A guest post by Ovi

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to August 2021. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

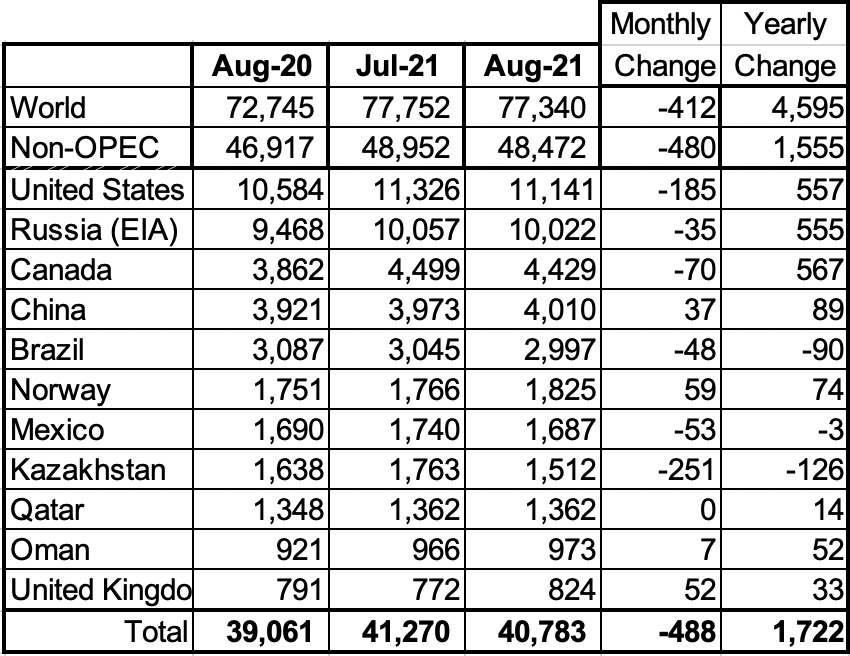

August Non-OPEC production declined by 480 kb/d to 48,472 kb/d. The three biggest contributors to the decrease were Kazakhstan, 251 kb/d, US, 185 kb/d and Canada 70 kb/d, for a total of 506 kb/d. Russian output dropped by 35 kb/d.

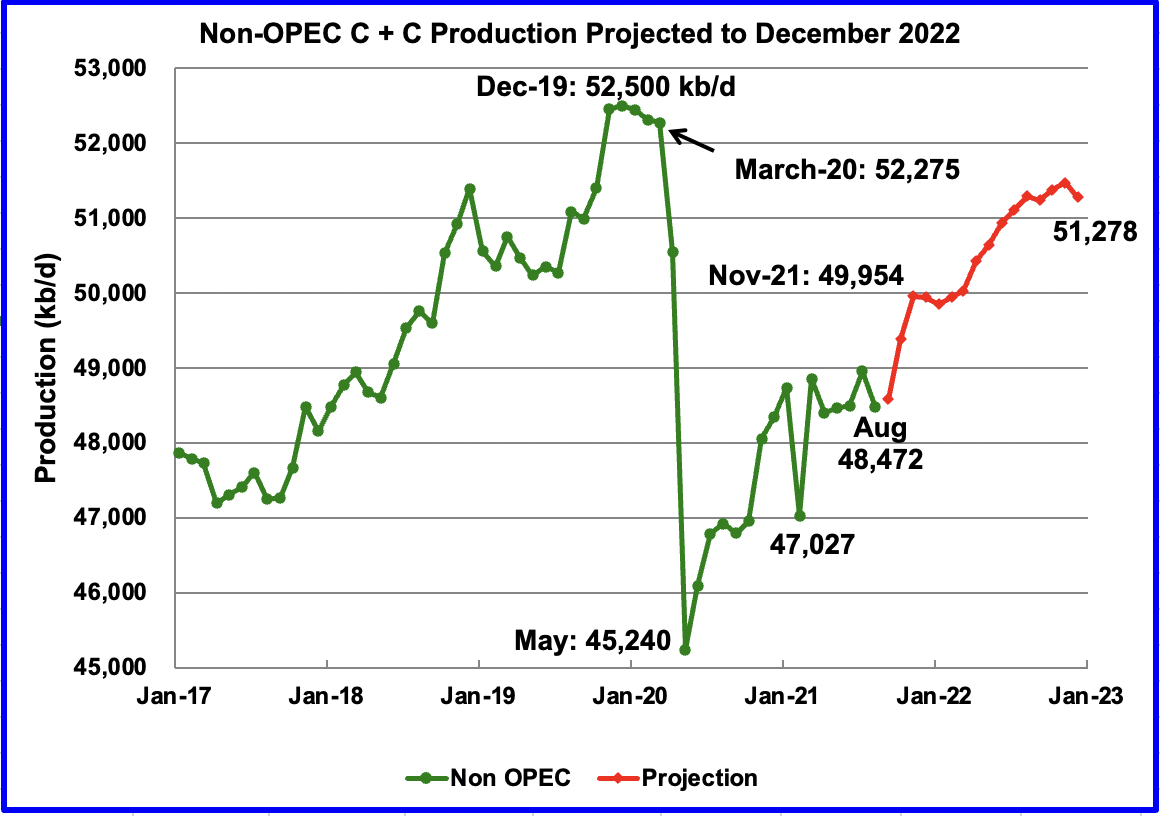

Using data from the December 2021 STEO, a projection for Non-OPEC oil output was made for the time period September 2021 to December 2022 (red graph). Output is expected to reach 51,278 kb/d in December 2022, which is 301 kb/d lower than reported in the previous post.

From August 2021 to November 2021, with projected output of 49,954 kb/d, an additional 1,375 kb/d of oil is expected from Non-OPEC countries. The two biggest increases occur in October and November

Each successive STEO report has reduced the forecast December 2022 output. For instance, in the August report, Non-OPEC output was projected to reach 52,213 kb/d in December 2022, which is 935 kb/d higher than projected in this report.

In the previous November report, the difference between the peak production in 2019 and 2022 peak was 921 kb/d. In the current report, the difference has increased to 1,222 kb/d.

Above are listed the world’s 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The last two have currently fallen below 1,000 kb/d.

In August, these 11 countries produced 82.7% of the Non-OPEC output. On a YoY basis, Non-OPEC production increased by 1,555 kb/d while on a MoM basis production decreased by 480 kb/d to 48,472 kb/d. World YoY August output was up by 4,595 kb/d.

Production by Country

The EIA reported Brazil’s August production decreased by 48 kb/d to 2,997 kb/d. September increased to 3,001 kb/d according to this source and then dropped by 223 kb/d to 2,778 kb/d in October. (Red Markers).

According to OPEC, production in October declined mainly due to maintenance in the P-76 FPSO in Buzios field. Maintenance has impacted crude production this year and this is expected to continue until the end of year.

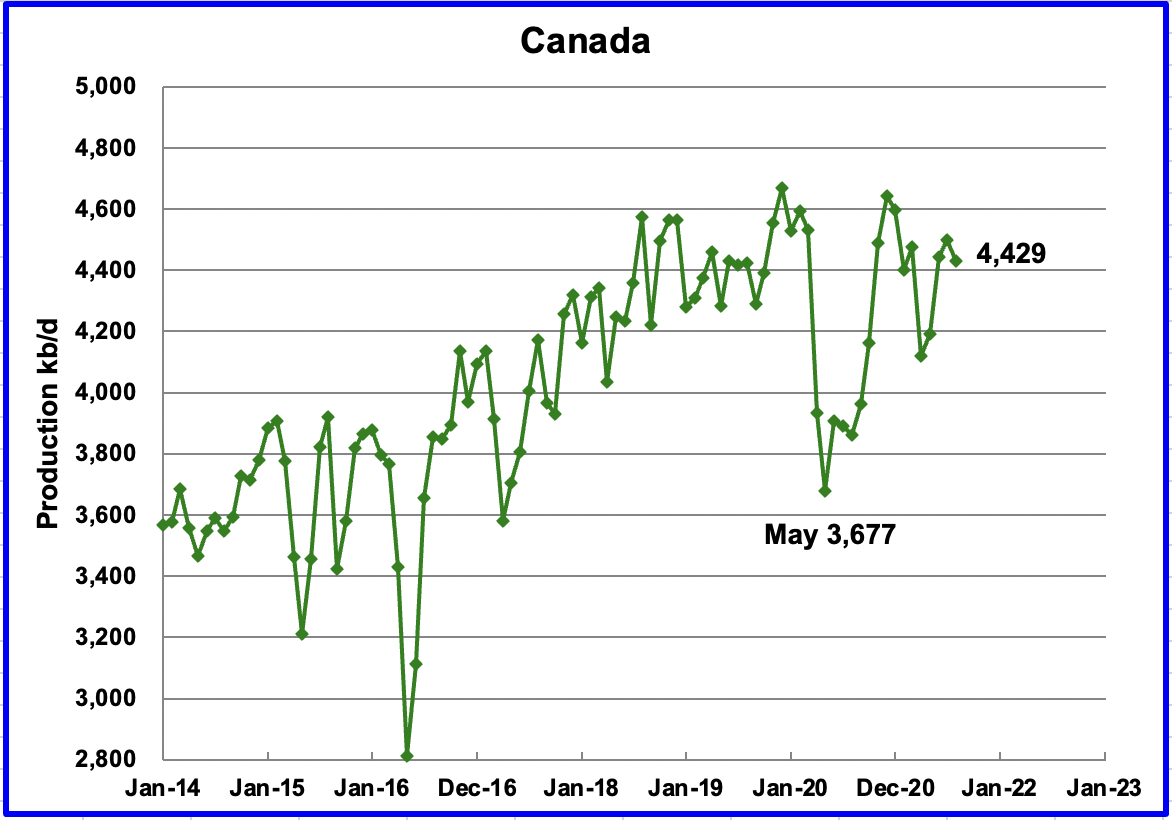

According to the EIA, August’s output decreased by 70 kb/d to 4,429 kb/d. The Canada Energy Regulator (CER) has retracted its earlier August production numbers and consequently no estimate is available from them.

On October 1, the updated Enbridge Line 3 pipeline began operating to deliver crude to Superior Wisconsin. The new line delivers more crude and is safer since it replaces a 50 year old pipeline.

Michigan has moved its attempt to shut Line 5 from Federal courts to state courts. Canada has invoked the 1977 Canada/US treaty, which Canada claims prohibits Michigan from interfering with the operation of a cross-border pipeline.

In September Canada shipped 164.2 kb/d by rail to the US which was 4.5 kb/d lower than in August.

The EIA reported China’s August output increased by 37 kb/d from July to 4,010 kb/d. In September it increased further to 4,042 kb/d and then dropped 79 kb/d to 3,963 kb/d in October according to this source. (Red markers)

From January 2020 to January 2021, China’s daily output increased by 72 kb/d to 3,995 kb/d. For 2021, no growth is apparent up to October 2021. Note that October production is slightly lower than January 2021.

Mexico’s production, as reported by the EIA for August declined by 53 kb/d to 1,687 kb/d. Data from Pemex shows that September output rebounded to 1,782 kb/d and then dropped slightly in October to 1,771 kb/d. (Red markers).

Production has been range bound between 1,650 kb/d and 1,800 kb/d since January 2019. Note that October production is essentially the same as March 2020.

Kazakhstan’s output decreased by 251 kb/d in August to 1,512 kb/d due to maintenance in the Tengiz field. September output is expected to recover to close to 1,700 kb/d,

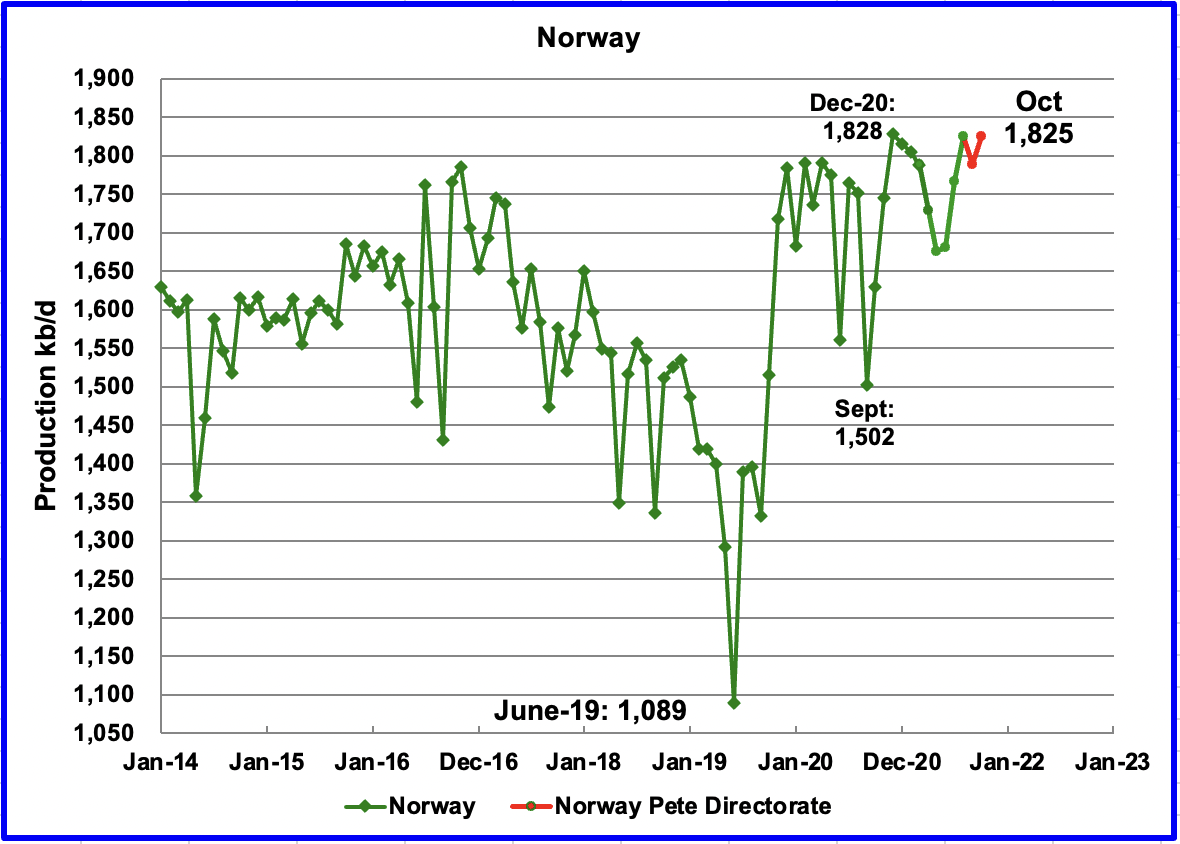

The EIA reported that Norway’s August production was 1,825 kb/d, an increase of 59 kb/d over July. The Norway Petroleum Directorate (NPD) reported that production in September decreased to 1,789 kb/d and then rebounded to 1,825 kb/d in October, red markers.

