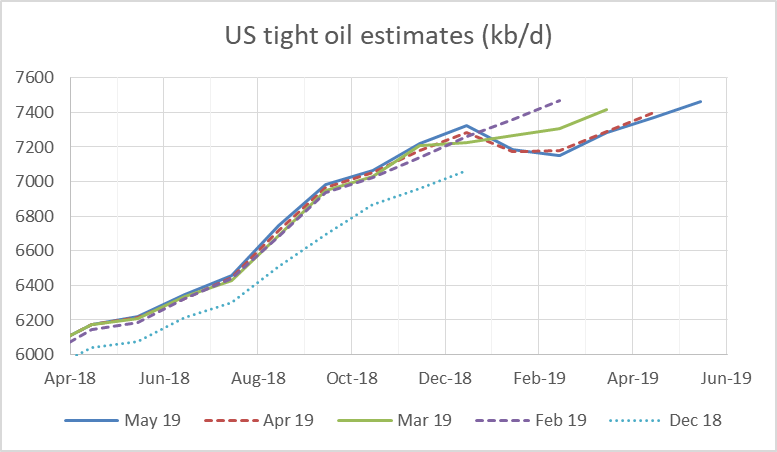

New tight oil estimates were recently released by the EIA. The chart below compares estimates from Dec 2018 to May 2019, where the Dec 2018 estimate is that estimate with the most recent month estimated being Dec 2018 and likewise the May 2019 estimate has May 2019 as the most recent month estimated. The May 2019 estimate is fairly close to the April 2019 estimate with a slight downward revision of the April 2019 estimate from 7399 kb/d to 7368 kb/d, March 2019 was also revised lower by 10 kb/d from 7292 kb/d to 7282 kb/d. For May 2019 the most recent estimate is 7462 kb/d and if past history repeats this estimate may be revised lower next month.

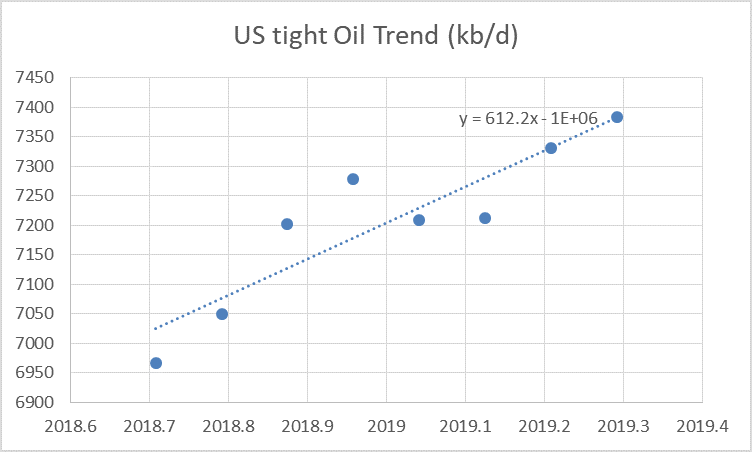

Due to the repeated revisions both higher and lower, (from July 2018 to Dec 2018 the data has been revised higher several times, while data from Feb 2019 to April 2019 has been revised lower) I use the average of the March through May 2019 estimates to guide a projection of future output. The most recent data point from May 2019 is dropped and a trendline is fit to the most recent 8 data points from this three data set average (April 2019 is the average of two estimates from April 2019 and May 2019). The chart below presents this trend line.

The oldest data point is Sept 2018 and the slope of the trend line is 612 kb/d for the annual rate of increase in tight oil output. The trend line passes through the March 2019 data point (7331 kb/d) and assuming the trend continues, the output in Dec 2018 would be 7790 kb/d, an increase of about 500 kb/d from Dec 2018 (7280 kb/d).

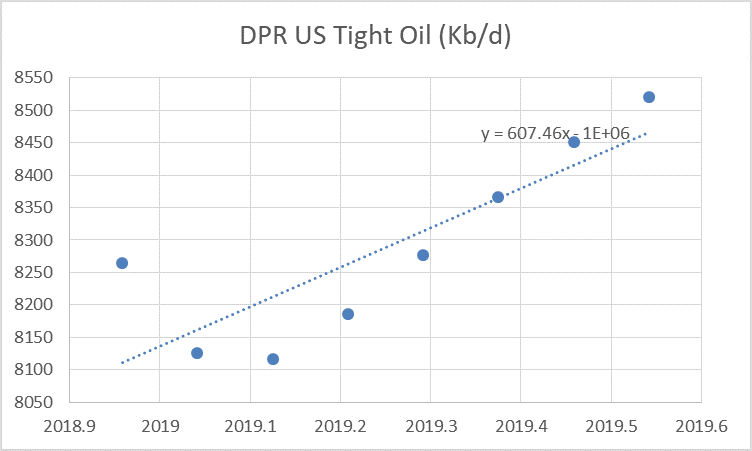

An alternative projection can be based on the EIA’s Drilling Productivity Report, by fitting a trend line to the most recent 8 months of the DPR estimate (in this case Dec 2018 to July 2019). Note that the DPR estimate is higher than the tight oil estimates by about 900 kb/d because conventional output from the various tight oil regions is included in the estimate.

By coincidence the DPR estimate also has a slope of about 600 kb/d for the annual rate of increase in output. The trend line passes very close to the May 2019 DPR estimate of 8366 kb/d, if we assume the trend is followed from May 2019 to Dec 2019 we arrive at a projected output of 8720 kb/d in Dec 2019 about 455 kb/d higher than Dec 2018 output (8265 kb/d).

If we take the average of these two projections we have a 475 kb/d increase in US tight oil output from Dec 2018 to Dec 2019, with perhaps a 200 kb/d window of uncertainty, resulting in a projected 375-575 kb/d tight oil increase from Dec 2018 to Dec 2019 or 7655 to 7855 kb/d of US tight oil output in Dec 2019.

Hi gang. I had hoped to have a post out next week on US and World production. Unfortunately, I will be extremely busy, moving my base from Pensacola Florida to Las Cruces New Mexico. That will take at least a week, closer to two weeks. Closing on our house here and driving a U Haul truck to Las Cruces. a three-day drive, then closing on a house there, unloading and moving in….hopefully. But there could always be delays.

I will have an OPEC post in mid-July and hopefully, a US and World post the end of July. But nothing at the end of June, regretfully.

Ron

Have a safe trip.

All best!

be safe

Moving to Las Cruces, NM? Please be aware of Billy The Kid!!

https://oilprice.com/Latest-Energy-News/World-News/Canadas-Senate-Passes-Energy-Bills-In-Defeat-For-Oil-Industry.html

You can have your pipeline, but you can’t ship it out. It ain’t Texas, baby!

And Mexico has decided to give up on deep water oil. Durn stuff takes too long to get out of the ground (i.e. before Obrador’s six year term is up). No worries though, they’ll get still be producing 600K/d extra barrels by 2025…

https://oilprice.com/Latest-Energy-News/World-News/Pemex-No-Longer-Interested-In-Deepwater-Oil-Projects.html

Dennis, the calculations look very reasonable. Reality may differ.

GuyM,

Thanks. Yes reality can be much different, I would put the probability at about 65% that US tight oil output will be in the range I have estimated in Dec 2019. We won’t know the answer until April 2020 when EIA estimates have stabilized. A war in the middle east would raise oil prices quite a bit and might push us above the high end of the estimate and a severe financial crisis before November 2019, might reduce crude demand and crash oil prices so that tight oil output is less than my low estimate.

Predicting is hard, especially the future. 🙂

Dennis, we’ve been 10 minutes off an armed conflict – and are probably in a hair-trigger situation which will give way to something really conflictive. What are your predictions about prices and flow rates concerning all that?

He called it off, because he was told up to 150 people may die. If we have a President who didn’t realize that multiple missiles would kill someone, we aren’t working with a full deck of cards. Anything is possible from here on out, because it is only a matter of time before someone on the US side is killed, injured, or captured. It’s the way they play. And, I think this President followed Jimmy Carter’s role as far as he could. He was just afraid he could not garner enough public support over a drone. A drone don’t have no mama.

One side, or the other will give an excuse. If both sides were cocked and loaded, it doesn’t end here. Damn, he does not need the Democratic Party support, he just needs red neck support, because that’s what got him elected. And, we are not talking red necks in the South, only. Red necks are all over the country. They come in all sexes, sizes, skin colors, nationalities, religions (big one in this case), and party affiliations. “Bubba” won’t be the only one screaming for a lynching.

The end result? Nothing. We will never win over the people, or control anything, including oil. Just a lot of devestation.

