A Guest Post by Ovi

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for Non-OPEC countries. The charts are created from data provided by the EIA’s International Energy Statistics and are updated to October 2022. This is the latest and most detailed world oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few of these countries and the world. The US report has an expanded view beyond production by adding rig and frac charts.

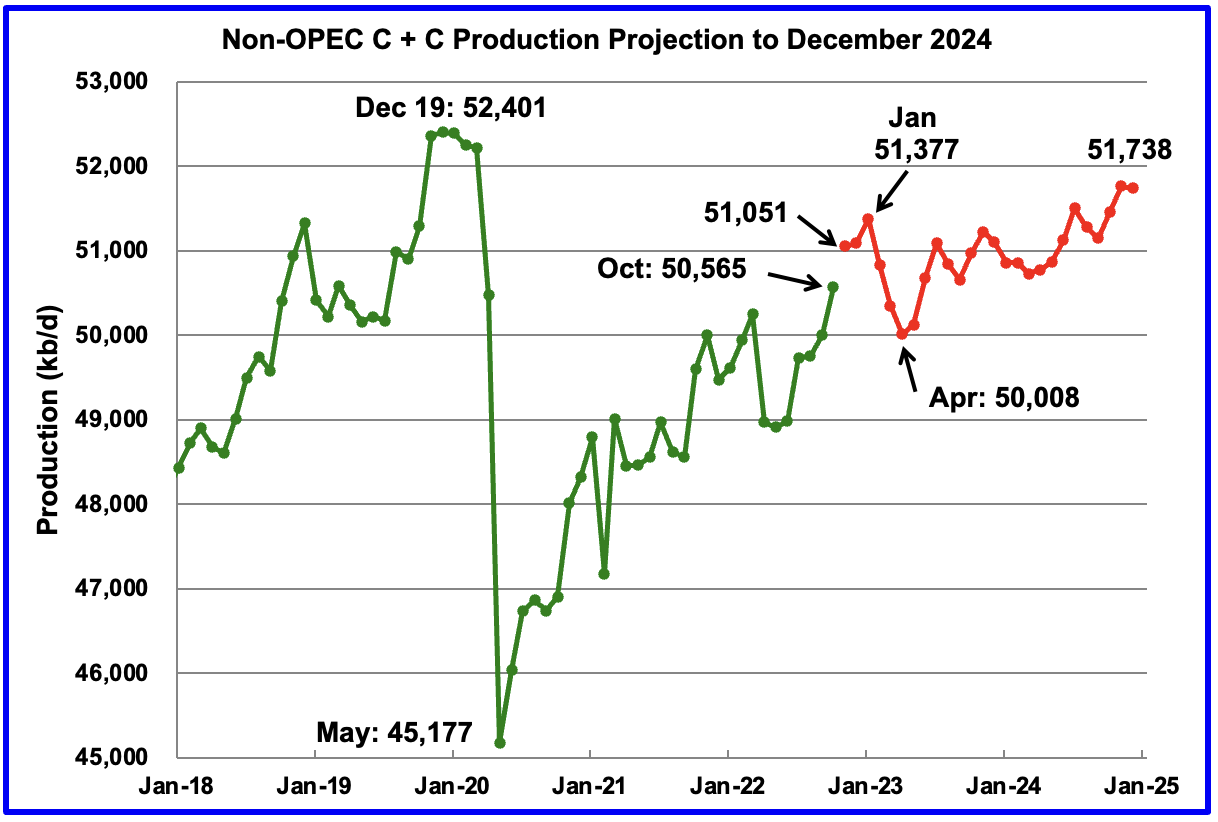

October Non-OPEC oil production increased by 562 kb/d to 50,565 kb/d. The majority of the increase came from Kazakhstan, Norway and the US.

In the last report, it was noted that the STEO was expecting October to add 527 kb/d. They came very close. 👏👏

Using data from the February 2023 STEO, a projection for Non-OPEC oil output was made for the period November 2022 to December 2024. (Red graph). Output is expected to reach 51,738 kb/d in December 2024, which is 663 kb/d lower than the November 2019 peak of 52,401 kb/d.

Note that after the January 2022 post pandemic high of 51,377 kb/d, production drops to 50,008 kb/d in April 2023, before resuming its climb. The drop is primarily due to a projected drop in Russian oil output.

The production increase of 361 kb/d from January 2023 to December 2024 is largely due to rising U.S. production. See Next chart.

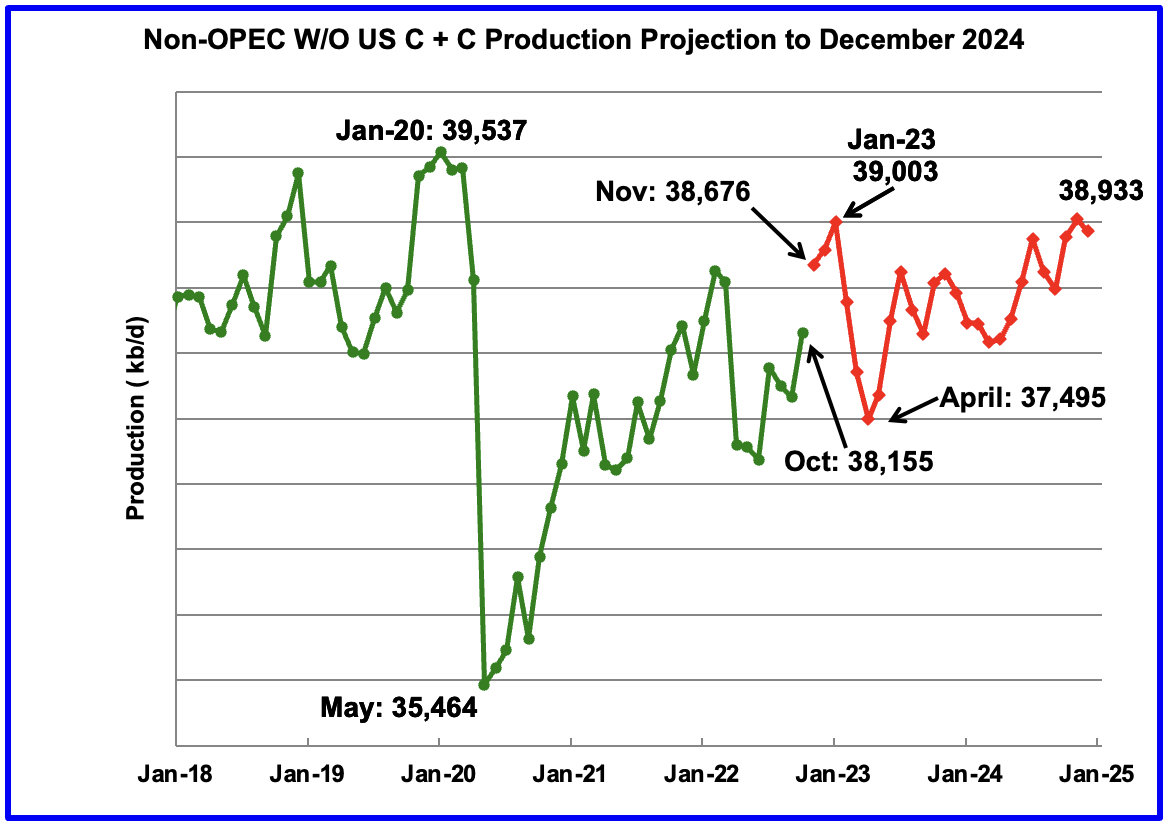

From January 2023 to December 2024, production in Non-OPEC W/O the US drops by 70 kb/d. This implies that most of the output increase seen from January 2023 to December 2024 comes from the US.

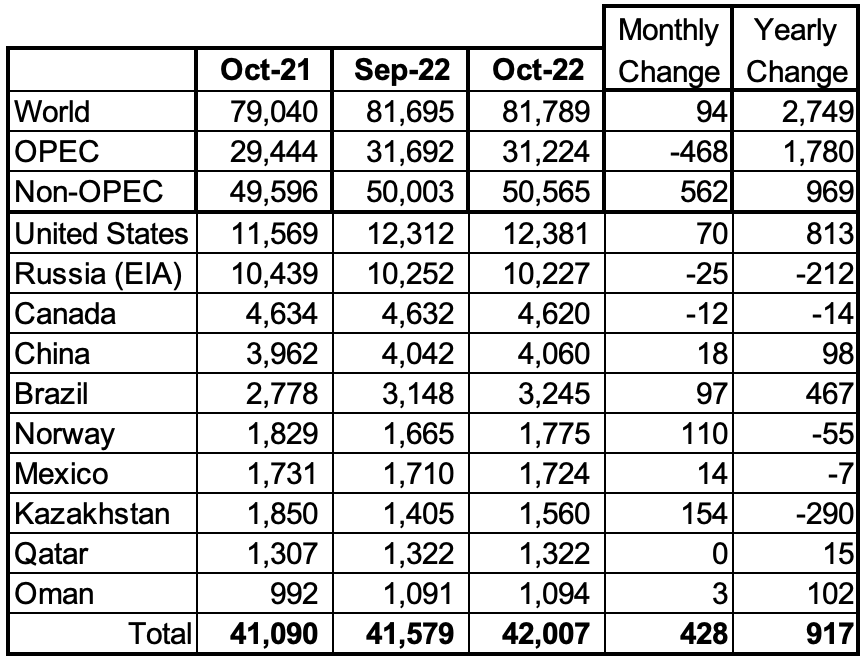

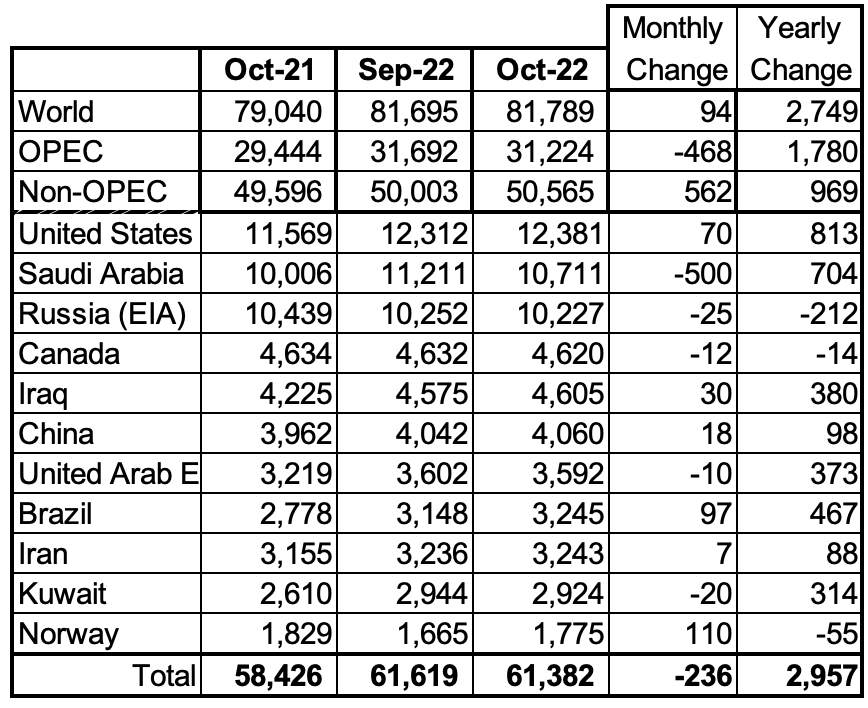

Listed above are the World’s 10th largest Non-OPEC producers. The criteria for inclusion in the table is that all of the countries produced more than 1,000 kb/d. Only Russia and Canada experienced a small MoM production drop in October. The overall October production increase for these ten Non-OPEC countries was 428 kb/d while as a whole the Non-OPEC countries increased output by 562 kb/d. OPEC C + C dropped by 468 kb/d in October but YoY increased by 1,780 kb/d.

In October 2022, these 10 countries produced 83.1% of the Non-OPEC oil. On a YoY basis, Non-OPEC production increased by 969 kb/d. World YoY October output increased by 2,749 kb/d.

Non-OPEC Production Charts

The EIA reported Brazil’s October production increased by 97 kb/d to 3,245 kb/d. October’s production was a new record high for Brazil which was not sustained in November and December.

Brazil’s National Petroleum Association (BNPA) reported that November’s output dropped by 150 kb/d to 3,095 kb/d and December had a further drop to 3,074 kb/d.

According to OPEC, the November output reduction was mainly due to some issues at the Tupi field installations.

Much of Brazil’s production growth will be from the sub-salt frontier, where highly productive reservoirs containing light and low sulphur oil have been explored.”

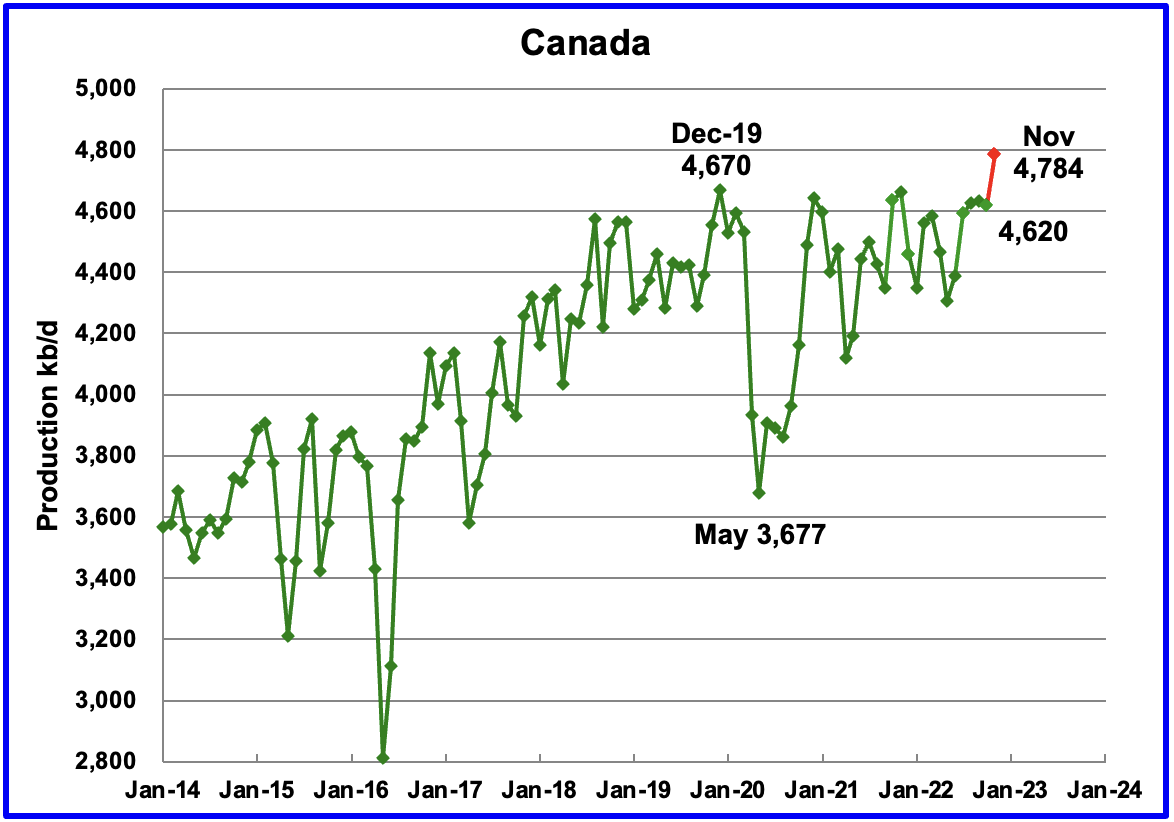

According to the EIA, Canada’s October output decreased by 12 kb/d to 4,620 kb/d.