Earlier this year, the NPD implied that Norway’s production would exceed the December 2020 output in the latter half of 2021. There are still two months to go.

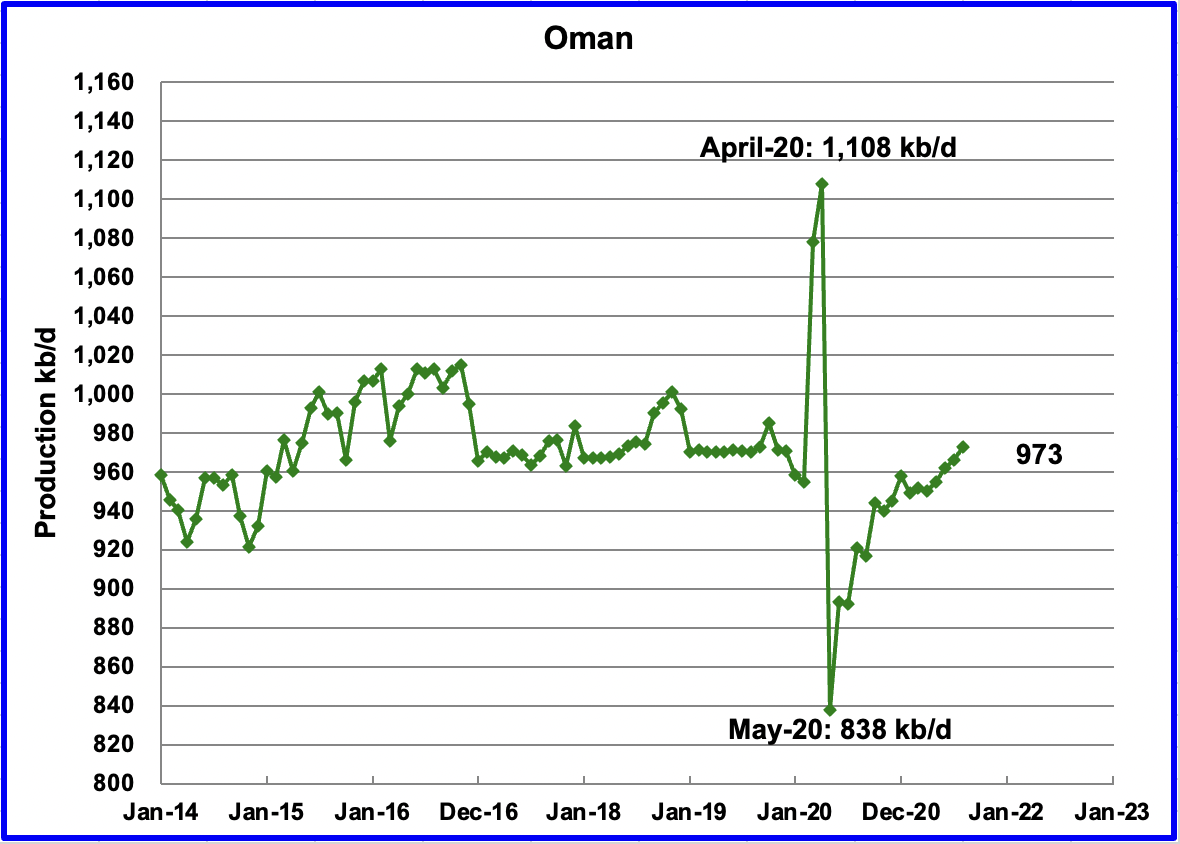

Oman’s August production increased by 7 kb/d to 973 kb/d.

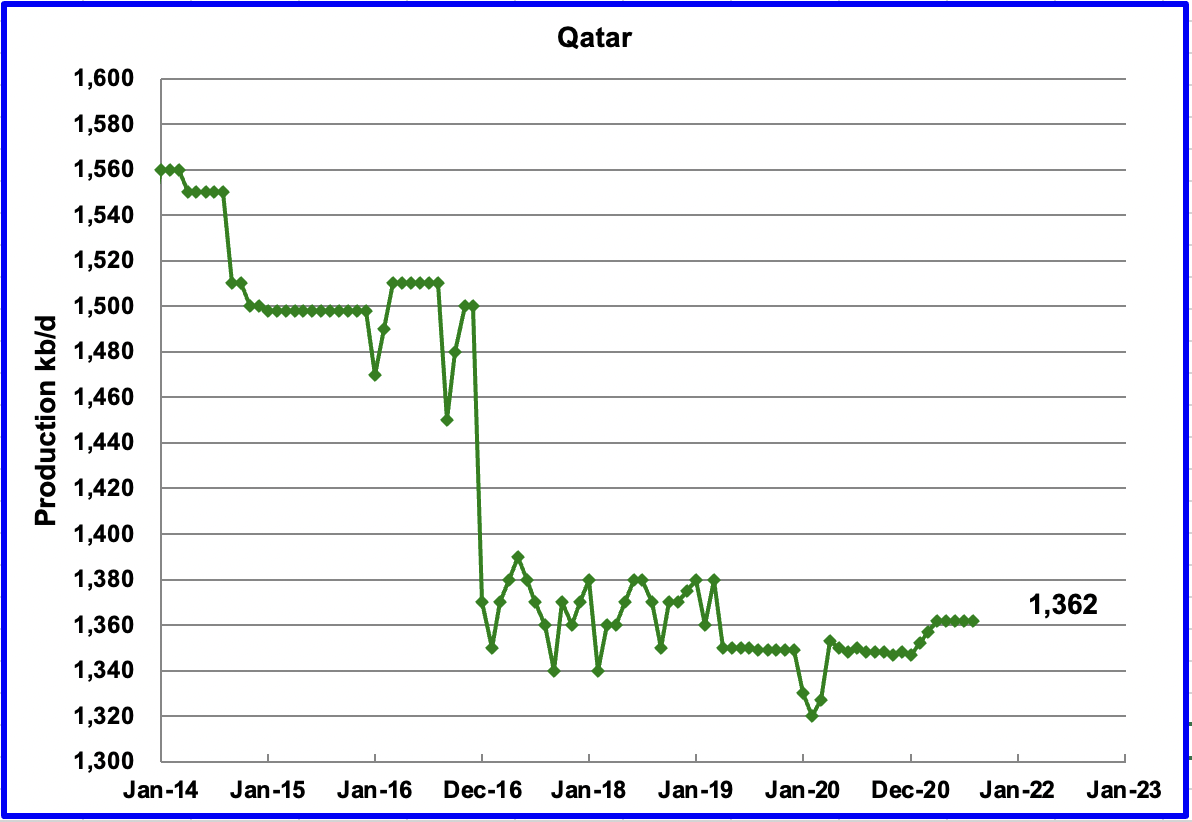

August’s output was unchanged at 1,362 kb/d.

The EIA reported that Russian output decreased by 35 kb/d in August to 10,022 kb/d. According to the Russian Ministry of Energy, Russian production increased by an additional 417 kb/d in October. This source reported that output in November increased by an additional 47 kb/d to 10,890 kb/d.

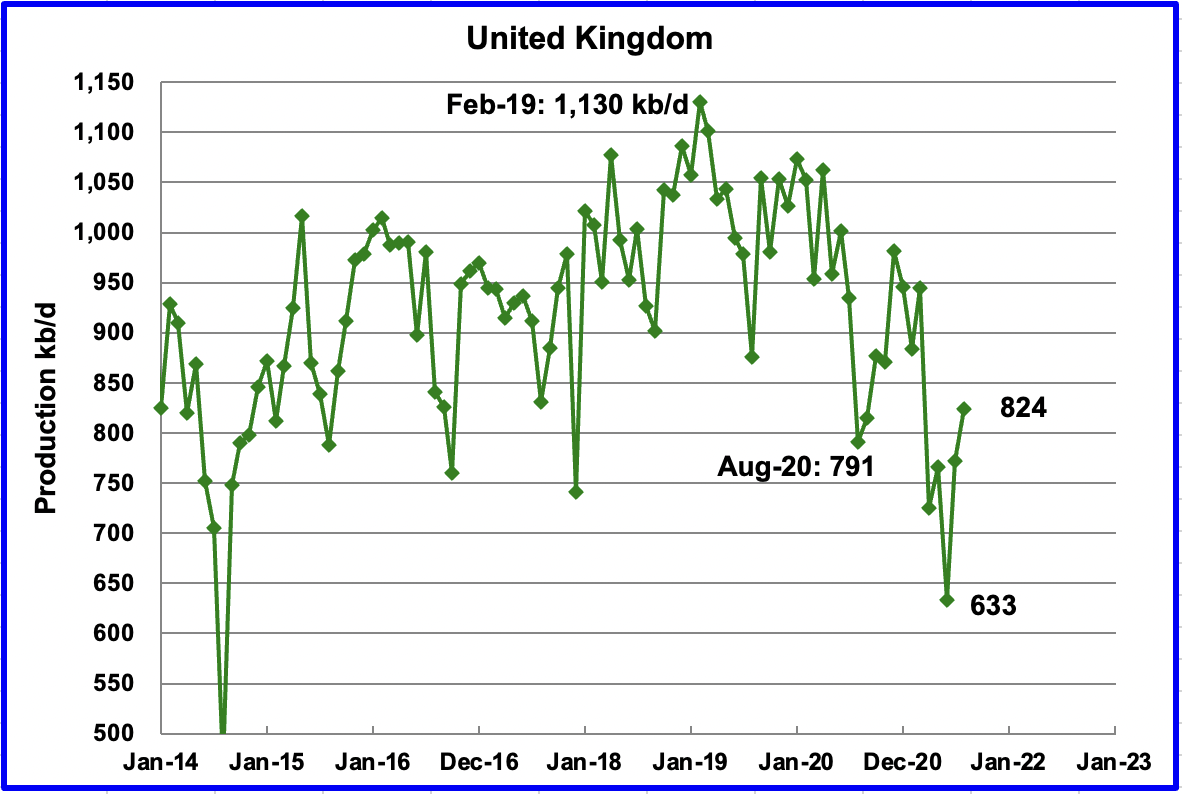

UK’s production increased by 52 kb/d in August to 824 kb/d due to the completion of some of the planned maintenance.

According to OPEC, the lowest-ever production recorded this year of 633 kb/d was due to extensive maintenance on the Forties Pipeline System (FPS), planned work overs, and a full production shut-in at the UK’s largest producing field, Buzzard.

Assuming that UK production can return to 950 kb/d by February 2022, that implies a decline rate of 60 kb/d/yr. Will drilling be able to slow or stabilize output at this level or will the decline continue?

