A guest post by Ovi

All of the oil (C + C) production data for the US state charts comes from the EIAʼ’s Petroleum Supply monthly PSM. After the production charts, an analysis of three EIA monthly reports that project future production is provided. The charts below are updated to August 2021 for the 10 largest US oil producing states.

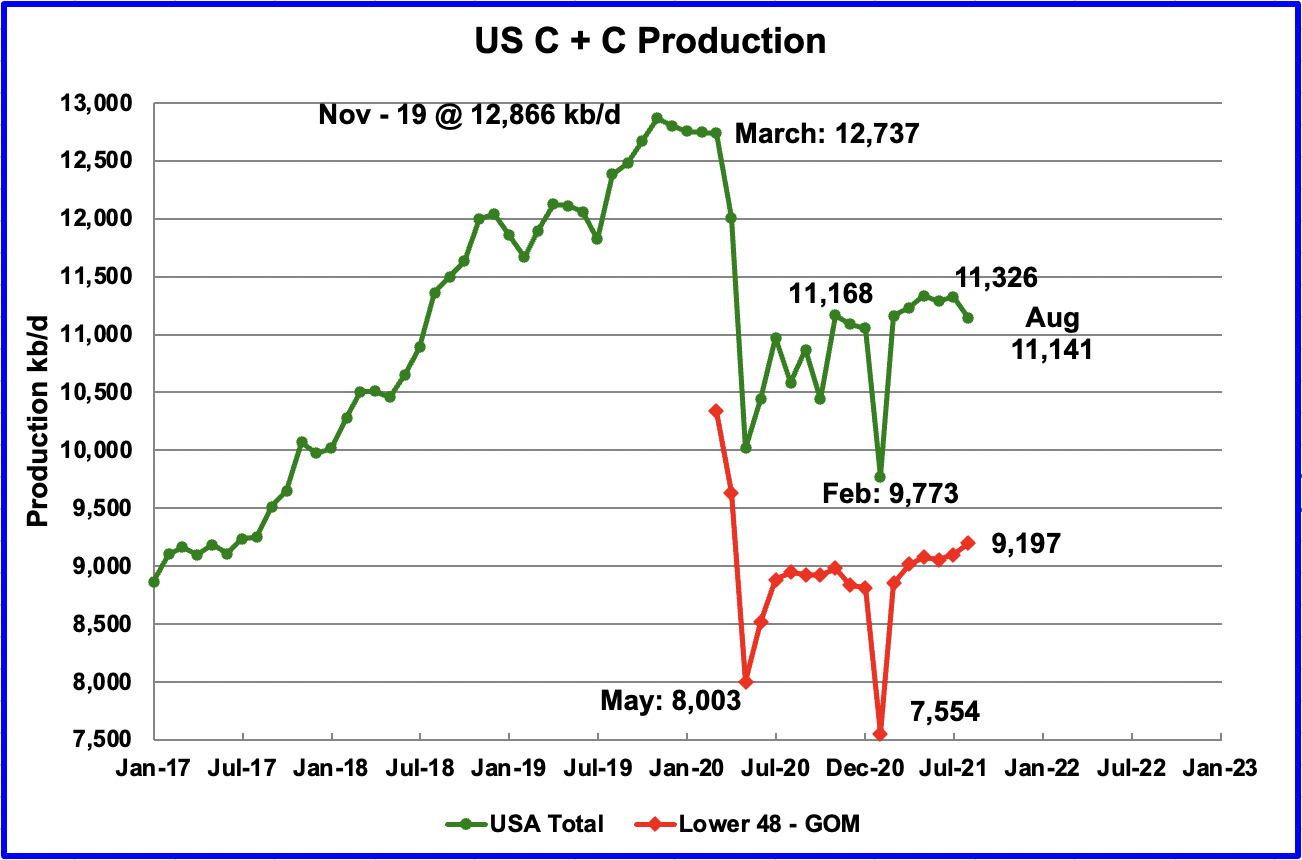

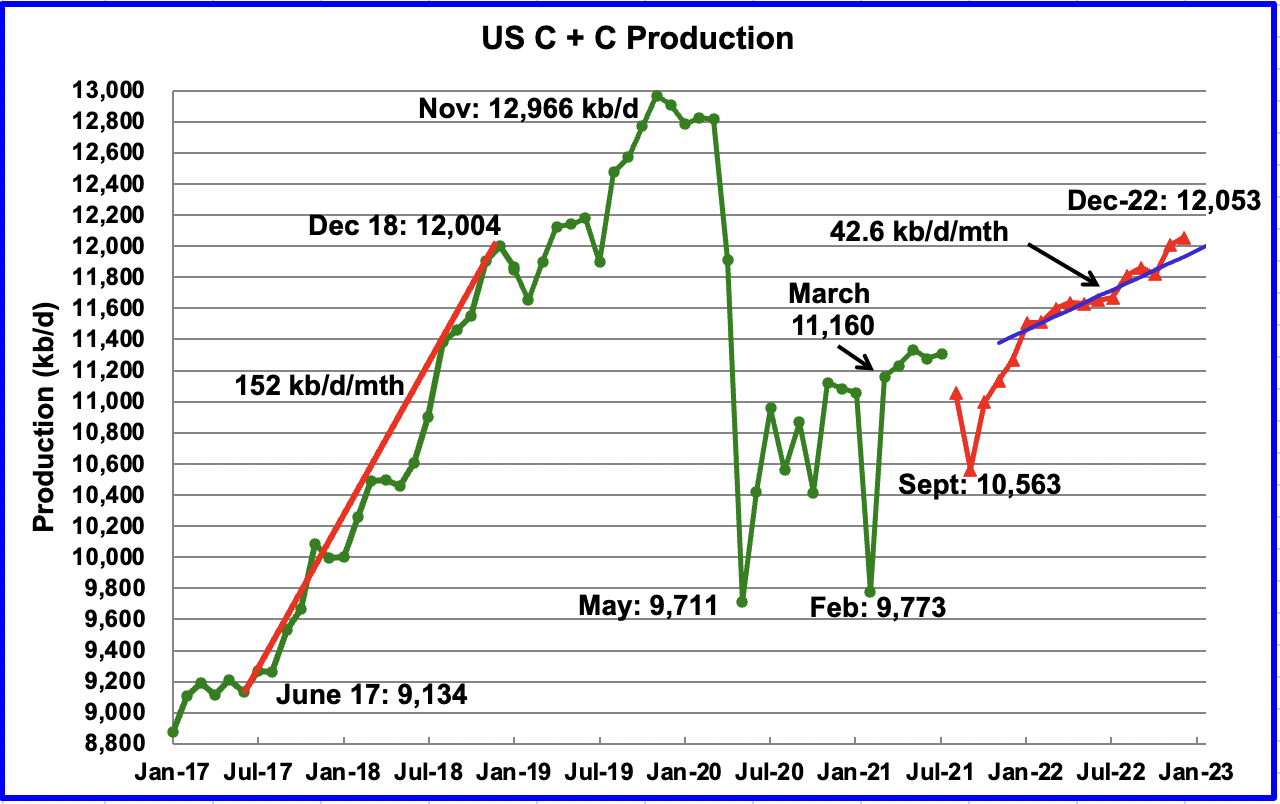

U.S. August production decreased by 185 kb/d to 11,141 kb/d. July was revised up from 11,307 kb/d to 11,326 kb/d in the October report. Note that August production is lower than November 2020, which was 11,168 kb/d, primarily due to Hurricane Ida’s impact on GOM production.

The October STEO report forecast US August output would be 11,060 kb/d. The EIA’s first estimate for August production in the October report is 81 kb/d higher. September is forecast to drop further since the impacts of hurricane Ida lasted longer than expected. Unexpected and extensive damage to platforms was done in the GOM.

While overall US production was down, a better indication of the health of US oil industry can be gleaned by looking more closely at the onshore L48 states.

In the onshore lower 48, August production increased by 98 kb/d to 9,197 kb/d. The main contributors to this increase were New Mexico, 50 kb/d, North Dakota, 29 kb/d and Texas, 18 kb/d for a total of 97 kb/d. This is a staggering increase since, if it continued at this monthly rate, it would translate into 1,164 kb/d/yr. This is a remarkably different picture for US oil output than many participants paint/forecast on this website.

Based on the DPR section below, it is forecasting that output in North Dakota will slow from the 29 kb/d increase posted in August. A better guess for future monthly growth according to the DPR is closer to 5 kb/d. Regardless, that would still leave the Big 3 producers increasing monthly production at a rate close to 70 kb/d/mth.

To get a better understanding of how long this rate can continue, it will be necessary to fully understand the contribution to output that the completion of DUCs is making, especially in the Permian/New Mexico. Also rigs are being added at steady rate in the Permian/New Mexico, more so than other basins/states. See New Mexico output further down.

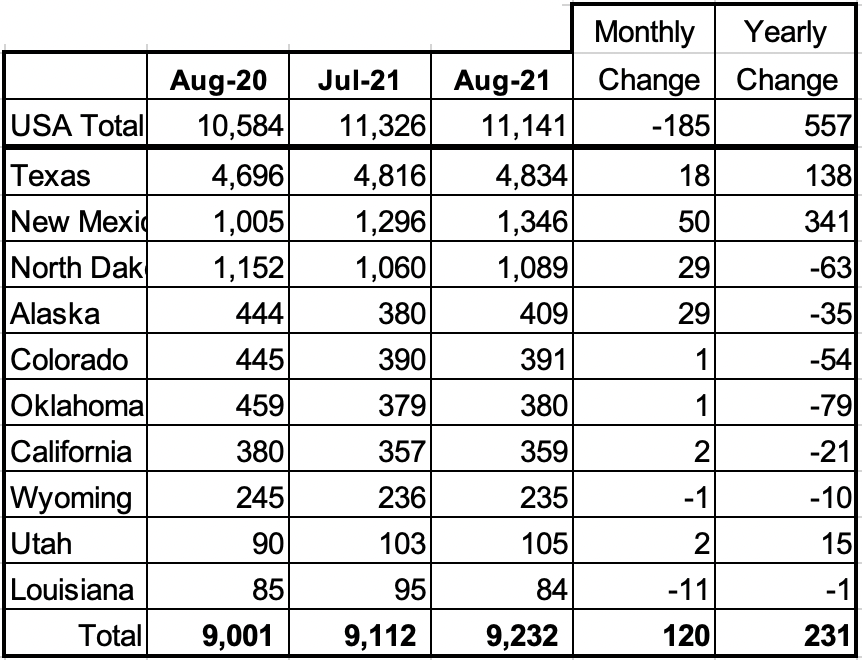

Listed above are the 10 states with the largest US production. These 10 accounted for 82.8% of US production out of a total production of 11,141 kb/d in August 2021.

On a MoM basis, the largest increase came from New Mexico with 50 kb/d. On a YoY basis, US production increased by 557 kb/d.

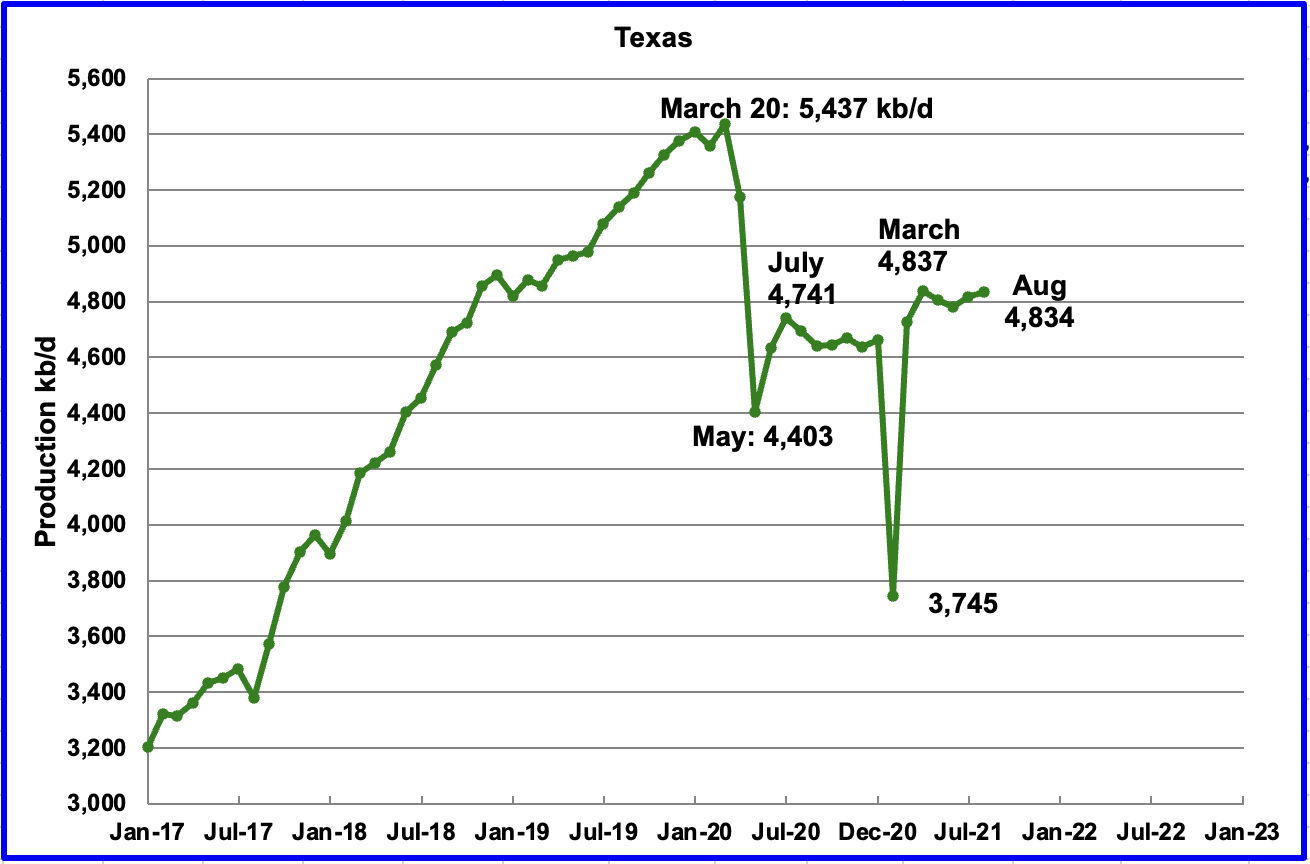

Texas production increased by 18 kb/d in August to 4,834 kb/d. Relative to July 2020, production is up by 93 kb/d.

In August there were close to 211 oil rigs in operation in Texas. By the week of October 29, 233 rigs were operating and production is slowly starting to increase.

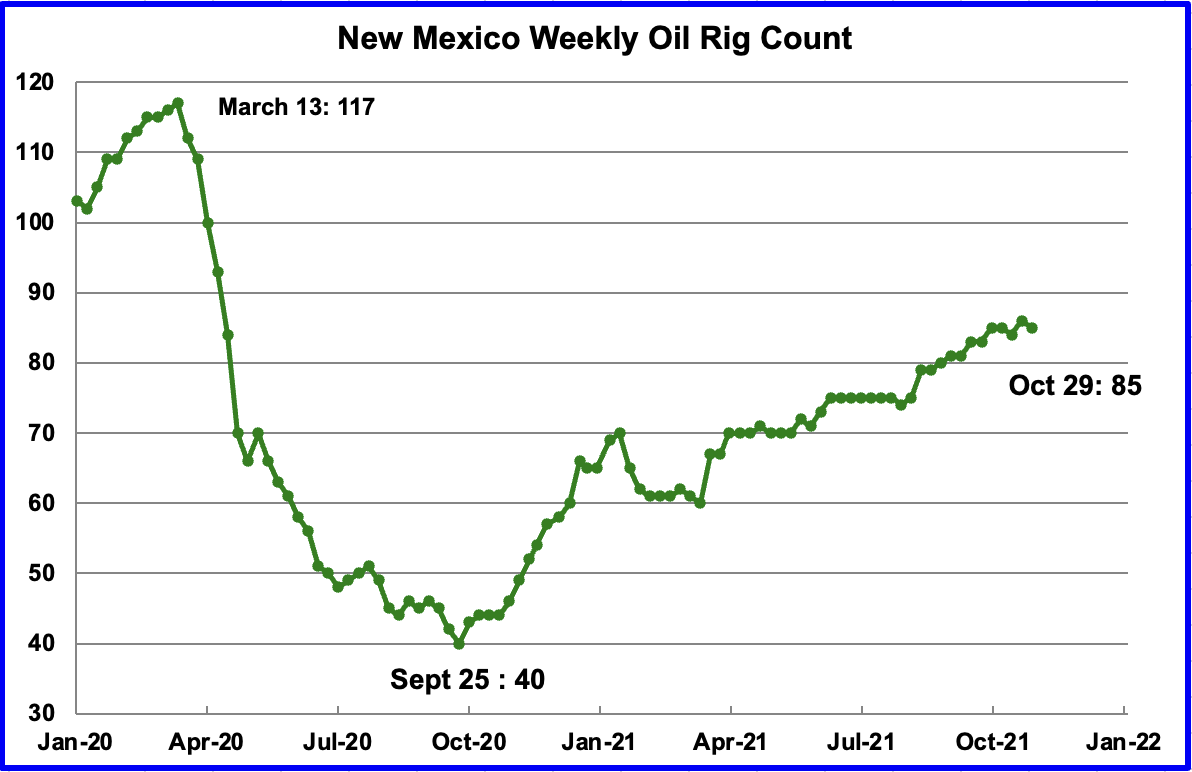

August’s New Mexico production set another new record and increased by 50 kb/d to 1,346 kb/d. The increase can be attributed to New Mexico’s Permian which is favoured over North Dakota, where higher production costs have curbed profits, according to this source

The steady increase in production is due to a steady increase in rigs as shown in the next chart and the completion of DUCs

New Mexico’s rig count dropped by 1 in the week of October 29 to 85. Note the steady increase in rigs since the end of July. From the end of July to the end of October, the rig count increased by 11.

According to the EIA, August’s output was 1,089 kb/d, an increase of 29 kb/d over July. North Dakota has officially lost its status as the nation’s second biggest oil producer to New Mexico, according to this source

Coloradoʼ s August output increased by 1 kb/d to 391 kb/d. Colorado has had an average of 9 rigs operating from the end of July to the fourth week of October. One rig was added in the last week of October for a total of 10.

