A guest post by Ovi

All of the oil (C + C) production data for the US state charts comes from the EIAʼ’s Petroleum Supply monthly PSM.

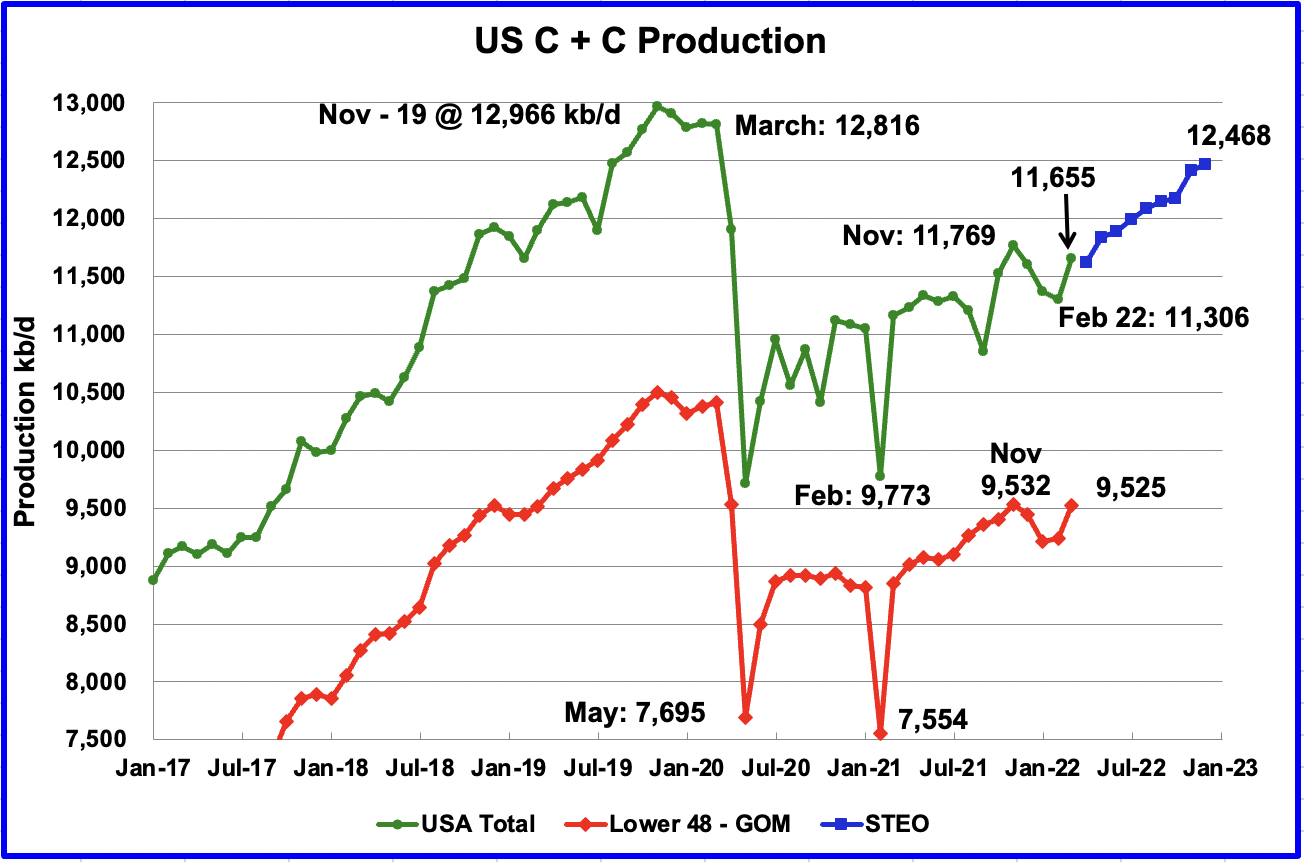

U.S. March production increased by 349 kb/d to 11,655 kb/d. Relative to November’s 2021 production of 11,769 kb/d, March is still 114 kb/d lower. The main increases came from Texas 147 kb/d, ND 66 kb/d and the GOM 75 kb/d.

While overall US production was up, a clearer indication of the health of US onshore oil production can be gleaned by looking more closely at the On-shore L48 states. In the On-shore lower 48, March production increased by 284 kb/d to 9,525 kb/d.

The blue graph, taken from the May 2022 STEO, is the production forecast for the US from April 2022 to December 2022. Note that it is forecasting a decline for April. Output for December 2022 is expected to be 12,468 kb/d, a revision of 129 kb/d lower than was forecast in the April STEO report. From April 2022 to December 2022, production is expected to increase by 842 kb/d or at an average rate of 93.6 kb/d/mth. Note the DPR and LTO reports below do not confirm the optimistic STEO production projection.

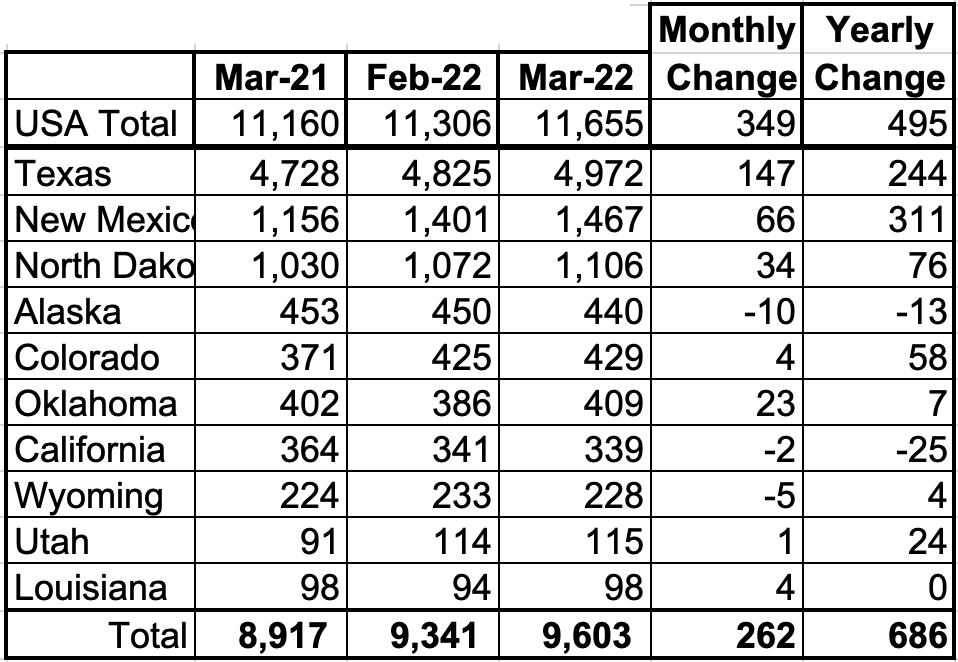

Listed above are the 10 states with the largest US production. These 10 accounted for 82.4% of all US oil production out of a total production of 11,655 kb/d in March 2022. Note that all of the above states, except Alaska and California, produced more oil in March than one year ago.

On a YoY basis, US production increased by 495 kb/d.

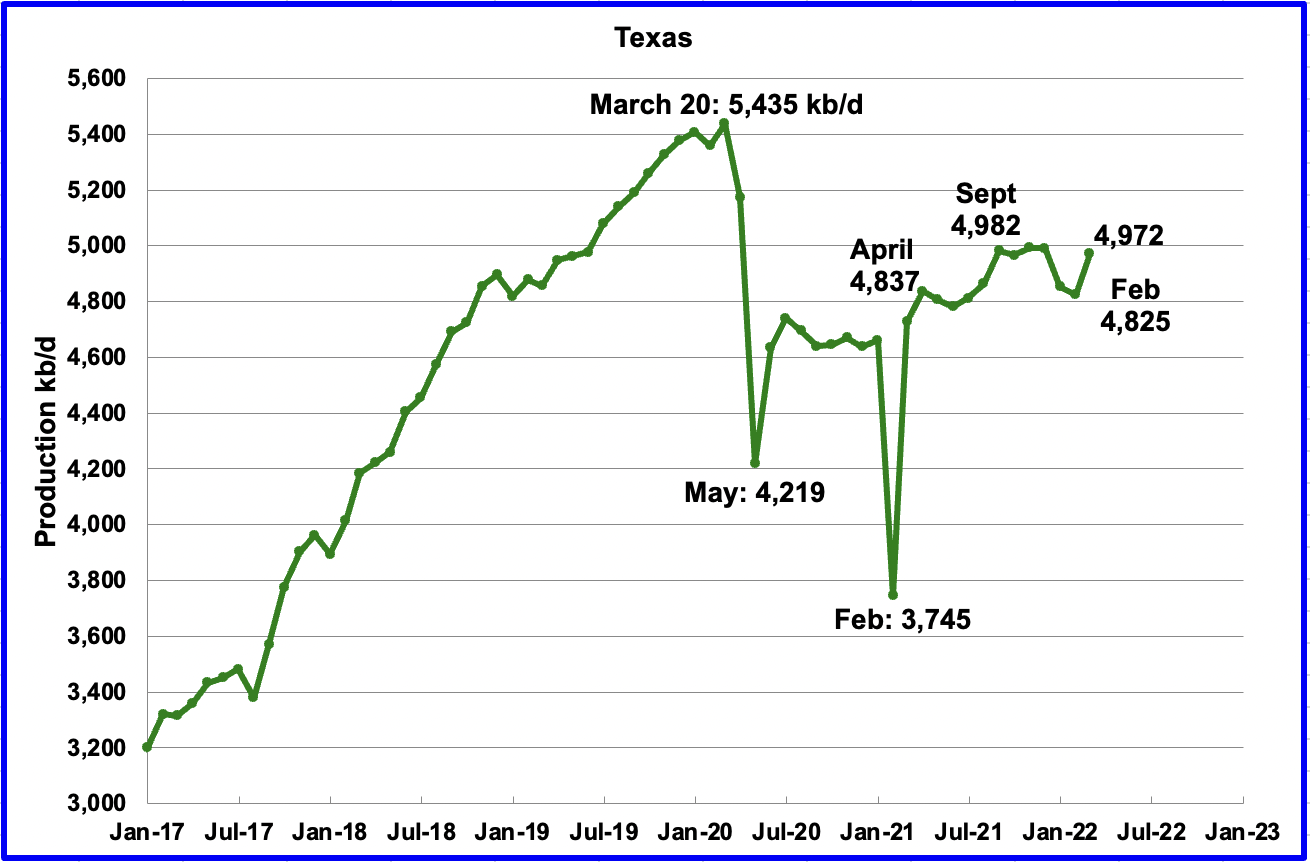

Texas production increased by 147 kb/d in March to 4,972 kb/d from 4,825 kb/d in February.

In September 2021 there were 204 Hz oil rigs operating in Texas. By the last week of March 2022, 275 oil rigs were operating, an increase of 71 rigs and production is back to the same level as September 2021, which was 4,982 kb/d.

March’s New Mexico production increased by 66 kb/d to a record 1,467 kb/d. Since December 2021, very close to 90 rigs have been in operation in the NM Permian. The production increase is due to more wells being completed than drilled. See DPR section below.

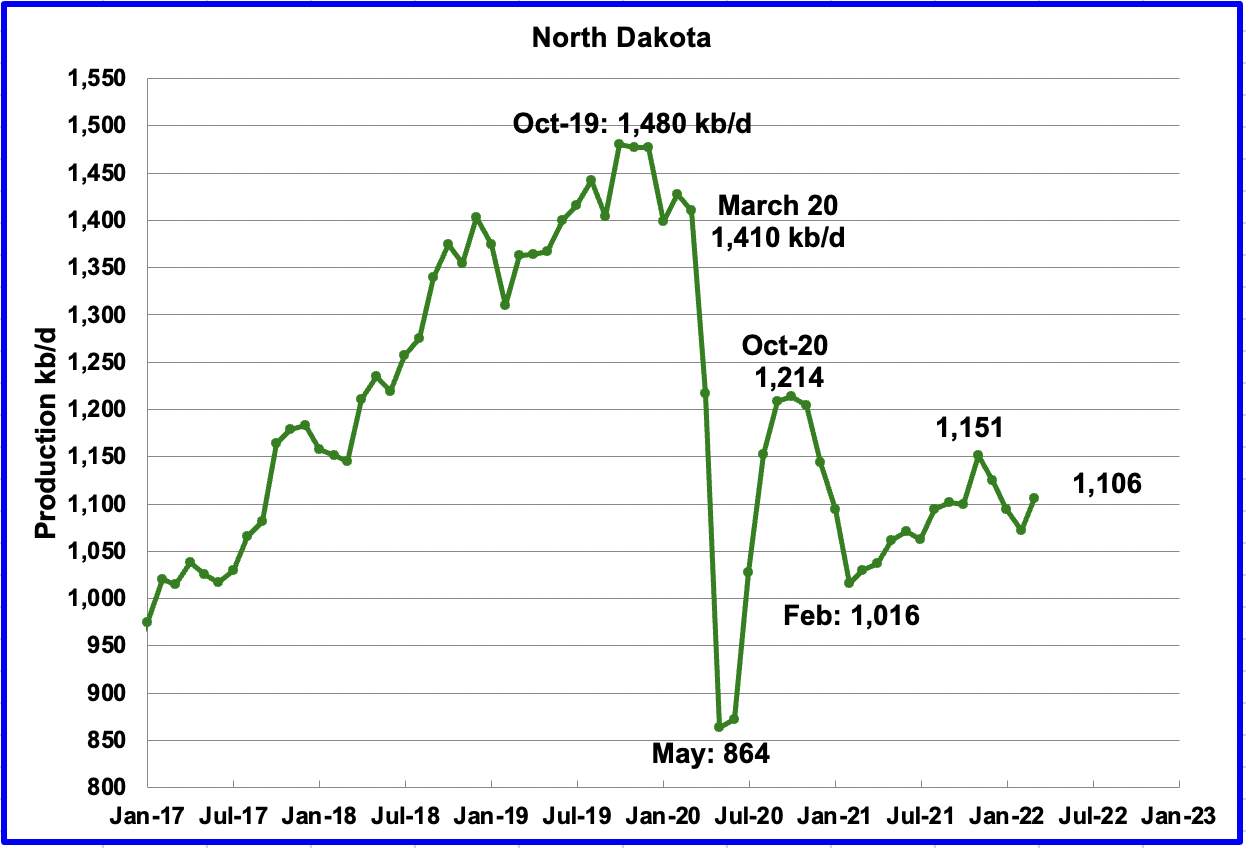

North Dakota’s March output was 1,106 kb/d, an increase of 34 kb/d from February.

According to this source, ND’s April oil production was hit hard by two winter blizzards.

“State officials say a pair of blizzards that smacked North Dakota in April caused a dramatic reduction in oil production. The Bismarck Tribune reported that State Mineral Resources Director Lynn Helms provided state regulators updated production estimates Friday. He said the state’s oil industry had been producing about 1.1 million barrels daily until the blizzards hit. The first storm began on April 12 and lasted three days. Helms says it caused production to fall to about 750,000 barrels per day. The industry had rebounded to 950,000 barrels per day when the second storm hit on April 23. That blizzard caused production to drop to just 300,000 barrels per day. Production has since increased to about 700,000 barrels per day.”

A rough estimate of what North Dakota production could be in April was made using the above information. The projected production is expected to be close to 860 kb/d, a loss of 240 kb/d.

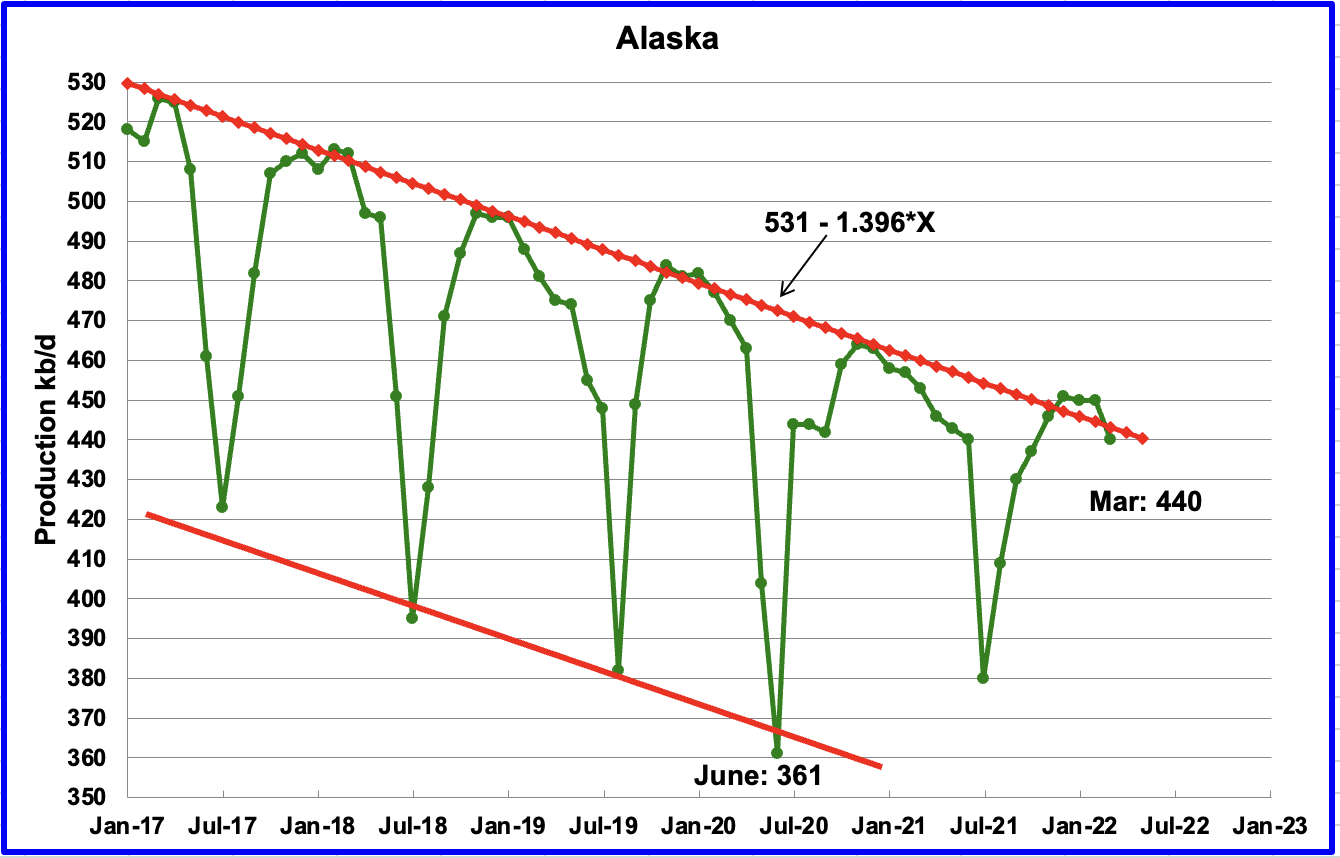

Alaskaʼs March output declined by 10 kb/d to 440 kb/d.

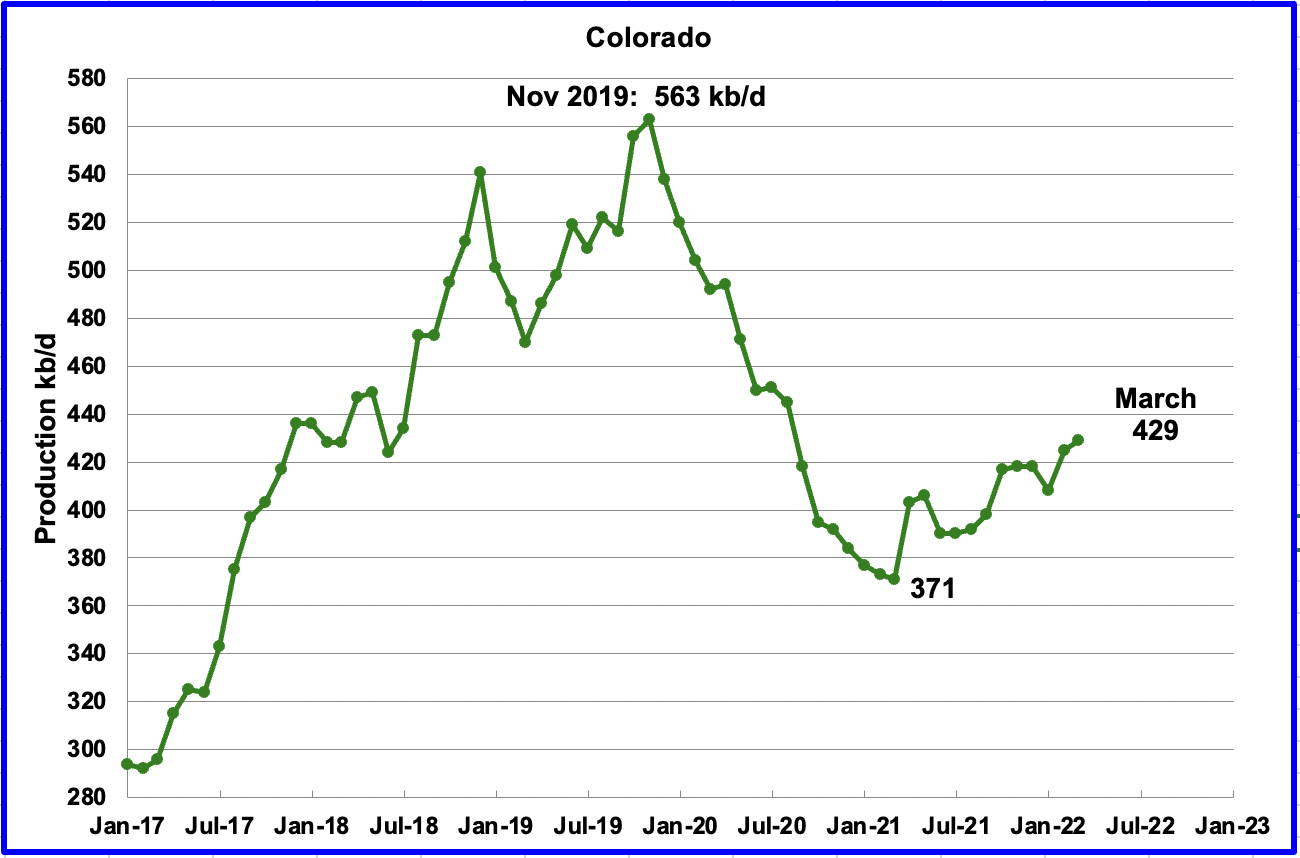

Coloradoʼ s March production increased by 4 kb/d to 429 kb/d. Colorado has had 10 hz oil rigs operating since November and had 12 operating in March.