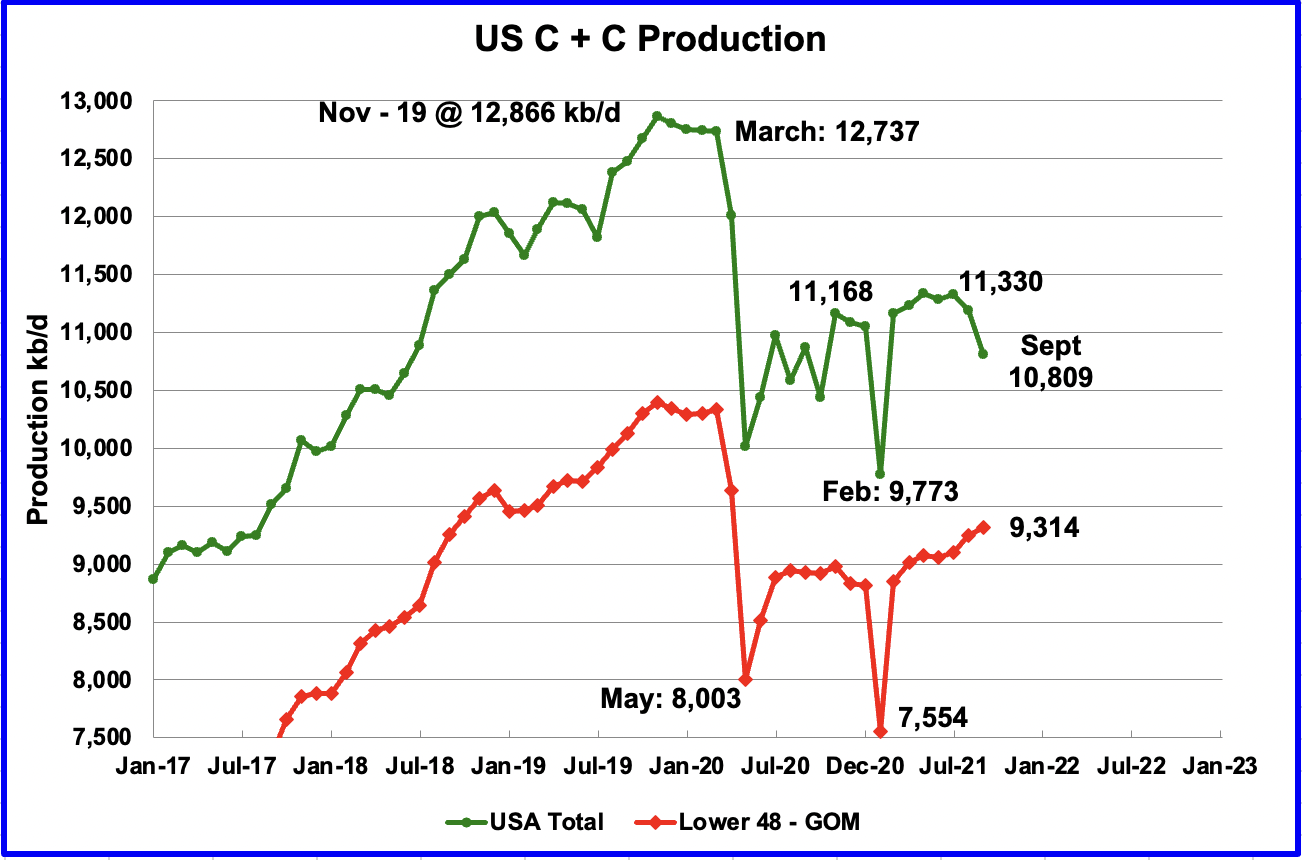

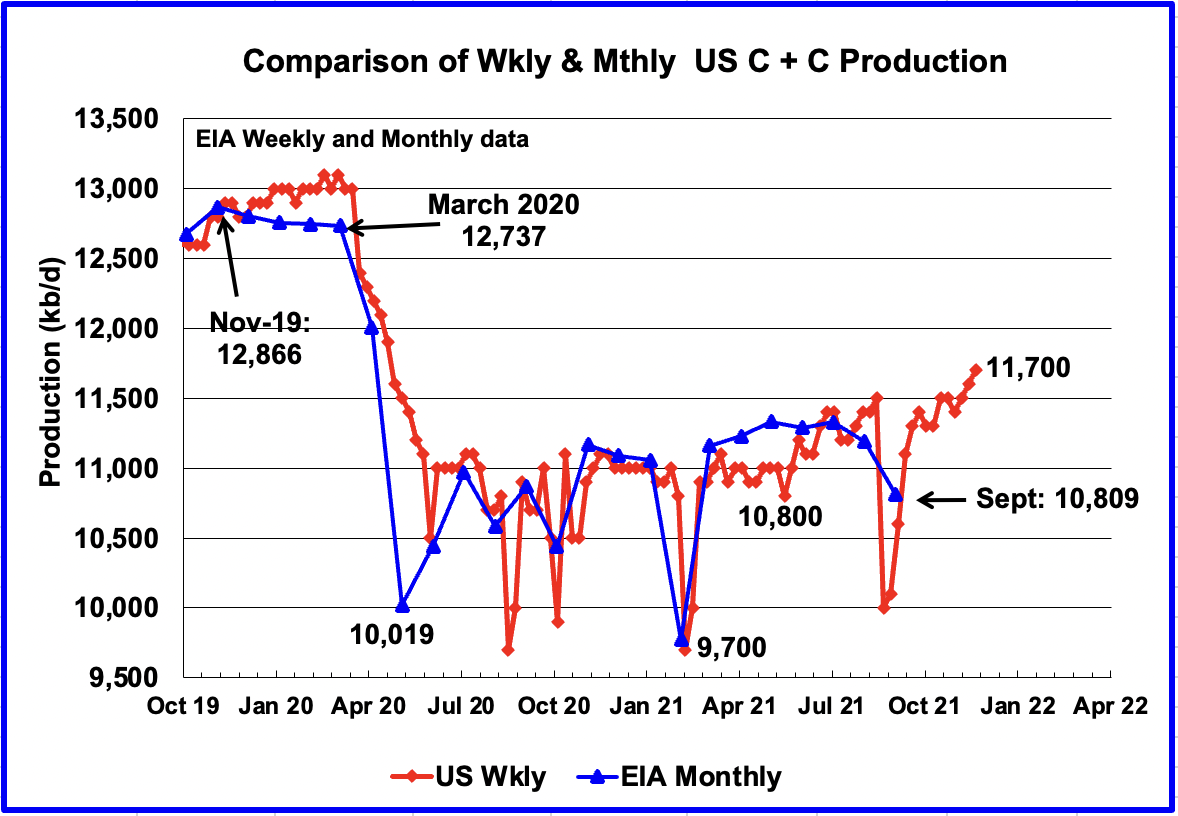

U.S. September production decreased by 380 kb/d to 10,809 kb/d. The drop is largely due to Hurricane Ida’s impact on GOM production. The GOM output dropped by 464 kb/d due to unexpected and extensive damage to platforms in the gulf.

The EIA weekly report has shown a continuous increase in production of 100 kb/d each week for the past three weeks since November 12.

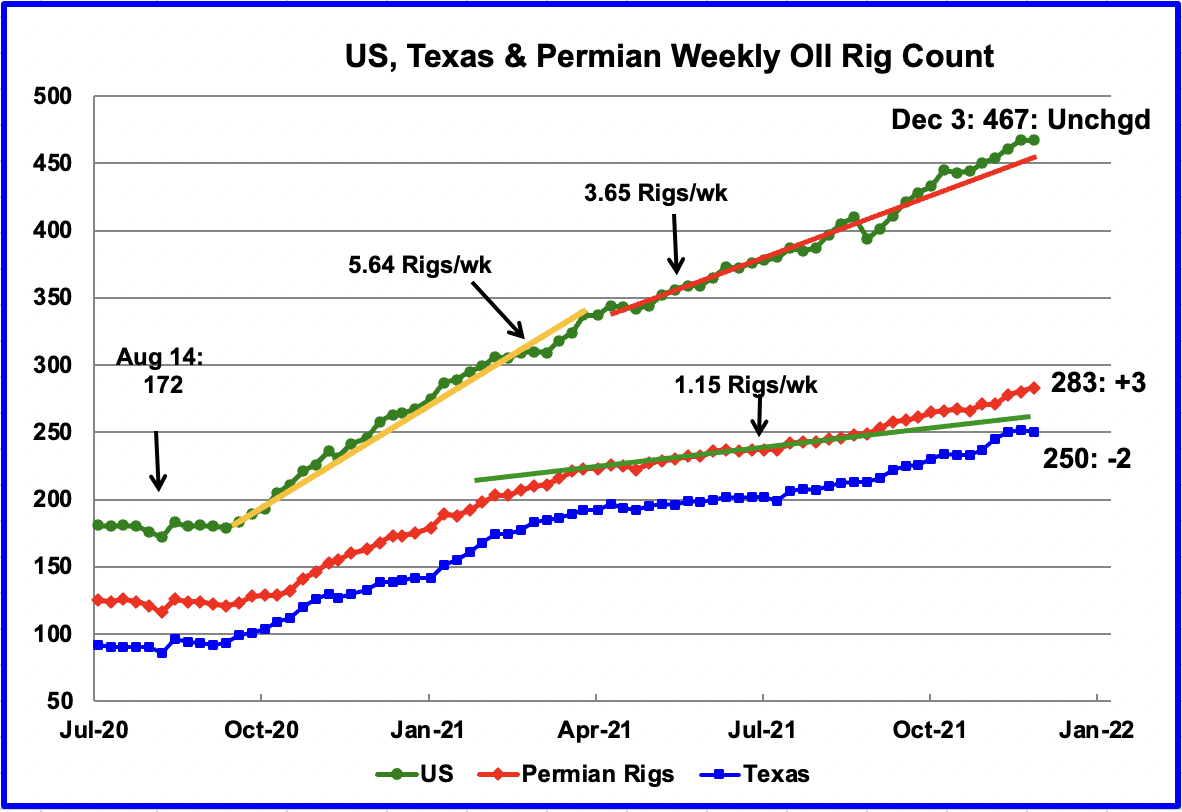

Since the beginning of April, the US has been adding oil rigs at a rate of close to 3.65 rigs/wk. For the week ending December 3, no oil rigs were added and remained unchanged at 467. Permian rigs increased by 3 while Texas rigs dropped by 2.

Since the end of July, the addition of oil rigs in the Permian has been at a rate closer to 1.15 rigs per week. However starting in September, it appears that rate of adding rigs has started to increase as can be seen by the red graph breaking away from the green line. Could this higher rate be related to the increasing price of WTI and a reduction in the completion of DUCs?

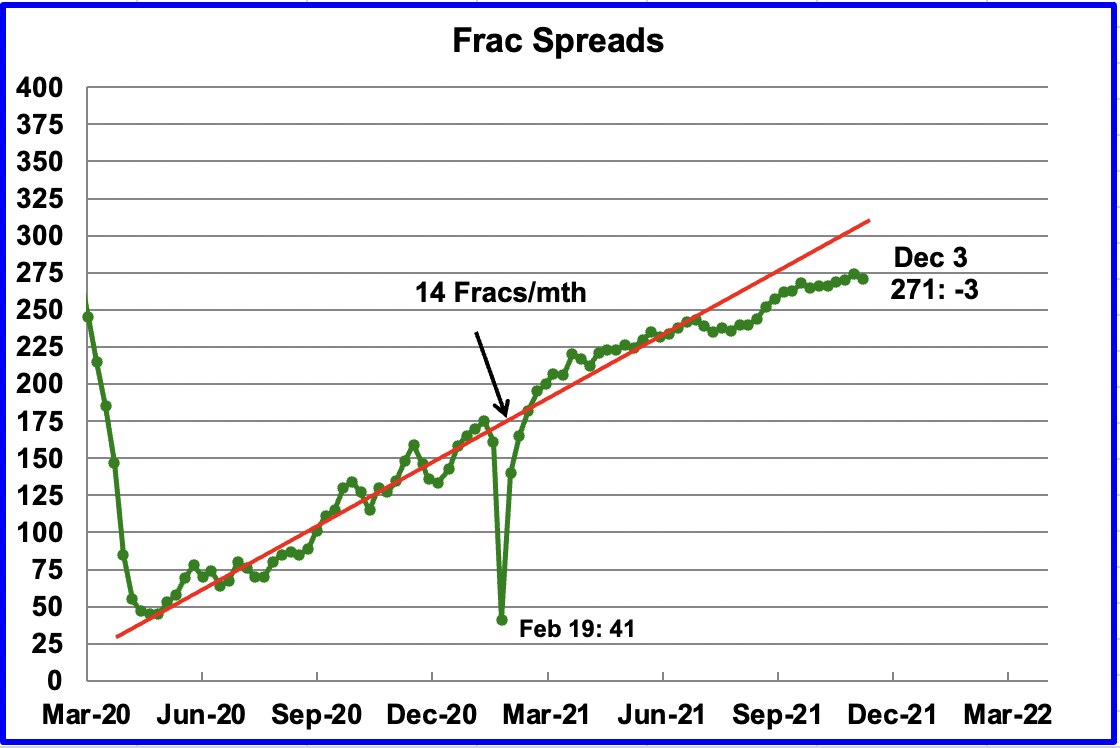

Starting from the week of July 23, 2021, frac spreads were not being added at the previous rate of approximately 14 spreads per month. While there has been an increase since then, there is a definite indication of slowing. During the week ending December 3, three Frac spreads were decommissioned.

Note that these 271 frac spreads include both gas and oil spreads, whereas the rigs information is strictly oil rigs.

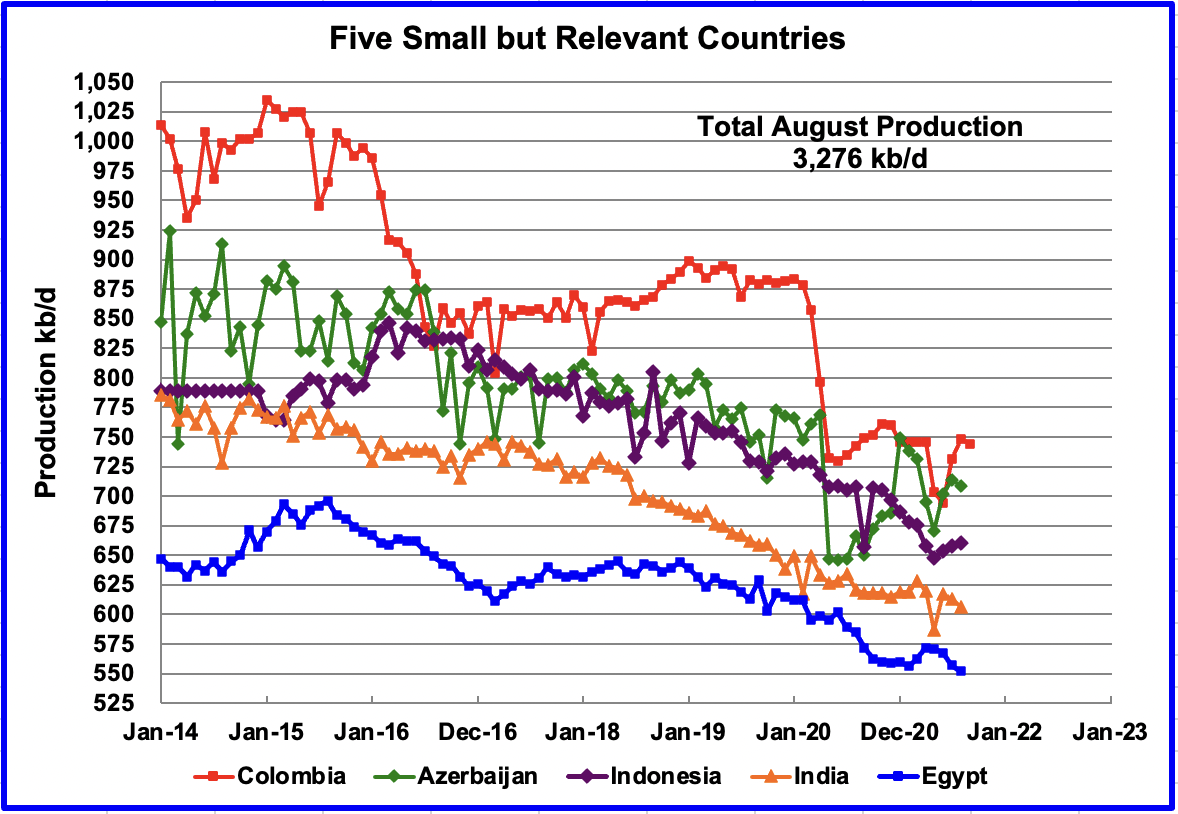

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined August production was 3,276 kb/d, up 4 kb/d from July.

