A guest post by Ovi

All of the oil (C + C) production data for the US state charts comes from the EIAʼ’s Petroleum Supply monthly PSM. After the production charts, an analysis of three EIA monthly reports that project future production is provided. The charts below are updated to July 2021 for the 10 largest US oil producing states.

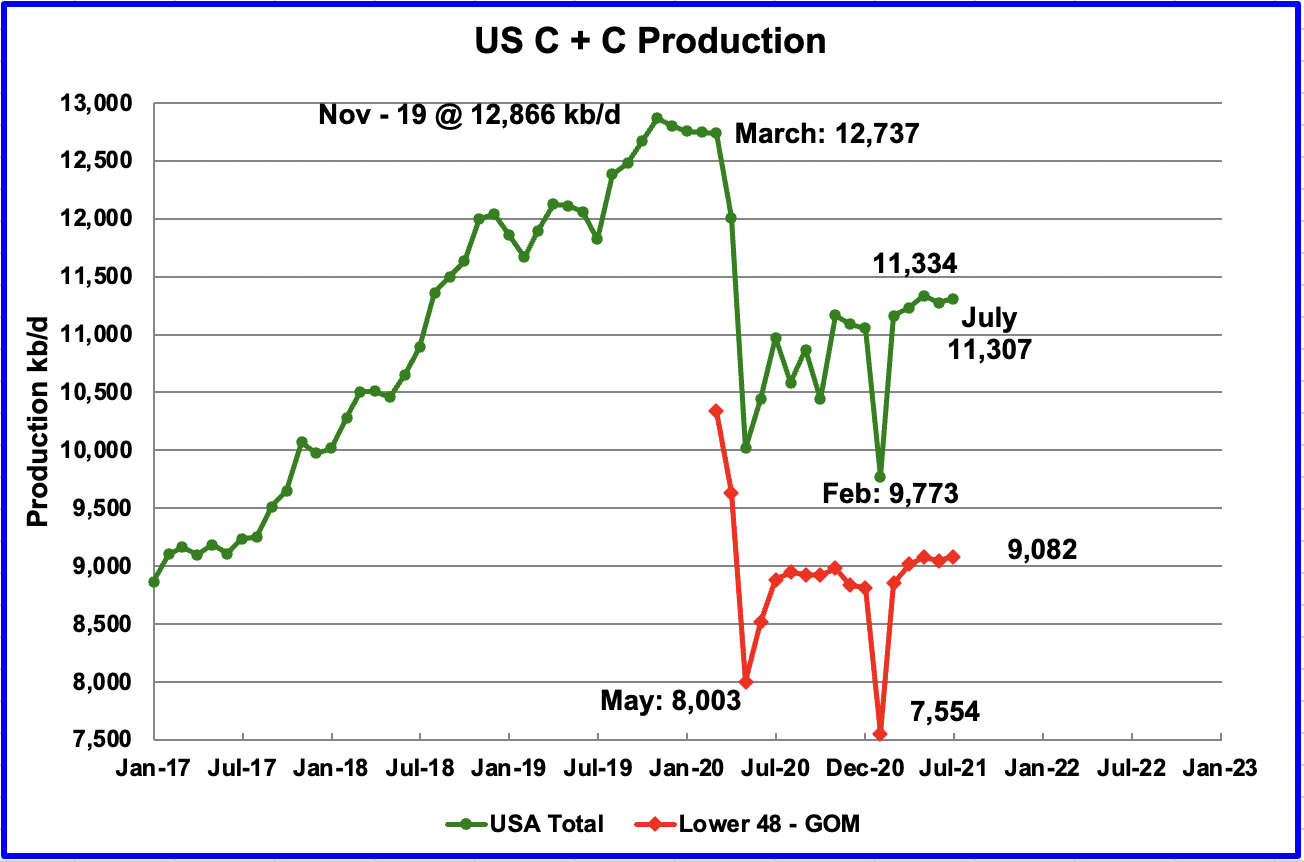

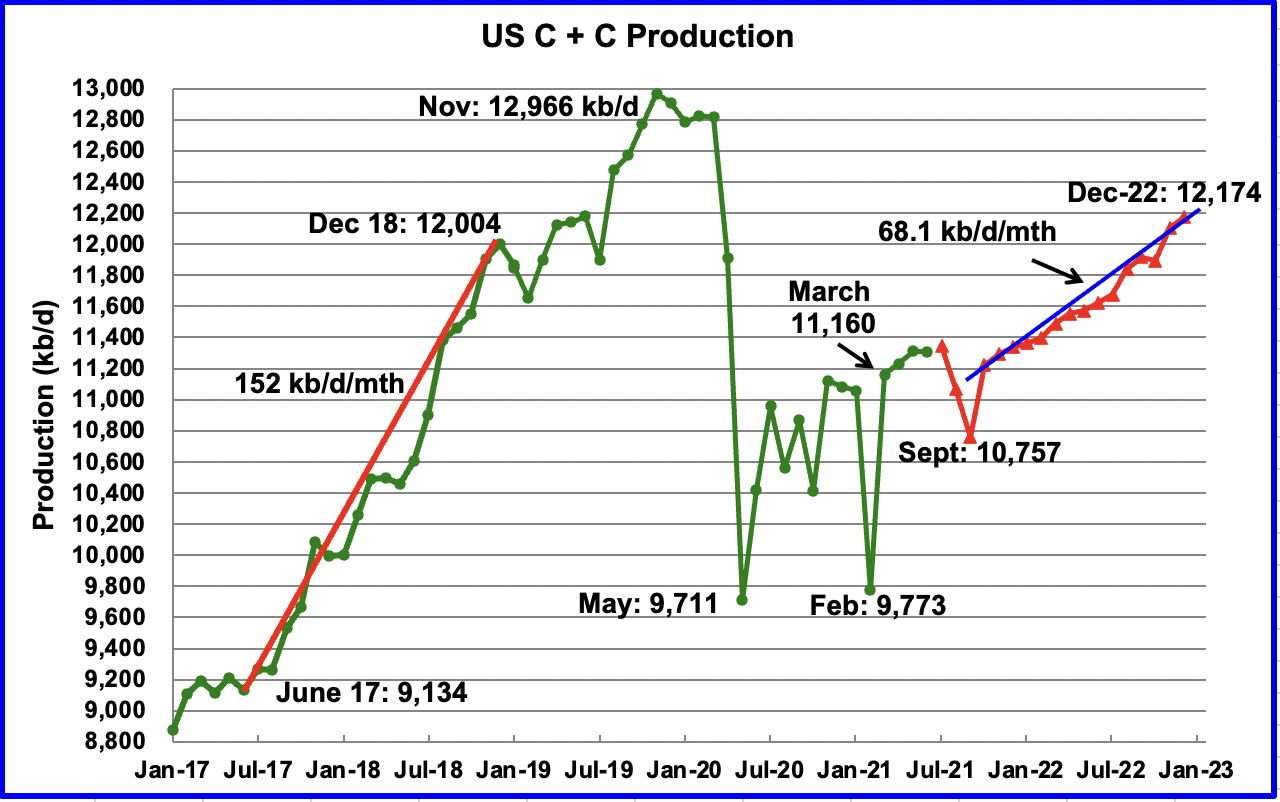

U.S. July production increased by 31 kb/d to 11,307 kb/d from June only because June was revised down from 11,307 kb/d in the August report to 11,276 kb/d in this report. From March to July, production increased by 147 kb/d or 36.8 kb/d/mth on average, down from 49 kb/d/mth in the previous report. July production is still lower than May’s output of 11,334 kb/d.

The September STEO report forecast US July output would be 11,347 kb/d, a reasonable forecast, high by just 40 kb/d. August is forecast to drop due to hurricane Ida.

In the onshore lower 48, July production increased by 35 kb/d to 9,082 kb/d and is 5 kb/d higher than May which was 9,077 kb/d, red graph.

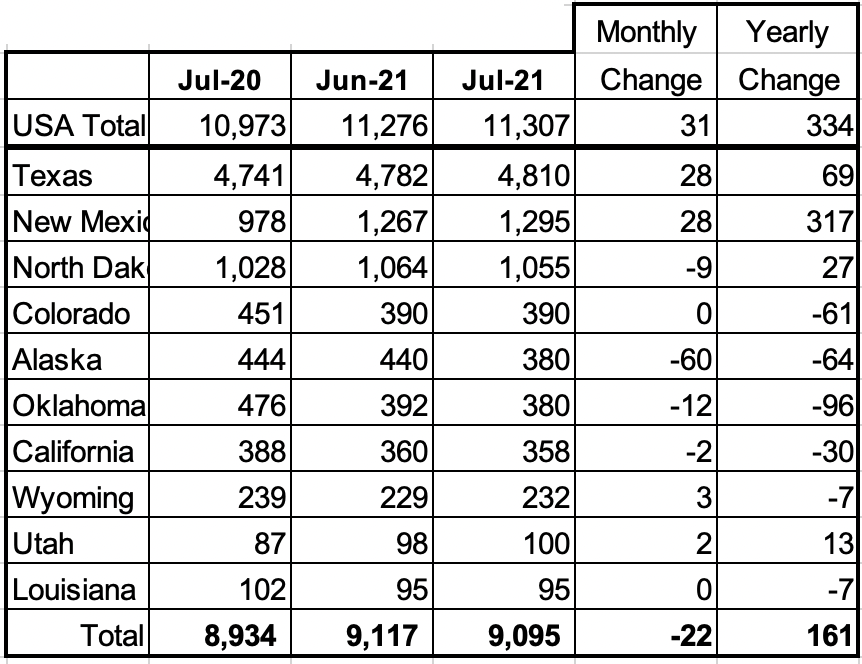

Listed above are the 10 states with the largest US production. These 10 accounted for 80.4% of US production out of a total production of 11,307 kb/d in July 2021.

On a MoM basis, the largest increases came from New Mexico and Texas, both with 28 kb/d. The combined gain from Texas and New Mexico was offset by Alaska’s drop of 60 kb/d due to summer maintenance.

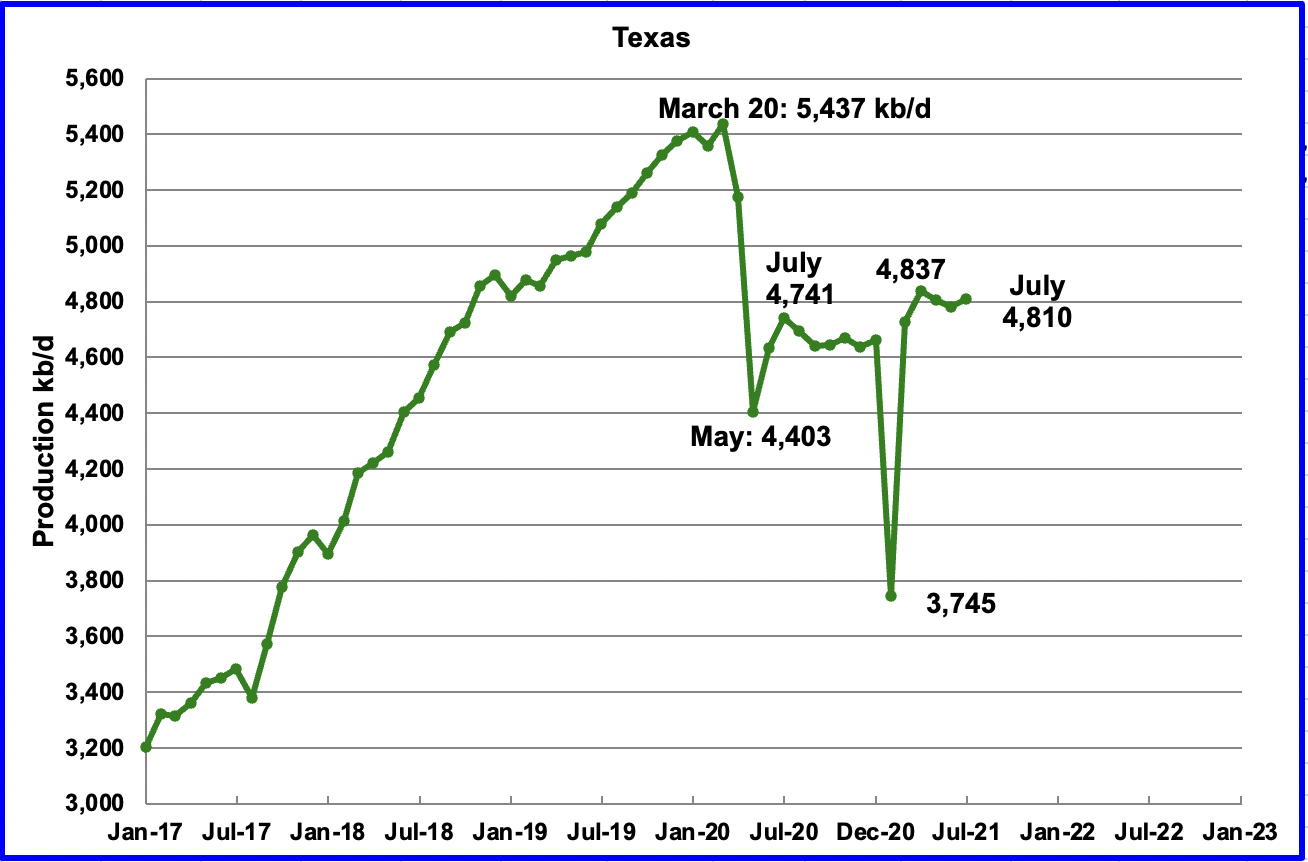

Texas production increased by 28 kb/d in July to 4,810 kb/d. In the EIA’s September report, June’s output was revised down by 9 kb/d from 4,791 kb/d to 4,782 kb/d. Note that Texas production decreased for two consecutive months, May and June and is still lower than April which produced 4,837 kb/d.

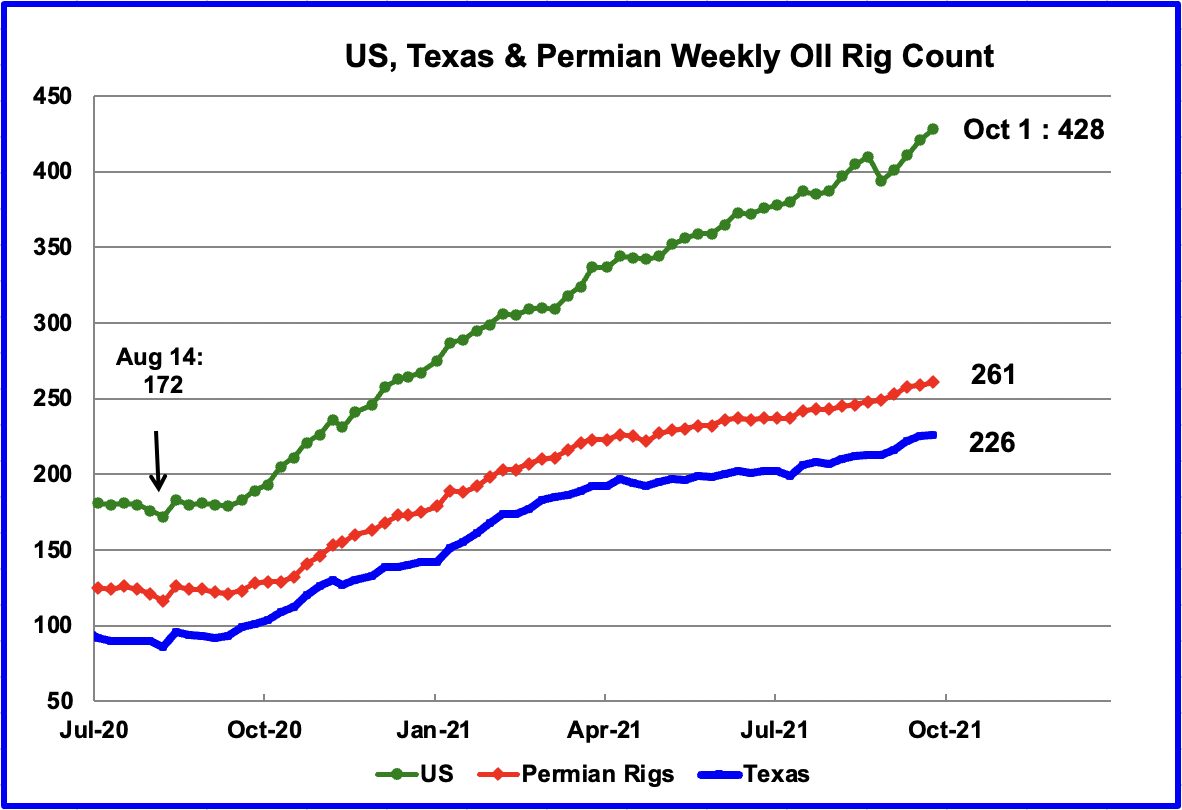

In July there were close to 203 oil rigs in operation in Texas. By the week of October 1, 226 were operating and production is slowly beginning to increase.

July’s New Mexico production set another new record and increased by 28 kb/d to 1,295 kb/d. The increase can be attributed to New Mexico’s Permian which is favoured over North Dakota, where higher production costs have curbed profits.

New Mexico had 75 rigs operating in the Permian in July and they increased to 83 in the week of October 1.

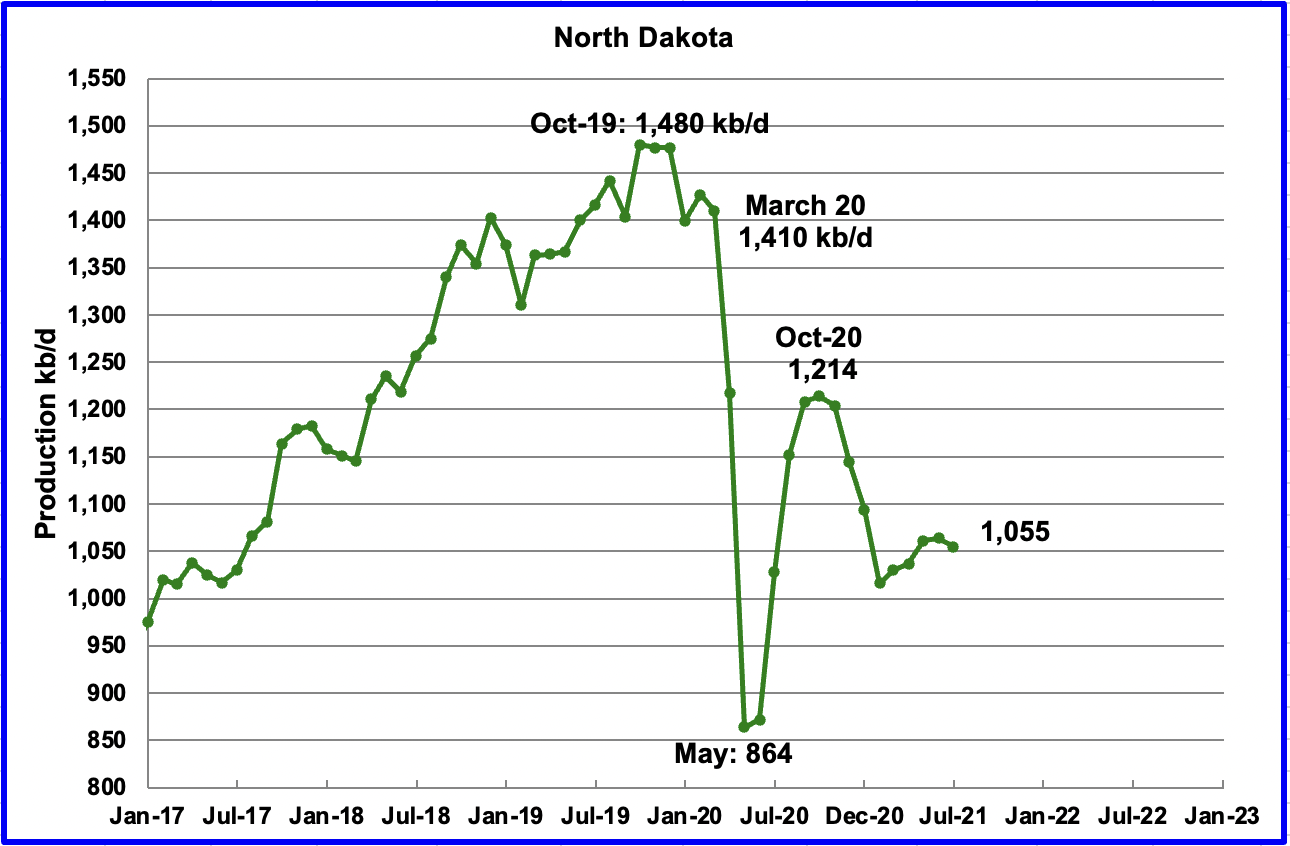

According to the EIA, July’s output was 1,055 kb/d, a decrease of 9 kb/d from June.

