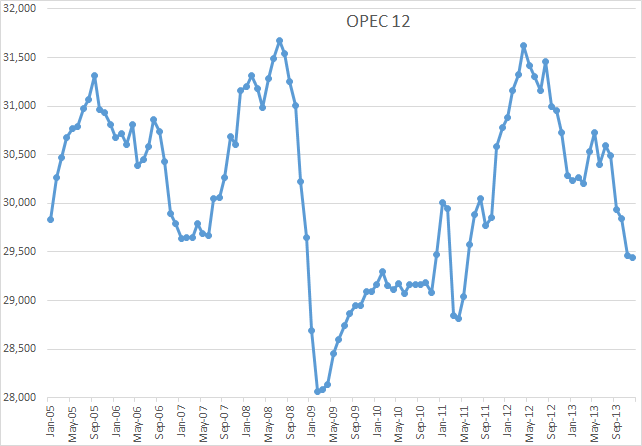

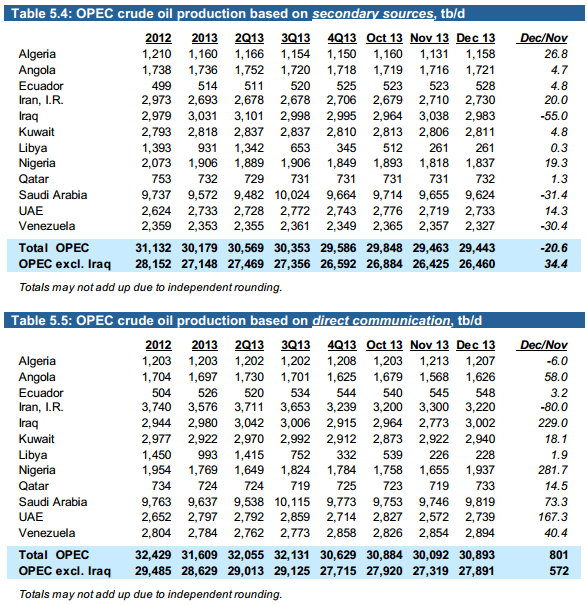

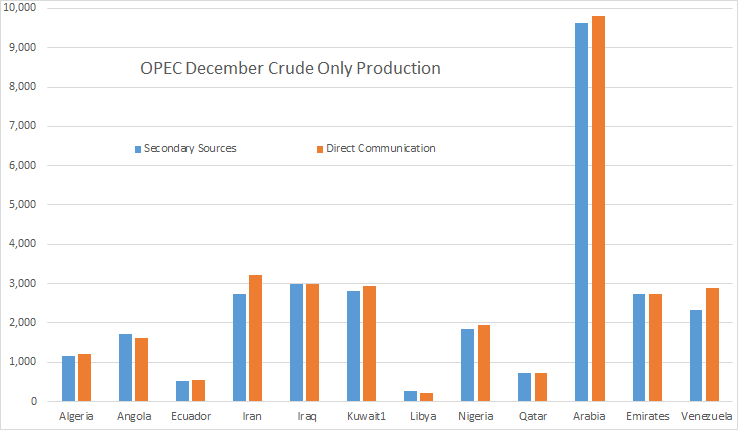

The OPEC January Monthly Oil Market Report is out with crude only production data through December 2012. Total OPEC crude only was 29,223,000 barrels per day, down 20,000 barrels per day. But that was after November production was revised down by 170,000 bp/d. So December production was down 190,000 bp/d from what they originally reported last month.

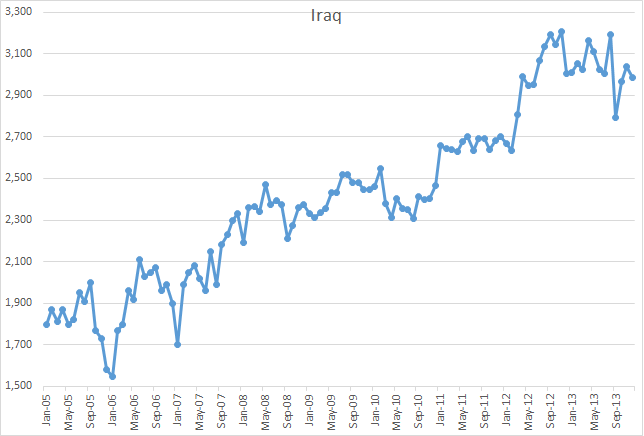

Big movers were Iraq and Libya. Iraqi November production was revised down by 132,000 bp/d and their December production was down another 55,000 bp/d meaning they were down 187,000 from what was originally reported last month.

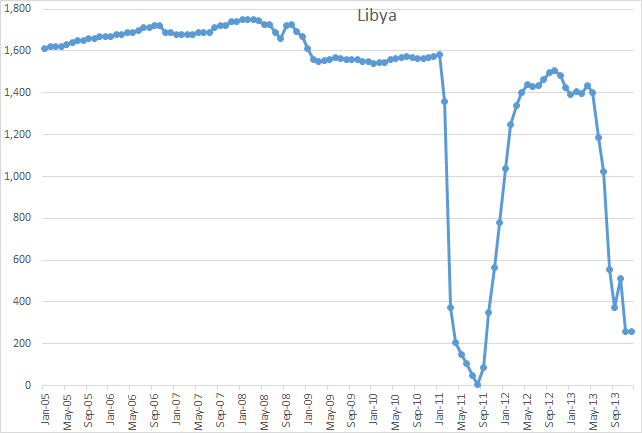

Libyan November production was revised down by 110,000 bp/d but they were flat from the new revised number in December.

However there are reports that Libyan production had increased to 600,000 bp/d by mid January.

