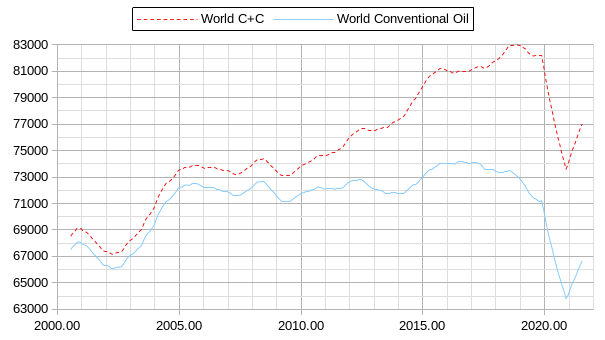

World Conventional Oil output peaked at a centered twelve month average (CTMA) of 74193 kb/d in July 2016. This peak is unlikely to be surpassed in the future. I do not include an estimate of unconventional oil produced in Venezuela as this data is difficult to find. In the chart below, I compare World C+C output to World conventional oil, which I define in this post as World C+C minus the sum of US tight oil and Canadian oil sands. The units for most charts (figures 11 and 12 are exceptions) will be kb/d on vertical axes. Data for oil output in all charts that follow will be the centered twelve month average output. Data is from the EIA’s International Energy Statistics.

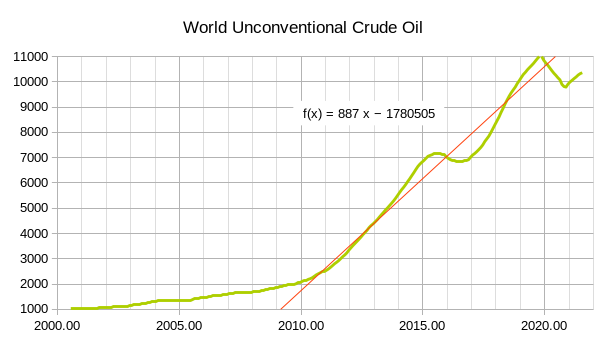

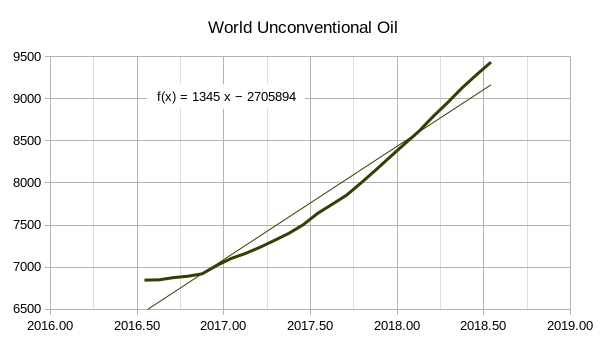

For comparison World Unconventional Oil output is shown in the chart below.

About 85% of the increase in World C+C output from 2010 to 2018 was from unconventional oil, the average annual rate of increase was about 887 kb/d from 2011 to 2019. Note that the annual rate of increase in World unconventional oil output over the 2017 to 2018 period was considerably higher at about 1649 kb/d.

The rest of this post will focus on World conventional oil output to attempt to find a likely decline rate for future unconventional World output, especially the period after the World unconventional CTMA peak in July 2016 up to July 2018 (where start of OPEC cuts in 2019 affects the CTMA after July 2018).

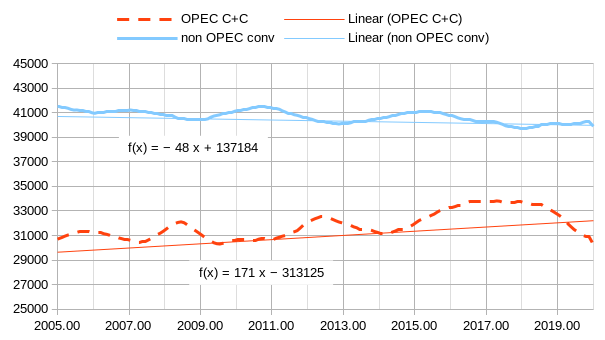

The chart below shows the overview of OPEC output and non-OPEC conventional oil output from Jan 2005 to Dec 2019

The general trend for non-OPEC conventional oil has been an annual decline rate of about 48 kb/d over this period and for OPEC output has increased at an annual rate of 171 kb/d over the same period.

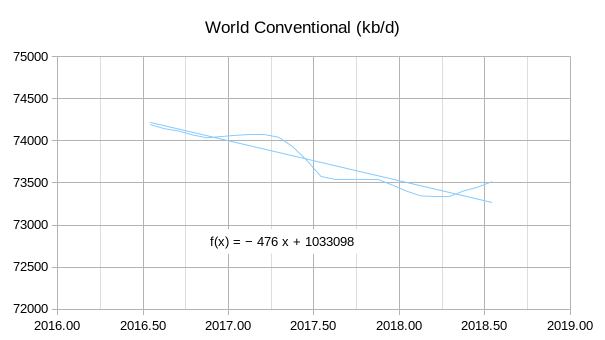

The chart below focuses on the shorter period from July 2016 to July 2018 for World Conventional output.

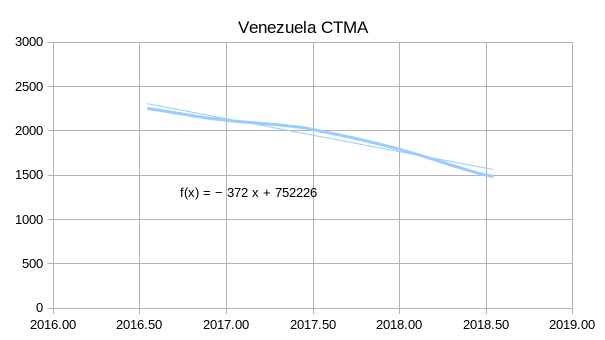

In the chart below note that much of this decline in output is from Venezuela, about 78% of the total.

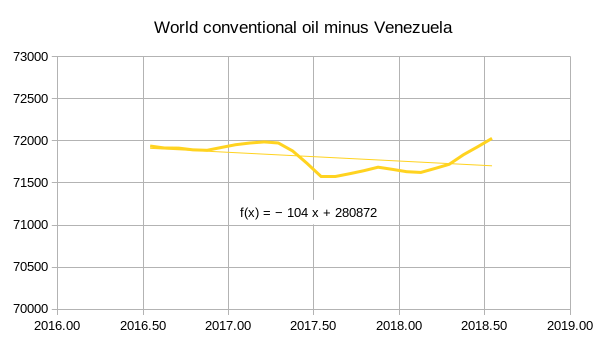

After July 2018 Venezuelan output has continued to decline reaching a low point for the CTMA of 458 kb/d in November 2020 and has since recovered to 595 kb/d by July 2021. My expectation is that Venezuelan oil output will stabilize around 700 kb/d and will cease to be a source of significant decline in World conventional oil output over the next 5 to 7 years. The chart below shows World conventional output minus Venezuelan oil output.

Output decreases at annual rate of 104 kb/d over the July 2016 to July 2018 period.

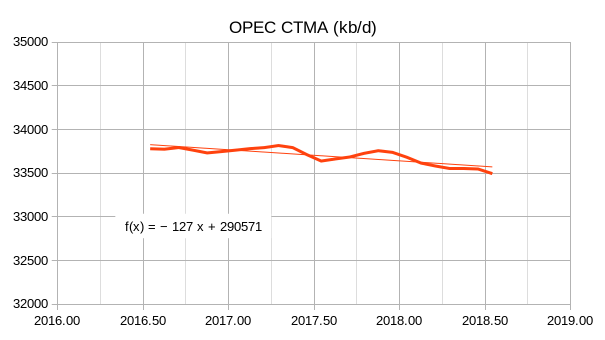

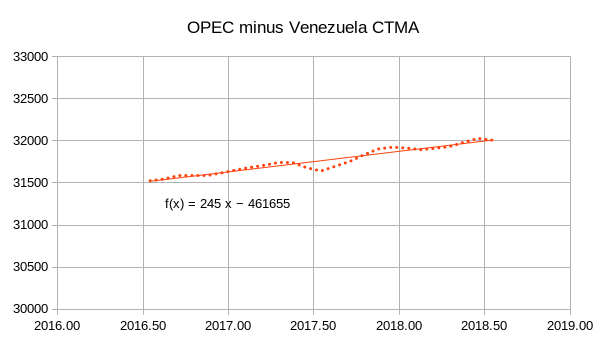

OPEC output decreases at an annual rate of 127 kb/d, but if we exclude Venezuela we get the following chart.

Without further future decline in Venezuela, we might see a rise in OPEC output as was the case from July 2016 to July 2018, especially while oil prices remain high.

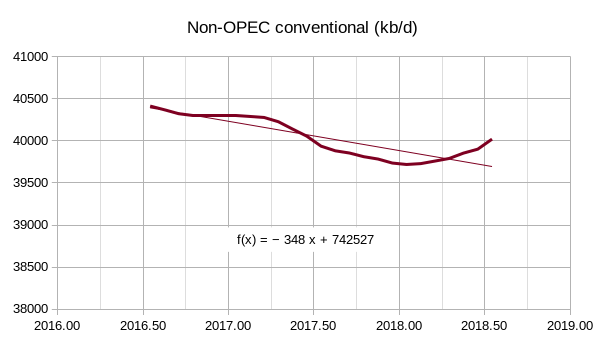

Most of the Period from July 2016 to Dec 2017 was a period of low oil prices and may explain the steeper decline in non-OPEC conventional output in the period from July 2016 to July 2018, relative to the longer term trend (2005 to 2019 in figure 3 above). This steeper decline is shown below, an annual rate of 348 kb/d rather than the longer term trend of 48 kb/d.

