costs for high pressure compressors may be offset with expanded use for re-injected field gas.

Time will tell, but the recent Bakken production profiles from Marathon, Hess, and Continental suggest that this may already be underway.

But as it is tier 2 and tier 3, if I am not wrong, there are less oil to extract and these areas are going to be more rapidly depleted than tear 1 area, especially if the rate of extraction is more important with the reinjection of field gas and the use of high pressure compresseurs : ? In other terms, they are doing what the Saudis have done : they maintain the extraction rate and by doing this, they accelerate the depletion rate : ?

Yes just when you thought the straw couldn’t get any bigger or complex and the slurping sound any louder. But we all know what tier 2 and 3 means. It’s the nooks and crannies behind the ice cubes as you suck the last remnants of your fountain drink.

Mr. Fleury,

As is conventional protocol, Tier 2/3 areas contain fewer/less hydrocarbons than so called core/sweet spots. (Original Oil/Gas In Place being the commonly used terms).

However, 3 distinct factors are now coming into play with longer laterals playing a contributing role.

First, the size of tier 2/3 areas is way, way larger than the core.

Secondly, while the recovery with longer laterals – percemtage-wise – is diminishing, the overall recovery rate continues to rise, and at somewhat reduced cost. (Seemingly mundane items like wet sand frac’ing are having outsized impacts on lowering development costs. Simulfracs, near universal use of Super Spec rigs, piped water in and out, large Central Battery Units … the list just goes on and on).

To emplace ~100,000 lateral feet of wellbore via 7 wells versus 10 is a huge savings. While the percentage of recovery will lessen versus shorter wellbores, this is more than offset with the financial returns.

(Years ago, the metric “percentage of OOIP recovery” was a hot topic, with 3%/5% the norm in the early Bakken years. Today, 12 to 15 percent is the average with recently retired Continental executive – Jack Stark – claiming 20% recovery was becoming routine).

Thirdly, (and Dennis seems to be one of the few who continuously emphasizes this), prospective areas at $100 WTÌ, $120 WTI will be enormous … not only in now-fringe areas in the main plays, but emerging regions such as the Powder River, Uinta, TMS, et al.

Much of the re-injected gas for AL is recycled as it is recovered at the wellhead, processed onsite, and then pumped back downhole. 60 to 120 thousand feet per day per well seems to be the norm according to public well production profiles for some Bakken operators.

When comparing Saudi extraction practices with re-injection of field gas for enhanced recovery (as distinct from Artificial Lift purposes), I will refrain from – what is now – conjecture.

My point in mentioning the deployment of expensive, high pressure natgas compressors for AL was to highlight that a crucial component for potential EOR – specifically, efficiently elevating formation pressure while simultaneously effecting a miscible sweep – was in the process of being implemented and may, ultimtely, be used for dual purposes (AL and EOR).

While I’d like to think WTI will be $100-120, something tells me it won’t be there much in the future, if at all.

Not that I am good at predicting the future. I’m no better than the others here at that, LOL.

I do think labor will be a huge issue going forward. There are some leases here operators want to give away. We won’t take them because we’d need help pumping them, and right now there is none to be had.

Shallow sand,

None of us knows the future price of oil. Only a few months ago I think I said maybe we would get to $80/bo in 2023, seems the oil is just not flowing like it used to, seems to suggest short supply, so maybe $100/bo is in the cards. WTI futures at $88/b as I write this.

Dennis.

My most recent prediction has been a range of $35-115. Trying to cover all the bases, LOL.

On conventional maybe increasing, there are some who are trying a new technique (or maybe not so new) with regard to re logging and re perforating old wells.

We have tried this recently. The original perforations only penetrated the zone about 19”. The new ones go out about 20’. In addition, before doing this, we have the well logged again. The new log indicated 6’ of zone that should have been completed the first time, but wasn’t.

Early results are favorable, but just one well and we shall see how long the additional production holds up.

There are a lot of re completion methods that can be tried in conventional fields when oil is priced right.

Shallow sand,

Thanks for the info, I did not know about this at all. My uneducated guess was that conventional onshore was simply rebounding after the crappy price environment and all the covid disruption and that it would then continue on the 2016 to 2019 decline trajectory. How long has this stuff been going on in the stripper well space, I am assuming it may be new as you have not mentioned it, but there is much I don’t know.

Shallow sand,

Glad to hear you finally got hold of a rig, maybe hold on tight and do some other wells?

At this price, I imagine it might pay out quickly, I am sure you will figure it out with folks that know far more than me.

Dennis.

Just one well. Rig laid well out, logged, re perforated and then ran back in and put on pump. No re frac or acid. All of original perforations were plugged.

Need to see how well performs for several months. This was just a test.

