A guest post by Ovi at peakoilbarrel.

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIAʼs International Energy Statistics and updated to March 2021. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

March Non-OPEC production recovered by 1,760 kb/d to 48,778 kb/d by returning shut in wells from the US winter storm to production status. The biggest contributors to the increase were the US, 1,401 kb/d, Russia, 150 kb/d, China 84 kb/d and Canada 83 kb/d. The US increase was driven by the recovery of oil output from the severe winter storm that affected Texas and other US gulf coast states in February.

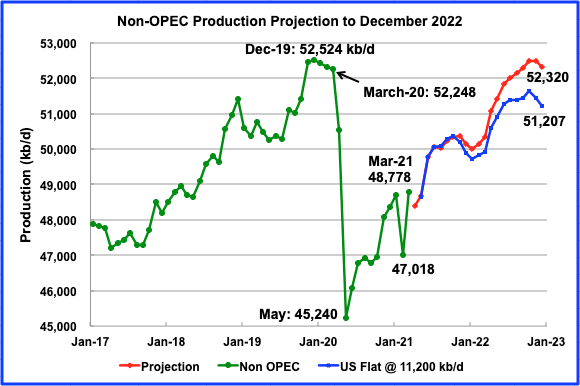

Using data from the July 2021 STEO, a projection for Non-OPEC oil output was made for the time period April 2021 to December 2022 (red graph).

Output is expected to reach 52,320 kb/d in December 2022, which is lower than the previous high of December 2019, by slightly more than 200 kb/d. In the July report, the forecast December 2022 output was revised up from 52,037 by 283 kb/d.

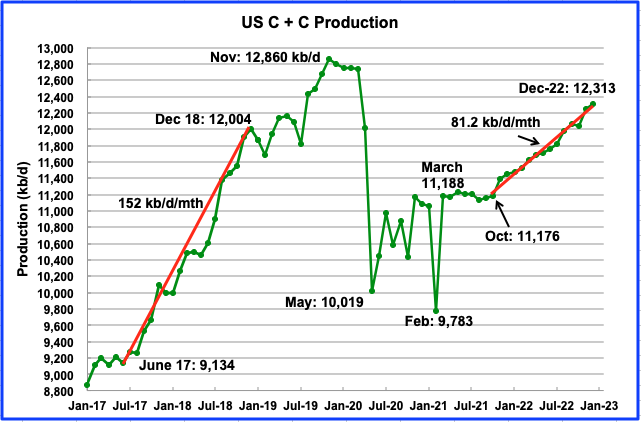

In the EIA July STEO, US output is forecast to be essentially flat at 11, 200 kb/d from March 2020 to October 2020, before beginning to increase every month. See US production chart further down.

The blue graph is intended to answer the question: “What would Non-OPEC output be if US production were to stay flat at 11,200 kb/d from May 2020 to December 2022?” As can be seen, production in December 2022 drops by 1,113 kb/d.

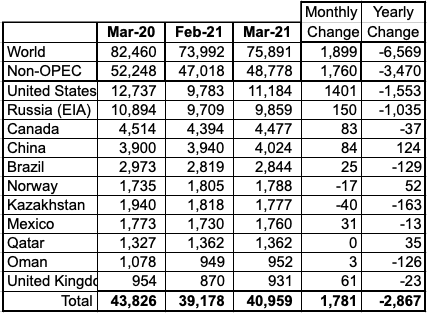

Ranking Production from NON-OPEC Countries

Above are listed the worldʼs 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The last two have currently fallen below 1,000 kb/d.

In March, these 11 countries produced 84% of the Non-OPEC output. On a YoY basis, Non-OPEC production decreased by 3,470 kb/d while on a MoM basis, production increased by 1,760 kb/d to 48,778 kb/d. World YoY output was down by 6,569 kb/d.

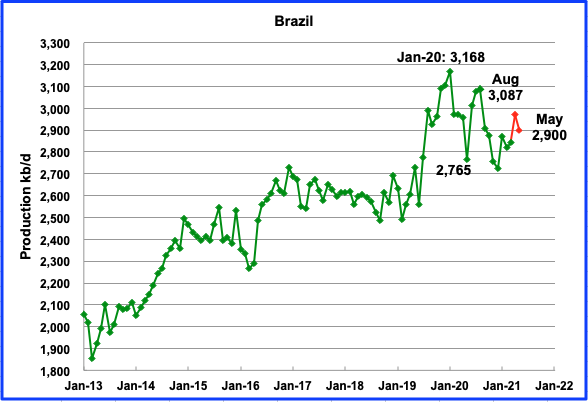

The EIA reported Brazilʼs March production increased by 25 kb/d to 2,844 kb/d. According to this source, May’s output decreased by 70 kb/d from March to 2,900 kb/d. (Red Markers).

“A key driver of Brazil’s growing petroleum production is the expansion in its pre-salt oil basins. By May 2021 pre-salt oil production was just under 2.7 million barrels daily, a notable 14% increase compared to the same period a year earlier, making it responsible for 93% of Brazil’s oil output and 71% of total hydrocarbon production.”

“The sweet medium grade crude oil grades pumped from Brazil’s pre-salt oilfields are growing in popularity among refiners, particularly in Asia where IMO 2020 and other regulations have sharply reduced the sulfur content of fuels. By October 2020 soaring demand from China for Brazil’s Lula and Buzios oil grades saw their prices spike sharply, trading at premiums to the international Brent price benchmark. At the time of writing this article Lula, which has an API gravity of 27 degrees and 0.27% sulfur content, making it heavier but sweeter than Brent, is trading at almost a 1% premium to the international benchmark price.”

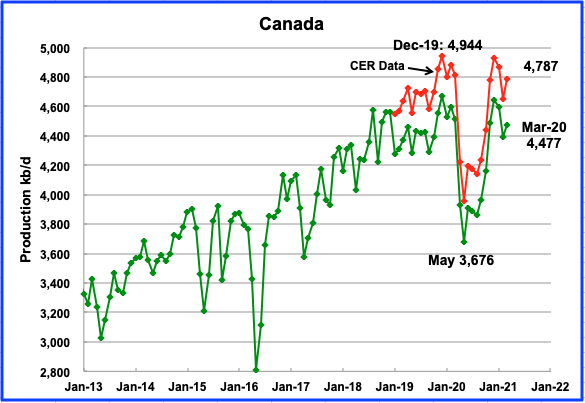

According to the EIA, March’s output increased by 83 kb/d to 4,477 kb/d. The Canada Energy Regulator (CER) reports March production was 4,787 kb/d. The CER data contains NGPLs. Oil exports by rail to the US in March were 175.6 kb/d but decreased to 129.7 kb/d in April.

On Wednesday June 23, 2021, the Biden administration passed up a chance to block Enbridge’s Line 3 pipeline replacement. Source.

The Biden administration signaled in a court filing this week that it does not plan to cancel federal permits for Enbridge’s Line 3 oil pipeline project, despite pleas by Native Americans and environmental groups for the president to intervene.

The U.S. Army Corps of Engineers used the filing to defend its decision in November to grant Enbridge a water permit for the project, the last major approval the Calgary-based company needed.

Wednesday’s filing by the Corps and its attorneys at the Department of Justice marks the first time President Joe Biden’s administration has taken a public position on Enbridge’s plan to replace its aging Line 3, which carries oil from western Canada to Enbridge’s terminal in Superior, Wisc., the Star Tribune of Minneapolis reported.

Environmental organizations expressed displeasure Thursday.

There is no guarantee the court will agree with the Army’s position.

According to this source, “Enbridge worked with local tribes in what Mr. Barnes called “the longest and most extensive” consultation process of its kind for an energy project. He added that the company was required under a consent decree reached during the Obama administration to replace its older pipeline.” In all of the articles I have read on this issue, this is the first time that I have read that the Obama Administration was instrumental in getting Line 3 replaced.

Oil Sands Production

A recent report from IHS Markit on the Canadian Oil Sands expects oil sands production in 2030 to be 3.6 million barrels per day, well above current level, but lower than prior projections.

“Canadian oil sands production has fully recovered from last year’s “COVID-19 Shock”—the largest contraction of upstream production in Canadian history—and has exceeded pre-pandemic levels. However, lingering COVID impacts, pipeline constraints and uncertainties related to an accelerating energy transition have reduced the longer-term growth projection for oil sands.

The latest forecast by the IHS Markit expects Canadian oil sands production to reach 3.6 million barrels per day (MMbd) in 2030, an increase of 650,000 barrels per day compared to 2021 levels (900,000 b/d from 2020). The previous IHS Markit forecast expected production to reach 3.8 MMbd in 2030.”

If higher WTI prices persist, the 3.8 Mb/d could still happen, provided pipeline capacity is expanded. This implies that oil sands expansion could increase annually at a rate of between 70 kb/d to 100 kb/d over the next 10 years.

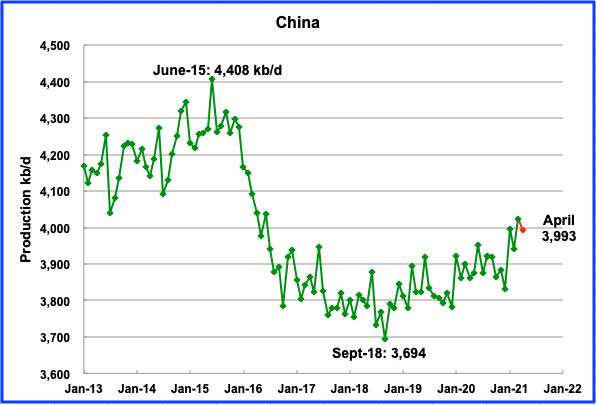

The EIA reported Chinaʼs March output increased by 84 kb/d over February to 4,024 kb/d. This source reported crude output in April was 16.41 million metric tons. Using 7.3 barrels per ton, April’s output was estimated to be 3,993 kb/d, down 31 kb/d from March.

