A post by Ovi at peakoilbarrel

All of the oil (C + C) production data for the US states comes from the EIAʼs Petroleum Supply monthly PSM. After the production charts, an analysis of three EIA monthly reports projecting future production is provided. The charts below are updated to June 2020 for the 10 largest US oil producing states.

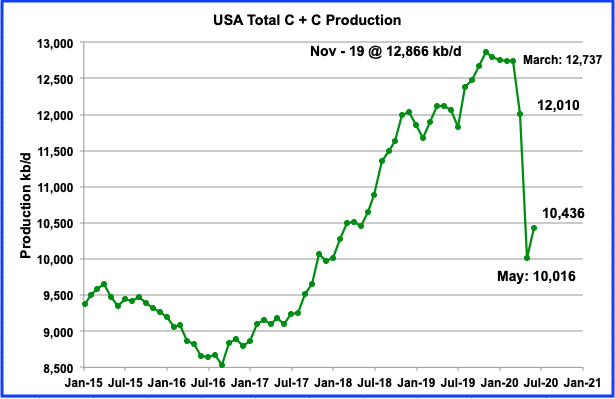

June’s production rebounded from May’s low by adding 420 kb/d. May’s output was revised up by 15 kb/d from the EIA’s July report.

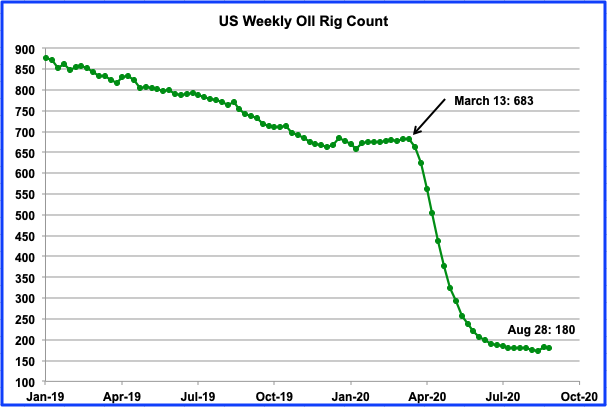

After adding 11 rigs in the week of August 21, the US rig count dropped by 3 in the week of August 28 to 180. Two of the 3 rigs were parked in the Permian.

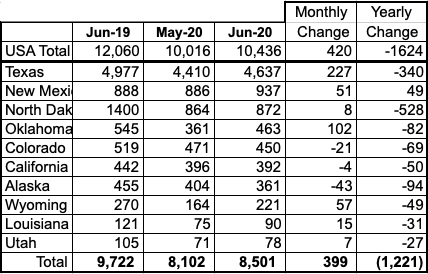

RANKING PRODUCTION FROM US OIL STATES

Listed above are the 10 states with production previously greater than 100 kb/d. Over the last few months, both Utah and Louisiana fell below 100 kb/d but are retained for continuity. These 10 accounted for 8,501 kb/d (81.5%) of US production out of a total production of 10,436 kb/d in June 2020. Note that of all these 10 states, only New Mexico produced more oil in June than in the same month last year. On a YOY basis, US June production was down by 1,624 kb/d.

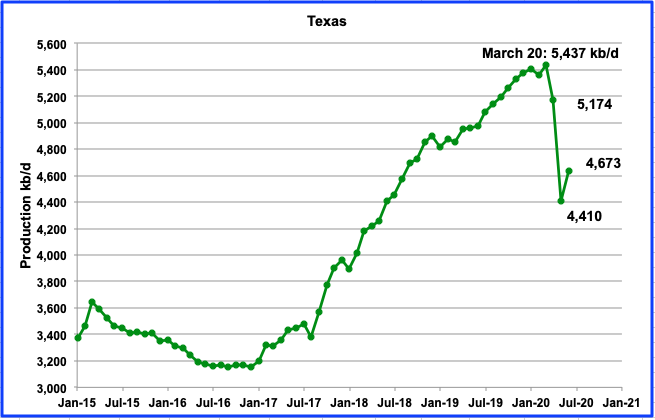

Texas production increased by 263 kb/d to 4,673 kb/d in June, an increase of 6%. This is less than half of May’s decline of 764 kb/d.

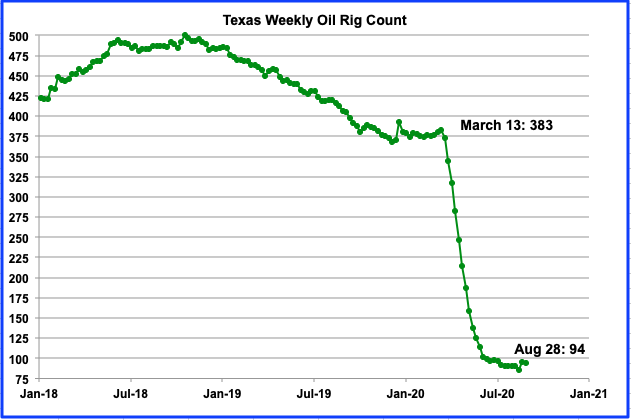

From March 13 to August 28, the Texas oil rig count dropped by 289 to 94 or 75.5%. An output drop followed in April and a larger one in May as shown in the previous chart. However while rigs continued to drop in June production did rebound as shown above.

June’s New Mexico production increased by 51 kb/d to 937 kb/d. New Mexico has now passed North Dakota to become the US’ second largest producer

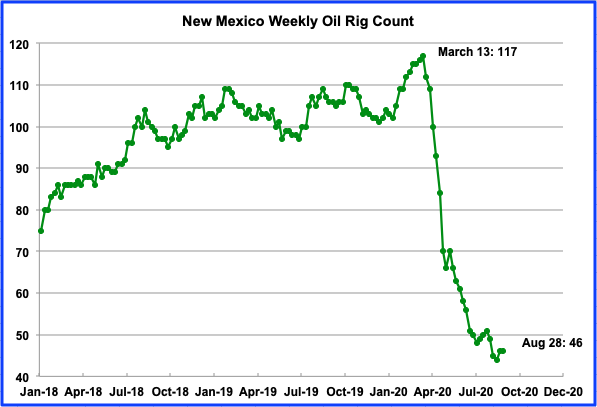

From March 13 to August 28, New Mexicoʼs rig count dropped by 71 or 61%. Over that same period, production dropped by 21%. Even though they dropped in June, June production increased.

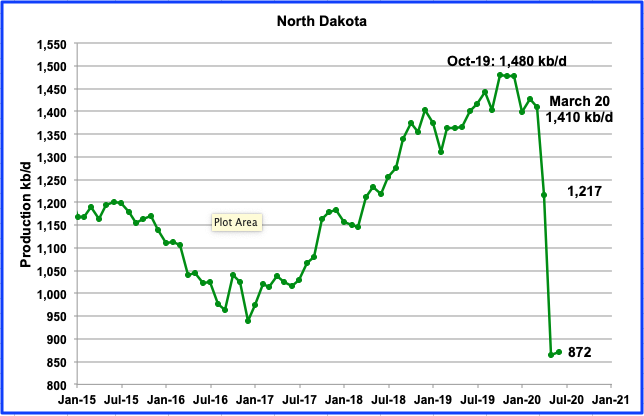

North Dakotaʼs oil production started to drop in November 2019 after peaking at 1,480 kb/d in October. In May output declined by 357 kb/d to 864 kb/d and then only added 8 kb/d in June to 872 kb/d..

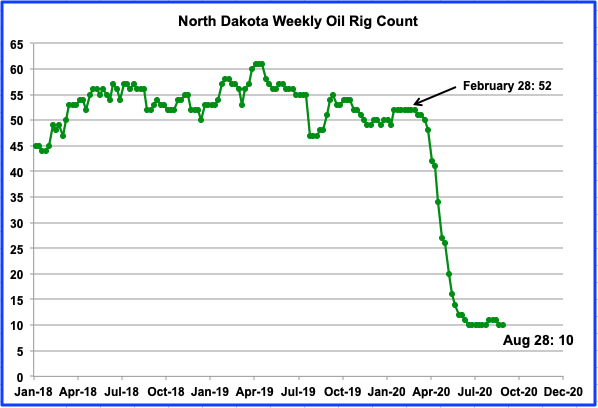

The North Dakota rig count has held steady at 10 for the weeks of August 21 and August 28.

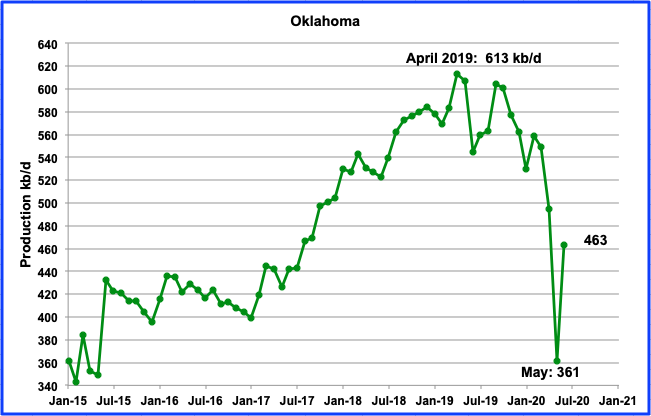

Oklahomaʼs output peaked in April 2019. From a low of 361 kb/d in May, production rebounded in June 2020 by 102 kb/d to 463 kb/d. Oklahoma had 10 oil rigs in operation from the week of Aug 14 to August 28. In January they had 50 oil rigs operating.

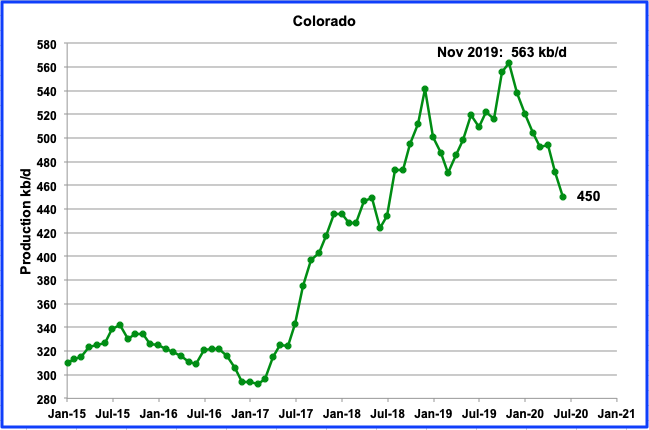

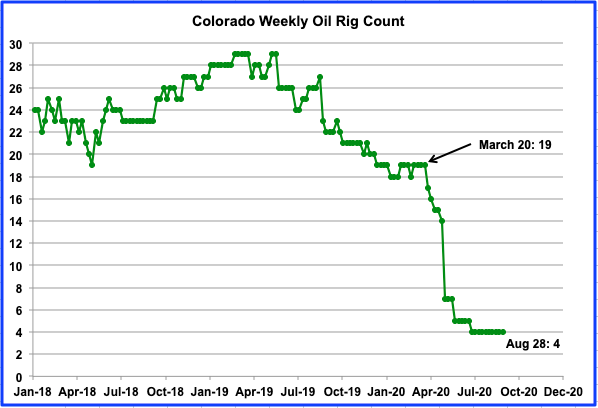

Colorado, after showing a small production increase in April, dropped by 23 kb/d to 471 kb/d in May and then dropped to 450 kb/d in June. Coloradoʼs oil rig count has held steady at 4 for the last 10 weeks.

