The Real Reason Why US Oil Production Has Peaked

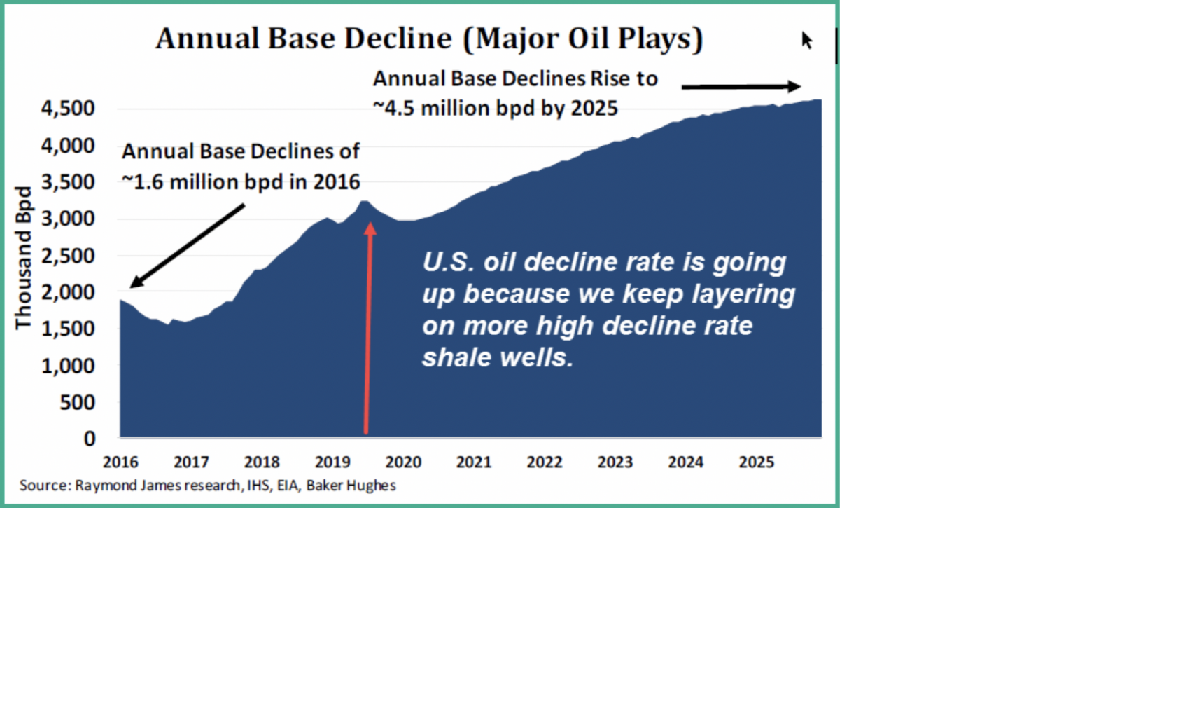

Raymond James recently estimated that over the last three years the U.S. decline rate for oil has doubled from 1.6 to 3.2 million barrels per day. The drilled but uncompleted well inventory (“DUC”) is back to normal, so the number of wells being drilled and the number of wells being completed is now about the same. We need over 12,000 new horizontal oil wells completed each year to hold production flat and the number of completed wells will need to go up each year.

The U.S. Energy Information Administration (“EIA”) forecast at the beginning of this year was that the U.S. shale oil plays were just getting started and that production would increase by at least 2 million barrels of oil per day (“MMBOPD”) each year for several more years.

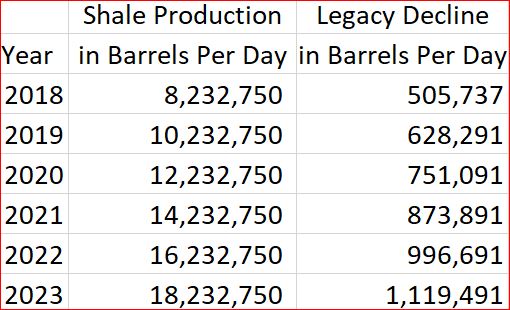

Now if you believe that U.S. shale production will increase by 2 million barrels per day each year for several more years, then I have a bridge that I think you might be interested in. But let’s just play “what if”, or what if it really did increase by 2 million barrels per day for the next five years.

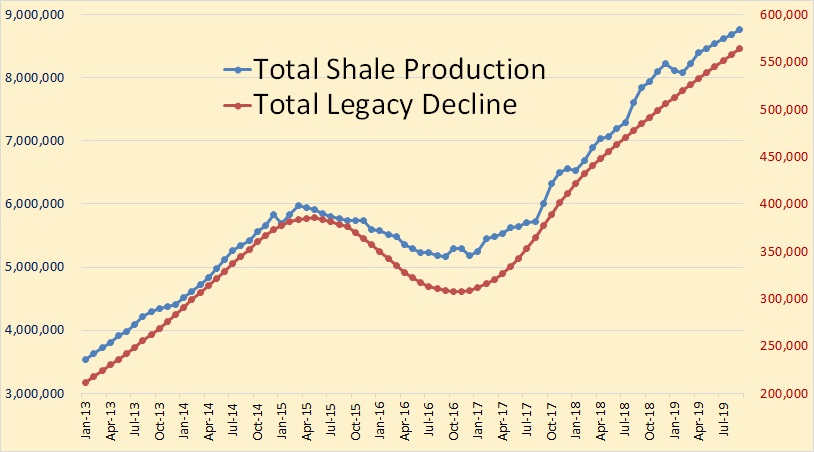

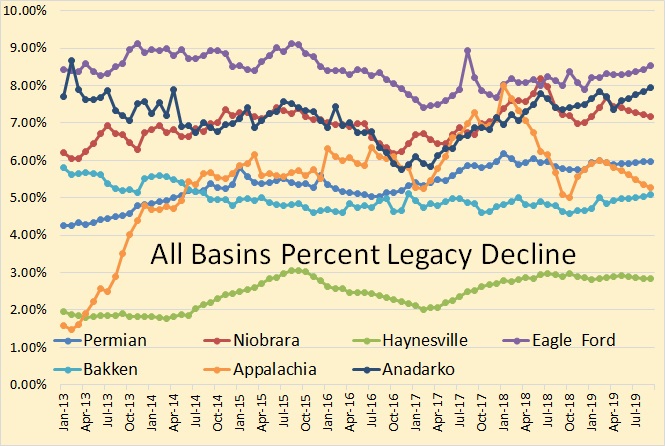

According to the EIA’s Drilling Productivity Report, December 2018 shale production, all basins, was 8,232,750 barrels per day and the legacy decline, for all basins, averaged 6.14 percent per month or 505,737 barrels per day.

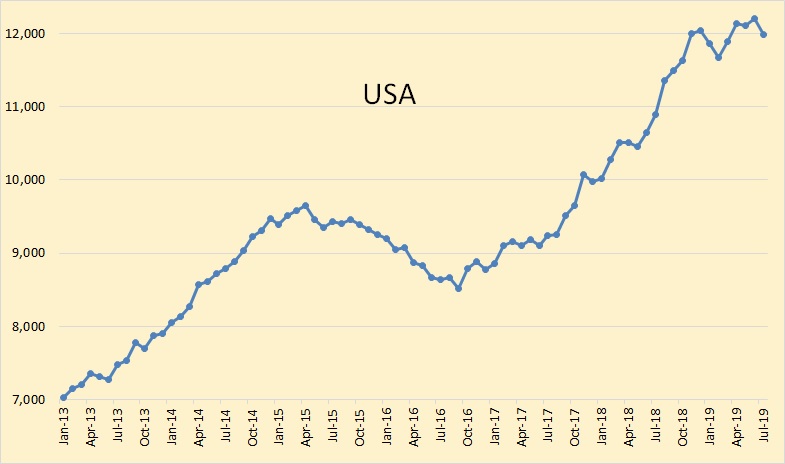

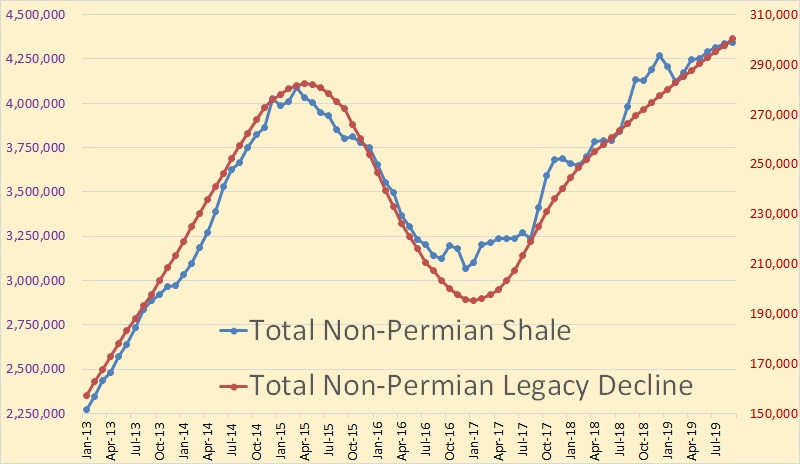

Legacy decline of over one million barrels per day would be a crippling requirement of shale producers. But not to worry, that is simply not going to happen. Now total US production did increase by two million barrels per day 2018. In fact, according to the EI.s Monthly Energy Review, US production increased by 2,064,000 barrels per day in 2018. But for the first 7 months of 2019, total US production has declined by 54,000 barrels per day.

USA production appears to have hit a snag. July production is now below November 2018 production.

In my opinion, legacy decline in shale production has reached a point where new production only replaces legacy decline. In fact, legacy decline may have reached a point where it is crippling shale oil production.

