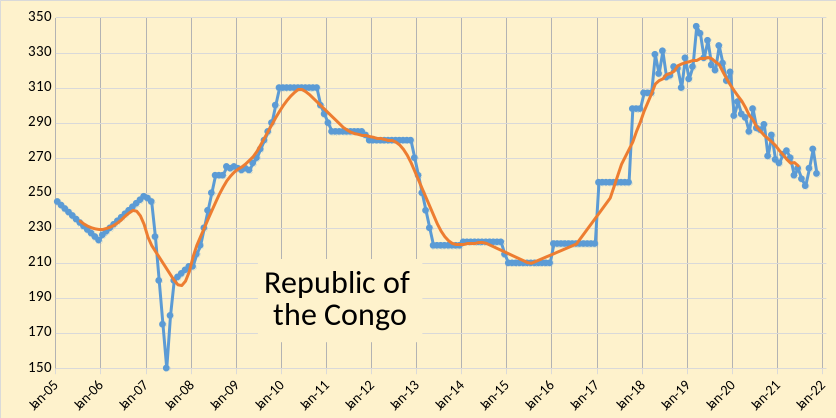

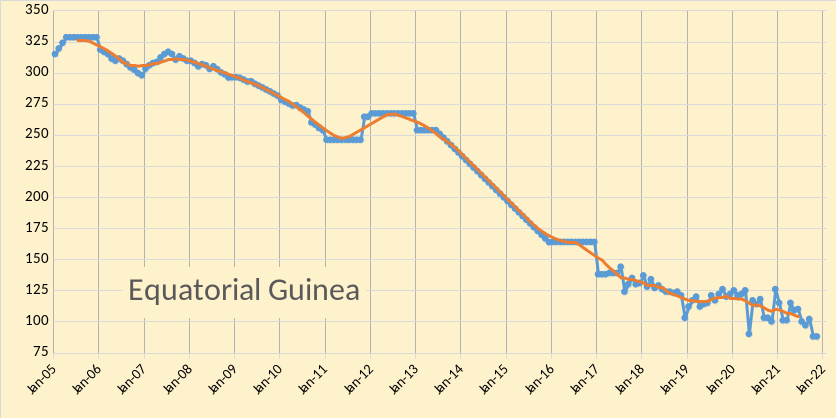

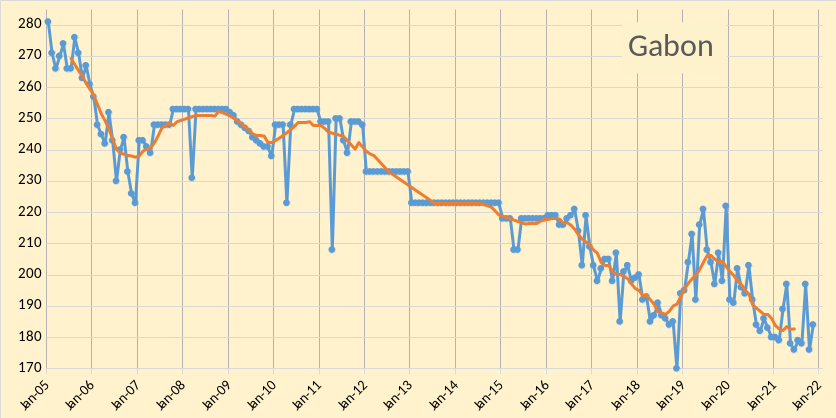

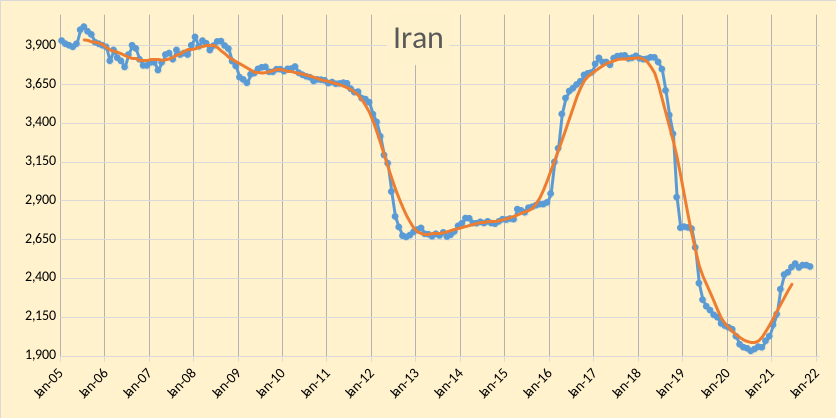

The OPEC Monthly Oil Market Report (MOMR) for December 2021 was published this past week. The last month reported in each of the charts that follow is November 2021 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