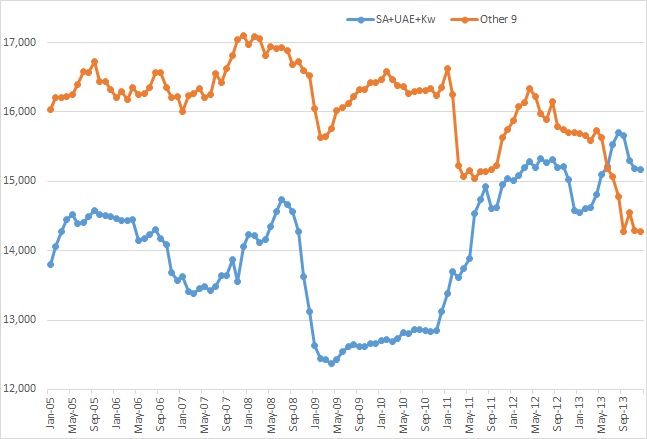

I am of the opinion that every OPEC country, including Saudi Arabia, is now producing flat out. Production varies from month to month because they keep on drilling new horizontal wells, pulling the cream right off the top of the reservoirs. They did cut production back in late 2008 but within a year every country except Saudi Arabia, Kuwait and the UAE was back to producing flat out again. Then when the Libyan revolution hit in 2011 these three began production producing flat out again.

Of course Libya and Iran could produce more but both are producing all they can “under the current circumstances”. But circumstances will always vary and limit production as Iraq is very aware of. So all we can do is look at production as it is today, not what it might be “if only”.

The OPEC MOMR used to report production numbers from “secondary sources” only. But Venezuela complained that their production was being under reported. So OPEC started then reporting two sources of data, one from those “secondary sources” and another from “direct communication”. Direct communication means: “We called them up and asked them and this is what they told us.”

I know you are wondering just who those “secondary sources” are. Well so am I but I would guess they are kind of an average of several sources, Platts being just one of them.

The page OPEC Charts has been updated with the December production data from the latest OPEC MOMR. Crude only production charts of all 12 OPEC countries are posted there.

To see all comments, or to leave a comment, click on the COMMENTS link below this line.

Off topic…

Around a $0.50 divergence between gasoline and diesel prices.

Sorry, wrong button.

From EIA U.S. Weekly Retail Gasoline and Diesel Prices.

Here’s an article about action on the rail transport safety front.

http://online.wsj.com/news/articles/SB10001424052702304419104579324851617264102?mg=reno64-wsj&url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB10001424052702304419104579324851617264102.html

It looks like both the railroads and the oil shippers are making a serious effort to get their act together safety wise before another accident results in loss of life, potentially ruinous litigation, cancellation of liability insurance policies, and a draconian response by state and federal authorities.

I’m just guessing of course but my guess is that the profits involved are ample to cover a the extra expenses involved in tightening up safety practices.

An old friend who used to work on the railroads before he retired says that when there is any doubt about the safety of a particular line( meaning the tracks themselves and the route they follow try towns, etc) or a particular train, it can almost always be taken care of simply by slowing down in the more dangerous spots.

Slowing down a train is as simple as telling the engineer to go slower; this has apparently already been done, quietly, in at least some cases, and it could be done on wide scale basis in a day or two given the need to plan revised loading and deliveries and so forth.

But the trains seem to be running on a tight schedule already and both the shippers and the railroads are anxious to keep them moving as fast as possible.

My guess is that there will be another accident or two before much of any consequence is done to prevent them.Hopefully they will be out in the deep country rather than in some village or town.

Every Norwegian is now an oil millionaire:

http://www.reuters.com/article/2014/01/08/us-norway-millionaires-idUSBREA0710U20140108

If I were a little younger and foot loose, I ‘d head that way and pursue the classic farm boy strategy to getting rich- marrying some farmer’s old maid daughter. 😉

Ron, thanks for keeping taps on the OPEC numbers. As we are on the topic of OPEC, could someone updated us about the status of Ghawar, last I read the field has produced 66b barrels as of 2007:

Beydoun in his book (The Middle East, 1988) reports that Ghawar had produced 19 Bbo by 1979. According to an article on Ghawar in the AAPG Explorer (January 2005), the cumulative production from the field was 55 Bbo. The International Energy Agency in its 2008 World Energy Outlook states that the oil production from Ghawar reached 66 Bbo in 2007 and that the remaining reserves are 74 Bbo.

http://www.geoexpro.com/article/The_King_of_Giant_Fields/d311f583.aspx

Assuming 5m a day has been produced from the field since then, this means an additional 11b barrels has been produced, bringing the remaining reserves to 63B, this means the world largest field is 55% depleted, would this be in the ballpark?

While Saudi Arabia certainly has several more decades of strong production, it is clear that they wont be adding to world supply and if anything as their internal consumption increase, their exports should decline over time. Only Iraq seems to have the potential to produce more, but considering the dubious political situation I wouldn’t count on it.

The only true world saviors for global oil supply (beside the Canadian oil sands) are the Bakken and the Eagle Ford with their 40% decline rate and their 10% to 15% of total area sweet spots.

Regards,

Nawar

Nawar,

The production from individual fields is a closely held secret in the KSA, I would revise the estimate by assuming 4 Mb/d from Ghawar since 2005, Euan Mearns used to follow this very closely so his guess would be much better than mine.

Dennis

Narwar, and Dennis also, not even 4 million barrels per day. In fact you cannot assume any figure to be constant because Ghawar production has, very likely, been falling steadily since that 2008 assessment. And of course that assessment was only a wild ass guess. The IEA has no idea what is going on there. But we do know what Saudi has been doing since then.

In December 2009 Saudi announced 2013 CO2 injection for Ghawar The project, planned for 2013, involves injecting about 40 million cubic feet of carbon dioxide daily into an area flooded by water in the Arab-D reservoir in the Ghawar field. But of course they claimed that “they really did not need to do this”. Yeah right.