Would note many injection wells have used the same tech and lowered well head and plant psi significantly.

Thanks again for the information Shallow sand, hope oil prices hold for you and things go well.

Shallow Sand labor is a huge problem. Probably the worst I have ever seen. It takes days to get work over units and equipment.

Shallow. Please give me a call.

Coffee:

Good points. Not to be a cheerleader for the much-aligned Bakken but since you used it as your index, there are many areas in the Bakken where field gas is 20-30% ethane, a much superior lifting gas to methane or CO2. Maintaining reservoir pressure, improving liquids extraction via immiscibility of ethane in water, etc., is dramatically affecting production, even wells in Tier 2, 3 properties. A well in Dunn county–designated “condemned property”–was a monster, mainly due to the gas cut. Reservoir pressure manipulation is a feasible thing in some areas.

We have been running roughshod through the shale basins. People are noticing–all over the world. Precious water is being taken out of the life cycle. Contaminated water is being jammed down holes where it doesn’t fit, sequestered forever. In this crazy process, we are deflowering virgins and leaving them as spoils of war.

Consider this: with recovery rates of 8-16%. there are thousands of old wells that are chock-full of oil and gas. In the total scheme of things, re-injection of field gas is pocket change. Combine that with plasma pulse fracking and the hated shale fields may put America over the hump, and help supply the world. Pollyanna, I know.

Gerry,

The bottom line is whether these methods will be profitable, I don’t have an answer, but I am skeptical at any price under $90/bo. For a short time we may see high oil prices and such methods might be viable, longer term if plugin vehicle sales continue growing at 39% per year we may see demand for oil fall faster than the supply of oil and oil prices may start to fall after 2029. If oil prices fall these EOR methods may no longer be viable due to a lack of profits.

Law of large numbers. We won’t see 39% per annum growth for long.

The mineral mines alone are going to take decades

Tim the tiny,

I expect the annual growth rates in sales volumes for plugins will fall, last year the share of new vehicle sales in Europe was about 19% plugins, the F150 lightening will be interesting to watch, initially they will be in very high demand. GMC will have Hummer and Sierra EV to follow in 2023. Lots of options coming to market near term.

Mr. Maddoux,

Good to see you posting here. Hope all is going well for you.

Regarding ethane re-injection, the ND EERC folks have a fascinating report (viewable online) touting the benefits of ethane (and propane) for effecting miscible sweeps.

One of the more intriguing charts showed the larger hydrocarbon molecules (aka asphaltenes) being mobilized to an outsized percentage compared to the smaller molecules (H10 from memory).

The strong implication is that these larger molecules are being left behind in primary recovery and may, in fact, be largely contributing to the dreaded early decline via capillary blockage.

With the increasing use of microproppants, clearing these innumerable tiny pathways will be another benefit when effective EOR is employed.

Again, great to hear from you on this site.

OPEC+ Fails To Reach Production Targets In January

OPEC has again failed to meet its own production targets again in January as the group lifted production only 210,000 additional barrels per day for the month.

Looking at this through a monthly lens, the group increased production by just 210,000 bpd instead of the 400,000 bpd increased production that the alliance agreed to—creating a January shortfall of 190,000 barrels per day.

But the real shortfall is much larger.

Looking back at the base amounts that OPEC is working with, and factoring in each month’s planned increased production, January production cuts from OPEC show a much larger shortfall.

OPEC’s actual January production cuts still amounted to 2.803 million barrels per day short of the base levels when OPEC agreed to the cuts. This compares to the pledged cut for January of 2.129 million bpd.

This equates to an extra 674,000 bpd in cuts for January than what OPEC has agreed to.

In terms of actual production, OPEC produced 27.8 million bpd in December, lifting this to 28.01 million bpd in January. Noteworthy increases came from Saudi Arabia (+100,000 bpd), Nigeria (+50,000 bpd), and the UAE and Kuwait (+40,000 bpd each). These production gains were partially offset by decreased output by Iraq (-30,000 bpd) and Libya (-40,000 bpd).

Ron

Does this author have access to some data that is not publicly available. There is no reference. Articles should show up in a day or two with more info.

Ovi, her sources are the same “secondary sources” that the OPEC MOMR uses, but usually just one or two of them. The data is open to other news agencies who ask for the data. These early reports are seldom exactly right but they are usually pretty close.

secondary sources for oil production data, OPEC was careful to maintain a balance between the type of entity it would use. The secondary sources comprise two PRAs (Platts and Argus), one news agency (Energy Intelligence), one consultant (IHS Markit) and two energy agencies (IEA and EIA).

Isn’t this 700 kb/d shortfall just the cumulated shortfalls that OPEC+ has accumulated month after month, missing every time its target?