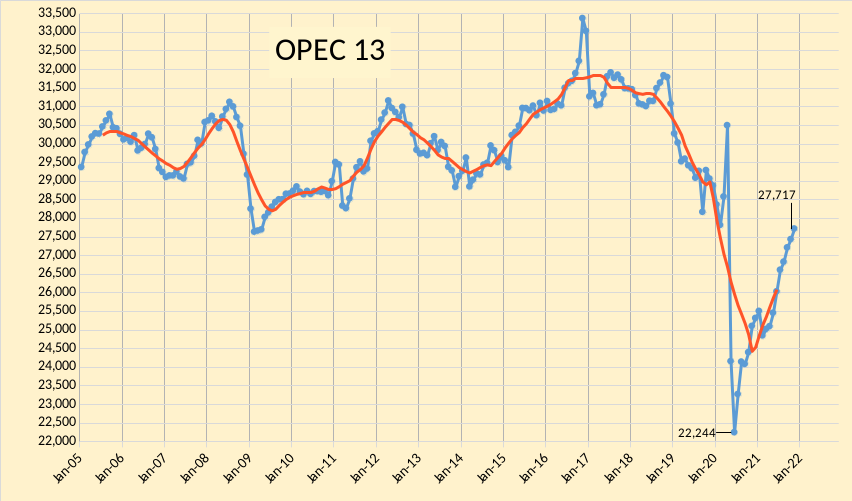

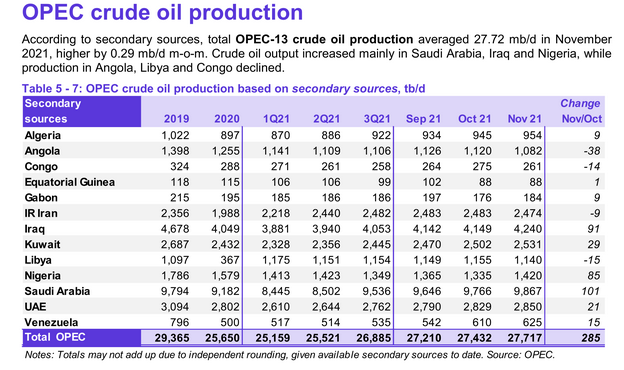

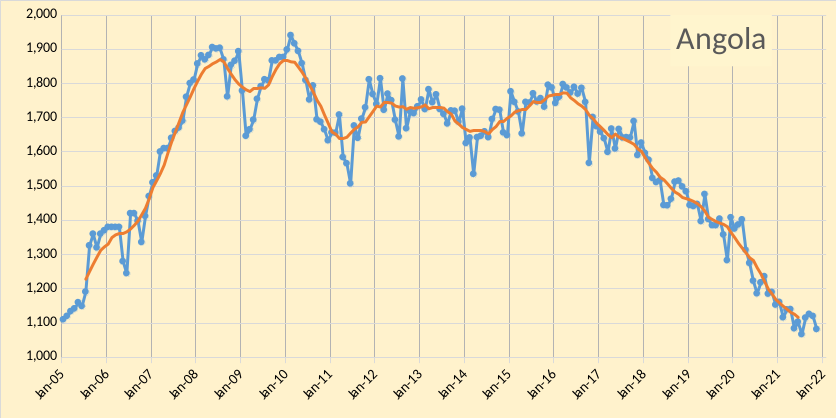

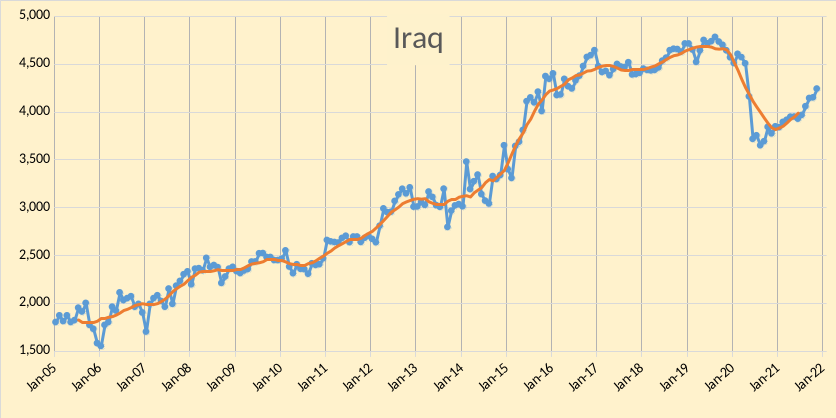

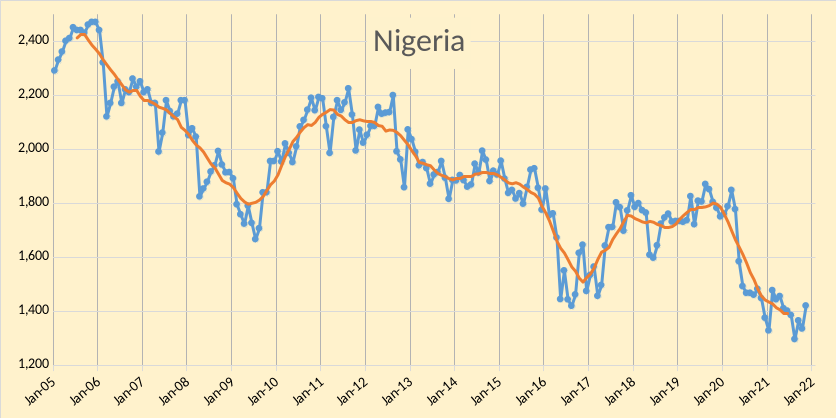

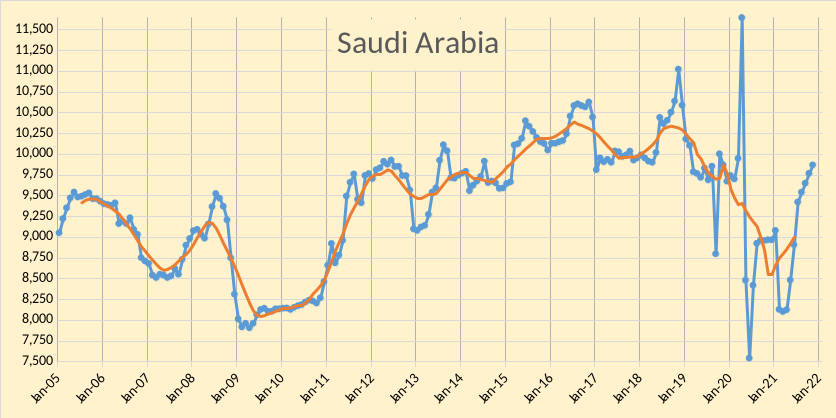

OPEC produced 27717 kb/d of crude oil in November 2021 based on secondary sources, an increase of 285 kb/d from October 2021. October 2021 output was revised lower by 21 kb/d from what was reported last month and September 2021 output was revised down by 26 kb/d compared to the November MOMR. Most of the increase in OPEC output was from Saudi Arabia(101 kb/d) followed by Iraq (91 kb/d), and Nigeria (85 kb/d). Six other OPEC members saw increases of less than 29 kb/d in November 2021. Decreased output from Angola (38 kb/d), Congo (14 kb/d), and Iran (9 kb/d).

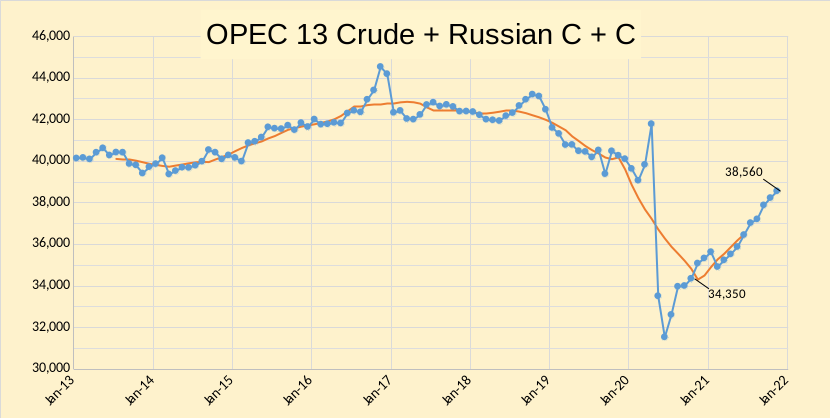

OPEC crude plus Russian C + C output was 38560 kb/d in November 2021, this is 1543 kb/d below the December 2019 level (40103 kb/d). The most recent centered 12 month average was 36490 kb/d in May 2021. In the past 12 months OPEC 13 crude plus Russian C+C has increased by 3475 kb/d. My expectation is that Russia, Saudi Arabia, Iraq, UAE, and Kuwait may be able to increase their combined output from the November 2021 level by about 1610 kb/d, raising OPEC plus Russian output to about 40165 kb/d or to slightly above the December 2019 level of output. Potentially Iran could also raise output by 1300kb/d over a 12 month period after sanctions relief from the US. Currently I do not expect this will occur based on reports on talks with Iran about the JCPOA.

World liquids output increased by 0.88 Mb/d in November 2021 to reach 98.28 Mb/d, this is about 3.2 Mb/d less than liquids output in November 2019 (101.5 Mb/d). OPEC crude output was about 1.2 Mb/d less in November 2021 than two years earlier (27.7 Mb/d vs 28.9 Mb/d).

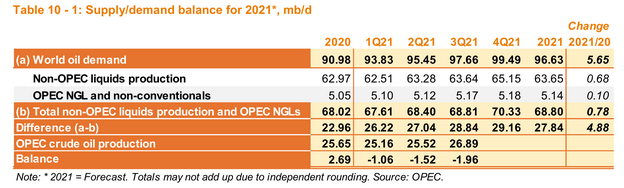

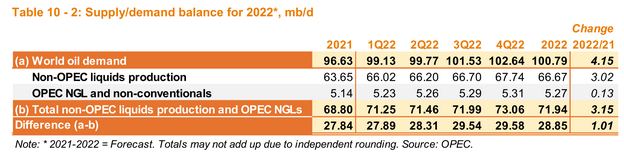

There is a poor estimate of future Russian liquids output in the December MOMR where output increases by 680 kb/d in the first two quarters of 2022. For comparison, from 2021 Q1 to 2021 Q4 ( over a 3 quarter time span) output increased by 680 kb/d or 227 kb/d per quarter. A more reasonable estimate would be a 453 kb/d increase in Russian output over the first half of 2022 (227 kb/d per quarter). Making this adjustment increases the call on OPEC to 28 Mb/d for 1Q22 and to 28.54 Mb/d for 2Q22, assuming demand estimates are correct and other non-OPEC supply estimates are correct.

OPEC might be able to increase output to as much as 28.5 Mb/d for 1Q2022 and meet the call on OPEC for that quarter and they could also meet the call on OPEC for 2Q2022 of 28.54 Mb/d, by the third quarter of 2022 OPEC will fall short by 615 kb/d and possibly by 815 kb/d because they have likely overestimated Russian output by at least 200 kb/d for 3Q2022. See MOMR Appendix for breakdown of non-OPEC supply for 2022.

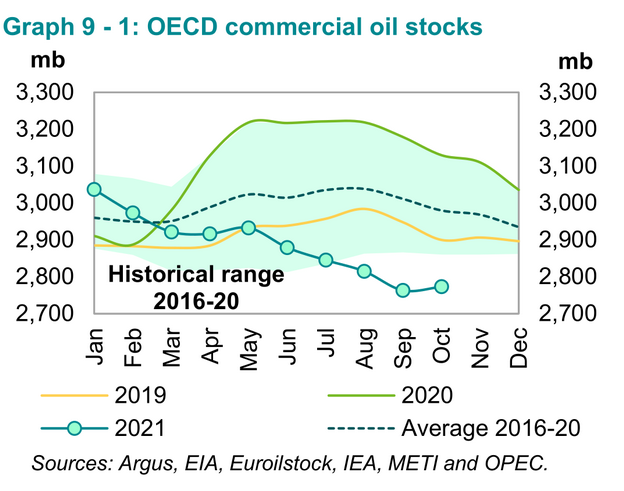

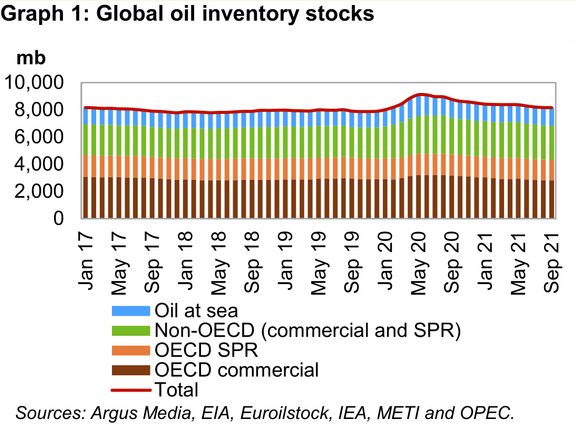

OECD commercial stocks rose by 9.9 million barrels in October to 2773 Mb, this is 207 Mb below the 5 year average and 174 Mb below the 2015 to 2019 average. Typically low stock levels put upward pressure on oil prices. Unfortunately we do not have a very good estimate of non-OECD stocks, but based on the November MOMR report on World stock levels, it looks like non-OECD stocks are at about 57 days of forward consumption vs OECD stock levels of 94 days of forward consumption, the stocks need to rotate to non-OECD nations and until that occurs there will be upward pressure on oil prices. I have assumed about 8500 Mb for total World stocks for 2021Q3 based on the November MOMR chart, reproduced below.

Ron

This image has been shared on social media. A picture is worth a thousand words.

Saturation.

Lightsout . Tks buddy . That looks like a cancerous cell image to me . It seems the cancer cannot spread further ( no more places to drill ) . You just confirmed what Ron and others like have been spouting ( along with the Russia situation ) for over the last year . Excellent find .

Lightsout,

Wrote this in 2019, seems relevant again.

https://aktiertips.se/northern-ghawar-water-and-production/#more-214

Check out water saturation, and dates. Then draw the obvious conclusion.

That water cut is for the very northern part of Ghawar. Ghawar is long. This leads to the question of what are the water cuts for the other parts of Ghawar?

From Twilight in the Desert, the further south you go, the less conducive the oil formations are for producing. From what Matt Simmons was trying to get across was that the Saudis were going to proceed southward and harvest the oil as they went along. The northern part would be harvested first and the southern part would be harvested last. With wells all along Ghawar, I’m not so sure of my interpretation.

Seeing the decline in production is not surprising. I think Ghawar reached a peak production in 1985(?). But I know the Saudiis have other fields that are producing to try to make up for the decline.

Seeing the decline in produced oil storage is of real concern. Thank you all for what you are doing!!

Happy Holidays to you all!!

Peterev,

Exactly, the northern parts were of course produced first as they were of superior quality. The field is actually 4 fields separated by faults and different rock quality.

The northern part is today more or less done, it will be a massive amount of water produced per barrel produced. This is something that they can handle as those facilities is in place and such massive investment was economical due to the size of the field. But today in northern parts it will be water with specs of oil in, northern parts are at the very end.

Southern will produce for a good while longer. But this is also a reason why the ipo came as a shock to most people when the 3 mboepd number was revieled, as everyone had just been repeating the 5 mboepd number that was considered the production level for what 20 years without applying effect of time and common sense to that number.

So basically, Saudi Aramco has to rely on other fields to make up for any Ghawar shortfall or pump more from more difficult to extract parts of Ghawar. In either case, Ghawar is past peak and we have to transition to alternatives to make up for the shortfalls.

So the blue is water, green is oil/water mixture, and red is oil? And when they started extracting oil from Ghawar, all of it was oil?