I expect that the high oil prices (over $90/b in 2021$) that are likely from now until 2030 may cause the annual decline rate to return to the 2005-2019 trend of 48 kb/d.

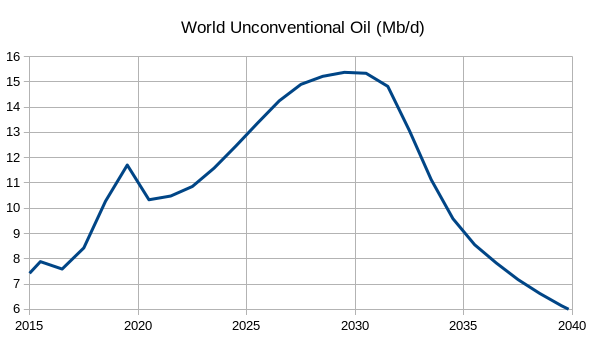

Chart in Figure 10 above shows the annual rate of increase in unconventional oil from July 2016 to July 2018, I expect future annual rates of increase will be significantly lower, on the order of 600 kb/d from 2022 to 2029.

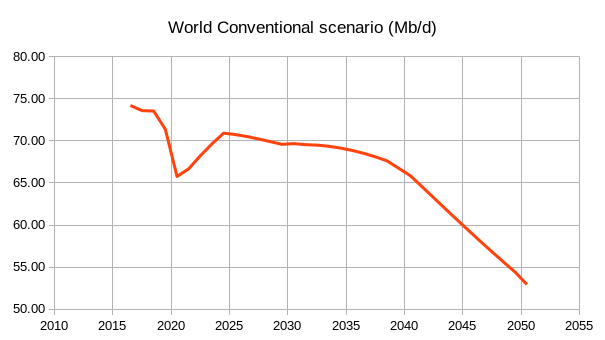

It is unclear if conventional oil will continue to recover at the rapid pace we have seen over the past 18 months where the annual rate of increase in World unconventional output has been about 4384 kb/d, if that rate should continue, (doubtful due to Russian aggression in Ukraine and resulting sanctions) in 12 months World conventional output would reach 73324 kb/d, not far below the level when the World was at its previous peak in Nov 2018 (74132 kb/d and CTMA was 73051 kb/d). This is a highly unlikely result due to a permanent decline in Venezuelan output of roughly 1500 kb/d from July 2016 to December 2021, it is possible other OPEC producers might increase their output over the long term, but I doubt future World conventional output reaches a CTMA of 71500 kb/d or higher in the future.

My scenarios for future World output assume conventional oil output recovers much more slowly as in chart below.

My expectation is the new peak will be due to an increase in unconventional oil, both tight oil and Canadian oil sands, with an increase from 10.5 Mb/d in 2021 to 15.4 Mb/d in 2029 as shown in the chart below.

These two scenarios combine to give a scenario which peaks in 2030 at about 85 Mb/d.

Dennis , thanks because unconventional is the” real thing” and it has been out of the picture for too long . Your effort and the work you put in is greatly appreciated .

Thanks hole in head. Note that tight oil and oil sands are the real thing. The notion that these cannot be used to produce gasoline, jet fuel, and diesel fuel is not correct. About 13% of the World’s crude plus condensate is unconventional oil as of Dec 2021 roughly 10500 kbpd of 80000 kbpd total. This increase in output of 9500 kbpd in unconventional output over the 2009 to 2019 took a lot of pressure off World oil markets, in fact it coused oversupply by the third quarter of 2018 and led to OPEC plus agreeing to cut output in 2019.

“The notion that these cannot be used to produce gasoline, jet fuel, and diesel fuel is not correct.”

Can anyone point me in the direction to quantify petroleum product output vs. API gravity? While *some* diesel fuel can be made from lighter liquids, surely we get less yield as gravity increases.

Who ever really claimed that tight oil wasn’t “real” in terms of hydrocarbons? The issue is general depletion of a finite resource. Tight oil will peak faster due to shorter plays and the more intensive drilling and/or tar sands mining needed. There’s also just a lot less of it vs. conventional supply history, regardless of ERoI factors.

Fracking saved us temporarily from the conventional oil plateau that preceded the 2008 recession, which people still naively blame on financial schemes alone. The curves in this article show no solid future for any type of oil. And “renewables” entirely depend on it, even if their landscape sprawl wasn’t a growing environmental problem.

HHH , As we see the Yen unravelling this comes in .

Hong Kong’s Hang Seng Index, where many Chinese companies are listed, plunged 3.7% on Monday and is down 31% year-over-year. At 19,869, the index has regressed to a level first seen in January 2007.

What will this do to the HKD peg ? Any additional info .

Hong Kong’s banking sector is the most over leveraged in the world. They are leveraged at 850%. Their real estate market is the most over leveraged in the world. They are pegged to the dollar. Rising interest rate in US are a major problem for Hong Kong.

A lot of dollar financing that flows into Hong Kong comes via Japanese banks. Any foreign outflows put extra stress on the Peg.

The trend for World C+C output CTMA from July 2000 to July 2019 is an average annual rate of increase of 795 kb/d as shown in chart below. As before the data is from EIA international Energy Statistics.

https://www.eia.gov/international/data/world/petroleum-and-other-liquids/monthly-petroleum-and-other-liquids-production?pd=5&p=00000000000000000000000000000000002&u=0&f=M&v=line&a=-&i=none&vo=value&vb=173&t=C&g=none&l=249–249&s=944006400000&e=1638316800000&ev=true

Hey ho , Steel ( Silver) away . For those who have read “The Lone Ranger ” comics .

Thanks Dennis, great data visualisation and interesting projection.

Just to clear things up for myself, can you please give a specific definition of conventional and non-conventional oil.

I was a bit confused, when you include and redacted Venezuela, is that from a conventional or non-conventional source, I am assuming Venezuela has both ?

A table of major producing countries and their respective source of conventional, non-conventional production or both might be handy here. I assume all OPEC+ is conventional?

Thank you Iron Mike,

Taking Venezuela out of the equation takes out mostly conventional oil and a bit of unconventional oil, in 2020 and 2021 OPEC estimates unconventional OPEC production at 100 to 110 kb/d (all of this is likely to be from Venezuela, but it is not stated explicitly in MOMR, see table 5-6 on page 44 of April MOMR).

So basically all of World non-conventional except 100 kb/d in 2020 and 110 kb/d in 2021 produced in the Orinoco belt of Venezuela is included in my estimate, non-conventional data for Venezuela for earlier years is difficult to find so for simplicity I just included the Venezuelan non-conventional (total for other years besides 2020 and 2021 is unknown) with the rest of the World’s conventional oil.

The short answer to your question comes from this line in the post:

…World conventional oil, which I define in this post as World C plus C minus the sum of US tight oil and Canadian oil sands.

I probably should have said that I define non-conventional oil as the sum of US tight oil output and Canadian Oil sands output, I apologize for not communicating clearly.

If I had a good estimate for Venezuelan unconventional oil output, I would include it.

Tight oil data comes from link below

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

Canadian Oil sands data from link below ( sum Alberta upgraded and non-upgraded in HIST bpd tab)

https://www.cer-rec.gc.ca/en/data-analysis/energy-commodities/crude-oil-petroleum-products/statistics/estimated-production-canadian-crude-oil-equivalent.html

The chart below subtracts the OPEC estimate for Venezuelan conventional crude oil (using secondary sources data) from the EIA’s estimate for Venezuelan total crude plus condensate production to estimate Venezuelan unconventional crude plus condensate output. There is no way to know the ratio of unconventional crude to condensate in this estimate and thus I left it out of the analysis ( and thought it would tell us very little ). Even if we assume condensate output is zero, the amount of unconventional output seems to be fairly insignificant (even lower than the OPEC estimate, in 2020 it is 26 kb/d and in 2021 it is 38 kb/d, under the assumption that condensate output is zero. Chart below is the centered 12 month average for this estimate.

Great, thanks for the clarification. World C+C – (U.S tight oil + Canadian oil sands), seems like a very reasonable estimate of world conventional oil production to me.

I don’t think there will be further unconventional sources added to the mix from other parts of the world. The cost and technology is not there in my opinion, but that’s just my conjecture.

So if i am getting this correctly, you are asserting that world conventional c+c will not surpass the 2016 peak, but recover slowly through this decade. And the growth in overall world production of c+c will come from unconventional i.e. U.S and Canada.

Interesting and plausible assertion. I think two obvious obstacles that might stop your projection is bank funding and government policy towards fossil fuels (in Canada and U.S).

How high do you think (U.S tight oil + Canadian oil sands) production will go and peak?

Why don’t you think OPEC+ can surpass 2016 peaks ?