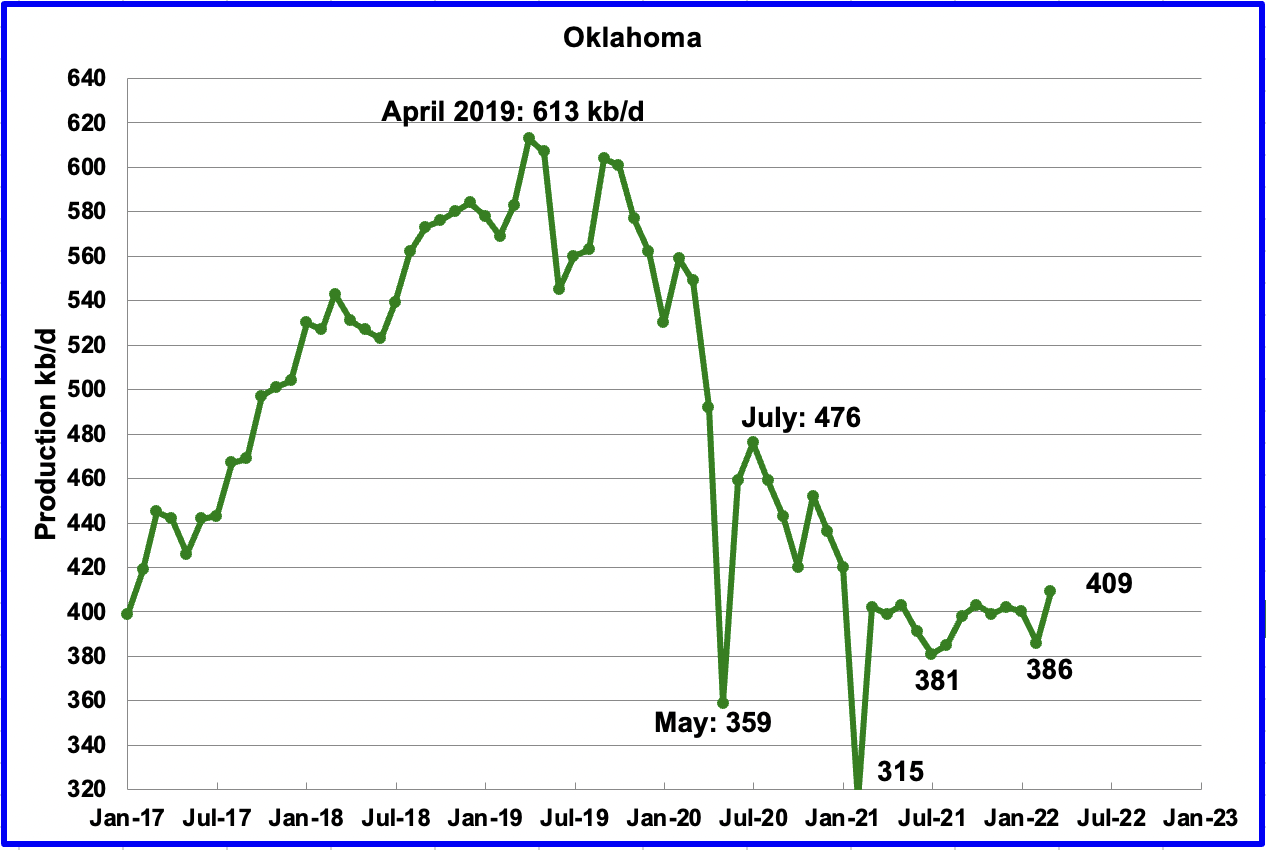

Oklahoma’s output in March increased by 23 kb/d to 409 kb/d. March’s output broke out above the 380 kb/d to 400 kb/d range it has been in since March 2021. The rig count has increased from 17 in March 2021 to 48 in March 2022.

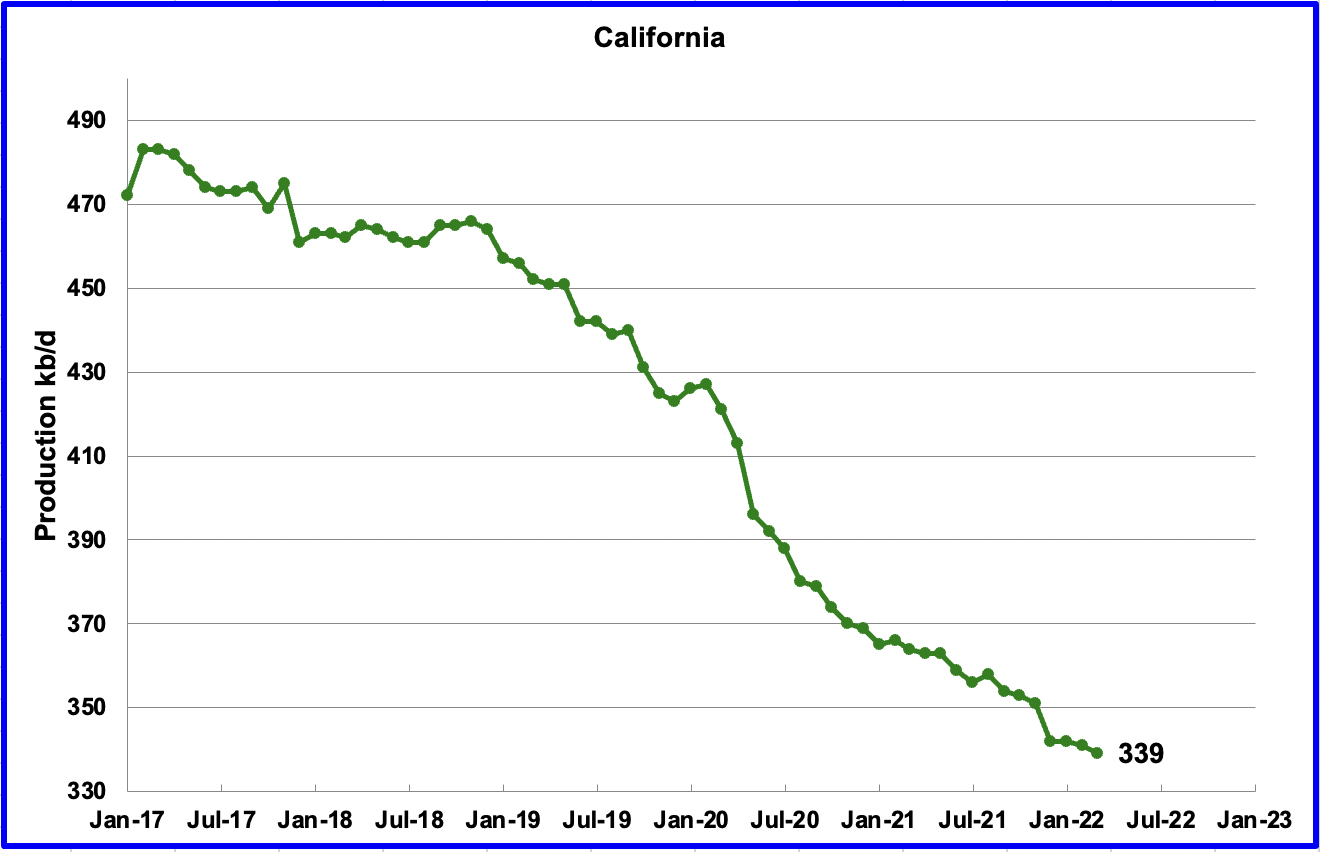

Californiaʼ s slow output decline continued in March. Output decreased by 1 kb/d to 339 kb/d.

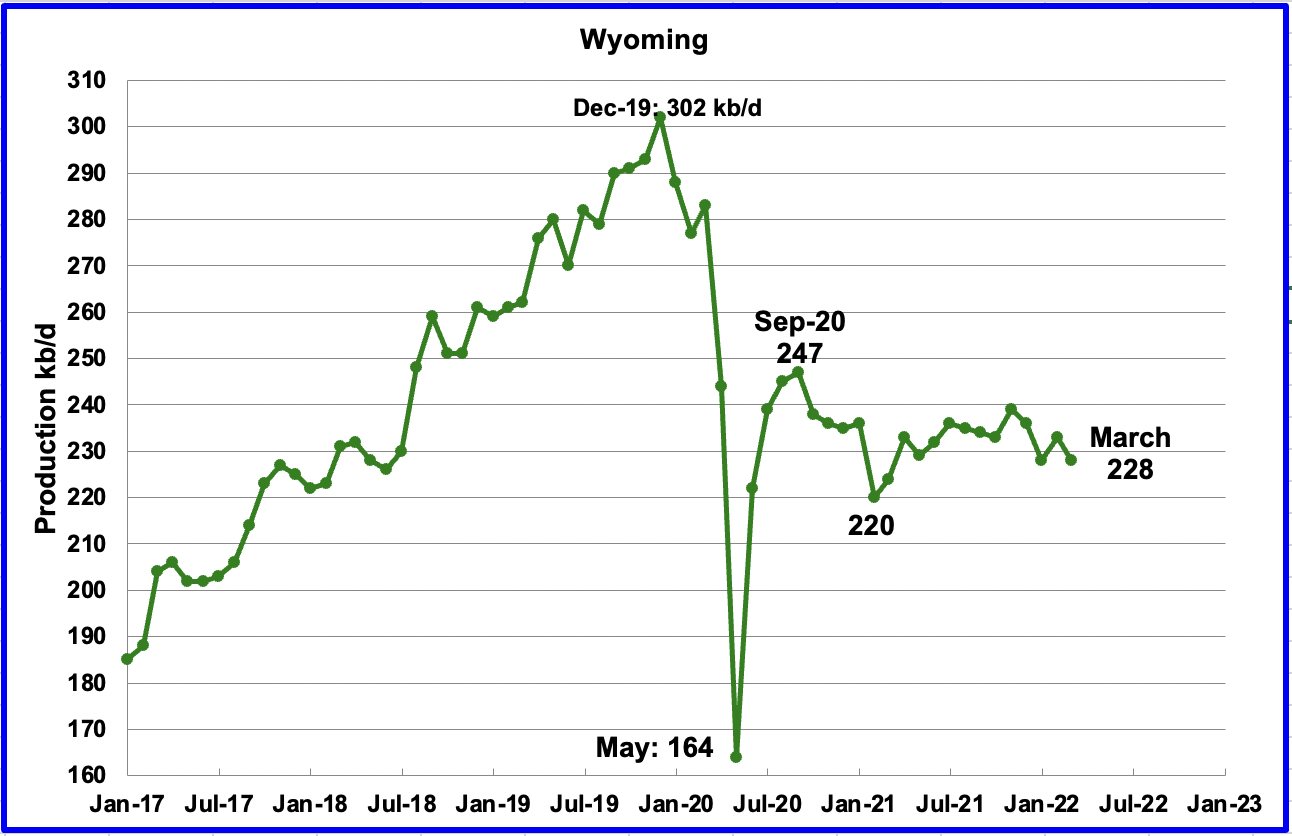

Wyoming’s production has been in a slow unsteady decline since September 2020 when output reached 247 kb/d. In March 2022 output decreased by 5 kb/d to 228 kb/d, down 19 kb/d from September 2020.

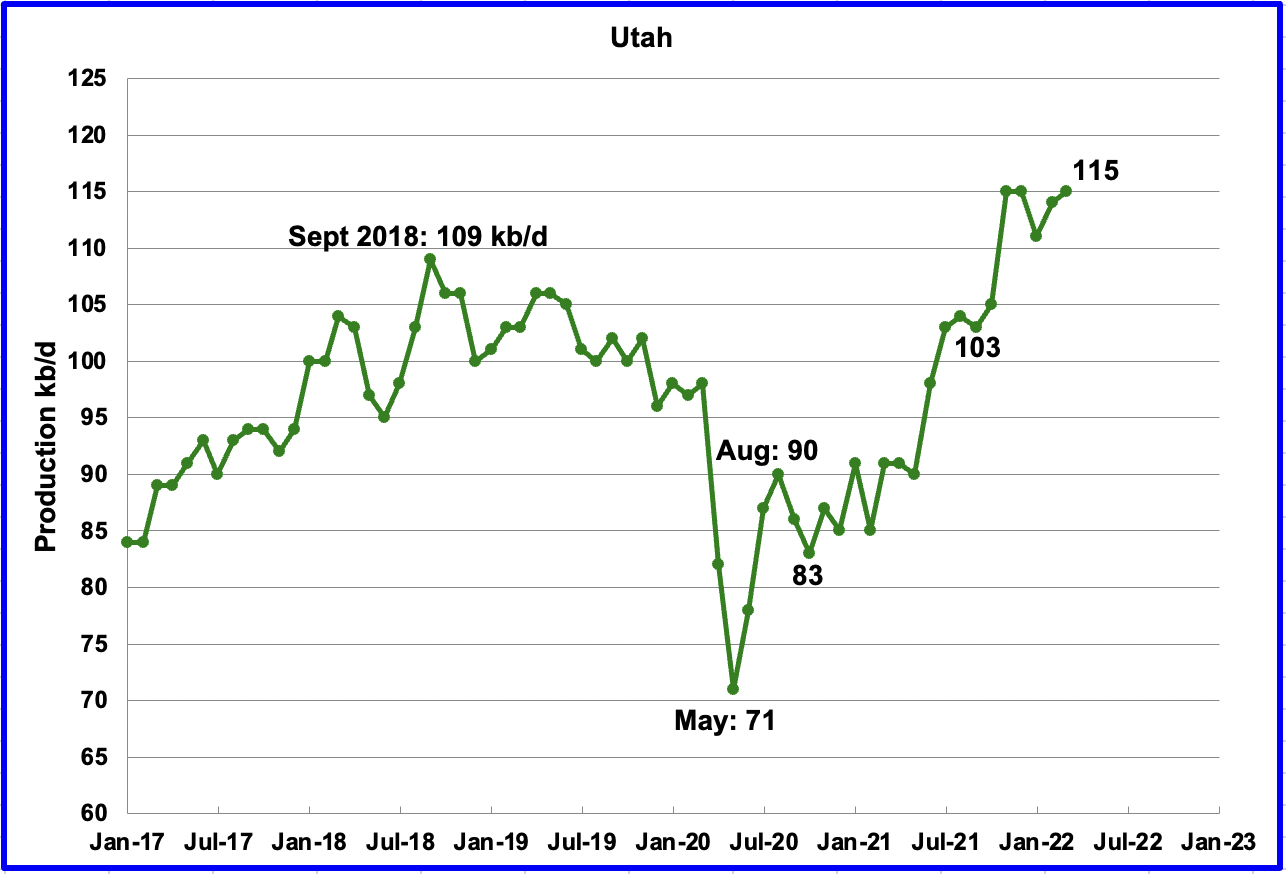

Utah’s production increase from the low of May 2020 appears to have stopped/slowed in November 2021. March’s production increased by 1 kb/d to 115 kb/d.

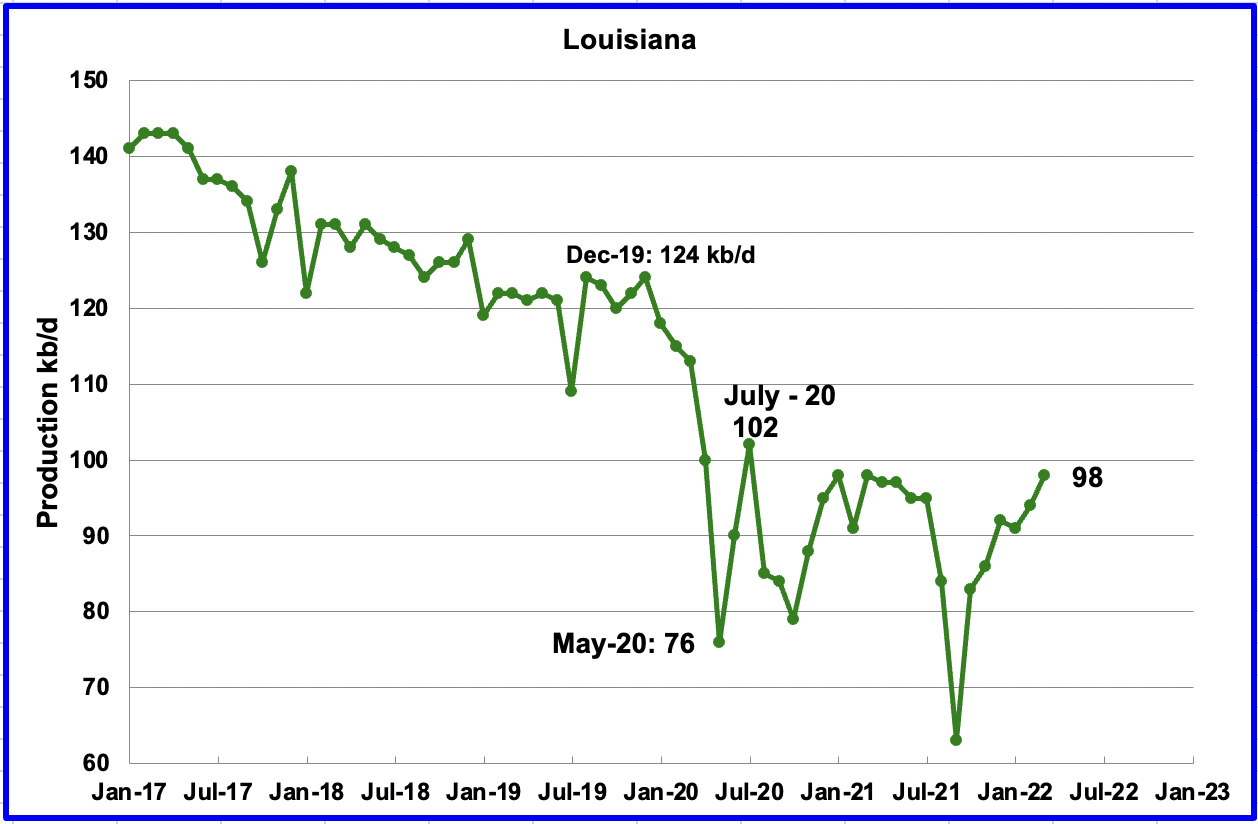

Louisiana’s output increased by 4 kb/d to 98 kb/d in March. Louisiana was one of the hardest hit states by hurricane Ida in late August. March’s output increase indicates that Louisiana’s slow recovery is continuing. Louisiana had 2 Hz oil rigs operating in March.

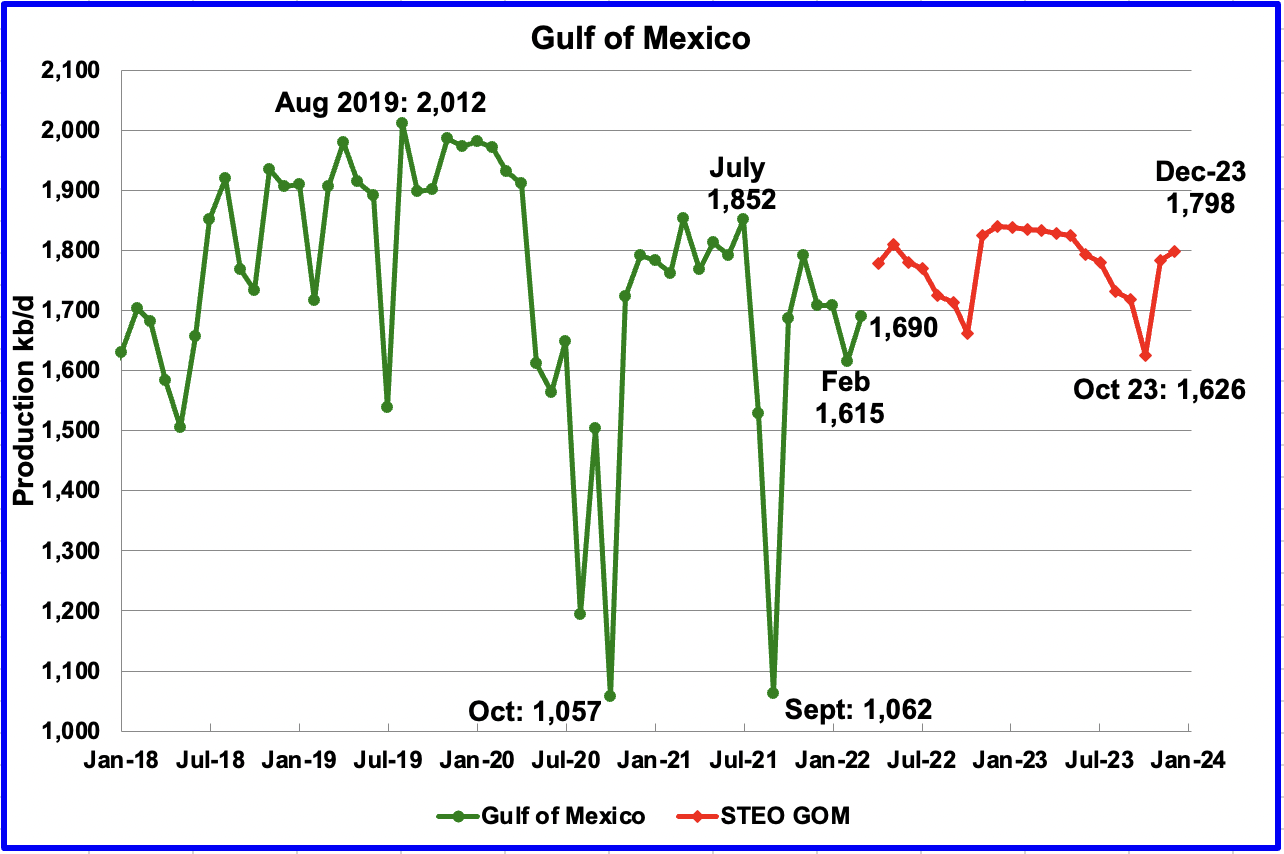

GOM production recovered in March from the decline that started in November 2021. March’s increase was 75 kb/d to 1,690 kb/d. If the GOM was a state, its production would normally rank second behind Texas.

The May 2022 STEO projection for the GOM output has been added to this chart and projects output will be 1,798 kb/d in December 2023. This is 10 kb/d lower than projected in the April report and 214 kb/d lower than the high of 2,012 kb/d in August 2019. For April 2022, the STEO is projecting an increase to 1,778 kb/d.

A Different Perspective on US Oil Production

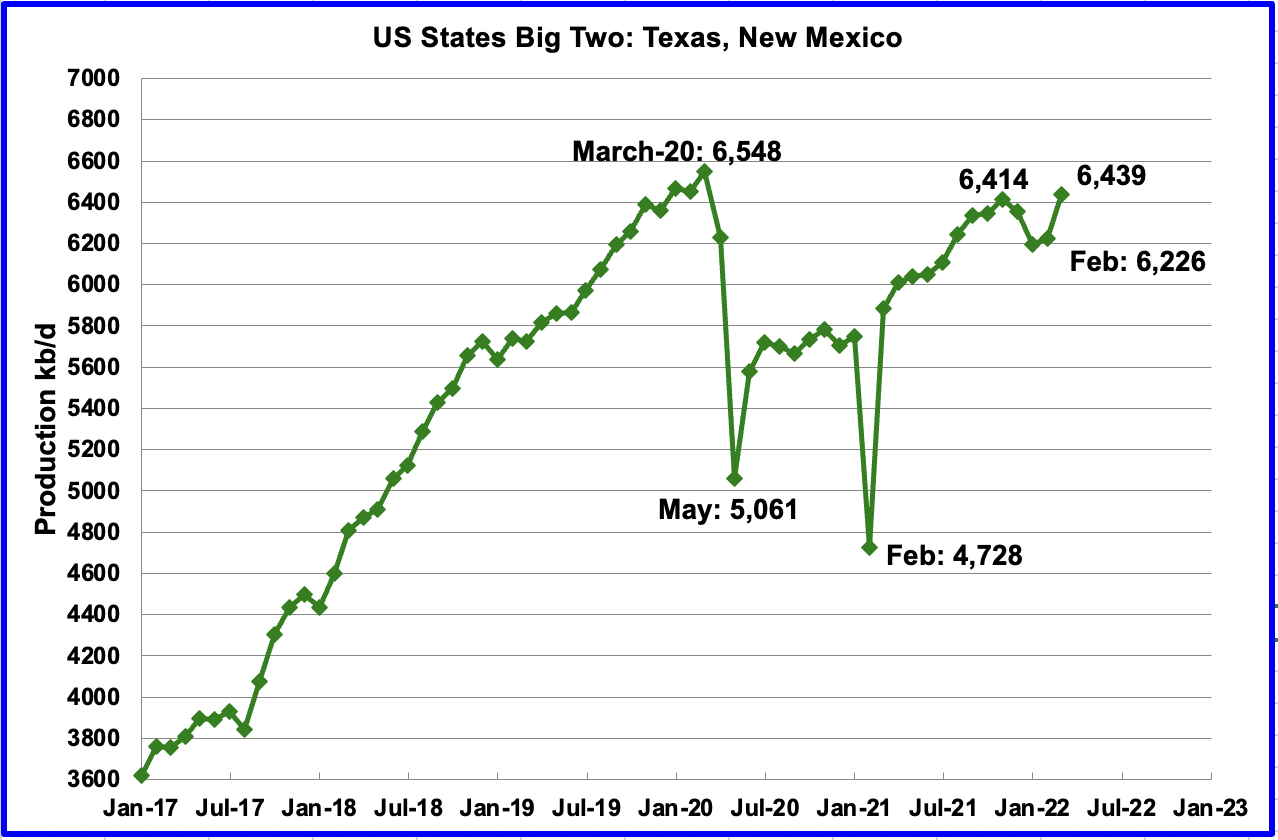

The Big Two states, combined oil output for Texas and New Mexico.

