A guest post by George Kaplan

Remaining Reserves

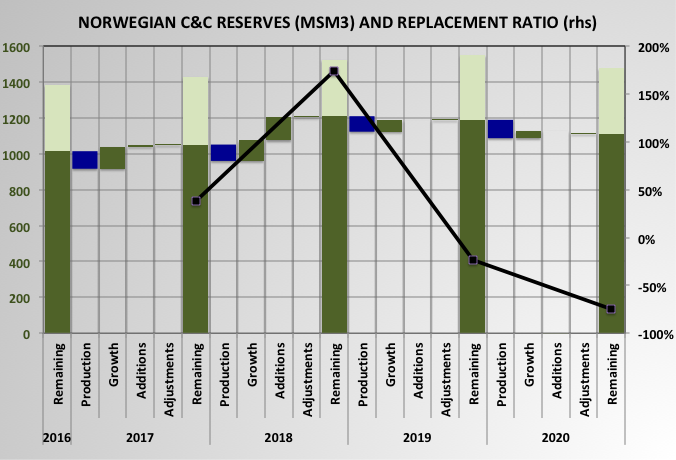

The increase in remaining C&C reserves that has been seen over the last few years, and has come mostly from growth in Johan Sverdrup, has run its course and there was a significant drop in 2020, even as production continued to climb. The reserve replacement ratio has been 38%, 174%, -24%, -75% for 2017 through 2020.

The Norwegian NPD does not use the standard proven/probable/possible categories but based on the way growth occurs the dark colours are close to a P1 reserve number (producing or in development in NPD terms) and the light colour represents a resources or a P3 value (production in clarification or production likely but not yet evaluated). Growth mostly is given by moving resources from the light areas to the dark. New discoveries are usually initially added to the resources.

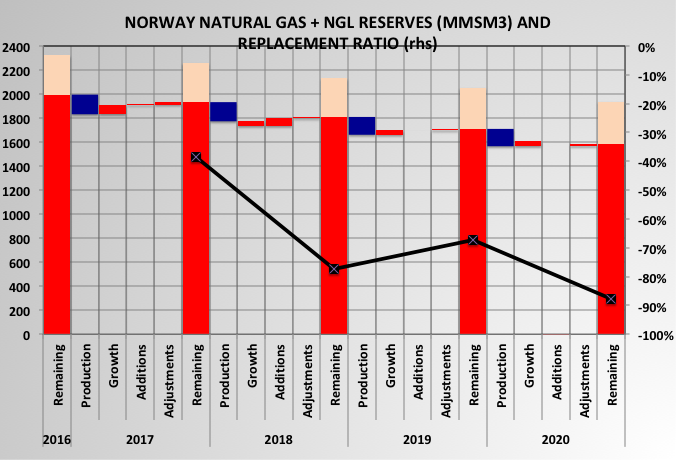

Natural gas reserves continued their steady decline. At some point this must get the notice of the customer countries, principally the UK. The reserve replacement ratio decline has been accelerating as -38%, -77%, -67%, and -88% for 2017 through 2020. At -100% there are no additions and all production is lost from the reserves.

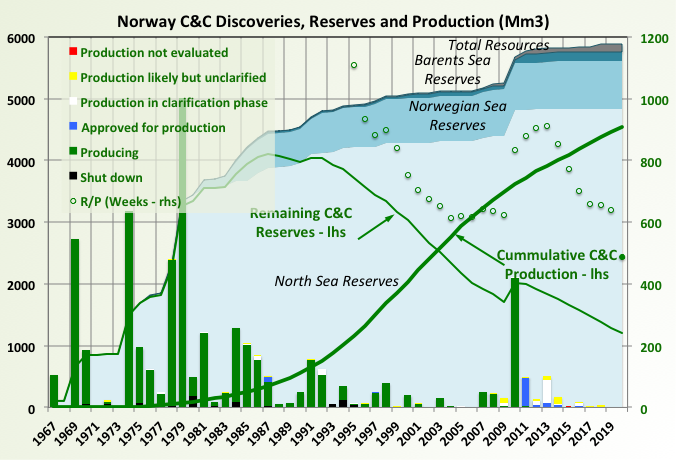

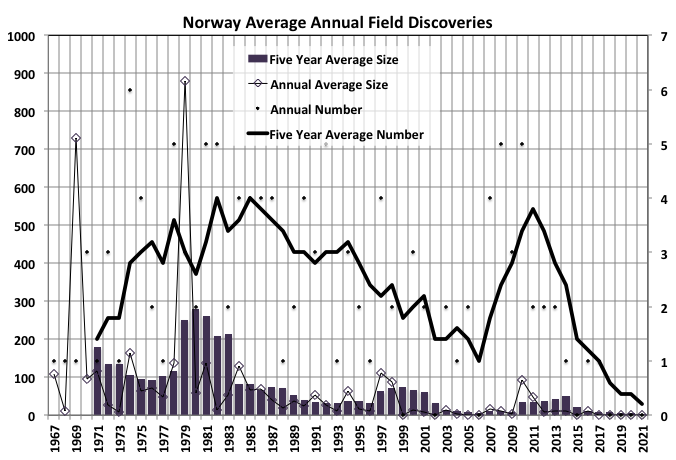

Original Reserves and Discoveries

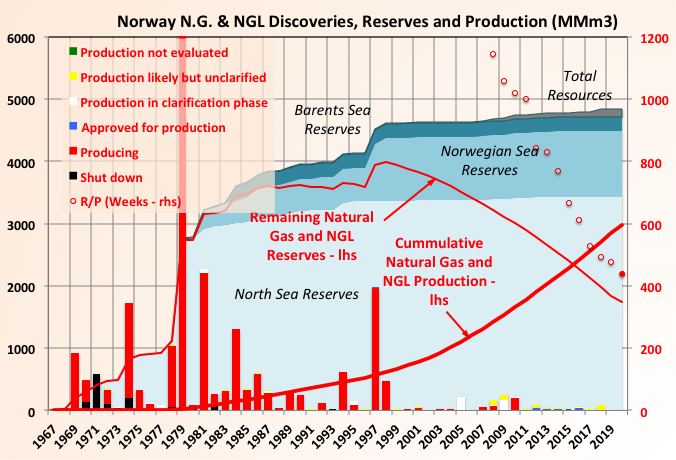

The remaining reserves shown here are backdated against the original discovery year; hence the growth shown above disappears after the 2010 Johan Sverdrup discovery. Really major discoveries for both oil and gas finished in the 1980’s except for single anomalous finds that followed (gas at Ormen Lange in 1997 and oil at Johan Sverdrup in 2010).

R/P for C&C dropped significantly to 9.4 years (490 weeks), the first time it has been below ten years.

Natural gas R/P continued to fall and is now at 8.4 years. With low and falling R/Ps and reserve replacement ratios approaching -100% the Norwegian basin is showing signs of old age despite the effects from Johan Sverdrup and the putative boost from the Barents Sea.

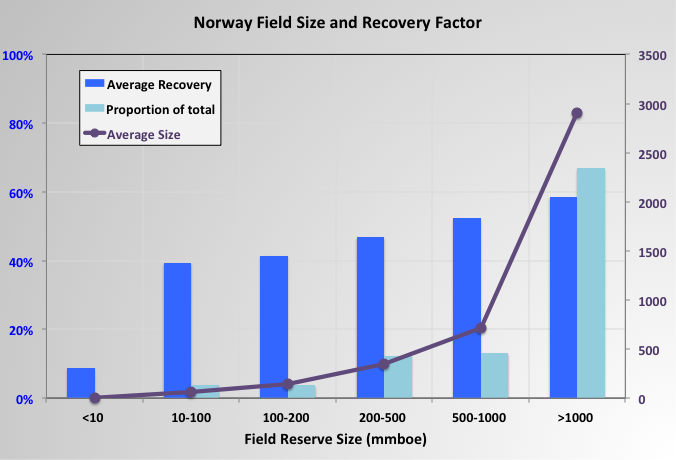

Recovery Rates

Most Norwegian production comes from large fields (the UK side is a bit different and has more and smaller fields) and the larger fields generally get better recoveries. The Norwegian state encourages high recovery rates through the tax and duty regimes but also helps in directing and funding appropriate research.

The highest recovery fields tend to be natural gas, but the largest oil fields have been achieving greater than 60%. The reservoir models in Norway were sophisticated from the start, probably close if not equal to those in Saudi, and have allowed efficient management of the resources.

Drilling

For all its laudable green credentials the Norwegian state does everything possible to extract and sell as much of its hydrocarbon resources. One of the principal ways is to encourage continued drilling through tax incentives. Hence the number f new wells, especially for exploration has stayed high even after peak production and as discoveries have dwindled.