I’m guessing the answer is “mostly yes.” Oil floats on water, and water was always part of the original formation, but since the 90s or so they have injected massive amounts of sea water into the rock, driving out the oil. Now horizontal wells sit on top of that fragile remainder of “red” in the picture. Oh. Fuck.

Colours look like elevation markers to me

Thanks Dennis for all the effort inspite of all the disagreements we have . Take care and be well .

Hole in head,

You are most welcome. I like different points of view, though perhaps my tone sometimes suggests otherwise.

My apologies if I come across as rude in some cases. Happy holidays.

You are anything but rude! You put many of us to shame….

Mike B,

Thanks, I try not to be, but do not think I always succeed.

Dennis, as someone who disagrees with you often, I will say that I have never seen you be rude. Quite the opposite.

Niko,

Well I guess I assume I come across as either rude or annoying to others. My explanations sound like lectures I guess and it makes it seem as if I think I know everything, which is quite far from what I believe.

I often seem to inspire rude responses from others so I assume that to those people my comments are offensive. Hard to know what is in the minds of others and often I type something quickly without considering carefully how it might be misinterpreted by others.

Typically when I ask questions or explain myself in detail, I am simply trying to learn from others, if I explain the details of my thinking clearly others can point to things I have missed. When I don’t understand something someone says, I ask questions and perhaps these are too pointed in some cases and I offend.

It’s good to be self-aware Dennis, but don’t take it too far. That way lies madness.

FWIW, I think those who get annoyed with you are more often annoyed not because you are offensive, but because they disagree with the assumptions which feed into your analysis, and because you tend to refer back to that analysis endlessly. That can be very frustrating for those with a different view.

Niko,

Probably true. Often the argument runs along the lines that the USGS studies are not to be believed, for my Permian Basin analysis I only pick the best areas (those with the highest EUR per acre) and eliminate about 40% of the prospective net acres in the 3 USGS assessments of the Permian Basin (I use 30 miilion acres of the 50 million acres proposed in the USGS studies and reduce undiscovered TRR from 70 Gb (USGS mean estimate) to 50 Gb for my best guess estimate. For comparison the USGS F95 estimate for Permian UTRR is about 40 Gb, so my estimate is pretty conservative. The USGS F5 estimate for Permian UTRR is 110 Gb (they believe there is a 95% probability the UTRR will be less than 110 Gb and a 95% probability it will be more than 40 Gb with a 90% probability the UTRR will fall between 40 and 110 Gb.)

Of course when I do not explain in enough detail, I am accused of having a “black box” model, such as the oil shock model by Paul Pukite, the details of which can be found in a university library as in link below.

https://ursus.maine.edu/search~S1?/Xmathematical+geoenergy&searchscope=1&SORT=D/Xmathematical+geoenergy&searchscope=1&SORT=D&SUBKEY=mathematical+geoenergy/1%2C3%2C3%2CB/frameset&FF=Xmathematical+geoenergy&searchscope=1&SORT=D&1%2C1%2C

Algeria, Iraq, Kuweit, UAE and SA have their output steady increased the last months. They are the only ones in OPEC that still have reserve capacities – they are mostly the countries with the biggest reserves, too.

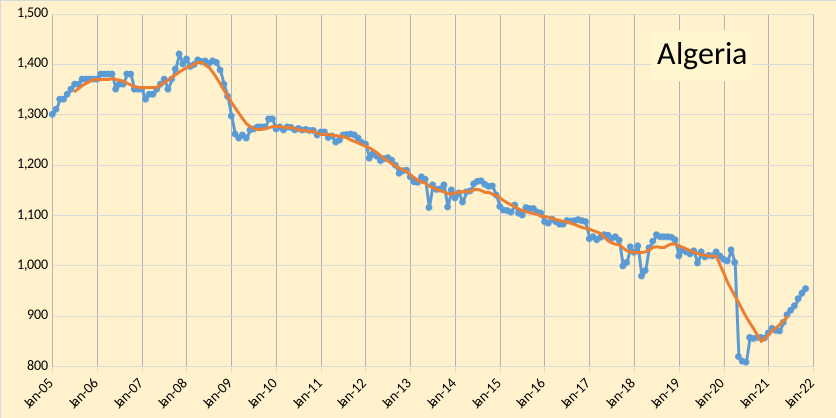

I don’t know how you got Algeria in that group. They certainly don’t belong there. Algeria is in terminal decline with no spare capacity and very little production. They have been recovering from their Covid cuts but have almost reached their production limit as the line on the chart below shows.

Eulen , yes but all except KSA are below their 2019 figures . In 2020 all had cut output to put a floor on price which was plunging . Hey , but KSA is selling from inventory . Someone posted about KSA inventory a couple of posts ago . As to reserves , I will ask Ron to take the call on this . He has blown the fraud on this earlier and I am sure he will love to do it again along with the cartoon he posts .

Hole in head,

The must have very large inventories. Lets see in the past 12 months Saudi Arabia has produced 3.5 billion barrels, but most of it is coming from stocks, that is a big stockpile, especially considering that OPEC estimates total World petroleum stocks are about 8 to 9 billion barrels, so I guess the Saudis hold over a third of this.

Do I have that right? Can you produce a reliable source confirming this?

Dennis , I think though not sure but Seppo had posted somewhere the world inventory going from 3.1 billion barrels to 2.9 billion barrels over the last year . Maybe Seppo will read this and revert . As to the Saudi’s use of inventory to mask decline was Rationalluddite ( again not sure ) . Really would have to go thru the posts of the last 3 months to search .

Dennis , I did not say that all they sold to the market came from inventory . What I implied was that some portion of their sales came from inventory . Just clarifying . A case of bad communication here .

Hole in head,

Yes misinterpreted sorry.

OPEC and OPEC plus production and quotas

Thanks for the work Dennis, always appreciated.

Putin: The feasibility study of a gas pipeline project from Russia to China through Mongolia will be ready in the coming week

According to the President of Russia, the optimal route and length of the gas pipeline have already been determined

MOSCOW, December 16. / TASS /. Russian President Vladimir Putin is pleased with the progress of the project to build a gas pipeline from Russia to China via Mongolia. Speaking to reporters with a statement following the Russian-Mongolian talks, the Russian head of state said that a feasibility study (FS) for this pipeline would be ready in the coming weeks.

“In practical work – a project to build a transit gas pipeline through Mongolia from Russia to China. Work is progressing, and is moving forward successfully,” Putin said. In his opinion, this gas pipeline “may become a continuation of the Russian Power of Siberia – 2” pipeline.

“The optimal route, length and other parameters have already been determined, a feasibility study is being prepared. I think it will be ready in general in the coming weeks,” the Russian president said.

The Soyuz Vostok gas pipeline will run through Mongolia and will become an extension of the Russian Power of Siberia-2 gas pipeline, the export capacity of which may exceed the capacity of the Power of Siberia gas pipeline by more than 1.3 times. Construction work on the project may begin in 2024.

On December 5, 2019, Gazprom and the Government of Mongolia signed a Memorandum of Understanding, which provides for a joint assessment of the feasibility of implementing a project for pipeline gas supplies from Russia to China through Mongolia. In April 2021, a feasibility study for the construction of the Soyuz Vostok gas trunkline was approved. The feasibility study for the gas pipeline construction project includes a detailed calculation of investment and operating costs; it is being prepared by the special purpose company Gas Pipeline Soyuz Vostok.

PS Initially, another option was considered for the route through the Russian-Kitpai border (in Altai) But there is a difficult mountain route, the absence of roads in settlements, reserves.

From Mr Shellman . He never disappoints .

https://www.oilystuffblog.com/single-post/the-binge?postId=2afb1d74-471f-429f-be16-d0f75059cce2

It’s worth the look just for that “Drilling Binge” chart (and Mike’s jeremiad tone). Holy crap.

Very well written, something the average lay person can understand. Wonder what was the vote tally that repealed the export ban.

The initial vote in the house of representatives was 261 to 159.

https://babin.house.gov/news/documentsingle.aspx?DocumentID=458

That stalled in the senate and later the bill passed both houses as part of budget reconciliation. Republicans allowed an extension of renewable energy tax credits in exchange for ending the export ban.

https://www.bloomberg.com/quicktake/u-s-crude-oil-export-ban

It was mostly republicans in support of the end of the crude export ban.

Another home run by Mr Shellman . Scroll thru the comments section especially . Love this .

https://www.oilystuffblog.com/forum/forum-stuff/reserve-replacement

Some people here, despite having an interest in energy issues, have some profound misunderstandings.

To correct a statement from the last oil post 5 days ago, and in the spirit of presenting facts rather than opinion

“Also the Brits thought they had excellent offshore wind resources until they turned out to be not excellent”

To the contrary, the wind reserves of offshore N.Europe are world class outstanding- they just need to be developed. Its like Texas or Saudi after only 2 wells had been drilled.

The offshore wind energy production will blow the nuclear and onshore wind energy production out of the water (far outstrip) over the next couple decades for most of the N European countries.

If factual information is of any interest in regard to the only real bright spot in the European energy future north of the Alps, here is a treasure trove of geographically based info.

https://globalwindatlas.info/

Note that average annual wind speeds at hub height greater than roughly 6.5 m/s on land and 7.5 m/s offshore are currently economically viable and are thus energy reserves- like a ripe fruit waiting to be plucked.

For individual offshore country analysis here is a gift of great information- https://esmap.org/esmap_offshorewind_techpotential_analysis_maps

(click on the country of interest on the map)

For example- The current offshore wind reserve of Finland is estimated to total 302GW if fully developed with the current generation of turbines. That is roughly equivalent to the electrical output/yr of 100-120 full size (1000MW) nuclear reactors, conservatively.

And for UK- the wind reserve total offshore is 1,800 GW- roughly 6 times that of Finland.

And lastly, all things ‘Wind Europe’- https://windeurope.org/about-wind/daily-wind/top-countries

Lets recall that current production does not equate to reserve status or future production, whether on the upside for solar or the downside for coal or oil.

Hicks . ” To the contrary, the wind reserves of offshore N.Europe are world class outstanding- they just need to be developed. ”

Not important . If the crude in Ghawar does not get into the tank of Joe Six-pack in Montana it’s value is nothing more than the sands of Sahara . What matters is not the size of the tank but the size of the tap . The ” if ” part has been addressed by Ron and me to all the forecasts of Dennis so no need to elaborate . The rest of your post and the scenarios therein only work if we have nett surplus energy . Unfortunately we are 6 years past ACP , over NG and peak coal next year as per Doug’s post on the other thread . I am not going into quality issues of oil and coal because they indicate we are over tipping point and at best doing ,what Rune calls the ” red queen ” on the total energy mix .

