A guest post by Ovi

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIAʼs International Energy Statistics and updated to May 2021. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

May Non-OPEC production increased by 44 kb/d to 48,421 kb/d. The biggest contributors to the increase were Canada, 71 kb/d and the US, 82 kb/d. Offsetting the increases were declines from Norway, 54 kb/d and Italy, 43 kb/d.

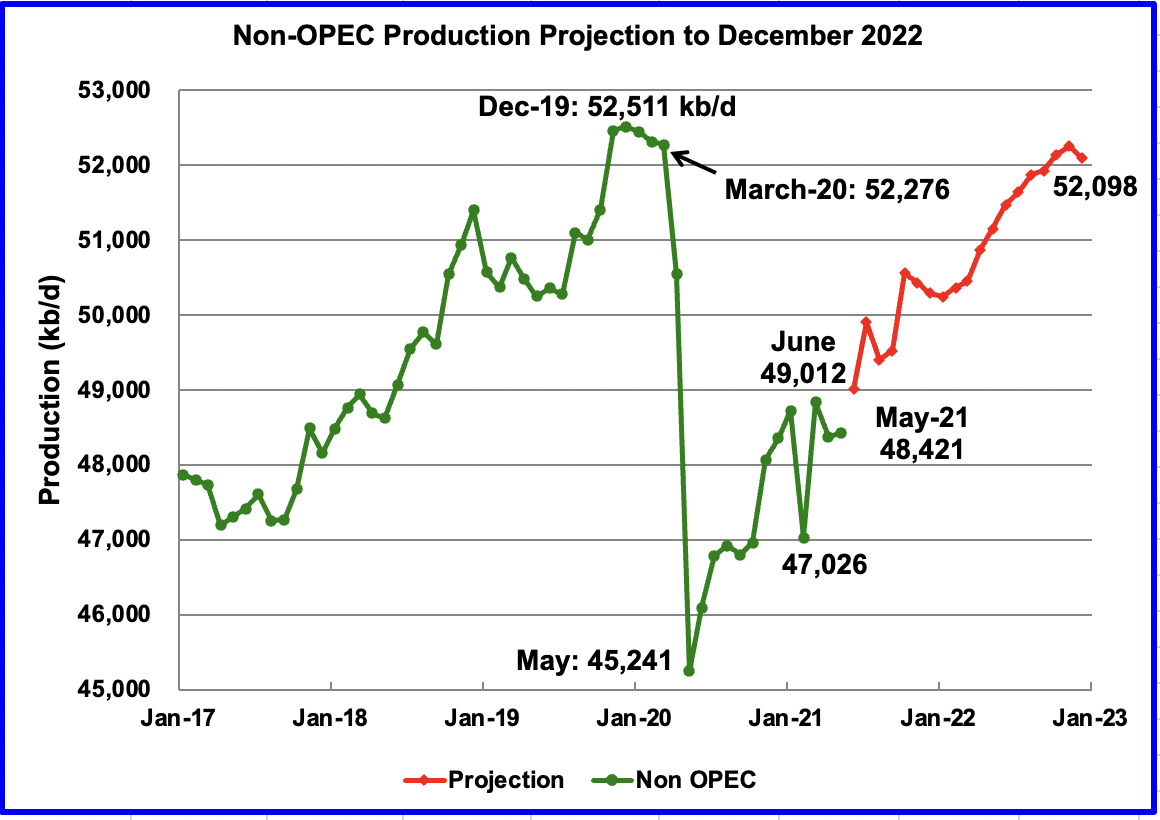

Using data from the September 2021 STEO, a projection for Non-OPEC oil output was made for the time period June 2021 to December 2022 (red graph).

Output is expected to reach 52,098 kb/d in December 2022, which is lower than the previous high of December 2019, by slightly more than 400 kb/d. In the September STEO report, the forecast December 2022 output was revised down by 86 kb/d from 52,184 kb/d in the August report to 52,098 kb/d.

June production for the Non-OPEC countries is projected to increase by 591 kb/d to 49,012 kb/d. About half of that increase is expected to come from Canada as maintenance on a few oil sands coker units/plants is completed. The 49, 012 kb/d output in this report was revised down by 347 kb/d from 49,359 kb/d in the August STEO.

Ranking Production from Non-OPEC Countries

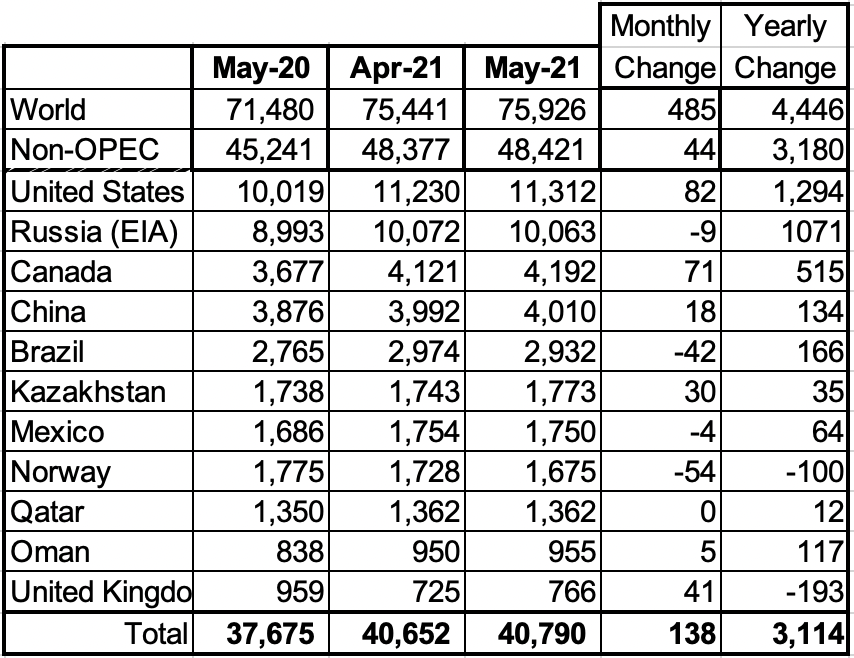

Above are listed the worldʼs 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The last two have currently fallen below 1,000 kb/d.

In May, these 11 countries produced 84.2% of the Non-OPEC output. On a YoY basis, Non-OPEC production increased by 3,180 kb/d while on a MoM basis production increased by 44 kb/d to 48,421 kb/d. World YoY output was up by 4,446 kb/d.

Production by Country

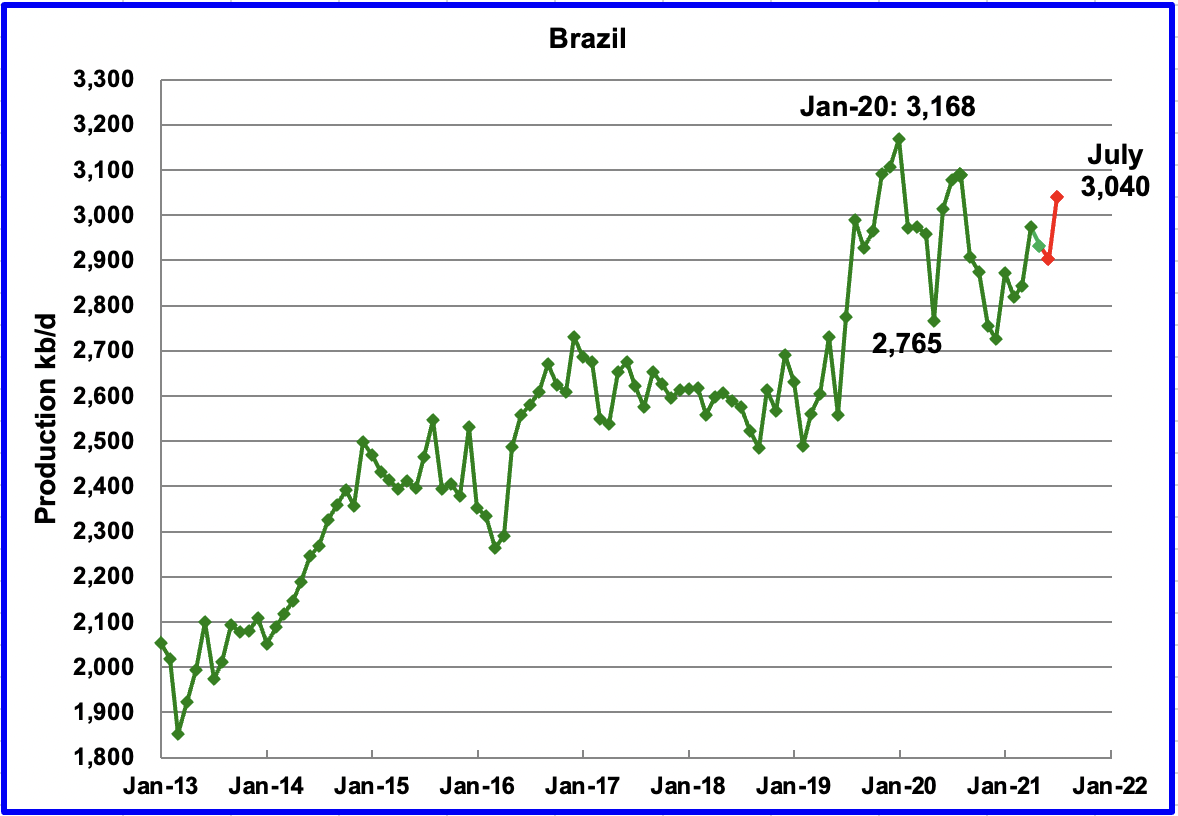

The EIA reported Brazilʼs May production decreased by 42 kb/d to 2,932 kb/d. According to this source, June’s output decreased by a further 29 kb/d from May to 2,903 kb/d and July rebounded to 3,040 kb/d, according to this source. (Red Markers).

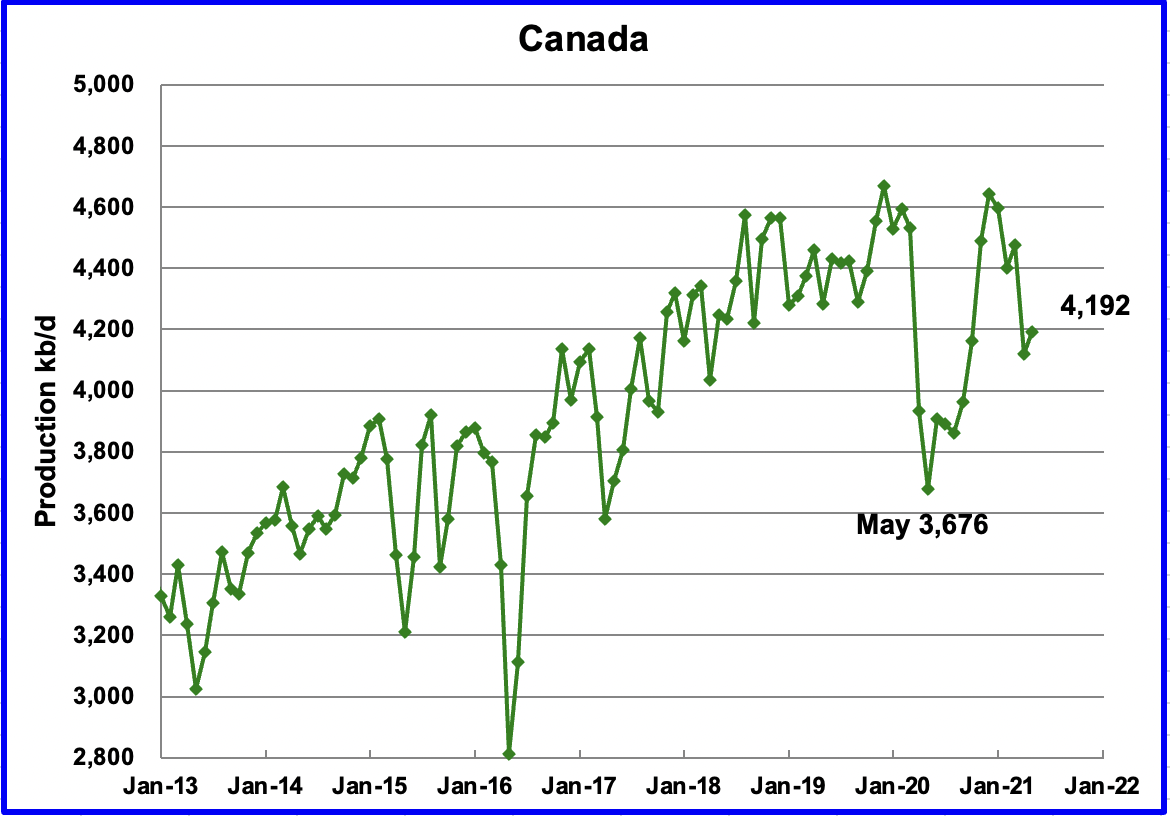

According to the EIA, May’s output increased by 71 kb/d to 4,192 kb/d. The increase was due to some oil sands plant maintenance being completed. As more is completed, production should return to the 4,600 kb/d range.

Oil exports by rail to the US in June were 131.6 kb/d, little changed from April and May and down by close to 45 kb/d from March. The June rail loadings are down from a peak of 411,991 bpd shipped on the railways in Feb. 2020 before the COVID-19 pandemic knocked out oil demand and led to a collapse in oil prices.

According to this source, Enbridge’s 390,000-bpd pipeline expansion is in ‘final innings,’ lifting hopes for capacity-constrained oil patch. Long anticipated and frequently delayed Line 3 is expected to begin filling with crude in late September.

Canada is the U.S.’s largest source of oil imports, shipping just over 4 million barrels per day of oil on average in May.

An interesting comment: “The same US administration that retroactively cancelled Canada’s Keystone XL Pipeline is now pleading with OPEC & Russia to produce & ship more crude oil,” the premier tweeted last week. “This comes just as Vladimir Putin’s Russia has become the 2nd largest exporter of oil to the US.”