Mexicoʼs production, as reported by the EIA in March was 1,760 kb/d. Data from Pemex shows that May production was essentially the same at 1,763 kb/d. (Red markers).

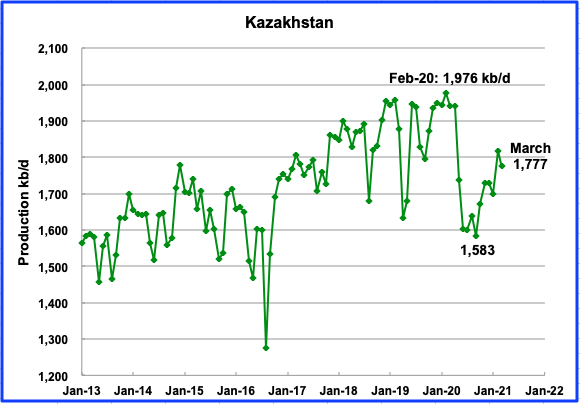

Kazakhstan’s output decreased by 41 kb/d in March to 1,777 kb/d.

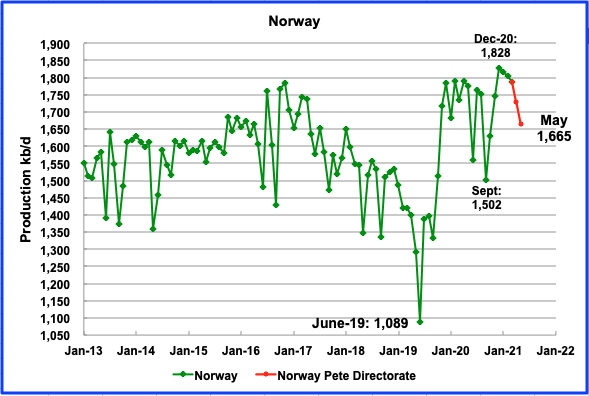

The EIA reported that Norwayʼs March production was 1,788 kb/d, a decrease of 17 kb/d from February. The Norway Petroleum Directorate reported that production in May dropped to 1,665 kb/d after dropping to 1,728 kb/d in April, red markers. The production drop since December is 163 kb/d and is partly due to maintenance.

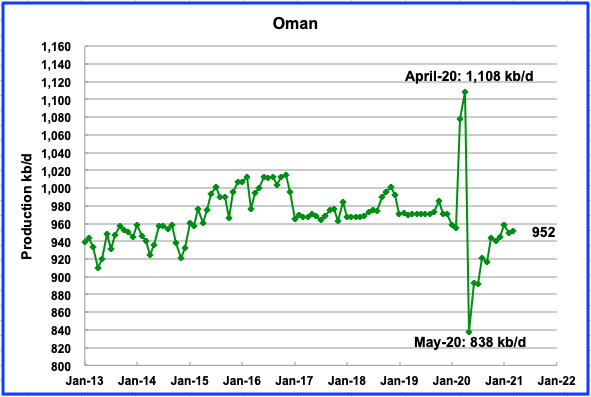

Omanʼs March production increased by 3 kb/d to 952 kb/d.

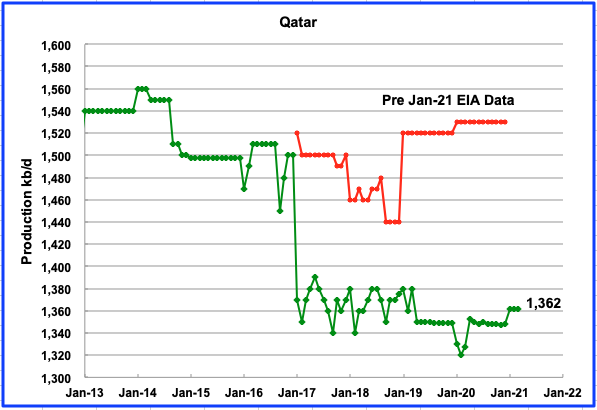

March’s output was unchanged at 1,362 kb/d.

Qatar’s output was drastically revised down by the EIA in its January 2021 report. The red graph represents the EIA’s earlier assessment of Qatar’s production.

According to the Russian Ministry of Energy, Russian production decreased by 9 kb/d in May to 10,467 kb/d. The difference of close to 400 kb/d between the US and Russian numbers indicates a difference in the definition of Crude plus Condensate.

Bloomberg reported June output to be 10,419 kb/d, a drop of 48 kb/d.

“Producers pumped 42.64 million tons of crude and condensate last month, according to preliminary data from the Energy Ministry’s CDU-TEK unit. That’s about 10.419 million barrels a day, or 0.5% less than in May, Bloomberg calculations show, based on a 7.33 barrels-per-ton conversion rate.”

“This output drop may be because Russia is still trying to get back in line with its compliance and the Energy Ministry is trying to enforce some discipline,” said Ron Smith, senior oil and gas analyst at BCS Global Markets.”

Should the OPEC+ agree on further hikes, Russia will be able to boost its oil production quickly in August, according to analysts from Bank of America, Fitch, Wood & Co., Renaissance Capital and BCS Global Markets.

“I don’t see any problems with crude production, and for sure Russia can increase its output by over 100,000 barrels a day in August should OPEC+ reach a consensus,” Smith said.

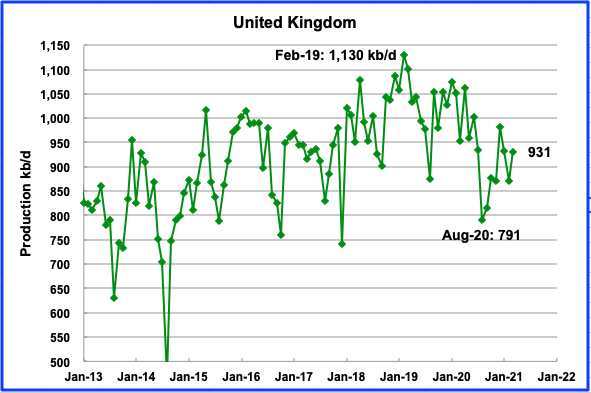

UKʼs production increased by 61 kb/d in March to 931 kb/d.

US production was updated in the previous post. The most significant information update since then has been the EIA’s release of the July STEO. They are now predicting essentially flat output from March to October. It then begins to climb in an almost linear manner up to December 2022 at an average rate of 81.2 kb/d/mth. It is not clear why output begins to climb almost linearly after November.

The July STEO has added 166 kb/d to December 2022 output from the previous June report which was 12,147 kb/d.

The July STEO is beginning to add more weight to the flat output projections shown in the DPR and LTO charts in the previous US post.

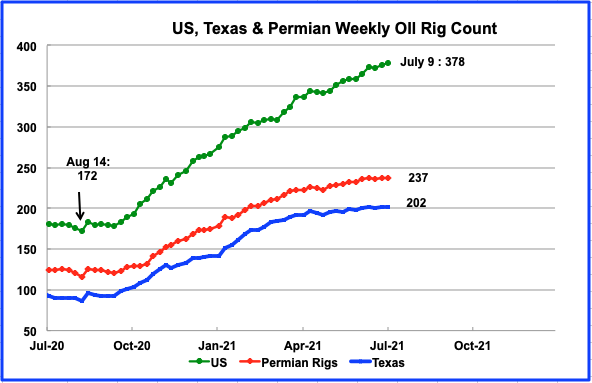

While two rigs were added in the week of July 9, no rigs were added in Texas or the Permian.

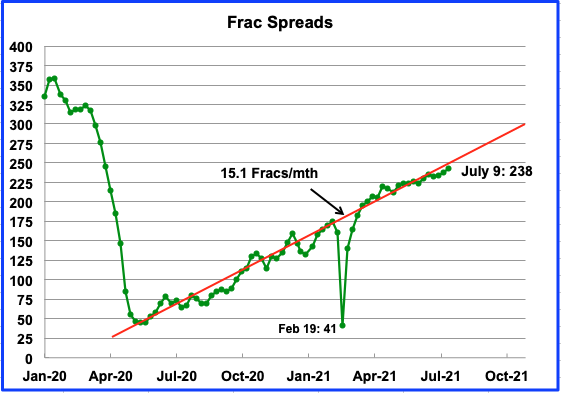

During the week of July 9, 4 frac spreads were added, bring the total to 236.

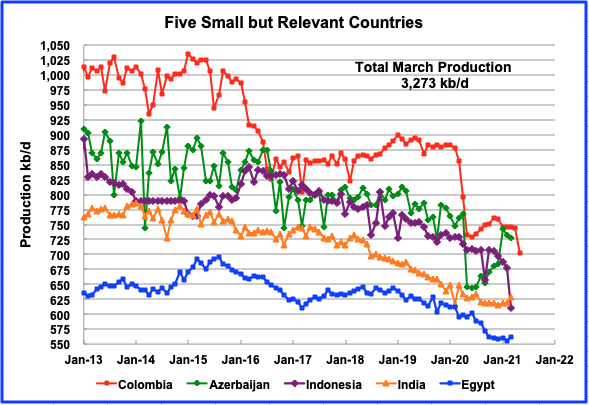

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined March production was 3,273 kb/d, down by 58 kb/d from February. Indonesia dropped by 68 kb/d in March and Columbia dropped by 42 kb/d in May

World Oil Production Projection

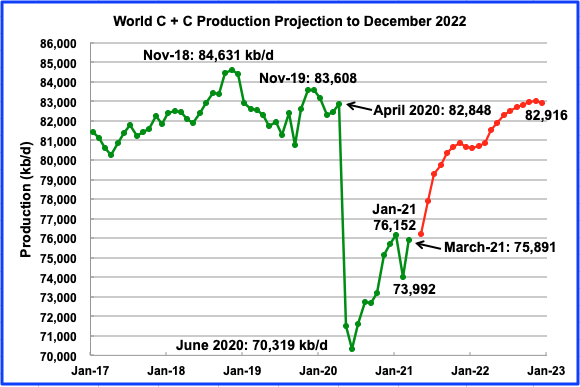

World oil production in March increased by 1,899 kb/d to 75,891 kb/d according to the EIA. Of the 1,899 kb/d increase, the biggest contributors were the US, 1,401 kb/d, Russia, 150 kb/d, China 84 kb/d and Canada 83 kb/d.