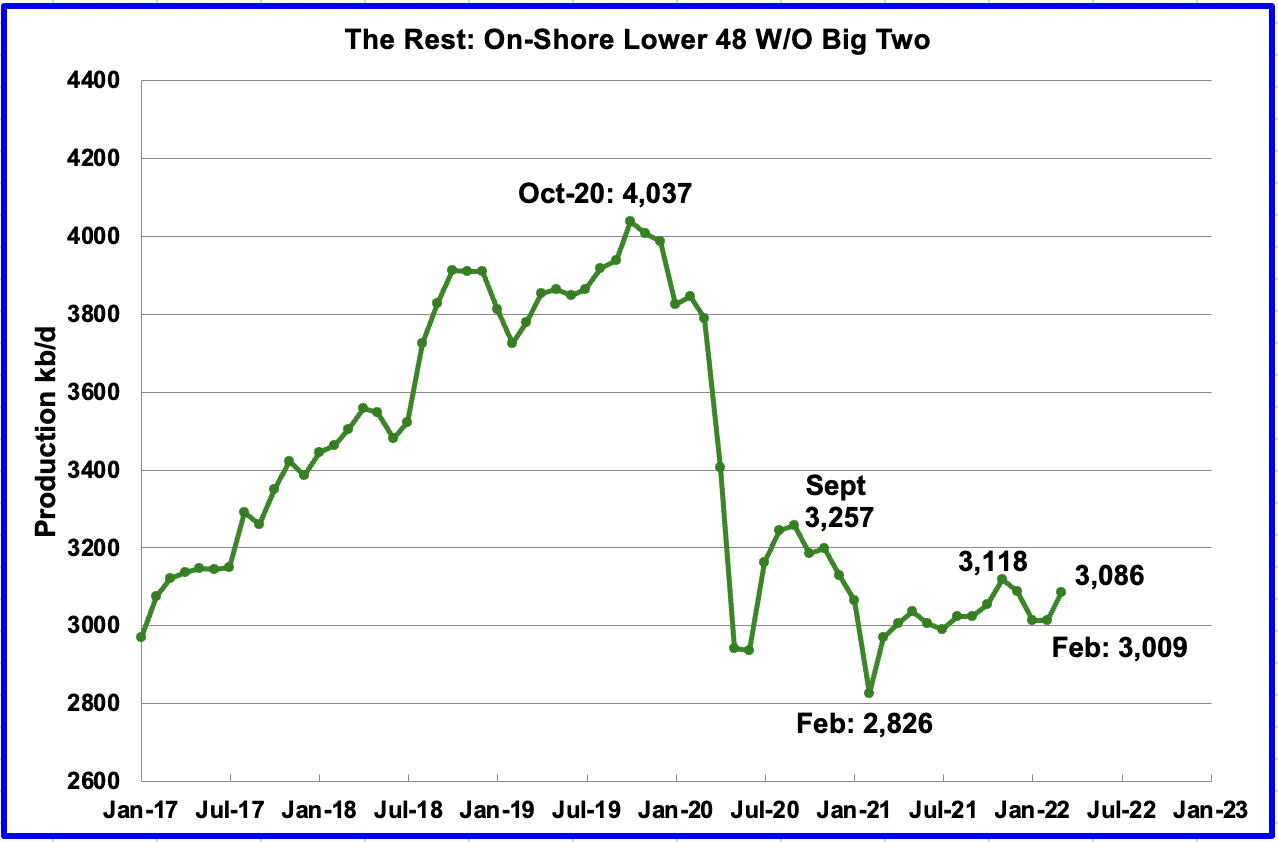

Oil production for The Rest

To get a different perspective on US oil production, the above two charts have broken US state production into two groups, “The Big Two” and the “On-Shore L48 W/O Big Two” or The Rest.

March production increased in the Big Two states by a combined 213 kb/d, with Texas adding 147 kb/d and New Mexico adding 66 kb/d.

Over the last year, the Rest appear to be holding steady at close to 3,000 kb/d. For March production increased by 77 kb/d to 3,086 kb/d.

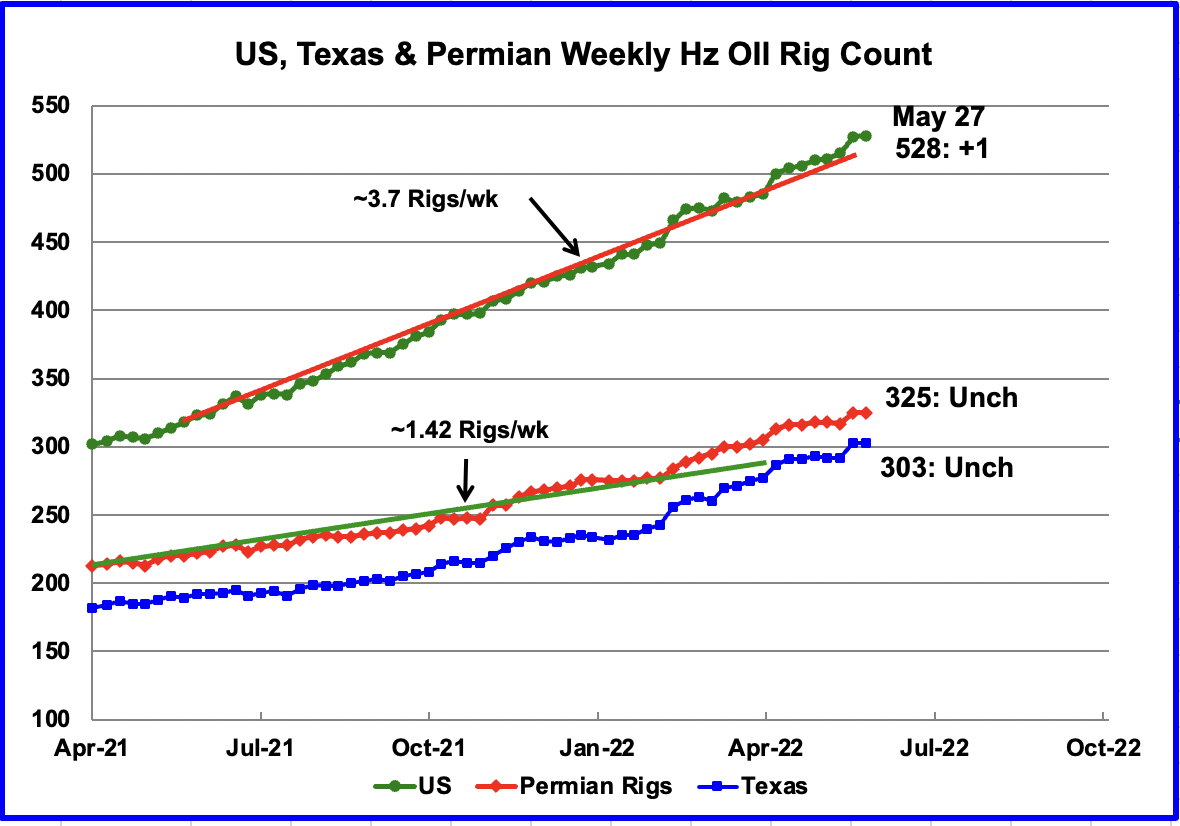

Rigs and Fracs

The US total Hz oil rig count for the week ending May 27 was 528, an increase of 1 over the previous week. The latest rig data appears to continue the earlier trend of the addition of 3.7 rigs/wk, on average. Comparing the slope of the Texas rigs since the beginning of 2022 with the US rig chart, it appears that the increase in US rigs is primarily occurring in Texas.

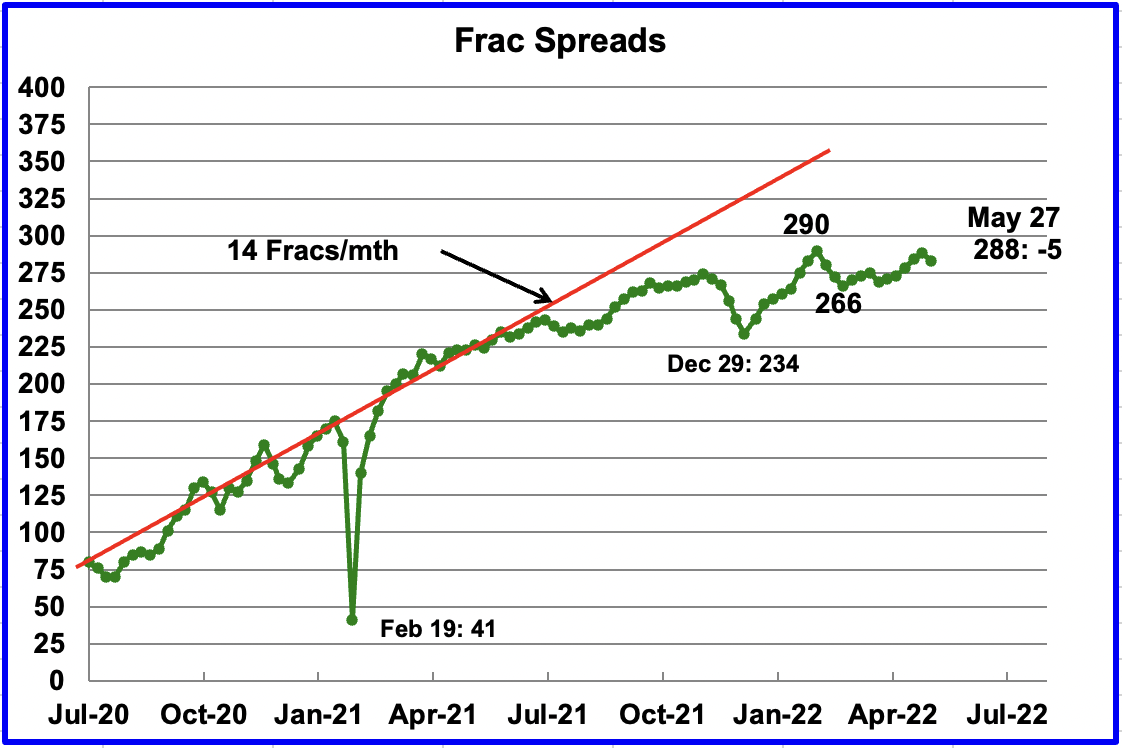

During December 2021, 37 frac spreads were decommissioned primarily due to the holidays and the total dropped to a low of 234 at the end of December. During the month of January, 27 frac spreads were reactivated and in February an additional 29 were added for total of 290.

In the week ending May 27, the frac spread count decreased by 5 to 288 and was down 2 from the high of 290 at the end of February. The drop in Frac spreads could be due to the Memorial Day weekend. Clearly the rate of frac spread additions has slowed since late November 2021.

Note that these 288 frac spreads include both gas and oil spreads, whereas the rig information is strictly Hz oil rigs.

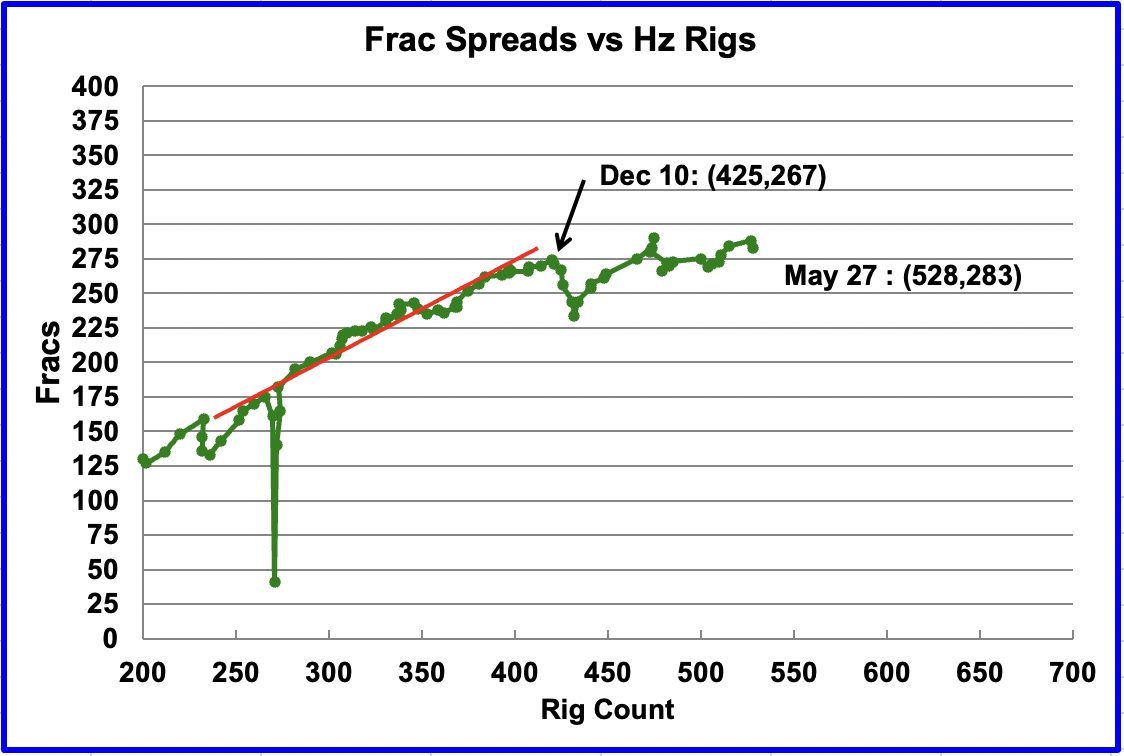

This chart shows the relationship between the rig count and Frac Spreads. Since the week of December 10, 2021 the increase in weekly Frac Spreads compared to the weekly rig increases has slowed. While 103 oil rigs were added over that period, only 16 Frac Spreads were added. Does this imply that Frac spreads are getting more efficient at completing wells or does it imply that companies have decided to complete fewer wells or does it imply a shortage of Frac materials such as water and sand?

WTI

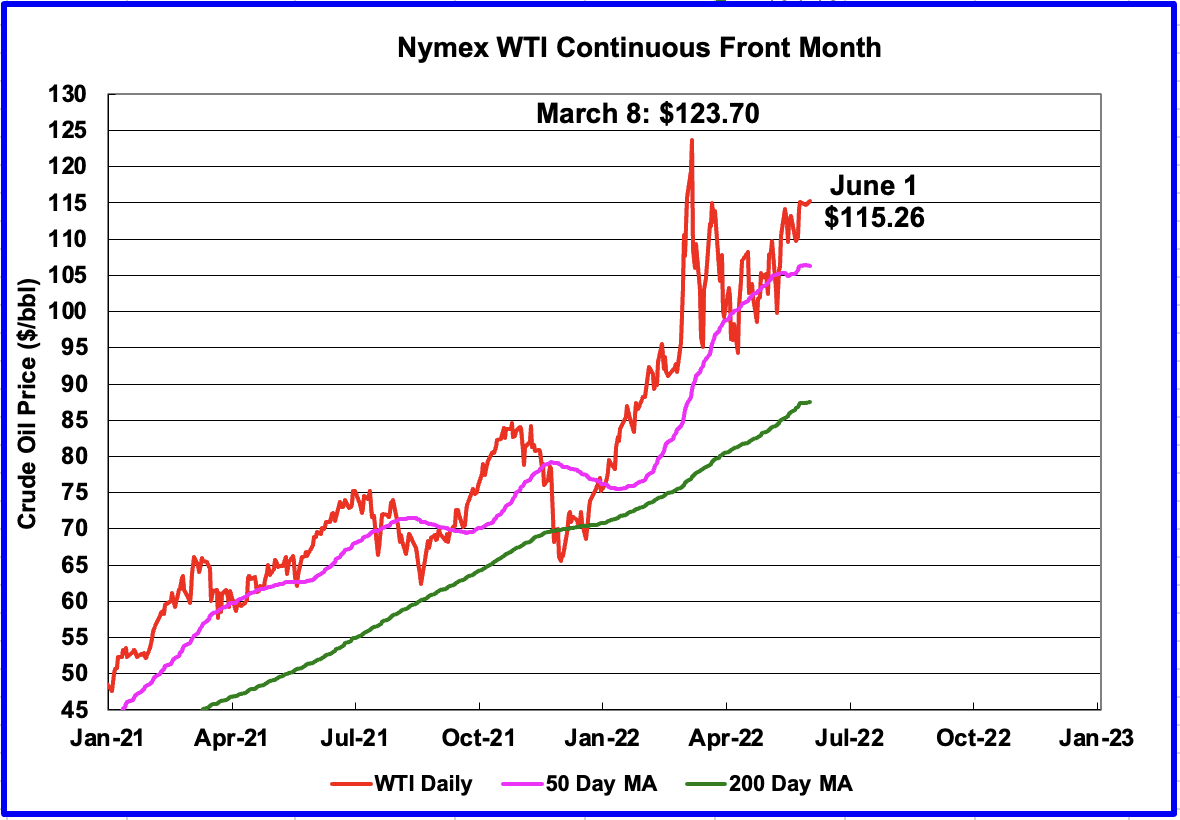

The WTI July contract settled on June 1 at $115.26/b. It is now $8.50/b below the previous high of $123.70. The recent increase is due to Shanghai and Beijing reopening after the lockdown associated with the recent Omicron outbreak. The SPR release is being totally ignored.

1) Short Term Energy Outlook (STEO)

The May 2022 STEO provides projections for the next 22 months, starting with March 2022 to December 2023, for US C + C, OPEC and other oil production related information of interest.

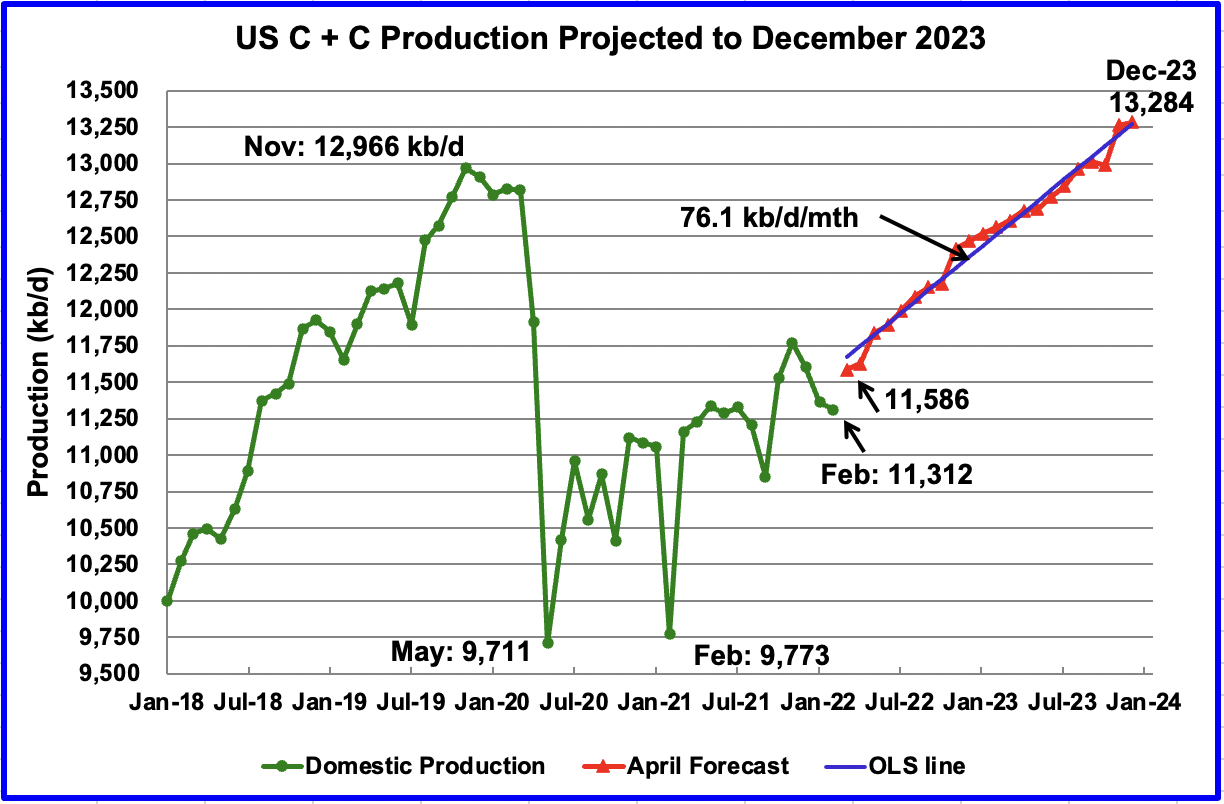

The May 2022 STEO has revised downward its projected US oil output from March 2022 to late 2023, primarily in 2022. December 2023 has been revised up by 30 kb/d from the previous April 2022 STEO. In December 2023 output is expected to reach 13,284 kb/d.

Using only the projected data from March 2022 to December 2023 to fit an OLS line, the STEO is forecasting production will increase at an average rate of 76.1 kb/d/mth, similar to the average rate of 75.4 kb/d/mth estimated in the April report. If the December 2023 output is achieved, it will be 318 kb/d higher than the November 2019 record. The monthly rate translates into a tearily increase of more than 900 kb/d/yr. A difficult challenge.

Note the discrepancy of 69 kb/d between the actual March US oil production of 11,655 kb/d vs the STEO forecast of 11,586 kb/d. A reasonably good estimate.

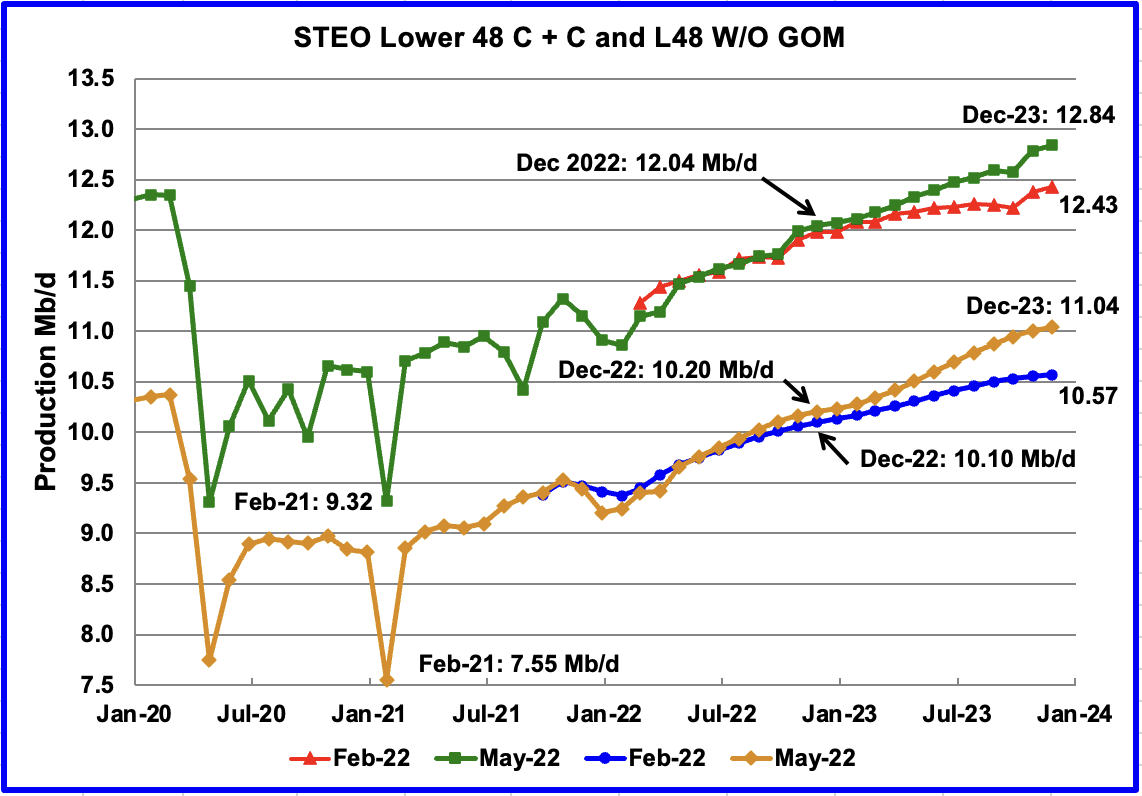

This chart compares the STEO’s forecast for the L48 states from the February report with the current May 2022 report to better illustrate changes in the EIA’s forecast. For the Lower 48, the December 2023 output is essentially the same as in the April report, an increase of 2 kb/d to 11.04 Mb/d. However production in 2022 has moved closer to the original February forecast.

The April STEO output projection for the Onshore L48 states for 2022 has also been revised down in the May report to show decreased production. The output projection for December 2023 is essentially the same, again increased by 2 kb/d while 2022 production has moved closer to the earlier February forecast.