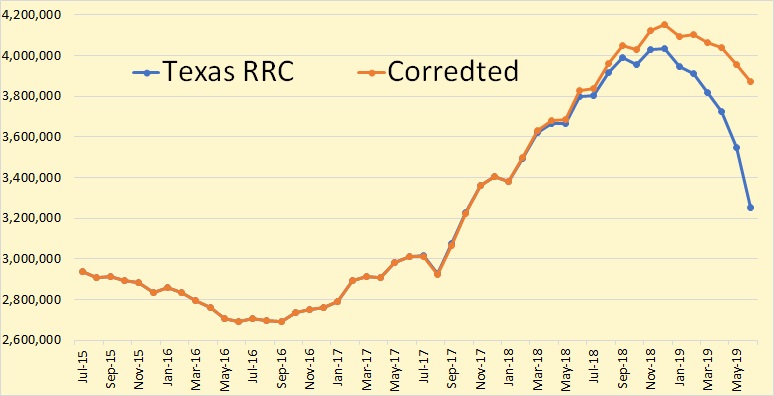

Those who have followed this blog for years know that Texas oil production is reported by the Texas Railroad Commission. But their data is very slow coming in, sometimes it is more than a year before all the data has come in. However, Dean Fantazzini, Energy economist, Deputy Head of MSU’s Chair of Econometrics and Mathematical Methods in Economics, has developed a program that uses the vintage data to make a pretty good estimate of the actual data. His past corrected data has been relatively accurate.

If Dr. Fantazzini’s data is correct then Texas peaked in December 2018 and has declined by 280,000 by June.

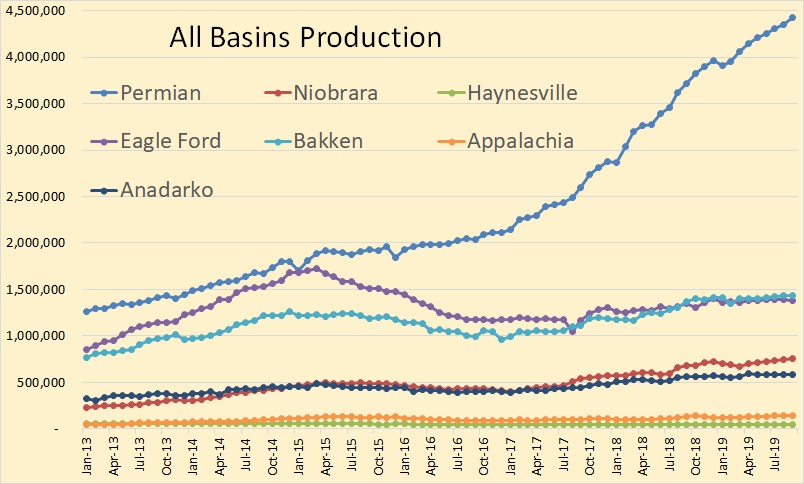

All the below charts were created from the EIA’s Drilling Productivity Report. The data is through September 2019 and the last few months is, of course, an estimate. Historically the estimate for those last few months has been overestimated.

Notice the last six months is pretty much a straight line. That is because most of it is just an estimate.

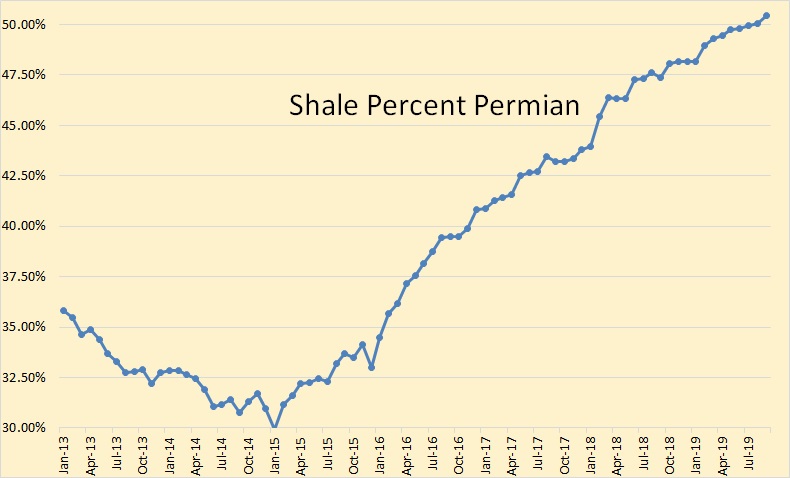

It looks like the Permian is pretty much the story as far as US shale is concerned.

The Permian is now just over 50% of total US shale production.

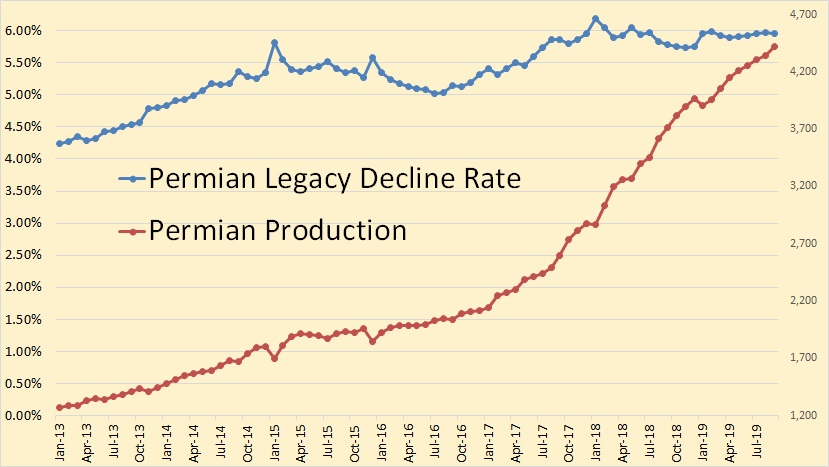

Permian Legacy Decline has been slowly rising and now sits at about 6%.

Eagle Ford has the highest legacy decline rate, now about 8.5% per month.

It looks like shale production, outside the Permian, has pretty much hit the wall. Pay no attention to those last four months. They are just the EIA’s wild ass guess.

In conclusion: Very high legacy decline, now over 6% per month, is shale’s Achilles heel. Of course, there are other problems as well. Bankruptcies are rampant, running out of sweet spots and the price of oil is just not high enough. It appears that the USA has peaked, or peaked until the price of oil rises at least $20 a month.

And check this one out:

Oil and Gas Bankruptcies Grow as Investors Lose Appetite for Shale

EIA monthlies to June

https://www.eia.gov/petroleum/production/

Dean’s charts self correct after a couple of months. Good estimates. Red Queen is already catching up. And, it will catch up faster the next six months from June, as most of the independents have severely cut back on capex.

Your Wall Street journal link has a firewall. Never mind, I got through. Good post.

where do you see that independents have severely cut back on CAPEX?

Grateful for more information/links.

Cheers

I googled “Shale Capex Cuts” and got about a dozen hits of shale capex cuts. Just three of them are below.

US Shale Operators Cut CAPEX, Up Production

https://www.rigzone.com/news/us_shale_operators_cut_capex_up_production-01-mar-2019-158282-article/

Montage Resources reduces drilling, cuts 2019 Capex

https://www.kallanishenergy.com/2019/08/08/montage-resources-reduces-drilling-cuts-2019-capital-spending/

US Shale Firms Cut CapEx, Up Production

https://www.aogdigital.com/energy/item/8981-us-shale-firms-cut-capex-up-production

https://csimarket.com/stocks/single_growth_rates.php?code=EOG&capx

https://rbnenergy.com/surprise-surprise-part-3-eandps-paring-capex-despite-strong-2018-profits-2019-prices

It’s widespead, simply google.

Pioneer has not only reduced its capex, it’s reduced its workforce by 25%. Apache has given up on the Alpine High, their biggest capex. It’s 90 % gas, how stupid can you get? Yadda, yadda, Yadda. Just google the company for capex, and put 2nd quarter 2019. Voila!

Your sure to get a positive statement from the company, but just concentrate on the capex going forward. For example, we’re losing money had over fist, translates to reduced operating expenses will provide an increased return for 2019. Get serious. None of these companies are going to say, we are screwed.

EOG could make it, most of the rest are totally screwed.

Even EOG will get pulled under the waves, probably sooner than later. All those wells, all of them, deplete at breakneck pace.

My latest post uses data from the BP Statistical Review published in June 2019

26/8/2019

2005-2018 Conventional crude production on a bumpy plateau – with a little help from Iraq

http://crudeoilpeak.info/2005-2018-conventional-crude-production-on-a-bumpy-plateau-with-a-little-help-from-iraq

Nice post, Matt.

Yes, nice post, Matt. And, good summary on US production, Ron. Nice to see these updates. Quite informative.

Hi Matt,

Can you or anyone explain this: “When adding the new data for 2015-2018 it was discovered that the 1980-2014 data had been changed – mainly increased by up to 1.24 mb/d in 2014”?

As mentioned in the introductory graph 1 I did an analysis in 2015. Of course I kept the data in an Excel file which I did not touch since then. When I downloaded the EIA data up to 2018 I found these differences

Reminds me of what Khalid Falih said about shale.

“I have no doubt in my mind that U.S. shale will peak, plateau and then decline like every other basin in history,” Al-Falih told reporters at OPEC’s Vienna headquarters. “Until it does I think it’s prudent for those of us who have a lot at stake, and also for us who want to protect the global economy and provide visibility going forward, to keep adjusting to it.”

Dr. Raymond Pierrehumbert will be proven right belatedly.

https://slate.com/technology/2013/02/u-s-shale-oil-are-we-headed-to-a-new-era-of-oil-abundance.html

Yeah, he was right. I could never imagine West Texas could ever support the lofty imaginations.