World Oil Production

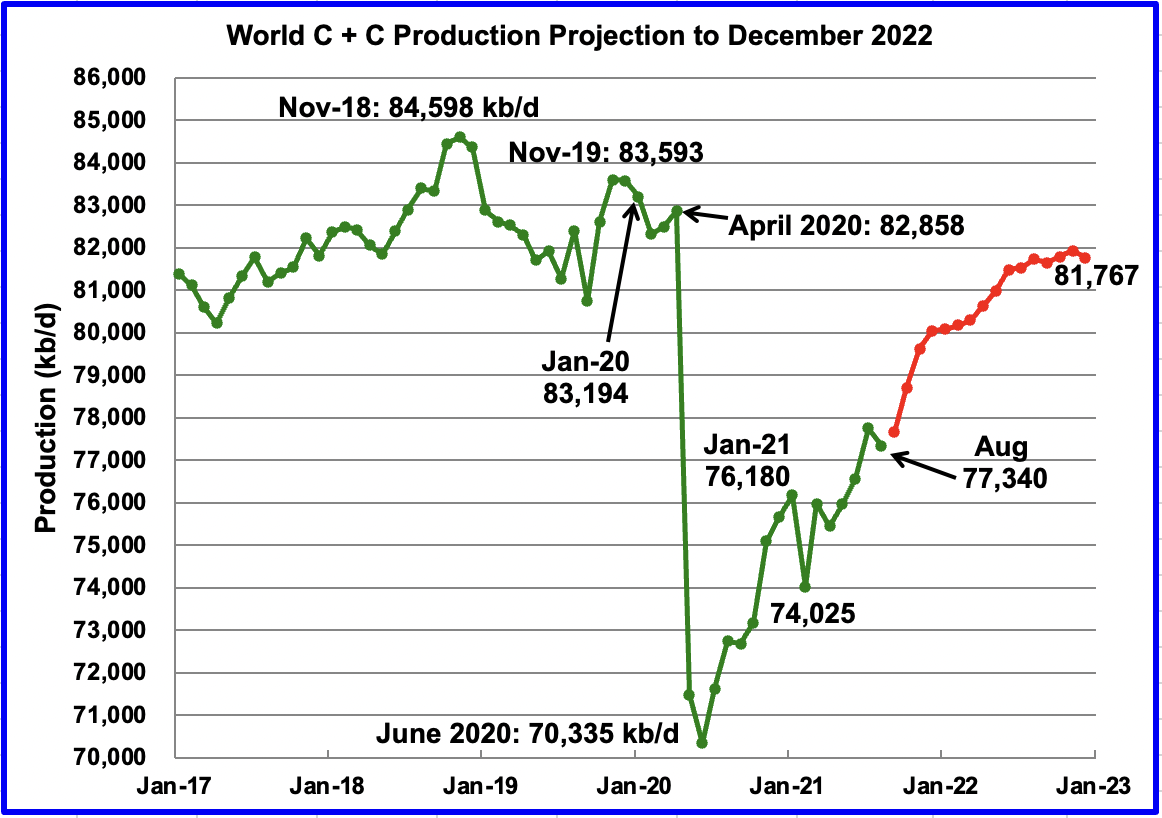

World oil production in August decreased by 412 kb/d to 77,340 kb/d according to the EIA. Of the 412 kb/d decrease, the three biggest contributors with declines of over 100 kb/d were Kazakhstan, 251 kb/d, US, 185 kb/d and Nigeria 170 kb/d, for a total of 606 kb/d.

This chart also projects world production out to December 2022. It uses the December STEO report along with the International Energy Statistics to make the projection. (Red markers) It projects that world crude production in December 2022 will be 81,767 kb/d, 380 kb/d lower than forecast in the previous report.

The current December 2022 forecast is 2,831 kb/d lower than the November 2018 peak of 84,598 kb/d. As best that I can remember, this may be the biggest gap that has been reported and it continues to get bigger. Also note that August production is 5,854 kb/d lower than the January 2020 pre-pandemic rate of 83,194 kb/d. Which countries will reduce this gap by producing more oil when demand returns to the January 2020 level?

OPEC produced 28,868 kb/d of C + C in August, which is 1,877 kb/d less than in January 2020. That means that the Non-OPEC countries need to supply 3,977 kb/d (5,854 – 1,877) of oil if world demand/supply were to get back to the January 2020 level, say by late 2022.

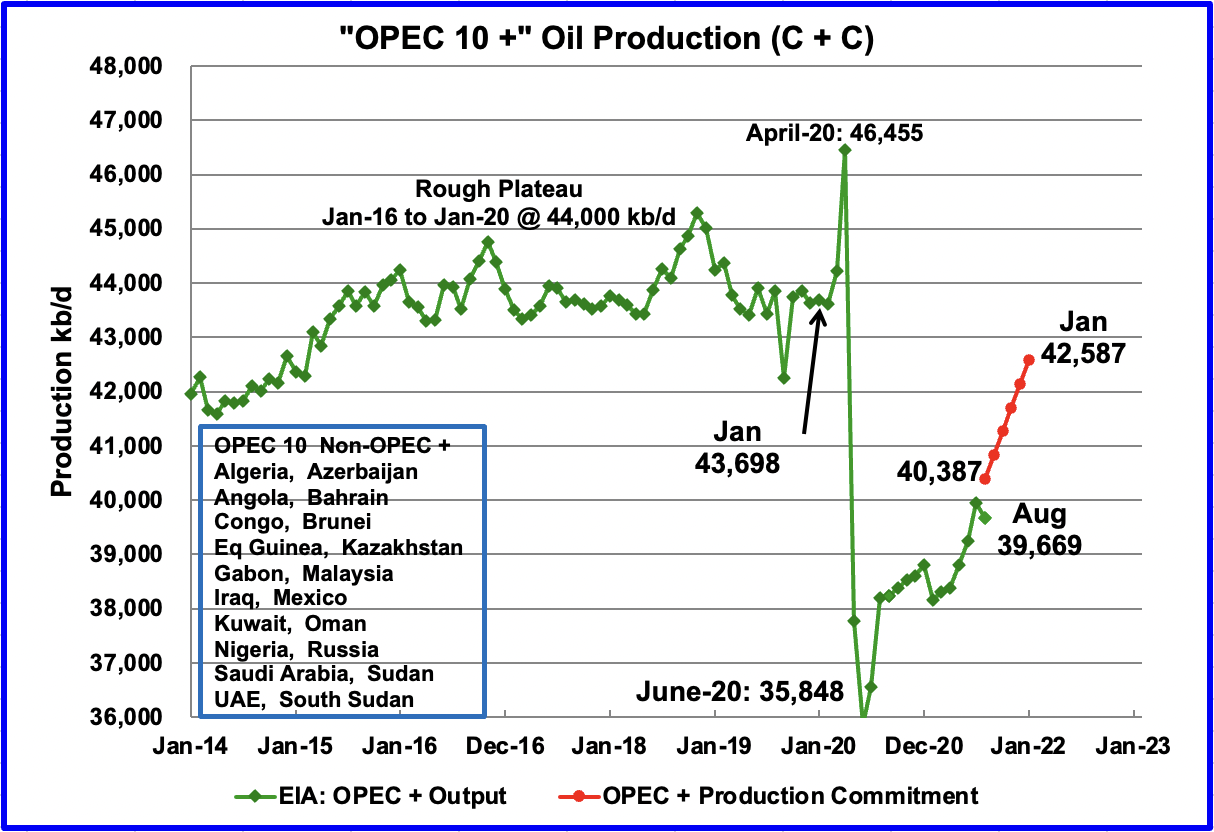

Another way to look at future supply requirements is to ask what do the “Non-OPEC +” countries need to supply to meet the former demand/output rate of January 2020? To get back to the January OPEC + rate of 43,698 kb/d, OPEC + needs to supply an additional 4,029 kb/d (43,698 – 39,669). To make up the difference, the Non-OPEC + countries need to supply 1,825 kb/d (5,854 – 4,029). Can the US, Canada, Norway, etc., increase their supply to meet this challenge over the next year or two?

Either way one examines the question of re-meeting the January 2020 demand/supply for oil, a year or two from now, it sounds like a daunting task for either the OPEC + countries or the Non-OPEC + countries.

The red line in this chart is the projected output as promised by the OPEC + countries starting in August 2021. OPEC + has committed to add 400 kb/d to the market every month till January 2021. Since the chart reports oil output in terms of C + C, 10% has been arbitrarily added to the 400 kb/d (440 kb/d) to roughly account for the condensate in the OPEC portion of OPEC + output.

For August the target output was 40,387 kb/d, based on July’s output of 39,947 kb/d. The actual output was 39,669 kb/d, short by 440 kb/d in large part due to the problems in Kazakhstan noted above.

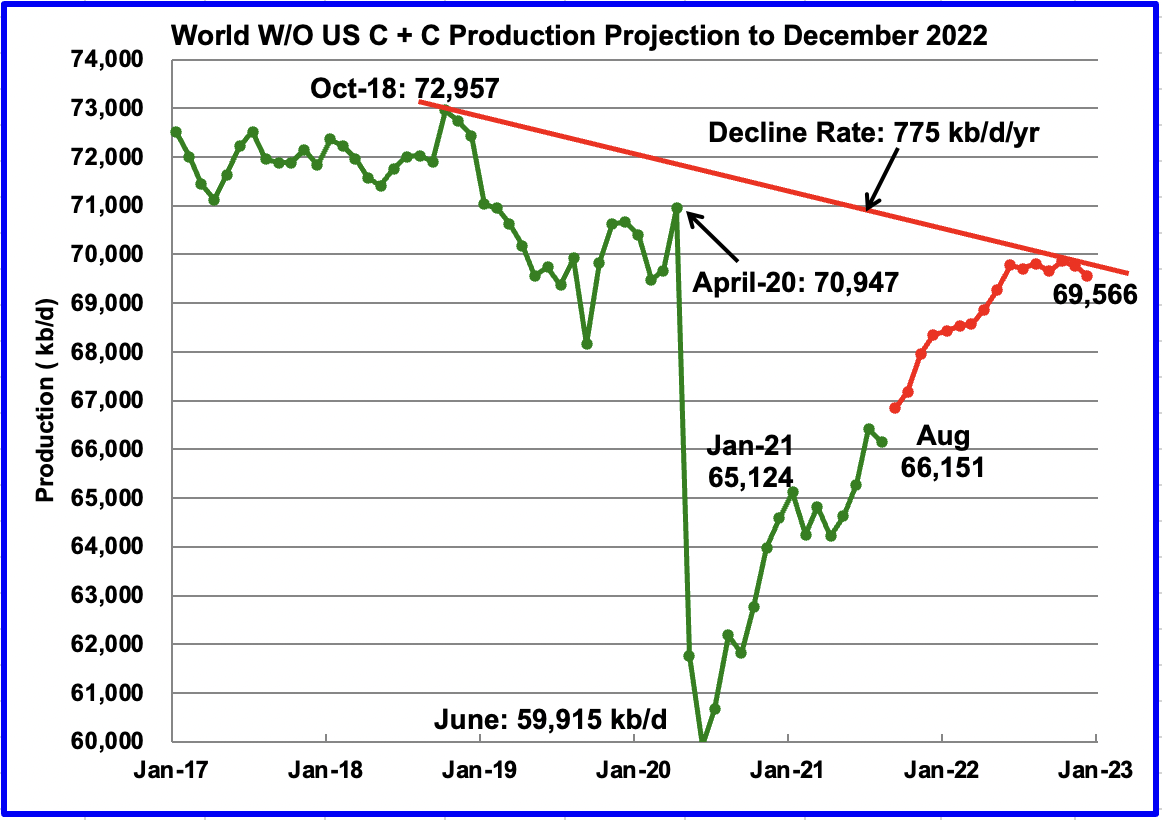

August World oil production W/O the US decreased by 271 kb/d to 66,151 kb/d according to the EIA.

This chart also projects world production out to December 2022. It uses the December STEO report along with the International Energy Statistics to make the projection, red markers. It projects that world crude production W/O US in December 2022 will be close to 69,566 kb/d.

The current December 2022 forecast is 3,100 kb/d lower than the October 2018 peak of 72,957 kb/d. If the Oct 2022 output were to be the next future peak, that would imply that the net decline rate of world oil fields, except for the US, is close to 775 kb/d/yr.

Activist Investor Dials up Pressure Against Exxon Mobil to Act on Climate

In an interview with Yahoo Finance, van Baal said his investor group FollowThis has filed a shareholder resolution requesting that Exxon Mobil (XOM), for the first time, set and publish medium- and long-term targets to reduce greenhouse gas emissions and energy products, consistent with the goal of the Paris Climate Agreement.

“Big Oil can make or break the Paris Climate Accord and we need shareholders to support them and if needed to push them to commit to the Paris Climate Agreement and start investing differently,” van Baal said. “That’s the only way we have any chance to fight the climate crisis.”

