A post by Ovi at peakoilbarrel.

All of the oil (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM. After the production charts, an analysis of three EIA monthly reports that project future production is provided. The charts below are updated to April 2021 for the 10 largest US oil producing states.

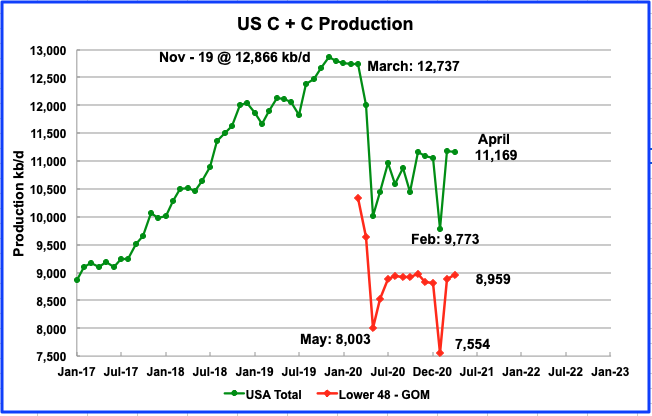

U.S. April production was essentially flat. It decreased by 19 kb/d to 11,169 kb/d from Marchʼs output of 11,188 kb/d. It was also 113 kb/d higher than January’s.

The June STEO report forecasted US April output would be 11,082 kb/d vs the reported actual output for April of 11,169 kb/d, an under estimate of 87 kb/d.

In the onshore lower 48, April production increased by 80 kb/d, red graph. The 99 kb/d difference between the US’ decrease and the On-shore L48’s increase was largely due to the 92 kb/d decrease from the GOM.

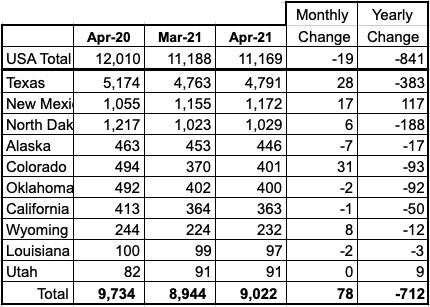

Ranking Production from US States

Listed above are the 10 states with the largest US production. These 10 accounted for 80.8% of US production out of a total production of 11,169 kb/d in April 2021.

On a MoM basis, the largest barrel increases came from Colorado, Texas and New Mexico. On a YoY basis, all states except New Mexico and Utah had a lower output than last year. Note also that New Mexico’s output surpassed North Dakota and moved into second place.

Production by State

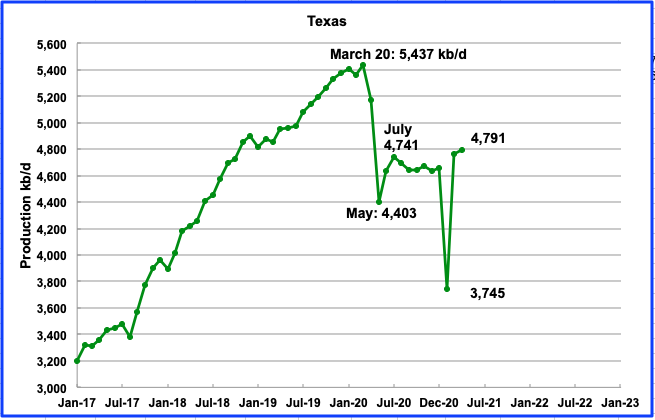

Texas production increased by 28 kb/d in April to 4,791 kb/d. In the EIA’s June report, March’s output was revised up by 18 kb/d from 4,745 kb/d to 4,763 kb/d.

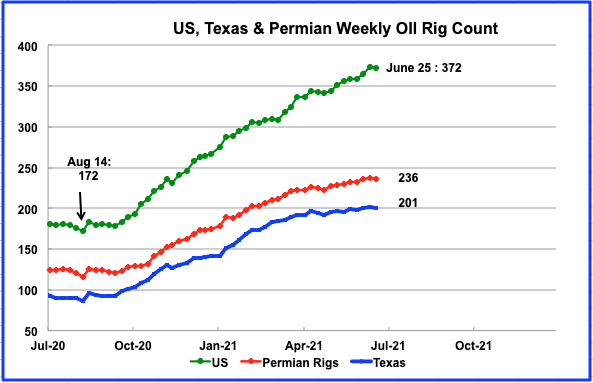

In April there were close to 194 oil rigs operation in Texas. By the fourth week of June 25, 201 were operating. From the end of April to the week of June 25, Texas added 7 oil rigs. It appears that the rate of adding rigs in Texas has slowed. See Rig chart in Section 4 further down.

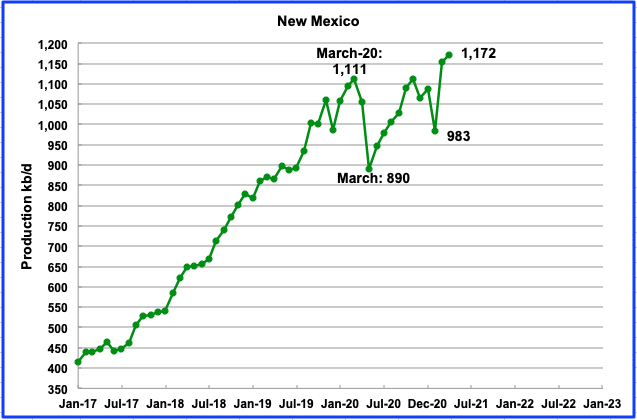

April’s New Mexico production increased by 17 kb/d to 1,172 kb/d. April’s output is a new record.

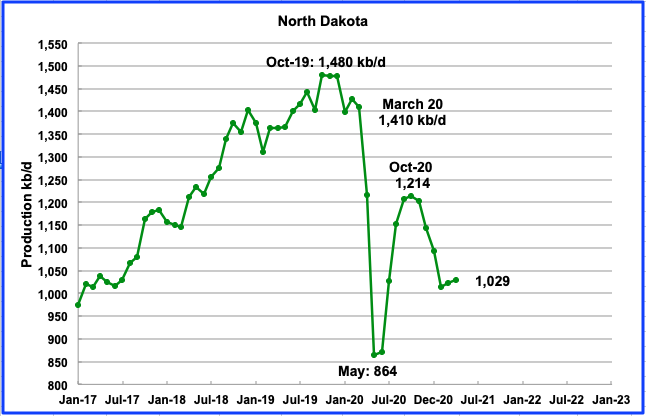

According to the EIA, April’s output was 1,029 kb/d day, an increase of 6 kb/d from March. During April, North Dakota had 15 rigs operating and by the fourth week of June they had increased to 17.

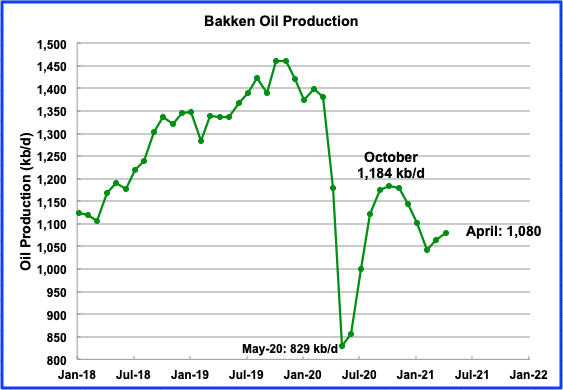

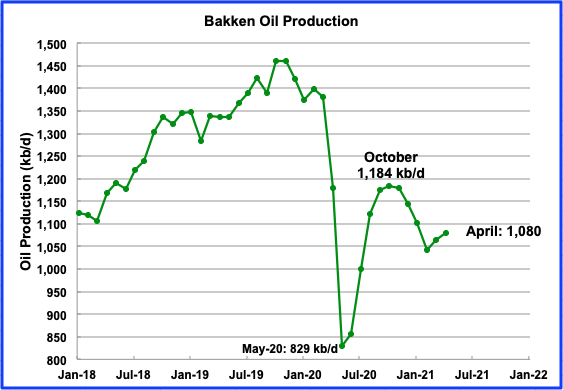

The North Dakota Oil and Gas division reported that April’s output in Only the Bakken was 1,080 kb/d. It is surprising that the EIA reported total April output for North Dakota was 1,029 kb/d, 51 kb/d lower than the Bakken alone. Does ND include NGPLs in their report?

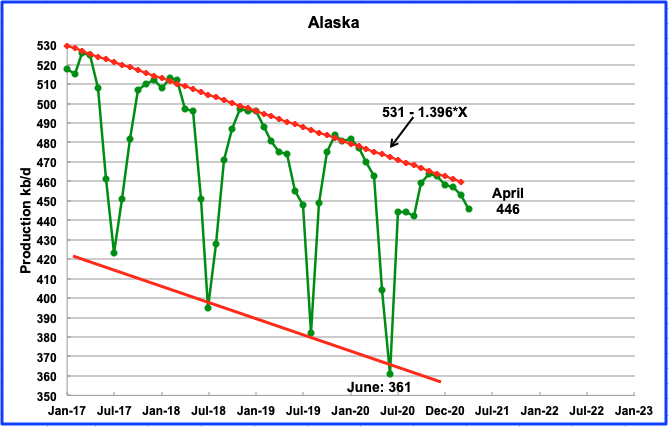

Alaskaʼs April output decreased by 7 kb/d to 446 kb/d.

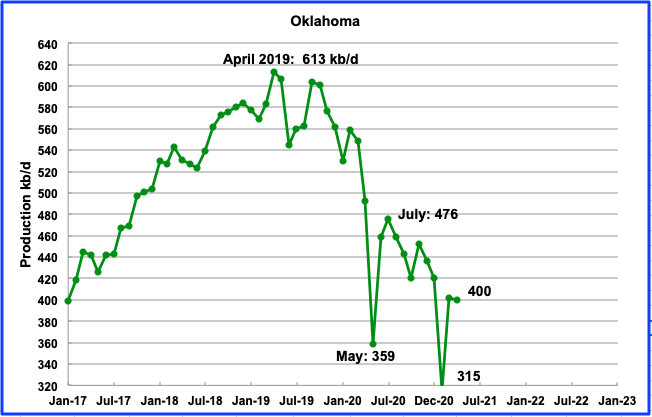

April’s Oklahoma output decreased by 2 kb/d to 400 kb/d. In July 2020, Oklahoma had 10 rigs operating. During April, 21 rigs were operating. By the end of June they had increased to 27. Even though 11 rigs were added from July 2020 to April 2021, production dropped by 76 kb/d.

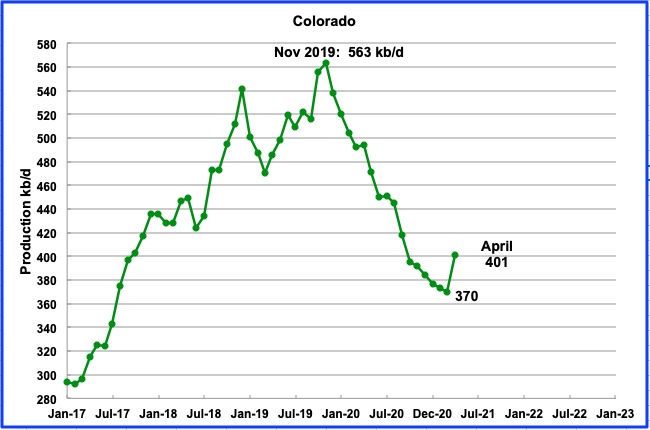

Coloradoʼs April output increased by 31 kb/d to 401 kb/d. From March to April, Colorado increased their oil rig count from 7 to 9.

