A post by Ovi

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for Non-OPEC countries. Normally the charts are created from data provided by the EIA’s International Energy Statistics in the first week of the month. Unfortunately the EIA was not able to update the production information for March until today. Consequently the charts below are produced from a mixture of country specific sites such as Brazil, Norway and China and the July STEO and the International report. The International report was used to update the March production data.

Where STEO data was used, the ratio of C + C to All Liquids was calculated. The average from the last six months was used to project the March production numbers and extended to May in a few cases.

World oil production charts are found at the end of this post.

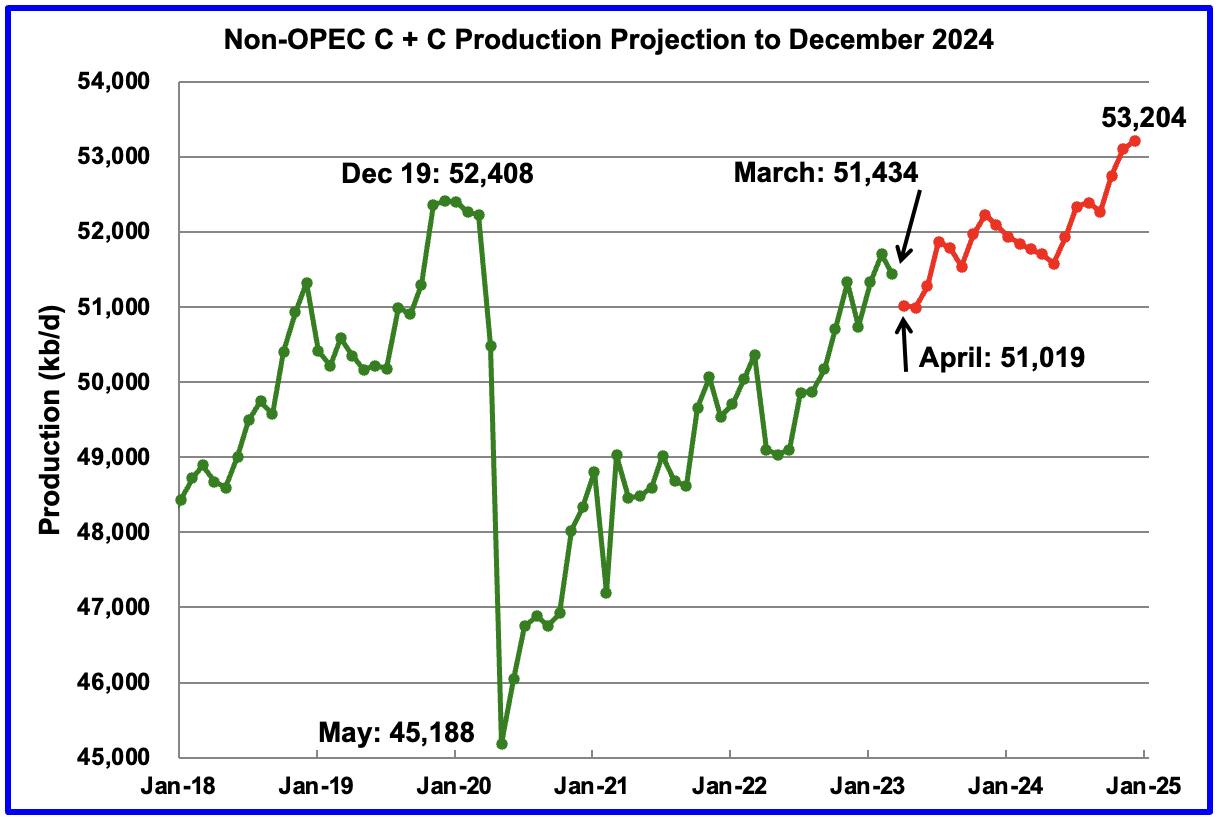

March Non-OPEC oil production dropped by 268 kb/d to 51,434 kb/d. The largest decreases came from the Russia, 300 kb/d and Brazil 146 kb/d.

Using data from the July 2023 STEO, a projection for Non-OPEC oil output was made for the period April 2023 to December 2024. (Red graph). Output is expected to reach 53,204 kb/d in December 2024, which is 796 kb/d higher than the December 2019 peak of 52,408 kb/d.

From April 2023 to December 2024, oil production in Non-OPEC countries is expected to increase by 2,185 kb/d, possibly an unrealistic forecast. According to the STEO, the major contributors to the increase are expected to be US, close to 500 kb/d and Canada close to 800 kb/d, both on the high side. Russia is expected to provide the largest drop.

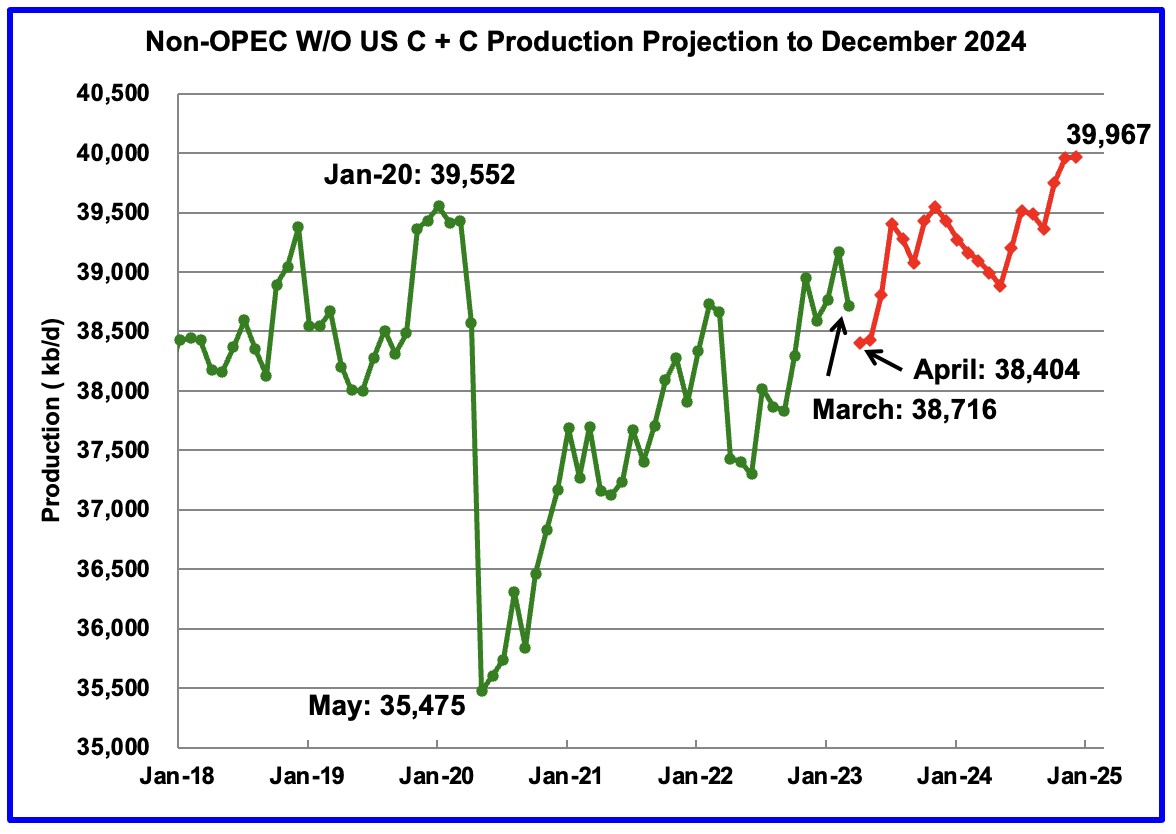

March production dropped by 454 kb/d to 38,716 kb/d.

From April 2023 to December 2024, production in Non-OPEC countries W/O the US is expected to increase by 1,563 kb/d.

Note that December 2024 output exceeds the pre-covid high of 39,552 kb/d in January 2020 by 416 kb/d.

Non-OPEC Oil Production Ranked by Country

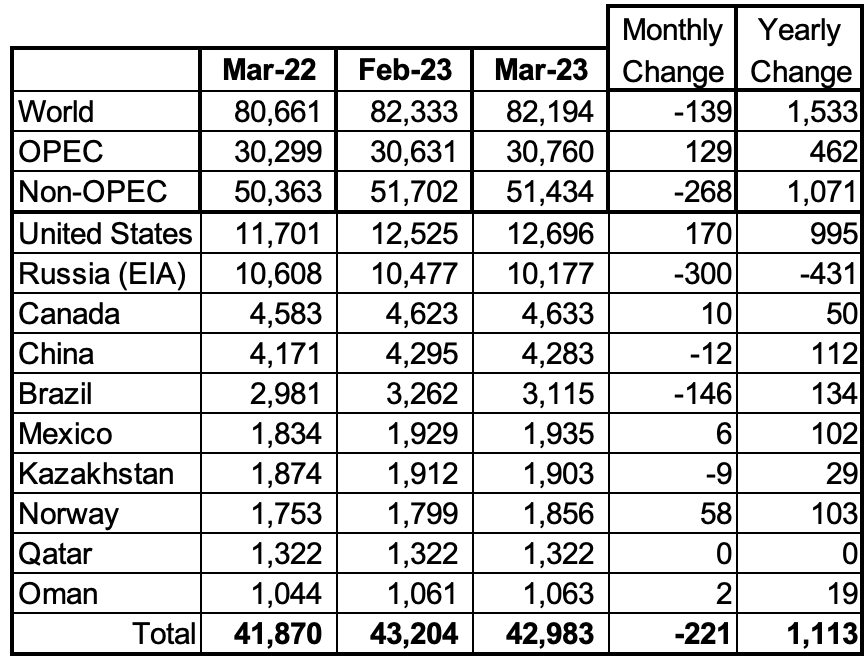

Listed above are the World’s 10 largest Non-OPEC producers. The criteria for inclusion in the table is that all of the countries produce more than 1,000 kb/d.

The March production drop for these ten Non-OPEC countries was 221 kb/d while as a whole the Non-OPEC countries saw a production decrease of 268 kb/d. In March Russia and Brazil had the largest production drops, a combined 446 kb/d.

In March 2023, these 10 countries produced 83.9% of Non-OPEC oil production.

OPEC C + C production increased by 129 kb/d in March while it increased YoY by 462 kb/d. World MoM production decreased by 139 kb/d while YoY output increased by 1,533 kb/d.

Non-OPEC Oil Production Charts

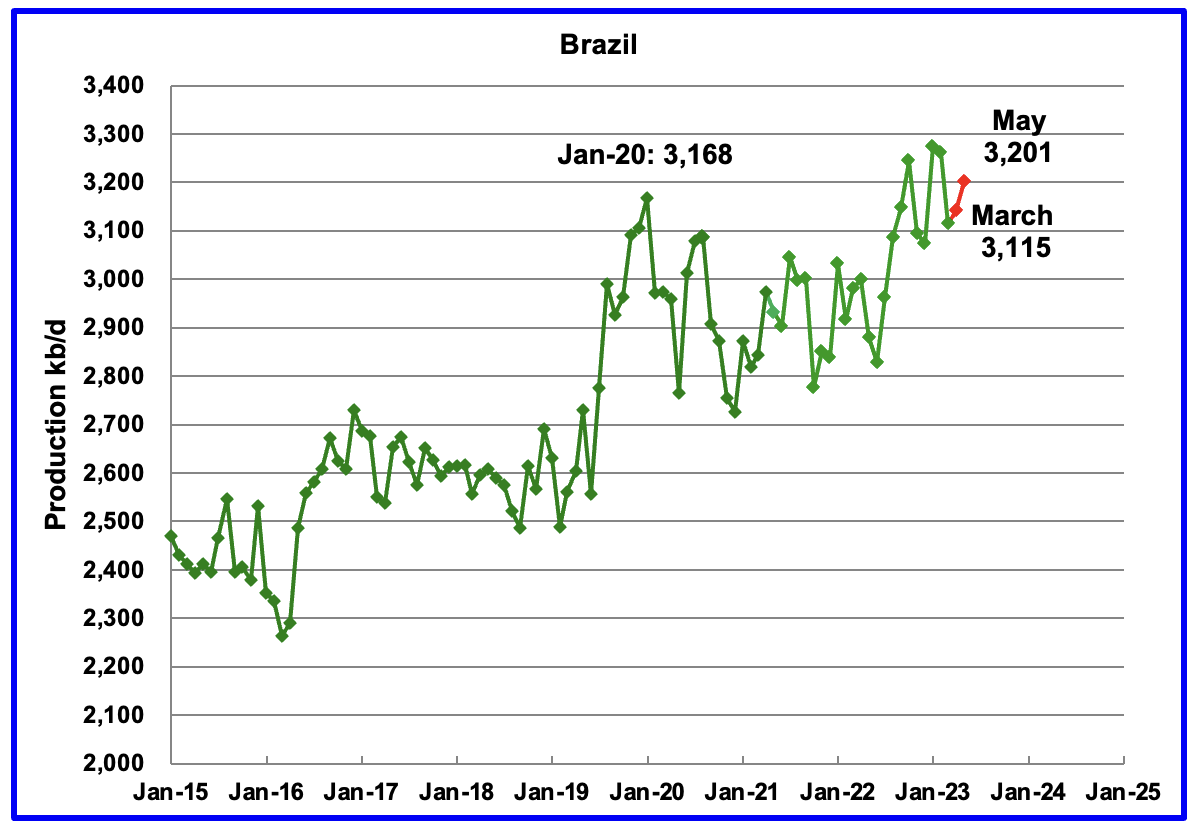

Brazil’s National Petroleum Association (BNPA) reported that March’s output decreased by 147 kb/d to 3,115 kb/d. April and May rebounded with May production reaching 3,201 kb/d, red markers.

