A guest post by Ovi

Each month the EIA produces four reports which project oil output for the US and the World. The Short Term Energy Outlook (STEO) forecasts oil output for a period of 12 to 24 monthsg into the future for US and World oil production. A second report, the Drilling Productivity Report (DPR) forecasts the combined production for conventional and tight oil in the main tight oil basins, four months ahead of the EIA monthly report. Their third report, Light Tight Oil (LTO), reports on only the tight oil produced in seven tight oil basins and a few smaller ones. A fourth and final outlook is the Monthly Energy Review (MER) that forecasts US output two months past the official US production numbers, for this report that will be October and November.

Normally the Outlooks report appears at the end of the monthly US report. For this month it has been posted separately and early.

1) Short Term Energy Outlook

The December STEO provides projections for the next 15 months, starting with October 2021 to December 2022, for US C + C and other countries.

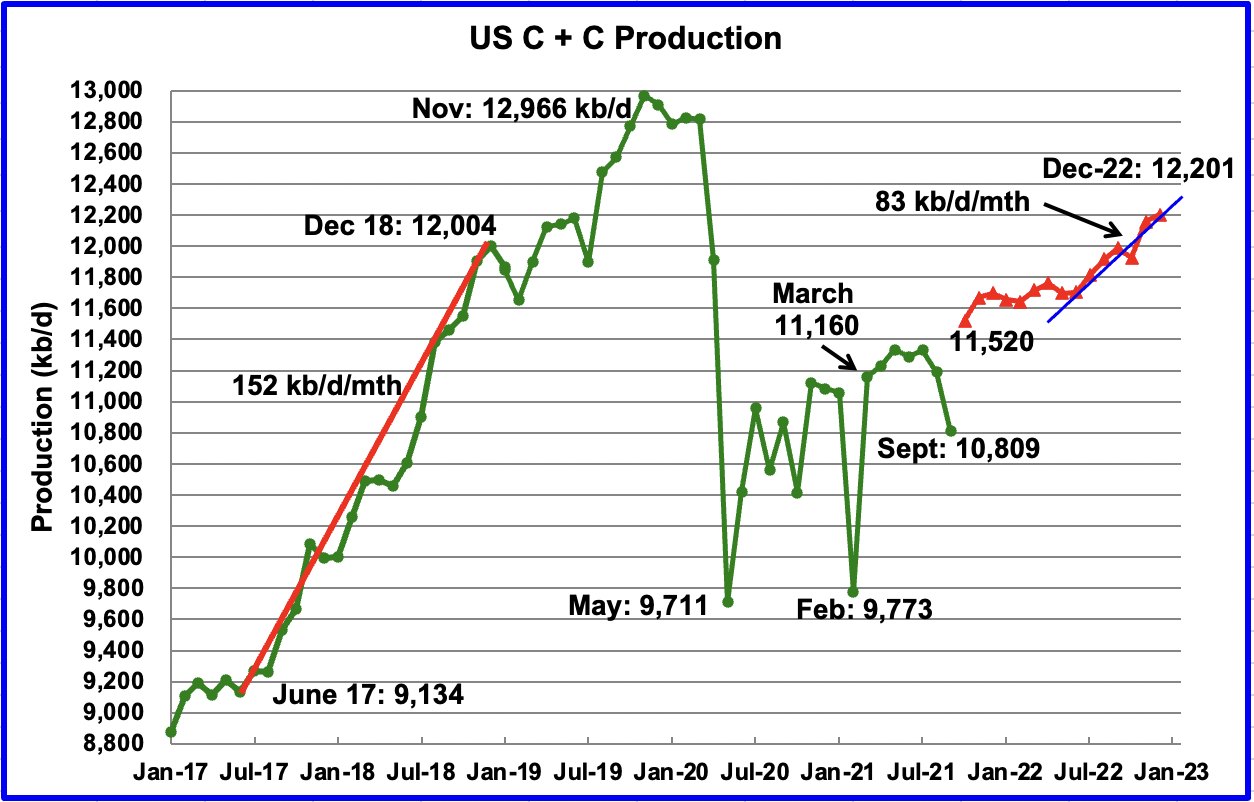

There has been a major downward revision to projected US output in the December STEO. Output from November 2021 to June 2022 will remain essentially flat at close to 11,700 kb/d. Output in July 2022 will then begin to ramp up to the end of the year and increase at a rate of 83 kb/d/mth. The projected December 2022 output has been decreased by 49 kb/d from the output reported in the November report to 12,201 kb/d.

October 2021 output is projected to rebound to 11,520 kb/d. The weekly estimates issued by the EIA for October indicate an average output of 11,381 kb/d, 139 kb/d lower than the STEO estimate.

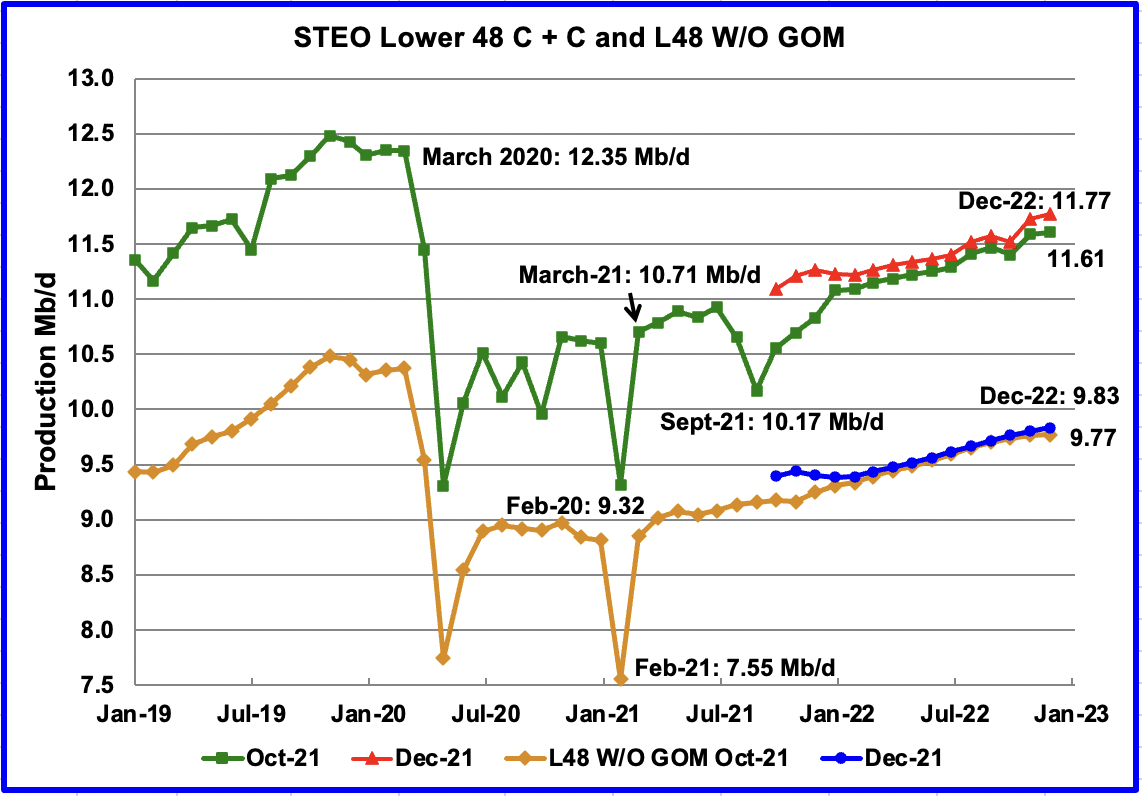

This chart compares the STEO forecast from the October report with the current December report to better illustrate how the output forecast for December 2022 changed. For the Lower 48, the December 2022 output has been revised down by 40 kb/d from 11.81 Mb/d to 11.77 Mb/d. For most of 2022, production was revised down by approximately 60 kb/d closer to the earlier October forecast.

The December output projection for the Onshore L48 states has also been revised down closer to the October forecast. For the Onshore L48, the output projection for December 2022 has been decreased by 60 kb/d to 9.83 Mb/d. From March 2022 to December 2022 output is forecast to increase at an average rate of 43.3 kb/d/mth

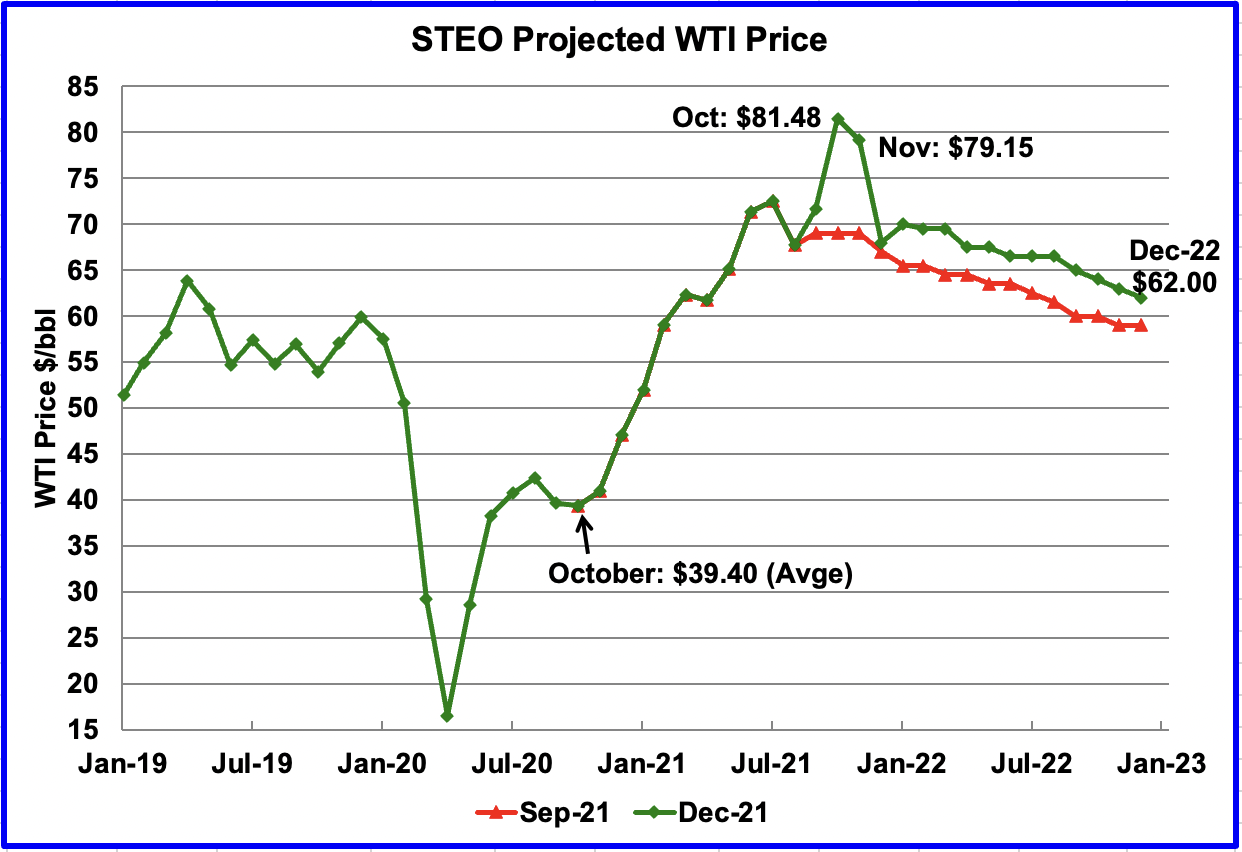

The December 2021 STEO oil price forecast continues to show a steady decline from the October peak of $81.48/bbl to $62/bbl in December 2022. The December 2022 price has not changed for the last three months.

The big forecast change for WTI occurred in updating from the September report to the December report. The major change in the current December forecast is the drop in the average December 2021 price to $68/bbl and then popping up to $70/bbl for January 2022 and then essentially staying flat for February and March.

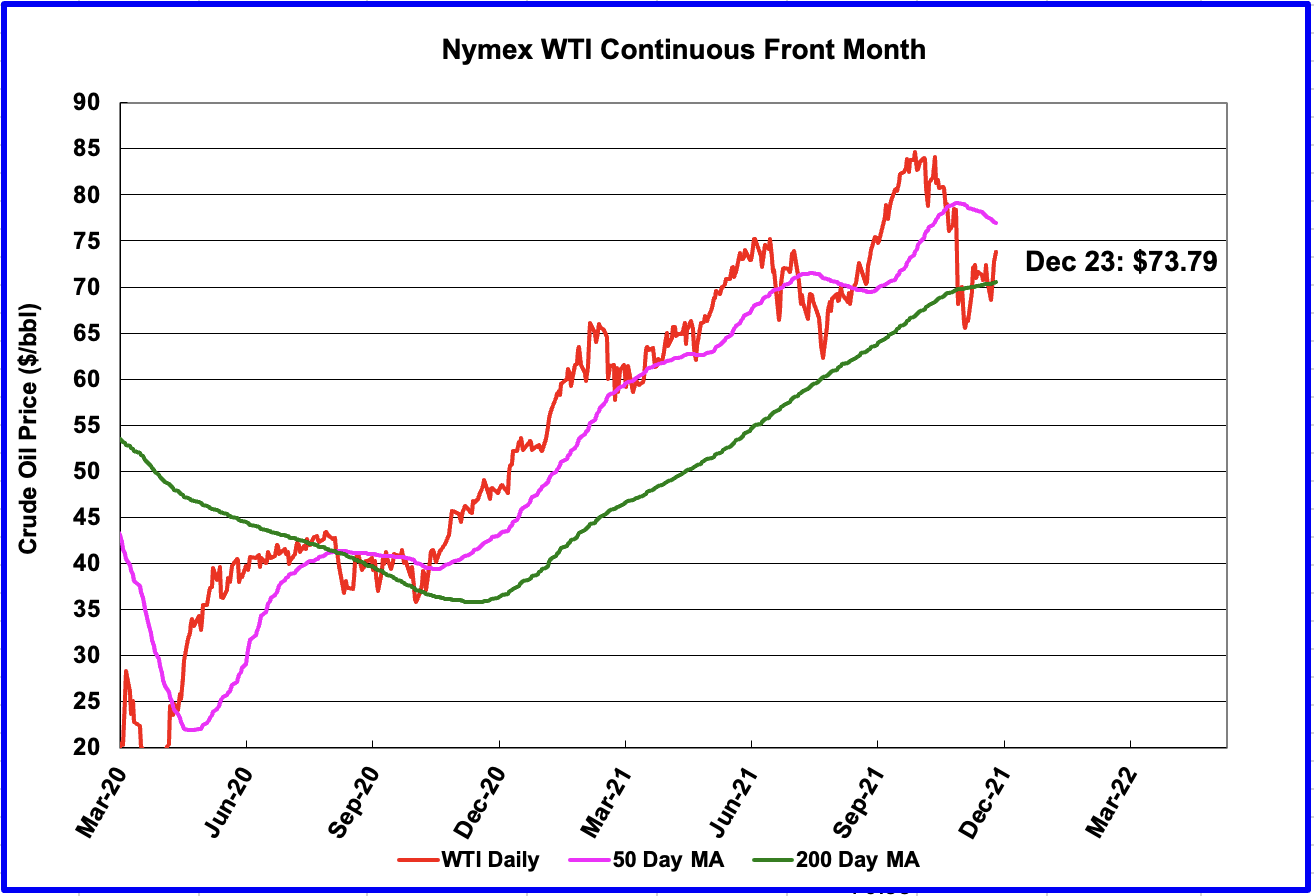

The February WTI contract settled at $73.79 on December 23, $4.29 higher than the EIA projection of $69.50 for their February forecast.

WTI on December 23 settled above the 200 day moving average. The recovery can largely be attributed to the initial over reaction to the Omicron variant and how it would affect the economy and oil demand.

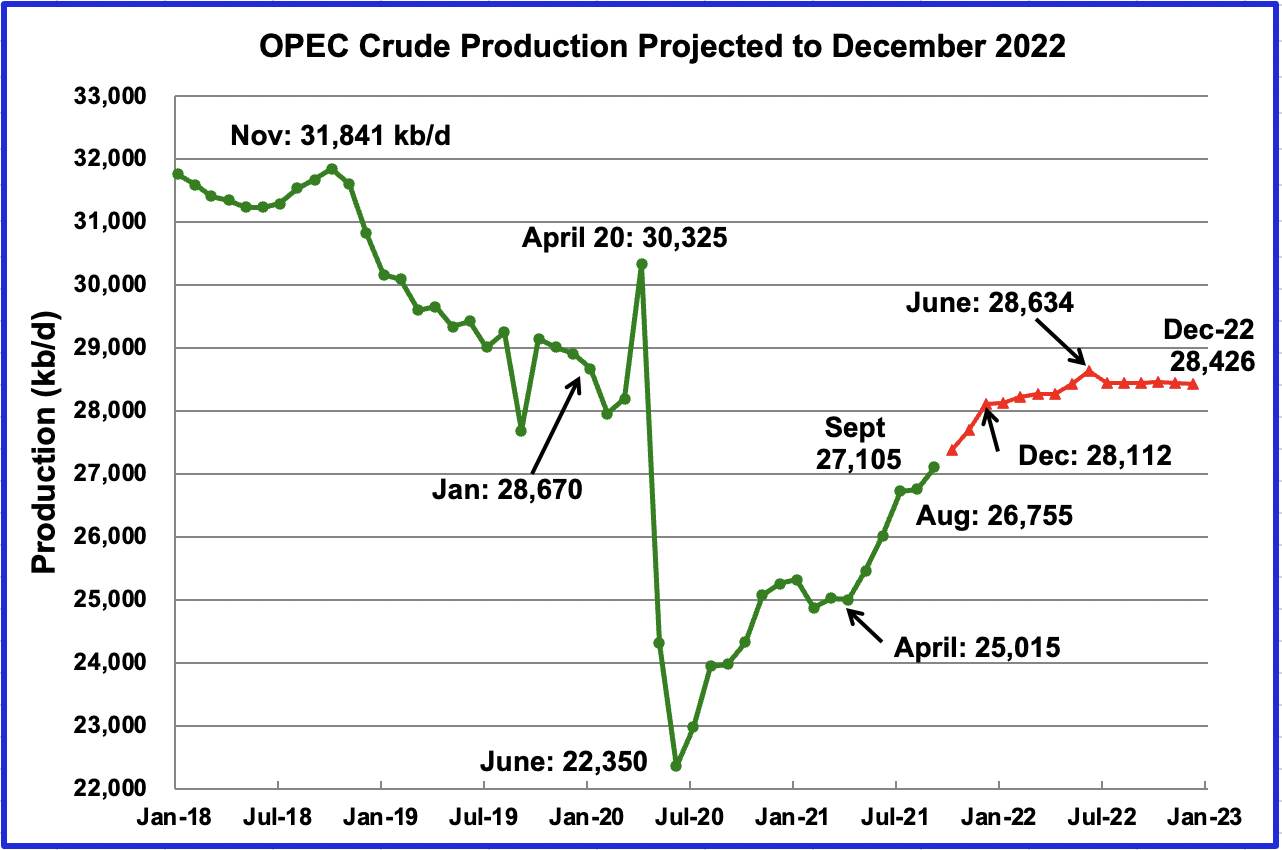

This chart shows the STEO’s December forecast for OPEC crude output to December 2022. OPEC’s output is projected to increase from April 2020 to December 2020 by close to 3,100 kb/d, which is roughly 100 kb/d less than forecast in the November report.