Even the move to electrifying offshore platforms is partly an economic choice: using cheap hydroelectric supply from shore frees up gas for sale that would otherwise be used for power generation. (As an aside when I lived in Oslo it had an excellent integrated light transit system, I understand that the emphasis on personal EVs has partly been at the expense of public transport, which has falling passenger figures at the moment.)

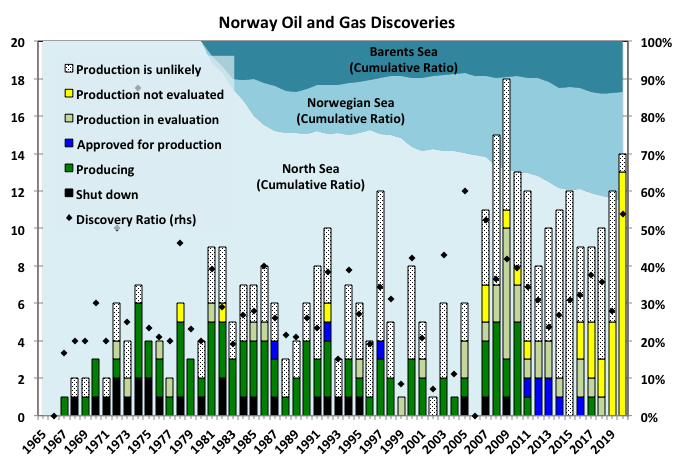

Discoveries

The chart below shows the number of discoveries rather than their sizes of reserves. The most noticeable thing is the futility of most of the exploration drilling since 2010 – most of the discoveries are non-commercial (note that many of the not evaluated category will be shown as non-commercial), and those shown were originally recorded as discoveries and do not include wells indicated as dry, as hydrocarbon shows only or those abandoned (there will be more dtail on this in the next post).

The viable discoveries are getting fewer and smaller as shown below, with only 2010, which included Johan Sverdrup and a number of smaller discoveries, interrupting the trend.

(To follow: Norway Part 2, Production and Wellbore History)

Off-topic Finish: Books, Blogs, Podcasts and Youtube Suggestions

The End of Anthropology? | Gifford Lectures 2019 | Prof Mark Pagel | Pt 4

This is the fourth in an excellent series on cultural and language evolution. This looks at possible futures. Global culture has been tending towards homogenization within large cities, and this is based on growing prosperity. One thing he doesn’t really address, though I think he might have liked to, is what happens as prosperity (read cheap energy) starts to fall. I think there is some overlap between this and the apparent similarities in life cycles of different civilisations and empires.

Future Scenarios

This was written around 2007 and has four alternative futures looking at consequence of the collision of climate change with energy shortages. While it’s a bit out of date (in particular that climate change is worse than that envisaged, in terms of speed and consequences, and the energy peaks have been delayed, both of which favour collapse over the alternatives I suspect) it is interesting to see how current trends are matching (or not) the scenarios presented.

Reality Blind

This is the ex Oil Drum editor Nate Hagen’s open access book about human race’s various predicaments with an emphasis towards energy depletion.

Problems, Predicaments, and Technology

There’s lots of debunking of the bright green future here however, like a lot of articles on the other side of the argument it can be a bit light on real data, for that this paper from Bill Rees is a pretty sobering read and the most succinct statement of our real, overall predicament that I’ve seen:

We argue that while the [Green New Deal] narrative is highly seductive, it is little more than a disastrous shared illusion. Not only is the [Green New Deal] technically flawed, but it fails to recognize human ecological dysfunction as the overall driver of incipient global systemic collapse. By viewing climate change, rather than ecological overshoot—of which climate change is merely a symptom—as the central problem, the [Green New Deal] and its variants grasp in vain for techno-industrial solutions to problems caused by techno-industrial society.

Through the Eye of a Needle: An Eco-Heterodox Perspective on the Renewable Energy Transition

Assessment of the Extra Capacity Required of Alternative Energy Electrical Power Systems to Completely Replace Fossil Fuels

Simon Michaux is a lot like Jean-Marc Jancovici, Ugo Bardi, David Mackay and Tom Murphy. His papers are full of facts and figures that are hard to refute, and rather than try the technocopians tend to just ignore him. He’s also worked extensively in industry so understands the issues of getting mega-projects completed, even with proven technologies, of which there are a distinct lack in some aspects of the putative energy transition. This is a long read but worth at least a look at the abstract skim through (it’s worth keeping in mind as reading it that all the infrastructure required is to be developed in parallel with the Chinese belt and road initiative, which in itself will require huge raw materials, e.g. as much concrete as has ever been used to date, though admittedly some of it is supposed to be part of the energy transition – see articles by Bill Laurance for more comment).

One thing that seems to be missing from this paper and others concerning the energy transition is discussion of the increasing complexity that needs to be introduced to keep civilisation running and the almost inevitable reduction in resilience that goes with it. From previous civilisation decline studies (e.g. by Tainter, Costanza) it seems that simplification is possibly the best way to avoid complete collapse; but the technocrats’ proposed solutions are the opposite, in fact even the concept of simplification as an option appears to be outside the technocopians ken. The proposed futures involve increased integration both geographically and systemically, overbuilding to compensate for intermittency, reliance on arcane control networks, longer supply chains, more components etc.

Given enough time a stable environment and a business culture that didn’t prioritise short term profit above all else something robust might eventually emerge before the available resources are exhausted but we have none of those. Whatever is produced is not going to be resilient and will be more open to unforeseen failures and malevolent actors with uncertain recovery methods and timing. More than the technology, the complexity of the social structures and institutions needed to build, operate and maintain it will be particularly vulnerable and fragile.

The Great Plague

The Oxford University podcasts are always interesting; this is one of a series of ten concerning previous pandemics and their similarities, or not, with Covid-19 (click on the ‘Futuremakers’ keyword to access the others and two other series covering AI and climate change).

Megacancer ~ Exploring the Pathology of Industrial Civilization.

This looks at world issues with a bent towards evolution, our genome and how it limits our choices. Despite how the technocopians like to tell us in their TED talks that their giant intellects can overcome everything if we just do exactly what they tell us, it’s not quite that simple (see also Tim Watkins here on issues of Technocracy).

National Oil Companies and Climate Change

If you think the putative energy transition is going to be fast and effective then listen to the turgid, self-congratulatory waffle in these discussions from some of the people who should, in theory, be among those leading the way. There are a few good bits (i.e. actual data rather than aspirational vapour-ware) most of which also indicate that we haven’t a hope of meeting the Paris commitments, but whether many viewers actually make it through to them is questionable.

Chatham House – Undercurrents

This has fairly short but entertaining episodes concerning various geopolitical issues, but always from a BAU perspective.

Drilled

The latest series look at the natural gas and petrochemical industries but any and all are interesting.

This Storm

Love him or loathe him no one writes like James Ellroy. This is the second book of his third series (after the L.A. Quartet and the Underworld USA trilogy) of slightly alternative looks at 20th Century US history. I think the greatest never filmed book is the last of the first set, White Jazz; George Clooney is supposed to have been interested, but I can’t think of anyone less suited to playing an Ellroy character, as fine as some of his films have been. I read somewhere that the publisher said the first draft was too long so Ellroy just chopped out various conjunctions, articles, participles, adverbs and adjectives, which gave it its unique style.

Gresham College Lectures

Gresham College is just next to the City, hidden away in an old building (but not its original, which was in the heart of the City yet managed to survive the Great Fire, but not later redevelopment) and surrounded by shiny new ones. After Oxford and Cambridgeit is the third oldest institute of higher learning founded in England, in 1597, and the primogenitor for the Royal Society. I’m not sure of it’s exact charter but it doesn’t have undergraduates, instead its resident and visiting professors (and there have been some very famous ones like Wren and Hooke) seem expected only to think great thoughts and to give public lectures, and hence these are usually pretty good (and generally well attended, at least pre-Covid). Originally there were seven professorships set up: astronomy, geometry, physic (i.e. medicine), law, divinity, rhetoric and music so there could be a lecture each day. There are now ten, with the addition of business, environment and information technology, but the lectures aren’t that frequent. I am especially interested in the series by Sarah Hart concerning mathematics and art (e.g. how and why we perceive beauty), but I have recently been hooked on some of the astronomy and history of religion lectures.

Excellent article. The recommended reading list is useful as well, especially the Finnish study on the resource requirements needed to support energy transition.