The article does say US production still has an up side, but prices would have to be higher.

If there is not enough supply then oil prices will obviously go higher as the did in 2003-2005 and in 2012-13.

US drilling rig count is very low at the moment being only 742, at it’s highest recently the US could have 1,400 drilling rigs working.

1,400 drilling rigs will certainly complete enough wells so new supply would exceed decline rates. When oil prices are over $100 as they were in 2012 and the number of drilling rigs are 1,400 then you can wake me up.

Sleep well, Hugo. It will be a long time.

Hugo,

You want to focus on horizontal oil rigs. The count was as high as 1100, but many of those rigs were lower power rigs no longer economic to operate, a lot of the current rigs are higher power and far more efficient at drilling 3300 meter laterals commonly drilled today.

Dennis

Where do you get info on that?

Hugo,

Go to pivot table at page below, then select horizontal oil wells.

https://rigcount.bhge.com/na-rig-count

A comment on oil rig chart from 9/1/2019 6:03 PM posted above. The horizontal oil rig count decreased by more than a factor of 5 from Dec 2014 to June 2016. There were only 24% of the Dec 2014 horizontal oil rigs still running in June 2016, tight oil output was 82% of the March 2015 maximum in Sept 2016 (there is about a three month lag between changes in rig count and changed in output due to time to drill and then frack the well.)

Holy f*ck Hugo, you are a raving lunatic. The oil prices can’t go higher, otherwise there will be a repeat of 2008. Clearly you are incapable of learning from the past.

Mike Sutherland,

2008 financial crisis had very little to do with high oil prices as proven by recovery during 2011 to 2014 during a period of high oil prices.

It is interesting how so many people want to keep believing the idea that the high oil and nat gas prices led to the financial crises of 2008-9.

At first I was among them.

But as the episode unfolded and the gross financial/regulatory mismanagement story gradually became public, that older narrative is no longer ringing the truth bell.

But people do seem to cherish it.

I have heard that the financial sector is now an even bigger portion of the economy than it was then. Atleast we have a guy with a hell of lot of bankruptcy experience as our leader now. I’m sure that you must be aware that it was Russian investors who bailed him out of his worst episode.

Sutherland

People like you who show mindless emotions just display their ignorance on all levels.

The oil price was over $100 for nearly 4 years between 2011 – 2014. The global economy did very well during that time

So do try and educate yourself

Yes Mike, its ridiculous to suggest that the US housing crisis and collapse caused the Worlds Greatest Recession. Here are two serious studies that contract the reigning paradigm.

https://www.nber.org/digest/aug15/w21261.html

“The U.S. Foreclosure Crisis Was Not Just a Subprime Event

The crisis began in the subprime mortgage sector, but twice as many prime borrowers as subprime borrowers lost their homes over the full sample period.

Many studies of the housing market collapse of the last decade, and the associated sharp rise in defaults and foreclosures, focus on the role of the subprime mortgage sector. Yet subprime loans comprise a relatively small share of the U.S. housing market, usually about 15 percent and never more than 21 percent. Many studies also focus on the period leading up to 2008, even though most foreclosures occurred subsequently. ”

https://www.brookings.edu/wp-content/uploads/2009/03/2009a_bpea_hamilton.pdf

Causes Causes and Consequences of the Oil Shock of 2007–08

“ABSTRACT This paper explores similarities and differences between the

run-up of oil prices in 2007–08 and earlier oil price shocks, looking at what

caused these price increases and what effects they had on the economy.

Whereas previous oil price shocks were primarily caused by physical disruptions of supply, the price run-up of 2007–08 was caused by strong demand

confronting stagnating world production. Although the causes were different, the consequences for the economy appear to have been similar to those

observed in earlier episodes, with significant effects on consumption spending

and purchases of domestic automobiles in particular. Absent those declines, it

is unlikely that the period 2007Q4–2008Q3 would have been characterized as

one of recession for the United States. This episode should thus be added to

the list of U.S. recessions to which oil prices appear to have made a material

contribution.”

Yes Mike . . . 6 years of $100+ oil caused the Greatest Recession Ever. For each of those six years the US economy sent and lost $100 billion overseas in additional oil expenses.

Further more, it is no coincidence that the so-called PIIGS, the Euro nations hit the hardest spend the most on oil

https://www.businessinsider.com.au/the-oil-peak-has-been-reached-2010-10

This is a complex question.

Hamilton said oil was “a material contribution”. That’s not the same as being the primary cause.

What’s the causal link between PO and recession/depression?

James Hamilton showed one: that oil shocks caused fear, uncertainty and doubt among car buyers, who put off purchases, thus reducing overall capital investment, thus reducing aggregate demand, causing recession.

“…, the technological costs associated with trying to reallocate specialized labor or capital could result in a temporary period of unemployment as laid-off workers wait for demand for their sector to resume. Bresnahan and Ramey (1993), Hamilton (2009b), and Ramey and Vine (2010) demonstrated the economic importance of shifts in motor vehicle demand in the recessions that followed several historical oil shocks.”

page 26 http://econweb.ucsd.edu/~jhamilton/handbook_climate.pdf

The problem: this is a short term effect. If oil prices stay high, drivers will switch to buying more fuel efficient vehicles and car sales will rise again. Again, this is what we saw from 2011 to 2014: oil prices stayed high, and yet car sales recovered to historically very high levels.

Every recession since the World War II (save one) was preceded immediately before by an oil price spike. Every significant oil price spike was followed by a recession. Not spikes in other commodities, nor any other tracked market. That is cause, not correlation.

Not spikes in other commodities, nor any other tracked market.

Oh, my lord, no. Have you looked at the correlation of copper with the economy?

What is Doctor Copper

The term Doctor Copper is market lingo for the base metal that is reputed to have a Ph.D. in economics because of its ability to predict turning points in the global economy. Because of copper’s widespread applications in most sectors of the economy — from homes and factories to electronics and power generation and transmission — demand for copper is often viewed as a reliable leading indicator of economic health. This demand is reflected in the market price of copper. Generally, rising copper prices suggest strong copper demand and, hence, a growing global economy, while declining copper prices may indicate sluggish demand and an imminent economic slowdown.

https://www.investopedia.com/terms/d/doctor-copper.asp

On the other hand…

If that doesn’t convince you, that means you feel very strongly that the world economy has been deeply harmed many times by it’s dependence on oil. That suggests that it might be a good idea to diversify from oil a bit, doesn’t it?

Peter Starr,

Generally we do not want cause preceding the effect unless we believe in time travel (works nicely in fiction, but not so much in physics). So your 6 years of $100/b or higher oil prices has very little to do with the cause of the GFC as there was only a single year of high prices that preceded the GFC (in 2008 the average WTI spot price was $99.67 and then the price fell to less than $80/b for 2009 and 2010 (annual average price), back in 2008 to 2010 the average annual Brent crude price was a bit lower than WTI. From 2011 to 2014 average annual Brent spot price was a bit higher than WTI and was 111,112,109, and 99 US dollars per barrel of oil in 2011 to 2014 respectively. During those years Global real GDP was growing at 2 to 3% annually. This fact calls into question assertions that oil prices over $98/b will cause a global recession. Of 5 years recently (since 2000) where this has been the case only 0ne of 5 coincided with a Global recession. Note also that Hamilton’s work focuses solely on the US, other studies have found that high oil prices have little effect on the World economy, though clearly a sudden supply shock as in 1973-1974 and 1979-1981 can have detrimental effects.

It is not as clear that the World is quite as dependent on oil as was the case in 1973 to 1983 as oil is a much smaller part of the overall energy mix today in comparison to that earlier period.

Peter Starr

The 2010 article is a joke. Do you know where the graph came from?

It was produced by one of the oil OilDrum contributors who told us that Saudi Arabia peaked in 2008. According to his in-depth knowledge of the country. Saudi Arabia would be producing on 6 million barrels per day by now.

Look at the graph carefully, it has oil and condensate production falling from 82mmbd to 67 today.

Do you actually know what it is today?

Can you not tell when an article is written by someone who obviously knows nothing on the subject?

The Saudi information/graph is not the one I referenced. Look at the chart; “PIIGS’s reliance on oil.” (I rarely post here, and am not able to paste a graph)

Peter

OK lets stick with what you posted.

The graph has oil production peaking in 2008 and falling to 67 million barrels per day.

Why on earth re post such rubbish?

These countries do not suffer from peak oil but corruption

https://www.greens-efa.eu/files/doc/docs/e46449daadbfebc325a0b408bbf5ab1d.pdf

Portugal losses 18 billion Euros per year, the equivalent of 1,700 for each person.

Corruption in Italy costs 237 billion equal giving 11 million Italians the average wage.

Italy at the moment spends 26 billion on oil, that gives you some perspective on what their problems really are.

IIRC it wasn’t the problem with sub-prime and outright fraudulent mortgages that was the problem, it was the bundling of them into CDOs and the fraudulent credit ratings given to those that undermined the entire credit market. No-one knew how good their collateral was! Those CDOs were deeply interwoven into complicated financial structures that took years to unravel, and in the meantime only the government backing prevented a complete shutdown of credit.

The price of oil may (or may not) be an aggravating factor, but certainly not a cause by itself.

Hello, i m from spain.

Ron, you say that we are reaching the physical limits and then in the end you say that if it goes up $ 20 we can produce more, is it a contradiction?

Yeah, there is sort of a contradiction there. Sorry about that. But we are seeing the physical limits hit in much of the world, regardless of the price. But if oil hits $80 to $100 a barrel, a lot more shale could be produced. But that will not change things in the long run. It could delay peak oil by a year or two.

If the price of oil rose to $ 150, how much would US oil production go up? 13.14 or 16 million barrels per day? which is the limit geological?