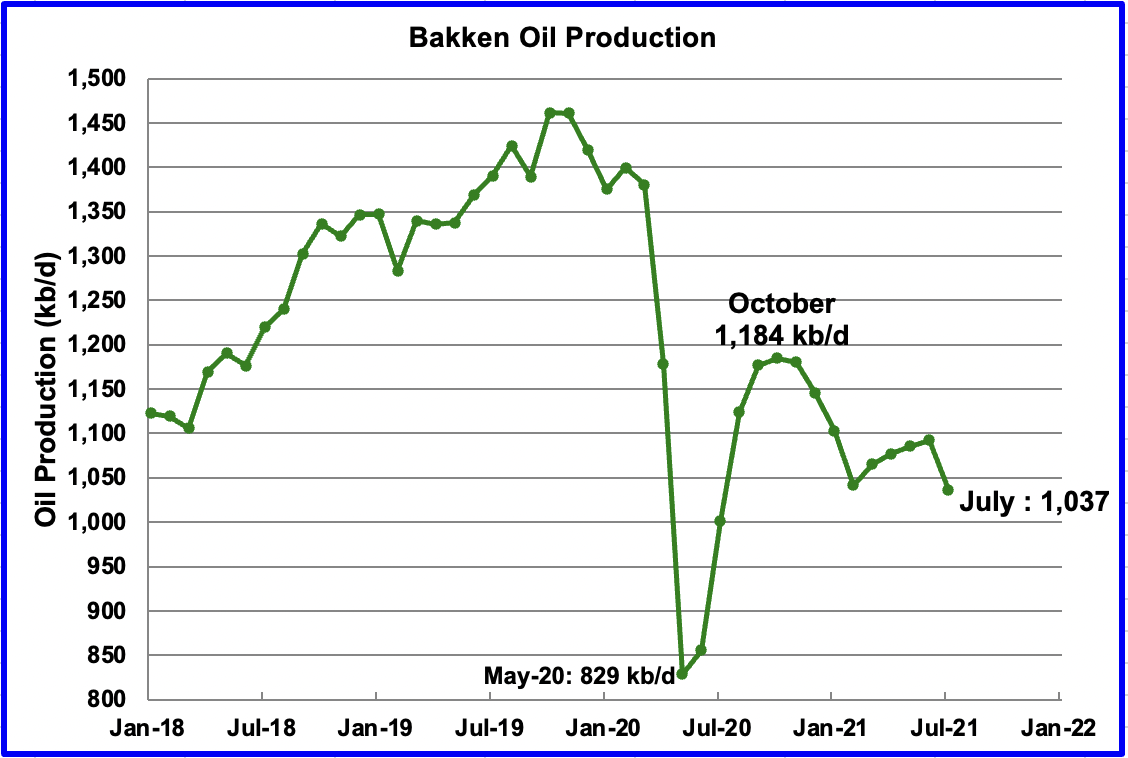

Data for the Bakken from the North Dakota Oil and gas Division indicates a much larger drop in July. According to the ND O&G division, output dropped by 55 kb/d in July to 1,037 kb/d. See the DPR section further down.

Note that output for all of North Dakota for July was 1,078 kb/d according to the ND O&G division, a drop of 55.7 kb/d from June. Not clear why the EIA reports lower output than North Dakota for July.

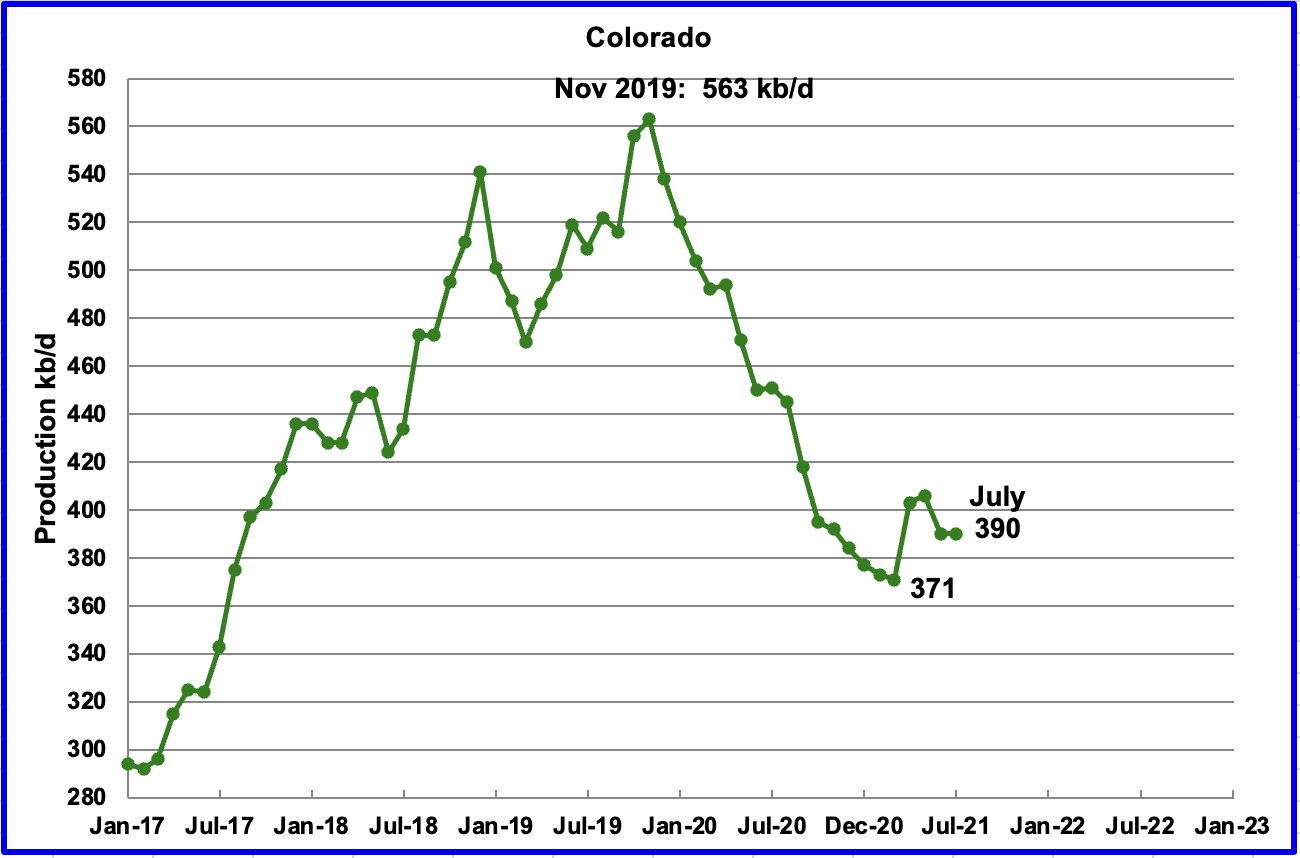

Coloradoʼ s July output was unchanged at 390 kb/d.

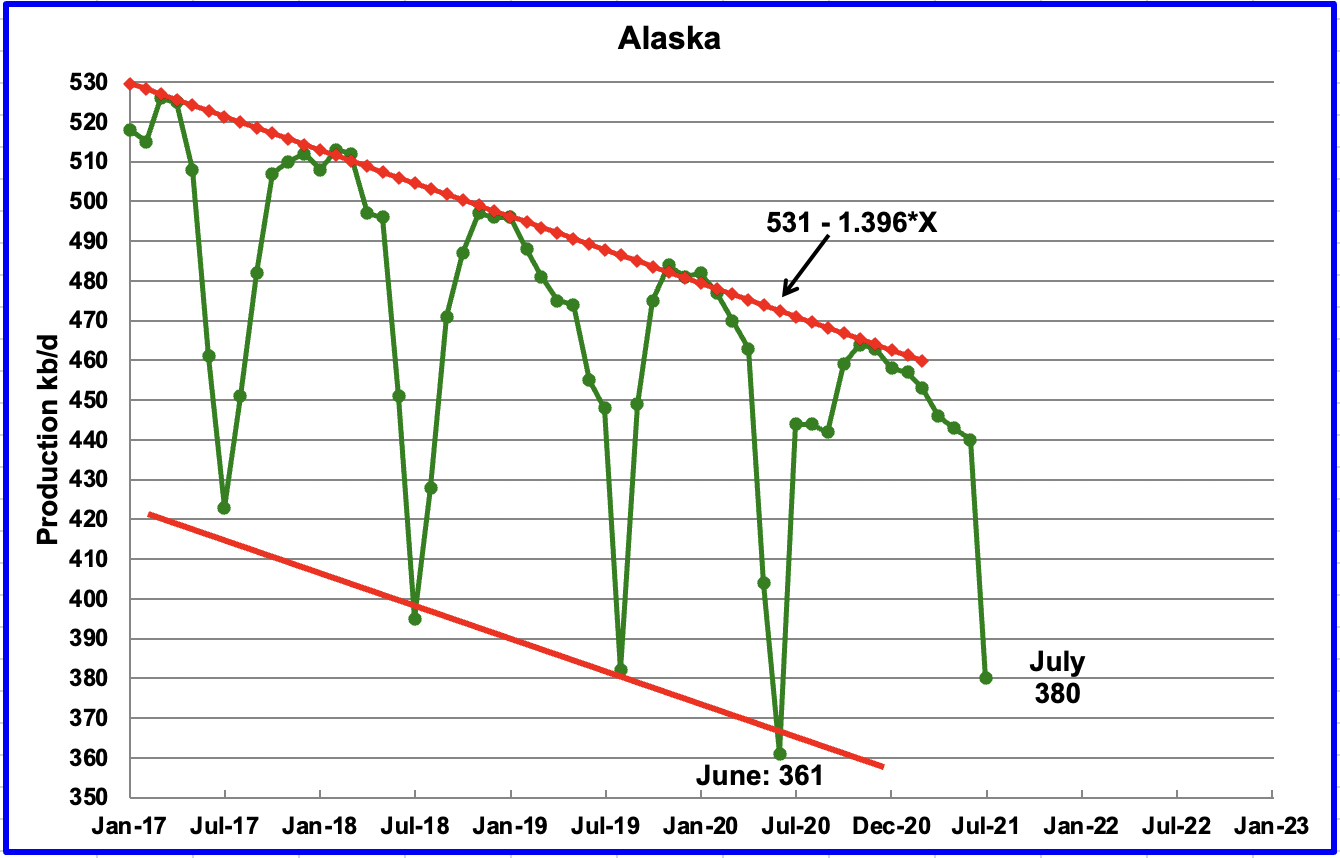

Alaskaʼ s July output decreased by 60 kb/d to 380 kb/d due to maintenance.

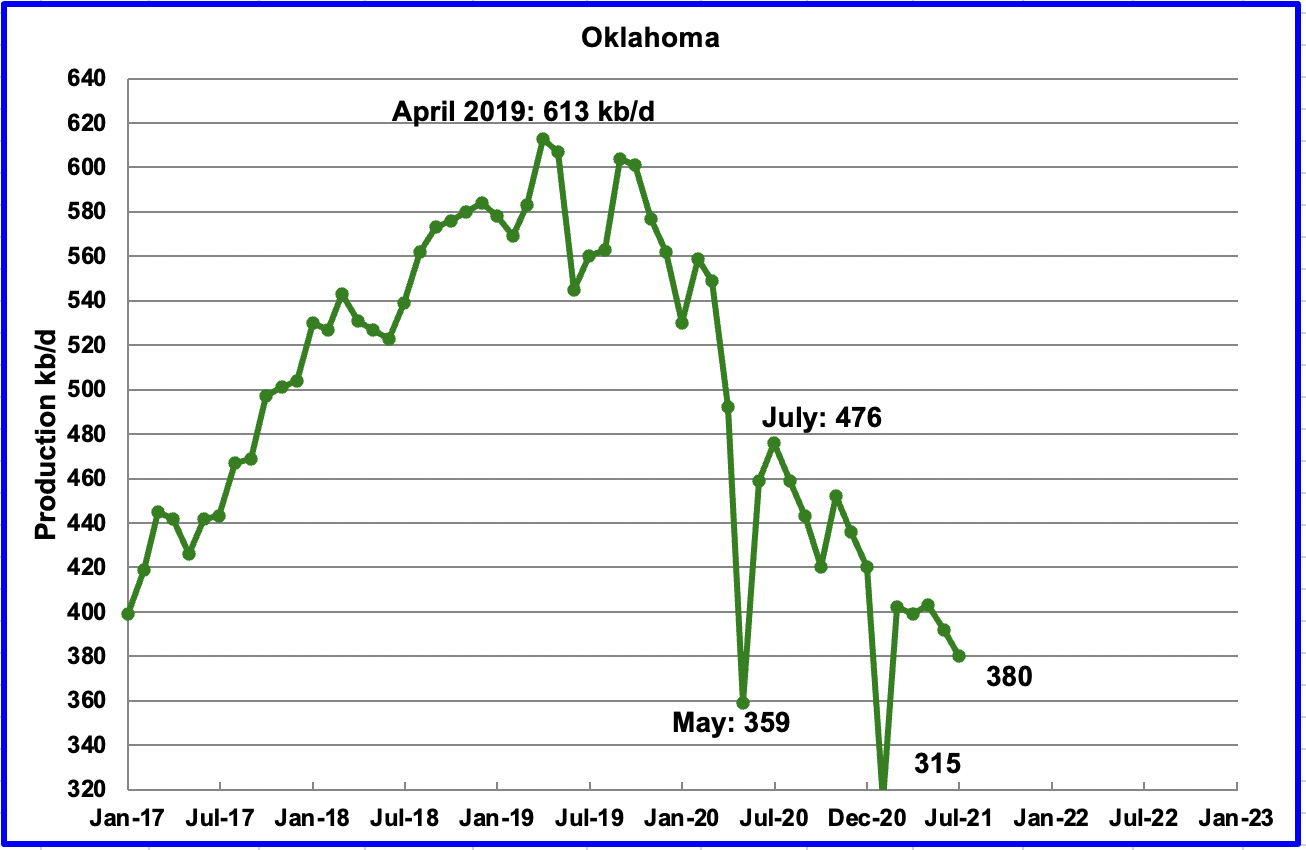

Oklahoma’s output in July declined by 12 kb/d to 380 kb/d.

For the week ending October 1, 39 rigs were operating in Oklahoma. From the end of May to the end of July, the rig count increased from 28 to 30. Oklahoma’s increasing the rig count is not offsetting the decline rate.

Difficult to explain increasing rigs and decreasing production

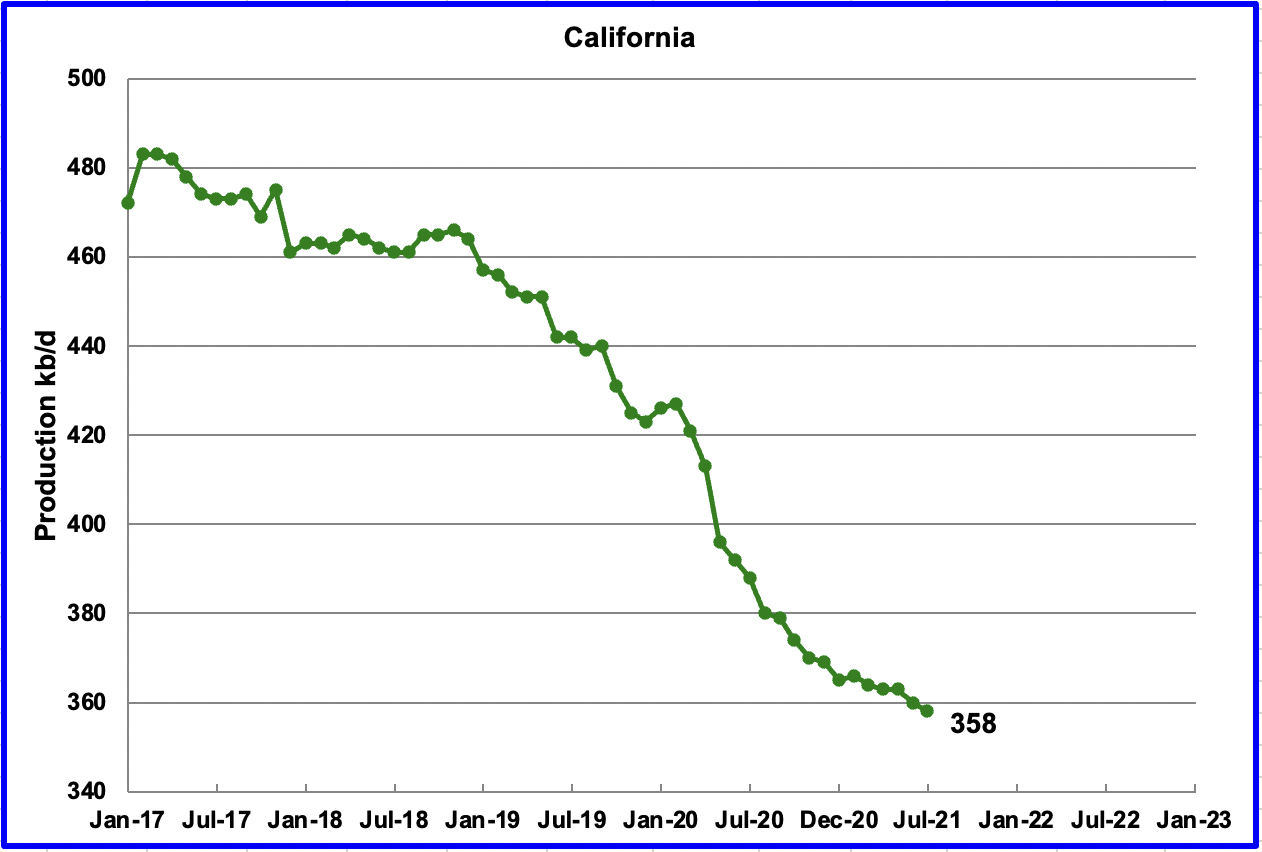

Californiaʼ s slow output decline continued in July. Its production decreased by 2 kb/d to 358 kb/d.

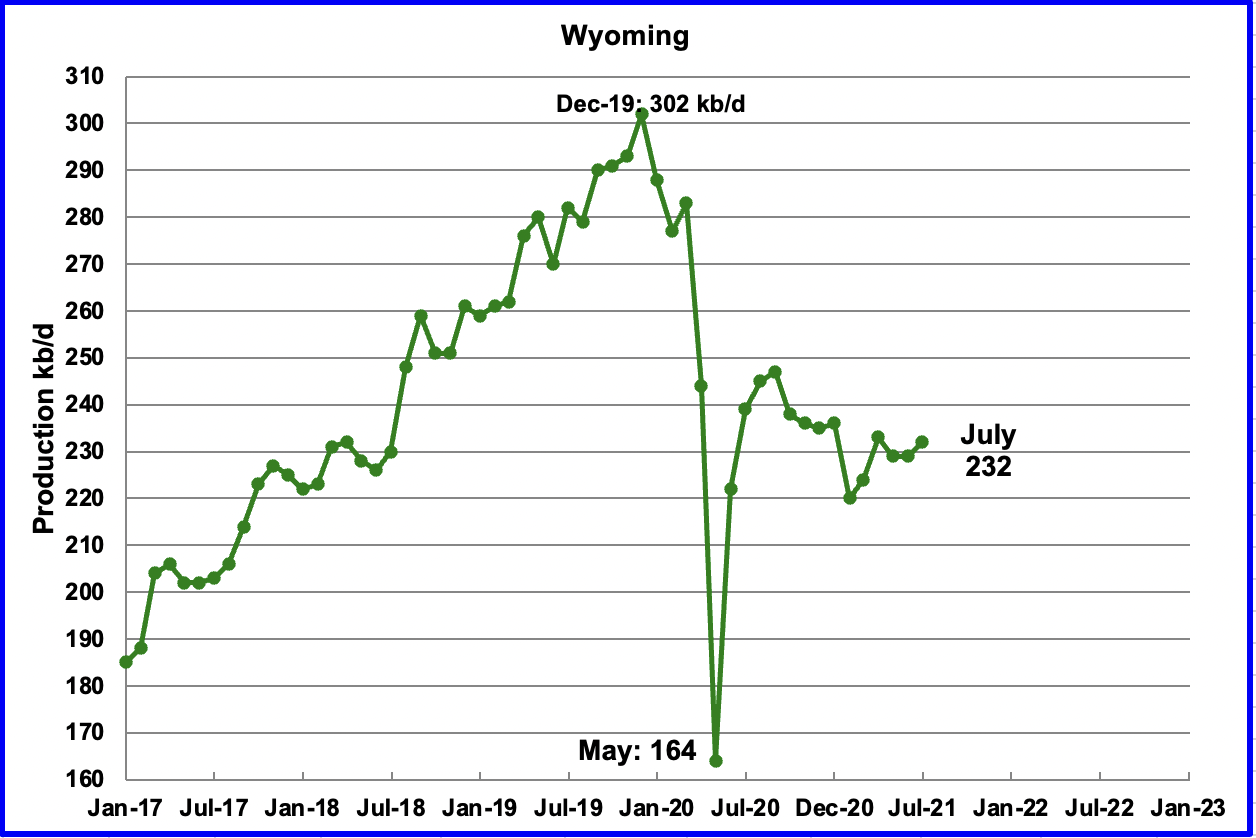

Wyoming’s production in July increased by 3 kb/d to 232 kb/d. Wyoming had 3 oil rigs operating in May and they increased to 17 by late September.