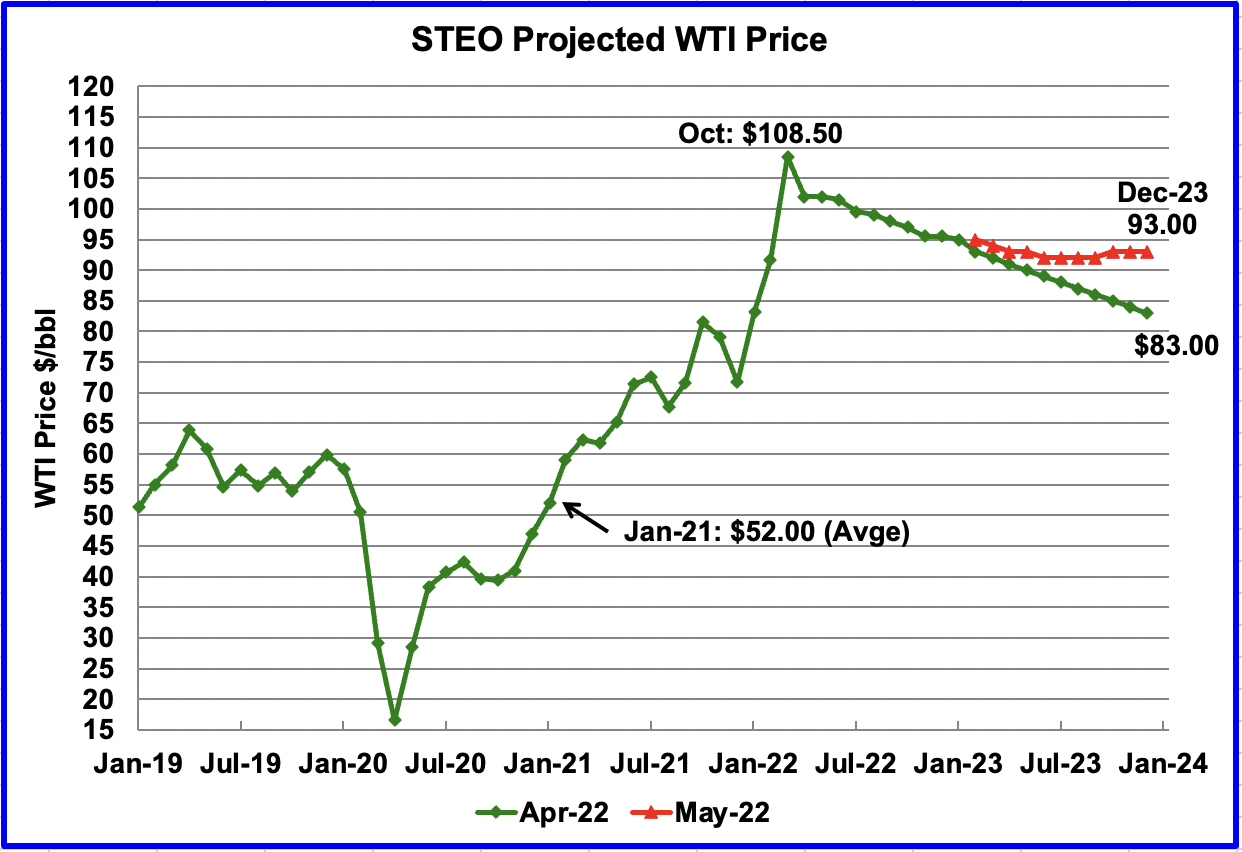

The May 2022 STEO oil price forecast continues to show a steady decline from the EIA’s new March peak of $108.50/bbl to $93/bbl in December 2023. Essentially the EIA is continuing to forecast that the only direction for the price of WTI going forward is down to $93/bbl. However what is different with their latest forecast is that the price of oil is shown to stabilize in the $93/b area during the later half of 2023.

However, it should be noted that the December 2023 price has been increased over the last four months. In the January 2022 report, the December 2023 price was projected to be $62/bbl. December 2023 has now been increased by $31/b to $93/b.

The July contract settled at $115.26 on June 1, $15.75/b higher than the EIA’s forecast of $99.50/bbl average for the July contract.

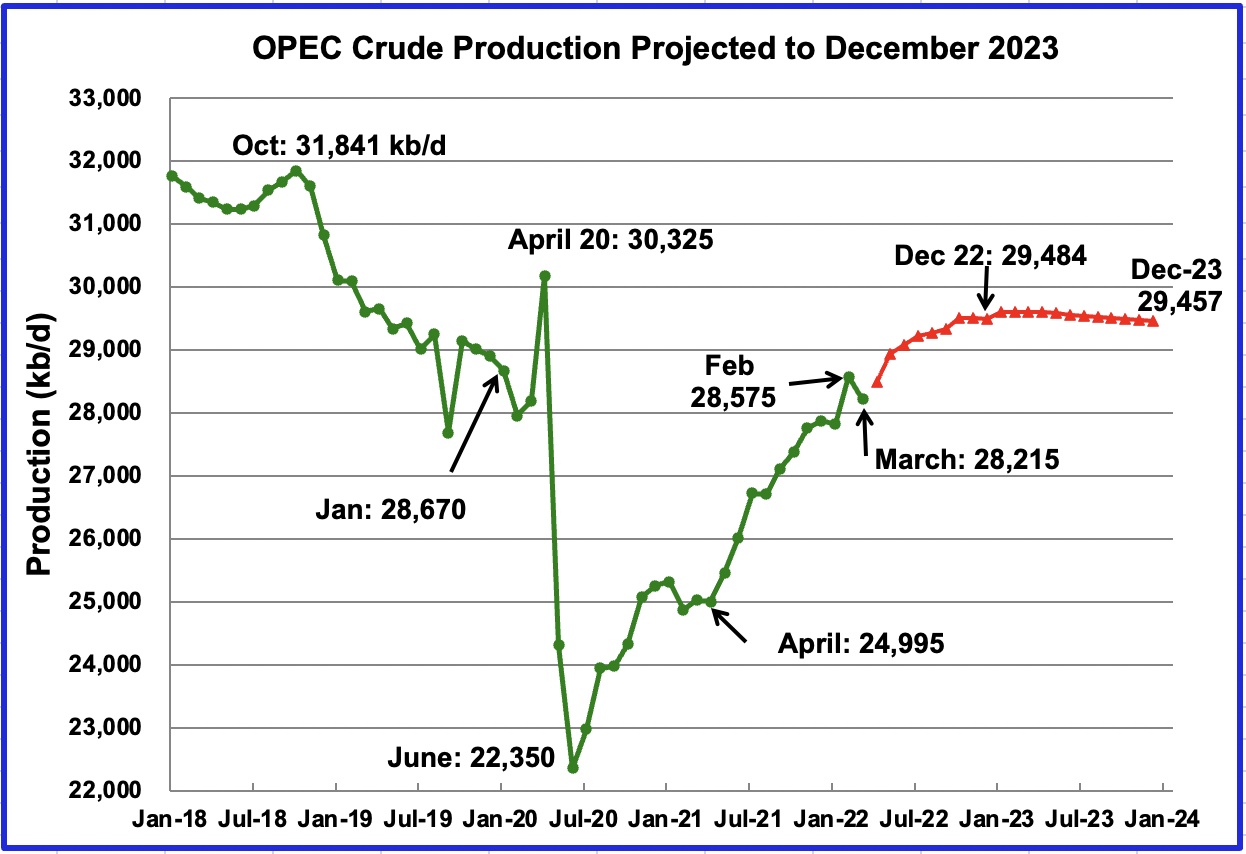

This chart shows the STEO’s May forecast for OPEC crude output from April 2022 to December 2023. OPEC’s output is projected to increase from April 2022 to December 2022 by 994 kb/d to 29,484 kb/d. After December 2022, production remains essentially flat at close to 29,470 kb/d out to December 2023.

The May report has increased OPEC output in December 2022 by 170 kb/d over the April report. Similarly December 2023 output has been increased by 170 kb/d. Considering the the difficulties that OPEC is having in meeting its production commitments, the source of this increased production is not clear.

For April 2022, the May STEO forecasted OPEC production to be 28,490 kb/d. Actual April production as reported by OPEC was 28,648 kb/d, higher by 158 kb/d. It is not clear why the STEO estimate was low.

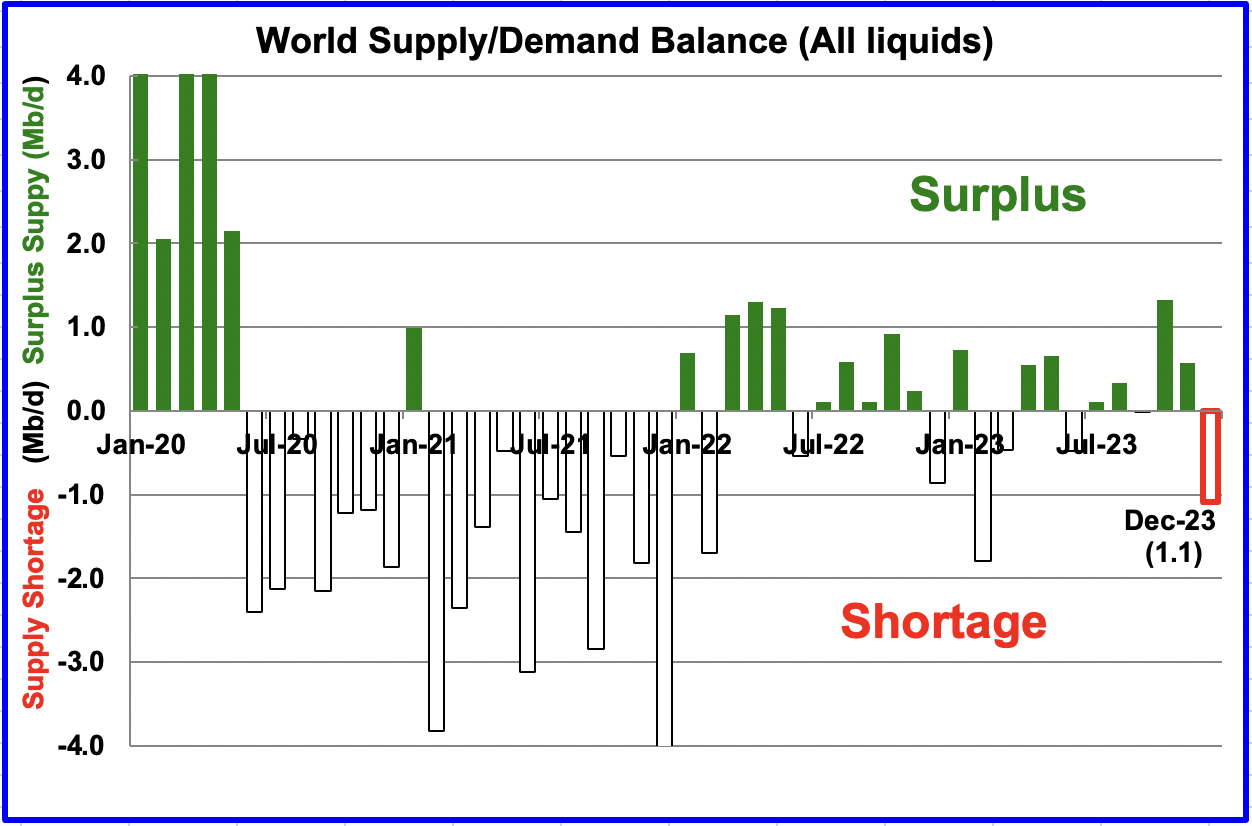

This chart shows the historical world supply/demand balance up to March 2022 and after that, the EIA’s forecast out to December 2023.

From April 2022 to December 2023, the STEO is forecasting an average monthly surplus of close to 167 kb/d down from 518 kb/d in the previous report. The sanctions on Russian oil and increased prices may account for the downward revision to this month’s surplus forecast.

2) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The May DPR forecasts production to June 2022 and the following charts are updated to June 2022.

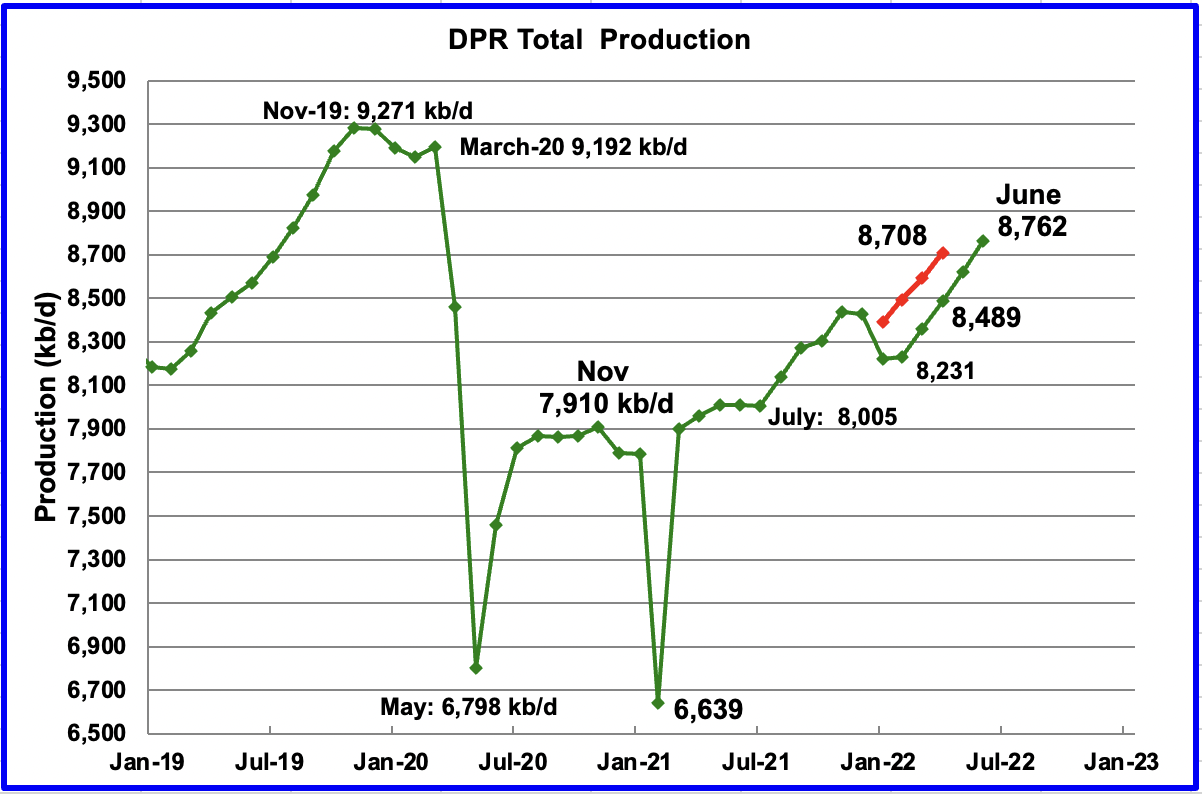

Above is the total oil production projected to June 2022 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional fields.

After the EIA reported lower than expected US onshore L48 production for December and January, the DPR revised its output forecast down.

The DPR is projecting that oil output for June 2022 will increase by 142 kb/d to 8,762 kb/d. From February’s output of 8,231 kb/d to June 2022, output in the DPR basins is forecast to increase by 531 kb/d or by an average of 133 kb/d/mth. Note that this monthly production rate is much higher than the STEO rate of 76.1 kb/d projected for all of 2022 in the STEO section above.

It is difficult to asses what is really happening in the near term in the DPR basins since significant revisions are made to the previous few months. For Instance, did June production really increase by 142 kb/d? In the March DPR report, April output was projected to be 8,708 kb/d (Red markers). The current May report revised April output down to 8,489 kb/d, down 219 kb/d, and June is now 54 kb/d higher at 8,762 kb/d than April’s output reported in the March DPR forecast. So what is the real increase/trend?

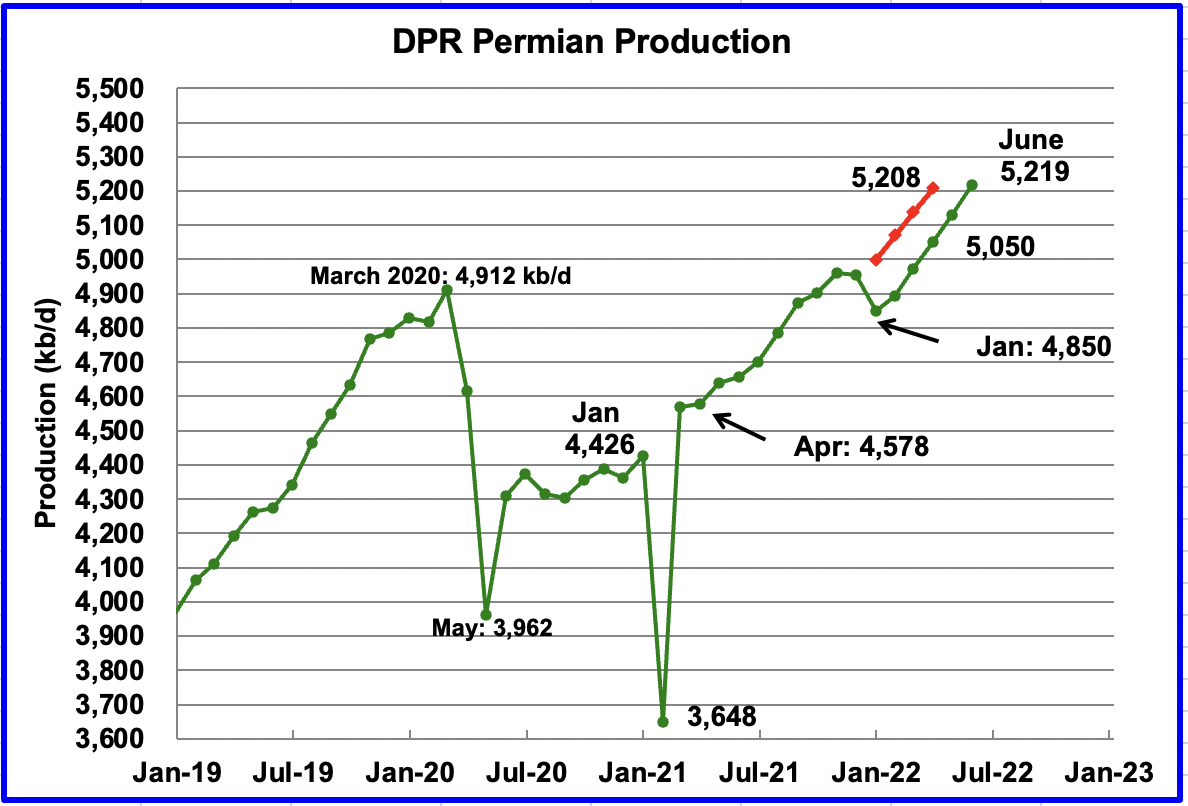

Permian output exceeded 5,000 kb/d in April 2022 and continues to increase. In June, production is expected to increase by 88 kb/d to a new high of 5,219 kb/d. From January to June, production is forecast to increase by 369 kb/d or at an average rate of 73.8 kb/d/mth. If the Permian were part of OPEC, at 5,219 kb/d it would be the second largest producer after Saudi Arabia.

Due to revisions, June’s Permian output is 11 kb/d higher than the DPR’s April’s production forecast of 5,208 kb/d reported in the March report. (Red markers). April was revised down by 158 kb/d to 5,050 kb/d from the May report.

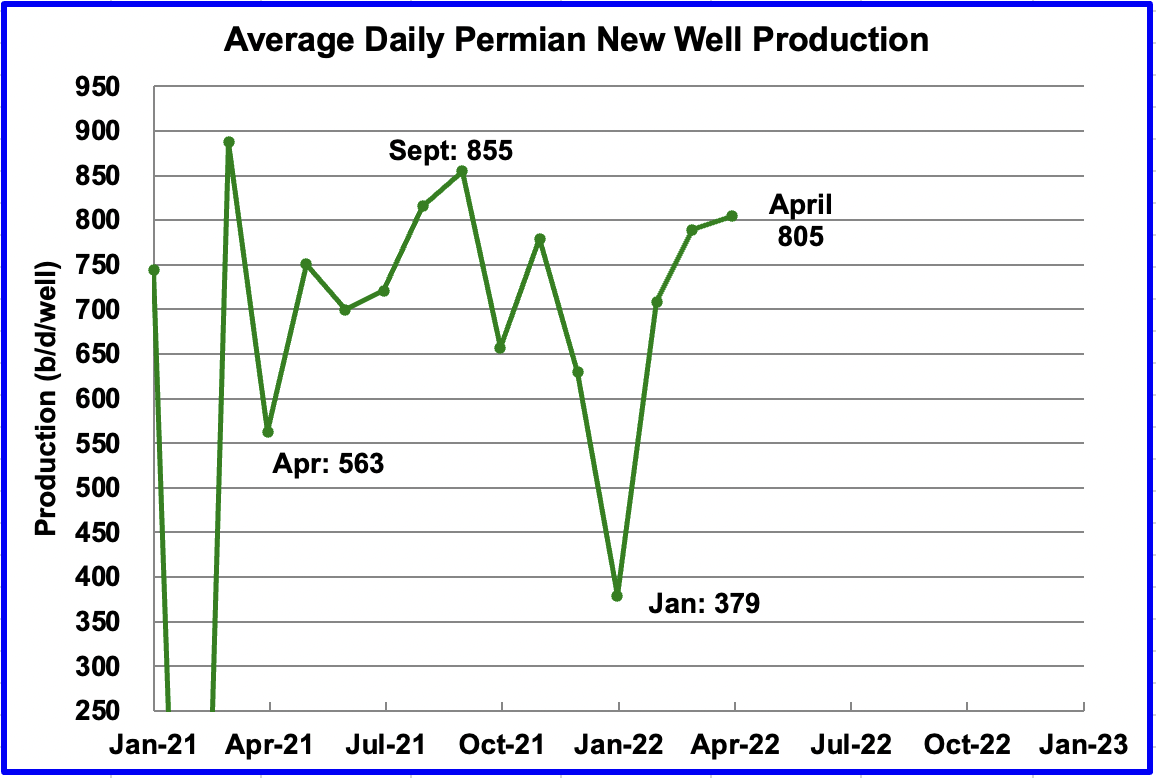

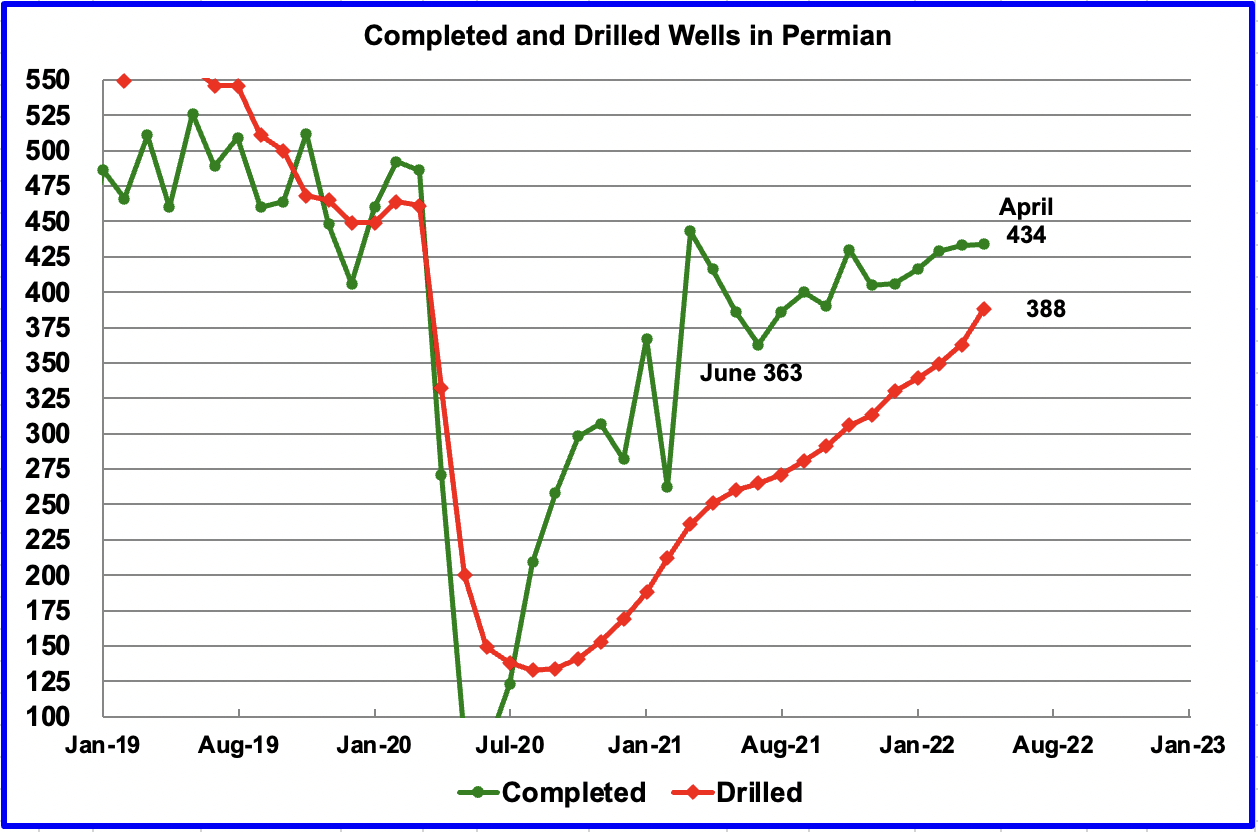

During April, 388 wells were drilled and 434 were completed in the Permian. The completed wells added 349 kb/d to March’s output for an average of 805 kb/d/well. The overall decline was 270 kb/d which resulted in a net increase for Permian output of 79 kb/d. Of the 434 completed wells, 336 were required to offset the decline. It is the completion of the additional 98 DUCs, over and above the drilled wells that accounts for the increase in the production in the Permian.