Coloradoʼs oil rig count has been 4 for the last 10 weeks.

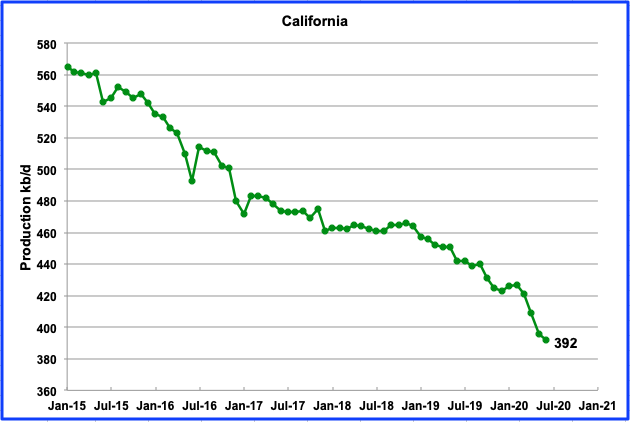

Californiaʼs slow output decline has accelerated in the last few months and dropped below 400 kb/d. June production was down by 4 kb/d to 392 kb/d and is giving an indication of slowing decline. During the last 10 weeks, California had only 4 rigs operating.

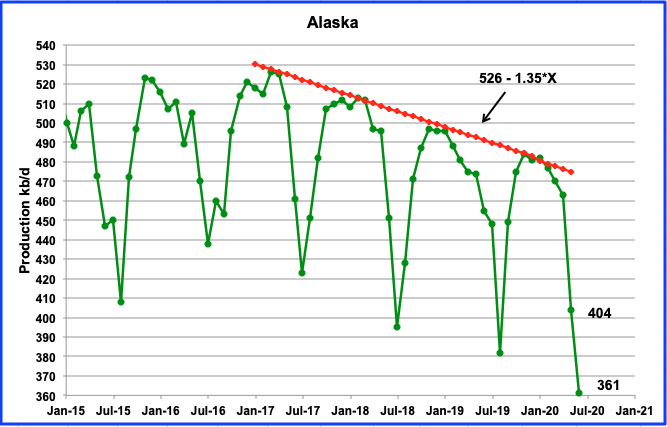

Alaska production continues its annual summer decline. In June output dropped by 43 kb/d to a new low of 361 kb/d. This is 21 kb/d lower than the August 2019 output of 382 kb/d.

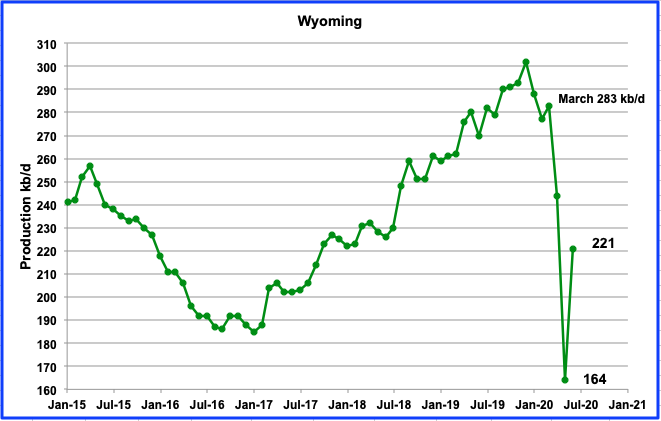

Wyomingʼs production in June increased by 57 kb/d to 221 kb/d. During the week ending August 28, Wyoming had 1 oil rig in operation, down from a high of 20 in January 2020.

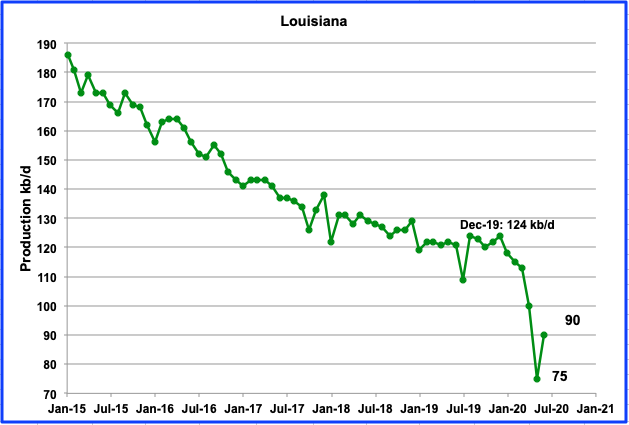

Louisianaʼs output began its steady decline in January 2020. However in June production rebounded by 15 kb/d to 90 kb/d. In January 2020, on average, 22 oil rigs were operating. There were 11 oil rigs operating during the weeks of August 14 to August 28.

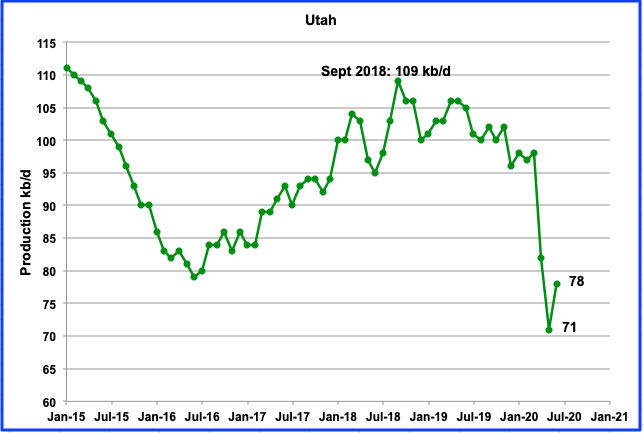

Utah’s output has been in an overall decline since September 2018 when it was 109 kb/d. The production bottomed in May 2020 at 71 kb/d and rebounded to 78 kb/d in June. There were five oil rigs operating in Utah during the weeks of August 21 and 28.

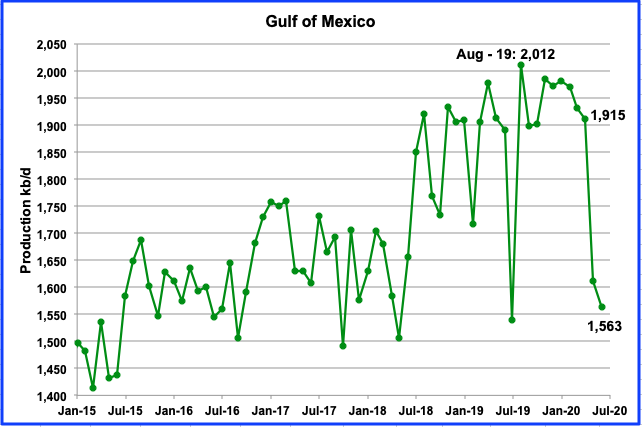

In June the GOM’s production continued to decline by another 49 kb/d to 1,563 kb/d. If the GOM were a state, its production would rank second behind Texas.

UPDATING EIA’S THREE OIL GROWTH PROJECTIONS

1) DRILLING PRODUCTIVITY REPORT

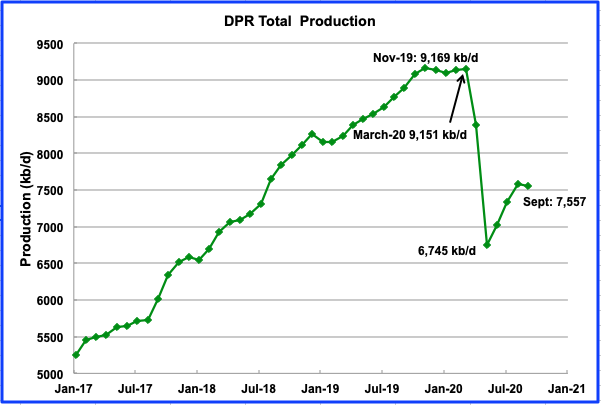

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the five principal tight oil regions. The charts are updated to September 2020.

Above is the total oil production from the 7 basins that the DPR tracks. Note that the DPR production includes both LTO oil and oil from conventional wells/fields.

According to the August DPR report, LTO oil and conventional oil output peaked in November 2019 at 9,169 kb/d. The projected output in September 2020 is 7,557 kb/d, down 20 kb/d from August. Note that the August output was revised up from 7,490 kb/d to 7,577 kb/d. The biggest drop occurred in May, when production dropped by 1,646 kb/d to 6,745 kb/d. Output is expected to reach a minimum in May and then begin to increase in June. The contribution from four of the LTO basins is shown in the charts below.

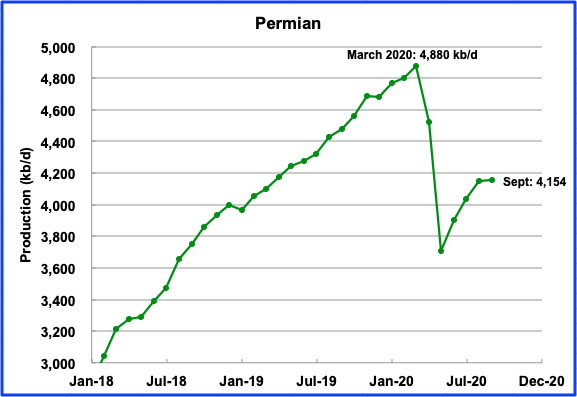

Permian output in September is projected to be 4,154 kb/d, essentially the same as August, up by 7 kb/d. July was revised down from 4,160 kb/d in the July report to the current 4,039 kb/d in the August report.

The Bakken had two big output drops in April and May and then is projected to begin increasing output from June to September to 1,191 kb/d.

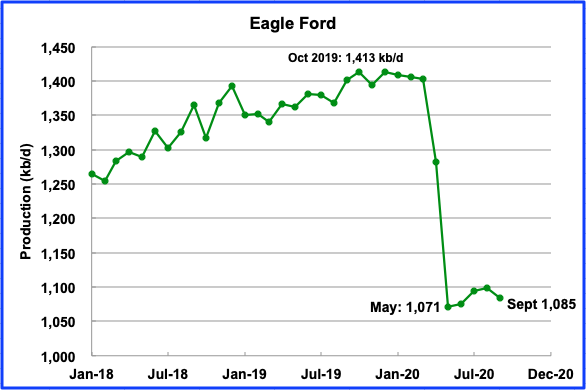

Eagle Ford’s output had its biggest drop in May, 211 kb/d to 1,071 kb/d. No significant increase in the Eagle Ford basin is expected between May and September. September’s drop is projected to be a much smaller 14 kb/d to 1,085 kb/d.

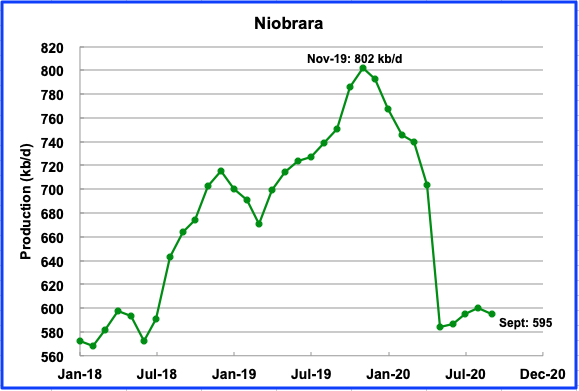

Niobrara output is expected to drop by 5 kb/d in September to 595 kb/d.