P.S : I need to loose 10 kg and all I ” just need” is to get my a*** out of the chair .

Hey, its up to you and a couple hundred other northern European residents to decide whether or not it is important to develop the domestic energy sources available.

You do have alternatives to developing the huge offshore wind resource. I’ll list them for you in case you’ve lost perspective

1. rely entirely on imports from Russia and the middle East. [This will be much more expensive in the post-peak era, and will likely be unreliable for too long. You will be competing with the Asians for that oil, gas and coal]

2. build hundreds of nuclear reactors. A few dozen a year few should be a good start.

3. burn the forests. that will give a few years of warmth.

4. run huge electric transmission cables up from solar generating facilities in the Med/Saharan zones [if they’ll willing sell the energy to you- I suspect they’ll be using most of it domestically].

5.deploy wind turbines

6. downsize the economy/population very rapidly, to match the decline in available energy

Its a tragic mix of choices.

Ignore the wind option if you would like to adhere to your 20th century outlook on this.

You have plenty of company- That is the attitude and current path of most of the world.

Hicks , you are one of the commentators with a round head on square shoulders . First let me quote Brendt from the last post and my response . I never knew it would come in such a short period .

“Berndt . ” “As long as the total net energy provided by all energy sources meets the needs of society, we are ok.” No, its the other way: The needs of society adapt to the energy available. That is recognizable from the number of cars sold, which goes down since 2017.”

Very well explained . I will be use this in the future to help others in better understanding of our energy conundrum . Tks .

So from your bullet points 1to 6 the only option is number 6 . Just as peak oil is a predicament then so is overshoot . Malthus ,Catton , Paul Elhrich warned us , but nobody was listening . Time to pay the piper . I agree with you ” a tragic mix ” . Number 6 is not an option by choice or desperation , it is the only option by default . Tragic , yes but then ” predicaments don’t have solution , they have only results ” .

P.S : Write off Asia . China is wobbly with a single default of Evergrande and in India 2/3 of the population survive on 5Kg of wheat / rice provided free per month for a family . Who is left ?Pakistan , Sri Lanka .? The future is not globalisation . The future is ELP ( Economise, Localise, Produce) . Who coined ELP ? I have forgotten but I think it was Richard Heinberg . Long supply chains will not work at the twilight of the oil age . Mankind will be forced to adjust to dwindling energy resources . TINA ( There Is No Alternative ) . This is our future . ”

In 1944, 29 reindeer were introduced to the island by the United States Coast Guard to provide an emergency food source. The Coast Guard abandoned the island a few years later, leaving the reindeer. Subsequently, the reindeer population rose to about 6,000 by 1963[6] and then died off in the next two years to 42 animals.[7] A scientific study attributed the population crash to the limited food supply in interaction with climatic factors (the winter of 1963–64 was exceptionally severe in the region).[1] By the 1980s, the reindeer population had completely died out.[2] Environmentalists see this as an issue of overpopulation. For example, ecologist Garrett Hardin cited the “natural experiment” of St. Matthew Island of the reindeer population explosion and collapse as a paradigmatic example of the consequences of overpopulation in his essay An Ecolate View of the Human Predicament.[8]

ELP was coined by Jeffrey Brown, “westexas,” whom I miss hearing from.

Thanks Mike B . Would love to have him back plus some others like Rockman , Rasputin etc .

That is ELM

Hole, et al-

there is a big different between being hopeless and despondent as you are (if I understand the position you stand on correctly),

vs advocating for doing nothing adaptive or innovative.

Hole in head,

Every statement about the future in involves if statements. So not a criticism of any weight in my opinion.

It is a case of the pot calling the kettle black.

Both you and Ron also have ifs, so what?

@Hickory ”The offshore wind energy production will blow the nuclear and onshore wind energy production out of the water (far outstrip) over the next couple decades for most of the N European countries.” That’s clearly impossible due to the the fanciful nature of the wind power supply. Below, you have the production of electricity in Germany with the pale blue and dark blue representing respectively electricity coming from onhsore and offshore wind turbines. How the grid managers can cope with that? How a regular economy can cope with a messy energy supply? German industrialists have warned that if the electricity supply was to become a mess, they would leave Germany and go elsewhere where the electricity supply is regular.

https://www.agora-energiewende.de/en/service/recent-electricity-data/chart/power_generation/20.11.2021/20.12.2021/today/

Regular (I guess that means even in this case) or cheap? But I guess they could buy some quick-built and cheap reactors from Areva? /S

For the unfamiliar, read up on Hinkley point C and Olkiluoto 3, regarding grid stability look into HVDC.

Edit: because I don´t think the industry is willing to pay more for electricity than it absolutely have to.

Areva is also proposing a gen 3 model rated at 1100 MW (ATMEA). Then, less costly to build.

On variable sources of electricity- “How the grid managers can cope with that? How a regular economy can cope with a messy energy supply?”

It will be hard work compared to a managing source that is on 100% of time, obviously.

[Lets remember that even nuclear plants generally have capacity factor of roughly 80-90 of the time-not 100%, and worse if they have problems]

Across the world the grid managers are struggling to learn how to make it all work better, and yes there is a long way to go.

Nonetheless it is a hell of better to have variable energy source to manage than a constant shortfall.

Long duration energy storage mechanisms, like pumped hydro or hydrogen, will be used to help even out the load vs demand.

And perhaps some of these northern European will decide to go faster and further with nuclear energy as well, but even so they will need to get on with the wind deployment fast. No one solution is going to replace the energy we have all become used to.

Pumped hydro is only intraday storage for a few hours. You’ll need deep hydrogen caverns, + a complete infrastructure of modified gas plants ( or hydrogen cells). That’s not cheap, and not fast to build either. And you need a hell more wind turbines to create the reserves, since you’ll have to fill the storing losses.

Otherwise, you’ll have the problems we have now here in Germany:

https://energy-charts.info/charts/power/chart.htm?l=en&c=DE&stacking=stacked_absolute_area

At this chart you see pumped hydro at work, it’s the light blue. They are loading up in the night.

We have cold sunny calm weather at the moment.

Wind is build strong enough to deliver more than 50% of complete load – if there is wind. Lot’s of these turbines sit at the north sea, which is not a bad wind area.

Still, doubling won’t help much in the moment.

The result you can see here, the current spot market prices – they are between 30 and 60 cents at the moment:

https://energy-charts.info/charts/price_spot_market/chart.htm?l=en&c=DE

(When the wind is blowing they are between 0 and 5 cents normally).

These are base prices, luckily we have fixed tarifs here. Otherwise loading a tesla would be much more than 100$ – there come a lot of taxes and clean energy distributions on top of these prices.

Eulenspiege-

certainly these things like electrical or hydrogen storage, and transmission, and generation beyond coal are going to take time, money and sense of urgency to get done. So would building many dozens of nuclear plants.

Use the time of nat gas wisely. It won’t last forever.

And regarding the management of an increasingly complex grid and variable sources of energy- managers will learn to handle it much better. Probably the hard way.

That is going to be painful during heat waves or arctic spells.

I wouldn’t advocate retiring coal or gas burners anytime soon, but they can be turned down when electricity is available form other sources.

” Man’s gotta know his limitations ” Clint Eastwood in Dirty Harry .

https://notalotofpeopleknowthat.wordpress.com/2021/12/20/power-when-you-need-it-not-with-wind/

Dennis,

There is an absolutely fascinating ‘story’ being played out right now in your area regarding electricity – specifically cost and looming scarcity.

If you are somewhat familiar with your region’s ISO site (or wish to learn … no better time than now and in the coming weeks), the ongoing data is showing nosebleed prices that are clearly intertwined with temperature, dearth of wind, and plunging temperatures.

In similar fashion to our European friends, New England is on the cusp of experiencing a white knuckle ‘ride’ – energy wise – as winter is just getting underway.

Coffeguyzz , what is surprising ? I posted about “The Olduvai Theory ” a couple of posts ago and was given a tough time . Understand the three basic legs of what we call as industrial civilisation are oil , electricity and metals . Oil is the key . Once oil goes so do the other two legs of IC . We are now 6 years past ACP (After Current Peak , tks West Texas fanclub for the acronym ) . The great unraveling has begun . See how fast the CC narrative has changed by the governments worldwide . Read this on the Non Petroleum thread . All are rushing to burn coal . Fascinating for those who believed in the “tooth fairy ” , nothing fascinating for those who live in reality . Coming from Netherlands . NG storage was 60.1% exactly a month ago today it is 43.7 % . By mid Feb we (Benelux) are out until and if Mr Putin is not kind . Grab some popcorn .

HIH,

Regarding New England’s electricity situation in particular, it is not at all surprising to those who have been closely following … rather it is instructive to the nth degree.

Tomorrow’s cost for New England’s wholesale electricity – at this time of day – is about $128/Mwh.

Neighboring New York is ~$50 per and PJM is ~$43/Mwh.

The biggest differences (of several) is New England’s scarcity of nat gas and the dramatic increase in reliance on both coal and oil (!) to generate power.

There. Is. Virtually. No adequate replenishment for the coal and oil when it is consumed … and winter has yet to arrive.

(The 1,100 Mw dropoff in 14 hours from wind generation – the equivalence of 1 of that region’s 3 nuke plants – is greatly magnifying the precariousness of this situation).

Bob Meltz,

You asked about a scenario for tight oil with a more consistent confidence intervals from 2025 to 2040.

I redid my scenarios with the maximum oil price at $75/bo for Brent in 2020$ from 2022 to 2028, the ratio of high to low scenario is about 1.26 to 1.37 (about 1.28 at peak). I use a log scale in chart which corresponds to ratios better.

Thanks Dennis,

That’s still an awfully tight range of URRs by 2040. How would you have to change your model to have, for example, something closer to a 2:1 ratio between your upside and downside cases? By the way, what is the current cum production for US tight oil?

Bob Meltz,

From Jan 2010 to Oct 2021 cumulative output of tight oil is about 18.7 Gb.