According to the EIA, most new oil production in Colorado comes from the Niobrara Shale formation located in the Denver-Julesburg Basin in northeastern Colorado, where oil production in one county, Weld, is the source of almost 9 out of every 10 barrels of crude oil produced in Colorado. The Wattenberg field, much of which is in Weld County, is the fourth-largest U.S. oil field based on proved oil reserves and ninth-largest gas field based on proved natural gas reserves. The Piceance Basin in the western mountain region is the other primary crude oil-producing area in Colorado.

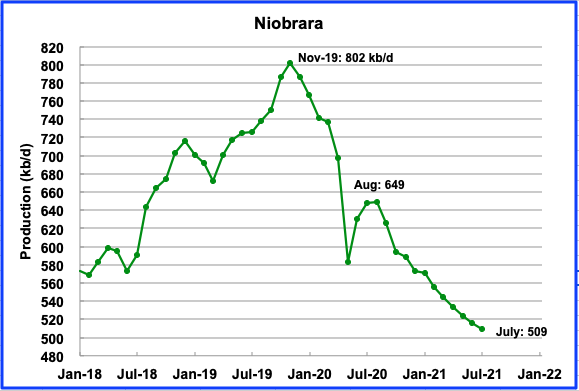

The June DPR shows steadily decreasing production from the Niobrara basin. Could the April increase shown in the Colorado chart above be due to shut wells being brought back on line?

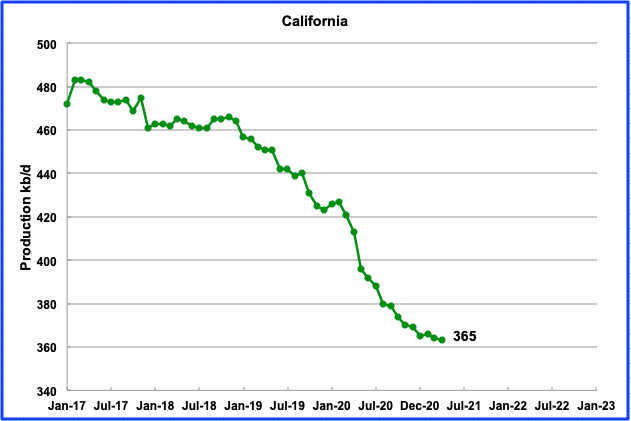

Californiaʼs slow output decline continued in April. Its production decreased by 1 kb/d to 365 kb/d.

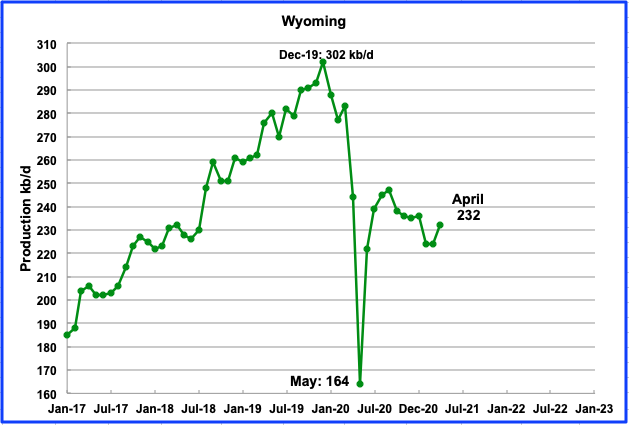

Wyomingʼs production in April increased by 8 kb/d to 232 kb/d. Wyoming had 3 oil rigs operating in April and they were increased to 9 by late June.

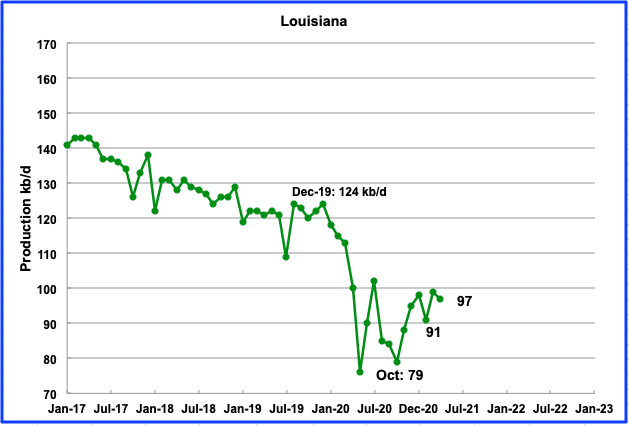

Louisianaʼs output decreased by 2 kb/d in April to 97 kb/d.

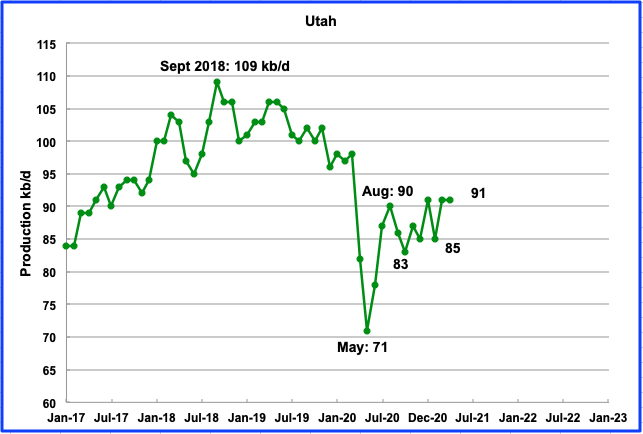

April’s production was flat at 91 kb/d. Eight oil rigs were operational in April and were increased to 10 by the fourth week of June.

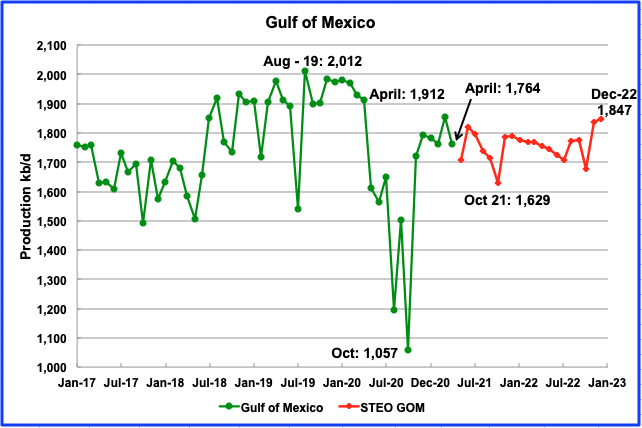

Production from the GOM decreased in April to 1,764 kb/d, a decrease of 92 kb/d from March. If the GOM were a state, its production would rank second behind Texas.

The May STEO projection for the GOM output has been added to this chart and projects output to be 1,847 kb/d in December 2022. This is an increase/revison of 59 kb/d over the previous report.

1) Short Term Energy Outlook

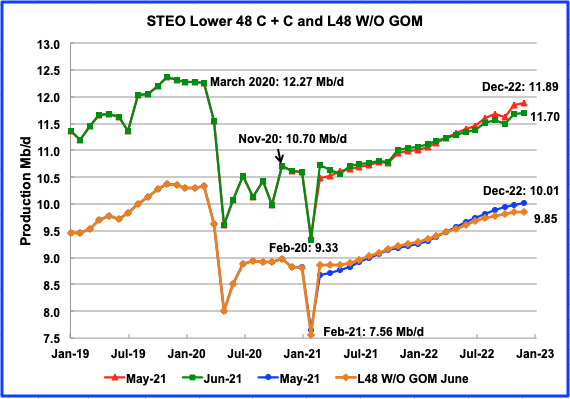

The STEO provides projections for the next 13 – 24 months for US C + C and NGPLs production. The June 2021 report presents EIAʼs updated oil output and price projections to December 2022.

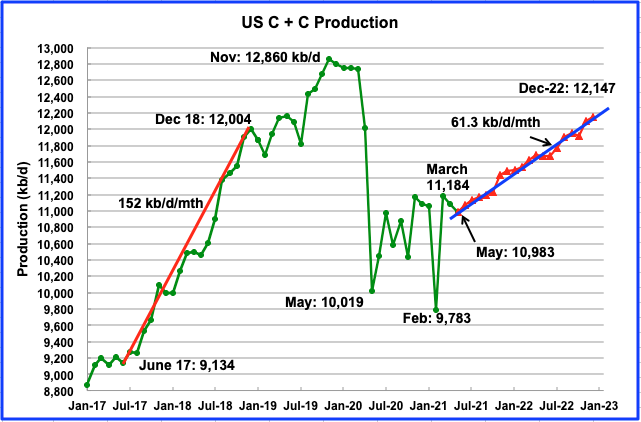

According to the June STEO, US output is projected to decrease in April 2021 to 11,082 kb/d and then drop further in May to 10,983 kb/d before beginning to increase in June.

The June STEO also revised down the December 2022 production forecast from 12,334 kb/d to 12,147 kb/d, a drop of 187 kb/d. Starting in June, the revised forecast drops the average monthly US output increase to 61.3 kb/d/mth from last month’s estimate of 75 kb/d/mth. This rate is less than half the unprecedented rate from June 2017 to December 2018.

This should be welcome news to OPEC. If demand growth were to approach 1,000 kb/d in 2022, this would mean that OPEC would have room to increase their production, depending on what the rest of Non OPEC does, excluding the US.

The June STEO output projection for the L48 states is very similar the one provided in the May report except for the output drop of 190 kb/d in December 2022 and the extra 240 kb/d in March 2021 which reached 10.73 Mb/d and exceeded the November 2020 level of 10.70 Mb/d.

The EIA continues to project a significant increase in production in the L48 starting in June 2021. From May 2021 to December 2022, the US will add 1.13 Mb/d by going from a daily production rate of 10.57 Mb/d in May to 11.70 Mb/d in December 2022.

In the onshore L48, L48 W/O GOM, production starts to increase in May 2021 from 8.86 Mb/d to 9.85 Mb/d in December 2022, an increase of 0.99 Mb/d. The average monthly increase in production rate from March 2021 to December 2022 is 47.1 kb/d/mth.

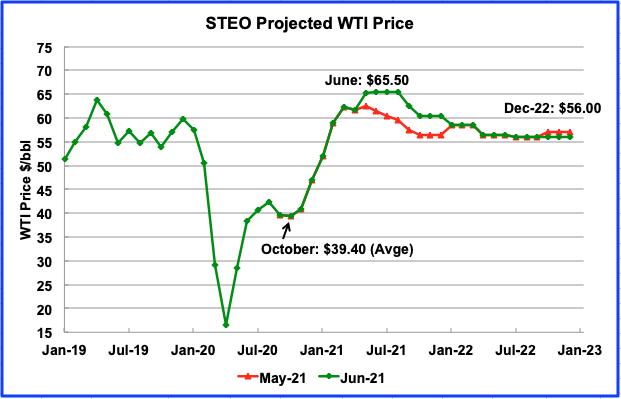

The June 2021 STEO price forecast was significantly revised up from the one in May. From May to August, WTI is expected to average $65.50. It drops to a low of $56.00/b in December 2022.

The August WTI contract settled at $75.16/bbl on July 2, higher than the EIA projection of $65.50. September Brent settled at $76.17/bbl.