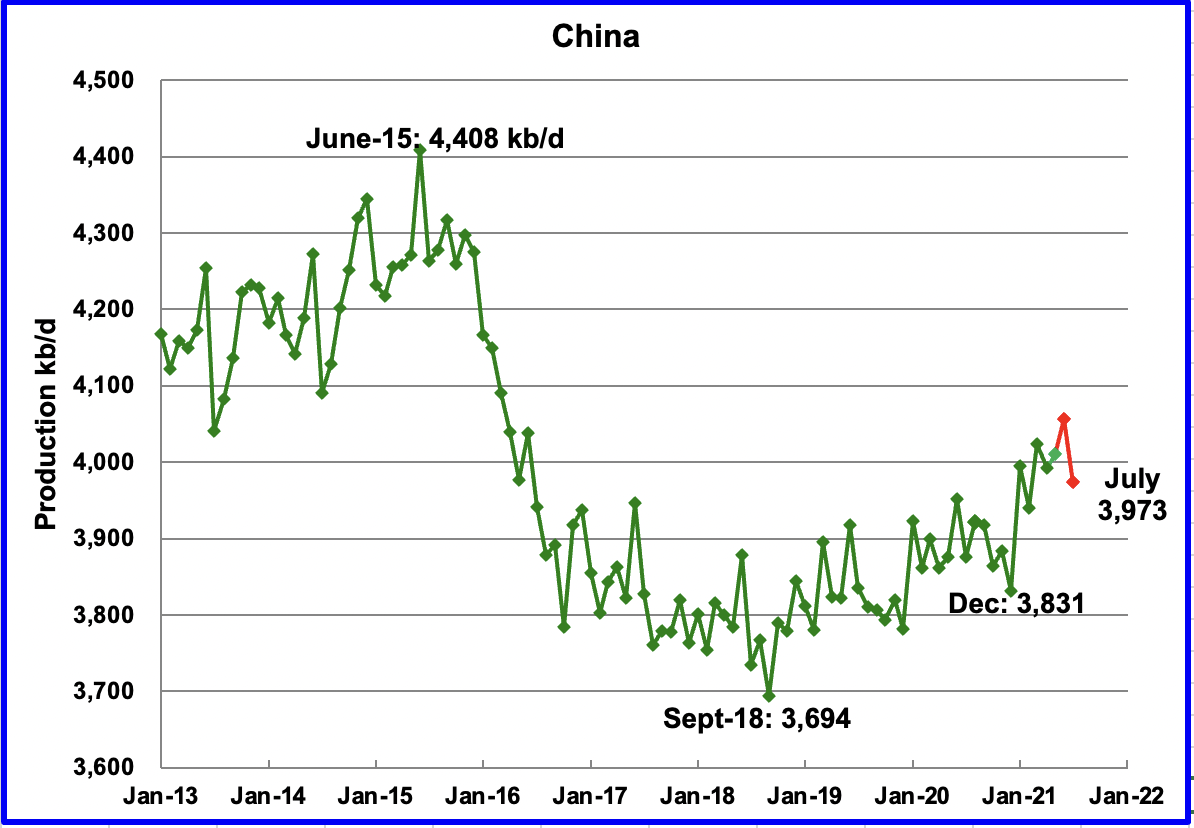

The EIA reported Chinaʼs May’s output increased by 18 kb/d from April to 4,010 kb/d. According to this source, China’s output decreased by 83 kb/d in July to 3,973 kb/d.

Mexicoʼs production, as reported by the EIA in May was 1,750 kb/d, down 4 kb/d from April. Data from Pemex shows that July production was up slightly to 1,772 kb/d. (Red markers).

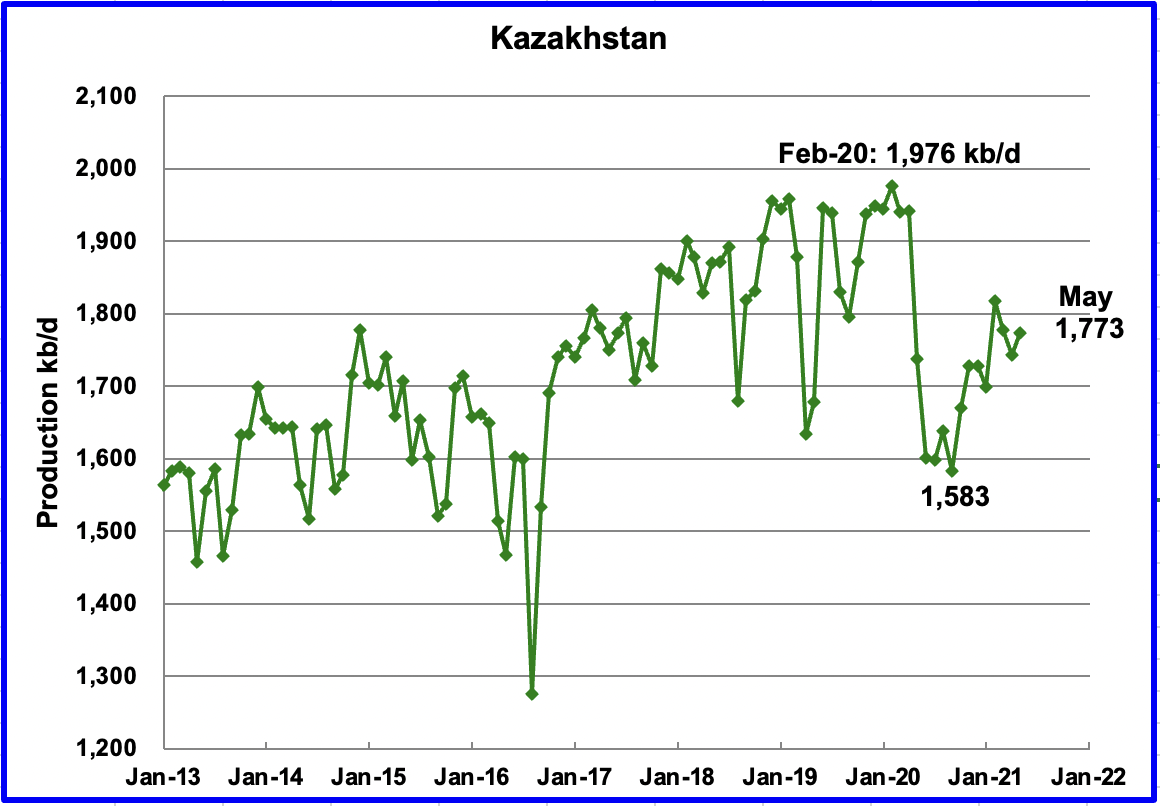

Kazakhstan’s output increased by 30 kb/d in May to 1,773 kb/d. Will it get back to its pre-covid level which is 200 kb/d higher?

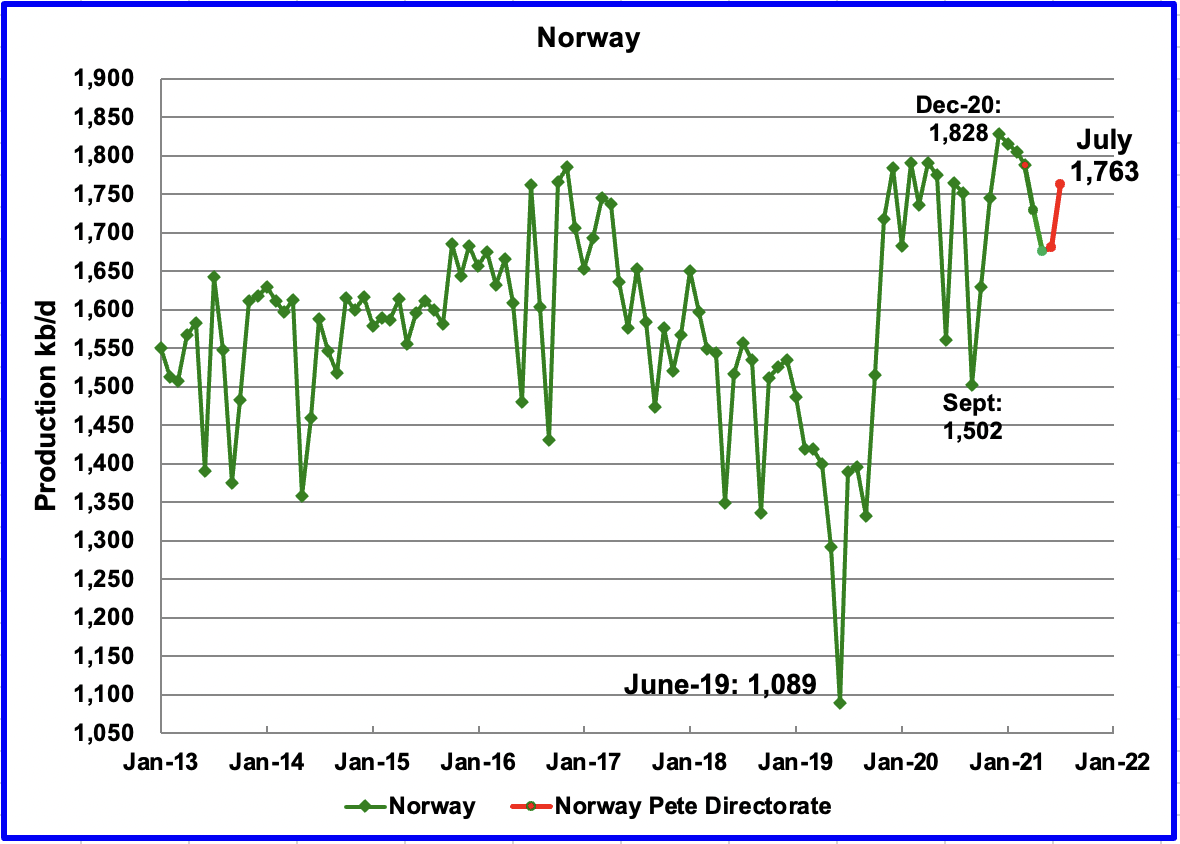

The EIA reported that Norwayʼs May production was 1,675 kb/d, a decrease of 53 kb/d from April. The Norway Petroleum Directorate (NPD) reported that production in July had recovered to 1,763 kb/d, up by 83 kb/d, red markers.

The NPD announced earlier this year that production would increase in the second half 2021. July was the first month showing a significant production reversal. Will production exceed the previous high of 1,828 kb/d in December 2020?

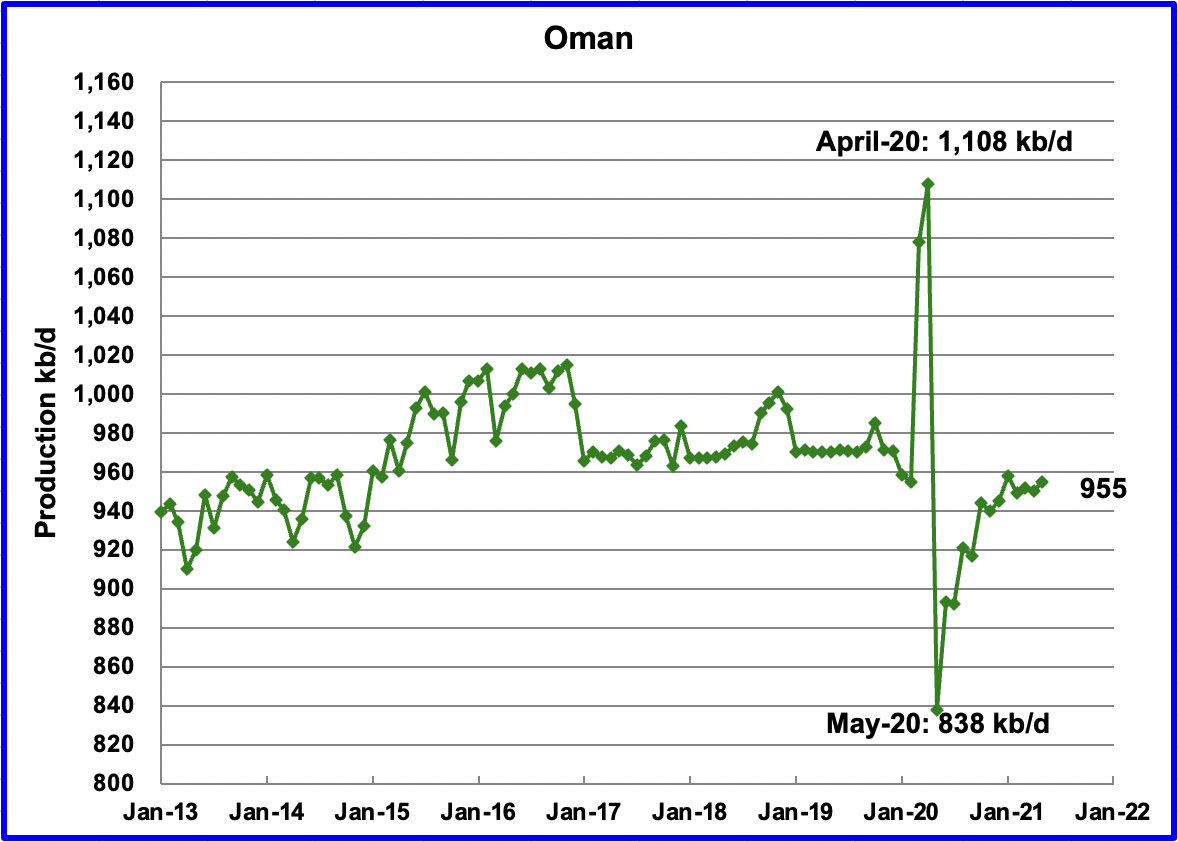

Omanʼs May production increased by 5 kb/d to 955 kb/d.