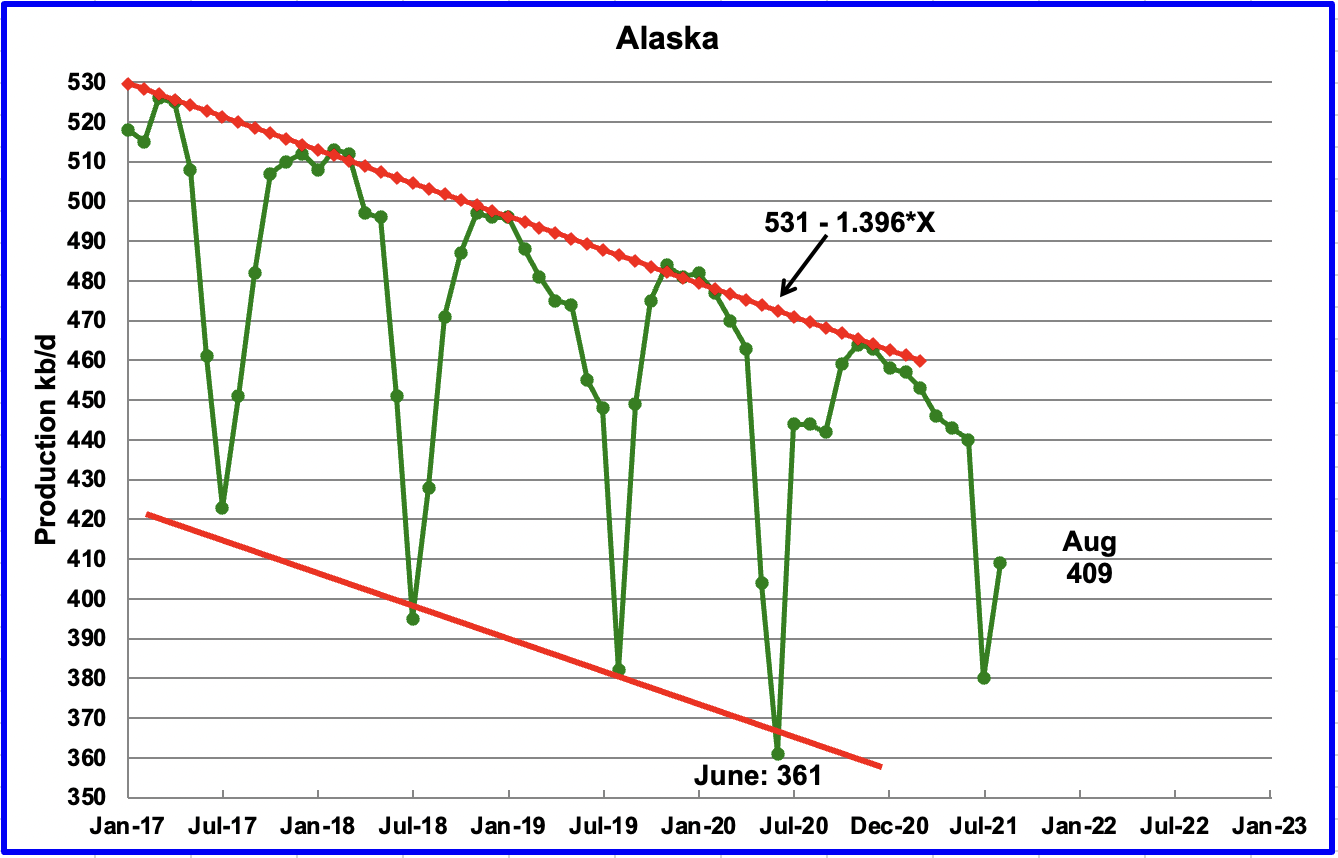

Alaskaʼ s August output increased by 29 kb/d to 409 kb/d as maintenance started to decline.

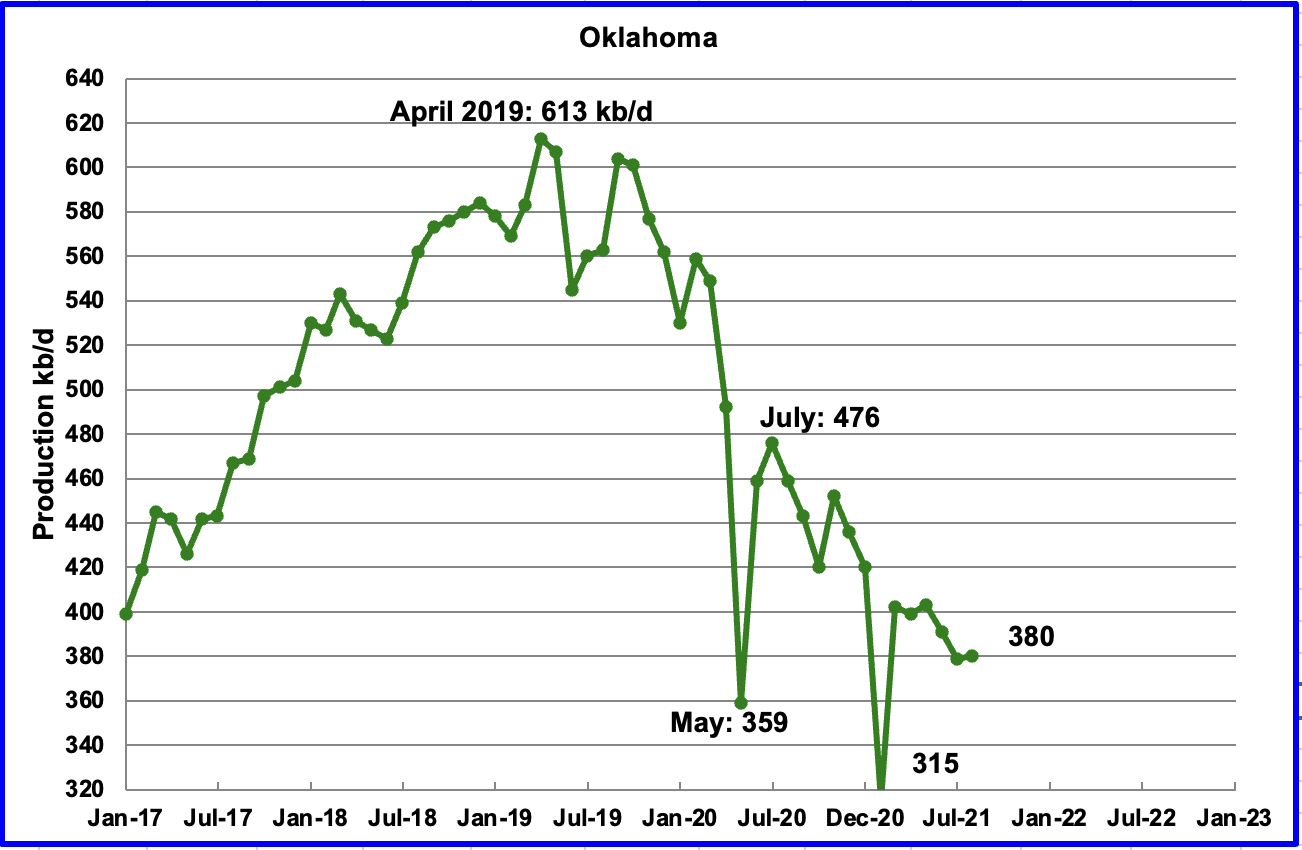

Oklahoma’s output in August increased by 1 kb/d to 380 kb/d. During August, Oklahoma had 30 rigs operating.

For the week ending October 29, 43 rigs were operating in Oklahoma. Oklahoma’s increasing the rig count is having difficulty in offsetting the decline rate in its oil fields.

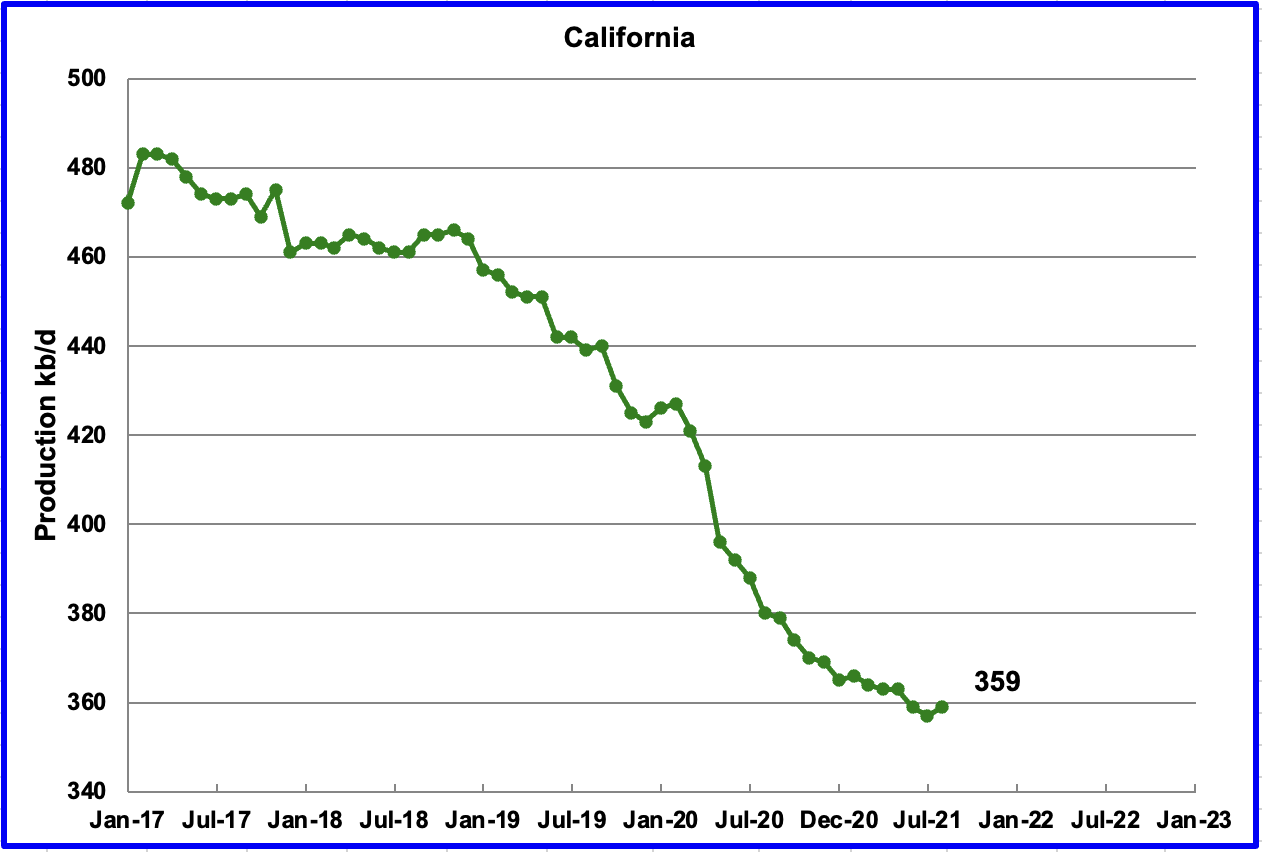

Californiaʼ s slow output decline reversed in August by increasing its output by 2 kb/d to 359 kb/d. California had 4 rigs operating in August and has slowly increased them to 9 in the week ending October 29.

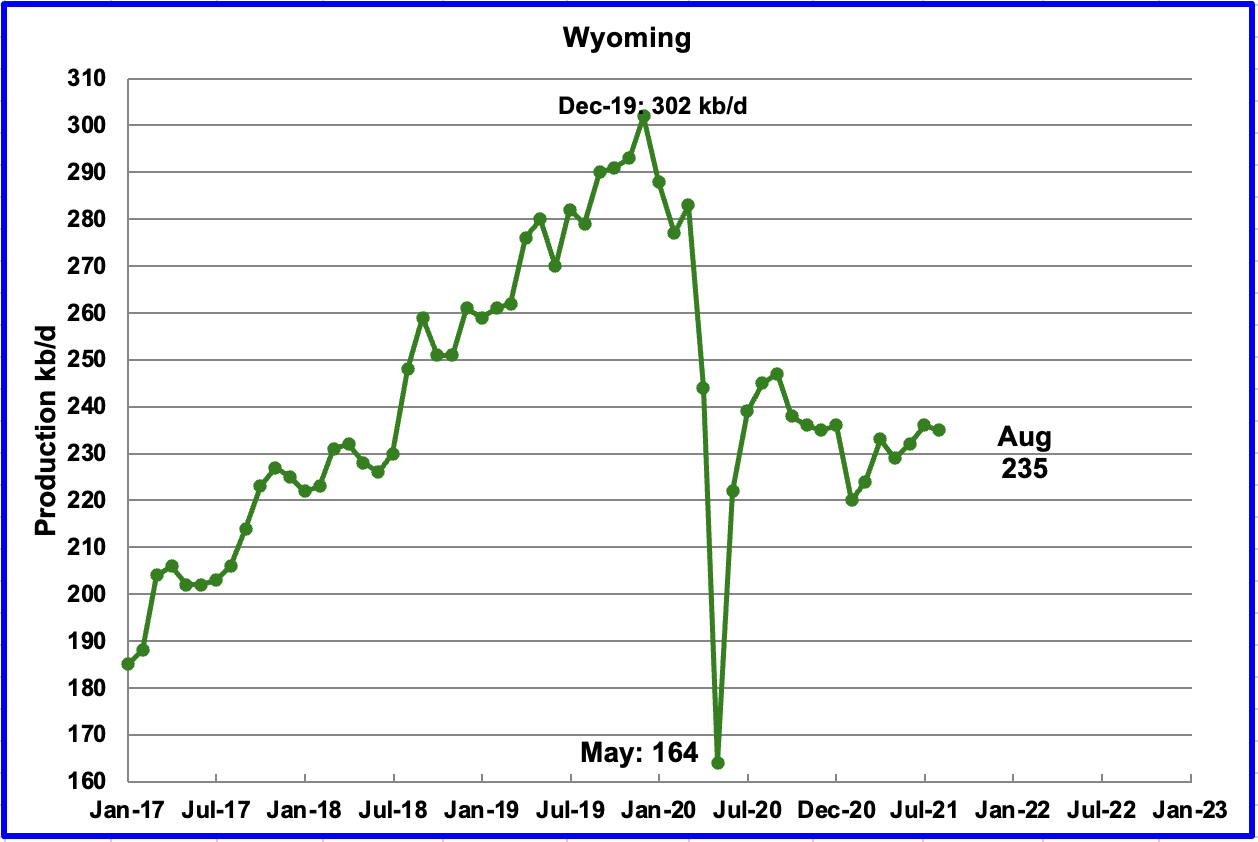

Wyoming’s production in August decreased by 1 kb/d to 235 kb/d. Wyoming had 15 oil rigs operating in August and decreased to 13 by late October.

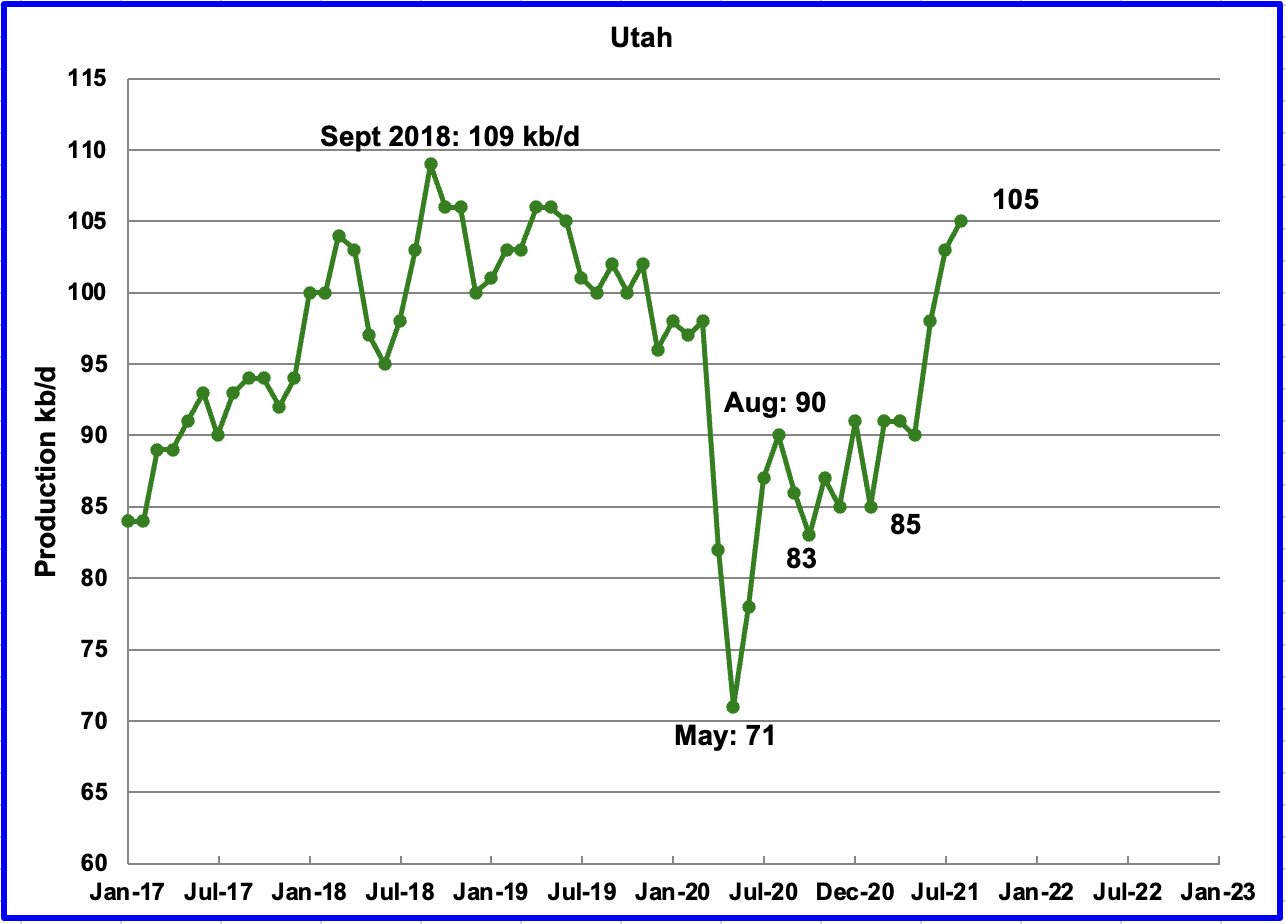

August’s production increased by 2 kb/d to 105 kb/d and is approaching its previous high of 109 kb/d achieved in September 2018. Utah had 11 oil rigs operating at the end of August and by the end of October the number had dropped to 8.