2) LIGHT TIGHT OIL (LTO) REPORT

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The August report updates the charts to July 2020.

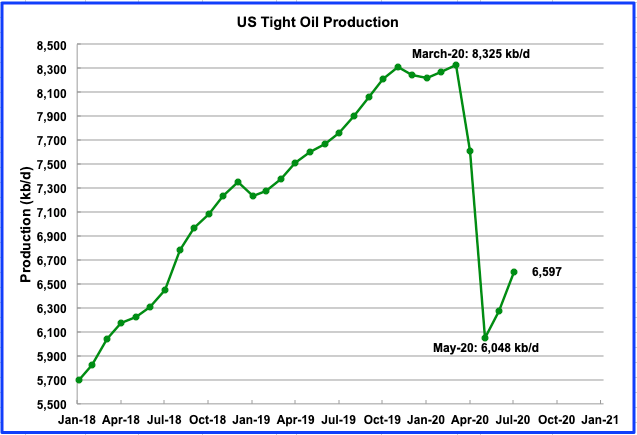

July’s total LTO output is expected to increase to 6,597 kb/d from a low of 6,048 kb/d in May. The drop from April to May was 1,564 kb/d.

Note that the August report brought significant revisions to the previous projections. For instance the July LTO report projected May output to be 6,970 kb/d compared to the latest estimate of 6,048 kb/d, a downward revision of more than 900 kb/d.

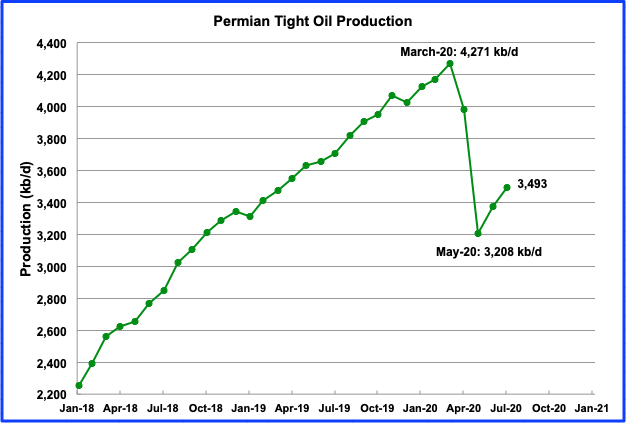

Permian output in July is projected to be 3,493 kb/d, an increase of 285 kb/d from the May low of 3,208 kb/d.

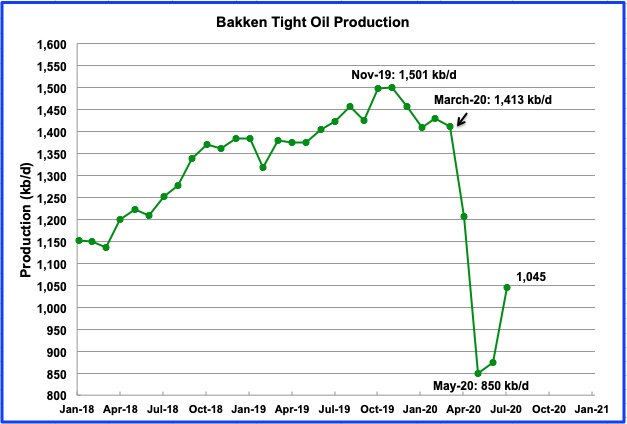

The Bakken is expected to add 195 kb/d to the May low of 850 kb/d by July.

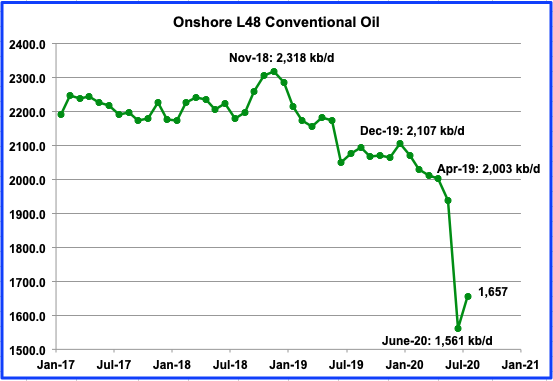

Conventional oil declined in the Onshore L48 by 442 kb/d from April to June. July is expected to restore 96 kb/d of conventional oil. Interestingly conventional oil in the L48 also peaked in November 2018, the current peak oil date.

3) SHORT TERM ENERGY OUTLOOK (STEO)

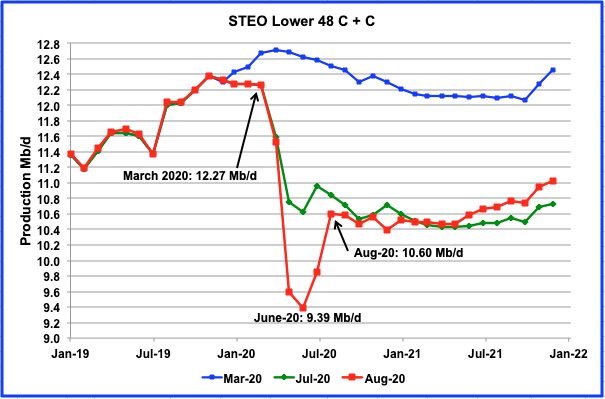

The STEO provides projections for the next 13–24 months for US C + C and NGPLs production. The August 2020 report presents EIA’s oil output projections out to December 2021

The August STEO report revised its July report estimates/projections down from May to early 2021. The production estimates for May, June and July are less than 10,000 kb/d. This is surprising since many wells that were shut down could have been reopened as the price of oil recovered. The August PSM estimated May output to be 10,001 kb/d. There has been much speculation as to whether the next PSM will revise May output up or down. The STEO is projecting a major drop of 2.88 Mb/d in US L48 production from March 2020 to June 2020. (Note that the STEO projection shows June to be the low point for US production. The first chart in this post shows that May was the low.)

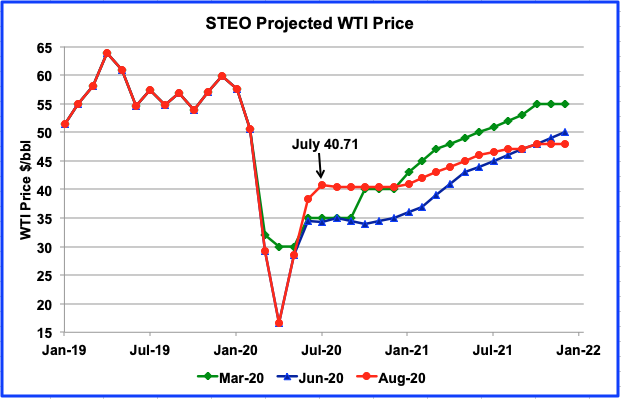

Now that the price of WTI has moved above $40/b in early August, it appears that the STEO March projection was closer to the early August price of $40/b than their June estimate. The August STEO is now projecting an average WTI price from July to December of $40.50, which is lower than the current price, close to $43.00 on September 1, 2020.

World Oil Production

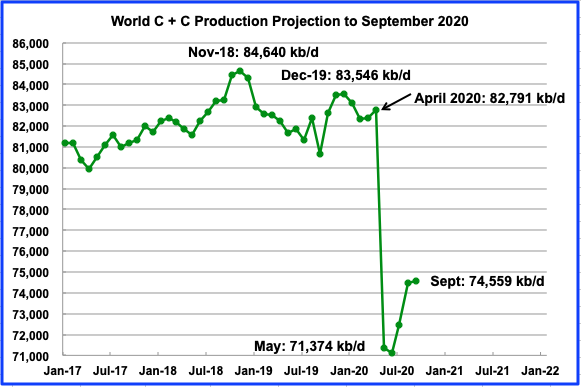

World oil production decreased in May by 11,417 kb/d to 71,374 kb/d. OPECʼs production decrease of 6,136 kb/d in May was added to Non-OPECʼs decline of 5,281 kb/d for a total decline of 11,417 kb/d. June is projected to be the low point in world oil output. Production is expected to recover to 74,559 kb/d by September. Note that the December 2019 high of 83,546 kb/d was 1,094 kb/d lower than the high of November 2018.

When will it end ?

https://www.reuters.com/article/us-global-oil-shale-investments/second-u-s-shale-booms-legacy-overpriced-deals-unwanted-assets-idUSKBN25R1GG

Sorry HH, I did not see your post until after I posted Jeffrey’s email with the same link.

I expected a little better rebound, and I’m really suprised that offshore production was down.

Now, I expect July production to be similar to June. Just WAG, as always…

An email from Jeffrey Brown. Comments below the link are his:

Second U.S. shale boom’s legacy: Overpriced deals, unwanted assets

In May 2019, Occidental bought Anadarko Petroleum for $38 billion, taking on debt to outbid oil major Chevron Corp (CVX.N) in a big bet on bigger growth in the largest U.S. oil patch in Permian Basin. The combined company was worth about $80 billion when the deal was announced, but is now worth just $12.1 billion.

Occidental cut expected capital expenditure for this year by more than half after oil prices plummeted and dropped its quarterly dividend to a penny per share.

“You took a company (Occidental) that was healthy, and potentially an acquisition target itself, and it looks like you created a much larger unhealthy company,” said one energy M&A lawyer.

Occidental stock is down about 90% from its peak in 2011, with a market cap of less of than $12B.

Maybe Chevron will step back into the game and buy them (Occid/Anadarko) soon.

Dennis ,on the last thread you posted ”World Bank suggests World real GDP falls by 5.2% in 2020 and then rises by 4.2% in 2021, growth would only need to be 1.3% in 2022 to get us back to the 2019 level of World real GDP. This is their reference scenario, they also have more pessimistic and optimistic scenarios ” .

Well the GDP data landed on my desk for growth of some major economies in the second quarter .

1 . India -23.9%

2. UK -20.95%

3. France -13.8%

4. Italy -12.4%

5.Canada -12.0%

6.Belgium -12.0 %

7 .Germany -10.1%

8. USA -9.5%

9. Japan -7.6%

10. China 3.2 % (believe this at your own risk )

I don’t see any chance of a recovery . I have earlier posted the situation in SE Asia . maybe you should reassess the situation . Read this

https://www.thetimes.co.uk/article/germany-extends-its-furlough-scheme-until-end-of-2021-nq9m58jb8

Obviously Germany sees no recovery till 2022 . In the Netherlands the scheme is now extended to July 2021 .

Hole in head,

Just reporting what the World bank’s middle estimate was in June. I agree it may be wrong. Likely any guess of future events will be incorrect, yours, mine, and anyone’s.

IMF June outlook at link below

https://www.imf.org/en/Publications/WEO/Issues/2020/06/24/WEOUpdateJune2020

An excerpt:

Global growth is projected at –4.9 percent in 2020, 1.9 percentage points below the April 2020 World Economic Outlook (WEO) forecast. The COVID-19 pandemic has had a more negative impact on activity in the first half of 2020 than anticipated, and the recovery is projected to be more gradual than previously forecast. In 2021 global growth is projected at 5.4 percent.