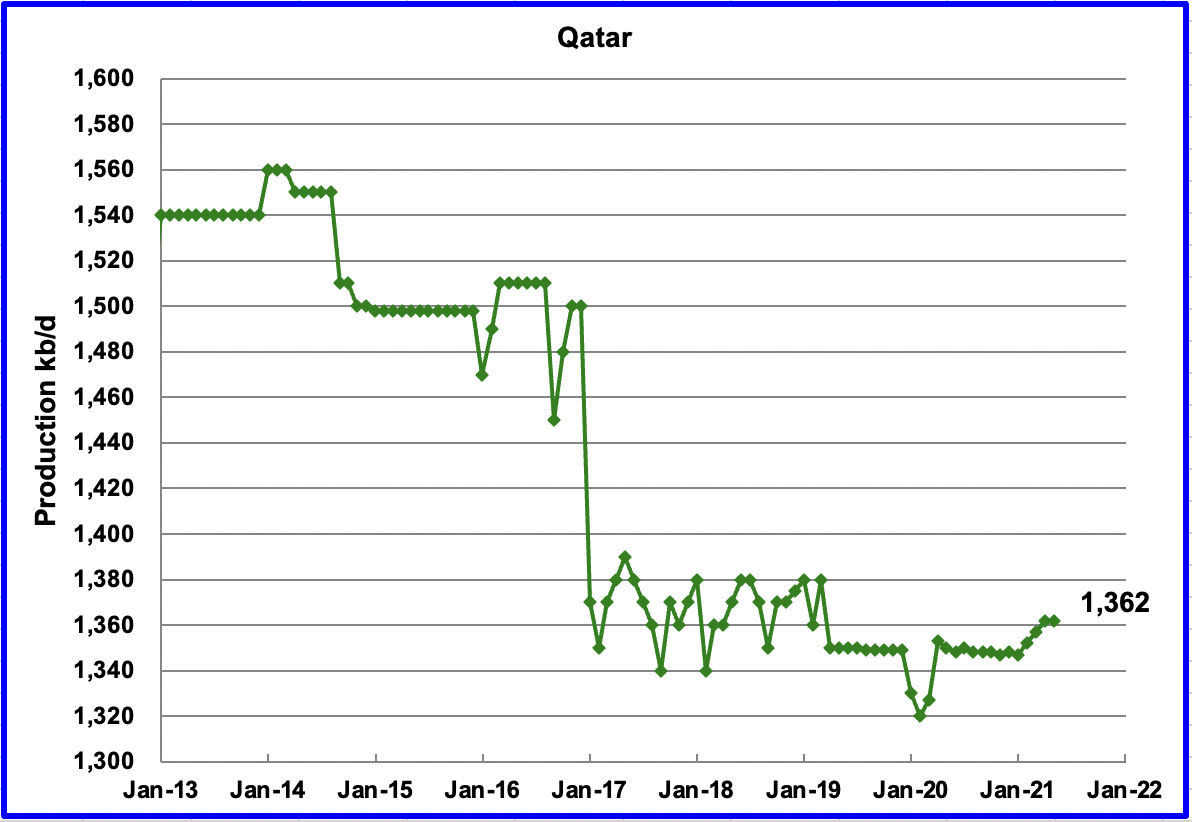

May’s output was unchanged at 1,362 kb/d.

The EIA reported that Russian output decreased by 9 kb/d in May to 10,063 kb/d. According to the Russian Ministry of Energy, Russian production in July was 10,461 kb/d.

According to Reuters, Russian oil and gas condensate output decreased to 10.43 million barrels per day (bpd) in August from 10.46 million bpd in July.

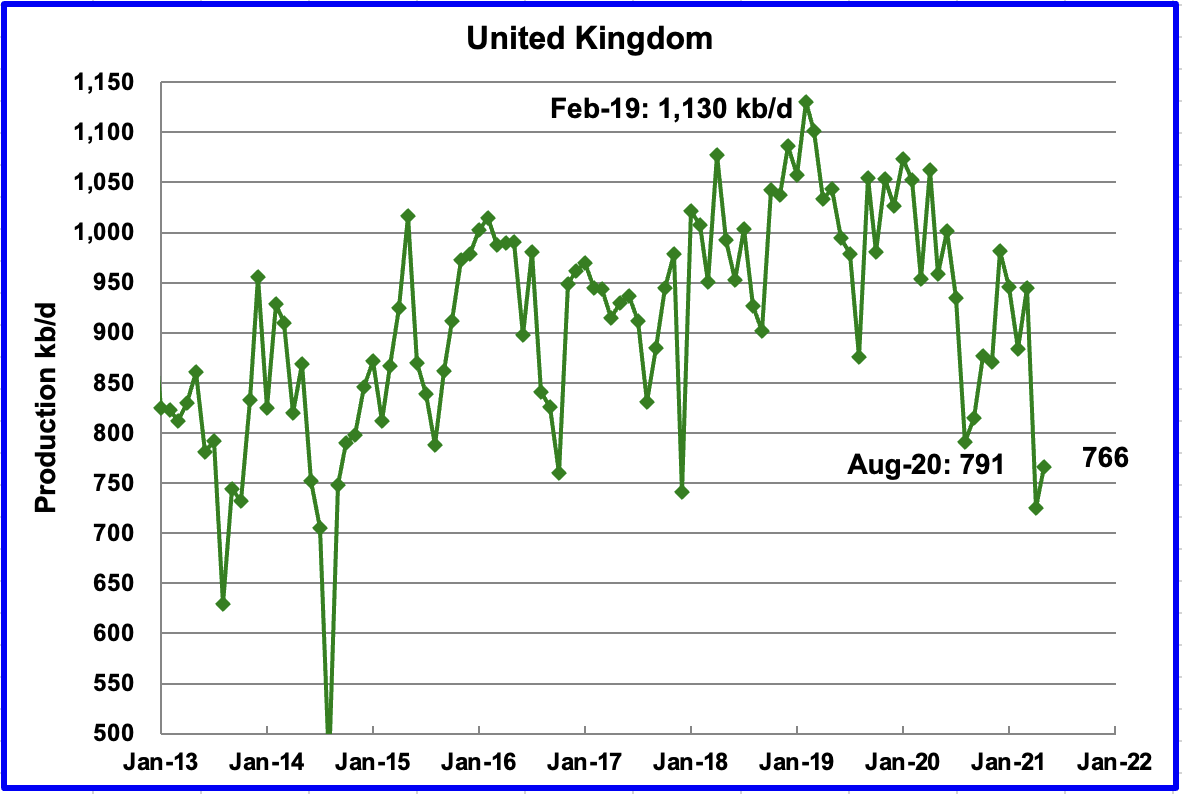

UKʼs production increased by 41 kb/d in May to 766 kb/d.

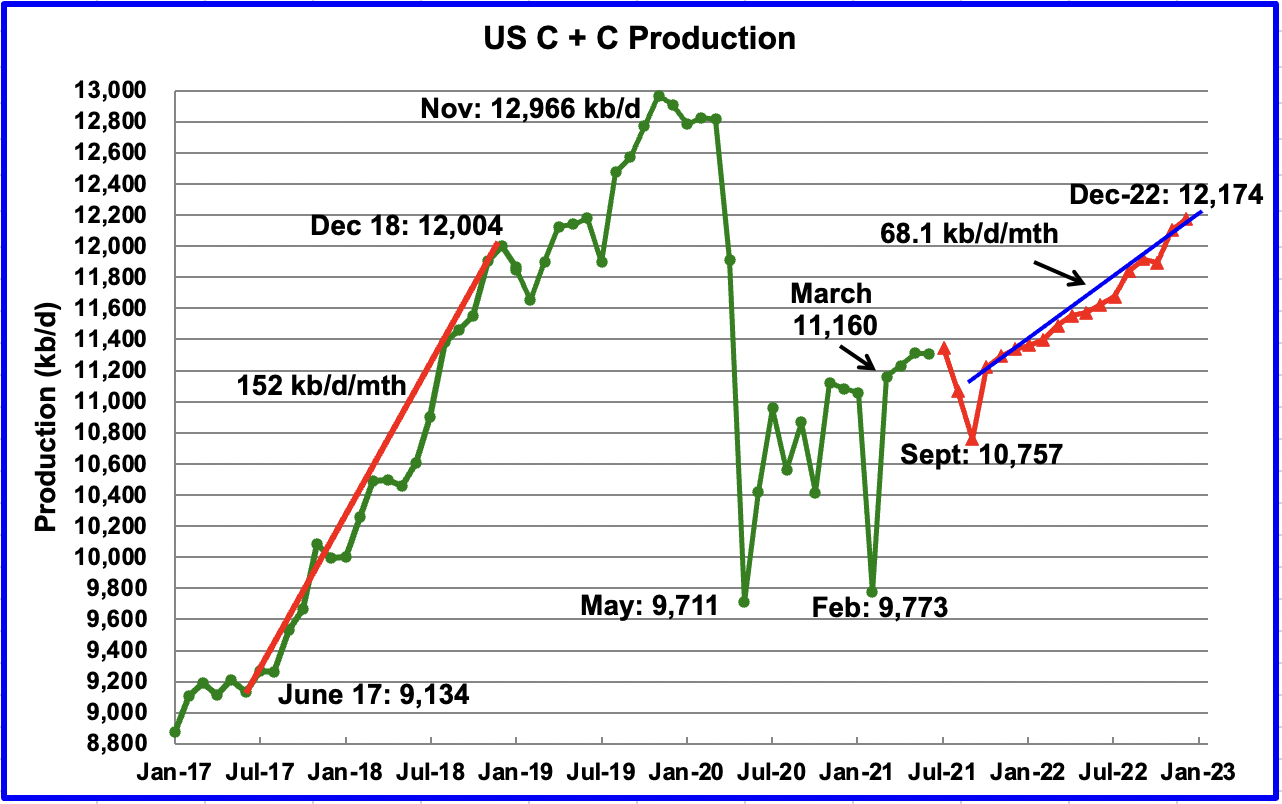

U.S. June production was essentially flat at 11,307 kb/d. The main change in this chart is the September STEO projection, red graph. August and September outputs are forecast to drop. September is projected to hit a low of 10,757 kb/d due to hurricane Ida.

The December 2022 output has also been revised down by 57 kb/d from 12,231 kb/d to 12,174 kb/d. The expected monthly increase in US production from October 2021 to December 2022 is now 68.1 kb/d/mth, down from 72.8 kb/d/mth. It is still not clear where this increase will come from. This monthly rate, if correct, is less than half of the rate in 2017 to 2018 and will be a relief to the OPEC + countries

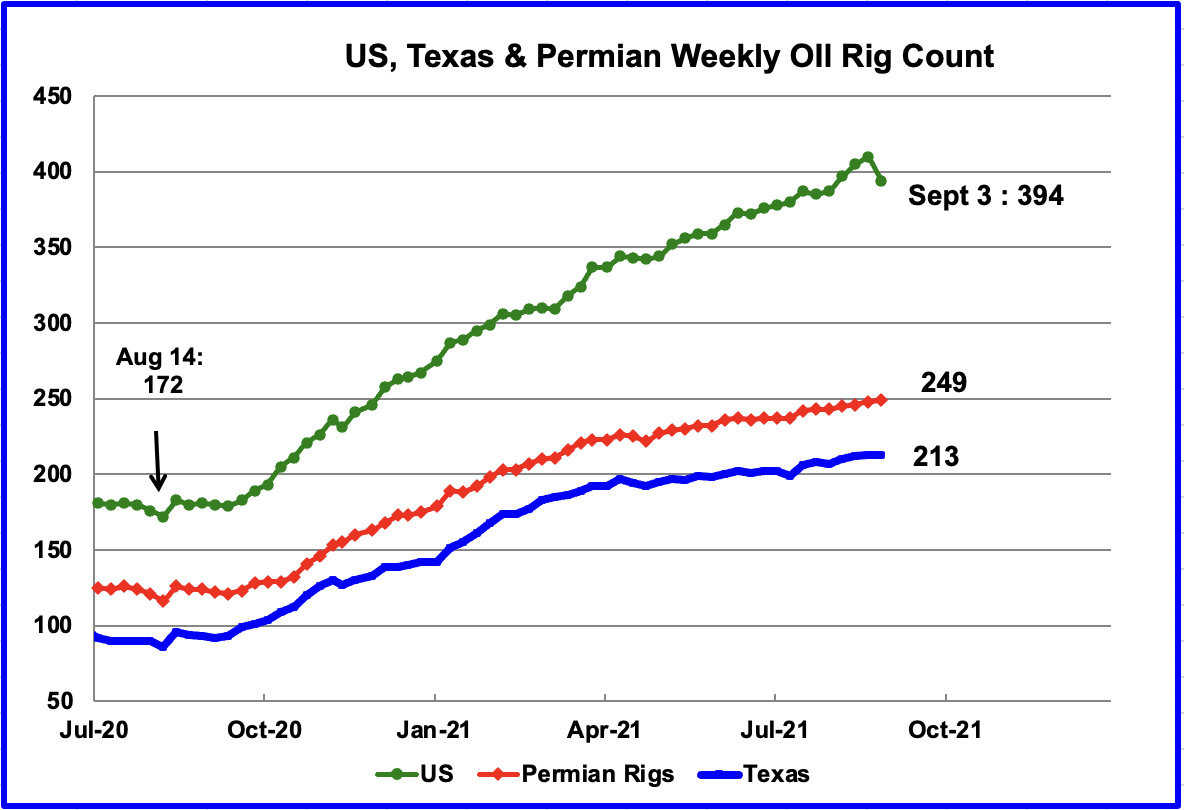

In the week of September 3, the US oil rig count dropped by 16. This was due to 17 rigs being rendered inoperable due to hurricane Ida hitting Louisiana. Interestingly Louisiana had increased their rig count by 3 a few weeks earlier.

