A post by Ovi at peakoilbarrel

All of the oil (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM. After the production charts, an analysis of three EIA monthly reports that project future production is provided. The charts below are updated to September 2020 for the 10 largest US oil producing states.

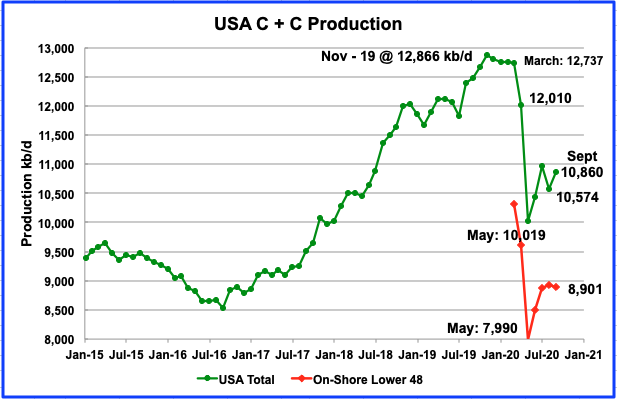

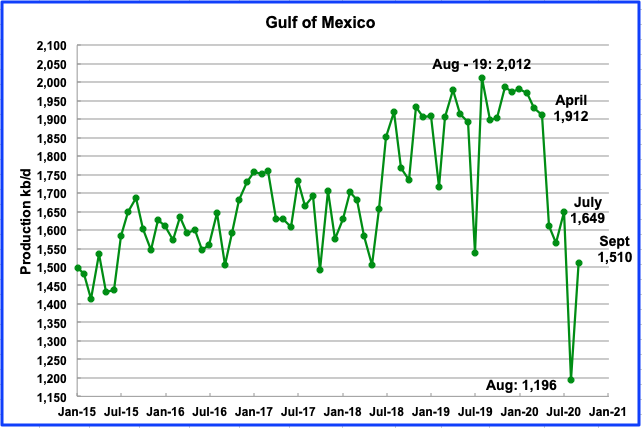

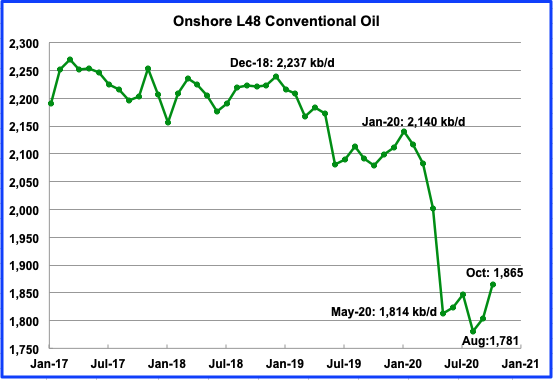

Septemberʼs US production increased by 286 kb/d to 10,860 kb/d from Augustʼs output of 10,574 kb/d. Septemberʼs increase was largely the result of the GOM coming back on line after being shut due to hurricanes. This can be seen in the September On-Shore L48 production graph which was essentially flat at 8,901 kb/d, actually down by 22 kb/d.

During July, August and September there were approximately 180 rigs operating in the On-Shore L48. It will be interesting to see how the addition of 60 rigs in October and November affects production in the On-Shore L48 states. (See next chart)

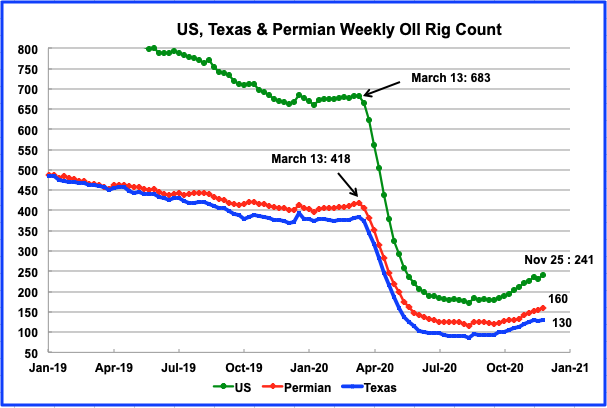

The US continued to add rigs in November. The rig count increased by 20 in November to 241 by the week of November 25. The rig count reached a low of 172 rigs in the week of August 14. Since then 69 rigs were put back into operation as the price of WTI increased from $36 at the end of October to $44 at the beginning of December.

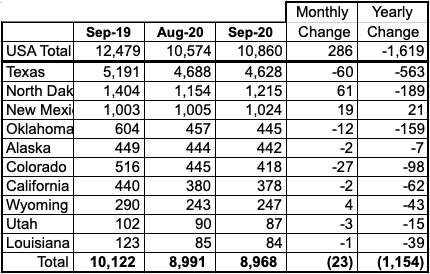

Listed above are the 10 states with production previously greater than 100 kb/d. Over the last few months, both Utah and Louisiana fell below 100 kb/d but are retained for consistency. These 10 accounted for 8,968 kb/d (85.1%) of US production out of a total production of 10,860 kb/d in September 2020. North Dakota had the largest MoM increase.

On an MoM basis September, US production increased by 286 kb/d while on a YOY basis production was down by 1,619 kb/d. If GOM were a state, its production of 1,510 kb/d would rank second after Texas.

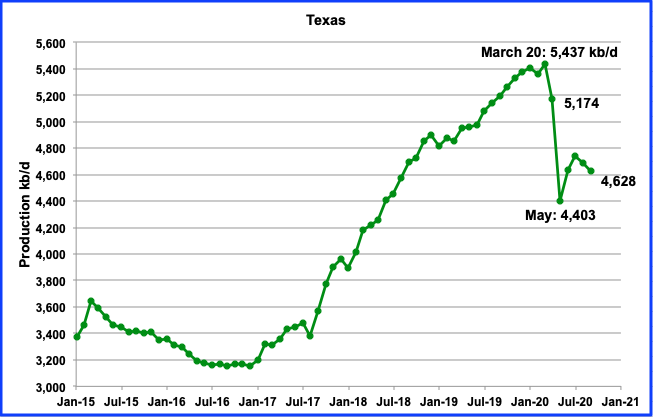

Texas production decreased by 60 kb/d in September to 4,628 kb/d. From the rig chart above, Texas rigs increased from a low of 90 in July to 130 in the week of November 25. During September, the number of oil rigs increased to 99. The increase in operational rigs has not been sufficient to overcome the decline in Texas LTO fields. Let’s see if the additional rigs increase production in October.

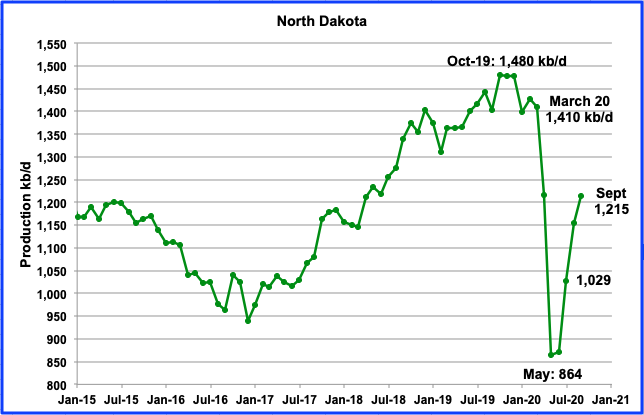

September’s output was 1,215 kb/d day, an increase of 61 kb/d over August. September’s output increase was almost 1/2 of the August increment. Since the production low in May, ND added 351 kb/d by September. During September, 9 rigs were operational.

Septemberʼs New Mexico production increased by 19 kb/d to 1,024 kb/d. New Mexico had 43 rigs operating during September. By the week of November 25, 57 rigs were operating.

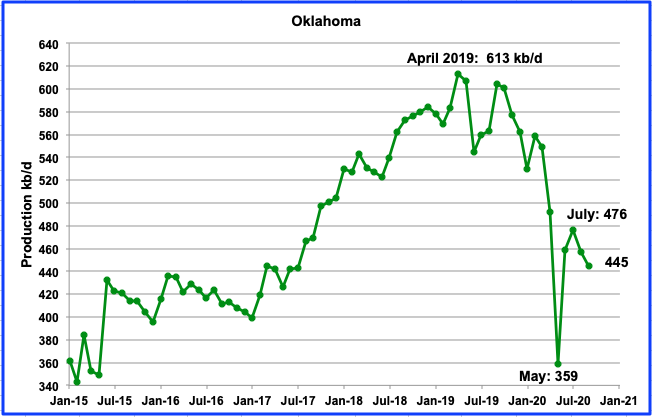

From a low of 359 kb/d in May, Oklahoma’s production rebounded in July to 476 kb/d. However August production dropped by 19 kb/d and September’s by 12 kb/d to 445 kb/d. During September 11 rigs were operating in Oklahoma. In January 2020, 50 oil rigs were in operation.

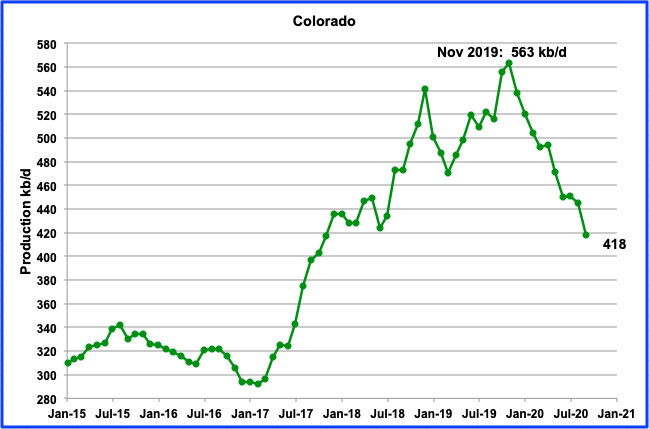

Coloradoʼs September’s output decreased by 27 kb/d to 418 kb/d. Coloradoʼs oil rig count dropped from 4 in September to 3 in October and then back to 4 in late November. In January, 18 were in operation. Colorado has entered a steady decline phase after reaching its peak in November 2019.

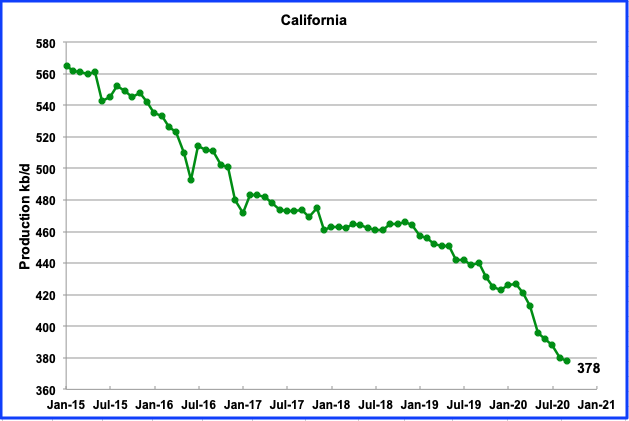

Californiaʼs slow output decline continued in September. September production dropped by 2 kb/d to 378 kb/d.