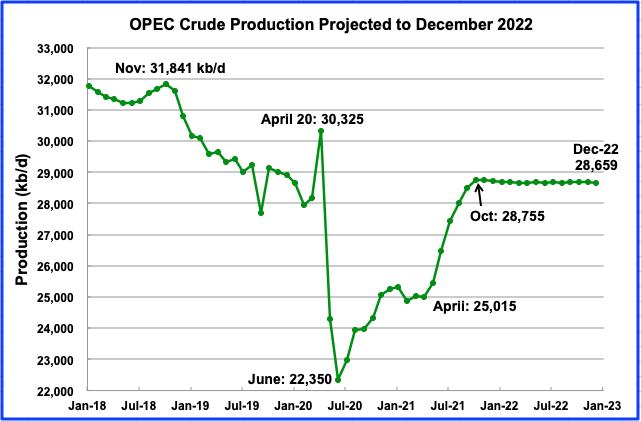

This chart shows the STEO’s forecast for OPEC crude output to December 2022. OPEC’s crude output is projected to increase from April to October by essentially 3,700 kb/d. After October output remains flat. The October output is virtually the same as OPEC’s output on January 2020, just prior to the onset of the pandemic.

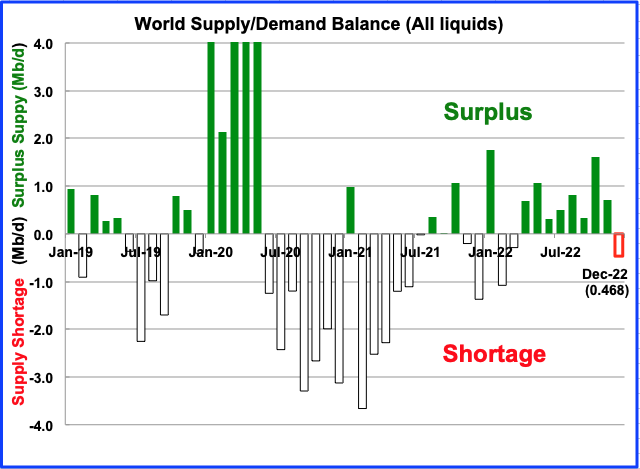

This chart show the historical supply/demand situation up to March 2021 and after that, the EIA’s forecast out to December 2022. After the supply surplus from February to June of 2020, world oil supply was intentionally reduced by OPEC and its partners. The US also reduced its output but the reduction was related more to the low price of oil.

From July 2021 to December 2022, the STEO is forecasting an average surplus of close to 322 kb/d. To get an idea of how this forecast changes, a record will be kept of the December 2022 shortage to see if it rises or falls. A recent report indicates that OPEC is concerned with the surplus shown after July 2022.

In the May report, the December 2022 deficit was 0.88 Mb/d. In the June report it has been reduced to 0.468 Mb/d.

2) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The following charts are updated to July 2021.

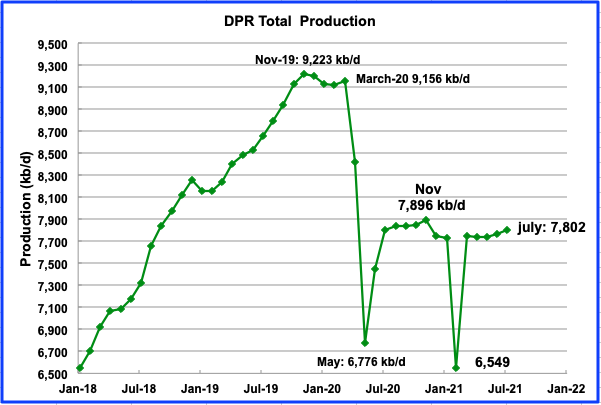

Above is the total oil production from the 7 DPR basins that the EIA tracks. Note that the DPR production includes both LTO oil and oil from conventional fields

The DPR is projecting output for July 2021 to increase by 37 kb/d over June to 7,802 kb/d. From March to July, output in the DPR increased by 51 kb/d.

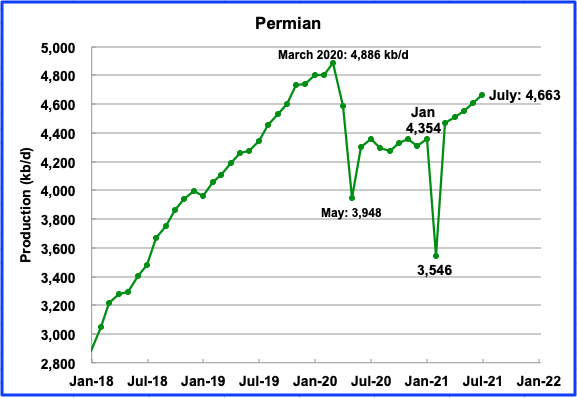

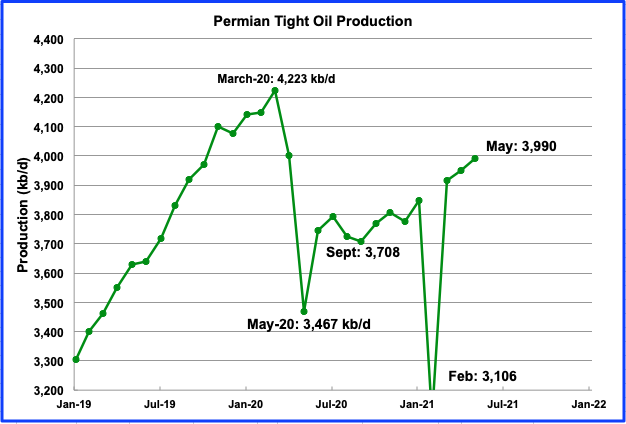

Permian output in July 2021 is projected to be 4,663 kb/d, up by 56 kb/d from June. From January to July production increased by 309 kb/d or approximately 51.5 kb/d/mth.

During June, 235 rigs were operating in the Permian, up from 100 in November. These 235 rigs are clearly sufficient to offset the decline from older wells and are increasing production.

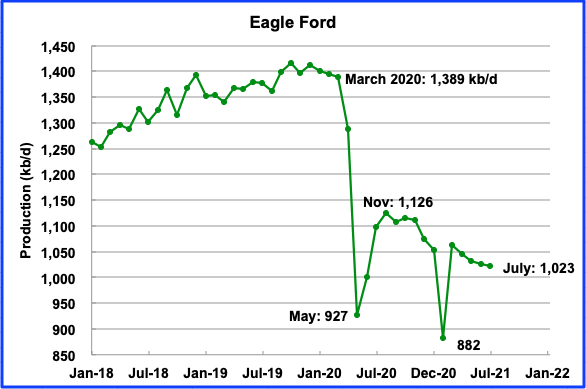

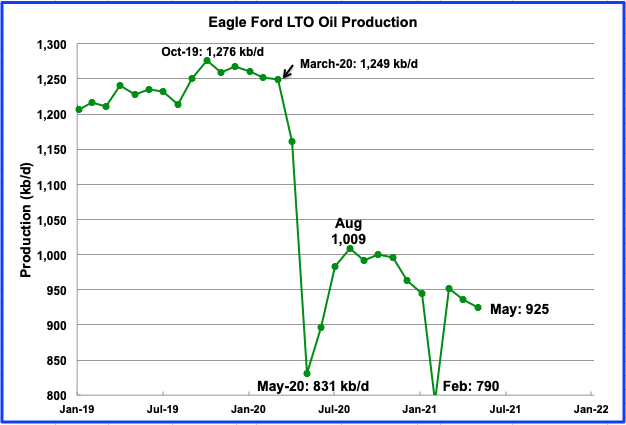

Eagle Fordʼs output reached a recent peak in November after shut in wells were brought back online and then output began to decline. In July, Eagle Ford’s output is expected to drop by 4 kb/d to 1,023 kb/d.

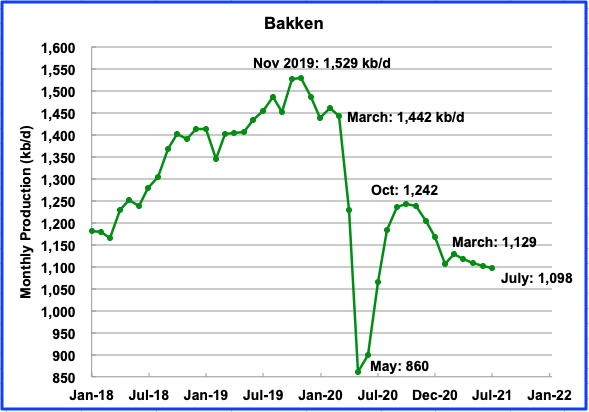

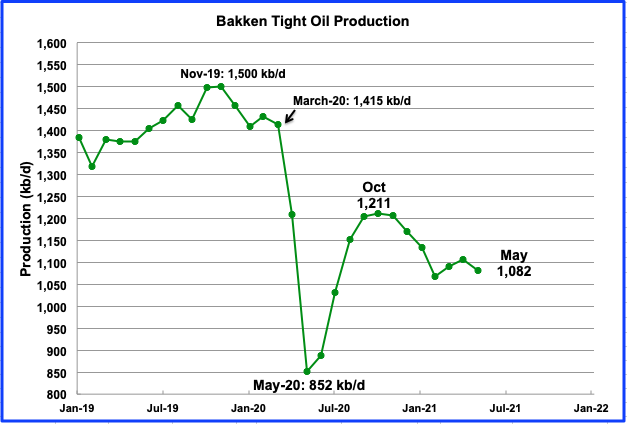

The DPR forecasts Bakken output in June to be 1,098 kb/d a decrease of 4 kb/d from June.

This chart shows Bakken oil production as reported by the ND Oil and Gas division. While the ND O & G division is reporting an increase of 6 kb/d in April, the DPR is projecting a decrease of 11 kb/d in the previous chart.

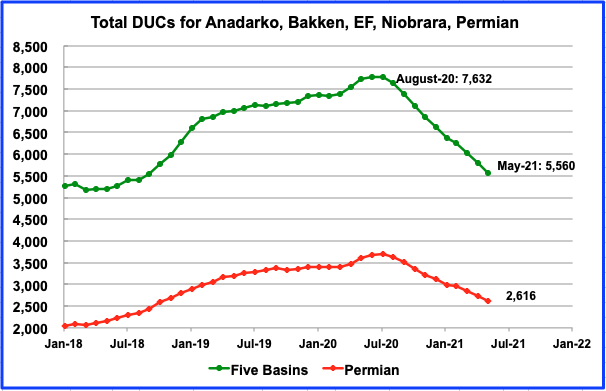

During May, 233 DUCs were completed in the five major oil basins as the DUC count fell from 5,793 in April to 5,560 in May. The average numbers of DUCs completed each month since August 2020 is 230/mth. Of the 233 completed DUCs in May, half, 115, were completed in the Permian.

3) LIGHT TIGHT OIL (LTO) REPORT

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The June report projects the tight oil production to May 2021.

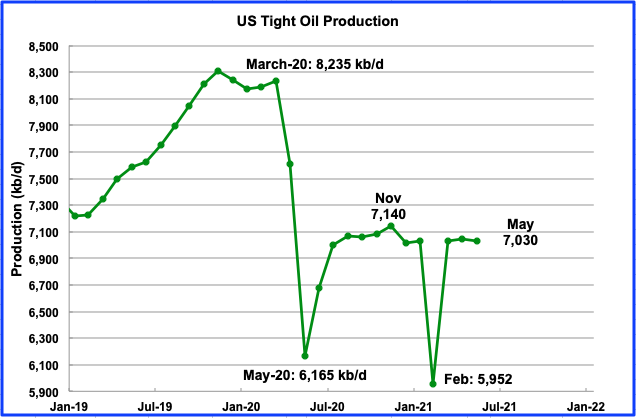

June’s LTO output is expected to decrease by 15 kb/d to 7,030 kb/d. Note that May’s output is still lower than August 2020 output by 41 kb/d. In the June report, April’s forecast output of 6,923 kb/d was revised up to 7,045 kb/d.

