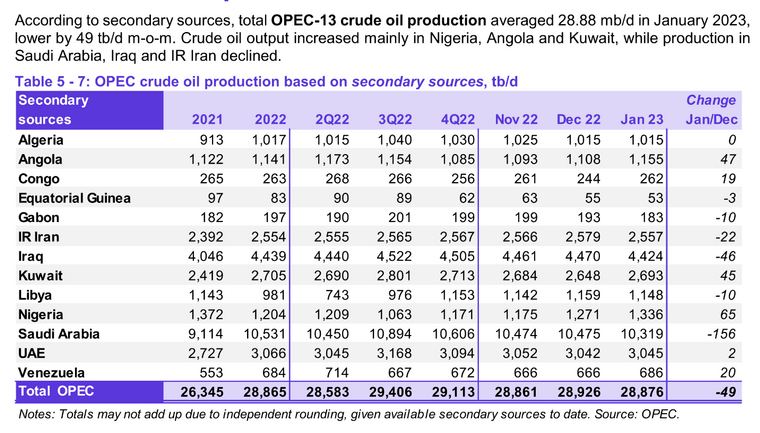

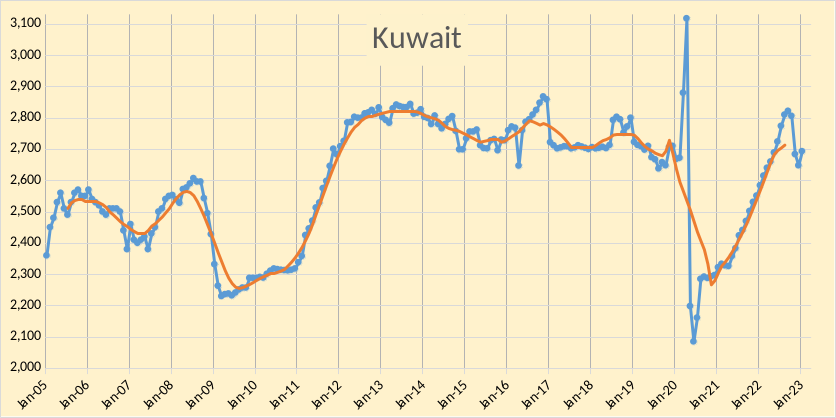

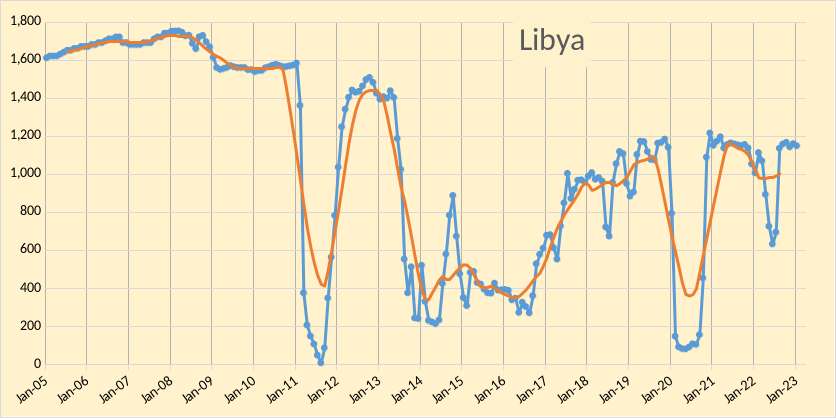

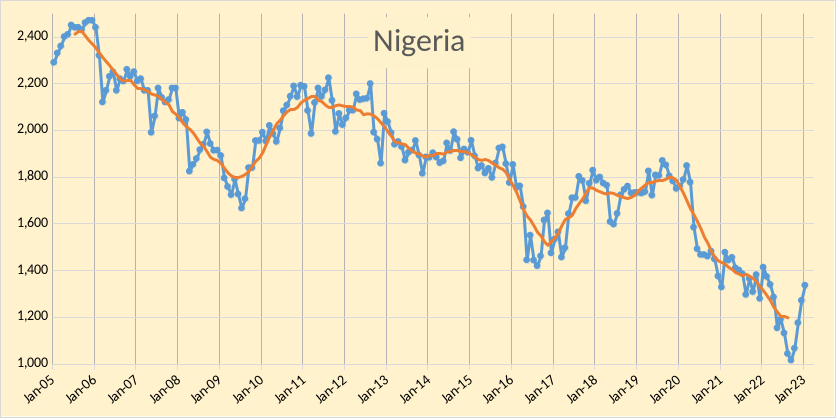

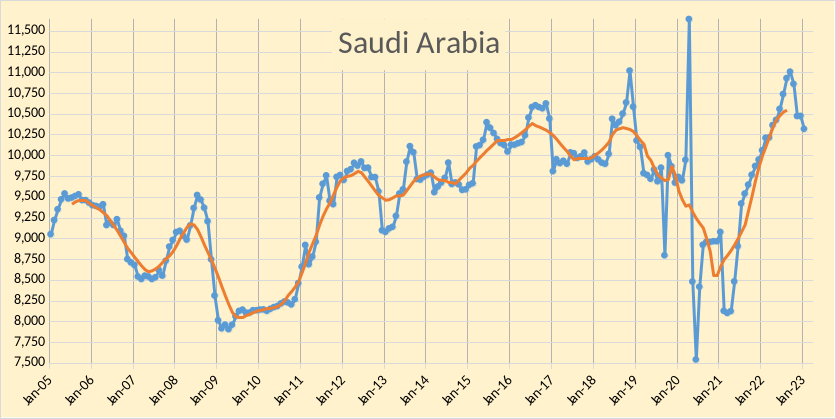

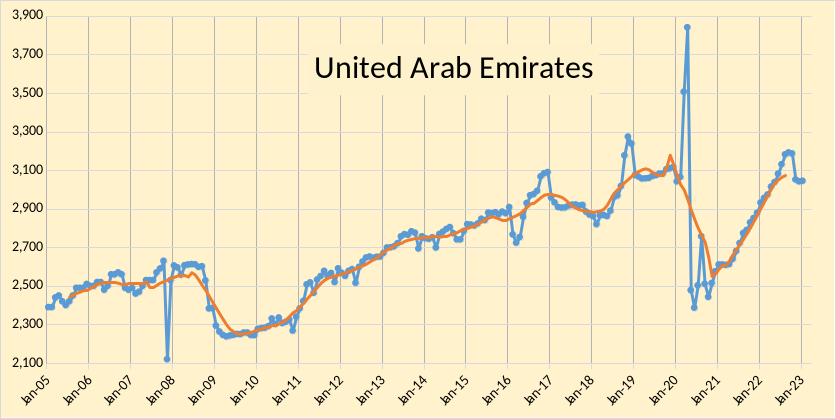

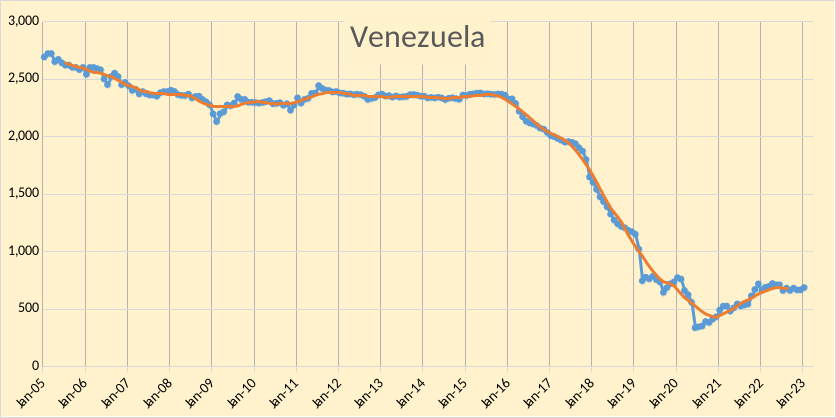

The OPEC Monthly Oil Market Report (MOMR) for February 2023 was published recently. The last month reported in most of the OPEC charts that follow is January 2023 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In most of the OPEC charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

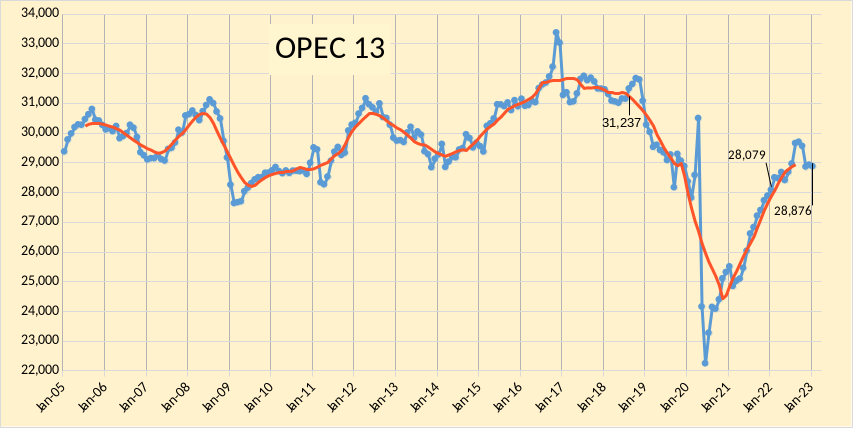

OPEC crude output was revised lower in December 2022 by 45 kb/d compared to last month’s report and November 2022 OPEC crude output was revised lower by 16 kb/d. OPEC output has increased by 797 kb/d since January 2022, from 28079 kb/d to 28876 kb/d in January 2023. When the World was at its centered twelve month average peak for C+C output in August 2018, OPEC crude output was 31237 kb/d (as shown on the chart), January 2023 OPEC crude output was 2361 kb/d below that level.