Iron Mike,

Note that the 2016 peak in the post is OPEC, not OPEC plus. Part of the problem is Venezuela which produced about 2255 kb/d at the 2016 peak, about 1500 kb/d more than its December 2021 monthly level, in addition other OPEC nations such as Algeria, Angola, Congo, Eq Guinea, and Gabon will continue to decline at about 100 kb/d per year. It is conceivable that OPEC returns to the 2016 peak, but there will be many nations in the World with declining conventional output which may offset any increases in output by the big 5 OPEC producers (Iran, Iraq, Kuwait, Saudi Arabia, and UAE.) Remember also that as Hickory points out below, that Russian output is also unlikely to recover to its previous peak which is another reaon that World unconventional output is likely to reach its 2016 peak in the future. Also keep in mind that US and Canadian conventional oil has been declining for many years, this is likely to continue. All of this is of course a guess by me, and my guesses about the future are very likely incorrect.

I use the Canadian Energy Future “Current Policies” scenario to estimate future Canadian oil sands output and my own tight oil analysis to estimate future tight oil. Note that my tight oil analysis looks at the economics of individual tight oil wells and only has a number of well completions that can be financed from operating cash flow after paying dividends and servicing existing debt. In short, no external financing is needed for the tight oil scenario, if oil prices remain above $75/bo in 2021$ through 2035 before dropping due to lack of oil demand.

Your general observation that my scenario may not be correct, both for the reasons you suggest and many others (wars, depressions, and things I have not considered) I agree with 100%.

Chart below gives , tight oil and oil sands scenarios and figures for unconventional oil output.

data in spread sheet at link below

https://peakoilbarrel.com/wp-content/uploads/2022/04/oil-shock-scenario.ods

Your posts state that you expect oil demand to fall faster than supply. I’m under the impression that peak (supply) oil was the main issue. Do you really believe we can replace that demand with renewables? Or are you thinking steady decline of our economy that kills the demand?

Would love to read any resources on the peak demand idea if you have em handy.

Tom,

I am focusing on crude plus condensate and it is not necessarily renewable energy, but the transition to battery electric vehicles and plugin hybrids that will reduce demand for oil. Note that my scenarios suggest that it is not so much a matter of peak demand, when output reaches a peak in 2030, it will be supply at a market clearing price that will be the limiting factor and oil prices are likely to be quite high, perhaps $150/bo in 2021 US$ or higher when that peak in the centered twelve month average occurs.

In the years between 2030 and 2035 oil prices may continue higher or might stabilize as the market will not believe that peak oil has actually been reached until 5 years or more after the peak. I expect the transition to electrically powered vehicles will cause demand to start falling faster than supply is falling, I have a range of scenarios with faster and slower transition to plugin vehicles with demand falling below supply between 2033 and 2037 with a best guess of 2035. Chart below has dashed line as supply with no transition to EVs with low high and average demand scenarios (depending on assumptions about the speed of the transition.

World Conventional Oil in chart below, with data.

People should really keep in mind that extrapolations that rely on eliminating a swing producer are extremely speculative. If US LTO had not stepped up, prices would have risen higher and stayed higher longer. That would have had a lot of impacts, and it’s likely that other supplies would have risen, including LTO in other countries and bitumen/tar sands, and that consumers would have switched more quickly to substitutes like more efficient ICEs, hybrids, EVs, telecommuting, carpooling, mass transit, local electric delivery, online shopping, etc., etc.

It’s like saying: what would the last election have looked like without a key state, like California or Texas? Well, a lot of things would have changed, long before the election, and we’d be in a very different world.

You can’t just pull out a key element, and do simple extrapolations…

Nick,

That is true, note that in my analysis I mostly eliminated a single producer to see what the output of the rest of the producers looked like. It is certainly true that without that output things would have been different, it is impossible to know what it would have been. Note that Venezuela was a major producer in 2014 and earlier with output around 2500 kb/d for many years, today it has fallen to 700 kb/d, a much less significant producer. As far as conventional vs unconventional, this is simply a useful division in my mind to see what output has looked like and the trends of each. Trends always change over time. Note also that the shock model uses past discoveries, past production, resource development rates in the past, and historical extraction rates. The model assumes discoveries in the future are constrained by geology (using USGS estimates) and economics (where eventually oil prices will fall in 2035+/-5 due to demand for oil falling faster than supply of oil) and that future development of resources and extraction rates are similar to the recent past. Past trends of output are not a part of the analysis.

An alternative view of unconventional oil

A picture is worth a thousand words!

Oil sands should be stacked at the bottom for clarity.

A transition to EVs (will require a new mining industry) can only happen when the economy is OK. But the economy is not OK since the oil price shock of 2008 which caused the financial crisis. The response was QE1 – QE3 which financed the shale oil boom, but also created a gigantic asset bubble which can pop any time.

Ukraine war will change everything as Russia is among the 3 big oil producers.

A transition to EVs (will require a new mining industry) can only happen when the economy is OK.

Investment in tractors increased sharply during the Great Depression. Farms were under much more financial pressure, and so in order to survive they spent more on the new high tech, rather than less.

By 1928 the first General Purpose Tractor was introduced, which allowed for planting and cultivating three rows at a time, Maybe that’s why investment in tractors increased so sharply. Maybe cuz they were newly available.

FWIW- 1930’s American farmer investment in general purpose tractors is a poor model for predicting global EV adoption rates.

Survivalist,

Tractors and combines substantially increased farm production and labor productivity, starting roughly in WWI.

“All during the war, Food Administrator Herbert Hoover exhorted farmers in this country to increase production. As the prices realized for their products rose, farmers began to borrow money to buy more acres and new machinery, especially farm tractors since labor costs were sky high.”

https://www.farmcollector.com/farm-life/u-s-farmers-during-great-depression/

1930’s American farmer investment in general purpose tractors is a poor model for predicting global EV adoption rates.

Why do you think so? Remember that the term EV’s applies to all classes of vehicles: light passenger vehicles, buses, trucks, trains, boats, etc. Think “electrification of transportation”. Of course, light vehicles account for almost half of all oil consumption, but Peak Oil concerns seem to generally focus more on commercial/industrial applications, where classic $-ROI will drive investment.

Although, really I don’t know why very high oil prices wouldn’t have the same impact on light ICEs. We can see that demand for hybrid-electric and plug-in vehicles is rising very quickly.

Remember that farmers were in desperate straits, and credit was very tight during the 30’s what with rural banks going bust, but farmers still increased their investment on new equipment.

“1930’s American farmer investment in general purpose tractors is a poor model for predicting global EV adoption rates”. – Survivalist

Why do you think so? – Nick

Because people today buying EVs aren’t 1930’s American farmers and EVs aren’t tractors. Duh! Why do you think it is a good proxy? Are tractors to farmers the same as cars to non farmers?

And just to clarify, you’re talking about American farmers and American EV buyers. You’re not making a global analysis of humanity and its future trends.

Will African & Asian consumers adopt EVs at a similar rate to American farmers adopting tractors in the 30’s? If so, Why? On what basis? Inquiring minds want to know. Lol

Maybe this is Nicks way of saying he forecasts EVs will be adopted rapidly and thoroughly, but has run out of reasons to say why that’s the case… so he pulls 1930’s farmers out of his ass, cuz a 1930’s farmer buying a tractor is just like a 2022 soccer mom driving around looking at show homes. Tomayto tomahto.

As it turns out, in reality, the adoption rate of tractors in USA in 1920’s and 30’s was pretty low as farmers feared bankruptcy.

The Diffusion of Tractor Technology

https://www.jstor.org/stable/3874881

A Note on the Real Cost of Tractors in the 1920s and 1930s

https://www.jstor.org/stable/3742205

Maybe Nick just makes shit up?

Survivalist,

My argument is in reply to this comment: “A transition to EVs (will require a new mining industry) can only happen when the economy is OK.”

My reply is that a transition can happen when an economy is not ok. And such an argument is helped by a counter example, of such a transition during such a time. Horses to tractors is such a transition, and the Depression is such a time.

Here’s one discussion:

The Depression did have an effect. During the early 30s, sales of farm machinery dropped dramatically. In 1930, there were about 200,000 tractors produced. By 1932, only 19,000 tractors sold. Some manufacturers went out of business or were sold to other companies, but those that remained continued to invent new machines or better parts. By 1935, over 160,000 tractors were being produced again. In some cases, farmers got their first government checks and bought machinery.

At every step in the process of growing crops, new machines were being developed during the 1930s.

Plows: For the first time in the 30s, plows were mounted directly to the tractor so they could be lifted out at the end of a row.

Planters: Grain drills and corn planters got better at distributing seeds accurately and quickly.

Mechanical cultivators: When the tricycle tractor was invented, it allowed allowed farmers to drive cultivators through closely spaced rows.

Harvesters: In 1935, the first wheat combine that could be operated by just one man was invented. The corn and soybean harvesters were not far behind.

https://livinghistoryfarm.org/farminginthe30s/machines_01.html

Another:

“Hanging On

Despite some of the worst times in history, farmers hung on with everything they had. They fought to stay on the land and to make a living. And what’s even more remarkable is that they fought to find the money to invest in some of the most revolutionary new agricultural technologies to come along.

Bigger and better tractors with new rubber wheels.