The June report revised February output further down from 6,028 kb/d to 5,952 kb/d.

Permian LTO output in June is projected to increase to 3,990 kb/d, an increase of 39 kb/d. From the September low of 3,708 kb/d, LTO output in the Permian is increasing at an average rate of 35.3 kb/d.

The Bakkenʼs May output is expected to decline. May’s production dropped by 24 kb/d to 1,082 kb/d.

The Eagle Ford basin is expected to produce 925 kb/d in May, a decrease of 11 kb/d from April. May’s decline continues the trend that started in December 2020.

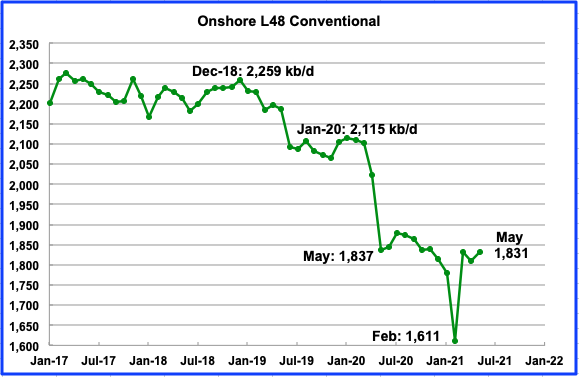

Conventional oil output in the On-shore L-48 is expected to increase by 22 kb/d to 1,831 kb/d in May 2021. This estimate is based on a combination of the May LTO output and the June STEO report that projects US on-shore L48 to May.

On a YoY basis, May to May, production of conventional oil is essentially flat, i.e. just down by 6/kb/d.

4) Rigs and Fracs

There is a hint that the addition of weekly oil rigs is slowing. It is most pronounced in Texas, from April to June 2021. From the end of April to the week of June 25, Texas only added 7 oil rigs. In the week ending July 1, 4 oil rigs were added in the US to raise the total to 376. The Permian added 1 to 237.

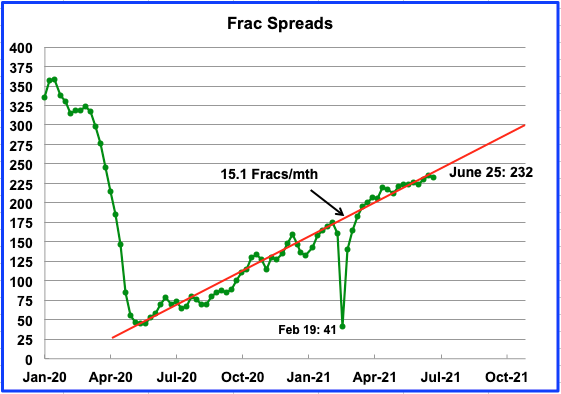

Frac spreads continue to be added at a rate of approximately 15 spreads per month. In the week ending July 2, 2 frac spreads were added for a total of 234.

World Oil Production

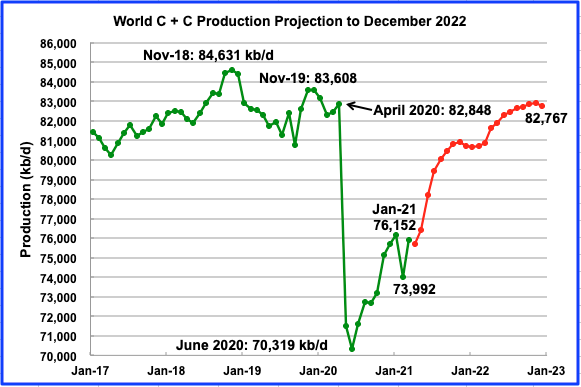

March’s world oil production increased by 1,899 kb/d to 75,891 kb/d according to the EIA. The biggest contributors to the increase were the US, 1,401 kb/d, and Russia, 150 kb/d. The US increase was simply the recovery of oil output from the severe winter storm that affected Texas and other US gulf coast states in February.

This chart also projects world production out to December 2022, red graph. It uses the June STEO report along with the International Energy Statistics to make the projection. It projects that world crude production in December 2022 will be close to 82,767 kb/d.

Note that the December 2022 output was revised up from March’s EIA’s production report by 127 kb/d.

Great post Ovi. You must have put in a lot of hard work creating it. Thanks.

Ron

Thanks.

Yep, thanks Ovi

Hightrekker

Thanks

Great post.

My call , World C+C peak at 84,631 mbpd Nov 2018 . US peak C+C at 12,866 mbpd Nov 2019 . Any dissidents (excluding Dennis ) ?

Hole in Head

How long do we have to wait before we can says those numbers and dates were peaks.

First , as usual great work . Second the answer to your question , MAYBE till Dennis joins our team . 🙂

Hole in Head

Let’s give him one year to come around.

🙂 . 🙂 . ROFL .

Sorry guys, you will have to wait until 2028, unless I get some new peer reviewed information.

I expect the World peak will be 2027/2028 at 84 to 87 Mb/d, best guess 85 to 86 Mb/d.

Just realized I forgot to mention I look at average annual output rather than single months which are less important in my view.

So current World peak is 2018 is 83083 kb/d and US output in 2018 was 10964 kb/d with US peak the following year at 12248 kb/d. Note that 2018 was the first year that the US surpassed the 1970 peak of 9637 kb/d.

We should know for sure sometime between January and December 2022. We will know when it is confirmed that Russia is in decline. That will be the tipping point. Many producers are already in decline but Russia is now the largest. Of course, the US being in decline, the two largest producers in the world, would leave no doubt about it.

Ron,

I just looked up the Vostok project. I put no credence on the numbers but full production is supposed to be 733 million barrels a year.

It’s an if and when thing. I’ve no way to know if Vostok would offset Russia’s production decline to any great extent.

It took me a while but I found it: Russia’s Rosneft Announces Start of Vast Arctic Oil Project

Sechin said the Arctic endeavour would eventually produce 100 million tonnes of oil per year.

Between now and 2024 he said that 30 million tonnes would be sent from the Arctic along the so-called Northern Sea route connecting the Atlantic Ocean to the Pacific.

It will eventually produce 100 million tons a year but in the meantime, they hope to produce 30 million tons between now and 2024. But another link said something entirely different:

Rosneft discovers new oil, gas field at Russian Vostok Oil project

Moscow — Russia’s largest crude producer Rosneft said July 23 that it has discovered a new field containing an estimated 20 million mt, or around 146 million barrels of oil, and 1 Bcm of gas, as part of its Vostok Oil project in Northern Russia.

Oh well, I guess we will just have to wait and see.

Let me remind you that Ugra is Western Siberia.

Yekaterinburg. By the end of 2021, the oilmen of Ugra are expected to produce 215 million tons of oil. This was announced by the Governor of the Okrug Natalya Komarova on the sidelines of the INNOPROM-2021 exhibition.

“In January-May of this year, our enterprises produced 86.5 million tons of oil, which is 8% less than in the five months of the previous year. At the same time, more oil was produced in May 2021 than in May 2020 (according to regional authorities – 18.2 million tons, which is 2.4 million tons more than in May 2020) And this allows us to assume that by the end of 2021 oil workers will produce 215 million tons of oil – slightly more than in 2020. Which is explained provided by the OPEC agreement, a gradual increase in production “, – said the head of the Khanty-Mansi Autonomous Okrug.

She also noted that the revision of tax parameters in oil production from 2021 could lead to a significant decrease in investment activity

—–

Yes, at the peak of production in Ugra (in 2007), 278.41 million tons of oil were produced, which is about 60% of that year.

I was unable to post a mining schedule here ….

Ron,

I expect 2022 output will only be a bit above 2021. New peak in 2024, 2025, 2026, and 2027, 2028 will be about the same as 2027 and then decline.

No doubt each year from 2024 to 2027 people here will say that new peak year is the ultimate peak. They may be right in 2027 or 2028.

What Robert Rapier did not analyze in his OilDrum post was that the logistic model applied to large oil province (say the world) shows empirically that the peak year moves further into the future by 1/4 to 1/3 year as the next years data is available.

By a slight alteration of Zeno’s paradox, peak oil never happen. 🙂

Thanks Ovi. KSA,Russia and US are starting to look like a line of domino’s.

Great post.

Frack spread count with extrapolation, frack spread count reaches 350 in Feb 2022 if current rate of about 179 increase per year continues to Feb 2022.

The frac spreads are producing no incremental output growth whatsoever, so your graph actually means a production decline.

We will see. The frack spread growth arrested the decline in output from the pandemic, there is a lag between frack spread count increase and completion rate of a few months. Permian output has been increasing and this has been offset by decreases in other tight oil basins. Soon this will change to Permian output increasing by more than the decrease in other basins and frack spread count may continue to increase. Eventually we will see growth in tight oil output as the frack spread count continues to increase.

We will revisit in Feb 2022 when frac spread count is 350 and see where US tight oil output is.

Maybe you can give us your guess for US tight oil output in Feb 2022, my guess is 7122 kb/d for Feb 2022, 7918 kb/d for Dec 2022, 8643 kb/d in Dec 2023.

I gave it in the peak oil thread. In the best case production will be flat. The rapid decline will start in late 2023 as the hubbert curves all hit and then it will be rapid collapse.

https://peakoil.com/forums/new-wolfcamp-data-t78034-20.html

https://i.ibb.co/zx2p84N/036-D7590-D188-4-B9-D-BD43-1-B188-E73-FBB2.jpg

This differs from my earlier number because they changed the definition of wolfcamp, but the total production is the same, nothing can stop the bakken collapse.

Dennis

I think the controlling issue is rigs. It looks like Texas and Permian rigs are starting to roll over. Not quite sure what the lag time is between fracs and rigs. If there is a slowing in completing DUCs, I would think the increase in fracs would follow.

Ovi,

Let’s assume your expectation for $85/bo in 2022 proves correct, under that assumption I expect the completion rate would increase rather than decrease, in addition the DUC count will continue to decrease and horizontal oil rig count is likely to continue to increase.

To me the important metric is frack spreads, as DUC count reaches some critical level, more rigs will be needed and rig count will increase. I agree the slope seems to be decreasing at present in the Permian, also for the US as a whole the oil rig count slope vs time has held steady. When DUC count for big 4 tight oil basins (Bakken, Permian, Eagle Ford, and Niobrara) falls to under 5000, we are likely to see an increase in the rate that rigs are added, we will see.

Dennis

I should clarify my slowing remark.

My thinking is the the best DUCs are being fracked now. By best I mean cash flow positive wells. Comments appear every so often regarding dead DUCs. Of the remaining 2600 Permian DUCS, how many are economically fracable or cash flow positive.

Another question I have is, why was there such an increase in DUCs. Did it have something to do with tax losses. Clearly those wells incurred big expenses and no revenue. I can see how this would delay paying taxes.

Ovi,

My guess is DUCs increased as prices dropped in 2019 and from the pandemic, the industry is slow to adjust. Now excess DUCs are being utilized, as to how many are profitable, no idea, the dead DUCs meme may or may not be correct. No doubt there are some that are not viable, as to what pecent, I will not speculate, I will leave that to pros. They have never given a number that I have seen. Perhaps they would guess.

I think the STEO OPEC projection may not take account of a removal of Iranian Sanctions, I would say it could be as much as 1500 kb/d higher in Dec 2022, if Iranian sanction are removed.

In addition the STEO price projection is likely $30/bo too low for Jan 2022 to Dec 2022, if it were adjusted to a more realistic level like $80/bo, then non-OPEC output would also be higher.

Bottom line, the Dec 2022 World C plus C output projection looks very conservative based on information available on July 3, 2021 imo.