Specifically, the resolution from FollowThis calls on Exxon to go beyond addressing operational emissions, but all of their emissions, including Scope 3 or indirect emissions stemming from activities or assets that are not directly controlled by the oil giant. Van Baal said that accounts for 90% of the firm’s carbon footprint, making it a critical piece of addressing climate action.

The resolution, filed ahead of the 2022 annual general meeting (AGM) frames Exxon Mobil’s failure to act as a financial risk, making limiting global warming “essential to risk management and responsible stewardship of the economy.”

“On the demand side, we have to make different choices. But on the supply side, the energy industry, which is now the fossil fuel industry, should completely overhaul the supply of energy,” van Baal said. “The only way to achieve that is to stop investing in exploration of more oil and gas and start the exploration of new business models in renewables.”

Another wunderkind helping to move the peak oil date forward.

https://finance.yahoo.com/news/activist-investor-dials-up-pressure-against-exxon-mobil-to-act-on-climate-201859590.html

A very informative update, much appreciated!

But from the frac spread chart, if you create a line from march to december -21 you´ll get a quite less steep increase, and with that in mind, the Non-opec projection (first graph) might be seen as quite optimistic, possibly…?

Laplander

You are correct in that there is an indication over the last months of 2021 that the weekly frac spread additions are slowing. In the DUC section of the previous US post, one can see how the completions are also slowing. This ties together nicely.

What is not clear is whether seasonality has something to do with the slowing of frac spread additions, i.e. Xmas is around the corner. Maybe someone in the business could provide some insight on whether completions slow around Xmas/New Year.

To clarify my point to new readers, from Jan -21 to Aug -21 Non-opec (first chart) seems quite flatish/slight increasing but with a projected rise in the works. But since a large part of the increase has been supposed to come from the US I guess them boys will have to frac a lot more, not less?

Ovi,

There is a growing divergence between # of rigs to wells drilled/ # of frac spreads to total completions performed.

As the length of laterals continues to increase in the Permian, a single rig will trend towards drilling fewer wells in a given time frame. (This is somewhat offset by the ever faster rates of lateral feet drilled).

Likewise with frac spreads, it is becoming more common for 2 spreads to be operated by, essentially, one crew as the hardware has evolved so 2 pairs of wells are frac’d simultaneously.

Hardware such as the Hydraulic Completion Units – pioneered by Deep Well Services and their imitators – are playing a role in greatly boosting the efficiencies in creating these longer laterals.

While this can muddy the waters somewhat in attempts to continue with historical comparisons, the ‘Appalachian Basin’ model may offer an effective framework for ongoing analysis.

To wit, due to the wildly hetergenous nature of AB leasing/drilling units, most AB operators use the metric ‘lateral feet drilled per 24 hours’ and ‘number of stages frac’d in 24 hours’.

Thus, a 4 well pad with individual lateral lengths of 18,000′, 15,000′, 12,000′, and 7,000′ containing stages varying in length from 150 feet to 280 feet can be homogenized in the just-described manner.

(An operator may present this pad as, say, 52,000 lateral feet drilled in a total of 12 days, with completion rates of 14 stages per day for the ~260 stages frac’d).

I have no idea how observers could easily ‘crunch the numbers’ and produce an AB model to the Permian or the wider US, but – again – the direct rigs to wells/spreads to completions framework is becoming increasingly disconnected.

CoffeeGuyzz

Interesting info on what is happening in the drilling and fracing world. Need to ask a question. Appalachia is gas. Do the same variations in gas technique and progress also apply to oil drilling/fracing.

I have been tracking Fracs vs Rig count and have noticed that the number of frac spreads to rig count started to fall off in early September, see attached chart. However as noted in the post, the frac spreads include both gas and oil spreads, whereas the rigs information is strictly oil rigs.

Ovi,

Although a bit of an overstatement, there is essentially no difference between the drilling/completion process of an unconventional oil well versus an unconventional gas well.

The biggest differences arise in the hydrocarbon recovery process which is way harder/more expensive for oil than it is for gas. This should be understandable when one is getting a viscuous liquid out of a rock, flowing into a fist-sized ‘pipe’, travelling 2 miles sideways, and then 2 miles to the surface as has been done every day for almost 20 years in the Bakken.

Natgas flows much more readily with liquid removal (mostly water) in the vertical being one of the bigger (and more easily overcome) challenges.

From all accounts, the completion companies have repeatedly stated that qualified labor shortages are their biggest difficulties right now.

How much of that may be reflected in your data, I do not know.

Coffee.

You mention labor issues, and I wholeheartedly agree that is a major issue.

Do you see that subsiding?

I have been beating the drum on this for awhile. We saw it getting to be a problem in our field before COVID. Now it is to the point that we don’t know what we will do as our employees retire.

Very few with any skill are interested because they see it as a dead end career. There is a lot to know, and it is a dangerous job too, so you cannot just throw somebody out there.

Add in the serious drug abuse issues in the oilfield, I don’t see how we have another boom, even if the geology allows for it.

But I am not in a shale field and assume our wage scale is lower.

Shallow,

‘Do you see that subsiding’?

No, quite the contrary.

Not to go off topic (oil thread wise), it seems to becoming increasingly rare to encounter anyone under 30 who is hungry to work, willing to put in an extended period of training, can focus on instructions, and exhibits excellent customer/interpersonal skills.

Easy for me to write all this off as routine curmudgeonly evaluations on my part, but … there really does seem to be a sea change in culture when it comes to younger people – collectively – willing to roll up their sleeves and get ‘er done.

The era widely populated by such individuals may be in our past.

Coffee.

I don’t know that I completely agree that it is an age issue, I do think we all tend to spend too much time on these smart phones, even the 50+ crowd.

Working in the oilfield is a challenging job physically. It is outdoors in extreme weather. It is dangerous work. There are so many more jobs now that don’t require these physical demands, more than ever before. Think of how many can work from home now, as compared to just 10-15 years ago when shale really took off.

Oil and gas work occurs in mostly rural areas. The desire of the populace to live in rural areas is shrinking. The population of rural areas is shrinking. I have children and nieces and nephews. Right now not looking like any will live in a rural area for their careers. The enrollment at our high school is just 2/3 of what it was when I went there 35+ years ago.

The great financial crisis occurred 2008-2009. Many were willing to move to the Bakken, EFS and Permian to work at jobs that paid higher than where they lived. Now, there are plenty of jobs everywhere, and those jobs pay as much or more comparable to the oilfield jobs.

Next, for younger people, job stability doesn’t look good at all for the oilfield. There have been three bad busts in the oilfield since 2008. Policy makers want to move away from using oil. Surveys show many don’t want to work in the industry because of its perception as dead end, or worse, an immoral industry due to climate change issues.

Last, the oilfield mostly has to drug test due to the dangerous nature of the work. This eliminates millions of Americans. Many millions of Americans love their drugs. Pot is becoming legal in more places. Pot stays in the system for a long time. If you are committed to smoking pot, it isn’t easy to keep your oilfield job. Same is true for the harder stuff, although those on the harder stuff tend to not show up for work much anyway.

Of course, all these things could change. But not looking that way right now.

Ovi,

Maybe the chart would be better if it included all horizontal onshore rigs vs frac spreads?

Thanks again Ovi!

Ovi,

There are good explanations for World minus US decrease in output over Oct 2018 to Dec 2022, OPEC plus cuts from 2018, US sanctions on Iran and Venezuela, and Worldwide pandemic causing a crash in demand and oil prices. This is hardly what I would call net decline.

There is likely to be a shortage of oil and high prices by the end of 2022, this is likely to increase investment in the oil industry and output may also rise and also demand will be destroyed due to high prices. The market will be forced into balance.

Dennis

We only have data up to August 2021. The line I put in the chart goes to October 2022. I have no idea what the EIA assumes in their forecast. I note though that from July 2020, Iranian production has increased from 2,516 kb/d to 3,241 kb/d. Not sure how much additional output the EIA has added out to October 2022. Venezuela has bounced back and now seems stuck around 550 kb/d from a low of 360 kb/d.

I do keep track of the net decline in 27 countries and it is closer to 500 kb/d/yr. Venezuela and Iran are not among those 27.

I guess that if Hillary had not done her Veni, Vidi, Vici thing, at the expense of Stevens et al, Libya would still be extracting 1,6 mbpd… But K trusted E over USD, see where that got him…

Edit: or maybe not 1,6, but who knows?

Ovi , now that is what I call a performance . The real stuff , ” All beer , no froth ” .

Ovi,

What is the basis for choosing the 27 nations in your chart?

I get a similar result for Jan 2010 to Dec 2019 for World C plus C minus the C plus C output from the following list of 11 nations (Venezuela and Iran are included due to sanctions and politics causing an arbitrary drop in output)

Brazil

Canada

Iran

Iraq

Kuwait

Norway

Russia

Saudi Arabia

United Arab Emirates

United States

Venezuela

I use EIA data, the trend in annual decline in output for the “rest of World” is about 500 kb/d over the 2010 to 2019 period.

The average annual increase in C plus C output from the 11 nations listed above over the 2010 to 2019 (using OLS trendline) is 1497 kb/d per year.

Also notice in chart below for “rest of World” (World minus 11 listed nations) that decline was practically nil from mid 2016 to the end of 2019 (only a decrease of 14 kb/d per year).

Dennis

Here are the countries. There are more than 27. I just counted the cells in the visible line of Excel. My Bad. This uses the EIA world data. At the end is the formula to save you the trouble of typing it in, in case you want to look at it before tomorrow when I get around to sending you the spread sheet.

Cell D7 is Jan 2004 for Algeria. The rest should line up.

I will send you my spread sheet tomorrow and I will update this reply with an explanation for every one to see.

Algeria, Angola, Argentina, Australia, Austria, Azerbaijan, Belarus, Belize, Brunei, Burma, Cameroon, Chad, Croatia, Cuba, Czech R, Cote d”Ivoire, Egypt, Eq Guinea, France, Gabon, Georgia, Germany, Greece, Guatemala, Hungary,India, Indonesia, Italy, Japan, Lithuania, Malaysia, Mexico, Netherlands, New Zealand, Nigeria, Norway, Peru, Philipines, Romania, South Africa, Spain, Sudan,Tomor-Leste, Trinidad, Tunisia, Ukraine, UK,Uzbeekisstan, Vietnam, Yemen.

D7 D9 D12 D15 D16 D17 D21 D23 D32 D35 D39 D43 D52 D53 D55 D56 D62 D64 D77 D80 D82 D83 D88 D93 D101 D103 D104 D109 D111 D125 D130 D137 D148 D151 D154 D159 D166 D167 D173 D193 D196 D198 D208 D211 D212 D221 D223 D226 D229 D232

It occurs to me that some of this decline in the “rest of world” might be due to libya. It seems you have focused on non-OPEC less Russia and US, where I include some of the declining OPEC nations (except Iran and Venezuela). To me, an inclusion of all declining nations gives a clearer picture.

No I was incorrect, it seems you include most of the declining OPEC nations.

Dennis

I started looking at the list of declining countries in mid 2019 and made up the final list in March 2020 after looking at countries in decline in different ways. I ended up with three criteria.

Mar 20 – Jan 2004: Output in March 2020 had to be less than Jan 2004

Mar 20 -Dec 07: Output in March 2020 should be less than December 2007. This was to cover countries that were low in production and then increased for a while and then started their decline again. Egypt.

Feb 20 – July 18: Output in Feb 20 should to be less than July 2018. For instance, if some country had a big output decline and then went flat or slightly up, I would include it. A variation on the second criteria.

These were not hard and fast criteria. They were guidelines used as I looked at each country’s chart. In the end it was an Eyeball Decision. For example, Norway had a big decline up to 2012 and then goes sideways and adds a bit. It is in my list.

I stopped looking at declining countries when Covid hit. Recently, as world production started to recover, I updated the chart to July and July was back on the line after the divergence before and after covid. That is why I posted the chart. It will be interesting to see what happens going forward.

There is a pretty clear steady downtrend in the totality of output from these countries and no discernible flat spots at this point.

I have sent you the spreadsheet. If someone would like to see it, they can get it from you.

Thanks Ovi,

If we add libya to my original list and call “rest of world” all oil producing nations besides that group of 12 that I listed, I think we arrive at a similar number. I use Jan 2010 to April 2020 for the data range. Annual decline rate is about 460 kb/d per year.

Dennis

By adding Libya, your slope declined. Also you have much more production than in mine. In 2010, the production in your chart is 29,000 kb/d. Mine only has 19,000 kb/d. I guess we agree that there is a decline of roughly 500 kb/d. Will it continue or will it slow.?

Dennis

I wonder if the bigger producers have more funds to do maintain drilling while the smaller countries in my list don’t do much or as much maintain drilling. That could affect the net decline slope.

Ovi,

There must be a group of relatively flat or slightly increasing producers that are included in my group which is mostly nations that are not significantly increasing output. Looking at your chart it looks like output was pretty flat from 2004-2008, so to me the slope from 2008-2019 would be of greater interest.

The 12 nations on my list (when we add Libya to the original list) increased output roughly 1500 kb/d per year from 2010 to 2019. I imagine they can increase by 1000 kb/d as a group from 2022 to 2027, this gives a net increase of about 2500 kb/d for the World over that period and my guess is that the increase may be somewhat more than this when we add Guyana (with an expected increase of 850 kb/d from 2021 to 2028.)

Dennis

I will look at my rest of the world and check their increase and post later.

Dennis

Here is My Rest of the World W/O US. I left the US out to get a better idea of what the rest of the world was doing. From Jan 2008 to October 2018, rest of the world W/O US was increasing at 935 kb/d/yr. I tried to take the steepest part of the graph.

Ovi,

So your rest of world is every nation except your group of declining nations, the drop after 2018 is the OPEC plus nations that are not part of your declining group reducing output to try to support oil prices. US output increased by 567 kb/d per year on average from Jan 2008 to Dec 2017.