This chart also projects world production out to December 2022. It uses the July STEO report along with the International Energy Statistics to make the projection, red markers. It projects that world crude production in December 2022 will be close to 82,916 kb/d. This is 1,700 kb/d lower than the November 2018 peak of 84,631 kb/d.

World Proven Reserves

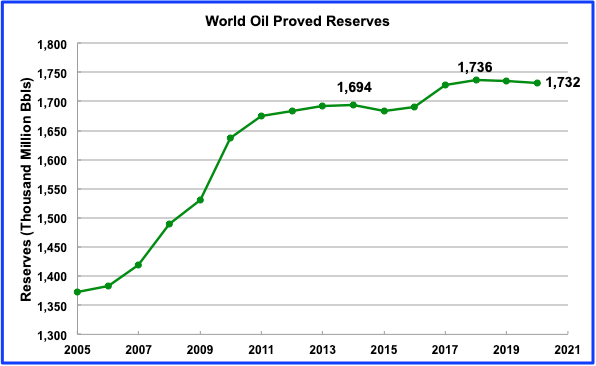

This chart shows BP’s world oil reserves updated to 2020. From 2006 to 2011, 291 B barrels were added to the world’s reserves. Of the 291 B, contributions came from Venezuela (210), Iran (16) and Iraq (28) for total of 254 B barrels. Are these increments believable??? More critically from 2011 to 2020, only 58 B barrels were added.

The only significant reserve additions between 2011 and 2020 occurred in 2017. This increase was due to the US adding 11.3 B barrels and Saudi Arabia adding 29.8 B barrels for a total of 41 B barrels. Without this increase world reserves would have been little changed from 2011 to 2020. Removing the 41 B barrels would put 2020 reserves at 1,691 B barrels, 3 B below 2014 which came in at 1,694 B barrels. It is the slowing yearly rate of increase that is more critical over the last eight years rather than the absolute level of the proven reserves.

Since the peak in 2018 at 1,736 B barrels, proven reserves have fallen by 4 B barrels. Clearly the world’s oil reserves are currently in their plateauing phase.

Some confusing info from this morning’s weekly Inventory report.

July production is now up to 11,400 kb/d up from 10,800 kb/d six weeks ago. The STEO report in the US section of the above post forecasts flat production close to 11,200 kb/d out to October. It will be interesting to see who got it right, the flat production predictors or those predicting increasing output.

Thank you to the contributors of this site for your hard work, expertise and vision. I have followed for many years and it has been beneficial inhelping me stay focused in doing the work that I can that may make some difference for my children in the difficult times that surely lie ahead. The debate over the date of the absolute peak in oil production has always amused me. I am wondering if one of you modeling wisards good take the data from from one of Dennis’s runs and conver it to arough approximation of net oil. Perhaps a rough factor coud be applied to conventional, deep oil, tight oil, sand tar that would approximate the net available after the energy inputs of extraction. I know the boundaries of where to set the cost of extraction are debateable, but a rough approximation would do. Then take the net oil and compute the net oil per capita. When that is done we will all see that the true peak of oil has already occurred, after all this is what really matters to an industrial society ofth brink. Thank you.

Tom,

I don’t have the data needed to do that and think net energy is best looked at at a total society level for all sources of energy. A big problem with a net energy analysis is where to draw the boundries when looking at an individual product. I think a useful way to look at fossil fuel is to consider exergy which is the work a unit of energy can perform. For most uses of oil we get about 0.25 to 0.33 Joules of work for each Joule of energy that we burn (these are rough averages). This is not what you are looking for, but keep in mind that as we transition to electrical transport far less energy is needed because losses are more like 10% rather than 66%. As we move to solar and wind we eliminate further losses in fossil fuel power plants, though modern natural gas combined cycle plants are pretty good with efficiency as high as 60% (real world probably more like 50 to 55%).

I think i already pretty thoroughly destroyed renewables in my second post on peak oil.com, but in any case there’s problems.

Wind is 40% efficient. The rest goes to deforming the blade. It’s physically impossible for any wind system to EROI.

Solar burns up. Ivanpah, Al Dafra etc. Every single major solar plant built in the desert simply burned down.

Renewables will fail, libs will not survive.

Mark, in agreement with you on renewables . Maybe reduce the pain a little but definitely not a savior . Not enough EROEI in terms of total resources and land used .

Tell Iowa all about wind.

The people in that state got 57% of their electricity from wind energy in 2020.

Excellent work Ovi.

Iowa doesn’t manufacture anything. It proves the point.

Too add , 57 % works because 43 % from FF is there to subsidize it , the vice versa does not . 43% can stand on it’s own legs . Heck it can replace 57 % in a jiffy in a free market .

Germany manufactures a lot. And its electricity is about half renewable. Also about a quarter of new German cars are hybrid or all electric, so its beginning to be an issue in for the oil industry as well.

The hubris of oilmen thinking their pitiful little rigs can outproduce the sun and wind is astounding. Go out to West Texas at dawn and check the temperature. Then wait till noon and check it again. How much oil and coal would it take to heat all that air from horizon to horizon? Happens every day.

Germany probably has the worst wind industry in the world which is borderline bankrupt.

Mark –

Yes, wind doesn’t make much money in Germany. In fact the entire energy industry worldwide looks a lot less profitable than it did a few decades ago. Coal companies are bleeding cash, power plants all over the world are looking like stranded assets, and nuclear is pretty much dead. Even Saudi Aramco is hurting, borrowing money to pay its dividends.

This isn’t only because of renewables, but from the point of view of profits, wind and solar are primarily spoilers. The are extremely low margin industries that are undermining the profits of the fuel selling business, much like downloaded music destroyed the CD-ROM based music industry.

Nice way of thinking about it. Essentially big oil is now in the position of trying to compete against other “bottled water” suppliers where they will have to create their own niche. In music, the niche is making money via live performances.

Efficiency only matters when the fuel is in short supply. Wind is not in short supply, so efficiency doesn’t matter. “Peak Wind” is not a problem, as long as the sun shines and the Earth rotates.

What matters is whether you can build wind turbines cheaply enough to compete.

The wind turbines you don’t build waste 100% of the wind blowing all around us.

Solar panels pay the energy “debt” in 2-3 years, and last 20-30. Solar panels are increasingly made using solar as Chinese manufacturers look to cut costs.

Alimbiquated-

Photovoltaic panels last much longer these days.

For example Panasonic EverVolt modules also have efficiency ranging from 20% to 21.2% and power output of at least 92% is guaranteed after 25 years.

Once again- Power Output of at least 92% is guaranteed after 25 years.

Show me an oil well with such slow depletion.

The solar panels made by Enel green power with a technology (HJT) developed by the CEA (Commissariat à l’Énergie Atomique et aux énergies) have an efficiency of 24,63% and a life span of 30 years.

You don’t get it.

You are correct- I don’t get ‘it’, in fact I reject ‘it’

I am into realism, whether the facts match my inherent bias or not.

Speaking of realism, still waiting for your secret/unpublished scientific facts that indicate Covid-19 was created as a bioweapon, as you asserted.

Ok here.

https://www.google.com/amp/s/mobile.reuters.com/article/amp/idUSKBN29C26E

Just laugh at their fact check. A bat virus binding to human receptors.

Tom , an impossible task . What matters is not cost of extraction but the cost of getting the crude oil out of Ghawar to the petrol tank of ” Six Pack Joe ” in Montana . In this supply chain are electricity , natural gas , petrol/diesel , petro refinery stocks etc . Impossible to measure at the different stages . If the oil in Ghawar does not get to the tank of “Six Pack Joe ” its value is zero . What you are looking for an EROEI analysis which is not possible . Sorry to disappoint .

You don’t even need eroi, it’s the Betz equation for wind turbine efficiency as I said.

Wind is physically impossible as a energy source.

Totally agree.

LTO,

At least use a name so we know what you agree with. On a smart phone we cannot tell.

DC,

You supply an arrow for the quivers of those of us who don’t use the beastly things.

(shambles away muttering)

Great post Ovi, thanks!

Ovi , just repeating myself . Terrific . Just a little suggestion for all those who write the posts . Is it possible to give a 24 hr to 48 hr notice that a new post is coming ? The reason is that a new post comes up and comments on the old post continue but maybe unread . Of course the regulars read everything ,I am talking about the lurkers . I have earlier opined that as PO becomes mainstream (it will) this site will have more and more viewers . Just my two piece , at the end of the day it is your call .

Toby

Much appreciated.

Hole in Head

Thanks.

Interesting idea. I could give an estimated time for an update. Let’s see if that helps.

Peak oil will never be mainstream, people will just be totally overwhelmed and attribute it to some minor proximate cause like covid or news events or whatever.