The over-building of wind and solar power infrastructure is a partial solution to intermittent supply, only if such a strategy can be deployed without curtailment. If wind power provides the greater part of generation, as it will in most northern countries, excess power is best stored as heat for end use. Wind electricity production is greatest in autumn and winter and thermal energy storage is cheap in terms of capital cost. A wind and solar dominated strategy with over building, works best if at least some liquid fossil fuelled gas turbine generating capacity is retained for deep lulls.

Presently, most industrial economies have electricity production between 500-1000W per capita. Electricity demand does not vary by more than 20% above or below average. This is because the huge seasonal energy demands associated with heating and daily demands from transportation, are directly supplied by natural gas and petroleum. This is the principle reason why electricity only constitutes around a quarter of delivered energy use in most developed countries. In the future electricity will need to supply transportation and heating functions as well, using heat pumps and resistance heaters and electric and stored energy vehicles. This will increase electricity demand and will also make it more variable on both a daily and seasonal basis.

Electric vehicles (road vehicles) are especially problematic if charging is not well distributed throughout the day. The problem is especially severe if rapid charging becomes a mainstream solution. The demand placed on the grid would rapidly overwhelm installed generating capacity in most countries. But I suspect that this is a problem that will not materialise. In a world where the EROI of primary energy sources is falling, battery electric vehicles are going to be less affordable to most people in the future. It is highly unlikely that they will ever reach the number of ICE vehicles on the roads at present.

In fact, I would point out that electric vehicles have provided a significant fraction of the world’s passenger and goods transportation for around a century. But these vehicles are not cars with batteries replacing fuel tanks. They are rail based systems that draw power directly from the grid, via a catenary, trolley pole, or third rail. Transportation by train or tram, is far more energy efficient than car based transportation, whether that car is fossil fuel powered or battery powered. A Practical electric vehicle revolution needs to be based around collective rail transportation, especially if the energy supply is low EROI electrical power. Battery electric vehicles just don’t make sense from a whole system embodied energy viewpoint, if primary energy EROI is falling. They stem from a lack of lateral thinking, in which people expect new technology to enable living patterns that were established in an era of abundant fossil energy. Unfortunately, this also means that suburban living arrangements established in the fossil era will not be sustainable in the post-fossil era. For Europe and Japan, urban sprawl could only spread within tightly constrained geographical boundaries. For the US and Canada, this was not the case and the transition will be much harder, requiring substantial relocation of people into more collective living arrangements, around nodal transportation hubs.

Good points! As I replied to a co-worker lamenting the cost of electric vehicles (another co-worker has a Model 3) my response was “Not everyone should have a car, at all!”

But a well functioning public transportation system is needed, I think Alan from the big easy (New Orleans) was a proponent of light rail, which is a very energy efficient way to move people around. I went to Saigon/Ho chi minh a couple of years ago, and the numbers of 2-stroke, gasoline powered scooters were mind boggling, think they have some efficiancy improvements to make there, quite easily. But they are still on the ascent of FF easyness so I can´t blame them. In comparison, the metro in Paris was working quite well, but it took a bit of work, and energy, to get there building it, other examples would be Tokyo, NY, London, you get the picture…

I might repeat myself, but live well and use less! (and plan ahead)

>For Europe and Japan, urban sprawl could only spread within tightly constrained geographical boundaries. For the US and Canada, this was not the case and the transition will be much harder

This isn’t really true. Suburbs are only feasible thanks to vast investments in suburban infrastructure, and are not driven by land prices.

The usual argument revolves around population density. But Sweden has about 25 people per square mile, whereas the US has about 35. Sweden does not have a problem with sprawl. Why? because they don’t waste public money on low ROI suburban roads. Here is an interesting blog article about the financial reality of suburban infrastructure:

https://www.strongtowns.org/journal/2015/1/29/the-argument-for-less-infrastructure

Another point is that population density is a poor metric for urban planning for two reasons.

First, it depends on averages, which make little sense on a national scale. For example, if Alaska declared independence, the population density of the United States would increase significantly. What effect should that have on infrastructure planning in Florida? None. It makes much more sense to talk about medians, not averages.

Second, nobody every drove a car a square mile, so planning roads based on population per square mile is nonsense. It wildly overestimates distance traveled by looking at its square. It’s just bad math.

A more sensible measure is median distance between household. And guess what? The numbers look much closer for North America and Europe.

this efect is the same if Scotland left the UK, the population density would dramtically rise but in reality England would still be the same with the same planning issues.

Forbin

Good points. I will read the article you linked and give it some thought.

As I young man, I was greatly influenced by J Crawford’s Car Free Cities.

https://carfree.com/

It seems a little idealistic now, but with fossil fuels declining in both production and surplus energy, it’s time would appear to me to have come. I doubt that Crawford’s ideas of purpose built rail based cities are practical, as it would require completely reworking established urban environments. But integrating electrified light rail (trams) into urban environments in a way that replaces altogether car travel, provides a workable and demonstrated option. It would allow urban living to continue with high rates of personal mobility, without the need for a drop of diesel fuel. And it is sufficiently energy efficient to be workable with low EROI grid based electricity, such as that produced by wind and solar power, with gas turbines providing backup.

I’m glad this site finally is reasonable and admits we’re all gonna die.

Even this article is flawed because Norway’s growth is heavy oil.

https://i.ibb.co/NTXJVQ3/3-D9-B0452-A62-D-4-CD8-947-E-D2-BDC5674999.png

” If wind power provides the greater part of generation, as it will in most northern countries, excess power is best stored as heat for end use.”

In Europe another strategy could be to use the large hydro reservoirs in Sweden and Norway (> 80 TWh) as batteries for long term storage of energy.

George, during our weekly phone conservation this morning my Norwegian Niece (an active Reservoir Engineer currently still advancing up the ranks) said, based on her somewhat limited observations, she agreed with your assessment of Norway’s C&C situation.

She also remarked that your finish was most interesting before adding, no doubt experimenting with (or showing off) some English vernacular: “that off-topic stuff of Mr. Kaplan is ‘bloody brilliant’”. I don’t know if it was brilliant or not but there was certainly a lot of fun food-for-thought included there!

Thank you and your niece. Some of the pieces in that list are brilliant I think, me managing to put them together in an almost coherent post obviously isn’t but it seems to have provided some seed for thought, which is probably the best you can hope for in any blog. How are your wildfires doing?

Thank you for the update, been putting some faith in Norway during the downslope of FF extraction, but doesn´t look overly optimistic…. (also a good thing I guess (and think))

How is Troll doing, I think I´ve read that the idea was to drain the gas first, while keeping pressure up, and then get the oil?

Also another question, on Snövit, I guess the LNG is selling at a premium at the moment, but how about reserves?

(my brother was there as an electrician a couple of years ago, apparently there are five “747” RR gas turbine engines powering the compressors/coolers, looked impressive on picture)

The NG from snowhite might also be used as feedstock for the steel industry in northern Sweden, as an H2 supply for direct reduction of iron ore, with or without carbon capture of course, just a side note, we´ll see about that later.

Best regards!

/Laplander

Troll III is the opposite than you said, they got the oil rim with clever horizontal drilling while maintaining the gas pressure but have now switched to blowing down the gas so the oil production will drop quite quickly.

I’ll check Snohvit reserves as I write the next post which will be about production and well bores mainly. I know there has been at least one other discovery nea by that will be tied in. The turbine drives are mystery to me. The compressors there are variable speed electric drives (the only major LNG plant to have them) and I thought the intent was to eventually switch to an external feed from the hydroelectric projects, but so far that doesn’t seem to be proceeding. From UK perspective Ormen Lange might be a bigger concern, it feeds UK gas exclusiely but is over 50% depleted and now reiies on subsea compression. There are a couple of smaller fields tied to the same gas plant but they are going to start to depleting pretty soon (in fact one, Dvalin, seems to be a bit of a dud already).

Did some research on the liqufaction in Melkoya/Hammerfest, apparently they had a bad fire there late last year, starting in one of the gas turbines driving the electric generators (LM6000, an aeroderivative made by GE, not RR as I claimed)

But apparently they were lucky and could put it out successfully, found some claims that the whole complex could have been lost, but Equinor claims there were no such risk. However the facility has been closed since then, scheduled for restarting next month, but that seems to have been pushed to march 2022 after the investigation by PSA, the Norwegian Petroleum Safety Authority, according to LNGprime.com.

So this may also have affected the NG prices in Europe, had completely missed this incident.

Tried to edit but can´t attach a file in the editor?

Anyway, found a picture, courtesy upstreamonline, looked bad…

Correct,

An image cannot be added in the editor, only in an original comment.

I checked the R/P and there’s probably around 18 years left, which makes sense as LNG plants are typically designed to maintain around full throughput for 20 to 25 years (they are much less efficient, and maynot work at all at lower throughputs).

Great Post as usual George. Thank you.