Dennis

Just to clarify, the US is not in there also. Maybe you intended that in your reply but I don’t see it specifically. So the US rate has to be added to the 935 kb/d/yr, which I don’t think is correct for late 2021 and 2022 and beyond.

Ovi,

Yes the US rate would be added to the 935 kb/year, the US can probably increase output at 500 kb/d per year from 2022 to 2027, much will depend on the price of oil and whether tight oil producer realize that they have a narrow window from 2022 to 2028 to produce as much as they can without causing a supply glut, after 2028 demand may start to fall faster than supply and the window for profits in the tight oil space (and the oil sands space for new projects) will be closed.

See comment linked below to see an alternative tight oil scenario.

https://peakoilbarrel.com/non-opec-oil-production-drops-in-august/#comment-731530

David Hughes 2021 assessment for shale oil is just out. Required reading!

https://www.postcarbon.org/publications/shale-reality-check-2021/

o The total tight oil projection is 4.5 times higher than proven U.S. tight oil reserves and more than triple all proven U.S. crude oil reserves at yearend 2019.

o The total shale gas projection is 3.6 times higher than proven U.S. shale gas reserves and 63% of proven reserves plus unproven resources.

o In most plays the EIA forecasts exit 2050 at high production levels—often significantly higher than current production rates —implying that vast additional resources would remain after 2050.

And here is the killer, Bold mine:

SUMMARY FINDINGS

• The EIA’s AEO2021 reference case play-level production forecasts through 2050 are found to be highly to

extremely optimistic for the most part and therefore are unlikely to be realized (although they are

somewhat less optimistic than in its earlier reports).

• In most plays, meeting EIA production forecasts through 2050 would require the recovery of all proven

reserves and a high proportion of the EIA’s estimates of unproven resources. (In one play over 100% of

proven reserves plus unproven resources would be required.3)

o The total tight oil projection is 4.5 times higher than proven U.S. tight oil reserves and more than

triple all proven U.S. crude oil reserves at yearend 2019.

o The total shale gas projection is 3.6 times higher than proven U.S. shale gas reserves and 63% of

proven reserves plus unproven resources.

o In most plays the EIA forecasts exit 2050 at high production levels—often significantly higher

than current production rates —implying that vast additional resources would remain after 2050.

• The EIA appears to have overestimated drillable area in most plays, and also extrapolated well estimated

ultimate recovery (EUR) over wide areas when they are in fact highly variable.

o As sweet spots become saturated with wells and drilling of necessity moves into lower quality

parts of plays where average well production is lower, per-barrel drilling and completion costs will

increase to levels significantly higher than the EIA’s optimistic assumptions of less than $30 per

barrel for most tight oil plays and less than $15 per barrel of oil equivalent for most shale gas

plays.

So much for the EIA’s URR estimates. 🤣 They are not worth a bucket of warm spit. 😂

Oh oh – I think it is the labor shortage.

Their dealer of coke and happy pills has run away – now they are sober and have to rewrite everything ;).

In an earlier thread I showed a tight oil scenario based on two separate oil price scenarios. The scenario has been corrected to a single oil price scenario that rises to Brent price in 2020 $ of $75/b maximum that starts to decrease in July 2028 and reaches $36/bo in 2020$ in July 2041 and then remains at $36/bo.

The chart below compares my scenario with the AEO 2021 tight oil reference scenario, my URR is 69 Gb(2000-2060), the EIA has URR=137 Gb, if we assume linear decline of the EIA scenario to zero output in 2060.

Note also that Hughes has not given any output scenarios since 2014, there he only gave output scenarios for Bakken and Eagle Ford and my scenarios for those two plays are consistent with his best guess in 2030, about 750 kb/d for Eagle Ford plus Bakken output in 2030 for both my scenario and Hughes in Drilling Deeper. Peak 12 month centered average output for my scenario (DC) is 9.27 MB/d in 2027.

Link to 2014 Report by Hughes on tight oil

https://www.postcarbon.org/wp-content/uploads/2014/10/Drilling-Deeper_PART-2-Tight-Oil.pdf

See Fig 2-95 on bottom of page 143. My scenarios for Bakken and Eagle Ford have cumulative output of 13.1 Gb from 2012 to 2040 vs 13.9 Gb for Hughes scenarios from 2014, he has never updated these scenarios.

Price scenario used for tight oil scenario in chart below.

In my opinion this oil price scenario is exceedingly conservative.

The “DC” tight oil scenario is updated to account for lower Permian completion rates due to falling oil prices in oil price scenario above see link below

https://peakoilbarrel.com/non-opec-oil-production-drops-in-august/#comment-731394

URR falls from 69 Gb to 59 Gb.

FOA Food price index continues up. Current reading is higher than the 2011 average but still lower than the peak.

“The FAO Food Price Index (FFPI) averaged 134.4 points in November 2021, up 1.6 points (1.2 percent) from October and 28.8 points (27.3 percent) from November 2020. The latest increase marked the fourth consecutive monthly rise in the value of the FFPI, putting the index at its highest level since June 2011.”

https://www.fao.org/worldfoodsituation/foodpricesindex/en/

Opec+ adds 410,000 b/d but remains short of target

Opec+ deal participants raised their combined crude output by 410,000 b/d last month on the back of strong increases from Nigeria, Saudi Arabia and Iraq, but the group was still 580,000 b/d short of its November target, according to Argus’ latest survey.

Opec’s two largest producers also delivered strong output growth in November. Saudi Arabia raised production by 110,000 b/d and Iraq increased by 90,000 b/d. Iraq was one of only five in the wider Opec+ group to exceed its quota last month. It must make up for its historical overproduction through a compensation scheme that has been extended until the end of June next year, although the coalition’s focus on compliance has waned as several countries struggle to meet their growing targets.

There is a more extensive compliance table at the end of the article.

https://www.argusmedia.com/en/news/2282120-opec-adds-410000-bd-but-remains-short-of-target

The days of OPEC worrying about its members overproducing has past.

“Between August and November, OPEC+ added 1.04 million bpd in total to its production, which was nearly 600,000 bpd below the target for the four months

https://oilprice.com/Energy/Energy-General/OPECs-November-Oil-Production-Still-Below-Target.html

So OPEC + which had supposedly cut production by 3 or 4 mbpd during the peak of the Covid crisis to support prices can’t get it up again . Solution : Send them Viagra . Hopefully it might work . 🙂

Maybe viagra is one of the secret ingredients in those frack cocktails those Permian boys are sending downhole. Don’t tell the Saudis!

Shell had announced another discovery in the Perdido Fold Belt area in the deepwater GOM

https://www.rigzone.com/news/shell_makes_another_discovery_in_gom_perdido_corridor-10-dec-2021-167263-article/

This is the 4th discovery they and partners have made since 2018 – including Whale, Blacktip and Leopard.

One reason it took so long to make these discoveries (the Perdido host itself has been online since 2010 or so) is most of them are subsalt/subraft, and the overlaying salt and rafted material is very complex. Alot of advances in seismic processing has gone into creating usable images that resulted in identifying the prospective structures.

Assuming all of these discoveries ultimately get developed, there has to be at least a billion barrels of recoverable oil out here (my estimate). The investment decision has already been made for Whale – with a new facility and estimated recoverable resources of 490 mmboe.

By the way, I used to be SouthLaGeo. Retired now so going by my real name.

Mr. Meltz,

Thanks for the link.

Considering that 20,000 psi hardware is being developed (initially for Chevron’s Anchor project), and that the outrageously high estimates for Brazil’s pre salts continue to be trumpeted, is it reasonable to think that significantly more hydrocarbons may be found in the GOM sub/pre salt?

Or, at a minimum, vigorous exploratory efforts may be expended as – noted in your post – seismic improvements continue to evolve?

Coffeeguyzz,

Will significant discoveries be made in the GOM sub-salt? In my opinion,, not a lot, with a caveat – that caveat being I’m not sure how many more discoveries Shell and partners could make in the subsalt part of the Perdido Fold Belt,, as seismic data quality continues to improve. The subsalt in this part of the Gulf has always been very challenging. I suspect, though, that they are nearing the end of quality prospects, but that is just a guess.

In other prospective subsalt areas – such as the subsalt Miocene centered in Southeast Green Canyon and extending over to Mississippi Canyon and Atwater Valley,, I believe only small opportunities remain there,, those that would be tied back to existing facilities, like BP’s Puma West discovery announced earlier this year. In these areas, I don’t believe improvements in seismic will result in significant discoveries. Seismic improvements will probably result in more effective field development though.

The other remaining area of new reserves in the GOM subsalt will be Wilcox/Lower Tertiary fields that have already been discovered and are either on a development track, like Anchor, or are likely to be developed, like North Platte and Shenandoah, and I suspect a few more.

Gentleman , ” technically feasible does not mean economically viable ” . How many times must I repeat this ” mantra ” .

Hole in head,

Bob Meltz (aka SouthLageo) has probably forgotten more about geology than you or I will ever know.

When he speaks, I just listen and learn.

Dennis , let us get things in order . I have posted several times that when it comes to GOM Mr Kaplan and SL Geo ( now Bob Getz) were my ” go to guys” . I hold these gentleman in high esteem on GOM matters . Mr Getz and Mr Kaplan will confirm that . My post was in response to Coffeeguyz post of some technical achievement of 20,000 psi . I followed your interaction with Coffee on the last post regarding NG . I did not intercede . Reason ?? In all your posts all you talked about was technical possibilities and not a word about price or about financial markets . I know of my limitations as an armchair guy , so I always bow to the opinions of the ” on hands ” . As to “When he speaks, I just listen and learn. ” , well that is what I do not only for Mr Kaplan or Bob Metz but also SS , Mike S , LTO , Rasputin etc . By the way no offense to your post , just clearing the muddy waters .

Hole in head,

When you say “Gentleman”, it is far form clear who is being addressed, if the comment was directed toward Coffeeguyzz, then address the comment to him, then it is clear and I would not have commented.

Hole in Head,

So what you are getting at is it is technically feasible for the operators to produce the discoveries I mentioned, but it may not be economically viable. I agree with that. I assume when an operator sanctions a project that at least they believe it to be economically viable. The only projects of all I mentioned that have been sanctioned are Anchor and Whale.

That doesn’t mean the others won’t be sanctioned, just that the operators need more appraisal information to make that call, and some may end not getting developed (at least initially) after appraisal.

Bob Meltz,

Do you expect this will impact GOM output over next 5 to 10 years?

You are always welcome to do a post on anything here if you are interested.

Thanks as always for keeping us up to date.

Dennis,

These projects, are significant enough to have a measurable impact on GOM output – either resulting in another peak, or at least a plateau.

Let me mull around the offer of a post – I’ve been thinking about putting one together on the current state of the Wilcox/Lower Tertiary in the deepwater GOM – how well has the trend lived up to early expectations, etc.

Thanks Bob.

I think you have my email, if not give a shout out here at the blog. Thanks for all of your insights.

More detail on Whale project at link below, first output expected in 2024 with peak output of 100 kboe/d, recoverable resource expected to be 0.49 Gboe, note at peak output about 36.5 million boe/year are produced. So if the resource estimate is correct output could be at this peak level for about 13 years.

https://www.shell.com/media/news-and-media-releases/2021/shell-invests-in-the-whale-development-in-the-gulf-of-mexico.html

Another Shell development expected to start producing in 2022 is Vito with peak output of 100 kboe/d and a resource estimate of 300 million boe, enough for about 8 years of peak output. Info on Vito at link below

https://www.offshore-energy.biz/shell-makes-fid-for-vito-development-in-gulf-of-mexico/

The design of the Whale project is similar to Vito according to Shell.

This the current outlook from JP Morgan-

“According to the investment bank, household net worth is at all-time highs in many developed countries, and excess savings are elevated. Consumption will likely be strong for years amid strong labor market conditions and the capacity to take on more debt,”

“A vibrant economy means robust demand for oil, and JP Morgan even said last week that crude oil prices could soar to $125 per barrel in 2022 and $150 in 2023 due to OPEC’s limited capacity to boost production.”

https://oilprice.com/Energy/Energy-General/JP-Morgan-Predicts-The-End-Of-Covid-A-Strong-Economy-And-125-Oil.html

Market disagrees with this projected future. Global bonds yields peaked back in October. Obviously short term rates are pinned near zero in most places. And long term bond yields are falling and flattening the curve.

Every time FED goes into tightening mode long end of curve flattens. If you don’t know the 10 year is at about 1.5% currently.

FED only has 1 maybe 2 interest rate hikes in them. Anymore than that the entire yield curve all the way out to the 30 year is going to invert. And only way to correct that is negative nominal interest rates.

How do you square that when CPI is running at 6.8%? You can’t and you’ll be roasted in the next election cycle.

China cutting their RRR rate only happens when things aren’t going well.

In a vibrant economy the dollar’s value falls. Because everything is smooth sailing. Well if DXY is heading back to 80 then maybe we get $125 oil.

Not going to happen. And only way FED can tame inflation is a stronger dollar.

I mark 2022-2023 as the biggest economic crash any of us will ever see in our lifetimes. Hope I’m wrong. But this vibrant economic outlook is for lack of a better word donkey shit.

I agree, inflation has the potential to spiral out of control yet. I think oil prices could have the potential to continue rising in this environment, with the DXY increasing as well (which seems counter intuitive) but the current environment allows for this to occur.

I can see the S&P and Dow continuing to edge higher and higher as inflation spirals. The trend can break dramatically only if the fed decideds to make some serious moves against inflation.

But at the moment i just dont see that happening. The fed serves the rich upper echelon of society. So the stockmarket not tanking is their primary motivation, regardless of whether inflation hurts the little guys, i don’t think they give a shit unless there is significant social unrest.

Deflation could occur only if the feds hand is forced and then we might witness the biggest exit out of assets (property and stocks) the likes of which the world has not seen before. The signs are there already with distorted price discovery and company evaluations. So there is going to be potential for a significant market downturn but it is hard to predict when, maybe when we see a signficant sharp increase in the 10 year yield, the end game starts. I don’t know.