Mark , agree that the politicians are going to mask peak oil with some other cause for the misery it will bring. However the truth will come out .Can’t keep it hidden too long . A lot depends on the media . A couple of incidents (riots,rationing,accidents) and hysteria sets in ,blown up the media .

When the the price of gasoline hits $5 to $6, there will be many reporters getting educated on peak oil and reporting on it. People pay attention when their wallet is hit.

How will anyone know if it hits $1 and no one is buying? The high prices will come in short bursts, but not be sustained and fall back. A little trickier to read what is happening then.

It costs about €1.55 a liter in Germany, nearly $7 a gallon.

America hasn’t been able to supply itself with oil since the late forties. Nobody complained. George Bush claimed there was no need to conserve because America was the land or plenty.

It’s the land of plenty of imports, but nobody cared. Nobody will worry about peak oil.

In my state (Washington) the cost of electricity is the same as the nationwide average ($0.11/kWh) .

It takes $4.07 to charge a Ford Mustang E to go 100 miles when taking into account the vehicles real world efficiency performance (37 kWh/100 miles).

To get the same cost performance, gasoline would have to cost $0.98/gallon

(assumes the US average car gas efficiency of 25 miles/gallon)

How will gasoline compete? Petrol products will be increasingly diverted to other non-transport important uses, such as in the industrial sector. This will happen due to cost competition from electricity, but also the higher value that will be placed on petrol for non-transport uses as depletion of oil gets real.

The economy will be facing a very difficult juggling act, shifting priorities and making tough choices. One easy choice will be shifting petrol away from routine transportation use and increasingly towards other critical/irreplaceable uses.

It will happen- like gravity happens.

Ovi, bullseye . Like they say ” Nothing bad happens , till it happens to you .” There was no Covid for the ” Covid deniers ” till they got infected .

A 1.7mb/d drop in global production in 3 years is alarming. Factor in inventory draws of 6-8m barrels a week from a total of 445.5m total, reduced capex from the supermajors and the IEA estimating demand to reach 101mb/d by the end of the year. It won’t be long until the politicians have to come clean.

p.s. President Jimmy Carter did tell the truth 40 years ago and was elected out of office.

Trade falls faster than production, and combined with population growth a relatively small fall will starve most of the world.

Mark, the sum of all my fears . A small wiggle and everything grinds to a halt . I think there will be no explosion or implosion but more like someone put a fistful of sand in the mobil oil and the engine seizes , grinds to a halt . The car is intact but the damage is done . All who have suffered low back pain understand that the disc slips less than a millimeter but one is bedridden and immobile .

My first impression . It is only US that contributed but that was because of extraordinary circumstances ( rebound from the winter storm ) . The rest Russia, China and Norway are just ” fill in the blanks ” . Maybe Ovi should change the headline . How about ” US rebound from winter storm raises Non -Opec production ” . 🙂

Check the new Headline

🙂 .

Second impression . Of those in the + column , China does not count because it is a nett importer . Norway will be flat . Nothing new happening . Their new oilfield Sven Nordurp is just about covering for their decline , Qatar is basically NGL and not crude . For the rest it is “Adois Amigo ” . 🙂

Hole in Head

I saw headline a few months back that we should expect one more bump up from Norway in H2 from Sverdrup

Ron

What do you know about this project. Is it being over hyped by as Sechin?

https://www.reuters.com/world/china/exclusive-rosneft-seeks-tempt-trading-houses-into-arctic-oil-project-sources-say-2021-01-28/

“The Vostok projects should already produce 30 million tonnes of oil by 2024 which rounds up to 600,000 barrels per day. This will need to increase to 50 million tonnes after the first phase, and 100 million tonnes after the second, which adds up to one million and two million barrels per day respectively.”

https://oilprice.com/Energy/Crude-Oil/Rosneft-Starts-Work-On-Mega-Arctic-Oil-Project.html

I have been reading about this project. From your link:

Rosneft has estimated its resources at 44 billion barrels, enough to supply the world for over a year, and said it could produce 1% of global oil later this decade at a price competitive with the cheap barrels of Middle Eastern producers.

1% later this decade is about 800,000 barrels per day or less. That may be a little ambitious but it will not be a game saver for Russia. Their old brownfields will have declined way more than that later this decade. But they are obviously over-hyping it in order to gain investors. From your link:

Vostok will require vast investments in new pipelines, roads and other infrastructure in East Siberia and the Arctic, with oil to be shipped to Asia via the Northern Sea route.

SNIP

Talks stalled after the oil price collapse of 2020, according to sources with knowledge of the matter, while approaches to oil majors have also generated little interest so far due to their rising emphasis on green energy.

This will be some really expensive oil. It will very likely be slow going due to lack of investment and laying roads and pipelines in such a challenging environment. But it will likely eventually get done. But as far as the peaking of world oil production goes, this will make very little difference.

https://coastalreview.org/2015/06/an-offshore-timeline/

https://www.geoexpro.com/articles/2017/07/russia-fall-in-offshore-exploration-investment

It takes about three years from discovery to develop a well and deep water wells only last 5-10 years. Most of the Russian offshore outside Sakhalin is deep water, and the Far East is not perceived as growing.

Virtually all Russian offshore discovery was before 2014. This means by 2020 that production should have peaked. It’s a drag on growth not a benefit. The second arctic development we are talking about starts production in 2024 by which time the other developments would have depleted anyway.

The only reason Russian production increased after 2017 at all was that OPEC ordered a cut. Russian production grew 2% in 2016 then was flat for three years. The growth, plateau and decline was deferred to now.

With offshore declining rather than growing this wipes out the entire Russian growth. A 2% decline rate with an added 1% from offshore means capacity fell 6% from 10,800 in early 2020, or 10,100 now.

That gives Russia no room for growth whatsoever, it’s producing at capacity.

Ron,

Many including me thought tight oil would make little difference. High oil prices can change things as it did with unconventional oil, deepwater offshore, and Arctic oil. Eventually there will be a peak when either due to a fall in demand at whatever price level is reached in the future (peak demand) or due to no supply available at an oil price at which there is both demand and resources that can be extracted profitably (peak supply). We can recognize which it is by the slope of the price curve, peak supply will have a positive slope (for yearly average price) and peak demand would have a negative slope. No idea which it will be, it’s a coin flip imo.

Eventually there will be a peak when either due to a fall in demand at whatever…

No, no, no, Dennis, peak oil will not eventually happen, peak oil has already happened. Damn, I thought you knew that. 😉

We can recognize which it is by the slope of the price curve, peak supply will have a positive slope (for yearly average price) and peak demand would have a negative slope.

Yes, that would have been the case if it had been a demand peak. But it was a supply peak. And you are very mistaken that a supply peak would necessarily have a price positive slope. Dennis, no one knew it was the peak when it happened. Everyone was producing flat out and all anyone saw was a supply glut. Dennis, just think about it. If everyone produces flat out, isn’t it just common sense that there would be a supply glut? And if there is a glut, why on earth would there be (A) a price spike and (B) why would anyone recognize it as the peak?

All delaying the peak accomplishes is making it more sudden. We’ve gone from gradual decline to 2030, to an abrupt social collapse in a few years.

Ron,

If 2018 was the peak, then it was peak demand, and yes everyone was producing flat out in 2018 (to position themselves for higher quotas), but the fall in output was precipitated by the fall in oil prices in autumn 2018 due to oversupply of oil. In 2019 output dropped because OPEC cut output to support oil prices. So the “peak” in oil output was due to a glut of oil on the market and production dropped in response to lower oil prices. That’s a peak demand story, not a peak supply story. A peak supply scenario would have oil prices rising and after the peak oil prices would rise further with falling output until an oil price was reached that would balance the market. Today (or in 2027 when it occurs) that price would be approximately ($150 to $200/bo for Brent in 2021 US$).

There is no peak demand, renewables are obviously physically impossible and you’re an example of how low the standards are for physics education.

Ron-“peak oil will not eventually happen, peak oil has already happened”

OK. Good call.

Now what (besides dramatically higher prices in the next few years)?

We won’t know if 2018 was the peak for some time, but it very well might have been. But I think Ron is correct about the price/supply/demand dynamic near the peak. If prices increase, production will increase until prices fall. It will be during a period of falling prices that the peak will be reached, i.e. Ron’s “glut”, since production will have been goosed by high prices in preceeding years. Since it takes time for production to fall after prices fall, the peak is likely to be at a time of low prices.

After the peak, production will fall and prices will rise again. If we see prices similar to those from 2008-2015 (in inflation adjusted dollars) and production doesn’t exceed the 2018 peak, then we will have solid evidence that the peak was then. But Dennis might be right about price slopes if using much longer time periods, perhaps decadal averages rather than annual averages.

The wild cards in the oil demand/supply/price dynamic are other dramatic economic events like pandemics, trade wars, hot wars, cyber wars or financial crises. A crippled global economy will use a lot less oil. Whether prices skyrocket or plunge might depend on factors other than oil production capacity. Some places might have gluts and low prices and other places might not have oil at any price.

Thanks Joe,

It is certainly difficult to predict what will happen. But for examples of peak supply see 1973, and 1980, 2018 was an example of a glut, with supply outrunning demand. I see a clear difference between 2018 when supply decreased due to action by OPEC to support oil prices.

Obviously lots can happen to the economy, but if oil prices remain over $80/bo in 2021$ for 3 years (average price over a three year period) and the peak has not been exceeded (centered 12 month average peak), I will be willing to admit that 2018 may have been the peak (or move my probabilty estimate to more than 50%).

Dennis Wrote:”

But for examples of peak supply see 1973, and 1980, 2018 was an example of a glut, with supply outrunning demand. ”

LOL! There was a peak Supply of $5/bbl Oil int the 1960s, but there has always been a glut of $300/bbl Oil. Prices go up, triggering demand destruction. Demand peaks because of price. If the Price of Oil was at $20/bbl today, demand would be considerably higher.