Much of Brazil’s upcoming 2023 production growth of close to 100 kb/d will come from the highly productive pre-salt fields. From March 2022 to March 2023, production from the pre-salt fields increased by 134 kb/d.

According to the OPEC MOMR: “Crude oil output is set to increase through production ramp-ups in the Buzios (Franco), Mero (Libra NW), Tupi (Lula), Peregrino, Sepia, Marlim and Itapu (Florim) fields. However, offshore maintenance is expected to cause some interruptions in major fields. Petrobras has also started production at the fifth FPSO in the giant Buzios field in the deepwater pre-salt Santos Basin offshore Brazil, according to Offshore Magazine; the Almirante Barroso platform has capacity to produce up to 150 tb/d of oil and 6 million cm/d of gas and inject 220 tb/d of water.”

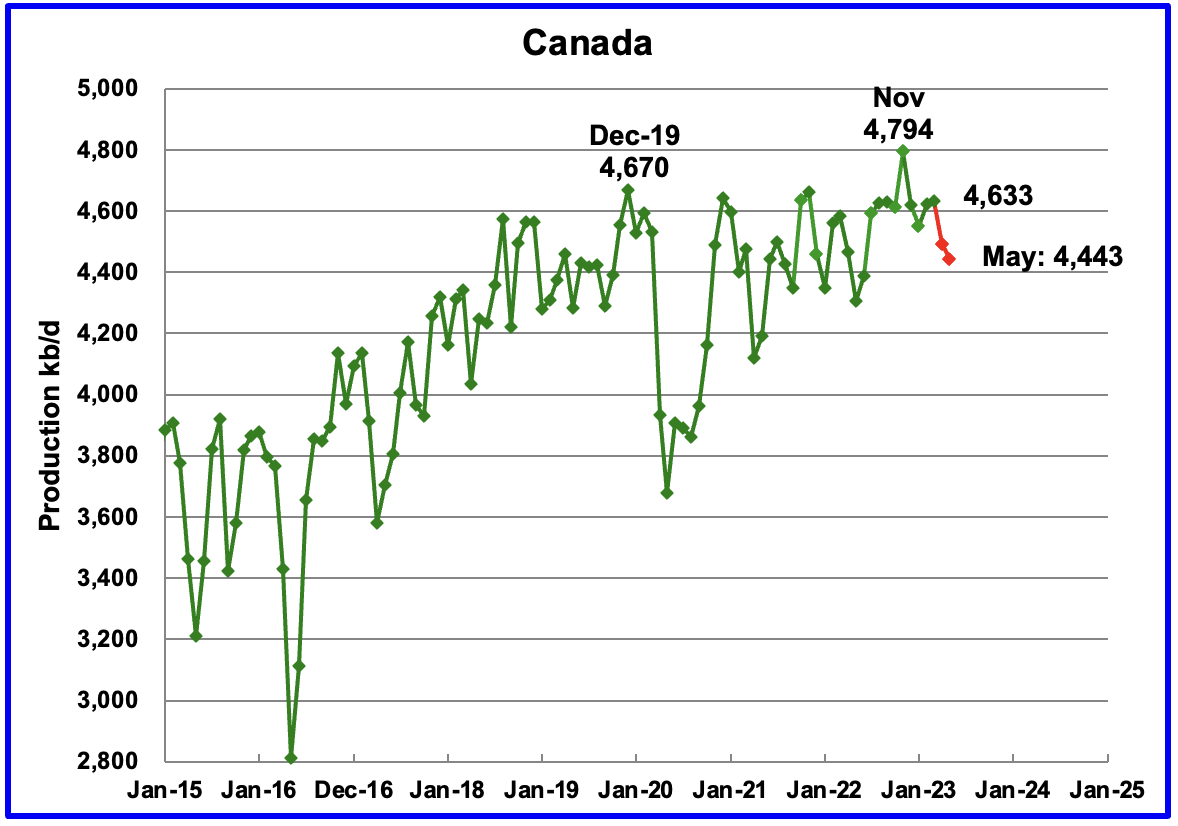

According to the STEO, Canada’s production rose by 10 kb/d in March to 4,633 kb/d. Production dropped in April and May to 4,443 kb/d.

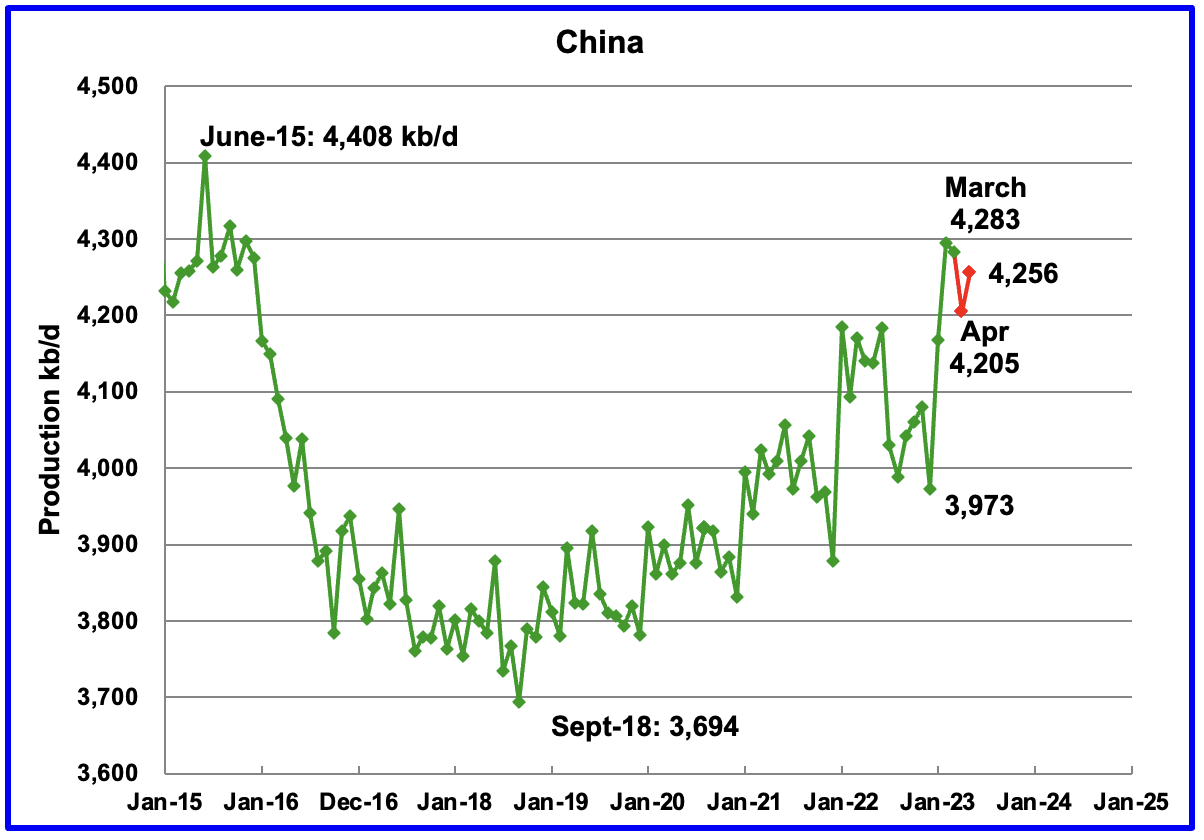

The China National Bureau of Statistics reported that production during April and May was 4,205 kb/d and 4,256 kb/d respectively. March production dropped by 12 kb/d to 4,283 kb/d.

Since September 2018, China’s production has increased by close to 600 kb/d. Bloomberg notes that the “Most Overlooked Oil Production Boom Is in China”

“Spending billions of dollars via its state-owned energy giants China National Petroleum Corp. (CNPC), China Petroleum & Chemical Corp. (Sinopec) and Cnooc Ltd., Beijing has been able to reverse the decline in domestic oil production that started in 2015, lifting output this year to a near all-time high.In doing so, the country is somewhat damping the need to buy crude overseas, complicating the efforts of Saudi Arabia and its OPEC+ allies to control the market.

On top of extra Chinese output, OPEC+ is already battling higher-thanexpected oil production from several of its own members that are under Western sanctions: Russia, Iran and Venezuela.

From the low point in 2018 to the peak in 2023, China has added more than 600,000 barrels a day of extra production – more crude than some OPEC+ nations generate daily. Pumping about 4.3 million barrels a day now, China is again the world’s fifth-largest oil producer, only behind the US, Saudi Arabia, Russia and Canada, and ahead of Iraq.

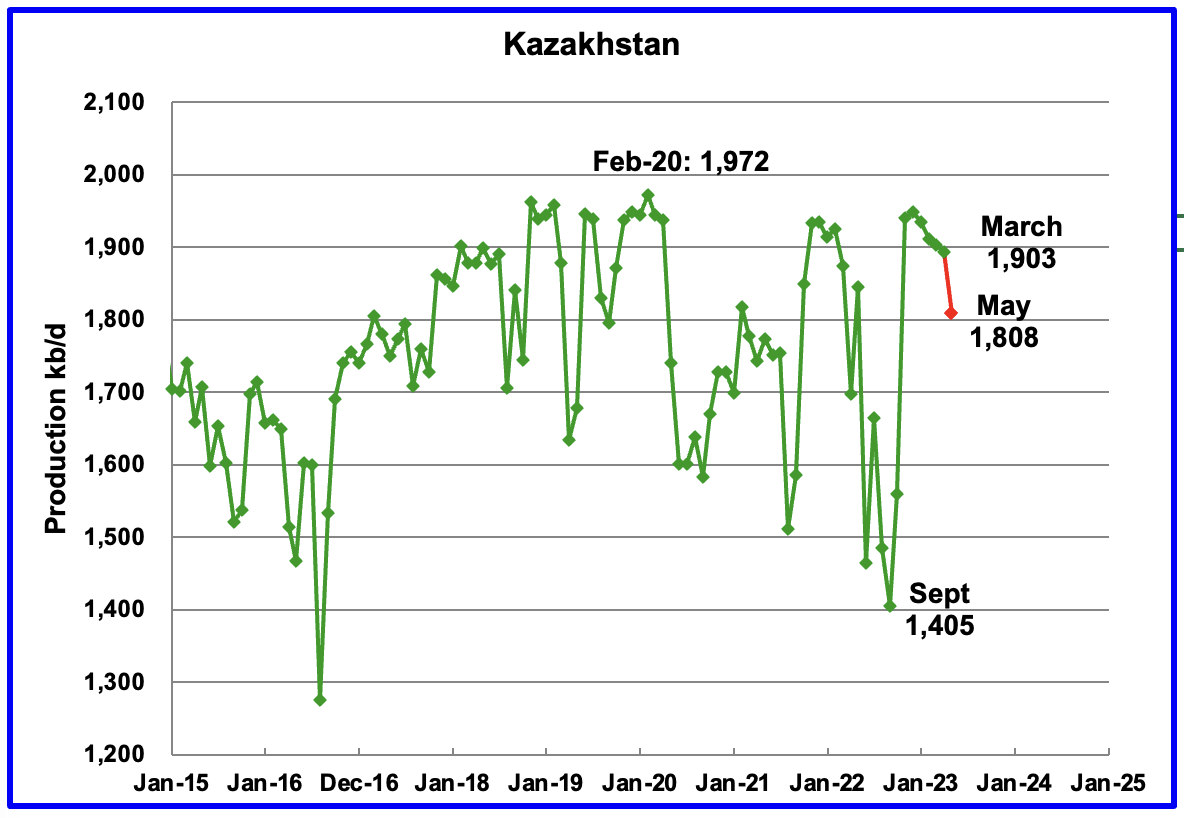

Kazakhstan’s output decreased by 9 kb/d in March to 1,903 kb/d. Production decreased in April before dropping in May to 1,808 kb/d.

Mexico’s production for March was 1,935 kb/d an increase of 6 kb/d over February. Output rose to 1,964 kb/d in May, according to Pemex.

Mexico has recently revised its definition of condensate. This has resulted in the EIA adding an extra 60 kb/d, on average to the Pemex report. The red markers include the additional 60 kb/d.