The Canada Energy Regulator (CER) reported October output of 4,944 kb/d, 324 kb/d higher than the EIA due to a difference in the definition of condensate. Preliminary CER estimates indicate that Canadian production could rise by 160 kb/d in November to 4,784 kb/d after accounting for the typical 320 kb/d higher production reporting by the CER. If this November estimate is correct, Canadian oil production would exceed its previous December 2019 high of 4,670 kb/d.

According to OPEC, the November increase was largely due to the Hibernia field coming back online after October maintenance and gains were seen in upgraded crude. It represents the highest Canadian production on record.

According to this source, Total oil production in Alberta climbed to 3.96 million barrels per day (bpd) in November, a new peak and 2.2% higher than the previous monthly high set in September 2022.

Rail shipments to the US in November dropped by 18 kb/d to 122 kb/d.

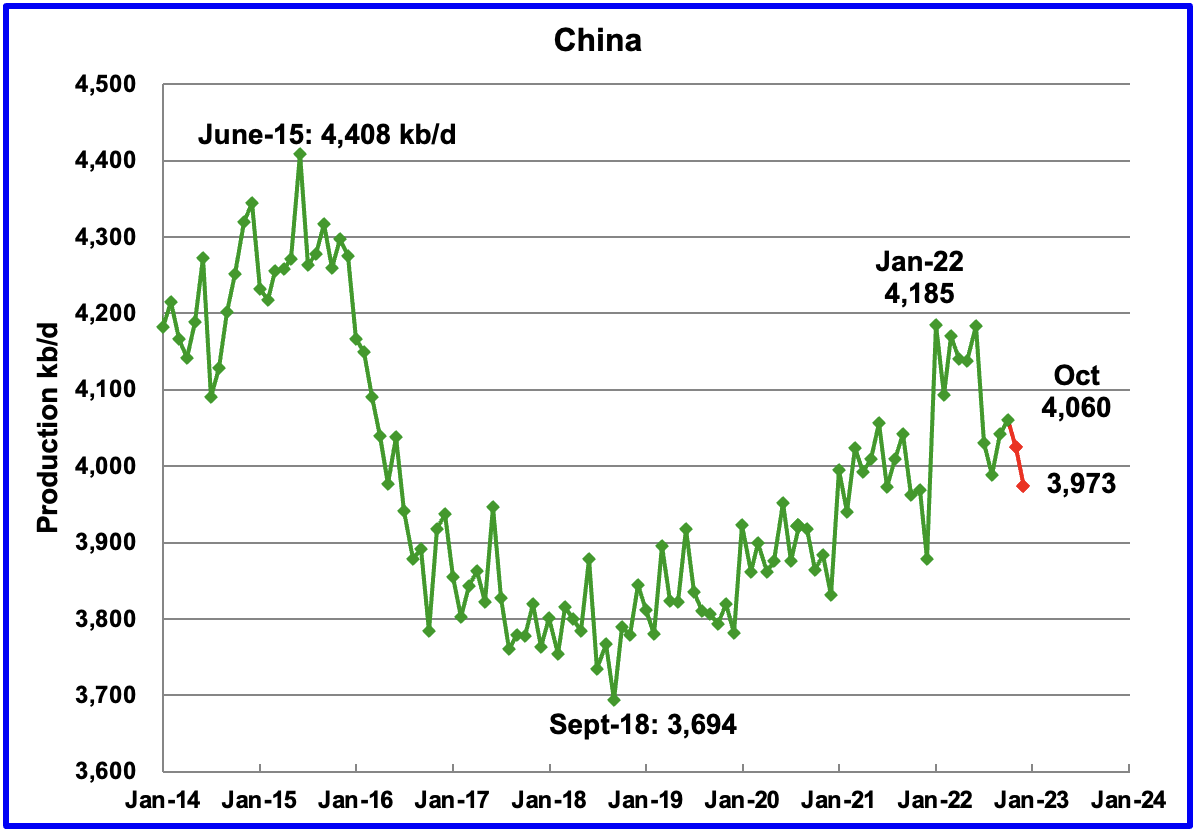

The EIA reported China’s output increased by 18 kb/d to 4,060 kb/d in October.

The official China bureau reported that China’s output decreased to 4,024 kb/d in November and decreased further to 3,973 kb/d in December, red markers.

Note that December’s output is down by 212 kb/d relative to the January 2022 high of 4,185 kb/d. China may be close to its current maximum production level of approximately 4,000 kb/d to 4,200 kb/d. To offset declines, the national oil company is investing in conventional wells, deep water wells and is also drilling for shale oil.

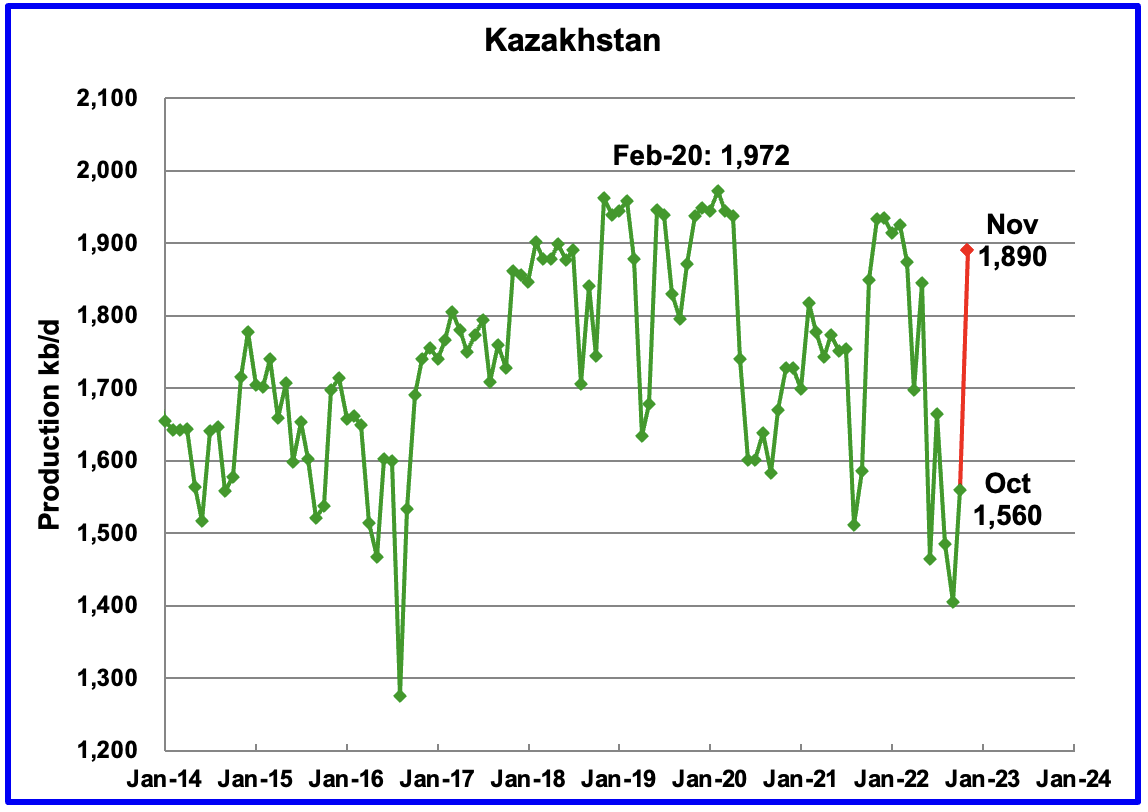

Kazakhstan’s output increased by 154 kb/d in October to 1,560 kb/d.

According to this source production was expected to recover in November. Production was restored in late October after the gas leak was repaired and reached 1,890 kb/d in early November, an increase of 485 kb/d over the September low of 1,405 kb/d.

Mexico’s production as reported by the EIA for October was 1,724 kb/d an increase of 14 kb/d over September.

The November and December estimates, red markers, were obtained by using the Pemex increments over October production and adding those to the EIA’s October output because Pemex reports higher production than the EIA.

According to OPEC, the total crude production decline in Pemex’s mature fields is projected to outweigh production ramp-ups, mainly from Mexico’s foreign-operated fields.

The EIA reported that Norway’s October production increased by 110 kb/d to 1,775 kb/d. This is 11 kb/d higher than reported by the Norway Petroleum Directorate.

The Norway Petroleum Directorate (NPD) reported that production in November was down by 16 kb/d to 1,759 kb/d and then added 33 kb/d to 1,792 kb/d in December. (Red markers). The December increase was due to the startup of Johan Sverdrup 2.

According to the NPD: “Oil production in November was 8.7 percent lower than the NPD’s forecast and 5.7 percent lower than the forecast so far this year.” For December they wrote, “Oil production in December was 9.7 percent lower than the NPD’s forecast and 6.1 percent lower than the forecast so far this year.”

According to Equinor, the start-up of giant Johan Sverdrup’s Phase 2 took place on December 15. At plateau the field will produce 720,000 barrels of oil/day.

The two phases now account for around one-third of the country’s oil production and add a heavier, sour crude to the North Sea’s predominantly light sweet flows. It is expected that the field’s total export will be stepped up gradually as further commissioning and testing of systems are ongoing. In addition, the Njord field is back online after a multi-year modification process and has been upgraded for future tie-back developments by the Fenja and Bauge fields.

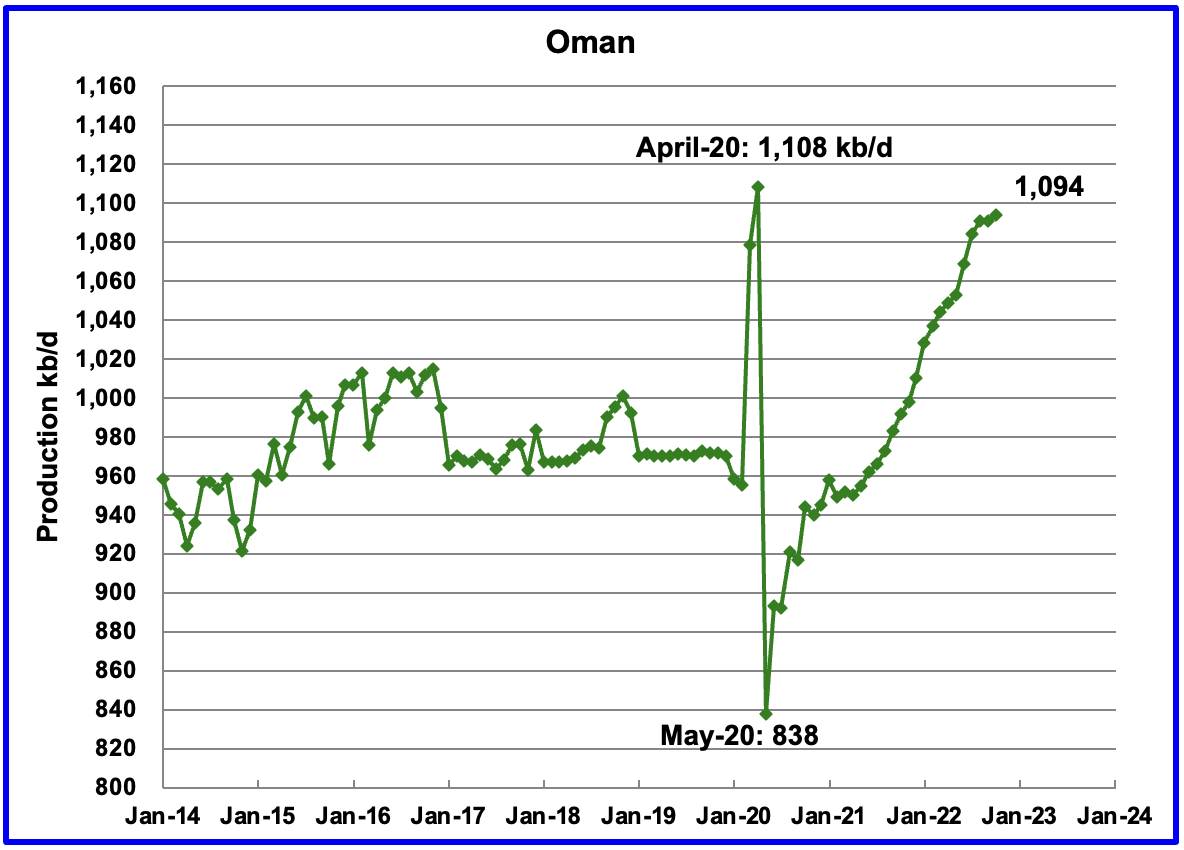

Oman’s production has risen very consistently since the low of May 2020. Oman’s October production increased by 3 kb/d to 1,094 kb/d. It is 14 kb/d short of its pre-pandemic high.