World Bank real GDP data for 1960-2019 at link below

https://data.worldbank.org/indicator/NY.GDP.MKTP.KD

Chart for 1980-2019 with exponential trend line for those 40 years in chart below, average annual growth rate 2.92% per year. Future rate is not known. The vertical scale is trillions of 2010 US$ (title of chart is mislabelled, I forgot the trillions.)

Note that World real GDP growth shifted from an average annual rate of 4.7% per year from 1960 to 1979 to 2.92% per year from 1980 to 2019. If we assume a similar shift occurs from 2020 to 2059, the we might see only average annual growth in real GDP of 1.2% per year over the next 40 years. One problem with such an assumption is that it does not take account of changing population growth, the analysis would be better in terms of World real GDP per capita (though still imperfect as it does not account for general well being or income distribution).

Just in . Australia down by -7 % . The ASX is up 1.6% on the news . First recession in 30 years . Theater of the absurd .

For World Bank data for World real GDP per capita from 1960 to 2019 we have the following average annual growth rates over 20 year periods.

1960-1979, 2.73%

1980-1999, 1.28%

2000-2019, 1.60%

future long term growth rate perhaps 1 to 1.25%, but essentially not known.

Dennis , I have already posted that if you were to follow WB and IMF then Greece should be running the marathon and Italy be running against Usain Bolt . Reminds of a Richard Pryor movie ,the dialog was when Richard was caught in bed with another woman in bed . Here goes :

Wife : I can’t believe what I am seeing .

Richard : Whom are you going to believe, your f ****** eyes or me ?

🙂

Your choice . 🙂

Hole in head,

Every forecast of the future proves incorrect, whether EIA, IEA, IMF, WB, you, or me.

The statistics are pretty obvious. The number of possible future scenarios is infinite and odds of presenting a correct scenario of the future are zero.

It really is that simple.

So complaining that old scenarios were incorrect is kind of like complaining that water is wet. 😉

The historical data is probably pretty accurate.

Sorry Dennis , you have not understood the concept of ” phase change ” in spite of my best efforts . All past experiences and narratives fail in the current environment .

Hole in head,

Your phase change is a nice theory without proof. There have been severe economic downturns in the past, always followed by recovery eventually.

If we make all of the wrong moves of 1929 to 1932, perhaps we will see a World depression as severe as witnessed in 1929 to 1938. I just don’t think humans are quite that stupid, but I could be wrong. As I have suggested before, the odds are long against your phase change scenario over the 2020 to 2029 period.

It is not that I do not understand, I am simply not convinced that your scenario for the future is correct.

We will see as the future unfolds.

Dennis

Americans are literally drinking bleach these days. Don’t underestimate stupidity.

Doodles,

Do you actually know anyone who drinks bleach?

There are a few really stupid people out there, unfortunately some of them are in positions of power.

Dennis,

Thankfully I do not as I’m in Canada, not that we don’t have special folk here as well.

But a google search returns a disturbing amount of news headlines of this happening across several states.

Beware of annualized numbers. For instance, that India figure of-23% is annualized.

Annualized GDP Data Can Be Misleading

When it reports quarterly GDP, the BEA presents the data several different ways to aid in analysis. Among them, GDP is presented as:

A percentage rate of growth or contraction from one quarter to the next. This figure was -9.5% in the preliminary Q2 GDP report.

A percentage rate of growth or contraction in the quarter on an annualized basis. This was the -32.9% figure in the preliminary Q2 GDP report.

That latter, annualized rate projects how much the economy would grow or shrink if the rate of change seen in the quarter continued at the same pace for four consecutive quarters, with some adjustments for seasonality and compounding effects.

There are reasons to look at GDP on an annualized basis. When the economy is operating more normally than it is now, annualizing helps you compare the quarter-to-quarter rate of growth for two different periods and understand in which the economy was expanding at a greater annual rate.

The trouble with this annualized GDP reading is that big outliers can create very distorted annualized readings. As the New York Times put it, if you got a $500 bonus one month, you wouldn’t think of it as a “$6,000 raise, on an annualized basis.” One-time windfalls like bonuses or one-time economic disasters like Q2 of 2020 can’t really be translated into a long-term trend.

The Extraordinary Second Quarter of 2020

As you may have noticed, the second quarter of 2020 was extraordinary. It’s fair to say that economic performance and the resulting data were a complete anomaly, thanks to the near-total economic shutdown that lasted for much of the quarter in most of the country in response to COVID-19.

In order for the economy to actually contract in 2020 as a whole by an annualized rate of down 32.9%, GDP would need to contract in Q3 and Q4 at a quarter-over-quarter rate similar to Q2, down at least 9.5%.

While many states have begun shutting back down again in light of more recent surges in coronavirus cases, the overall U.S. economy seems largely to have arrested its considerable contraction.

A considerable portion of the GDP contraction in Q2 was due to the coronavirus-driven total economic shutdown, during which there was virtually no retail, travel or hospitality activity whatsoever, accompanied by skyrocketing unemployment.

But economic activity was already picking up at the end of Q2. Consumer spending, especially on homes and autos, increased in June. In addition, 4.8 million new jobs were added in the month, although this part of the recovery appears to be slowing.

https://www.forbes.com/sites/advisor/2020/07/31/how-bad-was-second-quarter-gdp-really/#6ec60b714430

Nick , India figure is not annualized . It is quarterly . I report from ground zero and if you are interested can give you a detailed analysis industry-wise .

That’s correct. This is not annualized – India doesn’t report such data. Annualized data is confusing and I wonder why USA continues to do that. India is down 24% compared to same quarter (AMJ) last year. This was with 16% growth in government spending.

Jul-Sep would also be bad. GST collections for Jul and Aug are down about 14% and 12% compared to respective months last year. This compares to fall of 72% (yes negative 72%), 38% and 9% for months Apr, May & Jun respectively. June did see a bit of recovery, but things continue to be bad even as governments have opened up a lot more. Note that inflation is up nearly 6% compared to 3-4% recent quarters. So, real GDP growth would be lower than what you can infer from tax related stats.

Don’t expect any more fiscal or monetary stimulus (on account of higher inflation) to improve growth in short term. Any growth needs to be from private sector. However, there is so much fear and so don’t expect India to turn around soon even if governments open up completely. While stock markets are up close to pre-covid levels, it does not reflect activities on the main street. Western economies seem better poised for growth compared to India.

Diesel sales in Aug dropped 22% compared to Aug-2019. It dropped 13% compared to Jul-2020. Not sure why. Petrol (gasoline) fared better at -8% compared to Aug-19. Note that Petroleum products are more expensive now than it was in March because of higher taxes (this is not part of GST).

My guess . India will be the next Lebanzuela . Timeline starts Apr 2021 up .

It looks like a lot of people are confused by this. Here’s an article in India Today which reports that the US (at -9.5% on a quarterly basis) did worse than India (the bar chart shows the comparison).

https://www.indiatoday.in/business/story/gdp-contracts-by-23-9-india-second-worst-performer-after-us-among-major-global-economies-1717173-2020-08-31

So, India was hit harder than any other economy. Other articles report that the Indian lockdown was more aggressive than other countries, and argue that there will be a payoff in the form of a faster recovery. Does that seem reasonable?

Nick, the current govt messed up big time by doing a lot of dumb stuff . Three actions that cooked the goose .

1. Demonetization of the total currency except for small denomination in 2017 . They demonetized the old currency without printing any new notes . More dumb the new notes they printed were different in size to the old notes and could not be dispensed by the ATM machines . So then they had to refit all the ATM’s . This really was knockout blow .

2. A new tax system like VAT to consolidate taxes . Badly planned and even worse badly executed . Instead of 2 rates viz one rate for essentials like food ,medicines etc and one rate for all others they came out with 6-7 slabs . No proper definitions . Worst everything was planned to be digital in a country where there is sporodiac electricity , poor coverage of internet and most important more than 50% of the population is illiterate . Botched up.30% of the small business closed down as they were unable to complete or follow the rules and regulations . When Covid hit there was already a slowdown .

3. Came Covid and the government delayed action . When it did, it gave only 4 hrs rpt 4 hrs time for people to stock up on food . The lock down was announced at 8 PM ,imagine the panic . The lock-down was brutal . The police and local authorities were given unlimited powers to put people in jail . Everything came to full stop . After a month and a half they realised that they had failed in controlling the virus and that the treasury was empty . They then proceeded to do the unlock down . That was also done in a haphazard manner without any planning and botched execution . The three blows knocked the bottom out of the economic system and the country landed in a hole so deep . Wait for the coming quarter results in Oct ,this figure will be about 35 % as per the economists . All is frozen . All is dead . Terrible .

Down 35%? I don’t expect that. I am no economist and we still have Sep to go. But my wag would be negative 12-18%. And results would be published only by end of Nov.

This should be of interest to you .

https://www.youtube.com/watch?v=CQHshrl4iiw

Satish, another one that will be of interest to you . The Professor says it is not 24% but 34/35 % . Enjoy .

https://www.youtube.com/watch?v=yuKmhErXNNk

Well yes, even the official data for Q1 (AMJ) goes with those caveats that unorganized sector data was projected based on organized sector and that it was likely worse. But he doesn’t talk about -35% for current quarter. He mentioned -10%.

I agree economy is terrible in India and I have moved large part of my savings out of India and into precious metals mining companies around the world.

Satish, the last para . Do not ever,ever disclose this . the b****** at ED and DRI will make life miserable for you under FEMA(before was FERA) . I have first hand experience with the SOB’s .

I am aware of these regulations and am well within these. As someone who speaks for liberty and against government, I will add that I am shit scared of them and will not mess with these guys.

You are allowed foreign remittances upto $250,000 per annum including for purposes including foreign equity stakes. Disclosures during tax filing though have become very complicated since last year. You can make a career out of it with even tax auditors clueless on how to report these.

Happy for you . I don’t know the current regulations as I come from the era of FERA ,and of a period when even to send $ 100 overseas for a component meant getting RBI permission . Best of luck with your investments .

For Belgium, we have a drop of 12.1% at 2020Q2 compared to 2020Q1 when taking into account cyclic factors.

2020Q2 vs 2019Q2 is a drop of 14.4%.

Unemployement has only slightly increased currently, but a lot of companies are entering in very difficult times. Bankruptcies will increase in the coming month.

Current scenario is a GDP drop of 10.6% YoY in 2020, a recovery of 8.2% in 2021 and growth of 2-3% in 2022 to full recovery.

The German data indicate that the 2020 recession is as deep as the 2009 one.

The extension of Kurzarbeit scheme is convinient, as it is quite flexible. The important number is people in the scheme, this number is actually decreasing.

It is indeed expected that German will reach the same level of economic activity as December 2019 at the beginning of 2022, that would be the same picture as in 2011. What is your issue?