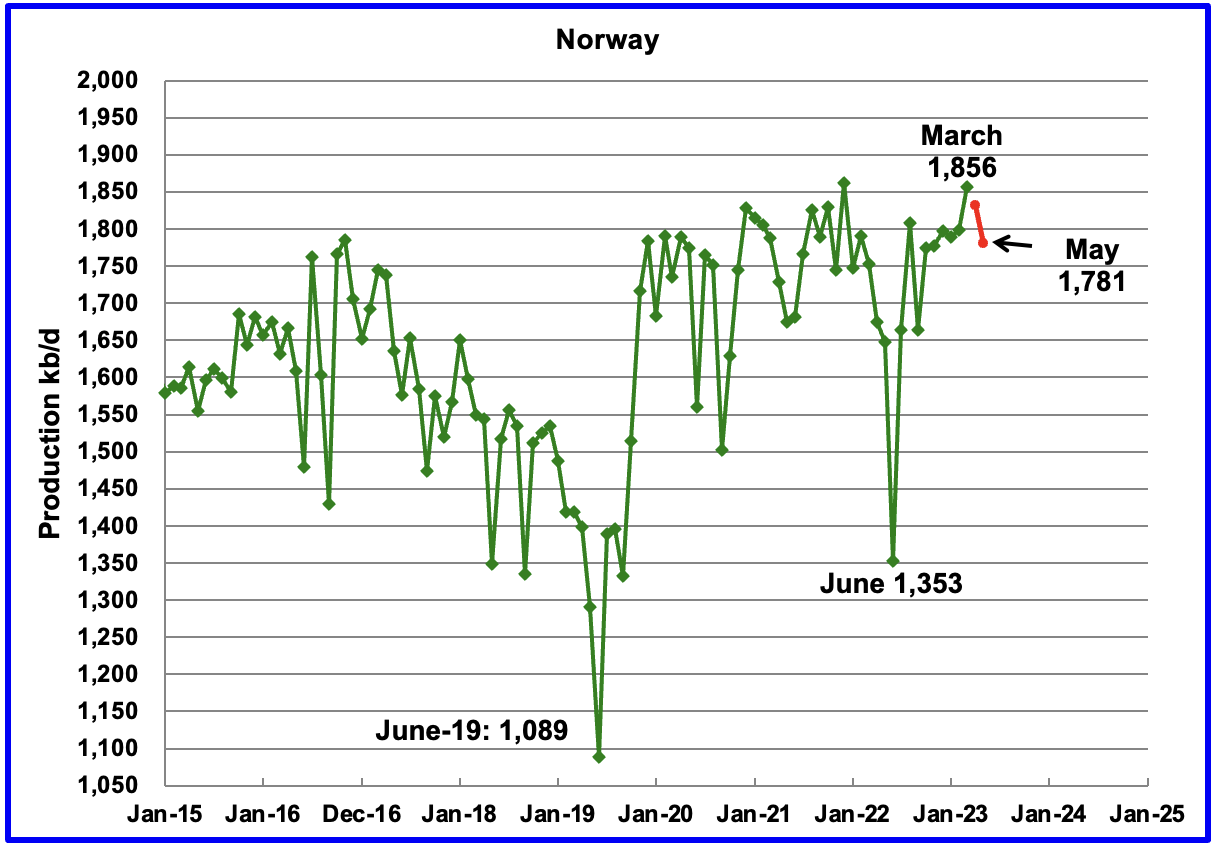

The EIA reported Norway’s March production to be 1,856 kb/d. The Norway Petroleum Directorate (NPD) reported that May’s production dropped to 1,781 kb/d. (Red markers).

According to the NPD : “Oil production in May was 1.3 percent lower than the NPD’s forecast and 0.8 percent lower than the forecast so far this year.”

According to this source, “The North Sea’s biggest oil field Johan Sverdrup now has the capacity to produce as much as 755,000 b/d of crude.”

“Norway’s state-controlled Equinor, which operates the Norwegian field, said it performed a successful test confirming the increased capacity this week, marking a 35,000 b/d rise from the field’s previous capacity. Equinor said it aims to maintain crude production “towards this level going forward”.

Johan Sverdrup came on stream in October 2019. A second phase started in mid-December last year, raising capacity to 720,000 b/d from 535,000 b/d.

Data from the Norwegian Petroleum Directorate (NPD) show production hit a monthly record of 714,000 b/d in March. Figures for April are not available yet, but Vortexa tracking data suggest exports of the grade exceeded 700,000 b/d last month. Loading schedules show exports will fall to 687,000 b/d in May and 697,000 b/d in June.

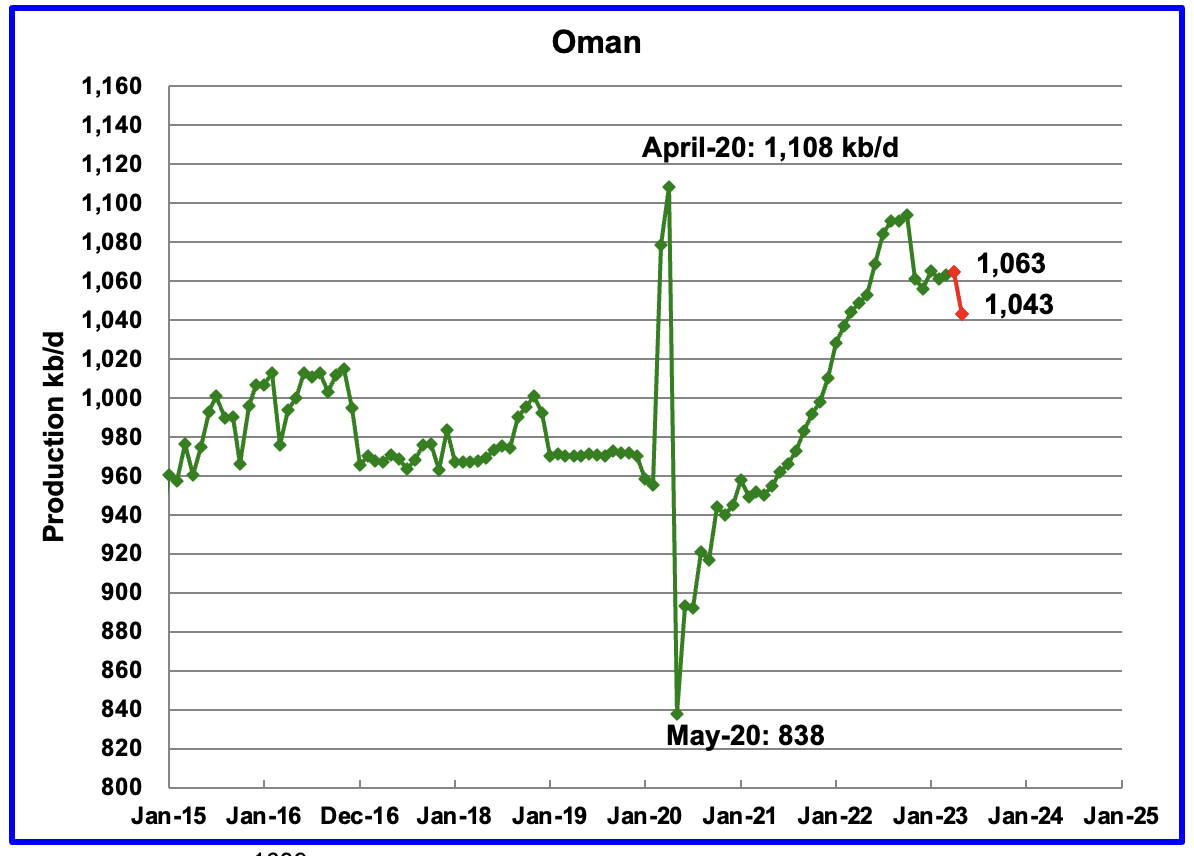

Oman’s production has risen very consistently since the low of May 2020. Oman’s March output was essentially flat but dropped to 1,043 kb/d in May.

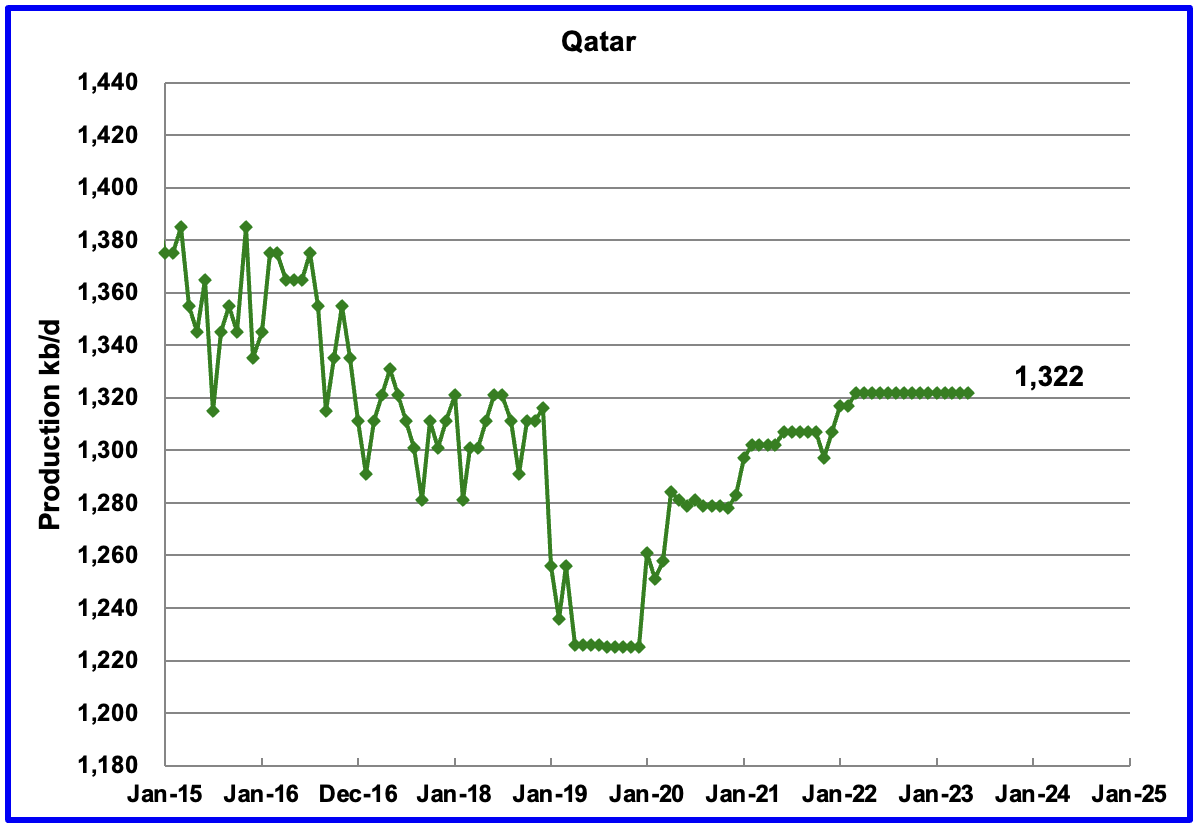

Qatar’s March to May’s output was unchanged at 1,322 kb/d, possibly due to lack of updated information .

The July STEO forecasts that Russian output decreased by 300 kb/d in March to 10,177 kb/d. It further expects Russian output to drop to 9,898 kb/d by May 2023. (Green Markers). The EIA reported that Russian production dropped by 300 kb/d to 10,177 kb/d. The STEO production numbers are very close to those reported in the EIA’s international report

Using data from Argus Media, production for the Russia Ministry data was estimated. For March, Argus reported that Russian production of crude was 9,600 kb/d. If the typical Russian monthly condensate output of 900 kb/d is added to the crude production, Russian C + C in March would be close to 10,500 kb/d, a drop of 400 kb/d from February. April production was assessed at 9,700 kb/d of crude or 10,600 kb/d of C + C.

For May, the Argus Media report shows that Russian production decreased to 10,400 kb/d, after allowing for 900 kb/d of condensate.

Typically the difference between the Russia Ministry data and the EIA was 400 kb/d. Comparing the May production figures, the difference is close to 500 kb/d.