I think the game is up, OPEC-13 is averaging about 6% annual decline since 2017. I think OPEC is now in terminal decline. Perhaps production could be increase short term, but the long term trend will be at least a 6% decline, and probably will accelerate because Advance Oil recovery methods have reached there limits. Its likely most of OPEC fields now need to chase after pockets of trapped oil as the field oil columns and declined just two or three meters.

My guess is that global economy cannot sustain Oil prices above about $120\bbl. It might spike higher even bet the 2008 $147/bbl high, but it will trigger a global recession or depression, and probably a few wars.

Most of the industrialize nations are printing money just to maintain BAU. The EU & US have been doing QE nearly continously since 2008. That should be an strong indicator that the global economy is close to the tipping point. Not sure how the world will handle a global economic depression. The last one occured in the 1930s and triggers revolutions\civil wars and WW2.

The Great Depression was extremely mild and calories didn’t change. It was just a preexisting population crisis.

This one will be a shitfest.

The Great Depression was extremely mild and calories didn’t change. It was just a preexisting population crisis.

Of course, and what they call slavery wasn’t so bad either. After they gave the Africans free passage to America they immediately gave them jobs.

What is it that makes some people so goddammed ignorant of history????

Yes. The analysts who worked for the Shift project even included the extraction in the Bhazenov formation in their oil production forecast. And even with that, the oil production of Russia will decrease to 29% less in 2030.

Ovi,

Much of the increase in reserves were from the Orinoco belt in Venezuela (these are similar in quality to Canadian oil sands, but somewhat easier to extract because of higher average ambient temperatures near the equator.) I tend to put both oil sands from Canada and Venezuela in a separate “extra heavy oil category”. and would have a conventional oil reserve chart which would also subtract tight oil reserves. Chart attached “Conventional Oil” excludes Canadian oil sands, Orinoco belt, and tight oil reserves.

Note that in my models I only expect 150 Gb of the extra heavy oil resource to be extracted through 2300 (end of my models time frame). The total reserves reported by BP in 2019 is 424 Gb in Canadian oil sands and Orinoco belt. Jean Laherrere expects about 200 Gb of this resource might be extracted in his 35 country oil forecast published in August 2018. Note also that Laherrere has a total crude plus condensate URR of about 3000 Gb, my best guess Oil Shock model has a URR of about 3050 Gb, pretty close to Jean Laherrere’s 2018 estimate.

tight oil reserves are only available from 2011 to 2019, but using a zero tight oil reserve assumption for other years (due to lack of information), I get the following for Conventional oil reserves from 1980 to 2019.

You should give the big stick back to Ron. We aint stupid.

Houtskool,

Ron is always welcome to take the blog back, he wanted to move on, I am happy he still helps and comments. The chart is simply BP statistical review of world energy reserve data which ends in 2019 for historical data, then I deduct the Canadian oil sands and Orinoco reserve data reported by BP and also tight oil reserve data reported by EIA.

Data for chart uses BP statistical review of world energy 2021 for World, Canadian oil sands, and Orinoco belt data and EIA tight oil reserve data, conventional is defined as World oil reserves minus tight oil reserves minus Canadian oil sands reserves minus Orinoco reserves.

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

See data table 2 from EIA page linked below and go to previous issues (2011-2018) for estimates from earlier years.

https://www.eia.gov/naturalgas/crudeoilreserves/

The chart above uses data from those sources.

Also note that these are supossedly proved reserves, but an article published in 2014 states that BP proved reserves reported in 2011, were the same as proved plus probable (2P) reserves reported by IHS the same year. See section 3b, below figure 5 in paper linked below

https://royalsocietypublishing.org/doi/10.1098/rsta.2013.0179

an excerpt from that paper:

Globally, BP [13] estimates 1263 Gb of conventional proved reserves in 2011 (slightly more than cumulative production to date) and 389 Gb of non-conventional proved reserves. The latter comprise 169 Gb of Canadian oil sands and 220 Gb of Venezuelan extra-heavy oil, but both estimates are disputed and only a fraction of this volume is likely to be recovered over the next 25 years. In principle, global 2P reserves should be larger than 1P reserves, but according to an authoritative industry source (IHS Energy) global 2P reserves are approximately the same as national declared 1P reserves—suggesting an overstatement of proved reserves by several producing countries.

Dennis

There are two sources of oil sands. One is very close to the surface and covered with over burden. The over burden is cleared and the oil sands are recovered in an open pit mining operation, similar to open pit copper and gold mines. My understanding is that as the pit expands the over burden gets thicker and at some point the open pit mines stops expanding. Not sure at how many feet of overburden that happens.

The other source of oil sands is deeper and is recovered using a process called SAGD, Steam Assisted Gravity Drainage. In this case, steam is injected into a horizontal hole and the liquified bitumen is pumped to the surface by a submersible pump. Some solvents are now being added to the injected steam to improve the efficiency, Ratio of steam to barrels recovered.

As the technology advances and prices stay elevated, more will be recovered. According to National Resources Canada, the total Canadian proven oil reserves are estimated at 171.0 billion barrels. However as technology improves, “ultimate potential reserves, or the oil estimated to be recoverable as technology improves, are estimated at more than 300 billion barrels.”

So it will be a while before we know what the potential is for the oil sands. However, because it is capital intense on the front end, the rate of expansion of annual production is limited to between 75 kb/d and 100 kb/d/yr

I think the SAGD process is more energy intensive than the mining operation. I recall seeing a paper where the cost of producing a barrel of synthetic sweet crude (SSC) from SAGD vs mining was compared. As I recall, with low NG prices, SAGD was more economical. SAGD needs NG to get the bitumen out of the ground and then more to upgrade it to SSC. The mining operation uses diesel in their massive shovels and the trucks that bring the oil sands to the first stage operation, a bitumen/sand separator, i.e. a huge pot of hot water and solvents. The bitumen floats and the sand sinks.

https://www.nrcan.gc.ca/energy/energy-sources-distribution/crude-oil/oil-resources/18085

I am not sure that with a heatwave of 50 ° C and the forest fires they are currently experiencing, they will have the same motivation. https://globalnews.ca/news/7995210/bc-wildfire-map-2021/

Dennis

I forgot to ask. Why does that chart stop at 2019, now that the 2020 data is out.

Ovi, For reserves the data ends in 2019, so that’s the last data point I have for World, extra heavy, or tight oil reserves.

Thanks for the explanation on oil sands (I knew that, but no doubt many others may not have).

It one time I used 500 Gb for extra heavy oil resources (following Jean Laherrere’s estimate). In 2018 Laherrere revised his extra heavy oil estimte to 200 Gb (100 Gb each from Canada and Venezuela), I have further assumed that Canada will be about 100 Gb and Venezuela about 50 Gb.

My thinking on this is that demand for oil will fall below oil supply by 2035 as the World transitions to electricity for transport and that by 2040 oil prices will fall below the level that new investment in oil sands will be profitable, Middle east and Russia will be fighting for market share and we may see Brent oil prices drop to $30/bo in 2021 US$.

I am skeptical that oil sands resources extracted in Canada will ever reach more than 100 Gb. According to BP only about 20 Gb of Canadian oil sands is under active development and about 14 Gb total had been extraxted at the end of 2019, so a total of 34 Gb, extracted plus active development of resources.

I may well be wrong however as in the past I have consistently underestimated future oil output, this may be true of most of my future scenarios despite the prevailing sentiment of most who comment at POB.

Dennis

I generally agree with you future outlook. However with ever increasing population, I cannot see oil demand falling below 50 Mb/d.

Currently 55% of energy goes toward transportation and 45% for industrial use. I can’t see airplanes, trains and ships being powered by electricity in the next 20 years. So at this point I think oil demand will move asymptotically toward 50 Mb/d. The question is “How long will it take to get close to 51 Mb/d”

The changes our society will be required to make to move that asymptote below 50 Mb/d is anybody’s guess.

Ovi,

In 2018 according to BP stats regional data, gasoline and diesel use was about 51.7 Mb/d for World, leaving about 31.3 Mb/d for other uses in 2018 for World C plus C (assumes C plus C output at 83 Mbo/d in 2018). I ignore biofuel and NGL, not important for land transport. Over time the land transport use of fuel will disappear, perhaps by 2050. Other uses of fuel will become more efficient over time counteracting the increase in population, air transport may move to synthetic fuel, and ships can be natural gas powered. Even if not, my model has World C C at 50 Mb/d in 2058 with extra heavy oil at 5.54 Mb/d in that year, peak for XH at 6 Mbo/d. There is likely to be too much oil rather than not enough after 2050 when oil output will be about 61 Mb/d (this ids for a 3050 Gb URR scenario, current cumulative C plus C output (end of 2020) is about 1400 Gb. World reserves about 1400 Gb, the extra 250 Gb comes from reserve growth. Note that in 2050 cumulative C plus C is 2290 Gb for my best guess scenario. In 2100 cumulative C plus C is 2892 Gb for my scenario.

Almost all locomotives are actually diesel-electric hybrids.

https://en.wikipedia.org/wiki/Diesel_locomotive#Diesel%E2%80%93electric

In imagination, it is easy to convert to battery operated where the major battery power is on another rail car that is switched out as needed for recharging. By coupling, decoupling in turn on opposite ends of the train, it would not even be necessary for the train to slow down. It could even be a flow battery which are housed in cargo containers already.

Only in underdeveloped countries trains are not electric – or on rarely used tracks going to small towns.

Even the transsiberian railway is full electric, all subways are electric.

