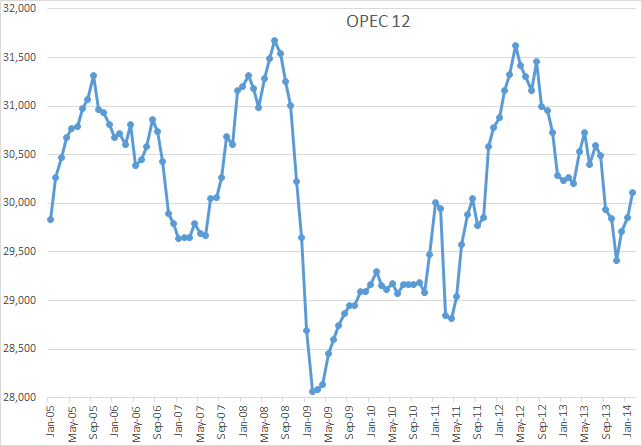

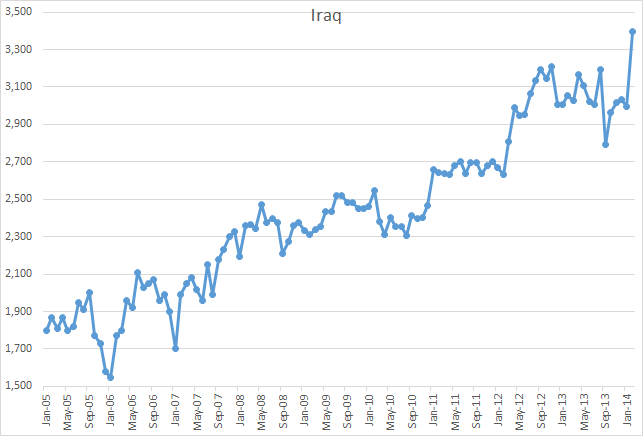

The OPEC Monthly Oil Market Report is just out with OPEC crude only production numbers for February 2014. OPEC Crude production was up 258.6 kb/d in February on the strength of a big jump from Iraq. Iraqi crude oil production was up 400 kb/d to 3,397 kb/d. OPEC crude only production, less Iraq, was down 141.4 kb/d.

Iraq was the only big gainer this month.

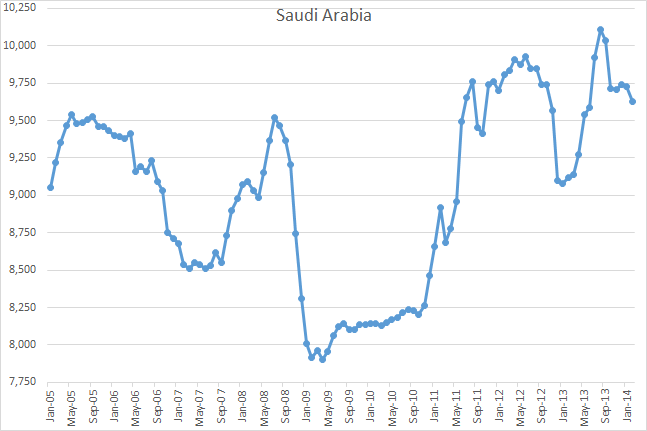

Saudi Arabia was down 102 kb/d but that was after January production had been revised up by 99 kb/d.

Saudi admitted, early that their old giant fields were in steep decline. Ravensworth.org published the following quote about eight years ago however their web site has since been taken down:

One challenge for the Saudis in achieving this objective is that their existing fields sustain 5 percent-12 percent annual “decline rates,” (according to Aramco Senior Vice President Abdullah Saif, as reported in Petroleum Intelligence Weekly and the International Oil Daily) meaning that the country needs around 500,000-1 million bbl/d in new capacity each year just to compensate.

That quote by Abdullah Saif was widely circulated. and in 2007 International Business Publications published this on page 144:

One challenge for Saudi in achieving their strategic vision to add production capacity is that their existing fields sustain, on average, 6 to 8 percent annual “decline rates” (as reported by Platts Oilgram) in their existing fields, meaning that the country needs around 700,000 bbl/d in additional capacity each year just to compensate for natural decline.

However in 2006 Saudi Arabia’s Center for Strategic and International Studies claims they have gotten this decline rate down to almost 2%.

Without “maintain potential” drilling to make up for production, Saudi oil fields would have a natural decline rate of a hypothetical 8%. As Saudi Aramco has an extensive drilling program with a budget running in the billions of dollars, this decline is mitigated to a number close to 2%.

The drilling program they are talking about is those horizontal wells placed at the very top of the reservoir. Now imagine, that with all those brand new horizontal wells sucking the oil right off the top of the reservoir, they still had a decline rate of over 2%! Of course that was in 2006. It is likely that the water has already hit many of those horizontal wells and their decline rate is now well over 2%. More likely it is a lot higher than that.

But they have brought on Khurais and Manifa since then with a combined production capacity of 2 mb/d. That has enabled them to keep their production levels up… for now. Saudi may, just may, be able to produce half a million barrels per day more than they are right now but I doubt it.

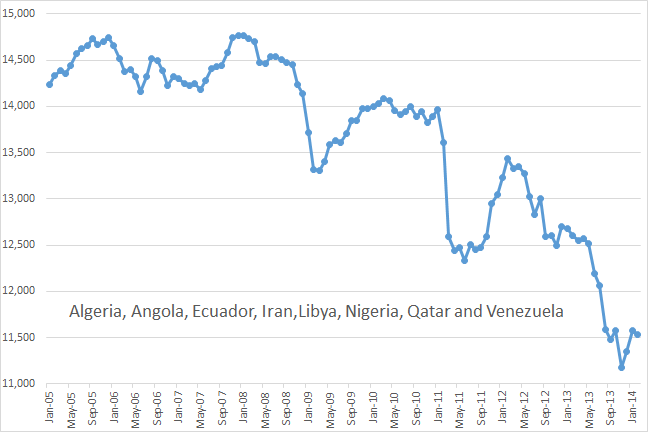

Okay then is OPEC producing flat out? There is absolutely no doubt that, with the possible exception of Saudi Arabia, they are. Eight OPEC nations have serious declining production since 2005. Even to suggest that these eight nations are not producing flat out is to deny reality. To believe that they would deliberately cut production while four countries, Iraq, Saudi Arabia, Kuwait and UAE, are increasing production is delusional.

What about the other four? Iraq makes no bones that they are producing every barrel possible and hope to produce more. And I have discussed Saudi Arabia but what about Kuwait and UAE?

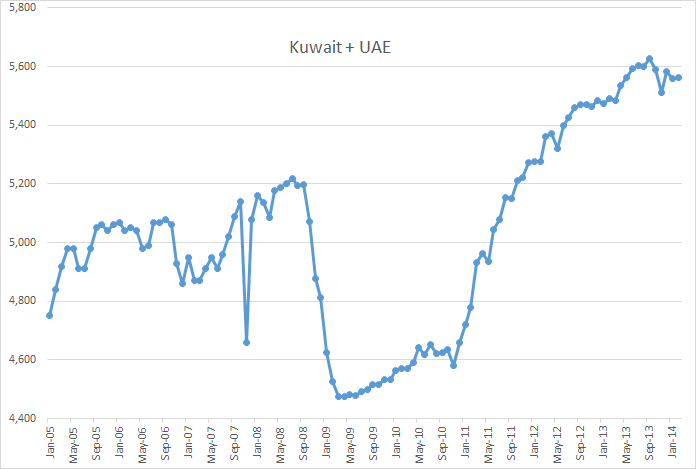

Kuwait and the UAE were later than Saudi Arabia in getting their infill drilling program going. They both started their infill drilling program around 2007, delayed it during the drastic OPEC cuts from late 208 until early 2011, but have since gone full steam with that program. They reached their peak about a year ago. I expect them to hold at this level for two or three years before they start a not too slow decline.

Yes, it is my sincear opinion that OPEC is now producing every barrel they possibly can. OPEC production may increase slightly as Iran dlowly increases their production as sanctions are lifted. And there is even a slight chance that peace may break out in Libya and their production increases, but not likely.