From March 2022 to December 2022, OPEC output is expected to be relatively flat, close to 28,400 kb/d, and with a June peak of 28,634 kb/d.

For November 2021, the EIA STEO forecast production to be 27,695 kb/d. Actual November production as reported by OPEC was 27,717 kb/d, higher by 22 kb/d. Amazingly accurate projection by the EIA.

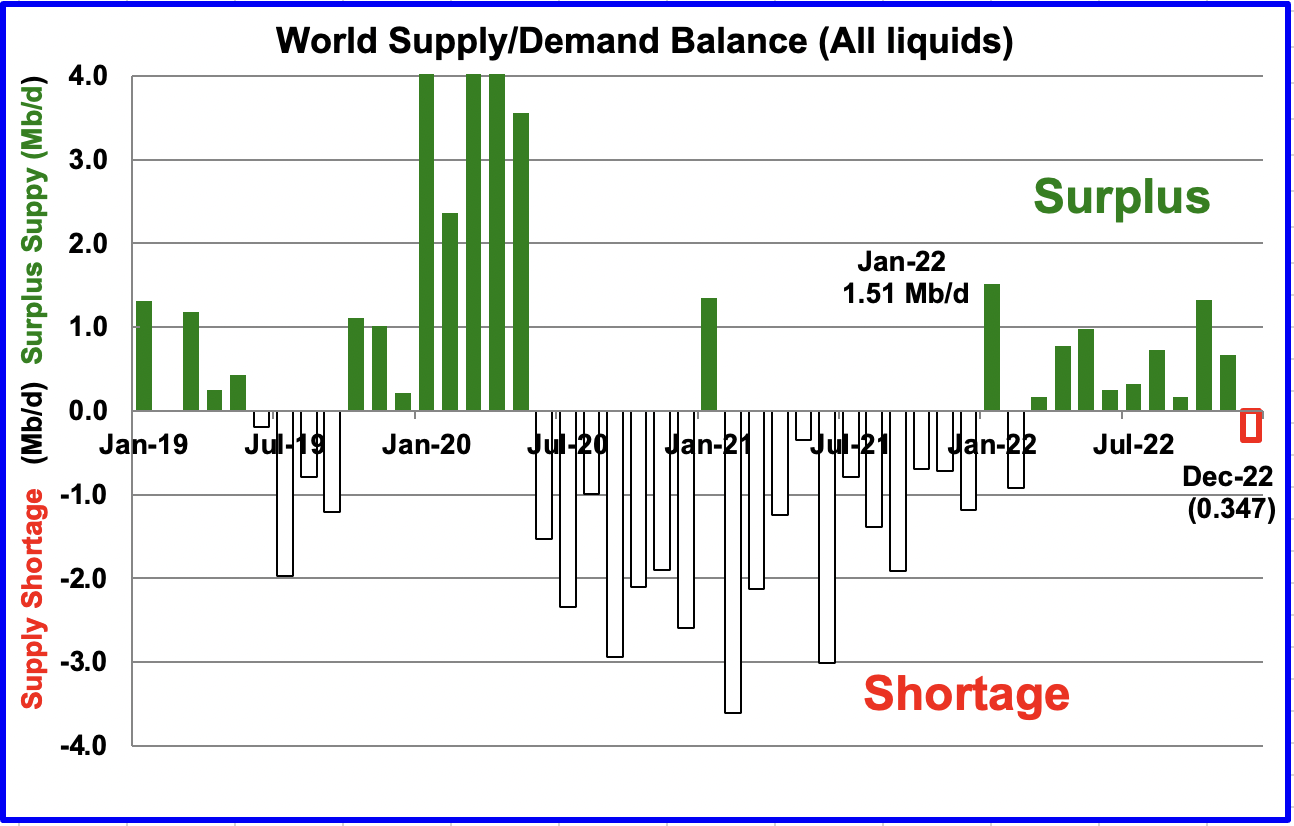

This chart show the historical supply/demand balance up to November 2021 and after that, the EIA’s forecast out to December 2022. From March 2022 to November 2022, the STEO is forecasting an average surplus of close to 595 kb/d. For December 2022, demand is expected to exceed supply by 347 kb/d.

This expected surplus between April and December, along with the variant, Omicron, and the US SPR release may make OPEC + reconsider their planned monthly 400 kb/d production increase after January 2022 at their January meeting.

January 2022 is expected to be the first month with a surplus of 1.51 Mb/d since July 2020, followed by a deficit in February and then back into a surplus.

2) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The December DPR forecasts production to January 2022 and the following charts are updated to January 2022.

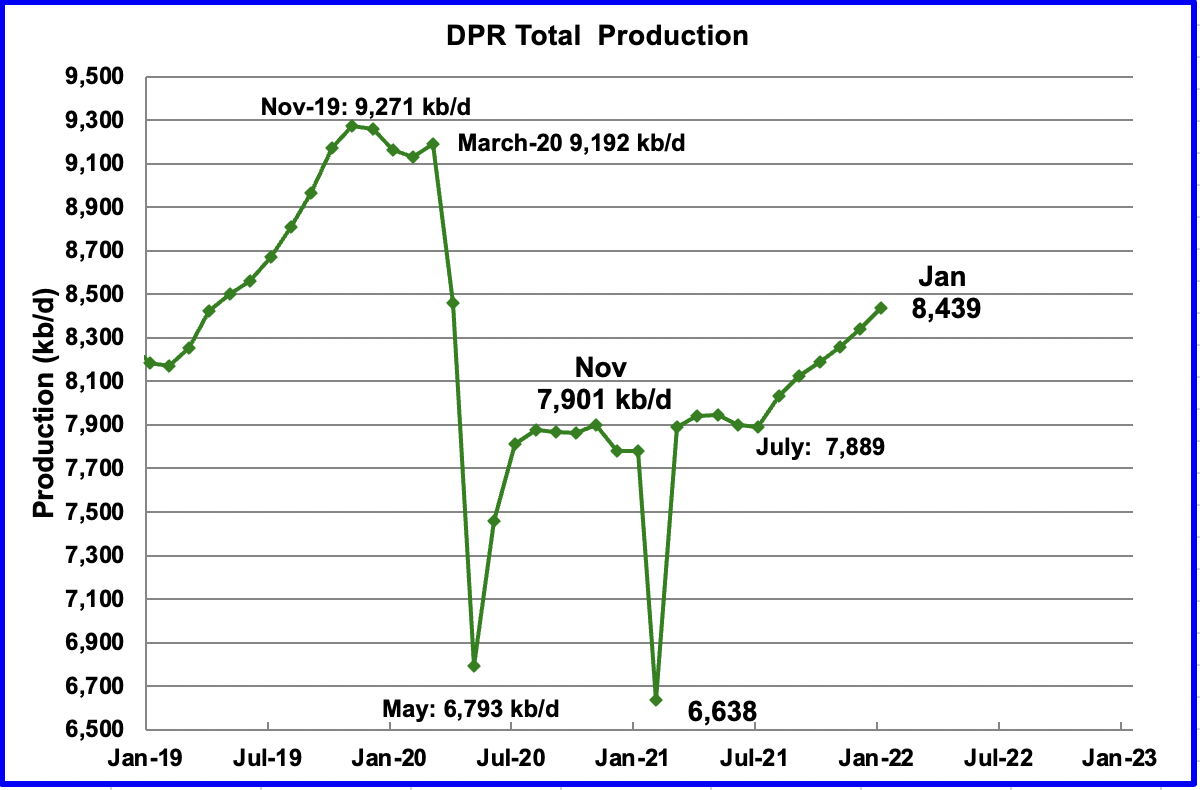

Above is the total oil production from the 7 DPR basins that the EIA tracks, projected to January 2022. Note that the DPR production includes both LTO oil and oil from conventional fields

The DPR is projecting that output for January 2022 will increase by 96 kb/d over December to 8,439 kb/d. From July to December, output in the DPR basins is forecast to increase by 550 kb/d or 91.7 kb/d/mth and appears to be accelerating since January added 96 kb/d. The Permian basin is the primary contributor to the US production increase.

If the average output rate of 91.7 kb/d/mth were to continue for another year, this would add 1,100 kb/d/yr to US production, which could potentially begin to disrupt world oil supply and cap the increase in the price of oil to below $100/bbl.

This 1,100 kb/d /yr projection is in sharp contrast with the STEO forecast above which indicates that from November 2021 to June 2022, output will remain essentially flat at close to 11,700 kb/d.

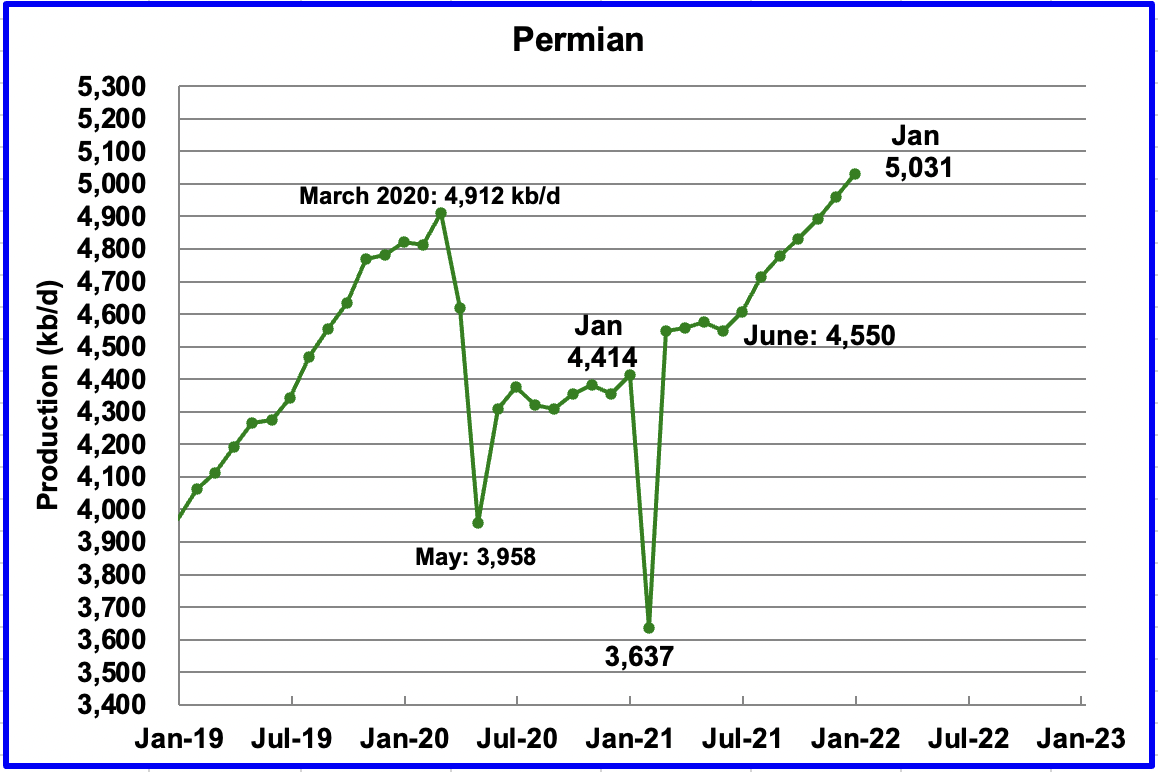

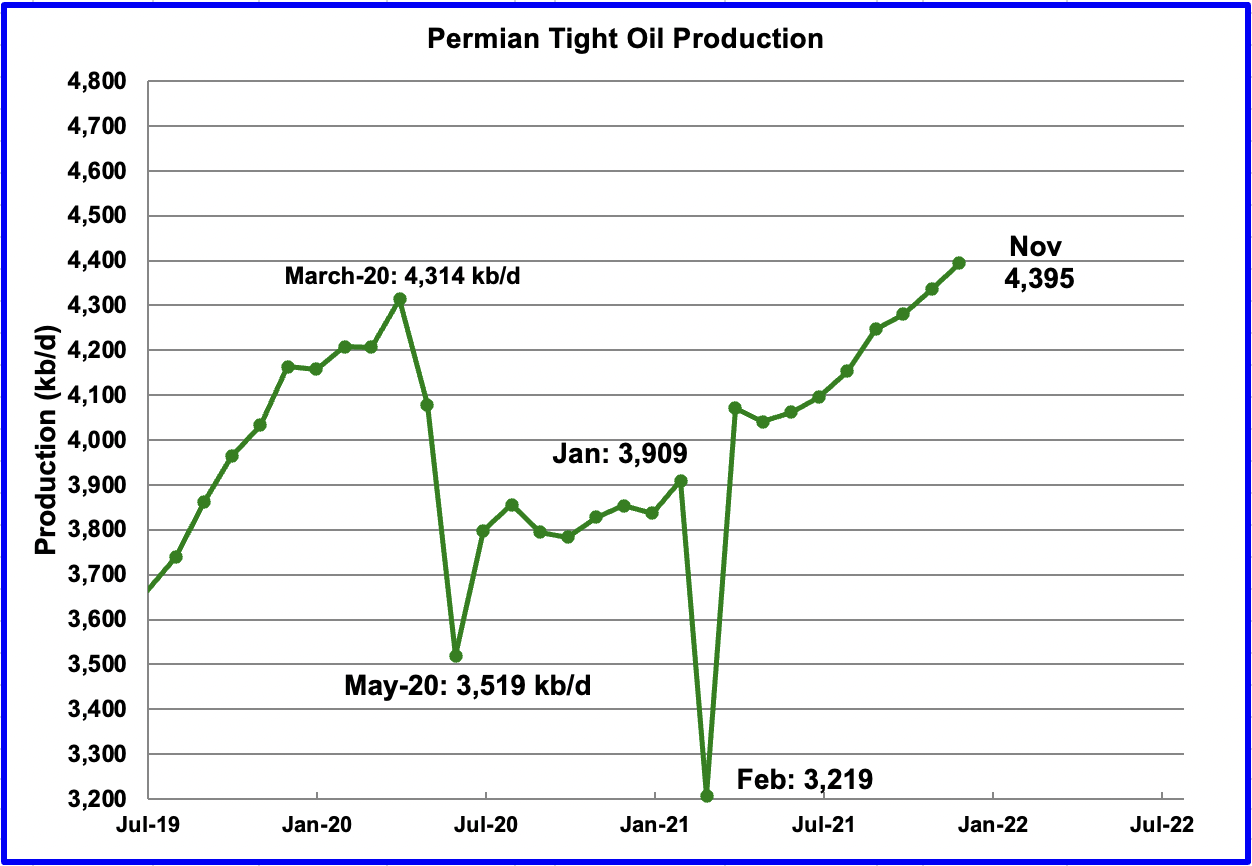

Permian output is projected to reach a new production high of 5,031 kb/d in January. From June to January production is forecast to increase by 481 kb/d or at an average rate of 68.7 kb/d/mth.

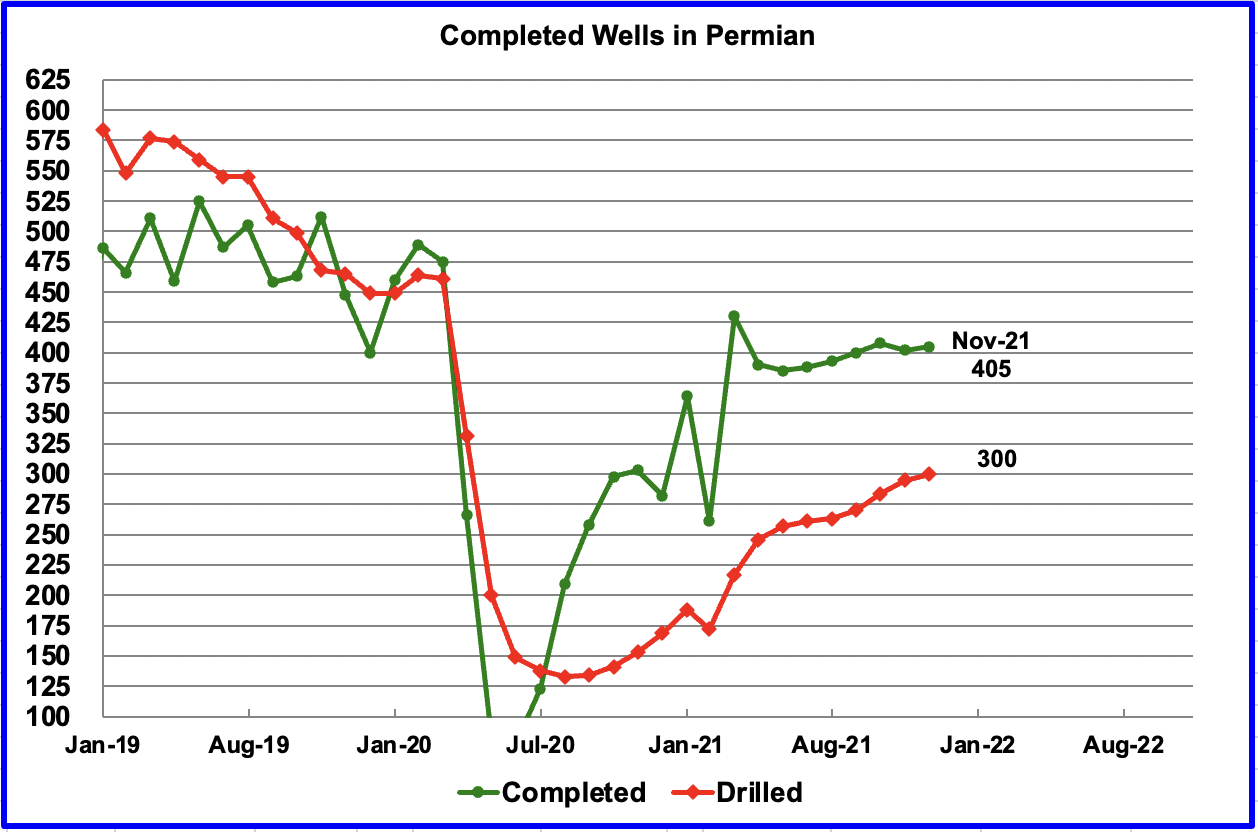

During November, 300 wells were drilled and 405 were completed in the Permian. The completed wells added 312 kb/d to the forecast November output for an average of 770.7 kb/d/well. The overall decline was 251 kb/d which resulted in a net increase of 71 kb/d. Of the 405 completed wells, 324 were required to offset the decline. It is the completion of the additional 81 DUCs, over and above those drilled, that accounts for the increase in the production in the Permian.