LTO Survivor and anyone interested,

Paper linked below suggests 1580 foot spacing is optimal for Wolfcamp Delaware Basin, for maximum 150 day IP and EUR.

https://irispublishers.com/gjes/pdf/GJES.MS.ID.000663.pdf

Excerpt(from paper conclusion, on page 8):

Maximum values for both EUR and IP OIL are obtained when log (ROA) is approximately 12.5, which implies an optimum ROA of approximately exp (12.5) = 268,337 ft2.

EUR drops with the increase in overlap between horizontal wells due to interference. EUR shows a linear relationship initially for an overall range of 0-50 %, then decreases sharply due to increase in the communications.

The work suggests the higher the overlap (ROA>60%) between wells, the lower expected IP for 150 days and EUR from the well. This leads to a spacing of 10 acres. This leads to a development spacing of 10 acres, This leads to linear spacing between laterals of 1580 feet.

The results show a good correlative fit (95% confidence interval) between 150-day oil IP and EUR, and at least in this area of the Delaware Basin, the relationship between spacing (ROA) and well performance is clear.

Mr Kaplan , will go through your post tomorrow ( sleep time in Europe ) , but the first paragraph itself was a woozy . ” The increase in remaining C&C reserves that has been seen over the last few years, and has come mostly from growth in Johan Sverdrup, has run its course and there was a significant drop in 2020, even as production continued to climb. The reserve replacement ratio has been 38%, 174%, -24%, -75% for 2017 through 2020. ”

In boxing terms a “KO ” . Good Night . You sir are a “Gem ” .

Thank you for your lucid analysis. This ends the stupid debate and the will of the Greens in France to abruptly shut down the country’s nuclear power plants and instead open 20 gas-fired thermal power plants. What gas will they be supplied with?

Kind of reminds me of those 60 or so planned coal fire and blast furnaces that are schedule to be built in China. They don’t even have enough fuel to run all the current ones much less add 60 more. They are rationing power in China right now not because they don’t have enough power plants. Not because they want to be net neutral carbon by such and such date. But because they lack supply of coal.

People believe these are temporary problems with supply chains that will be fixed.

Where does the price of steel go if China can only produce a 10th of what they use to. It goes higher. Just like the price of oil right up until the point where the debt bubble pops. Then the price of everything crashes.

HHH , any thoughts on the crypto ban curve ball thrown by China ? Is it a pre-emptive strike against capital flight in light of the Evergrande fiasco ?

I, too, would like to know, because thus far from the peanut gallery online, I’ve heard everything from “China has been banning crypto since 2013, lol” and “Finally, they’re getting serious.” I was thinking this may have some relevance to the Evergrande situation and be a reminder or actual implementation of new safeguards.

I also kinda just want crypt to die already.

A lot money that flows into China from the outside world is US dollars. Last thing they can afford is to have to watch US dollars flow out. Due to debt defaults. It not just Evergrande that has recently defaulted on US dollar denominated debts in China. Evergrande is just the largest and most important.

Most of the dollars that have flowed into China will never leave. Why American billionaires invest there is beyond me. It maybe made sense to invest there 20-30 years ago but not now.

Property sales have crashed like 65% in China. Loss of confidence. Capital flight happens when people lose confidence. In the UK and rest of Europe have a bigger problem looking ahead as they don’t have the capital controls that China has.

We are still in the period where everyone believes these energy issues are just temporary supply shocks. Vast majority of people haven’t even considered that these are permanent supply shocks that don’t get fixed.

There exists a large disconnect between what people believe and what reality is.

Banning crypto is just the CCP attempt to preserve their power for as long as possible. Capital flight is a threat.

Don’t forget that real estate prices for the most part don’t crash over night like stock market can. This China situation will take 12-18 months to play out. Maybe longer.

You will see lack of demand for commodities from China and there will be long list on countries that are effected by that.

But don’t worry all is fine our central planners said so by saying they’d be tapering QE and raising interest rates soon. Go buy stocks 😂

The Chinese hold a lot of foreign currency because the Chinese produce more than they consume, not because American billionaires invest there.

IT’s simple really: If you produce more than you spend you export the surplus. In exchange, you get money, typically foreign currency, as that is what foreigners have. Another way to put this is that you are a net saver.

But you can spend your money on investment as well as on consumption.

Savings – Investment = Exports – Imports

As long as China keeps exporting more than it imports it won’t have any shortage of foreign currency. The money keeps pouring in. Consumption is much lower than production, so savings easily cover investment.

I think your ill informed on how China’s monetary system actually works. I won’t fault your for it because most people don’t.

China has to have US dollars on hand to expand their local currency base. I know people believe they can print or expand the monetary base by whatever they choose. That belief is not reality.

For every $1US currency they have on hand they can expand their monetary base or credit by about 6 yuan.

If China decided to bailout Evergrande. Call it $300 billion bailout. It would mean currency peg gets broken. And not by a little because for every 1 US dollar they have there are about 6 yuan. It would drain $1.8 trillion yuan out of their banking system with no way to replace those yuan.

Additionally – China needs to buy/hold foreign currency because it can’t allow the yuan to strengthen too much. It’s very much a managed currency so China ends up holding lots of USD which then is invested in treasuries (among other assets). Treasuries are a whole lot safer than keeping the money in the bank so don’t confuse their UST holdings with a desire for USD assets – it’s because they want a artificially weak yuan.

Rgds

WP

Chinese energy policy for the last decade, seems to have focused on trying to stretch the benefits of their static coal production from deep mines. I think they are fully aware that time is running out. Their new coal power plants are ultra critical units, with thermal efficiency upwards of 45%. That is some 50% more energy per unit coal than the lower technology, saturated steam plants that they replace. The declining capacity factor partly reflects their use as backup plants for wind and solar powerplants. A lot of people seem to think that this heralds China’s ambition to transition to a 100% renewable economy. More likely, they are attempting to stretch their limited coal reserves long enough to allow nuclear new build capabilities to grow to the point where they can replace coal altogether with nuclear fission.

TONYH –

I agree that one big reason for building new coal plants in China is to get rid of older plants. More efficient plants are also cleaner. The Communists Party is nervous about pollution because it makes them look incompetent.

The coal industry is doing terribly however, with very low capacity factor and huge losses. Much of the new building is being done by the provinces despite the plans of the central government. There isn’t a grand plan.

The recent massive build-out of solar was also done by the provinces against the will of the central government. The provinces built panel production in competition with each other to dominate the industry, and then consumed the output to keep the manufacturers afloat.

They are still moving forward with nuclear, but Fukushima makes them very nervous. The disaster made the Japanese government look like idiots. The Communists believe they can keep on running the show in China unopposed as long as people have faith in their ability to lead the country. In their view, a single nuclear accident could destroy that faith.

Agreed. China has hit peak coal which means their production costs keep rising from here, which means their selling price keeps rising, in turn blowing out the profit margins of the countries that are selling them coal. It also means that the cost of renewables is going to go up fast than the rate of inflation – because they are all made from Chinese coal. Renewable energy is too expensive to make renewables – we all know that.

That graph was from a paper by Chicom academics in 2017. The last four years shows that the production peak has a flat top.

It is curious (and likely no coincidence) that China is hitting peak coal just as it’s working age population peaks. Fewer workers means fewer miners. The Chinese demographic situation looks awful. Their population will halve by 2100.

https://youtu.be/vTbILK0fxDY

When this is coupled with their energy supply problems, the future begins to look ugly for them. In some ways analogous to Japan. The difference is that Japan hit its peak at much higher per capita income. It also did so at an earlier time, when it could outsource to the rest of the world, which was still growing.

Who knows, they may come up with a solution. They are clever folk those Chinese. Cleverer on average than white people and harder working as well. Maybe they can grow clones in baby tanks or something? Neccesity is the mother of invention, so to speak.

Eh, remember, this was the nation that was so forward thinking they show trialled all their academics to death, wiped out native pest control leading to famine, and didn’t see any problems with a one (male) child policy. There isn’t enough fentanyl in all of Shanghai to dull the pain from those decisions.

Sounds like they’re fucked too. We just get to see them go down in a more interesting fashion while they take all our manufacturing capacity with them and murder the GND. King Coal is dead. Long live… ?

Kleiber —

It’s pretty simple really. Electricity is too cheap in China, but the Communists hesitate to raise prices for political reasons. And they are squabbling pointlessly with the Australians.

Thanks G. Kaplan!

The Norwegian population is at sleep as a whole thinking it is BAU. The disappointing developments in the Barents Sea has been known for some time despite the encouraging Shtokman field across the russian border ( yet to be developed). There are more gas reserves than oil reserves in Norway for the next few decades I believe, at substantially lower levels (I do not dare to guess; I am just a layman) when coming down from the high rates in the early 2020’s after a while.