Definitely GuyM. For me that all smells like aiming at China. The United States at this moment in time can survive with its own oil and Canadian exports. This won’t last forever, so THIS is maybe the last moment in history they can play the big game. A conflict with Iran will create enormous devastation and one of the hardest hit countries economically will be China: oil imports are their weak point though they are struggling so much to become electric. Trump is playing all or nothing at a very high level and we cannot be sure that he controls everything enough to bring this point home.

Or, maybe just for re-election?

GuyM, I think this depends on the real power structure behind the government. If Trump is convenient, things will play out positively for him: No cyclic economic crisis before his reelection and well-mastered tensions with China and the “enemies” Venezuela, Iran, Russia, and Syria. If another president looks more promising, the economic crisis will hit in the worst moment (about six month before the election) and Trump’s handling of the exterior situation will look utterly dumb. I’m convinced the deep state and the FED have the power to manage this. It’s just a question of timing the inevitable.

For example, look at what happened in the Persian Gulf: Trump retracted in the very last moment. This is not positive. Because if in the next (IMO inevitable) event just a single US-soldier dies, he has no other choice than to go full force. Never a false flag would have been easier to stage. So technically Trump is now completely in the hands of those I would call the real deciders.

China will play a large roll in whether trump get re-elected.

If they decide they prefer his dysfunctional governance to his opponent, then they will engage in a trade deal that will allow to trump to declare victory. It will likely be a very superficial victory.

If they decide they would prefer to engage with a different administration, they will likely refrain from a trade deal until after the election.

Have you asked yourself why Putin preferred trump? The answer is not pretty (for trump, or the USA).

This is probably an absurd point of view. But in my opinion, it might be in Iran’s interest to drag the U.S into war, probably as indirectly as possible. That way they might significantly reduce the chance of Trump being re-elected. (Obviously lives will be sacrificed in this scenario)

The question is if it would work and would a Democrat president stop the war and go into the same JCPOA deal again. Who knows. Very unpredictable.

Well, Mike, as absurd IMO is that Iran would risk self-destruction to get rid of Trump. He’s certainly a PITA for them, but closing the Strait of Hormuz to crash the global economy and to blame it on Trump wouldn’t work: Trump could blame it all on Iran while keeping on cooking a controlled conflict with them, showing the world that the US doesn’t depend on oil from any other continent. This would be a very difficult situation for a Democrat to step in and to promise a better solution. The US would be relatively well off compared to Asia and Europe and even could emerge out of such a constellation relatively more powerful. But it could also end up in a terrible mess. As you wrote: Who knows. Very unpredictable.

More likely they attack Saudi Arabia directly. Same impact, more justifiable if not outright popular. No one likes Prince Bone Saw.

Nobody is his fan, but they need his oil,

Yep-

Iran could take those 10 million barrels a day away in 15 minutes.

I would worry more about a third party doing something, in the Straits, to try and trigger an American attack on Iran.

NAOM

@notanoilman:

The third party might be a rogue CEO of a failing shale co, burning his last dime…

Iron Mike,

A war would ensure Trump’s reelection in my opinion.

If you are right, then the chances of war is huge.

The resultant high oil prices would kill the already anemic global growth and cause a recession and thereby probably fuel a decrease in oil prices as demands decrease. (I guess the volatility in oil prices will go through the roof at that point)

The world is just too unpredictable though, i honestly have no idea what is going to occur.

Oh, could not agree more. We have guesses, but no one can predict anything in this crazy world.

Dennis,

why do you think so?

Nation at war tends to support POTUS. Unfortunately it doesn’t matter how good or bad the leader is, just human nature.

Not necessarily. It depends on whether or not the nation supports the war. Lyndon Johnson would not have been reelected in 1968 had he chosen to run.

And yes, he was eligible to run under the 22nd amendment as he has served less than two years of Kennedy’s term.

Ron,

Good point. I doubt a war with Iran would be like Vietnam, I think it would go more like Iraq, not a lot of US casualties and people would support Trump, though there would not be the outrage of the WTC attack, so perhaps I am wrong. Vietnam was pretty bad with 33,000 KIA from 1966-1968. The worst 3 years in Iraq there were 2600 soldiers that died, not good but 10 times fewer than Vietnam. In Afghanistan, the worst 3 years so far there were 1200 US soldiers who died.

Generally the President will find public support in a time of war, LBJ was the exception.

Iran is three times as large as Iraq in size and population and there’s the Straight if Hormuz chokepoint. Much more mountainous also. A ground invasion would not go well. More similar to Afghanistan than Iraq imho.

Dennis,

I think you’re grossly mistaken about Iran. Invasion of Iran would be much much harder than Iraq. Iran has a well trained army, with war experienced generals who know the region extremely well, their army also has some serious capabilities.

Sure the U.S is technically much superior, but a ground war in Iran would be a disaster for all concerned.

I also believe there is a possibility Iran has nuclear weapons. And the current regime is fanatic enough to use them. (Assuming they do have them)

I’m afraid you underestimate the Iranian power and the likeliness of Russian and Chinese supporting the Iranians. The Russians are seeing the American bases coming closer to their borders all the time and they are starting to become nervous and want a buffer zone or at least stop the American expansion.

What surprises me with American thinking is that Americans seem to only concentrate on American dead soldiers and pretend that the dead civilians and soldiers in the opponent country just don’t exist.

Stephen-

I agree.

The coming week should be interesting…

Iran’s ten days for Europe to fix its JCPOA-commitents runs out.

And then there’s the G20 in Japan on the 28th.

Will Iran put Trump to shame once again, before the G20? Or will it conclude that it’s tactically more sound to wait till after the G20?

Not so simple. I wouldn’t be surprised that if the US attacked Iran, that it would then lash out via its proxies- such as Hezbollah attacking Israel,

and taking strong action in Iraq to strengthen its control there.

They won’t be meek.

Hi Tom,

Perhaps your nation is different. In the US there is a tendency for the average citizen to focus on deaths of its own soldiers in a military conflict.

Any deaths are bad, but it hits harder for most people when it is the death of a family member, friend, or neighbor.

Consider the fact that Iran and Iraq fought a lengthy war that was basically a stalemate. How did Iraq fare in the most recent wars with the US?

I am no military expert, but I suspect a war with Iran might have a similar result.

I do not however think it is a good idea by any means, due to the suffering it would inflict on the Iranian people.

” I think it would go more like Iraq, not a lot of US casualties and people would support Trump”

No. Iran is much stronger than Iraq, that according to US estimates. And quite important, Iran has proxies. Think a little bit harder about Beirut 1983….

Only air/missile strikes do not decide anything, the moment ground forces are involved, the US government is not in a strong position.

Dennis,

If only American lives matter, I think that explains very much about US and US foreign politics. And can for instance explain why John McCain can be regarded as a hero in US and a war monger outside US. And the lack of evidences required to start a war. Now the last few days it has in this forum been discussed whether it was a wrong or right decision to attack Iran, completely ignoring the fact the so-called evidences are not really evidences. Iran has provided proof that the drone was shot down above Iranian territory. It would thus be wrong of US to attack Iran, kill civilians and possibly start WW3. If anyone in US cares about what’s morally right or wrong in the world outside US they should protest against an attack on Iran. But as the world outside US only has about 96% of the population, maybe it is too much to ask.

Iran has provided proof that the drone was shot down above Iranian territory.

Really now? We have their word. And to you, that must be the proof you speak of. Is that correct?

Tom, you just cannot make up shit and expect people to accept it as fact. I know, Trump tries that trick several times a day. But he doesn’t get by with it and neither do you.

Ron, what shit did I make up this time?

Iraq and Afghanistan have much lower populations than Iran; Afghanistan already had a civil war going on and Iraq had a very unpopular dictator and major ethnic divisions.

Iran is very unified and much larger than either. It would be worse than Vietnam for the US. The number of Americans killed would be larger than the number sent into Iran.

The US has a history of sending aircraft into foreign airspace and lying about being in international airspace. The Iranians are telling the truth.

Nathanael Wrote:

“The US has a history of sending aircraft into foreign airspace and lying about being in international airspace. The Iranians are telling the truth.”

The US also has a history of antagonizing Iran (mostly over the 1979 embassy event).

Obviously the the US planes were over or very close to Iran’s border, likely to provoke Iran to take action. The whole Farse with the Iranian Naval boat rescuing the crew and claiming Iran was recovering an unexploded mine. It wasn’t a Mine, it was a Ladder stablizer. The video did show the tanker crew getting rescued using the ladder, before them removing the ladder stabilizer magnet.

I have the habit of reading several sources from different viewpoints to understand the full picture.