No one knows just how successful this tertiary recovery attempt really was because, as Dennis says, it is a closely guarded secret. However the Society of Petroleum Engineers has lots of papers on file from Ghawar: The Oil Drum’s contributors has provided us with some of them.

In the below graphs the blue is water and the red is oil and as red fades to blue the in-between is water mixed with oil.

Figure 2. Sections of the Uthmaniyah region of Ghawar showing the water flood progression. (Original source: Figure 12 of Al-Mutairi et al, Water Production Management Strategies in North Uthmaniyah Area, Saudi Arabia, SPE 98847, June 2006.)

Figure 3. Section through Ain Dar region, from Stuart Staniford,original source Alhuthali et al, Society of Petroleum Engineers Paper #93439, March 2005.

After looking at these graphs you realize that the claim that Ghawar is still producing at 5 million barrels per day is simply not valid. Everything is just a guess of course, but I would guess Ghawar’s production at about 2.5 million barrels per day. Saudi has been able to keep production numbers up by bringing on other fields, primarily Khurais, Manifa and Shaybah. However they now have no other large fields to bring on line. They are now exploring the Red Sea under a mile of water and 7,000 feet of salt. And of course they are looking at CO2 injection

Dennis, Ron I appreciate the feedback. Ron those graphs are certainly very telling. Talking about reserves secrets. Recently BP came with their global oil production outlook up 2035, we know that BP uses OPEC reserves at face value in their estimates for future production, but I am not sure how you can predict production up to 2035, if you don’t know the extent of recoverable reserves in most of those OPEC countries.

Regards,

Nawar

Thanks Ron,

You are likely correct that 4 MMb/d may be to high (I was thinking of an average output level since 2008), I have no idea, I just thought 5 was too high and maybe 2.5 is too low, if we assume 2.5 can the other fields still get output to 9.5 MMb/d, you also follow this more closely than me.

BTW I posted some charts in the comments to the Bakken post which may be of interest. I estimated Eagle Ford output through Oct 2013, about 1.07 MMb/d and Bakken and EF together are close to 2 MMb/d, they will likely hit it in November if EF output just remains flat.

I looked into this a little further and based on the EIA report for KSA, the major fields besides Ghawar have a capacity of 6.2 MMb/d so if KSA is producing 9.5 MMb/d and the output from smaller fields is negligible, Ghawar would have to produce 3.3 MMb/d, KSA does not produce 9.5 MMb/d of Crude at all times so Ron’s 2.5 MMb/d estimate for average output may be on the money. As Ron pointed out, we don’t know for sure, but Ron’s WAG is better than my initial 4 MMb/d guess. In fact average output from 2008 to 2012 was 9.15 MMb/d, so over that period average Ghawar output may have been 2.95 MMb/d (if the major fields are responsible for all output.)

DC

DC

Does anybody have a seriou s estimates as to often oil tankers leave a loading port less than fully loaded?

I’m sure it must happen for a various reasons but I’ve never seen any data on how frequently it happens , and therefore how much less oil is actually being shipped by tanker than would be estimated simply by counting the trips made and totaling them up.

I find it extremely interesting that the “direct communications ” production totals are so uniformly less than the secondary sources.

The result might have something to do with less than fully loaded tankers.

I hope somebody tallies up the discrepancies and posts the result here.

I’m just a spectator and too lazy to do it myself.

You have that backwards of course. Direct communications totals are uniformly more than secondary sources. For December secondary sources had total OPEC crude production at 29,443 kb/d while direct communications had total OPEC crude production at 30,893 kb/d, 1,450,000 barrels per day more than secondary sources.

The primary reason for this is Venezuela wanting to show that they are producing just as much oil as they did before the strike and all the oil workers were fired. That and Iran wanting to show that the sanctions are having little to no effect. They are both just lying about their production numbers.

senior moment and red face!Should have had some coffee before I looked at the graph.

I just goofed, I suppose in another few years somebody will have to come looking for me whenever I leave the house.

OFM,

Not sure about leaving port partly full, but I am currently anchored up in a free parking zone off Singapore. When I look out the window I can see over a dozen VLCCs, going nowhere. I am not sure how many normally sit around unemployed, but it does seem a lot in one place.

I think long distance oil maybe in decline at the moment.

Well there sure is an awful lot trundling around on trains in North America that used to come by tanker from the Middle East. But that middle eastern oil is still being sold elsewhere. So it’s not clear if those VLCCs are newly idle.

I do wonder what will happen to the global oil price once Shale LTO goes into decline and the US returns to this market only to find it in competition with the purchasers that stepped up to fill the orders that the US is currently not taking [but used to], which include China, and the producers home markets?

Northwards looks likely. And when: 2015? >2016?

“But that middle eastern oil is still being sold elsewhere.”

As WT would point out, ever more of it is being consumed right at home in the Middle East, so not being sold or shipped anywhere…

Saving Oil and Gas in the Gulf

Chatham House Report

Glada Lahn, Paul Stevens and Felix Preston, August 2013

Note: units are in metric kilotons of oil equivalent, Saudi Arabia mostly uses oil for electricity generation.

So if I’m doing the conversion correctly, 300,000 Ktoe x 6.84 barrels/tonne all divided by 365 = about 5.6 mbd being burned in the ME… and climbing rapidly. We’d better find more Bakkens, Ghawars, Cantarells…

The oil that shale replaced would not be anchored off Singapore. It would be coming from the East.

I have flown into Changi airport in Singapore often and there are pretty much ALWAYS a lot of ships anchored offshore, so this is a good data point to have but without the comparison to normal traffic numbers . . . .

If you have made that route often and are seeing more than usual, then it’s even better data.

Watcher,

That Anon was me, I forgot fill in details.