Interesting tidbit. From the BP consumption numbers:

Already noted KSA took over 4th place in the oil consumption list of the world, passing Japan, who declined far more in 2020 than KSA. Japan -11.4%. KSA -2.5% Japan 3.27 mbpd

Russia declined mildly, too. 4.6%. 3.2 mbpd now

So Russia. Lancet peer reviewed says their Sputnik V vaccine works very well. Solid trial data. But they are getting virus slammed right now and maybe it will prevent them catching Japan this year. Japan’s present death spike looks subdued in comparison, but they have the Olympics spike coming.

Overall it was interesting to see who didn’t decline (only China) and who declined very little — KSA, Norway, Russia — all of whom have oil to burn, as it were. If you have it, price doesn’t matter. You can define the price inside your own borders for your own consumption. Charge whatever you want externally.

Norway, Brazil, China and Australia grew oil output last year. How nice.

Norway peaked decades ago. China officially believes peak is imminent. Brazil and Australia are irrelevant.

Australia has shutdown its last refinery (Shell) . Wonder from where they will get their inputs ? Closest refinery is in China ? Why do they keep poking the dragon ?

HIH, there are massive, modern refineries in Singapore which provide most of the refined product imported to Australia. They are the reason Australia’s old, relatively small (equals much less efficient) refineries are closing.

Tks Phil , I was aware of the refineries in Singapore as they are used by Malaysia , Indonesia and Brunei for refining their crude . Just forgot they were around . Thanks for waking me .

What do you mean by ”China officially believes peak is imminent.” ? The peak of oil production in China was in 2015. They are speaking of the global oil production peak? They are living in an other world. It seems well that this peak in oil production is behind us. And I think that the people who are saying this are going to produce goods for the glory of China in some laogai, because in this case, the wonderful plans of World domination by China conceived by their dictatorXi Ji Ping will disappear in the trash can.

Reminder of the embarrassing situation of KSA out-consuming Japan at 1/4 Japan’s pop. When Russia overtakes them, this will be less uncomfortable since Russia has 10 million more people.

But, of course, KSA will then be consuming more than Russia, too. With 1/4 of Russia’s population. This might come up in OPEC+ conversations.

In the next few years, we are going to find out if the Export Land Model is accurate.

All these high-price / low-price scenarios fall apart if oil is unavailable at any price.

Just out of interest I checked what was Norway’s sale of petroleum products in 2020 in volume. Turns out it was down 7.2% yoy from 2019. Aviation being the big contributor with -53%, while shipping going the other direction 7%. Increased oil production in Norway means the oil goes somewhere, often nationally. Does not equal consumption for sales.

https://www.ssb.no/en/energi-og-industri/olje-og-gass/statistikk/sal-av-petroleumsprodukt

Thanks Ovi for all the work. Much appreciated. There is an error in your first sentence above, the update is to March 2021 (not February).

Rystad estimates 9 months before US extraction can increase. They estimate US extraction will break 12 mbd in October 2022: https://www.rystadenergy.com/newsevents/news/press-releases/us-shale-gets-tempted-by-high-prices-but-boosting-output-to-tap-opec-inaction-would-take-months/

Many thanks Ovi for your work!

The rystad report is interesting. Gas production grows much faster than oil production in their forecast. They are also forecasting that the higher gas production is from associated gas from Permian, Eagle Ford, Williston and Rockies rather than core gas regions of Appalachia and Haynesville.

This ties in very well with Mike’s views, presented many times on his oilystuffblog and here, that GOR is increasing and gas is increasingly displacing oil in the core oil producing shale basins. The trend of increasing gas ratio has not stopped – Mike thinks so and I completely agree. Please correct me Mike if I am wrong.

This is another strong headwind that the US shale sector faces when they try to increase production. And this headwind will only get stronger over time.

Ancient archer,

Yes without enough gas pressure the solution gas drive will be lost, shale profile provided this data for free in the past, but is only available by subscription now. Looking back at older reports GOR was quite a bit higher in Eagle Ford than Bakken or Permian, past of the increase may be due to more development in the Delaware basin which is gassier than the Midland.

Note that at $3/MCF, the natural gas and NGL along with the C plus C makes these wells (as of 2019) quite profitable for the average Permian well based on the 2019 average well profile.

Patzek agrees with Mike and you that the rising GOR will be a problem. This is probably correct and we may already be seeing it with falling well productivity. It will be interesting to watch. So far the productivity has fallen pretty gradually, again I do not have the data for productivity per lateral foot.

My model for all US tight oil (annual average output) is below URR=72 Gb (through 2052).

On model above, I did not extend the chart to the future very much, as many find such extrapolations absurd. Note that based on the assumptions I have made (oil prices start to fall in 2033 due to assumed transition to electric transport gradually reducing demand for oil) US tight oil output falls to 5000 kb/d by 2035 and to less than 2000 kb/d in 2040, in 2052 (final year of scenario) US tight oil output is 50 kb/d. From 2034 to 2041 annual decline rates are in the range of 15 to 20% per year for tight oil output for my scenario.

How did you decide that the recovery would be in 2022, is it just a made up number? Obviously it’s based on whatever rig model but when did you decide rigs will recover, and if they already did why is there no effect?

Also, isn’t your model just a (incorrectly made) hubbert curve, which you are so adamantly against?

Mark for an explanation of how the model works see

https://peakoilbarrel.com/oil-field-models-decline-rates-convolution/

Also you can see Webhubbletelescope’s (aka Paul Pukite) explanation at link below

http://theoildrum.com/node/10221

Also some details are covered in chapter 9 of the booklinked below, available in many University libraries

https://agupubs.onlinelibrary.wiley.com/doi/book/10.1002/9781119434351

Short answer, no not a hubbert model.

Dennis, your convolution model is wrong because in reality countries go into accelerating decline to a negligible output (Venezuela, FSR, etc). Empirically the field abandonment causes faster than linear decline to almost zero, not the slowing decline you predict. Can you find any countries or fields which behaved as you’re suggesting?

Also, that article doesn’t solve the problem at all because you haven’t described why you decided wells would recover in 2022 or whether it’s just a made up number. In particular, you haven’t described why the 2021 recovery got moved to 2022.

It seems you just automatically assume it will happen “next year”, or you are using Rystad, which is always wrong and over predicts. You can see here https://www.rystadenergy.com/energy-themes/commodity-markets/oil/oil-market-analytics/ https://www.rystadenergy.com/contentassets/751682232fd8428a9243cf8bea4ccd24/oil-market-analytics—v1b—graph-4.jpg

they were predicting tight output to recover fully by now.

So either way it’s just a made up number, other people have made up numbers as well and their predictions have also been ineffectual.

The recovery in 2022 is based on an assumption of increasing completion rate in the Permian basin primarily. Of course every prediction beyond today is made up, note this is also true of average output for 2021 as we still have 5.5 months until we reach the end of the year. The only annual tight oil data we have is through 2020, but most readers here are aware that the future is not known and that a model of future output is based on a set of assumptions about the future and doing the simple math to determine the output that results from those assumptions.

Mark,

The model has not changed a lot in the past few months except a slight revision lower for Permian output.

Tight oil starts to recover in Mid 2021, just as before, but the annual average tight oil output is lower than 2020, because output does not return to the levels of early 2020 until 2023 for my scenario. Although you believe the model is wrong it accurately matches 2010 to 2020 tight oil output.

Monthly scenario below.

Mark,

As far as your belief that the tight oil model is incorrect, chart below shows model output based on the well profiles I have found using decline curve analysis (DCA) on data gathered at shaleprofile.com. I also use well completion data gathered form shaleprofile .com. The well profiles and completion data for 4 major plays and “other US lto” are convolved in 5 separate models and the data is summed to find US tight oil model output. This is compared with EIA tight oil data in chart below from Jan 2010 to Dec 2020, correlation coefficient is 0.997.

Click on chart for clearer view.

Dennis, I believe you have a good, simple model of the lag between drilling and production. If you give me the source code I can have more specific comments but you probably don’t hand that out.

Every model is easy to make based on trends. It’s the inflections that cause models to fail. The federal reserve can predict 50% of GDP when it just goes straight up but that goes to 0% during recessions.

The 2015 crash was predicted by rigs so you got it right. Going forward rigs have fallen by half and have stopped recovering so that should mean a continued production fall.

So I’m not even saying your model is wrong, I’m saying there’s a hidden magic number there saying recovery is in 2022 because if you only use rigs as a predictor then that can’t happen. You probably have a good model you are just hacking it and biasing it up.

And although rigs did in fact stay low after 2015, that’s because laterals increased. Laterals are unlikely to increase due to crowding.

Mark,

The model will only be correct beyond May 2021 if future completion rate matches my model guess. I do not use rig count as a predictor as that would simply add another assumption about rig efficiency which changes over time in ways that cannot be predicted. I look at past increases in completion rates and assume these provide an upper bound to future increase in completion rates, I also look at future price expectations (a future oil price scenario is part of the model) and future expectations for economic growth to gage future oil demand.

In any case, predictions of the future have zero probability of being correct, infinite scenarios when one is chosen chance of being correct is one divided by infinity.

Mark,

You asked:

Can you find any countries or fields which behaved as you’re suggesting?

US L48 onshore conventional declined at about a 3.5% annual rate from 1970 to 2010, if we take the more recent and shorter period of 2000 to 2011, the average annual rate of decrease in US L48 onshore conventional oil output was about 1.7%. When we aggregate World output decline is likely to be more gradual as everyone is not on the steep part of their decline curve at the same time.

Mark said:

The convolution model is not wrong. It is actually correct because that is the actual mathematical description of what is happening when one considers a number of fields depleting over an extended period of time.