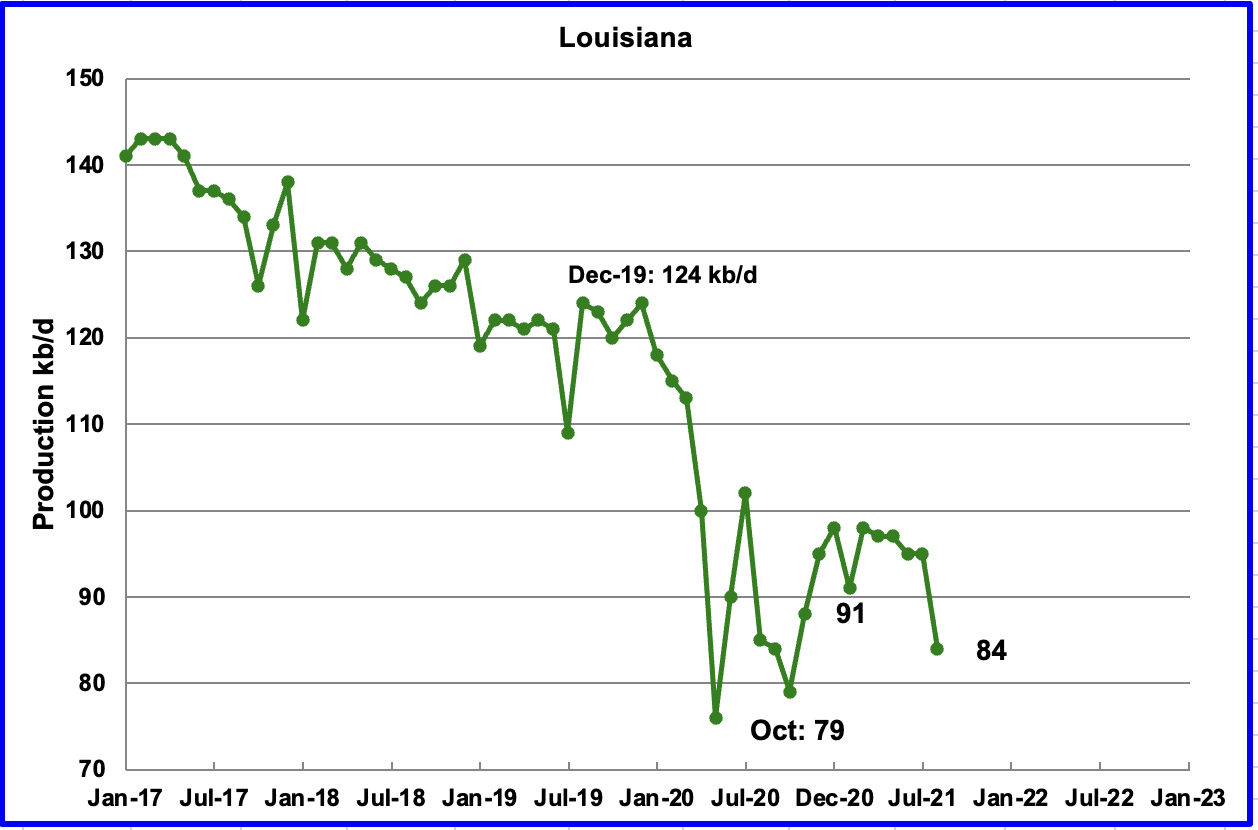

Louisiana’s output dropped by 11 kb/d to 84 kb/d. Louisiana was one of the hardest hit states by hurricane Ida in late August.

Production from the GOM dropped in August by 312 kb/d to 1,535kb/d. If the GOM was a state, its production would rank second behind Texas, even after its production was disrupted by hurricane Ida.

The October STEO projection for the GOM output has been added to this chart and projects output to be 1,835 kb/d in December 2022, little changed from the previous September report, red graph. The August output forecast by the STEO was 1,517 kb/d. A very good estimate, off by only 18 kb/d.

1) Short Term Energy Outlook

The October STEO has made further revisions to US output relative to the September STEO due to hurricane Ida which struck Louisiana. August and September production have been lowered while the US December 2022 output and the monthly growth rate have also dropped.

September 2022 output is projected to hit a low of 10,563 kb/d due to hurricane Ida. The weekly estimates for September issued by the EIA give an average of 10,680 kb/d, higher by slightly over 100 kb/d.

The December 2022 US production forecast has been reduced by 121 kb/d in the October report to 12,053 kb/d. However, and possibly more significant, the monthly growth rate from January to December has dropped from 68.1 kb/d/mth to 42.6 kb/d/mth. The reduction in the growth rate is due to an increase in the forecast January output and the decrease in December 2022. (Red graph)

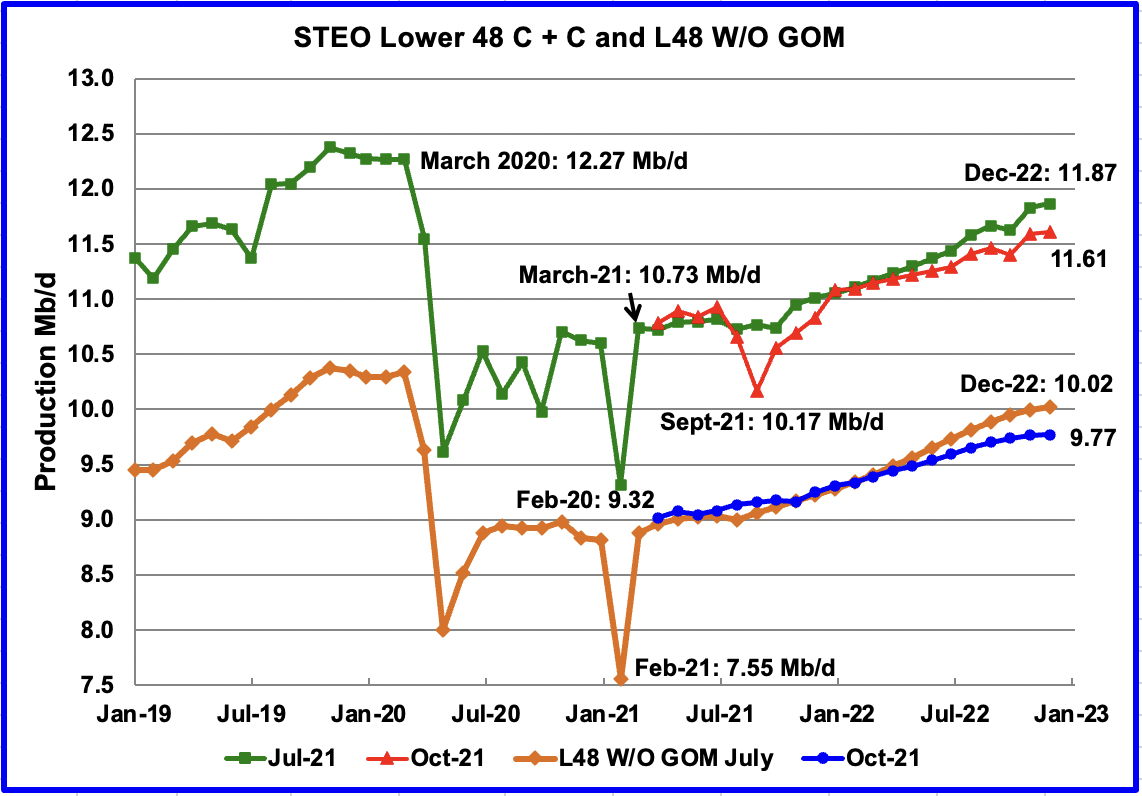

This chart compares the STEO forecast from the July report with the current October report to better demonstrate how the December 2022 forecasts have been slowly dropping. For the Lower 48, the December 2022 output has been revised down by 260 kb/d from 11.87 Mb/d to 11.61 Mb/d.

The October STEO output projection for the Onshore L48 states is also lower to the one provided in the July report. For the Onshore L48, the output projection for December 2022 is 250 kb/d lower than it was in the July report. Also, note that there is almost no growth in going from November 2022 to December 2022.

The October 2021 STEO oil price forecast shows a steady decline from the peak of $79/bbl in November to $62/bbl in December 2022. The big forecast change occurred in moving from the June report to the September and October reports. Note that on the day before the STEO was released, the WTI settled price was $80.64/bbl.

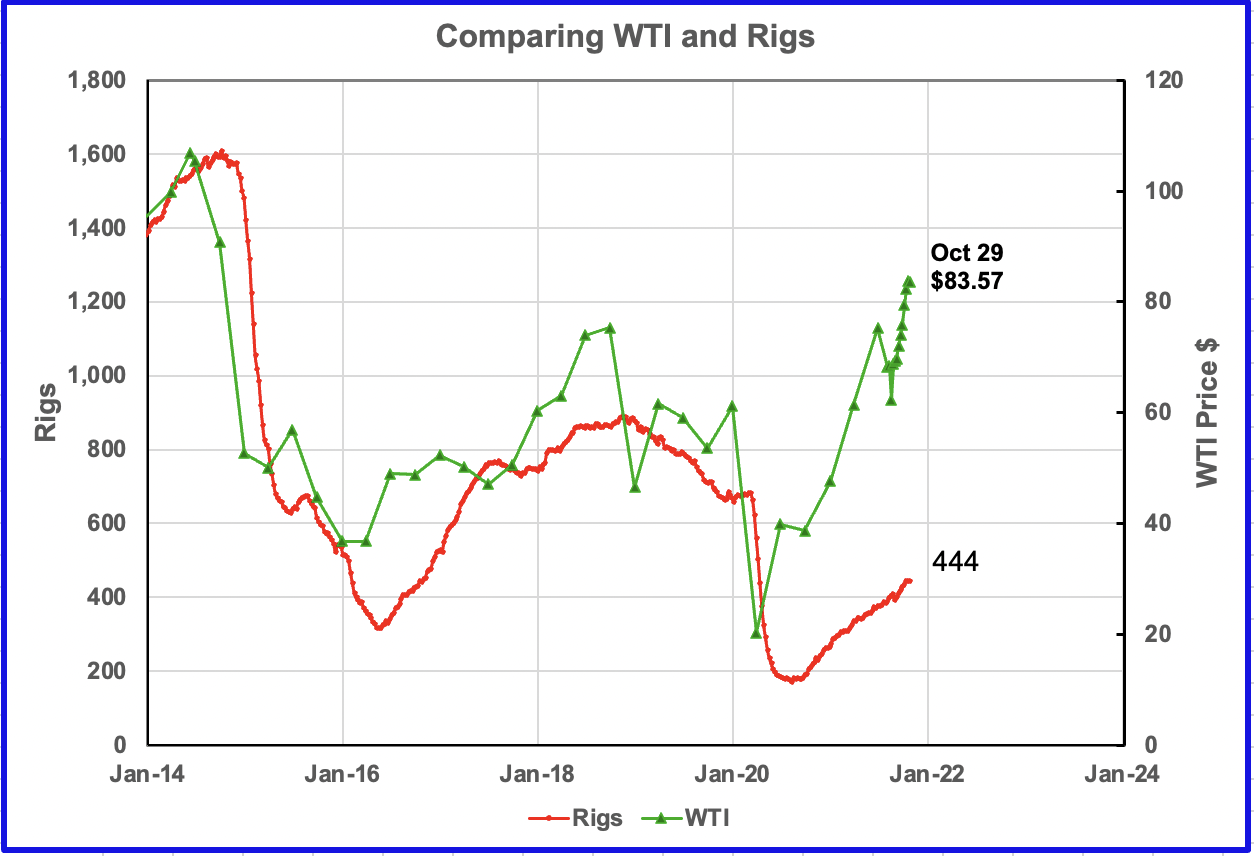

The December WTI contract settled at $83.57 on October 29, $7 higher than the EIA projection of $78.00 for the their December forecast.

This chart compares/tracks the number of oil rigs with the price of WTI. The rising price of WTI appears to lead the rise in rigs by about 6 months. The front month WTI settled price for the December contracton October 29 was $83.57.

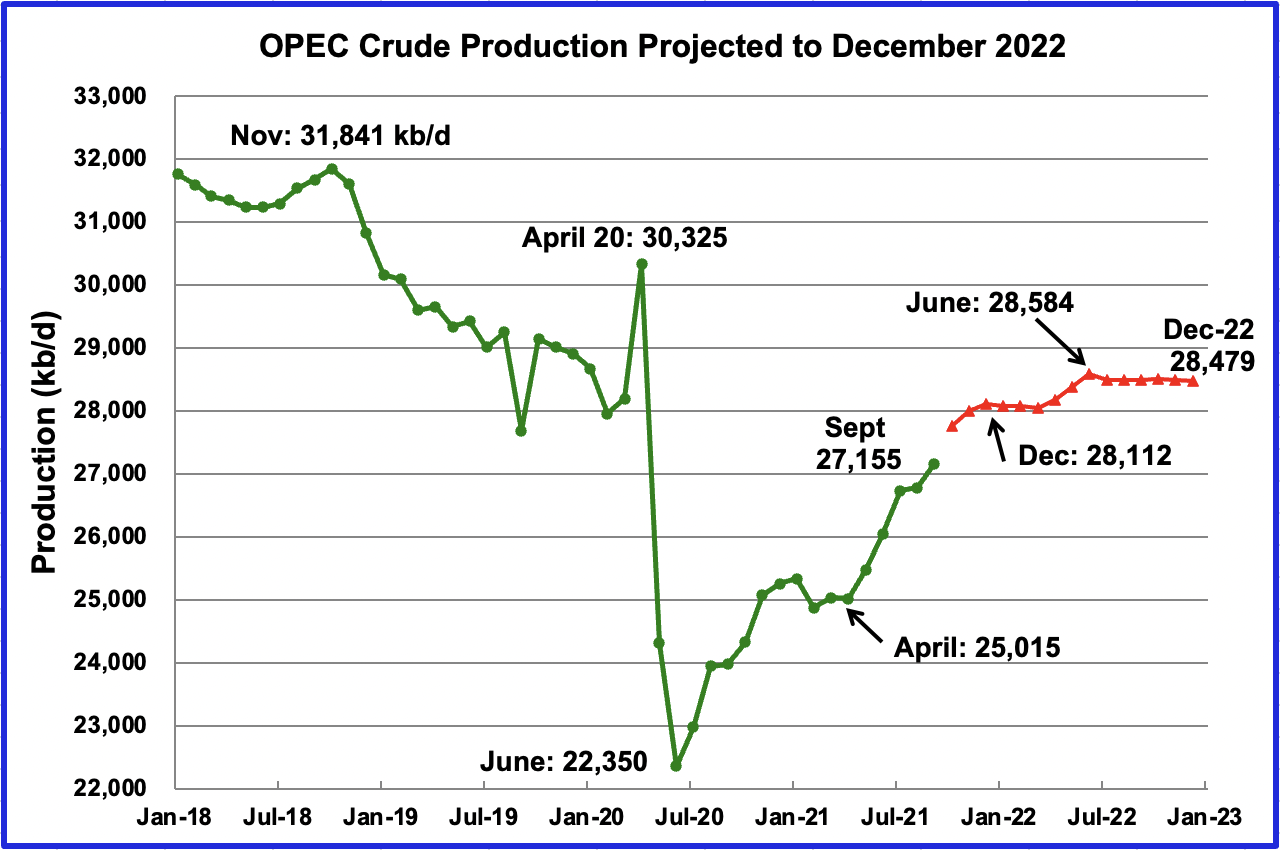

This chart shows the STEO’s October forecast for OPEC crude output to December 2022. OPEC’s output is projected to increase from April 2021 to December 2021 by close to 3,100 kb/d.

For September 2021, the EIA forecast OPEC production to be 27,155 kb/d. Actual production as reported by OPEC was 27,328 kb/d, a reasonably close estimate. October is projected to add 600 kb/d.

In July, OPEC + announced they will add 400 kb/d/mth from August to December for a total of 2,000 kb/d. Of the 2,000 kb/d, OPEC will add 1,382 kb/d according to the EIA.

OPEC’s production for the second half of 2022 is projected to be flat and close to 200 kb/d lower than OPEC’s output on January 2020, just prior to the onset of the pandemic.

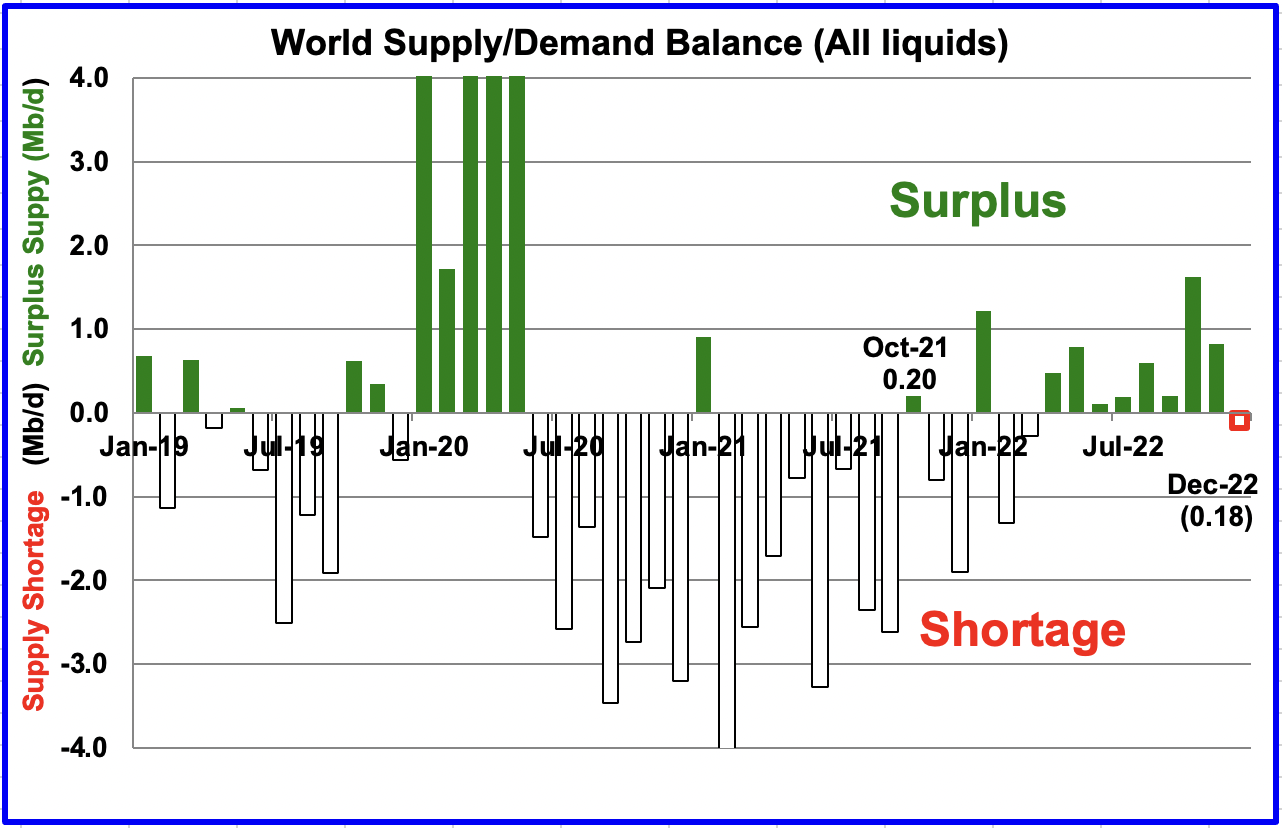

This chart show the historical supply/demand situation up to September 2021 and after that, the EIA’s forecast out to December 2022. September is showing a shortage of 2.6 Mb/d before moving to small surplus of 0.2 Mb/d in October.