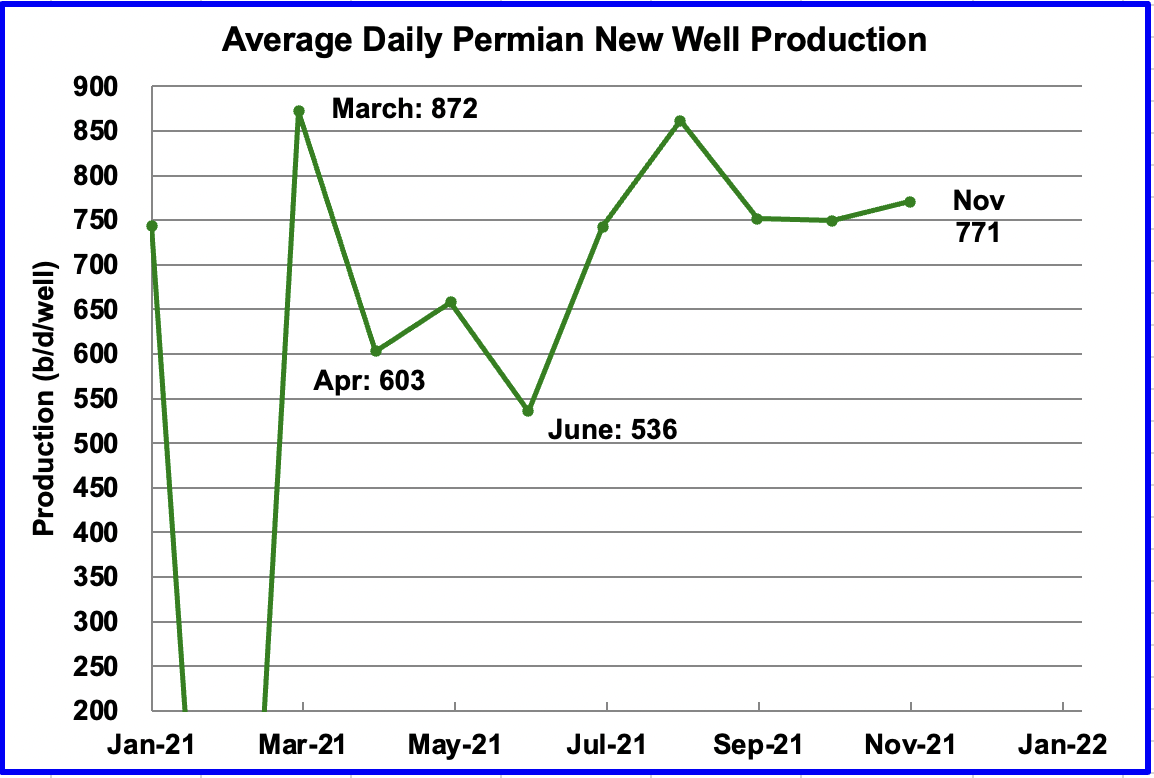

This chart shows the daily production from the average new Permian well tracked on a monthly basis. The daily output from new Permian wells was divided by the number of completed wells, as reported in the DPR and DUC reports.

For instance, during November, the new wells produced 312 kb/d from 405 wells for an average of 771 b/d. The DPR back checks their earlier estimates and it appears that the average first month output is bouncing around 750 kb/d. Well data is only available up to November to make this estimate.

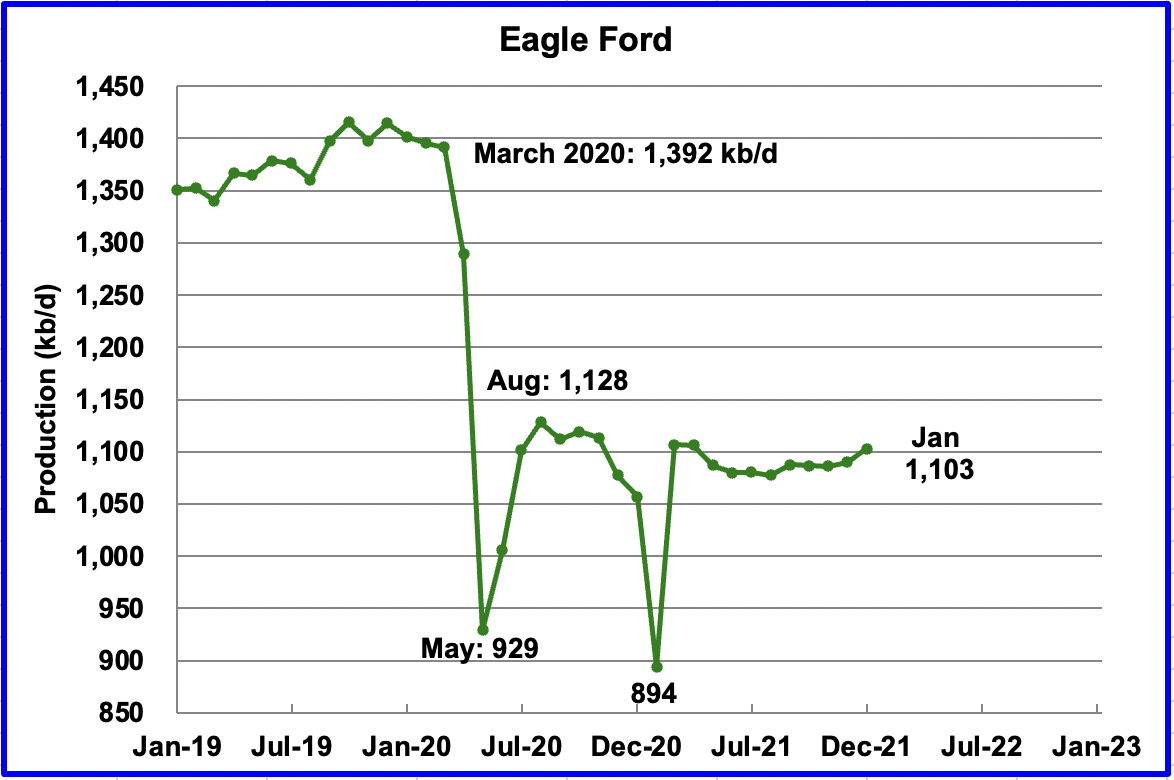

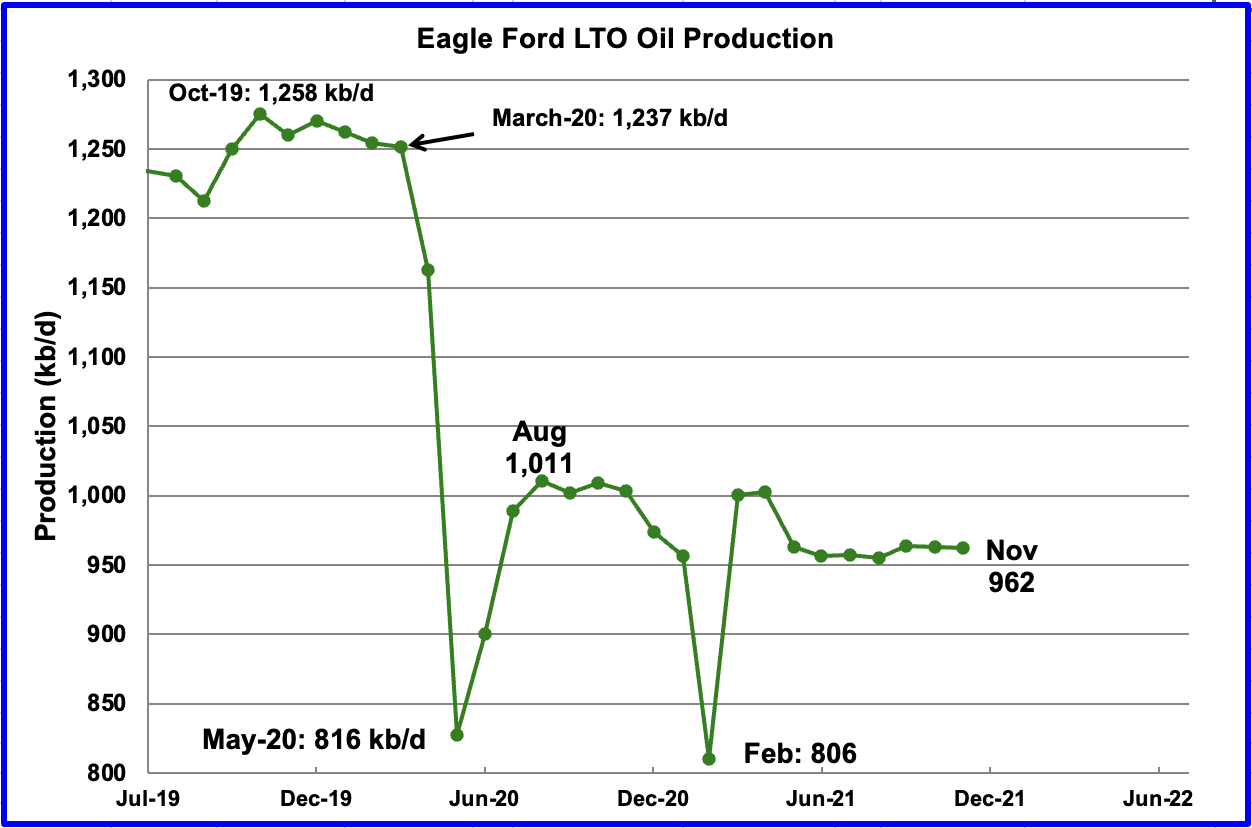

Output in the Eagle Ford basin has been showing an increasing trend since September 2021. For January, output is expected to increase by 13 kb/d to 1,103 kb/d.

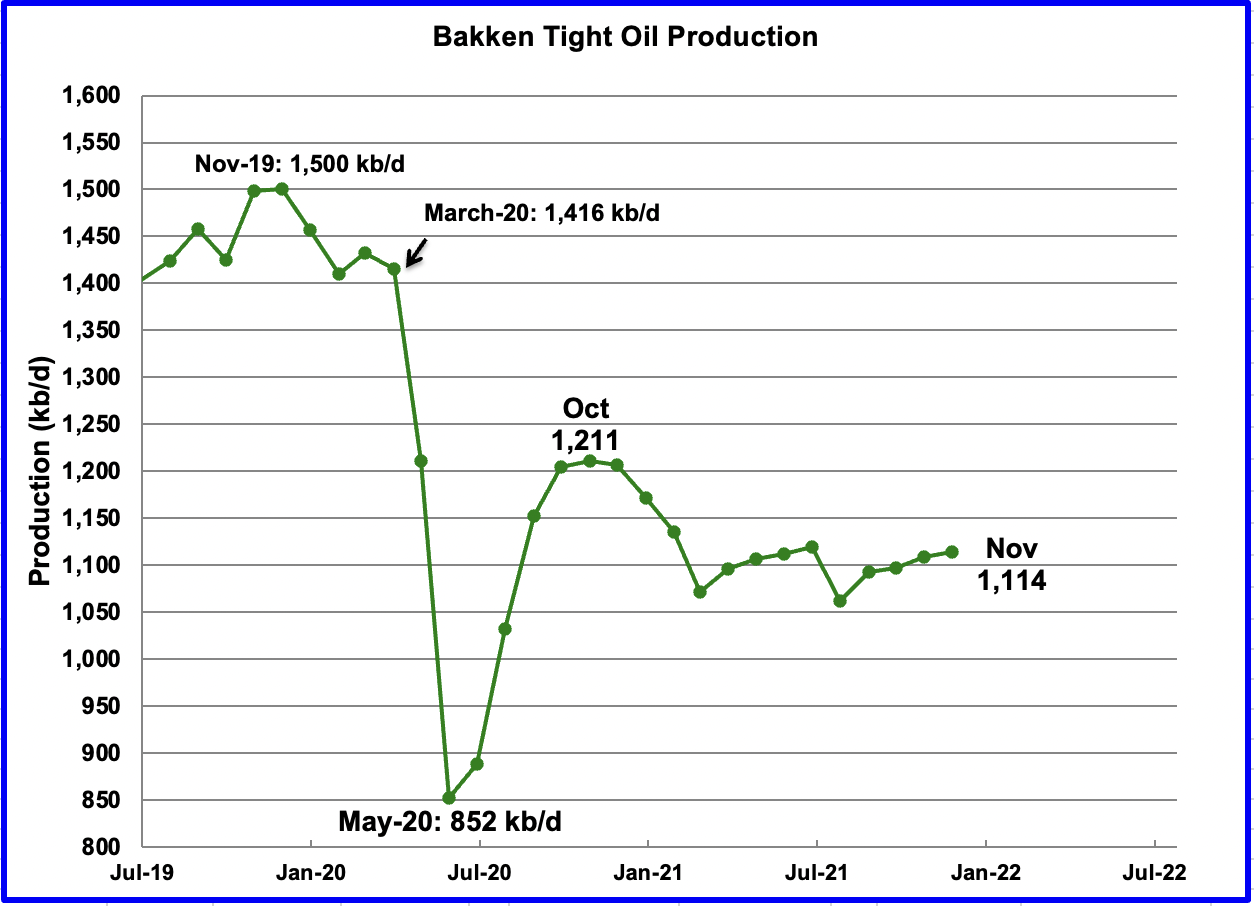

The DPR forecasts Bakken output in January to be 1,154 kb/d an increase of 8 kb/d from December.

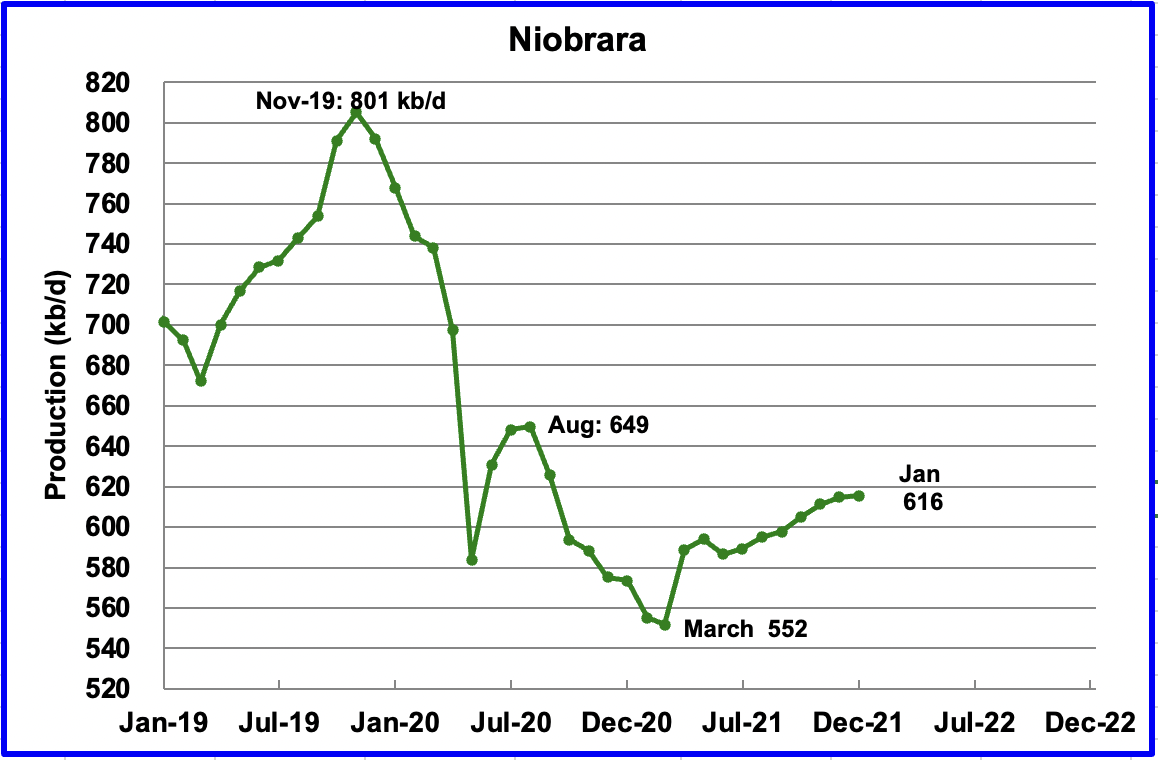

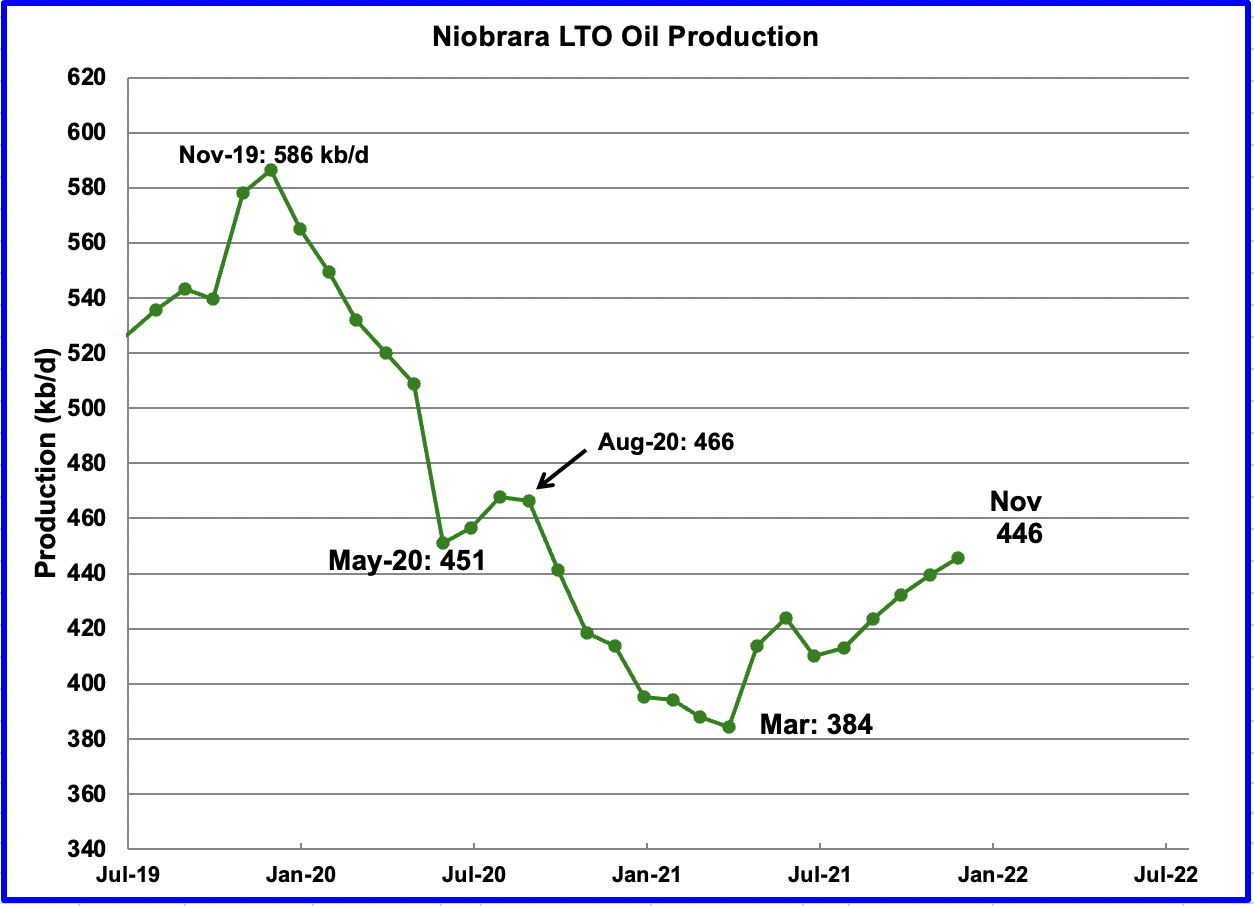

Output in the Niobrara has been rising since July but is now showing signs of starting to plateau.