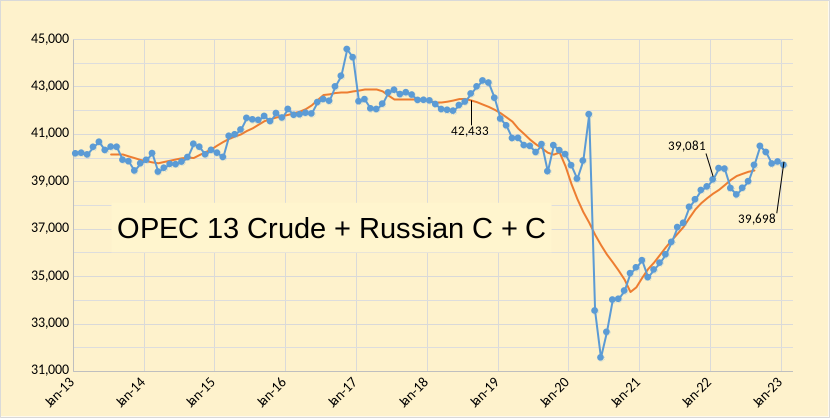

In the chart below we have Russian C + C and OPEC crude oil output. The centered 12 month average (CTMA) of output for OPEC13 crude and Russian C+C was 42443 kb/d in August 2018 when World C+C output was at its centered 12 month average peak, output for Russia and OPEC was 2735 kb/d below the August 2018 CTMA at 39698 kb/d in January 2023. In the past 12 months OPEC and Russian output has increased by 617 kb/d from 39081 kb/d in January 2022.

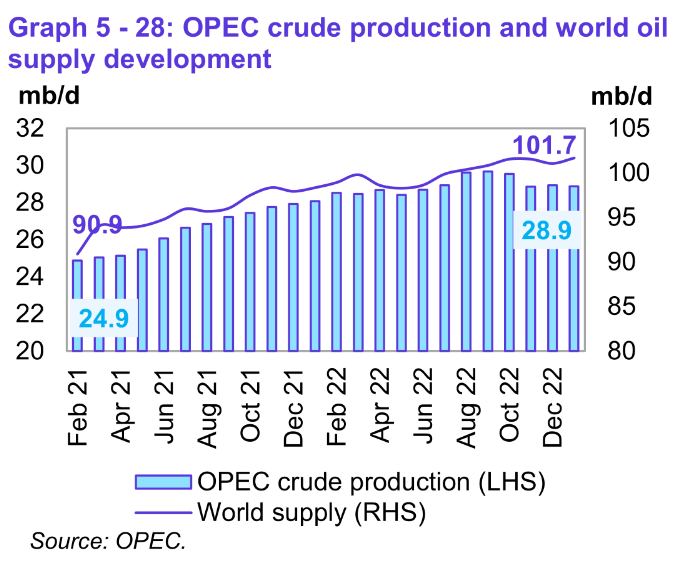

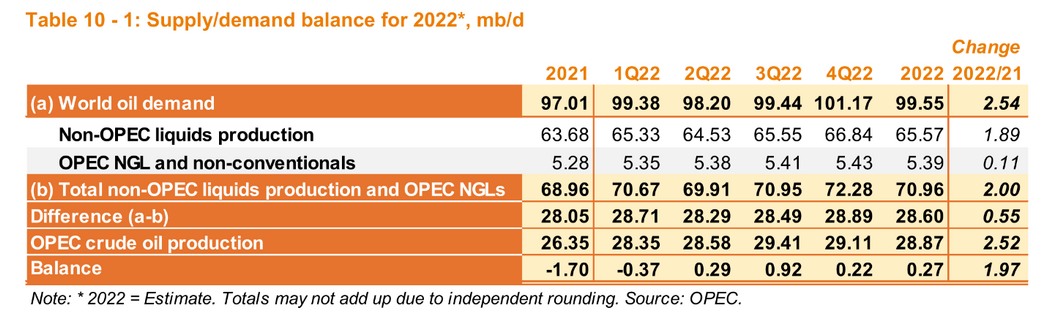

Based on OPEC estimates, World Oil Suppy (all liquids) was 101.7 Mb/d in January 2023 10.8 Mb/d higher than output in February 2021, OPEC crude oil output increased by 4 Mb/d over the same 23 month period.

OPEC expects demand for OPEC crude to be 29.42 Mb/d on average in 2023, this is similar to OPEC crude output of 29.41 Mb/d for 2022Q3. If the OPEC estimate is correct, then oil prices may be fairly subdued in 2023, perhaps remaining in the $80 to $90/bo range for Brent crude ($75 to $85/bo for WTI).

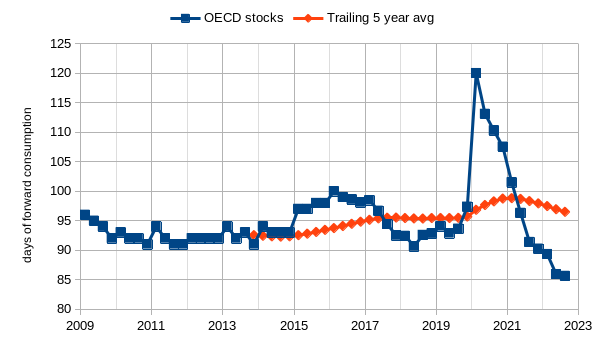

OECD oil stocks remain near the low point since 2009Q1 at around 86 days of forward consumption. Based on OPEC estimates of World supply and demand the 2022 year end level of World stocks is higher than year end 2018 by about 398 million barrels, this would be about 4 days of forward consumption higher World stock levels than year end 2018 for year end 2022. This is the reason that OPEC has cut output since the third quarter of 2022.

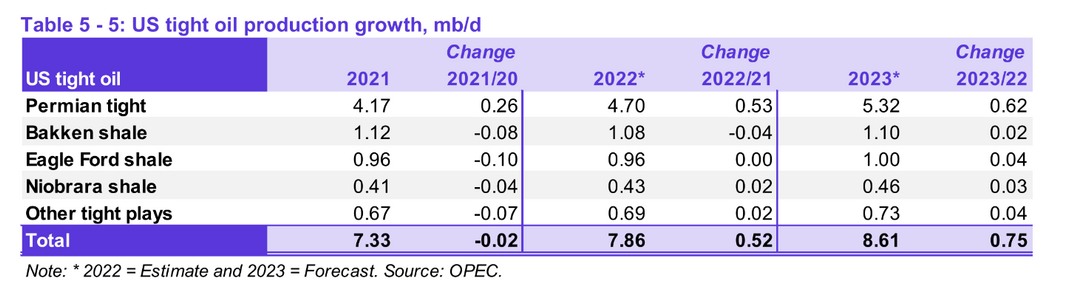

OPEC estimates that US tight oil output will increase by about 750 kb/d in 2023 (when we compare average annual 2022 output with average annual 2023 tight oil output. Most of the increase (620 kb/d) will come from increased Permian basin output.

Who knew keeping track of peak oil would be like watching paint dry.

Who knew?

You must be kidding. The paint dried years ago. You are watching a dry wall. 🤣

.28 years since Colin Campbell called global peak oil in 1990….and that is only to #6 claimed or occurred in the 21st century. It took like 14 years for global peak oil circa 1979 to finally go into the dustbin, Close to half a century between US peaks, 124 years between peaks for Ohio, etc etc.

What sort of a nonsensical comment is that? Can you not see that OPEC production is declining on all those charts that Coyne has provided? That the all-time peak for all liquids is still November, 2018? (Which Coyne studiously avoids mentioning, BTW)

My comment is, as usual, highlighting the number of years that can go by before another peak is reached, in a geographic region where it has been claimed. And then..you know…egg on face results.

Knowing WHY this happens is critical to understanding the overall problem, and then solving knowing how to account for it. Peak #6 of this century, claimed or occurred, was certainly in 2018. More reasonably, it being #6 of this century…would anyone like to go for a #7? A fair question, but one rarely answered honestly by a true believer. To them…the last peak is THE peak. Repeat ad infinitum. I really need to make up a t-shirt, something like “How many Peak Oils have YOU fallen for?” and then see who comes up to me all irritated at the idea that was so obvious early in the century but not a question the faithful can ever bring themselves to ask, let alone attempt to answer.

Thanks, RGR, for that deep insight. We all know, or should know, that the past tells us exactly what the future holds. There have been peaks in the past and other peaks that surpassed past peaks. Therefore we can conclude that this will be the pattern in the deep future. There will be future peaks that surpass past peaks and further peaks that surpass those peaks.

What would this blog be without such deep philosophical insight from minds such as yours? 😀 😃 😄 😁 😆 😅 😂🤣

If you don’t understand why older peaks were claimed, and wrong, you won’t ever know whether or not you aren’t pulling the same bone headed move when predicting the next. I asked this question of Dennis on his modeling a year or two ago now, to see how far down the road his thinking on this had gone.

Philosophy? Pfft. How about science?

RGR,

There only could be some more crude oil peaks in the future if more countries are able to do the same as the U.S. (large scale fracking).

Ron pointed out that more than 60 countries are in terminal decline already. They badly need fracking (the climate does NOT).

By the way, I remember you as someone writing some strange comments at the former PO site, Theoildrum. Far from scientific comments. Or maybe it was another RGR

To HAN NEUMANN:

I hung out at TOD, yes. Shortly after I was challenged to name someone worthy of representing a counter opinion, and did so in the form of a published scientist working for CSIRO who had written on peak oil, that’s when I was banned. I was told it would emit too much CO2, encouraging such an expert from so far away to come to the ASPO conference. Amusingly, after the conference folks happily discussed their trips, via air travel.

“Terminal decline” is a tricky term, often claimed as it was in the US and world in the past…and you know what happened next. So anyone who wants to proclaim a terminal decline better be able to prove it using data, and I don’t mean slapping a bell shaped curve on production, or guessing at a URR without the necessary technical information.

As far as strange comments, you would have to provide more detail. I certainly got into all sorts of debates back and forth online back then, and one of those strange comments might have been bashing contemporaneous peak oil claims with nothing but Hubbert Linearization, claims of “discovered means produced in 40 years”, random bell shaped curves fit to just about everything, etc etc. Strange back then daring to know these things, but yet more oil ultimately made my point. It took 6 years just to sort through all the chaff, history, science, and piece together how to avoid the obvious pitfalls of the old way, while building the new. By then the entire fad was easing off in light of more oil. Again.

If you don’t understand why older peaks were claimed, and wrong, you won’t ever know whether or not you aren’t pulling the same bone headed move when predicting the next.

If you don’t understand why past production profiles is no guide to future production profiles, then there is no hope that you will ever understand one damn thing about the probability of future oil production.

My opinion on this is:

There is still enough cheap enough to produce oil – so the final peak oil is more a political product than a geological.

It’s more about war / boycotts / billion $ OPM available cheap than about %recoverable oil in places.

So it’s absolute hard to predict – the russian war nobody had on screen, and there are a lot of wildcards.