The reason for the tight range is that all assumptions about TRR, oil price, etc are the same for the three scenarios. The what if question being asked here is how do the scenarios change if the completion rate is different. A more realistic confidence interval would consider different TRR (as in your GOM scenarios), different oil prices and different completion rates.

Also note that the URR estimates are from 2010 to June 2046.

As to getting 2 to 1 ratio, a simple way to accomplish this is to assume different TRRs for the scenarios and different oil prices.

I could try this as well, in steps, first price and then maybe TRR.

These scenario assume only a change for Permian basin (to simplify things for me), Permian basin scenario is in the range of 31 Gb to 39 Gb, TRR assumed to be 55 Gb for all scenarios and oil price scenario identical, these could be changed, do you prefer price or TRR?

Max price change to 50/b for low scenario to $100/bo for high scenario might get us to your 2 to 1 ratio. If not we could change TRR assumptions.

Also for Permian scenarios from Jan 2022 to June 2046, the cumulative output is 24 Gb to 32 Gb.

Thanks for the explanation.

Hi Bob,

I will try price first. TRR for permian I would use 45 Gb, 50 Gb and 57 Gb. I can definitely get to a 2 to 1 ratio. But my best guess for now is $85/b max Brent Price in 2020 $ and 50 Gb TRR for Permian basin. So I would revise my price scenarios to 75, 85 and 95 $/b in 2020$.

Correction, my best guess TRR for Permian tight oil is 55 Gb, so I would likely use a range of 50 Gb to 62 Gb for TRR.

Bob Meltz,

USGS mean undiscovered TRR (UTRR) estimate for Permian basin tight oil is 70 Gb with about 5 Gb of cumulative production and proved reserves at the time of the estimates (2016 to 2018).

The F95 UTRR estimate is 40 Gb and the F5 UTRR estimate is 110 Gb. I use a very conservative UTRR estimate of 50 Gb for Permian basin tight oil for the scenarios I have presented, this might be roughly an F80 estimate for UTRR, an F20 estimate might be a UTRR of 95 Gb.

Also my middle Permian scenario with URR of about 35 Gb is only about 46% of the mean USGS TRR of about 75 Gb for Permian basin tight oil.

Federal estimate of Bakken’s future oil potential lowered after thousands of wells drilled

A new report from the U.S. Geological Survey suggests the Bakken and Three Forks rock formations contain another 4.3 billion barrels of untapped recoverable oil, a 40% drop from the agency’s last estimate in 2013.

The decline is in part due to 11,000 wells that have been drilled into the formations in the last eight years, collectively producing billions of barrels of oil predicted in the earlier estimate.

“We weren’t all that surprised that the number went down,” State Mineral Resources Director Lynn Helms said Friday during his monthly press briefing on North Dakota’s latest oil and gas data. “I think we were surprised how much the number went down.”

The wells drilled into the rock formations have produced 4 billion barrels of oil to date. Helms said he anticipates the future output of those wells will consist of another 4 billion barrels. The USGS estimate released this week covers oil production anticipated from future drilling. Combined, those figures add up to 12.3 billion, which Helms characterized as “on the lower side” of his expectations for the formations.

A significant amount of drilling has occurred in the core area of the Bakken oil patch around Watford City. Helms said about 80% of what’s considered the best mineral acreage in the Bakken oil patch has already been drilled, and companies are looking to innovate in parts of the region farther from the center.

A typical oil well in North Dakota extends for 2 miles horizontally underground, but some companies plan to drill longer 3- or 4-mile wells in outlying areas to produce an amount of oil equal to wells in the heart of the oil patch, Helms said.

The USGS also revised down its expectations for natural gas production in the region. The 2013 estimate anticipated 6.7 trillion cubic feet per day of additional recoverable gas in the Bakken and Three Forks. The latest estimate puts the figure at 4.9 trillion cubic feet per day.

Helms said the Oil and Gas Division plans to take a deeper look at the USGS analysis in the future.

The state’s latest data released Friday shows that North Dakota’s oil production in October again held steady at 1.1 million barrels per day, where it has hovered for all of 2021. Daily natural gas production fell 1% from September to 2.998 billion cubic feet.

The oil and gas industry is capturing 94% of all gas produced, meeting the state’s target in place to reduce the amount of gas wastefully flared, often due to a lack of infrastructure. There are several parts of the Bakken where flaring is significant, however, and Helms said he plans to work with companies that have wells in those areas to try to mitigate the issue.

Ron,

The USGS estimate in 2013 had a TRR of about 12 Gb, the current estimate confirms this. One needs to add cumulative output and proved reserves to undiscovered URR to get a proper URR estimate.

Ron,

There have not been any new assessments of tight oil in the North Dakota Bakken since 2013, the newer assessments in 2020 were for shale gas and conventional resources, a bit of tight oil in Tyler formation, but only 0.125 Gb. See

https://www.usgs.gov/centers/central-energy-resources-science-center/science/williston-basin-oil-and-gas-assessments

In 2013 undiscovered TRR was about 7.4 Gb and reserves were about 3.2 Gb, so roughly 10.6 Gb of remaining resources at that point. From Jan 2013 to July 2021 about 3.4 Gb have been produced form North Dakata Bakken Three Forks, of the original undiscovered TRR roughly 80% was in North Dakota so in Dec 2012 North Dakota Bakken/Three Forks remaining TRR was about 9.1 Gb. At the end of July 2021 remaining TRR would be about 5.7 Gb. Note that at the end of 2019 about 5.4 Gb of proved tight oil reserves were in the North Dakota Bakken/Three Forks, about 0.6 Gb of North Dakota tight oil was produced from Jan 2020 to July 2021, so if there have been no additions to proved reserves in those 18 months, the remaining proved reserves would be 4.8 Gb, with the potential that 0.9 Gb might be added in the future, in fact it is likely that proved plus probable reserves (2P reserves would be the petroleum engineer’s best estimate) in the North Dakata Bakken/Three forks might be 5.7 Gb or higher as of July 2021.

Ron,

I was incorrect, there is a new assessment at link below by USGS

https://pubs.usgs.gov/fs/2021/3058/fs20213058.pdf

As of the report (published in December 2021) the mean estimate of undiscovered technically recovereable resources in the Bakken/Three Forks is 4.3 Gb with 90% confidence interval of 1.3 Gb (F95) to 7.3 Gb (F5).

About 3.3 Gb of tight oil has been produced from the Bakken Three/Forks up to Dec 2019 and proved reserves at that time were 5.5 Gb adding cumulative production proved reserves and UTRR gives us total TRR which is 3.3 plus 5.5 plus 4.3 equal to 13.1 Gb. This essentially confirms the 2013 USGS assessment.

Also note that my estimate of Bakken URR is about 7.4 Gb and my guess is that about 1.4 Gb of “proved reserves” in the Bakken Three/Forks may not be profitable to produce. This would suggest that all of the undiscovered technically recoverable resources in the 2021 Bakken/Three Forks assessment might not be developed. Note however that my Bakken scenario uses a low oil price maximum of $75/bo in 2020 US$. A higher oil price may result in a higher North Dakota Bakken URR than my scenario, I am doubtful that much of this undiscovered TRR will be produced, perhaps 1.3 Gb at most which suggests a URR of perhaps 10 Gb (if proved reserve estimates are accurate).

“In similar fashion to our European friends, New England is on the cusp of experiencing a white knuckle ‘ride’ – energy wise”

As coffeeguzz said, a white-knuckle energy ride is in store, and not just for a few months this winter and not just for a few regions- for everyone.

Most of the worlds citizens and decision makers have failed to grasp or digest are some of the major ramifications of what is beginning-

First- it is going to take a lot more money to keep the depleting oil and gas and coal energy production ‘spigots’ flowing. Collectively, a lot more money will have to be spent- just to keep running in place for a while,

and before long even more money will have to be spent just to keep the backsliding on supply from being too steep.

This money will come from your pocket, from your credit if you’ve got some, and from your savings.

You, and your relatives, and your neighbors and your state, and your country. That means there will be less money for other things- Other things that people are accustomed to or reliant on.

Secondly, a huge amount of money will have to be spent simultaneously on attempts to deploy all sorts of other energy mechanisms that aren’t on the verge of global depletion. There will be different options for different regions, but will certainly include a huge transition from personal combustion engines to electric motors vehicles, and generation from various sources like nuclear, wind, solar, geothermal (perhaps), and in yet 50 more years- fusion power.

And this will all require huge money expenditure. As will infrastructure like transmission and energy storage.

The point here is that we cannot continue to pretend that that we can take only one path at a time. These huge dual energy paths will need to be traveled ( and purchased) simultaneously.

At this point we are at least 20 years late on full-scale dual energy (fossil and non-fossil) adaptation to the time of post-fossil peak (roughly now). It has been much easier to ignore those who have been telling the story and instead spend money on other things, all less important. And easier to just pretend that the fossil energy was inexhaustible.

We won’t be making up that 20 (or 30) year delay. We will be playing a very sad game of scramble, with a few more billion people on deck than there was when this whole situation should have been taken seriously.

Despite the very late date there are still big choices on spending and goals that need to be made now.

Some regions, and companies, and countries will handle this much more poorly than others.

RWE of Western Germany warns of a possible natgas shortage at its power plants this winter

https://news.in-24.com/news/401637.html

Martin , welcome to the blog . Very interesting info for me based in neighboring Belgium and following what is happening in Netherlands with regard to natural gas . Please keep updating . Tks

A comment was made above regarding use of crude stocks by SA to boost output. There is some evidence of that in the two attached charts for very short time.

On September 2019, Abqaiq was attacked. Drop in stocks can be seen as they used them to maintain commitments to their customers

On April 2020, SA increased output to pressure other OPEC plus countries. A drop in stocks can be seen.

However since January 2021, stocks have been essentially flat.

https://peakoilbarrel.com/opec-update-december-2021/#comment-731810

Ovi,

What source do you use for stock data? It is not clear how good this information is. Generally petroleum stocks anywhere except the OECD tends to proprietary, the JODI database tends to be incomplete, though I have nort looked at ot for a few years perhaps it has improved.

The production amounts given by secondary sources is the oil produced which flows to stockpiles, some is consumed locally and some is exported and that will affect the level of stockpiles.