From April 2022 to November 2022, the STEO is forecasting an average surplus of close to 600 kb/d. This is one reason why OPEC + is reluctant to add more barrels too early to the market to avoid another major surplus next year.

2) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The October DPR forecasts production to November and following charts are updated to November 2021.

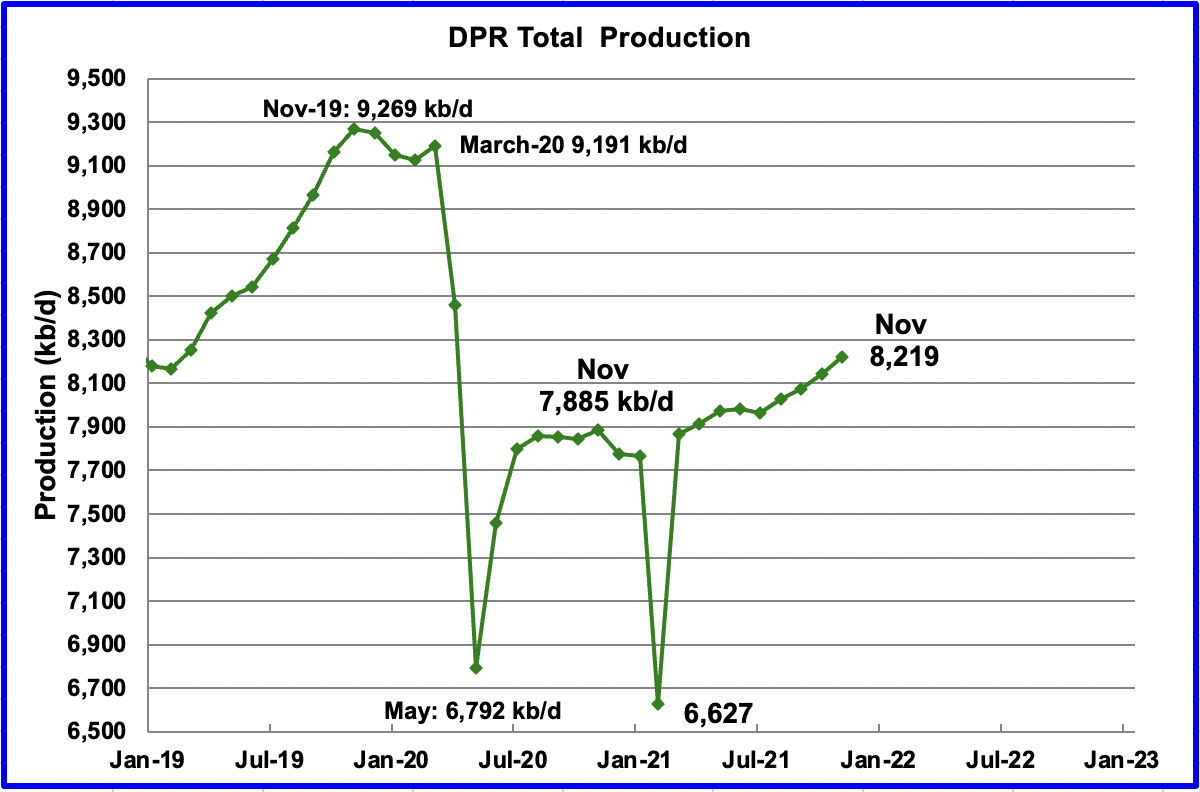

Above is the total oil production from the 7 DPR basins that the EIA tracks, projected to November 2021. Note that the DPR production includes both LTO oil and oil from conventional fields

The DPR is projecting that output for November 2021 will increase by 76 kb/d over October to 8,219 kb/d. From July to November, output in the DPR is forecast to increase by 255 kb/d or close to 64 kb/d/mth and appears to be accelerating since November added 76 kb/d. The two basins primarily contributing to the forecast increase are the Permian and the Niobrara. See charts below.

If the November rate of adding 76 kb/d/mth were to continue, this translates into adding 912 kb/d/yr to US production, which could potentially begin to disrupt world oil supply and cap the increase in the price of oil to below $100/bbl.

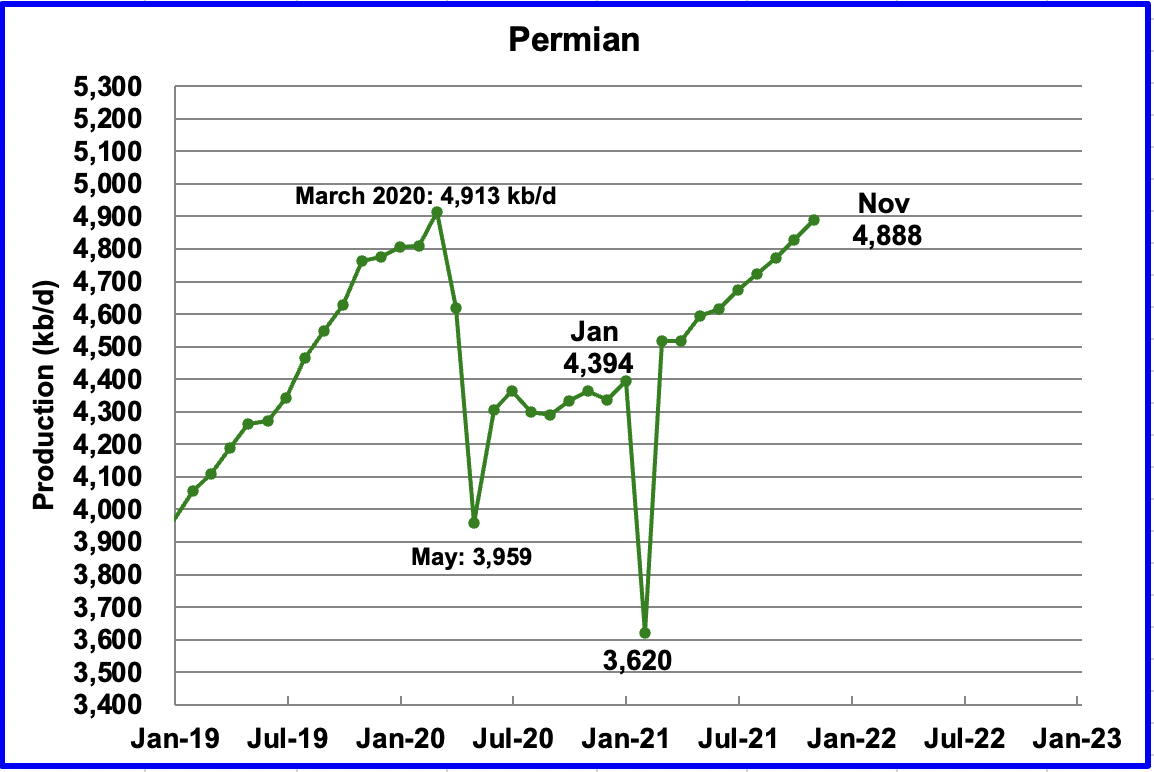

Permian output in November 2021 is projected to be 4,888 kb/d, up by 62 kb/d from October. From June to November production is forecast to increase by 272 kb/d or approximately 54.4 kb/d/mth. At this rate, Permian production will exceed the March 2020 peak of 4,913 kb/d in December.

During September, 284 wells were drilled and 409 were completed in the Permian. The completed wells added 294 kb/d to the forecast September output. The decline was 244 kb/d which resulted in a net increase of 50 kb/d. It is the completion of the DUCs, over and above those drilled, that accounts for the increase in the production in the Permian.

Since well completion data is only available up to September, production comments in the previous paragraph were limited to September.

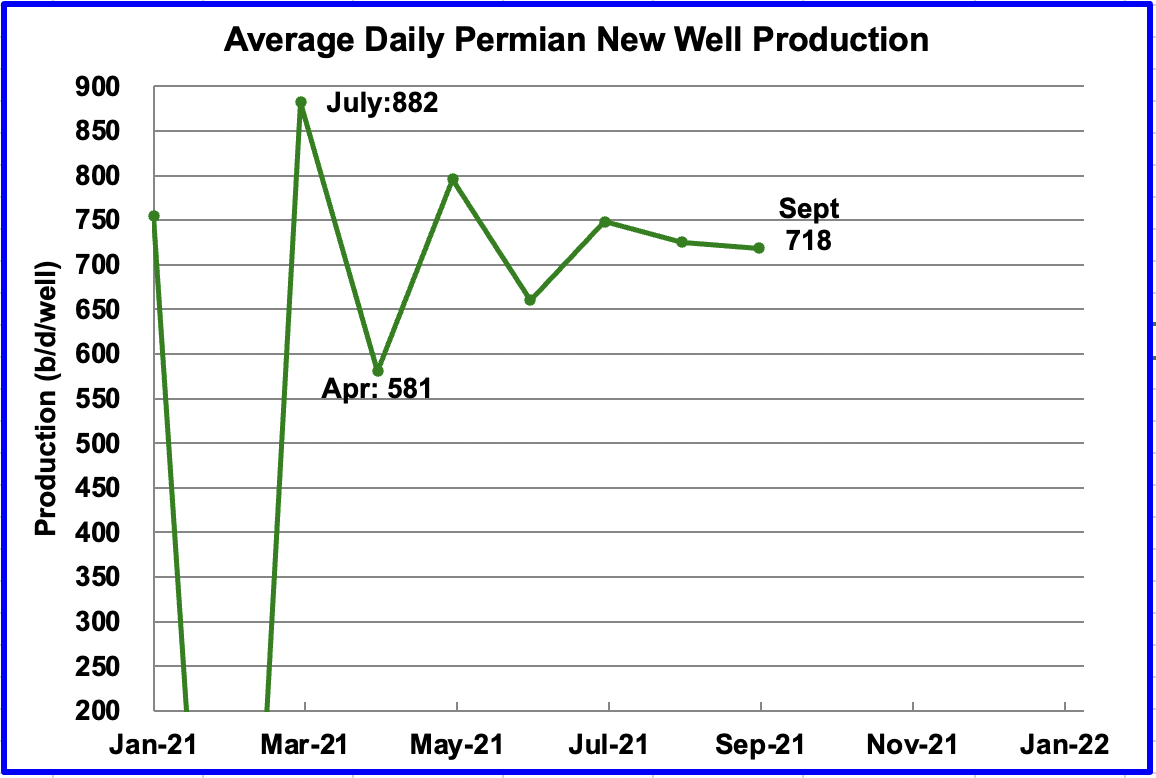

This chart shows the daily production from the average new Permian well tracked on a monthly basis. The daily output from new Permian wells was divided by the number of completed wells, as reported in the DPR and DUC reports.

For instance, during September, the new wells produced 293,820 b/d from 409 wells for an average of 718 b/d.

Interestingly, Shaleprofile shows a peak production rate in the second month of 891 b/d for Permian wells for wells completed in 2021. This is the highest rate recorded by Shaleprofile for Permian wells. It will interesting to track this parameter to see how Permian wells perform going forward as more DUCs are completed.

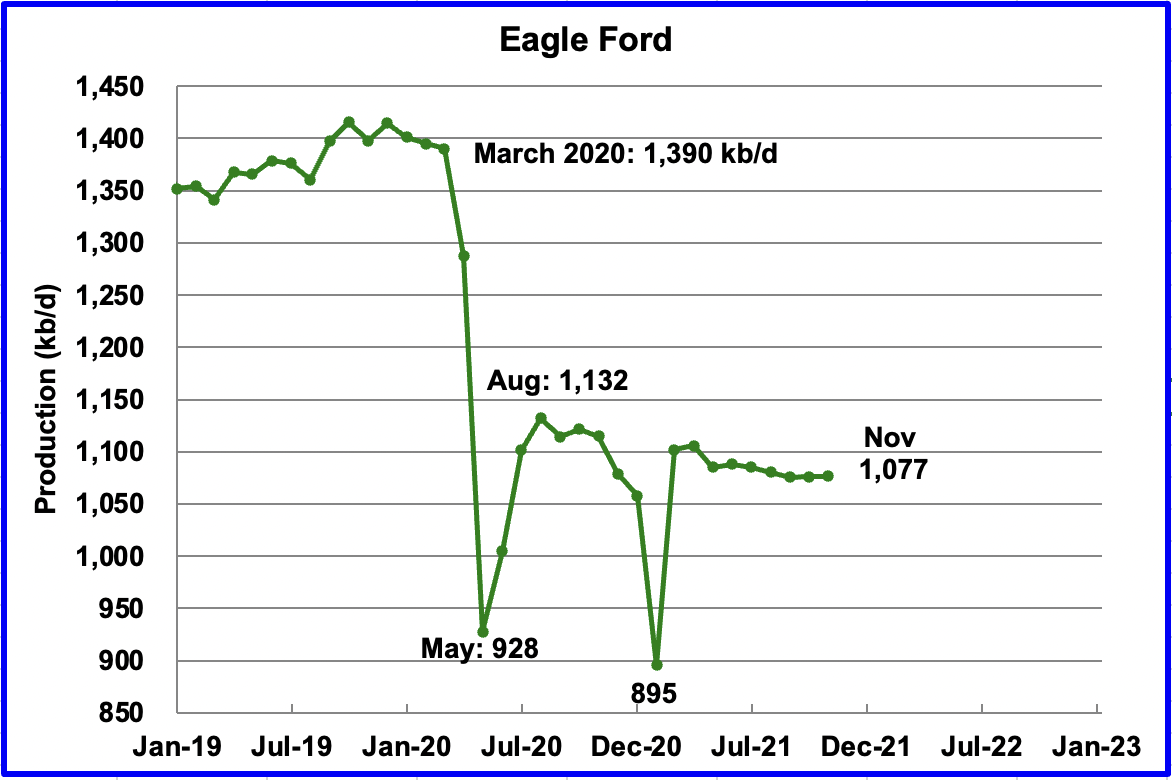

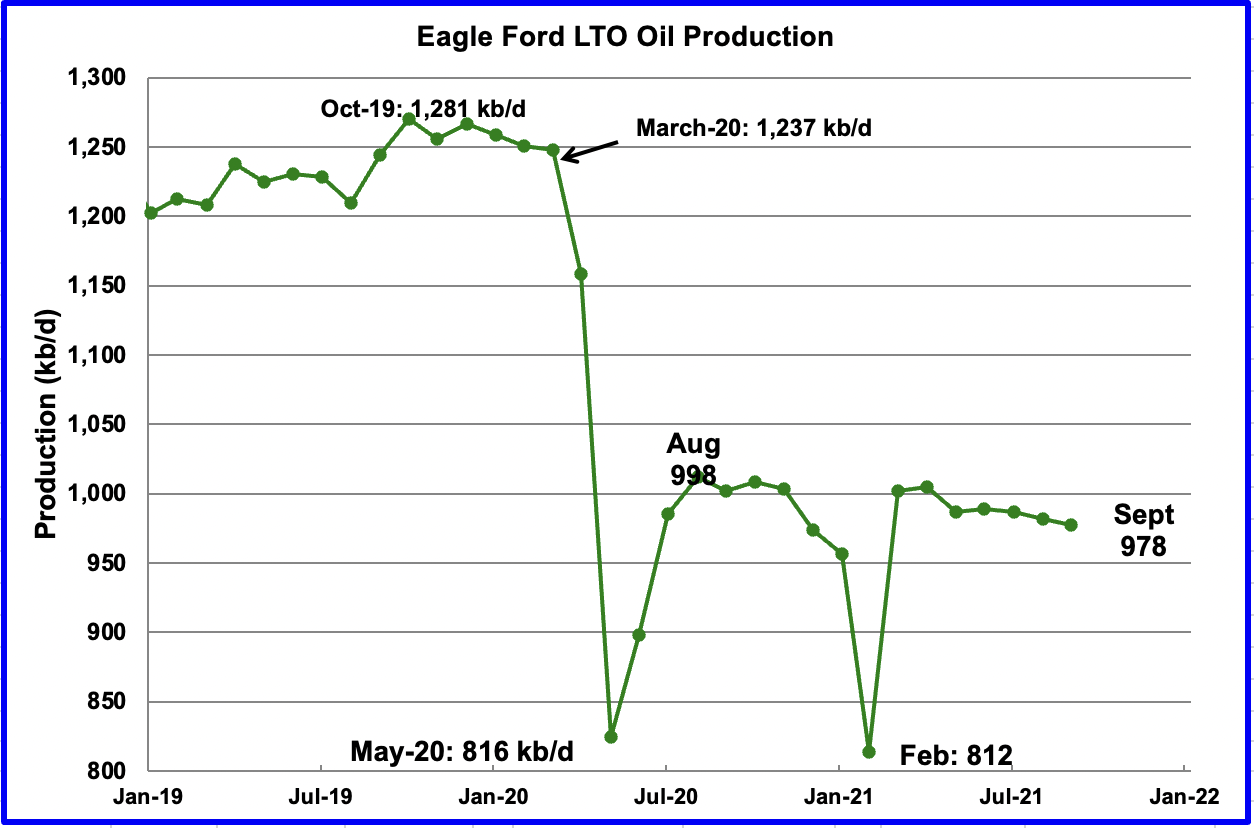

The DPR forecast for the Eagle Ford basin has shown a dropping but slowing output trend for six consecutive months. However output is expected to increase by 1 kb/d in November.