Here is the Iranian view of the tension.

https://www.presstv.com/Detail/2019/06/26/599490/US-sanctions-IRGC-Iran-Leader-Khamenei-Zarif-

I doubt Iran will hold talks or meetings again with the USA until all sactions and treaties are reset to normal as they were 24+ months ago.

Hightrekker,

I think if pre-conditions were dropped by all sides, that talks might proceed, but I am no expert.

With Trump’s offer to talk, maybe we will just end up with a deal very similar to what Obama negotiated and Trump will just proclaim victory.

Of course, that won’t satisfy the administration hawks but perhaps Trump will push them out.

I think if pre-conditions were dropped by all sides

Iran (and the rest of the world) knows Trumps “pre-conditions” are useless, and not honored.

With the economic conditions put on them, they are going to continue to embarrass and put pressure on the US. It won’t be that hard.

Iran knows they are dealing with a 6 times bankrupt scammer from Queens.

Tom,

War is a bad idea. Perhaps on that point we agree. Iran has been involved in quite a bit of fighting.

Particularly in Syria in support of the Assad regime.

Tom,

Nowhere did I say only American lives matter.

When you hear about someone you don’t know that has died on the opposite side of the planet, does it affect you in the same way that the death of a close friend or sibling would affect you?

For most humans the affect is different. That is all I said. Any other interpretation is a lack of reading comprehension.

Dennis, when you mentioned the number of casualities in different wars, you only refered to American ones. I’m shocked.

Note that I wrote “If only American lives matter.. .”

Tom,

Ron brought up Lyndon Johnson not running for reelection in 1968 because anti-war sentiment was high.

One possible reason for the antiwar sentiment was due to the large number of Americans killed in combat, so I investigated that in comparison to G W Bush who was reelected.

As I have suggested for many humans it is not that other lives don’t matter, it is that the lives of those who one knows and loves matter more.

Perhaps you are different and all lives matter equally to you, for the average person this may be true in theory, but in practice they are affected differently by a death of someone closely related.

No point in discussing further, there is not a correct answer and I have limited knowledge of social psychology.

Are you affected the same by every death worldwide? When my younger brother was murdered and my parents died, it affected me differently than the 50 million other deaths that typically occur each year.

Perhaps I am unusual in that regard.

Dennis, you are missing the point. In the upper video in this article, your president’s last word (about 1.20) is proportionate. It’s a key word.

https://caitlinjohnstone.com/2019/06/22/the-fact-that-americans-need-to-be-deceived-into-war-proves-their-underlying-goodness/

What is the ratio of killed innocent civilians in a war US started to the number of dead US soldiers? 100:1?

The US may not care about the dead civilians but some people will care and some will lose their own family.

Wars have been won by some very poor generals, but never by a committee.

The US did fairly well with Eisenhower et al ending up with a German surrender 10 months after D-Day in 1944. But, he had to work with a “committee” trying to keep British, French, Russian, and US politicians all happy. Of course, Russia wanted the invasion in 1942/1943.

I’d class Eisenhower as a pretty good general, who had a wide compass in a very large war.

OK, so kind of – an external enemy will distract the people from internal problems / challenges etc.

Do you (Dennis or anyone) think that more wars have been initiated in the first president period than the second, due to this?

Tom,

So far in US history, I don’t believe any wars have been started to win an election. Always difficult to predict how an election will go. It is possible that if it appeared as if a President tried to provoke a War in hopes of gaining public support it might backfire and they would not be reelected to a second term of office.

I see your point but I would like to actually go through all the wars and check statistics, if I had some more time…

Some people thought the Gulf War of 1990-1991 was done to win an election. G H W Bush lost in 1992.

Yikes. “W”’s administration had a number of motivations for invading Iraq, but helping with reelection seems like a very likely element in the mix. My sense is that he really liked the idea of being a war president, and that it would help politically…

Many of his core don’t want us in another war. Neither do some of the Fox commentators. And Dems don’t want it.

So the number of voters prepared to rally around him in another war would be in the minority.

https://www.nytimes.com/2019/06/21/us/politics/trump-iran-strike.html

Thank God for those who don’t want a war.

Rand Corp’s simulations of WW3 indicates that US gets whipped.

https://www.rt.com/usa/453550-us-loses-world-war-three/

Feel free to discredit the source since it is Russian and I will find western sources saying essentially the same.

The simulations could of course just be another tool to get more spending on the US military, which BTW is more than double as big as China’s and Russia’s military spending combined.

If the Rand Corp simulations are correct it is a paradox that the US will loose, given the high military budget. It is also a paradox that with this enormous spending, countries such as Iran is looked upon a threat to the US. Iran has not got missiles capable of reaching US. There has not been war on American ground for decades (I call 9/11 for terrorism) and it seems bizarre to suggest how other countries than China or Russia could possibly be a threat to US. The threat is that a limited number of soldiers in a US base far away from US die, which will lead to a massive unpropartional counter attack. Why would any country be stupid enough to do so?

An increase in the defense budget will likely just make defense contractors richer but not improve our capabilities. We’ll get hardware that is more expensive but doesn’t work well enough.

I think the future of warfare is cyberspace; other countries are already better at it than we are.

Also “winning” is ill-defined these days because there is less likely to be a national government that is in a position to represent an entire group that will officially surrender. And then once the war has “ended” there need to be occupation troops to keep the peace. It gets expensive and manpower intensive.

The issue is that US military spending is completely misdirected. It’s all used to line the pockets of military contractors, or for pork barrel spending, or to “show off”. It has *nothing to do with* genuine national defense — nothing at all.

That’s why the US loses every war it gets into.

Wow, interesting.

But, still the US has by far the most powerful defence in the world, right? And countries such as Iran is not a real threat to the US, or?

I agree. Contractors charge high prices to deliver goods and services that are often outdated by the time they are delivered and don’t work right.

Our defense economy enriches contractors, but doesn’t buy us as much protection as it should.

It’s kind of like healthcare in the US. We spend more per capita than any other country but we don’t have the best healthcare system in the world.

Iran can destabilize the global economy by destroying most of the oil production infrastructure around the gulf.

Its very likely that an Iran\US war will escalate into a global war, as many counties depend on ME Oil. Once the Nukes start flying its game over pretty much for everyone. Didn’t anyone see the 1980’s movie: WarGames “The only winning move is not to play the game”

Read this GEM:

“US has no evidence of Syrian use of sarin gas, Mattis says”

https://www.apnews.com/bd533182b7f244a4b771c73a0b601ec5

“he U.S. has no evidence to confirm reports from aid groups and others that the Syrian government has used the deadly chemical sarin on its citizens, Defense Secretary Jim Mattis said Friday.”

And who is really using chemical weapons in Syria?

“U.S.-Led Forces Said to Have Used White Phosphorus in Syria”

https://www.nytimes.com/2017/06/10/world/middleeast/raqqa-syria-white-phosphorus.html

“A United States official acknowledged that American forces who are fighting the Islamic State, also known as ISIS, in Iraq and Syria have access to white phosphorus munitions, but he said it was not being used against personnel. The official spoke on the condition of anonymity because he was not authorized to discuss the use of the munition.”

Of course the US Also has no evidence that Iran targeted the two tankers a few weeks ago, either but will still use it for prelude for war.

I don’t think Trump will allow this, no matter what the hawks in his administration want. He wants to get re-elected. Neither the Dems or his supporters want another war.

Trump keeps threatening to pull out of countries because he says our allies won’t help us. I think something like that is more likely to come than launching another war.

I am pretty sure a war with Iran would ensure the end of the United States federal government. The US would get its ass kicked — this is overspecified — Iran has a population the size of Imperial Japan and would be defending its home, and it’s a technically advanced country with a strong military. The US has a weak military which is mostly designed to support military contractors through pork-barrel spending, and not to win wars. Pretty much everyone in the US already opposes the Middle Eastern wars which the US is continuously losing, and another one would be super unpopular.

IMHO, ‘calling it off because casualties’ was to generate a bragging point to use in his campaign ‘look what a nice guy I am for not wanting to hurt people’. There have been a couple of other things that have happened that look like set pieces to give him crowing points.

NAOM

notanoilman,

It makes him look indecisive and foolish. Better to have said nothing.

“Better to have said nothing”

Totally agree but we will need to wait and see what he says on the stump. If a war starts the disciples may not think much of rising oil prices, shortages and falling stock markets.

NAOM

“the Clowns are in charge of the circus.”

DC,

“It is better to remain silent and be thought a fool than to open one’s mouth and remove all doubt.”

Mark Twain

Better indecisive than starting WW3.

There”s allways a chance that he finally comprehended some of Putin`s wisdom that conflict in MENA would be a catastrophic disaster for all. There is always a sliver of hope he has the Neocons close on purpose to limit some of the chaos they create.