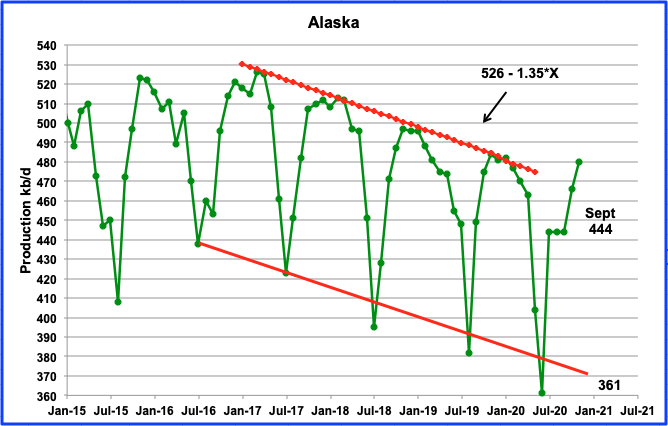

Alaskaʼs September output continued flat at 444 kb/d. Typically September shows an increase but not always. However this source reports October production to be 466 kb/d and this source indicates that November output will rise to close to 480 kb/d.

The October and November increases may be associated with the bringing on line of a new field which was announced in early 2020.

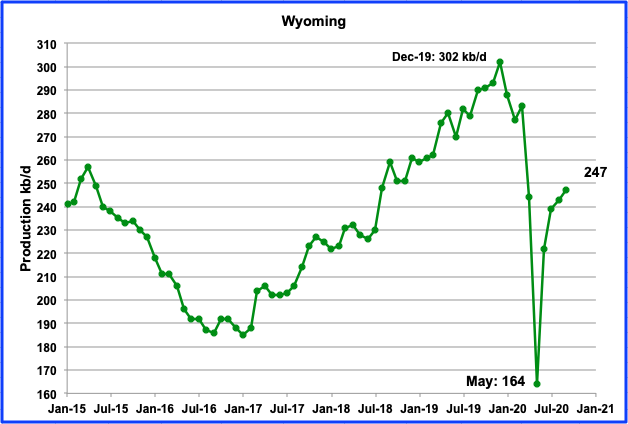

Wyomingʼs production in September increased by 4 kb/d to 247 kb/d. During the month of September, Wyoming had 1 operational oil rig.

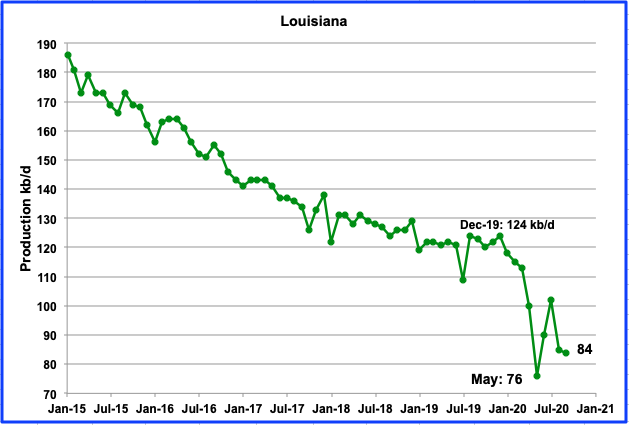

Louisianaʼs output dropped by 1 kb/d in September to 84 kb/d and appears to be in a steady slow decline. In January 2020, on average, 22 oil rigs were operating. During the week of October 30, 13 oil rigs were in operation, a decline of 1 since September.

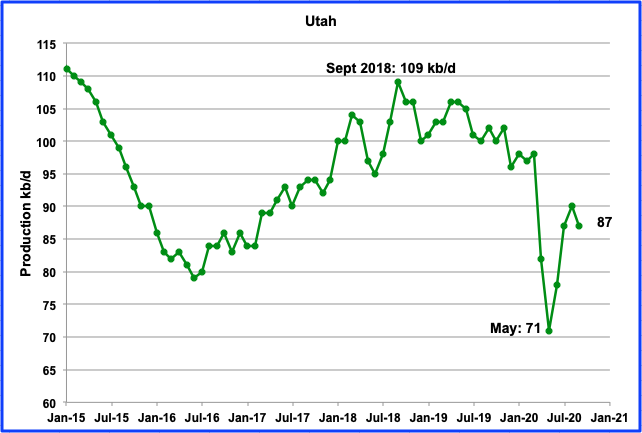

Utahʼs production bottomed in May 2020 at 71 kb/d and rebounded to 90 kb/d in August. September production dropped by 3 kb/d to 87 kb/d. Three oil rigs began operating in Utah in October. No Rigs were in operation from weeks 18 to 41. Week 41 is early October,

Production from the GOM fell to a new low of 1,196 kb/d in August , a drop of 453 kb/d due to hurricanes. September saw a rebound to 1,510 kb/d, an increase of 314 kb/d. If the GOM were a state, its production would rank second behind Texas.

UPDATING EIA’S THREE OIL GROWTH PROJECTIONS

1) DRILLING PRODUCTIVITY REPORT

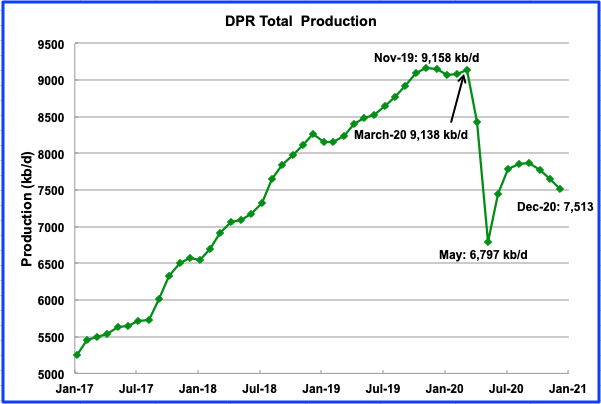

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the five principal tight oil regions. The charts are updated to December 2020.

Above is the total oil production from the 7 basins that the DPR tracks. Note that the DPR production includes both LTO oil and oil from conventional wells/fields.

According to the November DPR report, LTO oil and conventional oil output bottomed in May 2020 at 6,797 kb/d. The projected output for December 2020 is 7,513 kb/d, down 139 kb/d from November.

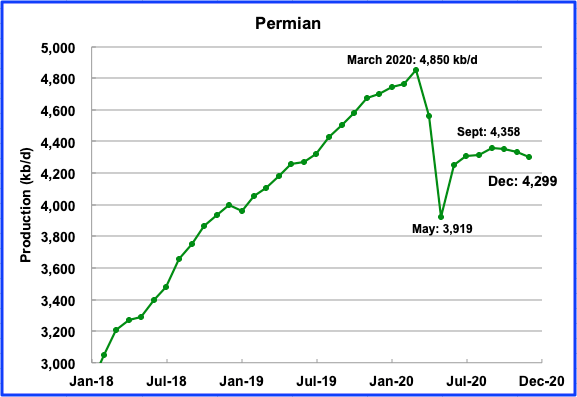

The contribution from three of the DPR/LTO basins is shown in the charts below.

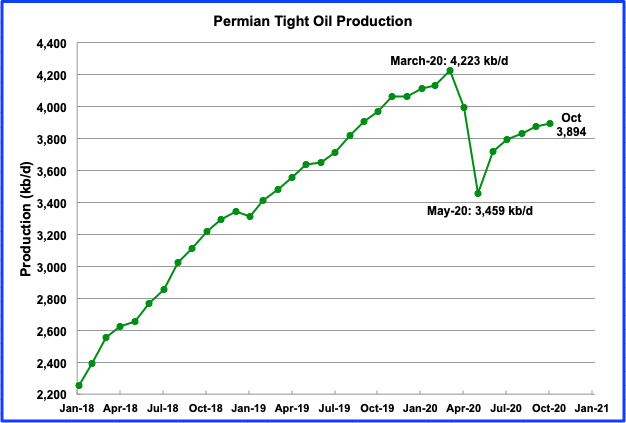

Permian output in December is projected to be 4,299 kb/d, down by 37 kb/d from November. Since the May low, the Permian has added 380 kb/d but output has rolled over since the current high in September. The source for the roll over is given in the next chart. Note that production began to drop in October even as oil rigs were added as shown in the rig chart above.

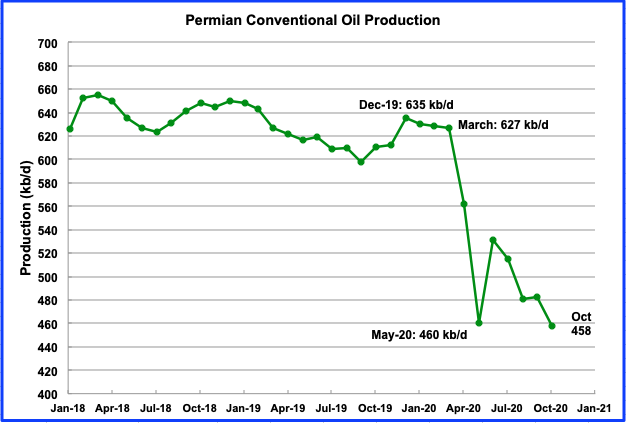

This chart shows the production of conventional oil in the Permian. It was obtained by taking the difference between the DPR and LTO reports. Since conventional production increased in June, it has been in a steady decline ever since. In October, production was down 25 kb/d from September and down by 169 kb/d from March. While in Section 2, Permian LTO output is shown to be increasing, the decline in conventional production results in an overall DPR decline starting in September 2020.