Who would pay for it? Who could pay for it?

That’s the lesson from the first round of peak oil predictions (which crashed in 2010): If the price gets too high, people won’t buy the associated products.

There must be some absolute limit on how high prices can go, but who knows what that is?

Are we at the point where the producers say, “We can’t produce at a lower price,” and the consumers say, “We can’t buy at a higher price”?

Michael

That is not true. a hybrid car can do 200 miles per gallon

If people bought hybrid cars they could easily afford $150 oil

If people could afford hybrid cars…

I sure can’t.

Hybrid cars are the cheapest option, if you include the very low cost of fuel (and some maintenance is lower, such as brake replacement).

A used hybrid is very cheap. Used electrics, like the Chevy Volt, are also very cheap.

What are you driving?

I live on a farm and drive a 2003 Ranger.

Luckily, work is only 8 miles away, and I’m home most of the time during summer.

Ah, not really a car.

It will be a while before there are cheap used hybrid or electric pickups available.

Hugo,

It seems that you underestimate the importance of crude oil in the world. High oilprices will affect many other things, including food prices. Not much of a problem for the wealthy, more so for the people with low income, that is the majority of world population.

If only wealthy would be living on planet earth maybe we wouldn’t have this forum I think. One of the dangers of Peakoil lies in the consequences for the billions of people who are happy when they have enough to eat every day and can think or dream of buying a cheap car, now or in the future.

Han

I was really talking about US not being at peak now.

Oil prices were over $100 for nearly 4 years and the world economy was doing fine.

At that price oil is only 4% of income expenditure. Mortgages can be as high as 50% of income.

House builders can make 400% profit on houses, if house prices fall a bit they will still be rich.

Once oil production peaks and starts to fall, things will be difficult until enough electric cars are sold.

The number of electric cars sold will need to be at least 50 million of the 100 million, in order to cope with peak oil.

I thing the world will be behind the curve here for several years.

I think between 2025 and 2030 things will be very difficult.

However I still think environmental degradation and lack of water will be far worse in the years ahead.

https://www.circleofblue.org/indiawater/?gclid=EAIaIQobChMIn4fa6PKv5AIVjbTtCh2DMgWHEAAYASAAEgJlSfD_BwE

https://www.abc.net.au/news/2018-11-23/china-water-crisis-threatens-growth/10434116

Hugo,

I was referring to:

“If people bought hybrid cars they could easily afford $150 oil“

My answer related to the general effect of high oilprices in the world. The U.S. could afford oilprices higher than $100/b, but the U.S. depends also on how healthy the world economy is. I don’t see Trump’s plans becoming reality anytime soon.

Not only fuel prices are going up with rising oilprices, that from many other products and food too. Big part of world population spends the majority of their income on food and transportation. The less money that remains for other things, the less mobile phones, etc will be sold. It’s that simple.

“I think between 2025 and 2030 things will be very difficult.

However I still think environmental degradation and lack of water will be far worse in the years ahead.”

Probably, indeed. Peak oil consequences and climate change will even bite harder the next decade. Forests in many countries on fire now. Various positive feed back mechanisms on the way for runaway climate change.

We cannot just start to transition to EV’s, thinking everything can go on the same way with growth, growth and more growth. The next economy has to be a shrinking economy for us to survive. Will the monetary system survive that ?

“If people bought hybrid cars they could easily afford $150 oil”

The loon has spoken.

Michael B,

Were you driving in 2011 to 2014, gasoline prices were quite high? Did you stop driving? In Europe petrol prices are 2 to 3 times the price in the US, people buy more efficient vehicles and perhaps drive less, but they still use their cars.

I live in Europe and yes, gas prices are much higher than in the US. But our economies are adjusted to this… This is mainly taxes, so the money flows back in our economies. And these taxes were incremental over decades, not a sudden surge.

The thing is, when you have strong prices change it also change the budget allocation. Usually, driving habits don’t change much because they are linked to you revenue (if you can’t go to work, you don’t get paid). So, you cut somewhere else… consumption of goods decrease.

The rise of oil prices wasn’t the main cause of the recession of 2008. But it had an impact, maybe just the tip to make everything falling apart in this fragile financial house of cards.

On the opposite, the price plunge of 2015 created a budget for goods consumption and there was a stimulation of goods consumption boosting economies.

This is how I understand it, roughly. This is not exactly this, but from a consumer POV, this is what happens.

Tita,

I mostly agree that the speed of change in oil prices will be important and yes it can affect consumer spending when oil prices rise, eventually it can result (after a 1 to 3 year lag) in consumers switching to more efficient vehicles, using more public transport, car pooling, combining trips, walking, biking, etc. Only the purchase of a new car might see the 1 to 3 year lag, other factors could take effect immediately.

In the case of the US and other oil producing nations, the higher oil prices also flow back into the economy, in fact lower oil prices hurts those oil producers so income is cut for those in the oil industry.

Agree Tita.

It is not entirely a geological limit. The limits are legion. Workers, water, roads, and in the case of the Permian, trying to convince your family to stay in a really tough location. The major obstacle is going to keep independents alive before the majors take over everything. Upstream to downstream in the US is the major goal. Exporting at high prices would be a waste in the long term. And, it’s not only the majors, there is ConocoPhillips, Marathon, and a host of other downstreams that want a bigger piece of the pie.

At this point MOST of the independents are toast. Can they stay alive long enough for prices to rise? Stay tuned, but, my bet for prices to rise any goes into 2020. Why, I don’t know, but that’s the direction. Inventories have to approximate zero, which I agree is a stupid guess. But, everything points that way.

Gail the Actuary argues the world economy can’t afford higher oil prices

http://ourfiniteworld.com/2019/08/22/debunking-lower-oil-supply-will-raise-prices/

Do you know many people , or countries, who would not divert financial resources from other expenditures in order to keep their petrol consumption up.

I don’t.

Maybe if a barrel was over $100 people would scale back discretionary (frivolous) uses, but still, people tend to find the stuff extremely useful.

In the 2030’s, when people will have more electric transport, it may be different.

Thats how I see it, anyways.

Look at the statistics. US motor gasoline supplied.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MGFUPUS2&f=M

High oil prices tend to suppress economic activities. The US went into a recession end 2007. Gasoline demand was down

It is true Matt that USA demand went down with the economic crises of 2008-9, about 10-15 % for a few years.

That decline was driven not by a sudden shock in oil price, or even high oil price, but by a loss of buying power for other reasons- a financial crises/mismanagement on a very large scale.

I assert that if the economy had not had a sharp recession at that time, then the oil consumption would have kept slowly growing even at those higher prices present at that time.

“High oil prices tend to suppress economic activities.”- I certainty agree with you, but the question is ‘how high can the prices go before they cause a reduction in consumption?’

And that answer is surely not fixed, and varies by degree of economic strength in a country, and how much frivolous use in present.

I consider the world economy to be at risk for economic depression, at any time, just because we are so far into gross overshoot, and depression is a natural symptom of ‘mild’ contraction. We like to walk along the very thin edge of a partially frozen lake, as if the whole surface is frozen solid deeply. By that I mean that most countries take very high degree of risk with their financial well being, living/growing far beyond their means. Just count up the debt to measure the degree.

So, yes, we could move into a situation where higher oil prices couldn’t be afforded. But until we enter a big slowdown event, it seems the world economy could afford considerably higher fuel prices.

You get so much valuable horsepower, even at a $100 bucks its an incredible deal…. unless of course you have an electric vehicle that can replace your particular use.

Matt,

You have cause and effect reversed, the high oil prices were a combination of a high level of economic activity leading to high demand for oil with supply not growing fast enough to meet that demand. The economic crash was due to an overheated housing market and poor banking regulation leading to a financial crisis. The oil price had very little to do with it.

High oil prices from 2011 to 2014 were handled by the World economy with little problem, the prolonged crisis in Europe was due to poor monetary and fiscal policy in European nations where the lessons learned during the Great Depression were ignored.

Can you imagine if we got an oil price shock. Say to $150. What would the ECB central bank of Europe be able to do about it. Raise short term interest rates?

High priced oil can’t be allowed under any circumstance. At this point in the game high price oil is not just a country killer it will take whole continents with it.

I think the ceiling of affordability is a lot lower than most believe. $70

Doesn’t the affordable price in USD depend on the value of USD relative to other currencies?

I’d say it does. And when you realize China’s credit creation over the past 10 year is more than the combine credit creation of the US, Europe,and Japan. Those 2 trillion in dollar reserves they own in the form of US treasuries won’t buy them a whole of time.

30%-50% devalue of the yuan to the dollar is in the works and there is nothing they can really do about it.

Think about Japan too. They can’t raise interest rate either no matter what the price of oil is. I’d say the US has little room to raise rates also.

This all sets up a choice. If your the FED do you unleash QE4-5 or whatever it is and push oil price back to over $100 and watch everything implode? Or do you do nothing and watch everything implode?

shallow sand,

For other nations the obvious answer is yes. Exchange rates change all the time, this has been true since the Gold standard was abandoned in the 70s. But clearly for any given set of exchange rates a higher oil price in US dollars will raise everyone’s price of oil in Euros, pounds, etc unless the increased price of oil results in different exchange rates (a distinct possibility).

HHH. Yes timing is a big part of the equation. Fast changes (shock to use your term) are difficult to adapt to, and cause chaos beyond their magnitude.

Slower changes are more digestible to the economy, and peoples behavior.

HHH,

I think the World will have no problem with $70/bo, oil prices averaged about $110/b in 2017 $ from 2011 to 2014, the World could handle that oil price and perhaps even $140/bo in 2017$, my guess is that $150/bo for Brent crude in 2017$ or higher might cause problems.