My point is there is OPEC has no spare capacity. If anyone seriously doubts my opinion on this subject then please post your reasons, and name the countries you believe are not producing flat out, in the comments section below.

Updated charts of all 12 OPEC countries can be found here: OPEC Charts

Energy & Capital is a web site that pushes energy stock. They are usually bullish, very bullish on shale oil and usually deny peak oil. That is why it was so surprising to get their latest edition in my email box. However this is just one writer for Energy & Capital. I am sure most others have a different opinion.

Over the past few months, I’ve been sharing my concerns about shale oil.

Namely, that it’s more comparable to a Ponzi scheme than any sort of boom.

I’ve articulated the reasons for my thesis, including fast decline rates, the amount of new rigs and wells needed, and a cost of production that’s been higher than the price of sale for some time now.

And further down he says:

Predictions are tough, especially with a still-struggling economy. If I had to say, prices at least need to rise to the marginal cost of production at $115ish. Trouble with that is anything over $110 for a sustained time causes recession, which of course would send prices lower making projects unviable once more.

It’s classic peak oil. It never went away, we’ve just been able to paper over it with free money for the past half decade.

Seems like the majors realize the gig is up. They’re selling unconventional assets in a big way, wanting to mitigate risk and capex by getting back to conventional. Still, conventional peaked in 2005 and that strategy seems like a last-ditch effort.

Note: I send out an email notification to about 110 people when I have published a new post. If you would like to be added to that list, or your name removed from it, please notify me at: DarwinianOne at Gmail.com

I have been describing tight oil as a Ponzi scheme to my friends and colleagues for some time–I would guess this is also the opinion of many on this site. Cheap money seems the obvious driver. I have often wondered why more people in the investment community have not recognized this. I wonder how long it will take for the meme to change.

Best,

Tom

As a follow up to my comment. I know that if I show this article to my friends and colleagues it will not change their minds about oil abundance. The story will be dismissed because the gentleman who wrote the article is obviously trying to sell something.

Cave Bio,

The world is full of low-middle-high level intellectual idiots. I love that term in one of Bill Cosby’s older comedy routines… BRAIN DAMAGE. What we have today is a society that suffers from BRAIN DAMAGE on an epic scale.

There really is no other way to describe it.

Some say that it is Normalcy Bias… but I rather like the term Brain damage. In all reality, it doesn’t matter what term we use to describe a society that has totally lost its way. Of course I am not saying everyone and we really can’t blame most folks as they are basically gullible. If the Western Media was doing its job of informing the public instead of working for the corporations & oligarchs.. then the current situation wouldn’t be so bad.

Anyhow, the truth always finds a way to float back to the top.

steve

Hi Steve,

I am not quite so sanguine about the truth becoming obvious–it is simply too easy to scapegoat and obfuscate. For instance, as production drops in N.D. companies can blame the E.P.A. and environmentalists. You can imagine analogous excuses being invented for production drops in the M.E., or Russia etc.

I just think that, for the average person, it will become more difficult to figure out what is going on as time moves forward.

Best,

Tom

I have been pointing out various small cracks that have been appearing in the peak oil denial camp for some time now and for what it is worth I personally believe that within a few years (perhaps as few as two or three but not more than five or six or so would be my guess) there will be open acknowledgement of peak oil in a substantial portion of the main stream media.

Of course a good bit of that same mainstream will deny peak oil until the last possible minute and then blame it on whale lovers ‘n dimmerkrats after that either forever or until overshoot does away with media beyond the town crier and hand written notices on the doors of local courthouses.

When the cracks grow large enough the denial dam will collapse in very short order because that is the nature of dams that fail.

There is going to be a huge difference between peak oil denial and climate denial because climate change is not going to arrive over the space of a year or two with rising prices and lines at gas stations and articles in the news about oil fields being shuttered because the dribble of oil coming out of exhausted wells isn’t sufficient to cover operating costs.

There is probably nothing as sure as rationed gasoline to get the attention of Joe Sixpack unless it is rationed food.

And rationed gasoline is surely in the cards.

This is a question of when rather than if once deliveries begin to become erratic and prices spike sharply.

I will not argue that rationing will be permanent although that seems likely to me.

The powers that be when the time comes may be able to keep control of the situation by allowing prices to rise to the point that enough people are forced out of the market to do away with the need for rationing by decree after a while.

MY opinion for what it is worth is that this country is headed for European style soft socialism and that it will arrive almost out of the blue sometime within the next couple of decades when the right politician comes along – the politician who is able to get all the ”have-nots” and enough of the ”have a littles” together to vote for him.

The have nots already outnumber the haves by a huge margin but so far the ”have a littles” don’t understand that they will be joining the ” have almost nothings” rather than the vaunted ”one percent”.

The ‘have a littles” are still more numerous than the ” have almost nothings” and they are also more likely to vote.For now they are voting mostly with the one percent because they still believe in the dream.

But the time when enough of them vote with the have nothings to change things beyond recognition is is coming.Overshoot guarantees it.

I really hesitate to compare the future situation of this country with the situation that allowed Hitler to come to power in Germany but I have put in my time studying why he did come to power and it boils down to this.

He would never have been more than the boss of some small city except for the fact that Germany was basically a collapsed country in desperate straights and the people were ready to follow any charismatic leader who could convince them he could turn the situation around.

Somebody was going to be that leader and unfortunately for Germany and the world the cards fell in such a way that Hitler came out on top.

Let’s hope and pray that when the time comes and this country is in a state of collapse or near collapse that our emergent leader is not a mad man.

If we are lucky we will morph gradually from the current business as usual model to one that enables us to deal with sudden and acute shortages of oil and other essentials without our going mad max.

In that case we hopefully get a European style socialist government rather than a dictatorship.We can all be equally miserable together and when you get right down to it the average German or Frenchman is actually pretty well off in terms of having a decent home and plenty to eat and all the other things that truly matter.

We don’t believe America will ever go for a European level gasoline tax because we haven’t yet realized that in another generation the majority of Americans aren’t going to own a car or two or three cars unless maybe there is a mass acceptance of electric vehicles that can be charged with coal and wind and maybe solar and nuclear power.

When my six year old cousins are riding buses and street cars they are not going to look favorably on people still in cars of their own and they will be perfectly eager to vote in huge gas tax and dedicate it to building more street cars and buses.

Hi Mac,

I have long enjoyed reading your commentary and I greatly appreciate your opinion. It is certainly going to be very interesting to watch how the media handles this story over the coming years.

From my vantage point the media today is at once divided and united on the issue. On Fox News of course it is the environmentalists and the Keystone pipeline etc. that are the problems. On Rachel Maddow’s show she brings on experts who talk about greedy speculators pushing up price. However, in both of these seemingly completely dichotomous world views the idea that there is plenty of oil is a unifying underlying assumption.

It may be that the liberal media picks up on the truth faster than the conservative media, but then again I may only be saying that because I am a liberal and I hope that the liberal press is quicker to grasp reality. Time will tell.

One quote sticks in my mind: “The American way of life is non-negotiable”-Dick Cheney. How will the reality of peak oil square with the reality of American politics? If the past is our guide, obfuscate and scapegoat to keep power. But I like your ideas better.

Best,

Tom

Following is my graph of the Six Country Case History*, showing the normalized production, net exports, ECI Ratio (ratio of production to consumption) and remaining post-1995 Cumulative Net Exports (CNE) by year (1995 values = 100%).

Note that based on the seven year 1995 to 2002 rate of decline in their ECI ratio, estimated post-1995 Six Country CNE were 9.0 GB. Actual post-1995 Six Country CNE turned out to be 7.3 Gb.

*Combined production and consumption values for the major net oil exporters, excluding China, that hit or approached zero net oil exports from 1980 to 2010.

I’ve got someone working on a similar graph for Saudi Arabia, but following are the normalized values, with 2005 values = 100%. Estimated post-2005 CNE, based on the seven year 2005 to 2012 rate of decline in their ECI Ratio are about 56 Gb (total petroleum liquids + other liquids, EIA).