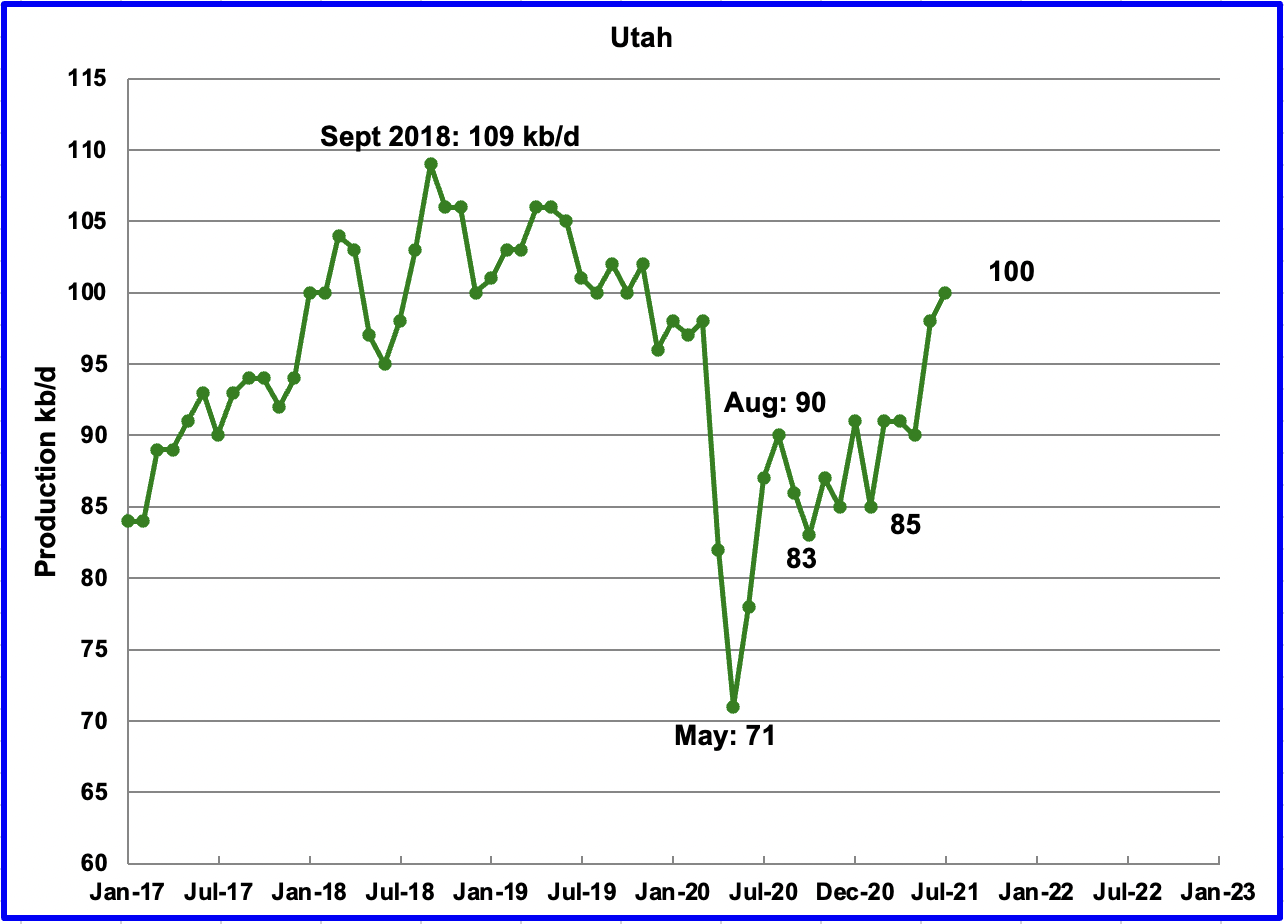

July’s production increased by 2 kb/d to 100 kb/d. Ten oil rigs were operational in July and were unchanged at 10 by the fourth week of September.

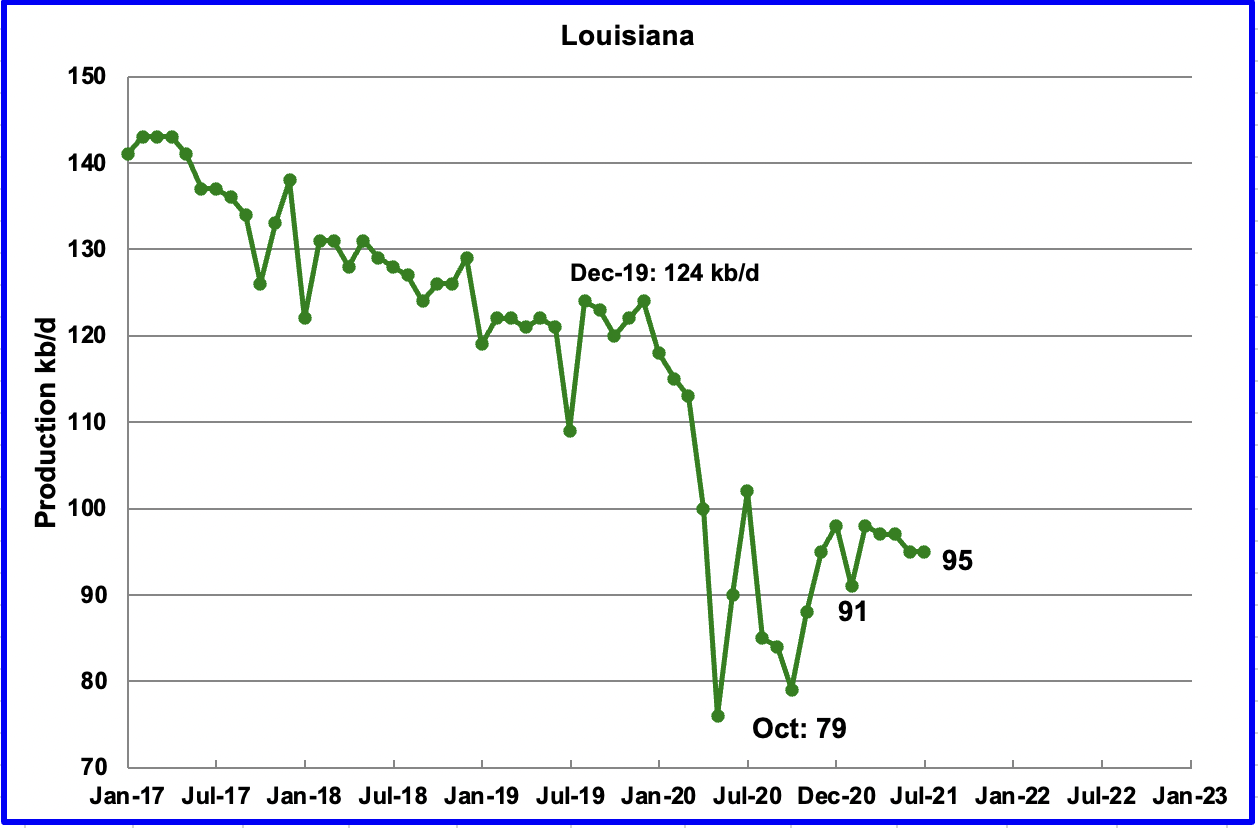

Louisiana’s output was flat at 95 kb/d.

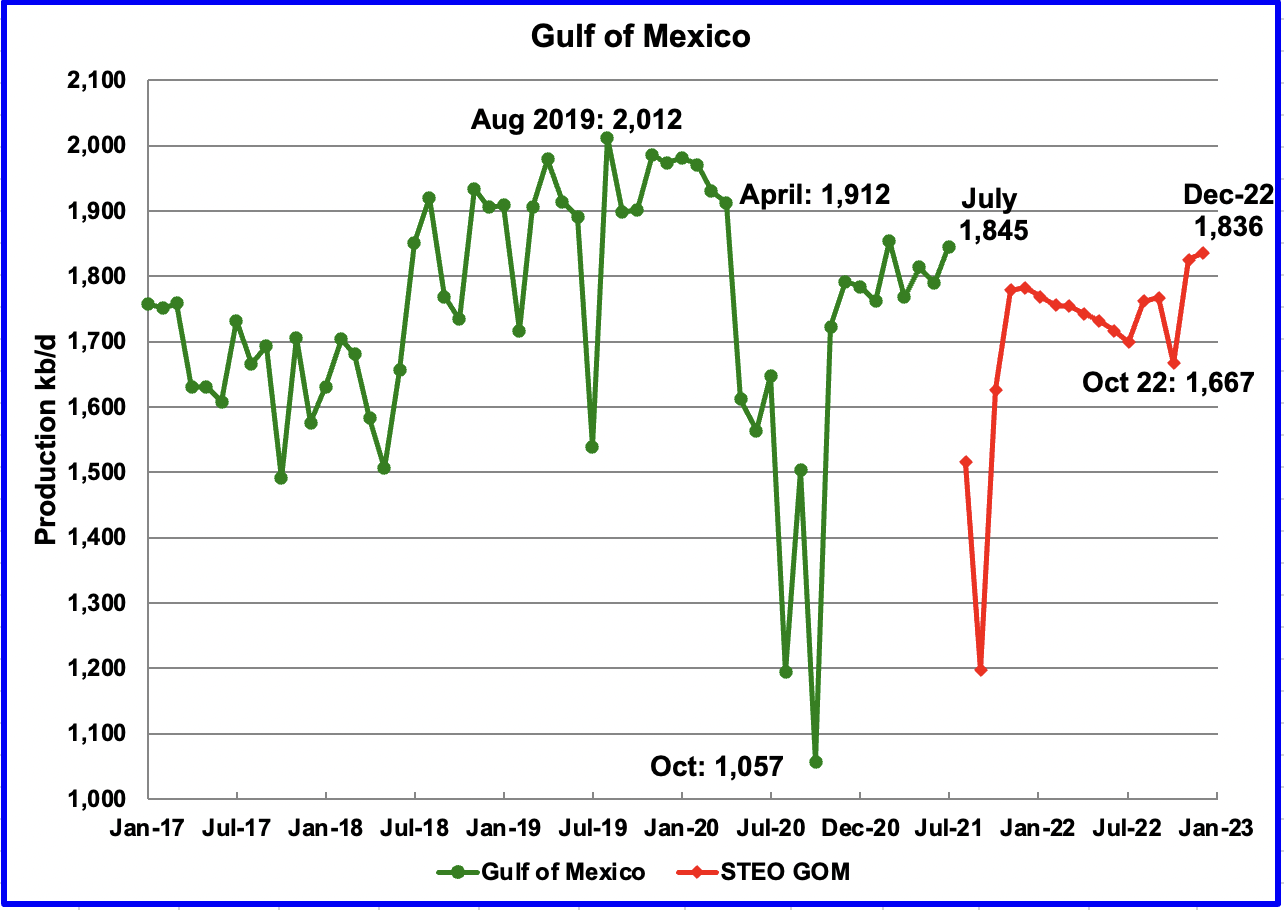

Production from the GOM increased in July by 56 kb/d to 1,845kb/d. If the GOM was a state, its production would rank second behind Texas.

The GOM increase is relatively large because June’s output in the September report was revised down from 1,825 kb/d in the August report to 1,789 kb/d. In other words 36 kb/d of the 56 kb/d are due to the revision.

The September STEO projection for the GOM output has been added to this chart and projects output to be 1,836 kb/d in December 2022, little changed from the previous August report. However due to hurricane Ida, August, September and October output have been revised down drastically.

1) Short Term Energy Outlook

The STEO provides projections for the next 13 – 24 months for US C + C and NGPLs production. The September 2021 report presents EIAʼ’s updated oil output and price projections to December 2022.

There has been a major revision in the September STEO relative to the August STEO due to hurricane Ida which struck Louisiana. While U.S. May and June production are essentially flat at slightly over 11,300 kb/d, August and September are forecast to plunge.

The July forecast output of 11,347 kb/d turned out to be 11,307 kb/d.

September is projected to hit a low of 10,757 kb/d due to hurricane Ida. The weekly estimates for September issued by the EIA give an average of 10,600 kb/d.

The December 2022 output has also been revised down by 57 kb/d from 12,231 kb/d to 12,174 kb/d. The expected monthly increase in US production from October 2021 to December 2022 is now 68.1 kb/d/mth, down from 72.8 kb/d/mth last month. It is still not clear where this increase will come from. This monthly rate, if correct, is less than half of the rate in 2017 to 2018 and is music in OPEC’s ears.

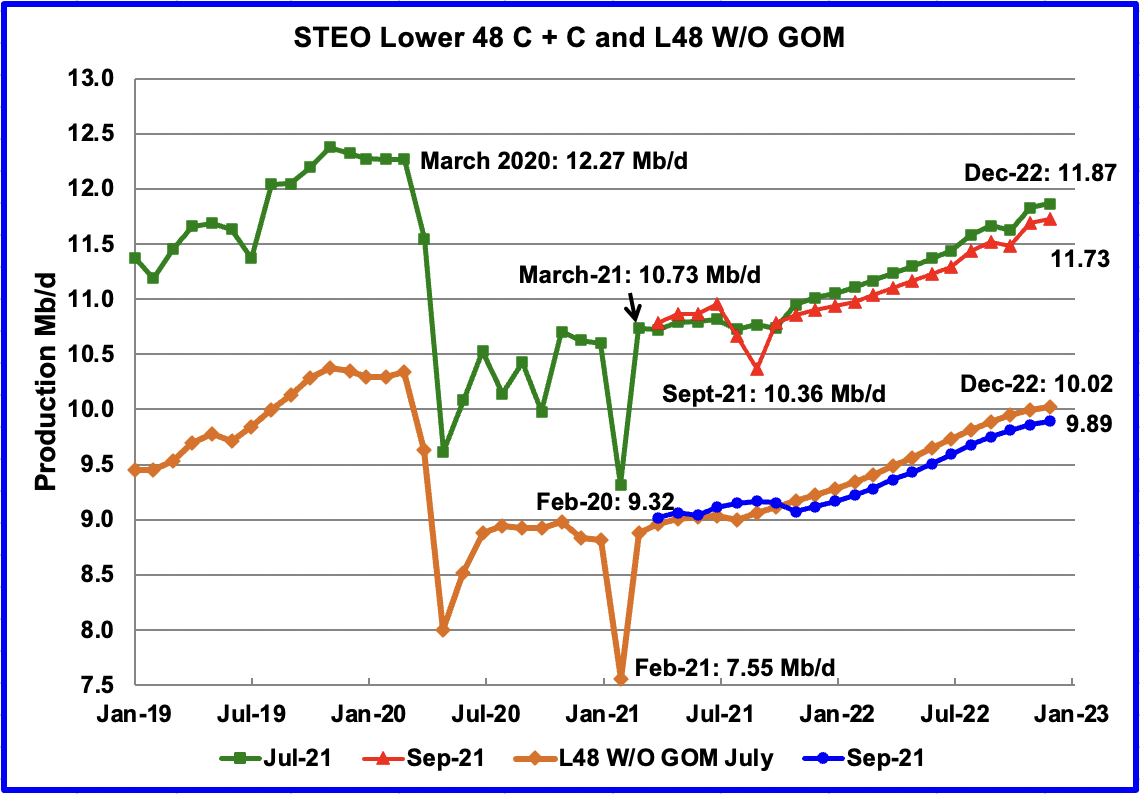

The September STEO output projection for the L48 states is very similar in shape, but lower, to the one provided in the July report. The output decrease forecast in the September report is roughly 130 kb/d from late 2021 to December 2022.

Similarly for the lower 48, the September projection for December 2021 is 110 kb/d lower while the December 2022 is 130 kb/d lower.

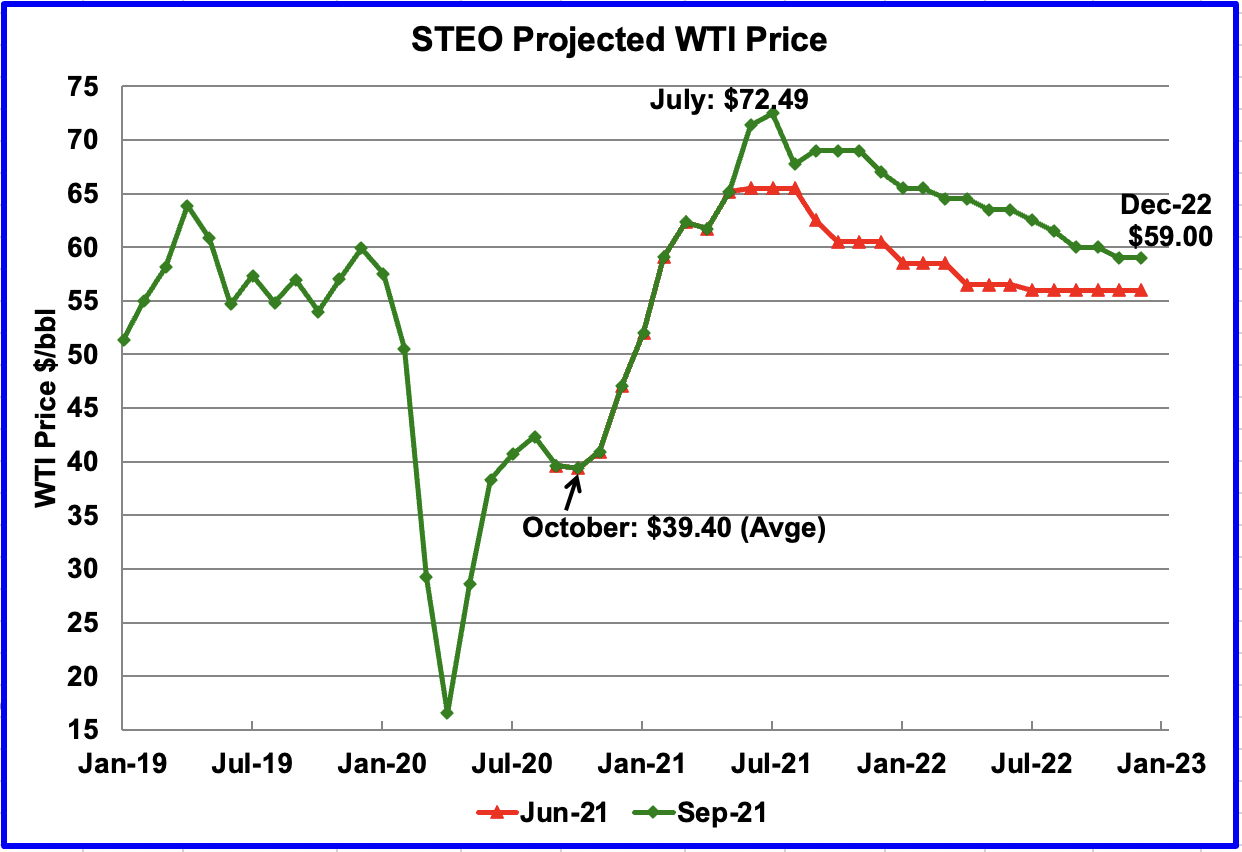

The September 2021 STEO oil price forecast shows a steady decline from the peak in July, $72.49, to $59 in December 2022 and is little changed from the August report. The big change occurred in moving from the June report to August report.

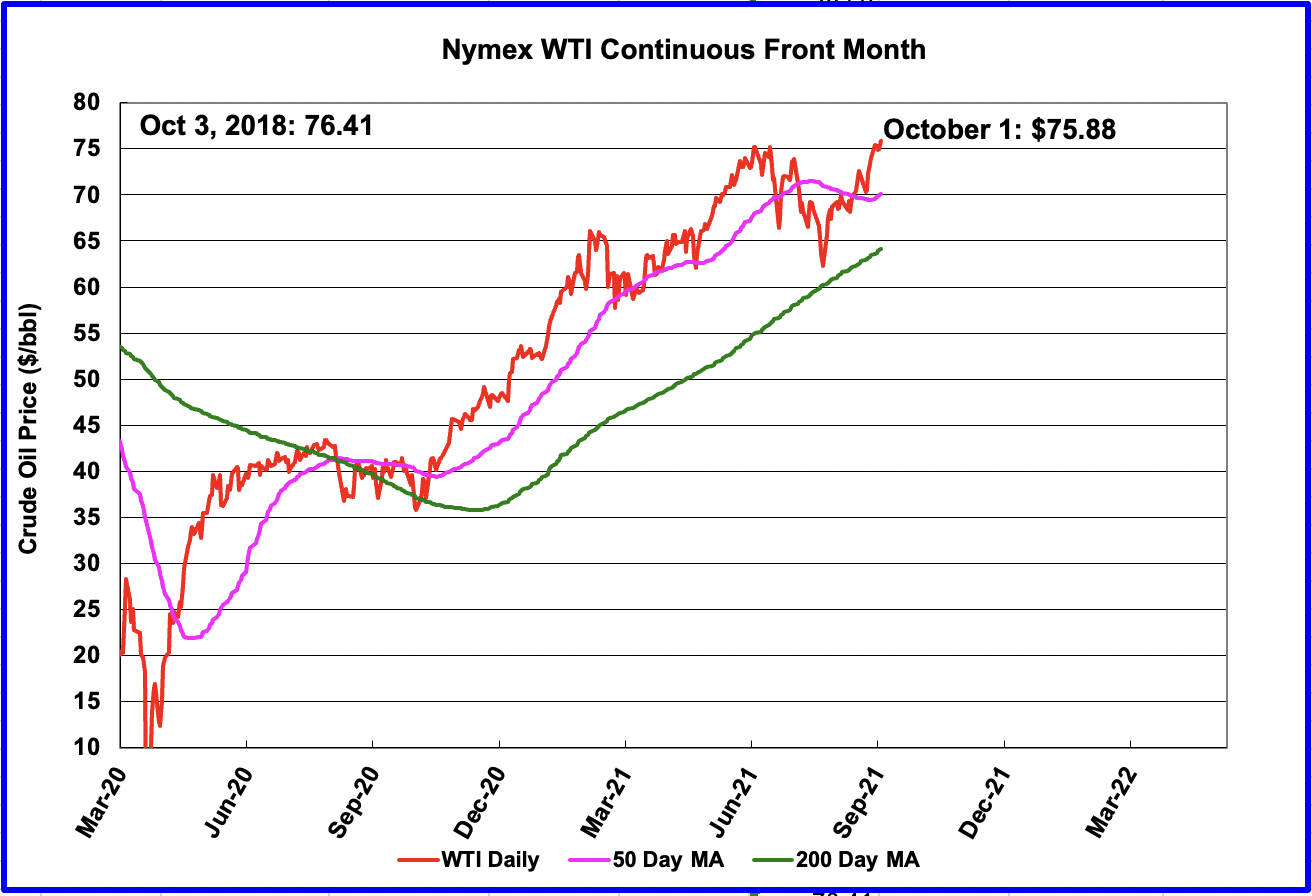

The November WTI contract settled at $75.88 on October 1, $7 higher than the EIA projection of $69.00.