We are anchored west outer port limits, which is a free anchorage area, and where ship owners put there ship in warm storage waiting for work. The areas aroud Changi tend to be for other uses

http://www.mpa.gov.sg/sites/port_and_shipping/port/port_services_and_infrastructure/anchorages.page#western

Unfortunately I have nothing to gauge the area by, as this is the first time I have been anchored here, but most likely will get to see a bit more, if we don’t get work ourselves. It just surprised me the number of VLCCs that were here, compared to the number of smaller vessels.

Nod, good data.

Singapore is a great city to be stuck in. Expensive hotels, but if you are berthing on ship and commuting in for sightseeing, perfect.

Some news about Shell:

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/10580630/Shells-gas-gamble-has-left-a-sour-taste.html

http://www.bloomberg.com/news/2014-01-17/chevron-is-said-to-seek-buyers-for-1-billion-in-u-s-assets.html

Among these, West Texas pipelines.

http://www.nytimes.com/2014/01/21/business/international/shell-to-sell-stake-in-australian-gas-field.html?ref=energy-environment

Interesting follow-on in the NYT: Shell and other companies spending a lot on capex but with little return and cash flow, so selling off assets to support the capex and appease investors with dividends and share buy-backs. Who can spell “unsustainable”?

Some commenters on ZH have this macro theme correct. When some array of numbers threatens civilization, the numbers get changed. If too much debt exists, it is expunged, and the debtholders will be made whole via printing.

Only oil matters. Can’t print oil.

Does Keystone XL Have a Place in the Oil-by-Rail Safety Debate?

ANALYSIS: The realities of the oil market make it clear that even if the Keystone and similar pipelines were operating, they would not be supplanting rail.

By Elizabeth Douglass, InsideClimate News, Jan 17, 2014

Earth’s Record 41 Billion-Dollar Weather Disasters of 2013

By: Dr. Jeff Masters, Wunderground.com, 2:00 PM GMT on January 17, 2014

Interesting. Canada had a weather disaster too that was record breaking. June flooding in Alberta cost in excess of 6 billion (tally is not total yet) with 1.7 billion in insured losses. See here: http://www.thestar.com/business/2014/01/20/severe_weather_losses_hit_a_record_32_billion_in_2013.html

and here: http://www.calgaryherald.com/news/Province+boosts+cost+Alberta+floods+billion/8952392/story.html

Mother Nature’s lesson didn’t sink in. She’ll keep trying ’til we get it… but she won’t be able to stop once we do.

US Army colonel: world is sleepwalking to a global energy crisis

Senior figures from industry, military and politics explore risks of financial chaos, oil depletion and climate catastrophe

Posted by Nafeez Ahmed, Friday 17 January 2014, 06.01 GMT, theguardian.com

FYI, you can find Nicole Foss talking about what I’m about to read later tonight along with the rest of the contents of this POB page:

http://permaculturenews.org/2014/01/17/crash-on-demand-a-response-to-david-holmgren/

It’s great to see another old TOD hand here, TOG,FM!

Here’s a one line extract from your link:

” The situation we find ourselves in is at such an extreme in terms of comparing the enormous overhang of virtual wealth in the form of IOUs with the actual underlying collateral that the reset could be both rapid and devastating.”

Oil in the ground- easily recoverable, good quality oil- is one of the assets comprising the “underlying collateral”.

And “reset” is a mild and not so scary term for a hard economic crash.

Hi, old farmer mac, thanks for the warm hello, and likewise. Ron has a nice no-nonsense blog here…

As for ‘reset’, reset to what exactly? ;\

Another landmark on the way to the end of the oil age:

http://blogs.scientificamerican.com/plugged-in/2014/01/17/photo-friday-teapot-dome-the-last-u-s-government-owned-operating-oil-field-is-closing-its-doors/

It’s worthwhile to read the history of the Teapot if one has the time.

BP Energy Outlook 2014 has just been published:

BP Energy Outlook Long Term Trends with video

There are many clickable downloads at the above link including the one below.

Power Point slide presentation :

BP Energy Outlook 2035

Quite a few miracles coming (GDP decouples from energy, oil production keeps growing up to 2035, etc)

Went through it. Seems largely worthless. Predictions based on . . . probably nothing but “I heard this”.

A few charts that were obscure, but interesting. One showed OPEC gas exports falling, and that looks like maybe a presumption that KSA and others will start to tap Qatar for electricity generating nat gas.

And yes, there was quite the divergence of GDP from oil consumption, in contravention to what . . . 100 years?

Some recent production, net exports* and ECI data (ECI is ratio of production to consumption) for the OPEC 12 countries. (Note these production values are for total petroleum liquids + other liquids, versus the crude only data that Ron is showing.)

2002:

P: 28.9

NE: 23.2

ECI: 5.1

2005:

P: 34.8

NE: 28.8

ECI: 5.4

2012:

P: 36.3

NE: 28.0

ECI: 4.3

Based on 2005 to 2012 rate of decline in the OPEC 12 ECI ratio, estimated post-2005 OPEC 12 CNE (Cumulative Net Exports) are about 260 Gb. CNE for 2006 to 2012 inclusive were about 70 GB, suggesting that estimated post-2005 OPEC 12 CNE were about 27% depleted in seven years.

Note that this CNE methodology was too optimistic for the Six Country Case History, which were the six the major net oil exporters, excluding China, that hit or approached zero net exports from 1980 to 2010.

*EIA, total petroleum liquids + other liquids, million barrels per day

Thanks Jeff, this is very interesting. I fixed your typo.

Ref Jeffrey Brown:

This paper published late in 2011:

‘Burning Oil to Keep Cool’

The Hidden Energy Crisis in Saudi Arabia

Glada Lahn and Paul Stevens

December 2011

http://www.chathamhouse.org/sites/default/files/public/Research/Energy,%20Environment%20and%20Development/1211pr_lahn_stevens.pdf

is interesting, albeit nothing new to those who have followed the Foucher/Brown insight.