Normalized Saudi Values (2005 = 100%)

Production

2005 100%

2006 96

2007 92

2008 97

2009 88

2010 95

2011 101

2012 104

Annual Net Exports

2005 100%

2006 95

2007 89

2008 96

2009 83

2010 89

2011 91

2012 95

ECI Ratio (Ratio of Production to Consumption)

2005 100%

2006 93

2007 85

2008 96

2009 79

2010 78

2011 70

2012 71

Estimated Remaining Post-2005 CNE by Year**

2005 100%

2006 94

2007 89

2008 83

2009 78

2010 74

2011 69

2012 63

**By definition, post-2005 CNE are declining, the question is, at what rate?

Thanks Ron…very interesting.

I will send excerpts of this post on to friends but now limit myself to only those folks who send me articles, (usually about gold). I believe that this is also the year we will see reported declines in MSM as the lies will not hold water anymore. A need for $115.00 to break even in the LTO plays is huge. I remember not too long ago my neighbour exclaiming his doom and gloom when oil hit $60.00. Now, we accept $100 oil as simple reality as it scrolls across the ticker on CNBC. High prices are simply normal, now. I don’t even hear much bitching at the gas pumps anymore. People are used to it.

Paulo

The clearest example I have yet found of the stark difference between production and CNE (Cumulative Net Exports) depletion is the Six Country Case History.

As their production increased by 2% from 1995 to 1999 (all is well!), their remaining post-1995 CNE fell by 54% (all is not so well after all).

An appeal for a terminology mod.

We have decline rate. That’s the degree to which production declines from a well already drilled, or wells already drilled.

We have “mitigated decline rate”. That’s the degree to which production falls in a field from wells already drilled PLUS new wells drilled in that particular field.

We have oil production. That’s the sum of the effects of decline rate, mitigated decline rate, and new discoveries brought online.

The point being the first two are getting doubly used here and there as “decline rate”.

Watcher, I am not really sure of what your point is. However I don’t really see a problem except those who confuse “decline rate” with “depletion rate”. They are two entirely different things.

But a person must define what “decline” they are talking about, a country, a field or an individual well. As long as they do that I don’t have a problem with the term “decline rate”.

Matt Simmons used two decline rate terms, gross (the underlying decline rate from existing wells) and net (the net decline after new wells, enhanced recovery, etc.) are added (assuming a production decline). For example, note that the observed net crude oil decline rate for Alaska from 2005 to 2012 was 7.1%/year.

Of course, regardless of whether we see a positive rate of change in production (increasing production) or a negative rate of change in production (declining production), depletion is a one way street.

As noted above, as Six Country production increased by 2% from 1995 to 1999 (a +0.5%/year rate of change) their remaining post-1995 CNE fell by 54% (a -19.4%/year rate of depletion in remaining post-1995 CNE). As noted above, it’s not whether the rate of change in remaining post-1995 Six Country CNE was negative, the question is, how fast was it depleting?

Matt Simmons used two decline rate terms, gross (the underlying decline rate from existing wells) and net (the net decline after new wells, enhanced recovery, etc.) are added (assuming a production decline).

Ya. Pretty much that. If the Saudis get away with claiming a 2% decline rate and don’t qualify it as “net” or “mitigated” vs “gross”, it makes the geology look a lot better than it is.

“It makes the geology look a lot better than it is”

Geological smoke and mirrors will work on foolish investors and politicians. Just don’t try to pull that decline bait-and-switch on Mother Nature.

https://www.youtube.com/watch?v=LLrTPrp-fW8

OPEC:

I applaud your covering OPEC. Understanding if it is functioning is critical to discussing industry supply/demand with insight. I don’t think your work is the last word, but it is absolutely covering something that I want get more insights into.

As recently as 2008-9, it sure as heck looks like there was cartel action. Not a competitive market. That downspike is huge and happened after a price drop (to get it back up). SA and the composite of Kuwait and UAE were all involved in the cartel action. Even the little blip from SA in 2012 looks like some action to reduce price.

On the decline of SA fields. Is 7% really such a concern? How does it compare to what expected from fields of that maturity? We’ve always (since the beginning of oil) had wells declining and a need to take continued actions to replace lost production. The “replace another Saudi Arabia” is kind of an overdone meme. The question is only if we can do it or not. We have plenty of times in the past (including in some ways within SA itself, with new fields). But can we do it in the future?

Perhaps of greater concern is the concentration of oil production in OPEC (and Russia). To the extent that production gets more concentrated in NOCs, than it empowers the cartel. Even within OPEC, having less members leads to easier coordination, less cheating. A powerful thing about US production is that all our production is not even coordinated. It comes from many different companies…so it’s free competition. Of course, if you believe OPEC is not functioning as a cartel, you could care less about concentration of supply there.

As recently as 2008-9, it sure as heck looks like there was cartel action.

Nomy, I have covered that point many times before, both here and on TOD. The last time was on January 16th. Update: OPEC January MOMR with December Production Data where I wrote:

You wrote:

On the decline of SA fields. Is 7% really such a concern?

Are you serious? Really Nomy, when you write something like that it makes me question anything else you might say.

Ya. I don’t think he understands the significance of 7%.

That’s a huge number.

That’s 700K out of the 10 million bpd that has to be found each year via new discoveries, and the geography of KSA is most decidedly already explored.

I’m not saying it’s not serious (or that it is serious). I’m just saying I don’t know how to think about it. I don’t know what is typical (so is it out of the ordinary, like new info). Obviously their production is not monotonically reducing at 7%. So, they do new projects or the like.

Or maybe I’m so used to Bakken oil, that 7% seems pretty good to me. 🙂

It is serious or not depending on the time frame you have in mind.

It really doesn’t matter a whit if you are talking about the next couple of months and it probably doesn’t matter much for the next six months.

You say:

The “replace another Saudi Arabia” is kind of an overdone meme. The question is only if we can do it or not.

I am no expert by any means but I have heard of the law of diminishing returns .It seems very likely that you have too. Surely as much as you post here you must be aware that as the old legacy fields deplete the industry is moving to ever smaller and mostly ever lower quality new fields that cost a lot more per barrel to produce and deplete faster than ever.

Unless you believe in miracles just why do you think there is a possibility ” we can do it in the future?”

I just can’t see any way it can happen even if we export some democracy to Venezuela.

Why don’t you fill us in with a couple of scenarios that could come to pass?

http://www.reuters.com/article/2013/10/27/aramco-rigs-idUSL5N0IF0VT20131027

Oil service firms rush to Saudi for busy drilling year ahead

* Saudis plan 210 rig count by end-2014 from 160 now-sources

Don’t know what they are drilling but they certainly plan on drilling a lot faster. It wasn’t that long ago, 20 drilling rig was all they needed to maintain production. Something has certainly changed in the past few years.

From your link:

Saudi Arabia is the only country able to produce much more oil than it needs to.

Yeah, that’s pretty much common knowledge in the oil business but you would be surprised at how many in the MSM think other OPEC nations have spare capacity. And I seriously doubt that Saudi has much, if any spare capacity.

The size of that capacity cushion, which helps dampen price volatility, is a frequent subject of speculation in the global oil market.

Its the belief that spare capacity exist is what dampens price volatility. If they really knew the truth there would be a lot more volatility. But the speculation is growing louder, largely based on what Saudi does, not what they say. And what they are doing is “drill, baby drill”.

If the horizontals are actually in the “top” of the reservior I doubt they are seeing much water, and are probably seeing gas more than anything. The way that I see KSA increasing their production is using EOR on the fields that have responded well the waterflood, including Ghawar. I am not sure if they could get a miscible CO2 flood to work but they more than likely could get a decent kick from an immiscible CO2 flood.

Where would they get the co2?

I guess they could retrofit their oil fired electrical generating plants to get it but that would be a huge undertaking and it would take at least three or four years under the best of circumstances to get such a program up and running on a scale that would matter.

There hasn’t been anything in the news about such a program unless I have been napping more than usual.

But I understand from reading some other energy sites that they are seriously contemplating going to photovoltiacs in a big way to cut down on burning their own oil to make the juice needed to air condition their nation sized sauna.

It seems that the price of solar power has fallen to the point that they can sell the saved oil at a profit at current prices after paying for the solar farms.

And in the future … .well the sun will still be free but the price they can get for their oil is almost certainly going to be up.