I question whether Saudi stockpiles decreasing to half of the Jan 2018 level is reasonable, though more history would be needed to know the “normal” level of stocks. For the World stock levels are approximately 8.5 billion barrels for yearly production of about 36 billion (all liquids) so roughly one quarter of annual production is held in stockpiles, Saudi production is roughly 3.6 billion barrels per year, but consumption is only 1.3 Gb per year and 25% of this would be 325 million barrels, it is surprising that petroleum stocks would be only 135 million barrels, but perhaps that is crude stocks.

In any case, my guess is that the secondary source production data is fairly accurate, and the stockpile data less so.

Dennis

I went to the Jodi site and it had the option of creating your own chart. So I selected stocks, SA, and the time period Jan 2018 to October 2021. I then requested that the data be downloaded.

What puzzles me is where did all of that crude stock go that was released from January 2018 to January 2021.

I have sent you the Excel file.

Thanks Ovi.

Dennis

As requested, more history.

Still wondering where all of that crude stock released from August 2015 to January 2021 went. Implies the world was consuming more than was being produced during that period.

Also note that the slope is not that different between the first chart and this one.

That looks a little strange to me. There was a stock build when the price came down in 2015 and they cut production. And in 2020 when the price crashed stocks were drawn. That looks like a cash flow problem.

Toby

The April 20 draw down is associated with the SA increase in output to 11,700 kb/d of crude. After that they cut back production, but oil deliveries were lower and the excess output went into increasing their crude stocks. After July, stocks started to drop again.

However I do agree that it would be insightful to have a full explanation of that huge draw down.

Correct. When they were back at close to 9 mb/d of production in august (secondary sources) stocks went down further.

In early 2021 production reported by secondary sources was a lot lower and stocks also decreased. Then production went up to almost 10 mb/d and stocks were flat.

So if production reported by secondary sources (tanker tracking data) includes the stock draws, that would mean that proction ist fluctuation a lot or Saudi consumption is.

I don´t think that data is really acurate.

Thanks Ovi,

I wonder how accurate the Jodi data is. In any case in my mind it is World stock levels that are important, there was a glut during 2020 and in 2021 stock levels have come down. From Jan 2014 to Sept 2021 Saudi crude stocks fell by 140 million barrels. When one considers cumulative World output of crude plus condensate from Jan 2014 to August 2021 (224 billion barrels), the Saudi stock change is a tiny amount (0.06%=140/224000).

To me, the “saudi selling from inventory” story is much ado about nothing.

Also note last figure in post where global petroleum stockpiles are about 8000 million barrels, current Saudi stocks (if Jodi data is accurate) would be 1.75% of the total.

Dennis

This discussion did not start because of world stock levels. The question that keeps coming up is whether SA uses its crude inventory to adjust its deliveries and production numbers. Since one cannot see deep into SA, this question keeps arising. As noted above, there appears to be two instances where stocks could have been used to make production levels look bigger. The stock change is not proof but only an indicator.

There is another case that also looks interesting. From September 2018 to November 2018, production (C “+”C) went from, 10,738 to 10,938 to 11,218 kb/d. This extra boost in production resulted in an extra 20,880,000 bbls of output. Over that same time period stocks dropped by 15,586,000 bbls (223,804,000 – 208,218,000). So while 20.9 M extra barrels were pumped, stocks dropped 15.6 M bbls or 74.6% came out of inventory. Coincidence or intentional. Who knows, but interesting.

Also note that Nov 2018 is our current peak oil. Maybe it really is about 480 kb/d lower using the SA September production of 10,738 as their previous peak. Also the SA September 2018 output level was the same as the previous peak of July 2016.

This raises the question of whether SA was trying to send a message that their production capability continues to rise.

A bit of speculation to add to the “What’s happening inside the KSA puzzle?”

Ovi , a very well defined post with all the figures and the correct questions .

Ovi,

Pretty sure the secondary sources have this figured out, ending stocks are previous period stocks plus production minus domestic consumption (refinery input and direct burning of crude) minus exports. The reported production is the oil produced that period.

Chart below looks at delta stocks each month vs delta production using data reported at JODI from Jan 2002 to Oct 2021for Saudi Arabia. Not really correlated.

Dennis

I was looking for particular situations when SA could have used inventory to mask production drops or to send a different message to the market. A general analysis over all time would not find a needle in a haystack.

Now that the stocks have stabilized in the 135,000,000 bbls range post January 2021, it may be easier to see anomalies.

Looking at the SA April output surge to 11,642 kb/d from the March output of 9,946 kb/d, the increase was 1,696 kb/d. In April SA stocks dropped 12,747,000 bbls, or 425 kb/d or 25% of the increase. The drop in stocks sticks out very clearly in the stocks chart above.

Looking at the distribution of the deviations above and below the OLS line, both September 2019 and April 20 stick out as anomalies. For me the coincidence is too big to ignore.

Ovi,

The explanation for either case (Sept 2019 or April 2020) would simply be that stocks changed due to Saudi Araamoco decisions. In Sept the attack on facilities slowed production so the flow into stocks decreased and stock levels decreased, so that one is pretty obvious.

In April 2020 the Saudis were trying to send a strong message to the Russians so they tried to flood the World market with oil by increasing output to as high a level as possible and by drawing down their stocks.

The idea that some seem to have (others besides you) that the Saudis are maintaining production by drawing from stocks is silly. Their average monthly stock levels have been 215 million barrels from Jan 2002 to Oct 2021 and their average monthly crude output has been 281 million barrels over the same period, how is it that production could be maintained by pretending that stocks are production?

Consider the thought experiment that Saudis are claiming 500 kb/d of output that is really just being sold from crude oil stocks. Let’s also assume they do this for 12 months. Each month stocks would need to decrease by about 15 million barrels, so if stocks started at 280 million barrels they could maintain such a posture for at most 18 months and in the 19th month stocks would fall to zero. Over the July 2020 to August 2021 period, Saudi Stocks fell by about 1.3 million barrels per month while monthly average production increased by 44.5 million barrels above the June 2020 level.

If we are going to assume “production” increases are simply a draw down from crude stocks, only 3% of the production increase would be explained. To me,this explains very little based on the Jodi data.

Dennis

Let me be clear I never intended to send the message that SA was dumping inventory on a steady basis to boost output.

From my last reply “I was looking for particular situations when SA could have used inventory to mask production drops or to send a different message to the market.”

My takeaway from this discussion and looking at the data is that SA maximum sustainable production is closer to 11 Mb/d rather than 12 Mb/d like they claim they have. I think the Sept effort was also trying to demonstrate their 12 Mb/d capacity and they couldn’t quite get there so they used their crude inventory.

I am still curious about the huge draw down from January 2016. Did they need the cash or was it some concern with the “stranded assets” theory that was starting to circulate.

Ovi,

Others have claimed that Saudi Arabia is declining and hiding it by drawing stocks.

I agree that Saudi capacity is likely overstated, I take maximum 12 month average output as capacity, a single month output total is of little interest. For Saudi Arabia this maximum is 10388 kb/d in July 2016 (centered 12 month output).

Dennis

I would buy that 10,500 kb/d is closer to the truth. It could be more clear in a year or so when SA may have to offset the decline in some of the other OPEC countries.

Saudi Arabia C Plus C output

Hi Tks Ovi for bailing me out . Muchos Gracias .

HIH

Your welcome. Those two spikes were obvious places to check.

There is also a possibility that the increase starting in April 18 and ending in November 18 at 11,281 kb/d might have been assisted with the use of inventory. Stocks dropped from 235,421,000 bbls in March to 208,218,000 bbls in November. Not sure what the issue would have been back then. A lot of maintenance?

Ovi,

Is there stock data From Jan 2013 to Dec 2017?

Dennis

See above

Updated charts by Jean Laherrere

https://aspofrance.files.wordpress.com/2021/12/graphsjhl-17dec21.pdf

See page 8, world oil production & discovery. He shows discovery at lowest ever since 1930s. Where’s that oil hiding??

As of the end of November, total global discovered volumes this year were estimated at 4.7 billion barrels of oil equivalent (boe), the Oslo-headquartered energy researcher said. With no major finds announced so far this month, the industry is on course for its worst discoveries total since 1946.

https://www.energyvoice.com/oilandgas/374382/2021-sees-oil-and-gas-discoveries-sink-to-lowest-level-in-75-years/

————

This is less than two month supply!

Oil is falling hard this morning.

Let’s see if next year gets hard for shale, again. Falling prices with taper tantrum from the FED, and ambitious drilling plans to execute in a supply chain chaos enviroment.

HHH – let’s see at which % reduced stock prices the margin credit bomb will ignite. When this happens, it will tear down oil prices next to 0, too – just by all these hedge fonds having to sell to scramble cash.

I think this will be the most important factor to oil production next year.

Only asymmetric way to play this is being long US dollars. Now there are certain things it’s better to be long US dollars against. But the heart of the problem is not enough dollars to service debt and push prices higher. So when margin calls go out it’s a cascading effect. Market takes escalator up but it’s an elevator in free fall on way down. All kinds of things will get sold into and illiquid market to meet margin calls.

Easiest thing to watch for the average people who don’t really dive deep into markets and how and why they work is just watch 10 year government bond yields. As FED and ECB and other central banks attempt their exit of QE. 10 year bond yields will fall towards zero and in all likely hood go negative. Ushering in negative nominal interest rates. Not only in US but also in Australia, New Zealand, Canada and UK.

This is deflationary. Not the inflation story you hear and read about everywhere. 2022 is shaping up to be a train wreck.

Government debt is one thing (they can print via ECB/FED), but private long bonds…

You’ll pay negative interrest on a AAA corporate bond, just to probable get it defaulted during a real deflationary scenario. Deflationary crashs are all about getting money to be able to pay back debt.

To stop this the FED will have to send out the money dumping helicopters…

But the 10 year market will have to orientate new when QE runs out. The biggest buyer will go away – and what a buyer. It’s like stock buyback – independend of valuation, chart , macroeconomic thoughts bind buying like a robot.

At least I know the stock market can’t live without these buybacks (from cheap money as you already stated) anymore.

Another thougt I had this weekend.

At the moment the turkish lira crashs hard. But the central bank does the same as here – having lower interrest rates than inflation. Only the believe in Euros and Dolloars is much higher – and that’s the only thing that keeps a monetary inflation away.

Biden’s $2 trillion spending plan got shot down by fellow Democrats. US treasury will be issuing less debt if that remains a no go.