DUCs and Drilled Wells

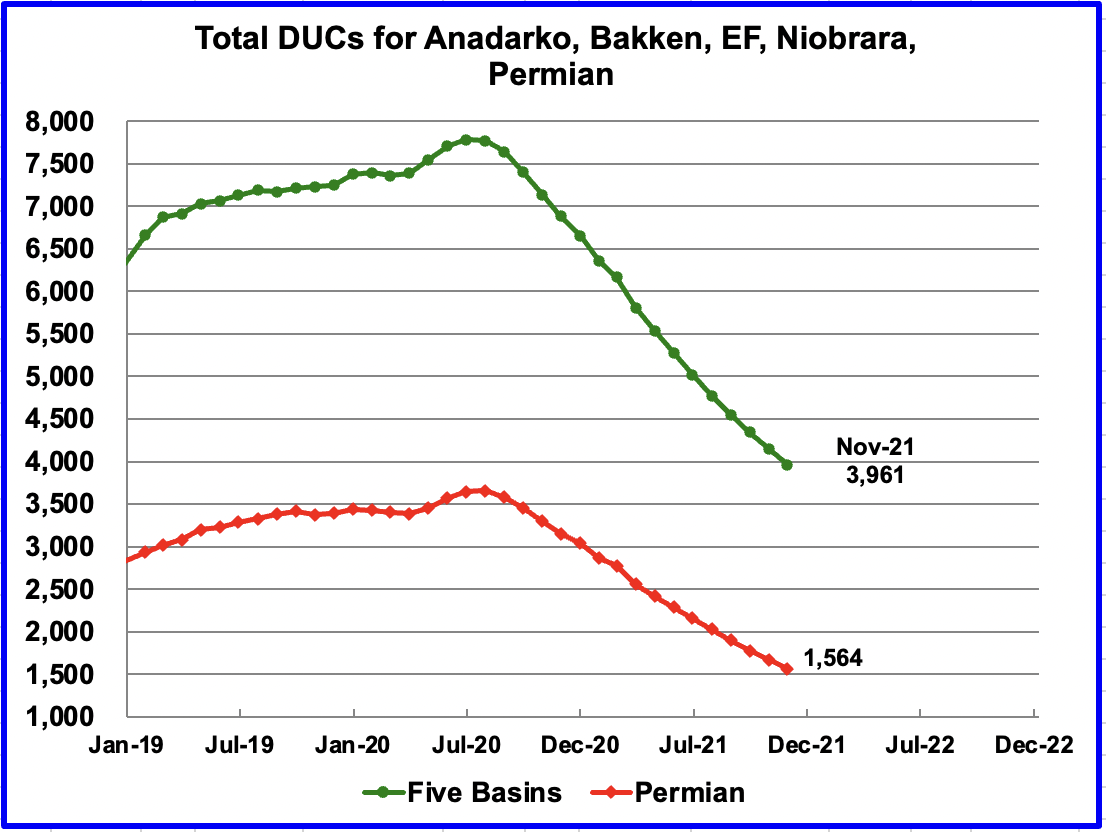

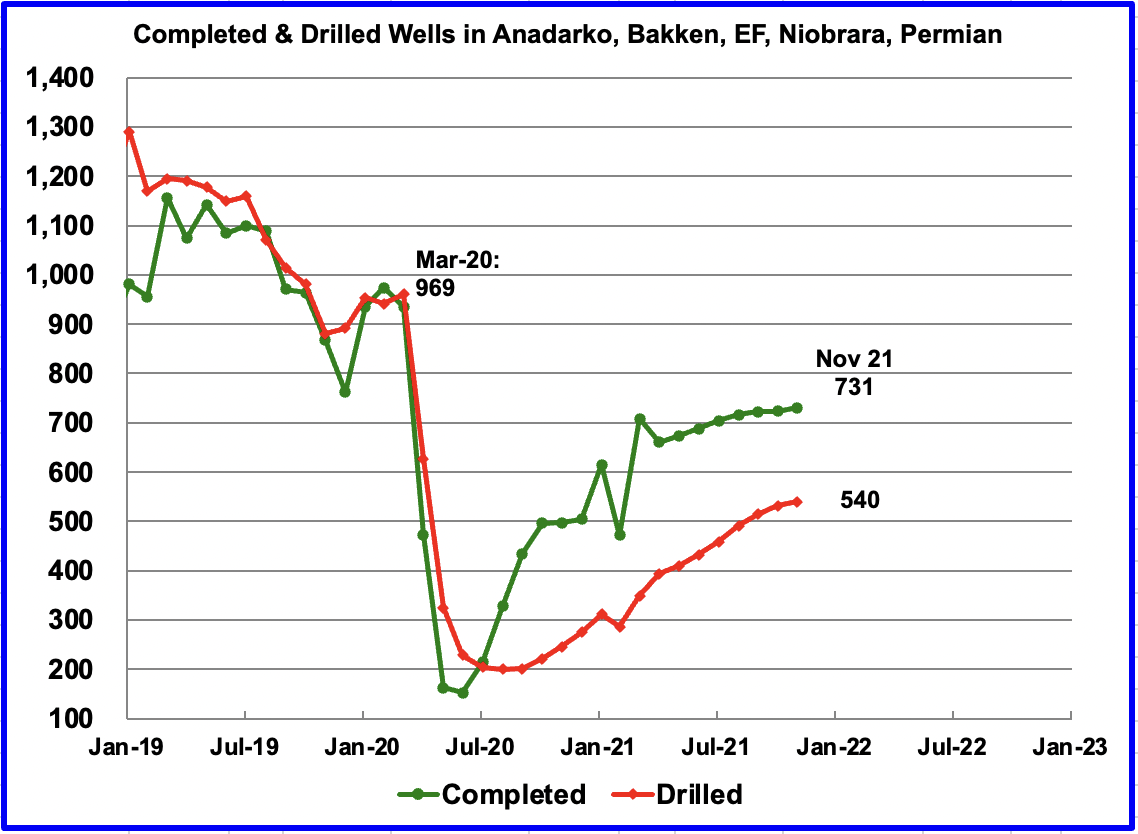

In these five primarily oil basins, the utilization/completion rate of DUCs has started to slow. For example, in March 2021, 359 wells were completed. In October and November, the utilization rate, i.e. completion rate was down to 191.

In the Permian, 105 DUCs were completed in November, down from 130 in July and August. If Permian DUCs were to be completed at the latest rate of 105/mth, that translates into a 15 month supply, assuming the remaining 1,564 are all commercially viable.

While the completion of DUCs has slowed, the overall completion of Wells has also slowed in these five oil basins. To compensate, there were earlier indications from a few months ago that drilling was also increasing. However for October, completions increased by 8 to 731 while drilled wells also increased by 8 to 540.

In the Permian, a similar trend in slowing completions is developing. In November 405 wells were completed, 3 more than in October and 300 new wells were drilled.

As can be seen in this chart, in the August to October period, the number of drilled wells increased at a higher rate than in the May/July period and appears to be slowing after September.

3) LIGHT TIGHT OIL (LTO) REPORT

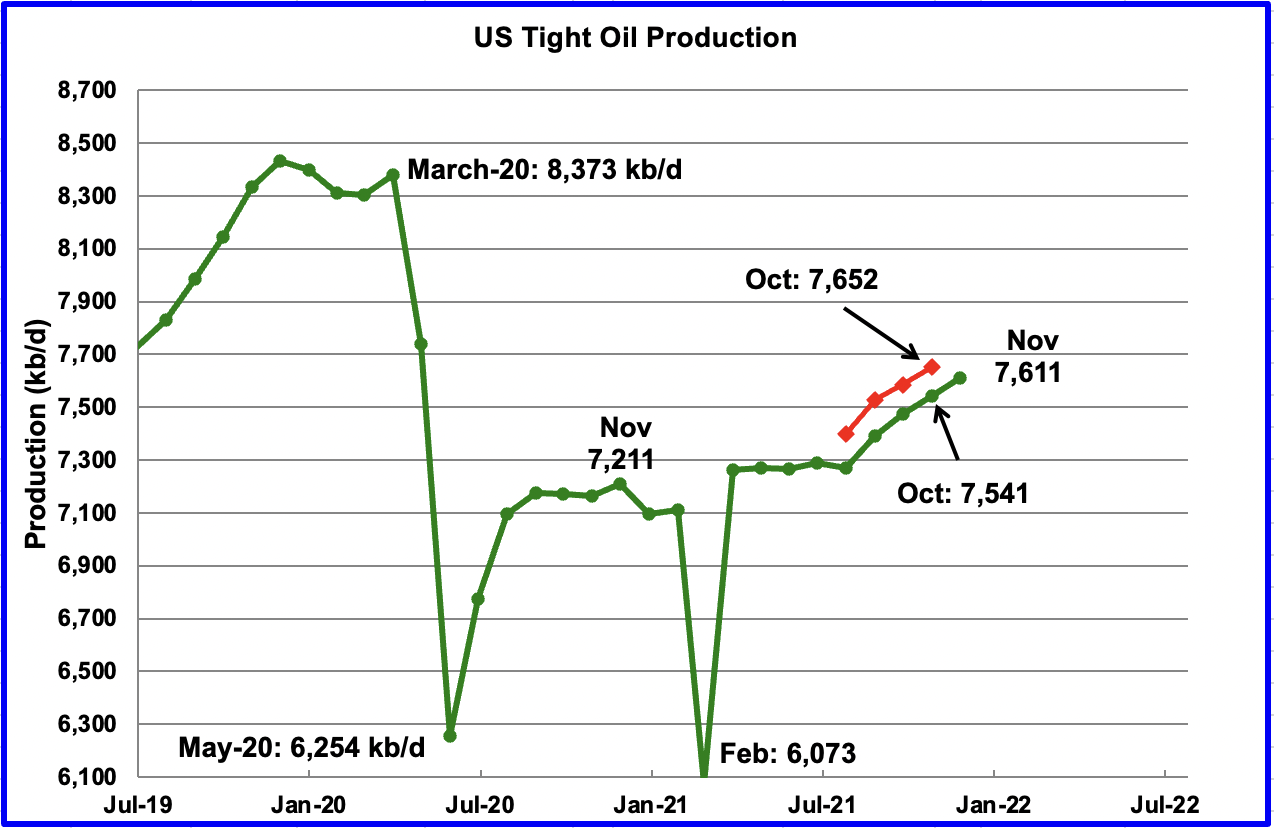

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The December report projects the tight oil production to November 2021.

The December LTO report revised down the November LTO projections by more than 100 kb/d from July 2021 to October 2021. For instance, October was revised down by 111 kb/d. The four point red graph shows the previous November LTO forecast. The other change from the November chart is the flat output from March to July.

November’s LTO output is expected to increase by 71 kb/d to 7,611 kb/d.

Permian LTO output reached a new high in November of 4,395 kb/d, an increase of 59 kb/d. From July to November 2021 Permian output grew at an average rate of 60 kb/d/mth.

The Bakken’s November output increased by 5 kb/d to 1,114kb/d.

The Eagle Ford basin is expected to produce 962 kb/d in November, essentially flat from October which came in at 963 kb/d.

Output in the Niobrara in the latest LTO report in showing steadily increasing production since July. November output is expected to be 446 kb/d, an increase of 7 kb/d.

The rising output can be attributed to the increase in rigs from 7 in June to 11 in November.

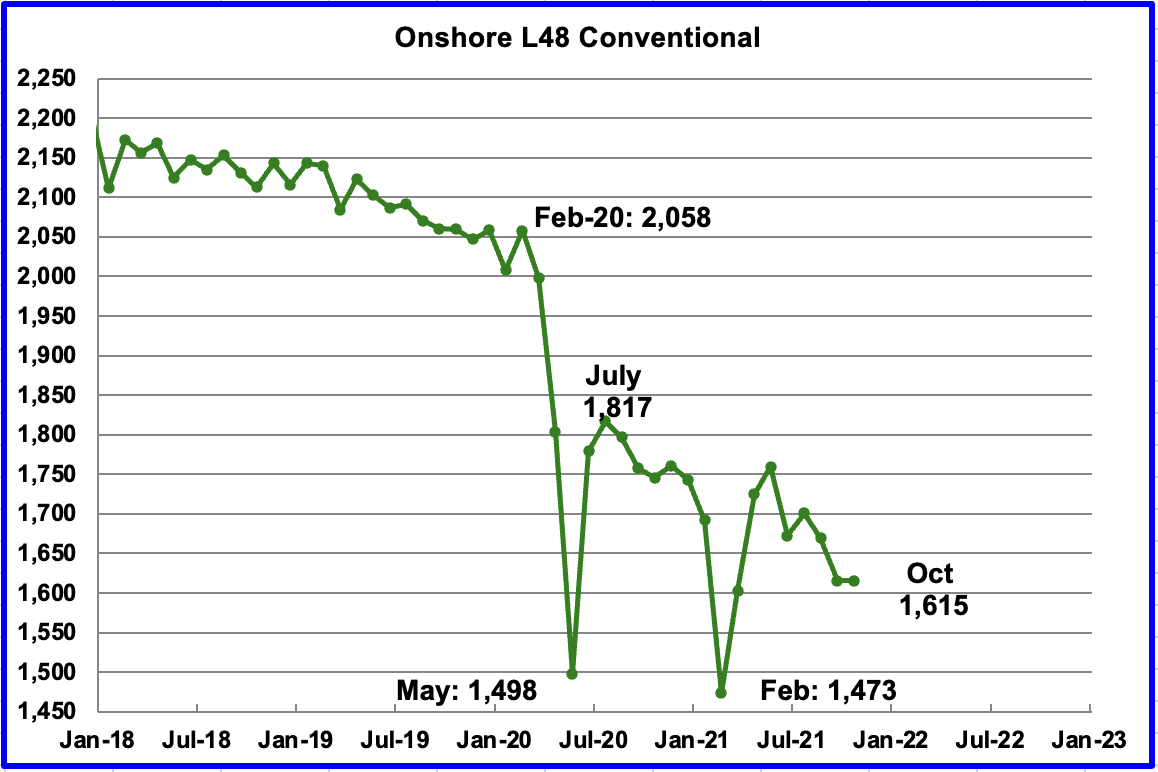

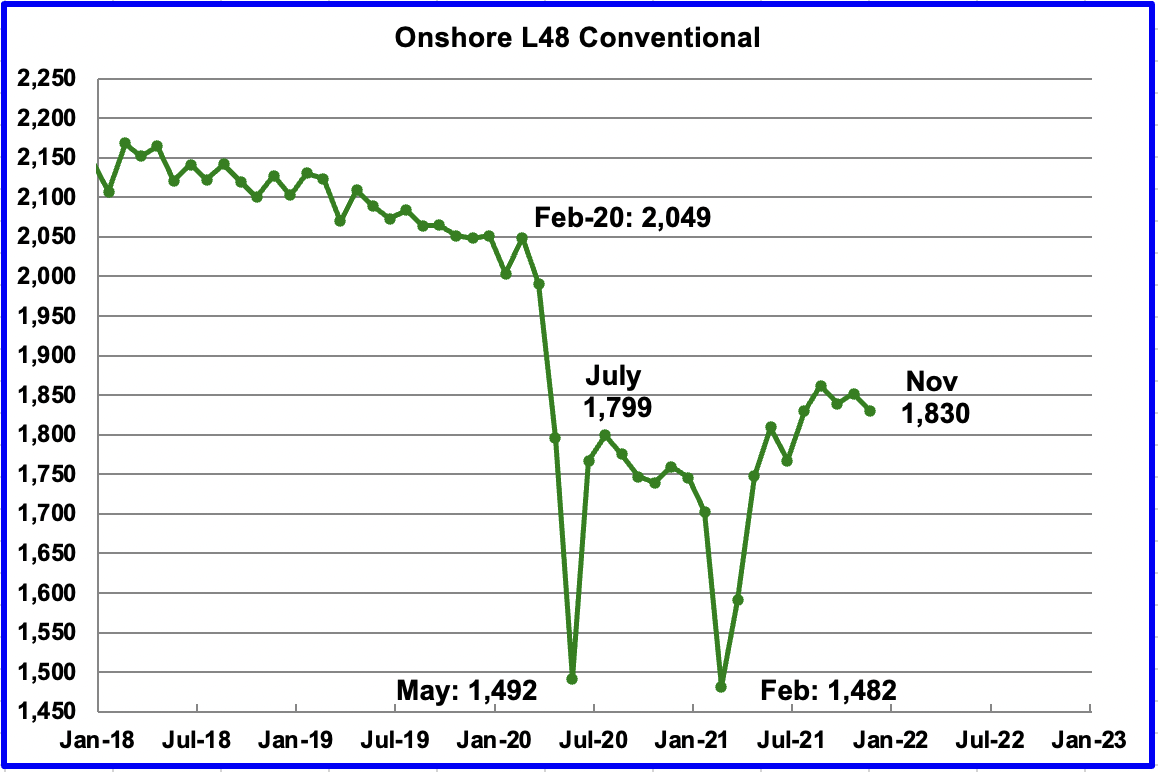

Onshore L48 chart from November STEO and LTO reports.