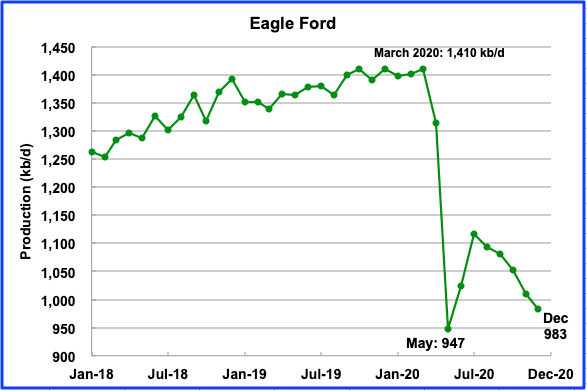

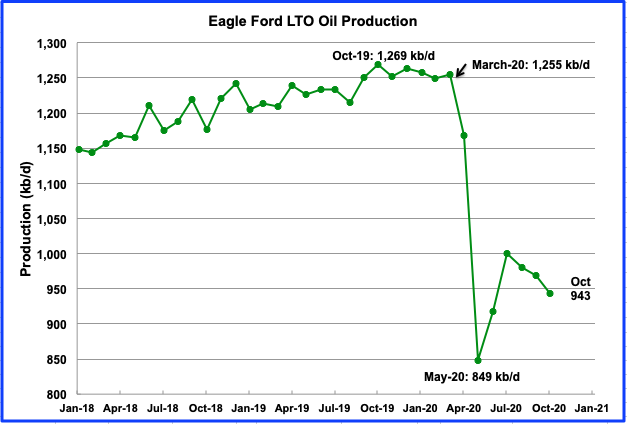

After bottoming in May, Eagle Fordʼs output reached a local peak in July and then began to roll over. In December, EF output is projected to drop by 27 kb/d to 983 kb/d.

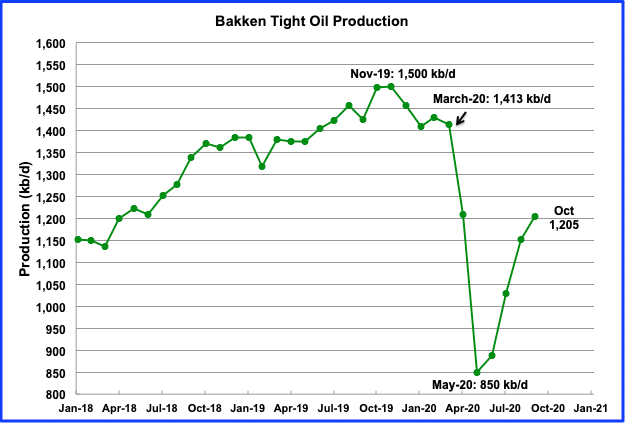

After the Bakkenʼs two big output drops in April and May, output began to bounce back in June. In December output is projected to be 1,133 kb/d a decrease of 33 kb/d from November.

2) LIGHT TIGHT OIL (LTO) REPORT

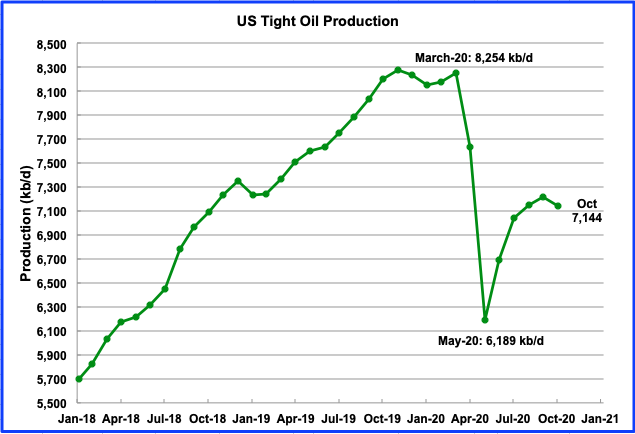

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The November report projects the tight oil production to October 2020.

Octoberʼs LTO output is expected to decrease by 70 kb/d to 7,144 kb/d from September’s 7,214 kb/d. Note that the November report has increased the September estimate from the October report by 67 kb/d, raising the September estimate from 7,147 kb/d to 7,214 kb/d.

Permian LTO output in October is projected to be 3,894 kb/d, an increase of 19 kb/d from September.

The Bakkenʼs October output is expected to be 1,205 kb/d, an increase of 51 kb/d from September.

The Eagle Ford basin is expected to produce 943 kb/d in October, a decrease of 26 kb/d from September. The number of operational drilling rigs in the EF has increased from 9 in September to 19 in November. In January 68 were operational. How many operational rigs are required to keep output from falling in the EF basin?

Conventional oil is expected to increase in the On-shore L48 to 1,865 kb/d in October. An increase of 61 kb/d from September.

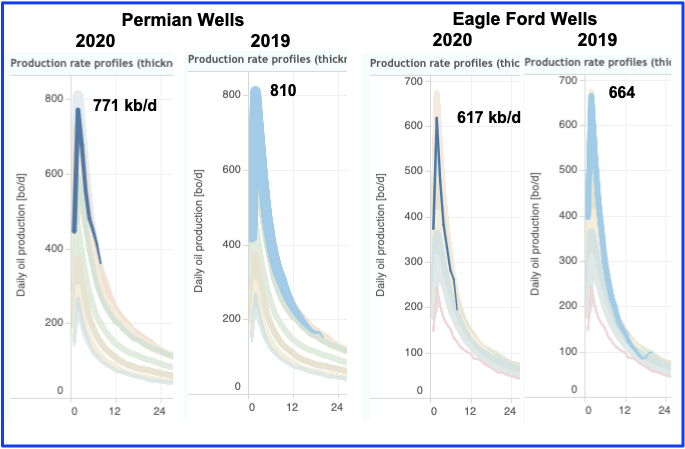

3) Have LTO Wells Peaked?

Another version the above question is: “Have the sweet spots in the Permian and EF been fully exploited?

The above graphic was created using charts from Shale Profile. The individual charts compare the peak production rates for the second month for wells in the Permian and EF for the years 2020 and 2019. In both cases the peak rates for 2020 are lower than 2019. The Permian and EF wells are down by 5% and 7% respectively. Actually, the average EF well peaked slightly higher at 673 kb/d in 2017 rather than the 664 kb/d shown. Shale Profile also shows that with current drilling rates holding steady, production going forward will continue to drop to a lower equilibrium level in these two basins.

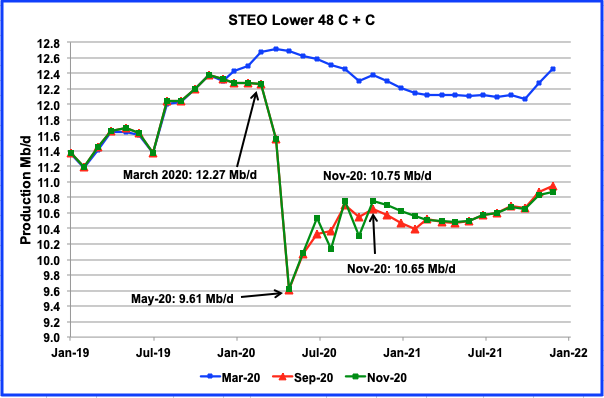

4) SHORT TERM ENERGY OUTLOOK (STEO)

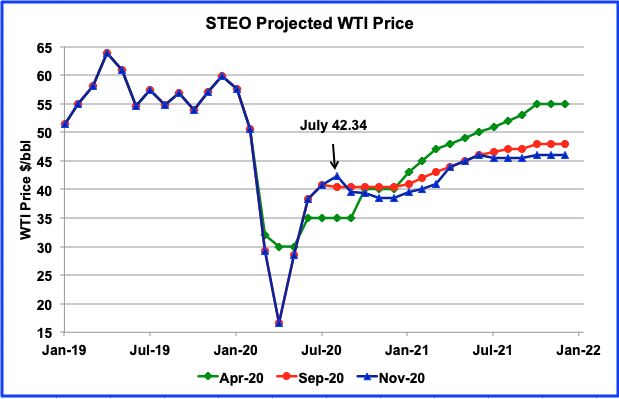

The STEO provides projections for the next 13 – 24 months for US C + C and NGPLs production. The November 2020 report presents EIAʼs updated oil output and price projections out to December 2021.

The November STEO report output projection for the L48 is very similar to the one that appeared in the October report, not shown. From November 2020 to February 2021, output is projected to be approximately 140 kb/d higher than was expected in the September report. Note that the November STEO is not projecting any meaningful output increase after November 2020.

The November STEO is projecting a WTI price below $40/bbl from November to February. However on October 30 December WTI futures contract settled at $35.79/bbl. Since then it has climbed to $44/bbl in Early December..

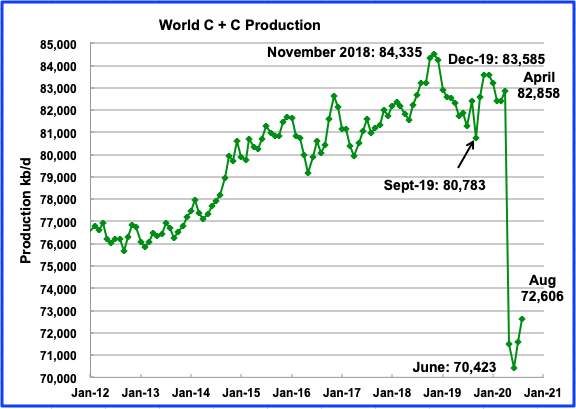

World Oil Production

World oil production reached its lowest level in June at 70,423 kb/d. August added 1,036 kb/d to reach 72,606 kb/d, which is 2,183 kb/d more than June. Of the 2,183 kb/d, 1,575kb/d came from OPEC and 607 kb/d from Non-OPEC.

Dennis , I told you so .

https://energy.economictimes.indiatimes.com/news/oil-and-gas/diesel-electricity-demand-slumps/79522054

https://edition.cnn.com/2020/12/01/asia/delhi-farmers-india-protests-intl-hnk/index.html

No , it is not hundred thousand , as I write it is a million plus . As Gerald Celente says ” When people have nothing to loose , they loose it ” .

Less than 10% drop in diesel consumption as well as total electrical production/consumption, in India since before Covid.

Doesn’t sound like the end of the world. They will be back to prior trend before long, barring a new ‘event’.

Hickory , you know nothing about nothing . See this video . I have repeatedly said ” If it’s not happening to you ,don’t think it’s not happening ” . The gentleman being interviewed was the numero uno at the statistics dept of the govt . Above him was the Prime Minister . Period . I think you did not click on my second link .

By the way , how would you like if I drew 10% of your life blood ? You are dead , my dear friend . All on this blog know ” Energy is the economy ”

https://www.youtube.com/watch?v=2PGa1E-7EGc&ab_channel=TheWire

You’re flat out wrong. Energy is not the economy.

Alimbiquated , my dear friend then what is ?Please what is , amplify .

The economy is accumulated knowledge, combined with accumulated physical capital (equipment, infrastructure, etc) and physical resources (sun, air, metals, biosphere, minerals, etc., etc., etc).

The Romans in Londinium 2,000 years ago were sitting on a lot of coal. Russia, the Aztecs, locations like Venezuela and Iraq: they all had oil. But they didn’t know how to use it. And now we have access to 100,000 terawatts of sunlight, because we know how to use it.

Knowledge (accumulated intellectual capital) is the key.

The last century or two have seen a massive increase in energy consumption and economic activity, which has led some to believe they are fundamentally related. Economists have always disagreed.