There are a lot of prioritation issues going forward. Can we have a green aluminum/ferro silicium/silicon/copper industry in Norway going forward based on hydro/wind power or must all electricity be exported to who (UK, Germany, Netherlands, Denmark) and when? For what purpose? To keep the lights on? A half way solution must be worked out. We got a socialist government now in Norway. They are always going to go for a compromise when dealing with Europe (as did the more right side government “Høyre” the last 8 years)” There is a spoiled population in Norway – it could be nationalistic vibes if living standards go too far down. That is why the extensive electrification policy of transportation may be a way to keep most people content with less gasoline/diesel consumption. The Norwegian state is very powerful and we will probably see substantial more offshore wind power and rework of hydro projects in addition to electrification of transportation subsidised in a big way going forward. Rather that, than infuriating Norwegians.

“From previous civilisation decline studies (e.g. by Tainter, Costanza) it seems that simplification is possibly the best way to avoid complete collapse”

I agree very much the statement above. The purpose of the energy transition is maybe to prolong the fossil fuel age, and to enjoy a more simplified life rather than complain about it?

I think that you should be “sig self nog”, with the exception of us poor swedes! (leaving us not supporting you very well during ww2 out of the picture…) Anyway, Sweden has been exporting power, by a 2-4 kMwh basis, with quite a bit of it wind of it, as well as Norway has, but mostly hydro I guess in your case (give or take, a bit lower numbers perhaps for Norway)

This was for last month to mainland europe, from what I can see from Nordpoolgroup.com, it´s free access for all it seems, lots of interesting numbers there.

So perhaps maybe we should form an alliance, letting the southerners freeze in the dark!

Just kidding, main reason from my point of view for the high electricity prices in EU is less gas from Russia and Norway and other european countries, in the Russian case maybe they are also a bit annoyed by the NS2 debacle…Dropping a fuel rod during maintenace in a swedish reactor, prolonging standstill might not have helped… (but should be shut down permanently anyway, so I don´t mind)

Wood stoves are underrated!

Just the ABSTRACT of that thar REES paper is a fucken DOOZY.

“Green New Deal proponents are appallingly tolerant of the inexplicable.”

LOL

George, you might want to reconsider the link to “Megacancer,” unless you really think SARS-CoV-2 is a “plandemic.”

‘They’re hacking you now with an engineered virus and mRNA “vaccines”.’

‘Fess up now, or GTFO.

I don’t think I should only suggest authors who I agree with in all things, in fact I doubt if any exist, Ellroy certainly wouldn’t be there however entertaining I find him. People can make their own minds up about the content of any of the things above. We probably all have some areas where we find it impossible to apply proper logic. It’s a problem if that can end up having a malign effect on others but I doubt that’s the case with a sparsely read blog like that or maybe any blog except those that appeal to fashions, which can change quickly and be easily swayed. My main problem with climate deniers, for instance, is not the drivel they spout but how mind-numbingly tedious, repetitive, unimaginative and ewe-like they all are (and cowardly, but that’s a different objection).

I don’t get why Covid and vaccinations seem to make so many apparently sane people go slightly bonkers (or more than slightly in some cases). It may have something to do with “my body is a temple at which I worship” or that medicine is so far from an exact science (much more so than earth sciences, even given however complicated they are). Chris Martensen is another who can write mostly good stuff but not for Covid – although I did notice he interview David Icke who was a professional goalkeeper and well respected TV presenter but is now a full time wacko who believes in lizard people, so I’m not sure I’ll be going there again.

I don’t think I should only suggest authors who I agree with in all things, in fact I doubt if any exist, Ellroy certainly wouldn’t be there however entertaining I find him. People can make their own minds up about the content of any of the things above. We probably all have some areas where we find it impossible to apply proper logic. It’s a problem if that can end up having a malign effect on others but I doubt that’s the case with a sparsely read blog like that or maybe any blog except those that appeal to fashions, which can change quickly and be easily swayed. My main problem with climate deniers, for instance, is not the drivel they spout but how mind-numbingly tedious, repetitive, unimaginative and ewe-like they all are (and cowardly, but that’s a different objection).

I don’t get why Covid and vaccinations seem to make so many apparently sane people go slightly bonkers (or more than slightly in some cases). It may have something to do with “my body is a temple at which I worship” or that medicine is so far from an exact science (much more so than earth sciences, even given however complicated they are). Chris Martensen is another who can write mostly good stuff but not for Covid – although I did notice he interview David Icke who was a professional goalkeeper and well respected TV presenter but is now a full time wacko who believes in lizard people, so I’m not sure I’ll be going there again.

Thanks. The reason I asked: The woman below is someone I grew up with. She believed some of the bullshit that Megacancer spouts, refused to get vaccinated and is now dead because of such ignorance. It’s personal now:

https://www.kentucky.com/news/local/education/article254490102.html

I can’t help but notice that most of the people dying from COVID under the age of 70, are heavily overweight. That includes the two women pictured in the link. Whilst I don’t doubt that getting vaccinated will reduce individual risk, shouldn’t this crisis also be a wake up call to the terrible metabolic health of people in the US? This is the principle reason that the US has been hit so hard and also why the UK has been hit harder than Sweden, which never took any coercive measures to confront COVID-19.

The American people are out of shape and their immune systems just cannot cope with the infection. The food industry has developed in toxic ways; producing high calorie density foods, full of ingredients like corn syrup and palm oil, which are ruining people’s health. And it is leaving them wide open to disease. Instead of fixating on people that declined to take poorly effective vaccines, which is really just scapegoating, this crisis should bring home to you all the importance of improving fitness and nutrition across the nation. No one wants to talk about this, because it is so hard to confront. It is easier just to find convenient people to blame and vent your frustration upon. But the fact is that bad food is causing catastrophic increases in heart disease and cancer, that are now seriously damaging human life expectancy. Vulnerability to COVID is just another disease to add onto a very long list.

Agreed 100%, Tonyh. I have been overweight and prediabetic for several years.

I started intermittent fasting 3 weeks ago. Completely eliminated sugar (not that I used to eat a lot of sugar). Now I eat just 2 meals a day with zero snacking between meals. Time interval between dinner and next day’s lunch is 16 hours.

I have already lost 5-6 pounds. This is now going to be my lifestyle for the rest of my life (there will be rare days when I eat sugar or eat snacks).

If Americans were metabolically healthy (sensitive to insulin) Covid would have killed so few people we would not have noticed there was a pandemic.

SUYOG,

Pre diabetes and type II diabetes are completely reversible. It calls for a change in our eating habits. So no bread, sugary drinks, cake, ice cream and even no potatoes or corn. Insulin acts on protein and especially to carbohydrates. It has zero action on fats. Its all the carbs that Americans eat that do us in. Best of luck to you.

Thanks Docrich. I agree with you 100%. I have watched a large number of YouTube videos from top of the line scientists and doctors. Some illustrious names are: Dr Robert Lustig who is a pediatric endocrinologist working at U of California. He has absolutely fascinating lectures on the damage done to the human body by consuming fructose. Dr Jason Fung who is a nephrologist practicing in Toronto. I have learnt so much from these people. I will always be grateful to them.

Hey George, your buddy at Megacancer is even crazier than I imagined:

The virus and lock-downs may be designed to put Western nations on a semi-war footing so that people can be managed in what will be a very challenging time. The virus may be a means to reduce population too…

I want to thank you for advertising his blog here at POB.

I side with George on the topic of censorship.

On the topic of the pandemic I have heard people say what I consider to be very misleading things on all sides, including Anthony Fauci. (A link to my little blurb on the pandemic: https://www.math.univ-toulouse.fr/~schindle/articles/pandemic.pdf)

Matt Taibbi has looked at the topic of censorship rather closely. Here is a link to some of what he has to say on the topic with a link to a video of an interesting debate on the topic of free speach with Nadine Strossen and Amna Khalid on “Fire”: https://taibbi.substack.com/p/responding-to-on-the-media-on-free

No one said anything about “censorship,” schmuck.

If someone is going to post bullshit about being “hacked” by vaccines, I’m going to bitch about it, especially as I know someone who refused to be vaccinated and died. G+K is a dumbass for passing such shit around.

And by the way, go fuck yourself. Censor that.

Schnizy, from your link:

Our aim is to examine a simple model to determine which policies should be

adopted in order to end the pandemic with as few vaccinations as possible.

This paper is antivaxx bullshit. We are in the midst of a pandemic that is literally killing people by the thousands. Vaccinations are the only way out of this pandemic. We need to stop all the deaths. So please do not post even one more antivax post on this blog. Not one more.