But there are many interesting snippets, charts, and factoids in it,and it is well worth a read. In particular, it seriously addresses what will have to be done to avoid zero exportable oil by 2038 (assumptions are in appendix 1, and it acknowledges the weaknesses inherited in choice between datasets).

Saudi aims for 16 nuclear power plants by 2030 odd, but even then, will only supply 20% of its anticipated electricity demand.

The report characterises the demand as “unrestrained” due to subsidy.

Elsewhere, I note that average temperatures in Saudi have been on a rising trend since 1985, and this is leading to increased demand for electricity for cooling…

Loz

Incidentally, as Jim Hansen noted yesterday in his newsletter, we saw yet another record high weekly withdrawal rate in US natural gas storage last week.

Yes a great place to see year to year withdraws is this site:

AmericanOilman.com

5 Year Comparison Chart

Ron,

Re:Gahwar

In WEO 2008, the IEA stated that Gahwar was at plateau phase of production(>85% of peak) at 5.1mbpd.Do you think it’s decline was 10% annually since(to 2.5mbpd now)?

Don, the IEA did not really know what Ghawar’s production rate was in 2007. I think 5.1 mb/d was a bit high. Bun no, the decline has not been a constant 10% per year. Early in the last decade Saudi launched a strong infill drilling program. Ghawar is a anticline, as shown in the graphs above. They drilled horizontal wells along the top of the anticline sucking the oil right off the top with a much lower water cut. By doing this they got the decline rate down from about 8% per year to almost 2%. The following is from 2006:

Saudi Arabia’s Strategic Energy Initiative

Without “maintain potential” drilling to make up for production, Saudi oil fields would have a natural decline rate of a hypothetical 8%. As Saudi Aramco has an extensive drilling program with a budget running in the billions of dollars, this decline is mitigated to a number close to 2%.

Understand they were admitting an 8% decline rate then but by sucking the oil out a lot faster they got their decline rate down to between 2 and 3%. They were deceasing the decline rate but really increasing the depletion rate. That means when the water does, or did, hit those vertical wells at or near the very top of the anticline, they would hit a cliff.

And yes, I do believe that sometime since that article was written in 2006 they did hit that decline cliff. I believe that now the decline rate is higher than 10%.

Ron,

Also,WEO 2008 states “The observed post-peak decline rate is, thus, a mere 0.3% per year. “

Post peak decline rate of what… Ghawar, Saudi, OPEC or perhaps the world? Saying a decline rate of 0.03 percent is like giving the baseball scores. They were 3 to 2, 5 to 7 and 6 to 0.

Ron,

That quote was specifically in relation to Ghawar.

Ron,

Also,Re: Gahwar,WEO 2008 states “The observed post-peak decline rate is, thus, a mere 0.3% per year. “

Strange, WEO 2008 says the decline rate was 0.3% when Saudi admitted they had gotten it down from 8% to almost 2% per year.

http://www.spiegel.de/international/europe/hydropower-dams-threaten-river-wildlife-in-balkans-a-943318.html

The world is hitting energy limits right and left. Damming a few more rivers won’t have any discernible impact on oil supplies but in the end when there are no more rivers left to dam, the result will be more pressure than ever on natural gas supplies and ng is fungible with oil to some extent today and will be more so later on since it is not hard to build trucks and cars to run on the cheaper ng,assuming it stays cheaper than oil on an energy content basis.

Now for an off topic question; How do you make the auto spell checker allow you to type the abbreviation without”correcting ” it to “but”?

Now for an off topic question; How do you make the auto spell checker allow you to type the abbreviation without”correcting ” it to “but”?

What on earth are you talking about? BTU perhaps? Anyway I don’t have any such a problem so I have no idea. However if you make it all CAPS then you should have no problem. But about BTUs:

The air conditioner salesman asks the lady customer: How many BTUs do you need?

Answer: I need enough BTUs to cool two BUTs as big as TUBs.

Yes! – BTU works.Thanks.

OFM,

As per our discussion the other day, your cynicism is not without merit…

Enbridge Northern Gateway undermining democratic process in Burns Lake Band, critics say

Jenny Uechi, Vancouvr Observer, Posted: Jan 17th, 2014

Nobel Week Dialog, Science & Society, 9th December 2013, Gothenburg

Exploring the Future of Energy

Session 1

Session 2

Lots of stuff of interest. Stumbled on this in the comments of Stuart Staniford’s blog. He is back blogging again.

Thanks for the tip – but the links are not hot.

Sorry,

Birol, BP’s Ruhl, and Pachauri are in this session…

http://www.nobelweekdialogue.org/watch-online/morning-plenary-sessions/session-1/

Chu and many other Nobel physicists have an interesting panel discussion in this one…

http://www.nobelweekdialogue.org/watch-online/morning-plenary-sessions/session-2/

National Energy Board responds to oil release south of Regina

12 hours ago by CNW Group

The National Energy Board (NEB or Board) is responding to a release of crude oil on the Alberta Clipper pipeline south of Regina, Saskatchewan owned and operated by Enbridge Pipelines Inc. The release was reported to the NEB just before noon today. The size of the release has yet to be determined by the NEB. There is no immediate safety concern for local residents and precautions are being taken to ensure continued public safety.

Iraq needs Kurdish oil income to avert budget collapse -lawmaker

BAGHDAD, Jan 19 (Reuters) – Iraq cannot finance its projected 2014 budget deficit unless the northern Kurdistan region pays its oil export revenue into the national treasury – or loses its share of state spending, a senior lawmaker said on Sunday.

Haider al-Abadi, head of parliament’s treasury committee, told Reuters the budget, swollen by extra expenditure, would “collapse” if the state kept paying the autonomous region its 17 percent share even as the Kurds withhold oil export proceeds.