Countries with lot’s of recoverable oil to develop, hanging on the political side:

Iran

Iraq (still too much unrest)

Lybia

Venezuela

Canada (here it’s green politics not increasing production)

They have enough reserves to push an addional 10mbpd togesther, or even much more possible (tar sands).

So when guessing about the final peak oil, we would need to do much more political discussions – ouch.

So I start with fictional scenarios – Venezuela and the US are already talking again. When Maduro would take a big bribe – making his socialistic paradise possible again with US money, All the oil can be developed now. Even possible the tar sands, the socialistic government would be able to keep out the “pesky” enviromentalists.

Eulen , I think you are on the right track . The oil price will be determined less by economics and more by geo-politics starting from 2023 . Scarcity or surplus can be created by sanctions , hold up production , release from SPR , QE or QT . etc . These are factors over which the traders have no control .

I’d argue that QE and QT don’t matter because bank reserves or the amount of bank reserves on FEDs balance sheet doesn’t matter because it’s not money in real economy chasing goods and services.

Real liquidity providers. The commercial banks

will cut back, way back on lending if there is any shortage of fuel.

HHH , you are correct . I should have used ” Global Liquidity ” . The USD is flowing back to the US and the Yen is flowing back to Japan to square their current account deficit .

To Ron:

“If you don’t understand why past production profiles is no guide to future production profiles, then there is no hope that you will ever understand one damn thing about the probability of future oil production”

Telling petroleum engineers that reservoirs will suddenly stop following the basic properties of Darcy’s Law is no different than claiming 2+2=5 and expecting people to take you seriously.

Perhaps you weren’t referring to the well and field level information engineers apply the basic physical principles and math to, but rather aggregate production profiles? If you want to tell the world that the physics at this level doesn’t work, feel free, but don’t expect scientists and engineers to believe a word you say until you can prove that 2+2=5. I am presuming of course that you aren’t confusing well and reservoir behavior with the geographical aggregation of production data. And please, don’t say “Hubbert Linearization” because then I’ll have to figure out a way to get a giggling emoji to work in this format. I was able to disprove that idea within 48 hours of the first time I bumped into it. Like…back when I didn’t know much else about this topic.

RGR, you are blowing smoke.Darcy’s Law??? That law was formulated by Henry Darcy based on the results of experiments on water flow through sand beds. Of course, we are dealing with the flow of oil through sandstone here, but that has not one damn thing to do with the decline in production of world oil production. But you think you are snowing people with your bullshit. You are not. In the computer business, we used to say “If you can’t dazzle them with brilliance, then dazzle them with bullshit.” It is obvious to everyone here that you are trying to dazzle us with bullshit.

And the rest of your post is just more bullshit. We are not dazzled RGR.

I have met a lot of bullshitters in my time, but you top them all.

To Ron:

“And the rest of your post is just more bullshit. We are not dazzled RGR.”

Dazzled? Oh my Ron, this is hobby time in McPeakster land. Things need to be kept basic to match the expected understanding level of average reader. As far as being a bullshitter, well, the difference between me and the average bullshitter is I what knew 17 years ago that you and all the other McPeaksters only figured out recently. You can call me a precognitive bullshitter if you’d like I suppose, that would be more accurate.

Ron-

“Reports that say that something hasn’t happened are always interesting to me, because as we know, there are known knowns; there are things we know we know. We also know there are known unknowns; that is to say we know there are some things we do not know. But there are also unknown unknowns—the ones we don’t know we don’t know. And if one looks throughout the history of our country and other free countries, it is the latter category that tend to be the difficult ones.”

Former Secretary of Defense Donald Rumsfeld

Keeping track of HHH’s prediction of $25 WTI by March’23 has been interesting. My (virtual) options on the March futures contract expired Feb 15th. Here’s the result, -16% (click to enlarge):

All the yield curves everywhere are still saying lower interest rates are coming. They don’t tell you exactly when. I look to be early with my call.

WTI is still in slight contango out until June. Have to read that as there is a demand issue since everyone agrees it’s not an over supply issue.

https://market-ticker.org/akcs-www?post=248111

If the FED doesn’t get inflation under control. The FED and Congress will be the target of rioting.

They will save themselves first.

Interest rates are going up until inflation stops. Perhaps not in a straight line.

And don’t forget the USA government is literally insolvent or soon will be (Medicare SS Interest Military > Revenue ).

The government cannot pay the electricity bill for the Capital Building without borrowing money or selling assets.

And the Treasury to Central Bank bond buying “circle jerk” causes inflation.

When do people start demanding higher interest on their “Risk Free” losing money to inflation bonds?

The US economy is not the world economy. US politics aren’t really the point.

The world economy will continue to be deflationary thank to globalization, technical innovation and the steady slog of experience curves. In the past few years there have been massive supply chain disruptions, but there is no particular reason to think they will continue indefinitely, so central banks will have to go back to near zero interest.

“The US economy is not the world economy. US politics aren’t really the point.”

True.

But the World relies on the US Navy for commerce and oil by boat.

If the US government collapses you might have to say goodbye to that.

The US may decide it doesn’t have the money to police the world for almost no benefit.

And Europe, and Asia are a mess financially as well.

Thank you Dennis, great work. At the bottom of your post you noted OPEC’S estimate for the growth of the Permian at 620kb/d. That is higher than the estimate from Plains, and clearly higher than LTO’s. After reviewing a few of the corporate reports there are still inflationary pressure building into the cost structure of these firms. With the near unprecedented volatility in the underlying commodity prices I tend to agree with LTO, unless we get oil over $80 and keep it there, those prediction are unlikely to happen. If Goldman’s Curry is right sure that could happen.

ON a more personal note, I read the exchange between Mike S and RGR in the last post. I noted some humility and some meeting of the minds between the two of them. While I have very different views on a host of subjects with Dennis, I should note that my personal communication with him he was kind, generous of his time and polite. It does not mean I agree on much with him and I attempt to use data to support my ideas. To me this is all about ideas.

Who, on an individual basis is “right” is not important. What is important is that, as a county and as a civilization through honest, respectful and vigorous debate we get as close as we can at being right.

I have been very upfront with my goals and life experience and have tried to give an honest evaluation of the developments in the oil and gas business. Since the early days of posting here, I was roundly criticized, as were all of us who took a view point against the narrative being pushed on the forum. Many left, many I assume were banned, like myself. NO big deal. But all advancement in human endeavors are achieved by thinking outside of the box, questioning all things that have come before. This should go without saying, but for some reason, this most basic principle is lost on many here. But time has proved my positions right where my arguments at the time could not.

I alway try to keep the debate on ideas and data, when some wants to arm wrestle me to see who is right, I am always taken back. In my world as an exploration geologist, on the road selling deals and raising money, every idea I ever put to paper was questioned. I love the game, I love having to defend my ideas. I once showed a deal to exxon in the mid 1990’s in Houston, every single one of their representative were more educated than me and more experienced than me. They treated me with respect, ask the appropriate question in an honest dialogue on my presentation. No they did not take the deal, was not big enough for them, but they wanted to see any other deals I came up with, there is the lesson.

If my issues with Mike S were simply observations, we would have no issues. He advances ideas and causes like no export of US oil that is a position that 1) is way outside the mainstream, 2) would immediately bankrupt the whole industry, 3) upset our trading partners, 4) would lead to innumerable lawsuits from every mineral owner in the state, including the State of Texas itself. From where I sit, it is not serious, practical or legal and it is worth of all the criticism I can muster. It makes no difference what my name is, pick any republican texas politician and they would make the exact same argument.

Texastea,

You’re welcome.

My model for the Permian with a conservative oil price scenario ($75/bo for WTI) has average annual Permian tight oil output increasing by about 400 kb/d in 2023 from the average 2022 level. So I tend to agree that the OPEC estimate for Permian tight oil output in 2023 may be too optimistic.

I also tend to agree that we all tend to throw insults a bit more than is necessary on the internet. It is unfortunate. If I eliminated all comments with insults, we might not have many left. Not enough hours in the day to do that much moderation.

US is a nett crude oil importer.

The vast volumes of condensates require heavier crudes for blending. What refineries decide to do as they look to the future is the wild card (no one is in control, so to speak). So there’s a potential bottleneck.

Canada heavy and US condenstates are a good-enough marriage that suits both. So North America can profitably export oil.

As a non-US observer, I can’t help notice the ‘burn’ of strategic oil reserves, supposedly re-fillable once oil is at about 70 USD. Why release it? To keep the price down before an election. Politics.

My conclusion there is that politicians in US will do anything at all, change any law, to ensure moderately priced oil for Americans. Even mandate an ‘onshoring oil act’.

And don’t forget the geopolitical dimension. The Russians sell very little oil to USA, but quite a lot of diesel to Europe. Europe (and US) use an economic blockade such as the world has never seen before, plus a NATO trained and armed Ukraine (possibly the second best army in the world) as a tool to try to destroy Russia. Uh, fine.

But Russia will not refuse to sell oil to the EU (unless the importer demands a laughable ‘capped’ set price). What it has done, and will do, is sell discount oil to India and China/South East Asia, with it not to be sold third party to ‘capping’ countries. If the trend ‘east’ continues, the EU has to ship in oil from much further afield, adding shipping costs to the price of oil. More expesive in the west, and even in the US, in time.

So long as there is no recession the price of oil must trend to a higher plateau, but with a clear east-west price differential. Making US oil sales to the EU more profitable.

Making domestic gas prices more expensive.

The US government is caught on the horns of a dilemma – unpopular high domestic petrol prices, or, in the longer run, regulate. Regardless of whether it makes sense or not. Well, then the US govt is faced with being the most vile of manifestations – a ‘socialist’ policy. That’s unacceptable to the American voter.