Shadow Lenders Take Over In The U.S. Shale Patch

Banks have started to cut their exposure to the U.S. shale patch, seeing more than 100 producers and oilfield services firms go bust last year and feeling the environmental, social, and governance (ESG) pressure to reduce credits to fossil fuels. While traditional lenders are cutting their losses and de-risking energy loan portfolios, alternative capital providers are stepping up to scoop up U.S. energy debt at a discount and take part in debt or equity transactions that could give them returns sooner than a loan would for a bank.

Since the oil price crash in 2020 and the downturn in the U.S. shale industry, banks have been wary of their exposure to the sector. The commodity price slump last year dramatically cut the value of the assets of oil and gas firms, against which they have traditionally obtained loans from banks.

Running for the Exit

Lenders slashed the amounts of reserve-based loans to the U.S. shale firms in the middle of last year.

But it is not only purely financial considerations that are driving reduced bank exposure to the oil and gas industry. ESG lending and aligning loan portfolios to the Paris Agreement goals are now more prominent than ever.

For example, asset manager Schroders, which holds many bonds in the banking sector, is engaging with banks to understand their fossil fuel exposure.

“Banks that are highly exposed to the fossil fuel industry face significant financial, regulatory and reputational risks as a result of the transition to a low-carbon economy,” Schroders said, explaining its rationale to identify the exposure of the banks to oil, gas, and coal.

Increased pressure from the ESG universe, coupled with years of poor returns of U.S. shale firms, have prompted several major transactions in which banks have sold energy debt to hedge funds and private equity firms.

Hancock Whitney, for example, agreed last year to sell $497 million worth of energy loans to certain funds and accounts managed by alternative investment provider Oaktree Capital Management. Hancock Whitney expected to receive $257.5 million from the sale of the reserve-based loans (RBL), midstream, and non-drilling service credits.

Hancock Whitney’s main reason to sell the energy loans was to minimize the risks to its loan portfolio.

“The primary objective of this sale is to continue de-risking our loan portfolio by accelerating the disposition of assets that have been impacted by ongoing issues within the energy industry, and have now been further complicated by COVID-19,” Hancock Whitney’s President and CEO John M. Hairston said.

At the end of 2020, Bank of Montreal decided it would wind down its non-Canadian investment and corporate banking energy business.

Most recently, ABN AMRO announced last week it would sell a $1.5 billion portfolio of energy loans to funds managed by Oaktree Capital Management and affiliates of Sixth Street Partners. The portfolio consists of loans to around 75 companies active in the North American energy markets.

With this sale, ABN AMRO is withdrawing from oil and gas related lending in North America as part of a process to wind down its non-core activities and significantly reducing the non-core loan book.

Overall bank credit is in contraction. And has been for a year or more. That is why I have little faith that this recovery has any legs whatsoever. If you look at the chart on US Bank credit and loans only other time you see even the slightest contraction in bank credit is 2008-2009. And it matters where the money comes from.

When a hedge fund or private equity group buys shale oil debt they are moving dollars that already exist around. When a pension fund buys shale oil debt they are just moving dollars that already exist around. But when a bank loans the money. The money is created via the loan. Money supply is expanded when banks lend.

If banks aren’t expanding the money supply and people and company’s are paying down debts which they usually do on a monthly basis. Which contracts the money supply. There is a dollar shortage coming.

Moving existing dollars around can put a bid under the price of pretty much any and everything for awhile. But over long run it’s not sustainable because the pool of existing dollars to bid up price runs out. And when there is a dollar shortage prices drop in a hurry.

Now if banks decide they want to start lending maybe we can get oil price over $100 and maybe it can be sustained. Right now banks would rather buy government T bills that yield 5 basis points instead of lending to the economy. Think about that for a minute and let that sink in. Most corporate bonds yield 400-500 basis points. And banks would rather own T bills that yield just 5.

Our economy is sick beyond belief.

South Sudan oil output declines as fields reach peak

UBA, July 2 (Reuters) – South Sudan is experiencing a rapid decline in oil output, with its oilfields yielding less crude after reaching maturity, a senior government official said late on Thursday.

At least five blocks “have already reached their peak and are on the decline”, Awow Daniel Chuang, Undersecretary in the Ministry of Petroleum, told Reuters.

From your link: The country’s crude output now stands at 154,000 barrels per day (bpd) compared with 180,000 bpd in 2019.

That works out to be 7 to 10% per year, depending on how many months they are talking about. But it is even worse:

The country, which plunged into civil war from 2013 to 2018, relies on crude sales for revenue but authorities have struggled to return production to prewar levels of 350,000 to 400,000 bpd.

War often causes damage and decline that cannot be recovered. Venezuela, even if they get a country to invest many billions in their recovery, will never return to their glory days, they will never get even close.

And population of 45 million keeps increasing at the rate of 2.2%.

Some news about Iraq:

Iraqi minister says BP mulls quitting Iraq, Lukoil wants to sell up

Iraqi Oil Minister Ihsan Abdul Jabbar said in a video posted on Saturday on the ministry’s Facebook page that BP (BP.L) was considering withdrawing from Iraq, and that Russia’s Lukoil (LKOH.MM) had sent a formal notification saying it wanted to sell its stake in the West Qurna-2 field to Chinese companies.

Iraqi tax commission cracks down on international energy companies

Iraq’s top tax authority has ordered government departments to stop issuing visas and halt imports for nearly two dozen international energy companies whom it accuses of late tax payments.

If enforced, the orders, dated June 27, 2021, could prevent some of the biggest players in Iraq’s oil, gas, and electricity sectors from bringing staff and equipment into Iraq, effectively depriving the country of work that is needed to meet its own production targets at a time when insufficient gas feedstock is causing nationwide electricity failures.

Iraq power cuts stir protests as summer temperatures scorch country

The power cuts have hit the south of Iraq especially hard. In Basra, where Iraq’s oil wells are situated, people have started taking to the streets in protest and main roads had to be shut down.

Gasoline Shortages In Iran As Tanker Drivers Shun Fuel Shipments

An official of Iranian Truck and Fuel Tanker Drivers’ Union said Thursday that drivers were refusing to transport fuel due to low or late payments from the government. There has been a shortage of supply in gasoline stations in recent days in various parts of the country.

In a statement published on social media Thursday, the National Association of Drivers’ Unions expressed solidarity with striking contract oil and petrochemical workers and said drivers would join their strike if the oil workers’ demands were ignored.

The Canadian National Energy Board’s Production of Canadian Crude Oil is out. Seems like they update about once every 2.5 to 3 months. After dipping for seven months due to covid, looks like they are settling out on a plateau of about 4.8 million barrels per day.

Ron,

A 5 month plateau? Over the past 10 months looks different from a plateau. We will see how the next few months look.

No, Dennis, the plateau began in November of 2019, interrupted for seven months because of covid. So overall it is a 17-month plateau. Canadian production could increase slightly in the next few months. But they are not going to save the world from peak oi. Nothing is going to save the world from peak oil Dennis, you need to accept that fact.

We will see. We disagree often, on this point one of us has been wrong. 😉

When shale became the keystone of supply 10+ years ago I predicted that oil would never dip below $75 again. It was as plain then, as it is today, that shale’s heavy capital costs require a logical oil price of +$75. I forgot to consider that the damn shale producers would just kept on borrowing. But I think Dennis does a good job of trying to factor in the psyche. Now or in the near future the dominoes of collapsing Saudi, US and Russian production will leave oil supply well below demand. When that happens folks are going to poke a lot of holes in the ground, and teetering governments will frantically pull levers to pump money into stuttering economies.

In my own little company we’ve been buying rigs and property so that we can double or triple our new well drilling when the price is right. Even if others aren’t similarly prepared, a $100+ oil price will bring old and new drillers out of the woodwork. Over my 30+ years in this business I’ve seen that woodwork explode every time the boom recurs. Here on the bumpy plateau there are still many conventional infill drill sites and second tier shale locations remaining. Dennis isn’t talking about holding off peak forever. But he is talking about the old familiar boom. I think we should assume that frac spreads will climb much faster than current rates. Maybe the heavy decline rates will make the boom a mere pop. But just like most of us underestimated how long the shale fraud could go on, maybe we shouldn’t underestimate how crazy it will get out there when oil prices surge, and the lengths that governments will go to keep economies afloat even in the face of unbearably high oil prices.

This is helpful in understanding what the end might look like. If we see a spike in prices; corresponding to everyone running and pushing every pipe they can find in the ground and all it does maintain a bumpy plateau and then the price falls back, we will know we are there. This exercise may needed to be repeated a few times, just to be sure. I think we are there.

The endgame of all extraction businesses is known. The endgame is financial

failure. That is why there are 60,000 abandoned mines in Australia

(https://australiainstitute.org.au/report/dark-side-of-the-boom/). One

cannot predict exactly how the financial failure will occur. There are two

extreme cases between which the endgame will play itself out. One extreme

case is that lenders cease financing the activity causing the activity to

stop. The other extreme case is that money is created to keep the activity

going until wages drop so low that workers walk off the job. Both cases can

be seen in Venezuela. Foreign investors disappeared and the local currency

doesn’t pay oil workers a living wage. That is why Pollux’ post below

(https://peakoilbarrel.com/us-april-oil-production-flat/#comment-720338) is

significant.

PAOIL.

I have been thinking about this too. However, there has never been a time until now when US and most other Western governments discouraged increased oil production.

There has never been a time when XOM and CVX said they’d hold production flat for ESG reasons. There has never been a time when European majors said they would intentionally allow production to decline for ESG reasons.

Also, how about financing. Is there still bank financing out there for you that is secured wholly by oil and gas assets? I know after prior busts it’s dried up, to come back with the price of oil, but will this time be different?

Finally, are there still enough young risk takers out there to try to finance this and are there enough workers out there to even get the job done? We have had a workover rig sitting on a well of ours for two weeks. Once the crew gets done on another rig, they will work on the rig on our well. The company owner is like you, he snapped up several rigs for dirt cheap during COVID. However, he’s having big trouble finding anyone who can operate them. Can’t even find hands.

I guess that’s my simple question. Is this time different? Or, when oil rockets past $100 will all of those who are discouraging more oil for environmental reasons change their tune?

Well put Shallow Sand.

I’ll re-emphasize the concern over credit cost/availability.

It will very likely become a significant unfavorable ingredient to economic considerations of all sorts of energy production projects.

Shallow sand,

Let’s say it is different this time and supply remains short. What do you think happens to oil prices?

Let’s imagine oil prices go to $150/bo. Does it seem realistic that oil supply would remain short and tbat there would be no increase in supply?

Let’s say that seems reasonable? Increaze oil price assumption by 50 per barrel, repeat until supply increases.

Things never remain tbe same, it is always different.

Dennis , ” Let’s say that seems reasonable? Increaze oil price assumption by 50 per barrel, repeat until supply increases. ”

Challenge , increase price by $ 150 and ask DRC , Equitorial New Guinea , Ecuador or any entity past peak oil to increase output . Your statement ” Things never remain tbe same, it is always different. ” sounds like ” I am a little bit pregnant ” . 🙂

Hole in head,

All that happens is that supply is higher than it would be at a lower set of prices. Not necessary that this be the case everywhere, just for the World as a whole. Also demand decreases as prices increase, along with an increase in supply. If there are wells that are not profitable at $100/b, but are profitable at $150/b then the increase in price means those extra wells will be completed and produce oil, whatever output comes from those wells adds to existing supply and makes it higher than before those wells started producing.

The price of oil does tend to affect oil supply.

Great Post.