Anyway in recent decades there has been a “decoupling” of economic activity and energy consumption. Put another way, we are getting much more energy efficient.

And, as Nick points out, we now have much simpler ways of getting energy than we used to. That’s actually a separate point, but for the energy industry it is very important.

I would say that the accumulated knowledge (human capital) and physical capital that exists today is the result of energy consumption, not a separate resource that drives the economy. Without the energy provided by the fossil fuel revolution, there would be no universities to provide the knowledge or factories to produce the goods. Before humans understood how to use fossil fuels to drive machinery, fossil fuels were relatively unimportant compared to the energy provided by sun to grow crops and trees which provided the vast majority of energy used by humans. That’s why it made sense to wage wars to capture land. I don’t see how energy is not the economy. I think it always has been and always will be.

As usual the cornucopians are incorrect and provide no references for their outlandish claims about decoupling. In 2016, the International Resource Panel published a report indicating that “global material productivity has declined since about the year 2000 and the global economy now needs more materials per unit of GDP than it did at the turn of the century” as a result of shifts in production from high-income to middle-income countries. That is to say, the growth of material flows has been stronger than the growth of gross domestic product. This is the opposite of decoupling, a situation that some people call overcoupling.

https://www.resourcepanel.org/reports/global-material-flows-and-resource-productivity-database-link

It seems to me that the cornucopians often fail to think globally- just like Cold Blob Bob. To support their decoupling hypothesis they’ll likely cite some data that pertains to the American economy only. Weak tea, as usual.

Unsure I want the likes of Bill Gates, Prince Charles, Nick G, Klaus Schwab and/or other similar kinds of imposed government-corporate ‘leaders’ and their ‘shills/drones’ telling us how we’re to ruin our lives.

The historical and current results from that sort of thing speak for themselves.

Thank you for this great video. Possibly the best explanation I have heard regarding the meaning of GDP. Fascinating that India’s small GDP growth was due to increased profits derived from massive layoffs and drawn down of stocks. The industrial production numbers show a very different picture. Truly shows how deceptive GDP can be.

Jesus. Are we witnessing people peddle the decoupling and “economy isn’t energy usage” bollocks? I thought this blog had moved past aping neoliberal economist talking points.

Yes, I guess energy was never really that important for any organism, really. And sure, we can arbitrarily increase efficiency forever too.

No, you can’t improve efficiency forever, but current tech and economy are far from perfect.

Energy isn’t the only thing important for an organism. An organism also requires mater, for example certain elements like sodium for communitaion of nerve signal, calcium for building bones etc. And organisms require a huge amount of information, not only genetic information but also a huge about of structural information from the level of protein folding, up through cells structure, tissues, organs and at the organism level where there is a constant flood of communication via hormones. So energy is something, but not everything.

Be that as it may, this isn’t about political ideology. It’s the result of a sober look at technology trends.

you can’t improve efficiency forever

That’s true in some abstract, taking-things-to-the-limit way. But in a practical, tangible sense you pretty much can: you can improve efficiency to the point where the problematic input becomes unimportant.

For instance, relatively simple calculations for military ballistic trajectories required a room-sized computer in WWII. This computer, built with mechanical relays, used an enormous amount of power. Fifty years later, after 50 years of continuous improvement in computational power and energy efficiency, a hand-held calculator could do the same work, and it could run on the power it generated with a small photovoltaic strip. As a practical matter, running as it did on ambient sunlight energy, it’s power was no longer something that required any thought at all.

Similarly, the work required to produce food in the US has declined continuously for the last 200 years. It used to be that 90% of people worked on the farm. Now it’s less than 1%, and almost all of the cost of food in the US is from processing that happens after the food leaves the farm. Basic food commodities (flour, sugar, salt, etc) are extraordinarily cheap and obesity is a far larger health threat than starvation. And labor productivity on farms continues to grow.

The same thing is happening with manufacturing. Every year manufacturing engineers reduce the work required to make stuff by 2-5%, year in and year out. Even Chinese workers are being displaced by automation, and factories are becoming quieter and quieter as there are fewer and fewer people in them (“light-out”, it’s called). We’re getting to the point where stuff is so cheap that transportation and supply-chain costs are getting to be more important than the factory costs, leading to the importance of companies like Walmart and Amazon, which aggressively work to make those things cheaper.

You might think that electric motors can’t improve efficiency much in an EV. The answer to that is that motors are a small part of an overall system. More significantly, the more important measure of efficiency is the power that a vehicle requires to move, before any consideration of the drive train: that comes from aerodynamics, drive train losses, suspension/tire losses, etc..

On a practical level, US cars only get about 23MPG overall. That can be improved to 46MPG without much practical difficulty, and again to 92MPG and then 186MPG, if you count only liquid fuel inputs for a plugin hybrid like the Chevy Volt.

On a theoretical level: cars have already been developed that are efficient enough to run solely on solar power. The latest version of the Aptera ( https://www.aptera.us/ ) is a good illustration of what can be done. Like the solar-powered calculator, at that point the problem becomes unimportant.

Passiv-Haus is another example: insulation improves to the point you don’t need a furnace for heating.

No, as a practical matter efficiency can keep improving forever, until you go so far that you just don’t need to improve that thing any more, and you move on to the next thing.

“Exxon faces $20 billion hit from ‘epic failure’ of a decade ago”

On Exxon, the XTO shale purchase didn’t pan out well, to put it mildly.

Nat gas peaked at over $15/Mbtu in 2005, and now is around $3.

‘As recently as 2012, Exxon was the world’s most valuable company. But today it is valued at just $161 billion — smaller than T-Mobile US (TMUS), AbbVie (ABBV), Nike (NKE) or Adobe (ADBE). ‘

https://www.cnn.com/2020/12/01/business/exxon-oil-gas-writedown/index.html

I do feel sorry for those trying to make business decisions in this crazy fuel market.

You’ve got to hedge your hedges.

For Permian basin well quality, the more important measure is cumulative output for the average well, the 2020 wells (and it is a bit early to really make this judgement for 2020) look similar to 2019 wells at 6 months (both with cumulative output of about 103 kbo), both 2019 and 2020 wells are higher than the 2018 average well at 6 months (94 kbo). Chart from shaleprofile for Permian basin well quality (2019 and 2020), edited to show only cumulative output.

For Eagle Ford there has been deterioration in 2020 with 6 month cumulative at 75 kbo vs 2019 wells at 82 kbo and 2018 average wells at 81 kbo.

Dennis

I wasn’t calling the peak but merely indicting that we are close or at the peak. EF is clear and Permian is debatable. I looked at the cumulative data for the Permian and there is not much hint of improvement in 2020 vs 2019. The EF looks a little more clear in that the 2020 cumulative production is definitely behind 2018.

I wonder whether the laterals for 2020 are longer than 2018. If they are then the LTO wells have peaked.

Chart for well design blue line is Permian, violet is niobrara, green is williston, and orange is eagle ford. I agree Permian is at peak and might be beyond if lateral length has continued to increase, agree also that Eagle Ford is past peak for well productivity per lateral foot. Click on chart for slightly clearer view.

Dennis

Thanks for the info on lateral length. I guess the drilling machines just get more powerful.

I wonder how the costs keep going up as they add proppants and how it affect the break even price.

Ovi,

My guess is that an optimum length will be determined and average lateral length will level off, similarly with proppants, there is some operational optimum level, at that point real well costs level off or even drop as technical advances occur. Consider electric fraccing fleets at link below.

https://pubs.spe.org/en/jpt/jpt-article-detail/?art=7034

At the start of the year, there were about 290 active fleets of all flavors spread across the country, according to figures from Primary Vision. The firm, which publishes the US frac count weekly, estimates the active number was down to 47 at the end of last week—15 of which are believed to be e-fleets.

“It’s amazing that [e-fleets] accounted for roughly 3% of the market about 2 months ago and now they’re potentially about 30%,” said Matt Johnson, the president and chief executive of Primary Vision.

Note that it will take some time for the electric fracking fleets to replace the diesel fleet, probably 10 years or more. If we assume the electric fleets have remained at 15 then at current frac count (around 130) the percentage has fallen to 11% as of Nov. I don’t know if the e-fleet number has remained at 15 (the estimate in May 2020), that’s a guess.

The e-fleets are actually gas-electric hybrids, if I understand correctly. But where are they getting the gas from?

Alimbiquated,

In the Permian basin there is a lot of excess natural gas being flared, I imagine they can get the gas from nearby sites at close to zero cost.

The sites that are flaring NG would be the straightforward candidates for e-fleets.

Dennis

Thanks for the info on lateral length. I guess the drilling machines just get more powerful.

I wonder how the costs keep going up as they add proppants and how it affect the break even price.

Ovi , first let me thank you for the effort you put . Greatly appreciated as is of DC . Now to the truth . Shale was and is a Ponzi . So lateral length , proppants , etc are interesting only from a technical aspect . Better tech does not mean lower cost . Perhaps it only means faster extraction . As they say ” Putting lipstick on the pig ,is not going to win the Miss Universe contest ” .

P.S : Maybe the pig could win since Trump was the sponsored of the Miss Universe . 🙂

Chart from Enno Peters Oil Insights Report from Oct 15, 2020.

See https://shaleprofile.com/blog/us-monthly-update/us-update-through-august-2020/

left side of web page there is a link to download the report.

Again click on chart for larger view.

BY ”Williston”, you mean ”Bakken”?

Jean-Francois,

Yes, Enno Peters uses Williston Basin to refer to Bakken/Three Forks (as does Baker Hughes and many others).

“From a low of 359 kb/d in May, Oklahoma’s production rebounded in July to 476 kb/d. However August production dropped by 19 kb/d and September’s by 12 kb/d to 445 kb/d. During September 11 rigs were operating in Oklahoma. In January 2020, 50 oil rigs were in operation.”

Surely this represents drilling efficiency. Less rigs for comparable output with those stood down. Capacity is 523,000 in Oklahoma.

HUME , you said “Capacity is 523,000 in Oklahoma ” . Least important . The world is consuming +/- 90 millions barrels per day . Please don’t take it as offensive but ” It is like trying to make the swimming pool salty by pissing in it .” .

It represents a ” talking point ” , in the big picture it does not even make a blip on the graph .

Hole in Head

I was only trying to make the point 11 oil rigs appeared to be doing near enough the same work as 50 oil rigs in Oklahoma.

I agree with the point you’re making. Even the “energy is the economy” statement you made earlier. The response to your post where the Roman empire was given as an example of an economy without hydrocarbons belies the fact there wasn’t a global population of 7.8 billion people dependent on energy for their existence.

That Roman Empire comment was so ridiculously dumb, I had to check myself. It’s easily up there with “Titan has oceans of hydrocarbons, so let’s keep on consuming wantonly” stuff I heard years back.