We get our CO2 in the states (for EOR) mainly from domes, but I am not sure what is close to them. Supply is always a constraint when it comes to CO2, but it can be piped from basically anywhere like nat gas. I have not seen anything on KSA trying it, but it is the only way I can think of them hoping to maintain (or boost) their current production levels long term. I guess steam flood is another possibility but I have no idea if the reservoirs are right for it. They certainly do have the sun for PV stuff though.

Saudi has been talking about CO2 injection for years.

Saudis Announce 2013 CO2 Injection Plan For Ghawar – But Insist KSA “Does Not Need” Large-Scale EOR

Saudis eye CO2 injection at Ghawar

Saudi Aramco to use CO2 to boost Ghawar oil field output by 2013

CO2 is the Viagra for tired old fields. Bnd if that don’t work they are going to try their luck in the Red Sea.

Aramco boosts drilling in seismically tough Red Sea

Aramco is seeking reserves in anticipation of global economic growth and increasing demand for oil. The Red Sea is two kilometres deep in places with a 7,000-foot thick salt sequence which can distort seismic images, according to the magazine.

Under two kilometers of water and 7,000 feet of salt. That has to be some of the most expensive oil in the world… if they ever find any. It sounds like they are getting desperate.

According to Ron’s third link the Saudi ‘s have actually started construction on a co2 injection system that will be supplied with the co2 from a gas processing plant.

I suppose this implies that the gas going into the plant contains a lot of co2 as it comes from the wells.

The other two links appear to just be casual mentions of possible Saudi plans-but in any case they do seem to have at least a demonstrator program either under construction or maybe even up and running by now.

If it works they can probably get as much co2 as they want in the near term at least if it is a plentiful byproduct of cleaning up natural gas.

It is worth little or nothing commercially in terms of the price of it.

I can buy a big pressure bottle of purified co2 for twenty bucks which is obviously not much more than the cost of handling and shipping the bottles back and forth.

Mine comes from an air reduction plant which separates oxygen and nitrogen and the other gases in the atmosphere for sale. I use it as a welding shield gas because it is the cheapest thing available and works ok under most circumstances.

CO2, in the scale needed for industry use, is usually a couple bucks per mcf. KSA has a low OPEX, so if it works in the pilot I’m sure they will eventually expand it. With the Red Sea stuff, that seems to be the direction offshore operations are going. In the GoM and Brazil, “subsalt” is the new direction many operators are going. There are substancial hydrocarbons in the subsalt areas offshore Louisiana and in the Santos Basin offshore Brazil.

Ron, you have to admit it, that jump in Iraqi production is pretty impressive. What could account for such an off-the-charts one month increase? But they said to expect it. Iran, Iraq Warn OPEC of Big Oil Increases

Iraq reckons it can hit four million bpd next year in what would be the country’s biggest annual oil supply increase since the fall of Saddam a decade ago. That’s another half million barrels a day above the current high point. That would be pretty impressive. And the article cites skeptics:

But industry experts and oil company executives working on Iraqi oilfield development say a four million bpd output target looks very optimistic for next year because of infrastructure constraints and security issues.

“Those Iraqi estimates are over optimistic. I don’t think their production can hit that,” said Cuneyt Kazokoglu of energy consultancy FGE. “Neither can KRG exports hit 400,000 bpd. If they really push it perhaps they could do 300,000 bpd.”

“Iraq has serially failed to meet its expansion targets in recent years and this latest pronouncement stretches credibility,” said Farren-Price.

If Iraq can continue and if combined with another bump from Manifa, it could keep OPEC on the plateau for another year or two. Your thoughts?

you have to admit it, that jump in Iraqi production is pretty impressive.

They are 200 kb/d above where they were is September of 2012, seventeen months ago. I am not impressed. If they can do as well in the next seventeen months that will put them at 3.6 mb/d. I still won’t be impressed.

Manifa is keeping Saudi from an obvious decline. That is the best they can hope for for the next one year or so. And it will all be downhill after that. Yes OPEC may remain on a plateau for another year, perhaps two depending on what happens in Iran and Libya. But that is their best hope.

I think it should be obvious to anyone that OPEC is in no position to save the world from peak oil.

You’re a tough guy to impress! No, I didn’t mean it’s impressive from a longer term perspective, I meant it’s impressive as a single month increase. It’s a huge jump for a single month. I’m just wondering how the heck it happened.

Well yes, if it was a one month effort then it is quite impressive. However I think it was a clearing up of a lot of bottlenecks, especially at the Basra export terminal that allowed this jump in production. However what happens in the next few months will be very interesting. Will there be another such jump? We shall see.

Iraq returns as world’s fastest-growing oil exporter

Exactly what I was thinking – clearing a bottleneck. And that leaves open the possibility, just a possibility, of being able to sustain or perhaps even increase the current production levels for a while. Bottlenecks distort things and maybe Iraq’s production has been held back as a result. This will make Iraq a country to keep a close eye on over the course of this year.

Ron, the article you linked to contains some fascinating information. I’d like to highlights some choice parts.

“As long as Brent is $100-$110 there is no problem for OPEC and the higher volumes from Iraq are welcome,” said a Gulf OPEC delegate. “Their crude is required.” This is an outright admission that not only do OPEC members need $100 a barrel oil, but that they can’t make up for the losses from other OPEC members. Why would Iraq’s oil be “required” if KSA or UAE has spare production capacity?

“When the situation is settled in Libya with production of 1.5 million barrels per day and Iranian crude comes back, it will have an impact on prices. But not now.” The fear of falling oil prices expressed by this unnamed OPEC delegate is palpable. It’s clear that nobody wants to see oil go below $100 — they NEED that money. Do they really think Libya is going back to 1.5 mbpd? Do they really think Iran is going to come back big time? Maybe not, but just the prospect gives them a concern.

That revival, now into its fifth year, prompted Iraq to set an export target of 3.4 million bpd for 2014, including 400,000 bpd from the Kurdistan region, implying output of 4 million bpd, including oil used internally. By simple math this says Iraq is consuming 0.6 mbpd of oil a day internally. I had trouble confirming this number. One site says there were already close to 0.7mbpd in 2010. And Iraq is on a massive campaign to increase electricity generation. The plan was to use natural gas as the fuel, but those plans have stalled due to Iraq’s special blend of corruption and incompetence, so it’s likely that oil will be used. I expect that internal consumption will grow at a much higher rate than other producers.

But in the end, the biggest obstacle will be the deteriorating security and political situation. Momentum in Iraq’s oil growth slowed last year due to technical and security problems as well as a row between Baghdad and the autonomous Kurdish north. These factors could still keep the expansion in check.

The Kurds, at odds with the Iraqi central government over oil rights, stopped exporting via the national network more than a year ago. A pipeline running from Iraq’s northern oilfields to Turkey is repeatedly sabotaged, disrupting exports.

Rising violence has not hit operations in the south, but Western companies at work there say deteriorating security and the distraction of end-April elections may be slowing crucial contract approvals.

So, now I have to wait a whole month for the next OMR report! Ron, do you think you could get them to do weekly updates? 🙂

Here are the 2012 annual data for Iraq from the EIA (total petroleum liquids + other liquids for production, total liquids for consumption).

Production: 3.0 mbpd

Consumption: 0.75

Net Exports: 2.25

It looks like 2013 production might average about 3.1 mbpd, and consumption increased at about 6%/year from 2008 to 2012. So, basically Iraq’s net exports will probably be up slightly or flat from 2012 to 2013.

Iraq is one of seven of the (2005) Top 33 net oil exporters that showed an increasing ECI ratio (ratio of production to consumption) from 2005 to 2012. The other 26 countries showed a declining ECI ratio (which means that 26 of the top 33 net oil exporters in 2005 are trending toward, or have arrived at, zero net oil exports).

And to put Iraq’s rising net exports in perspective, consider Norway’s declining net exports (total petroleum liquids + other liquids, mbpd, EIA):

Iraq:

2008: 1.8

2012: 2.2

Norway:

2008: 2.2

2012: 1.6

Iraq + Norway:

2008: 4.0

2012: 3.8

Or, as Iraq has shown an average rate of increase in net exports of 100,000 bpd per year since 2008, Norway’s net exports have fallen at an average rate of 150,000 bpd per year since 2008.