And slandering Fauci will not help either.

No Ron, you are wrong. This is not antivaxx bullshit.

This is a modification of the standard model epidemiologists use to compute the percentage of vaccinated individuals in a population that will end either an epidemic or a pandemic. What the paper says is that unless the vaccinated social distance, a large percentage of those who are not vaccinated will die. You get vaccinated to save your ass, but it will not stop the pandemic. The paper indicates that the rate of vaccinated individuals needed to end the pandemic is higher than we were originally led to believe.

If you look at Norway for example, the average number of excess deaths since the beginning of the pandemic is negative (https://ourworldindata.org/excess-mortality-covid). They accomplished this with severe precocious lockdowns. Then they vaccinated a large percentage of the population (currently around 63%) and opened up. But the pandemic did not end. I originally heard estimates that a 60% vaccination rate would end the pandemic.

I object to blaming the non vaccinated for endangering the vaccinated. They are not endangering the vaccinated by dying except, perhaps, by overloading health care services. I think it is the vaccinated who are endangering the unvaccinated if they do not social distance.

Vaccination does not magically end the pandemic. Indeed, it is possible for the pandemic to persist with a 100% vaccination rate. Vaccination does save lives. Some say that vaccination encourages the development of vaccine resistant strains of covid. I have not looked at this carefully, but I currently don’t see why this is not a possibility.

Good points. I would add that this viral outbreak should have been the wake up call that America needed to improve its nutrition, metabolic health and reduce obesity. The generally poor metabolic health of the US population has left them vulnerable to infection. And there are bound to be other disease vectors in the future that pose even greater risks. Even if this virus were to miraculously disappear with high vaccination rates, the fact remains that the US population is facing a real pandemic of cancer and cardiovascular disease that is killing millions before their time and ruining lives years before it takes them. For some reason it doesn’t cause the same national panic as this virus, even though it is the most significant factor behind the high US mortality rates from COVID compared to other countries.

I wonder how the US population would have faired, if the COVID virus had arrived in the 1980s. Would the mortality rate have been anywhere near as bad? Would there have been the same hysteria, lockouts, mask policies, forced vaccinations? We will never know for sure. But the much lower obesity rates back then would have dramatically shrunk the mortality rate.

This paper indicates a J-shaped correlation between obesity and mortality from COVID-19.

https://pubmed.ncbi.nlm.nih.gov/32783686/

Then this pandemic never ends, and we perpetuate these curbs on normality indefinitely.

Thanks, but I’ll take my chances with the virus. Unlike some people, I had to work all through the lockdowns risking myself as a key worker and was promised vaccinations would be the gateway to normality again. If America wants to die on the hill of liberty because “my body, my rights” over vaccines, then so be it. The rest of the world is happy to move on.

Look at the US’ case rate compared to everywhere else. That said, there is little room for the virus to manoeuvre as many doomsayers (I can’t believe I’m the one shining a ray of hope here) seem to think it has infinite variability to evade vaccines. This is patently not the case, because it can only vary the ACE2 spike protein ligand to the degree that it can try and weasel out of antibody detection, but still act within the receptor matrix. Given Delta has by far out competed all other variants of interest and concern, and is being held in check by the vaccines with negligible mortality or severe sickness across all cohorts, I think it’s safe to say we open up.

Anyone who hasn’t taken the jab now? Too bad.

Pandemics are characteristic of the end of civilizations (see https://www.resilience.org/stories/2020-05-14/global-boom-pandemic-crash-is-history-just-repeating-itself/)

Decreased biodiversity increases the probability of pandemics (see https://books.google.com/books?id=RMmxxYUBQhgC&printsec=frontcover&dq=spillover: animal infections and the next human pandemic&hl=fr&sa=X&ved=2ahUKEwjRmuKfl57zAhU0CjQIHWI8A-4Q6AF6BAgHEAI#v=onepage&q=spillover: animal infections and the next human pandemic&f=false).

This is probably one reason pandemics characterize the end of civilizations. Civilizations tend to be efficient at destroying biodiversity.

There are two ways to end the pandemic (see https://www.math.univ-toulouse.fr/~schindle/articles/pandemic.pdf). The fastest way to end a pandemic is via quarantine. Everyone gets tested frequently and is immediately quarantined if sick. A vaccine giving lasting sterile immunity (the reproduction number of those vaccinated is 0) will end an epidemic or pandemic quickly if a sufficiently large portion of the population is vaccinated. The vaccines available for COVID 19 do not give sterile immunity. They could help to end the pandemic, but how much we don’t know because the data is not available to estimate the reproduction number of those vaccinated. I spoke with an epidemiologist last week who complained about the lack of data which should be collected. Another way to end the pandemic is to do nothing. The population is culled of those at risk and the virus and population become adapted to each other.

We are learning more about our immunization system. For example we are learning that our microbiome is responsible for a large part of our immunization (70% according to this author: https://book.umanaidoomd.com/). These authors say that the global food business favors pandemics (and otherwise makes us sick): https://us.macmillan.com/books/9780374602529

Best for your health eat food produced using agroecological methods.

There are lots of corona virus types in cirulation – many of then are the backbone of the common cold.

This one will stay, too. It can survive in animals, it’s easy to spead.

But with the vaccine it’s less deadly – and when there is a new variant there will be a new vaccine. Biontech said they need only a few weeks now for the vaccine – getting the approval is longer.

There are new vesions of the flu every year – so you don’t need to be a prophet to see that there will be new versions of corona, too. They have a new vaccine for flu every year (it’s much worse than the corona vaccine, but it helps).

Here the mass dying stopped from the vaccined people – so it helps a lot. Most people in hospital because of Corona now are either not vaccinated or have a completely broken immune system.

Living more healthy helps with anything – not only Corona.

Thanks George, always lots of food for thought.

Brought forward from the last thread .

HOLE IN HEAD

IGNORED

09/24/2021 at 10:19 am

Baggen , what is your thought about Richard Duncan’s ” Olduvai theory ” , which lays out a scenario based on decline of per capita electricity . Just dusting some books and see he had electricity shortages starting in 2012 . Suddenly electricity shortage is in the news .

https://oilprice.com/Energy/Energy-General/The-European-Energy-Crisis-Is-About-To-Go-Global.html

https://www.zerohedge.com/commodities/china-enforces-power-rationing-major-industrial-hubs-amid-shortages-and-climate-push

The current blip in European gas prices is meaningless in the long term. It is just part of the general supply chain disruptions caused by the pandemic. It doesn’t prove that renewables will save us, and it doesn’t prove the sky is falling.

The same is true of the current worldwide chip shortage. Does it mean that there will never be enough chips again, or that we have to find an alternative to chips? No and no. It proves nothing.

History is just “one damned thing after another”. Trying to attach an narrative to every little jiggle in prices is a fool’s errand.

I don’t know. I’d say the culmination of so many factors lately is indicative that not all is so rosy as many of our supposed benefactors would make out. The financial system, the HGV and other professional supply chain worker shortages, the increased cost of living in food, consumer goods and now all forms of energy, the housing markets of many nations, natural resource constraints from water to minerals. These all point to the situations prior to the pandemic finally coming to the fray with a vengeance, things which were on the horizon or already in play, but which either got delayed by the pandemic or came back harder because of the consequences of throwing that spanner in the works.

In the UK, everyone is blaming Brexit for things which are evident on the continent. I’m sure many Americans who didn’t vote Biden will blame him for the state of affairs over there. People will find their own narrative explanations for what is, at the end of the day, a simple matter of a complex super-organism experiencing a heart attack from which it may find it very hard to recover. The knock on effect of the semiconductor shortage alone is financially costly to many industries, but I’d be more concerned with the gas situation now given the writing on the wall.

Any one thing isn’t evidence of things being great or going Mad Max, I agree. But all of them together? That’s a potent brew. And I didn’t even factor in the more prominent appearance of climate related disasters over the last 18 months.

I’m watching to see how people overall react to this. Whether we turn to the usual accusations of the other tribe being incompetent or corrupt, or people awaken to the idea that something needs to change systemically.

Kleiber, I live in the UK too. We have a shortage of lorry/truck drivers. 100,000.

EU also has a shortage of drivers, about 400,000. But with a population of 450M, this a lot less than the UK with a population of 67M.

The EU shortage does not produce shortages in the supermarkets. The UK one does.

The UK also has a shortage of cheap EU migrant labour. So crops are rotting in the fields. Don’t think this is happening in the EU.

So yes, I’m blaming Brexit for problems in the UK which either don’t exist in EU or exist at a lower level.