Conventional oil output in the Onshore L48 declined by 22 kb/d in December to 1,830 kb/d. This estimate is based on a combination of the expected November LTO output and the December STEO report that has a forecast for the US On-shore L48 output for November 2021.

In the December LTO report, LTO output was revised down as noted above. This downward revised output has resulted in an increase in conventional oil output in the Onshore L48 after May 2021.

The other characteristic that has changed in the December report is the essentially flat to slightly declining output of conventional crude from July to November, which showed a declining trend in the November report. See previous chart.

However, a note of caution is in order to explain such a big change. Since conventional output is the difference between two large numbers, both subject to monthly revisions in the later months, conventional output can show big variations from month to month for the most recent months.

The chart that appeared in the November US update has been reposted above to show/compare how the last six months can change. As can be seen, the November report shows a drop in conventional output over the last six months while the current chart just shows a hint of decline.

Monthly Energy Review (MER)

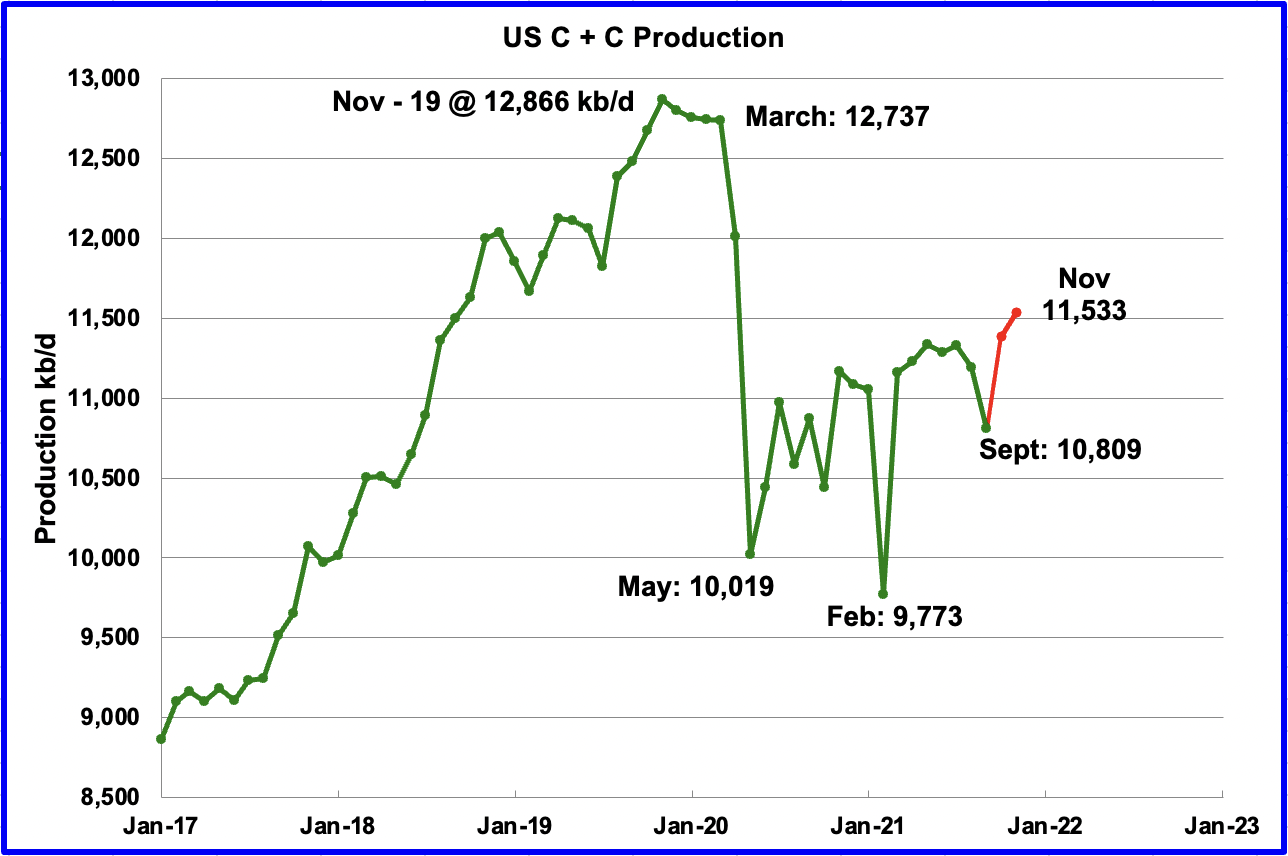

The Monthly Energy Review (MER) forecasts US output two months past the official US monthly production numbers, for this report that will be October and November.

US output in October is expected to recover from the loss due to hurricane Ida to 11,387 kb/d. November adds 146 kb/d to October to produce 11,533 kb/d. Red markers.

5) Rigs and Fracs

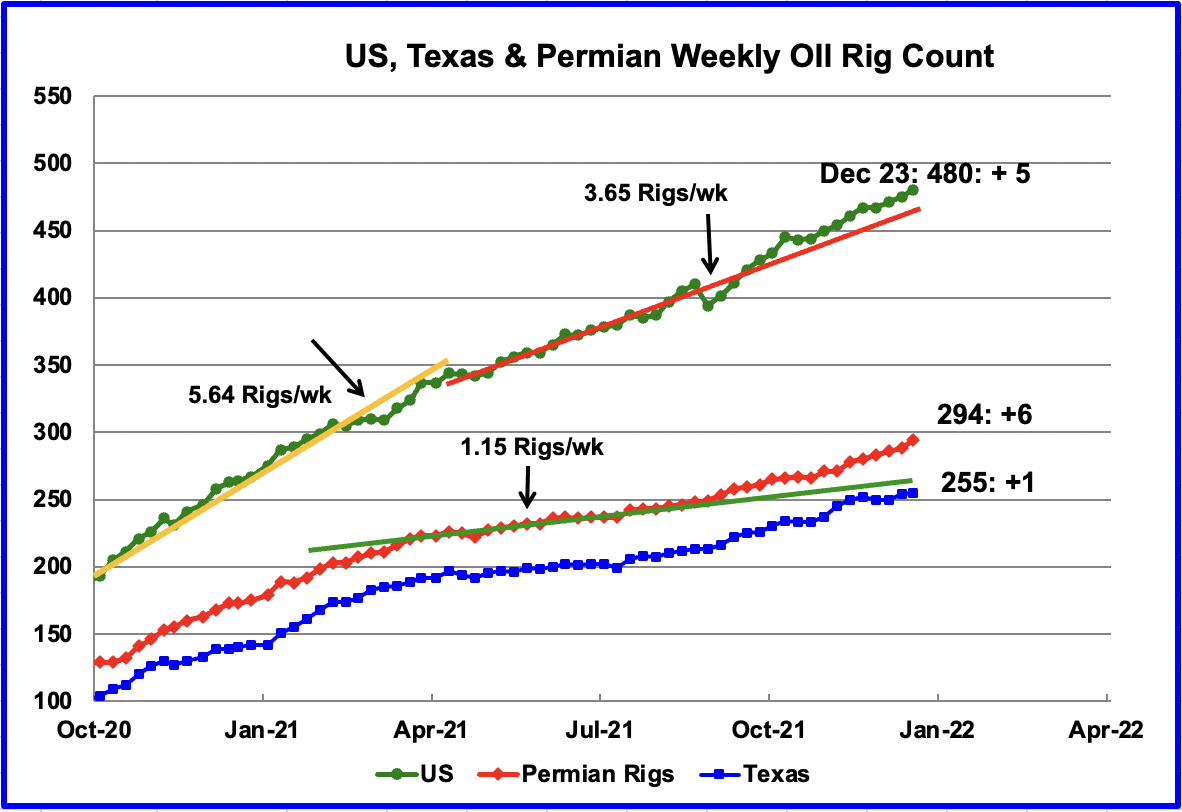

Since the beginning of April, the US has been adding oil rigs at a rate of close to 3.65 rigs/wk. Of these, the Permian has been adding 1.15 rigs/wk over the period April to early September. This means that more rigs were being added in other basins and states.

Since the end of September, it appears that the addition of rigs in the Permian basin has accelerated over the average rate as the red graph breaks away to the upside from the green trend line. On November 12 there were 271 rigs operating in the Permian. In the week of December 23, they increased to 294. Over this period, rigs were being added at an average rate of 4/wk. This seems to confirm that drilling in the Permian continues to be attractive to the drillers.

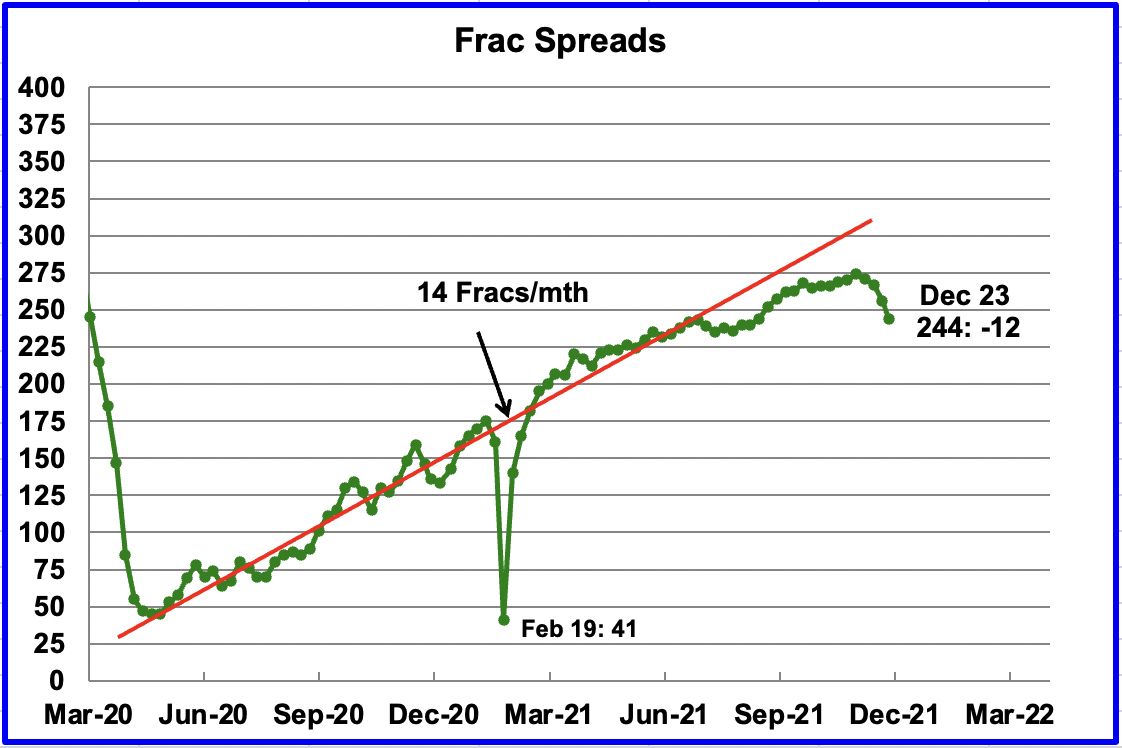

Starting in mid September, there were indications that frac spreads were being added at a slower rate than the 14/mth shown in the previous months. For all of the weeks in December, the frac spread count has been declining. For the week of December 23, 12 frac spreads were decommissioned. The decline in frac spreads in December is strictly a seasonal occurrence.

Note that these 244 frac spreads include both gas and oil spreads, whereas the rigs information is strictly for oil rigs.

Updated Oil Production from a Few Non-OPEC Countries

The following charts are updated to November using data provided by the country’s official web site.

Brazil’s November production increased by 74 kb/d to 2,852 kb/d according to this source (Red Markers). The October drop was due to continuing maintenance issues.

Output in China increased by 6 kb/d in November to 3,969 kb/d. Note that November 2021 production is only 46 kb/d higher than January 2020.

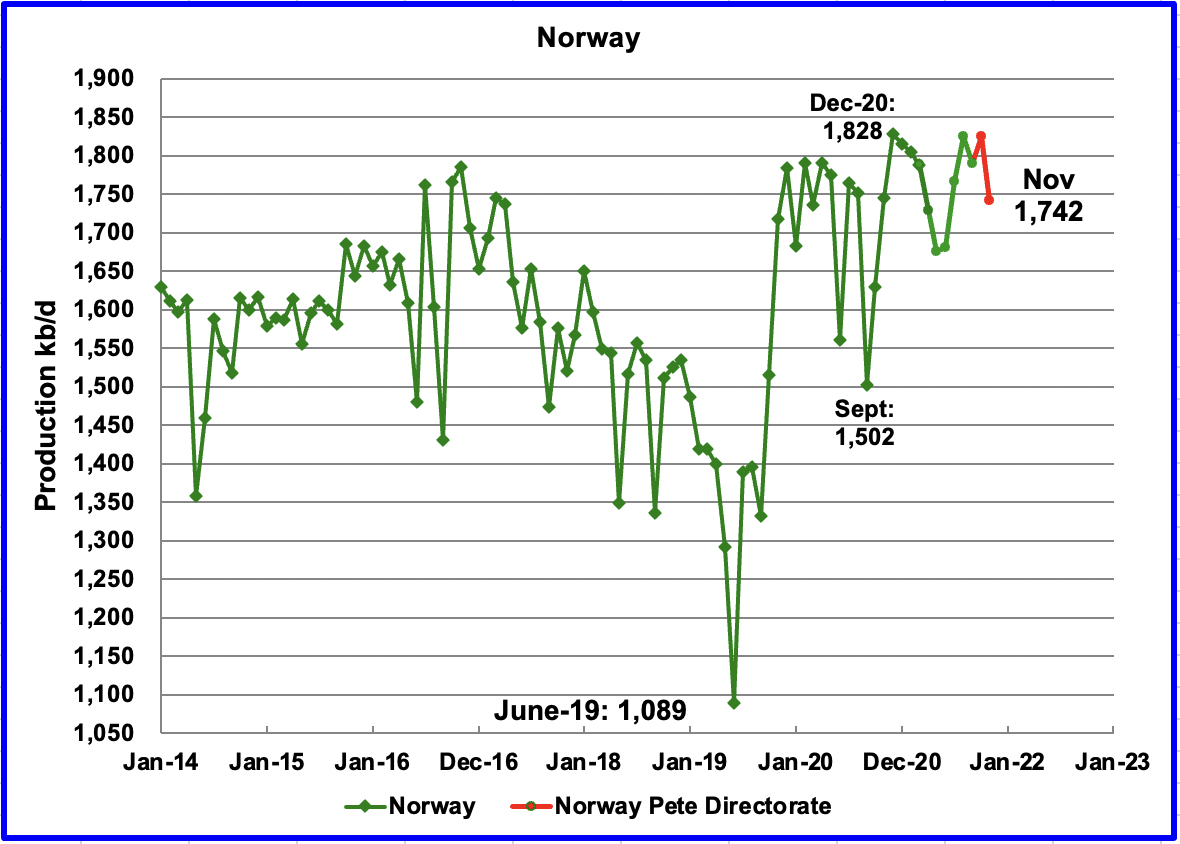

The Norway Petroleum Directorate reported that crude production dropped by 83 kb/d to 1,742 kb/d in November due to technical problems. The production level was 5% lower than the Directorate had forecast.

Non-OPEC W/O US

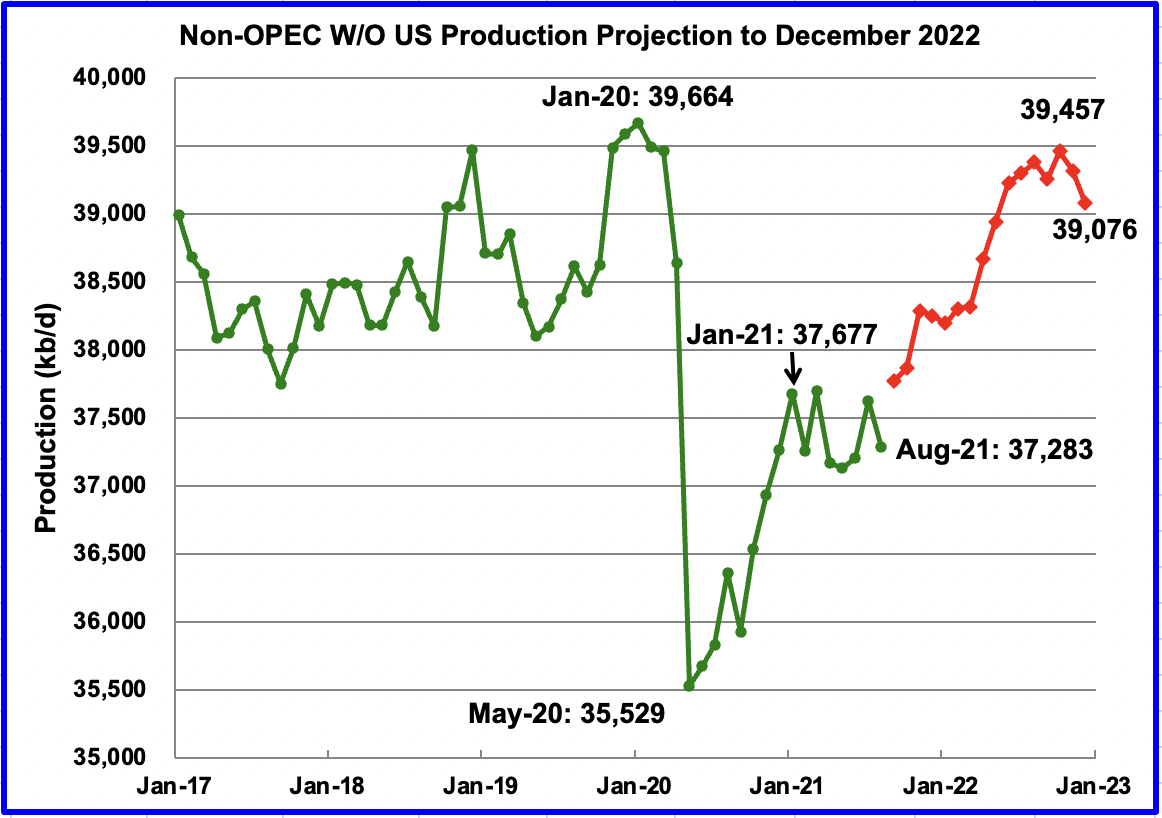

Non-Opec oil production W/O the US in August decreased by 339 kb/d to 37,283 kb/d according to the EIA. Of the 339 kb/d decrease, the two biggest contributors to the decrease were Kazakhstan, 251 kb/d and Canada 70 kb/d, for a total of 321 kb/d. Russian output dropped by 35 kb/d.