I didn’t do the math, but on average OPEC has raised its production by 200 kb/d each month, instead of pledged 400 kb/d. This trend has been on since last summer.

Ganesa,

OPEC and OPEC plus are distinct. The target for OPEC is a monthly increase of 250 kb/d, for the plus group from the DOC (Russia, and 9 other non-OPEC nations) the monthly increase is 150 kb/d, with Russia’s share being 104 kb/d). From June 2020 to December 2021 the average monthly increase for Russia plus OPEC has been 299 kb/d, the target for these nations was about 354 kb/d, so they have been 55 kb/d short of their quota on average each month, if we look at all OPEC nations (including Libya, Iran and Venezuela) plus Russia the increase over that period was 400 kb/d per month on average which is 50 kb/d above the target of 350 kb/d for OPEC10 (nations with quotas) and Russia.

The idea was to draw down excess oil stocks from the middle of 2020, the mission has been accomplished and oil prices are up which was the objective.

Ovi,

Nice work, thanks. Note the slow down in the rate of increase of tight oil completions in the Permian from September 2021 to December 2021 might have something to do with oil prices. Note that there is roughly a 2 month lag between changes in oil price and changes in completion rates and it is not the only factor as there are cost increases in supplies, equipment and labor that will influence business decisions by oil producers.

Dennis

I don’t understand why the oil prices in the chart are so different from WTI. Are these LTO prices.

Ovi ,

These are spot market prices. Different from futures prices. Data from EIA, monthly average spot market price for WTI.

https://www.eia.gov/dnav/pet/pet_pri_spt_s1_m.htm

Ovi,

The prices are spot market prices at Cushing, Oklahoma for WTI crude

Definition of spot price at EIA is

The price for a one-time open market transaction for immediate delivery of a specific quantity of product at a specific location where the commodity is purchased “on the spot” at current market rates.

For WTI-Cushing

A crude stream produced in Texas and southern Oklahoma which serves as a reference or “marker” for pricing a number of other crude streams and which is traded in the domestic spot market at Cushing, Oklahoma.

Definitions above from link below

https://www.eia.gov/dnav/pet/TblDefs/pet_pri_spt_tbldef2.asp

The chart you use is for futures contracts which can be different than market prices of physical barrels.

OPEC+ Is Being Way Too Optimistic About Its Supply Targets

Have these guys been talking to Dennis? 🤣

Ron,

Yes, they definitely give me a call before they set their targets. 🙂

Note that the 740 kb/d below target (target is about 40000 kb/d) is a little less than 2%.

This one is for my buddy steve for his negative narrative which helped make a more than 100% return on my purchases in ExxonMobil and Chevron of October of 2020. Click Click, didn’t have to even get my hands dirty. Thank you steve

Exxon, Chevron Hit Gushers of Cash — 2nd Update

9:12 am ET February 1, 2022 (Dow Jones) Print

By Christopher M. Matthews

The world’s big western oil companies are back in the money and once again attracting strong interest from investors as crude prices rise to their highest levels in years.

Exxon Mobil Corp. on Tuesday reported $23 billion in profit for 2021, its highest total since 2014, including $8.9 billion in profit in the fourth quarter. Last week, Chevron Corp. reported its most profitable year since 2014, earning $15.6 billion in net income in 2021 and $5.1 billion in the fourth quarter. The largest European oil companies, Shell PLC and BP PLC, are expected to also post resurgent annual results when they report in the coming days.

Exxon and Chevron are predicting a multiyear upswing for the industry as oil and gas demand surges from the depths of the pandemic and investment in new production slows. The strong results have lured investors to a sector many left for dead.

Exxon and Chevron have both said they would stick to more modest spending levels they laid out last year. Chevron’s planned capital expenditures for 2022 are down about 26%, while Exxon’s planned capital investments through 2027 are down 17% to 33% from its pre-pandemic plans. European oil companies have also said they would invest more conservatively in oil and gas production.

Chevron said last week that it generated $21.1 billion in free cash flow in 2021, its most ever. But it isn’t planning to plow most of it back into new oil and gas production, and expects its output could decline slightly in 2022. Instead, it increased its dividend by 6% and said it would buy back as much as $5 billion of its stock this year.

Exxon said it generated $48 billion in cash flow from operations in 2021, its most since 2012. Analysts expect it to raise its dividend later this year, and Exxon has said it would buy back as much as $10 billion in shares over the next 12 to 24 months.

The moves to return more money to shareholders instead of putting most of it back into new projects represent a reversal for Western oil companies, which have historically heavily reinvested cash in increasing oil reserves and production, a strategy that produced paltry profits over the past decade. Investors turned their back on the industry before the spread of Covid-19 and fled the space when the virus took hold. Chevron and Exxon’s shares fell nearly 50% in March 2020.