And one could add that the German labour market is now in a better shape than 2009

No issue at all , only a difference of opinion . You have verified exactly what I posted earlier and the link thereof that the authorities do not see any recovery till begin 2022 so they extended the furlough scheme to Dec 2021 . So where is the difference of opinion ? Dennis and you say we will be pre covid by sometime 1 Q 2022 . I am saying there is going to be no recovery, only a L shaped depression with several rebounds along the way . Forget ever reaching pre covid . Now coming to Germany, I am an ex auto man who has worked with OEM and keep in touch with what is happening . Well might be of interest to you that Continental workforce 100000 just fired 30000 and the boss said that another 10000 jobs will go . He sees no recovery till 2026 . See link . Regret it is behind a pay wall and only you can see the headline . I can send you such info on all the big OEM suppliers like Bosch,ZF, Valeo ,Luk, F&S,BWP,FAG,INA etc and of course on VW,MB also . No recovery in the auto industry means no recovery of the German economy . Just when things could not get bad Merkel is picking up a fight with its biggest market China over Hong Kong and Uighur Muslims . The public is underestimating the lethal blow Covid has dealt to the financial,economic,political and social system and is going to be terribly disappointed when things start falling apart . I only make an effort to make people aware of the gravity of the situation and in no way desire to scare them . To prepare you must be aware . Be well . link below

https://www.ft.com/content/db5b7869-8b0a-403e-b52a-f792df1bd736

Hole in head,

I am making an annual real GDP prediction for 2022, not a quarterly prediction. I expect annual output in constant 2010 US$ at market exchange rates will be greater than or equal to the 2019 level in 2022. No idea what the level will be for any particular quarter in 2022.

Highly likely I could be wrong, it might be 2023 or even 2024 before real GDP returns to 2019 level. I also agree IMF and World Bank are likely to optimistic in their best guess cases from June. These will be revised in September, and December, and … as they adjust based on new information.

Highly unlikely, less than 5% probability, that World real GDP will not return to 2019 level by 2025(full year).

Dennis ,thanks for your response . Like you said only time will tell . Let us wait it out . Can you do me a scenario where WTI remains in the range $ 45- 50 till end 2022 ? What will be the situation of Shale by then ? Of course this request goes to all specially to Shallow and Mike Shellman who cover themselves with the black goo so that a bum can live comfortably .

The tight oil scenario I use has oil price at 43, 45, 47, and 49 in June 2020, 2021,2022, and 2023. Tight oil falls to about 5 Mb/d in early 2022, and remains less than 6 Mb/d through June 2023.

See comments from earlier petroleum threads.

Chart of scenario for tight oil. Price starts at 45/bo for Brent in 2019 US$ in July 2020 and rises to $50/bo in Jan 2023, with prices assumed to rise linearly at a rate of $2/bo per year.

Dennis, just read the latest from Art Berman . He says ” “U.S. production may be 50% lower by mid-2021 than at year-end 2019. ” . I am more inclined to agree with him . I think you are underestimating the damage that the low oil prices will do to shale production .

hole in head,

We will see. My scenario assumes tight oil well completion rate remains at the June 2020 level (265 wells per month) until June 2021 and then will gradually increase to 530 wells per month over the next 20 months.

The forecast is consistent with that of Enno Peters from Shale profile up to June 2021.

Unlikely that oil prices remain low forever, my oil price scenario is quite conservative see

http://peakoilbarrel.com/us-june-production-rebounds/#comment-707881

I disagree with Berman’s analysis.

hole in head,

Consider the following tight oil supply projection from Enno Peters at wwww.shaleprofile.com

https://shaleprofile.com/us-tight-oil-gas-projection/

Tight oil output falls to about 50% of the peak level in Dec 2023, if the well completion rate remains at the July 2020 level (260 well completions per month) through Dec 2025, the Dec 2025 level of tight oil output is about 3800 kb/d.

Biden: ‘I am not banning fracking’

(CNN)Democratic presidential nominee Joe Biden said Monday he would not ban fracking in the United States if he were elected president, refuting repeated false claims by President Donald Trump about his stance on the issue.

“I am not banning fracking. Let me say that again: I am not banning fracking. No matter how many times Donald Trump lies about me,” Biden said in a speech in Pittsburgh.

Didnt we find explicit quotes from him during debates announcing his intention to ban fracking? I remember posting the video of the debate showing his quote. Clearly not a lie.

His staff has counted some votes in northeast PA.

Watcher,

Biden misspoke during a debate. The next day the campaign clarified the position.

In a March Democratic primary debate, he said: “No more – no new fracking.” The statement came after his then-rival Bernie Sanders said he would end fracking in the United States to combat global warming.

Biden’s campaign then said he meant he would not allow new federal land-drilling leases.

Dennis

I didn’t realize he misspoke. The GOP will run clips of the misspoken words. That is one of the problems. You get the first big headline on the front page. The correction is on P17.

I also think I heard him say that all NG power plants will be gone by 2035 and will kill Keystone XL. Between those three statements I said to myself, there goes NM, ND, PA, CO, OK, etc. Maybe he gains Nebraska with KXL.

I only heard the no new fracking, which I agree was a mistake. Generally campaign promises are difficult to keep and politicians often change their position, Trump does this about every 5 minutes he stands for only himself.

I don’t think Trump remembers or cares what he said 5 minutes ago. Neither do his followers.

Your being kind

Trump is worse than Hitler!!

Awoke To Cancel Culture’s Collapse

See here.

Rinses, repeats and presses of the reset buttons… with each new generation…

“Congratulations, you’ve inherited a dystopia. Now kindly run it, please. Thank you… Takers?”

Given what we are supposed to know about this nation-state crony-capitalist plutarchy dystopia, who in their right mind would run for president?

For the intermediate term (including the next presidential term),

fracking in the USA will be determined solely by economic factors. Period.

(yes, that is three periods for emphasis)

Who ya going to call to frack ? “Schlumberger has become the biggest oil-service industry player yet to abandon frack work in North America, a sign that activity in the U.S. shale patch may never revisit previous highs.” Ugly. How many Ba billion writeoff? Massive bleed out like BHP sale of Fayetteville.

https://www.rigzone.com/news/wire/schlumberger_sale_marks_shale_turning_point-01-sep-2020-163173-article/

I believe Halliburton will be happy to take that business.

World’s Largest Oilfield Services Provider (Schlumberger) Sells U.S. Fracking Business

https://oilprice.com/Energy/Energy-General/Worlds-Largest-Oilfield-Services-Provider-Sells-US-Fracking-Business.html

As for GDP above, and presumed consumption alignment, the most disquieting truth about it is a lot of stimulus flowed in Q2.

Watcher,

Yes some stimulus flowed, typically in a catastrophic economic situation more is always needed.

Interesting .

https://indianexpress.com/article/business/world-market/one-of-the-worlds-richest-petrostates-is-running-out-of-cash-6580063/

Russian oil production was up 479,000 barrels per day in August, from 9,382,000 bpd to 9,860,000 bpd. That is converting tons to barrels at 7.33 barrels per ton.

Reality Hits Shareholders Of Formerly Bankrupt Whiting Petroleum

“Whiting Petroleum Corp. (WLL) exited Ch.11 bankruptcy on September 1 and shareholders are getting 0.0133557960 of “new” WLL shares ” Thank god for Energy Dominance

https://seekingalpha.com/article/4372075-reality-hits-shareholders-of-formerly-bankrupt-whiting-petroleum

This is much worse than the 1 for 4 share reverse split Whiting had done pre BK.

It’s not like that at all. The charts are misleading. What’s referred to as energy ‘consumption’ in the charts is an unavoidable mistake in labeling. It unfortunately treats all the fuel consumed in all sectors of the economy equally. But that is really wrong.

The fuel used to produce fuel is not only an ‘expense account’ item, but is also on the expense side of the energy ledger, and thus doesn’t contribute to the greater social need for liquid fuel. This simple notion is exemplified by the Permian/Bakken shale bust, and explains why the world came out of the so-called shale revolution $200 Trillion in unpayable debt.

peter,

If oil prices remain at $55/bo or less for Brent in 2019$, then Permian debt will not be repaid.

A scenario with oil prices rising by about $2/bo annually until reaching $ 70/bo and then remaining at that level for 10 years and then declining at the same annual rate to $30/bo allows all debt to be paid by 2032 and the cumulaive net profits of about 400 billion out to 2060. Total economically recoverable resources about 45 billion barrels for Permian in such a scenario.

Correction, I remembered Permian URR incorrectly, it is about 51 Gb of economically recoverable resources (ERR) for oil price scenario in chart below, for all US tight oil the ERR for this oil price scenario is about 78 Gb.

Some Latino site has translated this months post into Spanish.

https://www.diariodelatinos.com/?p=42395

Ha, bueno… Fernando?

Hey, I like the new mathematical names by the way: Dennis+Coyne, Nick+G, shallow+sand… All very+cute.

Yours,

~ Cae+MacIntyre ^u^

https://www.manufacturing.net/energy/news/21172618/qa-more-oil-and-gas-bankruptcies-coming

https://peakoil.com/consumption/peak-oil-production-seen-by-2040-as-iea-calls-2020-turning-point-for-energy

Total CEO expects oil supply to peak between 2030 and 2040. By 2050 supply might be around 40 mb/d. That suggests a steep decline rate after the peak.

Toby,

An oil shock model which assumes a URR for C+C of 3000 Gb and a peak in 2030 at 84 Mb/d (C plus C) has World C plus C output at 57 Mb/d in 2050, reaches 40 Mb/d in 2063. I assume in this scenario there is a slow transition to alternatives to oil as supply declines and also that oil prices remain low (under $70/bo in 2019 US$). A faster decline in demand might lead to lower output than this scenario, but it would be demand driven, not due to lack of supply.

The Real Reason The Oil Rally Has Fizzled Out

Focusing mainly on the decline rate of shale and the lack of new drilling, I’ve made the point repeatedly in OilPrice articles that the shale miracle in the U.S. is over. Here is a link to my most recent writing on this topic. Shale was thought to be impervious to decline by many. Some of us (speaking of myself here) always knew better as we understood the short-decline nature of the rock. Now companies are taking write-offs on shale as they did deepwater assets a few years ago, meaning there are reserves we thought would be available in the years ahead that will now be uneconomic.

Seems US oil production fall below 10 Mbpd, is it related to bad weather?

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

Freddy

I think this drop is related tp the Hurricanes from last week when GOM wells were shut down.

Bloomberg Radio blurb. US domestic air traffic July -70 percent compared to July 2019. China domestic air traffic in July -30% compared to July 2019.

Latest from Art

https://www.artberman.com/2020/09/03/stop-expecting-oil-and-the-economy-to-recover/

Thanks,Longtimber . Good find .

Art is basing his ideas on Nate Hagens. Nate, in turn, is 50 years out of date. Nate assumes that fossil fuels are essential, and that they can’t ever be replaced by, say, wind and solar. He calls solar “fixed”. I suppose that’s true, but it’s fixed at 100,000 trillion watts! He quantifies current human energy consumption at 17 trillion watts…

and provides this source:

https://www.sciencedirect.com/science/article/pii/S0921800919310067?via=ihub#bib0385

which claims that renewables cannot replace FF for high temperature industrial applications:

“4.5. Energy substitutability

Modern economic theory considers all inputs fungible and substitutable. If the price of one input gets too high, the market will develop an alternative. However, energy does not cooperate with this theory because different sources of energy exhibit critical differences in quality, density, storability, surplus, transportability, environmental impact, and other factors. For instance, there are hundreds of medium and high heat industrial processes (for textiles, chemicals, cement, steel etc.) using fossil fuels that have no current (or even under development) alternative using low- carbon technology (Khanna et al., 2017). Energy can only be substituted by a similar form/quality energy.”

based on the following source: https://escholarship.org/content/qt1ph8w8m2/qt1ph8w8m2.pdf

The citation does not support that claim. It instead assumes that renewable electricity can support industrial processing of glass, etc. Three specific applications are considered, including:

Replacing fossil fuel melting with electricity in the Glass sector

Replacing coal firing with electricity in the Food and Beverage sector

Replacing heat dryers with electricity in the Pulp and Paper sector

Nate is Right and Wrong. If we remove head from ass PV is magic . If you buy stuff that is not Grid Dependent L O C A L PV with Storage works better than anything. If you continue to reject the majority of watthours, not a chance – UR Toast. Energy Transition has to be done in Phases. No Light Out – Oh wait, energy required for solid state light is minuscule.