This chart also projects Non-OPEC W/O US crude (C + C) production out to December 2022. It uses the December STEO report along with the International Energy Statistics to make the projection. (Red markers) It projects that Non-OPEC W/O US crude production in December 2022 will be 39,076 kb/d, 588 kb/d lower than the January 2020 peak of 39,664 kb/d.

Crude Imports from Russia

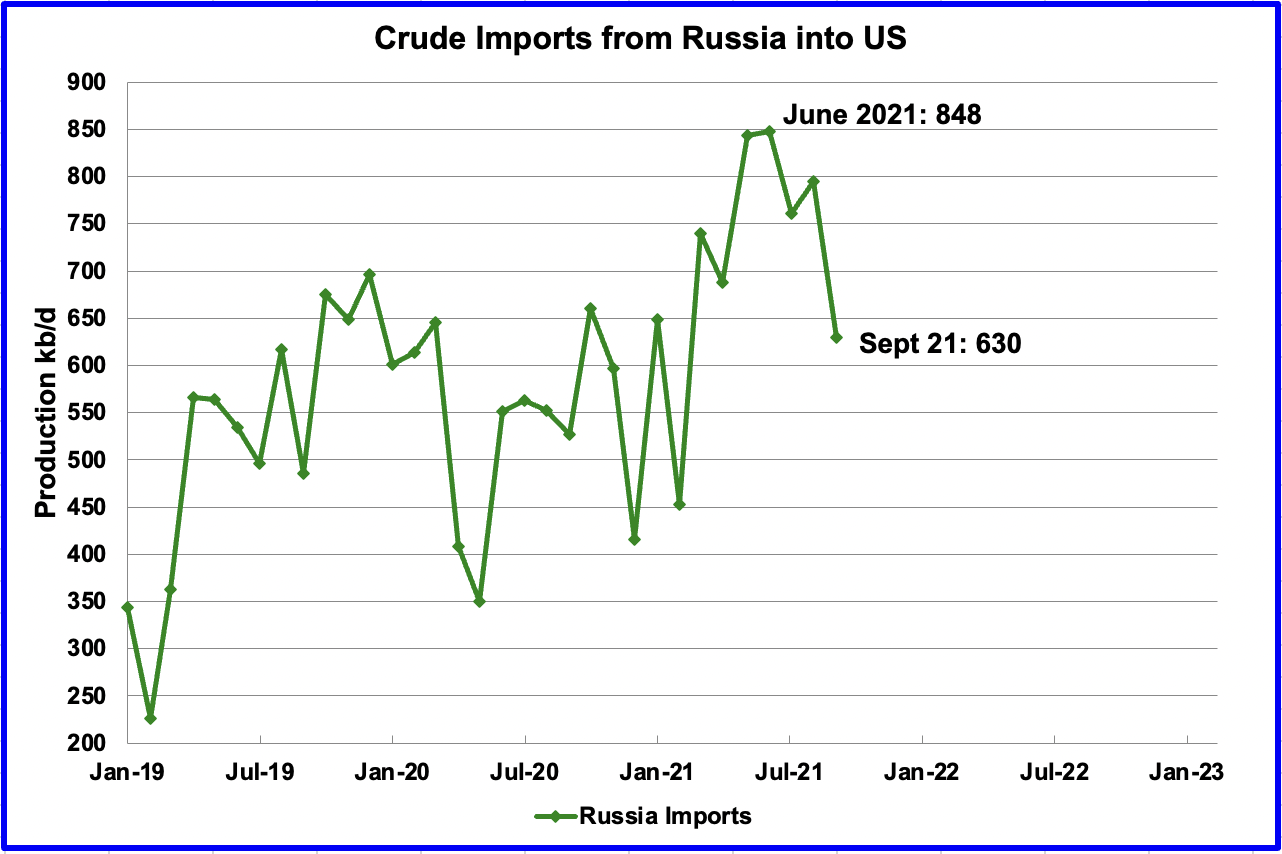

Imports of crude oil from Russia have increased since 2019. Imports of over 100 kb/d into the US started in 2005. In September 2021, imports were 630 kb/d.

Who has more leverage in the upcoming US/Russia negotiations?

Seasons Greetings to One and All. Also all of the best for the upcoming New Year.

The EIA has just released the October US production numbers, one day early. I will try to post the full US update sometime within the next 48 hrs. New Year celebrations permitting.

Output was up by 651 kb/d to 11,473 kb/d from the Hurricane Ida low of 10,822 kb/d. The STEO had forecast a rebound to 11,387 kb/d, low by 86 kb/d. The red dot in the chart is the MER November estimate from their December report.

I wish all of our participants a Happy, Healthy and Prosperous New Year

Thanks for the post Ovi!

Merry Christmas to all the writers, readers and commenters here; on the most highly esteemed and intellectually rigorous collapse blog on the net.

Tks Ovi for the Christmas gift . Conclusion Nov 2019 at 12,899 kbpd is the peak as per EIA at least till June 2022 . It cannot be surpassed post June 2022 because by then the “viable ” DUC’s will pass out . Their price projection ( always wrong) does not see $ 85 oil as is the hypothesis for the work done by Dennis .

Hole in head,

I use $75/b for Brent which would be about $72/bo for WTI in 2020 $. As far as viable DUCs running out, rig count can increase and more wells can be drilled, problem solved. Horizontal oil rig count in US has been increasing at an annual rate of 236 per year from August 14, 2020 to Dec 16, 2021. In August 2020 there were 207 horizontal rigs operating in the US and in December 2021 there were 521 horizontal rigs operating in the US.

If the trend of the past 16 months continues for another year the US horizontal rig count would increase to 757 rigs by Dec 2022.

In Jan 2018 the US horizontal rig count was about 805, this was a time when US tight oil output was increasing very rapidly.

Ron might say if, if, if, but he also uses past trends of historical production to anticipate the future.

Yep, Thanks!

I wish everyone on this site Happy Holidays, Merry Christmas and a healthy and happy new year.🎊🎄🎁

Ovi once again thank you for this excellent post.

Two things strike me as very ominous. One is the rapid decrease in DUCs. At the current rig count and if zero DUCs existed we would be in terminal decline which by the way will accelerate faster than most people think. The second observation is that as we drill more and more increased density wells, we will see the average boepd fall well below the current average of 770 boepd. Quality locations are diminishing quickly and with the lack of capital and service cost increase we will be trading water unless oil prices surpass $100 per barrel.

I believe the STEO actually does try hard to predict production and price but is too far removed from the industry to understand the micro tends in real time occurring inside of the industry which could foil their predictions. If oil is $62 per barrel by the end of 2022 then we will absolutely see a decline in the rig count and further decline of LTO oil and gas production. We have seen peak oil. No getting around it unless we see sky high prices which would even get the ESGers to jump back in because they can’t resist the temptation to “potentially” make lots of 💵💵💵💰💰💰

LTO Survivor

Thanks

Going forward the output in the US is all about the Permian, DUCs and additional rigs for the next 6 months. We will have more insight by then.

In the mean time here is the info that I find confusing. Rigs are being added in the Permian at a much higher rate than this summer. Is this because WTI is back over $70. Also other posters are saying pipe is in short supply and expensive. Somebody must have the pipe to drill all these wells.

Looking at the latest Permian info from Shale Profile, it shows that the 2021 wells have a peak rate of 894 b/d while the peak for the 2020 wells is 822 b/d. Permian wells are getting more oil out in the first year and therefore returning cash faster.

I am not clear of how to sort out the conflicting information of pressure loss, cross talk, denser drilling, poorer quality wells with rising rig counts and rising peak production for 2021 Permian wells.

I wish you a Merry Christmas and a Happy, Healthy and Prosperous New Year. Also thanks to you and all of our participants on the quality of the information provided.

Ovi,

Unfortunately we do not have information on how average lateral lengths have changed over time. It might be that lateral lengths have increased and the well productivity when normalized for lateral length has decreased. Note that I assume well productivity when normalized for lateral length started to decrease in Jan 2019 for the average Permian basin well, but that is a guess on my part, I don’t have enough information to make an accurate assessment.

Dennis

In the latest update for the Permian, Enno states “productivity per lateral foot has already slightly fallen since 2016.” This to me this implies that laterl length is a weak variable and that oil output continues to increase almost linearly with increasing length.

To me it sounds like friction is coming into play here. As the length increases there is an increase in the pressure drop as the oil from the extremities has to travel further and also increase the flow speed. This effect drops as the flow speed drops.

Ovi,

To me the cumulative output is of more interest and productivity per lateral foot is important because the productive acres are limited and longer laterals use up more acres.

Enno Peters data has shown productivity per 1000 lateral feet was at a maximum in 2019 and was relatively flat from 2016 to 2019.

See chart in post linked below.

https://shaleprofile.com/blog/permian/permian-update-through-september-2020/

direct link to image below

https://shaleprofile.com/wp-content/uploads/2020/12/Productivity.png

Ovi,

Note that Enno is looking at specific counties in Midland basin about 25% of all Permian output. For the entire Permian Enno has shown in the past that peak 6 month cumulative output normalized for lateral length was 2019.

I take 2018 as peak and assume decrease started in 2019 for new well EUR per thousand feet of lateral.

Ovi,

I have several observations regarding the data. Number one: are they counting barrel of oil equivalent (boe) which includes natural gas? If so, higher GORs could lead to a false positive reading of real oil production. Gas has been converted into a barrel oil by dividing 1,000 MCF by a factor of 6 for the past 40 years. For example, gas production of 42 million cubic feet per day divided by 6 equals an additional 7,000 boepd to the numbers. The higher the GOR, the more it skews the barrels of oil equivalent to the upside. Let’s say gas sells for a total netback to the producer at $4.00 per MCF. The revenue for on that day would be $160,000. If the 7,000 boepd was actually instead actually 7,000 barrels of oil per day (bopd) , the value would be $490,000 per day which would give the producer much more revenue and in turn become more profitable.

All of this is to say that if “boepd” is being used rather than bopd, companies are incentivized to produce these wells faster to make up for the lost revenue created by higher GORs and less actual bopd. This ultimately leads to faster pressure depletion and a quicker path to decline.

Secondly, why more rigs in the Permian? If this is truly a race to the bottom and CEOs understand what I saw plainly in front of me, they are incentivized to increase drilling rigs to increase production marginally and show growth to the investors. This is production growth in the short term but devastating to long term growth as the bottom hole pressure (bhp) will diminish more rapidly leaving far fewer available economic drilling locations available for development. Like the “Red Queen” in Alice in Wonderland, you have to pedal faster and faster just to stay in place.

The “dirty little secret” is that at some point in the near future, this production will fall off a cliff even in the Permian and all of the CEOs know this. Therefore because of the significant amount of debt still burdening these companies, while the price is higher, there is incentive to drill these wells faster to pay off debt, return money to investors, and pretend to show growth. This is actually mathematically impossible with $70 oil. In my opinion, all available cash should be used to reduce debt and then the shareholders will be paid.

At current prices, the shale business is only economic for those players investing 100% equity. Levered returns in a steeply declining asset base is folly and will only lead to more bankruptcies down the road. Every CEO knows this but he also believes that we have hit peak oil and believes that oil prices will be higher in the future to bail them out

Further to LTO’s comments: it is a misconception to believe Permian tight oil wells drop out of a vending machine all exactly the same; there is a human element to the oil industry that data hounds fail to recognize and/or chose to ignore (no disrespect to Ovi, at all).

Why does IP6MO (initial potential 6 months) appear to be higher than previous years? Its not because of better rock or better frac designs, its because of much higher prices and operational procedures designed to maximize cash flow. The exact same thing is happening in the APP Basin because of much higher gas prices and so those meatheads can export American LNG for more bucks. For shale oil, debt maturities are looming and interest rates are going up. D&C costs are going up in 2022, 20-25% is my guess. The panic is now, or about to be, fully underway.

Lateral lengths and proppant loading have stabilized in the Permian the past 2 years. Well productivity IS declining in the Permian; its masked by multi-well lease/unit reporting in Texas and by the human/operational component; artificial lift processes, for instance. Permian wells are being gutted for cash flow reasons; you’ll see after year 4 what that does to EUR’s. Nothing is getting better in the Permian, it is getting worse. High grading is now paramount to survival. THATS about over; the hearts of the watermelons are drilled up. DUC’s are all but gone. https://www.oilystuffblog.com/forum/forum-stuff/_duck

The BOE thing LTO brings up is relevant. 3-4 years ago when the shaleco’s were touting 1.5MM BOE EUR’s I suspected then it was because they were predicting rising GOR, at 6:1, and USED GOR to confuse the general public.

Most of the increase in rig count is small, non-public independents using equity, as LTO points out, not debt, and facing Federal income tax burdens in 2021 from higher prices. How do you avoid a lot of taxes? Reduce taxable income by putting rigs back to work before year end to take advantage of IDC deductions. Large public shalecos (PXD, DVN, FANG) don’t do that because they have NEVER paid Federal incomes taxes and because of tax loss carry forwards from 14 years of losses, won’t for the next 20 years.

What’s dumber than trying to predict oil prices? Predicting rig counts based on a linear trend. Good grief. History has NO precedent for that.

I am trying to help here. Folks like LTO should not be ignored; they, we, live this stuff every day. Its not a hobby for us.

What is the most relevant question facing the future of HZ tight oil in America? Where is the money going to come from to develop it? The resource play is still not profitable and it is still deeply in debt and dependent on other people’s money…on credit/debt.

“Energy (oil) has no solutions, only uncertain responses to change.” Art Berman

Mike,

Why are small independent producers increasing their number of operating rigs? Note that Permian horizontal rig count has been increasing for quite a while (about 18 months), perhaps that stops on Dec 31, 2021, we will soon see.

Do these guys not know what you know? Based on what you and LTO survivor are saying we should be seeing rigs decrease and output falling in the Permian basin.

The linear trend is not a prediction of where rig count will go, it is simply showing where it has been, I say simply that if the trend continues then rig count will reach some level in the future.

As I point out often, the number of possible future scenarios is infinite, the probability of choosing the “correct” scenario of the future is 1 divided by infinity, which is exactly zero.

I agree the future is unknown, I point this out often even though is is quite obvious to everyone here.

At a WTI oil price of $73/bo (2022 to 2028) and with Permian wells costing $10.5 million (full cycle cost, oil price and capital cost in 2020$), all debt can be paid back for Permian oil producers by the end of 2025 even with 25% of free cash flow paid out as dividends. This assumes natural gas price at $3.50/MCF in 2020$ from Oct 2021 to 2025.

The money for this development is from operating cash flow (GAAP), no new debt is needed.

One thing to consider is that peak demand for oil may arrive by the end of 2028, there is a narrow window where oil prices may be high from 2022 to 2028, after that oil prices may start to fall and tight oil will no longer be profitable to produce.

I have tried to include plug and abandon cost for horizontal tight oil wells in my scenarios and have guessed it might be 500k in 2020$ on average for Permian basin wells, can you give me a better guess?

I have a low completion rate scenario (31 Gb) and a high completion rate scenario(39 Gb) for Permian basin. The lower scenario has cumulative net revenue of one trillion dollars (in 2020$) by the end of 2050 (excess cash that is not needed to pay back debt after 2025 is assumed to be invested at a real annual rate of return of 5.5%). The higher completion rate scenario has cumulative net revenue of 1.239 trillion in 2020$ by the end of 2050 (as before excess cash flow is invested at annual real rate of return of 5.5%)

At no time in recent history has the US rig count been as low as it was 2H20; of course the rig count has been increasing the past 18 months. It had no where to go BUT up. You repeatedly hypothesize and plot rising rig counts/well completions to justify your models about the future. You’re good at googling, Dennis Coyne, google who is adding those rigs the past 2 quarters, and why.

I stand by my position (offered to Ovi, not you) on why IP180’s are increasing; its because of prices and operational methods designed to take advantage of prices. Wells in the Permian are NOT getting better.

Half your predictions you qualify with the world “if,” the other half with the word, “will.”

In looking for a possible answer for increasing rig counts this late in the year, when yearly budgets are typically exhausted, I suggested an effort to reduce taxable income thru IDC deductions. The tax paying part of my industry has done that very thing for the past 50 years. You, of course, would not know that. Following IRS procedures allows an operator to take IDC for months, and many wells, after the first of the next year. At no point did I suggest the rig count would stop increasing 31 December; that stupid reply was designed to embarrass me. As was the reply suggesting I must be wrong because I don’t follow the herd mentality. Shallow and LTO, both oily folks, don’t either, by the way.

“All Permian Basin debt WILL be paid back by 2024 and all future development in the basin WILL be from net revenue, NOT requiring additional debt.” A bold statement, that, with absolutely nothing at risk.

Every time I comment here, in a desire to help others understand the complexity of the oil business, that it’s more than a bunch of statistics, you fucking rag on me mercilessly with the express intent of discrediting me and controlling the content of your blog. I am a threat, I suppose, to your baseless predictions. Lets leave it at that. I will NOT comment anymore.

Thanks Mike,

Sorry to offend, I agree the Permian wells are not getting better, my assumption is that average new well EUR is likely decreasing in the Permian basin.

My question is why is rig count increasing? It would seem that tax credits are a bad reason to make a money losing investment from my perspective.

Both you and LTO survivor seem to be saying that we can expect a crash in Permian output any day now.

I am simply trying to reconcile what I see in the data and what both of you are saying.

Chart below takes Permian horizontal oil rig count from Baker Hughes and assumes (incorrectly no doubt) that rig efficiency is 1.3 wells drilled per rig to find horizontal oil wells drilled (potentially) in the Permian Basin, it then projects horizontal oil wells drilled in the Permian basin based on my medium scenario (where WTI remains at $72/bo in 2020$ or less in the future and natural gas sells fro $3.50/MCF and NGL sells at 35% of the price of crude.

This is what may happen, though of course low probability as there are many possibilities. Note that horizontal rig count would increase gradually from 276 on Dec 23, 2021 to 445 in August 2024 (just above previous peak of 443) and to a maximum of 510 horizontal oil rigs in August 2025, horizontal oil rig count falls starting in March 2027.

Note that I create scenarios based in part on what we have seen historically when oil prices were rising, I expect oil supply will be short in the future causing oil prices to rise. If I am wrong the scenarios will also be wrong.

Mike I ask questions to learn from you, I will refrain in the future.

The question of why rig counts have continued to increase I guess might be explained by tax credits, I just tend to assume the people running small independent oil companies are smart, it is their money on the line in most cases so I am assuming if they are using their capital to drill wells, they believe they will be successful. Just trying to understand what’s happening.