Combines that ended the era of threshing…”

https://livinghistoryfarm.org/farminginthe30s/farminginthe1930s.html

Here’s a nice chart showing numbers on the farm of horses vs tractors. We see a fairly uniform transition interrupted briefly by the Depression:

https://livinghistoryfarm.org/farminginthe40s/machines_13.html

This briefly says “The Great Depression brought further deleveraging in the U.S. agriculture sector as another collapse in farm profits during the 1930s slashed farm investments and triggered another wave of farm bankruptcies.”

https://www.kansascityfed.org/documents/1378/2013-Farm Investment and Leverage Cycles: Will This Time Be Different?.pdf

The two articles you provided seem to explain the sharp rise in sales in 1934, still well in the middle of the Depression. The first argues that tractor sales rose after tractor implements became more useful.

https://www.jstor.org/stable/3874881

This article argues that tractor sales rose after tractor prices dropped in the period 1923-1934.

https://www.jstor.org/stable/3742205

To summarize: farm investment in tractors dropped at the beginning of the Depression, but rose sharply in the middle as tractors became more and more attractive.

Depending on how long the Russian invasion and ‘western’ world displeasure/sanctions last,

Russian oil output might undergo a big decline. A decline that will be hard to recover from.

They have very limited ability to redirect oil output from established customers.

The pipeline capacity to elsewhere (the east) is already full, and is less than 20% of export volume.

Shipping will be unable/unavailable to take up much slack.

If wells get shut down for lack of off-flow capacity, many of the marginal ones (Russia has lots of these I have read) may never get restarted.

Its a new race to the bottom, as war generally is.

The oil charts will look different as a result.

So will the balance sheets.

So will the maps.

“While all EU states have taken steps to cut imports of Russian fossil fuels, there has been little impact on Moscow’s earnings from crude exports so far, as Asian countries continue to buy up cheap Russian crude that European buyers don’t want.

According to a Bloomberg analysis, crude oil exports from Russian ports have risen sharply in recent weeks, with the Kremlin’s revenue from crude oil export duty surging by 25 percent for the week ending April 22.”

https://www.bloomberg.com/news/articles/2022-04-25/russia-oil-flows-jump-to-four-million-barrels-a-day-as-asia-buys?sref=By7uNNel

Note Hungary Austria Bulgaria, Czech Republic, Slovakia have not signed onto any embargo. All EU votes to date have been non-binding. That list of countries adds to 945K barrels/day consumption. All embargo talk out of Germany has been of a stretched phase out schedule depending on solar to fuel trucks, one supposes. Germany consumption 2.2 million bpd. Numbers pre Covid.

Watcher , Eu is a bunch of morons .

https://www.theepochtimes.com/european-union-to-cut-russian-oil-and-gas-imports-to-zero-by-2027_4427794.html?welcomeuser=1

The Epoch Times is a far right mostly fake news outfit.

Check them out on wiki pedia.

However,

if the invasion is not quickly called off and the sanctions are upheld for a long period,

it will bite into Russian oil production simply for lack of materials, capital, and technical/human resource from external sources- such as Halliburton, Schl.., Baker-Hughes.

To what extent?- time will tell.

Won‘t happen, I think. The complete territory of the Donbass Republics will come under Russian control and Russia will maintain the land bridge to Crimea. The Asov Sea from now on is a Russian sea and will stay so, everything else are pies in the sky. Europe and the US better get along with that, because a long war of attrition will only be won by Russia – at a higher cost for all. Yes, everything could have been arranged in a much nicer context and this war is terrible for Europe. Bit things are how they are and not the way we wish they were.

I have suspected from the start that Russia will be able to take the east and as much of the south coast as they are motivated to take, including Odessa.

But it will be a very costly victory. They are now hatred in Ukraine and all of their neighbors to the west will be indefinitely on guard against them.

The economic pain for them is just starting and is not going to fade anytime soon.

Putin would have been wise to just keep earning oil and gas dollars for the decade without earning a mountain range full of hate, mistrust and hard economic push back.

He has motivated Europe back to a military preparedness stance, and to much more rapidly pursue a path of alternatives to Russian energy.

Foolish or delusional move he has made.

He has motivated Europe…to much more rapidly pursue a path of alternatives to Russian energy.

I agree. That’s a significant silver lining.

Vulnerability to cutoff supplies is a basic problem with fossil fuel, and this is a little bit like OFM’s brick upside the head.

Maybe Hickory. I see Europe going down much faster than Russia. The old continent doesn‘t have resources and they will be bankrupt within months. And then they will adapt the oldfashioned way: by collapse. Russia will be hurt, but they will always have energy and food. And China has already replaced Europe‘s factories and badly needs russian gas and oil. In short: WTF is Europe?

Could have been a cooperative world. Didn‘t happen.

There’ll always be takers of Russian oil, by sleight-of-hand or otherwise. What’s important is that it is consumed before the New World’s is. Someone’s got to be the last-man-standing – I prefer it to be US.

Iran, for instance, will in the long term benefit from their economic sanctions – they’ve still got their oil that will in later years be worth much more than the $20/bbl that the North Sea was depleted at. Iran will enjoy being the de-facto power of the Middle-East once the Saudi’s oil is all gone. Assuming there’s no invasion and occupation, of course.

Unofficial . Russia has cut off gas to Poland for not paying in Roubles . Friday was the date of settlement . As of today their storage is 75% full .

https://www.onet.pl/informacje/onetwiadomosci/onet-nieoficjalnie-rosja-wstrzymala-dostawy-gazu-do-polski-co-dalej/sf4jdzj,79cfc278

Translate using Google .

Hole,

It’s official already. Russia has cut off gas to Poland, Lithuania and Bulgaria. So far.

We did not in Poland extend the contract for 2023 anyway, so it does not impress us. Gas for next winter is contracted from Norway, the US and Qatar. But of course gas prices are going up.

Denis, how would the main graph look like if we consider deepsea also as unconventional? Would the blue line take another significant hit?

West texas fanclub,

Unknown, I do not consider deep water offshore or Arctic oil to be unconventional oil, I think in terms of continuous and conventional reservoirs, following USGS methodology.

The outages hit much of the Bakken oil patch, causing the phone of North Dakota Pipeline Authority Director Justin Kringstad to ring off the hook Monday as energy companies called in to report on how the storm had impacted their operations.

Kringstad estimated that the state’s daily oil output fell by as much as 60% relative to the start of April, due to a loss of electricity across the region and snowy roads making it impossible for trucks to reach energy infrastructure. North Dakota recently had been producing 1.1 million barrels of oil per day, a figure that he believed had already fallen 25% a week and a half earlier when another blizzard hit the state.

https://bismarcktribune.com/news/state-and-regional/blizzard-damage-unprecedented-montana-dakota-utilities-says-thousands-remain-without-power/article_12c58514-c49a-11ec-94f7-5f6103a0b6c9.html

Oil production: Nigeria leads Q1 shortfall, World Bank cites sabotage

The World Bank has said Nigeria has the largest shortfall among oil-producing countries due to sabotage within the oil production system and other factors, such as low investments and the COVID-19 pandemic.

SNIP

“At present, the largest shortfalls are in Nigeria (0.5 mb/d) and Angola and Russia (each 0.3 mb/d). Production has been affected by a variety of temporary factors including maintenance (Kazakhstan and Libya), protests (Kazakhstan), sabotage (Nigeria), and bad weather (Iraq, Libya).

It’s just one damn thing after another. When are these bad things going to stop happening in the oil patch? 😫

Lack of food in the Middle East later on this year has potential to be severe enough that social disorder disrupts oil flow.

HHH, in comparision, the previous color revolutions will look like a big love parade.

Dennis, your two last charts, conventional and unconventional oil production, leaves me speechless. You have conventional oil increasing by about 4 million barrels per day by 2024. Do you really believe that? I mean seriously???

Ron,

Yes I am serious. December 2021 World conventional output was 68940 kb/d as I have defined it in my post.

To reiterate I define conventional output as World C plus C minus the sum of US tight oil output and Canadian oil sands output. My future scenario has World conventional average output in 2024 at 70635 kb/d, about 1695 kb/d higher than the most recent data point (December 2021). Over the December 2020 to December 2021 period, World conventional output has increased by 3800 kb/d, over the next 30 months I am expecting an annual rate of increase of about 678 kb/d for World conventional output (1690/30*12). Chart below has monthly data for World conventional oil up to Dec 2021 and my scenario (annual data) from 2022 to 2030).

December 2021 World conventional output was 68940 kb/d as I have defined it in my post.

No Dennis, that number was not defined anywhere in your post. And your chart does not show that. I tried to line up December 2021 on your chart and I get about 66500 kb/d. And your 2024 point on the chart is at least 4 million bp/d above that point. That is what I was referring to. Your data in your comment above puts the increase at 1,695 kb/d. Your chart shows an increase of about 4,000 kb/d.

Your data of an increase of 1.7 million bp/d may be close but you just got overly ambitious when plotting your data. 🤣 However I would bet that March 2022 conventional oil data will not be surpassed. And it definitely has no chance of surpassing the 2018-2019 production data.

Ron I meant conventional output as I defined it in my post. I plotted average annual data, the annual average for 2021 is 66600 kb/d for World conventional oil output. We do not know what March conventional oil output is at present, we only have data through Dec 2021. We also do not know what future output will be, Russian output will decrease, high oil prices may lead to increased output elsewhere as new resources are developed. It is also possible we will see a change in where Russian oil flows over time. The oil which was exported to Europe may simply be diverted to China, India, and elsewhere (Africa and South America perhaps). The supply that is displaced with Russian oil may flow to Europe, all impossible to know in advance.