Iraq has two things going on. An article was posted about two Ron posts ago and talked of the big jump. Mostly it is a Basra terminal upgrade that emptied some tanks. They will likely see a monthly decline of modest size and then resume fighting for increases.

The big question mark is the Kurds, as that quote above addressed, think they can tack on 500K bpd this year, but the won’t because Iraq’s central gov’t refuses to pay them. They talk of shipping direct to Turkey and getting paid autonomously, but lots of pressure from outside is trying to discourage that.

Regardless, Iraq’s potential for big near term gain is in the Kurdish north. And has been for about 18 months. No fix yet.

Heya i am for the first time here. I came across this board

and I find It truly helpful & it helped me out much. I am hoping to give one thing

again and aid others like you helped me.

This is noteworthy – oil giant Chevron is cutting its production forecasts (that decline in CAPEX already having its effect?), and also raising its estimates for the future price of crude:

http://www.reuters.com/article/2014/03/11/chevron-investor-idUSL2N0M80SU20140311

If it walks like a duck, and quacks like a duck, perhaps it is time the MSM realised it is a duck?

Thanks loads for the article link. There are quite a few lines to be read beteween.

Chevron Corp, the second-largest U.S. oil company, cut its 2017 production forecast on Tuesday by 6 percent, citing project delays and asset sales, while saying high prices have pushed its new baseline for oil to north of $100 a barrel. This is really telling. Their production decrease is NOT the result of project delays and asset sales — it is because of depletion. The other things are merely preventing them from offsetting that depletion. This is a tacit admission of what their decline rate from existing production is.

The company, like many of its peers, has seen mixed results from heavy spending to lift oil and natural gas production, and shareholders in the sector are pushing for more cost discipline. Cost discipline? This is putting lipstick on a pig. Producing oil costs what it costs, and costs have gone up not for lack of discipline but due to more challenging production environments which is due to (dare I say it?) Peak Oil!

Chevron trimmed its 2017 production outlook to 3.1 million barrels of oil equivalent per day (boepd) from a previous forecast of 3.3 million boepd, but stuck to plans to spend $40 billion this year on capital projects, about as much as last year. So where’s the discipline? With discipline like that who needs indulgence? Paying the same for less, sounds like Peak Oil to me.

“Our growth strategy remains intact, though some things have changed,” Chief Executive John Watson said at the company’s analyst day in New York. “Our travel strategy remains intact, though some things have changed.” Captain of the Titanic.

Despite the more cautious production forecast, Chevron raised the oil price used in its planning models to $110 a barrel from $79. Exxon Mobil, the largest U.S. oil company, is using a similar level of $109 a barrel in its budgets, based on 2013 average prices. Yowsuh! Their planning model has been using $79 a barrel? Do their offices have windows? Do they have any contact with the real world?

“There comes a point when some projects just won’t be able to compete for capital” below $110 per barrel, Watson told reporters after the analyst meeting. There comes a point INDEED! Does anyone smell higher oil prices in the offing?

“When prices increase, it’s just arithmetic at that point,” he said. I’m glad to know that arithmetic comes into play at SOME point.

While Chevron has insisted on keeping capital expenditures high, many of its peers have cut spending, bowing to investor demand for reduced spending on exploration projects and boosts to dividends and share repurchases. Those darn investors. Did they actually expect to get something in return for their investment?

So the best goes on. Oil companies face the music and try to paper over it in the best corporate-speak they can muster. Their target oil price is now in line with reality, but it seems that even at that target they are having trouble justifying expenditures. Drip, drip, drip.

“Watcher says:

MARCH 12, 2014 AT 2:29 PM

Ya. I don’t think he understands the significance of 7%.

That’s a huge number.”

As the late Dr. Albert Bartlett used to say: ‘The greatest shortcoming of the human race is our inability to understand the exponential function.’

Ron……or anybody….

Of the total production increases from the shale plays over the last few years….does anybody know the overall API of this oil? So the 2 mbpd plus increase in production…How much is condensate, NGL’s, ect……? Is 30% of total production condensate and NGL’s? If we use the 30% number, then our actual crude increase would be 1.4 mbpd(on 2 mbpd increase) that could be converted into transportation fuels like gasoline and diesel. I don’t know what the number is but from my research I am under the impression it is a high number of total production that is too light to make transportation fuels.

does anybody know the overall API of this oil?

The North American Crude Boom

Thanks Ron! The presentation is very useful. I am surprised I hadn’t seen it before.

Jaw drop.

Middle distillates are diesel and kerosene, as best I understand the labeling.

The jawdrop is that I found text I posted last Ronpost (I invent this term) that suggested Bonny Light has less Middle Distillates than LLS, which was compatible with LTO. This table says what I thought was true originally — LLS is not the right yardstick. Bonny Light is, and LTO has far, far less diesel in it than Nigerian conventional oil.

This is pretty big, Ron. We need to track this down.

If we subtract out condensate (which is a byproduct of natural gas production), I suspect that we have not seen a material increase in actual global crude oil production, i.e., crude oil with an API gravity of 45 or less.

Hi Jeff,

As far as I know there is no world data which separates crude from condensate.

So you can offer opinions, but that is all they are. Your opinion may be correct, but basically we don’t know the crude/condensate split at the world level, or even in the United States (with the exception of Texas).

If you don’t count OPEC.

You are correct, we know crude for opec, that’s 30 of 75 or 76 MMb/d of C+C, for the non-OPEC part of the C+C, how much is condensate and how much is crude?

I can’t even get a good definition of what IS condensate.

Some of the harrumphing about oil quality is just peaker sympathy. Yeah, Eagle Ford stuff is a little overlight (and varies all the way to wet gas). And everyone knows it…not like this board discovered it!

And Bakken oil is almost identical to WTI. So I laugh at all the conspiracy theories on suspect quality of Bakken oil.

And this is something after all the mid 2000s harrumphing about too heavy, too sour, to be hearing that there is too much light sweet crude! (I remember distinctly hearing how there was a lack of light sweet.) There’s a reason why the world price for WTI/Brent is higher than Persian Gulf heavy/sour. It’s a lot cheaper to process and you don’t have to do so much cracking.

Natgas storage withdrawal of 195 BCF last week, leaving storage at one BCF above the 1,000 BCF mark.

http://ir.eia.gov/ngs/ngs.html

Next winter may be “interesting.”

How hard will it be to replenish that?

Lots of variables. Among them are: Actual storage level at end of heating season, summer demand (especially as coal fired power plants continue to be shut down, and as we see some problems with hydroelectric plants out west, due to low water levels), rate of change in production and finally the weather next winter.

However, US dry processed natgas production has been flat at about 66 BCF/day since late 2011, and Canada has shown a multiyear decline in production (through 2012). Given the Citi Research estimate (that we lose 24%/year from existing natgas production), we have to put on line about 16 BCF/day of new production every year, just to maintain 66 BCF/day. This requires us to add, every year, the productive equivalent of a little more than all of Canada’s 2012 natgas production or about twice the 2013 output from the Marcellus–every year–just to maintain current production.

Also I suspect that EIA revisions to the 2013 data will probably show a year over year decline in US natgas production.

So, it will be “interesting,” but there is a real possibility of skyrocketing natgas prices and supply shortfalls next winter.

Canada’s dry processed natural gas production fell from 18 BCF/day in 2005 to 14 BCF/day in 2012. When we plug in consumption, implied Canadian net exports of natural gas fell by about 38% from 2005 to 2012, and the US remains a net importer of natural gas (from Canada).

If natural gas prices skyrocket, that will solve the problem, supply will increase and demand will decrease.

On the supply side, it’s an interesting question, given the increase in decline rates.

Looking at the current and futures pricing…market is saying “not hard”. 🙂

1000 million barrels of oil is approximately 12 days of supply, a few hours less.

7 percent decline, 930 million barrels or a supply of some 9 days and 15 hours.

Looks steep to me.

Reducing demand by increasing the price is going to work to a benefit of all.

A demand of 500 million barrels in a 20 day time frame is going to have a positive effect on all systems.