Golden Years: The Golden Age of U.S. Natural Gas Part IV—How Much Supply Is Reasonable to Expect, and Why?

published by Rick Smead, RBN Energy, on Wed, 01/15/2014 – 20:00

Golden age or golden years?

Rune Likvern posted me this earlier today. I thought I would share it with you. Check out more on the Bakken at his site: Fractional Flow

Ron,

And FWIIW I recently updated the production data for Elm Coulee and Elm Coulee Northeast (Mainly Bakken in Montana, ref chart below) with a cut off as of Aug 2013, even if data are published through November 2013, I suspect the most recent months will be revised upwards, but feel confident that few changes will come to data as of August 2013 and earlier. During this update I found data was revised as far back as January 2013, albeit those revisions were tiny.

I suspect production from Bakken in Montana is leveling out. Some companies have not added wells for 6 months and in general wells in Elm Coulee are poorer than those in North Dakota portion of Bakken.

Again FWIIW average flow per well as of August 2013 was 41 Bbl/d in Elm Coulee and 88 Bbl/d for Elm Coulee Northeast.

Best

Solar steam for enhanced oil recovery appears to be cheaper than natural gas in the Middle East:

http://www.bloomberg.com/news/2014-01-20/solar-beats-gas-unlocking-middle-east-s-heavy-oil-report-says.html

From the Telegraph in the UK. Have to get all the way to the penultimate sentence to find the key issue. But I guess he does hint at the contradiction of a supply bubble from expensive oil depressing the price: surely an unsustainable circle. This would suggest the end of the price stability of the last three years coming at some point [a year away?]: perhaps a price dip followed by a financial crunch on marginal producers-> fall in supply-> price rise and so on? As the writer says: ‘Much drama can intrude along the way.’

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/10575292/Coming-oil-glut-may-push-global-economy-into-deflation.html

Lots of folks using the word ‘repricing’ these days…

Gregor

Chris Nelder (btw Chris’ June 2012 Brent $105 floor and $125 ceiling forecast was prescient)

Dr. Sadad Al-Husseini

Ambrose’s scenario is quite possible. It’s best to be reminded that the highest the price has been recently was July 2008 and the lowest it’s been recently was December 2008 ( a $90 monthly average price difference). The oil price has been remarkably stable for quite some time… expensive but stable.

Unpleasant 2008-style volatility has to be expected at some point.

Pritchard is a world class reporter but I don’t know if he is a good energy analyst.

Given that I think the world economy isn’t doing all that well, I guess I must agree with him that if most of the places that could up their oil production such as Iran and Libya, if political conditions permit, oil could come down for some time, maybe a year or two or even longer if the world economy really does

do a nose dive.

But I can’t see how lower oil prices are going to hurt the overall economy at all.

In the meantime, depletion and rust never sleep, and here’s an article from the NYT about the tough times oil companies are having these days.

I’m not a stock market expert and I don’t have a MBA from some prestigious university, but I have read the business nerds for years, and a also a few books about the management of big businesses.

When an industry is in big trouble for one reason or another, and it is dominated by a few big corporations, as the oil industry is, it’s very common for top management to start cannibalizing the company in order to keep the stock holders happy in the short term.

It seems that the stockholders seldom notice that heir dividend check is the result of selling off assets rather than turning a profit running the business and that management therefore gets away with this strategy.

Reading just a little between the lines, this article seems to be saying that the oil majors are in a very tough spot and don’t really seem to see any way out of it.

Putting it another way, it can be read as evidence pointing towards peak oil.

http://www.nytimes.com/2014/01/21/business/international/shell-to-sell-stake-in-australian-gas-field.html?hpw&rref=business&_r=0

Climate Proofing of Farms Seen Too Slow as Industry Faces Havoc

By Rudy Ruitenberg, Bloomberg, Jan 20, 2014 2:27 AM ET

Wonder if Gerry and Barnaby were paying attention?

Train Derailment Temporarily Shuts Down Stretch Of Schuylkill Expressway

Mark Abrams, CBS Philly, January 20, 2014 7:46 AM

This article has summaries of spending world wide on renewable energy.

http://www.csmonitor.com/Environment/Energy-Voices/2014/0115/Clean-energy-investment-down-but-not-out

http://online.wsj.com/news/articles/SB10001424052702303802904579334023256421590?mg=reno64-wsj&url=http%3A%2F%2Fonline.wsj.com%2Farticle%2FSB10001424052702303802904579334023256421590.html

I suppose there might be some truth in this article because American refiners want only so much of the extra light tight oil these days, given that they are optimized for heavier crudes.

Modifying a refinery to use more of it would obviously be a time consuming and costly undertaking.

Now there’s another question to be considered, one that the WSJ won’t likely touch with a ten foot pole.

Why wouldn’t at least a couple of refinery owners go ahead and make the modifications needed to process this flood of LTO? They can get it cheap and there should potentially be plenty of money in refining it .

Maybe they refiners are like the pipeline operators?Maybe they don’t think the LTO boom will last.

We see speculation here- apparently well grounded- that nobody wants to build pipelines into LTO country because they believe the LTO boom will crash before they can recover their investment and make a profit.

OFM,

An example of what you refer to about building pipelines is ONEOK’s proposed Bakken Express pipeline that was to have carried Bakken crude to Cushing, OK. The company canceled the proposal when it couldn’t find enough subscribers.

Jim Cramer, at 9:32 A.M., 1/21/14, on CNBC:

“By the way, unless we get the export of oil. I mean there’s just a glut everywhere. Natural gas, because that’s a byproduct of finding oil, we burn off more than we use.”

My comments:

In effect, Jim Cramer seems to assert that the US is venting and flaring in excess of 50% of dry natural gas production. Here is the annual data table through 2013:

http://www.eia.gov/dnav/ng/ng_prod_sum_dcu_NUS_a.htm

In reality, in 2013 the EIA estimates that the US vented and flared less than 1% of dry natural gas production.