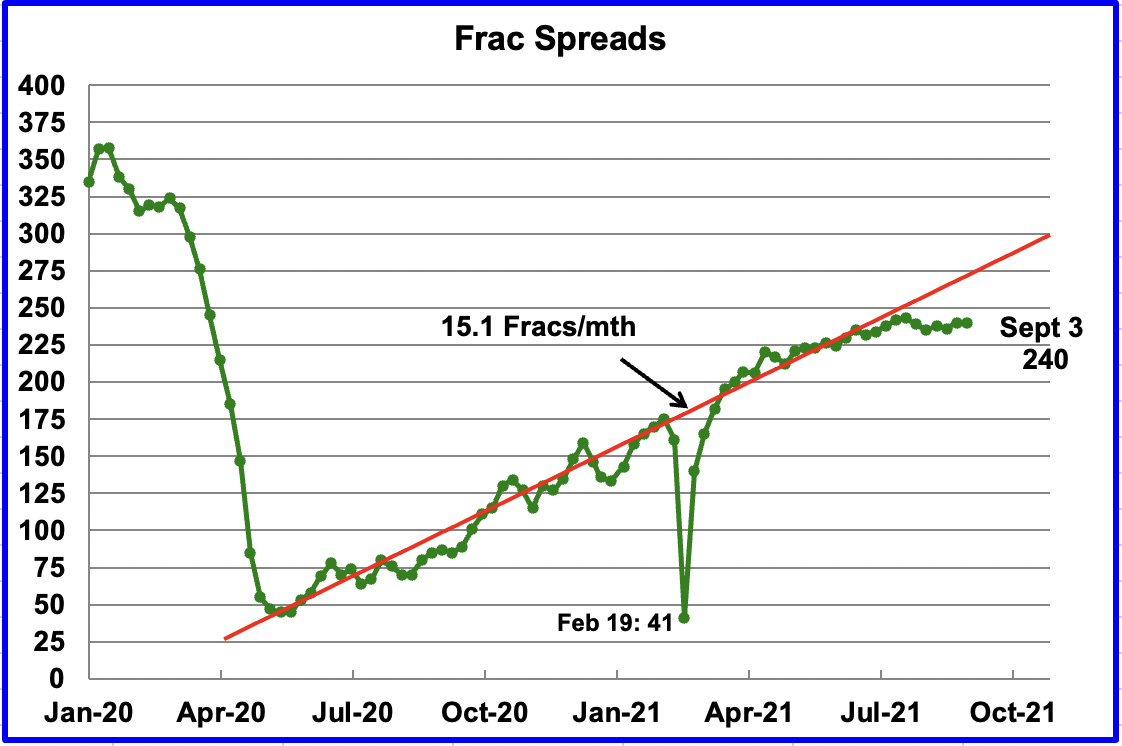

Frac spreads have largely been unchanged at close to 240 since the week of July 9.

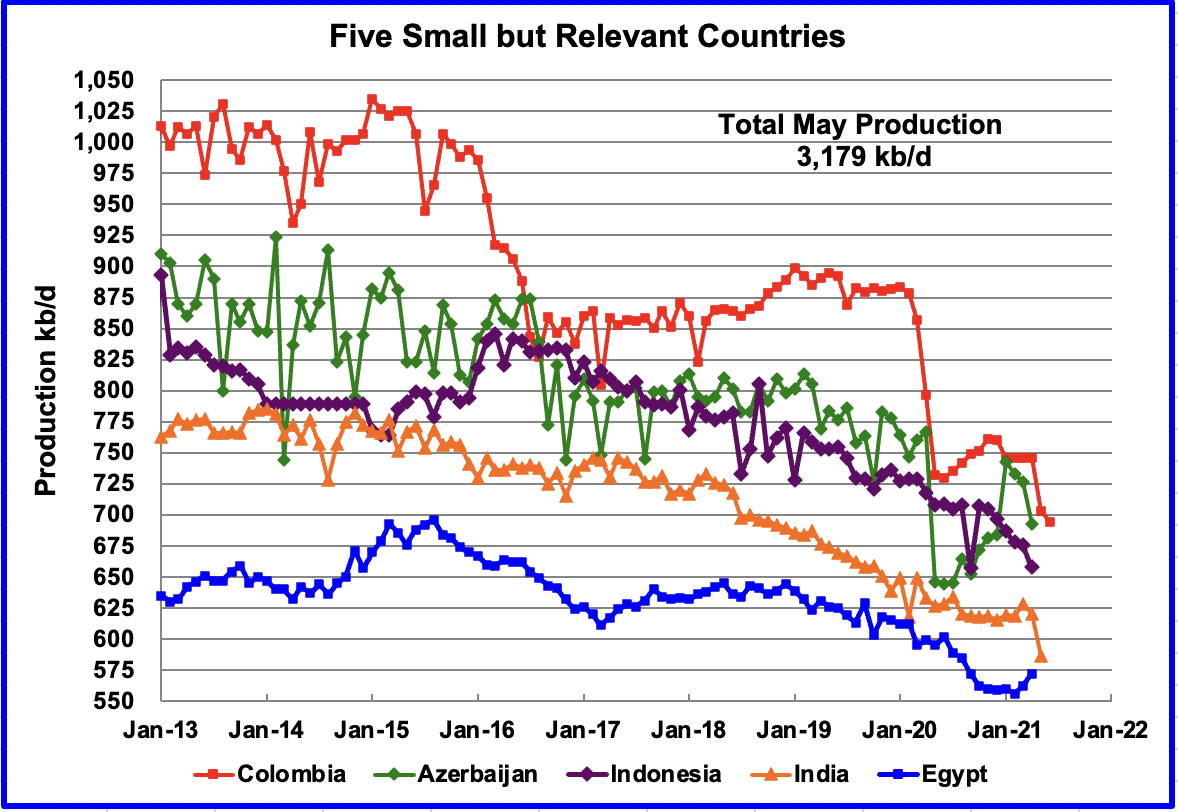

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined May production was 3,179 kb/d, down by 109 kb/d from April. The drop was largely due to small drops in all five countries, with Columbia being the largest at 42 kb/d.

World Oil Production Projection

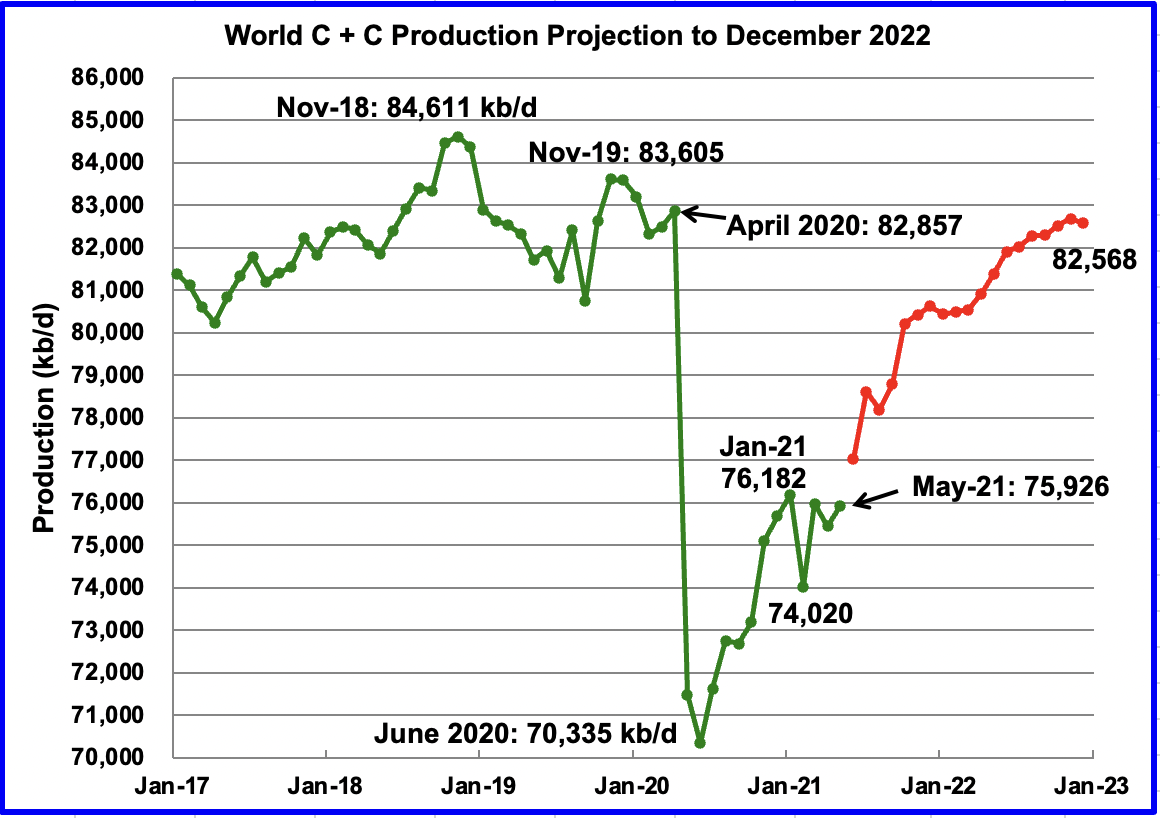

World oil production in May increased by 485 kb/d to 75,926 kb/d according to the EIA. Of the 485 kb/d increase, the biggest contributor was Saudi Arabia, 385 kb/d. There were a number of countries that had smaller increases of less than 100 kb/d, offset by countries with similar decreases.

This chart also projects world production out to December 2022. It uses the September STEO report along with the International Energy Statistics to make the projection, red markers. It projects that world crude production in December 2022 will be close to 82,568 kb/d, 380 kb/d lower than forecast in the previous report.

The current December 2022 forecast is 2,043 kb/d lower than the November 2018 peak of 84,611 kb/d. As best that I can remember, this may be the biggest gap that I have reported.

Ovi,

Great Update. Especially, the last chart. Indeed, it does look like Nov 2018 may have been the ultimate C & C production peak. We will see.

And, if we want to look at what I call THE DESTROYER OF CAPEX, let’s look no further than ExxonMobil’s U.S. Upstream Sector. We still enjoy a good laugh that ExxonMobil management stated they could make profits at $30 per barrel in the Permian. Well, if we look at the financials, ExxonMobil is Destroying Capital at a much higher rate than other shale companies.

Thus, ExxonMobil is robbing PETER (International Upstream Sector) to pay PAUL (U.S. Upstream Sector). Again, how much longer will ExxonMobil shareholders continue to watch Good Money be thrown after Bad in the U.S. Upstream Shale Black Hole?

steve

Great Report Ovi. I am still stunned at the production growth in the US. Our small Permian company continues to run two drilling rigs while keeping production flat-ish at 25k boepd. We are cash flow neutral at this rate while suffering some hedging loses at $50 oil. Must be the DUCs that are providing most of the production increases. I suspect we would be cash flow positive if we were not hedged. It is also interesting to see how Exxon continues to lose money as well but stays committed to the shale. Perhaps they are planning on higher prices coming down the pike.

I am still stunned at the production growth in the US.

I have no idea what you are talking about.

Ron,

Agreed. Maybe this OPEC vs NON-OPEC & U.S. Shale Decline Rates puts it into perspective the BIG PROBLEM ahead for the global oil industry.

You will notice that NON-OPEC Decline rates have been increasing at a healthy rate. But, when we factor in U.S. Shale Oil Annual Decline Rate at 48%, well then, we have arrived at the SENECA CLIFF.

How in the living Hell do you Offset Global Oil Production declines with a 48% Annual Decline Rate?

Maybe we can ask the Russians if they can help us with that ULTRA-DEEP ABIOTIC OIL. 🙂

steve

Ron,

LTO survivor has wells in the Permian basin. I think he was referring to growth in output there.

In the past 12 months Permian basin output (from tight oil estimates by play) has increased by 830 kb/d. Since Nov 2020 the increase in Permian basin output is 539 kb/d.

Ron,

The numbers were revised for the most recent report with data through July 2021. Output on the Permian increased by only 360 kb/d from Nov 2020 to July 2021. I made a mistake on the previous comment, used wrong column from spreadsheet. For past 12 months the increase was 354 kb/d, only about 29.5 kb/d increase each month on average, for the past 4 months the average rate of increase in Permian has been 42 kb/d each month, at an annual rate (if the rate of the past 4 months continues for a 12 month period) this would be about a 12% annual rate of increase.

Thanks Ron. I meant to say that I am stunned at production growth in the Permian.

Thanks LTO

Steve

I wonder how much of that International Capex is being spent in Guyana this year. The reward comes in a few years. They are doing a lot of drilling and have had some good hits and a few dry ones. I guess they have to borrow to make up the difference. According to this article revenue from Guyana is set to increase next year as production ramps up.

“IRVING, TEXAS – ExxonMobil reported a discovery at Whiptail in the Stabroek Block offshore Guyana. The Whiptail-1 well encountered 246 feet (75 meters) of net pay in high quality, oil-bearing sandstone reservoirs. Drilling is also ongoing at the Whiptail-2 well, which has encountered 167 feet (51 meters) of net pay in high quality, oil-bearing sandstone reservoirs. Drilling continues at both wells to test deeper targets, and results will be evaluated for future development.

The Whiptail discovery is located approximately 4 miles southeast of the Uaru-1 discovery that was announced in January 2020 and approximately 3 miles west of the Yellowtail field. Whiptail-1 is being drilled in 5,889 feet (1,795 meters) of water by the Stena DrillMAX. Whiptail-2, which is located 3 miles northeast of Whiptail-1, is currently being drilled in 6,217 feet (1,895 meters) of water by the Noble Don Taylor.

“This discovery increases our confidence in the resource size and quality in the southeast area of the Stabroek Block and could form the basis for a future development as we continue to evaluate the best sequence of development opportunities within the block,” said Mike Cousins, senior vice president of exploration and new ventures at ExxonMobil.

ExxonMobil envisions at least six projects online by 2027 and sees potential for up to 10 projects to develop its current recoverable resource base.