Did you mean March 2020, rather than March 2022? I agree that is not likely to be surpassed. My expectation for the annual average output is a maximum of 70.6 after 2019, the peak was 2016 at about 73.5 Mb/d for conventional oil. I agree the 2018 level (72.7 Mb/d) will also not be reached in the future for conventional oil, but unconventional oil may rise to 15.4 Mb/d about 5 Mb/d above the average 2018 level. At that point (2029) I expect conventional output will be about 70 Mb/d with a peak in World oil output at 85 Mb/d in 2029 or 2030.

Dennis, I know we do not have March 2022 data yet, I was just assuming it will be the high for the year. April will almost certainly be down from March and it will be all downhill from there for the rest of the year. So no, I meant March 2022, not 2020.

About Russian oil. All three of the big oil service companies as well as Shell, ExxonMobil, and BP have pulled out of Russia. And you don’t think that will affect their production? It simply doesn’t matter if they do find new routes to export oil, their production is going to suffer drastically when their equipment starts to deteriorate. Their new drilling of infill wells will drop dramatically also.

Prediction: Over the next 24 months Russian oil production will drop much faster than US production will increase. Wanna bet?

Ron,

No I have no insight about future Russian oil production, so not a bet I would make.

Oh my goodness Dennis. For a person with such an insight on world oil production, why would you have such a blind spot on Russian oil production? Is not Russian oil production part of world oil production? That looks like a little selective blindness to me.

Ron,

Difficult to predict how the politics will play out, the situation is highly complex from my perspective, even moreso than usual. I focus more on US tight oil output. I agree that Russian output will drop, whether is drops by more than the increase in US output, I cannot say. US output will likely only rise by 1000 to 1200 kb/d over the next 24 months, so I would agree Russian output is likely to drop by more than that at least in the short term, whether it rebounds after the war with Ukraine and how long that conflict lasts is difficult to predict.

According to analysts observing the intensity of light from Russian oil flares and taking into account other informations, Russian production fell from 11.1 Mb/d in February to 9.76 Mb/d in April (or 12% of decrease). They also mention the fact that production stabilized during the month of April. I suspect that the Russian oil companies used the Western sanctions as a pretext to decommission oil wells whose extraction had become unprofitable, especially in the Western Urals, knowing that it was in the air a few months ago. https://www.bloomberg.com/opinion/articles/2022-04-21/war-in-ukraine-the-second-wave-of-russia-s-oil-shock-is-starting?fbclid=IwAR1WNI-B9RwBnOniZodh81KtDp-VBGiwOHvGQbX3T8pel4akpI3cUwxxv7g

Russia was already in peak oil mode even before the Ukraine war started

28 Feb 2022

Russian oil production update Nov 2021

https://crudeoilpeak.info/russian-oil-production-update-nov-2021

Baker Institute for public policy

REROUTE, REDUCE, OR REPLACE?

HOW THE OIL MARKET MIGHT COPE WITH

A LOSS OF RUSSIAN EXPORTS AFTER THE

INVASION OF UKRAINE

Mar 2022

https://www.bakerinstitute.org/media/files/files/3bf292f2/ces-pub-russian-oil-040822.pdf

Dennis,

What do you mean by this ?

Remember also that as Hickory points out below, that Russian output is also unlikely to recover to its previous peak which is another reaon that World unconventional output is likely to reach its 2016 peak in the future

Did you meant to say conventional is unlikely to reach 2016 peaks ?

I added a couple of simple plots from the dataset you link, just for visualisation of already known facts.

First one is conventional vs unconventional as a % share of world production over the past 22 years.

The reason for conventional decline i believe is a geological one, not an oil price phenomena.

Some of the conventional oil output decline in the last 10 years has been due to the human factors-

Covid drop in demand with opec voluntary decrease output,

Libyan internal chaos,

Iranian imperialism and the ‘western’ pushback.

Agree, it could be a myriad of reasons including the ones you mentioned.

I just think the biggest factor is geological. I may very well be wrong.

Iron Mike,

Yes I do not think conventional oil output will return to the previous peak reached in July 2016 (for centered 12 month average output). I meant to say conventional and mistakenly said “Unconventional”.

I think conventional output has declined both due to geology and oil prices, but mostly geology. If you look at the centered 12 month average decrease in non-OPEC conventional oil output you will note the slope changes from positive to negative several times over a 15 year period. The changes in slope are due to changes in medium term oil prices in my view, but the overall long term decrease I believe is due primarily to geological and technological factors.

For OPEC conventional output, they very much respond to oil price as they often adjust output to affect the price of oil, that is why I focused on non-OPEC conventional which also responds to oil prices by changing their resource development plans in response to prices, thought there is a significant lag especially for new projects as lead time from FID to first output is typically 5 years or more for many large conventional projects.

Chart below is non-OPEC conventional C plus C output in kb/d, with OLS trendline from Jan 2005 to Dec 2019, data is CTMA.

Thanks Dennis, interesting analysis. Very reasonable forecasts there, unfortunately as you already acknowledged we don’t live in a reasonable world, and highly non-linear factors and unforeseen events will inevitably interfere with forecasts.

What do you have URR at 3200Gb? Do you also have an estimate of how much we have already produced out of the estimated URR?

Iron Mike,

Thanks. I agree completely that we do not live in a reasonable world, nor one where many use reason.

URR for conventional is about 2800 Gb and for unconventional about 200 Gb (75 Gb for tight oil and 125 Gb for oil sands), total World crude plus condensate URR is 3000 Gb. Up to December 2021 cumulative production of C plus C (starting in 1870) is about 1435 Gb. For the scenario I have presented cumulative production of C plus C is 2225 Gb in 2050, 2778 Gb in 2100, and 2977 Gb in 2200. In 2029 at the peak, cumulative output is 1681 Gb.

Interesting so around the peak in your model we would have exhausted just over 50% of URR.

I guess the ‘low hanging fruit’ so to say would have been all gone by then.

This one is of Dennis’s model of conventional and unconventional oil production projected into the future.

According to this, he sees a sharp drop off of unconventional oil production after 2030 and a steady decline in conventional around the same time.

Dennis I think based on first figure of % between conventional vs unconventional oil, I am not sure from a statistical point of view that downtrend could be consolidating or bottoming out. There is a possibility that downtrend will continue regardless of oil prices. I will make a simple forecast based on that thinking during the week if i get time to see how it would look.

Iron Mike,

An alternative stacked view.

Note I have updated the scenario a bit based on a comment by Ron.

https://peakoilbarrel.com/wp-content/uploads/2022/04/oil-shock-scenario2.xlsx

Note that output falls more steeply after 2035 due to a transition to electric power for land transport which reduces demand below supply and causes oil prices to drop, this leads to slower developmant of all oil resources (and likely an an end to most new development of unconventional and ultra deepwater offshore and Arctic resource development, only the cheapest oil resources will remain profitable (Onshore Russia and Middle east perhaps).

The assumptions behind this scenario may be wrong for many reasons and there are many assumptions, all of which are likely to be incorrect.

Yes much better visualisation.

So you think a decade will be suffice to reduce oil demand as electrification takes over. Interesting. You may very well be right. I honestly don’t know.

Regardless of electrification though, don’t you think geological factors will bite hard around or by 2035 ? I mean the oil energy cliff in your forecast seems to be around that year.

Also the conventional peak of 2016 is beaten in that particular projection.

Iron Mike,

In my chart the top is conventional plus unconventional, they are added, your chart puts the unconventional on top of the conventional. I will put another chart below in a new comment to clarify.

The conventional output peak remains 2016, but there is a new peak for total C plus C above the previous 2018 peak. In my scenario I assume extraction rates stop increasing after 2038 and time from discovery to first production decreases from 39 years on average (1918-2026) to a gradually decreasing level of 21 years from 2029 to 2039 and then increase to the historical level of 39 years from 2042 to 2050 (these two parameters apply only to conventional oil (tight oil is modelled separately and I use the Canadian Energy Futures current policies scenario for oil sands). After 2050 I assume resource development slows over time reaching 339 years by 2100. Discoveries (including reserve growth) are modelled separately as well and are an input into the oil shock model (a 2800 Gb model is used, see chart below). From discovery to production the discovered resources go through a fallow, build, and maturation stage until they reach the producing reserve stage where they are extracted at some annual rate e. Current extraction rate (2021 average) is 5.125% and producing conventional reserves at the end of 2021 were 476 Gb.

The model has steeper decline in conventional resources after 2040 due to the assumptions I have made as well as underlying geological resource constraints. The overall C plus C curve steepens in 2032 or so due to the steep drop in tight oil resources after 2031 which is also due to geological resource and technological constraints. So the short answer is yes, geological constraints will be a big factor by 2035, especially with the assumptions I have made. A different set of assumptions (say $300/b oil prices or some technological breakthrough I have not foreseen) could lead to plenty of oil supply even without an EV transition (or a Transportation as a Service transition). Click on chart for larger view.