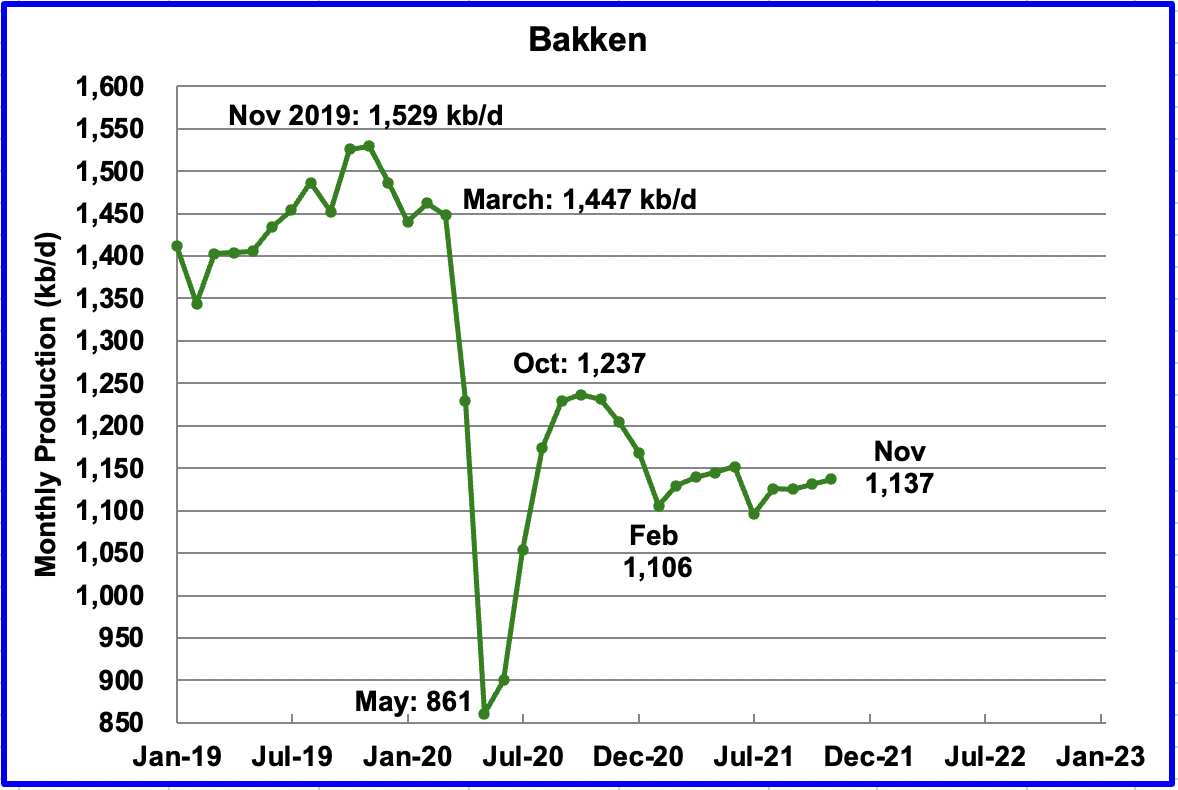

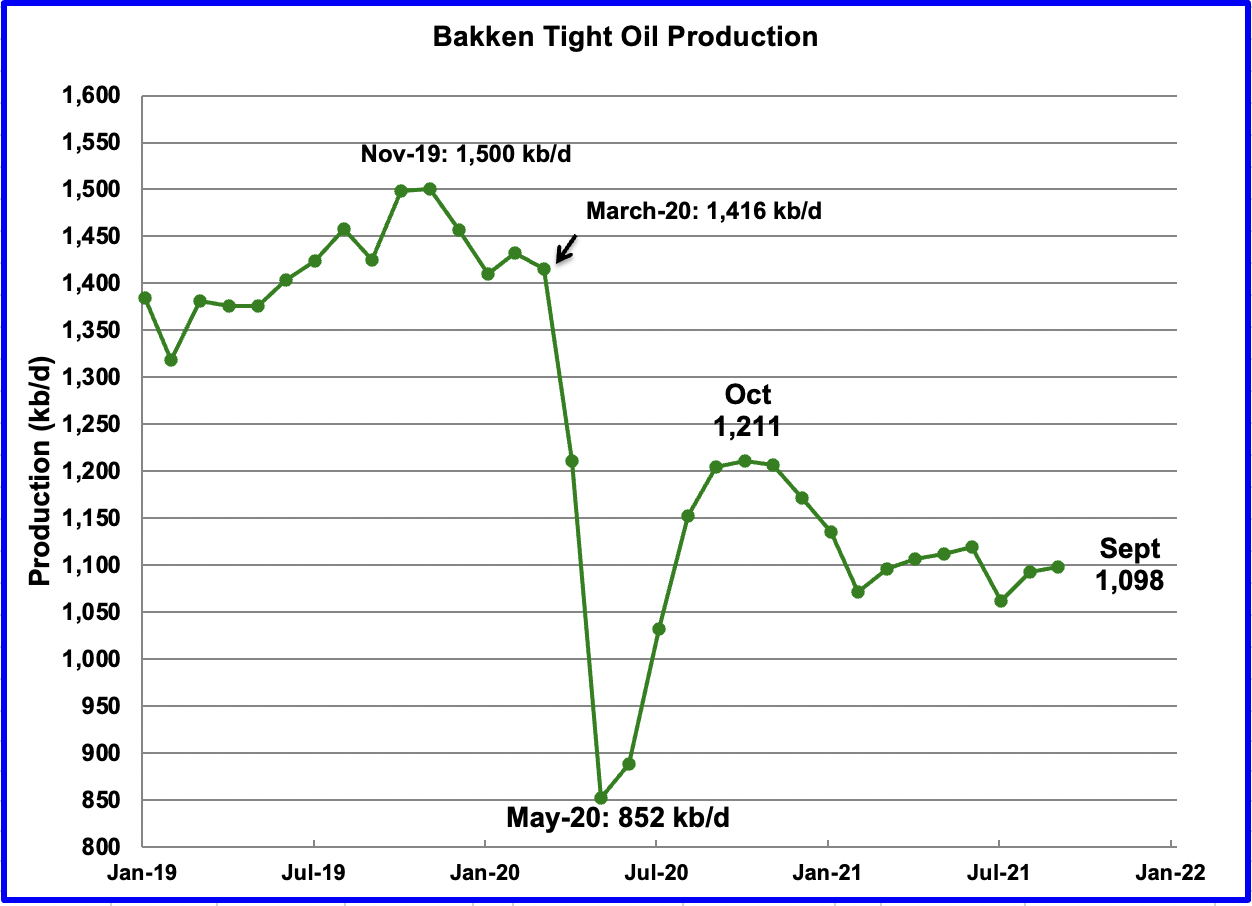

The DPR forecasts Bakken output in November to be 1,137 kb/d an increase of 6 kb/d from October.

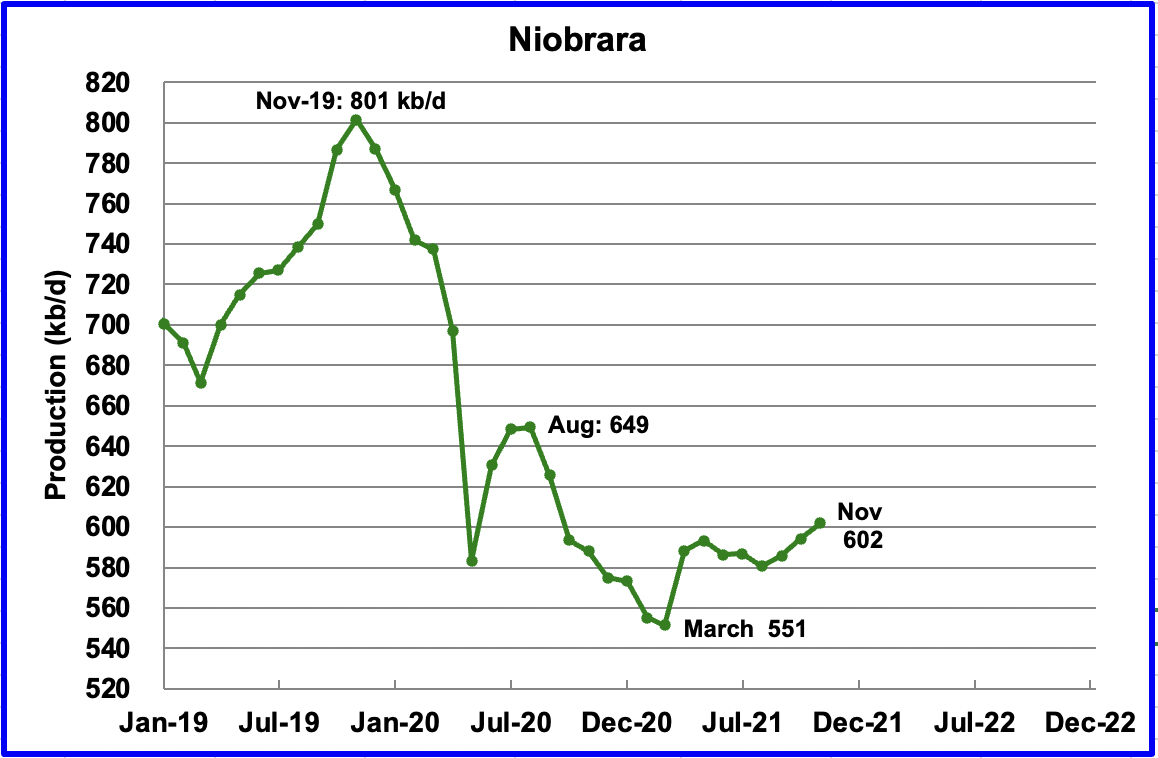

Output in the Niobrara reached a new low in March 2021 of 551 kb/d. Since then, output has been rising. November is expected to add 8 kb/d to 602 kb/d

The Niobrara is spread over Wyoming and Colorado. In June, 7 oil rigs were operating in the Niobrara. From August through October, the rig count had increased to 12.

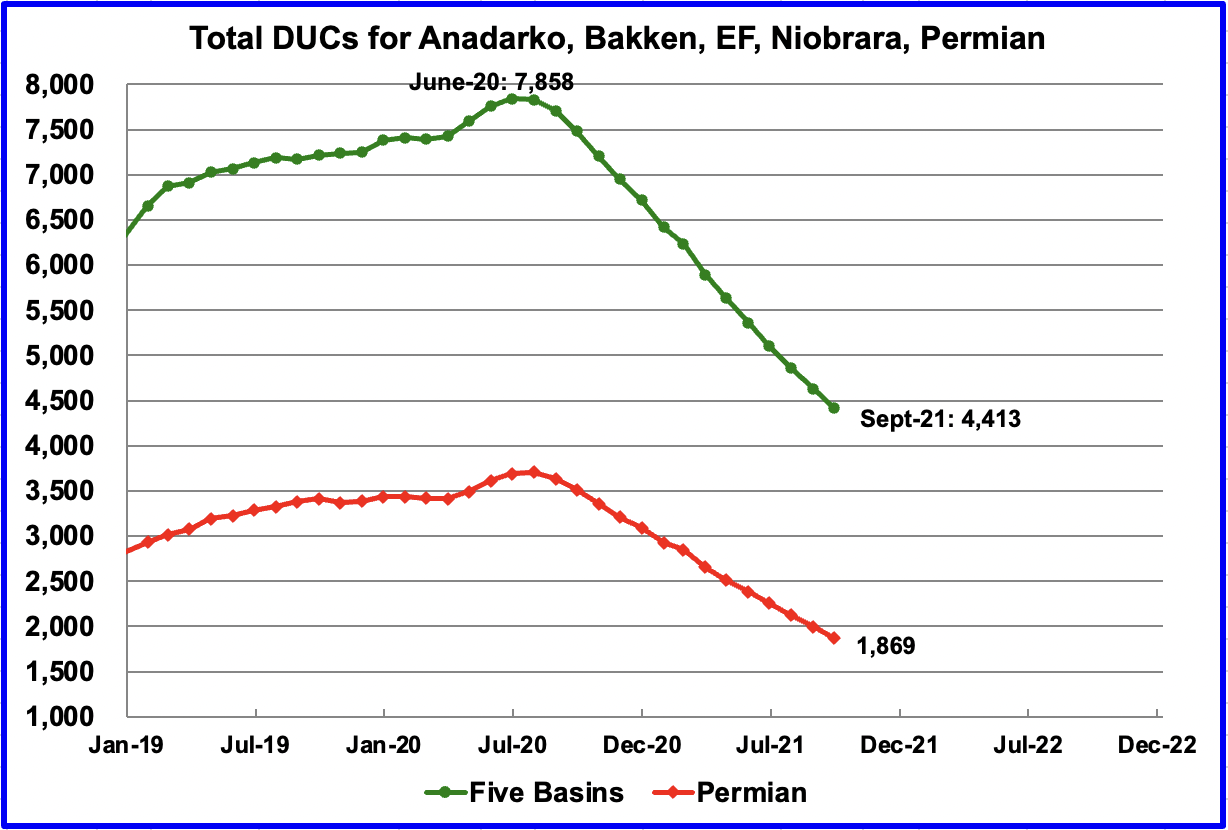

In these five primarily oil basins, DUCs have been completed at an average rate of close to 238 DUCs/mth over the last four months. In total, 219 were completed in September, according to the EIA. In the Permian, the average completion rate over the last four months has been close to 128 DUCs per month. In September, 125 DUCs were completed in the Permian.

The monthly completion of DUCs accounts for the increase in production in the Permian and the other oil basins.

3) LIGHT TIGHT OIL (LTO) REPORT

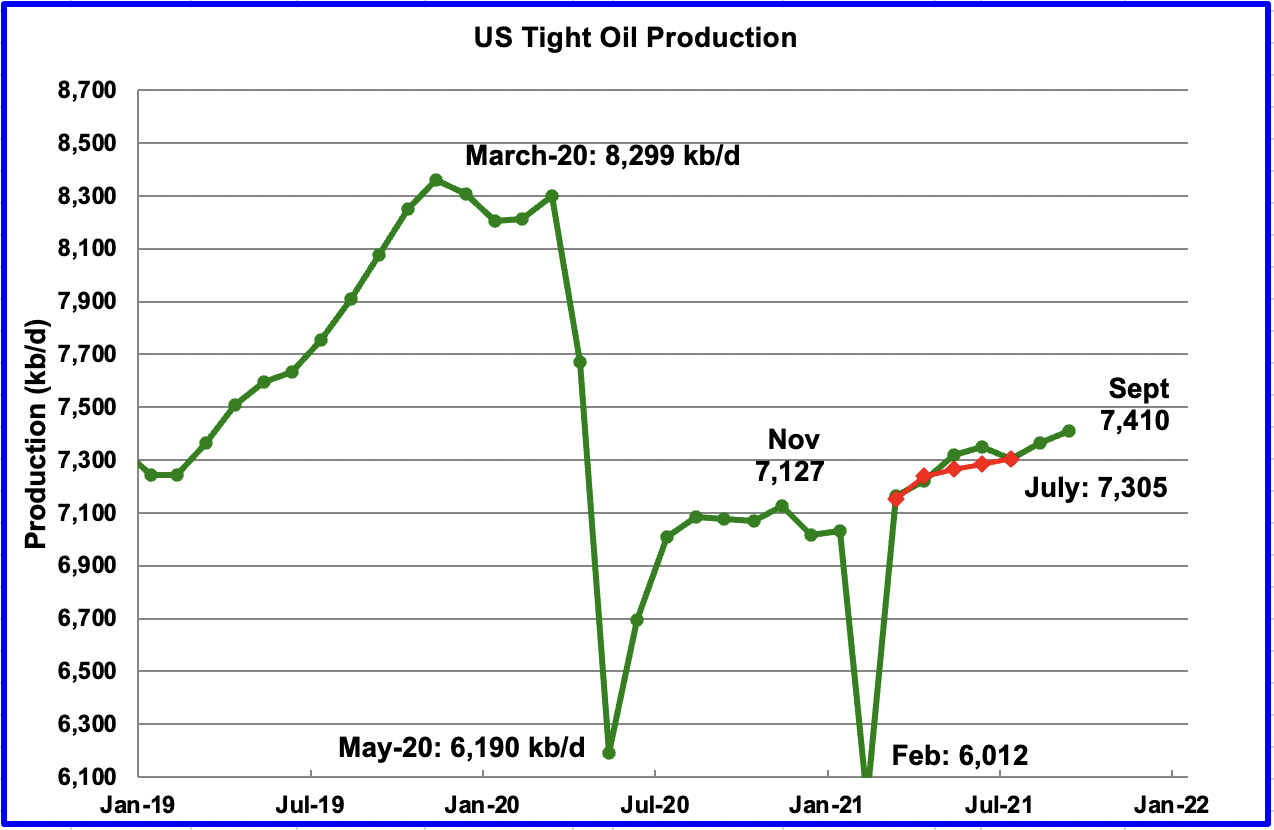

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The October report projects the tight oil production to September 2021.

The October LTO report has revised down the output estimates in the September report by roughly 50 kb/d to 100 kb/d. September’s LTO output is expected to increase by 44 kb/d to 7,410 kb/d. However in the October report, August output was revised down from 7,460 kb/d to 7,366 kb/d, a downward revision of 94 kb/d.

The red markers represent LTO output as reported in the August report and indicates there has been less growth in production since August or that the LTO estimates have been too optimistic in the last few months.

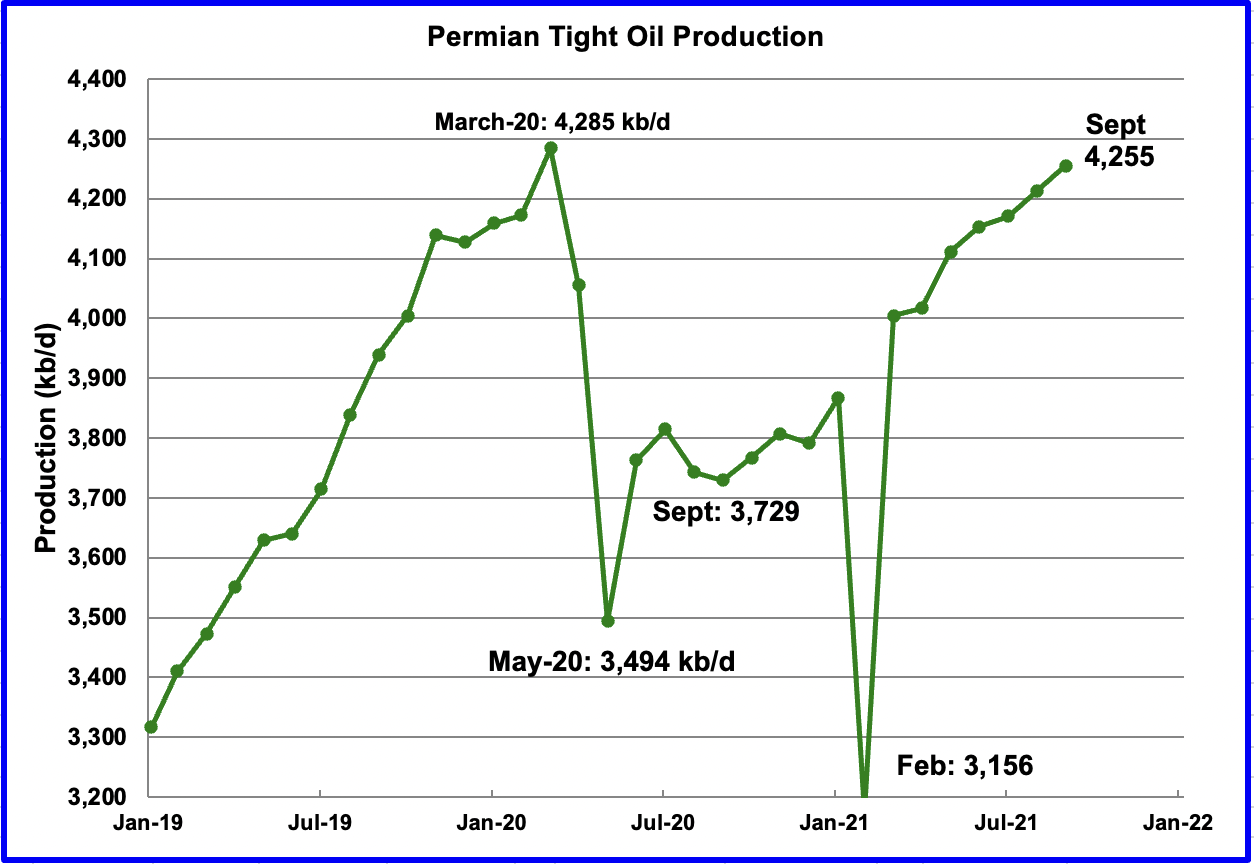

Permian LTO output in September is projected to increase to 4,255 kb/d, an increase of 42 kb/d. However the current September output is lower than the August output of 4,279 reported in the September report. Comparing August with August, the current August forecast is 4,213 kb/d vs the previous forecast of 4,279 kb/d, a decrease of 66 kb/d.