Art is basing his ideas on Nate Hagens.

I did not get that from the article. It reads like he simply agrees with Nate on many points. From the article:

I expect that the mix of energy sources will be similar initially. That will probably change as declines to meet the decreased carrying capacity of a society deprived of fossil energy productivity. Then, I imagine the world will move increasingly toward lower productivity energy sources like wind and solar. A viable economy may very well be created based heavily on wind and solar. It will, however, support a much poorer world than we have known for many decades in the world’s advanced economies.

I think that is being extremely optimistic. To expect a world economy supported by renewable energy to be as rich as an economy supported by fossil fuel is just totally unrealistic. Does anyone in their right mind believe air and sea travel and shipping relying totally on renewable energy to remotely resemble air and sea travel and shipping powered by fossil fuel?

Sure. Electricity from wind and solar is cheaper overall, than from fossil fuel. When wind & solar are overbuilt to anything like the 2.5x ratio of the current grid, the grid will produce (or be able to produce) 2.5x as much power as the current grid: the majority of the time wholesale electricity will be priced at almost zero.

So, electric transportation will be as cheap or cheaper then ICE transportation: this will cover the large majority of ground shipping: rail and most trucking.

Aviation is likely to use synthetic fuel. Synthetic fuel is technically doable now, its just very uncompetitive due to the high price of power, which is the majority of the cost of production. If there’s a great deal of very cheap electricity available then synthetic fuel will be roughly competitive with oil.

Water shipping might use hydrogen, as might long-haul trucking: it will be an interesting competition between synthetic hydrocarbon liquid fuel vs hydrogen.

When wind & solar are overbuilt to anything like the 2.5x ratio of the current grid, the grid will produce (or be able to produce) 2.5x as much power as the current grid: the majority of the time wholesale electricity will be priced at almost zero.

Oh good God, do you really believe that? Nick, you are simply delusional.

Aviation is likely to use synthetic fuel. Synthetic fuel is technically doable now, its just very uncompetitive due to the high price of power, which is the majority of the cost of production.

From thin air? No, that is not possible. Yes, you can produce nitrous oxide from thin air, but not jet fuel. The air contains no fuel.

The US Air Force Synthetic Fuels Program

Late in 2007 the US Air Force released the final test report covering flight trials of a synthetic aviation kerosene, flown over a year using a service B-52H bomber. This is first step in a carefully planned long term effort which is intended to wean the US military machine off imported petroleum products, the aim being eventual replacement of crude oil based fuels with products made from natural gas and coal, where possible sourced within the US.

Nick, synthetic aviation fuel is made from coal and natural gas, both fossil fuels!

I will not even comment on hydrogen. Hydrogen is a joke.

Ron,

First step, to understand renewable overbuilding: look up the overall installed generation capacity of the US. EIA has the data, take a look.

Next, do just a little research (just a quick google search) on synthetic liquid fuels. You’l find that there’s a great deal beyond the Air Force’s program of Gas to Liquid (GTL) and Coal to Liquid (CTL).

Here’s some articles I happen to have already:

Decentralized fuel synthesis from CO2 & water from air. “The process to convert them to a liquid fuel is well understood”, but a centralized large-scale facility might be better:

https://www.scientificamerican.com/article/could-air-conditioning-fix-climate-change/

Navy pilot plan for jet fuel from seawater, in 2014. Costs of $3-$6, 10 year development.

https://www.smithsonianmag.com/innovation/fuel-seawater-whats-catch-180953623/

followup on Navy plan, with inexpensive catalyst.

https://www.sciencedaily.com/releases/2020/07/200715123120.htm

H2 from seawater: new electrodes to put on par with freshwater

https://news.stanford.edu/2019/03/18/new-way-generate-hydrogen-fuel-seawater/

Remember: fossil fuels are pretty much just hydrocarbons: combinations of hydrogen and carbon. You can get hydrogen easily enough from water (seawater is cheap) and you can pick up the carbon from the air, or water (it has a higher concentration than air). The key ingredient, the difficult ingredient, the expensive ingredient is electricity. And that will be getting cheaper and cheaper. And even if it doesn’t it will stay affordable: combined with greater efficiency aviation and long distance shipping would be perfectly viable.

“Nick, synthetic aviation fuel is made from coal and natural gas, both fossil fuels!”

Please, try to understand the basics befor posting. You can of course make syn-fuel from H2 and CO2.

The price per kWh thermal energy is around 10-20 cents at the moment, that would be 160 – 320 USD per barrel.

The major contributions to the cost are electrolysis and costs of chemical reactor for the methanisation step, electricicty is secondary, that will however change with cheaper electrolysis and reaction.

The cheapest syn-methane is at the moment made by a combination of bioreactor and electrolysis, the biogas consists of 50% CO2 which is in the presence of H2 converted into methane by the bioorganisms.

The price per kWh thermal energy is around 10-20 cents at the moment, that would be 160 – 320 USD per barrel.

Well, this is for finished fuel, right? So you wouldn’t want to compare it’s cost to that of crude oil. You’d compare a cost of about $1.50 per liter to the per liter cost of conventional fuel (which is comparable in Europe).

The major contributions to the cost are electrolysis and costs of chemical reactor for the methanisation step, electricicty is secondary, that will however change with cheaper electrolysis and reaction.

Could you break out the costs?

Thank you Ron for the book recommendation – Alchemy of Air. I am in the middle of it and it has refocused my attention on what really matters. Humans have lived without FF energy (not many of us and not an easy life) but fixed nitrogen in the soil is the limiting factor. A must read.

Karen

I too am in the middle of reading this book. Great history. I was in Paris in 2005/2006 when I had my big awaking about oil after reading TEOTWAWKI. I remember being moved to tears (me and mine were drinking wine, eating cheese and bread on the lawn with the Eiffel Tower as a backdrop) when it came over me like a wave – watching all the people going about their busy lives, knowing that many didn’t have a clue as to what was going on in the world of energy. Life as the tip of the ice berg, unaware of what it took below to have the tip.

The Alchemy of Air is another eye-opener. If a majority of humans alive today understood what it takes to put food on the table, they would be shocked and scared. But they are not, thanks to all the distractions of the consumption age driven by technology. Thank sky daddy for all these marvelous contraptions that keep our heads down… every day I wonder, is this the day? Is this the day the other shoe drops? Something is holding it together, by a thread.

Could it be as a clothing ad I saw this morning online so aptly put it “Liquor (noun) – the glue holding this 2020 shitshow together.” Ah, well. Back to the book – thanks again Ron!

The role of atmospheric nitrogen conversion to usable forms [nitrite, nitrate,ammonia] in providing the protein supply of humanities 7.8 Billion cannot be understated.

If not for the manufacture of nitrogen fertilizers, population would be well less 2 billion, and maybe less than 1 billion. Within a decade- (how big is your spam warehouse?).

How much energy does the world consume to provide the nitrogen fertilizers?

“Worldwide, the Haber-Bosch process consumes 3 to 5 percent of all natural gas produced, around 1 or 2 percent of the world’s entire energy supply,”

I assert that this energy use will one of the last to go, in a world that is overpopulated and becomes short of energy. In this scenario, class 1 and 2 farmland becomes invaluable. We should already be treating it as such, rather than paving any of it.

There are a few technological advances that are of interest in the arena.

1. People are working to improve on the H-B process, and have been for a hundred years. No big breakthrough yet, but I wouldn’t discount the possibility out of hand. Here is an example of the work people are doing – https://phys.org/news/2019-04-ammonia-production.html

2. 2029-Imagine the wind is blowing strong 100m above the Iowa landscape on night, and the grid demand is low at this time night. All of the farm machinery batteries are charged up full. The electricity can be used for ammonia production.

Read up on the possibilities if you are interested-

https://www.sciencemag.org/news/2018/07/ammonia-renewable-fuel-made-sun-air-and-water-could-power-globe-without-carbon

https://www.ammoniaenergy.org/topics/green-ammonia-synthesis/

Yes, there really is an Ammonia Energy Association. Should be of no surprise considering how important the whole sector is to the life of humanity.

If not for the Haber /Bosch process, most of us would not be here right now.

And the planet would be in better shape.

Natural gas (aka methane aka CH4) is used because it provides hydrogen, which is combined with atmospheric nitrogen in the Haber-Bosch process.

There are other sources of hydrogen – the most straightforward is electrolysis of water, using seawater and renewable electricity. NG is not necessary to produce fertilizer.

—

If H2 got more expensive, how much would it increase the retail price of fertilizer, and how much would that increase retail food prices?

The fact that H2 from electrolysis isn’t price competitive is very, very different from it not being viable. Beta VCRs couldn’t quite compete with VHS, but if VHS had never existed, Beta would have worked just fine. There are an infinite number of other examples of things that were viable, but couldn’t quite compete.

If the H2 input is 30% of the retail price of fertilizer, and fertilizer is 10% of the price of food, then a doubling of cost for H2 would only increase food prices by about 3%.

And, how much would farmers shift their crops towards less intensive fertilizer crops, and more careful fertilizer utilization?

The point is: a substitute for NG for fertilizer does indeed exist. If we transition away from NG (or it depletes) it won’t be the end of the world. No one would starve.

—

That’s a worst case scenario, which assumes current pricing of electricity (and current electrolysis engineering). Large scale installation of wind and solar are likely to be over-built, to reduce the impact of intermittency. That will produce massive amounts of surplus power, which will be dirt cheap for this kind of off-peak, secondary consumption.

—

And, if it doesn’t, then that would mean that wind and solar intermittency was solved by less expensive tactics than over-building, which is only to the good, for the overall energy system.

On an overall system basis, it works either way.

Nick. “The point is: a substitute for NG for fertilizer does indeed exist. If we transition away from NG (or it depletes) it won’t be the end of the world. No one would starve.”

True perhaps, if we had 200 years to adapt (massive downsizing of population).

Otherwise, nice dream.

I’m not a buyer.

btw- I have high level Univ degree in food production and related sciences, so my view is a little beyond speculation on this.

btw- I have high level Univ degree in food production and related sciences, so my view is a little beyond speculation on this.

I don’t have any of that shit but I agree with you anyway. (-;

Hickory,

That’s fine- please give some specific argument, ideally something with numbers, showing why a transition would be so difficult.

Real Food Security

I’m tempted to agree by the simple fact that I can identify and eat, which I do, lots of so-called weeds in my immediate area.

Apparently, too, wild edibles are far more diverse and nutritious than the crap that passes for food at the grocery stores. Not only that, but they’re free, save for the effort required to gather them, and often very hardy, which might be a godsend, given climate and other ecosystemic change considerations.