And so it goes.

There is a reason that gas is flared. It is flared because it would be uneconomical for the oil companies to lay a pipeline to collect the gas. The gas that is flared is almost all from shale tight oil wells. They truck the oil out but of course cannot truck the gas out. And natural gas prices are low and the production falls off fast from these tight oil wells. They would not collect enough gas to pay for the pipeline to get it out.

Ron,

Yes the gas is flared because it is uneconomical to sell. But economics is a funny thing in business. Being “uneconomical” to most people sounds like they would be losing money, which ain’t necessarily so. It may just mean for money invested in drilling more oil wells brings a greater return on the investment, than spending that same money on pipelines and separation equipment does.

Which to me brings into play the moral question of burning off these resourses, not for the sake of making a profit but for the need to maximze the profit, where in my opinion we should instead be maximizing the use of the resourse and the longer term economic health of the economy, rather than just focusing on next quarterly numbers.

I suppose I would be burnt at the stack in Wall St for having such heretical thoughts, but nearly every country that has burnt off their excess gas to produce oil end up dreading the day they did. The US, (before shale) UK, Saudi Arabia, to name a few.

With the pad style drilling they are currently doing the collection of Nat gas becomes a whole cheaper than a few widely dispersed oil wells. A stroke of the pen with a sensible regulation would have the gas being put to good use in very short order. Not to mention pollution, greenhouse or any of that.

Toolpush, you make it seem so simple. Just a stroke of the pen. No, it’s all a package deal. The total economy of the well is what the oil companies are looking at. If they are forced to lay pipelines costing several millions of dollars, then they might not drill the well at all, leading to no oil nor gas.

Oil companies are not altruistic organizations. They exist to make money for their stockholders. You can rave until the cows come home that they should be more, that they should be good stewards of the earth, but that will not change anything one iota, they are in business to make a profit and they will fight ever attempt to regulate them.

The world is what it is Toolpush, not what we think it should be.

Hi Ron,

It is simply a matter of passing regulations to require that natural gas is collected and shipped somewhere or reinjected. States such as Texas already have such regulations in place. The federal government should pass a law similar to the Texas law for states that don’t have such regulations. States can pass their own regulations that are more demanding if they would like, the Federal regulation would be a minimum requirement. It really is just a stoke of the pen. If it is not profitable to do it by following the regs, then it won’t be done.

If Texas can do it, it can be done elsewhere.

DC

Dennis wrote:

It is simply a matter of passing regulations to require that natural gas is collected and shipped somewhere or reinjected. States such as Texas already have such regulations in place.

If Texas can do it, it can be done elsewhere.

Well now, someone should tell those folks down in the Eagle Ford area to start obeying the law. Hint: That long sweeping row of lights just below San Antonio is gas being flared in Eagle Ford.

Also, I am no oil man but I would bet my bottom dollar that reinjection of gas into a tight oil reservoir, where the only open spaces are those that have been blown open by fracking pressure, is a totally different animal than reinjection of gas into a porous reservoir.

This article explains why they are flaring in both Eagle Ford and the Bakken:

Shale oil boom sends waste gas burn-off soaring

“The gas is worth very little in comparison to oil,” said Bruce Hicks, assistant director of North Dakota’s state’s oil and gas division. “This is an oil-driven play.”

Companies say temporary flaring is unavoidable, especially in fields like the Eagle Ford and the Bakken where the pipeline infrastructure is incomplete.

Dennis, Texas does have an anti-flaring law. But the point you missed is that all the oil companies have to do is apply to the Texas RRC for an exemption… and they get it.

Ok I stand corrected. I think the regulations help, if there were no regulations and no need to get a permit to flare the gas, I think there would be more gas wasted. I am also not an oil man, but Rockman would often say that the regs in Texas were followed to avoid fines. If companies needed to pay a large fee to acquire the permits for flaring it would provide an incentive to build pipelines. I am pretty sure this is not the case in North Dakota, do you know if the companies need to pay a fee to acquire those flaring permits?

DC

No, I don’t know but I seriously doubt it.

Ron, you hit the nail on the head. It is a packaged deal. If oil companies are prevented from flaring gas then they would just have to look at the economics of the whole deal. If it wasn’t good enough at current prices, the well wouldn’t get drilled. What’s wrong with that? The Bakken has been known for 50 years but not exploited due to cost issues. If it had to wait a couple more years for oil prices to rise higher or gas prices to rise higher what’s the problem? At some point prices would make the combined oil and gas economical.

You know as well as anyone that the US will wish we had the flared gas in a few years time. Why apologize for the industry? They may have the upper hand politically but it doesn’t mean that what they are doing is good public policy or beneficial to the rest of the country.

If flared gas was called pollution, then the cost of preventing that pollution would just be part of the cost of doing business. Which is exactly what the rest of us have to deal with on a daily basis.

Ron,

That’s true of course, but my point is that Cramer is asserting that we are venting/flaring in excess of 66 BCF/day. To put this in perspective, 2013 annual Gulf of Mexico marketed natural gas production was 3.3 BCF/day (federal waters). So, Cramer is asserting that we are venting/flaring the productive equivalent of 20 times the daily production from the Gulf of Mexico.

[i]”Total OECD commercial oil inventories plummeted by 53.6 mb in November, their steepest monthly decline since December 2011, led by a plunge in crude oil and ‘other products’. Preliminary data for December indicate a further 42.5 mb draw in OECD inventories.”[/i]

This is from today’s Oil Market Report.

Small correction, Cramer is in effect asserting that we are venting/flaring in excess of 100% of dry natural gas production (not 50%).