Front month WTI settled price. Previous recent high, October 3/18, $76.41.

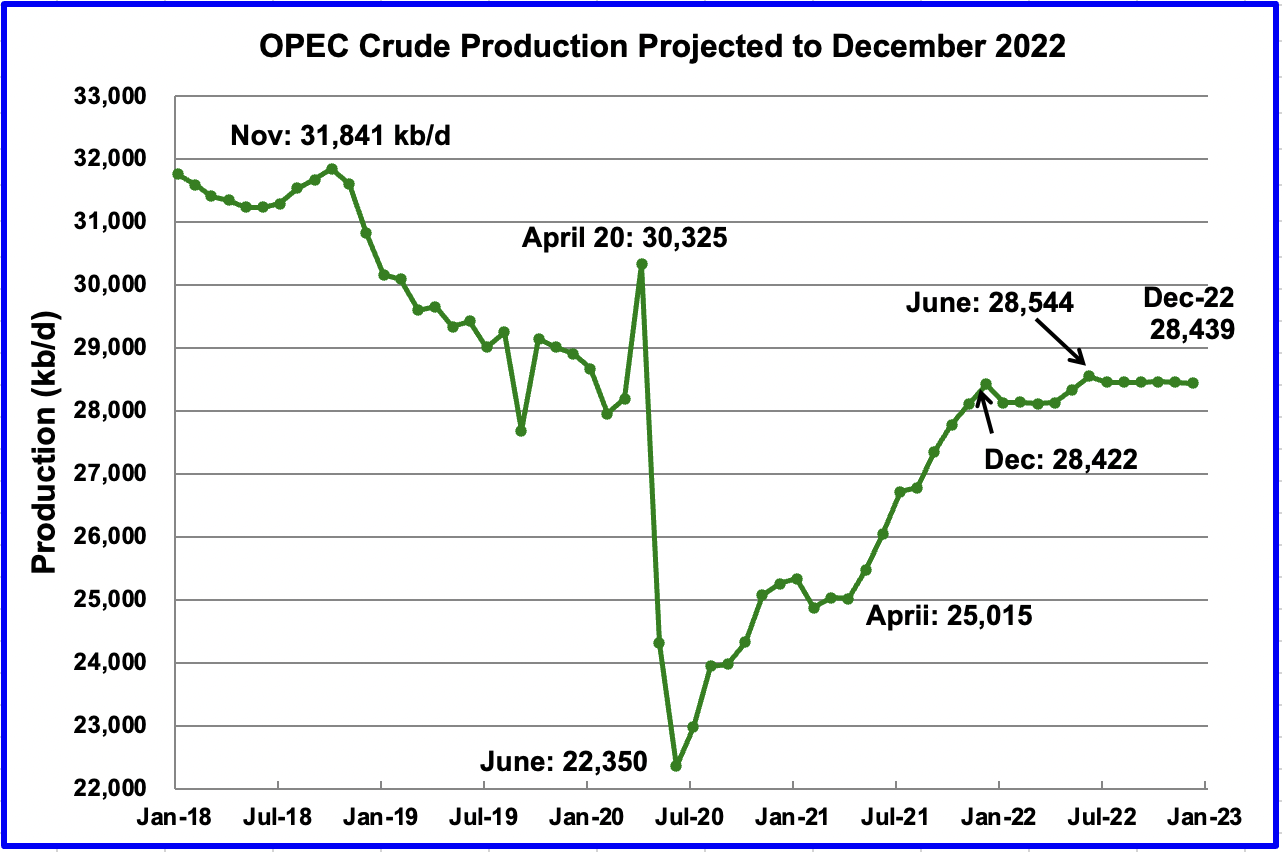

This chart shows the STEO’s September forecast for OPEC crude output to December 2022. OPEC’s output is projected to increase from April 2020 to December 2020 by close to 3,400 kb/d.

For August 2021, EIA forecast production to be 26,775 kb/d. Actual production as reported by OPEC was 26,762 kb/d. Amazingly accurate.

In July, OPEC + announced they will add 400 kb/d/mth from August to December for a total of 2,000 kb/d. Of the 2,000 kb/d, OPEC will add 1,712 kb/d according to the EIA. The EIA’s projected OPEC monthly increases for August to December are, 65, 575, 425, 329, and 318 kb/d, respectively.

OPEC’s production for the second half of 2022 is projected to be flat and close to 250 kb/d lower than OPEC’s output on January 2020, just prior to the onset of the pandemic.

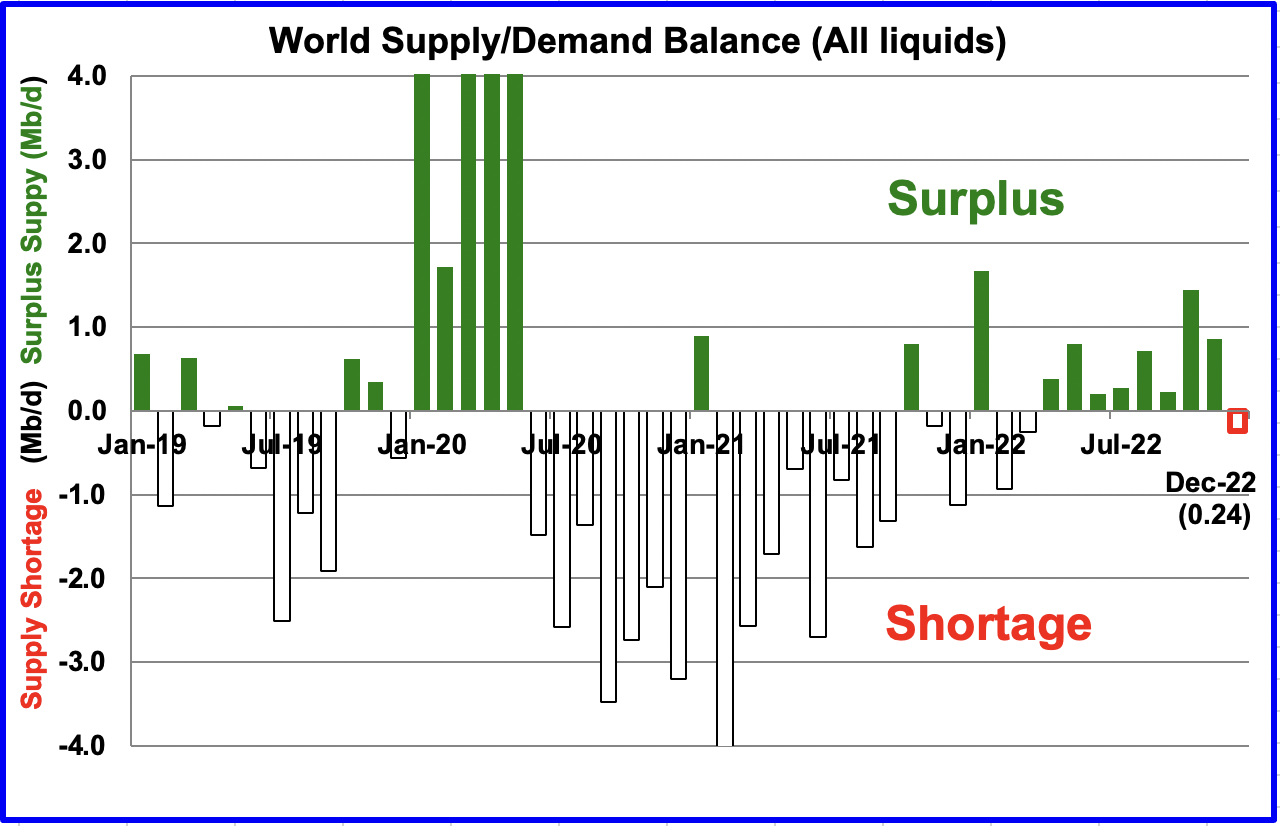

This chart show the historical supply/demand situation up to August 2021 and after that, the EIA’s forecast out to December 2022. After the supply surplus from February to June of 2020, world oil supply was intentionally reduced by OPEC and its partners. The US also reduced its output but the reduction was related more to the low price of oil.

From April 2022 to November 2022, the STEO is forecasting an average surplus of close to 610 kb/d.

2) Drilling Productivity Report

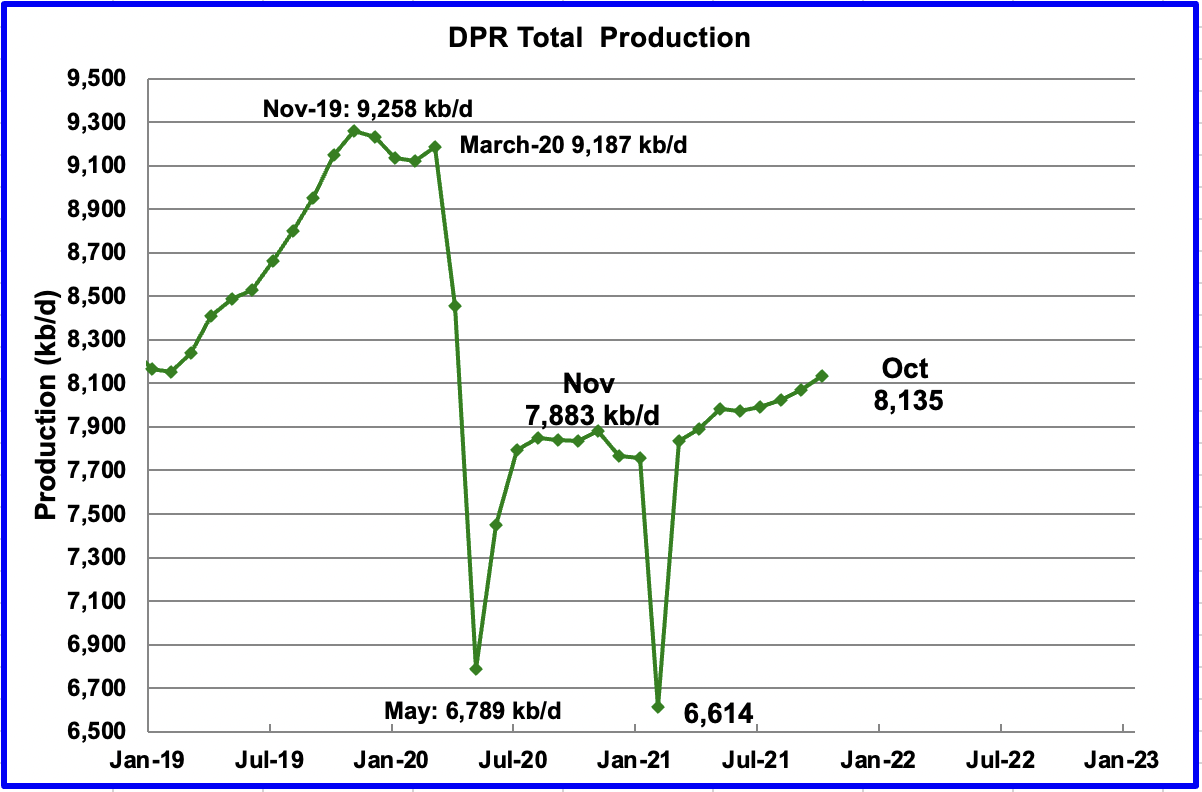

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The following charts are updated to October 2021.

Above is the total oil production from the 7 DPR basins that the EIA tracks. Note that the DPR production includes both LTO oil and oil from conventional fields

The DPR is projecting output for October 2021 to increase by 67 kb/d over September to 8,135 kb/d. From March to September, output in the DPR is forecast to increase by 298 kb/d or close to 42.5 kb/d/mth and appears to be accelerating.

The September output in the August SPR report was revised down from 8,085 kb/d to 8,068 kb/d in the September DPR report.

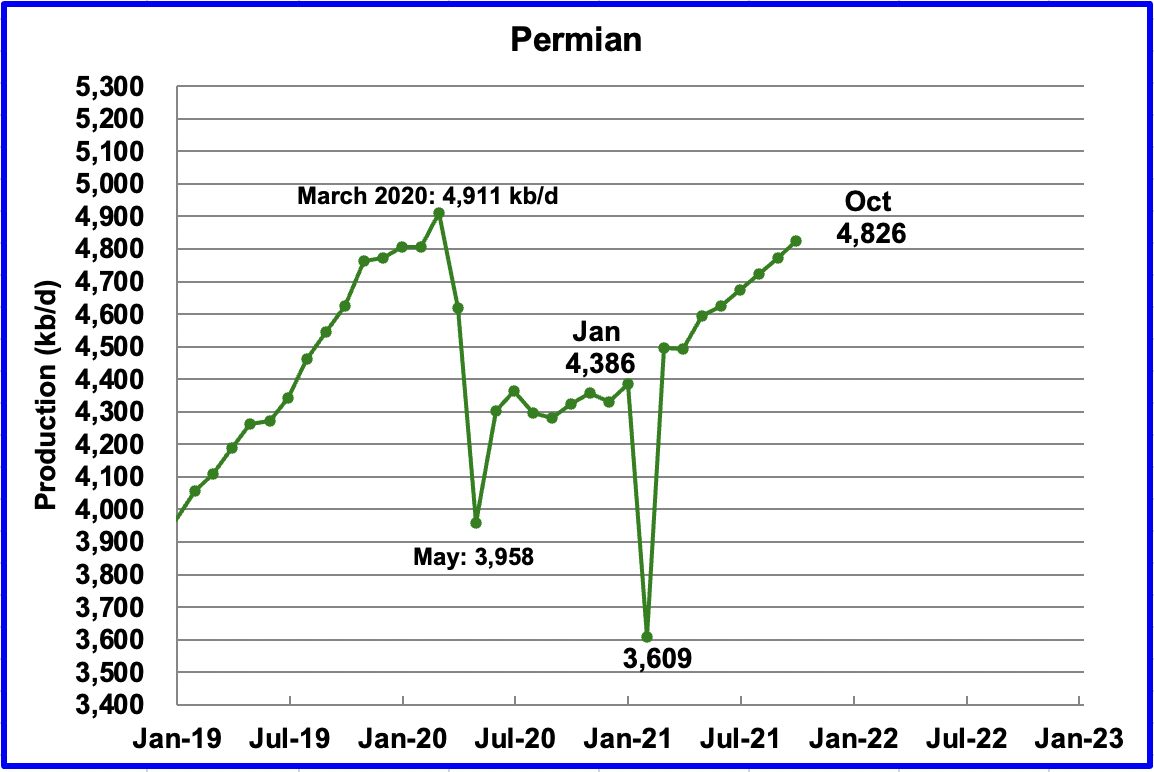

Permian output in October 2021 is projected to be 4,826 kb/d, up by 53 kb/d from September. From March to October production increased by 331 kb/d or approximately 47.3 kb/d/mth. At this rate, Permian production will exceed the March 2020 peak of 4,898 kb/d in December.

During July, 263 wells were drilled and 393 were completed. The completed wells added 286 kb/d to the forecast July output. The decline was 238 kb/d which resulted in a net increase of 48 kb/d. If no DUCs were completed, output would have been close to 191 kb/d. (263/393*286 = 191). This would have resulted in a decline of 47 kb/d rather than the 48 kb/d increase. Note that this is just a one month estimate. As time goes on and fewer wells are drilled and completed, the decline rate would also drop. The point being made here is that it’s the completion of the extra DUCs that is increasing production.

At some point more drilling will be required as the number of Prime/Sweet DUCs diminishes.

Shale profile has an excellent long term projection for the Permian.

https://shaleprofile.com/blog/permian/permian-update-through-june-2021/

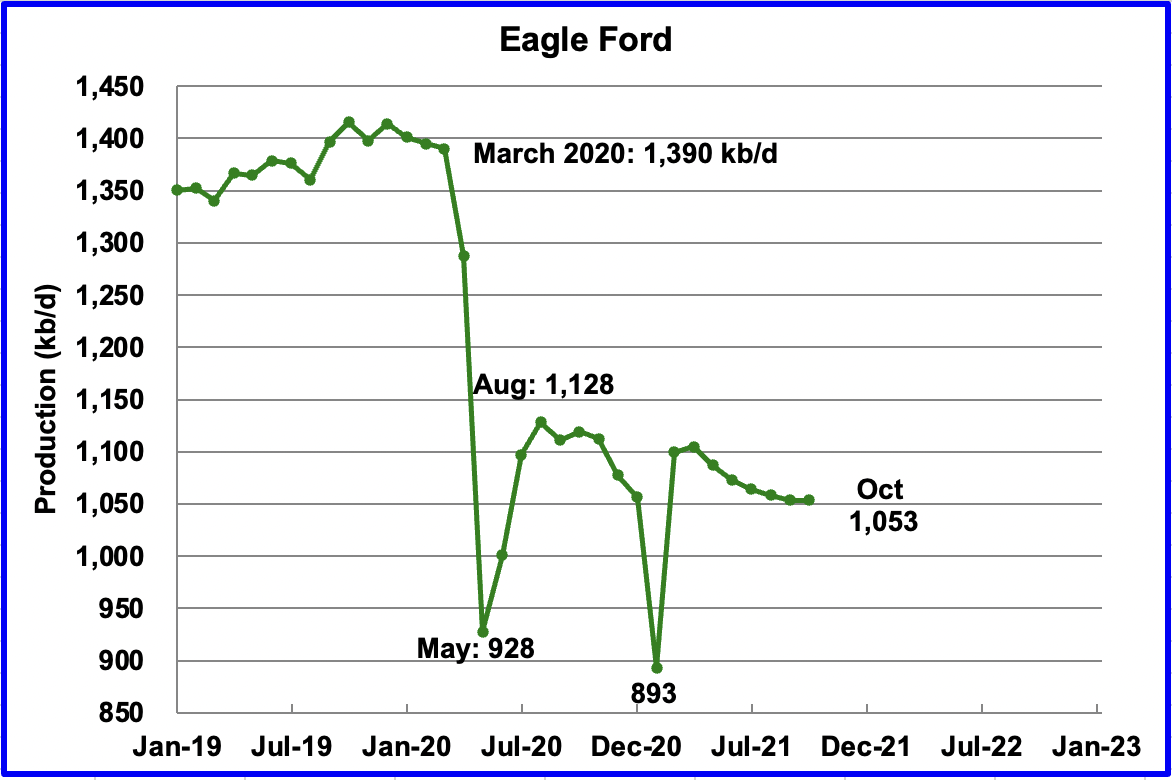

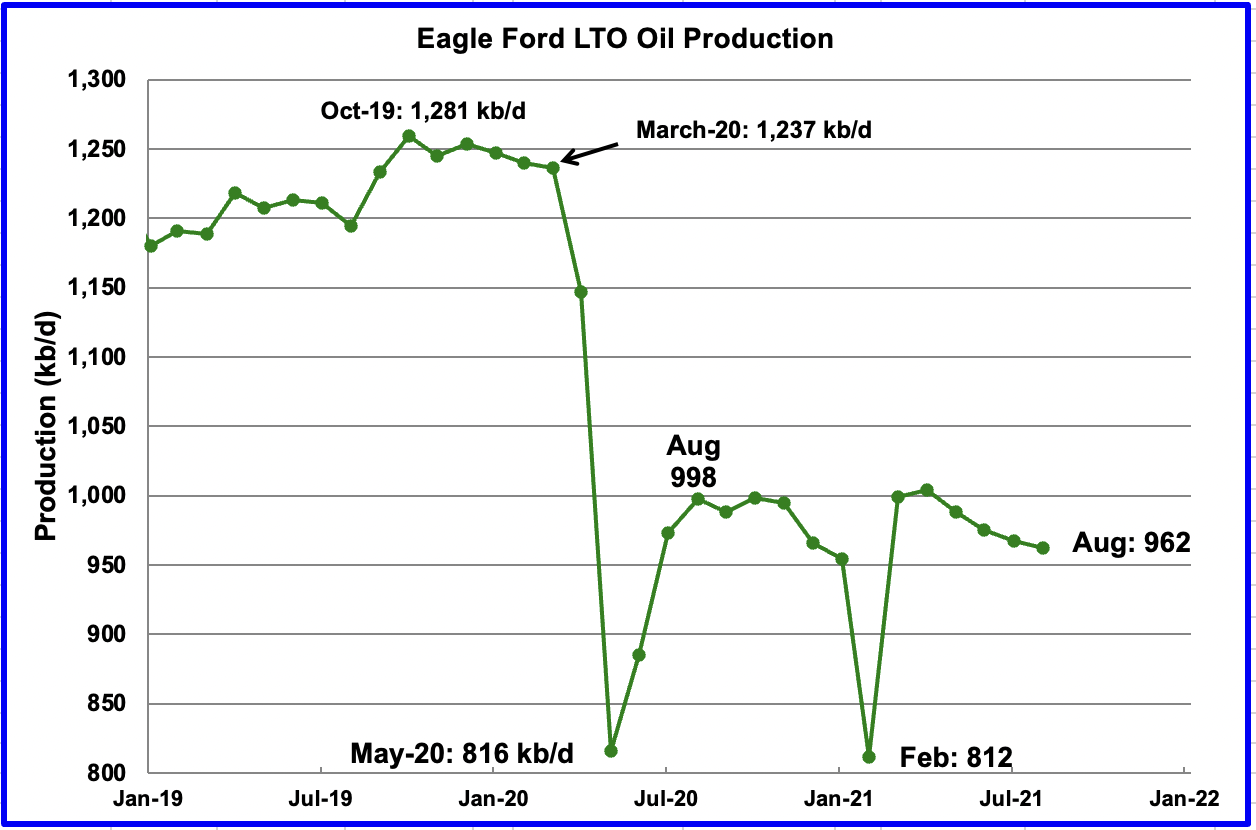

The forecast for the Eagle Ford basin has shown a dropping but slowing output for six consecutive months. Output is expected remain unchanged in October at 1,053 kk/d.