I think the World economic system is far more resilient than you believe with respect to the price of oil.

Dennis, central banks have no room to combat inflation due to oil price. They can’t raise interest rates now and in 5 years from now interest rate will have to be much lower than they are today as the debt burden grows.

Inflate your way out of debt is a false narrative. The only the thing that gets inflated is the total amount of debt. Doesn’t make it anymore payable just because you increase it. It’s a simple game of extend and pretend until it falls apart.

There is no place on earth that it’s closer to falling apart than it is in China. You know the last crisis China had 35% of all loans were Non performing loans. It’s going to be way worse this go around. The total amount of credit issued just in the last 10 year has never been done anywhere at anytime. Nothing even close. In order to keep all the debt from imploding their going to have to print a whole lot more.

HHH,

World debt to GDP is not at unreasonable levels, much of the increase is due to better access to credit markets in emerging economies. The debt boogie man is just not very scary to those that understand economics. There can be too much debt and the high current debt levels should be paid down so we can address future crises. Higher taxes on the upper income earners would be a start as well as fewer tax shelters for the wealthy, that tax revenue can either be used for necessary infrastructure or simply used to reduce government debt (or at minimum to balance government budgets).

Hi Dennis,

I suppose I fit into that ” The debt boogie man is just not very scary to those that understand economics.” category of not understanding.

There are two things about a high debt load that seem untenable to me in this current version of the world.

One is- we don’t pay it down when times are good, in fact we tend to add to it. The short period of paydown during the Clinton presidency was a rare moment.

Secondly, big debt load works if your prospects indicate that you can outgrow it, or atleast have longterm stable conditions to service it. Personally, the prospects for outgrowing the debt, when coupled with demographic and energy challenges we are up against, look low in probability to me.

I admit, perhaps am looking at from a conservative, over the hill standpoint.

Or maybe just realistic.

Another aspect- we use debt to maximize our economic growth, at a personal and society level. We tend to stretch our borrowing to the severe limit.

Is that max growth a good thing?

Have we grown too far too fast, like an obese person just because food was available?

I have great reservations about that behavior.

Hickory,

For all debt public and private debt to GDP has been growing pretty slowly at the World level.

I am not claiming that debt is never a problem, but simply that at the World level it is not currently a problem.

See

https://www.bis.org/statistics/totcredit.htm?m=6%7C380%7C669

chart below is based on data from BIS.

To me the chart is not very scary.

On borrowing, some borrow too much, others do not.

I suppose it comes down to optimism.

I don’t have enough of it, in regards to the worlds chances for smooth sailing.

And smooth sailing conditions are the presumption it seems to me.

I expect very choppy seas, and big debt is like having a crappy boat.

Hickory,

Hoover had much the same attitude. Have you read The General Theory of Employment, Interest, and Money?

https://www.amazon.com/General-Theory-Employment-Interest-Money-ebook/dp/B07JCJXDG4/ref=tmm_kin_swatch_0?_encoding=UTF8&qid=&sr=

Hoover’s aversion to government debt was a big reason that the US economy did so poorly in 1929-1932, he did not have Keynes work to guide him (the book was published in 1936), European government’s response to the GFC ignored all that Keynes taught us and was prolonged by their aversion to government debt.

So Dennis, lets consider it a fact that we do not ever pay down the accumulated debt, even in good times. That is our operating norm, and do not deviate from it to a significant extent. The chances of us moving towards a paydown stance are at less than zero.

With that in mind, do you still think there are no consequences to the practice?

It seems to me that we are creating a lot of winners with debt, and at some point there will have to come policy changes that will create a huge number of losers as a result. The trigger will be something that undercuts our prospects in a large way, like loss of reserve currency status. Regardless of the trigger, the debt load will add to problem in a huge way.

Is this normal- “There is currently more than $16 trillion in negative yielding debt around the world as central banks try to ease monetary conditions to sustain the global economy.”?

Hickory,

I agree too much government debt is a problem when the economy is doing well and in those situations it makes sense for the government budget to be in balance. In some cases there are investments which can raise welfare that will only be undertaken by the government, in those cases running a temporary budget deficit to make the investment may make sense, especially in a low interest rate environment.

It is not clear who buys these bonds with negative yields, seems a bad idea, better to just hold cash.

“It is not clear who buys these bonds with negative yields, seems a bad idea, better to just hold cash.”

Seems like a very broken system.

I don’t see how a massive haircut to bondholders can be avoided. At some point, the system of retirement savings and municipal funding will be kneecapped. I believe it will turn out to be a much more severe case of financial mismanagement than the 2008-9 episode.

Perhaps it is an early symptom of overshoot correction.

Gail “the Actuary” Tverberg is detached from reality. She’s convinced that Peak Oil will cause us all to abandon modern civilization and go back to subsistence farming. She seems to think that manufacturing, and rail and water freight transportation, simply didn’t exist before oil.

As for consumer reaction to higher oil prices: it’s not a question of whether people can afford oil, it’s a question of whether they think it’s competitive with alternatives.

There are a number of uses for oil, and each is different. There are some for which there are obviously better and cheaper alternatives, but which still use oil in surprising quantities, including: electrical generation; space heating; industrial process heat; petrochemicals, etc.

Most of the rest of the uses can be broken into many niches, each of which needs different solutions and which have different cost/benefits: taxis are very different from commuter cars; commuting is very different from recreation travel; local delivery is different from long haul trucking; ferries are very different from long-distance container vehicles.

A few uses will be challenging, like aviation and long-distance water shipping – they account for a relatively small percentage of overall consumption. Others, like taxis, will be pretty easy.

The history of oil is a long line of applications which have been replaced by better and cheaper alternatives: the first 30 years of oil was basically kerosene for illumination, which was replaced by electric light; Edison’s first electric generation plants were oil-fired, and 20% of US generation was oil-fired in 1979; space heating was big for a long time;, etc.

2nd, there’s no reason that alternatives have to be liquid fuels: there was a notorious study several years ago (Robert Hirsch) which concluded that mitigating Peak Oil would be expensive and slow, which completely excluded from the analysis hybrids and EVs!

3rd, Many cost benefit analyses are very incomplete: hybrids are a partial alternative, and are already the cheapest form of car. Pure EVs are cheaper than their ICE counterparts. But, that’s only the case over their lifetime: if you stop the analysis at 5 years, alternatives with greater capital cost are penalized. Similarly, the lower maintenance costs for EVs need to be included.

4th, learning effects and economies of scale have to be included: the Chevy Volt had a small battery and a generator: that configuration is inherently inexpensive, but GM was still paying off the costs of development and ramping up production (and wasn’t really all that committed to alternatives…). Eventually, plugin vehicles will be an obviously better and cheaper alternative.

Keep in mind that oil was dirt cheap for more than a century, and has only been moderately expensive for a few years at a time over the last 15 years. That’s not long enough for many industries and people to switch from short term elasticity to long-term elasticity mode.

5th, and perhaps most importantly, we have to take into account external costs. Oil has appeared very cheap, when in fact it was never cheap. Climate Change is very expensive. Oil wars are very expensive (estimates range from many 100’s of billions to the trillions). Heck, Professor Hamilton attributes much of the Great Recession to Peak Oil. Well, the GR vaporized what, 6 trillion in capital? If Peak Oil is responsible for 50% of that, that’s a cost of $3 trillion, or about $10 for every barrel consumed in the last 10 years!

If we fully load oil with all it’s costs, we’ll find that it’s not nearly as cheap or wonderful as we thought!

“Gail “the Actuary” Tverberg is detached from reality. She’s convinced that Peak Oil will cause us all to abandon modern civilization and go back to subsistence farming.”

I believe Dr. Jason Bradford has views of a perhaps similar nature.

https://www.postcarbon.org/our-people/jason-bradford/

PS ~ being an asshole is not a logical phallacy

Yeah, Bradford is being unrealistic as well.

And, yes, it’s possible for people to simply be an asshole for no particular reason, or just to sell papers, etc. But, more often people are insulting with a reason – to distract from the fact that their arguments are weak, and they must resort to insults instead.

Have you considered the possibility that Tverberg and Bradford may be right?

Just keep an open mind. I know as little about the future as the next guy. Mankind has never been in this situation before: 7,5 billion mouths to feed daily

I see no reason to panic, but just keep an open mind for all possible outcomes

Sure. I’ve been thinking about this stuff ever since the first Club of Rome report came out. I was much more pessimistic then, but I’ve been working with this stuff ever since, professionally and on my own time.

I’ve concluded that Peak Oil would be a good thing, and forgotten in a generation or two. Climate change, on the other hand, is serious stuff. Which is why PO would be a good thing: oil is dirty, expensive and risky. We need to kick the oil (and FF) habit ASAP.

We won’t be kicking that habit by mining yet more fossil fuels, among other, possibly, novel, environmental toxins, to build out, often by the same fossil fuel outfits no less, non-renewable renewable energy systems some seem to think they need like air and water. It’s too late.

When do you retire? If you haven’t yet, maybe it’s very soon so you won’t have to bother with all this pseudorenewable crap, such as if you’re professionally shilling for it, and paid to do so on POB.

We might have had the time and planet back when you were thinking of this stuff when the first Club of Rome report came out.

If Bradford is wrong he gets to have a nice life in the country.

If Nick is wrong he starves.

Balance of consequences, risk management and all that.

Nick seems like the “all the eggs in one basket” type, which, if you ask me, is a little odd for a dude who claims to have been contemplating the topic since 1972. Perhaps Nick is experiencing Peak Optimism?

Farming is a tough life. Small farming as one’s sole source of support is a miserable life. I don’t envy anyone who tries it based on predictions of TEOTWAWKI.