I’d say the neocons are convenient – Trump likes being on the brink of war to keep everyone scared. Fear is his ally. But…actual war would be a negative, so he’s on a tightrope.

A very risky strategy, except that I think the rest of the world understands it, and it’s convenient for some other countries, who are using the same strategy to maintain domestic power.

As Trump Wants To Avoid A Shooting War, Iran Will Use Other Means To Pressure Him

“Iran will continue to put Trump under pressure. As he wants to avoid a war that would hurt his re-election chances, Iran will use other means to pressure him.

The discussion about Trump’s decision not to ‘retaliate’ for the shoot down of a U.S. drone by Iran is still dominating U.S. media. The accounts of the various ‘sources’ contradict each other. Most likely Trump saw the trap of an ever escalating military conflict and did not fell for it. The Pentagon prepared a strike plan as it always does, but Trump never approved its execution.

One new detail about the White House discussion emerged in a New York Times story on the issue. The Pentagon and the White House are not sure where the Global Hawk drone came down. They do not trust that the U.S. Central Command is telling them the whole truth”——–

https://www.moonofalabama.org/2019/06/trump-is-afraid-of-a-shooting-war-but-iran-has-also-other-means-to-damage-him.html

The thing is, if we took a cold, abstract, geopolitical approach to the region, the US would ally itself with Iran and disconnect from Saudi Arabia and Israel.

Instead, US foreign policy appears to be driven by a combination of resentment and arrogance — emotional nonsense.

Westtexasfanclup,

I expect a war with Iran would result in higher oil prices, hopefully it does not happen, but an unstable POTUS would seem to increase the odds of war. If the war expands throughout the Middle east, we would see lower World C+C output no doubt.

Yes, unstable is a generous description.

Dennis, that’s what worries me: A war could be a tempting way to disguise the two root causes of the coming mess: The enormous debt bubble of money created out of thin air and peak oil. Because fiat money that is not backed by gold or even energy is a complete scam. Peak Oil signifies the total devaluation of money as a carrier of future energy and service which would mark the end of the actual financial power structure.

On the other hand, an economic crash coupled with the rebuild of a destroyed middle east could create the illusion of permanent growth, parting with that growth from a lower level than we’ve reached today – while all the banksters and politicians could point at their foe of choice: Iran.

It’s a bit like the oil crisis in the 80ties: Oil needed over a decade to get back to the level of its former peak. With the new, linear and not exponential growth, oil seemed to be abundant forever.

The actual system runs on two rails: one is reality, the other a carefully constructed illusion. It can’t really work without both, there would not be enough ground on reality alone to sustain it.

Westexasfanclup,

Global debt to GDP ratio is not really very bad. Emerging economies are gaining access to credit markets and have increased debt levels.

For advanced economies it is currently at about 265% of GDP, Japan has been over 300% since 1997 and is currently at 375% of GDP. Anything under 300% is probably fine. This is debt in all sectors, government, household, and non-financial industry.

https://www.bis.org/statistics/totcredit.htm?m=6%7C380%7C669

Saudi Arabia, IMO, committed the false-flag attacks on the tankers. Saudi Arabia desperately needs higher oil prices to balance its budget — every other OPEC member, including Iran, and also Russia, is openly saying they can tolerate lower prices.

Matt posts another in a long line of excellent reports-

http://crudeoilpeak.info/persian-gulf-oil-export-peak-after-tanker-attacks

https://www.forbes.com/sites/uhenergy/2019/02/21/its-not-just-the-permian-super-basins-are-a-global-phenomenon/amp/

No doubt will contribute later. Stave off peak oil, probably not.

The author of the Forbes piece on superbasins is Charles Sternbach, past president of the American Association of Petroleum Geologists. He championed the superbasin concept while AAPG president. Superbasins being defined as “basins that already have produced five billion barrels of oil and contain the potential to produce an additional five billion barrels (IHS Markit)”.

While I acknowledge that superbasins exist, I don’t think that promoting superbasins as a unique concept is actually going to help find new oil and gas resources. Since the downtown in oil prices in late 2014, the oil industry has focused their exploration efforts more on near-field exploration. The idea being that, if successful, these nearfield discoveries can be brought on production quickly because of access to existing infrastructure. While this, to me, supports the superbasin model (or it may better support the age-old industry maxim, “the best place to find oil is close to where you have already found it”), industry wasn’t doing it with a superbasin model in mind, they were doing it for economic reasons.

Might the superbasin model actually keep industry from exploring in frontier areas? In reality though, I think industry is exploring less in frontier areas because of their recent lack of success in frontier areas. Just recently, for example, Chevron and Equinor decided to get out of New Zealand. An exception is Total’s recent Brulpadda gas discovery off South Africa. I suspect, though, that they were hoping for oil.

That’s not a very useful definition. It would include both pre and post peak basins so long as both numbers are big enough. Several of the basins on the map are well post-peak. North Slope, North Sea, Mexico. None of those are targets for fracking recovery either.

I’m not sure what point the article is trying to make.

Hi SouthLaGeo,

As a geologist, I wonder what you think of my guesstimates of World URR.

Laherrere has World C+C less extra heavy oil in Orinoco Belt and Canadian oil sands at about 2600 to 3000 Gb (call it 2800 Gb as an average). His URR estimate for extra heavy oil is 215 Gb for a World URR total of about 3000 Gb.

My estimate defined a bit differently where I divide World C+C into conventional oil and unconventional, which I define as tight oil production plus Laherrere’s extra heavy oil definition (output with API Gravity of 10 degrees or less). Conventional is all C+C not fitting my unconventional definition. For conventional my URR estimate is 2500 Gb to 3100 Gb with a best guess of 2800 Gb. For extra heavy 200 to 500 Gb with a best guess of 350 Gb, and for tight oil 50 Gb to 90 Gb with a best guess of 70 Gb.

In rough numbers a best guess for World C+C URR of 3200 Gb with a range of 2750 Gb to 3700 Gb.

Do you have an estimate for World C+C URR? Or if not does my range seem reasonable?

Thanks.

Perhaps you saw this already, but some more detail at

http://peakoilbarrel.com/oil-shock-model-scenarios-2/

Propoly,

I agree with you. I think the superbasin concept is a good way of describing very prolific basins, but not much more beyond that. As I said, I don’t see it adding anything new to industry’s efforts to find new oil and gas reserves, and it may even keep industry from doing frontier exploration. In my opinion, both Forbes and AAPG are spinning this concept into something more than it really is.

Dennis,

I have a hard enough time trying to come up with good EUR estimates for the GOM. Jean Laherrere is awfully qualified to provide global estimates, and you are as well. I really can’t comment with any credibility on which I think is a better estimate.

Thanks SouthLaGeo.

I am far less qualified than Mr. Laherrere, and you.

Your input on GOM is much appreciated by everyone on this board.

Every comment you make makes us all wiser, thank you!

Yeah, I’m lost on the GOM without your input.

SouthLaGeo, from one AAPG member to another, would you please comment on what you believe might be the total loss of oil and natural gas jobs, near onshore and deepwater, from the GOM since say, 2012-2014. I am certain the great State of Louisiana has that data somewhere. The red fishing anywhere within 50 miles of the river mouth, by the way, sucks. I just came from there; I have never seen so much water; all of Breton is fresh enough to drink. Thank you.

https://www.thoughtco.com/we-will-never-run-out-of-oil-1146242

In any story, there is usually some basis of truth. There will always be some oil left in the ground.?

Seems to be more and more stories popping up like this. So, what is the purpose of it? Nobody is worried about it now. What? Me worry?

There has been a lot of talk on this thread about debt, and debt fueled funding of the shale industry.

I won’t pretend to understand debt, but there certainly seems to be something broken with finance at higher levels.

Is it just a huge game of kick the can down the road?

‘The World Now Has $13 Trillion of Debt With Below-Zero Yields’

from Bloomberg news, behind the paywall so I didn’t read it-

https://www.bloomberg.com/news/articles/2019-06-21/the-world-now-has-13-trillion-of-debt-with-below-zero-yields?srnd=premium

Yeah, it is a Big deal for shale now. If prices would have remained higher towards the $70 range for WTI, there would have been some internal funding for growth. It didn’t, so the companies are sucking wind.

There is a lack of external funding, as no one is happy about negative cash flow, which about 90% of the shale companies have managed to provide. Hence, growth for shale, this year, has a lot of headwind.

If you continually give projections that you can make a good profit at $40. Oil has been way over that for awhile. If you continue to post negative cash flow, then you lied. You get no more money. Simple. Big oil will be able to pick and choose lunch, soon.