Also, there are vast tracts of green space– often in the form of idiotic lawns that must be regularly mowed by fossil-fuel-powered machines– in and around towns and cities that are or can be used for urban gardens, no matter what’s grown. And when you bring the community in on gathering and gardening, including the kids, other positive effects can happen, like extra concern for the health of the locale, including its soils; extra general related knowledge, such as about other plants and their alternative usages, like for medicine; and self/local/community-empowerment, compared to the relative self-uselessness in some regards and worse inherent in letting some distant crony-capitalistic profit-driven chemical psychopathic corporations feed us.

“Down the hatch you little fuckers.” doesn’t seem too far removed from the attitude embedded in our plastic-wrapped corporate-industrial muffins, steaks and baby food.

That said, I wonder if some forms of education– formal or otherwise– can actually lead one further astray from reality or what works best.

My idea of ‘food production’ seems quite removed from genetic engineering, industrial processes and dumping a whole lot of toxins on already dead soil, but what do I know?

BTW, Dennis, you’ve sometimes asked me how we get to ‘Plan B’ or somesuch question. Well, there’s some more of my answer. If you live near the sticks near Boston, you should have a veritable buffet every summer right under your nose.

But gather wisely. Coax/Nurture/Plant the plants and let/help them grow. Be a kind of 'Johnny Appleseed' for everything. Don't mindlessly uproot/de-leaf/etc. everything and leave nothing behind. Think of the future and of other gatherers. Teach and do responsible gathering, always.‘Plan B’ is not really that hard to imagine and it’s beyond fantastic. It makes ‘Plan A’ look like the dystopia that it is.

But what is a healthy ecosystem but a kind of symbiotically well-managed resource by all its co-inhabitants? This appears key.

Nick, its a silly discussion. Like we don’t need the earth, because there are other planets that may be similar.

So, no thanks.

Yeah, I know. It’s like the discussion 120 years ago – everyone knew that oil powered horseless carriages couldn’t replace horses: there were way too many horses,and not nearly enough oil.

Oh, wait…

What will probably happen: New cereal crops will be bred that fix nitrogen themselves, making nitrogen fertilizers superfluous.

https://www.frontiersin.org/articles/10.3389/fmicb.2018.01794/full

Meanwhile “fake meat” will massively reduce demand for cereals.

There is also a good chance that the rise of EVs will significantly reduce the corn, rapeseed and sugarcane crops used to manufacture methanol.

I disagree entirely. Biomass per hectare is much higher in untouched natural systems than with human industrial agriculture: “The forest precedes man, the desert follows him .”

The soil is the plant gut. Industrial agriculture kills the plant microbiota. It is not sustainable. To avoid mass starvation we must turn to regenerative agriculture. No need for artificial fertilizers.

Flush toilets and sewage mains are perhaps the most environmentally destructive practice of man see

https://humanurehandbook.com/.

http://eautarcie.org/

http://carbonfarmingsolution.com/.

Schinzy, I don’t think you understand Hickory’s point at all. You are agreeing with him, not disagreeing. You quoted François René Chateaubriand: “The forest precedes man, the desert follows him .” And that desert produces nothing without ammonium nitrate.

Hickory was dead on with that statement.

The crop yields (things like gms protein/acre) in cropping systems under annual harvest without adding chemical fertilizer (or manures on a mass scale) are what we today would consider poor- instead of 160 bushels/acre of corn in the midwest, 20 or 30 bushel/acre would be reasonable if the land is managed very well.

Sure it is possible to do without nitrogen fertilizer, but the assumptions with that scenario would have to include a human population much closer to 2 billion than 8 billion, much less meat consumption/capita, and much more careful management of manure- including humans.

Sure we could get there. But it is fairyland to think that it is a short or easy path. How do you get to 2 billion people from 7.8 billion?

One way is to deplete the fossils at a rate that is faster than building up alternatives sources of energy production. That will reduce population the hard way (very hard). That is the path we are on.

btw- as slight aside, a profound plant science international effort is underway to re-engineer photosynthesis, and the early results are greater than surprising on the upside. From a science perspective, I’d put the whole effort in the shocking category.

I agree with Hickory in the sense that industrial agriculture used and uses huge amounts of artificial fertilizer produced from natural gas.

However, we did not have to do it this way. There are other means of feeding humanity. Hickory does not have a uniqueness theorom. The reason industrial agriculture sold was increased productivity, that is to say more food per hour of human labor. Regenerative agriculture can feed the world with less surface area and fewer energy inputs at the price of more labor inputs and a better understanding of ecology. The future is regenerative agriculture. The average age of the US and European farmer is over 55. Jean-Martin Fortier gets 300 applications a year from young people with diplomas willing to work for low wages at his farm because it’s exciting to learn to produce food with rather than against nature. Apricot Lane Farms has similar success.

Recommended viewing: How I fell in love with a fish and The Biggest Little Farm.

Remarks:

1) It is not easy. It takes time and creativity. It took Apricot Lane Farms 7 years to get going.

2) In order to succeed, we have to quit wasting the valuable resource that is our excrement. For hundreds of millions of years the microbiota in the soil has recycled animal excrement making it digestible for plants. That is how the system supported a far larger biomass than that produced by industrial agriculture for so many years.

3) I have not researched yields. One hears a lot of extraordinary claims about yields, but I don’t know of serious studies backing them up.

Schinzy,

How does labor productivity compare between the two systems?

Labor productivity…

1 barrel of oil = 8 years of human physical labor

Well, a barrel of oil, refined, can produce about 44 gallons of product (including “refinery gain”), which would cost at least $2.25 per gallon, or $100 per barrel of refined product. If we put those into an engine they might produce around 15 kWhs per gallon, for about 660 kWhs.

PV these days can produce power for less than 3 cents per kWh (1.3 cents in the very best places), so that power from solar would cost very roughly about $20.

Which gives us a clue as to whether oil can compete in the years ahead…

Permaculture & The Like

Our food, including our lives in general, need to return back to each human’s individual, visceral grasp as it were, or very close by, to have any hope of being saved.

We have become way too overextended, overspecialized and generally detached and fragmented and, as such, out of holistic touch with much of anything or anyone anymore.

‘Agriculture’, so to speak, needs to lose much of its meaning, especially vis-a-vis its inherent natural decontextualizations and, along with its human, enter into a new meaning and reality that seeks a renewed symbiotic and holistic relation with the rest of the living world. The sooner this happens, the easier and less painful it will be. If there has to be much difficulty or pain at all it is with remaining hooked on the current industrial agro drug.

It’s heartening to hear from Shinzy and other sources that an apparently increasing number of people, especially the younger ones, are kicking the habit with an interest in ‘getting back to the land’ where we belong.

More power to them/us.

It wasn’t like this in old times.

1 barrel of oil = a few weeks labour with the horse & cart or horse & plow

or

a week in the wood (if you only need the heat).

There was a lot of bio fuel usage in old times (horses, mules, donkeys, bulls). For long distance heavy transport it was wind energy.

For ferilizer:

Sewage sludge was used as fertilizer until a few years ago in Germany. That’s forbidden now, because of enviromental rules. They try to build facilities to reclaim at least the phosphor.

I’m a small organic dairy and we can’t use fossil derived fertilizers and are limited by the legume fixation rate and recycling of animal wastes for nitrogen. Its a more labor intensive system and not conducive to grain/commodity farming. Properly managed the average output might be brought up to 50% of current system but would take at least 5-10x number of farmers to do so.

I suspect the answers to food production going forward will be conventional ag adopting some of the soil regenerative practices of organic ag like cover cropping, intercropping and animal integration with more moderate uses of nitrogen and fossil fuel derived synthetics. I know wind to ammonia is feasible at high energy prices as well. Seems like all that is needed is high enough energy prices to drive it.

Mil…Farmer-

I completely agree.

“I suspect the answers to food production going forward will be conventional ag adopting some of the soil regenerative practices of organic ag like cover cropping, intercropping and animal integration with more moderate uses of nitrogen and fossil fuel derived synthetics. I know wind to ammonia is feasible at high energy prices as well. Seems like all that is needed is high enough energy prices to drive it.”

Indeed “The soil is the plant gut.”

https://symphonyofthesoil.com/

A must watch. we got to experience soil building in action @ Singing Frogs Farm attending The Peak Prosperity Conference.

Grow Your Own

“To turn the world into a dependency on staples has nothing to do with feeding the world, it has a lot to do with

controlling the food supply. The United States evolved a phrase during the Vietnam war, and the phrase was; ‘Food as a weapon’; the use of food as the ultimate weapon of control. And the tragedy is,the growth of agribusiness in the US has gone hand-in-hand with the US foreign policy to deliberately create hunger locally in order to make the world dependent on food supplies, through which you can then control countries and their decision-making ability. So hunger has become an instrument of war.” ~ Vandana Shiva“Control the oil and you control entire nations; control the food and you control the people.” ~ Henry Kissinger

Nick, self driving long haul trucking would even work based on batteries: The robotic vehicle would drive for about five hours, then recharge one hour. In 24 hours, it would be driving 20 hours, much longer and further than any human trucker, and this with a limited reach of about 350-400 miles per charge.

Super heavy trucks ruin roads

The Struggle to Mend America’s Rural Roads

As supersize vehicles bear heavier loads, maintenance budgets can’t keep up. Meet the Wisconsin farmers paying the price.

America road system is massively overbuilt and will never pay for itself. This is especially true in the rural Midwest. But rural folk vote Republican, so the waste will go on.

Lovely.

Yeah, that would work. And swappable batteries would work as well – with commercial fleets you have a limited number of service locations, so it’s much more feasible than personal passenger vehicles.

You might want to read my recent stuff on the non-petro side. A quote from it:

“‘In a world of renewable energy nothing is what it seems.’ ‘Environmentally friendly’ turns out to be devastating to the natural wold. ‘Cheap’ is expensive. ‘Local support’ is found at a distance. ‘Sustainable’ is strange to say, short lived and unaffordable. A ‘contract’ is not binding, ‘secure’ is actually unreliable. ‘Love’ is hate, ‘black’ is white, and ‘green’ is a murky shade of brown.“

The idea that air travel in its current form is essential to human civilization is very doubtful. For example, most flights in America are just compensation for miserable surface transportation.

Air travel is too fast — passenger planes have been slowing down steadily since the late sixties, to save fuel costs. so if there are fuel limitations, planes may simply slow down to compensate. Also hybrid planes with electric engines in addition to fossil fuel engines would save a vast amount of fuel. One big reason planes burn so much fuel is that they use the same engines to cruise as they do to take off, so they are wildly oversized for the job they do. Something similar applies to cars BTW, which is why mild hybrids switch off the ICE when they are on the highway.

To get serious about battery powered planes, batteries need to improve density by 50-100%, which will take years. But denying that technical progress is possible will make you look silly in a few years.

The idea that air travel in its current form is essential to human civilization is very doubtful.

I don’t think I have ever made such a claim.

But denying that technical progress is possible will make you look silly in a few years.

Works both ways. We were supposed to have flying automobiles by 1960. I could name dozens of other things that pie in the sky futurists have predicted that are also likely to never happen.