“The growth experiment is over,” said Jeff Wyll, senior energy analyst at Neuberger Berman. “Many of the leading companies have taken aggressive steps to win back investors.”

But what has benefited investors may not help consumers confronting rising energy prices. U.S. oil prices were trading at around $88 a barrel Tuesday. Chevron CEO Mike Wirth said last week that oil prices could top $100 per barrel in 2022. U.S. gasoline prices have reached their highest levels since 2014, averaging about $3.32 last week, according to the U.S. Energy Information Administration.

Exxon and Chevron have both said they would stick to more modest spending levels they laid out last year. Exxon plans to increase its 2022 capital spending by $4 billion to $7 billion from last year’s low levels. Even with the increase, Exxon’s planned capital investments through 2027 are down 17% to 33% from its pre-pandemic plans. Chevron’s planned capital expenditures for 2022 are down about 26% from its previous plans, while European oil companies have also said they would invest more conservatively in oil and gas production.

Exxon said Monday it is moving its corporate headquarters from Irving, Texas, to Houston as part of a business reorganization that the company said will yield $6 billion in structural cost savings by 2023.

Exxon’s oil and gas production unit had a turnaround in 2021, earning $15.8 billion in profit, up from a $20 billion loss in 2020. The company has focused its investments in Guyana, where it made six additional oil discoveries in 2021, and the Permian Basin of West Texas and New Mexico, where Exxon said it increased its oil and gas production by nearly 100,000 barrels a day last year and will boost it another 25% in 2022.

Both Chevron and Exxon plan to increase spending this year in some areas, including the Permian Basin, where shale wells produce rapidly, giving the companies flexibility to respond to higher prices. But overall, Exxon produced less oil and gas in 2021 than it did before the pandemic, while Chevron’s production is up slightly. Combined, the two companies represent about 6% of global oil supply.

The lower spending levels could lead to an even tighter oil and gas market in 2022, especially if the global economic recovery continues. Mr. Wirth said last week that some areas of fossil fuel demand, like jet fuel, have yet to recover.

“Even with the robust demand recovery that we’ve seen, there is still another leg to the demand improvement that is likely to occur here in 2022,” Mr. Wirth said on a call with analysts. “The issues, frankly, have been a little bit more on the supply side than the demand side.”

A different estimate of US L48 onshore conventional through November 2021 using EIA official tight oil estimate from Jan 2022 and latest PSM. The STEO is likely to be incorrect for October 2021 to Dec 2021, the PSM is likely to be more accurate. The chart below shows a strong recovery in US onshore L48 conventional output from June 2021 to November 2021 with output increasing by 265 kb/d or a 53 kb/d average monthly increase in crude output over that 5 month period. That is about a 2.9% increase in output each month, impressive.

Note that if we look at the trend for L48 onshore conventional from June 2016 to Dec 2019 the trend is exponential decline at about 2.43% per year, current output roughly matches that trend for November 2021 so if that long term ternd continues we would expect L48 conventional output to resume its 2.43% annual decline rate starting in December 2021.

Dennis

My original chart used STEO data and LTO data. The unexpected increase in the offshore would change the trend. However as I mentioned, the conventional oil numbers are the difference of big numbers and changes in the later months has a big impact on the results

Attached is a chart which takes the difference between the DPR and LTO output to gage how much conventional oil comes from the DPR basins. From June to November your chart shows an increase of close to 280 kb/d. The DPR/LTO chart shows an increase over the same period of 131 kb/d. Also there is close to 1,000 kb/d difference between the Onshore L48 and just the DPR basins. In what states are the 1,000 kb/d coming from?

Ovi,

It would be difficult to break out state by state as the tight oil data has basins that cross state lines (Williston, Permian, and Niobrara). Clearly there is conventional oil production outside the tight oil basins in the L48 onshore. Where exactly that occurs is less clear.

I guess you could tak groups of states such as Texas, New Mexico, and Louisiana(for Permian, Eagle Ford, and Austin Chalk), North Dakota and Montana (for Williston), and Colorado and Wyoming(for Niobrara) and deduct the DPR estimate from total C C output to get your answer, if you are interested. Breaking it down to individual states would require more research. You could probably ignore the condensate from Marcellus and other shale gas plays and focus on the five oil prone areas in the DPR (Bakken, Permian, Eagle Ford, Niobrara, and Anadarko).

DPR regions are designated by counties, and the EIA provides a list. Add up all production in those counties, within each DPR region, and call that “TOTAL” for each region. Now add up the formations designated as LTO or shale gas within each region, and the same counties, and subtract that total, by regional, from the TOTAL sum in each region. I presume you have access to well level formation designations?