Probably many would have a consistent positive cash flow at a consistent $65 WTI price. Others would be sucking wind at any price. Judgement day draws nigh.

Been drilling down into the BP bible release of last week. There is a tab on the spreadsheet revealing product consumption by region (and by product).

Middle distillates (this is where food and flying comes from) consumption growth:

US (grew consumption 2.5% overall) all Mids +3.8% Diesel 4.7% Jet fuel 1.7% gasoline -0.3%

[29% of US consumption is now Mids, 45% gasoline]

China (grew consumption 5.3% overall) all Mids +2.3% Diesel -0.4% Jet fuel +14% (!!!) gasoline +5.6%

India (grew consumption 5.9% overall) all Mids +4.0% Diesel +4.4% Jet fuel +1.9% gasoline +8.9%

The world as a whole grew jet fuel faster than any other category of consumption. +3.7%. Overall global consumption growth, 1.5%.

This, I predicted years ago. Electric cars displace gasoline (mostly visible in US so far), electric trucks & buses displace diesel (mostly visible in China so far), heat pumps displace heating oil (another middle distillate), oil is driven out of electricity production, but jet fuel continues to grow.

Nathanael,

If we focus on liquid fuels in BP’s regional consumption tab for the World by taking the sum of light and middle distillates plus fuel oil and look at how this total is split between gasoline and diesel fuel vs other products (including Jet fuel, fuel oil, and light distillates that are not gasoline) we find that the gasoline/diesel proportion has increased from 57% in 1980 to 71% in 2018 while the “other liquid fuels” proportion has fallen from 43% to 29%. While it is absolutely correct that the proportion of jet fuel has increased, other fuels such as fuel oil and light distillates not used in gasoline have decreased to offset the rise in jet fuel.

Also if we look at the increase in jet fuel use from 2000-2018, the annual rate of increase in jet fuel consumption has been 0.8% per year, but the crash in oil prices lead to a sharp rise in consumption in the 2014-2018 period at 3.84% per year.

From 2000 to 2013 the rate of increase in jet fuel use was nearly flat at 0.004% per year.

Texas + New Mexico production growth by API gravity over 12 month periods

Bar chart: https://pbs.twimg.com/media/D9r8H3KW4AEbb8J.png

Texas + New Mexico production by API gravity

Chart https://pbs.twimg.com/media/D9r8zbzXsAAmG9S.png

EIA -> https://www.eia.gov/dnav/pet/pet_crd_api_adc_mbblpd_m.htm

crude oil API -> https://en.wikipedia.org/wiki/API_gravity#Classifications_or_grades

Yeah, that is more in line with the story I posted. Not quite as high in condensate, though. Though, not sure they are including condensate, because greater than 50 is way too low. The timing looks right, too. They started out in a very wide pattern in 2016 and 17. Most outside of the three to four county area in Texas/NM was worse. Most has been confined to that area since. And that area does not have a lot of spaces left.

These figures do add up to the EIA’s Crude Oil and Lease Condensate Production 914 survey number if you add Alaska

It is without this, which is part of NGPLs. But the EIA doesn’t count this in the 914 number. Krishnan Viswnathan mentioned this as a possible cause of Line 13 (inventory error). I don’t know how much of it is produced in the Permian?

U.S. Field Production of Natural Gasoline (also known as pentanes plus or condensate)

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=M_EPLLNG_FPF_NUS_MBBLD&f=M

Totally confused. The 914 eventually matches up to RRC data that includes condensates, but the 914 data does not include condensates (obviously)?

Scratch the above. If you multiply oil over 50 times 30 or 31, you come close to the condensate monthly at RRC. The NGPLs are never counted as part of crude production, so that eliminates my confusion over oil production. The NGPLs should show up as part of plant production, though. Because that it where it first shows up.

The article I posted does not hold water in regards to 70% of new production being condensate, at all. The graph on condensate is way off. However, when you consider that higher API was higher in 2016 and 17 due to completions out of the sweet spots, the graphs on higher API may not be off much. Give this one to Dennis, though. Because, condensate at 70% is ridiculous.

GuyM and Energy News,

The confusion is that there is some pentanes plus collected in the field “lease condensate” and there is an identical product extracted from natural gas in the Natural Gas Processing plant where NGL is stripped from the natural gas to produce “dry gas” shipped to natural gas consumers by pipeline. The NGL has several components, ethane, propane, butane, and pentanes plus (also called natural gasoline).

The pentanes plus from the natural gas processing plant is part of NGPL (Natural Gas Plant Liquids) and is not considered part of C+C, even though it is essentially the same chemically as “lease condensate”.

Don’t know why it is done this way, just the way it is, perhaps.

Note that the WTL is 45 to 49.9 API, we don’t really have data for the split between 40-44.9 and 45 to 49.9 except for the US as a whole.

As a piece of ancient history (as I am ancient), the pentane plus fraction was called casing head gasoline and used to power oil field vehicles. It was notoriously low octane rating (about 80) and knocked badly.

http://gluedideas.com/content-collection/oil-field-practice/Casing-Head-Gasoline.html

The 914 data does include the condensates, everything from 10 degrees to over 55 degrees API that is produced as a liquid in the field and is not from a natural gas processing plant, once any natural gas that is separated from the crude stream (in the case of associated gas) is sent to the natural gas processing plant any condensate produced “off lease” becomes part of the NGPL stream and condensate produced “in the field” is “lease condensate” included in the 914 reports.

Statistics Canada also have two categories Condensate and Pentanes-plus but they add them both to the their total whereas the EIA leaves Pentanes plus out of the US total. It seems that the reason is historical…

October 11, 2014 (Reuters) New definitions needed for condensate and gas liquids: Kemp

…from a regulatory perspective, what matters is how hydrocarbons are produced. Broadly speaking any light liquid hydrocarbons recovered from natural gas processing plants (NGPLs) and oil refineries (LRGs) are treated as refined products, while those reclaimed from simple field separators (lease condensate) are treated as crude oil.

This focus on production stems from historical differences in the way the oil and gas industries were regulated by federal and state governments (usually with separate statutes, taxes and record-keeping systems for oil and gas production).

Under the EIA’s definitions, lease condensate is aggregated together with crude oil, while the products from natural gas processing plants and refineries are reported separately. This made sense at one time, when natural gas liquids and condensates were relatively minor byproducts of natural gas production and the refining industry.

https://www.reuters.com/article/us-condensate-usa-kemp/new-definitions-needed-for-condensate-and-gas-liquids-kemp-idUSKCN0HZ03220141011

You can have any oil production you want if you change the definition of oil. If you dig around online you will find mention of condensate definition threshold to be API 45. You can also find definition threshold to be API 50. And I’ll leave you to guess which one is most recent.

There is one fairly important item that it’s fairly easy to forget and that is all liquid of a given API number does not have the same distillate yield percentage of constituent parts. Meaning oil of API 42 from one geological location may have a diesel and kerosene percentage of x or y percent, but liquid with the same API number from a different location might have a different x and y.

The constituents combine to define the API density number. Different combinations can yield the same number. It’s quite popular to define oil by that number, but it’s not a good idea with global middle distillate consumption outgrowing total oil consumption.

“all liquid of a given API number does not have the same distillate yield percentage of constituent parts. Meaning oil of API 42 from one geological location may have a diesel and kerosene percentage of x or y percent, but liquid with the same API number from a different location might have a different x and y.”

Is this because of the sweet/sour component? I would think not, but what then? thanks in advance for an answer

Yes sulphur (sulfur) content is an example of how crudes differ.

Generally light oil (high API) has a high content of short carbon chain molecules whereas heavy (low API) contains more longer carbon chain molecules. And there are different types of carbon molecules too…

Composition by weight – Percent ranges

Alkanes 15 to 60%

Naphthenes 30 to 60%

Aromatics 3 to 30%

Asphaltics (big molecules)

https://en.wikipedia.org/wiki/Petroleum#Composition

Energy News,

No the carbon atoms are all the same (there is no such thing as a carbon molecule it is always combined with either oxygen (as in CO or CO2) or hydrogen (as a hydrocarbon), there are different numbers of carbon atoms in the various types of hydrocarbon molecules, perhaps that is what you meant to say.

So the smallest is methane with one carbon atom CH3, then ethane with 2 carbon atoms, propane, with 3, butane, with 4, and pentane with 5 carbon atoms, these are the natural gas and NGLs with pentane plus being 5 to 7 carbon atoms in the molecules. An octane has 8 carbon molecules. Diesel fuel is a mixture of hydrocarbons with molecules from 9 to 16 carbon atoms. Gasoline mostly has hydro carbon molecules in the 5 to 8 carbon atom range. The alkanes (which have only carbon and hydrogen atoms) longer than 16 carbon atoms are used to produce lubricating oil and residual fuel. Longer carbon chains from 25 carbon atoms to 34 carbon atoms are used to produce paraffin wax and longer chains of 35 molecules or more are asphalt. Note that the napthenes are isomers for a similar alkane with the same chemical formula C5H1o for both cyclopentane (a napthene) and pentane(an alkane). The different structure of the molecule (napthenes have a ring structure) gives then different properties (boiling point and melting point).