This chart shows the daily production from the average new Permian well tracked on a monthly basis. The daily output for new Permian wells was divided by the number of completed wells, as reported in the DPR and DUC reports. Note this chart is two months behind the DPR production charts.

It appears that the average first month output is close to 800 kb/d. January dropped due to bad weather in Texas. April was essentially unchanged from March at 805 kb/d and February was revised down to 709 kb/d from 795 kb/d.

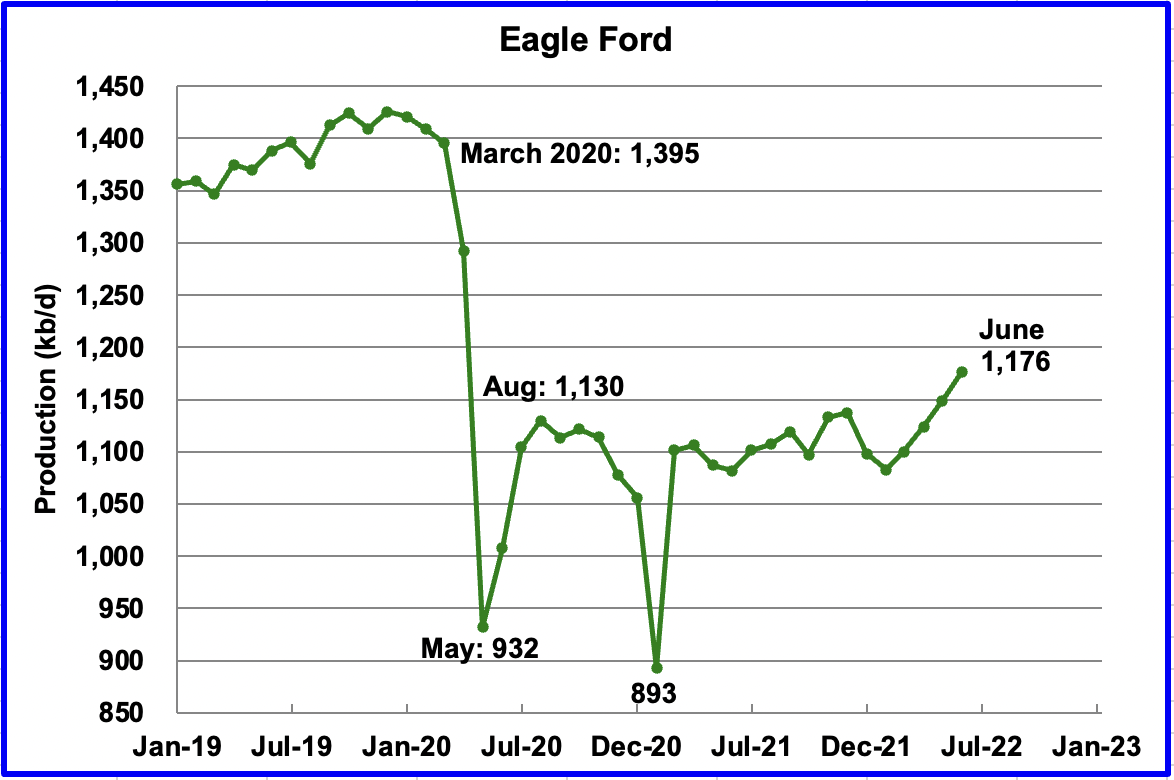

Output in the Eagle Ford basin has been showing an increasing trend since March 2022. For June, output is expected to increase by 27 kb/d to 1,176 kb/d. Since the beginning of the year, 19 rigs have been added up to the end of May for a total of 57, which explains the increasing output.

The DPR forecasts Bakken output in June to be 1,189 kb/d an increase of 17 kb/d over April. However after revisions, June production is 3 kb/d higher than was forecast for May in the previous report.

It has been reported that North Dakota April production was hard hit by severe winter weather and clearly this information has not be incorporated in the above graph. It is expected that April production will drop by close to 240 kb/d.

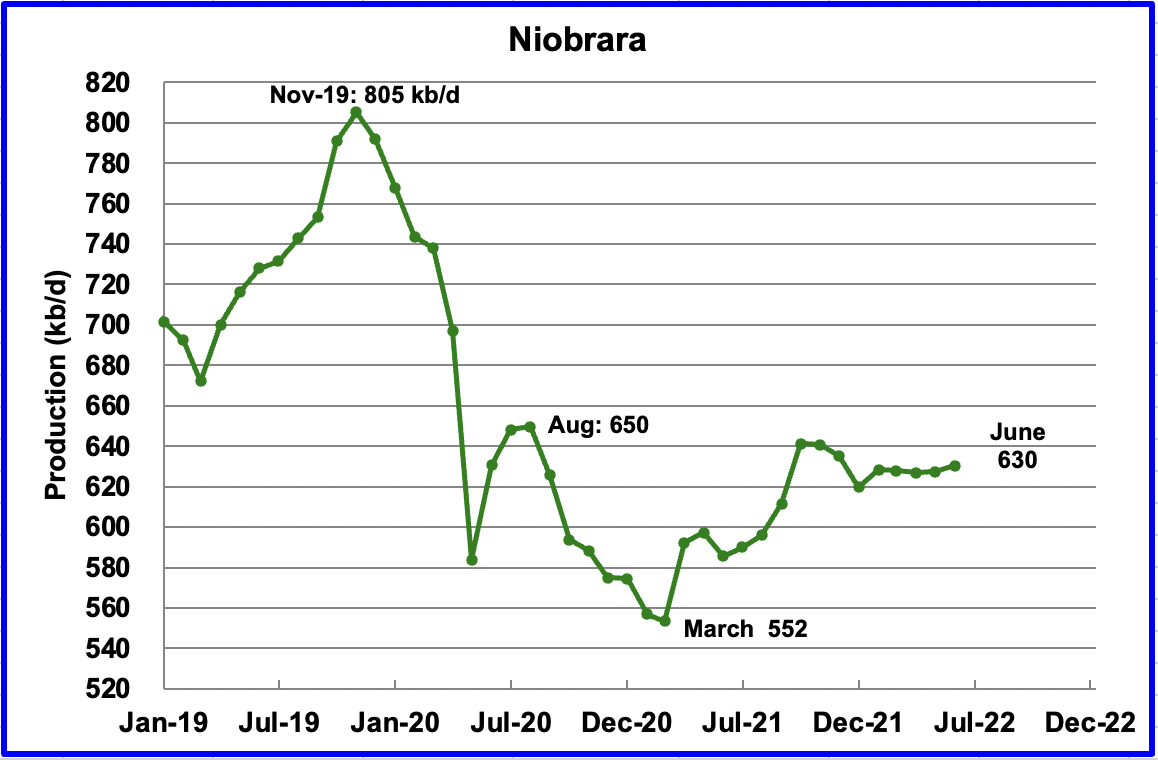

Output in the Niobrara is now showing signs of starting to plateau around 630 kb/d.

DUCs and Drilled Wells

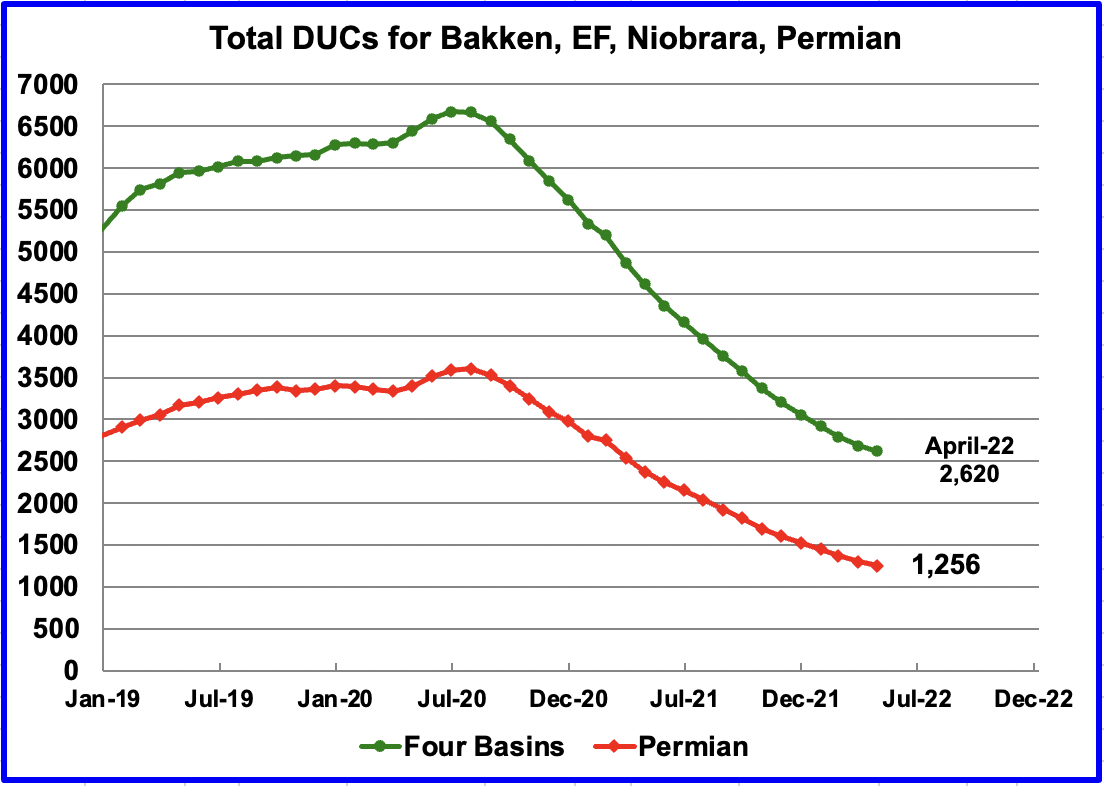

The number of DUCs available for completion in the Permian and the four major DPR oil basins has continued to fall every month since July 2020. Prior to July more wells were drilled than were completed.

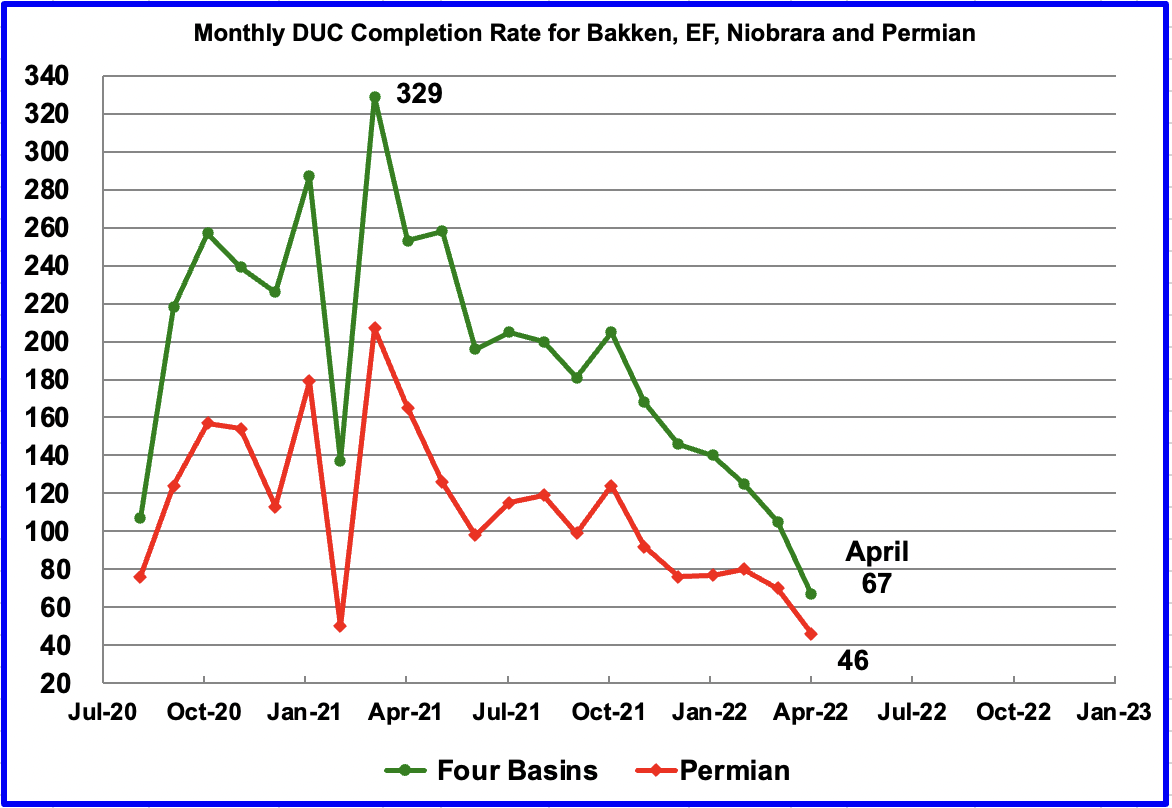

In these four primarily oil basins, the monthly completion rate of DUCs started to slow after peaking in March 2021. For example, in March 2021, 329 DUCs were completed. In April 2022, 67 DUCs were completed, 38 fewer than in March. Similarly the monthly completion rate for DUCs in the Permian continues to fall. It dropped from 71 in March to 46 in April. Is this an indiction that the remaining DUCs are getting less economic.

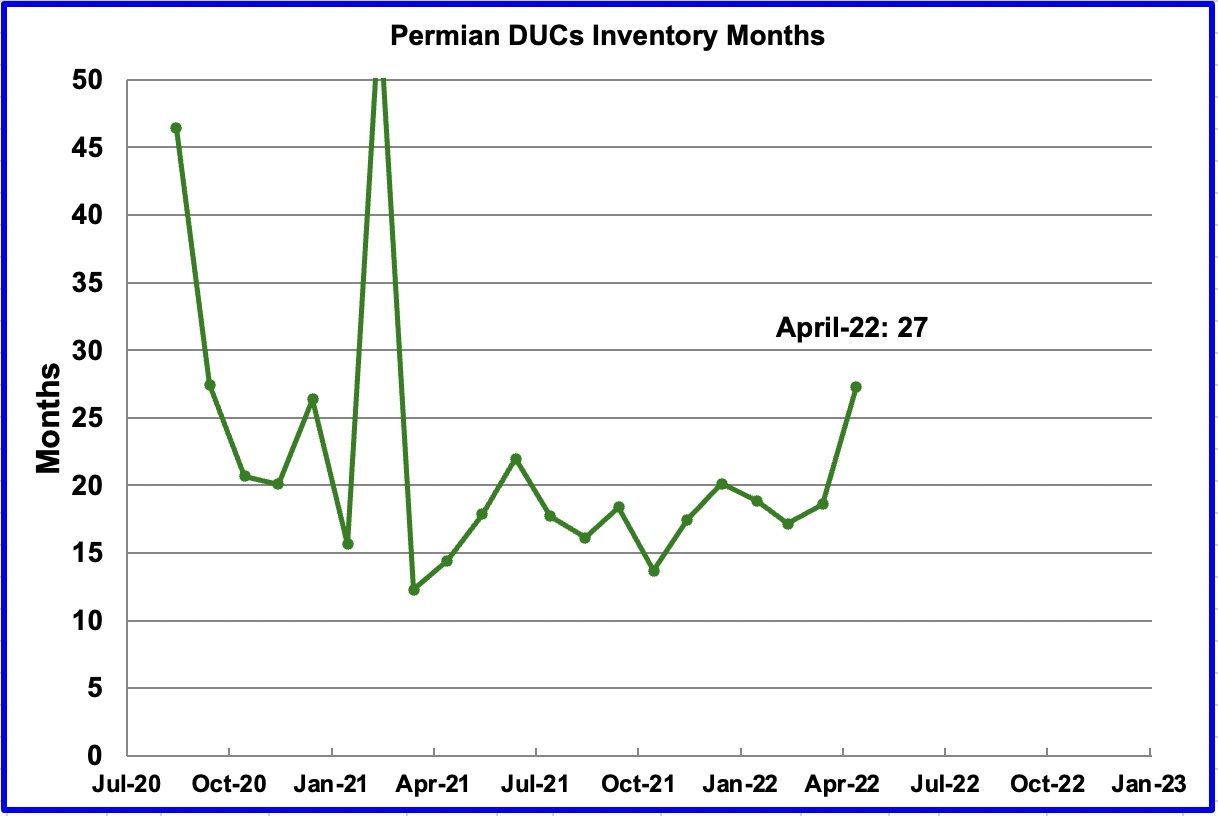

If Permian DUC’s were to be completed at the latest rate of 46 DUCs/mth, that converts into 27 months of DUC inventory, assuming the remaining 1,256 are all commercially viable. The increase in DUC inventory months is due to the slowing rate of completions.

In the Permian, the monthly completion of wells has reversed direction since the low of 363 in June 2021. In April 434 wells were completed, one more than in March and completions are showing signs of a slowing growth rate since February. During April, 388 new wells were drilled, an increase of 25 over March. To counteract the slowing completion of DUCs, drilling has been increased. See next chart.

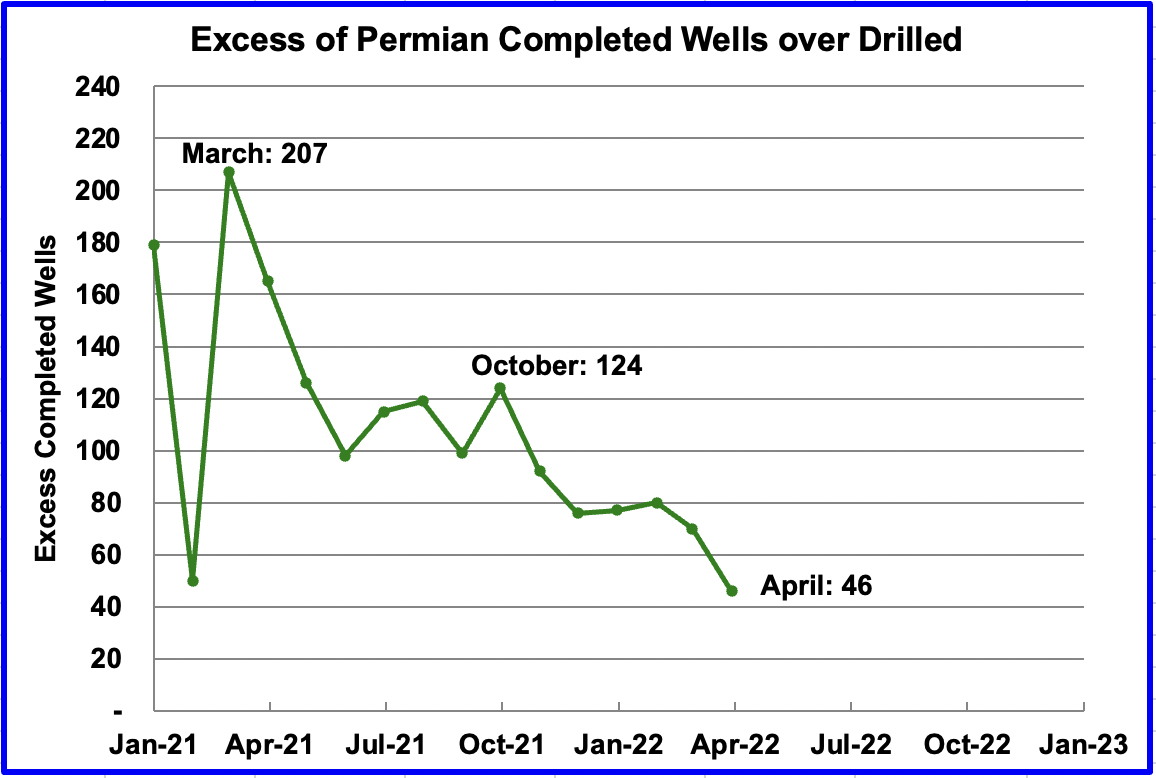

In October 2021, there were 124 more wells completed in the Permian than were drilled. In April the number of excess wells completed was down to 46 since the drilling rate was higher than the completion rate. To offset the drop in the use of DUCs, more wells had to be drilled.

DPR Production Decline Rates

The DPR reports monthly on the past and future production of tight and conventional oil in the seven basins along with decline rates. Typically the DPR is four months ahead of the EIA’s monthly production report.

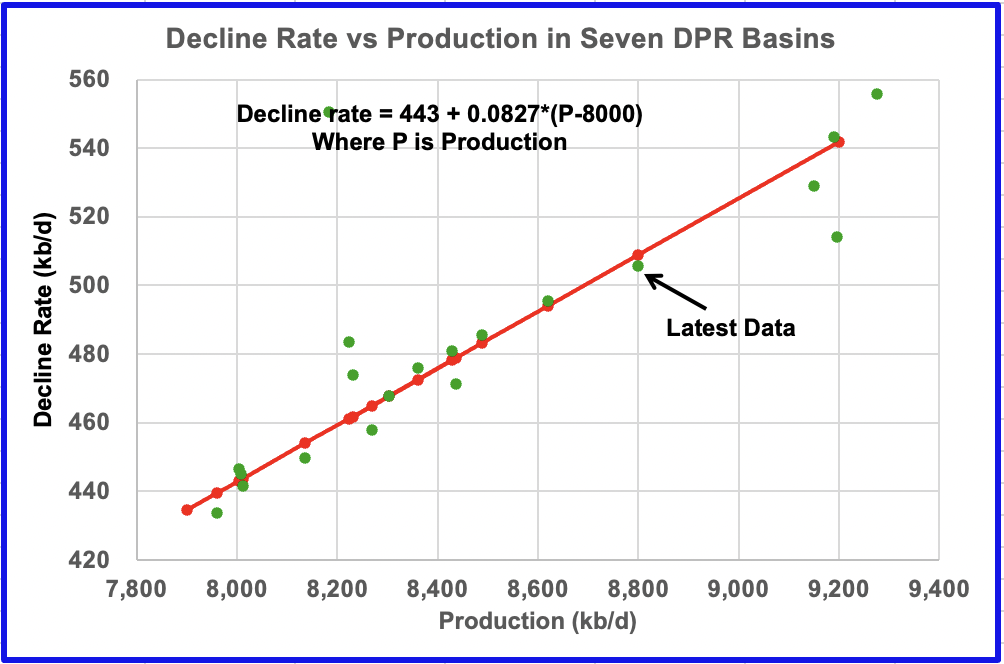

This chart shows the relationship between the decline rate and production rate using only the combined data from the seven DPR basins after April 2021. The OLS line only used the most recent data between April 2021 and May 2022. However the chart includes some data from the time when production was higher, i.e. the four markers around production at 9,200 kb/d. Their position close to the OLS line may be purely accidental since they are from a different dynamic production period.