The Liza Destiny floating production storage and offloading (FPSO) vessel is currently producing about 120,000 barrels of oil per day.

The startup of Liza Phase 2 remains on target for early 2022, and the Liza Unity FPSO expects to sail from Singapore to Guyana in late August 2021. The Unity has a production capacity of approximately 220,000 barrels of oil per day.

https://www.worldoil.com/news/2021/7/28/exxonmobil-tallies-another-significant-oil-discovery-offshore-guyana

Ovi,

Agreed about the Forward-Spending CAPEX on Guyana. However, that would make the situation for ExxonMobil’s U.S. Upstream Sector even worse… no? Gosh, if ExxonMobil is investing a lot of its International CAPEX in Guyana for future revenues-earnings, then I’d imagine it’s making the U.S. Upstream Sector look much better than it really is…. CAPEX to EARNINGS RATIO, that is.

As I have stated, it seems that many of the bigger players in the Permian have now switched to 40-45 Stage Fracks with over 20 million pounds of sand, being pumped down 15K Well-heads. Heard from a Tech at Schlumberger that the internals of these 15K wellheads were getting sandblasted to hell due to the high pressures and the massive amount of sand being pumped through them.

SHALE IRONY: Technology Meet Sand Blasting on Steroids.

steve

Thanks for all the great work Ovi.

Schinzy

Much appreciated.

Ovi , what would we do without you ? Probably tweedle our thumbs . 🙂 . Tks to all you guys who make these fantastic posts along with graphs etc . No exceptions in spite of differences on issues . Keep hitting the homers .

Biden’s Call for More OPEC Oil Is Still Bugging Shale CEOs

(Bloomberg) — Cimarex Energy Co. Chief Executive Officer Tom Jorden on Wednesday became the latest to bristle at President Joe Biden’s call for more oil production from OPEC, rather than from homegrown shale companies like his.

So little oil production growth is expected in the U.S. that the world’s top providers of drilling and fracking services are reorienting their businesses around overseas customers and pivoting away from North America. Despite a strong recovery in crude prices in 2021, the shale industry is largely resisting a repeat of previous boom cycles when it added new supply and contributed to a global glut.

“So little oil production growth is expected in the U.S”. This statement is very different than the EIA’s forecast starting in October.

Why does CEO Jordan need Biden to ask for more oil. Just go ahead and produce or is he really saying that he needs some incentives to produce more?

https://www.bnnbloomberg.ca/biden-s-call-for-more-opec-oil-is-still-bugging-shale-ceos-1.1649492

Ovi,

No worries, because according to Biden, the United States will increase Solar PV power to nearly 50% of Electricity power by 2050. Thus, we won’t have to worry about messy oil and all that fossil fuel stuff anymore.

We are just going to power everything with Electricity and Free Energy. 🙂

https://www.washingtonpost.com/climate-environment/2021/09/08/biden-solar-climate-change/

steve

You will be fine Steve, next month Exxon going to run 50% off blacksmith work. You can still get Dusty some new shoes for safe travels on the trail.

For the rest of us, Lyriq will define the future, coming early 2022

What is lyriq? Electric Cadillac?

shallow sand,

Correct, a caddy EV SUV crossover. Not available yet, expected in late 2022.

https://www.cadillac.com/electric/lyriq

Hunt,

What a pleasure to receive a response from you. Was wondering where you have been.

I am not worried about ExxonMobil. I don’t have any SKIN in the company. But, that may be a different story for shareholders dreaming of Dollar signs and Sugar Plums dancing in their heads.

Regardless… let’s enjoy viewing the SHALE BLACK HOLE through our telescopes while it’s still is around.

Also, I got my dibs on Musk’s newest Flying Electric Car powered by Clean Green Energy.

steve

Shale must be the high cost marginal producer. As demand increases, I don’t expect the majors to increase much capex in the Permian until the Middle East is back to pre-covid production and $100 plus WTI. We are already over $4 a gallon here. I don’t think anything under $6 will slow down the consumer here. There is a street 3 minutes walking distance from me that has 13 homes on it and there are 6 Tesla’s parked on the driveways.

There are three Tesla’s registered in my county of about 20K.

How many people still haven’t gotten a COVID shot?

I am not sure I can tell what is rational and irrational behavior these days.

From Our World in Data

Ca 56.7% fully vaccined

Tx 48.5% fully vaccined

Orange county 60.48% fully vaccined or 1,913,000 people

Shallow sand,

In 2020 about 1.7% of new cars and light trucks were EVs in the US, total new cars and light trucks registered were about 14.5 million with 254 thousand new EVs registered in 2020. About 79% of all new EVs registered in the US in 2020 were Teslas (200691).

Hunt,

While shale is the high-cost marginal producer, the Fed is the marginal buyer of last resort of Treasuries & Bonds. I am surprised that most Americans think this sort of activity is sustainable over the long run.

Furthermore, I am putting together an Energy Powerpoint Presentation for a Financial Group. In that presentation will include how Oil production growth, not the Fed, pulled the U.S. out of the 2008 Financial crisis. The same was true for the 1930s Great Depression and winning WW2. All due to oil production growth.

This sort of Oil Magic will not happen again. We just ran out of Shale Magic Fairy Dust.

While it’s neat and nifty to have so many Tesla’s in walking distance from your home, let me know what that looks like in say 5-10 years.

steve

I will agree with you about oil production being a major factor in pulling the economy out of 2008. Millions of jobs putting money which was being sent out of the country, got put into American workers pockets. I think you have it ass backwards in the 1940 era. Oil production growth was a result of WWll. Oil was in short supply and rashened because of the war. Women went to work because of a shortage of male labor. Government demand grew GDP, which needed oil to power it.

As long as technology advances keep inflation at bay. The Fed can play loose and free with rates and it’s employment mandate. The Fed doesn’t dig holes, they bring together the capital to do the job. It’s a lot easier to keep the airplane in the air. Than put it back in the air after it crashes. I’m sure there will be a day of reckoning.

You know fossil fuel is finite. Substituting is the only energy option. Your going to get a hole in your shoes dragging your feet. The Permian is the gift to make a transition. Let’s wait until the fat lady sings.

Steve, We are in agreement on the idea that there will be no new big pond of oil to come to the rescue, and depletion will be the trend from about now and going forward- indefinitely.

I ask you- in this scenario, isn’t it better to have an alternate mechanism to continue getting around?

In 10 years everyone who has a plug-in vehicle will still have affordable mobility.

Will we be able to say the same for those with petrol fueled vehicles?

I’m talking globally- not everyone has a Ghawar or a Permian within their borders. Importers are going to be in a huge battle for the remaining available exports.

Coal to liquids.

Coal to liquids.

Ha ha ha ha.

Plenty of well paid jobs in building and running those plants.

But those coal reserves you thought you had will only last half as long.

David,

with all due respect for someone who supposedly has a pretty good head on their shoulders, for you to blurt out “Coal to Liquids” and then hahaha…

My gosh, have you seen the Full Cycle EROI on Coal to Liquids? Have you seen the massive coal waste that comes from just transitioning to 2-5% of liquid fuels?

This is typical of the regurgitating a seemingly easy solution by “PLUG AND PLAY” coal to liquids… LOL.

If supposedly intelligent people are making these sorts of comments… no wonder we are going to head over the ENERGY CLIFF… DEATH, DUMB, BLIND… and STUPID.

Nothing personal, just the facts…

steve

Dearest Steve,

I am coming up on having served 50 years in the oil industry, on and off. My first job was a juggie on a seismic crew in 1974 out in the desert, living in tents and for lunch we would bash a can of food open on the corner of a Landcruiser trayback. You didn’t know what was in the can because the label had worn off on the way out to the desert.

When oil supply starts declining the price is going to run and run. Energy poverty is real poverty. Most of the functions provided to western civilisation now by coal can be provided by nuclear. And coal can go off to coal-to-liquids until coal runs out and we have to start using biomass to make synthetic liquid fuels. Right at the moment we are creating biomass in the US to burn in a power station in the UK, so biomass as a feedstock for synthetic fuels might do a lot. In the long term our standard of living will be determined by the cost of producing hydrogen from electrolysis using power from nuclear reactors. Carbon will be the means by which that hydrogen can be usefully handled, by enabling the production of a fuel that is liquid at standard temperature and pressure. The sooner we start using hydrogen from nuclear-sourced energy, the better as we can conserve all our carbon sources so they can be converted to liquid fuels, and plastics and fertiliser and all the other things that oil currently does. That includes nuclear power plants to provide heat and hydrogen to the Canadian tar sands for a starter.

David , your latest post is not worthy of your experience .

1. No more nuclear . NIMBY prevails except in China .

2. If we start creating biomass for fuels then where do we go creating (growing) our food > We are loosing top soil and agriculture land year over year .

3. Energy poverty is real poverty . You are correct . That is where we are headed . Be prepared .

4. Hydrogen economy has been debunked so many times that I will not even mention it .

Heck , shale will end up loosing at least a trillion and trillions was printed to get it going . Now you expect to start up the printing presses again to trigger another project which is even worse placed .

Too much hopium and pie in the sky thinking . Not expected from someone with your background . Disappointed .

Reluctantly I must do a copy paste of Steve’s comment

” If supposedly intelligent people are making these sorts of comments… no wonder we are going to head over the ENERGY CLIFF… DEATH, DUMB, BLIND… and STUPID.”

Steve, since you don’t seem to be keeping up with the light vehicle transport sector very closely, consider this-

I have a midsize all-wheel drive vehicle in my driveway (wifes car) that goes 100 miles distance on just about $1.08 of electric charge. And we charge it right in the driveway at the national average electrical cost of 11cents/kWh, which is the same for our particular state. She drives quite a lot for her work, and never goes to gas station anymore.

Its a great thing for this country to have this new option for transport, with such low operating cost/mile.

You might want to call it Jetsons, but no- this vehicle stays on the road. Its acceleration torque will pin you hard to the seat if you want to.

Its the real deal, and in another 5 years it will obvious to even those who have tried to ignore the sector.

How far does your vehicle go on $1.08?

She drives quite a lot for her work, and never goes to gas station anymore.

And how long does it take to plug it in at night? I mean, compared to driving to a gas station and pumping…

1-2 minutes.

It would interesting to actually clock it. I would have guessed that it was much shorter, but it certainly depends on your setup.

Hi Nick,

Range anxiety has been much hyped. I’ve owned an EV for over 3 years without being really concerned about not having enough juice. It takes me 20 seconds to either plug or unplug my EV. I recharge at 5 miles per hour using 120 V household current at 12 A. If I was concerned about not having enough juice at any point in those 3 years, I would have installed a 220 V 16 to 32 A home charging station and recharge at a maximum of 25 miles per hour. Yes, it costs money but if I am driving that much, the difference between $3/gal in a 40 mpg ICE and 120 mpge in an EV would pay for a charging station in less than 2 years.

In the above example and burning 10 gallons of gasoline, it would cost me $30 to go 400 miles. In an EV, $30 worth of electricity at $0.10 per kwh (300 kwh at 4 miles per kwh) would propel my EV 1200 miles. To do 1200 miles in an ICE, I would have to spend another $60. If I drive 12,000 miles per year, that’s a $600 saving that I could put toward a charging station. Installed, they are generally less than $800. So in less than 2 years, I’ve recouped my investment and can put the difference to paying down a loan or saving for a trip.

Hickory,

I do keep one eye on the EV sector. However, while it does provide an alternative for some, it won’t for many. This is the problem with scaling up EVs.

The world has slapped itself on the back for adding 5,300 TWh of Wind & Solar over the past twenty years. However, Oil-Natgas-Coal energy consumption has increased 42,500 TWh over the same period. Thus, the world added 8 Times more Fossil Fuel Energy consumption compared to Wind & Solar.

Now, let’s see if we can add that much more Wind & Solar with falling Fossil Fuel production.

steve

20 years isn’t an objective time frame. How about the last 2 or 5 years. That would be more current to today’s cost of solar installation.

Not objective.

https://www.salon.com/2021/09/09/gavin-dont-surf-the-california-recall-election-on-the-ground-in-orange-county/

I lived in Huntington Beach in 1967.

It was a bit different.

Of course, Dana Point had 400 people then.

And of course Huntington had The Golden Bear

https://en.wikipedia.org/wiki/Golden_Bear_(nightclub)

Steve,

Not clear that fossil fuel output will fall before 2030 and perhaps not until 2035 unless demand for fossil fuel falls, which it may as renewable power continues to grow at 15% or more per year.

Also for thermal power, only 40% of fossil fuel primary energy gets converted to electricity so 100 EJ of fossil fuel is the equivalent of 40 EJ of renewable power from wind or solar.

Renewable power output has doubled in each of the past 5 years. Note also that fossil fuel has a lot of thermal losses, only about 40% of primary energy is converted to useful work.

If we compare 5 year average annual growth rates of exergy for fossil fuel (1.7%/year) and renewable power (17%/year), it becomes pretty clear that renewables will take a big dent out of fossil fuel demand going forward. As fossil fuel depletes and becomes more expensive as a result it will only accelerate the transition to wind, solar, and battery powered land transport.

In 2019 the exergy of all fossil fuel consumption in exajoules was about 198.5 EJ (in 2020 it decreased, 2019 was the peak year), if renewables continue to grow at 17% per year the electrical output by renewables will be 54 EJ in 2030, an increase of 43 EJ over that 10 year period. If fossil fuel exergy use grows at the annual rate of the past 5 years (1.7%/year) we would see an increase of only 36 EJ, so fossil fuel exergy demand would fall by 7 EJ (about 3.5% of the 2019 level).

If we further assume the growth rate for renewable power drops to 10%/year from 2030 to 2040, then pewr from renewables increases by 87 EJ while fossil fuel exergy demand grows by only 43 EJ, so another 44 EJ bite out of fossil fuel demand, for a 20 year total reduction of fossil fuel exergy demand by 44 plus 7 or 51 EJ. That is 26% of 2019 fossil fuel exergy use.