In July, 57 wells were drilled and 101 were completed. The completion of 44 DUCs was required just to hold output flat. In July, EF had 912 DUCs remaining. How many of those are dead DUCs, 1/2? Anybody willing to venture a guess?

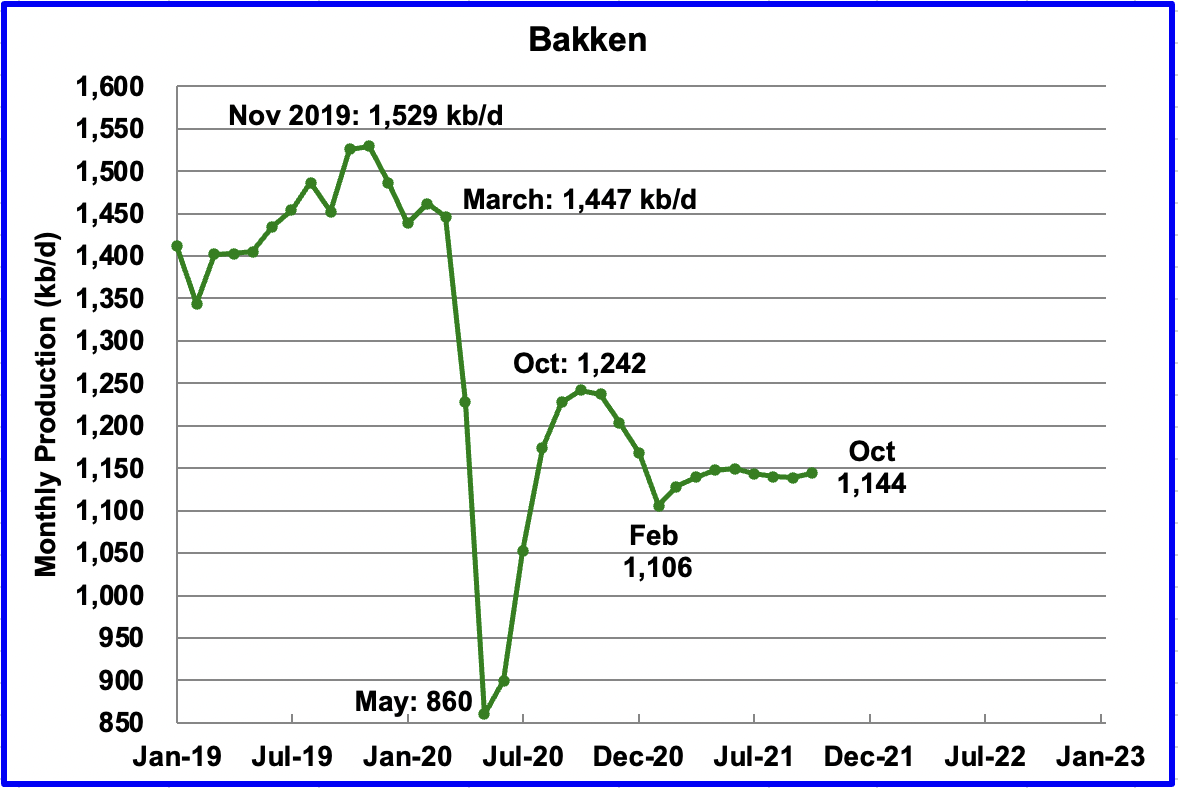

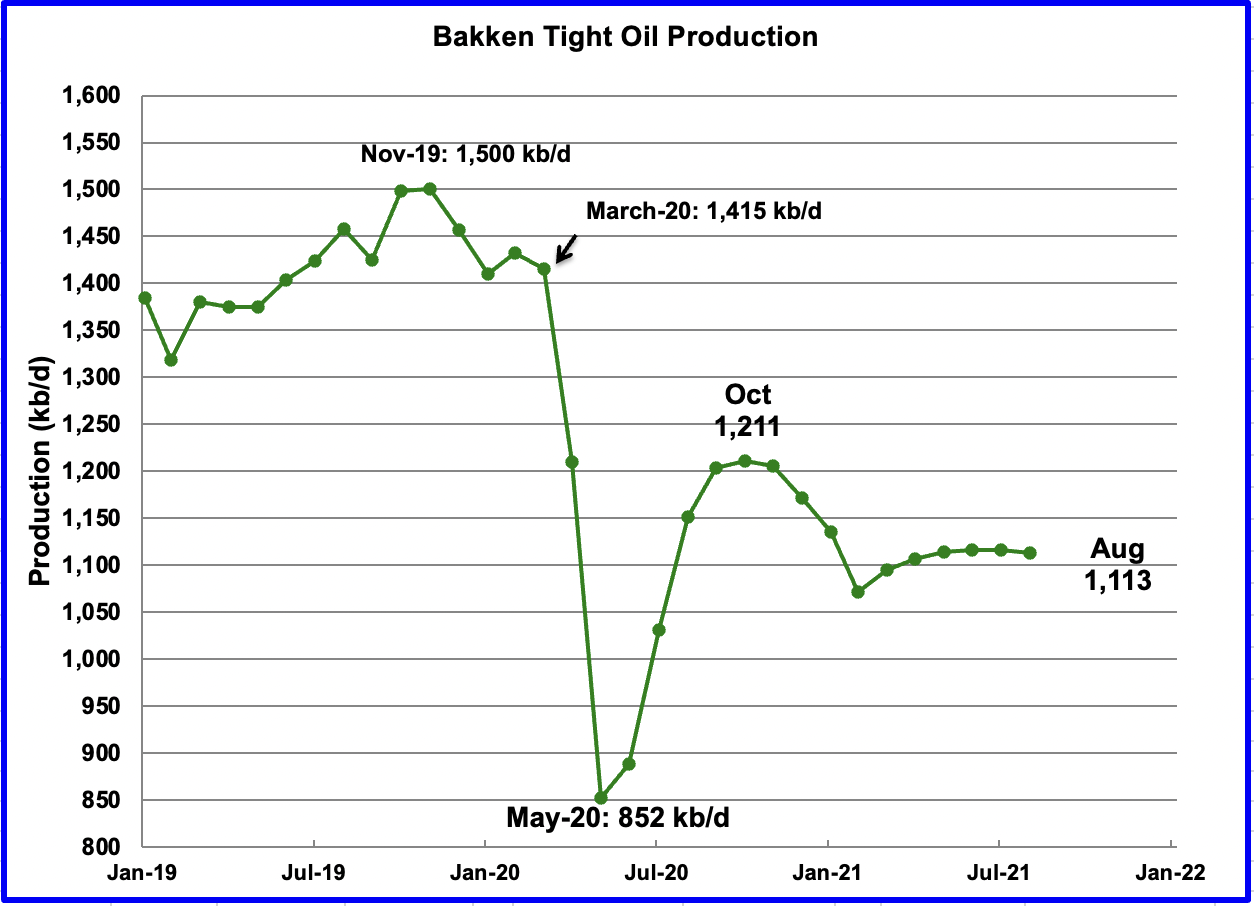

The DPR forecasts Bakken output in October to be 1,144 kb/d an increase of 5 kb/d from September.

Bakken data from the North Dakota Oil and gas Division looks different. See below

Output dropped by 55 kb/d in July to 1,037 kb/d. Only 14 producing wells were added in July instead of the more typical 150 to 200.

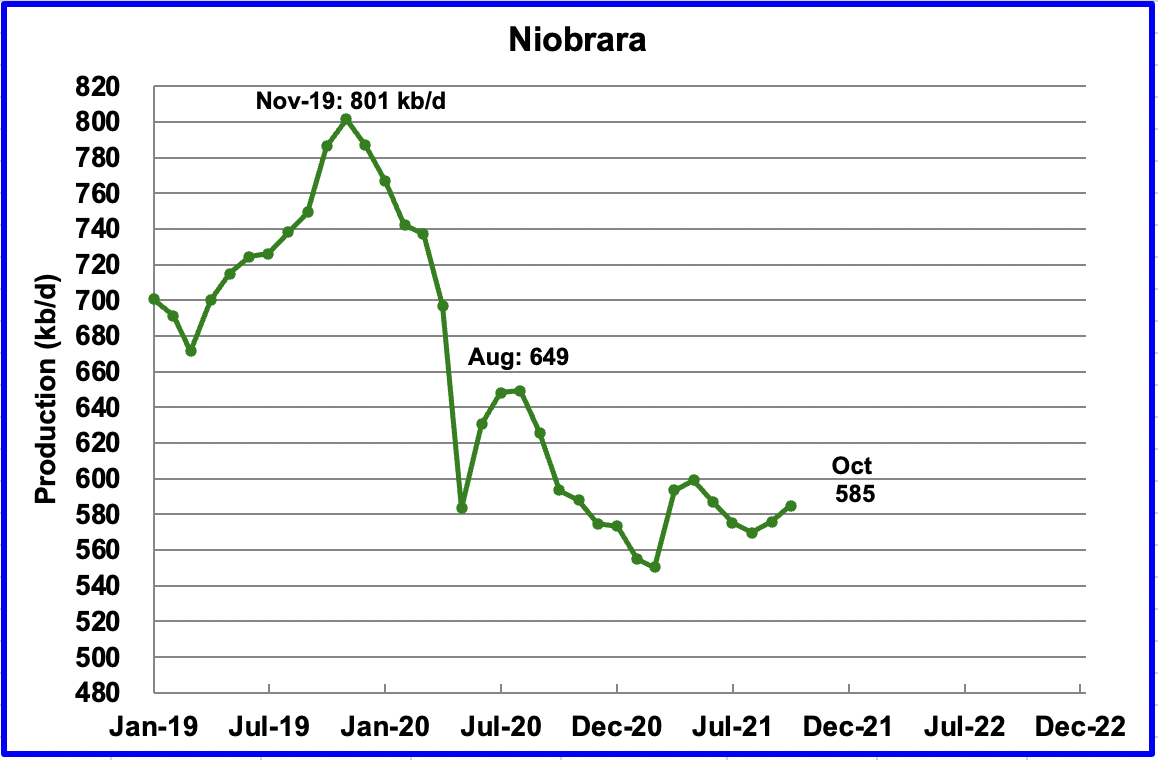

Output in the Niobrara reached a new low in August 2021, 570 kb/d. However, September and October are forecast to increase.

The Niobrara is spread over Wyoming and Colorado. In June, 7 oil rigs were operating in the Niobrara. By September, they had increased to 12.

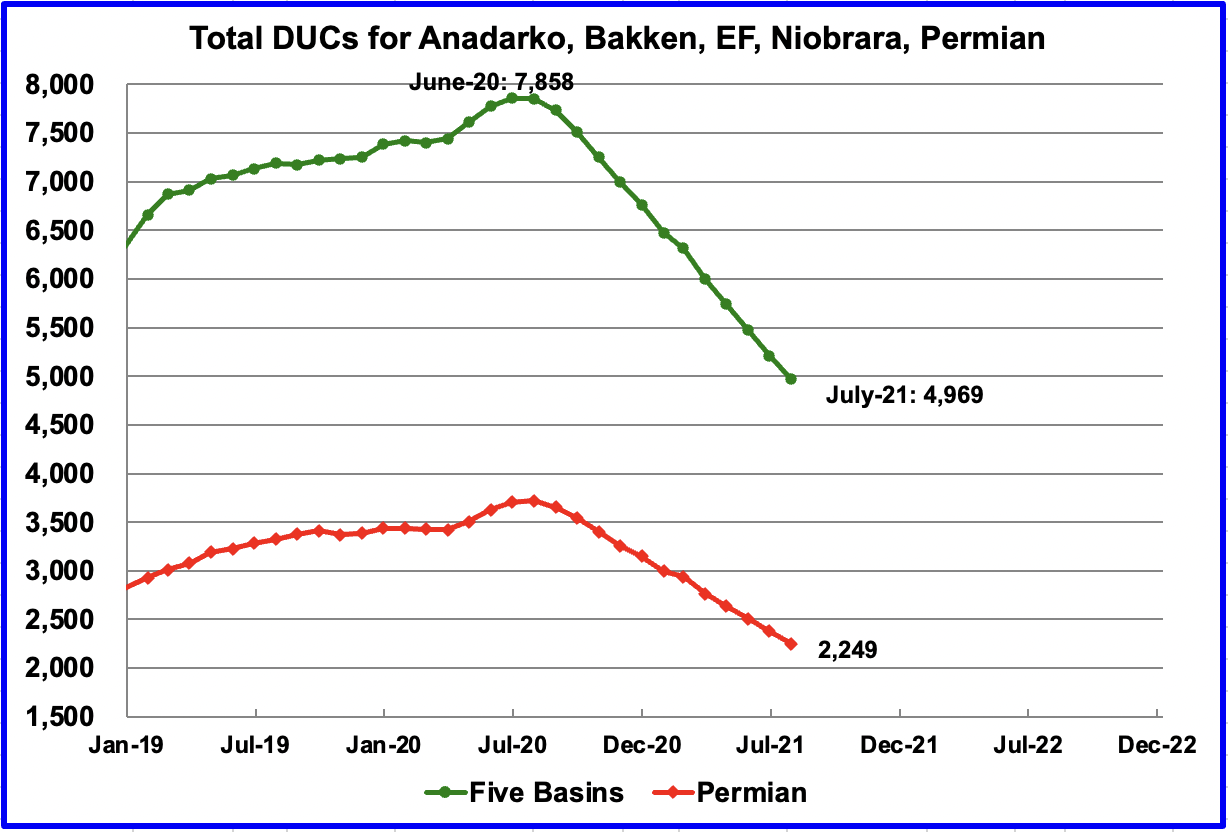

In these five primarily oil basins, DUCs are being completed at an average rate of close to 270 DUCs/mth. In total 243 were completed in July, according to the EIA. In the Permian, the completion rate is close to 135 DUCs per month. In July, 130 were completed in the Permian.

The monthly completion of DUCs accounts for the increase in production in the Permian and the other oil basins.

3) LIGHT TIGHT OIL (LTO) REPORT

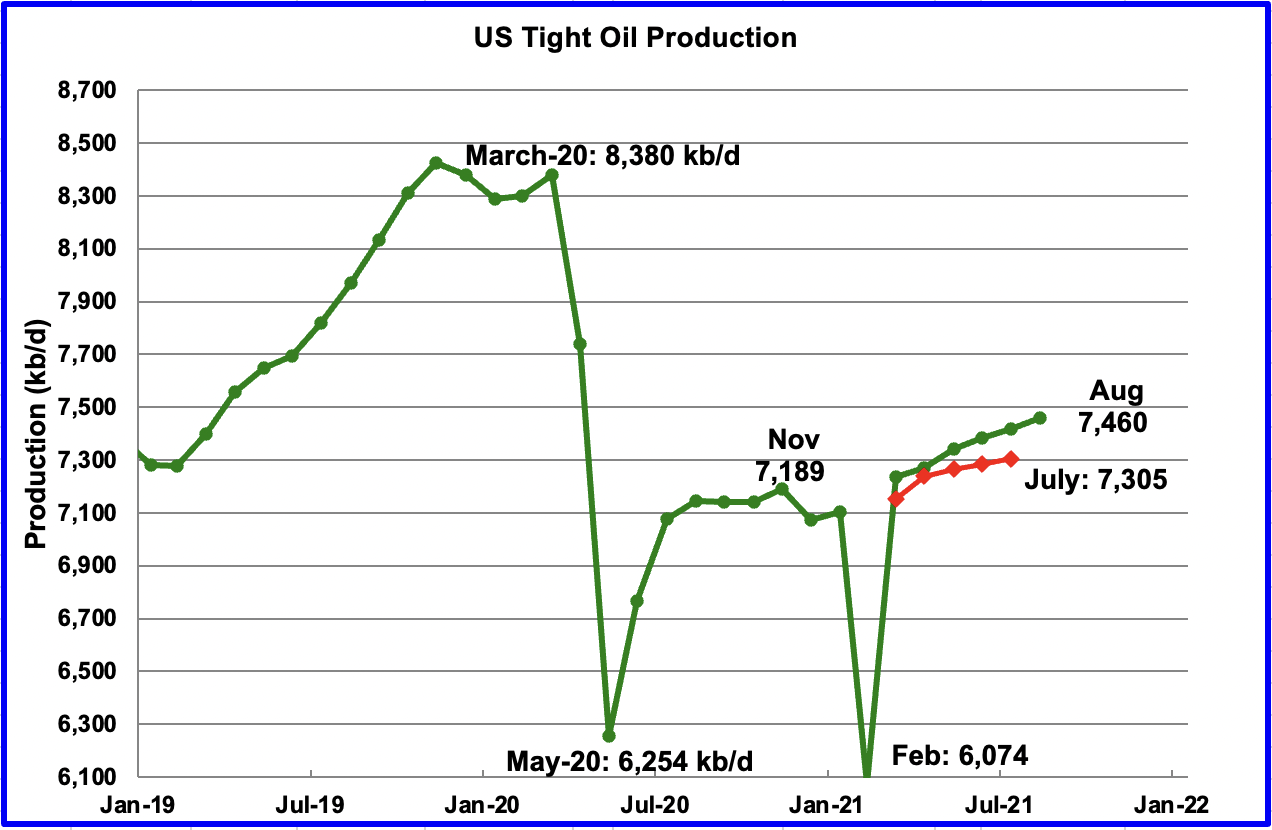

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The September report projects the tight oil production to August 2021.

August’s LTO output is expected to increase by 42 kb/d to 7,460 kb/d.

In the September LTO report, July’s forecast output was increased from 7,305 to 7,418 kb/d, an increase of 113 kb/d. It appears that the early estimates are always on the low side. The red markers represent LTO output as reported in the August report.

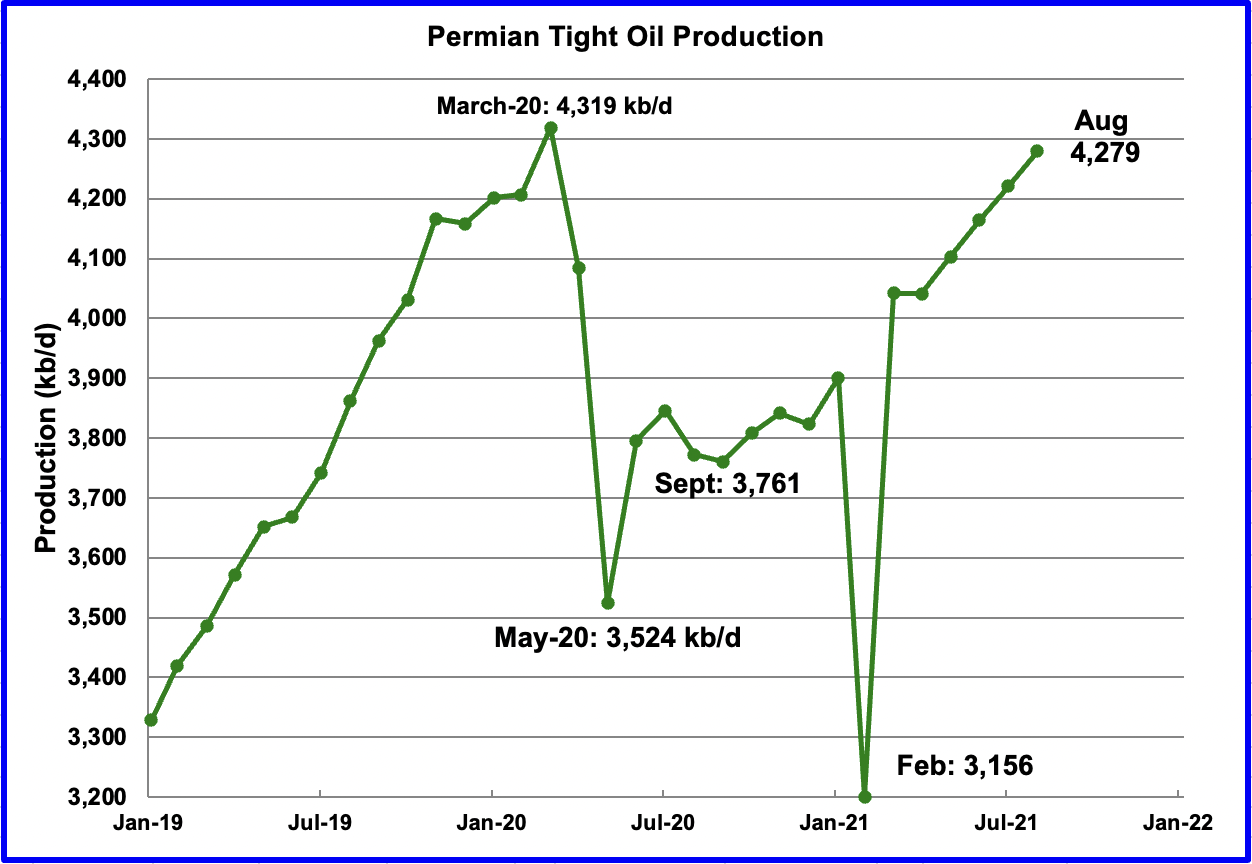

Permian LTO output in August is projected to increase to 4,279 kb/d, an increase of 58 kb/d. Production in the Permian continues to rise at an average rate of 60 kb/d/mth since April. At this rate, it could almost equal the March 20 high of 4,319 kb/d by September.

It should be noted that Permian DUCs are being completed at an average rate of close to 135 DUCs per month and contribute to the rising production.