No I do not have data on a county by county level, or well by well.

Isn’t this information available to the public through state websites and whatnot? I helped a state launch one of these systems back in the early 90’s, that one was still up and running last I looked, and I listen to other analysts often discuss the value to them of the North Dakota and Texas datasets available to them publicly. Perhaps, while accessible, it is difficult to be able to get it all at once?

Reservegrowthrulz,

The data is accessible, but it takes some skill to do it, that is how services like shaleprofile and enverus make money. Getting the data in a usable form takes some skill and we have 50 states, also the RRC production data is notoriously incomplete in early months, it takes 12 to 18 months for the data to become 98% complete. North dakota is much better, not sure about NM, CO, WY, etc.

I mostly rely on the EIA tight oil data and data from http://www.shaleprofile.com blog that is available for free.

US L48 onshore conventional, DPR region conventional, and other conventional oil (US L48 conventional not in DPR oil regions, which excludes Haynesville and Appalachia DPR regions).

The difference between Ovi’s estimate above and mine below for DPR conventional is that I exclude the “rest of tight oil” column from the tight oil estimate as we don’t know what formations that oil comes from (it may be regions very different from DPR regions). In addition, Ovi seems to be including all oil output from all seven regions of DPR report where I use only the oil focused regions from DPR (Permian, Bakken, Eagle Ford, Niobrara, and Anadarko).

Dennis

I am wondering why your DPR conventional crude is different than in my chart above. Your chart is showing close to 900 kb/d of conventional oil. Mine is showing 739.

December data I used: DPR 8,343 kb/d. LTO 7,604 kb/d. Difference 739 kb/d.

Ovi,

See my second paragraph. My DPR conventional is 5 DPR regions (not including Appalachia and Haynesville) minus EIA LTO (except for “rest of tight oil” because some of that is from Appalachia, Haynesville, Barnett, Powder River, etc which is not a part of the DPR regions I selected)

My DPR (5 oil regions) is 8117 kb/d, and my LTO (not including “rest of US tight”) is 7207 kb/d for November 2021, difference is 910 kb/d.

Dennis

OK. Got it. Missed that.

Ovi,

You ask the following:

The STEO is forecasting flat out for December while both the DPR and LTO are showing increasing production?

The STEO has a forecast for December 2021 of 11580 kb/d for US output and the PSM has November 2021 output at 11753 kb/d for US C plus C output. If the PSM estimate for November and the STEO forecast for Dec 2021 are both correct, this suggests a drop in output of 133 kb/d in December 2021.

Perhaps you are implying that the STEO is likely underestimating US output in the near term, if so I would agree. It is also possible the tight oil estimates will be revised lower next month as was the case this month. Estimates get revised both higher and lower as the EIA gets more complete information from other sources over time.

The STEO has US output reaching 11.75 Mb/d in July 2022, I think they may revise next month’s STEO as I doubt we will see flat output from November 2021 to July 2022 with crude priced at over $85/bo.

A big problem with the STEO forecasts is they consistently have been underestimating the price of oil, even the futures quote is at $73/b for Dec 2023, though I doubt oil will be selling at this price in Dec 2023.

Ovi,

You say:

This output rate projection of 96.5 kb/d/mth is in sharp contrast with the STEO forecast above. It indicates that from November 2021 to March 2022, output will remain essentially flat at close to 11,550 kb/d and then start to increase at a rate of 50.4 kb/d/mth out to December 2023, essentially 1/2 the rate indicated in the STEO.

Another way to look at this is the DPR has output at roughly 4580 kb/d in March 2021 and at about 5180 in Feb 2022 so roughly a 500 kb/d increase over 11 months, that would be about a 45 kb/d monthly increase over that 11 month period, which is similar to the STEO estimate.

Ovi,

Yes the July 2021 to Nov 2021 increase in L48 onshore is substantial, if we fit an ordinary least squares trendline to these 5 months we find the average monthly increase is about 94 kb/d. If we look at the 9 month period from March 2021 to November 2021 the average monthly increase in L48 onshore crude output is 75 kb/d. Going forward we may see something between the 50 kb/d monthly increase expected in the STEO and this 75 kb/d estimate, if it were an average monthly increase of 62 kb/d that would suggest an annual increase of 744 kb/d.

Note that my tight oil model has output of tight oil increasing by only 342 kb/d from November 2021 to November 2022, an average monthly increase of less than 30 kb/d. My model may be on the conservative side, despite what many think.

From Dec 2021 to Dec 2023 my tight oil model has an average monthly increase of 39 kb/d.