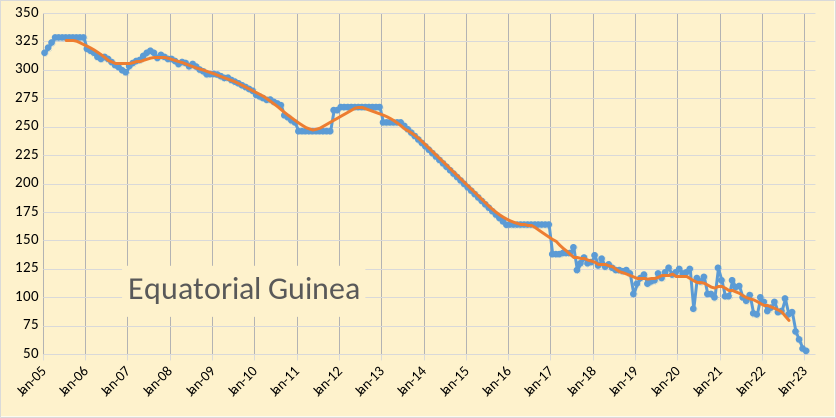

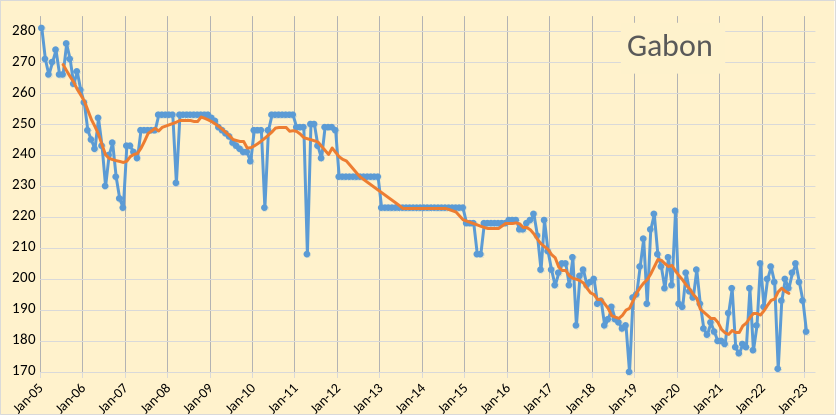

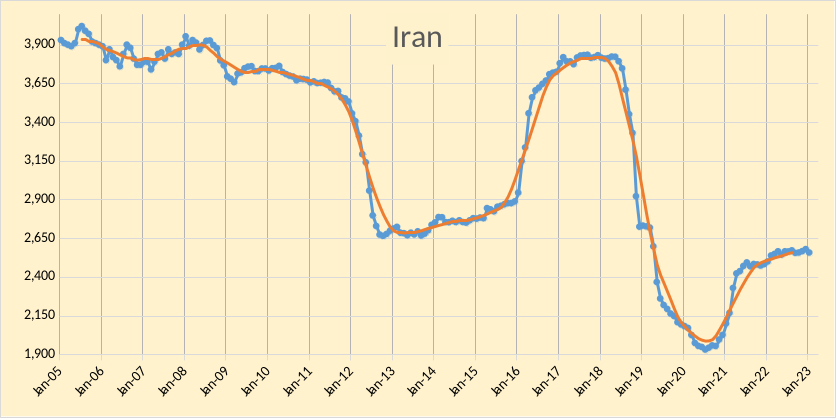

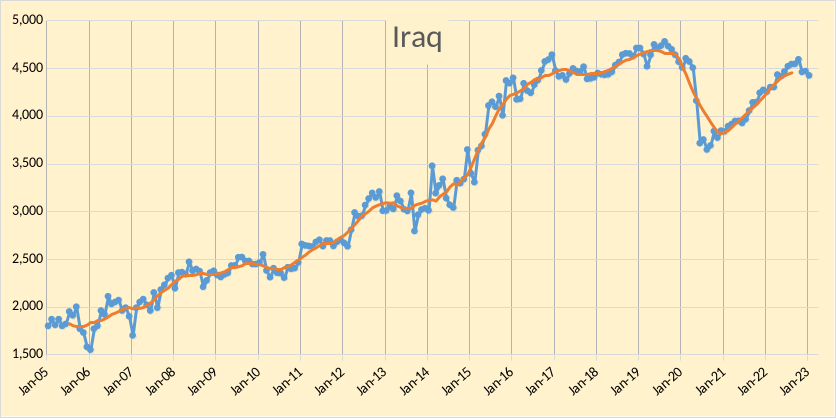

OPEC is basically 5 nations. I include I ran because in the unlikely event that sanctions are lifted, they might increase production by perhaps one million barrels per day over a period of one year or so. These five OPEC countries struggled mightily in August, September, and October but fell short of reaching any of their former highs. They have now fallen back to a level I think they can hold, perhaps for a year or two.

OPEC, less their big 5, is a sorry mess in perpetual decline. They are currently a million and a half barrels per day below the world peak in 2018 and over two and one-half million barrels per day below the OPEC peak in 2016. They will never recover. They are part of over 60 nations that are in decline and will ensure that the 2018 world peak in oil production will never be breached.

The data in both charts is through January 2023.

Ron,

If we eliminate Venezuela from the other 8 and show the “other 7” OPEC nations from Jan 2014 to Dec 2019, we find there is no decline, but instead a slight increase in output. Venezuela is a failed state which has little tao do with depletion.

You are correct, Dennis. If we could only show the years that put our argument in the best light and not show the years that make our argument look like crap, we could perform all kinds of magic with our charts.

But the last three years actually happened. Yes, they really did. And so did the years previous to 2014. To not show them would be deceptive.

I prefer to be honest.

Oh, one more point. Venezuela actually happened also. Their data, as well as their decline, actually happened. Politics is part of the big peak oil picture. It always has been and always will be.

Iran is politic-hampered, too – and Iraq a bit, too because of the Shia-Sunnie tectonic break going right through the country.

OPEC decline at the moment is a pure political thing – this will change at some point, but this is still in the future.

Some of the core OPEC states are starting green hydrogen / ammonia big now, already in the GW numbers. They have the solar ressources for this, and the money (or at least the credit score, which is equal to money in modern days. Nobody pays back).

Something going on:

https://www.swp-berlin.org/en/publication/the-hydrogen-ambitions-of-the-gulf-states

Perhaps the will decline with these new energy sources somewhat smooth – at Thyssen Krupp orders for eletrolysis modules trippled within a year to a billion $ value. I know that’s just a beginning compared to big oil and gas – but it’s already in the blllion $ region and not dabbling in Univerity laboratory region anymore. And with billion$ projects they can get the expertize to finally realize the double digit billion $ projects that will produce serious energy. Imagin SA having a 1mbpd oil decline, but an 2 mbpd hydrogen / ammonia equivalent gain. They will stay an energy powerhouse then.

The sun energy they receive on top of Ghawar is much more than the oil they extract.

If you conclude that electrolysis can produce economically viable hydrogen from solar

[or nuclear or wind]

then you have opened a wide door to a pathway for civilization beyond abundant fossil fuel.

Sure, oil and nat gas liquids will still be necessary for the molecular chemistries properties for specialized uses such as the petrochemical industry, but that is a small portion compared to the oil, coal and gas that simple undergoes raw combustion [insert comment-‘how primitive’].

When you combine the expense and inefficiencies of both hydrolysis, and fuel cell conversion of the hydrogen back to end use electricity, you may end up with a fuel storage/distribution system that is simply too expensive for many uses we have become accustomed to. Perhaps affordable for critical uses, however.

It will be most interesting to see how the industry evolves.

If this hydrogen energy storage system does become economically viable at scale, then the geography of energy undergoes a radical realignment, even somewhat further than wind and solar energy geography realignment already has (99% yet untapped).

I’m mostly describing what happening at the moment. Projects are in the GW range at the moment.

Remove yourself from storing and efficieny of the conversion – it’s more mining the sun in the right countries. Cells + elecrolysis + cryogen tankers are a complete module, as are drilling rigs + pipelines + handling infrastructure + tankers now.

It’s more like developing a conventional oil field. You invest x billion $, and get an installation that fills tankers for export. After 50 years, the oil field is empty – or the cells and converters rocked down. Rebuild from the scratch, only you don’t need to find a new oil field.

At the moment the oil is still cheaper, but the first will be forced by green western society by laws. As in everything, economy of scale has to kick in to make it real cheap by going in the double digit GW scale. This still has to prove viable. But all of it isn’t rocket science, more industrial expertice.

And this hydrogen is not about electricity – it’s green steel, green fertilizer and concrete. Lot’s of the stuff needed here before thinking about fuel cells. We have hydrogen pipelines here in Germany already, since 80 years for chemical industry. These will be the first customers. The current consumption is 55 TWH / year, all created from nat gas.

For example Krupp is building a complete hydrogen steel mill at the moment for additional demand. It will be without any sense to use conventional hydrogen to power it, you can still with coal then.

Local electricity from wind, solar + batteries, water, nuclear, geo, bio … is a complete different game.

PS: I own some Thyssen stock at the moment because I think they are cheap with all these opportunities. I don’t recommend anyone to buy anything and can’t push billion $ companies anyway.

Good to hear your thoughts on this.

Comment- although you indicate that “At the moment the oil is still cheaper, but the first will be forced by green western society by laws.”

As a contrary viewpoint I see fossil fuel depletion as the primary ultimate driver of energy system change. The secondary driver is geopolitical instability, and ‘green energy’ policies as being third.

Caveat- One could argue strongly that citizen concern over nuclear power safety in a country like Germany, after Chernobyl and Fukushima, is the primary driver of policy for that particular power mechanism.

I’ll remind the readers that

“Germany’s proven reserves of oil and natural

gas are modest and have been dwindling in

recent years after decades of production. As of

2018, indigenous production met [only] 3.7% of the

country’s Crude Oil use, 8% of its Natural Gas

use, and 55% of the country’s coal use. Once

considered the engine of its economy,

Germany’s hard-coal mining industry closed its

last active mine on December 2018…. Germany remains however as the world’s largest producer of

lignite”

Interesting podcast on the nuclear industry supply change, and Russian supply

https://podcasts.apple.com/us/podcast/columbia-energy-exchange/id1081481629?i=1000600971259

@Hickory

Germany has big resources of tight gas. But since the film “Gasland” every progressive and even most conservatives think that fracking will make their drinking water explode.

So they decided to import the fracked gas from the US to keep their nice green Bullerbü.

And use lignite and imported coal to switch off nuclear.

Wind energy investing stagnates, too – the price inflation that hit the oil fields in the US that is discussed here hit the wind mills as hard. So no Investor wants to build them with the current prices, only the most desperate ones.

Ron,

Chart below has Jan 2005 to Jan 2023 data for other 7. Average annual decline rate about 175 kb/d over the 18 year period.

Ron,

Sorry to repost a nearly similar chart to yours, I must have been working on mine at the same time as you and I had not refreshed the page before posting my chart (7 minutes after you had posted yours.

Ron,

Honest enough for you?