If the 10% growth rate of renewables continues to 2049 and fossil fuel exergy demand were to have continued the 1.7%/year trend (2014-2019 rate), then all demand for fossil fuel as an exergy source would be eliminated by 2049. No doubt some demand would remain as raw material input (fertilizer and steel) and some energy uses such as farming, air transport and water transport.

Not clear that fossil fuel output will fall before 2030 and perhaps not until 2035 unless demand for fossil fuel falls,

Well, there are basically three types of fossil fuels, coal, gas, and oil. And they are, for the most part, all three used for different functions. So I really don’t see how you can lump them all together.

Incidentally, the USA and the European Union have reduced their coal consumption while China has increased theirs. China now consumes more coal than the rest of the world combined. See chart at this link:World coal consumption, 1978-2020

One has to wonder how much longer the Chinese can continue mining as much coal as the entire rest of world, from a reserve base half that of the US. They would appear to me to be strong candidates for some sort of catastrophic energy crisis within the next decade.

Tony H , bullseye . China miracle was cheap labor , cheap land , cheap coal = cheap electricity and unlimited pollution . All 4 elements are exhausted and so is the Chinese economy . The unravelling has begun with the Ever Grande episode . Grab some popcorn .

Ron,

Steve lumped them together.

See

https://peakoilbarrel.com/may-non-opec-oil-production-up-slightly/#comment-725073

Generally from the perspective of climate change they all contribute to carbon emissions and all provide energy. As we move to electricity for transport oil will become less important and as wind and solar ramp up, coal and natural gas will become less important.

My response was to Steve’s comment which clearly lumped fossil fuels together.

Ron,

I’d imagine you realize that a large percentage of Coal & Natural Gas production comes as a result of Oil Production… correct?

While we did enjoy significant coal production-consumption in the late 1800s and early 1900s, we can thank petroleum for extracting and transporting a lot of this coal presently. Sure, some countries like Germany use electricity to extract coal, but most are powered by diesel equipment and transportation.

Unfortunately, we still don’t have long enough EXTENSION CORDS for Trains, Boats, Barges, or Ships. But, who knows, maybe a bright enough engineer in here could figure that one out.

So, when we head over the OIL ENERGY CLIFF, then by gosh, we will also experience a COAL & NATURAL GAS ENERGY CLIFF soon thereafter.

But, maybe if we can get those Space Aliens and Russian ULTRA-DEEP ABIOTIC OIL to help us out with energy, then we can continue being an excellent example of a species to the Universe by continuing our religious rituals of going to Starbucks, Walmart & Walt Disney.

steve

‘Unfortunately, we still don’t have long enough EXTENSION CORDS for Trains, Boats, Barges, or Ships. But, who knows, maybe a bright enough engineer in here could figure that one out.’

Why not capsule pipelines for transportation of physical goods? Basically, polymer lined steel capsules, maybe 1-2m in diameter, containing physical goods, with the capsules ballasted to be neutrally buoyant in water. These could be transported through water pipes, using electric power to pump the water, carrying the capsules along with the flow.

Probably quite a slow means of transportation, but energy costs would be lower even than rail and energy can come from direct electric. The drag between the water and the wall of the pipe, scales with the square of velocity. Assuming that wind turbines provide the pumping power, flow speed would vary according to the square root of power, so fluctuating power would result in only modest changes in delivery times.

Pipelines are the cheapest way of transporting bulk liquids. Using capsules, solid goods can be transported as well, without a drop of diesel. They would probably be best suited for shipping goods between nodes, serving a surrounding area. Short range electric or compressed air powered vehicles, with range of a few tens of km, could then be used to ship capsules from the node to the surrounding area and vise versa.

The pipes themselves would probably be polymer lined concrete. Pipe runs should be as straight as possible to minimise friction losses and reduce capsule wear by collision with walls. Flow will probably be laminar.

Capsules should be designed to allow them to fit onto rail and HGV trailers, such that they function as standardised container units.

You could even run these pipelines under water, provided that capsules are strong enough to withstand compressive forces from the water head. It should therefore be possible to ship goods between continents, by trailing the pipes along sufficiently shallow areas of seabed. Pipelines could in this way reduce the need for container ships.

Ron —

You are right that coal oil and gas aren’t strictly comparable.

Coal consumption peaked in 2013 and is definitely on a downhill slope. It can’t compete with the flexibility and efficiency of gas, and nothing can compete with renewables on price, since they are zero marginal cost.

Oil is primarily for storing energy in a moving vehicle, and will survive until battery powered vehicles replace the current fleet, which will take time. It is losing out to gas in the petrochemical business.

Gas looks like the winner among fossil fuels in the longer term. It’s primary weakness is that it can’t be transported overseas without liquification, which is expensive.

Steve- totally agree.

Scaling up the electric transport sector is going to be a huge job (huge amount of jobs).

And it will be very challenging to get a chunk of it done before oil depletion hits hard.

I am not optimistic the country or world will get the transition done in any kind of smooth fashion.

Hell, only about half the country has even got a pandemic vaccination, and that has been free.

People walk around as if the brain is starved for oxygen.

I think we will see excellent pricing for the oil industry this decade, as well as continued and growing boom times for the ‘all things electric industry’.

I know you are into the investment side of this discussion- have you watched the electric transport sector? compare Exxon or any of the other oil industry stock performance over this past 5 years to NEE, PWR, ENPH, AMRC,TAN, for example. Not a sector to ignore or dismiss.

Tony H , ” But, who knows, maybe a bright enough engineer in here could figure that one out.’’

Tony , you have already figured it out . Suggest you contact Mr Musk or Mr Branson . They are the only persons who I think are capable of implementing such bright ideas .

Steve-

To compete with EVs, oil needs to get under $20 a barrel. That isn’t anything special about EVs, it simply because oil is expensive compared to electricity.

If we assume you are right that there won’t be enough EVs to go around, then there will be clear winners and losers. Anyone who can’t get EVs won’t be able to compete because their costs will be too high.

That’s what you think now because EVs are very heavily subsidised by the government (society).

What pays for the upkeep and maintenance of roads? The petrol tax does. Don’t the EVs use the same roads and services? They do, but they don’t pay anything now because a tax on every litre/gallon of petrol is enough. But then again, EVs not only pay for the infrastructure they use, but they also get an upfront subsidy on the purchase price. The petrol/diesel vehicles also pay myriad taxes (included in the price of gasoline/diesel) that the govt. uses for other things.

That all is good, but free-ride that the EVs have currently is only going to last until the petrol/diesel vehicles are happy paying more to maintain the infrastructure.

Don’t worry, that is all going to end. EVs have to pay for the road infrastructure they use and pay for everything else that the petrol/diesel vehicles are paying currently. Probably some kind of pay per mile driven will be implemented for EVs – and looking at the taxes the petrol/diesel cars are paying (multiple times the actual price) – the tax on EVs is going to be multiple times that of the cost of electricity. I won’t be surprised if there are additional taxes/duties/charges etc that the EVs have to pay in addition because of the additional load they will put on the electricity grid.

So, you EV guys are being subsidised. You don’t even understand the ways you are being subsidised currently whereas the petrol/diesel cars are being burdened by high taxes/surcharges and are indirectly subsidising you. As the number of EVs on roads increase, be prepared to pay more.

“As the number of EVs on roads increase, be prepared to pay more.”

For the country, it sure beats being reliant on just a depleting energy source. As oil depletes it will get much more expensive.

>What pays for the upkeep and maintenance of roads? The petrol tax does.

Only in America I think. And actually, it doesn’t, that’s mostly a myth. DOTs around the country have been taking money out of other pots for decades. For example, states commonly use federal stimulus money to widen roads. Also states routinely borrow money to build roads and take money from sales tax revenues.

Be that as it may, you can tell electricity is much cheaper than oil because oil is rarely used to generate electricity. It’s too expensive. Islands like Hawaii use diesel because coal is too expensive to ship and handle, but other than that it has been driven out of the market.

EVs are very heavily subsidised

Some EVs have modest subsidies.

Petrol/diesel is far more heavily subsidized. Let’s start first with the substantial pollution for which society pays the healthcare costs (asthma, NOX, etc), and let’s not forget security costs (including trillions for oil wars and enormous standing military, private security costs of the “war on terror”). Then of course there’s climate change, which entails truly massive costs.

What pays for the upkeep and maintenance of roads? The petrol tax does.

As Alimbiquated pointed out, US petrol taxes haven’t covered road costs for quite some time. They pay for a portion of highway costs, but local governments have to pay for the majority of road costs out of their general funds.

And light vehicles don’t cause the majority of road maintenance costs: trucks do. Road wear is a function of weight and pressure, and light vehicles just don’t create the much. So, it’s trucking that is subsidized.

Petrol taxes should be far higher, or EVs should be “subsidized” at a far higher level.

—————————-

Other subsidies are worth mentioning in this context: US SUVs are subsidized by a $25k import tax; both road transport and aviation are massively subsidized by not paying property taxes, while rail pays property taxes.

The fossil fuel industry receives $5.3 trillion a year in government subsidies, despite its disastrous toll on the environment, human health, and other global inequality issues, a new report by the International Monetary Fund (IMF) published Monday has found.

http://www.commondreams.org/news/2015/05/18/governments-giving-fossil-fuel-companies-10-million-minute-imf

August 29 2013

Researchers from MIT’s Laboratory for Aviation and the Environment have come out with some sobering new data on air pollution’s impact on Americans’ health.

The group tracked ground-level emissions from sources such as industrial smokestacks, vehicle tailpipes, marine and rail operations, and commercial and residential heating throughout the United States, and found that such air pollution causes about 200,000 early deaths each year. Emissions from road transportation are the most significant contributor, causing 53,000 premature deaths, followed closely by power generation, with 52,000.

In a state-by-state analysis, the researchers found that California suffers the worst health impacts from air pollution, with about 21,000 early deaths annually, mostly attributed to road transportation and to commercial and residential emissions from heating and cooking.

The researchers also mapped local emissions in 5,695 U.S. cities, finding the highest emissions-related mortality rate in Baltimore, where 130 out of every 100,000 residents likely die in a given year due to long-term exposure to air pollution.

“In the past five to 10 years, the evidence linking air-pollution exposure to risk of early death has really solidified and gained scientific and political traction,” says Steven Barrett, an assistant professor of aeronautics and astronautics at MIT. “There’s a realization that air pollution is a major problem in any city, and there’s a desire to do something about it.”

Barrett and his colleagues have published their results in the journal Atmospheric Environment.

Interesting regarding US air pollution deaths. Globally, about one in five deaths are estimated to be caused or contributed to by air pollution.

To generate the equivalent figure of 200,000 early deaths per year through nuclear accidents, would take something like 20 poorly contained nuclear meltdowns with no evacuations, every single year. The US had one nuclear accident over 40 years ago, with close to zero radiological consequences. In the decades since then, the American people have suffered at least 10million casualties, the equivalent of a thousand nuclear meltdowns, due to fossil fuel air pollution, all because they were frightened of building new nuclear reactors. Human beings are genuinely stupid. This winter, tens of thousands of people are likely to freeze in Europe, because our leaders failed to make the investment in Nuclear Power that would have kept them warm. The same thing will happen year after year until the morons are removed from power.

Nuclear could work.

But, it’s slower to build, and much more expensive, than wind and solar (even including storage).

I think nuclear is the Betamax of energy (or the CD, for a more contemporary reference): even though it has a theoretical appeal it has been passed by history.

@Nick

There is no storage so far. Not at all – only a few pumped hydro storages designed long ago and a few battery packs only used to flatten net oscillation. Only a few Gwh, not multi TWh necessary only for the 24 hour storage.

Building huge battery packs the next 20 years would also counter bringing trucks, busses and cars to electric ones since battery production can only ramp up slowly. All big battery plans with other technology are still in lab state, or small prototype state.

Nuclear can be ramped up much faster if there would be a will. The most of it is good old steel + concrete technology. Plus the newer high tech part.

Don’t forget if you want to go the pure solar and wind way you have to build huge interconnections, too – to be able to push californian sun to New York or rainy windy east cost weather to California. This is multi megatons of copper or even more high tech (superconductor).

All this goes with a huge increase of mining of necessary raw materials. So an approach would be to build both to be faster. Building the hull of atomic plants – the containment, the generators, the cooling, the control centers ist just a redirection of construction industry – no new industry necessary. Build some less malls and skyscrapers to free the concrete and steel capacity.

100 miles on about 10kWh doesn’t sound right ? Most EV’s get 3 to 4 miles a kwh.

Huntington beach,

Correct the Tesla M3 gets about 4 miles per kWh, so at 11 cents per kWh, it would be $2.75 per 100 miles. Hickory may have been doing a comparison of a car with fuel economy of 40 MPG and the equivalent cost per gallon of gasoline. The Tesla M3 (or MY) would be like paying $1.10/ gallon for electicity compared to a Camry Hybrid (which gets about 40 MPG). I have both a Camry Hybrid and a Tesla M3, so these are real world numbers over 8 years for the Camry, and almost 3 years for the M3.

So for 100 miles the Camry Hybrid uses 2.5 gallons at $4/gallon at a cost of $10/100 miles. The Model 3 uses 25 kWh for 100 miles at 11 cents per kWh or $2.75/100 miles.

Thanks for the reality check HB-

my calculation was just wrong.

We are getting $2.88/100 miles.

For a petrol car to match that with USA average gas pricing on this very day [$3.18/g],

the car would have to get 110 miles/gallon

Thanks for the upadate. ”Kazakhstan’s output increased by 30 kb/d in May to 1,773 kb/d. Will it get back to its pre-covid level which is 200 kb/d higher?” Apparently, no. https://www.upstreamonline.com/production/kazmunaygaz-suffers-oil-production-slump/2-1-1047192

We continue to get mixed messages out of Russia. This is dated three days ago.