Iron Mike , all of projections made by Mr Coyne are inaccurate . So here goes :

1. Conventional oil peak 2016

2. C+C peak 2018

4 . US peak 2019

This will not change and I don’t care what Dennis , Mckinsey or a Tom , Dick and Harry says .

Why ?

1. All reserves reported by OPEC ( main source of conventional ) are bullshit crap . Only some one with an IQ=0 believes those figures .

2. Conventional oil cannot/ will not grow because there have been very few ECONOMICAL discoveries onshore in the last 10 years .

3 . It takes 10 years from discovery to pumping and 8 years from FID( First Investment Decision ) . None were made .

4. Dennis does not make any space for decline rates and how / what will replace this . Sorry Dennis LTO is not a replacement .

5. He makes no space for geo political shifts . As total energy flows decline conflicts will increase . Libya , Sudan, Nigeria will be the new normal .

6. He makes no space for a financial meltdown which is a WIP ( Work In Progress) ‘ OPM is already declined .

7. He makes no space for a ” Black Swan ” . How about an unintended Houthi drone hitting Ran Tura ? How about events get so bad ( whatsoever the reason , Shia vs Sunni , JCPOA fails etc) and the Strait of Hormuz is shut off .?

All his estimates are ” if ” and ” but ” and nothing imperfect happens . His talk about EV’s has been shattered by Matt Mushalik’s post . Sorry Mike , we don’t live in a perfect world . S*** happens .

You can come to your own conclusions . The unravelling has began .

Last something about Mckinsey and the ” Big Three ” . My son and daughter in law are in the top posts at E&Y . He tells me that most of the companies they provide consultancy are in such awe of their reputation that they never question what they write about . They make reports ( I have seen many ) with ” if ” and ” but ” caveats etc that they cannot be held accountable . Anyway he says 95% of the reports provided to the customers are in file 13 ( wastepaper basket ) . This is from the horses mouth . Take care and be well .

Hi HiH,

Dennis acknowledges we live in a highly erratic world, and is just making simple statistical models based on the information at hand.

From what I’ve read, he also acknowledges and is fully aware that any model he/x/y or z makes about the future, is most likely incorrect.

Regardless, i think these models come in handy, if not for anything else purely from a mathematical forecast point of view.

That said, i totally agree with most of the points you’ve written there.

It is always healthy to have a spectrum of opinions/analysis’s and not live in an echo chamber. And we should give respect to this broad spectrum from the optimist to the pessimist. Whether the truth lies somewhere in between remains to be seen.

I am more on the pessimistic side, that’s my bias/conditioning, i tend to see the worse in humans, if history is any guide i see that as a fact or in other words as part of our genes or nature. Extrapolating that in the context of energy, we will do whatever it takes to maintain our standard of living, even if it means destroying half the world. We are figuratively the snake eating its own tail.

Mike . A pessimist is an optimist armed with the facts . 🙂

Iron Mike and Hole in head,

Despite what many think, I am also a pessimist and most of my past scenarios have proven incorrect on the low side. See for example

https://oilpeakclimate.blogspot.com/2012/07/an-early-scenario-for-world-crude-oil.html

where at the time (July 2012) I said:

The high scenario attempts to ramp extraction rates to 1973 levels over a 30 year time frame, this seems quite unrealistic when considering that Saudi Arabia and other middle east OPEC members were aggressively ramping up production from 1960 to 1973 at the some of largest oil fields discovered to date.

I doubt that such world wide extraction rates will be seen in the future, but included it to illustrate that even if it were accomplished the peak would only move by a few years (to 2021 from 2019 in the medium scenario). Even the medium scenario is somewhat unrealistic as it ramps to 1990 extraction rates over just a 5 year period, the reality is likely to fall between the plateau and medium scenarios.

The chart is updated with recent EIA data (the only change from the original models) below. At the time, Hubbert linearization resulted in a URR around 2600 Gb (this method does not give reliable results in my view). Currently Hubbert Linearization suggests a URR of about 2800 Gb using 1993-2019 data. Generally over the 1998 to 2019 period Hubbert linearization has tended to underestimate World C plus C URR.

Currently my estimate of World URR is 3000 Gb, with 1408 Gb of crude plus condensate extracted up to the end of 2020. This suggests at that point about 1600 Gb of resources remained to be extracted. According to BP there are 1300 Gb of oil reserves and note that there are no doubt contingent resources, possible reserves and reserve growth that might be added to these totals. Also note that my scenarios extend to 2300, if we assume all oil extraction stops by 2100, my scenario for the World Shock model have cumulative output of 2780 Gb by 2100.

There are many who would consider my scenario unrealistically pessimistic, most would also agree that black swan events by their nature cannot be predicted in advance. Future major economic recessions, major wars, pandemics, asteroid strikes, alien invasions, etc will tend to alter future projections.

Every scenario of the future is incorrect except one, there is an infinite set of possible futures so the odds of choosing the correct scenario is infinitely small, essentially zero.

For information on possible resources see following by Jean Laherrere from August 2018, nice table summary at end of report, he estimates World URR of about 2700 Gb.

https://aspofrance.org/2018/08/31/extrapolation-of-oil-past-production-to-forecast-future-production-in-barrels/

Hole in head,

All forecasts are inaccurate, I agree. Every forecast makes assumptions about the future, they are never correct. I will note that you also have ifs and buts in your forecasts, read your comment lots of “How abouts” as far as I can tell, just another form of if and but. My guess is that we have muddled through in the past and will continue to do so in the future, the exact path is unknown by all.

I say this again and again, maybe you haven’t been paying attention.

Dennis . ” My guess is that we have muddled through in the past and will continue to do so in the future, the exact path is unknown by all. ”

Exactly where we differ . You presume the past will /can be the future . I don’t . I have repeatedly said ” yesterday is not tomorrow ” . You are not paying attention . There are tipping points or what is called ” crossing the Rubicon ” . We are in ” phase change ” . There is no going back , just like a girl becomes a woman when she reaches puberty . Peak oil ( energy) is phase change and that is why you have no answers to my bullet points on why conventional oil has peaked and further growth in LTO is impossible . I have seen your response to Iron Mike and you start with ” presume ” , I don’t presume , I just state the reality on the ground . Of course there are ” black swan ” events that can change the outcome , but then that is why they are called “black swan” .

Hole in head,

You assert that we have crossed the Rubicon etc. I am not convinced by assertions.

I use peer reviewed papers to estimate reserves, see for example

https://royalsocietypublishing.org/doi/10.1098/rsta.2013.0179

See section 3b where they say:

Globally, BP [13] estimates 1263 Gb of conventional proved reserves in 2011 (slightly more than cumulative production to date) and 389 Gb of non-conventional proved reserves. The latter comprise 169 Gb of Canadian oil sands and 220 Gb of Venezuelan extra-heavy oil, but both estimates are disputed and only a fraction of this volume is likely to be recovered over the next 25 years. In principle, global 2P reserves should be larger than 1P reserves, but according to an authoritative industry source (IHS Energy) global 2P reserves are approximately the same as national declared 1P reserves—suggesting an overstatement of proved reserves by several producing countries.

Basically the conventional proved reserves reported by BP are equal to 2P reserves (which is the technical best estimate of reserves) in 2011, OPEC may be overstating reserves, but overall for the World total 2P reserves (which is the engineering best estimate of reserves) the BP proved conventional reserves are pretty close to this number.

I agree 2016 will be remain the peak for conventional, your assertion that tight oil and oil sands cannot replace some conventional oil is wrong. 2018 is not likely to remain the peak for World C plus C and 2019 is also not likely to remain the peak for US output. There are lots of oil discoveries that were never developed fully, World producing reserves are approximately 474 Gb at the end of 2020, about 2600 Gb of cumulative discoveries, and about 1400 Gb of cumulative production, this leaves about 700 Gb of resources to be developed along with the producing reserves already developed, there are likely to be future discoveries and reserve growth over time especially if oil prices are high. The decline in resources is built into the model, new resources are developed every year which replace those that are consumed, this is what oil companies do. And yes LTO and oil sands are a replacement, if this was not the case they could not be sold. Your 5, 6, and 7 are not events that can be predicted, there will be wars, and economic crises, these cannot be modelled in advance, the model is adjusted to account for these as they occur.

My lack of clairvoyance is a major shortcoming, I really need to get that crystal ball out of the shop. Hey that’s why I have you, so you can tell me what will happen in advance, though specific dates and perhaps changes in real GDP would allow me to model what might occur.

HInH- “all of projections made by Mr Coyne are inaccurate ”

What you and others who express this view continually and utterly

fail to comprehend is that

a projection is of course inherently inaccurate because it is an estimate of what will happen in the future.

Not a complicated idea. Grade school.

Nonetheless, the projections are very a useful attempt at fostering understanding and discussion of the factors at play.

The projections display what future production is theoretically possible based on current information and assumptions. Dennis is in constant search mode for updated information that may affect input assumptions. Hats off for the diligence and transparency.

As I see it, actual production is likely to be lower because of things like pandemics, wars, economic restraints (sanctions or trade wars), terrorism, depression for whatever cause, and other factors that cannot be accurately predicted or quantified.

I have great appreciation for the effort Dennis has put to this task, and as he has said he generally has underestimated actual production.

The biggest take home message i have gleaned from various projections of global output is just how much more oil and gas and coal is still underground, with a very long and fat tail of potential production after this peak plateau.