DC,

Energy News is saying short and longer carbon chain molecules not short and longer carbon molecules.

Hyphens would have helped but hyphens are in short supply on the internet.

Synapsid,

I could have shortened it I guess to there is no such thing as a carbon molecule, he meant to say hydrocarbon molecule.

Tapis Blend “crude” has been around for many years, the API is 47.2. These super light crude blends have historically traded at a premium because they can be refined into gasoline, jet fuel, and diesel fuel very cheaply. The heavier grades require more complex refineries to crack the longer chaine hydrocarbons in heavier grades of crude into useable products. The residual fuel, asphalt, and petroleum coke are very low value products, one can get a lot of those from very heavy grades of crude, but they are not very useful products.

see

https://oilprice.com/oil-price-charts

https://corporate.exxonmobil.com/en/Crude-oils/Crude-trading/tapis

and chart below.

chart for Tapis blend price, most recent price is $68/bo from 2 days ago.

Geeze, thats Malaysia. It traded for a premium over here, too, until we produced too much of it. Now, it is trading at an increasing discount.

It wasn’t even separated from WTI until a few months ago. Blending it with WTI was clogging up pipelines. Too many complaints, and now it is separated, and selling at a discount. Called WTL. Now, they are able to move it through pipelines, but only in batches. Last I heard, it was about a $2 discount to Midland. API 45 to 50.

GuyM,

The point is that on the World market a 47.5 degree API gravity crude trades at a premium, once it can be exported the discount may become a premium.

If the world market can support it. I keep reading that they have a lot of doubt of that. There is a dearth of heavy oil to mix it with.

GuyM,

Seems strange as most of World output is considerably heavier than 40 API, probably an average of under 30 degrees API gravity for World C+C output.

Most of the OPEC “light” grades of crude are about 25 to 35 degrees API gravity. The heavy grades are often 10 to 25 degrees API. Plenty of heavy oil in Canada.

It’s stuck in Canada, or the US. Pipeline to the West Coast has been OKd, but right after that they passed a law against shipping exports.

I imagine the problem will be resolved, either by exporting light, importing heavy, or reducing output of light. Probably a bit of all three.

The shipping ban applies to building new ports north of Vancouver. There is already one port near Vancouver that is supplied by the current Trans Mountain pipe which will be continued to use. The issue is will the new pipeline get built to increase the volume of crude.

Hi Dennis,

Only saw this now. Following your link to exxon you will see your typo – API is 42.7 – not quite as light as your comment 🙂

I only followed the links because I was curious you found a price for tapis. It used to be quoted as a commodities price (not sure if futures or spot) in Singapore, but the contract was abandoned I believe due to insufficient supply to base the contract on.

Cheers, Phil

Phil,

Thanks for the correction, yes a typo on my part sorry.

Note that most of the tight oil output is in the 40-45 range, with a likely average of about 42.5, so not a lot different from the Tapis blend which is also in the 40-45 degree range for API.

Energy News,

If one simply deducts Alaska’s C+C output however, the 914 data matches the API data’s totals exactly. Chart below shows API gravity for all US crude for less than 35.1 API, 35.1-40 API, 40.1-45 API, 45.1-50 API and 50.1 and higher API. The average level for each of these (not weighted by production) categories is 28%, 19%, 31%, 12%, and 1o% respectively. The Average API gravity weighted by output for all L48 output with known API gravity is shown on the right axis. The average API over the entire Jan 2015 to March 2019 period, weighted by output each month is 39.3 degrees.

The WTI API specification is 37 to 42 degrees, with a historical average of about 39.6 degrees. Seems all the concern over too much condensate is way overblown, at least as of March 2019. In March 2019 the average API gravity for US output was about 40 degrees, well within the WTI specification.

If the crude gets out of spec, import the appropriate grades of crude and blend to suit the refineries, if this cannot be done profitably, then export the lighter grades to where they can be utilized profitably. The export ban was lifted to allow this flexibility.

The Natural gasoline that is reported at that link is not part of C+C output as it is part of NGPL output. Basically, of the 4728 kb/d of NGPL produced in March 2019, 500 kb/d was natural gasoline (aka pentanes plus) and 4228 kb/d was liquified petroleum gases (LPG) which consists of ethane (C2), propane (C3), and butane (C4).

see

https://www.eia.gov/dnav/pet/PET_PNP_GP_DC_NUS_MBBLPD_M.htm

https://seekingalpha.com/amp/article/4271620-u-s-tight-oil-estimate-projection-december-2019

Posted in seekingalpha. Congrats DC,

Interesting that they grab this without asking, but it is ok as I want people to read what I write.

I imagine the check is in the mail. 🙂

It’s a reasonable estimation. I don’t think it will get that high, but it is supportable. At least it is a balance to EIA bull. But, at this point, I have No credibility, yet. So, I am happy with yours. Right now, the ones who believe flat oil output for 2019, are in the same numbers as those that believe the world is flat?

Though, if it approximated your low, I’d feel somewhat vindicated.

GuyM,

If oil prices remain where they are now (say for example OPEC decides to raise output in July) then the low number is more likely. If OPEC either keeps output where it is or decides to cut further (doubtful in my view) then I expect oil prices will rise and we might see my best guess estimate (475 kb/d increase from Dec 2018 to Dec 2019).

I agree that most of the estimates out there are too optimistic, a lot of it comes down to the price of oil and of course that is difficult to predict.

Can you remind me what your latest estimate is for US tight oil output in Dec 2019. My low end estimate is a 375 kb/d increase from Dec 2018 to Dec 2019, I think you have said “flattish”, would that be 100 Kb/d+/-100 kb/d?

It also comes down to the financial conditions to the companies that produce it. They need additio nal capex to expand.

I believe flattish would be -100 to +300. Or, 100 plus or minus 200, if you prefer. And, at this late date, oil prices rising are less of a factor. It has to be up for awhile, before there is much movement. 2020 is a story of a different horse.

Guym,

Interesting, so are you assuming a recession is likely or that OPEC will decide to reclaim market share? I just don’t see a likelihood of a fall in US tight oil output. What is your oil price expectation, as perhaps that would explain the -100 kb/d estimate?

Uncertainty in GOM, mainly. Hurrica

nes? If GOM substantially increases, then my estimate is way off. Right now Permian is holding up other shale declines. Okla will soon be dropping, Bakken is not looking so healthy, and Permian increase was only keeping up with EF drop as of March. And, we are just coming out of a miserable price drop, resulting, no doubt, with another quarter of negative cash flow.

The independents only have one option to survival now. Capex well within cash flow. Hopefully prices will continue to improve. If not, they are dead. Not all, but, at least, half.

GuyM,

I realize now we are talking about slightly different things. You are predicting US output and I am specifically focused on US tight oil output. Possibly this explains some of the difference. SouthLaGeo predicts about flat GOM output, I think he is probably right and he is far more tuned in to developments there than me.

Typically the hurricanes are in the fall, December output is usually not affected.

So if you were talking about US tight oil output, does a fall in output still make sense, maybe 200+/-200 kb/d?

No, I am not expecting a fall in output. At most, a 300k increase. So, we are not that far apart.

GuyM,

Thanks, last I checked it seemed we were on roughly the same page (I came around to your point of view really), I thought perhaps your estimate had changed. So now I am thinking 100 to 300 kb/d for your estimate and call it 400 to 600 kb/d for my estimate (for round numbers). If we merged the two estimates we’d have 100-600 kb/d with a best guess of about 350 kb/d.

Like I said, fairly close. I’m usually too pessimistic?

And, the big picture will put us far short on world supply, period.

GuyM,

If we look at tight oil trailing 12 month average output, even an assumption of a 200 kb/d increase from Dec 2018 to Dec 2019 gives a ttm average that increases by 900 kb/d in from dec 2018 to dec 2019.

I still agree that World output may be short, though higher oil prices will increase tight oil output in 2020 to 2023 by about 1500 kb/d over those years (500 kb/d annual increase).

The increase results from the big increase from July 2018 to December 2018.

That’s further than my time binoculars can see to, I can’t even reach 2020 with them.?

Dennis

I have taken a slightly different approach to analyzing the tight oil production data. My interest is in trying to detect any sign of slowing in the most recent production data, using only the latest data.