The latest data for June was added to the chart but the OLS line was not recalculated. Note that it falls very close to the original OLS.

The equation says that for every 100 kb/d of production increase, the decline rate increases by 8.27 kb/d, on average. That makes sense since the newest wells have the highest decline rates.

3) LIGHT TIGHT OIL (LTO) REPORT

The EIA’s LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The May 2022 report updates tight oil production to April 2022.

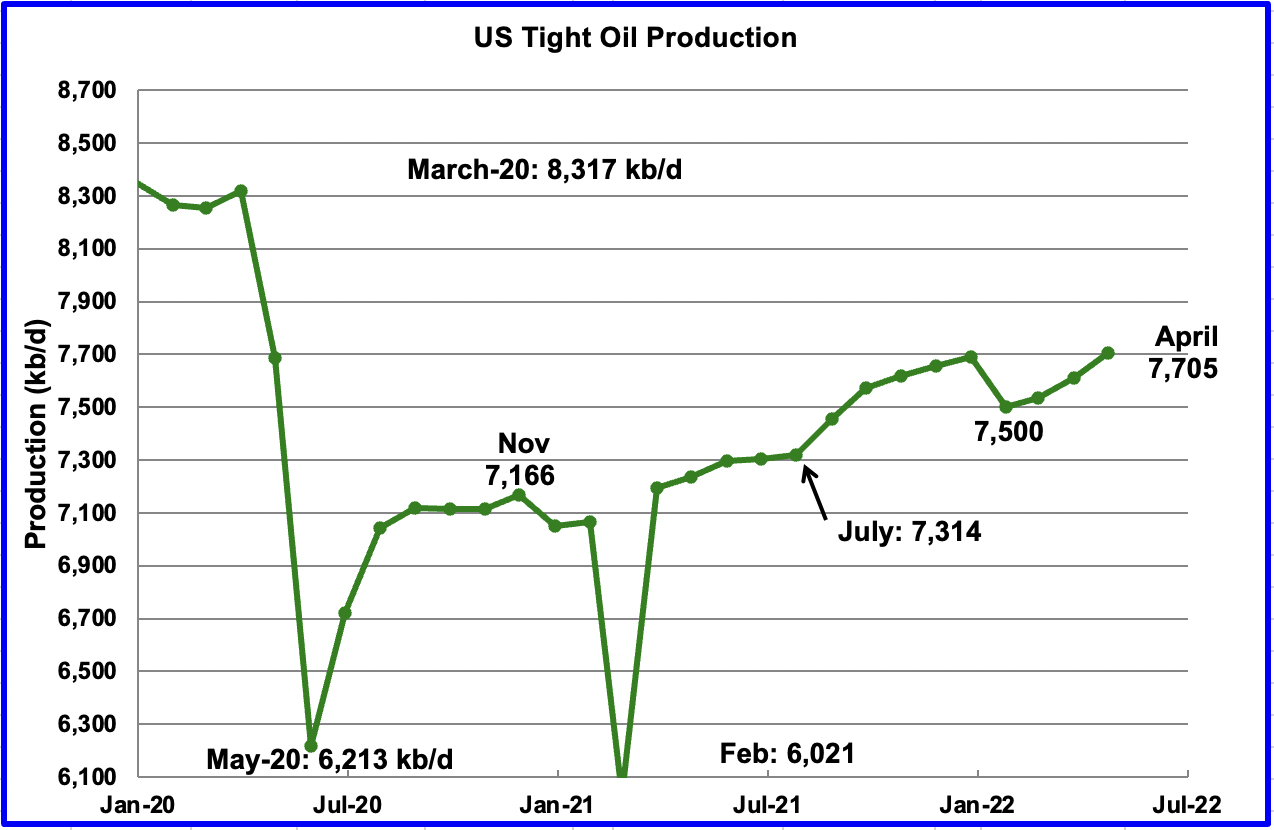

The May LTO report made downward revisions to their April production forecasts reported in the previous post. The biggest revisions in output occurred in February and March and were lower than the previous ones. This follows the same trend reported in the DPR report.

April’s LTO output increased by 95 kb/d to 7,705 kb/d. However, it is just 4 kb/d higher than the March output of 7,701 kb/d reported in the April report.

To get a better indication of the recent trend in LTO growth, it is better to look at the growth from January 2022 to April 2022. Over that period, output increased by 205 kb/d or at an average rate of 51.3 kb/d/mth. This is 67% of the expected US oil production growth rate reported in the STEO section above. There appears to be a disconnect between the STEO and DPR and LTO reports.

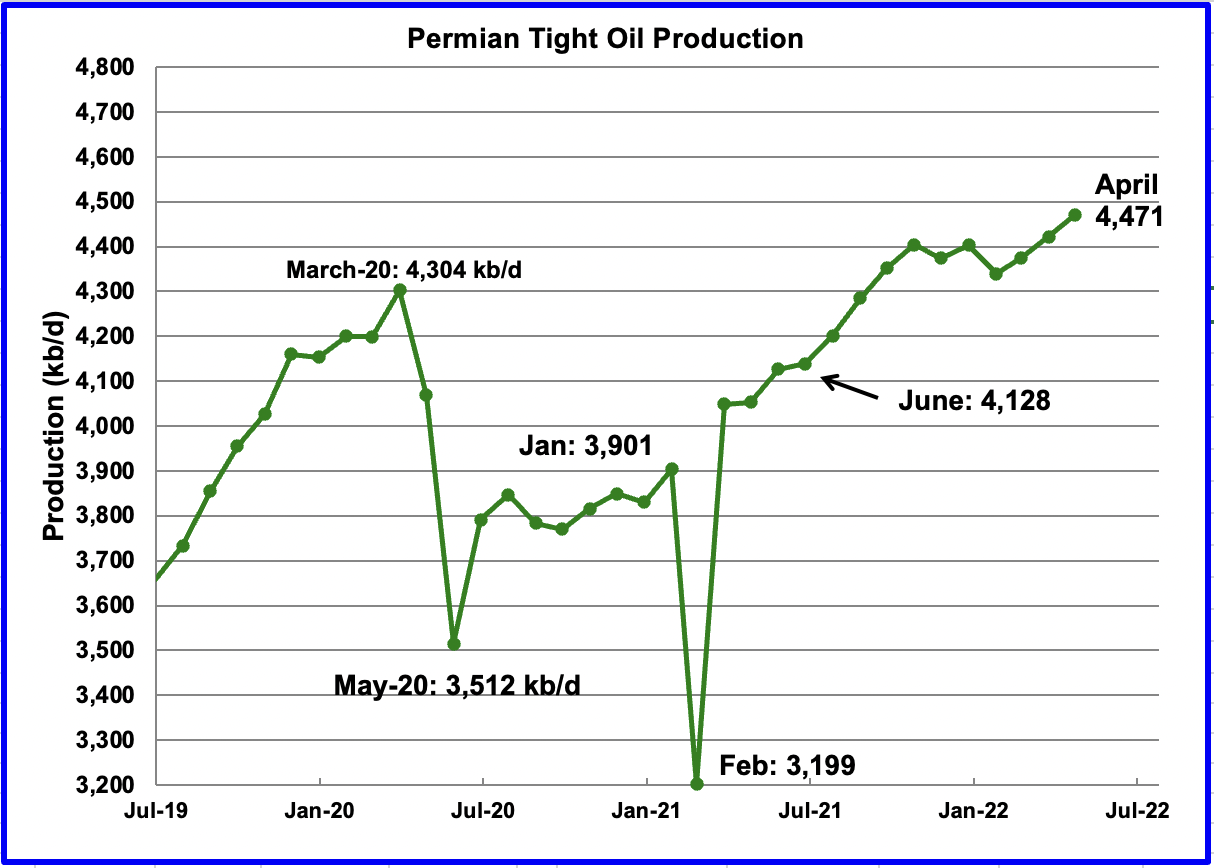

Permian LTO output first reached a new high of 4,351 kb/d in September 2021. April’s output increased by 49 kb/d to 4,471 kb/d and is 167 kb/d higher than the high of 4,304 kb/d recorded in March 2020.

Note that the April’s output is 8 kb/d higher than the March output of 4,463 kb/d reported in the April report. The initial estimates for January, February and March were all lowered from last month’s report.

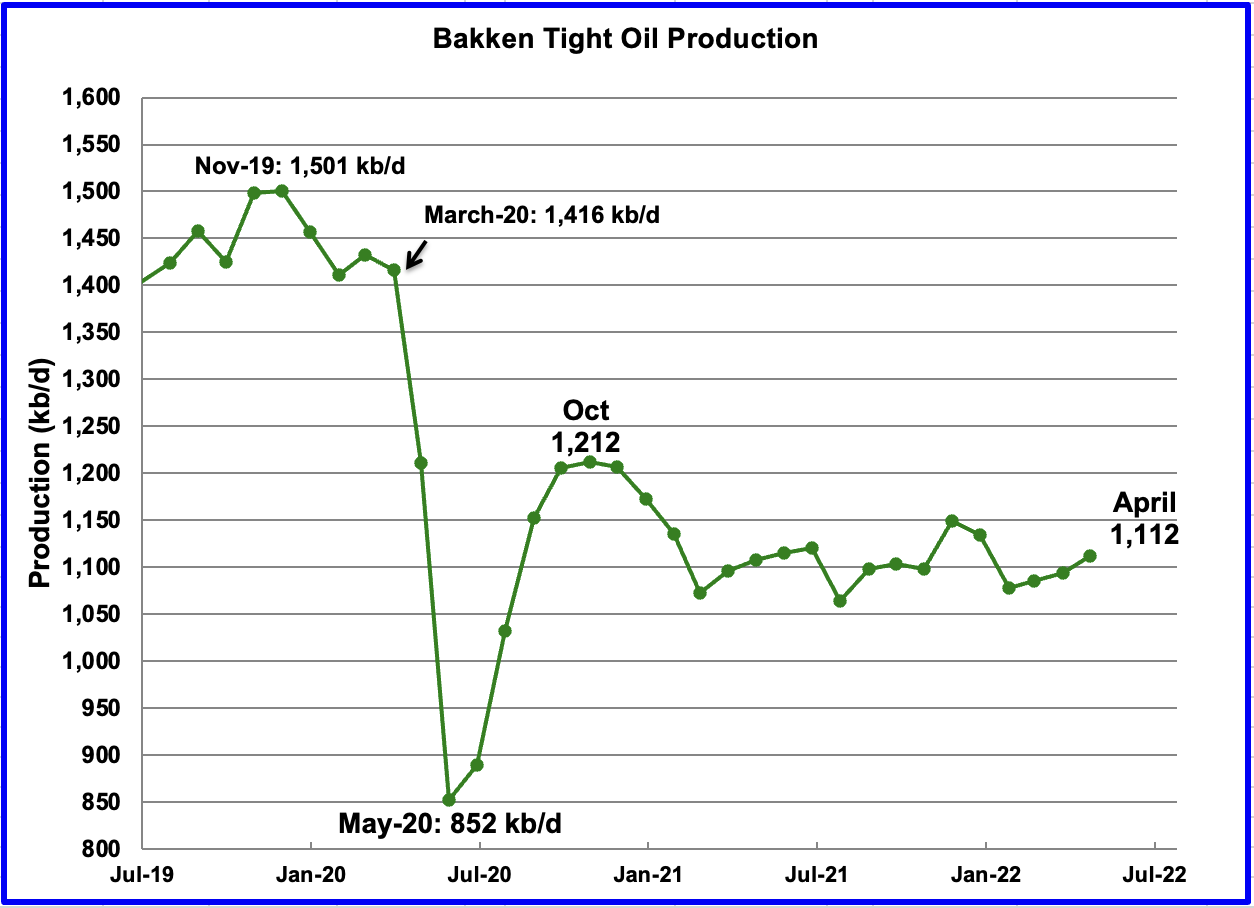

The Bakken’s April output increased by 18 kb/d to 1,112 kb/d. Note it is still below the October 2020 level of 1,212 kb/d and below the 1,125 kbd production reported in the March LTO report. Again February and March were revised lower.

According to this source, ND’s April oil production was hit hard by two winter blizzards. This drop has not been incorporated in April’s LTO production for the Bakken.

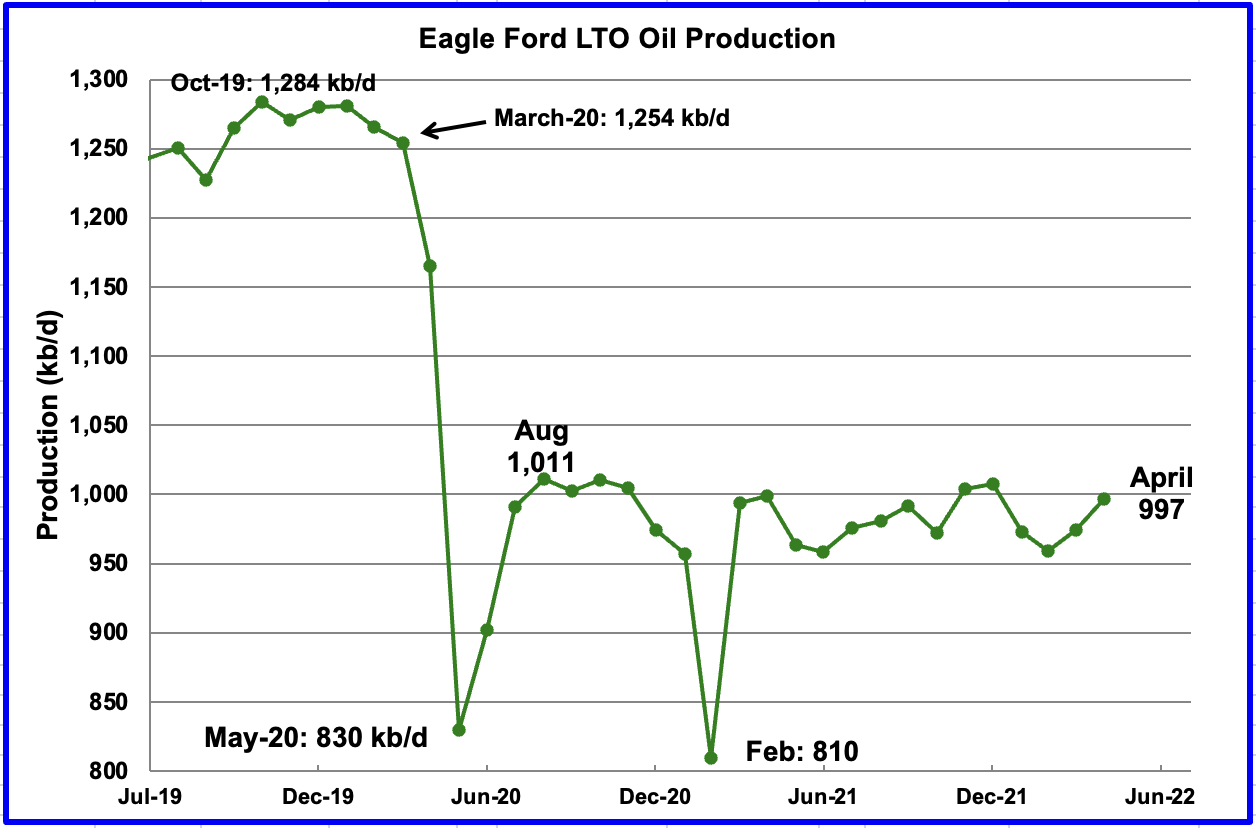

Production in the Eagle Ford basin since August 2020 has been essentially flat at close to 1,000 kb/d. Are the drillers doing this intentionally or is it just accidental or geology?

The Eagle Ford basin production increased by 22 kb/d to 997 kb/d in April.

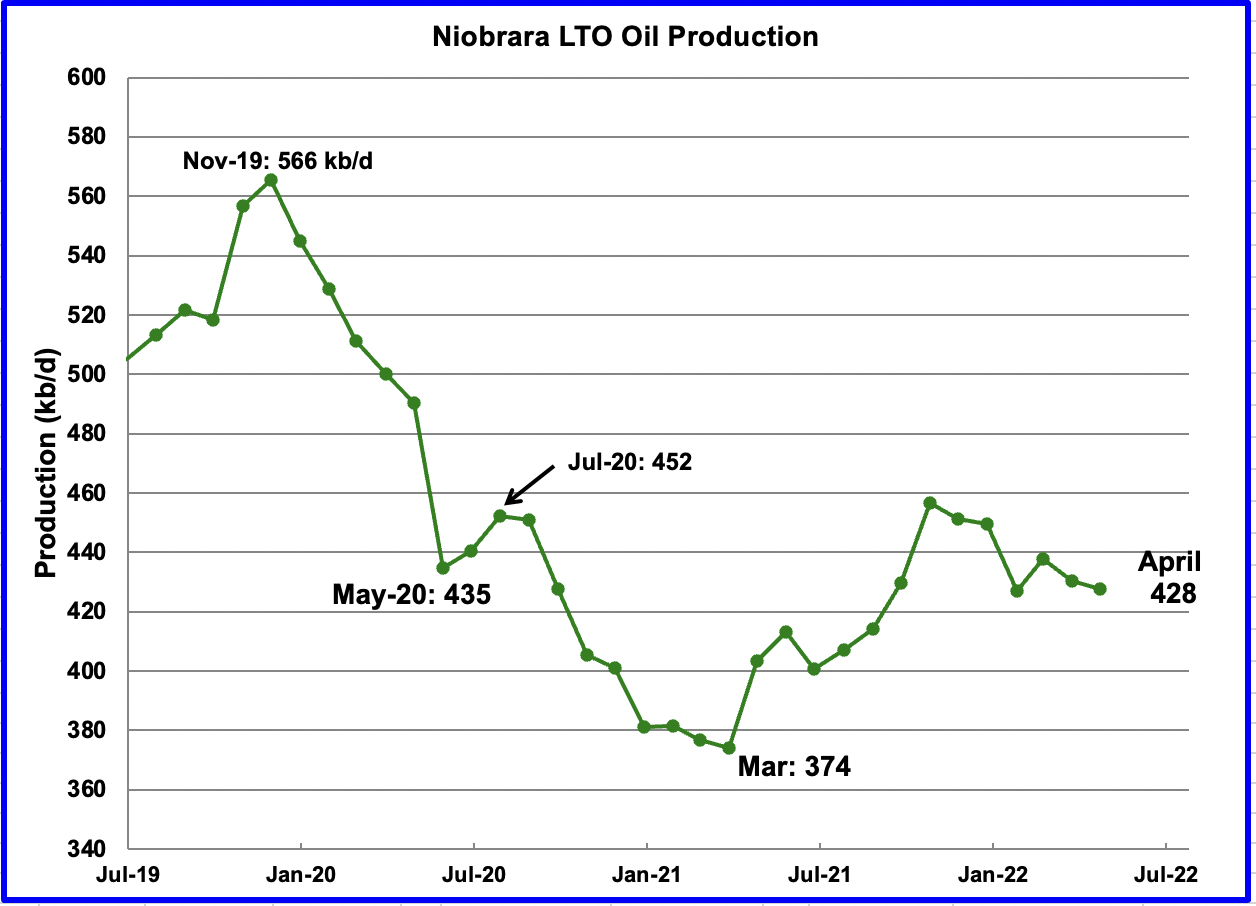

After increasing production from March 2021 to October 2021, output in the Niobrara began to drop in November 2021. April’s output fell by 5 kb/d to 428 kb/d.

On-Shore L48 Conventional Production

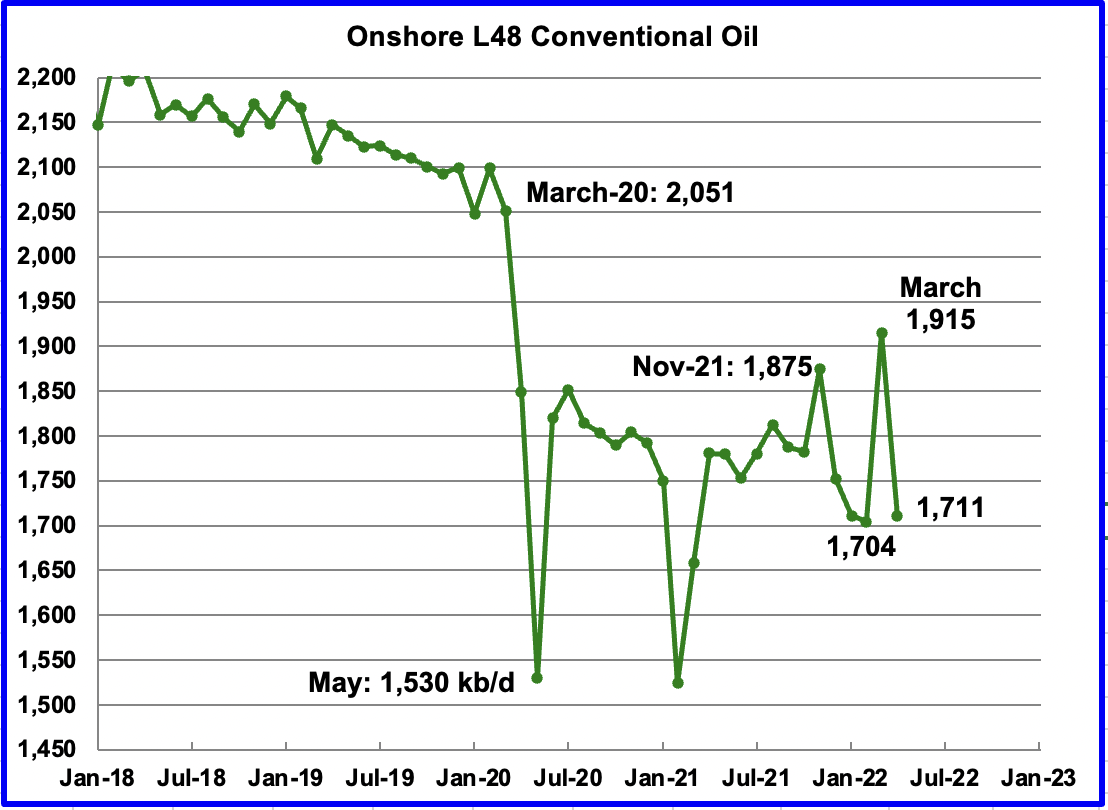

Conventional oil output in the Onshore L48 rose by 211 kb/d in March to 1,905 kb/d but is expected to drop to 1,711 kb/d in April. This estimate is based on a combination of the expected April LTO output and the May 2022 STEO report that has an April 2022 forecast for the US On-shore L48 output. Data from January to March in the STEO has been replaced by the actual EIA production data from the current Mayl report.

A note of caution is in order. This chart is derived by subtracting two large numbers which are subject to revision, particularly the last two months, March and April. Only small revisions were made in the November to February production data.