Yes, an honest graph Dennis, but totally irrelevant as to Peak oil. What happened years before the peak is irrelevant. But… it does give us a good look at history. And I am a history buff. So thanks.

Dennis, where did I ever say that ONLY my charts are relevant and honest?

The OPEC peak is a combination of US sanctions on Iran and Venezuela and oversupply in 2018 plus the pandemic that followed. Yes politics happens and politics may change in the future, it is doubtful that sanctions will continue forever and the political situation in Venezuela might change in the future if the population gets tired of a failed socialist experiment and revolts.

Dennis, regardless of the cause, geology, politics, demand, or price. The decline happened, end of story. OPEC is now producing flat out, or very nearly so, and they are producing over 3 million barrels per day less than they did in 2016.

Ron,

Iran is producing 1200 kb/d less due to sanctions and Venezuela is producing about 1300 kb/d less than when OPEC was at its peak, all of this adds to 2500 kb/d and in October 2022 OPEC output was about 2593 kb/d below its centered 12 month peak in April 2017. This is not a very big decline (93 kb/d over 5.5 years would be about a 17 kb/d annual decline rate.) This has little to do with depletion.

I think your calculations are a bit off, Dennis. My figures show OPEC less Iran and Venezuela to be currently approximately 2 million barrels per day below their 2016 peak and 600 Kb/d below their pre covid average.

However, this makes no difference. Iran and Venezuela are still part of the peak oil picture regardless of the reason for their decline.

Click on chart below to enlarge.

Ron,

I focus on 12 month average output. The peak for OPEC minus Venezuela and Iran was 26620 kb/d in Jan 2019 (centered 2 month average). In January 2023 output was 25633 kb/d, about 987 kb/d lower than the 12 month average peak. Earlier I did a different comparison of OPEC 13 peak of C plus C (12 month average) with October output from EIA data. Note that in recent months OPEC has cut output by 682 kb/d, so the decline is only about 300 kb/d from Jan 2019 without this cut. In addition the OPEC peak was March 2017 (for CTMA) at that time OPEC less Iran and Venezuela was at 26065 kb/d which was 455 kb/d less than the level in September 2022 (recent peak for OPEC 13 output.)

Other 7 from Jan 1973 to October 2022, EIA data.

I love that chart, Dennis. Very relevant and honest. It clearly shows that the combined production of these seven nations began to decline around 2010.

We all agree! Right?

Please post zero-scaled graphs when representing data, as Ron says above, to not do so is deceptive and dishonest. Thank you!

I don’t recall ever saying that. I very seldom post zero-scale graphs. And I don’t think I am being deceptive. Zero-scale graphs have their advantages and disadvantages. The big disadvantage is they mask the magnitude of the change. And that is the very thing I like to emphasize.

Very long-term graphs are best shown as zero-scale graphs. But very short-term graphs are best shown as non-zero scale graphs.

Not sure why something that is not zero scaled would be dishonest. If you really think so that you should scale both the X axis as well as the Y axis – but where to start time? 4.5bn years ago? The Birth of Christ? Or use some other religious starting date? And why limit yourself on the high value to the high value of the dataseries? Why not use, say 10 billion. Or 100 billion?

Zero scaling most of the time makes no sense and leads to a graph which does contains data but does not necessarily convey information. Changing scales of data without pointing it out however can be quite misleading.

Rgds

WP

WEEKENDPEAK, You replied to my post. I think you meant to reply to GOT2SURF’s post. I agree with you.

To avoid confusion, just mouse over his “reply” button, and click it. Or, you could simply state to whom you are talking to.

My bad – post wast directed at Got2Surf.

rgds

WP

Ron,

The combined average annual decline was about 174 kb/d from 2005 to 2022. The big 5 increased output by about 400 kb/d annually from 2005 to 2019 so it seems likely OPEC will be able to maintain a plateau or perhaps increase output gradually for a few more years.

Perhaps so, they may increase production slightly. But the odds are about the same that they will decrease production slightly. At any rate, they peaked in 2016, two years before the world peaked.

From Hickory /Gerry discussion on the last post:

“unless China, India, Pakistan, and many other countries adhere to a lower carbon footprint by banning the burning of bituminous coal in power plants”

That would be good, but consider a different perspective

The per capita CO2 emissions of the US is more than twice that of China, and more than 7 times greater than India. And Pakistan almost 20 times less/person.

“Its kind of like a massively obese person telling 7 thin people that they need to eat less because combined they eat twice as much as he.

I have an alternative analogy. It’s like your have 5 people on a life raft 500 miles from shore with limited food.

Two of the people let’s call them USA and EU seek to limit the amount of food and water to make it to safety back safely. The other 3 let’s call them Russia, china and India. The say no we are going ahead and eating like we want to. The USA and the EU go on a hunger strike. After 4 days, the US and the EU are weak but Russia India and China have never felt better even as their food supply is low. So they Kill EU and start to eat him. The US is now too weak to do anything. When they are done with eating the EU they eat the USA. Now they arrive at shore safe and sound fat and happy.

But I think that’s the plan all along.

It’s more like junkies going cold turkey than fat people going on a hunger strike. Europe and the US waste vast amounts of energy, and vast amounts of money to feed that habit.

It’s insane to go on being a net importer of any energy source when there is so much ambient energy that can be harvested at a lower cost.

This doesn’t mean poor countries don’t need more energy. To continue the drug analogy, pain killers are an important part of medical treatment. But at some point, taking too many becomes a problem.

https://www.youtube.com/watch?v=qKVkrWssSQ4

15 largest oil rigs on the planet.

This is absolutely amazing feats of engineering.

But these things are sitting ducks militarily.

The engineering here beggars belief. These massive investments are also testimony to the fact that oil extraction is going to continue until it cannot anymore, emissions be damned.

Nuclear is unaffordable . The world’s largest nuclear electricity producer EDF , France .

..EDF posted a historic loss of 17.9 billion euros in 2022 and increased its debt to a record 64.5 billion euros. Its revenue grew 70% to 143.5 billion euros, driven by the rise in energy prices, but the group is in the red with a very heavy net loss, compared to a profit of 5.1 billion in 2021.

Difficult the problem of affordable energy…….

nuclear first japan, now england;

https://oilprice.com/Alternative-Energy/Nuclear-Power/Nuclear-Power-Will-Play-A-Key-Role-In-The-UKs-Energy-Transition.html

and looks to be done in the private sector…who would have thought…oh yea me.

With all oversight, regulation, social insurance, long-term maintenance+clean-up, monitoring, policing+security, etc done by a competent (read: non-MAGA) government, LOL

YOU get what WE pay for.

UK is a joke and so is Finland and so is EDF .

https://www.cityam.com/edf-inflation-drives-hinkley-point-c-nuclear-power-plant-costs-from-26bn-to-33bn/

https://ieefa.org/articles/european-pressurized-reactors-nuclear-powers-latest-costly-and-delayed-disappointments

After 13 years behind schedule the EDF plant in Finland launches . My info is they have shutdown again because of technical faults .

https://www.worldnuclearreport.org/Europe-s-First-EPR-13-Years-Behind-Schedule-Olkiluoto-3-in-Finland-Starts-Up.html

Nuclear was never feasible without subsidy . I am not even talking about waste disposal .

HIH

The article below quotes 60 months from initiation to startup at a cost of less than 3 billion USD for a nuclear reactor. A big difference from the sclerotic approach in western democracies.

In a world of dwindling fossil fuels, reliable continuous electrical power supply will be more expensive than we like whether it is from nuclear or from intermittent sources plus storage.

https://www.chinadaily.com.cn/a/202209/16/WS6323dc25a310fd2b29e7808f.html

Old Chemist the Chinadaily article says” according to Jiemian.com ” . What is Jiemian.com ? Can’t find it on the web . I give you hard facts ” boots on the ground ” , Here is a page for the abandoned , delayed , cancelled nuclear plants in the USA alone . All due to cost overruns . If you want I can draw up a list of other countries also . I am not anti nuclear but I point out the futility of planning for a nuclear future . Too many sinkholes on the road ,

https://www.powermag.com/interactive-map-abandoned-nuclear-power-projects/

HIH

Major business news purveyor in China.

https://en.jiemian.com/

The dead nuclear projects in the developed world are justifiably dead and I agree nuclear has no possibility of sustaining BAU, nor do renewables, but in a world south of a billion souls they could provide the basis for continuing a technological civilization provided people were willing to devote a very significant portion of their economy to energy production.

Will it happen? Probably not.

I am sure you agree that developing countries with decent infrastructure can execute major construction projects much more economically than the developed world.

Olkiluoto 3’s stratup is again delayed. This time emergency valve needed soem repair. The new startup is projected to begin on April 15th. https://yle.fi/a/74-20019142

This historic loss is due to the lack and the delay for the maintenance of the nuclear reactors (covid), which forced to them ot be arrested in the same period. Furthermore, there have been what is called the ten-years inspection wich coincided wiht the delay of maintenance. This resulted in a lack of production, therefore, less turnover with increased expenses of maintenance.To this, you must add the obligation for EDF of selling at low price (Arenh) to energy brokers to maintain an artificial free energy market. So, it has been more difficult for EDF to generate a profit. Anyway, I confirmed you that nuclear energy necessitates a lot of capitals and generates a lot of costly maintenance. That’s the price to pay for producing energy. It is effectively more costly than simply pick up oil and gas in the ground as we had not the obligation to produce this oil and gas.

JFF , copy/paste , but this guy is in France and knows the s***.

” The French government sets twice a year what the ‘ energy cost’ may be for consumers. They have determined that the price may go up by up to 15% on 1 February…. and so goes! In summer, a new price agreement is made etc etc. Since EDF is now a fully nationalised company again, some kind of ‘ utility’ balance is sought each time. What can the consultant pay and what does it cost to keep EDF’s nuclear arm afloat….

That’s tightrope walking on the narrow rope…. too cheap for EDF to function properly and too expensive for the ‘ yellow jacket’….

This year will be exciting because very soon the financing of the new nuclear fleet plans will have to be put in place. They are making a real attempt at utility pricing by using the French savings to good effect to finance a sloppy 50 billion after all…. “

HIH

That’s just domestic customers if you want the real story look at commercial rates. Hint it’s why local bakeries are gone and all our glass is now coming from Spain.