Mean less debt for central bank to buy. But the bigger problem is less collateral being made that is used to make loan and ultimately that means less dollars created by commercial banks. Margin debt takes a hit with less collateral to used to borrow more money to pump prices.

It’s deflationary.

They need fresh money fast. Or a new spending program, fast.

Wallstreet has started moving. It’s just still in the trend channel, so no damage to the upwards chart – so far. But several stuff is near key support, including oil. And as written, there is this 1 trillion dollar atomic margin bomb under wallstreet.

Times get interresting.

In another arena, the turkish lira is crashing hard today, nearly 10%. Turkey is the 19th biggest economy world wide, so no tiny country.

In another arena, electricity spot prices reached 60 cents in Germany. People are shielded now ( tarifs here are at least fix for the year ), but damage is done under the hood. No mention in the newspapers.

In the same arena, first utilities announce they could need to shut down their gas power plants for some time in the winter. We shut down some atomic plant in 10 days.

Oil price has so far been hit hardes from the current price jitters – could crash soon, while shale companies plan to increase drilling for next year.

Times get very interesting. Should I buy a generator?

There are a few large systematic European banks that have a lot of exposure to Turkey.

They about to lose their shirts. Partly the reason the Euro is rallying today. Some unwinding going on.

I think WTI will be doing well to average $50 in 2022. Oil needs everything running smoothly to go to $85 or higher and stay there.

https://cms.zerohedge.com/s3/files/inline-images/eu%20power%20prices.jpg?itok=ya-GyQJp

TSHTF in Europe electricity markets . Poland is cheapest . Why ? Coal powered plants . Try stopping coal burning .

Europe gas up another 7% so far today. €147 per MWh ~$280 per barrel of oil equivalent. French power contracts at 442.88 euros (new ATH).

https://www.barchart.com/futures/quotes/TG*1

https://www.energylive.cloud

https://twitter.com/JavierBlas

EUROPEAN ENERGY CRISIS: Day-ahead electricity prices across much of Europe set fresh and frightening record highs. Germany jumps to an incredible €431 per MWh. At current prices, energy-intensive industries will rather shut down and re-sell their power on the spot market

Anyone here know what causes this? Nat gas here in Europe too.

…up another 4% so far today.

Russian gas flows to Germany via Yamal-Europe stop, Gascade data shows

Russian gas flows to Germany via the Yamal-Europe pipeline stopped on Tuesday morning, data from German network operator Gascade showed.

… up over 19% right now. French power contracts at 452.94 euros (new ATH).

https://twitter.com/JavierBlas/status/1473211653806338051

France is resorting to **burn fuel-oil** to keep the lights on this morning.

https://twitter.com/alexlongley1/status/1473258236308557828

UK gas at $320 a barrel of oil equivalent

Libya’s Sharara, Hamada oil fields and Zawiya terminal shut due to PFG blockade

Libya’s key southwestern oil fields of Sharara and Hamada, and the 300,000 b/d Zawiya oil terminal, have been shut down after a blockade by a unit of the Petroleum Facilities Guards, sources close to the matter said Dec. 20.

Yeah, the oil supply is bound to collapse after peak oil, which is in the past.

Saudis Are Right to Warn of a Collapse in Oil Supply

The world’s need for affordable oil isn’t going to disappear anytime soon. If supply doesn’t pick up, that won’t bode well for any of us.

This won’t win me any friends among the green lobby, but Saudi Arabia’s Oil Minister Abdulaziz bin Salman is right to warn of a potential energy crisis resulting from falling investment in fossil fuels. Here’s why.

The prince warned that worldwide oil production could fall by 30 million barrels a day by the end of the decade because there is not enough being spent on the exploration for and development of new resources. That implies production of less than 70 million barrels a day.

Of course, he is talking his own book. The kingdom holds vast reserves of oil beneath its sands and under the shallow waters of the Persian Gulf — and it wants to see a healthy market for that oil for years to come.

But his warning isn’t entirely self-serving. Saudi Arabia’s oil riches aren’t open to foreign investors, so his call for more spending is actually aimed at encouraging competition with the kingdom.

This serves as a recognition of two things: First, the world’s need for affordable oil isn’t going to disappear anytime soon; and second, despite its oil reserves, Saudi Arabia can’t supply it all by itself.

Even the International Energy Agency, which has been incorrectly cited as calling for an end to new oil developments, sees oil demand remaining near pre-pandemic levels by 2030.

Even with the environmental policies that had been announced prior to the United Nations COP26 Climate Change Conference in November, the agency saw 2030 oil demand at 500,000 barrels a day — just 0.5% below its pre-pandemic level. In its “Sustainable Development” scenario — which sees advanced economies reach net zero emissions by 2050, China around 2060, and all other countries by 2070 at the latest — the drop by the end of the current decade is estimated to be just 9 million barrels a day, or 9%. That would still leave the world needing about 90 million barrels a day of oil by 2030, a supply shortfall of 21 million barrels a day — more oil than was consumed by the U.S. in 2019 — according to the Saudi minister.

There is a lot more to this article, along with a couple of great graphs. You should read it.

The ND Monthly Oil Production Statistics is just out. Not much change, production was down 3,700 barrels per day. Their production has been flat for nine months. Their production is down just over 400,000 barrels per day since their peak in November 2019.

Wrong URL for the ND stats. Here is the correct one:

https://www.dmr.nd.gov/oilgas/stats/historicaloilprodstats.pdf

For ND Bakken/Three Forks production the link is below

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

Bakken scenario below, ERR is 7.4 Gb from Jan 2000 to Nov 2044, output is zero for ND Bakken Three Forks tight oil after that.

Thanks Ron.

There are companies that are investing at a pace comparable to pre-Covid level like CLR and MRO and these companies hold production flat. Others like XTO and COP are not investing right now despite the fact that there is a lot of good acreage left to drill. XTO and COP have around 150 DUCs there but probably focus on the Permian. Production will go up with the price of oil and 4 Bbl left to be developed.

This is what I keep seeing. Lots of drilling and zero production increases. At current prices, drilling will diminish in 2022 despite budget increases. Costs are going up daily and pipe is hard to come by. The energy crisis is coming soon if the price keeps gyrating like it has the past seven years. There is no way to plan if you can’t hedge and you can’t predict profits. It’s uninvestable politically and economically in its current condition.

This is what I am seeing, the past 4 months US tight oil output has increased at an annual rate of about 1027 kbd. Data from spreadsheet linked below (EIA official tight oil data).

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

About 70% of the increase in tight oil output over the past 4 months has been from Permian basin tight oil which is at a new peak of 4395 kb/d, the March 2020 peak was 4314 kb/d for Permian basin tight oil output.

LTO- “The energy crisis is coming soon if the price keeps gyrating like it has the past seven years. There is no way to plan if you can’t hedge and you can’t predict profits. It’s uninvestable”

Unfortunately price gyration in this industry seems just about guaranteed. I don’t know of any reason why it won’t get worse than last decade. The upswing in LTO production in the last decade was somewhat of a steadying influence on the pricing. The only steadying mechanism I am aware of going forward is the very gradual shift of demand toward electric vehicle miles.

LTO.

An example of the volatility:

Received quotes for WTI puts this morning.

Calendar 2022 $61.50 WTI put quote was $6.70.

Calendar 2023 $57.50 WTI put quote was $10.37.

I assume somehow the big players are able to use SWAPS and cost less collars without having to post margin?

We always had to use puts because we would have had to post cash margin.

This is how volatile the WTI market is.

We bought puts back in the day for less than $1 per barrel.

Shallow sand,

My impression is that hedging has not been affordable for smaller producers for some time.

When was the last time you actually bought puts for crude?

Toby,

Not all of the undiscovered technically recoverable resources will be developed in North Dakota unless we see higher oil prices. The Permian basin has lower transport costs to refineries (or export terminals) and the focus on developing resources might be Texas and New Mexico rather than North Dakota. Potentially there might be 2 Gb of probable reserves that might be developed in the Bakken, but only if proved reserves are not overstated, it may be that the final 2P reserves end up being close to current proved reserves, in which case none of the undiscovered TRR might be developed. I doubt it will be more than the F95 estimate.

Dennis,

I am not sure if I unstand that study and Helms´comments correctly. Helms says 4 Bbl were produced and there will be another 4 Bbl produced from producing wells. That would mean the 4.3 Bbl of undiscovered resources includes PUD reserves. Is that correct?

Toby,

Helms is incorrect about the amount of future production from producing wells. He is basing that on a very optimistic EUR estimate for the average producing well. Helms is correct that about 4 Gb has been produced so far from the Bakken/Three Forks. If no new wells were completed in the future, (so that the total number of completed wells is unchanged in the future) then only 1.4 Gb more oil would be produced in the Bakken/Three Forks. My scenario has about 16200 horizontal wells completed in the Bakken/Three Forks of North Dakota from Dec 2004 to October 2021 and total wells completed of 22745 from Dec 2004 to July 2029 (no wells are completed after that date in my scenario.)

The USGS assessment has 4.3 Gb of undiscovered technically recoverable (UTRR) resources in all of the US Bakken/Three Forks, we would add cumulative production (4.4 Gb) and proved reserves (about 5.8 Gb) to the UTRR for an estimate of total TRR of about 14.4 Gb. Some of this TRR is in Montana (unclear what proportion). Note that if we assume 95% of this will be from North Dakota (that’s speculation on my part) the North Dakota TRR would be about 13.7 Gb, my scenario is for North Dakota only and uses a conservative oil price scenario, but even with a higher oil price scenario I doubt the North Dakota Bakken/Three Forks will produce more than 9.5 Gb, 8.5 Gb might be my current best guess (I believe the scenario presented is quite conservative).

Dennis,

I absolutely agree that 4 Bbl of future output from existing wells is too optimistic. The question is, what is the definition of UTRR.

https://www.usgs.gov/faqs/what-are-technically-recoverable-oil-and-gas-resources

As the USGS does not classify any kind of reserves the USGS doesn´t care about reported PUD reserves. I think PUD reserves are part of what the USGS classifies as TRR. Undiscovered simply means undrilled according to google.

That means you can not add up cumulative production plus undiscovered TRR plus proved reserves to get total TRR.