World Oil Production Without the US

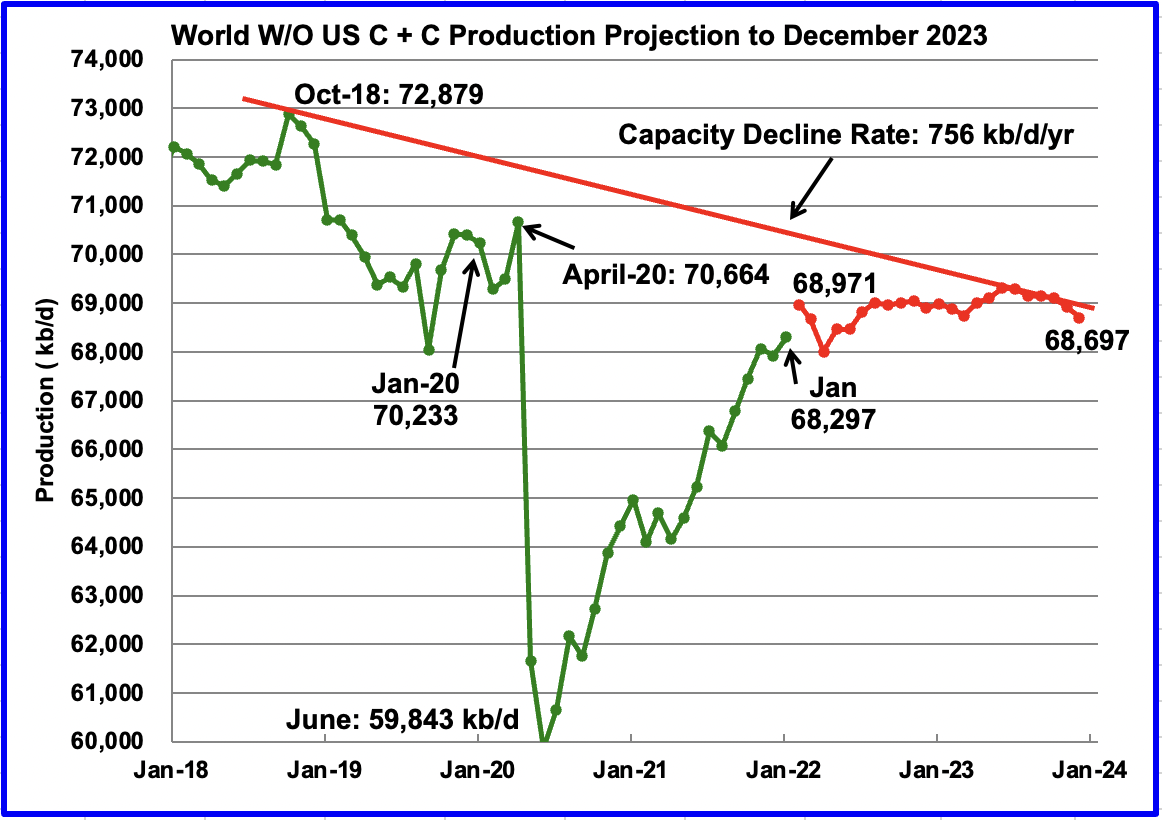

World W/O US oil production increased by 379 kb/d to 68,297 kb/d in January 2021 according to the EIA.

This chart also projects world production without the US to December 2023. It uses the May 2022 STEO report along with the January International Energy Statistics to make the projection. (Red markers). It projects that World crude production W/O US in December 2023 will be close to 68,697 kb/d. Note this projection estimates that World Output W/O US will be essential flat for the next two years. In other words, starting in February 2022, World oil production without the US will be close to 3,900 kb/d lower than in October 2018.

The essentially flat output also means that any increase in World oil demand will have to be provided by the US over the next to years. According to this source, the US permian will be up to the challenge.

Note that the chart also shows a Capacity Decline Rate line of close to 756 kb/d/yr over the years 2018 to 2023. Capacity decline encompasses natural decline and decline associated with reduced investment for drilling and exploration.

Thanks Ovi.

What do you think of Ed Morse’s $70 WTI call?

$70 is the new $50 IMO (pre-COVID labor and supply crunch).

Really appreciate you doing these posts!!

SS

He is an oil bear. I agree that if a recession starts oil will drop. However so will production out of the Permian. At this point with Russian, Venezuelian and Iranian sanctions, I can’t see oil below $90/b.

It is a bit of a chicken and egg situation. I think that oil above $125/b also begins to slow the economy. Not sure at what point the price of oil pushes the economy into a recession.

Ovi.

Part of the price issue, of course, is lack of refining capacity.

SS

I keep reading about that, but I am not sure that is the whole story. China is the new refinery. They import crude and export a lot of refined product.

I am not sure of the state of the current Europe/US gasoline/diesel trade exchange. Europe used to need more diesel than the US. In the process they made excess gasoline which they shipped to the US. The US was the opposite. They made excess diesel and shipped it to Europe and a reasonable balance was maintained. I do not know what the state of that exchange is now. I keep reading that there is a shortage of diesel in the US. Maybe that is being affected by the refinery shutdown, more so than gasoline.

Ovi.

I’m sure it’s not the whole story, but I’m also sure it is a factor.

The EIA has some very good data on refinery closures. 4.5% of capacity went offline post – COVID in the USA. It was very interesting to me.

Many small refineries closed 1991-2018. But in recent years some much larger ones closed, plants with capacity of over 100K BOPD. COVID did to them something similar as to other industries. In the panic many good employees were terminated, and they didn’t come back. New ones are harder to find as it’s seen as a dead end long term, as is upstream.

Almost 3 million BOPD of refining capacity has been closed since 1991. I think since the Marathon Garyville, LA refinery was completed in 1976 there has only been one new refinery built, a small one in ND. Refineries have added capacity, but apparently not enough for right now.

Refining has been very volatile. I live near a decent sized one and know many who work there. Interesting to pick up tidbits of info and opinion from them.

I’d really recommend readers peruse the EIA refining data. I hadn’t looked at it closely for awhile and had forgotten how much detail is published.

One anecdote, California has lost over 750k BOPD of refining capacity since the EIA began collecting data in 1982.

OTOH, states along the Gulf Coast have added a lot of capacity despite no new refineries being built.

In terms of refining, this is definitely a year we can’t afford to have a hurricane which has major impact upon that Gulf Coast refining. Would be a catastrophe.

Shallow sand,

It is not clear that anybody wants to build new refineries or expand capacity in the US. We can export the excess tight oil to nations that have refineries better suited to light oil and then import finished products from those nations. Or we could ban exports of crude which might force some refinery adjustments, but this might not be the most cost effective solution. The result might simply be lower output of tight oil and higher prices paid for imported crude suited for current refinery capacity in the US because the lower total output of World crude will tend to drive prices higher.

This is counterintuitive, a ban on US crude exports is likely to drive imported crude oil prices higher and the marginal barrel refined in the US is imported and will set the price of gasoline, diesel, and jet fuel.

Dennis.

I wasn’t commenting on anything other than there have been some larger refineries closed in recent years.

I suspect there won’t be another refinery built in the USA.

The executive branch is rumored to be looking into assisting idled refineries back into production.

CA has the highest fuel prices in the lower 48. I know taxes play a big part. Environmental factors matter too. Do you think shrinking refining capacity has also played a part?

All part of the volatility in the bumpy energy transition.

If I am not mistaken, the largest refining capacity decline in the past decade was the big explosion and destruction at the Philadelphia complex in 2019-

335,000 bpd capacity

https://www.hydrocarbonprocessing.com/news/2021/07/refinery-closures-decreased-us-refinery-capacity-during-2020

Shallow sand,

Smaller refinery capacity may be a part of the problem, my guess is that the larger problem is disruption in the entire system due to shortages of oil, both due to OPEC restraint on increasing output and sanctions on Russia, Iran, and Venezuela.

You make an excellent point on lack of spare capacity and problems if a hurricane hits Gulf coast refineries. It would make more sense if SPR was saved for those situations, though I am not sure how long refined product can be stored, it would be good to have some set aside for emergencies, if it is possible.

Centered 12 month average % of operable refinery capacity utilized in US

https://www.eia.gov/dnav/pet/pet_pnp_unc_dcu_nus_m.htm

Weekly chart at link below

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WPULEUS3&f=W

SS , tks for bringing the refinery issue . I have said earlier that getting the crude from Ghawar to the tank of Six Joe Pack in Louisiana is a closed loop system which is extraction , transportation ( pipelines ) and refining . When one of the chain breaks Six Joe Pack will run on empty .

Refinery capacity in the US

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mocleus2&f=a

Capacity of 18.8 Mbpd in 2018 and 18.1 Mbpd in 2021, about a 3.7% decrease in refinery capacity. The highest gross input (monthly) was 18 Mbpd in June 2018, average annual input in 2018 (highest annual average) was 17.3 Mbpd. At the 2021 average operable capacity this level would be a 96% utilization rate. By March 2022 operable capacity had fallen to 17.9 Mbpd and at that level a 17.3 Mbpd input would be a 97% utilization rate.

We may indeed be suffering from the lack of refinery capacity that shallow sand pointed us to.

““Building a refinery is a multi-billion dollar investment. It may take a decade. We haven’t had a refinery built in the United States since the 1970s. My personal view is that there will never be another refinery built in the United States.” Chevron CEO June 2022

Ovi,

I agree, 90 to 125 seems like a likely range for WTI over the next 12 to 18 months.

On DPR production decline rates, this is very sensitive to the time period involved and whether the completion rate is rising, falling or relatively stable. During a period with relatively stable completion rate from Jan 2019 to Jan 2020 ( in the range of 900-1300 completions per month, with 9 of 12 months in the range of 1100 to 1300 completions), the decline rate was relatively flat. See chart below.

A more general idea of what DPR decline rate looked like from March 2017 to March 2020 is shown below, for much of the early period from March 2017 to December 2018(green diamond markers on chart), the completion rate was rising rapidly from 900 to 1300 completions per month, then the completion rate fluctuated up and down between 900 and 1300 completions per month over the next 2 years, with 2019 being relatively flat in terms of the change in legacy decline as shown in previous chart. The brown triangles represent data from April 2021 to April 2022 and are shown for comparison, if the completion rate stabilizes at say 1100 completions per month we may see the rise in legacy decline either slow down or stop as it did in 2019. The curve seems to have shifted, perhaps due to changes in the average well profile for tight oil basins, the highest legacy decline rate to date has been about 570 kb/d and if the equation from the recent data holds into the future, that level of legacy decline would be reached at about 9530 kb/d for the 7 region DPR oil output total. Blue upright triangle markers in chart are Jan 2019 to March 2020 data. Data from April 2020 to March 2021 are not shown on chart.

Dennis

Between your two charts you have shown the fallacy of looking at different completion regimes. In an increasing completion regime the decline rates are essentially the same. In the original chart posted above, I chose to look at the period when completion rates stabilized and were growing. Also I wasn’t sure if the earlier wells had a different initial rate and whether that could affect the results. Your chart seems to indicate (Green and Purple markers) that the initial rate has no effect. The main consideration seems to be whether completions are increasing or decreasing.

Regardless, we have come to roughly the same conclusion, the decline rate increases by close to 8.3 kb/d per100 kb/d increase, on average.

Ovi,

Yes I was interested in whether the slope would be similar. There are many variables, probably better to look at individual basins and changes in well profiles may affect the relationship. My thinking was that as the completion rate became somewhat stable, that legacy decline rate may not increase as quickly, this seems to be the case.

By stable, I mean a constant completion rate at some level x, my guess is x may be about 650 for the Permian from 2023 to 2028.

OPEC+ agrees to raise output by 648K BPD in July and again in August

Oil ministers from OPEC+ nations agreed on Thursday to lift output by 648K barrels per day (BPD) in both July and August, according to sources speaking to Reuters, in line with the recommendation made by the group’s Joint Ministerial Monitoring Committee earlier in the day. With Thursday’s meeting having now ended, the next meeting has been penciled in for 30 June.

Thursday’s decision marks a departure from the groups policy over the last year and a bit of raising output at a more measured pace of 432K BPD each month.

The target rates are attached. Note that SA’s production level is above the highest rate it has ever sustained for more than six months. In H2 2016, SA maintained a production level of 10,600 kb/d for six months before dropping back to 10,000 kb/d

https://www.fxstreet.com/news/opec-agrees-to-raise-output-by-648k-bpd-in-july-and-again-in-august-202206021326

Comparing what they require in July versus April production there are a few unreasonable assumptions. Angola will not increase production by 342 Kb/d in three months. Nigeria will not increase production by 886 Kb/d. And of all the rest, only Gabon seems resonable.

But by far the most unreasonable is their projection for Russia. They have Russia down for 10,833 Kb/d, and that is crude only. Russia must hit a new all-time record high in C+C to produce that much crude only. They would have to produce more than their record monthly high C+C of 11,680 kb/d in December 2018 if they are going to produce 10,833 kb/d of crude only.

Sorry about the misspelling of Must increse by. I cannot correct what in in the graph.

Here are the increases for the non-OPEC portion of OPEC+. For some reason Mexico was not included in the report I copied this data from a couple of weeks ago. At any rate, this graph is totally unreasonable for any of the nations except South Sudan. But the Russian data is totally absurd

Ron

Mexico was part of the OPEC plus deal for just one year. They are now committed to 1,753 kb/d and it does not change. They have some deal whereby they sell oil forward and do not want to affect that deal. They may be on the losing side this year.

So far, I have not seen any evidence that Americans are curtailing oil use [or derivative products]

at $120/barrel.

Anyone else seen data to indicate curtailed consumption due to oil price [and not including that due to supply chain disruptions which are a different story] ?

Hickory

Definitely hear a lot of casual/personal comments of not taking a long trip but no hard evidence.

At least that explains the stories for things like 1/3 of those on $250k/pa salaries are living paycheque-to-paycheque and 48% of families needing tax credits to be able to feed their kids.

Also, “excess savings” is dropping like a rock. Gotta love that newspeak lingo for social safety nets.

“Anyone else seen data to indicate curtailed consumption due to oil price?”

My “data” consists of the observation that more and more gigantic, fat-ass trucks with exhaust pipes like garbage cans keep speeding past our house at all hours, without a f*cking care in the world.

So much for rural serenity.

Ovi,

First let me say, I really appreciate your oil updates. I count over 40 charts in this update. I especially find the last chart interesting showing how the REST OF THE WORLD, minus the United States shows a plateau over the next two years. Of course, there could be revisions, but I don’t think it will change the overall scenario all that much.

This is especially bad news for the Global Economy and Financial System. Why? Because, as you are likely aware, our highly leveraged debt-based financial system survives on a growing energy supply to maintain the $300 trillion of debt in the world. When the oil supply plateaus and declines, the entire Highly-Leveraged Debt-Based Financial System begins to unravel.

I don’t believe many understand the ramifications of this predicament. Since the 2008 Financial Crisis, with the help of Ben Bernanke & the Fed, U.S. Shale Oil came to the rescue accounting for 75% of the net Global Oil Production growth over the following decade.

We can see that in the chart below. If we look at two time periods BEFORE and AFTER 2008, the REST OF THE WORLD accounted for 12.7 mbd of growth from 1997-2008. However, this totally flipped after 2008 as the United States and Canada accounted for 12.6 mbd of growth while the REST OF THE WORLD was basically flat.

Thus, we can thank lousy Tar Sands and mostly unprofitable Shale Oil for allowing Business as Usual to continue in the world from 2009-2019.

But, as your last chart shows, there is no real growth ahead. I believe after 2025, the World will begin to head down the ENERGY CLIFF and this will only escalate as we reach 2030, and afterward.

Thanks again for the update.

steve

Could you define what you mean ‘CLIFF’,

seeing as how the downslope rate is a ‘big deal’?

Hickory,

I have posted this chart in this blog before. This chart comes from a video done by Nate Hagens, and how debt was used to bring forward production to a higher level, due to a massive increase in debt, especially since 2000.

The chart is explained in his two-hour video presentation at the 38 minute mark, but discusses the global oil situation extensively, so it may be worth the watch:

https://www.youtube.com/watch?v=qYeZwUVx5MY&t

However, as oil production begins to decline, it will pop the $300 Trillion Global Debt Bubble. When debt implodes, so will oil production. Thus, we have the ENERGY CLIFF, similar to the SENECA CLIFF.

steve

When has the oil industry not had credit available to them? Perhaps in the mid eighties during the S+L crisis in Texas, but mostly they have always had access to debt and utilized it when it made financial sense to do so (such as when interest rates were very low and profits were very high).

As to whether we see a cliff, will depend in part on demand and the transition to electric transport. The cliff will come because nobody needs the oil any longer and it may happen very quickly from 2030 to 2040.

Dennis,

Do you really believe in what you wrote here: “The cliff will come because nobody needs the oil any longer and it may happen very quickly from 2030 to 2040.”

Nobody needs oil any longer???

I disagree with this assessment, but I would welcome any other members to chime in.

steve

Steve —

One oddity of you analysis is equating oil with energy. In fact most energy consumed by humans does not come from oil, as this analysis from Lawrence Livermore National Lab shows.

https://flowcharts.llnl.gov/sites/flowcharts/files/2022-04/Energy_2021_United-States_0.png

The chart shows that oil is mostly used for transportation, and most of this is “rejected” — that is wasted. That’s because most of the fuel you buy goes into pointlessly heating your radiator.

Also LLNL doesn’t even address the fact that America’s transportation system is hopelessly inefficient, burning more than twice as much oil per capita as leading industrial powers like Germany or Japan.

https://www.worldometers.info/oil/oil-consumption-by-country/

It is sometimes argued that America’s massive wastefulness is related

to population density, but rich low density countries like Sweden don’t use anywhere near as much oil.

The reason we consume so much oil is that it is cheap. If the price goes up, people will consume less.

Steve,

Poorly stated by me. The idea is not that nobody needs oil, but simply that demand for oil will be lower than the supply of oil available at a high oil price that prevails before 2030 (likely in the range of $100 to $125/bo in 2021 US$). This will result in falling oil prices and expensive oil such as Arctic oil and tight oil, followed by new oil sands projects and new ultra deepwater offshore projects will no longer be viable. There may indeed be a Seneca cliff in oil demand as the transition to electric transport will be much swifter than imagined by most mainstream agencies (IEA, EIA, OPEC, etc).

Do you remember when you thought to yourself, why would I ever pay $500 for a cell phone? It was not that long ago (first iphone was released in June 2007). In 15 years people will be saying, remember when people use to use liquid fuel in light vehicles and thought they would never own an EV? At that point World demand for crude oil may have fallen to 69 Mbpd and in 20 years demand may have fallen to 48 Mbpd. See chart below for one possible scenario where no approval of full self driving vehicles is assumed, demand drops much more steeply once robo taxis are approved widely.

“It is sometimes argued that America’s massive wastefulness is related to population density, but rich low density countries like Sweden don’t use anywhere near as much oil.” ~ Alim

Thanks Tips; got it, as soon as Americans cease to be wasteful & inefficient gluttons then we’ll be saved. We’ll all set a watch. Cheers.

Survivalist, no worries. President Oz will surely lead the US to energy nirvana.

Diesel haulage trucks are “waste”, lol.

Global electric HGV fleet when? That Tesla Semi, aaaaaany day now… gotta keep the faith…

When will some folks understand that the West is ” The Landfill Economy ” ? Our economic system is based on the premise ” Your waste is my income ” . Keep this up and we are all going to the destination — ” The Landfill ” . Enjoy it till you reach there .

I really enjoy Mike S input. It is great to hear someone who is such an expert. That is a compliment.

I think Dennis does a great job.

Ron, Ovi, Bob, etc….are doing an amazing job.

I don’t understand the insults.

Peak avocado,

I agree that Ovi, Bob, George, and Islandboy do an excellent job.

I also agree Mike Shellman’s comments are wonderful and I am grateful he is willing to share his expertise , the insults are fine.

Kleiber,

A number of truck companies offer heavy duty EV trucks in Europe. At current prices for diesel fuel they may be very attractive.

Dennis. I thought the recent narrative was that banks were getting out of financing fossil fuels?

False narrative?

Confusing, ain’t it, Shallow?

In fact the “narrative” now (on AOB) is that no tight oil company needs to borrow money at all because at these product prices they can, a.) pay down ALL debt in just a few years, b.) replace ALL of the ENORMOUS , and escalating, base decline rates of US tight oil while, c.) continue to grow production in the Permian from 5.3 to 8.0 MM BOPD in just a few years (in the face of a 35% increase in D&C costs) and, d.) continue to increase dividends and buy back shares of stock to appease the people that now own them and control very breath they take.

What else? Oh yeah, that it’s GOOD that America continues to export its last remaining hydrocarbon resources at the rate of 75% of total Texas tight oil production, and now, 20 BCF of natural gas LNG exports….because demand will fall to little of nothing by April 23, 2033 and we won’t need it anyway. Good grief ! All this from an expert from Maine who has never even seen an oil well in his life much less written a check to understand one.

I am unclear why anybody wanting to actually know what the future holds regarding America’s fossil fuel future even reads this dribble. It’s gotten laughable, and the talk of my industry, who believes it all is all anti-oil, let’s get to EV’s ASAP, political minded horse shit.

Ovi, yours is good work. and yours Bob; thank you. I truly don’t understand why you men bother but thanks for trying.

@Mike

It’s fact that we have to phase out the heavy use of oil in the next 30 years. That has nothing to do with anti-oil or being a dreaming woke green pothead.

It’s just the last 20 years, where prospectors found less than you oil men pumped. So we need a plan B. Plan B contains the part not to ruin the existing oil industry, since the switch over will take a lot of time. Lot’s of new infrastructure has to be build, using oil. That’s not done in 10 years.

Money and debt will be the least problems – there is always the possibility of a war economy when things go wrong badly. And money can be created, debt can be destroyed. Yes, it produces some chaos. In my family history one event destroyed a few million $ in current value during a dept shakeoff.

You can stop exporting oil in the USA, but this will shoot the oil price to the moon in the current enviroment. The US refineries can’t intake that much light oil, so you still will have to import some stuff while reducing producing LTO. At the low price of 200$+, since this means another -3 mbpd on the world market – while LTO on the US only market will be cheap. Just more chaos.

Shallow sand,

Financing can occur through selling stock and selling bonds, my guess is that major oil companies and large independent oil companies can get a line of credit as needed.

At $100+ per barrel, these companies can self finance out of operating cash flow. The point was simply that debt has been part of corporate operations for quite a while.

Let’s say someone offers you a loan at 1% interest and you see an opportunity where the likely ROI is 25%, many businesses would take the loan and pocket the net 24% return.

Shallow sand,

Was that my narrative? I think I have said that at prices over $100/bo Permian producers should have positive operating cash flow. As far as what oil companies choose to do with this cash flow, I think they know best what should be done with the money they earn. Currently Permian producers seem to be paying down debt, returning cash to shareholders, and buying back their stock with just enough investment to increase output by about 8.6% per year.

The average 2020 Permian well with assumed well cost of $14 million (40% higher than before pandemic) in 2020$ and OPEX cost of $18/bo over the life of the well and a wellhead oil price of $100/bo, NGL price of $35/b, and natural gas price of $5/MCF would payout after 16 months and at a nominal discount rate of 65% the discounted net cash flow over the life of the well would be $14.6 million. The undiscounted net revenue over the life of the well would be $37 million, leaving a profit of $23 million after deducting the capital cost ($14 million) of the well, that is a return on investment of about 264%.

If we reduce the oil price assumptions to $90/bo at wellhead, NGL at $31.50, and natural gas at $4/MCF (all on 2020 $), cost assumptions the same as previous example.

Then the well pays out at 21 months, at 36 months net revenue is $18.5 million, at 60 months net revenue is $23 million and at the end of the well’s life (assumed to be 20 bopd) at 168 months, net revenue is 32 million. In this case a nominal discount rate of 50% results in discounted net cash flow over the life of the well to be around $14 million.

The cumulative oil output of the average 2020 Permian well is about 284 kbo at 36 months, 348 kbo at 60 months, and 478 kbo at 168 months when well is plugged, cumulative NGL is 168 kb at 168 months and cumulative natural gas is 2030 million cubic feet at 168 months. At 60 months cumul NGL is 100 kb, natural gas cumul is 1209 million Cu ft. At 36 months cumul NGL is 74 kb, and cumul nat gas is 891 MMCF.

Dennis. Not your narrative. This is MSM stuff.

I have read many MSM articles indicating banks are trying to get out of the fossil fuel lending business.

Until the current administration got its ass in a crack with $5 gasoline and $6 diesel, plus $300 coal and $8 nat gas, it was strongly arguing against further financing of fossil fuel production.

IEA said recently that drilling should cease. 2020 Dem Pres. candidates were climbing over themselves in debates that we should “keep it in the ground.”

As with many other topics, a lot of irresponsible sloganeering and impossible policy goals (Green New Deal anyone) (MMT anyone) has had an affect.

In any event, the Dems are screaming about greedy oil companies when they should be thankful for $5 gasoline, as that should speed up the energy transition. I thought that was the idea? I guess it isn’t worth losing and election to stick with that one?

Shallow sand,

Spreadsheet with 2020 avg Permian well breakeven analysis at link below

https://drive.google.com/file/d/1LcqTBCJMGGbquk8iUryGx2oAX3XJJqbR/view?usp=sharing

Shallow sand,

I agree many silly claims are made by politicians of all political stripes. High gas prices hurt politicians, so Republicans will probably do well in November. Biden would be wise to not jump on the windfall tax bandwagon, a recipe for even higher fuel prices. It would also be wise to allow permitting on Federal land and water and open up offshore leases for bids in the GOM. We will need energy to enable a transition to non-fossil fuel energy, there are no magic wands, this will take 15 to 30 years to accomplish.

Shallow sand,

Would love to get your input on my breakeven analysis to correct what I have missed.