Cruise ships that haul people out to sea to stand in the sun for a few days is a complete waste of fuel and electricity. For profit businesses such as cruise lines should become defunct long before any coal-fired power plant to generate electricity or even a coal gasification plant. Coal production and consumption for energy generation is a far better investment than a company offering vacations that are useless and a huge waste of diesel fuel. They can be, for lack of a better term, bankrupted long before any coal-fired power plant. Filling a cruise ship with 1000 tons of fuel and burning it up for a few thousand people to take a joy ride is a crime. good grief

BNSF week 10 report shows an increase of some 1150 oil tankers from week 9 and an increase of approximately 1800 cars in week 10 of 2013.

http://www.bnsf.com/about-bnsf/financial-information/weekly-carload-reports/pdf/20140308.pdf

No shortage of demand for oil.

Ronald, millions of barrels of oil are used every day on stuff we could do without. The entire vacation industry is something we could do without. However… there is a very big caveat here. Many millions of people are employed in the leisure industry around the world.

Were we suddenly forced to do with only the basic essentials for life we would save millions of barrels of oil per day but hundreds of millions of people would be unemployed. If they all went on public assistance then the world’s already overburdened entitlement programs would go broke. Economies around the world would collapse.

We are locked into this system. There is no way out save a dramatic reduction in population.

“Try like hell, carousel.”

“No way…I’m a runner!”

😉

Hi Ron,

“If they all went on public assistance then the world’s already overburdened entitlement programs would go broke.”

There are lots of more useful things unemployed people could do, if the private sector is unable to employ them, create a WPA.

It’s the same thing Dennis. WPA was just an entitlement program, a make work program.

If a make work program would work then why are we not doing it right now to solve our unemployment problem? Because it would cost too much that’s why. Now picture the unemployment being 25%. Could we create make work programs for all those people?

Remember we are talking about a permanent situation here, not something temporary. When the world’s oil supply starts to decline it will decline…. forever.

When the world’s oil supply goes into very serious decline it will be something that the government cannot fix. And they especially cannot fix it with make work programs.

Quite a lot of environmentalist fundraising events are driven to. Shut those down and you save a lot of gasoline.

Quite a few cruises are investment seminars and tax deductible (and how cool is that). I’ll bet we can find some environmentalist lecture cruises, too.

haha

So the “”make work” could be to build solar panels, wind turbines, HVDC transmission lines, public transportation, more rail lines, and electrification of rail lines. There is lots of make work which is more useful than say a military buildup to fight WW2, which is what solved a 25% unemployment problem in the late 30s and early 40s.

The military build up for WW2 was a temporary thing. The government could not have continued that forever.

I don’t think you have thought this thing through. If the vacation travel, the leisure travel, and the entire leisure food and lodging industry collapsed then not only would the people in those industries be out of work but those who depend on their business would be out of work also. Fewer cars would be sold, fewer clothes would be bought, less of everything would be bought.

Oh but wait, you are going to put them all to work for the government, building government owned solar panels, rail lines, wind power plants and so on. They get a government check so no one is thrown out of work.

And as oil production declines further then more people will be out of work. Put them on the government payroll also. And pretty soon everyone is on the government payroll.

Hell, this might work after all. Damn, why didn’t I think of that.

P.S. I would have put a smiley face after that last remark but I cannot find one that indicates sarcasm.

Doesn’t matter where the pay check comes from Ron. It can be the gov’t or a cruise line, makes no difference.

Absolute nonsense, it makes all the difference in the world. People pay money for the cruise. The employees of the line earn money. They pay taxes. The cruise line pays taxes. It is earned money for work and a product is delivered. And the government gets their cut to help pay their expenses.

However if you are on the dole, or on a make work project, you are delivering no product, you are earning nothing, you pay no taxes, you are a drain on government resources.

Look at it this way. In a working society everyone can work, produce a product, earn a living and pay taxes. It would work if everyone did it.

But if you are on a make work program like the WPA and everyone is on such a program, there is no tax base and the government collapses.

I know Dennis, you desperately want a way for the world to work after the oil is gone. You want people to live happily ever after. It won’t and they won’t.

Hi Ron,

Government employees pay taxes as far as I know. A government an also spend money on roads, public transport and so forth by hiring private companies.

You often cite examples of what is called the multiplier effect in macroeconomics.

You seem to forget that this effect works in both directions when people lose their jobs it works in the negative direction (if we assume high unemployment is negative), when the government hires a worker or buys goods and services, then it starts a multiplier effect in the positive direction (increasing employment and income by more than the dollars spent).

There is a possibility that as prices for oil and natural gas rise, that substitutes will replace much of the current oil and natural gas usage. As cruises and airline travel become more expensive less liquid fuel will be used for those things and relatively more will be used for mining, food production, and industrial processes.

Those who become unemployed will need to find other employment, if there is not enough private employment, the government can either provide employment directly or hire private contractors to do useful projects until unemployment is reduced to 6% or less.

Oil and natural gas is not likely to decrease as rapidly worldwide as it has in specific regions or countries, unless by chance the regional peaks hit simultaneously in all places at once, the probability of that occurring is quite small and the decline is likely to be gradual.

As oil production declines other energy industry takes its place. All the equipment which depends on liquid fossil fuels also must be replaced, that requires that stuff gets built, which requires workers which means jobs. You assume the jobs lost are more than the jobs gained, you may be incorrect.

A final thought, the government involvement is only a temporary measure during a crisis, if done properly (if the government stimulus is large enough), the economy does well and private industry sees potential for profits and the need for government stimulus is lessened, so the idea that everyone works for the government is nonsense.

Dennis, is that working in Greece right now? How about Spain or Portugal?

And liquid fossil fuels will only be the first to go. Then gas will start to decline, then coal, then the forests will disappear. And it is a world problem, not a problem of just the USA. It is not working in Greece and it won’t work here. There are just some things the government can’t fix. In fact there are an awful lot of things the government cannot fix.

I agree Ron there are many people who still think that a windmill can be built, transported and maintained with wind. Of course not they can’t, from mining to lubricating, they need oil. The point being, when oil starts to decline, ALL other energies will decline all together. Bye bye renewables.

Russia Massing Military Forces Near Border With Ukraine

http://www.nytimes.com/2014/03/14/world/europe/ukraine.html

Excerpt:

MOSCOW — Russia’s Defense Ministry announced new military operations in several regions near the Ukrainian border on Thursday, even as Chancellor Angela Merkel of Germany warned the Kremlin to abandon the politics of the 19th and 20th centuries or face diplomatic and economic retaliation from a united Europe.

In Moscow, the military acknowledged significant operations involving armored and airborne troops in the Belgorod, Kursk and Rostov regions abutting eastern Ukraine, where many ethnic Russians have protested against the new interim government in Ukraine’s capital, Kiev, and appealed to Moscow for protection. . . .

With NATO announcing its own deployments of fighter jets and exercises to countries on Ukraine’s western border, the crisis appeared to worsening despite 11th-hour diplomatic efforts to halt a secession referendum scheduled for Sunday in Crimea. The ouster of the government of Viktor F. Yanukovych and Russia’s subsequent intervention in Crimea has deeply divided Russia and the West, and in Berlin, Ms. Merkel underscored the potential risks of what is being called the worst crisis in relations since the end of the Soviet Union. Appearing before Parliament on Thursday, Ms. Merkel criticized Russia’s actions in some of her toughest language to date, declaring that “the territorial integrity of Ukraine cannot be called into question.”

Looking forward to a layout of oil/fuel sources for NATO equipment. That will be amusing.

I fundamentally agree with most of the comments left on this site, but when I look at the Brent Oil futures market I see backwardation, with the April 2014 contract at 107.75 and the Dec. 2019 contract at $91.94. This confuses me. I’m not saying that markets can’t be wrong, but the implication of most posts on here, is that steadily increasing decline rates will slow existing production rates leading to decreased supply and therefore suggesting higher prices in the future, hence, one would expect Contango. Does the futures market, a market probably dominated by large insiders, have it all wrong?