Toby,

See the following article

https://www.willistonherald.com/news/oil_and_energy/bakken-still-has-4-3-billion-barrels-of-undiscovered-oil-out-there-in-addition-to/article_772d86de-61e2-11ec-9515-334eb210643b.html

I think the author explains things pretty well where they say 4 Gb of produced oil and 4 Gb of proved reserves and then add the UTRR. I would do it a bit differently with proved reserves at the end of 2019 at about 5.3 Gb and cumulative production up to Dec 2019 at about 3.3 Gb for a total of 8.6 Gb, then add 4.3 Gb to that for a total TRR of about 12.9 Gb, so the 4 Gb is a rough estimate of current proved reserves (assuming there have been none added since the end of 2019 it would be 4.6 Gb actually).

On proved undeveloped reserves, those are the portion of proved reserves that have not been developed and are not yet producing any oil, these reserves are included in the proved reserves total and are not considered a part of undiscovered TRR, total TRR is cumulative production, proved reserves and UTRR.

Undiscovered is not the same as undrilled, consider a 2 square mile lease with 4 potential locations for wells, but only one well has been drilled. If all 4 wells that are eventually drilled have similar EUR of 400 kb, but only one of the 4 wells has been drilled and completed, the PDP reserves would be 399,999 b after the first barrel is produced, and the PUD reserves would be 1200 kb, but the total proved reserves would be booked as 1600 kb.

See pages 9 and 10 of following document from Society of Petroleum Engineers (SPE)

https://www.spe.org/en/industry/petroleum-resources-management-system-2018/

As I am not a petroleum engineer I will defer to those in the business that know more than me.

Dennis, given the enormous amount of drilling that has been done in US tight oil plays, are there really any undiscovered reserves left? If there are indeed undiscovered reserves, where would these be located?

Dennis,

I can´t acces the website but anyway.

How could the USGS take into account any PUD reserves from the E&P companies 10-Ks when estimating UTRR? The USGS knows existing wells and makes an estimate on future wells.

I am still pretty sure that UTRR refers to all undrilled wells so that past production + PDP reserves + UTRR = total TRR. 4 Bbl of PDP reserves is optimistic but that is what Helms is talking about.

Toby , USGS and EIA are the only agencies that have the resources( funds) , manpower and mandates to collect the and correlate the data on the O&G industry . Both of them have been proved to be useless . The problem is that Dennis uses this as his base ( not his fault and not discount his effort ) but the basic of mathematics is ” if the hypothesis is incorrect then the result will be incorrect ” . One does not have to be a nuclear scientist to understand . To compound the problem are the definitions . 2p , 3 P , PUD , DUC etc , the worst is ‘” oil yet to be discovered ‘” .

P.S ; The two agencies can only provide data on the US oil and gas . US only produces about 10 million barrels against the current world production of about 78 million barrels . I have from a long time supported the ELM model of West Texas . That will be the tipping point .

Hole in Head,

the problem is, that there is no other data than the data published by USGS and EIA. But if that data is used we should make sure that we know what we are talking about.

ELM might hit hard, I agree. Some oil exporting countries will have to cut subsdies for fuel etc. like Egypt did and the Saudis are also doing this right now. If oil is your only source of income you can´t afford not to export it.

Toby,

I assure you that undiscovered TRR does not include proved reserves. Remember that not every website has correct information.

Undiscovered resources are those that are estimated to exist based on geologic, geophysical and geochemical information for the assessed rock layers. Undiscovered resources are contrasted with proven reserves, which are those quantities of oil and gas that have been confirmed to exist via drilling and production.

The excerpt above is from the press release from the USGS linked below.

https://www.usgs.gov/news/national-news-release/usgs-releases-oil-and-gas-assessment-bakken-and-three-forks-formations

When we use the term PUD reserves it stands for Proved UnDeveloped Reserves, there is a another category called PNP reserves which are proved reserves which are not yet producing.

On the page below look for “proved nonproducing reserves”, then look up North Dakota, see link below

https://www.eia.gov/dnav/pet/pet_crd_nprod_dcu_SND_a.htm

For North Dakota at the end of 2019 there were 2239 million barrels of proved nonproducing reserves in North Dakota.

At page linked below

https://www.eia.gov/dnav/pet/pet_crd_pres_dcu_SND_a.htm

we have at the end of 2019 5897 million barrels of proved reserves in North Dakota.

Proved producing reserves would be 5897-2239=3658 million barrels at the end of 2019. Where we differ in opinion is that you believe the 2.239 Gb of proved nonproducing reserves are part of UTRR. It is quite clear to me that this is not the case as the USGS says explicitly that proved reserves are not a part of UTRR, perhaps you believe the only reserves that are proved are those that are producing, but then why would we have a category of PUD or PNP reserves (where the first “P” in each of these stands for “proved”).

A comment by an oil industry insider or retired geologist might be of some help.

Dennis,

I did not say PNP reserves are part of UTRR. PNP reserves are part of the proved developed reserves whereas PUD reserves are not developed. And yes, I think PUD reserves are part of UTRR, at least kind of, as the USGS can not take PUD reserves into account. That doesnt make sense. UTRR is all that is undrilled.

We obviously disagree here. Perhaps some experts can comment.

And the 5.9 Bbl of proved reserves in ND probably also include PUD reserves, so PDP reserves should be a lot lower.

Frugal,

Their are large areas in each tight oil play that have very little drilling, the sweet spots likely have very little undiscovered resources, it is the non-core areas where the undiscovered resources might exist, note that for the Bakken/Three Forks in North Dakota I doubt that much of the undiscovered technically recoverable resource in the mean estimate will be profitable to produce at $90/bo or less in 2020$ (WTI price). Perhaps 1 Gb or so at most.

For other areas such as the Permian Basin the number is far larger with an ERR of about 35 Gb from Jan 2018 to Dec 2050, but proved reserves and cumulative production (Jan 2019 to Dec 2019) at about 14.5 Gb as of Dec 31, 2019, so roughly 20 Gb of undiscovered resources that may be profitable to produce of a mean USGS estimate of UTRR of about 55 Gb as of Dec 2019.

Toby,

Proved undeveloped (PUD) reserves are a part of proved nonproducing (PNP) reserves (if they are not developed, they are not producing). The PNP reserves can be further divided into PDNP (proved developed non-producing) reserves and PUD reserves and these would be added to PDP (proved developed producing) reserves to get the proved reserves total.

Basically the rule is quite simple, proved reserves of any type (PUD, PDP, or PDNP reserves) are not a part of UTRR (Undiscovered Technically Recoverable Resources).

Maybe Bob Meltz, Doug Leighton, George Kaplan, or Shallow sand could confirm this?

Hi Ron, from what I have read on this site it is exspected a slow increase in US shale unthil 2027, gues the output might furter slow down before it reach top. This is only 5 year to go. What I see is EIA is predicting oil surplus from 3Q 2022 and oilprice below 70 usd/bbl.

Other that follow this market is not agree with EIA conclusion and see a very tight oil market from 2022 where prices might go as high as 125 usd/bbl.

As I see it there are two main factors and it is the Spare capacity off Opec that varies a lot but might be 2 mill barrels a day even they predict it is 4 and than the US oil production is it able to increase as much as EIA predict?

Regarding Permian I see some majours are planning to double the production, but to me it seams the more production dthe higher decline that need to be replaced with more riggs, pepole, equipent that increase spending and capex. This might stop off it self before peak because off funds, pepole, equipment, places to drill as huge posibility for well interference that will increase with utilization off the Area.

If you think EIA estimat off shale is to optimistic when can we exspect a reviced version?

Well, the EIA’s estimate of US production is not really that important as far as peak oil is concerned. Even if us production does surpass its 2019 peak, which I doubt, it will not make any difference. The world C+C peaked in late 2018 with the average peaking in 2019. End of story.

I have taken a close look at all the world’s major producers and most of the minor producers. As a result, my confidence could not be any stronger that we are post peak.

Ron, I agree with you that the EIA is not much important. Today came their weekly update that show a draw on oil storrage off 7.2 mb incl SPR. The oil storage there is now below 5 years average with good margin.

The intetesting in this report was at a oilprice WTI at aprox 70 usd the L48 falls by 200k barrel a day and US oil production are now at 11.6 mbpd.

From EIA Steo they exspect US oil production will be 12.1 mb pr. Day in Q3 2022. and as I see this is with oil price about 70 usd each barrel. They exspect market to be oversupplied Q2 2022. The problem in Europe is gaz price that is more than 5 fold and compared to oil sold for 300 dollar each barrel. Many now use oil. As I know Sweden and France to produce electricity. I agree with you that peak US and Peak world is past. Permian will be the last hot spot but seems also there now is needed above 75 usd each barrel wti. This is caused by underinvestment in conventional oil and gas for several years and the green transmission that now we feel in Norway as electricity price here is in period almost 1 dollar each kwh incl. Fee or more than 10 fold. Our hydro power is exsported to EU trough some cables. When cold, no wind as the turbines can produce lots off pepole here is freezing in their homes as they cant afford to use electricity for heating. It is a terrible situation for many here.

Currently (20211222, 22:24 local swedish time) Norway is exporting 5544 MW, destination unknown, but probably to the highest bidder. (not Sweden, we are exporting too, but only 2097 MW

https://www.nordpoolgroup.com/Market-data1/Power-system-data/Exchange1/ALL/Hourly111/

And according to the same source, your base price is 228E/MWh, so I guess that fees and VAT adds about 3x that to get to 1 dollar per kWh, so the state and power line accountants should be happy at least.

So my suggestion would be to cut the outbound lines, in line with the discussion upthread about oil and Nigeria etc.

Yes it is all a big tragidy. Norway have lots off Hydro Power that is Green Energy. There have also been built out some windpower. This summer a new Exsport cable was finished and I think there are cables to both Germany and U. K. Suddenly the energy price in Norway became equal to U. K and Germany. When it is cold here and no wind in U. K price in Norpool might be for a period off day 6 nok + 25% vat and about 0.6 nok in fee for Grid i. e. If Hydropower it cost about 0,15 nok to produce. Norway is sepearated in 3 zones and in South it is most exspensive. To take a shower in yhe morning might cost 30 nok. Lots off pepole here fears the electricity bill for December. To drive Tesla espesialy at South off Norway have become more exspensive than diesel car even fuel price is 18 nok or 2 usd.