It is important to note that L48 onshore conventional output increased at an average monthly rate of 45 kb/d from March 2021 to Nov 2021, accounting for 60% of the increase over that period, tight oil output increased at an average monthly rate of only 30kb/d over that period. In the future I expect L48 conventional output will decrease so increases in L48 onshore output will be smaller than the tight oil increase by about 4 kb/d (monthly decrease in conventional L48 onshore).

Based on my modelling and the data, the 50 kb/d average monthly increase in L48 onshore output in the STEO looks optimistic, something close to this might be achieved from Dec 2022 to Dec 2024, perhaps about a 45 kb/d monthly increase in L48 onshore crude output.

Exxon and Chevron to Ramp Permian Output

Exxon Mobil Corp. said Tuesday it plans to boost output by 25% this year in the Permian Basin, the biggest U.S. oil-producing region. That comes four days after Chevron announced it will ramp up its own Permian supplies by 10%, from an even larger production base. Such aggressive targets from the Western world’s largest oil majors are a surefire sign that U.S. shale is back to growth mode after cuts in 2020 and a lackluster 2021.

Exxon’s 25% production increase will be “high-value growth” and comes on top of the 460,000 barrels of oil equivalent produced from the Permian Basin last year, CEO Darren Woods said on a call with analysts on Tuesday. Chevron, which produced an average of 608,000 barrels a day from the basin in 2021, also indicated that its Permian barrels are some of the most profitable anywhere in its global portfolio.

Exxon and Chevron “are resuming the ambitious growth plans of three to four years ago that were delayed by the pandemic,” Rystad’s Abramov said. And with more shale production now concentrated into fewer hands after a series of mergers over the past two years, “Exxon and Chevron will account for more of the forward growth profile than they did historically,” said Stephen Richardson at Evercore.

“U.S. production may surprise to the upside this year, but not by so much that it will significantly bring down oil prices,” said Elisabeth Murphy at ESAI Energy LLC. “On top of that, OPEC+ is having trouble lifting output to add the additional barrels.”

https://www.bnnbloomberg.ca/exxon-joins-chevron-in-permian-oil-surge-as-peers-preach-caution-1.1716902

I think Exxon and Chevron have more than enough locations to increase production but I don’t know where they are going to find the labor and equipment. The service industry is in a world of hurt

LTO Survivor

Do you think that since they are both big, that they can move their workers from other locations into the Permian. Any idea if they rent rigs and crews or do they own their own.

Nope. Plus I think it’s all talk. They CL tract out most of their field Labor which I have seen is either unqualified or in short supply. Plus it is easier and cheaper for Exxon and chevron to buy instead of drill. There so many zombie oil companies with lots of debt and no real future as a viable long term company.

A short abstract from some comments:

The bottlenecks for tight oil production increase:

– price of crude oil

– labor (workforce)

– equipment

I don’t have the knowledge to write something about the gravity of labor and equipment shortage and how long that could last.

Probably the worldeconomy can stand oilprices of $110-120 for some years. After that the consequences for the low income population will be terrible. Already now a lot of countries have problems because of this issue. Many hundreds of millions who struggle to survive each day. Social unrest will be one of the biggest problems this and the next decade(s). With high, but also with low oilprices. Anarchy is lurking in dozens of countries.

Russia Boosts Oil Output But Still Can’t Meet Its OPEC+ Quota

Russia ramped up its oil output in January yet likely pumped below its OPEC+ quota for a second consecutive month, as the nation’s producers struggle with a lack of spare capacity.

The Organization of Petroleum Exporting Countries and its allies, including Russia, will meet Wednesday to decide on production policy for March. Delegates from about half the coalition’s members say they expect the group to ratify another 400,000 barrel-a-day supply hike.

Ron

Russia’s comment on today’s increase.

“OPEC+ decision to enable Russia to resume oil output by 90%, says Deputy PM Novak”

“The conference decided to increase [oil production] by 400,000 barrels per day. For Russia it means that in March it will be able to additionally increase [production] by 100,000 barrels per day again. It will enable us to restore the level of reduced volume by 90%. As a reminder, in May 2020 Russia slashed production by 2 mln barrels per day, and considering the decision made we will see 1.8 mln barrels per day recovered as early as in March,” he explained.

https://tass.com/economy/1396813

Ovi, I have no doubt that Russia can restore production to 90% of their reduced level. They reduced by 2 million barrels per day so they are saying they can get to within 200K barrels per day of their pre-pandemic level. They are now within 300K bp/d of their pre-pandemic level. So they have another 100K bp/d to go before they get there. I think they can make it. But really all they are saying is that their production capacity has declined by 100K bp/d per year. Will that decline continue?