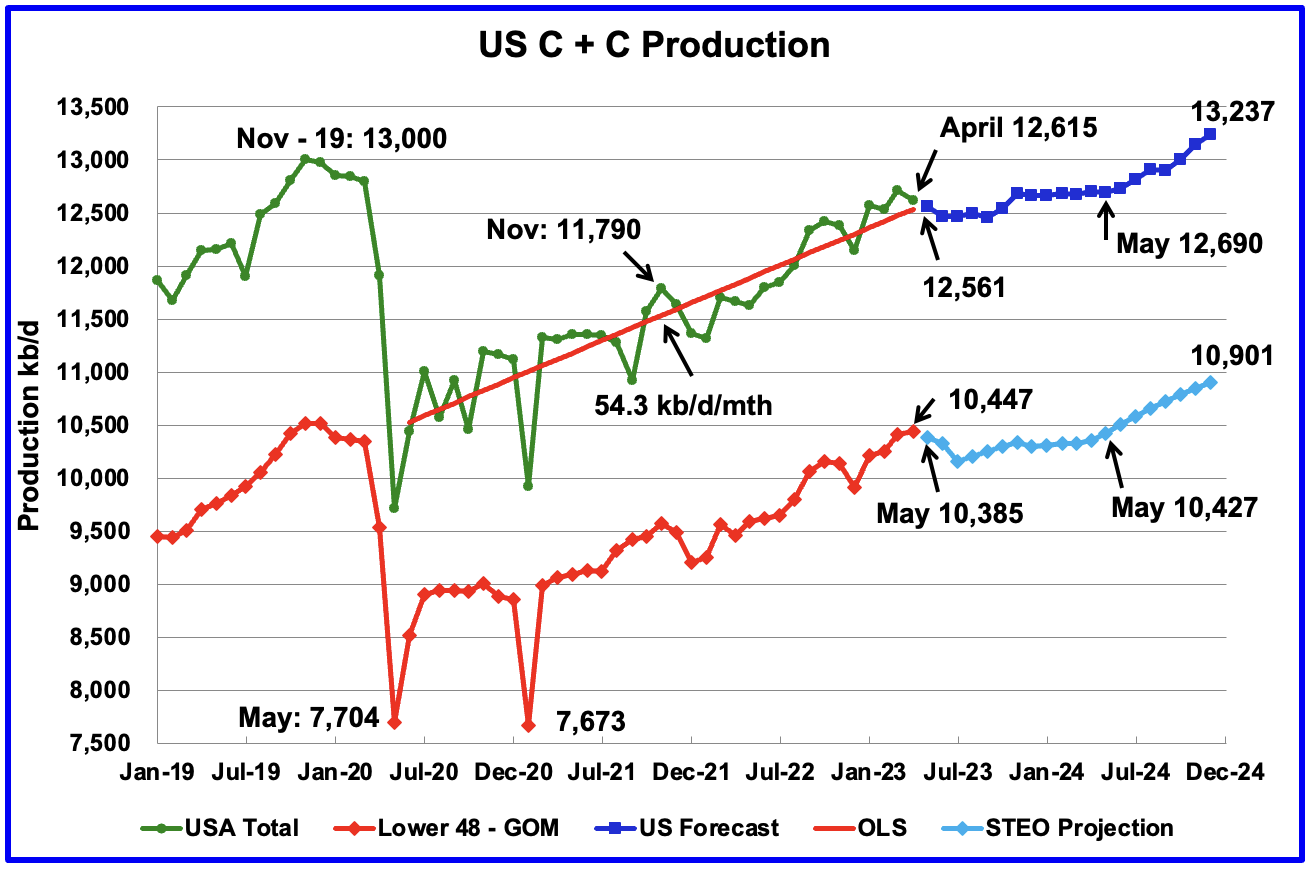

U.S. April oil production decreased by 53 kb/d to 12,615 kb/d. Some of the 53 kb/d drop, is due to the upward revision of February production to 12,717 kb/d. Output in December 2024 is expected to reach 13,237 kb/d.

Output from April 2023 to May 2024 is projected to increase by 75 kb/d. After May 2024, production is expected to increase by 547 kb/d. The majority of the 547 kb/d increase will come from the onshore L48, 474 kb/d.

In the onshore lower 48, production from April 2023 to May 2024 will drop 20 kb/d before beginning to rise to 10,901 kb/d in December 2024.

World Oil Production Projection

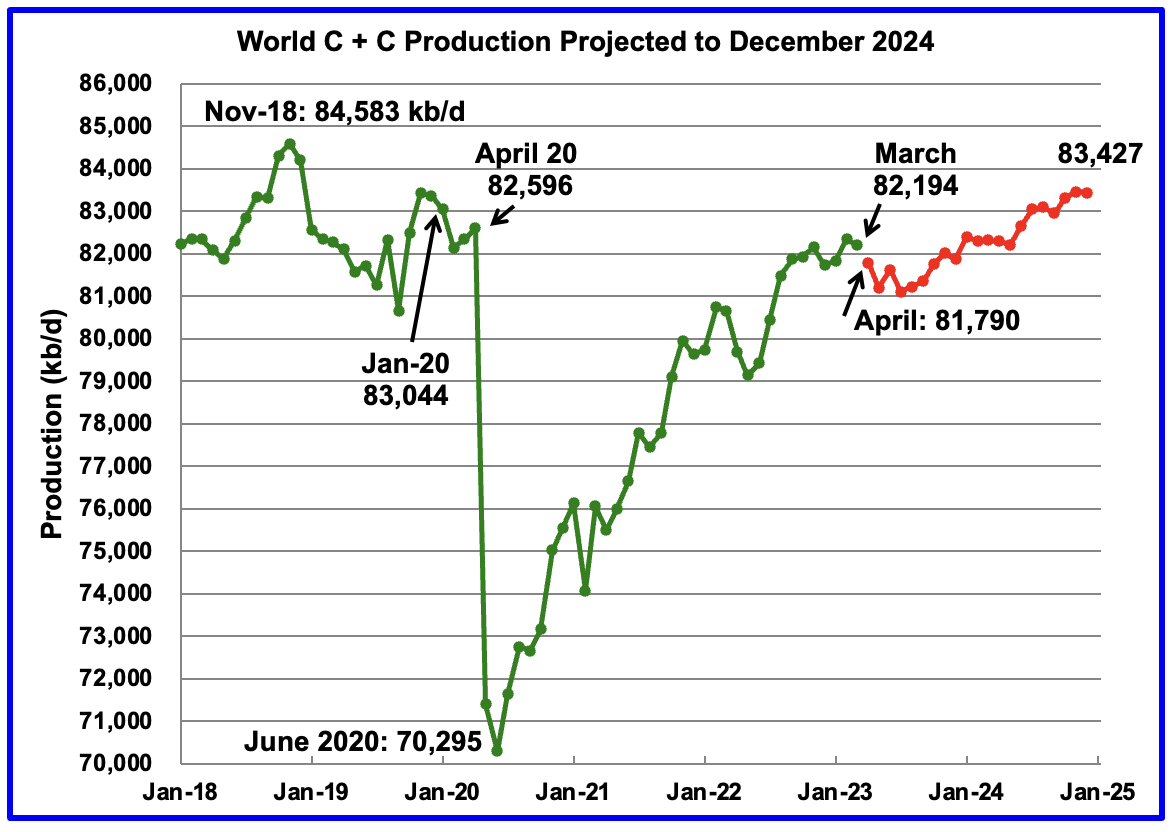

World oil production in March decreased by 139 kb/d to 82,194 kb/d.(Green graph).

This chart also projects World C + C production out to December 2024. It uses the July 2023 STEO report along with the International Energy Statistics to make the projection. (Red markers).

The red graph forecasts that World crude production in December 2024 will be 83,427 kb/d and is 1,156 kb/d lower than the November 2018 peak. Note that from March to July, production of 81,105 kb/d, production drops by 884 kb/d.

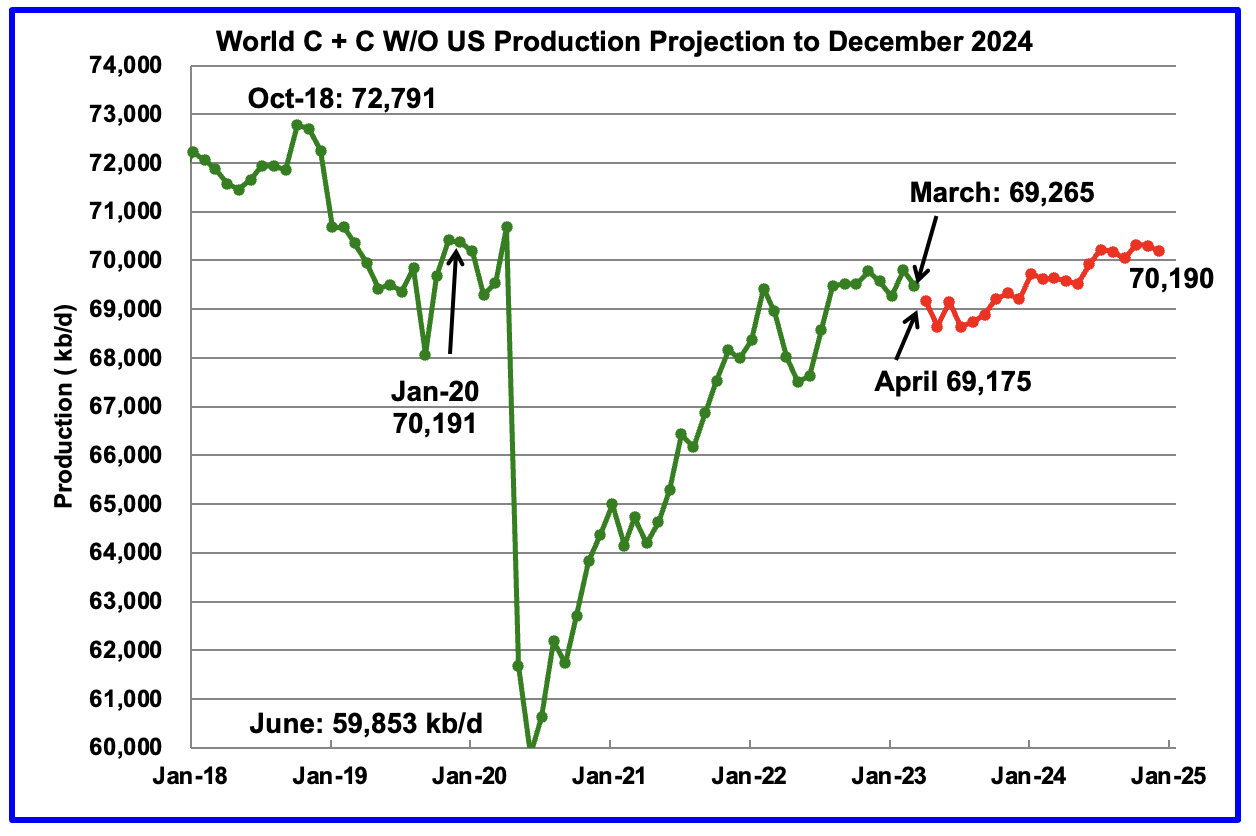

World without the US oil output in March decreased by 565 kb/d to 69,265 kb/d. Aprils’s output is expected to decrease by close to another 90 kb/d. December 2024 output of 70,190 kb/d is 2,601 kb/d lower than October 2018 output of 72,791 kb/d.

World oil production W/O the U.S. from April 2022 to December 2024 is forecast to increase by a total of 1,015 kb/d.

The OPEC Annual Statistical Bulletin was issued on 12th July.

https://www.opec.org/opec_web/en/publications/202.htm

There is virtually no change to any reserve numbers between 2021 and 2022 except that UAE added two billion barrels. Data that isn’t available elsewhere shows number of completed wells. Iran is especially interesting as Baker-Hughes does not report rig numbers there. The completions have been declining steadily since 2014, with a noticeable dip in 2020/21, which now looks to have been recovered. I don’t understand how Venezuela can hold production when there are no new wells being completed, I thought heavy oil wells generally had a shorter life and needed replacement or at least recompletion every few years, but it looks like I was mistaken. Given Iraqi ambitions from a few years ago to raise production to 6.5 mmbpd the completion activity is pretty useless (i.e. it’s fallen by over half and isn’t showing much sign of increasing). If you stick a straight line trend for total w/o Venezuela from 2014 then it would hit zero, i.e. signifying the end of any new developments, in the late 30s.

The only place where some OPEC numbers can be checked is in the sub-saharan countries. The larger E&Ps that operate there report production of all liquids of just under half of the amount reported by EIA for the countries. Note that some reported E&P production is from non-OPEC countries, like ExxonMobil in Chad, and some production from smaller E&Ps like Kosmos is not included, but the numbers are small and since 2011 the ratio of countries to companies has remained quite constant. The reserve numbers are quite different with the companies now reporting just over 3 billion compared to the countries at 45 billion (with the factor rising from about 5 to 15). R/P for the combined companies has fallen from 9 years to 6, for the countries it has risen from 31 to 39.

At the rate BP, Shell, Chevron and ExxonMobil are dwindling away I should think all are to some degree looking at how they can sell off their remaining assets sometime in the next few years. Eni and TotalEnergies have been holding production and have ongoing developments in progress so are likely to remain for some time.

And

Thanks for the great charts and info Mr. Kaplan.

Agree. Nice charts!

Thank you Ovi, excellent post.

Annual US Output and US L48 excluding GOM, 2018-2024, the 2023 and 2024 annual output is a forecast by the EIA’s STEO. Note that 2019 peak annual output is expected to be exceeded in 2023 and 2024 will exceed 2023, if the forecast is correct (it never is exactly right.)

I’m betting against a new peak. Not in this economy.

From the July STEO:

U.S. economy. Our forecast assumes U.S. GDP growth of 1.5% in 2023 and 1.3% in 2024, which is revised up from last month’s forecast of 1.3% in 2023 and 1.0% in 2024. The upward revision is partially driven by an updated estimate of real GDP growth in the first quarter of 2023 (1Q23) resulting from more consumer spending and aggregate investment than assumed in last month’s STEO. We use the S&P Global macroeconomic model, and we input our energy price forecasts to get the forecasts for the U.S. economy used in STEO.

GDP ? What is GDP ? Sorry friends behind paywall , So it is a copy paste .

WHAT IS GDP ?

Whenever their stuffed animals fall apart, my kids get their great-grandmother’s to stitch them up. It’s an emergency and they rush to the hospital for broken toys, which is luckily next door. This activity adds nothing to GDP but it makes the children happy and probably adds years to the old lady’s life. I think about it and I wonder. We’re really measuring the wrong things. We’re not measuring what matters at all.

As the original Robert F. Kennedy said about GDP, “it measures everything, in short, except that which makes life worthwhile.” A forest adds nothing to GDP while cutting it down is valuable. Care work, repair work, share work, these are all worth nothing. Raising children, caring for elders, caring for yourself? “Do that on your own time.” That’s the message from the ruling oligarchs, and ‘serious’ economists. Seriously? What is GDP even measuring?