More importantly, the risk that farming in the US will collapse due lack of fossil fuel is basically zero. There are a lot of things to worry about – worrying about that would be an enormous waste of time when a lot of other problems need our attention, like…the project to transition away from fossil fuels ASAP.

Not to mention that the idea that “Our Way of Life” will collapse, due to PO or a lack of FF, is a FF industry talking point.

How to move farming away from FF is a long discussion, but here’s a bit of information about one approach:

Corn takes about 3.5 gallons of diesel per acre, year round, to produce (a range of 2 to 5, with no-till at the low end). An acre of corn can produce the equivalent of about 320 gallons diesel (160 bushels per acre, 2.8 gallons of ethanol per bushel and .7 gallons of diesel per gallon of ethanol), so that’s roughly 1% of corn production needed to power tractors.

Corn ethanol would make a lot more sense for tractors than for light passenger vehicles.

You ever think about the World Nick, or just USA?

I believe Bradford is addressing risks to global food production secondary to peak oil AND climate change. I guess that’s what YOU call a fossil fuel industry talking point?

You got a one track mind dude. Blinders on. Your willing to ignore whatever it takes, as long as you can construct a a narrow problem definition that is solved by everybody buying a Tesla.

Nate Hagens has it that everybody carpooling with their ICEs would do better for the environment than everybody buying a new EV. I guess he’s mistaken too, eh Nick?

Well, you made a remark about personal strategies: “if Bradford is wrong…”. Both Bradford and I live in the US. So, I dealt with farming in the US.

I’ve said many times that carpooling is a good idea. It’s an extremely fast, cheap and effective way to reduce oil consumption. But, it doesn’t get you all the way. For that you need EVs. And, in the transition you want to carpool with the vehicles that use the least oil: sedans, that are either hybrids or EVs, and eventually EVs as they become available.

Bradford is dealing with risks to farming due to climate change? Well, I was reacting to his presentation being unrealistic about the impact of a transition away from oil, but I suppose it’s possible that he’s unrealistic about that, but has something useful to say about the impact of climate change. Could you explain that part? Please don’t just give a link: please give an explanation in your own words.

I attended a conference once where she gave her canned peak oil presentation. She’s smart enough to avoid posting comments here, but not much smarter than that.

Ask her a real question, and she’s like a deer caught in headlights.

She has a product to sell, and there’s a market for it. She makes a living out of it, as far as I can see.

She may or may not believe in her own presentations, lol.

Ironically, that appears as at least one of your canned responses for Gail, as I seem to have read that before from you.

If anyone cares to do an archive lookup, they may view the folly of your own commentary, such that I’ve periodically illustrated.

BTW, have you yet figured out how to ship New Yorkers to– where was it?– Iowa? LOL

Funny but true. You want to know what’s even sadier. You and I realize it’s his canned Travberg responce.

Ostensibly, Ron Patterson and Gail Tverberg both had to ban you from their blogs at certain points and that you changed your nicks there and had to here to return, yes? ChiefEngineer? DentalFloss?

So, if so, it sounds like you’re projecting a little, speaking of ‘sad’, yes? A little like OFM and his worm tongue (among other) bullshit, hm?

We ‘meet’ all kinds online too.

(1) Oil fired power plants were phased out after the 1st (US peak 1970 allowed OPEC to impose embargo) and 2nd oil crisis (peak oil in Iran 1975) not because of a planned, voluntary transition

(2) Hirsch’s slow mitigation. The 2008 oil price shock was a warning. Where are we 10 years later? Are we on a path away from oil?

(3) EV maintenance cost must include replacement batteries in the car and in your garage (to store power from solar panels – drive less in winter). The inverter for my solar panels lasted only 5 years

(4) EV s recharged from grid are mainly coal power driven

(5) The era of cheap, easy oil ended in the early 2000s (when the North Sea peaked), before the Iraq war

16/3/2013

Iraq war and its aftermath failed to stop the beginning of peak oil in 2005

http://crudeoilpeak.info/iraq-war-and-its-aftermath-failed-to-stop-the-beginning-of-peak-oil-in-2005

“EV s recharged from grid are mainly coal power driven”

Not in the USA, where coal makes up less than 25% of electricity generating capacity, down from 40% in less than 10 years (primarily due to replacement with tight nat gas production).

And some states, like the biggest in the country, get less than 5% electricity from coal, imported from neighboring states via the grid.

Outside of the USA there’s this place called “the rest of the world”. Climate change deniers often also ignore it when attempting to gain a picture of reality and explain it to others. Anyway, from what I understand the largest market for EVs, by a long shot, is China. I’d suggest, that it’s reasonable to suggest, that most EVs in the world, you know- on the entire planet, are being powered by electricity from a coal powered grid. Now, you can pat your countrymen on the back at every opportunity if you like, hand out some ribbons perhaps, but it’s starting to look desperate. Not a lotta big wins for the technocornucopia crowd lately.

Matt, here are my thoughts on each point:

1) I agree. I’m not sure what point you have in mind when you say that it wasn’t a planned, voluntary transition. Prices went up, and utilities moved quickly to substitutes. That makes it a good example of “The history of oil is a long line of applications which have been replaced by better and cheaper alternatives”.

2) “Are we on a path away from oil?”

Yes. Plugin vehicles are growing quickly. Are we pursing that path as quickly as would be optimatl? No.

On the other hand, another fundamental flaw in Hirsch’s analysis is the lack of discussion of short-term responses to Peak Oil. For instance, car-pooling is currently the largest alternative to single occupancy commuting – it’s bigger than mass transit. The average light vehicle occupancy is currently 1.2 people. That could be expanded literally overnight if we faced a serious short term problem with oil scarcity. That was true in 2005, and it’s dramatically true today, with everyone carrying a smart phone which can enable such things. A closely related alternative is car sharing, which could keep EVs at very high rates of utilization (as opposed to 5% utilization currently).

3) EVs have very low rate of battery replacement – every indication is that they’ll generally last the life of the vehicle (That appears true for Tesla and GM, no quite so much for Nissan, which skimped on the battery temperature management).

Rooftop PV is nice, but in now way is necessary to gain the benefits of EVs.

5) $60 oil is a bit higher than historical levels, when corrected for inflation, but…not much. If you adjust it as a percentage of household income levels, it’s lower.

What about, in the big picture global context (not cherry picking California), number 4 Nick?

4) EV s recharged from grid are mainly coal power driven

Btw, China seems to have some folks making good money on EVs. Something Musk’s vanity project seems a long way from doing. I wonder what’s up with that? Probably larger subsidies I’d imagine, although perhaps not on luxury brands.

“Against the backdrop of those corrections came a trailblazing show last week by Shenzhen-based BYD Company, China’s dominant maker of EVs. BYD — which stands for “Build Your Dreams” — counts Warren Buffett among its investors and posted a 632% jump in profit for this year’s first quarter to 749.73 million yuan ($111.4 million). It sold nearly 118,000 vehicles in the quarter, up 5.2% over last year’s first quarter. In comparison, BYD’s U.S. counterpart and EV maker Tesla posted a loss of $668 million on revenues of $4.5 billion in the latest quarter. The 63,000 cars it sold last quarter represented a 31% fall from the previous quarter.”

https://knowledge.wharton.upenn.edu/article/chinas-ev-market/

Well, it’s a long and complex question. Here are a few thoughts:

Pure ICE vehicles are about 25% efficient. EVs are roughly 3x as efficient. Coal produces about 2x as much GHG as oil, so an EV that was running 100% on coal would still be emitting fewer GHGs.

China’s grid is mostly coal, but it’s not 100%. As time goes by, coal’s share will drop. That’s also true of the rest of the world. We do want to have a long term point of view.

Most countries, like the ones that you and I live in where we have the most influence, have much lower shares of coal in their grid.

EVs can charge when coal’s share is low and when wind and solar and nuclear are high. So, EVs are effectively running on less than the average share of coal on the grid.

Because EVs can charge when wind and solar are strongest, they help create demand (and higher prices) for wind and solar. So, EVs help accelerate the transition away from coal.

EVs can charge when wind & solar are high, and delay charging when they’re low. This reduces the impact of wind & solar intermittency, makes wind & solar more useful and accelerates their installation in a second and important way.

Oil is polluting, expensive and risky. There is an enormous benefit to moving away from oil, even if the transition means burning some coal temporarily.

In regard to Nicks 2nd point, I do not recall Hirsch excluding hybrids and EVs from his an analysis. What he did point out in the second paragraph of his Executive Summary, was the size of the US vehicle fleet and the challenge in transitioning that fleet to new energy sources in a relatively short time frame. Here is a link to the Hirsch report in which he discusses hybrids in Chapter VI, Section A, “Conservation” and EVs, “Fuel Switching to Electricity” in Chapter VI, Section F:

PEAKING OF WORLD OIL PRODUCTION: IMPACTS, MITIGATION, & RISK MANAGEMENT

Looking at the current state of affairs, I would posit that we are almost at the end of the first decade of mitigation, if you use the introduction of the first of the new wave of EVs in late 2010 as the starting point. However it is not the “crash program” that Hirsch wrote would be necessary. I would also posit that we are actually undergoing some of the mitigation scenario’s described in the Hirsch Report, despite the fact that the term “hydraulic fracturing” shows up only once in Chapter VI, Section B “Improved Oil Recovery”.

Finally with regards to aviation, I am getting an increasing sense of an impending disruption in light aviation from the likes of the following article:

Quantum Air Signs Up For 26 Bye Aerospace Electric Airplanes

This small outfit, with no legacy (ICE) aircraft manufacturing base to hold it back, currently has a two seat electric aircraft with a promised flying time of over three hours undergoing certification with the FAA. They promise a 15x reduction in fueling costs, in addition to huge reductions in motor maintenance costs. Is this going to be the “Tesla” of light aircraft?