Is anyone buying any new pumping equipment for new frac spreads. Most of the good equipment is now

working, and most of the sidelined units are worn out and stripped for parts. Buying new is a long lead-time

proposition. My guess is frac spreads will have a hard time going up more than 10% from where they are now.

I know that here in Canada, only TCW has any idled spreads that can go back quickly–the rest are junk. Unless

a lot more can come back, tight oil production will be stalled, even if prices for WTI go much higher.

Pilot.

Of course, you need people to operate the equipment.

Is finding workers a problem in Canada like it is in the USA?

yes. Canada has the CRB–Canada Recovery Benefit–pays $500/week special unemployment benefit,Scheduled to continue until late September. It has affected all manner of business in

Canada, especially the service industries, Labor supply is a major problem. Most companies

are still repairing balance sheets, so demand for rigs and pressure pumpers is still slow. But

the second half of this year will see increased activity.

Pilot and SS

It seems that I recall a rather serious debate here on POB last year regarding the return of workers after the economy opened back up.

Right now reality validates one prediction of the future. However, wage inflation simply due to recalcitrance is getting to be quite a serious side effect. Imagine a burger franchisee in a small town begging for entry position help for $15 per hour. What would a rig owner or manufacturing company have to offer employees as an incentive to work and what would the price inflation to their customers look like? Based upon the discussions last year I don’t think anybody can claim a good idea of the outcomes because we’re in uncharted waters.

McDonald’s pays $15 an hour in Denmark. Seems to work fine.

Itseems hard to believe that an industry as profitable as the oil industry would go broke if people aren’t paid starvation wages.

I have a nephew who used to be a Motorman in the Alberta oil patch. His last gig was last year in Texas, where he got caught in a Covid quarantine of workers on his rig (IIRC). He is now an apprentice welder in Wawa. Gets to see his kids and wife on a regular basis, works normal hours, and no travel. Also no depression from being separated from his family, or concerns that there will be layoffs.

Unemployment Benefits aren’t the problem: horrible, soul-crushing, dangerous, unreliable jobs are (sorry, oil guys…however, I know you know about burnout and addiction in your workplaces, and the stress of weeks of 12 hour shifts). Workers have just had a one-year reminder that life is short: it’s going to take some time for them to forget. (I do realize that there is a disconnect here in that our civilization needs someone to do those jobs…and I don’t have a snappy answer for the problem.)

I’ve fitted Verhulst curves to the production for each of the LTO basins in the EIA data, as below (apologiesto OVI for taking up a chunk of the comments thread but this seems the most appropriate place to put these). I used three curves in each case though one or two would have been adequate in. most cases. The near term recovery from Covid impacts will have influrnces, but maybe not much for most as productions all may have peaked before the pandemic. The Permian fields are the ones most likely to change but these estimates will be a basis to see how big the effect is. As expected by most the ultimate recoveries are well below initial optimistic numbers.

Austin Chalk

Bakken

Bonespring

Eagle Ford

Niobara

Other LTO

Spraberry

Wolfcamp

George

Interesting charts. What is the data source. Can you add up all of those charts and provide us with an overall picture.

Happy Independence Day to All.

Thanks

Data source is EIA production – I don’t know which of the several different data sets they use, it just gives production to May for LTO each of those basins. The fits give about 13Gb left for the three Permian fields, 2019 figures for EIA gave 17.5, and I expect about 15 -16 when 2020 figures come out. There are no nes discoveries in the LTO fields – no wild cat or extension wells are being drilled so the remainng reserves just change because of a general downward trend because of initial overestimation of technically recoverable reserves with will again increase but not necessarily to 2019 umbers.

For the other basins the ratios of the remaining reserves from the curve fits compared to EIA numbers are much lower, but the fits should be better as the production for the those basins are so much further past their peaks, giving a much better idea of the expected decline trajectory (e.g. EF peaked in 2015, Bakken 2019, Niobara 2019, Austin Chalk – is that Woodford? – 2018/2019). Ratios are EF ) 0.7 vs 5.5, Bakken 1.5 vs 6, Niobara 0.4 vs 1.5, others 0.6 vs 4.

Thank you for this compilation but 2024 became 2025 and so on.

The years are correct, the problem is that the divisions are 15 months rather than 12, but it didn’t seem worth fixing after I’d noticed my midtake as it’s just the general shape of the decline that matters.

Ovi wrote: Can you add up all of those charts and provide us with an overall picture.

Yes, please, I would love to see that chart.

Any idea why the production peaks (except Spraberry) all have strong time correlation with the pandemic oil price collapse?

The coincidence of peak resource with the pandemic recession seems too…coincidental.

It’s a coincidence, shale has only been around ten years and that was enough time for bioweapons to advance.

“bioweapons to advance.”

Mine was a serious question and I was looking for a reality based explanation rather than some Q-spiracy talk.

I gave the serious answer.

The Permian fields peaked in March or April 220 si I can see Covid influence there, but others are earlier. Bakken and Niobara peaed in late 2019 and had steep declines before Covid, maybe the shareholders told the companies to stop spending on the fields where the core was reaching exhaustion, or the lenders told them they weren’t getting any more.

So, in the Permian why would anyone expect peak reserve extraction potential to just happen to be at a similar timeframe as the clearly evident Covid recession pullback prompted by demand collapse?

What I am getting at is that is seems too coincidental to be correct, such as ‘if the deal is too good to be true, it isn’t true”.

I do acknowledge that occasionally big coincidences do occur. Is that the explanation here?

I just fitted the curves, as I said above whatever story they tell won’t come out until it’s shown how close future production matches the extrapolation. I was surprised how close the remaining reserve projection matched EIA numbers for the Permian, and how far away they are for the others, but the curve fits have no others factors than knowing what past production is. I can impose remaining reserve numbers and see what the best fit becomes, but it’s possible to get carried away with this. The fits are intended in no way to be predictions. I assume people understand how dodgy extrapolating fitted curves can be without having to spell it out.

Mr Kaplan , for me you and South La geo were the ” go to ” guys for GOM issues . It is evident that you have talent more than I could envisage . Terrific work on the shale basins . All is crystal clear . The music is playing but the party is over in the shale play . Merci, Bedankt and Shaukriya .

Thanks George.

Some do not realize that these extrapolations may not be correct. So sometimes the obvious needs to be stated. Not all of us have your level of knowledge.

George

Great work. As for that V curve,, there are times when it really nails it. I keep daily track of covid cases in Ontario. Near the end of April , when cases moved up from 3,200 to 3,900, I put a V function through the data starting in mid-February. Ontario was coming out of its second wave and starting into it current one. I have not touched it since then. It has just started to break down at the 200 level. Cases have not dropped as fast as V since mid June as the vaccination rate has slowed.

Thanks for the explanation George.

The Permian and all the shale was starting to tail off at the end of 2019. Companies were going bankrupt and PE was getting out of the business. Right after the huge Oxy mistake of overpaying for Anadarko, we could see the industry was starting to slow significantly. Then the price war at the beginning of Covid was the death nail. When you add ESG, Greta, Tesla, and carbon capture to the mix it was a perfect storm to destroy the industry. The industry may never come back. The futures market while efficient in a way treats oil and gas like soybeans or corn and prices oil as just in time inventory. One drop more than needed and the price gets obliterated. One drop less than needed and the price goes through the roof and unfortunately you go through periods of time where the market needs some stability at higher prices to induce investment. However, without the US shale, I believe we would have seen a market under supplied and probably an earlier and more desperate push for alternative energy. We have seen the peak and we better start conserving and looking for alternatives or we will be in sustained energy poverty.

@LTO survivor : lucid observation.

LTO survivor,

Yes Permian output growth was slowing pre-pandemic and very low oil prices led to low completion rates during the pandemic.

As you have already suggested, the oil is there, higher oil prices are likely to lead to further output increases from the Permian. It will conservatively reach 6000 kbo/d by 2025, if oil prices go to $80/bo and remain at or above that level. Perhaps we will see oil at $150/bo, difficult to know, I think $100/bo is likely, not so sure we get to $150/b.

Looked at cumulative production plus proved reserves for Permian, Bakken, Eagle Ford, Austin Chalk, Niobrara, and Anadarko at the end of 2019. The total is 37.3 Gb. If we add probable reserves (assumed to be 50% of proved reserves) we get cumulative production plus 2P reserves of 49 Gb. This would be the minimum tight oil output I would expect in a low oil price scenario ($75/b or less).

LTO Survivor- “We have seen the peak and we better start conserving and looking for alternatives or we will be in sustained energy poverty.”

As I see it we are very, very far behind in this kind of effort.

We’ve got a mile to travel on the path in this decade, and we have made it less than a hundred feet in the last 10 years. So far its a limp effort by the country.

Most people have absolutely no idea what is at stake.

There is no backup plan.

We will need to go whole hog on all feasible/affordable approaches.

Or else we will burning all the coal and wood we can get our hands on.

The country will be dumbfounded to see how quickly we will log the continent for energy.

Tanker trucks, battery factories, solar farms, pipelines are examples of facilities that will need armed guards/escorts. Robotic or human if any can be hired.

Hi George and Hickory.

I would expand slightly on George’s thought of 07/04/2021 at 11:40 am. I think that these graphs show the results of geology combined with the availability of capital. With the exception of Austin and Wolfcamp (outliers as one is the oldest and the other the youngest), each of these graphs has two peaks: one around 2014-6, and one at 2020-1.

It seems to me that these peaks are too similar for human intervention not to be a major factor. My guess is that the first peak is the result of the price crash around 2014-16. The start of the second peak is the result of drilling programs planned and instituted during the high price environment of 2011-14, and the acme is the result of covid and a changing financial environment.

Thats how it looks to me as well Lloyd.

It will be very interesting to see how things go with production when the next price spike gets real.

While it is basic curve fitting I think there must be something more fundamental involved which produces production curves that follow Verhulst curve shapes. It is an empirical observation that all production curves can be accurately fitted with a series of overlapped Verhulst curves, except where an artificial limit is imposed such as with a cartel like OPEC (and in theory there could be other reasons, Hubbert mentioned environment concerns and pipeline limits as in Canada may be another). The pure Logistic curve, a special sort of Verhulst equation, can be derived theoretically from a birth and death population model, which is conceptually understandable in terms of wells being drilled, producing and eventually getting exhausted.

The more wells there are in a collection (e.g. from platform to field to basin to area to country) the closer the Verhulst fits can be made. Production curves tend to be closer fits than symmetrical logistic curves and usually are skewed to the left with fatter tails (maybe reflecting how wells work – a rapid ramp up, a plateau, an exponential decay tail). But the skew tends to get less as the collection of entities grows in number. I have tried to think how the theoretical model that gives a logistic curve could be adapted to give Verhulst equations but it’s a bit beyond me. There may be geological, technical or economic factors that mean the fit has to be with several curves (e.g. an area with distinct shallow and deep water production, the Piper Alpha break in the North Sea, the price collapses influencing LTO production) but the fits with two or three curves are still fairly good over the whole life cycle.

All that means that the past history of a production entity must give some indication of the future production (and ultimate recovery) it’s just a question of how and how accurate. For a single well there is no doubt that once in a run down stage the future can be fairly well estimated, without any particular physical understanding of what is actually going on. The further past peak things are the better the predictive capabilites

In this I disagree with Dennis’s method, insofar as I understand it. The past production history seems to play very little part in how the future looks in those models. He simply picks an ultimate recovery and then applies some, to my mind unjustifiably complicated, methods to match a profile to that number (ironically a number sometimes generated using logistic curve fitting, as with those from Laherrere). To me this is worse than curve fitting; it is single point fitting. Everything depends on picking the recovery; even with all the expensive super computers and sophisticated models the oil companies still rely on experienced and clever people like Laherrere (and for example SouLaGeo) to put their final blessings on recovery figures. Nowadays a lot of the estimates are expressed as as probabilities and generated with Monte Carlo models which can be an improvement if they are viewed critically properly understood (USGS can get completely carried away with this and seem to me to lose sight of the forest for the trees at times).