These people only look at the speedometer, never glancing at the fuel (E), and never thinking that the two might be connected. And we must just keep accelerating forever, they have no concept of a destination at all. Of course this ends in ruin. How could it not? We measure only prices and destroy that which is priceless. That’s what GDP is a measure of.

Waste

What GDP really measures it the rate at which we take things out of the Earth and put them in the bin. We’re literally standing in front of a steaming trash can crowing about how big it’s getting. In geological time, that’s all GDP is. Garbage Dug from Planet. In the long run every single human product is thrown away. Every service leaves only waste heat behind. What economics calls a measure of growth is, geologically speaking, just a measure of pollution. Every year we make things that don’t decompose for hundreds of years, using resources that took millions of years to form. What kind of math equation is this? How do you think it ends?

Pollution, of course, is not a biological concept. The oxygen ‘pollution’ of photosynthesizers became the manna of aerobic lifeforms. The ‘pollution’ of your own butt can grow the plants you eat. Nature is a cycle, and one creature’s shit is another’s breakfast. Economics, however, is a closed system which does not acknowledge (or measure) the existence of nature at all. Both the amount of resources nature has and the amount of waste it can take are assumed to be infinite. The only limiting factor is, within macroeconomics, nothing. It’s all just disembodied numbers that can keep growing forever.

In conventional economics, it is just assumed that you can keep drawing resources forever and dumping them forever and thus grow forever. Does this make sense in physics? No, but economics both not integrated with any of the other sciences (because its assumptions aren’t even provable) and simply doesn’t give a shit. ‘Don’t you like iPhones?’ is the general answer to questions about growth, and as long as iPhones can be produced, this is satisfying. As Upton Sinclair said, “It is difficult to get a man to understand something, when his salary depends upon his not understanding it.” Such is with the global economy, where our salaries literally depend on not understanding that the whole thing is a planetary Ponzi scheme.

The planetary Ponzi proceeds by taking resources from millions of years ago and dumping the costs on creatures not yet born. This is done not so much out of malice as sheer ignorance. Economics has no concept of the environmental space it operates in, nor the geological time. Because this trick has worked for 400 years is convincing enough to anyone that looks at quarterly reports, but to anyone that can do math the situation is completely fucked. As the physicist Tom Murphy says, “Having witnessed a half-dozen rabbits come out of the hat in the example of lighting technology, we are conditioned to believe more are forthcoming. It will be true until it isn’t any more. One way to put it is that 6 rabbits does not imply an infinite number.” We are now at least six doubling cycles into the garbage measurement we call growth, and now the whole thing is going in the bin. Garbage in, garbage out, as the computer scientists say.

Waste Heat

GDP is also not just a measure of useful things, it’s increasingly a measure of useless profit. Effectively waste heat. As the second law of thermodynamics says: “Not all heat energy can be converted into work in a cyclic process.” In the same way, not all value goes to the worker, increasingly most of it goes to the capitalist. Nobody sells anything at ‘cost’, and the goal is actually to maximize the waste (profit). Given that everything requires energy to produce, this actually accelerates the heat death of the livable planet.

The problem of a population exhausting resources is wildly exacerbated by a few capitalists trying their damnedest to maximize the waste. The incentives of capitalism are wildly aligned with the living planet. They make GDP go up and crow about their own ‘innovativeness’ which is just innovation in bullshit. The resources come from the past and the costs are dumped in the future. All they ultimately produce is a bunch of hot air called profit, and still die in their god-measured years.

Wasted Energy

GDP is denominated as money, but what is money? Since the gold standard tarnished it’s assumed that money is created out of thin air (by fiat) but it’s not called the petrodollar for nothing. USD is a promise that you can get oil, generally at gunpoint. As Vaclav Smil says in the first line of Energy And Civilization: “Energy is the only universal currency: one of its many forms must be transformed to get anything done.” As he continues, “Only the inputs of fossil energies — directly as fuels and electricity, and indirectly in agricultural chemicals and machinery — could sustain both an expanding population and a higher per capita supply of food.” I would add is per capitalist greed, ie the waste heat above.

Whatever civilizational ‘progress’ that GDP measures, it’s all paid for by ancient sugar daddies. There is a huge (and magnificently dense) energy subsidy built into every single good and service we buy. The source of this growth is not mere human ingenuity, we have dug up millions of years worth of more intelligent lifeforms and used their ingenious harnessing of solar power as stored energy. What did we do with this solar inheritance? Blew it all in a few centuries.

The almighty dollar is really backed by finite fossil fuels, which really backs us into a corner. Cut off this subsidy and civilization as we know it crashes. Keep it plugged in and this civilization burns. So our proximate choices are crash and burn, or both, as we seem to be choosing. To switch to renewables A) doesn’t allow this civilization and B) at best buys you a few centuries of snorting some other resources before the chessboard problem spills us out the petri dish once again.

The fact is that GDP is effectively a proxy for fossil fueled growth, and if we keep growing, we’re fucked either way. If we replace fossil fuels to keep growing, then we’re just fucked in a million other ways. Climate collapse is just a symptom of seeing the world this way. An electric bulldozer still bulldozes the planet, however green the paint.

What Now?

What does this have to do with a Paati stitching the leg on a stuffed animal for a child? Nothing. I have no solution. The thread she used is probably made out of petroleum, what do I know about solutions? I’m just a particle in the stream. What does one do about this problem? I dunno. We’re in much bigger doo-doo than ‘one’ can undo.

One ‘lesson’ is that we already live most of our lives outside of capitalism and that we could contract the role of markets instead of putting our hospitals and schools and town square in them, but that’s just one point among trillions of dollars saying the opposite. That’s the best I can come up with, and it’s still a political solution to a philosophical problem. It’s still wildly inadequate, like bringing a knife to a gun fight.

The deep philosophical problem is the very idea of endless growth, but changing that is a whole-ass shift in consciousness, which is way above my pay grade. All I can do is my dharma, which seems to be complaining to a few people that already know.

As long as people measure GDP and don’t measure the living planet, we’ll get more of the former and less of the latter. As the old business school adage goes, ‘you get what you measure’. The corollary of that is that ‘you lose what you don’t measure,’ ie everything that which makes life worth living. In fact, as long as we require measurement and science to understand our place in the world, we’ll keep getting lost in abstractions and miss the point, which is spiritual. But who am I to tell you that? I’m here in front of a screen, pointedly not looking out the window or playing with my children.

From where I sit GDP has nothing to do with me. It’s something stupid and meaningless and frankly evil compared to my own life, let alone the living planet. My kids don’t understand it and the dogs don’t understand it and I think they’re on to something. We somehow believe that GDP is important cause we see it on TV, but it’s not. It’s just a made up number to glorify waste, and waste heat, and wasted energy.

GDP is bullshit, but to someone under the bull, this is a purely academic observation. You can’t get the bullshit back in the butt, nor can you immediately the bull off’a you, especially with so many hopes riding on it. The best you can hope for is to try again over the next few lifetimes, with the ruins of GDP as fertilizer.

GDP is income, it is an imperfect measure no doubt.

GDP is a measure of at what rate we are destroying the natural world. Like someone once said, “If you really want to help the GDP, ram your car into a school bus, or go on a shooting spree”.

Brilliant post. Summation: humans and yeast are effectively the same.

Required

I tend to agree with you. In the US chart above, production is essentially flat from April 2023 to May 2024. All of a sudden production takes off in June and adds 547 kb/d over the next seven months. What happens next June. The EIA is still forecasting $80/b WTI in late 2024, not that different than $76/b today.

Is there a change of heart amongst the drillers. Is Drill Baby Drill going to reappear all of a sudden? 😟 😟 😟

I would certainly like to hear what some of the real drillers think about the possibility of production starting to take of next June.

Ovi,

Chart below has STEO oil price forecast in Real Dollars (July 2023 $). The forecast may not be accurate, but they expect real WTI oil prices (July 2023 $) to rose from $71.86 in May 2023 to $75.24 in Dec 2023, after that the price gradually rises to $77.29 by Dec 2024. The EIA model may think that a real WTI price is a thresh hold where the completion rate starts to increase in tight oil basins and that may explain the transition from flat output in 2023 to rising output in 2024. From June 2021 to Feb 2023 most months has real WTI oil price over $75/bo, and all months from March 2023 to Nov 2023 (except April) are expected to be below $75/bo. This might explain the nature of the STEO forecast for US output. Note the delay until June, might be based on an assumption that producers will wait to see prices stabilize above $75/bo for 6 months before the increase in completions starts (also it takes 3 to 4 months to ramp up drilling and completion activities).

You are not the only one, the peak is here according to this report:

https://info.gorozen.com/2023-q1-hubberts-peak-is-here

Svaya,

Note that they mistakenly estimate cumulative output from Permian basin at 14 Gb, it is about 10.7 Gb as of April 2023. If their 34 Gb estimate for Permian URR is correct, this suggests 50% cumulative output would be reached in July 2026, if we assume flat output from April 2023 to July 2027, my expectation is that their 34 Gb estimate is too low by at least 6 Gb and if I am correct and output also remains flat as assumed before, then 50% of cumulative output is reached in Jan 2028.

My best guess scenario has URR at about 40.5 Gb and reaches cumulative output at 50% of URR in October 2027.

This bits got me going:

“The most crucial development in global oil markets is depletion in the Permian basin. We

first warned about this in 2018, predicting the Permian would peak in 2025. In retrospect,

our analysis was too conservative. We now believe the basin could peak within the next

twelve months. The implications will be as profound as when United States oil production

peaked in 1970, starting a chain of events ultimately sending prices up five-fold over ten

years. If we are correct, this could not come at a worse time for oil markets: inventories are

tight, production in the rest of the world is declining, and investors are incredibly compla-

cent.”

If true this could be worse than Covid and that could have a similar demand destruction steep colapse like the one in 2020.

Also I cannot argue with this:

¨The question, of course, is how things develop from here. The Biden administration announced their intention to rebuild the strategic petroleum reserve, although we are skeptical they will be able to do so. Despite having built by 80 m b from their lows, commercial invento-ries remain near long-term seasonal averages. It is unclear how the US will be able to rebuild its SPR without driving prices dramatically higher. In fact, despite pledging to replenish the SPR at a price between $67 and $72, government inventories have resumed liquidating by 270,000 b/d since April 1st, 2023. The administration has many motivations for releasing oil from the SPR. Last spring, a genuine desire was to insulate commercial inventories from Russia-related disruptions. Many analysts believe the administration sought to depress gasoline prices in the fall before the midterm elections. Most recently, the administration likely used SPR sales to forestall the impending debt-ceiling breach.¨

… ¨the US strategic petroleum reserve currently stands at 371 mm barrels – the lowest level

since 1983 and half the peak reached in 2009. Since its introduction in 1975, the SPR has

been a successful buffer in dissuading “bad actors” from using oil supply disruption as a

weapon. With strategic reserves at such a low level, we are concerned groups may try to use

the “oil sword” again. As recently as 2019, Houthi rebels attacked an oil refinery complex¨

Svaya,

A post by the same group more focused on Permian Basin.

https://blog.gorozen.com/blog/the-permian-basin

Excerpt:

Our models tell us the Permian will ultimately recover 34 bn barrels of oil, of which 14 bn or 41% have already been produced. At current production levels, the Permian will have produced half its recoverable reserves sometime in late 2024; at this point, it will most likely stop growing, just like the other two basins.

This where they are mistaken, only 10.7 Gb of Permian tight oil has been produced, about 3.3 Gb less then they claim.

Data in spreadsheet at

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

Add together Spraberry, Wolfcamp, and Bonespring columns in spreadsheet and then sum the total and multiply by 365.25/12 to get millions of barrels of Permian tight oil output. The result is 10738.54 million barrels or 10.7 Gb.

Other than this mistake their analysis is excellent, though I think their URR estimate is likely low by at least 6 Gb for the Permian Basin.

Dennis –

Wondering if you have an updated version of your 2015 shock model (excluding US tight oil)? How well does the 2015 model match current data?

Thanks,

Svaya,

Correct. If I understand Dennis’ models correctly, Dennis’ models of a plateau in shale are based on the assumption that sweetspot style rates would continue for some time. As G&R point out, total rig count in the shale fields declined over the years not because of any technology breakthroughs or efficiency gains, but because the drillers got better at locating sweet spots.

Moving out of the sweet spots means increasing the drilling per acre and less productivity per acre. Double whammy. Its unlikely with shale’s low to nonexistant profitability (during the sweet spot years), increasing capex and declining quality inventories that future production will be sustained at current rates and neither does it look like steep declines could be mitigated.

I think shales steep declines are on the horizon.

Kengeo,

That model was based on C plus C less extra heavy oil URR of 2200 Gb and 500 Gb of extra heavy oil and was independent of my tight oil models. So the model was far too conservative and did not anticipate how important tight oil output would be. In 2022 the model forecast was for 69.5 Mb/d, too low by about 11 Mb/d compared to actual World output. C plus C less XH World output in 2022 was 64 Mb/d for Model vs 76.7 Mb/d for atual World C plus C less extra heavy output or about 12.7 Mb/d too low.