Please. Someone go and get these people an ecology textbook.

Hume

I think the pop in production in June was due to oil wells that were shut in April/May due to low oil prices being brought back on line. See link.

“Oklahoma last month adopted an emergency order that said some oil production could be considered economic waste. That allowed operators to opt to shut wells without losing valuable leases.”

https://www.reuters.com/article/us-usa-oil-oklahoma/oklahoma-regulators-take-no-action-after-oil-output-hearing-idUSKBN22N27O

Oklahoma likely has more stripper wells than any State besides Texas.

A lot of the lost production in OK likely was shut-in stripper well production when the price went negative.

I sat in on two NSWA conference calls at that time. A lot of the participants were from OK and most reported significant shut in production.

My guess is much of that has been restored.

SS,

Some investors have net arrangements, where the operator allocates revenue and costs and send a check for the net amount. If the well is shut in, then the net is negative. How long will the operator typically continue this without payment for expenses?

Depends on the operating agreement. Also depends on state law.

Okay, what if it’s in Oklahoma, and the well was drilled in the 50’s and has changed hands so many times since that the operating agreement has been lost?

We don’t have operations in OK.

Sounds like you need to speak with a good Oil & Gas attorney in OK.

Looks like Art Berman has a pretty pessimistic FORECAST for U.S. Oil Production over the next year.

steve

Apparently the Buda play will save the day Steve.

What’s that little uptick at or after September 2021 in the second graph? Are they trying to be cute?

Unsure this was posted already, but Chris Martenson has a video panel with Art, Gail Tverberg and Richard Heinberg. (Gail’s foggy screen image improves shortly.)

Among the first things that Chris says, BTW, is ‘Energy is the economy’.

Food prices are on the rise: http://www.fao.org/worldfoodsituation/foodpricesindex/en/

https://economicsfromthetopdown.com/2020/12/03/as-we-exhaust-our-oil-it-will-get-cheaper-but-less-affordable/

above is a link to a good article

here is the conclusion, but you should read the whole article to see how he get to the conclusion.

“But she doesn’t think prices will fall because of resource abundance. She’s a Malthusian much like Paul Ehrlich. Instead, Tverberg thinks we’re headed for a world where oil is scarce yet cheap.

To many people, such a future makes little sense. But that’s because we can’t imagine a world in which incomes collapse. But Tverberg can. And so I propose a hypothetical bet for the future: Ehrlich vs. Tverberg. Both scientists assume that oil will get more scarce. But in the Ehrlich scenario, oil prices explode. In the Tverberg scenario, oil prices collapse.

I once thought that the Ehrlich scenario was all but guaranteed. But today, my money’s on Tverberg. In the future, oil will be scarce and unaffordable. But I think it will also be cheap.”

Yes, he holds pretty much the same view as tim morgan (https://surplusenergyeconomics.wordpress.com).

Well, Jim, can you put the argument of this article in your own words? This is an important test. If the article makes sense to you, and you understand the assumptions and logic, then you should be able to put it in your own words.

Here are my words that Fix’s data supports: Peak oil is a low price phenomenon not a high price phenomenon. Peak oil is about extraction costs rising faster than market prices.

There are two ways for oil to become less affordable: prices can rise, or salaries can fall. Some of us think the second alternative will be the dominant economic phenomenon.

“ways for oil to become less affordable: prices can rise, or salaries can fall.”

Many people seem to have the notion that less and less people in the world can afford oil.

This is a view that is easy to entertain if you live in one of the areas of the world that is past its peak prosperity- is now getting older and lost the competitive advantages of the past century. It is not unusual for people here to express the view that this is the dominant global theme.

It is not. Maybe someday but not the last decade or the next one.

In fact, quite the opposite.

Never has there been such a huge middle class, or such a huge percentage of those in the middle class or higher.

And all of these people are getting an incredible bargain on the purchase of petrol.

Compare what it would cost to replace the work of motors/engines with manual labor.

To get a quick sense of the vast growth in the numbers of the global middle class (and above), check out Trend #3 in this article-

https://www.visualcapitalist.com/5-undeniable-long-term-trends-shaping-societys-future/

Sadly, the article cheats.

The author claims that oil prices have not risen: that over a long historical period, that oil prices are flat at around $40. He comes to this conclusion by including the very latest prices, which are artificially low due to Covid.

He then calculates an affordability index by dividing per capita GDP by the price of oil. He shows a chart that has a curve fitted to the data, and the curve shows a recent decline. Well…if the price of oil is flat, then this could only happen if per capita GDP has declined lately. And, except for the artificial (not oil related) impact of the Covid recession, it hasn’t. Why is the chart wrong? Well, either it includes a large temporary impact from Covid, or it does not include the latest oil prices, as the first chart did.

So. Do both oil prices and GDP go down during a recession? Sure. Is that useful for long-term projections. Not likely: both oil prices and GDP will rise again. If oil is unaffordable, it will be due to high oil prices. If the author thinks that Covid will cause a permanent recession, he has to make a case for that.

A deceptive analysis.

Schinzy,

I guess the question is: why should salaries fall? Especially, why would peak oil cause salaries to fall, if oil prices don’t rise? In fact, how would consumers even know that oil had peaked, if prices didn’t rise? What would change? If drivers, shippers, container ship operators and other consumers of oil don’t see a higher price, how would Peak Oil affect them? They’d just keep on buying as much oil as they needed, and life would go on…

Low salaries are typical of economic stagflation and contraction. See http://peterturchin.com/secular-cycles/ which is what peak oil will bring.

I believe peak profitable oil was in 2014.

Cost share matters a lot more than price. When the cost share of oil increases, people find ways of getting by with less oil.

There are a lot of ways people can use less oil. I am 65 years old. I started commuting by bicycle at the age of 10. A bicycle has been my main transportation since then (other than 2 bad years on a mopehead). Before the pandemic I was riding 3000 to 4000 Km/year. I am a French resident and don’t have a French drivers license. Median car trip distance in the U.S. is 4 miles (https://nhts.ornl.gov/vehicle-trips). Lots of these car trips could be replaced by bicycles at 1/6 the cost. Hybrid electric bicycles are making bicycles attractive to a much wider public. Hub generators for headlights have completely changed my life. My biggest bicycle expense used to be buying new lights (I live in the countryside and do a lot of night riding).

We heat with wood (masonry wood burners) and every year I implement an insulation project.

Our prediction is that Jevon’s paradox goes into reverse once we get past peak oil: in the growth phase of oil extraction the business is profitable and increased efficiency raises prices, in the contraction phase we predict increased efficiency will lower prices and business will be bad.

Schinzy,

You’re not hearing me. Why would Peak Oil be important if oil prices don’t rise? Why would the economy stagnate in a PO scenario if everyone still has cheap oil available? Presumably Peak Oil means limited supplies: how do consumers find out supplies are limited? Shortages? Why wouldn’t shortages mean that prices go up, as consumers bid up the price in order to get what they need?

—————-

On a separate note about Turchin, please note:

“ Peter Turchin and Sergey Nefedov explore the dynamics and causal connections between such demographic, economic, and political variables in agrarian societies…”

That makes all the difference. Agrarian societies have extremely low rates of growth, so empires and other fast growing and complex societies can only exist in the short term until they burn out, and are replaced by someone else.

Analysis of agrarian societies isn’t useful for understanding modern civilization.

Hey, Schinzy, you’re not hearing Nick!

Let us help you:

For the awesome knowledge of ?Nick?, that makes others’ pale by comparison and/or irrelevant (as the case may be), see here, and here to which we can add these more recent two:

One of my faves:

@Nick

Let me remind you that if your theory is not supported by empirical evidence, it’s wrong. And it doesn’t matter how smart you are or how beautiful the theory is.

You are asserting that scarcity is characterized by high prices. All I need is one empirical example in which scarcity is not characterized by high prices, and your assertion is wrong.

Here is one example: there is a fuel scarcity in Venezuela and yet gasoline in Venezuela is the cheapest in the world (see https://www.globalpetrolprices.com/gasoline_prices/).

There are many other examples. The homeless population of Los Angeles suffers from scarcity of all kinds of things that are relatively cheap.

In our recently published article ( https://www.springer.com/journal/41247) we argue that modern finance actually accentuates the economic phenomena observed in agrarian societies by Turchin and Nefedov. For example modern finance has increased wealth inequality in these times of stagflation.

I used to believe the law of supply and demand actually said something. It doesn’t. It fails the vagueness test. A law which is always satisfied doesn’t really say anything and no conclusions should be drawn from it.

Schinzy,

The “law” of supply and demand tends to be satisfied in perfectly competitive free markets. Most examples you cite do not meet that standard. It is fairly standard for there to be cheap prices and scarcity when prices are held at artificially low levels, this is often the case in planned economies where government fixes prices and quantities without regard for consumer demand so people wait in line for products that are scarce and then sell them on the black market, not a particularly efficient system.

What Dennis said.

A law which is always satisfied doesn’t really say anything

Oh, be serious. Who said that scarcity always means high prices, as if it was a law of physics? Of course Venezuela can set the price of petrol to 2 cents (far less than it costs to produce). On the other hand, try actually buying it for that price! You will be able to actually buy very, very little.

Look at the real world. If the supply of oil were to fall below what suppliers & consumers wanted and needed, they’d go to the “fungible” world market and they’d pay more. Prices would rise. That’s what happened in 1973, 1979, 1990, 2005, and 2012.

You need to present a credible reason why it wouldn’t happen again.

One more time: if Peak Oil happens, and it’s real, then what does it mean? It means that there’s less oil than consumers want and need. So, what will happen? Prices will rise, of course. Why wouldn’t they???

@ Dennis

If you look carefully, you will see that the law of supply and demand is defined in such a way that it is always satisfied, free market or not. There is no data that can refute the law of supply and demand. My contention is that because no data can refute the law of supply and demand, it is meaningless. One can make no inference from the law of supply and demand. In particular one cannot infer that scarcity is always characterized by high prices. All this nonsense about free markets is useless. What is important is to understand what drives markets in the real economy. Free markets is mostly a religious phenomenon.

@ Nick

Wealth inequality (which is rising, see Piketty’s books, actually his data can be accessed via his webpage) is why scarcity does not have to be characterized by high prices. If the people experiencing the scarcity have no money, they are not able to bid up prices. But your comment implicitly makes another unfounded assumption: that peak oil signifies scarcity. It does not. It means that oil extraction begins to fall. It does not imply scarcity because we waste so much oil. If oil were scarce, we would only use it when absolutely necessary, but if you look around, you see people using oil when they really don’t have to, because oil is cheap. That is why I contend that peak oil is a low price phenomenon. It is about extraction costs rising faster than market prices.

Purchasing Power?