If you have a minute. If you would prefer to get it emailed to you let me know. Some people do not trust google links.

Mike–

Your periodic jeremiads are greatly appreciated in this household. I enjoy reading your comments aloud to my mate.

Your gratuitous insults to people who run this site for free, not so much.

“All this from an expert from Maine who has never even seen an oil well in his life much less written a check to understand one.”

MikeB,

Mike S is correct that I have never been involved in oil production in any way. I have never claimed to be an expert, Mike is the oil pro (what I would call an expert) not me.

I also enjoy his comments, the insults are fine, I don’t care.

I have stopped responding to Mr Shellman’s comments because any response is considered insulting. I have learned a lot from Mike and appreciate all he has taught me.

“who has never even seen an oil well in his life”

Funny stuff. I have never seen an electron in my life. I have never been to the sun. I can’t say for certain that the moon isn’t made of green cheese since I’ve never been there either.

The earth sciences is a bleak and plodding research discipline that has the reaction time of molasses.

I really enjoy Mike S input. It is great to hear someone who is such an expert. That is a compliment.

I think Dennis does a great job.

Ron, Ovi, Bob, etc….are doing an amazing job.

Paul,

I think Mr. Shellman just wants to emphasize that he knows the oil business far better than I do.

I agree with him and have attempted to incorporate all he has taught me into my scenarios.

Shallow sand has given me some feedback on my breakeven analysis, I will let him share it here if he would like.

If any other experts would like to take a look at the spreadsheet and let me know the errors it is at link below.

https://drive.google.com/file/d/1LcqTBCJMGGbquk8iUryGx2oAX3XJJqbR/view?usp=sharing

Note that in early 2020 I assumed full cost of a new Permian well was $10 million in 2020 US$ and average OPEX over the life of the well was $14.37/bo in 2020 $, the analysis is done in inflation adjusted 2021 US$. Mr Shellman has mentioned that costs have gone up by 35%, so I used a 40% increase for full well cost in 2020 $ ($14 million) and OPEX increases to $17.87/bo in 2020 US$ over the life of the well.

At $71/bo for crude, $24.85/b for NGL and $4/MCF for Nat gas (all prices in 2021 $), the average 2020 Permian well pays out at 36 months. At a nominal annual discount rate of 27% the discounted cash flow is equal to the capital cost of the well where we assume the well is shut in at an output of 20 bopd at 168 months after first flow. Cumulative net revenue in real 2021$ over 168 months is 24.5 million, so a net profit of 10.5 million 2021$, if the capital cost of the well is paid for in cash (no interest payments).

Dennis,

Geologists, geophysicists, climate scientists, and assorted earth scientists do not like to hear anything new or novel. They are stuck in a discipline that can’t do controlled experiments or any experiments in the lab for that matter. This means that they are conservative and reluctant to adopt any new ideas, since nothing can be verified easily. And many of them become earth scientists because they would rather work outdoors than at a computer or in a lab. That’s why they often seem to have a chip on their shoulder, IMO.

Paul

Dennis this isn’t pre 2008. All loans of all types

are collateralized loans. Banks are a lot more balance sheet constrained then most people realize.

There isn’t enough high quality collateral by a wide margin as central banks have bought it all up. And $2 trillion in reverse Repo. Those treasuries can’t be used to financial engineer or rehypothecate collateral to create more loans. More money. Actual money that goes into real economy. Not bank reserves that never leave the FED.

Capital available to real economy over next decade is going to be scarce.

Shale oil is mainly financed through the sell of junk bonds instead of direct bank loans. Oil in the ground isn’t the collateral used to back the loan as in a direct bank loan.

Treasury bonds mainly T-bills are leveraged up in repo markets to create the money to finance shale oil.

Another reason FED only controls FEDs funds rate which is for interbank lending. They don’t control either interest rates for short term T bill or long term bonds. Which there is huge demand for both because banks use these T bills and bonds to financial engineer everything.

Which is also why FED can’t really hike rates to fight inflation without burning the economy down.

In theory FEDs funds rate should be the floor for interest rates. But reality is T bills are under the floor. Yet they will continue hiking rates even though they have historically always cut the FEDs funds rate to keep it under T bills.

There is a obvious problem here and shit will break as they continue hiking rates

HHH,

At current oil prices, there is plenty of cash flow and little need for new debt for oil companies. The oil companies can choose to not produce more oil and keep output flat and send all the cash flow to pay dividends and pay down debt we could even stop exporting oil and reduce tight oil output and save the tight oil for our great grandchildren, we would need to cut tight oil output by about 3000 kb/d or so, for those who believe that is a good idea. I personally think relatively free markets result in a more efficient allocation of resources, though obviously some regulation is needed for markets to function well.

Hi Mike , “I truly don’t understand why you men bother but thanks for trying. ”

Yes , you have a valid question . Why do we even bother ? We do it to see that the BS , inaccurate information and analysis is nipped at the bud and does not go mainstream . Ron has started this blog to get the correct info out to the public . Many here comment to rectify the incorrect conclusions . Hey ” Someone’s gotta play the piano in the brothel ” . 🙂 . Respects .

I understand the concept, but the Degree to which oil declines after peak for the next 10-20 years is clearly the big deal.

Nobody knows what that downslope will look like.

Could be steep, could be mild/gradual – depends on many interrelated variables.

That was the point of my rhetorical question on ‘Cliff”.

Hickory,

Yes it is clear nobody knows how this will play out. Below is a World C plus C scenario where there is no transition to EVs, output declines less steeply than a rapid EV transition and oil prices remain very high, demand decreases due to demand destruction due to high oil prices (perhaps as high as $200/bo in 2021$ by 2040.)

Thanks Dennis.

This is a very relevant chart for those who like to talk about a cliff.

If you compress the time axis (while keeping the data and time all the same), you can make a picture that looks like a cliff.

I see this chart as a global potential of oil output, but the human element is a big wild card that can diminish the potential, of course. Things like war, failed states, depression, protectionism, currency collapse, sanctions and trade tariffs, taxes and mandates, for example.

Hickory,

Yes the chart assumes we muddle along with something like BAU. An asteroid strike or WW3 would change things, as would Great Depression 2. I think all of these are low probability events, but my ability to forecast the future is not very good. It is certain that any scenario of the future will be wrong. Something between the scenario above and the earlier fast EV transition scenario may be in the ballpark.

Chart below is narrower to emphasize the steepness of the drop in output.

The big question to all of these supply concerns raised by Steve and Nate and most observers who recognize that peak oil is upon us, and that

declining supply is the new normal is-

‘what kind of adaptations are you making to survive in a country where oil and all of its derivative products (from petrol to paint)

are gong to be much more expensive or simply less available?’

[I realize that you project a new peak or at least plateau for this decade Dennis, but for practical purposes i consider that we have been and are roughly at peak currently]

Hickory,

Output may not rise much above the previous peak, but much depends on the speed of the transition, a no ev transition scenario could see World C plus C output rise to 88 Mb/d in 2029. I doubt we see this number due to at least a slow transition to EVs, so 85 Mb/d is my best guess in 2028 or so. High oil and natural gas prices may lead to quicker adoption of electric transport, wind, solar, hydro, and nuclear power, as well as an update to the grid with more HVDC transmission. Much to be done and some better government poicy would help, at minimum a carbon fee and dividend plan at the national level, maybe in exchange for further tax cuts and perhaps more leasing of federal lands to oil and natural gas producers.

So Dennis,

In essence you are basically saying any decrease in oil production in the future will come from a decrease in demand otherwise known as ‘peak oil demand’ due to the transition to EVs. Is that correct ?

Iron Mike,

No that is not what I intended to say. Sorry for being unclear.

With no transition to EVs, oil supply will be the constraint and oil prices will rise to a high enough level that some consumers will be priced out of the market. At that point the quantity consumed will be equal to the quantity supplied (as must be true in general). In the no transition scenario, supply falls because of oil resource constraints, oil prices rise enough to destroy enough demand that the oil market remains in balance.

Dennis,

Thanks for clearing that up. So basically if i understood you correctly, your view is:

Either EV transition occurs which will naturally drop oil demand;

Or we need to experience extended periods of recession to curb oil demand as supply constraints kick in due to geological factors.

Would that be correct?

Iron Mike,

I didn’t mean to imply that there would be a recession, but I can see how one would come to that conclusion, especially if they think the only alternative for current levels of oil use is a transition to EVs, which I tend to focus on.

What else could be done to reduce the use of oil?

1. More efficient and smaller ICEVs

2. Hybrid Vehicles

3. Better urban and suburban planning so more walking and biking can be used in place of vehicle use.

4. Car pools

5. More use of public transportation

6. Other stuff I haven’t considered

Oil demand destruction does not necessarily imply a recession, if oil is used more efficiently in combination with substitution of other means of transport.

In short, oil demand destruction does not equal recession.

Also I think it is unlikely that there will be no EV transition, the main question is how quickly it occurs. The higher the price of oil, the higher the demand will be for EVs and the more quickly that auto makers will move to the production of EVs.

Higher oil prices=faster transition to EVs and plugin hybrids and smaller more efficient ICEV as well as greater use of any mode of transport that uses less oil.

Dennis,

There is some points you and I will disagree on here.

You think with the growth economic system where you need more consumers (the west is importing them from 3rd world), there will be a decrease in oil consumption ? I disagree with you, as long as human population is increasing (regardless of the decreasing rate) and the standard of living is maintained or increasing for the poorer people of the world oil consumption will be maintained or increase depending on supply.

I agree with carpooling this can reduce oil consumption but how much is the question, and I don’t know. Also more efficient ICEVs could lead to Jevons paradox situation so I am not entirely confident on that either.

More efficient public transport is crucial. But this would apply to newly built cities. I mean established cities would seldom fork out billions of dollars to change their public transport infrastructure. So again i am skeptical on how much impact this will have.

The only known event to have immediate and efficient demand destruction of oil consumption are recessions. This is a observable fact historically speaking.

And i also disagree with your hypothesis that higher oil prices lead to quicker transition to EVs. That is not true at all. The price of metals required for battery production are up with oil. Your premise would only be true if oil is the only commodity that is exhibiting high prices while the prices of metals are down. Which is definitely not the case at present.

I’d like to point out that high energy pricing can be one cause of economic contraction but many other causes exist, such as war and pandemic and financial policy choices.

Some of these causes will cut into oil demand more than others.

It looks to me like we run a very high risk of oil demand destruction in this decade and next due to recession/depression, whether from unaffordable energy and/or from the other causes.

EV replacement of ICE will have a smaller role in this.

For a long time, in the absence of economic contraction, any demand destruction due to EV adoption in certain regions will be offset by increased oil demand in many other places in the world.

Iron Mike,

I agree that we see things differently, the future remains unknown, this will always be the case in my opinion.

On your last point, historically new technologies tend to become cheaper as they scale up, this is likely to be true for EVs so costs for EVs are likely to fall.

In the US gasoline currently costs about $5/gallon, a typical US midsize vehicle gets 30 miles per gallon, a cost of about 16.7 cents per mile. A Tesla model 3 goes about 4 miles on a kWh at a cost of about 13 cents per kWhr, so about 3.25 cents per mile.

Over a 150,000 mile life of the car the difference in cost is about 20,000 dollars. Currently the cost of a Chevy Bolt is about 32k. Model 3 is about 47 k.

High prices for lithium are likey to lead to higher supply and this may bring prices down.

People can also drive less and will tend to do so if prices of fuel remain high.

Chart of per capita crude plus condensate output, with projection after 2021 using UN population projection and my model for World crude. Potentially there could be a major depression after 2030, much will depend o the speed of the transition to alternatives to oil and/or greater efficiency.

Also see

https://en.wikipedia.org/wiki/Jevons_paradox

The effect only occurs for oil if the price of oil falls, which might not occur if supply falls as fast as demand falls.

Srsrocco

Thanks. I agree that the EIA outlook in the last chart looks pretty grim. However, there is this Reuters report that says Saudi Arabia is set for oil output capacity above 13 million barrels per day by 2027. Also Iraq will add a another one million barrels per day by 2027,

“MANAMA, May 16 (Reuters) – Saudi Arabia is on track to lift oil production capacity by more than 1 million barrels per day to over 13 million barrels bpd by the end of 2026 or start of 2027, the energy minister said on Monday.”

This may delay the peak, if they both can increase production.

https://www.reuters.com/world/middle-east/saudi-arabia-track-hit-oil-output-over-13-mln-bpd-by-2027-says-minister-2022-05-16/

Ovi,

Yes, I have seen the “Supposed” increase in Saudi and Iraq oil production in the next five years. However, even if we add this amount, what would the total be compared to the peak in Nov 2018? How much of an increase?

Would that push the total back above 101 mbd of total petroleum liquids? Maybe 102-103 mbd? So, from 2018 to 2027, we may see a net increase of 1-2 mbd of global oil production when we enjoyed nearly 13 mbd increase from 2008-2018??

Do you see what I am getting at here? This plateau in global oil production is not good for the Highly Leveraged Debt-Based Financial System.

steve

Steve , ” “The greatest shortcoming of the human race is our inability to understand the exponential function.” Dr Albert Barlett ‘

Here many forget the Liebig’s law of the minimum and Jeevan’s paradox . The end of growth is the beginning of collapse . Preaching to the choir ?

HOLE,

Indeed.

steve

The late Matthew Simmons already in 2007 called for a “Marshall Plan” for oil, and this is what we are seeing. He also said we should do a Manhattan project for alternative energy and throw very wide nets… It is scary to watch some of his older interviews just before the GFC, because they show why things are the way things are today.

The US Shale was the last hurrah of “The Oil Age”. One paraphrased quote I like from him is “Of course you pump more than never before when you are at the peak, but then comes the slope on the other side”. He even mentioned how expensive fracking was and that it would be a short lived phenomenon.

Also the graph above somewhere with the depletion rates using credit is exactly why they released the credit tsunami.

Well no help today from the $Billions invested in the UK, France and Germany. 106,000 MW installed, current production 2:00pm EDST ABOUT 7 MW of wind power Pure insanity.

Ervin , copy paste . “It all sounds a bit like having to pay to keep a taxi running outside your house to cover for when your car won’t start. ” LOL .

Follow up . “Except the car frequently won’t start. Get rid of the car. ” . 😉

For Germany. agora-energiewende.de For the UK and France. gridwatch.templar.co.uk

I just googled for the installed wind energy capacity.

Ervin , this website gives daily info on gas storage in the EU .

https://agsi.gie.eu/

Earth to Ervin…come in Ervin…newsflash 2022…

wind energy is variable….UK oil production peaked in the last century…UK gas production peaked 20 years ago…

its not very sunny in the UK…nuclear power plants are very expensive and take a long time to build…no one promised you that peak energy was going to be some sort of picnic…do you copy?

Hickory

I don’t disagree with anything your saying, BUT my post was at the end of five days where those three countries never got to 10% production of the installed capacity.

One of the concepts I remember from my college classes was in Systems Engineering. Every system has to have energy added to keep it functioning. The “energy” for all of those wind turbines I would say are the government subsidies and the first inline rule. Without that they would never have been built. That is not a solution to provide a modern society with power. Building a system to first and foremost is to reduce carbon dioxide is a recipe for disaster

Ervin , correct . Folks should read David Korowitz ” For something to work all time it should work every time and everywhere . ” Not difficult to understand .

Ervin,

if the UK pretends that there is not a massive wind energy resource offshore,

where do you suggest that the UK gets it energy from?

I suggest that we all will have to come to be thankful for what energy we do have available, even if all the various sources have big shortfalls.

The problem with the U.K. electric power system is too much politics and not enough engineering. Just build the most reliable, cleanest and least expensive system with absolutely no thought to carbon dioxide.

“build the most reliable, cleanest and least expensive system”

That recipe will likely result in the same product choices.

Perhaps coal would be a bigger part of the mix for a decade or two, but that depends on the cost of local production and the state of the combustion facilities.

How To Kill The U.S. Golden Shale Oil Production Goose?

Hit the U.S. Oil Industry with a WINDFALL PROFIT TAX… LOL.

U.S. Economic Officials Says Biden Considering Oil & Tax Windfall Tax

A White House economic advisor told a panel on Thursday that the Biden administration is now considering the U.S. congressional proposal that would place a windfall tax on oil and gas as prices at the pumps continue to soar, Reuters reports.

“We are very much open to any proposal that would provide relief to consumers at the pump,” National Economic Council deputy director Bharat Ramamurti told a Roosevelt Institute panel, as cited by Reuters.

https://oilprice.com/Latest-Energy-News/World-News/US-Economic-Officials-Says-Biden-Considering-Oil-Tax-Windfall-Tax.html

————————————

If the U.S. Govt gets it’s wish on passing a Windfall profit tax on the Oil & Gas Industry, this should do wonders for oil companies’ share prices and future upstream CAPEX expenditures.

Welcome to the ENERGY CLIFF.

steve

Steve

I haven’t heard this yet in Canada. Once it gets more visibility in the US it will spill across the border. Where was the US govt when these companies were losing billions?

In Canada they are now putting a surcharge on banks that earn more than a Billion. Sounds great but every working person’s RSP (Similar to 401k) is 33% populated with Cdn bank stocks. Most people didn’t realize that there RSP were going to be hit but they voted the Libs in.

I figure the next sector to be hit will be oil industry. They will probably call it a WFT and say they will invest in solar and wind. The Wind will be coming out of the capitol.

Ovi,

Agreed. But, the U.S. Govt doesn’t get the credit for being the first to go after those NASTY OIL COMPANIES. It seems as if the U.K. won the FIRST PLACE AWARD last week with a stunning 25% tax.

UK Hits Oil & Gas Companies With 25% Windfall Tax

The UK Chancellor of the Exchequer, Rishi Sunak announced on Thursday a windfall tax of 25% for oil and gas companies.

25% Energy Profits Levy may slow down investments in North Sea oil.

The “windfall tax” is temporary and will be phased out when oil and gas prices return to historically more normal levels.

https://oilprice.com/Energy/Energy-General/UK-Hits-Oil-Gas-Companies-With-25-Windfall-Tax.html

—————————————-

The U.K. will PHASE OUT the Windfall Energy Tax when prices go back to more normal levels. Never gonna happen… LOL.

GOD HATH A SENSE OF HUMOR.

steve

The absolute dumbest tax in the world if you are wanting more supply rather than less. Leave it to the politicians to make the wrong decisions and the absolute wrong time. Reminds me of my past PE Partners.

LTO SURVIVOR,

Agreed… go figure. And, you should see what the U.S. Govt plans with the Strategic Petroleum Reserve by 2028 and then 2032. Besides the LUNACY of selling 180 million barrels from the SPR by the Whitehouse to help with what they label as “PUTIN’S OIL INFLATION,” they will continue to draw down to 400 million barrels over the next 6 years.

All of these future SPR withdrawals are based on PAST LEGISLATION… LOL

Check the chart below.

As they say about most politicians… STUPID IS… STUPID DOES. You can’t make this SHYTE up.

https://www.eia.gov/todayinenergy/detail.php?id=50476

steve

Total lunacy

How many days left?

Steve, the chart you posted doesn’t even reflect the approximately 5 million BO per week we are drawing from the SPR now.

Pretty wild we are drawing so much from the SPR and still having commercial stock draws most weeks.

It’s why Biden is going to KSA hat in hand. Just wonder if they and their fellow Gulf producers can really ramp up that much?

@Shallow

The real fun starts when China gives up on Covid paranoia. They hamper internal travel by a lot (every truck driver has to do a lot of COVID tests crossing a district border), not only in the lockdown regions.

The gulf states can show now what’s their real capacity.

On SPR,

We have about 526 million barrels of crude in SPR and import about 6.4 million barrels per day (and we export about 3.3 million barrels per day of tight oil) so we have 82 days of supply, and if we look at net imports (around 3.1 Mb/d) we would have about 170 days of supply.

Looking at all stocks of crude and products in the US there was 1681 million barrels as of May 27 with product supplied of 19.5 Mb/d, that is about 86 days of supply.

A final way of looking at crude stock levels is that total crude stocks on May 27 were 941 million barrels. Crude input to refineries in the US is about 16 million barrels per day while US output is about 11.6 Mb/d and about 3.7 Mb/d of crude was exported in the past 4 weeks, the rest goes to refineries (7.9 Mb/d), so a net of 8.1 Mb/d would be needed from crude imports, if we assume instead all of this came from the existing stocks we would have 116 days of supply.

LTO Survivor,

There are some who think we should ban exports of crude oil, I think that is a bad idea as my understanding is that we do not have refining capacity well suited to handle 7 Mb/d of tight oil output. What are your thoughts? Do you think a ban on US exports of crude would be a good idea?

Steve,

That will never get passed in the US Senate. Nor should it in my opinion.

Dennis , my guess . He may not ban the export of crude oil but how about banning the export of diesel because that is what is hurting the max to the public in USA . Europe is then FUBAR with the sanctions on Russian Urals . What a web we mortals weave ? Trapped .

P. S : Putin does not have to win votes .

Hole in head,

It is not clear where the authority lies in banning exports, it may require a law to be passed, I am not really sure. Only about 1 Mb/d of diesel net exports from US. US has stocks of about 28 days for diesel consumption, but only about 2 days of stocks of finished gasoline stocks, although there are 25 days of consumption of motor gasoline blending components stocks. Chart with US distillate stocks at link below.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MDISTUS1&f=M

Tks Dennis . I thought that the US exported a lot of diesel to EU . My wrong .

Hey Ovi , belated but terrific post . Better late than ever . Thou are groot ( great ) .

HIH

Thanks

One forecast-

“Oil demand from passenger cars, two-wheelers, three-wheelers, and buses has already peaked,” the report said. “Commercial vehicles are now the only segment contributing to growth.”

” The displacement of oil as a road fuel will accelerate through 2025 as the uptake of electric vehicles ramps up, according to a new report. Electric passenger car numbers are seen surging to 77 million over the next four years, according to BloombergNEF’s latest outlook on the sector, up from about 20 million now. That almost four-fold increase will push the amount of oil that EVs curb from transport use as high as 2.5 million barrels a day by 2025, up from about 1.5 million barrels a day now.

Much replacement will be going from passenger cars to using the bus – by cars not affordable anymore to a spectrum of people. Inflation will do this to many people.

Many young people here, especially the green educated town youth, are anti-car. Most of them can’t afford one anyway without the help of the parents – so it’s a kind of sugarcoating it.

A big problem here are flexible work times. I know in the 80s, where office was from 7:30 to 4 pm, car pooling was normal to share the costs.

More important perhaps, the car industry has radically scaled back R&D in new combustion engines. They are betting the house on EVs. For better or worse, the next generation of vehicles is going to be partially or completely electrified.

It takes years and billions of dollars to develop a new model, or a new engine. There isn’t much sense in debating whether EVs are coming or not. The decision has already been made. We just have to wait and see how it plays out.

Updated info on global ev deployment and oil/ICE displacement-

Electric Vehicle Outlook 2022- BNEF

A few random statements from the executive summary-

“EVs of all types are displacing 1.5 million barrels per day of oil usage, equivalent to about 3% of total road fuel demand.”

“The rising cost of batteries does not derail near-term EV adoption. Some of the factors that are driving high battery raw material costs – war, inflation, trade friction – are also pushing the price of gasoline and diesel to record highs, which is driving more consumer interest in EVs. Internal combustion engine vehicles are also becoming more expensive to produce [and operate].”

“China and Europe account for almost 80% of EV sales in 2025, with adoption running much slower elsewhere. The U.S. market starts to pick up from 2023 but still only represents 15% of the global EV market in 2025.”

“The acceleration in EV adoption means that combustion vehicle sales peaked globally in 2017 and are now in permanent decline. By 2025 passenger ICE sales are 19% below their 2017 peak. Managing the decline while investing in the future is a major challenge for some legacy automakers.”

https://about.bnef.com/electric-vehicle-outlook/

Hickory I don’t really understand the excitement of EVs taking over the passenger market when we will surely suffer black outs this summer due to an under supplied electric grid in the United States. Aside from peak oil we also will suffer from an lack of infrastructure to supply the necessary electric power to run homes, factories, computers, bitcoin mines and now electric cars. We should have been building nuclear plants since the 1970’s. There is no magic bullet yet available to defeat the diminishing scarce resources being used by the global population.

While I sincerely hope through ingenuity and brilliant minds we will solve for an energy future reducing dependence on fossil fuels, we are not there yet.