Fitting a line to the Jan 18 to Dec 18 data shows that production was increasing at an average rate of 153 kb/d/mth. Fitting a line to the Feb 19 to May 19 data shows the production rate increasing at an average rate of 105 kb/d/mth., an approximately 31% decrease. I understand that it is a bit of a stretch to fit a line to only four data points. However, in the next few months we will have a few more points and be able to compare today’s production rate with a new average.

If the trend you show in your chart of downward revisions, the slope associated with those four points should decrease.

As an aside, thanks for the great work you put into this site.

Ovi,

You’re welcome, thank you for your insightful comments.

I agree that the rate of increase has slowed considerably from 2018, I use annual rates of increase and have about 1500 kb/d for the annual rate of increase in US tight oil output in 2018, note that I did two separate estimates using 8 months of data, the first using EIA tight oil data from Sept 2018 to April 2019 and the second using the DPR model from Dec 2018 to July 2019, in each case the slope of the trend line was about 600 kb/d (coincidence only). I am more skeptical of the DPR estimates so I used the 600 kb/d annual rate of increase from March 2019 (EIA tight oil estimate) and projected forward to Dec 2019 (450 kb/d over 9 months) to arrive at my central estimate. My expectation is that oil prices will rise so if anything this would be a conservative estimate (as prices were quite low from Nov 2018 to March 2019 which should tend to reduce capital spending ceteris paribus).

Looking at your chart, I would prefer to look at a trendline over the past 12 months. I did this with an assumption the April will be revised down by 10 kb/d next month and that May will be revised down by 35 kb/d next month (same as revisions to March and April in Jnne’s update). We get a trendline with a slope of 89.5 kb/d per month that passes close to the Jan 2019 data point. This is extended to Dec 2019 and we get 8148 kb/d in Dec 2019, an annual increase of 823 kb/d from Dec 2018. To this I would add uncertainty of +/-100 kb/d, so 723 to 923 kb/d.

We could also combine this with my original estimate and that of GuyM to cover low, medium and high cases. which would give an average (200, 500, 800 kb/d) of 500 kb/d with perhaps a one sigma uncertainty of 200 kb/d (300-700 kb/d range) and a 2 sigma uncertainty of 400 kb/d (100 to 900 kb/d) as a very rough guess.

The low end would require low oil prices/severe recession and the high end continued robust economic growth/high oil prices. Low economic growth=real World GDP growth of 2% per year or less at market exchange rates, high economic growth= real World GDP growth of 3.5%/year or higher, low oil price=$60/bo for Brent in 2018$ or less, high oil price= $80/bo for Brent crude in 2018$ or higher.

Dennis

When I eyeballed the data, I considered the Jan 19 and Feb 19 points to be outliers. Some event had broken the Jan 18 to Dec 18 trend. As such, I was then looking for the beginning of a new trend. The data from Feb 19 to May 19 appear to be the beginning of a new increasing trend. The rate is 105 kb/d/mth., which as you suggest may be a bit high and I agree.

However strange as it may seem, projecting my equation out to Dec gives a production rate of 8.2 Mb/d for Dec 19. Coincidence? (Note x in this equation is months after February, so for Dec, is x=10).

However this initial rate should decrease so we should expect an output lower than 8.2 Mb/d in Dec, provided WTI stays in the $55 to $65 range.

Dennis,

You quoted earlier in one of the posts:

The worst 3 years in Iraq there were 2600 soldiers that died, not good but 10 times fewer than Vietnam. In Afghanistan, the worst 3 years so far there were 1200 US soldiers who died.

According to wikipedia, the total number of U.S casualties in the Iraq war 2003-2011 was: 36,710.

And in Afghanistan 2001-present: 22,266

Too much to write here about the Iraq war, at one point the U.S army ended up paying insurgents cash money to help them and fight for them instead of against. Why? Because they were getting their asses handed to them.

You think the U.S army can pay Iranian soldiers and the revolutionary guard or shia militias like Hezbollah? I doubt it. These guys are as fanatical as the insurgency in Iraq if not more, and they are much better equipped and trained. Hezbollah is currently operating in Venezuela and it is rumoured they have underground cells in the U.S.

You think a war with Iran will be similar to the stats in Iraq? A ground war with Iran would be worse than Vietnam in my opinion and the outcome a disaster in the making. I also fear as I said above, they have a few nuclear weapons. It was rumoured in Iran when i was young that the Soviet Union sold some to Iran near the end of the cold war.

Ground forces (ours) in Iran would be sheer nuts. Israelis and Saudis would take over decimating nuclear positions. Decimating, or taking over Iran is not feasible. Slowing it down is. JMO. Of course, the best tactic is to leave it alone, but I am not part of this idiotic Administration. They do hate us for a reason, ya know. And those reasons pre-date the old Shah. We’ve only made it worse, since.

What’s wrong with America, that believes the solution to any international problem is war?

“Violence is the last refuge of the incompetent.”

Isaac Asimov

He has been my favorite for 61 years. I was nine when I first read his stuff, mostly SF at the time.

Carlos,

Many Americans do not support these wars, but contrary to what some seem to believe the US is not responsible for all evil in the World.

The US presidential election system is a strange one based on a compromise when the constitution was written. It is not based on popular vote, areas with low population density are over represented in the electoral system so we can have a situation where the president loses the popular vote (48% Clinton to 46% Trump) but wins the election. Also in 2000 Bush lost the popular vote, but the difference was only 0.5%.

Bottom line Trump does not have a lot of popular support, but unfortunately is able to manipulate the media to his advantage, he will be difficult to defeat in 2020 and the opposition party (Democratic Party) is quite fractured between moderate and left wing voters so a good candidate to oppose Trump may not win the nomination.

In any case, most Americans do not support Trump’s policies, many of us were in total shock when he won the election.

When is it appropriate to use force? The answer is not always clear.

It seems to me that the alternative to Trump last go-around was quite keen on war also. I seem to recall she campaigned on an act of war with Russia, and was not shy to gleefully make light of murder. America has one political party- it’s called The War Party, and it has two wings- The D’s & The R’s. Buuuuuuuut, most Americans don’t support it, so there’s that.

Pepsi and Pepsi Lite—

Take your pick.

Mike, Dennis was talking deaths, you are talking casualties. Two entirely different things.

A “casualty” is a military person lost through death, wounds, injury, sickness, internment, capture, or through being missing in action.

Oh right. Yes my bad.

It’s ok, I argue with Dennis, too. Just to try to figure out what I’m missing. This board is extremely informative. No discourse, no learning. Sometimes I miss a “the” or “an”. I am directionally challenged, too. Sometimes West is East.

Iron Mike,

No problem, I looked at the statistics for deaths, injuries can be very bad as well and these days with better combat medicine the ratio of injuries to deaths has likely risen since Vietnam, War is a terrible thing, taken far too lightly by the old men making these decisions, in my opinion.

Iron Mike,

I believe any war is a bad idea.

My statistics were for soldiers killed in action. Not accidents, injuries, etc.

Bad idea to go to war and a dumb idea to pull out of Iran deal and raise tensions.

As I said seems in Iran Iraq war neither side had the advantage.

I don’t really follow military stuff, so I may well be wrong.

Dennis, when I saw this comment, I realised i might have misundeestood too. Sorry about that. Probably we agree more than I thought.

Tom,

No problem I can see how my comments could be misunderstood.

>Too much to write here about the Iraq war, at one point the U.S army ended up paying insurgents cash money to help them and fight for them instead of against. Why? Because they were getting their asses handed to them.

But paying people not to fight make a lot more sense than fighting them anyway. Dropping a million dollar bomb on a guy earning two dollars a day is just dumb, unless you are an arms salesman. Few if any soldiers ever fight 10,000 days, so even if you kill him you lose $980,000.

Afghanistan was particularly bizarre in this area. At times the Pentagon was burning through $100 bn a year fighting a war there. The country’s GDP is about $20 bn. So the US was spending five time’s the country’s GDP to lose a war against a few guerrillas.

The real tragedy is that the country’s problems are easy to solve in a low tech way. Afghanistan needs to be reforested, and it needs flood control and irrigation. So all the Pentagon has to do to end the war is hire a few hundred thousand people for a few dollars a day to plant trees and dig ditches. That would dry up the labor market and end the insurgency, which relies on mercenaries. And the beauty of it is there are no targets to attack when all you are doing is soil reclamation.

Tom,

Point is not that there should have been a strike. It was a bad idea. The point is that the deliberations should not be public knowledge. Trump is a moron for bringing it up.

It may be a stupid tactic to try to get Iran to negotiate. In case you haven’t noticed I am not a supporter of Trump.