The Bakken’s August output declined by 3 kb/d to 1,113 kb/d.

The Eagle Ford basin is expected to produce 962 kb/d in August, a decrease of 5 kb/d from July.

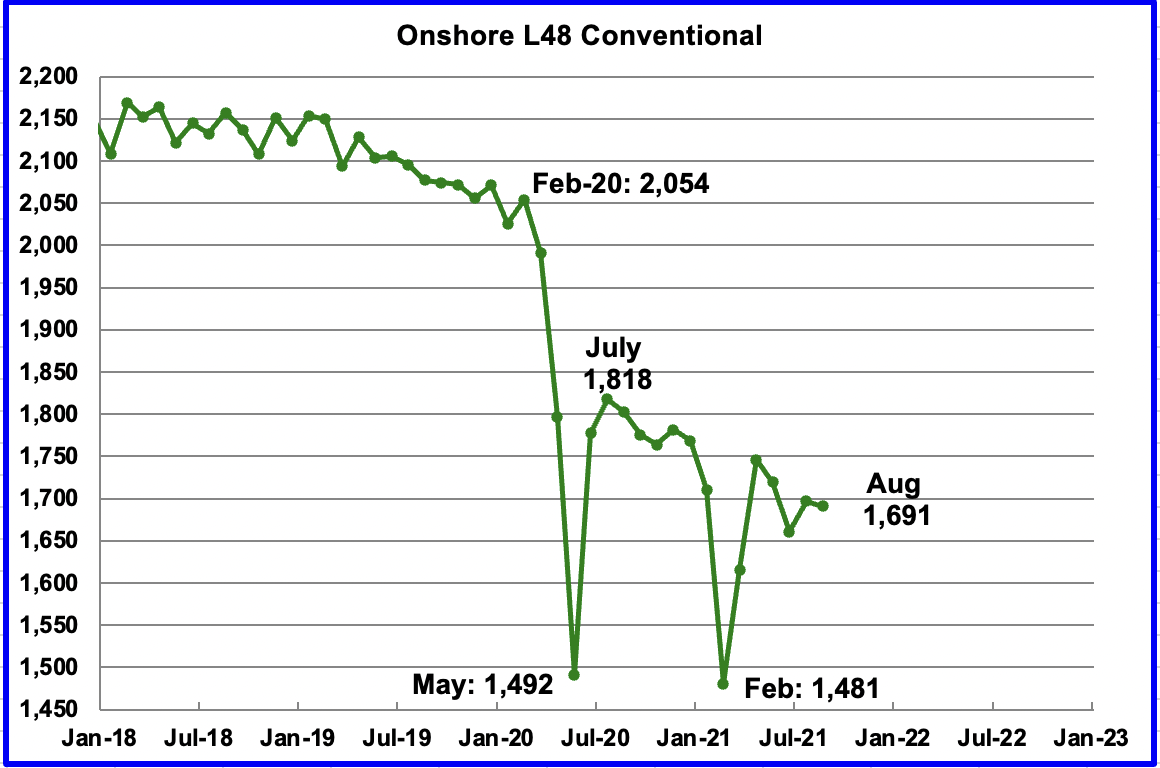

Conventional oil output in the On-shore L48 is expected to decrease in August by 6 kb/d to 1,691 kb/d. This estimate is based on a combination of the August LTO output and the September STEO report that has a projection for the US on-shore L48 output for August 2021.

In the September LTO report, LTO output was revised up by close to 100 kb/d. This revised output resulted in a decrease in conventional oil output. The July conventional output of 1,794 kb/d in the August report has been revised down by 127 kb/d to 1,697 kb/d in the September LTO report.

4) Rigs and Fracs

Since the end of August to the end of September, the US added 18 oil rigs for an average rate of 4.5/wk. Of the 18, 5 were added in New Mexico, 8 in Oklahoma, 13 in Texas and 6 in New Mexico. Six were decommissioned in Louisiana due to hurricane Ida, and 1 each in Ohio and Utah.

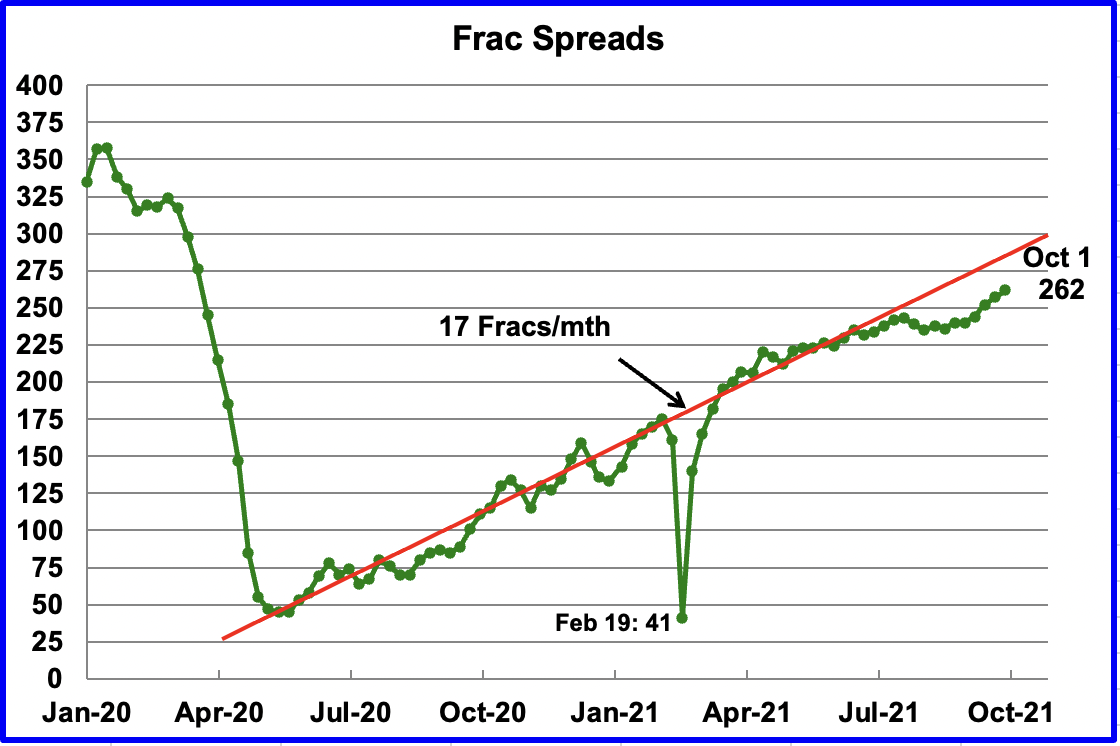

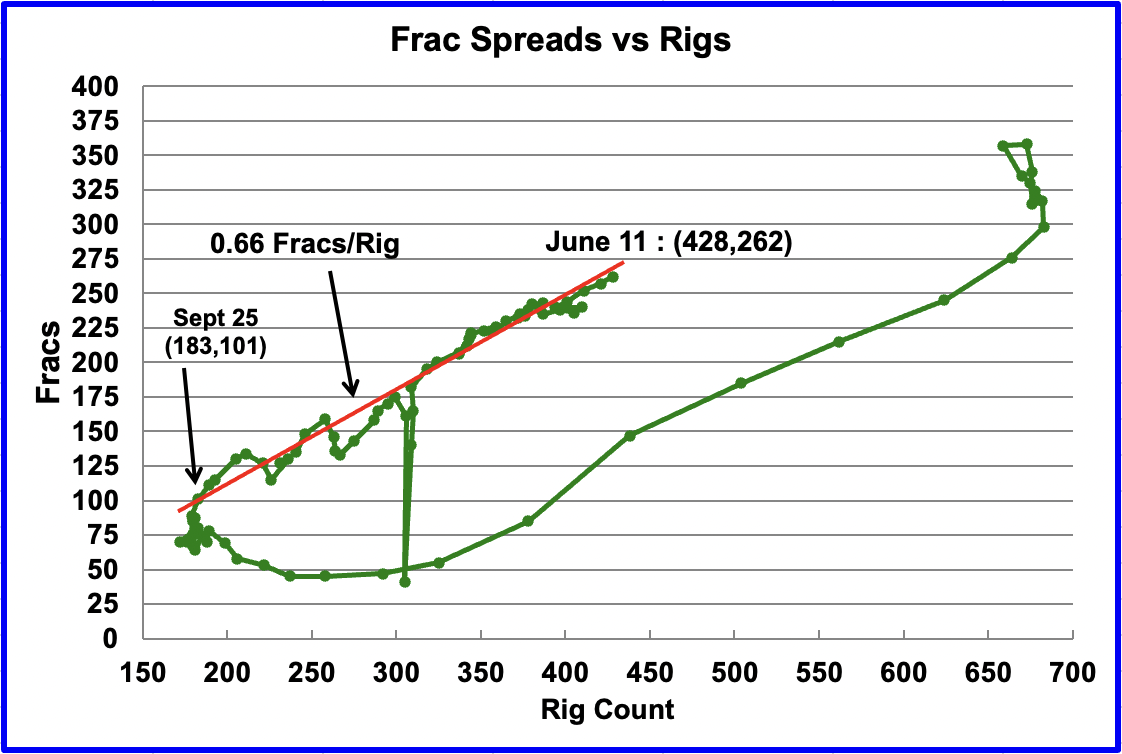

Since the week of July 23, frac spreads were not beeing added at the previous rate of approximately 17 spreads per month due to hurricanes. However, for the past few weeks, frac additions have been back to the previous rate of closer to 17/mth. Note that these 262 frac spreads include both gas and oil spreads, whereas the rigs are strictly oil rigs.

This chart shows how Frac spreads are added in proportion to rigs. Over the last three weeks, Frac spreads additions are back to the previous rate of roughly 2 Fracs spreads for every 3 rigs.

Here are some graphs by John Kemp on the European natural gas situation.

https://fingfx.thomsonreuters.com/gfx/ce/zjpqkjzympx/EUROPE%20GAS%20AND%20ELECTRICITY%20PRICES.pdf

As mentioned in link and far below, NS2 is reported to be beeing partially filled/tested.

We´ll see how that plays out, depends on what the russians want to put in it, and when, at what price, if that´s not been set already obviously.

The impact on US and Quatari LNG exports to Europe will also be interesting to follow of course.

https://www.reuters.com/business/energy/nord-stream-2-starts-filling-pipeline-with-gas-tests-2021-10-04/

Laplander , I don’t know about USA LNG exports but Qatar is ” Housefull ” . Prebooked by Japan , South Korea , Taiwan and India under long term contracts . A little maybe leaking off to Europe but 70-75% s the four countries mentioned . Europe buying from USA doesn’t make sense considering the freight .

Just eyeballing but it looks like on average ~2-3 BCF/day to Europe from the US from 2019 and up to July 2021, but with quite large variability, current volumes/prices unknown to me, but likely possible to find.

https://www.eia.gov/todayinenergy/detail.php?id=48876

Laplander , I will not argue over what I don’t understand/ don’ t know , so I will stick to what I do know . The Baltic states + Poland wanted to stop NS 2 because that would by-pass them . So they announced ” We are going to boycott ” Russkie” gas and we will import LNG from USA to show we are energy independent . Understand this decision was when Trump was POTUS and not under Biden . Problem was as I mentioned “freight costs ” . Solution . Traders like Trafigura . Glencore etc come into the picture . They loaded LNG at Yamal (Russia ) on LNG carriers flying under flags neutral( Panama , Liberia etc ) delivered it to the stupid (intelligent) Balts + Poles and labelled it as US origin . They creamed the freight arbitrage from USA to Europe + profit . This was labelled as a US import in the Balts + Poland . Winners were Trafigura , Glencore etc and the looser was Balts + Poland . The Balts and Poles boasted ( 6-7 months ago ) we are going to be the one’s going to break the Russkie monopoly on gas supplies to Europe . Well , to cut a long story short Europe zonder (without ) Russkie gas is FUBAR . Europe is FUBAR without “Don ” Putin . You need their oil , gas and coal . All in Europe should ” Hail Putin ” otherwise buy yourself blankets ,quilts and start eating potatoes to survive . I am not joking .

https://www.youtube.com/watch?v=bBtW9uGjd8U&t=3s&ab_channel=RT

Don’t mess with Putin .

Quite interesting, will try to find out more about that, but if there is a buck to be made, someone will, one way or another. I have no agenda for/against Putin/Russia, but at the moment their NG is quite valuable for Europe (since the continental part of it has a one brick / one glazing window insulation strategy in housing and a lot of industral efficiancy gains to be made)

So like it or not, they affect the energy situation in Europe quite heavily, and from what I´ve read, the transit losses through mainly Ukraine were big, hence the bypass, so business related again.

(Of course Estonia, Latvia and Lituania were really badly treated by USSR before, and after WW2 by Sweden in Baltutlämningen but that is another question)

Edit: Since there is EIA US LNG export data and quite likely import data for Europe, these could then be compared if you could get hold of them.

Not that I don´t think it´s been done, but how much, and by whom? and sadly, provable in courts…

Edit again, good video : )

In GoM 250kbpd o so of Shell production is still out because of structural damage to one of their pipeline transfer platforms and might be fo another couple of months. And, like last year, the late season conditions in the Caribbean and Gulf will be highly conducive to storm formation with convective and moist air, very warm waters with high heat content to low depths and low wind shear, so the second half of October through maybe to early December could see plenty more deferment.

George

Thanks for noting that. I intended to mention that in the GOM comments but forgot.

I expect to see this reduced GOM production show up in the next STEO.

Ovi,

GOM light production peaked in 2018. Any growth now is stuff that isn’t oil. The api 30-40 has been declining for years.

I made a GOM reserve estimate to show how depleted it is.

GOM is 160 million acres at 30% porosity. The productive layer is about 300 meters. This comes to 500 trillion barrels of rock.

Assuming a high TOC of 5%, 10% soluble, and 5% light that’s 125 billion barrels oil in place or 37 billion at 30% recovery. Half of that is federal GOM or 19 billion.

Current cumulative production in federal is 19.5 billion barrels. As you can see they have blown past the reserve of light oil and are now using other products. It’s physically impossible to get more out, even under generous assumptions of hydrocarbon generation.

Tks Ovi . So 12,893 kpbd still remains king , inspite of all the huff and puff .

HIH

It will take a while.

Ovi , want to make a bet it will not be breached ?

Ovi: How far back date wise can you go on lower 48 conventional?

Again, much thanks for this!

Shallow Sand

With a bit of work, I can get it back to 2010. Appreciate that back then, LTO was just starting and US production was just above 5,200 kb/d. Will post chart later.

Ovi, you appear to be including the shale boom as conventional production. Nothing grew after about 2000 besides tight fields. To the extent it’s not included as EIA LTO it’s because EIA substantially changes their definition, just last year they doubled their Wolfcamp production for example.

Conventional production is the pre-2000 trend line and it is basically zero by now.

Shallow Sand

Attached is the L48 conventional starting in 2010. It is US total minus Alaska minus GOM minus LTO. It peaked in Dec 2014 at 2797 kb/d.

The graph below shows the yearly lower-48 over a long period. Note that it is in exponential decline.

Seppo.

Thanks for this!

This graphic should be generating a lot of discussion here!

Excellent graphic showing the effects of price on production. From 1/10 to 1/15 a 12% increase at basically $100 oil. Then a 30% decline from 1/15 to 1/20 at about $60 oil. Followed by a larger decline with $20 to $40 oil.

Yes.

Remember prices in the decade prior to 2010. 1998 saw $8-12 well head prices. Early 2000 was $15-30. Then came the Iraq war. $40s in 2004. $50s in 2005. $60s in 2006, $70s-$90s in 2007. Peaked at $140s in 2008, crashing all the way into the $20s in late 2008, early 2009. Then ramping back up 2010 into the $70s, followed by $85-105 2011-14 until the late 2014 crash.

But wow, has inflation hit us like a ton of bricks. Just got the bill in the mail for a couple of tubing jobs. Over $1K each, we were paying as little as $550 just last year.

We are plugging low volume wells to have enough down hole equipment to keep the good wells going.

I don’t think people here want to admit how things are right now supply chain wise and inflation wise.

Labor wise, those two wells I refer to don’t get pulled if a guy who works a full time factory job had not helped out on his days off.

I drove 2 hours S through countless little stripper fields Friday. Still many SI wells with weeds growing up around them, same with tank batteries. Many had that abandoned look.

Long term this “energy abundance” from US shale is going to be one huge head fake.

We need to ramp the renewables quickly, but we also need to get a clue and understand that it’s not going to happen overnight and also not without tremendous economic cost.

The Congressional progressives have no clue about the starvation and suffering premature “leave it in the ground” will cause. We are so far away from being in a position to do that, based upon recent energy events in UK, Europe and China.

Completely agree SS, including those last 3 statements

SS- really appreciate your first hand insight on what is happening on the ground.

Thanks

Shallow sand,

What were the prices in 2018 or 2019 for similar work, last year I imagine demand was low and prices might have been low.

Thanks Ovi!

For US L48 onshore conventional from Jan 2000 to Dec 2019, the exponential trendline (using ordinary least squares regression) has an average annual decline rate of 1.24% per year.

Chart below, with logarithmic vertical axis (to show decline rates more clearly).

Dennis, you decline rate might be too low. For 2020 your equation gives 2058 kb/d and for 2000 it gives 2629 kb/d, but your data appears to be around 3000 kb/d in year 2000.

From the peak of lower 48 to 2020, I get 3.4% decline rate. For a large oil province such as lower-48, the decline rate is usually in the 5% range, as it will be for the world. Smaller regions such as Norway have decline rates of 10% in the exponential decline part of the curve.

Seppo, it’s because America has very generous policies for stripper wells, those wells are producing 15 boe/d at some pitiful eroi.

America has 7 million barrels per day production below api 45, and a million wells. The average well in America produces seven barrels per day. At that pitiful rate you could produce for a long time.

EG

From https://nswa.us./stripper-wells

USA has about 400,000 stripper wells with less than 15 b/d and these account for 7.4% of oil production. There are some 360,000 natural gas wells with production less than 90 Mcf/d and these account for 8.2% of the US production.

Decline rate, lambda, for exponential decline is given by lambda=q(t)/(Qf-Q(t)), where q is the yearly production and Q is the cumulative production and Qf is the ultimate.

Seppo,

I was referring to why the decline was slow, and it’s because stripper wells.

That 1 m bpd production is basically all the “conventional” oil. You can see https://www.eia.gov/dnav/pet/PET_CRD_API_ADC_MBBLPD_M.htm , although this data is somewhat convoluted. Diluent artificially moderates api by averaging grades even though it’s useless when input to a refinery.

If we take the API 30-40 as the definite oil then America only produces two million bpd onshore. Half if not all of this is stripper wells.

As for the non-stripper production, you’re not seeing it decline because heavy and condensate are being produced at a loss. You’re not seeing a decline rate, you’re seeing these otherwise useless oils becoming popular due to ethanol, plastic and other interest group uses.

The actual decline rate of American wells is pretty much globally average and we can’t see it because all the real, conventional, non stripper production is dead. Conventional drilling died by 2000 and there are no conventional wells left, so that’s close to the decline rate you gave. You can ask AdamB on peakoil, he was drilling conventional wells in the nineties which were probably the last ones.

You can look up decline rates on GOM projects and those are extremely steep, most wells die after 3 years and then get water flooding or heavy oil. GOM requires a treadmill of new rigs replacing the entire production every 3 years.

Seppo,

Slope based on ordinary least squares regression on natural log of lower 48 onshore conventional c plus c output from Jan 2000 to Dec 2019.

From 1986 to 1999 the rate of decline was about 3 to 4% per year, perhaps due to lower oil prices and less investment by producers.

Dennis,

No, that was just the actual decline, the 1-2% decline later was because everything was reduced to stripper wells.

https://www.eia.gov/todayinenergy/detail.php?id=24932

Once it becomes a stripper well the decline becomes extremely slow. Mclintock well continues to produce after 160 years.

Seppo,

The URR is unknown, I define decline rate as a function of time, not as a function of output. We are defining things differently, usually when we define a rate for something it is with respect to time and in general the quantity in question (in this case US L48 onshore conventional C plus C output) is plotted on a semilog chart with time on the horizontal axis and the quantity in question plotted on a log scale vertical axis. The exponent of the exponential function fit to the data gives the annual decline rate when we use years as our unit on the horizontal axis.

Dennis:

I plotted the data according to the suggestion of Arps in “Analysis of decline curves”. Transactions of American Institute of Mining, Metallurgical and Petroleum Engineers, vol 160, pp-228-2147, (1941). This comes to the same result as plotting the solution for an exponential decay on a semi-log paper, and gives a quicker eyeball estimation by examining the slope. It also gives a quick estimate for the URR. Of course URR is not static and is modified as new data is recorded year after year, but the URR does drift much and for the lower-48 appears to come close to Hubbert’s 1956 estimate (tight oil making a separate category).

Seppo,

Problem with the solution is it depends on URR, the way I do it gives us decline rate directly without any assumptions about URR, seems a better method as there are fewer unknowns (just slope and intercept), though I suppose the URR is dependent in the intercept so simply two different approaches that give the same result.

Using US L48 onshore conventional C plus C output data from the EIA over the Jan 1981 to July 2021 period, my method gives an annual decline rate of 3.11%. If we do a rough calculation from 1970 peak to end of 2019 (10000 to 2000 kb/d over 49 years) we get about a 3.2% average annual decline rate over a 49 year period.

Dennis

What I got was stated above “the peak of lower 48 to 2020, I get 3.4% decline rate. For a large oil province such as lower-48, the decline rate is usually in the 5% range, as it will be for the world.”

So the same as you!!