The problem is that you need to formulate your issue in mathematical terms so that it can model the empirical data.

I don’t think you have studied in detail how well Dennis and others can monitor the ongoing decline of the Bakken just by using a most basic convolution-based model.

Dennis, thats after it fell to a virtually negligible level. The Pennsylvania oil fields are operated after 100 years as museums.

Dennis, if we take your R2 literally it means you either predicted covid or have a very short predictive period.

Dennis,

I don’t think there will be a major rebound because of the drought. US is going to soon declare a Tier 1 emergency soon since all of the major reservoirs in the Western US, are at all time lows, and drought is likely to persist for considerable period. I think that will impact well completions in 2022.

It’s ironic you complain about the hubbert curve being moved back (it hasn’t, you’re just aggregating) when your own predictions of recovery keep being moved back.

Basically the only way someone would take your made up, physically impossible numbers seriously is if they didn’t read you.

Mark,

Clearly you have not done the analysis, read the work from Laherrere.

https://aspofrance.org/2018/08/31/extrapolation-of-oil-past-production-to-forecast-future-production-in-barrels/

His own analysis shows how his estimates of C plus C less extra heavy have evolved, a bottom up analysis doesn’t work because only fields and nations past their peak will yield a useful estimate. I do an estimate of World C+C minus extra heavy minus tight oil. It yields an estimate today of about 2600 Gb, I showed this chart earlier.

https://peakoilbarrel.com/us-april-oil-production-flat/#comment-720763

In the chart below, I see what the same type of analysis would yield using 1982-1997 World C plus C less tight less extra heavy oil, result is 1600 Gb, so in 23 years the URR increased by 1000 Gb. How much will URR increase over the next 10 years? I think my guess of 200 Gb (2800 minus 2600) is quite conservative, about half the rate of increase from 1997 to 2020 (a little over 400 Gb every 5 years).

Yes, and north ghawar peaked in 2000. They started in south ghawar in 2003 to stop the collapse. I can cite any of this, simply ask.

Indonesia began to plunge rapidly in 1997 leading to the “Asian financial crisis “. If you were to pluck out Indonesia from that estimate you’d get a different peak when somebody else peaked.

So even when you incorrectly aggregate as you do it still predicts the next peak in whatever resource is dominating your curve.

In fact if we drop a few countries dominated by offshore and heavy oil (FSR, Brazil, China, uae and Angola), we find that conventional oil peaked in 2005. Outside Saudi, 1998. Hubbert curve for conventional oil is looking good.

As for your question, the current curve gives 2.5T, which is the same as your number. It’s not gonna budge. You simply time the peak a little different, the curve says it already passed.

Mark, the word salad is not convincing. Read the Laherrere paper, you need to aggregate if you want to get an accurate answer. If we only include post peak regions there is no way to estimate the ultimately recoverable resources of regions with increasing output.

Read and learn.

Oh and you make many claims, most of it without any published work to back it up.

You seem to think Ghawar is the World, it is one field, a large one, but 3.8 of 83 or 4.6 % of World output and we don’t really have any data on it after 1982 except an occasional guess that output was 5 Mb/d in 2003 or 3.8 Gb in 2017 (roughly a 2% annual average decline rate over 14 years).

Ghawar is effectively Saudi output minus the offshore fields (which we usually get some kind of estimate for).

Here is the cite of where they started south ghawar in 2003 and this drove production growth to 2005.

https://www.google.com/amp/s/www.albawaba.com/amp/business/light-oil-field-discovered-saudi-arabian

“Published April 10th, 2003 – 02:00 GMT

Yabrin, a new field of Arabian Light crude oil, has been discovered by Saudi Aramco in the Kingdom’s Eastern Province, Minister of Petroleum and Mineral Resources Ali Al-Naimi announced recently.

The new oil field is 260 kilometers southeast of Riyadh and 50 kilometers south of Haradh, which is at the southern end of the giant Ghawar field.”

Of course there isn’t any information on what they did with the field because Saudis don’t publish that. However it would seem to explain their growth.

Now that’s out of the way, and you didn’t ask for more citations I’ll get to the rest.

“If we only include post peak regions there is no way to estimate the ultimately recoverable resources of regions with increasing output”

That is actually what you are doing for example with your 1900-45 US troll. So if anything your source refutes your point (as usual). You literally don’t even think about what your saying, your goal is mere contradiction and hoping the readers are too dumb to think.

If you disaggregate then of course all the growing fields are included, and there could be new fields but those are usually minor. Like I showed you could easily predict the entire 20th century US oil production using hubbert curve data from about 1945, broken by individual state instead of your aggregation troll. If you made some allowance for Louisiana you could predict everything in 1935 or maybe even earlier if you had data. The hubbert curve is limited by data availability and not even the methodology.

You assume the hubbert curve “gets better” over time but I think it’s actually gotten worse, for example conventional oil peaked in 1998 and not 2000 like hubbert predicted. If I get bored enough I will compare the extrapolation before and after 2020 also.

Because most production is in countries that aren’t growing, or are barely growing, Ghawar is about half of the global growth. Saudi Arabia grew 2m/d from 2000 to 2019 and the world outside America grew 5m. So yes, this one tiny field is enough to change the entire world production.

Mark,

The citation is for a discovery, the rest is pure speculation on your part. You draw conclusions based on very little information and claim you have proven your case, far from it.

Mark,

When I get good information, such as the stuff I learn from shallow sand, LTO survivor, Rasputin, and people who prefer I not use their name, I adjust my assumptions about the future. Sometimes lower (as when I changed my well spacing assumption from 1000 feet to 1320 feet for Permian basin and lowered my TRR estimate from the USGS mean of 75 Gb to 60 Gb) and other times I adjust higher as in 2018 when the USGS Delaware Wolfcamp and Bonespring assessment was published (I had guessed the TRR was about half of the USHS mean estimate for Delaware). Note that I still believe it likely that the USGS mean TRR estimate is more likely, so my best guess for the Permian remains 46 Gb.

In 2012 when I did my first oil shock models I used 2500 Gb to 2800 Gb for total World C+C URR (conventional and nonconventional). Since that time I have revised my estimates higher to about 2800 Gb minimum and 3200 Gb maximum with a best guess around 3000 Gb (for conventional and unconventional resources).

For you the math may be different, but in my world 3000 is a larger number than 2650 Gb, so your “revised lower” is backwards, unless you mean up is down.

See below for early model

https://oilpeakclimate.blogspot.com/2012/07/an-early-scenario-for-world-crude-oil.html

For something more recent see (June 2019)

https://peakoilbarrel.com/oil-shock-model-scenarios-2/

My best guess scenario has been revised a bit lower for URR as I currently expect World oil demand to fall after 2035, also in June 2019, I did not foresee the Global Pandemic.

You actually haven’t adjusted your predictions much except moving the recovery back another year. Your well spacing assumption is close, you have no concept of lateral overlap. In reality laterals are a mile and overlap at that distance. Anything less is some odd case. Of course you’ve already heard this many times and will just keep spacing wells 25x denser than they could be. You take whatever they say and make the smallest possible adjustment to what you already believe.

World production outside America went down after 2012 so it’s bizzare that caused you to increase your estimate. Obviously what you are doing is continually delaying the peak. The reason why poverty statistics stop after 2013 isn’t mere negligence, it’s because things started getting worse then. There is an accelerating growth of poverty, conflict and starvation in most of the world after 2013 due to peak oil.

Of course you, standing in the 1 country growing oil production will just ignore this even as it comes here.

About yabrin field, either they produced from it or it was some sort of aramco conspiracy to create fake reserves, which is what you’re implying.

Because it’s such a small discovery and part of a existing field I doubt they would report anything else. Of course you can take this as lack of evidence but so says the person whose entire model is a made up number saying the economy will recover in 2022.

Mark,

LTO survivor says 4 wells per mile, pretty sure he means 1320 foot spacing between laterals, unfortunately, although I have asked him many times he chooses not to answer this question. Must be a trade secret. It is the assuption I used. As to your suggestion of 1 mile well spacing, I will let oil pros who know far more than me comment. I am fairly certain you are wrong, but I will let others chime in.

You are asking about different things. 4 wells will work if you have different benches or something like that.

What matters is overlap and not the maximal possible wells you can drill in ideal conditions, which is what that 4 number sounds like. Some companies have extremely good acerage and others don’t so you can get totally different answers depending on what someone’s job is.

Mark,

The model takes the average well profile, some wells will be better others will be worse. For the average well, only profitable wells are completed (part of the analysis is a dicounted cash flow model) basically I assume oil companies know where the sweet spots are, they start there and when they are fully drilled they move to areas that are slightly less productive. That’s why the model comes up with only 120 thousand wells out of 190 thousand possible locations (based on a 60 Gb TRR assumption) get completed in my scenario (including the 28 thousand wells already completed in the Permian basin). You can claim it is wrong all you want. Time will tell us who is correct.

Mark,

You said:

World production outside America went down after 2012 so it’s bizzare that caused you to increase your estimate.

Here’s World C C from 2010-2018, before the 2019-2020 oil glut.

As usual you are off by 180 degrees.

Dennis,

https://stratasadvisors.com/Insights/2019/110419-Upstream-Q3-2019-Global-Crude-Condensate-Production-Outlook

Global crude oil production (excluding condensate) in 3Q19 was 76.2 million b/d,

Global condensate production in 3Q19 was 6.2 million b/d,

Of which the us was at least 18

https://www.eia.gov/petroleum/production/

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=M_EPL2_FPF_NUS_MBBLD&f=A

Leaving 82-18 = 64 non US production so there is something wrong with your graph. You have 72. You apparently threw in American condensate (most of global condensate).