I am aware that there is wide variability in well productivity, I used to be able to see this at shaleprofile as in link below.

https://public.tableau.com/shared/9MY8QC538?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

It is now only available to subscribers so I no longer have access to this data.

Found a newsletter by Rystad at link below (April 2021)

https://www.rystadenergy.com/newsevents/news/newsletters/UsArchive/shale-newsletter-april-2021/

In 2019 they had D and C average cost at 900 per lateral foot ($9 million for a well with a 10 thousand foot lateral), in 2020 and 2021 they estimate that cost for drilling and completion dropped to 733 per lateral foot (7.33 million for a well with a 10 thousand foot lateral). If drilling and completion costs rise by 23% in 2022 that brings the cost of a well with a 10 thousand foot lateral back to the 2019 cost level.

I assume in my scenarios that drilling and completion cost remained at the 2019 level and never dropped in 2020 and 2021. Full cycle well cost is assumed to be 11 million in 2020 $ for the average Permian basin horizontal tight oil well.

Those remediation costs are just eye-popping! Insane!

What can’t be paid won’t be paid…so…’the Govt. will have to pony up the cash.

The Govt., of course, is the taxpayer.

In a potentially slip-sliding economy late 2022.

Wallets slamming shut. More oldies, fewer workers, increasing social security costs (bankrupt fund).

Top it with increasing costs of climate coping.

And airco demands more energy. With a rickety grid interconnection.

Oh my, oh my. There is potential for discontent.

And vast amounts of money spent on military rather than cleaning up many, many ‘consequences’, intended and unintended?

Hard decisions have to be made everywhere – but that don’t get you re-elected.

Thanks LOZ nice comments, and yes the colossal waste on our unneeded military budget (at least ten times too large) will be the Achille’s heel that brings us down – hands down the biggest waste of energy and resources in the history of the world.

Mike,

Don’t you dare stop commenting! You offer the real world comments that are needed to offset the other stuff!

LTO/Mike

Thanks for your detailed info.

Yes I look at a lot of data and take in a lot of information from both of you, which I appreciate very much. I also follow Enno’s Permian data and Dennis’ models. At this point it leaves me sitting on the fence. I will try to keep reporting all of the data as best as I can and hopefully at some point some piece of data will provide the clue that the Permian has peaked.

Six months from now, hopefully the outlook should be a little more clear.

Threads like the above are what keep me coming back here, even though I know next to nothing. Fascinating stuff, gentlemen.

LTO Survivor,

The EIA data is crude plus condensate production for tight oil, it does not include natural gas output.

The natural gas output is reported separately under shale gas output.

See link below for tight oil data under “tight oil production estimates by play”

https://www.eia.gov/petroleum/data.php#crude

See link below for shale gas production data under “dry shale gas production estimates by play”

https://www.eia.gov/naturalgas/data.php#production

The EIA does not report in boepd, also shale profile does not report in those terms.

Merry Christmas to everyone and to make the New Year a Happy one remember to take 4000 IU of Vitamin D3 daily.

Add k2 to the mix.

I take both everyday.

But the data on covid are mixed, and in late stages may possibly be harmful.

But many humans are deficient.

“take 4000 IU of Vitamin D3 daily.”

That is too high, between 1000 & 2000 IU is sufficient. Taking excessive amounts of D3 can cause health issues such as kidney stones.

That is not high at all.

Because synthesis of 1,25-dihydroxyvitamin D (the most active metabolite of vitamin D) is tightly regulated, vitamin D toxicity usually occurs only if excessive doses (prescription or megavitamin) are taken. Vitamin D 1000 mcg (40,000 units)/day causes toxicity within 1 to 4 months in infants. In adults, taking 1250 mcg (50,000 units)/day for several months can cause toxicity. Vitamin D toxicity can occur iatrogenically when hypoparathyroidism is treated too aggressively.

https://www.msdmanuals.com/en-au/professional/nutritional-disorders/vitamin-deficiency,-dependency,-and-toxicity/vitamin-d-toxicity

FWIW: I a person that was taking 50K IU per week had issues (Kidney Stones). I am trying to help you, not hurt you.

LTO Survivor,

I agree, if oil prices as predicted in the EIA STEO are correct, then the horizontal oil rig count will likely be flat to down. I doubt the EIA oil price scenario is correct, World oil supply is likely to be short of supply in the second half of 2022 and oil prices are likely to be $75/bo or higher for WTI in 2020 $.

Permian basin scenarios. low scenario with maximum completion rate of 525 new wells per month and high scenario with maximum completion rate of 800 new wells per month.

It occurs to me that the USGS undiscovered TRR for the Permian Basin is about 70 Gb with about 5 Gb of proved reserves plus cumulative production at the end of 2017 (3 assessments in 2016, 2017, and 2018) so TRR is about 75 Gb for Permian basin mean estimate by USGS.

For the Bakken Three Forks of North Dakota in 2013 the USGS mean TRR estimate was about 11 Gb.

So my middle scenario above for Permian has 35 Gb of a 75 Gb TRR being produced, about 47%.

For the Bakken my best guess scenario has 7.5 Gb for ERR of 11 Gb TRR or 68% and note that for the North Dakota Bakken/Three Forks cumulative production plus proved reserves at the end of 2019 was about 8.7 Gb or 79% of TRR.

The Permian scenarios I have created are quite conservative, if the North Dakota Bakken is any guide and it may be no guide at all. Only time will tell.

See this video of John Solomon ” The American Energy Crisis ” . Also addresses the stripper wells and the mom/pop operations and their problems . Long but interesting .

https://justthenews.com/tv

HIH

I would not classify JS as an unbiased reporter. He was fired by The Hill.

https://www.politico.com/news/2020/02/19/hill-john-solomon-failed-disclose-details-115976

He’s a Russian spy.

Bullseye . Comment by Norman Paigett , author of ” The end of more ” . This was on OFW .

“Putting aside the incessant noise about covid

our infinitely more critical problem can be summed up in 12 words:

We don’t have an energy problem

Our problem is paying for it . ”

Yes, if you can’t pay for it ,then you can’t have it . Energy poverty .

A question for HHH or anyone who has the answers . What happens if the Chinese devalue the Yuan ?

Depends on how fast the rate of devaluation they choose to do. Or are forced to do. And how far they have to take it. They can take it to the weak side of the trading band. Around 7.00000 as long as it’s slow moving it doesn’t mean much.

Technically that is about 6700 basis points or ticks from where it is now. Which is a large move but it doesn’t mean SHTF in China or elsewhere.

Now if we see a move above 7.00000 to say 8.00000 or higher particularly if it’s an uncontrolled move then there will be blood in the streets.

Hong Kong currency peg would likely break well before mainland China unless mainland China gave Hong Kong US dollars to defend it’s currency.

Hong Kong will look like Turkey before China. That is how you’ll know it’s on verge of happening in China.

China has a lot of dollar reserves to burn through before any type of uncontrollable devaluation would happen.

But then again when Japan’s bubble pop it was due to lack of US dollars. What would be the scenario that would lead to China lacking US dollars?

Well if every country decided to bring manufacturing base and supply chains home. Or just move them to India or Vietnam or elsewhere to lower cost would trigger this. And that is already happening.

Which is why China needs a cheaper currency to begin with to stay competitive. 7.0000 might not be enough to stay competitive.

How this will play out in oil demand? Maybe less demand in China but more demand elsewhere. Might just be awash.

SHTF when there is nowhere to produce cheap shit due to a lack of energy not necessarily just oil but total energy.

If Europe doesn’t figure out how to keep the power on this winter then industry will start to shut down. What will the trade data between all of Europe and China look like? China might have to go into lockdown if demand dries up in Europe.

But until we get an actual crisis. Wall Street and the pension funds are going to continue ramping stock valuations higher. So the rug under oil prices might not be pulled just yet.

HHH,

I read with interest you comment on “China might have to go into lockdown” because of energy shortage . I was wondering if this latest Omincron is being used as an excuse in the UK and Europe to do the same , Machiavellian of me but just maybe I’m reading to much into it .

Thanks

Forbin

Well it’s easier to lockdown a city of 13 million people over 250 cases of Omincron since your policy is zero tolerance. Than it is to say Europe is having and energy crisis and demand from Europe may never return to where it once was.

You can buy time to figure out a path forward to keep people employed and not rioting.

I don’t think the average Chinese citizen would complain too much at first though as their work week is 12 hrs a day 6 days a week. They could easily adopt a more western work week and be less productive. But that would mean less pay. So might not go over too well no matter what.

Part of China’s problem is wages have increased dramatically and labor is no longer cheap. Becoming poorer isn’t going to go over too well anywhere. Lockdowns are just a tool to manage people.

Another thing of note in regards to China. US stimulus checks that were used to buy shit at Walmart and Amazon aren’t coming in 2022. Which mean demand from US consumers will be down.

And the extra child tax credit. Without Biden’s BBB spending bill. That expires. Less money in pockets of US consumers to spend.

Doesn’t sound great for oil prices does it?

China is at a crossroads. Their zero tolerance for Covid policy is no longer sustainable with Omicron. Either route for them is potentially very damaging economically. A rock and a hard place…

“ Scientist who warned the world of Omicron variant says China’s ‘Zero Covid’ policy WON’T WORK against super-transmissible mutant strain as city of 13 million is locked down”

https://www.dailymail.co.uk/news/article-10344169/amp/Scientist-warned-world-Omicron-warns-China-Zero-Covid-policy-WONT-WORK.html

HHH Wrote:

“I don’t think the average Chinese citizen would complain too much at first though as their work week is 12 hrs a day 6 days a week”

China does not impose rent mortatoriums on those under lockdowns. The majority of chinese work long hours is to stay afloat and not end up homeless.

“China’s problem is wages have increased dramatically and labor is no longer cheap. ”

Only matching the decline of the Yuan, as inflation is running rampant. Food and energy prices are up over 30% in 2021.

Forbin and UK based followers . Are you prepared ?

https://consciousnessofsheep.co.uk/2021/12/20/the-uk-energy-rationing-plan/

Reminder from 1st January many new conditions as per the Brexit agreement come into play .

Be Well .

BOE raised interest rates a laughable 0.15% at their last meeting. I have to believe just about everyone there has their hands on the sell button.

There are some who buy when everyone is selling. But that is under the pretense that there is not much further to fall and there will be a rebound as things get worked out.

Wonder what happens when there is a permanent shock that is never recovered from. You can’t really buy the dip. The pound could easily go to 0.75cent or as low as 0.50 cents to the dollar. And stay there. Their currency could easily lose 2/3 of its value in a relatively short amount of time if energy crisis plays out in worse case scenario.

Only thing they can do to prevent worse case scenario from playing out is to make sure at all cost there is enough damn energy.

Kinda feel like we are all just waiting around to see which domino falls first. The idea that everything everywhere will somehow fall into place and allow high enough prices to allow a new peak in oil production is laughable.

HHH, my POV which agrees for most of your conclusions . Let us asses the situation worldwide . There are 6 continents and let us take one at a time .

1. Africa and South , Central America : Dead . No reprieve . Expect the situation to go from bad to worse .

2 . Australia & NZ ; One trick ponies depending on China . Who advised them to do such to do such drastic shutdowns ? Who told Australia to punch its biggest customer in the nose ? Stupid acts that will have consequences . To top it all Australia shutdown it’s last refinery and now must import all its finished fuels . How good ?

3. Europe : Another stupid move punching Mr Putin in the nose . The industry has put in its papers and if the situation does not improve they will mail in the keys . UK I have already posted the energy rationing plan link earlier .

https://www.wsj.com/articles/europes-industrial-firms-flash-warning-on-energy-costs-11640345803

Asia : Only two countries matter . China and India the rest are important but not critical .

India : Disaster in the pipeline . 50% youth unemployment . 15% WPI in Nov so wait until March when the CPI will be 15% . Politically the right wing is stoking fires for a caste war . A very undercurrent of intercommunity violence is being constructed . No reprieve .

China : Agree with all you have written except that the Chinese dollar crisis is already here . They lowered their RRR rate by 0.5% to release $ 188 billion into the Fx market to ease liquidity . The CCP is going to need all the USD reserves to cover its energy imports ( coal imports up by 200%) and also to backup the unwinding of the housing bubble now under progress . Under severe stress . Thanks for putting the spotlight on the HKD peg . It’s vulnerability flies below the radar .

North America : Cannot improve on what you have said except the addition of the risks posed by the Canadian housing and private debt bubbles .

MIddle East will continue with its wars and instability .

The conclusion is that 2022 will be as bad ( if not worse ) than 2021 . Don’t see how high prices can come except for some supply shocks . Entering into a period what is called “the age of consequences ” where we will pay for all our actions financial , political, environmental ,social etc is the creation of the ” perfect storm ” .

There is a big take home message regarding energy in UK, and every other country-

Better learn to change the pattern of behavior

and begin to rapidly rely only on domestic energy sources.

Use this current time (it is two-three decades late but better to use these few years of grace-relative low price for oil and gas*)

to build as much domestic generation capacity as you can afford to.

Because importation of oil, and gas, and electricity produced by other countries,

is going to prove either very very expensive, or

simply unavailable.

You can’t rely on tankers from the Middle East, or from the USA, etc

or pipelines from Russia. These sources are prone to disruption, or

to being purchased by other higher bidders.

Whether its nuclear, wind, coal, geothermal, or solar better build out capacity while resources are affordable.

in addition to cost/GWhr for these various options, we all must consider years/GWhr-

by that I refer to

how many years does it take from 1st day of planning to 1st day of production of a new generating facility or project.

*-yes, oil and gas are still cheap now, compared to the future

Hi Ovi, Merry Christmas and thanks for this very interesting and informative update.

The EIA report seems very optimistic related to US shale shall save the world from an emerging energy cryzis.

Last week the L48 production decrease with 100k bpd, many off thoose remaining ducs are dead ducs as they are drilled to close, it might something will happen Q1 2022 that will make the oilprice forcast off EIA to more look like a joke. What if US oil priduction declines, Opec + spare production are used and the world demand increased related to less impact from covid? Than oil price might be 125 usd instead off 70 as EIA predict.

Global growth is decelerating. And will continue to decelerating through 2022. As central banks continue to tighten monetary policy. Oil had it’s run up. While it might not sell off immediately. Top is likely in.

We’d need to see accelerating growth. Rising bond yields. Every downturn in the economy since 1986. The yield curve recovery has been less and less. Economy is already started to decelerate and we still haven’t made it back to 2% on the 10 year.

The reflations just keep getting weaker and weaker each time we get a crisis.

$125 or $150 oil is like a gold bug calling for $5000 gold.

Oil price is a proxy for future growth and inflation expectations. Just like low bond yields low oil prices tell you that the future growth and inflation prospects aren’t good. Manufacturing data is already decelerating not in contraction but decelerating month over month in most places.

Maybe we somehow avoid a recession in 2022. But the idea that Covid is main driver of growth or not so much growth in 2022 ignores everything else the matters.

We already know loans, and or credit creation by commercial banks aren’t happening at the rate needed to sustain growth. Our fractional reserve banking system that can loan out $10 for every $1 of deposits is only loaning out $2 for every $1 of deposits.

With no added government spending and less monetary stimulus from FED and other central banks. How exactly is growth going to not only continue but accelerate?

Show me where the money creation is going to come from and I’ll get onboard with the $125,$150 or even higher oil prices.

“LONDON (Reuters) – The world’s economic output will exceed $100 trillion for the first time next year”

and oil price will be higher.

January historically is best month of the year for stocks. I can see us having a risk on move that carries oil prices up. Not sure that equals new highs for oil. I’m more bearish medium to long term oil price than I am short term. There are just too many bad situations that can get a whole lot worse to put any long term bets on higher oil prices.

Most of the things I talk about don’t play out over a short term period of time. I make trades that are complete opposite of my medium to long term views all the time if all the technical chart information lines up to indicate price direction. I’m in a risk on position right now.

After Thanksgiving 12% drop in oil prices and pullback in stocks look to have been a bought the dip opportunity. All the Yen currency pairs are pointing up. Until crisis strikes again it’s likely going to be risk on for awhile.

But there are some big potential crisis brewing almost everywhere you look. So while I am long risk again. That can change in a hurry.

If things are great as some media outlets say they are then 10 year bond yields will get back over 2% We will see steepening yield curve in 2022. Not flattening of yield curve.

Money creation isn’t there to support these higher prices. FED knows this and which is why they stuck to the transitory narrative for so long. Supply chains just aren’t normalizing like they thought.

As bearish as I am on the overall outlook. I understand the mechanism that drives stock valuations. And why only pro’s can short it successfully. The bid under stocks comes from pension funds having to have 7% return on capital. Pension funds buy the corporate debt that allows CEO’s that want to get paid the capital to do stock buybacks.

Unless crisis is acute direction is up for stocks. Which in theory should be good for oil price.

Freddy

I think I will keep watching what is happening with well quality at Shaleprofile. When it starts reporting that peak output in Permian well has started to decline, that will be the clue that US production from LTO will be plateauing and the starting to drop.

Ovi, there are several factors that should be followed closely in the year to come. As many here in this forum have written capex will increase as result off inflation is high, lack off pepole, items like pipes, flanges and other parts are difficult to get. As I see all this depleation from tight oil need to be replaced every month in additional to new production as total US production can increase. There must be lots off wells both new and old that need maintenance, spare parts and if there is capacity problems in both labor and equipment this will add a growing downward pressure on the production. Signs might already come to the surface. As I remember they was in 2019 manage to increase lateral lenght above 20 000 feet, but with this also came some new challanges and increase cost as they need more power, the risk drilling equipment get stuck or break increase. The benefits is they get more oil from the well at least to start with and I believe thoose wells have higher depleation rates as more fracking stages adds child wells challanges and interferences to hit fractions from other wells that cause pressure dropps and other.

I know from oilreservoirs off sandstone where they inject water and chemicals to wash out more oil from the pores thoose structures getting more fragile as time goes by. In permian

that I guess have same problens it means the more holes, laterals, is drilled the more problem you might have to controll the fraction after fracking and this again might force them to reduce power as to much interference with old wells. Such issue will increase break even price for a well that I believe today is above 70 usd wti and it is increasing aldso in Permian. I can understand the banks and investors want to have back most off the money they have borrowed before it is to late. I know many Company went bankrupt and loans where transfered to cheap stocked with huge losses as result for the creditors but think still there is huge amounts that shall be payed back and it will be interesting to see if shale oil ever will be profittable adding the cost it took to developing it.

Thanks Freddy , very well explained for a layman to grasp the complexity and head winds .

Thanks Freddy

Your insights are much appreciated

Ovi, think this might have some info you can use in your midell.