If you add in Libyan, Iraqi, and Iranian production, then price will crash. SA/Kuwait/UAE would try to boost it by cartel action (withholding supply, as they did in 2008-2009) but it’s an open question if they could keep that up, especially given growing non-OPEC production. They tried in the 1980s and ended up throwing in the towel for 20 years. I think the futures markets are an averaging of two different scenarios: continued short markets and depletion versus a crash.

If we really want lower prices, we should encourage all non OPEC production (especially US and Canadian). Should remove sanctions on Iran, let the Kurds and Libyan rebels ship, ship, ship.

Bottom line is we definitely do not see Hotelling rule pricing (simple depletion story). We see the opposite of that.

https://en.wikipedia.org/wiki/Hotelling_rule

Hi Nony,

If we look at market prices for oil, rather than futures prices, then we see real oil prices rising since 2001(US imported oil price from EIA). see http://www.eia.gov/forecasts/steo/realprices/

and chart below (real oil prices are the Blue line).

Note the 2001 real price was about $29/barrel and in 2013 it was $100/barrel for an average annual increase of 8.5% over these 11 years. The Prime rate of interest has been around 5% over this period. The Hotelling rule predicts that the oil price should grow at the rate of interest, over the period in question it has grown by more than this rate.

Maybe there is a depletion story going on, but one that is less extreme than people think. So, we could go from 30 to 80 (or whatever) and it would fit the rule. With 30 to 100 being too high. (So that’s why the futures market wants to project back down to 80.)

Of course, the Hotelling model is based on some abstractions (e.g. same level of demand in the future).

And of course those abstractions would tend to understate the case.

It is likely that demand will grow, although eventually a high enough price for oil may result in substitutes that reduce demand.

If you add in Libyan, Iraqi, and Iranian production, then price will crash.

“If” is what playing the futures market is all about.

There’s another ‘if’ too: growth in demand, especially from China.

This is the big difference with post 70s supply/demand picture.

Patrick Reynolds wrote:

“There’s another ‘if’ too: growth in demand, especially from China.”

It likely that China is going to fall into a recession this year. Loans left and right are being defaulted on. Copper prices are down by about 15% this year. Unless the Chinese Central bank starts pumping liquidity and credit its doubtful China’s economy will avoid a recession. Once China is in recession the rest of Asia will follow as China imports lots of resources and equipment from its neighbors. That said there is the risk that China will start a war to distract its citizens from its domestic problems.

I think if growth in Asia collapses we will see a drop in oil prices leading to a decline, or perhaps a collapse in drilling. Even if LTO production can increase, if the price and demand isn’t available, production will peak later this year. It looks like economics is going to trump geology.

DMG, markets are very often wrong. Bear Stearns was dominated by big insiders and they were so dead wrong they they completely wrecked their company and almost wrecked the world economy.

Oil markets are often wrong also. The short term oil futures market is dominated by speculators. They are wrong about 50% of the time. The long term futures market is dominated by hedgers. They are wrong about 50% of the time also but they are not gambling like the speculators, they are hedging, guaranteeing themselves a set purchasing price of selling price. They expect to be wrong about half the time.

So when we are talking about the December 2019 contract we are talking mostly about company executives hedging their future crude oil sales or purchases. Oil company executives, as we know, are usually optimistic when it comes to world oil production. We know that from reading their press releases and interviews. And on the other side, the purchasers of crude oil, they have the EIA and the IEA, as well as company executives like the BP CEO to give them advice. And these people have historically been dead wrong in their predictions.

And there are other factors that both speculators and hedgers are getting very bad advice. They rely on the same folks, the IEA et al, to tell them how much spare capacity OPEC has. And the believe them when they tell them that a “call on OPEC” will automatically deliver more oil if the world needs more oil.

The Henry Hub (natgas) monthly spot price fell to $1.95 in April, 2012. At that time, 4/12, does anyone know what the natgas futures price was for 4/14?

In any case, in April, 2012 there were natgas traders talking about natgas prices approaching $1.00.

In contango at $3.75ish.

http://quotes.ino.com/charting/history.gif?s=NYMEX_NG.J14.E&t=l&w=15&a=50&v=dmax

I was under the assumption (ass [out of] u [and] me) that Manifa had such a Vanadium content that no refinery existed that could handle such crude. Could someone clarify for me please!

Yes, the answer to the Vanadium problem was simple, build your own refinery, or refineries, capable of handling the Vanadium. And that is exactly what Saudi Arabia did.

Just an old doomer meme:

http://www.bearmarketinvestments.com/manifa-oil-malodorous-but-really-not-that-bad

Yeah, it’s poor quality oil, but there are ways to handle it and SA even built its own refineries that were constructed in a way to handle the high V content.

Project has been pumping since April 2013, was projected to reach 500,000 bpd by July 2013 and expected full capacity (900,000 bpd) by end 2014.

Eye opening quote from an article and searching for a table:

“The take away for investors is that the Saudis have adequate spare supplies to replace Libya’s lost production. But the quality of the oil is mostly inferior. You can’t just substitute one barrel of Saudi oil for one barrel of Libyan oil. For example, it takes three barrels of Saudi oil to make as much diesel as Libyan oil.”

Maybe Libyan oil should be the yardstick and not Bonny Light.

Sorry a bit off topic, but does anybody have anything on the latest trends in US Natural gas both conventional and shale? Looking for latest production figures and rig count etc.

EIA Natural Gas weekly update is a good place to start.

http://www.eia.gov/naturalgas/weekly/#tabs-supply-1

Natural Gas Forecast March 8, 2012, Technical Analysis

http://www.ibtimes.com/natural-gas-forecast-march-8-2012-technical-analysis-422204

Excerpt:

Natural gas markets continued to look very weak during the Wednesday session as the market fell yet again. The recent breakdown of the massive symmetrical triangle was 60 cents tall, and as such gives us an implied target of $2 in this market. There is absolutely nothing on this chart that suggests otherwise, and to be honest – $2 will more than likely only be a pause in this decline. The $1 mark is one a lot of analysts are calling for now, and we tend to believe them. We sell rallies on signs of weakness, and never, ever buy this contract.

Natural Gas Forecast April 10, 2012, Technical Analysis

http://www.fxempire.com/technical/technical-analysis-reports/natural-gas-forecast-april-10-2012-technical-analysis/

Excerpt:

The fact is that the market is falling like this for a reason: supply and demand. The market rarely is this cut and dry, but the natural gas situation is very obvious. The supply of natural gas is simply far too large in order for the demand to ever come close to exhausting it. The United States and Canada* both have been finding more and more supplies over the last year or two, and with new drilling techniques, the amount of available natural gas supplies should only increase as time goes on.

My comments:

*Note that US dry processed natgas production has been flat at about 66 BCF/day since late 2011, and annual Canadian natgas production fell from 18 BCF/day in 2005 to 14 BCF/day in 2012.

file:///Users/westexas/Desktop/Henry%20Hub%20Natural%20Gas%20Spot%20Price%20(Dollars%20per%20Million%20Btu).webarchive

Monthly spot natgas prices:

http://www.eia.gov/dnav/ng/hist/rngwhhdM.htm

Here is the chart with both real (in red) and nominal prices (in blue) for natural gas using EIA monthly data.

Thank you Jeffrey,

The EIA is projecting record Natgas storage injection for 2014:

http://www.eia.gov/todayinenergy/detail.cfm?id=15391&src=email

Does this seem even remotely realistic?

They don’t have a choice, given the implications of forecasting an average injection volume.

You need a record injection to make up for the record withdrawal.

From the link…

While the projected storage build for the upcoming injection season would be a record, total Lower 48 end-October inventories in 2014 would still be at their lowest level since 2008. High injections would not fully erase the deficit in storage volumes caused by this winter’s heavy withdrawals.

http://portal.ransquawk.com/headlines/north-dakota-oil-output-rose-by-6-500-bpd-in-january-according-to-a-state-official-13-03-2014

Isn’t that the whole point of the futures market though? I mean if the price doesn’t rise enough how will they out bid Asia & Europe for LNG cargoes? Or do they expect Canada to supply the entire shortfall?

Director’s cut for ND is out:

https://www.dmr.nd.gov/oilgas/directorscut/directorscut-2014-03-13.pdf

Watcher’s rumor is correct (JAN oil up 7 k bpd from DEC, still far short of the NOV rate). Weather continues to be blamed and also natural gas plant being down. Rig counts up slightly and appears to be investor confidence for development drilling. Weather expected to continue to be issue until April.