I thought it was common knowledge that incomes in some areas have more or less stagnated since the eighties. Presumably, wages in other areas have followed suit since then, as the middle class ostensibly gets/has gotten gutted. If so, then even if products and services prices don’t/didn’t go up much, the stagnating incomes, relatively-speaking, would ‘fall’.

I also thought that, being at The Oil Drum as well, we would have at least some sense that currency is a claim on energy.

Lastly, increasing government debt may affect income as well.

There is no requirement that things make economic sense. There’s no reason why scare oil has to price higher.

We’ve seen negative interest rates for years. We saw negatively priced oil.

These are real events. This is not idle musing and speculation. These things happened.

Why would we think that scare oil cannot be priced low.

Not for long – the negative price was an overshoot on the future market.

When oil is scare, prices will get high. Because contracts can’t be fulfilled, so the highest bid will get the stuff. Iraqu won’t sell the oil as a charity run.

When no one can pay the high prices – then oil isn’t scare. Then there will be enough of it to fill all orders. And prices can fall.

Even when you have an all electric car and truck scenario: There will be only a small production left, but small demand. Even here, a low price has to pay the costs, otherwise the stuff will stay in the ground (in the long run). Even a state company can’t pump forever if it isn’t payed (think Venezuela). Prices tend to be low then because most production will come from strippers with no more drilling costs attached. Even here you can see: Shale and others will switch off the pumps when the price is too low. As done this year.

I think it will be a pork cycle, as in many commodities. Investment will go up and down, and since price sensivity and investment are on different time scales, prices always will behave strange so you can’t see a direct dependency between price, production and demand. You have a lot of chaotic movement here, especially with traders working on the short time scale, too (hello HHH 😉 ).

So to call: Consumer cycle time cars for round about 12 years (deciding pickup truck or small car), planes > 10 years, too. Retiring gas guzzlers in a high price enviroment a few months.

Fracking 1 year, conventional 3 years, deep sea 3-5 years, or creating a complete new frontier 10 years.

Additional politics, switching off or on oil producing countries in a few days to years rendering all planning to void. Imagine a landslide green victory in Canada – poof 4mb/d gone. Not impossible.

It’s no wonder there is no direct correlation between price and production with that many factors if you just plot price against demand gain or something like this.

But low prices and scare ressources for longer time are only possible in socialism: In Rumania gas for cars was very difficult to get, but it was dirt cheap. Only few had cars, but even for the state companies it was difficult to get the gas they needed – at least without corruption. So the real price was corruption.

I am a living example of how low prices and scarce fossil fuels can go together. Yesterday, the regulator hurdles were cleared (after three months since solar panel installation) and the panel power was turned on. The price of electrical heat for me is less than the price of propane delivered. Now the propane is a backup fuel. If there are enough families like me, propane usage will drop like a rock even as propane stocks dwindle.

Your example:

When the price is low enough, and demand low, local trade companies will rotate propane out of stock – or close their doors forever when propane was their business.

Then you’ll have to mail order it and pay high transport costs when you want to refill your bottles (no tank filling anymore), making it an expensive backup fuel.

Low demand = high prices, since economy of scale collapses after some time.

In 50 years then you’ll buy gas again at the drugstore, for drugstore prices, as during the first Mercedes Benz ride.

No more pipelines, it has to be transported by trucks on land. No more big tankers, it has to be transported in special secured containers on a container freighter with dangerous goods insurance.

So oil will cost 200$ / barrel + – and most will get to handling and transporting.

Just spinning this scenario.

We’ve seen negatively priced gas being flared off for generations. We also see negatively priced plastic being carted off at great expense to landfills.

When the Khmer Rouge were chasing everyone out of Phnom Pen, the traffic jams made cars useless. People were willing to trade a Mercedes limousine for a bicycle.

The idea that things have “intrinsic” value — somehow related to the cost of creating or extracting them — is simply wrong. Marxists believe it, which is why you used to see piles of rusting steel on the outskirts of Eastern European cities, but no toilet paper in the stores. Planners believed that steel was “more valuable” than toilet paper.

Spending lots of resources making something does not make the product valuable. Howard Hughes spent vast sums building the Spruce Goose, the biggest airplane ever built, but it was worthless and never flew.

In a drought, water has a positive value. In a flood, negative value. Water has no intrinsic value. Neither does oil.

Alimnbiquated , a very thought provoking post . I have read it 2-3 times and still digesting it . Never thought about things this way . Intelligent .

Alimbiquated,

Regardless of drought or flood, water has an intrinsic value to all life on earth.

Put a gun to a man’s head and all his possessions are worthless to him in that moment.

Value is determined by scarcity. The innate property of a resource can also give it value.

97 per cent of all water on this planet would kill a person if they were to consume it. Only 3 per cent is eligible for drinking.

The Marxist philosophy of a centrally planned economy led to shortages of toilet paper. Marxism when practiced, values nothing. Not even life.

Poisoning The Well As Modus Operandi

Value is determined in one’s head.

Thus, if one is ‘psychopathic’, will their ‘values’, if they have any, necessarily align with scarcity? Ok, now extend that individual example to a society: What would a sociopathic society ‘value’, and how would it operate?

Like this one?

Is Anything Real?

It’s often, if not always, about context, which I keep mentioning…

So then how does this sort of global ‘quasiculture/pseudoeconomy’ roll out so-called renewable energy, or as Tim Watkins puts it, ‘non-renewable renewable energy-harvesting technologies’ (!), and might it manifest along similar lines as your mentioned traffic jams?

Why wouldn’t it?

Child Is My Name by Kemopetrol

Jim,

I started reading the link and then realised the only way the premise could reach the stated conclusion was if the specific commodity were priced in a depreciating currency relative to gold.

Whereby the commodity would be considered inexpensive if it were brought with gold.

Omitting The Fine Print

‘Cheap’ is relative: If it’s unaffordable, then it’s too expensive.

If you need food to get food, that makes food different from, say, a can-opener.

Food powers the ability to get food and that can be a problem when food becomes increasingly scarce and/or poorer in nutrition/calories and/or difficult to obtain.

It seems a little (or a lot) like a snake eating its tail– an image and comment, incidentally, which I’ve posted hereon some years ago when we were talking about this sort of thing.

Can you use a can-opener for food? Maybe, since matter is energy. But the issue then becomes one of modifying our bodies and the can opener. Easy-peasy, right?

Some people like to tell us such things like there are huge amounts of sunlight energy hitting the planet while chronically omitting that kind of fine print.

BTW, Gail seems quite willing to learn, such as from her blog’s readership, rather than,say, doubling down on some convictions, despite evidence to the contrary (while rationalizing it away in fits of denial and delusion, etc.). And if so, this is where Gail may have an advantage and why I keep tabs on her blog. Speaking of which…

Humans Left Sustainability Behind as Hunter-Gatherers

Tverberg is pretty simple minded in my estimation, but she has a product, a brand, and she knows how to sell it to her followers.

Now about cheap oil…….

I simply can’t even imagine a scenario where by I will park my tractors and trucks and go back to horses and mules…… even if diesel fuel is twenty bucks a gallon in present day money…….. unless maybe I can replace these machines with affordable electrically powered machines.

I can do more work in a day with one worn out fifty year old tractor with ten gallons of diesel that three men with teams of two horses each can even contemplate doing, and two hundred bucks isn’t going to go very far when paying three men, raising and training six horses, and feeding them EVERY day of the year……. when that tractor uses ZERO fuel on days it’s not used.

Oil might conceivably get cheap because we develop substitute technologies, but as it gets to be less plentiful, the price of it will go orbital as we use less for trivial purposes and more for essential work.

We sure as hell aren’t going to transport food from the bread baskets of the world to the megacities using horses and wagons. Wood and coal fired trains, maybe. Wind and solar powered trains, yes. Wind and solar powered trucks, yes again.

Under the, “did you know” category.

Oman uses quite a bit of solar energy to heat water which is used recover oil in EOR steam operations.

From what I can see, Oman has about 8,000 producing/injecting wells, has at times produced over 1 million barrels a day, but is now producing a little over 700,000 barrels per day.

From what I can tell, Oman has some of the highest operating costs in the Middle East.

Hopefully I am not posting information that is already widely known here.

It would be interesting to know how much solar and wind power is used to produce oil around the world. I bet a decent percentage of US oil is produced by wind generated electricity.

Well, Texas got about 18% of it’s power from wind last year. Texas wind power is disproportionately located in West Texas, as is oil production, so you have to figure that wind is powering a lot of that oil production.

Solar power is easy to locate in remote locations, and it’s a lot cheaper than diesel generation, so it works nicely to reduce diesel costs for pumping, etc.

I have the impression that a lot of stripper wells only operate part of the time: can you schedule pumping preferentially during the middle of the day when solar power is available?

Yes, most of the wells that pump part time have timers which can be set to shut on and off at specific times.

In fact, many of the early drilled shale wells also pump part time.

The DOE released a draft report of its examination of methane emissions from stripper wells. COVID will delay the final report, as it delayed data gathering in some locations. Hopefully the final report will be released before the end of 2021.

The draft report is very favorable for stripper well operators. It finds that methane emissions from stripper wells are negligible.

I have argued repeatedly that stripper wells in the USA should not be targeted by environmentalists. These wells have such a small environmental footprint as compared to US shale and US offshore oil and gas production. It is generally conceded that oil and natural gas will continue to be consumed for decades. Therefore, those wells with the smallest environmental footprint should be most favored.

Further, stripper wells are mostly operated by small, family owned businesses. Therefore, preservation of same are beneficial to the small, mostly rural communities where they are located.

Hopefully the Biden Administration will wait for the final report and will consider the FACTS contained therein.

The Obama Administration didn’t do nuance with regard to the industry. Hopefully the Biden Administration will.

I’ll hope for this.

The problem is, stripper operators are an easy target to aim for – no big lobby in Washington as the huge companies. So some enviromentalists could aim for them, too since they want to kill all CO2, no matter the costs.

At least our enviromentalists here – they just killed a new build modern coal plant, which replaced an old stinky one from the 60s. So the old one continues running, and the enviromentalist are happy.

They even kill lot’s of planned wind energy parks – at the moment it’s very difficult in Germany to get a license for new ones because of enviromental concerns. But they have fixed dates to switch off all coal and nuclear.

The hardcore center of green movements wants to downsize people by law – no cars, vegan diet, no tourism and smaller condos (one family houses are evil anyway). They get a lot of positive media coverage, simply because green is in and there is a lot to write about to fill the newspapers and webpages.

Good luck in the USA now Trump is gone.

Who are these hardcore greens? Got any names? They sound like strawmen to me.

Environmental Defense Fund, Sierra Club, Clean Air Task Force, Earthworks, just for starters.