Lightsout . I know and I am on top of this . In January 15 companies filed to shutdown plants firing 500 persons PER PLANT in Belgium . Till date the rate of bankruptcy filing in the area of Flanders where I live are up by 55 % . The real epidemic will start in April when the energy subsidies will end . I avoid posting on this because it can be very depressing . EU is filing for bankruptcy . Energy is the economy .

https://www.brusselstimes.com/345509/empty-spaces-in-city-centres-bankruptcies-in-belgium-set-to-increase-in-2023

https://www.txtreport.com/business/2023-02-18-the-number-of-bankruptcies-in-the-european-union-has-hit-an-eight-year-high.HJ2TIS06s.html

Thanks for sharing.

Just some EU economic news for those interested . EU central banks are showing losses for 2022 . They told me ” the casino never looses ” . 🙂

https://www.swissinfo.ch/eng/bloomberg/euro-area-braces-for-era-of-central-bank-losses-after-qe-binge/48299944

BASF just released it’s annual report . 2600 jobs gone . Read the report . LNG cannot replace pipeline gas for 24/7/365 industries . Just too expensive .

https://twitter.com/JavierBlas/status/1629012829163474946

Lightsout , talking about glass bottles . Buy your wine now . 🙂

https://www.thedrinksbusiness.com/2023/02/glass-bottle-shortage-major-concern-for-french-wine-producers/

Yes nuclear is expensive and takes a long time to deploy.

Yet over the coming 3 year period the world is on tap to add 302 TWh of nuclear power,

which is an 11% rise.

During the same 3 year period [2022-2025]

Renewables are on tap to add 2,450 TWh new production capacity,

which is a rise of 29.3%.

So, the renewables will be adding over 8 fold greater capacity than nuclear, and picking up momentum rapidly.

During the same period global coal electrical production will be down about 1% and natural gas sourced electric production down about 1%.

This data and projections are provided by the IEA.

[see the chart about 1/2 way down- Global electricity generation by source in 2022 and 2025, terawatt hours. Source: Carbon Brief analysis of IEA figures. Chart by Carbon Brief using Highcharts.

https://www.carbonbrief.org/renewables-will-be-worlds-top-electricity-source-within-three-years-iea-data-reveals/%5D

Also note that the decisions on national and regional electricity generation are made by a combination of local utility, regional planning agencies, and national government policy, as well as major funding agencies, banks and to some extent private equity entities.

Not you and I.

We’ll see.

There will be no nuclear electricity plants in the future . Why ?

1. The biggest constraint is the steel used in construction of the dome . Only Nippon Steel can make this and only for 2-3 domes per year .

2. Uranium mining can be done but the processing of this into U 235 is more than 50 % in the ex Soviet Union . So instead of being dependent on gas you are going to be dependent on U 235 from FSU .

3 . Minimum time required to put up a reactor from ground breaking to launch is at maximum efficiency 12 years , but delays can be another 12 year . Total 20 years ( keeping fingers crossed ) . Yeah , we just run out of road to kick the can down the road .

Wake up .

Nuclear is certainly the generating tool of the greatest complexity, and therefore the most fragile.

In the US there has been a 70 year failure to come up with a high-level radioactive waste

handling and disposal mechanism.

The military and commercial high-level radioactive waste that hasn’t been lost or disposed of via unintentional dispersal at sites like Rocky Flats or Hanford,

remains in temporary holding ponds.

I am highly skeptical of acceleration in the industry, and the human ability to handle the radiation with impeccable technique and diligence.

About the disposal of nuclear waste and I am speaking of the high radioactivity ”wastes” such as the minor actinides and the fission products, there are solutions. The minor actinides can be used as fuel in fast neutron reactor (they become fissionable at high energy) and the fission products (especially the LLFPs, long life fission products) can be transmuted into non-radioactive elements or short lived radioactive elements in a fast neutron reactor with a suitable moderator. I am not responsible of the absurd decision of US authorities to not reprocess the fuel wastes of the American nuclear sector.

No problem–

In 24,000 years, half the problem will be partially solved.

1) With fast reactor, the necessity of building pressure domes is no more required. It is a necessity with the use of water as a coolant. With coolants such as sodium, lead or salts, the system can be operated at nearly ambiant pressure and the coolants are not going to evaporate. 2) To build new reactors, new domes have not to be built. Let’s empty the old installations and let’s put a new one inside the dome. Areva is able to empty a dome in 4 years. 3) I have asked to someone involved in nuclear security about the origin of the steel needed for the pressure domes. He has never heard that this kind of steel was only build by Nippon steel. 4) With fast reactors, what you need is Pu 239 and U 238. In france, we have plenty of U 238 (300000 t) and we have enough Pu 239 to start a fast reactor sector.

5) Part of the French nuclear sector can be fueled with MOX. No need of U 235.

JFF , what is stopping EDF and Areva from implementing the changes and steps that you have pointed out in the posts ? Surely they are aware .

When I look at new technologies I always apply the principle- “if it is any good why are we not using it”. Carnot on the earlier thread . All that is technically possible may not be economically feasable .

The main problem for nuclear sector in France is the political class. The nuclear sector is under the authority of the government. As pointed by an administrative officer of the CEA, the political class is devoided of the minimum of the scientific and technical knowledges necessary to assess correctly the challenges of nuclear industry. In past, that was the case. Now, it is no more the case. The political leaders are managing nuclear sector on a small scale, primarily guided by the idea to attract the little portion of electorate which is antinuclear or by the liberal obsession with cutting public spending. You must add to that the conservativeness of nuclear sector executives which are still stuttering an umpteenth version of the pressurized water reactor. For example, some are dreaming of replacing the aging pressure vessels in 900 MW reactor. But a power station director, when asked why everything was replaced in a reactor and not the pressure vessel, gave a stupid answer by saying that it was not planned because the pressure vessels are weighing several hundred of tons. Which is an absurd answeer as the pressure vessels are installed by internal cranes which are still in operation to proceed to the replacement of vapor generators (they have the same weight than the pressure vessel). It’s just unjustifiable and it is a blunt decision made several years ago by some narrow-minded EDF executives. Likewise, a few years ago, the CEA executives, despite the progress made in the field on a theoritical level and a practical level, were considering molten salts reactor as a possibilty only in an indefinite future, while, in the same time, Chinese researchers were building a prototype of molten salts reactor and activating it. This has changed as, by a blunt decision due to absurd motivations, French liberal government decided to shut down the project of sodium-cooled reactor ASTRID and to invest absurdly in SMR. The CEA scientists involved in this project were devoided of project and they decided to launch by themselves a program of molten salt reactor (MOSARELA for MOlten SAlt REactor and Life-cycle Assesment) based on the works of the LPSC (Laboratoire de Physique Subatomique et Cosmologie) and they received subsidies (perhaps 50 millions euros) as part of the plan of post-covid economic recovery when their American counterpart (Terrapower) has received 150 millions dollars from the DOE and the Chineses have devoted 1 billion dollars for that.

Barakah construction went smoothly and came in on time and on budget.

Lightsout , Barakh was supposed to start in 2017 and came online in 2022 . Cost of project is supposed to be $ 30 billion . How much did they really spend ? No idea as still ” work in progress ” . However I would still say it is a job ” well done ” .

https://en.wikipedia.org/wiki/Barakah_nuclear_power_plant#:~:text=Barakah%20was%20chosen%20as%20the%20site,2011%2C%20including%20Korean%20President%20Lee%20Myung-bak.&text=Barakah%20was%20chosen%20as,Korean%20President%20Lee%20Myung-bak.&text=chosen%20as%20the%20site,2011%2C%20including%20Korean%20President

The link no longer works. Anyway, the beneficiaries of renewable (intermittent) energy sources such as solar panels and wind turbines are going to be amazed by the necessity to turn on the nearby gas power plant to compensate the lack of wind or the lack of sun. That’s how it is working in Spain. As a result, renewables are doomed by the projected decrease of gas production after early 2030s. Unless nuclear power is put in place to supplement the intermittency of renewables.

JFF , your post 19/2/2023 at 9.49 am expressing frustrations with the politicians . Well , Is there anything we can do to solve this ? The people get the leader they deserve . See listing .

1, Biden

2 , Trudeau

3, May, Johnson , Truss , Sunak .

4 . Macron

5 . Scholtz

6 , Van der Leyden

7 . All the leaders in 3 Baltics + P .

8 , Arden (NZ)

9. Morrison (AU)

Then all wonder why the heck we are down the rabbit hole . My sympathies , I am as frustrated as you are .

nat gas is the future just sayin….

https://www.energypolicy.columbia.edu/the-us-gas-balancing-act/

Sorry TTT , NG is not the future . Degrowth is the future .

I don’t know what Degrowth is.

By Degrowth you mean Contraction, correct?

Degrowth is a movement.

https://en.wikipedia.org/wiki/Degrowth

Degrowth emphasizes the need to reduce global consumption and production (social metabolism) and advocates a socially just and ecologically sustainable society with social and environmental well-being replacing GDP as the indicator of prosperity.

See also: Less is More: How Degrowth Will Save the World

by Jason Hickel (Author)

The word for that is “euphemism.”

Your energy consumption will in that case be limited to the firewood you can collect in walking distance. Like communism, nuclear energy hasn’t been properly tried yet. It is that or darkness.

https://www.nature.com/articles/d41586-021-02459-w

Thorium.

You build a Thorium Reactor with a Coal-to-Liquids facility and you can get the Thorium out of the coal. Electricity and Liquid fuels all in one.

For those countries with Coal and Thorium would be a big win (not counting climate change)

Oak Ridge labs (USA) had a working Thorium reactor but it was abandoned because you can’t produce Nuke Bombs with Thorium.

The Chinese are now trying to build a Thorium reactor and I think India is too.

The chinese prototype is additional aimed at producing a medium sized, fabric produced reactor that is only sampled at the construction site – analog to the giant wind turbines.

That’s the right way for a big rollout, not this french behemoth that is single constructed at the site. Compare building an italian supercar or a Ford. Imagine building a wind turbine by building it onsite. Nobody could pay this.

Germany tested with Thorium in the 70s-80s, too. But instead of getting better after the failed prototype, they stopped everything due to the anti atom protests and build coal power plants instead.

There is much more thorium than uran avialable, and it’s a byproduct of other mining already.

Granite has an increased thorium content, and there are geological anomalies with increased thorium. For example in Bornholm it is not recommended to stay in old cellars too long due to radiation – Radon from the Thorium decay chain is everywhere in the underground.