When I say my past models were very conservative, this is a good example.

Anon,

I have thought since 2012 that steep tight oil decline was just around the corner, for the past 13 years I have had to pudh the date that average well productivity would decrease in the North Dakota Bakken/Three Forks to next year. It did happen in the Eagle Ford back in 2017, though productivity bounced back up in 2020 and 2021 after falling in 2018 and 2019. For Bakken productivity see

https://novilabs.com/blog/north-dakota-update-through-may-2023/

The average well productivity increased from 2012 to 2019 and has held steady from 2019 to 2022, still waiting for the decrease some 10 years later. I am assuming average well productivity in the Permian basin holds steady at the 2020 level (it actually increased in 2021, but my model does not reflect this increase). I will wait for actual evidence of average well productivity decline to below the average 2020 level before incorporating it into my model, many of my past scenarios were too low because I predicted falling average well productivity when in fact it did the reverse. Eventually it will fall, when it occurs I do not know.

My understanding is that costs have been starting to decrease in the oil patch, if oil prices rise we may see increased profits and completion rates. My best guess model has completion rates falling from about 500 per month recently to about 475 wells completed per month. It might be somewhere in the 450 to 500 range, 475 is just a guess.

Dennis,

You prefer to look at URR as a very important metric (it is). Goehring & Rozencwajg’s research shows there’s a magic moment when shale oil fields begin their stagnation and decline, that is, when 60% of sweet spot acreage (Tier 1) has been drilled. URR might not be as decisive of an aid in forecasting peak as G&R’s AI modeling might have suggested.

Watch from 32:00-40:00:

https://www.youtube.com/watch?v=iHzWGnbI9nw&t=1927s

Just my two cents, if you go first for the sweet spot wouldn’t the decline be steeper. My basic logic tells me that the offset that should come from sweet spots will come istead from sour spots thus not helping the decline rate which is pretty high for tight oil.

Anon,

My tight oil models are not as focused on URR as my shock models. I use actual well productivity based on Novilabs data and the prospective area for tight oil development identified by the USGS. Note that when I do this analysis for the Bakken my results are similar to what G & R have for URR estimates (I have 9.5 Gb for North Dakota Bakken/Three Forks vs a 9 Gb estimate by G & R). Note that the USGS has a mean TRR estimate for the ND Bakken of about 11 Gb so the G & R URR estimate is about 82% of the mean TRR estimate. For the F95 ND Bakken TRR estimate the USGS has about 9 Gb, similar to the G & R URR estimate. For the Permian basin the TRR mean estimate is about 75 Gb with the F95 estimate at 44 Gb. For the Bakken model, the wells I have being completed are about 8 million of 15 million prospective acres and for the Permian it is about 23 of 50 million prospective acres. The URR is a function of average well productivity times number of wells completed for my tight oil models. Output is also a function of average well productivity and completion rates. Future completion rates are not known, nor is future average well productivity. I do not have access to tier on and tier 2 prospective area data, so the G & R estimates may be more accurate. They do make a very basic error on cumulative production in the Permian basin, which makes me question their analytical thoroughness, unclear what other errors they may have made.

Dennis,

Re Goehring and Rozencwajg’s ” … very basic error/analytic thoroughness” …

One year ago, G&R published a 35 page report that – among other things – called for a near quadrupling of HH from then $8 and a convergence of US and global natgas pricing.

Hmmm …

Their ‘neural modeling analysis’ (gotta love that marketing) called for only ~4,500 more Marcellus well locations (this, when ~12,500 wells had been drilled).

Since publication, over 550 wells in Pennsylvania alone have been spud. Adding in WV’s should bring the total to 700+ wells. Extrapolation should indicate that new Marcellus production will end by 2030.

If anyone believes that, they are nuts.

This is another display of Art Berman tier work that an unsuspecting public is prone to accept unless some due diligence is exerted on the part of serious students in these matters.

>Their ‘neural modeling analysis’

I’l take math and common sense(from experts on the field) every day over the neural network and I am a computer geek.

But if there is no math (a formula that reverses a curve of data) I’ll take the neural modeling analysis over marketing blah blah.

Ruh-roh is better than blah, blah!

OPEC Crude oil annual output 2018-2024 with STEO forecast for 2023 and 2024.

https://oilprice.com/Energy/Crude-Oil/Iraq-Takes-First-Step-Towards-Becoming-The-Worlds-Biggest-Oil-Producer.html

I think it is actually possible to build out and exploit more of the northern oilfields in Iraq. Especially heavy oil in the kurdish region. Corruption and lack of desire from larger oil companies to invest there has delayed expansion in the landlocked territory. There are some landlocked opportunities across the border in Iran also; chinese contractors have been working there.

Let us see what will win , the oil or the water .

https://www.iraqinews.com/iraq/iraqs-marshes-suffering-its-worst-heatwave-in-40-years/

OPEC crude plus US C C, EIA data 2018-2022 and STEO forecast for 2023 and 2024, annual average output.

In 2024 output is expected to be about 1050 kb/d less than 2018.

Using forecast above and the STEO total liquids forecast for Non-OPEC less US and assuming the 2022 ratio of crude plus condensate to total liquids continues in 2023 and 2024, along with the 2022 ratio of OPEC crude to OPEC C plus C also continuing into 2023 and 2024, I get the forecast below for 2023 and 2024 annual average World C plus C output. 2024 output is about 401 kb/d less than average 2018 output, in 2023 and 2024 World average annual C plus C output increases by about 900 kb/d each year. Of this 900 kb/d annual increase in World C plus C output about 490 kb/d comes from the US,

I agree with Ovi’s assessment that this seems optimistic. Note however that first quarter 2023 World output was at about 82,113 kb/d. So achieving 82,580 kb/d in 2024 only entails a 467 kb/d increase from the 2023Q1World C plus C output level.

My best guess model has 2024 World C plus C annual average output at 82410 kb/d (a 297 kb/d increase from 2023Q1 output).

Did you see the MOMR?

Non-OPEC is down 0.3 mb/d

OPEC is down 0.55 mb/d

That’s over a 3 month period…

Kengeo,

Under World Oil Supply I find:

Non-OPEC liquids production (including OPEC NGLs) is estimated to have increased m-o-m in June 2023 by 0.5 mb/d to an average of 73.0 mb/d. This was higher y-o-y by 2.7 mb/d. Preliminary estimated production drops in June were mainly driven by Russia and were more than offset by rises in OECD Americas and Other Eurasia.

From 2023Q1 to 2023Q2 there was a small decrease as expected due to reduced Russian output. Also the World was oversupplied in 2023Q1 by 0.35 Mb/d so the market adjusted to a lack of demand.

From: Table 11 – 1: World oil demand and supply balance, mb/d (Monthly Oil Market Report, July 2023)

OPEC Non-OPEC change:

1Q23 vs 2Q23: -0.86 mb/d

2Q23 vs 3Q23: -1.18 mb/d (assuming OPEC down 0.1mb/d monthly)

Total Non-OPEC production

1Q23 – 65.23

21Q23 – 64.92 (-.31)

3Q23 – 64.04 (-.88)

OPEC crude oil production (secondary sources)

1Q23 -28.82

2Q23 -28.27 (-.55)

3Q23 -~28 (-.3)

ovi and dennis great stuff!

picking up our discussion from last April, my thesis’s were 1)nat gas is the future to a eventual transition to nuclear, 2)we are entering into golden age for legacy domestic oil producers and 3)that inflation will remain sticky. 1970’s style redo.

With the recent announcement of Buffett taking a majority interest in the Maryland LNG plant and today exxon /Denbury news as well as a number of my mlps (PAA for example) making major moves to multi year highs, points to my conclusions being “dead balls accurate.”

add in the collapse of the ESG narrative and public companies shunning new green projects for lack of profits leaves only broke governments to fund the boondoggles, that half-life is now very short.

While WTI oil continues to trade below $80, cost are coming down rather precipitously. I still think $80-$90 will be the “New” range unless we get some more black swan (war) news. I still think odds favor china going into Taiwan before the next US presidential election.

https://www.rigzone.com/news/this_is_the_goldilocks_price_for_oil-13-jul-2023-173324-article/

On inflation, the $ has now broke well below the established head and shoulders pattern. Target around 94-95. We may have seen the low print on CPI and PPI but I expect it to stay in this range UNTIL…

The big wildcard now looks to be the BRICS currency announcement schedule for august with sometype of gold back trading currency, I have seen where 43 other countries have ask to participate. This should be a huge weight on the dollar. I think we are seeing two trading blocks being set up. I expect that to be inflationary as well as a much weaker dollar. There is nothing the fed can do about that.

Hard to say the exact reasons for this, but some combination of corrupt US government, using the dollar as a weapon and the idiocy of mandated green energy utopia being imposed of non interested countries representing 1/2 the worlds GDP and 3/4 of the worlds population.

With the era of the pandemic over and the world is getting back to normal, I agree at the right price the US will achieve a new record high oil production, be the largest LNG exporter and the near term future will be a golden age for domestic energy producers.

ON a side note even in my little central Texas town I see a Tesla every and then, and of course in Austin in the high end neighbor hoods they are as common as labradors. I got that one wrong. But diesel is $3.09 so I am OK with that.

I saw the Biden administration will refill the SPR but not until his next term😂

https://www.zerohedge.com/energy/us-strategic-petroleum-reserve-will-not-be-replenished-anytime-soon

Texas tea,

Little indication of nuclear taking off, either in the US or worldwide, nuclear consumption was down 4.8% in 2022 for the World and 1.4% in the US. Natural gas consumption for the World was down 3.1% in 2022, but is up at an annual rate of 1.7% per year over the past 10 years. Consumption of non-hydro renewable power was up by 13% in 2022 and had an average annual growth rate of 12.6% from 2012 to 2022. In fact if we look at the increase in consumption of primary energy by the World in 2022 it was 6.63 EJ, of this total 5.49 EJ was from renewables (including hydropower) for an 82.8% share of the increase in energy consumed in 2022. Data from the Statistical Review of World Energy.

https://www.energyinst.org/statistical-review

Dennis, keeping the faith😎

https://oilprice.com/Latest-Energy-News/World-News/Future-Of-Oil-Demand-Is-Brighter-Than-Youve-Been-Told.html

Not sure about the rest of it, but I agree with your oil price assessment, TTT:

Only change is suspect $80-$100 ($80 would keep production growth -if even possible- minimal. $90 would make many producers “happy”, and $100+ could spur new/more development…

But of course consumers would like prices <$80, which in my opinion isn't going to happen.

Texastea,

We will see how it goes, reduction in share of fossil fuel use has proceeded slowly falling from 93% to 82% from 1965 to 2022, for the past 10 years the share has fallen a bit faster from 86% to 82%, but we need to go from 82% to zero in the next 28 years, nearly 3% per year on average. Of course some percentage of fossil fuel is not used for energy, but as in input for other materials such as plastic chemicals and fertilizer. To address climate change we need to ramp up non-fossil fuel energy as rapidly as possible while reducing the use of energy as rapidly as is feasible. I hope we will see demand for fossil fuel fall rapidly after 2030, so far we are not doing nearly enough.

Dennis —

Little indication of nuclear taking off

Not only that, but the fleet is getting older quickly, though you don’t see this in the production numbers.

Pretty soon the big burst of investment of the 70s will reach end of life. Capacity additions came to a virtual standstill in the 80s, and a 40 year gap in investment will be hard to compensate for. Most nuclear reactors are over 30 years old.

So even if a lot of new nuclear plants are built between now and 2050, capacity is likely to be lower than it is now.

TTT,

That is an excellent, wide ranging comment regarding several energy, political, and economic topics.

Some perspective/context, perhaps, focusing on current hydrocarbon realities …

If anyone reading this posting has not yet SERIOUSLY read (and re-read) the above link from OFM (hope things are going well for you, Mac. Tnx for the link.), one would be advised to appreciate the production/capacity numbers from Iraq presented therein.

In just the last 4 months, approximately $40 billion has been committed to 3 new/expanded LNG projects (Port Arthur Phase 1, Plaquemines Phase 2, and yesterday’s mammoth Rio Grand LNG Phase 1).

The 40 Mtpa (Million tonnes per annum) from just these 3 projects will match the much ballyhooed Qatar LNG expansion. The anticipated brownfield expansions from Port Arthur and Rio Grande will add an additional 3 Billion cfd demand to the near 6 Billion cfd already required for these 3 FID-approved projects.

As Cummins continues to incrementally introduce the X15L natgas engine – for Class 8 trucks – to rave reviews (CNG prices were about half of diesel’s in the US in 2022), the widespread rollout in a few months is stirring great anticipation.

You oil-centered folks who focus on potential oil scarcity might be advised to ‘broaden your horizons’, if only as (unpalatable?) thought experiments regarding alternative scenarios to an oil-deprived world.

While TTT’s comment about a looming gold backed currency is more probable – and lifestyle shattering – than many might think, the chances of oil scarcity is near the bottom of likely future situations which we – globally – will encounter.

coffee I always appreciate your comments, opinions and world view. I will say it, first of all because you probably wont and secondly of all because your ideas have stood the test of time. It was you and me a decade ago calling out the BS, sticking to our guns and time has proven us right. I said many times… all that green energy will do is pick up SOME of the over all INCREASE in energy demand. A decade later and many trillions of $$$ later, that simple obvious truth in now mainstream. I have NO idea if the current estimate for necessary expenditures to get to this carbon neutral world takes into account the inflationary pressures or the replacement cost of the failures of the current green energy infrastructure because it does not matter. Neither europe nor the US can afford it. no one else cares.