Production in the Permian continues to rise at an average rate of 48 kb/d/mth since April. At this rate, it should exceed the March 20 high of 4,284 kb/d in October.

It should be noted that Permian DUCs are being completed at an average rate of close to 128 DUCs per month and are a major contributor to the rising production.

The Bakken’s September output increased by 5 kb/d to 1,098 kb/d. However note that this rate is 15 kb/d lower than the August rate of 1,113 kb/d reported in the previous report.

The Eagle Ford basin is expected to produce 978 kb/d in September, a decrease of 4 kb/d from August. However, for the Eagle Ford, the LTO report increased the August output from the last report by 20 kb/d to 982 kb/d.

Output in the Niobrara has been almost unchanged since April at slightly over 400 kb/d. April, May and June were each revised down by close to 10 kb/d in the October report.

Conventional oil output in the On-shore L48 is expected to decrease in September by 21 kb/d to 1,748 kb/d. This estimate is based on a combination of the September LTO output and the October STEO report that has a forecast for the US on-shore L48 output for September 2021.

In the October LTO report, LTO output was revised down by close 50 to 100 kb/d. This downward revised output results in an increase in conventional oil output in the Onshore L48. The August conventional output of 1,691 kb/d in the September report has been revised up by 78 kb/d to 1,769 kb/d in the October LTO report.

Since July 2020, output in the Onshore L48 has been dropping at an average rate of close to 10 kb/d/mth, even though there were significant and unexpected drops in February and June.

4) Rigs and Fracs

Since the beginning of April, the US has been adding oil rigs at a rate of close to 3.66 rigs/wk. Of these, the Permian has been adding 1.43 rigs/wk. This means that more rigs are being added in other basins and states. Note that over 90% of the Permian rigs are horizontal ones.

Since the end of July, it appears that the addition of rigs in the Permian has accelerated over the average rate. Could this be related to the increasing price of WTI?

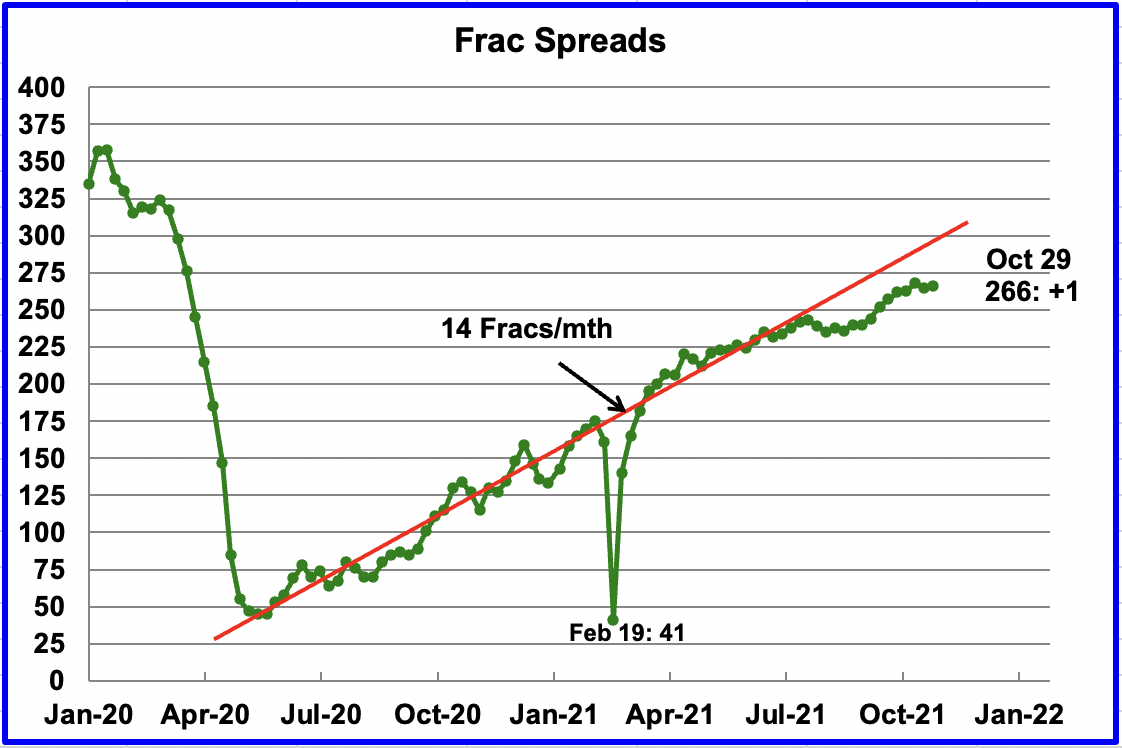

Starting from the week of July 23, 2021, frac spreads were not being added at the previous rate of approximately 14 spreads per month. Was the slowing due to Covid, not sure? However, starting in mid September, there are indication that frac spreads are being added at close to the previous rate of 14/mth.

Note that these 262 frac spreads include both gas and oil spreads, whereas the rigs information is strictly oil rigs.

Hi gang. I have posted a new page called:

From Whence the Fine-Tuned Universe

You can get there simply by clicking on the link up-top, just to the right of the “Peak Oil Barrel” logo, or you can just click this link:

https://peakoilbarrel.com/thefine-tuneduniverse-com/

Comments are welcome but only on the page comment section. Please do not reply here, on this post. Comment there only.

Also, please read the entire post before commenting. It is a 15 to 20-minute read. I have put many hours of research into that short essay. I have read perhaps 10 books on the subject and watched perhaps 200 YouTube videos on that subject and related subjects.

So please, no knee-jerk replies after reading the first two paragraphs or so. If you comment without reading, that means your mind is already dogmatically convinced of your opinion. And that is one of the subjects of the essay. That is, you may already have a dogmatic worldview that blocks any other opinions or theories, not allowing them to even be considered.

Thanks in advance for your comments. Ron

Dennis

Thanks. Yes Typo. It is correct in the table.

In a comment in an earlier post, Ovi suggested that perhaps we should look at directional and horizontal rigs for tight oil. I have done that for the Permian and for all of the US onshore oil rigs that are horizontal and directional.

Note that the axis is in days so the slope of the trend lines in the equations on the chart are rigs per day, multiply that slope by 365 to get annual rate of increase or by 30.4 to get monthly rate of increase.

Annual rate is 184 for all of US onshore horizontal and directional rigs and 70 for Permian basin for the period from April 23, 2021 to Oct 29, 2021. Monthly rates are 15.3 and 5.9. Weekly rates are 3.53 and 1.35.

Dennis

Maybe you or someone else could explain where a driller uses horizontal rigs and directional rigs. For instance I read that vertical rigs are used to start the well.

Can a horizontal rig also drill the lateral bores of a well?

Ovi,

It is not clear to me what the difference is between a horizontal and a directional drilling rig. Note that for the Permian basin for Week ending October 29, 2021, there were 3 directional rigs (range of 0 to 4 from April to Oct) and 247 horizontal rigs and 16 vertical rigs running (with a range of 10 to 16 from April to Oct). Also note that the Permian split from New Mexico to Texas in horizontal plus directional rigs is shown in chart below from April to October 2021. For WE 10/29 it was 170 TX and 80 NM.

Ovi,

Any rig drilling at any angle besides 90 degrees (vertical) is considered a horizontal rig, so I believe the answer is yes, the laterals are drilled by a horizontal rig, the horizontal rigs are capable of drilling the vertical section of the well, but perhaps it is not always cost effective to do so.

Ovi,

You use a spudder rig or vertical rig to drill down to a point to set your intermediate casing. Once the casing is cemented, then a horizontal rig is brought in to finish the hole. The reason the is done is because the spudder rigs are way cheaper to operate and use than bringing in a bigger horizontal rig from the beginning. In other words, it is a waste of money to use that rig for the mundane vertical. It does save time and money.

It is interesting to note that if there weren’t DUCs completed in addition to the new drilled wells, then production would either be flat or slightly falling in the Permian.

My company though continues to run two rigs and production is flat as a Mesa.

LTO Survivor

Is your production flat because these are new wells you keep drilling and you don’t have access to some pre-drilled DUCs?

https://www.dailymail.co.uk/news/article-10147369/Russian-westbound-gas-supply-Yamal-Europe-pipeline-comes-halt.html

“President Joe Biden has warned Vladimir Putin not to weaponise natural resources for political purposes after Russian gas pipeline starting flowing backwards out of Germany.”

Slim Jim , what a whopper . Don’t make it a one time post . Continue with all your views and comments . Welcome abroad .

Here are my views:

1) I had no clue gas pipelines could flow backwards.

2) If you are dependent on Putin for natural resources its time to move to another country.

I just read the quality content here. No one should care about my opinion.

SLIM JIM,

So if Europe is dependent on Putin and Russia for Natural Gas, where do you suggest that they turn to for energy supplies?

European Natgas production has fallen from 25.7 Bcf/d in 2014 to 21.1 Bcf/d in 2020. But, at the same time, European Natgas consumption has increased from 48.4 Bcf/d to 52.2 Bcf/d. Thus, Europe is in a sticky predicament because it has designed a GREEN ENERGY Policy that needs more Natgas.

With the world’s WHITE ELEPHANT called the Global LNG Industry basically turning GOLD into LEAD by constructing LNG Production & Export Facilities at $7-$30 billion a POP, plus $250 million for a new LNG Carrier (twice the cost of the largest VLCC Oil Carrier), and another $1-2 billion for an LNG Import Facility… LNG is a major Natgas EROI destroyer.

And, on top of that the Islamic attack on Total’s large $20 billion LNG Facility in Mozambique earlier this year, which is now if FORCE MAJURE… this has put a lot of U.S. and Canadian LNG projects on HOLD or have canceled.

So, when Europe decides to DITCH that nasty Putin to get Natgas from somewhere else, we wish them all the luck because we wonder where they are going to get cheap and readily available supply with current Natgas stocks still at 79% of where they should be… as they head into the winter.

steve

Australia? Putin’s got ’em by the uncircumsized balls!

Again….I personally would be “chucking a sneaky” and move to Canada.

SLIM JIM,

That is wise and excellent advice to move to Canada. Now, if you can send out an email to the 447 million citizens in the European Union… that would be nice.

steve

Slim, why not move to Russia ? Added benefit , the male to female ratio is skewed and all those beautiful Russian women in surplus . Better than Canada . 🙂

I don’t want hidden camera’s everywhere I take poo poo.

Canada is best Peak Oil spot IMO.

You get the 900 billion dollar US military…for FREE!!!!!

Steve , agree with you . LNG is a white elephant just like shale as a matter of fact even worse . The loss of 35 % energy in transforming gas to liquid and then liquid to gas at destination is crazy . EROEI is in my opinion negative . The problem is what to do ?? Answer : This trade will continue till it can’t . In an earlier post I had mentioned the LNG problems in India where 100 % import is from Qatar . Sky high prices for urea . The farmers are weeping tears of blood but the alternative is not to sow . The nation sleeps on an empty stomach . The “Energy Cliff ” is a bitch .

SLIM JIM , here we value everybody’s opinion . As a side note by your name I thought you were from Holland but it seems that you are based in UK . Why ? “Slim ” in Dutch means ” intelligent ” . As to Australia or Canada , the answer is Canada , The only nation with excess land , water , forest and energy and not in population overshoot . HHH has posted about the financial bubble their but still the best looking horse in the glue factory . 🙂 Australia was good but not anymore they shutdown their refineries so dependent on energy . Sorry , coal is not a transportation fuel . Most worrying, it is in the frontline of CC . Water starvation and adverse effect on agriculture as the Murray- Darling basin dries up . The continent is going to have less precipitation and more wild fires due to dry conditions . Take care and be well .

All I know is if China doesn’t continue finding enough coal to keep the lights on then demand from China falls off a cliff and dominos start falling all over the map.

China also has a diesel shortage currently that isn’t getting talked about much.

How high can oil price go if China continues spiraling down? There is potential for a whole lot of demand destruction that those who are calling for $100 oil aren’t considering.

Interesting times we live in.

If worse case scenario plays out oil could be back at $20 within 24 months. The oil bulls better hope coal finds its way to China power plants or they are screwed.

The problem is China isn’t a physical lack of coal. The problem is that coal prices are so high that power plants can’t produce electricity and sell it at a profit at the regulated electricity price.

A solution would be to raise the price of electricity to consumers, but the government prefers to keep it artificially low.

They are importing coal at a loss because cost aren’t being recouped by end users. They have to burn through US dollars in order to subsidize coal.

I disagree that home grown supply isn’t a problem. They can control price of domestic supply because domestic supply is priced in Yuan not dollars.

Domestic supply should be easy fix for them. But that’s not the case.

If there was no problem with domestic supply there wouldn’t be any news about power blackouts

Slim Jim

If you cut the upstream compressors and a few further downstream, the the gas would flow backwards as more downstream compressors are cut since their residual pressure is higher than in the upstream segment.

It is not happening because the compressors were reversed.

LTO Survivor,

For large companies doing a multi-well completion (say 4 wells at once from a large singe pad area), would a vertical rig be brought in initially to drill the vertical sections of the 4 wells, then pull out the vertical rig after the vertical casing is set and bring in a horizontal rig to complete the well? I would think logistically it would be simpler to use the horizontal rig for the entire drilling operation (with different tools used at different stages of the operation) and it would save time.

Yes. absolutely the spudder rigs will drill the intermediate hole on all four wells. Then they will bring in the bigger rigs.

LTO survivor,

Ok thanks. How are the 16 vertical oil rigs operating able to keep up with the 247 horizontal oil rigs? Are they 15 times faster? I would think just the moving and setting up of the rigs would not allow this to be possible. By the shale profile estimate about 1.3 wells are drilled per rig per month so with 247 rigs we would have about 327 wells drilled per month, if we assume all 327 wells also were serviced by the 16 vertical rigs operating that would be over 20 wells drilled per month for each vertical rig (and we would also need to assume no vertical oil wells were drilled). So that would be 1.5 wells per day on average. Seems when we add in moving the rig and setting it up and than taking it down to move to the next site this wold not be possible. How long does it typically take to take a rig down, move it down the road and then get it set up for a new job?

Curious if anyone can help with my question or whether my assumptions are accurate. I’m under the impression some portion of LTO production is over leveraged or debt driven that will be defaulted on. If so is there a percentage of present US production that one can characterize as a losing investment?

LEEG,

At current oil prices, most oil companies are doing ok, a few may still go bankrupt due to poor hedging decisions and too many completions when oil prices were low. There are many that think all tight oil is a losing bet, I do not agree with that assessment, but I am not an oil man so could well be wrong.

LEEG , all are bankrupt . Financial engineering , lies and misdirection along with the FED policy of QE and ZIRP have kept the LTO game alive . The music is playing but the party is over . This is not financial advice .

Permian supply projection has completion rate at 316 wells per month from Dec 2021 to Dec 2029 and output reaches 5594 kb/d by Dec 2029. I have a conservative scenario with completion rate at 390 wells per month from Jun 2022 to Dec 2029 (this is consistent with about 300 oil rigs drilling horizontal tight oil wells in the Permian). My scenario has Permian putput at 5201 kb/d in Dec 2029.

The shale profile supply projection is superimposed on my chart (solid colors are from shaleprofile), my model is the dotted blue line.

As I often suggest my model is quite conservative, a model with 350 completions per month barely reaches 5000 kb/d by the end of 2029, I have not tried a model with a completion rate lower than 350 new wells per month (this is the current completion rate assumed by my model for Oct 2020 to Oct 2021, past 13 months).

Dennis

Shale profile is showing 2,141 producing oil wells as of July 2021. An average of 306 wells/mth. In 2020 they completed 3,578 wells or an average of 297/mth. Why should well completions jump to 390 wells/mth starting in 2022.

Interestingly close to 90 rigs have been added to the Permian since January, but the rate of well completions remains roughly the same at 300 wells/mth. Puzzling?

Ovi,

Note that for my model shown in chart in previous commnet, I assume 350 new wells per month are completed from Oct 2020 to Oct 2021. Note that the shale profile numbers are based on RRC data which takes some time to be fully updated. Take a look at the following from one year ago at shale profile.

https://public.tableau.com/shared/MQX5WMN8F?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

Link above has better image.

March 2020-311 wells completed, April 2020-209 wells, May 2020-154 wells, June 2020-143 wells, and July 2020-161 wells

Ovi,

In the link below we have well completions (shale profile calls these “first flow” wells) for Permian from the July 2021 update (published in Oct 2021).

https://public.tableau.com/shared/W67RG4FHG?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

a poor quality image is posted below,

In the more recent estimate we have the following for wells completed in Permian:

In March 2020-424 wells, April 2020-287 wells, May 2020-190 wells, June 2020-182 wells, and July 2020-213 wells. The difference from the one year earlier estimate was

March +113, April +78, May +36, June +19, July +21

Of course we do not know what the future revisions will be for Jan 2021 to July 2021. Also note the difference in completions between the DUC spreadsheet and shale profile for Permian basin, for the EIA data they have 375 completions per month for Permian basin, with recent rates at about 405 completions per month (August and Septempber average).

Rigs have been increasing as have frac spreads, I imagine the completion rate will also increase.

Using data from the DUC spreadsheet for past 12 months for Permian completions and using an OLS trendline I get a monthly increase in well completions of about 11.98 per month. My scenario has completion rate at 350, 355, 360, … , 380, 385, 390 from Oct 2021 to June 2022, less than half the rate of increase estimated by the EIA over the past 12 months. Given the high oil price level and rising oil rig count in the Permian, this scenario seems conservative to me and the model output result is far more conservative than the shale profile supply estimate (400 kb/d lower output at the end of 2029).

What is your expectation for future completion rates? I would be happy to model it.

Forgot chart sorry.

From shaleprofile.com at link below (see well status and lick on first flow at upper left)

https://shaleprofile.com/blog/permian/permian-update-through-july-2021/

DC,

…”Permian putput…”: More perceptive than you may have intended.

Dennis there is really only about 4 more years of inventory. We are at the red queen. Without additional DUCs being completed there would not be an increase in production. If we see a $100 oil price handle and $4.00 per mcf gas price then maybe you will see a quick spike but really there isn’t enough equipment, personnel or financial backing to cause a surge. There would need to be a vibrant Oilfoeld service industry but who will lend to the sector to grow capacity?

I don’t want to burst your bubble Dennis but it comes down to inventory and we are quickly running out. Look for more consolidation in the Shale sector and this is not a vote of confidence but a way for companies to hide the dire inventory status.