Mr Kaplan , not much to add to your explanation . Just two finishing touches :

1. The past is not the future .

2. it is hazardous to drive by looking in the rear view mirror .

Hole in head,

A Verhulst equation uses the past production to predict future output.

Yes one looks ahead, but generally one uses past experience and what one has learned from that to anticipate what may lie on the road ahead. Perhaps it is different for you.

Thanks George,

The model for conventional output uses past output, past discovery, and estimates of producing reserves to estimate average development time from discovery to producing reserves. A range of estimates for URR are used, those for Laherrere, USGS, and others are used to provide a range of URR estimates which gives a bound to the discovery model, which lately I set at about 2800 Gb, but have used a range of 2500 to 3100 Gb for conventional resources, arriving at 2500 using a Verhulst fit to World conventional output and using the USGS 2000 World conventional resouce estimate for the high end (3000 Gb and adding 100 Gb because if it were redone it would likely be higher than 20 years ago).

I focus on my best guess 2800 Gb URR estimate for World conventional output, in 2018 when Laherrere did an update of his estimate it was about 2700 Gb for conventional oil (when I first chose the 2800 Gb best guess, Laherrere’s estimate was about 2400 Gb for conventional oil.

I think Laherrere does great work, his methodology has tended to give conservative estimates in the past and the analysis I do builds on his work and the work of others, USGS, Steve Mohr, to name but a few.

Lots of good stuff from 2014 at

https://royalsocietypublishing.org/toc/rsta/2014/372/2006

Wow Thanks George. This is starting to look like an impending collapse. On a side note the West of Shetland fractured basement play appears to be entering it’s final act.

The charts for the Bakken, Niobrara, Wolfcamp and Eagle Ford implie, that the number of completions is limited to a few more wells in each basin. At the same time we see upticks in production reported by the states and rig counts increasing slowly in all basins. We see that well productivity is declining slowly in some areas but it is not crashing. Are you really serious?

They can spam rigs all they want if they underlying resource is depleted.

It’s not physically possible to fit more wells in Permian at 1 mile spacing. The graphs showing you can space wells 400ft ignore overlap, if you look at overlap it pretty much kills anything below the current lateral length which is a mile.

I get that, but the charts say that there is nothing left to produce but some DUCs and output is going to crash tomorrow. There are more than 500 DUCs and more than 1500 permits in North Dakota and there is a decent amout of tier 1 acreage left to drill. I would agree that more than half of the potential locations in the Bakken are already producing. I also agree that companies dont have a lot of cash flow to spend because a lot of cash is lost to hedging. But I do not agree with chart above. That is only possible if fracking is banned tomorrow except for locations that are already permitted.

DUCs are the worthless wells nobody wants. Rapid growth in drilling activity has done nothing for production no matter how many DUCs are consumed.

You need to ask the spacing on these wells and it’s terrible.

Spacing of DUCs may be too close in the Permian, but not in the Bakken. Many are spaced on 256 to 320 reservoir acres, some a little closer. I dont think there are many dead DUCs in ND.

Mark,

How do you explain the decreasing DUC counts over the past 9 months or so?

Dennis,

DUC counts fell from 7651 in December to 6521 in may, are we reading the same data?

https://www.eia.gov/petroleum/drilling/xls/duc-data.xlsx

It’s a consistent 2% monthly fall and half the DUCs are fake https://www.naturalgasintel.com/lower-48-duc-count-overstated-in-eia-data-says-raymond-james/

So 2 years left before DUCs are completely gone. Rig growth can be excused because it fell a lot, but even then it’s slowing down while productivity is falling faster.

DUCs are ultimately irrelevant because they will just interfere once they run out of land. It would be better to have “DUCs with spacing greater than a mile” or “sections with remaining DUCs” because the raw count includes spudders and useless crowded wells.

If you meant to say drilling has increased, that is futile. The hubbert curve is a physical principle and drilling for oil where it’s already overcrowded will be futile and result in falling productivity as we see.

Mark,

See

http://theoildrum.com/node/2357

Hubbert linearization is a curve fitting exercise which tells us very little. It has about as much physics behind it as astrology.

Dennis,

Again very dumb post, already addressed, hubbert is specific to a grade of resource. Shale and conventional are separate as are vertical and horizontal drilling .

Mark,

Some may find hubbert curves useful, but it is simply a curve fit, no physics to back it up. One can create a set of assumptions for a physical model where the Hubbert curve would be the result of a special case of a more general model. In the real world there is no reason such a set of assumptions would be satisfied except by random chance.

See Chapter 7 pp 85-88 of Mathematical Geoenergy (link below)

https://www.amazon.com/Mathematical-Geoenergy-Discovery-Depletion-Geophysical/dp/1119434297

most university libraries will have a copy of this book.

Dennis,

In this case it does have physics because your estimate requires more oil than would fit. But of course you don’t care and will just keep pleading for production to increase as libs are obviously annihilated.

The model is one of a typical depletion profile per well convolved with expected number over time tempered by a guess on how many more. It’s a much more nuanced model than a Hubbert curve.

Dennis Coyne claims that:

“Hubbert linearization is a curve fitting exercise which tells us very little. It has about as much physics behind it as astrology.”

Here is a thought experiment. The past oil production depends on a multitude of factors, geology, discovery year, past production, wars, price, technology etc. Consider N factors and assume that one can quantify the contribution of each factor in the past production and “plot” how the past oil production has been influenced by each factor. The result is that one gets a unique curve in the N-dimensional space. Now project this curve to the axes Q vs Q’/Q. The curve that tends toward a straight line if the logistic model is valid includes all the information that can possibly influence oil production. Comments are welcome.

Seppo,

Under certain assumptions the Verhulst (aka logistic) equation will describe future output for a physical model of oil depletion. The problem is that it does not work in every case and will often lead to poor estimates of URR. One can easily use historical production from the United states to demonstrate this. Early fits to the historical production data would have lead to severe underestimates of the URR. Data from 1900-2020 at

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPUS1&f=A

Or link below has data 1859-2020

https://www.eia.gov/opendata/qb.php?sdid=PET.MCRFPUS1.A

If you use the first link, US cumulative C plus C production from 1859 to 1899 was 943.359 million barrels.

Using HL from 1945 to 1970 suggests URR of 203 Gb see chart.

Click on chart if it is too small.

Seppo,

Here is the US HL using 1905 to 1945 when annual P/ cumulative P was at about 5.4% (in 1945), the HL misses badly, URR=69 Gb, current cumualtive in 2020 is 235 Gb, if we subtract tight oil (19 Gb cumulative at end of 2020) we still get 216 Gb, over 3 times larger than HL from 1945.

For US tight oil the annual production divided by cumulative production was at 17.5% before the start of the pandemic (end of 2019). Based on the US data the annual output divided by cumulative (Q’/Q) needs to be under 7% to get anything close to a reliable estimate using HL (something with a 90% confidence interval within +/-10% of best guess). Perhaps in 2035 we might have the data needed for a reasonable URR estimate for tight oil using a Verhulst fit. For now I would put my best guess at 85 Gb+/-10 Gb for the URR of US tight oil.

sorry forgot chart, click on chart then zoom in for larger view.

Again dcoyne posts the same dumb graph combining shale and conventional, which is like combining oil and coal in the same curve. Just because the data is aggregated that way doesn’t make it right.

In 1945 Louisiana was just starting production. That accounted for half of the production growth. https://www.sciencedirect.com/science/article/pii/S0895717711005140

Spraberry did not exist until 1943.

By the time hubbert made his prediction all the fields were producing and he got a perfect fit. The correct way to use the hubbert curve is per field or when fields are all producing and anything else is a troll.

Mark,

It does not work, certainly not in 1950 or any earlier date you might choose. Late in the game after 1963 or so one gets a pretty good estimate for L48 onshore conventional when annual production divided by cumulative production is around 0.038 and we get a URR estimate of 175 Gb or so. The main point is that early estimates when annual production divided by cumulative production are higher as is the case for tight oil currently, the HL method underestimates output. It is a simple fact, just use the data. It is too early to use a Verhulst equation for tight oil to estimate URR. At the end of 2017, L48 onshore minus tight oil cumulative was 179.6 Gb and using HL from 1981 to 2017 gives a URR estimate of about 190 Gb for US L48 onshore conventional C plus C.

We have no data for early spraberry so you cannot test if it works. But every individual state followed the hubbert curve as far as we can tell, you’re just incorrectly aggregating them.

In fact if we crudely extrapolate the RRC data we get a crazy hubbert curve for Texas peaking in 1996.

https://i.ibb.co/mN1qy57/94243317-2-BB7-4726-868-A-D9-C838-E04-A77.jpg

The curve will over predict production if it’s trying to combine multiple fields that are just starting to accelerate.

If we shift the parameter a bit we get a great fit, the excess being spraberry.

https://i.ibb.co/VgHfPp9/3984-E425-546-C-4-F2-D-A874-F9-E894-B92830.jpg

Dennis, you did not comment on the thought experiment I posed. That thought experiment was to address the claim about other factors than astrology. By the way, it the position of planets influenced the past oil production, that would have been one of the N variables. I hope that you see that this parenthetical remark is made tongue in cheek, but not for the important N-1 parameters.

—–

A number of months ago I asked you and Paul, how many parameters does your model have and how they are estimated. Your and Paul’s responses did not answer this. The more parameters a model has, the more they can be adjusted to come up with a variety of scenarios. I think you have said in the past that you use Laherrere’s estimate of the ultimate, something above 3500 Gb if memory serves.

How did Laherrere come up with this? By the logistic model.

——

Econometric models follow this pattern and need to be restarted every year (or quarter) with new initial conditions. The same is true for weather prediction, but for different reasons.

—–

I also posted a few days ago that the logistic model for the world C&C moves the peak year about 1/4 or 1/3 a year (which I now correct to 0.4 years or 4.8 months) into the future as data for each subsequent year is available. This is based on empirical evidence for the world crude and condensate from data from 1995-2020. The empirical formula is

—–

t_p = 2014 0.4 (t_a – 2005)

—–

If this formula remains valid for the years from 2005 till 2030, it shows that the peak year will have shifted from 2020 to 2024 in 9 years.

The lack of agreement for the logistic model with the actual comes from two sources. The first is clear from all the discussion that have taken place on this forum; namely it requires a long time for the linear fit to develop, if it develops at all. The second is that the oil province may be too small. Whereas the conditions for a tendency to a normal distribution, as the sample size is increased, are not strictly satisfied, they do not have to be for the composite distribution to become near Gaussian.

—–

In addition, the bottom-up analysis by the Uppsala Hydrocarbon Study group predicted about fifteen or so years ago that peak will be 2017, although many of their papers braketed the range to a rather wide interval.

Seppo,

The model uses URR and a single constant for the dispersive discovery model, to create a fit to past discovery data with room left for reserve growth for discoveries of the past 20 years or so, then a single parameter for development time. historical extraction rates are based on past World output data, future extraction rates are a guess based on past extraction rates and expected future World demand for C plus C.

The model is really not that complicated. Note that a single future extraction rate could be used to create a simple future scenario, that would reduce the number of parameters. Basically there would be 4 parameters. Not as simple as the 2 parameters for a simple verhulst model, but if one uses 2 or 3 or more curves in the analysis we get 4, 6 or more parameters for out simple model. Some more complicated formulations don’t have a symmetrical curve and I image that may add another parameter to each curve so it would be 3, 6, 9 or more parameters in that case.