Russia to produce 506 mln tonnes of oil 2021, taking into account OPEC + deal 06/09/2021Bold mine

The volume of oil production in Russia at the end of 2021, subject to OPEC + restrictions, may reach 506 mln tons, which is 1% less than in 2020, Russian Energy Minister Nikolai Shulginov told reporters on Thursday on the sidelines of the sixth Eastern Economic Forum (EEF).

At the same time, the volume of processing exceeds the last year’s figure by 2%, Shulginov said. “Oil production is 1% lower than last year. I believe that this trend will continue. By the end of the year, it will be about 506 mln in tonnes. It will all of course depend on supply and demand, and the implementation of the OPEC agreement. The refining will be about 2% higher,” Shulginov said.

In other words, Russia will export less and less oil but consume more and more internally.

China sells oil reserves to lower prices in unprecedented move

China made an unprecedented intervention in the global oil market, releasing crude from its strategic reserve for the first time with the explicit aim of lowering prices.

Another OPEC estimate for August Production

In late August, Reuters reported: “The Organization of the Petroleum Exporting Countries has pumped 26.93 million barrels per day (bpd), the survey found, up 210,000 bpd from July’s estimate. Output has risen every month since June 2020, apart from in February.”

In early September Bloomberg reported: “Output from OPEC’s 13 members averaged 27.11 million barrels a day in August, according to the survey. Saudi Arabia increased by 200,000 barrels a day to 9.63 million, while Iraq ramped up by 110,000 a day to 4.08 million. Both countries were roughly in line with their new, higher targets.”

Today S & P Global Platts reported:

OPEC’s 13 members pumped 26.97 million b/d in the month, a rise of 140,000 b/d from July, while nine non-OPEC partners led by Russia added 13.29 million b/d, a drop of 90,000 b/d, according to the latest S&P Global Platts survey. (Very close to initial Reuters estimate)

The combined output of 40.26 million b/d marks the sixth straight month the alliance has stepped up production. But it could have been more in August.

The current OPEC supply accord calls for monthly 400,000 b/d increases in the group’s collective quotas, as it aims to capture the global economic recovery from the pandemic.

Iraq, Russia, Saudi Arabia, and the UAE were the largest gainers in the month, but Kazakhstan underwent major field maintenance that saw its output decline, and Nigeria suffered a significant oil spill near a key export terminal that shut in production.

Several other members continued to pump below their allocations due to a lack of spare production capacity.

Libya, which is exempt from a quota under the deal, also had a field outage.

Russia, the main non-OPEC participant, surged its production by 130,000 b/d to 9.77 million b/d, the survey found, as domestic deliveries rose. That is above its quota of 9.60 million b/d.

Kazakhstan undertook maintenance at its Tengiz field, and as a result, its output fell to 1.30 million b/d in August, according to the survey. The maintenance is scheduled to end in mid-September.

Million b/d of CRUDE

OPEC-10 AUGUST CHANGE JULY QUOTA

Iraq 4.10 0.11 3.99 4.061

UAE 2.78 0.06 2.72 2.765

Saudi Arabia 9.57 0.09 9.48 9.600

TOTAL 10 22.81 0.20 22.61 23.286

TOTAL OPEC 26.97 0.14 26.83

Russia 9.77 0.13 9.64 9.600

Kazakhstan 1.30 -0.18 1.48 1.491

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/090921-opec-crude-output-up-slightly-in-august-hampered-by-outages-s-p-global-platts-survey

Russia, the main non-OPEC participant, surged its production by 130,000 b/d to 9.77 million b/d, the survey found, as domestic deliveries rose. That is above its quota of 9.60 million b/d.

Russia’s August oil, gas condensate output fell to 10.43 mln bpd Bold Mine

MOSCOW, Sept 2 (Reuters) – Russian oil and gas condensate output decreased to 10.43 million barrels per day (bpd) in August from 10.46 million bpd in July, according to Reuters calculations based on an Interfax report citing energy ministry data on Thursday.

Total oil and gas condensate production was 44.09 million tonnes, Interfax reported, versus 44.24 million tonnes in July. The ministry does not provide a breakdown for the production of oil and condensate, a type of light oil.

The Ministry hasn’t updated its web page for August yet. It is usually out by this time. I have seen it as early as the 2nd day of the month.

https://minenergo.gov.ru/en/activity/statistic

More speculation on Russia from oilprice:

https://oilprice.com/Energy/Energy-General/How-Much-Oil-Is-Russia-Really-Pumping.html

Time will tell!

Great article Stephen, thanks. There are some interesting stats coming out concerning Russia in the latest OPEC MOMR. Dennis will have an OPEC report coming out soon and I will comment on it then. But it is a real eye-opener.

Ron,

expected news from Russia:

Average daily production of oil and gas condensate in Russia from September 1 to September 15, 2021 amounted to 1.458 million tons. The indicator increased by 2.3% versus the August level.

Russia cuts production under the OPEC + agreement. But from January it can increase it as part of a gradual easing of restrictions. So, in January, the agreements allowed the Russian Federation to increase oil production by 125 thousand barrels per day (b / d), in February-April – by another 130 thousand b / d per month, in May-July – by another 38 thousand b / d. / s per month. In August and September, Russia increased production by 100 thousand b / d per month in accordance with the agreements in OPEC +.

In total, since the beginning of January, Russia has increased oil production by 6.3%, when the average daily oil production was 1.371 million tons. In September, according to the terms of the deal, Russia should produce no more than 9.704 million barrels per day of oil (gas condensate is not taken into account), TASS reports.

If we translate the Russian statistics on oil production from tons to barrels according to the coefficient adopted for Russian Urals oil – 7.33, then the average daily crude oil production in Russia in mid-September amounted to 10.687 million barrels against 10.05 million barrels in December 2020. At the same time, gas condensate is not taken into account in the OPEC + deal, and Russian statistics do not disclose separately the production of oil and condensate.

Russia produces on average 800-850 thousand bpd of gas condensate per month.

California Seeks to Avert Blackouts by Burning More Gas

California is asking the federal government to declare an “electric reliability emergency” so the Golden State can lean more heavily on fossil fuels to avoid blackouts.

The state’s main grid operator wants the U.S. Department of Energy to suspend air-pollution rules for some natural gas-burning power plants in case their output is needed “to meet demand in the face of extremely challenging conditions including extreme heat waves, multiple fires, high winds, and various grid issues,” according to a filing. The last time California received a waiver of such length and breadth was 21 years ago during the Western Energy Crisis.

While the cost of green energy keeps falling, has anybody looked at adding in the cost of keeping a backup system?

Ovi,

California needs major grid upgrades, this is true of much of the US which has done a very poor job of maintaining infrastructure.

As wind and solar power expand, less backup will be needed, I imagine utility companies and electricity suppliers have looked at this question. Much of the backup is already in place, those comanies that keep these facilities operational will receive a premium price when the electricity is needed, probably about 5% of average load will be needed for backup in a worst case scenario once a renewable system is fully built out. Only a portion of this will need to be from fossil fuel, some will be battery, some pumped hydro, smome can be provided by synthetic fuel produced using excess power on windy days and excess power produced in summer from solar power.

Dennis

Look at what happened in Texas this winter. If people are prepared to lose power for five days, I guess less backup will be acceptable.

Ovi,

The problem in Texas was a lack of natural gas due to natural gas infrastructure not being prepared for severe winter weather, it also hurt Texas that their grid is independent of the rest of the US. For most of the US the grid is interconnected, so outages in one area allow supply of electricity to continue from other areas.

As I said the backup exists already in the US and gradually wind and solar will replace older fossil fuel power plants until we get to a steady state where the appropriate amount of backup exists.

Better grid interconnection also helps to avoid the need for backup.

“has anybody looked at adding in the cost of keeping a backup system?”

Ummm..yes. It is a whole industry.

Technologies and cost sometimes brought to the table on the non-oil thread.

In the news today is the imminent listing of Energy Vault on the NYSE valuation at about $1B

https://www.energyvault.com/

just one example of the action in this sector.

For cost analysis of various energy options Lazards is highly regarded-

here is the 14th v 2020-

https://www.lazard.com/media/451419/lazards-levelized-cost-of-energy-version-140.pdf

and the storage cost report of the same date-

https://www.lazard.com/media/451566/lazards-levelized-cost-of-storage-version-60-vf2.pdf

While the cost of green energy keeps falling, has anybody looked at adding in the cost of keeping a backup system?

Ovi,

In a free market, prices are set by the marginal costs at any given time. So zero marginal costs for wind and solar (and hydro) are very bad news for anyone trying to sell fuel.

There is some hope that you can sell fuel to compete with batteries, but the prices there keep falling as well. In America in particular there is little emphasis on reliability, as recent events in Texas (and many others elsewhere) have shown. So even if batteries are not up to the job, or too expensive coal and gas plants are likely to run out of money and go broke, if wind and solar keep growing.

Those power plants don’t exist to provide electricity. They exist to increase shareholder value. Once they stop doing that, they will vanish. What comes later is anyone’s guess.

The key question is not how much electricity wind and solar can produce, or how much batteries cost. The question is how damaging they are to the balance sheets of traditional energy providers.

In a free market, prices are set by the marginal costs at any given time. So zero marginal costs for wind and solar (and hydro) are very bad news for anyone trying to sell fuel.

That energy is never free. It cost a lot of money to build solar farms and wind farms, a lot of money. And the maintenance on both is never-ending. And they belong to someone or the electric grid company. And they want a profit.

Those power plants don’t exist to provide electricity.

Oh really? I thought that was why much of Louisana is still in the dark. Just what is it they do if they don’t generate electricity? Why do people send them money every month if not for the electricity they generate?

They exist to increase shareholder value. Once they stop doing that, they will vanish. What comes later is anyone’s guess.

Oh good Lord! They own the grid. The grid will never vanish. If you got all your electricity from wind, solar, and batteries, the same guys would own them. And you would send your monthly payment to the same address and the same organization. And the same shareholders would either make or lose money, which is exactly what they are doing today.

Ron,

The electricity industry has changed over the years, most utility companies simply provide transmission and distribution services and electricity producers sell their product to utilites or directly to consumers as the electricity supplier.

Dennis, it makes no difference. The grid is necessary and someone must pay to maintain it. The electrical companies still maintain the local grid. They are the ones who provide all the transformers and substations. They are the ones who repair the grid when it is damaged by a storm. There is no such thing as free energy as Alimbiquated seems to believe.

That energy is never free.

Ron,

You are absolutely right of course. But the marginal cost is zero. Put another way, curtailing solar or wind output doesn’t save a penny. Those maintenance costs are still there.

So there is never any incentive to cut production if prices are non-negative, even if the company is losing money hand over fist, even if it is bankrupt. This situation is very different than the situation of a gas-fired plant, which has to buy gas to keep operating. If the company can’t service its debts, or electricity prices fall below fuel prices, the fuel-based plant stops producing electricity.

In financial accounting terms, solar output is always cash flow positive, (assuming electricity prices are positive) even if the balance sheet shows a loss. Market prices are determined by cash flow, not by the balance sheet.

So renewables are like the chip industry, not the energy business. Why are chips so cheap? “Moore’s Law” isn’t the only reason. Another reason is that it is dirt cheap to make chips once you have built a foundry. The foundry might cost billions though, so as so as you have one, you start a brutal fight for market share to get your money back. When a new generation of chips comes out, the price holds for a few months before a crash comes.

Oilmen are used to wild swings in prices and waiting out the bust until the next boom comes. But renewables change the game, whether they are “really” cheaper or not. Every solar PV plant that gets built will produce flat out for decades no matter whether it makes money or not, price be damned.

The grid will never vanish.

The grid (in America at least) is only there as a way of selling electricity at a profit. It exists because people make money burning coal. I am not very optimistic about its future as renewables suck more and more profit out of electricity production. Reliability is already terrible compared to Europe.

You might think it would be stupid for a rich country not to have a grid. But:

It is stupid for a rich country not to have universal health care that pays for cures rather than procedures. And yet here we are.

It is stupid for a rich country not to provide higher education at prices anyone with the talent and motivation can afford. Need I explain? And yet here we are.

It is stupid for a rich country not to have a dense network of passenger trains and in major cities. And yet here we are.

American cities expect people to work for minimum wage at McDonald’s, but don’t even provide sidewalks for the poor to walk to work, because nobody can charge people to use the sidewalk. Who will provide a grid when the money is sucked out of electricity generation?

What makes you so sure the grid will survive? Are you worried poor people might not have electricity? Touching.

Renewable energy is a diversion into a dead end. Humanity could continue to harness modest amounts of energy from biomass, hydro and wind. But there is no possibility of replacing the energy flows that we presently receive from fossil fuels with renewable electricity from the sun and the wind. The problem is not so much intermittency, but low power density. The result is that wind and solar power require 1-2 orders of magnitude more embodied energy and raw materials than an equivalent fossil or nuclear system.

A 1GWe average solar farm would cover about 200 square kilometres of land in Northern Europe. A wind farm of equivalent power at maximum possible packing density, would cover 500km2. To generate serious amounts of power from renewable energy sources, the systems need to be country sized. A nuclear steam supply system capable of generating 1000MWe of power, enough for a city of 1-2 million people, would fit inside a modest 4-storey building. The resource requirements for a nuclear power system are tiny compared to those of any alternative solar or wind based energy source. The fact that these sources are in any way financially competitive, indicates how distorted the energy market has become.

Below is a link to the 2015 Quadrennial energy review, produced by the US department of energy.

https://www.energy.gov/quadrennial-technology-review-2015

Go to Section 10, Table 10.4 for a summary of materials inputs into several different types of powerplant in ton/TWh. Here are some tallys per TWh:

Nuclear (PWR) = 760t concrete / cement; 3t copper; 0t glass; 160t steel; 0t aluminium.