LTO survivor,

My model has output flat until the end of 2022 (actual Permian output has been up), over the long run output increases from 3781 kb/d in Dec 2020 to 5202 kb/d in Dec 2029. Over 9 years this is a 37.6% increase in output or an average annual increase in output of 3.6%. I would hardly call this a surge in output more like a gradual increase in output. With higher oil price levels the inventory of viable well locations might increase, we will see. Also at these prices growth can be financed out of operating cash flow. If producers remain disciplined it will keep oil prices high.

Dennis,

Every once in awhile mention the difference between a “projection” and a “prediction”. A projection is based on a specific scenario chosen and the assumptions built-in to the scenario, so a specific numerical projection essentially extrapolates from the parameters chosen. OTOH, a prediction is a projection with a high degree of confidence.

What is nice about this distinction is that you can show what scenario is required when your projection is challenged. So when LTO_Survivor questions the projection as stated, one can show what scenario is required to match his assertion. I think you are doing this implicitly, but its useful to state this approach as a disclaimer occasionally.

Unfortunately Paul I cannot make any predictions as thefe are too many future assumptions that need to be guessed correctly for any scenario to rise to the level of a prediction.

I would say that the recent scenario is very likely to be lower than future Permian output. Probably with 80% confidence. I have also presented high oil price and high TRR scenarios that likely have an 80% probability that Permian output will be less than that scenario, that is the best I can do.

Dennis , my response to Slim Jim vanished again just a minute ago . Please retrieve and rectify the problem .

HH, I restored your post but I have no idea how to fix the problem.

Tks for the prompt action . Greatly appreciated .

Hi Ovi , for August the excuse is Ida , what are the excuses for Sept and Oct . Just joking .Wanted to say a thankyou for the work done . Impeccable as usual .

HiH

The real story story is in the onshore L48 and what is happening in Texas, NM and ND. How long can they keep on producing at between 70 kb/d and 80 kb/d. Right now the key is the DUCs. If WTI stays in the $80 to 90 range, more rigs will be brought in to replace the DUCs and they may keep on producing at the same rate.

Not sure what the situation is with the latest DUCs. As noted in the post, ShaleProfile is showing record peak production for the second month for the 2021 wells. Is this new peak from DUC wells or the new wells they are completing?

Ovi,

Keep in mind that every tight oil well that is completed is a DUC before it gets completed. So perhaps you mean are these old DUCs or new DUCs? It is difficult to tease out the age of the DUCs.

Looking at DUC spreadsheet from DPR and focusing on Permian basin, I get the following analysis.

Assumptions:

1. DUCs from Jan 2017 of 1279 are “dead DUCs” and non-viable at present.

2. From peak Permian DUCs in July 2020 DUCs added from Feb 2017 and newer are completed from oldest to newest (this is no doubt wrong, but we don’t have the data to be more accurate).

Based on that set of assumptions the DUCs completed next would be wells drilled March 2019, at present based on the most recent DUC spreadsheet there are 683 more DUCs to complete that were drilled from March 2019 to Sept 2021, in September, based on the assumptions of my analysis 125 DUCs were completed in Sept 2021 that were drilled in Feb and March of 2019, we have another nearly 4 months of DUCs before drilling rate will need to increase to completion rate, if rate of completions of older DUCs from Sept 2021 continues. This seems unlikely as the horizontal rigs running are capable of drilling 321 wells per month, this implies about 79 older DUCs get completed each month if the rig count does not change. Using that estimate there would be enough older DUCs to last 8.5 months (683 DUCs/79 DUCs per month). Of course if oil prices remain high or continue higher, it is likely the rig count will increase to 308 which is enough to drill 400 wells per month and keep DUC count stable if completion rate is 400 per month. That is consistent with my 38 Gb scenario if the drilling inventory increases over time as I suspect will occur with higher oil prices (WTI at $90/bo by June 2023 in 2020$).

>> The European Investment Bank (EIB), the lending arm of the EU, has vowed to close a loophole that allows it to lend money to oil and gas firms despite a ban on financing fossil fuel projects.

The EIB, the world’s largest multilateral bank, which is active in 160 countries, announced in 2019 it was phasing out lending to fossil fuel projects within two years, as it sought to become a “climate bank”. >>

Way too much talk about Capex at RDS, XOM, CVX, whoever. Groped around and I’m pretty sure financing sources like this flow at the NOCs. They don’t fund spending in a purely internal way.

A great 21 minute video: Saudi Arabia’s Oil Problem

Early in the video, it hints that peak oil may have indeed been in 2019. But it dwelled no more on that point and went on to discuss Saudi’s oil problem.

Putin ordered to gazprom to increase gas delivery to Europe after having ended the filling of Russian reserves. This had the effect to decrease significantly the price of gas on European market. Perhaps, it would have the effect to decrease also the price of oil barrel as some oil was burned in place of gas because burning oil products to produce electricity was cheaper than burning gas in some places. https://www.lci.fr/economie/prix-du-gaz-vladimir-poutine-ordonne-a-gazprom-d-augmenter-les-livraisons-a-l-europe-le-cours-degringole-2200435.html?utm_term=Autofeed&utm_medium=Social&utm_source=Facebook&Echobox=1635520157&fbclid=IwAR0rchNftfiARN2IWbNdkIEVSEk64sN1HvUCzPMBxEN0SYadMLvfa8lZIA0#xtor=CS5-111

Interesting stuff . No one in the shale patch will discuss this .

https://www.forbes.com/sites/uhenergy/2021/10/27/with-higher-prices-and-no-growth-this-oil-boom-is-a-bust/?sh=537fdcc15daa

Picked this from Mike S blog .

Another post courtesy Mr Shellman . A post by Art Berman . Needs no introduction .

https://www.oilystuffblog.com/chart-stuff

The Berman blog confirm my recent experience. I know everyone wants to think Permian growth will continue unabated through 2029 but based on my experience and if you read carefully between the lines of the Shale targeted Public company IR presentations then all would understand that these companies are running out of drilling inventory and it will only get worse in terms of spacing and pressure depletion as time marches on.

If this were business as usual and this was 2016, I would easily embrace D. Coyne’s model for Permian production. But this is 2021 and we know a lot more about parent/child wells, well spacing and pressure depletion. We are closer to the Permian Peak than his model suggests. Just sayin………

LTO Survivor,

Yes we do know more now than in 2018 when the last USGS assessment was published for the Permian basin. For a quick reminder the 90% confidence interval for the USGS TRR estimate for the Permian basin was 45 to 114 Gb with the mean estimate (best guess) at 75 Gb. In my model I only include the highest productivity benches assessed which total about 50 Gb for the mean estimate, so I have already reduced the TRR estimate to 50 Gb which is fairly close to the F95 USGS estimate of 45 Gb (for those not familiar, this means the USGS experts believe the probability is 95% that the Permian TRR will be more than 45 Gb), there is likely at least an 85% probability that the Permian TRR will be more than the 50 Gb that I assume in my scenario. For the medium oil price scenario I have utilized (oil price rises to $95/bo by 2029 in this scenario) and the low completion rate I have assumed the economically recoverable resource (ERR) is about 38 Gb. Perhaps LTO survivor is correct at current oil price levels, but my expectation is that the price of oil will continue to rise.

In a conversation with LTO survivor he has suggested perhaps 5% annual growth in Permian output might be reasonable, my scenario has Permian output rising at an average rate of 3.6% per year from Dec 2020 to Dec 2029,

Full scenario in chart below, my guess is that there is about an 80% probability that Permian output will be higher than this scenario, it is extremely conservative in my opinion.

Dennis,

I am not saying your graph is right or wrong . Honestly I have no clue what a higher price will do for the Shale industry. I think we now have higher prices in general because the entire exploration and production side of the industry collapsed during the Saudi/Russian price war simultaneous with the onslaught of Covid. To make matters worse, at the end of 2019 as we were just beginning to test the parent/child relationship between shale wells, we began to see startling results of much less bottom hole pressures, higher GORs, and more extension of frac lengths departing from our wide held industry belief of limited drainage.

The Oil resource is there and abundant but getting it out of the ground with less bottom hole pressure will be a monumental task. I have always believed that some day we will use applied materials to reduce the surface tension of the oil/rock and allow down hole separation to augment production but without enough bottom hole pressure much of the resource will be left behind. Secondary recovery never works too well in a fractured reservoir (whether man made or natural). I believe Co2 will work more effectively but this is extremely expensive and corrosive on equipment and pipe. The price of oil would have to be at $200 per barrel to justify this kind of basin wide project.

I really believe you have done an excellent job using the materials and information and math to come up with your prediction. However it is the hidden story in the boardrooms and engineering departments of all of these companies that is not being revealed to give you a true look into the mechanics of this oil production that comprises your prediction.

LTO Survivor,

I appreciate the feedback. Note that based on your comments my estimate for the Permian has been revised quite a bit. It seems no matter how low I go, it is not low enough.

I am not sure if you follow Enno Peters work at shaleprofile.com. The link below gives a flavor of his recent thinking on the Permian basin. Note also the question I asked him in the comments and his answer there. I use his answer in the chart below (his chart is the green solid projection) where I compare his estimate with my own model. In both cases the completion rate is the same from June 2022 to Dec 2029 at 390 new wells per month (his estimate is 300 rigs/month at 1.3 wells/rig/month so 300*1.3=390 wells/month).

https://shaleprofile.com/blog/permian/permian-update-through-july-2021/

My estimate is extremely conservative (it uses the 4 wells per section width estimate you suggested and average well EUR of about 435 kbo decreasing gradually after Dec 2019).

Note that by Dec 2029 Enno Peters supply projection has output at about 6500 kb/d and my projection is at 5200 kb/d. I think it likely the completion rate will be higher than 390 new wells per month, probably it will gradually increase to at least 500 new wells per month if oil prices rise to $95/bo or more as I think is likely.

You are certainly correct that there is much information that I do not have, but generally tight oil has surprised me to the high side, perhaps this time it will be different.

In the chart below the blue dotted line represents my very conservative Permian basin model (where the completion rate is 390 new wells per month with 300 horizontal oil rigs rotating from July 2022 to Dec 2029). The shale profile projection has 390 wells completed from 2022Q1 to Dec 2029.

Comparison of older scenario using 75 Gb TRR and lower oil price scenario with Brent at a maximum of $80/bo in 2020$ from 2022 to 2032 with more recent scenario which assumes oil price rises to $95/bo in 2020$ by 2030 (it reaches $80/bo in 2020$ in late 2024) oil price remains at $95/bo until Dec 2033 and price decreases to $80/bo by Jan 2036 and to $42.5 by mid 2041 and then remains flat. TRR for more recent scenario is 50 Gb. Note that I assume the lower TRR tends to favor a higher oil price as supply is likely to be less if resource is less extensive.

The older scenario has oil prices falling more slowly to $48/bo in 2020 $ by late 2059. Another difference is the older scenario assumes the completion rate climbs to 550 new wells per month by March 2030 and this rate continues to late 2036 and then completion rate falls to zero by June 2041.

In any case, the response to suggestions that my scenario was far too optimistic was to create a more conservative scenario. In my opinion any scenario lower than the 38 Gb scenario in the chart below would have a probability of 20% or less. That is, possible but not very likely.

Also notice that the older scenario has a maximum output of about 6250 kb/d which is less than the supply scenario created by Enno Peters with only 300 rigs (maximum of 6500 kb/d in Dec 2029). Part of the explanation for the difference is that Enno does not attempt to estimate future reductions in new well productivity, I do make such an estimate for wells after Dec 2019, based on USGS assessments and assumed completion rates for my scenarios.

I realized the 49 Gb scenario in the earlier chart was actually not really a very high output scenario, below I pick a different “high output” Permian scenario with the same oil price assumptions as earlier but in this cas the completion rate is higher reaching 624 wells in June 2026 and with the completion rate remaining at that level until Dec 2033, TRR is 75 Gb as before and ERR is 56 Gb with 162000 total wells completed in the Permian basin for the scenario. I also show the average of the 38 Gb and 56 Gb scenarios with an ERR of 47 Gb, that scenario would have a maximum completion rate of 507 wells from 2026 to 2033. My guess is that there is about an 80% probability that Permian output would fall between these two scenarios. The average low/high scenario is shown as an illustration, impossible to say what the best guess scenario might be, just somewhere between high and low, perhaps within 10% of the average low/high 47 Gb scenario shown.

The

Four more UK energy suppliers go bust amid high gas prices

https://www.theguardian.com/business/2021/nov/02/four-more-uk-energy-suppliers-go-bust-amid-high-gas-prices

(I know this is gas and not oil, but the other site is very dead)

Dennis,

I just dont believe we have 14 years of drilling inventory. I think that’s where we differ. Perhaps there is more than four years of drilling inventory with a lower rig count but I believe we are looking at 8 years at the most and once it hits the end, you will see a 40-50% drop off in year one unless 25 bopd stripper wells are profitable at the price at that time.

LTO Survivor,

I appreciate the feedback as my models may be much more realistic based on your input. I do not know what the specifics of the drilling inventory is, but note that the spacing you have suggested is used (1320 feet between laterals) and a 9000 foot average lateral length is assumed. I take the highest productivity benches from the Permian assessments (2/3 of total TRR assessed or 50 Gb best guess TRR). For my medium oil price scenario, I get about 44 Gb and 113000 total wells drilled on 30 million acres at 272.7 acres per well ( note the 113k wells includes 15.5k wells completed by Dec 2016), if all wells possible (ignoring economics) were completed the total wells completed would be 126.5k wells in the Permian basin. Note also that the original Permian assessment has 50 million acres of prospective area, I have excluded 20 miilion acres of lower productivity in the 38 Gb scenario in the charts above.

I remember early assessments of the Bakken/Three Forks in 2012/2013, many of those assessments thought the drilling inventory would be far lower than what actually was drilled and completed. It turns out the USGS assessment for the North Dakota Bakken/Three Forks in 2013 proved surprisingly accurate once we apply the economics as I have done. I get an ERR nearly equal to cumulative production plus proved reserves at the end of 2019 by using the USGS assessment and a model based on well profile date from shaleprofile.com and a set of economic assumptions.

My guess is that the USGS assessments have improved over time as they get more data on tight oil and new research on well performance in tight plays. Of course I may also be wrong as I have been many times before.

Here is a quote from an early blog post in Dec 2012:

Based on these models I think the upper limit to tight oil output from the Bakken and Eagle Ford in 2020 is about 2.7 Mb/d rather than the 5 Mb/d predicted by the IEA. Note that these estimates are quite optimistic and should be thought of as an upper bound to what may be attainable. This is an increase of about 1.6 Mb/d over current US tight oil output of about 1.14 Mb/d. A more realistic scenario might be a doubling of output to 2.3 Mb/d in 2020.

The post is at the link below

https://oilpeakclimate.blogspot.com/2012/12/update-on-bakken-model-using-hyperbolic.html

In summary, the IEA did a forecast in 2012 with US tight oil reaching 5 Mbo/d in 2020, my “optimistic” estimate for Bakken and Eagle Ford was 2.7 Mb/d in 2020 (Permian and Niobrara were not even on my radar at that time). By coincidence, the high point for Bakken and Eagle Ford in Feb 2020 was 2.68 Mb/d. Note however that I missed the 5.53 Mb/d of output from the rest of US tight oil in Feb 2020. Actual US tight oil output peaked in March 2020 at 8.3 Mb/d so I was too low by more than a factor of 3 in my December 2012 estimate of US future tight oil output.

My incorrect guesses on tight oil have mostly missed on the low side except in cases where there were oil price crashes, where my scenarios missed on the high side.

I expect my $95/bo oil price scenario (where that price is not reached until 2029 with Brent prices rising from $71/bo in late 2021 to $95/bo in 2029, in 2020$) may be conservative we might see $120/bo by 2029 and I doubt we will see any average annual Brent oil price under $80/bo from 2022 to 2029 in 2020 $.

LTO Survivor

Currently, it is all about the DUCs’ contribution to the Permian’s output.

During September, 284 wells were drilled and 409 were completed. The completed wells added 294 kb/d to September’s output. The decline was 244 kb/d which resulted in a net increase of 50 kb/d.

However, if the DUCs were excluded it’s a whole different story. Scaling the output by the ratio of wells drops the Permian output to 204 kb/d. (284/409*294,000 = 204,000). So with no DUCs the Permian output would have declined by 40 kb/d in September.

Alternatively, it takes 339 new wells to just offset the current decline rate of 244 kb/d.

Hi Ovi,

At shale profile they estimate about 1.3 wells drilled per month for each horizontal oil rig in the Permian basin. For week ending 10/29 there were 247 horizontal oil rigs rotating, if that count continues we would see 321 new wells drilled going forward. Over the past 6 months Permian horizontal rigs have been increasing at about 3.5 per week. If the rate of increase falls to 2 rigs per week we still see wells drilled increase to 342 per month by January. The DUC count will stabilize over time and then will increase as completion rate stabilizes at some higher level (probably 390 to 410 wells completed per month). If the rigs operating in the Permian increase by 100 (over a 12 month period) to 347 that suggests about 450 wells drilled per month, if only 410 wells were completed per month that implies increasing DUC counts by 40 per month, once the optimal DUC count is reached for producers they will reduce the operating rigs so that completions and wells drilled will be the same and the DUC count will stabilize.

Dennis

Just read this comment from an oil analyst where he said that a well used to cost $7M. $2M to drill and $5M to complete. However he said that drilling cost is much more than $2M now and that the drillers are using the DUCs to reduce their costs and implied that well completions will slow when the DUCs are depleted.

This is also true. Figures don’t lie but liars can use figured to hide the truth.

The IHS North American E&P index had been at its lowest since 2014 but had a big jump in the second quarter and I expect there will be a bigger one in the third (the figures for which should be out soon hough I don’t know the exact release dates).

Worldwide the UCCI has been increasing about as fast as it did when the industry went slightly bonkers in 2005 to 2008. Again 3q may be even higher. One thing this means is that capital expenditure doesn’t rise the actual development and ultimately the number of new wells will decline. It also will add to any risk aversion already present in the E&Ps (and maybe their potential lenders).

Worldwide the UCCI has been increasing about as fast as it did when the industry went slightly bonkers in 2005 to 2008. Again 3q may be even higher. One thing this means is that capital expenditure doesn’t rise the actual development and ultimately the number of new wells will decline. It also will add to any risk aversion already present in the E&Ps (and maybe their potential lenders).

And one last une the downstream index is the highest and climbing the fastest it ever has.

Ovi,

I assume full well cost is 10.5 million in 2020 US$ in my model for the Permian basin. I ignore the drop in well cost during the pandemic and assume well cost is unchanged from July 2017 to July 2036 at 10.5 million in 2020 US$. From 2010 to 2017 I assume real well cost gradually increases from 7.5 million to 10.5 million in 2020 US$ due to increases in lateral length, number of frac stages, and increase in proppant use.