If the BRICS are successful and roll out a competitive trading currency to the dollar that is widely adopted, I think the best scenario example would be the collapse of the soviet Union for the EU and the US. In that world green energy and reparations will be used in past tense only. The world wont end but life as we now enjoy it will.

Now I don’t know the future but there is a wiff of panic, the old energy companies CEOs’ from Norway to France to Texas and now even the big wall-street banks have come to our view. its drill baby drill for the foreseeable future.

Pandemic stimulus or transfer payments from of government are largely gone. Individual tax receipts are something like 20% lower in 2023 than they were in 2022. Income on average is down 20% year over year. Nothing inflationary at all about that fact.

Combined that with millions getting hit with having to repay student loans. Recession is near. Hard landing is near. Much lower oil prices are near.

HHH- market is already under pressure, while possible, what do you see as the trigger for the event? $150 oil seems twice as likely as $50…there’s unlimited demand at $50 and moderate demand at $100, aren’t the suppliers in the driver seat?

Look, main stream narrative that all is good is BS. All is not good: look no further than China if you want to confirm that. Look no further than yield curves be it USA, Germany, Canada or UK or whatever. They are fuckin telling things aren’t good or inflationary.

How anybody could think inflation will somehow prevail in current economic environment is ludicrous. Not based in reality. Based in bullshit.

We have deflationary money in Eurodollar market. We also have no lender of last resort in Eurodollar market to re-collateralize the market when necessary.

If you want a black swan that really isn’t a black swan that brings everything down look no further than commercial real estate.

“If you want a black swan that really isn’t a black swan that brings everything down look no further than commercial real estate.”

Where I live and work, workers are refusing to go back to the office. Even the management can’t request you to come back with a straight face as they don’t want to either.

If you force your empleyees to come back, your competitor will hire up your good ones.

I forgot where I read it, but a financial commentator said it is better for

the business to default on their commercial loan and walk away then sit on an empty builiding.

It’s a $14 trillion market. 80% of these loans are on the balance sheets of the small and medium sized regional banks. Same banks that are underwater on treasury bonds that caused a few bank failures earlier this year.

As the underlying collateral for these loans gets repriced. These banks will be unable to borrow their way out. As the large banks aren’t going to accept the collateral these banks have. And they also won’t be doing the one thing that the economy needs them to do. Which is make new loans.

Credit crunch is already here. You can see it in demand. You can see it in the global trade data. Imports and exports falling like a rock everywhere.

The FED and rest of the central banks will be cutting rates back to zero soon enough. But that won’t be inflationary. They will be cutting in response to money in real economy vanishing like a fart in a hurricane.

What’s interesting is all the data supports HHH arguments on the economy, all the way up to the point of oil to $50. Oil has recaptured trend is actually bullish. “Should” it be that way given these economic conditions? No. But you’ve got a powerful price control mechanism in OPEC, tons of oil shorts to unwind, and a little thing called Peak Oil, that even if we aren’t “AT” peak oil, we are close enough that there isn’t SUFFICIENT slack outside OPEC to calm The Machine. The machine has its Sauron eye on oil, and its more than likely going up from here. TTT take a victory lap.

Not sure we are looking at same charts but there is nothing bullish about the WTI or Brent chart. Trend is clearly down. But then again when looking at charts people tend to see what they want.

Based on the macro oil is heading lower. Much lower.

Dollar is having itself a pullback. Before going higher. Nothing gets to where it’s going in a straight line.

How do I know that? When the economy is doing well the dollar weakens. Loans are made. Business is done. When the economy is bad the dollar strengthens.

Both oil prices and the value of the dollar depend on what state the global economy is in. Sure OPEC can get oil prices to rise for a bit by cutting production. But time and time again the temporary bump in prices just doesn’t last.

Show me why the economy is going to take off and start booming and I’ll get onboard with higher oil prices.

Right now all I see are reasons why the economy is headed straight off a cliff. What is going to trigger the growth in demand? China? Europe? USA? Japan? Please tell me because I’ve been looking and can’t find any reason to believe growth is going to boom anytime soon.

And btw, slowing inflation isn’t really what you want when the amount of debt exploded higher much higher over the course of about three years. We are told getting inflation back to 2% is a good thing. I don’t see it as a good thing. I see it as a major problem.

China’s year over year inflation came in at 0%. That is a huge problem and not just for China. Means they can’t pass on higher costs to consumers nor increase employee pay without directly effecting the bottom line. Profits are going to be tanking.

All economics prognostication is based on game theory. OTOH the finiteness & non-reewability of crude oil can’t be gamed.

“Not sure we are looking at same charts but there is nothing bullish about the WTI or Brent chart. Trend is clearly down”

I use trend as meaning on a 3 month basis because that’s a significant time frame for the machine that does most of the trading. a trade being 3 weeks (in order to front run the Month-over-month. Oil hasn’t made a new low in 4 months. In addition, Oil Volatility (OVX) is very low, just touched 30. The last time it was in that range was August 2020. Oil went from $40 to about $110 from there. Now, some of that was Ukraine war shock, but last I checked the war is still happening. And like I said, CFTC net speculative longs are still extremely low so people are positioned heavily short.

We are already seeing some significant reflation that’s already started in quite a few commodities (Palm Oil – up 22% in 1.5 months, Cotton -no new low in 9 months, Lumber – up 42% over 6 months). Which will only keep the Fed higher for longer-er. That’s what the signals I’m seeing are saying, and the signal can trump Macro. We are still seeing the downturn in things like industrial inputs, but even cobalt is now up 13% in the last month. That is not screaming deflation but reflation, for now. It is maybe even probable that oil will turn back down but I certainly wouldn’t be pressing oil or energy stock shorts right now. We are 4.5 months past the “oil is going super low” deadline of March, given about a year ago. Even giving some slack, at some point you might have to change your position on the matter.

There is a lot of talk about GDP on this site. But a better measure of how well off an economy is doing is GDI. The I stands for income. And here in the US that is in contraction. Not growing at a slow rate. Contacting.

All 18 or 19 times GDI has contracted in last 100 years we’ve had a recession. You need to let this recession play out before getting bullish on oil again.

The month after we hit our all time low in unemployment rate think it was 2.5% way back in 1954 or maybe it was 52 we went straight into recession. So unemployment figures actually don’t give good insight into if a recession is on the way or not.

The narrative of soft landing will soon give away to reality.

HHH,

Good point. Link below to real domestic gross income for US.

https://fred.stlouisfed.org/series/A261RX1Q020SBEA

HHH –

We can all agree that at the end of June WTI hit a low of ~$68 and has settled to ~$76, a 12% increase in 3 weeks. Over 6 months WTI has bounced between ~$66 and $83, current price is neutral in this range. Past 2 years WTI has generally traded between $60-$70, except for 2nd half 2021 and most of 2022 where it traded between $80 and $120, peaking 12 months ago at $121.

As far as GDI is concerned, please see following:

I think your expectation for $50 oil is based on 15+ year old pricing…look at correlation between WTI and GDI, looks very bullish for oil as far as I can tell…

Dr Tim Morgan discusses peak oil , renewables , EcoE ( EROEI) , G & R report .

https://surplusenergyeconomics.wordpress.com/2023/06/17/258-written-in-the-skies/

HiH, thanks for posting this. Here is the link again.

‘PEAK OIL’ AND THE UNFOLDING INFLEXION

Finally, someone that knows what the hell they are talking about. 🤣

From the comments the author, Tim Morgan, says:

“I remember back in about 2003 being asked by one of my bosses whether peak oil would really happen (“yes”), and when (“about 2018”). We’re never going to “use up” all the oil in the ground, but a lot of what remains isn’t cost-effective.”

I am unclear, but is he saying that in 2003 he picked 2018 as the date for peak oil? At any rate, he goes on:

With 2019 as the baseline, I’m projecting oil supply lower by 18% in 2030, and 33% by 2040. This is a compound annual decline rate of about 2%, which sounds gradual, but mounts up over time. I may be revising these numbers later this month when we get definitive data for 2022.

That works out to 3% decline thru 2030, then 2% decline to 2040…

That would bring total recovery to ~1950 Gb at 2040…doesn’t seem unreasonable, but I suspect slightly higher decline rates, 3-5% (5-7% per others).

Lots of different opinions on decline rates, I’d guess we’ll have a good idea within 12 months though…

Hole in head,

I recognize very well there are physical limits, I have degrees in both physics and economics rather than history and political philosophy which is Tim Morgan’s background. At point of use the EROEI of wind and solar are actually better than oil and natural gas and calculations that assume the best approach is to build just enough capacity to meet demand and then build enough backup storage capacity with batteries and pumped hydro are incorrect. The cheapest economic cost system builds about 3 times average load in wind and solar capacity, widely distributed and highly interconnected with HV transmission, such a system reuires very small anounts of backup power in the order of 1 to 2% of average load. Excess power can during high wind or solar periods can be used to produce synthetic fuels (this is free power that would otherwise be wasted). These fuels can be used to produce steel, cement and to power any other high heat processes that cannot be more cheaply done with electric arc furnaces. There are no technical limits here, it is simply a matter of building stuff using technology that has already been developed. Any claims that physicists and engineers who have worked on these problems don’t understand simple physics is something a historian or political philosopher might proclaim, but it is false.

Also claims that energy is the source of all value is very appealing to a Marxist who would argue, no labor is the source of all value. There is no single source of value, or more correctly and single good could be chosen as a yardstick and using an input output matrix for all goods in society we could value all other goods in units of oil, apples, water, or chia pets, any item will do. Claims that energy is special are no different than a Ricardian or Marxian claim that labor is special and all goods should be valued in labor.

No single good has any special importance, not energy, not labor, not bananas.

Dennis wrote: No single good has any special importance, not energy, not labor, not bananas.

This is my third time to edit my reply. I give up. Words cannot express how much I disagree with that statement. So I will say nothing except the words I have placed in bold below.

Energy drives the world. Without it we are back to the stone age.

Ron,

Energy is important, so is clean water, fertile soil, air quality. To suggest that only energy matters is incorrect in my view.

Goddammit, Dennis, no one ever said “Only energy.” Intelligence is also important. We have had since life first evolved on earth, clean water, fertile soil, and air quality. We have only had fossil energy for just a little over two hundred years. In that time, the population over the world has exploded over eightfold. Now you tell me, was that due to clean water, or fertile soil, or air quality? Was that due to something that has existed since hominids evolved, or was it due to the sudden appearance of fossil fuels?

What made the difference Dennis? I await your reply. Was the sudden appearance of fossil fuels a factor in the sudden appearance of the industrial revolution and consequently the dramatic population explosion? Or did the sudden explosion of the fossil fuel revolution have nothing to do with it?

I await your reply. This is going to be interesting. 🤣

And it took hundreds of millions of years for the sun to energize all the plants and animals that turned into oil…oil is the ultimate renewable energy, it just takes a real long time to charge the battery!

Proverbs 27:22 Even if you pound a fool with a pestle Like crushed grain in a mortar, His foolishness will not leave him.

Ron,

A whole host of ingredients combined to make that expansion possible, improved healthcare leading to lower rates of mortality, innovations in agriculture allowing more people better access to food. Technical innovation in general. The widespread use of fossil fuel was an an ingredient, but claims of energy being the “master resource” are overblown and asserting that energy is the source of value which is implicit in a Surplus Energy Economic Model is just silly. Any good can be claimed to be the source of value and if the claim can be made for any good ( an input output matrix can be created for any good showing this is the case) then the source of value is entirely arbitrary, it gives us no new information.

The point is a fairly simple one, a complex phenomenon cannot be boiled down to a certain thing as being all important in my view. This is sometimes termed as essentialism, this approach leads to a set of blinders that limits understanding in my view rather than enhancing it.

Dennis wrote, bold mine: The point is a fairly simple one, a complex phenomenon cannot be boiled down to a certain thing as being all important in my view.

That was supposed to support this statement: No single good has any special importance, not energy, not labor, not bananas.

He went from any special importance to all important. He just moved the goalpost a tad in my opinion. Nevertheless, I would even disagree with that last statement. Just because many things added to the population explosion it still does not mean that one thing and one thing only enabled the industrial revolution that, in turn, enabled the massive population explosion. That one thing was fossil energy, coal and oil.

That point has been made over and over again by many historians. None better than David Price in his great essay: Energy and Human Evolution That essay was once a page on this blog until I took it down a couple of years ago.

Ron,

I disagree with the master resource designation that fossil fuel has been anointed with by many. Important, yes, master resource I don’t think so. There is no master resource in my opinion. There are many important resources, energy is one of them, my point is that among the many important ingredients to society, I would not elevate energy to some special status, knowledge might be important as well and the ecological fitness of the planet.

knowledge might be important as well and the ecological fitness of the planet.

Knowledge??? The ecological fitness of the planet??? How about consciousness? Oh, I forgot, you said, “no single good.” Consciousness is obviously not a “good” where knowledge and the ecological fitness of the planet are both “goods”… I guess.