Without that boost your graph proves rest of world (ROW) production peaked in 2012.

Mark,

I use EIA International data see link below

https://www.eia.gov/international/data/world/petroleum-and-other-liquids/annual-petroleum-and-other-liquids-production?pd=5&p=00000000000000000000000000000000002&u=0&f=A&v=line&a=-&i=none&vo=value&vb=173&t=C&g=none&l=249-00000000000000000000000000000000000000000000000201&s=94694400000&e=1577836800000&ev=true

data can be downloaded to a spreadsheet using download options link (csv table)

The data is crude plus condensate, you can also get data from BP at link below

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Mark condensate and NGLs are not the same thing. There is not a good estimate of US condensate, a portion of NGL is condensate (but only about 11.5% in 2019 was pentanes plus aka C5 aka condensate), there is also lease condensate which is mixed with crude at the lease and is not quantified by the EIA. That is the reason most places report crude plus condensate with the exception of OPEC.

We would need a longer data set than 2016 to 2020. I think C plus C data is fine.

World C plus C minus US C+C from 2010 to 2018 using BP Statistical Review of World Energy crude plus condensate data.

Click on chart for larger view.

So in 2018:

World 83m CC

US 11m

2012:

World 76.5

US 6.5

World increased 6.5

US increased 4.5

Then Iraq grew 2m

https://tradingeconomics.com/iraq/crude-oil-production

So peak oil outside America and Iraq was 2012.

Mark,

Yes and if we take out all nations that have increased output, then the World minus those nations will be in decline.

What is important is World C+C output. So far that peaked in 2018, perhaps that will be the final peak, but I am doubtful, I would put the odds at 9 in 10 that World 12 month average C plus C output will exceed the 12 month peak in November 2018 (centered average) by December 2028.

Mark,

It is you who does not think.

The methodology assumes we can take a region such as the US and predict future output based on past output. If we do this for US L48 onshore conventional output (excluded GOM, Alaska, and tight oil) in 1945 we get a very different result than in 1985, that is a simple fact. Deny all you want. The point is the method does not work when annual production divided by cummulative production is over about 0.05, it really is that simple. So a Verhulst equation applied to tight oil output at present is likely to underestimate the URR, likely by a factor of 2 or more.

As to what is physically possible or made up, the future is unknown, most of my past scenarios of the future (made up as all scenarios of the future must be) were claimed to be physically impossible or absurdly optimistic.

(This applied to all my cases, low medium or high.)

In hindsight, nearly every one of my scenarios that were a best guess estimate (typically I called these a medium or average scenario, between high and low cases explored) proved to be too pessimistic.

We will have to wait a few years to see if history repeats. My guess is that it will, because despite what some believe my scenarios tend to be quite conservative and there is likely a 60% probability that they will prove too low rather than too high.

Because you’re aggregating different fields into a single thing. It’s like comparing apples and oranges production and saying both will fall when only oranges are.

Every individual state followed the hubbert curve. I gave examples for the ones that mattered. TX and LA. Can you find any state that doesn’t follow the hubbert curve?

Mark,

When you do an HL for Texas or Lousiana or any state for that matter, you aggregate fields. I am simply doing a larger aggregation following Jean Laherrere’s example.

So wait, you acknowledge every individual state followed the hubbert curve and yet the national doesn’t, and so you use the measure that doesn’t work?

Ok fine. If you’re going to combine thousands of individual fields into a single variable, even in your real model I don’t see how you could make your model any worse.

Mark,

You are correct that I was missing data from Gulf of Mexico and getting a bad estimate for USL48 onshore conventional using HL.

It remains the case that for early Hubbert linearizations for data before 1932 when annual production of C plus C divided by cumulative production was about 0.06 or higher that we would have underestimated URR for US L48 onshore conventional oil (estimate would be 20 to 25% of the estimate today (40 Gb vs 180 Gb).

The main point is that using a Hubbert type analysis for tight oil is likey to be a severe underestimate of tight oil URR. For tight oil befor the pandemic for tight oil annual production divided by cumulative production was about 0.17 and in May 2021 had decreased to 0.127, still much too high for an accurate result.

No I have never done HL for individual states, but my guess is that in every case an early HL when annual production divided by cumulative production is over 0.1, that the estimate will be inaccurate. I am simply saying that an HL on a state would require an aggregate of all fields in the state, when an HL gets to under 0.01 for aP/cP it is probably going to give a good estimate for conventional oil unless some very large field is discovered late (which is not likely).

Ah I see, thank you for not shifting anything. So the growth rate is just going to be blatantly wrong now.

Permain rigs are barely growing anymore, less than 1% monthly, if we plug this into your model we should get a decline. What is the lag between rigs and production? I think it should be 18 months but yours seems less.

Mark,

Most use 9 months for rigs, but I focus on frack spreads and the lag there is shorter, about 4 to 5 months at most.

I see. So since frac spreads have started increasing around end 2020 you expect production to grow now.

That’s a reasonable, fair prediction and seems to have been wrong for the past month or two but I understand if you give it time.

Often there will be a bit of lag as production turns around, notice that my scenario under predicts tight oil output for April and May 2021 by about 200 kb/d and doesnt reach the May 2021 actual level until Jan 2022. The completion rate may in fact be somewhat higher than I have guessed, at least through May 2021.

tight scenario (shorter time scale displayed but scenario unchanged) below. As always output beyond May 2021 unknown, model based on an assumed increase in completion rate from 570 in June to 750 in Dec 2021, (an increase of about 30 per month on average) in Dec 2022 the completion rate rises to 1030 per month with a gradually slowing rate of increase. This guess is very likely to be incorrect.

“Permain rigs are barely growing anymore, less than 1% monthly”

Lots of DUC wells in the Permian. Its going to take a while for the backlog of DUC’s to complete. That said, I think there might issue obtaining the water needed to complete all of the DUC’s.

FWIW: On my radar is the real possibility of soaring food prices in 2022 as farmers are cut off from access to water. Soaring food prices global is likely to break a lot more instability in the Middle East, which could impact oil production & transporting Oil (ie attacks on Tankers).

What I am seing is a financial impossibility. To reach the level of production of the end of 2019, the shale oil industry invested so much that they get a collective debt of 300 billions of dollars. I don’t think that the investors are going to be even more generous.

Schinzy

Thanks. I couldn’t tell you how many times I reread the article before it was posted.

From shaleprofile posts from Dec 2020 (last month when GOR was available on blog)

For Permian advanced insights GOR (link below) I have following (fuzzy, go to second link below for better chart)

https://shaleprofile.com/blog/permian/permian-update-through-september-2020/

https://peakoilbarrel.com/adv-2/

So true. This is what happens when the pressure has dimisnished. The GOR will only get larger.

For Eagle Ford I use Dec 2020 shaleprofile post below (advanced insights GOR)

https://shaleprofile.com/blog/eagle-ford/eagle-ford-update-through-september-2020/

GOR is much higher in Eagle Ford see link below for chart

https://public.tableau.com/shared/YZZD5Y9KX?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

Better link for Eagle Ford GOR chart below

https://peakoilbarrel.com/adv-4/

Thanks Dennis,

Mike had some good charts from shaleprofile in his blog that I can’t seem to find now. Maybe he can put those up here as well for the benefit of people here.

And also from the charts you have put up Dennis, it seems that GOR is trending up over the years. That will likely continue for the next few years and when pressure drops below a certain level, I expect we will see a sharp fall in oil volumes. While this might be the mechanism by which individual wells operate, we will see a slow cumulative impact on the basin and the total shale production. First, it will be difficult to increase oil production from shale, then it will fall slowly and after that it will collapse all of a sudden, echoing how people go bankrupt!

From Ernest Hemingway’s novel The Sun Also Rises:

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually, then suddenly.”

Hemingway could easily have been talking about declines in Shale oil output!!

😉

“From Ernest Hemingway’s novel The Sun Also Rises:

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually, then suddenly.”

Hemingway could easily have been talking about declines in Shale oil output!!

That’s a good one Ancient . 🙂

Ancient Archer,

Note the different scales for the Eagle Ford vs Permian GOR charts, Eagle Ford goes up to a GOR of 10 on the vertical scale, Permian only goes to 7.

Look carefully at Eagle Ford vs Permian, permian has mostly been at about a GOR of 3, Eagle Ford has been at 5 for years. As more and more wells are drilled a field will tend towars a highe GOR because older wells have higher GOR, also when completion rate decreases there are fewer new wells which tends to drove GOR higher. Look especially closely at the yearly GOR curves and see how the Permian curves have a different sahpe from the Eagle Ford curves which quickly go to a GOR of 5 or more where the Permian curves tend not to be as flat and gradually rise to a GOR of 5 late in the well’s life (over 60 months).

I agree this will become a problem eventually, different oil people have different thoughts on this. Perhaps no more wells will be drilled, that will tell us it is a serious problem. To date, when I look at the well profiles, I do not see a problem, the drop in productivity has been minor so far, even in the Eagle Ford.

Please hear me out.

There are two typical avenues for higher produced GORs: drilling in gassier parts of the reservoir and/or pressure depletion. The first cannot be helped as the rock is where the rock is and the second is partially man made.

These reservoirs, by their very nature, are typically solution gas drive reservoirs, also referred to as depletion drive reservoirs, augmented by rock compaction in varying measure. I discussed this with Mike on OSB in a recent forum or two. There will be much left behind oil due to pressure drop whether from general depletion or simply the inability of fractures to effectively contact near zero permeability oil bearing pore spaces. Dissolved gas breakout results in a negative relative permeability ratio where the less viscous gas move through whatever flow channels that exist more readily than the more viscous liquid hydrocarbons; and not to forget, formation waters.