The producers are completing more wells than they are drilling because they had an excess inventory of DUCs due to the pandemic, at this point they may be close to an optimum level and will likely increase the drilling rate to the completion rate that they desire.

As to whether completion rate slows, will depend on what happens with rigs, so far the trend has been up both for rigs and frack spreads, the rate of increase might slow down, but the fact that oil prices are quite high suggests the reverse.

George,

Great charts thanks.

Mike assumes that analysts assume nothing changes over time. My models have changing completion rates, changing costs, and changing well productivity. As to future values for any of these variables nobody knows what they will be. So I create scenarios with different completion rates which affects well productivity, I assume as completion rates increase that the rate of decrease in well productivity increases and vice versa. I use the simplifying assumption that future well design will be unchanged at the average 2019 lateral length, proppant per well, frac stages per well and well spacing and that well costs wil rise at the same rate as the rate of inflation (that is real well costs will be unchanged per lateral foot). If well design is unchanged in the future, increased operating efficiencies could offset rising matetial and labor costs and keep real well cost flat.

An older study from IHS at link below

https://www.eia.gov/analysis/studies/drilling/pdf/upstream.pdf

It would be interesting to get an estimate of average well cost (drilling, completion and land cost) for midland and delaware basins in 2019. My current guess is $10.5 million in 2020 US$, but there are many who know far more than me who could make a better estimte.

Your guess Mike is spot on. Well costs are around $10.5 million and rising.

Thanks LTO Survivor.

I just talked to someone in the UK who paid £1.50/litre (US$7.76/gallon) to fill up his car. This is the highest price ever in the UK. Strangely he said that traffic volumes have not decreased. For some reason, high fuel prices do not seem to affect people’s driving habits, or maybe there’s a delayed effect?

I just paid slightly more here in Sweden (17,75 SEK/l) to fill up the car, and a small can for the snowblower, stings a bit but sure beats walking and shoveling. Here a small comfort is also that much of the cost is tax that keeps our social systems running, however bloated they may be… And the same here, no visible affect on traffic volume, yet at least.

Perhaps high oil prices lead to faster transition to EVs. If so the demand for oil may eventually fall. This will likely require many years probably 2033 before oil demand falls below supply.

A couple of years ago the sighting of a Tesla was a happening here, now I see quite a few while commuting to work, mostly white Model 3s due to tax reasons since they, just barely, fall below the tax break limit for corporate cars…

But we are a fairly prosperous country, hard to see that happening in Vietnam etc. But ingenuity will hopefully help.

Addendum, there are also some electric snowmobiles developed, hopefully that will work out well.

For some petrol, and natural gas liquid products, I suspect people will work very hard to continue on with purchase even at much higher price levels, such as many of the derivatives of the petrochemical industry like resins and adhesives and paints and synthetic fibers, etc.

On the other hand, steady high prices of gasoline are likely to drive people towards vehicles with plugs even more rapidly than the current clip.

Does anyone here know if there is relative excess or shortage of the specific refined products of crude oil- just for example is there plenty of jet fuel but not enough asphalt? Perhaps this varies regionally.

Lots of substitutes for petrochemicals: coal, biomass, electrolytic H2 and atmospheric C. Chemical engineering has a lot of ability to transform things.

Asphalt is easily replaced by concrete.

A surprising amount of oil, diesel and gasoline are used in commercial, industrial and residential generators. Solar with or without batteries are already eating into that.

As renewable power gets cheaper and oil-based liquids get more expensive synthetic fuels will become competitive.

The same can be seen in The Netherlands. Record gasprice, but even more traffic than in 2019.

But the government will put an end to all this: new COVID-mandates.

Office-workers will have to work from home again just like in March 2020.

People need cars to get to work. The cost cutting won’t be coming from driving miles, but from discretionary spending.

And, indeed, the UK economic recovery has been slowing down lately.

From the Oil and Gas Journal reporting ion a Morgan Stanley analysis:

Last year, global capex fell to $350 billion and has not rebounded in 2021, and probably won’t in 2022 either. If capex stays stable at current levels, global oil supply will likely roll over around 2024 and then decline sharply thereafter.

Meantime, “sustained high oil prices are likely needed to restore balance: Unless more investment is forthcoming, or major demand break-throughs are made, oil prices will likely search for the level where some demand erosion kicks in. We raise our 2022 first quarter Brent forecast to $95/bbl and our long-term forecast from $60/bbl to $70/bbl,” Morgan Stanley said. Here Morgan Stanley defines ‘long term’ as the period starting in 2023 and stretching into the second half of the decade.

https://www.ogj.com/general-interest/economics-markets/article/14213072/morgan-stanley-global-oil-supply-likely-to-peak-earlier-than-demand

The Brent crude benchmark will hit $120 per barrel by the end of June 2022, Bank of America said in a research note this week, cited by Bloomberg.

The catalyst for BofA’s increased price forecast is the current global energy crisis that has seen prices for crude oil, coal, natural gas, and LNG skyrocket as the market tightens.

Just a month ago, BofA had forecast that oil could reach $100 over the next six months—and that was if we had a winter that was colder than usual. At the time, this was expected to be the most important driver of the global energy markets.

Excerpt from article linked below at oilprice.com

https://oilprice.com/Latest-Energy-News/World-News/Bank-Of-America-Sees-120-Oil-By-June-2022.html

Dennis

I think this is a bit of a stretch. It all depends on the assumptions. OPEC says there will be a supply surplus starting in June/July.

Not sure what BAC is assuming. Some analyst and participants on this site say OPEC will have difficulty in increasing their production much next year when all of their taps would have been reopened. OPEC would have to stumble at the 28,500 kb/d level and covid will have receded and world economy is into a good recovery to drive prices higher than $100.

I am more in the $90 to $100 range if the big 3, Texas, New Mexico and North Dakota keep increasing production at 70 kb/d/mth and reduce pressure on OPEC+

Ovi,

I agree with your oil price estimate, just thought the change in prediction by BOA was interesting, I think $95+/-5 per barrel for WTI in 2020 US$ is a reasonable estimate. Of course the experienced oil guys know that predicting the price of oil is a fool’s errand.

Just saw this.

OPEC oil output rise in October undershoots target

LONDON: The increase in OPEC’s oil output in October fell short of the rise planned under a deal with allies, a Reuters survey found on Monday, as involuntary outages in some smaller producers offset higher supplies from Saudi Arabia and Iraq.

The Organization of the Petroleum Exporting Countries (OPEC) pumped 27.50 million barrels per day (bpd) in October, the survey found, a rise of 190,000 bpd from the previous month but below the 254,000 increase permitted under the supply deal.

The biggest rises in October came from OPEC’s top two producers, Saudi Arabia and Iraq, which both boosted output largely as promised according to the agreement.

https://www.thenews.com.pk/print/905135-opec-oil-output-rise-in-october-undershoots-target

It will be interesting to see what comes out of the OPEC+ meeting on Thursday this week. Promises of more oil or stay the course?

Frugal,

I believe they will stay the course until we have sustained Brent prices of $100/bo or more for a month or more.

Was having trouble posting this, sorry if I spammed it a bit.

I am going to make an argument that I have been rolling over in my head for some time. My disclaimer is that I am fairly uneducated in this area. Everything I am saying here could be wrong, or only half-correct. But I still think it will spur some interesting discussion regardless.

Here is my simple thesis: A transition to EVs will not reduce demand for petroleum, at least in the short to medium term.

I’ll make two supporting arguments.

We Still Need the Rest of the Oil

We need to make clear what EVs actually replace. EVs replace gasoline. Currently, EVs on the market replace only vehicles that consume gasoline. That is, light cars and trucks. EVs that replace heavier vehicles, those that consume diesel (cargo trucks, tractors and heavy machinery), kerosine (airplanes), and bunker fuel (cargo ships) are not yet practical in a meaningful way. It will take many developments in battery technology before these applications become practical. Further, EVs do not replace the non-fuel uses of petroleum. Plastics, asphalt, pharmaceuticals, etc.

Fractional distillation is the process that (most) oil refineries use to separate petroleum into its component hydrocarbons. By boiling the oil, and then allowing the components to condense at their individual boiling points, the oil is separated into these disparate products. Via this process, about 45% of a typical barrel of oil is refined into gasoline. And that is the portion of the barrel that usage of EVs will turn into a waste product. But there is a rather big problem. You still need the rest of the barrel. You still need diesel, kerosine, asphalt, and all the rest. Just because you no longer want gasoline, does not have any effect on the need for the other products of petroleum. Which means you will still need the same number of barrels of oil.

Of course, this situation, if it becomes reality, could have some strange results. Since producers are no longer making money on the gasoline, but presumably still have the same costs to extract and refine the barrel, the costs of other oil products could rise. Another outlandish possible effect, is that perhaps refineries will begin flaring gasoline.

One solution to this problem would be to retrofit refineries to turn the gasoline into something else. If the gasoline were converted into other petroleum products (similar to the coal liquefaction pursued by Germany during WW2), overall demand for oil would decrease, as gasoline would be taking the place of other petroleum products. Doing this conversion is certainly possible. I have NO IDEA the costs or difficulty of doing so. I cannot imagine it would be cheap, or that it could be accomplished very quickly.

Regardless of the long term results, if initially the transition to EVs means we simply want less gasoline, we will still want the same amount of oil. Lack of demand for gasoline doesn’t reduce demand for all the rest. Onto my second argument.

Price Goes Down, Demand Goes Up

What is likely to happen when demand for gasoline falls off a cliff? Well, the price of gasoline would drop. Due to the need to make other products, refiners will still be producing a LOT of gasoline. And there is a great distribution network for it already. And it will be very, very cheap.

Anything producers sell it for, beyond the cost of distribution, will be free money from a product no one wants any longer. Is $0.20 per gallon reasonable? If producers don’t sell it, they pretty much just have to dispose of it. I’d imagine this entirely erases any economic reason for individuals to switch to EVs, not to mention stimulating a search for other uses of gasoline. I imagine it could power ships, or heavy machinery, or what ever else. And it’s gonna be so cheap that there will be a pretty massive incentive to make use of it. This is pretty much Jevon’s paradox at a massive scale. The result? Any large reduction in demand for gasoline will incentivize finding new uses, and demand for gasoline will go right back up.

Taking these two arguments together, I just don’t see EVs doing much to reduce demand for oil. Interested to hear everyone’s thoughts.

Niko —

This is a really good point. A big shift to EVs wouldn’t reduce oil consumption evenly. It would just hit those sectors that power light vehicles. There could be lots of surprises in store.

Two other thoughts occur to me:

First, US refineries produce a lot more gasoline than the rest of the world:

https://www.greencarcongress.com/2020/07/20200714-refineries.html

Second, in Europe EVs are hitting diesel car sales very hard, but not gasoline car sales.

https://www.economist.com/graphic-detail/2021/10/01/european-sales-of-electric-vehicles-have-nosed-ahead-of-diesels

I forgot that diesel powered light vehicles are more popular elsewhere. There’s that American ethnocentrism coming out. This would indicate that EVs can reduce demand for both diesel and gasoline, though to varying degrees. However, I think there is a portion of diesel which is still very hard to replace, and the other products of petroleum seem unaffected. At what point has enough of the barrel become low worth that it is no longer economically feasible to extract and refine the barrel at all?

My second point remains the same. Reduction in demand (for diesel AND gasoline) reduces price which disincentives transition and encourages finding new uses for what would be stranded assets. The interactions and results here are likely to be complicated.

Niko,

As demand goes down for fossil fuel price will decrease, but that will drive higher cost oil from the market, there will come a point where the gas stations will also not be able to operate because the price of fuel will be so low that profits become nil. Fewer gas stations will make ICE cars inconvenient relative to electric and they will be considered inconvenient. A little like seeing someone drive to work in a hrse and buggy or riding a horse. Perhaps a cattle rancher might do so, but generally people use ICEV and before long the ICEV will be the horse to the EV.

For large trucks batteries may get there eventually though electrified rail with last mile heavy duty EVs from rail to store or warehouse and EV delivery trucks and buses. We will get there, but it will take 10 to 20 years to accomplish.

As demand goes down for fossil fuel price will decrease,

The point I am trying to make is that demand for petroleum does not decrease as a singular unit. Rather, demand for specific petroleum products decreases, while demand for others remains. If producers can’t sell some of the barrel, they will likely have to increase prices on the rest. They will also have a large waste product problem, since those undesired products will be by-products of producing the stuff that people still want.

Will there be fewer gas stations? Or will gas stations add charging stations, continue selling (much cheaper) gasoline and diesel, and become hybrid affairs. What will be cheaper for refineries? Finding a way to get rid of these massive streams of waste product, or finding someone who wants to burn it, and burn it very cheaply? In 1978, gasoline prices were $0.65/gallon (inflation adjusted 2020 dollars, see https://www.usinflationcalculator.com/gasoline-prices-adjusted-for-inflation/) . So gas stations can obviously still be profitable at this price level. Do EVs still have an economic advantage over ICEVs at this price? Is it conceivable prices could go lower? I have seen analysis which suggests that fueling EVs costs about the equivalent of gasoline at $1.16. if EVs lose the price edge due to falling demand for gasoline, what happens to the economic incentive for switching?

The point is, as demand for these individual products (gasoline and diesel) decreases, there is a very large incentive to find a way to continue getting rid of them. And a very large economic incentive (in the form of rock bottom prices) for consumers to keep using them. The other products of petroleum will have to pick up the price slack, but since there are no good viable replacements, those products likely have very low elasticity of demand.

Unless you can easily convert any product of a barrel of oil into any other product, this problem will remain.

Niko,

The quantity of gasoline can change based on the type of refinery used. The market will adjust as things change in my opinion.

We will get there, but it will take 10 to 20 years to accomplish.

I will not try to guess how long it will take us to get there, but if we do, it will be because of declining supply, not declining demand.

Right now, today, oil prices are over $80 a barrel… because of declining demand? I really don’t think so. Demand is not declining, it is increasing. And supply is not keeping pace. But EVs are going to turn all that around soon. Not a chance.

Please don’t get me wrong, I hope I am mistaken. I hope EVs take over the world and IC vehicles will be reduced to the trash heap, including my 2007 Nissan pickup truck. But it is not going to happen. Well not anyway soon that is, not soon enough.

But I hope, I dearly hope, I am wrong.

Ron,

EV sales are growing very rapidly, it will not be long before petroleum demand starts falling faster than petroleum supply, my guess is 2030 to 2035, I also could be wrong.

Of course Dennis, you could be wrong. And so could I. And we usually are. 😂

Ron,

Yes predictions are usually wrong, on that we are in agreement.

Declining supply will happen before declining demand. Even with oil prices at $85 per barrel, the industry is dead and no one wants to invest except those of us who recognize the value of scarcity and depleting reserves. In any other time period in the past 50 years, higher prices would create the boom-like activity. Now it is more like a “dead cat bounce”. We would see deals coming out of the woodwork but this is not happening. There has been way too much destruction of the oilfield service infrastructure, labor disillusionment and retirement of highly skilled geoscience professionals, capital flight and green wave investing. You can only kick the dog so many times until he finally runs away.

LTO Survivor,

I agree. I expect supply to start declining in 2028 and high oil prices will balance supply with demand, by 2033 I expect enough EVs and plugin hybrids will be on the road that demand will begin to fall faster than supply at prevailing oil prices (by that time the prevailing oil price may be well over $100/bo in 2020 $.)

High oil prices may lead to an accelaration of EV sales growth, currently there are long wait times for popular EVs as supply cannot keep up with demand for popular models, currently if you order a Tesla Model Y (crossover mid-size SUV) delivery is expected in April 2022.

Niko —

Another similar question is what will happen to the ethanol market. About 40% of the US corn crop is refined to ethanol. There is an oversupply.

Europe has a similar problem, but will probably react by kicking out imported palm oil as a short term fix.

If EVs due suppress demand for oil, political pressure to increase the percentage of ethanol in fuel will increase. If oil prices fall, it will get more and more expensive to do that.

Ethanol fuel saved Midwestern farming from collapse when it was introduced, but it is a wobbly market.

There is some flexibility in refineries. There are units called hydrocrackers and catalytic crackers that turn heavy oil fractions into diesel or gasoline (hydrocrackers add hydrogen, which often comes from steam reforming natural gas, cat crackers remove carbon which is burnt to CO2 to provide the energy for the reaction). There is some nudge room within a refinery design to change the ratio of gasoline to diesel, but refineries can be modified to favour one or the other (at the cost of the changes and shutdown time to implement them). I would imagine it would be possible (and might already have been done although I can’t see why anyone would have looked into it) to find catalysts and a reaction route the gives the small amount of polymerisation needed to make diesel from gasoline with hydrogen or water as a byproduct.If the demand became apparent I’m sure the refining companies would be all over it. There are processes called alkylation units that take short chain alkanes (C3 to c5 I think) and make long chains ones which are used as fuel additive (I think for adjusting octane numbers and for anti-knock but am probably wrong). The new process would be something along those lines e.g. adding some short chain alkanes to long chain gasoline. Of course I could be completely wrong and this has been tried and found to be technically (e.g. no suitable catalyst) or economically impossible.

Interesting. So we can interchange diesel and gasoline to some extent. What about the other constituents of the barrel? Can we make kerosene from gasoline or diesel, for example?

There is no process designed yet that I know of. Presently it is possible choose to make either from heavy oil depending on what sort of cracking is used. Hydrocracking I think makes quite a wide range of paraffins so I’d imagine some are kerosene.

It is certainly possible at low efficiencies to turn gasoline to diesel because gasoline can be reformed to syn gas and then reacted to make diesel just as is done with gas/coal in gas to liquids/coal to liquids plants. Whether you’d ever choose to do it that way is questionable economically.

Gasoline is C7s to C11s, kerosene C12s to C15s and diesel C16 mostly (cetane). CTL and GTL make diesel, but I’d imagine any process that was viable could be tweaked to make kerosene.

I completely agree and have made point #1 previously – i.e. turning gasoline into a waste product is a huge problem for the other distillates and could create absurd price incentives (i.e. running gasoline generators to create electricity?)

Point #2 is also excellent. Since most people can’t afford new cars, let alone renewables, there will be massive incentives to postpone transition (other than early adopters).

In consulting with a municipality recently they are trying to move their Facilities department (a fleet of light vehicles for everything from streets and sanitation to park district) to EV’s. Among other problems is one they seemingly hadn’t considered – the unionized repair personnel who maintain all these vehicles will need to be re-educated.

They also assumed they would be selling the FF vehicles, not scrapping them – so somebody is buying them?

All in all I see a slow transition. I’m planning to get an EV once I get a charger through my condo board (20 yr old high rise in a major US city – no other charging stations in the building yet), but will keep our FF vehicle. I think lots of “lower upper class” folks will do similar.

I’ve been harboring very similar questions Niko- well stated.

The answers to the questions about feasibility, degree of flexibility, and cost of altering the crude oil fractional output are paramount to the trajectory of the industry and energy supply.