Nevertheless, I think battery-powered passenger and cargo planes are a pipe dream. Yes, there will be battery-powered planes. Hell, a human-powered plane crossed the English Channel. It didn’t carry any passengers, however. But do you think batteries will every replace bunker fuel to power ships on a months-long journey? Nuclear of course, but not batteries.

But you miss my point entirely. I believe the days of ever-advancing technology making our lives better are over. All those things have made it possible for our earth’s population to reach unsupportable levels. The future is not as rosy as it used to be.

Ron.

My young brother in law says something that seems to ring true. He’s a smart guy, even keeled to the point of being maybe too much so. Works hard, basically works and helps my sister in law take care of their young kids.

Here’s the gist of what he says: “I sat in high school and watched 911, rest of high school was Afghanistan and Iraq, graduated college as GFC hit so took a year to find a job, things started to seem normal, then Trump was elected, and now we have COVID. I really wonder if there will be a ‘good time’?”

From a distance he has also watched the volatility in the oil and grain space we have dealt with, plus a highly volatile stock market. National debt soaring.

Yep, have to say 1980’s and 1990’s weren’t too bad in relation.

Shallow Sand

My take is that I lived the golden years, 1975 to 1995. Retired from full time work in 97 as I felt things were starting to turn. Did private consulting for five years and then retired my pen.

Life’s Short

Golden Years

“Don’t let me hear you say

Life’s taking you nowhere, angel

(Come get up, my baby)

Look at that sky, life’s begun

Nights are warm and the days are young

(Come get up, my baby)…”

Ron

Airbus built a small Electric plane to fly across the channel. Not much chance to scale it up.

https://newatlas.com/first-electric-aircraft-cross-english-channel-airbus-cri-cri/38410/

Ron –

Ever advancing technology is making lots of people’s lives better. For example cell phones may seem like a pointless toy in countries with plenty of land lines, but they are a revolution in Africa. Phone based banking is also a revolution, allowing vast numbers of people who will never see a brick-and-mortar bank to save and invest.

Solar + LED are bringing light to the poorest, like here in Mauritania:

https://www.google.com/maps/@18.1052389,-15.9479861,3a,75y,248.9h,90.08t/data=!3m8!1e1!3m6!1sAF1QipPnQuENIidd6oPG9VhpcRArcreFsgLgEfagA_tT!2e10!3e11!6shttps:%2F%2Flh5.googleusercontent.com%2Fp%2FAF1QipPnQuENIidd6oPG9VhpcRArcreFsgLgEfagA_tT%3Dw203-h100-k-no-pi-4.0159774-ya305.04364-ro6.472701-fo100!7i3584!8i1792

Also short hop commercial passenger flights are coming very soon:

https://www.aerospaceservices.ca/2020/08/25/from-seaplanes-to-eplanes/

https://www.flightglobal.com/airframers/all-electric-grand-caravan-makes-maiden-flight/138600.article

Meanwhile, battery density continue to rise.

Wow never read anything like that from Mr Berman before. Basically he’s saying the collapse of civilization has begun.

References Nate Hagans The Great Simplification, read it because both of these dudes are way smarter than any of us.

https://citizenactionmonitor.wordpress.com/2019/06/10/the-great-simplification-coming-next-decade-with-30-drop-in-capitalist-economies-says-dr-nate-hagens/

References Nate Hagans The Great Simplification, read it because both of these dudes are way smarter than any of us.

Yeah, I agree. Well, that is concerning the subject under discussion here.

Today’s Oil rig count

US up 1 to 181

Permian flat at 124

Texas down one due to Texas Permian down 1. NM Permian is up 1. Louisiana added 2 to 13, up from a low of 9, 5 to 6 weeks ago. What is the encouraging news in Louisiana that makes the drillers add rigs?

In the meantime WTI dropped below $40 today to 39.60.

Interesting to look at futures quotes for Dec 2025, WTI at $49/bo and Brent at $53/bo so the market believes oil prices will rise, by roughly $2/bo per year over the Dec 2020 to Dec 2025 time frame. This happens to be consistent with the rate of increase of oil prices in my scenario, though in my scenario I use real oil prices rather than nominal oil prices, so mine is different (steeper by about 2.5%, assuming an average rate of inflation of 2.5% over the next 5 years, note if there is a long period of slow or no economic growth, we would expect lower rates of inflation from 0 to 1 %).

Permian Horizontal Oil Rig (HOR) count, average HOR count from week ending July 2, 2020 to week ending September 4, 2020 was 121.

Keep in mind that 2.5% is the carrying cost of oil. If the future price is lower than that, the oil needs to be sold.

Mexican oil production was suppose to rise in 2021. This looks increasingly unlikely as it’s Maloob field is in free fall, down 30% yoy.

https://oilprice.com/Latest-Energy-News/World-News/Mexico-Shuts-The-Door-To-Foreign-Oil-Companies.html

Energy 4 Lighting

Just as an FYI, the Honeywell AGT1500 turbine engine powers the M1 Abrams tank. It runs on 3 diesel fuel variants and 2 jet fuel variants. 1500 horsepower and 25 Hp per ton. Range 260 miles. Weight 60 tons.

If you are an invading force, do you really think you’ll bring your electric grid with you and have your troops depend on some enormous photovoltaic array to power . . . what? What battery is going to give you 1500 Hp for 260 miles? And when it’s discharged, how do you deal with that? 260 mile long extension cord for recharge with that cable about as vulnerable as anything can be.

The military may play around with that stuff if it makes some Congress critter whose budget vote they need happy, but it’s never going into battle.

See the discussion above about synthetic liquid fuel.

Remember, fuels are just hydrocarbons – fossils are not essential to their production.

Collateral Murder, Cannon Fodder & Meticulously Mapping Squandered-Energy Energy Declines

At the same time, civilizations didn’t decline/collapse because of fossil fuel burning or climate change, although there were apparently some forms of ecocide inherent within their doomed trajectories.

In any event, this implicitly feeds back to Watcher’s comment regarding the military as a kind of corruption underlying how some civilizations may operate or evolve to operate and how their captive populations can accept and work with and within their fundamentally and systemically-corrupt structures.

You know, like sending the kids to a meaningless war they, like their kool-aid-imbibing parents, don’t understand and have practically nothing to do with, save for being victims of the propaganda machine?

We see it with most if not all nation-states today– with their fundamentally ethically-corrupt modus operandi and rule/legal structures– and with populations whose members occupy this very virtual watering-hole.

This, as they measure, illustrate and discuss squandered-energy energy declines with attempts at relative precision yet with some appearance of imprecision to, and/or neglect for, certain realities underpinning their relatively-tragic lives.

Right guys? High five.

Keres, by Mikael Fyrek, from the album, Further Asunder

Frac Spread count was 87 on Sept 4 see 3:15 of video below

https://www.youtube.com/watch?v=Ba6xz_dzxFY

More detailed US frac spread count. Low point was in May 2020, where the trailing 4 week average on May 29 was 48 frac spreads, the recent trailing 4 week average was 81 and on Feb 28, 2020 it was 319.

Note that the US frac spread count includes both natural gas and oil focused frac spreads, we don’t have the breakdown between oil and natural gas for frac spreads, but the ratio of oil to natural gas horizontal rigs might be used as a proxy to make an estimate of oil focused frac spreads.

Using Baker Hughes North American Rig count pivot table

https://rigcount.bakerhughes.com/na-rig-count

we can find the ratio of horizontal oil rigs to total US horizontal rigs and use this ratio multiplied by US frac spread count to estimate the oil frac spread count. The trailing 4 week average oil frac spread count is shown in chart below. Fairly flat from late May to first week of Septempber, after a steep drop from early March to late May (from 277 to 36, then a recovery to about 54 for most of the Summer.)

I think we are going to have a little oil price pullback over next 5 weeks. And it has everything to do with Europe and Brexit. UK just gave the EU a five weeks notice that a deal must be made. Nobody in their right mind will be pilling money into Europe over next 5 weeks with that kind of uncertainty hanging over. Money is going to exit and be taken off the table. It is US dollar positive. But also very negative for growth in Europe at same time. Not good for oil price or demand.

The whole letting inflation run over 2% is a head fake by the way. Truth is the Fed can even create money. They create reserves accounts and pay the primary dealers 0.1% on them. Cash people think is created during QE isn’t cash. The Fed doesn’t hand over cash for the treasuries and MBS the buy from the primary dealers. The money never leaves the Fed. It does clean balance sheets of toxic debts. But that is all it does. In order to have inflation banks have to make loans and people have to take loans.

Any uptick in bond yield will be bought. Any uptick in yield is contractionary and it forces yields back down. Yields go negative there is no other place for them to go. The government stimulus that everyone thinks is inflationary isn’t. The dollars that are used to buy that debt aren’t newly created dollars. They are bought with existing dollars by foreigners which buy about 60% of new debt. Then US pension funds and insurance companies buy around 18-20% and the primary dealers mop up what is left. Again when the Fed does QE it takes the asset from the primary dealers But the money never leaves the Fed.

Oil makes back to $100 but it is due to underinvestment to bring new oil on over next 3-4 years.

HHH,

Yes the central banks can do little to create inflation, those who understand economics well know this. Fiscal policy might help prevent deflation during an economic downturn, but rarely is the stimulus large enough. WW2 perhaps the obvious exception.

Short of WW2 level stimulus isn’t serious deflation all but guaranteed then?

Millenial Farmer,

Depends on the level of fiscal stimulus chosen by national governments. If the choose the Herbert Hoover approach and try to balance the budget in the face of an economic depression, then yes we might see serious deflation. Not all politicians are dumb enough to take that road, so it depends on the intelligence of our elected leaders.

Could be that we see deflation, but my expectation is low inflation (under 1% annually through 2023).

I hope you are correct in expecting our leaders to make the right choice. Probably goes without saying but think its critical longer term that we don’t just deficit spend to stave off deflation but rather focus on net energy delivered to society and long term maintenance costs of such infrastructure. Nothing i’ve seen in the green new deal really makes sense from those angles, not sure on status of current nuclear tech but maybe the time is ripe for new investment there?

The nuclear industry is already dead, although its corpse is still warm. The fleet is old, and in America nothing new is even in planning except the failing Vogtle project in Georgia.

The energy industry has been one of the world’s most profitable in the past, but the next ten years will see a tidal wave of wind solar and batteries entering the market. Their primary effect will be to suck all the profit out of the industry, thanks to their very low marginal costs.

There is a lot of discussion about peak supply or peak demand, but the looming threat to all energy companies is steadily declining profitability. That’s what is killing the coal industry. There is plenty of coal, and plenty of demand for electricity, but no way to make money in coal. Nuclear is hopeless as well, with companies resorting to wholesale highjacking of democracy to extort subsidies, and still failing. The great shale boom never turned a nickel profit, and the rest of the oil industry is in steady decline. Gas will be the last man standing.

Nuc issues are discussed on the non-fossil thread.

From 2 weeks ago-

Updates from the nuclear energy sector-

1. The first up small modular nuclear (SMR) reactor in the world has now made it through entire the regulatory approval process, now with final approval to begin 1st site construction Idaho. The company, out of Oregon State Univ, has a 60 MW design that can be linked together up to 720MW. Their major investor is the engineering company Fluor.

https://www.nuscalepower.com/