Maybe use Google and read up on this issue rather than making an off the cuff comment?

We live where our wells are and own much of the surface where we operate. We have a vested interest in not polluting where we live/ land we own/ air we breathe. Just like the vast majority of stripper well operators. There aren’t absentee owners of these wells like there were in the 1970s and 1980s. Almost no public companies operate stripper wells, and most operators have less than 500 BOEPD of gross production.

I am just trying to put the facts out there as almost all are uniformed on this issue. I assume the greens don’t care about killing small, family owned businesses for no real environmental benefit. Hopefully maybe the moderates will take a second look?

” I assume the greens don’t care about killing small, family owned businesses for no real environmental benefit.”

I really doubt that Shallow Sand.

Probably its the opposite.

Please know that the vast majority of petrol consumers have absolutely no idea that there are family owned businesses in the energy sector. For most people, the experience is all about a faceless interaction with a multi-billion dollar oil/refining/utility company.

Sorry, I have no good recommendation on how to combat that lack of familiarity.

Please keep in mind that over 80 million voters selected one of the most moderate of the democratic candidates to make it to the debate stage, to be the next president.

Alimbiquated: I think I missed that you were referring to another post and not to mine. Apologies for that.

Think I will otherwise let the post stand.

Simply no need to shut down wells operated by small businesses that have small footprints and have been in operation for decades, all in the name of the environment, when those are the least polluting of any out there.

I will note the Biden Administration has proposed a jobs program for out of work oilfield workers, which would involve the plugging of abandoned (orphan) wells. That isn’t a bad idea at all.

In fact, the few high emitting stripper wells that environmental groups tend to find are these abandoned wells, which are not properly configured.

When I say abandoned, I mean wells for which the company that has the responsibility for plugging the well has long went bankrupt, and for which the states cannot afford to plug.

Some of these wells would be good to re-activate, however I assume most of those worth it were re-activated during the 2005-14 high oil price era. We took over a few ourselves.

In fact, in the DOE draft, 40% of methane emissions came from just two wells. One was a gas well that had a high casing hole, the other was an oil well that had a faulty well head configuration. This was of the over 200 studied.

I suspect that if the Biden Administration went out and plugged the top 5% methane emitting abandoned wells, it would get a lot more bang for its buck, as opposed to reinstating the methane rules for active stripper wells.

Shallow Sand,

I’m interested in your comments on reactivating wells that have not been properly abandoned. How long after the fields were abandoned did you or others come back to reactivate the wells? How successful were the wells? Did you just get “mega-flush” production, or was it more substantial than that? Do you know – were the wells in structurally crestal positions, or were they off structure? thanks, SouthLaGeo

SouthLaGeo. The wells we have reactivated over the years are almost all completed in a shallow Pennsylvanian sandstone that was discovered in over 100 years ago. The wells we have reactivated have ranged from completion dates of over 100 years ago to as recently drilled as the 1980’s.

Production is minimal decline. An example would be two wells we reactivated in 2006. The wells offset an active lease we already operated. Both were drilled and completed in 1957. The wells were in the state orphan well fund. They had been abandoned open hole since 1986. We equipped them, ran new lines and set a new tank battery. Produced water gravities from the fiberglass salt water tank to the battery on the adjoining lease, where it is re-injected.

TD 950’ /-. Rod pumped, one with a 10 pumping unit. The other a 16. Chemical with one gallon of corrosion inhibitor every 14 days, circulate for 6 hours. Have sold 500-600 BO annually since 2006. $200 per month electric. Wells were drilled with a cable tool rig, minimal failures. Straight holes.

Another well in the same zone about 4 miles East. D & C in 1976. Abandoned in 1988. Open hole from then till 2010. Same deal, re-equipped, new lines and battery. Again, we operated offsetting lease. Again, we dispose of the water on the offsetting lease. Has been producing 210-240 BO annually. Electricity $100. One down hole failure in 2014 and one in 2018, both tubing holes, ran in new pumps also.

Another, three well lease. Injection well had casing hole. We plugged it. Converted one producer to injection. It was drilled in 1980. Other producer drilled in 1957, over 30’ of pay, same Penn sand. Produces 1.3 BOPD and 50-60 BWPD. Was shut in 1998. We reactivated 2012. Equipment was left, we pulled well, tested tubing, blew 3 of 33 joints. Ran in new pump. Haven’t had a failure since, knock on wood. Electric $175 per month. Dispose of water at 450 psi.

These are some successful examples. We have had others that maybe weren’t so good.

There is usually a flush, 5-15 BO on day one. After that, slow decline, flattens out in about a month.

The key is having a well for injection. I have had my eye on a one well lease for many years, but need higher oil to justify drilling an injection well.

As far as structure, I may not be able to answer this well. The Penn sand has multiple lenses. Therefore, it has been difficult to get an “optimal sweep” by water flood. There seems to be changes at times. Water breakthrough seems to show up, and then disappear. But never floods out wells, just sometimes have to adjust flow rates down the various injection wells, if there are multiple wells in the project. Mostly wells drilled in 5 spot patterns, 10 acre spacing.

The exception is an 800 acre area, same sand, but continues to have a strong water drive. Water is all disposed in a deeper zone, maybe some communication. This area was all abandoned in the late 1960s. Slowly reactivated from late 1970s to present. Have found wells with a metal detector even, that weren’t plugged, but cut off and buried. We permitted, re-nippled up and re-equipped. Those have done very well, and are all cable tool holes drilled prior to 1911!

Field consists of about 20K acres. Cumulative of about 275 million barrels, over 95% coming from depths under 1,600’.This year will be the lowest production year ever. Almost all shut in due to negative price. Mostly reactivated now. Not aware of any new wells in 2020. Very few new since 2014. We drilled our last one Q3, 2014.

Shallow, thanks for the extended reply.

A few more questions around stripper wells – do stripper wells always, or almost always, produce at a high water cut,, that is around 100 barrels of water for every barrel of oil?

Also, regarding the reservoirs stripper wells produce from – are these reservoirs that at the very beginning of their productive lives produced more conventionally –maybe had water free production for a few months or years while producing hundreds of barrels of oil per day (realizing some of these wells may have been drilled over 100 years ago). Then, as time went on, and the wells starting producing more and more water, the wells became stripper wells?

SLaGeo.

Water cuts vary greatly.

100 BW per BO or more is common.

However, in the same zone we have a one well lease that produces 3 BO to 1 BW. Several wells are on time clocks.

IP’s were 20-1,000 at field discovery. Water came fairly quickly and there is published history of regulation of water disposal as early as 1911. Around that time, water began to be disposed of into abandoned oil wells. Accidental water flooding over 100 years ago. Planned floods didn’t occur until WW2.

Thanks again, Shallow. Alot of good information.

SouthLaGeo.

No problem. Like your offshore posts.

Keep in mind I’m just making reference to one field. There are stripper oil wells all over the United States, and there are differences I am sure.

There are many areas where the decline is much steeper than the field I am referring to.

Kansas, for example, has a pretty detailed website that gives production histories for all leases in the state. It is free. Several other states also have free data, but some are easier to navigate than others.

You might check those out if you are interested.

One of the big issues with stripper wells is handling water. Not only what to do with it, but how corrosive it is. Also, if producing out of more than one zone, water compatibility can be an issue. We bought a lease once that had wells producing from two zones commingled into one battery. It made a lot of oil (for our field) but thankfully we sold it before it ate our lunch.

“Ende Gelände”, Extinction Rebellion, lot’s of local groups. The green party here has an hardcore eco wing, too – think at it like BLM or Bernie Sanders fans of the Democratic party, in contrarian to more middle politicans.

Just google some.

Eulenspiegel,

You live in germany? Im qurious how has the consumer price developed for you on electricity over the last years with your all in renewables strategy?

I just got the update from electrical company here in sweden for next year with the regular price increase but what was interesting was they actually specified it needed to be done due to increased renewables in energy mix.

I have also seen exactly what you are talking about with the green fanatics here that only seem to think in one step. We are closing down our nuclear reactors and one is set to final termination now on year end, during this summer it actually had to be emergency activated togheter with firing up old oil burner plants to compensate for renewables under delivering during heat period of summer. We also now have major issues with power supply in Stockholm and in southern sweden to the point that businesses cant be established since power cant be guaranteed, leading to lost jobs and income.

Next summer will be interesting when there wont be any possibility to reactivate the reactor, i predict more oil burning all in the name of environment and this will be celebrated as some kind of win.

We are at 30 cent / Kwh, rising every year. Plus base tariff. Electric cars would as expensive than Diesel at the fuel price level.

Things go interesting here, too. Nuclear will be shut down the next years, coal, too.

New Wind plants are very scare – lot’s of nimby protests and hardcore enviromentalists (Wood and animal protectors) with endless juristic battles. Wind / solar energy storage build up is near 0, too.

They tried to cut down the entry barriers for new wind plants, but failed in the first try. Perhaps the corona stimulus package gives a new push here – they’ll have to build something to sink this money.

I don’t know how this should work, the last few days we had 10 GW wind / 60 GW total energy usage production and nearly 0 solar, so coal gas and nuclear is running on full power.

https://energy-charts.info/charts/power/chart.htm?l=de&c=DE

(imagine all the red and brown stripes gone – and Gas is already full throttle. Without Northstream 2 no possibility to increase this much – and nobody wants to build new gas plants anyway. Too much risk envolved.).

EULENSPIEGEL,

Thanks for reply, i googled some also on my own and could see what your saying that you are roughly on 30 cents/ kwh up about 50% in the last 10 years. Quite expensive.

If im not mistaking you import a lot from France now right? And they have quite clean energy production with a lot of nuclear but have decided to follow your example. So i guess that means both you and France will need to import more from someone else in the future, i cant figure out who that should be.

Yeah i read you had a future gas problem as gas consumption is expected to increase with your lower base load energy production and more renewables, and supply will decrease from Dk,Uk and norway in coming years so your options will be more from russia or perhaps more ngl from Us, is that your opinion also?

Meanwhile swedens latest virtue signaling environment projekt has backfired quite hard, tax on plastic bags in stores. Witch has led to people refusing to buy the bags so marginal tax increase witch ofc was the real reson and now people are using the free “environmental” bags who are supposed to be used for bio waste only for everything, so garbage sorting has ceased to exist in some cities as people now just throw everything in the same bins and bags and dont care anymore. Another win for the environment in the books i guess.

I checked your link now, holy moly that would be like removing 75% of your production without any viable option. Will be interesting and your consumer prices will go through the roof and ev will have higher operational cost than a petrol car. Looks like you are putting your position as an industrial giant in europe at risk here.

HiH, i dont understand what you are trying to say, i was ironic about my previous last statement before this edit. What i meant was it was yet another pointless signal politics initiative that turns out to be bad for the environment in the end.