I give up, Dennis. You win. I cannot possibly argue with such logic. Over to you on this subject. 🤠

Ron,

Hmm, knowledge (in particular scientific understanding) is not important? I think their are a number of attorneys that focus on intellectual property who might disagree. We can disagree, I just think essentialism is a dead end.

Dennis, knowledge is very important. I just thought we were discussing the importance of goods, as in goods and services. And you mentioned energy, labor, and bananas. Labor is not “goods” but it is definitely a “service”. Now you pitch in knowledge and the ecological fitness of the planet.

I was not aware that those two were considered either goods or services.

No Dennis, I cannot argue with such logic. I give up.

Ron,

You may not have heard of the labor theory of value, but it was the basis of value used by Classical and Marxian Economics. Any good or service could be chosen as the measure of value, one could choose an hour of labor, a barrel of oil, or a ham sandwich, the choice is entirely arbitrary.

Modern economics has no objective theory of value.

See

https://en.wikipedia.org/wiki/Léon_Walras

Using input output models, it can be shown that any good or service could arbitrarily be chosen as a measure of value. For this reason we could arbitrarily choose energy as our measure of value in an economic model, but the fact that it is an arbitrary choice suggests the foundation of such a model is built on sand.

You bring up the conditions necessary for rapid population growth and what might have changed from earlier times, ecological fitness of the planet has no doubt decreased due to fossil fuel, but the relative fitness at the beginning of the industrial revolution was likely necessary, the increased scientific knowledge over time is quite important in my view, as is the increased energy availability during the fossil fuel age.

Dennis, I don’t have a problem with labor. My whole argument was about energy and nothing else. Without energy, planes don’t fly, cars and trucks don’t run, farm machinery doesn’t run, factories don’t run, food is not produced, and the world just dies.

Without energy, none of us eat. Without energy, we all die. Well, most of us, anyway. There may be enough bugs, roots, and other such food to keep perhaps one percent of us alive.

But you say energy has no special importance. I would not dare argue with someone who actually believes that. Hell no, I wouldn’t dare. 🤭 You win this argument because I am out of it.

Ron,

How would we do without water, air, or soil? Not well I imagine. The point was really about value theory. Nowhere did I say energy was of no importance. How about steel, cement, aluminum, or even sand? It is all interconnected, there is no master resource in my view.

Dennis, you said: No single good has any special importance, not energy…

Sooo… energy is not especially important. And to back that statement up you say that air, water, and soil are also important. Well, okay Dennis, you win. Bye now.

Dennis,

How would we do without water, air, or soil? Not well I imagine. The point was really about value theory. Nowhere did I say energy was of no importance. How about steel, cement, aluminum, or even sand? It is all interconnected, there is no master resource in my view.

This is true, but everything you mentioned requires energy for its formation. I think the key to Rons argument is all things being pretty much equal fossil fuels where the key to our increase in life standards, medicine, the explosion of our population and our ability to exploit and make the resources you mentioned.

I personally think fossil fuels are extremely special and a master resource. Without them humans would be either living in caves or a primitive agrarian society. For example without an industrial society, our taste buds would have never experienced a big mac or complex artificial sugars found in sodas and lollies, beethovens music would never be heard or Kants philosophy ever read, or quantum mechanics proving Einstein wrong. None of these things i think would be possible without fossil fuels.

Iron Mike,

I do not agree, that fossil fuels were the key, just a piece of the puzzle, scientific advances were also important. In fact an argument could be made that fossil fuel has done more harm than good, had these resources been unavailable perhaps other forms of energy that were less environmentally damaging might have been developed more quickly and human population might not have grown as rapidly as we have seen for the past 200 years. Impossible to know as we cannot rewrite history.

Maybe rather than being a key for development of civilization, fossil fuel might be viewed as the key to destroying the planet.

Not sure I agree that water air and fertile soil require fossil fuel, steel, cement, and aluminum perhaps, though steel was around long before oil and natural gas and before coal was used to a large degree as a fuel. It was not produced in the same quantities as today, mostly used for swords and knives before the industrial revolution.

I guess I just can imagine that things would have been very different without fossil fuel having become so dominant in society.

There has been both good and bad with the rapid economic growth that has come with the exploitation of fossil fuel. Does the good outweigh the bad? I would answer no. Is it possible that knowledge could have progressed without the use of fossil fuel, certainly there was quite a bit of knowledge that had been developed prior to 1870 when oil and natural gas started to be widely used.

It is of course impossible to know how things might have developed without the use of fossil fuel as history cannot be rewritten. In my mind energy and matter are both important, neither is very useful without the other.

Dennis,

The exponential growth in scientific advancement wouldn’t have been possible if humans used the time necessary to think instead of constantly occupied with hunting or plowing the fields all day. Time is necessary to think, to exploit and make resources and to come up with new things.

Time implies something/somebody else doing the hard parts of life for you so you can explore other avenues of living. It started with slavery. If industrial civilisation was a car, the engine is fossil fuels. Engine is the main component of a car. The other parts of a car are necessary, but the engine is where the magic happens. We can agree to disagree here.

Yes i agree one can argue that its detrimental. But i ask those people to put their money where their mouth is and completely cut out fossil fuels out of their life. Who will step up ?

We live in a complex world, usually something which is useful can also kill us. Like say a knife. Essentially everything has a price and given biological evolution there was only one path humans would ultimately take and that was to exploit fossil fuels. We like all other species are programmed to exploit and reproduce. That is our path of least resistance. It also happens to be our achilles heel, which will be perilous as biological evolution is slow, and we will likely breed and exploit ourselves into extinction. Well those who depend on industrial civilisation anyways.

I sometimes think the earth evolved humans to get out of the icehouse state it had fell into the last 40 million years or so. Humans have the potential to reawaken greenhouse earth, which has been the lions share of earths history if i am not mistaken.

This is fairly easy to prove. With unlimited or cheap energy, humans can supply themselves with water, and food. Does unlimited food imply more energy – no, not really. Except that well fed slaves can work for a little longer. Does unlimited or cheap water beget more food and energy? Not really, unless it’s behind a high elevation dam. Energy will buy you other goods. Other goods will not provide energy.

On a practical basis-

There are a few sources of energy production that are not directly due to combustion,

such as potatoes and other plant products that store energy from current years growth, animal and human labor,

nuclear, photovoltaic, wind and hydroelectric power.

But humans emerged from the animal world as a result of combustion and we should assume that As Goes Combustion So Goes Humanity.

By and large.

It remains a proof of concept that humanity can get by without combustion of the stored Sun energy storage products of coal, natural gases and oil,

at least in significant numbers.

We can and will get by for a long time on a mixed system of energy that includes a long fat tail of combustion along with all the others we can come up with (yes even corn ethanol which is a pitiful net energy producer).

I suspect that humans will burn just about everything that they can get their hands on.

I am also of the camp that believes that the numbers of humans will roughly match the trajectory of net energy available, with about a 10-20 year lag. There are other reasons human population could decline of course, but if not it will then come down to energy.

Got2surf,

That reminds me of the “assume a can opener ” joke. So to prove that energy is the master resource, we just need to assume we have an unlimited supply of energy.

Maybe sand is the master resource because there is so much silica on the planet, we can just build solar panels using the silica and we have all the energy we need.

I don’t think either argument is very convincing.

Information drives the world. Energy is ultimately only used to collect information. And current tech is extremely inefficient.

I recommend the book “The Touchstone of Life” for an interesting discussion of this.

Dennis –

Take a look at this estimate for decline rates:

“A projected range for average decline rate on post-peak production is 5-7%, equivalent to around 3-4.5mb/d of lost production every year.” Simon Michaux, 2019 Paper, Geological Survey of Finland

Current OPEC decline rate is ~8%, for a 5% decline, we could expect OPEC monthly decline of at least 0.1 mb/d…if Non-OPEC decline continues at similar levels then we can expect monthly decline of between 0.2 – 0.3 md/d.

Annually, that’s somewhere between 2.4 – 3.6 mb/d. That puts 2024 production between ~78-79 mb/d.

This works out to 3-5% annual decline…

From the comments section of Dr Morgan’s blog .

” It’s important to keep in mind the difference between depletion and decline with regard to oil fields. Any oil removed from a field adds to depletion and the annual depletion rate is the amount of oil removed per year divided by the remaining recoverable oil in the field.

The decline rate, if any, is just the rate at which oil removal declines from year to year. Extra infill drilling and enhanced oil recovery techniques can keep a field from having any decline at all, although a gradual decline usually starts at less than 50% field depletion.

My view is that governments and energy companies will do everything in their power to increase oil production or at least not let it decline, even as depletion continues apace. Like rust, depletion never sleeps. But this means that eventual production decline rates are likely to be much greater than expected, especially since 25% of world production comes from 25 fields and half of world production comes from a only a few hundred fields (out of 50,000-70,000 fields, depending on how they are separated for counting). When the giant and the super-giant fields near the end of their production plateaus (negative or very small decline rates), oil production will fall off a cliff. ”

This paper explains it all: https://royalsocietypublishing.org/doi/10.1098/rsta.2012.0448

Hole in head,

You should read the paper.

From Section 4d of the paper

Aleklett et al. [43] estimate that the typical regional depletion rates of RRRs are of the order of 2–5%

Let’s take the average which would be 3.5%, this happens to be the decline rate for my World model from 2043 to 2100.

Here is a link to the abstract of the paper referenced (43).

https://www.sciencedirect.com/science/article/abs/pii/S0301421509008519?via=ihub

Interestingly they projected C plus C output of 55 Mb/d in 2030, the paper is from 2010, even the IEA was projecting 75 Mb/d in 2030 which the authors though was much too optimistic. This was before tight oil was recognized as being important. Without any tight oil output, my model would have output at about 74 Mb/d in 2030.

Dennis , ” Hole in head,

You should read the paper. ”

If I do everything , then what will you do ? Just pulling your leg . 🙂

Kengeo,

Not all areas have decreasing production, the 5 to 7% decline rate is for those fields in decline. On OPEC decline, also that refers to those field with declining output and also assumes no further development in that field (the natural decline rate is the rate a field declines with no further development. From 2018 to 2022 OPEC output declined at about 2.9% per year (using OLS trend through annual output data) and this was mostly due to OPEC cuts due to a lack of demand for oil. The more important number is World output because OPEC tries to balance the World market and keep oil prices relatively stable, World average decline from 2018 to 2022 has been about 1.1% (if we drop 2020 and 2021 due to low demnd from pandemic the decline is about 0.7% per year). The low oil prices over this period (with the brief spike in 2022 due to War in Ukraine) show definitively this decline is due to lack of demand for oil rather than oil depletion.

Getting the facts is important . 1P or XP . Reserves or resources . Mike S on the subject .

https://www.oilystuffblog.com/forumstuff/forum-stuff/fish-in-a-lake?origin=notification

Hole in head,

A nice summary by Mike. I think Laherrere does a good job on this, his guess is around 3500 Gb for URR for world C plus C, mine is about 2600 to 2700 Gb, perhaps the reserve growth and discoveries will stop after 2022 (unlike what has happened for the past 152 years). Are reserve and resource estimates uncertain? The answer is so obvious I have never thought to even ask it.

Dennis,

Your model from start to finish of oil production, i don’t think it can be 2600-2700Gb URR. Can you show me how you are getting that result for URR including the chart please. Are you using AUC to calculate URR ?

Iron Mike,

Not sure what AUC is.

Spreadsheet with data at link below, model is 2600 Gb, 2700 Gb is a “high model with higher extraction rates” (not included here). Below is my current best guess model. The URR just adds up yearly production from 1870 to 2294.

https://peakoilbarrel.com/wp-content/uploads/2023/07/world-model.xls

Iron MIke,

Yes I use area under the curve (AUC) to find URR. Note that the model is not a Hubbert curve and the peak does not occur at 50% of URR. I have made some subtle changes in decline rates for the model after 2043, now the model declines at around 2.5% per year on average from 2030 to 2043 and from 2044 to 2100 the average rate of decline is about 3.5%. After 2100 the annual decline rate is assumed to be about 10.5% per year.

The model can easily be modified to a 3.1% annual decline rate from 2044 to 2294 by changing the rate that the extraction rate is assumed to decrease after 2044. This change increases URR to 2665 Gb from the earlier 2600 Gb estimate (all of the change is from 2100 to 2294 where the model is highly speculative in any case), cumulative output to 2100 is about 2580 Gb in either case.

Dennis,

Thanks for that. i will check your URR. For some reason it seems low to me. But i am probably mistaken.

Iron Mike,

In response to your questions about decline rates I have changed the scenario somewhat after 2040. Earlier I had more gradual decline up to about 2070 and then the decline rate steepened. This seemed artificial so I modified the scenario after 2040 so tht the decline rate was around 3.5% where earlier it had been about 2.7 or 2.8% (I can’t remember exactly). So perhaps you were assuming 2.7 % decline after 2040.Under that assumption (2.7% average annual decline rate from 2041 to 2294) the URR would be 2879 Gb. So my changing the decline rate in response to our conversation may have changed things. The decline rate from 2041 and later is around 3.6%, with cumulative production around 2570 Gb in 2100.

Dennis,

I checked and you are right i get a URR for your model of ~2600Gb.