Pension funds and insurance companies are loading up on safe and liquid assets. Long end of bond market. In some cases theses are negative yielding assets depending on where your talking on the globe.

They’d rather own safe and liquid assets. And lose money instead of buying risky assets. That gives you a little window into what they are thinking.

Stocks continue their march higher due to CEO decisions to do buybacks regardless of what the current price is. Regardless of what economic outlook is. Stock are completely 100% divorced from reality. They don’t tell you anything about the economy.

Money isn’t leaving bonds. Bond market doesn’t believe the growth story that the media, politicians and central banks are pushing.

Which is why as FED exits QE long end of yield curve falls towards 0%

I see commodities getting absolutely hammered including oil as inflation not only cools off but disinflation returns. It’s exactly what bond market is saying. Exactly what the offshore dollar funding or Eurodollar market is saying. It’s what the pension and insurance companies are saying.

I think FED is going to get forced by markets to make a choice between everything blowing up and nominal negative interest rates. During 2022-2023

Good call – I believe the CRB just turned Bearish after a 17 month bull run. Those calling for “spiraling inflation” have not gotten the message – accelerated QE tapering

Well , even Art Berman discounts $100 oil . See the link in my other post . Another point he brings up is that the Permian is past peak or expiry date .

There is always the chance of severe downturn, for so many legit reasons.

[the biggest one that is underappreciated is the chaos that may ensue after the 2024 US election]

But speaking of chances, it is more likely that the delaying game of ‘kick the can down the road’ will continue to be played with surprising success by the worlds big financial policy makers for the next 2-3 years.

And if so, oil price is going up and up.

Hicks , no there are no chances of a severe downturn because we are already in a severe downturn . If you ignore to recognize it then I have nothing to add . The second part of your post ” kick the can down the road ” you are correct ” so far , so good ” . The problem is that we have run out of road . Oil prices ?? I keep out of this, but my bet with Dennis stands ” $25 by 2025 .” Day to day chatter on this is not worthwhile ,at least for me .

“then I have nothing to add”

perfect truth

Hole in head,

No evidence of downturn on a World basis. The expectation for the World is 5.9% real GDP growth in 2021 and 4.9% in 2022. You are correct that we have fallen off the previous growth path for World real GDP, inflation is due to the World economy growing faster than the supply chain can keep up, at least in part.

For US 2021Q4 seasonally adjusted annual rate of real GDP growth we have

https://www.atlantafed.org/cqer/research/gdpnow

Excerpt

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2021 is 8.7 percent on December 9, up from 8.6 percent on December 7.

Your oil price prediction is likely to be off by a factor of 3 or 4.

Dennis , the first part of your comment was already replied in the last post when I mentioned about the ” base effect ” and the BS of IMF , WB etc . No need to repeat myself .

“Your oil price prediction is likely to be off by a factor of 3 or 4.” . I can say the same for all the forecasts you make and I believe there are many who support my POV . Only time will tell . We are going to be in 2022 in a fortnight , so three years is not a long time . POD ( Rockman) is now in play full time .

Hole in head,

Find a reputable forecast thats supports your POV and we can discuss.

In the mean time, calling forecasts you don’t agree with BS is a pot kettle thing.

Hmm,

So you think my guess for oil price of $95/bo is 3 to 4 times too low? I don’t think so. I would guess there is about a 99% probability that the price of oil will fall between $50 and $150 per barrel, probably a 67% probability it will be between $75 and $125/bo these are annual average Brent oil prices in 2020$ and this is the range of annual average oil prices I expect from 2022 to 2028. Your guess of $25/b in 2025 is that a month average or are you going for daily or minute by minute oil prices?

Dennis, I agree with your price projections with the caveat that I could be horribly wrong. Let me explain. Peak oil is definitely on the horizon. That would send oil prices through the roof if that became generally known. However, peak civilization is also definitely on the horizon. That could send oil prices through the floor if that became generally known. So,…. it could go either way.

Ron,

Yes peak oil will cause higher prices until we get to a point that demand falls faster than supply, my guess is 2028 or so. If we get to peak civilization that would also reduce oil prices, it is less clear to me when that occurs. Do you have a time frame in mind?

My oil price predictions assume we muddle through until 2030, after that we see oil prices falling to match supply with demand.

I never get oil price predictions right.

If we get to peak civilization that would also reduce oil prices, it is less clear to me when that occurs. Do you have a time frame in mind?

No Dennis, I have no time frame in mind. But I would bet 10 to 1 that peak oil will come before peak civilization. So I would bet prices would rise, rather dramatically, before they collapse. But of course, that is just a wild-ass guess.

Ron,

Surprisingly we agree on most points, where we probably disagree is the likelihood of civilizational collapse in the next 20 years or so, my guess is that this proabability is less than 10%, your guess would likely be higher (maybe 90% or higher). Longer term if carbon emissions are not reduced along with human population (from falling fertility ratios) the probability of civilization collapsing increases unless humans become smarter than yeast.

Surprisingly we agree on most points, where we probably disagree is the likelihood of civilizational collapse in the next 20 years or so,

Dennis, I am pessimistic but not that pessimistic. I would give it 40 to 50 years at least. And I don’t see a sudden collapse. I think the collapse itself will last perhaps 20 years as one country after another slide into anarchy.

But I am not really worried about myself. As I tell my kids, I will be safely dead by then. Of course I am deeply worried about them and my grandkids.

Ron,

Thanks. We are in pretty close agreement on several things, it is just the peak supply vs peak demand for oil where we have different opinions. My guess is that we will see peak supply from 2024 to 2027 with a rough plateau in output, but by 2028 there may be enough electrically powered light transport on the road that the pressure will be taken off of oil supply and oil prices will start to fall, then we will see significant decline in output as more expensive resources (new tight oil and oil sands projects) are postponed permanently and supply decreases to match falling demand for oil.

You probably see this playing out very differently. Oil price scenario below.

Yes Dennis, very differently.

Worldwide number of battery electric vehicles in use from 2016 to 2020

There were some 6.8 million battery electric vehicles in use globally in 2020. That year, more than three million new battery electric vehicles were added to the worldwide fleet.

HOW MANY CARS ARE THERE IN THE WORLD IN 2021?

There are about 1.446 billion vehicles on Earth in 2021. About 21% of those vehicles are in the United States.

Do the math, at that rate it would take 482 years to replace them all. Of course, the rate will pick up. If they double then it would take only 240 years to replace them all. And if they quadruple, then it would take only 120 years to replace all the internal combustion automobiles. Heavy trucks are another matter altogether.

Dennis, all this is really beside the point. The point is demand will not drop nearly as fast as you expect it to drop. But right now demand is still quite low due to the pandemic. When it does return, if covid declines, it will hit the production limit. Then all hell will break loose. I expect prices to rise dramatically at that point.

Ron,

I just addressed this question at the comment linked below.

https://peakoilbarrel.com/non-opec-oil-production-drops-in-august/#comment-731563

The average annual growth rate of new plugin vehicle sales from 2014 to 2021 is about 38% per year. If we assume the sales growth continues at 35% per year from 2022 to 2028 then the plugin vehicle fleet grows to 185 million by 2028 and to 694 million by 2035. I assume the growth in new plugin vehicle sales falls from 35% in 2028 to zero in 2033. New plugin vehicle sales continue at the 2033 rate of 76.4 million per year until the entire light vehicle fleet is replaced in 2050. Half of the World light vehicle fleet is replaced by 2035.

Note also that in reality most miles travelled occur in newer vehicles, but in my scenario I have made the conservative assumption that on average old vehicles are driven the same number of miles as newer vehicles. By 2035 in my scenario, demand for C plus C falls to 75 Mb/d, an amount that can easily be met by World supply. I also assume a transition for heavy trucks starts in 2025 and proceeds at a similar rate to the earlier light vehicle transition. About half of the heavy vehicle fleet is replaced by 2045 and 99% of the heavy vehicle fleet is replaced by 2060. For simplicity I assume fuel demand for air and water transport remain at the 2018 level (basically I do not try to analyze air or water transport demand).

Update of car sales diagram

Following the discussion, if the inflation corrected or the current oil price is better to use for the diagrams, i now prefer a different unit: The oil price has been transformed in a percentage value corresponding to the energy content of a barrel of oil (in boe, barrel of oil equivalents.). For this the energy productivity diagram has been used.

The maximum price which has ever been paid was on July, 3rd, 2008, with 144 $/bbl, that is 20.5% of a boe. Therefore, 20.5 % has been the practical limit up to today.

For car sales, the following diagram results. About 7% of a boe seems to be a limit. Below 7% the car sales can increase, above 7% they decrease.

Hi Berndt , could you convert the percentages into BTU’s available from a barrel of oil ? Makes it easier for a “dumbkoff ” like me to understand . Your posts are always interesting . Tks

Energy unit conversion is here:

https://www.traditionaloven.com/tutorials/energy/energy-multimenu.html

1 BOE = 1700 kWh

1 BOE = 5 800 640.78 British thermal units (BTU / energy)

Energy productivity is time dependent and about 0,54 $/kWh in 2021.

Norway horrified as new rates make EV charging prices higher than petrol

https://thedriven.io/2020/01/20/norway-horrified-as-new-rates-make-ev-charging-prices-higher-than-petrol/

That company won’t be around long in Norway they charge those kind of rates.

They propose to charge the equivalent of 89 cents/kwh,

whereas at my house I pay a fixed rate 11 cents/kwh-

Which also happens to be the national average in the USA.

It costs us less than $10 dollars to go 300 miles.

SK,

That article is almost 2 years old.

It would be interesting to learn how current electricity pricing translates into costs for recharging EVs.

“Norway, March 2021: The price of electricity is 0.136 U.S. Dollar per kWh for households and 0.078 U.S. Dollar for businesses which includes all components of the electricity bill such as the cost of power, distribution and taxes. For comparison, the average price of electricity in the world for that period is 0.135 U.S. Dollar per kWh for households and 0.124 U.S. Dollar for businesses.”

Very good prices.

Sounds like that company quoted above is charging a huge markup. People will work hard to charge elsewhere- like at home or work.

Here are the spot prices in September.

These are the spot prices today

Car sales peaked and were declining in all 5 of these countries well before COVID was even a thing.

The so called record savings here in the US. Is actually just $2 trillion in government transfer payments that are on the balance sheets of non bank entities within the economy. No goods and services were created and attached to the creation of this so called savings.

When the stimulus money hit people’s bank accounts. Banks actually take the money and buy US treasuries. Banks have to have a asset to back the $2 trillion in deposits which are their liability.

Well the assets that are backing these deposits. Which are mainly short term US treasury bills and notes. When FED raises short term rates the assets backing the deposits loses value. So banks will have to buy larger amounts of treasuries to back these deposits.

Which is why we see US banks holding a record amount of US treasuries. Over $4 trillion worth currently.

Current problem is FED through QE removed too many bills and notes from financial system. They removed too much of the collateral from the financial system and financial system lacks the collateral it needs to function properly. We know this is true due to the amount of reverse repo or banks using their cash at the FEDs reverse repo window to borrow collateral.

Shortage of collateral equals less dollars being created or borrowed. Inverted Eurodollar curve is screaming that this is taking place right now.

Look anybody or any article that you read that paints a rosy future is purely propaganda and when a large bank does it it’s to sell you on an idea.

Berndt,

Apologies, I seem to be a bit slow. 20.5% of what? What value was 144 divided by to get 20.5%? 100/20.5*144 = 702, so 144/702 = .205. What is 702?

Niko, my energy productivity diagram gives a value of ~0,412 $/kWh for 2008. With a barrel of oil (1700 kWh energy content) a GDP of ~702 $ has been created in 2008. 144 $ is 20,5% of 702 $.

Berndt.

The chart shows no relationship between oil price and global car sales over the past 8 years.

For example, both the highest and lowest oil price times were associated with low end car sales,

and the higher periods of car sales were associated with mid range oil price.

Clearly, other factors are much more important. Things like interest rates, general prosperity and pandemics.

Also take note that EV’s,PHEV’s now comprise over 10% global new sales [and growing rapidly]. These don’t require petrol, btw. Tesla, VW and the various Chinese manufacturers are far out in front, but others like GM and Ford have big aspirations.

I’m still experimenting, how to optimize parameters, to find out the relevant oil prices limiting car purchases. There are time effects:

– Each point in the car sales diagram is the average for 12 months.

– A person who decides to buy a car does not get the car in the moment the decision is made, it takes some weeks or months until the car is received.

If i assume a delay of three months between oil price value and car sales value, the following diagram results.

Up to now, the 3 months delay has given the highest R2 values.

The oil price limits for car purchases for the three time spans are:

2013-2015: ~237 $/bbl

2016-2018: ~57 $/bbl

2019-2021: ~48 $/bbl

Especially the 2016-2018 time span has a very high R2 value of 0.76. The red crosses form nearly a straight line.

Invitation: Take the diagram above and play with the numbers.

Example: For an oil price of 70 $/bbl about 150000 less cars are sold in 3 months (blue straight line), that is 50000 cars less per month. That is 600000 less cars in a year. How high will the oil price go, and how long ?

I have no idea how realistic such Gedanken Experiments are.

Finally, my oil price and production diagram.

The oil price is for Brent and it is in BOE.

I interpret the price maxima and their fit line as the maximum the world economy can afford for oil.

The price minima and their fit line are the minimum the oil producers can tolerate. Blue stars indicate the price limits for car production, transformed to BOE.

Both lines crossed each other in the autumn of 2020.

The y-scale is in percentage of BOE. The price is not dollar, it is energy. The blue triangle with the question mark shows an energy amount. This energy is additonal energy, which was not required before the autumn of 2020. This energy must come from somewhere. Somebody must sacrifice his percentage of the BOE so that the oil producers can get it.