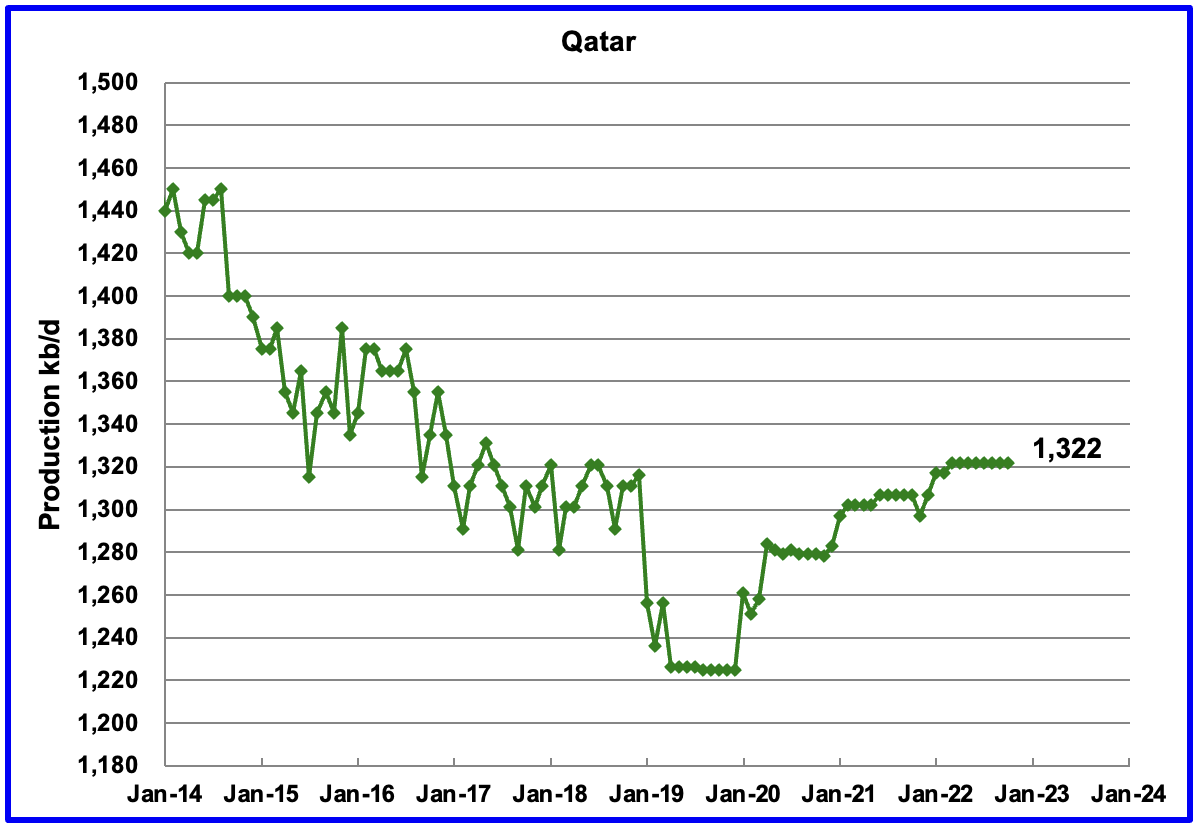

October’s output was unchanged at 1,322 kb/d.

The EIA reported that Russian output decreased by 25 kb/d in October to 10,227 kb/d.

Russia’s Ministry data for November production of 10,900 kb/d was taken from this source. In light of all of the sanctions, it is surprising to see such robust production.

December production is shown unchanged based on this statement: Russia will keep oil production in December at the November level amid the EU’s embargo and the price cap, Deputy Prime Minister Alexander Novak told reporters.

The EIA production numbers for November and December are derived from the Russia Ministry data by subtracting 404 kb/d. In the past, when production data was obtained directly from the Russian Energy Ministry, it was found that the EIA arbitrarily subtracted 404 kb/d from the Ministry data.

Production at Russia’s Sakhalin-1 is near capacity after Exxon’s exit. According to this source: Oil output from Russia’s Sakhalin-1 project has recovered to 140,000-150,000 barrels per day (bpd), about 65% of the capacity.

On February 10, 2023, Russia announced it will cut oil output by 500,000 bpd in March.

Russia will cut oil production by 500,000 barrels per day, or around 5% of output , in March, Deputy Prime Minister Alexander Novak said on Friday, after the West imposed price caps on Russian oil and oil products.

The price of Brent crude rose on the news of the output cut from Russia, the world’s second-largest oil exporter after Saudi Arabia, increasing by more than 2.5% on the day to $86.6 per barrel.

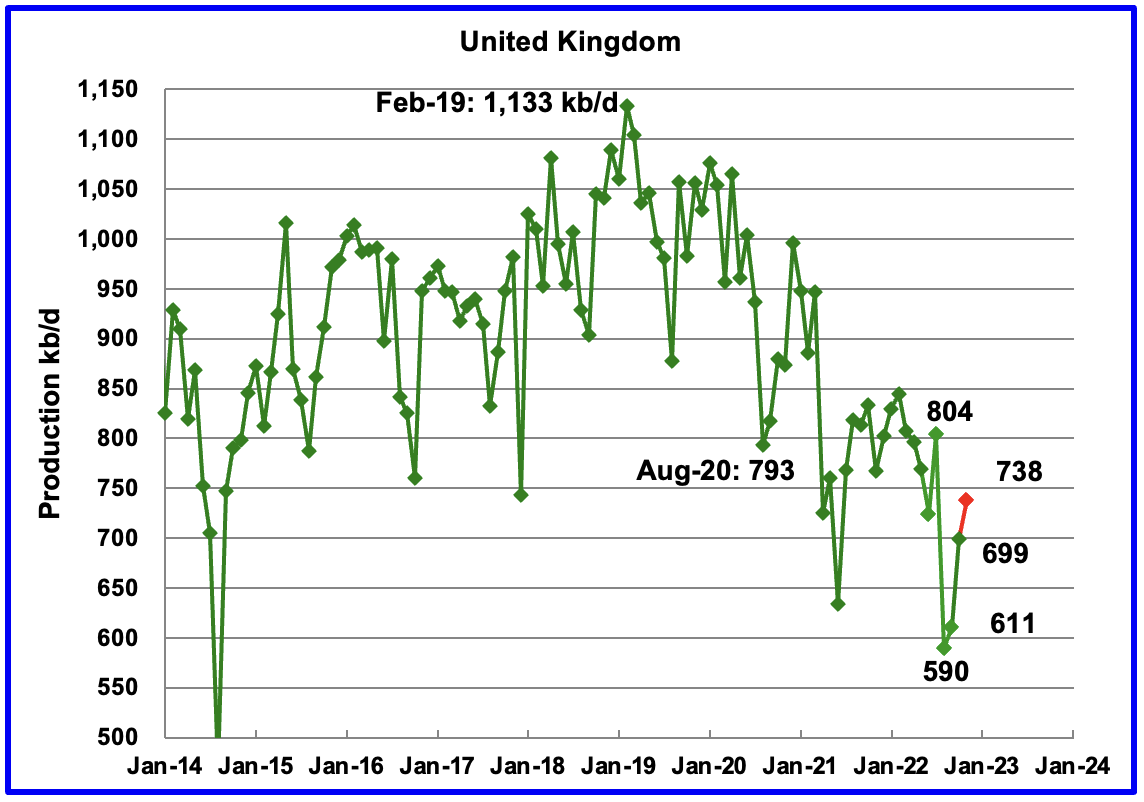

The EIA reported UK’s production increased by 88 kb/d in September to 699 kb/d. According to OPEC, “UK liquids output in November was down by 3% from the same month a year earlier, mainly due to extended maintenance and natural declines.”

According to this source, North Sea Transition Authority (NSTA), October’s production was 718 kb/d. According to this source October output was 682 kb/d. The average for these two estimates is 700 kb/d, which is very close to the EIA estimate.

Using these same two sources for November production and averaging the estimates suggests expected November production should be close to 738 kb/d, red marker.

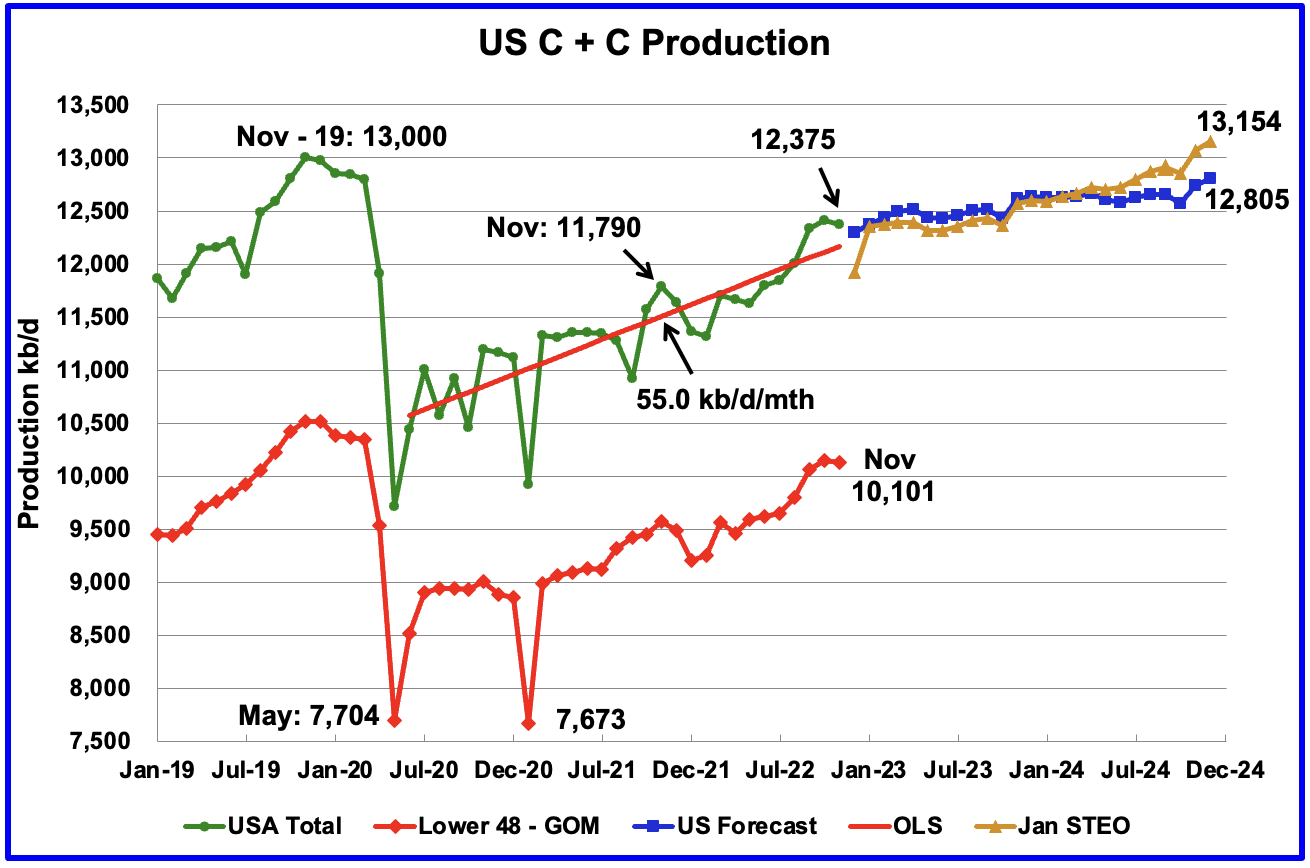

U.S. November production decreased by 35 kb/d to 12,375 kb/d. For November, the state with the largest increase was Oklahoma with 19 kb/d while North Dakota had the largest decrease, 23 kb/d. The GOM also experienced a production drop.

While overall US oil production decreased by 35 kb/d, the Onshore L48 had a larger drop of 50 kb/d to 10,101 kb/d. This means that the source for the largest US production decrease came from the Onshore L48.

The Blue graph, taken from the February 2023 STEO, is the production forecast for the U.S. from December 2022 to December 2024. For comparison, the Orange graph from the January STEO has been added to show how the latest forecast has dropped the December 2024 projected output from 13,154 kb/d to 12,805 kb/d, a drop of 349 kb/d and back below the November 2019 peak of 13,000 kb/d. Also note the change in the projected December 2022 output.

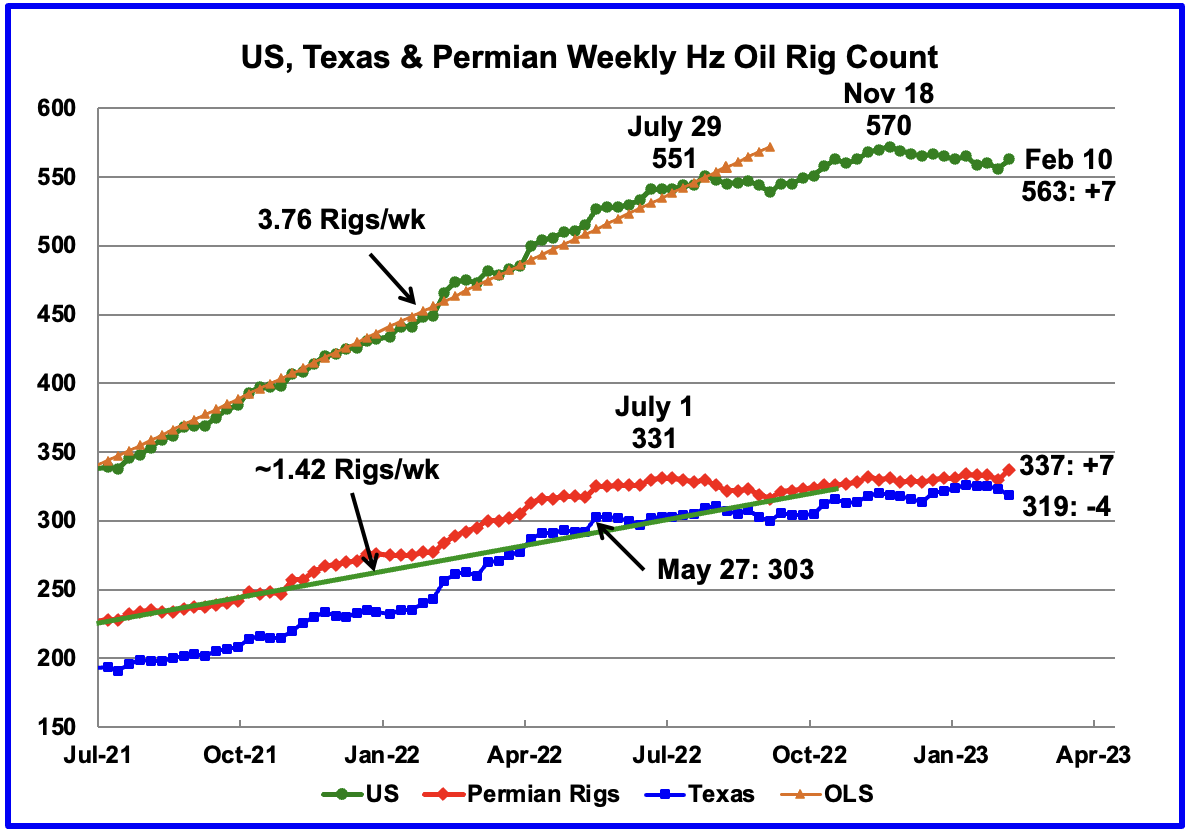

Since the beginning of April 2021 through to the week ending July 29, 2022, the US added horizontal oil rigs at a rate of close to 3.82 rigs/wk, orange OLS line, and peaked at 551 rigs in the week ending July 29. However since then the number of operational rigs has wondered sideways.