Wind = 8000t concrete / cement; 23t copper; 92t glass; 1800t steel; 35t aluminium.

Solar PV = 4050t concrete / cement; 850t copper; 2700t glass; 7900t steel; 680t aluminium.

Compared to a pressurised water reactor nuclear power plant, a solar PV plant producing the same electric power output will require some 5.3x more concrete; some 280x more copper, some 49.4x more steel; and thousands of times more glass and aluminium. Wind turbines (presumably onshore) require about an order of magnitude more materials for the same amount of electrical energy generated. There is no indication that these quantities include any materials investments needed for energy storage. This would require further materials investments in pumped hydro, CAES or some other means. This increases the materials cost of wind and solar still further. Embodied materials are a reflection of embodied energy.

Wind and solar power only appear competitive at present, because of hidden subsidies and the fact that their huge embodied energy costs are being met by fossil fuels. The steel needed to fabricate wind turbines and PV frames is produced using coal. Solar panels are made in China using cheap coal derived electricity and forced labour. The huge amounts of concrete are produced using natural gas. The polymer blades are a product of oil derived naphtha. And the huge quantities of embodied materials must be mined and shipped using diesel powered equipment.

Nuclear is pretty much a dead relic of the 50s. Boiling water simply isn’t a cot effective way to generate electricity.

The nuclear industry needs to go back to the drawing board and figure out how to generate electricity without generating hard radiation and heat.

OMG. This is entirely unrealistic.

Wind and solar don’t need that much space. Fossils and nuclear need more than the amounts shown. The “energy density” argument is obsolete: wind and solar are cheaper.

A 1GWe average solar farm would cover about 200 square kilometres of land in Northern Europe.

That’s about 10x too large. A GWe is one billion watts. If we figure 10% capacity factor (which is conservative), then we’re talking 10 billion watts peak capacity. Peak solar insolation is 1 kilowatt per square metre, so we need 10 million square metres. If we assume a 50% factor for spacing between panels, then we need 20M square metres. That’s 20 square kilometres. Plus rooftop solar “consumes” no space at all.

The calculations for wind are also terrible, because they assume that all of the land inside the wind farm between the turbines is “consumed” by the farm. That’s silly, and it’s off by about 100 to one. Also off-shore wind “consumes” almost no space at all.

I haven’t fully reviewed the materials argument, but one problem jumps out from me at the source: for FF and nuclear it doesn’t include fuel or upstream requirements, only the generator. So, the material requirements for coal generation don’t include the materials used for the coal mine!

Wind and solar will continue to be cheaper than fossil fuel electricity, even if they use their own outputs as inputs to build more capacity. Why is that? Because they’re cheaper! If they’re cheaper than fossil fuel and nuclear plants when they’re using FF inputs, why wouldn’t they be cheaper when they’re using their own power output as inputs to building more, cause their power oututs are…cheaper.

OMG.

A big wind tower uses round about 200 square meters of space here – by law the foundation has to be covered by at least 1 meter of soil. That’s enough to plant corn or grow a forest on top on it.

For example: https://www.mz.de/lokal/merseburg/wie-das-land-mit-repowering-der-windanlagen-die-landschaft-aufraumen-will-3170065?reduced=true

You see, the loss for the farm is almost zero.

The main needed space are the access roads for maintaince. I think that’s the same as shales stripper wells – you need to be able to reach the location with a truck. When you build them in farm you can use the access road for heavy farm equipment, too.

Something is going on in Russia, I am not sure what. The data is just in from the Russian Ministry of Energy: Stastics Russian C+C was down 35,000 barrels per day in August.

But we are getting some strange signals out of Russia.

This Rystad page, Russia’s oil supply set to break Covid-19 chains, rise to a new record in July 2022 and peak in 2023,

has Russian production reaching new heights next year and peaking at 12.2 million barrels per day in 2023. The article mentions “greenfields” 6 times and “brownfields” 0 times. Over 60% of Russian oil production comes from brownfields.

This article, from last November, may explain why:

Russia prioritises new projects at expense of brownfields.

From 2021, the development of mature oil and gas projects, or so-called brownfields, will cost Russian producers more due to taxation changes, while greenfields will continue to enjoy tax incentives. Currently, oil consumption is reducing due to unfavorable market conditions, but the changes may backfire when demand recovers.

The article goes on to explain how Putin is giving all tax breaks to Arctic production and abandoning the brownfields.

To guarantee returns of new investments, the Kremlin also worsened the operating conditions for dozens of large brownfields that switched to a trial netback taxation mechanism in January 2019. Due to state support, these projects have been considered significantly less expensive to operate compared to new developments in the Arctic.

So that’s what’s happening in the Russian oil patch. The next few months will tell us how it’s working out.

The Russian authorities have totally underestimated the effect of reducing the prolific rate of infill drilling needed to sustain production in the old brown fields. Rystad simply add new production taking no account of decline rates for legacy wells. I have worked for Russian’s and there will be a delay before any action is taken to reverse the situation. The stages in the process will be.

1 wait to see if it improves

2 look for something or someone to blame

3 try to fix it without telling the government

4 tell the government and put your tin hat on.

Lightsout , second thanks for today .

Have big oil fields actually been discovered in the Russian Arctic, or do they just think there’s lots of oil there?

Some oil has been discovered in the Russian Arctic, but most of it is a long way from development.

Russia Begins Development on Arctic Oil Project That Will Produce 25 Million Tons of Oil Per Year

That works out to be half a million barrels per day by 2024.

Russia’s national oil company has begun construction on a massive project in the Arctic that officials say will produce 25 million tons of oil each year by 2024. The new operation is possible only because the Arctic is now traversable in places and at times it previously wasn’t, due to sea ice levels plummeting as the planet warms. Hahahahha everything is fine!

The Barents Observer reported this week that construction ships have been spotted off the coast of the Taymyr Peninsula in Siberia and have dropped off around 20,000 tons of construction materials to begin building what will be the Arctic’s biggest oil terminal. The project, called Vostok Oil, is owned by Rosneft, which is controlled by the Russian government but has a number of private investors (including BP, which, if you’ll recall, has big plans to be net zero by 2050). The CEO of Rosneft told Vladimir Putin that the company had also started drilling in a new license area this month as part of the project.

The proposed project is dauntingly huge. Rosneft said that it anticipates exporting 25 million tons of oil a year by 2024, 50 million tons by 2027, and 115 million tons by 2030.

In barrels per day that’s .5 million by 2024, 1 million by 2027, and 2.3 million by 2030. Ambitious but I don’t think that will overtake their brownfields decline. Also, I think that 2.3 million barrels per day by 2030 is overly ambitious.

Ron . there is a saying ” China will grow old before it becomes rich ” . Same applies to the Vostok project and the Chinese “One Belt One Road” project . Not enough surplus nett energy to spread around such gigantic endeavors .

About the vostok oil project, RUB 10 trillion will be needed. Where are they going to find these funds? ”Massive infrastructure requires massive investment. There are estimates that project implementation will require at least RUB 10 trillion. But despite such colossal costs, experts believe that the project will still be lucrative and oil prices will actually remain quite reasonable, at USD 35–40 per barrel. ” https://arctic-russia.ru/en/project/world-class-cluster/

By the way, they are looking for contractors. https://www.reuters.com/business/energy/rosneft-begins-hunt-contractors-massive-vostok-oil-project-2021-06-07/

It has to be noted Ron they are investing heavily in gas.

https://youtu.be/ekzzAMbyfjU

It is propaganda video. Gazprom has no (more) spare capacities to supply Europe. https://www.upstreamonline.com/production/no-answer-russia-fails-to-boost-gas-deliveries-to-europe/2-1-1047019

JFF , agree . I am surprised at the change in the narrative . We never thought that a gas crunch could come faster than oil . What were we missing ? OR Is it the unravelling of the false data and lies that have been fed to the public over the several years ?

No false data and lies have been fed to the public. It’s just a problem of blindness and lack of informations among people in general. But, yes, I admit the awakening is hard.

There’s an energy crunch unfolding in Europe, especially with the UK in a very precarious position with respect to power and heat generation. Coal plants due to be mothballed next year were fired up recently for emergency production, and interconnectors are being seen as unreliable due to other issues. Europe has far below average NG stocks going into autumn, and the wholesale power market prices have spiked as they would were we in a cold snap. I’m sat in my garden and it’s 23ºC outside right now in September. What happens if it actually gets cold?

https://www.thetimes.co.uk/article/0decb912-116d-11ec-86b8-9dcf48a101ba?shareToken=11a09cd43e1fa5181008abd4ea0dca51#

This is when you see popular uprisings against gov’t policy. And if they see this is down to botched renewable policy, well, I don’t think appealing to peoples’ better nature will help if they’re freezing in the dark and their jobs are unable to function.

The situation is bad .

https://www.theguardian.com/business/2021/sep/08/two-uk-energy-suppliers-succumb-to-record-surge-in-prices

I have created three Oil price scenarios for Brent oil in 2020 US$/barrel, see chart attached.

The low scenario has a maximum oil price of $70/bo (2021-2035), the Medium scenario a maximum oil price of $95/bo (2029-2033) and the high oil price scenario has a maximum oil price of $120/b (2029-2033).

What do people think is the most reasonable of these scenarios?

Nobody will think these are correct, but answers might be, below the low scenario or between the medium and high scenarios. Or present your preferred scenario (best guess, or a range of guesses).

The medium scenario is just the average of the low and high scenarios. The decrease in oil price after 2035 is based on an assumption that demand falls either due to a transition to electric transport or possibly due to a depression due to declining oil availability, which I expect will start around 2030 in the absence of a transition to electric transport (or a very slow transition).

I took another look at USGS assessments of tight oil resources in the Permian Basin.

https://www.usgs.gov/centers/cersc/science/permian-basin-oil-and-gas-assessments?qt-science_center_objects=0#qt-science_center_objects

In all three assessments Midland Wolfcamp(2016), Spraberry (2017) and Delaware Wolfcamp and Bonespring (2018) there were about 50 million net acres of propective area to be developed. A “net acre” is the prospective acres times the probability of a successful well, if we have 100 acres with an average success rate of 80% we would call that 80 net acres.

The different “benches” of the Wolfcamp, Bonespring, and Spraberry formations in each of the sub-basins studied have different average EURs per well. If we assume the average well will have a 9000 foot lateral with 1320 foot well spacing (273 acres per well) the EURs range from 175 kb to 691 kb.

Listed from lowest to highest (in kb):

175, 222, 227, 244, 259, 259, 329, 344, 381, 413, 456, 456, 456, 456, 521, 524, 691

The mean TRR estimate by the USGS for all of these benches adds up to 70 Gb of undiscovered resources and when we add cumulative production plus proved reserves at the end of 2015 (5 Gb in total) we get a TRR of 75 Gb.

I have adjusted this estimate by dropping the lowest productivity benches (from 175 kb to 344 kb), one bench form Spraberry, 3 from Midland, and 4 from the Delaware basin. This leaves the benches with average EUR from 381 kb to 691 kb (9 benches in all). The USGS mean undiscovered TRR estimate for these 9 benches is 52 Gb, but this leads to a high average EUR of 468 kb for the 30 million net acres comprising the 6 benches (from 50 million total net acres in the USGS estimate for all 17 benches analyzed). To date the average Permian basin well in 2019 has an EUR of about 407 kb (this assumes the well is shut in at 20 bo/d output). At 273 acres per well we would have about 111000 wells that could potentially be completed, assuming 407 kb per well would lead to about 45.2 Gb of undiscovered TRR, when we add the cumulative production plus proved reserves at the end of 2015 (before the first assessment was completed) we get a TRR of 50 Gb.

Note that this is quite a conservative estimate as the F95 USGS TRR estimate is, 44 Gb where F95 means there is a 95% probability that the TRR will be 44 Gb or more. So my estimate might be the equivalent of an F85 TRR estimate, if the USGS analysis is accurate.

Using this new TRR estimate and the three oil price scenarios presented earlier, I made the following maximum completion rate assumptions for a low, medium, and high oil price scenario at 450 wells per month, 525, wells per month and 600 wells per month respectively.

OPEX about $15/bo in 2021 (average OPEX of $16.50/bo over life of well) and rising as the field depletes, well cost $10.5 million, plug and abandon cost 500k per well, NG $2.50/MCF, NGL sold at 35% of the price of crude oil, royalty and taxes 28.5%, wellhead price $5/b less than Brent, all prices in 2020 US$, discount rate 17.5%, interest rate 7.5%, dividends are 25% of net revenue.

Wells completed range from 89000 for low price scenario to 124000 for high oil price scenario.

Note that 15500 wells had been completed in the Permian basin by the end of 2017, the 110000 wells completed to extract the 45 Gb of undiscovered TRR are competed after Dec 2017 in these scenarios, so without the economic analysis where all potential wells are completed we would have about 125500 total wells competed to extract 50 Gb of oil.

Dennis

This post of yours may well be amongst the most informative and relevant of all your years of engagement on this site.

Good for you for going deeper past the mere ‘headline’ encapsulations that seem to form the evaluative basis of so many.

Additional insight …

Those USGS presentations were published in November 2016, May 2017, and November 2018, respectively.

As such, the analyzed wells are somewhat archaic by current practices.

If you choose to learn of more modern protocols, the 118 page June, 2021 presentation from Liberty Resources describes many of the factors involved in economically fracturing/developing today’s unconventional wells … particular relevance can be found on pp. #s 43 – 47.

Looking forward, the new hardware enabling so called simul fracs are claimed to save $400,000 per completion.

Ongoing advances in diverter technology and water processing (enabling re-use of both frac fluid and produced water) are enabling both operational and economic benefits. (Common for Appalachian Basin operators to use 100% recycled water for frac’ing.)

If you follow lateral length on Enno’s site for Permian wells, expect ongoing increase in length up to the 15,000 foot threshold.

Again, AB technology is arising in Texas, which provides additional motivation for lease consolidation.