So much more countries will be energy independend with it. Or you can just buy a few tons of thorium, it’s very volume efficient ( 9.5 Gwh / Kg, or round about 7000 barrels of oil energy equivalent per Kilogram).

Yes, there are many possibilities that work.

Another thing for energy indipendence: Deep Geothermy will work an many places, too. With the possibility from the shale boom to drill very long wells cheap and fast, many geothermal ressources at 5-10 km depth can be accessed.

Well, everything you said is true grape ape. But you know, Kirk Sorenson really tried to get the thorium thing going again for decades, and he’s still sitting in limbo. I’ve heard of both the Chinese and Indian thorium projects, but as far as I know the commissioning of those reactors is still several years away. So I guess we will see at that time what really becomes of thorium energy production.

Here is a thought. Right now they’re a bunch of guys hitting a little white ball around in Los Angeles with thousands watching and in Daytona a bunch of guys are driving around an oval for hours with thousands watching. Both events producing nothing useful for society consuming huge amounts of energy. The PGA and NASCAR, for the common good, should be outlawed immediately.

I believe there is no hope for a wise transition to a simpler less energy using culture. Humans are at their core animals, and the wast majority will seek temporary short term comfort and thrills. Over long term wise decisions.

Degrowth will happen regardless. Collapse now and avoid the rush å wise man has said.

I disagree…. golf and car racing are very useful for our society because they are our society. Those excesses are symbiotic with the freedom we enjoy in the United States. They represent what free countries can achieve when citizens are left to pursue their own personal creativity and passions.

Your passion may be sailing and tapping on your keyboard writing on this blog. Mine may be tennis and genealogy. Others golf and car racing. All these different “non survival level” passions reflect our success as a nation and society to provide the incubator for them to occur.

Plus, how boring would life be without rampant excess?

My comment was meant as a ‘tongue in cheek’ remark. I look forward to watching both. I find the outlawing of gas cooking and heating as outrageous. I wasn’t born yet but try to imagine waking up on February 19,1942 and thinking what the future might be for the world. Nothing lay ahead but an endless war. Humans survived and flourished beyond anything imaginable in 1942. What’s to say today will be anything different.

We need entertainment every so often to escape reality.and perk up our spirits.

Correct, in a free market the public sets the value of the entertainment.

This statement from Ervin was inaccurate “Both events producing nothing useful for society”. It’s his opinion. Others disagree him with their actions.

Ervin , the problem is that the economic system is designed to work in the environment where ” my waste is your income ” . This will die a natural death as Seideman has commented . Suggested reading ” The Landfill economy ” and ” Bullshit Jobs ” .

Ervin…I don’t think that outlawing optional uses of oil is the right mechanism to preserve more important uses of oil, as you suggested ‘in jest’

But I would be in favor of heavy use tax on energy that was being used for optional or frivolous uses.

That is one step before rationing, but still allows somewhat of a market mechanism to determine priorities.

Of course a country could decide to institute no mechanism of prioritizing the consumption of depleting oil, allowing the residual production to just flow towards those with the most money- as is the status quo now throughout most of the world during this time before oil decline.

“But I would be in favor of heavy use tax on energy that was being used for optional or frivolous uses.”

Or better yet, solar powered race cars. It could energize progress to a fossil fuel free transportation system.

Those are interesting thoughts, but what about the energy consumed in other non-productive activities such as the production of TV & Hollywood movies? Or things like the super bowl, baseball, airline and cruise ship vacation sectors? The construction of sports stadiums, theaters, and other public venues? Even things like Apple iPad and i-phone devices which consume huge amounts of energy, but are used almost entirely for entertainment and are of no productive value whatsoever? That even goes for things like Facebook, tick tock, Instagram, Twitter and the like. All of those things consume huge amounts of energy, are frankly time wasters/distractions, and are absolutely non-productive entities?

All good points Mike+S.

If there was to be a heavy use tax on energy that was being used for optional or frivolous uses, in order to help prioritize oil products for critical use,

then I suggest that all of those activities that you list that require oil products would be on the table.

This might seem like drastic measures to most people who have become accustomed to great abundance of oil products, but I suggest that this is a transitory condition in the history of humanity.

I’d rather see a phased in use tax on optional uses of oil rather than strict rationing, although at some point that next step might be necessary.

We should be using what is left at a much slower pace, as if it was irreplaceable.

After about 2 months of China reopening the Baltic Dry Index is at 538. It’s worse now than at any point during the lockdowns. Because the problem isn’t and never was Covid or lockdowns.

If China isn’t loading up on raw materials. Oil demand will follow suit.

You have to guess, as it is the future and all. My guess oil prices will bungee higher with in 6 months. That will quickly cause a new wave of higher inflation across the board (which never really went away), but have no real appreciable impact on oil production because it will not be high enough long enough to do that. The price of oil will slide back down with in months and will hit new lower levels than we have seen recently. Causing the next step down in over all production.

No reason for oil prices to go higher. Global recession is taking place. Japan export numbers were atrocious and this was after China reopening. Down 11% yoy

HHH, you may be right. the only reason I see a possible short term bump is that folks here and in Europe want a narrative so badly that things are great and getting better. By spring we will be draining the SPR and giving out more money to do anything to give that impression. When that does have the positive effect desired; more lower cost oil, we will get the real rebound. Less lower cost oil. But none of my scenario may be necessary… Just go straight to the less lower cost oil as you suggest.

North Dakota’s Bakken shale “holding back” U.S. oil production

(Bloomberg) – North Dakota’s Bakken shale — traditionally one of America’s larger, busier shales — is showing signs of maturation, threatening to hold back U.S. oil production as the world thirsts for more crude.

Mature wells that are producing more gas than expected are hurting crude output from the Bakken, the Energy Information Administration said in an email on 2/7. The deteriorating performance was the main reason the agency cut its estimate for 2024 U.S. oil output to 12.65 MMbpd from an earlier projection of 12.8 million.

The weakening oil production outlook comes as Russia’s war in Ukraine, which has disrupted global supplies, grinds toward its first anniversary. At the same time, the International Energy Agency is forecasting higher global oil consumption as China shows signs of a stronger-than-expected economic recovery.

Even at the lowered estimate for next year, U.S. output would still set a record, surpassing the 12.3 MMbpd produced in 2019.

Interesting that the article doesn’t mention whether they are talking about Bakken as a region, versus formation. If their information came from the DPR (EIA was the reference in the article), which is regional and not formation specific, maybe the EIA doesn’t know why the volumes there seem to have been knee capped since the end of Covid. Increasing GOR isn’t it, but I’ve heard that one before from the EIA folks. Increasing GORs are a given in all US solution gas drive shale oil reservoirs in the US, particularly the Eagle Ford. The Bakken is no worse than any of the others, except the Eagle Ford.

For the record, all US solution gas drive oil reservoirs are in their mature forms.

Interesting that the article doesn’t mention whether they are talking about Bakken as a region, versus formation.

North Dakota production is in decline. That decline will keep total US production from increasing as much as many expect.

Now is this decline coming from the Bakken as a region or as a formation?

I haven’t a clue as to what the hell you are talking about.

I like knowing the individual moving parts of a system. Comes in handy in knowing why a decline is a decline. As compared to those who, upon seeing a decline, declare yet another peak oil.

Oh, for God’s sake, let us not get ridiculous. No one looks at one little oil patch and declares peak oil. You are just being silly.

As for peak oil, the US is just a bit player in the grand scheme of things. And the Bakken is just a bit player inside a bit player.

But… are we talking about a region or a formation? Just what the hell is the difference? Is one declining but not the other? I think you are just blowing smoke. You are trying to show expertise but I see the opposite.

The Bakken is a region according to the DPR. A group of counties listed on the spreadsheet data that they provide. Within that region are some 44K wells. And many, many formations. The Bakken, with it’s various benches, is just one. And comprise perhaps 14K of the 44k wells. The other 30k wells are other formations. One of them is important. The others currently irrelevant.

To folks who know anything about geology, the Bakken is a formation in the Williston Basin, and the folks who built the DPR don’t have a clue about anything more than made up geography, And no one in my world for a second would think knowing this is expertise any more than you would think someone adding 2+2 and getting the right answer is a surprise.

And just why did you feel the need to bring peak oil into this debate? You never miss a chance to spout your opinion that peak oil is bullshit. The headline was “North Dakota Bakken shale is ‘holding back’ US oil production”. And this was Bloomberg, people who generally know what the hell they are talking about.

But you criticized the article because they didn’t say whether they were talking about a region or a formation, as if this made a critical difference. And then you indicated that this difference had something to do with peak oil.

I know you believe all those who believe peak oil in neigh are blooming idiots, but you are a minority of one on this blog. I believe peak oil was in 2018, and Dennis believes it will occur in this decade. Yet you wrote on 02/15/2023 at 10:04 am:

“Not only is there enough crude and natural gas to melt the poles, depending on price, there is enough to make sure that peak oil isn’t assured in this half of the 21st century.”

That is about the dumbest thing I have read all year.

“Not only is there enough crude and natural gas to melt the poles, depending on price, there is enough to make sure that peak oil isn’t assured in this half of the 21st century.”

“That is about the dumbest thing I have read all year.”

Which doesn’t negate the validity of the comment, or more importantly the system built to prove it.

“Increasing GORs are a given in all US solution gas drive shale oil reservoirs in the US, particularly the Eagle Ford.”

This statement implies that higher initial GOR’s in new wells and exponentially increasing GOR from old wells in pressure-depleted cores of shale basins is not a big deal. It IS a big deal. It is a PARTICULARLY big deal in both sub basins of the Permian where late life decline rates are accelerating, EUR’s are declining, and now 1/2 of the revenue stream, or more, from a tight oil well is associated gas related. Please read that last part again and realize that 1/2 of that revenue stream has now been whacked by about 40% because natural gas prices have nose dived.

“For the record, all US solution gas drive oil reservoirs are in their mature forms.”

ALL of America’s oil basins are headed for hospice care. They’re plum wore out from making America the greatest economic powerhouse the world has ever seen the past century (Tight oil and gas had LITTLE to do with that, BTW). Keeping American oil and gas IN America use to give us the leg up, the industrial advantage over other countries in the world. Apparently that is no longer the goal. Now its about money, and votes. The theory of AFFORDABLE oil and gas production no longer being able to keep pace with demand is a joke, right? “Peak Oilers” are stoopid and un-American.