In the week ending February 10, the number of rigs increased by 7 to 563, 7 fewer than the post pandemic high of 570 on November 18, 2022.

In the week ending February 3, Permian rigs rose by 7 to 337 and Texas rigs dropped by 4 to 319. Note that Permian rigs are are at a new post pandemic high of 337 rigs.

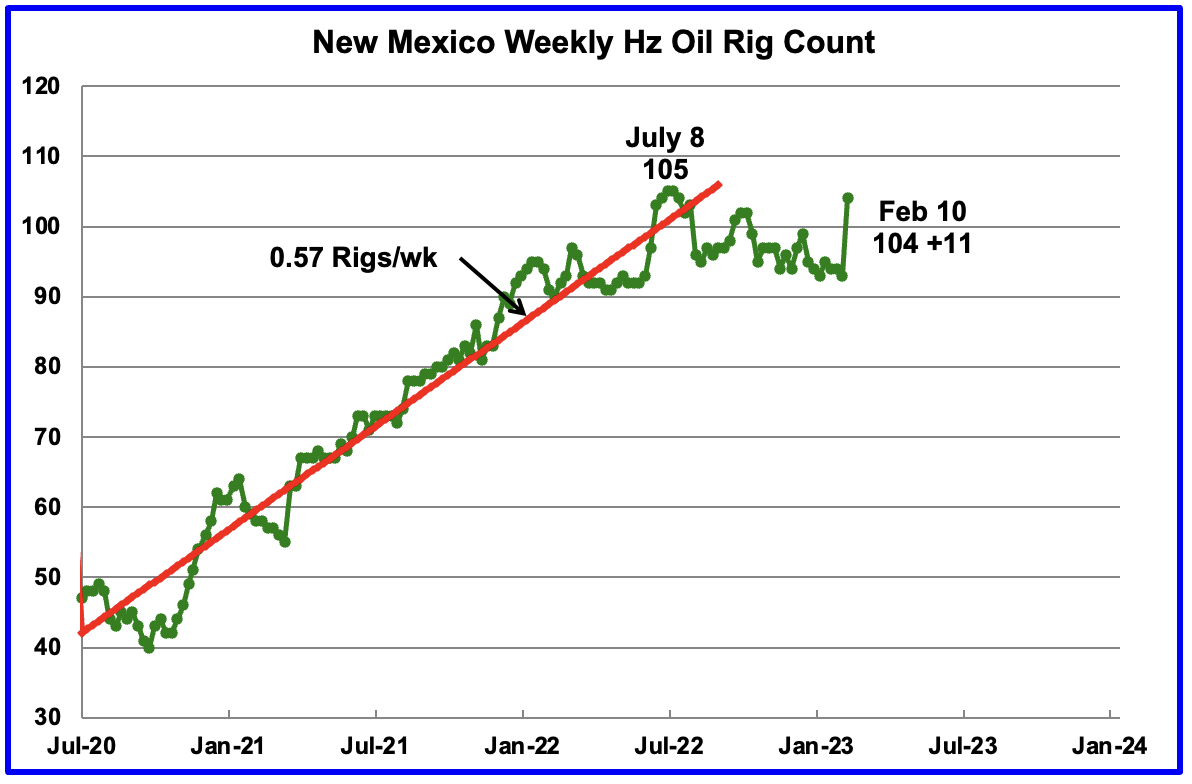

It appears that there was a movement of rigs from Texas to New Mexico in the Permian since the rig count in New Mexico jumped by 11 while Texas dropped by 4.

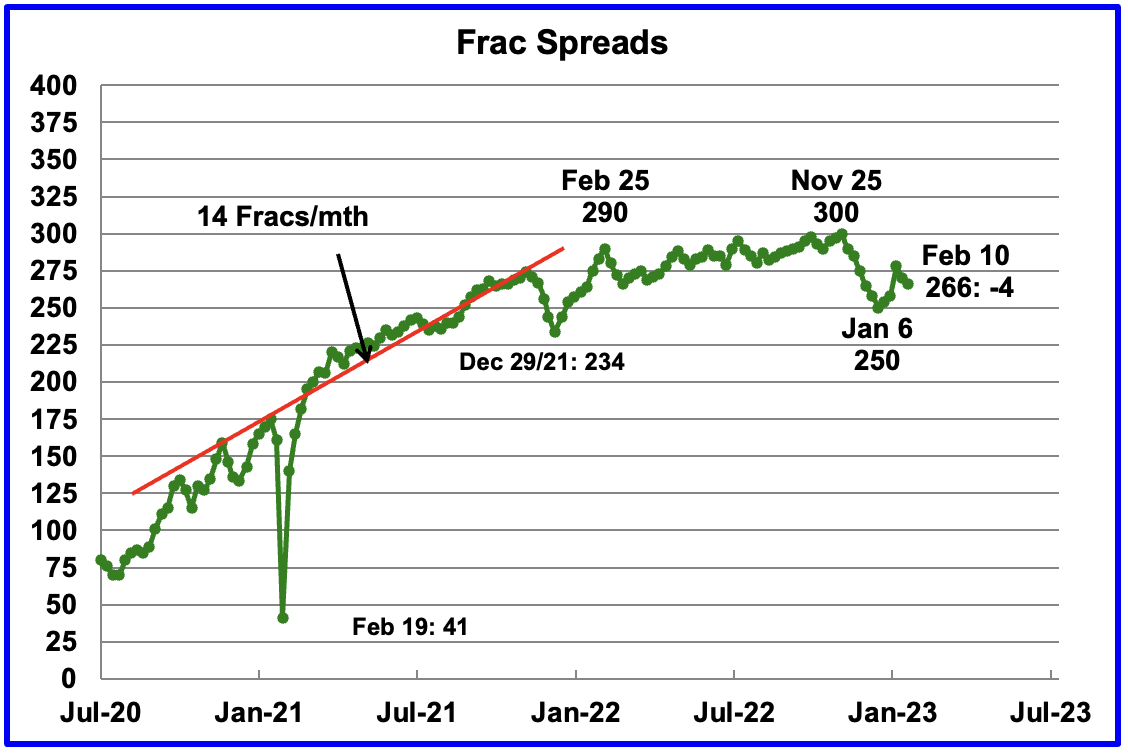

For frac spreads, the general trend since late February 2022 can best be described as essentially flat around the 290 level but with a hint of a slow increase toward 300 frac spreads. At the beginning of the 2022 Thanksgiving and Christmas holidays, the frac count began to drop. The frac count bottomed in the week ending January 6 at 250 and then began to recover. A similar trend occurred last year.

For the week ending February 10, the Frac count decreased by 4 to 266. It seems that the increase of 20 for the week ending January 27 may have been a counting error.

Note that these 266 frac spreads include both gas and oil spreads.

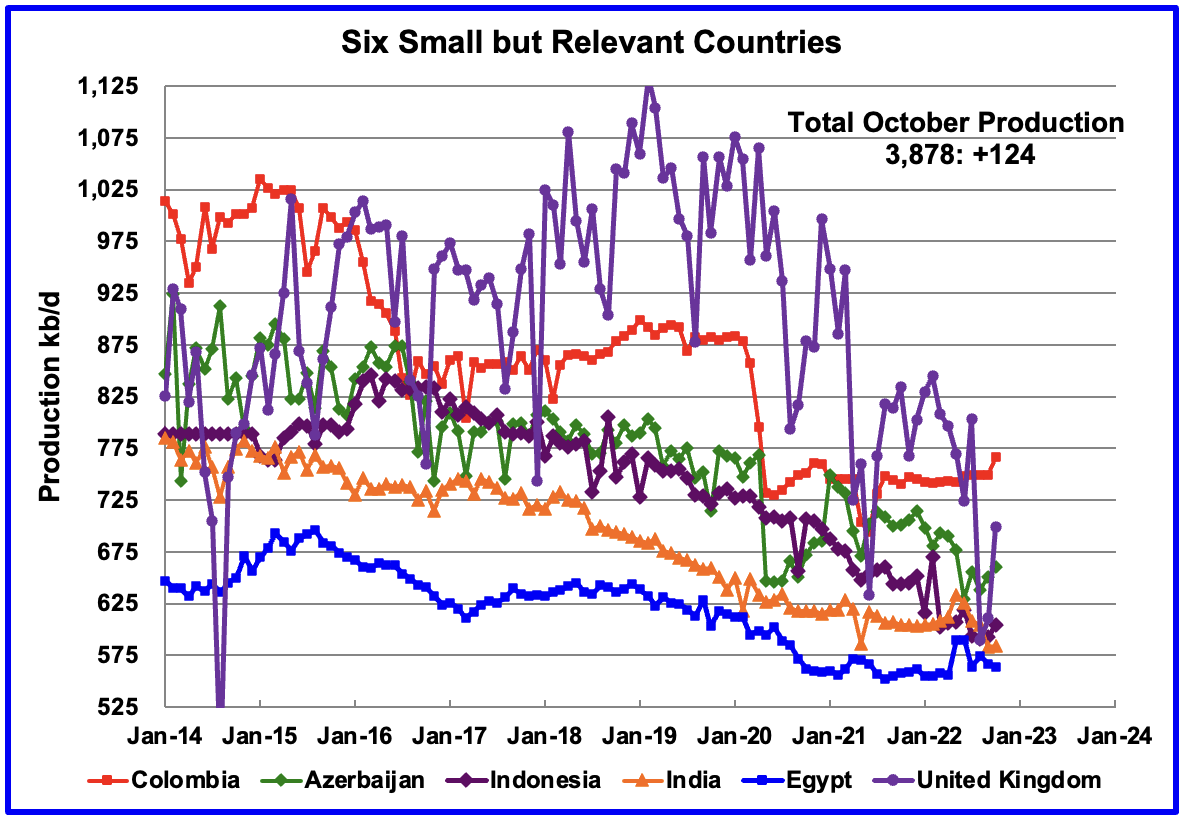

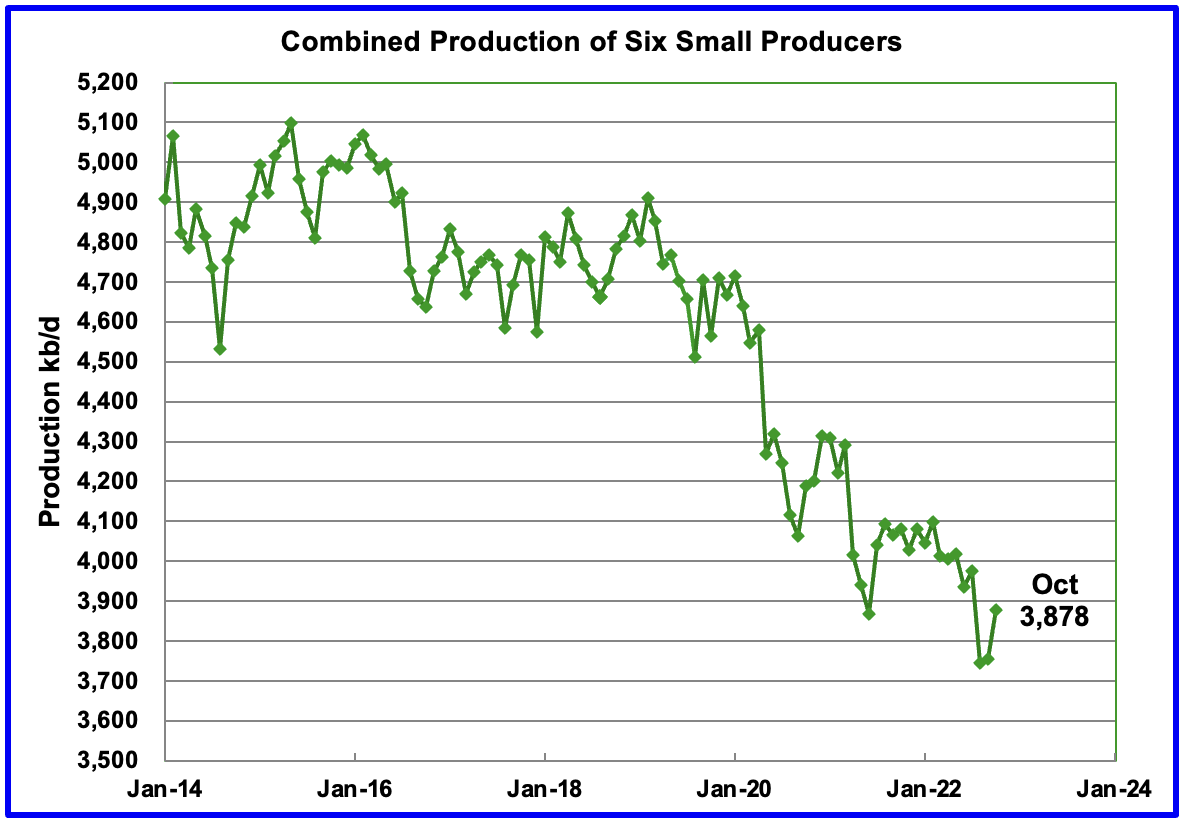

These six countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Note that the UK has been added to this list since its production has been below 1,000 kb/d since 2020.

Their combined October production was 3,878 kb/d, up 124 kb/d from September’s 3,754 kb/d. The UK contributed 88 kb/d of that increase.

The overall output from the above six countries has been in a slow steady decline since 2014 and appears to have accelerated after 2019.

World Oil Production Ranked by Country

Above are listed the World’s 11th largest oil producers.

In October 2022, these 11 countries produced 75.0% of the world’s oil. On a YoY basis, production from these 11 countries increased by 2,749 kb/d.

The largest increase came from the Norway, 110 kb/d. Saudi Arabia had the largest production drop, 500 kb/d.