Ron,

The highest 12 month output that Russia has reached (post Soviet era) is 11.3 Mbpd. They do not expect to achieve that by March, but if condensate is 900 kb/d (a guess by Ovi) and they continue to increase output by 100 kb/d each month, they would get there by April 2022, unclear if they can do it but we will know by May 1 or so.

Dennis

This is what I recall reading.

” If condensate output was the same as in November — some 930,000 barrels a day — then daily crude-only production was around 9.973 million barrels, about 37,000 barrels below its December quota.”

https://www.worldoil.com/news/2022/1/3/russia-s-weak-december-oil-production-signals-lack-of-capacity

Dennis, the numbers quoted by both Ovi and I are C+C, not crude only. The numbers quoted by the Minister of Energy are also C+C. The numbers cut by Russia for the covid demand collapse was 2 million barrels per day, C+C. They are speaking of restoring 90% of that cut by March. That would be 1.8 million barrels per day C+C. That would put them at 200K barrels per day below their pre-covid level, or 100K barrels per day, C+C, above where they are now.

It is pretty clear what the Minister of Energy was saying, Dennis. And I stand by my math above.

OPEC just confirmed another 400 kb/d for March. Targets attached. Note that SA and Russia must both supply 10,331 kb/d. With Russian condensate around 900 kb/d, that implies 11,231kb/d of C C for March. About 231 kb/d more than in Ron’s chart above.

Saudi Arabia has historically had trouble maintaining production above 10 million barrels/day so they’re probably maxed out at the moment.

https://d3fy651gv2fhd3.cloudfront.net/charts/saudi-arabia-crude-oil-production.png?s=saudiarabcruoilpro&v=202201181548V20200908&d1=19220227

Frugal

I think from March going forward, we will begin to see increasing stress put on the SA supply capabilities. Every month their promised supply increment increases by slightly over 100 kb/d, 104 kb/d for March. Same for Russia.

I will be watching the SA stocks to see if they continue to fall.

At some point OPEC plus will need to adjust quotas to those that might be achieved. Otherwise the quotas mean very little. I don’t think they want to admit they are approaching or may have reached maximum capacity.

UPDATE 1-U.S. crude, distillate stockpiles fall; gasoline builds – EIA

Feb 2 (Reuters) – U.S. crude oil and distillate inventories fell last week as fuel demand increased to its highest level since August 2019, the Energy Information Administration said on Wednesday.

Crude inventories fell by 1 million barrels in the week to Jan. 28 to 415.1 million barrels, compared with expectations in a Reuters poll for a 1.5 million-barrel rise. Supplies have been declining over the past two months due to strong demand and as production struggles to keep up.

These weekly numbers are just a random walk. There are imports and exports of oil and products – and such a tanker hauls more than a million barrel. So nothing only the smoothed monthly curve is of any value.

I assume the SPR numbers are accurate.

If so, the SPR hasn’t been this low since 2002.

The long term is exact – in the weekly data there are wild swings. Depends much on if a tanker has unloaded or loaded, these weekly +2 or -2 million barrel storage change can be just one big tanker departing or coming extra. The biggest almost carry 4 million barrel of oil or products.

So it’s a random walk even when the data is exact. Too fine time scale to see anything – the most important thing for this data is the computerized oil future trading. Monthly smoothened averages are important.

The SPR data should be accurate.

For the real overview and the oil price prediction the world storage is important – oil can be transfered easyly, or stored floating or evade counting at all. This is not an easy job, the EIA just got 200 million barrels missing (That’s why I think oil prices will be strong short term).

Don’t know if anyone has seen this yet, but Russia, who produces just under 62% of the globe’s ammonium nitrate, has just banned exports for 2 months (at least)

https://www.fertilizerdaily.com/20220202-russia-stops-the-export-of-ammonium-nitrate/

They are holding on to it to ensure they have enough for themselves over the next year.

I shouldn’t need to explain how serious this is for global food production if this export ban is extended.

It also emphasises to me the importance of the Export Land Model to understanding how the downward descent will catch most by surprise as the Power Law kicks in on available exports of fossil fuels and their essential products.

The Western politicians seem to forget that sanctions can be reflected back too. Belligerent actions have consequences. So too does infinite growth magical thinking.

I hereby announce that the “Peak Fossil Fuel Age” descent has begun.

Buckle up kids.

Why Canadian gas prices have hit record highs

No obvious signs that high gas prices are reducing traffic on this side of the border, although some people are second guessing their purchase of a gas guzzler.

EIA reported inventory this morning. More interestingly is how their weekly production numbers peaked in the last two weeks of December at 11,800 kb/d and have dropped every week since to 11,500 kb/d last week.

I understand there is lot of skepticism about these numbers but they must be getting some kind of info indicating that production is dropping.