One of the other things to think about is that Honda is developing a Flouride battery with roughly 8 to 10x the energy density of today’s Lithium Ion which would mean 30 hours of flight time for the Bye Aerospace Electric Airplanes.

I’d be cautious about hijacking a petroleum thread for one’s non-petroleum non-renewable renewables and electric car and related agendas/fantasies.

Previous civilizations didn’t collapse and/or decline because of fossil-fuel-burning, incidentally, as bad as burning them at scale appears. And so energy alternatives aren’t going to make much of a difference if the reasons why previous civilizations declined and/or collapsed are not addressed, and may in fact make matters worse, since, for examples, we are dealing with near 8 billion people now and depleting resources and environment– unlike much of fossil fuel-burning history.

The above note is not a “highjack”. It is a side note to add to the possibilities as we go forward. Electric airplanes don’t use JP-4 fuel which means less demand for crude oil processed into that fuel. Will it happen? Who **really** knows??? But it adds to the question of what might extend the peak to the point of irrelevance?

With regard to electric vehicles, there is the question of how transportation will evolve. How will people get around and trade for food, goods, and services? After seeing a lot of pontifications fall flat on their asses, the sentence: “I have it on highest authority that if you sail far enough, you will fall off the ends of the world.” keeps repeating itself. Again, will it happen? What effects will it have on crude oil demand???

The graphs I posted here were created by Exxon Mobil. Did they take into consideration a rapid transformation from ICE to EV based vehicles?

As always, when we run short of something, we look for substitutes. And yes, what Robert Callahan says can come true, but how do we work with it to mitigate these effects? Are we on the Titanic or on a plane where Scully is the pilot or just merely observers? Will a pandemic reset the population growth curve?

What’s **your** game plan going forward?

*How Green Energy and EVs Will Drive Humanity Over a Cliff*

By 2050, there will be at least 2bn cars on the world’s roads. If all of those cars were EVs, annual production of neodymium and dysprosium would need to increase by 70% and stay at that level until 2050. On the same basis, annual copper output would need to increase 100%, and cobalt output would need to increase by at least 250% to meet global demand.

The increase in renewable energy infrastructure needed to provide power for EVs would also consume more metals and minerals. Wind turbines require a lot of steel, while solar panel installations consume several scarce minerals, such as high purity silicon, indium, tellurium and gallium. Extracting the minerals themselves is also a power-hungry process, adding to demand.

https://www.petroleum-economist.com/articles/midstream-downstream/power-generation/2019/ev-revolution-could-stall-due-to-mineral-shortages

Demand for copper, for example, could rise by 275 to 350% by 2050, according to academics at Yale University. The World Bank estimated in 2017 that action to limit the rise in global temperatures to 2C from pre-industrial levels could mean a seven-fold increase in demand for cobalt and an 11-fold increase in demand for lithium by 2050.

https://www.ft.com/content/4863fff2-8bea-11e9-a1c1-51bf8f989972

The current EU target is to ramp up production of Electric Vehicles 200 times by 2030. But, here’s the thing – this would lead to an increased demand for production inputs of cobalt, lithium and nickel and copper to build the electrical vehicles. However at 100 times the demand world cobalt resources would be exhausted in 8 months, lithium in 5 years, nickel in 4 months and copper in 5 months.

https://www.resilience.org/stories/2019-06-20/propaganda-for-renewables-a-critique-of-a-report-by-oil-change-international/

Electric cars use twice as much copper as internal combustion engines. So-called smart-home systems – such as Alphabet Inc’s Nest thermostat and Amazon.com Inc’s Alexa personal assistant – will consume about 1.5 million tonnes of copper by 2030, up from 38,000 tonnes today.

https://www.reuters.com/article/us-usa-lithium-electric-tesla-exclusive/exclusive-tesla-expects-global-shortage-of-electric-vehicle-battery-minerals-sources-idUSKCN1S81QS

Negative effects from the mining of metals like aluminum, cobalt and rare earths could impact a range of creatures from flamingoes to gorillas, plants, and even deep sea creatures.

https://news.mongabay.com/2019/06/shift-to-renewable-energy-could-have-biodiversity-cost-researchers-caution/

The Future of Electronics May Depend on Deep Sea Mining for Minerals

https://www.allaboutcircuits.com/news/deep-sea-mining-metal-resources-advanced-technology-devel/

If, as the IEA predicts, there are 125 million electric vehicles (EVs) on the road by 2030, it will require roughly 10 million tonnes of copper – a 50% increase over current annual global copper consumption (20 million tonnes).

The additional wind turbines built by 2030 would require roughly two million tonnes of copper – about 10% of the world’s current production.

That’s not even taking into account how much copper would be needed for a quadrupling of solar power, and all the enhancements to the electrical grid and charging infrastructure for electric vehicles that will be required.

Given how much aluminum, metallurgical coal, copper, aluminum, zinc and rare earths are required for each wind turbine and each EV – and how much lithium and cobalt are needed for EV batteries – it begs the question: Will the transition to a low-carbon economy lead to “peak metals” (the point of maximum metal production)?

The targets that governments are setting for themselves for electric vehicle and renewable energy adoption will require a massive increase in mining, and there’s some question as to whether the new mines required can even be built in time to meet the demand according to the timelines being set.

https://www.mining.com/global-energy-transition-powers-surge-demand-metals/

Rare earth metals are used in solar panels and wind turbines—as well as electric cars and consumer electronics. We don’t recycle them, and there’s not enough to meet growing demand.

https://www.vice.com/en_us/article/a3mavb/we-dont-mine-enough-rare-earth-metals-to-replace-fossil-fuels-with-renewable-energy

According to some estimates, humanity currently uses resources 50% faster than they can be regenerated, but several major resource shocks have gone underreported – and may change the way we live irrevocably. The top 3 supply shocks coming 1. Helium 2. Sand 3. Phosphorus.

https://www.rt.com/news/463547-top-impending-supply-shocks/

**Final List of 35 Minerals Deemed Critical to U.S. National Security**

Take any of the minerals in the next list and Google it, followed by the word, ‘shortages’.

https://www.usgs.gov/news/interior-releases-2018-s-final-list-35-minerals-deemed-critical-us-national-security-and

This next graph shows how many times more we need of each critical mineral for all our green energy dreams to come true.

https://hips.hearstapps.com/hmg-prod.s3.amazonaws.com/images/dd782292-5885-404a-ad3e-b27209279959.jpg?crop=1xw:1xh;center,top&resize=768:*

What a gishgallop of nonsense.

neodymium and dysprosium – not required for motors, Tesla and others use induction motors.

high purity silicon, indium, tellurium and gallium – Solar panels do not require the last two, Silicon is plentiful, Indium has substitutes and is not a requirement for Solar.

I am not accepting predictions of doom for renewables from anywhere called ‘petroleum

cobalt – not required for batteries and, for that matter, neither is Lithium. Copper, guess what – ICE cars use it too.

IEA predicts – IEA predictions are not known for being anywhere near accurate.

Windmills and solar do not need rare earths, they mostly do not use any. As for steel and copper, fossil fuel power stations, nuclear etc also use these.

Ugh, I am not going to spend the time tracking down each fallacy, it is just a load of bollocks.

NAOM

Yes, Hirsch does briefly consider both hybrids and EVs.

But…he completely excludes EVs from his analysis. He says so explicitly:

“Such a shift in public preferences is unpredictable, so electric vehicles cannot now be projected as a significant offset to future gasoline use….There are no known near-commercial means for electrifying heavy trucks or aircraft, so related conversions are not now foreseeable.”

He also dismisses hydrogen for transportation – while I think H2 can’t compete with passenger EVs, they’re very viable for and likely to be used in heavy vehicles, and very likely would be viable if they were actually needed for light vehicles (which again, I think is unlikely).

The bottom line for Hirsch is that only liquid fuels will do: “Production of large amounts of substitute liquid fuels will be required.”

This is entirely unrealistic.

The Hirsch Report was dated February 2005, almost six years before deliveries started for the battery electric Nissan Leaf and the hybrid Chevrolet Volt in December 2010. This was also seventeen months before the first prototype Tesla Roadster was revealed to the public on July 19, 2006, in Santa Monica, California. It was only twenty months after the company Tesla Motors had been incorporated to pursue the idea of electric cars.

What would be entirely unrealistic is to expect that Robert Hirsch and his team could have anticipated that Tesla Motors would amount to anything or that EVs would have advanced as much as the have since the preparation of the report, which would have been almost complete in late 2004. Think about it! The report mentions hydraulic fracturing in passing ONCE! If they hadn’t figured out that fracking would heave resulted in an abundance of NG and a 5% addition to liquid fuel supplies, how could they have had any idea that 300 mile EVs would be available in 2019.

Who knows? In another five years we could be discussing how the rise of electric light aviation caught everyone by surprise!

Well, it’s good of you to forgive the Hirsch report for being flawed. But…the flaws are still fundamental.

Electrification is the primary solution/substitute for oil, and the Hirsch report misses that completely. It concentrates on direct replacements for liquid fuel, like Coal to Liquid, something that just isn’t a good idea and thankfully is unlikely to take off.

As a secondary matter, I think that was clear back in 2005. Heck, it was clear many years before that: Porsche invented the plugin hybrid back in 1904, and it would have reduced liquid fuel consumption by 90%, enough to allow ethanol to cover the remaining 10%. Evs have been around for more than a century (before ICEs), and they’ve always been viable, even if they didn’t seem competitive.

A technical planning report isn’t supposed to report on current fashions, as the Hirsch report does (as we see in his reference to “public preferences” for ICEs). It’s supposed to think a little outside the box, not mirror the culture of the current transportation industry. That was entirely possible – other people were doing it at that time (I certainly was, and I didn’t invent these ideas). But, again, that’s a secondary matter. The primary problem is that the Hirsch report is unrealistic.