World Oil Production Projection

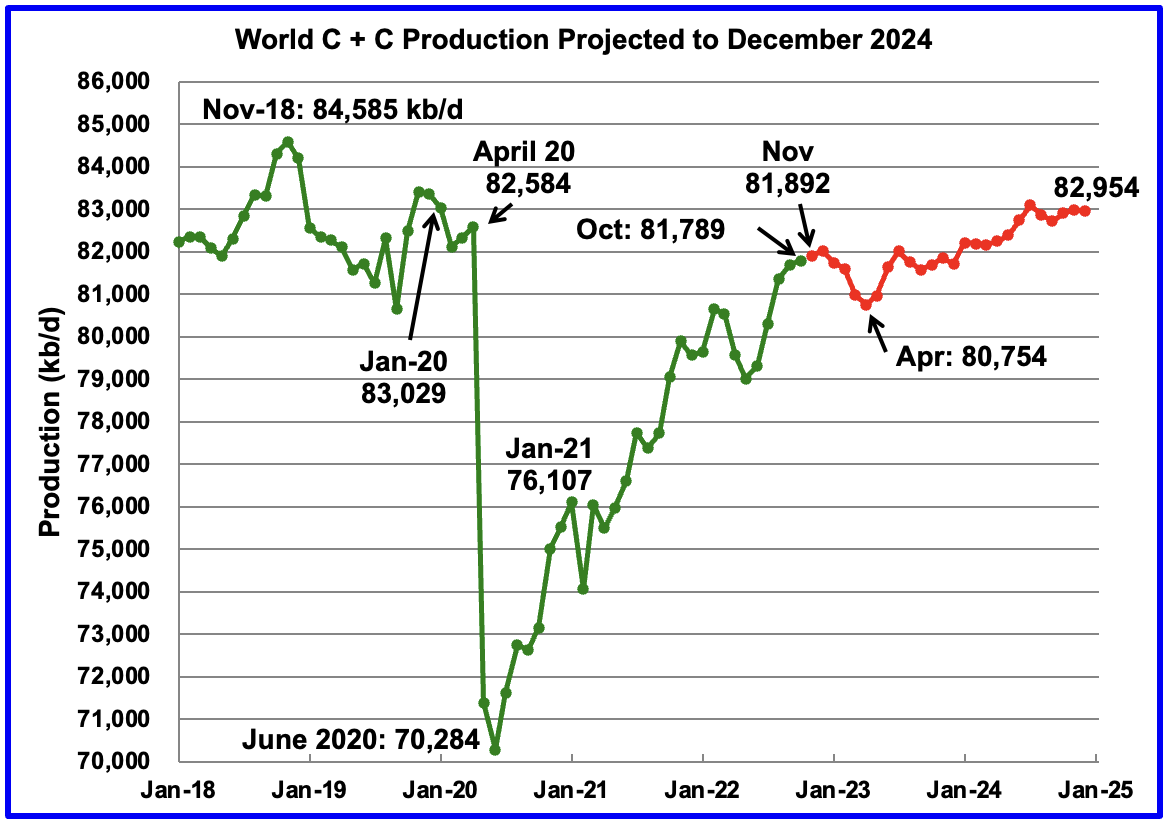

World oil production in October increased by 94 kb/d to 81,789 kb/d according to the EIA (Green graph). November is expected to add 103 kb/d to 81,892 kb/d.

This chart also projects World C + C production out to December 2024. It uses the February 2023 STEO report along with the International Energy Statistics to make the projection. (Red markers).

It projects that World crude production in December 2024 will be 82,954 kb/d, 266kb/d lower than the 83,220 kb/d in the previous post. Note that this post pandemic high of 82,954 kb/d is 1,631 kb/d lower than November 2018 peak of 84,585 kb/d.

The drop from November 2022 to April 2023 is primarily due to a projected drop in Russian oil output.

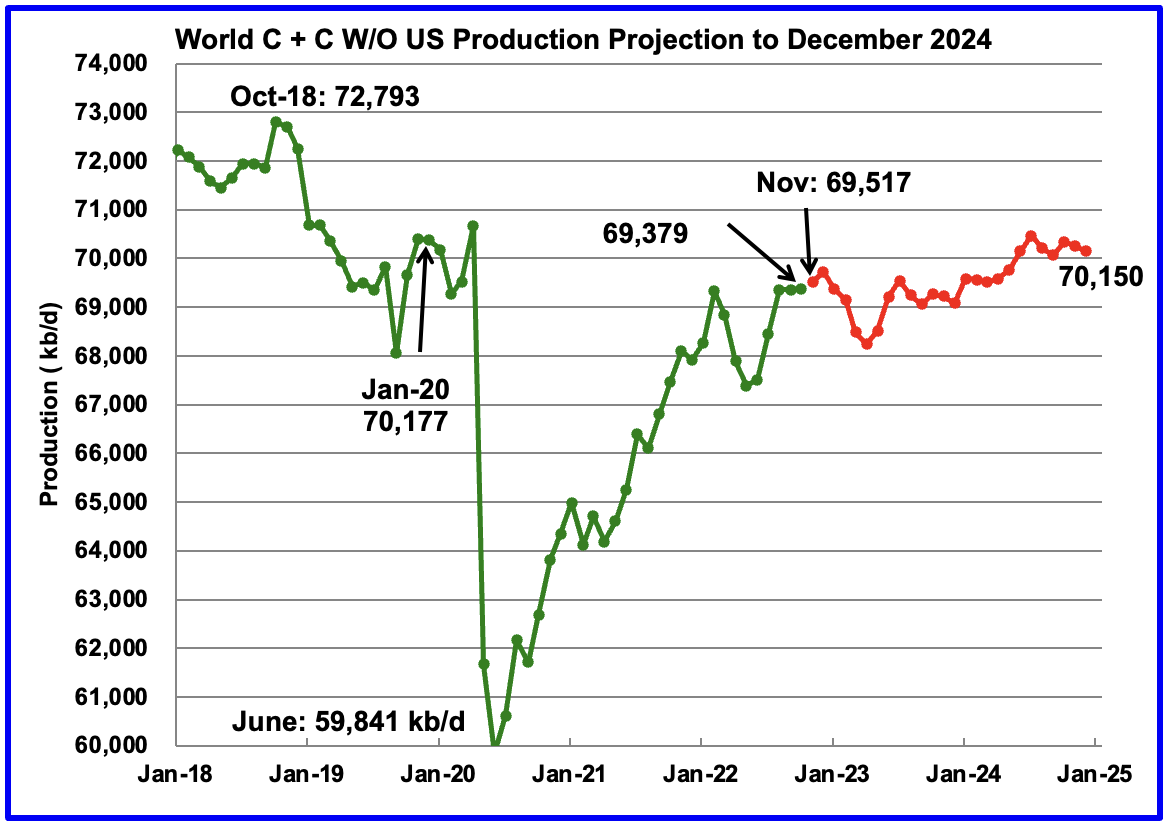

The increase from December 2022 to December 2024 is 930 kb/d. Of the 930 kb/d, 411 kb/d comes from World W/O U.S. production. See next chart.

World oil production W/O the U.S from December 2022 to December 2024 increases by a total of 421 kb/d, or at an average rate of 211.5 kb/d/yr.

Opec+ production slips, driven by Saudi drop

Opec+ production fell in January, pulled down by lower Mideast Gulf supplies and a slight decline in Russian output.

Production slipped by 250,000 b/d to 38.06mn b/d, more than 2mn b/d below the group’s combined quota (see table). This was the biggest mismatch between actual and targeted production since October, when the group’s collective target was much higher.

Production by non-Opec members fell by 110,000 b/d thanks to lower supplies from Bahrain, Malaysia and Russia. Opec members’ production was 140,000 b/d lower as Saudi output fell by 220,000 b/d, under pressure from a steep drop in exports and a maintenance-driven decline in refinery throughputs. Iraqi production edged down after bad weather disrupted Basrah loadings and outages curbed runs at a number of refineries in the country.

These falls were partly offset by a rebound in Nigerian output, which increased for a fourth consecutive month to 1.38mn b/d. But a recovery in Bonny Light output looks to have stalled, possibly because of the shutdown of one of the grade’s supply pipelines. Nigeria was still producing 360,000 b/d below quota in January despite the monthly increase, while Angola fell 310,000 b/d short. Saudi production was 230,000 b/d under target.

There is a lot more to this article, including a table showing the production of every OPEC nation as well as every OPEC+ nation. A comparison is made with December production as compared to January production.

Ron

There appears to be a difference of opinion between Argus and Platts.

The OPEC+ coalition increased its crude oil production by 40,000 b/d in January, the latest Platts survey by S&P Global Commodity Insights found, as Russian production remained relatively resilient to the impact of sanctions.

Russia’s volumes fell just 10,000 b/d in the month to average 9.85 million b/d, according to the survey, despite an EU embargo on imports of Russian crude and an accompanying G7 price cap that went into force Dec. 5.

Elsewhere, Nigeria and Congo-Brazzaville showed healthy recoveries, offsetting declines in Saudi Arabia and neighboring Bahrain.

OPEC’s 13 members pumped 29.09 million b/d in January, up 110,000 b/d from December, the survey found, while the bloc’s nine allies led by Russia produced 13.66 million b/d, down 70,000 b/d.

I have attached the production file because Platts on occasion does not permit it.

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/020923-opec-january-crude-oil-output-grows-with-russia-still-resilient-to-sanctions-platts-survey

Yeah, I saw Platts’s survey and was aware of the discrepancy. Obviously, one of them is wrong. Here is the big difference. From Argus:

Opec members’ production was 140,000 b/d lower as Saudi output fell by 220,000 b/d, under pressure from a steep drop in exports and a maintenance-driven decline in refinery throughputs.

Platts has Saudi Arabia down only 60 Kbp/d.

Your chart is November to December, Not December to January. Here is the Platts Data. OPEC+ January crude oil output grows, with Russia still resilient to sanctions: Platts survey

Either way, we will know when the OPEC MOMR comes out Tuesday.

Thank you OVI for the work. After reading it, I went through the comments. Interesting to say the least. This year will show a much clearer tendency.

No comment is the best comment .

https://mishtalk.com/economics/without-subsidies-how-many-people-will-buy-an-ev

This diagram displays the number of BEV sales for USA, China, EU and Germany. For the EU and USA the data are for quarters and divided by three to get monthly values.

And the end of each year, the sales numbers jump, and fall in january.

And a remark: In Germany, the subsidies are introduced, to reduce the CO2 emissions. In 2022, coal power plants have been reactivated, and the CO2 emissions have increased. Despite about subsidies in the order of 5 billion euros for car buyers in 2022, the CO2 emissions have been larger than in 2021. No effect by all the subsidies concerning CO2 !

In China, more than 50 percent of electricity are generated using coal, increasing in 2022. No effect by all the subsidies concerning CO2 !

I have two close friends that just purchased PHEV,s ONLY because of the subsidies. They would not have considered the purchases otherwise.

Non-OPEC’s Oil Production Rise Continues in October . Yeps . 2 mbpd below it’s peak in 2019 . If you are in a hole 50 ft down and clawback 25 ft , you are still in the hole . 🙂

Thanks for the work Ovi, always appreciated.

Schinzy

Thanks. Much appreciated.

Interesting .

HIH

In the US update last week, the attached chart was posted. The November and December rates are very similar to the numbers for peak rate in your chart.

“Natural gas gross withdrawals from horizontal wells in the United States…accounted for 78% of all U.S. natural gas production.”

In 2021 64% of US oil production was from shale wells, 15% from the GOM and 4% from Alaska, per EIA.

Shallow,

with respect to your question on the last post, most mlps, incurred massive capex as they were installing the infrastructure to build out the markets and deliver supplies. We will never know what they (stock price) would have done had the covid shut down not occurred, but I saw that as an opportunity to build positions in several companies including PAA, EPD, and ET. This is not a promotion but the theory for me is nat gas will be the bridge fuel to nuclear, largely because it has to be. It’s cheap, it’s abundant, it’s relatively dispersed and it’s geographically available. Because it’s a vastly abundant commodity and subject to huge price swings, I hope to capture the growth in the industry while limiting my risk exposure. Much like buffett I tend to make investments with long holding periods. To LTO’s point, I have know idea who will be right, LTO or PAA’s management, but with the majors picking up steam and with the wide level of contacts they should have their finger on the pulse of what is going on. Also, in the article I posted, it noted DVN is building a new pipeline from WAHA to the gulf coast. I also own DVN. There is a whole different discussion about this that we should have at another time. One of the clues on how the whole horizontal play was going to fully play out was watching the capex of the midstream guys, where and why are they putting resources in the ground. I pointed this out a number of times on this blog at the time.

Despite some folks views of executive management in general and oil and gas specifically, my experience is that they are generally pretty sharp, they are problem solvers, not all will win, it does not work that way, but one should at least pay attention to what they are saying. Those companies that are now past covid with much stronger financials are in a good position going forward in my opinion. my regards

I bought HEP back in 2011. Sold it in 2019. Didn’t do well and K-1’s were a pain. Also owned CLMT and LGCY (which eventually went BK).

Lost money on all 3 MLP’s that I owned so I swore them off.

I bought one short after the corona crash, but already sold it because it had a big run and my depot bank was revolting because they couldn’t do K1’s. I donated the tax just to the US government (payed double).

But it was a 400% run in one year, they have been in fire sale in May 2020.

It sucked buying them before 2020 – I think they will be in permanent decline since the oil and gas boom is temporary.

With 5-7% dividend they need at least 20 years to pay out investment (I bought mine at 25% dividend) before a gain – and I don’t give the oil and gas boom much longer even when the stuff is needed (political reasons).

So the current price of them doesn’t leave space for much improvement, beside the normal up and down of the stock exchange.

I am going to take the other side of that bet. Good trade however on your part. Like you, I bought my initial positions during the spring and summer of 2020. They were being dumped, despite some them cutting their distributions to repair their balance sheets, EPD being an exception, they continue to increase their distributions and buy back units. My cost basis has been cut in half from my original purchases, the increase in the distributions give me a mid teens payout, on top of the near double of unit price. So getting 15% annual return in the distribution that is rolled back in on a quarterly or semi annual basis gets me the compounding effect while generating cash flows that will be take free until my units are fully paid for. Depending on what you believe inflation is that is equal to or better. Now if you truly think the companies have a short life cycle yea, no since holding them. But that conclusion is not backed up by the continued expansion of their lines or the number of long term purchase agreements that are being made. I don’t have the numbers on my fingertips, but the increase in demand of LNG as well as the infrastructure to both ship and receive is off the charts worldwide. Of course again, you might be right, these folks probably don’t have a clue as to what they are doing. Same with coal miners, unless governments worldwide outlaws the use of fossils fuels, the low cost provider will win out in the long term🖖

https://www.infrastructureinvestor.com/europes-energy-crisis-turns-lng-into-a-hot-opportunity/

It’s impossible for natural gas to be become the bridge between oil and nuclear power. Indeed, the world natural gas production will peak around 2030 according to an analysis of gas reserves and production data from rystad data base (think tank ” the shift project”). Instead of dreaming of extracting natural gas, it would be more useful to begin building facilities to produce with bioreactors microalgal biomass for methanisation. The technologies to mass produce microalgal biomass are available and are already used for the production of chemicals coming from the microalgae.