The quote above is designed to minimize GOR concerns and what that does to OIL liquids recovery. It is inaccurate. Solution gas drives are typically associated with very low perm. sandstones or dense shale, or “tight” SRV’s, or when SRV’s communicate with each other. Step away from pressure depleted cores, not very far, and GOR’s go back to being normal.

What constitutes ALL solution gas drive reservoirs in the US? Tight shale, tight sandstones driven by solution gas, are all over the place. We haven’t even looked at half of them.

Well-bore storage. A common sense operational phenomena. Shut a tight oil well in for a long period of time and fluid, and gas, move to the pressure sink to fill the previously vacated porosity in the shale “container,” or the SRV. That is why pump off controls were invented. Google…gravity. It’s no miracle of Mother Earth nor is it a possible groundbreaking discovery in technology.

Who said, where is the link, for this single event occurring in the Bakken to be because of nearby, offsetting gas re-pressurization?

Phfttttttt.

I am unfamiliar with your claim that someone is repressuring in the Bakken? If so I would be amazed it is the first such effort. New ideas sometimes work out, look how shale oil and gas development turned out.

Peak oilers can be amusing, no one has ever claimed Colin Campbell and Jean were stoopid. Okay fine, some of the ones who lack any reasonable geoscience experience might be slack jawed and silly, but that is mostly the internet crowd of Happy McDoomsters.

I have no interest in minimizing GOR concerns, you assign motive where none exists. And you aren’t the only one with a career in drilling, completing and producing oil and gas wells. In my case, it was my first career, and instead of just continuing to do the same thing forever, I took what I had learned and moved on to the next one.

Is the pressure equalization so unheard of around here that you need to explain it? Do people not KNOW that reservoir pressure will begin to equalize within a given pressure cell if you the outflow is reduced to zero? Why not just say Darcy’s Law, point out the differential pressure component and leave it at that, then the more mathematically oriented can look it up and understand fluid flow in porous media the same as everyone else does.

Just one question though, you appear sensitive to the idea of GOR changing? A perfectly natural, observable, and predictable effect in these kinds of reservoirs? Are you operating under the assumption that folks who were in the shale oil and gas development business back in the 80’s and 90’s didn’t already know about it AND were modeling it, or just the peak oil noobs? For Pete’s sake, how do you expect anyone to get reasonable project cost estimates if you don’t take known effects like this into account? Expected time frames to water coning? Effects of offsets and injection? That’s just for the easy discrete reservoirs, don’t even get me started on reserve estimates after SPEE instituted the probability metrics for reserves, and then kicked out Monograph #3 to explain how.

Re the Bakken,

Bruce Oksol posted a fascinating production profile the other day (February 16) of a decade old Zavanna well (# 22044).

After being offline for a year, it came back online with a quadrupling of oil output and a tenfold increase in natgas production.

Far more intriguingly, perhaps, is that ~450,000 cubic feet per day of production is being consumed onsite (that is, the difference between gross production, product sold, less flaring is almost a half million cubic feet per day).

Something big be afoot in NoDak.

What? Something that will actually cause Bakken oil production to increase significantly?

It looks like the Bakken is going to meander around 1 million BOPD for awhile. 1 million BOPD is very important.

Right now it looks like the USA is going to be on a plateau. No more million BOPD per year growth. Doesn’t appear we need that anyway, oil prices aren’t high.

I for one hope we are through with the 2015-2020 oil prices. Although must admit $70-$75 isn’t as good as it used to be, with the service and materials inflation we have experienced since the beginning of 2021.

Last year was the best year we have had since 2013. Doesn’t look like 2023 is going to be quite so good.

You are correct shallow sand

Continental is attempting to get permitting for a township size (36 sections 23040 acres) gas injection pilot in the springer formation in Grady County Okla. Ron, I think what coffee is referencing is that the operators shut in a set of wells while simultaneously injecting gas in other wells and produce oil in yet another set of wells. So at any given time, one set of wells is completely shut in where BHP builds, some wells will be producing and some will be injection wells. This in fact will show up as a drop in total production, but not necessarily due to depletion. The operators and minerals owners are hoping that less production today will mean greater overall recovery over time.

Coffee did I get that right?

I might add Devon alluded to a similar program in their latest CC but gave no details.

TTT,

Essentially, yes.

I was not specifically describing any recognized process as much as pointing out WAY anomalous aspects in this Zavanna-owned (a private company) well.

There is a dearth of published info on EOR which may be understandable as this paradigm-shattering approach will upend many present ‘realities’.

I would not be surprised if Harold took his company private before a doubling of Continental’s recoverable resources became acknowledged via EOR.

Coffee…are you aware of the number of years that Harold has been trying to get EOR to change the booked reserves on his MT/ND properties? Just as a hint, it has been longer than this website has been in existence.

The well of which you speak did come back after a year off line, with the increase you mentioned. And within about 30 months was right back to where it started prior to shut in. Except now it is declining far faster than it had been prior to the shutin. Was this temporary oil increase deemed to be something other than the usual flush production after shutting a well in for a long period of time, or was any sort of workover or recompletion done in the intervening year? It should also be mentioned that it’s gas production has increased by an order of magnitude, far above even its initial gas production back in 2012 or so. That isn’t a normal side effect of just flush production, usually while both oil, gas and water will spike, they generally don’t disassociate in their respective ratios. And whereas oil is falling off quickly, gas production has been relatively stable, another anomalous feature in and of itself. So what was done to turn the well into a gas well? GOR>6 happened nearly 2 years ago, within about a year after it came back online. Did someone want this to be a gas well on purpose?

When I look at the monthly reports for ND, I see a few wells with 0, and more listed SI.

What happens to make a well be deemed SI? Is that something the operator applies for, or does the state do that when a well has reported 0 production for a specific time?

Is there a specific reason EOG has so many SI wells in Parshall? I have always focused on that field because it was an “elephant” back in the day, the best wells along with Sanish, plus being one with lots of wells.

The 459 wells averaged just over 20 BOPD in Parshall in 12/2022.

Is there a shortage of service workers still in ND? I assume when there is a down hole failure, it is a long wait for a workover rig?

Have electricity prices went up in ND like they have elsewhere. We received our highest electrical bills ever this month. They will go down a little soon, as some leases we are bypassing water to keep plants and batteries from freezing.

For example, one big lease had a bill of almost $6,600 the period 1/5 – 2/5/2023. Last year that was almost $5,300.

Seems like several private companies have bought a lot of older Bakken wells over the years. How are they getting along.

I’m still interested in reading about the operational side of this. I have always thought operating these very deep horizontal wells would be a challenge as they matured. I assume that is still the case.

Would appreciate seeing some stats as to shut in shale wells in the major oil basins, if anyone has that.

As someone who is part of a family that operates wells mostly completed either 1905-1911 or 1975-1985, it interests me to see how these horizontal wells fare as time goes by.

Shallow sand,

Data on the number of shut in wells can be found at post below, this probably is not what you are looking for. As of Dec 2021 about 9869 wells in 4 major tight oil basins were plugged or inactive out of about 90000 total wells completed up to that date in the same basins, so about 89% of completed wells were still producing. Most of these wells were completed after 2009 (about 2700 wells were producing at the end of 2009 in the 4 major basins, Bakken, Eagle Ford, Permian, and Niobrara).

https://novilabs.com/blog/us-update-through-december-2021/

No, that helps.

I tend to focus on the operational side, and in conjunction the longevity side of these wells.

Although I’m sure not similar in many ways, these wells remind me of the “deep” wells in our field. 3,900’-4,200’ vertical holes drilled in the 1970’s. Tight formation, likely the source rock for our sandstone wells which are 850’-1,100’ deep and have produced 98+% of the 300 million barrels of oil our 20,000 acre field has produced since 1905.

These wells came in very strong, 50-500 BO IP’s. Many had cumulative production of over 50k BO within 1-3 years. But the longevity hasn’t been there. Tend to produce more and more water, along with gas which has to be flared as our field doesn’t have much gas infrastructure. Tend to cost a lot to operate and most now make 1 BOPD or less.

A company from out west bought a lot of “deep rights” in our field and drilled two vertical wells to this formation around 2012. Both wells still producing. They were careful on perforating in order to keep the water production to a minimum. One of the wells has over 30k cumulative, the other just around 15k. Probably cost around $300k to drill, complete and equip back then. Vertical holes.

RGR,

Re the Zavanna well … as I no longer subscribe to the NDIC site, my knowledge of this well’s production history comes from Bruce Oksol’s February 16th posting (themilliondollarway.blogspot.com) spanning only the 2 years ending in January 2020.

While the ‘routine’ bump in oil/water output may be the result from nearby wells’ fracturing (Bruce calls it the ‘halo effect’ … been going on forever), that huge natgas increase is certainly not normal.

In fact, if one looks at the gas Produced, Sold, and Flared columns, one finds about 450,000 cfd unaccounted for.

Where is this gas coming from?

Where is it going?

Re Continental and EOR …

Article ftom 6/15/22, oilgasleads.com, Continental wants a short gas supply pipe to do huff ‘n puff on 2 Bakken wells, similar to a 3 well pilot underway in Oklahoma.

Uplift is expected to run 25%/60% if successful.

Lottsa below the radar EOR work underway all over.

Is re injecting NG into the well considered use?

rgds

WP

WP,

I do not know the specifics, but I imagine state regulations dictate just how the natgas is categorized as it is a taxable/revenue product.

This likely also applies to the gas used in gas lift which is becoming routine.

A few years back, a tiny Canadian company named Granite Oil was running a fascinating EOR operation in the Saskatchewan Viewfield Bakken by re-injecting treated field gas and water to maintain pressure.

While their recovery rate improved, low oil prices did the company in and they were taken private, I believe.

They had an arrangement with the government (ultimate owner of the minerals) to re-use the natgas.

Ron

That last statement is incorrect. US production peaked at 13 Mb/d. The updated US chart is in the Non-OPEC post that went up last week. Even by December 2024, US production is less than 13 Mb/d.

https://peakoilbarrel.com/non-opecs-oil-production-rise-continues-in-october/

You are correct, Ovi. I checked the data and found that for some strange reason, the STEO data differs slightly from the World data.

02/20/2023 at 9:47 am

Ron

I checked tab 4atab in the STEO and November 2019 is showing 13 Mb/d.