What output level did the Uppsala group predict for the peak in 2017?

Note the decription above that I gave was for the conventional oil shock model only. To this is added a tight oil model which uses a different method using well profiles (three parameters for each to fit output data from shale profile) and past completion data, sveral tight oil plays are modelled separately (5 separate models and typically 4 to 8 well profiles for each play as well as a decline parameter used for decreasing well profiles after some date). In addition there is a separate extra heavy oil model using three parameters, this is based heavily on Canadian Association of Petroleum Producers forecasts, and an assumption that Venezuela might attain half the Canadian level delayed by 15 years, the extra heavy oil model has only a URR of 150 Gb in recent models, with perhaps 100 Gb from Canada and 50 Gb from Orinoco belt. Tight oil has about a 96 Gb URR for my model for a total URR of 3050 Gb.

This assumes there will be transition to electric transport that reduces demand for oil after 2035 so that oil prices start to fall, this leads to falling extraction rates for conventional oil and less extra heavy oil produced.

I have honestly never understood the Hubbard argument.

Consider counting. It is useful at first, but gets less so as the numbers get bigger.

2 ist 100% bigger than 1, 3 is 50% bigger than 2, 4 is 33% bigger than three, 5 is 25% bigger than 4, 6 is 20% bigger than 5 and so on.

Each time you count one step higher, you add a smaller percentage to the total. But that doesn’t mean you will eventually run out of numbers.

Of course the curve isn’t straight, but it’s pretty straight for numbers higher than 15.

“I have honestly never understood the Hubbard argument.”

The Hubbert argument is OK, but the mathematical Hubbert curve (logistic) is primarily a heuristic . People should realize by now that even though it was really designed for ecology and epidemic modeling, it barely even works for that. We discussed this in post from last year:

https://peakoilbarrel.com/the-oil-shock-model-and-compartmental-models/

You cannot find any example of the hubbert curve being wrong.

Mark said:

The derivation of the Hubbbert curve in its form as the derivative of the Logistic S-curve is found in our book Mathematical Geoenergy (Wiley/2018) in Chapter 7. This has nothing to do with the ordinary Loggistic derivation, as it includes the concept of dispersion and a variation of rates and finite volumes to draw from. This is a mathematically exact derivation, so take it in that context.

https://pbs.twimg.com/media/E542pyPWQAAm_-O.png

The hubbert curve was derived from the p/z curve, which is the simple observation that pressure goes down as a well is depleted. Discovery would be relevant in some cases but once discovered the wells will follow p/z. P/z curve originated from craft and Hawkins.

The dispersive discovery model is interesting but it doesn’t tell us when the field will enter production, which has to be determined empirically.

Mark said:

Well, neither does the Hubbert curve which also requires an empirical calibration.

As I said, there is a connection between the Hubbert (Logistic or Verhulst) curve and the Shock Model used in conjunction with a dispersive discovery input, which provides a good calibration for the historical timing.

The result is that the Hubbert curve can be derived from these ideas, making the Shock Model much more generally applicable — and therefore the more practical of the two .

The underlying resource is still there but it is the pressure that is being rapidly depleted. The rock is so tight that it needs virgin type pressure to move to oil through rock to the well bore plus the fracs do heal and close up due to the overburden of sediment. So there you have it tight rock, a sea of oil and no pressure. I suspect it will take re-pressurizing the reservoirs with dry gas and some type of applied materials to coax more oil out of the ground. By the way most companies were producing full out to get enough oil to pay back the costly investment. The resource is there- how to get it out and to surface is the difficult proposition. We squandered the bottom hole pressure.

“We squandered the bottom hole pressure.”

Could you explain what this means? By haste, or by technique?

Thank you.

LTO Survivor

This company tried water flood

https://www.jwnenergy.com/article/2017/4/21/waterflood-technology-advancing-saskatchewans-tigh/

This article is from 2017. If it had worked good, everybody would do it now. So I think it was a dud – shouldn’t pay out much more than it costs.

Both. Haste to get pay back quickly and because of the debt burden and technique by flowing these too hard and too quick followed by submersible pumps required to move the water and oil.

Could CO2 or N2 be used to re-pressurise the rock? Seems a waste to use methane.

LTO survivor,

Have you tried 1320 foot spacing with all wells completed over a short period (within a few weeks of each other) so the 2 sections (2 miles by 1 mile with four 10,000 foot laterals along the 2 mile length) are drained as a single unit? I would think this would eliminate the child well problem and maximize total output per acre.

At some point you mentioned you have about 300 well locations that might be viable, I assume these are not child well locations as you have suggested those would require $150/bo oil prices to be viable and would not be viable at the present time.

Dennis,

The two parameters in the logistic model are obtained from the data and after it has been decided which points to include in the linear trend. Hence they are not adjustable. The only adjustable parameter is the starting year for the linear trend. If this is decided by choosing the points that gives the minimum curvature, or rather in a quadratic fit, by the smallest value for the coefficient of the X^2 term, then one is not free to choose this one at will either. Hence from this point of view the logistic model has no adjustable parameter.

—-

Since you have 4 adjustable parameters, there are plenty of scenarios to plot.

About the EIA OPEC crude oil production projection. They forecast a resumption of the 4 Mb/d cut and an increase of OPEC oil production until October 2021. How can this be possible as there are several countries which are experiencing oil production decline since, at least, 2020 spring and as other are cuting in their oil production. For example, the EAU will decrease their oil exports of 15% in september of this year : something like 396 kb/d less of exportation (production?) in September. If the production decline of Angola follows a linear trend, it gives 95 kb/d less in October. Congo. If the decline of production follows a linear trend, it gives 11 kb/d less in October. Gabon. If it follows a linear trend, 7,8 kb/d less. For Nigeria, I suppose that there will be 70 kb/d less in October. 70 11 95 400 7,8 = 579,8 kb/d less potentially in October for these 5 countries. Unless the rest of OPEC countries is able to increase the production of 4,5 Mb/d from now to October, it is doubtful that the production forecast of EIA will be carried out. And furthermore, imagining that the OPEC countries will be able to maintain their production at the level forecasted for October 2021 is completely fanciful.. Are the statisticians of EIA coming from a magic world?

Yes

For George Kaplan’s estimates for Permian the total URR estimate is about 17 Gb, this is close to the cumulative production plus proved reserves estimate at the end of 2019. Total for all US tight oil is around 31 Gb for Mr Kaplan’s estimates. All plays except Spraberry are past peak so according to this analysis the peak in tight oil is behind us.

It will be interesting to see what happens in the future. I expect all plays except the Permian basin may be past peak (as a group I call non-Permian tight oil), but think we will see significant increases in Permian basin output, with a minimum of 27 Gb and best guess of 46 Gb.

Release Date: November 28, 2018

Estimates Include 46.3 Billion Barrels of Oil, 281 Trillion Cubic feet of Natural Gas, and 20 Billion Barrels of Natural Gas Liquids in Texas and New Mexico’s Wolfcamp Shale and Bone Spring Formation.

source: https://www.usgs.gov/news/usgs-announces-largest-continuous-oil-assessment-texas-and-new-mexico

Dennis,

Ron calculated the Permian basin cumulative production at ~ 7Gb. Which is 15.2% of TRR produced (not including 20Gb NGL). Which implies USGS believes LTO production still has some ways to go. I am assuming you are agreeing with this assessment because it is coming out of USGS right?

I think the USGS is overstating reserves like OPEC does. In any case it will be interesting to see how this plays out.

Iron Mike,

See

https://www.usgs.gov/centers/cersc/science/permian-basin-oil-and-gas-assessments?qt-science_center_objects=0#qt-science_center_objects

The 2016, 2017, 2018 assessments have a total mean undiscovered technically recoverable resource (UTRR) of 70 Gb, the discovered resources (cumulative production plus proved reserves) at the end of 2017 were about 5 Gb, so the total TRR (discovered and undiscovered) is about 75 Gb. Permian cumulative production at the end of 2019 was about 5 Gb and proved reserves at the end of 2019 was 11 Gb, so roughly a total of 16 Gb of discovered resources at the end of 2019. My best guess estimate for Permian URR is about 46 Gb for a maximum Brent oil price of $80/bo in 2021$, a higher oil price assumption (say Brent oil prices rising to $120/bo in 2021 $) would increase the URR to perhaps as much as 60 Gb and a lower oil price (say $60/bo in 2021$) would reduce the URR estimate (perhaps to 30 Gb).

Note that the TRR estimates resources not reserves, I start with TRR, apply economic assumptions (well cost, oil price, natural gas price, LOE, discount rate, interest rate, royalty and tax rates, and transport cost).

See post linked below for a post I did 6 months ago on Permian basin

https://peakoilbarrel.com/permian-basin-the-death-of-tight-oil-has-been-greatly-exaggerated/

Also note there are a range of TRR estimates from 44 Gb to 114 Gb (90% confidence interval), I also used a range of oil price assumptions, though clearly there are an infinite number of possible scenarios of the future that could be done, I picked 9 representative scenarios. Recently I created newer scenarios with different oil price assumptions, with a best guess of about 46 Gb or 40 Gb if wider well spacing is assumed (1000 feet vs 1320 feet), in both cases I assumed a lateral length of 8500 feet. For the USGS mean estimate they assume about 49 million net acres to be developed in the Permian basin at the end of their studies in 2016, 2017, and 2018. So about 250 thousand wells for the narrow spacing and about 190 thousand wells for the wider spacing.

Dennis,

Thanks for the link. That is a lot of oil that is technically recoverable. So your 46Gb estimate seems to peak around 2030 for the ERR~TRR scenario.

You have much more knowledge about this than I do, but lets assume the USGS analysis of TRR is right, do you think banks are willing to finance oil companies to economically recover the oil in place?

Iron Mike, is it likely that the banks that have suffered massive losses on shale oil loans already will be willing to put out millions more? The companies they loaned to have gone bankrupt, so they have no hope of recovering that money. Of course, those same USGS numbers were there before they made all those bad loans. Do you think the banks will say: “But this time it will be different”? 🙂

Ron,

For the Permian basin specifically there were no USGS studies of tight oil (what the USGS calls continuous resources) until 2016 (midland Wolfcamp), 2017 (Spraberry), and 2018 (Delaware Wolfcamp and Bonespring formations). My models assume new wells are finaced from cash flow from 2021 to 2034 (that’s when the last tight oil well is completed in the Permian basin for my 40 Gb scenario based on an assumed 60 Gb TRR, roughly a 68% probability that TRR is higher than this based on the USGS analysis.) The USGS 90% confidence interval for Permian basin TRR is 44 Gb to 114 Gb with a mean (best guess) estimate of 75 Gb.

My models assume new wells are financed from cash flow from 2021 to 2034 (that’s when the last tight oil well is completed in the Permian basin….

Errr… I am a little confused here Dennis. Just how much of a companies cash flow is available to pour back into drilling new wells. How can you just “assume” there will be enough cash flow to pour back into drilling new wells.

But hey, if they can do it why not? Why didn’t everyone just do that instead of borrowing money to drill those wells? Just use cash flow and eliminate borrowing money.

But what the hell do I know? After all, I am no financial expert. But you know what Dennis, I have a sneaking suspicion that you are not either. 😉

Ron,

I am not an expert financial analyst, but the basic analysis is not difficult. See chart below which takes all completed horizontal wells in the Permian basin from 2010 to May 2021 and then makes a guess about future completion rates.