It’s impossible for natural gas to be become the bridge between oil and nuclear power. Indeed, the world natural gas production will peak around 2030 according to an analysis of gas reserves and production data from rystad data base (think tank ” the shift project”). Instead of dreaming of extracting natural gas, it would be more usefull to begin building facilities to produce with bioreactors microalgal biomass for methanisation. The technologies to mass produce microalgal biomass are available (yes, royalties must be paid for scientific institutes holding the patents) and are already used for the production of chemicals coming from the microalgae.

JFF , right and wrong .

1 . Natural gas as a bridge . Yes you are right . It is imposible .

2 . Microalgae or whatsoever . You are wrong .

What you are suggesting is rearranging the chairs on the deck of The Titanic . We all know how that ended .

“US Shale to Set New Output Record in March. According to the EIA’s latest Drilling Productivity Report, crude output from the US’ seven biggest shale basins will rise to a record 9.36 million b/d in March on higher Permian production, up 75,000 b/d from this month, setting a new all-time high. ”

https://oilprice.com/Energy/Oil-Prices/US-Shale-To-Set-Production-Record-In-March.html

I am not taking a position on this just posting the estimates, that is one estimate from government and one from industry saying the Permian production is going up this year. to be determined on how much

Eagle Ford Resource Cost Curve. Just love it when people go all the way down the rabbit hole.

Article from here: https://www.eia.gov/petroleum/weekly/archive/2022/220803/includes/analysis_print.php

Deceptive. Sloppy writing is, I believe, what you said about mine.

“Down the rabbit hole” is an insult to people and implies they can’t think for themselves. People that are worried about their oil future are NOT stupid, or un-American. For instance people DO know the Permian is actually two, distinctly different sub basins. They are also beginning to see a big problem down the road, in spite of the lying. Scary, ain’t it?

Past performance is never indicative of future results.

Profitability is a qualitative term; I never heard, “internal rates of return” in the 60 years I’ve been a WI owner until the tight oil phenomena came along. Its corporate doo-doo. It matters only how long it takes to get your money back, and what the ROI is over how many years. ROI is what keeps the tight oil business’ credit cards in their purse, not 10% IRR with selective costs ignored. Who picked 10% IRR as a benchmark? Rystad? Phfttttt.

Stick a fork in the Eagle Ford, its done. The recent uptick in rig counts WAS gas price related. They’re also drilling a few deeper laterals below the upper EF to AC facices change in Karnes, in a deep, thick section of shale. Good wells. The hole is small, limited. Won’t last long, IMO.

Folks genuinely interested in their oil future need to realize that data is now days easily manipulated. Second, know your source. Lobbyists are paid to lie. Politicians lie to say what people want to hear, for votes. Thirdly, royalty owners getting free income in America’s shale basins are ALWAYS going to have a whole different idealism and data set than anyone else…don’t mess with them. They’ll cut your liver out before they’d admit things were changing. Free royalty owners need your support, and your money.

With regards to pipelines, they are like toll roads, with one exception: at some point the commerce that pays the toll dries up. Right now there is amazing need for just about every pipeline that will carry NG in Texas. This is made more attractive by the fact that the Permian is becoming gassier by the day as the GOR of oil wells increases. But one has to interpret that in the proper perspective too. An increasing GOR is an end-of-life marker. Next will come an increasing WOR when the salts migrate in, pulling in water, and that’s it. Not to pour water on your investment idea but the important part is going to not be when to get in, but when to get out, because at some point these will be pipelines with no transportation commerce.

No disagreement Gerry. While I have noted the concern on this blog relating to the rising GOR in the Permian I think many “may” be missing the bigger picture. In other words, I do not believe DVN is building their new pipe line to capture that gas. They have bigger fish in mind.

I have not worked professionally the Permian but I think I have figured out what is going on. Watching how this is playing out, there are numerous long term 20 years nat gas contracts being signed by energy hungry countries out into the future. The US midstream is getting their share. Let’s say you have some huge gas reserves, currently you do not want to develop them as it does not make sense economically. What do you do? Do you build your own pipeline, eliminate the middle man and get the volume and pricing in place before you kick off development? just an Idea. Something to watch.

I know of several very large landowners (minerals owners) whose land sits atop mostly gas reserves. There is no take way capacity for that gas right now. Interesting enough some of these formations are the same ones being exploited in the Anadarko basin. Again in the Anadarko you have an oil leg, a wet gas leg and a dry gas leg, same in the Eagleford. There is hardly any development in the gas leg of these reservoirs, but they are vast. IN other words there is going to be gas to put in those lines for sometime to come. IMHO.

Good point.

I have some holdings in the dry gas part of the Anadarko Basin (the Hogshooter formation of the Granite Wash) and those pipes are running about half full.

However, there is room for a resurgence in that basin.

There’ll be gas in the Permian pipelines for a very long time, too.

For those dismissive of nuclear i give you:

https://japannews.yomiuri.co.jp/business/companies/20230210-90175/

every journey starts with a first step. many reason for this, you have a bankrupt country that probably does not want to be dependent on their biggest enemy (threat) China (materials)for their energy security.

Japan has to import all their uranium. At what future price? While the stuff coming from Canada and Australia might continue to make it to Japan, maybe. The stuff from Kazakhstan probably won’t make the journey.

Nuclear only has a future if you can source the fuel at a price you can pay. If your currency hyper inflates due to lack of available energy supply. You won’t be importing expensive fuel to keep the lights on.

Oh well, its back to the drawing board for the green energy enthusiast:

“It is this simple truth that drives corporate decisions on spending and production growth or de-growth. It’s the most fundamental rule of economics, and that’s the rule of supply and demand. As Shell’s former chief executive Ben van Beurden once put it, while the world needs oil, we will continue to supply it with oil.

The other pretty simple truth that prompted Big Oil majors to step back from their transition path may well have been the subpar performance of low-carbon energy lately. Cost inflation, component failures, and trade tensions with China, the undisputed leader in the manufacturing segment of the renewable energy industry, have all combined to push returns from these ventures lower.

Government subsidies seem to have not been enough to motivate Big Oil to stick to that path without even looking at alternative routes to its promised net-zero future.”

https://oilprice.com/Energy/Crude-Oil/Big-Oils-Back-In-Fashion.html

All the yield curves. Be it treasury yields, Eurodollars, German bunds, or even the Canadian yield curve are calling for lower yields on bonds.

You can’t square lower bond yields and higher oil and gas prices. In current environment higher energy prices equals higher bond yields.

Bond yields are pricing in recession and lower yields.

The market is betting massively that the central banks don’t have a clue. And are raising interest rates for all the wrong reasons. And disinflation and deflation are more of a concern than inflation will ever be.

From Javier Blas

@JavierBlas

“It increasingly looks like the Biden administration missed the window to buy oil for the SPR. US officials said they wanted to see prices in the $67-$72 range.

WTI is not trading at $72 until January 2025. And the benchmark is not trading below $67 until March 2026 | #OOTT”

Art Berman on spacing .

https://twitter.com/aeberman12/status/1624790180556075010

Spacing on shale wells that he claimed won’t make significant oil in the US? Or maybe Barnett wells with $3000/month OpX? I was at one of his SIPE talks when he claimed that the first horizontal ever drilled was in the early 80’s. Amusingly, the directional drillers I learned from had been doing them since the 60’s. A history major was Art’s first degree, maybe he just couldn’t be bothered to even learn the history of the oilfield prior to saying silly stuff?

Art Berman graph .

Art’s EURs, or did he get them from Enverus? Particularly PRISM. Anyone want to use their license to find out, or do I have to? In the past Art has seemed to lowball EURs when compared to the work of folks who do it for a living. These ones look relatively high, so I’d say there is a reaosnable chance he just used the software to do some time vintaging. It is common with the 2 main information providers. When compared to the folks who have done them for a living and are required to swear to it on the SEC forms and reserve audit reports. They know what they are doing and the numbers usually undercut the more automated nature of the systems used by the subscription services to generate them.

You like to rail on people anonymously, without using your real name, so by my way of thinking it’s hard to give your comments much credibility. I assume you are reservoir engineer, who thinks his shit doesn’t stink, this thing with Berman is part of a century old age rift between engineers and geologists and that years ago Berman made some predictions based on rock that did not come to fruition because of $400B of borrowed capital and fiscal irresponsibility.

I am neither an engineer nor a geologist but have been drilling oil and gas wells, with my own money, likely while you were struggling with History 101. Well productivity in HZ tight oil wells IS going down in the Permian, gassy oil wells are turning into oily gas wells, late life decline rates are accelerating and liquids EUR’s are headed down. Let’s not confuse liquids with BOE at 6:1; THAT trick is really getting old.

In the unlikely event anybody actually believes that reservoir engineers are required to “swear” by reserve audits on SEC forms, and never exaggerate, or never lie, shall we take a little stroll thru recent history? With Shell, or Exxon? How about Degolyer etal’s work in the KSA? The WSJ caught the tight oil industry red handed just a few years ago exaggerating EUR’s, booked PDP, and proximity based PUD reserves. Likvern and others have since proven the WSJ’s allegations.

I know Art, I am sure he’d appreciate you confronting him directly, not from a distance. He uses his own name and is criticized constantly. He’ll be ready. In the meantime I would, personally, love to see something you have published about Permian EUR’s.

By the way, I don’t see US or world reserves growing every year, I see them yo-yoing with a definite trend down, depending, of course, on who’s lying about what.

I stay anonymous because I learned my lesson circa 2005 about faith based believers. When irritated at what you say online, they then show up at the office and need turned away by the armed guards. Let alone the emails to the boss. Oh, maybe not the fine upstanding citizens around here, but when you disturbed their belief system back in 2005, well, things were different then. Like I want the armed, prepper, doomers knowing my name and where I live. There is also what I do for a living, which directly touches on the subject of resources and reserves, domestic and global, both the scientific analysis and practical application sides. And I’m not paid to educate the world through anything other than my work published work on the topic, scientific, practical application, projections, or otherwise.

I don’t “know” Art…but I pay attention to what he says. Any reason why you didn’t once contradict some of the absolutely ridiculous things he has claimed in his defense? Do you believe a petroleum geologist not even knowing that a source rock can be a rock rock and make prolific amounts of oil in the US is a GOOD thing?

If you wish to talk about reserves and their growth down through the ages, or particulars on how those numbers can go sideways, I’d be happy to. But that conversation begins with the obvious of course. Back around the mid 90’s there were XX barrels of oil reserves on the planet. Today, after cumulative production more than those reserves, the current reserve number is higher. Reservegrowthrulz for a reason, and even if it can’t go on forever because that is ridiculous, once you understand a basic fact of the past, and how and why it occurs, then you can begin the conversation on how to predcit it in the future. A necessary part of any peak oil model obviously, and Hubbert knew it in the early 70’s and stopped publication of a paper until he could account for it. His first quantification of it put to practical uses was with the USGS in 1975. I agree with folks who think it is important of course.

You know Art? Cool. Go ask him how he managed to pull the stunts I mentioned, and what has he learned from having been proven wrong. Because while I don’t “know” him, I was there when he said these things (SIPEs talks or AAPG national convention), or they were wonderfully captured on video for future use. Why he couldn’t be even be bothered to pick up the phone, talk to those of us who had been doing shale development since the 80’s, and ask a few questions prior to ponticating, well, only he knows the answer to that one.

So let me get this straight – back in 2005 some peak oil folks showed up at your office and threatened your life and had to be escorted away by armed guards? As someone active in the peak oil community then I feel like this would have been big news. Let me just say I’m struggling with this narrative.

I struggled with the fact of it when the boss came into my office that day and told me what had happened. And why would it be big news? Were you watching the serious peak oilers back in the day, rather than the nutters? They are different groups, live in two different ecosystems, and both are fascinating.

And because of that 18 years ago you’re too chickenshit to use your real name

There are to many guns and poorly educated nut cases with miss placed egos out there. RESERVEGROWTHRULZ is no fool.

An ounce of prevention is worth a pound of cure.

RGR , on your comments regarding Mr Berman and Mr Shellman > “The lady doth protest too much, methinks ” . — Hamlet .

At one time we were advised to be careful about using your actual name on the internet as it may get back to your employer. But over time we realized that If all you do is write about science and scientific ideas on the net, it doesn’t matter because no is actually paying attention, and least of all intellectually curious.

RGR,

some folks may be missing the forest because of the trees. There are more than one type of “analyst.” There are those who want to be right, that is correct/accurate because their reputation and personal and perhaps their professional integrity demands it. They study the data, they draw appropriate conclusions, they adjust as new data comes in, self correct and they admit when they are wrong.

But then there is the other kind, the screamers, the doom and gloomers, the name callers, the chest pounders, that are in it for the attention, the clicks, to sell a news letter, paid propagandist or whatever. Being accurate, being right, being truthful, being humble, plays no part in their analysis or predictions. I would put Art and Mike in the same category as I put Al Gore and John Kerry and our local guy Steve.

They are to the oil and gas profession as Gomer and Goober are to the town of Mayberry.

And there are a number of great Americans who use alias, include Benjamin Franklin and Mark Twain. for a complete list I have attached a link. I am sure none of these folks have any balls either. Weak minds develop weak arguments.

https://en.wikipedia.org/wiki/List_of_pen_names

TT2, or T3, whatever it is at the moment:

For me to feel insulted by your comments, I would first have to respect you. I don’t. You are nothing to me. I suspect you are just a day trader worried about anybody hurting your “investment” portfolio. Clearly you have never owned working interest in a tight oil well; anywhere, ever. You have daddy’s RI in Oklahoma, maybe, but when you say ‘we’ just drilled a well it’s because you own stock in somebody who actually did. You’ve never operated, for sure.

If you are actually a Texan (God, hep us), please move to Huntington Beach, California… you will raise the average IQ in both states when you do.

Mark Twain, dude; you are not.

I simply consider you, and anybody else, a coward for insulting others anonymously. HB has insulted my values, my family name (3 generations in Texas oil!) because he simply does not agree with me. How fucked up is that?

It’s interesting to me that you. including the engineer, are all deathly afraid of repercussions from your insults, but essentially think it’s good to CONTINUE insulting, as long as it is anonymously. Yikes !

RGR, how many people in the front office did you have protecting you while you were telling everybody how stupid they were because they were worried about their oil future? Ten? Good grief. I’ve read your shit on the PO news board. You are flat ass nasty.

Howzabout debating without insults, with real data? Or, if you are actually IN the oil business, with experience, with first hand anecdotal evidence? If you don’t like what people write, write something yourself. You did this and that a long time ago ( I use to speak at SIPES meetings all over Texas, BFD), under a big corporate shelter…whup. Got any WI now? I like to debate people with WI, facing P,A & D costs. Get over what Berman said 10 years ago…are you In?