He looks even more the moron. What person over an 80 IQ would not know that multiple missiles would not kill someone??? I voted Republican before he ran, he’s an evil lying SOB.

“The point is that the deliberations should not be public knowledge. Trump is a moron for bringing it up.”

Nope. We should expect way more transparency from those that we pay to run our nation.

Overall I have little respect for Trump but when he allows the War Hawks to continue right up to the point of executing their atrocities and then puts a stop to it and let us all see the pure evil that Bolton really is, then I am more than happy to congratulate Mr Trump.

Anyways, It appears that the demand for petroleum products (at current prices) continues to evaporate and the Globalists including the Saudis are desperate to keep it levitated. So we get to see oil tankers getting hit.

A question I have is, What parties stands to loose from the damages to the two vessels and contents?

So all this talk of war with Iran could possibly be nothing more than posturing from all sides, to keep the illusion of growth alive for just a wee bit longer.

Farmlad,

Trump claims (though I tend not to believe what he says as he blurts out a combination of truth and fiction at all times) that he asked for options to retaliate and then decided the estimate of 150 deaths was not proportionate. Who knows what the real story is, it may be entirely false, a made up story to try to threaten the Iranians and get them back to the negotiating table.

A problem with so much falsehood coming from the mouth or twitter account of POTUS is that nobody believes a word he says. This will come back to bite him and unfortunately the nation as a whole.

National security matters have always been done in secret and there are many good reasons for that as is plain to many.

The uncertainty caused by the specter of war is not generally positive for economic growth. It might raise oil prices, which is the opposite of what Trump is aiming for.

Some of the comments from political analysts are a bit funny. They say Trump is the opposite of Theodore Roosevelt. He boasts loudly and carries a small stick.

Why should we torture a country that we have been torturing since before 1953? Are we that crass as a nation? Let’s end this BS, and show them we have some capacity of being human.

Iran can take almost 20% of oil off the market in 15 minutes.

The world uses a lot of oil—–

To me, it’s not about oil. It’s about treating people with respect that is due. As a nation, we have failed miserably.

“I suppose I need to adopt a Good Christian attitude to all of this. First of all, none of the people supposedly in trouble are invisible “unborns”. Secondly, the lands in question are very, very far away, inhabited by folks with the wrong skin color, and I don’t know any of them.

Besides, everybody who matters knows climate change is an invention of AlGore.”

Non, no. He invented the Internet. Check that , he was responsible for legislation that created the internet. Ok, in reality, he don’t know a bit from a byte, but he is responsible. In reality, he is no less dangerous than the incumbent, maybe. Or, no, he’s less dangerous, maybe.

You are right!

But he sort of invented it—-

A mrere 5% of the world’s oil comes from Iran. The Saudi, Dubai, Abu Dhabi, Kuwait, and Iraq oil can always be shipped out in other directions, though it would take a few weeks to arrange transport.

http://scanex.ru/upload/medialibrary/642/6427b8b81067da752904dcc41ea7cbe6.jpg

What routes would those be, please?

I’m sure you know better about rerouting millions of barrels per day than every strategist who has looked at the Strait. Never mind Iran bombing Ras Tanura or something.

Let’s not. Cutting Iran out itself isn’t long term viable. Even if the Saudis could make it up, and they’re 600k under their quota for some reason, that would burn all of global spare capacity to meet *current* demand. Anything else on either supply (e.g. Libya heating up, major hurricane in the Gulf of Mexico) or demand still going up 1.5M/day from 2018 even though production is down and the world starts quickly chewing through stocks.

Anyone have stats on immigration/refugees from Iran’s hood in recent years?

Iran being less arid than other Gulf states is close to being self-sufficient in food. The same cannot be said for Saudi Arabia.

Plus, a major civilization for 5 thousand years.

When they become US citizens, they prefer to be called Persian.

Iran’s corn imports are going through the roof – close to 11 mtpa which is enough to feed 33 million vegetarians:

Iran’s wheat imports are all over the shop. Like most of the Middle East they have breed themselves to the point of being reliant on imported grain. Big starvation event coming.

And 2.4 mtpa of soybeans which will be needed to offset the bad amino acid profile of the corn. Wheat is ideal. All up about 20 mtpa of imported seeds and grains and meal – enough to feed half their population including what is converted to chicken protein. If the Straits are closed to shipping they could truck grain in from Russia.

I keep debating whether the flow of money to unprofitable fracking will dry up *before* electric vehicles cause the demand peak (meaning one more big oil price spike), or *after* (meaning oil prices on its way straight down).

Well, this report may indicate that the money flow is drying up now:

https://www.desmogblog.com/2019/06/23/former-shale-gas-ceo-says-shale-revolution-has-been-disaster-drillers-investors

Well, probably true for oil, too. However, the article is all about gas, not oil.

Yeah, the article is about gas (including “wet gas”, which generated a lot of the “oil” supply).

But if you look around, there’s damn little in the way of really wet *oil* fracking fields. Bakken and Permian, right? Maybe Eagle Ford? Bakken’s aleady peaked and so has Eagle Ford, so that leaves the Permian. Just the Permian. One field in the whole world. And it’s still got a very high gas to oil ratio compared to traditional conventional oil…

Er, whatever, dude.

I guess there’s a reason so much money is being dumped into the Permian, but you’d think eventually the investors would put the money in some other industry which actually earns money.

Like education?

Nathanael,

At the right oil price ($70/b for Chevron who has a high Net revenue interest (low royalty payments) for their Permian assets) plenty of money can be made in the Permian basin. Other basins may be able to keep output flat with higher oil prices and you are forgetting the Niobrara, and Anadarko basins, though you are correct that most of the increase in US tight oil output is likely to come from the Permian basin from now until 2028 or so, with a likely peak for US output in 2025, if the mean USGS TRR estimates prove correct and oil prices continue to rise.

The Anadarko Basin is toast, now. Output Will go down. Too many changes in the rock for horizontal drilling. Not in all areas, but in a bigger area than first guessed.

GuyM,

You probably know more than me. It does seem that most of the tight oil increase this year has been from the Permian Basin. If we look at the trend for Permian basin for the past 5 and 12 months we get and average slope of about 728 kb/d for average annual increase, if we extend this from May 2019 to Dec 2019 we get about a 600 kb/d increase for Permian output from Dec 2018 to Dec 2019, if we further assume the rest of Us tight oil output besides the Permian basin is the same in Dec 2019 as in Dec 2018 then we get a 600 kb/d increase in US tight oil output, this is a lower annual increase than 2018 by roughly a factor of 2.5 (1500 kb/d in crease in 2018).

This would be consistent with a medium rate of increase in oil prices (to about $75/bo for Brent) and no severe World recession through Dec 2019.

Okay as regards distillate yields. You go to an assay and look at the atmospheric cuts for the boiling point of middle distillates. 150 degs C to 300 degs C.

Equinor’s assays show some Nigerian liquid API 47.9. Middle distillates about 38%.

Eagle Ford API 46.6. Middle distillates 29-30%

Watcher,

Lot’s of heavy oil in the World, that can be cracked to get needed levels of middle distillates. There is much more heavy crude than light crude, this is just not a problem, much ado about nothing.

In 2018 48% of liquid fuel (middle and light distillates plus fuel oil) was light distillate and 47% of liquid fuel was middle distillate. Of the total crude produced the percentages were 39% light distillates and 43% middle distillate. You do realize that Eagle Ford output is only 1.4% of the World’s crude output and all US tight oil is about 8% of World C+C output. Most of World crude output is medium to heavy and the heavy crude is cracked at refineries to yield the a proportion of light and middle distillates that meets demand.

I just grabbed two flows of equal API to answer a question above. There are several Eagle Ford variants and that one has more middle distillate than others. None of which has anything to do with % of the world.

The fastest growing product consumption is middle distillates per BP. As for getting it from heavy oil, that will also produce some gasoline. There is no global coordination of what refiners do what kind of oil. If you do heavy oil, you won’t have enough gasoline and have to import it. If you do light oil you’ll have to import middle distillates. Suppose there are no distillate exporters.

Optimal is conventional Libyan oil that has a good proportion of each.

You don’t have to run out of oil. You can run short. And there is granularity in this. You don’t have to run out of diesel. You can run short of it, while seeming to have enough oil.

Two minutes later it says I can’t edit that comment.

In the export basket of countries that export oil there are two primary sources of D2 diesel, post refining, shipping the diesel itself.

Iran and Russia.

If you are trying to answer my question, thank you but I still am unsure of what factor leads to different distillate yields from the same API?

Greenbub,

Any crude blend is a mixture of many different types of hydrocarbon molecules (and other stuff), the API gravity is an average of that mixture.