Why do you assume that “I interpret the price maxima and their fit line as the maximum the world economy can afford for oil.”?

Prior price maxima in your timeframe were temporary supply/demand imbalances and price volatility in a notoriously dysfunctional market, and did not cause any sustained economic contraction. Furthermore, these price peaks were not occurring at times of oil supply constraint.

The minima explanation is simpler : they are caused by OPEC actions.

The maxima are:

03.07.2008 143,95

02.05.2011 126,64

13.03.2012 128,14

08.02.2013 118,9

29.08.2013 116,91

19.06.2014 115,19

04.10.2018 86,07

25.04.2019 74,94

06.01.2020 70,25

11.03.2021 69,63

1. Most of them are caused by political action. Some are caused by speculation. Some are caused by economics.

2. Physics tells me, that the oil price has upper limits and must have maxima.

3. Most important: The maxima exist.

Berndt,

What is your reasoning behind Physics tells me, that the oil price has upper limits and must have maxima.?

Oil prices are more or less dictated by supply/demand, speculation, geopolitical tension, monetary and fiscal policy.

The only physics that comes into it is technical recoverable resource (TRR). I think.

I will offer a contrary view-

The upper limits of oil that the world can ‘afford’ have not been tested yet.

It would take a sustained average price above a certain level for at least 6 months with resultant decline in global economy activity to invoke the idea of reaching an unaffordable price.

But its a lot murkier than that- some places and some people will pay any amount for their oil products, and yet much of humanity will priced out of discretionary use at somewhere less than $100/b. For uses that are not discretionary, much higher prices will be tolerated by most who are currently consumers of the products.

And of course- higher prices will stimulate production from reserves that are now marginal.

The chart shows global airline passenger from 1970–2019. 100% of this travel is discretionary (sorry to burst anyones bubble on this). By the end of the decade we will see how covid and peak oil and other events affect this trend.

@Iron Mike

Sorry, but i can’t explain the derivation, the formulas and results here. It’s too complicated.

@Hickory

Thesis against thesis.

Limit reached against limit not reached.

Physics against economics.

We can’t solve that.

PS: The blue triangle in my last diagram is your “Gedanken Experiment”.

Iron Mike,

Berndt may be thinking that from a big picture perspective we cannot use more energy than we have available, and that observation is correct when we look at all energy that is available to society.

Where these types of analyses miss the mark is to assume this type of analysis applies to individual types of energy (say oil production). This would be true perhaps in a World where only energy derived from oil could be used in the production, refining and distribution of oil and for every input into each of those processes.

That is not the World as it exists so a more general analysis of all energy used by society would be required and it would indeed be a complex analysis.

Hickory —

It’s also worth mentioning that airlines don’t live to move passengers around. They are mostly a tax scam and operate private currencies, aka frequent flier systems. They idea that the world would come to an end if these useless entities went out of business is ludicrous.

https://www.youtube.com/watch?v=ggUduBmvQ_4

Dennis, you are wrong.

All energy types included in oil production are included in the oil price.

I have described that in detail in the book:

Die kurze Endphase des Ölzeitalters: Erdöl, Autoproduktion und Thermodynamik

ISBN-10 : 3347487311

ISBN-13 : 978-3347487314

available at amazon.

It is in german, not english.

The blue line of the following diagram shows the required exergy calculated using thermodynamics, and the violett line shows the exergy calculated using the oil price.

Because thermodynamics does not include all exergies of the oil production process, the oil price calculation gives higher values (as to be expected).

Berndt,

I would need a German speaker to comment on your book. The price of a product is determined by supply and demand in the short run, long term in a perfectly competitive market where business attempt to maximize profits the price will move towards marginal cost of production, but average costs can be very different from marginal cost and will depend on the cost curve of the entire industry relative to demand, price will be determined at the margin, both the physics and the economics are important.

Perhaps the main point is that oil does not need to provide any net energy to be useful as other properties such as its energy density can make it a useful product, just as electricity is useful due to its convenience. As long as the total net energy provided by all energy sources meets the needs of society, we are ok.

Dennis,

the oil price since the beginning of 2020 is determined by two things:

The Covid19 pandemie drove the price down

and OPEC, reducing the amount of oil reaching the market, drove the price up.

Only if that is generalized, so that all details vanish, the “law of supply and demand” is determining the oil price.

In reality, today OPEC is ruling the oil price.

The “law of supply and demand” always has been valid for the past. It is impossible to use it for correct prediction of the oil price. Despite the law can’t be used to correctly predict the price in two weeks, when the two weeks have passed, people will say, the law has determined the price.

Compare this prediction capability with a law of physics, for example the law of gravitation.

Excuse me, but the “law of supply and demand” is useless.

“As long as the total net energy provided by all energy sources meets the needs of society, we are ok.” No, its the other way: The needs of society adapt to the energy available. That is recognizable from the number of cars sold, which goes down since 2017.

Berndt,

The causality runs in both directions, supply adapts to demand and demand adapts to supply. Which blade of the scissors cuts the paper? I agree future demand and supply cannot be predicted and so future price cannot be predicted. Social science is far more of a challenge than physical science both because controlled experiments are impossible and because a theoretical understanding of society affects how individuals behave, thus changing society and rendering the theory obsolete. The only way to develop a social theory to avoid this second problem would be to not reveal the theory to anyone.

Price is always an interaction between seller and buyer, so saying one or the other is “the” cause of the price is not sensible.

OPEC does not rule prices any more than Covid-19, there are many things that will influence the price of oil both now and in the future.

Berndt . ” “As long as the total net energy provided by all energy sources meets the needs of society, we are ok.” No, its the other way: The needs of society adapt to the energy available. That is recognizable from the number of cars sold, which goes down since 2017.”

Very well explained . I will be use this in the future to help others in better understanding of our energy conundrum . Tks

Berndt,

Well said.

The price is determined by supply and demand, or rather, marginal supply price and the marginal demand price, when these 2 meet that is the free market price.

However, as you said, covid is decreasing demand amount and hence the marginal demand price. But we can do nothing about it.

The supply side is in the hands of opec or rather, the marginal supply is only with opec (plus is included). Till the point in time that opec supplies the marginal barrel of oil, i.e. it has spare capacity, it will be in control. Shale was in control from 2015-2020 but it will move from their hands to the Saudis, where all or most of opec spare capacity resides. That’s what the Saudis wanted and they got it with the stunt they pulled last year.

Let’s see how long opec spare capacity lasts. Till then opec or rather saudi will have power over the oil price. after they, they will also lose power over the price because of limitations on their ability to produce. The limitations of anyone (Saudis) to produce will be reached for the first time ever in history. Let’s see how oil price moves with that realisation in mind.

I am predicting OPEC Plus will lose control in Fall 2022.

One of my favorites Art Berman . Very interesting connecting the dots .

https://www.youtube.com/watch?v=r1ohXxKWiI8&t=3490s&ab_channel=RebelCapitalist

Very good interview.

Shows clearly that we are between a pair of teeth.

Collapse the economy, or burn to a crisp. Take your pick.

Like the Late Bronze Age collapse, it will happen, regardless.

Revision to Permian model to account for falling prices after 2028 assumed in my oil price scenario, well completion rate falls faster after 2028 than in the previous scenario and reduces total weels completed to 89000 wells from Jan 2010 to June 2032 (no horizontal oil wells completed in the Permian aftr June 2032 in this scenario). ERR from horizontal oil wells completed after Dec 2009 falls to 34 Gb. Most of the change in output is after 2028 compared to earlier scenario so peak is unchanged, just a thinner tail.

Using the Permian scenario above with my previous scenarios from Bakken, Eagle Ford, Niobrara, and other US tight oil (not in the big 4 tight oil plays) the chart below compares the new US tight oil scenario with the AEO 2021 reference case tight oil scenario. The new “DC” tight oil scenario has a URR of 59 Gb compared to the earlier scenario with URR of 69 Gb. EIA’s AEO 2021 tight oil URR is roughly 137 Gb from 2000 to 2060.

Note also that the oil price scenario that I use is very conservative so the 59 Gb would be an F95 estimate, if a more realistic oil price scenario was utilized (perhaps a maximum Brent price of $95/b in 2020 $ in 2025), tight oil URR would be higher than 59 Gb, perhaps in the range of 70 to 80 Gb.

Shale profile supply projection at link below

https://public.tableau.com/shared/6FDHZG3ZH?:display_count=y&:origin=viz_share_link&:embed=y

More explanation at

https://shaleprofile.com/us-tight-oil-gas-projection/

From Shale profile, a supply projection for US tight oil. This assumes no increase in completion rate and no change in rig efficiency or average new well productivity from Nov 2021 to Jan 2028. In reality the completion rate will increase while average new well productivity is likely to decrease (that is what I assume in my scenario for future tight oil output).

For this scenario from shaleprofile, tight oil output is about 9570 kb/d in Jan 2028. My scenario has US tight oil output at 9280 kb/d at peak in March and April 2027 with Jan 2028 output at 9170 kb/d. The shaleprofile projection has US tight oil output at 9386 kb/d in March 2027.

Dennis.

When these projections are made, are there any comments made as to how many locations are physically left in each county, for example?

I looked at Midland County, TX. The county is 900 square miles. It is my understanding that for two mile laterals that two sections are needed, so 1.280 acres. This means if the entire county was divided into 1.280 acre drilling units, there would be 450.

Per shaleprofile there have been more than 3,000 horizontal shale wells completed in Midland County, Texas. How many wells can be drilled per 1,280 acre drilling unit before the problems LTO Survivor has mentioned become an issue?

I assume you have reviewed some granular studies on how many locations are actually possible and at what point well communication becomes a serious problem.

It seems like maybe these projections don’t take into account how many locations are actually left, and how productivity per well may decline as tighter spacing necessarily occurs.

I know this subject has been discussed here many times. Maybe someone has done the math by actually identifying each drilling unit, looking at the number of wells already completed, and estimating the number remaining? Maybe this in depth study would be proprietary? Maybe shaleprofile has this in its subscription service?

Shallow sand,

At shaleprofile I do not think the number of locations are taken into account. David Hughes looked at this for Bakken and Eagle ford and I have done so for Permian basin based on USGS studies. One thing to keep in mind for the Permian is that there are several different “benches” or horizons that can be drilled. Lets assume for simplicity there are at least two viable benches on average in Midland county, each 2 section unit can have 4 10000 foot wells in each bench. so 8 times 450 or about 3600 locations.

According to USGS Permian basin assessments (see link below)

https://www.usgs.gov/centers/central-energy-resources-science-center/science/permian-basin-oil-and-gas-assessments

There are about 50 million net acres of undiscovered resources in Permian (Midland and Delaware basins), of these the highest productivity benches have about 30 million net acres to be developed (as of the end of 2018). Based on comments by LTO survivor the optimum set up is a well spacing of 1320 feet, if we also assume average lateral length of about 9500 feet we have about 273 acres per well on average, so 30 million divided by 273 is 110 thousand potential locations, in my Permian scenario has about 68.5k wells completed after Dec 2018, economic limitations based on my assumed oil price scenario leads to only 62.2% of potential locations being developed.

Note that from Jan 2010 to Dec 2018 roughly 21k horizontal oil wells were completed in the Permian basin.

I do not have access to the full potential of shaleprofile as it is quite expensive for a full subscription ($3348/year), not really in my budget as this is simply a hobby.

The scenario from shaleprofile has a total of 25128 wells completed from Jan 2022 to Dec 2027, the assumption of no productivity decrease is clearly not realistic, but neither is a fixed completion rate for the next 6 years, the realistic scenario is a gradually increasing completion rate and a gradually decreasing level of new well productivity, that is how my model works.

My question ? Does it really matter how much shale can produce ??? The US refineries can’t use it so it must be exported at a loss . Not a very intelligent move as far as finance is concerned . Further the capacity of the foreign refineries to use shale is limited since all of them were designed before LTO came on line . What can you do with more production ( disclaimer : I know there will be no additional production , US peaked at 11.8 mbpd ) ? Send it to the SPR to replace what Biden released( sell 30 API and replace with 47 API, what a joke ) or flush it down the toilet ?

Hole in head,

There is plenty of capacity to handle the ligher tight oil throughout the World, it is very easy to refine. There are some who would like to stop the US from expoting any crude oil, if that becomes law, then there will be little point in any increase in tight oil output because US refineries can only handle about 5 Mb/d.

Many oil producers do not think this would be wise policy.

US peak C plus C output was about 12.5 Mb/d in Oct 2019 (centered 12 month average).

Your model for gradually increasing completion rate is due to your prediction that oil prices will increase during that timeframe?

Also, I do know there are multiple formations and benches within each formation. However, some of these have been very uneconomic to date. Also, it is my understanding there is communication between the benches and formations when it comes to fracks, such that maybe the multiple layered approach will not be as successful as initially hoped. For example, I think Encana’s (now Ovintiv?) “cube” completion efforts didn’t work out well at all. There were stories about that not working out in 2019. How are the RAB Davison wells doing now?

In any event, I think you have production falling off steeply after 2027. That isn’t all that far off.

I decided to look up the RAB Davidson lease. Encana drilled and completed 34 wells in their first “cube” design there. Those were completed in 2016 and 2017. Those 34 wells were all active in September and produced an average of 621 barrels per day, or a little over 18 BOPD per well.

So, I think is apparent 34 wells per 1,280 unit is too many, at least without much higher oil prices.

I note in reading about this Concho tried 23 wells in the Delaware Basin in Lea County. Those were completed in 2019. They are already down to 41.5 BOPD per well in 9/2021.

It looks like OXY has figured out 5-6 wells per unit is best. Likewise, even though Encana (now Ovintiv) still uses the term cube, a cube can be as few as six wells.

I suppose if oil gets well over $100 it might be worth it to drill on tighter spacing? Is that the idea?

Shallow sand,