Look at the graph, I also use only the slope and intercept. It turns out that the intercept can be interpreted meaningfully.

best Seppo

Seppo,

Yes I realized later that the URR estimate is based on x-intercept, so you simply used slope nd intercept just as I did, the two mthods are equivalent, but my method does not require knowledge of Arps equations it simply looks at output over time so anyone who understands mathematics would follow the analysis without further knowledge. I tend to assume people have at least a knowledge of high school level advanced algebra, but not necessarily any knowledge of petroleum engineering.

“The Budget Bill Could Place A Fee On Methane, And Big Oil Is Lying Like Hell To Stop It

In public, industry officials say companies have has an “economic incentive” to curb methane releases. In private, they have acknowledged that isn’t true.

The $3.5 trillion budget reconciliation package at the center of a heated congressional debate this week represents a unique opportunity for Democrats to advance ambitious climate policies. Among its provisions is a fee on methane, an extremely potent greenhouse gas released from a number of sources, including oil and gas operations.

The oil and gas industry is desperately fighting this proposed fee by reupping old, disingenuous claims about having an “economic incentive” to curb methane, since it is the main component of natural gas and supposedly valuable to fossil fuel producers. In other words: Don’t worry about our emissions, we’ll take care of them ourselves.

But in closed-door meetings, industry leaders have admitted the opposite: Methane gas has very little value. That fact undercuts the idea that it’s in the industry’s best interest to capture that gas and sell it rather than vent and leak it into the atmosphere.

Sen. Sheldon Whitehouse (D-R.I.) and other progressives introduced a provision in March that would assess a fee of $1,800 per ton of methane pollution beginning in 2023, with a 2% increase above inflation each subsequent year. In September, the House Energy and Commerce Committee voted to include the methane fee in the reconciliation bill, despite vehement Republican opposition.

Methane is 86 times more powerful than CO2 over 20 years in the atmosphere and accounts for approximately one-fifth of human-caused planetary warming. Atmospheric concentrations have spiked more than 150% since 1750.

Over the last three months, Exxon Mobil, the American Petroleum Institute and other fossil fuel interests have flooded Facebook with ads opposing the budget bill and its climate provisions. Exxon alone has spent $2 million on Facebook ads over the last three months, CNBC reported this week.”

https://www.huffpost.com/entry/fossil-fuel-industry-methane-fee-reconciliation-package_n_6157410ce4b075408bd6eb58

Agree that leaking methane to the atmosphere is a very bad idea. I do not know what the reserve levels are in the US but in the rest of the world it is far from valueless and no methane (the primary constituent of natural gas) is wasted. NG is currently trading in the UK at the energy content equivalent of $180 per barrel of oil. Of course, even at that price there will be a few oil wells where the cost of collecting producer gas exceeds its economic value.

NG reserves in Europe are 20% below 5 year averages, and in the typical winter fall from their current level to 10% remaining by march. (as shown in the link from the OP above).

Global oil supply may have peaked, but outside of the US, it is NG which may have permanently fallen behind global demand first.

Ralph

“Methane gas has very little value”.

“Methane gas has very little value”.

Putting aside any ideological filters, that article from yesterday from Huffpost can offer SO many lessons in information management, presentation, and the consequential world views of so many observers.

The article highlighted comments made almost 2 1/2 years ago by Ron Ness, head of the ND Petroleum Council.

The at-the-time pricing delivered at the Northern Border pipeline (takeaway for the Bakken) was $1.98 /mmbtu … essentially 1 M (thousand) cubic feet of natgas.

As per the Director’s Cut from 2 weeks ago, the Northern Border pricing was $4.77/mmbtu.

Big Difference.

Applying current pricing to most recent published gas output of ~2.6 Bcfd, shows gross revenues of ~$360 million for the month of September.

$360 million. One month. “… very little value”.

There is so much more to this gas flaring story if people were genuinely desiring to be informed, rather than having pre-held biases confirmed.

In North Dakota’s case, the running of gathering pipelines across the Fort Berthold reservation has been stymied by extraordinarily high demands for ROW compensation.

In ‘shale’ wells everywhere, the high decline of initial oil output is accompanied by a similar drop off in gas.

This makes for financially questionable build out of gathering lines absent a firm future trajectory of sufficient natgas production.

P.S. The Bowland and Weald basins contain a century’s worth of British natgas consumption.

Had Cuadrilla’s efforts not been thwarted in recent years, the UK wòuld be on its way to a drama-free energy situation.

Coffee , “P.S. The Bowland and Weald basins contain a century’s worth of British natgas consumption.

Had Cuadrilla’s efforts not been thwarted in recent years, the UK wòuld be on its way to a drama-free energy situation. ”

Yes , but what was the cost of extraction ?? The project was abandoned because it was uneconomical . Period . Shale is an exclusive US phenomenon . Of course the locals were protesting ,but when has an O&G company bowed to pressure from protesters ? Shell is extracting oil in the Niger delta from last 30 years inspite of agitations .

HIH

I do not know why you make the statement that extracting natgas from the Bowland was deemed uneconomical.

The first few stages that Cuadrilla was able to frac (out of the several planned) actually showed very promising results.

The explicit regulation limiting seismic readings during frac’ing to .5 on the Richter scale is what ended the operation.

This, despite readings of foot stomping football fans routinely registering at 2.0 or higher. (Some of the math whizzes here can calculate the percentage difference between .5 and 2 on the Richter scale. Big, big difference).

As regards shale being exclusively a US phenomenon … surely you are not lumping our Canadian neighbors in as part of the US, eh?

The Argentinian government may finally be surmounting topside obstacles to further unleash the vast potential of the Dead Cow.

The current 20,000 bopd output from the Bezhenov is rapidly increasing with Gazprom Neft alone projecting a tenfold increase (from their current 2,000 bopd) by 2025. The crippling technological sanctions are being overcome with typical Russian tenacity and creativity.

The Chinese shale gas output has been stymied as much by surface machinations as by the challenging geology and location. Do not be surprised if the current drama incentivizes increased output.

The Beetaloo Basin has ~half dozen exploratory shale wells with very positive results so early in the program.

The employment of American experts will greatly accelerate efforts there.

The analogy you present with Shell in the Niger delta is an interesting one.

I s’ppose that mercenaries roaming northern England, armed with automatic weapons to protect drill rigs is not a completely impossible-to-imagine scenario … but I suspect our British friends would not take too kindly to that situation.

Coffee, what a piece of BS . Let me dismantle most of them one at a time .

Bowland :Seismic was the excuse to get out . The fact was there was not enough to justify the CAPEX . Cost is not only extraction , it is also pipelines , pumps etc to get it to the customer . If the oil in KSA does not get to the tank of Six Pack Joe in Montana it ‘s value is the same as the sands of Sahara . This is a problem with gas . The only way on land is pipelines . Ever think why are they flaring gas in shale oil plays ?

Vaca Muerta : It was locked out and now we come to the interesting part . Argentina defaulted and it was locked out of the FX markets which meant no dollars for imports . Solution : The govt offered a guaranteed buy at $ 70 (Could be less , not sure of the price but was more than the prevailing WTI price ) but payment was to be in Argentinian Pesos . So yes it was expensive but the govt was running the printing press and the operator was having to pay the expenses in pesos , so no problem . Of course anything in excess was skimmed off by the politicians and the bureaucrats ,but that is standard practice . At least the govt did not have to go to Washington with a hat to beg for dollars .

Gazprom Neft + Vaca Muerta + all others ; I am going to use your terms ” unleashed potential ” and “future projections ” to explain .

My tennis coach says I must work on my ” unleashed potential ” so that I can defeat Roger Federer , he further ” projected ” that I could win 3-0 against Nadal at Roland Garros . All your other examples of Chinese shale and whatsoever are what in school was called “Bullshit in gravy ” . Suggestion , put your money where your mouth is and let me know how you made out . Adios .

P.S ; 2000 bopd to 20,000 bopd by 2025 . Hold my beer .

Methane has huge value – just as Putin. Look at the pricing.

The energy to compress gas is

W = nrt ln (v1/v2)

Lng is a thousand times denser so the last term is 30. 1 kg of gas is 3kwh, or 1,000 mols. R is .1 liter atmosphere per kelvin mol. Temperature is 300 kelvin so the constants multiply to 10 million atmosphere liters. Thats 1 trillion pascal liters or, since a liter is 1 thousandth if a cubic meter and a pascal is 1 n/m, that’s 1 billion Newton times square meter, giving a work per square meter of a billion Newtons. The 1 kg gas occupies a square meter so you need approximately a gigajoule or 300 kw hour to compress it to NGL. In other words the EROI of natural gas is around 1:100. Some of the energy to pressurize it is regained in use. If this process is 90% efficient the eroi improves to 1:10, if we only need to pressurize it 10x lighter than solid it’s 1:1.

Natural gas is a virtually useless energy source when derived from gas, but once already pressurized its a sunk cost and can be used like any fuel.

Ethanol guy

Not sure exaxctly what you may be trying to achieve/to convey with your postings on this site, but the untethered-from -reality nature of several of your comments reminds one of that ‘short on oil/mustang 19/Ingraham’ (?) character who posts/posted on both this site and the peakoil site.

LNG is methane reduced in temperature to ~ minus 162 degree Celsius/-260 Fahrenheit.

The only compression used in the process is pre rapid expansion which greatly reduces the gas’ temperature before entering the liquefaction phase … generally through the coil wound or brazed aluminum methods.

To describe the production of LNG in terms of extreme compression is beyond bizarre.

Coffeguyz,

The entire point of flaring is that it’s not actually rational to use natural gas. Natural gas has a density of .68 kg per m3. Ngl is 468. Getting natural gas to a usable form requires a thousand fold compression.

Even if we phrase it as cooling it’s the same problem. The specific heat of natural gas is 4 kJ per per kg k. Cooling it 200 degrees is 800 kJ per kg. But since it exchanges 1 kw per square meter per degree a cube of it will regain all its heat in five minutes. A 99% efficient insulator will keep it cold for about a day. The pipelines move fast, about 30mph so that’s enough time to get it to most places. Whether you phrase it as cooling or compression is almost irrelevant, it’s just a difficult material to work with.

Natural gas pipelines themselves don’t bother with keeping cool, they have compressor stations, and compression is a losing game.

http://naturalgas.org/naturalgas/transport/

Natural gas that is transported through interstate pipelines travels at high pressure in the pipeline, at pressures anywhere from 200 to 1500 pounds per square inch (psi). This reduces the volume of the natural gas being transported (by up to 600 times), as well as propelling natural gas through the pipeline.

Great info Ovi.

Dennis- does the chart of

“Tight oil outlook in the Permian, based on current drilling activity & well/rig productivity” out to 2029

from Enno Peters site (linked by Ovi) align with your projections for permian?

Pardon me if that has recently been addressed.

Thanks

Hickory,

No. The projection at shaleprofile.com assumes no change in well productivity, no change in rig efficiency, and no change in rig count. The first two assumptions match my own roughly, but I assume rig count will increase from current levels, if oil price increases to $95 per barrel by 2030.

Dennis,

The oil price is already 150 or so, considering half of shale is condensate frauding as oil.

Also why aren’t you including carbon credits? Those are the big driver of real energy prices.

Ethanolguy , I am following your posts with interest . I am confused so I am looking for some answers .

1. Oil price is already $ 150 ? I don’t get the connection with shale condensate masquerading as oil .

2 . The total US production is 11.700 kbpd .

a) Conventional from stripper wells 1,700 kpbd

b) Alaska 450 kbpd

c) GOM 1,550 kbpd

d) Shale 7.000 kbpd

e)Others 1.500kbpd ( bio fuels+ whatsoever )

Please assign API value according to your viewpoint for (a) to (d) .

Total production figures may not tally as are rounded for convenience .

Your posts on Natural gas transportation and also on Uranium are also eye openers and informative . Just like to add that for many years the uranium in the US power plants was being imported from Russia , a product of the dismantled nuclear warheads under the START treaty until Bush II refused to extend it .

The 150 comment is tongue in cheek but it’s not totally absurd. The eia table I keep posting

https://www.eia.gov/dnav/pet/pet_crd_api_adc_mbblpd_m.htm

Shows up to 70-90% of New Mex production may be condensate despite eia claiming around 5% in C C. The eia more or less directly contradicts itself or is using a conservative definition.

Condensate forms a mile or so deep, see https://www.offshoreengineering.com/oil-and-gas/petroleum-geology/1-hydrocarbon-formation

Tight fields are also light fields because depth, temperature and porosity correlate. Thus tight oil is almost synonymous with light products.

As for the second question

A) Strippers is going to be the older, good wells producing 30-40 api. Deeper, expensive, newer wells are lighter, there’s probably also an increase in heavy production but EIA does not even go back that far.

The problem with strippers is EROI. It takes a gallon of gas to move a ton of water. That’s 100:1 eroi. A normal well makes 1k bpd and similar water. A stripper does 15 barrels per day and the same water. Produced water kills EROI.

B) Alaska north slope is API 32. It is probably some decent oil, but production is obviously declining and it’s also not going to save things. California is unique in introducing thermal EOR to extract heavy oil. Most states are a lot of stripper wells, tar and condensate, the best oil is GOM.

C) GOM is pretty accurately recorded in EIA. It’s about half tar (heavy oil) and half oil. “Averages” to 30 but is really half light oil and tar each. Nothing fishy going on there. I gave the volumetric reserve estimate and it’s already been blown past. The initial ultra deep water boom was around 2010 and presumably by the time EIA starts recording API in 2015 they already depleted some of the early projects and have an increasing share of tar.

If you use only the GOM api 30-40 you get a very nice hubbert curve that peaked in 2018. The total collapse of the car industry and all these catastrophic events going on for years that everyone ignores stems from this and import quality declining.

D) Ethanol is the original, organic structure which created oil and now stabilizes tar and the corroded, biodegrarded heavy products. Shallower oil has worse biodegradation.

On an unrelated note the northern hemisphere has more salt domes because heat moves stuff north, to cold areas and salt helps protect oil in places it would otherwise degrade. Inert minerals like copper and gold stay put, but that’s another story. Europe has all the resources because heat moved heavy elements there and it helped to create the North Sea salt dome to prevent biodegradation. Correct me if I’m wrong but the North Sea has among the largest salt domes in the world.

Back to ethanol, it has 47 api, while gasoline is 55-60. Ethanol is slightly heavier than gasoline but can still be used more or less directly because as explained it is the basic, undegraded, organic progenitor of all oil. Thus the refining need is minimal.

Heavy oil is undesirable because large share of residue. A petroleum molecule has about 10 atoms and refining breaks one or so, raising specific gravity 10%. Thus 40 API oil becomes 55 api gasoline, and so on. Light oil is undesirable because refining things makes them lighter and thus you never get gasoline. Also as an aside the aromatics of oil are what matter because you get energy breaking the aromatic ring. Extremely light products are also undesirable due to their tendency to boil and temperamental behavior. You can use natural gasoline- drip gas or 55 api condensate- out of the ground but it will trash your car.

So if you combine ethanol with tar even in a relatively low percentage you get something sufficiently stable to be called gasoline. Because America hasn’t built a single refinery for decades and doesn’t maintain its existing infrastructure, if you cut all the corners, use ethanol and every desperate thing you can get usable gasoline out of tar. America consumes 9m bpd of gasoline. 4m from light oil and 1m from imports. That leaves 4m barrels, and because combining 47 api ethanol with 25 api Venezuelan tar gives something you can pretend is a 36 API normal refinery input. You can mix approximately 1 part ethanol and 4 parts tar and still get a reasonable input.

Of course the EROI of ethanol becomes low, half of all corn production goes into it, and even if ethanol is only waste parts like the stem, that waste is supposed to build topsoil and loss of it will impair future farming. Furthermore the cost of transporting and storing corn is high. Nevertheless in the short term it does allow more oil to be superficially useful.

I don’t like focusing on America but it has the best statistics so you can extrapolate to the rest of the world.

Thanks for your reply . When you say mixing tarsands oil to LTO and use this mixture for refining ,the resulting output will be what Jeffery Brown called ” Dumbell effect ” which was high in gasoline and bitumen but low in the intermediates . Please correct me if I am wrong . So much yet to learn . The US is acceptable as a sample since other nations don’t have this variety ,all they have is conventional crude and can be easily classified .

Hickory,

My best guess for Permian basin below, I assume the completion rate will increase from about 350 per month currently to a maximum of 525 new wells per month in 2025, the previous maximum was 521 wells per month in 2019 and the highest 12 month rate was about 460 in 2019, the average 12 month completion rate increased from 343 in Oct 2017 to 460 in March 2019 (in 18 months), or an increase of 6.5 wells each month on average.

My scenario assumes an increase from 350 wells per month to 525 wells per month over a 46 month period, and increase of 3.45 wells per month, so very gradual compared to 2018 (nearly half the rate of increase).

I am told this is impossible, but if current high oil and natural gas prices continue for a couple of years this seems a reasonable scenario to me. In fact it may prove to be conservative.

Dennis, the area under the red in your above chart, is about one-third, perhaps one-fourth, the area under the rest of the dotted line. And if you extended it out to 2040 it would be about one-tenth.

Nah…. that is just not possible that the Permian has only tapped one-tenth of its oil. That is just my opinion, however.

Ron,

https://i.postimg.cc/MHH2Qp60/DBB3-E30-B-9893-4-D85-921-E-7-F2-F105-D3-D04.jpg

New Mexico will peak in 6 months.

Texas already peaked. Permian will die soon.

Dennis model is only correct because nothing happened. If you break it down by states it has obviously peaked with New Mexico lagging.

Ron,

The URR for the scenario is 44 Gb, cumulative production for the scenario is 7.85 Gb in August 2021, about 18% of the URR. 50% of URR is reached in late 2028, but peak output is not reached until 2033 at 73% of URR, in late 2028 output is 6500 kb/d and output continues to gradually rise to a peak of 6800 kb/d in 2033, but perhaps there will be a plateau or a slight decline after 2028, I used a rather unusual flat topped completion rate capped at 525 new wells per month from 2025 to 2032. That scenario is not likely to be correct.

Dennis, your model is basically a flat line.

It would be interesting to predict specific fields (phantom, bakken) which are being absolutely obliterated by the hubbert curve.

The URR for the scenario is 44 Gb,

I understand that Dennis. But the part I do not understand is why do you believe that shit. 44 Gb is absurd, totally absurd. Yet you accept it without a moment’s hesitation.

Damn Dennis, wake up and smell the coffee. All your predictions are so way, way, off because you accept all those really stupid absurd URR numbers. Do you never have a moment’s doubt? You seem to believe those numbers like a fundamentalist believes the Bible. People who believe bullshit live in a dream world.

Ron,

The USGS TRR estimate for the Permian basin has a 90% confidence interval of 44 Gb to 114 Gb with the mean (best guess) estimate by the geophysicists at the USGS for Permian TRR at 75 Gb. The model I use has eliminated the lower productivity benches of the Permian basin and uses a TRR of 50 Gb. It is an extremely conservative estimate with a likelihood of about 80% that the TRR will be higher than I have assumed.

The URR depends on economics (future oil prices and costs to produce the oil), these are quite uncertain, but for the costs I have assumed (I assume they are similar to 2019 costs adjusted for inflation, that is real costs are constant for capital with OPEX costs rising as the field depletes) and the oil, natural gas, and NGL prices I have assumed the scenario is reasonable.

Note that you always have thought every scenario I have proposed is wildly optimistic and they have consistently have been a bit on the pessimistic side.

Perhaps the odds are on your side. 🙂

Ron,

Also as a reminder the USGS in 2013 estimated about an 11 Gb TRR for North Dakota Bakken/Three Forks, my scenarios for the Bakken suggest an ERR (economically recoverable resource) of about 8 Gb. At the end of 2019 proved reserves for North Dakota Bakken/Three Forks were about 5.5 Gb and cumulative production was about 3.3 Gb, suggesting an ERR of about 8.8 Gb. Undoubtedly you believe the proved reserve estimates for the Bakken are too high, but note that my scenario for the Bakken is almost 1 Gb less than proved reserves plus cumulative C plus C output from the Bakken/Three Forks.

Note also that for the Bakken/Three Forks the ERR is 7.9 Gb and mean TRR is 11 Gb, so ERR/TRR=72%. For Permian Basin mean TRR is 75 Gb and 72% of 75 Gb is 54 Gb, my Permian Basin medium oil price scenario has an ERR of 44 Gb. Bakken medium oil price scenario below.

Thanks for the followup Dennis.

As we have expected, higher prices for oil are going to be the driver of renewed incentive to sustain production. The common estimates of oil price will likely be conservative, as I see it.

Even as some great new electric vehicles are coming to market, it will take a long time to shift the landscape.

Hicks ” it will take a long time to shift the landscape.”

With due respect ,do we have the time ? You think so seriously ? My contention

1. Bob Hirsch in his report said 20 years to transition and he included replacements which included nuclear energy on which nothing has been done ( let us not argue why ) .

2. NG was supposed to be the bridge for this transition . Current events show that this bridge is not in for completion .

Sorry , higher prices will not bring on to market sources that do not exist . Personal experience I posted on the other thread . During the peak of the Covid 2 wave in India there was an acute shortage of oxygen . A $ 30 refill was going at $ 300 , but that did not mean that more oxygen was available , it only meant it went to the higher bidder . Current example , thermal coal . China is outbidding India so badly that in India power plants have a supply of only 4 days . Price is up 260% from $ 57 to $206 in one year . Where is the coal ?

Hickory,

Talking about prices is silly when everything is already drilled, and it’s impossible to change production. You can’t stop oil coming out of the ground once it’s drilled so the fact that debate even exists is proof that those people don’t actually matter.