P.s. Rune had some questions (more like jump to conclusions) about what the pricing means in the director’s cut. We should just figure it out (call them or whatever). I really doubt it is quality related as he was opining though. Perhaps it is Clearbrook pricing (pipeline terminal in Minnesota)? Right now, Midwest refineries are getting the oil at a discount because of the shipping cost to the coasts.

I think he’s quoting the North Dakota Light Sweet pricing from the Flint Hills Resources bulletin (http://www.fhr.com/refining/bulletins.aspx).

Why do I think that? The Bismarck newspaper publishes that pricing from that bulletin in its daily money section. Prices in past director’s cuts also match past bulletins, although in February’s director’s cut, it looks like he quoted the North Dakota Medium Sour price (for Feb 12) in the “today’s sweet crude price” line.

I should also say past monthly Flint Hills Resources North Dakota Light Sweet pricing is more easily found at http://www.fhr.com/refining/edq.aspx. These prices perfectly match the ones mentioned in the director’s cuts.

Awesome, thanks.

The monthly data still isn’t up. It is not likely to be up until tomorrow. I will get a post out then.

Let’s wait for Ron’s details when the whole shebang is available.

Reminder, CLR said recently that they are going to choke all new wells. They may not be the only ones. It would make a too convenient excuse for an upcoming peak, but on the other hand it’s a credible concept.

“The decline in EROI among major fossil fuels suggests that in the race between technological advances and depletion, depletion is winning. Past attempts to rectify falling oil production i.e. the rapid increase of drilling after the 1970 peak in oil production and subsequent oil crises in the US only exacerbated the problem by lowering the net energy delivered from US oil production (Hall and Cleveland, 1981). Increasing prices, thought by most economists to negate depletion through increasing incentives for exploitation, cannot work as EROI approaches 1:1, and even now has made oil too expensive to support the high economic growth it once did.”

H

News coverage of the JAN numbers:

‘“I would characterize it as somewhat disappointing,” North Dakota Department of Mineral Resources Director Lynn Helms said.’

http://bismarcktribune.com/bakken/oil-production-on-the-rebound/article_82ea22de-aaf7-11e3-adc6-001a4bcf887a.html

Ron pulled together some annual OPEC 12 production data for me. Note that condensate production is a byproduct of natural gas production.

If we round off to the nearest one mbpd (assuming that we have two significant figures of accurate data) and use complete annual data (through 2012), OPEC 12 crude only production was 31 mbpd in 2005 and in 2012 (no increase), while EIA OPEC 12 C+C production was 32 mbpd in 2005 and 33 mbpd in 2012 (3.1% higher than 2005).

Global C+C was 74 mbpd in 2005 and 76 mbpd in 2012 (2.7% higher than 2005). If we assume that the OPEC 12 countries are a reasonable representative sampling of global production (and of course we have a ton of condensate production in the US, which accounts for all of the recent increase in global C+C production), in my opinion it’s a reasonable inference that we have not seen a material increase in global crude oil production (generally defined as 45 or lower API gravity) since 2005. Of course, we need crude oil to produce distillates.

So, based on the foregoing, in my opinion it’s a reasonable conclusion that virtually 100% of the increase in global liquids production since 2005 has been condensate, NGL’s and biofuels. In other words, in my opinion virtually 100% of the increase in global liquids production since 2005 has been from byproducts of natural gas production and from biofuels.

Welcome to Peak Crude Oil.

“Turn ’till it strips, then back off a quarter-turn.”

9 years of peak crude oil and things are going fairly well. The next 10 years may be even better as we start transitioning away from oil. I notice that the new LED bulbs use about 10% of the energy of incandescent. Big savings are coming our way.

I have a lot of faith in technology myself given time for it to be invented commercialized and adopted on the grand scale.

But technology has hard limits to and the basics of physics and geology have been well known for a long long time now.

Nobody is ever going to invent a fuel that can substitute for oil unless somebody first invents a way to obtain energy in a useful form from an existing fuel at very low cost and the only possibility on the horizon is fusion.

And the probability of anybody who is reads this comment today living to see a working fusion power industry is so remote as to be pretty close to zero.

The problem with depending on technology at this late stage of the game is that the technological ambulance is on the way to the technological hospital with a critically ill patient and it is going to run out of gas before it gets there.

Of course there will be substantial amount of gasoline and diesel fuel available for a few more decades and maybe even for a century or longer but we are in big trouble if we run short in the short term because old man Business As Usual is already staggering along under a backbreaking load of other problems and he isn’t getting any younger.

Any deep and lasting shortage in crude on the world market will figuratively kill him.

We have already passed peak oil per capita and the world’s appetite for the stinky black stuff is not about to shrink any time within the next few decades unless it is because things get so bad that ….. well let’s not go there since hopefully that time is still some years off and there may be a few kids reading this site.

Now if we were rational we could manage peak oil without any problems at least here in North America.

All we would need to do is incrementally outlaw the sale of personal cars that weigh more than two thousand pounds over the next few years.

Write a thousand dollar ticket for the use of ” three quarter” (F250 sized ) pickup trucks and suv’s running empty on personal errands.

Double the standard for insulation in all new construction and double the energy efficiency of all large appliances.

Slap on a serious gas tax say two bucks a gallon incrementally a quarter((25 cents) every six months until gasoline is ten bucks and dedicate the money to setting up mass transit systems.

Give refundable tax credits for the purchase of 50 cc and smaller scooters and electric bikes and subcompact electric cars.

I could go on all day but this should be enough to get my point across.

Technology isn’t the problem.

”We have met the enemy and they is us.”

Yair . . . Old farmer mac or others in the “Know”.

Is there something in the US system of vehicle registration/licencing that encourages folks to use F250’s and such like to tow those strange gooseneck trailers instead of using a proper truck?

Cheers.

Nomy, please don’t post videos that have nothing to do with peak oil or energy. In fact don’t post anything unless it is connected to energy or at least climate change.

Understood.

I am looking for info on how much coal and natural gas are being saved on account of wind power generation now being up to a hair over four percent of total generation for the year in the US .

I know it will be somewhat less than a straight trade off because some fossil fuel plants either gas coal have to be kept running at low output as a ”hot spinning reserve ” and that wind requires more hot spinning reserve than conventional plants.

There are a lot of people out there who insist that wind saves no coal or gas at all and I would like to post figures from a reputable source.

As usual thanks in advance for any and all help!

“I am looking for info on how much coal and natural gas are being saved on account of wind power generation now being up to a hair over four percent of total generation for the year in the US .”

That would be zero, since any coal or natgas displaced by Wind will be used elsewhere. In the case of Coal it gets exported to Europe and Asia for overseas power plants. In the case of NatGas, Power companies are shutting down their old non-compliant coal plants and installing new NatGas Fired turbines.

Wind turbines don’t displace coal fired plants as wind generation output is inconsistent and there is no means to store excess power generated (at least at the majority of wind farm installation). Power companies keep there Coal fired plants operation 7×24 since it takes several days to restart it from cold shutdown. At best, it can partially replace Natgas Turbines that can be spooled up in about 45 minutes. That said Wind turbines have very unstable outputs as the can produce 100% of rated output and drop to zero in less than 15 minutes, since they are depend on wind. modeling can be done, by tracking weather systems but as we all know weather forecasting is still an art and not a science. Texas which has some of the largest wind farm installations already has as several close calls with blackouts because of the unpredictable power output.

The only way I see Wind displacing base load plants (Coal, Nuclear and Some NatGas Plants) is with pump water storage systems. In this system, the Wind farms are used to pump water into a large reservoir that supplies a hydro plant. The water pumps can operate at what every power level the wind farm can provide and the hydro-plant would be able to provide continuous, regulated output.

There has also been some work done on compress air storage system, that use compressed air that is pumped into permeable underground formations. but this is typically less efficient since compressors waste a lot of power and require frequent maintenance. The advantage to compress air storage is that it doesn’t rely of vast amounts of land and water to operate. In my opinion chemical storage systems are a dead end since all batteries degrade and are very expensive.