I think I would cut Hirsch some slack with regard to not seeing the possibilities. Every automaker is onboard with electrifying their fleets over the next two decades. My poster child for all this in not the Tesla but Ford announcing the electrification of the F-150.

To me, Hirsch’s report is a wake up to do something about impending shortages in crude oil supply. It’s implications go further than that with respect to the predictions from the Club of Rome.

How do we address them? “The sooner we start the better.” And Hirsch goes on to say with a 20 year head start, we might be able to weather this storm with some difficulty. If Exxon Mobil is correct about peaking around 2040, and with our forays into renewables, EVs, battery development, etc. we are well into trying to address the issues he raises.

My take away from The Hirsch Report is:

1) Peak Oil is a liquid fuels problem. Currently that challenge is largely being met by LTO as opposed to some of the options envisaged by the report such as coal to liquids, Gas to liquids and biofuels. Fortunately for the world economy, LTO has scaled to meet the challenge remarkably well.

2)The challenge posed by Peak Oil as a liquid fuels problem is that there are about a billion road transport vehicles worldwide, as well as agricultural, mining and industrial equipment that, rely on liquid fuels to function. This equipment represent trillions of dollars of capital investment that is expected to continue to function for between 10 to 30 years from their purchase date. As such, transitioning to a infrastructure that does not depend on liquid fuels will be an expensive proposition, that will take at least a couple of decades and will be difficult if there is not robust economic growth to support that transition. In the report and in public comments, Hirsch was very clear on that!

IMO the report is spot on with respect to the above two points and while LTO has given us a respite, the opportunity to press ahead with the transition away from liquid fuels is not being embraced with the urgency it should. Who knows how long LTO can measure up to the task of mitigating global Peak Oil?

PeterEV,

I agree – the Hirsch report argues for starting ASAP, and that’s a good thing. I just hate to see people rely on it as an authoritative report: the report dismisses viable alternatives, and gives an excessively long timeframe for a transition.

Islandboy,

I think that framing PO as a liquid fuels problem can lead us in the wrong direction.

As you note, oil is primarily used for transportation, so I’d say PO is a transportation problem. An emphasis on liquids points to LTO “drill, baby drill”, CTL, etc, while the solution is moving to electrification (and probably H2 for some heavy fleets).

I agree, a transition away from oil does bring up problems with stranded assets. OTOH, Hirsch exaggerates this problem: assets turnover significantly faster than the superficial data given in the report, and replacement through attrition doesn’t cost anything over and above BAU.

To the extent that stranded assets slow us down, this is an accounting problem: we have discovered that oil is far more expensive than we thought, and it’s mostly obsolete. This is now in the past: these are sunk costs, and they can’t be avoided. They must be “recognized” in an accounting sense, and the losses must be written off. This may make some losses for some comapanies and investors, and so they’re fighting this process.

OTOH, if we recognize that the losses have already happened, we’ll set the stage for large investments in new productive energy assets, which will stimulate the economy.

The real loser are FF companies and investors, not the larger economy.

Whenever you are challanged…

Interesting. Seems that Gail has read the book “The next economy” from Paul Hawken.

Gail has a substantial readership, which she interacts regularly with, at her blog. I also seem to recall reading her mentioning thereon that she has learned from her readership.

In any case, this is in relatively-stark contrast to both ‘islandboy’ and ‘Nick G’, whoever they really are, look like, or claim to be, speaking of detachments to reality. (In fact, Nick is on record hereon for writing to the effect that he can’t tell us his real or full name or why.)

Nick has a blog whose apparently last comment, dated 2015, deals with something to the effect of if we need crude oil to make plastic, as if we need yet more of the stuff, and more of the assorted crony-capitalist plutarchy industrial detritus that’s threatening the planet.

Now, I don’t know about you, but if I had to place my confidence on a choice of only one of the three, it would easily be Gail.

Gail is wrong.

The rest of the world can obviously afford higher oil prices, so in that she is wrong.

When prices go up, people use less. Didn’t fuel consumption drop and people moved to more efficient vehicles during the 70s oil crises? Happens every time.

NAOM

Circa 1980 my big Ford got about 10 mpg.

Paul,

pls document your assertion by some facts and hard data.

Matt,

There is an economic model that posits that scarce resources can be allocated efficiently in a free market. There are fundamental problems with this model such as how equilibrium market prices are reached. See

https://en.wikipedia.org/wiki/Léon_Walras#General_equilibrium_theory

and

https://www.amazon.com/Walrasian-Microeconomics-Introduction-Economic-Behavior/dp/020110461X/ref=sr_1_10?hvadid=78271538203209&hvbmt=be&hvdev=c&hvqmt=e&keywords=walrasian+economics&qid=1567605188&s=gateway&sr=8-10

There is indeed wage disparity, though this is not a new problem.

Chart below has GDP per capita in constant 2010 US$, this is essentially the World average real income per capita which has risen fairly steadily from 1965 to 2018, plotted on left axis.

On right axis we have GDP per kilogram of oil equivalent (kgoe)of energy consumption for the World and energy consumption per capita in tonnes of oil equivalent per year (toe/a) for the World.

Since 1965 energy use per capita has increased from 1.1 to 1.8 toe/a, while GDP per capita has increased from $4500 to $10,900 constant 2010 US$.

Data for chart on energy from BP Statistical Review of World Energy

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

GDP per cap data

https://fred.stlouisfed.org/series/NYGDPPCAPKDWLD

population data

https://fred.stlouisfed.org/series/SPPOPTOTLWLD

As to $40/b oil needed for wage growth in US, if we use real GDP per capita as a proxy for real World income growth in constant 2010 US$ we see in the chart below there is very little correlation between income growth and oil prices. The correlation between Oil price and real GDP per capita is very low with R squared of 0.27 and if we were to argue for correlation (there is none) the data would reveal higher oil prices are correlated with higher real income, though it seems likely the causation runs from high income to high oil price.

There is a strong correlation between energy consumption and real GDP as shown in chart below. R squared is 0.99 from 1965 to 2018.

Ron – Great post on shale production. I really appreciate all the work you do to provide the rest of us with information that I consider very valuable to me. I hesitate to ask, but if you can manage a bit of extra time I would very much like to see national consumption information tied to the production figure graphs (historical to present). Especially for major producers like USA, China, Saudi Arabia, Russia, etc… I think being able to see these graphs and figures would make it a lot easier to visualize and project production vs available exports. I am wondering if available exports might cause a blowup before peak oil is here for sure?

I would like to do that but my time is very limited these days. Though I am retired I have another project going that takes up most of my time. Also I don’t have any consumption data and don’t follow that subject very close.

Let’s face it, gentlemen: peak oil is dead.

I don’t mean there won’t be peak oil! Don’t confuse geologic, energy reality with what I’m talking about: peak oil as a well defined, understood, and sociological concept.

What I mean is this: at no point will human beings alive, whether now, 10, 50, 100 years from now, ever admit there was something called peak oil, that it actually happened and could be studied. It will simply be forgotten and erased from memory. Statisticians will lie, energy companies will lie, politicians will lie. Nobody will ever tell the truth, because that’s not what we are as a species. As a species, we are optimistic primate hunters. We had to be this way – the pessimists simply die out. Optimists survive and reproduce. Optimists do have a blind spot: they can never admit there is anything wrong with nature or human society or anything – everything is perfect and utopian forever. And there’s a certain self fulfilling logic here: if you survive and reproduce, isn’t everything just fine for you?

See what I mean. Let’s say global peak oil production actually does peak in 5 years, and then drops forever. Let’s say human population peaks in 10 years, then drops forever. What I’m saying is this: nobody will acknowledge this as such. Whoever is alive in 50 years, will simply use whatever is available to them, even if it’s very little, and they will believe everything is good and utopian and things are looking good! The future is bright! Because that’s what the politicians and corporations will tell them, and that’s what they themselves will believe. And it will be this way for the remainder of our species, whether this is centuries or millenia to come.

Remember, the pessimists die out. Including peak oil pessimists. We are Romans, gentlemen, and the barbarians are going to outlive us, and set up their own system. We’ll just fade into history, that’s all.

Statisticians will lie, energy companies will lie, politicians will lie. Nobody will ever tell the truth, because that’s not what we are as a species.

No, that is not correct at all. Yes, these people very often lie, especially politicians. Statisticians seldom lie. But nobody lies all the time. Well, perhaps Trump does, but he is an anomaly.

the pessimists simply die out.

Throughout history there have always been optimists and pessimists. Why should pessimist suddenly start all dying out while optimists survive?

Let’s say human population peaks in 10 years, then drops forever. What I’m saying is this: nobody will acknowledge this as such.

No one?? Oh yeah, I forgot, the pessimists are all dead. Yeah right! You tell a great story Dolph. But your human psychology is simply all wrong.

Nah, he’s close to correct.

There will be lines at gas stations. There will be scarcity. It will all be attributed to transitory factors and assurances that it will be fixed soon.

Then there will be wars and the deaths will accumulate and largely the deaths will be blamed on the wars and not on scarcity. There will be pretty good reason for this. It won’t be politicians trying to persuade the rightness of their policies. It won’t be oil company CEOs trying to keep their jobs.

It will eventually simply be to retain hope. Transitory effects is a much easier story to sell than — scarcity is forever, the oil is gone and there is no reset, there is only societal decline to extinction. People will much prefer transitory issues to that.

Lies are really easy when there’s a desperate desire to believe them.

Bullshit, he is not anywhere close to being correct. What is going to kill off all the pessimist? The pessimist plague, a virus that affects only pessimists?