Quotation of the week:

“Oil production from Saudi Arabia, OPEC’s leading supplier, declined 3.5 percent from the third quarter of 2013 to settle at 9.6 million bpd during the fourth quarter, leaving plenty of room for U.S. production growth.”

http://oilprice.com/Energy/Natural-Gas/What-Happens-After-the-Shale-Revolution.html

OK, so we need KSA to decrease production in order to “make room” for U.S. production growth. Huh?

Here’a an excerpt from an article at oil price .com today:

BP said in its report the United States should overtake Saudi Arabia this year in terms of oil production. By Riyadh’s own account, that comes as something of a relief as it addresses changes to its own market dynamics brought on by an increase in regional energy demand. For OPEC as a whole, its share in the oil market declines for much of the decade but recovers by 2020 as U.S. oil production slows down. BP’s report suggests U.S. oil production, meanwhile, falls by 75 percent through 2035.

Decline in U.S. shale production, and the inability of other countries to replicate the success, is not so much validation of peak oil theory as much as it is a return to the status quo, where Middle East and North African producers dominate the market.

I wonder what these guys would consider validation of peak oil theory when they can say “not so much validation of peak oil theory” in a sentence when they accept that US production will decline by 75 percent in the opinion of BP without raising an eyebrow in the previous sentence..

Propane shortage sets off epidemic of dickish* behaviour

Frank B. Edwards, Bungalo Books blog, Posted on January 10, 2014

As a reminder…

Propane Inventories Fall to Lowest Seasonal Level in 14 Years

By Dan Murtaugh Nov 20, 2013 2:12 PM ET

If all those folks in cold houses knew that they have gone without because so much propane went to dry corn that had a 40% chance of ending up being used to make ethanol that would then be used to fuel North America’s dismally inefficient fleet of personal vehicles they perhaps might be a bit chuffed.

Propane is also exported and exports have been growing significantly. End result is folks in the US and Canada will be paying the world price for propane.

chuffed

I don’t think that word means what I thought it meant. : )

… steamed or pissed would have been more appropriate.

I should have added for those who aren’t familiar that the EROI of corn ethanol is around 1.

Which is to say that the production of corn ethanol for fuel is a waste of effort.

I wonder if EROI calculations factored in the propane used to dry corn. That said this was a wet harvest in parts of the mid-west leading to the increased propane demand. Still, it can’t of but lowered EROI!

Corn based ethanol does accomplish one thing- it converts non liquid fuels not suitable for use in motor vehicles into liquid fuel.

Natural gas becomes nitrogen fertilizer which becomes corn which becomes ethanol.

Coal fired power plants supply electricity to corn farmers, distilleries, and the various businesses dealing in moonshine.

Ethanol as a motor fuel on the grand scale is an ecological disaster and a huge overall waste of resources that could be put to good use.

It’s hard to prove it directly but it’s also a humanitarian disaster in that it has forced up food prices to the extent that extremely poor people in some countries dependent on imported grain are actually starving, and it is causing a lot of poor people right here in the US hardship in the form of more expensive food.

Now as to irony unsurpassed:

The people who deny peak oil frequently lump ethanol in and talk about total liquids on a regular basis, knowing the public will assume the liquids are all petroleum.

If there ‘s any such thing as evidence of the scarcity of oil, it is ethanol in gasoline.

Hydrogen is also rearing it’s disastrously low EROI head again. Toyota is doubling down on H2 fuel cell vehicle development and the California Energy Commission is started doling out millions for fueling stations. It all appears to be driven by some bizarre desire to push NG further into the transportation energy mix without calling it natural gas, make it look “renewable” by pretending it is generated by solar power, and do it all at taxpayer’s expense. The same phrase Elon Musk recently used to describe the H2 concept also applies to ethanol, “it’s mind-bogglingly stupid”.

Maybe that’s the problem. It is so dumb that no one in either government or industry involved in ethanol or H2 wants to look like a grand fool and admit how dumb it really is, so they just press on with more programs, more energy and environmental smoke and mirrors.

HVAC – doesn’t matter how stupid it is. It just gives them another means of presenting a “diversity” of “fuel sources,” no matter that the sheeple have no idea from where or how the fuel source came. By suggesting the “diversity” of fuels, they can even get away with the silly claim that they are growing the energy pie – supposing that gee, now we have even more energy to play with, from thin air. Isn’t it nifty? See? Technology WILLsave us!

EIA : This Week in Petroleaum : Midwest propane markets tighten further on cold weather

Released: January 15, 2014

EIA : This week in Petroleum : Propane

And retail price…

Propane companies struggle to get supplies into Maine

EIA : Gasoline

EIA : Distillate (Heating Oil and Diesel)

Interesting how gasoline has been at the top of the 5-year average for a year and distillate has been at the bottom of the 5-year average for the last year and a half.

Lots of that Bakken BCO (Barely Crude Oil) yielding small fractions of distillate might do that? Not sure if that is the whole story but must be part of it.

Honest talk from an oil CEO starting around 5:30

http://www.bloomberg.com/video/petrofac-ceo-says-oil-industry-facing-cost-pressure-iE46O9OdQsqP3thRAAICMw.html

Koch Ends Plans for Pipeline to Illinois From Bakken

By Lynn Doan, Bloomberg, Jan 21, 2014 7:36 PM ET

Some local propane retailers are shorting their customers on the small containers commonly used to bbq outside and by some people to run their kitchen ranges and even to heat their homes.

They are charging the same price for refills but putting in substantially less.

If questioned they point to a small inconspicuous sign that gives the new higher price but a lot of customers don’t realize that other retailers still fill the tank all the way for the same money.

There has been no legal action taken so far about this to my knowledge but I have heard about a retailer being accused of thievery and persuaded to refund the difference rather than being hauled into court.

The above comment was wrongly attributed to “Anonymous”. The author posted me and informed me of such. If anyone else has this problem please let me know.

Ron DarwinianOne at Gmail.com