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/052121-us-upstream-industry-relying-on-longer-lateral-drilling-to-boost-cash-flows

As you can see you get less oil produced each foot if the latheral is long 10 000 – 15 000 foot.

Than it seems to me it this will have the impact you get more oil produced from a long lateral at least to start with but less barrels it will be tecnical possible to produce from the field.

Freddy Gulesto,

Good article thanks. From an economics perspective, the longer laterals may make sense, but from the resource perspective we may extract less oil per acre as productivity per lateral foot seems to decrease beyond 10 thousand feet. Even if it does not, we do not get any more oil per acre with longer laterals, just lower costs and higher profits.

Freddy,

Not many tight oil wells have laterals that are 20000 feet (though there are shale gas wells with 20000 foot lateral, 10000 feet is more typical for tight oil wells), costs may increase and prices may increase as well, if they do not output may stagnate, but $75/bo for WTI is high enough for profits in 2020$ at 2019 level of costs. Debt can be paid back out of operating cash flow as long as oil prices rise as much as costs.

Of course future costs and future prices are unknown, both are likely to be higher, how much higher each will be we just don’t know.

Coyne, it might be it was gaz wells.

At least I see from this article some in permian should now be 15 000.

https://www.hellenicshippingnews.com/drilling-and-completion-improvements-support-permian-basin-hydrocarbon-production-average-lateral-length-per-well-in-the-delaware-and-midland-basin-2/

Freddy,

Thanks. I focus on average lateral lengths which are around 9000 to 10000 foot range in the Permain, it is not clear much is gained by going longer in a tight oil well, but I will leave that to professionals who know more than me.

Ecuador’s oil production down ~400,000 b/d:

https://twitter.com/staunovo/status/1474388741183741975

Libya’s NOC says 300,000 b/d crude shut in: Update

Libya’s state-owned NOC said more than 300,000 b/d of crude production is shut in at fields in the western part of the country.

Nigeria’s Oil Woes Persist as Shell Halts Flows From Forcados

More than 200,000 barrels a day of Nigerian crude normally pass through the terminal.

Russia plans lower oil exports for Q1 2022 despite OPEC+ plan to raise output

Exports and transit of oil from Russia are planned at 56.05 million tonnes in the first quarter of 2022 versus 58.3 million tonnes in the fourth quarter of 2021…

https://twitter.com/xglobalmarkets/status/1475764105260810240

#RUSSIA’S OIL AND GAS CONDENSATE OUTPUT WAS 10.90 MILLION BPD BETWEEN DECEMBER 1 AND 27, FROM AN AVERAGE OF 10.89 MILLION BPD IN NOVEMBER.

RON PATTERSON

IGNORED

12/28/2021 at 9:27 am

A very interesting article on Russian future oil production. Bold mine:

Analysis: Russia seen missing its May target for pre-pandemic oil output

MOSCOW, Dec 28 (Reuters) – Russia is unlikely to hit its May target of pre-pandemic oil output levels due to a lack of spare production capacity but could do so later in the year, analysts and company sources said on Tuesday.

Deputy Prime Minister Alexander Novak, in charge of Moscow’s ties with the OPEC+ group of oil producers, has said output by May is expected to hit pre-pandemic levels, or about 11.33 million barrels per day (bpd) of oil and gas condensate, as seen in April 2020 .

However, many oil producers have reported they are almost out of spare production capacity having reduced output in tandem with other OPEC+ producers.

Part of the problem is old wells, mostly in Siberia, that are struggling to increase output, industry sources say.

Production of oil and gas condensate in December stayed at around 10.9 million bpd, in line with November, despite Russia’s OPEC+ quota rising by 100,000 bpd.

“It’s possible that Russia will be behind the output increase schedule in the first half of 2022 and not reach its pre-crisis level until the end of summer,” said Dmitry Marinchenko of Fitch Ratings.

Marinchenko said it would be hard for Russian companies to increase monthly output by 100,000 bpd and that they would need to intensify drilling.

“That would take some time,” he said.

A source at one Russian oil major said efforts to boost oil production have also been hampered by a lack of new wells at oilfields with high levels of water, as well as declining oil well production rates at hard-to-recover fields.

He said Russia would not likely hit pre-pandemic output levels before August.

Obviously Russia is struggling to increase oil production but finding that more and more difficult due to their very old brownfields with high water cut. They have been infill drilling those old fields and now find that there are no more places to drill. They try but just get mostly water.

Those who think Russia will be a major player in helping world oil production to reach new highs are dreaming. Russia will soon be in decline and part of the problem, not part of the solution.

Ron , put this on the old post . Just copy paste to the correct place .

When it comes to Russian Oil Reserves, we wonder if they may be just as Fictitious as the Middle East. With the oil industry transitioning to the VUNDERCHILD of the Oil Geologist and away from the Petroleum Oil Reservoir Engineer in the late 1990s, it’s anyone’s guess now of how much of the current reserves… are completely “BOLLOCKS?”

steve

Steve,

time will tell of course. Books are also written to make money.

From the year 2005 there is the book “Twilight in the desert” from Matt Simmons.

He raised the possibility that in the not too distant future, Saudi oil production will suddenly decline. He summarized what he learned about Saudi Arabian oil production by reading 200 academic papers.

Techniques (EOR) have improved a lot, but that also extracts crude oil a lot faster. A dangerous concurrence of circumstances. More than 15 (!) years have passed since 2005, so the ‘oil shock’ might well be about 5-10 years, or less, away.

Same could be the fact for Russia.

Han,

You bring up a valid point. However, Matt Simmons wasn’t an Oil Reservoir Engineer, who understood Fluid Dynamics, like Robert Dietrich. Rather, Simmons was a trained Investment Banker.

BIG DIFFERENCE in Analysis…

The DEVIL is in the DETAILS. And, I can assure you, Dietrich’s goal wasn’t to make MONEY if you read his book. But, to warn the world of the mistake by the Oil Industry switching from the science of Reservoir Oil & Fluid Dynamics to the study of “Oil In Place” Geology.

steve

Nowhere in the preface provided by Amazon does it say anything about the oil industry switching from reservoir dynamics to “oil in place” geology? I put quotes around it as well, as this reservoir engineer has never even heard of such a thing. Can you elaborate?

steve,

Thanks for clarifying.

I can imagine that fluid dynamics should be at least as important as “Oil in place” geology. Taking that into account, reading those 200 academic papers, the conclusion of Simmons could have been even more unfavourable. On the other hand, the advanced EOR techniques delay Peakoil or/and make the plateau last longer. The consequence for individual oilfields: the decline thereafter will be more steep.

Sorry to repeat myself, but I didn’t see a Steve clarification? I was just interested in where SRSRocco got the idea that this claimed change is happening. And what in the world is the the study of “oil in place geology”? In-place estimates are certainly part of reservoir engineering studies and calculations, did someone invent a new sub-specialty somewhere?

Simmons was an accountant, Lynch once famously said that you don’t ask an accountant reservoir engineering questions. Always struck me as more apropos than whatever Simmons thought on the topic. Simmons apparently also didn’t know production engineers operating within discretely reservoired fields (as opposed to continuous accumulations) consider themselves to be as expert in water handling as they are producing oil. Because if you can’t do the former, the latter doesn’t matter much.

Sorry to repeat myself, but I didn’t see a Steve clarification? I was just interested in where SRSRocco got the idea that this claimed change is happening.

Only a blooming fucking idiot would ever ask such a question. Any further comments from this idiot should be ignored.

Sorry for the rant but I am on my third toddy right now. And when I get just half snockered, I do not suffer fools lightly.

Bye now,

Ron

Ron,

Reservegrowthrulz is far from an idiot, he knows a lot about petroleum engineering and we could all learn much from him.

Dennis, I am sure ReserveGrowthRulz knows about oil production or something about it at least. However, anyone who makes this statement: I was just interested in where SRSRocco got the idea that this claimed change is happening., knows diddley squat about climate change.

Think about it. Just where did you get the idea that climate change is happening? Do you think that is a sensible question? How would you answer? Perhaps: From about 40 years of study by climate scientists? Would that be a sensible answer? But why give a sensible answer to a totally nonsensual question?

What is your opinion, Dennis? Or do you agree with the climate change deniers like ReserveGrowthRulz?

Ron, RESERVEGROWTHRULZ isn’t talking about climate change.

My mistake. I apologize. I misread his statment. I saw “claimed” and read “climate”.

Okay, I really screwed up. ReserveGrowthRulz, please accept my apology. I will try to do better next time.

Ron Patterson

Mr. Patterson,

Your last comment (posted 12:57 local time) is another display of the nobleness of your character.

For that (increasingly uncommon, sadly) public acknowledgement of a sincere albeit somewhat trivial misstep, you have once again shown your innate integrity.

While you and I probably disagree on about 90% of what is posted on this site, you have consistently put forth an unswerving drive to both seek out and convey Truth as best you can ascertain.

The fact that this site continues on in a (mostly) high level of discourse is due in no small part to the foundations which you have established.

For that, I offer you both my appreciation and congratulations.

Gerard

Thanks, Coffeeguyzz. I seem to be screwing up a lot since I reached this dotting old age. And when I get a bit tipsy like I was last night, it gets a lot worse. 😫 However, I really enjoy the dialogue here. I think it is a lot of fun. We can learn a lot about people just from the opinions they hold. But whatever that means, if anything, I am yet to figure that out.

Thanks again for the very kind words.

Ron

Oil Inventory update by Tracy Shuchart

Seppo,

What is the vertical scale on those charts?

Compare the lowest line to this, and it is 2900 MMB, so the tic marks are 50 MMB apart. It appears that the data has been corrected some.

Thanks Seppo.

Seppo,

This is stocks of crude? Or is it crude plus petroleum products? Does it include SPR stocks? Oil on water? For the globe this would be roughly 30 days of forward global consumption. It is unclear what is being measured in this chart.

Can European industry afford these prices .

Are those spot market prices in Europe, or do those big price spikes get passed on to residential customers as well?

In USA we have longterm stable regulated residential and commercial electrical pricing without short term fluctuations (I’m not sure if this applies to Texas where they have a separate system). For example, in our area we pay 11 cents/kwhr regardless of spot market pricing year after year.

For your curiosity, no.

Questions on the nuclear industry status in France-

Is there one plant design that has been settled on as the best, or are various designs still being deployed for new projects?

Roughly, what is the best case scenario for years of development of a new nuclear plant- from planning to completion? We have heard about projects that take over 20 years, but what is the best case.

Thank you

Hicks . Nothing is being done and nothing can be done . Too late to go in for projects that will take 10 years to come online . There is a project in Finland which EDF France ( Numero uno) in nuclear plants is working on since over 10 years and it is now a stone around their neck . Just some info which maybe outdated but the nuclear dome needs a special steel . A division of Nippon Steel , Japan is the only supplier . They can produce maximum for 2 or 3 domes per year . LTG prevails .

P.S : Laplander can add info on the project in Finland .

I was asking Jean-François Fleury, since he has some actual knowledge of the industry in his country.

And to your- ‘Nothing is being done and nothing can be done’…

Sorry to burst your bubble but the world will still exist in 10 years and 20 years.

With another billion people before too long.

So things will be done to change and adapt to the scenario.

And it will matter.

We may agree that it will be too little and too late, and too expensive.

Nonetheless things will get done. Choices will be made. Priorities will be set.

Winners and losers will be abundant, management will be poor,

wealth opportunity food and energy will be unequally distributed,

people will fight, and blame,

just as it has always been.

But things [energy projects] will get done.

Hicks , when did I say the world will cease to exist ? I only said no nuclear reactors will be built . Adapt to what ? Nett surplus energy is the key to all growth . We don’t have this . Our current financial system is based on continuous growth . The end of growth is the beginning of collapse , Money printing phase to disguise the energy cliff is over .The fish rots from the head down and collapse begins from the periphery to the centre . Energy projects will get done ??? How and why ?? Which country will build new pipelines and which shipping company will order new VLCC when their is no gas /oil to fill the pipelines and no oil to the VLCC .

Last tell me where is the steel going to come from for the nuclear domes ??? How about maybe Nippon Steel might not be able to deliver for 2-3 domes if they have to pay $25 per mcf for the LNG , not to mention other vulnerabilities . Special steels are not made on the kitchen stove .

In 2022 nothing will be done in France . The presidential elections are coming up and Mr Macron is fighting for his life while Mevrouw(Mrs) Macron has some other problems to tackle , like proving she is not a transgender . Read below . 🙂

https://www.bbc.com/news/world-europe-59753535

Hole- your opinions and rumors and media hype precede you by a mile.

It is a good thing that at least you value and enjoy them.

Olkiluoto 3 has got the U loaded and is estimated to start production in January, in full use next summer as they are increasing production slowly to make sure that systems work as they should.

To be more precise about your initial question ; yes and no, actually. There is effectively a regulated tarification for inhabitants and corporations. The tariffs are fixed by the CRE (Commission de Régulation de l’Énergie) which is in charge since the beginning of the 2000s of the proper functionning of the energies markets in France while the energies markets have been liberalized in Europe since the end of the 1990s. What is special is the fact that EDF is omnipotent for the production of electricity on the market. So, to create something that looks like a ”free market”, EDF is forced to sell a part of its electricity production at cost price to independent suppliers : they don’t produce energy most of the time and if so, it is negligible. They are just energy brokers. And they sell the electricity bought on the paper at the price they want. Thus, in order to allow these broker to exist on the market, the CRE has gradually increased the price of electricity and gas over the past ten years, in order to allow them to offer an electricity price inferior to the basic tarification of EDF. You have since the beginning of the 2000s the right to leave the regulated pricing to join another ”supplier”. And this done, you can not come back under regulated pricing. You can retake EDF as a provider, but it will be at the price of the ”market”. With the increase of the electricity prices on the market along the current energy crisis, some electricity brokers have given up as they were unable to honor the contracts made with customers. As a consequence, some idiots who thought they were doing good business by leaving the regulated pricing are forced to return to EDF at a higher price. The same is true for some industrial companies and due to the recent increase of electricity price, some will be forced to reduce their activities. About nuclear, the combustible load of the Flammanville EPR is forecast in 2022 (ouf!). For the rest, our Jupiter of non thought imagined to develop SMR (mini PWR) by 2030. And to launch the construction of supplementary EPR. For what is solid (the EPR), this will require the modification of the PPE (Programmation Pluriannuelle de l’Énergie) therefore a debate and a vote in the national assembly. Once this is done, there will be construction of a case for ”l’enquête d’intérêt public” which will last at least one year. And, once this is done, the construction work could be disturbed by the appeals to admnistrative justice. As EDF has gained experience with the construction of 4 EPR with two others still in construction, it can be assumed that they will take less time to build the next two EPR which are supposed to be less complicated to build. I don’t expect their commissioning before the beginning of the 2030s. On the front of Gen IV, as the project of natrium-cooled reactor (Astrid) has been abondoned to save all the euros they can, the CEA teams previously in charge of this project have decided to take charge of the development of a molten salt fast reactor, whose development, on ”paper”, was carried out by a team of the LPSC (Laboratoire de Physique Subatomique et Cosmologie). The CEA will do, on its own initiative, i.e. on its own basis, without state aid, a feasibility study of a small demonstrator located at the Hague to profit of the retreatment capacity of the Hague and the supply in uranium, plutonium and minor actinides coming from the retreatment of the fuel wastes. To begin with, they have done a weird choice of salt to dissolve the fuel but at this stage, that can be corrected.

Thank you for the reply.

Sounds like EDF needs real competition, but I suppose that would take a few decades to agree upon- decision making being what it is.

I am thankful the French nuclear program has been safe to date.

I wonder if energy shortage in these coming decades will incentivize some countries to cut corners on building nuclear facilities.

In the US we are no closer to developing a high level nuclear waste repository than we were ever before. But we do have a SmallModularReactor design approved, permitted and in the early stage of 1 st unit deployment for later in the decade.

https://www.nuscalepower.com/

No worries about cutting corners, just hire some blokes from Bulgaria, Romainia etc. and get the work done!

https://yle.fi/news/3-6323719

I guess the quality will be top notch!

Edit, this was long before things got interesting, and expensive…

“In the US we are no closer to developing a high level nuclear waste repository than we were ever before. ”

No worries- in 24000 years it will only be half the issue.

How were things 24000 years ago?

About small modular reactor business, I have no faith in that, especially with PWR. On the other side, US government is funding the development of a molten chlorides fast reactor with Terrapower. First a little demonstrator, which will be built on the Idaho National Laboratory site, and around 2030, a full-scale demonstrator of 1 GWe. With the development of this kind of reactors, the volume of the nuclear wastes could be reduced by the consumption, in these reactors, of the minor actinides coming from the PWR. About competition with EDF, I don’t feel the need for competition in the field of energy. For me, it is a common good and it has to be managed by the state, especially with a capital intensive sector like nuclear energy. Futhermore, the coming years are going to be highly challenging to cope simulateneously with the need to reduce our consumption of oil to avoid a climate disaster and the need to change our way of energy consumption with the reduction of oil supply. In my opinion, the states have their place to impose quickly a change of course while the market is unable to do anything without incentives of the states.

“the field of energy. For me, it is a common good and it has to be managed by the state,”

Interesting point of view.

For that to be successful you need to have a wise, coherent. proactive and functional government. In most countries, and certainly in the USA, we don’t have have those elements.

Therefore we have problems such as

-no nuclear waste program

-poor regional electric grid systems

-boom and bust cycles of oil production

-haphazard programs of energy innovation incentives,

for example.

We drift, and only remain functional because of the bounty we have stumbled upon.

Somethings on the French nuclear industry . From another Blog .

1. In France, it seems that the nuclear industrial complex is facing a bright future. Macron has taken a turn, investing three billion in the experimental SMR and EDF has launched an optimistic plan for 46 billion and the construction of 6 EPR reactors.

2. Well they are ‘dyed in the wool’ in France after 60 years of nuclear practice. So this week the French Court of Auditors has calculated the cost of nuclear energy taking into account some ‘uncertainties’ about the EPRs, the expansion and renewal of the reprocessing plant at La Hague and the expansion of the storage industry of Cigeo in Bure. All chain costs that have to be passed on because ultimately the ‘citizen’ has to pay for them.

3.The Court of Auditors has therefore called for the uncertainties surrounding the costs of future EPR2 nuclear reactors to be taken into account, and for the implications for waste management to be anticipated. “As regards the costs of future EPR2 reactors, the margins of uncertainty concerning the construction costs should be systematically tested, given the lack of maturity of this new reactor,” the Court notes in its conclusions. In its new report, it “provisionally” calculates a “cost range between 85 and 100 euros/MWh” for the electricity that would be produced. This is an estimate of their average discounted cost (LCOE) based on a number of assumptions.