I’m attaching a graph of UK wholesale electricity prices v France & Germany. Not blaming this on EU however…

As this is the FF thread, here’s UK nat gas storage…

Britain does not and never has had a shortage of unskilled labour for agricultural work. What is does have is an overabundance of people who sit on their hands and expect to live for free from taxpayers money. These people will moan incessantly about how little money they have and how cruel the government is for not taking better care of them with tax payers money. A large number of them are obese, smoke, live on a diet of fast food and seem to lack any personal initiative. The idea that they should get out in the fields and work for a living, is something that simply would never occur to them.

As for hauliers, there are shortages across the EU and within the UK for the same reasons. It is a difficult job, that requires long hours and days away from home. It is not conducive to quality of life. As HGVs have grown bigger, driving them has become more challenging and training and qualification requirements have increased. A lot of the financial cost of training falls on the trainee. So there generally aren’t enough new entrants into the industry to make up for losses due to retirement. With is why the average haulier is over 50.

As a Marxist, Norris naturally looks for an open borders solution. It appeals to his pet prejudices. But that clearly would not have been effective in this case, because the problem is endemic across the EU. The solution, if indeed there is one, lies at home. I would suggest that it is likely to consist of a number of measures: (1) Better government support and industry partnerships for haulier training; (2) Shifting more transportation to rail; (3) Use of smaller vehicles for transportation (for shorter road transit distances); (4) Relocalisation of food production and distribution infrastructure.

Relying on immigration from other nations to fill skills gaps is a foolish proposition. Firstly, it is not morally responsible. The UK NHS takes large numbers of doctors and nurses from third world countries, leading to a brain drain and poorer medical services there. Secondly, it pushes down wages for the UK workforce and contributes to the lack of skill base in the native populatikn. Thirdly, the constant influx of foreign immigrants, undermines the cultural integrity of the UK.

None of this will concern Norris of course, as the idiot has already said that he won’t read anything that I write. He is a typical small minded Marxist, who starts with an uncompromising prejudice and then looks for evidence and arguments that validate his narrow minded point of view. One thing that you do notice about these people is that they cannot tolerate people that don’t agree with them. They lack the emotional security to even consider that there might be other ways of looking at things and are threatened by people that don’t agree with them. This is why they are called ‘Snowflakes’. Their fragile egos are easily damaged. You see a few of them on this board. Norris, Hickory. I am giving Ron Patterson the benefit of the doubt.

Wow, you are such a psychoanalyst!

Hih,

Im not familiar with it and i dont have time to look at it now either.

Im just looking how things is playing bout in Sweden and how the same thing is happening in rest of Europe and will get even worse as time progress.

Nobody seems to be willing to acknowledge the fly in the soup, oil/gas cunsumptipn is actually increasing in the countries that are supposed to be the fore front of our transition. And how will it look when they have even less support from neighbors in the future.

It will get a lot worse before people understand i suspect.

Personally i shifted some of my capital into gas at the beginning of this year as i expected this result due to “green” decisions. Short of another corona surge or global economical meltdown i expect this situation to stay or get even worse especially if we get a cold winter in Europe.

Just have a feeling it will get cold this year.

Tks Baggen , no problem . Take care .

R/P for C&C dropped significantly to 9.4 years (490 weeks), the first time it has been below ten years.

Natural gas R/P continued to fall and is now at 8.4 years

Thanks George . Makes me go ehemmmmmmm .

What , me worry ? Alfred E Neuman

I need to buy Rafael Nadal’s yacht . 🙂

https://www.reuters.com/business/energy/europe-needs-long-term-energy-plan-eni-ceo-says-2021-09-25/

Interesting commentary by EIA at link below

https://www.eia.gov/petroleum/weekly/archive/2021/210922/includes/analysis_print.php

An excerpt:

We based this analysis primarily on the published financial reports of 54 publically traded companies, so the results do not necessarily represent the sector as a whole because the analysis does not represent the financial situation of private companies that do not publish financial reports.

U.S. oil producers have benefited from higher oil prices as evidenced by the higher revenue and increased cash flow from operating activities (also known as operating cash flow, or OCF) reported by these companies. Despite higher OCF, these companies have not increased capital expenditures to 2019 levels, which has contributed to higher free cash flow (FCF), the financial measure found by subtracting capital expenditure from OCF. As a result of positive FCF, many oil producers have had the ability to pay capital expenditures by using OCF rather than by raising debt or issuing equity. Through 2Q21, companies have also not significantly increased oil production, instead drilling fewer wells and accessing their inventory of drilled but uncompleted wells (DUC) to complete new wells at reduced costs.

According to their publically filed financial reports, the 54 U.S. oil producers that we analyzed have reversed their financial trends since 2018. Their FCF had been persistently lower than zero, but since 3Q20, FCF has become positive and has been increasing. Capital expenditures have trended downward and have remained lower than OCF since 3Q20 (Figure 2). With positive FCF, producers can pay for capital investment programs and use cash for other financing activities, including debt reduction, dividend increases, or share repurchases.

This suggests that the lower availability of financing for the oil and natural gas sector may be less of a problem than some people believe if current oil and natural gas prices levels continue (no increase) or increase further in the future.

The discipline shown towards capital investment in this sector does seem to be sensible, as rapid production increases would crash the price of oil and undermine profitability. With interest rates lower across the world than in 2007, economies should be able to tolerate higher oil prices for a while. The problem is that this is pushing up inflation, which will eventually induce central banks to raise interest rates. When that happens, the number of bad assets on the balance sheets of banking institutions will explode. And oil prices will collapse back down to $30/barrel.

Gail Tverberg observed a few years ago now, that there is no price for oil that is both affordable for consumers and profitable for producers. This is how peak oil will occur. Prices will ultimately be too low for producers to remain profitable. It stems from the EROI of the oil being too low to meet systematic energy requirements of our economic infrastructure. Low interest rates are an attempt at delaying the day of reckoning. But low interest rates cannot prevent the ensuing economic consequences that are the result of surplus energy falling below what is needed to operate a system that grew up on abundant High EROI energy. By cutting rates to zero 12 years ago, central banks were playing extend and pretend, hoping that something would turn up.

>Gail Tverberg observed a few years ago now, that there is no price for oil that is both affordable for consumers and profitable for producers.

Strange, my guess would be just the opposite. Saudi oil probably costs less than $30, and $120 oil barely dented US consumption.

In my view the huge gap between the cost of oil and the value of energy storage in a moving vehicle is responsible for the incredible amount of waste of oil resources. Seriously, Americans drive a three ton vehicle several miles to buy a pack of chewing gum. Happens all the time. The doesn’t seem to be any squeeze going on at all.

Yes. But remember that debt introduces a time lag between rising oil prices and the economic consequences of those prices. And we have been living with interest rates beneath inflation for 12 years now. Unfortunately, rising inflation is going to call time on those low rates in the relatively near term. But have you noticed that over the past 10 years, most people have been getting poorer? That is a direct consequence of high energy costs. The effect will be even more apparent when rates finally do rise.

It’s baffling that on the same day I’m seeing people queue for petrol they presume to be running out here, they’re also all driving vehicles twice the size of mine and on the motorway at 70+ MPH.

People have so much waste going on in places they don’t even think about, I wonder if they’ll ever cotton on to what they need to do should rationing become a thing again.

Which, cool story: https://apple.news/ANxjLAahnTsCfpQ4CXUYgTw

Looks like a north-western UK refinery is going kaput soon unless it’s bailed out.

As you said below you have to account for human nature and as such nothing makes sense unless it is seen in the light of evolution, most of which happened for us in tribes of groups of families of hunter gatherers in resource limited savanas. Even trying to explain modern behaviour in the light of previous evolution is difficult enough; trying to predict how traits picked up then will manifest in behaviour now is virtually impossible, Most arguments seem to start with, or include somewher, that first and foremost we try for a comfortable life, but what ultimately drives us is reproductive success – i.e. attracting a mate, having children and ensuring they get to reproductive age while ensuring our genes don’t get out competed by others. Add in a large predilection for fairness and tit-for-tat revenge and things can get complicated and probably quite nasty when the environment becomes resource limited again, as it is just starting to do.

George I do like the way you articulate your thoughts and couldn’t agree more. Alambiquated suggested that this is all a blip in the road which may be right if we somehow discover the next affordable energy source that is abundant, fungible and clean. I personally believe the pandemic exacerbated an already fragile global economic eco system based on and fueled by unlimited amounts of debt borrowed at unsustainably low interest rates. Scarce Resources that we have grown addicted to are beginning to dry up. How the world copes with a Mad Max scenario will be quite interesting.