If you look at permian all the important eases like Texas ten Y were drilled before 2015. Any drilling now is just screwing around, there are no new productive leases.

In Saudi there are no significant new oil projects for years and Aramco is firing people. Nowhere in the world seems to have any real chance of drilling a significant number of new wells. The oil industry is dead, it just takes another 3 years for people to die physically.

Of course price matters.

Unless you are just self-funded like yourself and are producing oil just for the pleasure of it.

Capitalism was never profitable https://desuarchive.org/his/thread/11943043/#11943043

Ovi, you do good work, thanks.

With regards to shaleprofile.com supply predictions I have addressed that, posted here by someone else; a miniscule change in well productivity (already occurring in ALL shale basins), a change in rig “efficiency” from 1.2 wells per rig per month to 1.0 wells, shows shale production declining to 2029, even in the Permian, and particularly in the Texas part of the Permian. Once DUC’s have run their course, soon, the tide will be out on shale oil.

The conjecture that rig rates will continue to rise, because they have the past few months, or because of higher prices, also occurring the past few months, is just an uneducated, inexperienced guess. It helps to understand all the ramifications of oil and gas development in the world if you started before 2008 and shale oil.

Respectfully, people believe too much of what they read on the internet. Two wrongs don’t make a right; folks need to think for themselves, as you have regarding DUC’s. The future of unconventional shale oil and shale gas in the US is far too important to let the need to be right, and others wrong, be important. We’re all in this together, even, particularly, our neighbors in Canada.

Mike

Thanks.

Could you explain why the rig “efficiency” has gone from 1.2 wells per rig per month to 1.0 wells. Is this because they are drilling longer laterals or is a real reduction in productivity?

Ovi, some of Enno’s tools have the ability to input ‘what-ifs,’ when we make minor changes in some of the metrics, future supply projections change; all that gentle slopping “growth” reverses to decline. They change rather significantly even for rig efficiency, or the number of wells one rig can drill in a month. The difference in 1.2 wells per month to 1 well per month is just a few days. Using Enno’s tool I input that change from 1.2 to 1.0. I don’t know that has happened yet, it certainly might.

Longer laterals might have something to do with it, employment problems will, supply chain disruptions regarding pipe, cement, sand, etc. Longer rig moves as core areas are drilled up. The shale sector is stressed at the moment for services. There is a lot of waiting going on. There are a host of extenuating circumstances that always make past results not indicative of future performance. The produced water problem in the Permian, for instance, WILL eventually lead to a slow down in how quickly remaining drillable locations can be developed. Rig efficiency is a poor metric; until 7 years ago, and shale, I’d never even heard of it.

To assume consistent well performance (productivity) this late in any Basin’s development is a stretch.

The point I wish to make is that predicting the “rate” of development of an oilfield is fraught with real life delays. And disappointments. Nothing EVER works out like you hope in the oilfield. Making guesses about oil prices has never worked. Ask anybody if they saw $38 oil coming in 2015, or -$38 oil in 2020, or $75 oil today. They didn’t. Nobody can.

There will be tens of billions of dollars borrowed for more gas pipe stuffed in the ground, more LNG ports built, all because of $6 natty, now, and about the time that all gets done the shale gas sector will have driven the price of gas back down to <$2.25.

Predicting my industry's behavior over the past century has historically proven to be like herding cats.

Mike

Thanks for the detailed explanation. The operational issues you mentioned in the second paragraph never crossed my mind.

The well productivity what if that Mr Shellman used was about 5.5% decrease each year in average well productivity.

In the past when duc count has fallen to where the E & P companies desire the count to be, they have increased the rate thet new wells have been spud.

As to what will happen to these rates in the future we can only guess.

LTO survivor has suggested perhaps 5% annual rates of growth, Mike might disagree with that guess.

Both of these men and shallow sand, Rasputin, George Kaplan, SouthaGeo, or anyone else with actual oil field experience would probably make better guesses than me.

I expect the rig count will continue to increase and rig efficiency will be roughly unchanged, generally with pad drilling and other recent changes the rig efficiency has tended to increase, labor shortages might lead to more intensive use of technology which tends to increase rather than decrease rig efficiency.

We will see.

Also DUC count (for big 4 tight oil basins, Permian, Bakken, Eagle Ford, and Niobrara) went down from 2015 (peak of 5117) to 2016 (to 3699) then reversed peaking in June 2019 (at 6005) then it decreased during the pandemic (to 4180 in May 2021)and is likely to reverse again in my opinion. Estimates from shaleprofile

https://shaleprofile.com/blog/us/us-update-through-may-2021/

Ovi,

If we combine Baker Hughes Permian basin horizontal oil rig count data with DUC data from EIA’s DPR for wells drilled in Permian basin (with the assumption that most of the permian basin wells drilled are horizontal tight oil wells from 2017 to 2021) we find an average rig efficiency of about 1.27 wells drilled per rig over that period (Jan 2017 to August 2021). Enno Peters uses an estimate of 1.2 wells completed per rig. If we assume eventually a steady state is reached where the DUC count is relatively stable and wells drilled is roughly equal to wells completed, then the efficiency in wells drilled vs wells completed will be the same.

Perhaps rig efficiency will decrease from 1.27 to 1.0 as Mr Shellman assumes, but my guess is that we are unlikely to see such a large decrease, especially considering that over time we have seen rig efficiency increase from the Jan 2014 to Dec 2016 period (based on shaleprofile spud data the rig efficiency was about 1.09 wells drilled per rig). If we combine the two data sets over the Jan 2014 to Aug 2021 period we get an average rig efficiency of 1.21 wells drilled per rig (this might be the basis for Enno Peters’ estimate).

In any case future rig efficiency is unknown (like all things about the future).

If we focus on times when rig count was high (330 to 440) from mid 2017 to mid 2019, the rig efficiency was about 1.3 wells drilled per rig.

The axes on th chart above are mislabelled, horizontal axis is rigs and vertical axis is wells drilled. Correct chart below.

Not an expert but it looks like the US will have plentiful Natural Gas Liquids for decades.

Therefore the feedstock for many products (ex plastics etc) and propane for heating will be readily available.

Where NGLs’ are relatively weak is for liquid transportation fuel- its going to be refined crude oil and electricity.

Good summary-

https://www.kindermorgan.com/getAttachment/babe6db9-ba7a-4f51-a100-5fd46b944540/White_Natural_Gas_Liquids.pdf

https://www.energy.gov/sites/prod/files/2017/12/f46/NGL%20Primer.pdf

What are the stocks of depleted uranium in USA? In France, we have 300.000 t of depleted U 238 which could be used along Pu 239, coming first from the PWR in service in France, into a Molten Salt Reactor. A scientist, Joël Guidez, of the CEA (Commissariat à l’Energie Atomique) explained (conference of 03/02/2021, University of Marseille with the Sfen) that with a scientist of the CNRS (Centre National de la Recherche Scientifique), they simulated (icapp 2019, Molten Salt Reactor to close the fuel cycle. Example of MSFR multi recycling applications, Joël Guidez et col.) the functioning of a 1 GWe MSFR (Molten Salt Fast Reactor) using a mixture of NaCl/UCl3/PuCl3 and they stated that to function regularly, they needed to add 1 t of U 238 per year. Perhaps, you should consider developing MSFR instead of using your reserves of NGL.

Du is not tracked. Total American uranium inventories are 50kt plus nuclear weapons. That’s about two years of consumption. Also mine production is falling pretty fast, Canada closed some mines.

A nuclear reactor needs to remove 300 Celsius heat from two thousand square meters per second. At a concrete specific heat of 1 kJ per kg per degree for a 1gw you need 1,000 tons to hold that heat for a second. The heat transfer coefficient of concrete is around 10 joules per square meter second kelvin. That means our concrete puts out around 6 mj, so we need about 500,000 tons of concrete. For perspective a nuclear plant costs a billion dollars and concrete is $100 per ton, so the concrete is 5% of the price.

Concrete needs approximately two tons of water per ton. At 1000 degrees it loses approximately 1 mj per second. Heating it for three hours is 12gj, with water 36 gj per ton. The reactor concrete comes to 36 terajoules per thousand tons. Steam has a hundred times more area so 3.6 petajoules or 1,800 petajoules for the entire thing.

The reactor produces 600 petajoules over its life, so eroi is 1:3. Nuclear doesn’t work.

The earth has e18 tons of dirt to a depth of a mile. E12 is uranium and e10 is useful isotope. 10% each is at correct temperature, depth and geography. That’s an e7 uranium reserve which is nothing.

Hickory , the reports by you are past expiry date (2016 ) . Here is the latest . I had posted the links earlier but at that time NG was not an issue . Just for your info , American Chamber of Commerce has asked for a ban on export of NG on the grounds that exports are causing a domestic shortfall and leading to higher costs to industry .

http://resourceinsights.blogspot.com/2021/09/its-all-connected-natural-gas-market.html

https://energybulletin.org/the-energy-bulletin-weekly-13-september-2021/

Apparently you didn’t see that the info I linked was not about the current economic status of the natural gas market.

Rather those postings were about the nature of Natural Gas Liquids.

Sorry Hicks , my error . Should have differentiated between NGL and NG .

In 2000, America imported 3m bpd of api 30-40 oil, compared to 1m now. It produced a little from Gulf of Mexico. The 2m gap was made up by Gulf of Mexico growth and ethanol. Ethanol is the waste parts of corn, which fertilize the soil, so this isn’t apparent yet because fertilizer is overapplied.

The light oil imports of America are starting to turn over, presumably like in the rest of the world, and at current rates America won’t import any light oil by 2024. The entire growth is heavy oil, condensate and other marginal fuels. Wolfcamp is a mile deep for example, which is where condensate forms. Because mixing averages api it’s safe to say api 30-40 is the useful oil and the rest is condensate or tar.

Society is collapsing extremely fast, everything is in deficit.

Ethanolguy , I think your calculation/ information is incorrect , but I will let others who have a better grasp of this chip in . Agree with your last sentence .

Here is the relevant data, you can see light oil imports are falling fast.

https://i.postimg.cc/15hz6MZM/CB74-DC03-7-F9-F-453-F-9-C0-D-384-C0-E80-AD39.jpg

https://www.eia.gov/dnav/pet/PET_MOVE_IPCT_K_A.htm

“Ethanol is the waste parts of corn,”

You don’t know what you are talking about (on all sorts of topics).

It is made from the starch in the endosperm of the kernel, which comprises about 80% of the kernel.

In this world easily digested carbohydrate is not waste by any measure.

Hickory it’s pretty obvious you’re a troll but I’ll cite it.

https://www.usnews.com/news/articles/2014/08/13/corn-waste-enters-the-renewable-fuel-fight

Cellulosic ethanol is a fuel made not from corn kernels, but instead the husk, stalk, cob and other waste parts of corn.

//

Now go to whine to the mods that you were caught being a troll.

Okay, guys, you are both right and both wrong. Just do a little googling and you will get the straight story. Corn ethanol is indeed made from the kernel of corn. From Ethanolguy’s link:.Cellulosic ethanol is a fuel made not from corn kernels, but instead the husk, stalk, cob and other waste parts of corn. However, How Corn is Processed to Make Ethanol Corn ethanol is made from the kernel of corn. I drink a little of it almost every day.

I think you will find that, by far, most ethanol is made from the kernel. However Cellulosic ethanol looks promising. But I have a question. If it turns out that you can get a lot of ethanol from the stalk, leaves, and husks, why cannot you get it from weeds or any other kind of cellulose? Just how economical is cellulosic ethanol?

Ron

Cellulosic ethanol production depends on special enzymes that can convert the cellulose into, I think a type of sucrose. The great hope in Canada was that wood waste could be used aa a source of cellulose. They never found the enzyme that had an economic yield.

Rather, I am interested in reality. Reality is fact based.

” Ethanol, made mostly from corn starch from kernels, is by far the most significant biofuel in the United States, accounting for 94 percent of all biofuel production” USDA (date of data not included)

“Cellulosic ethanol feedstocks are abundant and include corn stalks, plant residue, waste wood chips, and switchgrass. Making ethanol from these sources is more difficult because cellulose does not break down into sugars”… [without energy intensive and expensive processing]

On a related note- the US produces enough ethanol to provide roughly the equivalent fuel used by all on-farm liquid fuel consumption

So Putin now has not only Europe but also China by the balls . All hail “Don Putin ” . I am repeating myself ” Don’t mess with Putin ” .

https://tass.com/economy/1344259

What caused the massive oil spill off Huntington Beach? Here is what we know

Elly is fed by some 70 oil wells. The processing platform separates oil from water. “It’s just crude oil that’s sent to the shore,” Willsher said.

Amplify Energy has divers inspecting the potential source of the leak and investigating its cause. Willsher said his company notified the Coast Guard on Saturday morning about the spill after its company inspectors noticed an oily sheen in the water, and the flow into the pipeline suspected of leaking was shut down Saturday night.

Does anybody know the daily production rate of Elly.

https://www.latimes.com/california/story/2021-10-03/what-caused-the-massive-oil-spill-off-huntington-beach-here-is-what-we-know

Ovi.

I looked at Amplify’s website. It says 53 offshore wells in Beta field producing 3,600 BOPD as of Q2, 2021.

It appears almost a whole day’s production.

I am very interested in what kind of spill protection measures were in place and what one’s failed. Seems like this should have been noticed much quicker than it was.

We have sensaphones on all of our tank batteries that process significant amounts of water. (We are more concerned about produced water spills, as we process a lot more water than oil) Our pumpers have them dialed into their cellphones. The pumpers can call in and run through diagnostic checks and can hear the pumps. If there is an issue, the sensaphone calls the pumper and alerts him/her of it. If the pumper doesn’t answer, it calls the next pumper programmed in, and so on. If nobody answers, there is a field kill system that shuts all of the wells down and soon thereafter shuts the plant down. We have earthen dikes around all of our plants. They are supposed to hold 2 1/2 times the volume of all tanks within the dike. The dike walls are measured annually by well inspectors. We also have spill prevention plans that for each battery that were developed by an engineering firm. The spill plans are an EPA requirement.

We are required to do the above for our small onshore operations. Would think there would be significantly more required for offshore CA.

Leak detection on off shore pipelines is difficult to provide and more so as the actual flow becomes much less than the design flow. I doubt if any automatic system was incuded when.the pipeline was built. At best there would be regular pigging inspection for pipeline thickness. B`y BOEM site it looks like Beta operations only took this over in 2017, I’d imagine it’s a bit of a marginal operation especially after the last couple of years of low prices. It is fairy heavy oil and water cut is 80% so operating costs offshore are liely quite high.

I think this will be more common as infrastructure offshore ages, in some cases beyond its original desgn life, and operations have to be strealined more and more if they are to remain viable.

George.

I know almost nothing about offshore operations.

What types of pipeline leak detection devices are employed offshore?

Mostly just mass balance checks – measure what goes in and check against what comes out. They need a real time communications link between the two ends of the pipeline. For multiphase pipelines complex models have been tried but I don’t know if they have ever detected a leak, but have certainly generated plenty of false alarms. On shore there have been developments for acoustic detection for gas lines but I don’t know of anything like that off shore, but presumably a gas leak would make a noise which would travel well underwater. I doubt a liquid leak would be detectable like that though.

Amplify’s is struggling with bankruptcy.

Shallow Sand

67.9 barrels per day on average per well. Is this flow from natural pressure or through some enhanced recovery technique?

Oil prices on both WTI and Brent broke through the top of the spinning top candlestick that formed on September 28. Spinning top are indecision usually a reversal but not always.

Have to look higher in price now.

OPEC+ Choice to Drip-Feed Oil Supply Sends Price to 7-Year High

OPEC+ agreed to maintain its schedule of gradual monthly production increases, triggering a surge in crude prices.

Ministers ratified the 400,000 barrel-a-day supply hike scheduled for November after a short video conference on Monday. Going into the talks, there had been speculation that they could opt for a larger supply increase, but no such proposal was made, delegates said, asking not to be named because the meeting was private

George Kaplan

An update on GOM.

Meanwhile, Royal Dutch Shell Plc resumed production at one of its main U.S. Gulf of Mexico offshore facilities, more than a month after Hurricane Ida brought production in the area almost to a halt. Service was restored at Shell’s 100,000 barrel-a-day Olympus oil and gas platform.

https://www.rigzone.com/news/wire/oil_surged_to_2014_levels_monday-04-oct-2021-166616-article/

The Dutch TTF gas benchmark trades up 12% on the day at €106.3/MWh or $36/MMBtu or $205 per barrel.

[source] [Dutch TTF gas]

Aramco Says Gas Crisis Raises Oil Use by 500,000 Barrels a Day

The world’s biggest oil company said the global natural-gas crisis has boosted demand for crude by 500,000 barrels a day.

It looks like there may be unusually cold weather coming to the western USA and more supply disruptions in the GoM so US natural gas prices may just keep on climbing.

Pollux

Virtually all the world’s ships that run on dual fuel (LNG or ULSFO) are switching to the now much cheaper fuel oil.

This bodes very poorly for lower electricity generation prices as the back up fuel oil stocks are stocks are also being rapidly depleted. Areas that rely upon ULSFO for back up generation fuel (looking at you, New England) are entering precarious times should this be a very long/cold winter.

You may have the wrong conversion. The most recent one I have found says 0.59 bbl per MWh which is about US$67/bbl. Still a good price of course

Yes, 0.59 barrels of oil per MWh, so one barrel is 1.69 MWh. So you multiply MWh price by 1.69 to get barrel of oil. Then you multiply this by eur/usd rate.

Name , sorry to bother . Can you do the calculation figuratively ? Who is correct David or Pollux ?

Gas Prices In Europe Are Now The Equivalent Of $230 Oil

The benchmark European gas prices continue their rally this week, surging to new record highs on Tuesday to an equivalent of $230 a barrel oil, amid a wider energy commodity rally driven by supply concerns ahead of the winter.

Will be interesting to see the development when NS2 and Melkoya is operational, read that they have started to fill a part of NS2 for testing a couple of days ago, but depends on what the Russians want to export of course.

(Sweden has been exporting, as normal, during the last week at between 1,5-6 GW including whatever the 600 MW Karlshamn oil plant has produced, had negative electricity prices for some hours during the weekend)

https://www.nordpoolgroup.com/Market-data1/Power-system-data/Exchange1/ALL/Hourly1/?view=table

Pollux is correct. MWh is energy equal to 0.59 barrels of oil. Current Netherlands natural gas exchange price is 118 euros per MWh. 118 euros divided by 0.59 = 200 euros, which is now 232 dollars. So 118 euros per MWh = 232 dollars per boe (at current eur/usd rate).

ZeroHedge: “Gas Prices In Europe Are Now The Equivalent Of $230 Oil”

https://www.zerohedge.com/energy/gas-prices-europe-are-now-equivalent-230-oil

Up another 38% so far today (above 160 euros per MWh):

https://www.theice.com/products/27996665/Dutch-TTF-Gas-Futures/data?marketId=5285051

An article on oilprice.com that supports my suspicion I’ve written here often this year:

https://oilprice.com/Energy/Natural-Gas/The-Real-Reason-OPEC-Refused-To-Boost-Production-Further.html

The Opec has no more spare capacity, it has to be rebuild from the scratch.

My opinion was the paper shuffler from financial controlling cut all budget not necessary to support the current, voluntary cut, production. So no spare capacity after a year of cuts and a year of decline – and a lot to do to drill these infills and tap these side pockets (and do all the other stuff our oil men know about and I not). Work that should have been done last year in a normal time.

In the mean time power plants in Europe ordered less coal – because price was sky high. Now it is even higer. In some regions burning oil is now cheaper than burning nat gas.

If this continues this winter, times will get very interresting. As in the old chinese curse – may you live in interresting times.

Eulenspiegel, I agree. The whole natural gas, coal, and oil shortage are about to blow up in everyone’s faces. Yes the world MSM seems to be almost totally ignorant of what is happening. The winter of 2021-22 will be the winter of our discontent. The world will emerge a totally different world in the spring of 2022. It will be a colder, hungerer, and far more violent place. Covid will still be around but it will be far from the most serious of the problems we will face.

Ron, Eulen and many others , we are on the same page . We are now at “peak energy” but the MSM and many others don’t recognize it . All sources are peaking at the same time (Oil,gas,coal ) . We are going into a permanent decline in prosperity . Big problems up ahead .All take care and be well .

P.S : Actually we are at “Peak Everything ” as Steve had mentioned .

Not peak energy – there’s more gas here than oil, and even more coal.

It’s “just” the corona-chaos. Wrong planning, and China is on a feud with Australia boycotting everything from there – including coal. So supply chains are in a chaos. It takes time to redirect australian coal to India, and indian coal to China because of some politicans.

And here in Europe they close perfect working power plants and are expecting everything works fine. It does, until there is a day with low wind…. It’s all home made stew here – virtue signalling over everything. In Hamburg they dynamited a new coal power plant because of CO2 – so the old plant 10 miles away, with a much lower efficiency has to work on. And they close nuclear hoping it will be replaced with wind and solar (no storage in sight, not even on a plan).

This combined with chaotic supply chains gives more chaos.

EULENSPIEGEL,

You do realize that coal and natural gas are not extracted and transported by ENERGY TOOTH FAIRIES or made in STAR TREK REPLICATORS? Correct?

There is no coincidence that coal and natural gas production has surged the past 50 years along with the increase in oil production. Most coal is extracted and transported by diesel-powered machines and trucks-trains-barges-ships. These run on diesel for the most part.

This idea that we can just SIDESTEP OIL and produce all this wonderful natural gas and coal, suggests that many in the world believe in the ENERGY TOOTH FAIRY.

steve

Sorry, there is enough Diesel left for mining. Coal production does not fall now because someone not gets his truck filled up.