Just how much is affordable to bring up to the surface is an unknowable part of the equation.

What is clear is that we are grossly overextended on the fossil fuel reliance…

to the tune of billions and billions of people.

And yet most people approach the discussion and efforts at new energy production or energy efficiency as if infantile.

Hicks . ” Hats off for the diligence and transparency. ” Have I ever refuted that ? See the first message on this post , it is my appreciation of his work . Even Dennis will support that both of us” agreed to disagree ” but be civil . However as we stand today and all the data and info coming from the ” real oil men ” here and others whom I follow like Art Berman, John Kemp , Kurt Cobb, Kopits , Javier (Bloomberg) etc all his projections are inaccurate . His projections on LTO , world peak , US peak etc have all been inaccurate . His methodology has been commented on by many which is bottoms up . He uses data which is contaminated ( not his fault ) by EIA , IEA and USGS etc . Wrong hypothesis = wrong conclusion . GIGO . On the other issues we are mostly

in accord . We are now in the phase of ” energy poverty ” next is ” energy starvation ” . On the individual level as OFM stated ” I am prepared ” ( so am I) but ” I am ” is not the world . What would I do if I was the only one on this planet ? I don’t know what these billionaires like Theil etc are thinking buying real estate in New Zealand and Tasmania for doomsday . No man is an island . Living your life in a bunker or alone on 100,000 acres is not my idea of a life . Sorry , went of topic .

Hole in head,

Note that my scenarios take the ideas of the oil pros and include them in my assumptions. Things like pressure depletion rising water cuts and rising GOR are all expected. My scenarios have tended to underestimate not overestimate. As to future bad events, let me know when and how much real GDP decreases and it can be modelled, all else is simply hand waving.

Eni Prepares to Open Ruble Accounts for Gas as EU Warns Firms

Italian energy giant Eni SpA is preparing to open ruble accounts at Gazprombank JSC, allowing it to potentially comply with Russian demands that gas must be paid for in local currency, according to people familiar with the matter.

https://www.bloomberg.com/news/articles/2022-04-27/eni-prepares-to-open-ruble-accounts-for-gas-as-eu-warns-firms

Looks like companies are Breaking Rank with the EU stance on “NO GAS FOR RUBLES.” Eni is likely being logical here because Italy still imports 45% of its Natgas from Russia.

Also, while Mario Draghi has been scouring the globe for natgas, he believes Italy can ramp up imports from Algeria & Egypt. PHAT chance. Both countries have seen their net exports decline over the past 2-decades.

Will be interesting to see how many more companies-countries switch over to Rubles.

steve

Steve , all will pay left , right or centre . No exceptions . The alternative is freeze and starve . EU / ECB/ NATO/ IMF/ WB are a big club and as George Carlin said ” you ain’t in it ” . EU is the limit , kleptocracy + idiocrasy = catastrophe and that is what Europe is facing . Now another fight with Algeria . What could go wrong ? Morons to the left of them , morons to the right of them and into the valley of death charged the full EU . ( Parody on ” The Charge of the light brigade by William Tennyson )

https://www.bloombergquint.com/politics/algeria-threatens-to-cut-gas-flows-to-spain-in-spat-over-morocco

Thought you lived on Belgium Hole.

Steve , now Poland wants to get the taps turned on again . What happened ? Well, Germany refused reverse flow where upon gas would flow to Germany and then be re routed to Poland at a slight premium . Poland would pay Germany in Euro’s and Germany to Russia in Roubles . Germany said no , buy your own Roubles .

https://indianexpress.com/article/world/poland-seeks-to-restore-russian-firms-halted-gas-supply-7894143/

Iron Mike,

Chart for clarification. Uses same data as comment linked below

https://peakoilbarrel.com/decline-in-world-conventional-oil-output-and-peak-oil/#comment-739137

Yes i understand. So if the the unconventionals (U.S + Canada) don’t increase production (assuming various limitations) at the rate you anticipate, we might see higher oil prices as a result. Which will bring more motivations to produce unconventionals assuming no geological constraints.

You dont see a geological constraint for the unconventionals yet. More after 2030, as i understand.

My knowledge on unconventionals is very limited, but from reading the blog here, some people disagree with you, and some see geological limitations, or maybe ‘sweet spot’ constraints. This is an interesting puzzle which will probably be rectified in the next two years, regarding U.S tight oil production. If the 2018-2019 peak is surpassed then you will probably be right.

Regarding conventional, I believe the big four you mentioned can seem to increase production, but whether the peak of 2016 can be surpassed, anyones guess really. Whether there will be a cliff in production also remains to be seen, this decade will surely be ‘make or break’ for civilisation in terms of energy.

Iron Mike,

Note that the scenario I currently use for the Permian basin has a URR of 43.5 Gb out of a mean TRR estimate by the USGS of 75 Gb for 50 million prospective net acres in the Wolfcamp, Spraberry, and Bonespring plays of the Permian Basin. My scenario assumes only about 26 million net acres are actually utilized for completed wells spaced at 1320 feet and average lateral length of 9000 feet (273 acres per well). I assume slightly wider spacing in the Spraberry (1760 feet) and a total of 88,000 wells drilled after Dec 2017 and 70,000 wells drilled after Dec 2021, total wells completed for my Permian scenario are 103,750 from Jan 2010 to March 2034. Note that some people talk about 330 foot spacing, but LTO survivor has suggested that 1320 foot spacing works better, so I use that for my analysis. Obviously if tighter spacing was the norm, then more wells could be drilled, but EUR per well would decrease and costs per barrel recovered would increase (due to higher capital costs). I do believe there are geological constraints on tight oil, the constraints on oil sands are technological and economic more than geologic in my opinion.

There are definitely strong opinions on this that are different from mine, but looking at the data at shaleprofile, the analysis by the USGS, and the economics using discounted cash flow analysis, this is my best guess. Note also the the F95 TRR estimate by the USGS for the Permian basin is 44 Gb, that is about a 95% probability that the TRR will be at least 44 Gb. Peak output for the scenario is 8580 kb/d in 2029Q3. ERR=economically recoverable resources, which is also the URR.

Interesting analysis and modelling. Again sounds reasonable to me. What possible events do you think could curtail permian production ?

Mike , I presume that this question is for me .

1. OPM ( Other People Money ) is drying up .

2. All sweet spots are over .

3. The good DUC’s are over and out . What is left is tier 2 &3 all uneconomical .

4 . GOR / WOR are rising .

5. Pressure is falling .

6. Costs are rising , see my graph on steel tubing prices .

7. Experienced and intelligent labour is not available . LTO , SS , Mike S have lamented about this .

8. Shortages of sand . Posted links on this . Also many other inputs .

The issues posted have no solutions because they are geological mostly . Mother Earth rules . ” No way Out ” starring Kevin Costner , Gene Hackman .

Lol HiH,

I wanted Dennis to actually answer that question! But thanks anyways. Lets see what the future holds in store for us.

Iron Mike,

Tight oil producers could choose not to complete as many wells as I have assumed in this scenario either to keep investors happy by paying out big dividend checks or to pay down existing debt. The US could decide to not allow crude oil to be exported, this is a favorite of some people, this would tend to reduce completion rates as the US does not have the proper types of refineries to refine all the tight oil produced (that is the reason the export ban was lifted). There could be a crash in oil prices because OPEC ramps up output or due to a severe worldwide recession, if oil prices fall to under $60/bo (2021$) most tight oil well completions will cease. The scenario for the Permian I have used takes account of sweet spots becoming crowded and uses actual data from shale profile to model future output.

Also keep in mind the USGS did an assessment of the Bakken in 2013 using the same methodology as was used in Permian basin assessments in 2016 (Wolfcamp Midland), 2017 (Spraberry), and 2018 (Worfcamp and Bonespring formations of Delaware basin). The result for the North Dakota Bakken Three Forks was a mean URR of 11 Gb. My current best guess is a URR for ND Bakken/Three Forks of 8 Gb which matches very closely the proved reserves plus cumulative production at the end of 2020, this URR is about 73% of the mean TRR.

For the Permian 73% of the mean TRR would be about 55 Gb, my scenario is less than 80% of that (43.5 Gb). Below I have a scenario for Permian where completion rate is 400 new wells per month maximum vs a maximum of 650 new wells per month in previous scenario, in addition this new scenario has an oil price of $60/bo from 2027 to 2035 followed by decreasing oil prices reaching $30/b in June 2038 (30 months). URR is 40 Gb with 92,000 total wells completed. Note also that for both of these scenarios OPM is not needed, the future wells are financed entirely from cash flow.

Iron Mike and Hole in head,

On tier one running out, I have followed the Bakken since 2012, I expected by 2013 that we would see average new well EUR start to decrease in the Bakken as sweet spots ran out of room, in 2021 I was still waiting for this to happen. The Permian started really ramping up in 2013 as far as horizontal fracked well completions, the Bakken was at a similar level in 2007 and 14 years later we are waiting for new well EUR to show a significant decrease, maybe in 2027 we will see the same in the Permian basin, so far basinwide EUR decreases have been small in the Permian basin, we saw this over time in the Bekken where it looked like EUR was decreasing, then things turned around and it started increasing again. It could be different in the Permian, but so far I have not seen a basinwide chart for Permian EUR at 6 months normalized for lateral length that shows anything but minor decreases in EUR.