TT, you know where I am. come see me anytime. I am not afraid. When you insult a man you should do so, honorably, looking him straight in the eye. Californians don’t do that, real Texans do. I am circulating on bottom, waiting.

So is Art (not sure to which Mike you refer…Ruppert?) being like Al Gore and John Kerry a good comparison, or a bad one? Because I’ll bet you and I don’t necessarily agree on their value in the greater scheme of things either. If you mean that Art is the Gomer and Goober in Mayberry, that comparison makes more sense.

And I use an alias because I spent more time with whackadoodle peak oilers in my internet experimentations, and learned early on the disadvantage of being “known” on the internet. I’ve been found out through some detective work of course, made the mistake of mentioning an international presentation of some of my work in England, someone knew where I generally live, went through the speakers, matched the two up, etc etc. That person, while announcing they knew who I was has graciously kept it to themselves unless I say otherwise. Not all peakers are whackadoodles, even the internet based ones.

MS says-“HB has insulted my values, my family name (3 generations in Texas oil!) because he simply does not agree with me. How fucked up is that?”

MS, so if I understand you correctly. If someone doesn’t agree with your values, you are insulted. That is fucked up.

MS says- “For me to feel insulted by your comments, I would first have to respect you.” Thank you for your respect MS.

BTW, those aren’t baby diapers on the sands of Huntington Beach. There oil spill absorbent pads. Anyway, it’s nice to hear Huntington Beach and it’s surfing was your first choice last year for your Christmas vacation.

https://darrp.noaa.gov/oil-spills/public-meeting-and-call-restoration-projects-huntington-beach-pipeline-spill-california#:~:text=October 11, 2022&text=An underwater pipeline running from,miles offshore of Huntington Beach.

It’s nice to see you posting here at POB. I don’t take your comments personal. I just consider the source.

RGR,

So more than enough crude oil can be extracted and burned the next years to speed up global warming, making it soon possible for ‘big oil’ to drill the ice free Arctic.

Lucky worldeconomy; lucky world ?

“More than enough crude oil” : the number of monster SUV’s on the road can continue to increase. War material can be produced (and used) in increasing quantities, like e.g. NATO and Russia is planning.

All this climate climate climate on TV, internet news and radio – it’s complete BS.

It’s not a 100 meter sprint but a marathon, or even an ultra. You calculate around coming out of the start block faster.

In the same time Asia build 100 new coal power plants, see the articlese down here. The thing will only be solvable by technology, be it renewable, nuclear, geothermal or even fusion.

The new technology must be better than the old one – otherwise it won’t work. TV can scare the white western middle class in going on a vegan diet, but the western wolrd has no means of saying asian and other not westly people what to do. Or their governments, kings and presidents.

Even your small successes: The western squeezes of 1 mbd of oil usage with lots of laws, propaganda and taxes – Asia, south america and Africa says thanks to lower oil prices and increases consumption.

I can’t even turn the radio on in the car without a moderator saying “What have you done for the clima today?”. In the same time, the last nuclear plants here are shut down and coal plants powered up. Even developing own fracking gas, which produces less CO2 than import LNG or coal is YUCK! It’s kind of a clown world.

Sorry for the ranting, it’s not personal – only this TV focus.

Not only is there enough crude and natural gas to melt the poles, depending on price, there is enough to make sure that peak oil isn’t assured in this half of the 21st century. After that however, things get a bit dicier. The climate question, ES&G, legislation and governments deciding to finally do something about an energy transition, all of those would seem quite important to keep sea level rise from erasing Florida from the map.

I do find it interesting to hear the various thought modes that result in people being outright opposed to the electrification of transportation.

-There is simply the vested interest aspect. This is the strongest motivation, with people hoping to profit from oil depletion. For them the greater the shortage of affordable fuel…the better.

-of course there is the simplistic partisan aspect, with EV’s seen as technology of the socialists, or some such delusional thinking. This notion gets heavy funding from the oil and gas industry through its lobbying and advertising. Interestingly, other big industries like the automobile manufacturing industry of the world is taking the oil depletion scenario seriously.

-a smaller but very vocal crowd looks forward to the disruption of petrol shortage. They think that the chaotic scenario can be managed to their advantage, or that they will be privileged and avoid the worse of it or even profit from it- for them the greater the shortage of affordable fuel…the better.

-others think that we can put off development and deployment of EV’s for another 20 years- “just keep things unchanged’ in a business as usual mode. What they fail to realize is that waiting for a shortage of depleting fuel is simply too late to embark on such a big industrial transition. The disruption from waiting until the problem is full blown is just going to be…literally an economic crash.

Most people of the world prefer to avoid the mule cart scenario.

On about 4 acres of average grazing land you can sustain a horse.

For rough comparison reference- one solar panel under average US conditions will provide about

1500 miles of travel with a midsize AWD electric vehicle.

More if you live in the sunnier half of the country.

Many people embrace the idea of owning your own power production facility, even if it is just big enough to cover your annual mileage and home energy needs.

Agree. A lack of clarity regarding the future could be expected, when most people don’t have much time to think about much outside their job and family.

I have commented a lot about this subject before. It is so hard to understand for very many that it can be useful that we collectively reduce energy consumption for personal transportation a lot, maybe something like 5-10 times through electrification and reducing a little bit of the consumption, and still get a lot of the value out of transportation (not 100%; could be something like 60%-80% depending on what time scale we are regarding economic prosperity). All major changes are hard btw, and the young ones are more likely to embrace it.

Kolbeinih , ” young ones are more likely to embrace it. ” , Your assesment is wrong . 1990-2010 was the MTV generation , 2010-2023 is the I phone generation . I have worked with the young at the University of Gent including exchange students coming from all over Europe under the Erasmus program since 2010 . They are clueless . Their agenda is (1) how to milk their parents for money (2) what the hell to do from Friday evening thru Sunday . Now some realtime info . I have a friend who works for a large ( pan European ) interim . He said that the canditates fail at across the table interviews , Why ? They have lost the art of conversation and cannot maintain eye contact . All young ones are too busy texting . Hopeless or hope less ? 🙂

Interesting comment on same idea…the college I went to is now requiring a typing class for all engineering candidates…turns out youngsters aren’t as familiar with them as they once were.

Reserve growth my arse, light distillate and gas liquids ain’t crude and the US is not a major oil producer it’s all BS.

See this video of 17 years old trying to use a rotary dial phone . ROFL .

https://www.youtube.com/watch?v=1OADXNGnJok&t=6s

Behind the curtain stuff from Mike S .

https://www.oilystuffblog.com/single-post/runnin-outta-ammo?postId=4f5fa577-6863-48f8-93b0-c65d297f9a43&utm_campaign=532577f5-164e-4b16-a3ac-0e564572cf89&utm_source=so&utm_medium=mail&utm_content=1837512f-df52-4b83-97d7-9841f93ded83&cid=fa335351-37bb-44a6-9899-f8c34b4a0f81

Behind the curtain indeed. I would want to hide my claims behind one if I got it wrong as well.

“If it were not for Lea and Eddy Counties in New Mexico, the entire Permian Basin would be declining in liquids production.”

Oil growth in the Permian Basin, as defined by oil production from all counties considered to have Permian Basin in them, October 2021-October 2022 was 9.9 million barrels/per month (roundable to 10 if I had an urge) larger, give ot take. 26.0% of that came from all the counties Mike claims were declining, 74.0% came from the two counties that appear to be his favorites.

Why, when this information is so easy to check, would someone say a paragraph earlier “My Goal In Oily Stuff Is Awareness”? How about we just worry about getting it right instead?

I am not trying to hide my “claims, whomever you are. An engineer? I don’t know. You just seem scaret of the ramifications of using your own name when you insult someone.

I did not use the words “from behind the curtain,” somebody else did. Unlike yourself, I am out there. I ain’t scaret. If you don’t like what I write, don’t insult me behind your keyboard, write your own stuff.

So only 26% of all growth in the Permian Basin came from outside Lea and Eddy Counties, in New Mexico, the past year? Not my favorite counties, by the way…America’s long term energy future and the oily future of our kids is my favorite. America’s future is my favorite.

You are the engineer, I am nobody. You have a moral, and very implied, obligation to the country to tell the truth about reserves and all that stuff. Define oil, please. Is that stuff that is important to us, or does that matter to you? You’re not “worried” that 76% of Permian growth came from 1/2 of Lea County and 1/2 of Eddy County? Not worried about pressure depletion, falling productivity? None of that? Good to go for another 25 years?

I stand by my numbers and what they imply for my country. They are not my numbers, not my data, but stuff from Enervus, Novi, Welldatabase and the TRRC. We can’t lie about realized production in Texas, you know that right? I do indeed want people to see the other side of the rhetoric, to be aware, so they can stop listening to all the lies and make up their own minds. People can do that, you know? Folks are getting on to the tight oil and gas bullshit. They are starting to worry about their oily future, in spite of the dung heap.

That’s a good thing, right? We need to be ready for whatever arises.

HiH used the “behind the curtain” comment. I used a quote from the webpage as to the apparent dichotomy involved. And I didn’t say I didn’t like what you wrote. I said your information was inaccurate.

As far as my worries about the Permian, it is certainly important, but just one of the worries on the list when it comes to resource development globally. The Permian is the most interesting domestically at the moment, and the only reason I even noticed your claim is because I found it difficult to believe. And it struck me as interesting to check. You see, what I am interested in is that all US oil growth is Permian based, and therefore by extension 76% of all US oil growth is in your two favorite counties, and 26% in the rest of the Permian. That is interesting. I also used two of the information sources on your list, certainly not Novi however, and two others you didn’t mention. No point in relying on one set knowing from Dennis that some of these folks don’t even do all production, but seem focused on only newer development. Okay for Johnny Come Latelys I suppose, but insufficient for the best answer.

And those of us in industry when the world exploded post world oil peak in 1979, particularly those of us in the office that day in March 1986 when the price finally just collapsed, know the meaning of oil and gas bullshit, and worrying about our future, and it ain’t yet today what it was then. The day things went negative during Covid was wildly amazing, but that was an exogenous event.

I have been interested in peak oil since the day after Thanksgiving, 2005, and “worry” isn’t the right description. To even worry, you need to separate fact from fiction from religious dogma, learn about it, figure out why it went wrong so many times from many different angles, correct for that if it even had any value in the first place as an idea, and then gather the resources to solve it. Then you don’t worry anymore, you just run the solutions by scenario and see where your dependencies/sensitivites are. The Permian is no different. Just a pain in the ass with all the stacked formations, and benches within them, and getting the right measures of interference worked out. Not difficult…just a bit labor intensive to work through the data.

I don’t recommend standing by bad numbers though. As I said, when they are as easy to refute using data from multiple sources it just reflects badly on any conclusions you then draw.

As far as being “ready”, well aren’t we all after falling for peak oil ever since Colin Campbell declared it globally for 1990? 33 years of getting ready. I figure some of us older farts are going to dieoff naturally waiting to see if Peak Oil #6 this century is finally THE ONE. Or just #6 this century, claimed or occured.

The usual explainer to invoke at this point is to present the discrepancy between USA oil extracted versus oil consumed. On a daily basis, ~12 million barrels of crude are extracted daily from USA territory. Yet, USA consumption hovers around 20 million barrels per day.

“worry” is always the right description, and if it wasn’t for creative book-keeping suggesting that the USA is “net oil independent”, more people would be concerned.

From your US consumption number you need to deduct US exports of manufactured products from that crude, primarily refined product. 9.9 million barrels a day. So the correct US “consumption” number is more like 10.1 mmbbl/d.

Export data: https://www.eia.gov/dnav/pet/pet_move_exp_dc_NUS-Z00_mbblpd_m.htm

Now do the same for wheat. USA produces 50 million tonnes per year and consumes 30 million. It exports roughly the difference, give or take that some wheat is imported (and then either consumed or re-exported as food products) .

Part of the difference is that much of oil is imported for refining and then relabelled as a “domestic” source of oil. So the export page link you provided is the creative book-keeping I am referring to. What we need to see is a Sankey diagram for all the flows of crude oil. Too much is obscured by referring to only tables, as you can’t see the recursive flows.

Paul , agree . Creative book-keeping , like the BLS ( Bureau of Lies and S***) on CPI . First and Estimated CPI , then Actual CPI and then Revised CPI . Funny part is Revised CPI is always highest .Same on the oil markets , some of it evident . Here is a tweet .

https://twitter.com/aeberman12/status/1626262009204420617/photo/1

Reservegrowthrulz,

You need to look at net exports as the US imports petroleum products as well. Also much of the products exported are LPG. The best number to look at for consumption might be net crude inputs to refineries minus net exports of liquid fuels (gasoline, jet fuel diesel and residual fuel oil.)

I actually DID write, “without Lea and Eddy Counties the entire Permian Basin would be in liquids decline.” That IS inaccurate. I typically address issues in specific sub-basins within the Permian complex. I have gone back and changed the sentence to say “Delaware Basin.” Regarding that one sentence, I stand corrected.

The article, by the way, was about rising liquids gravity in New Mexico with comments from two ChEs. The quality of tight oil is not typically something cheerleaders like to address. They tend to just like big new production numbers.

I was operating in the late 70’s, with my own money at risk. When employees of big corporations lecture me about how hard things use to be, and what I should and should not be concerned about, I tend to tune that stuff out. I like debating things about the future with WI owners, who pay the bills. They tend to be way more realistic. Its a problem to find those kind of folks now days, however, particularly in shale plays. OPM and all that. My biggest critics seldom seem to have skin in the game. Like 2nd and 3rd generation royalty owners.

I too am an old timer, with many decades of observing decline and depletion, and I’ve learned it’s never too late to grow up, see things differently and embrace change as a simply fact of life. I am not sure what peak ‘oiler’ means but yeah, I am probably one of those.

Past results are never indicative of future performance, not in my oilfield.

Is it because folks around here don’t have a clue about the difference between the Midland and Delaware sub-basins that allow sloppy words to creep into our posts? Not just yours, I’ve done the same, and often wondered if it is because there is such

a large illogical and faith absed contingent that they don’t know the difference between a basin and a formation, let alone have a clue about how long horizontal wells and hydraulic fracturing have been going on, and sloppy just tends to work. It isn’t as though have the ability to critique it, let alone have the data to check statements.

I’ve noticed the same thing with my online blathering, precision in writing doesn’t get the same rigorous screening that published documents do, and I have also made online boo-boos. No harm no foul, and darn right past results aren’t indicative of future performance in my oil field. I was willing to buy shale development as a stop gap, but not a full blown “Make America Top World Producer Again”. And all those disappointed peakers out there who thought oil production can only go down in the future, imagine the amount of egg on those faces.