Baggen, you and Eulen are correct and incorrect at the same time . You said ” Another win for the environment in the books i guess. ” Correct . The economy will not be screwed( I said that) .Incorrect . Mankind is at a point where the choice is ” Starve and die because you want a low ” per capita ” energy and have no income or die because you are going to be fried with the high temperatures . As of this date in Belgium I am driving( I am a courier) and visiting customers without a winter jacket , gloves and a head mutt ( morning made a trip starting at 4.30 am ) . No problem ,absolutely comfortable . Climate change is real . Difficult times . I remember old Rockman commenting POD ( Peak Oil Dynamics) are more important then peak oil . He was correct . Be well .

P.S : Baggen , the battle is won , but the war is lost .

Hole, it’s only a “win”.

Virtue signaling and holier than holy is the media echo the last 5 years – no matter the colateral damage.

There is no reflection in the public debate only moral counts.

Closing more nuclear and coal plants, forbidding cars in the cities, taking more refugees, giving out more social benefit… all other opinions on this are evil.

For example the green Party, which is the 2nd biggest here has written in it’s new programm to introduce more unconditionsal social benefits, open borders for refugees inclusive easy getting the german passport and exit all fossil energy fast.

What possibly could go wrong – even conservative newspapers applauded. It’ s the most propable government next year CDU / green.

Nuclear is evil, fusion too, and geothermal isn’t wanted, too. Big conventionel hydro pump storages aren’t possible, too. So nothing happens at this time, only the deadlines closing the plants.

Baggen, I apologise . A bad cross connection . I have a better understanding of what you were getting to now .

Eulen , I know what you are talking about . I live only 120 km’s from Aachen . I think there is a misunderstanding between us . I am aware of what is happening in Germany and Benelux on the ” Green Front ” , just how unrealistic all the talk , proposals and future scenarios painted by them are . We are on the same page on this .

Yeah, the newest win for them:

They stopped the Tesla factory tree cutting for some lizard catching.

The forest they protect with all arms is a pine plantage, sceduled for harvest in a few years anyway. And without the Tesla plant nobody would have cared.

Additional, Tesla has to plant for every acre they use 2 acres totally ecologically correct mixed type forest on previos barren fields – that doesn’t count.

SS ,happy for you , finally you have some breathing space .

Hole in head.

We aren’t counting on this study ending the idea that we should be shut down. This study won’t stop the committed from thinking all oil is bad and trying to shut it all down.

Just need to keep getting the word out that there are thousands of small producers in the US who have business models and environmental footprints that are nothing like big oil.

I would say there is no comparison between the truthfulness of Obama and Trump. Yet Obama went ahead and tried to make the methane rules apply to stripper wells, without any data, based merely on wanting to placate the green movement. He also tried to eliminate “big oil” tax breaks, which was a lie as none apply to the majors and the most important one (percentage depletion) only applies to the first 1,000 BOEPD and is afforded almost all other miners.

Just like I wonder if Biden understands the difference between shale well fracs and the fracs stripper well operators do? Or, if given the opportunity, will he attempt to ban them all?

Politicians have so much on their plates so they don’t do nuance well. Further, unfortunately the stripper well areas are now 70-90% Trump. There will be little interest in doing those areas any favors, and there will be no representation of those areas within the Biden Administration.

It has been interesting seeing the few smart industry representatives trying to engage the Democratic politicians who are deemed moderate. They have been trying to educate them. I think the only way anyone will pay attention is if we have $4 gasoline, which looks extremely unlikely.

Oil is breaking out to the upside of the consolidation pattern it’s been in for about 8 days. On the WTI chart there really isn’t any resistance until we reach about $54 and even then it isn’t much. Only strong resistance I see comes in the mid $60’s. Strong move to the upside is likely underway.

USD/CHF broke it’s 4 month consolidation to the downside. EUR/USD broke it’s 4 month long pattern to the upside. USD/JPY made a move lower but hasn’t yet broke. I mention these currencies because there going to lead the bond market not follow. There is a speculative short position that is the largest ever short position in treasury bonds. 10 and 30 year bonds. This position will likely have to unwind sending yields on long dated treasuries towards zero. And the dollar much lower.

We going to get some price inflation. But it won’t be the good demand side price inflation. It will be the shitty devalued currency by 20-30% kind of inflation. Or much more if yields go negative.

The low bid on the last treasury auction I seen was 0.08% That was made by a primary dealer at a 30 year bond auction. Primary dealers think yields are going lower. Much lower.

Do you think the FED now urges the other big central banks to devaluate their own currencies to support the dollar?

At least the export industry in Germany here is not happy about the dropping dollar. I can’t think Japan is happy, too.

So one big round of money printing?

Eulen , I hope this will assist in seeing the big picture .

http://charleshughsmith.blogspot.com/2020/12/do-you-really-think-empire-will.html

Eulenspiegel,

The Fed has no need to put the squeeze on other central banks. Those banks are already stimulating their own economies with QE. Besides all economies are tied to the petrodollar and therefore U.S. monetary policy. If the dollar falls so does every other fiat currency.

Hume , I agree . I remember a US congressman saying during an earlier currency crisis ” Yes , it is our currency but it is your problem ” . Forget his name ,it was in the late 70’s .

If the dollar falls so does every other fiat currency.

You’re talking about exchange rates, right? If the dollar falls, don’t other currencies have to rise?

Yeah, by definition. Rising and falling is always relative to other currencies.

This lawsuit against Shell is on 8th December in Netherlands .

https://www.npr.org/2020/12/01/940717012/climate-case-against-shell-begins-in-the-netherlands

Hole in Head,

The lawsuit is a nonsense to be sure. Germany has societal backing and the political will to adopt renewable energy. But the country still needs to burn lignite to keep the lights on.

Perhaps certain countries need to periodical switch off their polluting energy sources to focus the minds of their citizens.

Hume, the lawsuit is in Netherlands and not Germany . The lawsuit is important because it’s decision will be a template for future actions by courts in other European countries especially in Northern Europe . Nonsense or not , I can’t say . Let us wait for Tuesday when it will be up for hearing .

The big ‘threat’ to petrol is not from environmentalist or politicians.

It is from two other factors.

One is economic stagnation, such you get from a pandemic (where the president and his followers don’t even have the balls or brains to wear a mask), for example.

The second, and bigger challenge, comes from the four horseman- that being

Ford Mustang E, VW ID.4, The Tesla’s, and The Chinese EV’s.

These vehicles (among a dozen other vehicles with plugs) will be undeniable.

Everyone will be well aware of this within 3 years.

Subnote- hybrid vehicles with both a plug and a petrol engine will be very successful this decade.

Hicks, watch out for happens on the 8th in Netherlands lawsuit as in my earlier post . The judgement will be a template for other countries in Europe . The lawsuit asks Shell to go Zero Carbon by 2030 . You underestimate the ” Green movement ” in Europe . It has percolated down to the school level here in Benelux . In Belgium we have our own Greta . The juffvrow ( young lady) is still in school . She brings thousands on the streets of Brussels . The politicians are useless . They will blow with the wind or with the money ,whatsoever lines their pocket . ECB and EU are planning a Euro 1.6 Trillion budget for “Green Energy” . The wind and the money point to let us go ” anti FF” . Logic . EV etc will make a dent, but the FF companies could handle that, if it was the only problem . I would hate to be a CEO of a FF corporation today .

How Green in Netherlands ? Netherlands is the biggest market for Tesla in Europe . Yes , even bigger than Norway .

The citizens of the EU would be foolish to not push hard for alternatives to petrol, in a world where they have to rely on importing a depleting resource. How economically and geopolitically vulnerable.

That strategic adaptation just so happens to align well with environmental concerns over global warming.-

got floodwalls?

Hickory,

The problem stems from the contradictory stance of the renewable adherents.

Here’s one for you http://www.endfuelpoverty.org.uk

contradictory

How? It seems pretty clear that helping low income folks is the top priority of this group. Secondary is choosing clean energy sources – fortunately clean energy is cheaper, and often can be installed on the roof.

Nick G1st,

The organisation also states it’s environmentally conscious.

Although the fundamental issue still remains. Renewable energy can’t replace the hydrocarbons we use to power our way of life. You can’t want more energy use for a select group while claiming to be environmental, as that energy has to come from fossil fuels. Therein lies the contradiction.

Renewable energy can’t replace the hydrocarbons we use to power our way of life..

Ah, there’s the problem: that’s just not realistic.

We’ve chosen to use oil for most transportation at the moment, but we don’t have to. We could electrify most transportation that is currently powered by non-fossil fuel sources, and use synthetic hydrocarbons or hydrogen for more difficult cases like aviation or long-distance water shipping.

Are you clear that “hydrocarbon” isn’t the same thing as “fossil fuel”? There are lots of sources of hydrocarbons, and they can be built from simple inputs like electrolytic hydrogen, and carbon from the atmosphere or seawater. That requires an energy input of course, but wind and solar power are already cheaper than fossil fuel energy, and getting even cheaper fast.

There is nothing contradictory with

-the desire to develop/deploy energy sources beyond the fossil fuels, which are on the cusp of depletion phase

-the goal of helping encourage society policies in which even poor people can have access to energy

In fact, if a country without abundant fossil fuel resources does not develop other sources like wind/solar/nucs/hydro, then most of the citizens will gradually enter the ‘energy poverty’ scenario. For some countries this energy poverty is much more likely. For other countries, they can avoid it. The prospect is in part due to geography (how windy or sunny it is), but also to a very large degree on the policies that a country adopts- just how aggressive they are in developing domestic resources. Ex- Neither N.Carolina or Arizona have any significant petrol production. Currently N.Carolina has much more solar production than Arizona, even though its prospects aren’t nearly as stellar. Its all about policy decisions.

Attached are six weeks of BH State and Basin oil rig counts. Over that same period, WTI has gone from $36/b to $46/b. The largest increase in Rigs has occurred in the Permian, 22, 10 in Texas and 12 in NM. Eagle Ford has added 6.

Looking at the states, Texas, NM and Colorado have added rigs over the last six weeks.

Will higher oil prices accelerate the activation of oil rigs?

Ovi,

According to Steve St. Angelo higher oil prices feed through the entire production line and operators can’t make a profit. Intuitively it makes sense on some level, but then I find myself asking the question. Why would a company start any venture in which they lost money when commodity prices rise?

Full interview.

https://www.youtube.com/watch?v=j0AG17fNiQ4&list=LL&index=6

A company starts a venture in which they will lose money when it is started with Other Peoples Money (OPM). When you use OPM, the first thing you do with the money is to pay your own salary. Have you looked at management compensation in these money losing LTO companies?

Hume

Schinz beat me to answering your question.