Today I met with some of my old energy investment banking friends and we were asked by some folks at lunch not in the Energy game what my four favorite oil stock are today. Frankly we could only name only two because of our similar views on the short life ahead for the Shalecos. There are no exits for many companies because there are no buyers and no new capital coming in to buy and develop.

I know the MSM keeps believing that the Shale Co’s are chomping at the bit to ramp up and bring on a slew of new production. The real reason they aren’t ramping up is only partially due to “corporate discipline” but the true reason is because (1) the child wells are mediocre ( ie. suck)(2) the GOR is rapidly rising. Most CEOs know their only chance for survival is much higher oil prices, pay down debt ASAP and consolidation. This is what I faced and I know every other CEO is seeing the same thing.

LTO Survivor,

Any estimate as to what 12 month average price for crude oil might lead to increased completion rates for Permian basin tight oil producers?

I have read that private companies that don’t need to worry about public shareholder sentiment have already started increasing their completion rates. I would imagine $75/bo or perhaps $85/bo might entice those who have waited to join the party. Though hedges might be holding some producers back from increased rates of development.

Kleiber , on the sidelines . Essar refinery is owned by the Ruia brothers from India . The Essar group (refinery , steel, shipping etc) is on the list of willful defaulters of the Reserve Bank of India . The passports of the two brothers (Shashi and Ravi ) have been impounded . They are evidently in dire financial straits in the UK also . Just a titbit.

Dennis and Tony H , FCF means f****** shit if you are up to your eyeballs in debt . I did not say this , the oilman Mike S did . As Richard Pryor says ” Whom are you gonna believe me or your f*****g LYING eyes ” when his wife catches him in bed with another woman . 🙂

Holeinhead,

The higher cash flow can be used for CAPEX and paying down debt. The concept is really not hard to understand. For the Permian basin this can easily be accomplished at well head oil prices of $67/bo (lower than current oil prices which many energy analysts expect to go higher in the future).

Note that LTO Survivor has told me that he expects oil prices to rise. He is also surprised that Permian basin output continues to rise, as oil prices rise further, Permian output will increase at an even greater rate, despite pressure depletion (which is expected) and water disposal costs (which I expect to rise). Note that my scenarios all predict higher OPEX over time as the Permian basin matures, part of this is due to rising water disposal costs, as costs rise there will be more recycling of water.

From the paper by Bill Rees-

“Not only is the [Green New Deal] technically flawed, but it fails to recognize human ecological dysfunction as the overall driver of incipient global systemic collapse. By viewing climate change, rather than ecological overshoot—of which climate change is merely a symptom—as the central problem, the [Green New Deal] and its variants grasp in vain for techno-industrial solutions to problems caused by techno-industrial society.”

This statement leaves hanging the question- ‘what other response to the situation is at all rational or at all effective?’

Surely the biggest problem in this world is the massive human population overshoot.

5-7 billion human beings in excess of some level of earth carrying capacity.

All of the other problems are a consequence.

Lets be clear- no energy policy is going to cure population overshoot and the ecologic and human catastrophe that is a direct consequence.

What can an attempted energy transition towards electrification on the front and back end accomplish?

1. blunt the extremely rough and catastrophic period of peak human population/energy that will be encountered in this century. Embrace no illusion- this time of peak population approach and plateau will not be met by a humble, kind, deferential humanity. Rather humanity will behave in the just the same it has always behaved when faced with shortage, poverty and gross inequity. Think ethnic cleansing.

But any blunting of the effects will be very patchy (some places much more than others) and partial.

2. partially limit the degree of climate instability. Switching from coal to wind and or solar is a real difference in the trajectory of climate change. But make no mistake- the extent of climate damage is only a matter of severity. Human beings will resort to burning the worlds remaining forests and coal if they can’t get enough fuel elsewhere.

If anyone has a rational plan for population and economic contraction that is not simply a recipe for bloodbath or forced euthanasia, bring it on. And best luck with getting humanity to buy in the program.

I do. And I think there is much that is sensible in the Green New Deal, as well as much that is not. The shift towards electrification is inevitable. It is only a question as to how it is done. Whether the future energy system is nuclear, renewable or nuclear fusion, the fact remains that all produce electricity. Producing synthetic fuels to burn in combustion engines has terrible exergy efficiency. With cheap nuclear energy, there are scenarios where it could be made to work, affordably, within the scope of existing transportation infrastructure. But it is a long shot I think.

But you will note that the parts of the world where human beings reproduce out of control, tend to be the poorest. They are places where women have no prospects of doing anything other than reproducing. What humanity really needs is a cheap and abundant energy source. This will allow the prosperity that will naturally reduce fertility rates by providing women options for careers and prosperity. You will not find that in low power density ambient energy sources like wind and solar power. These energy sources, wherever they have been used, have functioned only as a means of reducing fuel consumption in fossil fuel powerplants. And their physical resource requirements are huge, a fact that leads directly to poor EROI.

The solution to overshoot is to provide cheap and plentiful energy through closed fuel cycle nuclear fission reactors. A more wealthy humanity, would shrink its population as a natural result of declining fertility rate. Coercion is not necessary.

The article is pretty clear in section 4.2 on population reduction. The paper says single child but in other places I’ve heard them endorse a one or none birth policy as the only solution to the problems, with payments not to have children etc. It may be a theoretical solution but it’s never going to happen. I don’t see any solutions but I think people should be presented with the data and facts that has allowed me to come to that conclusion so they can make their own decisions and not be spoon fed greenwashed propaganda through rose tinted spectacles (people have told me I mix metaphors but I say as one door closes it’s never too late for a leopard to change its spots in mid stream).

It’s all the money we are willing to spend that will get us what we really need as society or else things will only get worse. The data suggests that more and more Western countries now enjoy prosperity but without more babies our beloved standards of living will simply collapse.

Angeleyes,

Nations can allow people to immigrate to their nations if there are not enough people. A fairly simple solution.

The world is not suffering from a shortage of humans, the reverse is true.

Actually, the high IQ nations of Europe and East Asia are suffering birthrates beneath replacement rate. The places where birthrates remain high, Middle East and Africa, are not places capable of providing large numbers of high IQ people that are useful in technologically advanced economies.

The solution to insufficient birthrates in white countries is for white European people to have more children. Not to import low IQ immigrants from the third world. That simply results in more mouths to feed that are unable to pull their weight. When London councils announced that they were no longer prepared to pay for social housing in London, the black population in surrounding counties suddenly jumped considerably. These people do not generally have the ability to hold down well paid jobs and afford their own shelter. The average black IQ is about 80, versus 100 for whites and 105 for East Asians. This awkward little fact pisses a lot of people off. It is a hard but intractable fact of life. It is not something that can be changed by better nutrition or schooling. It is due to genetic inheritance. On the other side of things, there is no point blaming them for something they have no control over. But these people are not going to be useful in filling in labour shortages in high income white western economies.

As for importing immigrants from high IQ East Asian countries, their demographics are even worse than ours. Some do choose to come here. But you have to ask yourself if draining the shrinking talent base of these other countries is the ethical thing to do. And regardless, importing people from ethnically dissimilar countries, undermines the racial and cultural integrity of your own nation, by importing large, resident foreign populations. All in all, this isn’t a very good solution to population or skill shortage problems. The solution is: have more children!

Yeah, for example, Germany allowed two low IQ Turks to come into the country. They founded the company Biontech and invented an mRNA vaccination for the Covid-19 virus, which further exacerbated the world’s overpopulation problem.

Worse, these low IQ immigrants are now testing a cancer vaccination, which could lead to an unmanageable fall in death rates.

We need to orient ourselves on high IQ individuals like the governor of Mississippi, who pointed out that Mississippians aren’t afraid of death, because they are Christians. He never immigrated anywhere, just stayed where he was. Visionary thinkers like these can solve our overpopulation problem.

Racial IQ measurements are about averages. There will be high performers in low average IQ groups and low performers in high IQ groups. It is the average that matters in so far as their contribution to the economy. And I would add that the Turks are not a low IQ nation, although their average is beneath West European levels.

https://h2oisrael.blogspot.com/2018/05/national-iq-set-updated.html

If western countries are to import labour at all, East Asians would be the best contribution to long term demographics. Japan, South Korea, China. But they don’t have any surplus to spare and importing resident foreign populations that are culturally and ethnically dissimilar from your own people, is a bad idea.

I’m… not going to wade into the eugenics quagmire that seems to be forming here (and yes, I’m well aware of the IQ variance based on “race”, whatever that even is).

But if anyone thinks mass immigration into these developed nations is going to happen, they’ve not been paying attention. Japan is a pretty good example of just what the UK is now going through. And even relatively open France and Germany are much less happy to take in masses of foreign peoples to prop up their economic growth.