“I do find it interesting to hear the various thought modes that result in people being outright opposed to the electrification of transportation.”

Well, there was the Super Bowl ad on “Premature Electrification,” which had to be as much a play on words as a parody of the human male condition. It was one hell of an ad–to go buy a gas-guzzling Ram or F-150 if you want to make sure you don’t run out of . . . power.

But as Hole In Head posted, the oil production scenario is taking care of the coming shortage in an unfolding train wreck. Mike Shellman pointed out that much of the newly categorized West Texas Light is actually “ultralight,” with an API greater than 50. This is coming from the only remaining spot of frenzied production in the Permian–the mighty Delaware sub-basin.

API greater than 50 degrees probably shouldn’t be called crude at all, but a condensate representative of the gases involved. So, get ready for this, the western part of the Delaware is actually a wet gas basin selling into a flooded alkane market.

We are quickly getting into a jam. And it’s going to make any concern about how quickly we convert to EV’s seem like playing with dollhouses.

“We are quickly getting into a jam. ”

Certainly, and jam is saying it very gently.

There are not many useful adjustments that can be made that will help adjust to depletion of oil.

We [US] could enact rationing to slow down consumption, and ban all net oil product exports.

We could restrict drilling so oil will last longer.

We could try to become best friends with Venezuela even though they are socialist leaning,

and we could be better partners with Canada.

We could put heavy fees on fuel use that is not considered critical.

If you enjoy watching battles just get a front row seat for enactment of any of these measures.

And, oh yeh, we could be enthusiastic adopters of electric vehicles… on a national basis.

It shouldn’t be a partisan/cultural issue at all.

None of these measures are a cure for depletion or will ‘save the world as we know it’.

But they all could help to some degree.

And maybe all will be necessary.

If it was me and I had to make an order of the option list, first would be a full court press on EV adoption, and second would be heavy fees on frivolous and optional oil use such as leisure travel (air/land/water).

We are very late to the game.

What would you add to the list of constructive and effective measures aimed at a continuation of a civilized society facing an escalating problem with affordable transport.

Lets keep in mind that in most countries of the world, the problem is much worse (earlier) than here in the energy fortunate US.

Optimize travel speed for efficiency, not convenience and in force it.

Here’s the rub if you slow transportation speeds to save fuel to achieve the same economic activity you have to increase the number of transportation vehicles and the infrastructure to carry them. It’s directly proportional. So economic activity will decrease or displace. Maximum Power Principle has probably been past so any choice is likely going to have negative effects.

“It’s directly proportional”

Bullshit, speed vs. power demand is not a linear function, it’s exponential

“Air resistance can be calculated by taking air density times the drag coefficient times area all over two, and then multiply by velocity squared.”

https://howthingsfly.si.edu/ask-an-explainer/how-do-you-calculate-force-air-resistance#:~:text=Air%20resistance%20can%20be%20calculated,then%20multiply%20by%20velocity%20squared.

“What are the limitations of the Maximum Power Transfer Theorem?

The critical limitation of the Maximum Power Transfer Theorem is, it cannot be used in nonlinear and unilateral networks. As efficiency drops to 50%, it is also not applicable in power systems.”

https://byjus.com/physics/maximum-power-transfer-theorem/

I have long ago come to the conclusion that humans will continue to consume all non-renewable resources at grossly unsustainable rates and so-called renewables are really just an extension of the scope of that consumption. Whether it takes a few decades or a century to deplete those resources the final result will be the same. Awareness of the problem has been around for some time but non-renewable resource consumption ( hydrocarbons in particular) keeps on going up, population keeps going up and a vanishingly small percentage of the population is willing to sacrifice any of their standard of living to stretch out the depletion for another decade or two.

Consider the statement by Macron last fall: “France has come to the end of the era of abundance” about the most understated possible statement of the situation. Has any other leader repeated that statement?

Made a more honest statement?

Preservation of a technological civilization will probably depend on a drastic reduction of the world population, coupled with a preservation of knowledge built up so far ( akin to the monasteries in the Middle Ages).

It is possible to visualize a few islands of technological competence surviving with nuclear reactors powered by military stocks of enriched uranium ( assuming it is not used for bombs). Planning and preparing for that would be prudent.

There are two potential sources of power to allow a re-emergence of a technological society:

Fusion power- presently well funded and being pursued by a lot of very smart people, but progress is slow, problems substantial and time is short to preserve BAU.

Fission power: Proven technology but viable uranium reserves are limited . Thorium is more abundant but with no proven commercial units, and distinct challenges dealing with molten salts if that route is taken.

There are massive quantities of uranium dissolved in sea water ( very dilute solution). A viable means of extracting this uranium would allow fission to power an industrial/technological civilization for thousands of years. With several decades of relatively cheap uranium available from traditional mining, no private enterprise is chasing this.

I have a litany of innovations that probably reflect my life to an extent that is not practical for wholesale adoption. I live in Paradise Valley so I was amazed over the last several days at the number of very large personal jets that came in for the Super Bowl, all of which are expensed for business and pay no surcharge for their carbon footprint. There are over 2,000 of these in the U.S.

I find it silly to block new NG pipelines, when coal with twice the GHG emission is being burned preferentially because it is cheaper and, in some areas, more accessible. Wyoming, for example, 2X overbuilt its coal-burning Jim Bridger Power Plant in order to sell California electricity. So California can brag about being a coal-burning-free state while importing rescue electricity from coal in Wyoming. And I’m not disparaging Ca or Wy.

I find it ludicrous that the Global Climate Change Conference gave attaboys to China, even though China put in more coal-burning power plants than the rest of the world put together. They would stop this if commerce were to put the heat on.

In essence, not to argue the point, but beside this hypocrisy, the EV market pales to the color of anemia. If we’re talking clean air, get rid of the coal tomorrow, slap a “sin tax” on private jets used for fun, put in some NG pipelines. I’ve flown private jet at times, and it’s better, but it’s stupid to use for fun and then drive an EV.

People are people, and the very rich don’t think they should be damaged by all this climate stuff. Neither does China. In China–and I can say this with certainty–they’re using bituminous coal (soft brown coal) to produce electricity that is used to charge EV’s.

I applaud any effort to slow the process of global climate change, but without using common sense it’s nothing. And common sense says get rid of coal. Common sense also says ban these “forever gases” that are still being used in the magnetic pivots in the largest wind turbines. Those “F” gases escape, just as any gas, and they have GHG emission ratios (to methane or CO2) in the thousands.

None of this argument will be taken seriously by the greatest offender–China–until the world community tells them they can’t do it anymore. The more windmills to produce “clean” electricity with which to charge “clean” EV’s, the more “forever gas” is used in the magnetic housing–there to escape at a certifiable and measurable rate. I could go on.

To build upon your china mentions. Let’s try a thought experiment. Using the relative minor, in terms of area (not human tragedy ) the Ukraine war and how it disrupted the global food and energy markets, and how the collective west responded.

I was completely wrong that Putin would go into Ukraine, there was no way he could take and hold a county that size with the forces he massed. I was shocked, but it happened. Now that we have pushed Russia into the arms of china, who as a global threat was minimized, because they can not feed or fuel themselves. Now they can, with the help of Russia they are now able to contemplate going into Taiwan. I am not predicting this but many are. If that happens what will the western response be. Where will the green energy materials comes from and at what cost. As a business man (dull spoon) these are the type of events we must plan for, we can’t afford to blindly get on a path that leaves us so vulnerable. The answer in part is you can kiss your green transformation goodby, at least for a generation.

There are several /bloggers journalist, Rapier, Javaier Blas, Abhi Rajendran that I follow almost religiously. All these fellows identify as climate activist supporters. But the difference between them and many on the forum is they do not live in an echo chamber. They are out in the real world, they deal with business leaders, financial leaders and both government and quasi government officials on a daily basis world wide. They are more informed, more reasonable and practical because of it. If I were some of you guys I would walk back from the climate ledge and get a broader world view as to what can be done and on what time table. If china goes into Taiwan, which I think is less than 50% chance, but that numbers is growing, what is your plan B? that’s the plan should be concerned about.

Kyle Bass interview this morning make of it as you will, he thinks china WILL go into Taiwan.

https://www.youtube.com/watch?v=m04VhV2o918

Mr. Maddoux,

Pakistan just announced an abrupt 180 degree policy change from LNG to coal – preferentially domestic sourced – for that country’s electricity production.

Plans call for a quadrupling of current capacity.

Re China/’Renewables’ (sic) … the brand new, $30 Billion Haoji railway can carry ~200 Million tonnes PER YEAR of coal from the world’s largest open-pit lignite and bituminous mines in Inner Mongolia.

(Online images are a gut punch).

As 1 Gigawatt electricity production equates to one large, 1,000 Megawatt power plant, China’s ~40 Gigawatt new coal burners built in 2021 – combined with 2022’s ~30 Gigawatts – are only slightly lagging the one-massive-plant-per-week pace that the additional >200 Gigawatts over the next 4 years will bring online.

These numbers/facts are irrefutable, as are the stated facts in your post.

To begin to recognize that profoundly incongruent psychological factors (self harming?) are present in this entire Global Warming/Renewable Energy (sic) narrative should be simply stating the obvious.

As dispassionate, objective (whatever that crucial term even means anymore) discussion has long ago ‘left the station’, cold hard Reality will manifest, as the Pakistani, Chinese (and even the Germans and Japanese) are now showing.

Hope you are enjoying the AZ sunshine.

from Abhi Rajendran

@ARaj_Energy:

When you demonize gas in the name of climate, you get this

#Netzero pathways die accordingly

Stephen Stapczynski

@SStapczynski

·

19h

MAJOR SHIFT: Pakistan is abandoning its LNG expansion plans because the fuel is too expensive, and instead will use more coal

🇵🇰🪨

🚢”LNG is no longer part of the long-term plan,” Energy Minister told Reuters

🏭 Pakistan to QUADRUPLE coal power capacity

Thanks, Coffee, I always learn from you.

I need to learn to be a bit more like Seneca wrote in his letters and just let things be.

It blows my mind that the so-called world community is beating the drum over EV’s when China and India make the rest of the world look like carbon pikers. China was/is at about 35%.

The numbers you tallied in your post illustrate the futility of EV’s when the main course is electricity.

coffee is a true gentleman.

Factual info is sometimes useful.

Here is the Global Energy Consumption trend by source since the turn of this century.

The numbers on the chart show the average annual change over past 5 years.

-Coal has been pretty flat for the past 10 years

-for Oil it looks like the bumpy plateau ( /- 5%) was mounted about 7 years ago

-So far Natural Gas is still on a very rapid growth phase. [no shortage of fertilizer anytime soon, if you’ve got shipping and credit]

-Nuclear….flat with a very long lead time for new production. Average age of power plants is 31 years, and 42 years in the US.

-Hydro. Rapid growth up to 3%/yr expected over the next 10 years, despite the best spots already have been already developed and the ecological damage these big plants do.

-‘Others’ (wind, solar, geothermal, biofuel) showing explosive but very early growth phase now just beginning.

[The 16% annual average growth over the past years is accelerating, with global solar generating capacity alone rising 23% in year 2021. By the end of the decade solar and wind global production will be obvious even to the impaired]

source graph- https://en.wikipedia.org/wiki/World_energy_supply_and_consumption#cite_note-1

2021 in the US Solar and Wind contributed 12% of total utility-scale electricity generation [US EIA]

yet only a fraction of 1% of the domestic energy reserve of these two modalities has been tapped thus far.

Limp effort thus far.

Hickory and HB, i like the ways you guys think. Let me help you make your list to reduce the use of oil to help it last longer.

1. make it illegal for the NE part of the US to burn oil to generate electricity. To make up the shortfall in electrical generation, transport all illegal aliens, using electric buses of course, up to the north east and make them pedal peloton bicycles that are hooked up to the electric grid for 10 hours a day 6 days a week.

2. make it illegal for any government official to fly, drive or ride in any thing that is not powered by electric motors.

leading by example is the way to win the hearts and minds of the ignorant masses.

3. make it illegal for all government officials to use any item that is made from oil, in whole or in part, for work or personal use. This would include the direct family members including children and grandchildren. Make it applicable to all blue state and local governments. Red states would be exempted because they supply the oil that the blue states non government citizens can legally use but only between the hours of 9:00 am and 9:30 am.

4. immediate confiscate and destroy any oil or oil derivative modes of transportation that green activist use, including their diesel burning ships and jet fuel burning planes.

5. Immediately require all transportation of food and medical supplies into blue states be electrical propelled devises, to include trucks, ships, and trains.

6. Require the build out of the green energy electric system using only materials that are mined, processed, transported and manufactured using exclusively renewable non nuclear energy non hydro electrical energy.

7. Optimize travel for all government officials, Hollywood woke actors and green energy executive/activist using only electric vehicles for strict efficiency not convenience and force it.

Happy to help, together we can make a difference 😂

So…basically nothing useful to say about the topic.

Texas Teat Wo said:

It’s a deal if no net tax dollars go to red states.

“What would happen if blue states stopped paying for red states?

A recent Rockefeller Institute study makes clear how much money flows out of Democratic-leaning states into Republican-leaning ones.”

https://www.minnpost.com/eric-black-ink/2021/12/what-would-happen-if-blue-states-stopped-paying-for-red-states/

In the meanwhile another 26 millions released from SPR .

https://www.bloomberg.com/news/articles/2023-02-13/us-to-sell-26-million-more-barrels-from-strategic-crude-reserve?sref=6uww027M&leadSource=uverify%20wall

What’s the reason for this?

There aren’t any elections right now, perhaps a try to curb inflation by reducing energy prices?

Eulen , I guess ” Old habits die hard ” . or “Insanity is doing the same thing over and over again and expecting different results.” – Albert Einstein . You decide . ;-0

Eulen , maybe this is the answer .

“Surplus Energy Economics, Dr. Tim Morgan’s blog, has part 3 in a series explaining “Prosperity” as the economic output remaining after all of the essential needs of sustaining the economy have been met, which is a lot like my “disposable” income after bills, taxes, rent and food. We know that when food, rent and gas prices go up, we are poorer, less prosperous. There are multiple drivers of this. Fuel cost, the “Energy Cost of Energy” is a big one. When gasoline is $6/gallon , everybody feels poorer. The rest of the economy declines, because people have to buy gasoline first. This is pervasive in the economy, but not as apparent. It is why the Biden Administration can sell oil from the strategic petroleum reserve to goose the economy, and its political fortunes, but won’t pay to refill it, which would raise the price of oil/energy and depress the economy.