Ovi,

That is simply a reflection of the STEO which is the basis for the weekly estimate of L48 output (including GOM). Notice the weekly data vs monthly from March to July 2021 and in Sept 2021, I often say the weekly data for output is just not very good. Occasionally it is correct, mostly it is not.

Footnote from STEO

Domestic crude oil production includes lease condensate and is estimated using a combination of short-term forecasts for the lower 48 states and the latest available production estimates from Alaska… For more details see Appendix B, under “Data Obtained Through Models

From Appendix B (page 38)

EIA estimates weekly domestic crude oil production using a

combination of short-term forecasts and the latest available production estimates from Alaska. The four data elements contributing to the estimate are:

• the most recent Short-Term Energy Outlook (STEO) model estimate (including interim estimates) for average daily production for the lower 48 States and the Federal Gulf of Mexico (GOM) (STEO Table 4a: http://www.eia.gov/forecasts steo/data.cfm?type=tables);

• daily production volumes delivered from the North Slope of Alaska to the Trans-Alaska Pipeline System (TAPS) (reported to EIA by the Alyeska Pipeline Service Company);

• daily volumes of natural gas plant liquids produced on the North Slope delivered to TAPS (reported to EIA by BP); and

• daily production for South Alaska estimated from monthly production reports (lagged by two months) from the Alaska Oil and Gas Conservation Commission (AOGCC).

Most of the uncertainty in the weekly estimate is associated with

the STEO forecast for lower 48 and GOM production.

An STEO from Jan 2021

These get revised each month as you know.

Dennis

I think it could be a message that the November output number published on Monday is a bit high. The weekly October and November numbers are close to the monthly average. Maybe their methodology is improving.

Ovi,

Yes you keep suggesting their methodology may be improving and you have been saying this for quite a while. I would suggest a broken analog clock os correct two times per day, this analogy is fairly close to the weekly estimates, I see no improvement. The basis for the weekly numbers is the STEO which changes month to month. The PSM is somtimes off a bit and gets corrected, we will know in the future if that proves to be the case for the November 2021 estimate. Maybe there is something going on on the GOM or Alaska where output is down by 250 kb/d or the tight oil estimates are incorrect. I just think it more likely the weekly data is wrong as is often true.

I am sure we have discussed this before.

Where does the EIA obtain data?

The monthly should be accurate if EIA is receiving the data from the states and from the crude oil purchasers.

The monthly data should not be estimates, but hard data from sources that have a very strong motive to be accurate, as a lot of $$ depend on the accuracy.

IHS posted December, 2021 production for our field a week or so ago. I looked it up and compared it to our records. It is accurate. Both 12/21 and annual for 2021. Cumulative too. IHS buys the data from the crude oil purchasers. IHS lists the purchaser for each lease. This was also accurate for our leases.

Surely EIA obtains data directly from crude purchasers?

Shallow sand,

The EIA tries to estimate, there are a lot of people in the market, too many to collect all the data perhaps. The EIA surveys large producers that represent about 90% of the market and then estimates the other 10%.

See the following spreadsheet from EIA

https://www.eia.gov/petroleum/production/xls/comp-stat-oil.xlsx

Also check out methodology PDF at following page (right side of page just above FAQ and map).

This is how they do their early estimates and they also look at state data, but some states report production levels quite late (see Texas tab). Note that the EIA survey of large oil and gas producers is called the 914 survey.

https://www.eia.gov/petroleum/production/

When I use the 914 survey to estimate TX and NM output and compare with EIA tight oil estimates for Permian and Eagle Ford over the March 2021 to November 2021 period, I find Texas and New Mexico’s combined output of C plus C increased by 479 kb/d. Permian and Eagle Ford combined output increased by 206 kb/d over the March to November 2021 period, the difference (conventional output in the two states) is 273 kb/d or an average monthly increase of 34 kb/d for conventional vs an average monthly increase of 26 kb/d for Permian plus Eagle Ford output over the March to November 2021 period. Despite all the talk of Permian increased output, for most of 2021 the increase has been modest (a monthly increase of 30 kb/d from Mar to Nov 2021 or an annual rate of increase of only 360 kb/d). The increase in conventional C plus C output has been more impressive over the past 8 months in Texas and New Mexico.

Shallow sand,

It may be that the EIA can buy the data from IHS, but they may not be able to report proprietary data. The IHS database is very expensive proprietary data as far as I understand. If the job was easy, the data would be cheap.

Dennis

I think part of the answer lies in the eye of the beholder. When I look at the data from July 2021 to November, my eye says the correlation is damn good, considering they are 8 to 12 weeks ahead of the EIA monthly numbers.

Let’s see what happens over the next few weeks after the STEO comes out next week.

Ovi,