We no doubt can find individual counties or individual operators that tell a story of decreasing EUR, I contend that the basin wide average is the important parameter, and I have not seen convincing evidence of a basin wide decrease in 6 month cumulative output in the Permian basin normalized for lateral length.

https://www.linkedin.com/posts/ted-cross-8520b635_permian-permianbasin-oilgas-activity-6925809304935518208-oBxG?utm_source=linkedin_share&utm_medium=member_desktop_web

It might be time for a new hobby, Dennis. The E in EUR stands for estimated. As the folks that bought shaleprofile.com, NOVI, now suggest, well productivity IS declining. I’ve proved that numerous times. When the largest producer in the entire Permian has lost 22% of its IP180 production levels in 30 months, at $75 oil, man…that’s a BIG deal. And regardless of what funky DCA one uses, THAT translates to lower EUR’s.

Saudi America is poopin’ out ! You need to get “unstuck.” It might help the credibility thing.

Mike,

It is a big deal when the basinwide average decreases significantly. So far I have not seen much evidence of that.

Dennis,

Its a big deal now, if you cant see that then you will just arrive at the obvious conclusion late and be more of an oil statistical archeologist then analyst.

I remember when you me and Ron discussed the exaggerated reserves of saudi and opec. It was just in front of your nose but you refused to see it, i know you now have changed your opinion on that subject but i think it took almost a year to see what was obvious. I think this will play out the same way.

Sure you can always say numbers dont reflect x yet, but that also means you dont have any feeling for whats about to transpire and will always be limited to hindsight.

If common sense is applied to what Mike just posted the direction should be clear.

Be prepared to change your opinion in a year or so.. again 😉

“If common sense is applied”

Common sense says to estimate the trends computationally applying the existing data. You can hand-wave all you want and then give a qualitative guess if that’s the approach you prefer.

Mike said:

Anybody ask Enno Peters how much he made from selling ShaleProfile to Novi?

Smooth move 😉

Paul,

Sure if you always want to be late to the party and never arrive to anything else then just another update and yet another pointless projection before your next revision.

Some time its good to unglue those binoculars.

Given the fact that crude oil has been extracted on for at least 140 years, pinning down a peak oil date to within +/- 10 years counts for something.

The interesting part is applying novel mathematical concepts to the analysis. You are correct in that if one had all the data, it would be a bean-counting exercise to track current production. Yet, as we wrote in Chapter 5

We all know the limits to making useful predictions, especially in regards to economic forecasts where the elements of human game theory arise (and are likely intractable) but the aspects related to a finite and non-renewable resource are more tractable.

Baggen,

In the past my projections have been too peesimistic and always people like you and Ron say at the time that they are wildly optimistic, on many occasions I have called my scenarios on the “optimistic” side. Time revealed that they were in fact pessimistic.

I think you are remembering incorrectly about Saudi reserves, I have usually said we don’t know what they are, but if we take the 2P estimates from 1980 and assume reserve growth similar to the US from 1980 to 2005 we get a number similar to today’s reported Saudi “proved” reserves, I have long said the Saudi “proved” reserves were likely 2P (or technical) reserves.

What is your claimed Saudi reserves? I do not remember the details of the conversation you refer to. There is a lot of arm waving out there, but many don’t actually make any claim that can be falsified.

Interesting and detailed global energy report by McKinsey

(analysis completed before the Russian destabilization of the global energy situation)

They explore five scenarios, but offer a conclusion about oil demand that is of particular interest-

“Peak oil demand is projected to occur between 2024 and 2027¹ driven

largely by EV uptake—a development that is already underway.”

Take note that this statement does not necessarily imply a rapid demand decline.

Long plateau more likely.

https://www.mckinsey.com/~/media/McKinsey/Industries/Oil%20and%20Gas/Our%20Insights/Global%20Energy%20Perspective%202022/Global-Energy-Perspective-2022-Executive-Summary.pdf

“Peak oil demand is projected to occur between 2024 and 2027″

Well of COURSE demand is going to peak: you can’t “demand” what you don’t have, post-peak. Stupidest goddamned shit I’ve read…

Mike B,

The difference between peak supply and peak demand is the price of oil, currently oil prices are relatively high indicating a shortage of oil supply relative demand, thus oil prices are bid higher. When we reach a peak demand situation there will be excess oil supply at prevailing oil prices and the asking price for oil will need to drop in order to sell the oil on the market.

See https://www.britannica.com/topic/supply-and-demand

The chart below is from the executive summary of the McKinsey report linked above by Hickory.

Note that my expectation is that global oil demand will peak in 2035, about 10 years later than the McKinsey report.

Dennis, question? You said you did not agree with their demand scenario of the McKinsey Report. Do you agree with their supply scenario?

Ron,

I did not see their supply scenario, I guess the highest curve could be considered the supply scenario, not really sure about that as I do my scenarios as crude plus condensate. My rough scenarios have a peak of 99 Mb/d, but I do those in barrels of oil equivalent, not sure about the McKinsey report, but EIA does their forecasts for liquids in barrels, not accounting for energy differences between crude, NGL, biofuel, etc, so it is pretty useless from my perspective.

The supply scenario looks high to me, maybe that is the reason they see peak demand so early.

Mike B , you are one of the few who walks with his eyes open . None are so blind than those who choose not to see .

My personal take is closer to that of Dennis- demand for petrol is not going to peak so soon.

_________

Demand will be higher than supply in this decade, with high prices until the product can no longer be afforded.

Secondarily, plug vehicles will very slowly cut into demand.

Those (people, companies, countries) that have plug vehicles will have much cheaper transport miles than those who don’t.

Demand will be higher than supply in this decade,…

I understand what you are trying to say, but you are not saying it correctly. Demand always equals supply with price as the arbitrator. If the supply drops then the price will rise until demand drops to equal supply. When the supply rises, the price will drop until supply drops to equal demand.

When the oil prognosticators talk about peak demand they mean demand will drop so low that producers cut back on production. Production, and prices, will drop right along with demand… they believe. I seriously doubt it. I see it the other way around. Production will drop and prices will rise until demand drops to meet supply. That will be the story for decades. Production will keep dropping and prices will keep rising until… Until total collapse or renewables take over the world. I would bet heavily on the former, that is total collapse. But fortunately, I will be safely dead when that happens.

Ron,

We will see, EV sales are growing rapidly, prices of EVs will likely come down due to economies of scale as the World ramps up output and high oil prices will make ICEVs a poor choice from a total cost of ownership point of view. By 2035 demand will be falling faster than supply at 2034 oil prices and oil prices will start to fall, there will be a lot of oil that becomes a stranded asset because of lack of demand for oil, especially expensive oil like tight oil, oil sands, Arctic oil, and deep water offshore oil.

Dennis, I see things a lot differently than you. Of course, I believe peak oil is three years in the past. That is not new as I have stated that many times. But I see things as a lot more critical right now. I believe that the month of March 2022, just last month, will be the high production month for the year.

It could be close if Putin decides to give up on Ukraine. Or something drastic happens to his rule. But it looks like OPEC is near production capacity.

Nigeria Says OPEC Is Out of Spare Capacity

A one minute video: Goldman’s Currie Sees ‘Severe’ Oil Supply Constraints

I think it is likely that we will see supply constraints this year! Dennis, there is just not nearly as much oil out there as your charts seem to indicate.

Edit: Actually OPEC+Russia was flat last month, (down 11,000 bp/d), so it depends on what non-OPEC less Russia did in March. If non-OPEC less Russia was down in March then February will likely be the high for 2022. I do say “lilely” as I have no crystal ball, but that is the way I see things heading.

Ron,

I believe supply is currently short, that is why oil prices are over $100/b, it is possible March or Feb could be the high point for the year due to falling Russian output, higher oil prices might bring a supply response from somewhere, difficult to say, but it would take time so in 2022 output might be the same as 2021 for the annual average, currently the centered 12 month output (which is my focus) is 66.5 Mb/d and December output was about 70 Mb/d, I doubt the 12 month average for 2022 falls below the 2021 average, but we will have to wait to see how things play out. Oil at $150/bo might lead to higher well completion rates in tight oil basins, some projects that were waiting on FID may get those at higher prices (though there would be a 5 year lag until we saw first oil on new projects).

Dennis, I have no doubt that the 2022 average C+C output will be higher than the 2021 output. But that is not saying much as the 2021 average was just a fraction over 77 million barrels per day. 2022 average production should beat that by at least 1.5, and perhaps 2 million bp/d. But the high was the 2018 average at just a tad under 83 million bp/d. We will finish 2022 at least 4 million bp/d below the peak.

Sorry, but you will have to redraw your charts. 🤣

Ron,

When I have the annual total in April 2023, I will adjust my figures. Note that my current guess is 79.9 Mb/d for 2022, so perhaps about 1 Mb/d too high, an easy adjustment to make. Chart below assumes you are correct for 2022 World C plus C annual average output at about 79 Mb/d. This is also likely to be wrong, we will not know 2022 output for 12 months (in April 2023).

we will not know 2022 output for 12 months (in April 2023).

Of course, we will not know the exact figures until that date. However, we will have a ballpark figure months before that date.

Trends do matter Dennis. That’s why they call them trends.